Notice of Meeting

Audit,

Risk and Improvement Committee Meeting

An Audit, Risk and

Improvement Committee Meeting of Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 16 November 2023

|

|

Time

|

2.00pm

|

Esmeralda Davis

Director Corporate and

Community Services

I2023/1739

I2023/1739

Distributed

03/11/23

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Code of Conduct for Councillors (eg. A friendship, membership of an

association, society or trade union or involvement or interest in an activity

and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

Committee members are reminded that they should declare and manage all

conflicts of interest in respect of any matter on this Agenda, in accordance

with the Code of Conduct.

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development

application, an environmental planning instrument, a development control plan

or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register

containing, for each planning decision made at a meeting of the council or a

council committee, the names of the councillors who supported the decision and

the names of any councillors who opposed (or are taken to have opposed) the

decision.

(3) For the purpose of maintaining the register, a division

is required to be called whenever a motion for a planning decision is put at a

meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described

in the register or identified in a manner that enables the description to be

obtained from another publicly available document and is to include the

information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are

reminded of the oath of office or affirmation of office made at or before their

first meeting of the council in accordance with Clause 233A of the Local

Government Act 1993. This includes undertaking the duties of the office of

councillor in the best interests of the people of Byron Shire and the Byron

Shire Council and faithfully and impartially carrying out the functions,

powers, authorities and discretions vested under the Act or any other Act

to the best of one’s ability and judgment.

BUSINESS OF MEETING

1. Apologies

2. Declarations

of Interest – Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Minutes

of the Audit, Risk and Improvement Committee Meeting held 19 October 2023........................................................................................................................................... 6

4. Staff Reports

Corporate and Community

Services

4.1 2024

Agenda Schedule................................................................................................. 8

5. Confidential Reports

Corporate and Community

Services

5.1 Confidential - Internal Audit Report Quarter

1 2023-2024............................ 10

6. Late Reports

7. For Information Only

7.1 Confidential - Section 355 Committee

Service Review................................. 12

7.2 Confidential - Cyber Security Quarterly

Update.............................................. 14

7.3 Update

information regarding proposed Caravan Parks internal audit............... 18

7.4 Delegation

of Functions 2023.................................................................................... 25

7.5 Annual

Legislative Compliance Status Report 2022-2023.................................... 32

Adoption of Minutes from Previous Meetings 3.1

Adoption of Minutes from Previous Meetings

Report No. 3.1 Minutes of the Audit, Risk

and Improvement Committee Meeting held 19 October 2023

Directorate: Corporate and Community Services

File No: I2023/1571

RECOMMENDATION:

That the minutes of the Audit, Risk and Improvement

Committee Meeting held on 19 October 2023 be confirmed.

Report

This report provides the minutes of the Audit, Risk and

Improvement Committee Extraordinary Meeting of 19 October 2023 for confirmation.

The minutes are available for viewing here:

Minutes

ARIC 19 October 2023

Report to Council

The minutes of this Extraordinary Meeting will be reported

to the Ordinary Meeting on 23 November 2023.

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

Report No. 4.1 2024

Agenda Schedule

Directorate: Corporate

and Community Services

Report Author: Mila

Jones, Governance and Internal Audit Coordinator

File No: I2023/1614

Summary:

The purpose of this report is to present the draft 2024

Agenda Schedule for consideration and endorsement by the Audit, Risk and

Improvement Committee.

RECOMMENDATION:

That the

Audit, Risk and Improvement Committee considers and endorses the Agenda

Schedule for 2024 (Attachment 1 E2023/107822).

Attachments:

1 ARIC

Agenda Schedule 2024, E2023/107822

Report

The draft Agenda Schedule for 2024

contains items to be considered at each meeting to assist the Audit,

Risk and Improvement Committee in fulfilling its obligations under the

Constitution and the Local Government Act. An agenda

schedule is prepared annually to ensure relevance of information provided to

the Committee.

In 2023 the Committee requested that the quarterly reporting

of the Operational Plan Performance Against Delivery Program and Strategies be

changed to an annual report. However, should the Committee now choose to

receive the report more often, this item has been listed in the attached

schedule as a quarterly report. This is a matter for the Committee to decide at

this meeting.

The Committee may also choose to include additional reports

as required during the year, through the Chairperson.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1:

Effective Leadership

We have effective decision making and

community leadership that is open and informed

|

1.2:

Engage and involve community in decision making

|

1.2.4:

Advisory Committees - Coordinate advisory committees to inform decision

making on their areas of expertise

|

1.2.4.2

|

Coordinate

the Audit Risk and Improvement Committee and internal audit program including

reporting

|

Recent Resolutions

Not applicable.

Legal/Statutory/Policy

Considerations

Section

428A of the Local Government Act 1993

Financial Considerations

Nil for this report.

Consultation and

Engagement

Consultation on the 2024 Agenda Schedule is via this report.

Confidential Reports - Corporate and Community Services 5.1

Confidential Reports - Corporate and Community

Services

Report No. 5.1 Confidential - Internal Audit Report Quarter 1

2023-2024

Directorate: Corporate

and Community Services

Report Author: Mila

Jones, Governance and Internal Audit Coordinator

File No: I2023/1617

Summary:

This report presents:

· The

Internal Audit Recommendations Summary Report for Quarter 1 2023-2024 prepared

by the Internal Auditor, Grant Thornton. The report is at Confidential

Attachment 1.

· The

full internal audit status report for Quarter 1 included at Attachment 1.

· The

Internal Audit of Property Services (Community Buildings) (undertaken in June

2023) completed by Grant Thornton. The findings of this review are at

Confidential Attachment 3. The audit received a review rating of Needs

Improvement and it identified two high, three medium and two low risk rated

issues.

· The

Internal Audit of Developer Contributions (undertaken in August 2023) completed

by Grant Thornton. The findings of this review are at Confidential Attachment

4. The audit received a review rating of Needs Improvement and it

identified one high, three medium and three low risk rated issues.

· The

Internal Audit of Disaster Recovery Planning (undertaken in October 2023)

completed by Grant Thornton. The findings of this review are at Confidential

Attachment 5. The audit received a review rating of Acceptable and it

identified two moderate and one low risk rated issues and one performance

improvement.

· An

Internal Audit Status Update from Grant Thornton for October 2023 at Attachment

6.

RECOMMENDATION:

1. That

pursuant to Section 10A(2)(d)i of the Local Government Act, 1993, the Committee

moves into Confidential Session to discuss the report Internal Audit Report

Quarter 1 2023-2024.

2. That

the reasons for closing the meeting to the public to consider this item be that

the report contains:

a) commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it

3. That

on balance it is considered that receipt and discussion of the matter in open

Council would be contrary to the public interest, as the

nature and content of internal audit reports is for operational purposes.

Attachments:

1 Confidential

- Internal Audit Recommendations for Quarter 1 2023-2024 including summary from

Grant Thornton, E2023/113666

2 Confidential

- (PRELIMINARY) Property Services Review - Internal Audit Report, E2023/109245

3 Confidential

- Developer Contributions Review - Internal Audit Report, E2023/109247

4 Confidential

- Disaster Recovery Planning Review - Internal Audit Report, E2023/111230

5 Confidential

- Internal Audit Status October 2023 from Grant Thornton, E2023/113667

For Information Only 7.2

For Information Only

Report No. 7.1 Confidential - Section 355 Committee Service Review

Directorate: Corporate

and Community Services

Report Author: Emily

Fajerman, Community & Cultural Development Coordinator

File No: I2023/1646

Summary:

In May 2023, a service review conducted by Grant

Thornton found that the Section 355 model of governance for community

facilities is no longer sustainable.

The review (E2023/106222) identified a number of risks

noting that most NSW councils have disbanded Section 355 Committees.

The purpose of this report is to present the service review

to the Committee and provide the Committee with an overview of the proposed

next steps.

RECOMMENDATION:

1. That

pursuant to Section 10A(2)(d)i of the Local Government Act, 1993, Council

resolves to move into Confidential Session to discuss the report Section 355

Committee Service Review.

2. That

the reasons for closing the meeting to the public to consider this item be that

the report contains:

a) commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it

3. That

on balance it is considered that receipt and discussion of the matter in open

Council would be contrary to the public interest, as:

The nature and content of internal

service reviews is for operational purposes.

Attachments:

1 Section

355 Committees Service Review Grant Thornton, E2023/106222

Report No. 7.2 Confidential - Cyber Security Quarterly Update

Directorate: Corporate

and Community Services

Report Author: Colin

Baker, Manager Business Systems and Technology

File No: I2023/1625

Summary:

This report provides a summary of cyber security activities

and IT service outages during the reporting period from 1 July 2023 to 30

September 2023

Two Cyber incidents were confirmed

in the past quarter. Legal services provided by HWL Ebsworth has subsequently

resulted in historical Council information being exposed in the legal

firm’s recent cyber data breach. The second cyber incident recorded was due

to a misconfiguration of a reporting tool (Microsoft Power BI). No data was

exposed, and this misconfiguration has been remediated.

There were no significant outages

of online services recorded in the past quarter.

Cyber improvement activities and

regular testing/assessment reviews of both Council and key vendors are ongoing.

Remediation of cyber vulnerabilities is progressing well.

RECOMMENDATION:

1. That

pursuant to Section 10A(2)(f) of the Local Government Act, 1993, Council

resolves to move into Confidential Session to discuss the report Cyber Security

Quarterly Update.

2. That

the reasons for closing the meeting to the public to consider this item be that

the report contains:

a) matters

affecting the security of the council, councillors, council staff or council

property

3. That

on balance it is considered that receipt and discussion of the matter in open

Council would be contrary to the public interest, as:

Exposes information security risks and

vulnerabilities that could assist unauthorised threats to Council's information

and systems.

For Information Only 7.3

Report

No. 7.3 Update

information regarding proposed Caravan Parks internal audit

Directorate: Infrastructure

Services

Report Author: Pattie

Ruck, Manager Open Space & Facilities

Malcolm Robertson, Manager Open Space and Facilities

File No: I2023/1628

Summary:

This report is in response to ARIC request for an internal

report from staff responding to points proposed in the Caravan Parks internal

audit draft scope (Attachment 1).

This report addresses the points

raised and aims to inform ARIC committee members on existing financial controls

and processes in place for both Suffolk Beachfront and First Sun Holiday Park.

The report also outlines

additional measures implemented following the 2021/22 financial audit

recommendations.

This information is provided to

allow ARIC committee members to consider the adequacy and effectiveness of

existing internal financial controls and processes for the two parks.

Attachments:

1 Draft

Scope - Caravan Parks Internal Audit for reporting to ARIC, E2023/67194

Background

The scope of the proposed internal audit review was to

“assess the adequacy and effectiveness of internal financial controls

and processes in place to completeness and accuracy of revenue generated by

Caravan Parks.”

The review was also proposed to conduct benchmarking of fees

and revenue of similar caravan parks with the geographic region.

Scope of the audit was to assess:

1. Financial

reporting obligations from the Contractor are met, as per Contract

2. Validation

of remuneration payments to contractors in accordance with Belgravia Pro

contracts

3. Financial

and operational processes and systems in place to ensure the integrity of the

financial and operational data.

4. Utilisation

/ Occupancy reporting vs. Revenue reporting including validating the

information provided (including site inspections being performed)

5. Month-end

reporting processes

6. Bank

reconciliations

7. Management

and Council reporting

8. Benchmarking

of performed against similar size and locations caravan parks

The audit plan also referenced the 2021 / 2022 Financial

Audit conducted by the AONSW, which had recommended:

9. More

detailed reporting from park management to enable improved analysis and

reporting of daily occupation rates and associated revenue streams.

10. Periodic site inspections

that will enable comparison of site occupancy against reported.

Staff initial response to the

proposed audit was to request that ARIC consider the findings and

recommendations made by the Audit Office of NSW (AONSW) in the 2021/22

Financial Audit prior to implementing a new audit. Actions recommended by the

AONSW audit were to be implemented during the 2023/24 financial year, with

completion by June 2024. These recommendations have been actioned in

full.

The proposed audit has a cost

against the operational budget for the holiday Parks of $25,000. There

are core operational matters that would benefit from this budget in the lead

into the 2024 Tender for management of the Holiday Parks, including research

into management models, rectifying compliance issues within the parks, and

addressing cabin replacement priorities to ensure the parks retain their

Approvals to Operate.

Staff have outlined existing

financial controls against the draft scope items so that ARIC may determine if

these provide adequacy and effectiveness of internal financial controls.

Current Internal Financial Controls

1. Financial reporting

obligations from the Contractor are met as per the Contract.

A

Contract checklist details all contractual requirements to be actioned. This

checklist is completed annually throughout the contract to ensure contractors

meet their obligations including financial reporting obligations.

Contract Checklist includes:

· Monthly occupancy reporting

· Monthly takings reporting

· Refund reconciliation reporting

· Weekly banking deposits

Other non-financial items are also

covered off through the checklist including WHS requirements, chemical use

details, safety sheets, insurance documentation, evacuation procedure manuals,

park rules and incident reporting.

2. Validation of remuneration payments to

contractors in accordance with Belgravia Pro contracts

As specified with the contract,

Belgravia Pro invoice monthly. Invoices are forwarded to Council’s

Contract Manager with accompanying Takings Report from the Newbook software

booking system.

The Newbook Takings Report breaks

down sources of income. The Newbook figures are cross checked against the

invoice breakdown received from Belgravia, and then reconciled against

Councils facility management spreadsheet which details contract

requirements. The invoices are then linked to the contract register in

Authority by administration staff.

3. Financial and operational processes and

systems in place to ensure the integrity of the financial and operational data.

Invoices and accompanying takings

report from the Newbook software booking system are forwarded to Council for

payment monthly. Council has independent access to this booking system for

review if required. Takings reports provided through Newbook break down

the sources of income. For example, cabin 1, or safari tent 2 or site no

7. These figures are compared to Belgravia’s invoice to confirm the

breakdown matches the invoiced figure for both parks.

Council has also introduced onsite

ad hoc spot checks to ensure information in the booking system is reconciled

with onsite occupancy. This process is completed by Council staff on a

random monthly basis with no pre warning to the onsite managers. Council

staff visit the parks and require a printout of the occupancy list times.

This occupancy report itemises sites, guest names, check-in and check-out dates

and provides occupancy details which is then compared to what is occurring on

the ground. Council staff then walk through the park and note down

occupied and unoccupied sites and reconcile this with the occupancy report.

4. Utilisation / Occupancy reporting vs.

Revenue reporting including validating the information provided (including site

inspections being performed)

As per contract, Belgravia Pro

provide monthly takings and occupancy reports. These reports breakdown

the income sources and occupancy percentages from each type of accommodation

and provide occupancy rates.

In response to the recommendation

from AONSW Council staff have implemented a robust onsite investigation

process. Onsite ad-hoc spot checks are completed monthly to ensure

information in the booking system is reconciled with onsite occupancy.

This process is completed on random timing with no pre warning. Current

electronic printout of the occupancy list is obtained from the park front

office and a walk through the park completed to reconcile booking system data

against actual occupancy.

Anomalies have been noted through

the onsite check, such as the occupancy report detailing a guest on a site, but

the site being unoccupied, or the walk through identifies a site being occupied

with the report indicating it is free. These discrepancies are followed

up with management. To date valid explanation has been provided in all

identified discrepancies. Common causes are a guest having checked out

early, but still showing as on site, or where a guest has moved sites resulting

in their allocated site being vacant. All discrepancies are noted.

To date, this monthly validation process has not required further

investigation, as all discrepancies have been substantiated.

5. Month-end reporting processes

Contractors provide both monthly

occupancy reports and takings reports. Staff undertake reconciliation of

takings reports with monthly contract invoices. Monthly onsite spot

checks undertaken by Council staff to ensure occupancy rates match takings and

occupancy reports.

Monthly financial reporting is provided

to the Executive Team and Managers outlining progress against Holiday Park

budgets. This reporting identifies variances or anomalies, which are then

investigated by staff. Mostly variances occur due to under/over

estimation of income or expenditure, either through misalignment of budget

profiling or where seasonal occupancy does not match expected.

6. Bank reconciliations

Belgravia Pro bank takings

weekly. The weekly banking amount is reconciled with the takings report

by finance staff and then input in Authority. The holiday parks utilise

industry specific software “Newbook” to produce their reports,

issue receipts and handle bookings. This software is used extensively

throughout the holiday park industry. There is no direct integration with

Authority but Council has independent access to the software system.

7. Management and Council reporting

Monthly financial reporting is

provided to the Executive Team and Managers outlining progress against Holiday

Parks budgets. Budgets for the parks are adopted annually, quarterly

budget reviews are undertaken and reported to management and Council.

Ad hoc Management and Council

reporting is undertaken when operational and budget decisions are necessary to

improve park operations outside of delegated authority.

Byron Shire Council Holiday Parks

are a Category 1 declared business activity. Income Statements and Statements

of Financial Position for the Holiday Parks Business Activity are published

within the Annual Report special purpose financial statements.

8. Benchmarking of performance against similar

size and locations caravan parks.

During Council’s annual fees

and charges process both holiday parks undertake a benchmarking comparison

including reporting from Review Pro. Review Pro provides reports and

insights to benchmark a property against competitors in the region, as shown in

the two extracts below. The Review Pro ratings are monitored on an

ongoing basis to identify if there are any trends that need to be addressed.

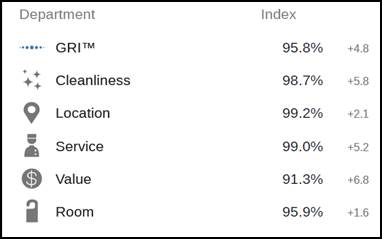

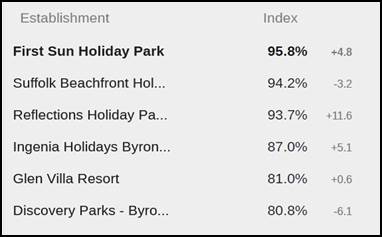

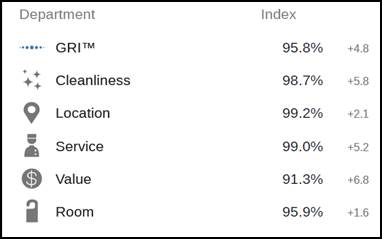

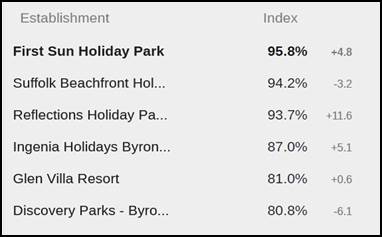

Figure

1: First Sun Global Review Index Assessment Sept / Oct 2023

Figure

2: Holiday Parks Northern Rivers Competition Ranking Sept / Oct 2023

This benchmarking, along with

analysis of published rates for competing businesses, provides the onsite

contractors and Council an opportunity to set fees and charges for the parks

that will remain competitive within the caravan park market in the Northern

Rivers area. Council is at a disadvantage as we are required to display

prices as a part of the fees and charges process. Competitors are not

required to do this.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

5:

Connected Infrastructure

|

5.4:

Provide accessible community facilities and open spaces

|

5.4.5:

Commercial facilities - Effectively manage Council owned commercial

properties including holiday parks and Tyagarah airfield

|

5.4.5.1

|

Ongoing

Management of First Sun and Suffolk Park Holiday Parks contracts, operations,

maintenance and capital renewal programs

|

|

|

|

|

|

|

|

|

|

Alignment with ARIC

Responsibilities

This report has been prepared to

support the committee in fulfilling the following responsibilities as set out

in the ARIC Constitution:

5.4. Financial Management

Review and advise Council:

c) of the

implications for Council of the findings of external audits and performance

audits and Council’s responses and implementation of recommendations

g) if

Council’s financial management processes are adequate

5.5. Governance

c) Review whether

management has adequate internal controls over external third parties such as

contractors and advisors.

Financial Considerations

The two holiday parks are declared business activities of

Council for the purposes of National Competition Policy reporting. Annual

special purpose financial reports outline the performance of the holiday parks

within Council’s published financial statements.

The financial statements show a required rate of return

based off the Commonwealth 10-year bond rate (3.66% for 2022) and then

calculate the notional subsidy if the result does not match that. Details

of this are in the notes to the special purpose financial reports.

Council holiday parks are profitable, currently debt free,

and provide a sizeable contribution to the General Fund in terms of dividend

and funding of corporate overheads to the tune of $1.568million in the

2021/2022 financial year. Without that contribution to the General Fund,

Council would be forced to reduce services elsewhere.

Financial Results for the 2022-2023 financial year have

shown that holiday park revenues have grown $1.697million compared to 2021-2022

financial year as advised to the Audit, Risk and Improvement Committee

following consideration of the Draft 2022-2023 Financial Statements at the 19

October 2023 Committee Meeting.

For Information Only 7.4

Report

No. 7.4 Delegation of

Functions 2023

Directorate: Corporate

and Community Services

Report Author: Mila

Jones, Governance and Internal Audit Coordinator

File No: I2023/1608

Summary:

This report is presented to the Audit, Risk and Improvement

Committee (ARIC) to assist the Committee in fulfilling its obligations under

its Constitution and the Local Government Act 1993.

Administration and review of Council’s delegations is

conducted by the Governance and Internal Audit Coordinator on a weekly basis

and reported to the Executive Team every six months and to the ARIC annually in

accordance with the ARIC Annual Agenda Schedule.

Attachments:

1 Delegation

of Functions - Mayor, General Manager, Directors, E2023/107820

Report

This report is submitted to assist

the Audit, Risk and Improvement Committee in fulfilling its obligations under

its Constitution and the Local Government Act 1993.

In accordance with section 377 of the Local

Government Act 1993 Council, by resolution, delegates its powers,

authorities, duties and functions to the General Manager.

The General Manager is empowered to delegate powers,

authorities, duties and functions to Council staff.

The full list of functions and authorities that have been

delegated to the Mayor, General Manager and Council staff is maintained and

administered in Council’s Delegations Register. This register is reviewed

weekly and updated six monthly or sooner if required, and may be amended due to

legislative changes, policy changes, resolutions of Council or otherwise. There

are a total of 241 active functions and authorities in Council’s

Delegations Register, with the relevant delegations assigned to approximately

340 staff, contractors and the Mayor.

Mayor and General Manager Delegations

The Mayor’s delegations have not changed since 23 June

2022 as reported to ARIC on 17 November 2022. The General Manager’s

delegations have been updated for the sole purpose of removing a time sensitive

delegation that was only applicable for 12 months following a natural disaster

(BSC113). Attachment 1 to this report provides the current delegations to the

Mayor, General Manager and Directors.

Review of Legislation

2022-2023

During this review period,

the amended, new or repealed legislation listed below was noted to have had no,

or minimal, impact on Council’s register of delegations:

1. Aviation Transport

Security Regulations 2005

2. Biodiversity Conservation

Act 2016

3. Biosecurity Act 2015

4. Boarding Houses Act 2012

5. Building and Development

Certifiers Act 2018

6. Cemeteries and Crematoria

Act 2013

7. Children and Young Persons

(Care and Protection) Act 1998

8. Children’s Guardian

Act 2019

9. Community Land Development

Act 2021

10. Community Land Management Act 2021

11. Companion Animals Act 1998

12. Companion Animals Regulation 2018

13. Competition and Consumer Act 2010

(Cth)

14. Constitution Act 1902

15. Crimes Act 1900

16. Criminal Procedure Act 1986

17. Design and Building Practitioners Act

2020

18. Disability Inclusion Act 2014

19. Electricity Supply (General)

Regulation 2014

20. Electricity Supply Act 1995

21. Environmental Planning and Assessment

(Development Certification and Fire Safety) Regulation 2021

22. Environmental Planning and Assessment

Act 1979

23. Environmental Planning and Assessment

Regulation 2021

24. Fines Act 1996

25. Fisheries Management Act 1994

26. Fire and Rescue NSW Act 1989

27. Food Act 2003

28. Fringe Benefits Tax Assessment Act

1986 (Cth)

29. Government Information (Public

Access) Act 2009

30. Health Records and Information

Privacy Act 2002

31. Heavy Vehicle National Law (NSW)

32. Public Spaces (Unattended Property)

Act 2021

33. Land and Environment Court Act 1979

34. Liquor Act 2007

35. Local Government (General) Regulation

2021

36. Local Government Act 1993

37. Local Land Services Act 2013

38. Ombudsman Act 1974

39. Plumbing and Drainage Act 2011

40. Privacy and Personal Information

Protection Act 1998

41. Protection of the Environment

Operations (Clean Air) Regulation 2021

42. Protection of the Environment

Operations (Clean Air) Regulation 2022

43. Protection of the Environment

Operations (Noise Control) Regulation 2017

44. Protection of the Environment

Operations (Waste) Regulation 2014

45. Protection of the Environment

Operations Act 1997

46. Protection of the Environment

Operations (General) Regulation 2022

47. Public Health Act 2010

48. Public Interest Disclosures Act 1994

49. Public Spaces (Unattended Property)

Act 2021

50. Road Rules 2014

51. Road Transport Act 2013

52. Road Transport (General) Regulation

2021

53. Roads Regulation 2018

54. Rural Fires Act 1997

55. State Emergency and Rescue Management

Act 1989

56. State Emergency Service Act 1989

57. State Environmental Planning Policy

(Biodiversity and Conservation) 2021

58. State Records Act 1998

59. Strata Schemes Management Act 2015

60. Swimming Pools Act 1992

61. Water Management Act 2000

62. Work Health and Safety Act 2011

63. Workers Compensation Act 1987

Review of Financial

Delegations

To clarify for staff the financial limits of delegations, a

review has been undertaken of all delegations that state a monetary figure. The

purpose was to clarify whether the figure is inclusive or exclusive of GST. As

a result of the review, the following delegations have been amended to include

whether the figure excludes or includes GST.

|

BSC00 - BSC006

|

Authorise

expenditure up to the limit of authority, being financial delegation to

$1000/2000/5000/10000/20000/50000/100000/250000 (ex GST) per transaction

Obtain quotations and

authorise the purchase of, and issue official orders for goods, works and

services required for the functioning of the Council and to incur expenditure

for such goods, works and services (excluding that for the purchase of major

items or works, plant, and/or motor vehicles) provided that and subject

to:

a) due provision has

been made in the approved Budget for the incurring of such expenditure;

or

b) the incurring of

such expenditure is otherwise authorised as per the Procurement and Tendering

Policy and Guidelines; and

c) the delegate not

accepting tenders which are required by the Act to be invited by Council.

|

|

BSC067

|

Funding agreements

– Children’s services

Create funding

agreements including Inclusion Support and other funding agreements up to the

value of $50,000 (ex GST)

|

|

BSC072

|

Write

off rates and charges payable up to a maximum amount

Write off, in

accordance with Regulation,

rates and charges payable, up to a maximum of $1,000 (ex GST) per transaction if the

person is unable to pay due to circumstances beyond their control or payment

would cause undue hardship,

in accordance with Council policies and

procedures

|

|

BSC091

|

Commencing or defending legal proceedings

Delegation to

commence or defend legal proceedings is limited to those proceedings in which Council's external solicitors (if engaged) estimate, in writing,

that the professional legal costs for the proceedings will be less

than $50,000 (ex GST)

unless commencement or defence of legal proceedings

has otherwise been authorised by Council

resolution. Where Council's external solicitors are not engaged delegation to

commence or defend legal proceedings is limited to those

proceedings in which Council's internal solicitors

estimate, in writing, that the disbursements for the

proceedings will be less than $50,000 (ex GST) unless commencement or defence of legal proceedings has

otherwise been authorised by Council resolution. Exercise of delegation is subject to Councillors being informed by

memorandum of its exercise and the progress of the

proceedings, together with current

cost expenditure, being reported to councillors monthly.

|

|

BSC102

|

Restrictions

on writing off debts to a council

The

amount above which debts to the Council may be written off only by resolution

of the Council is $10,000 (ex GST)

|

|

BSC106

|

Enter into a contract or authorise expenditure for works, for

an amount not exceeding $50,000 (ex GST)

Enter into a

contract or authorise expenditure for works,

for an amount not exceeding $50,000 (ex GST) provided:

a) The matter is urgent and cannot wait until the next available Ordinary Meeting.

b) For amounts over $15,000 (ex GST) the concurrence of the

General Manager is required.

c) Must be

reported to the next available Council meeting.

|

|

BSC113

|

Not

currently in use:

Entering

contracts primarily for the purpose of response to or recovery from a

declared natural disaster

Enter

contracts up to $2,000,000 (ex GST) but only for a contract that –

a) is primarily for the purpose of response to or recovery

from a declared natural disaster (as defined in the Regulation), and

b) is entered into within 12 months

after the date on which the natural disaster is declared.

|

|

DEG002a

|

Acceptance of

tenders other than to provide services currently provided by members of staff

of the council (s377(1)I of LGA)

Acceptance of tenders

is limited to:

a) Capital

works specifically itemised in a budget approved by Council (as

long as the tendered amount falls within the approved budget); or

b) Renewal of

existing contracts; or

c) Contracts that are

less than $500,000 (ex GST) in value

|

|

DEG088a

|

Development assessment determination exceptions Director

Make all determinations necessary under Part 4 Development Assessment and Consent of the Environmental Planning and Assessment Act, 1979 (Delegation DEG088) except as listed below:

…

ii. Any development

application that has an

estimated value exceeding

$10,000,000 (inc GST) or for subdivision

of land that will create

10 or more lots. (Res 22:311)

…

v. Any development

application where there

is a SEPP 1 Application to vary development

standards by 10% or more

( except when

associated with Development Applications with an estimated value exceeding $10,000,000 (inc GST)

or any subdivision

exceeding 10 lots). (Res

22-311)

|

|

DEG088b

|

Development assessment determination exceptions Manager

Make all determinations necessary under Part 4 Development Assessment and Consent of the Environmental Planning and Assessment Act 1979 (Delegation DEG088) except:

a) Any development application that has an estimated value exceeding $2,000,000 (inc GST)

|

|

DEG088c

|

Development assessment determination exceptions team leader/major projects planner

Make all determinations necessary under Part 4 - Development Assessment and Consent of the Environmental Planning and Assessment Act, 1979 (Delegation DEG088) except:

…

n) Any development application that has an estimated value exceeding $1,500,000 (inc GST).

|

|

DEG088e

|

Applications under Part 4 of the Environmental Planning and Assessment Act 1979

Delegations do not include determination of any:

Development Application

or Section 4.55 Modification Application that is referred to Council by the

Planning Review

Committee unless the stated issues

requiring referral are subsequently resolved to

the satisfaction of the Planning

Review Committee.

Application that has an estimated value exceeding

$10,000,000 (inc GST) or for subdivision of land that

would create 10 or more

lots…

|

Key issues

The delegations assigned to the Mayor and staff are based on

the position they hold in Council and the tasks they are required to perform in

that position. Staff are at risk of undertaking their roles illegally or not in

accordance with Council’s resolutions or policies, when acting outside

their delegations or by having incorrect delegations assigned to them.

To increase understanding and acceptance of delegations, the

Mayor and staff are required to acknowledge each function and authority either

electronically within the Delegations Register or in writing. This is done upon

commencement of their role or when delegations change.

Enterprise Risk Management

Delegations are listed as a control measure in

Council’s Risk Register with regard to the following risk areas:

|

Risk Title

|

Risk Description

|

|

|

|

Corporate Compliance

|

Council does not implement adequate

processes and controls to ensure corporate compliance across the organisation

and prevent fraud and corruption leading to significant illegal, fraudulent

or corrupt activity and/or breach of legislative or regulatory, requirements

resulting in penalties/sanctions, legal disputes or litigation and financial

loss

|

|

|

Fraud - Unauthorised Delegation

|

Council is bound to certain legal

and service obligations due to an officer of Council acting outside of their

delegation resulting in financial loss, potential legal ramifications and

reputational harm.

|

|

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1: Effective Leadership

We have effective decision making and

community leadership that is open and informed

|

1.1: Enhance trust and accountability through open and

transparent leadership

|

1.1.2: Governance - Ensure legislative compliance and

support Councillors to carry out their civic duties

|

1.1.2.2

|

Maintain, publish and report on relevant registers

including delegations, Councillors and designated staff disclosures of

interests, Councillor and staff gifts and benefits, and staff secondary

employment.

|

Legal/Statutory/Policy Considerations

· Section

377 of the Local Government Act 1993

· Section

378 of the Local Government Act 1993

· As

identified in the body of the report.

Alignment with ARIC

Responsibilities

This report has been prepared to support the committee in

fulfilling the following responsibilities as set out in the ARIC Constitution:

5.5. Governance

a) Review

whether appropriate processes and systems are in place for the management and

exercise of delegations.

Financial Considerations

There are no financial considerations.

Consultation and

Engagement

Prior to making any amendments to Council’s

Delegations Register, consultation is held with relevant managers, the

Executive Team, Council and when required, a firm of solicitors that Council

subscribes to for the purpose of delegations.

For Information Only 7.5

Report

No. 7.5 Annual

Legislative Compliance Status Report 2022-2023

Directorate: Corporate

and Community Services

Report Author: Mila

Jones, Governance and Internal Audit Coordinator

File No: I2023/1616

Summary:

This report presents the status of Council’s

compliance with legislative reporting requirements for the 2022-2023 financial

year.

Attachments:

1 Legislative

Compliance Reporting Register - Status as at 30 June 2023, E2023/77387

Report

The attachment to this report provides evidence of

Council’s compliance with legislative reporting requirements for

2022-2023. For this period there were mostly no areas

of concern where compliance was not met, or where actions had not been taken

towards compliance. There were two low risk instances of non-compliance

relating to:

1. The requirement for

Council’s GST Certificate to be submitted to the Office of Local

Government

2. Public Interest Disclosures

half yearly report to be lodged with the NSW Ombudsman

Measures have been taken to

overcome these failures. These items are denoted in red in the attached report.

Compliance reviews assess whether specific legislation,

directions and regulations have been adhered to. Council’s Legislative

Compliance Reporting Register provides:

· a system to retrospectively report on compliance.

· a systematic approach to the compliance calendar produced

by the Office of Local Government but also includes various other reporting

obligations including those required of environmental planning licences,

Government Information (Public Access) Act, Protection of the Environment

Operations Act and others.

The register itself will not

ensure compliance, however it provides a prompt and a tool to ensure Council

takes a systematic and comprehensive approach to reviewing and reporting on

compliance.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1:

Effective Leadership

|

1.1:

Enhance trust and accountability through open and transparent leadership

|

1.1.2:

Governance - Ensure legislative compliance and support Councillors to carry

out their civic duties

|

1.1.2.1

|

Coordinate

review, maintain and report on Council's Legislative Compliance Reporting

Register

|

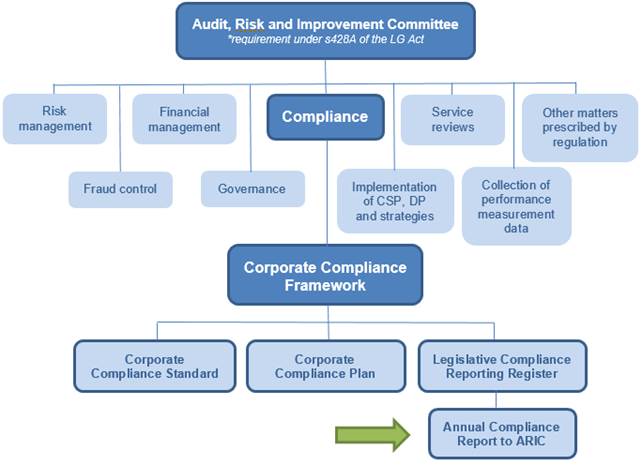

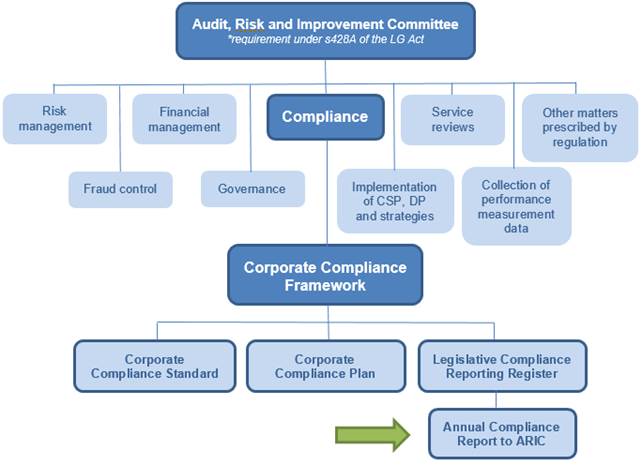

Legal/Statutory/Policy Considerations

This report meets the

requirements of the Office of Local Government’s proposed Risk Management

and Internal Audit Framework, and Council’s Corporate Compliance

Framework.

Council’s Corporate Compliance Framework includes:

- Corporate

Compliance Plan (adopted by Council on 25 June 2020)

- Corporate

Compliance Standard (adopted by Council on 25 June 2020)

- Legislative

Compliance Reporting Register (Attachment 1)

A compliance framework is important as it:

- promotes

a culture of compliance

- fosters

continuous improvement in compliance processes

- ensures

obligations are met and helps the organisation demonstrate its corporate and

social responsibilities.

Alignment with ARIC

Responsibilities

This report has been prepared to support the committee in

fulfilling the following responsibilities as set out in the ARIC Constitution:

5.1. Compliance

c) Review

the effectiveness of the system for monitoring compliance with laws and

regulations, policies and procedures.

Financial Considerations

Nil.

Consultation and

Engagement

This status report was

presented to the Executive Team on 9 August 2023 following consultation with

relevant managers and staff for the completion of the status update.

I2023/1739

I2023/1739