Agenda

Ordinary

Meeting

Thursday,

22 October 2020

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 9.00am

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Mark

Arnold

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the Code

of Conduct for Councillors (eg. A friendship, membership of an association,

society or trade union or involvement or interest in an activity and may

include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or vice-versa).

Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as of the provisions in the Code of Conduct (particularly if you have a significant

non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a meeting

of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Ordinary Meeting

BUSINESS OF Ordinary Meeting

1. Public Access

2. Apologies

3. Requests for Leave of

Absence

4. Declarations of Interest

– Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary

Interest Returns (Cl 4.9

Code of Conduct for Councillors)

6. Adoption of Minutes from

Previous Meetings

6.1 Ordinary

Meeting held on 24 September 2020

7. Reservation of Items for

Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 MURC

Bayshore Dr to Tyagarah..................................................................................... 5

10. Petitions

10.1 To

REFUSE Development Application DA 10.2020.370.1 - 68 Byron Street BANGALOW 8

11. Submissions and Grants

11.1 Grants

and Submissions October 2020............................................................................ 9

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Grant

of five year licence over Tyagarah Hall (25 Staceys Way, Tyagarah)................ 12

13.2 Five

year licence to Shara Community Garden Incorporated........................................ 15

13.3 Byron

Masterplan Guidance Group - appointment of new members............................ 19

Corporate and Community Services

13.4 Annual

Report 2019/20.................................................................................................... 22

13.5 Council

Investments - 1 September 2020 to 30 September 2020.................................. 26

13.6 Draft

2019/2020 Financial Statements............................................................................ 33

Sustainable Environment and Economy

13.7 Public

Exhibition for the 2020 - 2030 Byron Shire Sustainable Visitation Strategy and

Resilience discussion paper.............................................................................................................. 42

Infrastructure Services

13.8 Dingo

Lane Solar Farm Project Progress and Owners Consent to Submit Development

Application......................................................................................................................................... 45

13.9 Report

of Coastal Estuary Catchment Panel Meeting held on 10 September 2020...... 51

14. Reports of Committees

Corporate and Community Services

14.1 Report

of the Audit, Risk and Improvement Committee Meeting held on 20 August 2020 53

Infrastructure Services

14.2 Report

of the Local Traffic Committee Meeting held on 8 September 2020................. 58

14.3 Report

of the Local Traffic Committee Meeting held on 22 September 2020............... 63

14.4 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 8

October 2020......................................................................................................................................... 66

15. Questions

With Notice

Questions with Notice: A response to Questions with

Notice will be provided at the meeting if possible, that response will be

included in the meeting minutes. If a response is unable to be provided

the question will be taken on notice, with an answer to be provided to the person/organisation

prior to the next Ordinary Meeting and placed on Councils website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

16. Confidential Reports

General Manager

16.1 Confidential - Annual Review of GM's

performance.............................................. 69

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director prior to the meeting. Any suggested amendments to the

recommendations should be provided to Councillor Support prior to the meeting

to allow the changes to be typed and presented on the overhead projector at the

meeting.

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 MURC

Bayshore Dr to Tyagarah

File No: I2020/1560

|

I move:

1. That

Council prioritises the section of rail corridor between Bayshore Drive and

Tyagarah for investigation into the alternatives including multi use.

2. That

Council seeks landowners consent to carry out environmental works on the rail

corridor between Bayshore Drive and Tyagarah

3. That

Council seeks funding

a) for

the clearing of the vegetation on the line

b) for

the planting of suitable native species in the corridor with local Land Care

and environmental groups and

c) to

establish the corridor as a wildlife corridor.

4. That

Council, when funding is available, commissions a structural assessment and

cost estimate of the 6 timber bridges suitable for

a) combined

light rail and cycle/walkway and

b) cycle/walkway

on the rail line

|

Signed: Cr

Alan Hunter

Councillor’s supporting information:

Council has so far been unsuccessful

in securing expressions of interest from potential sponsors, commercial

operators, or government funding programs despite 16 years of discussions and

much council time and expense.

Government agencies have also not

expressed any interest in funding vegetative regeneration with our current

plans for the corridor unlike the 2 councils at each end of the rail corridor,

who have both been successful in securing funding for their rail trail plans in

the corridor.

The Casino to Murwillumbah rail

corridor has now been closed for any vehicular traffic on the rail line at each

end making any extension into Qld or rail connection south further into NSW

almost impossible.

The financial circumstances, post

COVID-19, for governments has now changed and will now find difficulty in

justifying the once favoured social projects and no doubt will continue to do

so in the wake of the pandemic.

The 4.7km of rail corridor from

Bayshore Drive to Tyagarah is relatively lightly overgrown and allows safer

access for staff, volunteers and contractors to do their work along the line.

It is also the cheapest and easiest to access by road.

This affords an opportunity to lower

the upfront expense and gain a better idea of the sort of options sooner than a

taking on a longer section of the corridor to Mullumbimby. Any further west

from Tyagarah will be significantly more expensive and take longer to do.

This section of the track is probably

to most valuable link for the wildlife corridor from west to east and would be

most beneficial for the safety of our little fury and other friends of the bush

providing safe passage away from the speeding traffic.

Staff comments by Christopher Soulsby, Acting Manager

Assets and Major Projects, Infrastructure Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

This notice of motion is partly inconsistent with resolution

20-518

Resolved:

1. That

Council closes Resolution 19-335, with the remaining actions being duplicated

within Resolution 20-127.

2. That

Council considers a budget allocation at the September quarterly review to undertake

further work on the Rail with Trail on the corridor between Mullumbimby and

Byron Bay. (Richardson/Cameron)

If this notice of motion is adopted it refines the scope of

the task and adds additional requirements. The inconsistency arises from

item 4 (b). The previous reports and resolutions on the MURC are

predicated on rail with trial. Item 4(b) whilst it is only seeking a

costing of the option for a trail on the formation, it will allow for a

comparison between the two options. This notice of motion gives clear

guidance to staff on the task to be carried out and the area of rail

infrastructure to be considered.

The approval pathway is via the SEPP Infrastructure.

Clause 79 of the SEPP allows for rail infrastructure facilities to be carried

out without development consent. This includes routine maintenance

(clearing of vegetation from the tracks) and environmental works if carried out

by or on behalf of a public authority.

Financial/Resource/Legal Implications:

If this NOM is adopted a revised cost estimate will be

provided in the quarterly budget review to undertake the works.

Is the proposal consistent with any Delivery Program

tasks?

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 1: We have infrastructure, transport and services which meet

our expectations

|

1.3

|

Support,

through partnership, a network of integrated sustainable transport

options

|

1.3.1

|

Ensure an

integrated and accessible transport network (SP)

|

1.3.1.5

|

Provide a

quarterly update report on the outcome of discussions with State government

and agencies about the multi-use of the rail corridor, including any policy

developments and funding opportunities identified

|

|

Community

Objective 1: We have infrastructure, transport and services which meet

our expectations

|

1.3

|

Support,

through partnership, a network of integrated sustainable transport

options

|

1.3.1

|

Ensure an

integrated and accessible transport network (SP)

|

1.3.1.6

|

Develop a

governance model to support rail corridor activation

|

|

Community

Objective 3: We protect and enhance our natural environment

|

3.1

|

Partner to

protect and enhance our biodiversity, ecosystems and ecology

|

3.1.2

|

Restore

degraded areas and habitats that have or provide significant or high

environmental and or community value

|

3.1.2.1

|

Undertake bush

regeneration activities to maintain and expand restoration of HEV sites on

Council owned or managed lands forming part of the Council bush regeneration

program

|

|

|

|

|

|

|

|

|

|

|

|

|

Petitions 10.1

Petitions

Petition No. 10.1 To REFUSE Development Application DA 10.2020.370.1 - 68 Byron Street

BANGALOW

Directorate: Sustainable Environment and Economy

Report

Author: Shannon

Burt, Director Sustainable Environment and Economy

File No: I2020/1428

Council is in receipt of a petition with 103 signatures

which states:

‘We the

undersigned petition Byron Council to REFUSE DA 2020.370 for the following

reasons

1. If allowed the Development would have a negative

impact on the Bangalow Heritage Conservation Area.

2. The Proposal does not comply with the future

direction of Bangalow Village; to protect our heritage buildings and

established gardens.

3. The removal of the established garden and the

addition of a detached commercial building would have a negative impact on the

location, impacting the appearance and amenity of the heritage precinct and

have an unacceptable impact on the adjoining property.

In Summary: We the

undersigned believe this is an overdevelopment of the historical site and not

in keeping with the charm and character of Bangalow as a Heritage Village

valued by locals and popular with visitors to our area. The DA is not in the

public interest.’

Comments from Director Sustainable Environment and Economy:

Development Application DA 10.2020.370.1 was presented to

the Planning Review Committee (PRC) on the 17 September 2020. The PRC has

called up the DA to Council for determination at a future meeting. The matters

raised in the petition will be considered in the staff assessment report to

Council.

|

RECOMMENDATION:

1. That

the petition regarding Development Application DA 10.2020.370.1 - 68

Byron Street BANGALOW be noted.

2. That

the petition be referred to the Director Sustainable Environment and Economy.

|

Attachments:

1 Confidential

- 10.2020.370.1 Petition 103 Signature - For refusal of DA, S2020/8444

Submissions and Grants 11.1

Submissions and Grants

Report No. 11.1 Grants

and Submissions October 2020

Directorate: Corporate

and Community Services

Report

Author: Alexandra

Keen, Grants Coordinator

File No: I2020/1529

Summary:

Council has submitted applications

for a number of grant programs which, if successful, would provide funding to

enable the delivery of identified projects. This report provides an update on

these grant submissions.

|

RECOMMENDATION:

That That Council notes

the report and Attachment 1 (E2020/79328) for Byron Shire Council’s

Submissions and Grants as at 1 October 2020.

|

Attachments:

1 Attachment

1 - Grants and Submissions Table, E2020/79328

REPORT

This report provides an update on

grant submissions since the last report.

Successful applications

In

September 2020, Council was successful in obtaining a $402,679 grant from the

Australian Government’s Bridges Renewal Program Round 5 for replacing

Main Arm Causeway #2, and a $2,000 grant from NSW Government’s Small

Business Month Program 2020 to host a workshop for small businesses in October

2020.

Unsuccessful applications

Council was not advised of any

unsuccessful applications during September 2020.

Applications submitted

Three grant applications were submitted in September 2020

for:

· Youth

Opportunities Program – Byron Shire Youth Solutions;

· Coastal

Zone Management Program - New Brighton Sand Dune Protection Project; and

· Australia

Day Branding Grant.

In late August 2020, four applications were submitted under

Transport for NSW’s Safer Roads Program for:

· Coorabell

Road;

· Wilsons

Creek Road;

· The

Pocket Road; and

· Tweed

Valley Way.

Upcoming grant opportunities

There are a number of upcoming grant opportunities for which

Council may submit funding applications including:

· Fixing

Country Roads 2020;

· Fixing

Country Bridges 2020;

· Everyone

Can Play Grants; and

· NSW

Public Library Infrastructure Grants.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 5: We have community led

decision making which is open and inclusive

|

5.6

|

Manage Council’s resources sustainably

|

5.6.12

|

Implement strategic grants management systems to deliver

priority projects for Byron’s community (SP)

|

5.6.12.4

|

Provide governance for grants management

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Under

Section 409 3(c) of the Local Government Act 1993 Council is

required to ensure that ‘money that has been received from the Government

or from a public authority by way of a specific purpose advance or grant, may

not, except with the consent of the Government or public authority, be used

otherwise than for that specific purpose’. This legislative requirement

governs Council’s administration of grants.

Financial Considerations

If

Council is successful in obtaining the identified grants, more than $14 million

would be achieved which would provide significant funding for Council

projects. Some of the grants require a contribution from Council (either

cash or in-kind) and others do not. Council’s contribution is funded.

The potential funding and

allocation is noted below:

|

Requested funds from funding bodies

|

$14,963,632

|

|

Council cash contribution

|

$2,321,857

|

|

Council in-kind contribution

|

$214,532

|

|

Other contributions

|

$112,869

|

|

Funding applications submitted and awaiting

notification (total project value)

|

$17,612,890

|

Consultation and Engagement

Cross-organisational consultation has occurred in relation

to the submission of relevant grants, and the communication of proposed grant

applications

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Grant

of five year licence over Tyagarah Hall (25 Staceys Way, Tyagarah)

Directorate: General

Manager

Report

Author: Pattie

Ruck, Open Space Facilities Coordinator

File No: I2020/1196

Summary:

Council advertised for a

Request for Proposal for a five (5) year licence over the premise at 25 Staceys

Way, Tyagarah colloquially known as the Tyagarah Hall. The Request for

Proposal was publically advertised from 13 July and closed at 2pm on 11 August

2020.

Submissions received for the

Request for Proposal were assessed by an independent Evaluation Panel from 12

to 24 August 2020 in accordance with the Tender Evaluation Plan. This

report recommends that the Evaluation Panel’s preferred Respondent is

granted a five (5) year licence to occupy the Tyagarah Hall for the purpose of

a community facility.

|

RECOMMENDATION:

That Council resolves to grant a five (5) year

licence to Tyagarah Community Association as the preferred respondent, over

part Folio 49/881232, 25 Staceys Way, Tyagarah colloquially known as the

Tyagarah Hall.

|

Attachments:

1 Confidential

- RFP-2020 Evaluation Panel Report: 5yr Licence over Tyagarah Hall, E2020/64130

REPORT

Council at its 13 December 2018 meeting resolved (18-825)

to reject all submissions received from a previous Request for Proposal process

to occupy the Tyagarah Hall for commercial purposes.

A subsequent Council resolution (19-237) from the 23

May 2019 meeting required a new expression of interest to be called from

non-profit organisations to licence the Tyagarah Hall and its immediate

surroundings.

A new Request for Proposal was run between 13 July and 11

August 2020 calling for non-profit associations to licence the Tyagarah Hall

over five (5) years. Council received two submissions:

1. COMS

Maritime Trainers and assessors Incorporated; and

2. Tyagarah

Community Association.

Evaluation of submissions

received:

Submissions received were assessed against predetermined

Compliance and Qualitative criteria’s.

The evaluation assessment period ran between 12 and 24

August 2020 in accordance with the Evaluation Plan. The Evaluation Panel was

chaired by the Community Project Officer (Joanne McMurtry) with probity advice

was provided by the Legal Counsel (Ralph James).

In accordance with the Evaluation Plan, the Evaluation Panel

was required to:

a) Evaluate

the compliance criteria and establish that a submission was compliant;

b) Score

the qualitative criteria;

c) Clarify

information with respondents if required; and

d) Make

recommendations of a preferred Respondent.

The Evaluation Panel independently evaluated both Request

for Proposal submissions by scoring each against the below compliance and

weighted qualitative criteria’s:

|

Compliance Criteria

|

|

1. Instrument of proposal:

i. Organisations name and details:

ii. ABN and Not-For-Profit

registration:

iii. Referee name and contacts:

|

|

2. Details of public liability insurance

or statement of ability to obtain required public liability insurance.

|

|

3. Proposed commencement date of

Licence.

|

|

4. Conflict of Interest Declaration.

|

|

Qualitative Criteria

|

Weighting

|

|

1. Describe your organisations vision

and proposed use of the Tyagarah Hall

Minimum information to

provide:

a) Describe details of your organisation

structure, legal entity status and provide a copy of your constitution or

similar.

b) Describe the social benefits and

social purposes provided by your organisation.

c) Describe the activities your

organisation will carryout in the Hall.

|

30%

|

|

2. Describe how your organisation will

manage the community hall and the key personnel involved:

Minimum information to

provide:

a) Describe how your organisation plans

to manage the Tyagarah Hall to allow for equitable access to individuals and

community groups, including your proposed hours and management of out of

hour’s usage.

b) Describe your anticipated hire fee

structure.

c) Describe your bookings management

system including the ability of that system to report numbers hiring the

Hall.

d) Describe your complaints management

processes.

|

40%

|

|

3. Describe available resources of your

organisation:

Minimum information to

provide:

a) Describe how your organisation will

pay rent and outgoings under the licence.

b) Describe how your organisation plans

to maintain and clean the interior of the hall and grounds immediate

surrounding the Hall.

|

30%

|

The Panel meet on several occasions to resolve discrepancies

before reaching a consensus as to the following preferred Respondent:

1. Tyagarah

Community Association be awarded the lease as the successful respondent.

The Evaluation Panel report is contained in Attachment 1.

There is no statutory requirement for Council to undertake

community consultation in granting a lease over Council owned operational land.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 1: We have infrastructure, transport and services which meet

our expectations

|

1.2

|

Provide

essential services and reliable infrastructure which meet an acceptable

community standard

|

1.2.6

|

Optimise

Council’s property portfolio (SP)

|

1.2.6.8

|

Deliver adopted

capital works program for Suffolk Park Holiday Park

|

Legal/Statutory/Policy

Considerations

Nil.

Financial Considerations

The Request for Proposal stipulated rent payable under the

licence is set at the value of minimum Crown Land rent currently $490

(excluding GST) per annum and increased thereafter by Consumer Price Index All

Groups Sydney.

Terms of the licence will require the Licensee to pay all

usage charges for all services connected to the Premises with Council to

subsidise annual fixed rates and charges plus carry out annual fire compliance,

pest inspections and control and cover building insurance for full replacement

cost.

Staff Reports - General Manager 13.2

Report No. 13.2 Five

year licence to Shara Community Garden Incorporated

Directorate: General

Manager

Report

Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2020/1254

Summary:

The Shara Community Garden s

Incorporated requests a new five (5) year licence to occupy Lot 2005 DP 808461

known as the Ocean Shores Shara Community Gardens. This report recommends

that Council enter into the proposed licence.

|

RECOMMENDATION:

1. That Council considers

all public comments received on the proposed five (5) year

licence to Shara Community Garden s Incorporated over Lot 2005 DP808461 known

as

the

Shara Community Gardens.

2. That Council

grants a licence to Shara Community Garden s Incorporated

over

Lot 2005 DP808461 on the following terms:

a) term

five (5) years with no holding over;

b) for

the purpose of a community garden as defined in Policy Byron Shire Community

Gardens 2020;

c) rent

to commence at $490 (exclusive of GST) and thereafter increased annually by

Consumer Price Index All Groups Sydney for the term;

d) the

Licensee to pay usage charges for all services connected to the land including waste management services and

provide public liability and contents insurance; and

e) the

Licensor to pay outgoings of the value of general land rates and fixed water

and sewer charges (if payable).

|

Attachments:

1 Submission

1 to Shara Community Gardens proposed 5 year licence, E2020/77219

REPORT

Background:

In March 2011, following

an expression of interest, Council granted a short-term licence to Mullumbimby Sustainability Education and Enterprise

Development Incorporated (‘Mullum SEED’) to occupy Lot 2005 DP

808461 for the purpose of the Shara Community Garden . The Shara Community

Garden Committee was then formed for the day to day management of the

garden.

In 2012 Council resolved (12-838) to grant a further three year licence to Mullum

SEED to occupy the Shara Community Garden . On expiry of that licence a further

five year licence was granted by resolution (15-105) to Mullum SEED to 3 April 2020.

In late 2019 Mullum SEED

notified Council that it no longer intended to hold a licence over the Shara

Community Garden and requested that Council transfer the licence to the

Shara Community Garden Committee. To allow Council sufficient time

to consider the request, the licence to Mullum SEED was placed on holding over

to 31 October 2020.

Direct negotiation:

Council staff commenced

working with the Shara Community Garden Committee in early 2020 to

determine if the Committee had sufficient membership, skills and financial

sustainability to hold a licence over Council owned land.

The Shara Community Garden

s Incorporated (‘SCG Inc’) was formed and has since demonstrated

its intention to comply with Council’s Community Gardens Policy and Procedures.

As a result, Council staff recommend that a new five year licence be granted to

SCG Inc over the Shara Community Garden site to commence 1 November 2020.

Section 46A of

the Local Government Act 1993 (NSW) authorises Council to directly

negotiate the proposed five year licence with SCG Inc because the incorporation

is a registered not for profit organisation.

Proposed new licence:

Lot 2005 DP808461 is Council owned

land classified and community land and categorised as a park. The Plan of

Management for the land expressly permits the grant of a licence for purposes

authorised by the Local Government Act. A licence for a

community garden to support the physical, cultural, social and intellectual

development of the public is a purposed authorised by the Act.

Terms of the proposed licence will

include:

i. 5 year term with no holding over;

ii. Initial rent to commence at $490

(exclusive of GST) and annually increased thereafter by Consumer Price Index

All Groups Sydney;

iii. Licensee outgoings:

a. all usage costs for all services connected

to the land including waste management services; and

b. public liability and contents insurances.

iv. Licensor outgoings:

a. Annual fixed rates and charges (if payable)

Public notification:

In accordance with s47A of the Local Government Act 1993

(NSW), Council publically advertised the proposed licence for 28 days between

31 August and 28 September 2020 and received one submission.

A summary of the submission received is tabled below:

|

Submission

|

Council response

|

|

· I support this

licence

|

Noted.

|

Section 47(4) of the Local Government Act 1993 (NSW)

requires that Council must consider all submissions duly made before granting

the proposed licence.

This report recommends that Council grant the proposed five

year licence to SCG Inc for the purpose of the Shara Community

Garden

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and sense

of community

|

2.2

|

Support access

to a wide range of services and activities that contribute to the wellbeing

of all members of the Byron Shire community

|

2.2.1

|

Develop and

maintain collaborative relationships with government, sector and

community

|

2.2.1.2

|

Participate in

and inform community planning

|

Legal/Statutory/Policy Considerations

s47 Leases,

licences and other estates in respect of community land—terms greater

than 5 years

(1) If a

council proposes to grant a lease, licence or other estate in respect of

community land for a period (including any period for which the lease, licence

or other estate could be renewed by the exercise of an option) exceeding 5

years, it must:

(a) give

public notice of the proposal (including on the council’s website), and

(b) exhibit

notice of the proposal on the land to which the proposal relates, and

(c) give

notice of the proposal to such persons as appear to it to own or occupy the

land adjoining the community land, and

(d) give

notice of the proposal to any other person, appearing to the council to be the

owner or occupier of land in the vicinity of the community land, if in the

opinion of the council the land the subject of the proposal is likely to form

the primary focus of the person’s enjoyment of community land.

(2) A notice of

the proposal must include:

• information sufficient

to identify the community land concerned

• the purpose for which

the land will be used under the proposed lease, licence or other estate

• the term of the proposed

lease, licence or other estate (including particulars of any options for

renewal)

• the name of the person

to whom it is proposed to grant the lease, licence or other estate (if known)

• a statement that

submissions in writing may be made to the council concerning the proposal

within a period, not less than 28 days, specified in the notice.

(3) Any person

may make a submission in writing to the council during the period specified for

the purpose in the notice.

(4) Before

granting the lease, licence or other estate, the council must consider all

submissions duly made to it.

s47A Leases,

licences and other estates in respect of community land—terms of 5 years

or less

(1) This section

applies to a lease, licence or other estate in respect of community land

granted for a period that (including any period for which the lease, licence or

other estate could be renewed by the exercise of an option) does not exceed 5

years, other than a lease, licence or other estate exempted by the regulations.

(2) If a council

proposes to grant a lease, licence or other estate to which this section

applies:

(a) the

proposal must be notified and exhibited in the manner prescribed by section 47,

and

(b) the

provisions of section 47 (3) and (4) apply to the proposal, and

(c) on

receipt by the council of a written request from the Minister, the proposal is

to be referred to the Minister, who is to determine whether or not the

provisions of section 47 (5)–(9) are to apply to the proposal.

(3) If the Minister,

under subsection (2) (c), determines that the provisions of section 47

(5)–(9) are to apply to the proposal:

(a) the

council, the Minister and the Director of Planning are to deal with the

proposal in accordance with the provisions of section 47 (1)–(8), and

(b) section

47 (9) has effect with respect to the Minister’s consent.

Financial Considerations

The Shara Community Garden s

Incorporated to pay annual rent commencing at $490 (exclusive of GST) with rent

to be annually increased thereafter by Consumer Price Index All Groups Sydney.

The Licensee to pay all usage charges for all services

connected to the land including waste management

services and to provide public liability and contents insurance cover.

The Licensor outgoings are limited to the value of annual general land rates

and fixed charges (if payable).

Consultation and Engagement

Council publically advertise the proposed licence for at

least 28 days between 31 August and 28 September 2020 for public comment.

Staff Reports - General Manager 13.3

Report No. 13.3 Byron

Masterplan Guidance Group - appointment of new members

Directorate: General

Manager

Report

Author: Claire

McGarry, Place Manager - Byron Bay

File No: I2020/1553

Summary:

The Byron Masterplan Guidance Group (BMGG) has been

established to influence and provide advice to Council on policies and

strategies relating to the implementation of the Byron Bay Town Centre

Masterplan.

Recent vacancies on the group resulted in Council running an

Expression of Interest process for new members. The opportunity was promoted

through media releases, social media and Council’s printed advertisements

in local papers.

23 Expressions of Interest were received, which were

considered by the BMGG at their September meeting.

This report details the applications received and the

recommendations of the BMGG.

|

RECOMMENDATION:

1. That

Council endorses and invites the 8 recommended applicants to join the

Byron Masterplan Guidance Group, being Applicant 1, Applicant 2, Applicant 3,

Applicant 7, Applicant 8, Applicant 11, Applicant 18, Applicant 22.

2. That

Council amends the Byron Masterplan Guidance Group charter to increase

membership number from 22 to 27.

|

Attachments:

1 Charter -

Byron Masterplan Guidance Group, E2018/19664

2 Confidential

- Byron Masterplan Guidance Group Members Expression of Interest applications -

September 2020, E2020/75079

REPORT

The Byron Masterplan Guidance Group has been established to

influence and provide advice to Council on policies and strategies relating to

the implementation of the Byron Bay Town Centre Masterplan (BBTCMP).

The key objectives of the group are to:

· Develop

and maintain communication and understanding between the community and Council

regarding the implementation of the BBTCMP

· Provide

comment and feedback to Council on projects relating to the implementation of

the BBTCMP

· Ensure

open communication between the group and Council

· Actively

engage with the community and provide feedback to Council on local aspirations,

visions, needs and concerns

· Identify

and assist in facilitating partnerships between the community and Council for

relevant projects.

The group is made up of up to 22 members, plus 3 Councillors

and the Mayor.

Recently, a change of circumstance for 4 members has seen

vacancies arise – there are currently 18 members in the group.

As per the group Charter, Council ran an Expression of

Interest process for new members from 20 August to 18 September 2020.

Candidates for membership were required to demonstrate

suitability on the basis of:

· An

understanding of and interest in Byron Bay

· Demonstrated

leadership skills

· The

ability to effectively listen to, and cooperate with community members holding

similar or different points of view

· An

ability to develop and sustain contacts with key individuals and groupings in

the local community.

Applications were received from 23 community members. The

Byron Masterplan Guidance Group met on 24 September to assess the applications

received and provide a recommendation to Council. The applications received are

contained in Confidential Attachment 2.

The group has recommended the appointment of nine new

members, which would increase the total membership from 22 to 27. The charter

can be amended to reflect this change. Eight of these new members were

identified through the Expression of Interest process, and one was directly

appointed earlier in the year to replace an outgoing representative from the

Byron Surf Club.

The group has recommended appointment of:

Applicant 1

Applicant 2

Applicant 3

Applicant 7

Applicant 8

Applicant 11

Applicant 18

Applicant 22

STRATEGIC CONSIDERATIONS

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 4: We manage growth and

change responsibly

|

4.1

|

Support the visions and aspirations of local communities

through place-based planning and management

|

4.1.2

|

Ensure consistency of place-based projects with community

Place Plans through embedding a governance framework that includes

planning, implementation and ongoing management

|

4.1.2.1

|

There are no actions identified in the 2020/21

Operational Plan

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

The above process has been conducted in line with the Byron

Masterplan Guidance Group’s adopted charter.

Financial Considerations

There are no financial implications of the above

recommendation.

Consultation and Engagement

The Expression of Interest opportunity was publicly

advertised. Recommended new members were determined by the Byron Masterplan

Guidance Group, for endorsement by Council.

Staff Reports - Corporate and Community Services 13.4

Staff Reports - Corporate and Community

Services

Report No. 13.4 Annual

Report 2019/20

Directorate: Corporate

and Community Services

Report

Author: Heather

Sills, Corporate Planning and Improvement Coordinator

File No: I2020/1528

Theme: Corporate Management

Governance Services

Summary:

Each NSW Local Government Authority is required under S428

of the Local Government Act 1993 to prepare and submit to the Minister

of Local Government an Annual Report.

The preparation of an Annual Report is an opportunity for a

Council to provide feedback back to the community on how the Council has

implemented its operational plan and delivered outcomes for the community.

Council is asked to note the

Annual Report 2019/20 and its submission to the Minister for Local Government.

A separate report on the

2019/20 Financial Statements will be prepared for the consideration of Council.

|

RECOMMENDATION:

That Council notes the Annual Report 2019/20 (#E2020/78609),

included as Attachment 1 to this report and its submission to the Minister

for Local Government.

|

Attachments:

1 Byron

Shire Council Annual Report 2019/20, E2020/78609

Report

Each Council in NSW has an obligation to prepare and submit

an Annual Report. It is an opportunity to celebrate Council’s

achievements and report back to the community.

The attached Annual Report has

been prepared in accordance with the Local Government Act 1993 and

includes the information prescribed in the Local Government (General)

Regulation 2005. Information that is required by the Local Government Act

and Regulation, or any other legislative requirement is noted with reference to

the relevant legislation in bold.

In addition to the prescribed information, this Annual

Report is one of the key points of accountability between Council and our

community. The Annual Report highlights some of our achievements in

implementing the Delivery Program over the last year and the ways in which

these activities contribute to the overarching objectives in the Community

Strategic Plan 2028:

· INFRASTRUCTURE

- We have infrastructure, transport and services which meet our expectations

· COMMUNITY

- We cultivate and celebrate our diverse cultures, lifestyle and sense of

community

· ENVIRONMENT

- We protect and enhance our natural environment

· GROWTH

- We manage growth and change responsibly

· GOVERNANCE

- We have community led decision making which is open and inclusive

Highlights for these objectives include:

Governance:

· Council

has met the challenges of drought, fire, flood and pandemic with all the

associated additional work, and still substantially delivered the Operational

Plan.

· In

a NSW first, a new co-design model was used to develop ‘The Byron

Model’, a community-led framework for making democratic decisions in

Byron Shire that can be widely supported by the community.

o As a direct

outcome 417 people have registered on Council’s ‘Citizens Lottery’

and since February 2020, participants have been randomly chosen to deliberate

on 2 citizen panels and participate in various community engagement projects.

· 78%

of residents are satisfied with Council, up from 69% in 2016

· Council

generated $76 million in own-source revenue, up 16% compared with 2015/2016.

· 78%

of Operational Plan activities were achieved and 11% substantially achieved

Growth:

· Innovative

Affordable Housing Developer Contributions Policy adopted.

· NSW’s

first bespoke planning provisions regulating events in rural areas, aiming to

reward good behaviour and reduce demand on public enforcement agencies.

· Bangalow,

Mullumbimby, and Byron Arts and Industry Estate masterplans developed through

community partnership.

· 867

development applications processed with an economic value of $340 million.

· 8.8%

increase in satisfaction rating for development application processing.

· 2,800

submissions for consultation on 22 land management strategic plans.

Environment:

· 24.7km

of the Brunswick River restored for fish navigation all year round, a

significant increase from 10 days a year for only a short distance from the

river mouth.

· On

a per resident basis, Byron Shire collects less residual waste and over 2.5

times more recyclables than averages for other council areas* (*The

Australasian FY19 Performance Excellence Program 16 December 2019 Byron Shire

Council, LG Professionals and PricewaterhouseCoopers).

· Community

partnerships established to protect and enhance Koala and Flying Fox habitat.

· 238

hectares of bush regeneration, up from 130 hectares in 2015/2016.

· Since

2017, there has been a 78% reduction in cigarette butt litter on our beaches

and a 31% reduction in overall litter across the Shire.

· In

Byron Bay, more than 20% of the water we use for urban purposes is recycled, up

from 12% in 2016.

Community:

· Five

parks and playgrounds and three skate-parks upgraded, valued at $3.38 million.

· $39

million in project grant funding announced in 2019/20, including the $25

million tourism. impact grant. It followed $18 million in grant funding

received last year.

· A

regional NSW first – in just five months Council Public Space Liaison

Officers supported 21 vulnerable people to access temporary accommodation.

· Resident

satisfaction with:

o parks and

playgrounds is 83%, up from 72% in 2016

o sporting

facilities is 91%, up from 79% in 2016

o quality of

town centres and public spaces is 80%, up from 70% in 2016

Infrastructure:

· Council

delivered a $36.2 million capital program in 2019/2020, its largest ever. This

is an increase of 55% compared with 2015/16

· A

bridge and causeway replacement and upgrade program was delivered with a value

of $5.2 million. $13.5 million has been spent since 2015/16

· As

a result 80% of bridges are now in fair to good condition, up 20% compared with

2015/16

· In

another NSW first, Council was awarded $25 million as a NSW Government Road and

Infrastructure Election Commitment, in recognition of the challenges experienced

by a regional council with a population of 35,081 managing more than 2.4

million tourists a year

· $24.6

million investment in roadworks, compared with only $9.8 million in 2015/2016

· 8.3km

of new share paths and cycle lanes was built, a 9% increase to the network

Operational Plan Achievements

Overall, Council achieved 78% of

planned activities against the measures in the plan. This compares to 81%

during 2017/18. However the total number of activities also increased from 301

to 413, which is a 37% increase. A small number of activities were

deferred/delayed, largely due to the impacts of COVID.

|

|

2019/20

|

|

ü

Achieved/completed

|

322 (78%)

|

|

l Substantially Achieved

|

45 (10.9%)

|

|

½ Partially achieved

|

30 (7.3%)

|

|

Ü Deferred/delayed

|

16 (3.9%)

|

|

û Not

achieved

|

0 (0%)

|

|

Total

|

413

|

STRATEGIC CONSIDERATIONS

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 5: We have community led

decision making which is open and inclusive

|

5.2

|

Create a culture of trust with the community by being

open, genuine and transparent

|

5.2.1

|

Provide timely, accessible and accurate information to

the community

|

5.2.1.3

|

Prepare and submit Annual Report

|

Legal/Statutory/Policy Considerations

Section

428 of the Local Government Act 1993 requires Council to

prepare an annual report within 5 months after the end of each year and to

detail its achievements in implementing its delivery program and the

effectiveness of the principal activities undertaken in achieving the

objectives at which those principal activities are directed.

The Local

Government (General) Regulation

The report

must include a copy of the council's audited financial reports prepared in

accordance with the Local Government Code of Accounting Practice and

Financial Reporting published by the Department, as in force from time

to time, and such other information or material as the regulations or the

guidelines under section 406 may require. A copy of the council's Annual Report

must be posted on the council's website and provided to the Minister.

Financial Considerations

The preparation of the document was funded within existing

budget allocations.

Consultation and Engagement

An accessible version of the Annual Report will be published

on Council’s website and the Report will be promoted via social media.

Staff Reports - Corporate and Community Services 13.5

Report No. 13.5 Council

Investments - 1 September 2020 to 30 September 2020

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2020/1534

Summary:

This report includes a list of investments and identifies

Council’s overall cash position for the period 1 September 2020 to 30

September 2020 for information.

This report is prepared to comply with Regulation 212 of the

Local Government (General) Regulation 2005.

|

RECOMMENDATION:

That Council notes the report listing

Council’s investments and overall cash position as at 30 September

2020.

|

REPORT

Council has continued to maintain a diversified portfolio of

investments. At 30 September 2020, the average 90 day bank bill rate (BBSW) for

the month of September 2020 was 0.09%.

Council’s performance to 30 September 2020 was 1.09%. This is largely due

to the active ongoing management of the investment portfolio, maximising

investment returns through secure term deposits, bonds and purchasing floating

rate notes with attractive interest rates. It should be noted that as

investments mature, Council’s % return will continue to decrease due to

the lower rates available in the current market.

The table below identifies the investments held by Council

as at 30 September 2020

Schedule of

Investments held as at 30 September 2020

|

Purch Date

|

Principal ($)

|

Description

|

CP*

|

Rating

|

Maturity Date

|

No Fossil Fuel

|

Type

|

Interest Rate Per

Annum

|

Current Value

|

|

24/03/17

|

1,000,000

|

NAB Social Bond (Gender Equality)

|

Y

|

AA-

|

24/03/22

|

N

|

B

|

3.25%

|

1,046,700.00

|

|

15/11/18

|

980,060

|

NSW Treasury Corp (Green Bond)

|

N

|

AAA

|

15/11/28

|

Y

|

B

|

3.00%

|

1,152,260.00

|

|

20/11/18

|

1,018,290

|

QLD Treasury Corp (Green Bond)

|

N

|

AA+

|

22/03/24

|

Y

|

B

|

3.00%

|

1,091,930.00

|

|

28/03/19

|

1,000,000

|

National Housing Finance & Investment

Corporation

|

Y

|

AAA

|

28/03/31

|

Y

|

B

|

2.38%

|

1,126,670.00

|

|

21/11/19

|

1,000,250

|

NSW Treasury Corp (Sustainability Bond)

|

N

|

AAA

|

20/03/25

|

Y

|

B

|

1.25%

|

1,028,020.00

|

|

27/11/19

|

500,000

|

National Housing Finance & Investment

Social Bond

|

Y

|

AAA

|

27/05/30

|

Y

|

B

|

1.57%

|

522,906.50

|

|

31/03/17

|

1,000,000

|

CBA Climate Bond

|

Y

|

AA-

|

31/03/22

|

N

|

FRN

|

1.02%

|

1,010,430.00

|

|

16/11/17

|

750,000

|

Bank of Queensland

|

Y

|

BBB+

|

16/11/21

|

N

|

FRN

|

1.93%

|

753,337.50

|

|

30/08/18

|

500,000

|

Bank Australia Ltd (Sustainability Bond)

|

Y

|

BBB+

|

30/08/21

|

Y

|

FRN

|

1.40%

|

502,890.00

|

|

07/12/18

|

2,000,000

|

Credit Union Australia

|

Y

|

BBB

|

07/12/20

|

Y

|

TD

|

3.02%

|

2,000,000.00

|

|

27/11/19

|

1,000,000

|

Coastline Credit Union

|

Y

|

NR

|

26/11/20

|

Y

|

TD

|

1.80%

|

1,000,000.00

|

|

06/01/20

|

1,000,000

|

Judo Bank

|

Y

|

NR

|

05/01/21

|

N

|

TD

|

2.10%

|

1,000,000.00

|

|

20/01/20

|

1,000,000

|

Westpac (Tailored)

|

Y

|

AA-

|

20/01/21

|

N

|

TD

|

1.41%

|

1,000,000.00

|

|

06/04/20

|

1,000,000

|

Police Credit Union Ltd (SA)

|

Y

|

NR

|

06/10/20

|

N

|

TD

|

1.75%

|

1,000,000.00

|

|

06/05/20

|

1,000,001

|

AMP Bank

|

Y

|

BBB

|

04/11/20

|

N

|

TD

|

1.65%

|

1,000,001.00

|

|

12/05/20

|

1,000,000

|

The Mutual Bank

|

Y

|

NR

|

09/11/20

|

N

|

TD

|

1.50%

|

1,000,000.00

|

|

25/05/20

|

1,000,000

|

AMP Bank

|

N

|

BBB

|

23/11/20

|

N

|

TD

|

1.65%

|

1,000,000.00

|

|

26/05/20

|

1,000,000

|

Judo Bank

|

N

|

NR

|

24/11/20

|

Y

|

TD

|

1.70%

|

1,000,000.00

|

|

28/05/20

|

2,000,000

|

AMP Bank

|

N

|

BBB

|

25/11/20

|

N

|

TD

|

1.65%

|

2,000,000.00

|

|

02/06/20

|

1,000,000

|

The Mutual Bank

|

N

|

NR

|

13/10/20

|

N

|

TD

|

1.25%

|

1,000,000.00

|

|

02/06/20

|

1,000,000

|

AMP Bank

|

N

|

BBB

|

01/12/20

|

N

|

TD

|

1.60%

|

1,000,000.00

|

|

03/06/20

|

1,000,000

|

Auswide Bank

|

Y

|

NR

|

02/12/20

|

N

|

TD

|

1.15%

|

1,000,000.00

|

|

02/06/20

|

1,000,000

|

ME Bank

|

Y

|

BBB

|

01/12/20

|

N

|

TD

|

1.13%

|

1,000,000.00

|

|

30/06/20

|

1,000,000

|

The Mutual Bank

|

N

|

NR

|

28/10/20

|

N

|

TD

|

1.05%

|

1,000,000.00

|

|

30/06/20

|

1,000,000

|

Coastline Credit Union

|

N

|

NR

|

28/10/20

|

N

|

TD

|

1.05%

|

1,000,000.00

|

|

24/07/20

|

2,000,000

|

Bank of Queensland

|

N

|

BBB+

|

19/07/21

|

N

|

TD

|

0.90%

|

2,000,000.00

|

|

28/07/20

|

1,000,000

|

ME Bank

|

N

|

BBB

|

29/01/21

|

Y

|

TD

|

0.63%

|

1,000,000.00

|

|

28/07/20

|

1,000,000

|

The Capricornian

|

Y

|

NR

|

27/10/20

|

Y

|

TD

|

0.70%

|

1,000,000.00

|

|

29/07/20

|

2,000,000

|

Macquarie Bank Ltd

|

Y

|

A

|

28/10/20

|

N

|

TD

|

0.50%

|

2,000,000.00

|

|

30/07/20

|

1,000,000

|

Judo Bank

|

N

|

NR

|

30/07/21

|

N

|

TD

|

1.25%

|

1,000,000.00

|

|

03/08/20

|

1,000,000

|

NAB

|

N

|

AA-

|

03/08/21

|

N

|

TD

|

0.85%

|

1,000,000.00

|

|

04/08/20

|

2,000,000

|

Suncorp

|

Y

|

A+

|

04/08/20

|

N

|

TD

|

0.70%

|

2,000,000.00

|

|

19/08/20

|

2,000,000

|

NAB

|

N

|

AA-

|

17/12/20

|

N

|

TD

|

0.70%

|

2,000,000.00

|

|

19/08/20

|

2,000,000

|

NAB

|

N

|

AA-

|

19/08/21

|

N

|

TD

|

0.80%

|

2,000,000.00

|

|

26/08/20

|

1,000,000

|

AMP Bank

|

N

|

BBB

|

26/08/20

|

N

|

TD

|

0.80%

|

1,000,000.00

|

|

02/09/20

|

1,000,000

|

Bank of Queensland

|

N

|

BBB+

|

01/09/21

|

N

|

TD

|

0.78%

|

1,000,000.00

|

|

02/09/20

|

1,000,000

|

NAB

|

N

|

AA-

|

02/09/21

|

N

|

TD

|

0.75%

|

1,000,000.00

|

|

07/09/20

|

2,000,000

|

NAB

|

N

|

AA-

|

05/01/21

|

N

|

TD

|

0.70%

|

2,000,000.00

|

|

24/09/20

|

2,000,000

|

NAB

|

N

|

AA-

|

24/09/21

|

N

|

TD

|

0.65%

|

2,000,000.00

|

|

30/09/20

|

1,000,000

|

Bank of Queensland

|

N

|

BBB+

|

30/09/21

|

N

|

TD

|

0.65%

|

1,000,000.00

|

|

30/09/20

|

2,000,000

|

CBA Green Deposit

|

N

|

AA-

|

30/09/21

|

N

|

TD

|

0.70%

|

2,000,000.00

|

|

N/A

|

11,253,596.12

|

CBA Business Saver

|

N

|

AA-

|

N/A

|

N

|

CALL

|

0.55%

|

11,253,596.12

|

|

N/A

|

2,512,235.79

|

CBA Business Saver – Tourism

Infrastructure Grant

|

N

|

AA-

|

N/A

|

N

|

CALL

|

0.55%

|

2,512,235.79

|

|

N/A

|

6,104,245.56

|

NSW Treasury Corp

|

N

|

AAA

|

N/A

|

Y

|

CALL

|

0.04%

|

6,104,245.56

|

|

Total

|

69,618,678.47

|

|

|

|

|

|

AVG

|

1.09%

|

70,105,222.47

|

|

Note 1.

|

CP = Capital protection on maturity

|

|

|

N = No Capital Protection

|

|

|

Y = Fully covered by Government Guarantee

|

|

|

P = Partial Government Guarantee of $250,000 (Financial

Claims Scheme)

|

|

|

|

|

Note 2.

|

No Fossil Fuel ADI

|

|

|

Y = No investment in Fossil Fuels

|

|

|

N = Investment in Fossil Fuels

|

|

|

U = Unknown Status

|

|

Note 3.

|

Type

|

Description

|

|

|

|

B

|

Bonds

|

Principal can vary based on

valuation, interest payable via a fixed interest, payable usually each

quarter.

|

|

|

FRN

|

Floating Rate Note

|

Principal can vary based on

valuation, interest payable via a floating interest rate that varies each

quarter.

|

|

|

TD

|

Term Deposit

|

Principal does not vary during investment term. Interest

payable is fixed at the rate invested for the investment term.

|

|

|

CALL

|

Call Account

|

Principal varies due to cash flow demands from deposits/withdrawals,

interest is payable on the daily balance.

|

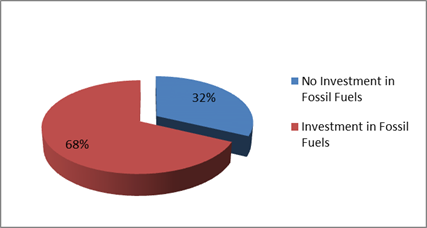

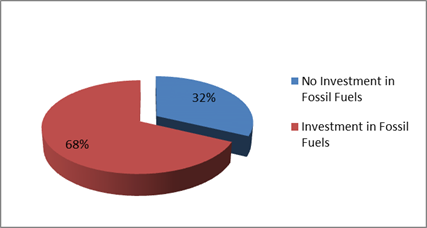

Environmental and Socially

Responsible Investing (ESRI)

An additional column has been

added to the schedule of Investments to identify if the financial institution

holding the Council investment has been assessed as a ‘No Fossil

Fuel’ investing institution. This information has been sourced through www.marketforces.org.au

and identifies financial institutions that either invest in fossil fuel related

industries or do not. The graph below highlights the percentage of each

classification across Council’s total investment portfolio in respect of

fossil fuels only.

The notion of Environmental and

Socially Responsible Investing is much broader than whether a financial

institution as rated by ‘marketforces.org.au’ invests in fossil

fuels or not. Council’s current Investment Policy defines Environmental

and Socially Responsible Investing at Section 4.1 of the Policy which can be

found on Council’s website.

Council has three investments

with financial institutions that invest in fossil fuels but are nevertheless

aligned with the broader definition of Environmental and Socially Responsible

investments i.e.:

1. $1,000,000 investment with the

National Australia Bank maturing on 24 March 2022 known as a Social Bond that

promotes Gender Equity.

2. $1,000,000 investment with

Commonwealth Bank maturing on 31 March 2022 known as a Climate Bond.

3. $2,000,000 investment with

Commonwealth Bank maturing on 30 September 2021 known as a Green Deposit.

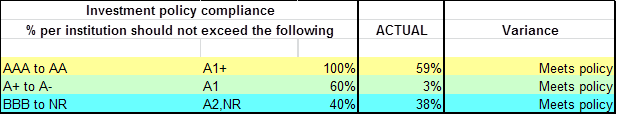

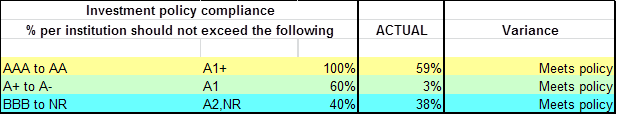

4.

Investment Policy

Compliance

The

above table identifies compliance with Council’s Investment Policy by the

proportion of the investment portfolio invested with financial institutions,

along with their associated credit ratings compared to parameters in the

Investment Policy. The parameters are designed to support prudent short and

long-term management of credit risk and ensure diversification of the

investment portfolio. Note that the financial institutions currently offering

investments in the ‘ethical’ area are still mainly those with lower

credit ratings (being either BBB or not rated at all i.e. credit unions).

Associated Risk

Moving more of the investment portfolio into the

‘ethical’ space will lower the credit quality of the investment

portfolio overall and increase the organisation’s credit risk (i.e.

exposure to potential default). To monitor this issue the ‘Investment

Policy Compliance’ table is now produced for each monthly Investment

Report to Council.

The investment portfolio is outlined in the table below by

investment type for the period 1

September 2020 to 30 September 2020:

Dissection

of Council Investment Portfolio as at 30 September 2020

|

Principal Value ($)

|

Investment Linked to:

|

Current Market Value ($)

|

Cumulative Unrealised Gain/(Loss) ($)

|

|

42,000,001.00

|

Term Deposits

|

42,000,001.00

|

0.00

|

|

2,250,000.00

|

Floating

Rate Note

|

2,266,657.50

|

16,657.50

|

|

11,253,596.12

|

CBA Business Saver

|

11,253,596.12

|

0.00

|

|

2,512,235.79

|

CBA Business Saver – Tourism

Infrastructure Grant

|

2,512,235.79

|

0.00

|

|

6,104,245.56

|

NSW Treasury Corp

|

6,104,245.56

|

0.00

|

|

5,498,600.00

|

Bonds

|

5,968,486.50

|

469,886.50

|

|

69,618,678.47

|

|

70,105,222.47

|

486,544.00

|

The current value of an investment compared to the principal

value (face value or original purchase price) provides an indication of the

performance of the investment without reference to the coupon (interest) rate. The

current value represents the value received if an investment was sold or traded

in the current market, in addition to the interest received.

The table below provides a reconciliation of investment

purchases and maturities for the period of 1 September 2020 to 30 September

2020 on a current market value basis.

Movement

in Investment Portfolio – 30 September 2020

|

Item

|

Current Market Value (at end of month) $

|

|

Opening

Balance at 1 August 2020

|

65,397,700.60

|

|

Add:

New Investments Purchased

|

9,000,000.00

|

|

Add:

Call Account Additions

|

4,000,000.00

|

|

Add:

Interest from Call Account

|

4,164.67

|

|

Add:

Interest from Tourism Saver Account

|

1,135.16

|

|

Less:

Investments Matured

|

6,000,000.00

|

|

Add:

T Corp Additions

|

0.00

|

|

Add:

Interest from T Corp

|

2,222.04

3

|

|

Less:

Call Account Redemption

|

2,300,000.00

|

|

Less:

T Corp Redemption

|

0.00

|

|

Plus:

Fair Value Movement for period

|

0.00

|

|

Closing

Balance at 30 September 2020

|

70,105,222.47

|

Term

Deposit Investments Maturities and Returns – 1 September 2020 to 30

September 2020

|

Principal

Value ($)

|

Description

|

Maturity

Date

|

Number

of Days Invested

|

Interest

Rate Per Annum

|

Interest

Paid on Maturity $

|

|

2,000,000.00

|

NAB TD

|

07/09/2020

|

90

|

0.90%

|

4,438.36

|

|

2,000,000.00

|

NAB TD

|

24/09/2020

|

365

|

1.60%

|

32,000.00

|

|

1,000,000.00

|

NSW Treasury Corp

|

25/09/2020

|

184

|

0.57%

|

2,873.42

|

|

1,000,000.00

|

Coastline Credit

Union

|

30/09/2020

|

92

|

1.05%

|

2,646.58

|

|

6,000,000.00

|

|

|

|

|

41,958.36

|

Council’s overall ‘cash position’ is not

only measured by funds invested but also by the funds retained in its

consolidated fund or bank account for operational purposes. In this regard, for

the month of September 2020 the table below identifies Council’s overall

cash position as follows:

Dissection

of Council’s Cash Position as at 30 September 2020

|

Item

|

Principal Value ($)