Public ATTACHMENTS

ATTACHMENTS

EXCLUDED FROM THE

Extraordinary

Meeting

AGENDA

OF 29 June 2016

4. Staff Reports

Corporate and Community Services

4.1 2016/17

Operational Plan

Attachment

2... FINAL 2016-2017 Operational Plan (for adoption 29 June 2016)............. 2

Attachment

3... Draft 2016/17 Fees and Charges presented to Council 29 June 2016... 58

Sustainable Environment and Economy

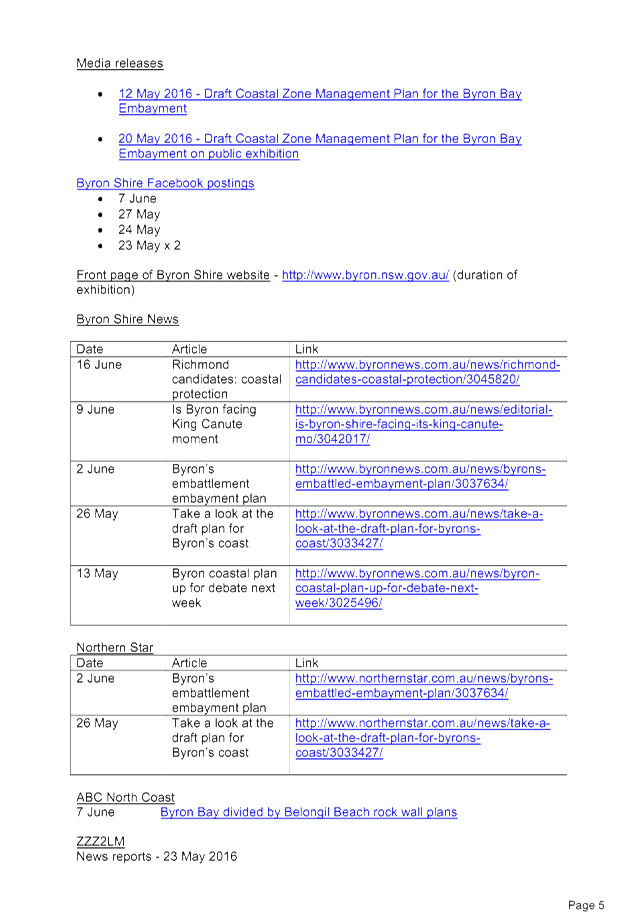

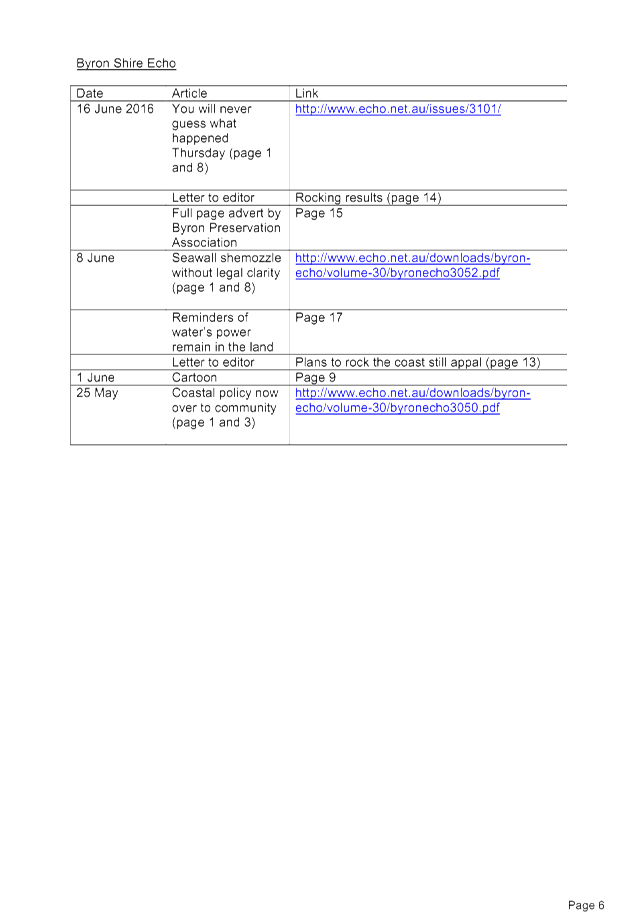

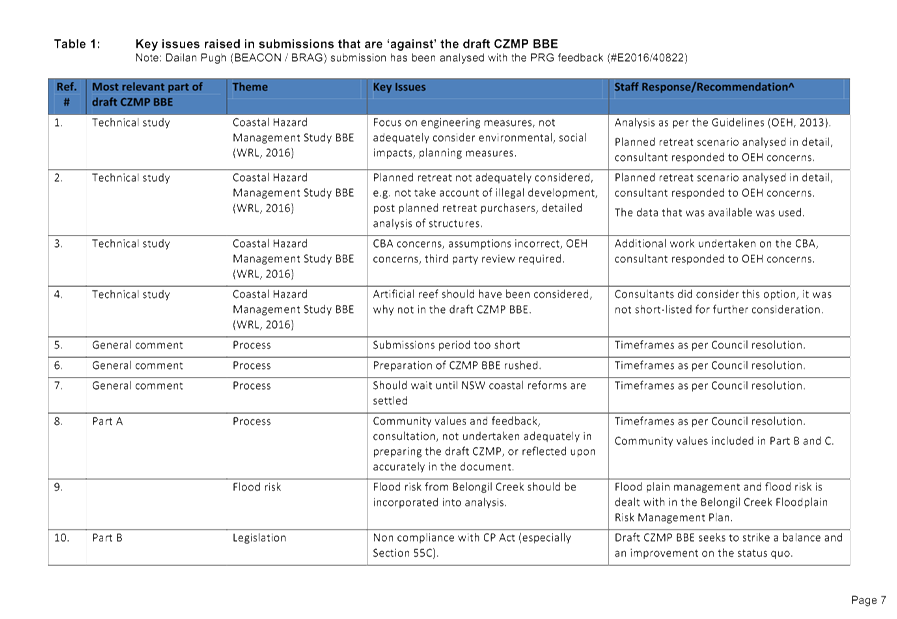

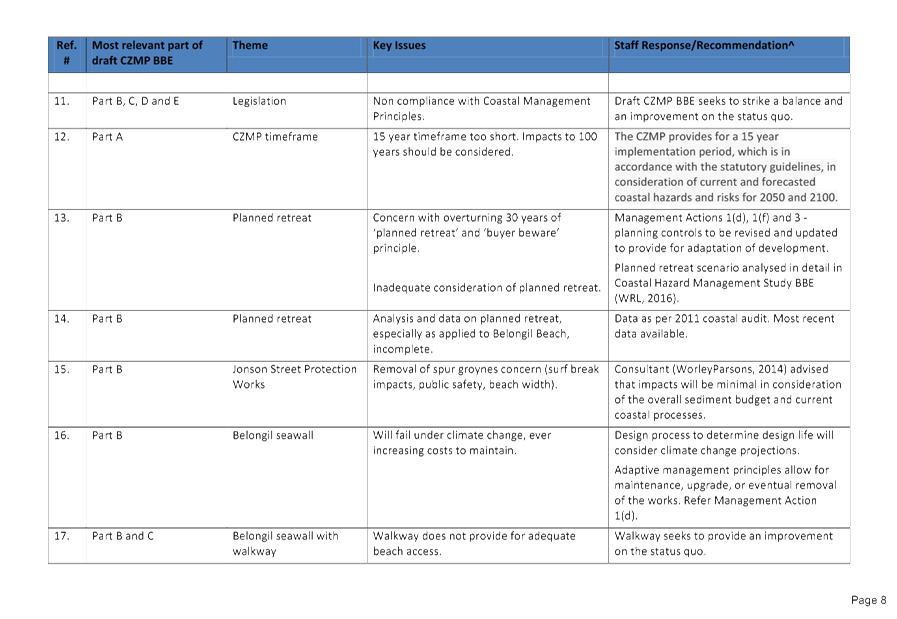

4.3 Draft

Coastal Zone Management Plan Byron Bay Embayment - Public Exhibition

Attachment

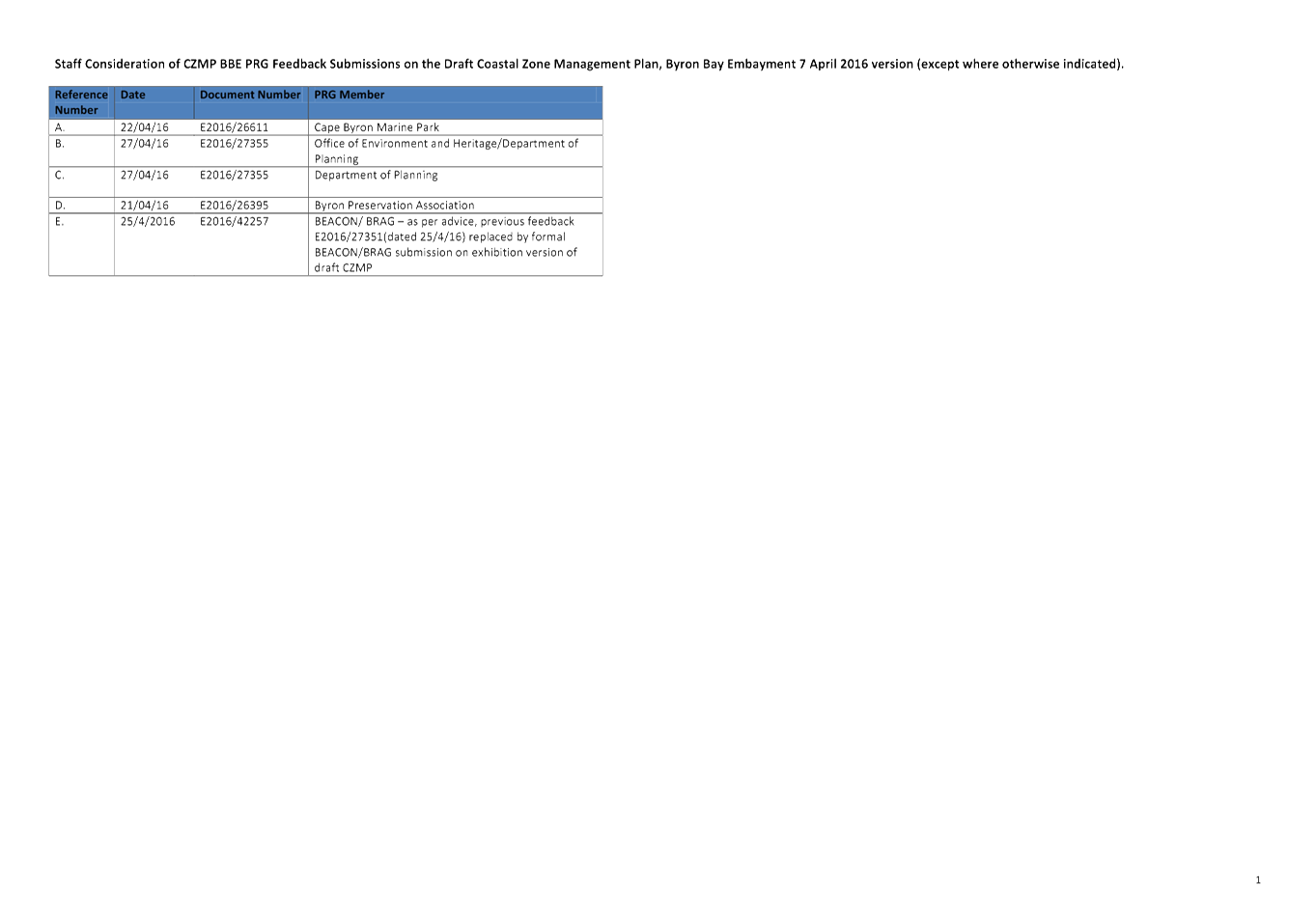

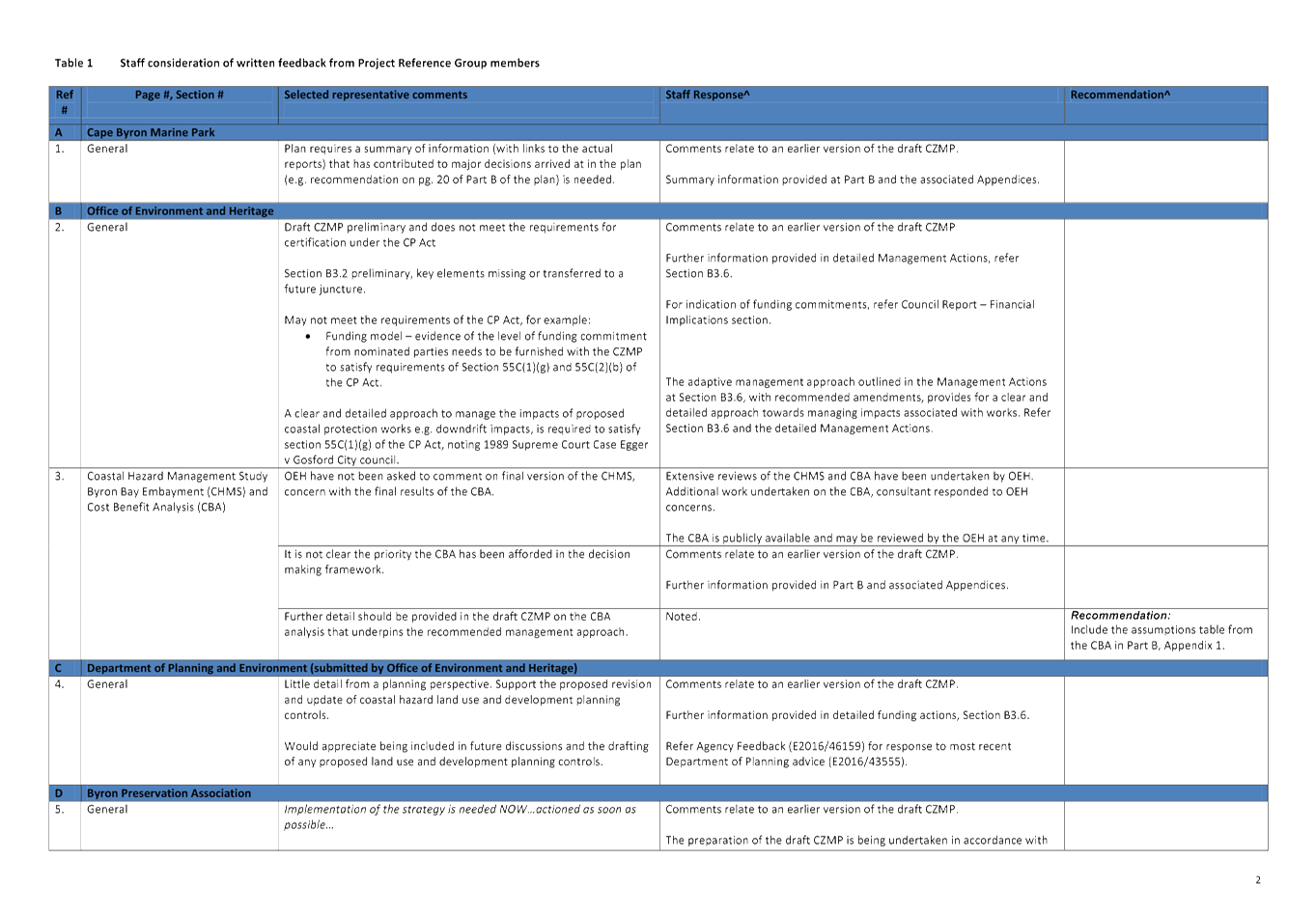

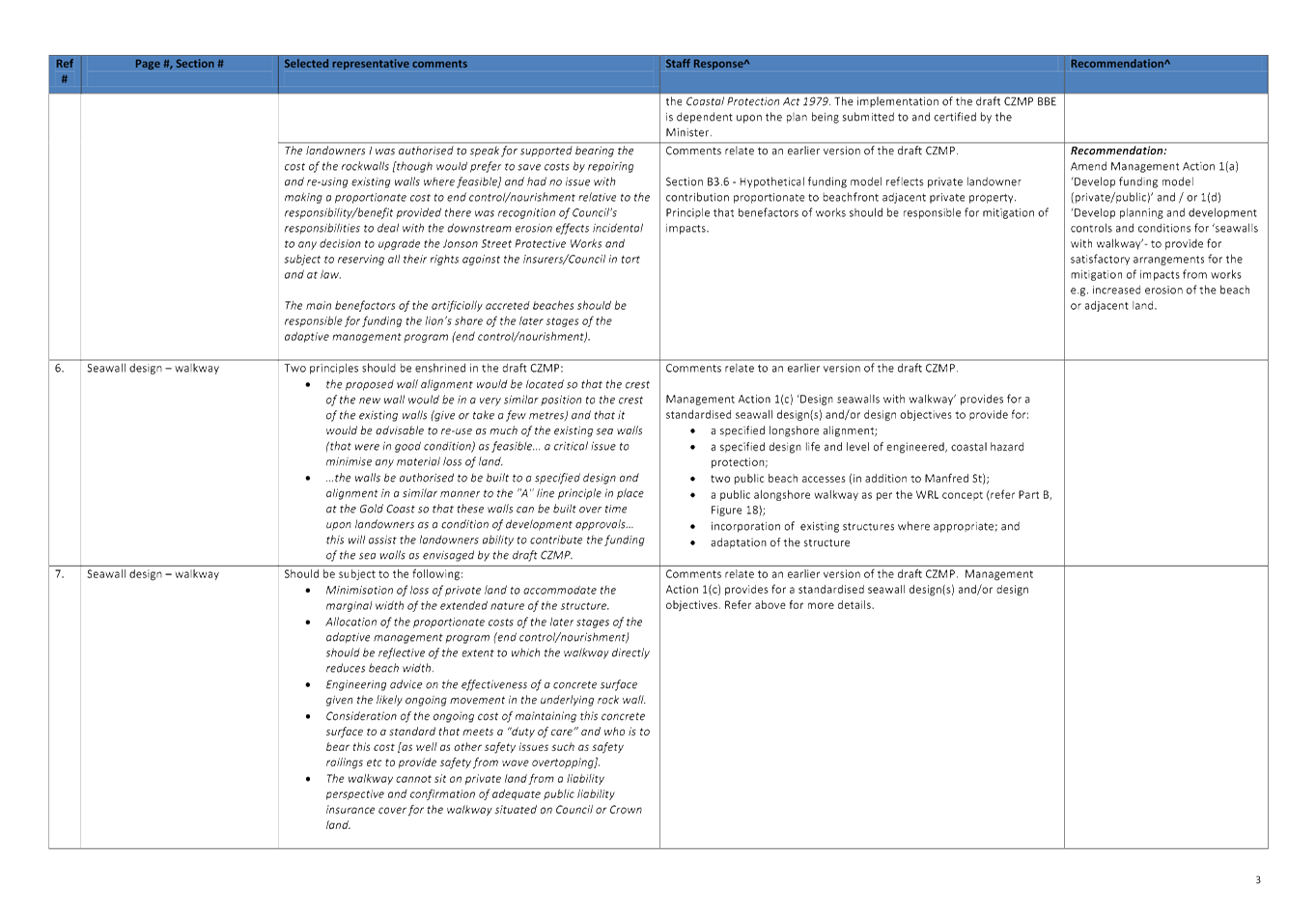

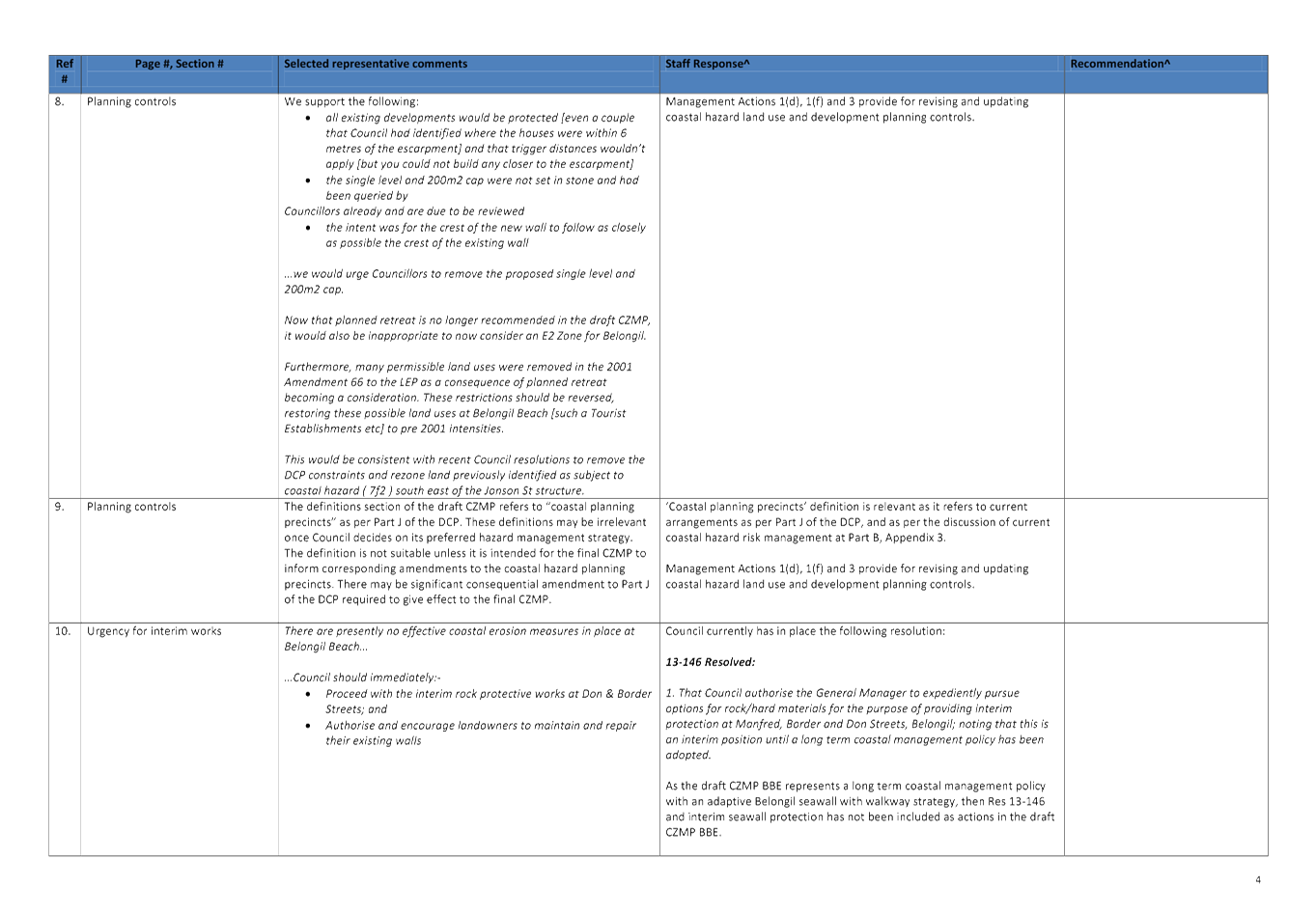

1... Exhibition Submissions Report - Draft CZMP BBE.............................. 179

Attachment

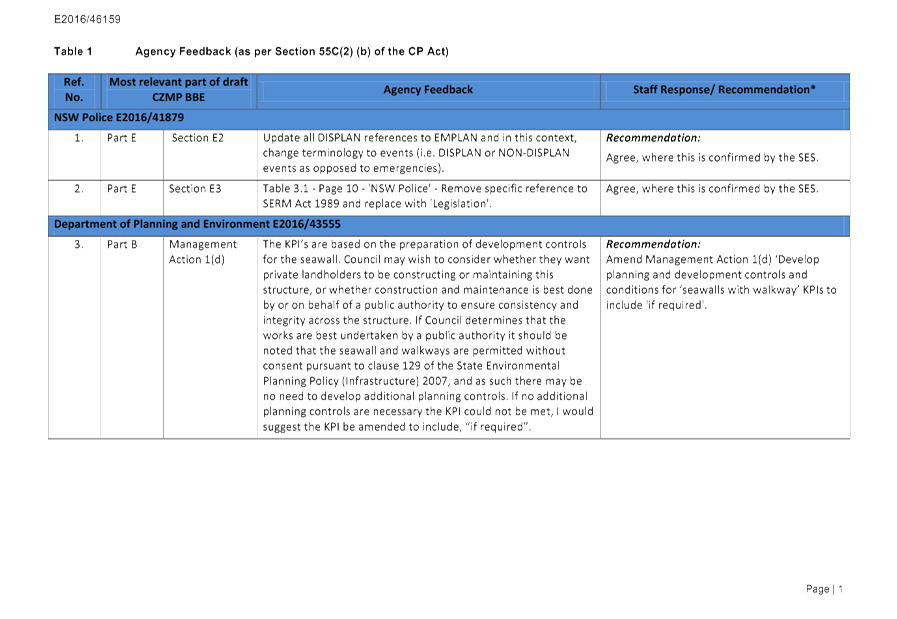

2... Agency Feedback on draft CZMP BBE (55C(2) (b) CP Act)............... 194

Attachment

3... PRG Feedback on draft CZMP BBE.................................................... 215

Attachment

4... PRG feedback on draft Exhibition Submissions Report....................... 227

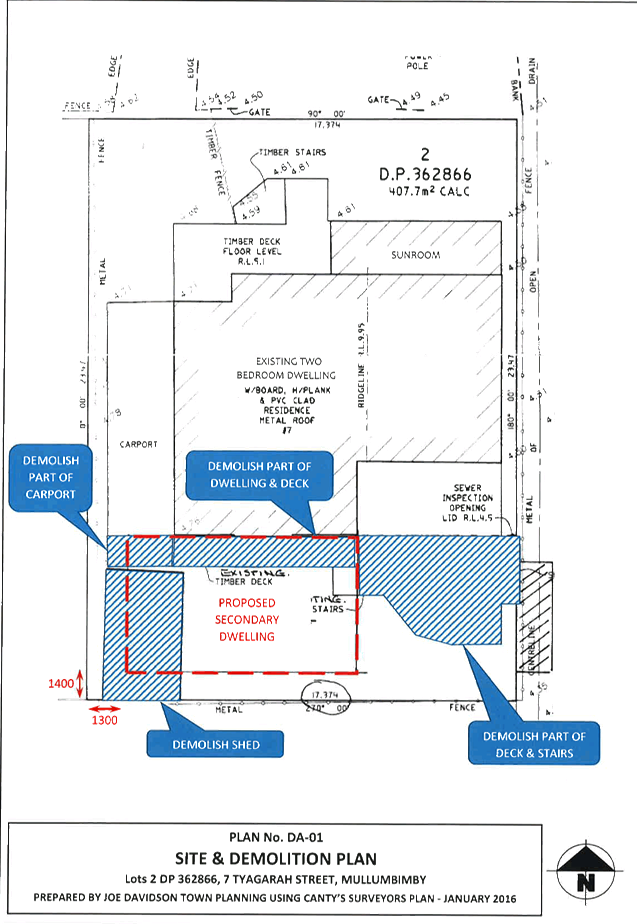

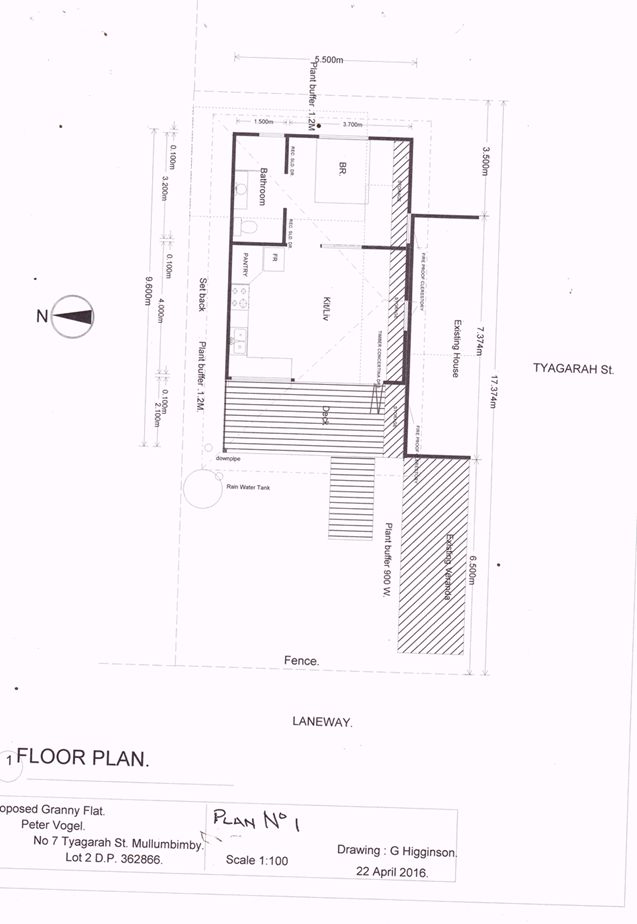

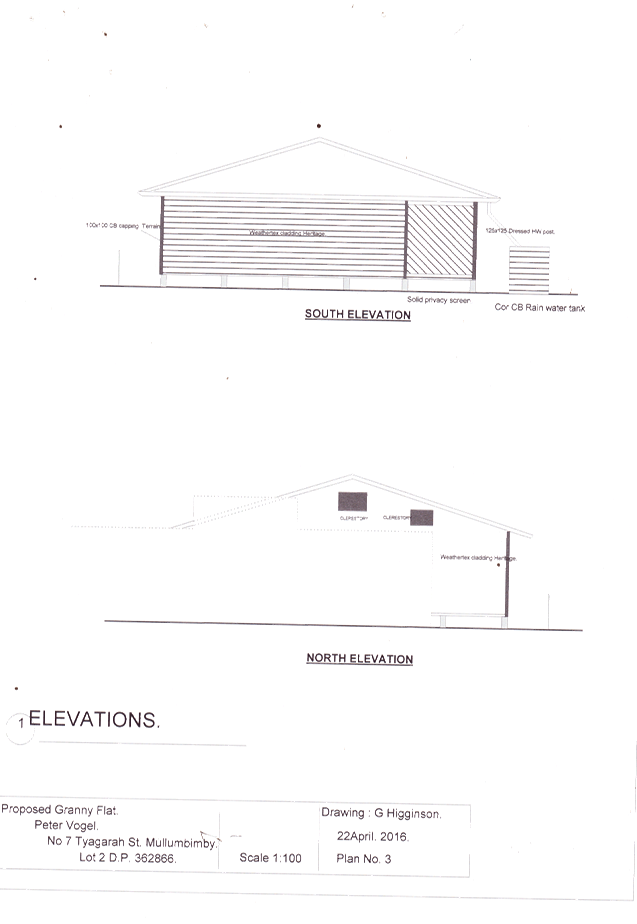

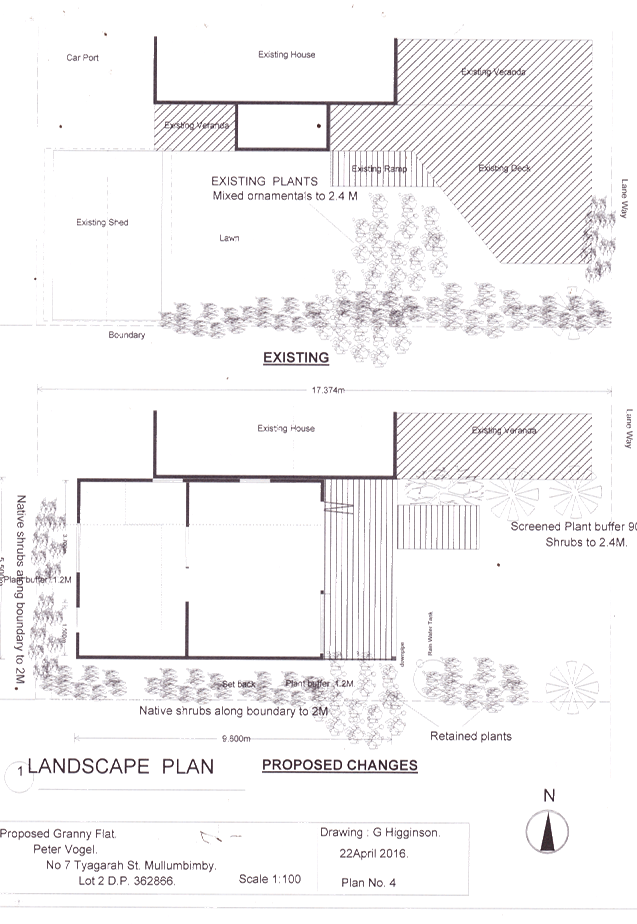

4.4 PLANNING

- 10.2016.34.1 Secondary Dwelling at 7 Tyagarah Street Mullumbimby

Attachment

1... Proposed Plans 10.2016.34.1................................................................ 230

Attachment

2... Conditions of consent 10.2016.34.1...................................................... 235

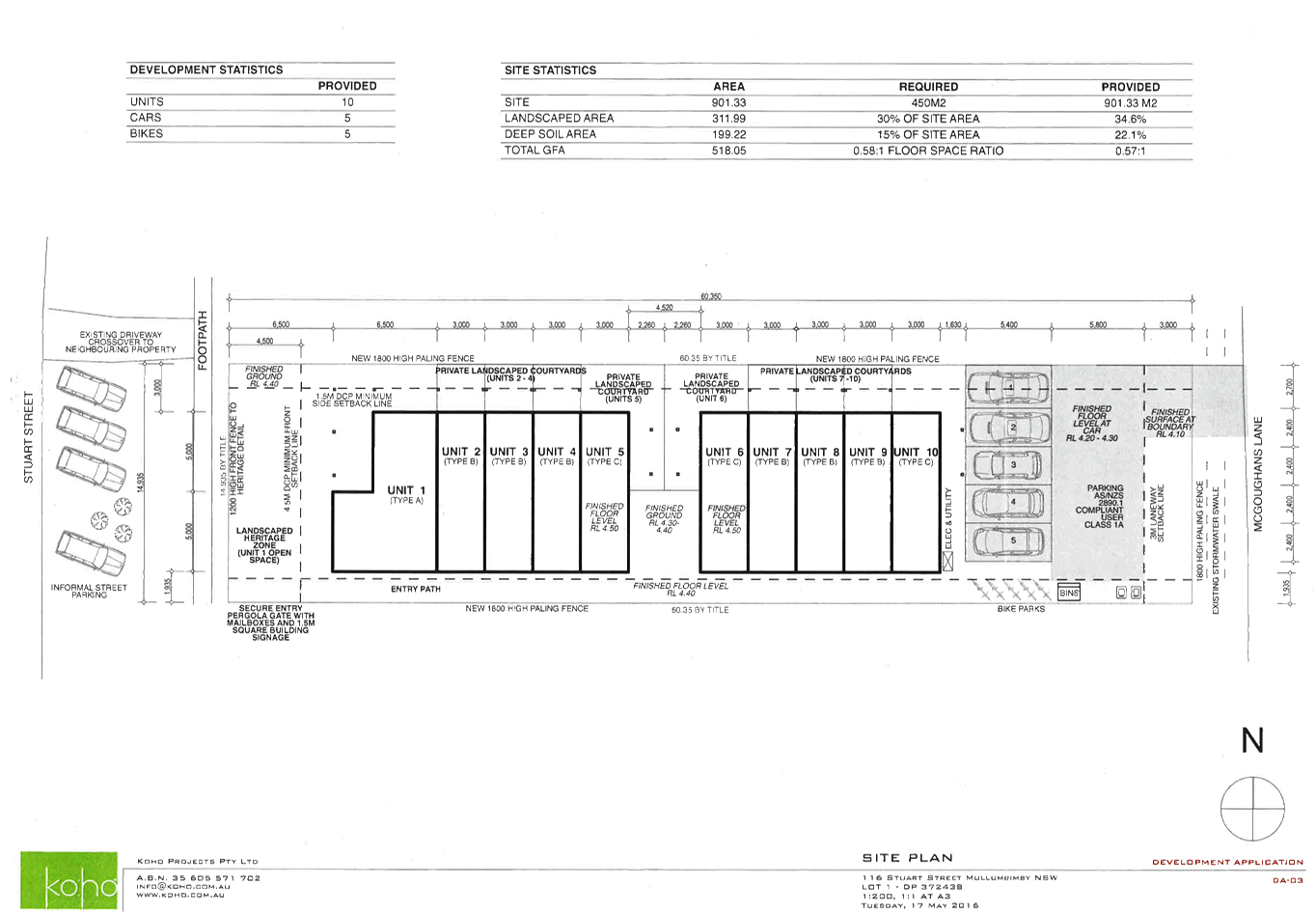

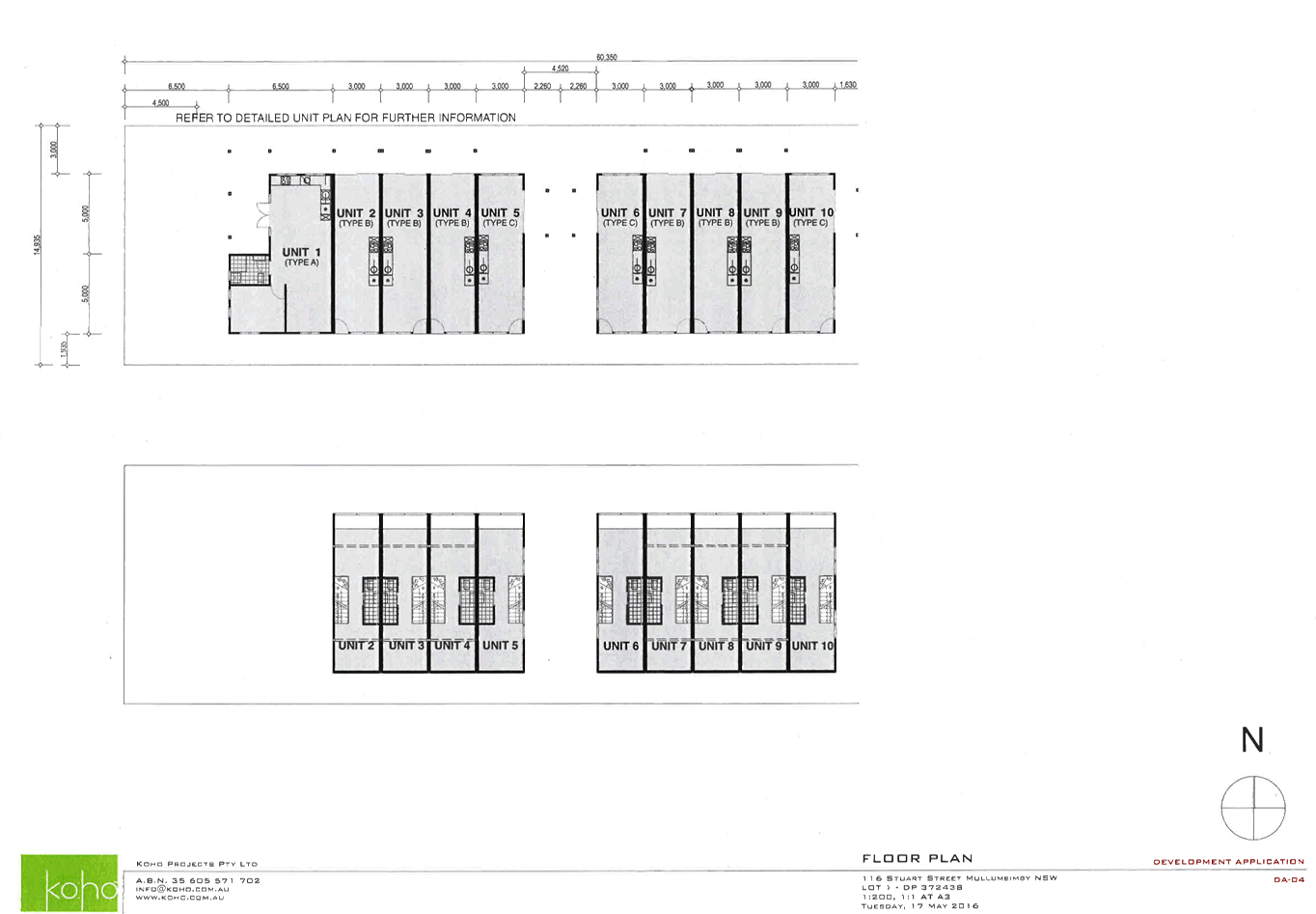

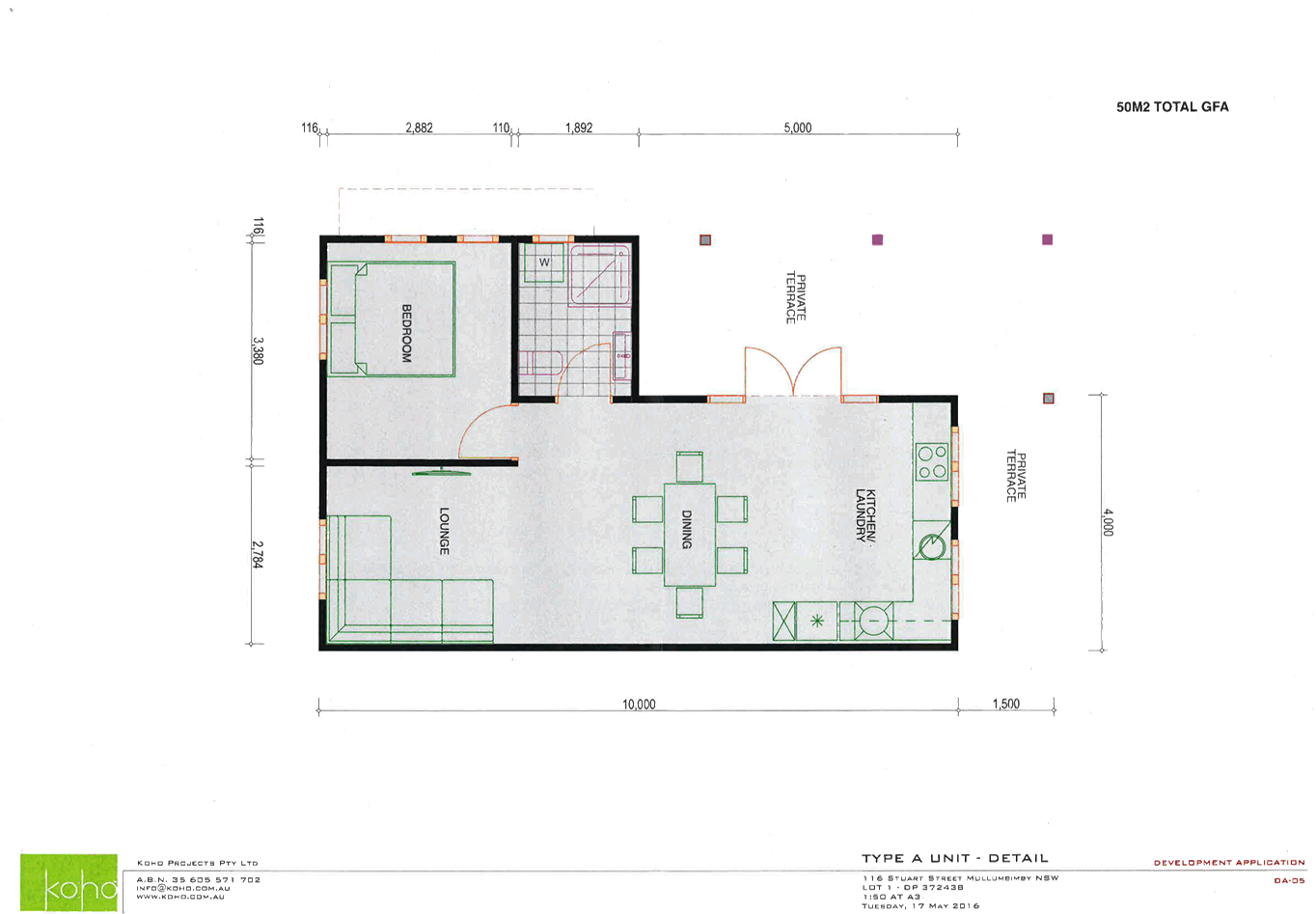

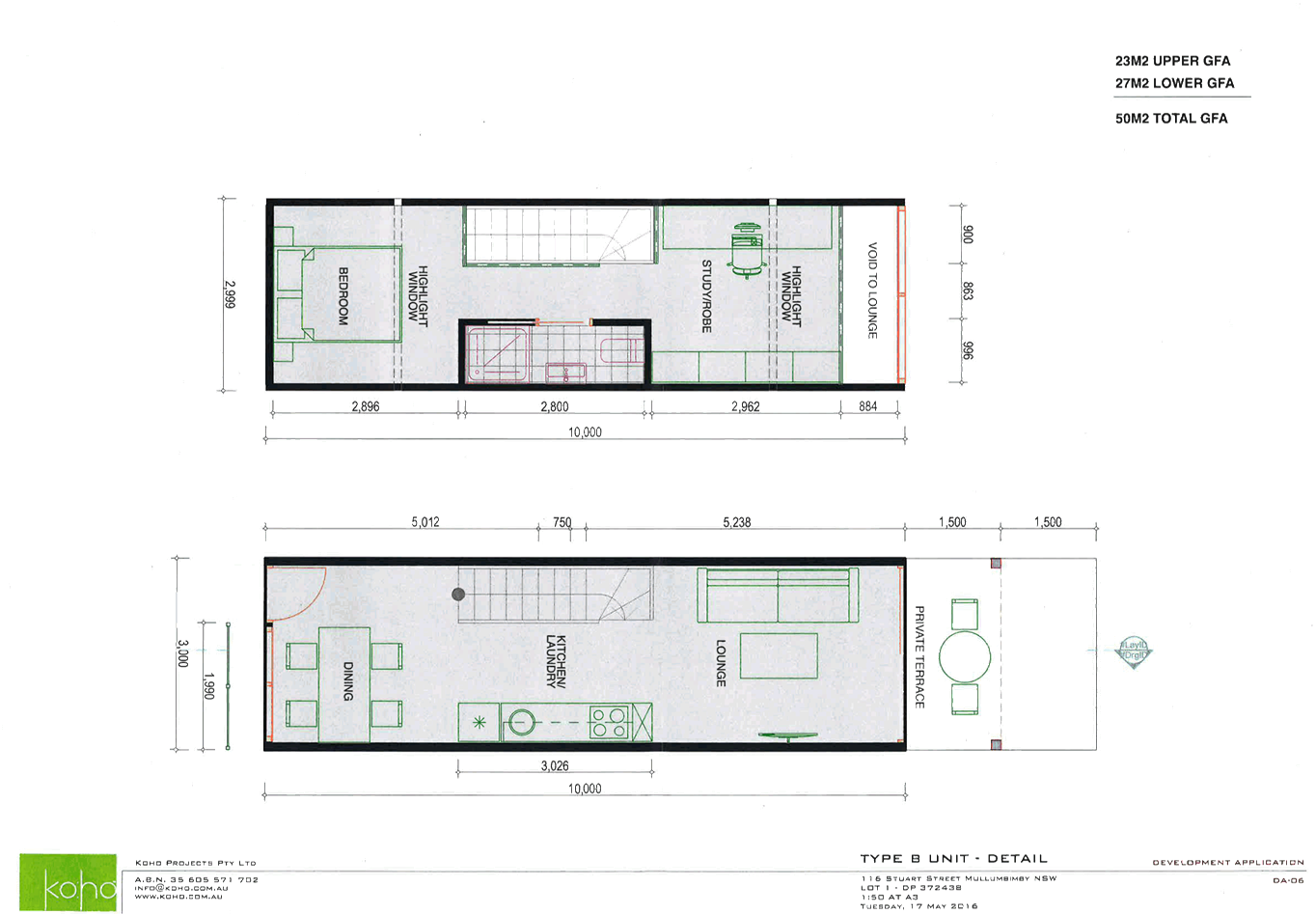

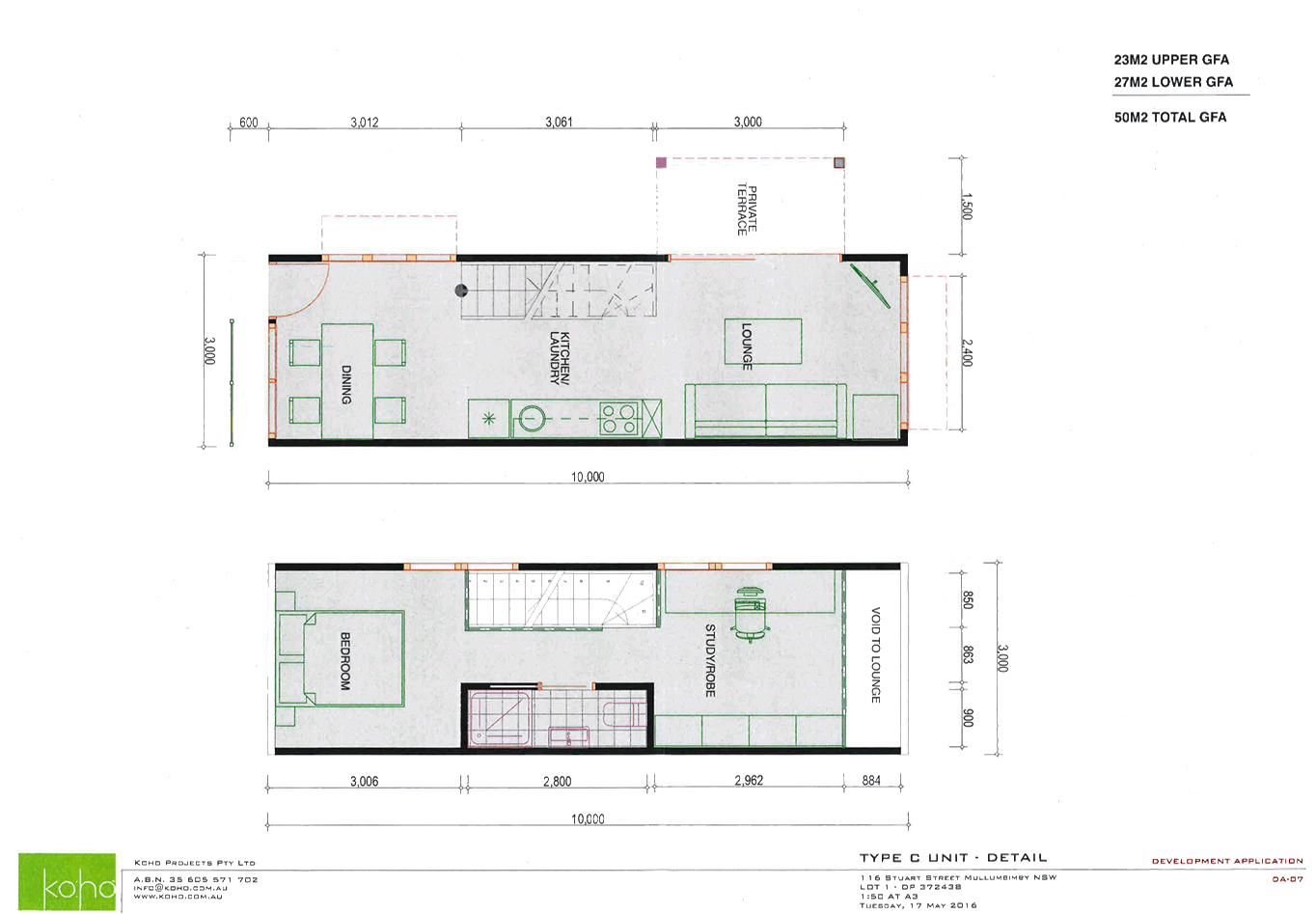

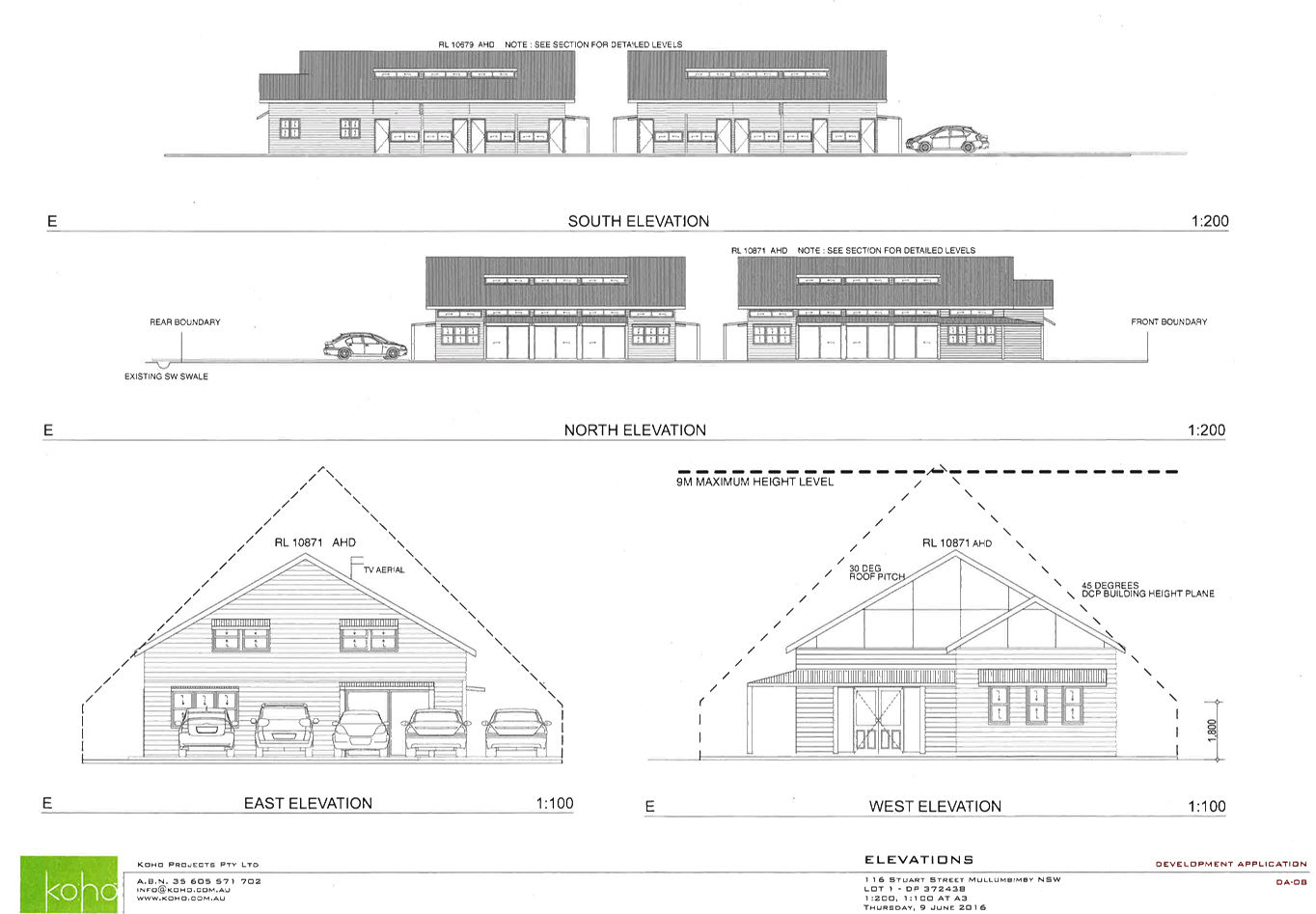

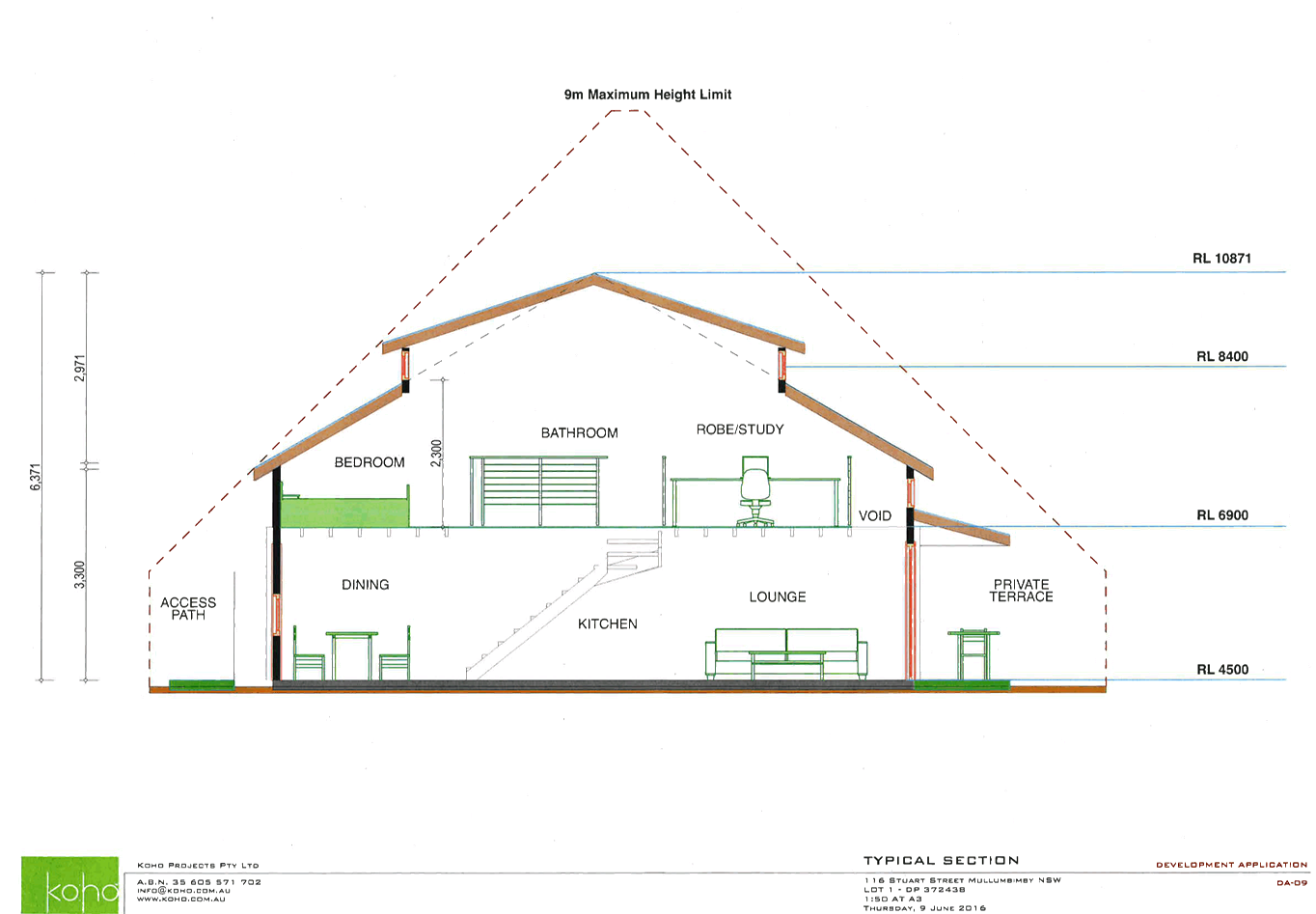

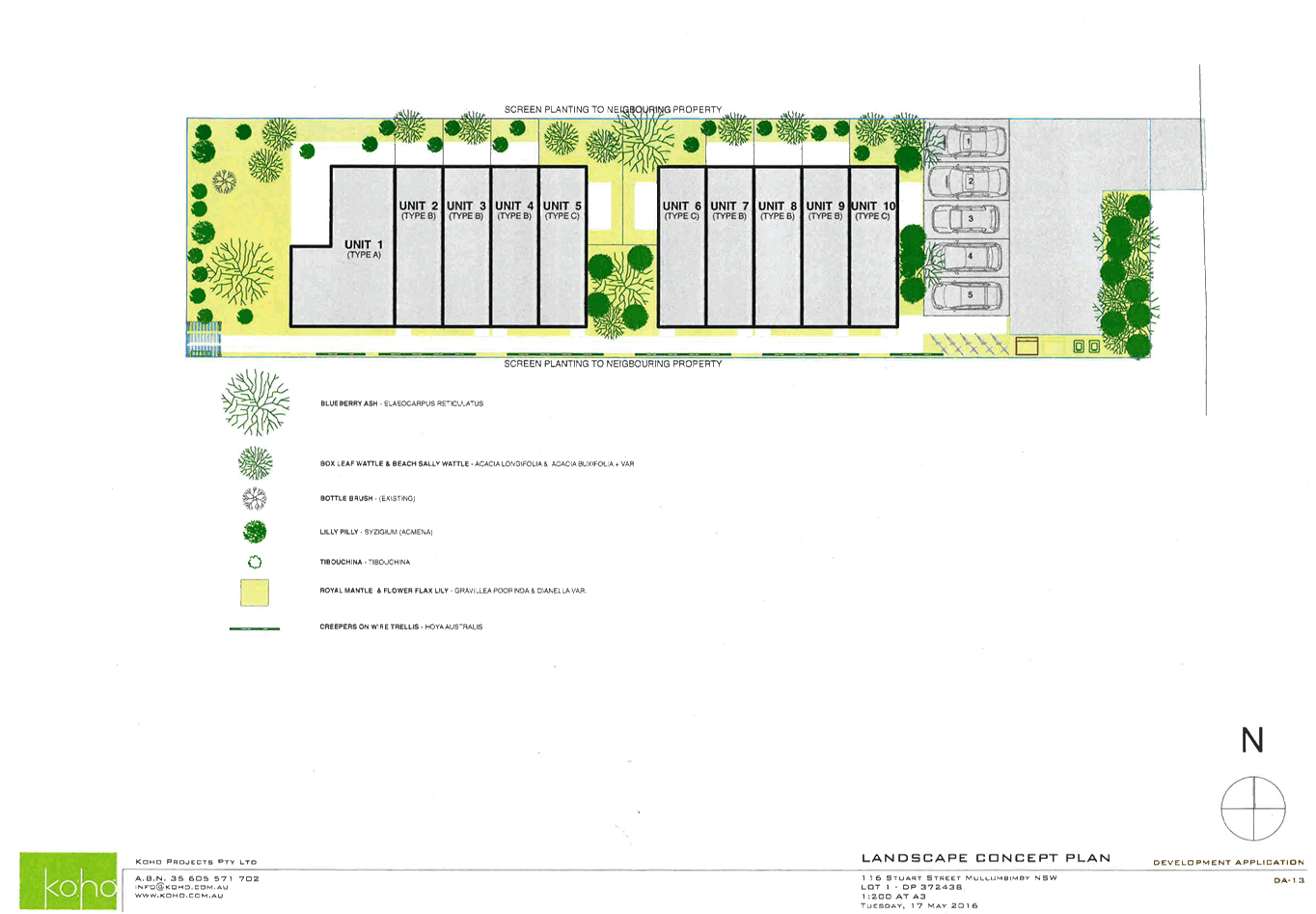

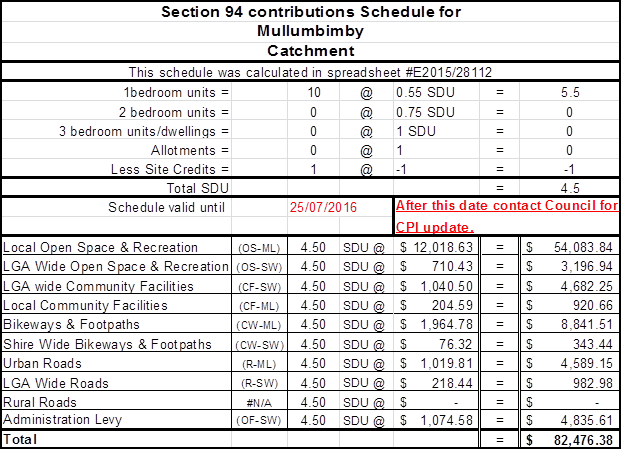

4.5 PLANNING

- Development Application 10.2016.189.1 - Multi Dwelling Housing (including 10

single bedroom dwellings, parking for 5 vehicles) and Demolition of existing

structures - 116 Stuart Street, Mullumbimby

Attachment

1... Plans prepared by Koho 10.2016.189.1................................................ 242

Attachment

2... Proposed conditions of consent 10.2016189.1...................................... 250

1. Late Reports

Late Reports

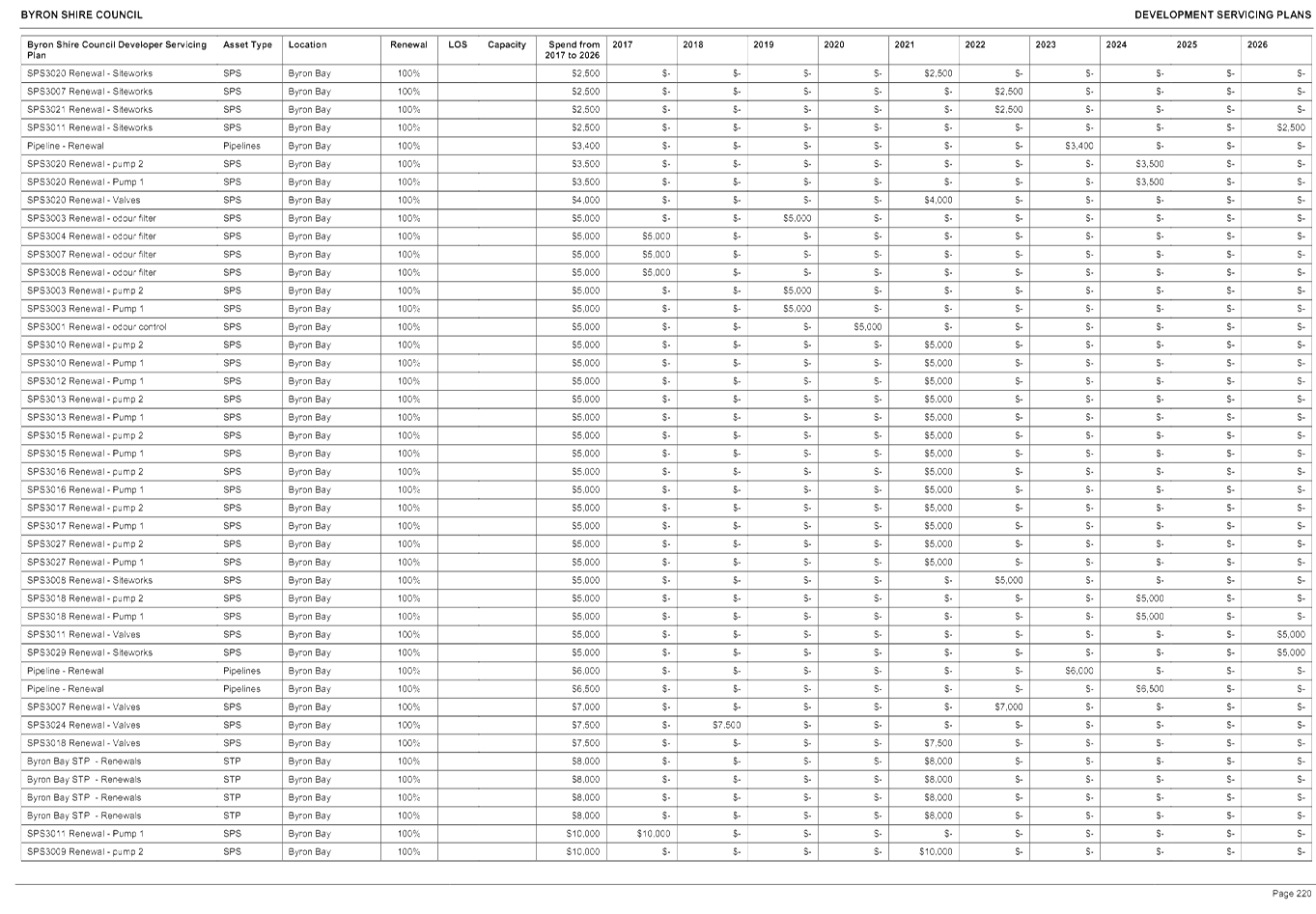

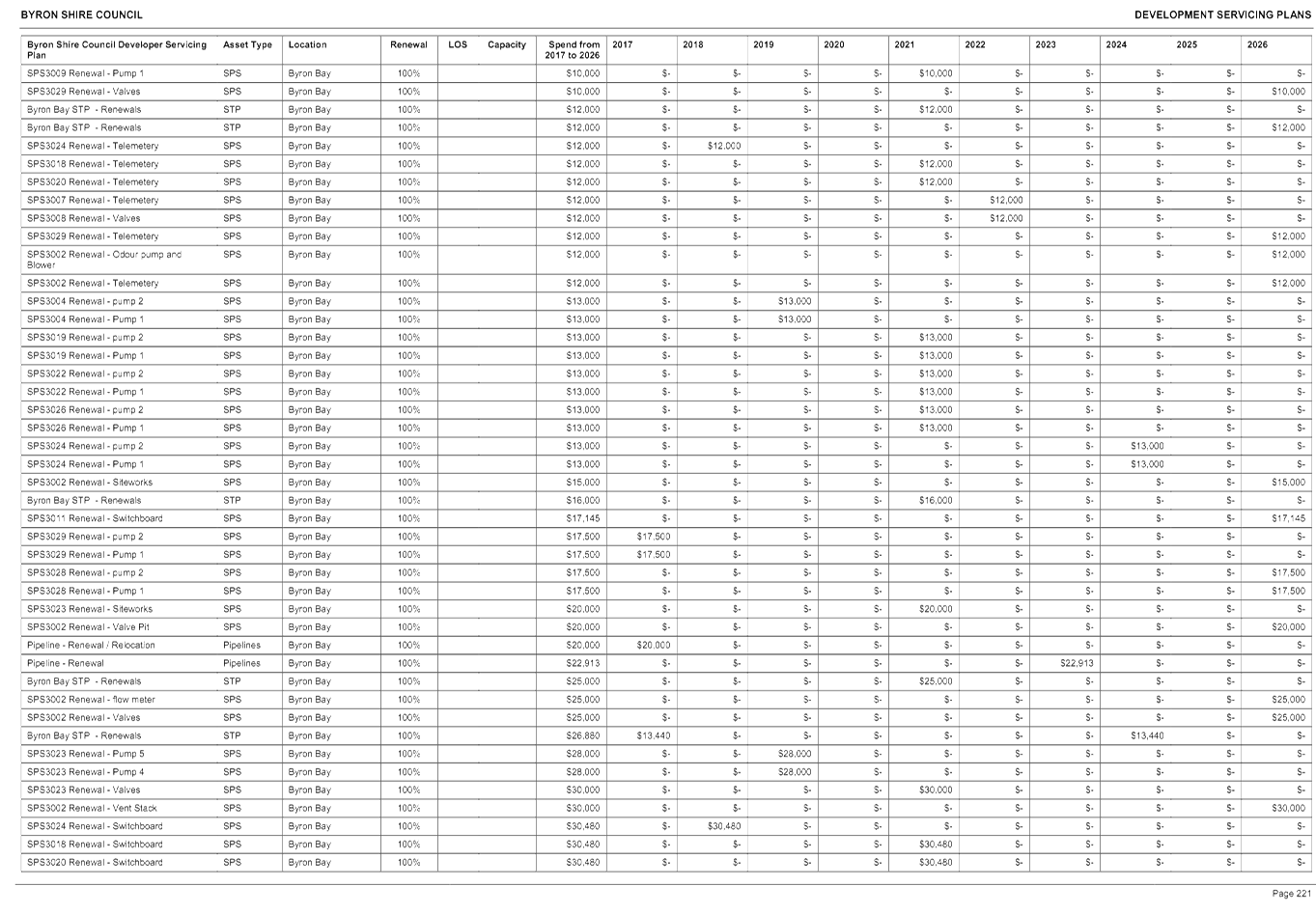

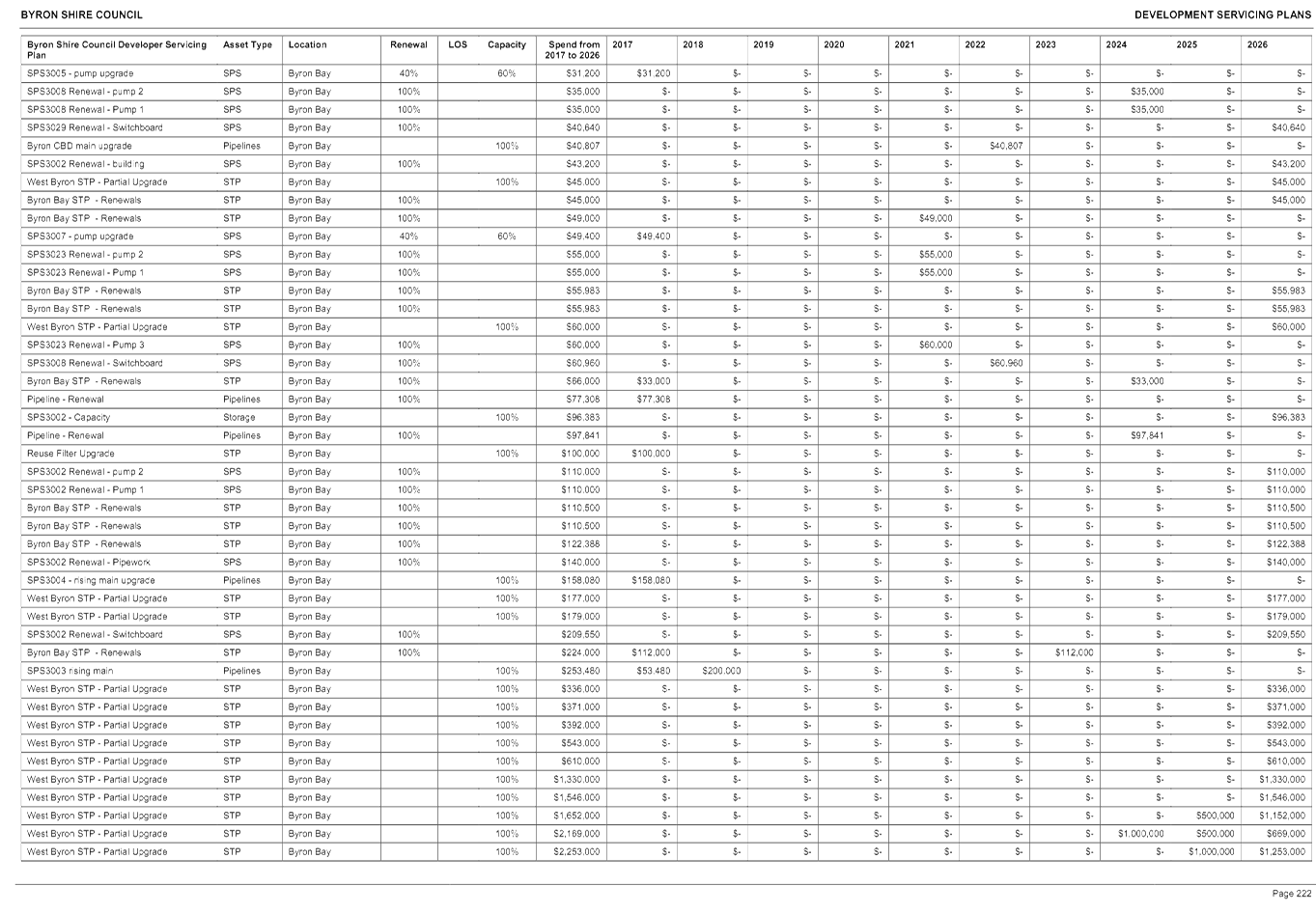

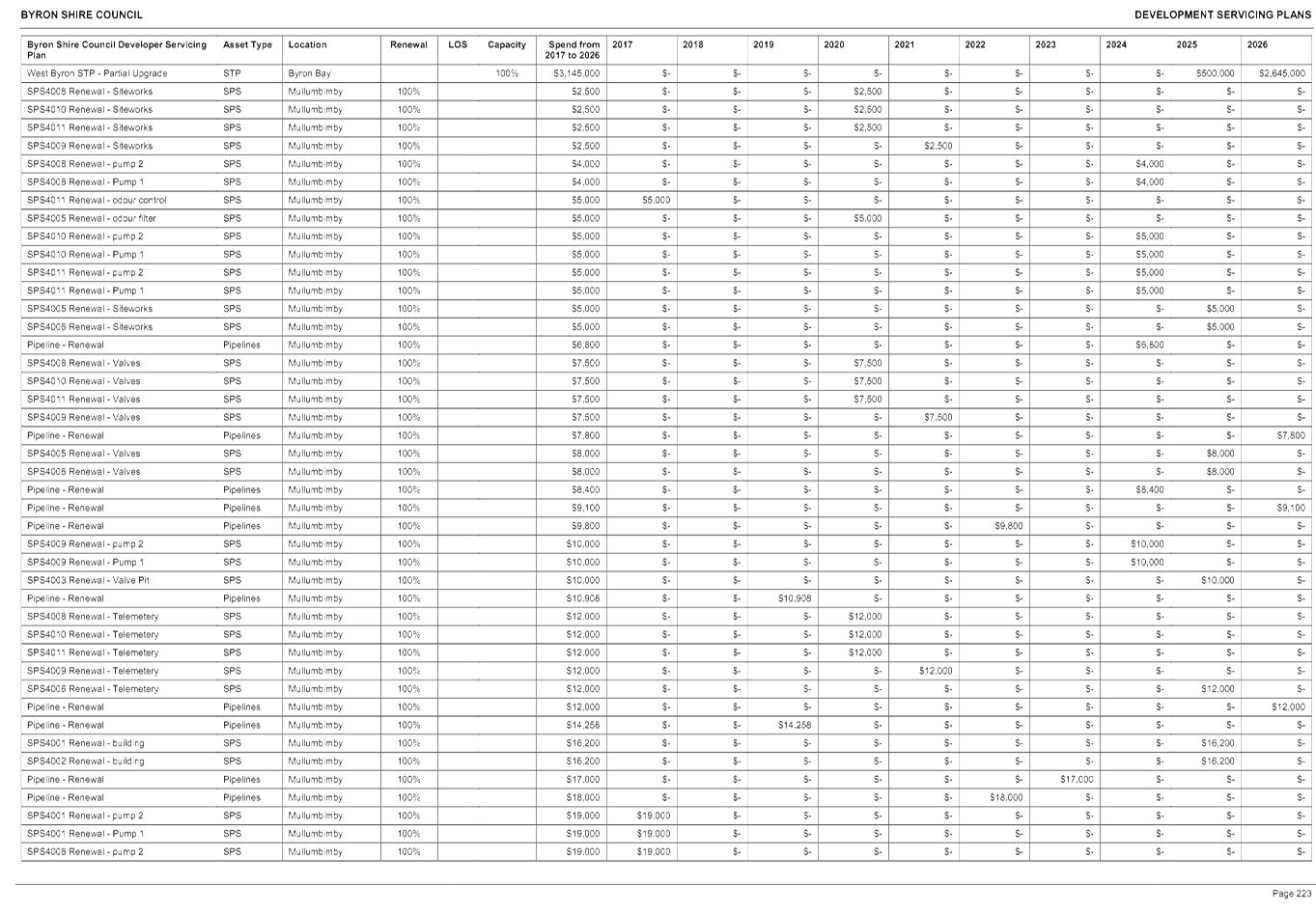

6.1 Developer

Servicing Rates

Attachment

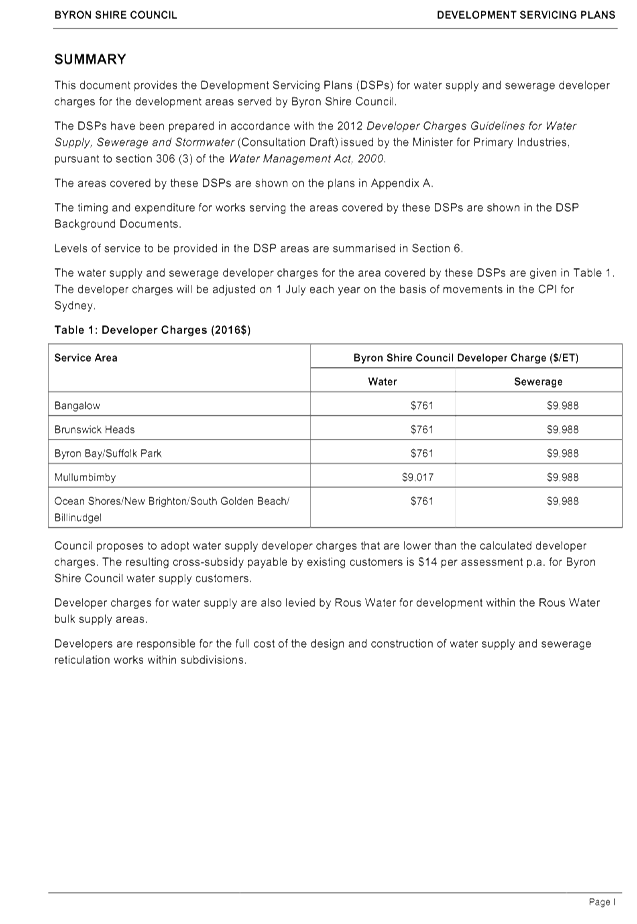

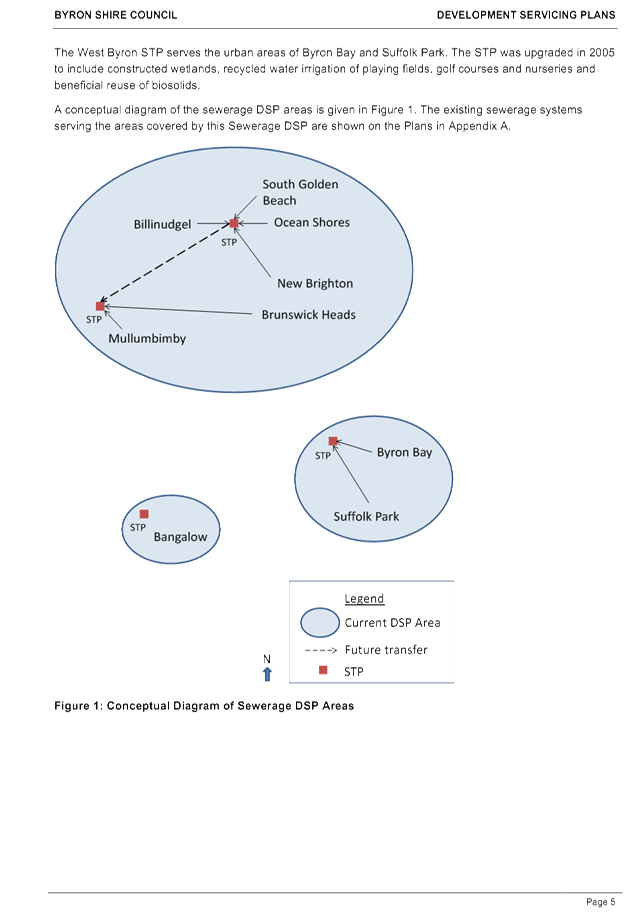

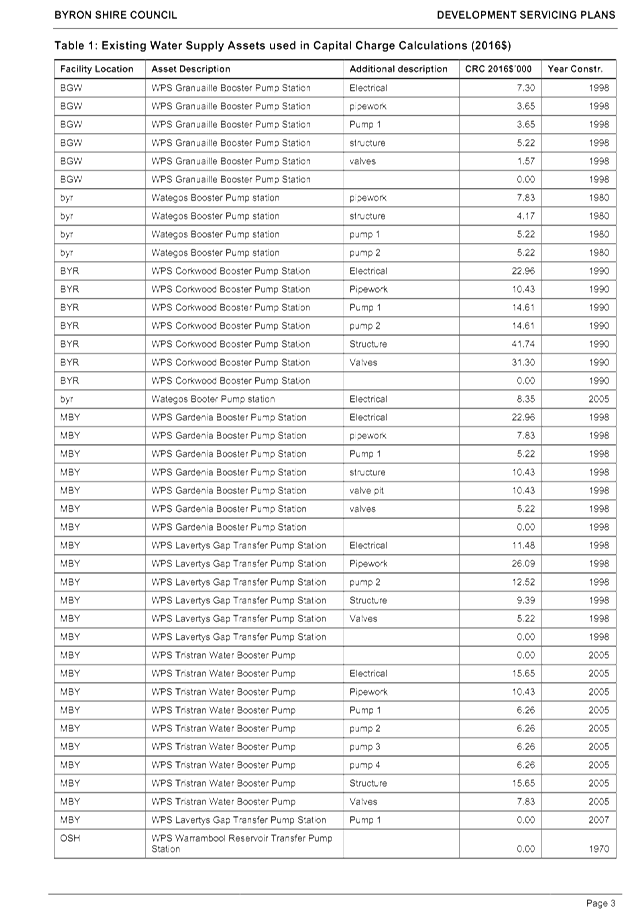

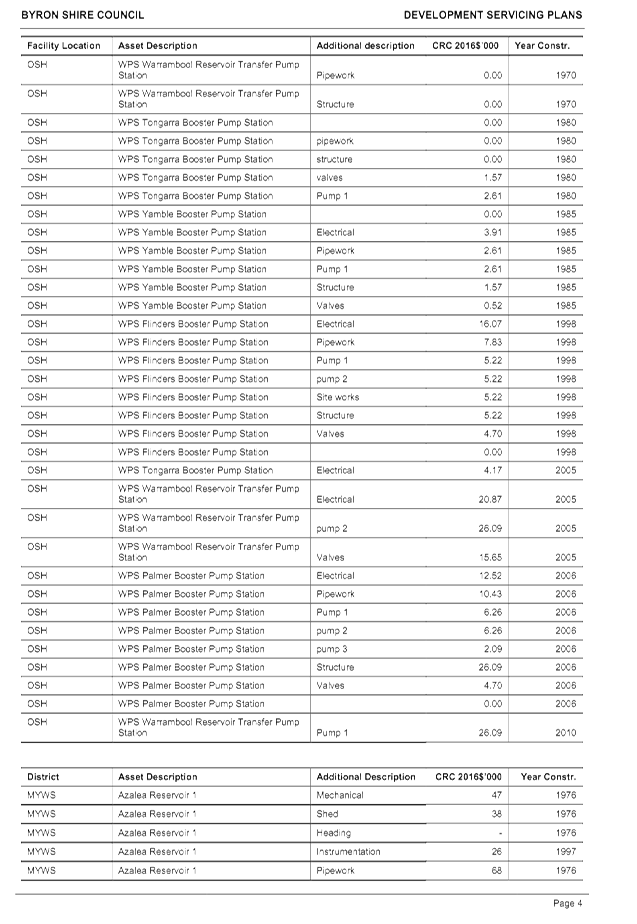

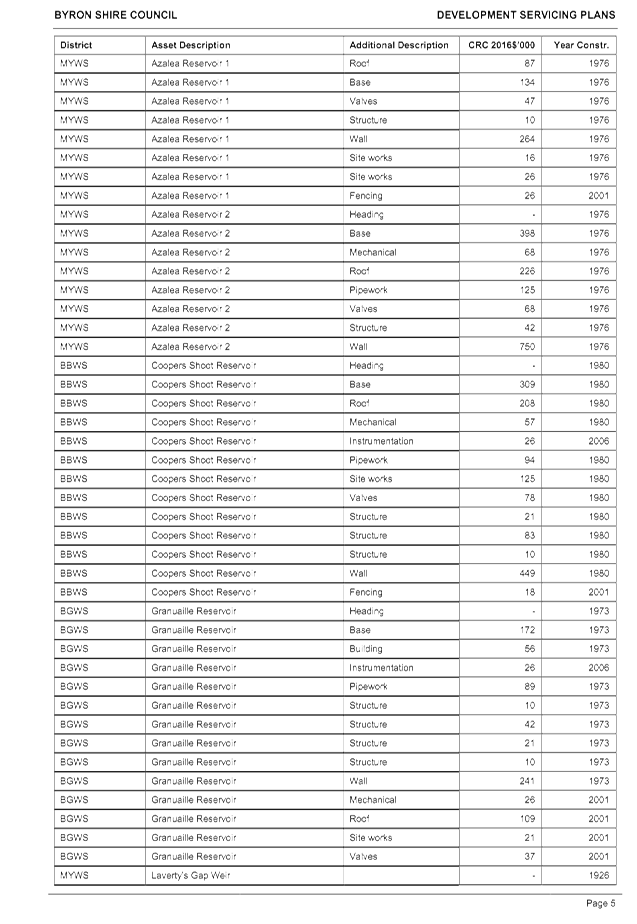

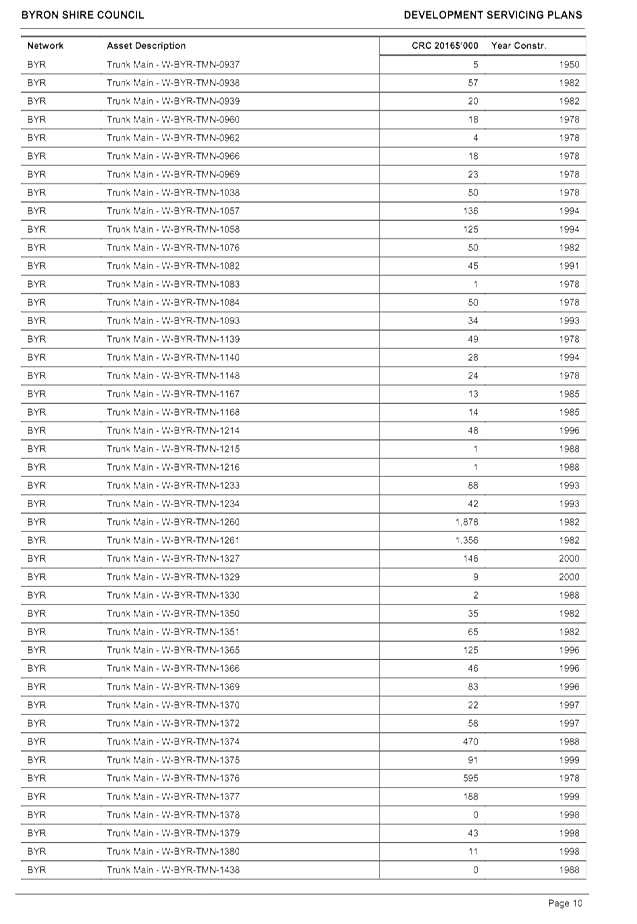

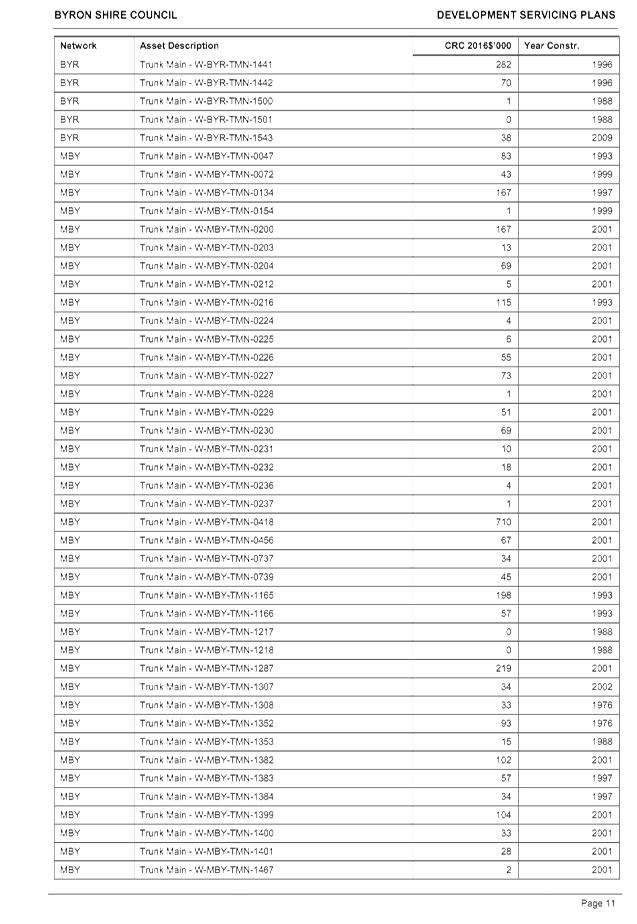

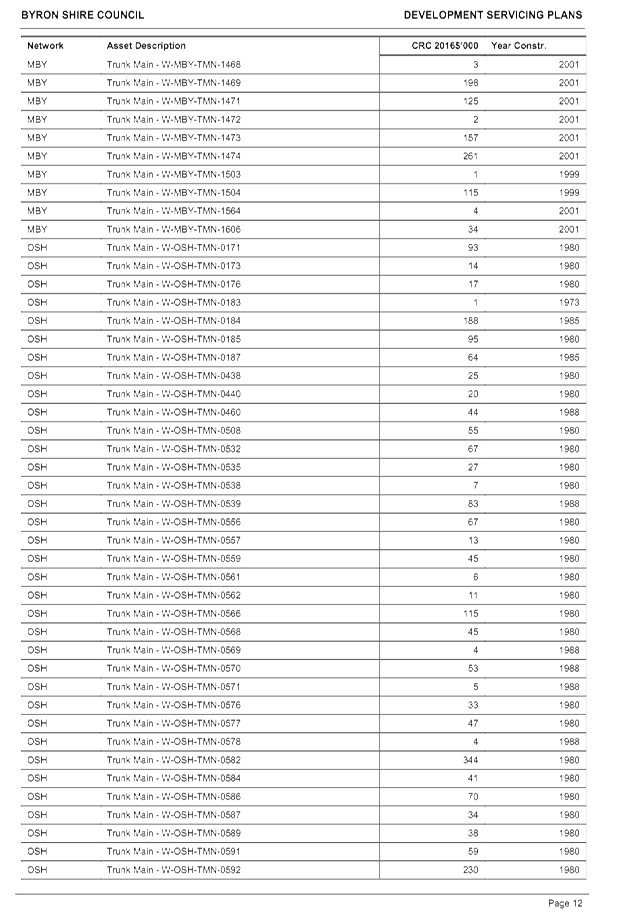

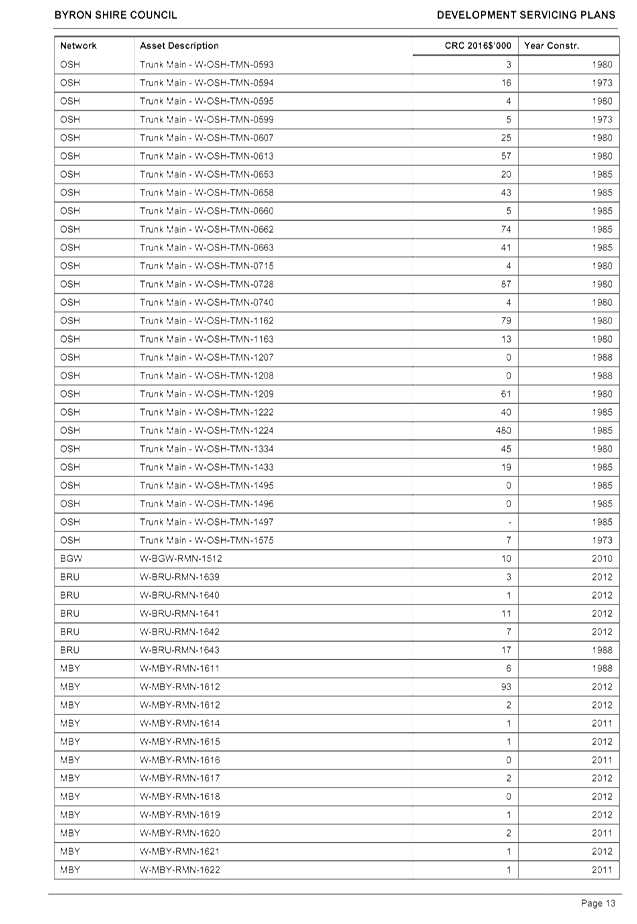

1... Byron Developer Servicing Plan Water Supply and Sewerage Rev 0. 262

Attachment

2... Byron DSP Background Document Rev 0........................................... 287

In person: 70-90 Station Street, Mullumbimby NSW

Postal Address: PO Box 219 Mullumbimby NSW 2482

Office Hours: 9.00am to 4.00pm Mon-Fri

Switchboard: 8.30am to 4.30pm Mon-Fri

Phone: 02 6626 7000

Fax: 02 6684 3018

Email: council@byron.nsw.gov.au

Web: www.byron.nsw.gov.au

Emergency After Hours 02 6622 7022

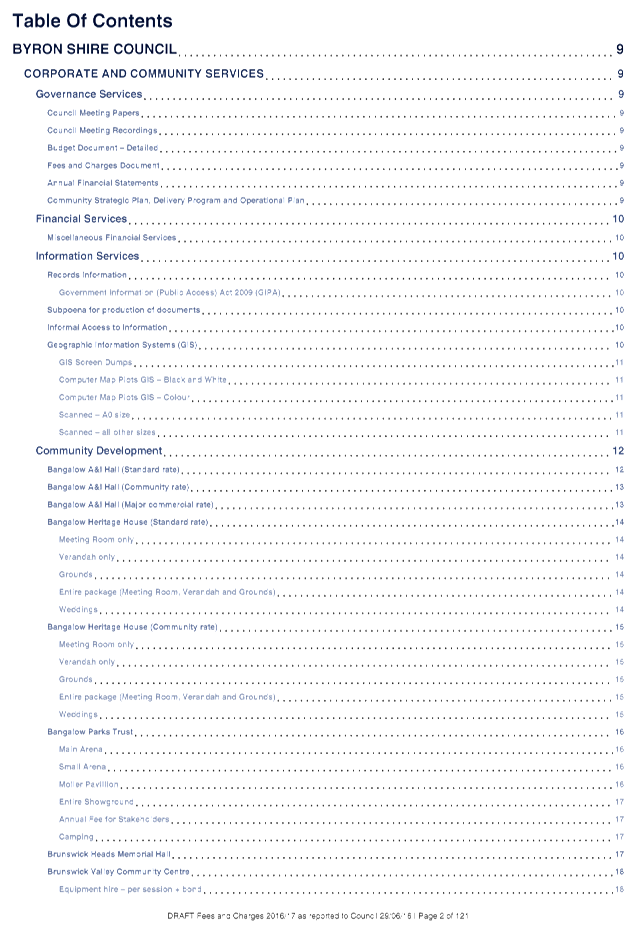

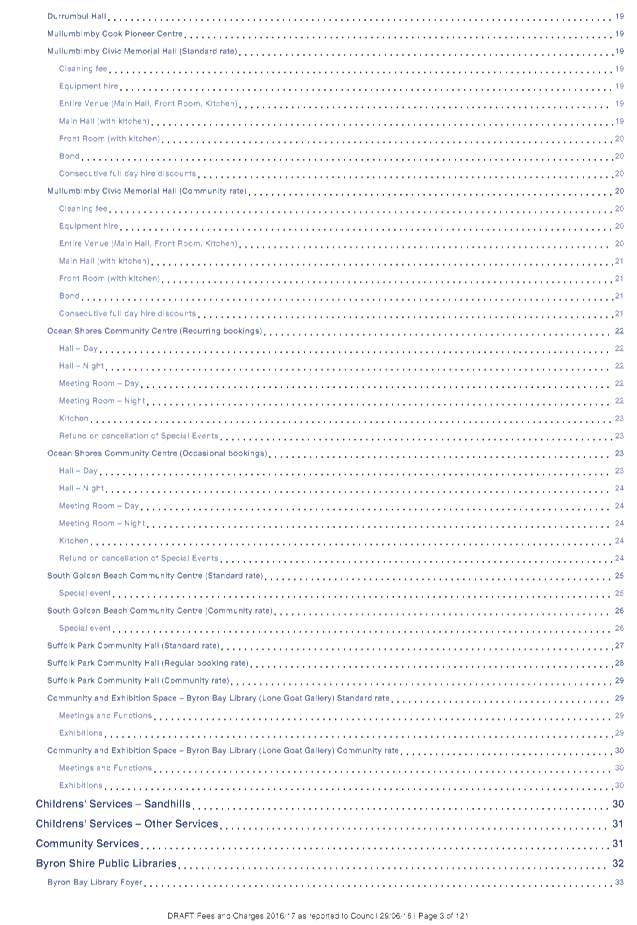

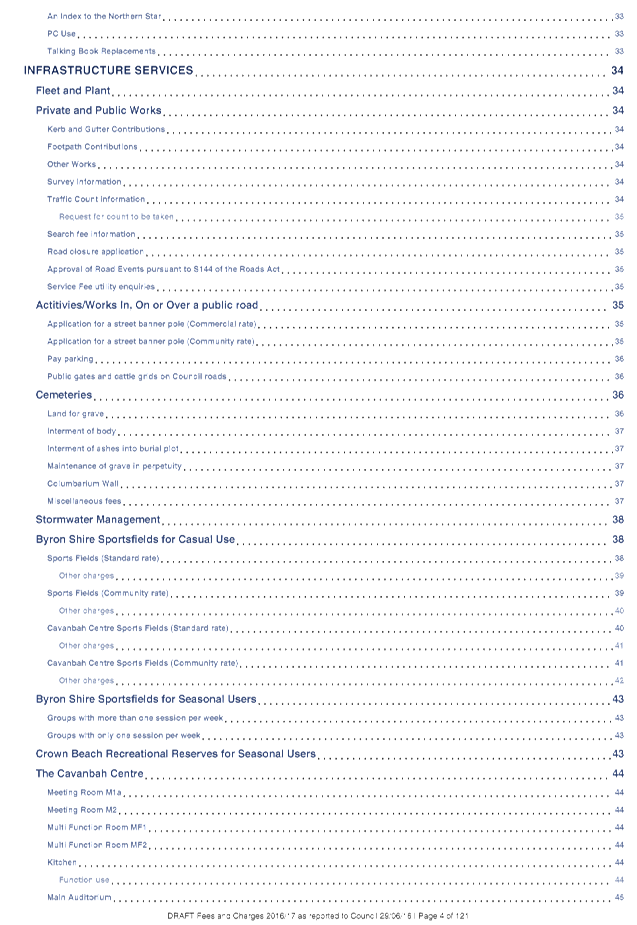

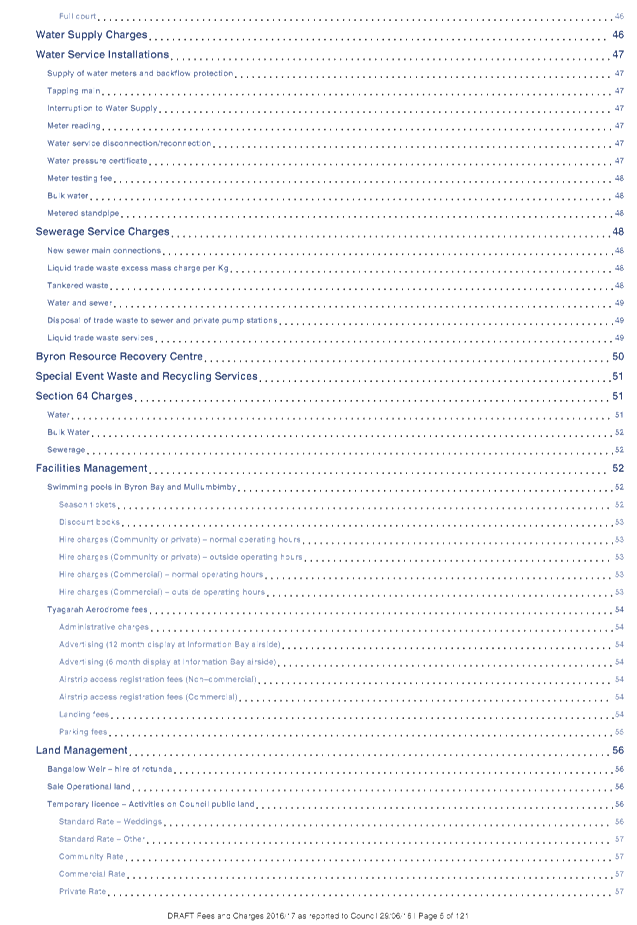

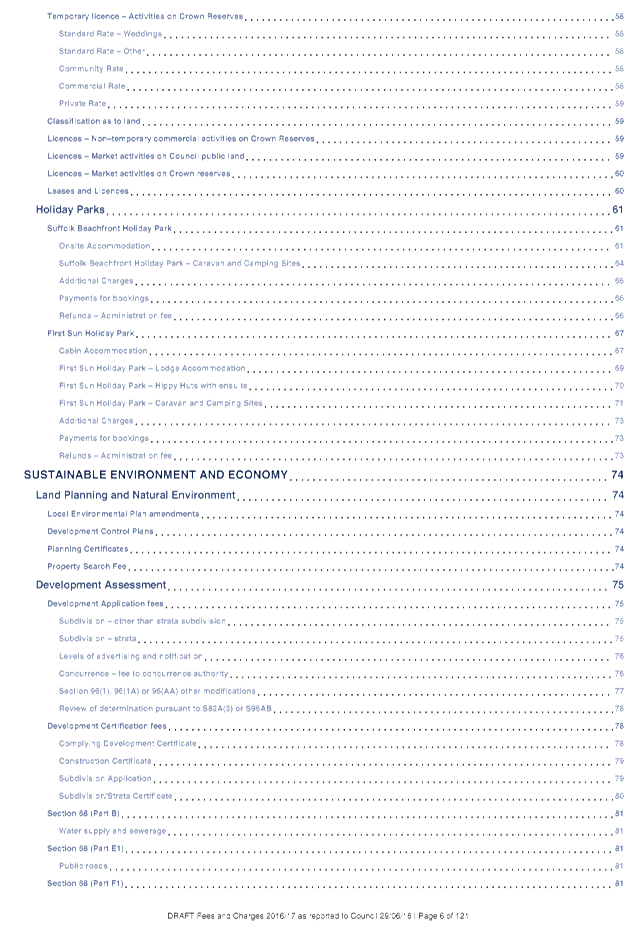

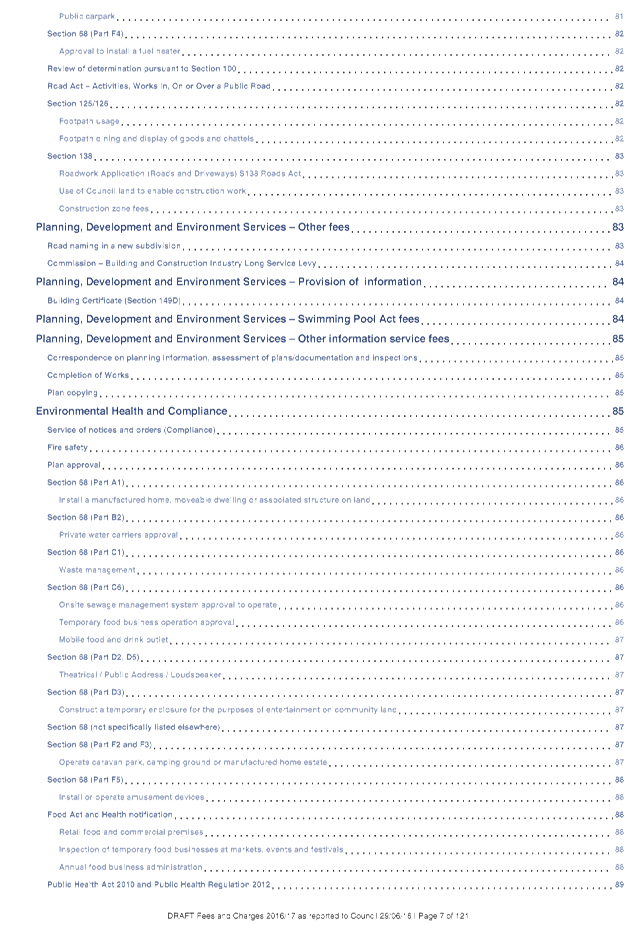

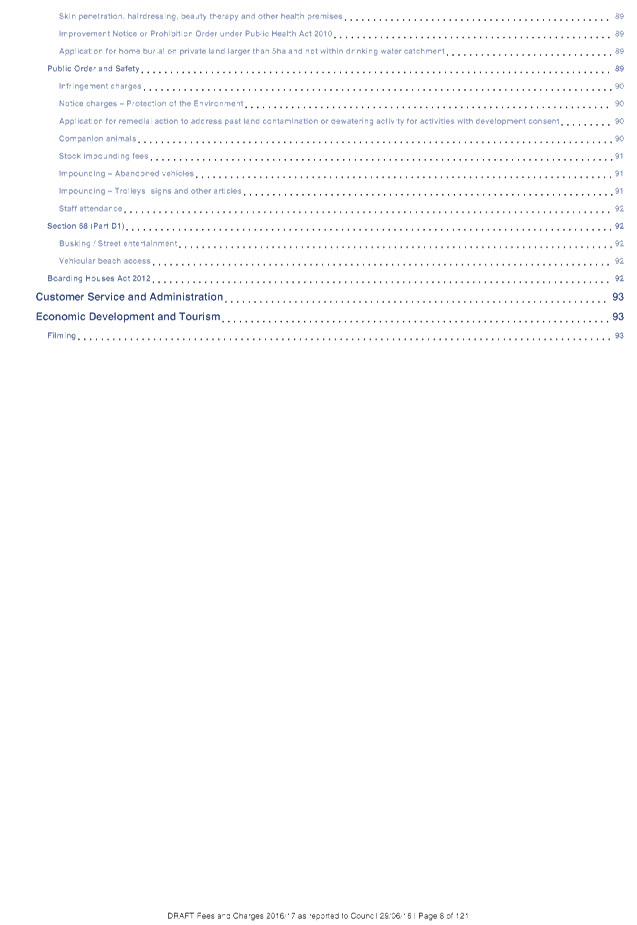

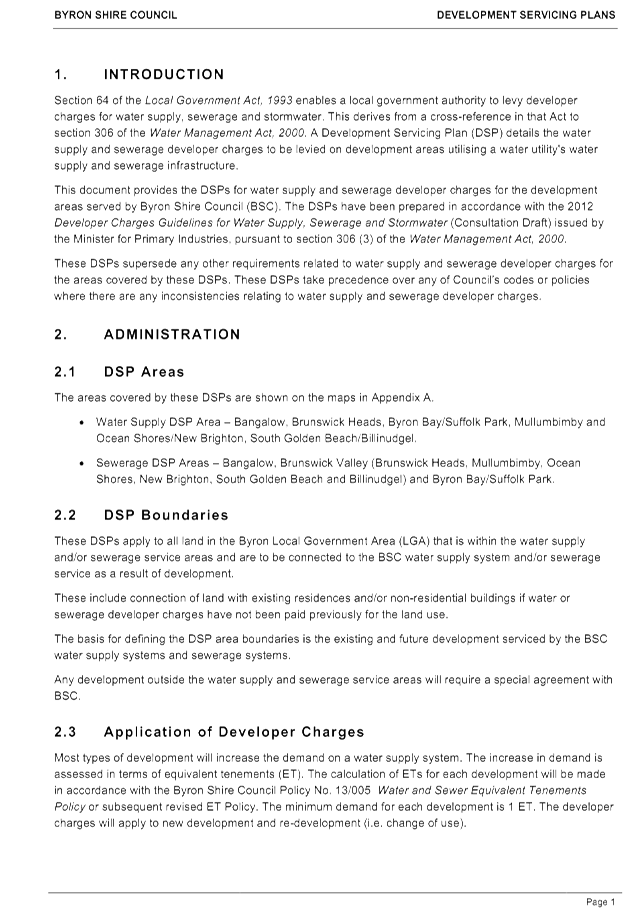

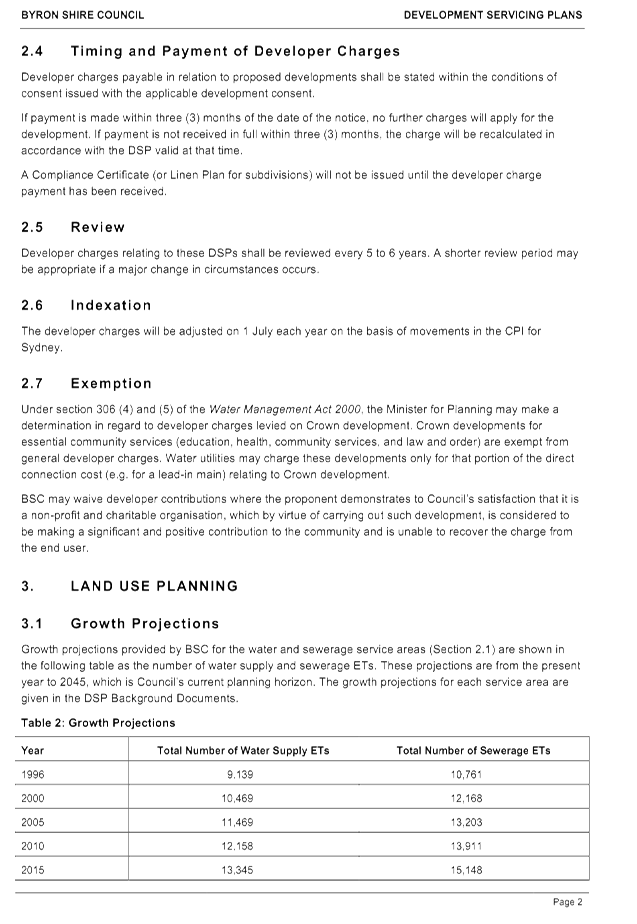

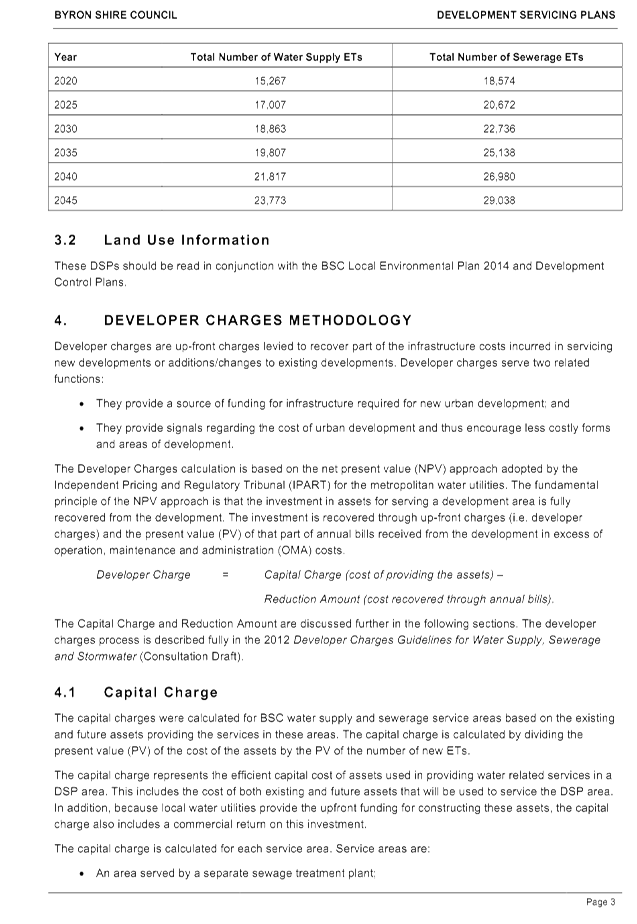

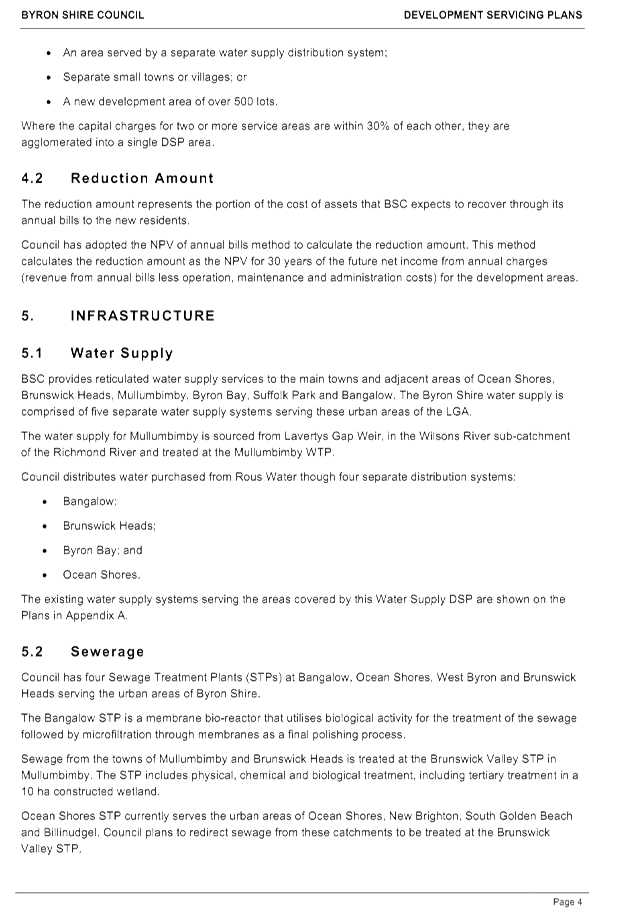

TABLE OF CONTENTS

INTRODUCTION.. 4

COMMUNITY

VISION.. 5

COMMUNITY

STRATEGIC PLAN – STRATEGIES AND OUTCOMES. 6

KEY

CAPITAL WORKS HIGHLIGHTS. 7

2016-2017

OPERATIONAL PLAN.. 8

INFRASTRUCTURE SERVICES. 8

Supervision and Administration. 8

Asset Management Planning. 8

Projects and Commercial Development 9

Emergency Services and Floods. 10

Depot and Fleet Management 10

Local Roads and Drainage. 11

Roads and Maritime Services. 13

Quarries. 13

Open Space and Recreation. 13

The Cavanbah Centre. 15

Waste and Recycling Services. 15

First Sun Holiday Park. 16

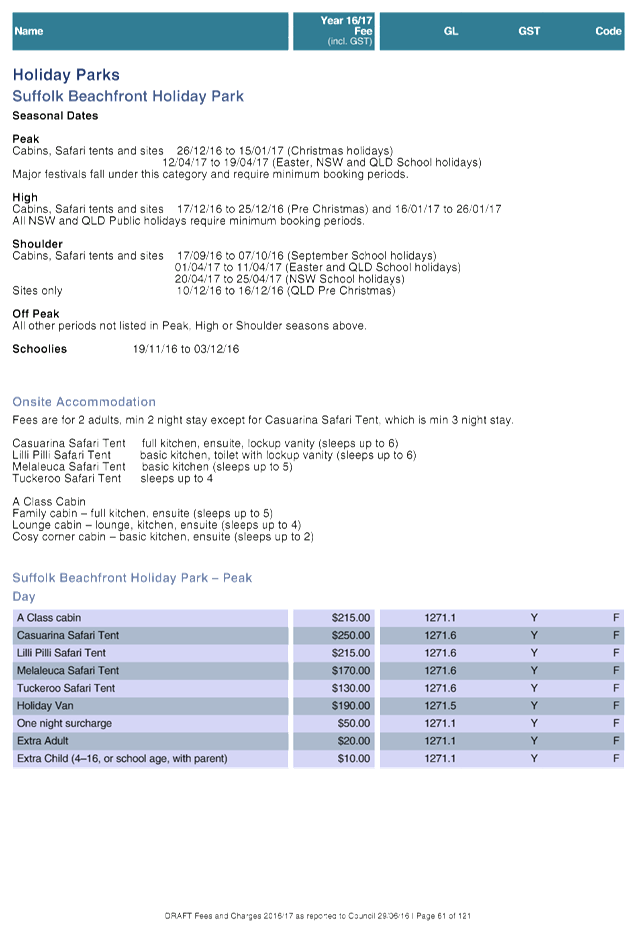

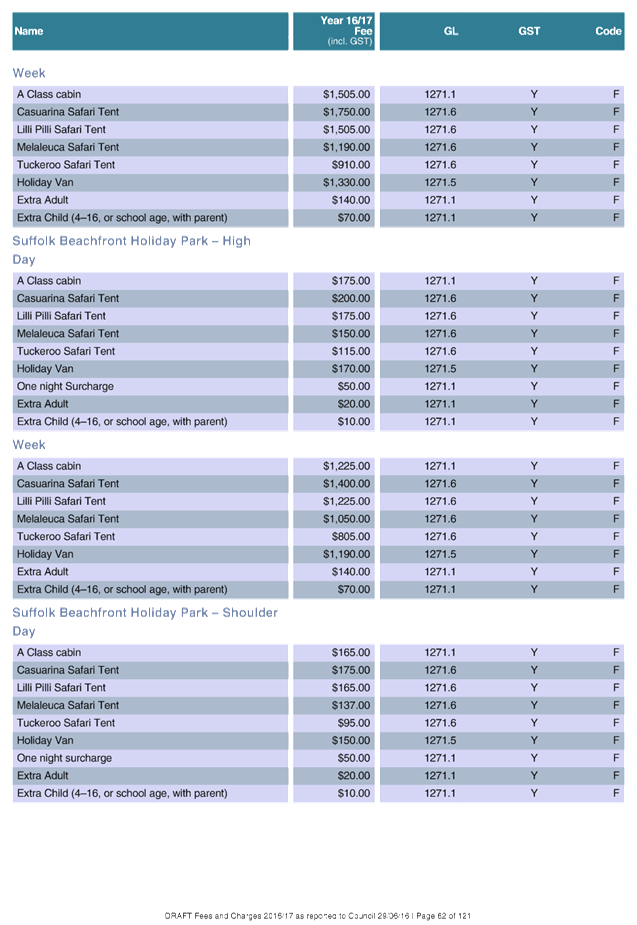

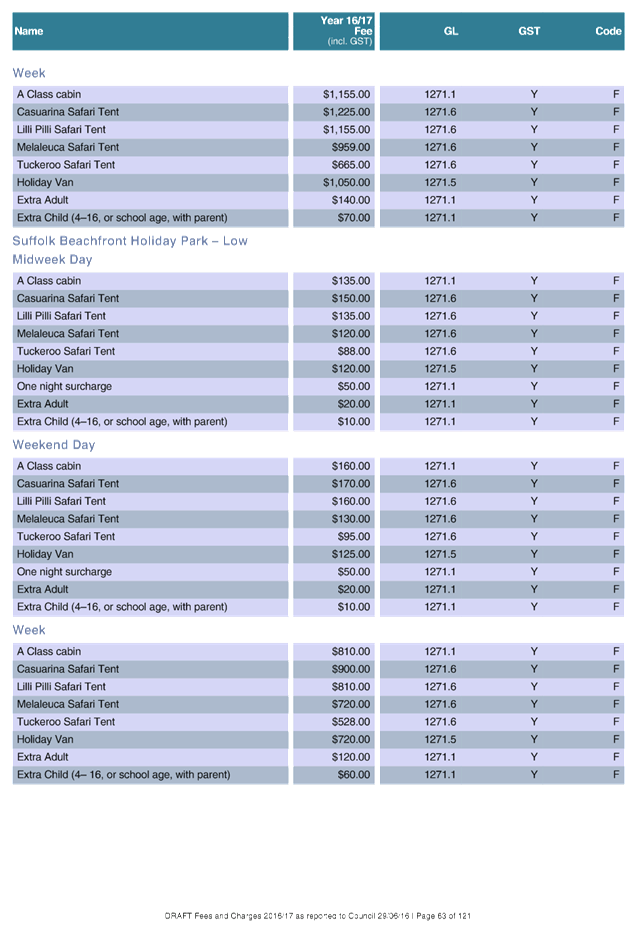

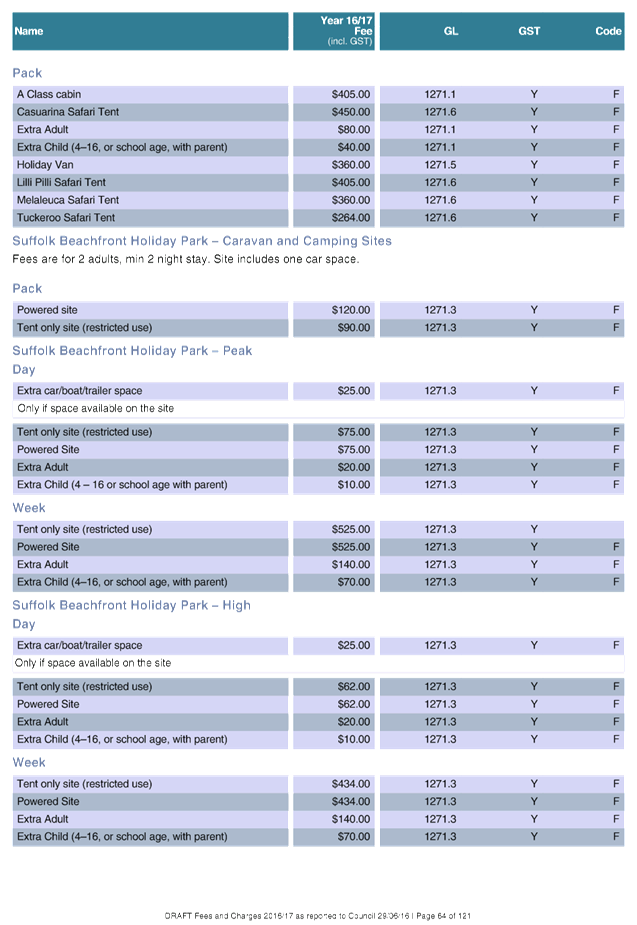

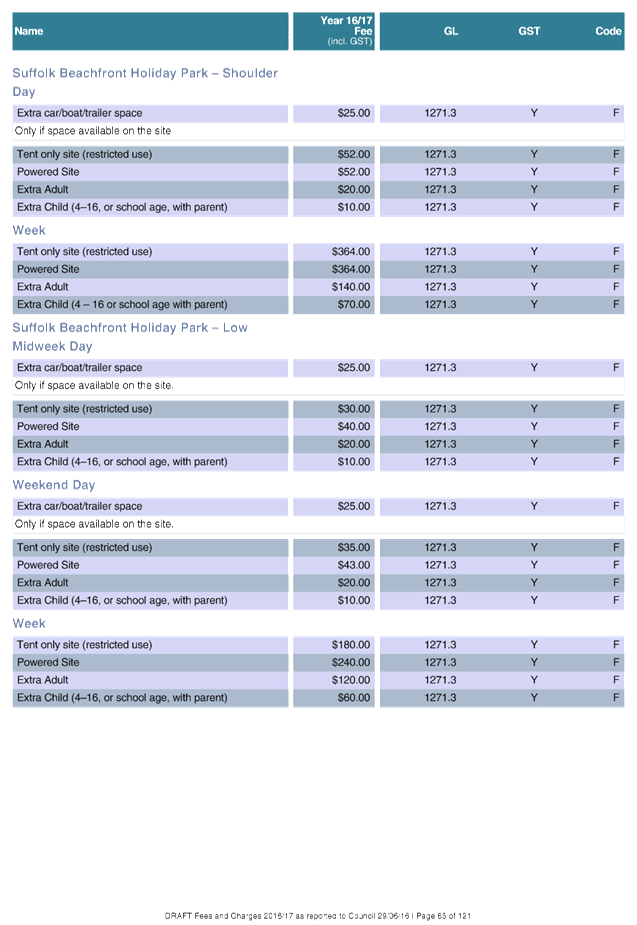

Suffolk Beachfront Holiday Park. 16

Facilities Management 17

Water Supplies. 17

Sewerage Services. 18

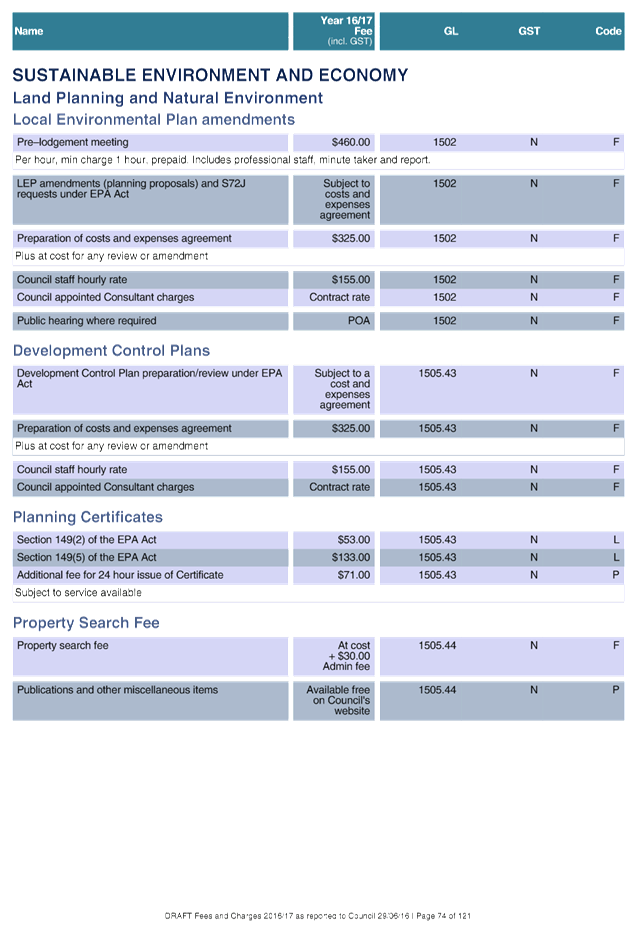

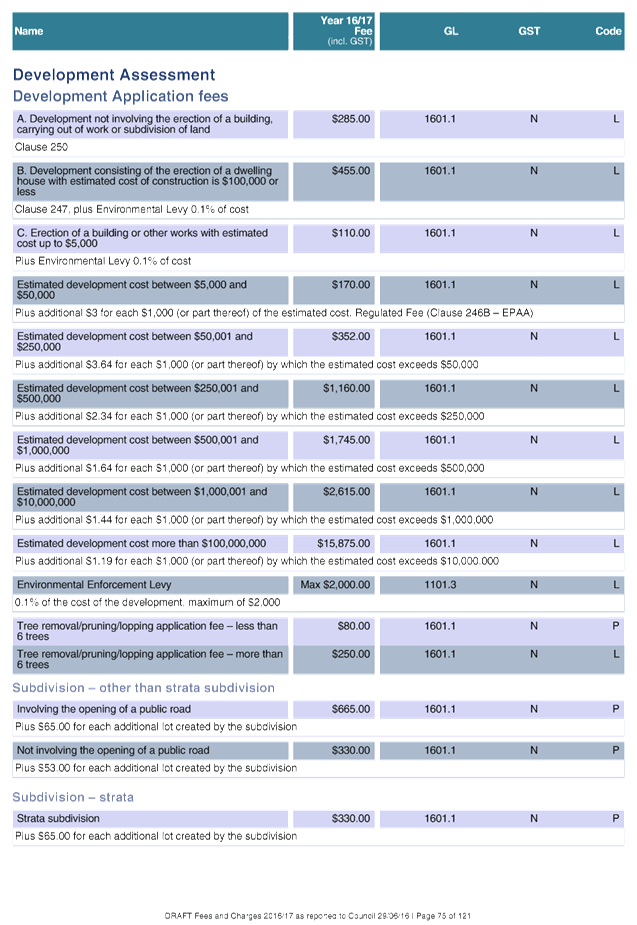

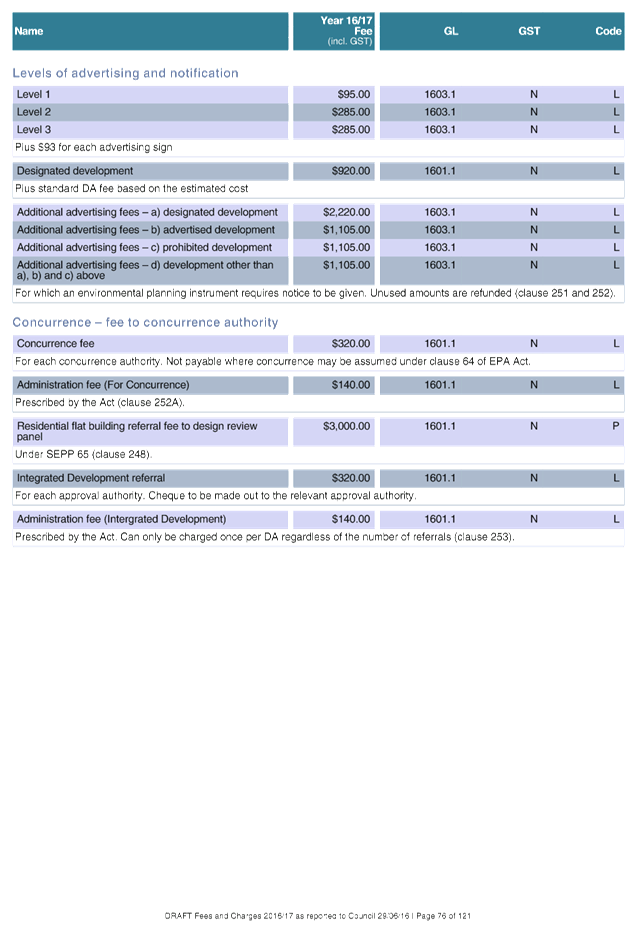

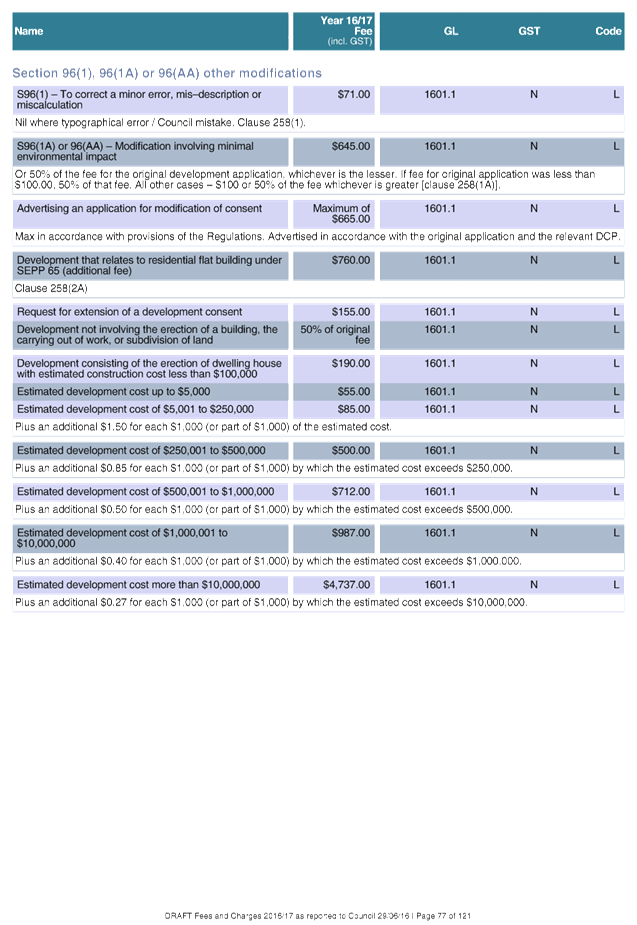

SUSTAINABLE ENVIRONMENT AND ECONOMY. 20

Development and Certification. 20

Environment and Compliance Services. 21

Planning Policy and Natural Environment 21

Economic Development 22

GENERAL MANAGER. 23

General Manager 23

People and Culture Services. 24

CORPORATE AND COMMUNITY SERVICES. 25

Public Libraries. 25

Children's Services - Other Children's

Services. 25

Children's Services –

Sandhill’s Childcare. 25

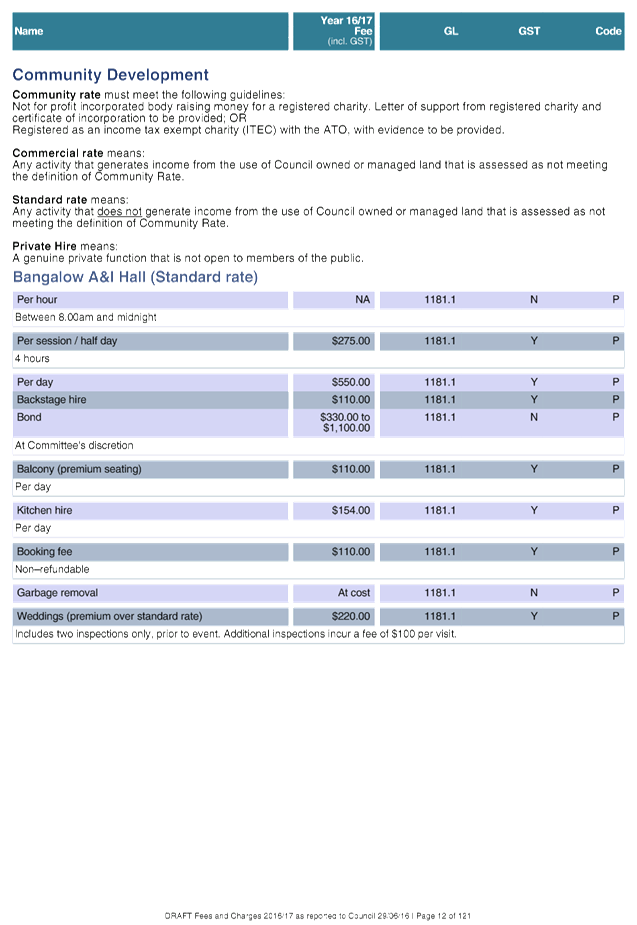

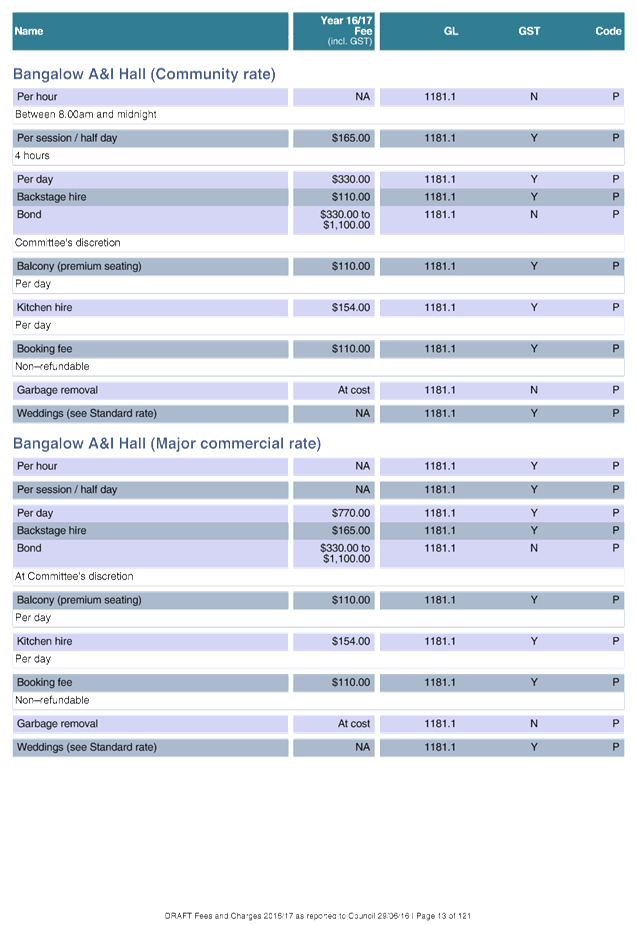

Community Development 26

Information Services. 26

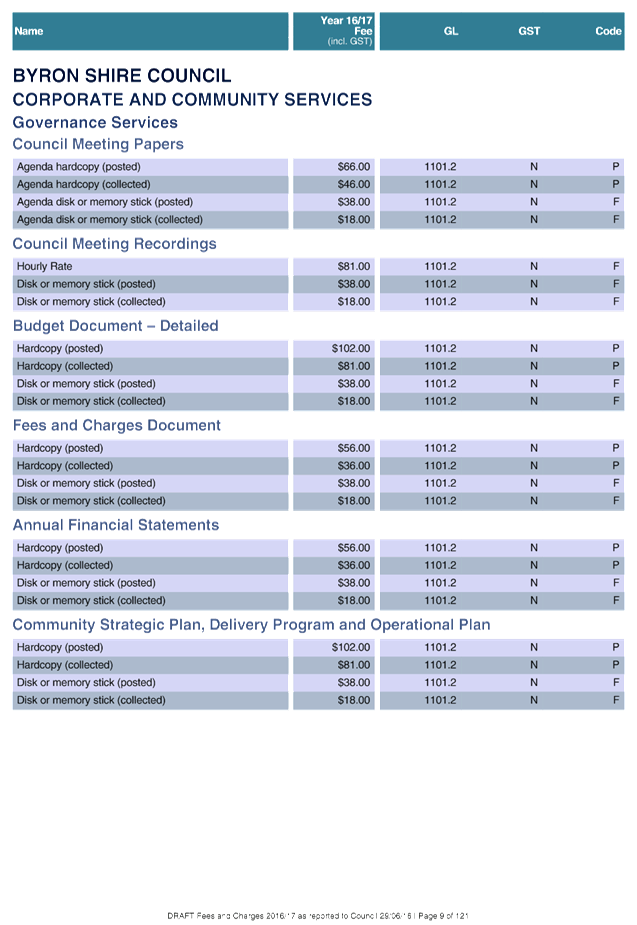

Governance Services. 27

Councillor Services. 28

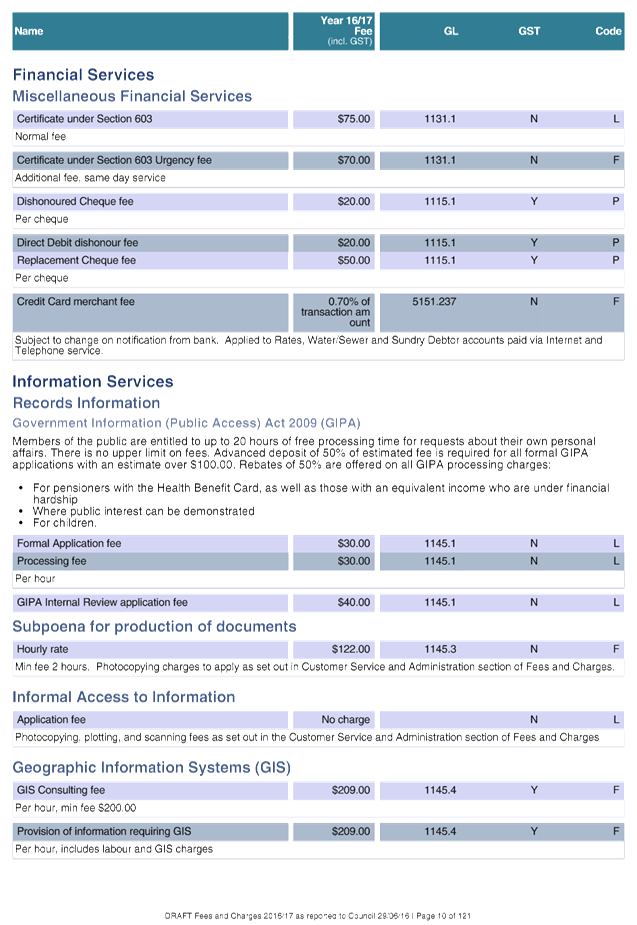

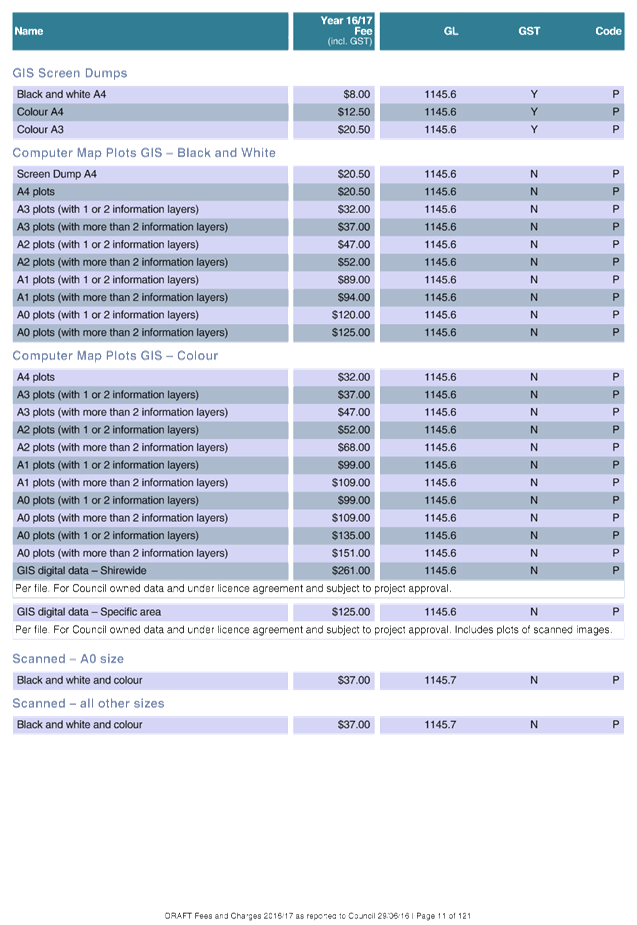

Financial Services. 28

2016-2017

BUDGET. 30

2016-2017

STATEMENT OF REVENUE POLICY. 35

RATING STATEMENT. 35

STATEMENT OF ORDINARY RATES TO BE LEVIED.. 37

STATEMENT OF CHARGES TO BE LEVIED.. 40

BORROWINGS. 52

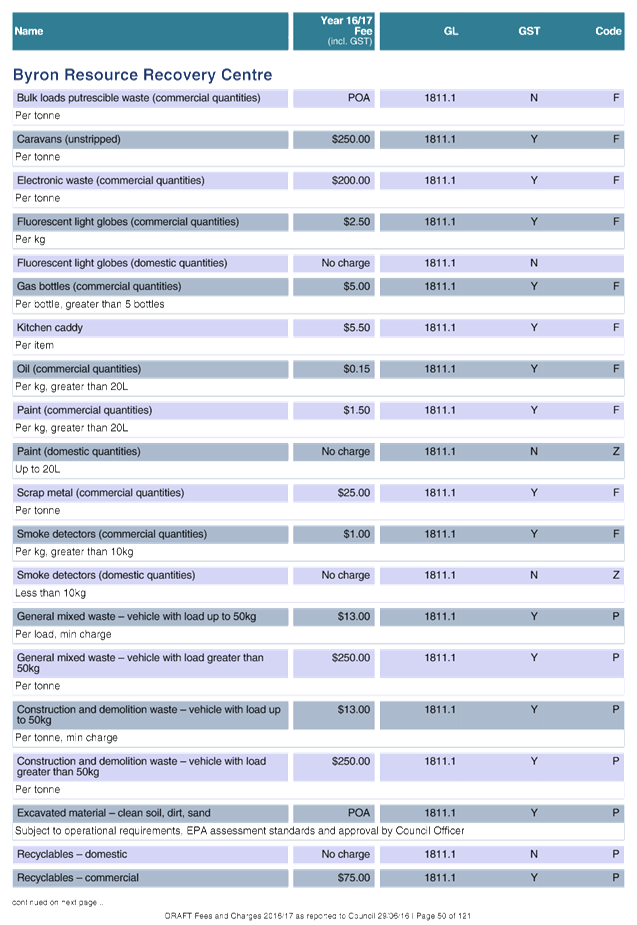

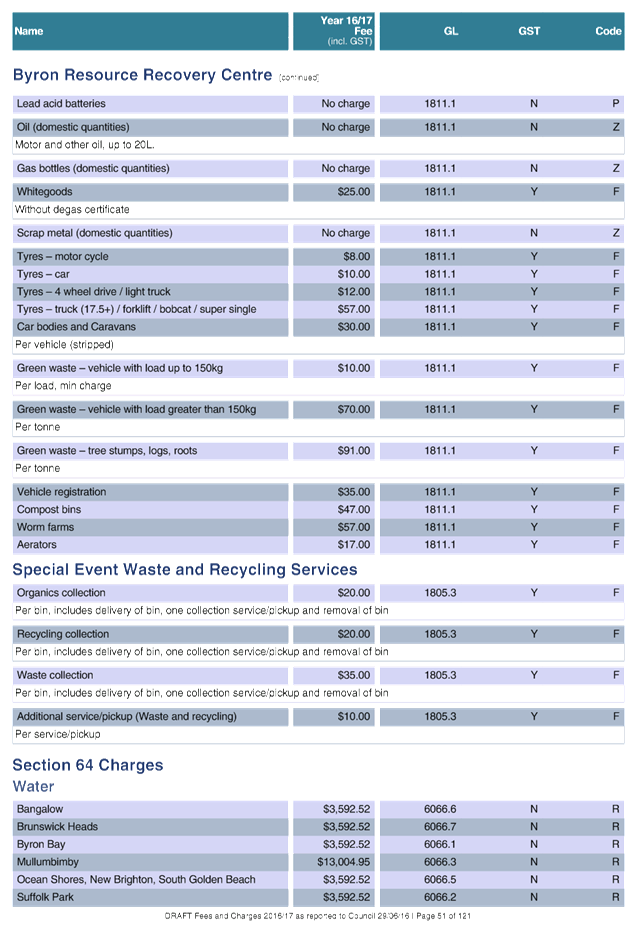

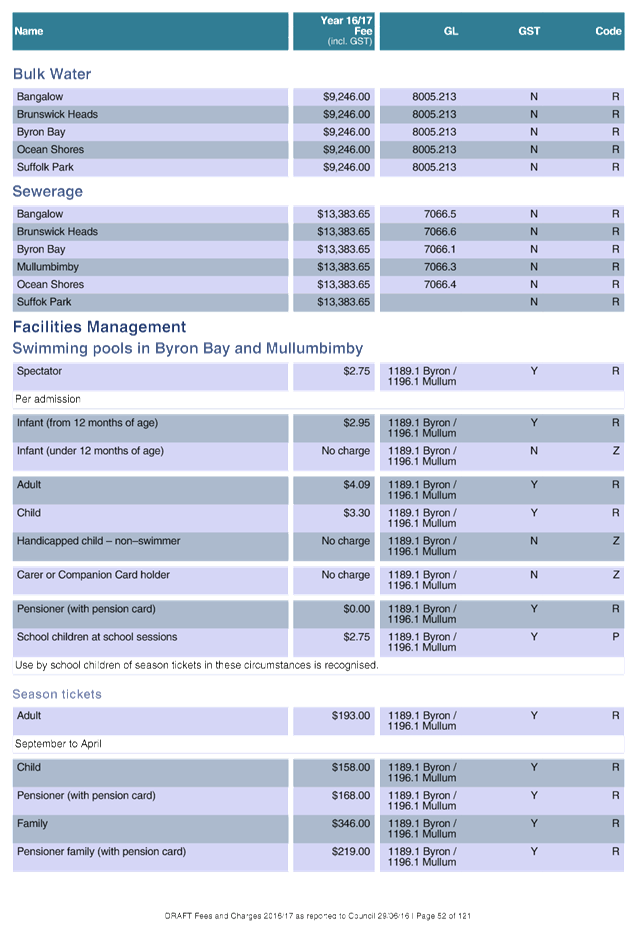

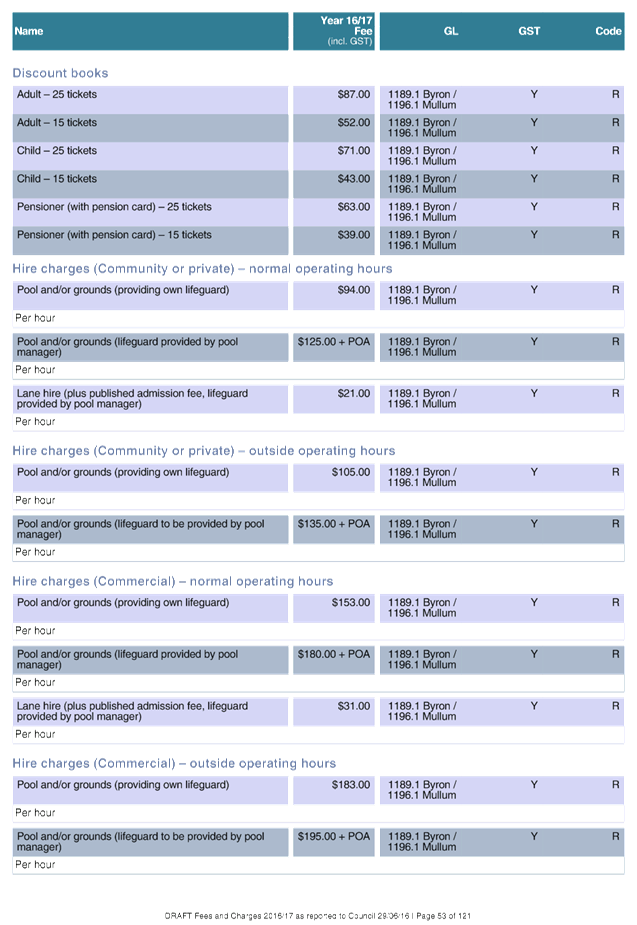

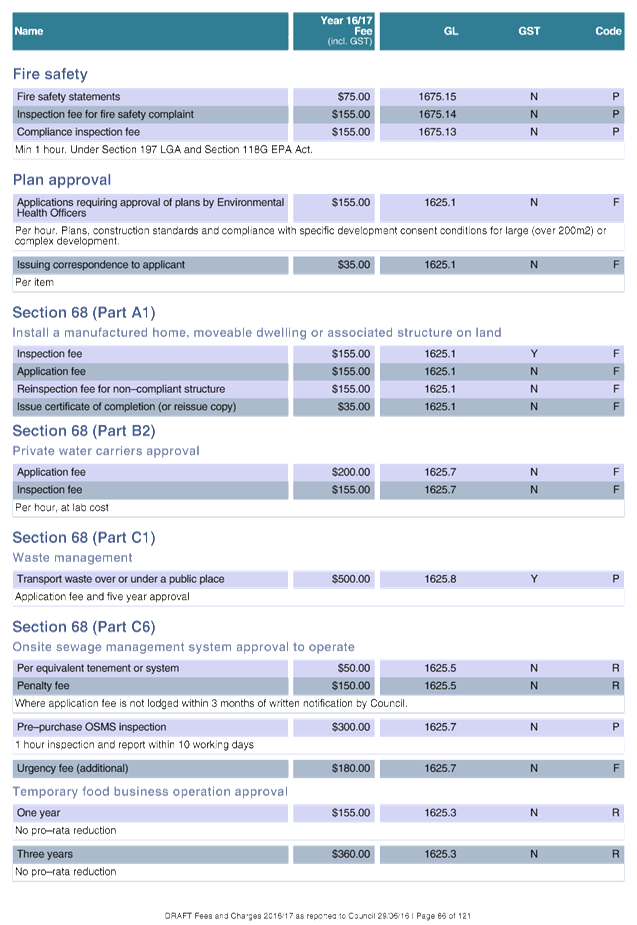

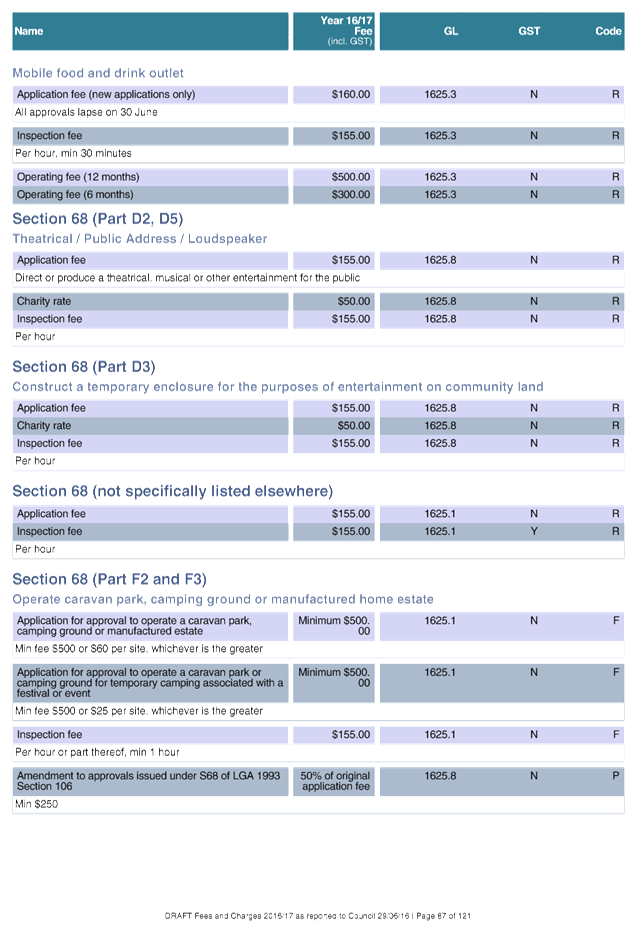

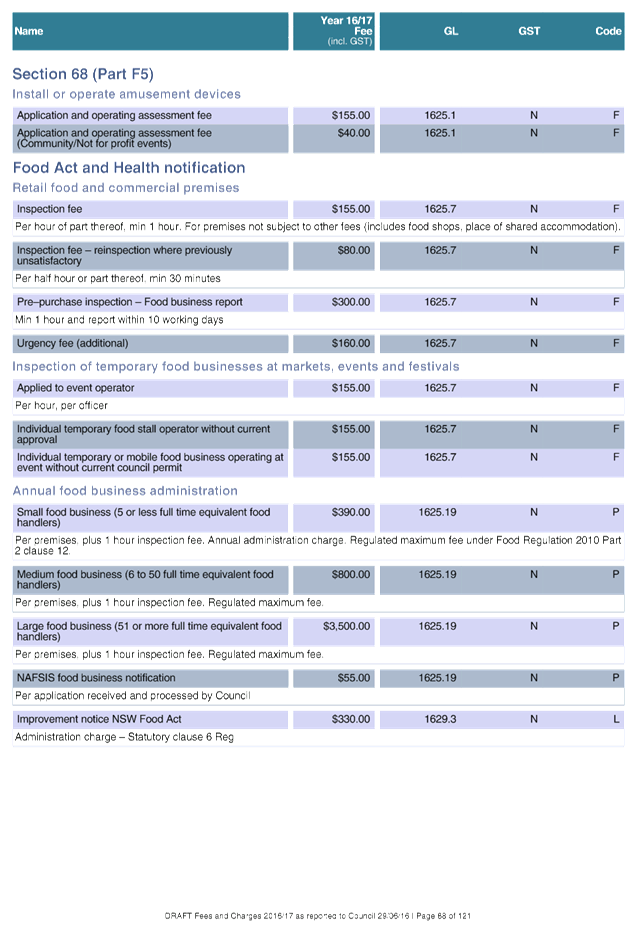

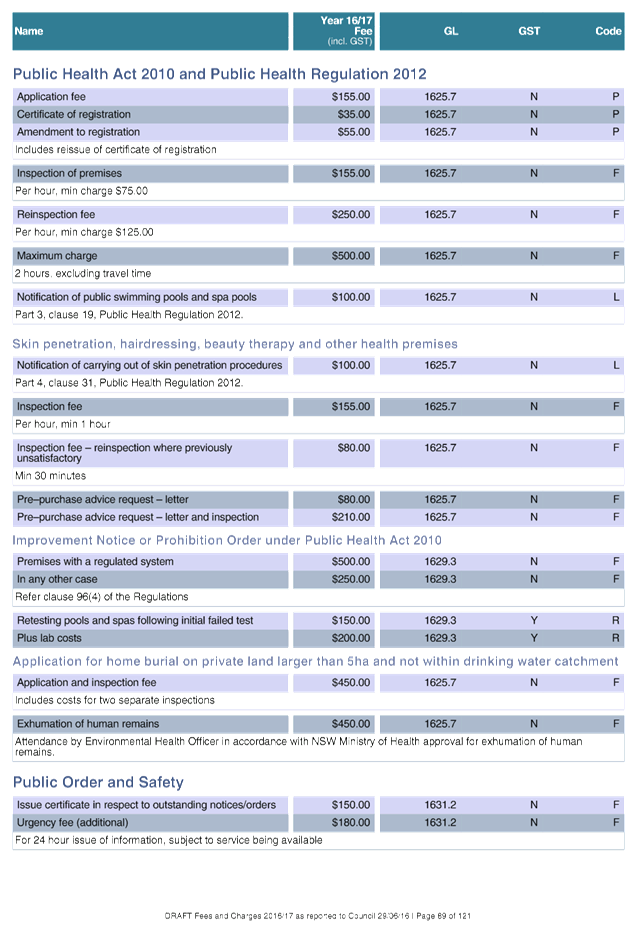

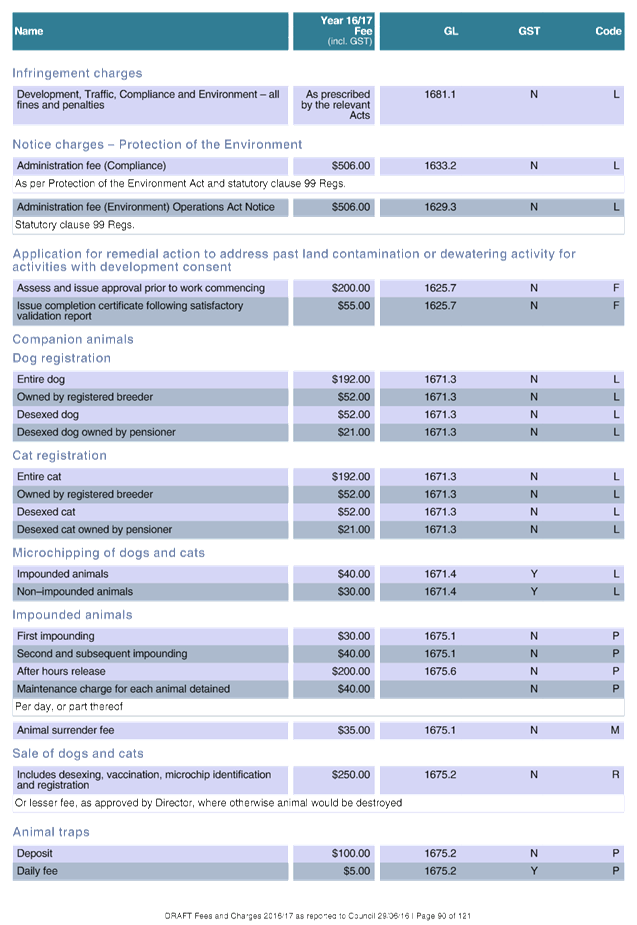

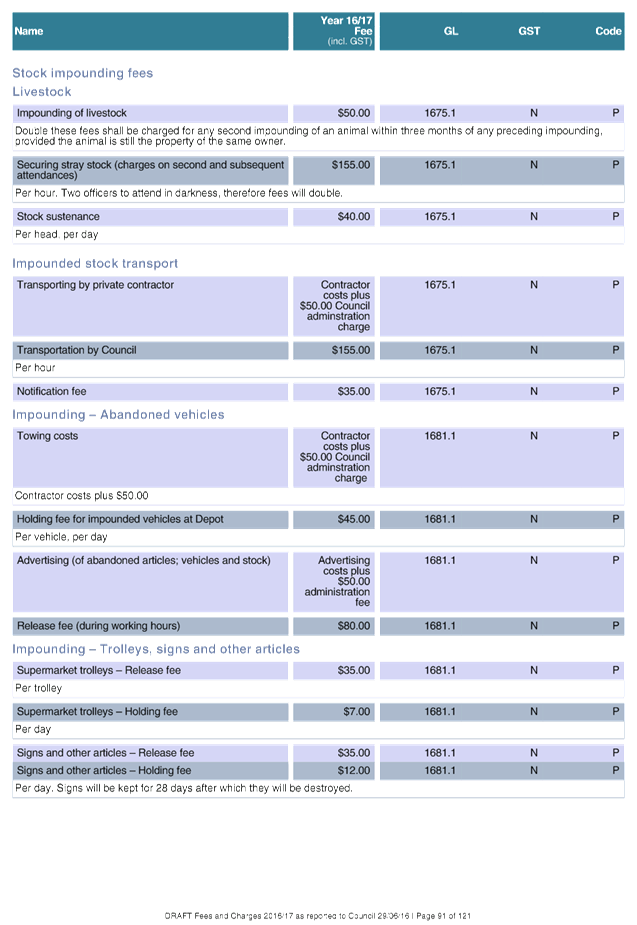

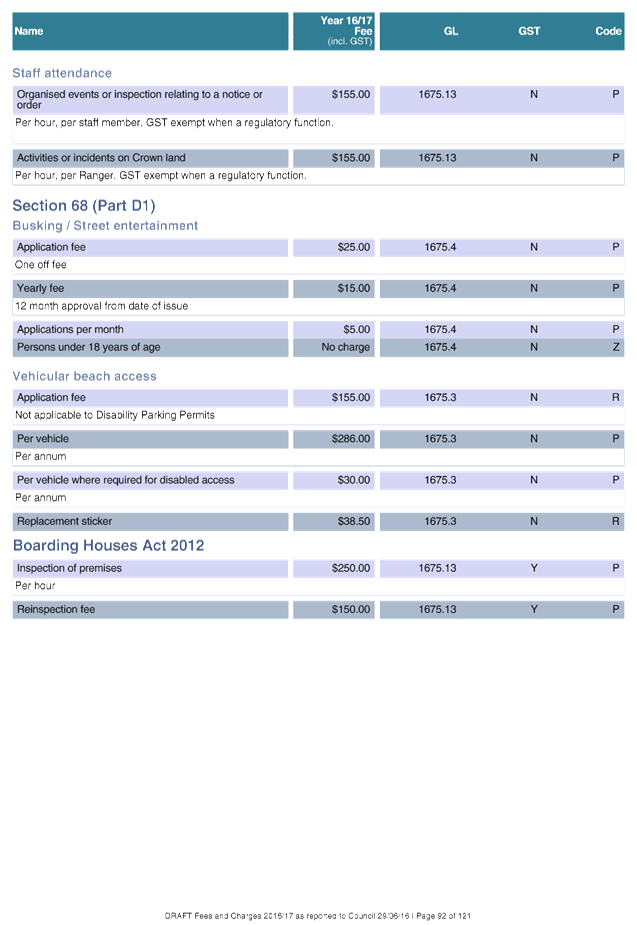

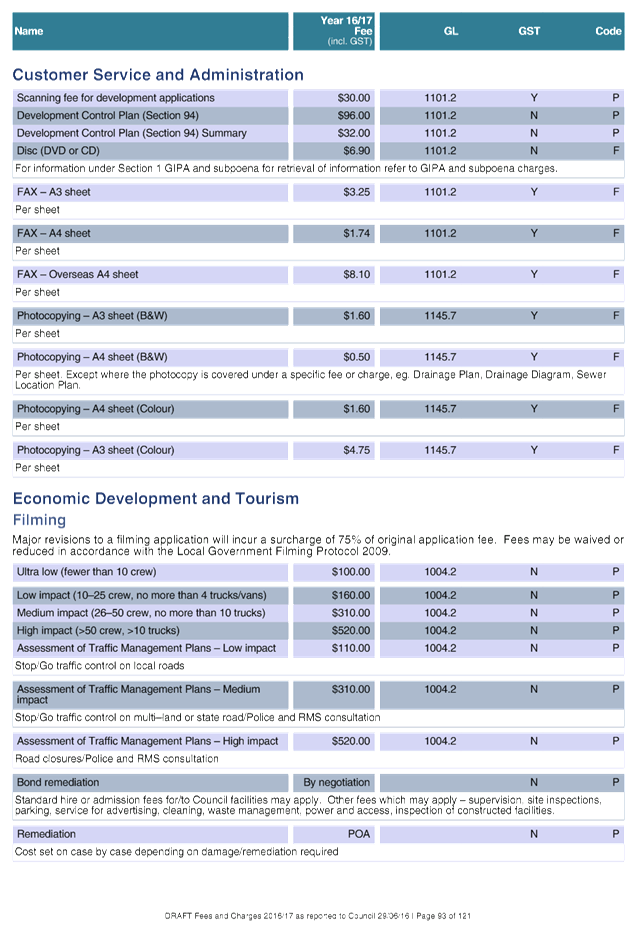

2016-2017 FEES AND CHARGES. 53

APPENDIX

1. 54

COMMUNITY STRATEGIC PLAN, DELIVERY PROGRAM AND OPERATIONAL PLAN

LINKAGES. 54

INTRODUCTION

Welcome to

Byron Shire Council’s Operational Plan 2016 - 2017.

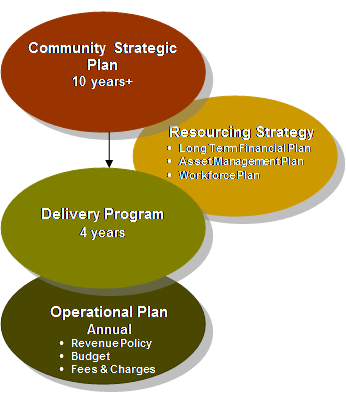

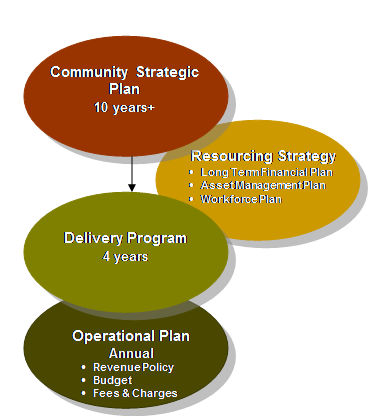

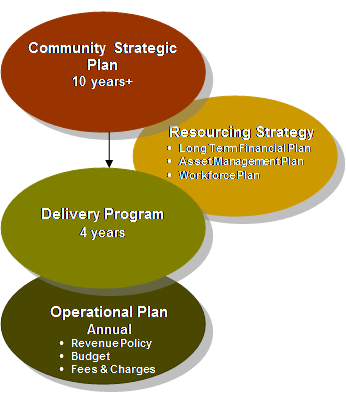

The

Operational Plan 2015 - 2016 is one part of the suite of Byron Shire

Council’s Integrated Planning and Reporting documents. These documents

are linked together by a matrix of actions that details how the

community’s long term aspirations and outcomes will be achieved.

Long Term Byron

Shire Council Community Strategic Plan 2022

(10 years) Developed

in consultation with the Byron Shire community, the long term community

aspirations for the future direction of Byron Shire have been captured as

Community Outcomes within the Community Strategic Plan (CSP). Long Term

Strategies have been included and they outline how the Community Outcomes will

be achieved.

Medium Term Delivery

Program

(4 years) The

four year program details the Key Activities that Council will undertake in

order to work towards achieving the Community Outcomes of the CSP.

Short Term Operational

Plan

(annual) The

Operational Plan lists actions Council will undertake in the coming 12 month

period. The Operational Plan also includes the Statement of Revenue Policy (the

annual budget and fees and charges).

In

addition, this suite of documents is underpinned by Council’s Resourcing

Strategy which consists of a Long Term Financial Plan, Asset Management Plan

and Workforce Plan. These documents outline how Council has considered, in the

medium to long term, the Shire’s finances, assets and workforce to

achieve the Community Strategic Plan outcomes.

Byron Shire

Council’s Integrated Planning and Reporting Framework is captured in the

diagram below:

Integrated Planning and Reporting

Framework

4 years

4 years

4 years

Byron

Shire Council’s integrated planning documents are built around five key

themes - Corporate Management, Economy, Society and Culture, Environment, and

Community Infrastructure.

Each key theme contains several outcomes

which are all underpinned with 17 strategies.

The Operational Plan details the actions

Council will undertake during 2016-2017 to deliver on the long term strategies

contained in the Community Strategic Plan.

COMMUNITY VISION

The

community’s vision is linking together our people, our place and our

purpose - it’s about the future of our whole community.

The

community’s vision is captured in the 10-year Community Strategic Plan

developed collaboratively between the community and Council in 2012.

The vision

defines a sustainable direction for our Shire, and sets out the strategic

direction for our future.

COMMUNITY STRATEGIC

PLAN – STRATEGIES AND OUTCOMES

CM1 Effective

governance, business, project and financial management

CM2 Informed

and engaged community

CM3 Effective

partnerships with all levels of government

CM4 Community

compliance with statutory requirements

EC1 A

diverse economic base and support for local businesses

EC2 A

sustainable tourism industry that respects and promotes our natural environment

and community values

EC3 The

development of a diverse range of arts and creative industries

SC1 Support

communities to achieve equitable access to an appropriate range and level of

whole of life services such as healthcare, education and housing

SC2 Achieve

active participation in local and regional community life

SC3 Respect

and understanding of Aboriginal heritage and wider cultural diversity

EN1 Protect

and enhance the natural environment

EN2 Sustainable

towns, villages and rural settlements that:

a) respect

our natural environment

b) create an

inclusive social environment and

c) integrate

harmoniously with the character of local areas.

EN3 A

low carbon community that integrates:

a) food

security

b) renewable

energy

c) climate

change

d) non-renewable

resource constraints, including peak oil and

e) economic and

social prosperity and resilience

CI1 Planning

for the future

CI2 Provision

of essential services

CI3 Renew

and maintain existing infrastructure

C14 Develop new infrastructure

KEY CAPITAL WORKS HIGHLIGHTS

2016-2017 OPERATIONAL PLAN

INFRASTRUCTURE SERVICES

Responsible Executive: Director Infrastructure Services

|

Total Budget:

|

Operating

Revenue

|

Capital

Revenue1

|

Operating

Expenditure

|

Capital

Expenditure2

|

|

$42,615,500

|

$17,191,000

|

$57,512,900

|

$52,124,600

|

1. Capital

Revenue excludes transfers from Reserves.

2. Capital

Expenditure excludes loan principal repayments and transfers to Reserves.

Supervision and Administration

Responsible

Officer: Director

Infrastructure Services

Budget

2016-2017

|

Operating

Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$0

|

$0

|

$178,300

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

1

|

Deliver the Operating Maintenance and Capital Works Programs

|

Complete Works

|

90%

|

51

|

|

|

|

|

|

Asset Management Planning

Responsible

Officer: Manager

Major Projects and Asset Management

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$0

|

$0

|

$121,100

|

$1,353,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality:

Various

|

|

|

Lot

12 Bayshore Drive Byron Bay Remediation

|

913,300

|

|

Implement

Station St Mullumbimby Subdivision

|

220,000

|

|

Tyagarah

Airfield Development and Subdivision

|

50,000

|

|

Lot

22 Mullumbimby South Development

|

60,000

|

|

Depot

Relocation

|

10,000

|

|

Surplus

Property Sales

|

100,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

2

|

Prepare infrastructure reports for the Financial Statements and

NSW Fit for Future program

|

Reports to Government including the Special Schedule 7 report

|

Completed on time

|

10, 24, 51

|

|

3

|

Develop levels of service for infrastructure to support

investment.

|

Adopted levels of service

|

Mar-17

|

24, 51, 52

|

|

4

|

Progress the outcomes of Asset Management Audits to improve

performance.

|

Scheduled audit outcomes completed

|

Jun-17

|

24, 51, 52

|

|

5

|

Improve the level and integration of asset information to better

assist decision making and focus infrastructure investment.

|

Independently audited databases and systems are assessed as

satisfactory.

|

Jun-17

|

24, 51

|

|

6

|

Revalue water and sewer assets in accordance with the Local

Government Accounting Code

|

Valuations completed

|

Jun-17

|

10, 24, 51

|

|

7

|

Creatively develop new and revised funding strategies for better

community outcomes.

|

Development charging plans continue to reflect community

priorities

|

Jun-17

|

24, 51

|

|

8

|

Actively work with government and industry leaders to improve

asset management performance.

|

Report local, state and federal asset benchmark data within

legislative timeframes, 100%

|

On time

|

10, 16, 18

|

|

9

|

Engage with the community on the challenges of asset management

|

Community Infrastructure Advisory Committee meetings held

quarterly.

|

Jun-17

|

24,51,52

|

Projects and Commercial Development

Responsible Officer: Manager Major Projects and Asset Management

Budget 2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$0

|

$0

|

$238,100

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

10

|

Develop the Myocum Quarry Transfer Station and Resource Recovery

Centre in line with the waste disposal strategy

|

Preferred option adopted

|

Jun-17

|

16

|

|

11

|

Deliver the Byron Bay Bypass Project which is a two lane road

from Shirley Street in the north to Browning Street in the south

|

Construction completed in accordance with the contract

|

Jun-17

|

50

|

|

12

|

Progress the development of Stage 2 of the Byron Bay Bypass

|

Feasibility assessment completed

|

Jun-17

|

50

|

|

13

|

Progress the replacement of O'Meara's Bridge

|

Adopted solution implemented

|

Jun-17

|

18, 47

|

|

14

|

Complete the sports field and infrastructure on the northern

section of Lot 5 Shara Boulevard

|

Construction completed

|

Sep-16

|

27

|

|

15

|

Progress the future use of the South Byron Sewage Treatment

Plant site and the integrated remediation.

|

Future use determined and implementation progressed.

|

Jun-17

|

24

|

|

16

|

Complete the Brunswick Heads Sewage Treatment Plant site

remediation to secure the site for a potential future use

|

Remediation completed

|

Jun-17

|

24

|

|

17

|

Progress the Mullumbimby Sewage Treatment Plant site remediation

to secure the site for a potential future use

|

Detailed remediation plan completed

|

Jun-17

|

24

|

|

18

|

Complete the remediation of Lot 12 Bayshore Drive Byron Bay and

implement the adopted future use.

|

Remediation completed, future use determined and progressed.

|

Jun-17

|

24

|

|

19

|

Complete the Station Street Mullumbimby subdivision project to

provide funds for important community initiatives

|

Subdivision completed

|

Dec-16

|

24

|

|

20

|

Progress the Tyagarah subdivision to provide funds for important

community initiatives

|

Rezoning completed

|

Jun-17

|

24

|

|

21

|

Progress Lot 22 Mullumbimby South development to establish a

future use that best serves the needs of the community

|

Future use adopted

|

Jun-17

|

24

|

|

22

|

Progress Valances Road Mullumbimby development

|

Implement the outcome of the Rural Land Use Strategy

|

Jun-17

|

24

|

|

23

|

Progress Lot 4 Mullumbimby development project

|

Implement the outcome of the Rural Land Use Strategy

|

Jun-17

|

24

|

|

24

|

Implement the Fletcher Street Byron Bay property development to

provide a long term source of funds for the community

|

Implement the adopted future use

|

Jun-17

|

24

|

|

25

|

Progress the evaluation of alternative sites for the Bayshore

Drive Works Depot

|

Assessment completed

|

Jun-17

|

24

|

|

26

|

Complete Lot 16 Dingo Lane Myocum property sale with a view to

repaying loans

|

Sale completed

|

Dec-16

|

24

|

|

27

|

Progress the implementation of adopted Byron Bay Town Centre

Master plan works

|

Works progressed

|

Jun-17

|

39, 40

|

|

28

|

Complete the Suffolk Park Hall Upgrade

|

Works completed

|

Jun-17

|

47

|

Emergency Services and Floods

Responsible

Officer: Manager

Works

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$226,300

|

$0

|

$831,300

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

29

|

Emergency Management

|

Plan

LEMC Meetings

|

Complete, 30/06/2017

Attended, as Scheduled

|

53

|

|

30

|

Flood Risk Management Study and Plan for North Byron

|

Plan, adopted

|

30-Jun-17

|

53

|

Depot and Fleet Management

Responsible

Officer: Manager

Works

Budget 2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$554,900

|

$0

|

$752,300

|

$1,042,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Plant

and Equipment

|

|

|

4x2

16,000 kg GVM TIPPER with weighing system

|

85,000

|

|

Sweeper

/ Truck

|

300,000

|

|

Ride

on Mechanical Street Sweeper

|

110,000

|

|

Small

Plant Replacements

|

47,000

|

|

Motor

Vehicle Replacements

|

500,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

31

|

Improve utilisation of heavy and light fleet

|

Utilisation report for previous financial year

|

Completed,

30-Oct-16

|

51

|

|

|

|

|

|

Local Roads and Drainage

Responsible

Officer: Manager

Works

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$2,964,300

|

$14,555,000

|

$12,496,700

|

$27,107,400

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Carparking

|

|

|

Locality:

Byron Bay

|

|

|

Lawson

St South Carpark - extension of carpark to Railway Park

|

210,000

|

|

Locality:

Various

|

|

|

Parking

Studies for Bangalow, Brunswick Heads and Mullumbimby

|

35,000

|

|

Road

Pavement Renewals

|

|

|

Locality: Rural North

|

|

|

Myocum Rd Segment 545.10 CH0.6-1.04km

|

600,000

|

|

Myocum Road

|

400,000

|

|

Bridges

|

|

|

Locality: Rural North

|

|

|

Main Arm Road - Blind Mouth causeway upgrade - construction

|

780,100

|

|

Locality: Byron Bay

|

|

|

Belongil Creek Bridge Works

|

|

|

Locality: Various

|

|

|

Bridge works subject to future bridge inspections

|

184,100

|

|

Locality: Rural South

|

|

|

O'Meara's Bridge Renewal

|

350,000

|

|

James Bridge Renewal

|

85,000

|

|

Footpaths/Kerb and Gutter Works

|

|

|

Locality: Various

|

|

|

Access ramps and footpaths Works

|

65,600

|

|

Replacement of damaged Kerb and Gutter Shire Wide as per

inspection Report

|

22,500

|

|

Replacement of damaged Footpaths Shire Wide as per inspection

Report

|

90,000

|

|

Locality: Byron Bay

|

|

|

Marine Parade Footpath at Wategos

|

395,000

|

|

Marvel St, Byron Bay - northern side Tennyson St to Middleton St

|

60,000

|

|

Locality: Bangalow

|

|

|

Leslie Street to Station St, Bangalow - footpath and stairs /

ramps across railway line

|

20,000

|

|

Locality: Ocean Shores

|

|

|

Rajah Road/Orana Road, Ocean Shores – Shopping Centre to

Wirree Drive

|

30,000

|

|

Drainage

|

|

|

Locality: Byron Bay

|

|

|

Burns Street Open Drain Maintenance

|

1,000

|

|

Lilly Pilly Drain Maintenance (use Levy as this funded the

wetland)

|

1,000

|

|

Bangalow Road - resolve stormwater flooding of backyard

|

50,000

|

|

Bay lane overland flow path and system application

|

10,000

|

|

Locality: Ocean Shores

|

|

|

South Golden Beach Street Drainage Upgrade - Peter Street

|

203,000

|

|

South Golden Beach Street Drainage Upgrade - Robin Street

|

179,000

|

|

South Golden Beach Street Drainage Upgrade - Helen Street (east)

|

15,000

|

|

South Golden Beach Street Drainage

Upgrade

|

15,000

|

|

Locality: Mullumbimby

|

|

|

8 Jubilee Ave - resolve flooding in front yard and nature strip

|

10,000

|

|

Locality: Brunswick Heads

|

|

|

Massey Green Caravan Park Stormwater infrastructure renewal

|

15,000

|

|

Locality: Bangalow

|

|

|

Bangalow Wetland Maintenance

|

2,000

|

|

Leslie Street - prevent flooding under house

|

55,000

|

|

Locality: Various

|

|

|

Minor urgent works

|

10,000

|

|

Reseal/Renewal Program

|

|

|

Locality: Various

|

|

|

Shire-wide Road Reseal Program

|

|

|

Goonengerry Road

|

209,200

|

|

Eureka Road

|

211,900

|

|

Coolamon Scenic Drive (South)

|

137,000

|

|

Broken Head Reserve Road

|

91,900

|

|

Rural Roads Program

|

|

|

Federal Drive, Goonengerry, pavement upgrade

|

730,000

|

|

Locality: Rural North

|

|

|

Grays Lane, Tyagarah, pavement upgrade

|

50,000

|

|

Settlement Rd

|

30,000

|

|

Coolamon Scenic Drive - Land Acquisition

|

100,000

|

|

Locality: Rural South

|

|

|

Rifle Range Road Intersection Upgrade at Lismore Road

|

54,800

|

|

Broken Head Road

|

600,000

|

|

Urban Roads Program

|

|

|

Locality: Byron Bay

|

|

|

Byron Bay Bypass

|

11,950,000

|

|

Lawson/Massinger Street, Byron Bay, roundabout and drainage and

kerb & gutter

|

1,131,900

|

|

Byron Bay Bypass Stage 2 investigations

|

250,000

|

|

Byron St

|

645,000

|

|

Locality: Ocean Shores

|

|

|

Beach Avenue, South Golden Beach

|

307,200

|

|

The Esplanade, New Brighton

|

216,000

|

|

Orana Road, Ocean Shores

|

1,040,000

|

|

River Street, New Brighton

|

466,800

|

|

Coomburra Crescent, Ocean Shores

|

658,800

|

|

Orana Road Ocean Shores

|

133,600

|

|

Locality: Suffolk Park

|

|

|

Clifford Street intersection with Broken Head Road, Suffolk

Park, traffic control upgrade*

|

1,400,000

|

|

Locality: Byron Bay

|

|

|

Bayshore and Ewingsdale Roundabout*

|

2,700,000

|

|

Parking Implementation

|

100,000

|

*subject

to securing grant funding

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

32

|

Improve the condition of local road and drainage assets by

undertaking renewal, upgrade, enhancement and new projects

|

Capital Works Program

|

Complete, 100%

|

51

|

|

|

|

|

|

Roads and Maritime Services

Responsible

Officer: Manager

Works

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$659,800

|

$311,000

|

$1,005,900

|

$371,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality: Various

|

|

|

Regional REPAIR Program

Broken Head Rd 763 - pavement reconstruction 5045m south of

Clifford St - approximately 400m long

|

311,000

|

|

Ewingsdale Road

|

60,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

33

|

Maintain access to Regional Road Block Grant funds

|

Annual Regional Road Return

|

Complete

|

17, 18, 48

|

|

34

|

Maintain access to Regional Road REPAIR Program grants

|

Grant applications

|

Submitted

|

17, 18, 48

|

Quarries

Responsible

Officer: Manager

Works

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$338,700

|

$0

|

$353,700

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

35

|

Completion of all mandatory returns to NSW State Government

departments

|

Submission of annual material

production quantities.

Submission of annual environmental testing results

|

By due dates

By due dates

|

3.21

|

|

|

|

|

|

Open Space and Recreation

Responsible

Officer: Manager

Open Spaces and Resource Recovery

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$833,900

|

$325,000

|

$5,571,100

|

$2,501,700

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality:

Byron Bay

|

|

|

Civic Improvements Byron Bay Town Centre

|

450,000

|

|

Byron Bay Town Centre Upgrade - Landscape/Precinct Plan

|

53,000

|

|

Upgrade Pathway lights from Apex Park to Clarkes Beach

|

60,000

|

|

Belongil Beach Access Upgrade

|

20,000

|

|

Apex Park Upgrade (Sprinklers and Turf Management)

|

50,000

|

|

Locality: Mullumbimby

|

|

|

Pine Ave sports ground Play equipment and shade sail

|

47,000

|

|

Pine Avenue Soccer Fields - replace fencing

|

30,000

|

|

Heritage Park upgrade

|

57,000

|

|

Heritage Park boat ramp upgrade

|

30,000

|

|

Locality: Brunswick Heads

|

|

|

Brunswick Heads Recreation Ground 6 Bay Storage Shed adjacent to

Carpark

|

37,000

|

|

Brunswick Heads Recreation Ground Carpark Reconstruction

|

5,000

|

|

South Beach Tennis Court

|

26,000

|

|

Sports Ground Storage Sheds*

|

100,000

|

|

Locality: Bangalow

|

|

|

Solar lighting around walking track

|

5,000

|

|

Bangalow Railway Park site rationalisation

|

30,000

|

|

Sports field electrical upgrades

|

25,000

|

|

Bangalow Weir

|

176,000

|

|

Locality: Ocean Shores

|

|

|

Fern Beach Play unit & sail

|

41,000

|

|

Installation of 2 x Grandstands at Tom Kendall Oval

|

8,000

|

|

Shara Boulevard Sports Fields Development

|

733,000

|

|

Revised Plan of Management - all sporting fields shire wide

|

15,000

|

|

Outdoor Exercise Equipment

|

105,000

|

|

North Shire Works Funded from Roundhouse

|

332,700

|

|

Locality: Various

|

|

|

Public Bubblers

|

40,000

|

|

Federal Tennis Court Surface Replacement

|

26,000

|

*subject

to securing grant funding

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

36

|

Improve amenity of iconic open space

|

Level of Service Maintenance Plans for all parks that have LOS

of 1

|

Developed and Implemented

|

40

|

|

37

|

Improve amenity of town centres

|

Landscape plans for all towns and village main streets

Level of Service Maintenance Plans

|

Developed and Implemented

Developed and Implemented

|

40

|

|

38

|

Promote volunteerism through beautify day events across the

shire

|

Beautify days delivered

|

4

|

40

|

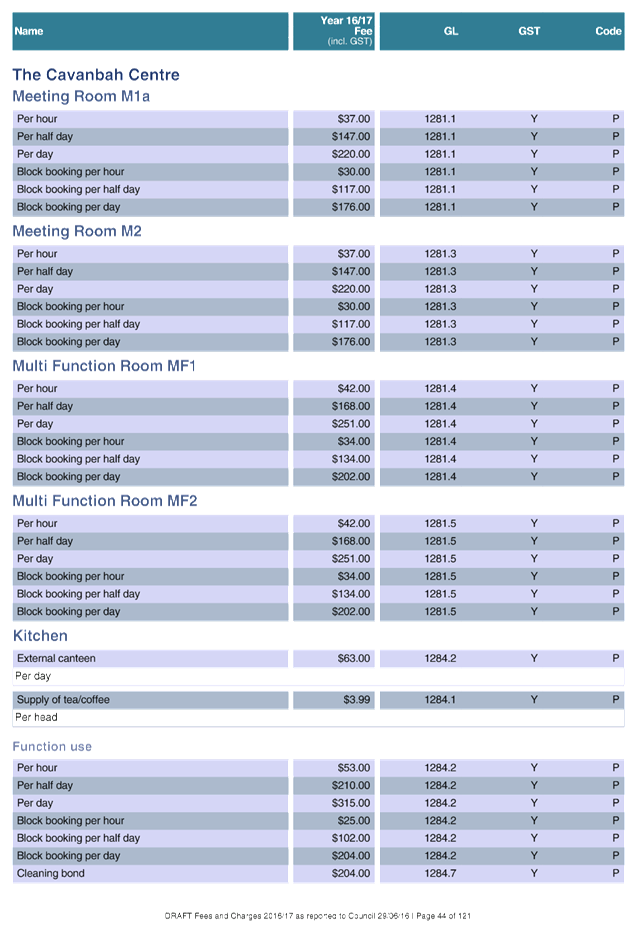

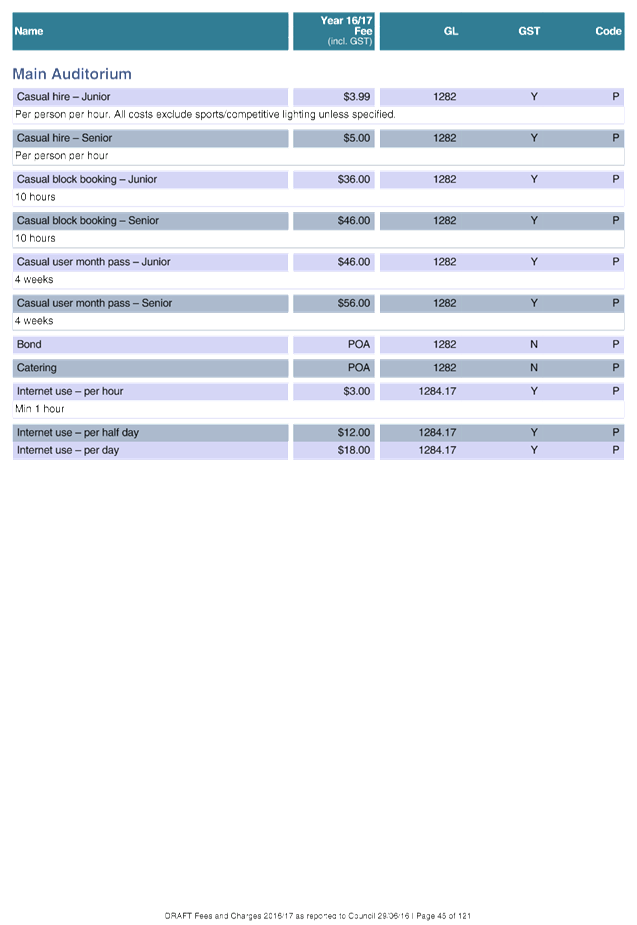

The Cavanbah Centre

Responsible

Officer: Manager

Open Spaces and Resource Recovery

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$328,800

|

$0

|

$837,900

|

$50,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality:

Byron Bay

|

|

|

Market

Infrastructure

|

35,000

|

|

Floor

Tiles

|

15,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

39

|

Deliver Capital Work Program

|

Works Program

|

Completed, 90%

|

35

|

|

40

|

Maximise utilisation and sustainability of facility

|

Income Sources

Income

|

Increased

Increased

|

35

|

Waste and Recycling Services

Responsible

Officer: Manager

Open Spaces and Resource Recovery

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$7,275,100

|

$0

|

$6,493,200

|

$538,500

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality: Rural North

|

|

|

BWRF - EPS Recycling

|

40,000

|

|

BWRF - Cardboard Recycling

|

45,000

|

|

BWRF - Resource Recovery Centre Master Plan

|

82,000

|

|

BWRF -Public Place Recycling Enclosures

|

30,000

|

|

Minor Capital

|

50,000

|

|

Resource Recovery Centre Rehabilitation - Leachate System

|

80,000

|

|

Resource Recovery Centre Upgraded Expansion

|

150,000

|

|

Development of New Landfill Capacity

|

13,400

|

|

WASIP – Sustainable leachate Management

|

48,100

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

41

|

Maintain Contract Management Plan for Waste and Resource

Recovery Collection Contract 2014-0011

|

Contractor KPIs

|

KPIs achieved

|

46, 56

|

|

42

|

Maintain compliance with the Federal Government’s

Emissions Reduction Fund contract conditions for the Myocum Landfill Gas

Carbon Farming Initiative Project

|

Compliance

|

Required allocation of ACCUs delivered

|

22, 45

|

|

43

|

Implement Revised Waste Disposal Strategy

|

Implementation

|

Yr 1 strategy objectives complete

|

16, 46, 55, 56

|

|

44

|

Implement Revised Resource Recovery Management Strategy

|

Implementation

|

Yr 1 strategy objectives complete

|

16, 46, 55, 56

|

|

45

|

Implement Revised Resource Recovery Education Plan

|

Implementation

|

Yr 1 plan objectives complete

|

16, 46, 55, 56

|

|

46

|

Continue membership and participation in North East Waste

regional waste management programs and initiatives

|

Participation

|

Maintained

|

16, 46, 55, 56

|

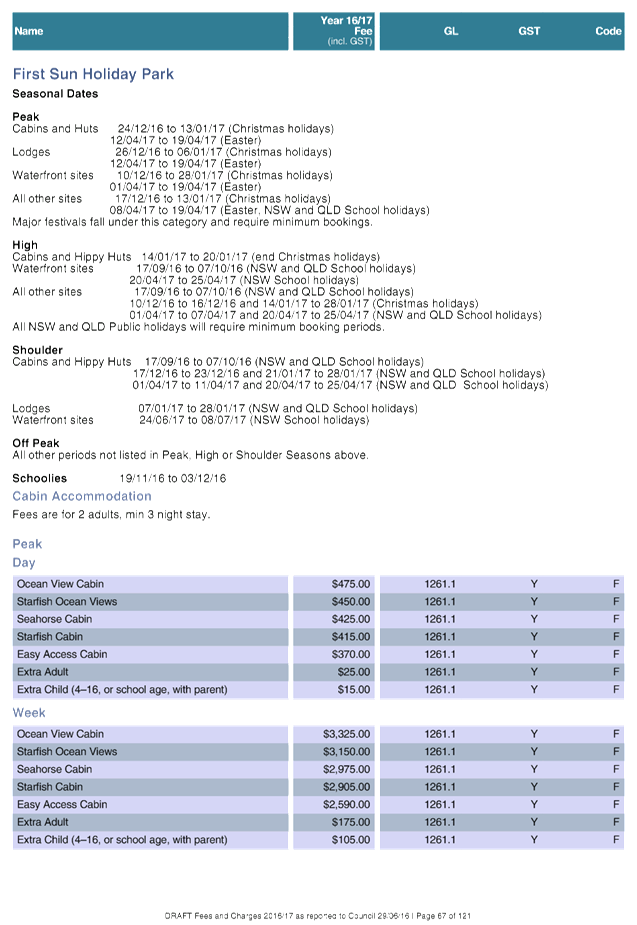

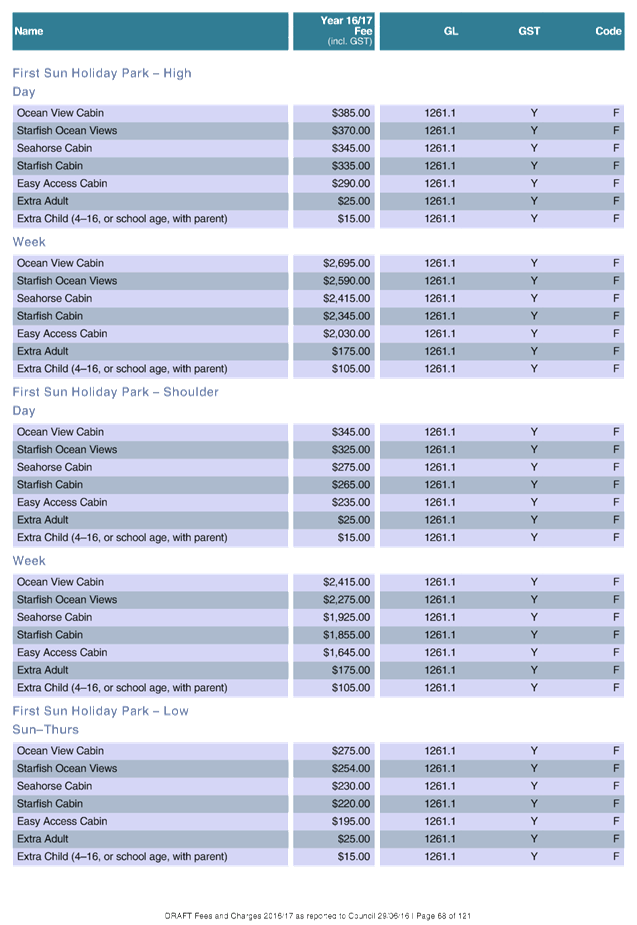

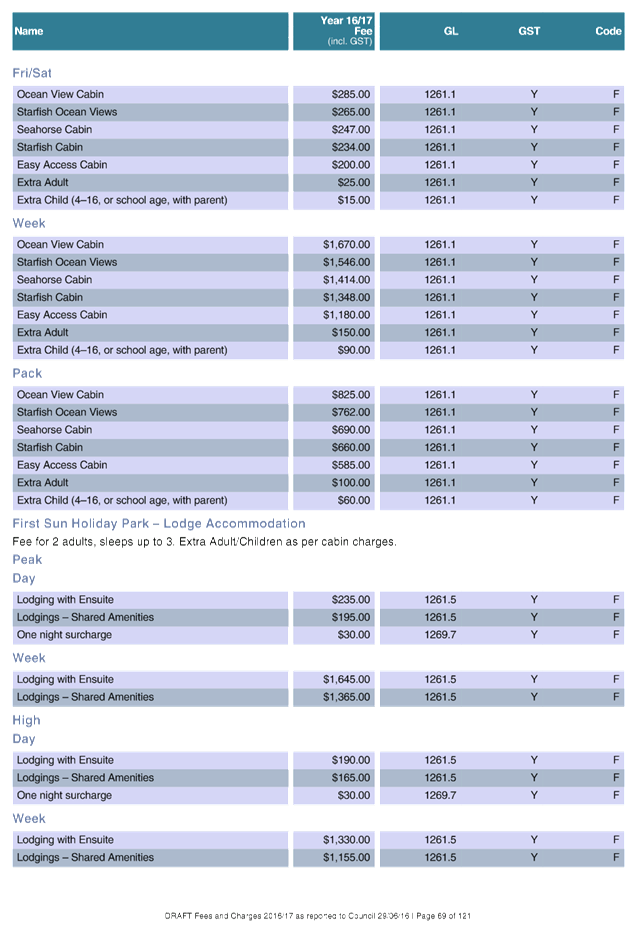

First Sun Holiday Park

Responsible

Officer: Manager

Open Spaces and Resource Recovery

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$2,994,200

|

$0

|

$2,483,000

|

$672,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality: Byron Bay

|

|

|

Cabins

|

200,000

|

|

Lodgings

|

60,000

|

|

Safari

Tents

|

50,000

|

|

BBQs,

Signs, Minor works

|

75,000

|

|

Amenities/Camp

Kitchen Refurbishment

|

230,000

|

|

Laundry

Refurbishment

|

50,000

|

|

Turf

Upgrade Management

|

7,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

47

|

Increase

accommodation facilities and upgrade amenities to ensure public satisfaction

of guests and economic benefit to Byron Shire.

|

Revenue

|

Increase

|

31

|

|

|

|

|

|

Suffolk Beachfront Holiday Park

Responsible

Officer: Manager

Open Spaces and Resource Recovery

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$925,900

|

$0

|

$947,300

|

$990,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality: Suffolk Park

|

|

|

Cabins

|

540,000

|

|

Safari

Tents

|

50,000

|

|

Amenities

Block Replacement

|

350,000

|

|

BBQs,

Signs, Minor works

|

50,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

48

|

Increase

accommodation facilities and upgrade amenities to ensure public satisfaction

of guests and economic benefit to Byron Shire.

|

Revenue

|

Increase

|

31

|

|

|

|

|

|

Facilities Management

Responsible

Officer: Manager

Utilities

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$963,700

|

$0

|

$2,729,400

|

$658,100

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality:

Byron Bay

|

|

|

Byron

Bay Pool Improvements

|

70,200

|

|

Railway Park Toilet Block Refurbishment

|

50,000

|

|

Byron

Bay Library

|

50,000

|

|

Locality:

Mullumbimby

|

|

|

Mullumbimby

Pool Improvements

|

21,600

|

|

Mullumbimby

Administration Centre – minor capital works program

|

31,600

|

|

Mullumbimby

Administration Centre - Carpet Replacement Program

|

53,400

|

|

Mullumbimby

Administration Centre - Chambers Air conditioning upgrade contribution

|

20,000

|

|

Locality:

Suffolk Park

|

|

|

Suffolk

Park Hall Upgrade

|

300,000

|

|

Locality:

Various

|

|

|

Public

Toilet Special Rate Variations – Renewal Program

|

61,300

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

49

|

Deliver Capital Work Program

|

Works Program

|

Completed 90%

|

22, 34, 40

|

|

|

|

|

|

Water Supplies

Responsible

Officer: Manager

Utilities

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$9,075,400

|

$600,000

|

$8,361,100

|

$9,324,900

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality: Bangalow

|

|

|

Bangalow

Reservoir Construction

|

571,400

|

|

Locality:

Brunswick Heads

|

|

|

Miscellaneous

Reservoir Renewals

|

30,000

|

|

Locality:

Mullumbimby

|

|

|

Argyle

Street South Side Water main Renewal

|

30,000

|

|

Mullumbimby

- Tincogan St Capacity Upgrade

|

300,000

|

|

Locality:

Ocean Shores

|

|

|

North/South

Ocean Shores Fire Main Upgrade

|

1,923,000

|

|

South

Ocean Shores Fire Main Upgrade

|

700,000

|

|

Reservoir

Renewals

|

155,900

|

|

Locality:

Byron Bay

|

|

|

Coopers

Shoot Reservoir - Additional Storage/Land Purchase

|

4,234,600

|

|

Miscellaneous

Reservoir Renewals

|

155,000

|

|

South

Byron pipelines capacity upgrade

|

200,000

|

|

Recycled

Waste Water from West Byron to Byron Foreshore res 15-616

|

525,000

|

|

Fletcher

Street Development Planning

|

250,000

|

|

Locality:

Various

|

|

|

Demand

Management

|

20,000

|

|

Miscellaneous

Extensions Water Reticulation System

|

200,000

|

|

Meter

Replacement Program

|

30,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

50

|

Upgrade of fire main capacity Ocean Shores

|

Pipeline design and construction complete

|

Jun-17

|

16, 20

|

|

51

|

Drought Management planning

|

Complete Regional plan and align Mullumbimby Plan

|

Jun-17

|

16, 20

|

|

52

|

Develop agreements for community art to be incorporated into

asset maintenance

|

Number of art on water assets increased

|

Jun-17

|

29, 37

|

Sewerage Services

Responsible

Officer: Manager

Utilities

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$15,474,500

|

$1,400,000

|

$14,112,500

|

$7,516,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality:

Bangalow

|

|

|

Bangalow

- Pump Station Renewals

|

206,000

|

|

Pipe

Renewals / Upgrades (Moved $50,000 Reserve funds $50,000 S64

funds from 2015/16 December Review)

|

306,000

|

|

Locality:

Byron Bay

|

|

|

STP

Upgrade

|

500,000

|

|

South

Byron STP Redevelopment/ Remediation

|

100,000

|

|

South

Byron STP Demolition/Removal

|

250,000

|

|

Recycled

Waste Water from West Byron to Byron Foreshore Res 15-616

|

525,000

|

|

Locality:

Brunswick Heads

|

|

|

Vallances

Rd Subdivision

|

130,000

|

|

Vallances

Rd nursery demolition

|

550,000

|

|

Lot

4 Mullumbimby Development

|

30,000

|

|

STP

- detailed site contamination study

|

1,841,000

|

|

Pump

Station Renewals

|

128,000

|

|

Locality:

Mullumbimby

|

|

|

Azalea

Street Sewer Replacement / Upgrade

|

850,000

|

|

Pump

Station Renewals

|

106,000

|

|

Mullumbimby

STP Site Remediation

|

100,000

|

|

Locality:

Ocean Shores

|

|

|

Pipe

Renewals / Upgrades - Bindarra Cl/Orana Rd/Kiah Cl

|

254,000

|

|

Pump

Renewals

|

390,000

|

|

Miscellaneous

Pump Station Upgrades

|

160,000

|

|

Ocean

Shores STP Upgrade Project

|

620,000

|

|

Locality:

Various

|

|

|

Demand

Management

|

20,000

|

|

Miscellaneous

Works

|

200,000

|

|

Telemetry

System Software Upgrade

|

50,000

|

|

Sewerage

System Capacity Planning

|

200,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

53

|

Obtain Council project approval on future of the Ocean Shores Sewage

Treatment Plant

|

Council resolution of project approval

|

Jun-17

|

45, 51

|

|

54

|

Implement a whole of Council response in the management of the

Belongil catchment

|

No of plan / strategy actions implemented

|

Jun 17

|

22, 44

|

SUSTAINABLE ENVIRONMENT AND ECONOMY

Responsible Executive: Director Sustainable Environment Economy

|

Total Budget:

|

Operating

Revenue

|

Capital

Revenue1

|

Operating

Expenditure

|

Capital

Expenditure2

|

|

$4,196,500

|

$1,817,000

|

$9,474,200

|

$0

|

1. Capital

Revenue excludes transfers from Reserves.

2. Capital

Expenditure excludes loan principal repayments and transfers to Reserves.

Development and Certification

Responsible

Officer: Manager

Sustainable Development

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$2,182,800

|

$1,817,000

|

$4,756,800

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

55

|

Provide efficient, objective and comprehensive development

assessment

|

Development applications determined within 40 days of lodgement

|

At least 60%

|

21

|

|

56

|

Provide efficient, objective and comprehensive development

certification service

|

Construction certificates processed with 28 working days

Complying development certificates processed within 20 working

days

Building certification inspections undertaken within 2 days of

notification

|

At least 80%

At least 80%

At least 80%

|

21

|

|

57

|

Provide guidance and education in planning policies and advice

to the public and stakeholders

|

Provide development industry forum / newsletter

|

At least 1 forum or newsletter provided

|

20, 22

|

|

58

|

Simplify the provision of consistent and accurate flooding

information provided to the development community / public.

|

Review the way that flood data and information is provided to

the development community and public.

|

Commence a review of the provision of flood information.

|

22

|

|

59

|

Provide a Local Heritage Advisory service

|

Grant conditions meet

|

Heritage Services provided in accordance with grants funding.

|

22

|

Environment and Compliance Services

Responsible

Officer: Manager

Sustainable Development

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$1,792,400

|

$0

|

2,267,300

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

60

|

Respond to enquiries concerning public health and safety

|

Customer Service Requests responded to within 25 days of

lodgement

|

At least 85%

|

19

|

|

61

|

Implement effective regulatory and compliance services and

programs to maximise the public health and safety of the community

|

Food business inspections undertaken in accordance with Food

Authority category requirements.

Onsite Sewerage Management Program implemented to Plan

Liquor licence applications responded to in accordance with

Council's Policy and the Liquor Act.

Companion Animals Management Plan reviewed

Suitable impounded animals rehoused

|

At least 90%

Plan Implemented

At least 80%

Commence review of the plan

At least 70%

|

19

|

Planning Policy and Natural Environment

Responsible

Officer: Manager Environmental and Economic Planning

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$221,300

|

$0

|

$1,864,000

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

62

|

Update vegetation mapping in line with legislative requirements

|

Vegetation Mapping

|

Reported to Council

|

42, 43

|

|

63

|

Finalise the Rural Land Use Strategy and commence

implementation of priority actions

|

Plan

Actions

|

Complete

Commenced

|

22, 25, 38

|

|

64

|

Finalise the Residential Strategy and commence implementation

of priority actions

|

Plan

Actions

|

Completed

Commenced

|

22, 25, 38

|

|

65

|

Review Byron DCP 2014 to a performance outcome focused plan (Resolutions

14-315 & 15-604)

|

DCP Review

|

Commenced

|

22, 38

|

|

66

|

Develop an Economic and Employment Strategy for general and

heavy industries. (Resolution 13-127)

|

Project Plan

|

Developed

|

22, 38

|

|

67

|

Continue staged review of Biodiversity Conservation Strategy

|

Project Plan

|

Milestones,

Met

|

42, 43

|

|

68

|

Finalise the Coastal Zone Management Plan

for the Byron Bay Embayment and commence

implementation of priority actions

|

Plan

Actions

|

Complete

Commenced

|

44

|

|

69

|

Progress the Bangalow Place Activation Masterplan and

commence implementation of priority actions

|

Plan

Actions

|

Complete

Commenced

|

22, 25, 38

|

|

70

|

Progress the Mullumbimby Place Activation Masterplan and

commence implementation of priority actions

|

Plan

Actions

|

Complete

Commenced

|

22, 25, 38

|

|

71

|

Progress the Byron Bay Town Centre Masterplan and commence

implementation of priority actions

|

Plan

Actions

|

Complete

Commenced

|

22, 25, 38

|

|

72

|

Implement priority actions in the Low Carbon Strategy

|

Year 2 projects

|

Commenced

|

46

|

Economic Development

Responsible

Officer: Economic

Development Coordinator

Budget

2016-2017

|

Operating

Revenue

|

Capital Revenue

|

Operating

Expenditure

|

Capital

Expenditure

|

|

$0

|

$0

|

$586,100

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

73

|

Continue implementation of Byron Shire Tourism Management Plan

|

Beautify Byron Fund

Business Sustainability Program

Visitor Services Strategy

|

Implemented

Implemented

Implemented

|

15, 28, 30, 31

|

|

74

|

Commence implementation of Byron Shire Economic Development

Strategy

|

Business Retention Survey

|

Complete and Reported to Council

|

16, 18, 25, 26,

|

|

75

|

Establish and undertake the Byron Bay Town Centre Place-making

Seed

|

Fund

|

Established

|

16, 17, 31, 32, 39, 40

|

GENERAL MANAGER

Responsible Executive: General Manager

|

Total

Budget:

|

Operating

Revenue

|

Capital

Revenue1

|

Operating

Expenditure

|

Capital

Expenditure2

|

|

$0

|

$0

|

$0

|

$0

|

1. Capital

Revenue excludes transfers from Reserves.

2. Capital

Expenditure excludes loan principal repayments and transfers to Reserves.

General Manager

Responsible

Officer: General Manager

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$0

|

$0

|

$0

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

76

|

Continue to build organisational capacity to deliver effective

and focused community engagement

|

Key staff IAP2 accredited

Key staff having completed an introductory or a specialised IAP2 course

Community Engagement Framework and Tool Kit Developed

|

At least 2

At least 5

Complete

|

3, 5, 6, 14

|

|

77

|

Increase social and digital media presence and information

dissemination

|

Number of hits on web and social media sites

Subscribers across digital platforms

|

Increasing

Increasing

|

13

|

|

78

|

Continue program of building staff capacity to deliver high

quality customer service

|

Customer Service Framework Implementation

% administrative and technical staff having completed facilitated training

|

Commenced

80%

|

3,6

|

|

79

|

Identify and action opportunities to improve customer service

|

Voice of Customer Measurement Systems

Customer Satisfaction Survey Action Plan

|

Implemented

Endorsed

|

3, 13

|

|

80

|

Coordination of benchmarking and monitoring of organisational

performance improvements

|

Business and Management Effectiveness Survey

Effectiveness Action Plan updated to include 2015 results and 2016 Actions

|

Complete

Endorsed and implement-ation commenced

|

24

|

People and Culture Services

Responsible

Officer: Manager

People and Culture

Budget 2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital

Expenditure

|

|

$0

|

$0

|

$0

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

81

|

Continue building leadership skills and capacity

|

Leadership Development Programs delivered to Team Leaders and

Supervisors

|

100%

|

24

|

|

82

|

Implementation of Balanced Scorecard Performance Planning

|

Balanced Scorecard system implementation to Manager level

4 quarterly reviews by Managers and Directors

Completion Rate for Balanced Scorecard Actions

|

1/7/2016

Complete

>90%

|

4, 6

|

|

83

|

Effective staff engagement

|

Workforce Survey Action Plan

Staff Suggestion and

Recognition and Reward Schemes programs

Indoor staff forums

Permanent Staff Turnover

Average days of workforce absenteeism per Equivalent Full Time Employment

|

Endorsed

2 each pa

At least 4 pa

<12.5%

<9 pa

|

6, 7

|

|

84

|

Effective injury management programs

|

Workers Compensation Premium (excluding impacts from State

Government formula changes or wages increases)

Return to work of injured workers

|

Reduced on 2015/16

80% in less than 10 days

|

8, 9

|

|

85

|

Implementation of Workforce Plan

|

Actions from Workforce Plan implemented

|

>2 pa

|

10, 11

|

CORPORATE AND COMMUNITY

SERVICES

Responsible Executive: Director Corporate and Community Services

|

Total Budget:

|

Operating

Revenue

|

Capital

Revenue1

|

Operating

Expenditure

|

Capital

Expenditure2

|

|

$25,951,800

|

$35,000

|

$5,685,700

|

$35,000

|

1. Capital

Revenue excludes transfers from Reserves.

2. Capital

Expenditure excludes loan principle repayments and transfers to Reserves.

Public Libraries

Responsible

Officer: Manager

Community Development

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$60,000

|

$35,000

|

$1,826,500

|

$35,000

|

Capital

Works Program 2016-2017

|

Capital Item

|

Budget ($)

|

|

Locality: Brunswick Heads

|

|

|

Brunswick Heads Library – new purpose built circulation

desk

|

5,000

|

|

Brunswick Heads Library - awning over front entrance

|

30,000

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

86

|

Manage Service Level Agreement with Richmond Tweed Regional

Library Service

|

Agreed Service Level

|

Met

|

34

|

|

|

|

|

|

Children's Services - Other Children's Services

Responsible

Officer: Manager

Community Development

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$426,100

|

$0

|

$428,200

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

87

|

Improve operations of Out of Hours School Care and Vacation Care

services in Mullumbimby, Byron Bay and Brunswick Heads

|

National Quality Framework Rating

|

Maintained

|

47

|

|

|

|

|

|

Children's Services – Sandhill’s Childcare

Responsible

Officer: Manager

Community Development

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$1,403,500

|

$0

|

$1,476,500

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

88

|

Improve service provision to provide quality accredited early

childhood education

|

National Quality Framework Rating

|

Maintained

|

47

|

|

89

|

Implement operational changes to the provision of Out of Hours

School Care and Vacation Care services in Mullumbimby, Byron Bay and

Brunswick Heads

|

National Quality Framework Rating

|

Maintained

|

47

|

|

90

|

Improve collaboration at regional level

|

Regional Forums Attended

|

2

|

47

|

Community Development

Responsible

Officer: Manager

Community Development

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$133,600

|

$0

|

$1,450,000

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

91

|

Expand disability inclusion planning into the development of

Council's Delivery Program

|

Disability Inclusion is embedded in the Delivery Program

|

Completed

|

11

|

|

92

|

Establish regional working group including State and Federal

agencies to undertake baseline service analysis

|

Service Map

|

Completed

|

18

|

|

93

|

Implement actions from the Arakwal Memorandum of Understanding

|

Actions implemented, 4

|

Completed

|

37

|

Information Services

Responsible

Officer: Manager

Business Systems and Technology

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$9,600

|

$0

|

$26,900

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

94

|

Implement prioritised actions from new (2016-2019) Information

Systems strategic plan within resource capability

|

Program delivery as per project plan

|

Milestones, met

|

3, 23

|

|

95

|

Finalise rollout of process mapping and documentation tools.

Train and support staff.

|

Process mapping and documentation tools

Staff surveyed to determine effectiveness of tools and training.

|

Rolled out

Staff trained

Completed

|

3, 23

|

Governance Services

Responsible

Officer: Manager

Governance Services

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$10,300

|

$0

|

$243,300

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

96

|

Improve

strategic planning and integration of strategic planning and reporting framework

processes and plans

|

Workshop

sessions conducted

Community

2017-2027

Delivery

Program 2017-2021 and support Resource Strategy

Operational

Plan 2017-2018

|

2

Endorsed

Endorsed

Endorsed

|

10

|

|

97

|

Provide

quality investigations and response services for conduct complaints

management

|

Conduct

complaints managed within prescribed timeframes

Public

Interest Disclosures and conduct complaints reporting compliant

Annual

training programs for Councillors and staff

|

100%

100%

Conducted

|

3

|

|

98

|

Implement

the strategic procurement roadmap for improved procurement outcomes

|

Project

Milestones

Process

Improvements Implemented

Training

programs

|

Met

2

Conducted

|

24

|

|

99

|

Improve

enterprise wide risk management

|

Training

sessions and workshops held

Business

continuity plan

Toolkit

|

2

Implemented

Developed

|

24

|

|

100

|

Establish

long-term licences for commercial activities on owned and managed open space

crown reserves

|

Competitive

process

|

Called

|

24

|

|

101

|

Establish

long-term licences for sustainable community market policy

|

Competitive

process

|

Finalised

|

24

|

|

102

|

Improve

lease and license rental income

|

Notice

and advice provided to asset managers >180 days of agreement expiry

Notice

and advice provided to executive team >150 days of agreement expiry

Annual

rent reviews conducted

Invoices

raised consistent with agreement

Annual

database audit

Process

Improvements

|

100%

100%

100%

100%

Complete

2

|

24

|

|

103

|

Coordinate

and provide legal services and written advice within agreed timeframes to

support decision making processes

|

Council's

critical projects, 3 working days

Internally

provided, 7 working days

Externally

provided, 21 working days

|

95%

90%

90%

|

24

|

|

104

|

Improve

governance services for quality and robust framework

|

Implement

gap analysis action plan

|

Complete

|

24

|

Councillor Services

Responsible

Officer: Manager

Governance Services

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$0

|

$0

|

$1,116,600

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

105

|

Process

Improvement initiatives

|

New

Councillor Calendaring System

Committee

Review

New

term Councillor equipment policy

|

Implemented,

September 2016

Completed

and Implemented, September 2016

Reviewed

and implemented, September 2016

|

12,

24

|

|

106

|

Coordinate and facilitate new

term Councillor training program

|

Training program

|

Developed and implemented

|

12, 24

|

Financial Services

Responsible

Officer: Manager

Finance

Budget

2016-2017

|

Operating Revenue

|

Capital Revenue

|

Operating Expenditure

|

Capital Expenditure

|

|

$23,908,700

|

$0

|

($882,300)

|

$0

|

Actions

2016-2017

|

Action Statement

|

Measures

|

Target

|

Delivery Plan Link

|

|

107

|

Identify and introduce targeted improvements to financial

performance reporting

|

Enhanced financial reporting tools

|

30-Jun-17

|

24

|

|

108

|

Implementation of improved E Services payment facilities for

Council utilising B-point contingent upon installation of Authority V6.11.

|

Integrated payment gateway with Council's contracted bank

reducing

Transaction costs

|

Established 30/6/2017

Reduced

|

24

|

|

109

|

Addition of water and sewerage assets to the Capital Value

Register (CVR) following revaluation of those assets in 2016/2017.

|

Assets added following revaluation

|

Completed,

30/6/2017

|

24

|

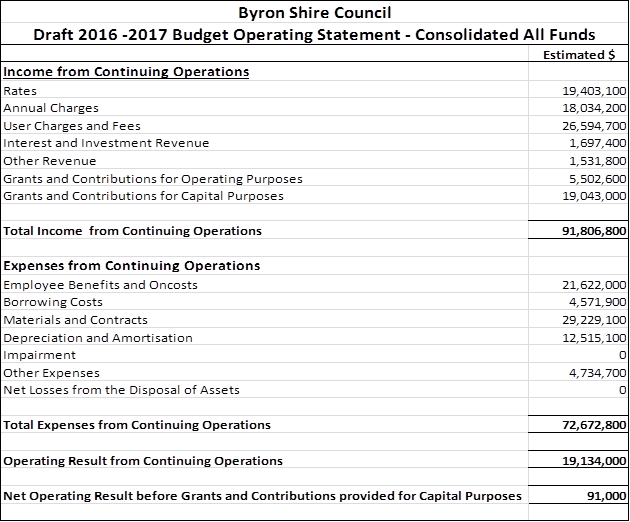

2016-2017 BUDGET

Byron Shire

Council has prepared the 2016-2017 Budget utilising the following parameters:

· Rate peg increase of 1.8% as

announced by the Independent Pricing and Regulatory Authority (IPART).

· Growth in rateable assessments of

1%.

· Indexation of operating expenditure

limited to 0.8% to assist in deriving a 1% efficiency gain.

· Provision for the 2.80% Award

increase from 1 July 2016 under the Local Government (State) Award 2014 for

Council staff.

· No new loan borrowings.

· Interest on investments around 3%

plus active management of the investment portfolio to maximise returns.

· Reflective of actions contained in

this Operational Plan.

As an

overall summary, Council’s Total 2016/2017 Budget is $127,496,700, made

up as follows:

· Operating expenditure (excluding

depreciation) $60,157,700

· Depreciation expense $12,515,100

· Capital works $52,159,600

· Debt repayment (loan principal)

$2,664,300

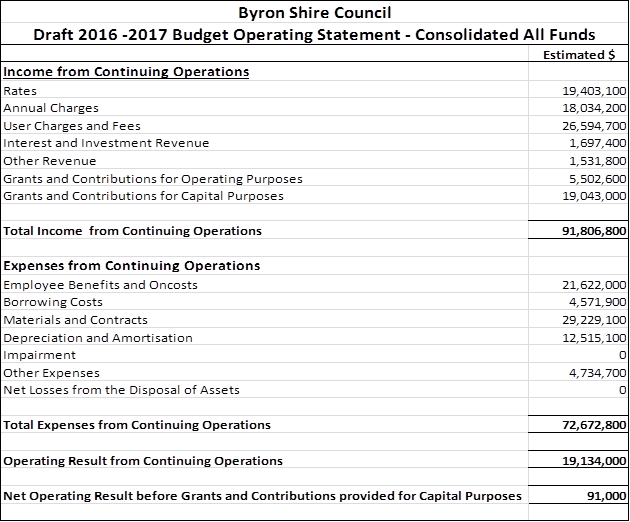

On a

Consolidated All Funds basis, Council is expecting a budget surplus in

2016/2017 of $91,000 as indicated by the following budgeted Operating

Statement:

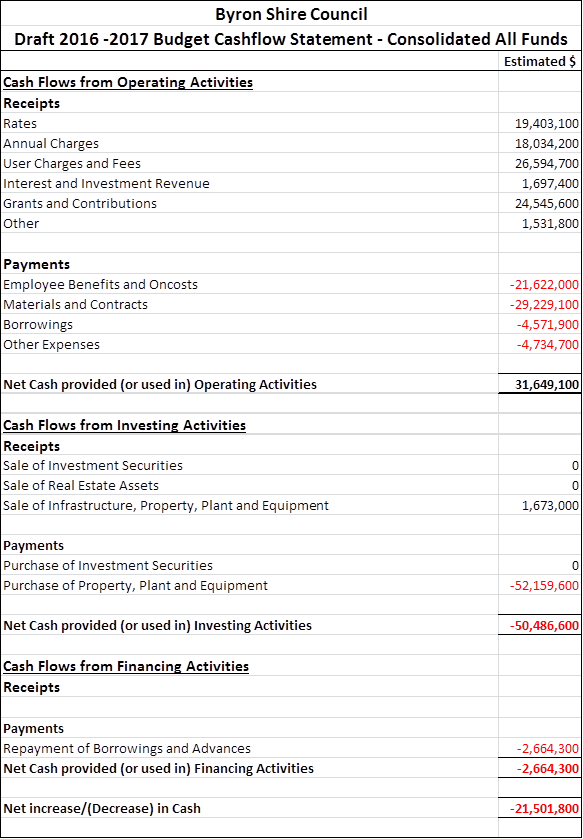

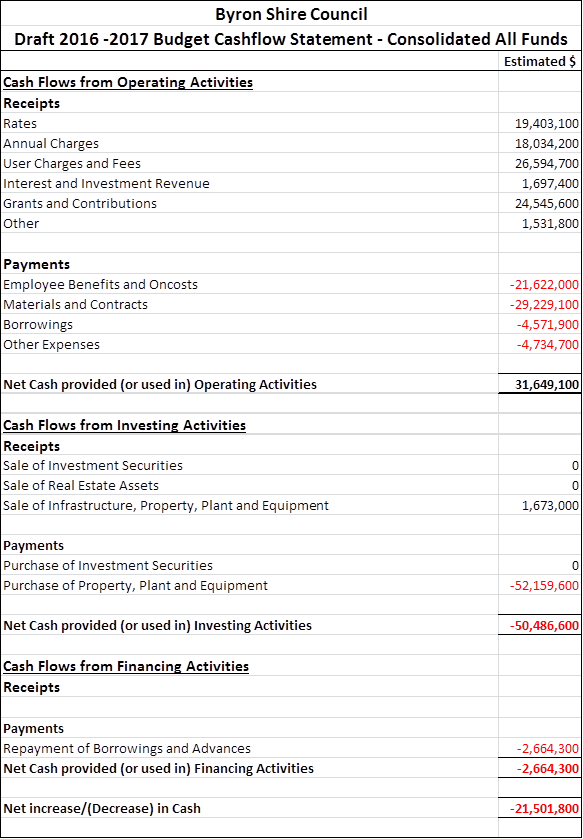

The

estimated movement in the cash position of the Council as indicated by the

2016/2017 Budget Estimates is indicated by the following budgeted Cashflow

Statement:

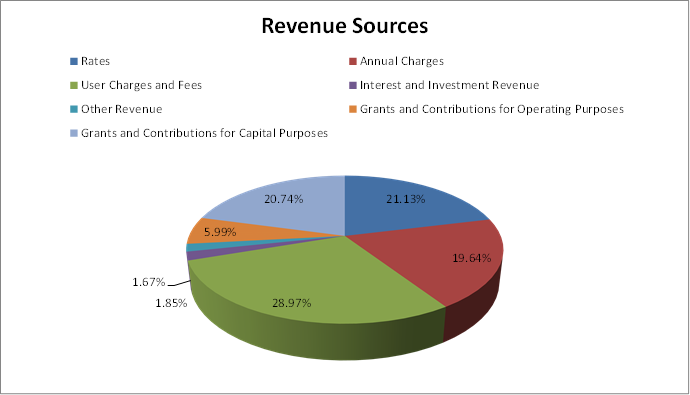

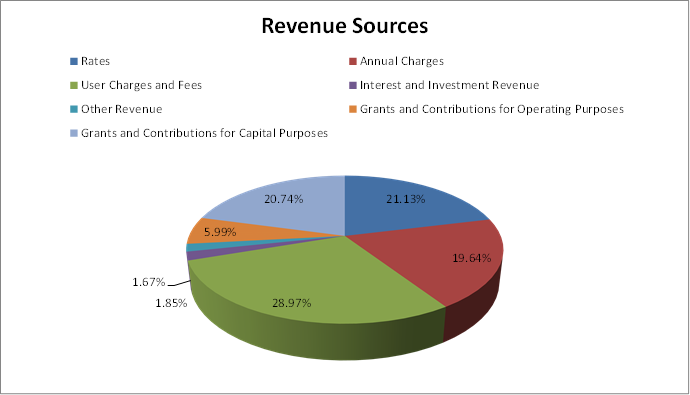

The revenue

sources within 2016/2017 Budget Estimates are proposed to come from the

following sources:

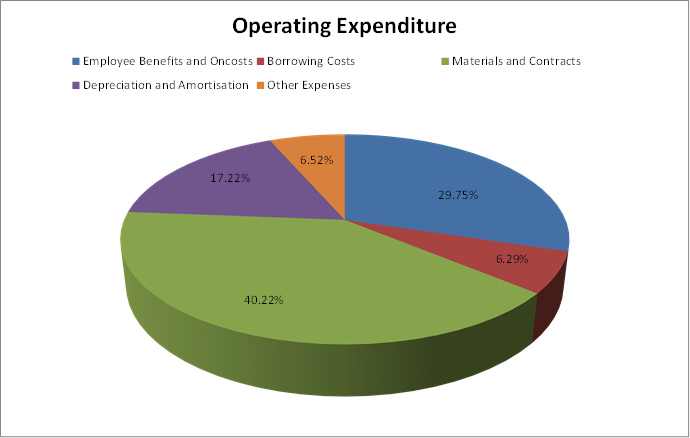

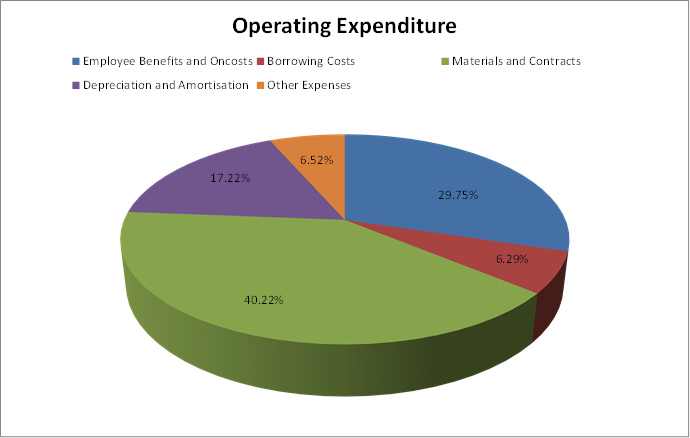

Operating

expenditure contained in the 2016/2017 Budget Estimates are proposed to be

allocated to the following expenditures:

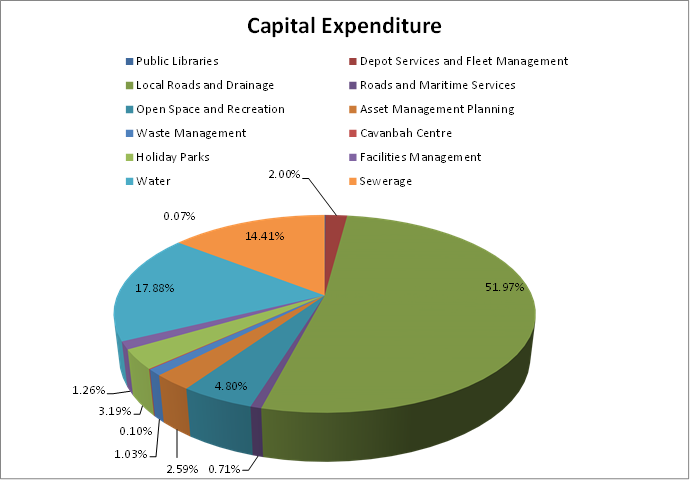

The

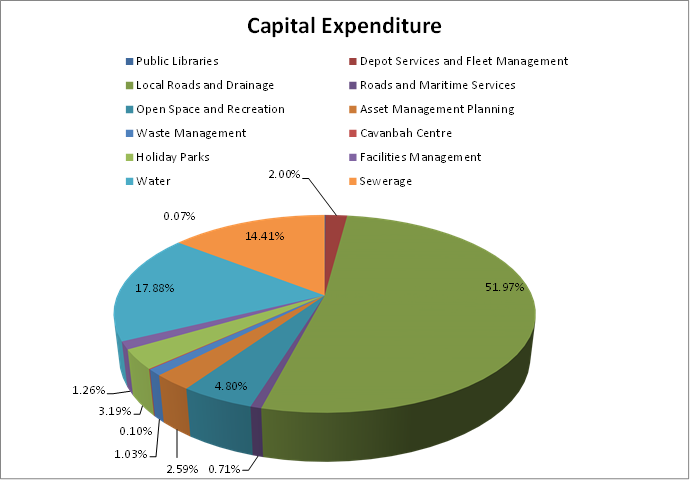

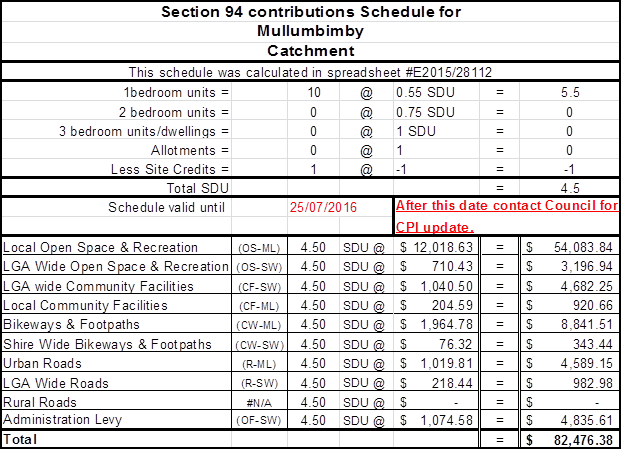

proposed Capital Works allocation included in the 2016/2017 Budget Estimates

are proposed to be expended in the following budget programs:

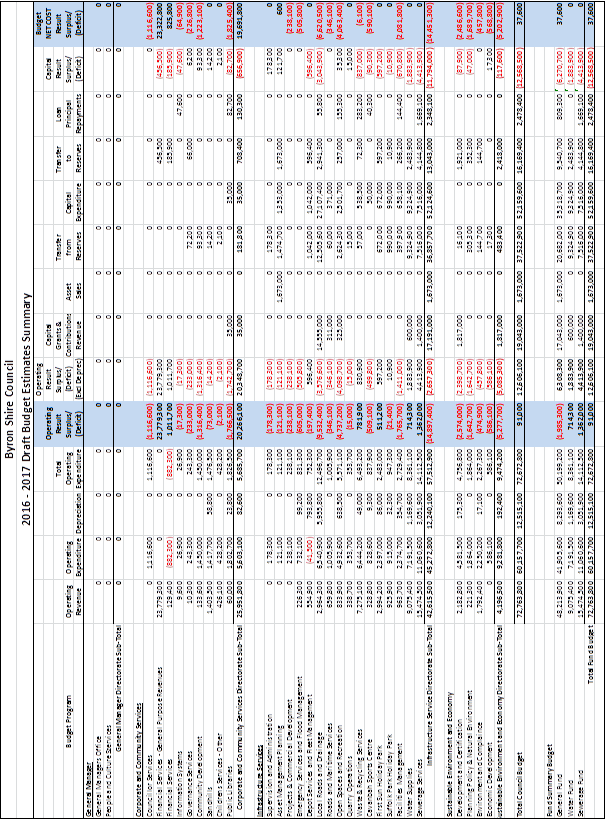

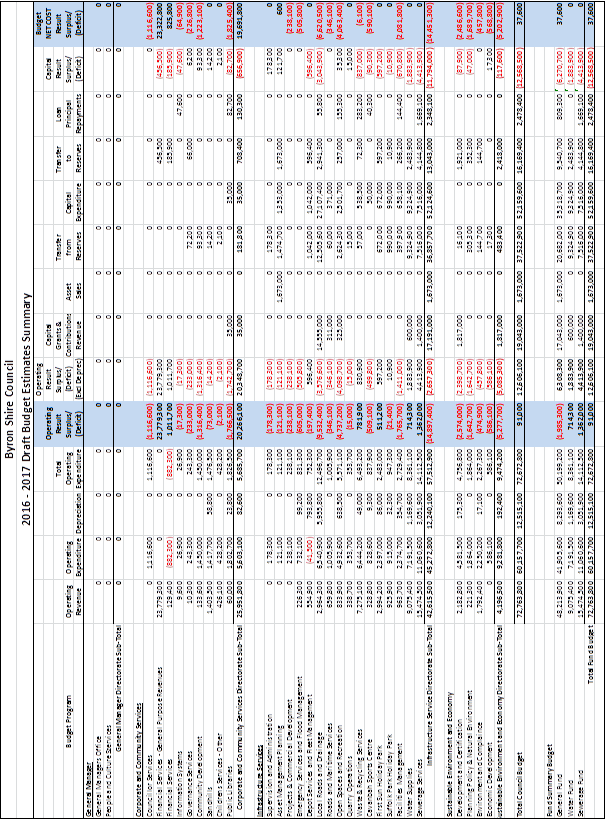

The

summarised 2016/2017 Budget Estimates by Budget Program and results for

Council’s General Funds, Water Fund and Sewerage Fund are detailed in the

table below:

2016-2017

STATEMENT OF REVENUE POLICY

RATING STATEMENT

Rating

Categories

Section 494

of the Local Government Act 1993 requires Council to make and levy ordinary

rates on all rateable land for the year 2016/2017.

In

accordance with the provisions of section 514 of the Act, all parcels of

rateable land in the Council’s area have been declared to be within one

or other of the following categories:

Ø Farmland

Ø Residential

Ø Business

Council has

determined the category / sub category for each parcel of rateable land is in

accordance with the definitions set out in Sections 515, 516, 517, 518, 519 and

529 of the Act.

Residential

(Section 516 LGA)

Section 516

of the Local Government Act 1993 (LGA), provides that:-

“Land

be categorised as ‘residential’ if it is a parcel of

rateable land valued as one assessment and:

(a) its dominant use is for

residential accommodation (otherwise than as a hotel, motel, guest house,

backpacker hostel or nursing home) or any other form of residential accommodation

(not being a boarding house or a lodging house) prescribed by the regulations,

or

(b) in the case of vacant

land, it is zoned or otherwise designated for use under an environmental

planning instrument (with or without development consent) for residential

purposes, or

(c) it is rural

residential land.”

Farmland (Section 515 LGA)

Section 515

of the LGA provides that: -

“(1) Land

is to be categorised as ‘farmland’ if it is a parcel of

rateable land valued as one assessment and its dominant use is for farming

(that is, the business or industry of grazing, animal feedlots, dairying, pig

farming, poultry farming, viticulture, orcharding, beekeeping, horticulture,

vegetable growing, the growing of crops of any kind, forestry, oyster farming,

or fish farming, within the meaning of the Fisheries Act and Oyster Farms 1935,

or any combination of those businesses or industries) which:

(a) has a significant and

substantial commercial purpose or character,

(b) is engaged in for the

purpose of profit on a continuous or repetitive basis (whether or not a profit

is actually made).

(2) Land

is not to be categorised as farmland if it is rural residential land.”

Business (Section 518 LGA)

Section 518

of the LGA provides that:-