Agenda

Ordinary

Meeting

Thursday,

24 August 2017

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 4.00pm

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Ken

Gainger

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Ordinary Meeting

BUSINESS OF Ordinary Meeting

1. Public Access

2. Apologies

3. Requests for Leave of

Absence

4. Declarations of Interest

– Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary

Interest Returns (s450A Local Government Act 1993)

6. Adoption of Minutes from

Previous Meetings

6.1 Byron

Shire Reserve Trust Committee held on 3 August 2017

6.2 Ordinary

Meeting held on 3 August 2017

7. Reservation of Items for

Debate and Order of Business

8. Mayoral Minute

8.1 Establishing

a Tourism Councils Advocacy Alliance........................................................ 5

9. Notices of Motion

9.1 Review

of Traffic and Roadworks for Ewingsdale Road.............................................. 10

9.2 Renewal

of the Tourism Advisory Committee................................................................ 12

9.3 Progress

of Council’s Resolutions .................................................................................. 14

9.4 Change

of Council Ordinary Meeting Date..................................................................... 15

9.5 Support

for a Tourism Accommodation Levy................................................................. 16

10. Petitions

10.1 Repair

and Resurfacing Coolamon Avenue Mullumbimby............................................ 20

11. Submissions and Grants

11.1 Byron

Shire Council Submissions and Grants as at 2 August 2017............................... 21

12. Delegates' Reports

13. Staff Reports

Corporate and Community Services

13.1 Richmond

Tweed Regional Library Deed of Agreement................................................ 24

13.2 Electricity

Procurement................................................................................................... 27

13.3 Election

of Deputy Mayor 2017-2018............................................................................. 32

13.4 Carryovers

for Inclusion in the 2017/18 Budget.............................................................. 36

13.5 Council

Investments July 2017....................................................................................... 41

13.6 Council

Budget Review - 1 April 2017 to 30 June 2017................................................. 48

13.7 Community

Strategic Plan review.................................................................................. 57

Sustainable Environment and Economy

13.8 Power

Up - Northern Rivers Electric Vehicle Strategy................................................... 60

13.9 Report

of the Planning Review Committee Meeting held on 20 June, 2017.................. 63

13.10 PLANNING

- Report update on Council resolution 17-121 Tyagarah Airstrip - 26.2015.1.1 65

13.11 Expressions

of Interest for membership of Northern Villages Guidance Group............ 69

13.12 Report

of the Planning Review Committee Meeting held on 1 August, 2017................ 71

Infrastructure Services

13.13 Bangalow

Parking Strategy............................................................................................. 73

13.14 Draft

Plan of Management - Byron Bay Recreation Ground......................................... 84

13.15 Review

of Pay Parking for Byron Bay............................................................................ 87

13.16 Mullumbimby

Parking Management Strategy.............................................................. 101

13.17 Brunswick

Heads Parking Management Strategy........................................................ 108

13.18 Event

- Chincogan Charge 2017 - Road Closure - 16 September 2017...................... 115

13.19 Mullumbimby

Skate Park Lighting Options................................................................... 117

14. Reports of Committees

Corporate and Community Services

14.1 Report

of the Arakwal Memorandum of Understanding Advisory Committee Meeting held on 2

March 2017................................................................................................................... 121

14.2 Report

of the Arakwal Memorandum of Understanding Advisory Committee Meeting held on

15 June 2017............................................................................................................................... 124

Infrastructure Services

14.3 Report

of the Local Traffic Committee Meeting held on 18 July 2017......................... 127

15. Questions

With Notice

Nil

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director prior to the meeting. Any suggested amendments to the

recommendations should be provided to Councillor Support prior to the meeting

to allow the changes to be typed and presented on the overhead projector at the

meeting.

Mayoral Minute 8.1

Mayoral Minute

Mayoral Minute No. 8.1 Establishing

a Tourism Councils Advocacy Alliance

File No: I2017/1016

|

I move that Council:

1. Endorse

the establishment of a Tourism Councils Advocacy Alliance (suggested name

only, to be finalised by the Alliance).

2. Support

the Alliance being led by Byron Shire Council including the resourcing of the

secretariat function to initially establish and run the Alliance.

3. Endorse

membership to the new Alliance being open to all Australian councils, and

that a letter of invitation for membership be sent to all council Mayors

and/or General Managers – to be signed by both the Byron Shire Mayor

and/or General Manager.

4. Endorse

the Alliance’s key roles, responsibilities and governance structure

(see Background Information below) which will be clearly communicated in the

invitation sent to prospective members, to attract councils with an interest

in the vision, charter and objectives of the group.

5. Support

the public announcement of the Alliance’s establishment including

setting of a provisional date/timeframe for the Alliance’s first

meeting.

|

Background Notes:

Research Paper Establishing a Tourism Councils Advocacy

Alliance (#E2017/61746) investigates the establishment of a collective

alliance (or group) of Councils to lobby State and Federal Government for

change to address tourism related issues and challenges affecting Local

Government areas nationally. The paper examines the need for the

establishment of a Tourism Councils Advocacy Alliance and suggests five

key roles for the group:

1) Collectively Develop Outcome-Focussed Strategies

To identify the range of tourism related issues brought to the table by

lgas with high levels of tourism and develop outcome-orientated lobbying and

communications strategies to address collectively agreed upon priority issues.

2)

Actively Lobby State And Fed Governments To Address Specific Funding

Inequities

Lobby State and Federal Governments to highlight the

impact of tourism on infrastructure (especially for LGA’s with the lowest

rate payer bases in Australia) and to change the criteria/rules around the

Federal Government Financial Assistance Grant funding formula, which does not

currently acknowledge the economic impact of transient populations on regional

areas with high levels of tourism. The aim is to achieve a more equitable

outcome for tourism impacted lgas.

3) Lobby For Resolution Of Short Term Accommodation / Private Letting

Regulation and ensure that LGA’s can access and benefit directly

from the imposition and collection of any bed tax or involuntary contribution

enabled through appropriate legislation.

4) Find Alternative Ways To Recover Costs From Tourism

And Tourism/Related Businesses

Gather research and ideas to identify other potential

tourism-related funding sources via voluntary or involuntary contribution

schemes.

5) Share And Develop Evidence-Based Policy

Undertake research around sustainable tourism practises and become a voice for

innovation in this area. Work collectively to address tourism impacts

including the impact of housing availability and housing affordability in

regional / non-metro areas (affected by airbnb and holiday let issues for

example).

THE VISION, ISSUES AND OBJECTIVES

Common to the success of any group is a shared vision, a mission/charter and

clear articulation of the issues that need to be addressed.

|

|

VISION

|

|

|

To build resilience and financial

sustainability for regional Councils experiencing the impacts of high levels

of Tourism.

|

|

|

CHARTER – GENERAL PRINCIPLES

|

|

1.

|

ALLIANCE AND COLLECTIVISM – to bring together councils sharing similar

tourism-related issues and others wanting to learn more in the tourism space.

|

|

2.

|

NETWORKING AND SHARING – to open up communication between councils in relation to

tourism issues and tourism management in a way that has not been done

before. Sharing information, knowledge and experience with the

aim of learning from each other, finding solutions faster and developing a

strategy and set of goals for the group to work towards. Developing

measurable outcomes for the group.

|

|

3.

|

COLLABORATION – increasing opportunities for councils to work together to

solve problems and to support each other (forming formal FRIENDSHIP ALLIANCES

when appropriate to support struggling councils in areas of shared interest

and benefit).

|

|

4.

|

ADVOCACY

– joining together to create a stronger and more effective voice for

whatever change is desired.

|

5.

|

RESEARCH –

identifying and addressing current and emerging issues for councils around

tourism by developing an evidence base. Using the evidence to inspire

further collaboration, innovation and leadership.

|

|

|

WHAT ISSUES COULD BE ADDRESSED?

|

|

1.

|

Financial / funding stress on councils with significant tourism versus rate payer ratio. This

includes the need for State/Fed government funding towards some of the

infrastructure used by visitors (both domestic and international).

|

|

2.

|

Opportunities to recover costs from

tourists and/or tourism related businesses:

· AirBnB (they already add a tax decided by the destination to

their booking system in 23 places around the

world – why not in our most needy areas?)

· Other online booking agency opportunities (Stayz etc)

· Hotel / bed tax (as achieved in much of Europe).

· Voluntary and involuntary contribution schemes.

|

|

3.

|

The need for greater State/Fed

investment in a range of tourism related services

directly impacting domestic and international visitors in regional

areas.

· Transport infrastructure including regional airports, roads, rail,

jetties

· Toilets and other basic visitor services

· Boardwalks, interpretative walks and signage

· Cultural infrastructure including galleries and interpretative

centres

· Strategic Planning / Masterplans.

|

|

4.

|

Inequities in State Government funding

based on ABS Census data. When planning for

services and infrastructure for regional councils, State Government needs to

take into account in their planning and funding arrangements the need for

coastal/regional councils to accommodate peak demand requirements - in places

where the permanent population can increase by 50% in any given year.

|

|

5.

|

Inequities in the Financial Assistance

Grants (FAGs) criteria

|

|

6.

|

Rates issues and the complexities

around Special Rates Variations.

This includes impacts from rate-pegging and

outdated rating provisions in the Local Government Act.

|

|

7.

|

The need for greater State/Fed

investment in Visitor Services and Visitor Centres – especially in areas where council cannot financially

assist.

|

|

8.

|

The impact of tourism on housing

availability and housing affordability in

regional areas (with the explosion of AirBnB).

|

|

9.

|

The challenge of ‘freedom

camping’ on local populations

|

|

10.

|

Others (as identified by the group)

|

GOVERNANCE FOR THE ALLIANCE

Structure

It is recommended that an alliance

structure is used in the initial stages of the group. A smaller

scale ‘alliance’ structure could be facilitated using a Management

Agreement model which would be set up by the instigating Council (the

lead/administrative Council) and as agreed to by the member councils. A

similar approach is already used by Byron Shire Council for a range of

cross-council programs/services including the North East Weight of Loads Group

(NEWLOG) and the Richmond Tweed Library Service.

If it chooses to, and the Alliance wishes to grow its

membership base over time, it may choose to create an Incorporated

Association. This would require funding (auspicing or from State

Government or another parent body) to run the association and meet the legal

and insurance requirements.

Membership

Unlike other regional advocacy groups, membership of the

proposed Tourism Councils Advocacy Alliance membership would not be defined

solely by geographical location.

Who can join?

Members of the proposed Tourism Councils Advocacy Alliance

would need to share common characteristics and impediments in managing

Tourism. Ideally, members would be from areas experiencing:

· Substantial visitor

numbers year round (strong growth over the last 2 -5 years) – and a consistent

transient population.

· Substantial visitor

numbers and disproportionate numbers of rate payers, resulting in community

concerns and lack of funding for infrastructure and services.

· Unwanted or undesirable

types of Tourism.

· Issues with holiday let,

AirBnB and housing affordability relating to tourism.

· Frustration caused by

the lack of recognition of transient populations in State and Federal

Government funding /grant criteria.

Membership Options

It is recommended that an inclusive approach is taken in

regards to membership with all councils, Australia-wide, invited to participate

in the Alliance.

It is recommended that the purpose and objectives of the Alliance are clearly

communicated so that invitees can consider the value of joining.

The membership process

A letter of invitation for membership would be sent to all

council Mayors and/or General Managers Australia-wide – to be signed by

both the Byron Shire Mayor and General Manager.

Meeting structure

· The Alliance would meet virtually

(video/teleconference) or convene as an adjunct to an already established forum

– such as the Australian Local Government Association national congress

or Local Government NSW annual conference (depending on timing, this might not

coincide with the Alliance’s first meeting).

· The agenda would be called for in advance with papers

circulated prior to the meeting. The chair would be the BSC Mayor.

· At least two meetings would be held per year –

recognising the time and cost of travel for member councils.

· The establishment of regular methods of communication

(in lieu of more regular meetings) would be developed – for example

teleconferences, e-bulletins, emails, member hub where members can share

information or a closed online group (Google docs or similar) or social media

platform.

Advocacy Strategies or Advocacy Action Plans would be

developed by the Alliance – enabling member councils to complete set

actions and tasks in between meetings.

Documentation

The following item/s would need to be developed:

· Terms of Reference for the Alliance

· An MoU, if deemed necessary by the Alliance.

Should a constitution be required for the group, it would be

developed at a later stage.

When establishing an Alliance, it is important to have a clear charter and key

priorities in mind, noting that the initial stage is to form the group and

build relationships and allegiance.

|

ACTIONS

|

YEAR 1

|

|

STEP 1

|

An invitation to all Australian councils from the Mayor of Byron Shire

Council and the General Manager to become part of a new, voluntary Alliance

that will address tourism-related issues.

|

WRITTEN INVITATION

|

|

STEP 2

|

A meeting with interested councils to put forward a proposed Alliance

Model/Structure and to solidify the group’s Vision, Objectives and

Terms of Reference.

|

MEETING / TELECONFERENCE

|

Resources and Costs

It is envisaged that Byron Shire Council will initially

absorb the cost of the secretariat function. Depending on meeting

frequency and outcomes, it is envisaged that this would be 0.1FTE. This

could be accommodated within Governance Services with the assistance of other

business units including Economic and Sustainable Development.

Signed: Cr

Simon Richardson

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 Review

of Traffic and Roadworks for Ewingsdale Road

File No: I2017/1073

|

I move:

1. That

Council review its plans for traffic management and for roadwork’s

along Ewingsdale Road and the access into Byron town centre.

2. That

staff undertake an assessment of future needs for Ewingsdale Road and access

into Byron town centre in light of all relevant available data including, but

not limited to:

i) the MR545 study;

ii) the Byron Town Centre

Masterplan;

iii) the

findings of the Access and Movement Strategy of (ii), and

iv) any other credible

studies or data.

3. That Council reiterates its

commitment to reducing traffic in Byron Town Centre and creating

opportunities for more public transport, pedestrians and bicycles.

|

Attachments:

1 MR545

Strategic Study. Pacific Highway (Ewingsdale) Interchange to the Byron/ Ballina

Shire Boundary (Broken Head), E2017/79201

2 Cardno

Brief for MR545 Traffic Study, E2017/80404

Signed: Cr

Cate Coorey

Councillor’s supporting information:

Whilst Council is committed to improving traffic management

into and around Byron Town Centre, there appears to be no overarching strategy

for works that have taken place – eg the Sunrise Boulevarde roundabout

– or for works that are due to take place, notably the Butler Street

Bypass and the roundabout at Ewingsdale Road and Bayshore Drive. There is also

an assumption that Ewingsdale Road must become 4 lanes. Some of these

assumptions are based on the findings of the MR545 Study.

Whilst it is likely that some roadworks are necessary, there

is still a lack of information as to the future needs and uses of transport in

and around town. This gap in knowledge needs addressing before we proceed with

major infrastructure projects.

The community, when consulted, has consistently conveyed a

desire to reduce traffic into town.

Given the noted increase of day trippers, the increase in

population and the likely significant increases due with the building of West

Byron and as developments such as Habitat on Bayshore Drive come online, there

is a pressing need for a coordinated approach to road traffic and other forms

of transport coming into and moving around town. The development of West

Byron makes the management of Ewingsdale Road a major priority for Council and

the community.

At this point we have no aggregated data that is recent and

yet we need this to make future plans. We are all aware of the increased

traffic volumes on this road. Strategies to manage bikes, buses and

public transport on this important corridor must be considered with the latest

data and the expectations of the community to reduce traffic numbers.

Staff comments by Christopher Soulsby, Developer

Contributions Officer , Infrastructure Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

Council staff engaged Cardno Consulting on 26 June 2017 to

undertake a desktop review of the existing traffic studies and to then prepare

a brief to undertake the work outlined in point 2 of this NOM. A first

draft of this work is expected by 21 August 2017. A full copy of the

brief to Cardno is provided as an attachment to this report (with the

commercial in confidence sections removed).

The following is a summary of the key points of the brief:

1 Consider the

Byron Bay Town Centre Masterplan;

2 Take into

consideration the new Access and Movement Strategy;

3 Options for

improving public transport;

4 Options for Park

and Ride to reduce traffic on MR 545;

5 Improved cycling

and footpath networks to reduce traffic on MR 545.

6 Options for

relocation of car parking in the Byron Bay town centre to the edges of town.

7 A road network

analysis centred around MR 545 and the Byron Bay town centre;

8 Intersection

analysis of the major intersections on the MR 545 network;

9 The modelling

associated with items 7 and 8 will take into account the following scenarios:

A Base

case as at 2017;

B Base

case plus growth at 2027 and 2037;

C Base

case plus the outcomes of each of the preferred options as identified in in items

3, 4 and 5 and all three combined plus growth at 2027 and 2037.

10 Infrastructure

required to support the outcomes required as a result of items 3, 4 and 5 and the

required road network upgrades.

11 This study will inform the

updated bike plan and PAMP.

In addition to this study staff have been working with Dr

Maree Lake and Engineering students at Southern Cross University who will be

undertaking a micro simulation model of intersections in the Byron Bay town

centre the Byron Bay town centre (intersections of Shirley/Butler,

Lawson/Jonson, Lawson Fletch and Lawson Middleton). This modelling will

take into account parking changes resulting for the Masterplan and traffic

volume changes due to the bypass.

Financial/Resource/Legal Implications:

There are no additional financial implications as this

project is currently underway and is already budgeted for.

Is the proposal consistent with any Delivery Program

tasks?

The project is already underway.

Notices of Motion 9.2

Notice of Motion No. 9.2 Renewal

of the Tourism Advisory Committee

File No: I2017/1074

|

I move:

1. That

Council confirm its commitment to sustainable tourism in Byron Shire as per

the Tourism Management Plan 2008-2018

2. That

staff prepare a report on the progress of the objectives of the Tourism

Management Plan 2008-2018;

3. Council

create a new Tourism Advisory Committee to provide guidance for sustainable

tourism in Byron Shire, and

4. That

advertisements are placed in the paper by XXX (earliest possible date) TBA

|

Signed: Cr

Cate Coorey

Councillor’s supporting information:

The sustainable management

of tourism in the Shire is lacking oversight.

In 2009 Council adopted a

Tourism Management Plan that was to end in 2018. The last annual report of the

TAC was for the years 2012-2013 and there has not been a TAC since the 2012

Council elections. With 2018 soon upon us, we need to be looking at the tourism

in Byron Shire into the future.

From the Tourism

Management Plan Annual Report 2012-2013:

The purpose of the

Tourism Advisory Committee (TAC - established 2009) is to:

1.

lead and implement the strategies and actions of the TMP

2.

foster links and engagement between Council, industry and

community interests

3.

work cooperatively with local, state and regional government

departments and agencies, local tourism and business organisations,

environmental stakeholder organisations and the community

4.

advise Byron Shire Council on the sustainable development,

marketing and management of tourism, including events and other cultural

initiatives, representing the interests of both the tourism industry and

resident communities across the Shire, with regard for the social,

environmental and economic benefit of the Byron Shire community

5.

act as an external focal point and forum for tourism businesses,

organisations and individuals involved in the tourism industry in the Byron

Shire Council area

6.

be aware of industry trends and statistics across local, regional,

domestic and international platforms

7. provide direction to the

various sub-committees established by the Tourism Advisory Committee to work on

individual areas.

As there was a local

government election in September 2012, the initial Tourism Advisory Committee

was disbanded at the end of the Council period in accordance with the TAC

Constitution (Terms of Reference). The newly elected Council re-established the

Tourism Advisory Committee, with an induction for the new Committee held in

December 2012.

Staff comments by General Manager:

(Management Comments must not include formatted

recommendations – resolution 11-979)

The Tourism Advisory Committee operated until mid 2016 when

it was superseded by the Sustainable Economy Panel (SEP). Staff comments which

were incorporated into the report recommending the establishment of the SEP are

still current.

Financial/Resource/Legal Implications:

Nil

Is the proposal consistent with any Delivery Program

tasks?

No

Notices of Motion 9.3

Notice of Motion No. 9.3 Progress

of Council’s Resolutions

File No: I2017/1075

|

I move:

1. That

Council receive an update on the progress to date of resolutions of Council.

2. That

Council hereafter receive a monthly progress report on the implementation of

council resolutions.

|

Signed: Cr

Cate Coorey

Staff comments by Anna Vinfield, Manager Governance

Services, Corporate and Community Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

Council currently receive a quarterly report on the status

of Council resolutions which details completed resolutions for the previous

quarter and provides a list of outstanding resolutions. This review process

allows Council to close resolutions which are encompassed within other

resolutions or are unable to be delivered due to resourcing or other

constraints. Council is scheduled to receive a review for the period 1 April

– 30 June 2017 at its Ordinary Meeting on 21 September 2017.

A list of resolutions is also available for Councillors on

the Hub and senior staff are available to provide information on specifics

projects or resolutions should Councillors have any queries.

Staff are reviewing the how Council (and community) are

informed about the status of resolutions to ensure that this is provided in a

more timely, transparent and easily understood format. As part of this

review staff will review the regularity of these reports.

Financial/Resource/Legal Implications:

Should the Council resolve to move from quarterly to monthly

reporting, additional staff resources would be needed to be allocated to

generate these reports, and the financial impact considered.

Is the proposal consistent with any Delivery Program

tasks?

Council’s adopted Delivery Program includes an action

(CM1.2.3) to monitor decision making to ensure alignment with corporate

documents as adopted or endorsed by Council

Notices of Motion 9.4

Notice of Motion No. 9.4 Change

of Council Ordinary Meeting Date

File No: I2017/1085

|

I move that Council change the

date for the October Council Ordinary meeting from 19 October 2017 to 26

October 2017.

|

Signed: Cr

Simon Richardson

Councillor’s supporting information:

A

scheduling mix up has ensured the I am scheduled to miss both September and

October Ordinary Council Meetings. After checking with staff, it seems that

moving the October meeting back one week will have little to no impact on other

scheduled meetings or Councillor duties. Thus, it would be appreciated if

Councillors considered it acceptable to move a meeting to allow me to attend

and chair the meeting.

Staff comments by Mark Arnold, Director Corporate and

Community Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

The Code of Meeting Practice enables the Council to set the

date of an Ordinary Council meeting by a Resolution of Council.

Rescheduling from 19 to 26 October would have the least

impact as there are no Committee meetings that would be impacted.

Community will be notified by way of public notice, e-news

and social media posts.

Financial/Resource/Legal Implications:

The public notice is included within existing budget

allocations.

Is the proposal consistent with any Delivery Program

tasks?

No

Notices of Motion 9.5

Notice of Motion No. 9.5 Support

for a Tourism Accommodation Levy

File No: I2017/1086

|

I move that Council:

1. Reiterates its support

for a bed tax/tourism accommodation levy.

2. Write to the State

Government, requesting that if it falls short of supporting a bed tax/visitor

accommodation levy, it establishes an expressions of interest process seeking

submissions from Local Government Areas to act as trial locations for the

implementation and management of a trial bed tax/ visitor accommodation levy.

3. Nominate itself for such

a trial should this process be forthcoming

4. Supports in principal:

a. a 2 or 3 level levy

system, whereby accommodation providers with rates are determined according

to varying per night price thresholds.

b. a length of trial of

between 2-5 years

c. providing Shire’s

participating within the trial the authority to determine the allocation of

levy revenue

5. Write to all local

representatives seeking their support, and to all political party leaders

also seeking support.

6. Write to NSW councils

seeking support to participate in the trial.

7. Prepare a

position paper to form the basis of a Council submission to the NSW

Government Short Term Holiday Letting Options Paper to reiterates its support

for a bed tax/tourism accommodation levy and to call for short term holiday

letting accommodation providers to be subject to such a levy

|

Signed: Cr

Simon Richardson

Councillor’s supporting information:

The

question of installing a bed tax has rarely been far from community thoughts.

Each year, Byron Shire (Byron Bay) welcomes a growing number of Australian and

international visitors to our beautiful surf beaches, seaside villages and

hinterland to ‘smile, slow down and chill

out’ in our sub-tropical

climate. In 2016, visitor numbers swelled to an all time record of

almost 2 million people.

Though

grateful for the jobs and economic opportunities that this tourism provides;

for a Shire with only 32,000 residents and just 15,000 ratepayers, Council and

our community are straining under the enormous weight of an extra 2 million

people a year (and greater growth expected to come).

We need

to explore revenue raising options not currently available to us; as what is

currently on the table is insufficient for our needs and fails our community. We need to explore and

implement processes to raise revenue that go beyond simply requesting locals

pay more. The recent special rate variation ensured locals were required to pay

more for our infrastructure improvements an this is fair-to a point. The

problem with raising the funds through special rate variations though, is once

more our base community is funding all of the infrastructure upgrade and

renewal. Council had no alternative but to seek revenue from locals, now, we

need to obtain more financial support from the visitors who use our

infrastructure to assist the community to work on Council’s

infrastructure back-log of $40M.

A bed

tax, or tourism levy has been used around the world for decades as a way to

raise revenue from visitors in order to fund the infrastructure impacts from

the visitation.

The

State government would be wise to accept that this is a universally accepted

and expected levy that will have minimal negative impact on either visitation

numbers or visitation expenditure. Currently, State legislation currently does

not enable LGAs in NSW to introduce such a tax. It is time that Australia

joined the rest of the world in enabling its tourist hotspots to benefit from a

Bed Tax and to alleviate the stress placed on our local communities.

Many

tourist centres around the world are finding themselves in a similar position.

Most of

the islands in the Caribbean have had to incorporate ‘bed’ type taxes

into their income calculations. In recent years a number of cities in Europe

have all had to introduce bed taxes. These include large tourist venues such as

Venice, Florence, Rome and Barcelona as well as a number of boutique holiday

destinations in Switzerland and Germany (eg. Cologne). In North America bed

taxes have been introduced in New York, Vancouver and other North American

Cities, especially in California and Florida. Dubai has recently introduced

such a tax. Levy levels fluctuate around the world, in America this is clearly

so: Boston adds 6% to the bill, Washington DC: 14.5%, Las Vegas 16% and Miami 6%. See the table below for

more examples globally.

|

|

|

million residents

|

International

visitors in millions

|

International

visitors per resident

|

bed tax

|

rate

|

|

London

|

England

|

8.67

|

20.12

|

2.3

|

yes

|

£1

|

|

New York

|

USA

|

8.49

|

17.37

|

2.0

|

yes

|

5.88%

|

|

Paris

|

France

|

10.6

|

16.61

|

1.6

|

yes

|

€2.48 for 3

star

|

|

Seoul

|

South Korea

|

10.2

|

15.24

|

1.5

|

yes

|

10%

|

|

Singapore

|

Singapore

|

5.6

|

14.65

|

2.6

|

yes

|

1%

|

|

Barcelona

|

Spain

|

4.7

|

13.86

|

2.9

|

yes

|

€1.5-2

|

|

Bangkok

|

Thailand

|

8.2

|

12.36

|

1.5

|

yes

|

7%

|

|

Kuala Lumpur

|

Malaysia

|

7.2

|

12.02

|

1.7

|

yes

|

RM5-30

|

|

Dubai

|

Dubai

|

2.6

|

11.68

|

4.5

|

yes

|

£3.5 / room

|

|

Istanbul

|

Turkey

|

14.03

|

9.37

|

0.7

|

no

|

|

|

Taipei

|

Taiwan

|

9.1

|

9.28

|

1.0

|

yes

|

5%

|

|

Tokyo

|

Japan

|

37.8

|

8.44

|

0.2

|

yes

|

¥100-200

|

|

Hong Kong

|

China

|

7.03

|

7.44

|

1.1

|

no

|

|

|

Los Angles

|

USA

|

18.68

|

7.36

|

0.4

|

yes

|

12%

|

|

Madrid

|

Spain

|

6.5

|

7.13

|

1.1

|

yes

|

€1.5-2

|

|

Miami

|

USA

|

6

|

6.4

|

1.1

|

yes

|

6%

|

|

Sydney

|

Australia

|

4.4

|

6.15

|

1.4

|

no

|

|

|

Munich

|

Germany

|

5.8

|

5.57

|

1.0

|

no

|

|

|

Rome

|

Italy

|

4.3

|

5.29

|

1.2

|

yes

|

€4-7

|

|

Berlin

|

Germany

|

3.6

|

5.22

|

1.5

|

yes

|

5%

|

Do

visitors complain about the Bed Tax when they visit Paris or Barcelona or Rome?

Perhaps some do, but many also understand that there is a price to pay for

tourism – many support the idea of

empowering the special destinations we all love to visit, to protect what it is

that makes them truly special. In terms of designing a Bed Tax that is suitable

for NSW (and Byron Shire), there is much to be learnt by reviewing the practises

and models employed overseas. A recent ‘Options for a Tourism Levy for London’ Working Paper, A

publication for the London Finance Commission (written by Matthew Daley, January

2017) provides an excellent summary of how Tourism Taxes are working around the

world.

All

Byron is asking of government is a fair go – our

regional and State economy will then continue to reap the dividends of a

thriving and sustainable Byron.

In the

2014 LEGISLATIVE

COUNCIL

(General Purpose Standing Committee No. 3) report: Tourism in Local

Communities, it was acknowledged that, “Adequate infrastructure is an

essential component of growing the visitor economy and ensuring a positive

visitor experience,” noting that ,”all community

infrastructure, encompassing roads, parking, water, sewerage, parks, public

toilets and other public spaces, services the needs of visitors and is impacted

by their use, particularly where visitation rates are high. As such, community

infrastructure plays a crucial role in the visitor economy. “

It also

acknowledged the deficiencies within the current tourism funding regime-with

the Regional Visitor Economy Fund ostensibly being for new

developments, whilst existing assets that require investment and upgrades

are not eligible. Thus, we can get some money for new things, but can’t

for upgrading or maintaining existing things.

This

can have the added impact of deterring future visitors as tourism expert

Cameron Arnold explained, “If the infrastructure is failing and people

are not coming or the quality of the tourist is decreasing then you are not

going to get that spend, you are not going to achieve that goal, so therein

lies the issue. If a town or accommodation outlet is starting to decrease in

its value then people are not going to come back.” Clearly then, ongoing

funding should be made available so that they [existing tourism assets] can be

maintained at a high standard.

We are

not alone. The Tourism Snowy Mountains [TSM] submission to the enquiry outlined

that in 2013, “there was over $2.8 million visitor nights within the

Snowy Mountains. A $1 levy would raise $2.8 million. Say you allow 10 per cent

for collection that is about $2.5 million that the RTO would have available to

them for their budgeting, their operations and their marketing. From a council

perspective we would argue that you make it $2 and the other $2.5 million can

come to council to help maintain the infrastructure that we have to maintain to

support tourism such as the appearance of our parks and the appearance of our

public toilets.”

Moving

into this financing regime via a trial could be advantageous in the ability to

adjust and research and quantity impacts of a bed tax. It could be argued that

Byron Shire (and indeed Australia as a whole) would benefit from research into

how price changes (such as adding a bed tax) and different price structures

might influence tourism behaviour. This extra research could provide a

better understanding of the actual impact of imposing an additional tax on

accommodation. With so many other countries and cities already operating

successful bed tax schemes, Australia (and the Byron Shire) is in a position to

take advantage of the lessons learnt. An evidence-based ‘bed tax’ scheme

could take advantage of the best models, achieving the greatest balance (and

having the least impact on visitor numbers if this is the desired outcome) and

systems of collection and administration.

Staff comments by General Manager:

(Management Comments must not include formatted

recommendations – resolution 11-979)

Proposal supported.

Financial/Resource/Legal Implications:

Nil

Is the proposal consistent with any Delivery Program

tasks?

Yes

Petitions 10.1

Petitions

Petition No. 10.1 Repair and Resurfacing Coolamon Avenue Mullumbimby

Directorate: Infrastructure Services

Report

Author: Dominic

Cavanough , Contract Engineer

Susan Sulcs, Administration

Officer

Phillip Holloway, Director

Infrastructure Services

File No: I2017/924

Theme: Community Infrastructure

Roads and Maritime Services

At Council’s Ordinary meeting held on 22 June Cr Richardson

tabled a petition containing 14 signatures which states:

“Repair and

Resurfacing Coolamon Avenue Mullumbimby”

Comments from Director Infrastructure Services:

Staff have met with the resident to discuss his concerns

about the road and the works being undertaken. Minor works will be completed

throughout the year as needed, however, more substantial works will need a

separate budget for capital renewal works.

Council funds for these types of works have been allocated

for 2017/18. The capital renewal works on this section of road will be

investigated and included for consideration for future years budgets as part of

the development of the 2018/19 Budget and Capital Works Program.

|

RECOMMENDATION:

1. That

the petition regarding Repair and Resurfacing Coolamon Avenue

Mullumbimby be noted.

|

Attachments:

1 Petition -

Repair and Resurfacing Coolamon Avenue, Mullumbimby, S2017/11778

Submissions and Grants 11.1

Submissions and Grants

Report No. 11.1 Byron

Shire Council Submissions and Grants as at 2 August 2017

Directorate: Corporate

and Community Services

Report

Author: Jodi

Frawley, Grants Co-ordinator

File No: I2017/1019

Theme: Corporate Management

Governance Services

Summary:

Council have submitted applications for a number of grant

programs which, if successful, would provide significant funding to enable the

delivery of identified projects. This report provides an update on these

grant submissions.

|

RECOMMENDATION:

That Council note the report.

|

Attachments:

1 Byron

Shire Council Current Submissions and Grants as at 2 August 2017, E2017/80406

Report

This report provides an update on grant submissions

including funding applications submitted, potential funding opportunities and

those awaiting notification.

Funding Applications – Successful

· Northern Byron Coastal

Creeks Flood Study (Floodplain Grants Scheme, NSW and Australian Government) -

$130,000

· Upgrade of 11 Byron

Shire bus shelters (Country Passengers Transport Infrastructure Grant, NSW

Government) - $110,000

· Bayshore Drive

Roundabout (Building Better Regions Fund Infrastructure Stream, Australian

Government) - $2,640,254

Funding opportunities identified for consideration by

staff

· 622 Bangalow Road Safety

Treatments, Safer Roads including Black Spot Funding (Roads and Maritime

Services, NSW Government)

· Pedestrian Access

Management Plan, Active Transport (Roads and Maritime Services, NSW Government)

· Byron Shire Bike Plan,

Active Transport (Roads and Maritime Services, NSW Government)

· Cycle/walking paths,

Broken Head road (Suffolk Park to Byron Bay), Active Transport (Roads and Maritime

Services, NSW Government)

· Cycle/walking paths,

Lismore Road, Active Transport (Roads and Maritime Services, NSW Government)

· Cycle/walking paths,

Ewingsdale Road, Active Transport (Roads and Maritime Services, NSW Government)

· Cycle/walking paths,

Balemo Road, Active Transport (Roads and Maritime Services, NSW Government)

· Shared Zones for Lateen

and Bay Lanes, Byron Bay Active Transport (Roads and Maritime Services, NSW

Government)

· Byron Bay Bypass, Fixing

Country Roads (Restart NSW, NSW Government)

· Bridges for the Bangalow

Agricultural Area, Fixing Country Roads (Restart NSW, NSW Government)

· Replacement of the

Blindmouth Creek Crossing, Fixing Country Roads (Restart NSW, NSW Government)

· Clarks Beach Amenities,

Stronger Country Communities Fund (Regional Growth Fund, NSW Government)

· Ocean Shore Community

Centre upgrade, Stronger Country Communities Fund (Regional Growth Fund, NSW

Government)

· Active Recreation

Waterlily Park, Ocean Shores, Stronger Country Communities Fund (Regional Growth

Fund, NSW Government)

· Refurbishment of

Sandhills Childcare Centre, Stronger Country Communities Fund (Regional Growth

Fund, NSW Government)

· Brunswick Library

renovation and extension, Regional Cultural Fund (Regional Growth Fund, NSW

Government)

· Brunswick Harbour Boat

Ramp, NSW Boating Now (RMS, NSW Government)

Funding submissions submitted and awaiting notification

· Fishing Platform

Brunswick River (Recreational Fishing Trust, NSW Government)

· Building capacity in

Byron’s Community Halls (Building Better Regions Fund Community

Investments, Australian Government)

· Blindmouth Creek

Crossing replacement (Bridges Renewal Programme, Australian Government)

· Replacement of the

Southern Shire Bridges (Bridges Renewal Programme, Australian Government)

· 3D Mapping Tool (Smart

Cities and Suburbs, Australian Government)

· Byron Bay Bypass,

Regional Jobs and Investment Package for North Coast NSW (Australian

Government)

· Shark Smart Alert and

Advice System, Shark Management Strategy Program (NSW Government)

Additional information on the grant submissions made and or

pending is provided in Attachment 1 – Grants report as at 2 August 2017

Financial Implications

If Council is successful in obtaining the identified grants

more than $18 million would be achieved which would provide significant funding

for Council projects. Some of the grants require a contribution from

Council (either cash or in-kind) and others do not. Council’s

contribution is funded. The potential funding and allocation is noted below:

Requested funds from funding bodies $11,382,238

Council cash contribution

$7,170,490

Council in-kind contribution

$93,025

Funding applications submitted and awaiting notification

(total project value) $18,645,733

Statutory and Policy

Compliance Implications

Council is required under Section 409 3(c) of the Local

Government Act 1993 to ensure that ‘money that has been received from

the Government or from a public authority by way of a specific purpose advance

or grant, may not, except with the consent of the Government or public

authority, be used otherwise than for that specific purpose’. This

legislative requirement governs Council’s administration of grants.

Staff Reports - Corporate and Community Services 13.1

Staff Reports - Corporate and Community

Services

Report No. 13.1 Richmond

Tweed Regional Library Deed of Agreement

Directorate: Corporate

and Community Services

Report

Author: Sarah

Ford, Manager Community Development

File No: I2017/960

Theme: Society and Culture

Public Libraries

Summary:

This purpose of this

report is to detail the development of the Richmond Tweed Regional Library Deed

of Agreement and gain Council endorsement of the Deed of Agreement as the

governance structure for the library service.

|

RECOMMENDATION:

That in

relation to the Richmond Tweed Regional Library Deed of Agreement, Council:

a) Adopt

the Deed of Agreement

b) Delegate

the General Manager to finalise and execute the Deed

c) Appoint

Lismore City Council as the Executive Council of the Richmond Tweed Regional

Library

d) Appoint

two Councillors to the Richmond Tweed Regional Library Committee members and

one alternate Committee Member once notice has been given that the Committee

has been formed.

|

Attachments:

1 RTRL

Planning and Reporting Framework 2017_27 April 2017_V3, E2017/71017

2 RTRL DOA

Version 13_ 28 Jul 2017 FINAL, E2017/78186

Report

The Richmond Tweed Regional Library (RTRL) service was

established in 1973 and consists of four member Councils including Lismore City

Council, Tweed Shire Council, Ballina Shire Council and Byron Shire Council. A

simple Agreement, signed in 1978, formed the basis of the governance structure

for the RTRL service, for which Lismore City Council was appointed the Executive

Council responsible for the delivery of library services on behalf of member

Councils.

The original Agreement was to be reviewed after five years.

A number of attempts to review the Agreement have occurred, however consensus

between member Councils as to a new Deed of Agreement was unable to be reached.

Lismore City Council continued as the Executive Council, delivering library

services on behalf of member Councils with little input from member Councils

into the planning and evaluation of services.

In February 2016, senior staff from the RTRL member Councils

agreed to meet bi-monthly to improve cooperation and collaboration. The senior

leadership group identified the first priority was to develop a governance

structure that supported participatory strategic planning and service delivery.

The senior leadership group engaged the University of

Technology Sydney (UTS) to undertake consultation with member Councils

including branch staff, managers, General Managers and Councillors, and develop

a Deed of Agreement that reflected the aspirations of the member Councils.

UTS completed a literature review and analysis of all

cooperative library agreements in NSW. It is noted that in order to meet the

legislative requirements of the Library Act 1939, and for the RTRL to continue

to be eligible for State Library NSW funding, there are significant constraints

on the content of the Agreement.

Consultation included four Charettes with staff and

Councillors, and a number of follow-up workshops with General Managers and the

senior leadership group in order to refine the Deed of Agreement.

The Draft Deed of Agreement was tabled at the 12 May RTRL

Committee Meeting. The RTRL Committee endorsed the Draft Deed of Agreement

subject to a number of changes including standardising terminology and removal

of inconsistent language; and review by Lindsay Taylor Solicitors. The changes

have been incorporated and the Deed of Agreement reviewed by Lindsay Taylor

Solicitors, with the Senior Leadership Group finalising the Deed of Agreement

on Thursday 27th July.

Key points of the Deed of Agreement are outlined below:

Term of the Agreement

The Deed of Agreement will be for a period of four years

from execution of the Agreement,

Clear lines of reporting and accountability

The RTRL Deed of Agreement clearly articulates the roles and

responsibilities of:

· Member Councils

· Executive Council

· RTRL Committee

· Senior Leadership Group

· Executive Officer

· RTRL Manager

The addition of a formal Senior Leadership Group opens the

way for joint strategic planning and evaluation by member Councils and adds an

additional layer of transparency.

Development of joint Delivery Plan and Service Level

Agreement

An RTRL Delivery Plan is to be developed jointly by each

member Council, RTRL Manager and Area Librarian to include:

· Collection development

· Development and delivery

of library services

· Staff training and

development

· Staff performance

appraisal including evaluation criteria and performance measures

· Maintenance and

improvement of Branch library premises and other buildings used in connection

with RTRL

· Analysis of LGA

demographics for the purposes of planning and improving library services

· Formulation of annual performance

measures relating to the delivery of library services

Provision for long term financial planning and asset

management

The agreement provides certainty for long term financial

planning (10 years) to occur, including an agreed formula for member Council

financial contributions, and clauses regarding entry of new member Councils and

retirement of existing member Councils. The Agreement also specifies the

development of an asset register for existing assets, as well as any future

assets acquired by the membership to protect member Council investments.

Staffing arrangements

Under the current Agreement, Lismore City Council is

responsible for employment of all staff across the RTRL, including branch

staff. The new Deed of Agreement makes provision for a review of current

staffing arrangements within two years, in order to determine whether branch

staff should be employed by member Councils, or remain employed by Lismore City

Council. Further, the Deed of Agreement provides for the Senior Leadership

Group to be involved in the structure and appointment of staff to RTRL Headquarters,

including recruitment and selection.

In summary, the RTRL Deed of Agreement provides a formal

governance structure that improves transparency, collaboration and long term

strategic planning. The Agreement provides the foundation upon which the member

Councils can work together to continue to deliver high quality library services

across the region, and more specifically understand the needs of local

communities and plan accordingly.

Financial Implications

Member Council contributions will continue to be based on

population as the most reliable, consistent and equitable formula. Should any

change to the formula be proposed, full consultation with member Councils will

occur.

Statutory and Policy Compliance Implications

The Deed of Agreement is governed by the Library Act 1939

Staff Reports - Corporate and Community Services 13.2

Report No. 13.2 Electricity

Procurement

Directorate: Corporate

and Community Services

Report

Author: Bronwyn

Challis, Strategic Procurement Co-ordinator

File No: I2017/990

Theme: Corporate Management

Governance Services

Summary:

Council’s three electricity contracts (large sites,

small sites and street lighting) expire on 31 December 2018. In the past,

Council has procured its electricity through the Local Government Procurement

(LGP) aggregated tender process. However, as a result of Council’s desire

to get the best value from its own electricity generation, as well as changes

in the electricity retailing market, it is proposed that Council run its own

electricity procurement process with the assistance of specialist consultants. This

will enable Council to request more flexibility and innovation (eg Local

Electricity Trading) in its electricity contracts than would traditionally have

been the case.

Lismore City Council is also pursuing local electricity

generation and is interested in exploring the ability to undertake local

electricity trading between its buildings. Lismore City Council has expressed

an interest in joining Byron Shire Council in this innovative electricity

procurement project. The inclusion of Lismore City Council will significantly

increase our buying power and offer the benefits of volume aggregation.

|

RECOMMENDATION:

1. That

Council endorse the procurement strategy set out in this report, in

particular that Council runs a two-stage procurement process to the open

market and that the scope includes Council’s essential business

requirements, the ability to purchase Green Power, and Local Electricity

Trading.

2. That

Council delegates short-listing of Expression of Interest respondents

and acceptance of tenders to the General Manager as provided for under

Section 377 of the Local Government Act 1993.

|

Report

Council has traditionally procured its electricity through

the Local Government Procurement (LGP) aggregated tender process using

LGP’s panel of prequalified electricity retailers. This means that, when

running electricity tenders on behalf of councils, LGP only sends the request

for tender to the five retailers on the panel.

Byron Shire Council is continuing to invest in ways to

generate its own electricity and is now at the point where it requires the

market to be more flexible and innovative in response to Council’s needs.

The traditional LGP procurement process is not able to accommodate

Council’s requirements for electricity innovation such as local

electricity trading.

Opportunity for change

Council has committed to becoming 100% net zero carbon emissions

by 2025 and as a result a suite of projects are being pursued. Additionally,

Council resolved as part 5 of resolution 17-086 that “Council commit

itself to source 100% of its energy through renewable energy within 10

years.” To achieve both of these goals, the following projects are

underway:

· Development

of a Zero Emissions Reduction Strategy to extend the Low Carbon Strategy;

· Solar

installation on Council assets (2017 – Byron Library, Sandhills Childcare

Centre, Myocum Landfill)

· Inclusion of

Local Electricity Trading in energy procurement process

· Energy

efficiency at the Mullumbimby Library

· Ground

mounted solar farm investigation

· Bioenergy

generation facility prefeasibility

· Power

purchase agreement investigation

· Battery use

at Sewage Treatment Plant investigation

· Solar car

park shading investigation

· Solar

monitoring of all Council’s solar assets.

To complement Council’s own electricity generation, it

is proposed that Council use its electricity procurement process to request local

electricity trading as part of its electricity contracts. This will provide

Council with a way to improve the value it obtains from its investment in solar

electricity.

Traditionally, excess electricity generated is sold back to

the grid at a lower value than the cost of the electricity purchased from the

grid which does not allow Council to take full advantage of the economic

benefits of the electricity generation. Our current electricity supply

contracts do not provide any feed-in tariff for excess electricity

generation, further eroding the value Council currently obtains from its

electricity generation.

Local Electricity Trading is an innovative method of

enabling Council to get value from the electricity it generates. Local

Electricity Trading is an arrangement whereby generation of electricity at one

site is “netted off” at another site. This means that Site 1 is

essentially “selling” or assigning generation to nearby Site 2. It

is specifically for the energy portion of an electricity cost and doesn’t

include or affect the network charges the Council will still be liable to pay.

The objectives of Local Electricity Trading are to:

1. Attribute

the value of exported electricity from one asset to the consumption of another

asset.

2. Show

the “netted off” value of electricity on the invoice or equivalent

billing statement.

3. Appropriately

value decentralised electricity exported to the grid.

Although electricity retailers can offer Local Electricity

Trading they are yet to do so for a number of reasons. In the competitive and

rapidly changing energy market of Australia, the ability of a retailer to

secure large customers with excellent credit ratings is paramount. The Local

Government sector offers both of these qualities. Local Government is rapidly

investing in decentralised energy generation and is keenly seeking retailers

that can offer flexible and innovative solutions to the emerging needs of this

new energy system. A retailer investing in the ability to provide Local

Electricity Trading will set itself apart from other retailers and will be

uniquely appealing to the Local Government sector.

Requirements of the new electricity contracts

Byron Shire Council has a number of requirements that any

electricity retailer will need to be able to fulfil if they want to secure

Council’s contract. Most importantly, the retailer will need to fulfil

Council’s existing business requirements, including:

· Provide continuity of

electricity supply for essential community services

· Support Council’s

continued use of Planet Footprint for emissions monitoring and reporting

· Provide exceptional

customer service and be responsive to Council’s needs

· Provide invoices in both

electronic and paper format

In addition to the mandatory business requirements, the electricity

retailer will also need to be able to support Council in moving towards a low

carbon/zero emissions future. This will include the ability for Council to

purchase Green Power as well as enable local electricity trading. Council will

also be expecting the successful retailer to provide only a minimal, or no,

penalty for decreased electricity use over the term of the contract.

Risks

As of 1 July 2017, the cost of electricity is anticipated to

increase by up to 20% for the whole market. This increase will not affect

Council immediately due to the current contracted price continuing until 31

December 2018 but will be evident in the prices sought for the new contract.

There are a number of risks associated with stepping away

from traditional electricity procurement methods as discussed below.

By not aggregating our electricity procurement with a number

of other councils, there is a considerable risk that the cost to purchase

electricity may increase more than if we use the LGP procurement process. The

proposed procurement process will allow us to evaluate if a contract with local

electricity trading provides acceptable value for money compared with a

traditional aggregated procurement process.

There is also a risk that, since local electricity trading

has real or perceived barriers to implementation by the retailers, the market

may not respond to our request for local electricity trading. However, this may

be offset by the desire for some electricity retailers to be the first retailer

to offer local electricity trading to the local government sector. This may be

particularly desirable for Tier 2 and “boutique” suppliers looking

to differentiate themselves in a somewhat crowded market.

The proposed procurement strategy discussed in the next

section will help to mitigate these risks.

Procurement Strategy

It is recommended that a two-stage procurement process be

implemented to establish a contract for the supply of Council’s

electricity. The first stage will be an Expression of Interest to the open market

to determine the market’s capacity, capability and willingness to

implement local electricity trading as part of Council’s electricity

supply contract as well as their ability to meet Council’s essential

business requirements. If, during this stage, it is determined that the market

cannot fulfil Council’s requirements then the process can be discontinued

and Council would then be able to undertake its usual electricity procurement

process to establish a traditional contract (including the opportunity to

purchase Green Power and provision of a solar feed-in tariff).

If the market responds positively and it is apparent that

the market can fulfil Council’s requirements then a short-list of capable

suppliers will be established. These suppliers will then be invited to respond

to a selective request for tender to ultimately decide the successful supplier.

It is at the selective tender stage that proponents will be requested to

provide details of their pricing structure.

It is proposed that the procurement will be carried out by a

third party with the required expertise in both the electricity market and

procurement. Both Local Government Procurement and Procurement Australia have

indicated an interest in conducting this work on behalf of Council. Outsourcing

the procurement to a third party will significantly decrease the probity risks

caused by potential or actual conflicts of interest of staff and the elected

Council.

The role of the electricity procurement consultant will be

to lead and coordinate the procurement process on behalf of Council.

Acceptance of Tenders

Due to the volatility of the electricity market, tender

validity periods are generally very short. The tender validity period refers to

the time within which a tender must be accepted after tenders close. Once the

tender validity period expires, the offer lapses. Electricity tenders typically

have a tender validity period of only a few days (often only 72 hours). This

means that it is not feasible to have the elected Council consider the tender results

at a Council meeting. It is recommended that Council delegate the acceptance of

tenders following both the Expression of Interest and Selective Tender stages

to the General Manager in accordance with Section 377 of the Local Government

Act 1993. A report can be provided to Councillors following evaluation of

Expression of Interest to advise of the results of the EOI.

Project Timeframes

As previously noted Council’s current electricity

contracts expire on 31 December 2018. The complex nature of this project means

that time is of the essence to ensure this project is delivered on time. The

following table provides an indicative timeline for the project’s major

milestones:

|

Milestone

|

Completion

Date

|

|

Electricity procurement

consultant engaged

|

August 2017

|

|

Expression of Interest

released to the market

|

October 2017

|

|

EOI evaluation complete

|

November 2017

|

|

Selective request for tender

released to the market

|

February 2018

|

|

Selective request for tender

evaluation complete

|

March 2018

|

|

Contract entered into with

successful tenderer

|

April/May 2018

|

These timelines are indicative only and will be confirmed

with the electricity procurement consultant.

It is important that the project is completed as soon as

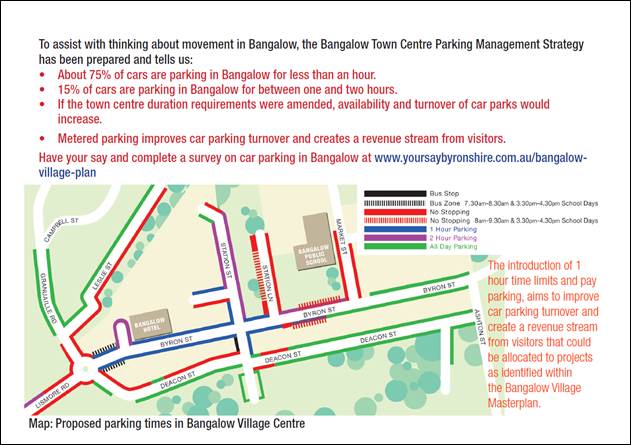

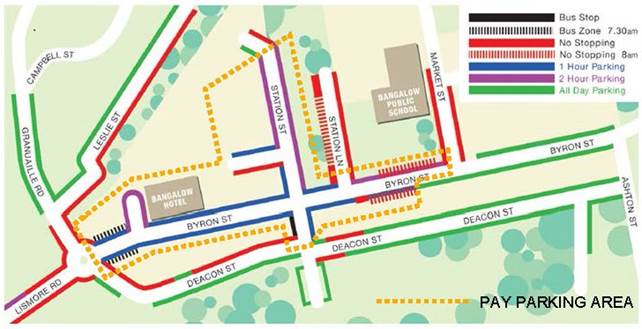

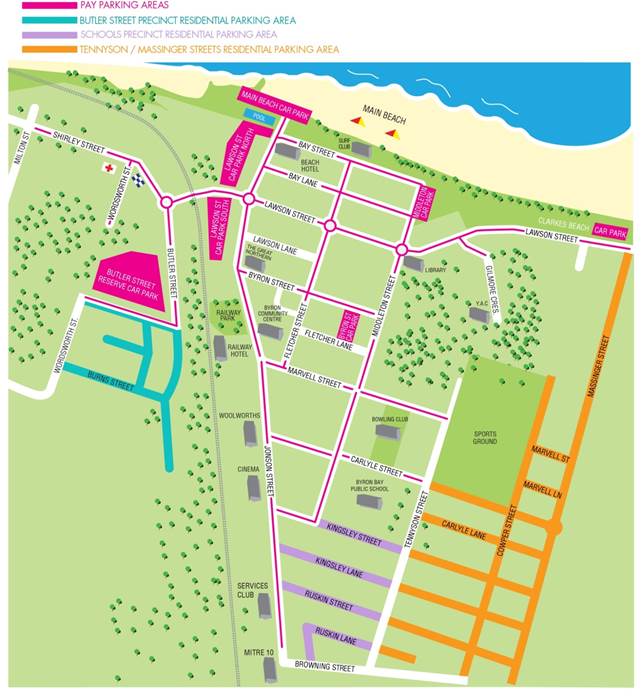

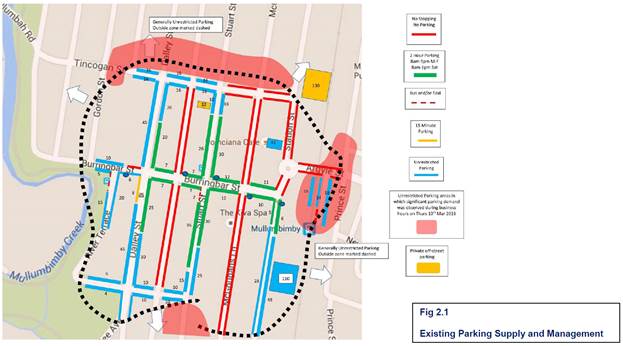

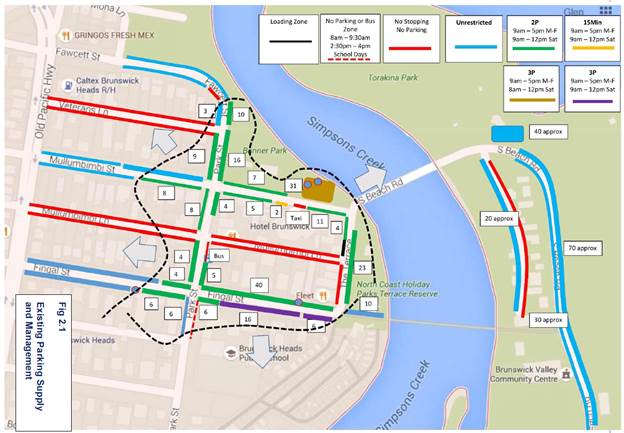

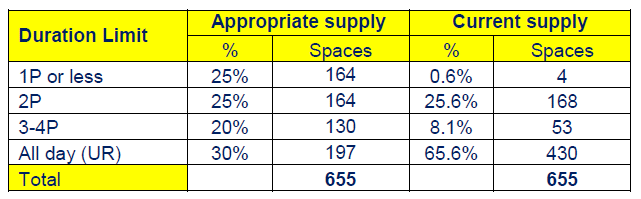

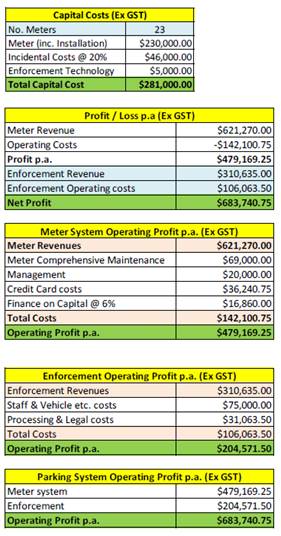

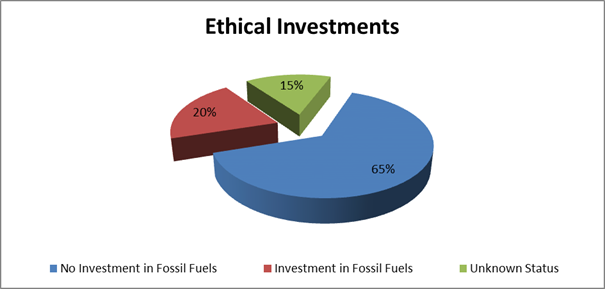

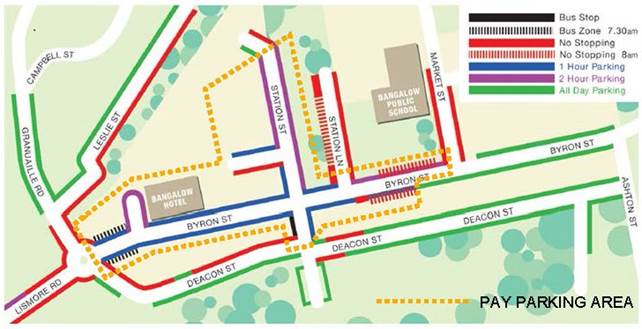

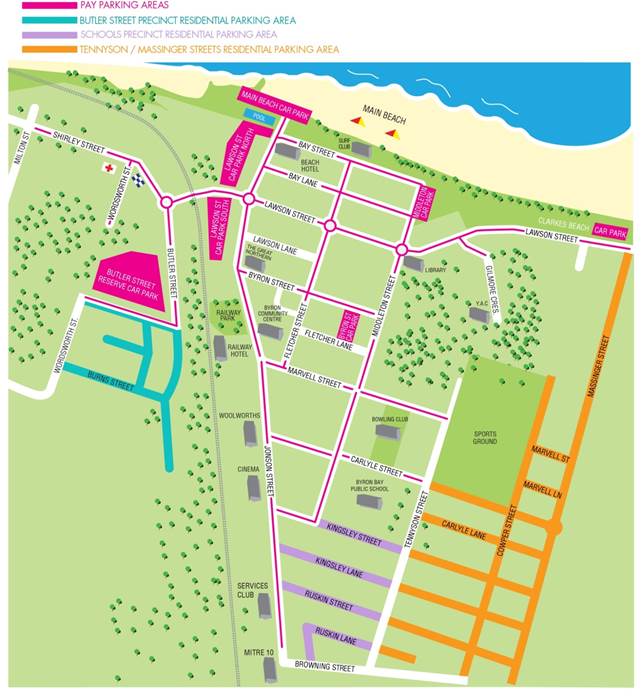

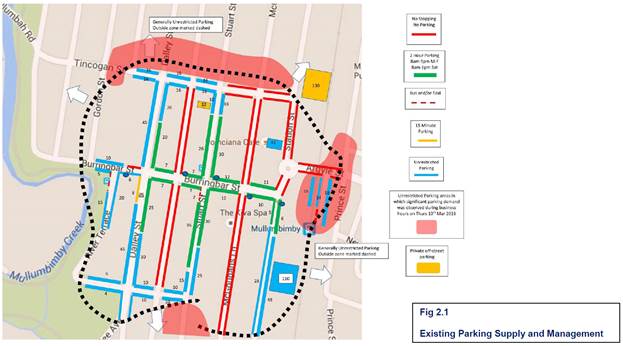

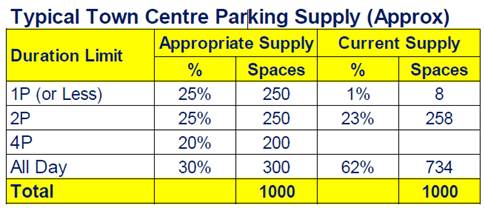

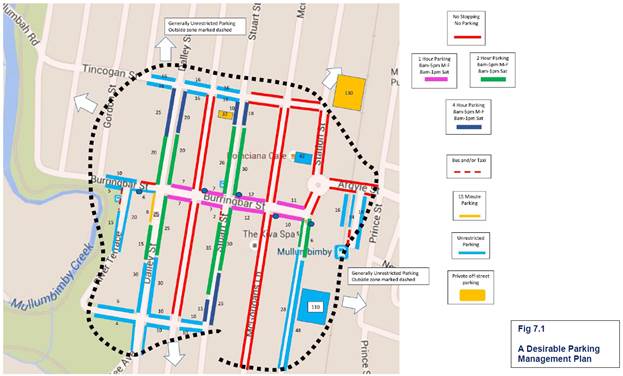

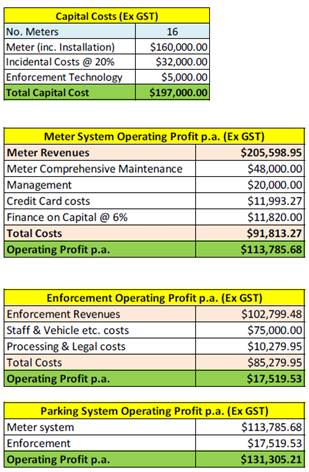

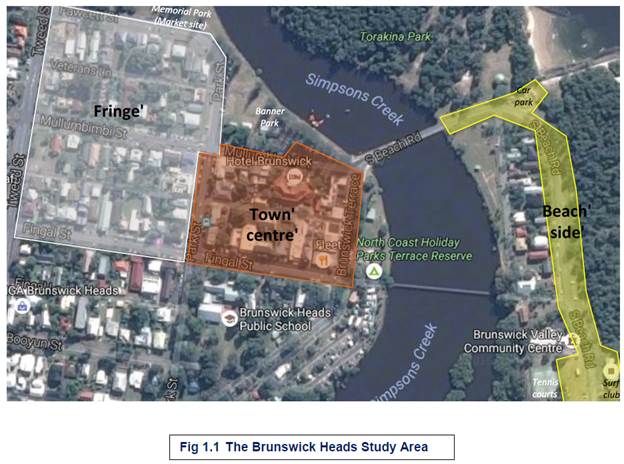

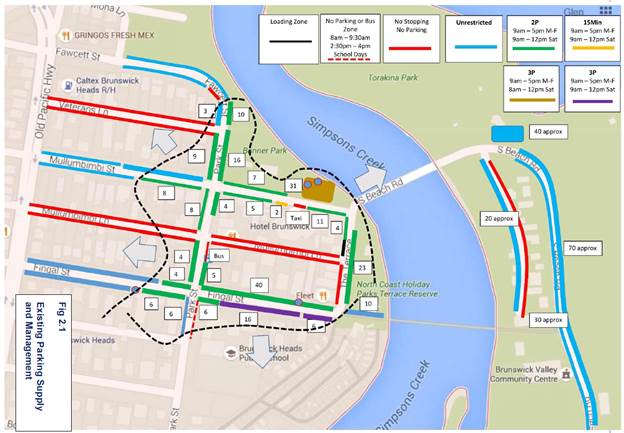

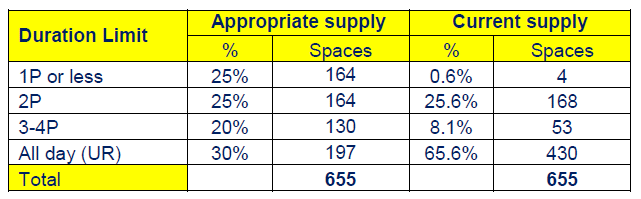

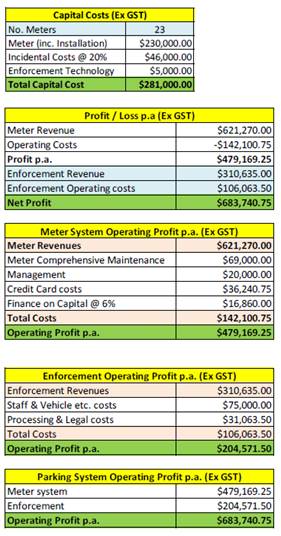

possible so that, if the project is unsuccessful, sufficient time is left to