Agenda

Agenda

Ordinary Meeting

Thursday, 22 May 2025

Agenda

Agenda

Ordinary Meeting

Thursday, 22 May 2025

Agenda Ordinary Meeting

held at Council Chambers, Station Street, Mullumbimby

commencing at 3:00 PM

Public access relating to items on this agenda can be made between 3:00pm and 4:00pm on the day of the meeting. Requests for public access should be made to the General Manager or Mayor no later than 12:00 midday on the day prior to the meeting.

Mark Arnold

General Manager

CONFLICT OF INTERESTS

What is a “Conflict of Interests” - A conflict of interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council official has that does not amount to a pecuniary interest as defined in the Code of Conduct for Councillors (eg. A friendship, membership of an association, society or trade union or involvement or interest in an activity and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter if the interest is so remote or insignificant that it could not reasonably be regarded as likely to influence any decision the person might make in relation to a matter or if the interest is of a kind specified in the Code of Conduct for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a matter if the pecuniary interest is the interest of the person, or another person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a matter if:

· The person’s spouse or de facto partner or a relative of the person has a pecuniary interest in the matter, or

· The person, or a nominee, partners or employer of the person, is a member of a company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the following:

(a) the parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or adopted child of the person or of the person’s spouse;

(b) the spouse or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary interest in a matter:

· If the person is unaware of the relevant pecuniary interest of the spouse, de facto partner, relative or company or other body, or

· Just because the person is a member of, or is employed by, the Council.

· Just because the person is a member of, or a delegate of the Council to, a company or other body that has a pecuniary interest in the matter provided that the person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

· A Councillor or a member of a Council Committee who has a pecuniary interest in any matter with which the Council is concerned and who is present at a meeting of the Council or Committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

· The Councillor or member must not be present at, or in sight of, the meeting of the Council or Committee:

(a) at any time during which the matter is being considered or discussed by the Council or Committee, or

(b) at any time during which the Council or Committee is voting on any question in relation to the matter.

No Knowledge - a person does not breach this Clause if the person did not know and could not reasonably be expected to have known that the matter under consideration at the meeting was a matter in which he or she had a pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts & the option chosen will depend on an assessment of the circumstances of the matter, the nature of the interest and the significance of the issue being dealt with. Non-pecuniary conflicts of interests must be dealt with in at least one of the following ways:

· It may be appropriate that no action be taken where the potential for conflict is minimal. However, Councillors should consider providing an explanation of why they consider a conflict does not exist.

· Limit involvement if practical (eg. Participate in discussion but not in decision making or vice-versa). Care needs to be taken when exercising this option.

· Remove the source of the conflict (eg. Relinquishing or divesting the personal interest that creates the conflict)

· Have no involvement by absenting yourself from and not taking part in any debate or voting on the issue as of the provisions in the Code of Conduct (particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993 – Recording of voting on planning matters

(1) In this section, planning decision means a decision made in the exercise of a function of a council under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development application, an environmental planning instrument, a development control plan or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register containing, for each planning decision made at a meeting of the council or a council committee, the names of the councillors who supported the decision and the names of any councillors who opposed (or are taken to have opposed) the decision.

(3) For the purpose of maintaining the register, a division is required to be called whenever a motion for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described in the register or identified in a manner that enables the description to be obtained from another publicly available document, and is to include the information required by the regulations.

(5) This section extends to a meeting that is closed to the public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are reminded of the oath of office or affirmation of office made at or before their first meeting of the council in accordance with Clause 233A of the Local Government Act 1993. This includes undertaking the duties of the office of councillor in the best interests of the people of Byron Shire and the Byron Shire Council and faithfully and impartially carrying out the functions, powers, authorities and discretions vested under the Act or any other Act to the best of one’s ability and judgment.

BUSINESS OF Ordinary Meeting

1. Public Access

3. Attendance by Audio-Visual Link

4. Requests for Leave of Absence

5. Declarations of Interest – Pecuniary and Non-Pecuniary

6. Tabling of Pecuniary Interest Returns (Cl 4.14 Code of Conduct for Councillors)

7. Adoption of Minutes from Previous Meetings

7.1 Ordinary Meeting held on 24 April 2025

8. Reservation of Items for Debate and Order of Business

9. Notices of Motion

9.1 Mayor's Discretionary Allowance................................................................................. 8

10. Mayoral Minute

11. Petitions

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Byron Bay Foreshore Concept Plans....................................................................... 10

Corporate and Community Services

13.2 Grants May 2025.......................................................................................................... 24

13.3 Mayor and Councillor Remuneration 2025/26......................................................... 28

13.4 Budget Review - 1 January to 31 March 2025........................................................ 34

13.5 Meeting Schedule 2025 - Timing of Meetings......................................................... 50

13.6 2024/25 Operational Plan Progress Report - Quarter 3 - March 2025............... 53

13.7 Council Resolutions Quarterly Review - Q3 - 1 February 2025 to 31 March 2025 57

13.8 Policies for Review....................................................................................................... 60

13.9 Appointment of Councillor Representative to Mullumbimby Showground Land Manager......................................................................................................................... 65

13.10 2024/25 Loan Borrowings........................................................................................... 68

13.11 Council Investments - 1 April 2025 to 30 April 2025.............................................. 73

Sustainable Environment and Economy

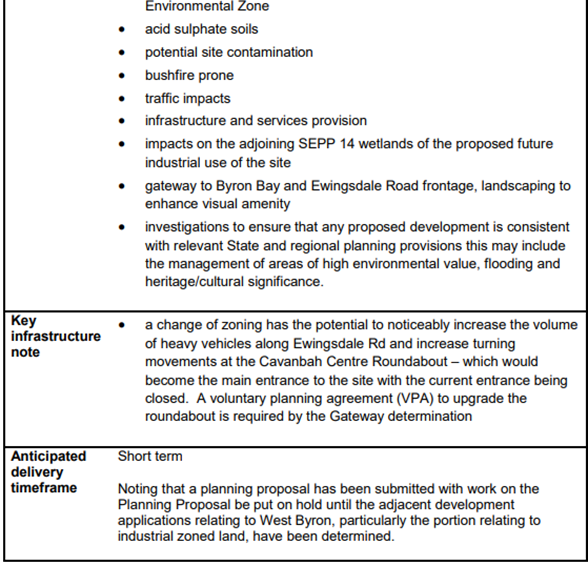

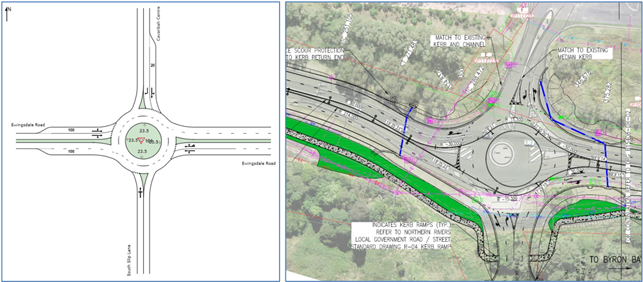

13.12 PLANNING - 26.2021.4.1 - Planning Proposal for 268 Ewingsdale Road Byron Bay........................................................................................................................................ 81

13.13 PLANNING - Submissions report - Amendments to Byron Shire DCP 2014 Chapter C2: Areas Affected by Flood...................................................................................... 99

13.14 Draft Affordable Housing Contribution Policy, Affordable Housing Contribution Scheme Procedure, Affordable Housing Planning Agreement Procedure and Affordable Housing Contribution Distribution Plan 2025........................................................ 105

14. Reports of Committees

Corporate and Community Services

14.1 Report of the Arts Advisory Committee Meeting held on 17 April 2025........... 116

Infrastructure Services

14.2 Report of the Water and Sewer Advisory Committee Meeting held on 17 April 2025...................................................................................................................................... 119

14.3 Report of the Transport and Infrastructure Advisory Committee Meeting held on 17 April 2025.................................................................................................................... 122

14.4 Report of the Local Traffic Committee Meeting held on 6 May 2025................ 124

No table of contents entries found.

15. Questions With Notice

Nil

16. Confidential Reports

General Manager

16.1 Confidential - Court proceedings over DA for 17-lot industrial subdivision - 288 Ewingsdale Road, Byron Bay.................................................................................. 128

Questions with Notice: A response to Questions with Notice will be provided at the meeting if possible, that response will be included in the meeting minutes. If a response is unable to be provided the question will be taken on notice, with an answer to be provided to the person/organisation prior to the next Ordinary Meeting and placed on Councils website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

Councillors are encouraged to ask questions regarding any item on the business paper to the appropriate Director prior to the meeting. Any suggested amendments to the recommendations should be provided to Councillor Support prior to the meeting to allow the changes to be typed and presented on the screen at the meeting.

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 Mayor's Discretionary Allowance

File No: I2025/627

I move that Council:

1. Notes the following donation from the Mayor’s Discretionary Allowance 2024/2025:

a) Mullumbimby and District Neighbourhood Centre - $1,500

2. Advertises the donation in accordance with Section 356 of the Local Government Act 1993.

\

Signed: Cr Sarah Ndiaye

Councillor’s supporting information:

The Mullumbimby and District Neighbourhood Centre played a crucial role in supporting the community in the leadup, during and after Ex Tropical Cyclone Alfred.

The centre provided food, support and facilitated volunteer efforts at a local level. I thank them for their ongoing commitment to deliver services to meet the community’s needs.

This contribution is made to recognise the service provided and the expenses incurred.

Staff comments

by Esmeralda Davis, Director, Corporate and Community Services

The proposed allocation of $1,500.00 to the Mullumbimby and District Neighbourhood Centre, will be processed and advertised accordingly.

Financial/Resource/Legal Implications:

Financial and Resource Implications:

The 2024/25 Budget adopted by Council included an allocation of $1,500.00 for budget item Mayor – Discretionary Allowance (unallocated). Sufficient funds are available for making the nominated donation of $1,500.00.

Legal and Policy Implications.

In relation to the making of Section 356 Donations from the Mayor – Discretionary Allowance, Council at its Ordinary meeting held on 14 May 2009 resolved as follows: -

“09-349 Resolved that Council confirm that all s356 donations, to be made from the budget allocation “Mayor – Discretionary Allowance”, must be the subject of a resolution of the Council at Ordinary or Extraordinary meeting.”

This Notice of Motion is to confirm the making of the listed Section 356 Donation.

The Section 356 Donation will be advertised, and public notice of financial assistance provided in accordance with Section 356 of the Local Government Act 1993.

Is the proposal consistent with any Delivery Program tasks?

Yes

|

CSP Objective |

CSP Strategy |

DP Action |

|

1: Effective Leadership |

1.5: Empower community leadership through collaboration, capacity building, and cultivating community driven initiatives |

1.5.1: Community grant programs - Provide financial assistance and grants to empower community groups and organisations to deliver priority projects

|

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Byron Bay Foreshore Concept Plans

Directorate: General Manager

Report Author: Claire McGarry, Place Manager - Byron Bay

File No: I2025/621

Summary:

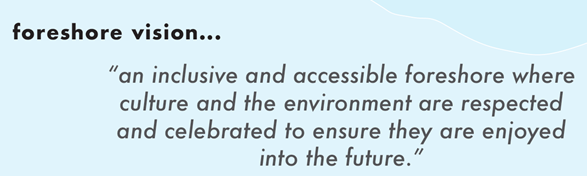

This report presents for endorsement concept plans for the Byron Bay foreshore. A key catalyst site for the Byron Bay Town Centre Masterplan, the foreshore is one of the community’s most valued places, as well as one that attracts a huge number of visitors every year. One of Australia’s most iconic locations, it is also under the strain of ever-increasing use and environmental impacts, with aging and degraded infrastructure.

Council engaged landscape architects Plummer & Smith to develop a concept plan for the foreshore which presents an overarching vision that can be delivered in stages over the next 5-10 years. The intent is that while works are prioritised and staged according to approval pathways and funding availability, each discreet project is designed and delivered with the broader integrated concept in mind.

In 2024, Council took two concept plans out to the community for feedback. This report summarises the project objectives, the consultation undertaken, the feedback received and the proposed next steps to see the plan come to life as live construction projects.

As part of that consultation, it became evident that the Main Beach carpark and the coastal protection structure between the First Sun Holiday Park and the Byron Bay Surf Life Saving Club require confirmation of proposed changes to the coastal protection structure before a concept for that section of the foreshore can be completed.

Direction on the modification of the coastal protection structure will be determined through the preparation of Council’s Coastal Management Program (CMP) for the Byron Shire Open Coast through the State led coastal management planning process. For this reason, it is recommended that concept planning for this area is temporarily paused until Stage 3 of the CMP concludes. As such, the report is silent on any decision making for the car park and coastal protection structure and recommends that Council endorses only the concept plan for the remainder of the precinct. The coastal management planning process and CMP will evaluate and determine the preferred modification option at this location for coastal protection in close consultation with community, which is expected later this year.

Overall, there is a high level of community aspiration for this site, and in this concept, we aim to create a space that retains the local rituals and rhythms of our place and celebrates its natural beauty. The design proposes a space where everyone is safe and welcome, a canvas on which the community can share its stories and show its creativity through future play and art elements. We want to create a space for people to linger, inspire the investment in infrastructure that Byron Bay requires, and provide for the future needs of the community and the environment.

RECOMMENDATION:

That Council:

1. Adopts the Byron foreshore concept plan included in Attachment 1 (E2025/46396).

2. Awaits the outcome of the preferred modification option for the coastal protection structure as part of Stage 3 CMP preparation, before continuing community discussions and design workshops to develop a concept plan for the foreshore precinct parking.

3. Notes the proposed actions within the priority actions table, and:

a) Endorses the design for new Apex Park amenities;

b) Prioritises the design of a new play space for Apex Park;

c) Endorses staff beginning succession and additional planting along the foreshore in areas that won’t be impacted by future construction;

d) Endorses the design for kayak storage; and

e) Shares the community’s feedback related to the Beach Café relocation with Crown Lands and encourages further community consultation through the Crown’s planning and approval process.

1 Byron

Foreshore Landscape Concept FINAL 250502, E2025/46396

![]()

2 Summary

of Byron foreshore consultation outcomes 2024, E2025/46211 ![]()

3 Raw

survey data - Byron foreshore community survey 2024, E2025/47352 ![]()

4 Combined

addditional submissions - Byron foreshore, E2025/47216

![]()

5 Confidential - Petition for Main Beach Carpark - July 2024, E2025/46603

6 Byron

Bay Foreshore - Apex Park Amenities report May 2025, E2025/46607 ![]()

7 Concept

Design Brief Main Beach Play Space, E2025/47349

![]()

8 Byron

foreshore succession planting plan, E2025/46210

![]()

9 Kayak

storage concept plan - May 2025, E2025/46614

![]()

Report

Background

The Byron foreshore is one of the catalyst sites identified in the Byron Bay Town Centre Masterplan, which envisages ‘a single coherent and connected foreshore open space’ and that Main Beach in particular ‘should be established as a continuous foreshore park, catering for large events, spaces for hanging out, picnics, passive and active recreation.’

In addition to the Masterplan, Council’s Main Beach Shoreline Project which commenced in 2019, undertaken by Bluecoast Consulting Engineers investigated a range of options for modification of the coastal protection structure between the First Sun Holiday Park and the Byron Bay Surf Life Saving Club to improve coastal protection, public safety and access and use of the foreshore and beach. Three (3) shortlisted options were endorsed by Council in 2023 to proceed to further evaluation and determination of the preferred option. The options and associated technical reports have been considered as part of this concept plan.

The rich cultural and historical context of the foreshore serves as a critical foundation for this concept plan, ensuring that any interventions are sensitive to the area’s heritage while also meeting contemporary needs. Environmental sustainability is prioritised throughout the design, with measures in place to preserve and enhance the natural environment.

The concept plan (Attachment 1) includes:

- detailed project background and site analysis

- design principles and vision

- key issues assessment

- design proposals

- materials / character palettes

It provides an overarching vision for the foreshore, which can be delivered in stages over the next 5 – 10 years. Once Council has adopted an overarching concept, detailed design can begin for early stage works which will be focussed on new amenities, play elements and additional plantings. The ‘priority actions’ section of this report details the proposed early stage works.

Project principles

(Excerpt from Design Document – Attachment 1)

Consultation

In acknowledgement of the significance of this site to the community, extensive community consultation was undertaken on concept options in order to inform the final concept included in this report.

The Byron Masterplan process, which identified this as a catalyst site for the town centre, was a result of over 18 months of comprehensive, robust community engagement including ‘town hall’ meetings, targeted stakeholder workshops, community design charettes, online campaigns and interactive surveys.

In early 2024, with the completion of the Byron Rail precinct, the Byron Bay skate park and construction of the Sandhills wetlands and town centre drainage projects underway, the focus for Council and community became the foreshore as the next key Masterplan site to focus on.

Through a competitive process, Council engaged Plummer & Smith to develop concept plans for the foreshore precinct, based on targeted consultation with a number of key stakeholder groups to inform design principles:

- Byron Masterplan Guidance Group

- Byron Surf Club

- Crown Lands

- Local Aboriginal representatives

- Commercial licencees

- Accessibility Working Group

- Local school groups

The feedback from these groups informed the development of two concept plans which went out to the community for consultation through June and July 2024. Council provided face to face and online opportunities for stakeholders to view the plans and ask questions, as well as providing feedback online through Council’s YourSay survey platform.

These included:

- Eight drop in community information sessions at local farmers markets, community markets and on site at the Byron Surf Club

- Online drop-in information sessions

- Project-specific mailing list established

- Promotion through social media and local media outlets

- Design workshops with local schools

- Letterbox drop and doorknock to directly impacted business and property owners

The aim was to maximise the number of responses and demographic / representative groups, and the feedback received was used to refine the concepts, prioritise staging and inform this report.

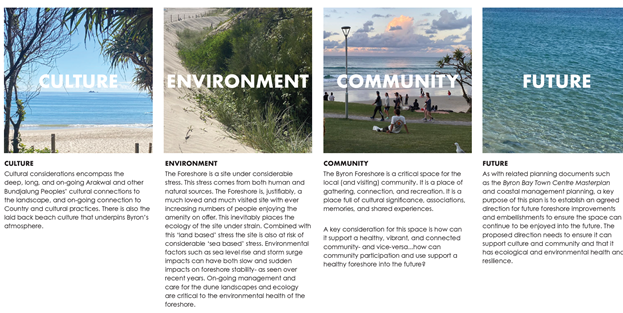

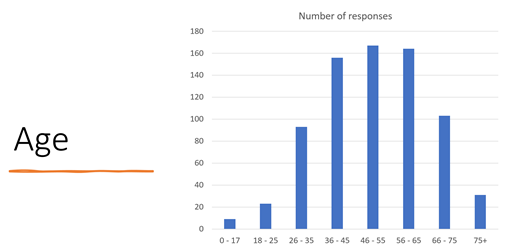

The community response was significant, with over 350 one-on-one conversations at drop-in sessions and over the phone and close to 800 survey responses, (64% higher than the Council project with the second-highest level of survey engagement).

Attachment 2 provides a summary of feedback received and Attachment 3 provides the de-identified raw data from the survey responses. A number of submissions were received which did not come through Council’s Your Say portal but were submitted within the consultation period – see Attachment 4.

Feedback received

The data shows that the vast majority of responses came from Byron Bay residents and businesses, with the age dispersal representative of local demographic data.

Overall, the data showed very strong community support for the project from Apex Park to Clarkes Beach, and division within the community on the best long-term design for the existing Main Beach carpark.

A number of responses highlighted that other issues in the Shire (such as pothole repair) should be prioritised over projects such as this.

Feedback for Apex and Dening Parks

The feedback on the concept for Apex and Dening Parks recommends a cautious approach to development, with a strong emphasis on preserving the character of Byron Bay while addressing the practical community needs and environmental concerns. The attached consultation summary provides further detail on each section of the project, but overall comments include:

· A focus on improving amenities and playgrounds with modern, inclusive designs

· Protecting natural habitats and considering impacts on local wildlife

· Creating pathways that balance accessibility with aesthetic considerations

· Prioritising accessibility including better parking, beach access and amenities

· Considering budget constraints and maintenance capabilities to avoid overextending council resources

· Balancing development with ecological preservation

· Ensuring that improvements benefit both locals and tourists and address concerns about commercial exclusivity and environmental impacts

The project team accept and agree with all this feedback and have incorporated it into the final concept for adoption, and will continue to do so through the detailed design process of each individual stage.

Feedback on car parking

This report recommends adoption of the concept plans from Apex to Clarkes, and further community consultation be undertaken to progress designs for the car park space once the preferred modification option for the coastal protection structure is endorsed by Council.

Direction on the modification of the coastal protection structure will be determined through the preparation of Council’s Coastal Management Program (CMP) for the Byron Shire Open Coast through the State led coastal management planning process. Council is currently in Stage 3 of the 4 staged CMP process. Stage 3 comprises identification and evaluation of coastal management options for managing threats and risks along with seeking feedback from stakeholders and the community to help shortlist the management options.

Two of the shortlisted options comprise changes to the alignment and position of the structure in the coastal landscape which will have implications for any proposed changes to the location and function of the foreshore area and car park (protected by the structure). For this reason, it is recommended that concept planning for this area is temporarily paused until Stage 3 of the CMP concludes. As such, the report is silent on any decision making for the car park and coastal protection structure and recommends that Council endorses only the concept plan for the remainder of the precinct.

Given the community’s passionate views, there is plenty of time for further discussion to resolve the future use of this space.

It is important to note that a local group created a petition in relation to the car park (Attachment 5) but were advised that due to incomplete and inaccurate information provided to potential petition-signers it was not viewed by the project team as valid data.

It was recommended that instead interested community members be directed to Council’s website, survey and/or project team.

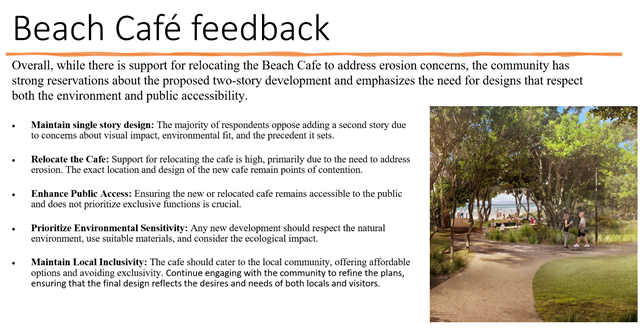

Feedback on Beach Café relocation

Separate to the Council-led upgrades, staff have been working with Crown Lands and the owners of Beach café to ensure that the café relocation, led by Crown Lands, integrates with the concept plan. The community feedback on this proposal is summarised below and this report recommends it be provided to Crown Lands to further guide their discussions with the lessee.

Priority actions

The intent of this report is to adopt an overall concept for the foreshore precinct, so that as funding becomes available for discreet projects within the footprint over the coming years, they can be designed in a way that connects into the broader vision for the site.

Through the design process, priority projects have emerged based on:

a) Aging and/or decommissioned infrastructure

b) Accessibility

c) Environmental (succession planting, shade trees)

d) Commercial lease timing

With that in mind, this report also seeks endorsement for the below action table and the projects contained within it to proceed to next stages of detailed design and/or construction.

Action table

|

Project |

Rationale for prioritising |

Current status |

Proposed action |

|

New amenities at Apex Park

|

1. Existing Exeloos were installed as a temporary measure in 2014 and have not been upgraded since

2. Existing amenities are not fit for purpose for current use and capacity does not meet current demand

3. Broader foreshore project aims to reduce visual clutter to maximise views from Apex Park play area towards Nguthungulli and Walgun, which are currently blocked by existing exeloos and shelters |

Detailed concept design complete (attachment 6) Funding application submitted – awaiting notification of outcome. |

Endorse detailed concept design for amenities to enable staff to go to market for design then construction tender once funding is secured.

|

|

New play space at Apex Park |

1. Old play space was removed in 2024 due to safety concerns

2. Regular and consistent community requests for replacement of play equipment as soon as possible due to high demand at this site |

Design brief completed (attachment 7) and Request for Quote is currently out to market |

Endorse prioritising a new play space so project team can proceed with concept design, including community consultation, with concepts to be reported to Council prior to detailed design commencing and funding applications submitted. |

|

Additional and succession planting throughout Reserve |

1. Some existing native plantings are beginning to reach the end of their life and need timely replacements

2. Some project elements (e.g. amenities) may require the removal of existing vegetation, so need to ensure they are replaced with additional plantings in logical locations

3. Significant community feedback through consultation regarding additional shade and extra planting to improve environmental outcomes |

Planting plan completed (attachment 8) |

Endorse staff to begin succession planting and additional planting in spaces that won’t be impacted by future works |

|

Construction of kayak storage |

1. Existing kayak storage structures are unapproved and need to be removed

2. Construction of a Council-owned storage structure would be allowable under existing Crown Lands licence and would enable Council to better manage commercial operations in the space

3. Commercial tender for kayak operations is due to commence in November 2025– construction of storage prior to this enables a clean transition operationally for successful tenderers |

Concept plans completed (attachment 9) Review of Environmental Factors is underway. Funding application submitted – awaiting notification of outcome. |

Endorse concept plans to enable staff to proceed to detailed design and construction, subject to funding.

|

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

5: Connected Infrastructure |

5.4: Provide accessible community facilities and open spaces |

5.4.2: Parks and open spaces - Provide and maintain active and passive recreational community space that is accessible and inclusive for all |

5.4.2.11 |

Complete Landscape Masterplan for Main Beach Reserve and commence design for renewal/upgrade of playground and public facilities |

Legal/Statutory/Policy Considerations

No legal implications for the adoption of concept plans.

Financial Considerations

Budget for the detailed design and construction of each stage of the project will be subject to applications for funding to state and federal governments.

Staff Reports - Corporate and Community Services 13.2

Staff Reports - Corporate and Community Services

Report No. 13.2 Grants May 2025

Directorate: Corporate and Community Services

Report Author: Donna Johnston, Grants Coordinator

File No: I2025/141

Summary:

Council is waiting on determination of 15 Grant Applications which, if successful, would provide funding to enable the delivery of identified projects. This report provides an update on grant applications.

RECOMMENDATION:

That Council notes the Grant Submissions Report for the month of April 2025 (Attachment 1 #E2025/44539).

1 Grants

Awaiting Determination - April 2025, E2025/44539

![]()

Report

Currently Council has 15 grant applications awaiting determination (refer to Grants Submissions as of 29 April 2025 - Attachment 1, E2025/44539).

Successful applications

The following grant has been successful:

|

Funding body |

Funding scheme |

Project name |

Total

project |

Amount

requested |

Council

|

|

Create NSW |

Special Entertainment Precinct Kickstart Grant Program | NSW Government |

Byron Bay Town Centre SEP |

$162,800 |

$162,800 |

0 |

Unsuccessful applications

The following grant has been unsuccessful:

|

Funding body |

Funding scheme |

Project name |

Total project |

Amount requested |

Council |

|

Department of Infrastructure, Transport, Regional Development, Communications and the Arts |

Housing Support Program |

Gulgan Road Roundabout |

$7.63M |

$7.63M |

0 |

|

Program over was oversubscribed. Feedback session being held in May 2025.bscribed. Feedback session being held in May 2025. |

|||||

Upcoming Grant opportunities

The program runs over 4 years from 2023-24 to 2026-27. It requires a partnership approach, bringing together governments and communities to plan and deliver multi-purpose regional precincts that are place-based, tailored to local needs and have a shared vision in how the precinct connects to the region. Partners can be from government, First Nations groups, community organisations, regional universities or private enterprise.

The program supports the planning and delivery of regional, rural and remote precincts, places that encompass multiple infrastructure elements delivered by various parties through long-term partnerships between multiple providers. Regional precincts may include business districts, neighbourhoods, activity centres, commercial hubs or community and recreational areas. They will be located in renewal areas and growth areas in regional centres, regional corridors, regional cities, as well as smaller town centres that serve as service hubs in more remote communities.

Council resolved (25-138) to enter into a Memorandum of Understanding with Mullum Seed to facilitate work with Council in applying for a Regional Precincts and Partnerships Program Grant.

Council will be applying under Stream One, in partnership with Mullum Seed, to seek funding to prepare a Masterplan for Lot 22 Mullumbimby.

Arts and Cultural Funding Program

2-Year Multi-year Funding | NSW Government – closes 26 May 2025

2-Year Multi-year funding provides core investment to the NSW arts and cultural sector to support sustainable growth of the industry, with a focus on all NSW citizens being given the opportunity to contribute to and experience arts and culture.

Applicants can apply for a minimum of $60,000 and a maximum of $200,000 per year, subject to type of organisation eligibility that is applying.

Council staff are preparing an application seeking funding to further extend the public programs at the Byron Bay Lone Goat Gallery.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Strategy |

DP Action |

Code |

OP Activity |

|

|

1: Effective Leadership |

1.3: Ethical and efficient management of resources |

1.3.1: Financial Management - Ensure the financial integrity and sustainability of Council through effective financial management |

1.3.1.9 |

Coordinate grant applications to support the delivery of Council projects and services within management plans, masterplans, strategic plans, council resolutions and high priority actions from feasibility studies; and support the management of successful grants |

Legal/Statutory/Policy Considerations

Under section 409 3(c) of the Local Government Act 1993 Council is required to ensure that ‘money that has been received from the Government or from a public authority by way of a specific purpose advance or Grant, may not, except with the consent of the Government or public authority, be used otherwise than for that specific purpose’. This legislative requirement governs Council’s administration of Grants.

Financial Considerations

If Council is successful in obtaining the identified Grants, this would bring funding sought to approximately $40.7 million which would provide significant funding for Council projects. Some of the Grants require a contribution from Council (either cash or in-kind) and others do not. Council’s contribution is funded.

The potential funding is detailed below:

Funding applications submitted and

awaiting notification (total value) $40.7 million

Requested funds from funding bodies $38.4 million

Council contribution cash $2.3 million

Council co-contribution in-kind $147,000

Other contributions $0

Funding determined in April 2025:

Successful

applications

$162,800 (total project value)

Unsuccessful/withdrawn

applications

$7.63 million (total project value)

Consultation and Engagement

Staff Reports - Corporate and Community Services 13.3

Report No. 13.3 Mayor and Councillor Remuneration 2025/26

Directorate: Corporate and Community Services

Report Author: Heather Sills, Manager Corporate Services

File No: I2025/404

Summary:

The Local Government Remuneration Tribunal has handed down its report and determination on fees for Councillors and Mayors for the 2025/26 financial year. A copy of the report is available from: LGRT 2025 Annual Determination.

The Tribunal determined a 3% per annum increase in the minimum and maximum fees applicable to each category, effective 1 July 2025 and one council was reclassified into a higher category.

This report outlines the Tribunal’s fee range and recommends that Council fixes the maximum fee available for the Mayor and Councillors for 2025/26.

RECOMMENDATION:

That Council:

1. Fixes the fee payable to each Councillor under section 248 of the Local Government Act 1993 for the period 1 July 2025 to 30 June 2026 at $27,860.

2. Fixes the fee payable to the Mayor under section 249 of the Local Government Act 1993, for the period from 1 July 2025 to 30 June 2026 at $68,800.

3. Does not determine a fee payable to the Deputy Mayor, in accordance with current practice.

Report

Each year the Local Government Remuneration Tribunal (Tribunal) must determine, in each of the categories determined under section 239 of the Local Government Act 1993 the maximum and minimum amounts of fees to be paid during the following year to councillors and mayors.

The Tribunal has released its 2025/26 Determination, in summary:

· a 3% per annum increase in the minimum and maximum fees will apply to each category, effective 1 July 2025.

· A review of categories is required at least once every 3 years. This was last carried out in 2023. The Tribunal will next consider the model, the criteria for each group, and the allocation of councils in the 2026 review.

· One council, Mid-coast, were reclassified into a higher category.

The Remuneration Tribunal has determined the maximum and minimum amounts of fees to be paid during the 2025/26 financial year. As Byron Shire Council is categorised as a Regional Centre the appropriate fee range is as follows:

|

Category |

Councillor/Member Annual Fee ($) effective 1 July 2025 |

Mayor/Chairperson Additional Fee* ($) effective 1 July 2025 |

||

|

Minimum |

Maximum |

Minimum |

Maximum |

|

|

Regional Centre |

15,830 |

27,860 |

32,940 |

68,800 |

*This fee must be paid in addition to the fee paid to the Mayor/Chairperson as a Councillor/Member (s.249(2) of the Local Government Act 1993).

Currently, the annual fees payable to Councillors and the Mayor for the 2024/25 financial year are the maximum fee fixed at $27,050 per annum for a Councillor, and an additional fee of $66,800 for the Mayor.

A full version of the determination is provided on the Tribunal’s website: LGRT 2025 Annual Determination.

Council’s Submission

Council made a submission to the Tribunal (24-544) about the fees payable to Mayors and Councillors in 2025/26.

The key points of the submission are outlined below, with the corresponding response from the Tribunal’s report.

|

Council’s Submission |

Tribunal Response |

|

Urged the Tribunal to apply the maximum increase available, to offset the increasing cost of living |

100. The Tribunal considered a range of factors in determining the amount to increase minimum and maximum fees payable to councillors and mayors. This included a wide range of economic data such as: • Consumer Price Index for the 12 months to December each year • Wage Price Index for the 12 months to December each year Local Government Remuneration Tribunal Annual Determination 2025 27 • Full-time average weekly ordinary time earnings for the 12 months to November each year • NSW Public Sector Salaries increases • Local Government State Award increases • IPART Rate Peg Base Cost Change • Public Service Senior Executive remuneration determinations, by the Statutory and Other Offices Remuneration Tribunal, and • State Members of Parliament Basic Salary remuneration determinations by the Parliamentary Remuneration Tribunal. 101. On this occasion the Tribunal has determined that a 3% increase will apply to the minimum and maximum fees applicable to existing categories |

|

Recognition of Deputy Mayors as a distinct category within the local government remuneration framework |

62. The issue of fees for deputy mayors was once again raised. 63. Three submissions asserted that the position of deputy mayor should attract its own distinct independent fee, beyond the fee provided for in s.249(5) of the LG Act. 64. The Tribunal dealt with this issue in its 2024 Annual Determination at paragraph 53-55. It was noted that the Tribunal lacked the powers to implement changes to the fee structure that would include a distinct independent fee for the position of deputy mayor. 65. There has been no change to the legislation to permit such a change. Therefore, the Tribunal is currently unable to introduce a remuneration structure that would include a distinct independent fee for the position of deputy mayor. |

|

Reduce the gap between minimum and maximum fees for each category |

101. On this occasion the Tribunal has determined that a 3% increase will apply to the minimum and maximum fees applicable to existing categories. |

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1: Effective Leadership |

1.1: Enhance trust and accountability through open and transparent leadership |

1.1.2: Governance - Ensure legislative compliance and support Councillors to carry out their civic duties |

1.1.2.3 |

Provide administrative support to Councillors to carry out their civic duties |

Recent Resolutions

22-222 - resolved to make a superannuation contribution payment to its councillors in accordance with section 254B of the Act.

22-070 - endorsed the submission to the Local Government Remuneration Tribunal on the fees payable to Mayors and Councillors in 2023/24 and sought re-categorisation to ‘Regional Centre’.

24-544 - endorsed the submission to the Local Government Remuneration Tribunal on the fees payable to Mayors and Councillors in 2025/26 Legal/Statutory/Policy Considerations

Section 248 of the Local Government Act 1993 states:

(1) A council must pay each councillor an annual fee.

(2) A council may fix the annual fee and, if it does so, it must fix the annual fee in accordance with the appropriate determination of the Remuneration Tribunal.

(3) The annual fee so fixed must be the same for each councillor.

(4) A council that does not fix the annual fee must pay the appropriate minimum fee determined by the Remuneration Tribunal.

Section 249 of the Local Government Act 1993 further states:

(1) A council must pay the mayor an annual fee.

(2) The annual fee must be paid in addition to the fee paid to the mayor as a councillor.

(3) A council may fix the annual fee and, if it does so, it must fix the annual fee in accordance with the appropriate determination of the Remuneration Tribunal.

(4) A council that does not fix the annual fee must pay the appropriate minimum fee determined by the Remuneration Tribunal.

Section 250 of the Local Government Act 1993 states that fees are payable monthly in arrears for each month (or part of a month) for which the councillor holds office.

Section 254B of the Local Government Act 1993 relates to the payment of a superannuation contribution, which came into effect on 1 July 2022.

Financial Considerations

Councillors and Mayoral fees currently paid:

$27,050 each x 9 = $243,450

Plus Mayor additional fee = $ 66,800

Total Paid $310,250

Councillors and Mayoral fees 2025/26 increased to maximum set by the Tribunal*:

$27,860 each x 9 = $250,740

Plus Mayor additional fee = $ 68,800

Total Paid $319,540

Superannuation contribution payments:

Council resolved (22-222) to make a superannuation contribution payment to its councillors in accordance with section 254B of the Act. In 2024/25 this will be payable at the rate of 12%, which is equivalent to amount under the Commonwealth superannuation legislation if the councillor were an employee of the Council. The rate increases by 0.5% percent each year until 1 July 2025 when it reaches 12%. This payment is in addition to Councillor fees.

12% x $319,540* = $38,344.80

*based on the assumption that councillors will determine to receive the full contribution.

Councillors are required nominate a superannuation account or if they do not wish to receive a superannuation contribution payment, may agree in writing to forgo or reduce the payment.

The draft 2025/26 Budget was prepared prior to the determination by the Tribunal. The amount determined by Council through this report will be incorporated into the final budget to be adopted at the 30 June Extraordinary Meeting of Council.

Allowance for Deputy Mayor

Section 249 (Clause 5) of the Local Government Act 1993 states that:

A council may pay the deputy mayor (if there is one) a fee determined by the council for such time as the deputy mayor acts in the office of the mayor. The amount of the fee so paid must be deducted from the mayor's annual fee.

As stated in the above clause, Council is not bound to set a fee, but if it so chooses must deduct that sum from the amount available under the Mayoral allowance.

Current practice is that the payment of a fee for an acting period by Deputy Mayor undertaking the role of Mayor, would apply only in instances where the Mayor has leave of absence endorsed by Council, and any pro rata fees would be deducted from the Mayoral allowance, where agreed on a case by case basis in accordance with section 249 of the Local Government Act 1993.

Consultation and Engagement

The Remuneration Tribunal consults with local governments to arrive at its determination. Byron Shire Council made a submission to the Remuneration requesting the maximum increase. Council has an adopted view that the current maximum fees for Councillors and Mayors are inadequate for the roles and responsibilities undertaken.

Staff Reports - Corporate and Community Services 13.4

Report No. 13.4 Budget Review - 1 January to 31 March 2025

Directorate: Corporate and Community Services

Report Author: James Brickley, Manager Finance

File No: I2025/441

Summary:

This report has been prepared to comply with Section 203 of the Local Government (General) Regulation 2021 and to inform Council and the community of Council’s estimated financial position for the 2024/2025 financial year, reviewed as at 31 March 2025.

This report contains an overview of the proposed budget variations for the General Fund, Water Fund and Sewerage Fund. The specific details of these proposed variations are included in Attachment 1 and 2 for Council’s consideration and authorisation.

Attachment 3 contains the Integrated Planning and Reporting Framework (IP&R) Quarterly Budget Review Statement (QBRS) as outlined by the Office of Local Government in circular 10-32.

This report was also considered by the Finance Advisory Committee at their Meeting on 15 May 2025.

RECOMMENDATION:

That Council:

1. Authorises the itemised budget variations as shown in Attachment 2 (#E2025/43407) which include the following results in the 31 March 2025 Quarterly Review of the 2024/2025 Budget:

a) General Fund – $0 movement to the Estimated Unrestricted Cash Result

b) General Fund - $1,093,000 decrease in reserves

c) Water Fund - $495,000 increase in reserves

d) Sewerage Fund - $948,200 increase in reserves

2. Adopts the revised General Fund Estimated Unrestricted Cash Surplus of $400,000 for the 2024/2025 financial year as at 31 March 2025.

Attachments:

1 Budget

Variations for General, Water and Sewerage Funds, E2025/43403 ![]()

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2025/43407 ![]()

3 Integrated

Planning and Reporting Framework (IP&R) required Quarterly Review

Statements, E2025/43408 ![]()

Report

Council adopted the 2024/2025 budget on 27 June 2024 via Resolution 24-328. Council also considered and adopted the budget carryovers from the 2023/2024 financial year, to be incorporated into the 2024/2025 budget at its Ordinary Meeting held on 15 August 2024 via Resolution 24-380, the September Quarterly Budget review adopted by Council at its ordinary meeting held on 28 November 2024 via resolution 24-545 and the December Quarterly Budget Review adopted by council on 27 February via resolution 25-019. Since that date, Council has reviewed the budget and progress through the first three quarters of the 2024/2025 financial year. This report considers the March 2025 Quarter Budget Review (QBR).

The details of the budget review for the Consolidated, General, Water and Sewer Funds are included in Attachment 1, with an itemised listing in Attachment 2. This aims to show the consolidated budget position of Council, as well as a breakdown by Fund and Principal Activity. The document in Attachment 1 is also effectively a publication outlining a review of the budget and is intended to provide Councillors with more detailed information to assist with decision making regarding Council’s finances.

Contained in the document at Attachment 1 is the following reporting hierarchy:

Consolidated Budget Cash Result

General Fund Cash Result Water Fund Cash Result Sewer Cash Result

Principal Activity Principal Activity Principal Activity

Operating Income Operating Expenditure Capital income Capital Expenditure

The pages within Attachment 1 are presented (from left to right) by showing the original budget as adopted by Council on 30 June 2024 plus the adopted carryover budgets from 2023/2024, followed by the resolutions between July and December and the revote (or adjustment for this review) and next, the revised position projected for 30 June 2025 as at 31 March 2025.

On the far right of the Principal Activity, there is a column titled “Note”. If this is populated by a number, it indicates there has been an adjustment in the quarterly review. This number then corresponds to the notes at the end of the Attachment 1 which provides an explanation of the variation.

There is also information detailing restricted assets (reserves) to show Council’s estimated balances as at 30 June 2025 for all Council’s reserves.

A summary of Capital Works is also included by Fund and Principal Activity.

Office of Local Government Budget Review Guidelines:

The Office of Local Government on 10 December 2010 issued Quarterly Budget Review Guidelines via Circular 10-32, with the reporting requirements to apply from 1 July 2011. This report includes a Quarterly Budget Review Statement (refer Attachment 3) prepared by Council in accordance with the guidelines. These Guidelines are currently being reviewed by the Office of Local Government.

The Quarterly Budget Review Guidelines set a minimum standard of disclosure, with these standards being included in the Local Government Code of Accounting Practice and Financial Reporting as mandatory requirements for Councils to address.

Since the introduction of the new planning and reporting framework for NSW Local Government, it is now a requirement for Councils to provide the following components when submitting a Quarterly Budget Review Statement (QBRS):

· A signed statement by the Responsible Accounting Officer on Council’s financial position at the end of the year based on the information in the QBRS

· Budget review income and expenses statement in one of the following formats:

o Consolidated

o By fund (e.g. General, Water, Sewer)

o By function, activity, program etc. to align with the management plan/operational plan

· Budget Review Capital Budget

· Budget Review Cash and Investments Position

· Budget Review Key performance indicators

· Budget Review Contracts and Other Expenses

The above components are included in Attachment 3 and outlined below:

Income and Expenditure Budget Review Statement by Type

This shows Council’s income and Expenditure by type. This has been split by Fund. Adjustments are shown, looking from left to right. These adjustments are commented on through the last 9 pages of Attachment 1.

Capital Budget Review Statement

This statement identifies in summary Council’s capital works program on a consolidated basis and then split by Fund. It also identifies how the capital works program is funded.

Cash and Investments Budget Review Statement

This statement reconciles Council’s restricted funds (reserves) against available cash and investments. Council has attempted to indicate an actual position as at 31 March 2025 of each reserve to show a total cash position of reserves with any difference between that position and total cash and investments held as available cash and investments. It should be recognised that the figure is at a point in time and may vary greatly in future quarterly reviews depending on cash flow movements.

Key Performance Indicators (KPIs)

The KPIs within this report are:

o Debt Service Ratio - This assesses the impact of loan principal and interest repayments on the discretionary revenue of Council.

o Rates and Annual Charges Outstanding Ratio – This assesses the impact of uncollected rates and annual charges on Councils liquidity and the adequacy of recovery efforts.

o Asset Renewals Ratio – This assesses the rate at which assets are being renewed relative to the rate at which they are depreciating.

These may be expanded in future to accommodate any additional KPIs that Council may adopt to use.

Contracts and Other Expenses - This report highlights any contracts Council entered into during the January to March quarter that are greater than $50,000.

CONSOLIDATED RESULT

The following table provides a summary of the overall Council budget on a consolidated basis inclusive of all Funds’ budget movements for the 2024/2025 financial year projected to 30 June 2025, revised as at 31 March 2025.

|

2024/2025 Budget Review Statement as at 31 March 2025 |

Original Estimate (Including Carryovers) 1/7/2024 |

Adjustments to 31 Mar 2025 including Resolutions* |

Proposed 31 Mar 2025 Review Revotes |

Revised Estimate 30/6/2025 at 31/3/2025 |

|

Operating Revenue |

121,626,000 |

(1,301,900) |

39,000 |

120,363,100 |

|

Operating Expenditure |

127,469,300 |

3,564,700 |

(870,700) |

130,163,300 |

|

Operating Result – Surplus/Deficit |

(5,843,300) |

(4,866,600) |

909,700 |

(9,800,200) |

|

Add: Capital Revenue |

52,658,200 |

(21,523,500) |

(5,411,600) |

25,723,100 |

|

Change in Net Assets |

46,814,900 |

(26,390,100) |

(4,501,900) |

15,922,900 |

|

Add: Non Cash Expenses |

20,657,300 |

0 |

0 |

20,657,300 |

|

Add: Non-Operating Funds Employed |

9,941,100 |

(486,900) |

(5,635,600) |

3,818,600 |

|

Subtract: Funds Deployed for Non-Operating Purposes |

104,669,500 |

(19,517,300) |

10,487,700 |

74,664,500 |

|

Cash Surplus/(Deficit) |

(27,256,200) |

(7,359,700) |

350,200 |

(34,265,700) |

|

Restricted Funds – Increase / (Decrease) |

(27,331,700) |

(7,284,200) |

350,200 |

(34,265,700) |

|

Forecast Result for the Year – Surplus/(Deficit) – Unrestricted Cash Result |

75,500 |

(75,500) |

0 |

0 |

GENERAL FUND

In terms of the General Fund projected Unrestricted Cash Result the following table provides a reconciliation of the estimated position as at 30 September 2024:

|

Opening Balance – 1 July 2024 |

$400,000 |

|

Plus original budget movement and carryovers |

75,500 |

|

Council Resolutions July – September Quarter |

0 |

|

Recommendations September QBR – increase/(decrease) |

0 |

|

Council Resolutions October – December Quarter |

0 |

|

Recommendations December QBR – increase/(decrease) |

(75,500) |

|

Council Resolutions January – March Quarter |

0 |

|

Recommendations within this Review – increase/(decrease) |

0 |

|

Estimated Unrestricted Cash Result Closing Balance – 30 June 2025 |

$400,000 |

The General Fund financial position overall has remained the same as a result of this budget review, leaving the forecast cash result for the year at an estimated balanced budget result and an estimated unrestricted cash result of $400,000. The proposed budget changes are detailed in Attachment 1 and summarised further in this report below.

Council Resolutions

Part 2 of Resolution 25-011 from the 13 February 2025 Planning Meeting requested consideration of allocating $40,000 in the next Quarterly Budget Review to undertake a feasibility study into installing a community battery for Byron Shire, including options for equitable operating models, technologies and sites within the Shire.

The next Quarterly Budget Review referred to in Resolution 25-011 is this Review and there is the possibility to provide funding should Council require it. A specific budget allocation has not been made but provision has been considered through a proposed additional transfer of $40,000 to the Property Development Reserve. This had been able to be achieved through additional interest revenue. It is understood that grant funding opportunities are currently being sought for the community battery as an alternative.

Budget Adjustments

The budget adjustments identified in Attachments 1 and 2 for the General Fund have been summarised by Budget Directorate in the following table:

|

Budget Directorate |

Revenue Increase/ (Decrease) $ |

Expenditure Increase/ (Decrease) $ |

Accumulated Surplus (Unrestricted Cash) Increase/ (Decrease) $ |

|

General Manager |

75,000 |

75,000 |

0 |

|

Corporate & Community Services |

145,900 |

137,900 |

8,000 |

|

Infrastructure Services |

(9,073,100) |

(9,080,500) |

7,400 |

|

Sustainable Environment & Economy |

60,000 |

75,400 |

(15,400) |

|

Total Budget Movements |

(8,792,200) |

(8,792,200) |

0 |

Budget Adjustment Comments

Within each of the Budget Directorates of the General Fund, are a series of budget adjustments identified in detail at Attachment 1 and 2. More detailed notes on these are provided in Attachment 1. The major additional items included are summarised below by Directorate and are included in the overall budget adjustments table above.

General Managers Office

· In the General Managers program, it is proposed to increase operating income due to legal fees recovered and increase operating expenditure due to additional legal expenses. The difference can be funded from the Legal Services reserve.

Corporate and Community Services

· In the General Purpose Revenues Program an additional $40,000 in interest revenue can be realised.

· In the Information Services program, it is proposed to move $45,000 budget from Cyber Penetration Testing to Cyber Security Vulnerability Management to cover actual costs.

· In the Corporate Services program, it is proposed to decrease operating expenditure due to $8,000 not required for Customer Service Initiatives in 2024/25. This can be redirected to the Foyer Security Works in the Facilities Management program.

· In the Community Development program, it is proposed to increase operating income and expenditure due to a grant being received from the Siddle Foundation for rough sleeping ($215,000). It is proposed to decrease operating expenditure by $5,000 due to $84,000 being added to the salaries budget for a Community Facilities Officer in the original 2024/25 budget, but only $79,000 being required. It is proposed to further decrease operating expenditure due to 2323.001 Public Art ($16,000), 2331.053 Aboriginal/Torres Strait Islander Projects ($4,000), 2331.058 Aboriginal Leadership & Engagement ($42,000) and 2331.106 Arts & Culture ($50,000) not being required in 2024/25 and move to the Draft 2025/26 budget.

Infrastructure Services

· In the Asset Management program, it is proposed to increase capital income due to the sale of part of road reserve Lot 1 DP1287743. It is proposed to transfer this to the Sale of Road Assets reserve.

· In the Projects & Commercial Development program, it is proposed to decrease operating expenditure due to the budgets for Property Consultancy Services ($10,700) and Survey Services ($8,600) not being required in 2024/25. It is also proposed to increase operating expenditure by $3,300 for a land valuation.

· In the Depot Services program, it is proposed to remove Loan funding of $3,672,100 for fleet replacement and fund this from the Plant reserve. During the course of 2024/25, the Plant reserve has obtained the capacity to fund these purchases through revised charge out rates and higher plant hire recoveries.

· In the Local Roads and Drainage program, there are a number of adjustments outlined under Note 8 on pages 54 to 56 in the Budget Variations explanations section of Attachment 1. Further disclosure is included on the second page of Attachment 2 under the budget program heading Local Roads and Drainage.

· In the Infrastructure Recovery program, It is proposed to adjust capital expenditure by for various EPARs to vary the budgets to a revised level of expected expenditure for the 2024/25 financial year.

· In the Open Space and Recreation program, it is proposed to decrease Capital expenditure by $96,000 due to 4835.317 Linda Vidler Shelter & Path Extension ($180,000) being removed and added to the Draft 2025/26 budget. This is offset by an increase against 4835.309 Playground Renewal ($84,000) due to a grant that has been approved.

· In the Waste Management program, it is proposed to decrease various budgets due to works not being undertaken this financial year. Further disclosure is included on the fourth page of Attachment 2 under the budget program heading Waste & Recycling.

· In the First Sun Holiday Park program, it is proposed to increase operating income as actual income for Tourist Sites is trending above the budget. It is proposed to decrease capital expenditure due to the Land Purchase of the Rail Corridor not being undertaken this financial year. This is loan funded and will be moved to the Draft 2025/26 budget. It is also proposed to change the loan funding ($165,000) of 4265.1 - Detailed design and preparation of DA to reserve funding. The Holiday Park reserve is able to accommodate funding these capital works in 2024/25 and therefore defer the Holiday Park reserve from paying loan repayment costs.

· In the Suffolk Park Holiday Park program, It is proposed to change the loan funding of 4270.2 - Bbqs, Signs, Minor works ($30,000), 4270.5 - Park Improvements ($15,000), 4270.6 - Compliance Works Program ($196,000) and 4270.7 - Caravan Replacements ($600,500) to reserve funding. The Holiday Park reserve is able to accommodate funding these capital works in 2024/25 and therefore defer the Holiday Park reserve from paying repayment costs.

· In the Facilities Management program, it is proposed to increase operating income and expenditure due to income received from the Electric Vehicle charging stations ($4,000). It is proposed to increase operating expenditure by a further $8,000 due to a budget of $22,600 being required for the Council Building Foyer Security upgrade. This can be partly funded by a decrease against the budget for the Chambers roof replacement which is complete ($14,600). This difference of $8,000 can be funded from a decrease in Customer Service Initiatives in the Corporate Services program.

Sustainable Environment and Economy

· In the Development & Certification program, it is proposed to increase operating income due to actual income being higher than the budget for Footpath Dining ($110,000) and the Information Technology Service Fee ($20,400). These can be transferred through their respective reserves. It is also proposed to decrease the budget for Development Application Fees ($213,600) as they are trending below the budgeted income due to a decrease in development applications across the Shire. This can be offset by adjustments to various income numbers where the actual income is trending higher than the budget. A further breakdown of these items is on page 3 of Attachment 2.

· In the Planning Policy & Natural Environment program, It is proposed to increase operating income and expenditure by $90,000 due to grants received for the Northern Rivers Ark Project ($85,000) and a Friends of the Koala Grant ($5,000). A further $207,300 as itemised on page 60 of Attachment 1 in expenditure has been reduced and transferred to reserve to fund a proposed staff restructure in the Planning Policy & Natural Environment/Economic Development area. Page 60 also details additional project expenditure budgets that will not be expended in 2024/25 but will be added to the Draft 2025/26 budget.

· In the Economic Development program, it is proposed to decrease operating expenditure due to budgets not being required for Tourism Memberships and Projects ($12,500) and Senior Capacity Building ($16,400). It is also proposed to decrease the budget for Billinudgel is back in Business ($21,000). Although this grant funded project was acquitted in 2020, two of the grants Council issued to local business’ as part of the project remained unspent and have subsequently been returned to Council.

WATER FUND

The estimated Water Fund reserve balances as at 30 June 2025, and forecast in this Quarter Budget Review, are derived as follows:

Capital Works Reserve

|

Opening Reserve Balance at 1 July 2024 |

$4,111,700 |

|

Plus original budget reserve movement |

(3,820,500) |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

1,099,200 |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

374,300 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

495,000 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

(1,852,000) |

|

Estimated Reserve Balance at 30 June 2025 |

$2,259,700 |

Section 64 Developer Contributions

|

Opening Reserve Balance at 1 July 2024 |

$1,746,500 |

|

Plus original budget reserve movement |

(1,253,000) |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

1,026,400 |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

297,300 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

70,700 |

|

Estimated Reserve Balance at 30 June 2025 |

$1,817,200 |

Movements for Water Fund can be seen in Attachment 1 with a proposed estimated increase to reserves (including S64 Contributions) overall of $495,000 from the 31 March 2025 Quarter Budget Review.

SEWERAGE FUND

Capital Works Reserve

|

Opening Reserve Balance at 1 July 2024 |

$7,577,100 |

|

Plus original budget reserve movement |

(2,588,900) |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

881,200 |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

1,150,000 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

590,600 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

32,900 |

|

Estimated Reserve Balance at 30 June 2025 |

$7,610,000 |

Plant Reserve

|

Opening Reserve Balance at 1 July 2024 |

$896,200 |

|

Plus original budget reserve movement |

0 |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

0 |

|

Estimated Reserve Balance at 30 June 2025 |

$896,200 |

The below reserve is funded from income received for temporary housing on Sewer Fund land.

Property Development Reserve – Temporary Housing

|

Opening Reserve Balance at 1 July 2024 |

$136,200 |

|

Plus original budget reserve movement |

136,200 |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

136,200 |

|

Estimated Reserve Balance at 30 June 2025 |

$272,400 |

Section 64 Developer Contributions

|

Opening Reserve Balance at 1 July 2024 |

$8,043,300 |

|

Plus original budget reserve movement |

(7,500) |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

(1,050,000) |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

255,200 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

357,600 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

(444,700) |

|

Estimated Reserve Balance at 30 June 2025 |

$7,598,600 |

Unexpended Public Works Grant

|

Opening Reserve Balance at 1 July 2024 |

$253,149 |

|

Plus original budget reserve movement |

0 |

|

Resolutions July - September Quarter – increase / (decrease) |

0 |

|

September Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Resolutions October - December Quarter – increase / (decrease) |

0 |

|

December Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Resolutions January - March Quarter – increase / (decrease) |

0 |

|

March Quarterly Review Adjustments – increase / (decrease) |

0 |

|

Forecast Reserve Movement for 2024/2025 – Increase / (Decrease) |

0 |

|

Estimated Reserve Balance at 30 June 2025 |

$253,149 |

Movements for the Sewerage Fund can be seen in Attachment 1 with a proposed estimated overall increase to reserves (including S64 Contributions) of $948,200 from the 31 March 2025 Quarter Budget Review.

Legal Expenses

A financial concern for Council over previous years has been legal expenses. Not only does this item represent a large expenditure item funded by general revenue, but can also be susceptible to large fluctuations.

The table that follows indicates the allocated budget and actual legal expenditure within Council on a fund basis as at 31 March 2025.

Total Legal Income & Expenditure as at 31 March 2025

|

Program |

2024/2025 Budget ($) |

Actual ($) |

Percentage To Revised Budget |

|

Income |

|

|

|

|

Legal Expenses Recovered |

0 |

60,000 |

0% |

|

Total Income |

0 |

60,000 |

0% |

|

|

|

|

|

|

Expenditure |

|

|

|

|

General Legal Expenses |

350,000 |

418,924 |

119.69% |

|

Total Expenditure General Fund |

350,000 |

418,924 |

119.69% |

Note: It is proposed to increase the Legal Services budget by a further $75,000 at this QBR, funded from the Legal Service reserve as legal expenses are trending higher than the existing budget. This should continue to be monitored to ensure there is enough funding for future expenses. This transfer from the Legal Services Reserve brings the budget into line with actual expenditure. If this transfer from the reserve is adopted, the Legal Services reserve will have a balance of $35,000 following the recovery of $60,000 in legal expenses. A budget for the legal expenses recovered is also proposed in this Quarterly Budget Review.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1: Effective

Leadership |

1.3: Ethical and efficient management of resources |

1.3.1: Financial Management - Ensure the financial integrity and sustainability of Council through effective financial management |

1.3.1.2 |

Provide Quarterly Budget Reviews to Council for adoption. |

Legal/Statutory/Policy Considerations

In accordance with Section 203 of

the Local Government (General) Regulation 2021 the Responsible Accounting

Officer of a Council must:

(1) Not later than 2 months after the end of each quarter (except the June quarter), the responsible accounting officer of a council must prepare and submit to the council a budget review statement that shows, by reference to the estimate of income and expenditure set out in the statement of the council’s revenue policy included in the operational plan for the relevant year, a revised estimate of the income and expenditure for that year.

(2) A budget review statement must include or be accompanied by:

(a) a report as to whether or not the responsible accounting officer believes that the statement indicates that the financial position of the council is satisfactory, having regard to the original estimate of income and expenditure, and

(b) if that position is unsatisfactory, recommendations for remedial action.

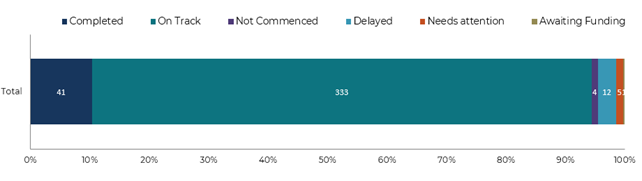

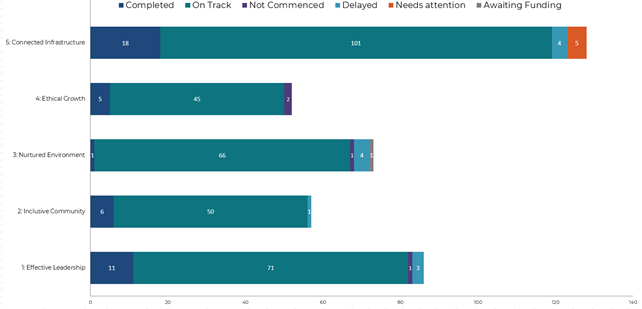

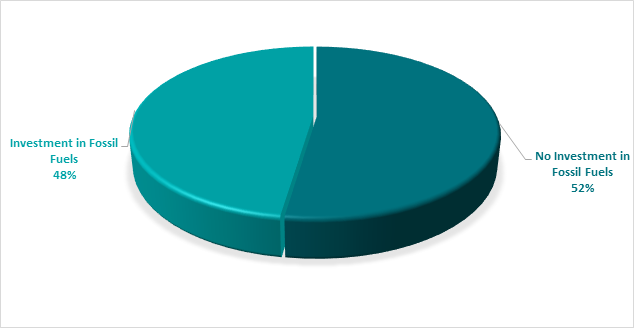

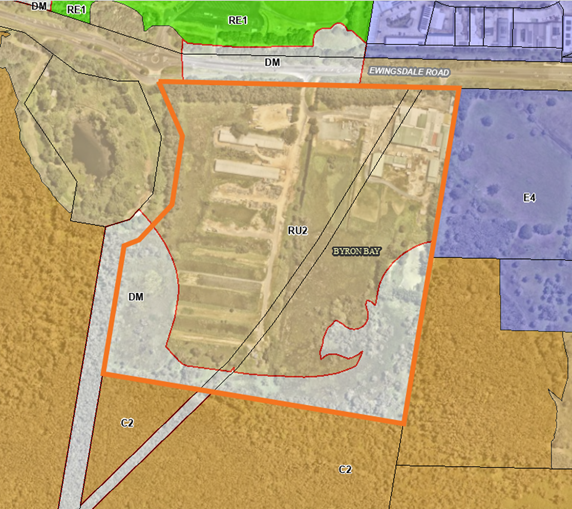

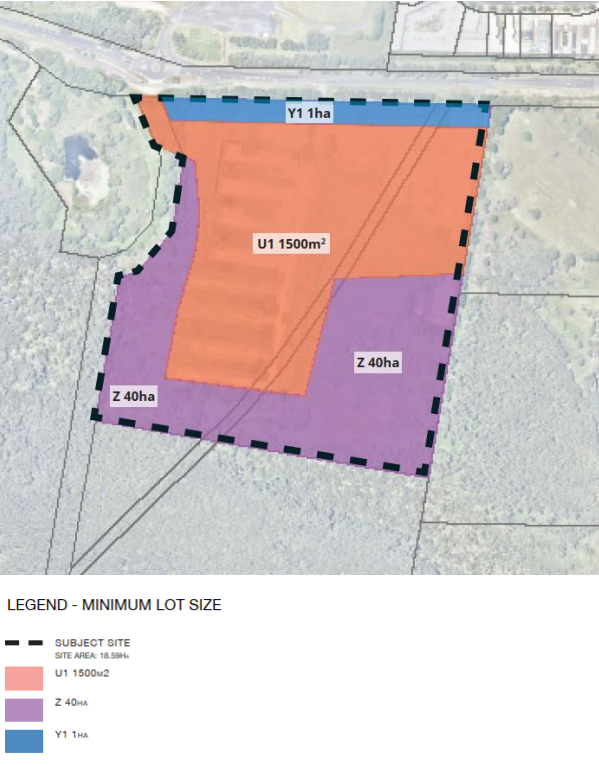

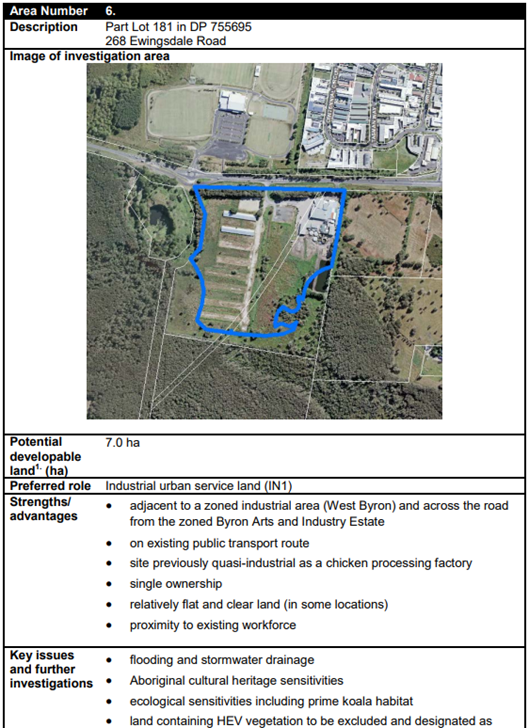

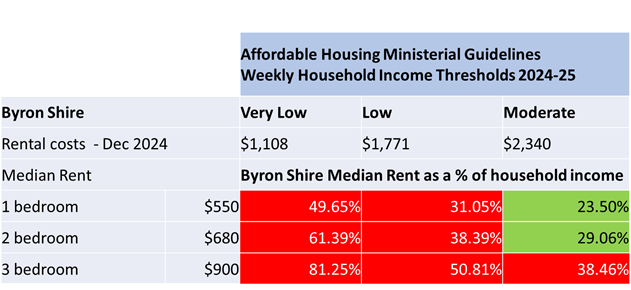

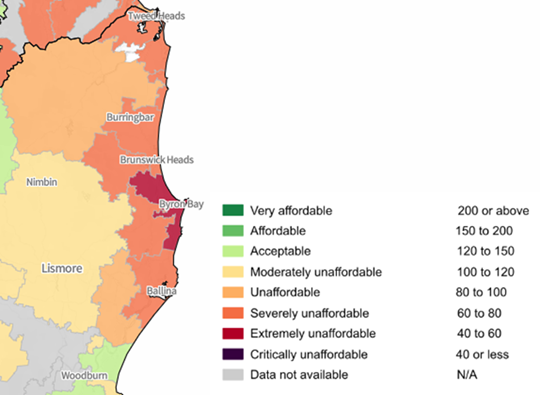

(3) A budget review statement must also include any information required by the Code to be included in such a statement.