Agenda

Byron

Shire Reserve Trust Committee Meeting

Thursday,

17 November 2016

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 2.00pm

Public Access relating to items

on this Agenda can be made at 2pm on the day of the Meeting. Requests for

public access should be made to the General Manager or Mayor no later than

12.00 midday on the day prior to the Meeting.

Ken

Gainger

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a member

of a Council Committee who has a pecuniary interest in any matter with which

the Council is concerned and who is present at a meeting of the Council or

Committee at which the matter is being considered must disclose the nature of

the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of maintaining

the register, a division is required to be called whenever a motion for a

planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Byron Shire Reserve Trust Committee

BUSINESS OF MEETING

1. Public Access

2. Apologies

3. Declarations of Interest

– Pecuniary and Non-Pecuniary

4. Staff Reports

Corporate and Community Services

4.1 Federal

Community Childrens Centre Lease.................................................................... 4

4.2 Temporary

Market Licence - Leona Rickerby.............................................................. 113

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director or Executive Manager prior to the meeting. Any suggested

amendments to the recommendations should be provided to the Administration

section prior to the meeting to allow the changes to be typed and presented on

the overhead projector at the meeting.

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

Report No. 4.1 Federal

Community Childrens Centre Lease

Directorate: Corporate

and Community Services

Report

Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2016/902

Theme: Society and Culture

Community Development

Summary:

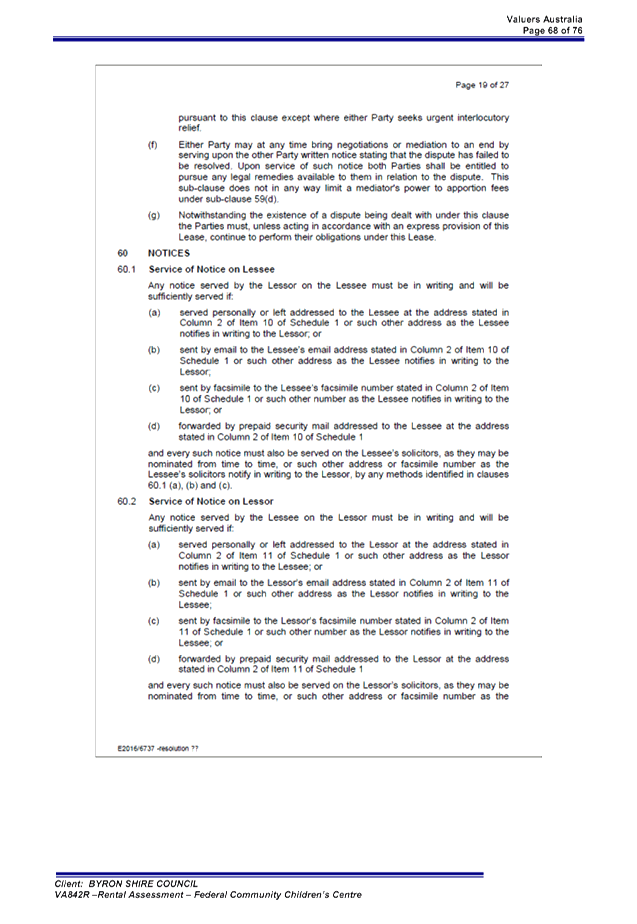

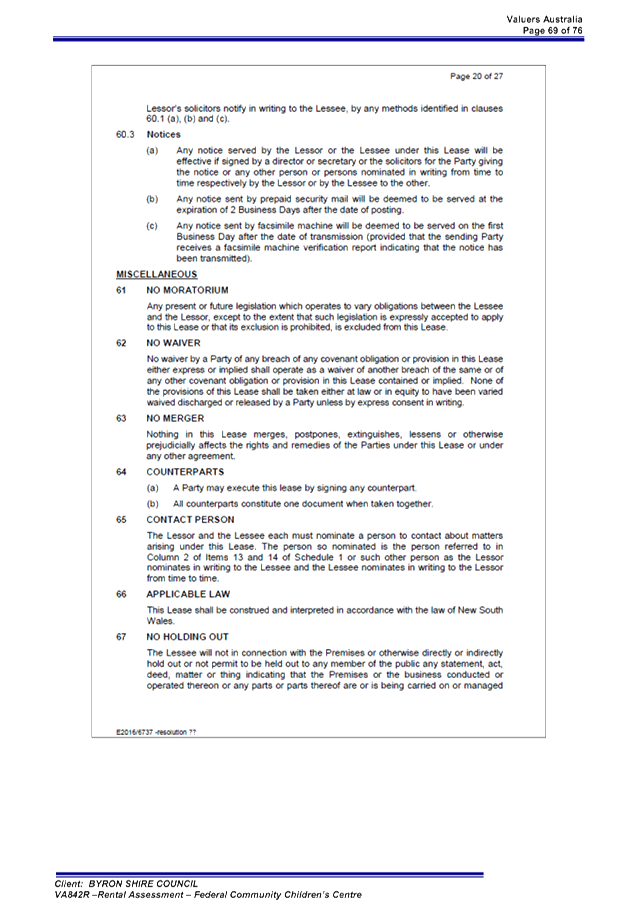

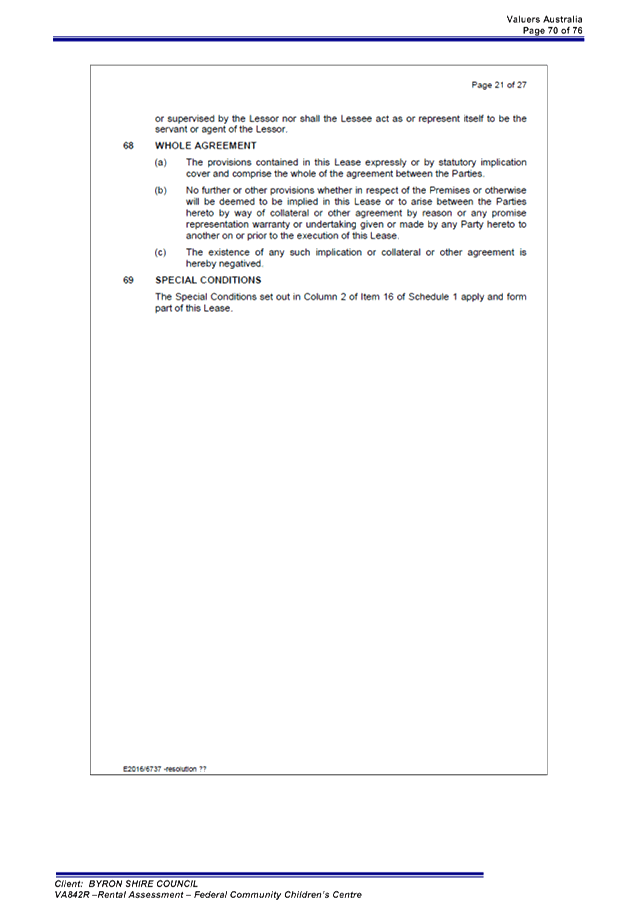

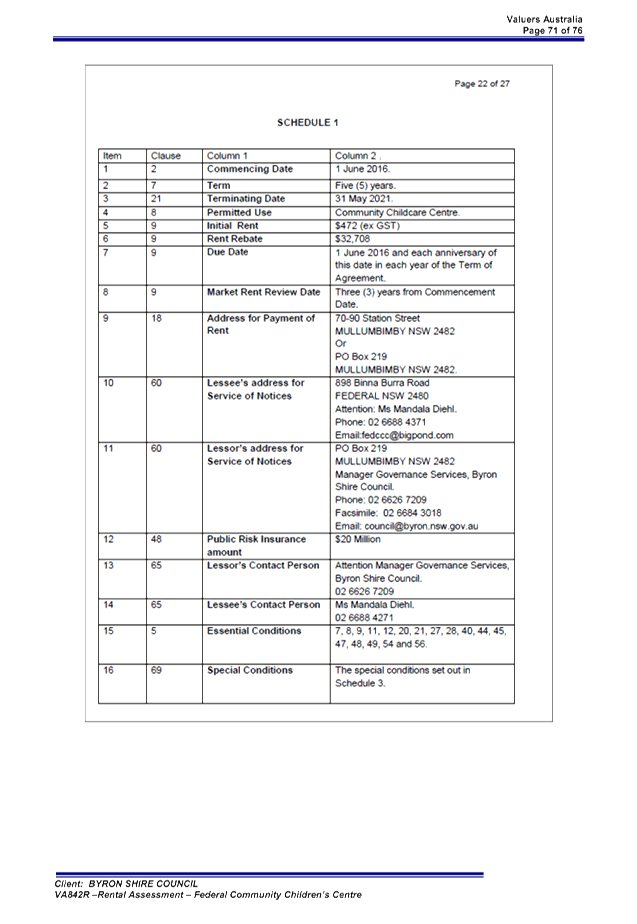

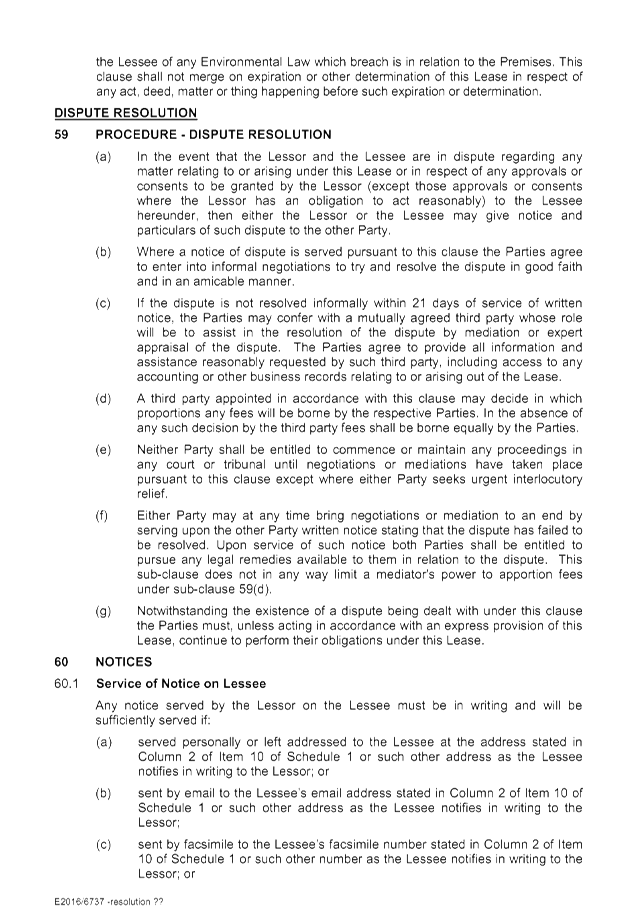

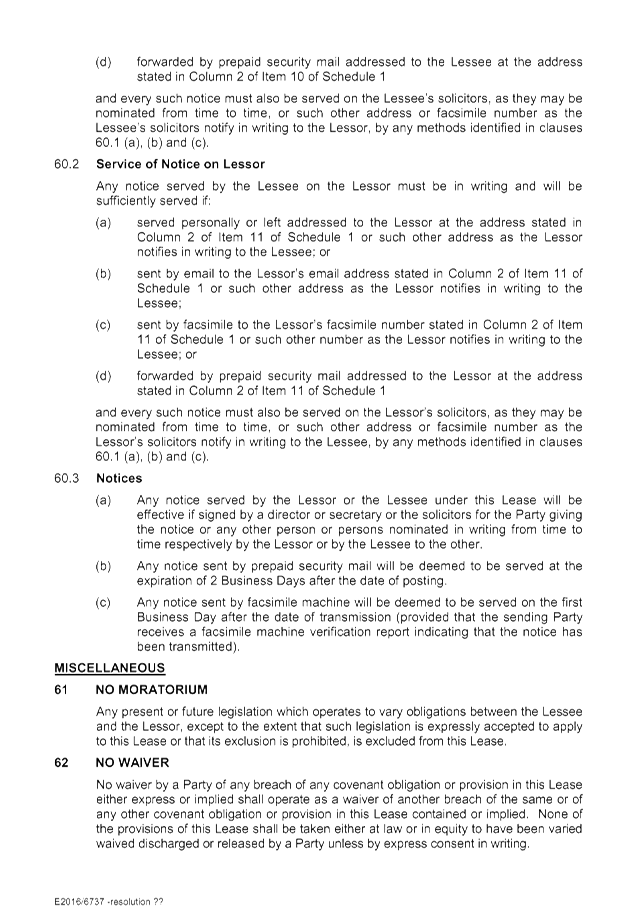

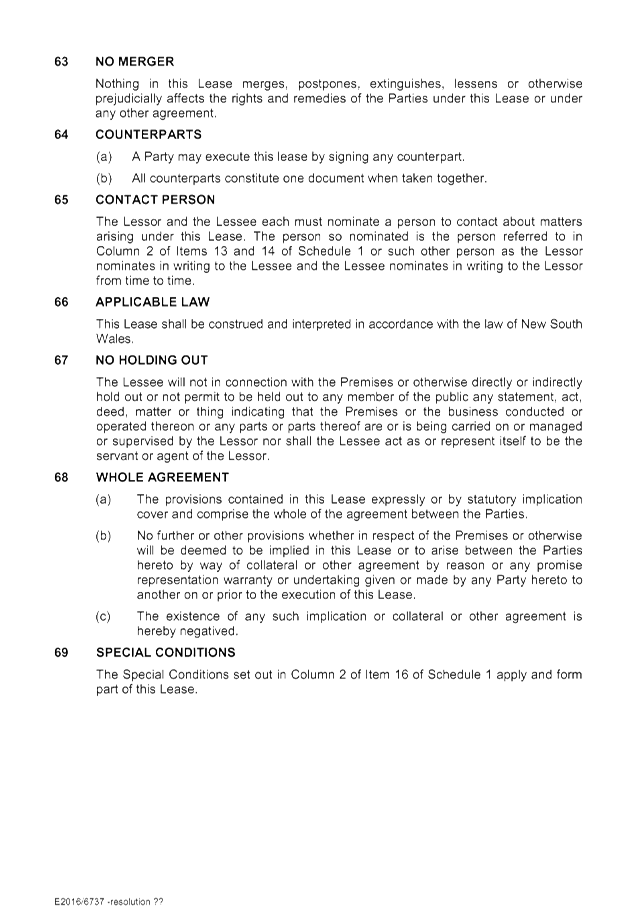

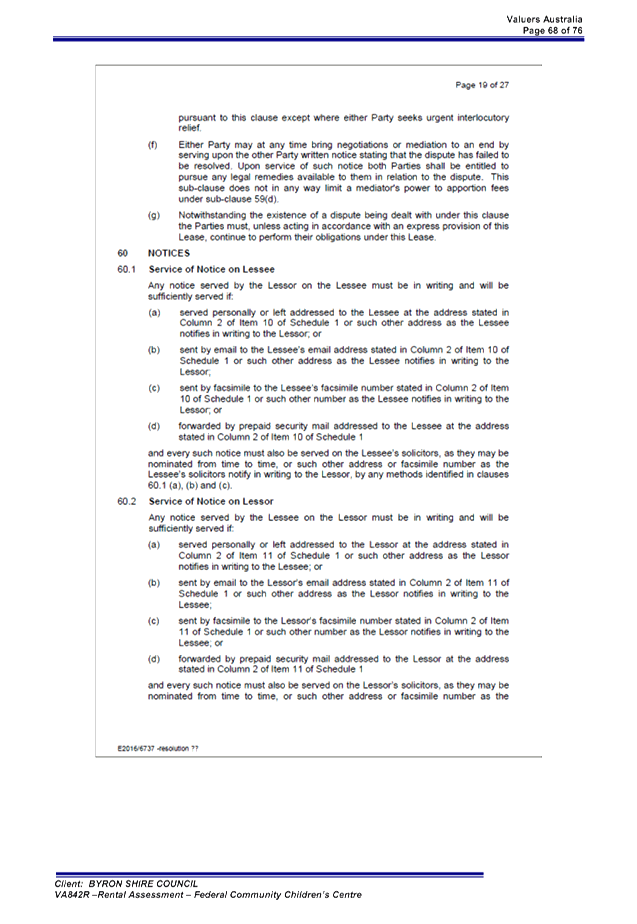

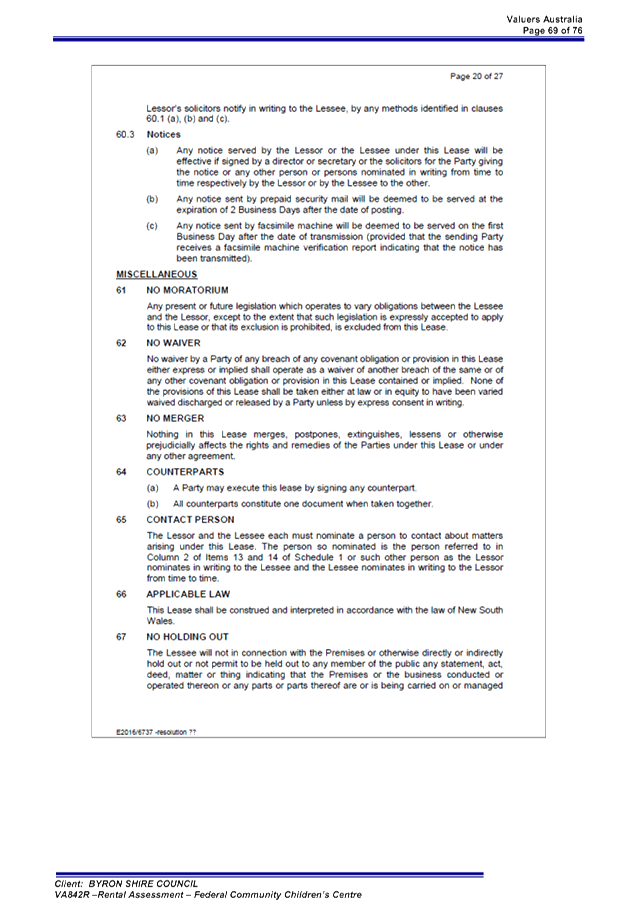

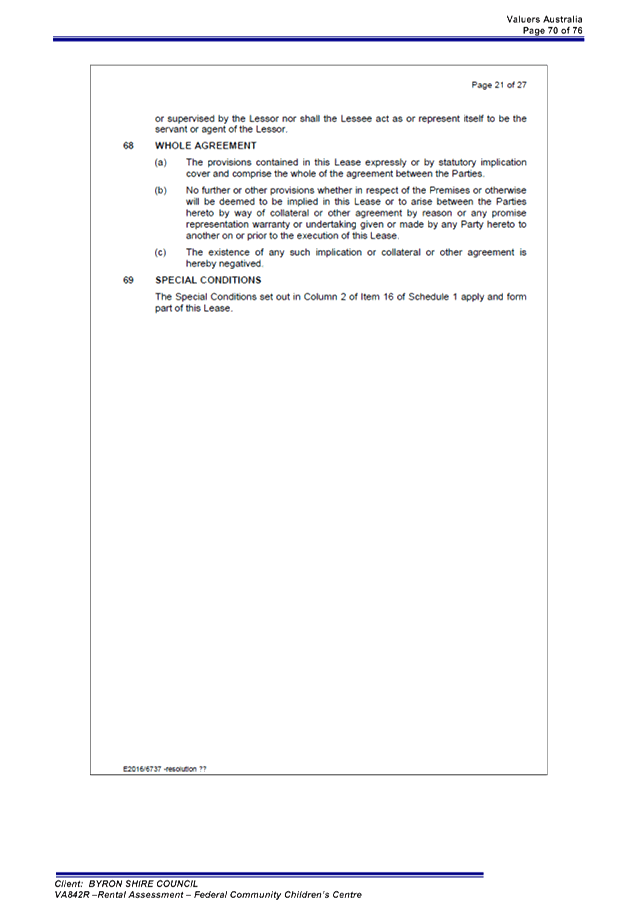

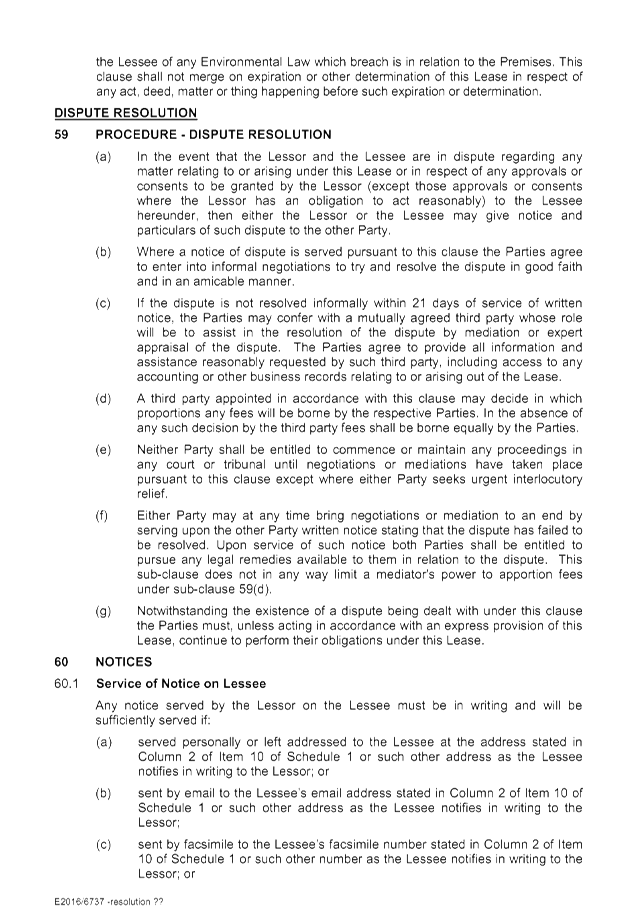

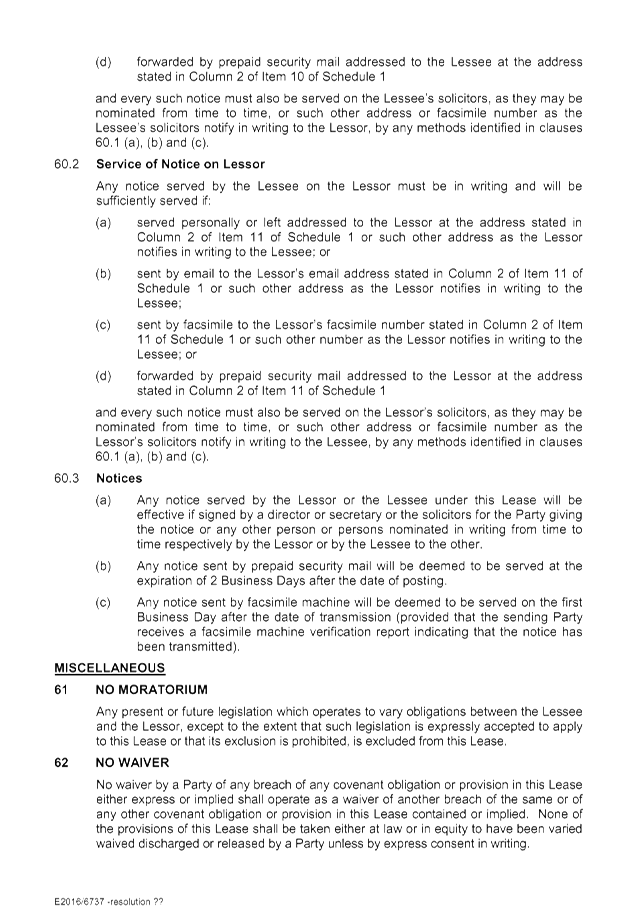

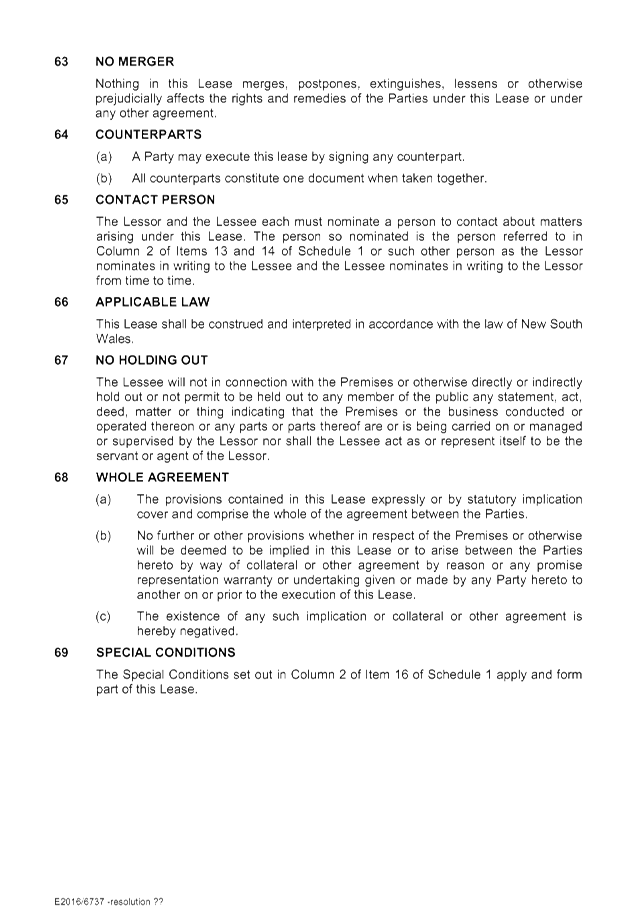

A twelve (12) month temporary trust licence was issued to

Federal Community Children’s Centre Inc (‘the Children’s

Centre’) to authorise their occupation of the land. This licence

expires on 31 December 2016.

The Children’s Centre has requested a new five (5)

year Trust lease at Crown minimum rent, with the Children’s Centre to

continue to pay all ongoing charges, undertake certain building repairs and

assist in the maintenance of the premises.

This report recommends the granting of a new five (5) year

Trust Lease to the Federal Community Childrens Centre Inc.

|

RECOMMENDATION:

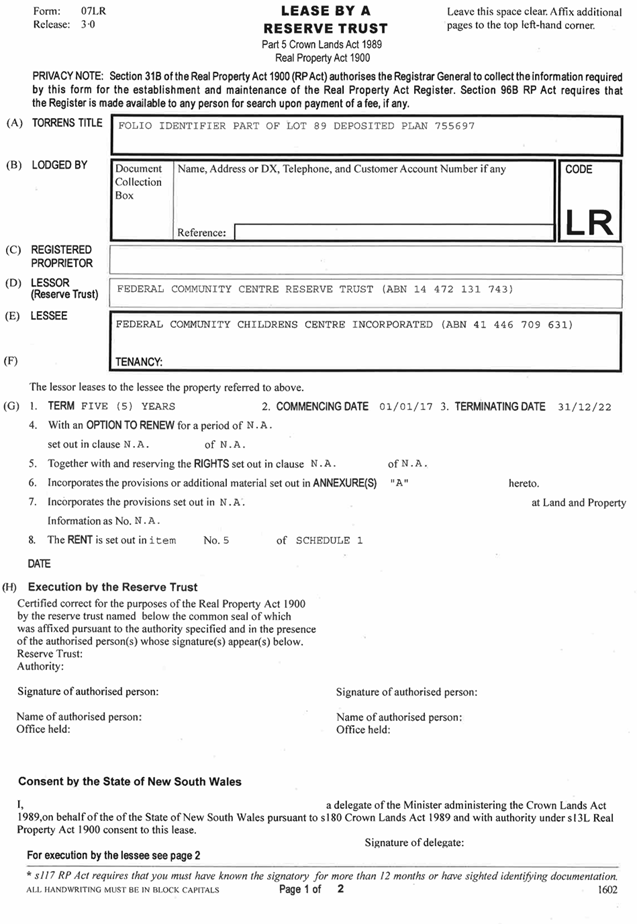

1. That

Council as the Byron Shire Reserve Trust (Federal Community Centre

Reserve Trust) authorise the General Manager to enter into a five year trust

lease with a one year option with Federal Community Children’s Centre

Inc over Lot 89 DP755697 (known as the old School House, Federal) with

following minimum conditions:

a) Minimum

Crown annual rent of $472.00 (ex GST) and increased by CPI annually;

b) All

minor maintenance costs to be met by the Lessee; and

c) All

Lease establishment costs including registration costs are to be met by the

Lessee, with the exception of the cost for the Market Rent Valuation of

$1,850 (ex GST).

2. That

Council note for Crown Reporting purposes the difference between the

minimum Crown annual rent of $472.00 (ex GST) per annum (as increased by CPI)

and the market rent of $46,500.00 (ex GST) is $46,028.00.

|

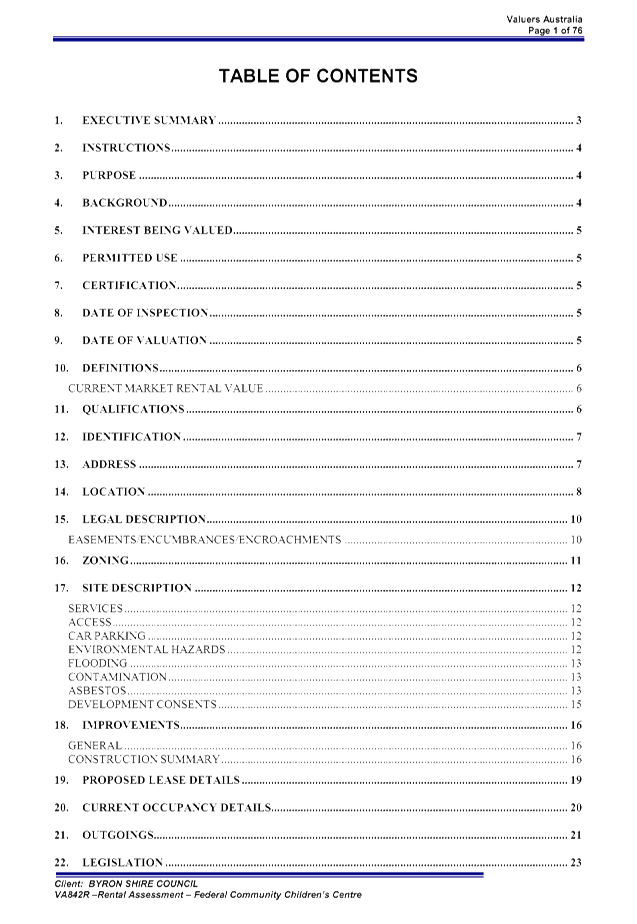

Attachments:

1 Market

Rent Valuation 2016: Federal Community Childrens Centre, E2016/92052 ,

page 8

2 Trust

Lease Federal Community Childrens Centre, E2016/92148

, page 85

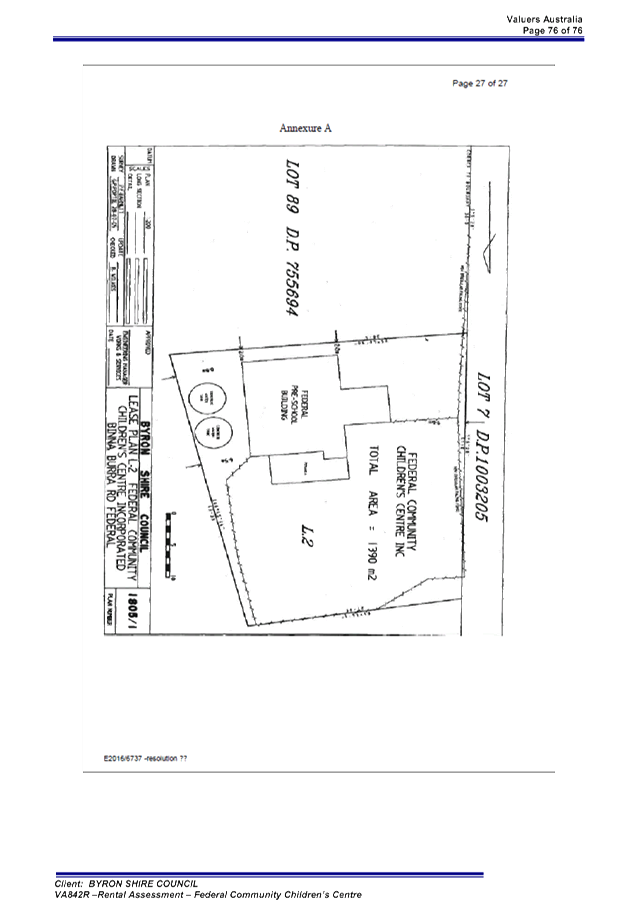

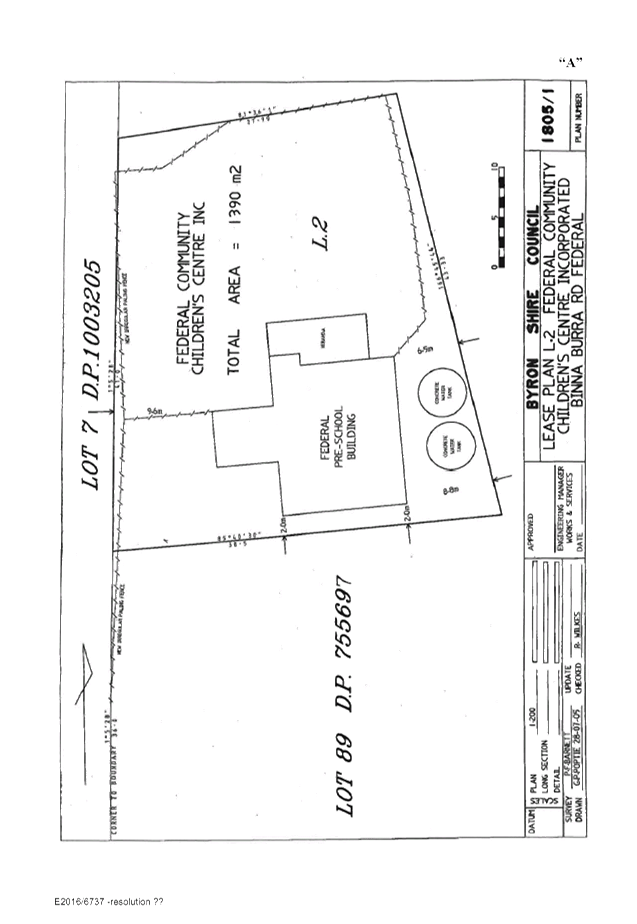

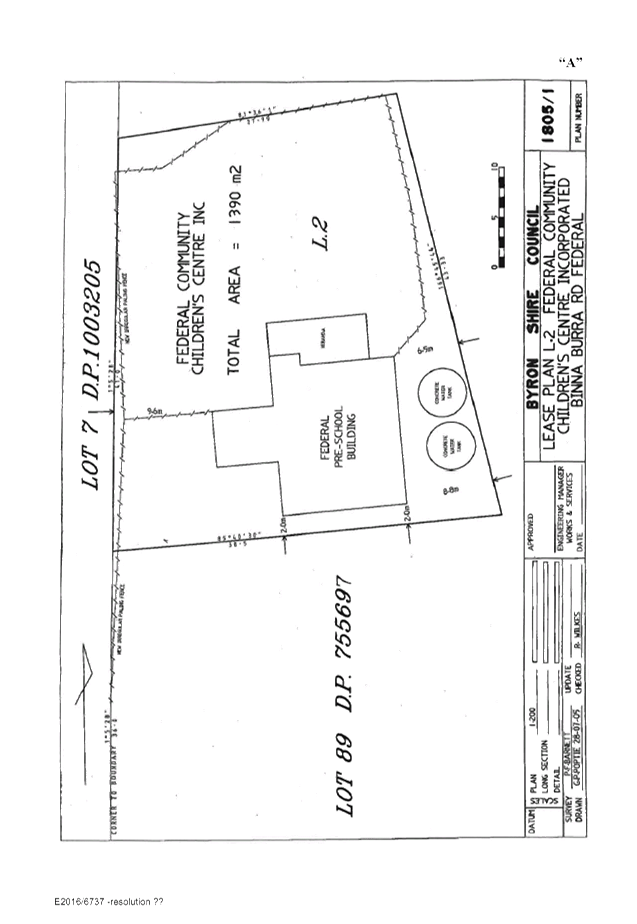

Report

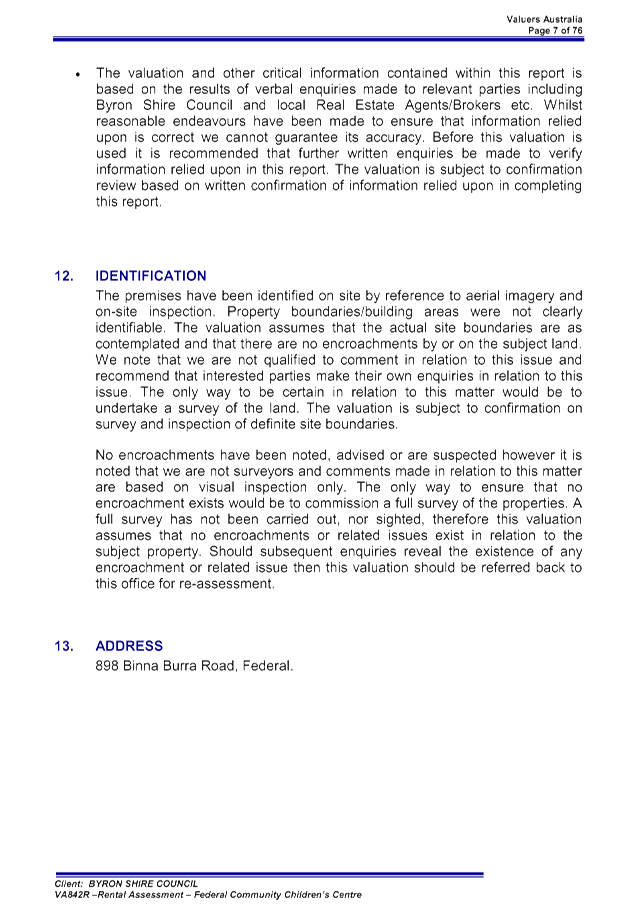

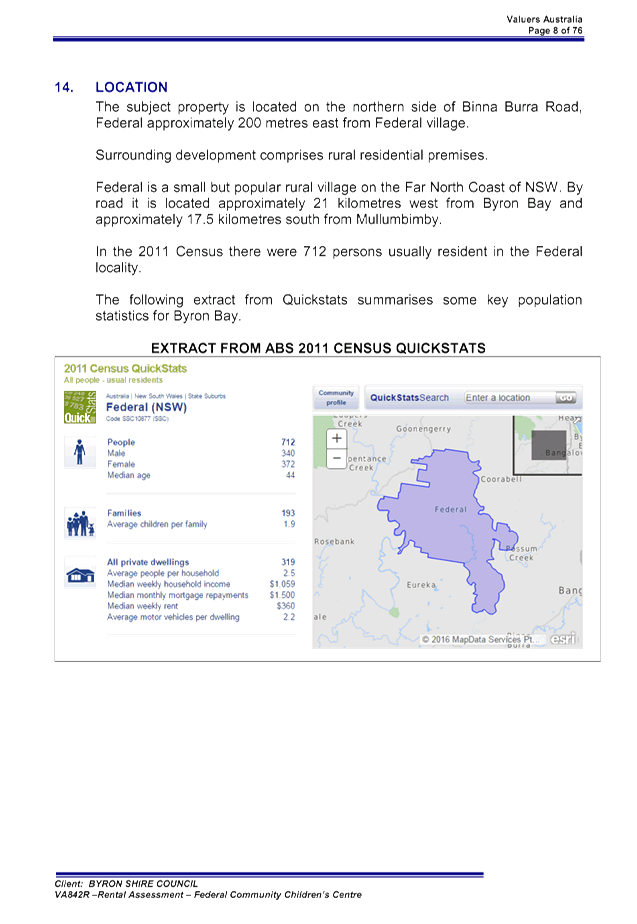

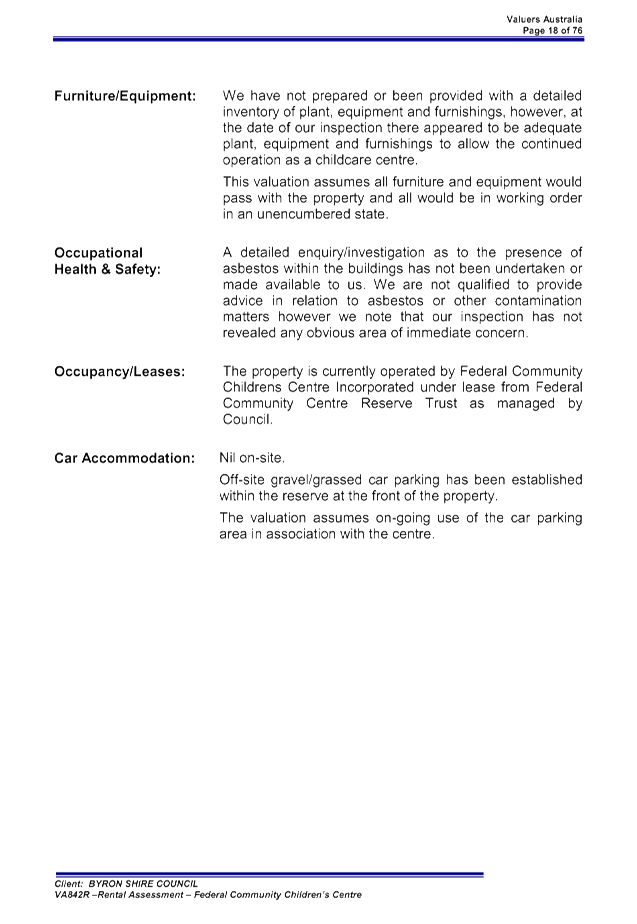

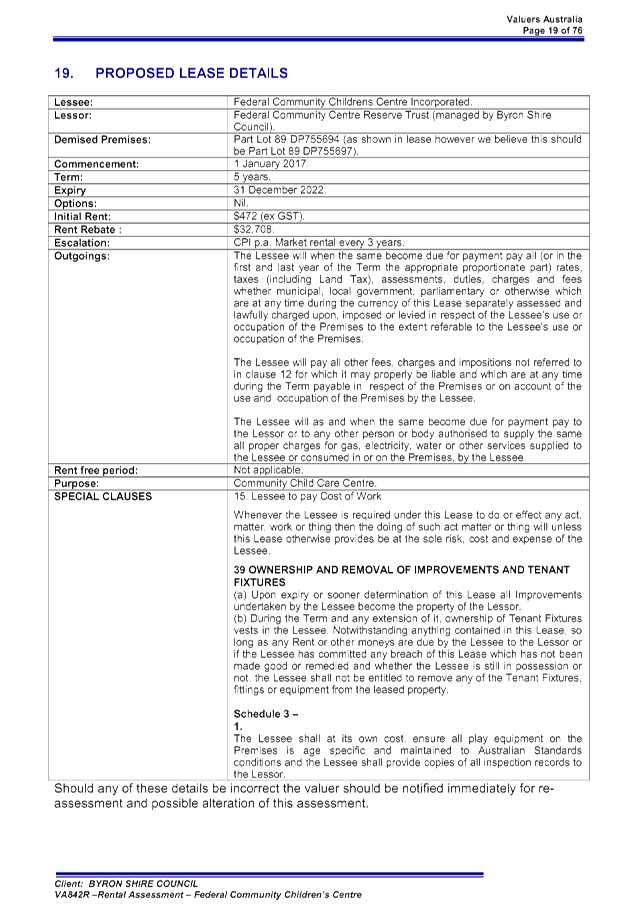

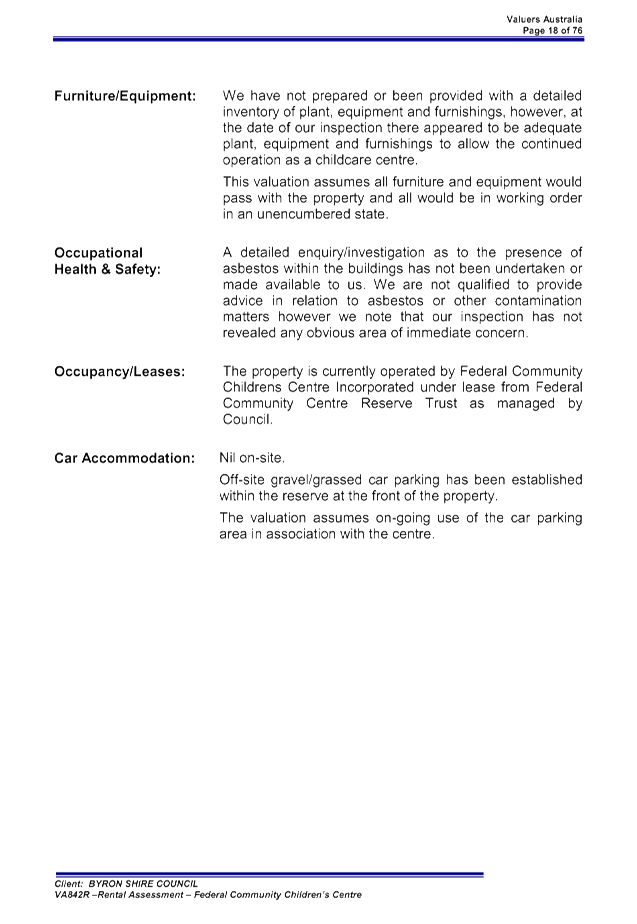

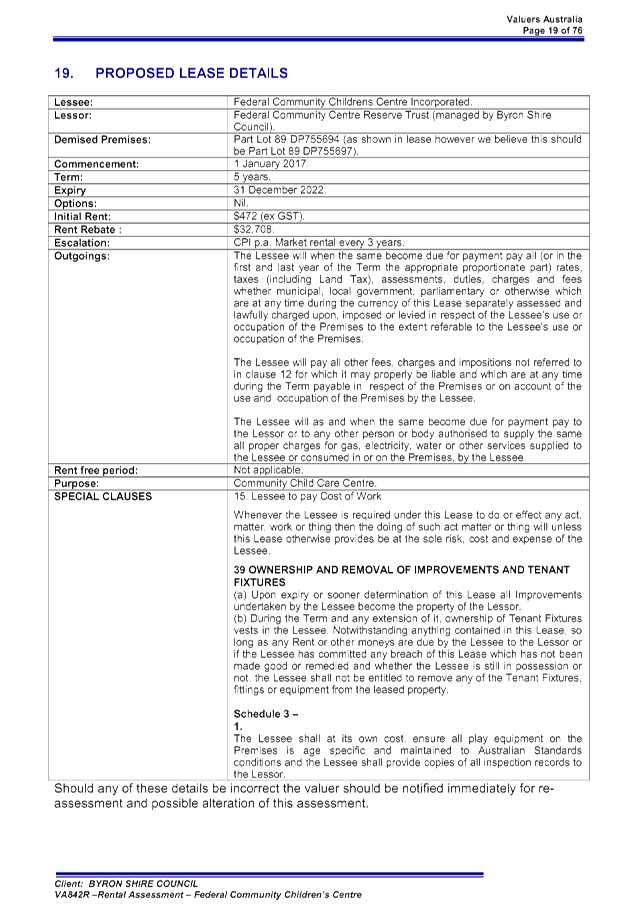

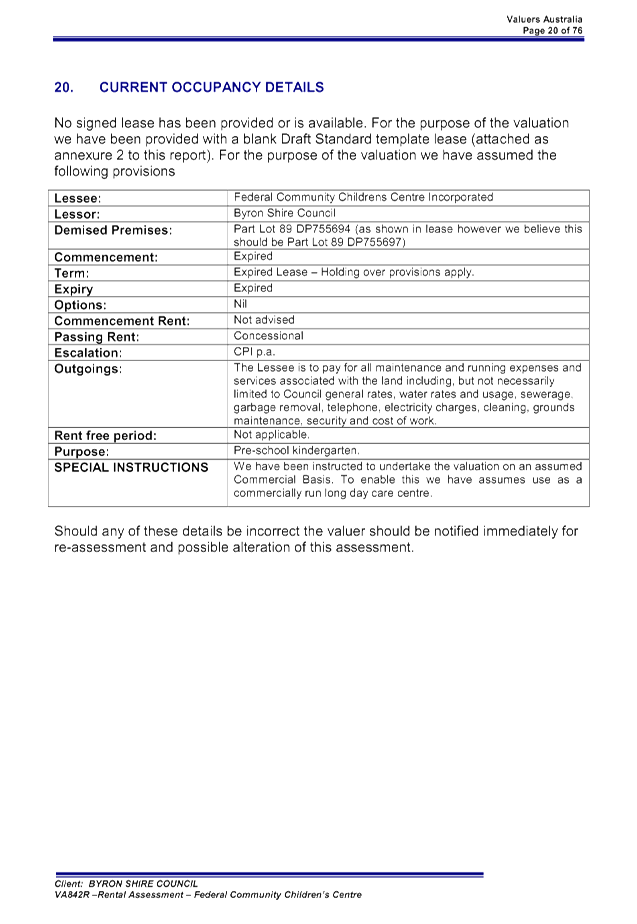

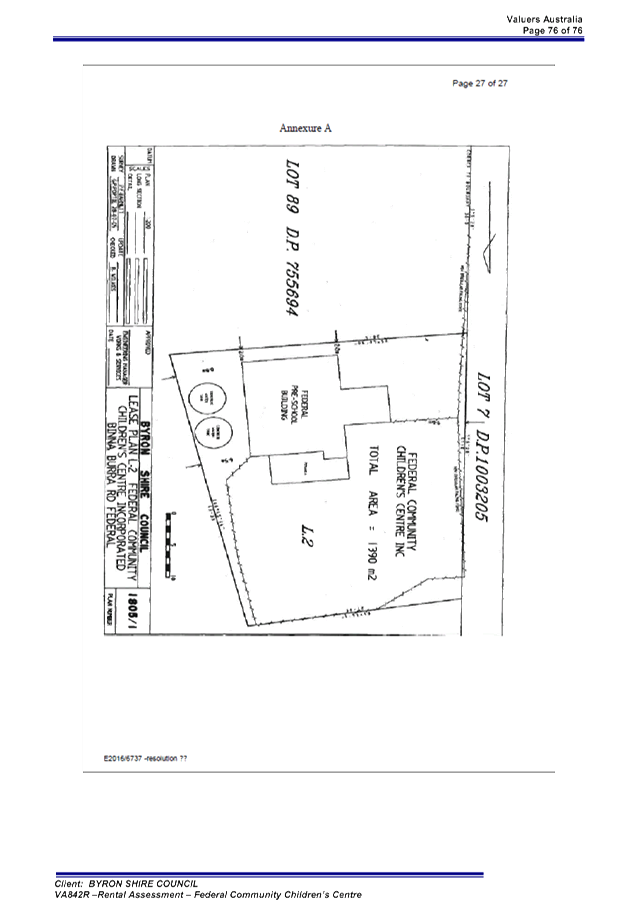

Land information

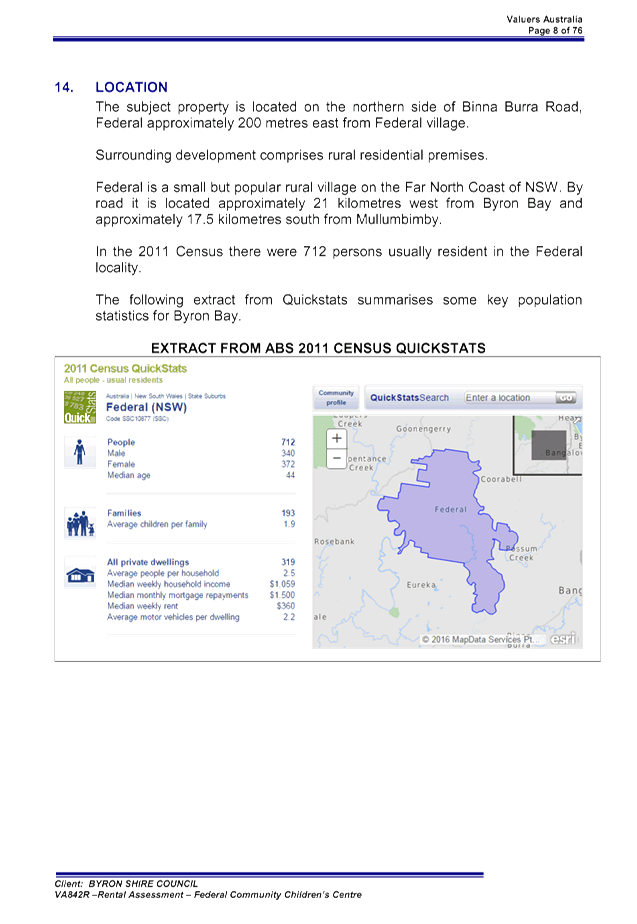

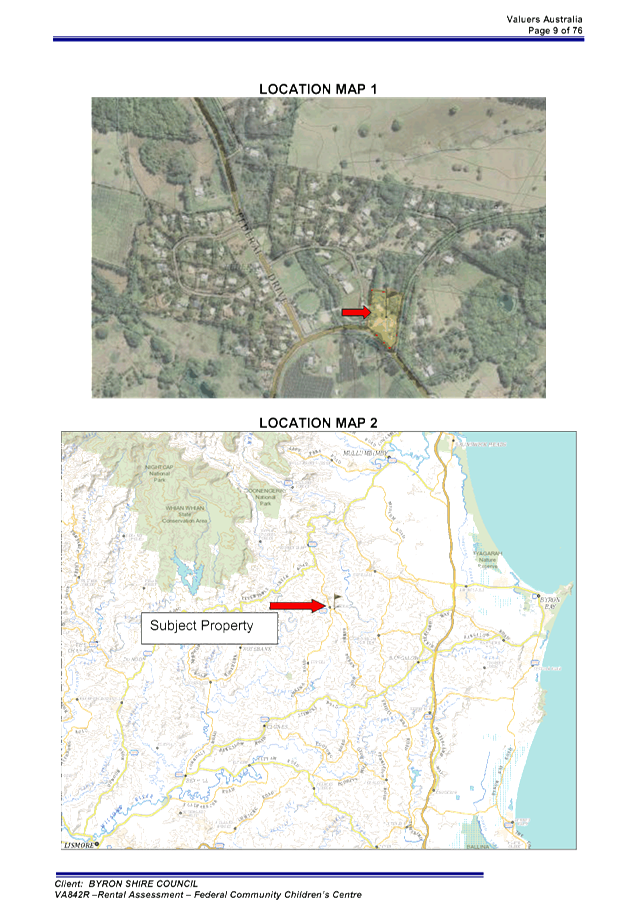

Part of Crown Reserve 95471,Lot 89 DP 755697 located at 898

Binna Burra Federal NSW 2480.

Owner – State of New South Wales (Crown Land).

Reserve Trust – Federal Community Centre Reserve

Trust.

Trust Manager – Byron Shire Council.

Gazetted 26/06/1981.

Gazetted purpose – Community Centre.

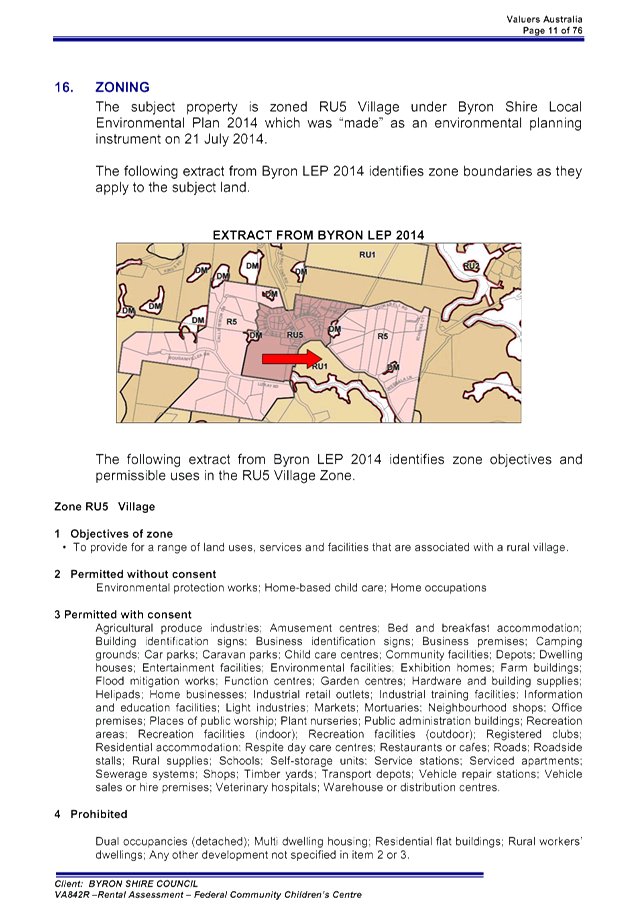

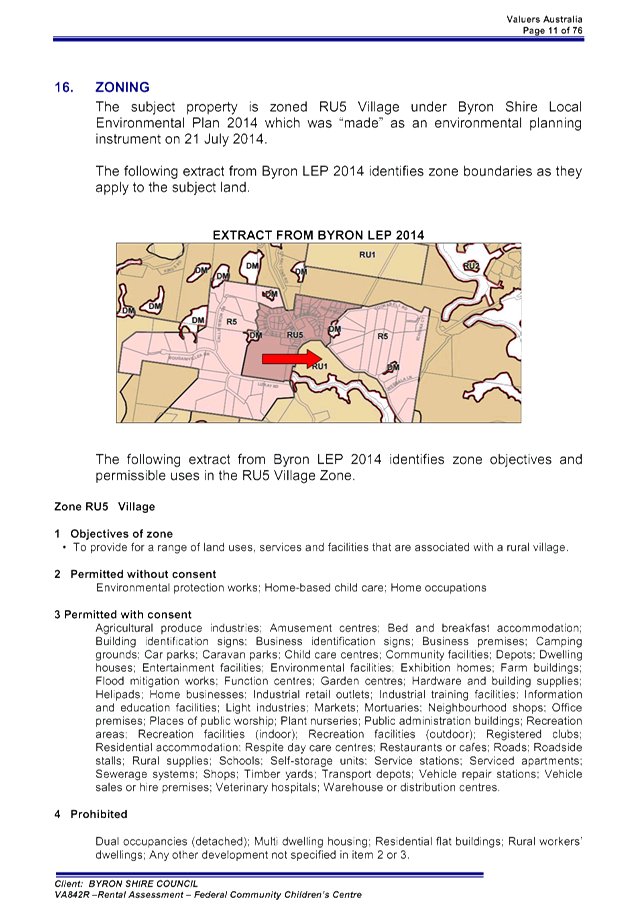

Byron LEP 2014 Zone – RU5 Village.

The proposed lease

The Federal Community Centre Reserve has previously entered

into three consecutive five year Trust leases with the Federal Community

Children’s Centre (‘the Children’s Centre’) expiring in

December 2004, 2010 and 2015. On expiry of the Trust lease in 2015,

Council entered into a temporary twelve (12) month Trust licence with the

Children’s Centre to secure occupation of the land and to allow Council

time to negotiate with the Crown a longer-term Trust Lease.

In a letter to Council dated December 2015, the

Children’s Centre requested a new five year lease as essential in

securing the premise for the continued operation of the Children’s

Centre.

Proposed five (5) year lease tenure

The proposed five year Trust lease tenure is consistent with

the Children’s Centre request to lease only 6% of the total land area

within Lot 89 DP 755697. To let a lease for a term longer than five years would

require a subdivision over Lot 89 DP 755697 at considerable cost of the

Children’s Centre.

The proposed lease is considered in the public interest

being to permit the Children’s Centre to continue provision of

children’s services and sole provider of those services to the Federal

Community. Further the Children’s Centre is a non-profit community based

service funded by the NSW Department of Family and Community Services and the

Department of Education. The Children’s Centre provides both pre-school

and long day care service and is vital part of the Federal

Community.

The proposed Trust lease is compatible with the gazetted

purpose of Reserve 95471 being a Community Centre.

The proposed leased area

Prior to 1999 the whole of Lot 89 DP 755697 being an area of

9133.03 m² was managed by the Federal Community Centre Committee. The

Children’s Centre expressed reluctance in taking a five year lease over

the whole of Lot 89 DP 755697, instead requested a lease over 1390 m² of

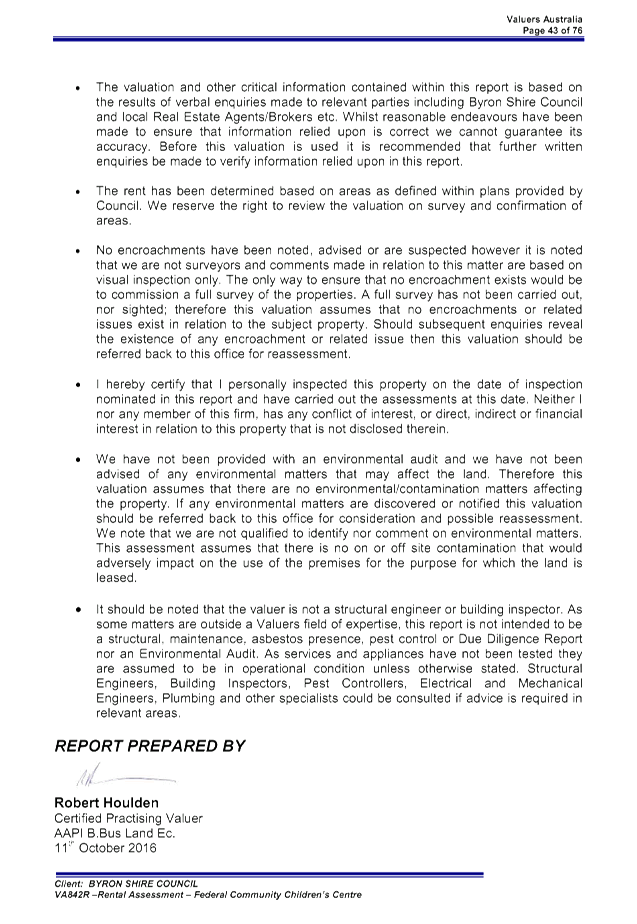

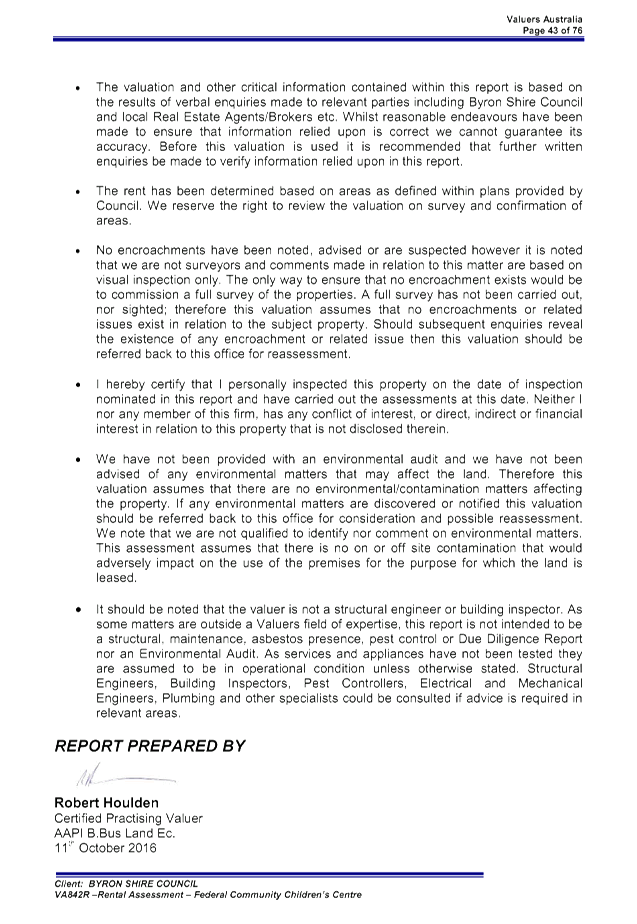

the land being the same area of land leased since 1 January 1999. The proposed

leased area includes the premises, a storage shed, gardens and a fenced

playground.

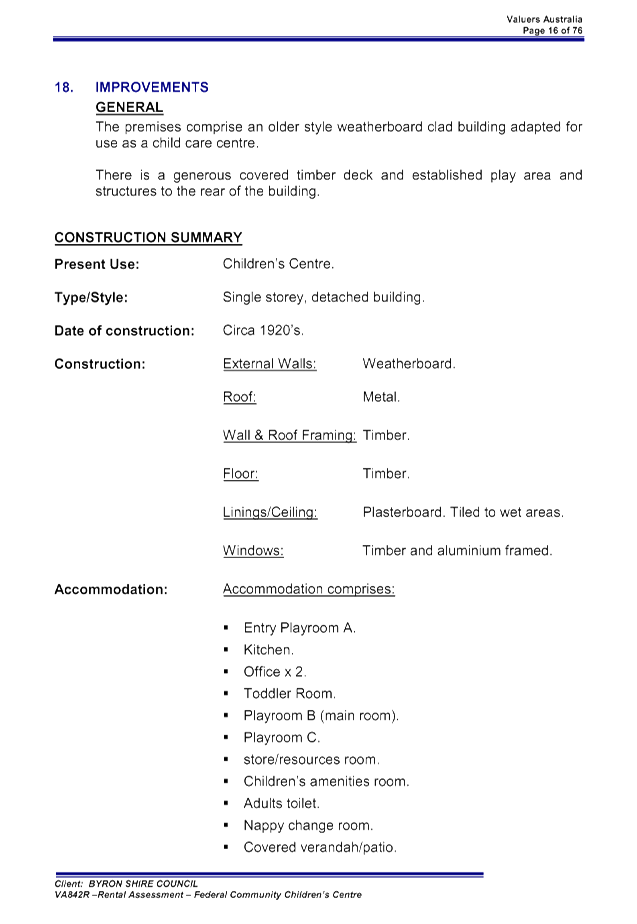

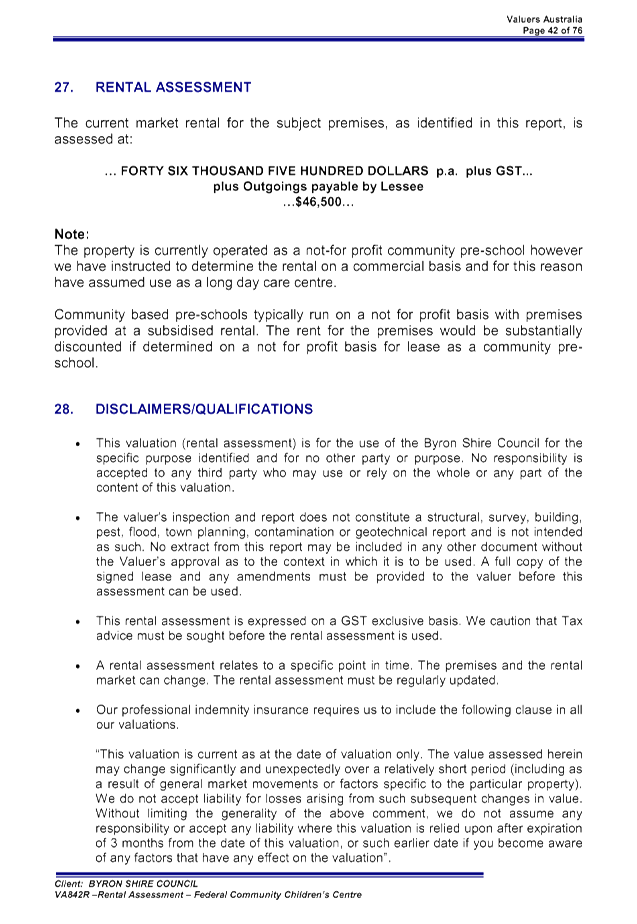

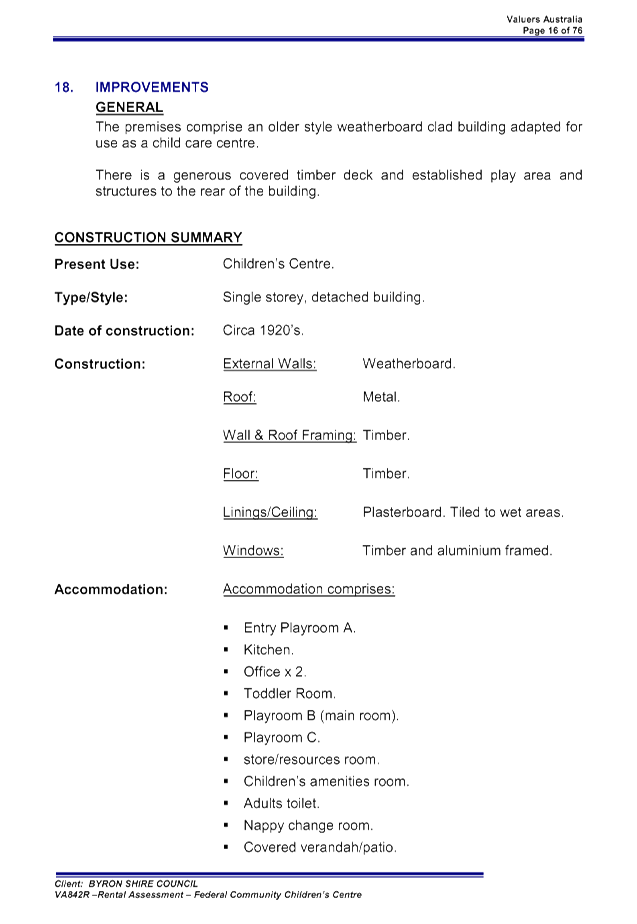

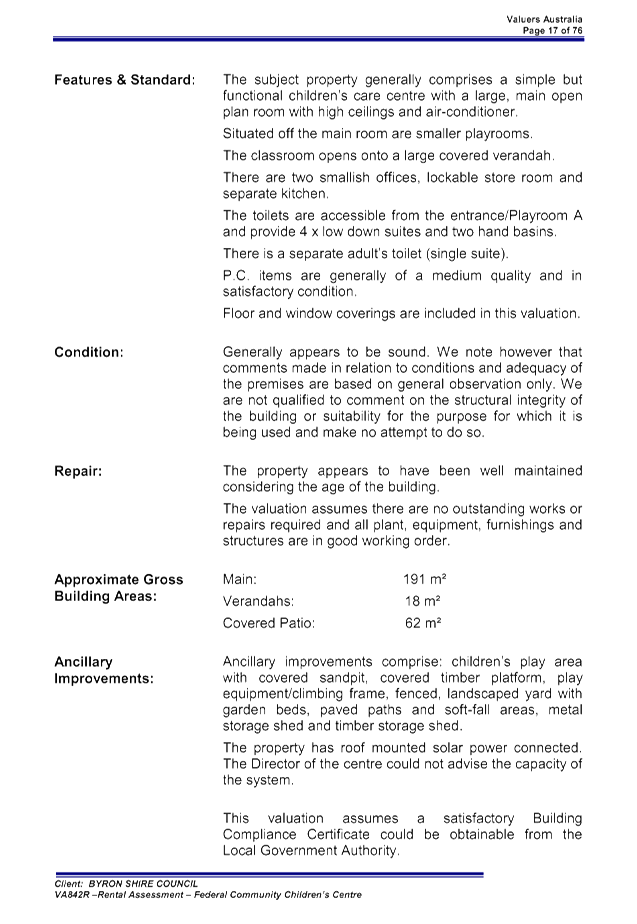

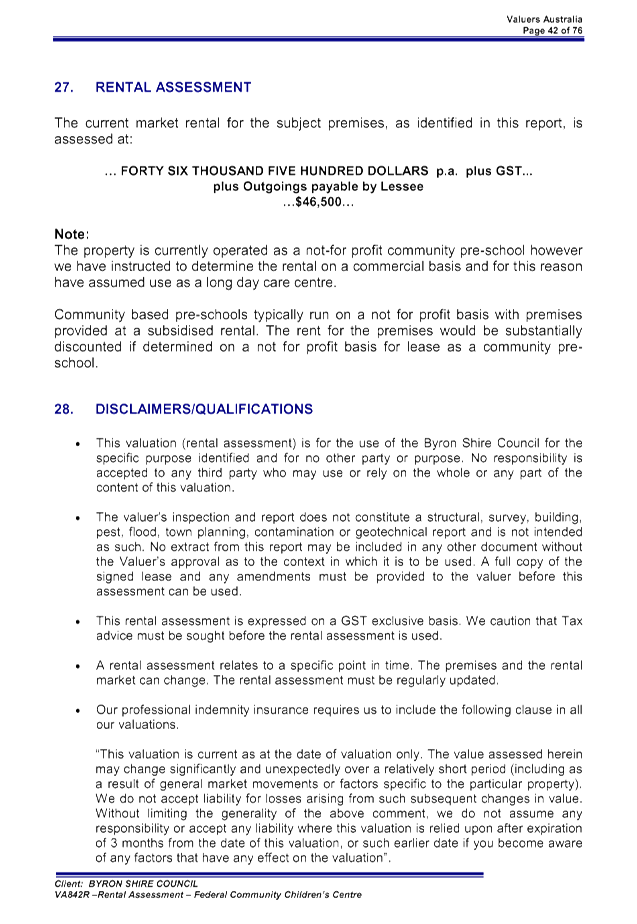

The leased premises

The Children’s Centre has contributed to improvements

to the premises since 1999. Recent improvements include development consent

granted on 9 February 2011 for alterations and additions to the premises to

accommodate five extra children and construction of a nappy change room. New

playground equipment was previously installed in 2007.

A 2014 building condition assessment report highlighted

urgent building maintenance which has since been completed. Council at its cost

carried out repairs to exterior cladding to stop water penetration, repaired

timber window frames and mouldings, gable boards, veranda entry stairs and

cleaning of gutters, removal of overhanging camphor laurels and implementation

of a program of roof maintenance and cleaning.

The Children’s Centre carried out repairs to shade

covers, children’s playground structures and the storage shed and removed

a paved area at the rear of the building to reinstate a visual termite barrier

and allow for ventilation to prevent moisture build-up.

Selection of the proposed Lessee

Council directly negotiated with the Federal Community

Centre Inc on the basis the proposed fell outside the Independent Commission

Against Corruption, (‘ICAC’) direct negotiation guidelines. The

decision was based on the cost to Council to publically tender the letting of

5-year Trust lease over the premises far outweighed any benefit to Council in

running that process. Given the restricted use of the Crown reserve and the

community benefit in retaining a childcare service provided by Federal

Community Children’s Centre since 1999 the cost to Council in running a

public tender process far outweighed any benefit of that process.

The Federal Community Centre Incorporated is a registered

charity 41 446 709 631 and registered provider under section 15, Children

(Education and Care Services) National Law (NSW) provider number PR-00003493

granted 1/19/2009.

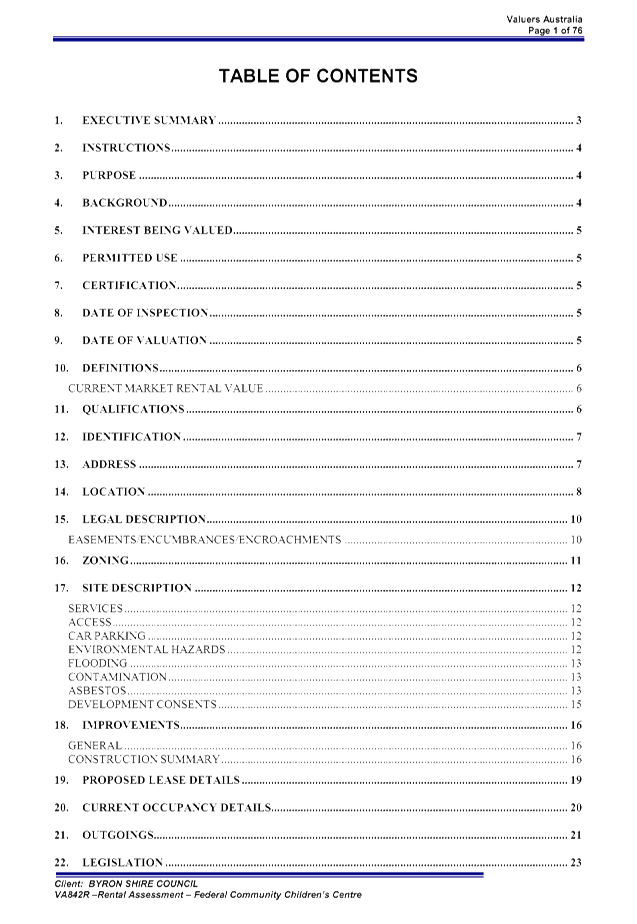

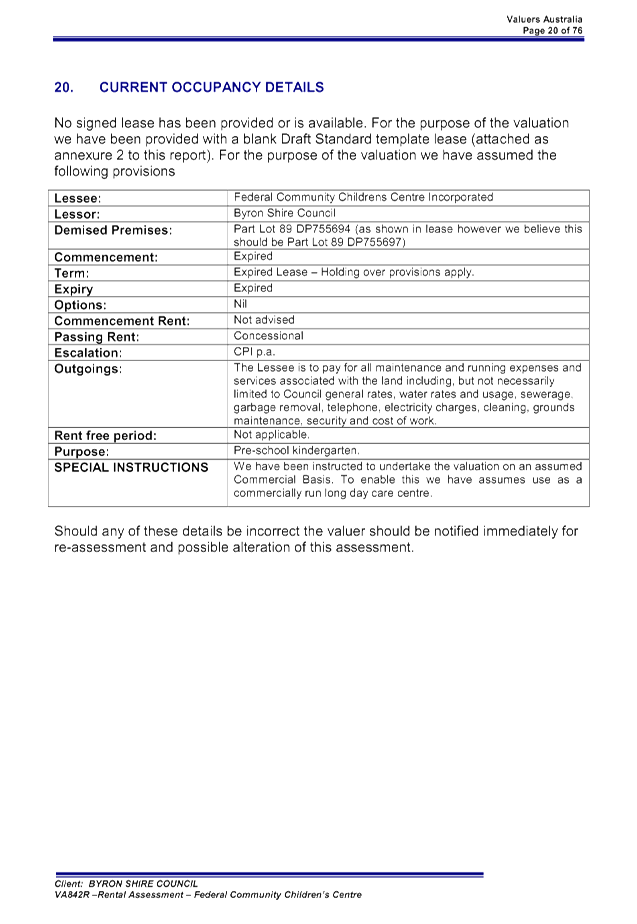

Financial Implications

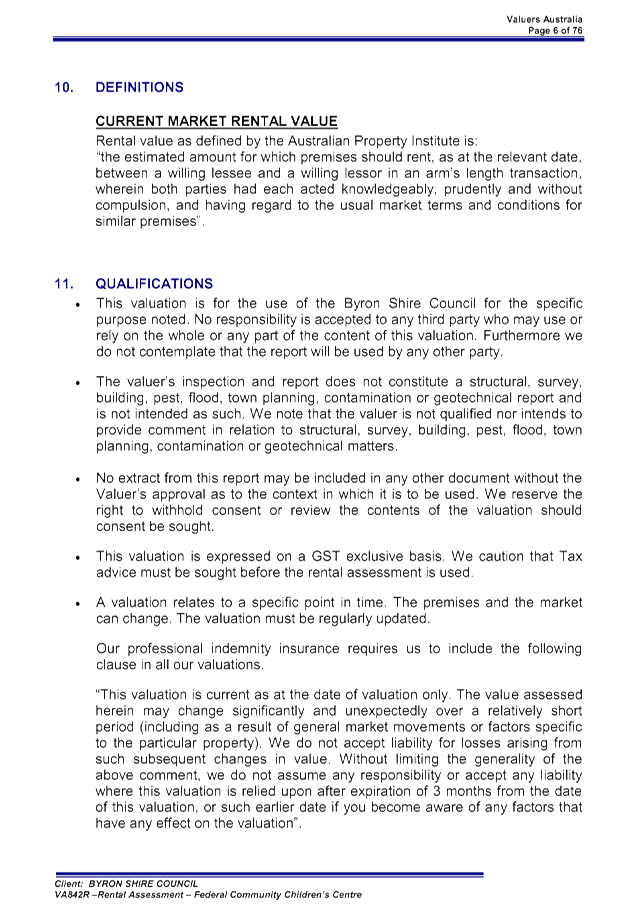

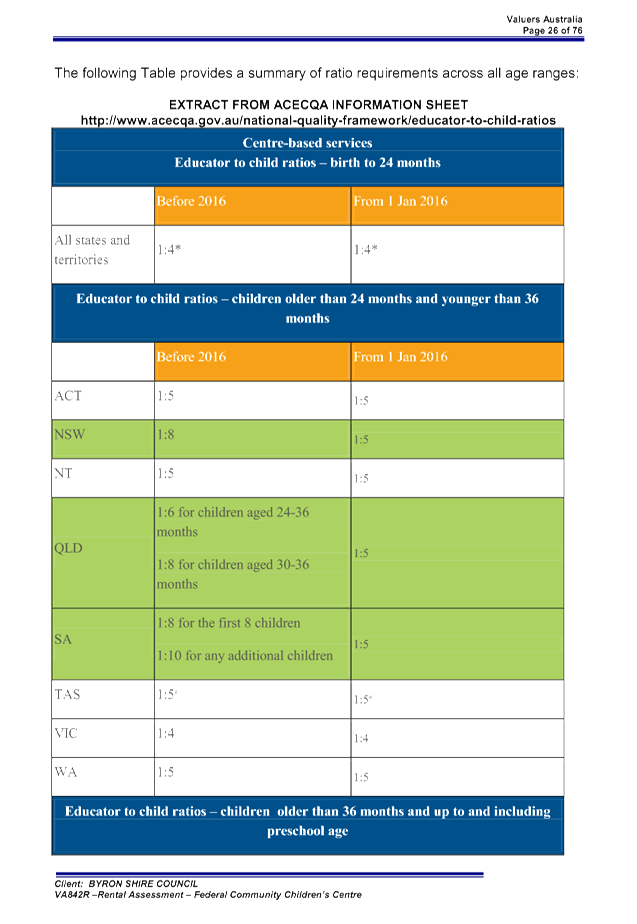

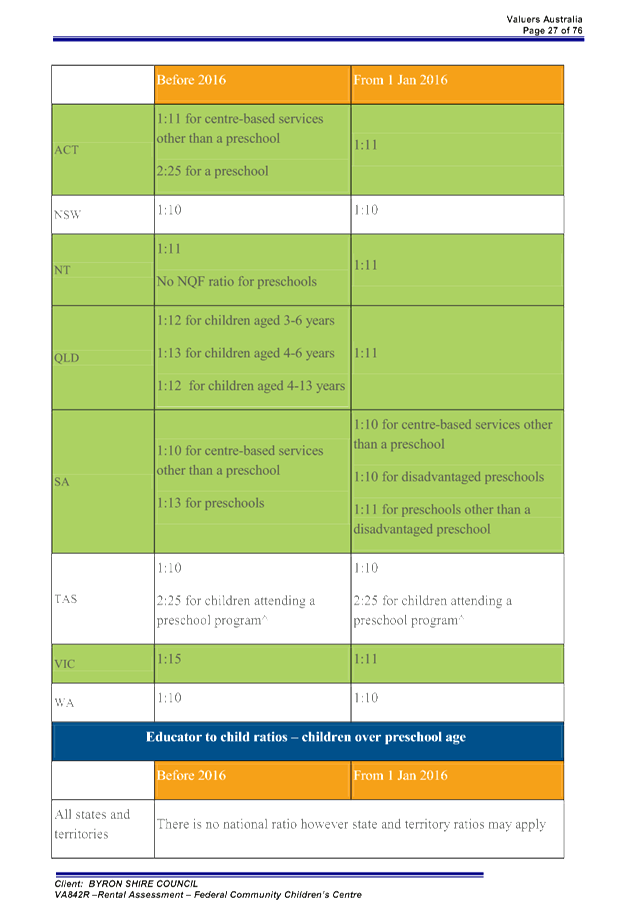

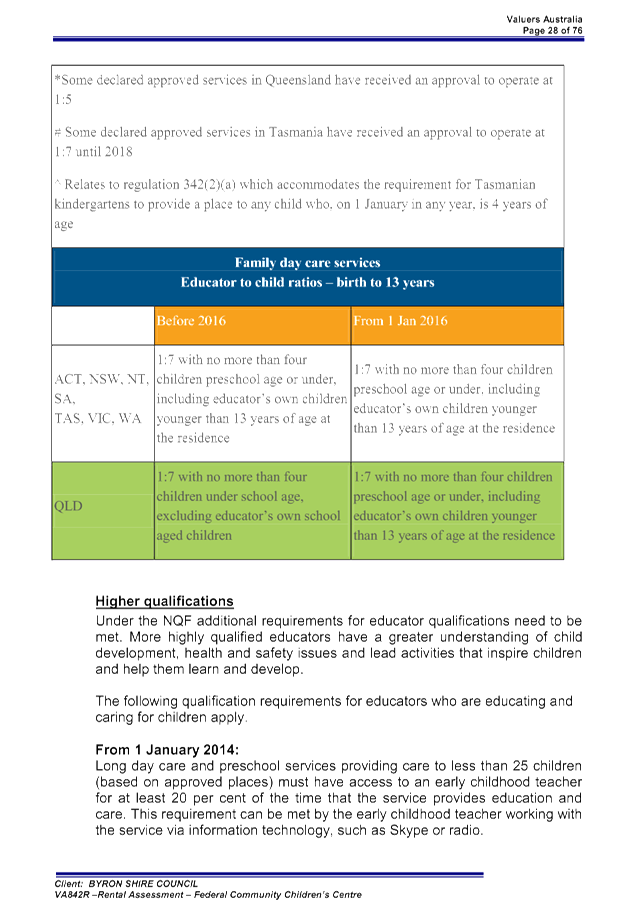

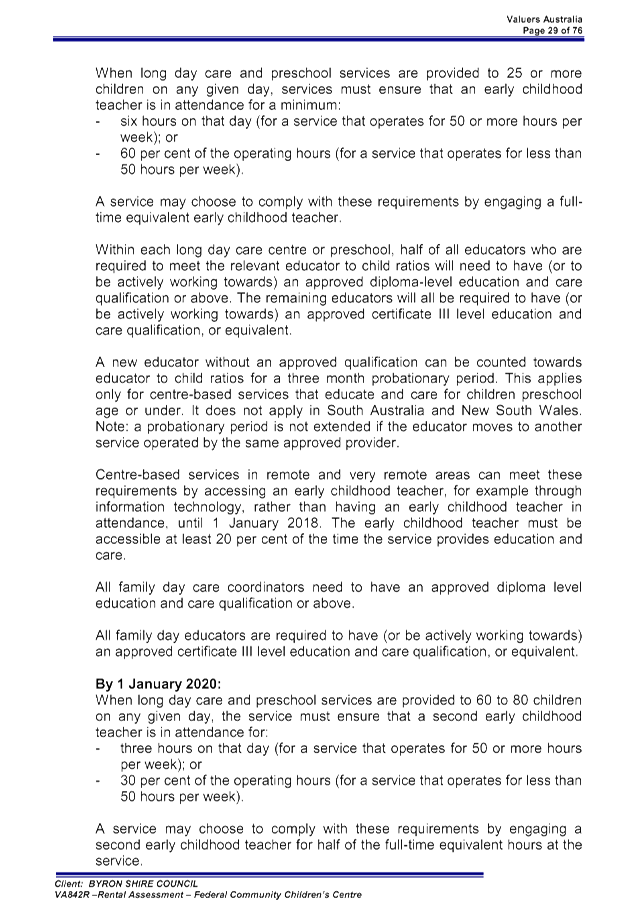

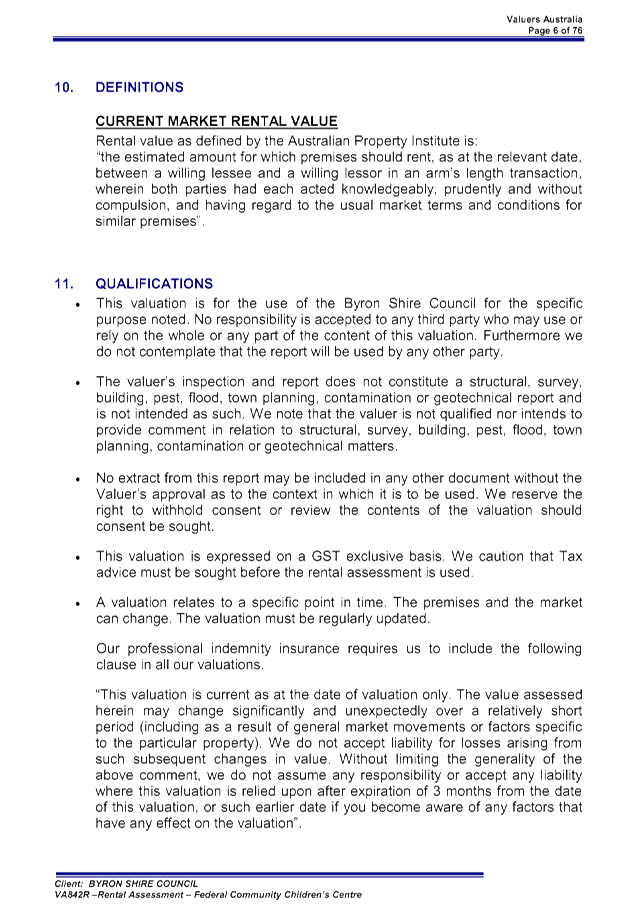

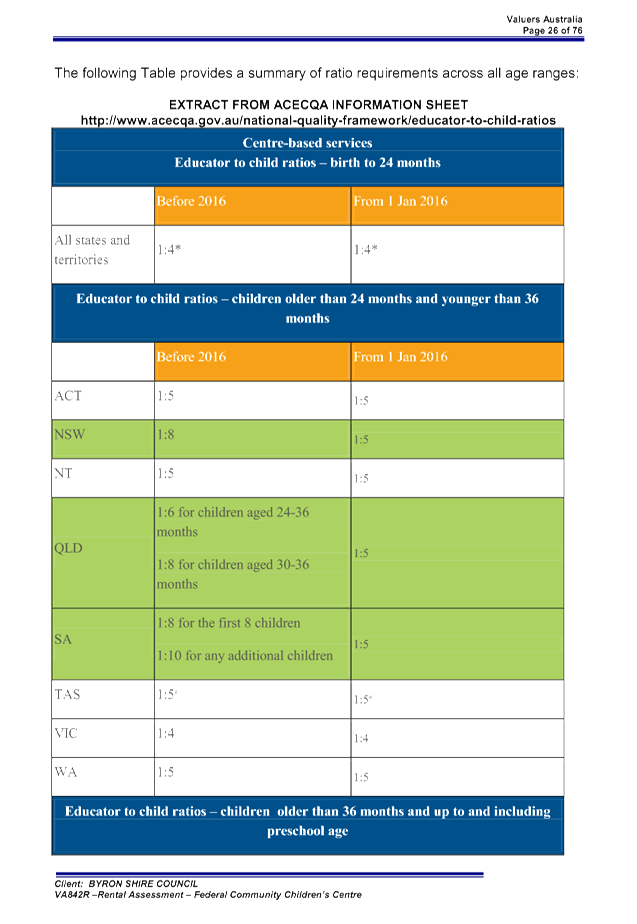

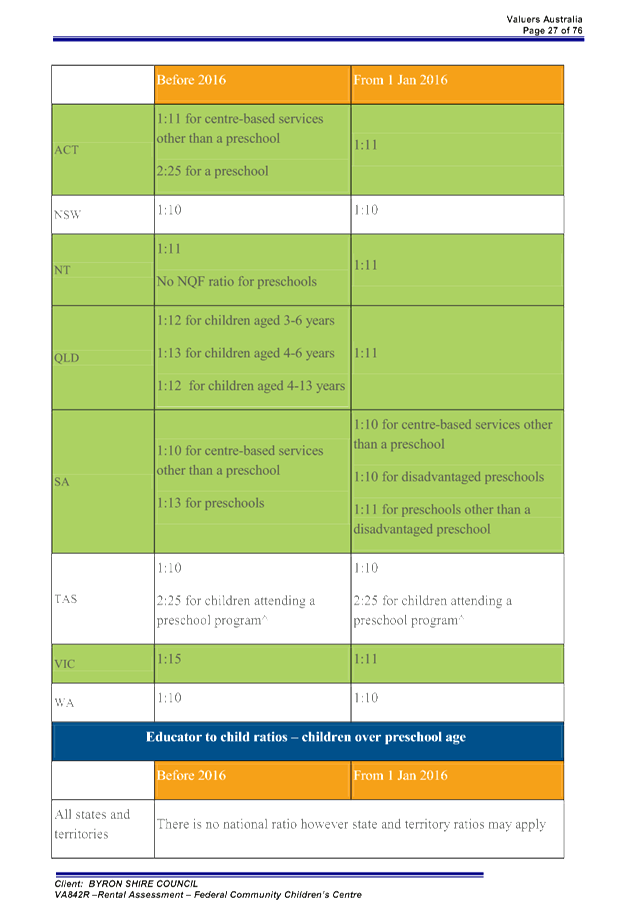

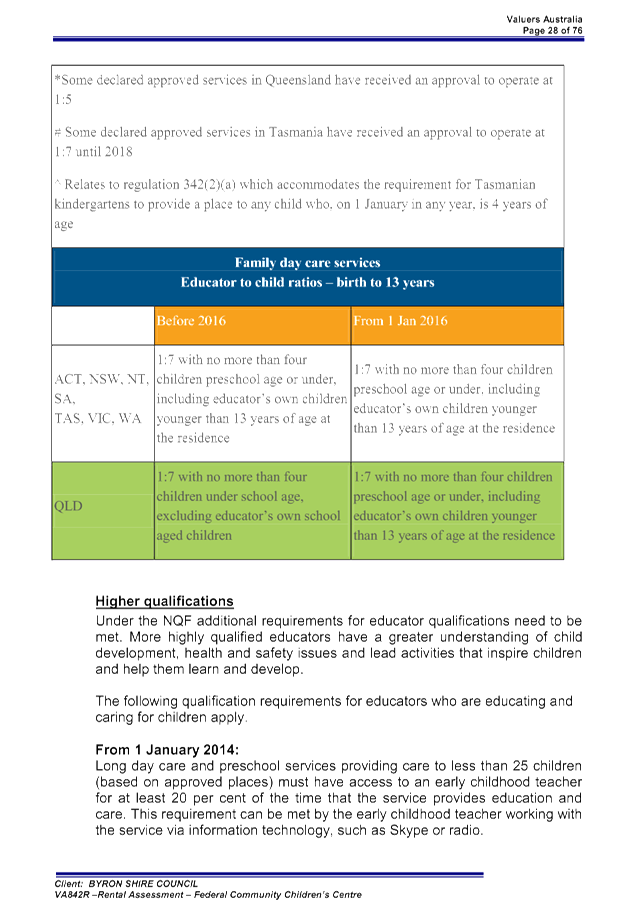

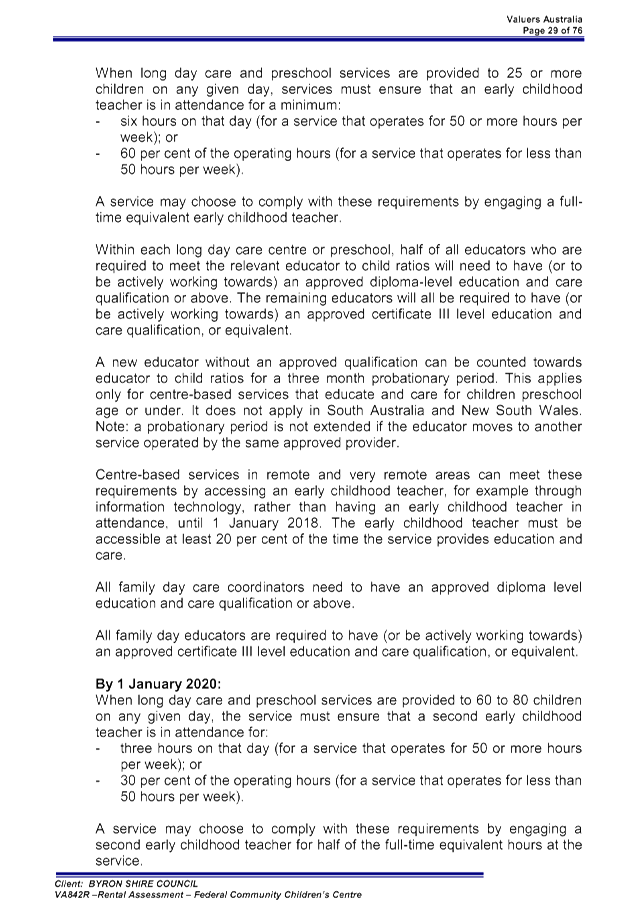

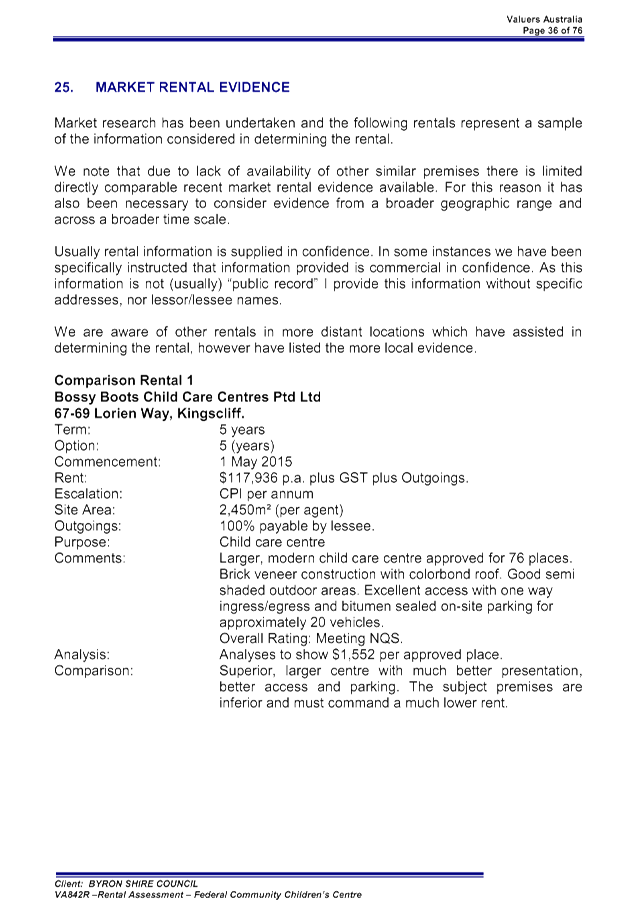

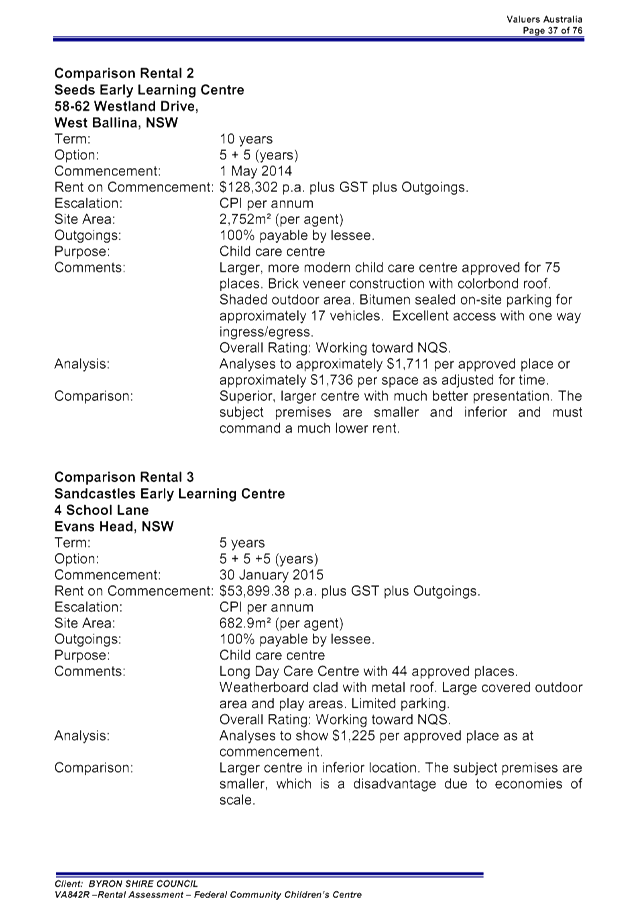

A market rent evaluation was undertaken by Valuers Australia

Real Estate Advisors which determined the annual market rent for the premises

is valued at $46,500 (ex GST). It has been recommended that the costs of

$1,850 (ex GST) for undertaking the Market Rent Valuation, should on this

occasion be borne by Council, as these costs were not identified by Council

during the negotiations as a cost of establishing the lease.

The Children’s Centre as a not for profit organisation

providing a childcare service to the Federal community is eligible under clause

2.2(b)(iii) of the Department of Primary Industries Catchments & Lands

Policy April 2012 for a maximum rent rebate to the crown minimum value of $472

excluding GST per annum. For Crown Reporting purposes the annual value of rent

rebated and reported as a subsidy is $46,028 (ex GST).

The costs for preparing the trust lease, including the registration

of the lease should be borne by the tenant, with the exception on this occasion

of the market rent valuation.

All minor maintenance costs of the building should be made

the responsibility of the tenant.

Statutory and Policy Compliance Implications

92 Reserve trusts

(1) The Minister may, by notification

in the Gazette, establish and name a reserve trust and appoint it as trustee of

any one or more specified reserves or any one or more parts of a reserve.

(2) A reserve trust established under

subsection (1) is constituted by this Act as a corporation having as its

corporate name the name assigned to the trust in the notification of its

establishment.

(3) The

Minister may, by notification in the Gazette:

(a) dissolve

a reserve trust, or

(b) alter

the corporate name of a reserve trust, or

(c) revoke the appointment of the

reserve trust as trustee of any one or more specified reserves or any one or

more parts of a reserve.

(4) A reserve

trust has the functions conferred on it by or under this Act.

(5) A reserve trust is charged with the

care, control and management of any reserve (or any part of a reserve) of which

it is appointed trustee.

(6) The affairs

of a reserve trust are to be managed:

(a) by

the Minister, or

(b) if

a trust board is appointed under section 93-by the trust board, or

(c)

if a corporation is appointed under section 95-by the corporation, or

(d) if

an administrator is appointed under section 117-by the administrator.

(6A) In this Division, a reference to a

"reserve trust manager" is

a reference to the Minister (to the extent that the Minister is responsible for

managing the affairs of a reserve trust), or any such trust board, corporation

or administrator.

(6B) There can be more than one reserve

trust manager for a reserve trust with the function of managing the

affairs of the reserve trust allocated between them by the Minister in

accordance with the following provisions:

(a) The Minister can allocate the exercise

of functions in respect of different aspects of the affairs of the reserve

trust or different parts of the reserve to different reserve

trust managers, as specified in the allocation or

as determined by the Minister, with those functions to be exercised in

accordance with such arrangements (if any) as may be determined by the

Minister.

(b) The Minister is the reserve

trust manager for any aspect of the affairs of a reserve trust or any

part of the reserve not allocated to another reserve

trust manager and is accordingly allocated the function of managing the

affairs of the reserve trust in respect of any such unallocated aspects of

those affairs or unallocated parts of the reserve.

(c) A reserve

trust manager has the function of managing the affairs of the reserve

trust only to the extent of the allocated functions and is, for the purposes of

this or any other Act or law, the reserve

trust manager to that extent only.

(6C) Subsections (6)-(6B) do not apply to a reserve trust

established for cemetery or crematorium purposes on or after the commencement

of section 73 of the Cemeteries

and Crematoria Act 2013 .

(6D) In this Division, a reference to a "reserve trust manager" , in relation to a reserve trust

established for cemetery or crematorium purposes on or after the commencement

of section 73 of the Cemeteries

and Crematoria Act 2013 , is a reference to the Minister administering that Act (to

the extent that the Minister is responsible for managing the affairs of that

reserve trust) or the trust board, corporation or administrator appointed under

that section to manage the affairs of the trust.

(7) If a reserve trust is appointed as

trustee of more than one reserve (or more than one part of a reserve), a

reference in this Part to the reserve (or part of the reserve) in relation to

the reserve trust includes a reference to any one or more of the reserves (or any

one or more of the parts of the reserve) of which the reserve trust has been

appointed as trustee.

(8) The Minister administering this Act

is to consult the Minister administering the Cemeteries

and Crematoria Act 2013 before exercising any function after the commencement of

section 73 of that Act with respect to a reserve trust established for cemetery

or crematorium, or related, purposes.

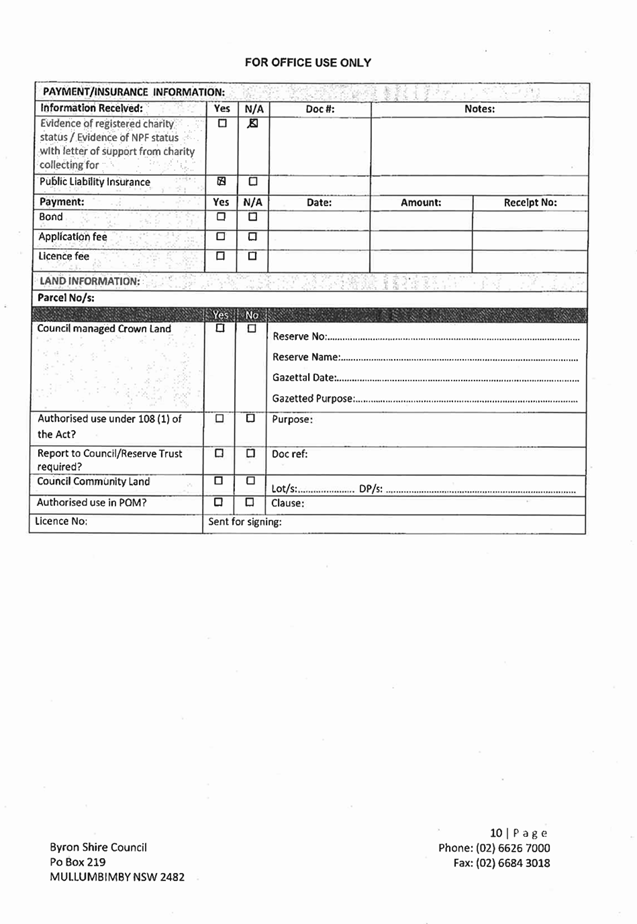

Staff Reports - Corporate and Community Services 4.1 - Attachment 1

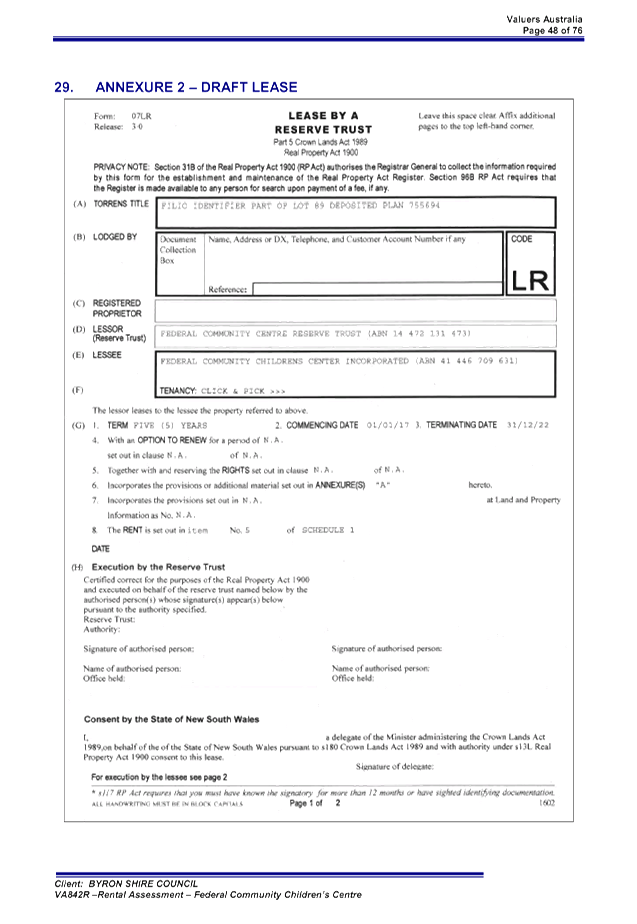

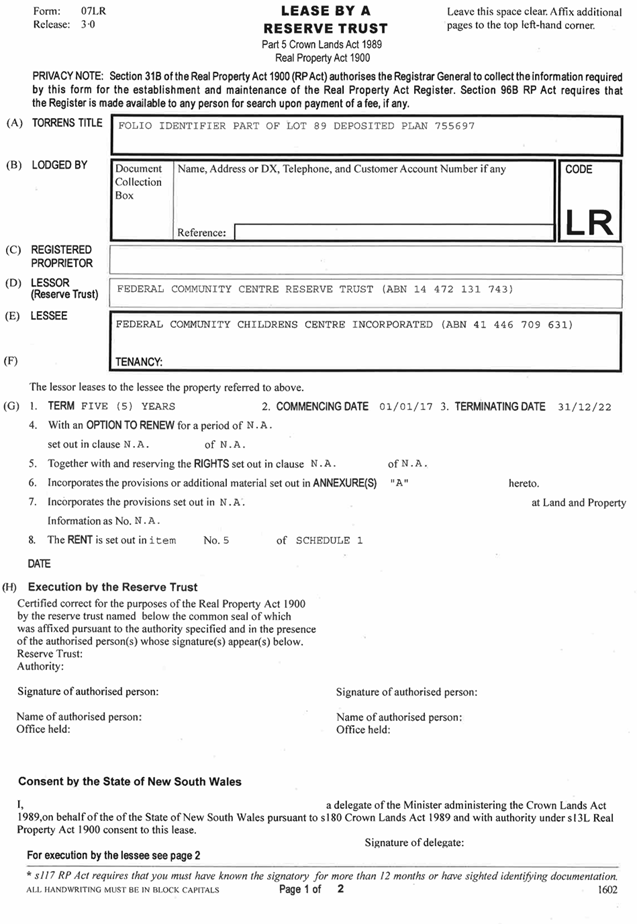

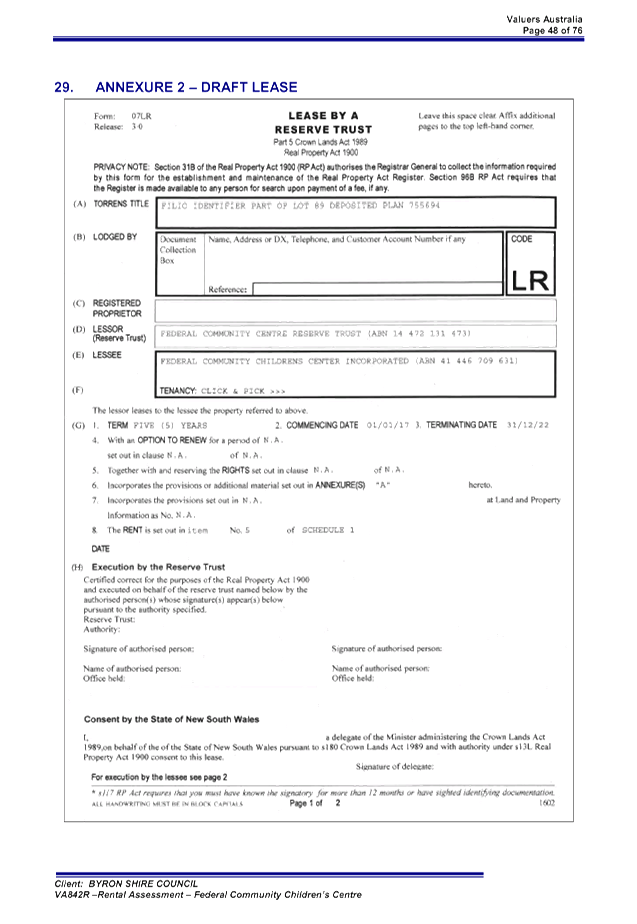

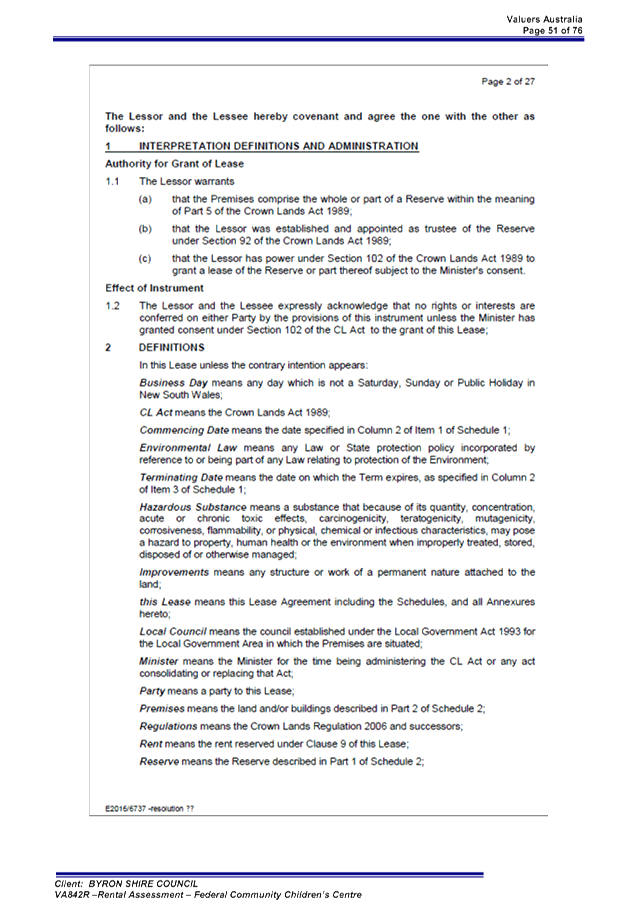

Staff Reports - Corporate and Community Services 4.1 - Attachment 2

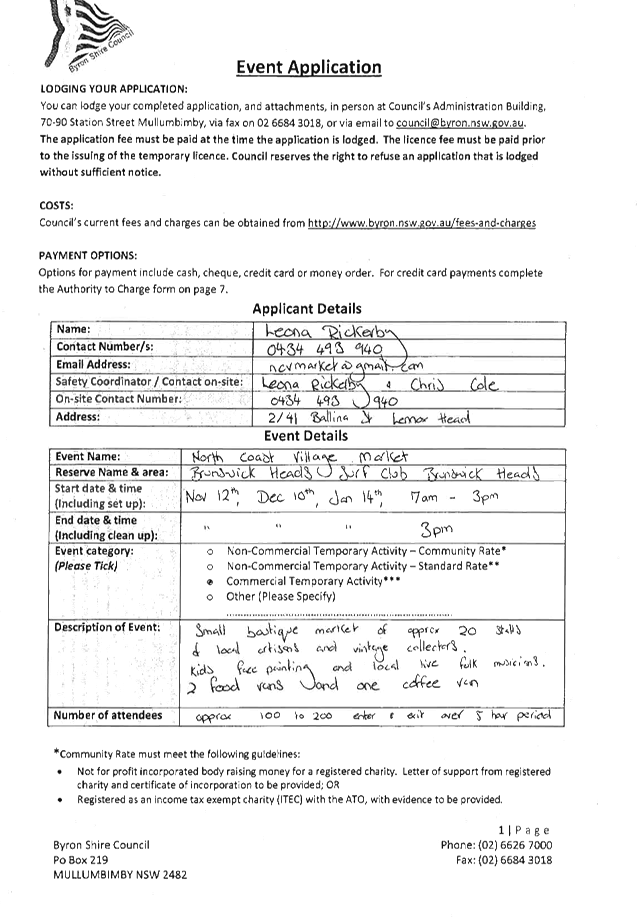

Staff Reports - Corporate and Community Services 4.2

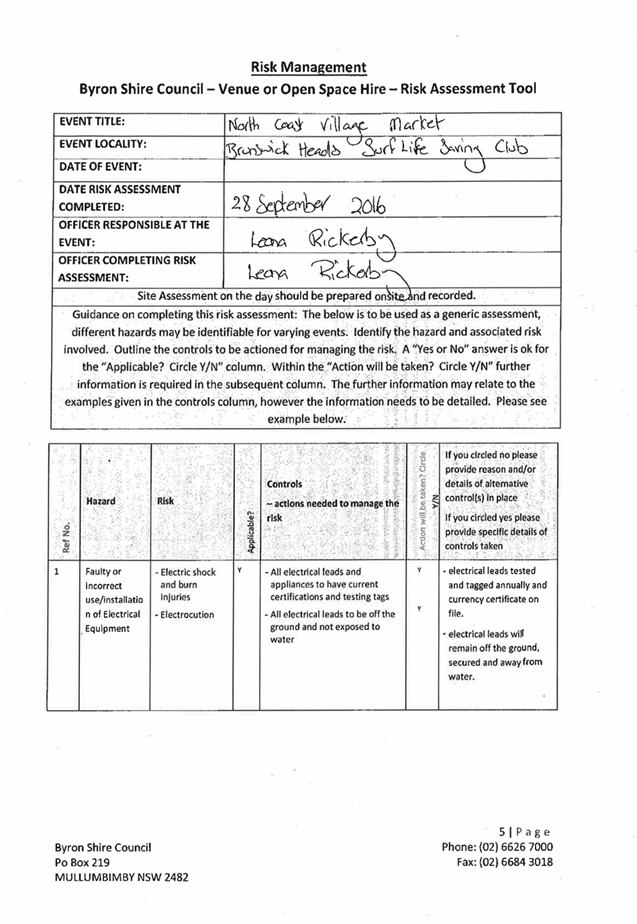

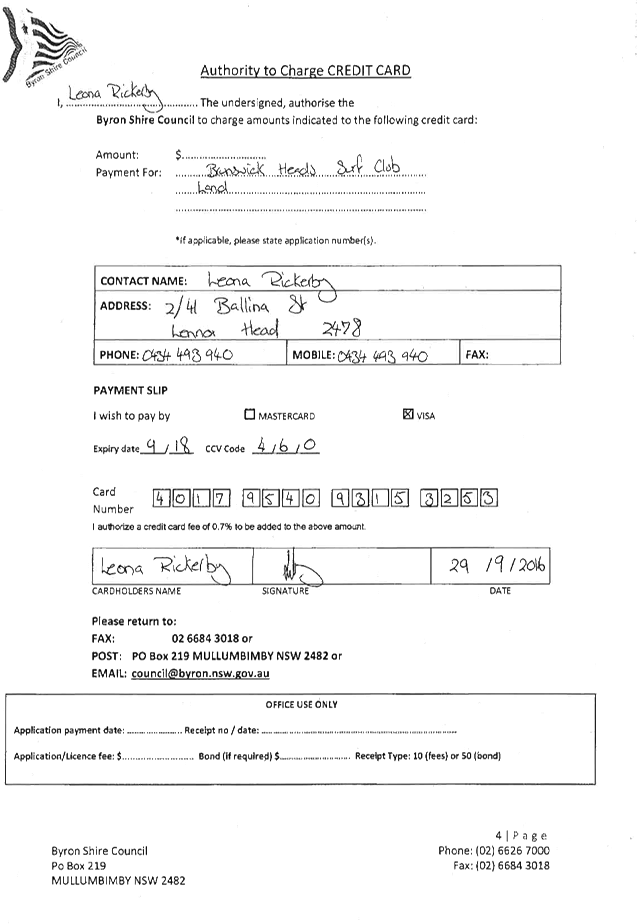

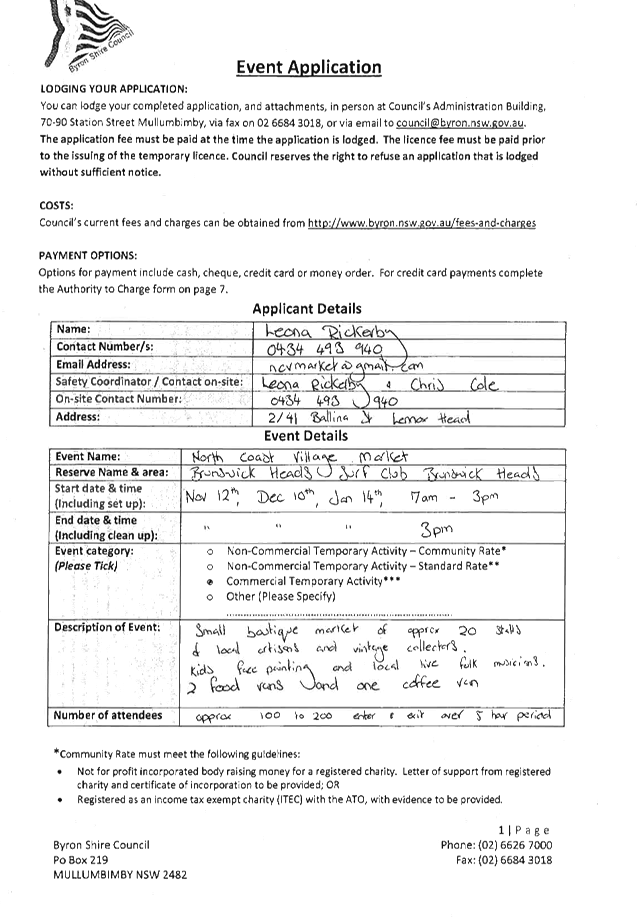

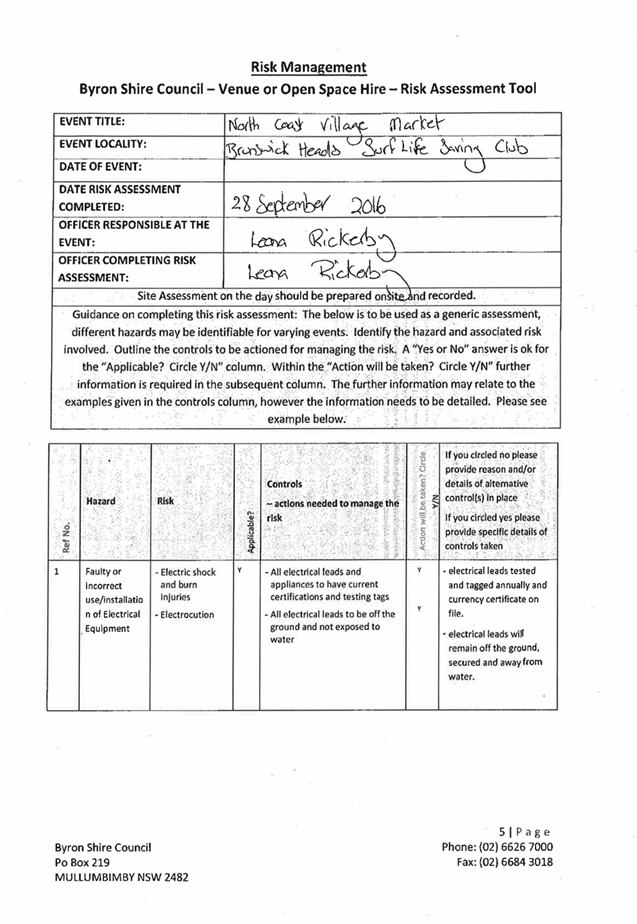

Report No. 4.2 Temporary

Market Licence - Leona Rickerby

Directorate: Corporate

and Community Services

Report

Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2016/1113

Theme: Economy

Economic Development

Summary:

Leona Rickerby has applied for a

temporary licence to hold a small beachside Artisan Market on two (2) dates,

being 10 December 2016 and 14 January 2017, on Crown land within the grounds of

the Brunswick Heads Surf Life Saving Club Reserve 97139.

This report outlines Council’s

obligation as the Byron Coast Reserve Trust Manager and recommends the Reserve

Trust grant a temporary licence for the proposed for the two (2) beachside

Artisan Markets.

|

RECOMMENDATION:

1. That

Council, as the Byron Coast Reserve Trust authorise the General

Manager to issue a temporary licence to Leona Rickerby to hold two (2)

beachside Artisan Markets on 10 December 2016 and 14 January 2017 on

condition:

a) The

Artisan Markets are conducted within the stall layout plan; and

b) Approval

for the jumping castle is obtained.

2. That

licence fee for Markets on Crown Reserves apply and include a one off

application fee of $229.00 for both markets and two (2) licence fees of $122.00

for the two (2) markets.

|

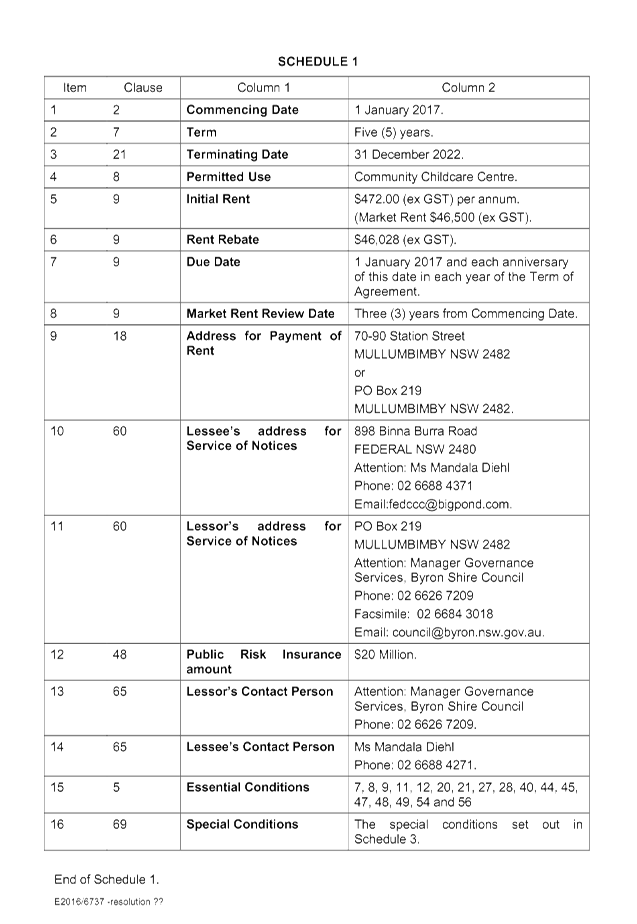

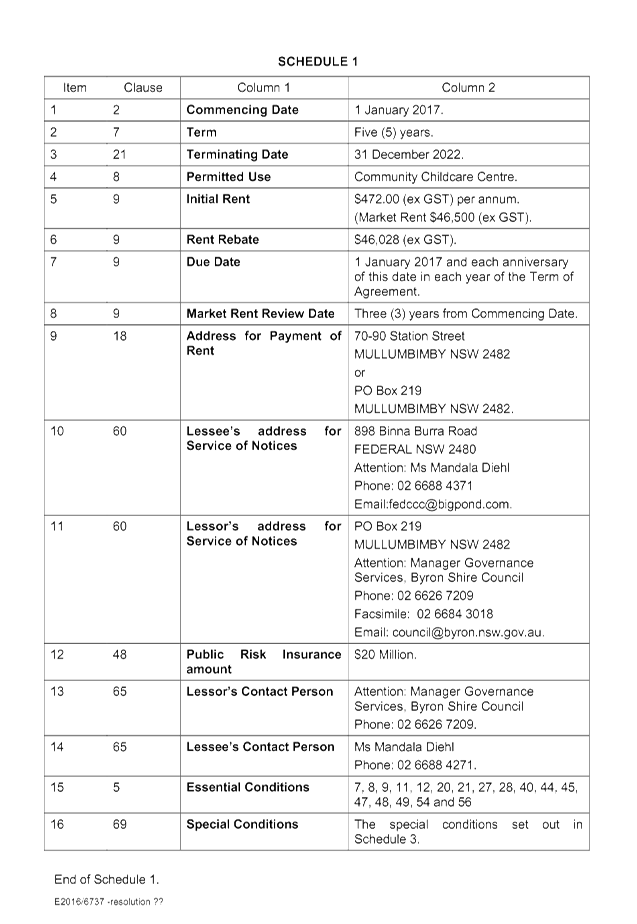

Attachments:

1 Temporary

Artisan Markets applicant Leona Rickerby in grounds Brunswick SLSC., E2016/94011 , page 116

Report

Beachside Market

Beachside Artisan Markets to be held part of Crown Reserve

R97139 Byron Coast Reserve Trust

Gazetted purpose – Public Recreation

Owner – Department of Primary Industries-Crown Lands

Division

Trust Manager – Byron Coast Reserve

Trust

Zoned – DM - Deferred Matter

No adopted Plan of Management

Policy and Legislative Considerations

Council adopted its Policy 15/007 Sustainable Community

Markets via Resolution 15-471. The Policy provides that

Council may on receipt of a Temporary Market application and following assessment

of that application grant a temporary market licence. The grant is

conditional on the application not being for more than three consecutives terms

and does not require development consent. Council must charge its adopted

Market Licence fee.

Policy No 5.52 Commercial Activities on Coastal and Riparian

Crown Reserves adopted by Resolution 11-100 defines a class of

activities that can be carried out on Crown Reserves without a formal Reserve

Trust resolution. A temporary Artisan Market is not an activity within the

class of activities, therefore formal approval from the Byron Coast Reserve

Trust is required.

In the absence of authority to grant a temporary market

licence under Policy No 5.52 the Byron Coast Reserve Trust has authority under

section 108(1) of the Crown Lands Act 1989 (NSW) to grant a temporary

licence for the prescribed purpose of markets in accordance with clause

31(1)(m) of the Crown Lands Regulations 2006 (NSW).

Application for Temporary Artisan Market

Council received an application for a temporary artisan

market licence from Leona Rickerby to hold a temporary artisan market

called the ‘North Coast Village Market’ in the grounds of the

Brunswick Surf Life Saving Club on three (3) days being 12 November, 10

December 2016 and 14 January 2017. Due to the requirement to report to the

Reserve Trust, the 12 November 2016 proposed market was abandoned.

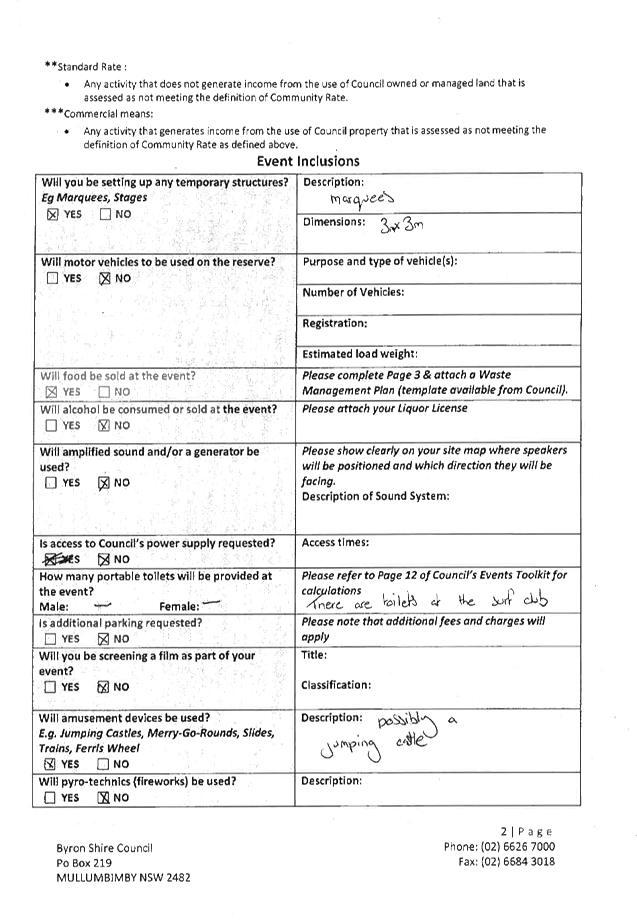

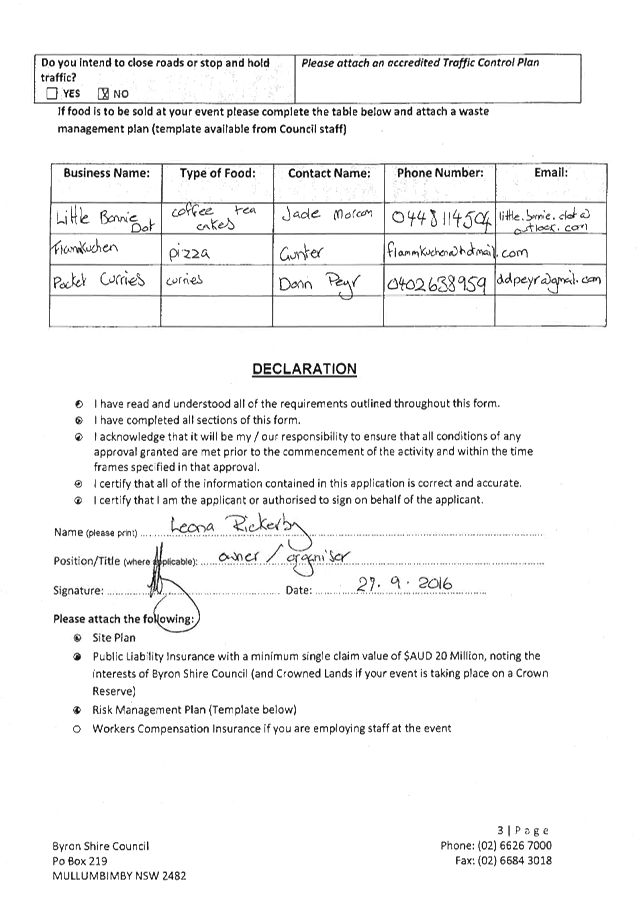

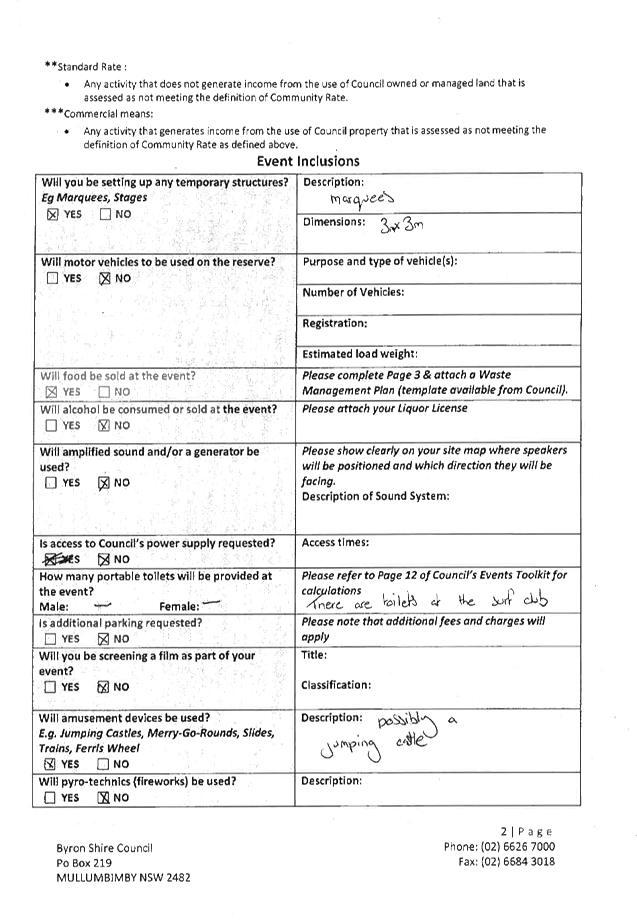

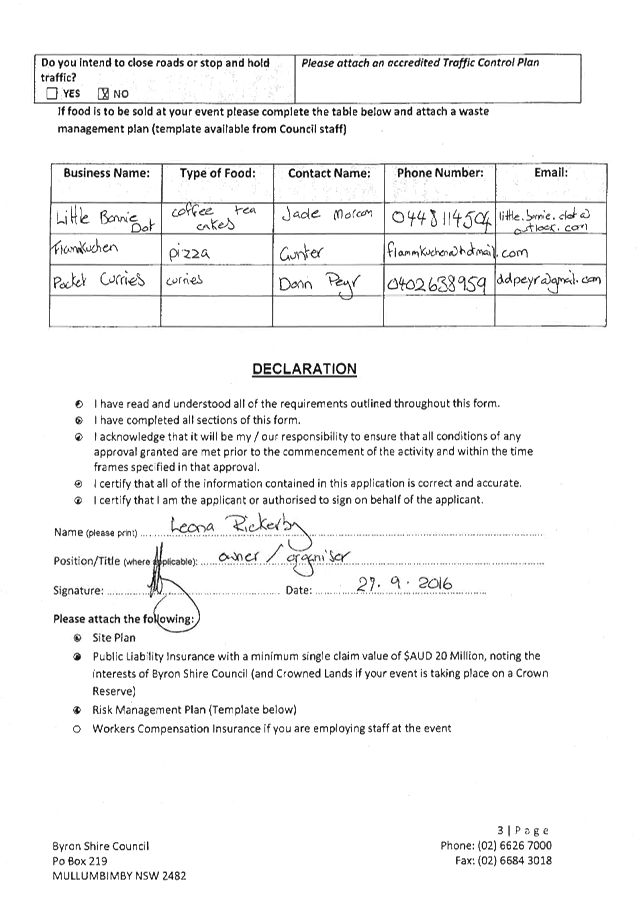

The temporary market proposal is for a small Artisan Market

of approximately 20 stalls of local artisans and village collectors with

entertainment provided by local folk musicians, kids’ face painting and

three (3) mobile food vans on each market day. The proposal markets will

operate from 8am to 3pm, with set up from 7am on each day.

Council determined the temporary artisan market to be held

on land zoned ‘Deferred Matter’ does not require development

consent in accordance with the Local Environmental Plan 1988. However, Council

has determined the proposal for a jumping castle will require approval in

accordance with s68 of the Local Government Act 1993 (NSW), and all

proposed food outlets must be Council approved. Further Council requested

both artisan markets must be conducted within the provided stall layout plan

and waste management plan.

Financial Implications

Council’s adopted fees and charges for temporary

market licences on Crown lands is a one off $229.00 application and a licence

fee of $122.00 per market, totalling $543.00 (inc GST) to hold both temporary

Artisan Markets.

Statutory and Policy Compliance Implications

Section 108 Crown Lands Act 1989

(NSW)

(1) A

reserve trust may, in respect of the whole or any part of a reserve, grant

temporary licences for grazing or any other prescribed purpose.

(2) A

temporary licence may be granted subject to conditions and is also subject to

such conditions as may be prescribed.

(3) A

temporary licence may not be granted for any purpose for which an authority,

permit, lease or licence may be granted under the Fisheries

Management Act 1994

.

(4) A

temporary licence ceases to have effect on the expiration of the prescribed

period after it is granted unless it is revoked sooner or is granted for a

shorter period.

Clause 31

Crown Lands Regulations 2006 (NSW)

(1) For the purposes

of section 108 (1) of the Act, in addition to grazing, the purposes for which a

temporary licence may be granted are as follows:

(a) access through a reserve,

(b) advertising,

(c) camping using a tent, caravan or otherwise,

(d) catering,

(e) emergency occupation,

(f) entertainments,

(g) equestrian events,

(h) exhibitions,

(i) filming (within the meaning of the Local Government

Act 1993),

(j) functions,

(k) hiring of equipment,

(l) holiday accommodation,

(m) markets,

(n) meetings,

(o) military exercises,

(p) mooring of boats to wharves or other

structures,

(q) sales,

(r) shows,

(s) sporting and organised recreational

activities,

(t) stabling of horses,

(u) storage.

(2)

For the purposes of section 108 (2) of the Act, in addition to any other

condition subject to which a temporary licence is granted, the licence is

subject to the condition that the relationship of landlord and tenant is not

created between the parties.

(3)

For the purposes of section 108 (4) of the Act, the prescribed period for the

expiration of a temporary licence is one year following the date on which it is

granted.

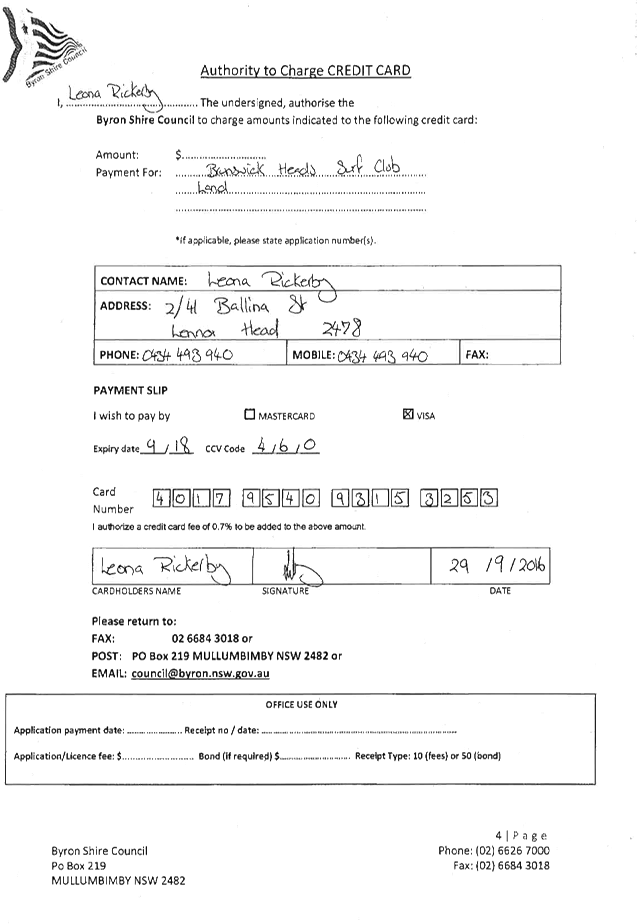

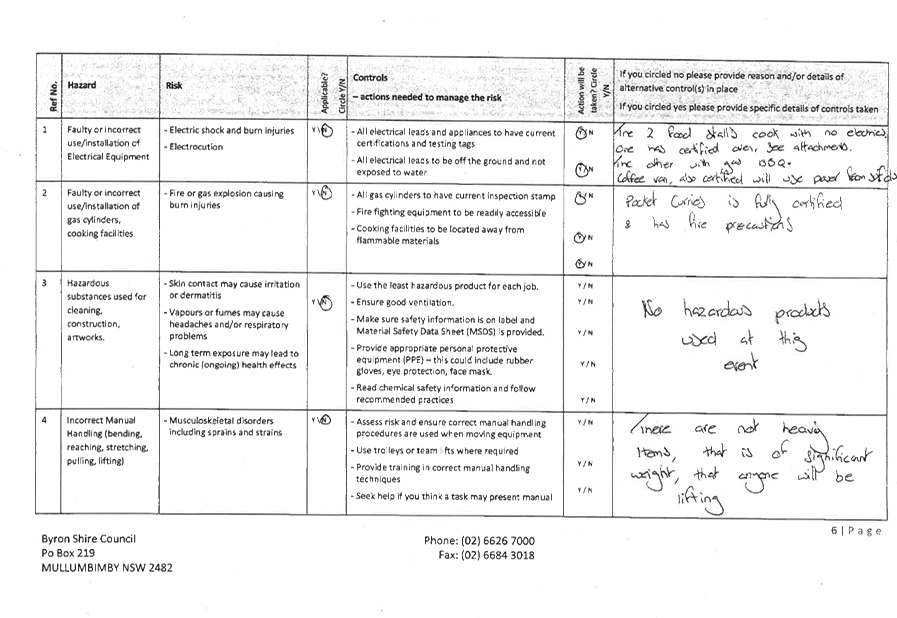

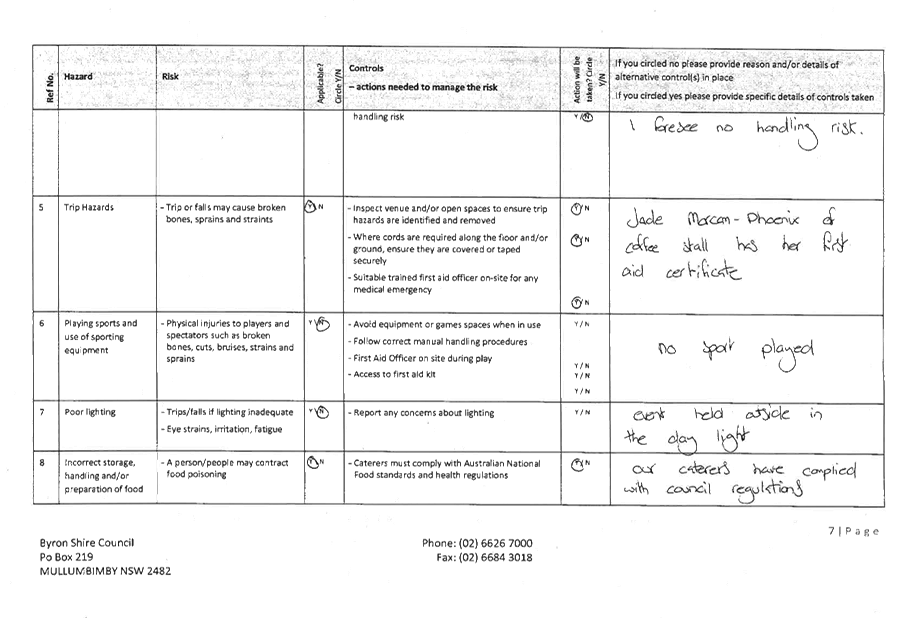

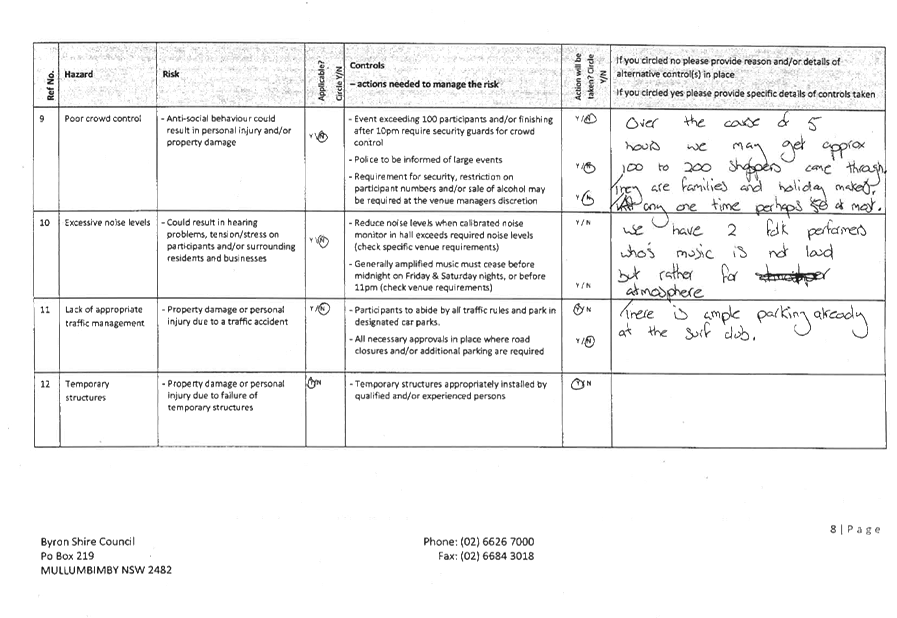

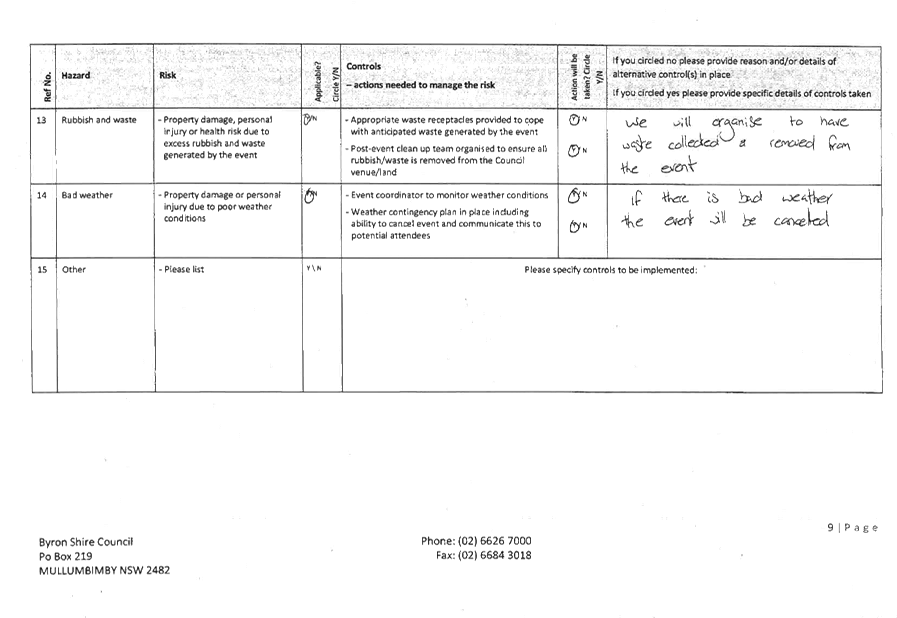

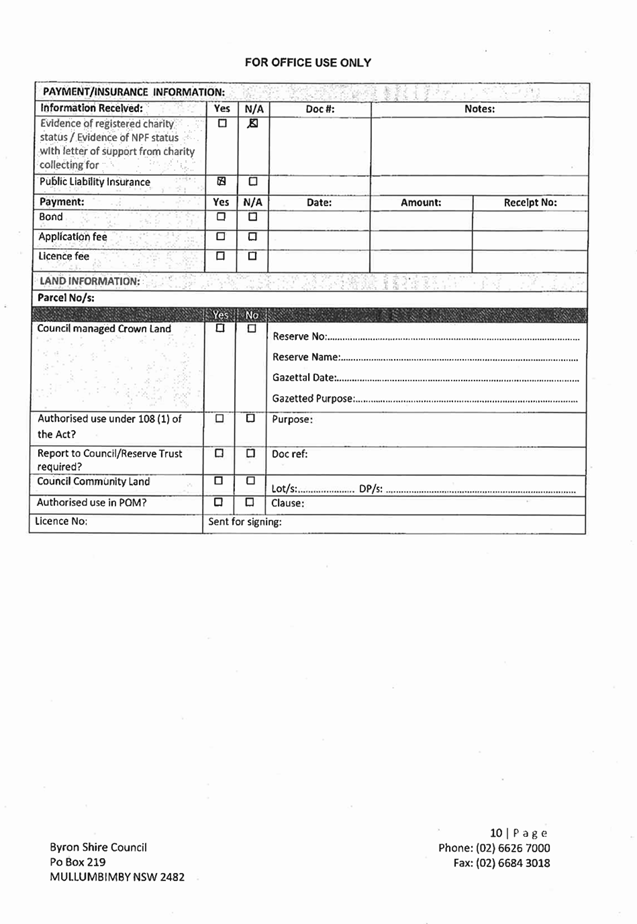

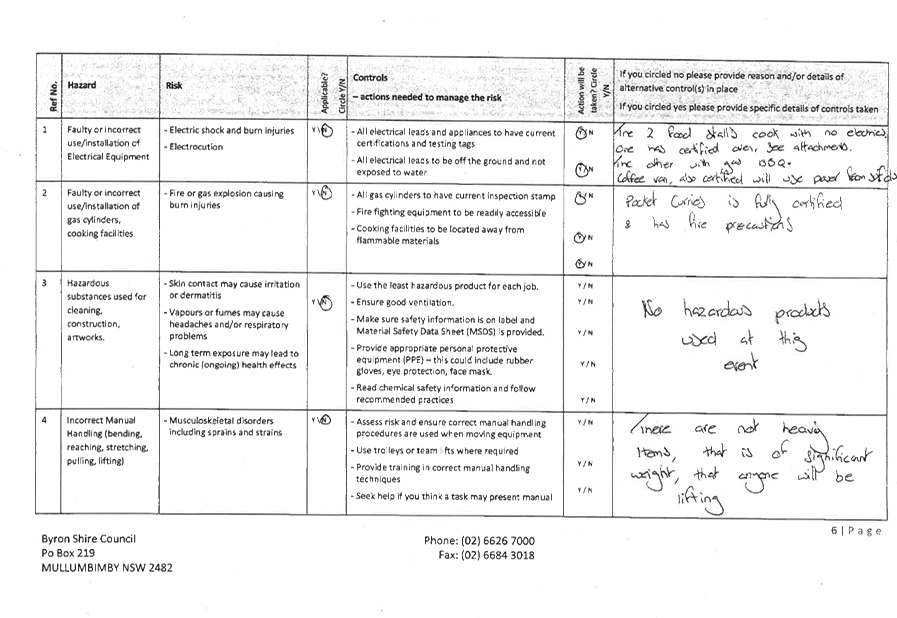

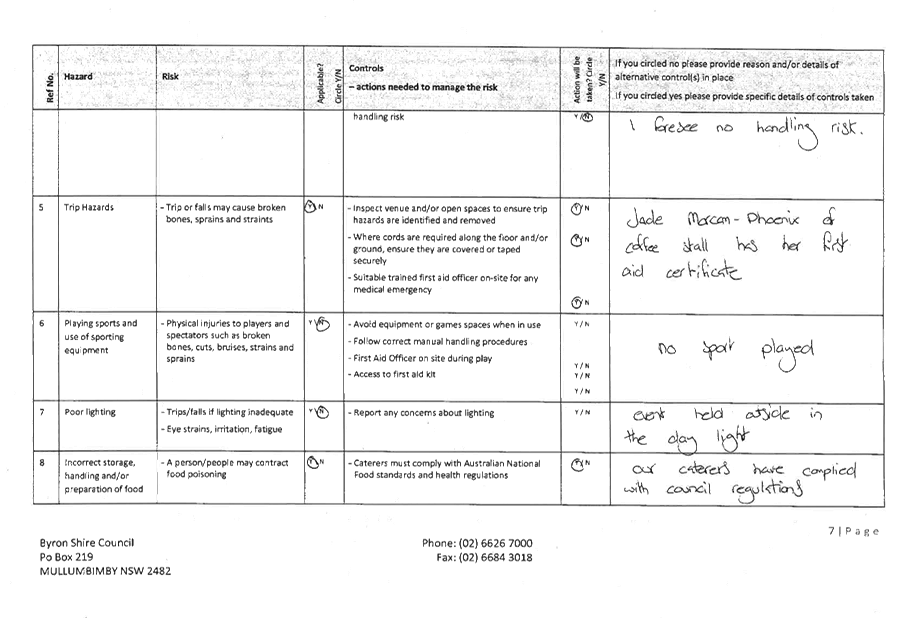

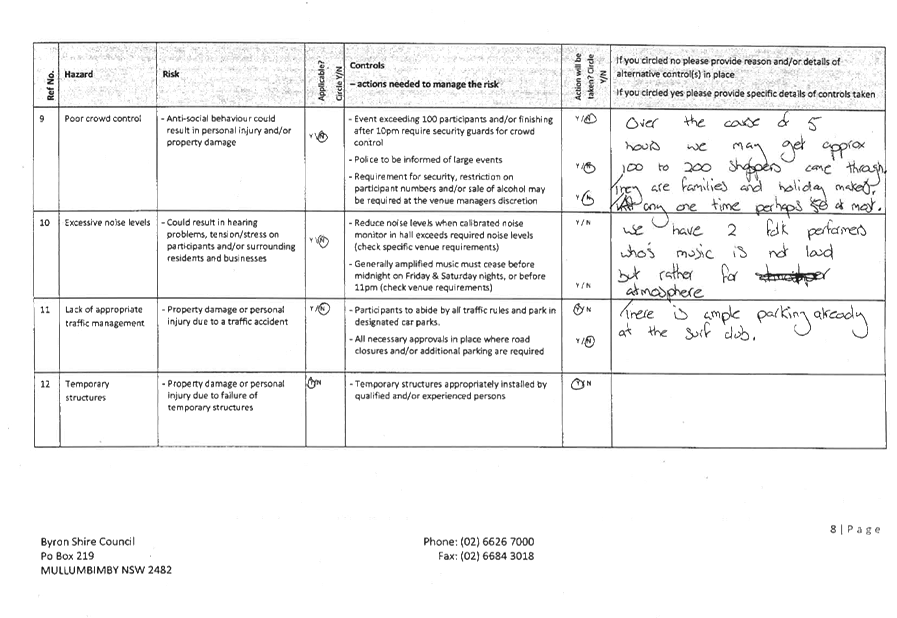

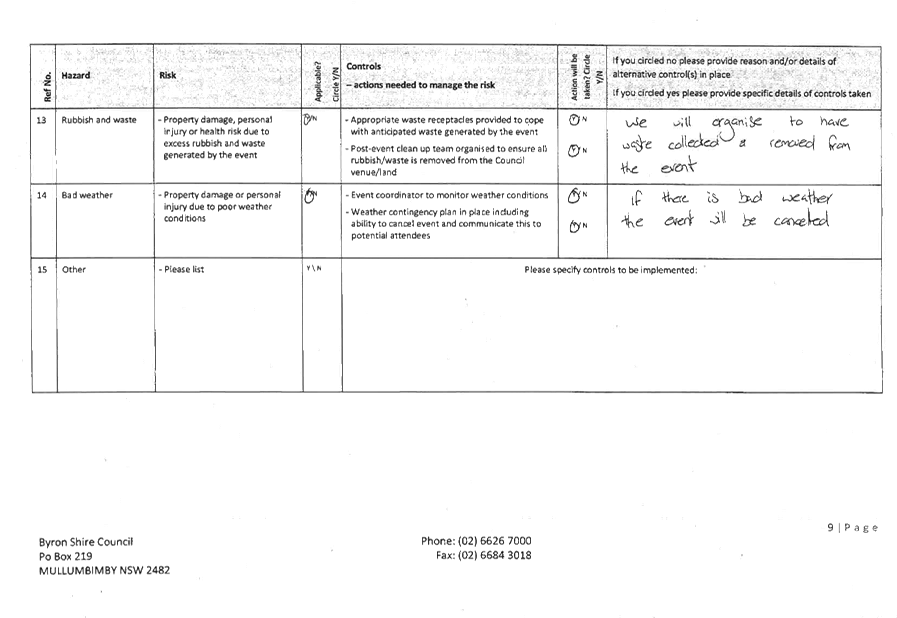

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.2 - Attachment 1