What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the Code

of Conduct for Councillors (eg. A friendship, membership of an association,

society or trade union or involvement or interest in an activity and may

include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or vice-versa).

Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as of the provisions in the Code of Conduct (particularly if you have a significant

non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

Report No. 4.1 Mayor

and Councillor Fees 2020/21

Directorate: Corporate

and Community Services

Report

Author: Esmeralda

Davis, A/Manager Corporate Services

File No: I2020/877

Theme: Corporate Management

Governance Services

Summary:

The Local Government Remuneration Tribunal has handed down

its report and determinations on Council’s categorisation and fees for

Councillors and Mayors for the 2020/21Financial Year. This report

outlines the Tribunal’s determination and the fee range for Mayor and

Councillor fees for financial year 2020/21.

|

RECOMMENDATION:

That

Council:

1. Notes

that Council’s categorisation remains unchanged as Regional Rural.

2. Fixes

the fee payable to each Councillor under Section 248 of the Local Government

Act 1993 for the period 1 July 2020 to 30 June 2021 at $20,280.

3. Fixes

the fee payable to the Mayor under section 249 of the Local Government

Act 1993, for the period from 1 July 2020 to 30 June 2021 at $44,250.

4. Not

determine a fee payable to the Deputy Mayor, in accordance with its current

practice.

|

Attachments:

1 Submission

Local Government Remuneration Tribunal - Mayor and Councillor Remuneration and

Categories, E2019/85065

REPORT

Each year the Local Government Remuneration Tribunal must

determine, in each of the categories determined under section 239, the maximum

and minimum amounts of fees to be paid during the following year to councillors

and mayors.

Review of categories

Section 239 of the LG Act requires the Tribunal to determine

the categories of councils and mayoral offices at least once every 3 years. The

Tribunal last reviewed the categories during the 2017 annual review.

The Tribunal wrote to all mayors in October 2019 advising of

the commencement of the 2020 review and invited submissions from councils on

the following matters:

1. Proposed classification

model and criteria

2. Allocation in the

proposed classification model

3. Range of fees payable in

the proposed classification model

4. Other matters

In determining categories, the Tribunal is required to have

regard to the following matters that are prescribed in section 240 of the LG

Act:

“240 (1)

· the size of areas

· the physical terrain of areas

· the population of areas and

the distribution of the population

· the nature and volume of

business dealt with by each Council

· the nature and extent of the

development of areas

· the diversity of communities

served

· the regional, national and

international significance of the Council

· such matters as the

Remuneration Tribunal considers relevant to the provision of efficient and

effective local government

· such other matters as may be

prescribed by the regulations.”

Twenty (20) submissions received from councils by the

Tribunal requested re-categorisation and were considered, having regard to the

case put forward and the criteria for each category.

Council’s submission sought re-categorisation to the

new Regional Centre category, and is attached for your reference (E2019/85065).

The Tribunal deemed that Byron’s population of 35,081 was significantly

below the indicative population of Regional Centre councils and Council was

considered not to have met the criteria to warrant inclusion in the Regional

Centre group. Two other Councils (Bega and Eurobodalla) sought the same

re-categorisation, with the same outcome. As a result, Council’s

categorisation remains unchanged as Regional Rural.

Remuneration

With the assistance of two Assessors, the Tribunal has reviewed

key economic indicators, and while it is required to give effect to the

Government’s wages policy in the making of this determination, it is open

to the Tribunal to determine an increase of up to 2.5 per cent or no increase

at all.

Given the current economic and social circumstances, the

Tribunal has determined that there be no increase in the minimum and

maximum fees applicable to each existing category. A full copy of the Report

and Determination of the Local Government Remuneration Tribunal is available at

https://www.remtribunals.nsw.gov.au/local-government/current-lgrt-determinations.

The Remuneration Tribunal has determined the maximum and

minimum amounts of fees to be paid during the 2020/21 financial year for

Regional Rural councils as follows:

|

|

Councillor/Member

Annual Fee

|

Mayor/Chairperson

Additional Fee*

|

|

Category

|

Minimum

|

Maximum

|

Minimum

|

Maximum

|

|

Regional Rural

|

$9,190

|

$20,280

|

$19,580

|

$44,250

|

* This

fee must be paid in addition to the fee paid to the Mayor/Chairperson as a

Councillor/member (s249(2)).

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.2

|

Create a

culture of trust with the community by being open, genuine and transparent

|

5.2.4

|

Support

Councillors to carry out their civic duties

|

5.2.4.3

|

Provide support

to Councillors – including councillor requests, briefing sessions,

provision of facilities and payment of expenses, and record keeping

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Section 248 of

the Local Government Act 1993 states:

1. A council must pay

each Councillor an annual fee.

2. A

council may fix the annual fee and, if it does so, it must fix the annual fee

in accordance with the appropriate determination of the Remuneration Tribunal.

3. The annual fee so

fixed must be the same for each Councillor.

4. A

council that does not fix the annual fee must pay the appropriate minimum fee

determined by the Remuneration Tribunal.

Section 249 of the Local Government Act also states (in the

case of the Mayor)

1. A

council must pay the Mayor an annual fee.

2. The

annual fee must be paid in addition to the fee paid to the Mayor as a

Councillor.

3. A

council may fix the annual fee and, if it does so, it must fix the annual fee

in accordance with the appropriate determination of the Remuneration Tribunal.

4. A

council that does not fix the annual fee must pay the appropriate minimum fee

determined by the Remuneration Tribunal.

5. A

council may pay the Deputy Mayor (if there is one) a fee determined by the

council for such time as the deputy Mayor acts in the office of the

Mayor. The amount of the fee so paid must be deducted from the

Mayor’s annual fee.

Section 250 of

the Local Government Act states:

Fees payable under this

Division by a council are payable monthly in arrears for each month (or part of

a month) for which the councillor holds office.

Financial Considerations

The annual fees payable to Councillors and the Mayor for the

2019/20 financial year were the maximum fee fixed at $20,280 per annum for a

Councillor, with an additional fee of $44,250 for the Mayor.

Councillors and Mayoral fees presently paid

$20,280

each x 9 = $182,520

Plus

Mayor additional fee = $

44,250

Total

Paid $226,770

Councillors and Mayoral fees 2020/21 as per the maximum amount

set by the Tribunal

$20,280

each x 9 = $182,520

Plus

Mayor additional fee = $

44,250

Total

Paid $226,770

The draft 2020/21 Budget to be considered at this

Extraordinary Meeting via a separate report includes a total allocation of

$232,600 for Councillor Fees and the Mayoral Allowance. The draft 2020/21

budget was prepared assuming the maximum fee with a 2.5% increase by the Local

Government Remuneration Tribunal. Given the approved increase has been set at

0%, this will create a $5,800 saving to the 2020/2021 draft Budget Estimates.

Allowance

for Deputy Mayor

Section 249 (Clause 5) of the Local Government Act states

that:

“A council may pay the

deputy Mayor (if there is one) a fee determined by the council for such time as

the deputy Mayor acts in the office of the Mayor. The amount of the fee

so paid must be deducted from the Mayor’s annual fee.”

As stated in the above clause, Council is not bound to set a

fee, but if it so chooses must deduct that sum from the amount available under

the Mayoral allowance.

Current practice is that an acting period for Deputy Mayor

would apply only in instances where the Mayor has leave of absence endorsed by

Council and any pro rata fees would be deducted from the Mayoral allowance

where agreed on a case by case basis in accordance with Section 249 of the

Local Government Act 1993.

Consultation/Engagement

The Local Government

Remuneration Tribunal consults with local governments to determine

categorisations and arrive at its fee determination. Byron Shire Council made a

submission to the Tribunal seeking a re-categorisation and the maximum

allowable increase of 2.5%.

Staff Reports - Corporate and Community Services 4.2

Report No. 4.2 Adoption

of the 2020/21 Operational Plan, including Budget, Statement of Revenue Policy,

and Fees and Charges

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

Esmeralda Davis, A/Manager

Corporate Services

Heather Sills, Corporate Planning

and Improvement Coordinator

File No: I2020/1035

Summary:

At its 25 June 2020 Ordinary Meeting, Council endorsed the

Draft 2020/21 Operational Plan (including the Budget, Statement of Revenue

Policy, and Fees and Charges) for public exhibition (Resolution 20-343).

The preparation of these documents is regulated under the

Integrated Planning and Reporting Framework requirements legislated by s406 of the Local Government Act 1993.

The report includes the 12 submissions received during

public exhibition for Council’s consideration and recommends a number of

proposed amendments. It also recommends that Council adopts the revised

documents.

|

RECOMMENDATION:

That Council:

1. Notes

the submissions received during the public exhibition period for the

2020/21 Operational Plan (including the Budget, Statement of Revenue Policy,

and Fees and Charges).

2. Adopts

the following documents:

a) Delivery

Program 2017-2021 and 2020/21 Operational Plan as exhibited, with the

amendments (included in Attachment 1 #E2020/55619) discussed in this report

under the heading ‘Draft 2020/21

Operational Plan – amendments’.

b) 2020/21

Statement of Revenue Policy including fees and charges as exhibited, with the

amendments (included in Attachment 2 #E2020/42781) discussed in

the report under the headings ‘Draft

General Land Rates and Charges (Statement of Revenue

Policy)’ and Draft Fees and Charges (Statement of Revenue

Policy)’

c) 2020/21

Budget Estimates as exhibited, with the amendments discussed in

the report under the heading ‘Draft

2020/21 Budget Estimates (Statement of Revenue Policy)’.

3. Adopts

the proposed fees as outlined in the report under the heading Draft Fees and Charges (Statement of

Revenue Policy) / Proposed Amendments, for the purposes of public exhibition

and then adopts these fees should no submissions be received.

|

Attachments:

1 Delivery

Program 2017-2021 and 2020/21 Operational Plan, E2020/55619

2 Draft

2020/21 Revenue Policy including fees and charges for adoption, E2020/42781

3 Confidential

- Review of Air Space Licence Fees - Byron Shire Council Final, E2020/43627

4 Community

Engagement Results - Operational Plan and Budget 2020/21, E2020/51634

REPORT

The Community Strategic Plan,

the Delivery Program and the Operational Plan form part of the Integrated

Planning and Reporting Framework which is a requirement under the Local

Government Act 1993.

The 4-year Delivery Program

turns the strategic goals found in the 10-year Community Strategic Plan into

actions. The annual Operational Plan spells out the detail of the Delivery

Program, identifying the individual projects and activities that will be

undertaken in a specific year to achieve the commitments made in the Delivery

Program. The Operational Plan must include the Council’s annual budget,

along with Council’s Statement of Revenue Policy, which includes the

proposed rates, fees and charges for that financial year.

Council undertook a significant review of its Delivery

Program in 2018 following the development of a new Community Strategic Plan and

recommendations from the Infrastructure Community Solutions Panel. It has not

been reviewed this year.

Draft 2020/21 Operational

Plan

The Operational Plan actions detail the activities and

projects Council will undertake. It is grouped under our five Community

Strategic Plan themes, which are:

1. We

have infrastructure, transport and services which meet our expectations

2. We

cultivate and celebrate our diverse cultures, lifestyle and sense of community

3. We

protect and enhance our natural environment

4. We

manage growth and change responsibly

5. We

have community led decision making which is open and inclusive

Within each theme, reading across, the Operational Plan is

structured by Community Strategic Plan objective and strategy, Delivery Plan

action, Operational Plan activity, financial implications, responsibility,

measure and due date. Links to Community Solutions Panel (infrastructure)

recommendations and Disability Inclusion Action Plan requirements are also

referenced.

The draft Operational Plan (Attachmetn 1) was placed on

public exhibition from 25 June to 23 July 2020. 9 written submissions

were received during this period (as outlined further in the Consultation and

Engagement section of this report).

Draft 2020/21 Operational

Plan – amendments

The Operational Plan presented to Council today includes

amendments based on the feedback from public exhibition as well as

administration changes.

Key amendments include:

· Administration

changes

o Inclusion of resolution

numbers where relevant

o Review of the section

titled Disability Inclusion Action Planning (DIAP) to provide increased

clarity about how the DIAP integrates with Integrated Planning and Reporting

and how to identify DIAP activities in the Operational Plan

o Amendment to OP activity

3.1.1.1 – Complete the review of Implement the Biodiversity

Strategy

o Amended responsible

officer for OP activity 3.2.1.12 to Manager Environmental and Economic

Planning

o Amended measure for OP

activity 3.3.1.1 to Coastal Hazard Assessment ‘progressed’

o Amended measure for OP

activity 3.3.1.4 to Stage 1 scoping study ‘progressed’

o Amended measure for OP

activity 3.4.1.2 to ‘Deliver’ farm mentoring program

o Amended measure for OP

activity 4.1.1.4 to ‘Design developed. Construction

commenced’

o Amended measure for OP

activity 4.2.1.1 to include ‘LEP amended to apply SEPP 70 to one or

more of the sites identified in the Residential Strategy’

o Amended measure for OP

activity 4.2.1.2 to ‘Feasibility assessment for proposed

Mullumbimby Hospital and Lot 12 development complete’

o Moved OP activities

4.2.1.4 and 4.2.1.5 to DP Action 4.3.1. These are now numbered 4.3.1.2 and

4.3.1.3 respectively

o Amended header for

Community Objective 4.4 to ‘Support

tourism and events that reflect our culture and lifestyle’

o Amended OP activity 5.2.3.1

to include the word ‘delegations: “Maintain, publish and report on relevant registers

including delegations, Councillors and designated staff Disclosures of

Interest, Councillor and staff Gifts and Benefits, and staff secondary

employment”

o Amended

OP activity 5.2.3.2 to “Review, update, and publish Council

policies online and report on the status of Council’s policy

register’

o Amended

OP activity 5.6.10.2 to include reporting focus: “Maintain and

provide status reports on the corporate compliance reporting register and

monitor for currency and non-compliance issues”

· Public

submissions and proposed changes

o New OP activity

1.6.1.7 – “Finalise audit of disability parking arrangements in

Byron Town Centre and prepare list of proposed improvements”

o New OP activity 5.6.1.3

– “Create collaborative leadership groups to develop organisational

responses to key community issues”

Draft 2020/21 Budget

Estimates (Statement of Revenue Policy)

The Draft 2020/21 Budget Estimates are based on the 2019/20

budget reviewed at 31 March 2020 Quarter Budget Review with various changes to

reflect the updated cost of service delivery across all programs developed from

the input received from each Council Directorate.

The Draft 2020/21 Budget Result on a Consolidated (All

Funds) basis as placed on public exhibition forecasted a deficit budget result

as outlined below at Table 1.

Table 1 –

Forecast Budget Result 2020/21 Consolidated (All Funds)

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

85,982,600

|

|

Less: Operating Expenditure

|

(74,126,400)

|

|

Less: Depreciation

|

(15,029,000)

|

|

Operating Result – Surplus/(Deficit)

|

(3,172,800)

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

(3,172,800)

|

|

Add: Non cash expenses – Depreciation

|

15,029,000

|

|

Add: Capital Grants and Contributions

|

23,810,200

|

|

Add: Loan Funds Used

|

27,000,000

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(79,681,000)

|

|

Less: Loan Principal Repayments

|

(3,508,400)

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(20,523,000)

|

|

Reserves Movement – Increase/(Decrease)

|

(20,146,800)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

(376,200)

|

Table 1 indicated a forecasted budget deficit result of

$376,200 and this relates to the General Fund. The forecast General Fund

Unrestricted Cash Balance position based on the draft budget included at Table

1 and placed on public exhibition is outlined in Table 2 below:

Table 2 –

Forecast General Fund Unrestricted Cash Balance

|

Item

|

$

|

|

Forecast unrestricted cash balance to 30 June 2020 at 31

March 2020 Budget Review (proposed)

|

23,700

|

|

Add: Estimated initial draft 2020/21 budget result

|

(376,200

|

|

Forecast unrestricted cash balance at 30 June 2021

|

(352,500)

|

During the public exhibition period, the Draft 2020/21

Statement of Revenue Policy incorporating the Draft 2020/21 Budget Estimates

has been further reviewed. The revised budget position is summarised in

Table 3 below:

Table 3 –

Forecast Budget Result 2020/21 Consolidated (All Funds) revised during public

exhibition period

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

84,278,300

|

|

Less: Operating Expenditure

|

(73,843,000)

|

|

Less: Depreciation

|

(15,029,000)

|

|

Operating Result – Surplus/(Deficit)

|

(4,593,700)

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

(4,593,700)

|

|

Add: Non cash expenses – Depreciation

|

15,029,000

|

|

Add: Capital Grants and Contributions

|

25,139,300

|

|

Add: Loan Funds Used

|

27,000,000

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(85,342,700)

|

|

Less: Loan Principal Repayments

|

(3,513,500)

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(26,281,600)

|

|

Reserves Movement – Increase/(Decrease)

|

(25,924,800)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

(356,800)

|

Table 3 indicates a forecasted budget deficit result of

$356,800 and this relates to the General Fund. The forecast General Fund

Unrestricted Cash Balance position based on the draft budget included at Table

3 is outlined in Table 4 below:

Table 4 –

Forecast General Fund Unrestricted Cash Balance

|

Item

|

$

|

|

Forecast unrestricted cash balance to 30 June 2020 at 31

March 2020 Budget Review (proposed)

|

23,700

|

|

Add: Estimated initial draft 2020/21 budget result

|

(356,800)

|

|

Forecast unrestricted cash balance at 30 June 2021

|

(333,100)

|

Note: Whilst Council’s financial position

and unrestricted cash balance has been impacted as a result of the COVID-19

pandemic as reported at the 31 March 2020 Quarterly Budget Review, a

preliminary review of Council’s budget position as at 30 June 2020 has

been conducted. Whilst the financial results from 2019/2020 financial

year are not finalised and are still being updated, it is likely the

budget position at 30 June 2020 has improved.

At the 31 March 2020 Quarterly Budget Review, Council was

projecting a $976,300 General Fund budget deficit for 2019/2020. This

result, pending further review may have improved by $626,300 in

unrestricted cash terms leaving Council with a revised estimated unrestricted

cash balance of $650,000 at 30 June 2020.

At this stage, this indicative outcome would provide Council

the capacity to fund the projected budget deficit proposed for the 2020/2021

financial year as outlined in this report. The 30 June 2020 Quarter Budget

Review outcome will be reported to the Finance Advisory Committee on 20 August

2020 and to Council on 27 August 2020.

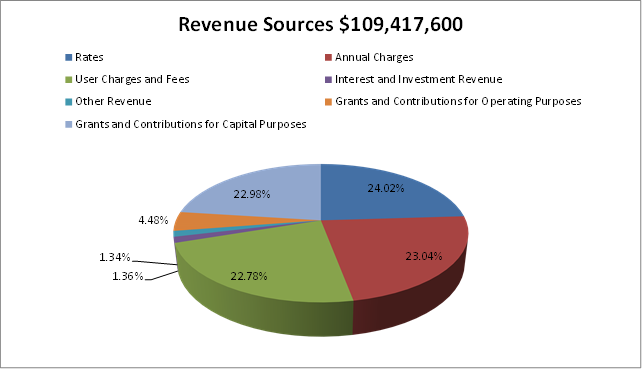

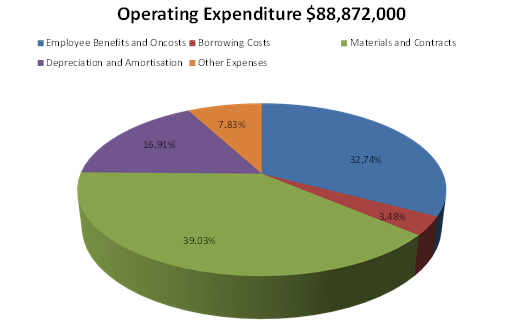

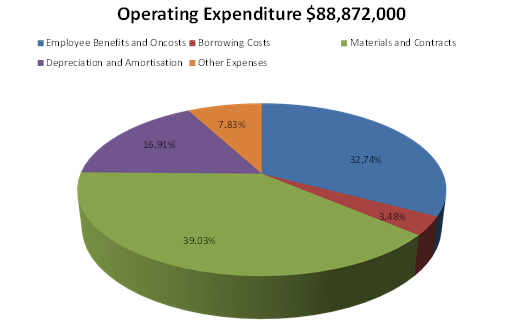

The revised Draft 2020/21 Budget Estimates indicate that

Council’s overall revenue and operational expenses are expected to be

derived from the following sources and allocated respectively as outlined in

the graphs below:

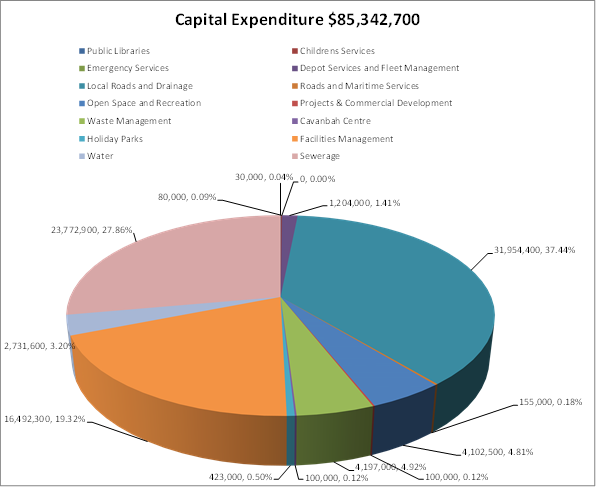

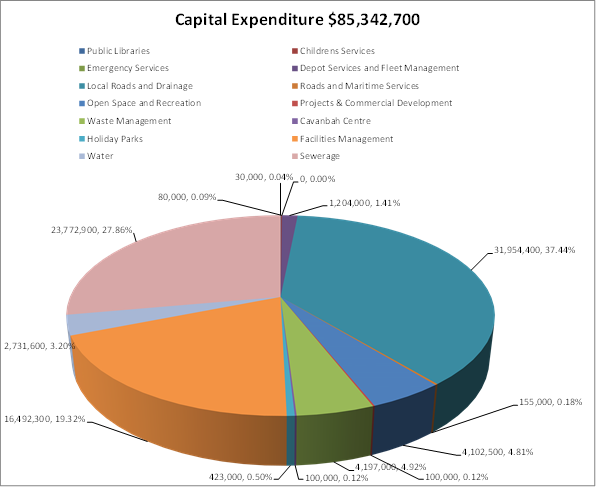

In addition to the operational aspects of the proposed Draft

2020/21 Budget Estimates as revised during the public exhibition period,

Council is proposing a capital works program of $85.343million.

By Fund, the projected capital works are:

· General Fund

$58.838million

· Water Fund

$2.732million

· Sewerage Fund

$23.773million

The Draft 2020/21 Budget Estimates also propose new external

loan borrowings of $27million to fund the Dingo Lane Solar Farm ($12million)

and Bio-Energy Facility ($15million) on the assumption that Council approves

these projects for construction following final determination of their

financial viability.

Proposed Draft 2020/21 Budget adjustments following

public exhibition

The major changes proposed to the Draft 2020/21 Budget

Estimates following public exhibition are:

· Council

has received 50% of its estimated entitlement to the 2020/2021 Financial

Assistance Grant from the Commonwealth Government prior to 30 June 2020.

This grant revenue will be restricted as at 30 June 2020 in reserve to be

carried forward to the 2020/2021 financial year. As a result of this

pre-payment, operating revenue needs to be reduced by $1,704,700 given the

advance grant funding already received.

· There

was an item in the draft 2020/2021 budget to increase the Mayor and

Councillors’ allowances by 2.5% but the Local Government

Remuneration Tribunal has not approved any increase for 2020/2021. This will

create a saving of $5,800. Mayor and Councillor fees are subject to another

report to this Extraordinary Meeting. The budget for Councillor catering at

meetings is also proposed to be reduced by $10,100 as the estimate included in

the draft budget for exhibition was overstated.

· Council

has completed its insurance renewal process for the 2020/2021 financial

year. Estimates included in the budget for insurances overall were

$65,700 more than required. This saving is being transferred to the Risk

Management Reserve to provide a further funding source for insurance excess on

any future potential insurance claims.

· The

budget for the interest only repayment of the loan borrowed for the remediation

of the former Mullumbimby Hospital has been reduced by $88,000 to reflect

actual payment amounts. The budget amount provided is in excess of requirement

given the favourable borrowing outcome achieved on that loan. This saving has

been transferred back to the Holiday Park Reserve which is currently funding

the loan repayments.

· Removal

of $5,000 expenditure for NE Hinterland Koala Conservation Project and

corresponding unexpended grant funding as this project was completed in the

2019/2020 financial year.

· Provision

of $150,000 funded from the Bridge Replacement Reserve for bridge capital works

following outcomes from future bridge inspections.

· Former

Byron Bay Hospital Redevelopment

In November 2018, the NSW

Government accepted a proposal from Council, on behalf of the community, to

retain the former Byron Hospital site as a community asset – the site was

sold to Council for this purpose.

On 27 June 2019, Council

resolved (19-286) to:

1. Note

the range of governance models investigated for the development and operation

of the former Byron Bay Hospital site

2.

Note the intention of the Community Steering Committee to form a

not-for-profit incorporated association to manage the project

3.

Nominate the incorporated association

formed by the Community Steering Committee as a direct lessee for the

site with a view to formalising the terms and conditions of this lease at the

next stage of the project

4. Be

provided with draft documentation for consideration prior to a lease being

negotiated, including but not limited to:

- Constitution of incorporated association and processes around Board election;

- Draft terms and conditions of head lease

- Draft terms and conditions of sub-leases

- Tenancy selection requirements

- Rental subsidy methodologies

5.

Request the General Manager, or his delegate, to

liaise with the Office of Local Government on the proposed mechanism to ensure

that Council meets its statutory requirements

In December 2019, Council provided the Community Steering

Committee with a draft head lease for consideration. In March 2020, the

Community Steering Committee provided Council with a draft constitution for the

incorporated association formed for the purposes of the project – Old

Byron Hospital Ltd.

During this period, staff and the committee have worked

together with architects DWP (http://dwp.com/) to develop concept plans for the site, which

will be reported to Council for endorsement in August 2020. These concept plans

have enabled staff and the committee to undertake more detailed financial

modelling on the project’s income and expenditure during both the

development and operational stages.

For Council to progress this project, there will need to be

a budget allocation in the 2020/2021 budget to provide for the project

management and construction of the required redevelopment works for the former

Byron Bay Hospital to facilitate the intended outcomes. This cost is estimated

at $3.5million and this amount is included as a budget adjustment. To fund

these works subject to appropriate approvals, it is recommended to borrow

internally from the Council’s Water Fund Capital Works Reserve. This

borrowing has the potential to be realised as an investment for the Water Fund

given the modelled interest payable on the loan, to be repaid to Council from

eventual rental income, is greater than Council can invest. If more funds

are required in the Water Fund than currently envisaged, it has the capacity to

borrow at most favourable interest rates and it is currently debt free. It is

suggested this could be a strategic use of Water Fund reserves subject to

approval.

In addition to Table 3 above, budgeted financial statements

incorporating an Operating Statement and Cash Flow Statement have been

produced. These financial statements, replicating the format of Council’s

Annual Financial Statements, are included in Attachment 1 as part of the

Operational Plan, along with a one page summary of all Council budget programs

as at 30 June 2021.

The immediate financial forecast of the General Fund for

2020/2021 has been discussed in detail in this report, however it is suggested

Council needs to look at its longer term financial position. The budget

projections still demonstrate the difficulty Council has absorbing additional

costs without corresponding revenue. It can only be emphasised that

Council must consider carefully the long term implications on its finances in

any consideration to add a new asset or service. The immediate issue to

redress during the course of the 2020/2021 financial year is the projected

budget deficit of $356,800 proposed should Council adopt the Draft 2020/2021

Budget outlined in this report. This will be a challenge for Council as it

continues navigating the COVID-19 pandemic.

Draft General Land Rates and

Charges (Statement of Revenue Policy)

The Draft 2020/21 Revenue Policy includes the proposed

rating structure, consistent with the structure revised by Council for the

2017-2018 financial year. This is outlined in Attachment 2. The rating

structure incorporates the final year of the approved 2017/2018 Special Rate

Variation (SRV) with the overall rate yield for 2020/21 increasing by 7.50%

(including rate pegging of 2.60% set by the Independent Pricing and Regulatory

Tribunal (IPART) for the 2020/21 financial year).

Given Council has an SRV approval for the financial years,

2017-2018 to 2020-2021, the Independent Pricing and Regulatory Tribunal (IPART)

has set the rating structure for the next two financial years, as the minimum

rates to apply have been determined by Order.

The 2020/21 financial year will also see the introduction of

new land valuations for the purposes of levying general land rates. The land

valuations are not determined by Council but by the NSW Valuer General. There

will be fluctuations in the general land rates payable by ratepayers and this

will solely be influenced by land value. Council has maintained the same rating

structure and revenue differentials applied to each rating category. Overall

land values have increased by 37.5% across the Shire but there have been some

significant and some smaller increases plus some decreases. This means that

while some ratepayers will see decreases, others will potentially see

significant increases. Increased land values do not increase Council’s

overall general land rating income, merely shift the balance of payment.

In respect of other charges, the Draft 2020/21 Revenue

Policy includes the following:

· Waste

Charges – increases in accordance with the Consumer Price Index (CPI)

– 1.80%

· Water

access charges increasing around 1.6% and water usage charges increasing by

7.7% from $2.60 to $2.80 per kilolitre. Water will now be the same price for

usage irrespective of whether a consumer is residential or non-residential,

providing equity for all consumers and continuation of the single tariff

introduced in the 2019/2020 financial year.

· Increasing

the sewerage access charge for residential consumers from $857 per annum to

$1,257 per annum. Whilst representing an increase of $400 per annum, the

increase will be offset by the removal of the sewerage usage charge for

residential consumers charged quarterly via the water/sewerage usage account.

These accounts will be issued in relation to 2020/2021 water consumption only.

The rationale for making this change for residential sewerage charges is as

follows:

o Council will be consistent with every other Council in NSW.

o WaterNSW only supports volumetric sewerage charges for

non-residential ratepayers in accordance with best practice pricing guidelines.

o The current charging is unfair because Council cannot accurately

measure each property’s discharge to the sewerage system. It is

currently assumed that 75% of water consumed is returned to the sewer.

o Residential ratepayers lack the ability to control discharge which

therefore creates a weak pricing signal which is the main intention of

volumetric charging.

o The sewerage charge will be come a fixed amount and a known

quantity. It will no longer vary based on water consumption.

o Provides more certainty to Council in respect of sewerage revenue as

the variability of water consumption is removed.

· The

stormwater charge has not increased. It is a regulated charge that has not

changed over the last fourteen years.

Draft Fees and Charges (Statement

of Revenue Policy)

The Draft 2020/21 Fees and Charges have been reviewed by the

respective program managers and included at Attachment 2. Where possible,

fees have been altered/increased to reflect the following specific changes:

· Increases

in the Consumer Price Index (CPI)/Indexation - assumed at 1.80%.

· Review

of fees and charges including benchmarking/cost of service provision and where

possible, introduction of new fees to assist Council to generate

additional/enhanced revenue.

During the exhibition period the Office of Local Government

released Circular 20-27 concerning revised fees for companion animals in line

with CPI. These changes will be made to the Adopted 2020/2021 Fees and Charges

as these fees are set by the NSW government, so are not required to be

exhibited and Council must implement them.

Proposed Amendments

It is proposed to further amend the 2020/2021 Fees and charges

with the following changes:

Air Space Usage Charges

Council’s Air Space Policy was adopted in 2012. The

policy was reviewed in 2017, where the amendments involved the requirement for

new constructions to seek approval under the Roads Act and existing buildings

be required to enter into a lease. Fees for licences were set at the same price

per m2 as footpath dining licences. This was later reviewed and

reduced by 50% in 2019. The current fees are:

|

Bangalow

|

$127.50 per m2 annually

|

|

Brunswick Heads

Brunswick Terrace, Fingal, Park and Mullumbimbi Streets

|

$108.00 per m2

annually

|

|

Byron Bay – Precinct 1 and 2

|

$240 .00 per m2

annually

|

|

Byron Bay – Remaining properties

|

$181.50 per m2

annually

|

|

Mullumbimby

|

$87 per m2

annually

|

|

Remainder of Shire

|

$87 per m2

annually

|

Council engaged a valuer to

undertake a review of the current airspace fee

structure. During this time the real estate markets have been

considerably impacted by COVID-19. There is

uncertainty around the implications of this on commercial rents

and real estate values. This valuation is based on pre-COVID-19 rentals. It

provides varying licence fee methodologies as used by other Councils to charge

for airspace usage.

On investigation of the varying methodologies used, the

valuer noted that methodologies adopted for determination of airspace rents

vary, with no one-single valuation methodology adopted. These include:

1. Direct comparison to other airspace rents.

2. Percentage of the rental value of the adjoining

commercial premises.

3. Market rent for developed veranda less the cost to

construct and an amount return on cost.

4. Percentage return on the value of the underlying land.

5. Percentage of value of the underlying land discounted

based on Maximum Floor Space Ratio.

6. Per chair basis, based on footpath dining rate.’

These methodologies are discussed in the valuation report at

Confidential Attachment 3.

The final recommendation in the

report is ‘that Council adopts a policy whereby licence fees

are determined at market by valuation, this represents the fairest and most

equitable approach to individual licensees, for different licence

purposes.’

Given the recommendation and acknowledging the current real

estate market, it is recommended that the 2020/21 fees and charges be amended

whereby licence fees are determined on an individual basis by market valuation.

Hall Fees and Charges

Council has received requests from Hall Committees to amend

the proposed draft fees and charges as follows:

· Bangalow

Showground – hire of the Old Scout Hall for half day should be $75.00

representing half of the daily fee of $150. It is currently listed at

$50. Additionally clarification is requested for evening fees for the Old

Scout Hall and Moller with the clarification being evening fees apply from 6pm.

· Bangalow A&I

Hall – amend fees for the use of air-conditioning at $100 and use of the

upgraded kitchen at $220 per day.

· Brunswick Valley

Community Centre – add a new fee for meals on wheels storage at $50 per

day.

The fees under the heading ‘Proposed Amendments’

are yet to be advertised in accordance with Section 610F of the Local

Government Act 1993 and it is recommended that Council resolves to publicly

exhibit the proposed fees and adopt them at the conclusion of the public

exhibition period if there are no submissions.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

|

CSP Strategy

|

|

DP Action

|

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.2

|

Create a

culture of trust with the community by being open, genuine and transparent

|

5.2.1

|

Provide timely,

accessible and accurate information to the community

|

5.2.1.1

|

Review

Operational Plan annually

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.5

|

Manage

Council’s finances sustainably

|

5.5.2

|

Ensure the

financial integrity and sustainability of Council through effective planning

and reporting systems (SP)

|

5.5.2.2

|

Complete annual

statutory financial reports

|

Legal/Statutory/Policy

Considerations

Section 405 of the Local Government Act outlines

the Operational Plan requirements, including public exhibition and timeframes.

The specific statements that

Council is required to disclose as part of its Revenue Policy are determined by

Clause 201 of the Local Government (General) Regulation

2005.

Financial Considerations

The Operational Plan includes the annual budget required to

fund the projects and services delivered as part of the Plan. The financial

implications are outlined in the body of this report.

Consultation and Engagement

The Draft 2020/21 Operational Plan and Budget have been

prepared based on the strategic priorities in the Community Strategic Plan and

insights from the 2018 Community Solutions Panel (infrastructure) and the 2018

Community Satisfaction Survey.

Initial community feedback was obtained through community

conversations held in February. The presentation included discussion on:

- how

the budget and operational plan are developed

- outcomes

and progress on investment of SRV and pay-parking funds

- projects

being considered

- input

on priorities from attendees.

The Draft 2020/21 Operational Plan and Budget was subject to

28 days’ public exhibition, from 25 June to 23 July 2020.

Community feedback was sought online via www.yoursaybyronshire.com.au

and an information booth in the Mullumbimby Office front foyer. Emails,

public notices, and media releases were distributed to reach the widest

population possible and provide the community with information and links to

engage with Council.

A detailed report of the outcomes of this consultation and engagement is

provided at Attachment 4 and the recommended amendments as per the public

exhibition are outlined in section “Draft 20/21

Operational Plan – amendments” of this report.

Submissions received:

Council received 12 written submissions. Council is required to

consider any submissions received during the exhibition period prior to the

Council’s endorsement and/or adoption of these documents.

The submissions have been considered and the proposed

changes to the Operational Plan are outlined in this report. A summary and

responses are provided in the comprehensive feedback document at Attachment 4.

The key issues raised are noted below:

· Footpath

maintenance and upgrades

· Pest animals

· Bush regeneration

· Bangalow Village

Plan

· Financial

management

· Accessibility

Staff Reports - Corporate and Community Services 4.3

Report No. 4.3 Making

of the 2020/21 Ordinary Rates, Charges, Fees and Interest Rate

Directorate: Corporate

and Community Services

Report

Author: Stephen

Ansoul, Revenue Coordinator

File No: I2020/1066

Summary:

Council placed the Draft 2020/21

Statement of Revenue Policy comprising the Budget Estimates, Rates and Charges,

Borrowings and Fees and Charges on public exhibition for twenty eight days

following consideration of Report No.13.4 Draft 2020/21 Operational Plan and

Budget for public exhibition in its Meeting held on 25 June 2020 (Council resolution

20-343).

The Statement of Revenue Policy

provides a detailed description of the rating structure for ordinary land

rates, charges and fees that Council will levy on the 2020/21 Rates and Charges

Notice, and describes the circumstances of a property to which a specific

ordinary rate, charge, interest or fee will apply. It also lists relevant

sections of legislation that allows for the levy of each rate, charge or fee to

be made.

Some statutory requirements have

been modified due to the COVID-19 pandemic.

The public

exhibition period seeking submissions on the draft documents closed on 23 July

2020, with the details of those submissions being the subject of another report

to this meeting.

Each year Council is required to make the ordinary

rates and charges pursuant to sections 533, 534 and 535 of the Local Government

Act 1993 (LGA), with section 543 of the LGA requiring Council to make a short

separate name for each rate and charge it makes. Council is also required to

set the rate of interest charged on overdue rates and charges in accordance

with section 566 (3) of the LGA.

This report satisfies these legislative

requirements for the 2020/2021 financial year.

|

RECOMMENDATION:

That in accordance with Sections 533,

534, 535, 543 and 566 of the Local Government Act 1993 (LGA), Council makes

the ordinary rates, makes the charges, makes the fees and sets the interest

rate to be charged on overdue rates and charges for 2020/21 listed in the

following tables.

1. Ordinary Rates

|

Name of Ordinary

Rate

(Rate Notice short

name)

|

*Rate in the Dollar

or Ad-Valorem amount ($)

|

Minimum Rate ($)

|

|

Ordinary

Rate Residential

|

0.1967

|

928.00

|

|

Ordinary

Rate Residential Flood

|

0.1967

|

464.00

|

|

Ordinary

Rate Business

|

0.3275

|

928.00

|

|

Ordinary

Rate Business Byron CBD

|

0.4616

|

928.00

|

|

Ordinary

Rate Mining

|

0.3275

|

928.00

|

|

Ordinary

Rate Farmland

|

0.1752

|

928.00

|

|

Ordinary

Rate Farmland Flood

|

0.1752

|

464.00

|

*Applied to 2019 base date land valuation

2. Domestic Waste Management Charges

|

Name of Domestic Waste

Collection Charge

(Rate Notice short

name)

|

Annual Charge ($)

|

|

Domestic

Waste 80L 3 Bin Collection

|

150.00

|

|

Domestic

Waste 140L 3 Bin Collection

|

316.00

|

|

Domestic

Waste 240L 3 Bin Collection

|

468.00

|

|

Domestic

Waste 140L Week Collect 3 Bins

|

827.00

|

|

Domestic

Waste 240L Week Collect 3 Bins

|

1054.00

|

|

Domestic

Waste 140L 2 Bin Rural Service

|

226.00

|

|

Domestic

Waste 240L 2 Bin Rural Service

|

336.00

|

|

Domestic

Waste Vacant Land Charge Urban

|

31.00

|

|

Domestic

Waste Vacant Land Charge Rural

|

31.00

|

|

Domestic

Waste Exempt Collection Charge

|

61.00

|

|

Domestic

Recycling Additional Bin

|

105.00

|

|

Domestic

Organics Additional Bin

|

121.00

|

|

Domestic

Waste 80L 3Bin Multi Unit Serv

|

150.00

|

|

Domestic

Waste 140L 3Bin Multi Unit Serv

|

316.00

|

|

Domestic

Waste 240L 3Bin Multi Unit Serv

|

468.00

|

|

Domestic

Waste 80L 2Bin Multi Unit Serv

|

150.00

|

|

Domestic

Waste 140L 2Bin Multi Unit Serv

|

316.00

|

|

Domestic

Waste 240L 2Bin Multi Unit Serv

|

468.00

|

|

Domestic

Waste Strata 2Bin Share Service

|

250.00

|

|

Domestic

Waste Strata 3Bin Share Service (fortnightly)

|

250.00

|

|

Domestic

Waste Strata 3Bin Share Service (weekly)

|

501.00

|

3. Waste Management Charges (Non-Domestic)

|

Name of Waste Management

Charge

(Rate Notice short

name)

|

Annual Charges ($)

|

|

Commercial

140L Waste & Recycle Service

|

510.00

|

|

Commercial

240L Waste & Recycle Service

|

584.00

|

|

Commercial

Waste 140L Bin Collection

|

510.00

|

|

Commercial

Waste 240L Bin Collection

|

584.00

|

|

Commercial

Rural Waste & Recycle Service

|

525.00

|

|

Commercial

Recycling 240L Bin Collection

|

131.00

|

|

Commercial

Organics 240L Bin Collection

|

121.00

|

|

Waste

Operations Charge Residential

|

86.00

|

|

Waste

Operations Charge Non-Residential

|

86.00

|

4. Mixed Waste Bin Changeover Fee

|

Fee

|

Charges ($)

|

|

Mixed

waste bin – size/capacity changeover fee

(first

changeover free of charge then all subsequent changes per property per

annum per owner/s attracts fee)

|

57.00

|

5. Stormwater Management Service Charges

|

Name of Stormwater

Management

Service Charge

(Rate Notice short

name)

|

Annual Charges ($)

|

|

Stormwater

Charge Residential

|

25.00

|

|

Stormwater

Charge Residential Strata

|

12.50

|

|

Stormwater

Charge Business Strata

|

$25.00 per 350m² of the

land area occupied by the strata scheme (or part thereof), proportioned by

the unit entitlement of each lot in the strata scheme, minimum charge $5.00

|

|

Stormwater

Charge Bus/Mixed Strata Min

|

12.50

|

|

Stormwater

Charge Business

|

$25.00, plus an additional

$25.00 for each 350m² or part thereof by which the area of the parcel

of land exceeds 350m²

|

6. Water Charges

|

Name of Water

Charge

(Rate Notice short

name)

|

Annual Charges ($)

|

|

Water

Access Charge 20mm Residential

|

190.00

|

|

Water

Access Charge 20mm Non-Residential

|

190.00

|

|

Water

Access Charge 25mm Residential

|

298.00

|

|

Water

Access Charge 25mm Non-Residential

|

298.00

|

|

Water

Access Charge 32mm Residential

|

489.00

|

|

Water

Access Charge 32mm Non-Residential

|

489.00

|

|

Water

Access Charge 40mm Residential

|

762.00

|

|

Water

Access Charge 40mm Non-Residential

|

762.00

|

|

Water

Access Charge 50mm Residential

|

1,191.00

|

|

Water

Access Charge 50mm Non-Residential

|

1,191.00

|

|

Water

Access Charge 65mm Residential

|

2,013.00

|

|

Water

Access Charge 65mm Non-Residential

|

2,013.00

|

|

Water

Access Charge 80mm Residential

|

3,049.00

|

|

Water

Access Charge 80mm Non-Residential

|

3,049.00

|

|

Water

Access Charge 100mm Residential

|

4,763.00

|

|

Water

Access Charge 100mm Non-Residential

|

4,763.00

|

|

Water

Access Charge Vacant Residential

|

96.00

|

|

Water

Access Charge Vacant Non-Residential

|

96.00

|

|

|

Usage Charges ($)

|

|

Water

Usage Charge Residential

|

2.80 per KL

|

|

Water

Usage Charge Residential – Non-Compliant

|

5.60 per KL

|

|

Water

Usage Charge Non-Residential

|

2.80 per KL

|

|

Water

Usage Charge Non-Residential - Non-Compliant

|

5.60 per KL

|

7. Wastewater (sewer) Charges and On Site Sewage

Management System Fee

|

Name of Wastewater (sewer)

Charge or Fee

(Rate Notice short

name)

|

Annual Charges or

Fee ($)

|

|

Wastewater

(sewer) Access 20mm Res

|

1,257.00

|

|

Wastewater

(sewer) Access 20mm Non-Res

|

849.00

|

|

Wastewater

(sewer) Access 25mm Res

|

1,964.00

|

|

Wastewater

(sewer) Access 25mm Non-Res

|

1,327.00

|

|

Wastewater

(sewer) Access 32mm Res

|

3,218.00

|

|

Wastewater

(sewer) Access 32mm Non-Res

|

2,173.00

|

|

Wastewater

(sewer) Access 40mm Res

|

5,028.00

|

|

Wastewater

(sewer) Access 40mm Non-Res

|

3,396.00

|

|

Wastewater

(sewer) Access 50mm Res

|

7,856.00

|

|

Wastewater

(sewer) Access 50mm Non-Res

|

5,306.00

|

|

Wastewater

(sewer) Access 65mm Res

|

13,277.00

|

|

Wastewater

(sewer) Access 65mm Non-Res

|

8,968.00

|

|

Wastewater

(sewer) Access 80mm Res

|

20,112.00

|

|

Wastewater

(sewer) Access 80mm Non-Res

|

13,584.00

|

|

Wastewater

(sewer) Access 100mm Res

|

31,425.00

|

|

Wastewater

(sewer) Access 100mm Non-Res

|

21,225.00

|

|

Wastewater

(sewer) Access Vacant Res

|

629.00

|

|

Wastewater

(sewer) Access Vacant Non-Res

|

629.00

|

|

Wastewater

(sewer) Access – Pump Res

|

1,232.00

|

|

Wastewater

(sewer) Access – Pump Non-Res

|

824.00

|

|

On-Site

Sewage Management System Fee (OSMS)

|

50.00

|

|

|

Usage Charges ($)

|

|

Wastewater

(sewer) Usage Charge Non-Residential

|

*SDF x 2.80 per KL

|

*SDF = Individual Property Sewer Discharge Factor (%)

8. Liquid Trade Waste Charges

|

Name of Liquid

Trade Waste Charge

(Rate Notice short

name)

|

Annual Charges ($)

|

|

Liquid

Trade Waste – Category 1

|

160.00

|

|

Liquid

Trade Waste – Category 2

|

267.00

|

|

Liquid

Trade Waste – Category 2S

|

267.00

|

|

Liquid

Trade Waste – Category 3

|

757.00

|

|

|

Usage Charges ($)

|

|

Liquid

Trade Waste Usage Charge

|

**TWDF x 2.34 per KL

|

|

Liquid

Trade Waste Usage Charge – Non-Compliant Cat 1

|

**TWDF x 3.87 per KL

|

|

Liquid

Trade Waste Usage Charge – Non-Compliant Cat 2/2S

|

**TWDF x 17.10 per KL

|

|

Liquid

Trade Waste Usage Charge – Non-Compliant Pump Stn

|

**TWDF x 3.87per KL

|

*TWDF = Individual Property Trade Waste Discharge

Factor (%)

9. Interest Rate on Overdue Rates and Charges

|

Name of Interest

Rate

(Rate Notice short

name)

|

Rate (%)

|

|

Interest

(01/07/2020 to 31/12/2020)

|

0.0%

|

|

Interest

(01/01/2021 to 30/06/2021)

|

7.0%

|

|

REPORT

Council will be continuing to apply the

Special Rate Variation (SRV) approval from the Independent Pricing and

Regulatory Tribunal (IPART) received on 9 May 2017 to increase its permissible

general income by 7.5% per annum for four rating years from 2017/18 (section

508A LGA). The 2020/21 financial year is the fourth and final year of the

increase. This SRV incorporates the rate pegging limit (which was announced as

2.6% for 2020/21).

The amounts outlined in the first table in

the recommendation to this report headed Ordinary Rates incorporate the 7.5%

SRV as it applies for the 2020/21 financial year. The permissible notional

income has not been re-calculated since Council publicly exhibited the Draft

2020/21 Statement of Revenue Policy. The ordinary land rates for

ratepayers individually for the 2020/2021 financial year will also be

influenced by new land valuations provided by the Valuer General, although any

increase in land value does not increase Council’s overall revenue yield

from ordinary rates due to the overall limit via rate pegging on

Council’s ordinary rate revenue.

The Office of Local Government advised via

Circular 20-21 on 26 May 2020 that the maximum interest rate on overdue rates

and charges is to be 0.0% for the first half of the 2020/21 Financial Year (due

to the COVID-19 pandemic) and then 7.0% thereafter. Council has traditionally

adopted the maximum permissible interest rate for overdue rates and charges.

This report and subsequent resolution satisfies the

legislative requirement for Council to make a rate or charge for the 2020/2021

financial year.

The levying of 2020/21 ordinary

rates and annual charges pursuant to section 546 of the LGA via the issuing of

a rates and charges notice will be undertaken prior to 31 August 2020.

This is one month later then is normally the case but is in keeping with COVID

amendments.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.5

|

Manage

Council’s finances sustainably

|

5.5.2

|

Ensure the

financial integrity and sustainability of Council through effective planning

and reporting systems (SP)

|

5.5.2.5

|

Manage treasury

functions of Council to maintain cash flow and maximise return on invested

funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

The Office of Local Government issued

Circular 20-12 on 17 April 2020 advising that Regulations have been made under

section 747B of the Local Government Act 1993 to temporarily modify the

application of the Act in response to the COVID‑19 pandemic. The

regulations made under section 747B modify the Act by:

·

Providing councils with a one-month extension to

adopt their 2020/21 Operational Plan (including Revenue Policy, Statement of

Fees and Charges and annual budget) before 31 July 2020.

·

Providing Councils with the option to delay

issuing rates notices to ratepayers until 1 September 2020, and the collection

of the first quarter rates instalment until 30 September 2020.

As a result of these changes, a

number of statutory deadlines have been modified. These are set out in the

table below:

|

Section of LG Act

|

Prior deadline

|

New deadline

|

|

Adoption of Operational Plan - 405(1)

|

By 1 July 2020

|

By 1 August 2020

|

|

Making of a rate or charge - 533

|

By 1 August 2020

|

By 1 September 2020

|

|

Date by which quarterly rates are payable - 562(3)(a)

|

31 August 2020

|

30 September 2020

|

Council is still required to make the rates

and charges and set the interest rate for 2020/21 pursuant to sections 533,

534, 535,543 and 566 of the Local Government Act 1993 (LGA). The relevant sections or sub-sections of the LGA are

summarised below:

533 Date by which a

rate or charge must be made

A rate or charge must be made before 1 August (1

September for 2020/21) in the year for which the rate or charge is made or

before such later date in that year as the Minister may, if the Minister is of

the opinion that there are special circumstances, allow.

534 Rate

or charge to be made for a specified year

Each rate or charge is to be made for a specified year,

being the year in which the rate or charge is made or the next year.

535 Rate

or charge to be made by resolution

A rate or charge is made by resolution of the council.

543 Each

form of a rate and each charge to have its own name

Council must, when making an ordinary rate or charge, give a

short separate name for each amount of the ordinary rate or charge.

566 Accrual

of interest on overdue rates and charges

The rate of interest is that set by the council but must

not exceed the rate specified for the time being by the Minister by notice

published in the Gazette.

Financial Considerations

The 2020/2021 budget, including proposed works and services

to be adopted by Council at this Extraordinary Meeting, is the subject of

another report.

The Draft 2020/21 Budget Estimates have been based on the

special rate variation increase of 7.5% as approved by the Independent Pricing

and Regulatory Tribunal (IPART) for the general rate income in its fourth and

final year.

Charges proposed for water, wastewater (sewer), stormwater

and waste services have been based on the works and maintenance requirements of

those areas and in conjunction with legislative requirements of the LGA to

establish such charges.

Public Access relating to items

on this Agenda can be made from 4pm on the day of the Meeting.

Requests for public access should be made to the General Manager or Mayor no

later than 12.00 midday on the day prior to the Meeting.

Public Access relating to items

on this Agenda can be made from 4pm on the day of the Meeting.

Requests for public access should be made to the General Manager or Mayor no

later than 12.00 midday on the day prior to the Meeting.