Agenda

Agenda

Ordinary Meeting

Thursday, 26 May 2022

Agenda

Agenda

Ordinary Meeting

Thursday, 26 May 2022

Agenda Ordinary Meeting

held at Conference Room, Station Street, Mullumbimby

commencing at 9.00am

Public access relating to items on this agenda can be made between 9:00 and 10:30 am on the day of the meeting. Requests for public access should be made to the General Manager or Mayor no later than 12:00 midday on the day prior to the meeting.

Mark Arnold

General Manager

CONFLICT OF INTERESTS

What is a “Conflict of Interests” - A conflict of interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council official has that does not amount to a pecuniary interest as defined in the Code of Conduct for Councillors (eg. A friendship, membership of an association, society or trade union or involvement or interest in an activity and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter if the interest is so remote or insignificant that it could not reasonably be regarded as likely to influence any decision the person might make in relation to a matter or if the interest is of a kind specified in the Code of Conduct for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a matter if the pecuniary interest is the interest of the person, or another person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a matter if:

· The person’s spouse or de facto partner or a relative of the person has a pecuniary interest in the matter, or

· The person, or a nominee, partners or employer of the person, is a member of a company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the following:

(a) the parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or adopted child of the person or of the person’s spouse;

(b) the spouse or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary interest in a matter:

· If the person is unaware of the relevant pecuniary interest of the spouse, de facto partner, relative or company or other body, or

· Just because the person is a member of, or is employed by, the Council.

· Just because the person is a member of, or a delegate of the Council to, a company or other body that has a pecuniary interest in the matter provided that the person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

· A Councillor or a member of a Council Committee who has a pecuniary interest in any matter with which the Council is concerned and who is present at a meeting of the Council or Committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

· The Councillor or member must not be present at, or in sight of, the meeting of the Council or Committee:

(a) at any time during which the matter is being considered or discussed by the Council or Committee, or

(b) at any time during which the Council or Committee is voting on any question in relation to the matter.

No Knowledge - a person does not breach this Clause if the person did not know and could not reasonably be expected to have known that the matter under consideration at the meeting was a matter in which he or she had a pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts & the option chosen will depend on an assessment of the circumstances of the matter, the nature of the interest and the significance of the issue being dealt with. Non-pecuniary conflicts of interests must be dealt with in at least one of the following ways:

· It may be appropriate that no action be taken where the potential for conflict is minimal. However, Councillors should consider providing an explanation of why they consider a conflict does not exist.

· Limit involvement if practical (eg. Participate in discussion but not in decision making or vice-versa). Care needs to be taken when exercising this option.

· Remove the source of the conflict (eg. Relinquishing or divesting the personal interest that creates the conflict)

· Have no involvement by absenting yourself from and not taking part in any debate or voting on the issue as of the provisions in the Code of Conduct (particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993 – Recording of voting on planning matters

(1) In this section, planning decision means a decision made in the exercise of a function of a council under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development application, an environmental planning instrument, a development control plan or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register containing, for each planning decision made at a meeting of the council or a council committee, the names of the councillors who supported the decision and the names of any councillors who opposed (or are taken to have opposed) the decision.

(3) For the purpose of maintaining the register, a division is required to be called whenever a motion for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described in the register or identified in a manner that enables the description to be obtained from another publicly available document, and is to include the information required by the regulations.

(5) This section extends to a meeting that is closed to the public.

1. Public Access

3. Requests for Leave of Absence

4. Declarations of Interest – Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary Interest Returns (Cl 4.9 Code of Conduct for Councillors)

6. Adoption of Minutes from Previous Meetings

6.1 Ordinary Meeting held on 28 April 2022

6.2 Extraordinary Meeting held on 19 May 2022

7. Reservation of Items for Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 Land and Funds for Emergency Accommodation..................................................... 7

9.2 Non-compliant companion animals........................................................................... 14

9.3 Parking meter time and cost amendments.............................................................. 19

9.4 Capricornia Canal and Marshalls Creek.................................................................. 25

9.5 Lobbying on key issues for flood impacted communities...................................... 30

9.6 Byron Bay Community Association support............................................................ 32

9.7 North Byron drainage and sewerage status............................................................ 35

9.8 North Byron Shire Masterplan.................................................................................... 38

9.9 Rebuilding after the floods.......................................................................................... 40

10. Petitions

11. Submissions and Grants

11.1 AGRN1012 Natural Disaster Funding - Local Government Recovery Grants... 45

11.2 Grants April 2022......................................................................................................... 50

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Nomination of Councillors to Byron Masterplan Guidance Group....................... 54

Corporate and Community Services

13.2 Mayor and Councillor Remuneration 2022/23......................................................... 57

13.3 Council Resolutions Quarterly Review - Q3 - 1 January to 31 March 2022....... 62

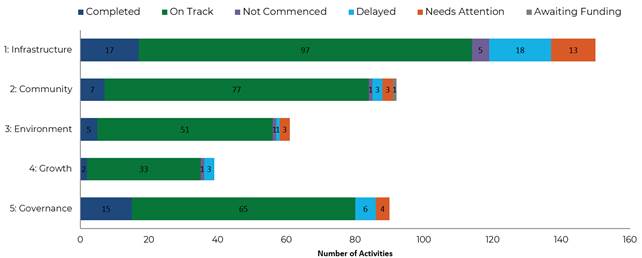

13.4 Operational Plan 2021/22 Quarter 3 Report - Q3 - 1 January to 31 March 2022 65

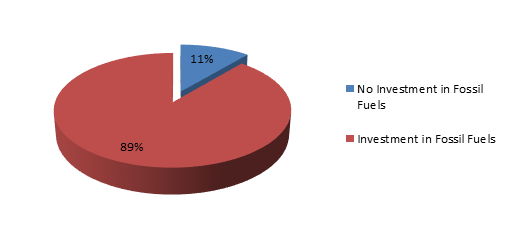

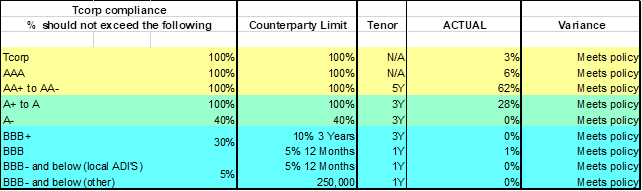

13.5 Council Investments - 1 April 2022 to 30 April 2022.............................................. 69

13.6 Budget Review - 1 January 2022 to 31 March 2022.............................................. 77

Infrastructure Services

13.7 Byron Shire Rail with Trail (Update).......................................................................... 90

13.8 Vallances Road PRG Update.................................................................................... 98

14. Reports of Committees

Infrastructure Services

14.1 Report of the Floodplain Management Advisory Committee Meeting held on 21 April 2022............................................................................................................................. 101

14.2 Report of the Water and Sewer Advisory Committee Meeting held on 21 April 2022...................................................................................................................................... 104

14.3 Report of the Local Traffic Committee Meeting held on 10 May 2022.............. 107

15. Questions With Notice

15.1 Emergency Plans....................................................................................................... 111

15.2 Fill for urban development on the Shire’s floodplains.......................................... 113

Councillors are encouraged to ask questions regarding any item on the business paper to the appropriate Director prior to the meeting. Any suggested amendments to the recommendations should be provided to Councillor Support prior to the meeting to allow the changes to be typed and presented on the overhead projector at the meeting.

BYRON SHIRE COUNCIL

Notices of Motion 9.1

Notice of Motion No. 9.1 Land and Funds for Emergency Accommodation

File No: I2022/353

I move:

1. That:

b) Council applies for funding from State and Federal government to provide the community with Temporary Supported Emergency Accommodation.

c) Council allocates a portion of the Mayoral Fund to specifically finance Temporary Supported Emergency Accommodation for the community in need, to be made available for Council owned, State Owned, Crown land or Private land.

2. That:

b) Council identifies all parcels of Council owned land that could hold Temporary Supported Emergency Accommodation for residents affected by floods, fires or any natural or declared national disasters.

b) Council owned land could host Temporary Supported Emergency Accommodation that includes pet friendly accommodation options that may not be provided through private landholders or elsewhere.

c) Council’s Planning Department submits any necessary Development Applications or Planning amendments to facilitate all manner of Temporary Supported Accommodation types such as motorhomes, tiny homes, modular and pod homes on Council owned land.

Signed: Cr Sama Balson

Councillor’s supporting information:

It was identified during our last Flood response meeting, that Byron Shire currently has over 500 households and1,287 people displaced by the February/ March floods 2022. Byron Shire already had a housing emergency; we now have a housing catastrophe.

I note that there is now a provision by State Government for landlords to host mobile homes for persons affected by the flood national emergency and that there is intended State funding as well as potential State land in discussion that may provide accommodation pathways, however right now there is private land and potential council owned land that may provide additionally needed accommodation. Funding remains a key issue to get this underway expediently.

If we identify and access existing funds available, we can start the delivery of housing outcomes alongside State Initiatives, that can broaden the scope and reach a higher demand for the diverse accommodation needed.

Pet friendly accommodation is desperately needed for local residents who are otherwise being offered emergency accommodation as far away as Grafton or South Brisbane. Families and individuals already facing flood trauma should not be faced with the additional trauma of having to leave their family pets to be able to stay near work and schools in the Byron Shire.

We have a duty of care to ensure we are doing everything within our power to support the community during such a time of need. Please let us ensure all options are being considered and all funding that could be made available to provide emergency accommodation is made available.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy and James Brickley, Manager Finance:

The recommendations of this Notice of Motion (NOM) are divided into two sections – finance and planning. Staff responses have been provided accordingly below.

Part 1 Finance:

· Council’s Finance Department identify any matured stocks, bonds or other funds that are not already committed to specific purposes and allocate the identified funds to the purchase of Supported Temporary Emergency Accommodation and infrastructure to support this accommodation that may go on council, State, Crown or private land.

· Council applies for funding from State and Federal government to provide the community with Temporary Supported Emergency Accommodation.

· Council allocates a portion of the Mayoral Fund to specifically finance Temporary Supported Emergency Accommodation for the community in need, to be made available for Council owned, State Owned, Crown land or Private land.

Comments from Manager Finance

In summary, it is suggested that Council does not have any funds adequate to assist with part 1(a) of this Notice of Motion.

The reference to bonds, stocks or other funds are assumed to be a reference to Council’s investment portfolio. Essentially the value of Council’s investment portfolio is committed for specific purposes and represents funds that are set aside for specific purposes already determined by Council through allocation in its current 2021/2022 budget and annual adoption of its Financial Statements.

Council has an adopted goal of maintaining an unrestricted cash balance of $1million. Based on the current 2021/2022 budget, this balance is estimated to be at $481,000 on 30 June 2022 but this outcome is prior to consideration of any financial impact upon Council associated with the February/March 2022 flood event. Council is currently half a million dollars below its preferred target to maintain some form of buffer against unforeseen expenditure or revenue loss.

Council is yet to consider the 31 March 2022 Quarterly Budget Review that will be presented to the 26 May 2022 Ordinary Meeting. It is likely that the current budget deficit for 2021/2022 of $36,600 may very well increase and therefore the unrestricted cash balance may very well further decline due to the following:

· Further decline in interest revenue from current historic low interest rates.

· Cumulative impacts of revenue losses since 1 July 2021 due to the Pandemic

· The need for Council to identify funding of up to $200,000 as its contribution to the restoration of infrastructure damaged by the floods.

· Council may need to absorb costs associated with the flood recovery that may not be funded but already incurred via any Commonwealth or State Government natural disaster funding

Information was recently provided to Councillors about the other problems that would be created if it reallocated any of its reserves known as ‘internal restrictions’ from their designated purposes. Council cannot reallocate any of its reserves known as ‘external restrictions’.

It can only be stressed that Council needs to be careful with its current financial position given the current circumstances that the February/March 2022 flood event has presented to Council itself and that it really does not have the capacity or ability to support in any meaningful way what Part 1(a) of this Notice of Motion is suggesting.

Whilst Part 1(c) of this Notice of Motion suggests that Council reallocate part of the Mayoral Fund to finance Temporary Supported Emergency Accommodation, which is a decision for Council, that may require Council to alter the terms of reference for this Fund. That aside, at the time of preparing this response, the Mayoral Fund is yet to receive any donations.

Part 2 Planning:

Comments from Director Sustainable Environment and Economy:

· Council identifies all parcels of Council owned land that could hold Temporary Supported Emergency Accommodation for residents affected by floods, fires or any natural or declared national disasters.

· Council owned land could host Temporary Supported Emergency Accommodation that includes pet friendly accommodation options that may not be provided through private landholders or elsewhere.

· Council’s Planning Department submits any necessary Development Applications or Planning amendments to facilitate all manner of Temporary Supported Accommodation types such as motorhomes, tiny homes, modular and pod homes on Council owned land.

Since the 2022 flood events staff have worked tirelessly and proactively alongside state government including the Premiers Department, Planning Department and Resilience NSW, as well as other northern region councils to identify solutions to house those displaced and living in temporary / emergency accommodation the result of the flood events.

To this end:

· A web link has been provided to advise of Temporary accommodation options - Byron Shire Council (nsw.gov.au) as per the recent State Government announcements. Separately, enquiries from landowners about camping ground and or caravan park development on private land for housing those displaced from the 2022 flood events are being logged and responded to as required by staff.

· 20 motorhomes have been set up at Byron Hospital for use in relation to COVID – servicing the whole region – Northern Rivers Health initiative.

· Staff identified around 14 council and crown land sites for consideration for temporary housing. These sites were presented to the Department of Planning (DPE) Flood Housing Recovery Team for consideration. Advice back from the Team was that 4 of these sites were deemed appropriate for immediate use and would be prioritised for temporary accommodation by the State Government. The remainder of the sites could be further considered for medium to longer term housing needs as part of the wider flood housing recovery process.

· Following this, staff met with representatives of the State Government Architect’s office to look at the various forms of temporary accommodation available, and that could suit the prioritised sites, as well as confirming site planning and set up requirements to ensure that safe occupation and servicing of the sites could occur.

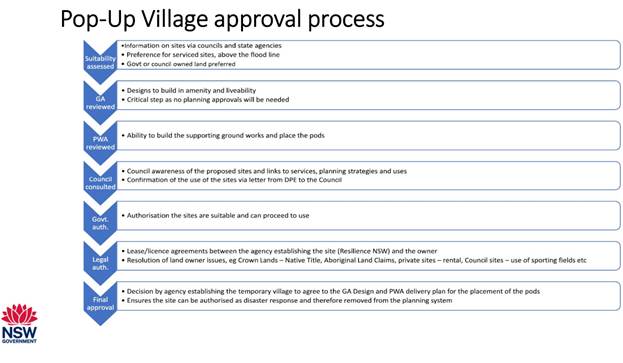

· Director Sustainable Environment and Economy now sits on the State Housing Recovery Taskforce. This Taskforce is a cross agency group within the NSW Government Flood Recovery Governance structure that has been set up to address short, medium, and long-term housing issues arising out of the 2022 flood events. This taskforce meets weekly. The key points from the most recent meeting being:

o 17 plus sites across 5 LGAs identified for temporary housing for 2000 plus households.

o Pop up temporary housing village designs progressing with each council on their priority sites.

o The key selection criteria include: • impacts of hazard (flooding and bushfire) • land ownership • current planning controls • access to water, sewerage, electricity, and roads • access to local services and shops

o Planning/SEPP amendments to enable the temporary housing on these sites expected to be notified shortly

o Notification process about the temporary housing sites aka pop-up villages in each council area to be coordinated by DPE Flood Recovery Team & Resilience NSW. Council to be consulted and advised of this as it is to occur.

o Pod Procurement update provided – multiple options looked at – EOI process used with a matrix of type, number, and delivery time frame. These need to be matched with sites. Supply is a challenge.

o Legislation changes to enable temporary housing on prioritised sites to be valid for up to 5 years. As such site planning must be undertaken properly.

o A community housing provider will be appointed as site manager of each of the sites to ensure appropriate selection and management of occupants, alongside Resilience NSW as the land manager for the length of the lease.

o Further funding package announcements are likely for planning and engagement re recovery and rebuilding options for flood impacted communities; to support emergency accommodation needs, support extension of emergency accommodation; to address the undersupply of social and affordable housing pre flood.

Below is a summary of the State Government endorsed process for temporary housing:

Below is a link to a recent announcement of the Ballina Shire ‘pod village’ and funding from the NSW Premier for investment in temporary modular housing to give people displaced by floods a home while they rebuild their lives.

$350 million modular housing package for flood-affected communities | NSW Government

Staff are confident that the 4 prioritised sites in Byron Shire will be progressed to announcement in the coming week/s.

In addition to the above, prior to easter, staff went about identifying emergency accommodation options for those displaced by holidaymakers following media reports that many people would be left car camping in the streets. Site availability at Mullumbimby Showground, Bangalow Showground investigated for motorhome, caravans, and tents.

Discussions with Service NSW also ensued about meanwhile use buildings in the Byron Town Centre.

As a last resort, the Cavanbah Sports Centre carpark was proposed as a pop-up drive-in camp area. A request for igloo style lockable tents was also made to DPE Flood Recovery Housing team after these were put on the table as an option by the State Government Architect’s office. These were not available as it seems. Notwithstanding the above, the camp area was established for the easter period (in consultation with the Mullumbimby Neighbourhood Centre), with no take up use.

Financial/Resource/Legal Implications:

Various implications re resourcing and funding depending on resolution of council.

Is the proposal consistent with any Delivery Program tasks?

|

CSP Objective |

CSP Strategy |

DP Action |

|

Community Objective 4: We manage growth and change responsibly |

4.5: Work to improve community resilience in our changing environment |

4.5.1: Develop and implement strategies for our community's needs |

While there is an action that this work can be linked to in the current Delivery Program, it needs to be understood that there is no current Operational Plan link to the 2022 Flood Event. This has meant that many staff have been redeployed and or seconded to this work, which has and is having an impact on current adopted Operational Plan activities.

BYRON SHIRE COUNCIL

Notices of Motion 9.2

Notice of Motion No. 9.2 Non-compliant companion animals

File No: I2022/283

1. Notes the recent perceived increase in the number of dogs visible in the Shire.

2. Acknowledges that a ‘Dogs in Public Spaces’ Strategy is being developed but the Community Engagement stage has been delayed by the recent floods

3. Shares the concern of many residents and visitors at the numbers of dogs in sensitive ecological areas and on public beaches and barking dogs in residential areas

4. Notes that there is substantial evidence demonstrating that the presence of dogs has a negative impact on biodiversity

5. Notes the priorities regarding dogs and cats in the adopted (Council Ordinary 24/3/22) Compliance Priorities Program Report 2021; and

a) requests staff to put further priority and emphasis on nuisance or off-leash dogs in environmentally sensitive areas such as Lilly Pilli, Belongil and Tallows estuaries and adjacent beaches,

b) requests staff to put further enforcement priority and emphasis on off-leash dogs in towns and villages,

c) enhances community messaging of 5a) and 5b) through local media and any other channels,

d) conveys the same to tourism and accommodation operators

6. Prepares a six-month review report, including any barriers to compliance in this area; and

7. Continues to work with NPWS to discourage the presence of dogs in National Parks and reserves.

Signed: Cr Michael Lyon and Cr Cate Coorey

From the Compliance Priorities Program Report 2021:

Very High Priority 1.3

Dangerous and/or menacing dogs;

High Priority 2.4

Uncontrolled dogs and/or cats including those kept on land where Policy or

Development consent prohibits it.

Routine Priority 4.1

Companion animals with a high emphasis on high visibility enforcement and public education

|

Customer Request Management Received 2021 |

|

|

|

Dogs Attacks |

101 |

|

|

Dogs Barking |

128 |

|

|

Dogs Found |

123 |

415 |

|

Dogs Nuisance |

292 |

|

|

Dogs Restricted |

5 |

|

|

TOTAL |

649 |

|

|

Companion Animal related penalty infringements issued on daily patrols |

57

|

$23,115 value of fines |

There appears to be an increase of dogs in the Shire in public places. News reports say that there is an overall increase of dogs Australia wide: https://www.dailytelegraph.com.au/news/nsw/australian-pet-ownership-reaches-record-high-during-covid-pandemic/news-story/3d6bafa280bd2715056c28a4961aeecd

Dogs with well-behaved owners are not the focus of this NoM - rather, it is people who do not control their dogs in places where they should be controlled. Byron can only be dog-friendly if dogs and their owners are people and wildlife-friendly. Many people are experiencing being uncomfortable or threatened by the presence of dogs and they are often frightening to children. Dogs have been seen running on beaches where they are not allowed, disturbing beachgoers and attacking other dogs. I have seen dogs chasing wallabies. It is terrifying for the wallaby, but I have had an owner say to me that it’s just the dog having a bit of fun. It can literally cause the animal to die of fright.

Byron has a strong history of preserving and protecting wildlife but this is being eroded by increasing numbers of visitors into wild areas and local people whose actions threaten our biodiversity. The world is in a biodiversity crisis, caused by human activity – particularly habitat loss or incursions into habitat.

The presence of dogs as an inhibitor of bird activity is well researched, eg:

https://www.researchgate.net/publication/6055768_Four-legged_friend_or_foe_Dog_walking_displaces_native_birds_from_natural_areas

Peter B. Banks and

Jessica V. Bryant. School of Biological, Earth and Environmental Sciences,

University of New South Wales.

STUDY USED SEVERAL NATIONAL PARKS SITES WITH:

1. PERSON WALKING WITH DOG

2. PERSON WALKING ALONE

3. CONTROL – NO WALKING ACTIVITY

· Cautious conservation managers and government legislation typically ban domestic dogs from sensitive areas such as national parks and reserves, however, these bans induce strong protest from dog-walking lobbyists who cite a lack of evidence because multispecies responses of wildlife to dog walking are unknown.

· Dog walking caused a 41% reduction in the numbers of bird individuals detected and a 35% reduction in species richness (compared with untreated controls)

· Humans walking alone also induced some disturbance but typically less than half that induced by dogs. Ground dwelling birds appeared most affected; 50% of the species recorded in control sites were absent from dog-walked sites.

· For birds which did not flee the site, there were 76% fewer individuals within 10 m of when dog walking occurred compared with control sites, suggesting that birds were seeking refuge away from the immediate vicinity of the threat.

· In the experiment testing bird responses to single and multiple walkers without dogs, bird abundance did not change with the addition of another human. This confirms that birds responded uniquely and additively when do and additively when dogs accompany walkers.

· Even dogs restrained on leads can disturb birds sufficiently to induce displacement and cause a depauperate local bird fauna.

· These effects were in excess of significant impacts caused by human disturbance, which also caused decline in diversity and abundance. Responses to transient human disturbance are well known.

by Sarah Nagel, Manager Public and Environmental Services, Sustainable Environment and Economy:

Staff have spoken to Cr Lyon and Cr Coorey prior to the agenda being published to clarify this notice of motion.

Section 32A of the Companion Animals Act defines a ‘nuisance dog’ to be:

a) is habitually at large, or

b) makes a noise, by barking or otherwise, that persistently occurs or continues to such a degree or extent that it unreasonably interferes with the peace, comfort or convenience of any person in any other premises, or

c) repeatedly defecates on property (other than a public place) outside the property on which it is ordinarily kept, or

d) repeatedly runs at or chases any person, animal (other than vermin and, in relation to an animal, otherwise than in the course of droving, tending, working or protecting stock) or vehicle, or

e) endangers the health of any person or animal (other than vermin and, in relation to an animal, otherwise than in the course of droving, tending, working or protecting stock), or

f) repeatedly causes substantial damage to anything outside the property on which it is ordinarily kept.

Pursuant to Council’s 2022 Compliance Priorities Program, dangerous or menacing dogs fall within the category of ‘very high priority’, uncontrolled dogs fall with the category of ‘high priority’ and noise disturbance (barking dogs) falls with the category of ‘high priority.

Council’s Animal Enforcement Officers patrol areas that have been identified as non-compliant and areas that are notified to Council by the community. Officers also investigate reports of nuisance dogs in accordance with Council’s Enforcement Policy. Officers undertaking these duties are ‘Authorised Officers’ pursuant to the Companion Animals Act 1998 and undertake their duties with the ability to exercise discretion.

Any approach to enforcement of Companion Animal Act offences must be consistent with the intent and objectives of the relevant legislation (including the Companion Animals Act 1998), procedural fairness, natural justice, due process, the NSW Ombudsman’s Enforcement Guidelines for Councils, Council’s Enforcement Policy and Council’s 2022 Compliance Priorities Program.

The concerns relating to nuisance dogs in environmentally sensitive areas is acknowledged. The concerns relating to off-leash dogs and barking dogs in towns and villages is acknowledged.

Staff can improve community safety in these areas though prompt and effective responses via visible and targeted patrols of areas with high reports of non-compliance with proactive enforcement of Companion Animals Act offences.

Staff can enhance community messaging through local media and other means; as well as conveying this message to tourism and accommodation operators.

Staff can prepare a six-month report reviewing progress and noting any barriers to compliance in this area.

Staff will continue to work with NPWS to discourage the presence of dogs in National Parks and Reserves.

Financial/Resource/Legal Implications:

Nil

Is the proposal consistent with any Delivery Program tasks?

Yes

2.4.3.5 Provide Companion Animal Management Services

2.4.3.6 Facilitate Companion Animal Education

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and sense of community |

2.4: Enhance community safety and amenity while respecting our shared values |

2.4.3: Enhance public safety, health and liveability through the use of council's regulatory controls and services |

2.4.3.5 |

Provide companion animal management services |

|

Community Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and sense of community |

2.4: Enhance community safety and amenity while respecting our shared values |

2.4.3: Enhance public safety, health and liveability through the use of council's regulatory controls and services |

2.4.3.6 |

Facilitate companion animals’ education |

BYRON SHIRE COUNCIL

Notices of Motion 9.3

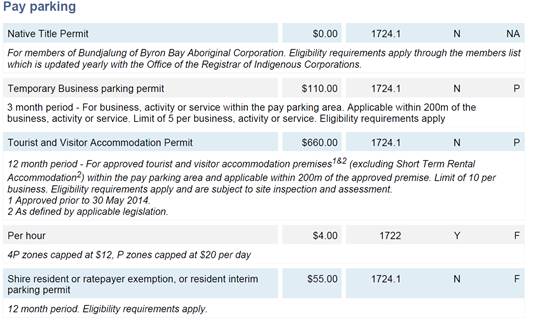

Notice of Motion No. 9.3 Parking meter time and cost amendments

File No: I2022/496

I move:

1. That Council increases the parking meter changes for non Byron Shire residents except for local businesses who employ staff outside of the area.

2. That Council re-evaluates the costs and time durations of current parking meter charges by:

a) Increasing parking fees to $7 per hour

b) Increasing one and two hour parking limits to three & four hours, to allow greater time for people to engage with local businesses and activities.

3. That the charges for local residents, ratepayers, and businesses and staff working in Byron Shire be decreased as follows:

Byron Shire Residents and Rate payers: $25 p/a (reduced from $55 per annum)

Temporary business parking: $60 p/a (reduced from $110) plus waive the 5 person limit to meet the need for the number of employees per business who travel in from outside the Byron Shire.

Signed: Cr Sama Balson

Councillor’s supporting information:

It’s been many years since the cost of parking in Byron Shire has been reevaluated, meanwhile the cost of housing for the community, the cost of food and basic living has increased substantially.

The cost of tourism on the Byron Shire impacts the local community in multiple ways. It reduces the number of housing stock for local residents, by tying up long term accommodation in holiday letting.

Added cars on the roads impact the state of the roads and infrastructure. Added tourism also impacts on systems such as waste, sewer and drainage.

In light of existing high impacts, now multiplied by flood impacts, we must raise internal revenue to help rebuild and provide ongoing support to our community.

Bed taxes and further parking meters are great ideas, but they are not immediate. These proposed increases in existing parking meter fees would provide fast and effective much needed funds, that will largely come from the tourist dollar whilst reducing cost for locals and workers within our community.

The revenue from the pay parking scheme since it was expanded is provided in the table below based on full financial years with 2021/2022 year to date and these revenues incorporate both meter revenue and permit revenue:

In the table below, the years 2019/2020, 2020/2021 and 2021/2022 have been impacted by COVID and more recently floods so may not necessarily be considered what could be called ‘normal years’. The years 2017/2018 and 2018/2019 are considered normal and represent where meter revenue has peaked where the fees set at that time were $4.00per hour.

The current pay parking fees and charges for 2021/2022 at outlined below at $4.00 per hour.

|

Year |

Meter Revenue $ |

Permit Revenue $ |

Total Revenue $ |

|

2016//2017 |

2,935,435 |

582,901 |

3,518,336 |

|

2017/2018 |

3,685,876 |

611,016 |

4,296,892 |

|

2018/2019 |

3,665,772 |

609,101 |

4,274,873 |

|

2019/2020 |

3,007,405 |

545,943 |

3,553,348 |

|

2020/2021 |

3,361,172 |

555,941 |

3,917,113 |

|

2021/2022 year to date 9/5/2022 |

1,853,702 |

436,734 |

2,290,436 |

|

If Council was to raise the fee to $7.00per hour, that is a 75% increase on the current fee.

Basing revenue at $3.66million on 2018/2019, the most recent ‘normal year’, that could potentially increase the revenue by another $2.75million to total $6.41million annually excluding permits.

In addition, I propose to increase the length of time tourists and locals can come and enjoy what is on offer, increasing one and two hour zones to three & four hours; this gives people an opportunity to enjoy a meal in local cafes and restaurants, browse local stores allowing adequate shopping time and enjoy outdoor recreation and other tourist attractions, such as kayaking, diving, a walk along coastlines or climbing to the lighthouse for example. Shorter parking times alongside increased fees may be a deterrent for tourist enjoyment, however increased prices with increased time limits would help to balance out the experience of enjoying what this beautiful place has on offer, with the benefit of increasing both revenue to support the community and allow time to enjoy local business and other natural attractions.

As per Table 2 Above and response from council staff:

“if Council were to make the scheme free for locals, the revenue loss most likely would be the value of the parking permits as a guide. Most of the permits issued are for residents so there is the potential to lose up to $600,000 in revenue… “

As the scheme currently operates, locals do not pay for parking if they have a valid parking permit ($55 fee) and abide by the time limit.

Again, the time limit increase will benefit local community members to enjoy greater benefits of what their community has on offer, including longer time to enjoy family & recreational activities.

I therefore propose that we reduce & amend the costs to the following:

Native Title permit: Remains $0

Byron Shire Residents and Rate payers: $25 p/a (reduced from $55 per annum)

Temporary business parking: $60 p/a (reduced from $110) plus waive the 5 person limit to meet the need for the number of employees per business who travel in from outside the Byron Shire.

Parking per hour increased to $7 (from $4 per hour)

These measures will.

1. Support local residents who need and deserve financial relief after enduring recent natural disasters.

2. Support local businesses to employ staff, many of whom have been driven out of the local community due to extremely high living costs and now travel in for work.

3. Increase hours of parking, that will in turn increase opportunities for local businesses to provide services to patrons and balance out the cost price increase with the value of added leisure time to enjoy Byron Shire sites, activities and local businesses.

4. These proposed increases will generate revenue for Byron Shire Council from the tourist dollar, to put towards the needs of locals in the community, including but not limited to, better roads, waste and infrastructure, as well as potential revenue on projects supported by Byron Shire Council to provide better supported housing outcomes for this community.

by James Flockton, Infrastructure Planning Coordinator, Infrastructure Services:

Staff have proposed a $1/hr increase to paid parking costs as part of the 2022/23 fees and charges process. The proposed new rate being $5/hr.

Any further increase at this time is not recommended given the current financial climate and recent flood events.

Time limits are separate to parking rates. A review of time limits will be undertaken as part of the Byron Movement Study that will be commencing later in 2022. This study will look at a range of traffic and pedestrian related matters.

There are current active Council resolutions that require further reporting to Council in relation to paid parking in 2022. This reporting will consider the implementation of paid parking in Brunswick Heads and paid parking fees in general. This reporting can also address paid parking opportunities in other towns centres and alternate fee structures for resident permits.

Discussion at a Strategic Planning Workshop prior to reporting to Council is recommended.

Current resolutions are as follows:

20-413 Resolved:

1. That in relation to consideration of proposed Parking Scheme changes within Brunswick Heads, Council:

a) Note the recommendations in the TPS Report - Brunswick Heads Parking Scheme Review 2020 (E2020/29468) including the recommendation "that Council should undertake a cost/benefit analysis with the objective to introducing metered parking into Brunswick Heads in order to address the capacity and compliance issues identified in this project”; and

b) Defer consideration of any changes to the Brunswick Heads Parking Scheme until the March 2022 Ordinary Council meeting due to the current impacts of the COVID-19 crisis.

c) Continue to monitor parking demand within Brunswick Heads and parking occupancy rates within the existing 1P and 2P time limited areas and the area east of South Arm Bridge; and

d) Not introduce pay parking to the CBD and Beach Precincts as identified in Figure 1.1b and Table 1.2b until parking occupancy rates return to 90% within the CBD Precinct.

2. That the report to the March 2022 Ordinary in response to the Recommendation from the TPS Report - Brunswick Heads Parking Scheme Review 2020 (E2020/29468) include a cost/benefit analysis and implementation plan for the introduction of a Pay Parking Scheme for Brunswick Heads incorporating:

a) Delivery Program;

b) Meter and sensor layouts;

c) Relevant time limit modifications;

d) Signs and line plan;

e) Permit system;

f) Business case with recommended pay parking fee rate and months over which the pay parking scheme should operate; and

g) Media and communications plan

21-442 Resolved that Council receive a report on:

1. Pay parking revenue in 2018-19 broken down into meter charges (combined), worker permits and resident permits, including an analysis of what the meter charges revenue would have been at $5 and $6 per hour.

2. Potential profit from schemes introduced into Brunswick Heads, Mullumbimby and Bangalow based on expected usage under business-as-usual conditions, at rates of $4, $5 and $6 per hour.

3. The Breakdown of pay parking revenue from meters originating from residents of NRJO, being Byron, Ballina, Lismore, Kyogle, Richmond Valley and Tweed Shires vs those coming from elsewhere.

4. Ways that parking meters in a town like Bangalow could be made to better suit aesthetically the Heritage nature of the town.

5. Details of areas identified for potential peripheral parking in Mullumbimby and progress of discussions with Transport for NSW for access and or lease.

6. Comparisons with other local government areas that have high tourist numbers and that have pay parking and how they manage their system of residential permits.

Both resolutions have been awaiting the recruitment of a new Traffic and Transport Engineer, following the resignation of our previous engineer in December 2021.

Staff are hopeful the third recruitment process has resulted in a successful applicant and that process is now being finalised.

Financial/Resource/Legal Implications:

Increases to paid parking rates will increase the revenue generated. Removal of the resident permit charge will reduce the revenue generated because the permits will still need to be resourced and this is funded from paid parking / permit revenue.

Further investigation is required to advise the actual dollar impacts.

The revenue figures quoted in the Notice of Motion if fees were increased as suggested in the NOM would only eventuate if the fee increase does not change utilisation of the parking scheme i.e. people currently paying $4.00 per hour would be happy to pay a 75% increase to $7.00 per hour. If utilisation of the pay parking scheme did decrease if the fee was increased to $7.00 per hour, Council may not realise any increase in revenue and could potentially lose revenue.

Is the proposal consistent with any Delivery Program tasks?

BYRON SHIRE COUNCIL

Notices of Motion 9.4

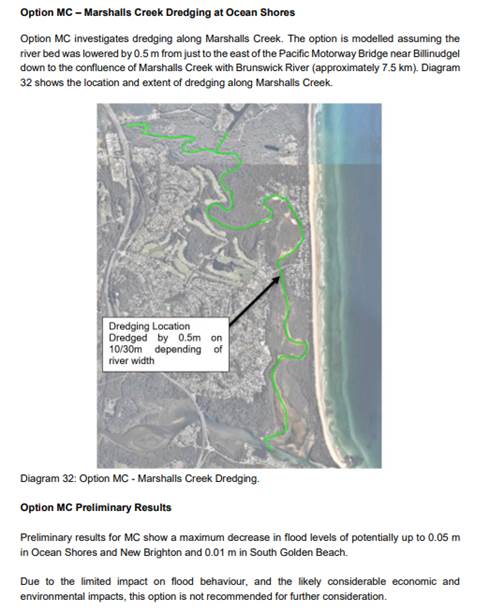

Notice of Motion No. 9.4 Capricornia Canal and Marshalls Creek

File No: I2022/498

I move that Council:

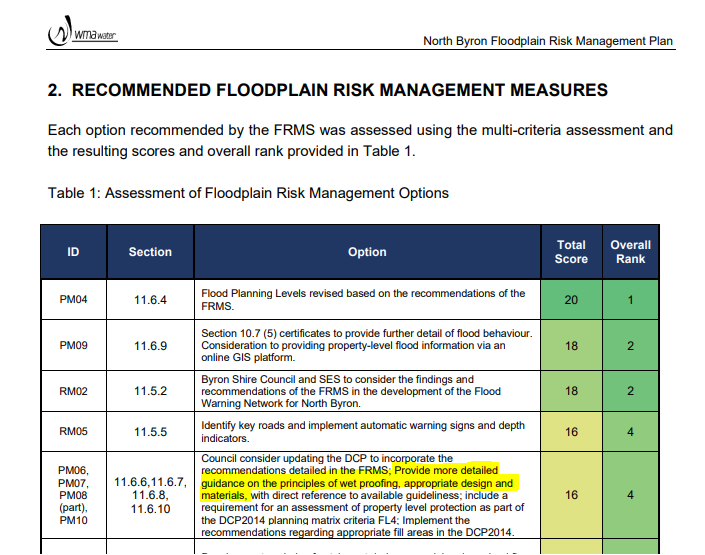

Refers the requests raised by the North Byron Shire community regarding dredging the Capricornia Canal and Marshalls Creek to Council’s Water and Sewer Advisory Committee, Coastal and ICOLL Advisory Committee, and Floodplain Management Committee with a view to consider the requests; in particular the option of removing the Marshalls Creek rock walls at Brunswick Heads and its potential to reduce siltation of Marshalls Creek.

Signed: Cr Asren Pugh

Councillor’s supporting information:

While many of the requests of the North Byron Shire community with regard to dredging, Marshalls Creek and Capricornia Canal have been looked at in the past, including significant studies, given the massive impact of the recent floods and the unexpected flood heights it is important to look again at the issues raised.

The Advisory Committees mentioned in the motion are where we bring experts and community representatives together to consider these matters in depth and provide recommendations to council. By requesting these committees to also consider these matter we can ensure that recommendations are consistent with any other work the committees are doing in response tot he floods.

Staff comments

by James Flockton, Coordinator Infrastructure Planning, Infrastructure Planning & Chloe Dowsett, Coast and Biodiversity Coordinator:

Staff consider it essential that Council committees maintain their focus and commitment to their individual subject areas.

Council’s Floodplain Management Advisory Committee consists of a collective group of agency representatives and community members with the sole focus of flood management. This committee’s purpose is to oversee and advise Council on the preparation, implementation and review of Flood Studies and Floodplain Risk Management Studies as required. This committee has previously considered dredging and/or removal of rock walls for flood purposes and did not support the options as per the adopted Floodplain Management Plan.

The Coastal and ICOLL Advisory Committee’s purpose is to assist in the development of Coastal Management Programs (CMPs) for the Shire’s coast, estuaries and ICOLLs. While there may be some overlap in this space with floodplain management, CMPs do not consider rainfall/catchment dominated flooding events, this is considered through the preparation of Flood Plans.

Flood Risk Management Options (Dredging and Removal of Rock Walls)

The North Byron Floodplain Management Study notes the

following on page 109 and can be found at https://www.byron.nsw.gov.au/files/assets/public/hptrim/land-use-and-planning-planning-strategies-working-documents-north-byron-coastal-creeks-flood-study/e2021-43013-north-byron-floodplain-risk-management-study-web.pdf

It is not unusual for dredging to provide limited if any flood mitigation results when modelled. This is usually because it does not create more storage or a mechanism to greatly alter flood levels because the dredged area fills with water and only allows for an increase in flow velocities. Further it can fill in again quite quickly with sediment moving in the creek system.

A number of rock wall alterations were also modelled in the study, none provided a level of flood mitigation that resulted in them being a recommended action in the Floodplain Management Plan. Further details can be found from page 102 of the above document.

The Brunswick Estuary is a system dominated by ocean processes in the lower reaches, like all the Shire’s estuaries/ICOLLs. There is a constant push of sand into the lower reaches due to the high littoral drift of sediment up the coast from south to north. This is evident in the formation of bars within the entrance. As such, lower catchment flood levels tend to be dominated by ocean levels.

Dredging campaigns in the Brunswick Estuary have historically been undertaken to improve the navigability of the estuary entrance for the commercial fishing fleet. Generally, the benefits have been short-lived with the dredging channels quickly filling in due to sediment deposits from the high littoral transport system along the coastline. Dredging activities have, however, changed the tidal prism of the Brunswick Estuary and have therefore altered the salinity regime, increased turbidity, and reduced areas of important habitat, such as shallow water, seagrass and intertidal mud banks. The ecological value of the estuary is unique falling within the Cape Byron Marine Park, and the impact of dredging to this waterway would be significant.

The North Byron Floodplain Management Study was developed by a reputable consultant with expertise in flood modelling and flood risk management. The development of flood plans follows a step by step process in accordance with the State Government Flood Manual and close consultation with experts within the flood department. The inclusion of options within a Flood Management Plan is based on robust science, modelling, sensitivity testing and expert knowledge.

Staff are aware that historical / legacy issues arise each time there is a flood event and our community has been significantly impacted, however to pursue management options that have already been assessed through a robust scientific process and deemed unfeasible results in loss of focus and distraction from implementation of actions in an endorsed Plan.

Recommended Investigation

A recommended action from the North Byron Floodplain Management Plan is to Develop a sediment transport model to investigate modification to the rock walls, as part of the Coastal Management Program for the Brunswick Estuary. This modelling is aimed at managing sedimentation from an estuary health perspective not flood mitigation.

Council is in the process of preparing Coastal Management Programs (CMPs) for its parts of the Byron Shire coastline, prioritising the Open Coast and ICOLLs in the four-stage process set out to develop the long-term strategy. Council has not yet commenced the development of a CMP for the Brunswick Estuary.

However, as part of Council’s preparation of CMPs for the Open Coast and ICOLLs, the Byron Shire Coastal Hazard Assessment, currently underway, which will cover the entire spatial extent of the Shire’s coastline and will inform the CMP. A key task of the Hazard Study is the development of a quantified conceptual sand transport model for the coastal zone. The preparation of sand transport model will include detailed assessment of:

· coastal geomorphology and geophysical setting

· marine and shoreline sediments

· wave climate and coastal processes

· time history of anthropogenic changes along the coastline (including minor and major works such as the Brunswick River training works)

· sediment budgets and the influence of natural and anthropogenic changes on sediment sources and sinks (sediment gains or losses determine whether shorelines will either erode or accrete).

Development of the sediment budget requires consideration of the various possible sources of sand, transport pathways, sinks, and agents of transport. The Brunswick River entrance is a known key source and sink of sediment which will be assessed in detail through this analysis as part of the study. Development of a quantified conceptual sand movement model is important as it focuses on sand transport (or sediment transport) and the key drivers that govern the processes of sand movement. The forcing agents (where does the sand come from and how?) will also be considered in the context of a changing climate. Understanding sediment transport is essential to inform decision making on potential coastal management options to address coastal hazards and/or key issues such as sedimentation.

A stakeholder workshop will be held to discuss the outcomes of the study and members of Council’s Coastal and ICOLL Advisory Committee members will be invited to attend. However, as noted above, Council has not yet commenced the development of a CMP for the Brunswick Estuary. Stage 1 of development of the CMP process comprises a Scoping Study to:

· collate existing information on the study area;

· carry out stakeholder and community engagement;

· understand values and management issues (i.e. such as community concerns regarding sedimentation of Marshalls Creek);

· identify any information gaps; and

· outline studies required to be carried out to inform the later stages of the CMP development.

It is not until Stage 3 of the CMP process where management options are identified and evaluated through risk assessment and cost, benefit analysis. Any management options such as dredging or rock wall alterations (to deal with sedimentation issues) would need to be supported as a feasible option in Stage 3 for inclusion in a CMP before it could proceed.

Financial/Resource/Legal Implications:

Development of a conceptual sand/sediment transport model is part of the Byron Shire Coastal Hazard Assessment currently funded and in preparation.

Commencement of a Coastal Management Program for the Brunswick Estuary is currently unfunded. However the planning of this process may commence in the 2022/23 FY pending funding and staff capacity.

Is the proposal consistent with any Delivery Program tasks?

Yes.

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 3: We protect and enhance our natural environment |

3.3: Partner to protect and enhance the health of the Shire’s coastlines, estuaries, waterways and catchments |

3.3.1: Implement Coastal Management Program |

3.3.1.1 |

Continue preparing a Coastal Management Program (CMP) in accordance with the staged process for Cape Byron to South Golden Beach |

BYRON SHIRE COUNCIL

Notices of Motion 9.5

Notice of Motion No. 9.5 Lobbying on key issues for flood impacted communities

File No: I2022/501

I move:

That Council lobbies (including writing a formal letter and raising in relevant meetings) the relevant government agencies, governments and ministers on issues important to local flood impacted communities. This may include incorporating these matters into Council’s submission/s to the NSW Flood Inquiry:

a) The inadequacy of the $7,200 in rental support provided to people unable to live in their primary residence due to flood impacts.

b) The lack of resilience in the communications network post flood. This includes the need for more mobile service backup systems, the need for alternative internet access options such as satellite (particularly at evacuation centres).

c) Support for a government reinsurance program for flood impacted communities in Northern NSW.

Signed: Cr Asren Pugh

Councillor’s supporting information:

These three issues listed above are important matters that have been raised by many in the community that have been impacted by the recent floods. While council has its own response to the communications problems faced during the floods for its own operations, drawing other levels of governments attention to those same needs in the community is a valuable role that we can play.

Many local properties are facing massive increase in insurance premiums or becoming uninsurable. While there are many other matters that we need to look at as far as flood proofing and building the resilience and the insurability of local properties, a government underwriting scheme is also an important part of the solution.

The way that the NSW Government has treated those that have been displaced by the floods has been deplorable. With people being forced to move out of temporary accommodation to ensure tourists can visit, to moving people to Brisbane or other far-flung places. People are facing tremendously high short term rental costs so they remain in the community while they rebuild. More support is needed.

Staff comments

by Esmeralda Davis, A/Director Corporate and Community Services, Corporate and Community Services:

An independent Flood Inquiry, led by Professor Mary O’Kane AC and Michael Fuller APM, has been established to examine and report on the causes of, preparedness for, response to and recovery from the 2022 catastrophic flood events.

Council resolved (Res 22-156) to prepare a submission and hold a Community Roundtable Meeting (held 10 May 2022) amongst other matters.

In response to Res 22-156, Council staff have prepared a comprehensive submission which will be the subject of a report to the 19 May Extraordinary Council meeting. This submission incorporates the three points raised in this notice of motion, in addition to a range of other issues relevant to flood impacted communities in our Shire.

The ‘issues important to local flood impacted communities’ are regularly raised in the various recovery forums including the Regional Recovery Committee and sub-committee meetings; meetings with various government agencies and delegates; and meetings with heads of government who visit our community. These will continue to be raised as the opportunity arises.

A formal letter to the relevant government agencies and ministers can be prepared, attaching a copy of Council’s submission to the Flood Inquiry.

Financial/Resource/Legal Implications:

The preparation of letters and submissions can be incorporated into existing resource allocations.

Is the proposal consistent with any Delivery Program tasks?

No

BYRON SHIRE COUNCIL

Notices of Motion 9.6

Notice of Motion No. 9.6 Byron Bay Community Association support

File No: I2022/502

I move that Council:

1. Acknowledges the request from the Byron Bay Community Association for financial assistance in relation to Byron Bay markets and the extenuating circumstances that have resulted in financial losses

2. Offers a line of credit of up to $100,000 to the Byron Bay Community Association from the Property Development Reserve to assist them with:

i) current shortfalls in markets revenue and

ii) cost of market relocation if development consent is given for the town centre site

3. Offers the line of credit to be available in five advances of $20,000 each with an interest rate set at 3.5% per annum

4. Connects the term of any amounts borrowed to the markets licence, which is valid until 31 October 2026

Signed: Cr Michael Lyon

Councillor’s supporting information:

In March 2022, Council received a request from the Byron Bay Community Association for financial assistance to ensure the long term financial sustainability of the Byron Bay markets.

A combination of factors have resulted in the Byron Bay markets running at a loss for this financial year, including cancelled markets due to COVID and extreme weather events, site challenges and a decline in customers and stallholder numbers.

The markets are part of the fabric of Byron Bay and are significant economic and social contributors to our Shire. Council and the Byron Bay Community Association are actively working towards future plans for the market that will allow for it to regenerate and rebuild in the centre of town and I’m confident the financial future of the markets looks strong.

Staff comments

by Claire McGarry, Place Manager – Byron Bay, General Manager

James Brickley, Manager Finance, Corporate and Community Services

Existing markets support

In acknowledgement of the valuable contribution the markets make to the local community and economy, and in recognition of the financial difficulty they are facing, Council has provided financial support to the Byron Bay Community Association for running of the markets over the past 2 years.

For example, Council has worked with Transport for NSW to restore the former rail ticket office building ($100,000 of works) and given a lease to the markets for offices and storage at minimum Crown rent (approx. $500/year).

Additionally, Council have undertaken the DA for the community market relocation rather than the Community Centre doing it as licensee.

Finally, Council has applied for grant funding to install permanent infrastructure (bollards, seating, garden beds) in the town centre to facilitate the relocation of the market to the rail precinct site. This infrastructure removes significant cost for the Byron Community Centre that they would otherwise need to be spending on water barriers, additional traffic controllers, signage etc.

Financial/Resource/Legal Implications:

Comment by Manager Finance

The Notice of Motion at part 2 is proposing to provide a line of credit of $100,000 via five advances of $20,000 to the Byron Bay Community Association.

If Council were to provide the advance, it would need to identify a funding source to do so. Council does not have $100,000 available overall on an unrestricted basis given its current budget position so it would need to reallocate funding from one of its available internal reserves. If this Notice of Motion proceeds it is suggested that the Property Development Reserve provide the funding on the basis there is an expectation the advances would be repaid over time with interest and repayments transferred back to the Property Development Reserve.

Part 4 of this Notice of Motion is connecting the term of the advances to the remaining duration of the market licence until 31 October 2026, although the Notice of Motion is silent in Part 3 on the timing of when the individual advances of $20,000 are to be made and what triggers an advance to be made.

Part 3 of the Notice of Motion is setting an interest rate at 3.5%. Council should at least charge an interest rate equivalent to what it could borrow so an indicative interest rate now would be around 4.0%. Council’s borrowing rates fluctuate and in the current environment over the remaining term of the market licence, loan borrowing rates are likely to increase further but any advance whenever made over the next four or so years to the Association would be capped at 3.5% interest. Potentially Council will be providing a subsidised line of credit and may have to disclose that subsidy to comply with Section 356 of the Local Government Act 1993. The level of subsidy can only be calculated based on the indicative Council borrowing rate at the time of the advance compared to 3.5%. Alternatively if the interest rate is not capped at 3.5% but equates to a rate Council could borrow at the time an advance is proposed to be made there is no subsidy issue.

Given the proposed staggered nature of advances with timing unknown, it is not possible to calculate any indicative repayments and this can only be done as and when advances are made. Clarification is also not known as an example if say $20,000 is provided as the fifth advance in January 2026, is it clear that the last advance plus interest along with any other outstanding advance amount will need to be repaid in full by 31 October 2026.

If Council provides a line of credit, it should also take some form of security to enable it to recover any outstanding amounts should there be a default. Whether such security can be applied to the Market Licence as advances proposed occur would need to be clarified or at least Council should register a mortgage over assets of the Association if that is possible which would be discharged if the line of credit is repaid in full. There also has not been any assessment as to whether the Association has the financial capacity to repay a line of credit with interest to Council. This should be a consideration.

Notwithstanding the merit of the request from the Association, Council should also be mindful of precedence in that it could receive other requests from organisations with similar circumstances and that it doesn’t have the financial capacity to act as a lender to multiple organisations that may be facing financial difficulties.

Is the proposal consistent with any Delivery Program tasks?

Yes

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and sense of community |

2.1: Support and encourage our vibrant culture and creativity |

2.1.7: Support range of existing, emerging and major events |

2.1.7.1 |

Continue to support event organisers in the delivery of events. |

BYRON SHIRE COUNCIL

Notices of Motion 9.7

Notice of Motion No. 9.7 North Byron drainage and sewerage status

File No: I2022/503

I move:

1. That Council receives a report at the June meeting on the following

a. The reported $260,000 underspend on drainage maintenance in the 2020-21 year and the reasons for this underspend

b. The historical (5 year) proportion of infrastructure spending that has been spent in the North Byron Shire area.

c. A timeline for the comprehensive assessment of the status of drains and sewerage infrastructure in North Byron Shire

d. The proposed works program for sewerage and drainage in North Byron Shire for 2021-22, 2022-23 and 2023-24

e. Grants programs that council might apply for to clean and repair the drains and sewerage within North Byron Shire

2. That Council’s internal drain clearing team prioritise work within the North Byron Shire community over the next 6 months

3. That members of North Byron Shire be invited to submit the worst cases of drainage or sewerage network disrepair to the relevant staff members for consideration into the future program of works, including the budget that is currently out on exhibition.

4. That a staff briefing be organised within 2 weeks, in consultation with relevant representatives from the North Byron Shire community, to discuss the program of works priorities and budget allocations for the next 3 years.

Signed: Cr Asren Pugh

Councillor’s supporting information:

The drains and sewerage network across the North Byron Shire has been left to deteriorate by successive councils over the last few decades. Residents are having to deal with sewerage coming into their backyards, drains that sit idle and filled with water for months at a time, grass and debris making it impossible for drains to work properly. Some sewerage pipes and drains have completely collapsed.

This motion is attempting to ensure that the community in North Byron Shire has a direct voice into the program of works for drains and sewerage repair over the coming years. The long history of neglect means that these issues will not be rectified quickly or cheaply, but it is time that council focussed on doing what we can to begin the process of fixing these problems.

Staff comments

by James Flockton, Coordinator Infrastructure Planning, Infrastructure Services

James Brickley, Manager Finance, Corporate and Community Services:

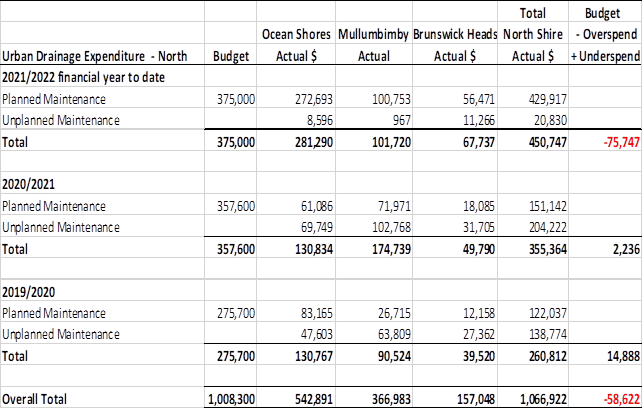

Item 1 - Staff can prepare the reporting as requested. However, Item 1a can be answered in these comments. Information was provided for a public meeting held on 26 April 2022 regarding drainage maintenance expenditure in the North of the Shire in the table below:

|

Overall Budget North $ |

Ocean Shores Actual $ |

Mullumbimby Actual $ |

Brunswick Heads Actual $ |

|

|

2021/2022 to date |

375,000 |

256,706 |

96,387 |

53,423 |

|

2020/2021 |

357,600 |

61,086 |

71,971 |

18,085 |

|

2019/2020 |

275,700 |

83,164 |

26,715 |

12,156 |

|

Total |

1,008,300 |

400,956 |

195,073 |

83,664 |

For the 2020/2021 financial year, the table above indicates an underspend of $206,639 comparing the addition of the actual expenditure for Ocean Shores, Mullumbimby, and Brunswick Heads compared to the overall budget, not $260,000 outlined in Item 1a. Unfortunately, whilst the annual budget allocations for the last three financial years for the North of the Shire in the table above are correct, the actual expenditures provided did not include all expenditure. Council currently separates drainage maintenance expenditure into planned maintenance and unplanned maintenance expenditures. The table above only provided planned maintenance expenditure which was in error.

A revised expenditure table for drainage maintenance in the North of the Shire is provided below that incorporates both planned and unplanned maintenance expenditure that more accurately reflects overall actual drainage maintenance expenditure in the North of the Shire against the overall budgets provided:

The table above indicates that the budget underspend for Urban Drainage Maintenance in the North of the Shire in the 2020/2021 financial year was $2,236, not $206,639 or $260,000.

Item 2 – Council’s StormWater Action Team (SWAT) prioritise various drainage maintenance tasks across the shire on an ongoing basis as new requests are received or inspection find new issues. SWAT aim to resolve the most urgent and impacting tasks first to ensure the whole shire is receiving a fair and appropriate service.

Item 3 – the community can do this at any time of the year by emailing council at its email address council@byron.nsw.gov.au

Item 4 – Staff can facilitate a meeting as required. Staff resourcing is currently focussed on Flood Recovery efforts including the preparation of applications for grant funding and 2 weeks lead time may be insufficient to adequately prepare relevant information for the briefing.

Financial/Resource/Legal Implications:

None.

Is the proposal consistent with any Delivery Program tasks?

No.

BYRON SHIRE COUNCIL

Notices of Motion 9.8

Notice of Motion No. 9.8 North Byron Shire Masterplan

File No: I2022/504

I move:

That Council receives a report at the June meeting on a timetable for the development of a Masterplan for the North Byron Shire. This may include different or separate processes for different parts of the community.

Signed: Cr Asren Pugh

Councillor’s supporting information:

By almost all accounts the process of developing the Masterplans for other parts of our community have been very well received, including in Bangalow and Federal. There are currently limited locations for centralised ‘community building’ infrastructure in the North of the Shire, in particular in Ocean Shores. A masterplan would ensure that the community would have a strong voice in developing a future plan for their own place. There are ongoing complaints from many in the Oceans Shores and surrounding community that there is little in the way of infrastructure spending or focus on the area. A proper masterplan, with the possibility of an ongoing masterplan committee, would ensure priority for the area when it comes to applying and receiving state and federal government grants.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy:

Council received Report No. 13.12 Expression of Interest for next village/town masterplan the ordinary meeting 28 October 2021.

https://byron.infocouncil.biz/Open/2021/10/OC_28102021_AGN_1272.PDF

This report provided inter alia summation of plans to date, and details on villages/towns to be considered for the next masterplan and methods for these.

At this meeting Council resolved 21-468:

1. That Council endorses an expression of interest process in early 2022 for the next village/town Masterplan as outlined in this report.

2. That Council receives a further report on the expression of interest process, with the report to include a recommendation for a preferred village/town masterplan and a project plan and resourcing plan showing staff time and other budget required to undertake the work.

3. That Council notes depending on 2, the timeframe for the new village/town masterplan may be delayed in part or all until Financial Year 2023/24.

4. That Council notes previous Resolution 20-432, particularly part 3.

5. That Council, with consultation, investigates further traffic calming and other treatments to slow traffic within the retail and service precinct as shown on the Pedestrian Amenity and Safety Plan including implementation of a 40kph or lower speed limit and a shared zone.

There have been delays to the EOI due to staff already working with the Federal Community on their masterplan; and the impact of Covid and the 2022 flood recovery projects on staff capacity to take on new/additional work.

The EOI is now expected to be considered later in 2022 as resources permit. A report to the June meeting would be pre-emptive of the EOI process.

Submissions from interested village/towns can be made to the EOI process at that time.

The Northern Byron Community Group is encouraged to make a submission to Council then when it can be considered alongside other EOIs from any of the other interested village/towns.

Financial/Resource/Legal Implications:

There is no forward budget identified for new village/town masterplans. A further report on the EOI process is required to determine this.

The report will also need to identify a preferred village/town masterplan and include a project plan and resourcing plan showing staff time and other budget required to undertake the work.

Depending on the above, the timeframe for the new village/town masterplan may be delayed in part or all until end FY22/23.

Is the proposal consistent with any Delivery Program tasks?

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 4: We manage growth and change responsibly |

4.1: Support the visions and aspirations of local communities through place-based planning and management |

4.1.1: Develop, implement and update Place Plans that promote place-based forward planning strategies and actions |

4.1.1.3 |

Investigate priority needs for future masterplans |

Notices of Motion 9.9

Notice of Motion No. 9.9 Rebuilding after the floods

File No: I2022/543

I move that Council:

1. Implements a ‘fast track’ DA process for applications directly related and limited to rebuilding on flood affected properties.

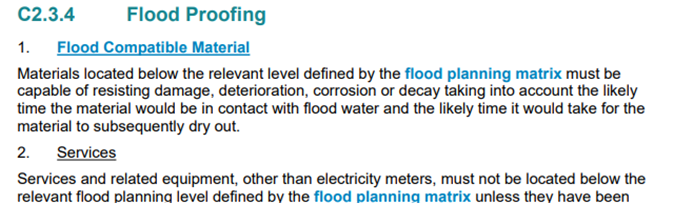

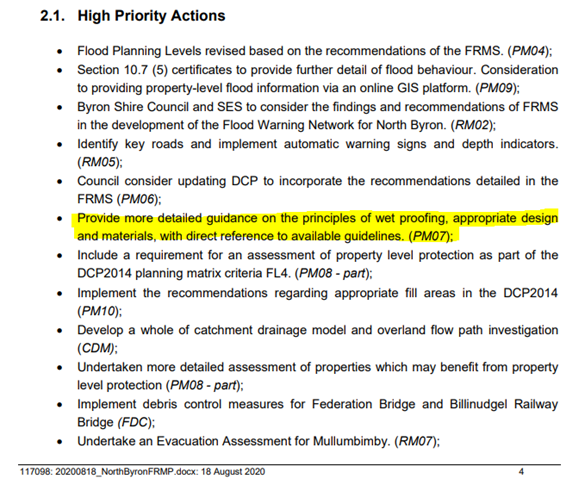

2. Provides advice to residents on appropriate standards for rebuilding within flood impacted areas including building materials and structural issues

3. Provides advice on likely changes to flood heights in flood impacted residential areas (inc Mullumbimby, Ocean Shores, SGB, Billinudgel, New Brighton) to assist residents with rebuilding

Signed: Cr Asren Pugh

Councillor’s supporting information:

Residents wishing to rebuild after the floods are facing significant hurdles to rebuilding in a way that builds their resilience to future flooding. They are waiting on guidance for upgraded building standards and flood heights. As a council we should be ensuring the swiftest decisions making possible for those wishing to raise heights to accommodate new flood heights.

I understand that there are significant legislative and other impediments to implementing this motion easily and will revise this motion in the lead up to the meeting following receipt of staff comments and consultation with the community.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy:

1. Implements a ‘fast track’ DA process for applications directly related and limited to rebuilding on flood affected properties.

The Department of Planning has made changes to state planning legislation to permit a range of low impact works to help people recover and rebuild after the floods without the need for development consent. https://www.planning.nsw.gov.au/Policy-and-Legislation/Disaster-and-Pandemic-Recovery/Repair-and-response-works It is now easier for homeowners to do necessary repair, demolition work as well as the use of shipping containers on sites impacted by the floods, subject to certain criteria. These changes are in addition to the Exempt and Complying Development Codes SEPP 2008 which permits a range of development subject to certain criteria or with a complying development certificate.

State Environmental Planning Policy (Exempt and Complying Development Codes) 2008 - NSW Legislation

Development applications however for rebuilds or works the result of the flood events or other not categorised as exempt or complying development will otherwise need to be reviewed on a case-by-case basis as not all may need a new development application depending on their individual circumstances.

Further, Council as a planning authority has certain legislative obligations that it needs to meet in relation to development applications. These obligations do not provide for selective and or preferential processing. There are also statutory timeframes set under the legislation for councils to meet which also act as the trigger for Land and Environment Court appeals in certain circumstances.

Below is a link to information about the development application process:

The DA process - Byron Shire Council (nsw.gov.au)

Below is a link to a recent report to council on legislation and development applications: