Agenda

Ordinary

Meeting

Thursday,

27 February 2020

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 9.00am

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Mark

Arnold

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the Code

of Conduct for Councillors (eg. A friendship, membership of an association,

society or trade union or involvement or interest in an activity and may

include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or vice-versa).

Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as of the provisions in the Code of Conduct (particularly if you have a significant

non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a meeting

of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Ordinary Meeting

BUSINESS OF Ordinary Meeting

1. Public Access

2. Apologies

3. Requests for Leave of

Absence

4. Declarations of Interest

– Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary

Interest Returns (Cl 4.9

Code of Conduct for Councillors)

6. Adoption of Minutes from

Previous Meetings

6.1 Ordinary

Meeting held on 12 December 2019

7. Reservation of Items for

Debate and Order of Business

8. Mayoral Minute

8.1 Supporting

Housing above Council Owned Carparks...................................................... 5

9. Notices of Motion

9.1 Julian

Assange................................................................................................................ 13

9.2 Petria

Thomas Swimming Pool in Mullumbimby - Conversion to year round facility.... 15

9.3 Positive

Change for Marine Life - River Warriors Program............................................ 17

9.4 Support

for Arts Northern Rivers.................................................................................... 21

10. Petitions

11. Submissions and Grants

11.1 Submissions

and Grants Report - February 2020.......................................................... 22

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Lease

over road reserve adjoining 27 Marine Parade Byron Bay.................................. 25

13.2 Lease

to Scouts NSW for occupation of the Byron Bay Scout Hall............................... 29

13.3 Lease

to Byron Region Community College Inc............................................................. 34

13.4 Variation

of temporary Byron Farmers Market licence at Cavanbah Centre................ 39

Corporate and Community Services

13.5 National

General Assembly of Local Government 2020................................................ 43

13.6 Heritage

Advisory Panel - Representatives.................................................................... 46

13.7 Investments

- 1 January 2020 to 31 January 2020........................................................ 49

13.8 Delivery

Program 6-monthly Report and 2019/20 Operational Plan Second Quarter Report -

Q2 - to 31 December 2019.......................................................................................................... 57

13.9 Investments

- 1 December 2019 to 31 December 2019................................................ 60

13.10 Budget

Review - 1 October 2019 to 31 December 2019............................................... 67

13.11 Policy

Review - Policies for repeal (part 3).................................................................... 77

13.12 Council

Resolutions Quarterly Review - Q2 - 1 October to 31 December 2020........... 84

13.13 Update

following sale of birds from The Lighthouse Sculpture...................................... 87

13.14 Councillor

Representatives to the Cape Byron Headland Reserve Trust Board............ 90

13.15 Electricity

Contract.......................................................................................................... 92

Sustainable Environment and Economy

13.16 Compliance

Priorities Program Report 2019.................................................................. 94

13.17 Tallow

Creek Urgent Dog Management - update on Res 19-602................................ 106

Infrastructure Services

13.18 Belongil

Creek Catchment Update............................................................................... 115

13.19 Tender

2019-0037 Repentance Creek Road Causeway Upgrade.............................. 121

13.20 Council

Resolution 19-322 Update - Brunswick Heads Periodic Parking.................... 125

13.21 Relocation

of Byron Bay Netball Club to Cavanbah Centre and Outdoor court lighting. 132

13.22 Bioenergy

Facility Vendor Selection and Future Work Plan......................................... 135

13.23 Suffolk

Park Pump Track Location.............................................................................. 146

13.24 Tender

2019-0066 Byron Creek Bridge Replacement................................................. 152

14. Reports of Committees

Infrastructure Services

14.1 Report

of the Local Traffic Committee Meeting held on 6 December 2019................ 156

14.2 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 3

December 2019....................................................................................................................................... 159

14.3 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 30

January 2020....................................................................................................................................... 161

14.4 Report

of the Water, Waste and Sewer Advisory Committee Meeting held on 30 January

2020....................................................................................................................................... 164

14.5 Report

of the Local Traffic Committee Meeting held on 28 January 2020.................. 167

15. Questions

With Notice

Questions with Notice: A response to Questions with

Notice will be provided at the meeting if possible, that response will be

included in the meeting minutes. If a response is unable to be provided

the question will be taken on notice, with an answer to be provided to the

person/organisation prior to the next Ordinary Meeting and placed on Councils

website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director prior to the meeting. Any suggested amendments to the

recommendations should be provided to Councillor Support prior to the meeting

to allow the changes to be typed and presented on the overhead projector at the

meeting.

Mayoral Minute 8.1

Mayoral Minute

Mayoral Minute No. 8.1 Supporting

Housing above Council Owned Carparks

File No: I2020/180

|

I move that Council:

1.

Support, in principle, facilitating the establishment of diverse

and affordable housing on Council owned carparks, without decreasing the

current number of available car parking spaces and having regard to the need

to avoid negative impact on recent investment in emissions reduction

capability.

2. Extend an invitation to

housing providers to a preliminary session to ascertain requirements,

possibilities and challenges for establishing housing above Council carparks,

and that:

a) This

session is to be a ‘without prejudice’ discussion prior to any

activation of a more formal EOI process;

b) Council

provides for internet based attendance.

3. Prior to this meeting, create a list of possible

sites for discussion and consideration.

|

Background Notes:

Councils

have an often volatile relationship with ‘development'-especially Byron.

Mostly, Councils process what is brought to us within guidelines and rules

largely created by the State Government. Sometimes we fight against poor

development proposals. And sometimes, we can help enable great development

proposals.

This

Mayoral Minute seeks support for Council to explore how we can enable

developments that are greatly needed by our some within our community and which

have the potential to be designed and created with innovation, sustainability

and beauty.

As we

all know all too well, affordable housing, or housing that is appropriate for

the housing needs of very low, low and moderate-income households is in dire

short supply in Byron Shire.

Byron

Council has a long held, and long term commitment to strengthening and

supporting our diverse community with appropriate housing and by demonstrating

strong leadership.

Though

we know that all levels of government must be active and involved in

contributing to increasing the supply of Affordable Housing, and that local government

is the least empowered level of government to do so; we should continue to try

and do what we can, where we can and how we can.

Currently,

Council is actively exploring ways of working effectively with the State

Government to increase the supply of Affordable Housing within the shire via

innovative and flexible planning provisions. We also continue to support an

inter- governmental approach to address the housing challenges facing many

residents of Byron, the Northern Rivers and Australia more generally.

As

well as focusing on advocacy and partnership, Council is exploring how its own

assets can be used for Affordable Housing and thus far, this has been through

looking at its vacant or unused land.

Now,

we should join other councils both nationally and internationally who are

looking to add value to their ‘lazy land’, or ‘lazy

airspace’.

According

to the University of Melbourne, (School of Design, Faculty of Architecture)

Project

3000: Producing Social and Affordable Housing on Government Land 2018, Lazy Government Land is

defined as “any government site currently occupied by a land use that

could be mixed with affordable and social housing but is currently not and

where existing buildings are currently under four storeys.” This could include,

libraries, community and neighbourhood centres, ground level car parking,

shopping and offices, some healthcare facilities, social services and childcare

facilities.

Adding

an affordable housing project above a ground level car park could have three

main benefits: it can minimise the impact of spatial dislocation of low income

households by providing housing within town centres, it can reduce the cost of

creating housing, and it can make better use of existing assets.

Starting

with Why

So,

why do it?

Using

our land to facilitate the creation of housing provides a high level of

influence and control, providing some great possible outcomes:

1. It

can ensure Council chaperones environmentally sustainable design (ESD)

principles into designs to reduce energy use for future residents of the

building. This would provide an environmental benefit as well; reducing the

utility bills for the low income household and establish leadership in

promoting sustainable design.

2. It

can help improve the wellbeing of people in a low income household by

providing opportunities for people to live within their existing community even

when they can no longer afford the private rental market or if they need to

downsize from a family home.

3. It

can facilitate cultural diversity, and support for housing for our local

indigenous mobs.

4. It

can enable low income workers to live close to where they work. This reduces

the time and cost of travel to work and means they have more funds available

for economic participation in the local community.

5.Simply put, it can make it financially stack up.

Affordable and social housing developers face significantly higher land costs

today than in the last three decades. Land typically constitutes between 10%

and 30% of development costs (Urbis 2011). By providing land for a

nominal fee, affordable housing provision is more possible. The value and

therefore cost of land within the Byron Shire makes it difficult for

non-profits to develop social housing. Council leasing its land to non-profits

for a nominal fee would eliminate this cost for housing providers.

Ownership

Considerations

Though

many twists along the road need to be travelled before final decisions are

reached, and without any desire to pre-determine outcomes, it would seem

reasonable to assume that the statutory regime may consist of a long-term

lease. The term of such lease is limited to 50 years under the Local Government

Act. The rental amount can be set by Council and hopefully, that it would be a

nominal, or peppercorn amount to ensure the financial viability and to navigate

around the high land cost barriers currently faced by low cost housing

providers.

The

benefit of the lease option is that the land remains in public ownership and

Council would retain significant control over the site. Council could establish

requirements for the use and development of the land and enforce these through

the lease conditions. A lease would provide Council with the highest level of

control over the site with the benefits for our community as shared earlier. A

lease is aligned with Council’s preferred position of ensuring public

land remains within public ownership.

A

potential shortfall of establishing a leasing regime is that a lease provides

less certain tenure and it may prove difficult for a housing association to

secure finance or funding.

Expression

of Interest Process

Again,

much road will be travelled prior to decisions being finalised, however, I

would encourage that within the Expression of Interest (EOI) process to

identify a suitable tenant for the site, the tenant would ideally be a

registered housing association or a charitable organisation capable of

delivering affordable housing on the site.

Relationship

with other Council Plans and Strategies

Providing,

or at least supporting, the provision of diverse housing within the Shire is an

outcome that is consistently espoused across numerous Council Plans and

Strategies. This is the case within our overarching, umbrella strategic

planning program- Our Byron Our Future: Community Strategic Plan 2028

(CSP) and its accompanying Delivery Program 2017-2021 and Operational Plan

2019-2020. Within the CSP it states, “The community told us quite

clearly, to “Providing strategies to ensure living in Byron Shire is

affordable for locals and future generations, and to ensure young people

don’t have to move from the area due to lack of employment or housing

options.” Pertinent sections within the identified Community Objectives

include:

• INFRASTRUCTURE: We have

infrastructure, transport and services which meet our expectations

• COMMUNITY: We cultivate and

celebrate our diverse cultures, lifestyle and sense of community, specifically,

‘support and encourage our vibrant culture and creativity’ and

‘support access to a wide range of services and activities that contribute

to the wellbeing of all members of the Byron Shire community.’

• GROWTH: We manage growth

and change responsibly, specifically, ‘support housing diversity in

appropriate locations across the Shire’ and ‘establish planning

mechanisms to support housing that meets the needs of our community.'

• GOVERNANCE: We have

community led decision making which is open and inclusive

Council

has also outlined its commitment to supporting diverse and accessible housing,

seen through the following Housing Affordability Initiatives:

• North Coast Community

Housing Project, Station Street Mullumbimby

• Lot 22 Stuart Street,

Mullumbimby

• Expressions of Interest for

Affordable Housing

• Residential Strategy

housing affordability measures

• Our Housing Challenge:

Local Communities: Local Solutions: Byron Perspective - 10 May 2019

• Housing Charrette, November

2018

• Byron Housing Roundtable, 5

July 2018

• Housing Summit, 10 February

2017

Lastly,

Council’s Homelessness Policy contains the recognition that all people

have a right to housing that meets their individual needs

Possible Sites

Currently

council holds quite a few parcels of land utilised for car parking. Some of

these include the Council Administration building carpark, the Cavanbah Centre,

North and South Lawson St Byron Bay, and Station St Bangalow. Of course if a

pilot project proves successful, it could inspire State government owned land

to follow suit.

Possible Housing Types

The

exact types of Affordable Housing (e.g. social housing, shared equity housing)

that could be provided through the development will naturally be explored

through the EOI process, or outlined by Council within the EOI process. The

mixture of Affordable Housing types that can be provided is influenced by

financial viability, available funding sources, different housing needs within

our community and wider planning models to ensure diversity and a healthy

interaction with the wider township. All things considered, Affordable Housing

developments would most likely comprise a range of housing across the

Affordable Housing continuum, and be available to people with a range of

incomes (between the very low to medium income brackets).

Examples from Elsewhere

Australia

Transforming

Housing is

currently working with the Lord Mayor’s Charitable Foundation and the

City of Darebin on an Affordable Housing Challenge: transforming the air rights

above a council parking lot into at least 60 social housing homes, as well as

additional affordable rental homes.

Seen

here, the City of Port Phillip has also recently completed an affordable

housing development above one of its own carparks.

The

UK

Overseas,

this seems a more matured

development process. The London firm Zedpods (zedpods.com) are an exciting case in

point. Erected on piles above car parks, they preserve both the original

parking space whilst offering cheap and quick-to-build housing above. The dead

air space above a parking bay becomes a home for someone to live in. Dwellings

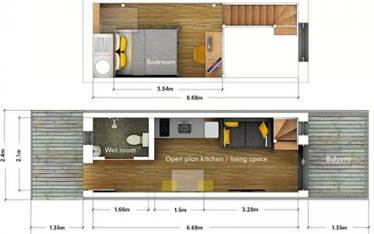

come with an open-plan kitchen and living room (with an adjoining bathroom and

balcony) takes up the space directly above the car parking space, whilst a

mezzanine floor above provides a reasonable double bedroom.

They

can be built in a single terrace above one line of parking spaces, or in two

facing lines with a communal space in the middle if the car park is bigger.

There

are double pods, too – with space for two bedrooms, a larger

open-plan dining-living area, and a separate kitchen.

And

for the more ambitious-minded car-park owner, the homes can be stacked in two

stories, though the construction of these involves resurfacing the car park

Germany

These

wooden structures are an excellent building material which is ideally suited to

its pre-fabrication and aesthetic radiance to build quickly houses, also just

because of the massive immigration. This project proposes in its feasibility

study to create in Koblenz on the area of the university a prototype as a

superstructure of the parking lot in front of the university.

|

|

Here

prefabricated modular components should be used for affordable housing. Due

to the high prefabrication wooden structures allow a fast, efficient and economical

construction process. In addition to shortening the construction period the

modular design allows a big flexibility.

|

|

|

Finally,

the planning for this multi-storey residential building is transferable to

other plots. The supporting structure allows adaptable floor plans in all

three residential floors, which can be divided individually via light

partitions. The supporting structure consists of composite floors made of

wood and concrete.

|

The

three upper floors have common areas. Access is via a staircase. If required a

lift can be installed. A solar system on top of the roof for heating support is

planned. The building is designed for refugees and foreign students, suggesting

to build 4 houses in the first phase.

Source

by HennerHerrmanns.

Signed: Cr

Simon Richardson

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 Julian

Assange

File No: I2020/17

|

I move that Council:

1. Notes

that WikiLeaks publisher, Julian Assange, was a resident of the Northern

Rivers region, spending four years living in Lismore from 1979 to 1983.

2. Notes

that Julian Assange is in very poor health and facing extradition from the UK

to the US in an unprecedented Espionage Act prosecution for engaging in

journalistic activity. If convicted, he faces 175 years imprisonment and

potentially the death penalty, therefore needs urgent consular support to

help him prepare his defence.

3. Notes

that Amnesty International’s Deputy Director for Europe, Massimo

Moratti said the UK must not extradite Julian Assange to the USA and that:

a) “The

British authorities must acknowledge the real risks of serious human rights

violations Julian Assange would face if sent to the USA and reject the

extradition request. The UK must comply with the commitment it’s

already made that he would not be sent anywhere he could face torture or

other ill-treatment.

b) “The

UK must abide by its obligations under international human rights law that

forbids the transfer of individuals to another country where they would face

serious human rights violations. Were Julian Assange to be extradited or

subjected to any other transfer to the USA, Britain would be in breach of

these obligations.”

4. Notes

that UN Special Rapporteur on torture, Nils Melzer said:

“My

most urgent concern is that, in the United States, Mr Assange would be

exposed to a real risk of serious violations of his human rights, including

his freedom of expression, his right to a fair trial and the prohibition of

torture and other cruel, inhuman or degrading treatment or punishment.”

He also stated, “In 20 years of work with victims of war, violence

and political persecution he has never seen a group of democratic States

ganging up to deliberately isolate, demonise and abuse a single individual

for such a long time and with so little regard for human dignity and the rule

of law”.

5. Notes

that in a recent interview on RN Breakfast with the leading torture expert,

Nils Melzer, he warned that Mr Assange could die in prison before getting his

day in court and confirmed that the British government’s handling of

the extradition case is in blatant contravention of international Human

rights Law.

6. Writes

to the Australian Foreign Affairs Minister requesting that the Australian

government must immediately step in to ensure the British authorities address

his poor health condition and to uphold the Human Rights of an Australian

citizen just as they would if Mr Assange was being held in Iran, Egypt,

Cambodia or Indonesia. They must not turn a blind eye to the violation of any

Australian's human rights, just because it is occurring in the West. The

letter should also reference the points made above.

7. Writes

to all our local State and Federal representatives asking to either join or

support the Bring Assange Home Parliamentary Group, which is currently made

up of 11 MPs from across party lines.

|

Signed: Cr

Sarah Ndiaye

Councillor’s

supporting information:

The motion provides all relevant information.

Staff comments by Vanessa

Adams, Director Corporate & Community Services

(Management Comments must not include formatted

recommendations – resolution 11-979)

Should the Notice of Motion be adopted officers will draft

letters accordingly for signature by the Mayor.

Notices of Motion 9.2

Notice of Motion No. 9.2 Petria

Thomas Swimming Pool in Mullumbimby - Conversion to year round facility

File No: I2020/29

|

I move that Council:

1. Conduct

a feasibility study into the financial viability of converting the Petria

Thomas Swimming Pool in Mullumbimby into a year round, solar heated facility

that could service the needs of the local and visitor population, by adding a

disability access ramp to the existing 50 metre pool, a splash

children’s pool and a rehabilitation pool.

2. Look

into the public health and social benefit that this facility would provide.

3. Research

other council areas that have installed similar facilities such as Ballina

Shire to see how these types of projects have worked in other similar communities.

4. Allocated

the appropriate budget to conduct this study in the 2020/21 budget.

5. Identify

potential funding sources including money from Council’s own funds and

appropriate grant opportunities and relevant timelines.

|

Signed: Cr

Sarah Ndiaye

Councillor’s supporting information:

Mullumbimby has grown with the addition of Tallowood and the

amount of people serviced by this village has grown to 3,500 directly and

approximately 7,000 when you take in the hinterland and the suburbs to the

north such as Brunswick Heads, Ocean Shores and New Brighton. The shire has

long needed a year round place to swim laps for their physical and mental

health and more appropriate rehabilitation facilities for people recovering

from injury or just maintaining health aging practices. While a fully equipped

hydrotherapy pool may not be possible, a warm water pool for general aquatic

fitness programs and basic level aquatic therapy would be a highly appreciated

addition to our region.

The Open Space and Recreation Needs Study 2018 identified

that ‘our community wants recreation, sports and aquatic facilities to

meet the Shire’s needs’ and while their may be some funding

challenges to overcome, this pool has a long history of being able to garner

community support to make things happen. The first Chincogan Charge in 1960 was

a fundraiser to build the swimming pool and the second race happened in 1967 to

celebrate its opening. Since then the community have also raised money for some

of the upgrades and other refurbishments. Both the State and Federal

Governments have also had a variety of rounds of funding that a project such as

this could meet the criteria. It is important we get the feasibility study

underway to see if it is a viable option and to apply for these funding grants.

Notes from the Recreational Study regarding the pool

included:

“The Petria Thomas Swimming Pool is the only 50 metre pool in

the Shire. Open between October to March, some survey respondents indicated

they are keen for the facility to be heated and open year-round.

Council’s Access Consultative Working Group advised that access into the

facility is not currently provided, for example there is no disabled parking,

kerb and guttering or all abilities pedestrian access, making access to utilise

the facility difficult. It is recommended that the Access Consultative

Committee Working Group, Mullumbimby High School and Petria Thomas Swimming

Pool operators work with Council to review pedestrian movement to address these

issues. In addition, while it is extremely expensive to add a ramp into the

pool, any future retrofitting or redesign of the pool should consider the

addition of a ramp, especially with an ageing community.”

The Mullumbimby Residents Association has long been

interested in helping to make this vision a reality for our community and has

recently been collecting signatures in support of the project and garner

community interest. To date they have over 1,000 signatures in support. They

have also had preliminary concept drawings prepared and while they may not meet

all the necessary requirements, they allow people to reimagine the space and

the opportunities it could present. So far the response has been very

enthusiastic with hundred already signing the petition.

While discussions have gone on around the possibility of

redeveloping the pool at Main Beach or building an aquatic centre at the

Cavanbah Centre, there have been multiple challenges at both of these sites.

Byron Bay is getting a huge investment in both the bike track from Suffolk Park

to Byron as well as the multi-million dollar skate park that has been earmarked

for the area behind the YAC and the Byron Library. This project would help

service the needs of the broader community and add value to the experience of

living in the hinterland and the northern parts of the Shire.

For a long time the main objection has been the cost,

however the Ballina Shire have shown that this does not have to be the case.

Having completed a full overhaul of their facility, the new facility was

expected to continue running at a deficit, however it is now running at a

profit. The popularity of a facility like this could see it breaking even or

increasing revenue for council and providing a host of benefits for the community.

Staff comments by Michael Matthews, Manager Open Spaces and

Resource Recovery

(Management Comments must not include formatted

recommendations – resolution 11-979)

The redevelopment of the Petria Thomas Swimming Pool would

provide the opportunity to achieve full accessibility in compliance with

current standards and best practise. It would also provide significant

opportunity to improve the facilities operational efficiency through the use of

modern equipment and technologies.

There are recent examples of pool redevelopment to current

standards that have moved the facilities financial position from an operating

deficit to an annual profit through significantly improving the facilities

utilisation relative to its operating costs.

Financial/Resource/Legal Implications:

Aquatic facility design including upgrades is a specialist

field that involves multi-disciplinary engineering skills including Civil,

Electrical, Mechanical, Environmental and architectural disciplines. A

budget to achieve a Grant ready project that could achieve all of the desired

outcomes could be sought from the market and put forward within Council’s

2020/21 budget process.

Is the proposal consistent with any Delivery Program

tasks?

Yes

Such a project is consistent with Provide active and passive

recreational Community space that is accessible and inclusive for all.

Ensure ongoing maintenance and upgrade of inclusive community buildings and

swimming pools, Increase accessibility of facilities, Provide council buildings

which are water and energy efficient.

Notices of Motion 9.3

Notice of Motion No. 9.3 Positive

Change for Marine Life - River Warriors Program

File No: I2020/52

|

I move:

That Council supports Positive Change for Marine Life

in its request for $20,000 to employ a person locally to coordinate their

River Warriors Program as part of our overall objective of ‘Bringing

Back the Bruns’, creating a healthy river system, supporting our local

biodiversity and marine environment.

|

Attachments:

1 Letter of

Support from NSW Department of Primary Industries- River Warriors Program -

Positive Change for Marine Life, E2020/3535

Signed: Cr

Sarah Ndiaye

Councillor’s supporting information:

The Brunswick River

System is a vital lifeline in our region. For many years it has been neglected,

used as a dump site in parts, had inappropriate and non fish friendly crossings

built across it, it’s been polluted with toxic chemicals and run-off, had

cattle pollute it, had it’s vegetation cleared and weeds grow in and

around it. Through multiple initiatives that include the work of local

community groups, land owners, council and the Department of Fisheries,

we’re seeing a renewed interest in the rivers overall well being.

Positive Change for Marine Life are a

local environmental group that have worked tirelessly to reduce plastic waste

in our oceans and waterways and educate thousands of people along the way. They

started in the Byron Shire but have since branched out up and down the coast

and now overseas.

Positive Change for

Marine Life recently received notification that we were successful in a Federal

Government grant through recommendation from Justine Elliott’s office.

This will in part fund a River Warriors Coordinator to take over and ramp up

the Brunswick River project. They are seeking an additional $20,000 to cover

the funding gap and to employ a person as the joint River Warrior’s /

Byron Bay Coordinator two days per week.

Attached are the

reports from Phase I and II of our Queensland Government CSA grant, with total

funding allocated at $47,000. All of these outcomes were achieved over an

18-month period and had media coverage across channel 7 and 9 News, Gold Coast

Bulletin, 4ZZZ FM, ABC Radio Gold Coast and Brisbane, Gold Coast Bulletin, as

well as across social media networks. They clearly show the quality and

quantity of environmental benefit achieved in this period. We need this kind of

education and engagement to clean up the Bruns. PCFML have a proven track

record of delivering great outcomes for ours and other communities. While some

may suggest we should open this up to the public, no other organisation is

offering similar programs so going through an EOI process will remove the

opportunities presented by the current funding they have already been allocated

and waste valuable time.

About the River Warriors Program

Positive Change for

Marine Life’s (PCFML) River Warriors initiative commenced in July 2017

when PCFML sponsor, The Byron Bay Cookie Shack drew our attention to a large

amount of debris and pollution in the Brunswick River in northern NSW. The

business offered us their support to run a kayak-based clean-up in order to

collect the debris and find out exactly what was there and where it came from,

whilst raising awareness to the issue throughout the broader community.

In just one public-facing clean with

project partners The Byron Bay Cookie Shack, Go Sea Kayaks, Byron Bay Eco

Cruises and Kayaks and Mullum Cares, they managed to collect over 1.5 tonnes of

debris - with 34 volunteers covering a 12km section of the river. Over the course

of the following 6 months they developed a plan of action to address this issue

at its source through ongoing surveys and engagement programs. They called the

initiative River Warriors.

Reaching out to like-minded community

groups, organisations and individuals in specific regions across northern NSW

and SE QLD (which are both home to diverse species and where debris levels were

noticeably high), they commenced Phase I of their first full-time River

Warriors project on Tallebudgera Creek, QLD in May 2018.

The main focus for the River Warriors

projects is to:

1) Run

consistent kayak-based surveys from source to sea (or as close to these areas

as accessible) collating and recording data on type, quantity, presence and

source of marine debris in order to mitigate it;

2) Upload

data into our ongoing marine debris database, as well as Tangaroa Blue’s

Australian Marine Debris Initiative (AMDI) database in order to keep a record

of findings, as well as to feed into and support ongoing research into debris

patterns and solutions;

3) Produce

a Marine Debris Report Card, the first of its kind to not only highlight the

issue of debris in waterways, but also to develop realistic and ongoing

management solutions and a marine debris rating system for waterways based upon

key variables outlined in our findings;

4) Utilise

the Report Card to assist us in Phase II of the project, which aims to engage

the community in our work through: awareness programs, educational signage,

regular on-water clean-ups, as well as the exploration of strategic bins,

litter mitigation devices, enforcement and monitoring programs, as well as a

flood response plan;

5) Produce

a subsequent report at the completion of Phase II, highlighting successes and

challenges and determining ongoing actions to ensure the creek can continue to

move toward or maintain an ‘A’ rating in the Report Card;

6) Obtain

further funding for a Phase III component of the project, installing mitigation

measures, facilitating a local Action group to lead the way in moving the

waterway towards an “A” rating, and conducting another round of

surveys to monitor changes to debris loads since the programs inception.

Since they were awarded with a

Queensland Government Community Sustainability Action Grant to support the Tallebudgera

Creek project in early 2018, they have been awarded subsequent funding to roll

the project out across regions in Northern NSW, SE QLD and Brisbane area. They

continue gathering baseline data from waterways in need across NSW and QLD,

whilst engaging local stakeholders in practical, hands-on solutions to address

marine debris at its source - creating long term behavioural change and a

culture of stewardship for these places of incredible ecological, recreational

and economic importance.

Below is some information about River

Warriors school based education programs offer, which are free.

Our River

Warriors: Source to Sea educational programs engage students in the topics of

marine debris and ocean pollution. We outline the environmental, social and

human health impacts associated to human waste that currently affects our

ocean, as well as solutions that we can all take to address the issue at its

source. The 45 minute presentations engage students through a series of

questions, photographs, information and short videos that explain:

1) Why the

Ocean is important;

2) What is

marine debris;

3) The problems

associated to marine debris;

4) How we all

contribute to the problem;

5) How we can

work independently and collectively to solve the problem;

6) PCFML

and what we do;

7) Our

approach locally to solving the issue, including our River Warriors initiative

on the Brunswick River.

PCFML staff

hold a current Working With Children Card (QLD Blue Card), current First-Aid

Certificates and we hold public liability insurance to $20 million for up to 50

people on-water and unlimited numbers on land.

Staff comments by Lucy Wilson, Resource Recovery Education

Officer, Infrastructure Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

1. While

PCFML’s River Warriors Program is an important environmental initiative,

Council staff have committed to undertaking a transparent and equitable process

for engaging with community organisations requesting funding assistance of this

nature, through the Community Initiatives Program 2019. This program allows for

an allocation of up to $5,000 for this type of activity by a not for profit

organisation. Therefore, a direct request for financial assistance from Council

for a program - that has also not been identified as a strategic priority - conflicts

with this agreed process, a process that Positive Change for Marine Life

requested.

2. The

Notice of Motion states that “PCMFL are seeking an additional $20,000 to

cover the funding gap and to employ a person as the joint River Warrior’s

/ Byron Bay Coordinator two days per week.

3. The

River Warriors Program has not been identified as a project in Council’s

IDLEEP, nor does it align with any of the actions in the Integrated Waste

Management and Resource Recovery Strategy (for adoption), and as such there is

no allocated budget for a river clean-up project within Resource Recovery for

19/20.

4. Council

currently provides In-kind support for the River Warrior Program through

rubbish collection, waste disposal costs and staff time at an estimated cost of

between $400 - $500 per clean up.

5. The

River Warriors Program is more closely aligned with the overall objectives of

the Bringing Back the Bruns Project, and if supported, it is recommended that

it should sit within that program, however this would need to be specifically

confined to the River Warriors program, and not for a broader role across the

Shire. Council currently resources a full time position to run litter and

illegal dumping programs across the shire.

Financial/Resource/Legal Implications:

If the proposal is supported

by Council, appropriate funding source is General Revenue

Is the proposal consistent with any Delivery Program

tasks?

Yes - 3.2.2 Support community environmental and

sustainability projects

The Community initiatives program can provide up to $5,000

to a not for profit organisation.

Notices of Motion 9.4

Notice of Motion No. 9.4 Support

for Arts Northern Rivers

File No: I2020/173

|

I move:

That Council write to Arts Northern Rivers to express

our support for their open letter to the Hon Paul Fletcher MP and write to

the Minister for Communications, Cyber Safety, and the Arts expressing that

support.

|

Attachments:

1 Arts

Northern Rivers - Open Letter to the Minister, E2020/9678

Signed: Cr

Sarah Ndiaye

Councillor’s supporting information:

We join Arts Northern Rivers in expressing our concern and

dismay at the decision to abolish a dedicated Department of Communications and

the Arts and merging it into a mega Department of Infrastructure, Transport,

Regional Development and Communications. We ask the Government to reconsider

this decision. To ensure we continue to have a vibrant, innovative and valued

arts and creative industries sector it is imperative that our Federal

Government reflects its commitment to its growth. We believe the removal of

arts from the title of this important department sends the wrong message to the

sector and our nation.

Staff comments by Deb Stafford, Community and Cultural

Development Coordinator, Corporate and Community Services.

Staff agree with the need for a federal departmental

structure that explicitly names the arts and addresses dedicated arts

considerations, such as Department of Communications and the Arts. If the NoM

is adopted, staff will prepare the letter for the Mayor accordingly.

Financial/Resource/Legal Implications:

None identified.

Is the proposal consistent with any Delivery Program

tasks?

Yes. Delivery Program Action 2.2.1 requires Council to

‘Develop and maintain collaborative relationships with government,

sector and community’.

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

|

Community

Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and

sense of community

|

2.2

|

Support access

to a wide range of services and activities that contribute to the wellbeing

of all members of the Byron Shire community

|

2.2.1

|

Develop and

maintain collaborative relationships with government, sector and

community

|

Submissions and Grants 11.1

Submissions and Grants

Report No. 11.1 Submissions

and Grants Report - February 2020

Directorate: Corporate

and Community Services

Report

Author: Alexandra

Keen, Grants Coordinator

File No: I2020/131

Summary:

Council has submitted applications

for a number of grant programs which, if successful, would provide funding to

enable the delivery of identified projects. This report provides an update on

these grant submissions.

|

RECOMMENDATION:

That Council notes the report and Attachment 1

(E2020/7580) for the Byron Shire Council Submissions and Grants as at 3

February 2020.

|

Attachments:

1 Attachment

1 - Grants and Submissions List, e2020/7580

REPORT

This report provides an update on

grant submissions since the last report.

Successful applications

Council was partially successful

in receiving $12,000 for heritage advisory services and $11,000 for local

heritage grants under the NSW Office of Environment and Heritage Community

Heritage program.

Unsuccessful applications

Three applications were

unsuccessful:

· Create NSW – Annual Organisational Funding for Lone

Goat Gallery;

· Community Resilience Innovation Program – joint

application with Tweed Shire Council for Operational Recovery Networks Program;

and

· Community Heritage – Byron Shire Heritage

Conservation Area review.

Applications submitted

Eight applications were submitted by Council under various

grant programs in December 2019. This included the submission of four

applications for funding under the NSW Government’s Fixing Country Roads

Program 2019 (round 2), three applications were resubmitted and a further new

application to upgrade the roads in the Byron Arts and Industry Estate was

lodged.

Applications were also submitted for:

1. Connecting

Byron – Rail Corridor Restoration – Building Better Regions Fund

Round 4;

2. Upgrade

to the Ocean Shores Community Centre – Clubsgrants Infrastructure Round

2;

3. Upgrade

to Rifle Range Road – Fixing Local Roads; and

4. Upgrade

to Minyon Falls Road, Grays Lane and Seven Mile Beach Road – Fixing Local

Roads.

Upcoming grant opportunities

There are a number of upcoming grant opportunities for which

Council proposes to submit a funding application, including:

· Clubsgrant

– Infrastructure Grant Program Round 3 – Brunswick Heads Memorial

Hall;

· Active

Transport Grants – Balemo Drive Stage 2;

· Combating

Weeds and Pests during Drought;

· Flagship

Fish Habitat Rehabilitation – Bringing Back the Brunswick River Stage 2;

· Create NSW

– Multi-year Funding – Lone Goat Gallery.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 5: We have community led

decision making which is open and inclusive

|

5.6

|

Manage Council’s resources sustainably

|

5.6.12

|

Implement strategic grants management systems to deliver priority

projects for Byron’s community (SP)

|

5.6.12.4

|

Provide governance for grants management

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Under Section 409 3(c) of

the Local Government Act 1993 Council is required to ensure

that ‘money that has been received from the Government or from a public

authority by way of a specific purpose advance or grant, may not, except with

the consent of the Government or public authority, be used otherwise than for

that specific purpose’. This legislative requirement governs Council’s

administration of grants.

Financial Considerations

If Council is successful in

obtaining the identified grants, more than $21 million would be achieved which

would provide significant funding for Council projects. Some of the grants

require a contribution from Council (either cash or in-kind) and others do not.

Council’s contribution is funded.

The potential funding and

allocation is noted below:

|

Requested funds from funding bodies

|

$21,144,347

|

|

Council cash contribution

|

$3,570,219

|

|

Council in-kind contribution

|

$482,255

|

|

Other contributions

|

$700,000

|

|

Funding applications submitted and awaiting

notification (total project value)

|

$25,896,821

|

Consultation and Engagement

Cross-organisational consultation has occurred in relation

to the submission of relevant grants, and the communication of proposed grant

applications.

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Lease

over road reserve adjoining 27 Marine Parade Byron Bay

Directorate: General

Manager

Report

Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2019/2023

Summary:

The owner of 27 Marine Parade Byron Bay has requested a new

five year lease as per a condition of development consent (51.2015.1017).

Mandatory public notification of

the proposed lease resulted in two submissions being received.

This report recommends that

Council grant the proposed lease.

|

RECOMMENDATION:

That Council delegate to the General Manager,

the authority to grant a new five year lease to Mr Stewart over 118.9m²

of road reserve adjoining 27 Marine Parade Byron Bay under the following

conditions:

a) term

five (5) years with no holding over or option to renew;

b) initial

rent set at $4,500 (excl GST) and increased (not decreased) annually

thereafter by CPI (all groups Sydney);

c) lessee

to pay all:

i) outgoings

payable over the leased land,

ii) maintenance

costs, and

iii) lease

preparation costs.

d) lessee

provide a minimum of $20 million public liability insurance coverage.

|

Attachments:

1 Confidential

- Current Market Rental Report - part 27 Marine Pde Byron Bay - Lease to Scott

Stewart 2020., E2020/3616

2 Submission

1 proposed lease over public road reserve adjoining 27 Marine Pde Byron Bay, E2020/2937

3 Submission

2 proposed lease over public road reserve adjoining 27 Marine Pde Byron Bay, E2020/4506

REPORT

Council granted development

consent (51.2015.1017) for driveway crossover and works in a road reserve

adjoining 27 Marine Parade Byron Bay. A condition of consent required the

applicant to enter into a lease with Council under the Roads Act 1993

(NSW) for structures encroaching on to the road reserve.

As a result Council entered into a

five year lease with Mr Stewart over 118.9m² of road reserve adjoining 27

Marine Parade Byron Bay in 2015. Mr Stewart has requested a new five year

lease following the expiry of that lease on 9 April 2020.

Proposed lease:

Terms of the proposed lease will

include:

· Maximum term is five years,

· Initial rent of $4,500 (excl GST) per annum as set by an independent rent

valuation by Valuers Australia Real Estate Advisors;

· Rent to be increased (not decreased) annually thereafter by

Consumer Price Index (all groups Sydney) for the term of the lease.

· Lessee outgoings:

o all outgoings payable over the leased land,

o a minimum $20 million public liability insurance coverage,

and

o all maintenance.

· Lessor outgoings nil.

Notice of proposed lease:

Council must give notice of the

proposed lease for a period of at least 28 days for public comment. Notice was

given between 18 December and 20 January 2020 and Council received two

submissions.

|

Submission

|

Council response

|

|

1. Value of rent under the lease

2. If terms of the lease permits the lessee and

friends to park vehicles on the public road reserve

|

· Rent will commence at $4,500 (excl GST).

· The lease is required as condition of development consent

51.2015.1017. The lease provides exclusive possession to the lessee to occupy

an 118.39sq encroachment onto the road reserve plus a 36.3sq driveway

crossover.

|

|

1. Object to proposed lease, wording formalise

indicates public land is already being used.

2. Long-time occupant of the area and request that

Council not permit the continual take-over of public land by private

developers in the location.

|

· The lease is required as condition of development consent

51.2015.1017.

· Council notes the concern.

|

Council is required to duly

consider all submissions received before determine if to grant the proposed

lease. This report recommends that a new five year lease is granted to Mr

Stewart in accordance with condition of development consent 51.2015.1017.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 4: We manage growth and change responsibly

|

4.1

|

Support the

visions and aspirations of local communities through place-based planning and

management

|

4.1.3

|

Manage

development through a transparent and efficient assessment process

|

4.1.3.1

|

Assess and

determine development applications

|

Legal/Statutory/Policy

Considerations

Roads Act

1993 (NSW)

153 Short-term

leases of unused public roads

(1) A roads

authority may lease land comprising a public road (other than a Crown road) to

the owner or lessee of land adjoining the public road if, in its opinion, the

road is not being used by the public.

(2) However, a

lease may not be granted under this Division with respect to land that has been

acquired by RMS under Division 3 of Part 12 (being land that forms part of a

classified road) except by RMS.

(3) A lease

granted under this Division may be terminated by the roads authority at any

time and for any reason

154 Public

notice to be given of proposed lease

(1) Before

granting a lease under this Division, the roads authority must cause notice of

the proposed lease:

(a) to be

published in a local newspaper, and

(b) to be

served on the owner of each parcel of land adjoining the length of public road

concerned.

(2) The notice:

(a) must

identify the public road concerned, and

(b) must state

that any person is entitled to make submissions to the roads authority with

respect to the proposed lease, and

(c) must indicate the manner

in which, and the period (being at least 28 days) within which,

any

such submission should be made.

155 Public

submissions

Any person may make submissions to the

roads authority with respect to the proposed lease

156 Decision

on proposed lease

(1) After

considering any submissions that have been duly made with respect to the

proposed lease, the roads authority may grant the lease, either with or without

alteration, or may refuse to grant the lease.

(2) If the roads

authority grants a lease, the roads authority must cause notice of that fact to

be published in a local newspaper.

157 Special

provisions with respect to short-term leases

(1) The term of a

lease, together with any option to renew, must not exceed:

(a) except as

provided by paragraph (b), 5 years, or

(b) in the

case of a lease of land that has been acquired by the roads authority under Division

3 of Part 12, 10 years.

(2) A person must

not erect any structure on land the subject of a lease under this Division

otherwise than in accordance with the consent of the roads authority.

Maximum penalty: 10 penalty units.

(3) Such a

consent may not be given unless the roads authority is satisfied that the

proposed structure comprises a fence or a temporary structure of a kind that

can easily be demolished or removed

Financial Considerations

Rent received by Council over

the five year term of the lease will commence at $4,500 (excl GST) per annum

and increased (not decreased) annually thereafter by

Consumer Price Index (all groups Sydney) for the term of the lease.

Consultation and Engagement

Nil.

Staff Reports - General Manager 13.2

Report No. 13.2 Lease

to Scouts NSW for occupation of the Byron Bay Scout Hall

Directorate: General

Manager

Report

Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2019/1876

Summary:

The Scout Association of Australia trading as Scouts

Australia NSW has requested a new twenty (20) year lease over the Byron Scout

Hall, 29 Tennyson Street Byron Bay. The requested lease is consistent

with the Plan of Management over the land.

This report recommends that Council offer a ten (10) year

lease at fully subsidised rent and other outgoings to Scout Australia NSW in

accordance with Policy Section 356 Donations –

Rates, Water and Sewerage Charges.

The report recommends that the

proposed lease permit Scouts to hire out the Hall, at its discretion (but

consistent with the Plan of Management) with all hiring income to be used for

building maintenance and the payment of outgoings.

|

RECOMMENDATION:

1. That

Council grant a new ten (10) year lease to The Scout Association of

Australia over part of Folio 444/28/758207 known as the Byron Bay Scout Hall

for the purpose of a scouting activities.

2. That

Council authorise the publication of the new lease to The Scout Association

of Australia for a period of 28 days for public comment.

3. That

in the event that no comments are received, Council delegate to the General

Manager the authority to enter into a new lease referred to in 1 above with

the following minimum conditions:

a) term

ten (10) years;

b) annual

rent of $22,600 to be fully subsidised by Council as a section 356 donation;

c) outgoings

of general fixed rates, water and sewerage charges also fully subsidised by a

section 356 donation in accordance with

Councils Policy section 356 donations – rates, water and sewerage

charges;

d) all

lease preparation costs to be met by the Lessor;

e) the

Lessee to pay outgoings of water, sewer and waste management user charges;

f) general

maintenance costs to be met by the Lesser

g) authorise

the Lessee to hire out the Byron Scout Hall, at its discretion (but

consistent with the Plan of Management) and annually report to Council on its

hiring function.

4. That

in the event comments are received from the public exhibition, that a

new report be tabled at Council’s April meeting.

|

Attachments:

1 Confidential

- Current Market Rent Valuation (Valuers Australia) for the Scout Hall, Byron

Bay 2020., E2020/4911

REPORT

Community Land and Plan of

Management:

Lot 444 Section 28 DP 758207, 29

Tennyson Street Byron Bay, is Council owned land classified as community and

categorised for general community use.

The Plan of Management Byron Bay

Memorial Recreation Grounds (‘POM’) expressly authorises the grant

of a lease, in accordance with quadruple bottom line outcomes.

A lease over the Byron Bay Scout

Hall would provide:

a) Social outcomes: the provision of a

facility to engage young persons in scouting activities.

b) Environmental outcomes: the provision

of a facility to support Scouts to educate young members to participate in

environmental initiatives and training courses.

c) Economic outcomes: the provision of a

facility, at subsidised rent, to support Scouts to provide a range of

activities for young persons.

d) Governance outcomes: to secure the

long-term tenure of the facility to support scouting activities in Byron Bay.

A lease to the Scout Association

of Australia trading as Scouts Australia NSW (‘Scouts NSW’) for the purpose of a scout hall is consistent with

requirements of the POM core objective of general community use and quadruple

bottom line outcomes.

The Proposed Lease:

Scouts NSW has formally requested

a new lease over the Byron Bay Scout Hall as means to resolve the ownership of

the scout hall building and a way forward. Scouts NSW request:

· a 20 year lease under same terms and conditions as a prior

10 year lease that expired 30 June 2010;

· that Scouts contain to maintain and repair the building

except all structural repairs that will remain with Council;

· full management rights of the Hall including the right to

hire the Hall out to other community groups, not-for-profit organisations,

local schools and the RSL Club for Anzac and Remembrance Day events;

· permit income from hire activities to be expended on

maintenance and running expenses of the Hall; and

· perform scouting activities for the local community.

Term of Lease:

In accordance with the Local

Government Act, Council must seek public comment for at least 28 days for

any lease to be granted over community land.

The term of the lease (including

options) must not exceed thirty (30) years under s46(3) of the Act.

Ministerial consent is required for any lease term (including options)

exceeding 21 years and where objecting submissions are received for any lease

term (including options) exceeding 5 years.

Scout NSW is seeking a new 20 year

lease over the Byron Scout Hall; however Council staff has concerns about the

requested term on the following basis:

a) the current POM over the land,

recently adopted by Council, has a life span of 10 years to 2029 and any new

lease term should not exist beyond Councils planned use of the land;

b) existing leases granted over the land

are limited to 10 years; and

c) cultural change within society is

leading to the decreased participation rate by young people in Scouts as

demonstrated by the recent closure of the Bangalow Scout Group.

As a result Council staff

recommend that the maximum term of a lease new lease is 10 years.

Subsidies:

a) Rent

Scouts NSW is a registered charity (57 030 516 857) and is

eligible for fully subsidised rent. Market rent for the Scout Hall has

been established by an independent valuation at $22,600 per annum (exclusive of

GST).

In accordance with Councils Policy

section 356 donations – rates, water and sewerage charges, Council will

subsidise 100% of general rates and fixed water and sewerage charges. Other

outgoings are:

b) Lessee outgoings:

i. all usage charges for all services connected

to the Scout Hall including waste management user charges;

ii. insurances, public liability and contents for

full replacement costs;

iii. general maintenance and repair to the Scout

Hall;

iv. annual pest inspection and controls; and

v. security services.

c) Lessor outgoings:

i. annual fire inspections and statements;

ii. structural maintenance and repairs; and

iii. building insurance.

d) Hiring of the Scout Hall:

The proposed lease will permit the Lessee to hire out the

Scout Hall to community groups, not-for-profit organisation, schools and the

RSL Club and others at Scouts discretion (but consistent with the Plan

of Management) with all generated income expended

upon the maintenance and running expenses of the Hall.

Direct Negotiation:

Council is permitted to directly

negotiate the proposed lease with Scouts NSW in accordance with

s46A of the Local Government

Act, because the Lessee is a not-for-profit organisation.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and

sense of community

|

2.2

|

Support access

to a wide range of services and activities that contribute to the wellbeing

of all members of the Byron Shire community

|

2.2.2

|

Support and

facilitate accessible, high quality early childhood education and activities

|

2.2.2.1

|

Improve direct

service provision and sector development to provide quality accredited early

childhood education

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Local Government Act 1993 (NSW)

s46A Means of granting

leases, licences and other estates

(1)

A plan of management is to specify, in relation to the

community land to which it applies, any purposes for which a lease, licence or

other estate may be granted only by tender in accordance with Division 1 of

Part 3.

(2) Nothing in

this section precludes a council from applying a tender process in respect of

the grant of any particular lease, licence or estate.

(3) A lease

or licence for a term exceeding 5 years may be granted only by tender in

accordance with Division 1 of Part 3, unless it is granted to a non-profit

organisation.

s47 Leases, licences and

other estates in respect of community land—terms greater than 5 years

(1) If a

council proposes to grant a lease, licence or other estate in respect of

community land for a period (including any period for which the lease, licence

or other estate could be renewed by the exercise of an option) exceeding 5

years, it must:

(a) give

public notice of the proposal (including on the council’s website), and

(b) exhibit

notice of the proposal on the land to which the proposal relates, and

(c) give

notice of the proposal to such persons as appear to it to own or occupy the

land adjoining the community land, and

(d) give

notice of the proposal to any other person, appearing to the council to be the

owner or occupier of land in the vicinity of the community land, if in the

opinion of the council the land the subject of the proposal is likely to form

the primary focus of the person’s enjoyment of community land.

(2) A notice of

the proposal must include:

• information sufficient

to identify the community land concerned

• the purpose for which

the land will be used under the proposed lease, licence or other estate

• the term of the

proposed lease, licence or other estate (including particulars of any options

for renewal)

• the name of the person

to whom it is proposed to grant the lease, licence or other estate (if known)

• a statement that

submissions in writing may be made to the council concerning the proposal

within a period, not less than 28 days, specified in the notice.

(3) Any person

may make a submission in writing to the council during the period specified for

the purpose in the notice.

(4) Before

granting the lease, licence or other estate, the council must consider all

submissions duly made to it.

(5) The council

must not grant the lease, licence or other estate except with the

Minister’s consent, if:

(a) a person

makes a submission by way of objection to the proposal, or

(b) in

the case of a lease or licence, the period (including any period for which the

lease or licence could be renewed by the exercise of an option) of the lease or

licence exceeds 21 years.

(6) If the

council applies for the Minister’s consent, it must forward with its

application:

• a copy of the plan of

management for the land

• details of all

objections received and a statement setting out, for each objection, the council’s

decision and the reasons for its decision

• a statement setting out

all the facts concerning the proposal to grant the lease, licence or other

estate

• a copy of the public

notice of the proposal

• a statement setting out

the terms, conditions, restrictions and covenants proposed to be included in

the lease, licence or other estate

• if the application

relates to a lease or licence for a period (including any period for which the

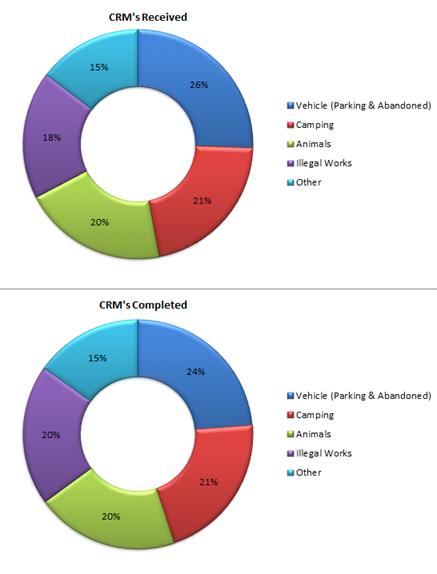

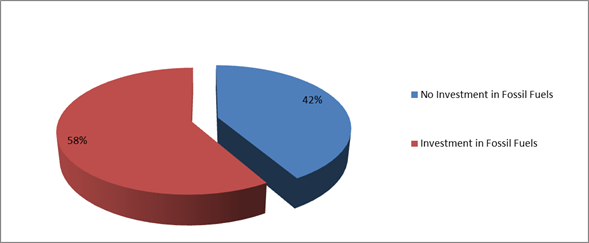

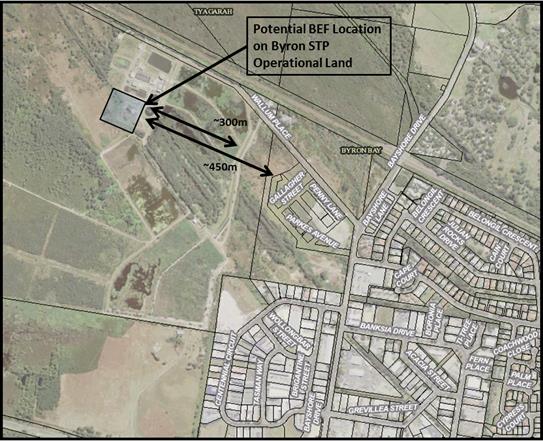

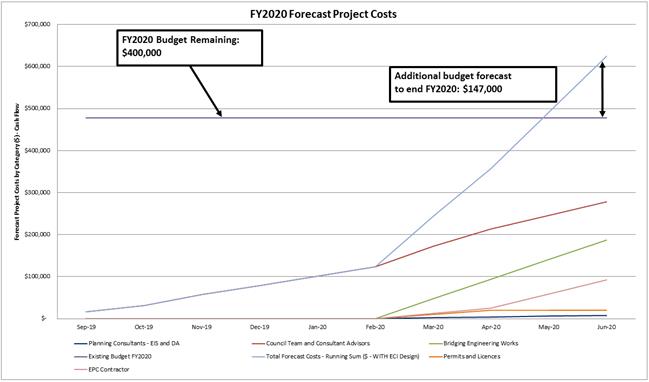

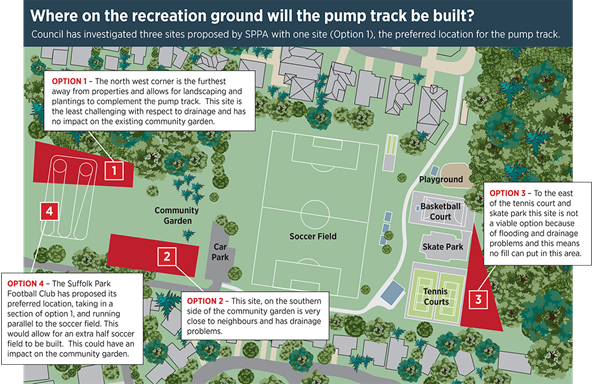

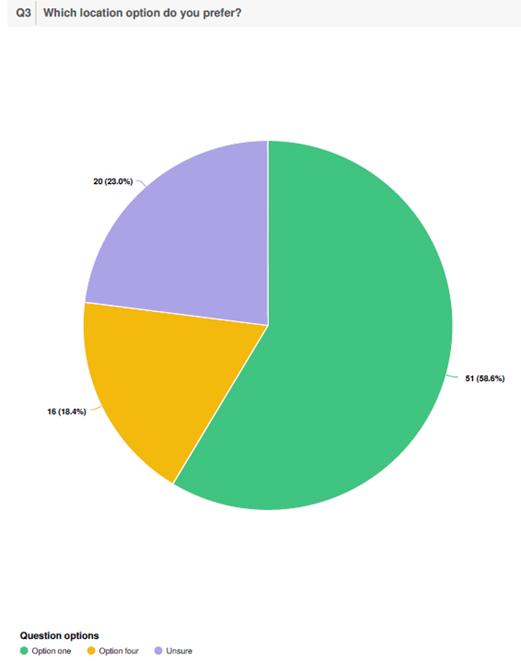

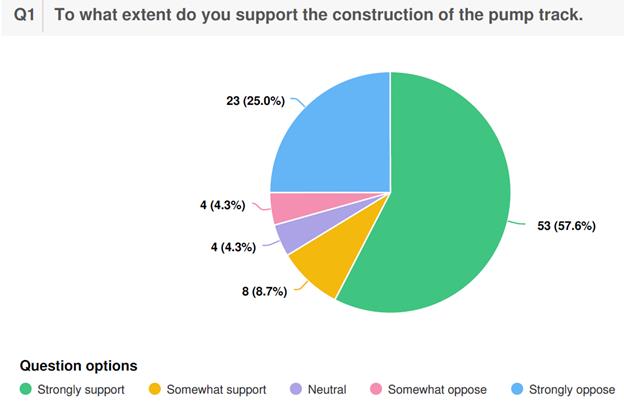

lease or licence could be renewed by the exercise of an option) exceeding 21