What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Code of Conduct for Councillors (eg. A friendship, membership of an

association, society or trade union or involvement or interest in an activity

and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary

interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

Committee members are reminded that they should declare and manage all

conflicts of interest in respect of any matter on this Agenda, in accordance

with the Code of Conduct.

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development

application, an environmental planning instrument, a development control plan

or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register

containing, for each planning decision made at a meeting of the council or a

council committee, the names of the councillors who supported the decision and

the names of any councillors who opposed (or are taken to have opposed) the

decision.

(3) For the purpose of maintaining the register, a division

is required to be called whenever a motion for a planning decision is put at a

meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described

in the register or identified in a manner that enables the description to be

obtained from another publicly available document and is to include the

information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are

reminded of the oath of office or affirmation of office made at or before their

first meeting of the council in accordance with Clause 233A of the Local

Government Act 1993. This includes undertaking the duties of the office of

councillor in the best interests of the people of Byron Shire and the Byron

Shire Council and faithfully and impartially carrying out the functions,

powers, authorities and discretions vested under the Act or any other Act

to the best of one’s ability and judgment.

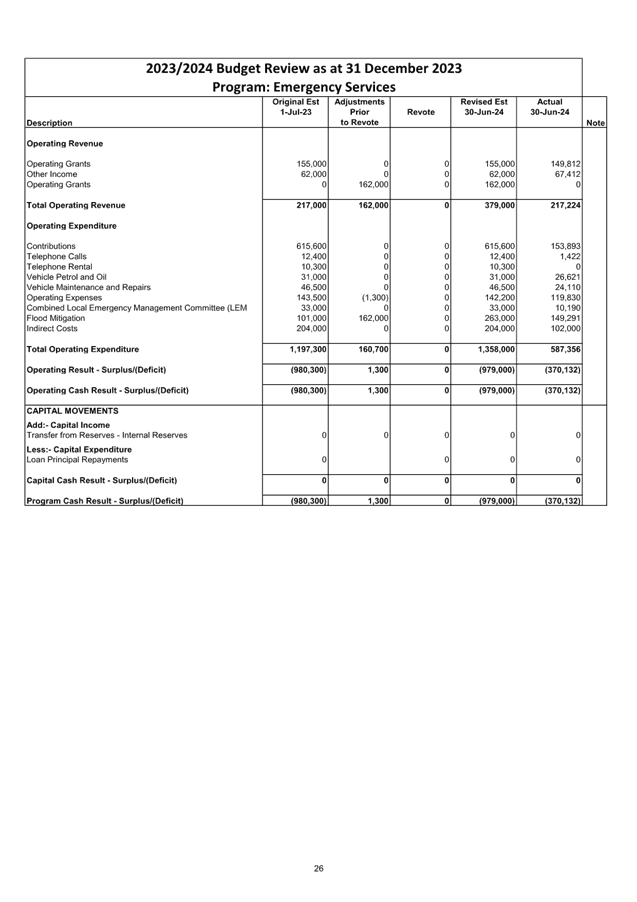

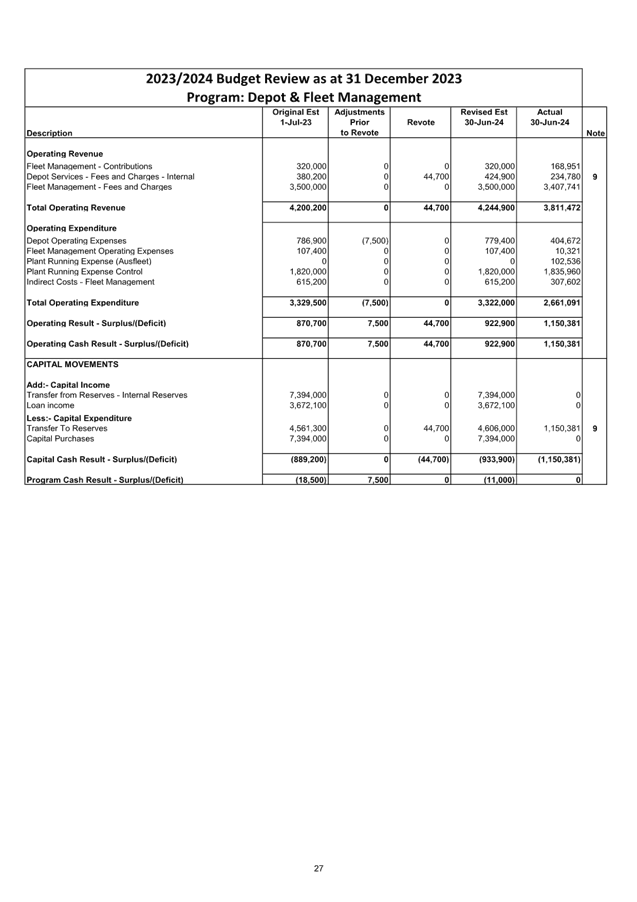

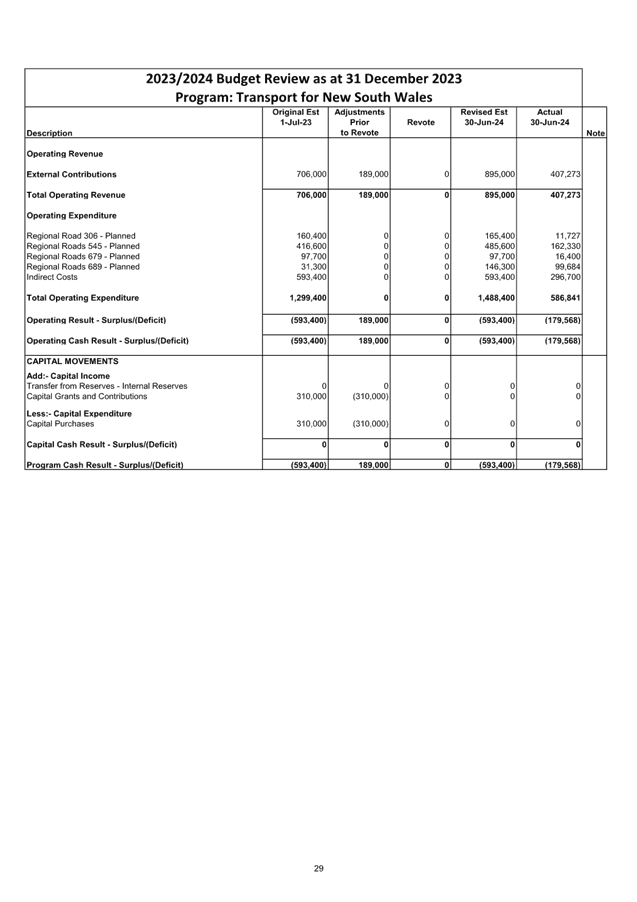

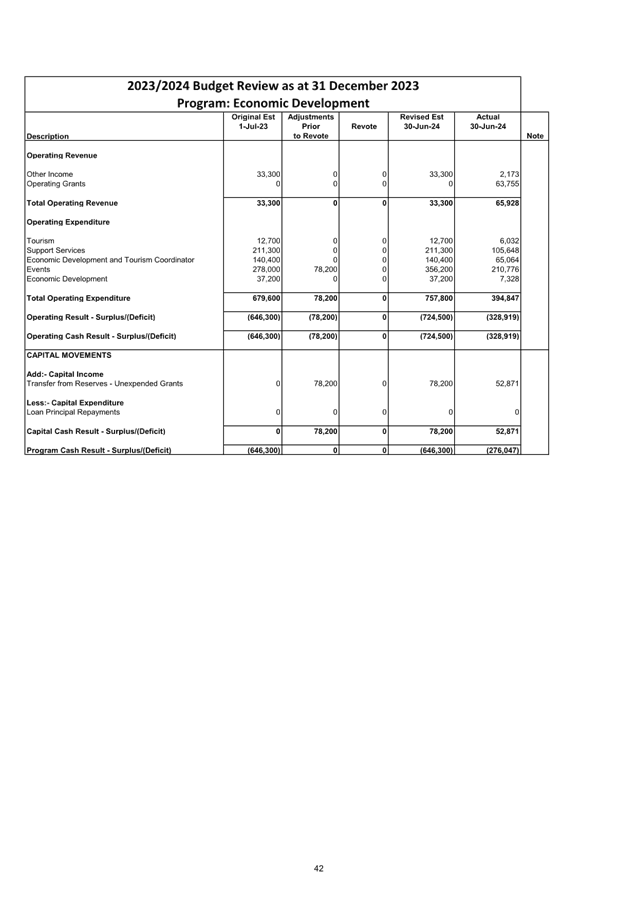

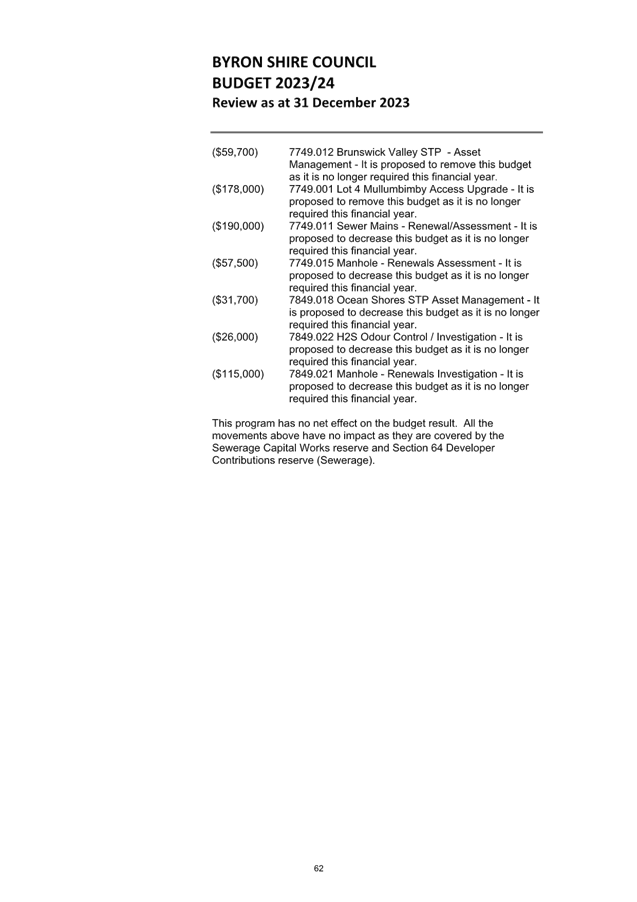

Staff Reports - Corporate and Community Services 3.1

Staff Reports - Corporate and Community

Services

Report No. 3.1 Budget

Review - 1 October 2023 to 31 December 2023

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2024/60

Summary:

This report has been prepared to comply with Section 203 of

the Local Government (General) Regulation 2021 and to inform Council and

the community of Council’s estimated financial position for the 2023/2024

financial year, reviewed as at 31 December 2023.

This report contains an overview of the proposed budget

variations for the General Fund, Water Fund and Sewerage Fund. The specific

details of these proposed variations are included in Attachment 1 and 2 for

Council’s consideration and authorisation.

Attachment 3 contains the Integrated Planning and Reporting

Framework (IP&R) Quarterly Budget Review Statement (QBRS) as outlined by

the Office of Local Government in circular 10-32.

RECOMMENDATION:

1. That

Council authorises the itemised budget variations as shown in Attachment 2

(#E2024/4306) which include the following results in the 31 December 2023

Quarterly Review of the 2023/2024 Budget:

a) General

Fund – $1,200 increase to the Estimated Unrestricted Cash Result

b) General

Fund - $2,772,500 increase in reserves

c) Water

Fund - $282,400 increase in reserves

d) Sewerage

Fund - $3,614,200 increase in reserves

2. That

Council adopts the revised General Fund Estimated Unrestricted Cash Deficit of

$250,000 for the 2023/2024 financial year as at 31 December 2023.

Attachments:

1 Budget

Variations for General, Water and Sewerage Funds, E2024/4306 , page 20⇩

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2024/4295 ,

page 84⇩

3 Integrated

Planning and Reporting Framework (IP&R) required Quarterly Review

Statements, E2024/4296 , page 88⇩

Report

Council adopted the 2023/2024 budget on 22 June 2023 via

Resolution 23-280. Council also considered and adopted the budget

carryovers from the 2022/2023 financial year, to be incorporated into the

2023/2024 budget at its Ordinary Meeting held on 24 August 2023 via Resolution 23-414.

Since that date, Council has reviewed the budget taking into consideration the

audited 2022/2023 Financial Statement results and progress through the first

half of the 2023/2024 financial year. This report considers the December 2023

Quarter Budget Review.

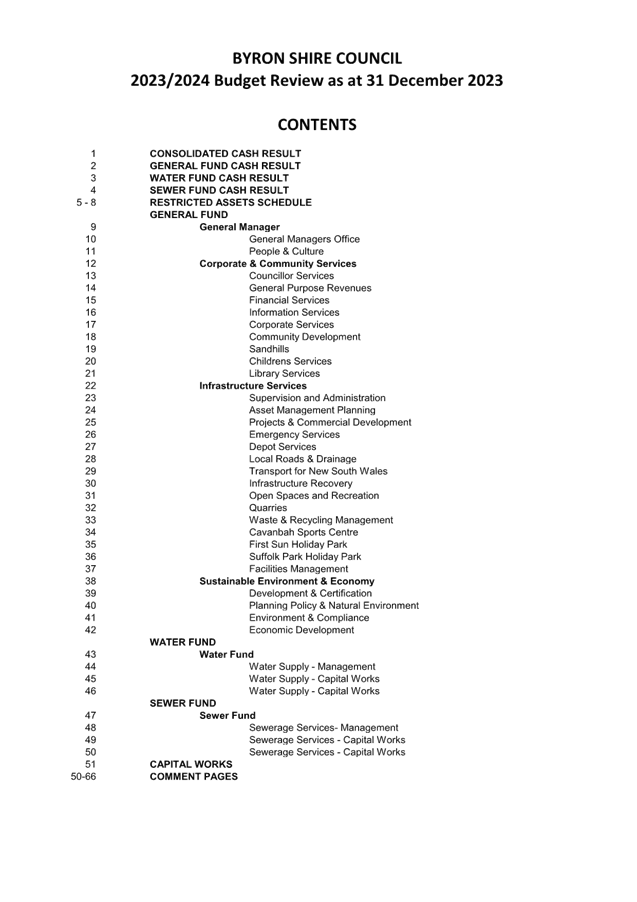

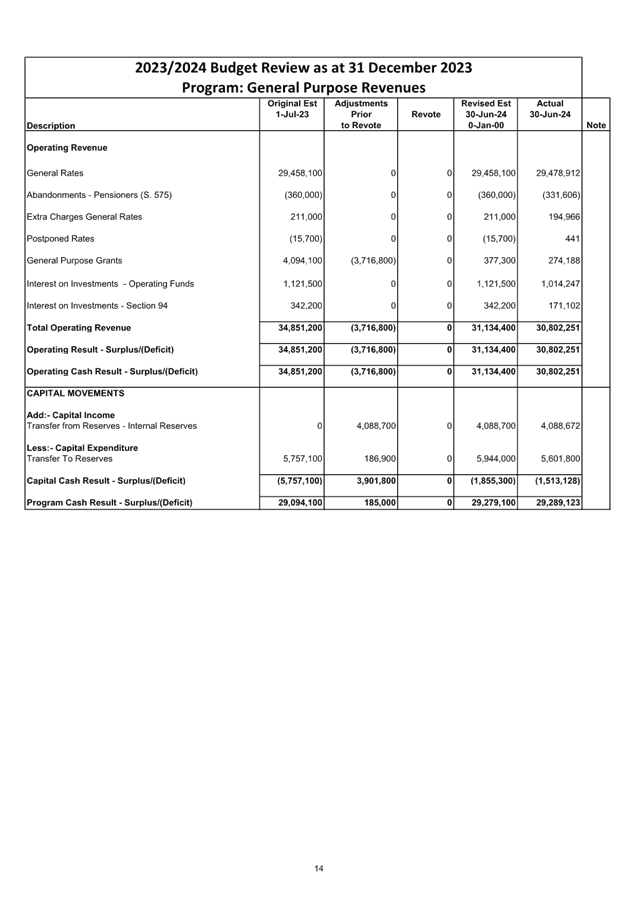

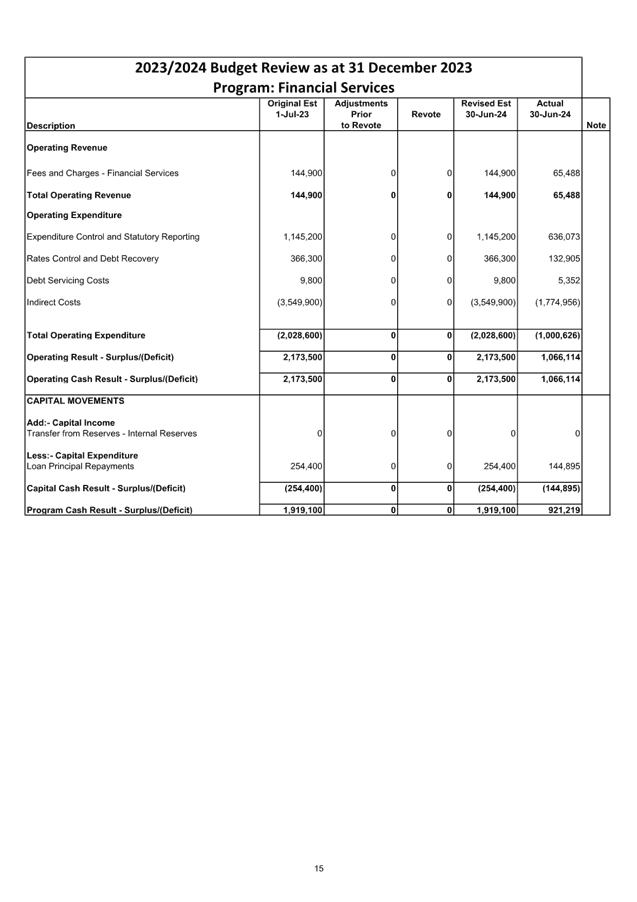

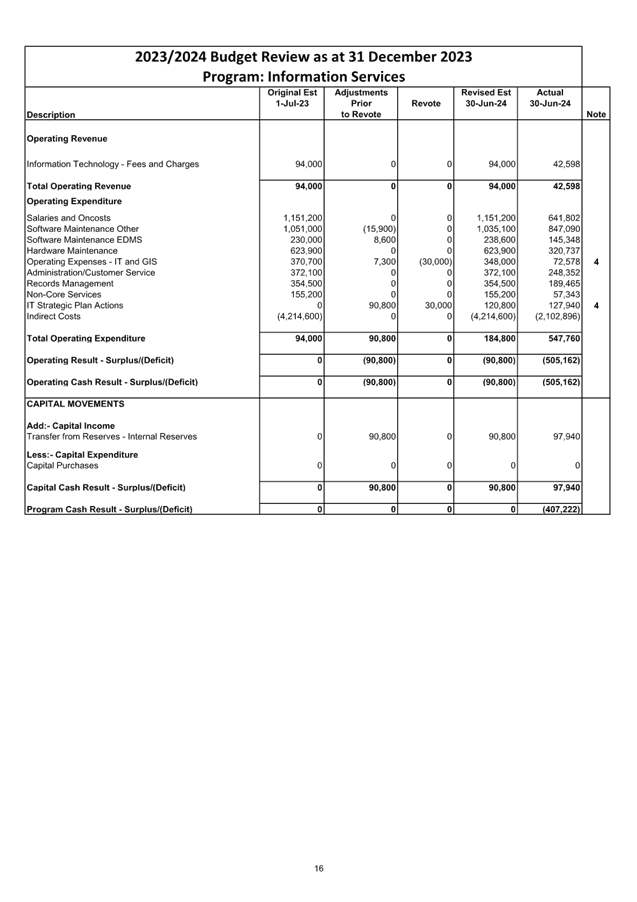

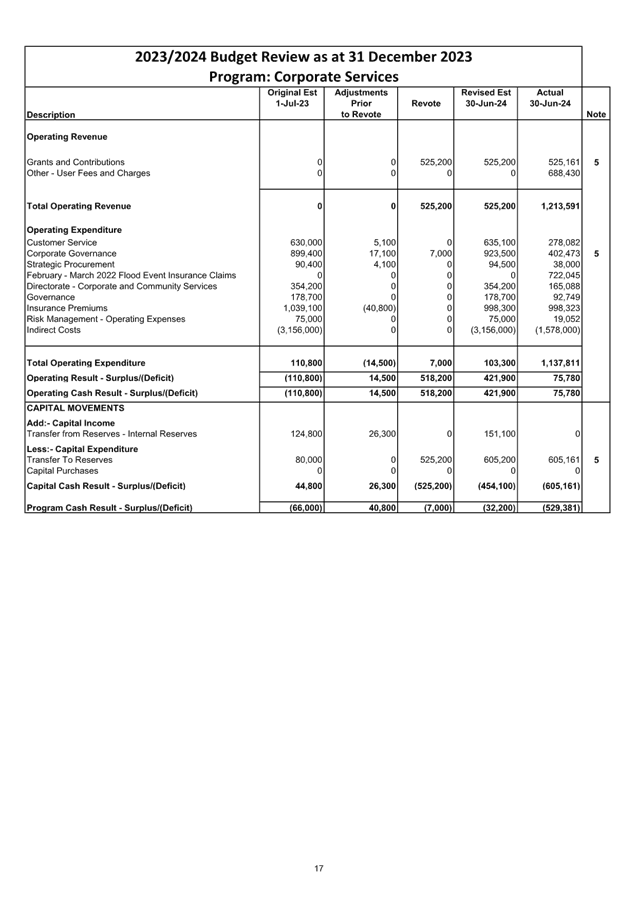

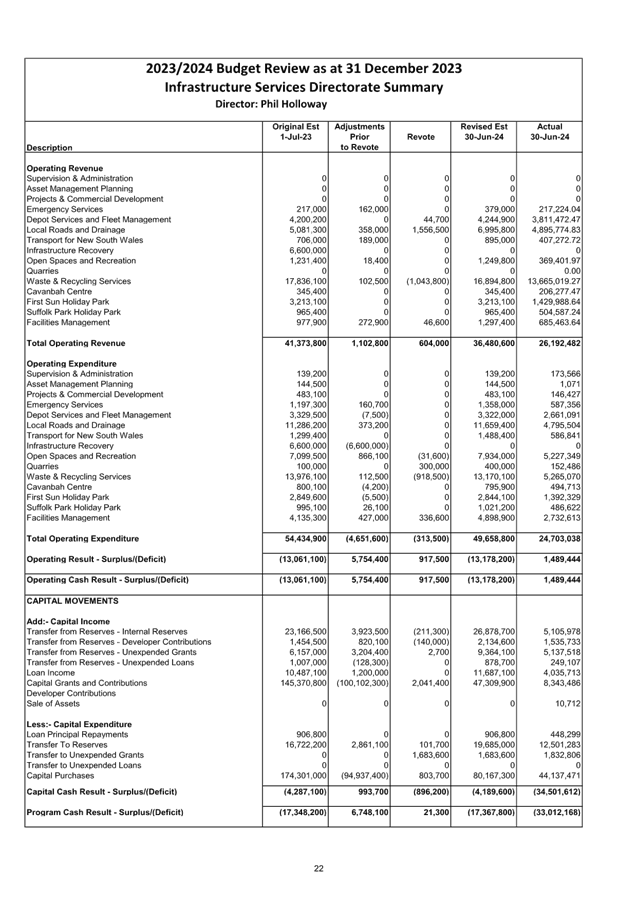

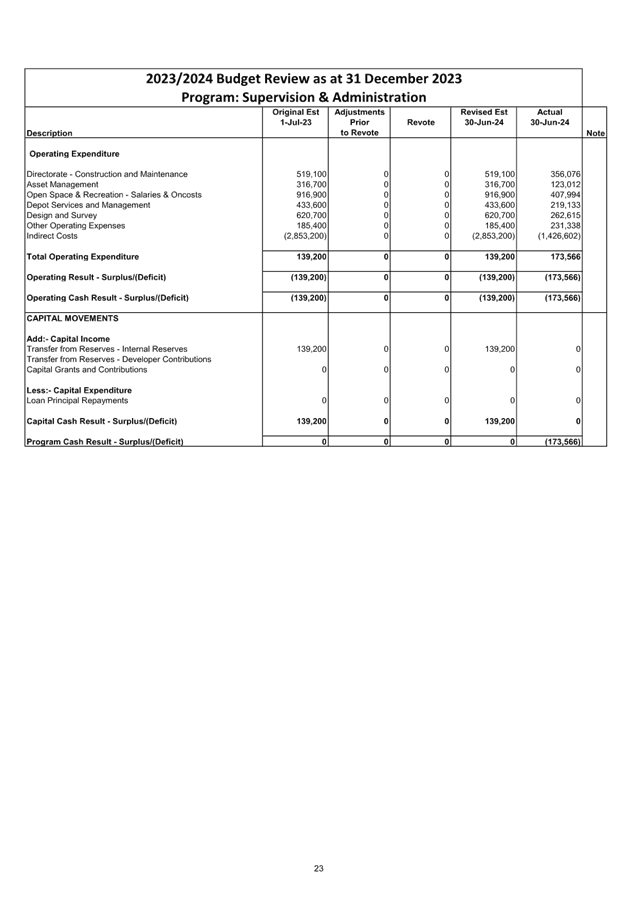

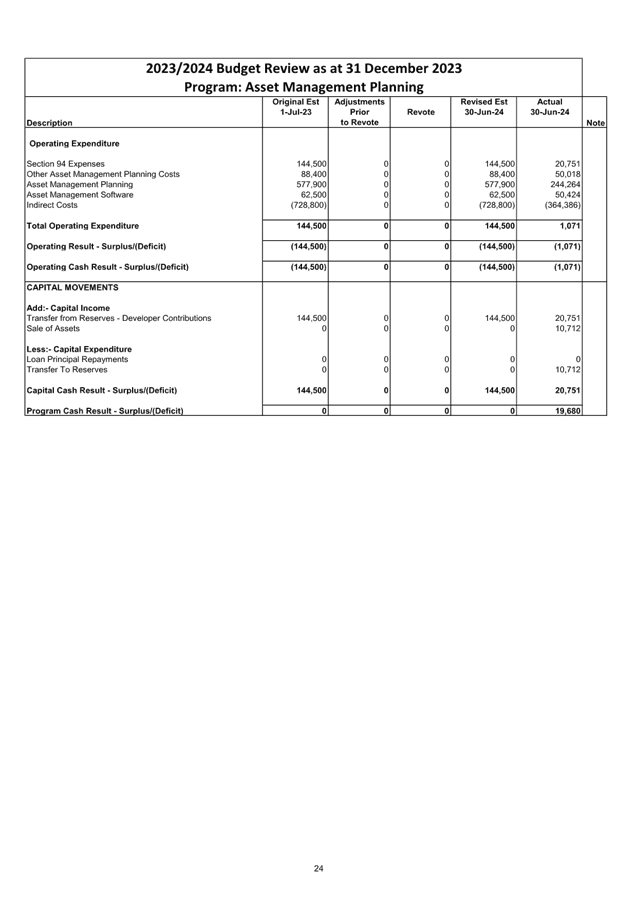

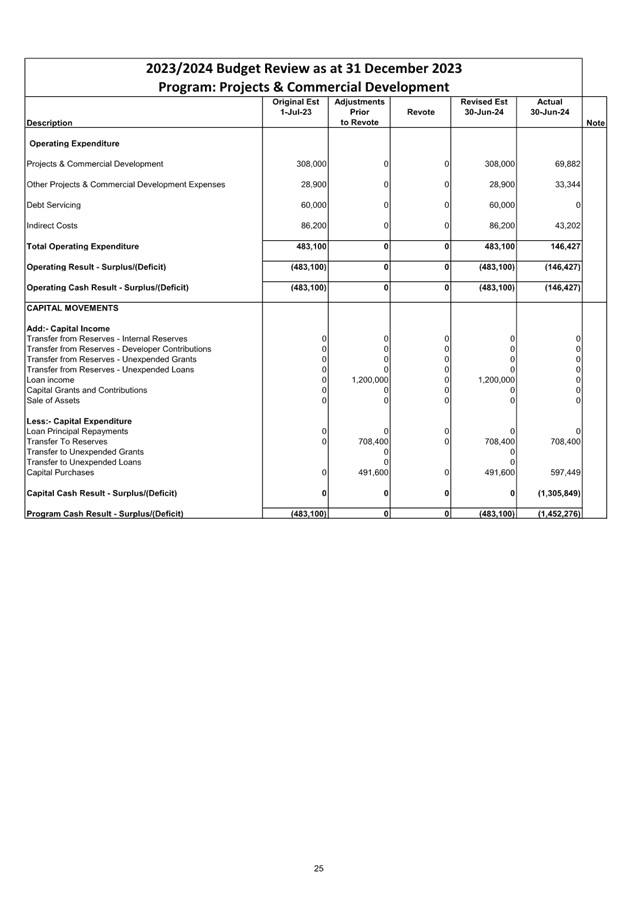

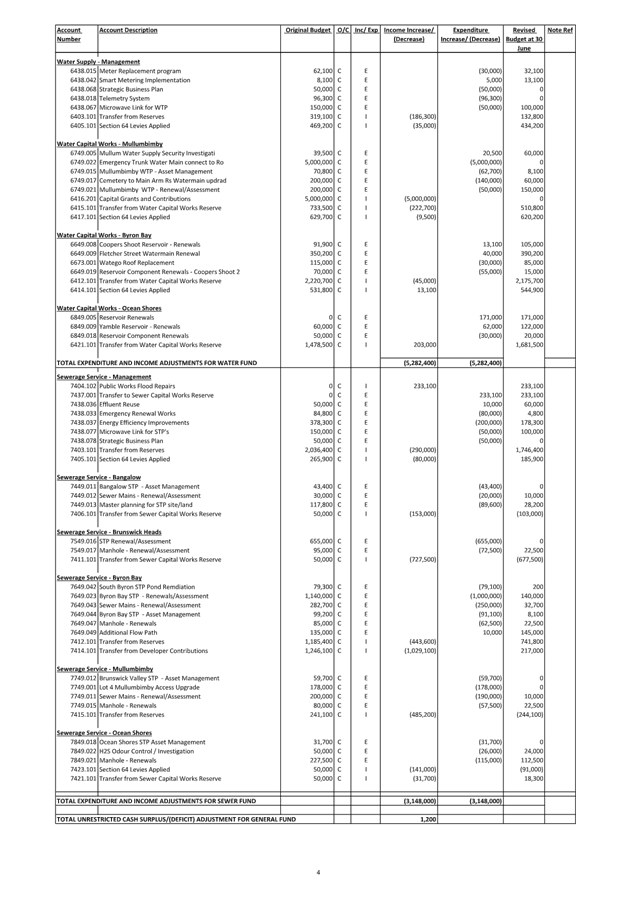

The details of the budget review for the Consolidated,

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget position of

Council, as well as a breakdown by Fund and Principal Activity. The document in

Attachment 1 is also effectively a publication outlining a review of the budget

and is intended to provide Councillors with more detailed information to assist

with decision making regarding Council’s finances.

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

The pages within Attachment 1

are presented (from left to right) by showing the original budget as adopted by

Council on 30 June 2023 plus the adopted carryover budgets from 2022/2023

followed by the resolutions between July and September and the revote (or

adjustment for this review) and then the revised position projected for 30 June

2024 as at 31 December 2023.

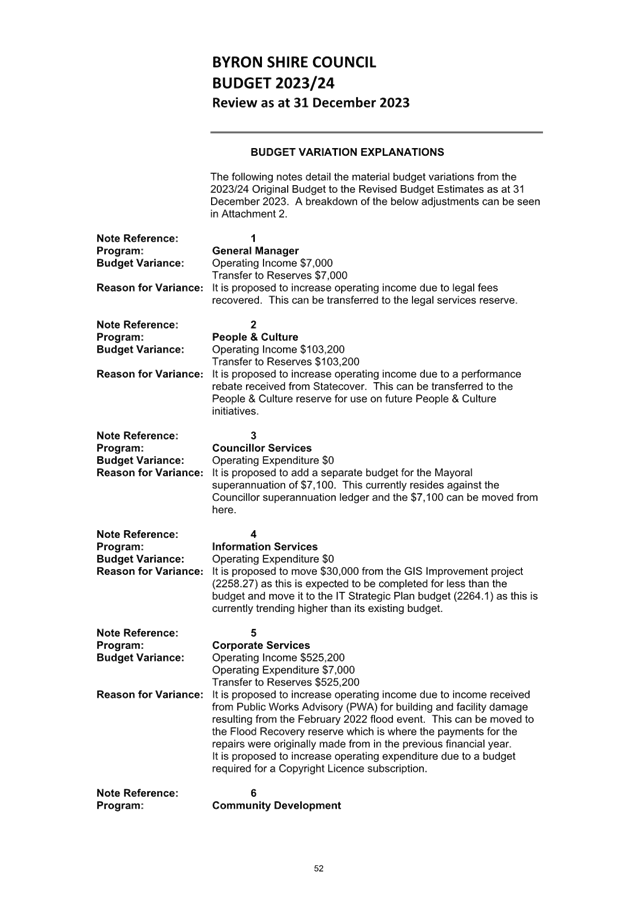

On the far right of the Principal Activity, there is a

column titled “Note”. If this is populated by a number, it

indicates there has been an adjustment in the quarterly review. This number

then corresponds to the notes at the end of the Attachment 1 which provides an

explanation of the variation.

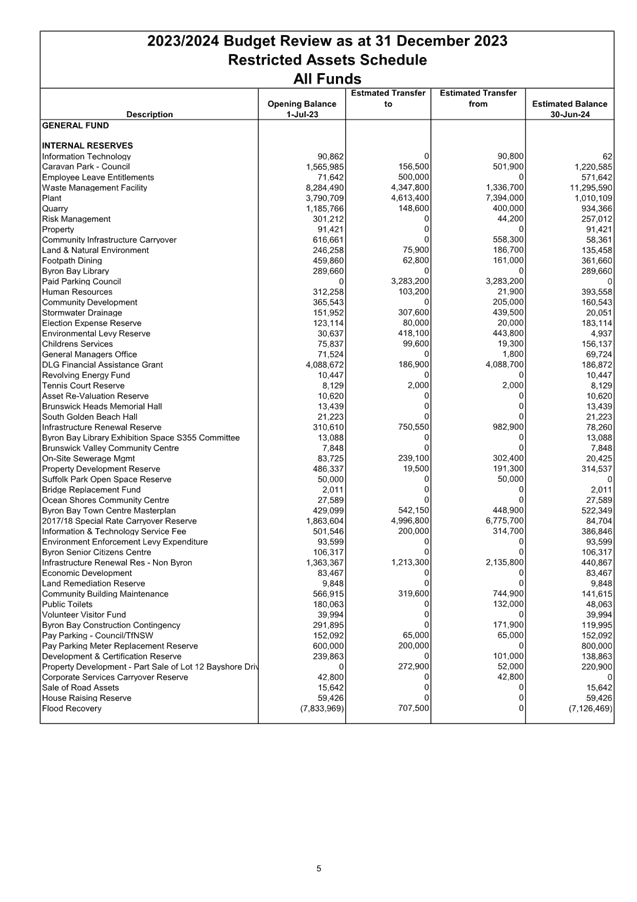

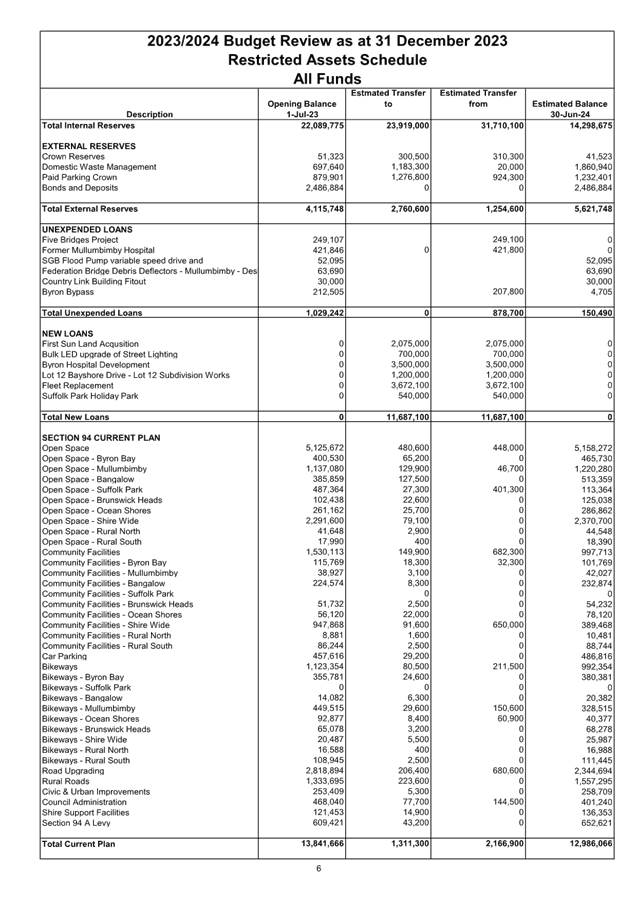

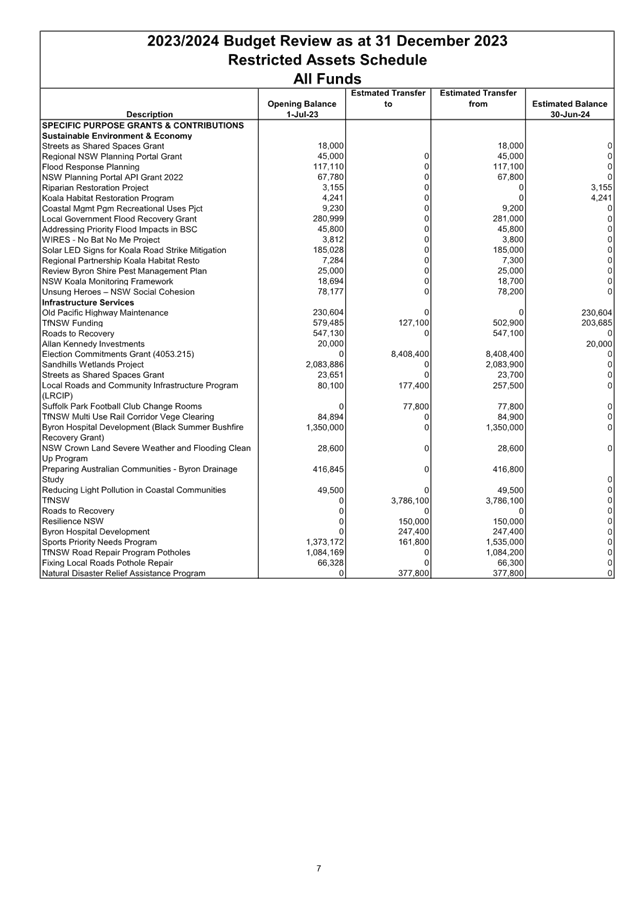

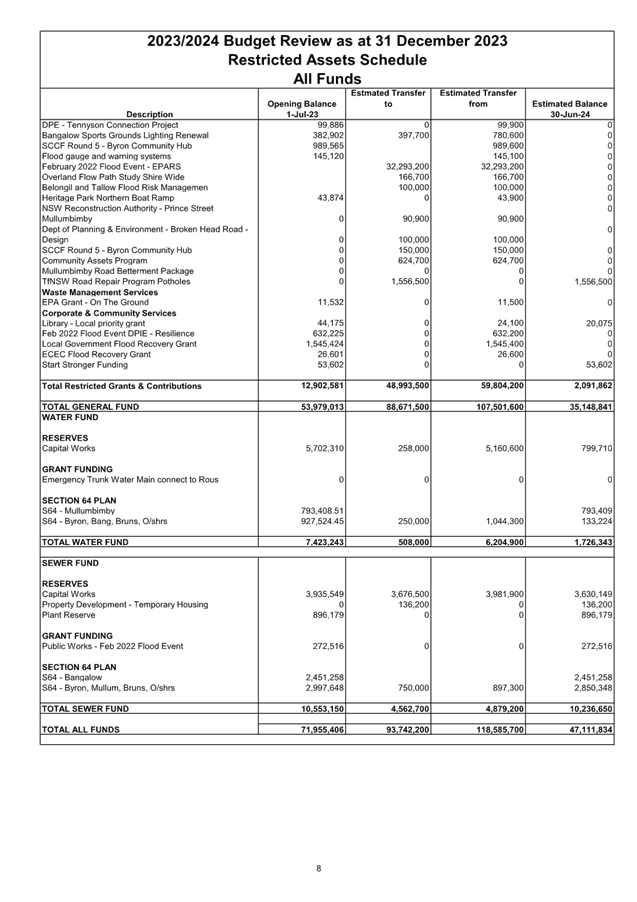

There is also information detailing restricted assets

(reserves) to show Council’s estimated balances as at 30 June 2024 for

all Council’s reserves.

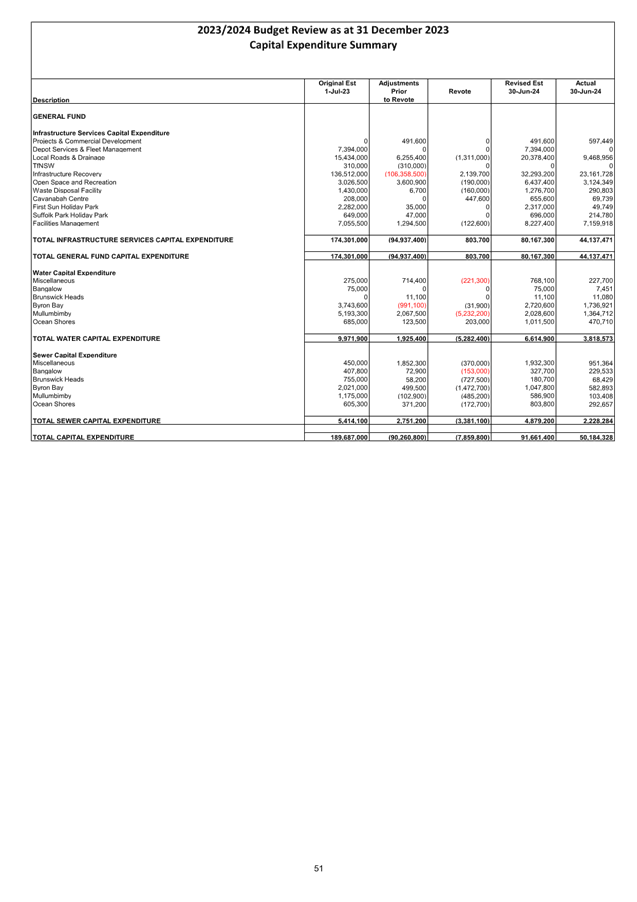

A summary of Capital Works is also included by Fund and

Principal Activity.

Office of Local Government Budget Review Guidelines:

The Office of Local Government on 10 December 2010 issued

the new Quarterly Budget Review Guidelines via Circular 10-32, with the

reporting requirements to apply from 1 July 2011. This report includes a

Quarterly Budget Review Statement (refer Attachment 3) prepared by Council in

accordance with the guidelines.

The Quarterly Budget Review Guidelines set a minimum

standard of disclosure, with these standards being included in the Local

Government Code of Accounting Practice and Financial Reporting as mandatory

requirements for Councils to address.

Since the introduction of the new planning and reporting

framework for NSW Local Government, it is now a requirement for Councils to

provide the following components when submitting a Quarterly Budget Review

Statement (QBRS):

· A

signed statement by the Responsible Accounting Officer on Council’s

financial position at the end of the year based on the information in the QBRS

· Budget

review income and expenses statement in one of the following formats:

o Consolidated

o By

fund (e.g. General, Water, Sewer)

o By

function, activity, program etc. to align with the management plan/operational

plan

· Budget

Review Capital Budget

· Budget

Review Cash and Investments Position

· Budget

Review Key performance indicators

· Budget

Review Contracts and Other Expenses

The above components are included in Attachment 3 and

outlined below:

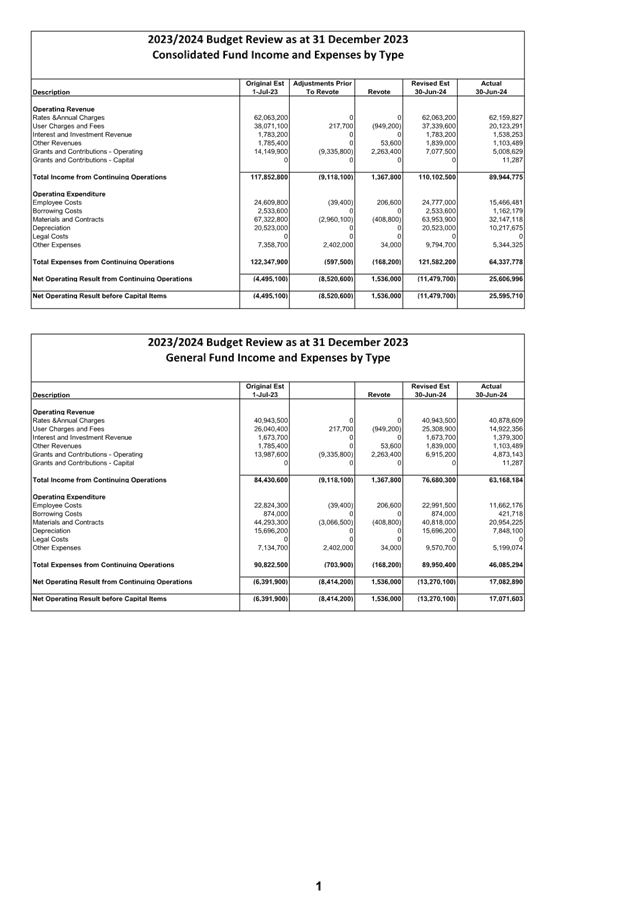

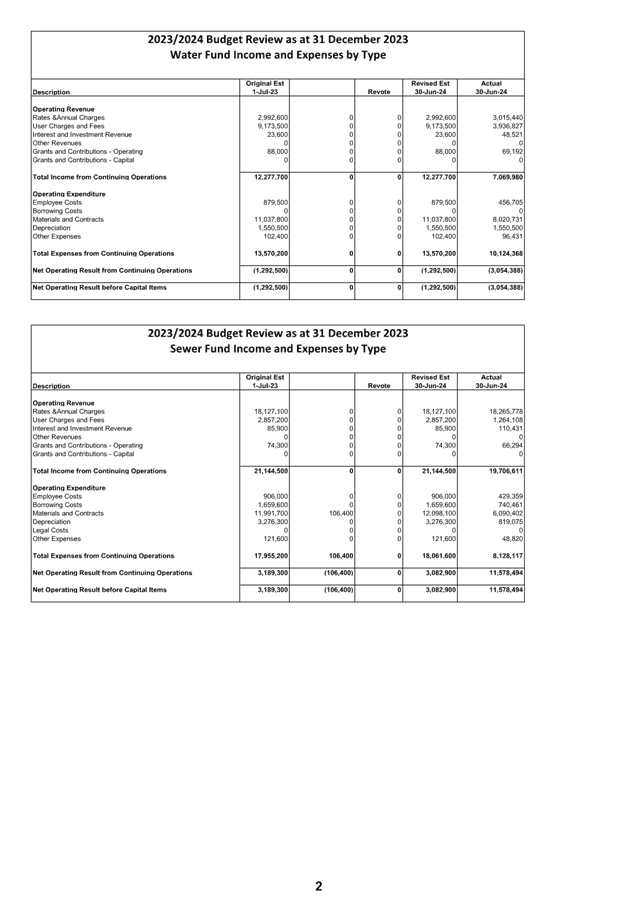

Income and Expenditure Budget Review Statement by Type

This shows Council’s income and Expenditure by

type. This has been split by Fund. Adjustments are shown, looking

from left to right. These adjustments are commented on through the last 13

pages of Attachment 1.

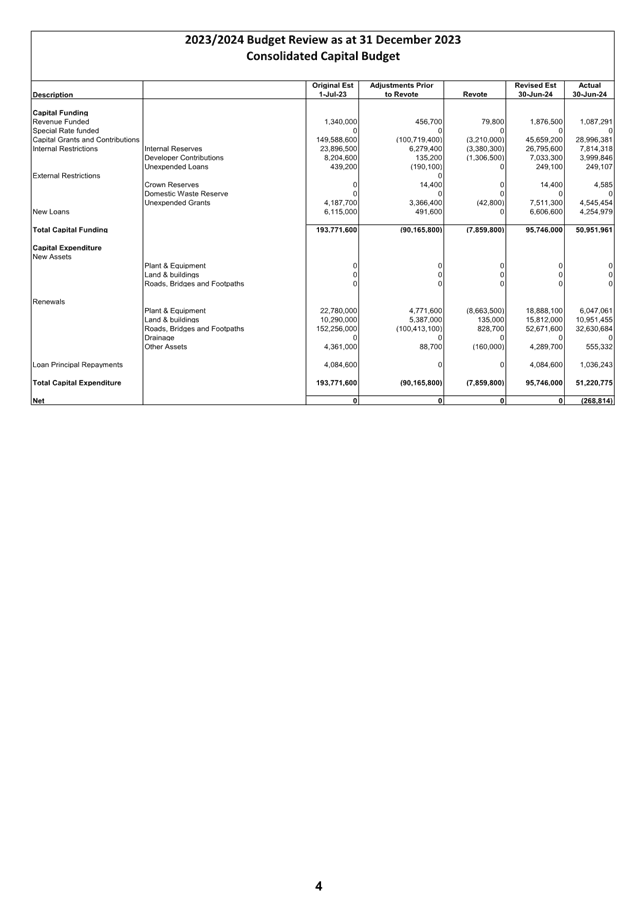

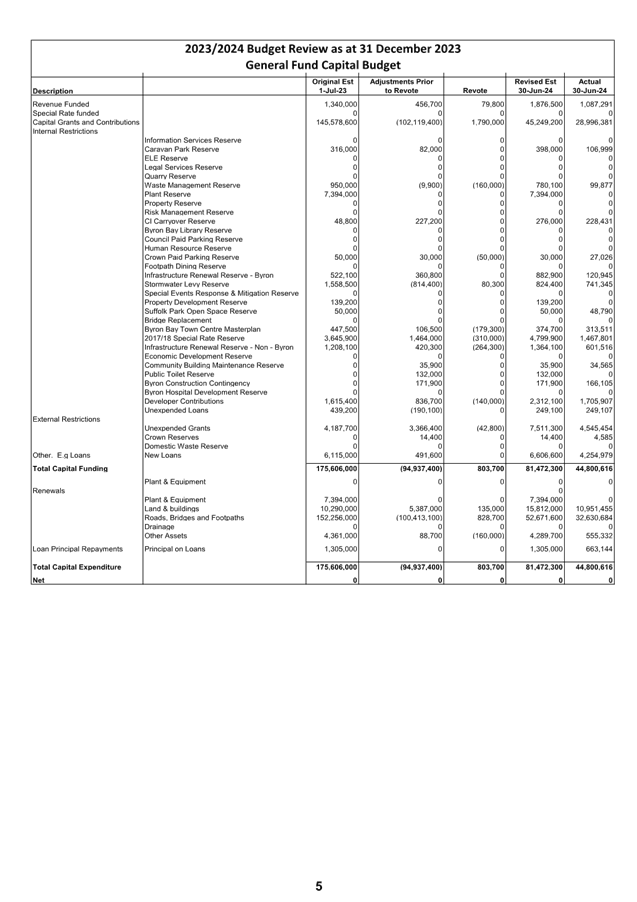

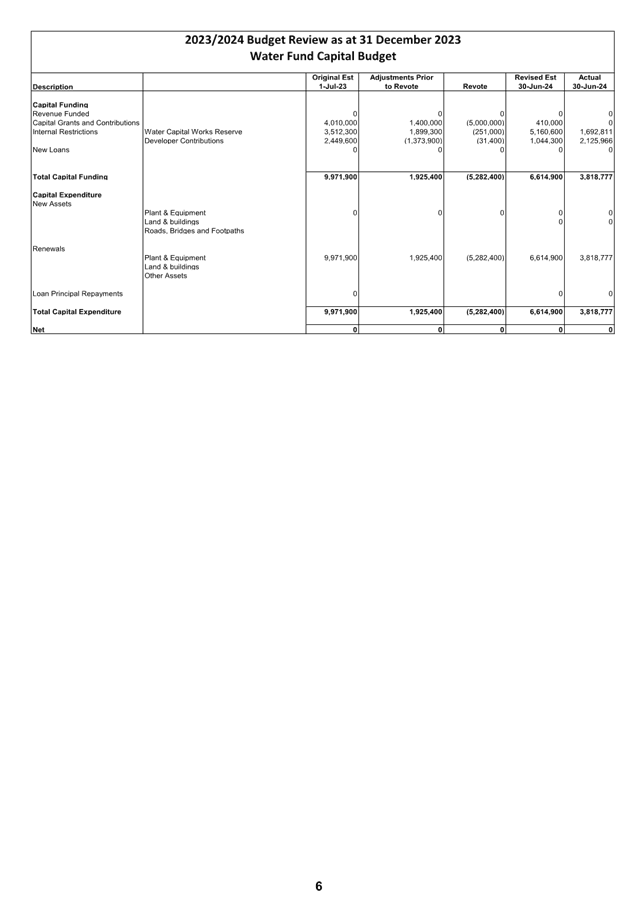

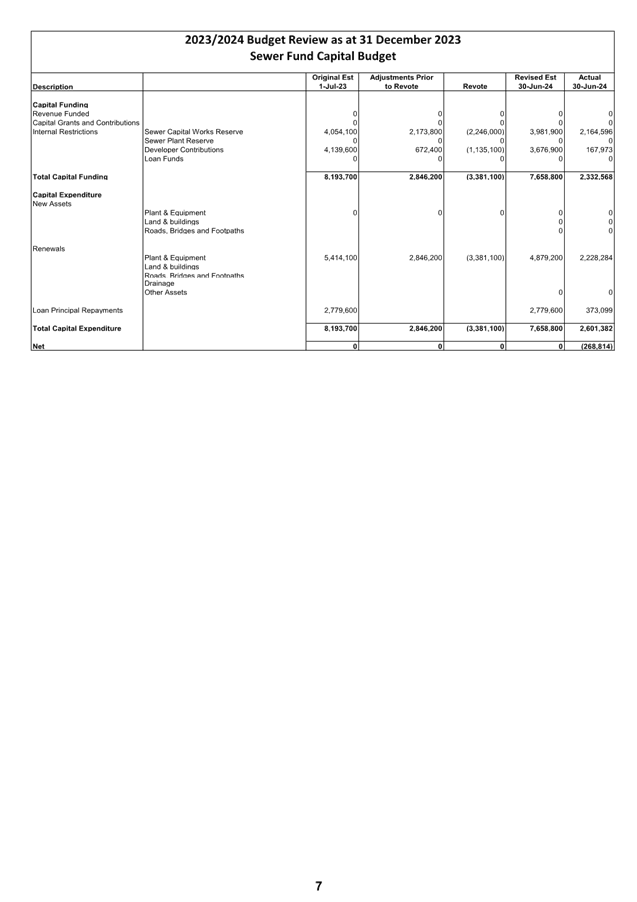

Capital Budget Review Statement

This statement identifies in summary Council’s capital

works program on a consolidated basis and then split by Fund. It also

identifies how the capital works program is funded. As this is the first

quarterly review for the reporting period, the Statement may not necessarily

indicate the total progress achieved on the delivery of the capital works

program.

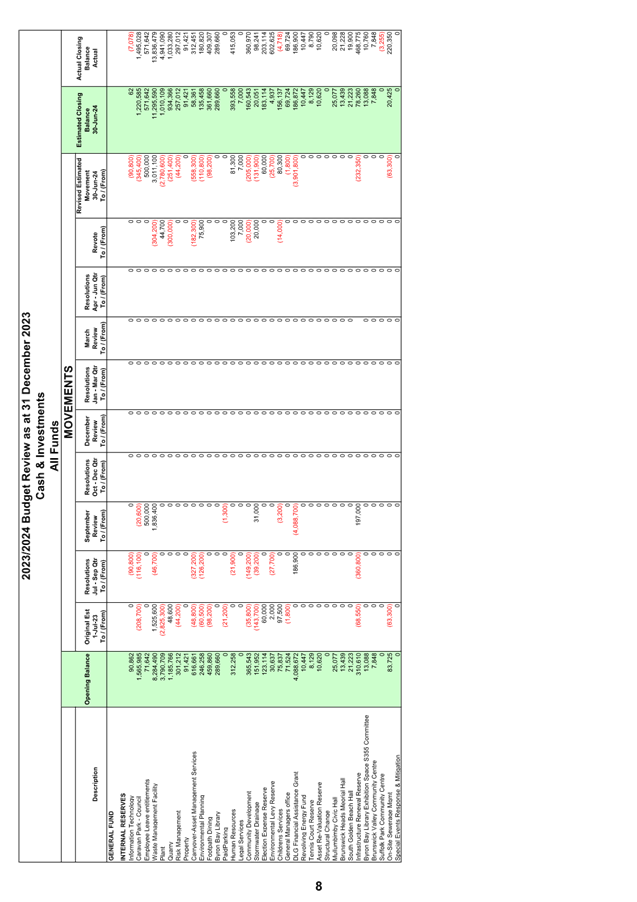

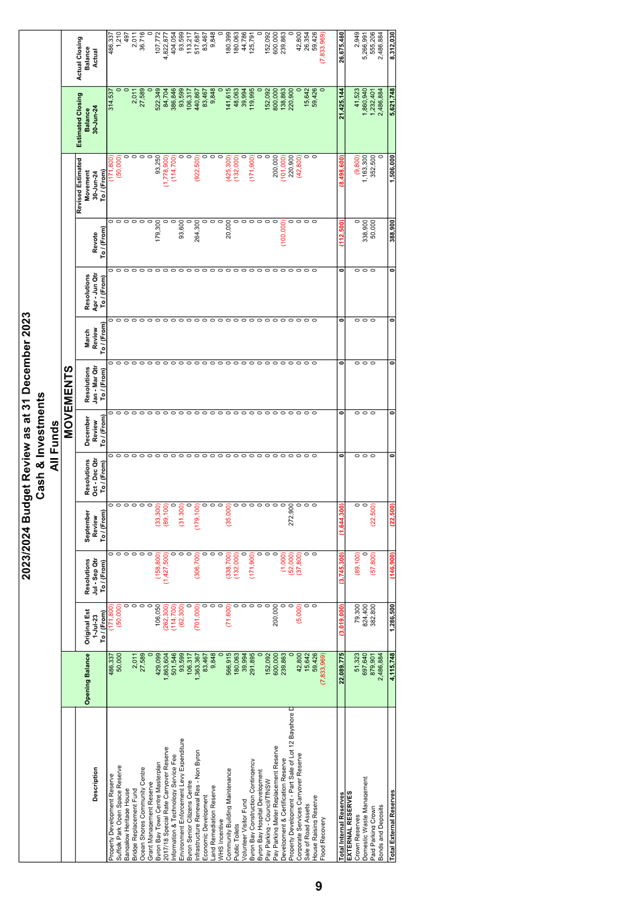

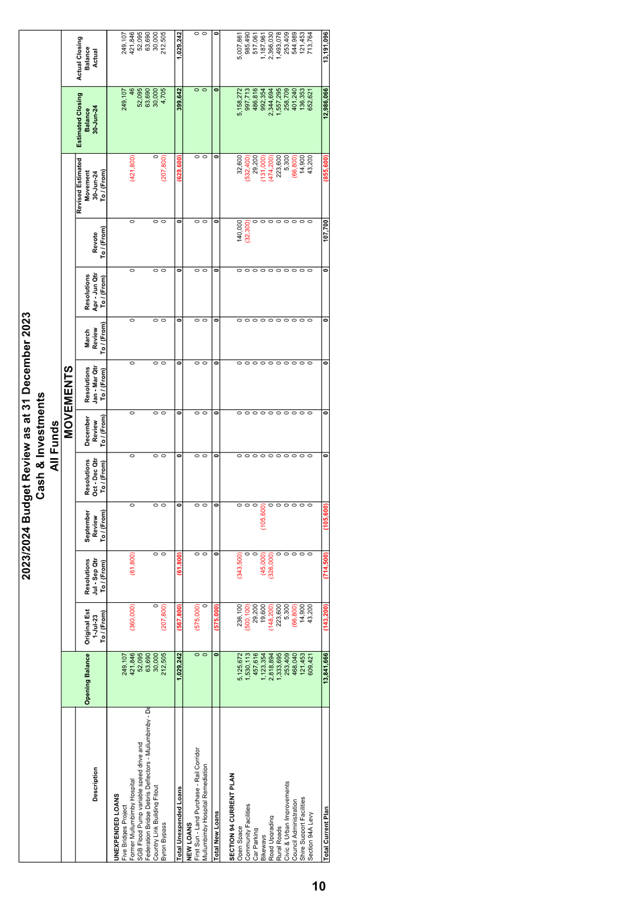

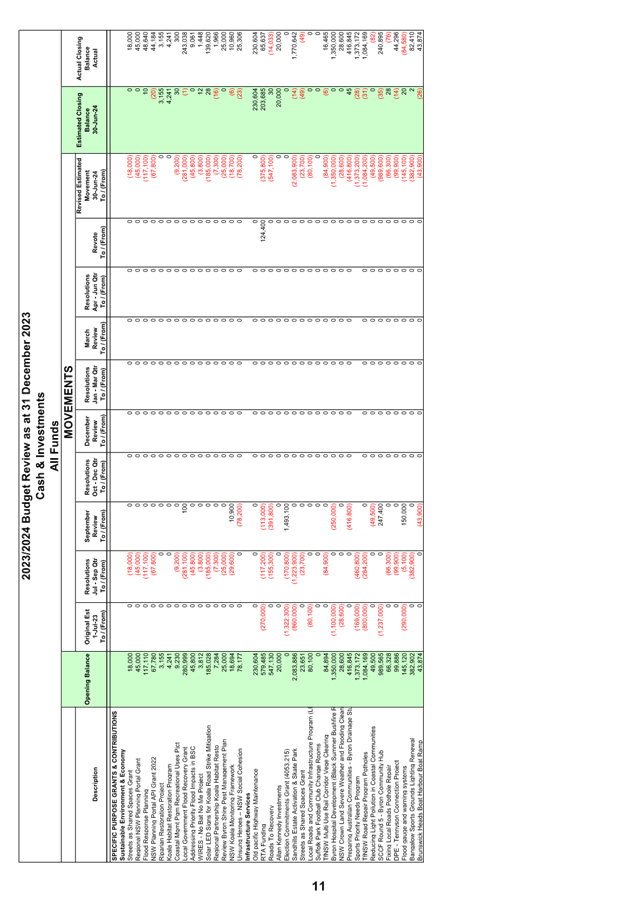

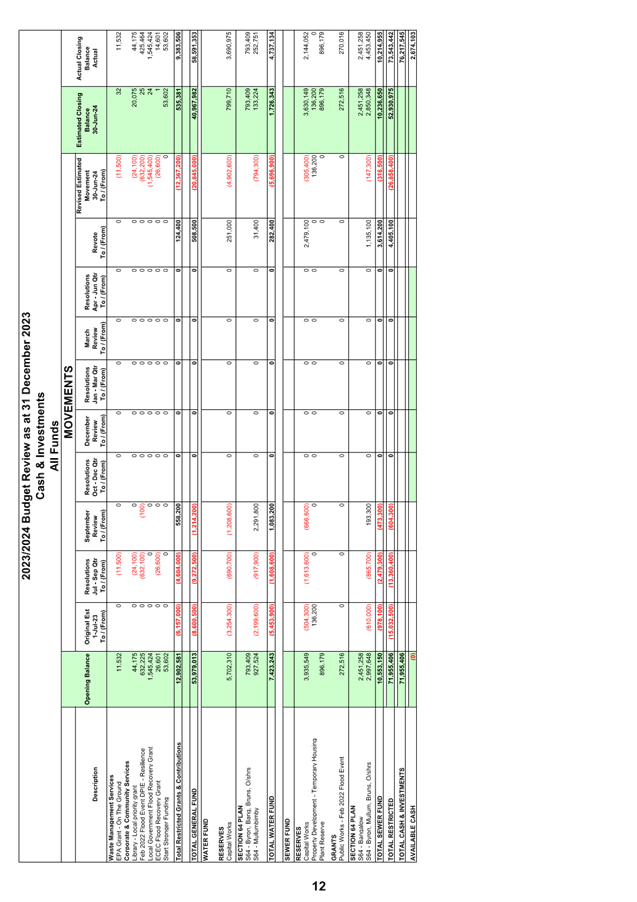

Cash and Investments Budget Review Statement

This statement reconciles Council’s restricted funds

(reserves) against available cash and investments. Council has attempted to

indicate an actual position as at 31 December 2023 of each reserve to show a

total cash position of reserves with any difference between that position and

total cash and investments held as available cash and investments. It

should be recognised that the figure is at a point in time and may vary greatly

in future quarterly reviews depending on cash flow movements.

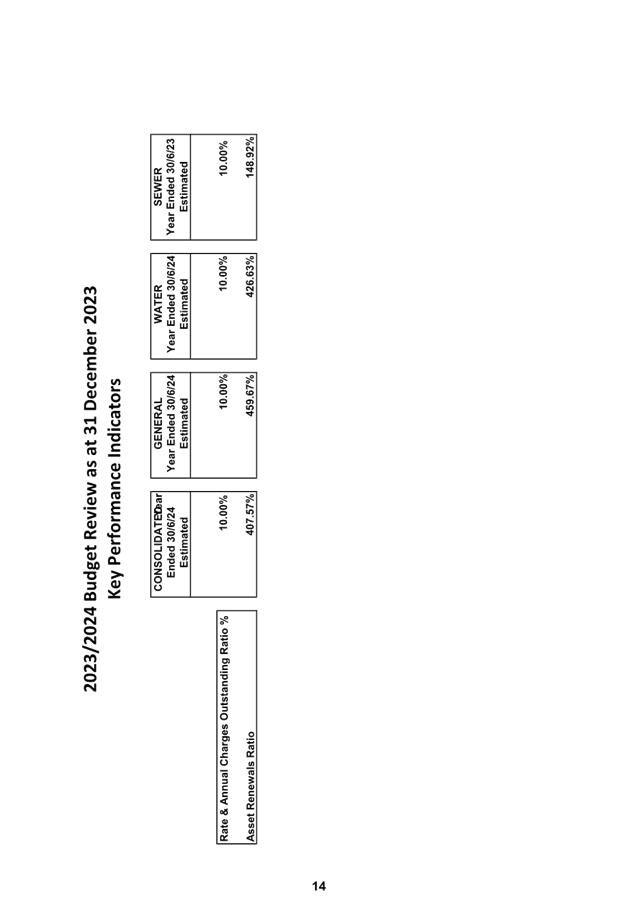

Key Performance Indicators (KPIs)

At this stage, the KPIs within this report are:

o Debt

Service Ratio - This assesses the impact of loan principal and interest

repayments on the discretionary revenue of Council.

o Rates

and Annual Charges Outstanding Ratio – This assesses the impact of

uncollected rates and annual charges on Councils liquidity and the adequacy of

recovery efforts.

o Asset

Renewals Ratio – This assesses the rate at which assets are being

renewed relative to the rate at which they are depreciating.

These may be expanded in future to accommodate any

additional KPIs that Council may adopt to use in the future.

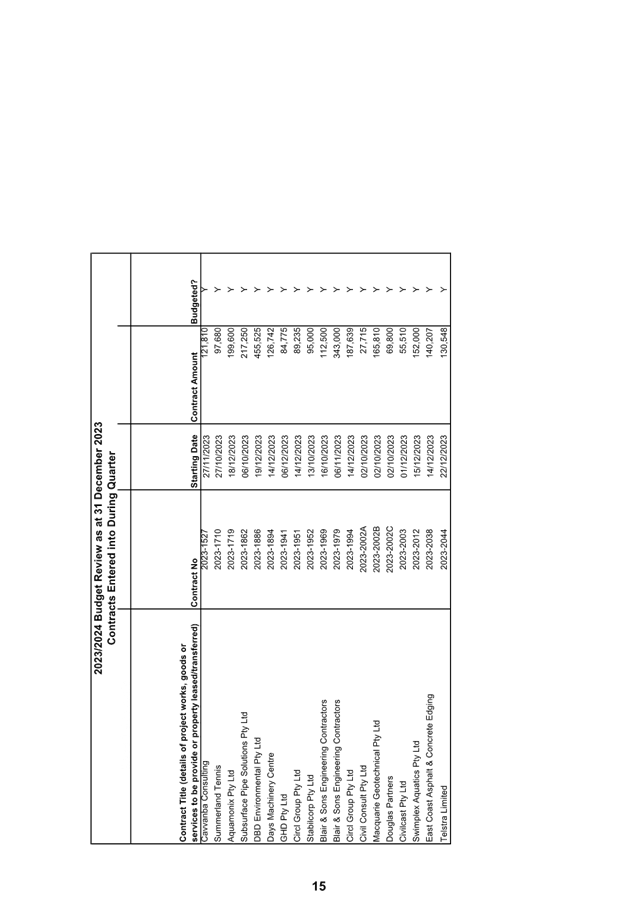

Contracts and Other Expenses - This report highlights any

contracts Council entered into during the July to September quarter that are

greater than $50,000.

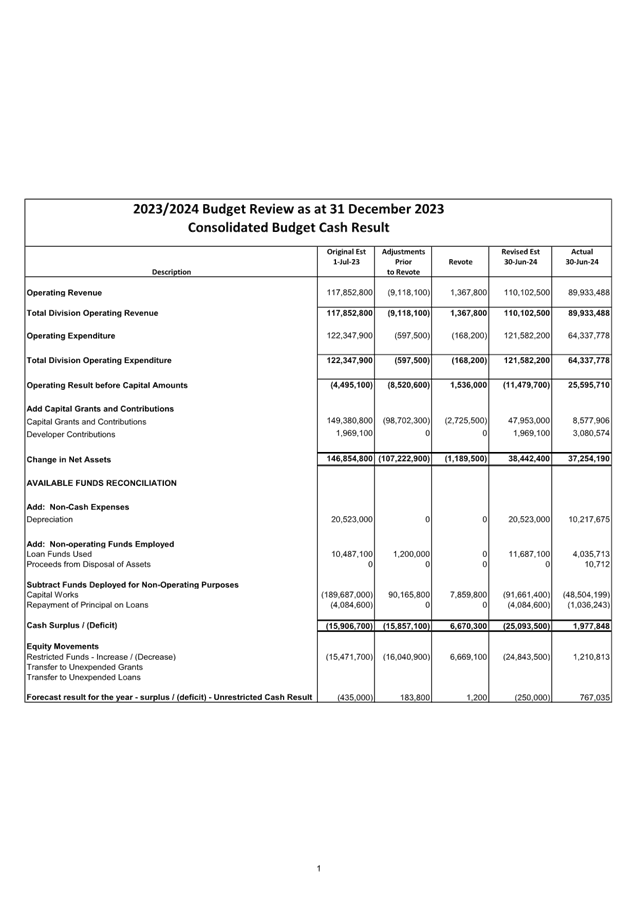

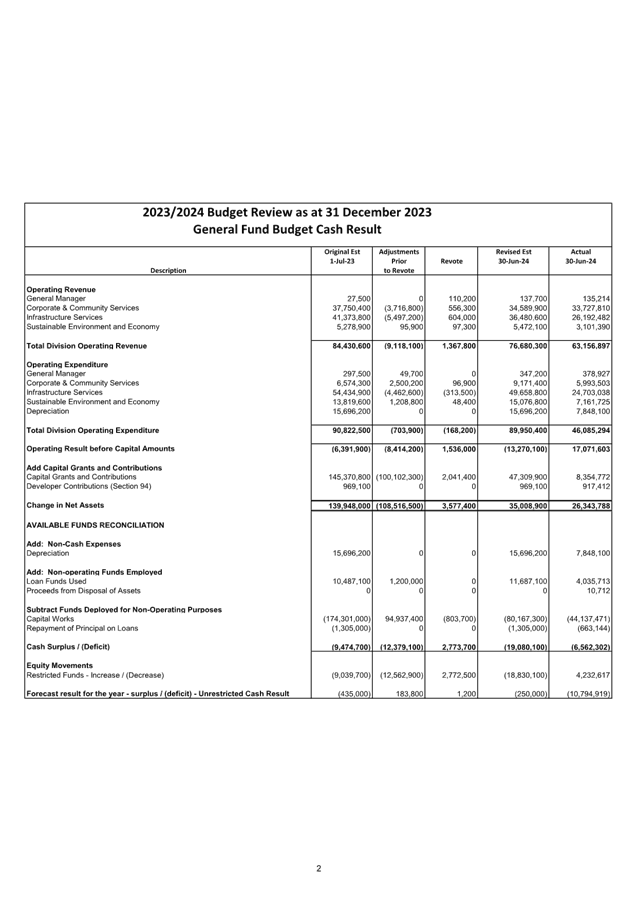

CONSOLIDATED RESULT

The following table provides

a summary of the overall Council budget on a consolidated basis inclusive of

all Funds’ budget movements for the 2023/2024 financial year projected to

30 June 2024 but revised as at 31 December 2023.

|

2023/2024 Budget Review Statement as at 31 December 2023

|

Original Estimate (Including Carryovers)

1/7/2023

|

Adjustments to 31 Dec 2023 including Resolutions*

|

Proposed 31 Dec 2023 Review Revotes

|

Revised Estimate 30/6/2024 at 31/12/2023

|

|

Operating Revenue

|

117,955,300

|

(9,220,600)

|

1,367,800

|

110,102,500

|

|

Operating Expenditure

|

127,753,000

|

(6,002,600)

|

(168,200)

|

121,582,200

|

|

Operating Result –

Surplus/Deficit

|

(9,797,700)

|

(3,218,000)

|

1,536,000

|

(11,479,700)

|

|

Add: Capital Revenue

|

155,394,600

|

(102,747,000)

|

(2,725,500)

|

49,922,100

|

|

Change in Net Assets

|

145,596,900

|

(105,965,000)

|

(1,189,500)

|

38,442,400

|

|

Add: Non Cash Expenses

|

20,523,000

|

0

|

0

|

20,523,000

|

|

Add: Non-Operating Funds

Employed

|

10,487,100

|

1,200,000

|

0

|

11,687,100

|

|

Subtract: Funds Deployed for

Non-Operating Purposes

|

(204,353,500)

|

100,747,700

|

7,859,800

|

(95,746,000)

|

|

Cash Surplus/(Deficit)

|

(27,746,500)

|

(4,017,300)

|

6,670,300

|

(25,093,500)

|

|

Restricted Funds –

Increase / (Decrease)

|

(27,311,500)

|

(4,201,100)

|

6,669,100

|

(24,843,500)

|

|

Forecast Result for the

Year – Surplus/(Deficit) – Unrestricted Cash Result

|

(435,000)

|

183,800

|

1,200

|

(250,000)

|

GENERAL FUND

In terms of the General Fund

projected Unrestricted Cash Result the following table provides a

reconciliation of the estimated position as at 31 December 2023:

|

Opening

Balance – 1 July 2022

|

$0

|

|

Plus

original budget movement and carryovers

|

(435,000)

|

|

Council

Resolutions July – September Quarter

|

185,000

|

|

Council

Resolutions October – December Quarter

|

(1,200)

|

|

Recommendations

within this Review – increase/(decrease)

|

1,200

|

|

Estimated

Unrestricted Cash Result Closing Balance – 30 June 2024

|

($250,000)

|

The General Fund financial position overall has increased by

$1,200 as a result of this budget review, leaving the forecast cash result for

the year at an estimated deficit of $250,000. The proposed budget changes are

detailed in Attachment 1 and summarised further in this report below.

Council Resolutions

Resolution 23-498 states

“that Council pays the hire

fees for the Ocean Shores Community Centre by Ocean Shores Art Expo on 3 to 6 November

2023”. The total of these fees was $1,200.

Budget Adjustments

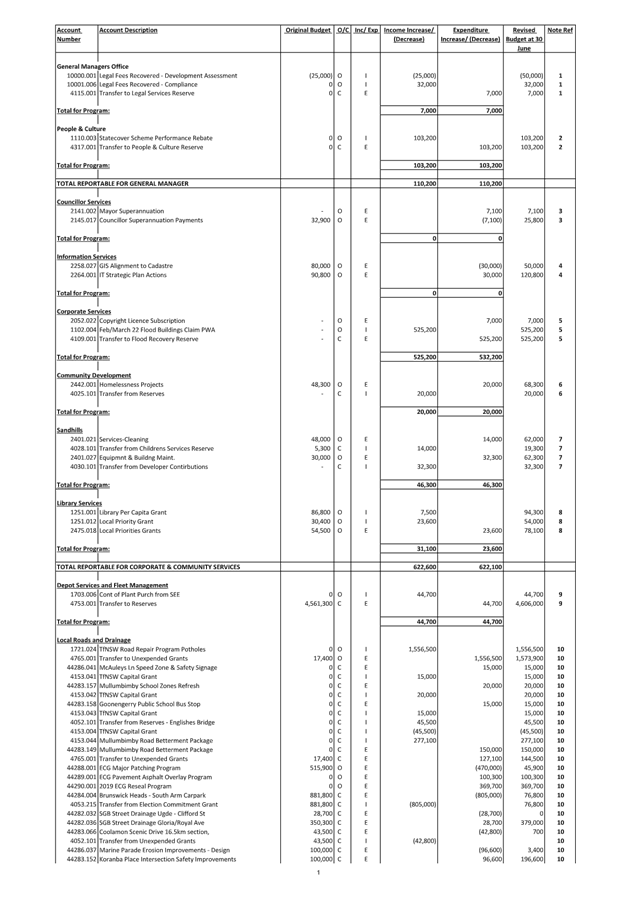

The budget adjustments

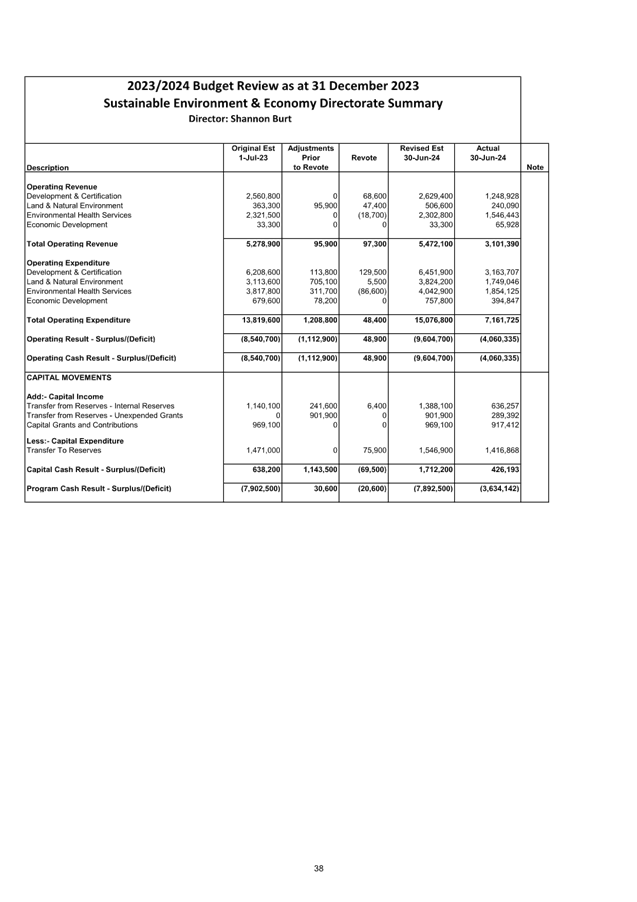

identified in Attachments 1 and 2 for the General Fund have been summarised by

Budget Directorate in the following table:

|

Budget

Directorate

|

Revenue Increase/

(Decrease) $

|

Expenditure Increase/

(Decrease) $

|

Unrestricted Cash

Increase/ (Decrease) $

|

|

General Manager

|

110,200

|

110,200

|

0

|

|

Corporate &

Community Services

|

622,600

|

622,100

|

500

|

|

Infrastructure

Services

|

2,296,800

|

2,275,500

|

21,300

|

|

Sustainable

Environment & Economy

|

197,300

|

217,900

|

(20,600)

|

|

Total Budget

Movements

|

3,226,900

|

3,225,700

|

1,200

|

Budget Adjustment Comments

Within each of the Budget Directorates of the General Fund,

are a series of budget adjustments identified in detail at Attachment 1 and 2.

More detailed notes on these are provided in Attachment 1 but in summary the

major additional items included are summarised below by Directorate and are

included in the overall budget adjustments table above.

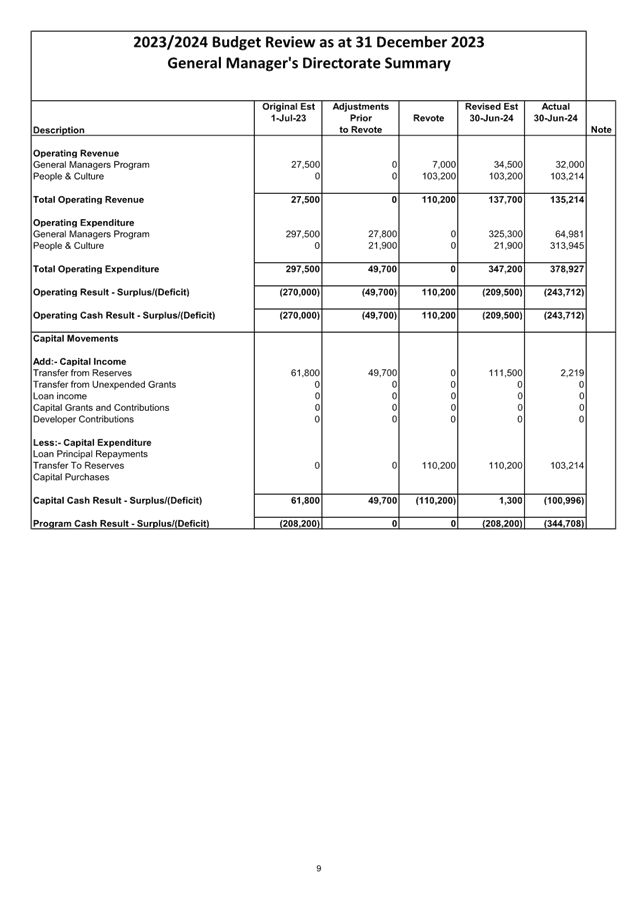

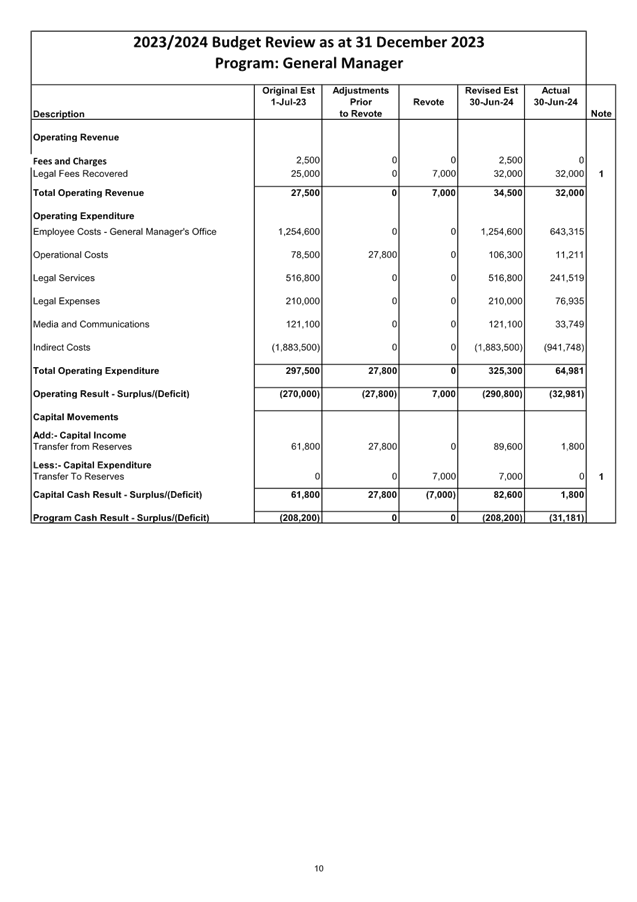

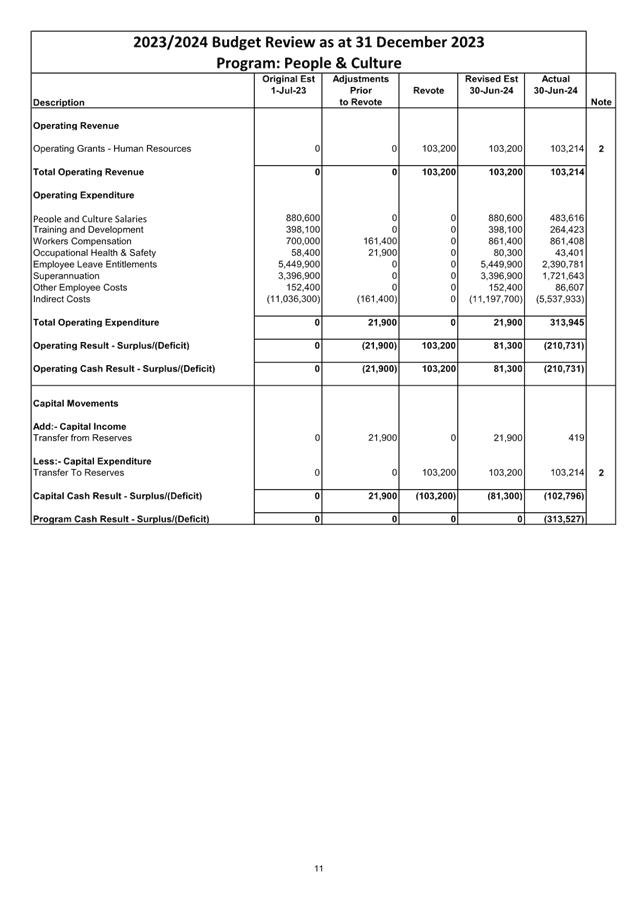

General Manager

· In

the People & Culture program, it is proposed to increase operating income

by $103,200 due to a performance rebate received from Statecover. This

can be transferred to the People & Culture reserve for use on future People

& Culture initiatives.

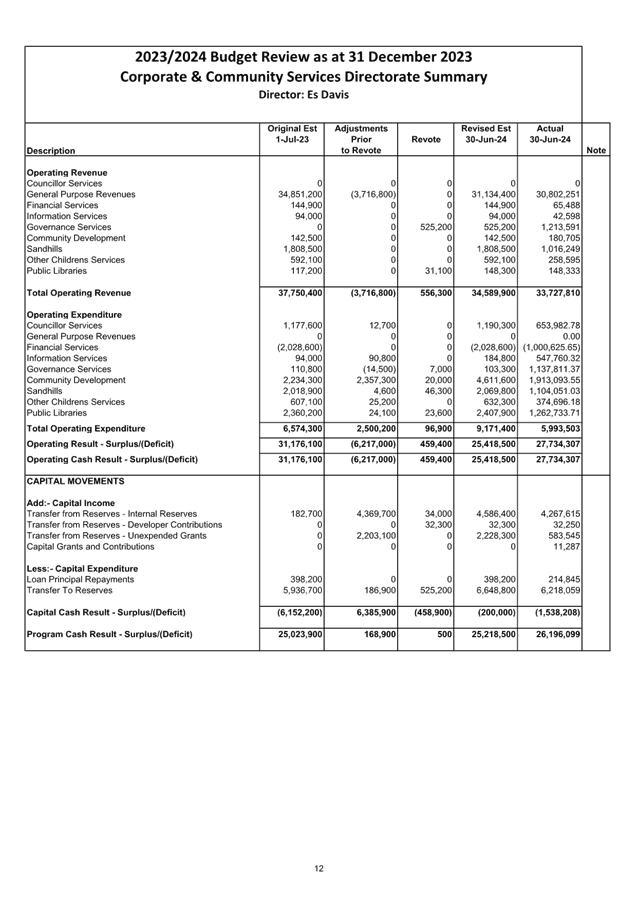

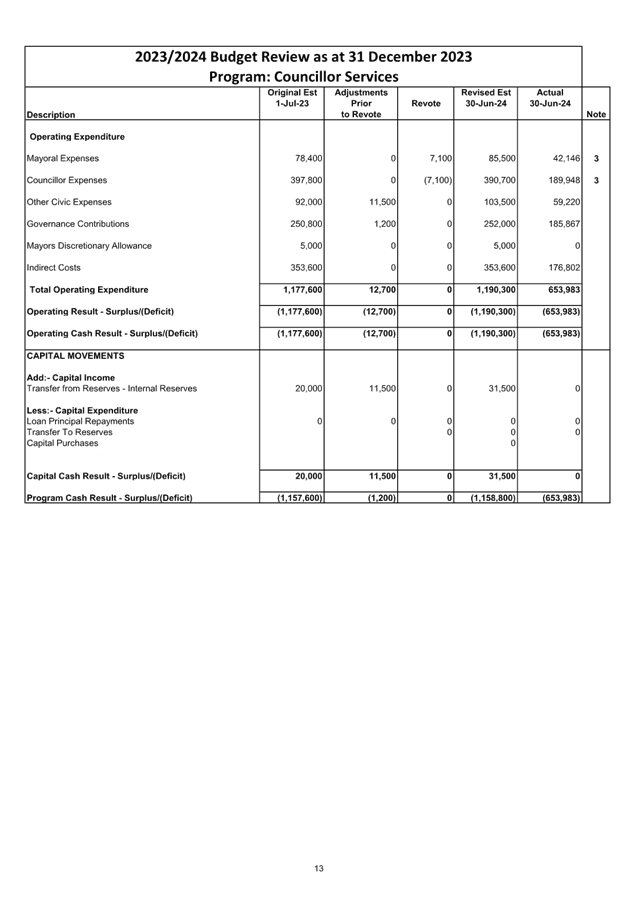

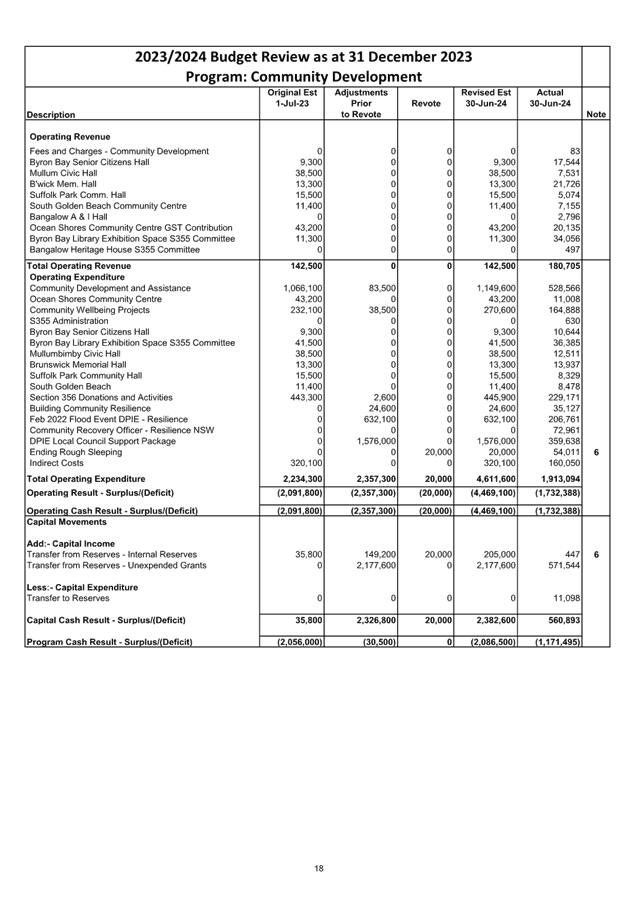

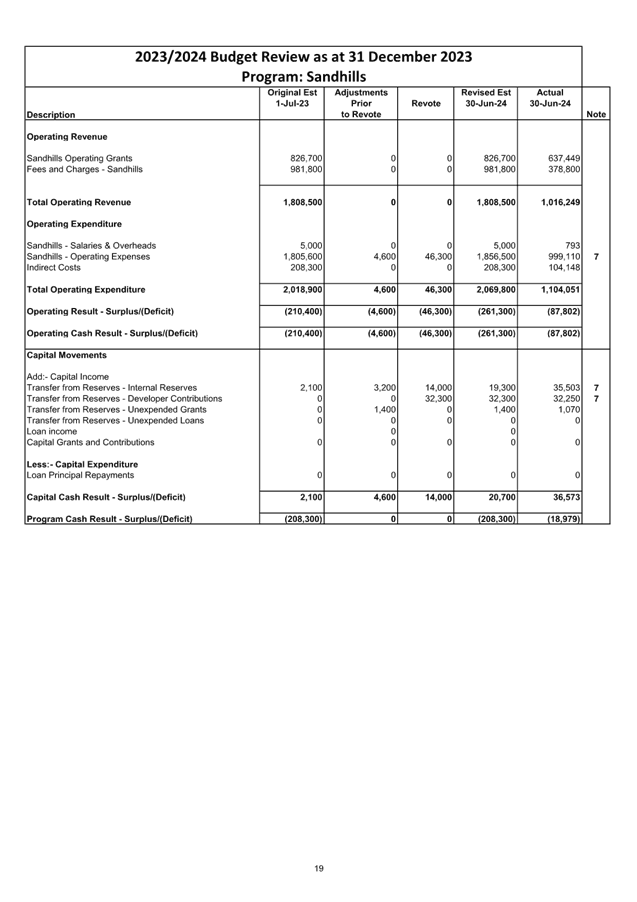

Corporate and Community Services

· In

the Corporate Services program, it is proposed to increase operating income by

$525,200 due to income received from Public Works Advisory (PWA) for building

and facility damage resulting from the February 2022 flood event. This

can be moved to the Flood Recovery reserve which is where the payments for the

repairs were originally made from in the previous financial year.

· In

the Community Development program, it is proposed to increase the budget for

Homelessness projects by $20,000 until contractual documentation for external

funding is executed. It is proposed to reimburse the Community

Development reserve by June 2024 once this has been finalised.

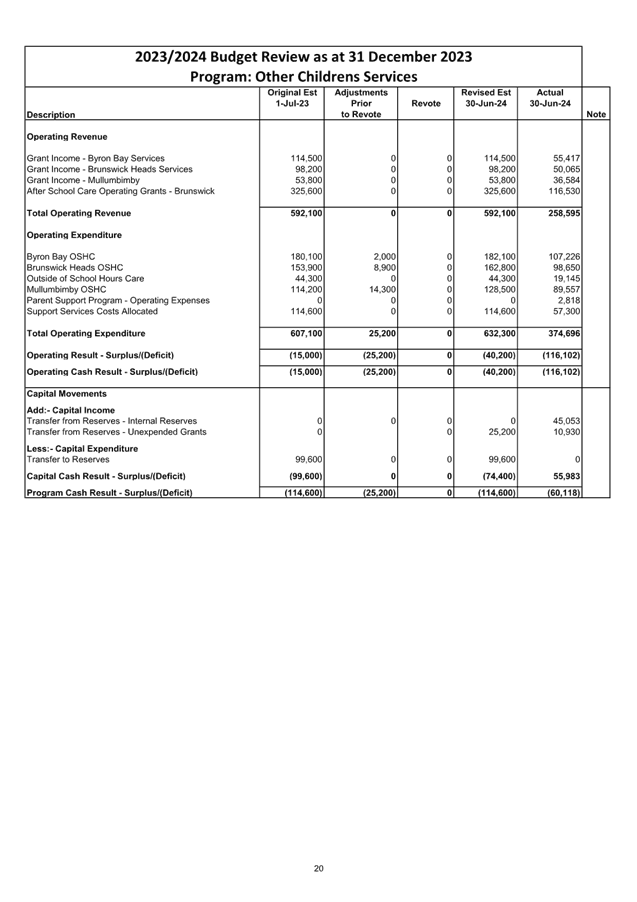

· In

the Childrens Service program, it is proposed to increase operating expenditure

due to the cleaning contract being higher than the allocated budget ($14,000)

and an increase required for the equipment and building maintenance budget

($32,300). The proposed increase to the maintenance budget is due to new

fences being constructed as a result of security breaches from the skatepark,

with this being funded from developer contributions.

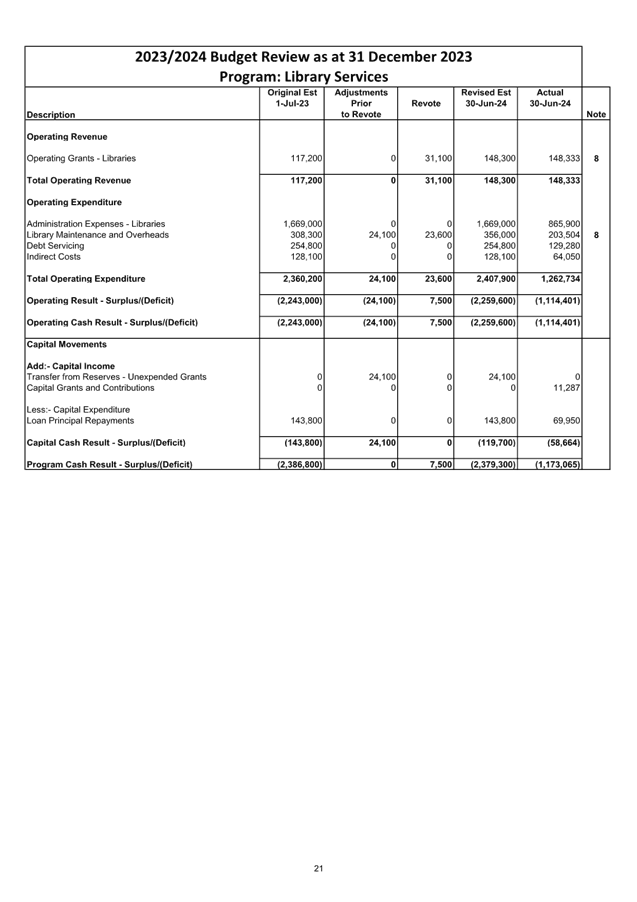

· In

the Public Libraries program, it is proposed to increase operating income due

to actual income received for the per capita grant ($7,500) and the Local

Priority Grant ($23,600) being more than the budget. It is proposed to

increase operating expenditure due to increased costs relating to the Local

Priority Grant expenditure to match the income received.

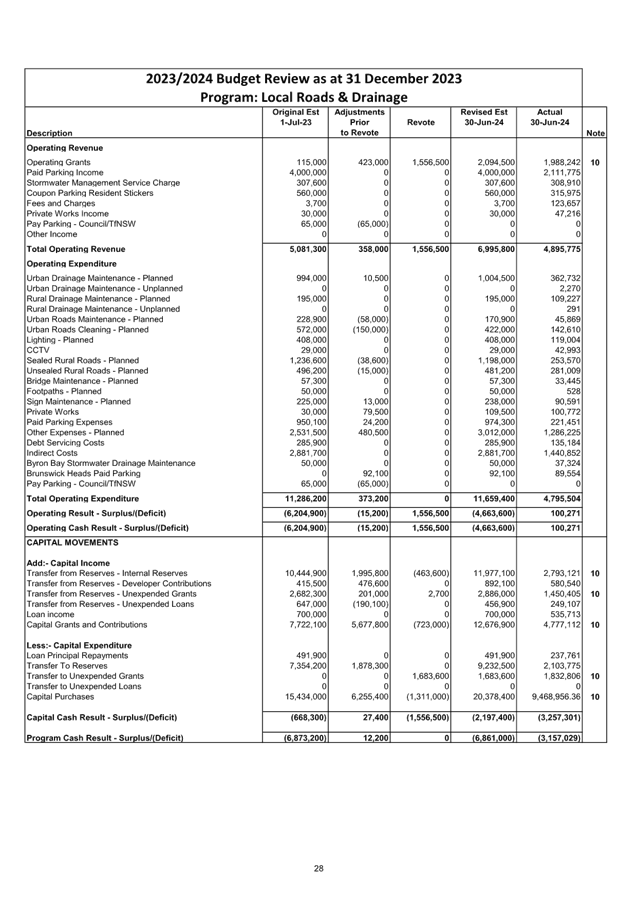

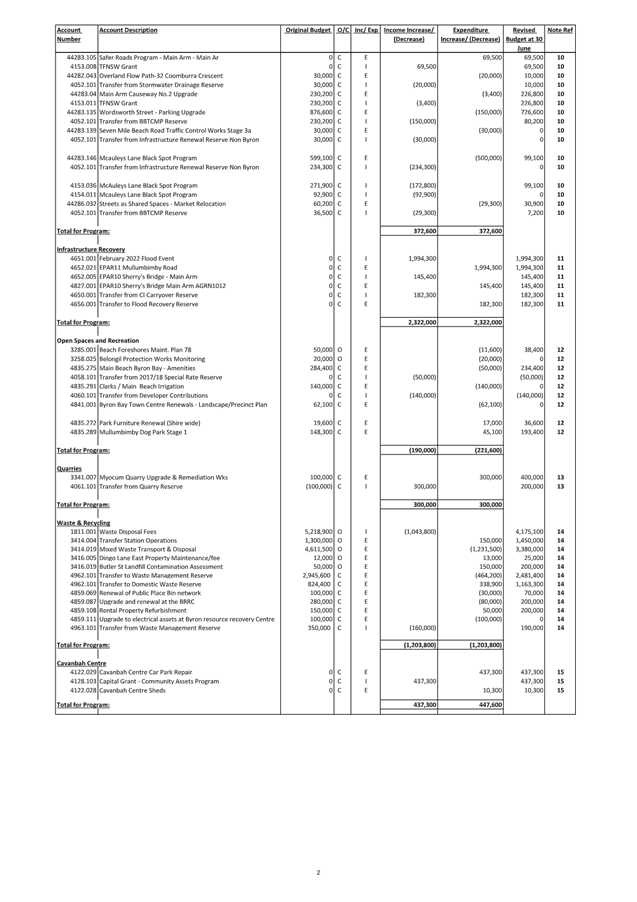

Infrastructure Services

· In the Depot

Services Program, it is proposed to increase operating income due to the SEE

directorate reimbursing the plant fund for the purchase of a Community

Enforcement vehicle. This can be transferred to the Plant reserve which

initially purchased the vehicle.

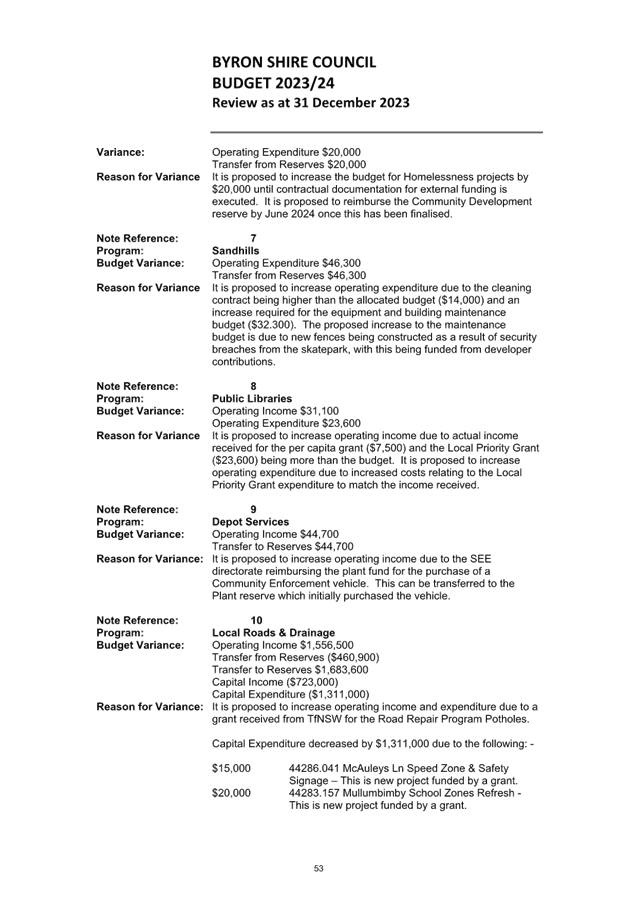

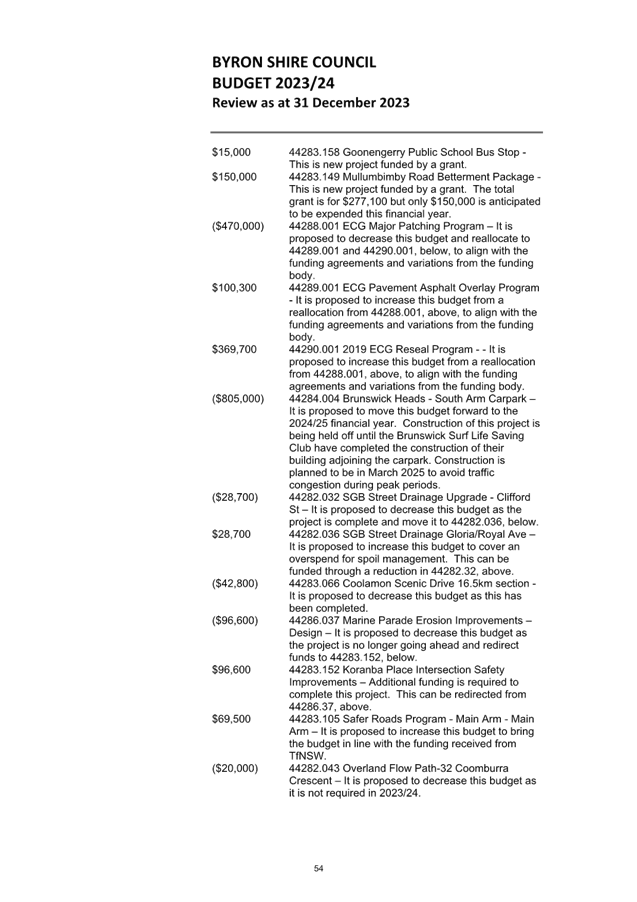

· In

the Local Roads and Drainage program, there are a number of adjustments

outlined under Note 10 on pages 51 to 53 in the Budget Variations explanations

section of Attachment 1. Further disclosure is included in the first and second

pages of Attachment 2 under the budget program heading Local Roads and

Drainage.

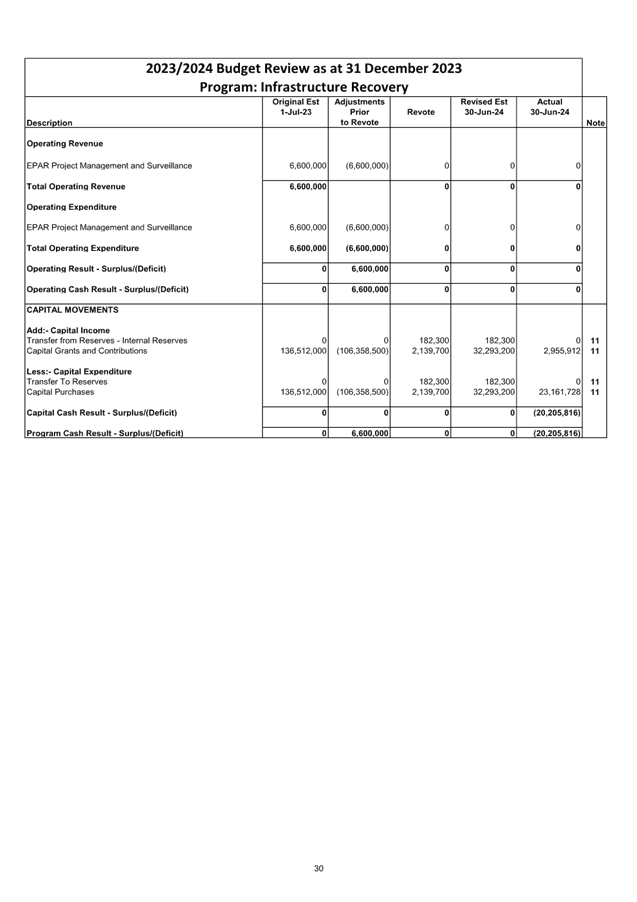

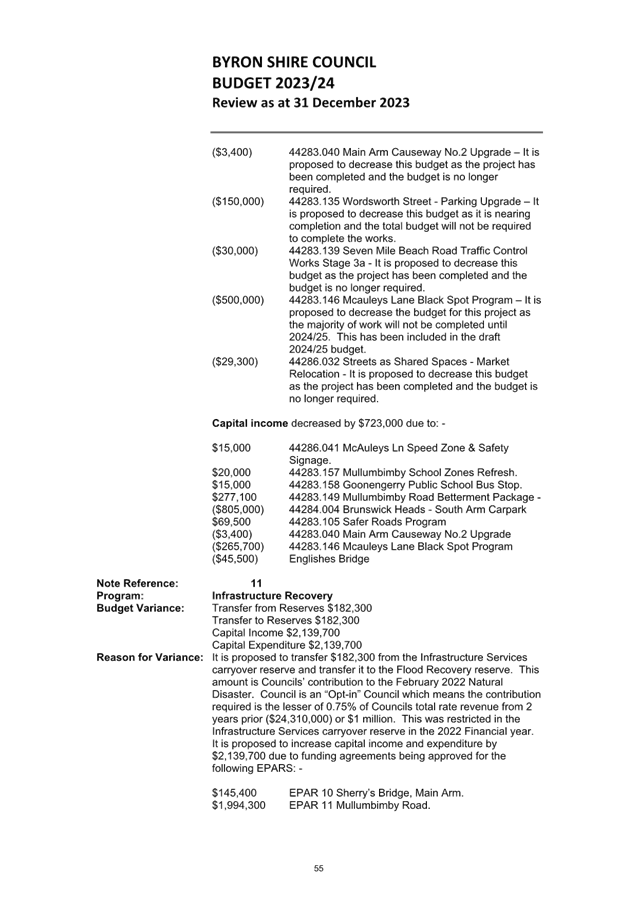

· In

the Infrastructure Recovery program, it is proposed to transfer $182,300 from

the Infrastructure Services carryover reserve and transfer it to the Flood

Recovery reserve. This amount is Councils’ contribution to the

February 2022 Natural Disaster. Council is an “Opt-in”

Council which means the contribution required is the lesser of 0.75% of

Councils total rate revenue from 2 years prior ($24,310,000) or $1 million.

This was restricted in the Infrastructure Services carryover reserve in the

2022 Financial year. It is proposed to increase capital income and

expenditure by $2,139,700 due to funding agreements being approved for the

Sherrys Bridge EPAR ($145,400 - EPAR 10) and the Mulumbimby Road EPAR

($1,994,300 - EPAR 11).

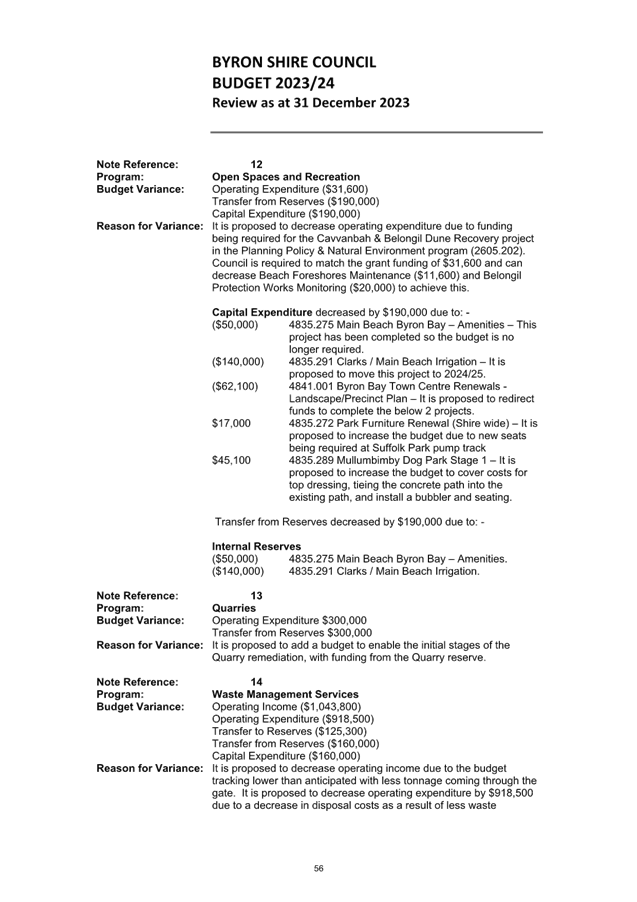

· In

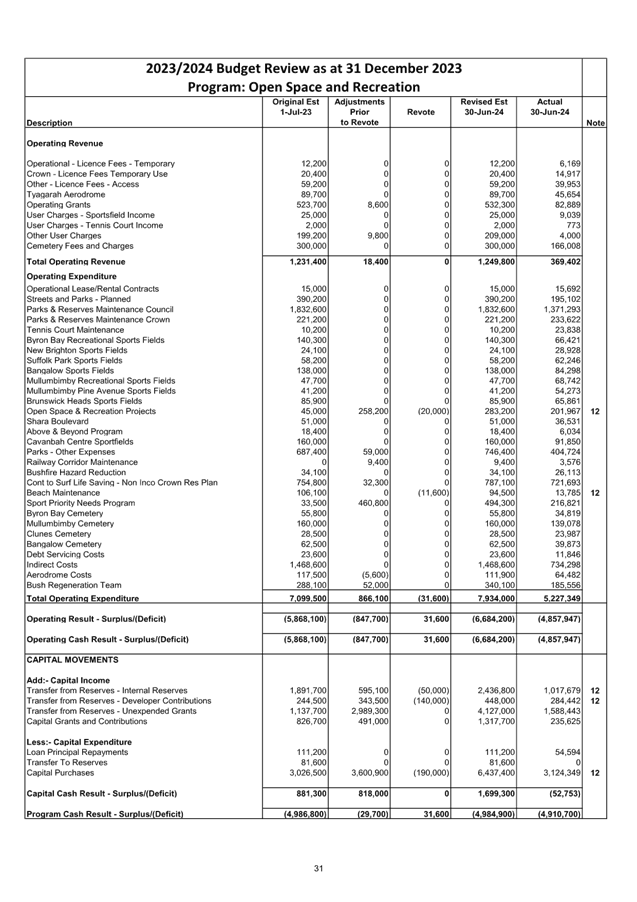

the Open Space and Recreation program, there are a number of adjustments outlined

under Note 12 on page 51 in the Budget Variations explanations section of

Attachment 1. Further disclosure is included on the second page of Attachment 2

under the budget program heading Open Space & Recreation.

· In

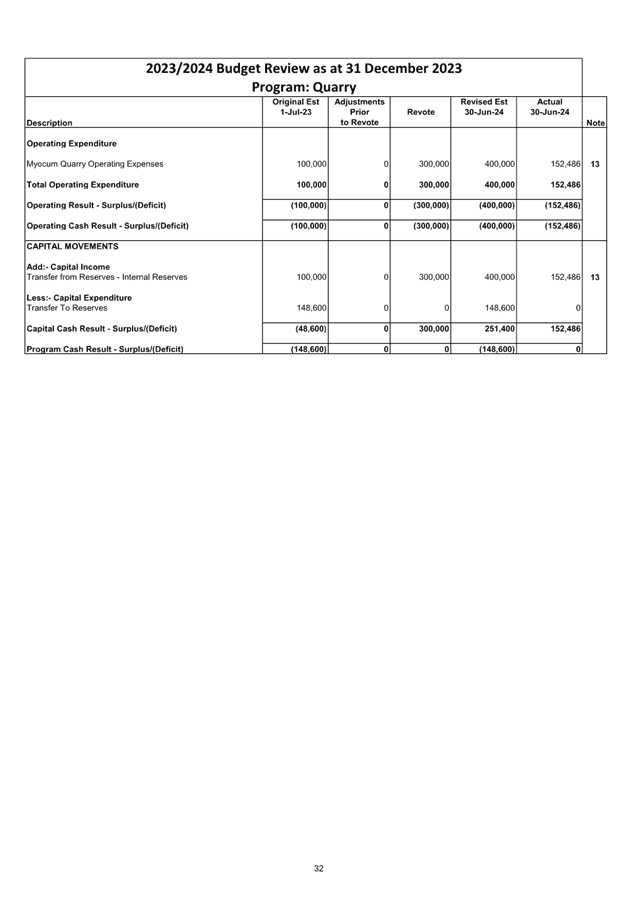

the Quarries program, it is proposed to add a budget of $300,000 to enable the

initial stages of the Quarry remediation, with funding from the Quarry reserve.

· In

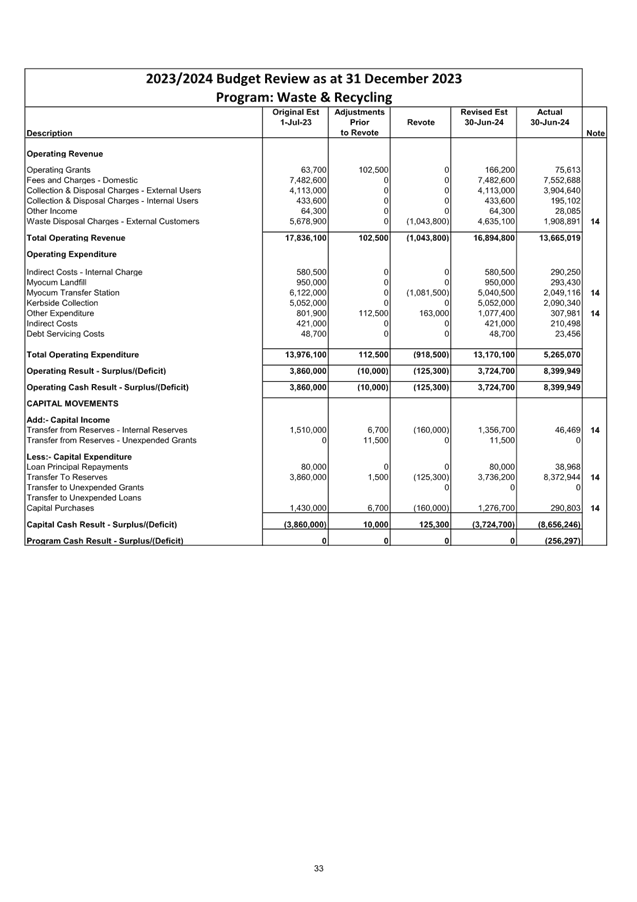

the Waste Management program, it is proposed to decrease operating income due

to the budget tracking lower than anticipated with less tonnage coming through

the gate. It is proposed to decrease operating expenditure by $918,500

due to a decrease in disposal costs as a result of less waste ($1,231,500)

offset by increases to green waste processing and plant costs ($150,000) and an

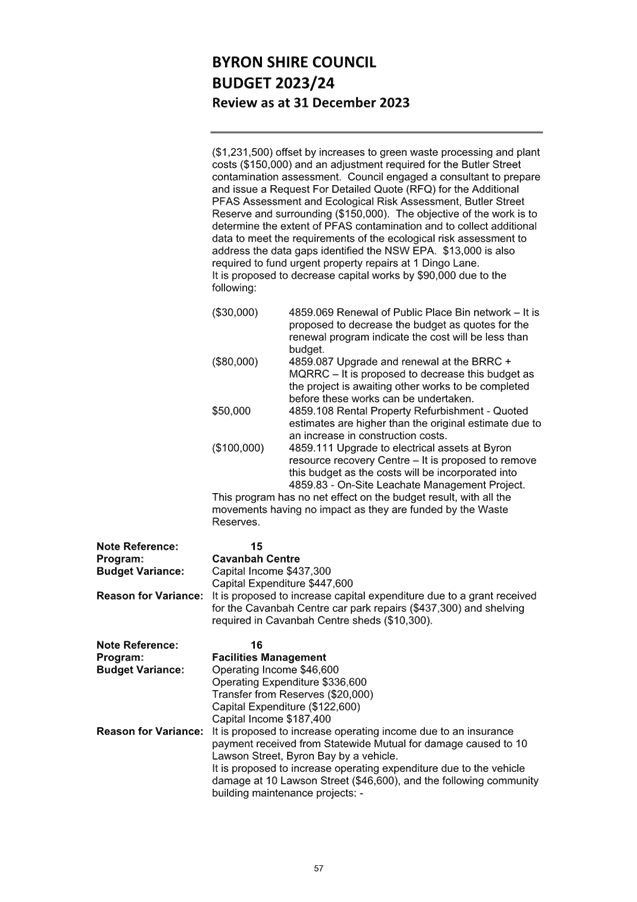

adjustment required for the Butler Street contamination assessment.

Council engaged a consultant to prepare and issue a Request For Detailed Quote

(RFQ) for the Additional PFAS Assessment and Ecological Risk Assessment, Butler

Street Reserve and surrounding ($150,000). The objective of the work is

to determine the extent of PFAS contamination and to collect additional data to

meet the requirements of the ecological risk assessment to address the data

gaps identified the NSW EPA. $13,000 is also required to fund urgent

property repairs at 1 Dingo Lane.

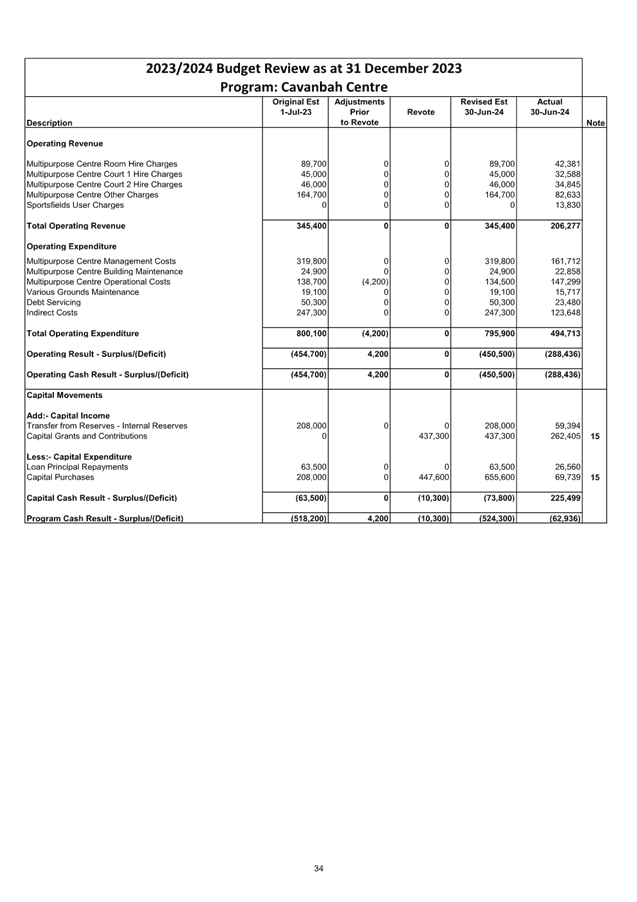

· In

the Cavanbah Centre program, it is proposed to increase capital expenditure due

to a grant received for the Cavanbah Centre car park repairs ($437,300) and

shelving required in Cavanbah Centre sheds ($10,300).

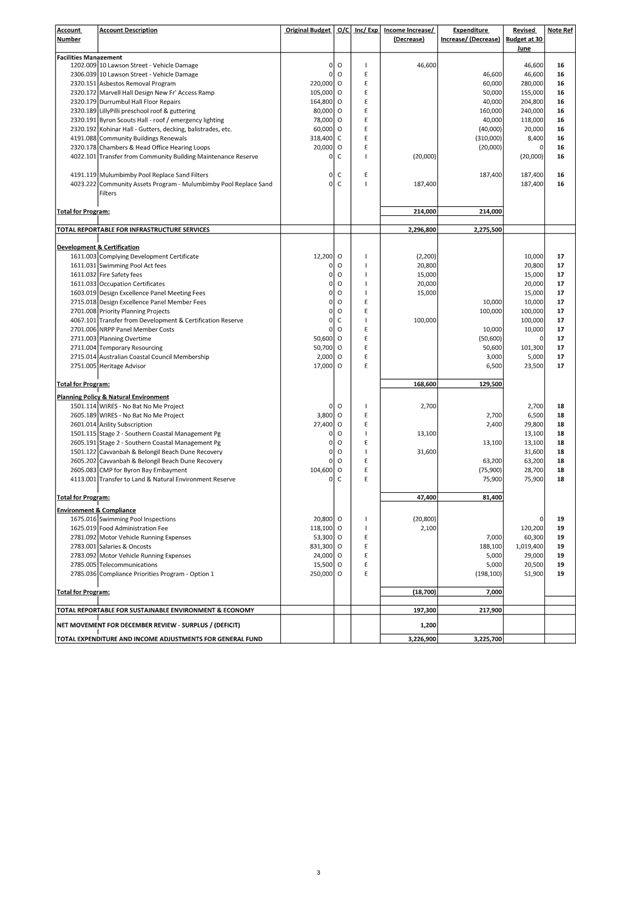

· In

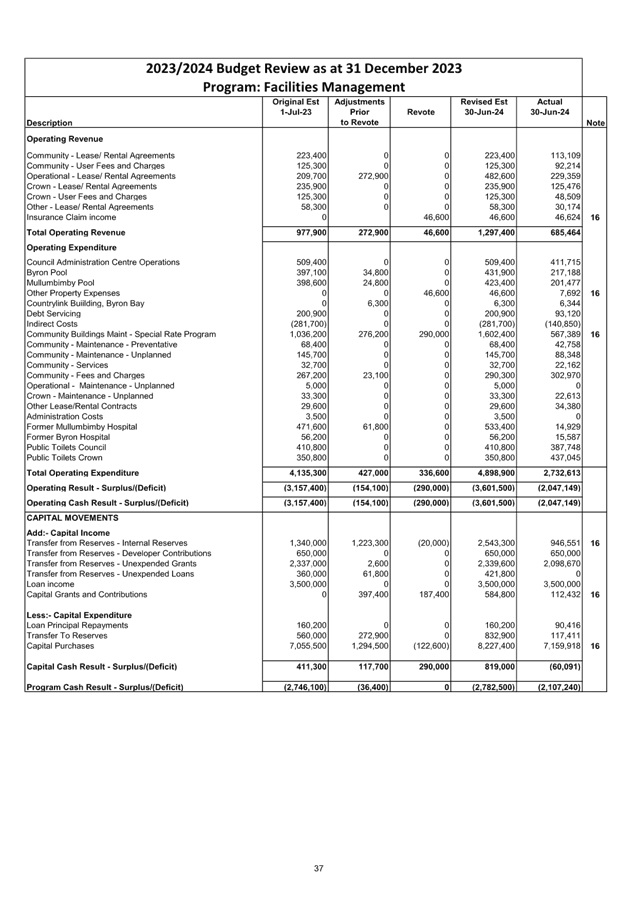

the Facilities Management program, it is proposed to

increase operating income due to an insurance payment received from Statewide

Mutual for damage caused to 10 Lawson Street, Byron Bay by a vehicle. It

is proposed to increase operating expenditure due to the vehicle damage at 10

Lawson Street ($46,600), and the following community building maintenance

projects: - Asbestos Removal ($60,000), Marvell Hall New Access Ramp ($50,000),

Durrumbul Hall Floor Repairs ($40,000), Lillypilli Preschool Roof &

Guttering ($160,000) and the Byron Scout Hall ($40,000)

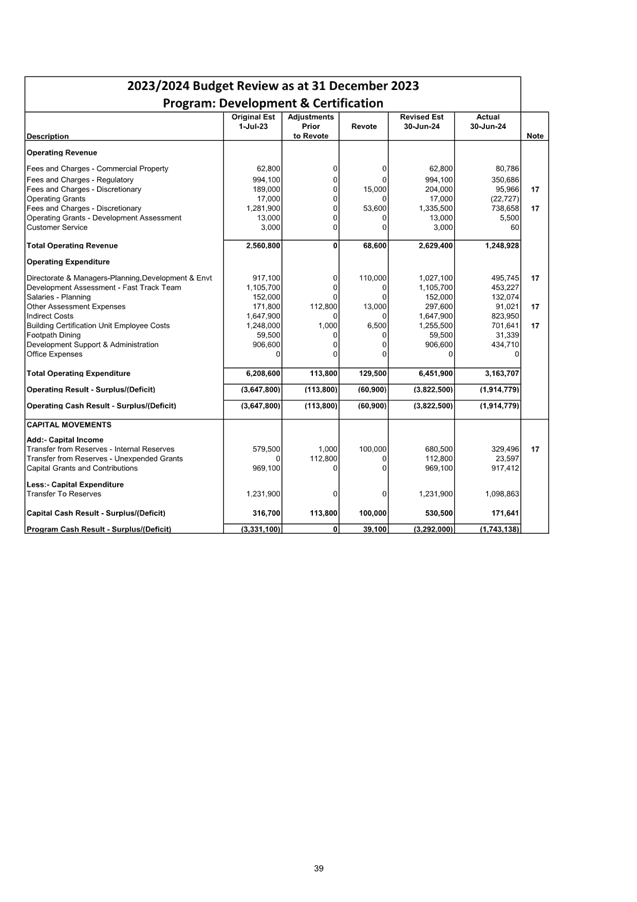

Sustainable Environment and Economy

· In the Development &

Certification program, it is proposed to increase operating income due to

budgets required for the Swimming Pool Act fees ($20,800, moved from the

Environment and Compliance program), Fire Safety Fees ($15,000), Occupation

Certificates ($20,000) and Design Excellence Panel meeting fees ($15,000) and a

decrease against Complying Development Certificate income ($2,200). It is

proposed to increase operating expenditure due to budgets required for Design

Excellence Panel member fees ($10,000), NRPP Panel member costs ($10,000) and

Priority Planning projects ($100,000, funded from the Development &

Certification reserve). It is proposed to increase the budgets for the

Australian Coastal Council Membership ($3,000) and Councils’ Heritage

Advisor ($6,500).

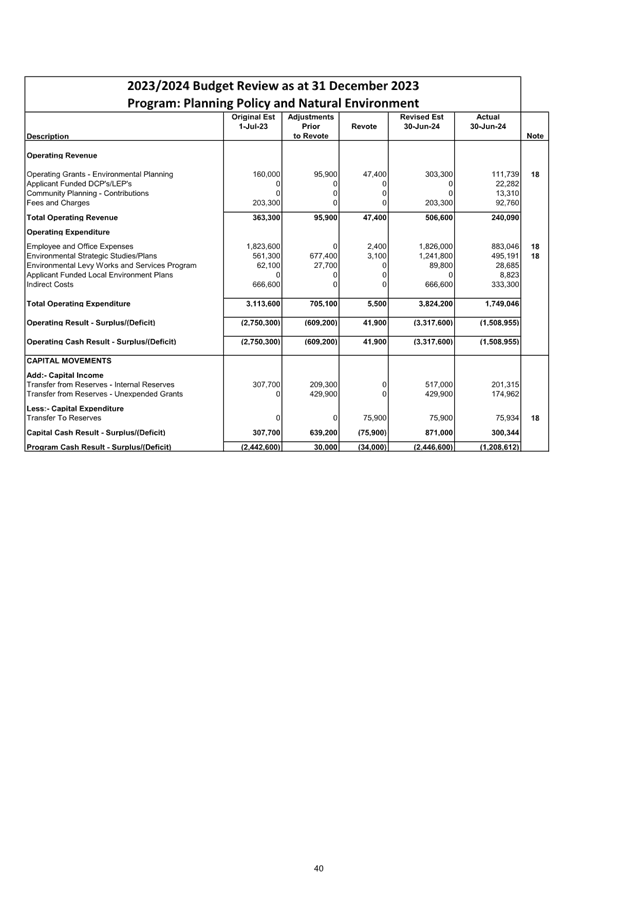

· In the Planning Policy

& Natural Environment program, it is proposed to increase operating income

by $47,400 due to grants received for WIRES – No Bats No Me project

($2,700), Stage 2 Southern Coastal Management Program ($13,100) and the

Cavvanbah & Belongil Beach Dune Recovery program ($31,600). Operating

expenditure increased due to the above grants in addition to an increase for

the Azility subscription ($2,400) and a Council contribution for the Cavvanbah

& Belongil Beach Dune Recovery project ($31,600). It is proposed to

decrease operating expenditure by $75,900 due to the CMP for Byron Bay

Embayment grant being expended in the last financial year. This should be

reimbursing the Land & Natural Environment reserve which is where the

original expenditure was funded from.

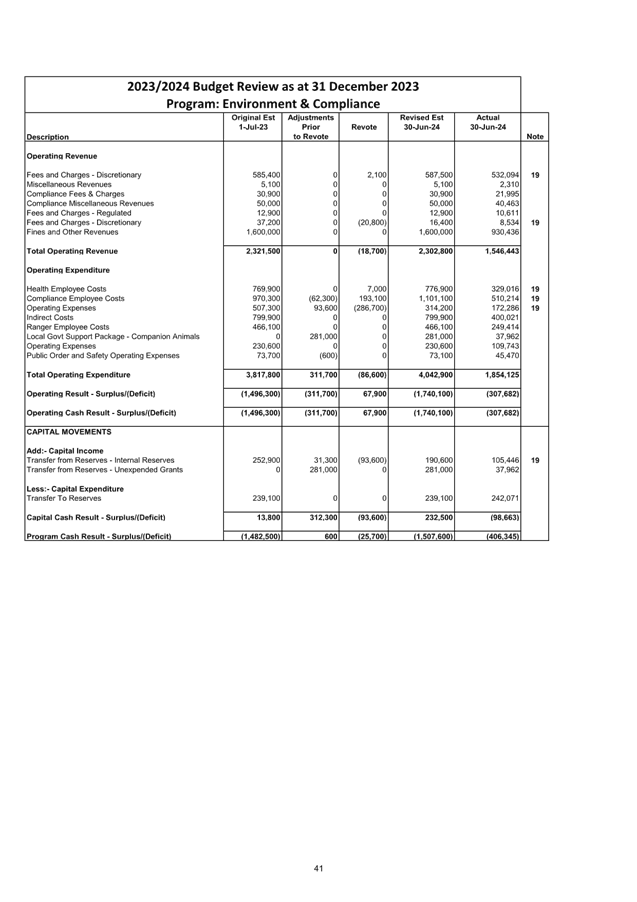

· In the Environment &

Compliance program, it is proposed to decrease operating income due to the

budget for Swimming pool inspections being transferred to the Development &

Certification program, above ($20,800) and an increase to the budget for Food

Administration Fees where actual income is slightly higher than the budget

($2,100). It proposed to increase operating expenditure by $7,000 due to

the addition of a new pool vehicle within the Compliance team and the running

costs associated with this. In addition to this increase, it is proposed

to decrease the Compliance Priorities Program- Option 1 budget by $198,100.

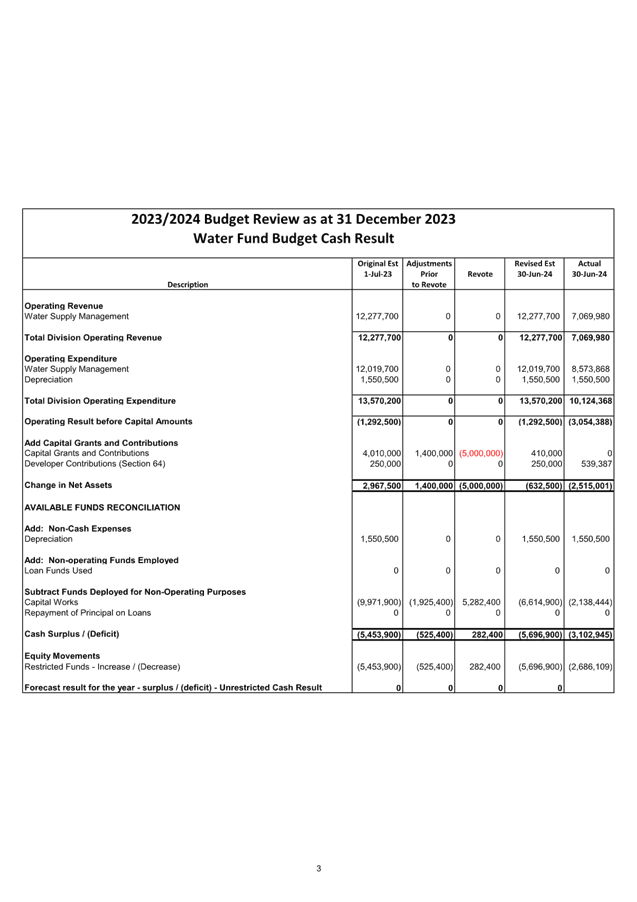

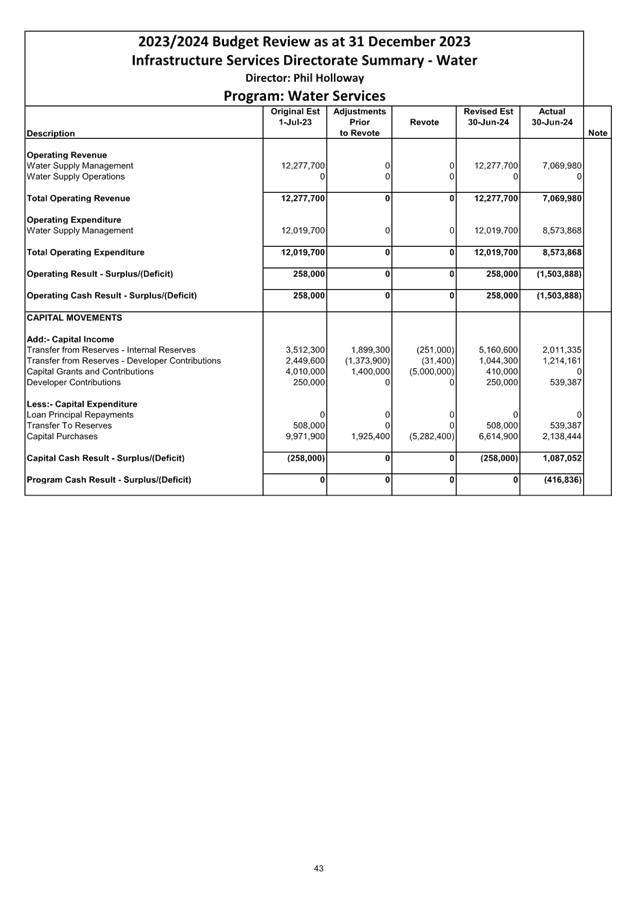

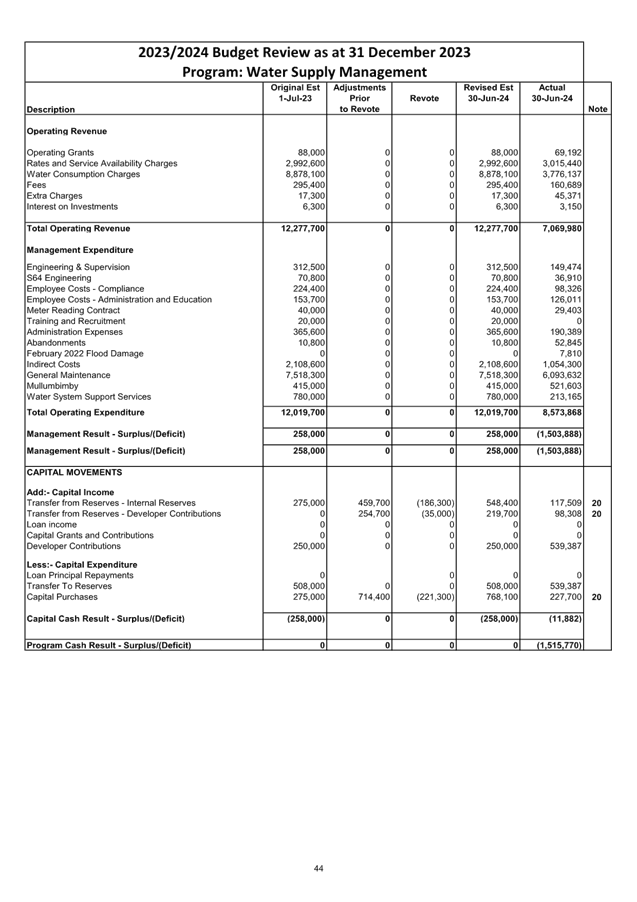

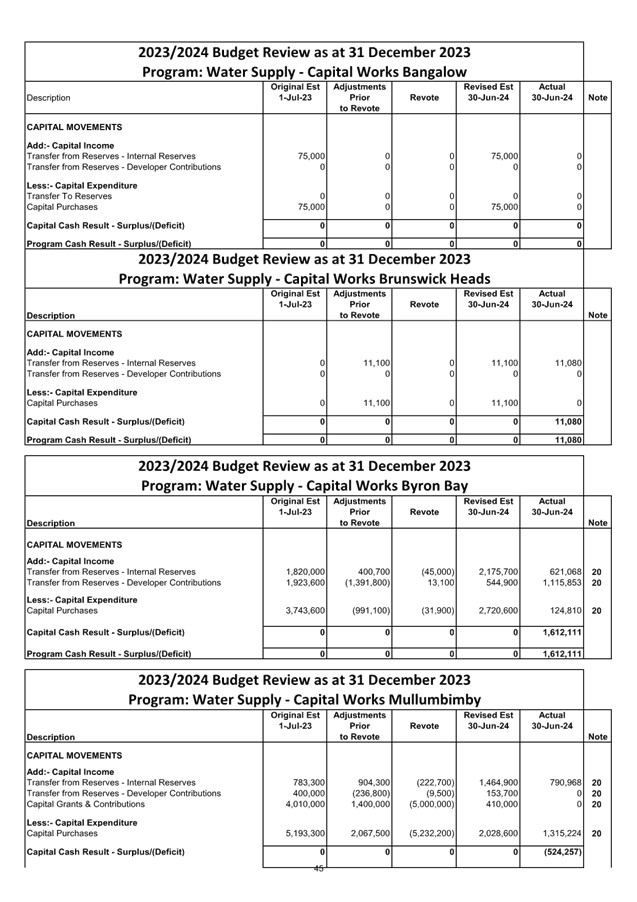

WATER FUND

After

completion of the 2022/2023 Financial Statements the Water Fund as at 30 June

2023 has a capital works reserve of $5,702,300 and held $1,720,900 in

section 64 developer contributions.

The estimated Water Fund reserve

balances as at 30 June 2024, and forecast in this Quarter Budget Review, are

derived as follows:

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2023

|

$5,702,300

|

|

Plus original budget reserve

movement

|

(3,254,300)

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

(690,700)

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(1,208,600)

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

251,000

|

|

Forecast Reserve Movement for

2023/2024 – Increase / (Decrease)

|

(4,902,600)

|

|

Estimated Reserve Balance at 30

June 2024

|

$799,700

|

Section

64 Developer Contributions

|

Opening

Reserve Balance at 1 July 2023

|

$1,720,900

|

|

Plus

original budget reserve movement

|

(2,199,600)

|

|

Resolutions

July - September Quarter – increase / (decrease)

|

(917,900)

|

|

September

Quarterly Review Adjustments – increase / (decrease)

|

2,291,800

|

|

Resolutions

October - December Quarter – increase / (decrease)

|

0

|

|

December

Quarterly Review Adjustments – increase / (decrease)

|

31,400

|

|

Forecast

Reserve Movement for 2023/2024 – Increase / (Decrease)

|

(794,300)

|

|

Estimated

Reserve Balance at 30 June 2024

|

$926,600

|

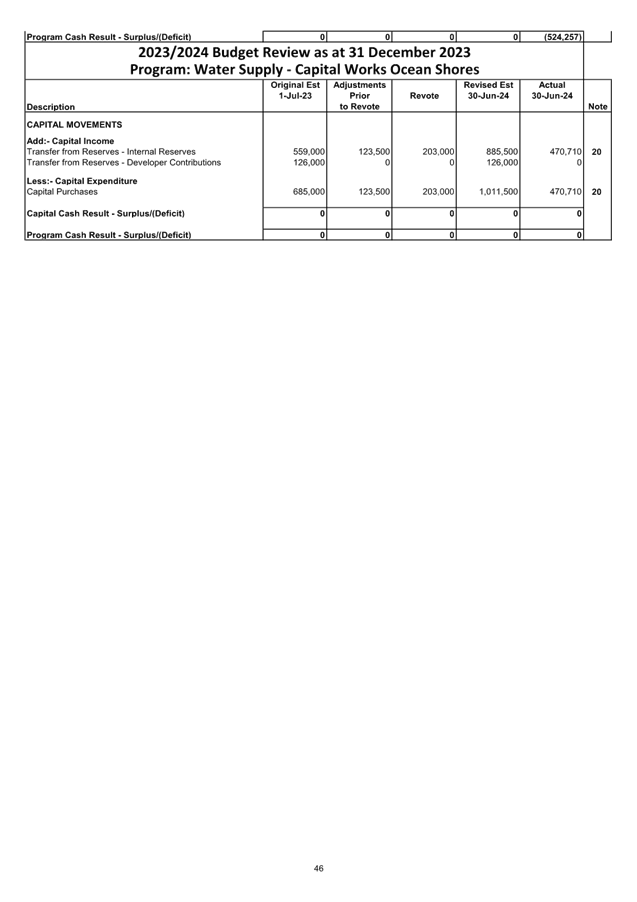

Movements for Water Fund can be seen in Attachment 1 with a

proposed estimated decrease to reserves (including S64 Contributions) overall

of $282,400 from the 31 December 2023 Quarter Budget Review.

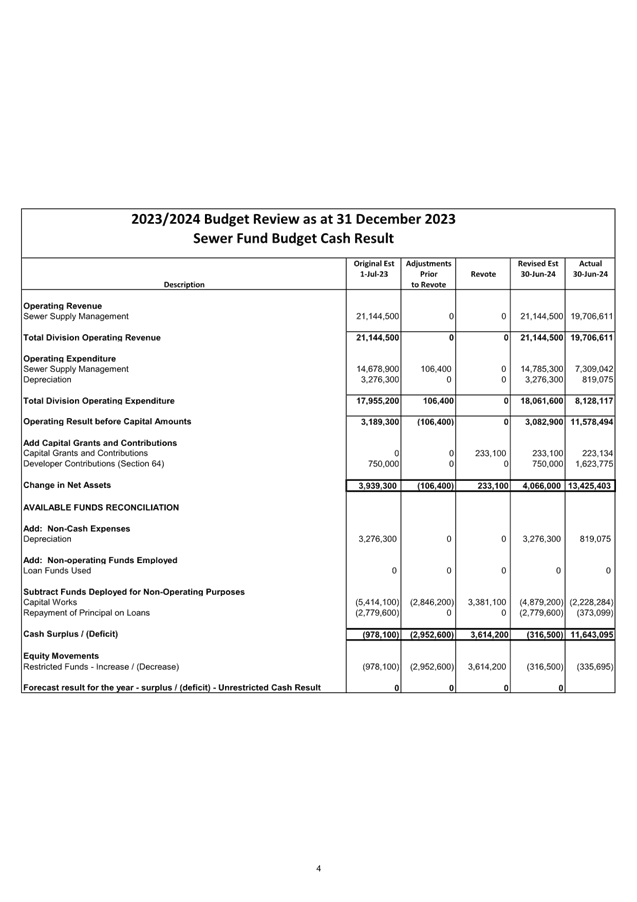

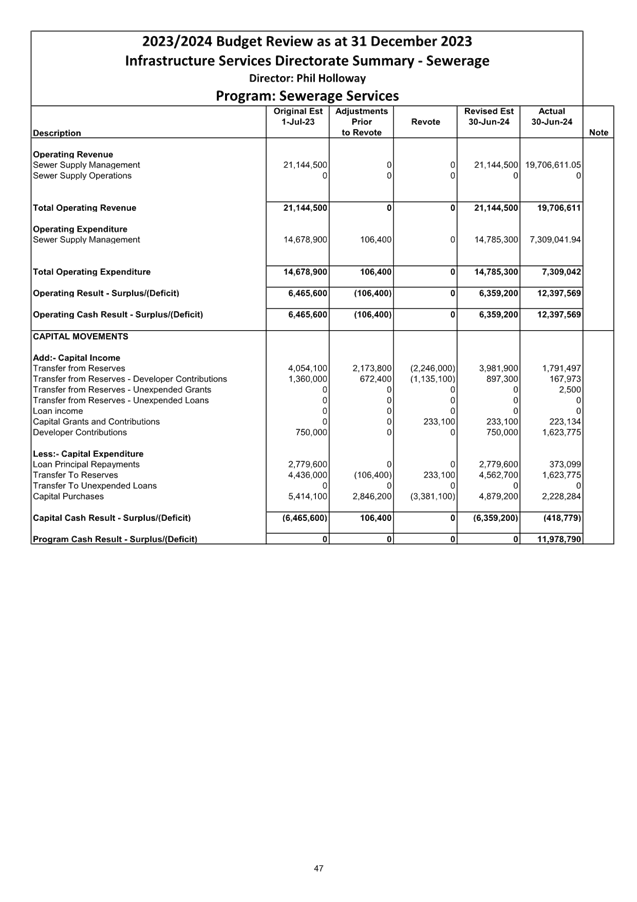

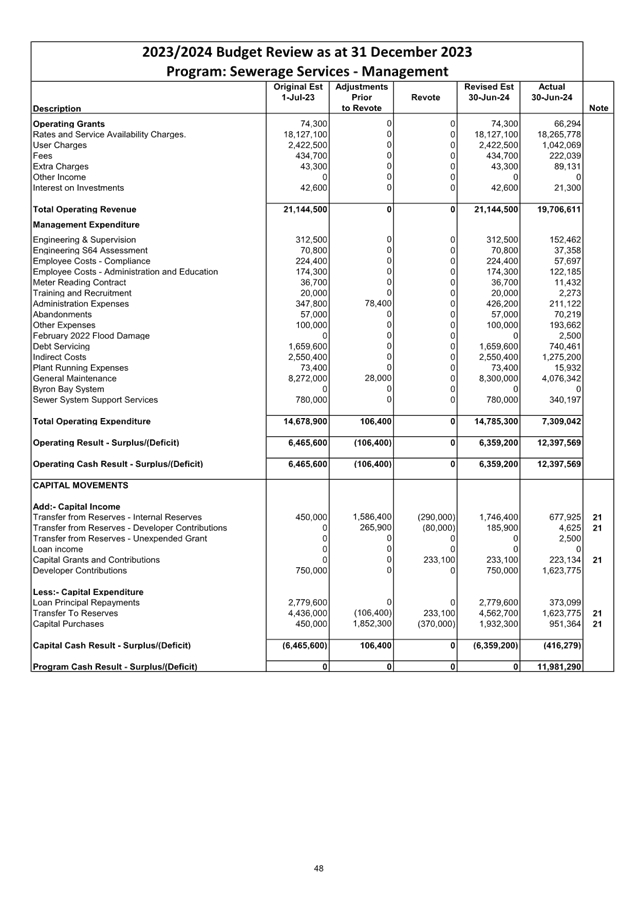

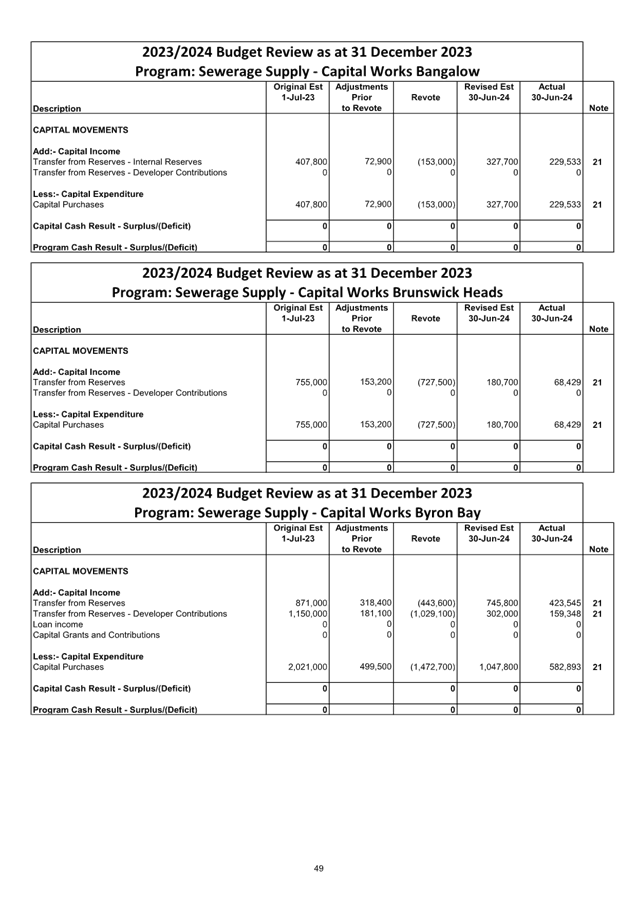

SEWERAGE FUND

After completion of the 2022/2023

Financial Statements the Sewer Fund as at 30 June 2023 has a capital works reserve

of $3,935,300 and plant reserve of $896,200. It also held $5,448,900 in

section 64 developer contributions and a $272,500 unexpended grant.

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2023

|

$3,935,500

|

|

Plus original budget reserve movement

|

(504,300)

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

(1,613,600)

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(666,600)

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

2,479,100

|

|

Forecast Reserve Movement for

2023/2024 – Increase / (Decrease)

|

(305,400)

|

|

Estimated Reserve Balance at 30

June 2024

|

$3,630,100

|

Plant

Reserve

|

Opening

Reserve Balance at 1 July 2023

|

$896,200

|

|

Plus original

budget reserve movement

|

0

|

|

Resolutions

July - September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Forecast Reserve Movement for

2023/2024 – Increase / (Decrease)

|

0

|

|

Estimated Reserve Balance at 30

June 2024

|

$896,200

|

It is proposed to create a reserve

for Property Development -Temporary Housing funded from income received for

temporary housing on Sewer Fund land.

Property Development Reserve

– Temporary Housing

|

Opening Reserve Balance at 1

July 2023

|

$0

|

|

Plus original budget reserve

movement

|

136,200

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Forecast Reserve Movement for 2023/2024

– Increase / (Decrease)

|

136,200

|

|

Estimated Reserve Balance at 30

June 2024

|

$136,200

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2023

|

$5,448,900

|

|

Plus original budget reserve

movement

|

(610,000)

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

(865,700)

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

193,300

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

1,135,100

|

|

Forecast Reserve Movement for

2023/2024 – Increase / (Decrease)

|

(147,300)

|

|

Estimated Reserve Balance at 30

June 2024

|

$5,301,600

|

Movements for the Sewerage Fund can be seen in Attachment 1

with a proposed estimated overall increase to reserves (including S64

Contributions) of $3,614,200 from the 31 December 2023 Quarter Budget Review.

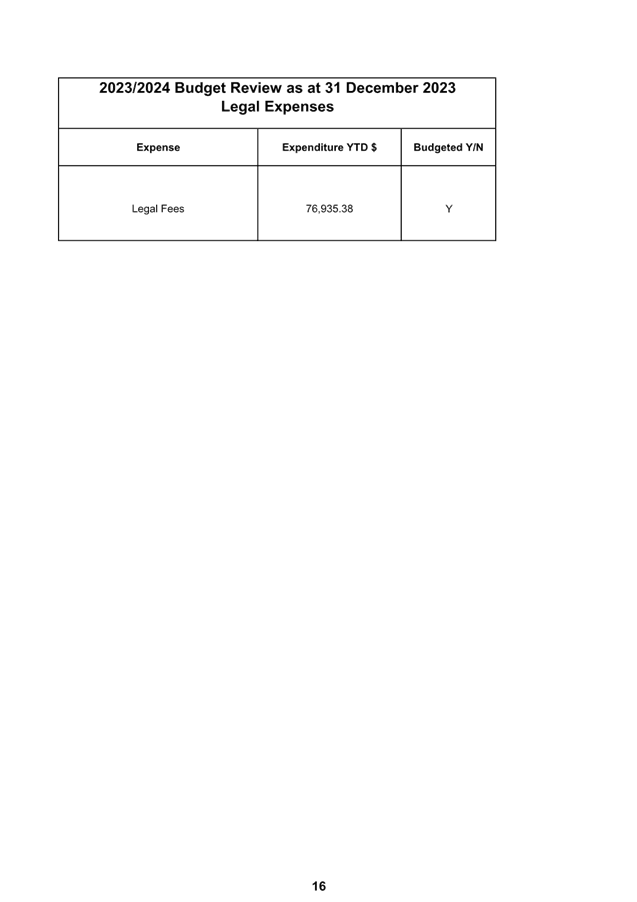

Legal Expenses

One of the major financial concerns for Council over

previous years has been legal expenses. Not only does this item represent a

large expenditure item funded by general revenue, but can also be susceptible

to large fluctuations.

The table that follows indicates the allocated budget and

actual legal expenditure within Council on a fund basis as at 31 December 2023.

Total Legal Income & Expenditure as at 31 December

2023

|

Program

|

2023/2024

Budget ($)

|

Actual ($)

|

Percentage To

Revised Budget

|

|

Income

|

|

|

|

|

Legal Expenses Recovered

|

0

|

32,000

|

0%

|

|

Total Income

|

0

|

32,000

|

0%

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

General Legal Expenses

|

210,000

|

76,935

|

36.63%

|

|

Total Expenditure General Fund

|

210,000

|

76,935

|

36.63%

|

Note: This should continue to be monitored to ensure

there is enough funding for future expenses.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1:

Effective Leadership

|

1.3:

Ethical and efficient management of resources

|

1.3.1:

Financial Management - Ensure the financial integrity and sustainability of

Council through effective financial management

|

1.3.1.2

|

Provide

Quarterly Budget Reviews to Council for adoption.

|

Legal/Statutory/Policy

Considerations

In accordance with Section 203 of

the Local Government (General) Regulation 2021 the Responsible Accounting

Officer of a Council must:

(1) Not

later than 2 months after the end of each quarter (except the June quarter),

the responsible accounting officer of a council must prepare and submit to the

council a budget review statement that shows, by reference to the estimate of

income and expenditure set out in the statement of the council’s revenue

policy included in the operational plan for the relevant year, a revised estimate

of the income and expenditure for that year.

(2) A

budget review statement must include or be accompanied by:

(a) a

report as to whether or not the responsible accounting officer believes that

the statement indicates that the financial position of the council is

satisfactory, having regard to the original estimate of income and expenditure,

and

(b) if

that position is unsatisfactory, recommendations for remedial action.

(3) A

budget review statement must also include any information required by the Code

to be included in such a statement.

Financial Considerations

The 31 December 2023 Quarter Budget Review of the 2023/2024

Budget has increased the overall estimated budget result by $1,200. This leaves

the movement against the unrestricted cash balance attributable to the General

Fund to an estimated deficit of $250,000 for the year, leaving the unrestricted

cash balance attributable to the General Fund at an estimated $250,000 deficit

at 30 June 2024.

It is the view of the Responsible Accounting Officer that

the short term financial position of the Council is still satisfactory for the

2023/2024 financial year, having consideration of the original estimate of

income and expenditure at the 31 December 2023 Quarter Budget Review.

This opinion is based on the estimated General Fund

Unrestricted Cash Result position and that the current indicative budget

position for 2023/2024 outlined in this Budget Review is further improved

through the remaining quarterly budget reviews for the 2023/2024 financial

year. Council must remember it has a short term financial goal of maintaining

$1,000,000 in unrestricted cash.

Council must also be mindful of its

cash flow position as the financial year progresses given the ongoing

expenditure on restoration of infrastructure from the February/May 2022 flood

events whilst experiencing significant delays in claims approvals, processing

and payments from the NSW State Government. This position will need continual

close monitoring as Council is delivering business as usual plus the flood

recovery.

It is essential that the Quarterly Budget Review for the

March 2024 Quarter is carefully considered in terms of delivery capacity and

Council’s financial position with a view to address the current $250,000

deficit as a minimum.

Staff Reports - Corporate and Community Services 3.2

Report

No. 3.2 2024/25 Budget

Paramaters

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2024/136

Summary:

This report is provided to the

Finance Advisory Committee to consider the proposed parameters and structural

issues impacting the preparation of the 2024/2025 budget. Aside from the

proposed budget parameters, the structural issues to the budget have existed

for some time and consideration should be given to address them.

RECOMMENDATION:

That the Finance Advisory Committee considers the

proposed parameters to be applied to the 2024/25 budget and discuss the current

budget structural issues.

Report

Council has commenced the process

of compiling the draft 2024/25 budget. A series of parameters governs the

entire budget development for the organisation. The intent of this report

is for the Finance Advisory Committee to consider these parameters as to their

relevance, validity or whether alternate parameters should be included.

In addition to consideration of

the budget parameters, this report will also outline to the Finance Advisory

Committee some structural issues that are impacting the budget and have done so

for a number of years. This report will identify these issues and invite

the Finance Advisory Committee to discuss and/or address these.

Budget Parameters

The overall Council budget is

governed by a series of parameters that take into consideration the current

economic factors and or conditions imposed upon Council. These parameters drive

some of the budget outcomes.

Preparation of the 2024/25 Budget

along with the other required Integrated Planning and Reporting documents

commenced in late November 2023. At this point in time, the first draft

of the required documents is being compiled and considered.

Included specifically in the

2024/25 Budget are the following parameters for the information of the Finance

Advisory Committee:

· The budget as at 31 December 2023 Quarterly Budget Review

is forming the basis of the initial 2024/25 budget. This will be updated

further with outcomes from the 31 March 2023 Quarterly Budget Review once

adopted by Council and prior to adoption in June 2023.

· Rate Peg Allowance – The independent Pricing and

Regulatory Tribunal (IPART) have determined the rate peg for Byron Shire

Council at 4.8% for 2024/25. This is based on the Cost index 3.9%,

Emergency Services Levy Factor 0.2%, Superannuation 0.4% and Population Growth

Factor 0.3%. The increase from the rate peg is estimated at

$1.414million.

· Allowance of 3.8% increase in expenses where applicable

which is representative of the Consumer Price Index CPI. This is based

off the rate peg on 4.8% less a 1% efficiency reduction which has been budget

practice since 2015. Coincidentally this is somewhat lining up with the

current Consumer Price Index of 4.1%.

· Wage increase of 3.5% in accordance with the Local

Government State Award 2023. Award increase equates to around $1.2million.

· Superannuation guarantee increasing from 11.0% to 11.5% for

2024/25 maxing out at 12.0% in 2025/26.

· Insurance premiums – allowing a 10% increase upon

indicative advice from the mutual.

· Electricity – expect a significant increase in

2024/25 possibly up to 30% under new contract but then certainty for the next

11.5 years. Increase is representative of the now impressive pricing

under the old contract Council secured but is no longer available in the market.

· Interest rates for new borrowings. Latest outlook is

for stability with potential decreases starting later in 2024. Current

indicative loan rates for Council are 4.93% for 10 years and 5.44% for 20 years

as at 5 February 2024.

Structural Budget Issues

Council’s budget cover a

wide variety of activities. In recent years it has been difficult to

balance the budget and Council has and continues to have structural

issues. The issues are as follows:

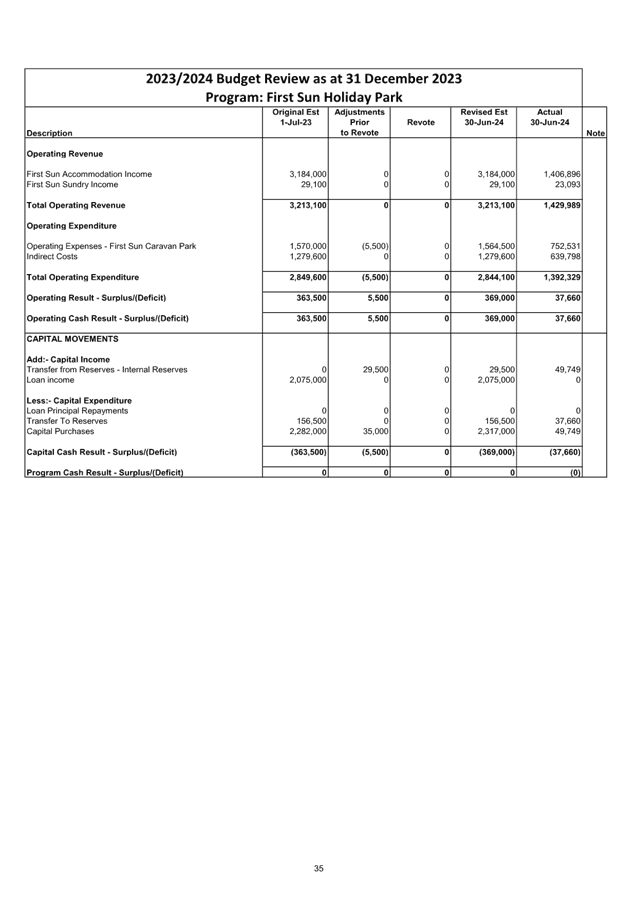

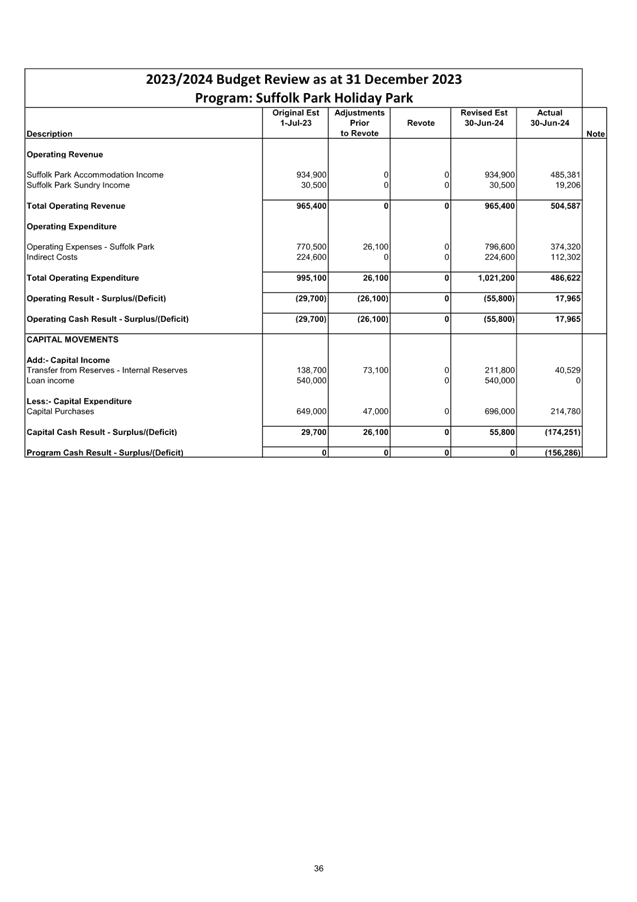

· Additional dividends from Council’s Holiday Parks and

Water/Sewerage Funds:

In addition to the current

overheads charged ($498,000 holiday parks, $1.468million, Water, $1.909million

Sewerage totalling $3.875million) Council also receives dividends from these

areas totalling $6million - being $1.006mllion from the holiday parks and

$0.559million each from Water and Sewerage. This then becomes a

contribution to and a funding source for the General Fund to fund all of its

activities. These amounts have increased over time but are now causing

funding issues within the holiday parks, water and sewerage to fund their

activities and future capital works. If these charges are reduced, there

will be more expenditure for the General Fund to absorb which will reduce

available funding for other items.

· Funding of the Works Depot:

The current budget contains $780k

in direct expenses for the Works Depot and $615k in overheads. These

costs currently and historically have been funded from the Plant Fund and not

General Fund. In this instance there is a direct subsidy to the General

Fund from the Plant Fund. The impact of these costs is a reduction in the

amount available from Plant hire revenues to firstly maintain the fleet and

provide funding for fleet replacement. The consequence of this over time

has meant fleet assets have been kept longer than they would ordinarily have

been which has diminished their residual value and potentially increased

maintenance costs.

The structural issues to the

budget have provided a mechanism for additional funding to the General Fund but

at the detriment to the Holiday Parks, Water, Sewerage and Plant Operations.

The impact of continuing this practice needs to be considered, as well as the

impact of ceasing the practice and needed to manage the reduced funding

available in the General Fund.

This is something the Finance

Advisory Committee may wish to consider as further input into the 2024/25

budget.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1: Effective Leadership

|

1.3: Ethical and efficient management of resources

|

1.3.1: Financial Management - Ensure the financial

integrity and sustainability of Council through effective financial

management

|

1.3.1.4

|

Financial reporting as required provided to Council and

management

|

|

1:

Effective Leadership

|

1.1:

Enhance trust and accountability through open and transparent leadership

|

1.1.1:

Leadership - Enhance leadership effectiveness, capacity, and ethical

behaviour

|

1.1.1.3

|

Develop

2024/25 Operational Plan

|

|

|

|

|

|

|

|

Legal/Statutory/Policy

Considerations

Section 406 of the Local Government Act 1993 and Section

196A of the Local Government (General) Regulation 2021 require Council to

comply with the Integrated Planning and Reporting Guidelines. The guidelines

require as part of the Annual Operational Plan that Council must prepare a

Statement of Revenue Policy and this is to include a detailed estimate of

Council’s income and expenditure – essentially the budget.

Financial Considerations

Council has a goal of achieving $1million in unrestricted

cash, but to date this is currently residing at zero. Council will be

looking at the 2022/23 31 March Quarterly Budget Review as an opportunity to

initially recover the current $250,000 budget deficit for 2023/24, and restore

some of the unrestricted cash balance.

Consultation and Engagement

There will be an opportunity

for the community to consider all of the Integrated Planning and Reporting

documents for 2024/25 when they are placed on public exhibition for 28 days

during April/May 2024 where Council will be inviting submissions from the

public.