Extraordinary Finance Advisory Committee Meeting

An Extraordinary Finance Advisory

Committee Meeting of Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 13 April 2017

|

|

Time

|

9.00am

|

Mark Arnold

Director Corporate and Community Services I2017/452

Distributed 07/04/17

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council under

the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Finance

Advisory Committee Meeting held on 16 February 2017

4. Staff Reports

Corporate and Community Services

4.1 Review

of Council Investment Policy............................................................................... 4

4.2 Draft

2017/2018 Budget Estimates................................................................................. 17

4.3 Draft

2017/2018 Revenue Policy.................................................................................... 91

Staff Reports - Corporate and Community

Services

Report No. 4.1 Review

of Council Investment Policy

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/341

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary Meeting held on 23 February 2017,

considered Report 13.4 regarding Council Investments January 2017.

Council resolved 17-043 part 2:

‘That a workshop on the financial investment

strategy occurs at the next SPW on 9 March 2017’

A presentation was provided to the Strategic Planning

Workshop (SPW) on 9 March 2017. Following from that presentation, this report

is provided to the Finance Advisory Committee to consider an updated Draft

Policy - Council Investments 2017 and subject to any consideration or

amendment, recommend to Council adoption of the Draft Policy - Council

Investments 2017 for the purposes of public exhibition.

|

RECOMMENDATION:

That the Finance Advisory Committee recommend to

Council:

1. That

the Draft Policy - Council Investments 2017 be placed on public

exhibition for a period of 28 days.

2. That

in the event:

a) that any

submissions are received on the Draft Policy - Council Investments

2017, that those

submissions be reported back to Council prior to adoption of the policy;

or

b)

that no submissions are received on the Draft Policy - Council

Investments 2017, that the policy be

adopted and incorporated into Council’s Policy Register.

|

Attachments:

1 Draft

Council Investment Policy 2017, E2017/24259

, page 7⇩

Report

Council at its Ordinary Meeting held on 23 February 2017,

following consideration of Report 13.4 regarding Council Investments January

2017, resolved (in part) as follows:-

17-043 part 2:

‘That a workshop on the financial investment

strategy occurs at the next SPW on 9 March 2017’

A presentation was provided to the Strategic Planning

Workshop (SPW) on 9 March 2017. Following from that presentation, this report

is provided to the Finance Advisory Committee to consider an updated Draft

Policy - Council Investments 2017 and subject to any consideration or amendment,

recommend to Council adoption of the Draft Policy - Council Investments 2017

for the purposes of public exhibition.

The Draft Policy - Council Investments 2017 is included at

Attachment 1. The document has been updated to comply with the new template

for Council policies and sets out the following guidance in relation to

Council’s investments:

· Set the objectives of

investing.

· Outline the legislative

requirements.

· Ascertain authority for

implementation and management of the Policy.

· Establish the capital,

liquidity and return expectations.

· Determine the diversity of the

investment portfolio.

· Environmentally and Socially

Responsible Investing.

· Define the risk profile.

· Establish legal title.

· Set benchmarks.

· Establish monitoring and

reporting requirements.

· Define duties and obligations

of Delegated Officers.

The new Draft Policy - Council Investments 2017

incorporating the above is provided for the Finance Advisory Committee’s

consideration, amendment and recommendation to Council, for public exhibition.

Financial Implications

There are no financial implications directly associated with

this report. However, the management of Council’s investments is a

significant responsibility. Poor investment decisions have the potential

to negatively impact upon the financial position of Council through either

revenue from investment interest or possible capital loss of principal

invested.

Statutory and Policy Compliance Implications

Section 625 of the Local Government Act 1993 governs how

Councils can invest. Specifically Section 625 states:

(1) A

council may invest money that is not, for the time being, required by the

council for any other purpose.

(2) Money

may be invested only in a form of investment notified by order of the Minister

published in the Gazette.

(3) An

order of the Minister notifying a form of investment for the purposes of this

section must not be made without the approval of the Treasurer.

(4) The

acquisition, in accordance with section 358, of a controlling interest in a

corporation or an entity within the meaning of that section is not an

investment for the purposes of this section.

The forms of investment approved by the Minister for Local

Government as identified in Section 625(2) of the Local Government Act 1993

refer to the Ministerial Investment Order. The most recent Investment

Order was issued on 12 January 2011 and the contents of this Order are provided

in Attachment 1 as part of the Draft Council Investments Policy 2017.

Clause 212 of the Local Government (General) Regulation 2005

also outlines requirements regarding Council’s investments as follows:

(1) The

responsible accounting officer of a council:

(a) must

provide the council with a written report (setting out details of all money

that the council has invested under section 625 of the Act) to be presented:

(i) if

only one ordinary meeting of the council is held in a month, at that meeting,

or

(ii) if

more than one such meeting is held in a month, at whichever of those meetings

the council by resolution determines, and

(b) must

include in the report a certificate as to whether or not the investment has

been made in accordance with the Act, the regulations and the council’s

investment policies.

(2) The

report must be made up to the last day of the month immediately preceding the

meeting.

In regard to Council investments, attention also needs to be

directed towards Section 14 of the Trustees Amendment (Discretionary

Investments) Act 1997 where a trustee must exercise the care, diligence, and

skill that a prudent person would exercise in managing the affairs of another

person. As Councils are acting as custodians when investing public assets, account

of the requirements of Section 14 should also be considered. Specifically

contained in Section 14(C)(1) are the following matters which should be

considered:

(a) the

purposes of the trust and the needs and circumstances of the beneficiaries,

(b) the

desirability of diversifying trust investments,

(c) the

nature of, and the risk associated with, existing trust investments and other

trust property,

(d) the

need to maintain the real value of the capital or income of the trust,

(e) the

risk of capital or income loss or depreciation,

(f) the

potential for capital appreciation,

(g) the

likely income return and the timing of income return,

(h) the

length of the term of the proposed investment,

(i) the

probable duration of the trust,

(j) the

liquidity and marketability of the proposed investment during, and on the

determination of, the term of the proposed investment,

(k) the

aggregate value of the trust estate,

(l) the

effect of the proposed investment in relation to the tax liability of the

trust,

(m) the

likelihood of inflation affecting the value of the proposed investment or other

trust property,

(n) the

costs (including commissions, fees, charges and duties payable) of making the

proposed investment,

(o) the

results of a review of existing trust investments in accordance with section

14A (4).

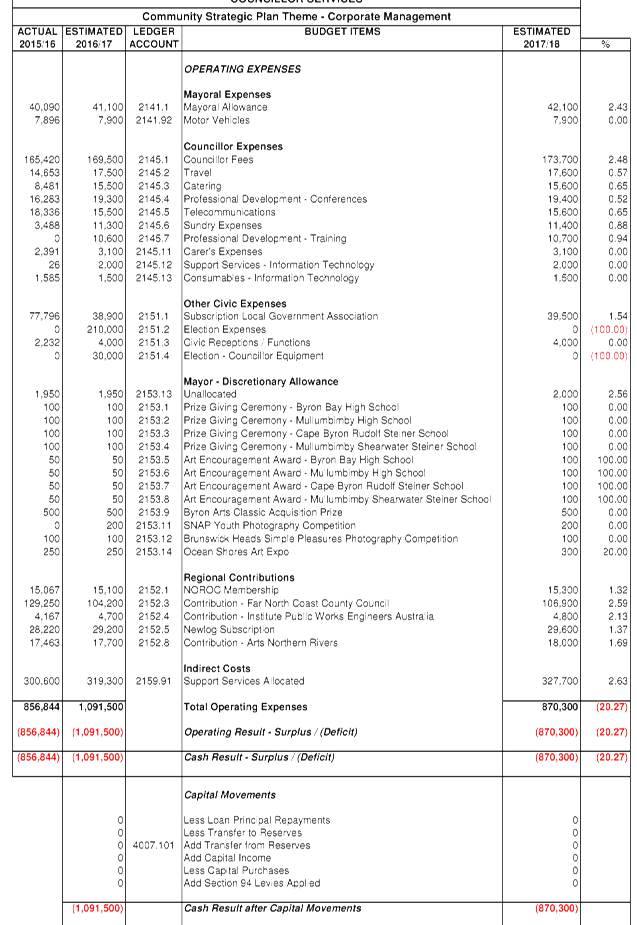

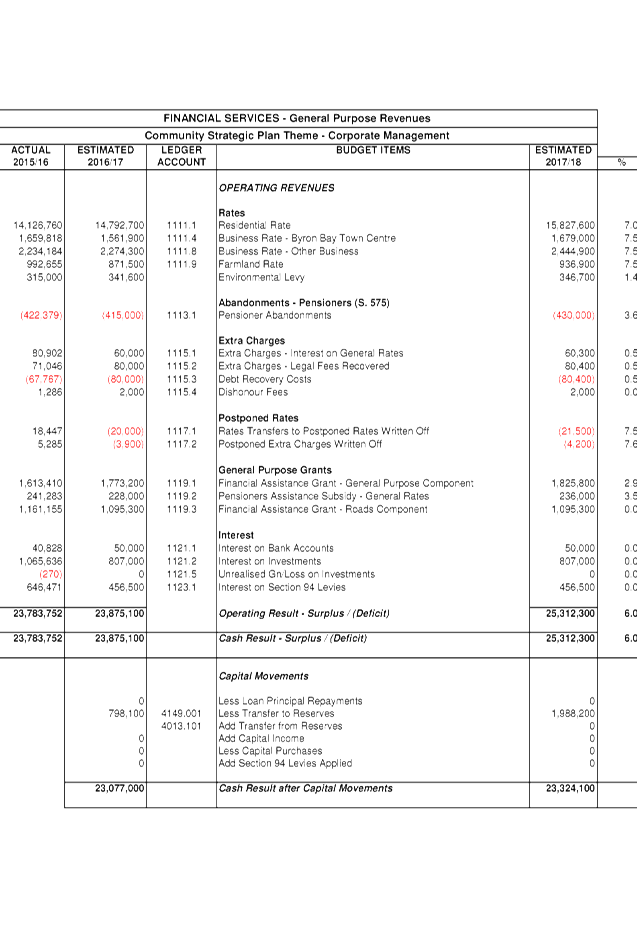

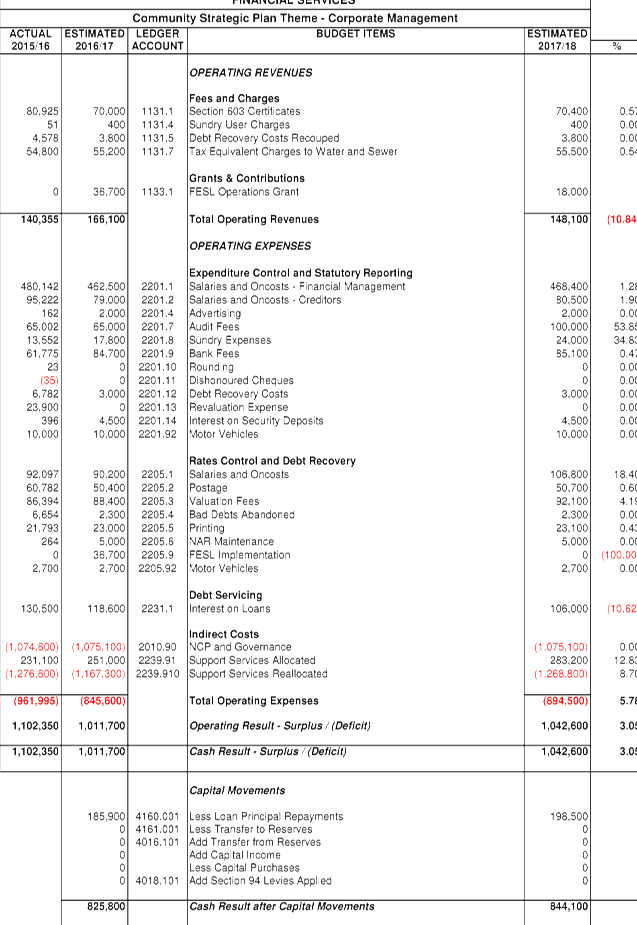

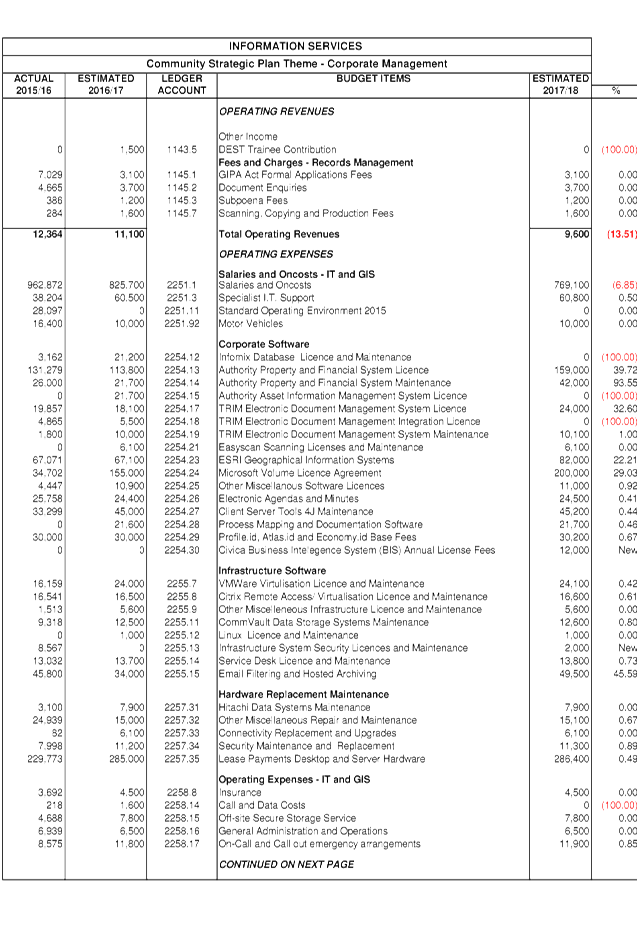

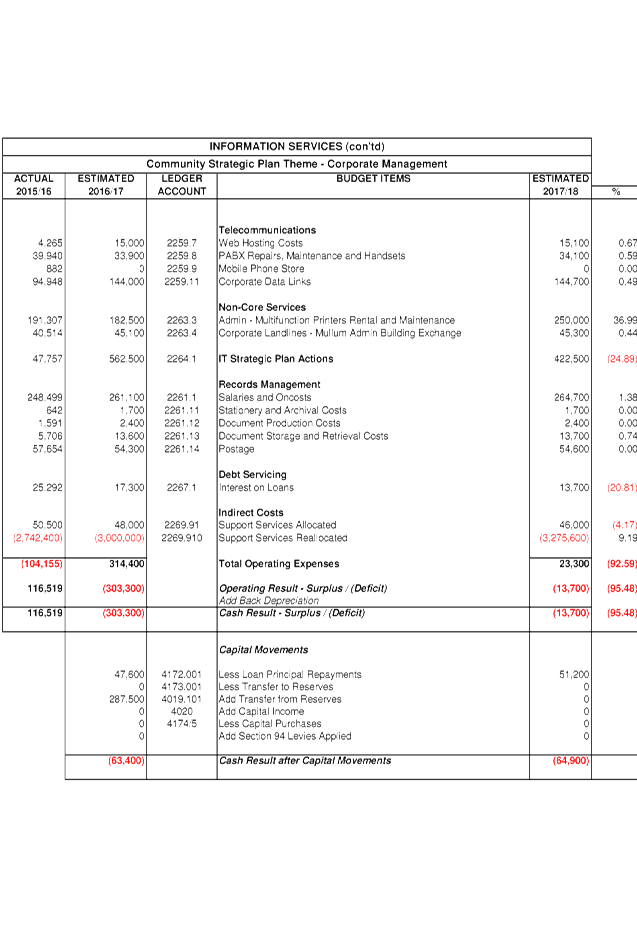

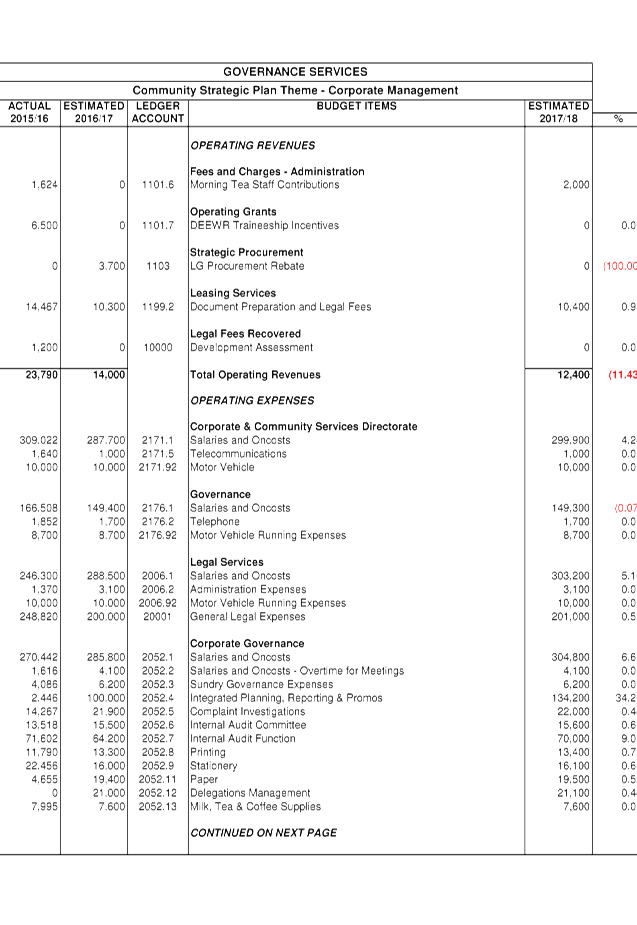

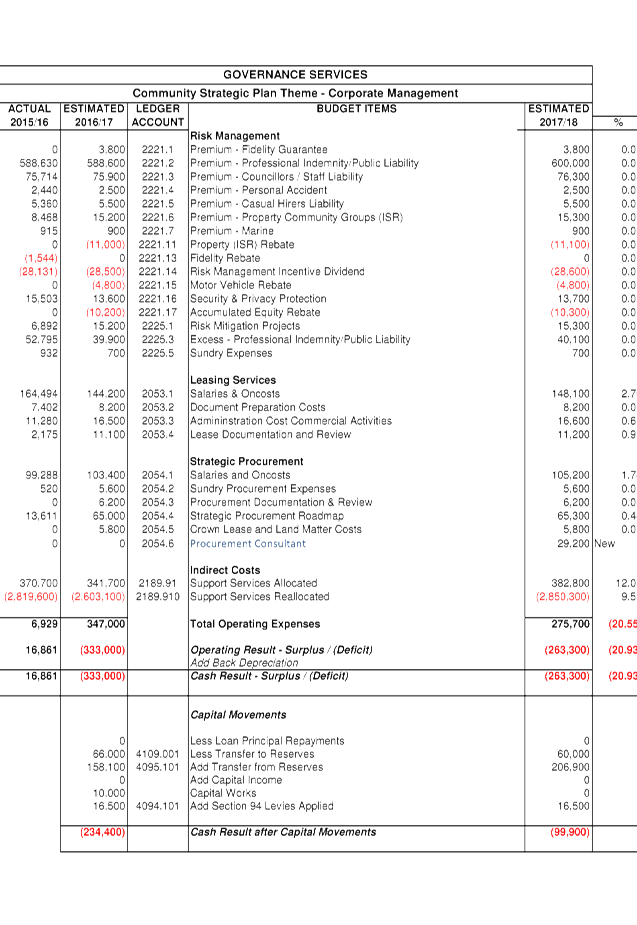

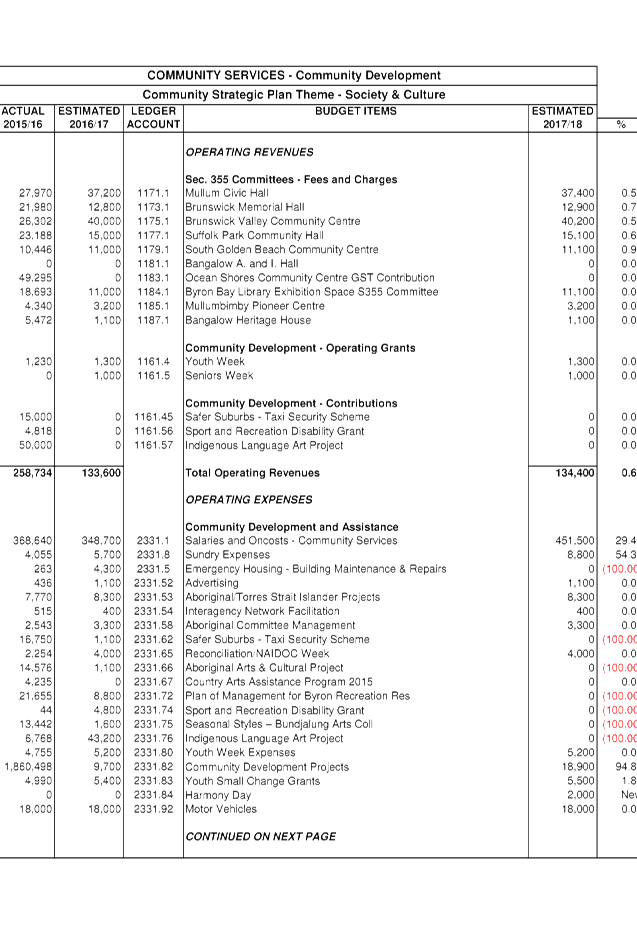

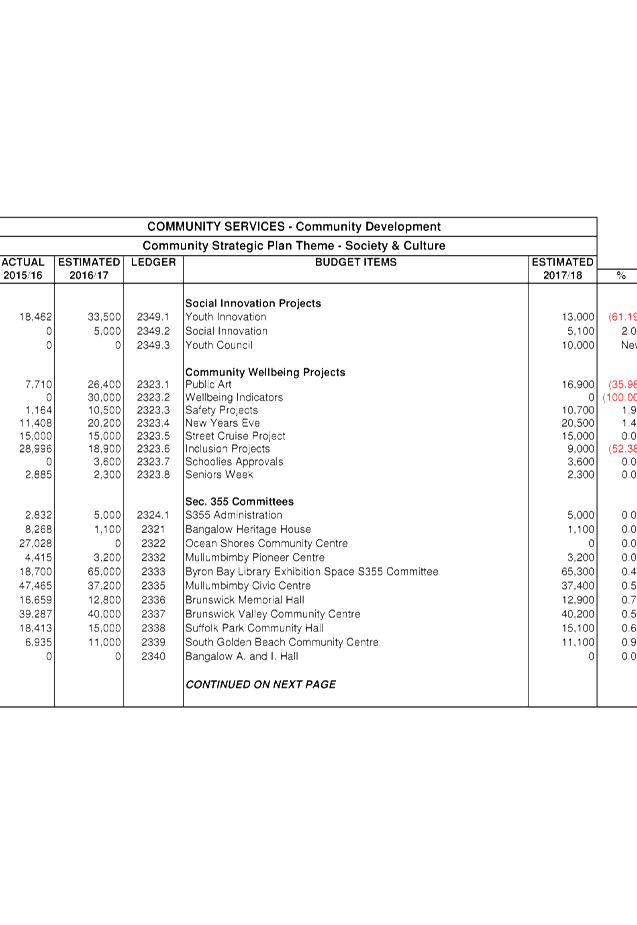

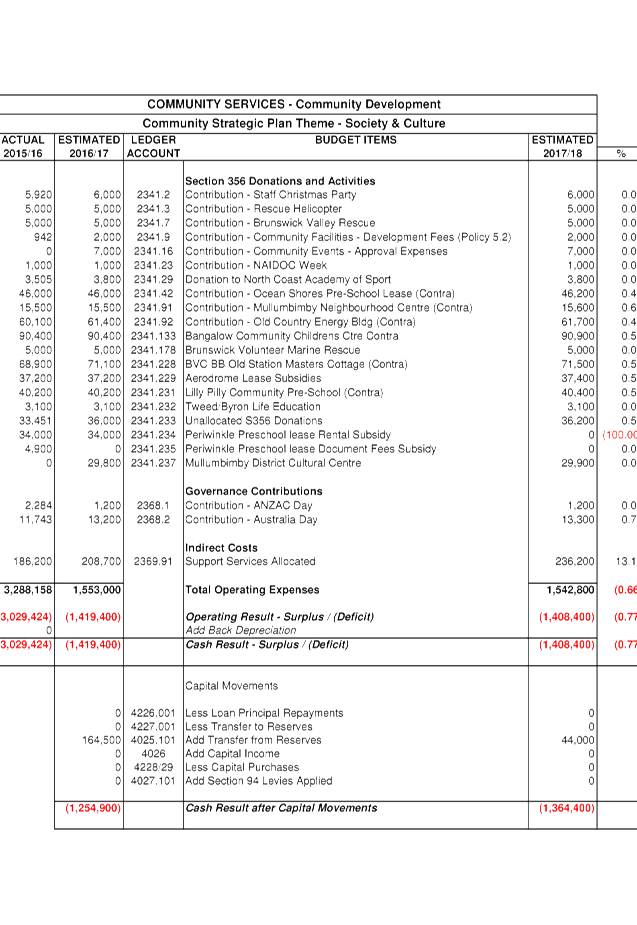

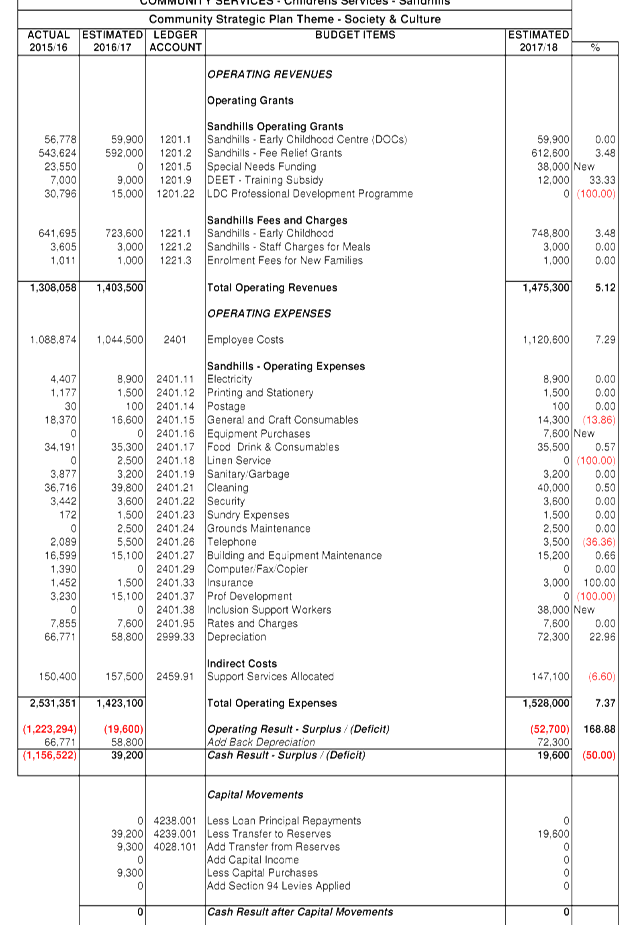

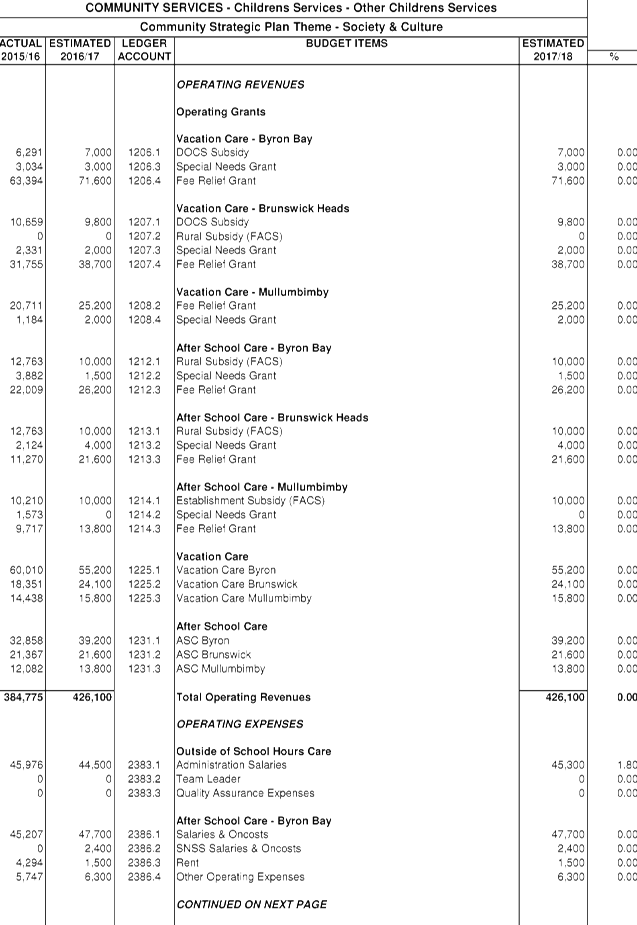

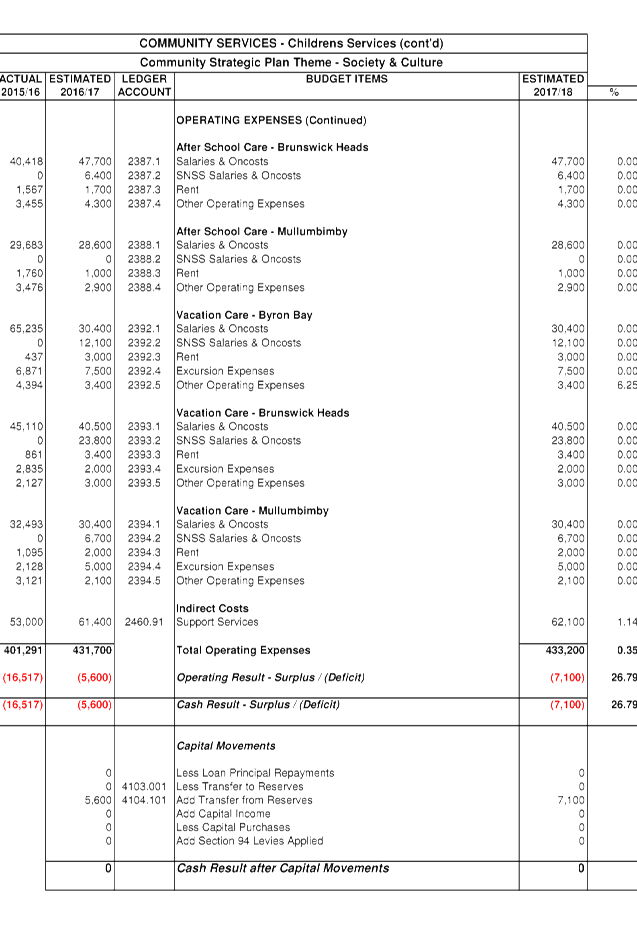

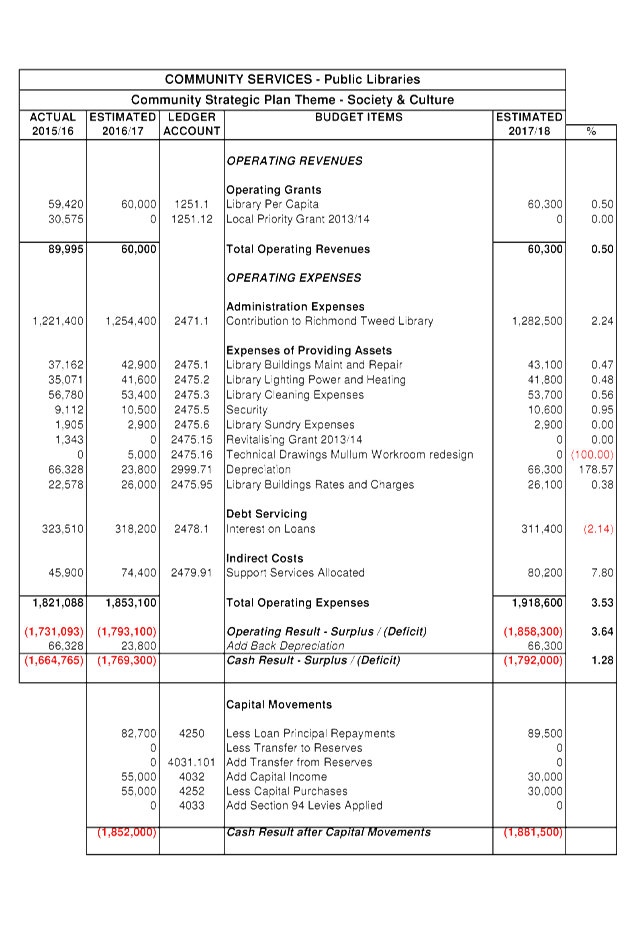

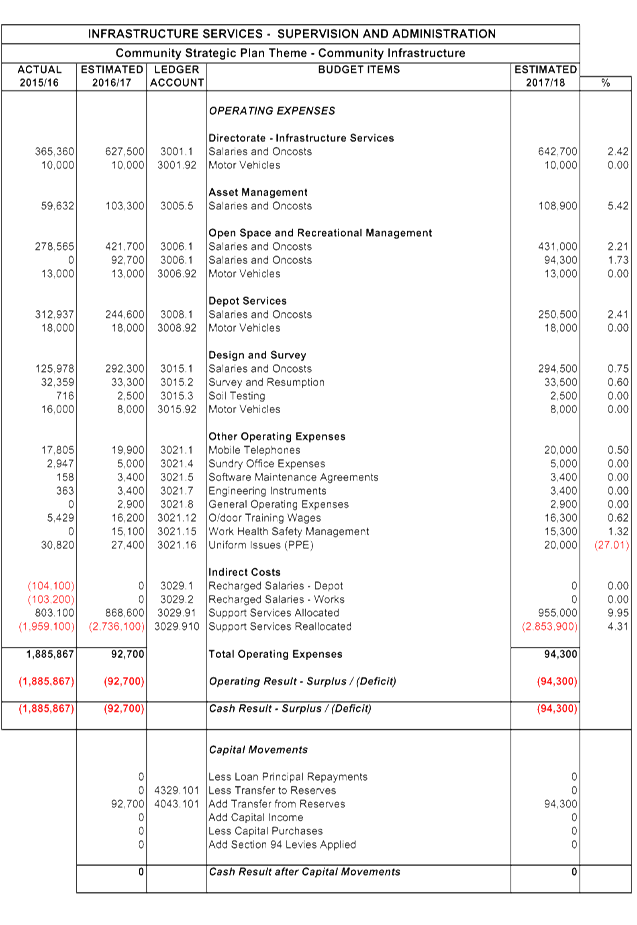

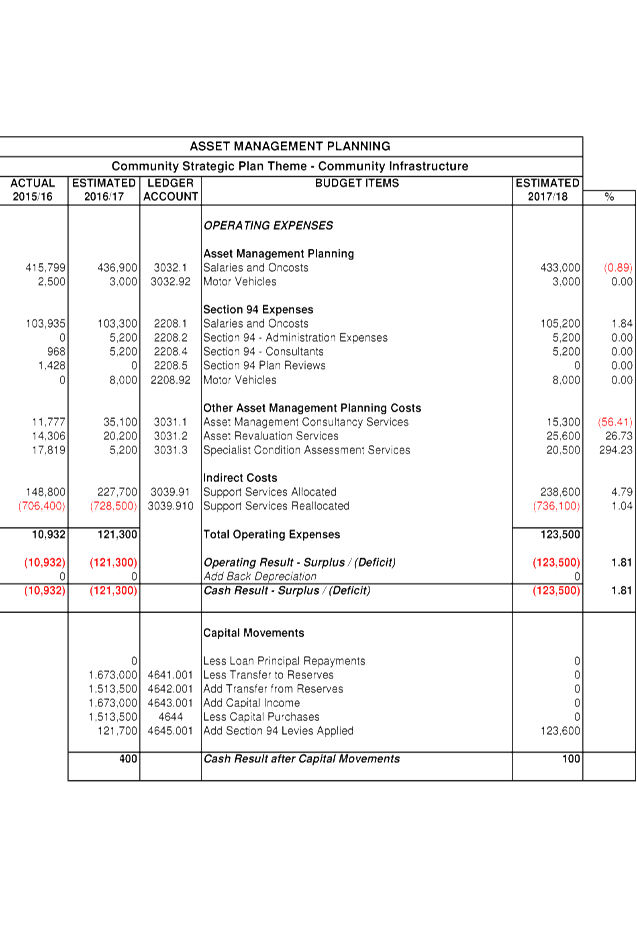

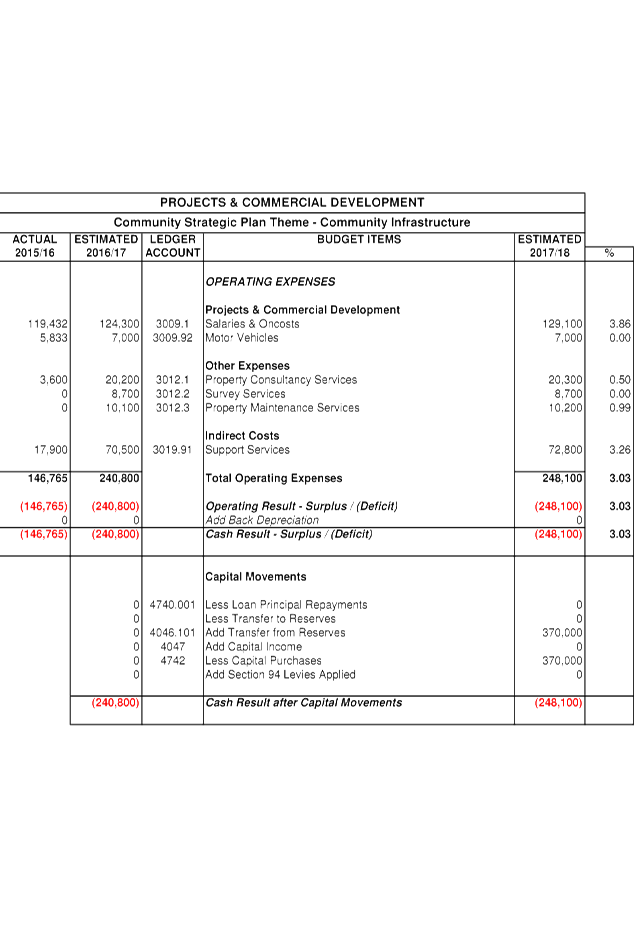

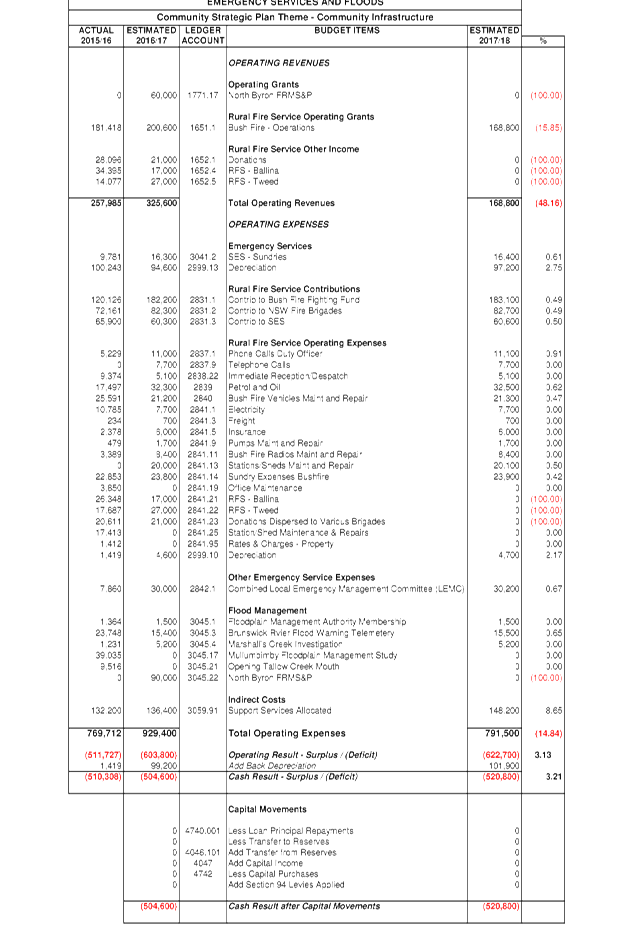

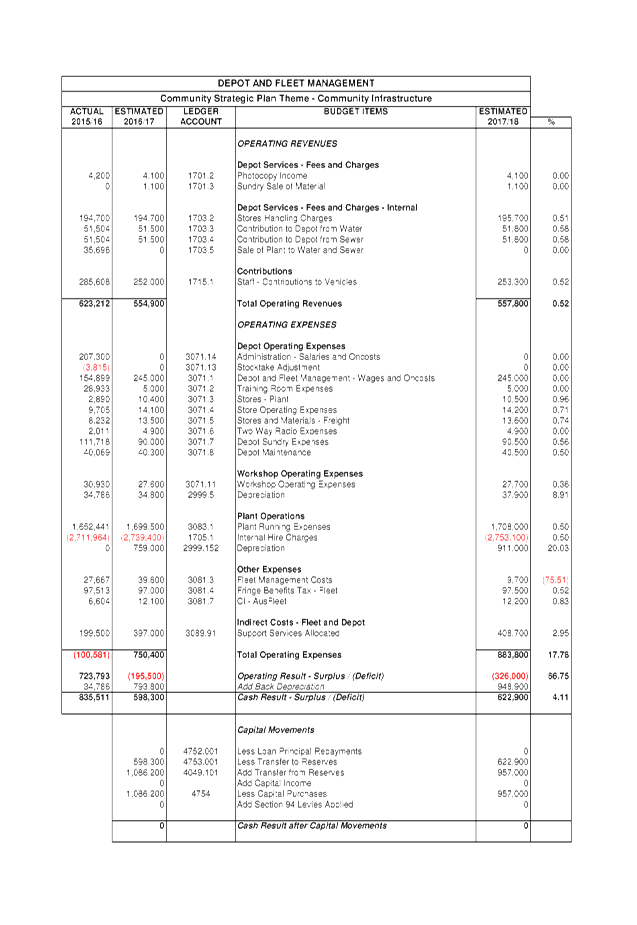

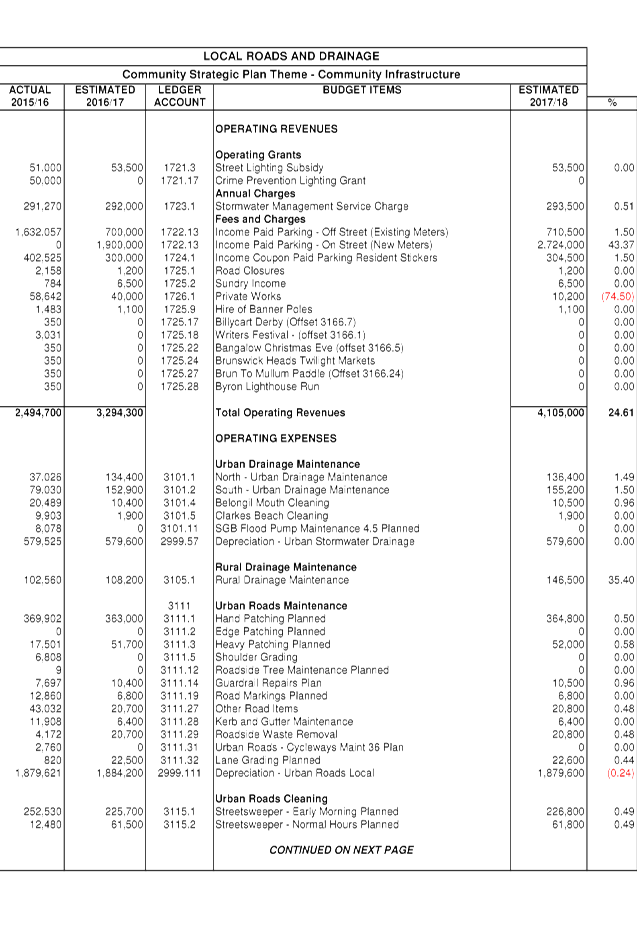

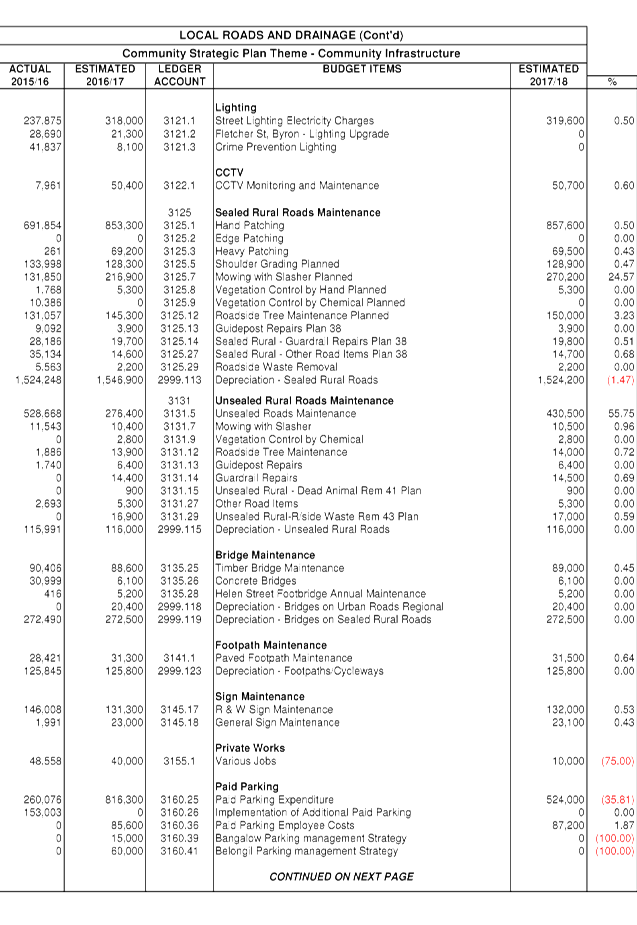

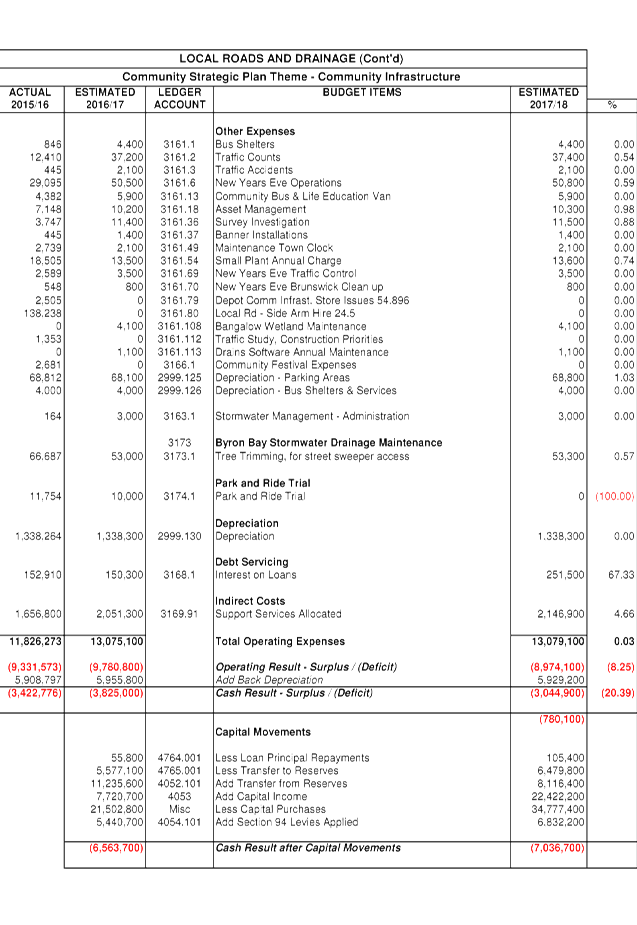

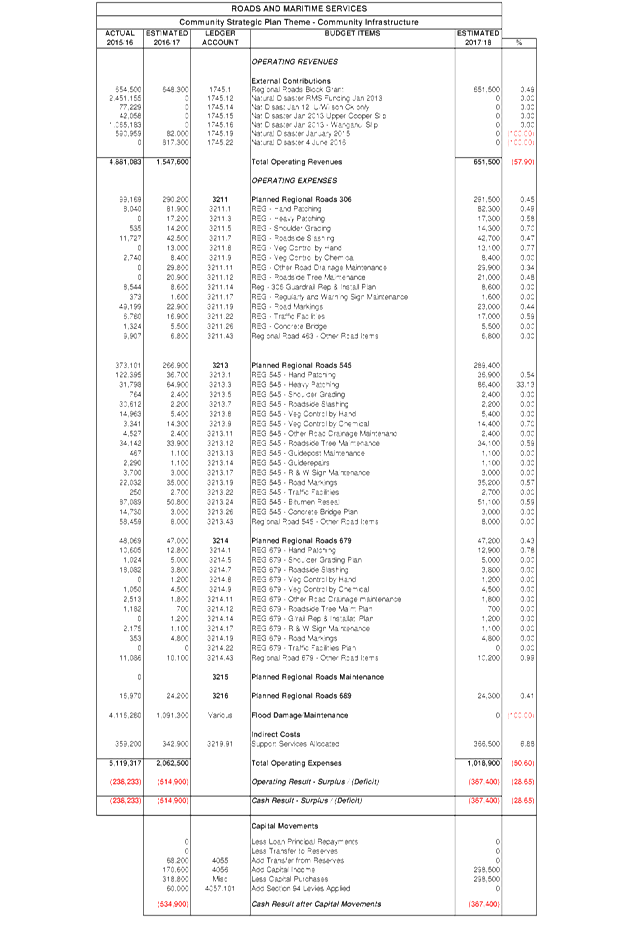

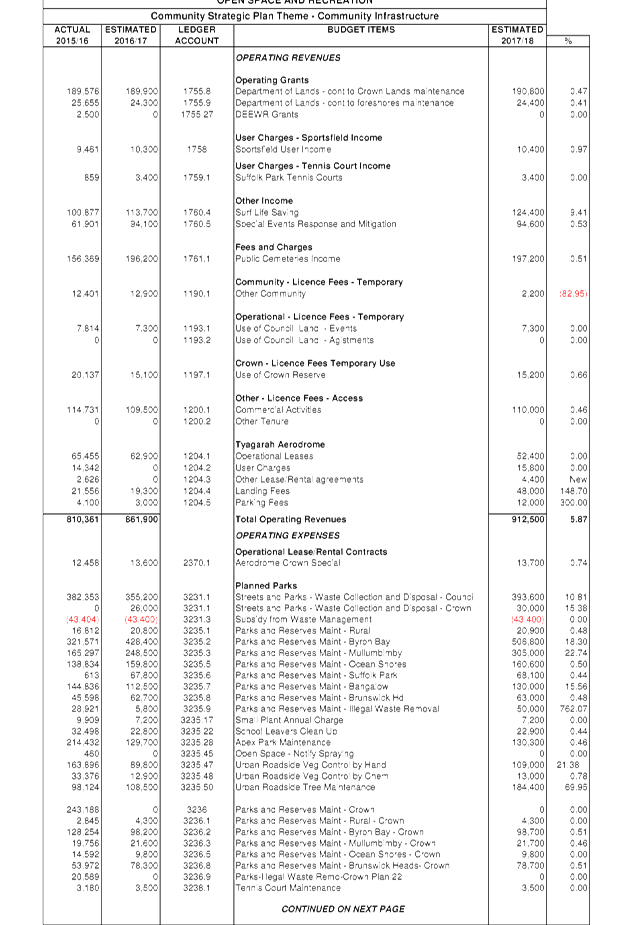

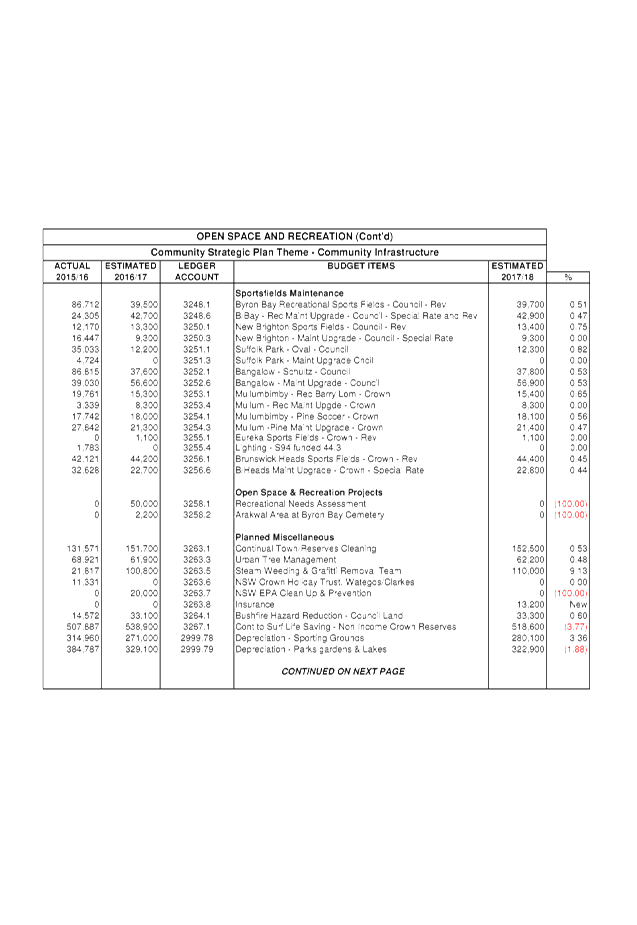

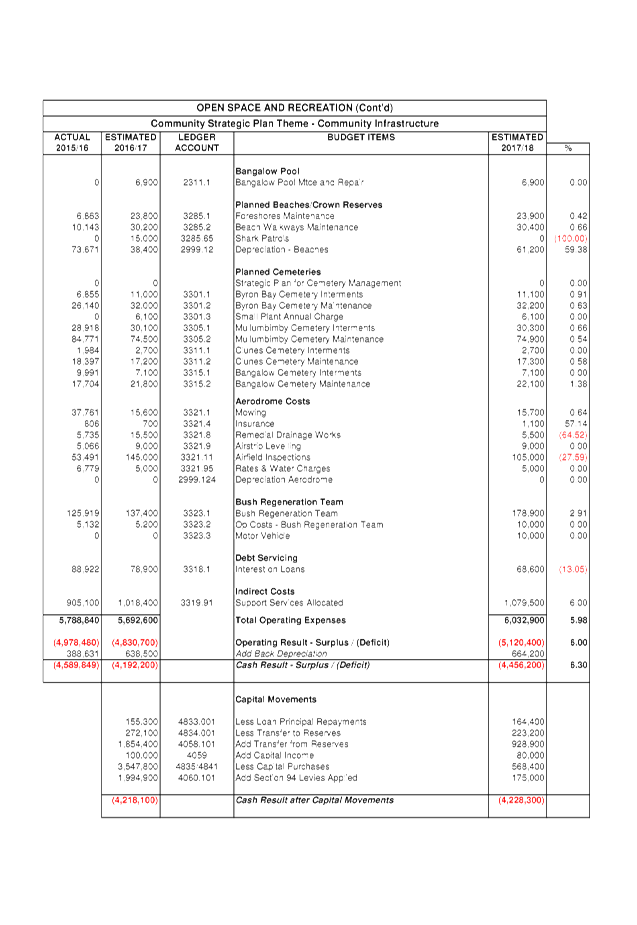

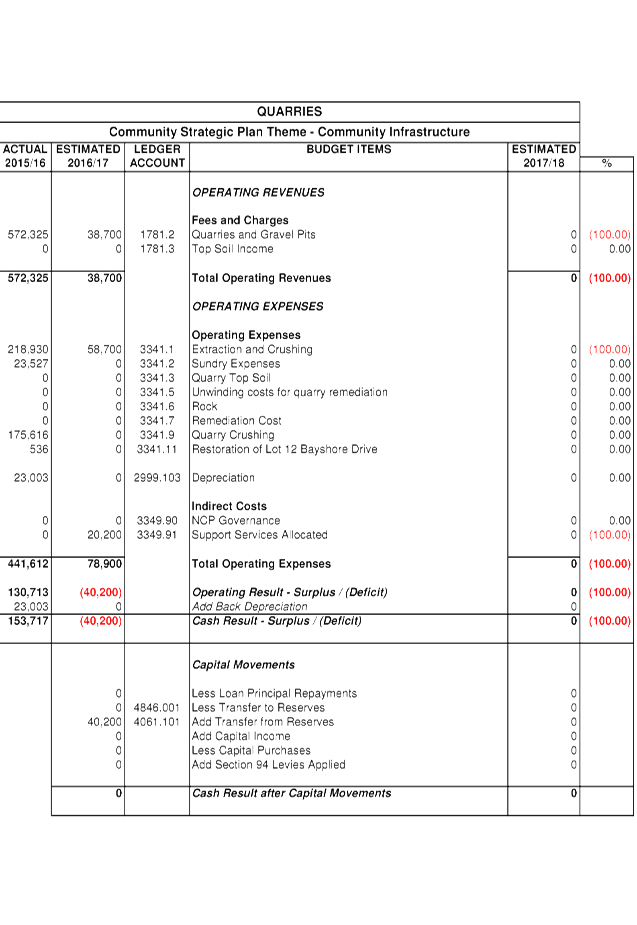

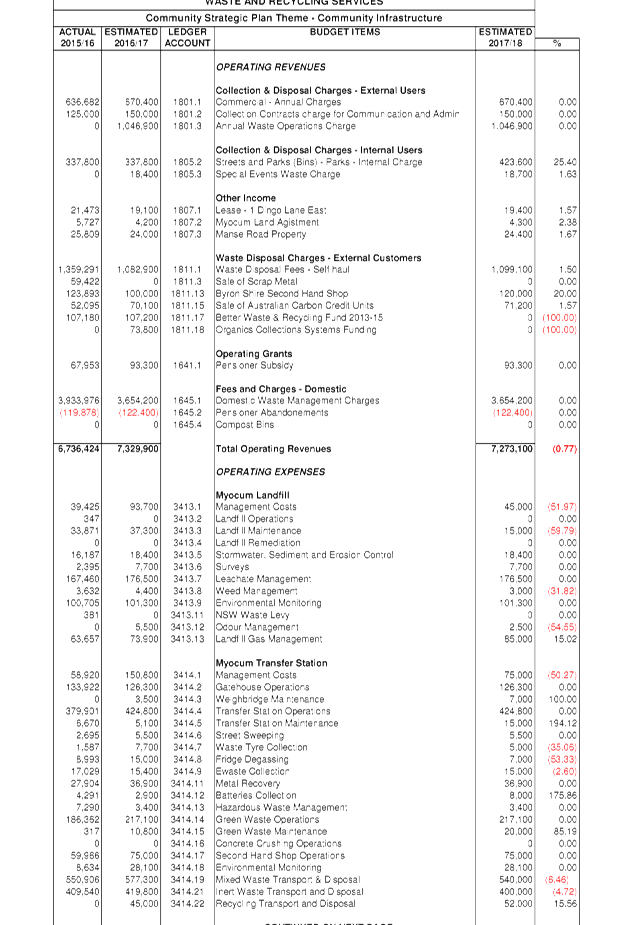

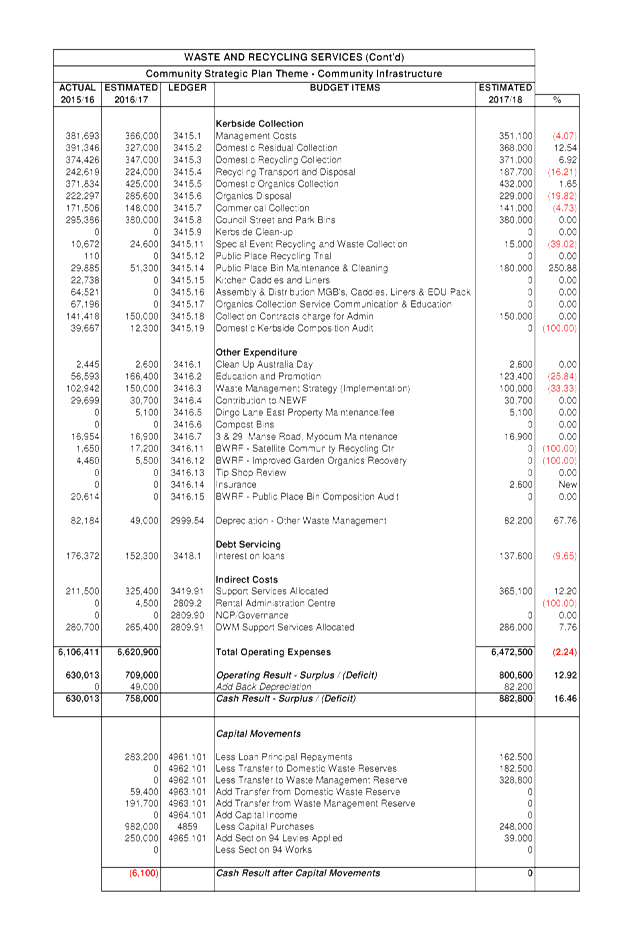

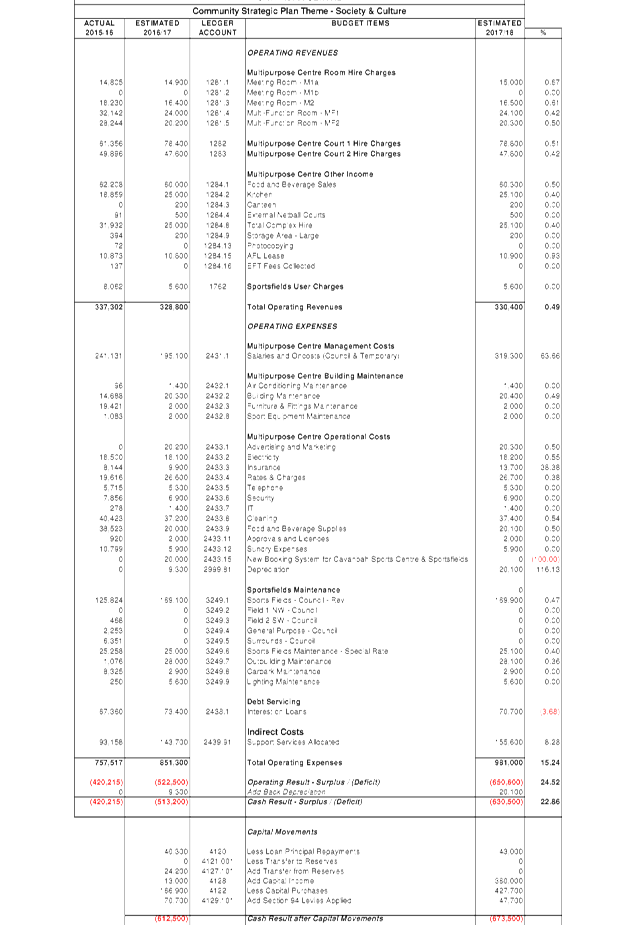

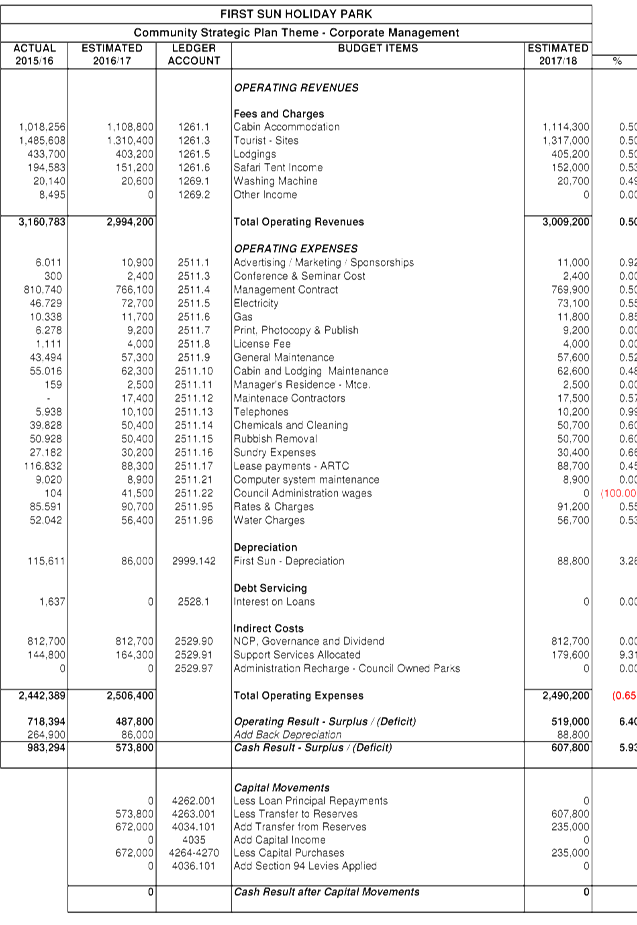

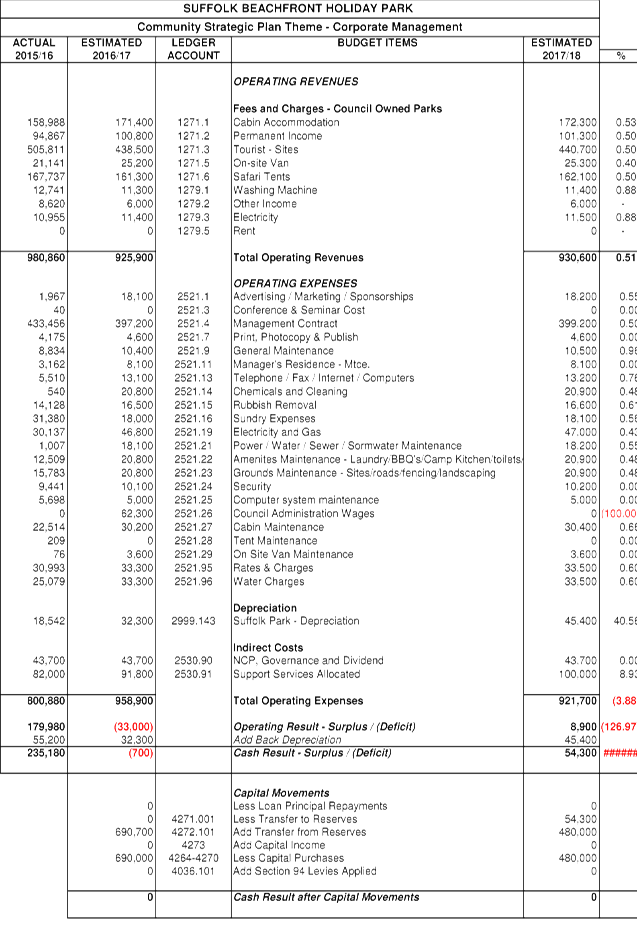

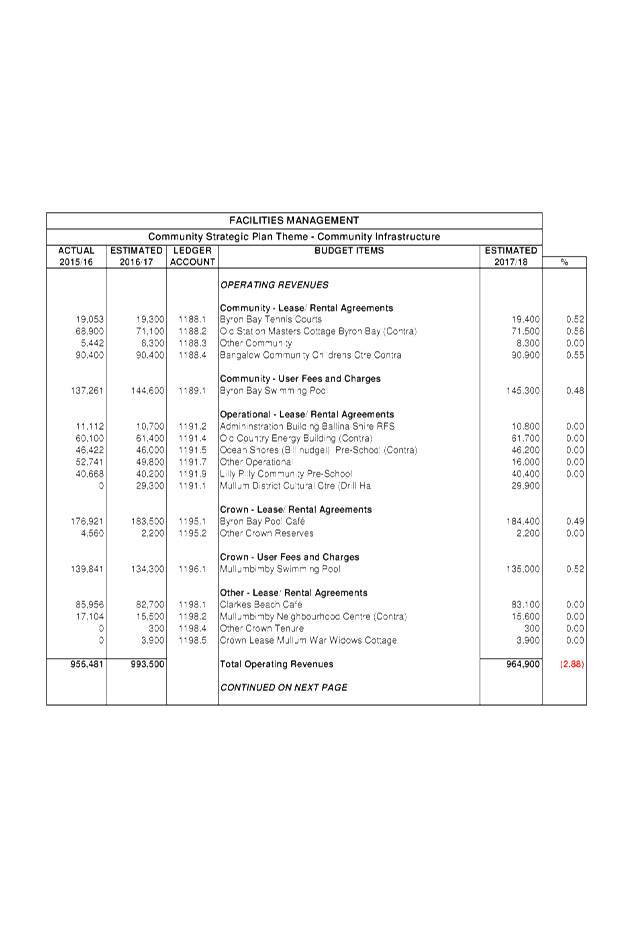

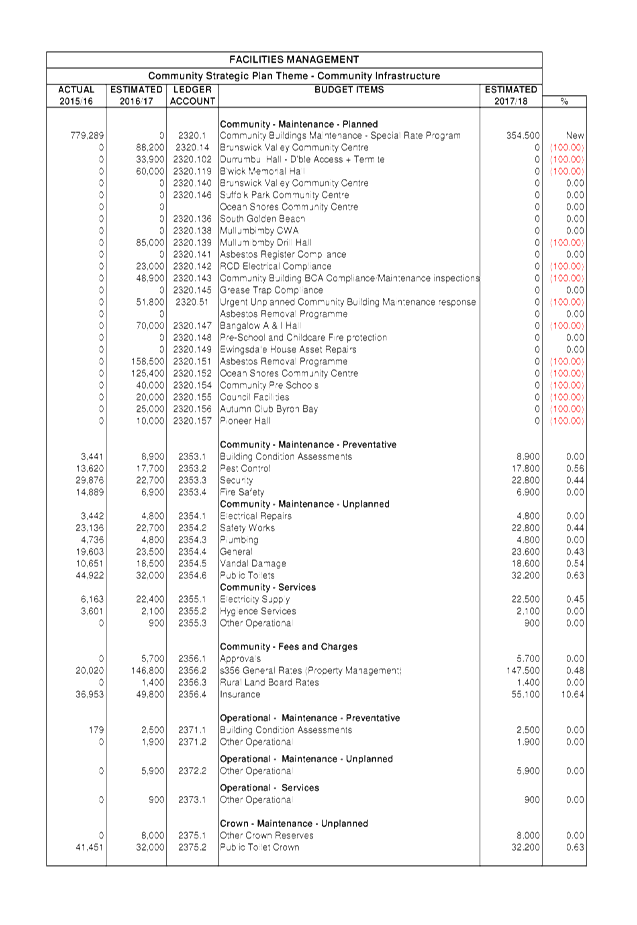

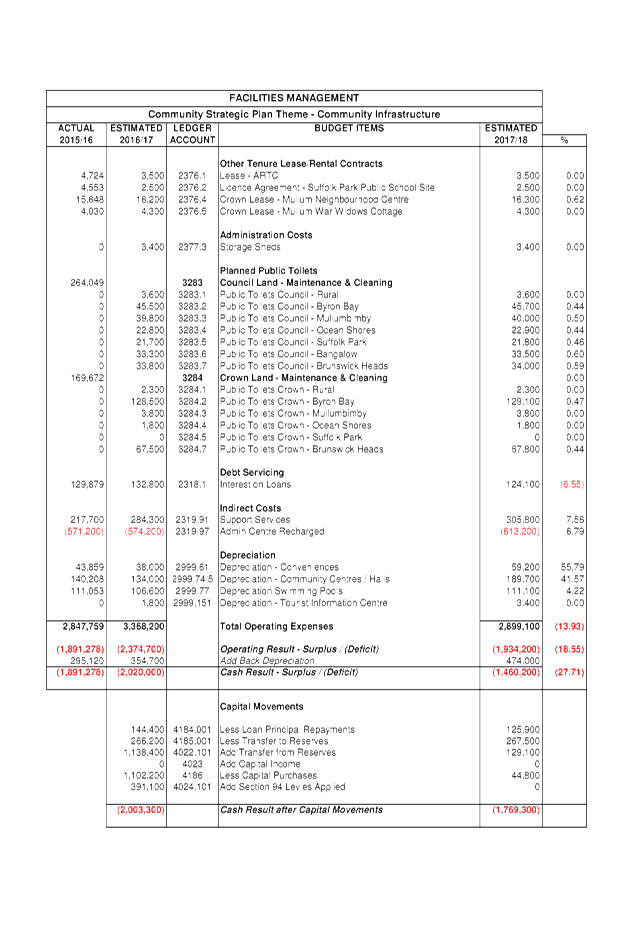

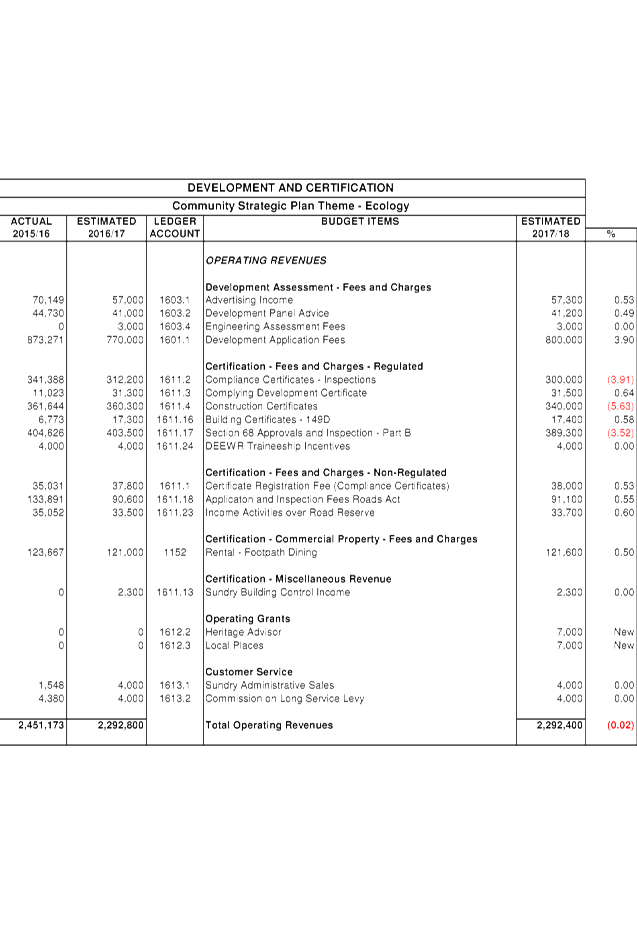

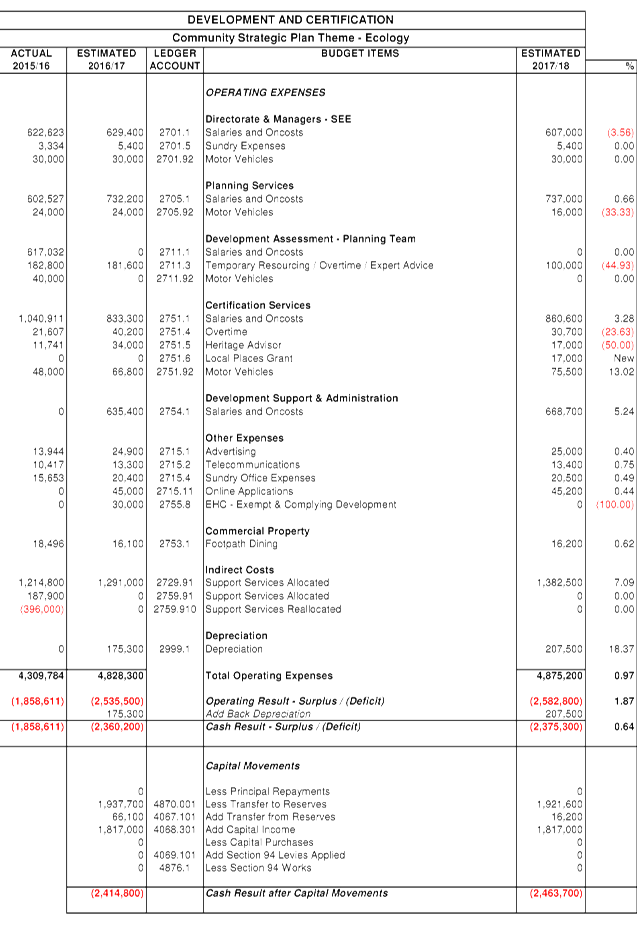

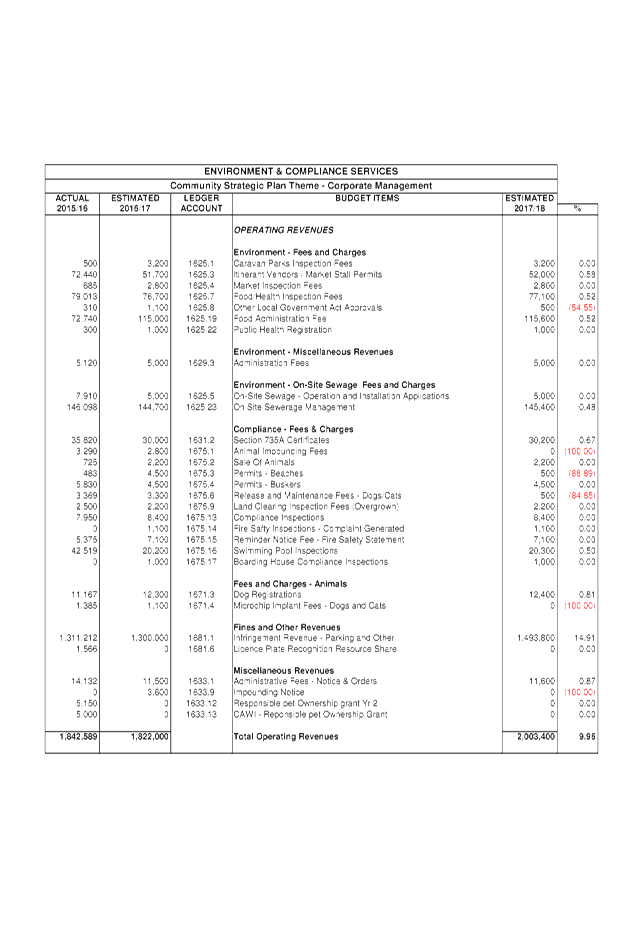

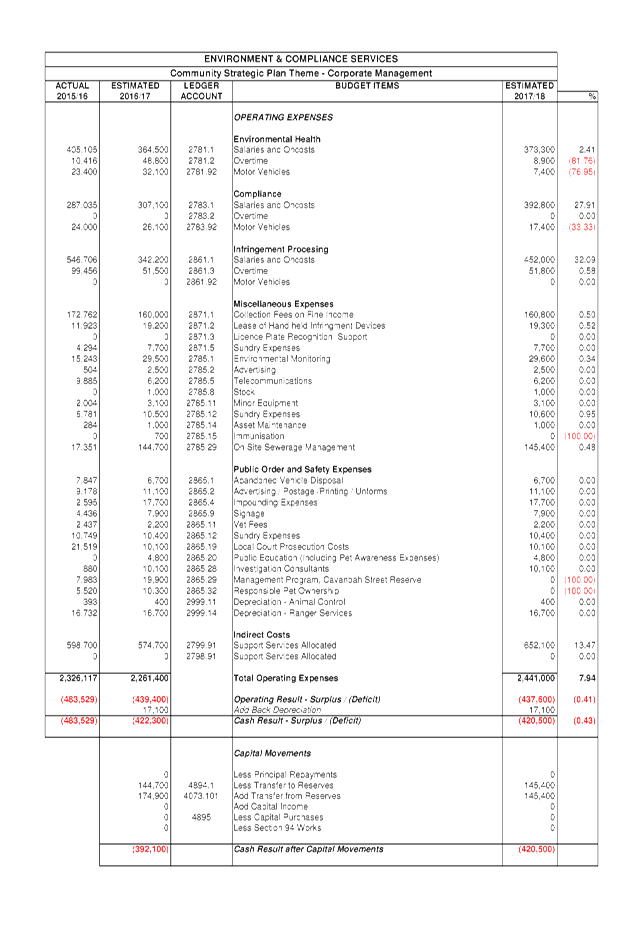

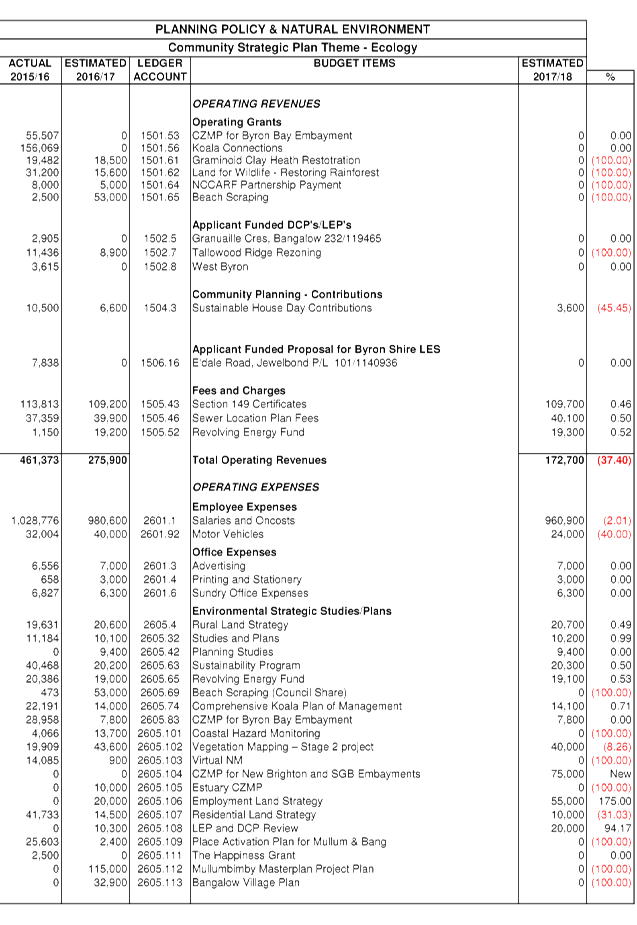

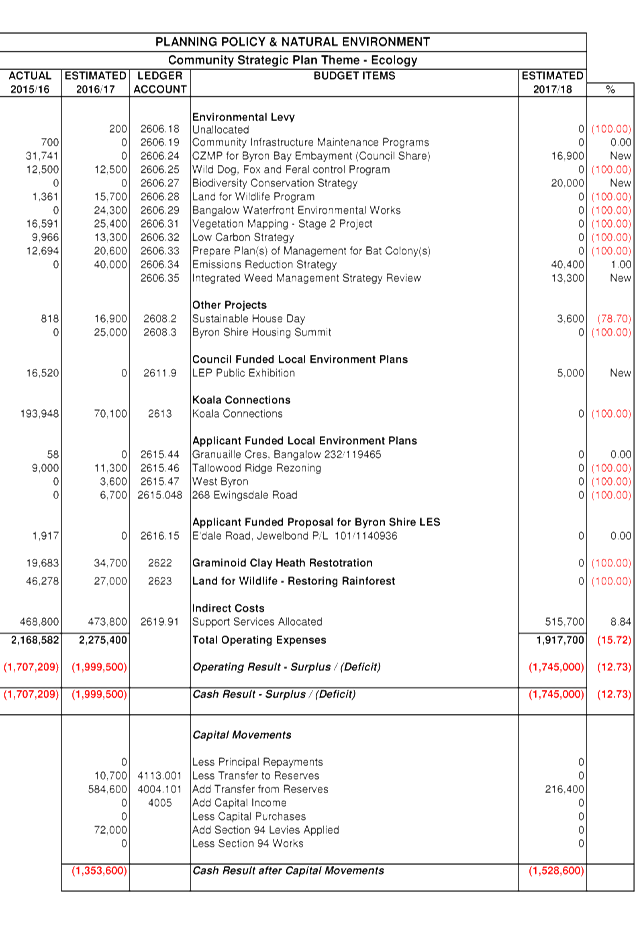

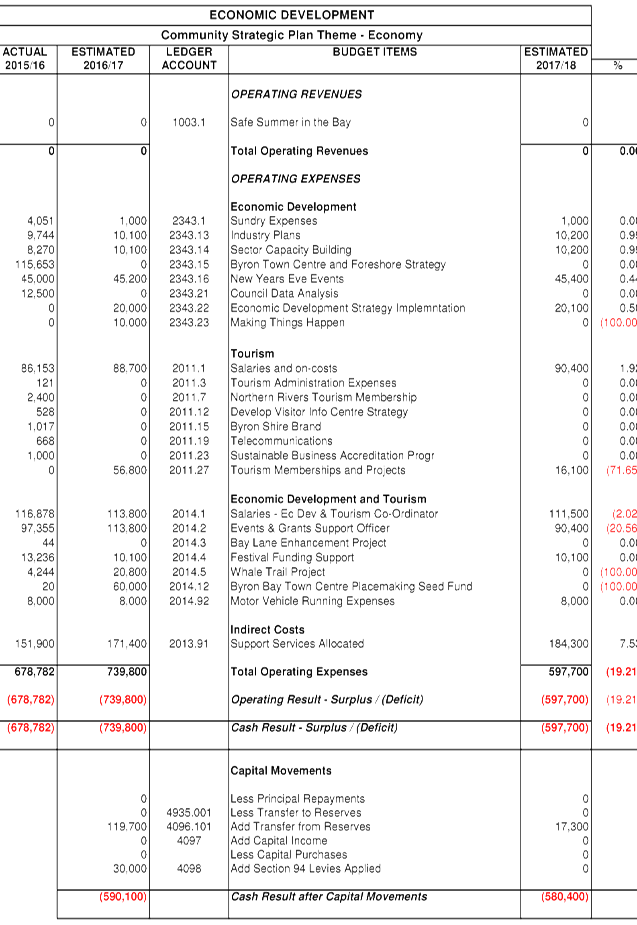

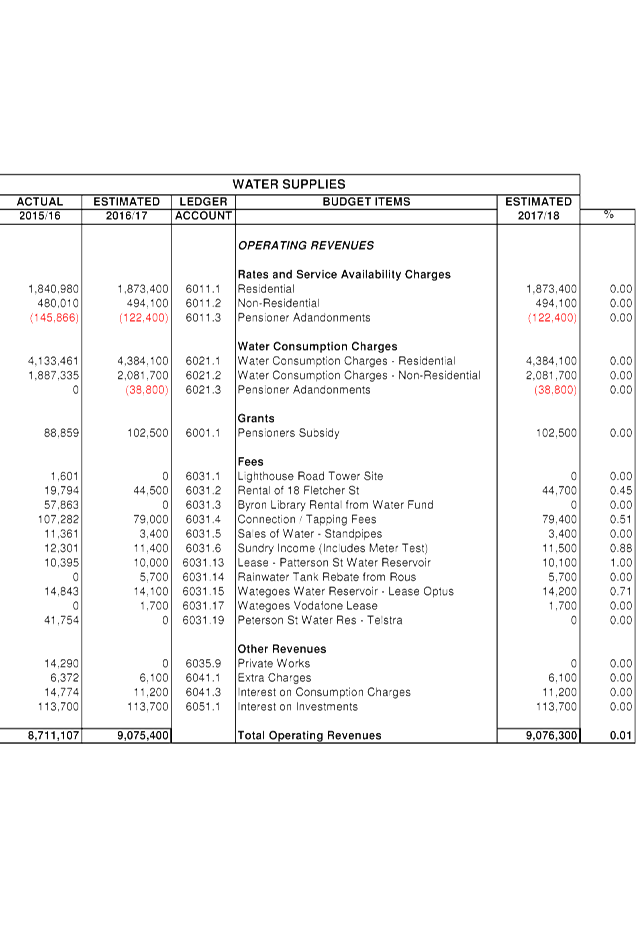

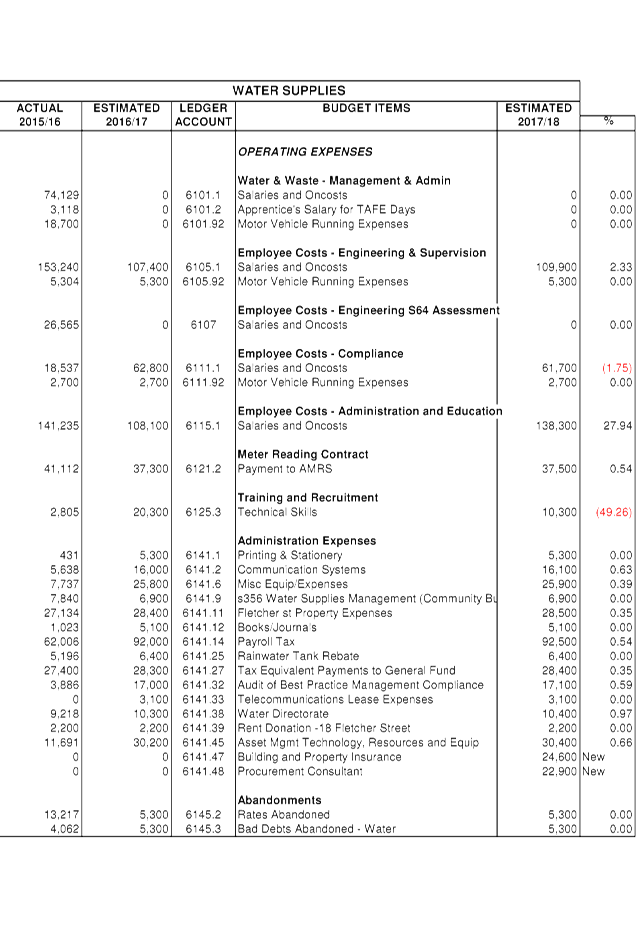

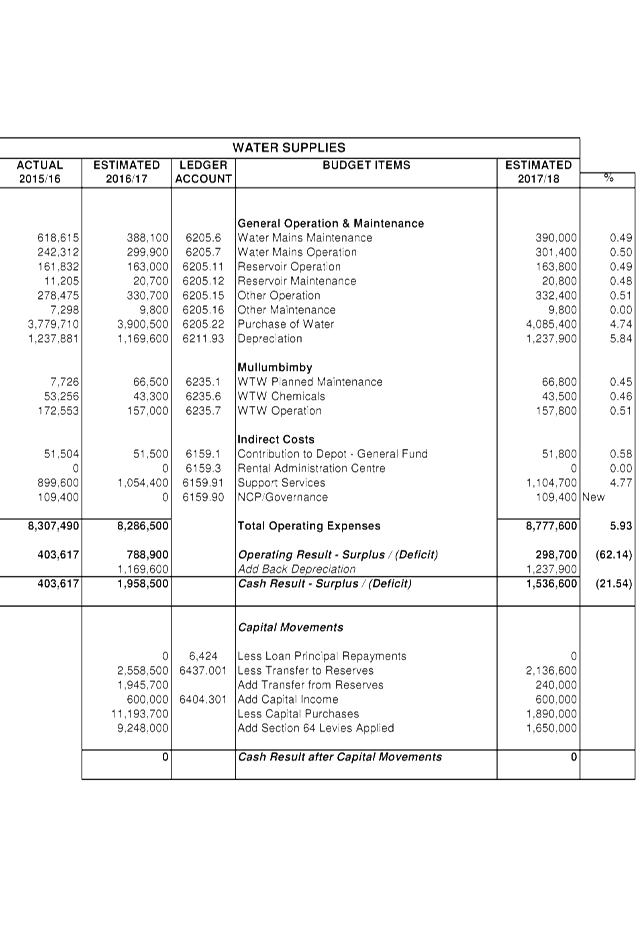

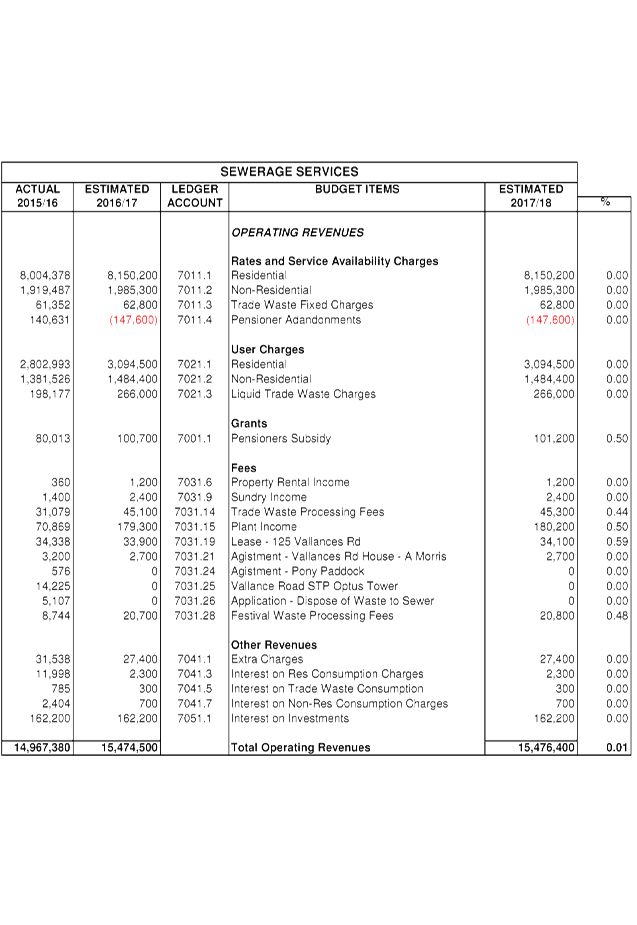

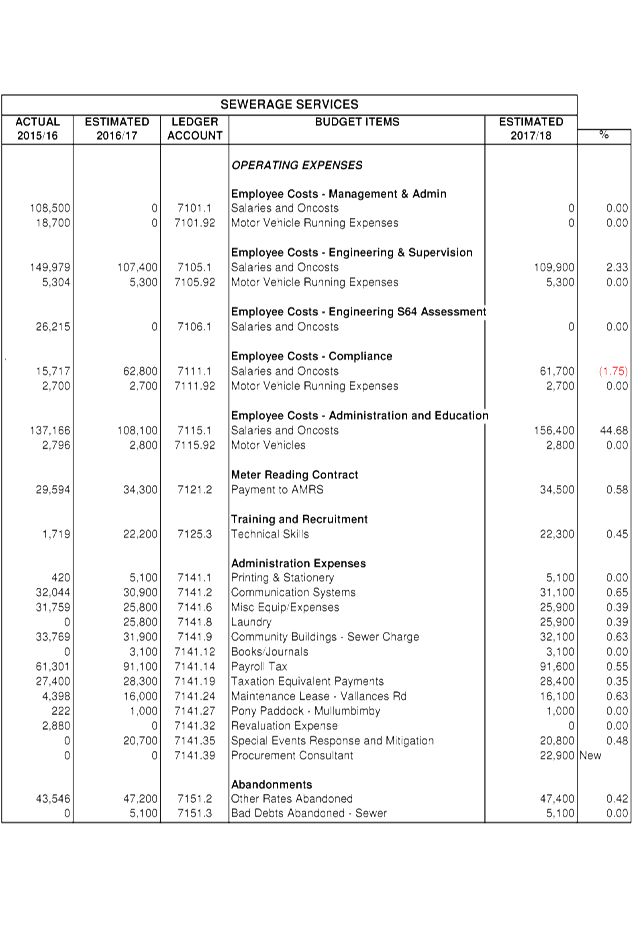

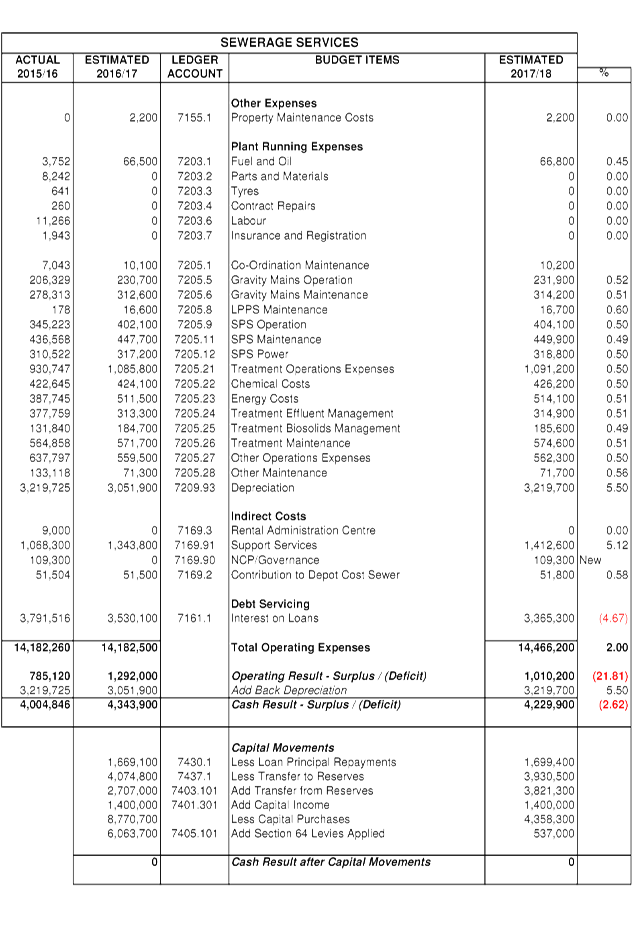

Report No. 4.2 Draft

2017/2018 Budget Estimates

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/344

Theme: Corporate Management

Financial Services

Summary:

The Draft 2017/2018 Budget Estimates have been prepared and

reviewed by the Executive Team. The purpose of this report is to provide

the opportunity to the Finance Advisory Committee to review the Draft 2017/2018

Budget Estimates in their current form and to recommend, subject to any

amendments, their adoption by Council for the purposes of public exhibition for

a period of 28 days.

|

RECOMMENDATION:

That the Finance Advisory Committee review the

Draft 2017/2018 Budget Estimates and subject to any amendments, recommend to

Council the adoption of the Draft 2017/2018 Budget Estimates for the purposes

of public exhibition.

|

Attachments:

1 Detailed

Draft 2017-2018 Budget Estimates, E2017/22841

, page 25⇩

2 Draft

2017-2018 Budget Summary Statemernts and Reserves, E2017/22852 , page 85⇩

Report

The Draft 2017/2018 Budget Estimates have been prepared and

reviewed by the Executive Team. The purpose of this report is to provide

the opportunity to the Finance Advisory Committee to review the Draft 2017/2018

Budget Estimates in their current form and to recommend, subject to any

amendments, their adoption by Council for the purposes of public exhibition for

a period of 28 days.

The Draft 2017/2018 Budget Estimates are based on the 2016/2017

budget reviewed at 31 December 2016 with various changes to reflect the updated

cost of service delivery across all programs developed from the input received

from each Council Directorate.

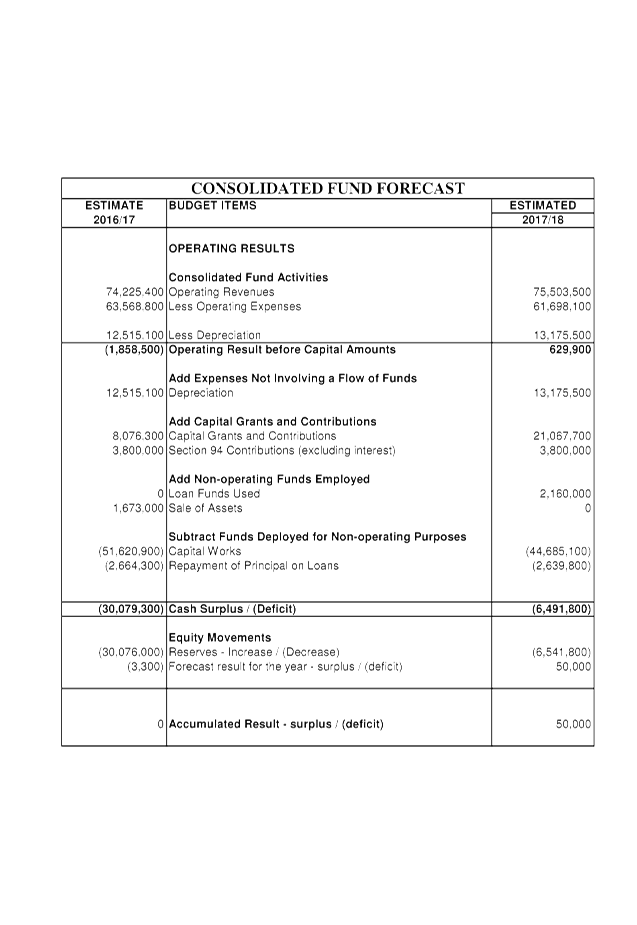

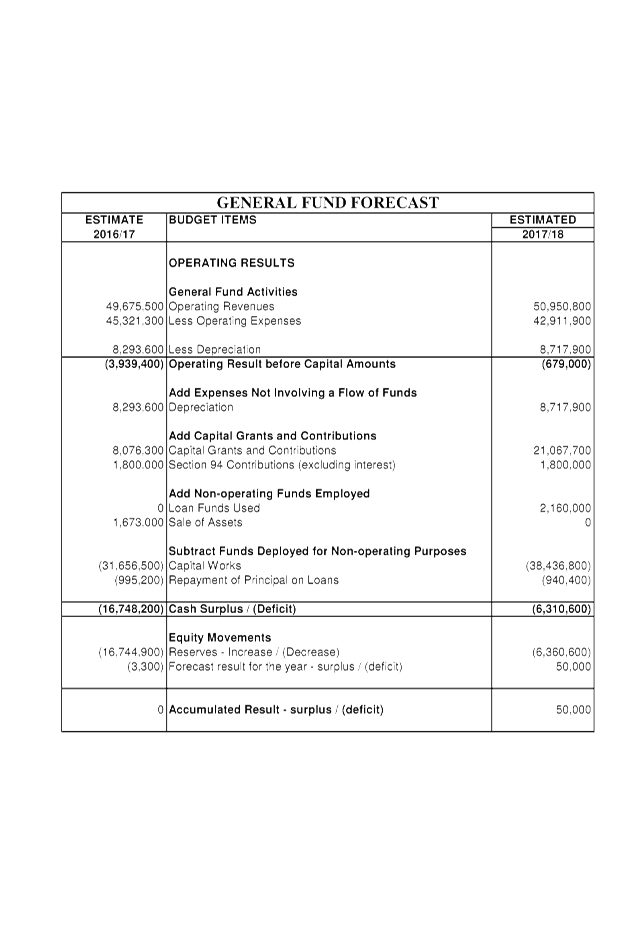

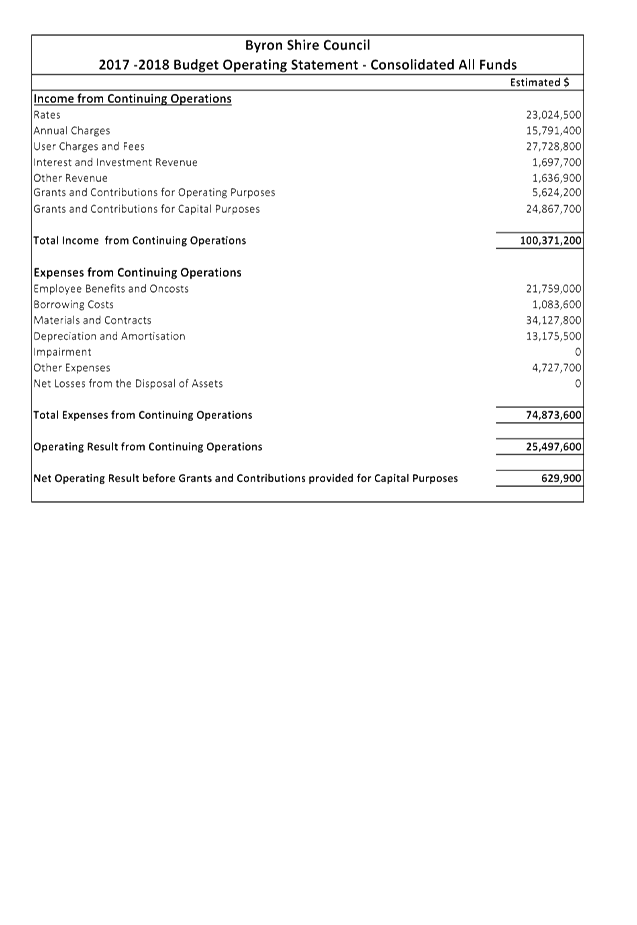

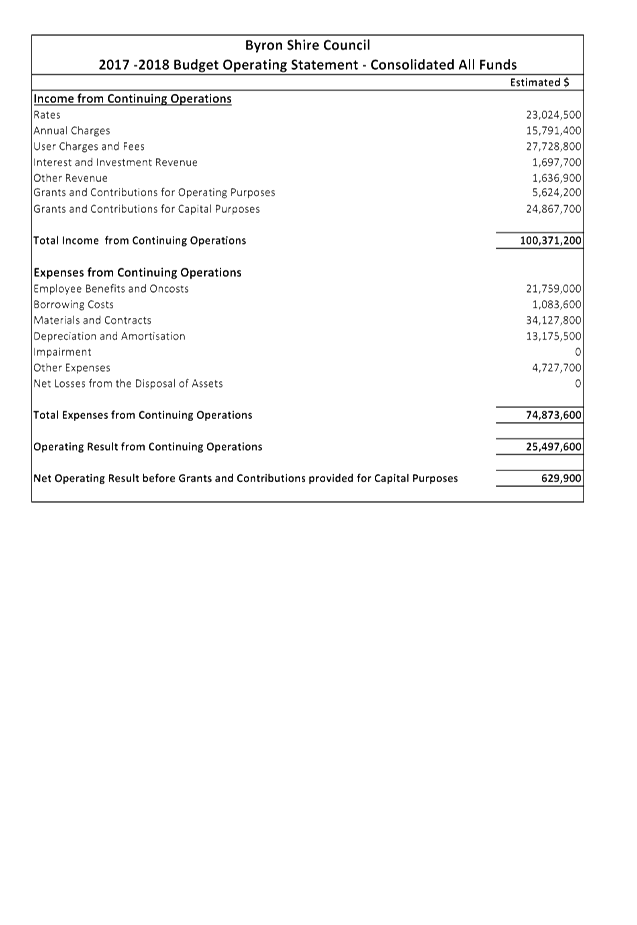

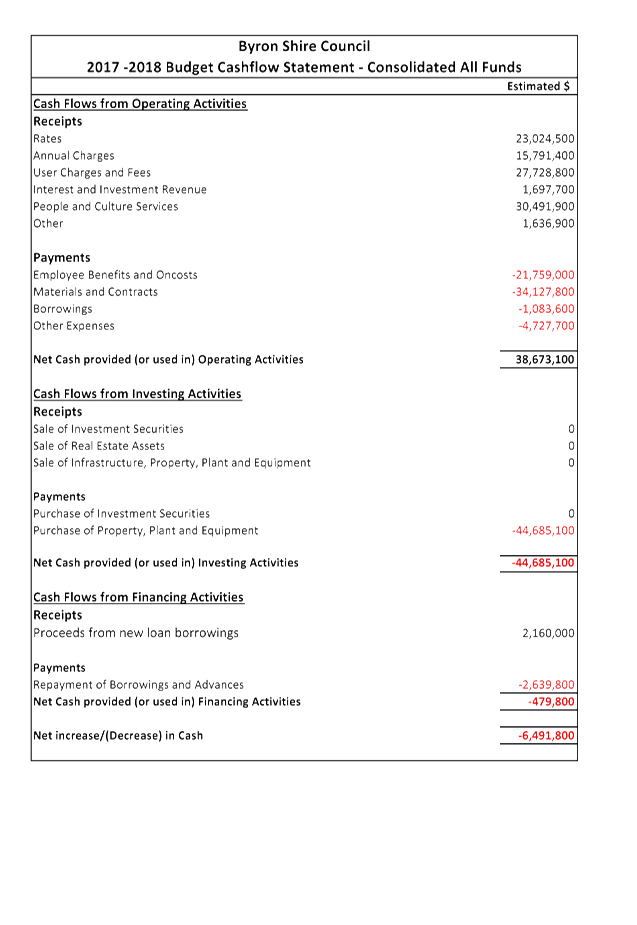

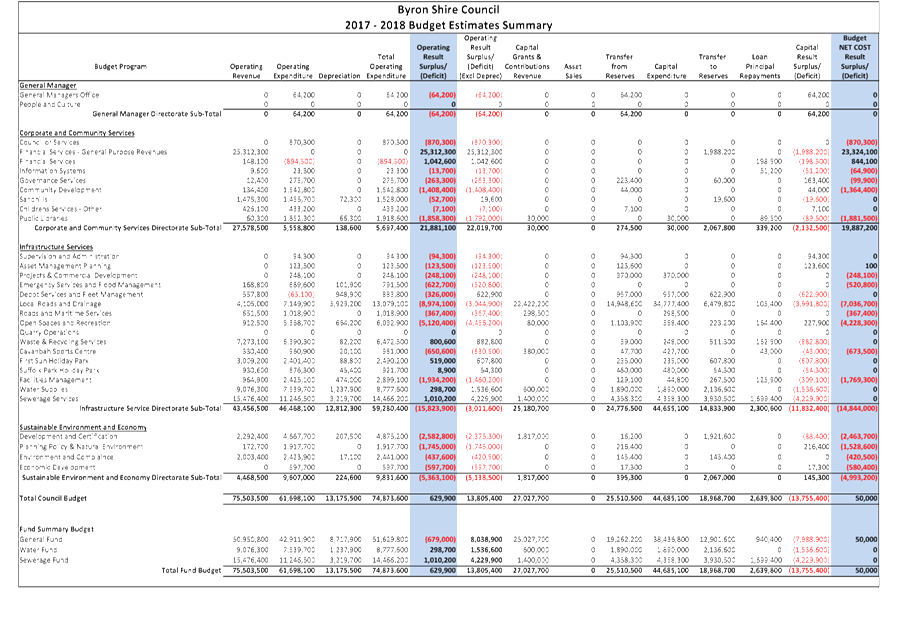

The Draft 2017/2018 Budget Result on a Consolidated (All

Funds) basis forecast a surplus budget result with the details of that result

being included below at Table 1.

Table 1 –

Forecast Budget Result 2017/2018 Consolidated (All Funds)

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

75,503,500

|

|

Less: Operating Expenditure

|

74,873,600

|

|

Operating Result – Surplus/(Deficit)

|

629,900

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

629,900

|

|

Add: Non cash expenses – Depreciation

|

13,175,500

|

|

Add: Capital Grants and Contributions

|

24,867,700

|

|

Add: Loan Funds Used

|

2,160,000

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(44,685,100)

|

|

Less: Loan Principal Repayments

|

(2,639,800)

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(6,491,800)

|

|

Reserves Movement – Increase/(Decrease)

|

(6,541,800)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

50,000

|

The above budget result in Table 1 is assuming the

Council’s application for a Special Rate Variation(SRV) of 7.50%

including rate pegging of 1.50% is approved by the Independent Pricing and

Regulatory Tribunal (IPART). If Council’s SRV is not approved, the

Draft 2017/2018 Budget Result on a Consolidated (All Funds) basis still

forecasts a surplus budget result with the details of that result being included

below at Table 2.

Table 2 –

Forecast Budget Result 2017/2018 Consolidated (All Funds)

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

74,318,500

|

|

Less: Operating Expenditure

|

74,770,100

|

|

Operating Result – Surplus/(Deficit)

|

(451,600)

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

(451,600)

|

|

Add: Non cash expenses – Depreciation

|

13,175,500

|

|

Add: Capital Grants and Contributions

|

24,867,700

|

|

Add: Loan Funds Used

|

2,160,000

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(43,822,700)

|

|

Less: Loan Principal Repayments

|

(2,639,800)

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(6,710,900)

|

|

Reserves Movement – Increase/(Decrease)

|

(6,760,900)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

50,000

|

The impact of the SRV in gross terms if not approved alters

the Draft 2017/2018 Budget Estimates on a Consolidated (All Funds) basis as

outlined in Table 3:

Table 3 –

Forecast SRV Impact on Budget Result 2017/2018 Consolidated (All Funds)

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

(1,185,000)

|

|

Less: Operating Expenditure

|

(103,500)

|

|

Operating Result – Surplus/(Deficit)

|

(1,081,500)

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

(1,081,500)

|

|

Add: Non cash expenses – Depreciation

|

0

|

|

Add: Capital Grants and Contributions

|

0

|

|

Add: Loan Funds Used

|

0

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(862,400)

|

|

Less: Loan Principal Repayments

|

0

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(219,100)

|

|

Reserves Movement – Increase/(Decrease)

|

(219,100)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

0

|

As Table 3 indicates the additional revenue from the SRV if

approved is estimated to be $1,185,000 which equates to 6.00% of the 7.50%

overall SRV increase. As the 7.50% includes the announced 1.50% rate peg,

if the SRV is not approved, it will be the 6.0% component or the estimated

$1,185,000 in 2017/2018 that Council will not be able to raise.

The detailed Draft 2017/2018 Budget Estimates prepared on

the assumption the SRV is approved are detailed at Attachment 1. The

amount of SRV revenue is currently allocated to the following budget items

listed in Table 4 below:

Table 4- Proposed

SRV Allocation 2017/2018

|

Item

|

Total

Budget $

|

SRV

Funding $

|

Other

Funding $

|

|

Operating Expenditure

|

|

|

|

|

Rural Drainage Maintenance

|

146,500

|

36,900

|

109,600

|

|

North – Urban Drainage Maintenance

|

136,400

|

21,100

|

115,300

|

|

South – Urban Drainage Maintenance

|

155,200

|

21,100

|

134,100

|

|

Byron Bay Pool Maintenance

|

40,900

|

12,200

|

28,700

|

|

Mullumbimby Pool Maintenance

|

40,800

|

12,200

|

28,600

|

|

Total Operating Expenditure

|

519,800

|

103,500

|

416,300

|

|

|

|

|

|

|

Item

|

Total

Budget $

|

SRV

Funding $

|

Other

Funding $

|

|

Capital Expenditure

|

|

|

|

|

Broken Head Road

|

1,191,600

|

300,000

|

891,600

|

|

Station Street Bangalow

|

46,600

|

46,600

|

0

|

|

Pine Avenue Mullumbimby

|

610,000

|

75,500

|

534,500

|

|

The Terrace Brunswick Heads

|

379,400

|

379,400

|

0

|

|

Byron Bay Town Centre – Landscape/Precinct Plan

|

88,400

|

60,900

|

27,500

|

|

Total Capital Expenditure

|

2,316,000

|

862,400

|

1,453,600

|

|

|

|

|

|

|

Transfer to Reserve

|

|

|

|

|

Byron Bay Pool – Renewals to be determined

|

219,100

|

219.100

|

0

|

|

Total Transfer to Reserve

|

219,100

|

219,100

|

0

|

|

|

|

|

|

|

Total SRV

|

3,054,900

|

1,185,000

|

1,869,900

|

Should the SRV not be approved, then the budget items in

Table 4 above will not proceed or will need the extent of works proposed

revised to accommodate available funding.

Table 1 (with SRV) and Table 2 (without SRV) indicates a

forecasted budget surplus result of $50,000 and this relates to the General

Fund. The forecast General Fund Unrestricted Cash Balance position based

on the draft budget included at Table 1 and 2 is outlined in Table 5 below:

Table 5 –

Forecast General Fund Unrestricted Cash Balance

|

Item

|

$

|

|

Forecast unrestricted cash balance to 30 June 2017 at 31

December 2016 Budget Review

|

1,146,500

|

|

Add: Estimated initial draft 2017/2018 budget result

|

50,000

|

|

Forecast unrestricted cash balance at 30 June 2018

|

1,196,500

|

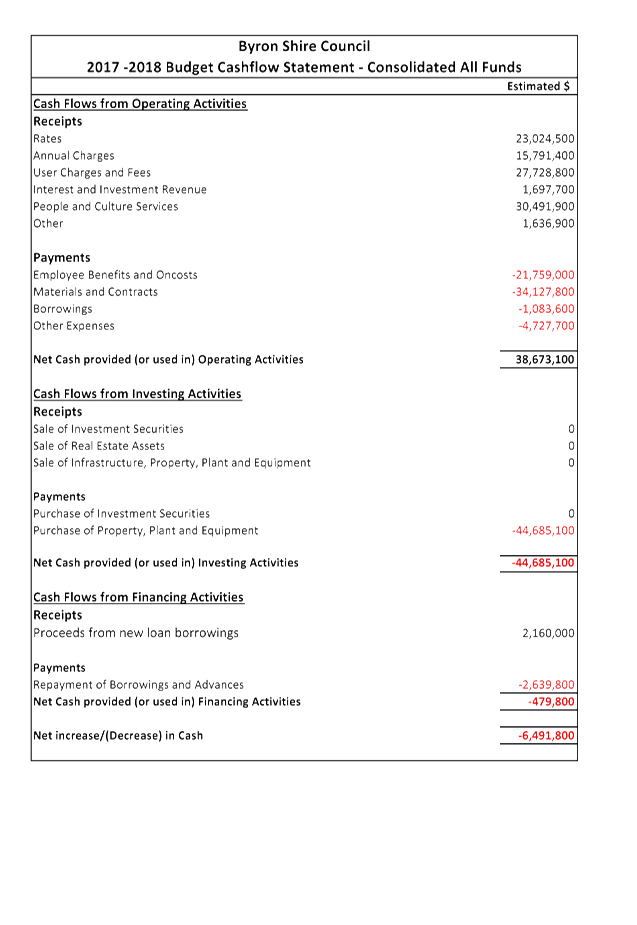

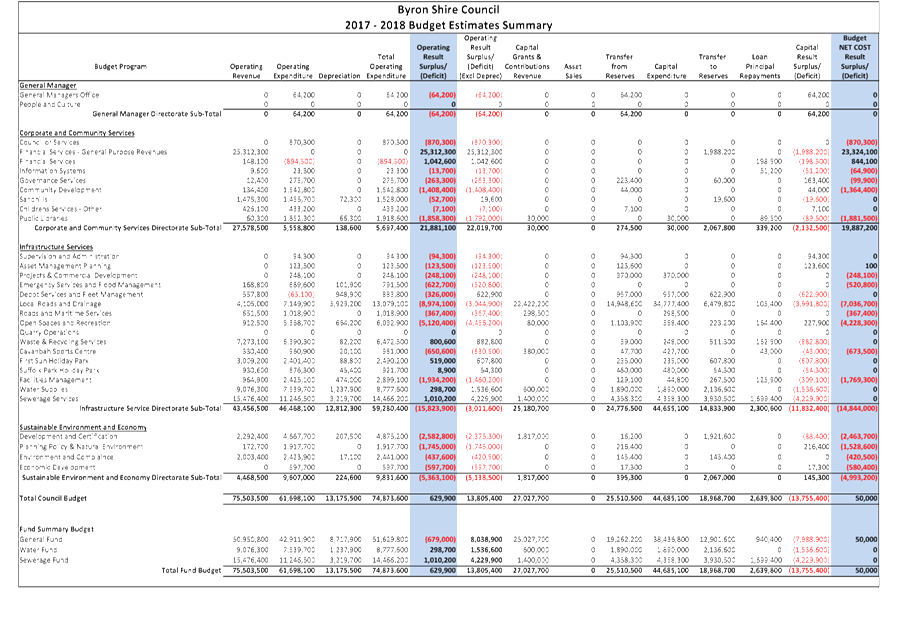

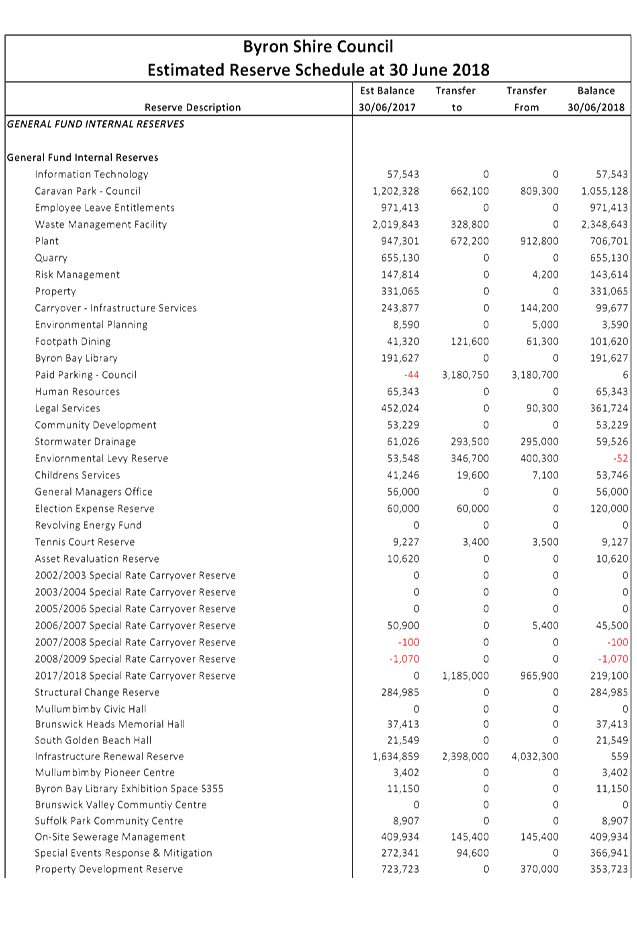

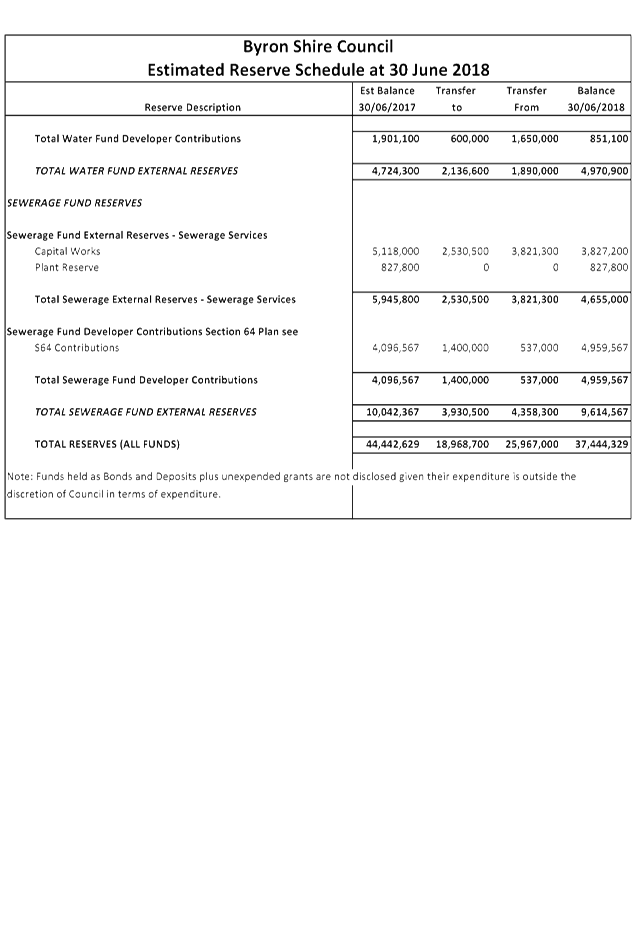

In addition to Tables 1 and 5 above, budgeted financial

statements incorporating a Operating Statement and Cash Flow Statement have

been produced. These financial statements replicating the format of

Council’s Annual Financial Statements are included in Attachment 2 along

with a one page summary of all Council budget program outcomes and the

estimated balance of Council reserves as at 30 June 2018.

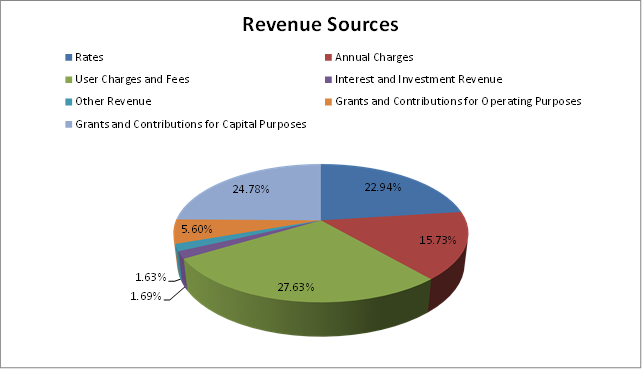

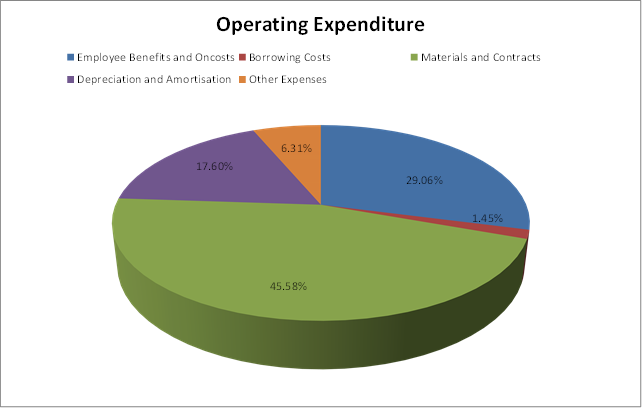

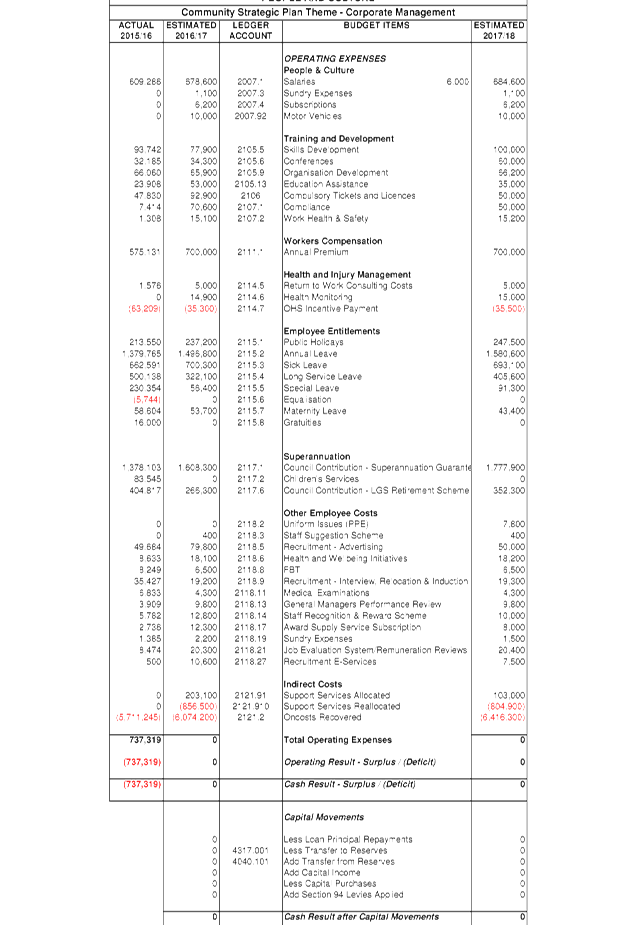

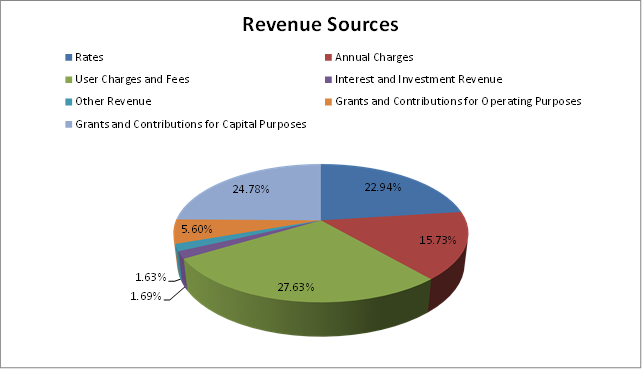

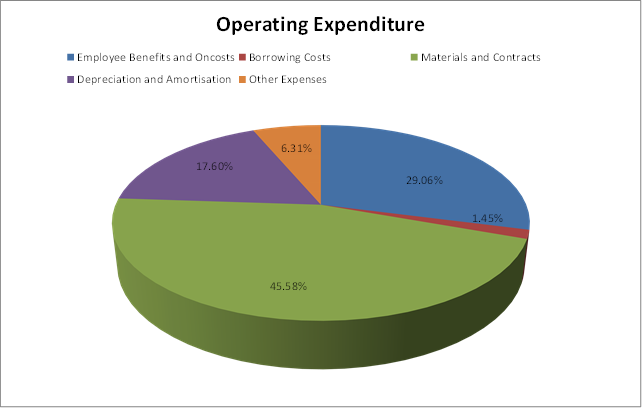

To arrive at the Draft Budget Results outlined in Table 1

(SRV option) for the 2017/2018 financial year, Council’s revenue and

operational expenses are expected to be derived from the following sources and

allocated respectively as outlined in the graphs below:

In addition to the operational aspects of the proposed Draft

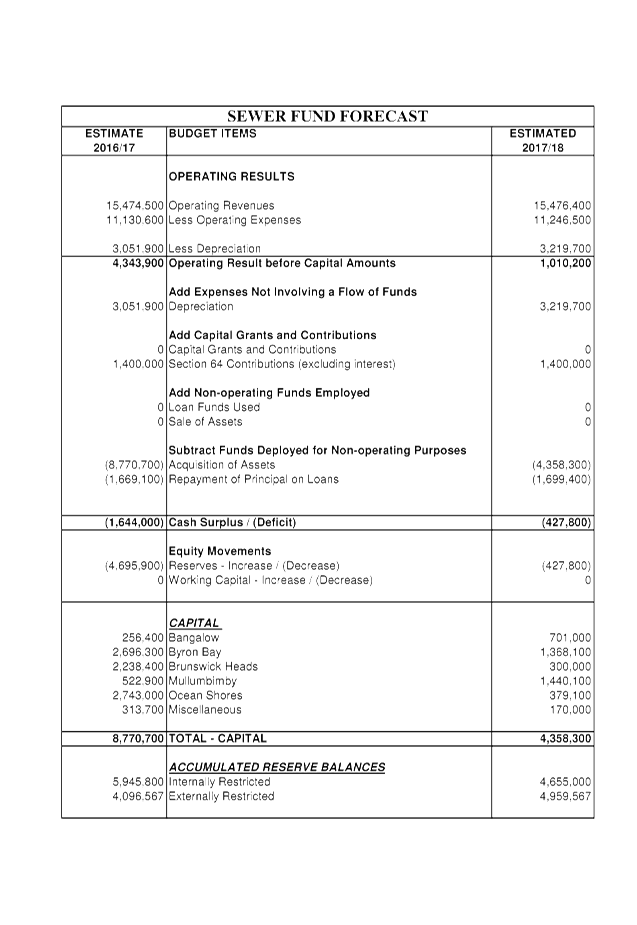

2017/2018 Budget Estimates, Council is proposing a capital works program of

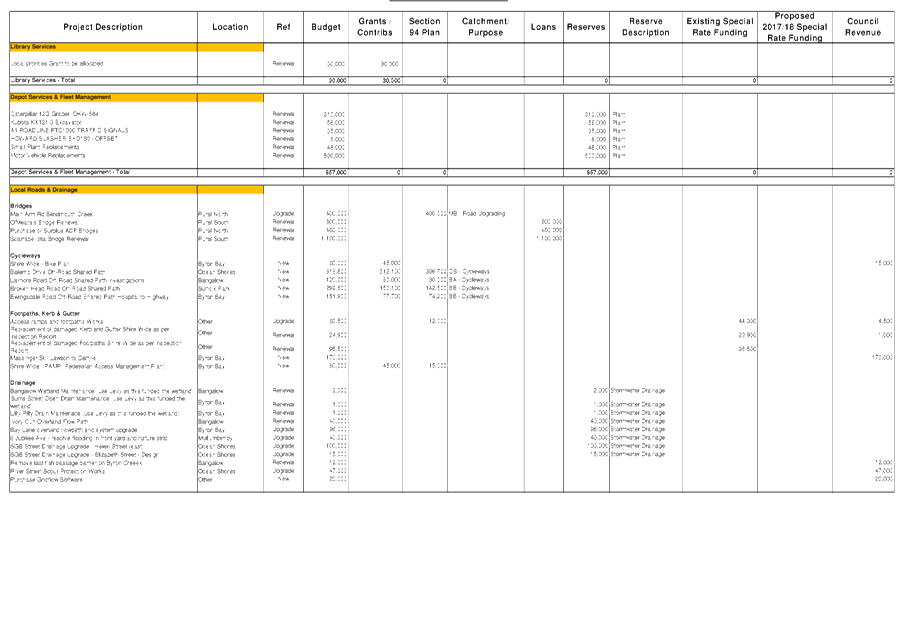

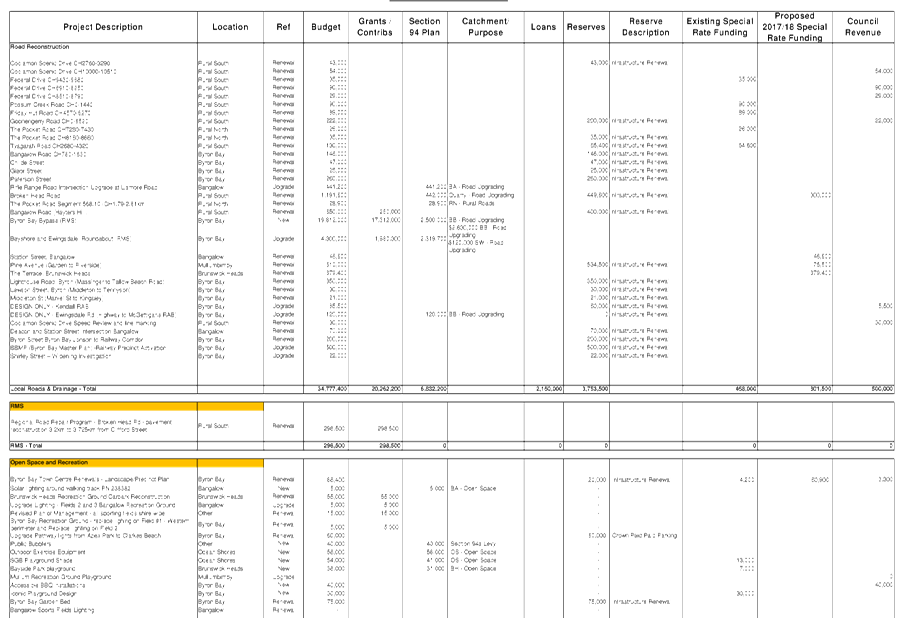

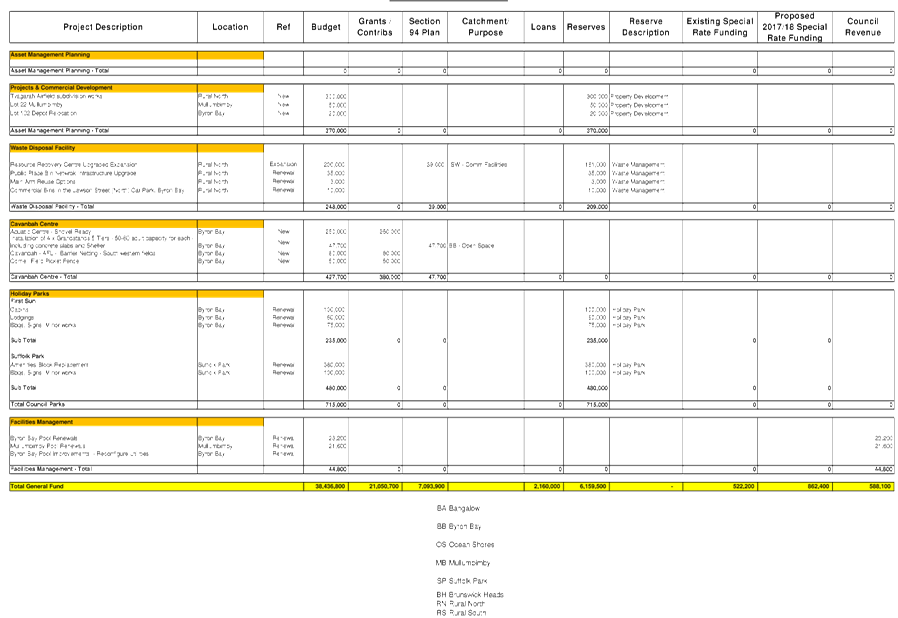

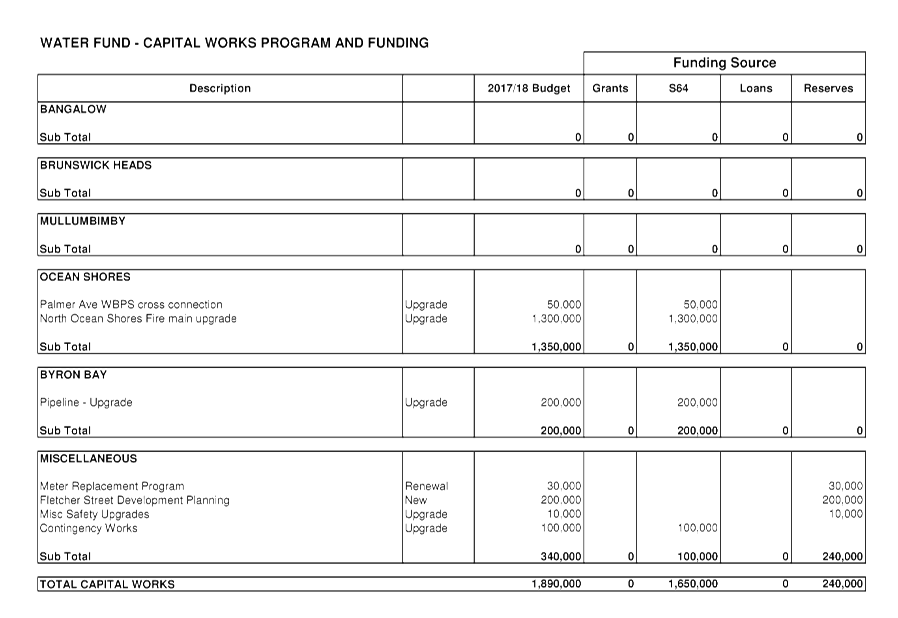

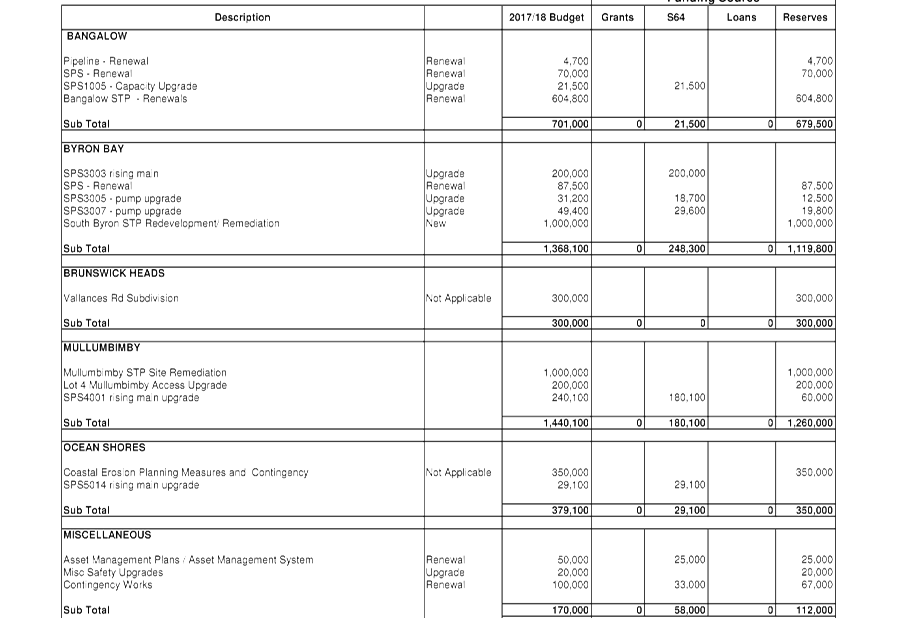

$44.685million (SRV option). By Fund, the projected capital works are:

· General Fund $38.436million

· Water Fund

$1.890million

· Sewerage Fund

$4.358million

Specific capital works projects have been detailed in

Attachment 1, which for 2017/2018 has been presented in a different format for

the General Fund, to improve the disclosure of funding sources for specific

projects including:

· Section 94 funding

to describe the specific part of the Section 94 Plan and catchment that is

providing the funding for a project.

· Where reserve

funds are funding a project, identification of the reserve being utilised.

· Separation of

funding provided by Special Rate Variations (SRVs) including previously granted

SRVs prior to 2008/2009 (Council’s last approved SRV) and the proposed

SRV for 2017/2018.

Of the $38.436million for capital works related to the

General Fund, $34.777million is allocated towards Roads and Drainage projects

including $19.812million allocated to the Byron Bay Bypass.

The Draft 2017/2018 Budget Estimates also propose new loan

borrowings of $2.160million of a $6.000million borrowing program over the next

three financial years to fund a bridge replacement program. These are the

first new loan borrowings for Council in at least the last five years as

Council has been concentrating of debt reduction. Whilst only $2.160million

is required for 2017/2018, should Council approve the loan borrowings, it may

be worth testing the market to consider the merits of borrowing the entire

$6.000million loan program up front, investing what is not required but

considering interest rates on offer at the time borrowings may be sought.

A presentation will be provided to the Council Strategic

Planning Workshop to be held on 6 April 2017 concerning the Draft 2017/2018

Budget Estimates subject of this report which will also provide a briefing to

members of the Finance Advisory Committee before consideration of this report.

Financial Implications

The proposed Draft 2017/2018 Budget Estimates provided in

this report indicate a projected budget surplus of $50,000. This

projected surplus is the estimated outcome whether Council’s application

for a Special Rate Variation (SRV) is approved by the Independent Pricing and

Regulatory Tribunal (IPART) or not approved.

Detailed financial aspects of the Draft 2017/2018 Budget

Estimates are outlined for the Finance Advisory Committee to consider earlier

in this report.

Statutory and Policy Compliance Implications

In respect of the Draft 2017/2018 Operational Plan, Council

must comply with the provisions of Section 405 of the Local Government Act 1993

as described below concerning the adoption of an Operational Plan.

405 Operational plan

“(1)

A council must have a plan (its operational plan) that is adopted before the

beginning of each year and details the activities to be engaged in by the

council during the year as part of the delivery program covering that year.

(2)

An operational plan must include a statement of the council’s revenue

policy for the year covered by the operational plan. The statement of revenue

policy must include the statements and particulars required by the regulations.

(3)

A council must prepare a draft operational plan and give public notice of the

draft indicating that submissions may be made to the council at any time during

the period (not less than 28 days) that the draft is to be on public

exhibition. The council must publicly exhibit the draft operational plan in

accordance with the notice.

(4)

During the period of public exhibition, the council must have for inspection at

its office (and at such other places as it may determine) a map that shows

those parts of its area to which each category and sub-category of the ordinary

rate and each special rate included in the draft operational plan applies.

(5)

In deciding on the final operational plan to be adopted, a council must consider

any submissions that have been made concerning the draft plan.

(6)

The council must post a copy of its operational plan on the council’s

website within 28 days after the plan is adopted.”

The specific statements required by Council to be disclosed

as part of its Revenue Policy are determined by Clause 201 of the Local

Government (General) Regulation 2005 as follows:

201 Annual statement of council’s revenue policy

“(1) The

statement of a council’s revenue policy for a year that is required to be

included in an operational plan under section

405 of the Act

must include the following statements:

(a) a statement containing a

detailed estimate of the council’s income and expenditure,

(b)

a statement with respect to each ordinary rate and each special rate proposed

to be levied,

Note: The

annual statement of revenue policy may include a note that the estimated yield

from ordinary rates is subject to the specification of a percentage variation

by the Minister if that variation has not been published in the Gazette when

public notice of the annual statement of revenue policy is given.

(c) a statement with respect to

each charge proposed to be levied,

(d) a statement of the types of

fees proposed to be charged by the council and, if the fee concerned is a fee

to which Division 3 of Part 10 of Chapter 15 of the Act

applies, the amount of each such fee,

(e) a statement of the

council’s proposed pricing methodology for determining the prices of

goods and the approved fees under Division 2 of Part 10 of Chapter 15 of the Act

for services provided by it, being an avoidable costs pricing methodology

determined by the council in accordance with guidelines issued by the

Director-General,

(f) a statement of the amounts

of any proposed borrowings (other than internal borrowing), the sources from

which they are proposed to be borrowed and the means by which they are proposed

to be secured.

(2) The

statement with respect to an ordinary or special rate proposed to be levied

must include the following particulars:

(a) the ad valorem amount (the

amount in the dollar) of the rate,

(b) whether the rate is to have

a base amount and, if so:

(i) the amount in dollars of

the base amount, and

(ii) the percentage, in

conformity with section

500 of the Act,

of the total amount payable by the levying of the rate, or, in the case of the

rate, the rate for the category or sub-category concerned of the ordinary rate,

that the levying of the base amount will produce,

(c) the estimated yield of the

rate,

(d) in the case of a special

rate-the purpose for which the rate is to be levied,

(e) the categories or

sub-categories of land in respect of which the council proposes to levy the

rate.

(3) The

statement with respect to each charge proposed to be levied must include the

following particulars:

(a) the amount or rate per unit

of the charge,

(b) the differing amounts for

the charge, if relevant,

(c) the minimum amount or

amounts of the charge, if relevant,

(d) the estimated yield of the

charge,

(e) in relation to an annual

charge for the provision by the council of coastal protection services (if

any)-a map or list (or both) of the parcels of rateable land that are to be

subject to the charge.

(4) The

statement of fees and the statement of the pricing methodology need not include

information that could confer a commercial advantage on a competitor of the

council. “

Report No. 4.3 Draft

2017/2018 Revenue Policy

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/345

Theme: Corporate Management

Financial Services

Summary:

The Draft 2017/2018 Revenue Policy has been prepared to

support the funding requirements of the Draft 2017/2018 Budget Estimates

subject to another report to this Meeting of the Finance Advisory

Committee.

The purpose of this report is to provide the opportunity to

the Finance Advisory Committee to review the Draft 2017/2018 Revenue Policy in

its current form and to recommend, subject to any amendments, its adoption by

Council for the purposes of public exhibition for a period of 28 days.

|

RECOMMENDATION:

That the Finance Advisory Committee review the Draft

2017/2018 Revenue Policy and subject to any amendments, recommend to Council

the adoption of the Draft 2017/2018 Revenue Policy for the purposes of public

exhibition.

|

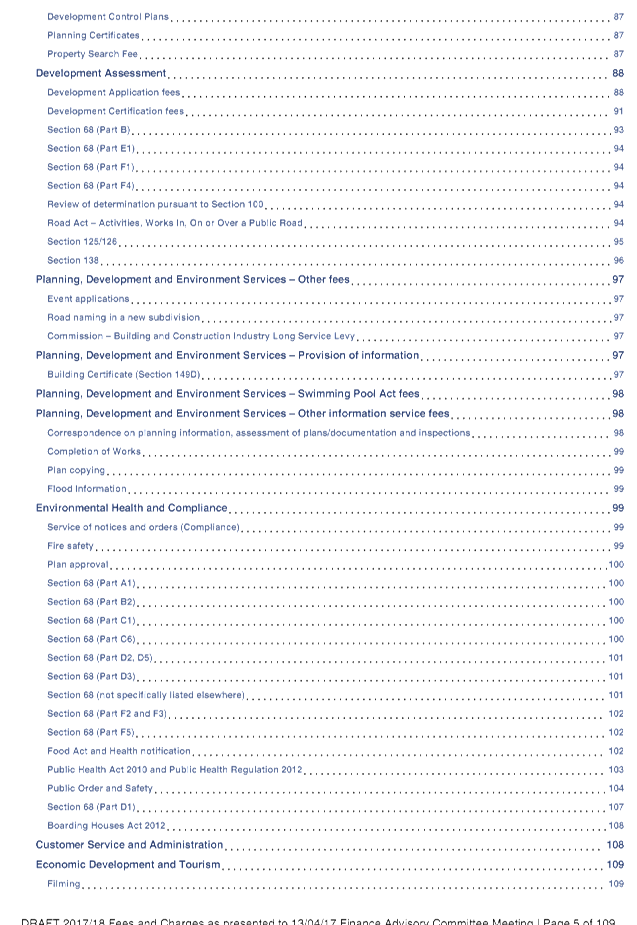

Attachments:

1 Draft

2017/2018 Revenue Policy, E2017/23434

, page 102⇩

2 Draft

2017/2018 Fees and Charges, E2017/24210

, page 122⇩

Report

The Draft 2017/2018 Revenue Policy has been prepared to

support the funding requirements of the Draft 2017/2018 Budget Estimates

subject to another report to this Meeting of the Finance Advisory

Committee.

The purpose of this report is to provide the opportunity to

the Finance Advisory Committee to review the Draft 2017/2018 Revenue Policy in

its current form and to recommend, subject to any amendments, its adoption by

Council for the purposes of public exhibition for a period of 28 days.

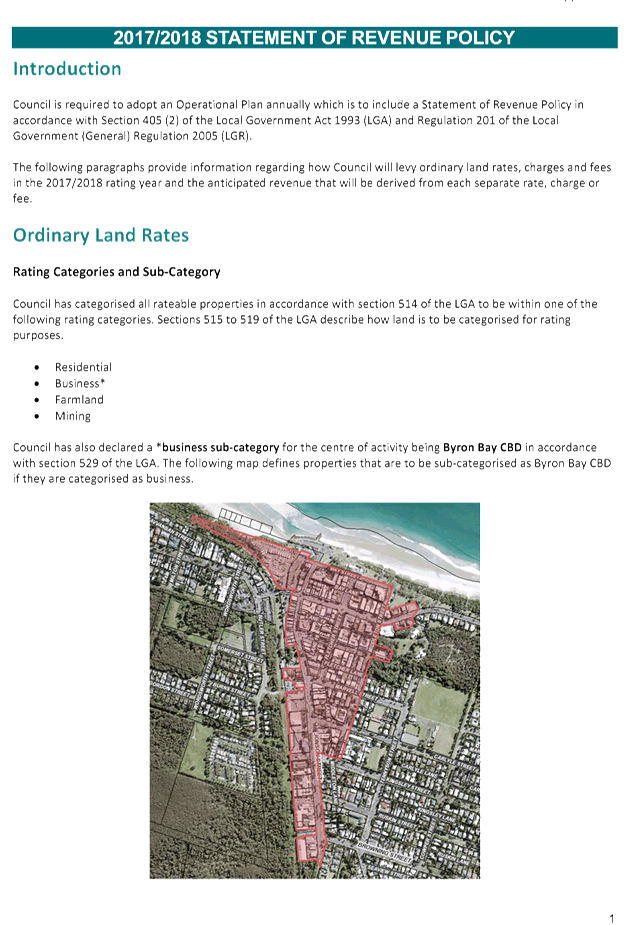

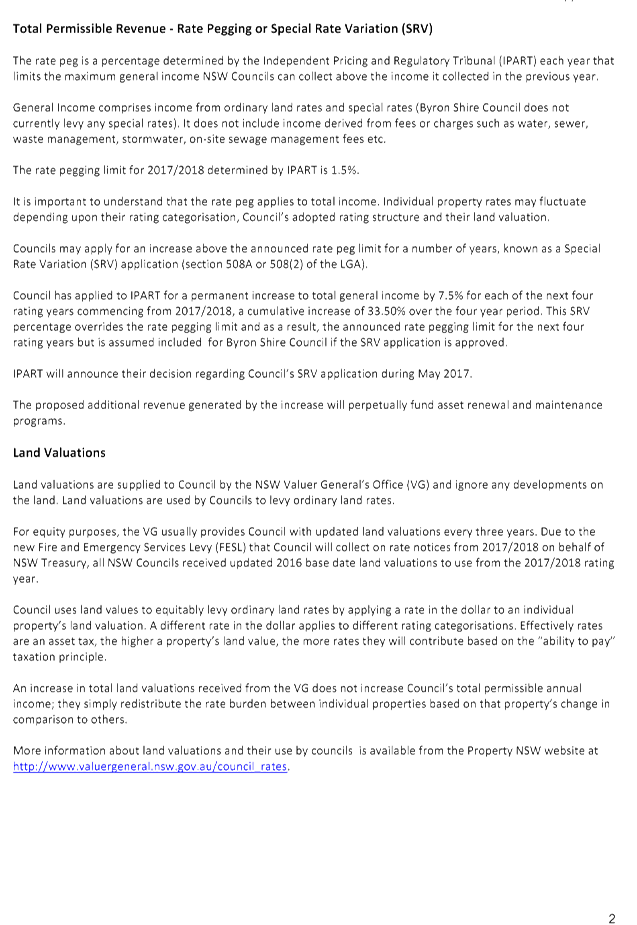

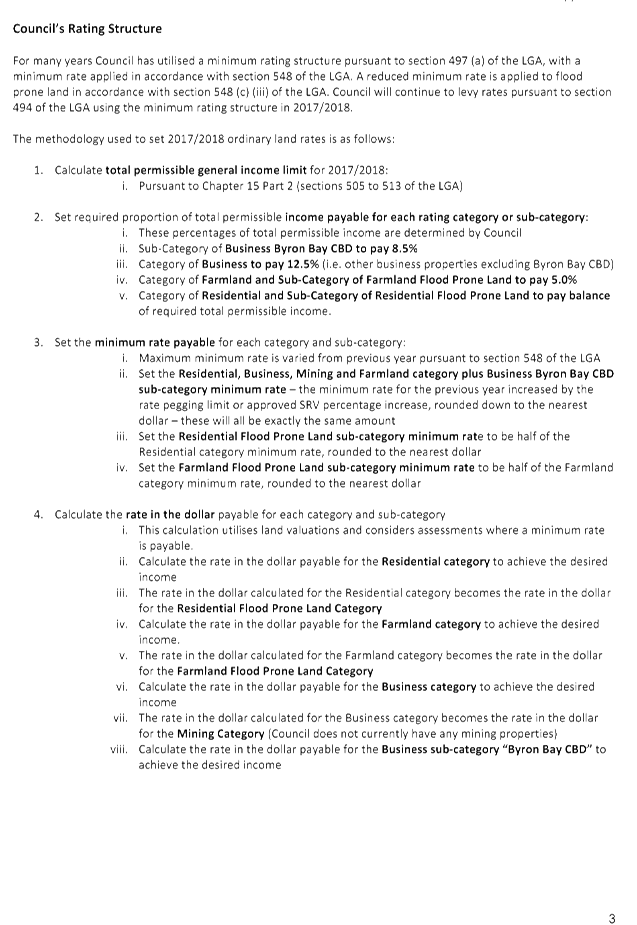

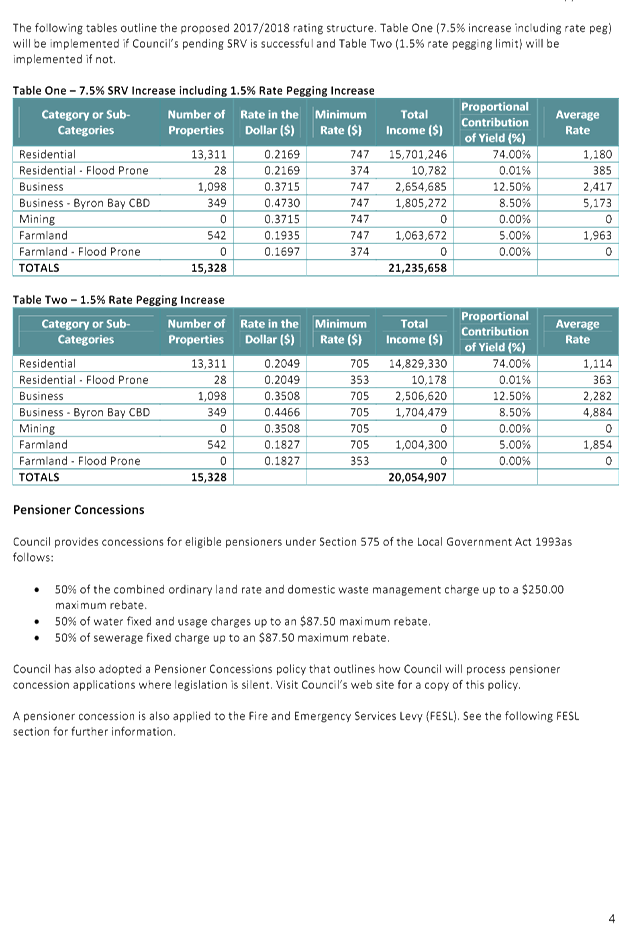

Draft General Land Rates and Charges

The Draft 2017/2018 Revenue Policy includes two rating

structure tables with the only difference being the rating yields

derived. As Council has applied for a Special Rates Variation (SRV), it

must show a rating structure table with the SRV included and one without the

SRV, on the basis that the SRV is not approved and only normal rate pegging is

applied.

The Draft 2017/2018 Revenue Policy in regards to the

Ordinary Rates section as been re-written to outline a proposed new rating

structure for Council to consider. The rating structure outlined in

Attachment 1 is based on outcomes from the following events:

· Council resolution

17-023 from the Ordinary Council Meeting held 2 February 2017.

· Presentation to

the Finance Advisory Committee 16 February 2017

· Review by the

Executive Team 1 March 2017

· Presentation to

the Council Strategic Planning Workshop 9 March 2017

· Presentation to

the Council Strategic Planning Workshop 6 April 2017 in conjunction with the

Draft 2017/2018 Budget Estimates.

There were a number of alternate options provided but the

option currently presented in the Draft 2017/2018 Revenue Policy is based on

the following:

· Retention of the

ad valorem rate subject to a minimum rate.

· Retention of

existing rating categories.

· Abolition of the

historical differentials where the ad valorem rate was established for

Residential, then the ad valorem rate for Business was set at 150% of

Residential, then the ad valorem rate for Business Byron Bay CBD set at 200% of

Residential and the Farmland ad valorem rate was set at 73.73% of Residential.

· Application of new

land values provided by the Valuer General for the 2017/2018 financial year to

coincide with the introduction of the Fire and Emergency Services Levy (FESL)

by the NSW Government.

· Application of the

Special Rate Variation (SRV) of 7.50% if approved. On this basis the

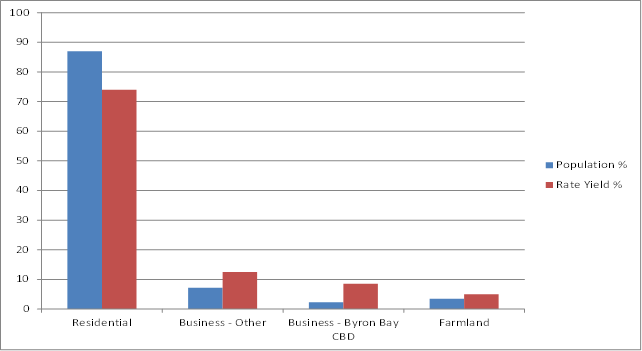

minimum rate will increase for 2017/2018 from $695.00 to $747.00 or $52.00.

· Redistribution of

the rating yields between rating categories as outlined in Table 1 below

compared to the rating yields from 2016/2017 which has reduced the rate yield

from the Residential category but increased the rate yield to the Business and

Farmland categories.

Table 1 – Proposed

Rating Yield % by Rating Category

|

Rating Category

|

% Proposed Yield

2017/2018

|

Actual % Yield

2016/2017

|

|

Residential

|

74.00%

|

76.20%

|

|

Business – Other

|

12.50%

|

11.50%

|

|

Business – Byron Bay CBD

|

8.50%

|

7.90%

|

|

Farmland

|

5.00%

|

4.40%

|

|

Total

|

100.00%

|

100.00%

|

The current ratepayer population in Byron Shire Council is

distributed amongst the following rating categories outlined in Table 2:

Table 2 –

Ratepayer Population Distribution 2017/2018

|

Rating Category

|

Number of

Ratepayer Assessments

|

Proportion of

Ratepayer Population %

|

|

Residential

|

13,339

|

87.00%

|

|

Business – Other

|

1,098

|

7.20%

|

|

Business – Byron Bay CBD

|

349

|

2.30%

|

|

Farmland

|

542

|

3.50%

|

|

Total

|

15,328

|

100.00%

|

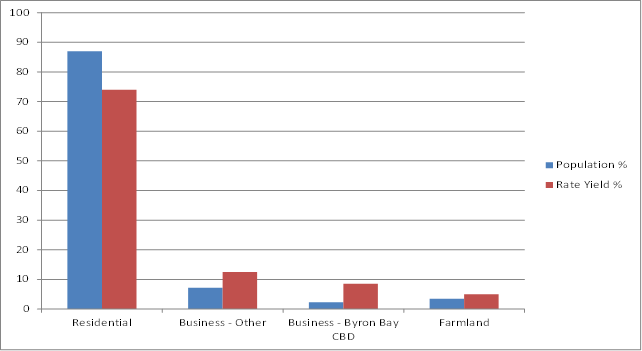

Given the distribution of the Ratepayer population, if

Council alters the redistribution of the rating yield amongst the rating

categories, a small decrease in the Residential rating category creates

significant increases in the Business and Farmland rating categories.

A comparison of the proportion of the ratepayer population

and proportion of rate yields contributed by each rating category is provided

in the graph below:

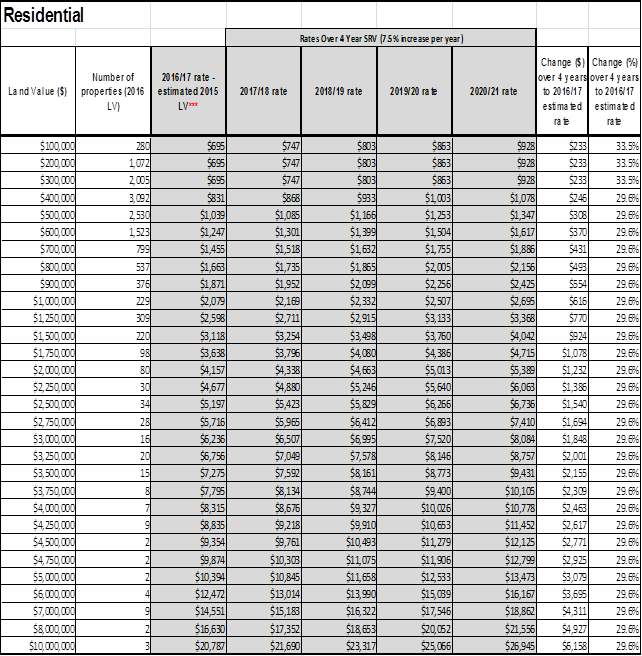

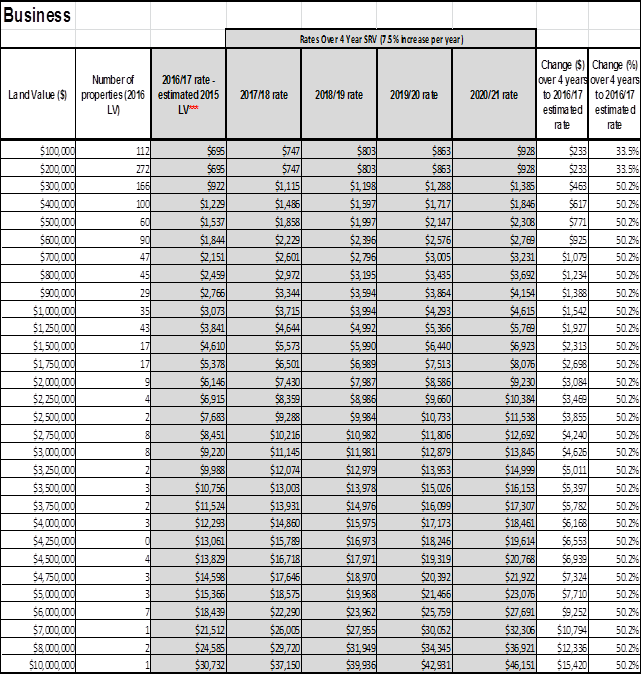

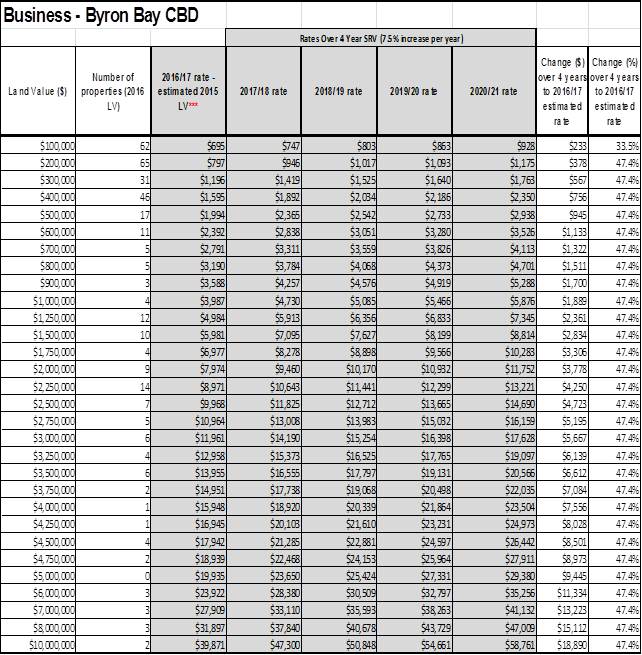

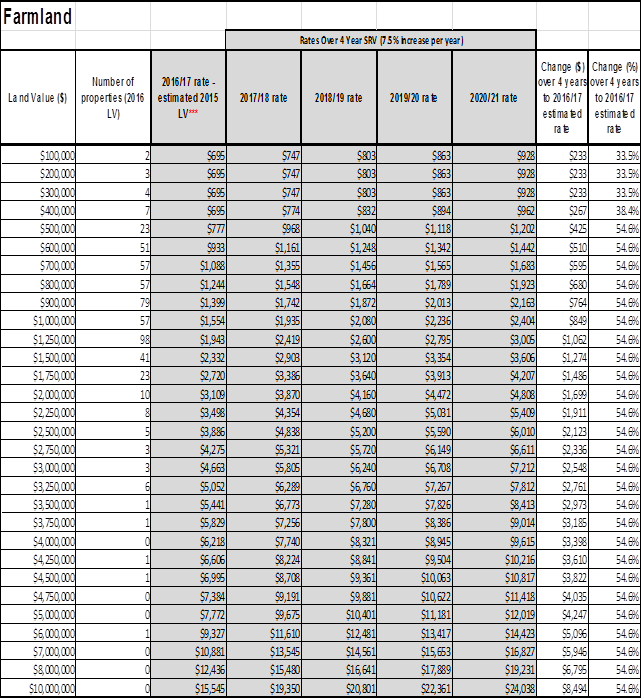

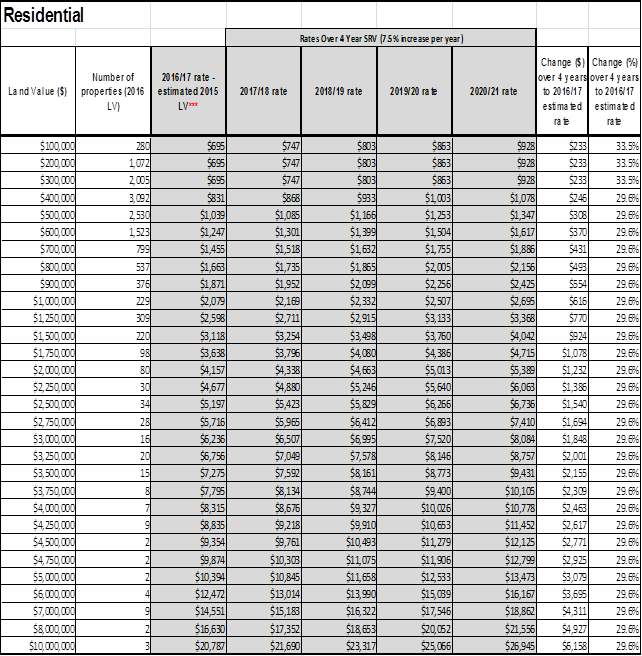

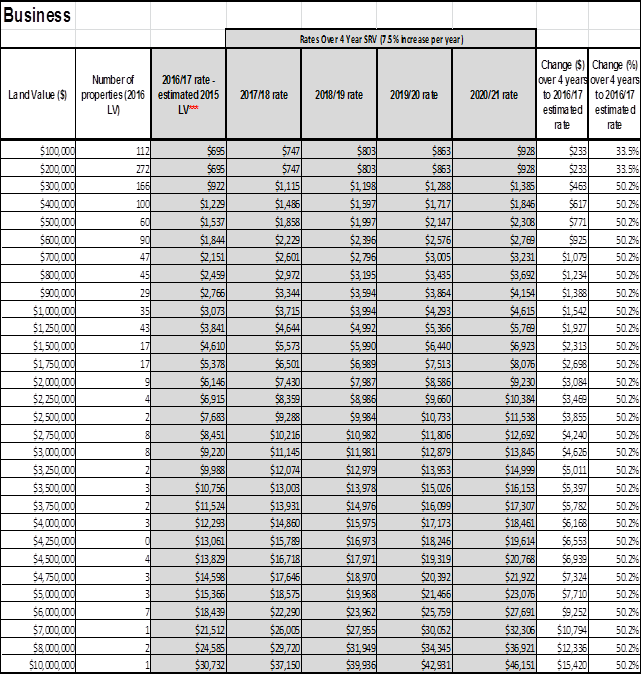

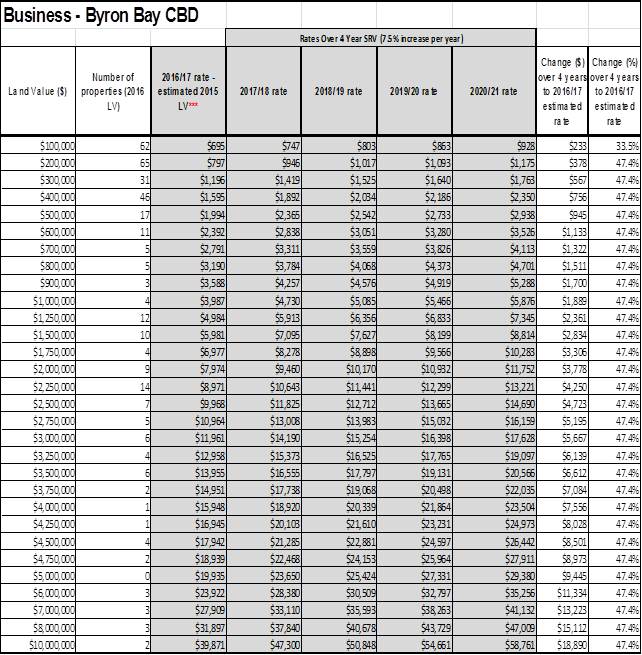

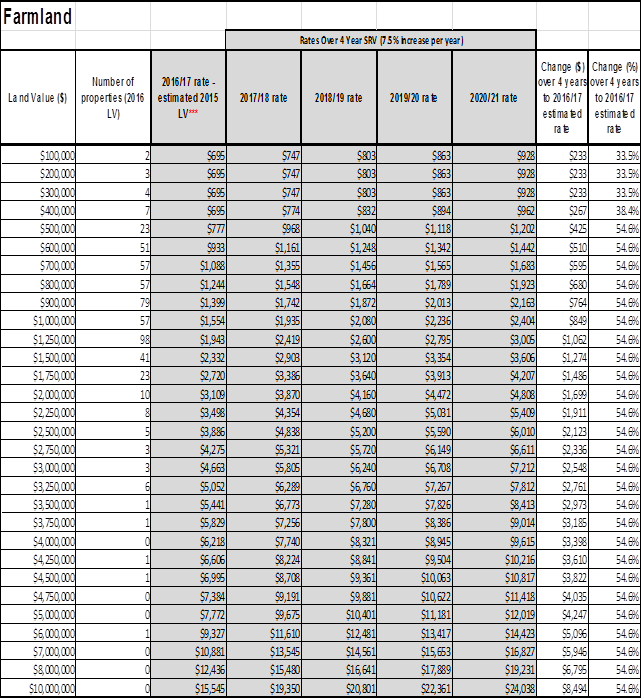

If Council proceeds with the suggested rating option

contained in the Draft 2017/2018 Revenue Policy, and assuming the SRV is

approved, a series of tables has been prepared to compare current 2016/2017

ordinary rates payable and to show the ordinary rate price path over the four

years of the proposed SRV by land value range and rating category as follows:

Table 3 –

Residential Rating

Table 4 –

Business – Other Rating

Table 5 –

Business - Byron Bay CBD Rating

Table 6 –

Farmland Rating

Please Note: *** The land values in tables 3 to 6

above are the new 2016 base date land value ranges to apply in the 2017/2018

financial year. To calculate the comparable 2016/2017 rates payable,

these land values have been discounted by the increase in the actual 2016 base

date land values by rating category to provide a more realistic and accurate

comparison. The discount applied is Residential 9.7%, Business –

Other 11.00%, Business – Byron Bay CBD 13.40% and Farmland 8.40%.

The outcome of the four tables immediately above (Tables 3

to 6) naturally will be different if the Special Rate Variation is not approved

and Rate Pegging only is to apply but represent an indicative outcome if it is

approved.

As the recommended rating structure for 2017/2018 will

create a redistribution of the rating yield, especially to the Business

category as a whole, which is now proposed to contribute 21.00% of

Council’s rate yield overall compared to the 19.40% previously

contributed. Council during the normal public exhibition period of the Draft

2017/2018 Operational Plan (including the Revenue Policy), will need to conduct

additional consultation with the Byron Shire Business community to ensure they

are informed of the proposed changes.

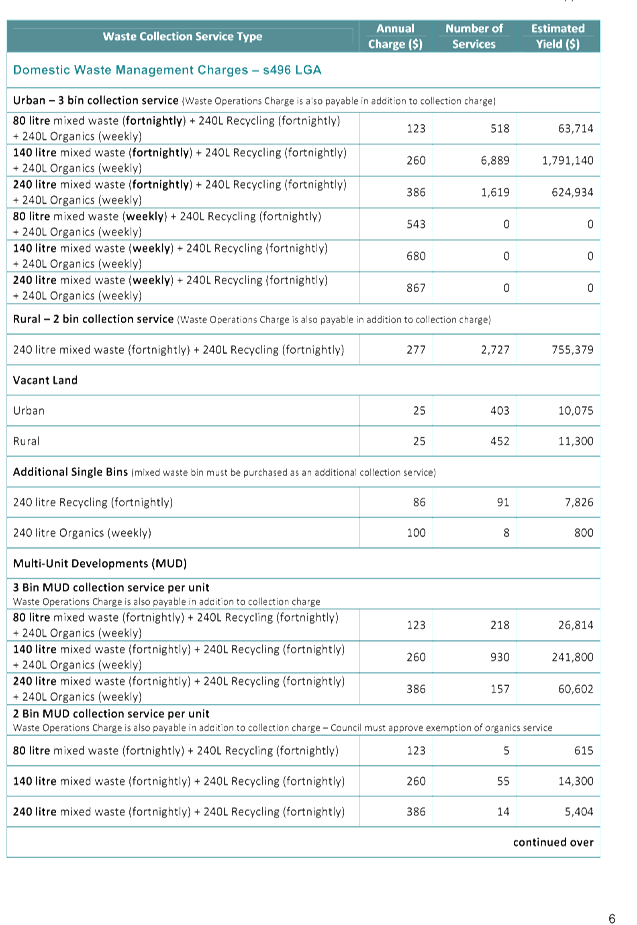

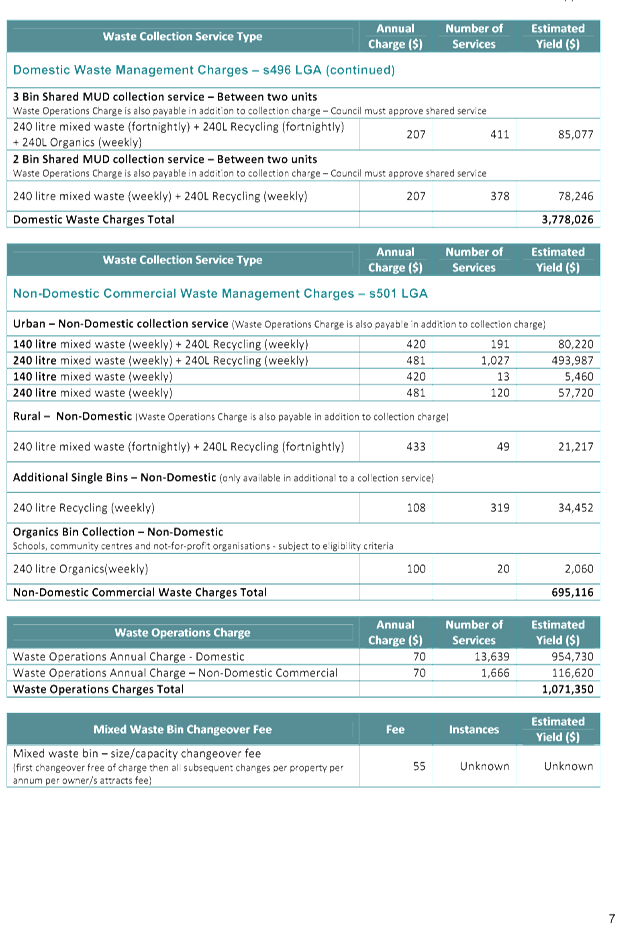

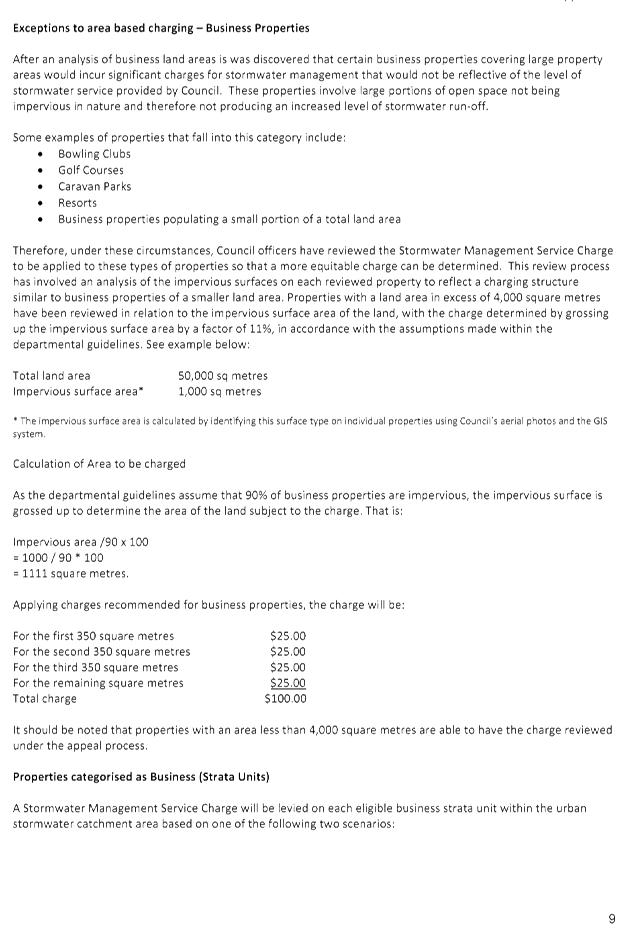

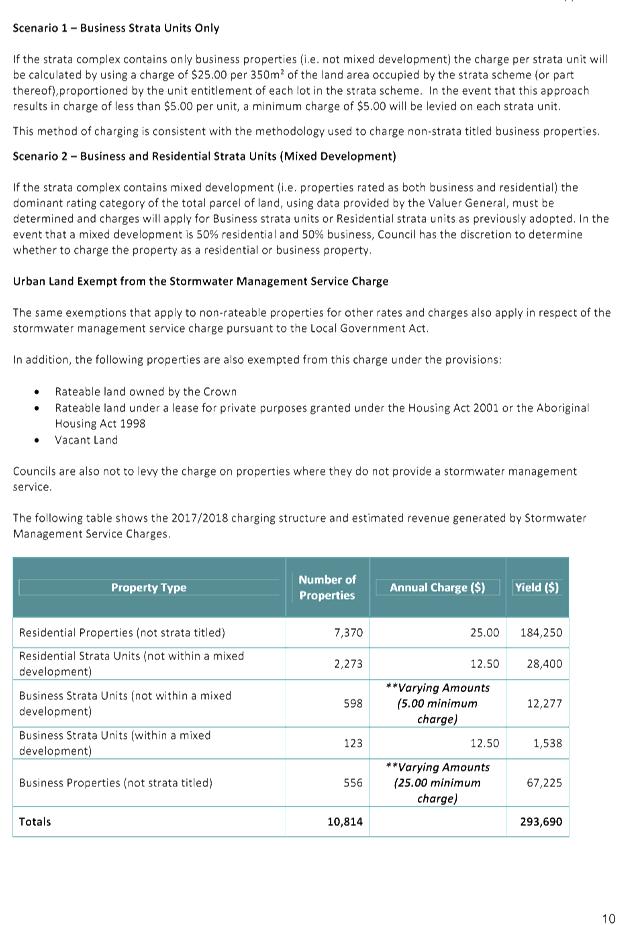

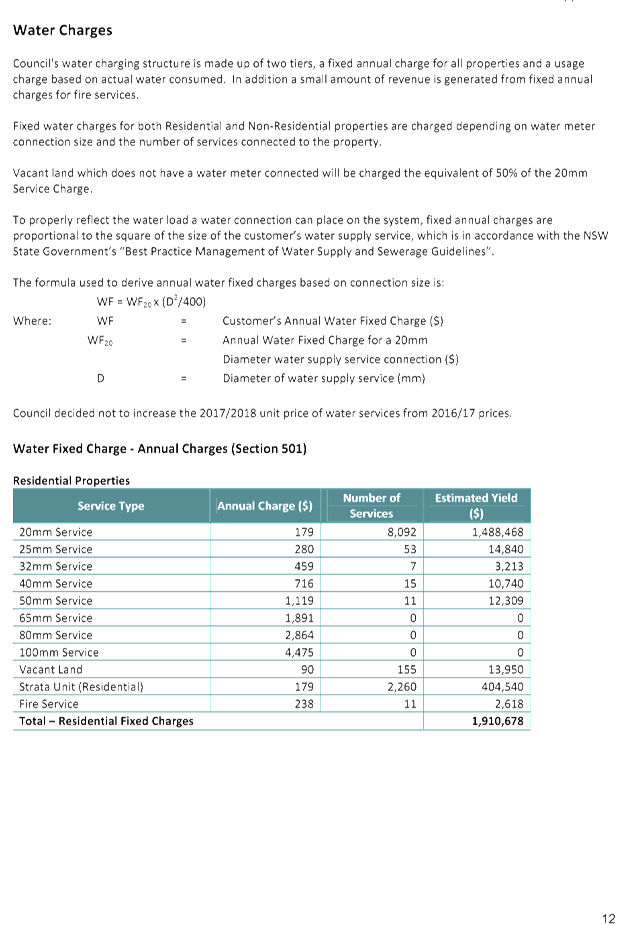

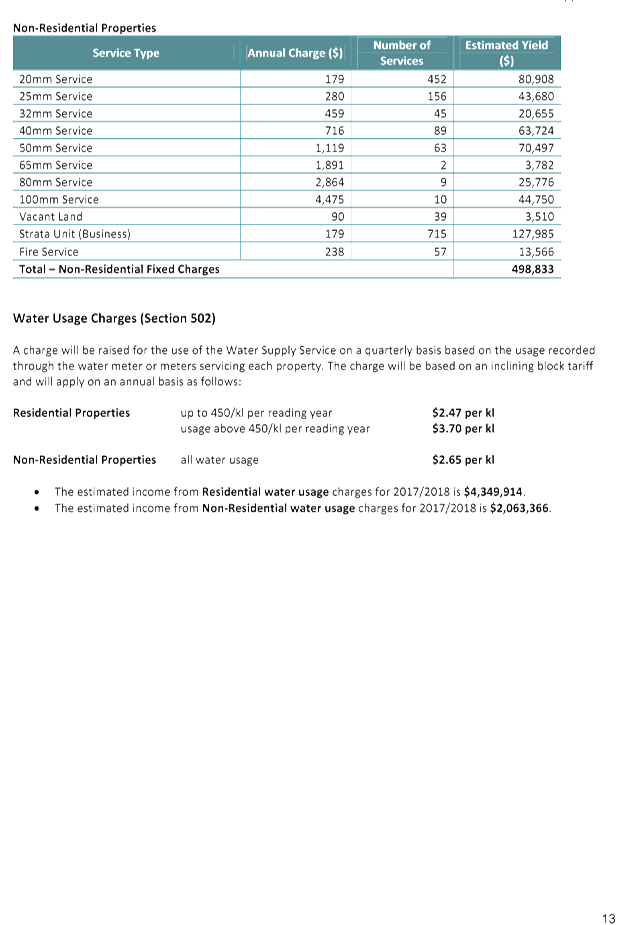

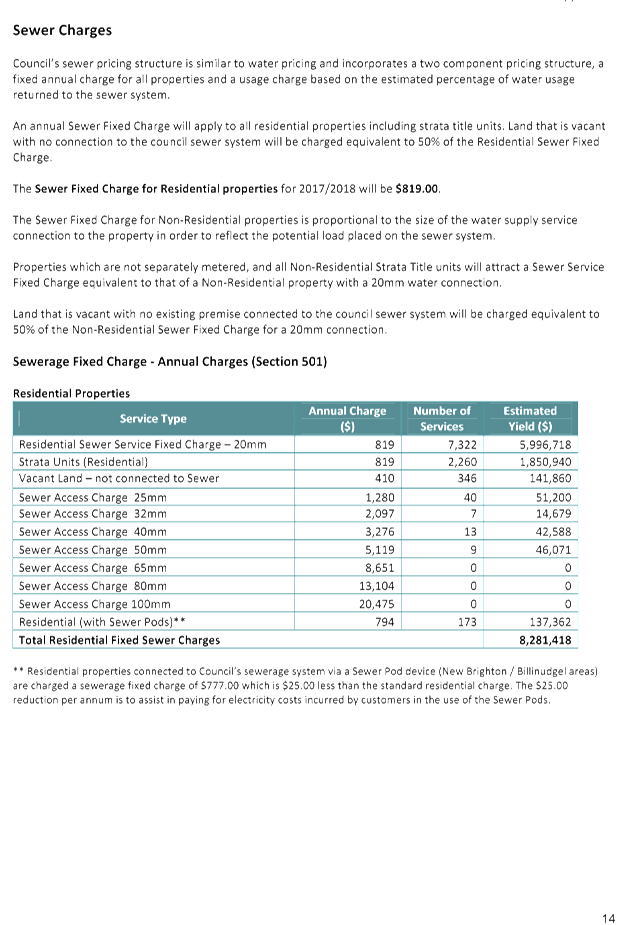

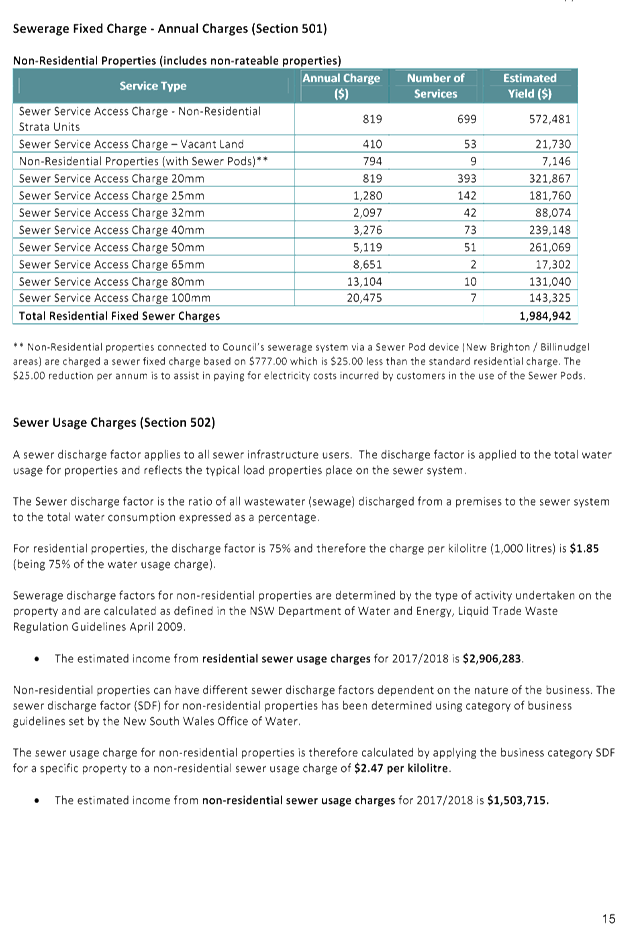

Given the proposed SRV, a review of waste, water and

sewerage charges has been conducted and it is proposed for 2017/2018 not to

increase these unit charges from those charged in 2016/2017. In respect

of waste charges, these have been reviewed to the extent of proposed service

types with the three bin service offered by Council. In addition, the

stormwater charge has not increased given it is a regulated charge that has not

changed over the last ten years.

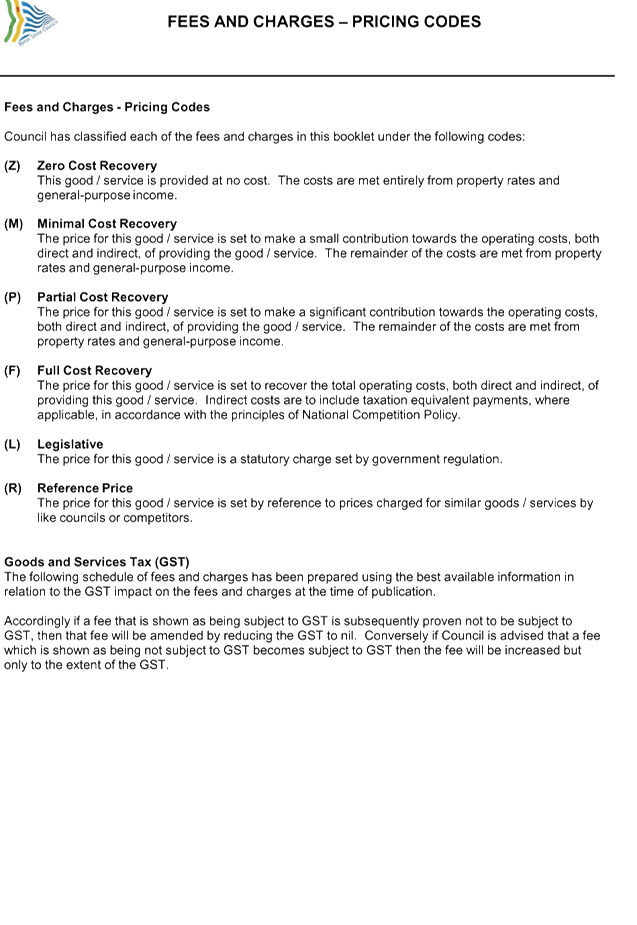

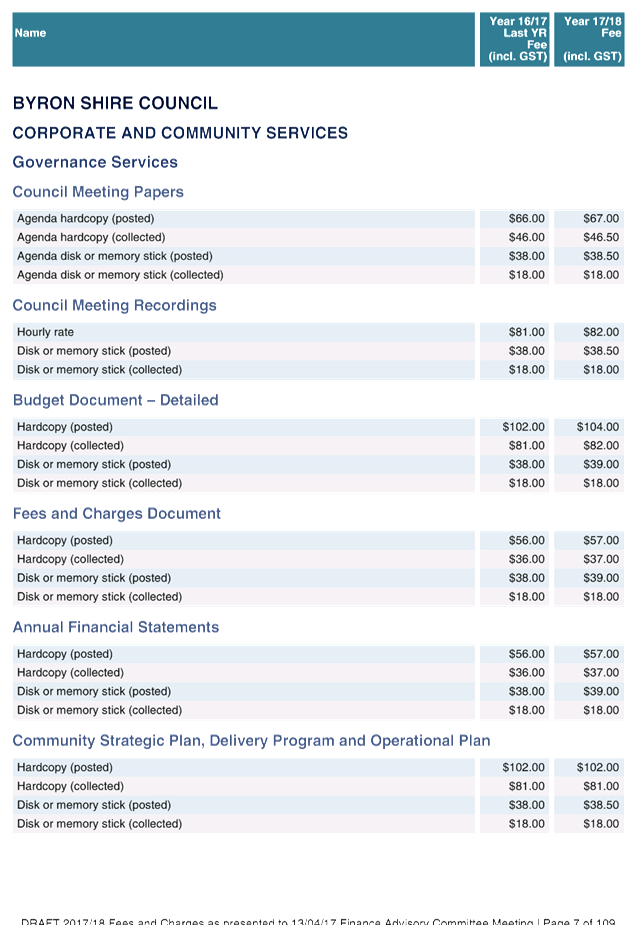

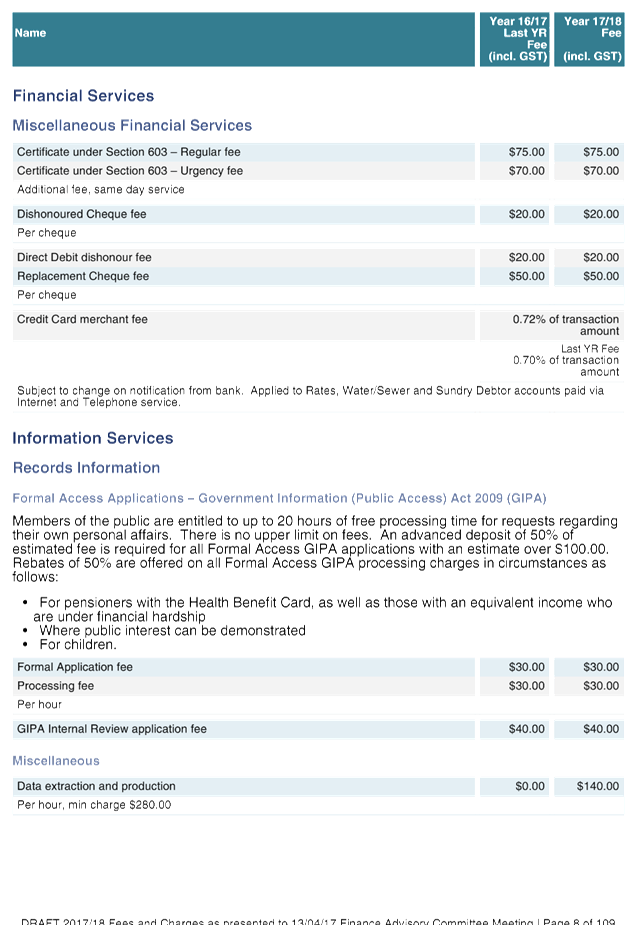

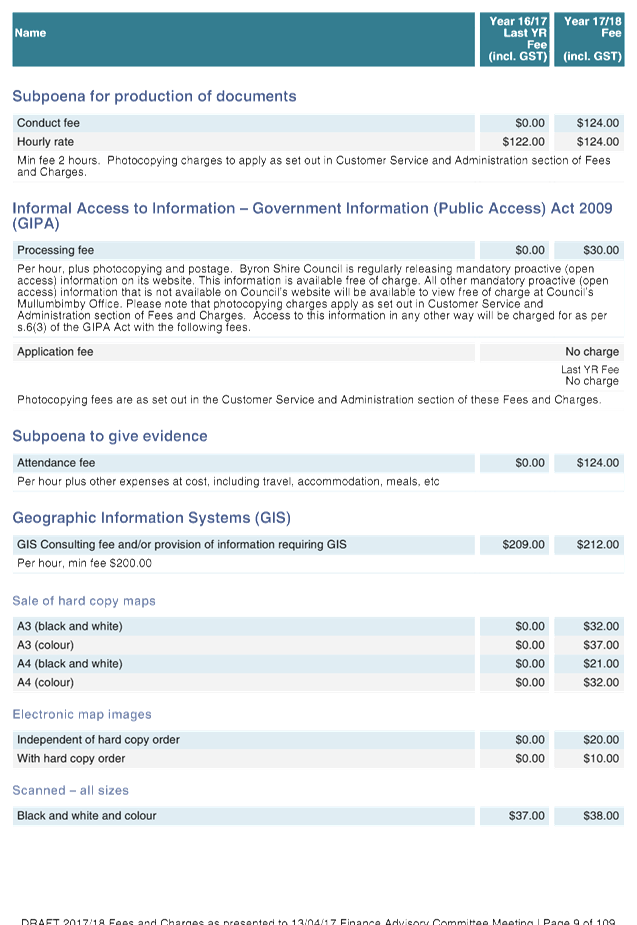

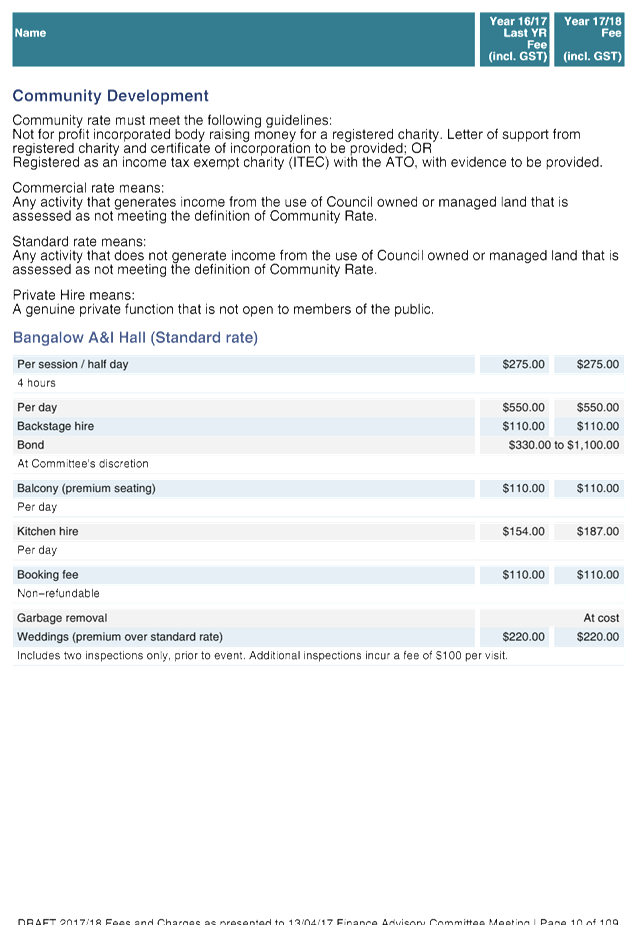

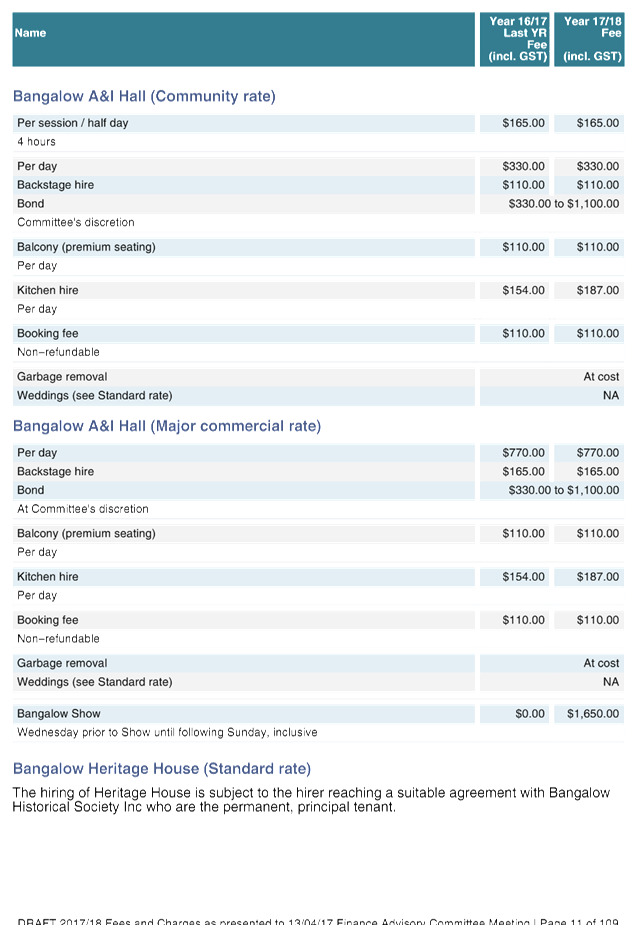

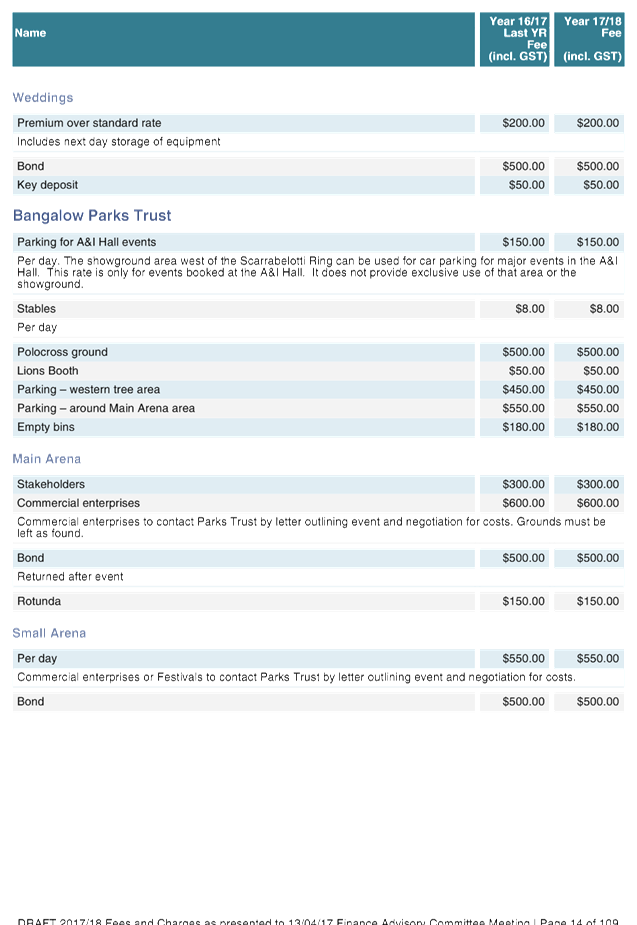

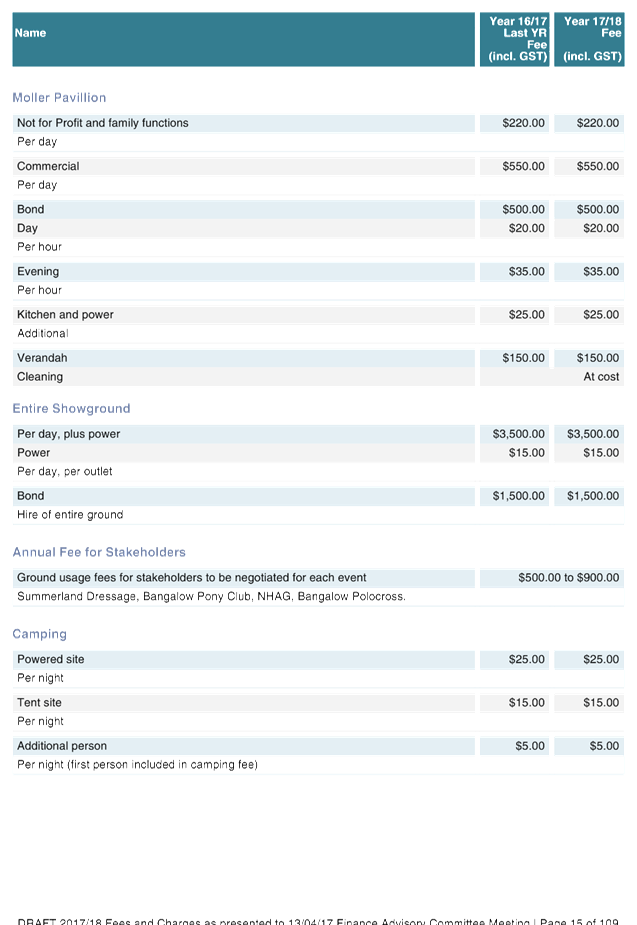

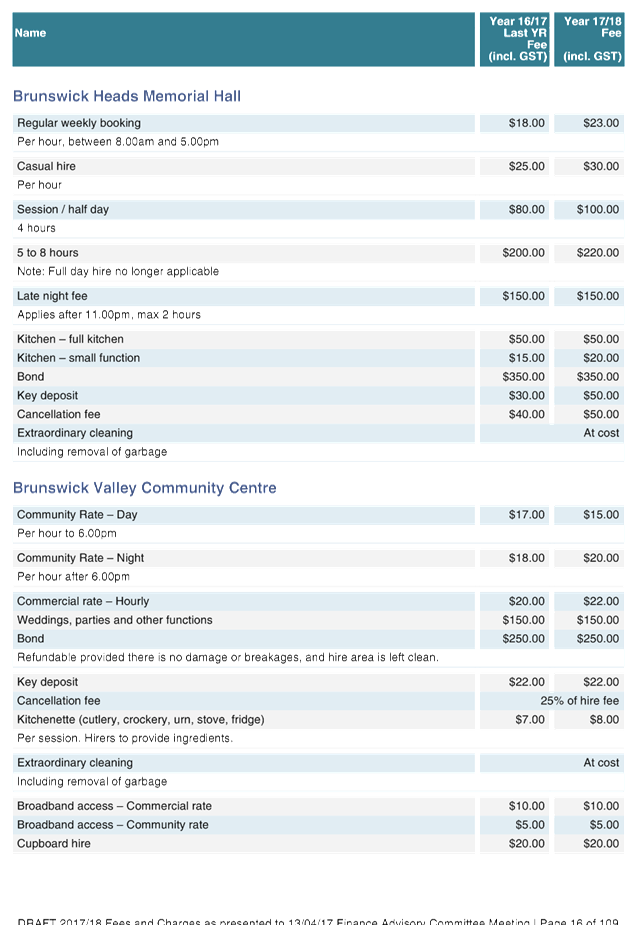

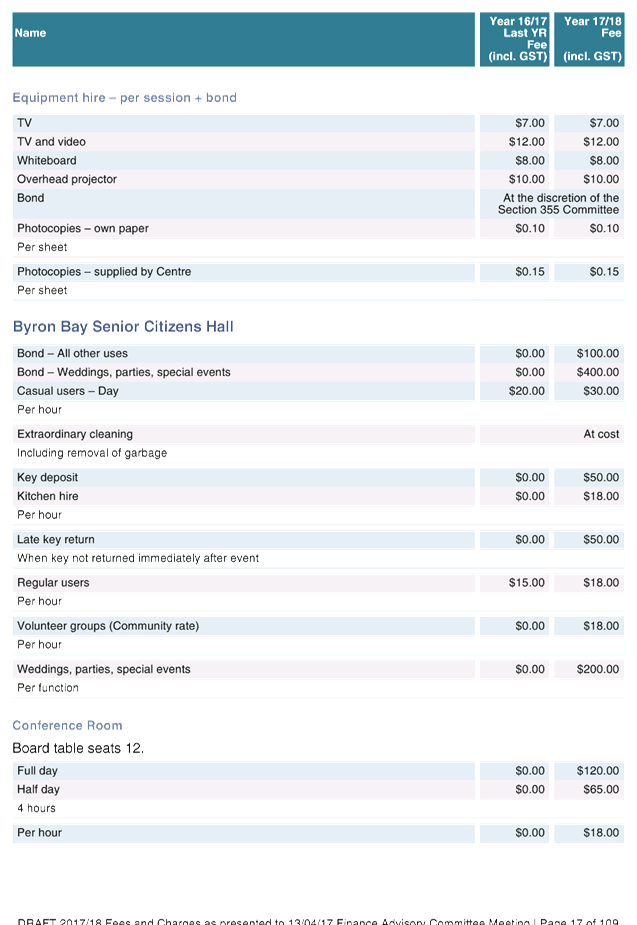

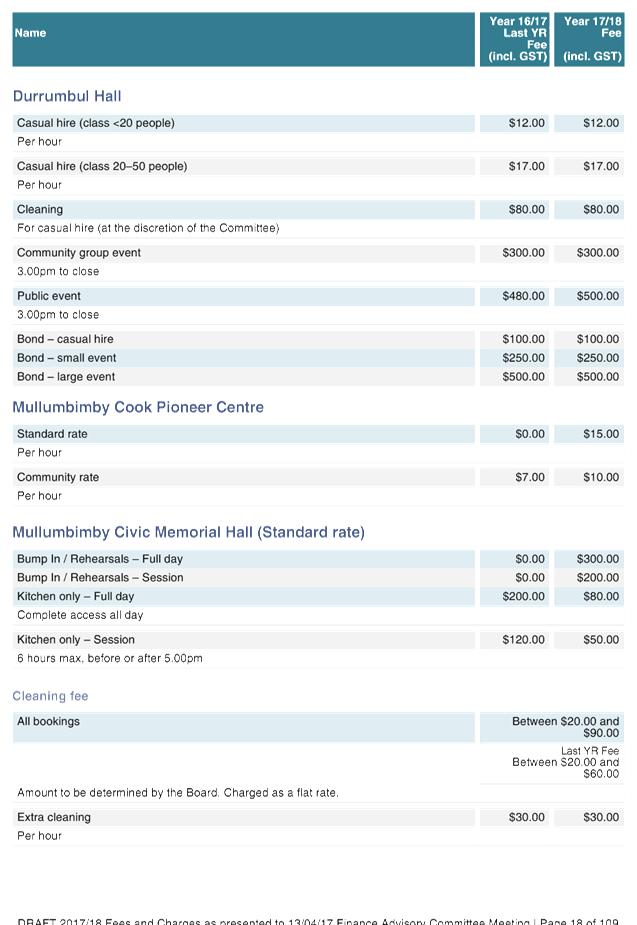

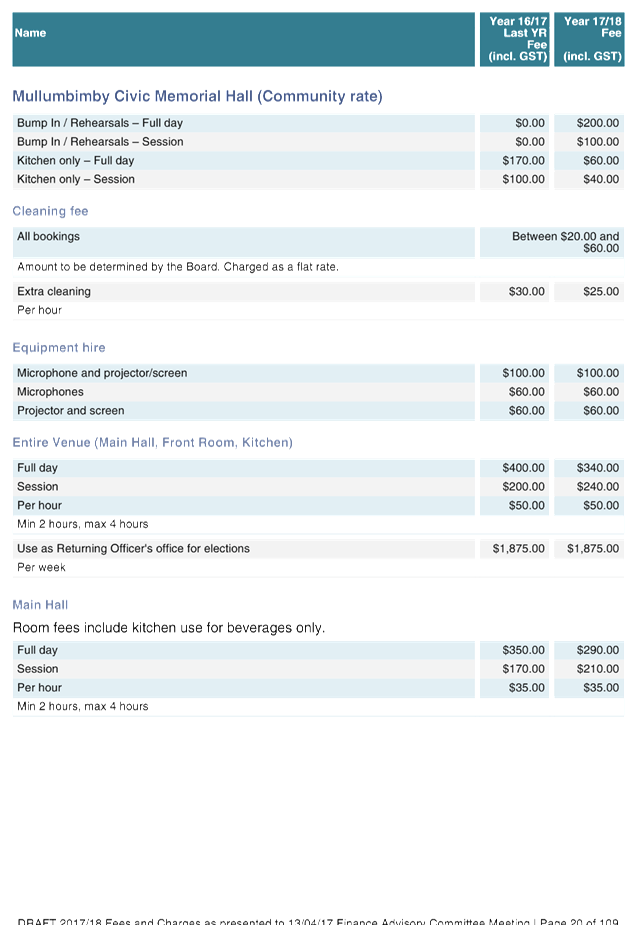

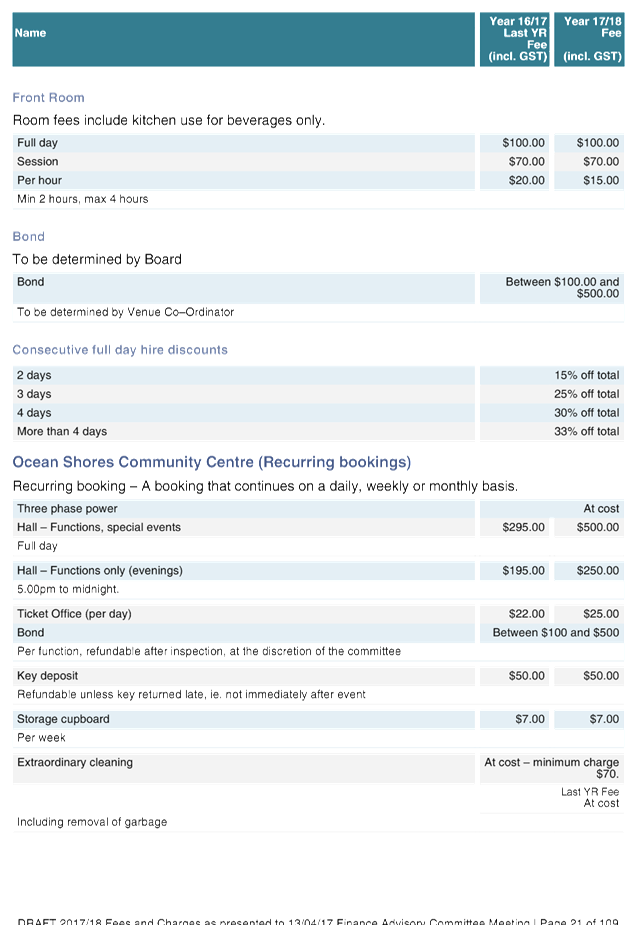

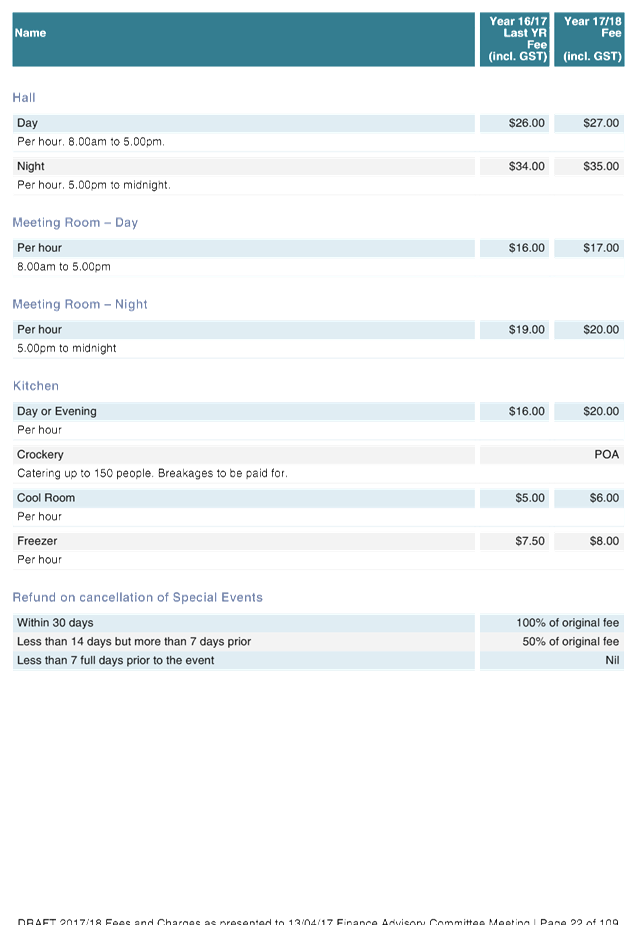

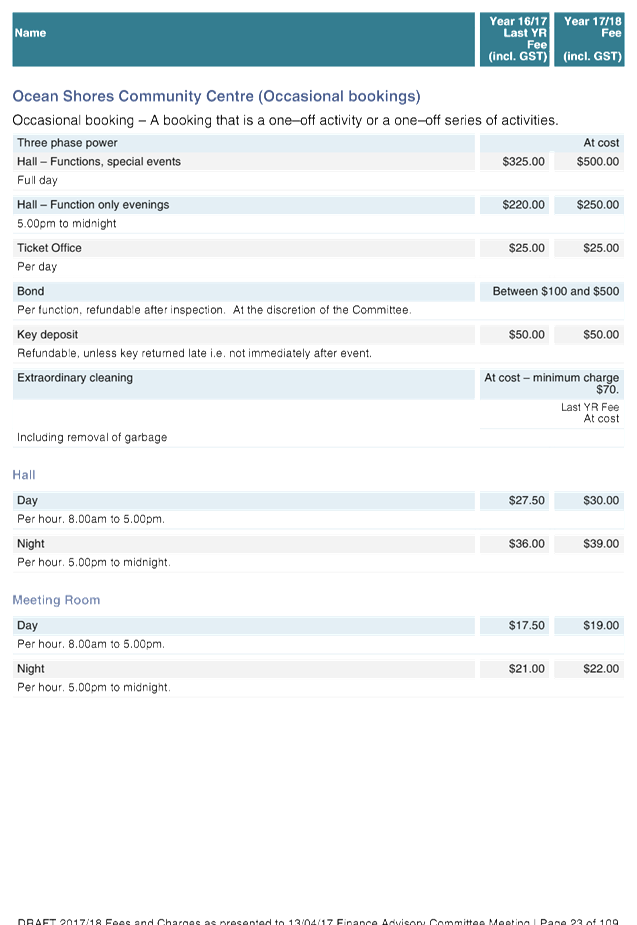

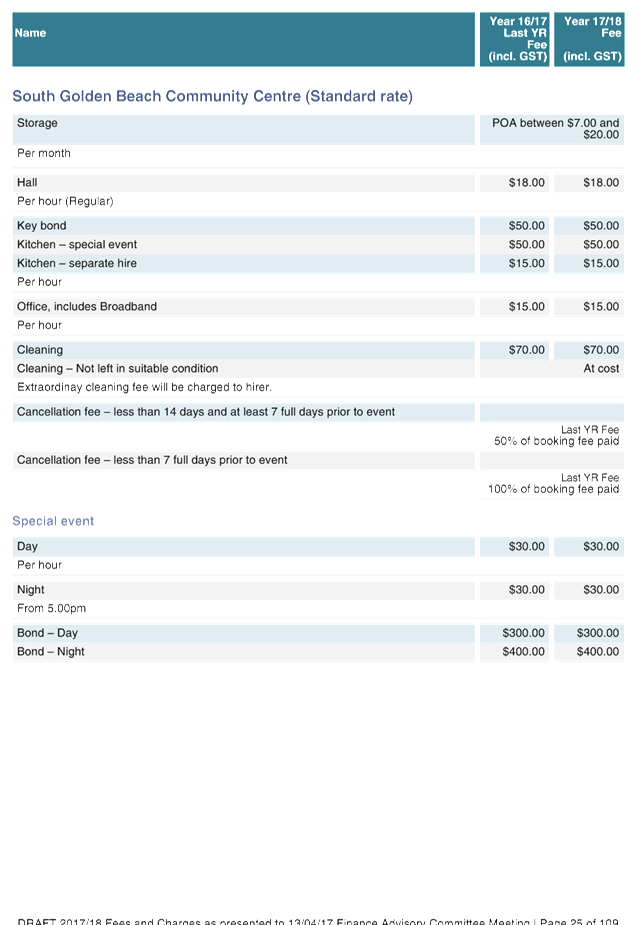

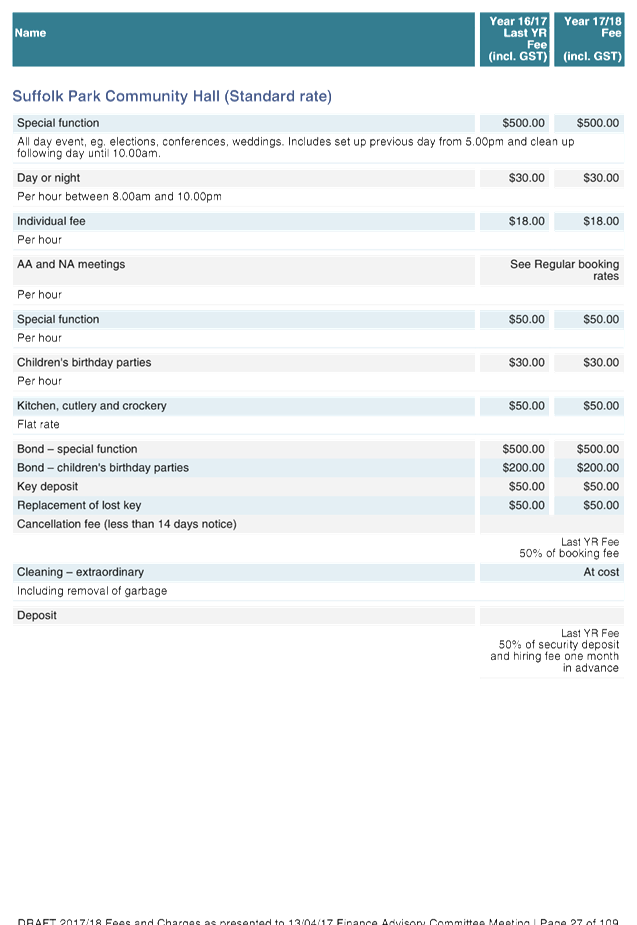

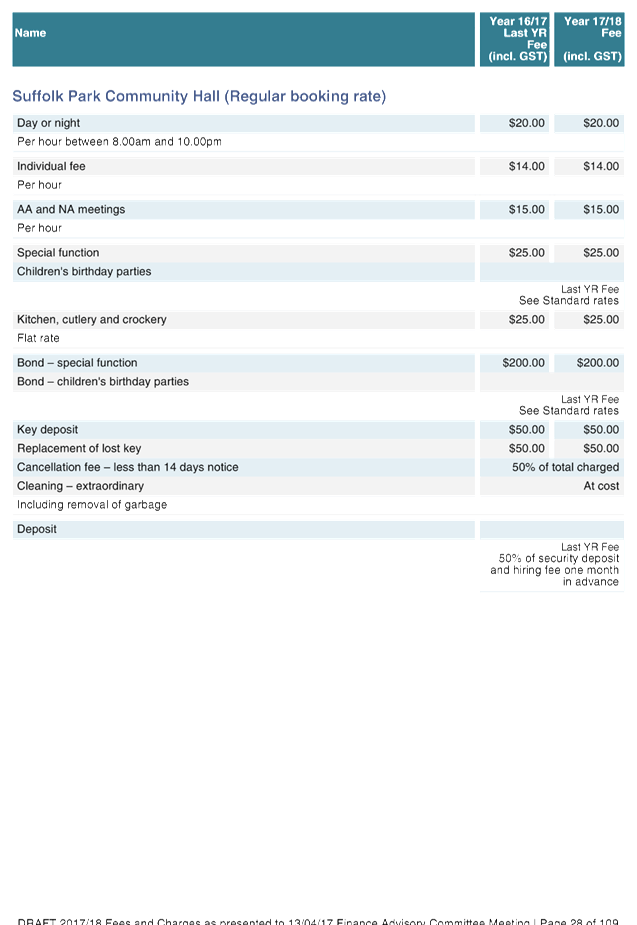

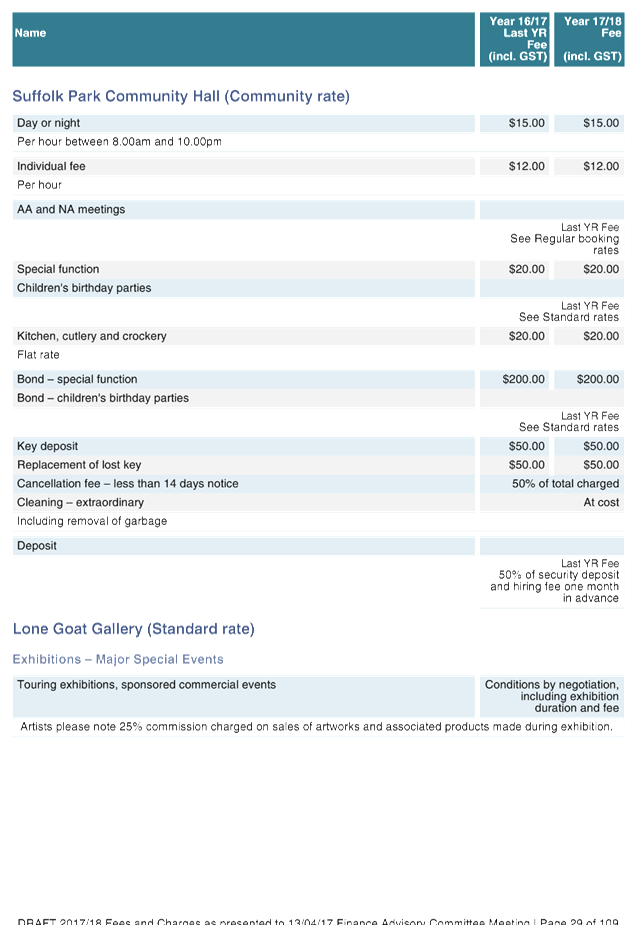

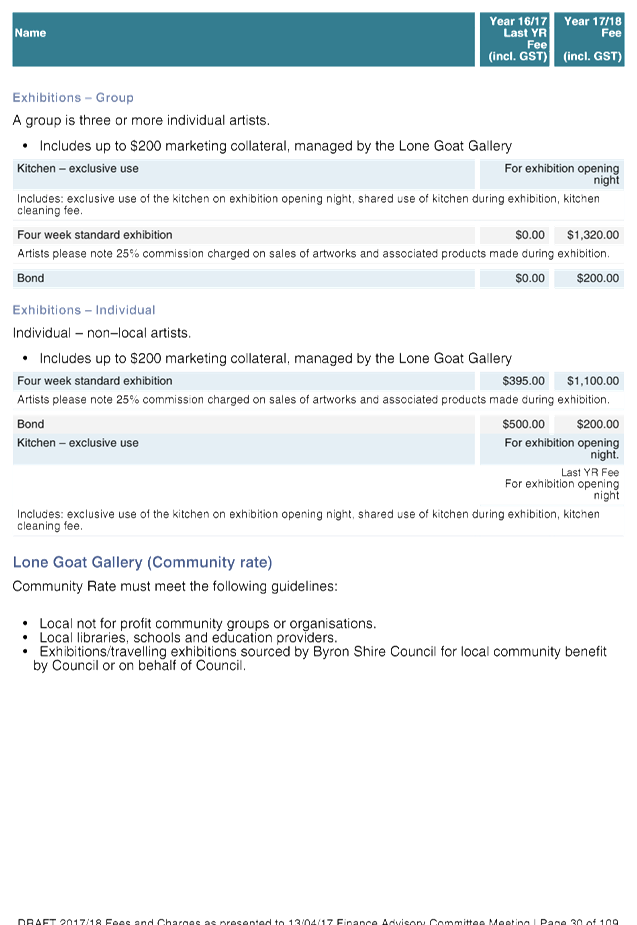

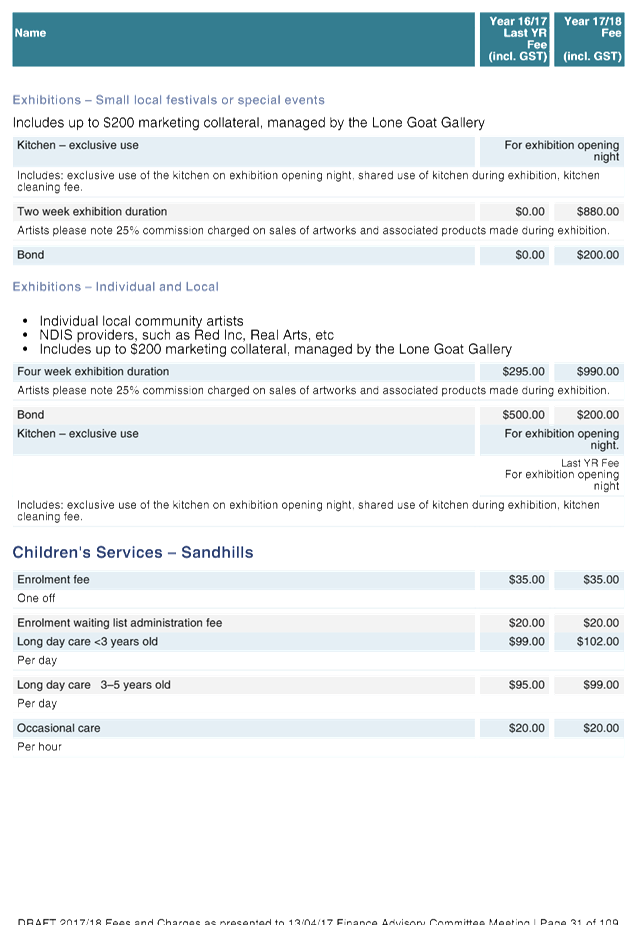

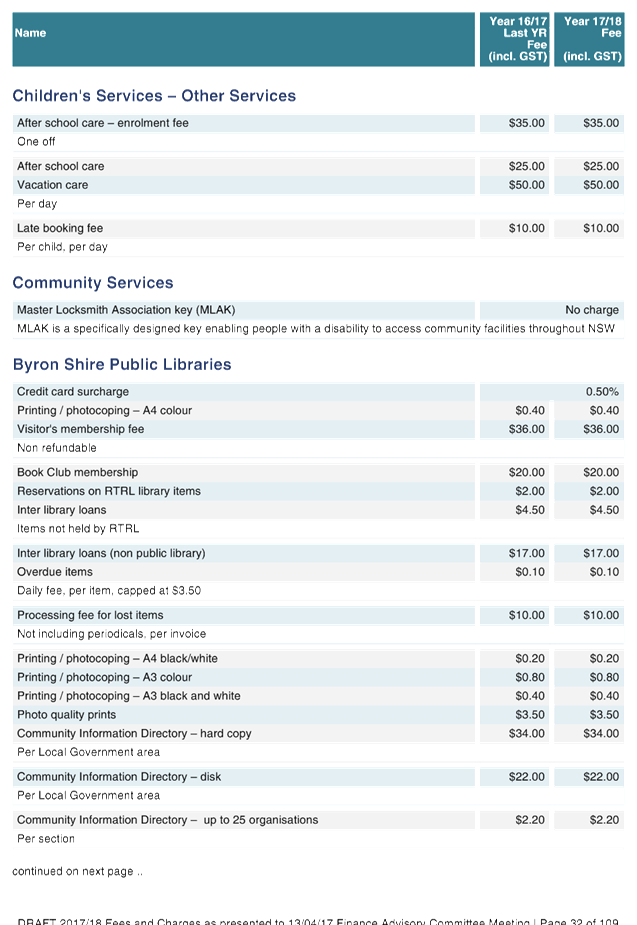

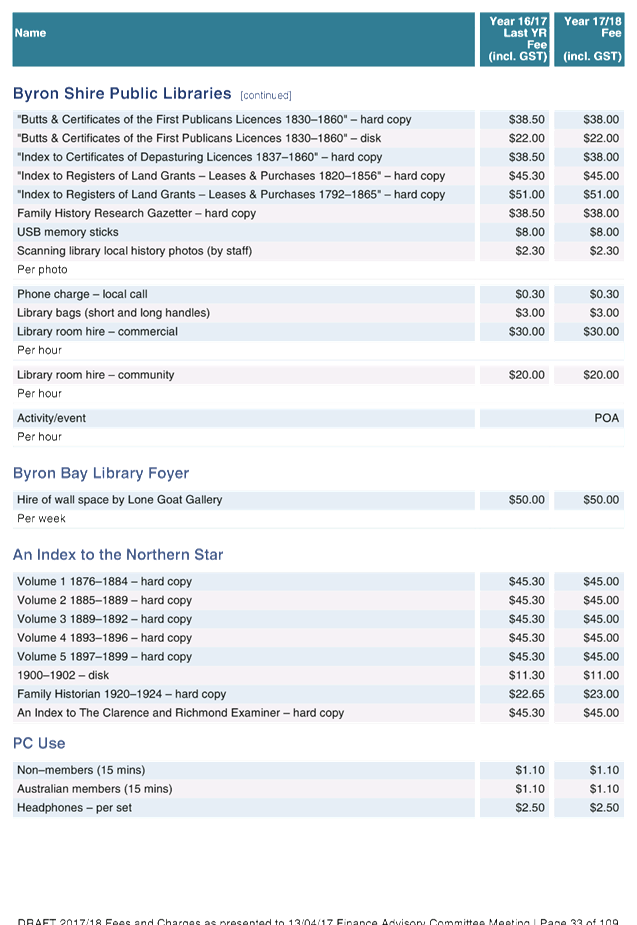

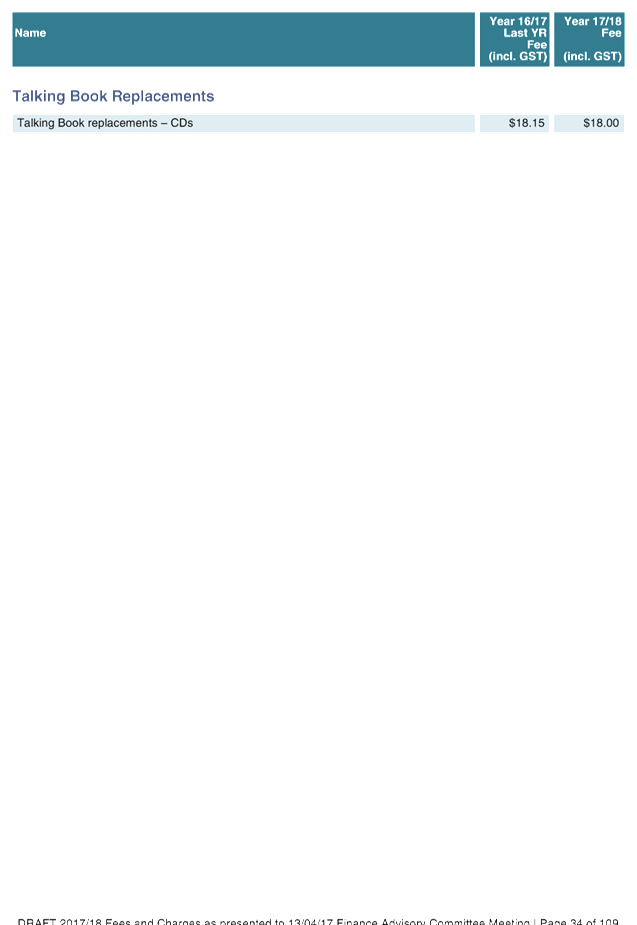

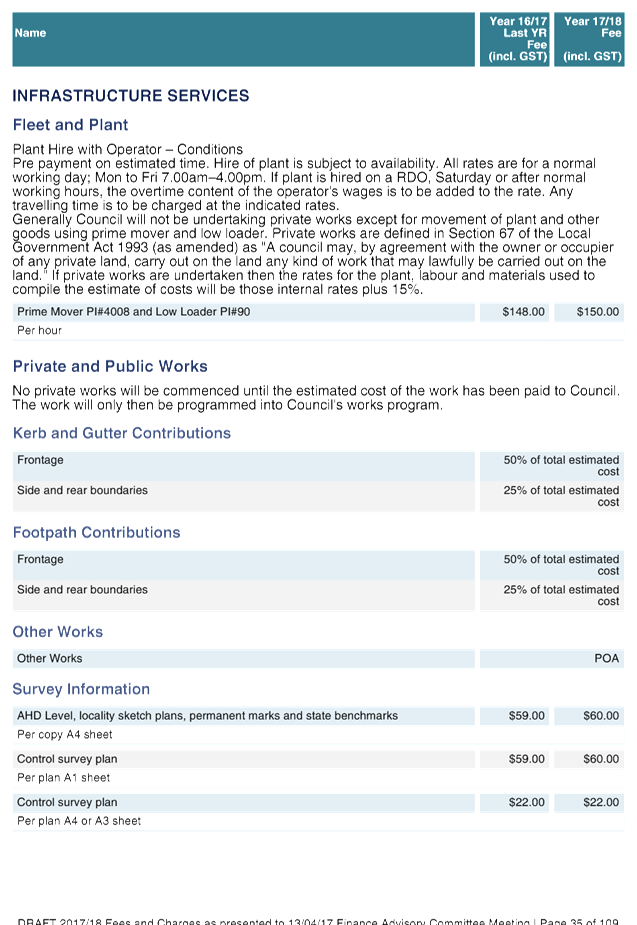

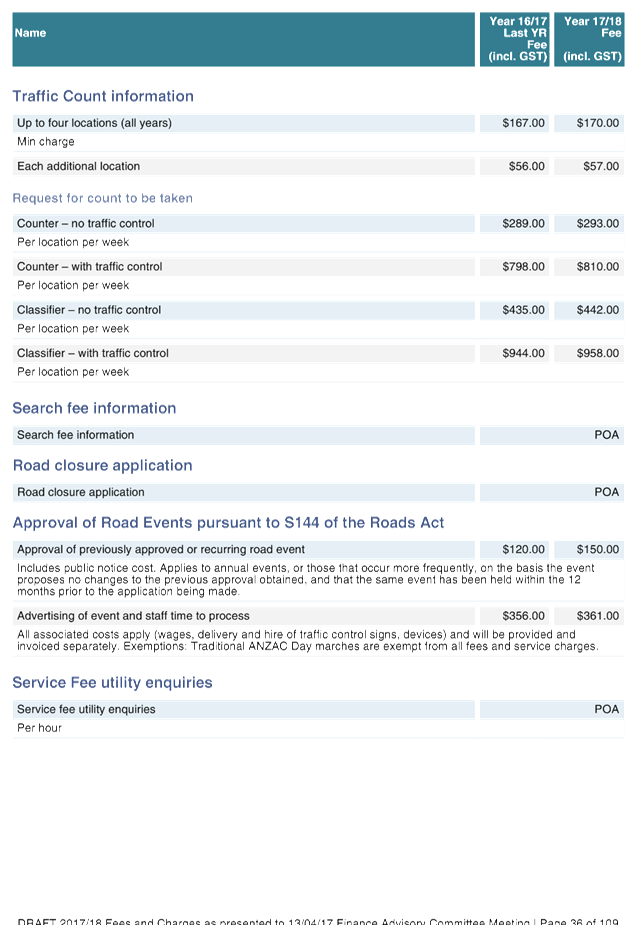

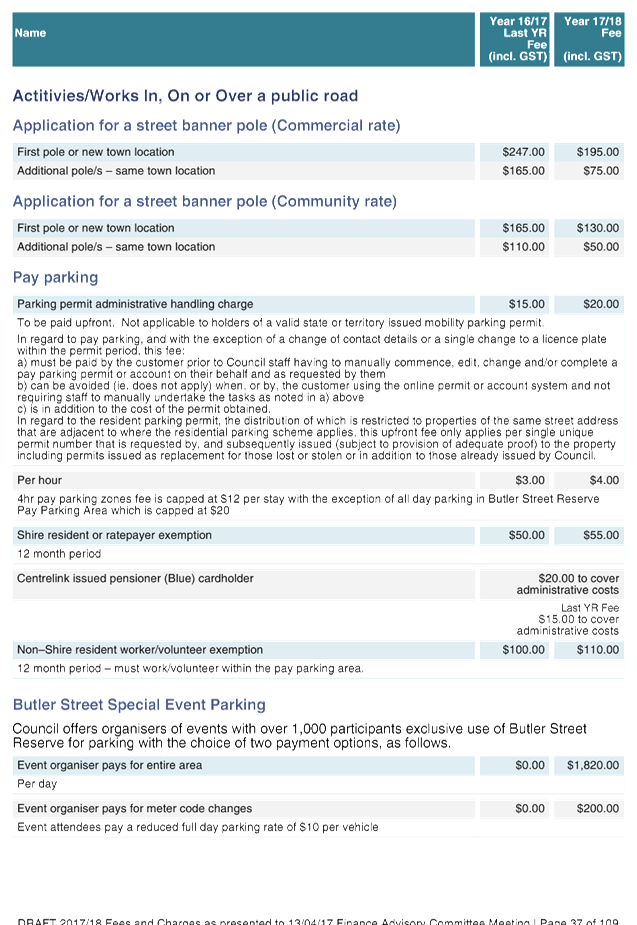

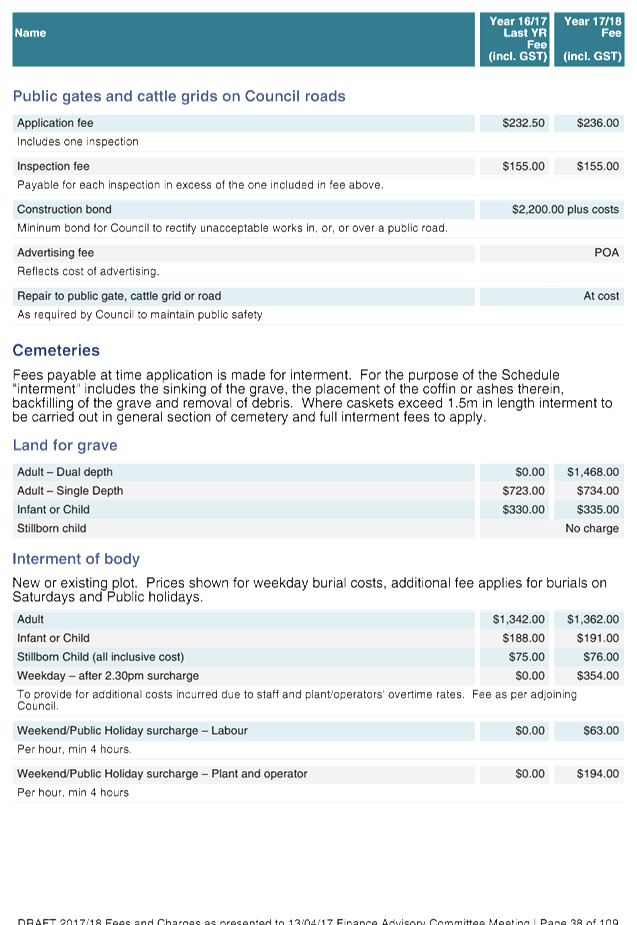

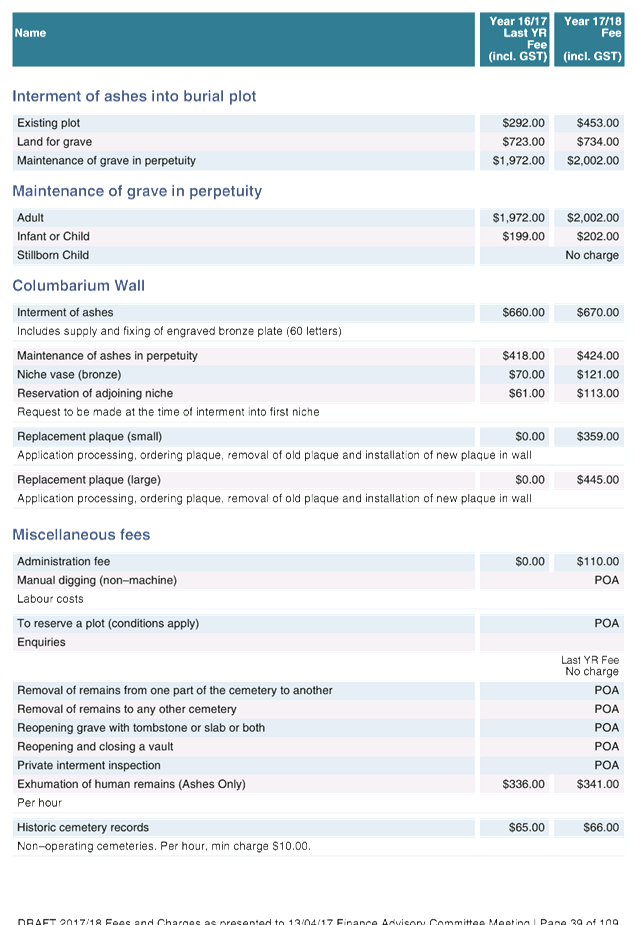

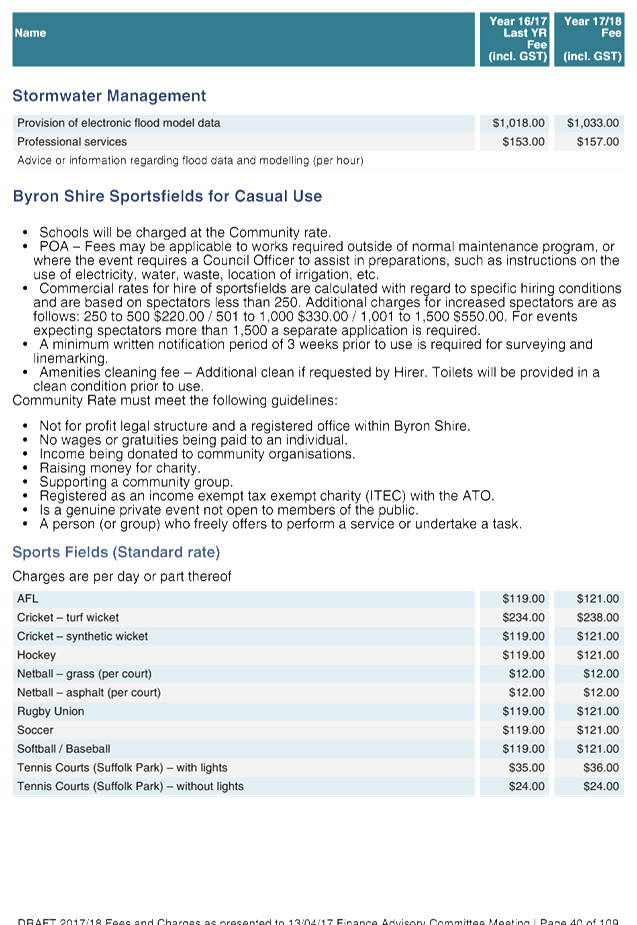

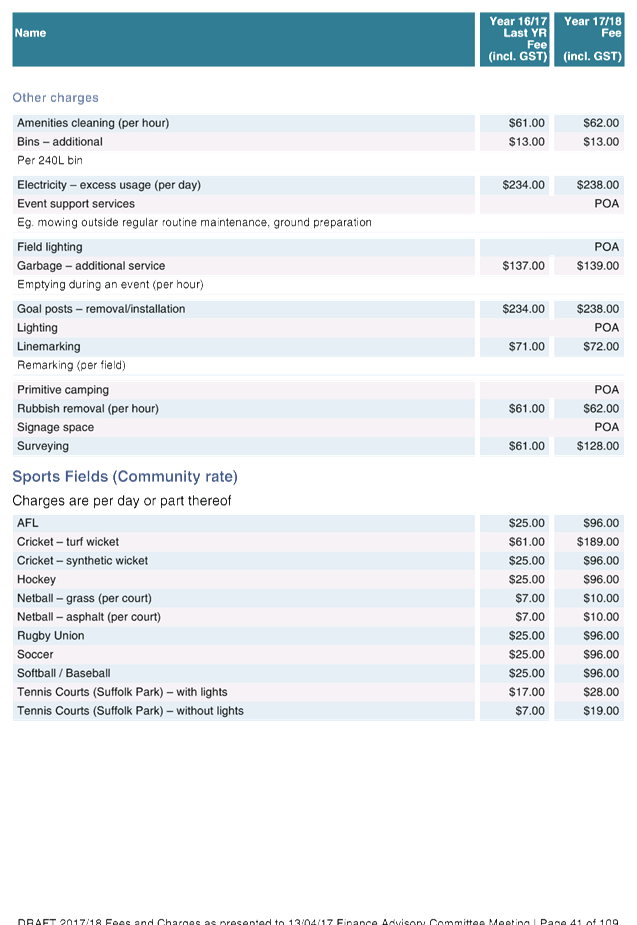

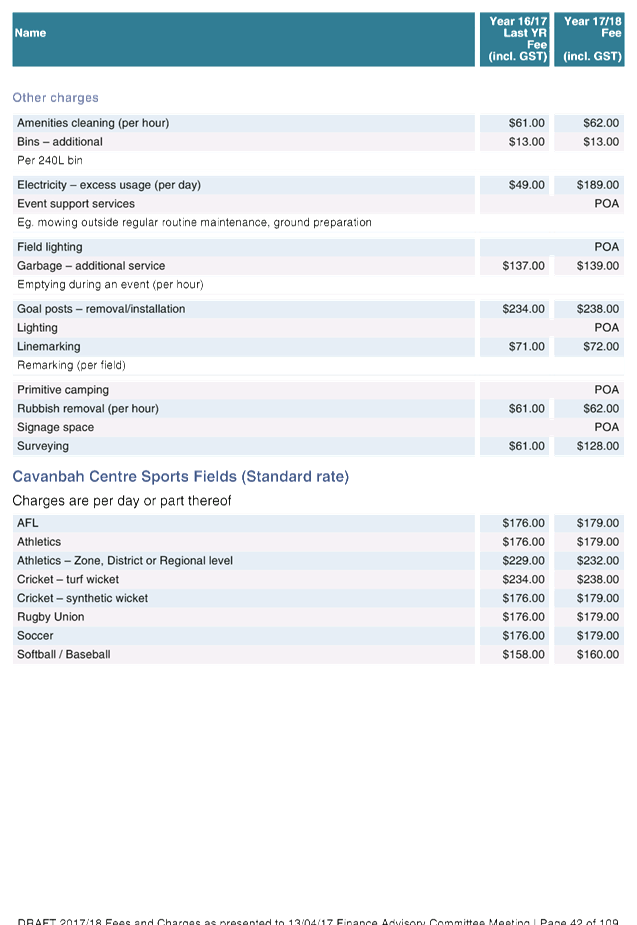

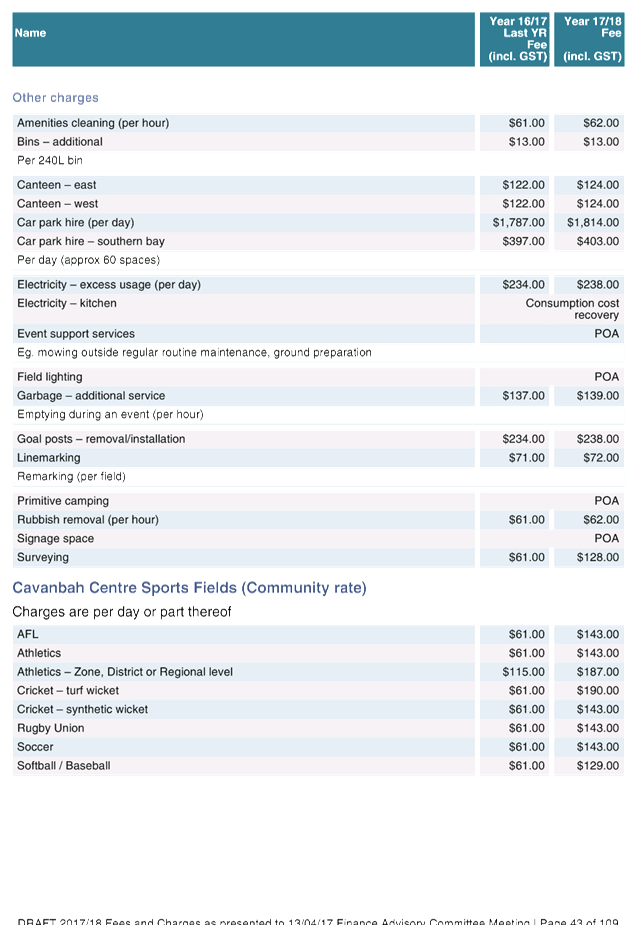

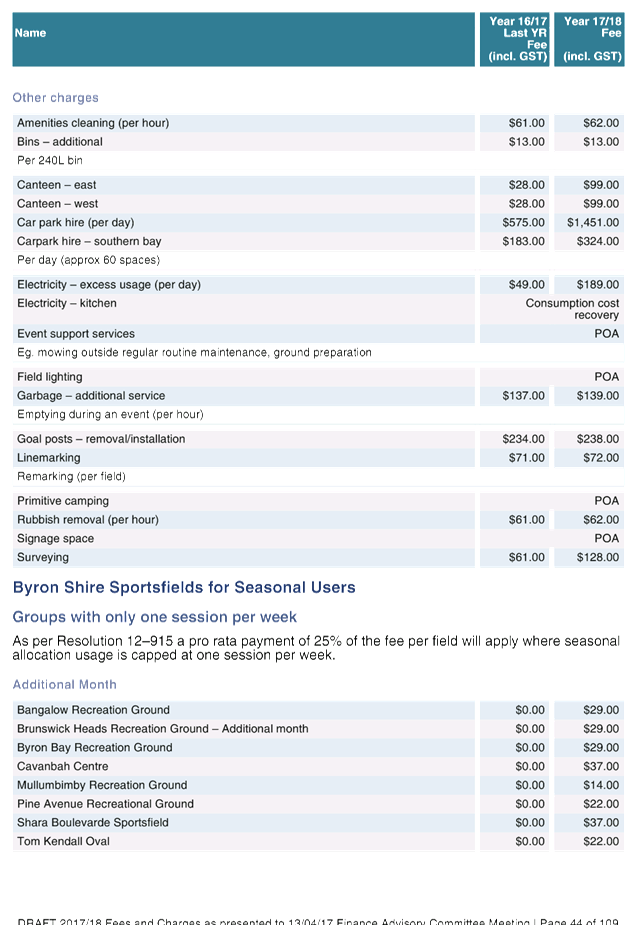

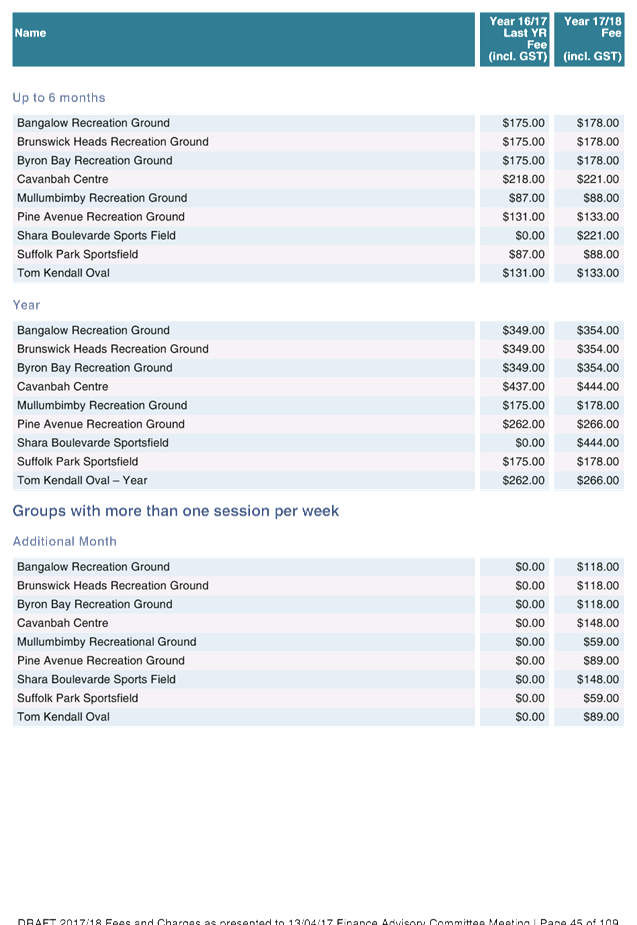

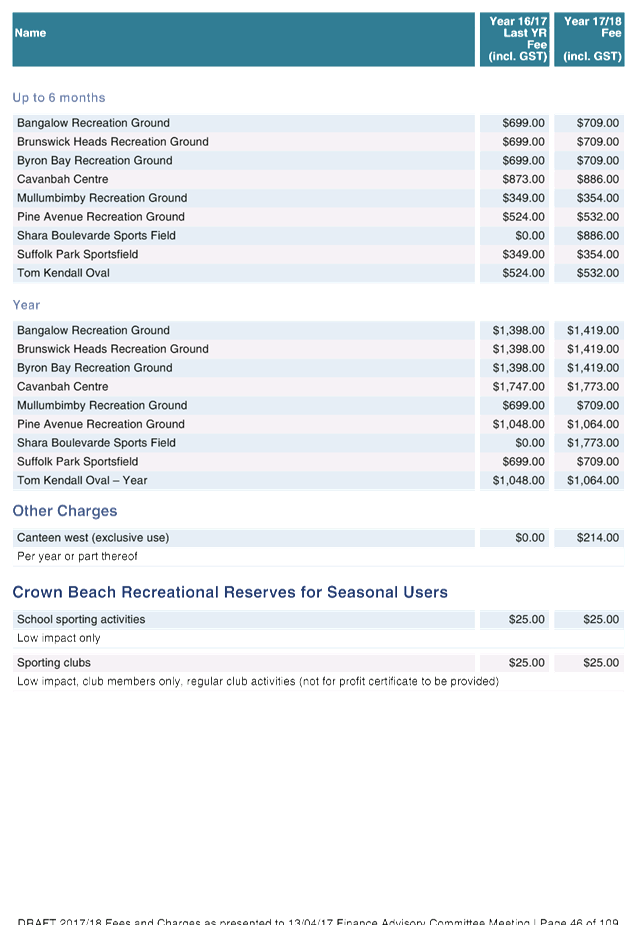

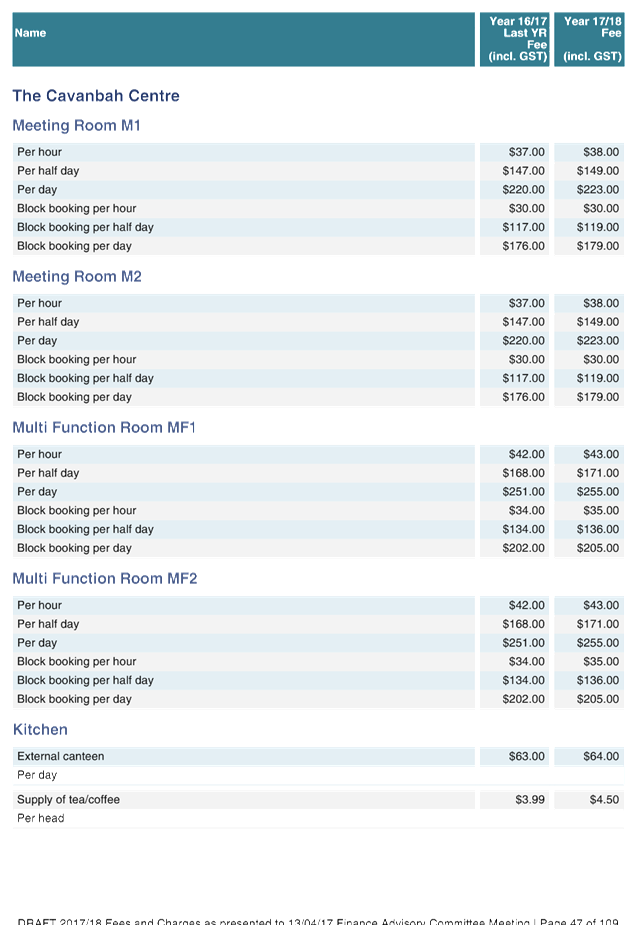

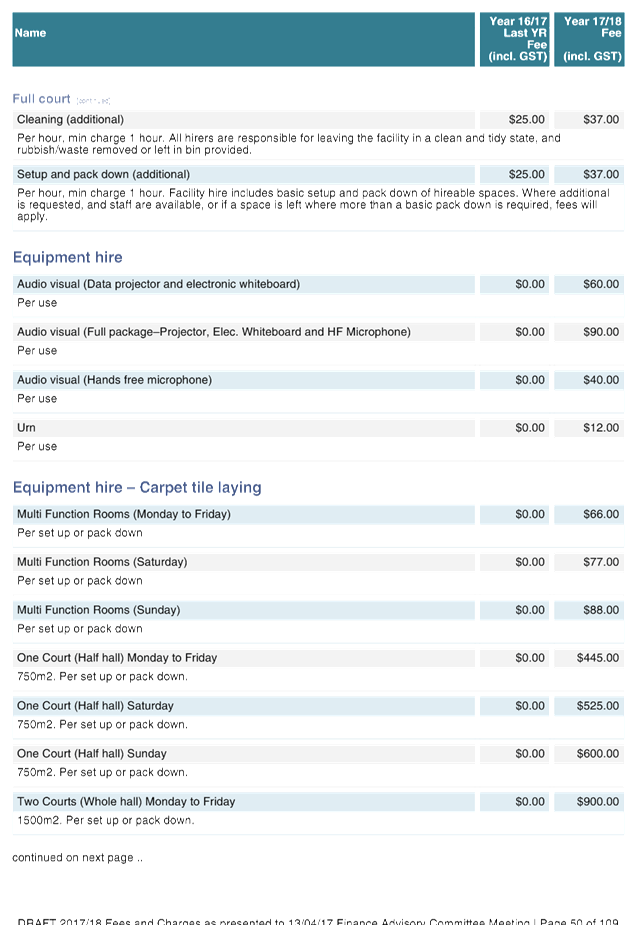

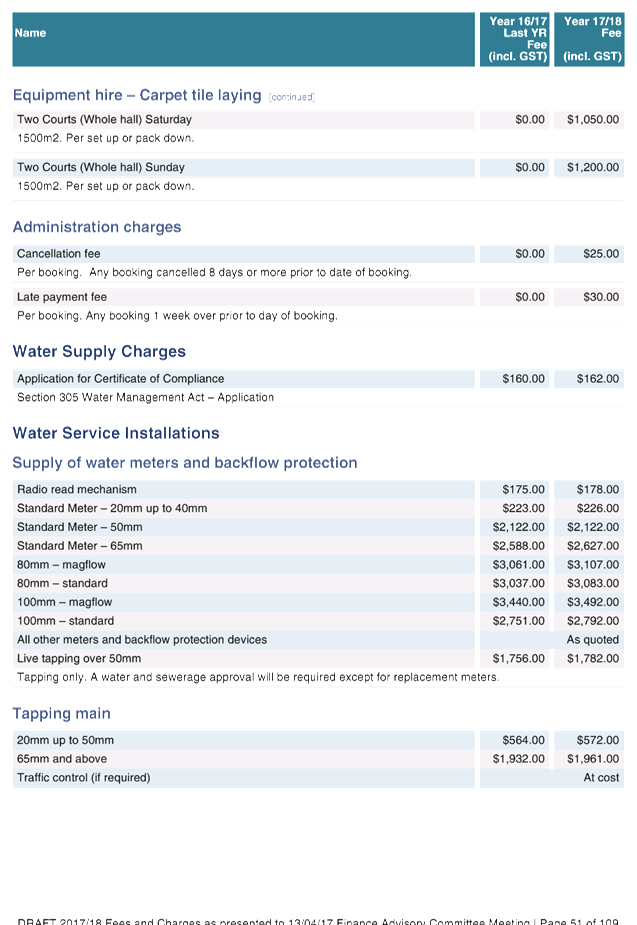

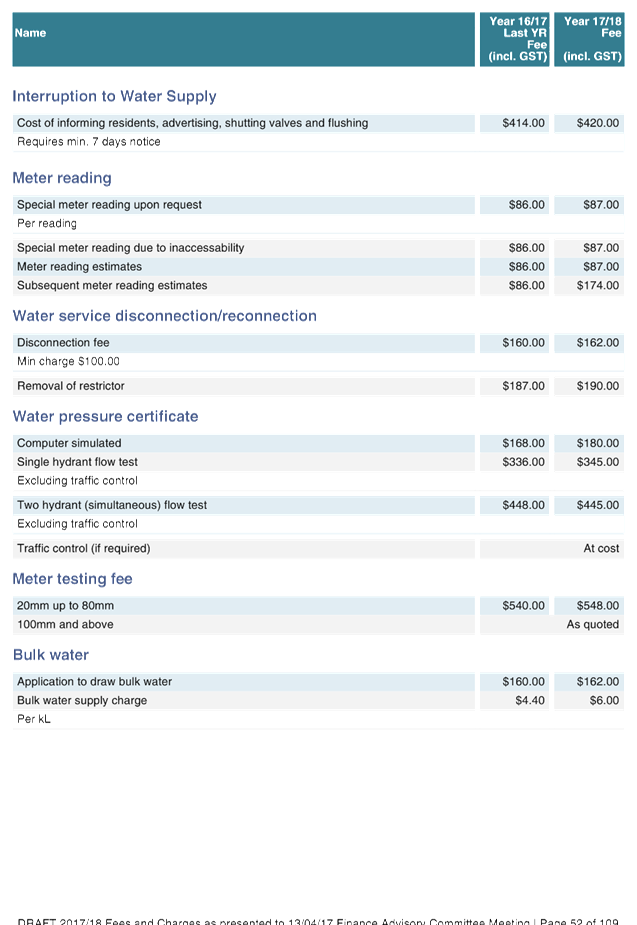

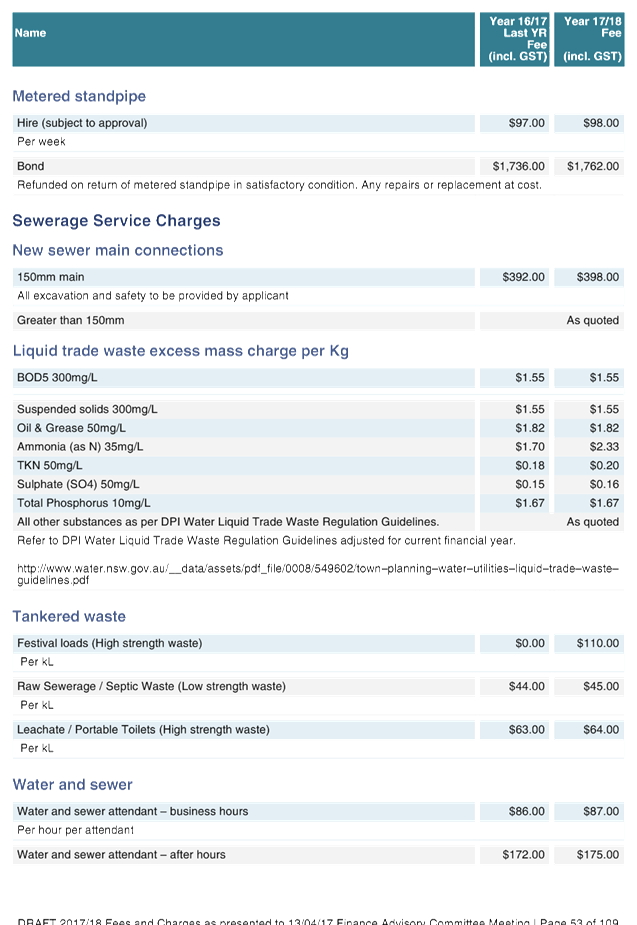

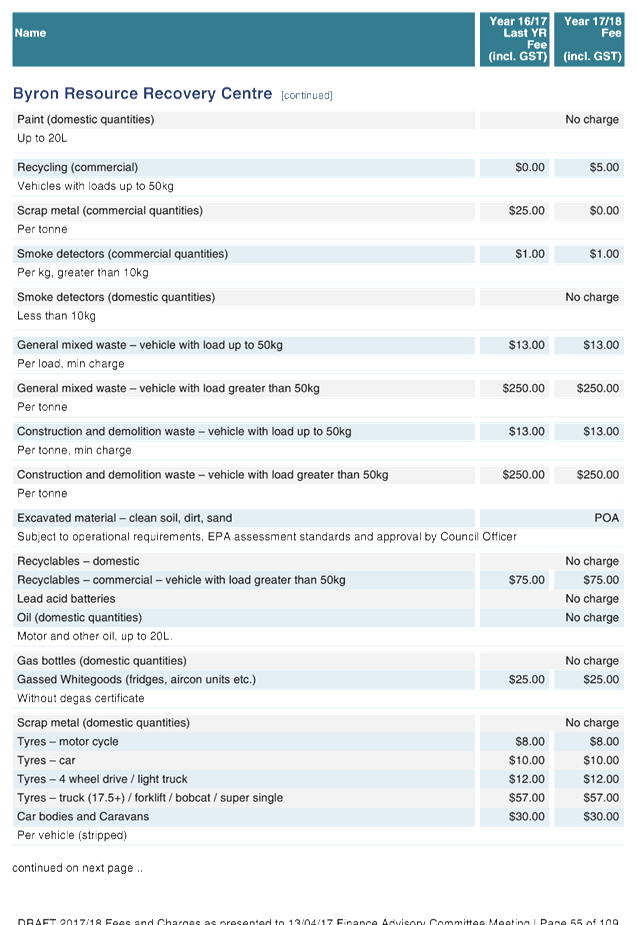

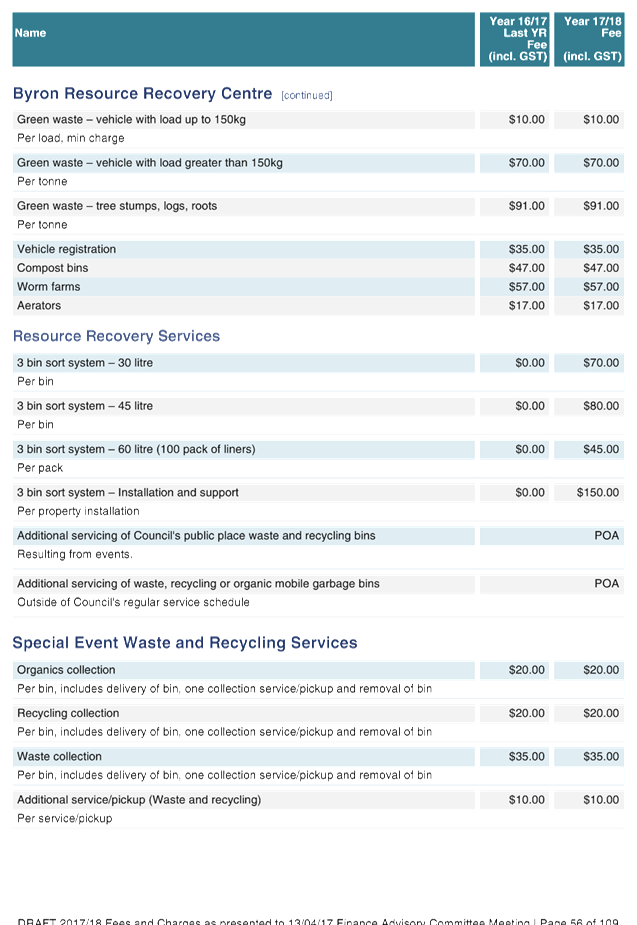

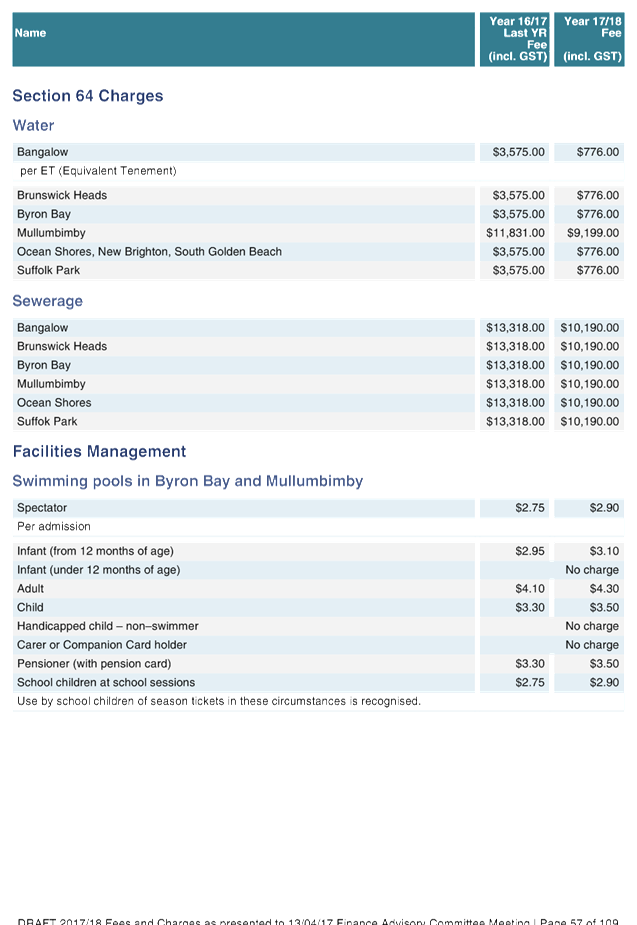

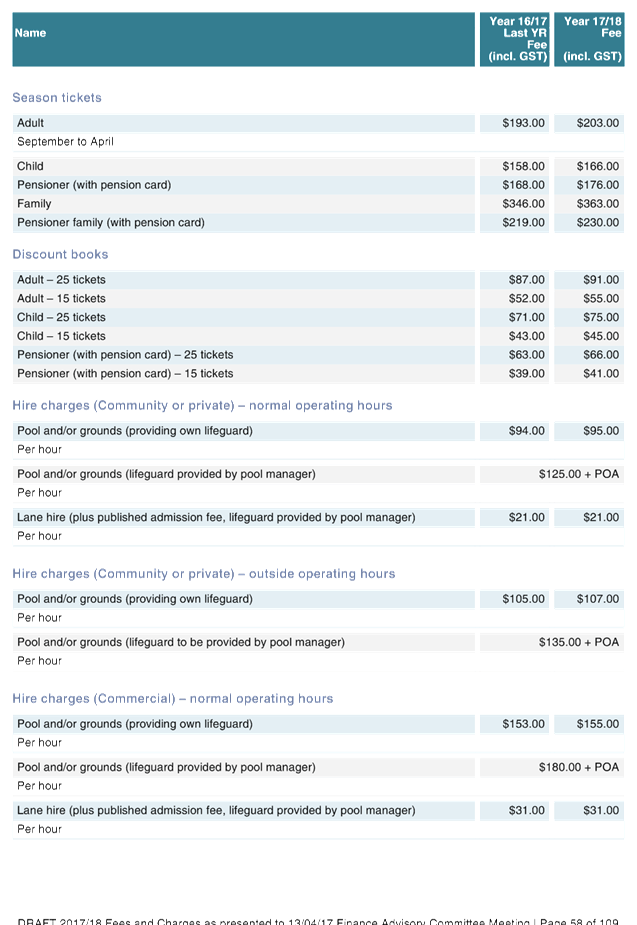

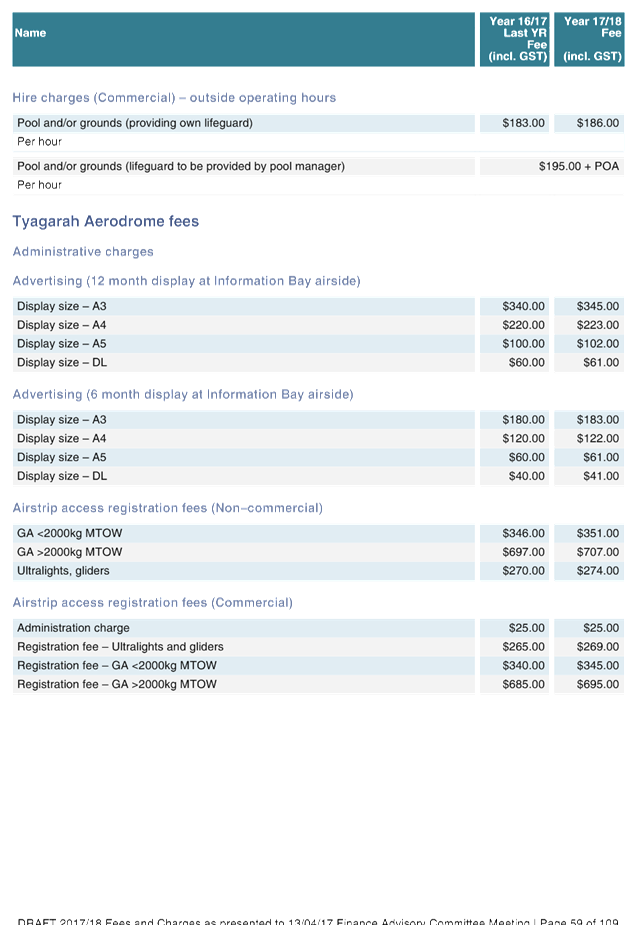

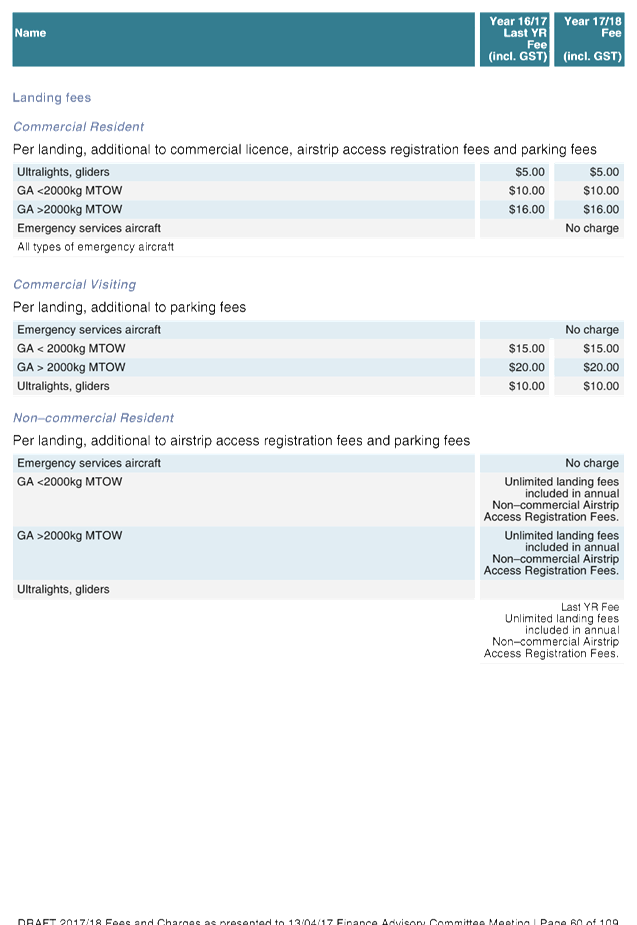

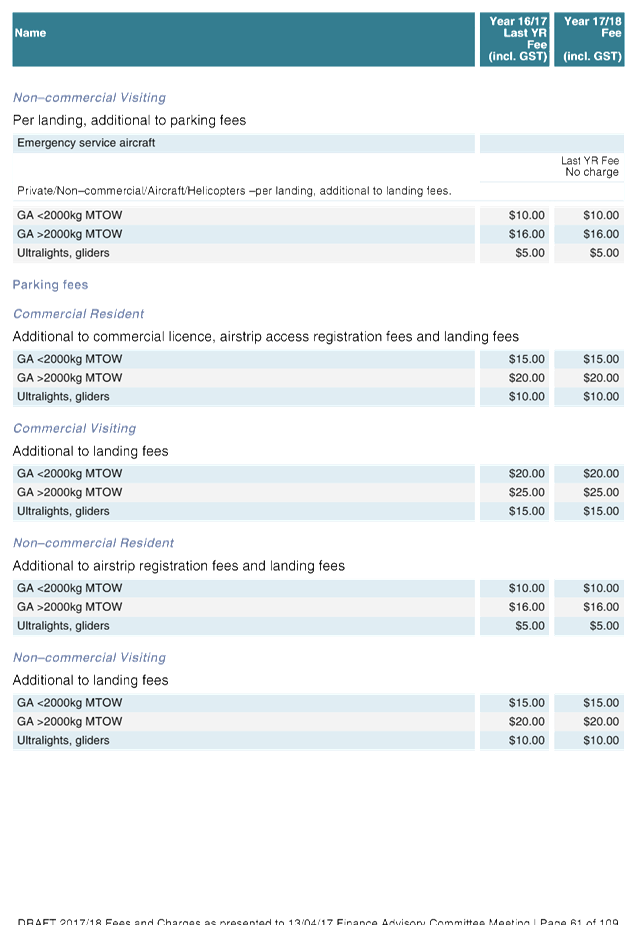

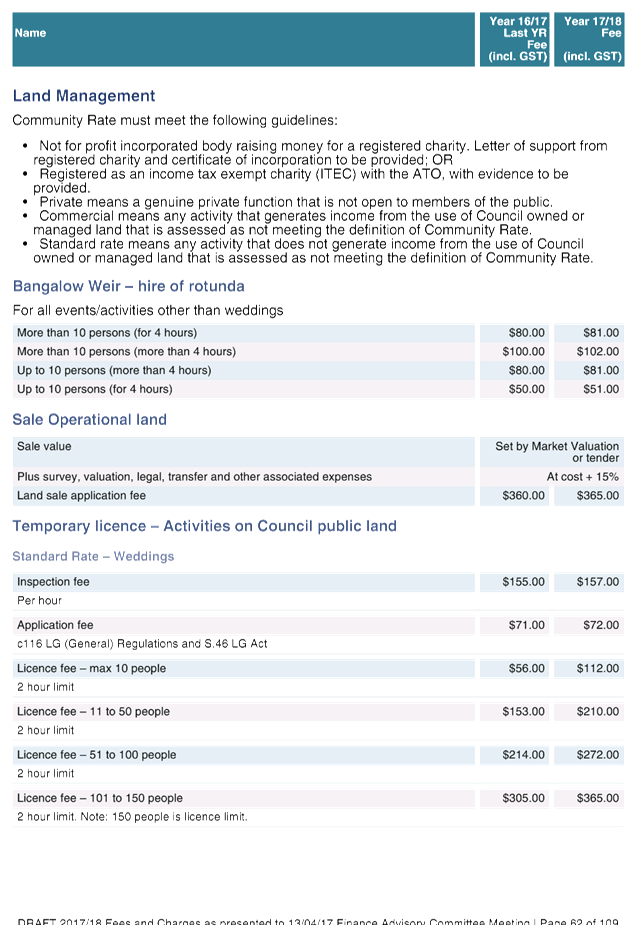

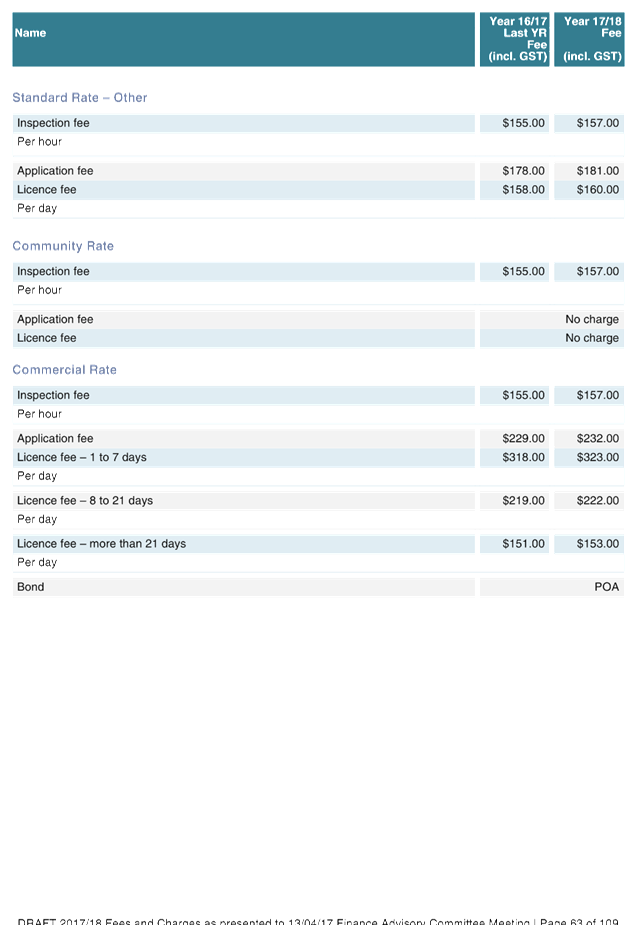

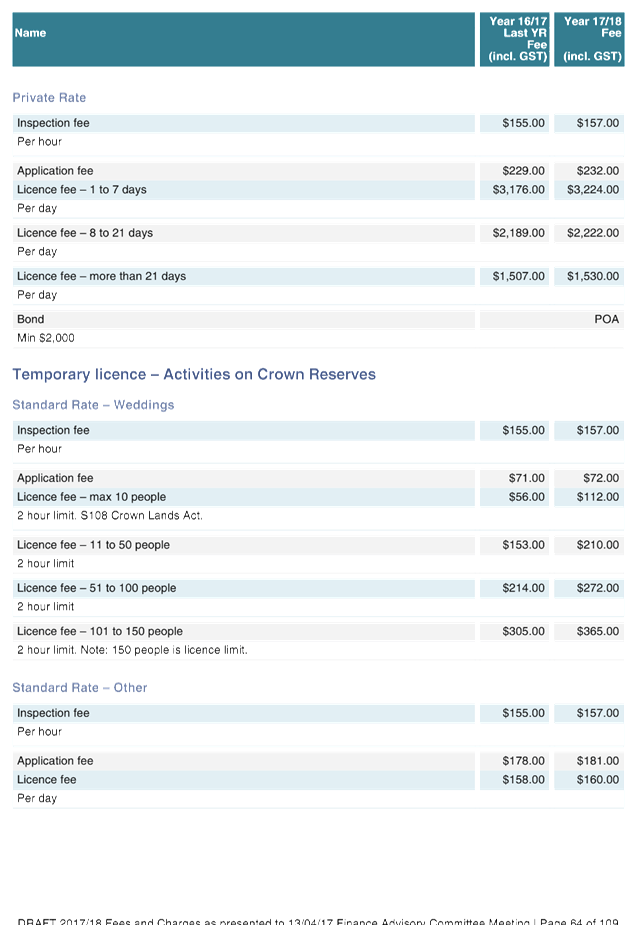

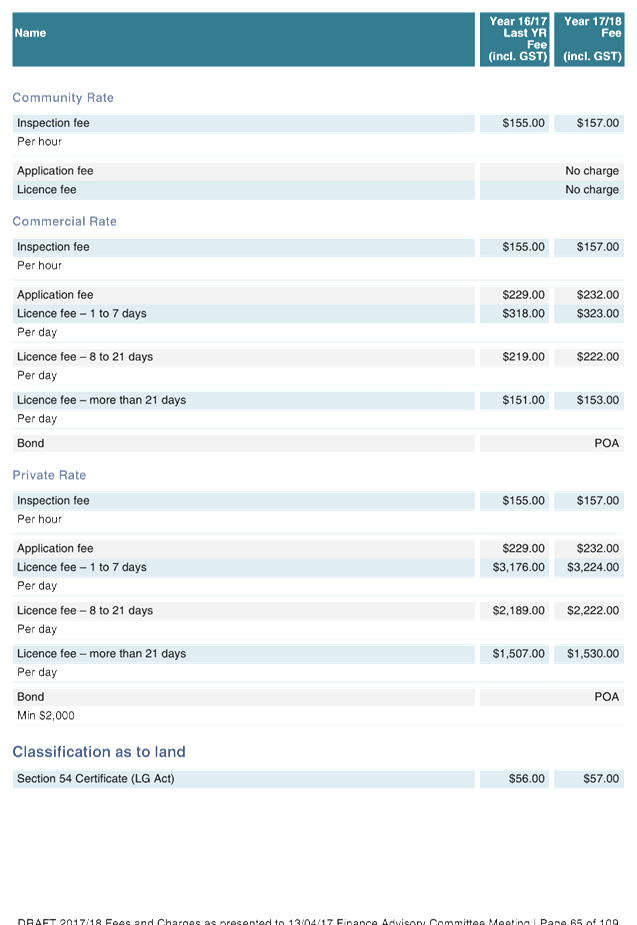

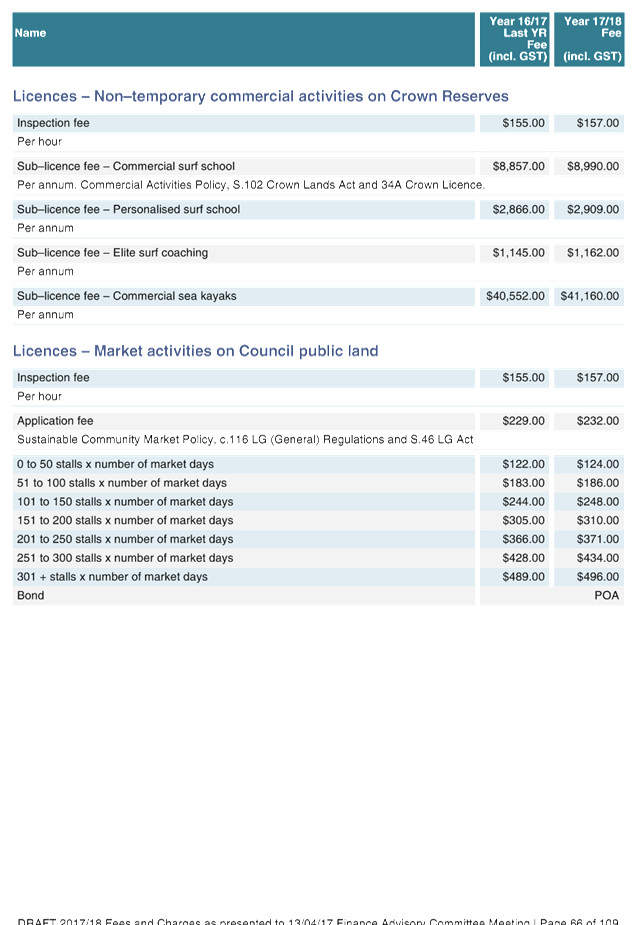

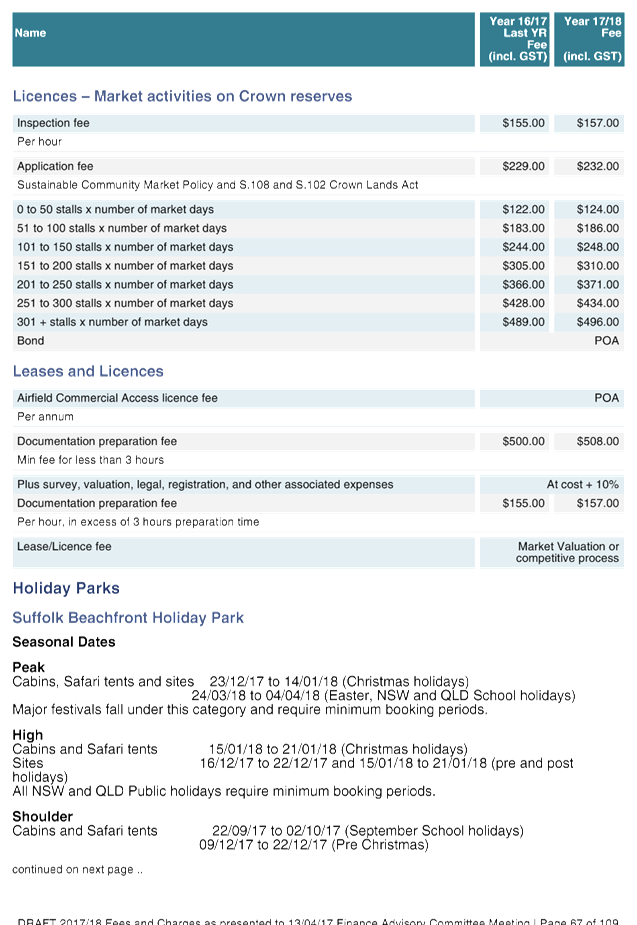

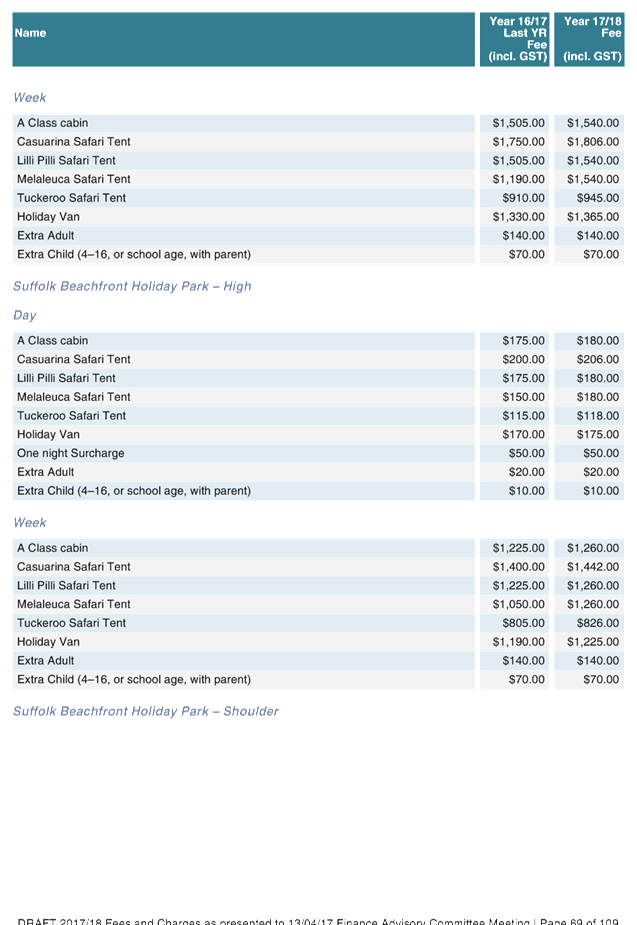

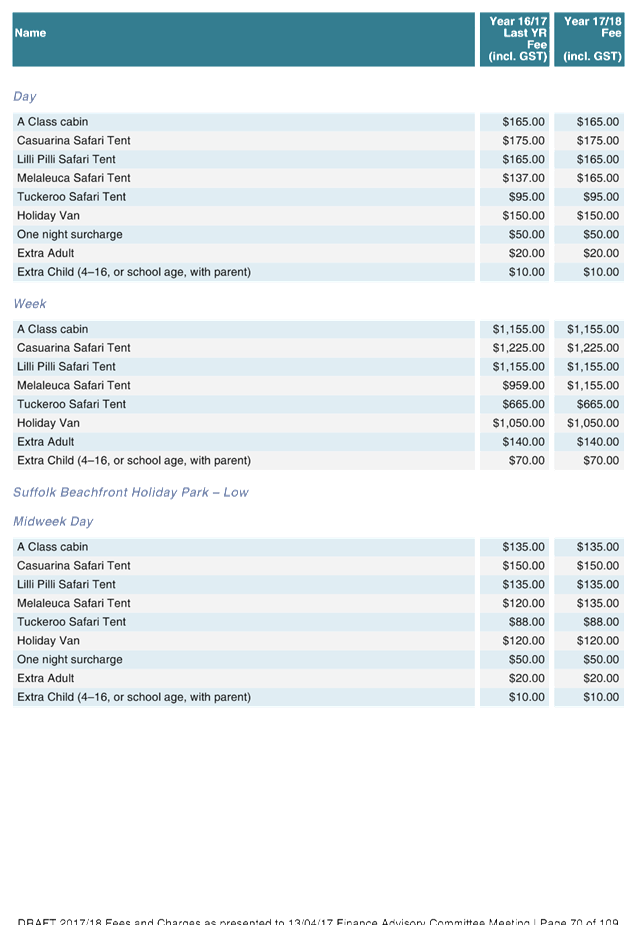

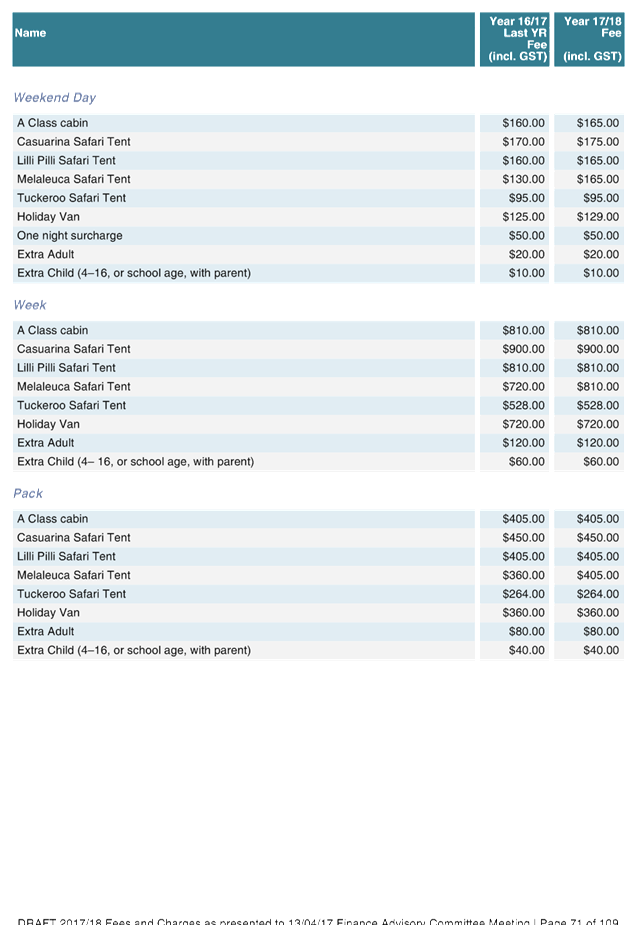

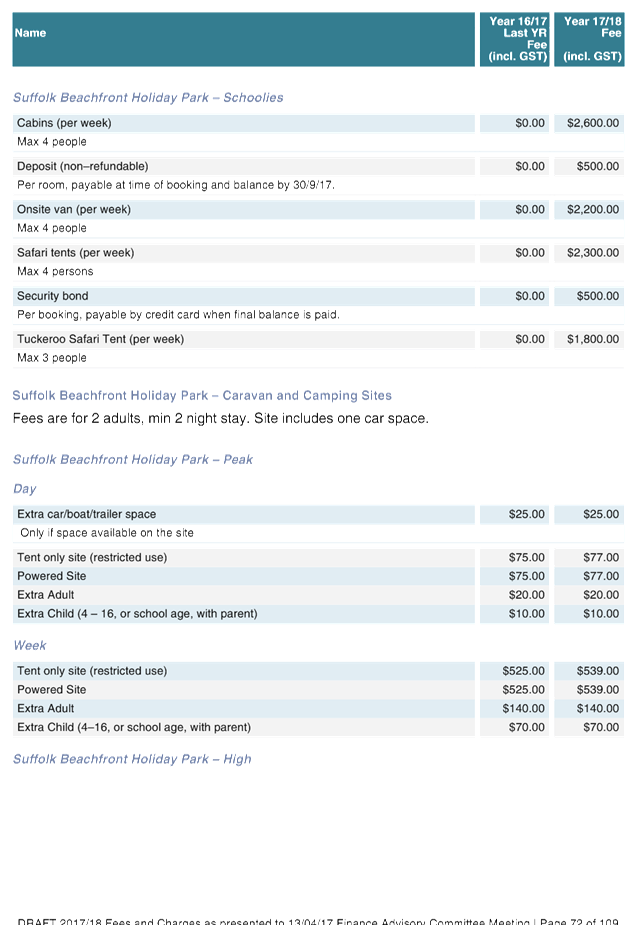

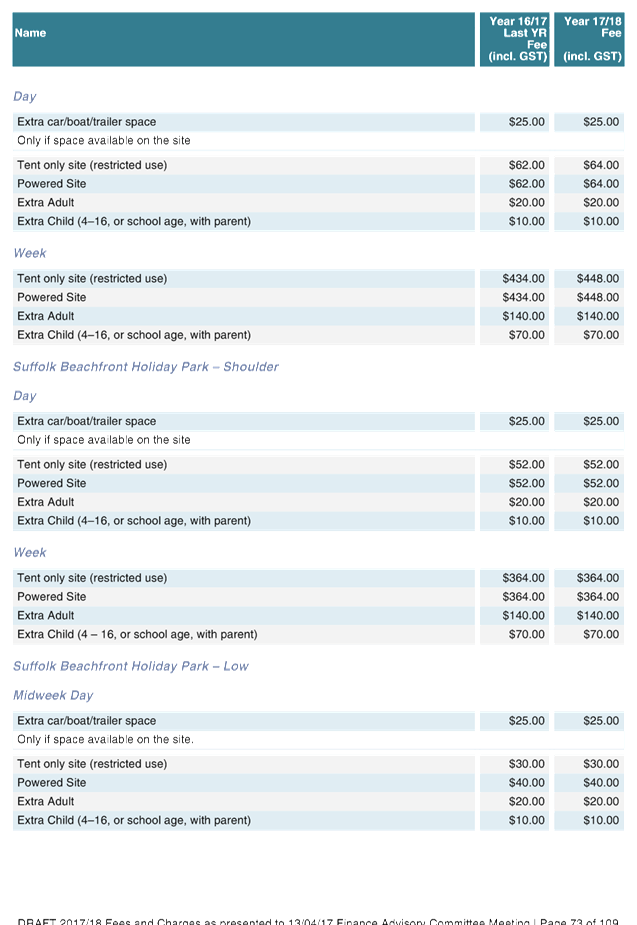

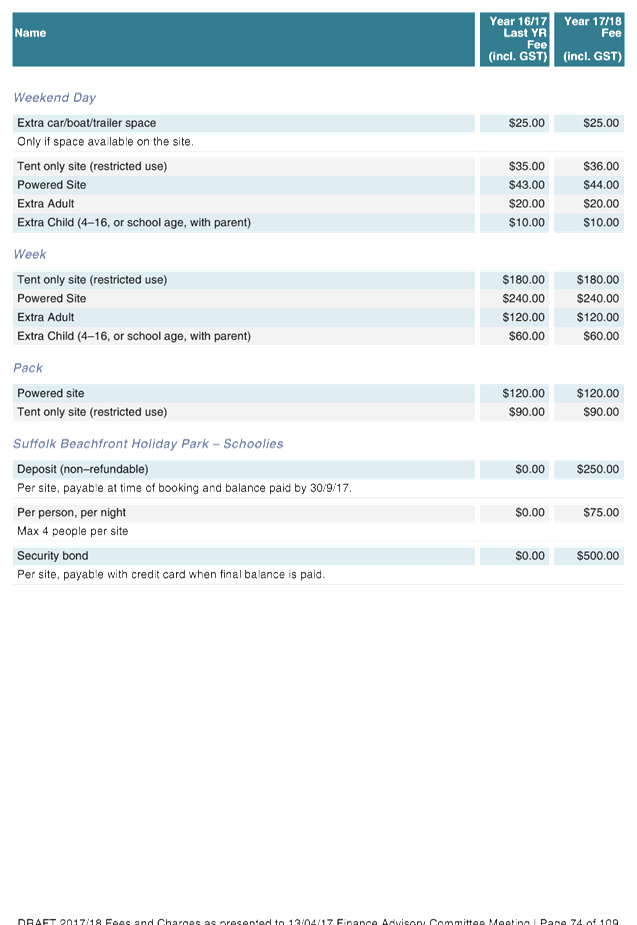

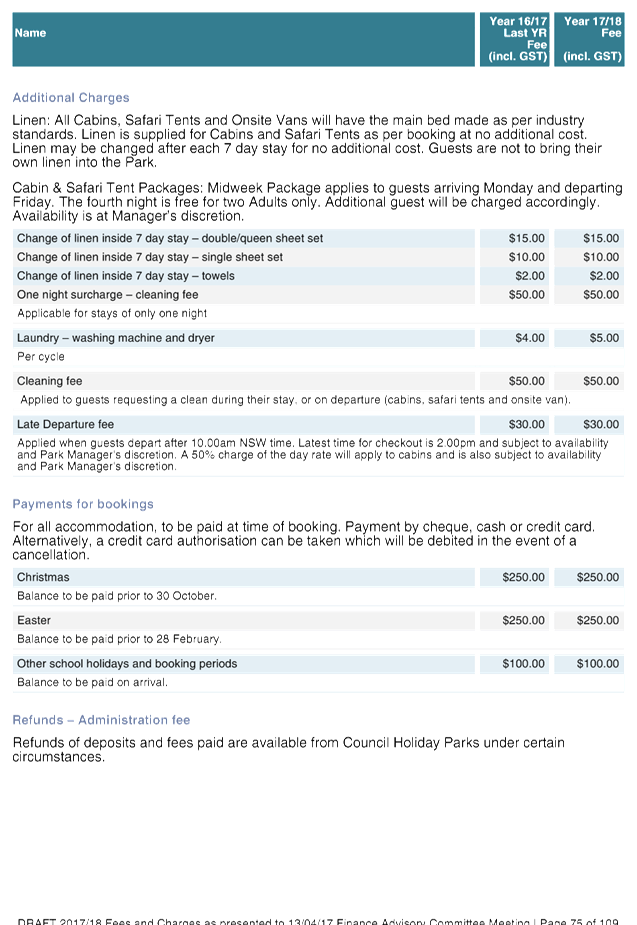

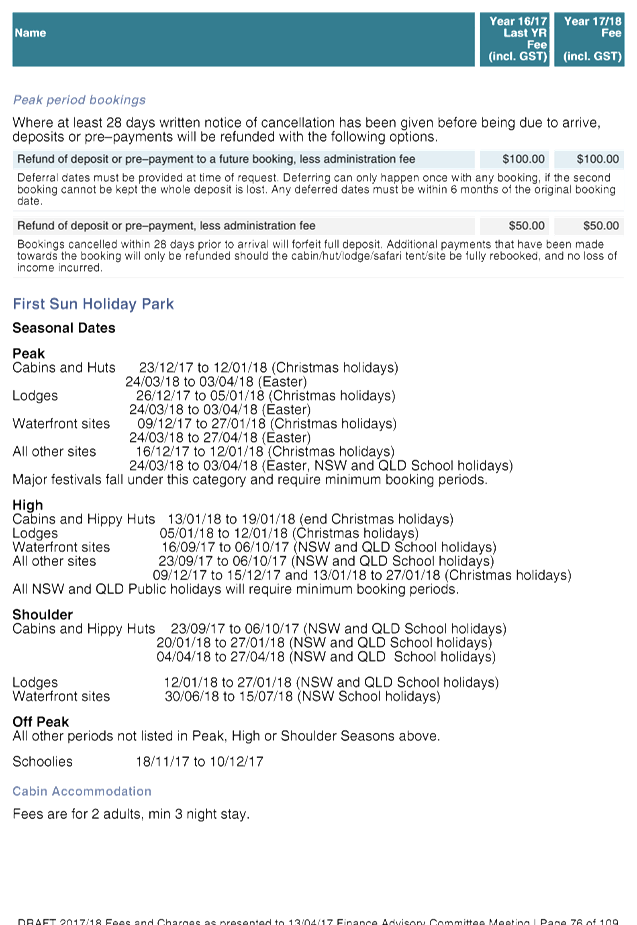

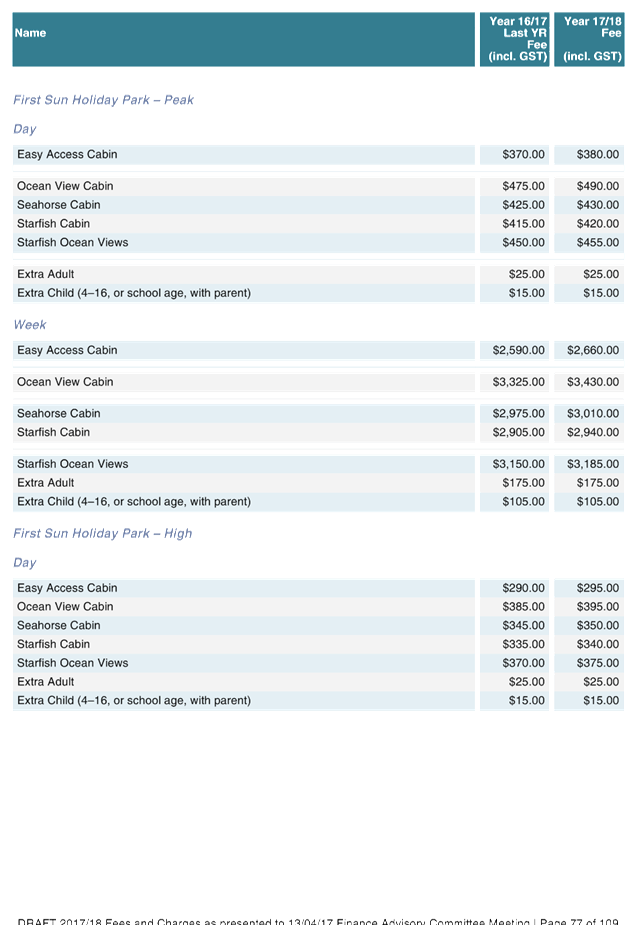

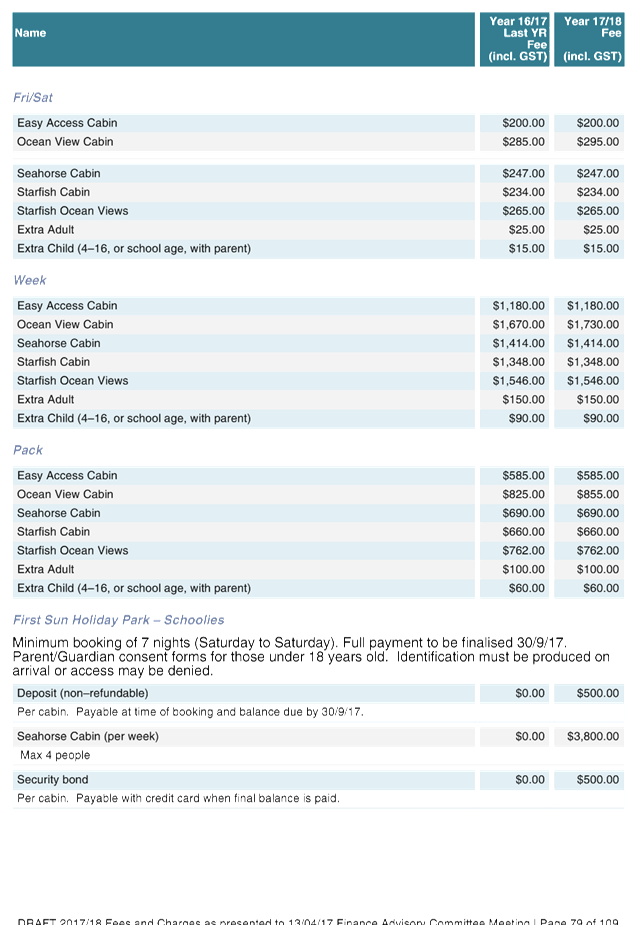

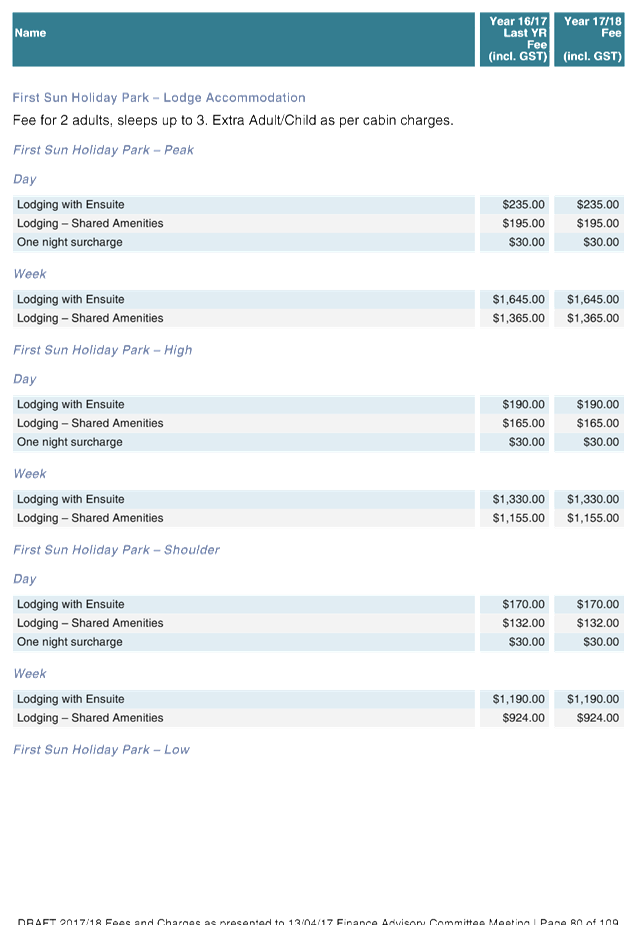

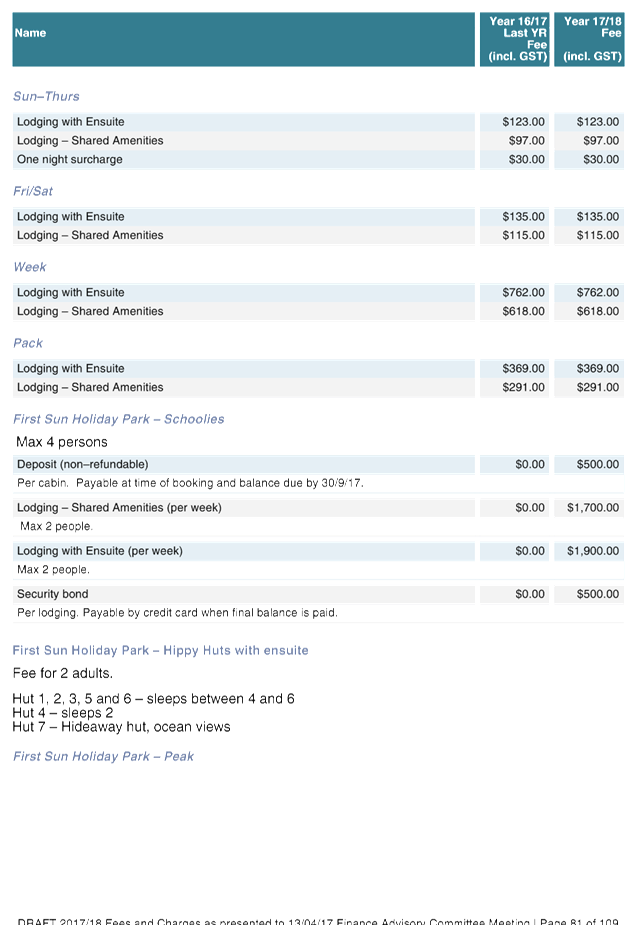

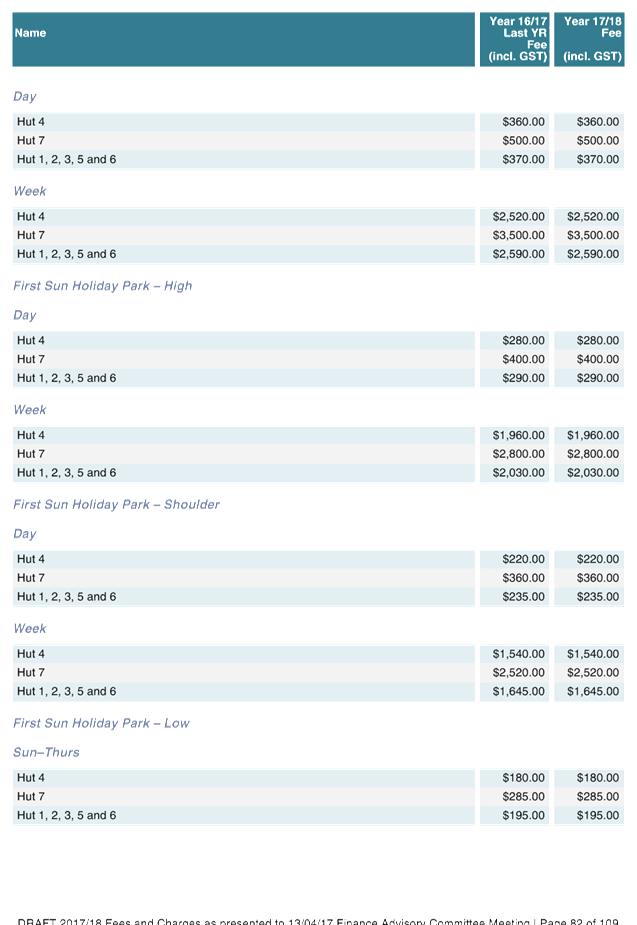

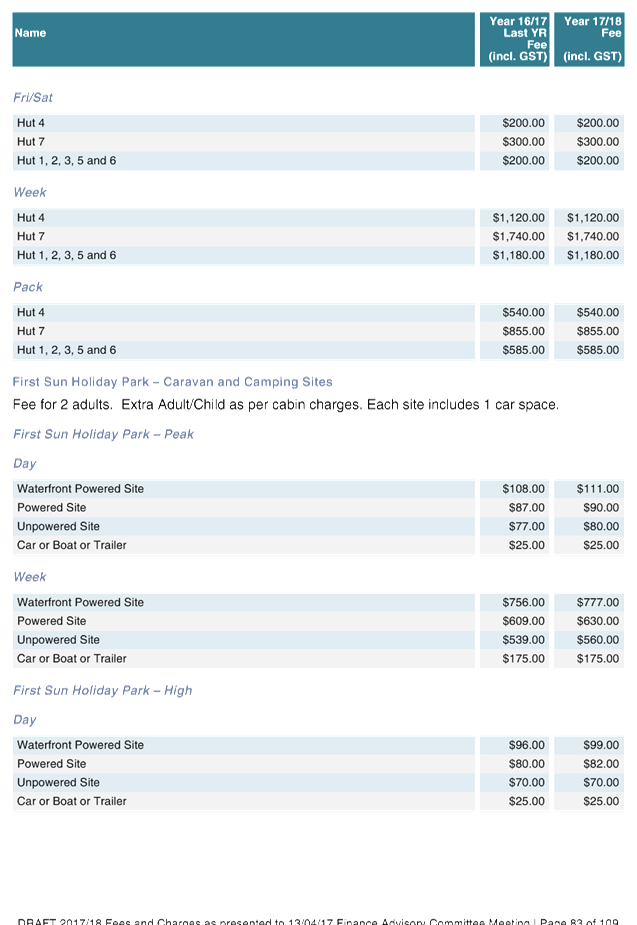

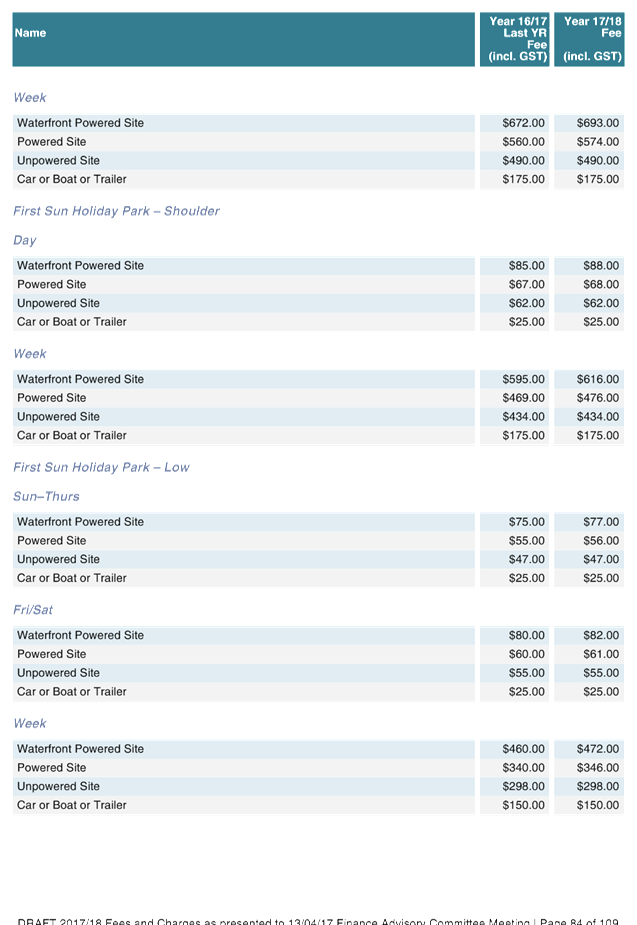

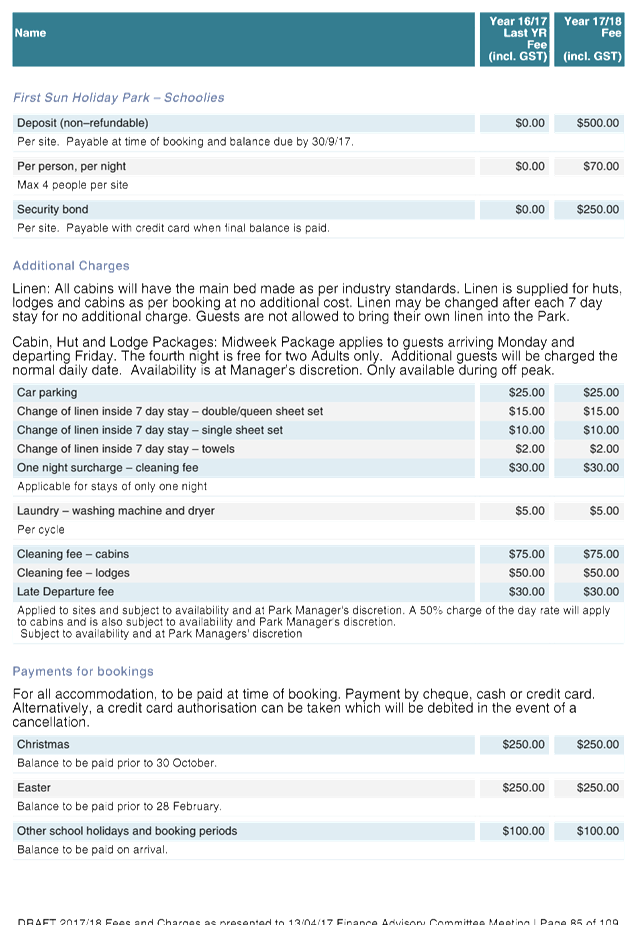

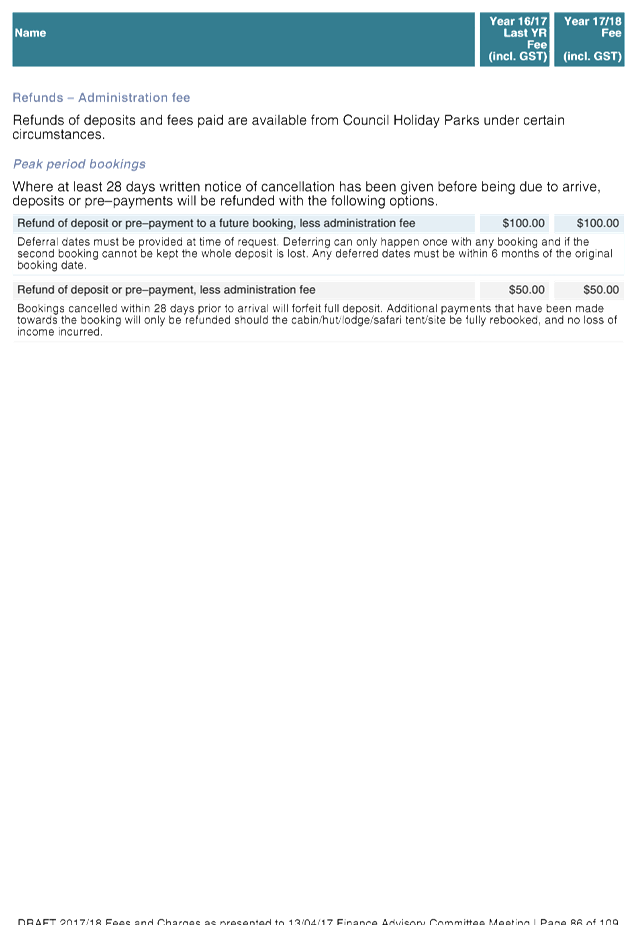

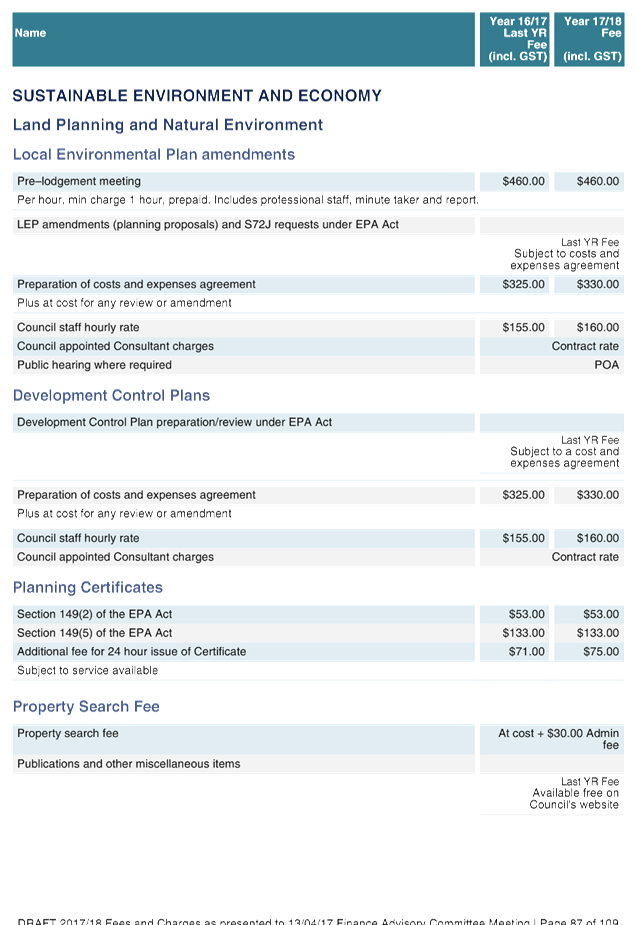

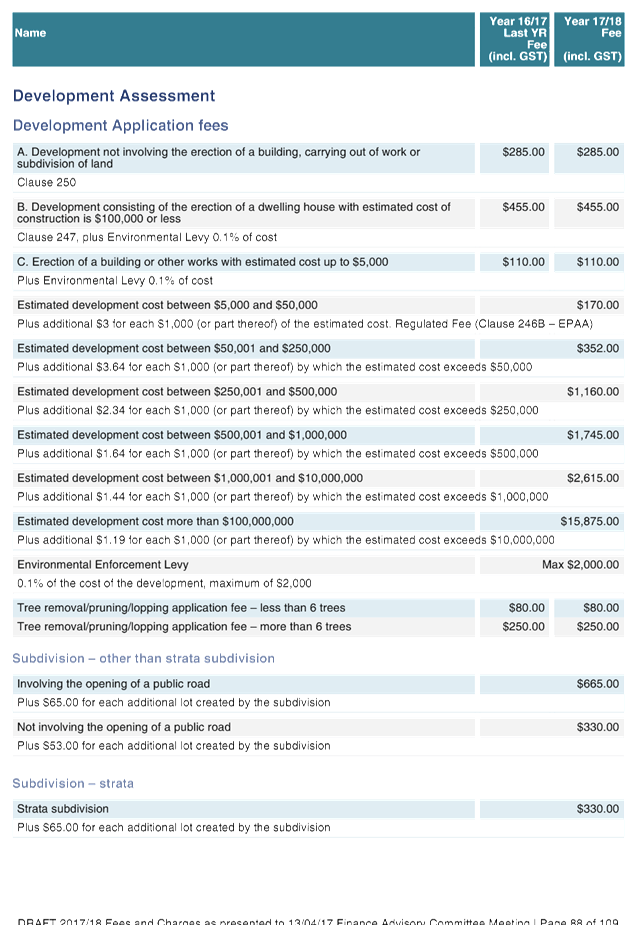

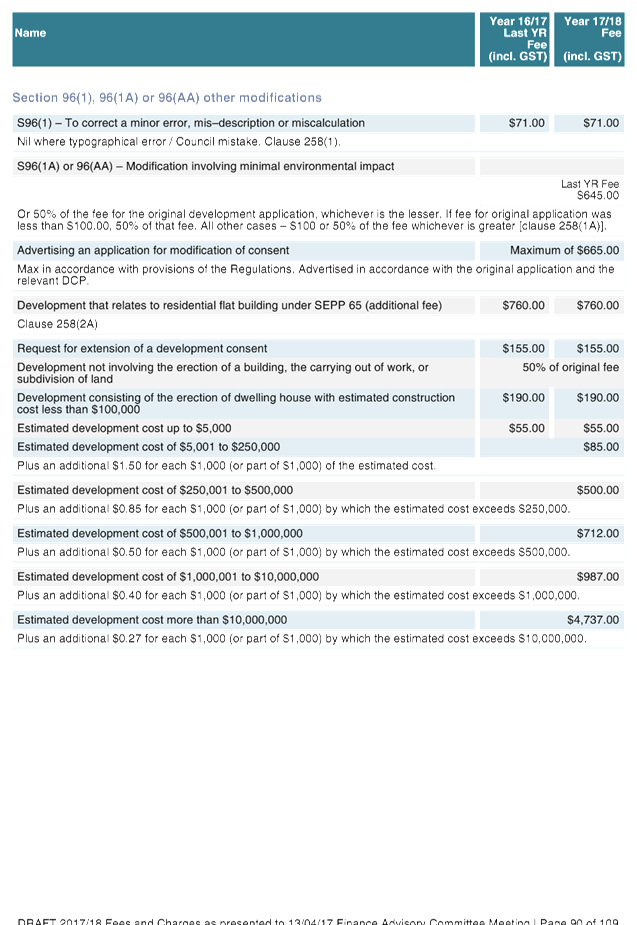

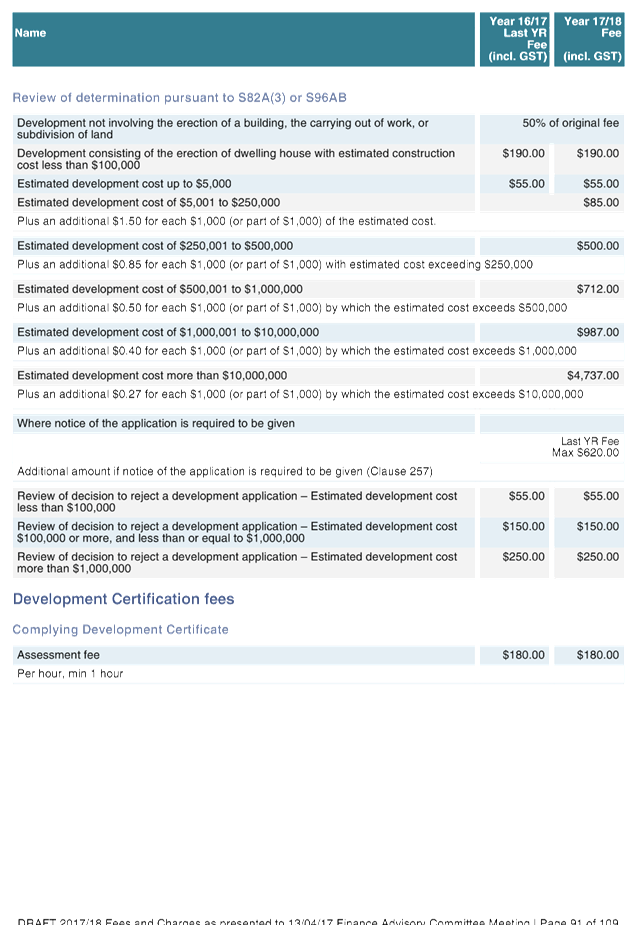

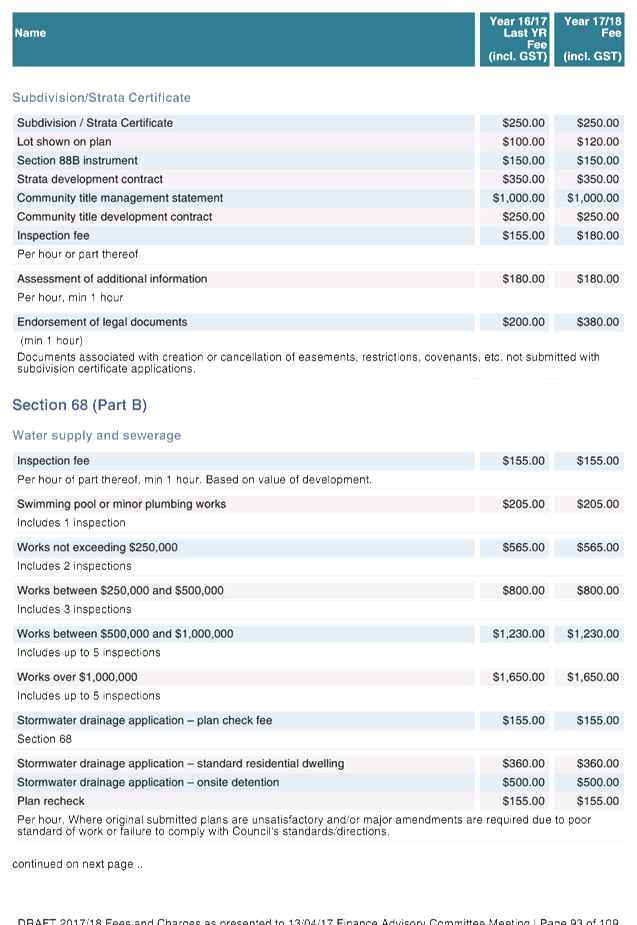

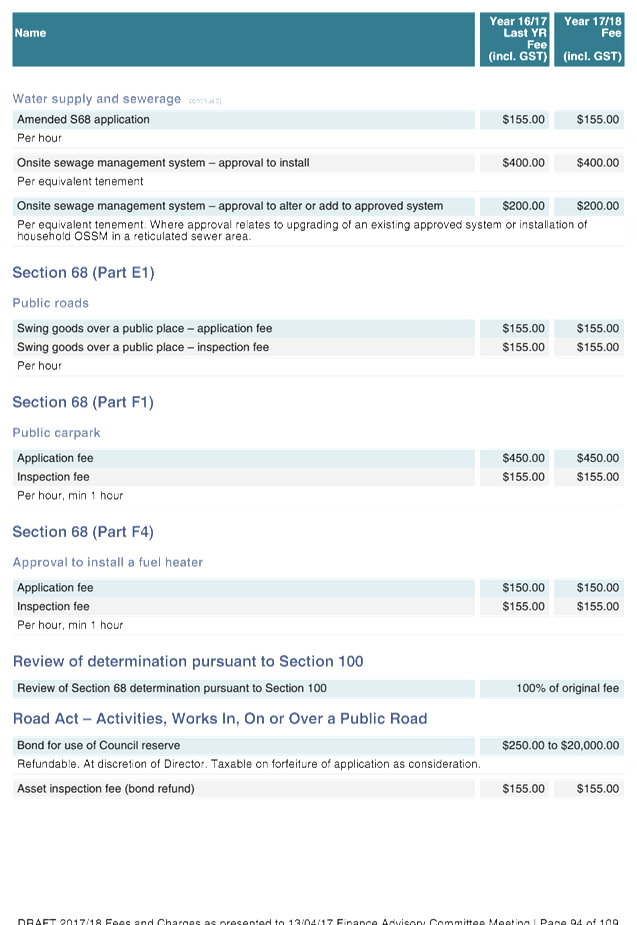

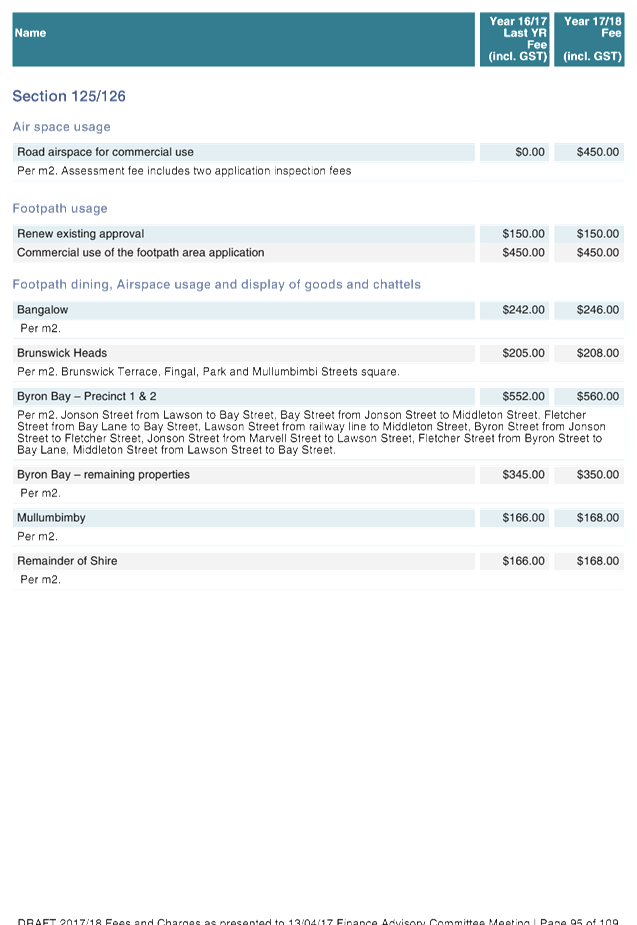

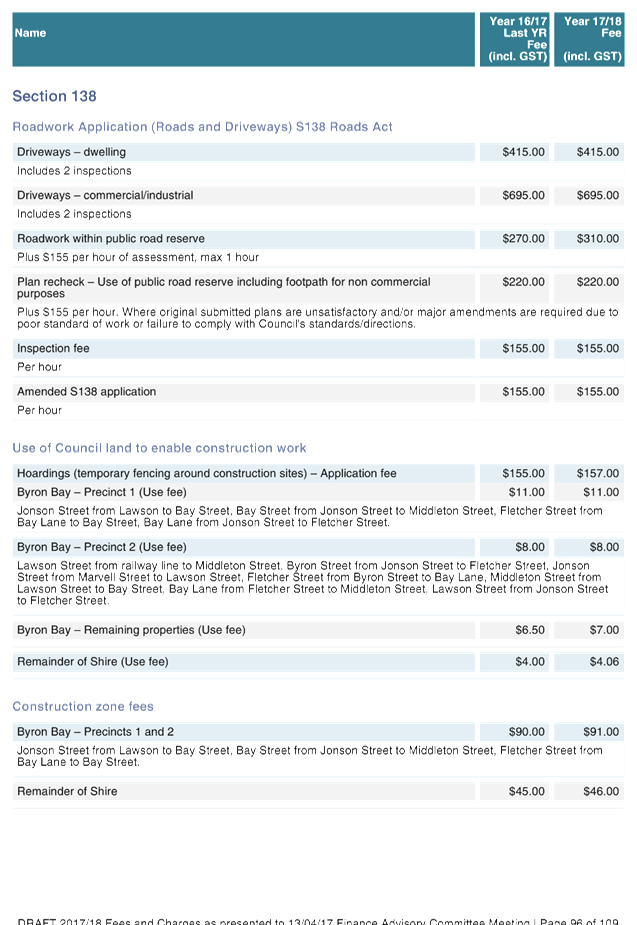

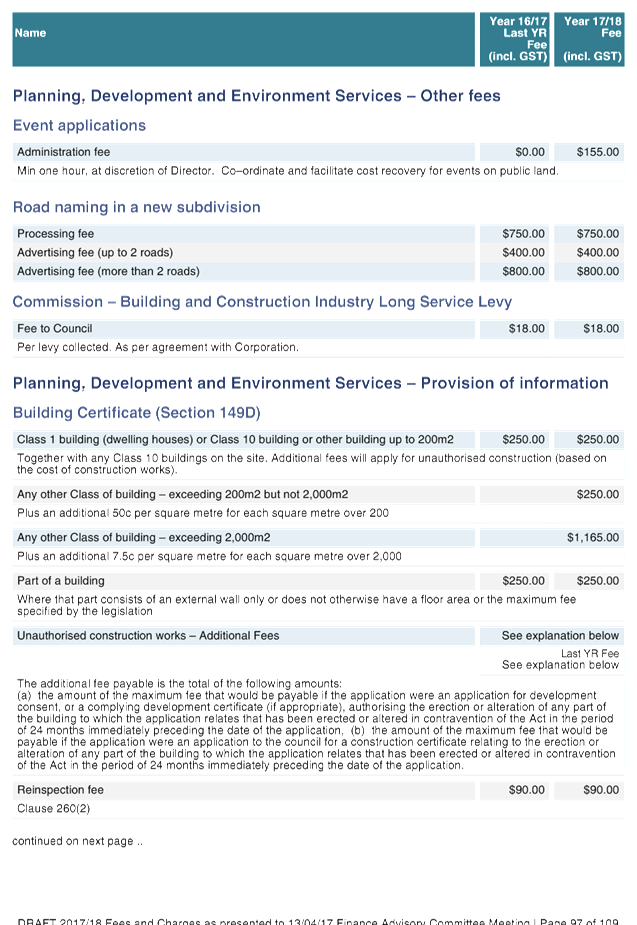

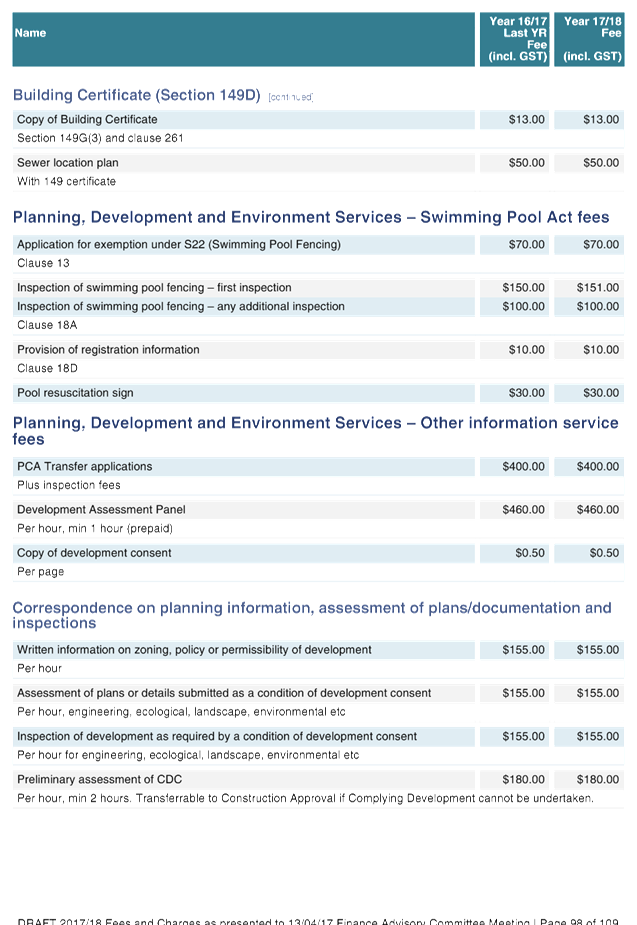

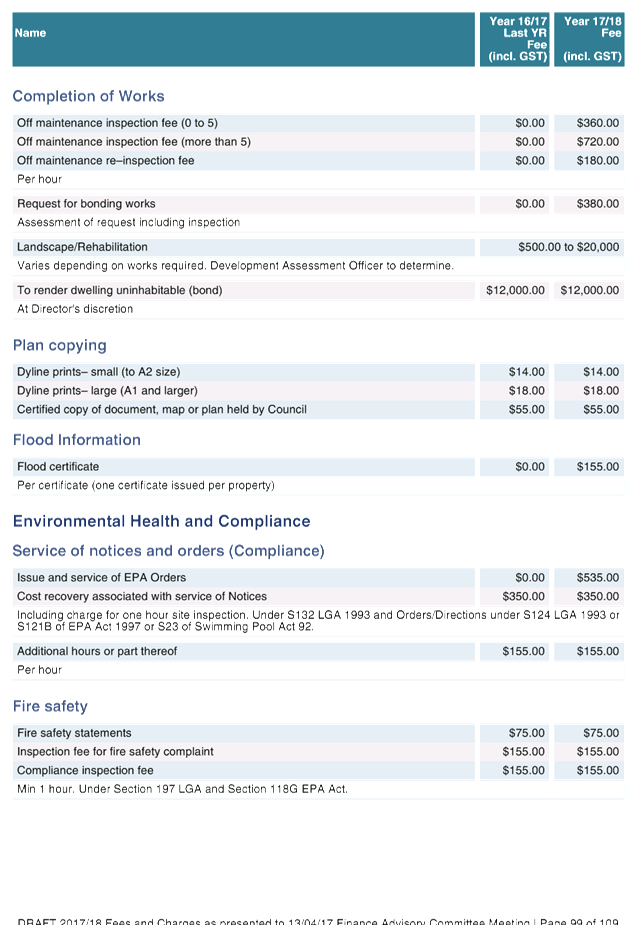

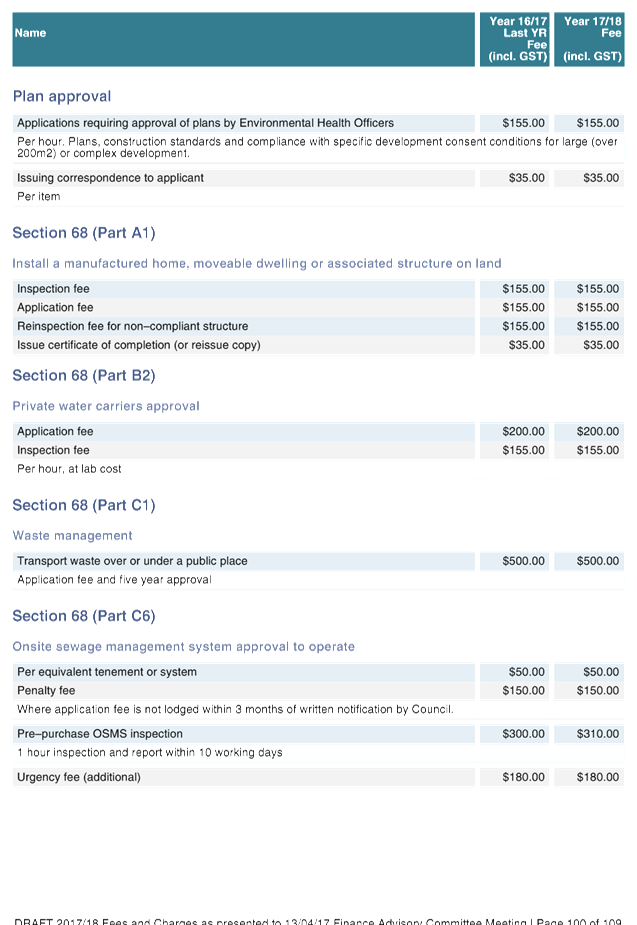

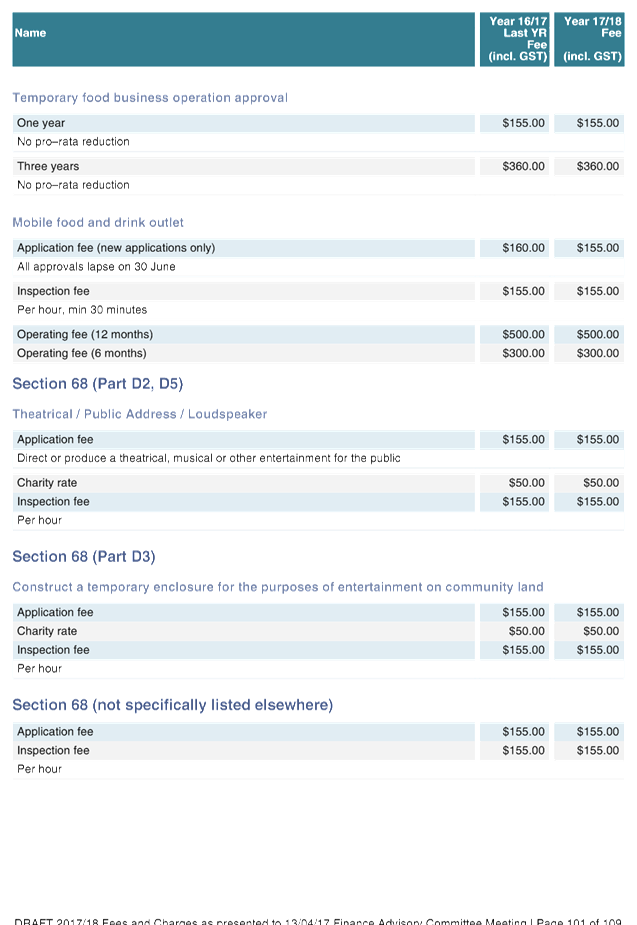

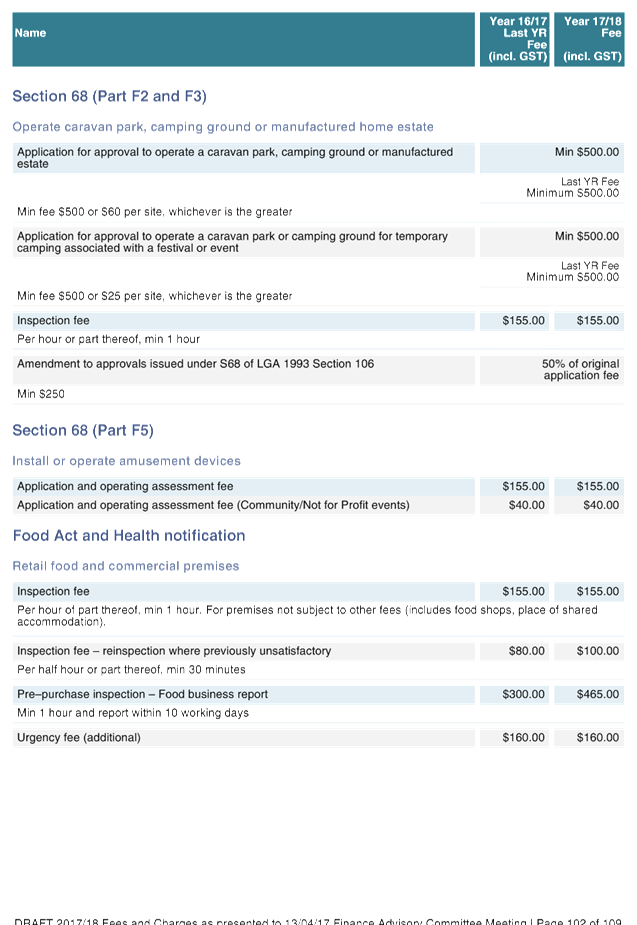

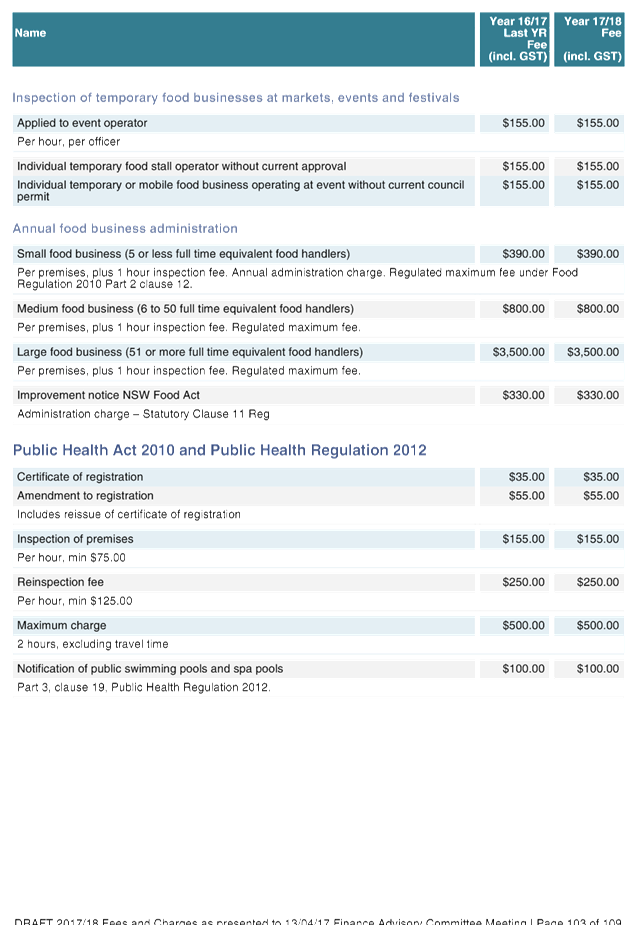

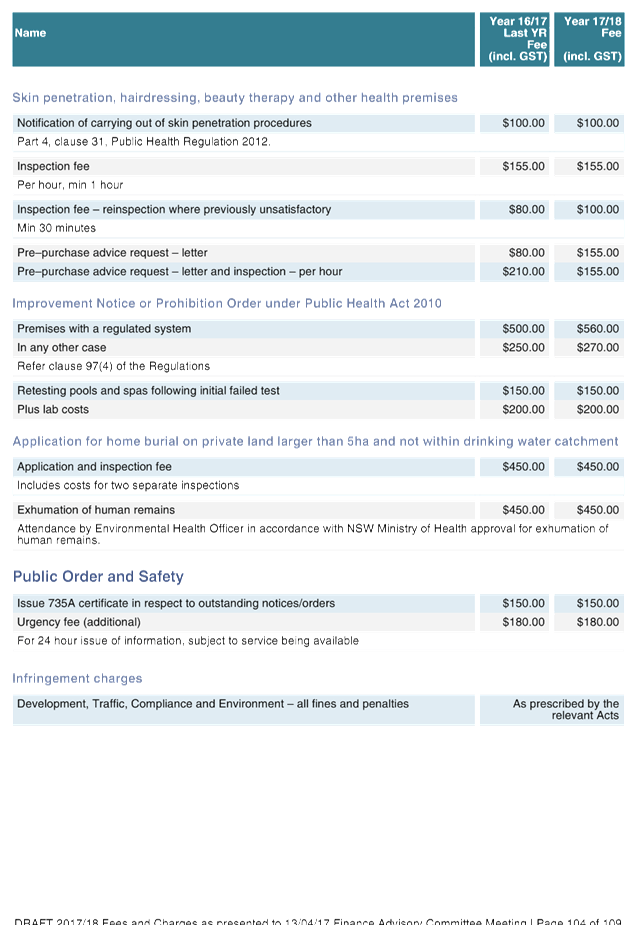

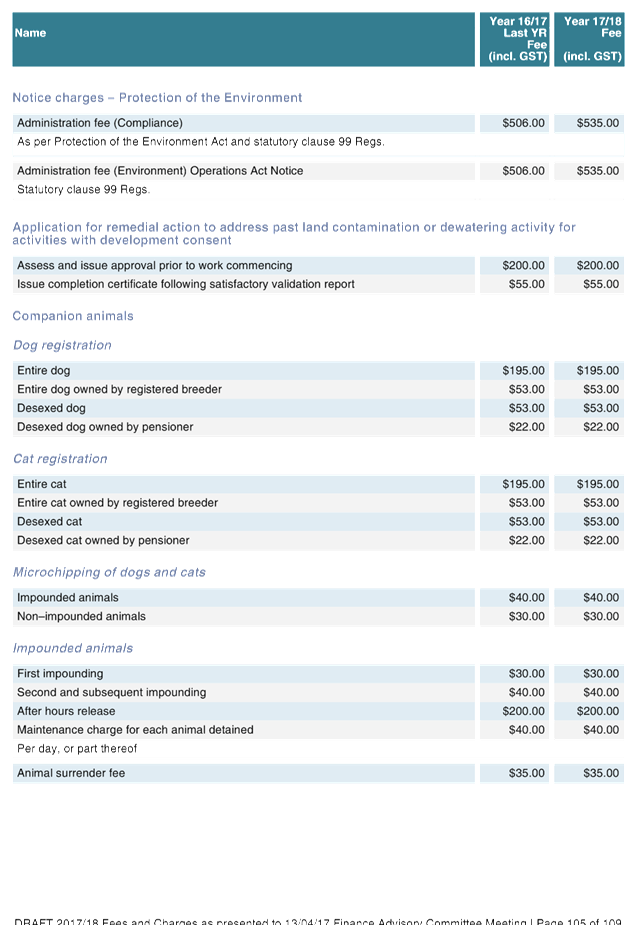

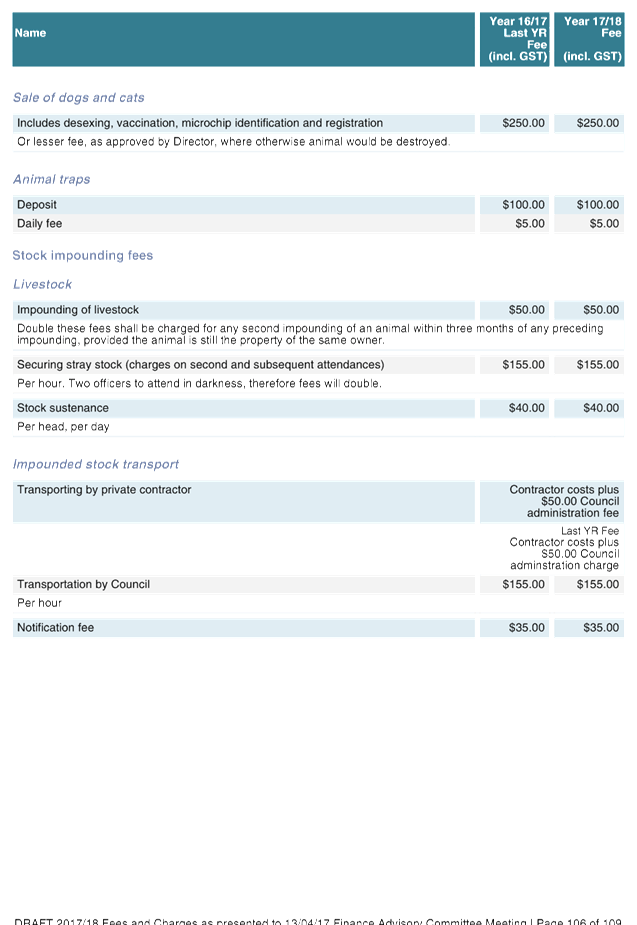

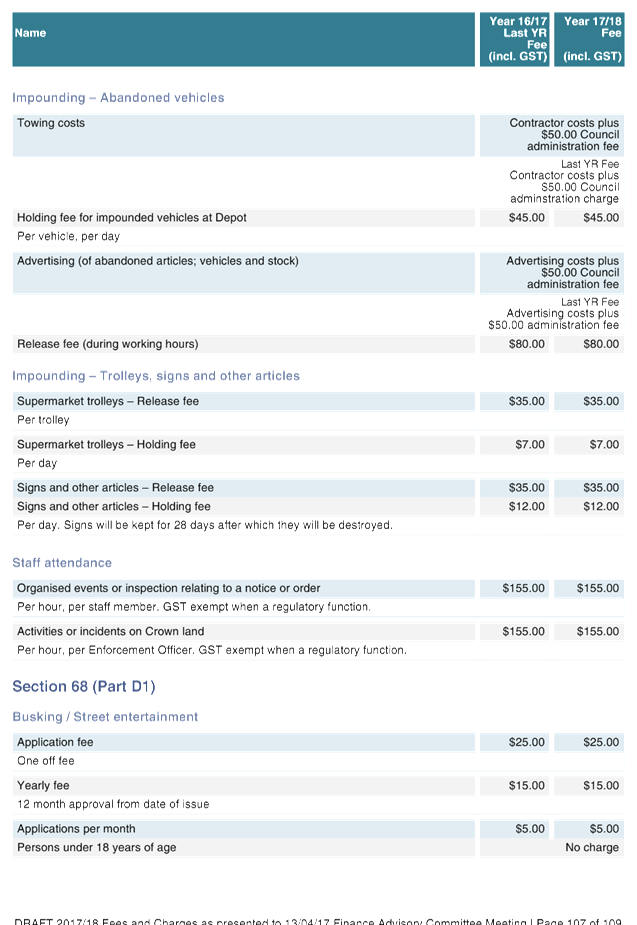

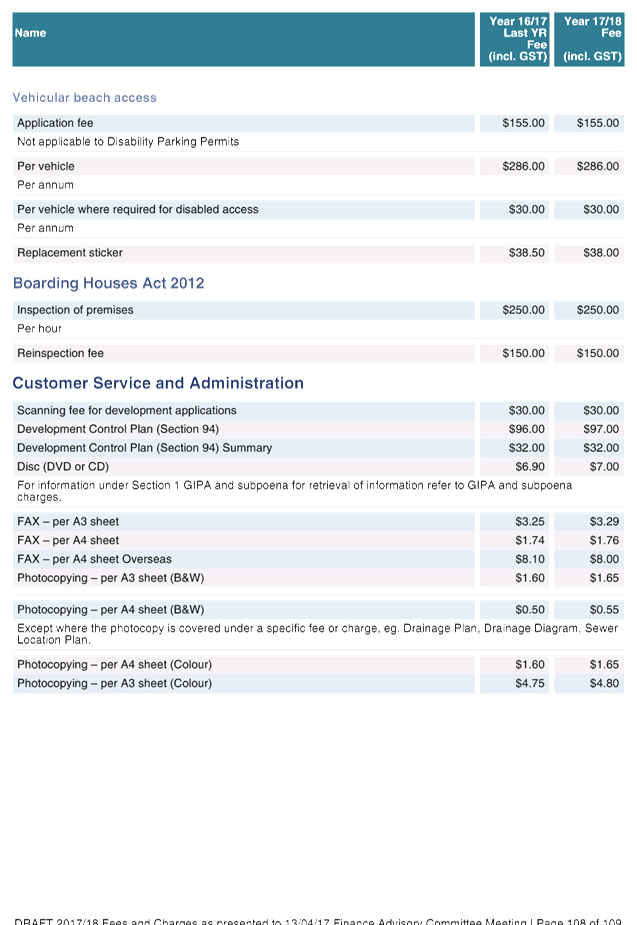

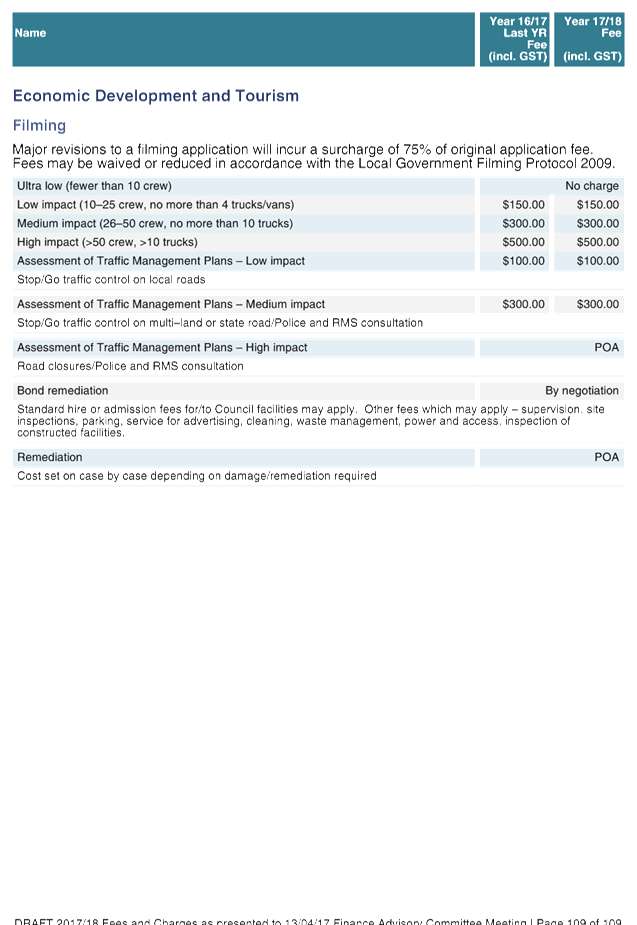

Draft Fees and Charges

The Draft 2017/2018 Fees and Charges have been reviewed by

respective program managers and included at Attachment 2. Where possible,

fees have been altered/increased to reflect the following specific changes:

· Increases in the

Consumer Price Index (CPI)/Indexation assumed at 1.50%.

· Review of fees and

charges including benchmarking/cost of service provision and where possible

introduction of new fees to assist Council generate additional/enhanced revenue

as themed by its Financial Sustainability Plan(FSP).

· The Office of

Local Government is yet to determine the fee to apply for Section 603

Certificates or the Statutory Interest Rate to apply to overdue rates and

charges. Once determination has been advised, it is proposed Council

apply the maximum amounts advised in respect of both items.

· Fees currently

disclosed for Richmond Tweed Regional Library are the current fees for

2016/2017. Council is yet to receive advice from Lismore City Council as

to the fees to apply for 2017/2018.

For the 2017/2018 financial year, the Draft Fees and Charges

have continued to be developed utilising fees and charges software to manage

fees and charges that was implemented on 2016/2017 for the first time.

Fire and Emergency Services Levy (FESL)

All Council’s in NSW for the first time will be

required to levy the Fire and Emergency Services Levy (FESL) on all rateable

property from 1 July 2017. The levy will be calculated on the basis of a

rate applied to land value depending upon the FESL classification applied to

each property.

It clearly needs to be understood, whilst the FESL will

appear on the Rate Notice, it is not Council revenue but is revenue for NSW

Treasury to assist in the funding of Emergency Services. This levy will

replace the previous levy included in insurance premiums for those in the

community who hold property insurance.

With respect to the FESL, Councils do not determine the

fixed charges/ad valorem rates to apply and will remit all FESL revenue

collected to the NSW Treasury. Councils are simply the collection agent

on behalf of NSW Treasury. It is for this reason, whilst there is some

disclosure in the Revenue Policy on the FESL, Council has not and will not

provide the fixed charges/ad valorem rates to be charged. Council is also

not required to approve the FESL charges.

Financial Implications

The Draft 2017/2018 Revenue Policy is an integral part to

Council’s Operational Plan and provides the basis for Council to raise

the required revenue to fund the estimated operating and capital expenditures

contained in the proposed Draft 2017/2018 Budget Estimates.

There are direct financial implications to ratepayers of

Council in regards to the proposed rates and charges contained in the Draft

2017/2018 Revenue Policy as it will determine, subject to final adoption after

public exhibition and consideration of submissions, what ratepayers will be

requested to pay when rate notices are issued in July 2017.

Statutory and Policy Compliance Implications

In respect of the Draft 2017/2018 Operational Plan, Council

must comply with the provisions of Section 405 of the Local Government Act 1993

as described below concerning the adoption of an Operational Plan.

405 Operational plan

“(1)

A council must have a plan (its operational plan) that is adopted before the

beginning of each year and details the activities to be engaged in by the

council during the year as part of the delivery program covering that year.

(2)

An operational plan must include a statement of the council’s revenue

policy for the year covered by the operational plan. The statement of revenue

policy must include the statements and particulars required by the regulations.

(3)

A council must prepare a draft operational plan and give public notice of the

draft indicating that submissions may be made to the council at any time during

the period (not less than 28 days) that the draft is to be on public

exhibition. The council must publicly exhibit the draft operational plan in

accordance with the notice.

(4)

During the period of public exhibition, the council must have for inspection at

its office (and at such other places as it may determine) a map that shows

those parts of its area to which each category and sub-category of the ordinary

rate and each special rate included in the draft operational plan applies.

(5)

In deciding on the final operational plan to be adopted, a council must

consider any submissions that have been made concerning the draft plan.

(6)

The council must post a copy of its operational plan on the council’s

website within 28 days after the plan is adopted.”

The specific statements required by Council to be disclosed

as part of its Revenue Policy are determined by Clause 201 of the Local

Government (General) Regulation 2005 as follows:

201 Annual statement of council’s revenue policy

“(1) The

statement of a council’s revenue policy for a year that is required to be

included in an operational plan under section

405 of the Act

must include the following statements:

(a) a statement containing a

detailed estimate of the council’s income and expenditure,

(b)

a statement with respect to each ordinary rate and each special rate proposed

to be levied,

Note: The

annual statement of revenue policy may include a note that the estimated yield

from ordinary rates is subject to the specification of a percentage variation

by the Minister if that variation has not been published in the Gazette when

public notice of the annual statement of revenue policy is given.

(c) a statement with respect to

each charge proposed to be levied,

(d) a statement of the types of

fees proposed to be charged by the council and, if the fee concerned is a fee

to which Division 3 of Part 10 of Chapter 15 of the Act

applies, the amount of each such fee,

(e) a statement of the

council’s proposed pricing methodology for determining the prices of

goods and the approved fees under Division 2 of Part 10 of Chapter 15 of the Act

for services provided by it, being an avoidable costs pricing methodology

determined by the council in accordance with guidelines issued by the

Director-General,

(f) a statement of the amounts

of any proposed borrowings (other than internal borrowing), the sources from

which they are proposed to be borrowed and the means by which they are proposed

to be secured.

(2) The

statement with respect to an ordinary or special rate proposed to be levied

must include the following particulars:

(a) the ad valorem amount (the

amount in the dollar) of the rate,

(b) whether the rate is to have

a base amount and, if so:

(i) the amount in dollars of

the base amount, and

(ii) the percentage, in

conformity with section

500 of the Act,

of the total amount payable by the levying of the rate, or, in the case of the

rate, the rate for the category or sub-category concerned of the ordinary rate,

that the levying of the base amount will produce,

(c) the estimated yield of the

rate,

(d) in the case of a special

rate-the purpose for which the rate is to be levied,

(e) the categories or

sub-categories of land in respect of which the council proposes to levy the

rate.

(3) The

statement with respect to each charge proposed to be levied must include the

following particulars:

(a) the amount or rate per unit

of the charge,

(b) the differing amounts for

the charge, if relevant,

(c) the minimum amount or

amounts of the charge, if relevant,

(d) the estimated yield of the

charge,

(e) in relation to an annual

charge for the provision by the council of coastal protection services (if

any)-a map or list (or both) of the parcels of rateable land that are to be

subject to the charge.

(4) The

statement of fees and the statement of the pricing methodology need not include

information that could confer a commercial advantage on a competitor of the

council. “