Finance Advisory Committee Meeting

A Finance Advisory Committee Meeting of

Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 18 May 2017

|

|

Time

|

2.00pm

|

Mark Arnold

Director Corporate and Community Services I2017/635

Distributed 16/05/17

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Finance Advisory Committee Meeting

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Finance

Advisory Committee Meeting held on 16 February 2017

3.2 Extraordinary

Finance Advisory Committee Meeting held on 13 April 2017

4. Staff Reports

Corporate and Community Services

4.1 Review

of Council Investment Policy............................................................................... 4

4.2 Budget

Review 1 January - 31 March 2017................................................................... 18

5. Late Reports

5.1 2016/17

Financial Sustainability Plan - Update on the Action Implementation Plan as at

31 March 2017............................................................................................................................... 126

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community Services

Report No. 4.1 Review

of Council Investment Policy

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/593

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary Meeting held on 23 February 2017,

considered Report 13.4 regarding Council Investments January 2017.

Council resolved 17-043 part 2:

‘That a workshop on the financial investment

strategy occurs at the next SPW on 9 March 2017’

A presentation was provided to the Strategic Planning

Workshop (SPW) on 9 March 2017. Following from that presentation, a report was

provided to the Finance Advisory Committee to consider an updated Draft Policy

- Council Investments 2017 on 13 April 2017. Following feedback from that

Meeting of the Finance Advisory Committee, this further report is provided

subject to any consideration or amendment, to recommend to Council adoption of

a revised Draft Policy - Council Investments 2017 for the purposes of public

exhibition.

|

RECOMMENDATION:

That the Finance Advisory Committee recommend to

Council:

1. That

the Draft Policy - Council Investments 2017 be placed on public

exhibition for a period of 28 days.

2. That

in the event:

a) that

any submissions are received on the Draft Policy - Council Investments 2017,

that those submissions be reported back to Council prior to adoption of the

policy; or

b) that

no submissions are received on the Draft Policy - Council Investments 2017, that

the policy be adopted and incorporated into Council’s Policy Register.

|

Attachments:

1 Draft

Council Investment Policy submitted to Finance Advisory Committee 18 May 2017, E2017/30990 ,

page 8⇩

Report

Council at its Ordinary Meeting held on 23 February 2017,

following consideration of Report 13.4 regarding Council Investments January

2017, resolved (in part) as follows:-

17-043 part 2:

‘That a workshop on the financial investment

strategy occurs at the next SPW on 9 March 2017’

A presentation was provided to the Strategic Planning

Workshop (SPW) on 9 March 2017. Following from that presentation, a report was

provided to the Finance Advisory Committee to consider an updated Draft Policy

- Council Investments 2017 on 13 April 2017.

After consideration of the Report, the Finance Advisory

Committee recommended to Council at its Ordinary Meeting to be held on 25 May 2017:-

“Committee

Recommendation 4.1.1

That the Finance Advisory Committee receive a

further report on the review of the Council’s Investment Policy at its

next meeting scheduled for 18 May 2017, with the following amendments to the

Draft Policy - Council Investments 2017 to be included:

a) Definition for Social

and Environmentally Responsible Investments

b) Decision

making process for the investment of funds with an authorised deposit-taking

institution.”

Following the Finance Advisory Committee Recommendation

4.1.1 above, this further report is provided subject to any further

consideration or amendment, to recommend to Council adoption of a revised Draft

Policy - Council Investments 2017 for the purposes of public exhibition.

The revised Draft Policy - Council Investments 2017 is

included at Attachment 1. The document has been updated to comply with

the new template for Council policies and sets out the following guidance in

relation to Council’s investments:

· Set the objectives of

investing.

· Outline the legislative

requirements.

· Ascertain authority for

implementation and management of the Policy.

· Establish the capital,

liquidity and return expectations.

· Determine the diversity of the

investment portfolio.

· Environmentally and Socially

Responsible Investing.

· Define the risk profile.

· Establish legal title.

· Set benchmarks.

· Establish monitoring and

reporting requirements.

· Define duties and obligations

of Delegated Officers.

The new Draft Policy - Council Investments 2017 incorporating

the above is provided for the Finance Advisory Committee’s further consideration,

amendment and recommendation to Council, for public exhibition.

Financial Implications

There are no financial implications directly associated with

this report. However, the management of Council’s investments is a

significant responsibility. Poor investment decisions have the potential

to negatively impact upon the financial position of Council through either

revenue from investment interest or possible capital loss of principal

invested.

Statutory and Policy Compliance Implications

Section 625 of the Local Government Act 1993 governs how

Councils can invest. Specifically Section 625 states:

(1) A

council may invest money that is not, for the time being, required by the

council for any other purpose.

(2) Money

may be invested only in a form of investment notified by order of the Minister

published in the Gazette.

(3) An

order of the Minister notifying a form of investment for the purposes of this

section must not be made without the approval of the Treasurer.

(4) The

acquisition, in accordance with section 358, of a controlling interest in a

corporation or an entity within the meaning of that section is not an

investment for the purposes of this section.

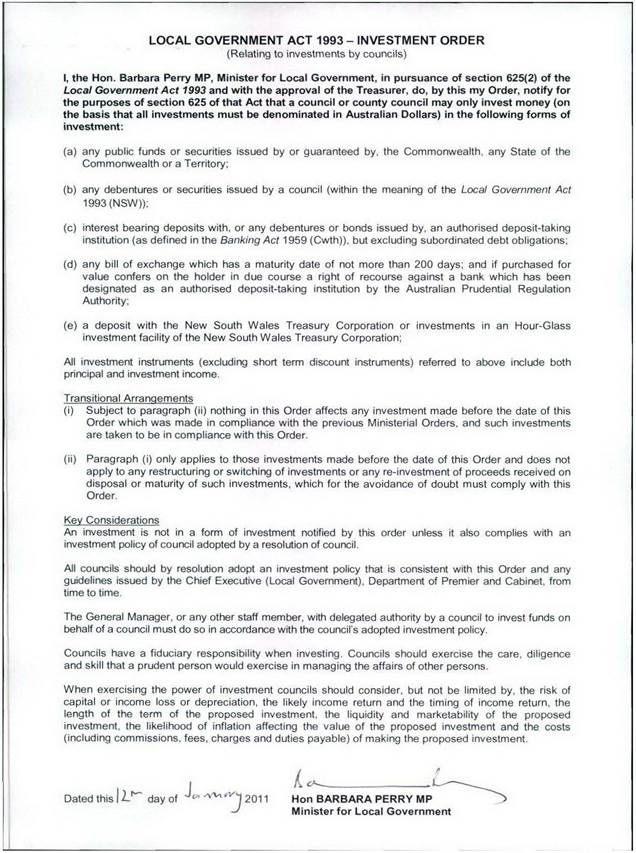

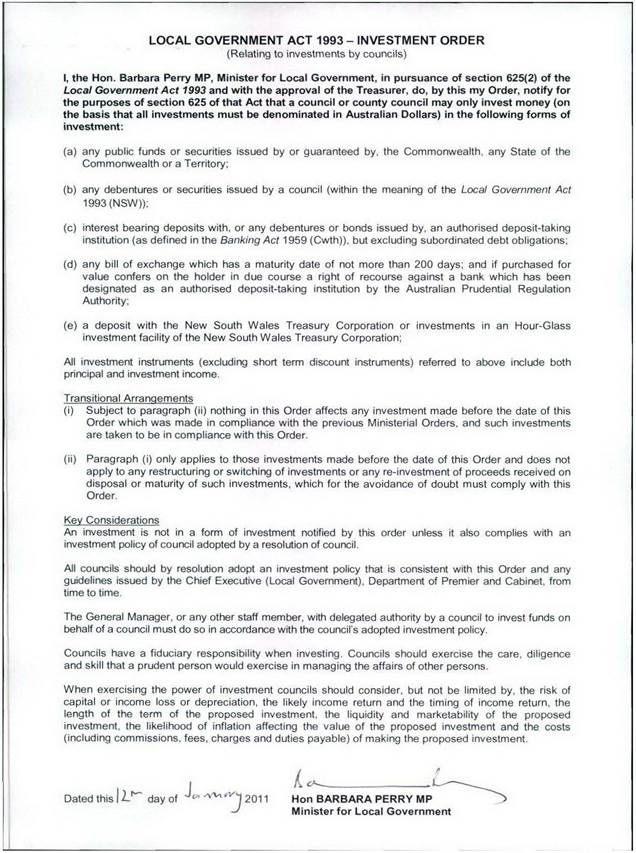

The forms of investment approved by the Minister for Local

Government as identified in Section 625(2) of the Local Government Act 1993

refer to the Ministerial Investment Order. The most recent Investment

Order was issued on 12 January 2011 and the contents of this Order are provided

in Attachment 1 as part of the Draft Council Investments Policy 2017.

Clause 212 of the Local Government (General) Regulation 2005

also outlines requirements regarding Council’s investments as follows:

(1) The

responsible accounting officer of a council:

(a) must

provide the council with a written report (setting out details of all money

that the council has invested under section 625 of the Act) to be presented:

(i) if

only one ordinary meeting of the council is held in a month, at that meeting,

or

(ii) if

more than one such meeting is held in a month, at whichever of those meetings

the council by resolution determines, and

(b) must

include in the report a certificate as to whether or not the investment has

been made in accordance with the Act, the regulations and the council’s

investment policies.

(2) The

report must be made up to the last day of the month immediately preceding the

meeting.

In regard to Council investments, attention also needs to be

directed towards Section 14 of the Trustees Amendment (Discretionary

Investments) Act 1997 where a trustee must exercise the care, diligence, and

skill that a prudent person would exercise in managing the affairs of another

person. As Councils are acting as custodians when investing public assets,

account of the requirements of Section 14 should also be considered.

Specifically contained in Section 14(C)(1) are the following matters which

should be considered:

(a) the

purposes of the trust and the needs and circumstances of the beneficiaries,

(b) the

desirability of diversifying trust investments,

(c) the

nature of, and the risk associated with, existing trust investments and other

trust property,

(d) the

need to maintain the real value of the capital or income of the trust,

(e) the

risk of capital or income loss or depreciation,

(f) the

potential for capital appreciation,

(g) the

likely income return and the timing of income return,

(h) the

length of the term of the proposed investment,

(i) the

probable duration of the trust,

(j) the

liquidity and marketability of the proposed investment during, and on the

determination of, the term of the proposed investment,

(k) the

aggregate value of the trust estate,

(l) the

effect of the proposed investment in relation to the tax liability of the

trust,

(m) the

likelihood of inflation affecting the value of the proposed investment or other

trust property,

(n) the

costs (including commissions, fees, charges and duties payable) of making the

proposed investment,

(o) the

results of a review of existing trust investments in accordance with section

14A (4).

Staff Reports - Corporate and Community Services 4.1 - Attachment 1

|

Draft Policy:

|

|

Council Investments

|

|

2017

|

INFORMATION ABOUT THIS DOCUMENT

|

Date Adopted by

Council

|

??-??-2017

|

Resolution No.

|

17-???

|

|

Document Owner

|

Corporate and

Community Services

|

|

Document Development

Officer

|

Manager Finance

|

|

Review Timeframe

|

Annually if required

|

|

Last Review Date:

|

June 2012

|

Next Scheduled Review

Date

|

May 2018

|

Document History

|

Doc No.

|

Date Amended

|

Details/Comments eg

Resolution No.

|

|

#574352

|

7/3/06

|

Res 06-86

|

|

#711341

|

27/9/07

|

Res 07-533

|

|

#838120

|

9/4/09

|

Draft amendments

reported to Council – further amendments see Res 09-181

|

|

#847260

|

21/4/09

|

Incorporating amendments

09-181 – On Public Exhibition

|

|

#906111

|

8/10/09

|

Res 09-805

|

|

#1241222

|

28/6/12

|

Draft amendments policy

reported to Council 28/6/12 Res 12-470 placed on public exhibition (Previous

Policy No 2.5)

|

|

#E2012/1401

|

15/8/12

|

Adopted after close of

Public Exhibition – no submissions received

|

|

#E2017/18817

|

13/4/17

|

Draft updated policy

reported to Finance Advisory Committee

|

|

#E2017/30990

|

18/5/17

|

Revised draft updated

policy reported to Finance Advisory Committee

|

Further Document

Information and Relationships

List here the related strategies,

procedures, references, policy or other documents that have a bearing on this

Policy and that may be useful reference material for users of this Policy.

|

Related Legislation*

|

Local Government Act

1993 – Section 625.

Local Government Act

1993 – Investment Order (of the Minister) dated 12 January 2011

(attached to policy).

Local Government

(General) Regulation 2005 – Regulation 212

The Trustee Amendment

(Discretionary Investments) Act 1997 – Sections 14A(2), 14(C)(1) &

(2)

|

|

Related Policies

|

|

|

Related Procedures/

Protocols, Statements, documents

|

|

Note: Any reference to

Legislation will be updated in the Policy as required. See website http://www.legislation.nsw.gov.au/ for current Acts, Regulations and Environmental

Planning Instruments.

TABLE OF CONTENTS

1. OBJECTIVES.. 2

2. SCOPE.. 2

3. DEFINITIONS.. 2

4. STATEMENT.. 2

4.1. Environmental and

Socially Responsible Investments. 3

4.2. Delegation of Authority. 4

4.3 Prudent

Person Standard/Ethics and Conflict of Interest 4

4.4 Authorised

Investments. 4

4.5 Risk

Management 5

4.6 Credit

Quality and Limits. 5

4.7 Safe

Custody Arrangements – Security of Title. 6

4.8 Accounting

and Reporting. 6

4.9 Performance

Benchmarks. 7

5. LEGISLATIVE

AND STRATEGIC CONTEXT.. 7

5.1. Community Strategic

Plan. 7

5.2. Legislative

Requirements. 7

6. SUSTAINABILITY.. 8

6.1. Social 8

6.2. Environmental 8

6.3. Economic. 8

6.4. Governance. 8

1. OBJECTIVES

The purpose of this Policy is to

provide a framework for the investment of Council’s funds at the most

favourable rate of interest available to it at the time of investment and

maximising return whilst having due consideration of risk, liquidity, and

security for its investments. Council must consider the purpose of an

investment opportunity in terms of environmental and social outcomes when

investing funds where the investment return is favourable relative to alternate

investment opportunities.

2. SCOPE

This Policy is to cover:

· Council’s

objectives for its investment portfolio;

· Applicable Risks

to be managed;

· Detail any

constraints or other prudential requirements to apply to the investment of

Funds;

· The applicable

legislation and regulation governing Council investments;

· The reporting of

investments;

· Appropriate

performance benchmark(s)

The Investment Policy is a policy

produced by the Corporate and Community Services Directorate. The Finance

Branch is responsible for the operation and updating of this Policy.

This Policy document replaces any

previous Investment Policy document approved by Council.

3. DEFINITIONS

|

ADI

|

Authorised Deposit Taking Institution as defined in the

Banking Act 1959 (Cwth).

|

|

Environmentally and Socially Responsible Investments

|

Defined by Council in accordance with resolution 15-515 as

disclosed at section 4.1 to this Policy.

|

|

Delegated Officers

|

Director of Corporate and Community Services

Manager Finance

Management/Assets Accountant

Financial Operations Accountant

|

|

RAO

|

Responsible Accounting Officer as prescribed by Regulation

196 of the Local Government (General) Regulation 2005.The Responsible

Accounting Officer of Byron Shire Council is the Manager Finance.

|

4. STATEMENT

While exercising the power to

invest, consideration is to be given to the preservation of investment principal,

liquidity, and the return of investment. Council therefore has several

primary objectives for its investment portfolio:

a) Compliance

with legislation, regulations, the prudent person tests of the Trustee Act and

guidelines issued by the Office of Local Government.

b) Preservation

of the investment principal amount invested.

c) To

ensure there is sufficient liquid funds to meet all reasonably anticipated cash

flow requirements of Council.

d) To

generate income from the investment portfolio that exceeds the performance

benchmark(s) established in this Policy.

e) Facilitate

the enhancement of environmental and social outcomes through investment of

Council funds as outlined in section 4.1 (part (i) and (ii)) of this Policy as

the decision making process at each investment opportunity available to

Council.

4.1. Environmental

and Socially Responsible Investments

Council gives preference to

finance institutions that invest in or finance Environmentally and Socially

Responsible Investments (SRI) where:

i) The

investment is compliant with legislation and investment policy objectives and

parameters;

and

ii) The

rate of return is favourable relative to comparable investments on offer to

Council at the time of investment

SRI status may be in respect of

the individual investment, the issuer of the investment, or both and should be

endorsed by an accredited environmentally and socially responsible industry

body or institution.

Environmentally and Socially

Responsible Investments will be assessed on the same basis as other investment

opportunities and the Council will select the investment that best meets its overall

investment selection criteria.

The

Council’s criteria relating to an SRI are those which:

• direct

investment towards the socially and environmentally productive activities

listed below

• avoid

investment in the socially and environmentally harmful activities listed below.

The criteria

for SRI are all desirable and not mandatory requirements.

Environmentally

productive activities are considered to be:

• resource

efficiency-especially water and energy

• renewable

energy

• production

of environmentally friendly products

• recycling,

and waste and emissions reduction

Socially

productive activities are considered to be:

• fair

trade and provision of a living wage

• human

health and aged care

• equal

opportunity employers, and those that support the values of communities,

indigenous

peoples and minorities

• provision

of housing, especially affordable housing

Environmentally harmful

activities are considered to be:

• production

of pollutants, toxins and greenhouse gases

• habitat

destruction, especially destruction of forests and marine eco-systems.

• nuclear

power

• uranium

mining

• coal

seam gas mining

• production

or supply of armaments

Socially harmful activities are

considered to be:

• abuse

of Human Rights and Labour Rights

• involvement

in bribery/corruption

• production

or supply of armaments

• manufacture

of alcohol, tobacco or gambling products”

4.2. Delegation

of Authority

Authority for the implementation

of the Investment Policy is delegated by Council to the General Manager in

accordance with Section 377 of the Local Government Act 1993. The General

Manager has in turn delegated the management of the Investment Policy to the

Delegated Officers as defined in this Policy. Specifically, day-to-day

management of Council’s investments rests with the Manager Finance as

Council’s RAO.

Any investment undertaken under

this Policy requires two Delegated Officers to approve the investment on the

following basis:

i) Investments

up to $1,000,000 in accordance with this Policy can be authorised by the RAO

and one of the Delegated Officers.

ii) Investments

greater then $1,000,000 in accordance with this Policy can be authorised by the

RAO and Director Corporate and Community Services.

Such authorisations extents to

Council Officers that may fill these positions from time to time when the

position incumbent is on approved leave.

4.3 Prudent

Person Standard/Ethics and Conflict of Interest

The investment portfolio of

Council will be managed with the care, diligence and skill that a prudent

person would exercise. As Trustees of public money, Delegated Officers

are to manage the Council Investment Portfolio to safeguard the portfolio in

accordance with the requirements of this Investment Policy and not for

speculative purposes.

Delegated Officers shall refrain

from personal activities that would conflict with the proper execution and

management of Council’s Investment Portfolio. This Policy requires

Delegated Officers to disclose any conflict of interest to the General Manager.

4.4 Authorised

Investments

All

investments must be denominated in Australian Dollars and be only those

investments prescribed by the Investment Order (of the Minister) issued from

time to time. The current Investment Order (of the Minister) is attached to

this Policy. Individual investments will generally be in at least $1,000,000

parcels wherever possible.

4.5 Risk

Management

In regard to performing

investment management on Council’s behalf, due consideration must also be

given to the following:

a) Preservation

of Capital – The requirement for preventing losses in an investment

portfolio’s total value.

b) Credit

Risk – The risk that a party or guarantor to a transaction will fail to

fulfil its obligations. In the context of this document it relates to the risk

of loss due to the failure of an institution/entity with which an investment is

held to pay the interest and/or repay the principal of an investment.

c) Diversification

– the requirement to place investments in a broad range of products so as

not to be over exposed to a particular sector of the investment market.

d) Liquidity

Risk – the risk an investor runs out of cash, is unable to redeem

investments at a fair price within a timely period, and thereby incurs

additional costs (or in the worst case is unable to execute its spending

plans).

e) Market

Risk – the risk that fair value or future cash flows will fluctuate due

to changes in market prices, or benchmark returns will unexpectedly overtake the

investment’s return.

f) Maturity

Risk – the risk relating to the length of term to maturity of the

investment. The longer the term, the greater the length of exposure and risk to

market volatilities.

g) Rollover

Risk – the risk that income will not meet expectations or budgeted

requirement because interest rates are lower than expected in future.

4.6 Credit

Quality and Limits

a) Direct

Investments

The amount invested with any one

financial institution should not exceed the following percentages of average

annual funds invested.

|

Long Term Rating

(Standard & Poors)

|

Short Term Rating

(Standard & Poors)

|

Maximum Percentage of

Total Investments

|

|

AAA to AA

|

A1+

|

100%

|

|

A+ to A-

|

A1

|

60%

|

|

BBB+ to NR

|

A2,

NR

|

40%

|

As an alternate to credit

ratings issued by Standard and Poor’s, Council can also utilise credit

ratings published by Moody’s and Fitch rating agencies

However, it needs to be recognised that the primary control of credit quality

is the prudential supervision of the Authorised Deposit-Taking Institutions

(ADI) sector.

Council should also consider

counterparty limits in terms of the amounts of investments held with any single

ADI. This should especially be the case for longer term investments.

Term to maturity limits should

be structured around the time horizon of investment to ensure that liquidity

and income requirements are met. Council always retains the flexibility

to invest as short as required by internal requirements or the economic

outlook.

b) Credit

Ratings

If any of Council’s

investments are downgraded such that they no longer fall within these

investment policy guidelines, they will be divested as soon as is practicable

whilst preserving invested capital.

4.7 Safe

Custody Arrangements – Security of Title

a) Where

necessary, investments may be held in safe custody on Council’s behalf as

long as the following criteria are met:

i) Council

must retain beneficial ownership of all investments.

ii) Adequate

documentation is provided, verifying the existence of the investments.

iii) The

custodian conducts regular reconciliation of records with relevant registries

and/or clearing systems

iv) The Institution or Custodian recording and holding

the investment on Council’s behalf will be:

o The Custodian nominated by New South

Treasury Corporation for Hour Glass Facilities (if used).

o Austraclear

o An institution with an investment

grade Standard and Poor’s, Moody’s or Fitch rating.

o An institution with adequate

insurance, including professional indemnity insurance and other insurances

considered prudent and appropriate to cover its liabilities under any

agreement.

b) Prior

to undertaking any investment it is imperative that the security of title of

the investment proposed must be in the name and ownership of Byron Shire

Council.

4.8 Accounting

and Reporting

Council will

comply with appropriate Accounting Standards in valuing its investments and

quantifying its investment returns including interest and fair value

gains/losses. Council will provide disclosure relating to its investment

portfolio at the conclusion of each financial year as prescribed by Accounting

Standards and the Local Government Code of Accounting Practice and Financial

Reporting.

Council is to

maintain a register of its investments including documentary evidence to

Council’s legal title to the investments held. The register of

investments is to be reconciled monthly to the general ledger which forms the

basis of monthly reporting to Council in accordance with Regulation 212 of the

Local Government (General) Regulation 2005 and the monthly financial report to

the Executive Team.

Reporting on

Environmentally and Socially Responsible Investment opportunities and outcomes

are to be included in the Investment Report provided to Council each month.

4.9 Performance

Benchmarks

The performance expectation of

all Council’s individual investments within the overall Council

investment portfolio will meet the performance benchmark in the table below:

|

Investment

|

Performance Benchmark

|

|

Cash / Direct Investments

|

Exceed average 90 day Bank Bill Swap Index

|

5. LEGISLATIVE AND STRATEGIC CONTEXT

5.1. Community

Strategic Plan

Council’s Investment

Policy supports the effective governance, business, project and financial

management of Council. Specifically strategy CM1.1 Improve the

transparency, effectiveness and accountability of Council and CM1.3 Improve

organisational sustainability (economic, social, environmental and governance).

5.2. Legislative

Requirements

a) Local

Government Act 1993 – Section 625(2).

b) Local

Government Act 1993 – Investment Order (of the Minister) dated 12 January

2011.

c) Trustee

Amendment (Discretionary Investments) Act 1997 – Section 14A(2), 14C(1) 7

(2).

d) Local

Government (General) Regulation – Regulation 212.

e) Local

Government Code of Accounting Practice and Financial Reporting as amended from

time to time.

f) Australian

Accounting Standards

g) Office

of Local Government Investment Policy Guidelines and Circulars.

h) Council

resolution 15-515 – Environmentally and Socially Responsible Investments.

6. SUSTAINABILITY

6.1. Social

The investment of

Council’s funds may provide the Council to seek investment opportunities

that assist in the improvement of society or the community through the

investment into projects where allowable that have positive social outcomes.

6.2. Environmental

The investment of

Council’s funds may provide the Council to seek investment opportunities

that assist in the improvement of the Environment through the investment into

projects where allowable that have positive environmental outcomes.

6.3. Economic

The investment of

Council’s funds provides the opportunity to generate revenue to assist in

the financial sustainability of the Council and to carry out its functions.

6.4. Governance

This Policy establishes the

framework for the management of Council’s invested funds and to ensure

due diligence and care is exercised by those charged with the investment of

Council’s funds.

ATTACHMENT

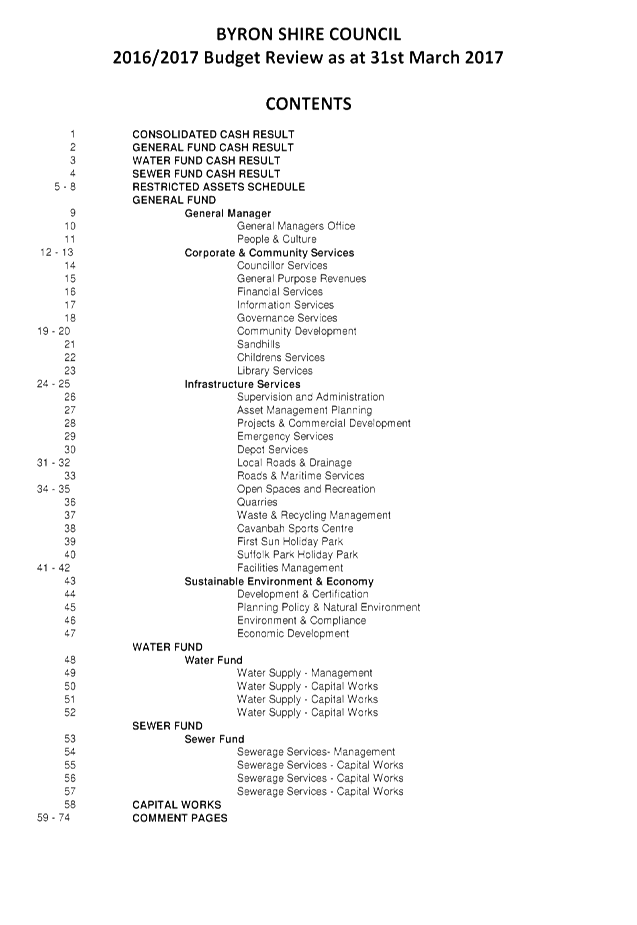

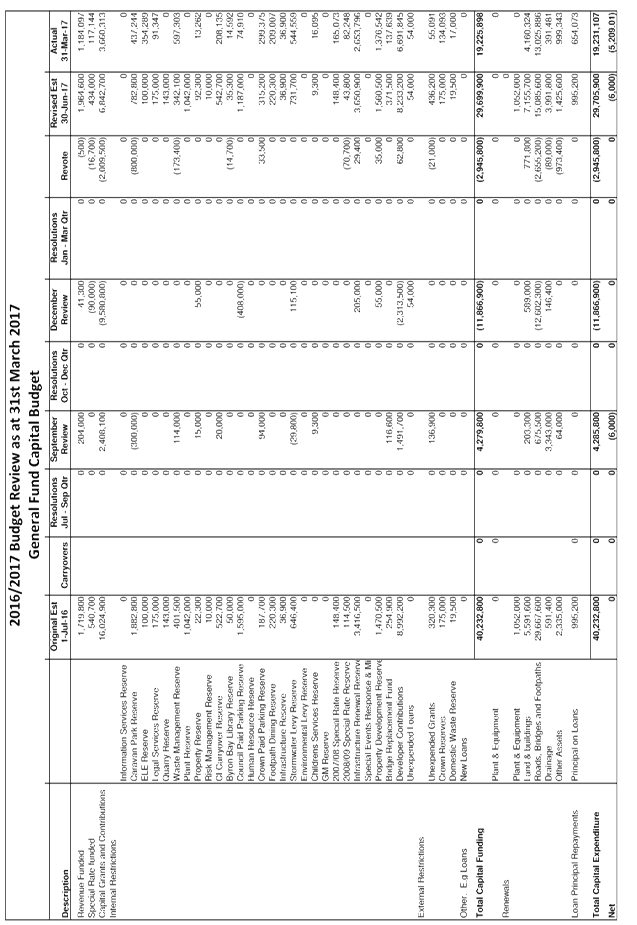

Staff Reports - Corporate and Community Services 4.2

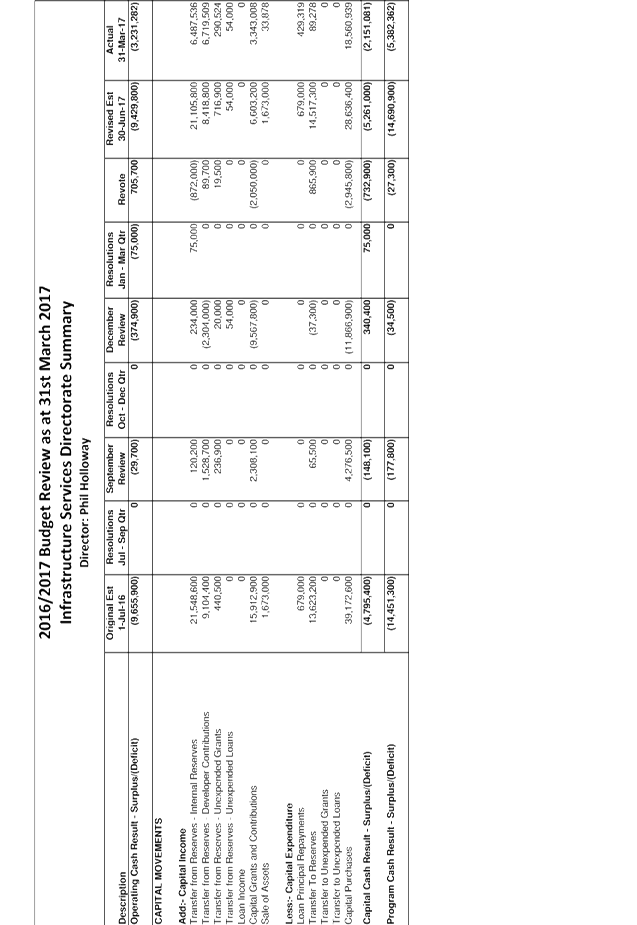

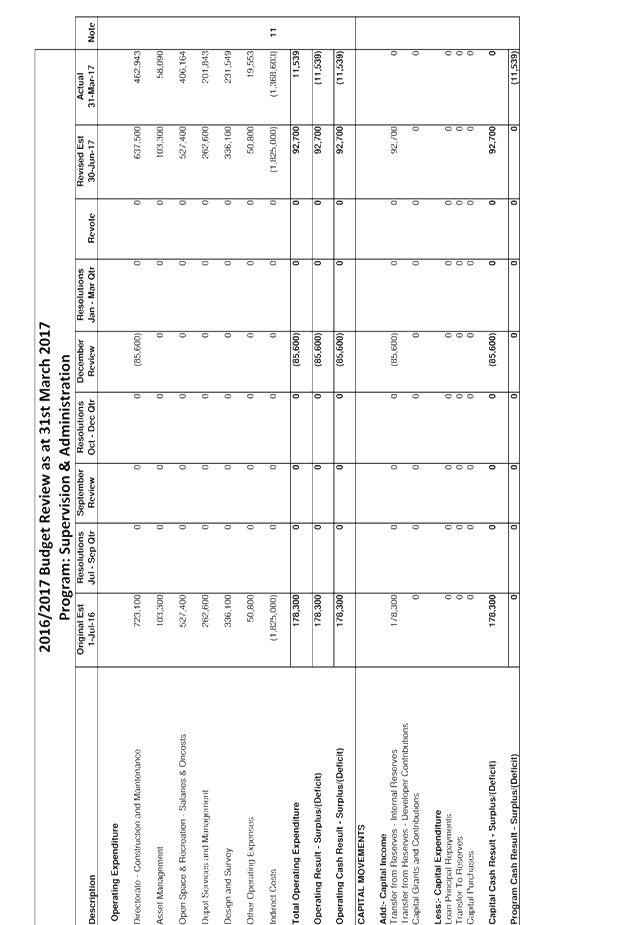

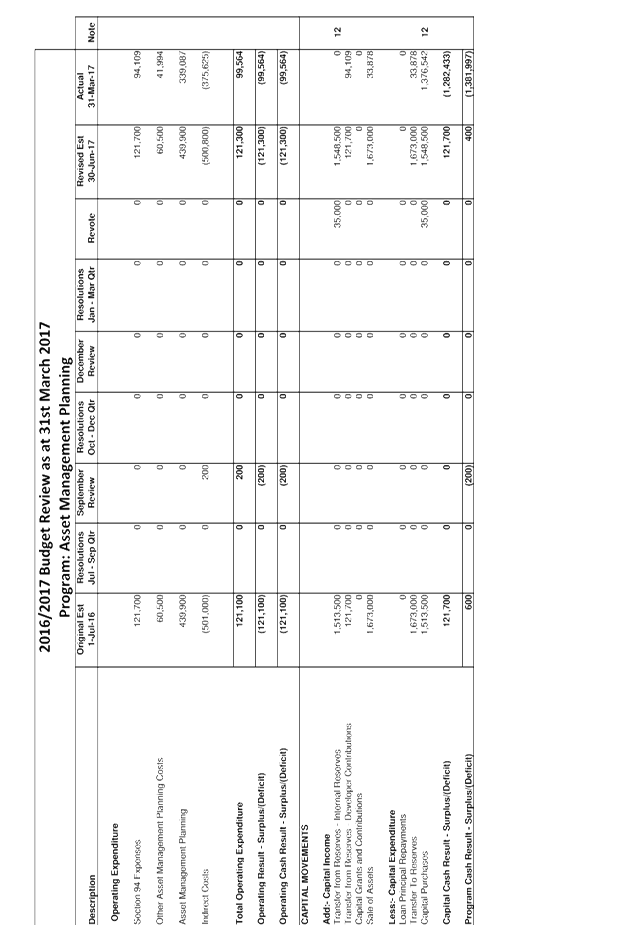

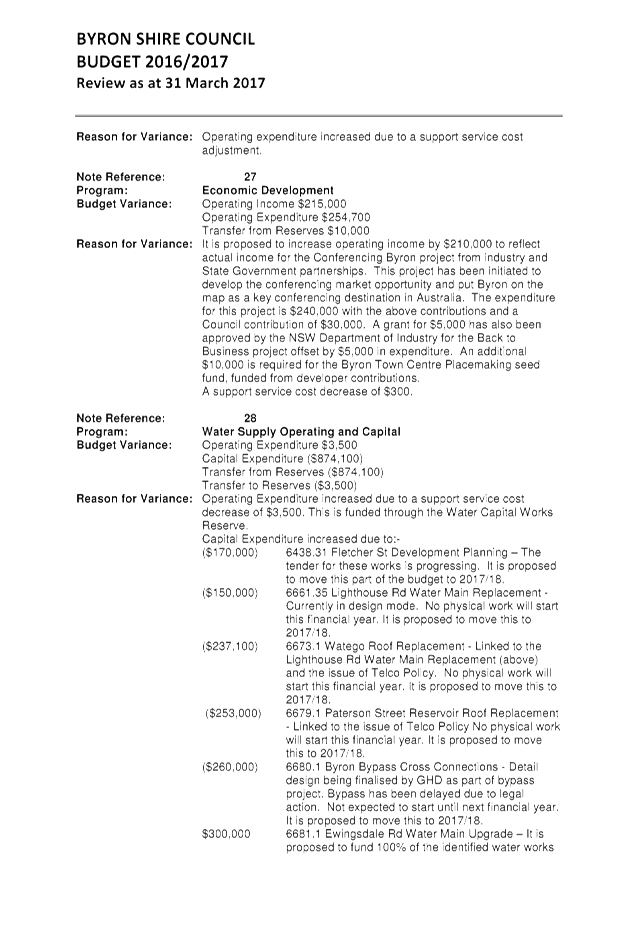

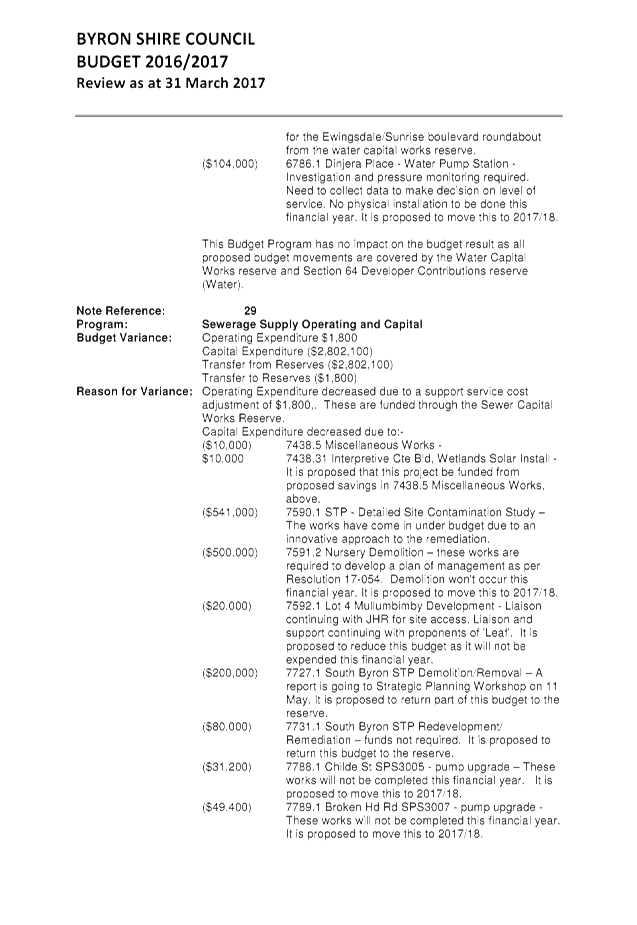

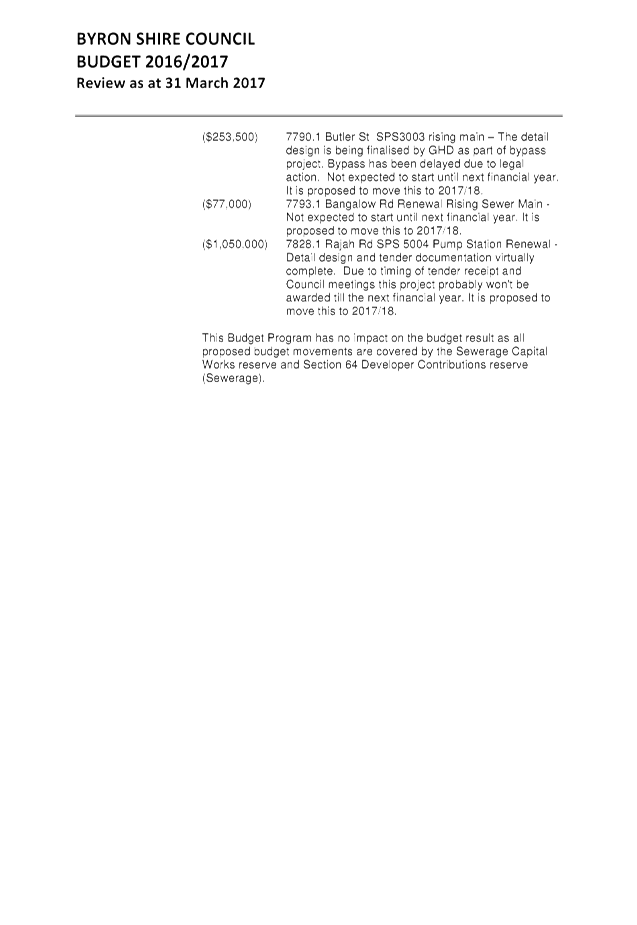

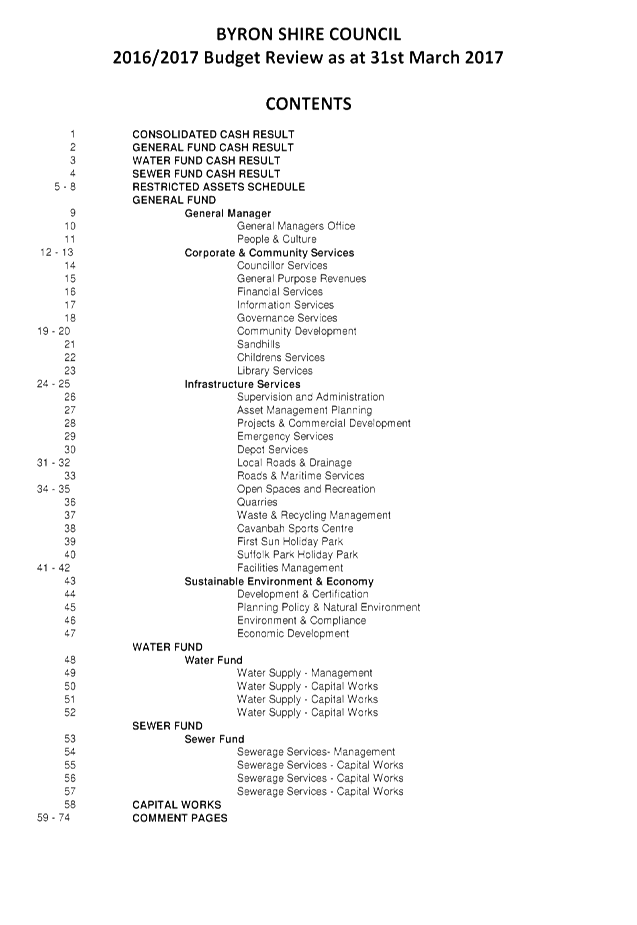

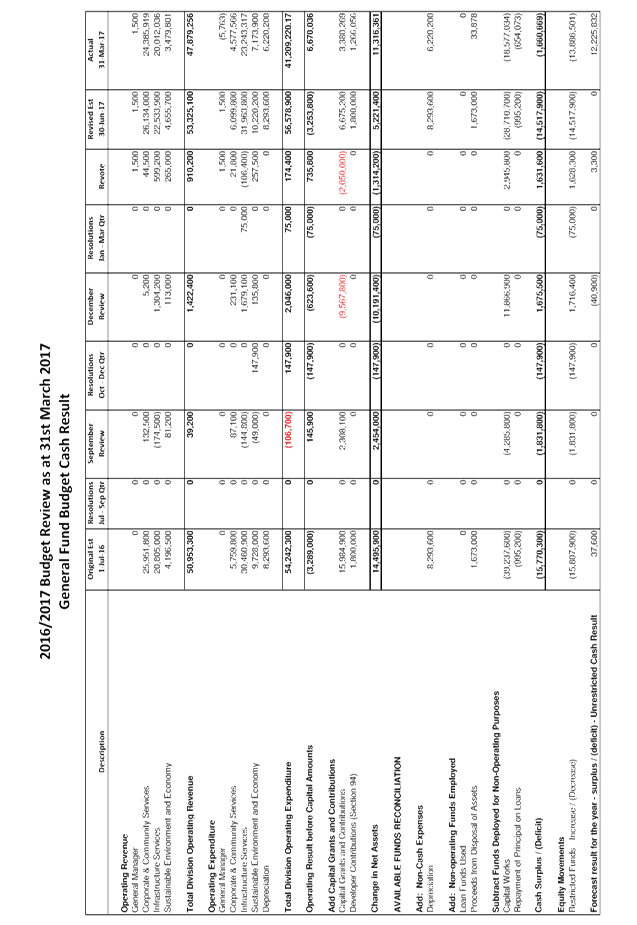

Report No. 4.2 Budget

Review 1 January - 31 March 2017

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/598

Theme: Corporate Management

Financial Services

Summary:

This report is prepared to comply with Regulation 203 of the

Local Government (General) Regulation 2005 and to inform Council and the

Community of Council’s estimated financial position for the 2016/2017

financial year, reviewed as at 31 March 2017.

This report contains an overview of the proposed budget

variations for the General Fund, Water Fund and Sewerage Fund. The

specific details of these proposed variations are included in Attachment 1 and

2 for Council’s consideration and authorisation.

Attachment 3 contains the Integrated Planning and Reporting

Framework (IP&R) Quarterly Budget Review Statement (QBRS) as outlined by

the Division of Local Government in circular 10-32.

|

RECOMMENDATION:

That the Finance Advisory Committee recommend to

Council:

1. That

Council authorise the itemised budget variations as shown in Attachment 2

(#E2017/31291) which includes the following results in the 31 March 2017

Quarterly Review of the 2016/2017 Budget:

a) General

Fund – $3,300 increase in the Estimated Unrestricted Cash Result

b) General

Fund - $1,628,300 increase in reserves

c) Water

Fund - $870,600 increase in reserves

d) Sewerage

Fund - $2,810,300 increase in reserves

2. That

Council adopt the revised General Fund Estimated Unrestricted Cash Result of

$1,145,200 for the 2016/2017 financial year as at 31 March 2017.

|

Attachments:

1 Budget

Variations fro General, Water and Sewerage Funds, E2017/31290 , page 28⇩

2 March 2017

Quarterly Budget Review, E2017/31291

, page 104⇩

3 Integrated

Planning and Reporting Framework (IP&R) Quarterly Review Statement, E2017/31292 ,

page 110⇩

Report

Council adopted the 2016/2017 budget on 29 June 2016 via

Resolution 16-348. It also considered and adopted the budget

carryovers from the 2015/2016 financial year, to be incorporated into the

2016/2017 budget at its Ordinary Meeting held on 25 August 2016 via Resolution 16-446.

Since that date, Council has reviewed the budget taking into consideration the

2015/2016 Financial Statement results and progress through the first three

quarters of the 2016/2017 financial year. This report considers the March

2017 Quarter Budget Review.

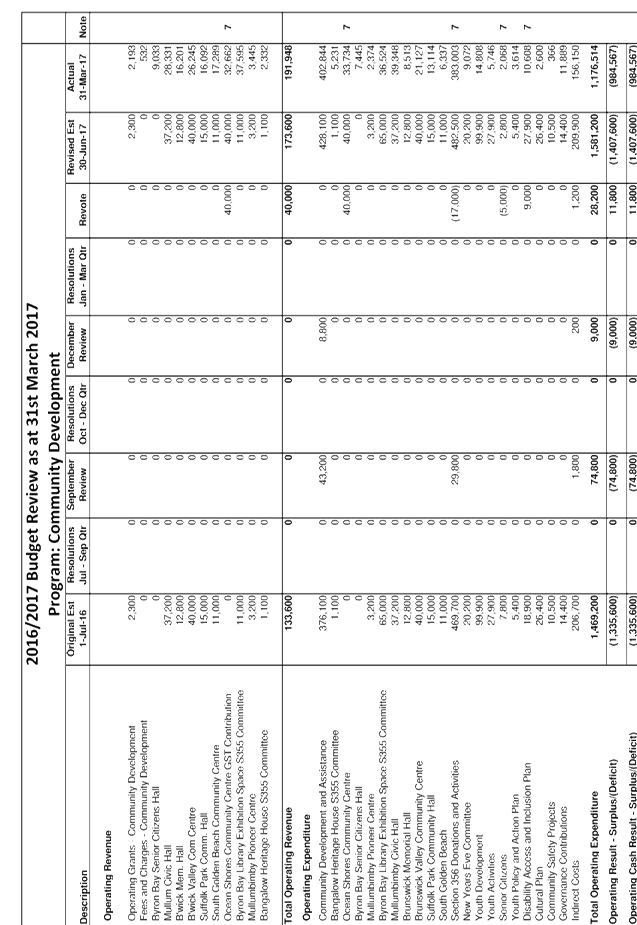

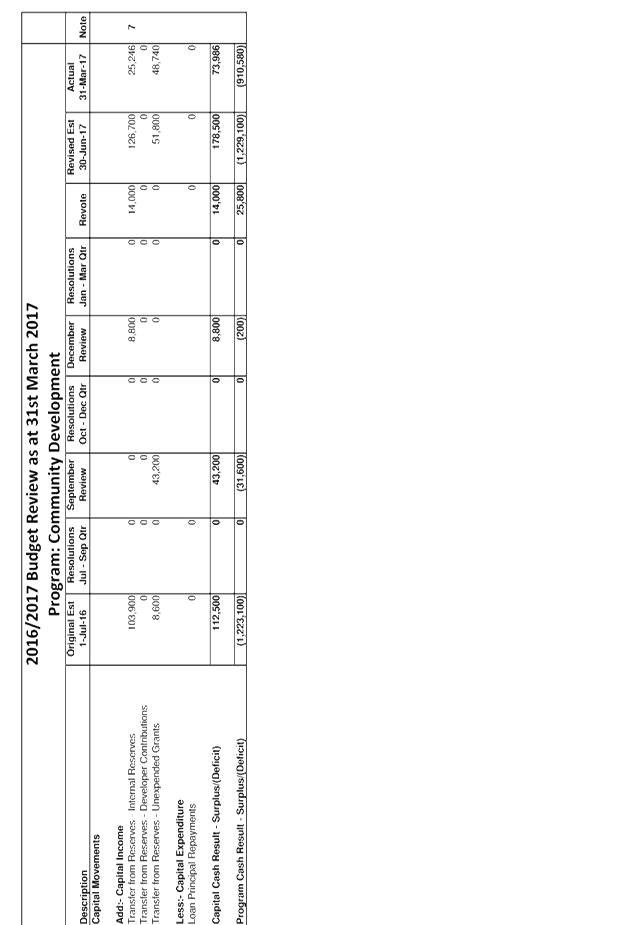

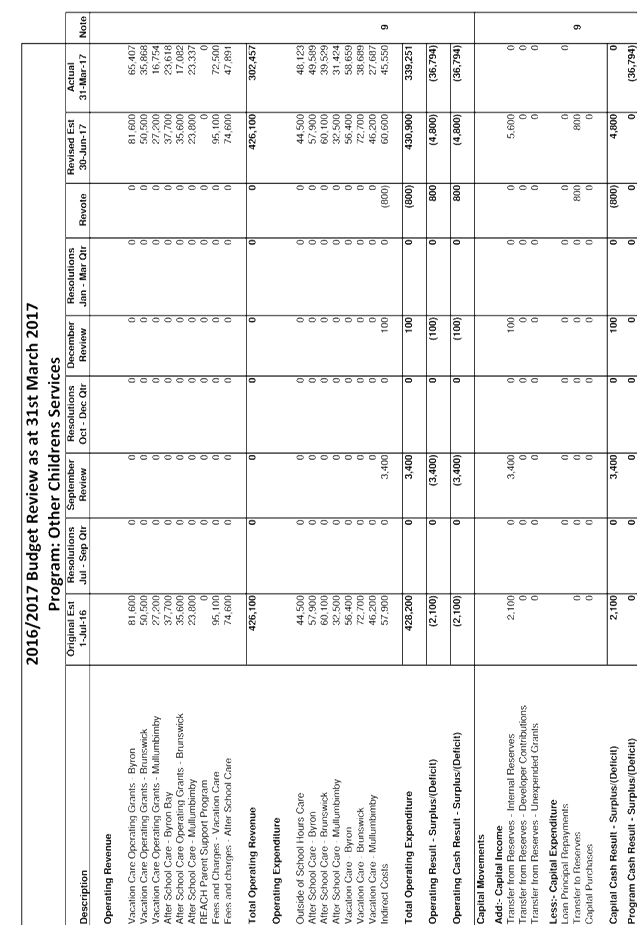

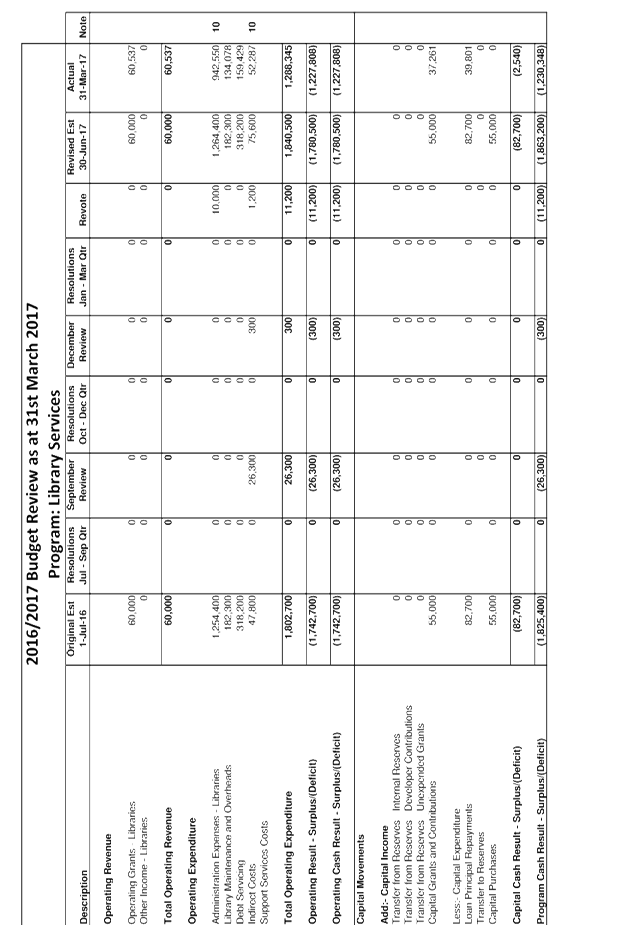

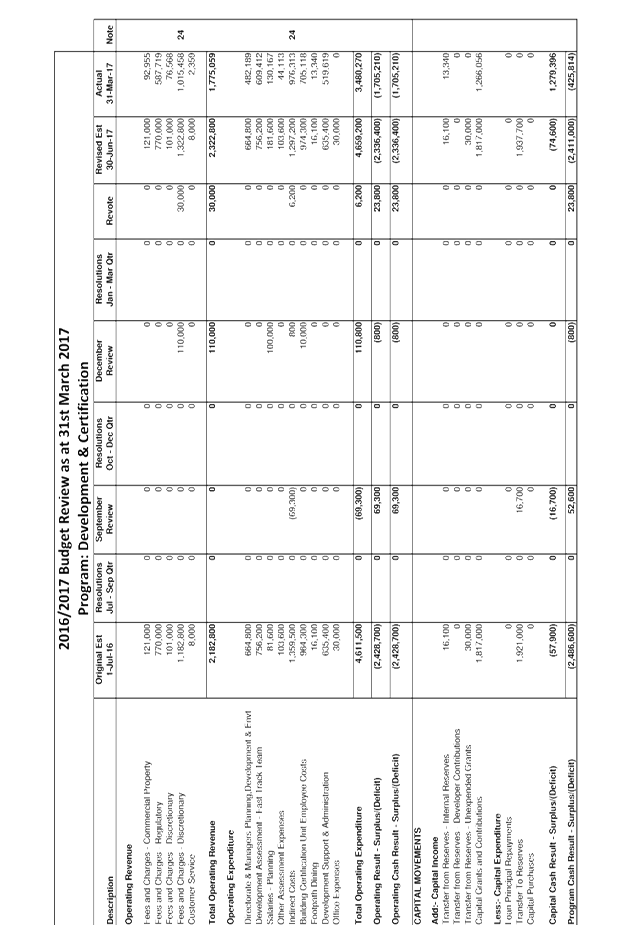

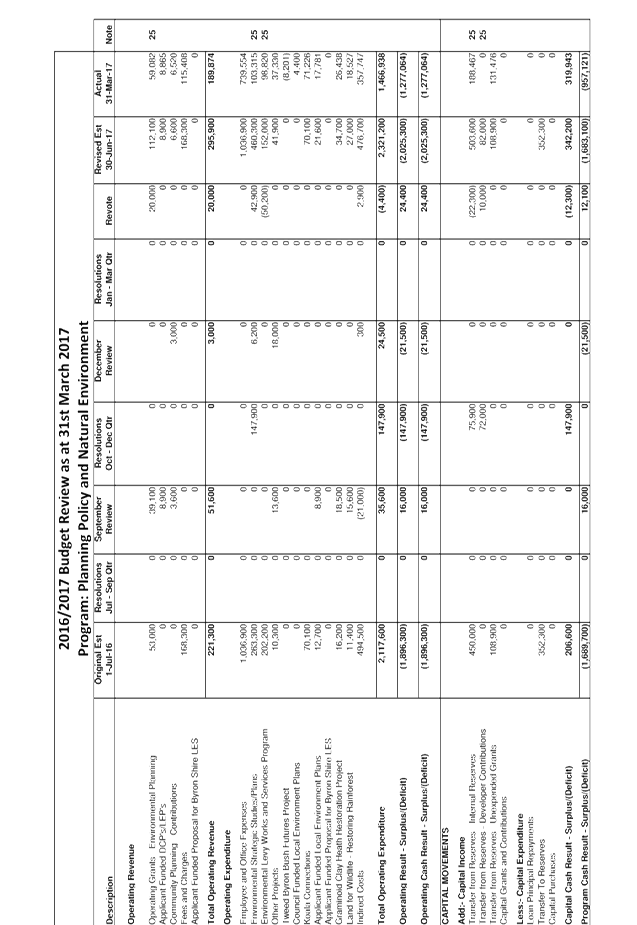

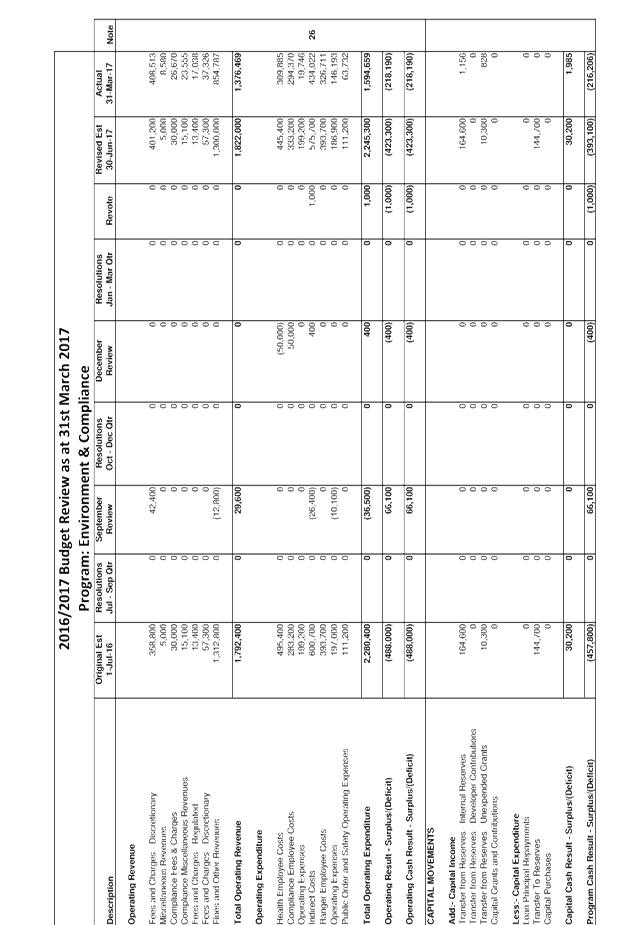

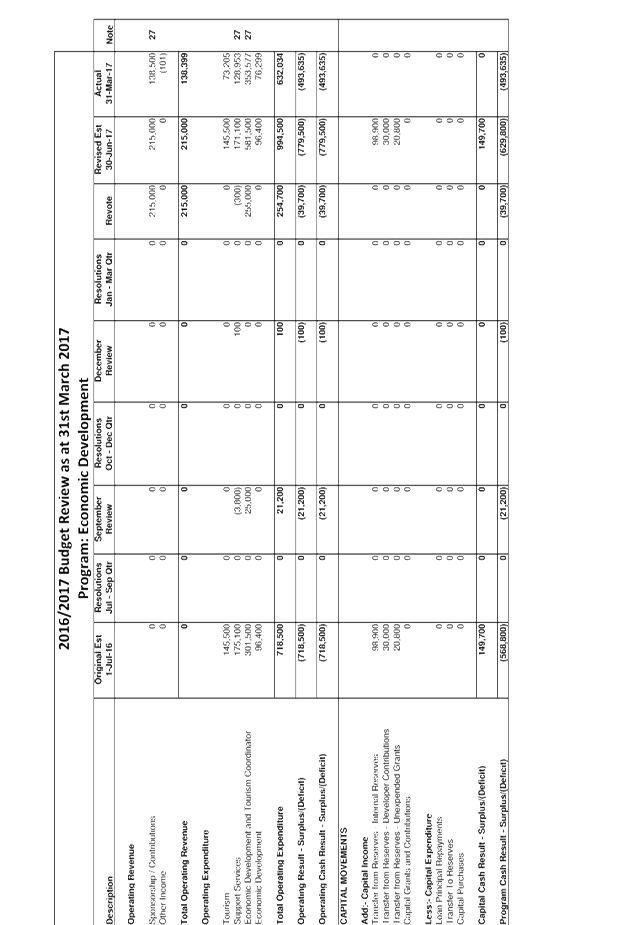

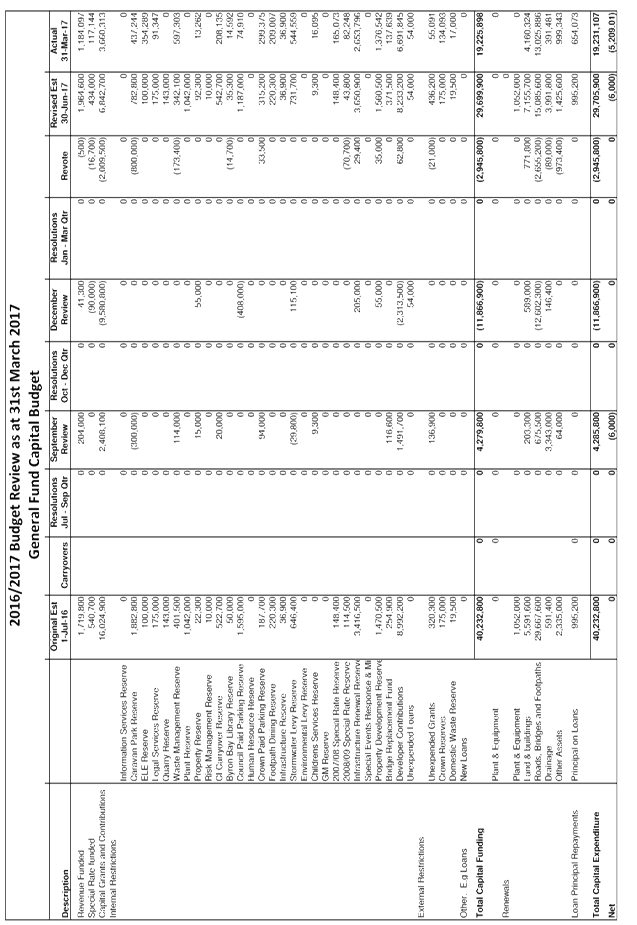

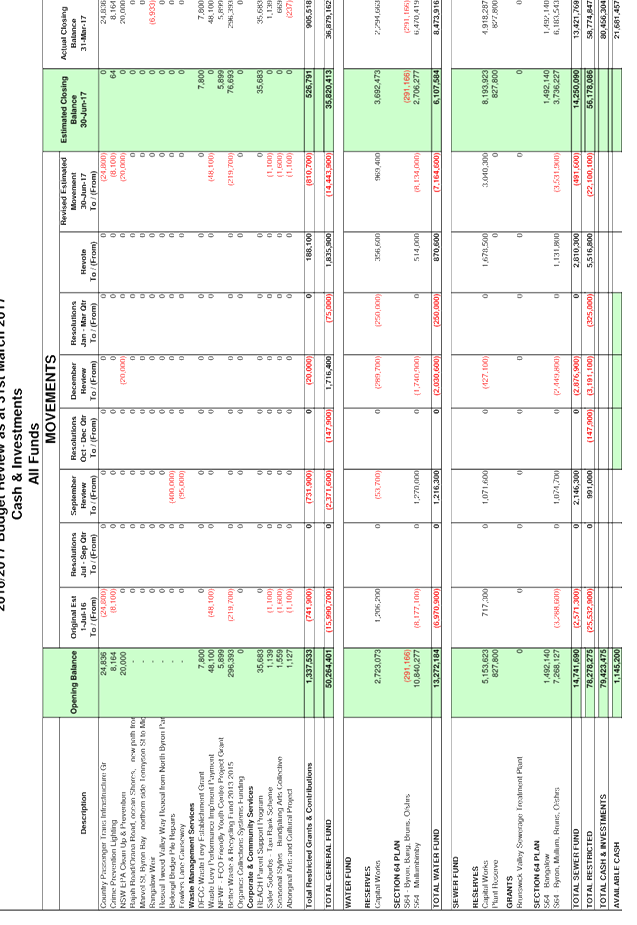

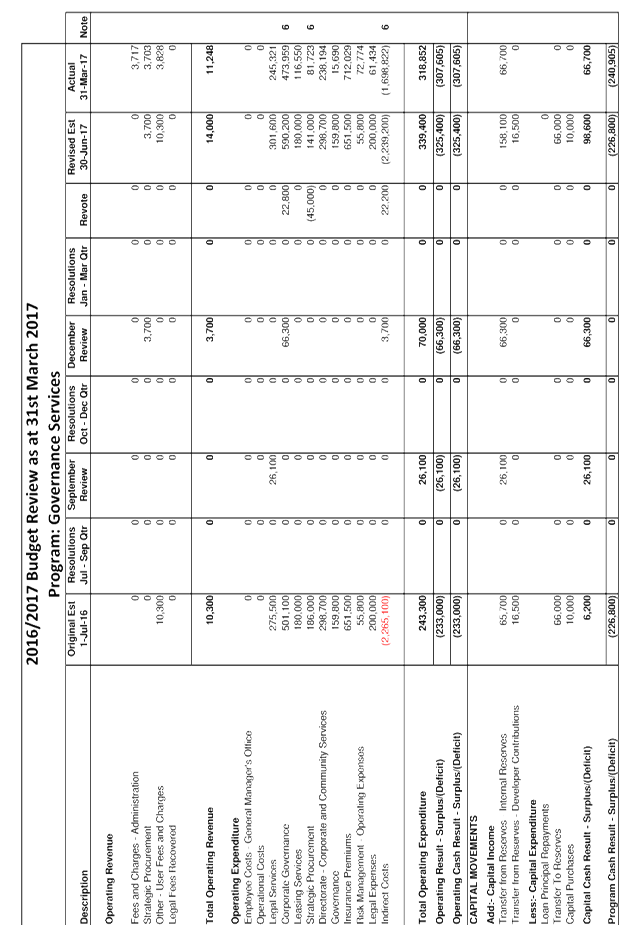

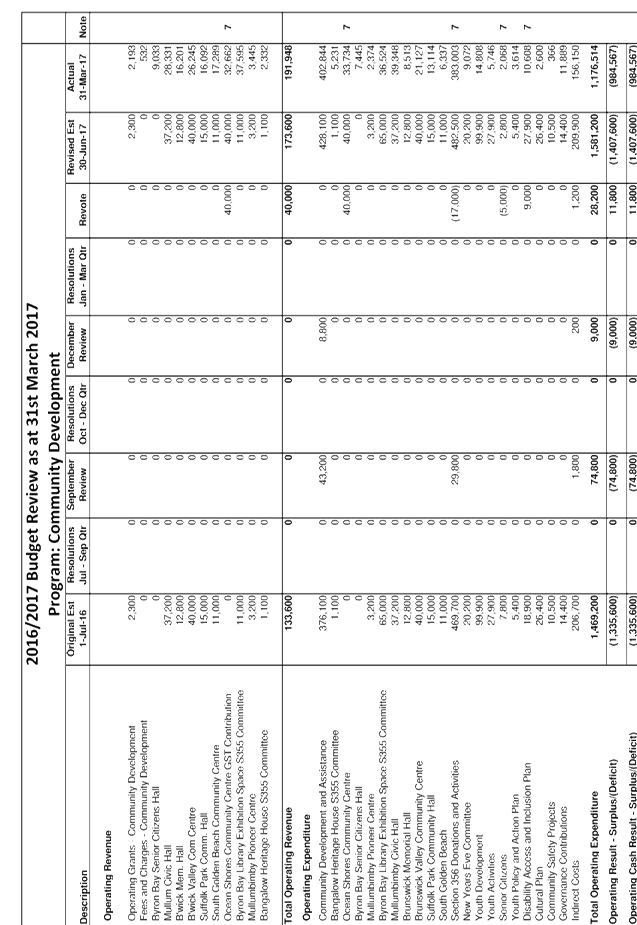

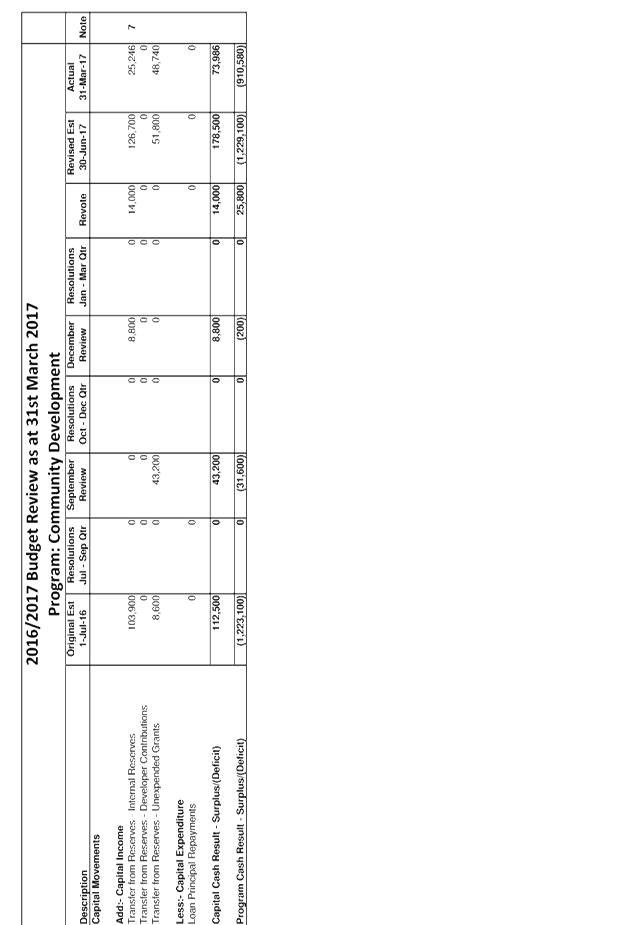

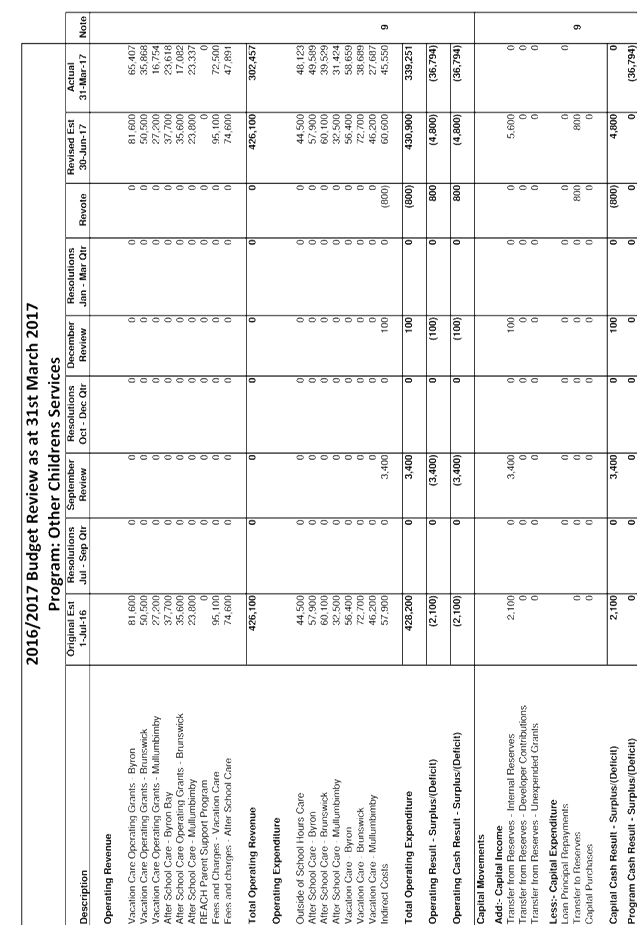

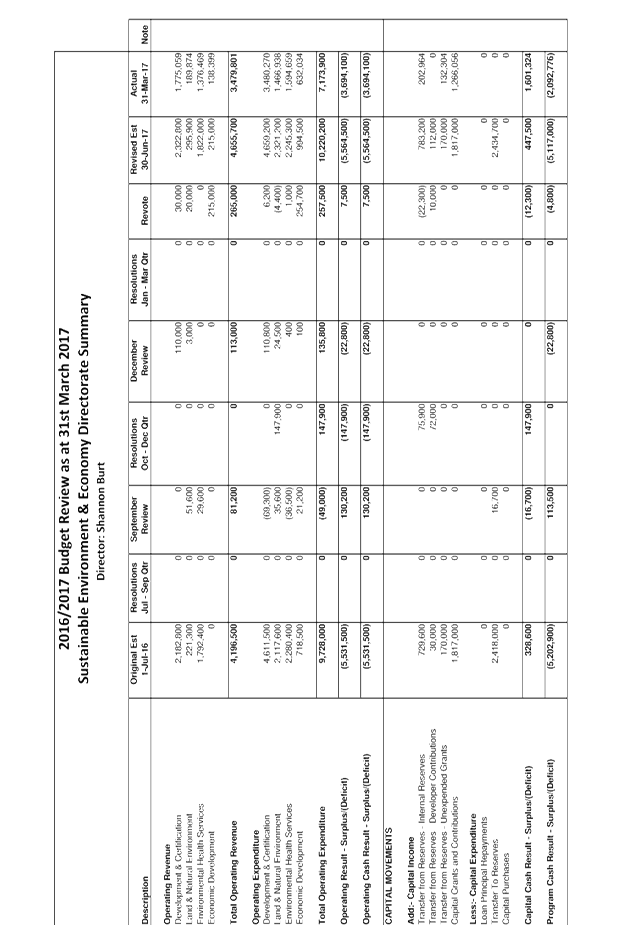

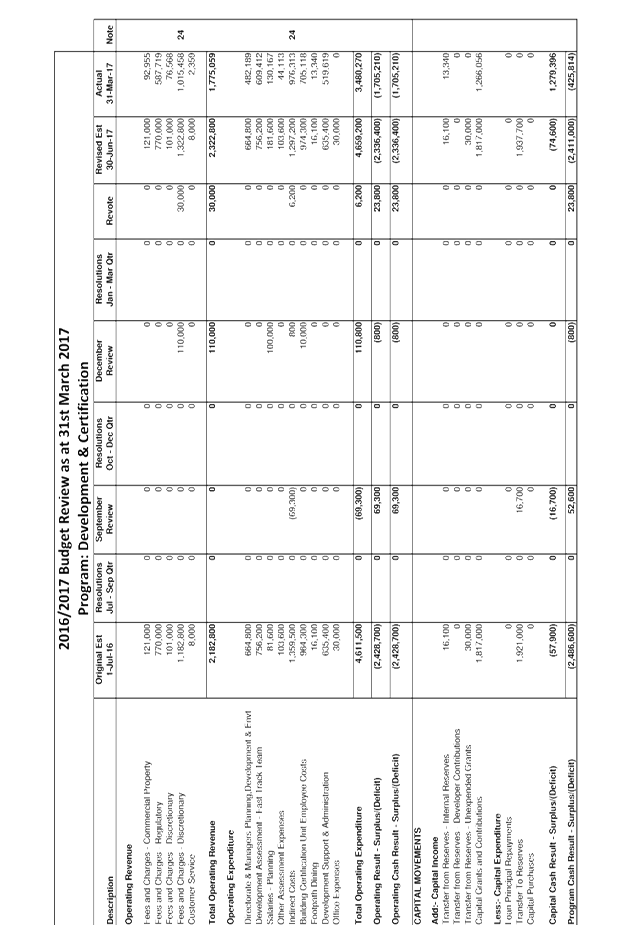

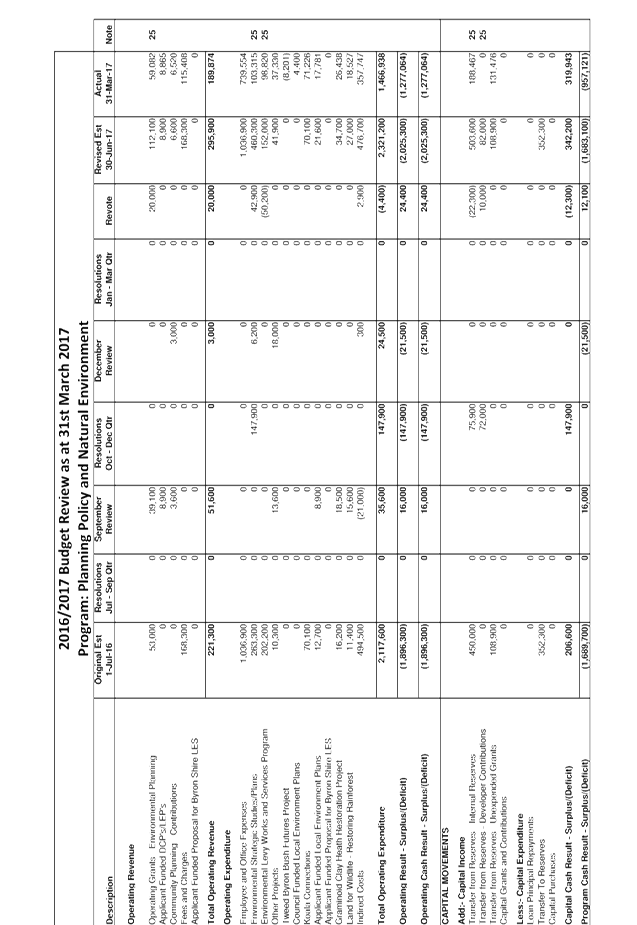

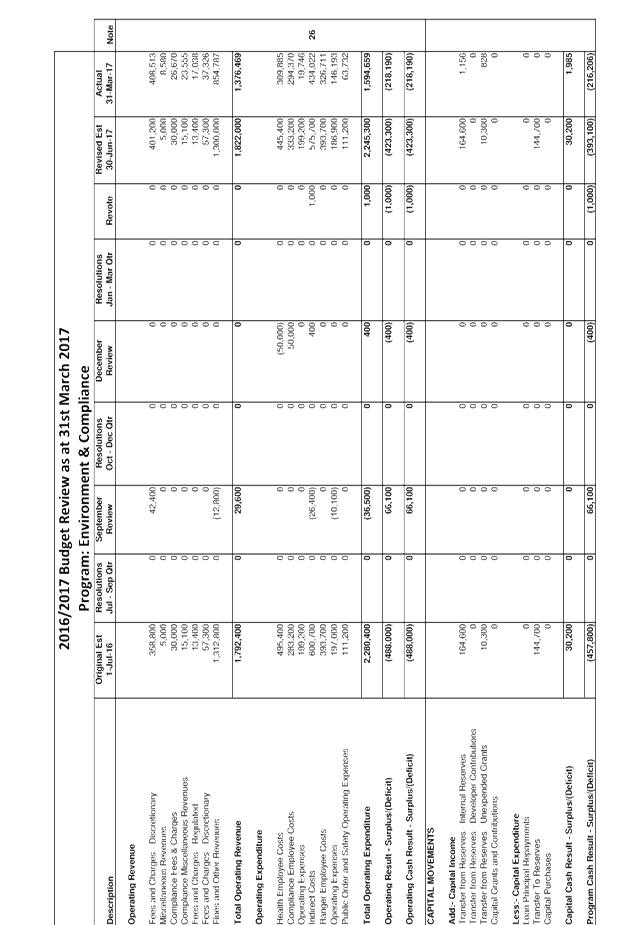

The details of the budget review for the Consolidated,

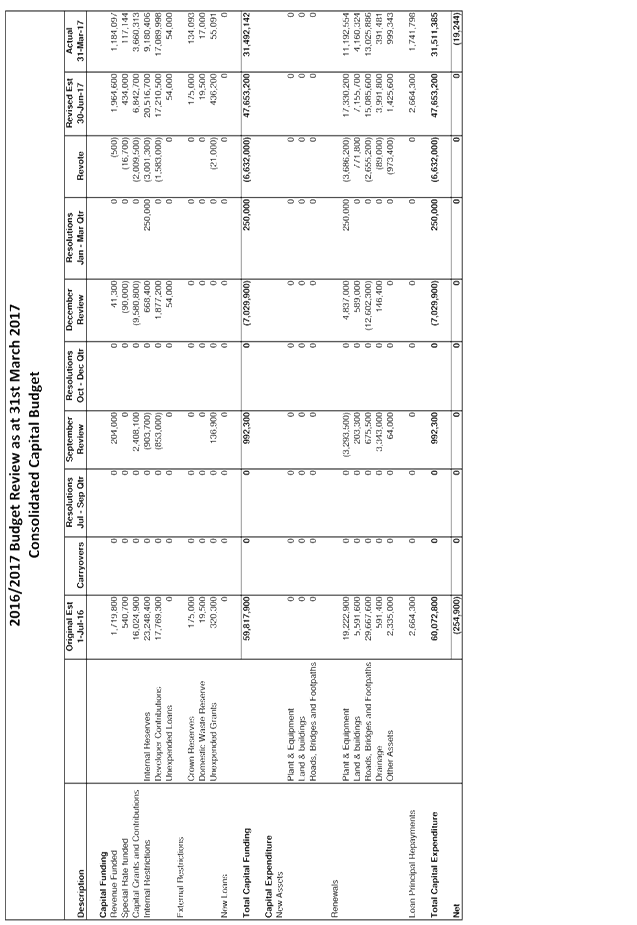

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget

position of Council, as well as a breakdown by Fund and Principal Activity. The

document in Attachment 1 is also effectively a publication outlining a review

of the budget and is intended to provide Councillors with more detailed

information to assist with decision making regarding Council’s finances.

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

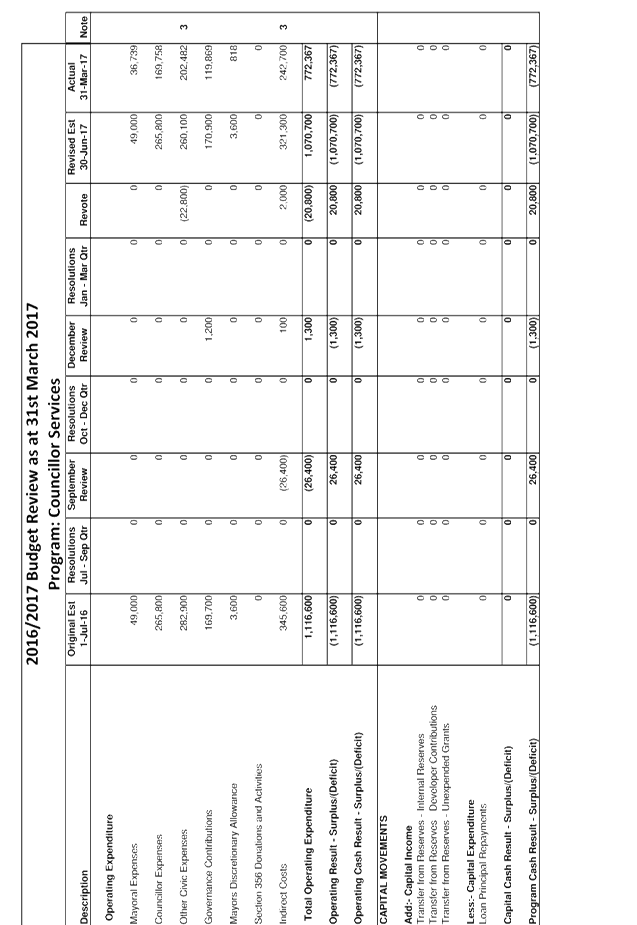

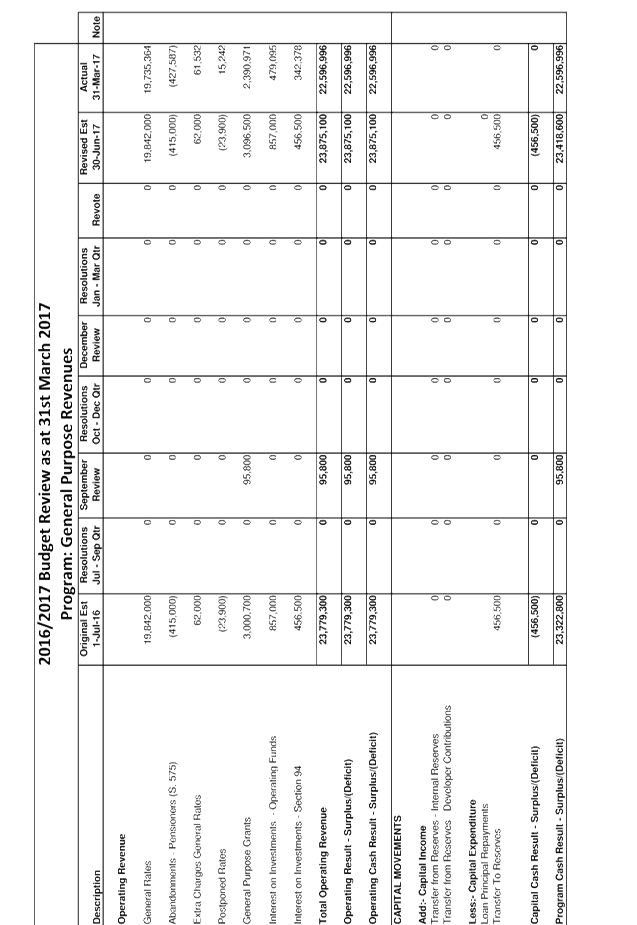

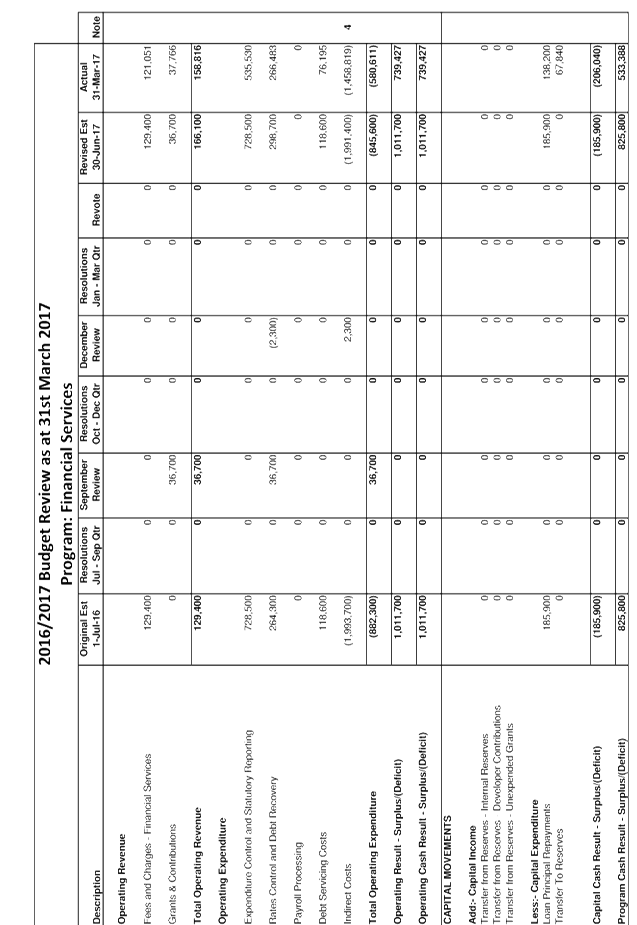

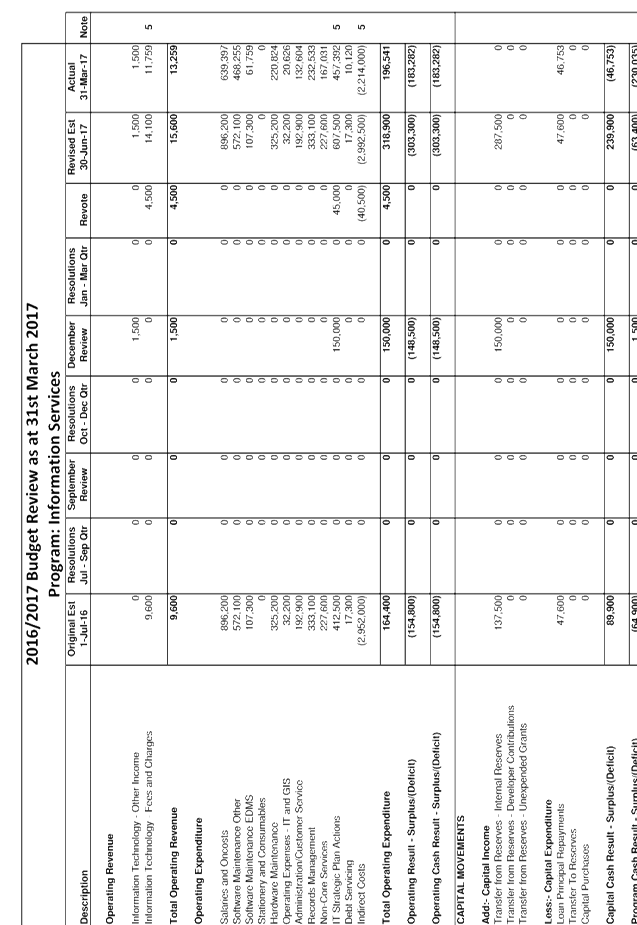

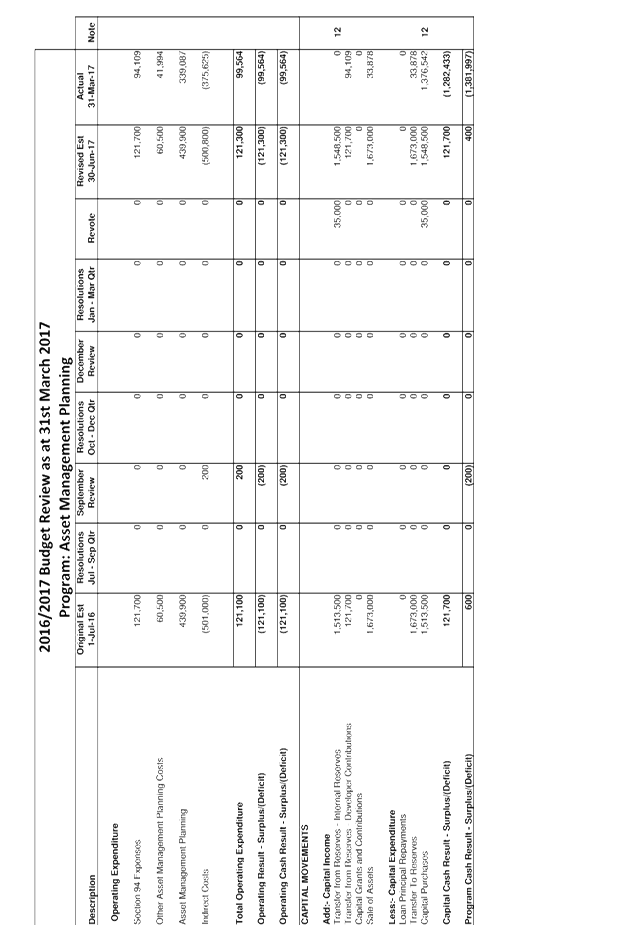

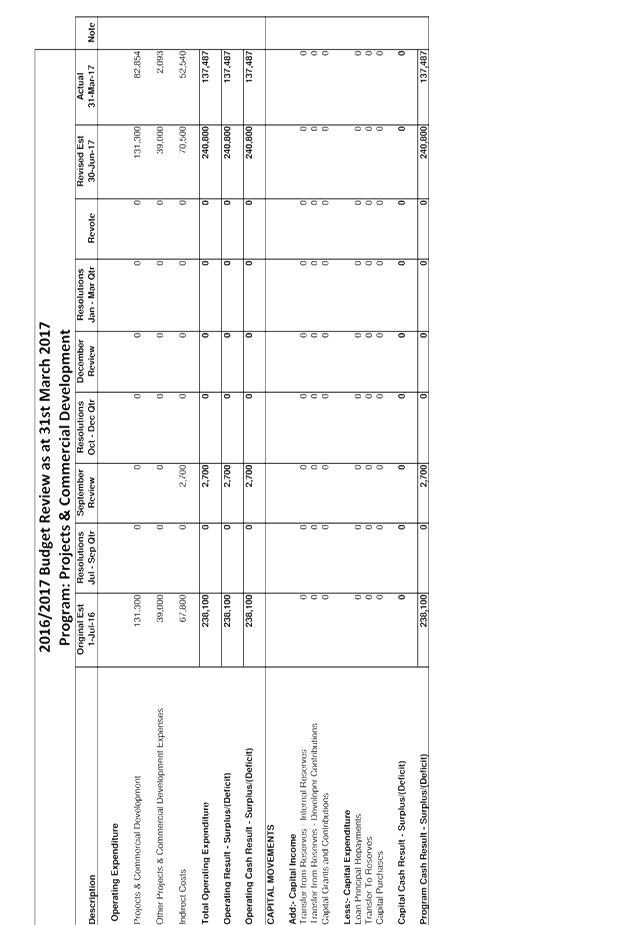

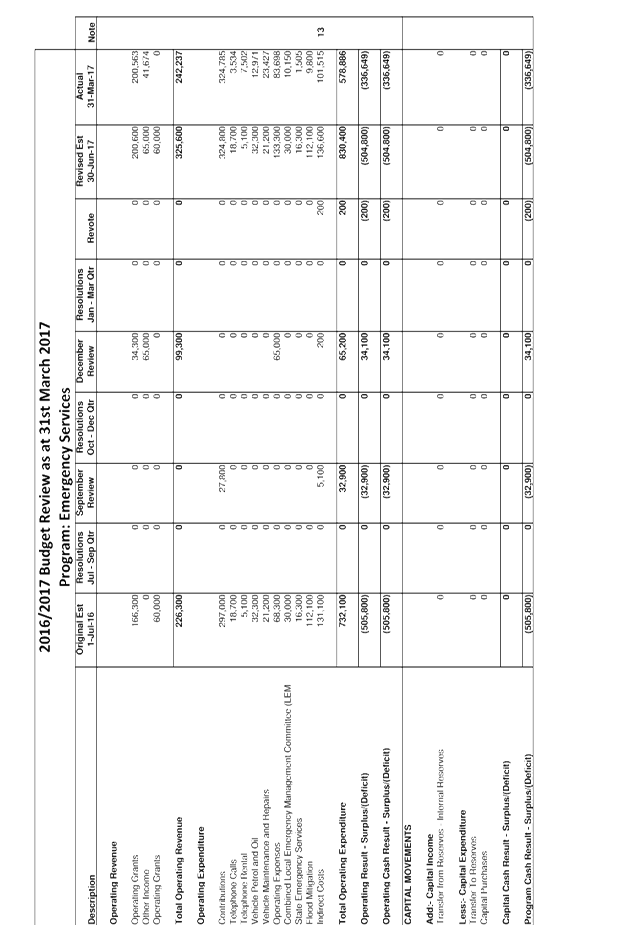

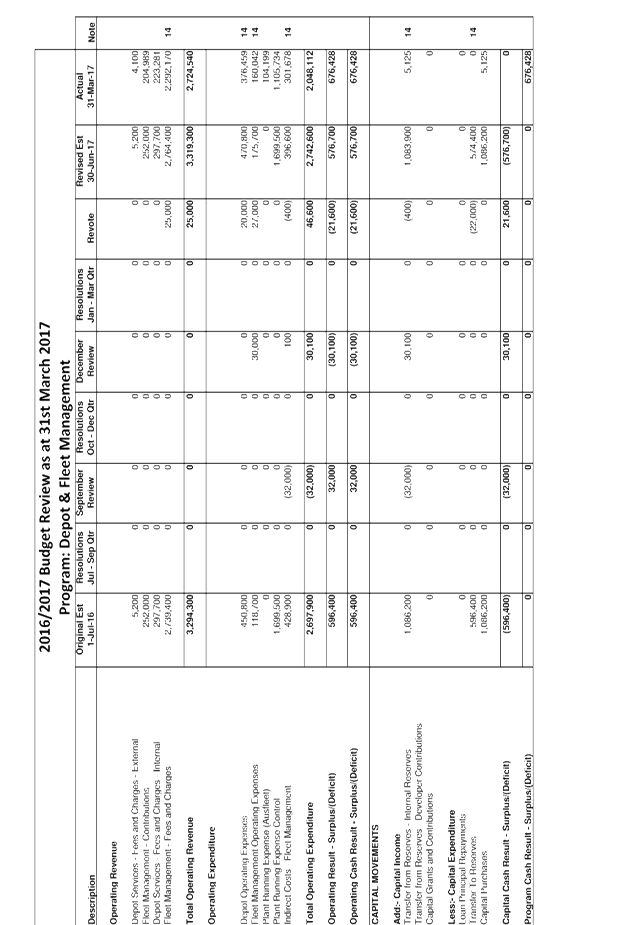

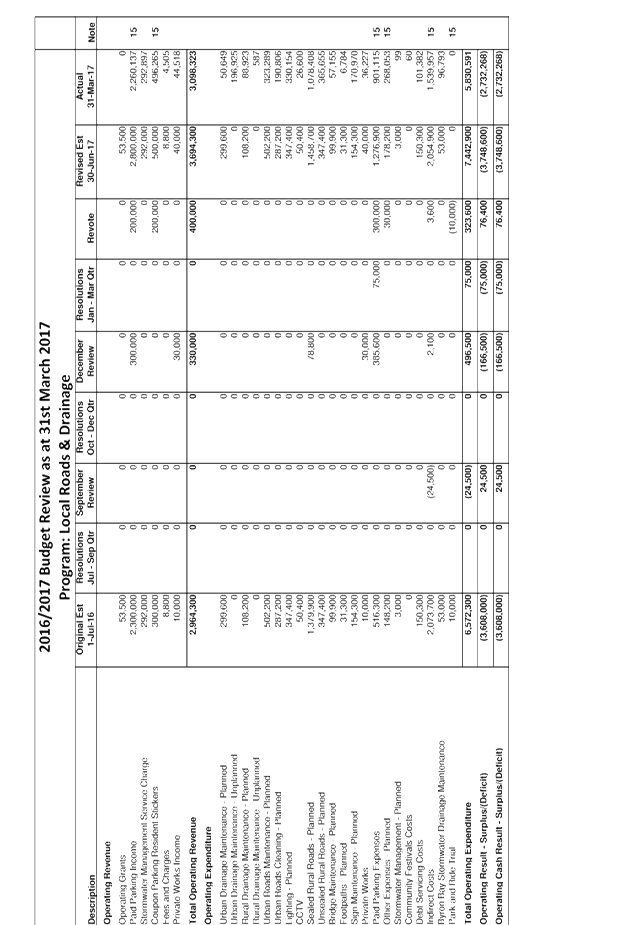

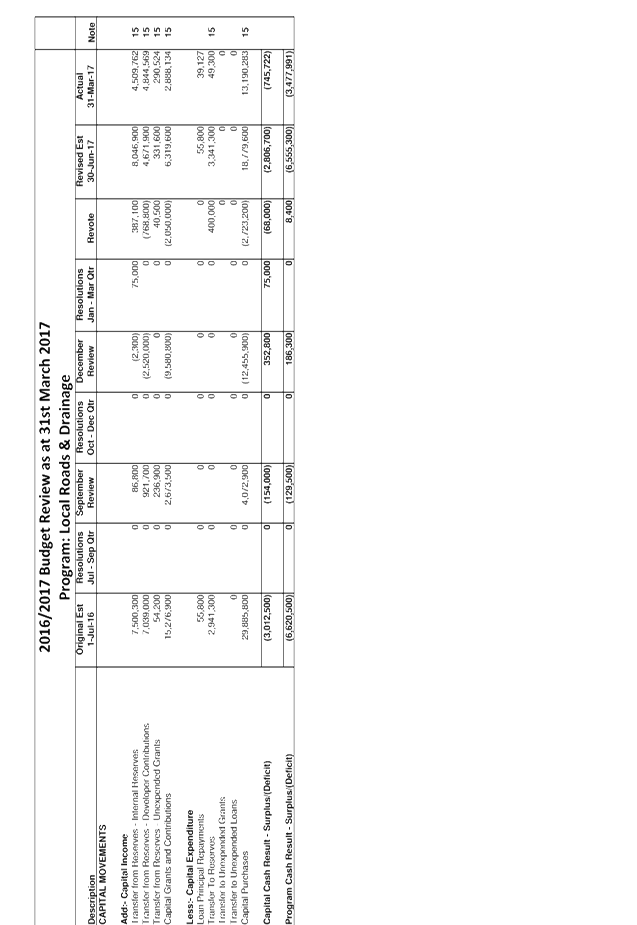

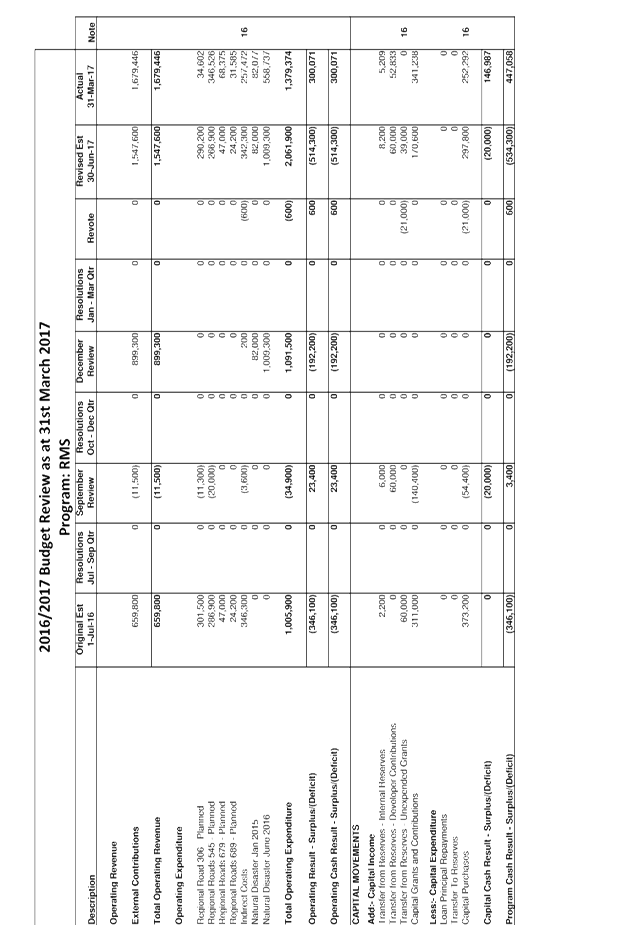

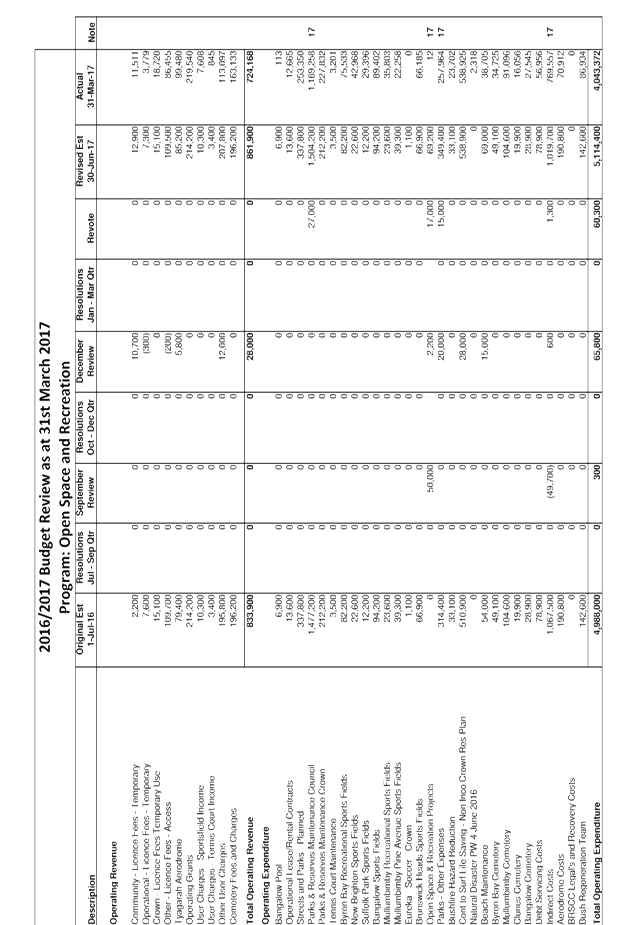

The pages within Attachment 1 are presented (from left to

right) by showing the original budget as adopted by Council on 29 June 2016

plus the adopted carryover budgets from 2015/2016 followed by the resolutions

between July and September, the September review, resolutions between October

and December, the December review, resolutions between January and March and

the revote (or adjustment for this review) and then the revised position

projected for 30 June 2017 as at 31 March 2017.

On the far right of the Principal Activity, there is a

column titled “Note”. If this is populated by a number, it

means that there has been an adjustment in the quarterly review. This

number then corresponds to the notes at the end of the Attachment 1 which

provides an explanation of the variation.

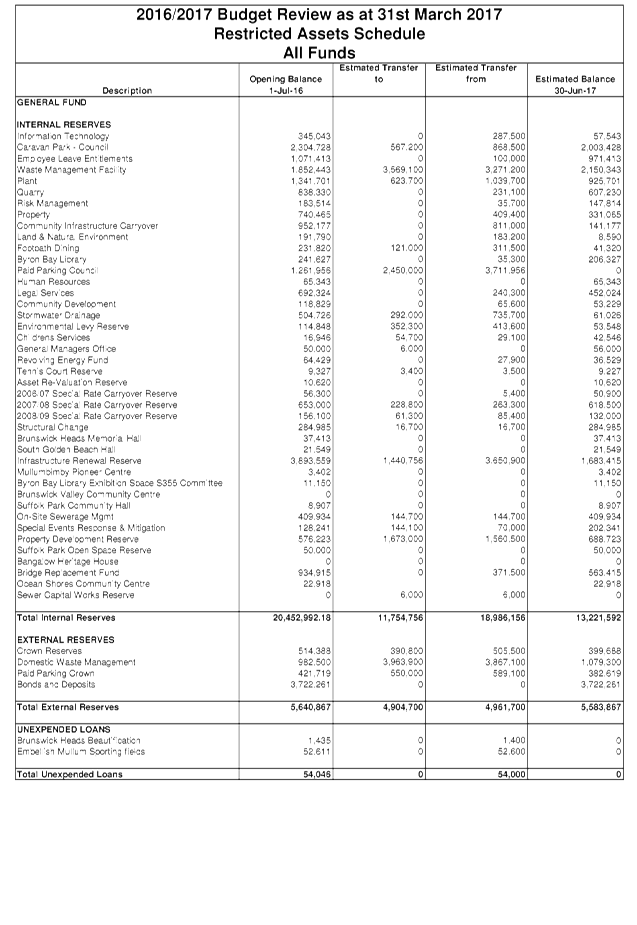

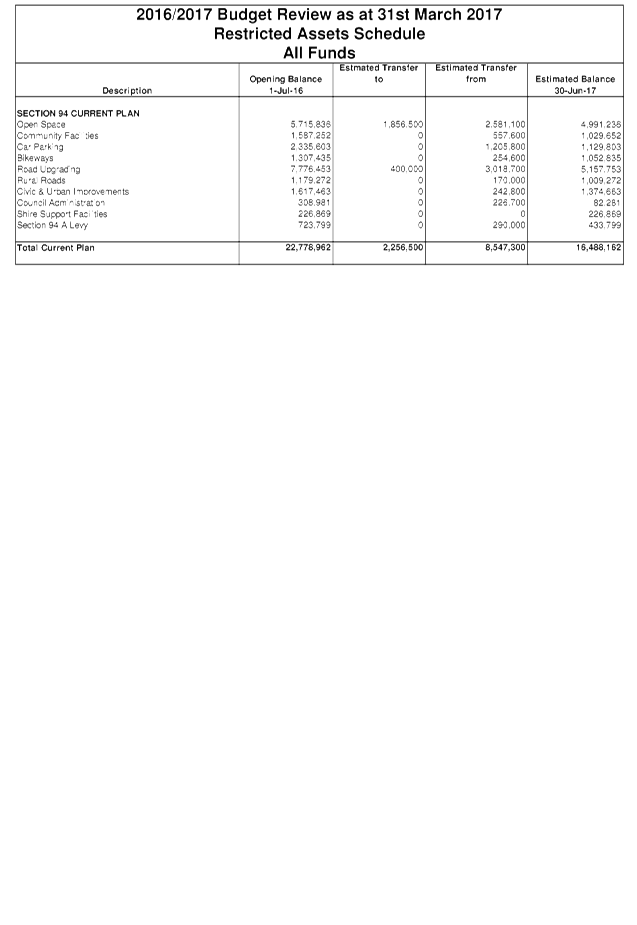

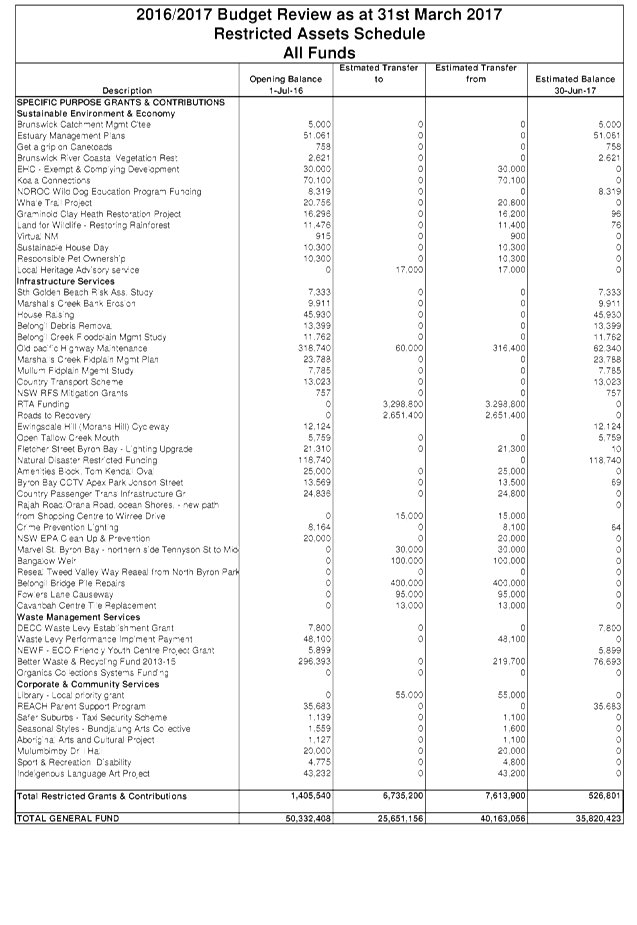

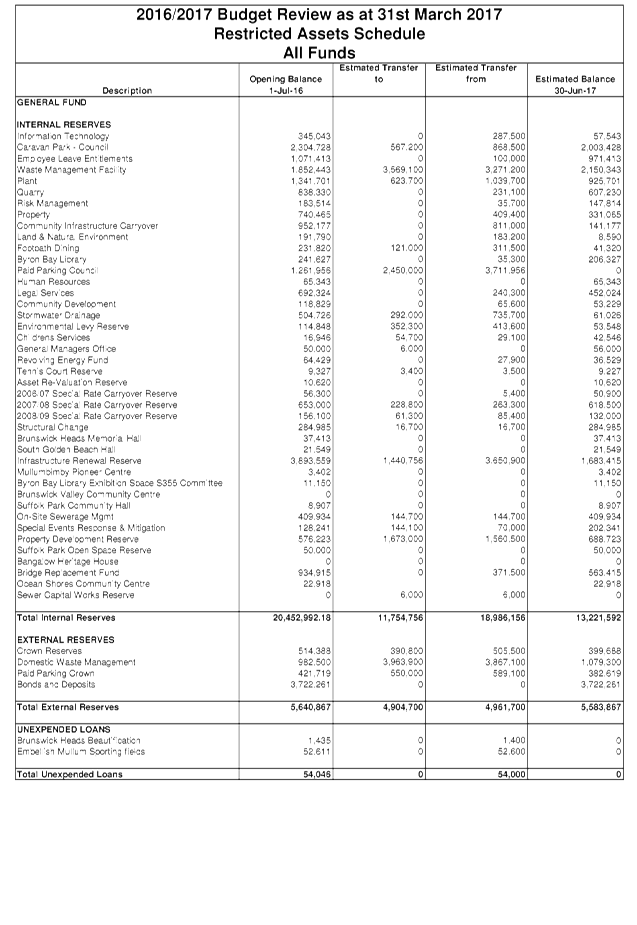

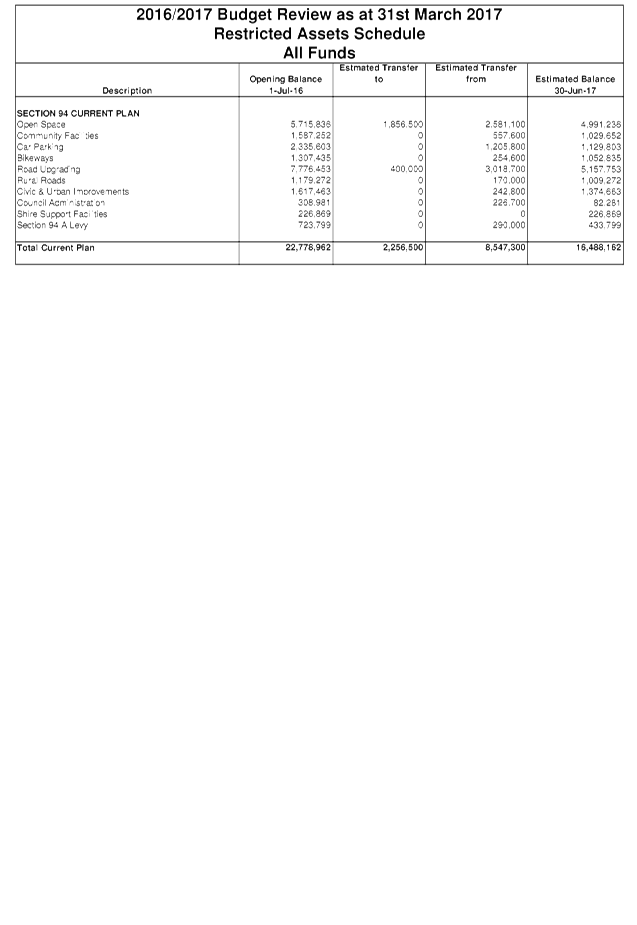

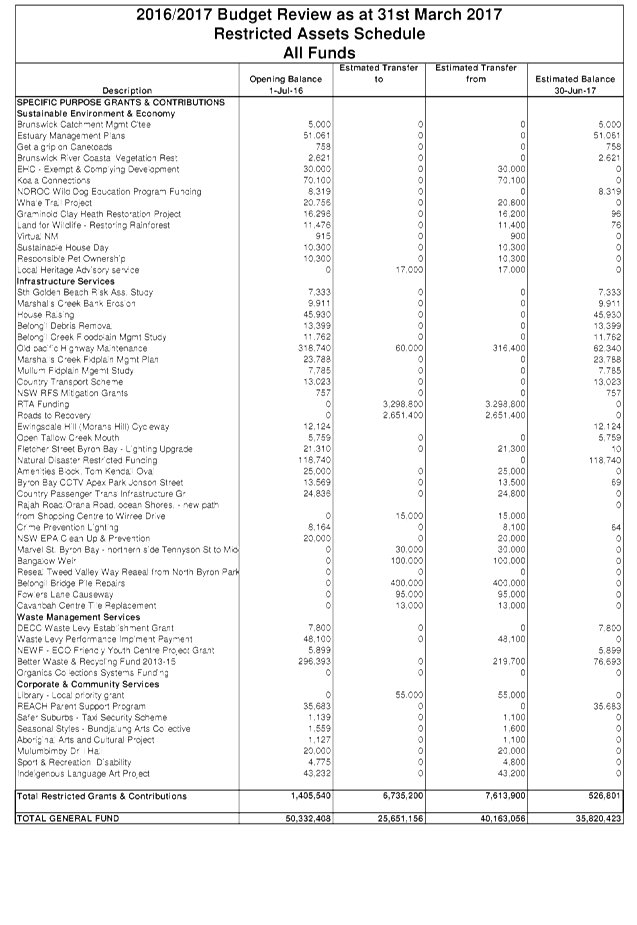

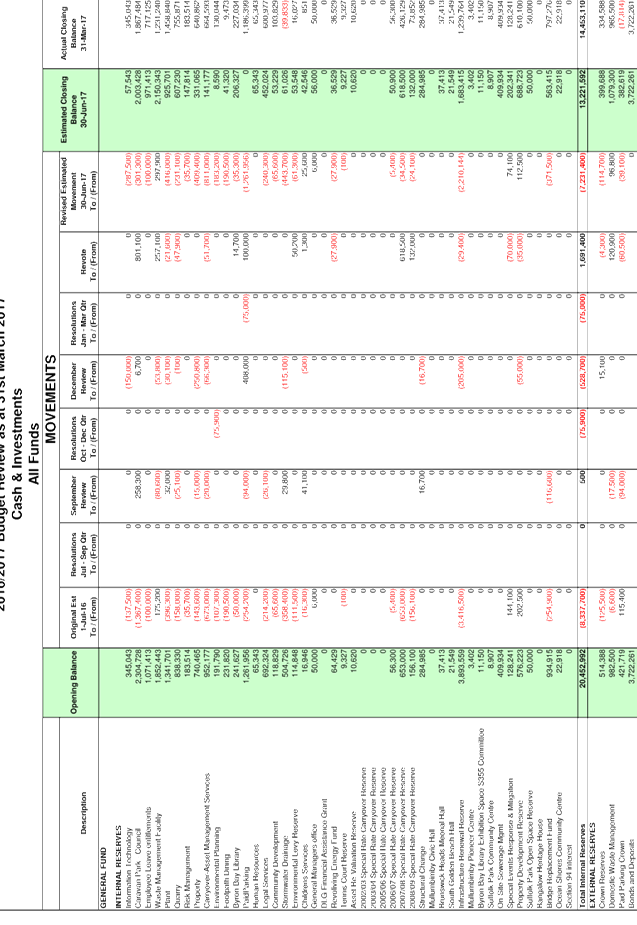

There is also information detailing restricted assets

(reserves) to show Council estimated balances as at 30 June 2017 for all

Council’s reserves.

A summary of Capital Works is also included by Fund and

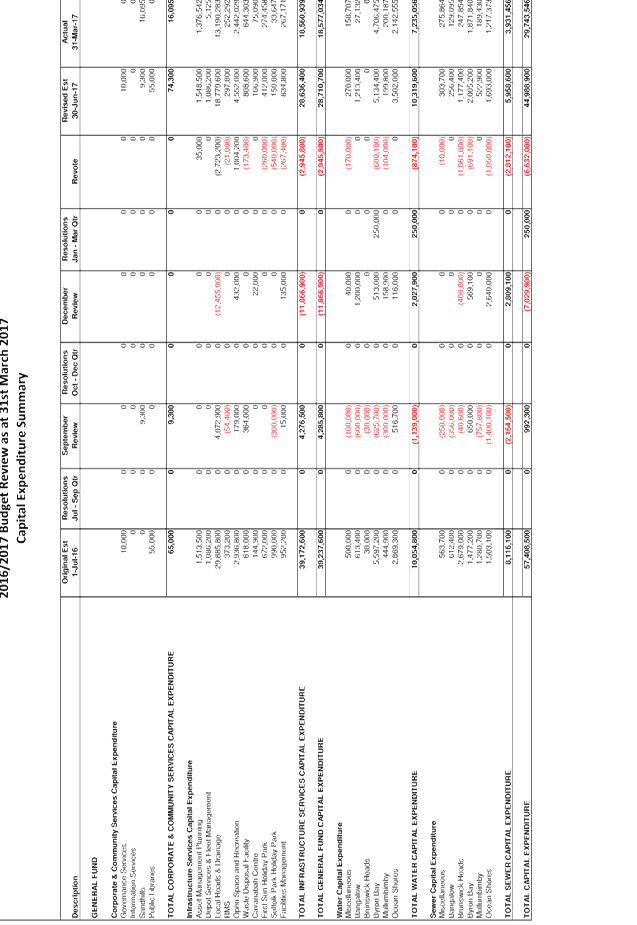

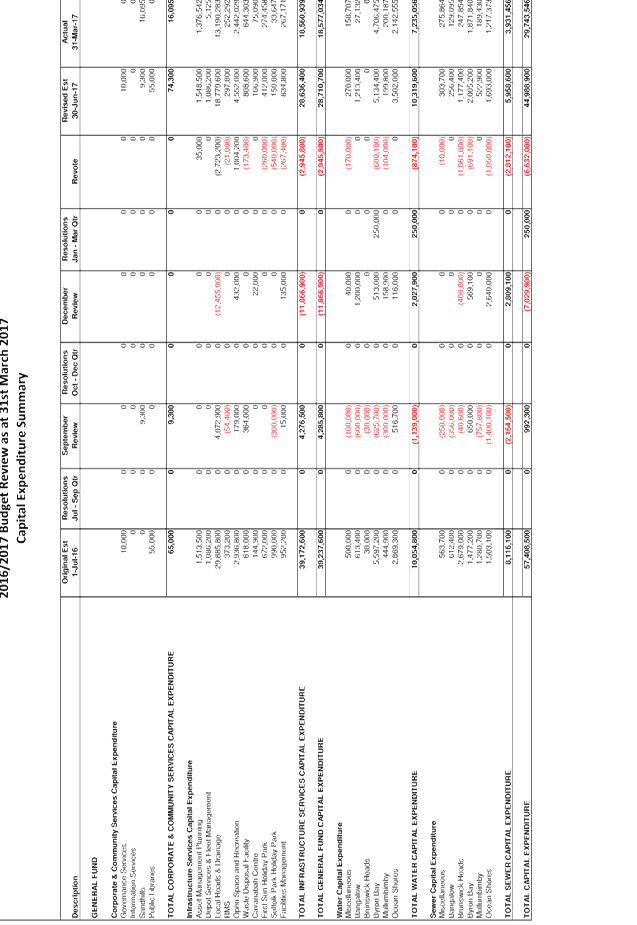

Principal Activity.

Office of Local Government Budget Review Guidelines:-

The Office of Local Government on 10 December 2010 issued

the new Quarterly Budget Review Guidelines via Circular 10-32, with the

reporting requirements to apply from 1 July 2011. This report includes a

Quarterly Budget Review Statement (refer Attachment 3) prepared by Council in

accordance with the guidelines.

The Quarterly Budget Review Guidelines set a minimum

standard of disclosure, with these standards being included in the Local

Government Code of Accounting Practice and Financial Reporting as mandatory

requirements for Council’s to address.

Since the introduction of the new planning and reporting

framework for NSW Local Government, it is now a requirement for Councils to

provide the following components when submitting a Quarterly Budget Review

Statement (QBRS):-

· A

signed statement by the Responsible Accounting Officer on Councils financial

position at the end of the year based on the information in the QBRS

· Budget

review income and expenses statement in one of the following formats:

o Consolidated

o By fund (e.g General, Water,

Sewer)

o By function, activity, program

etc to align with the management plan/operational plan

· Budget

Review Capital Budget

· Budget

Review Cash and Investments Position

· Budget

Review Key performance indicators

· Budget

Review Contracts and Other Expenses

The above components are included in Attachment 3:-

Income and Expenditure Budget Review Statement by Type

– This shows Councils income and Expenditure by type. This has been

split by Fund. Adjustments are shown, looking from left to right.

These adjustments are commented on through pages 59 to 74 of Attachment 1.

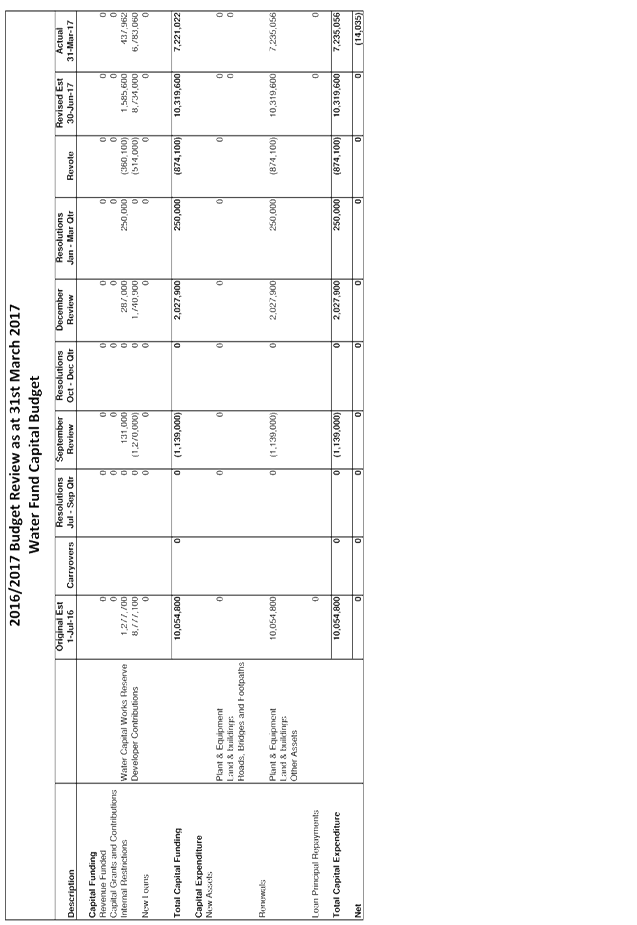

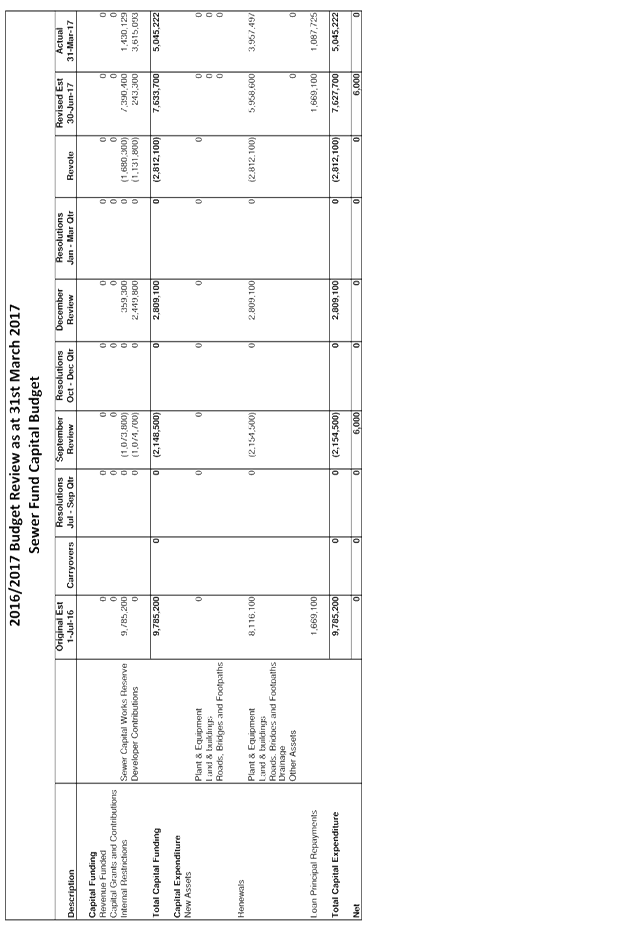

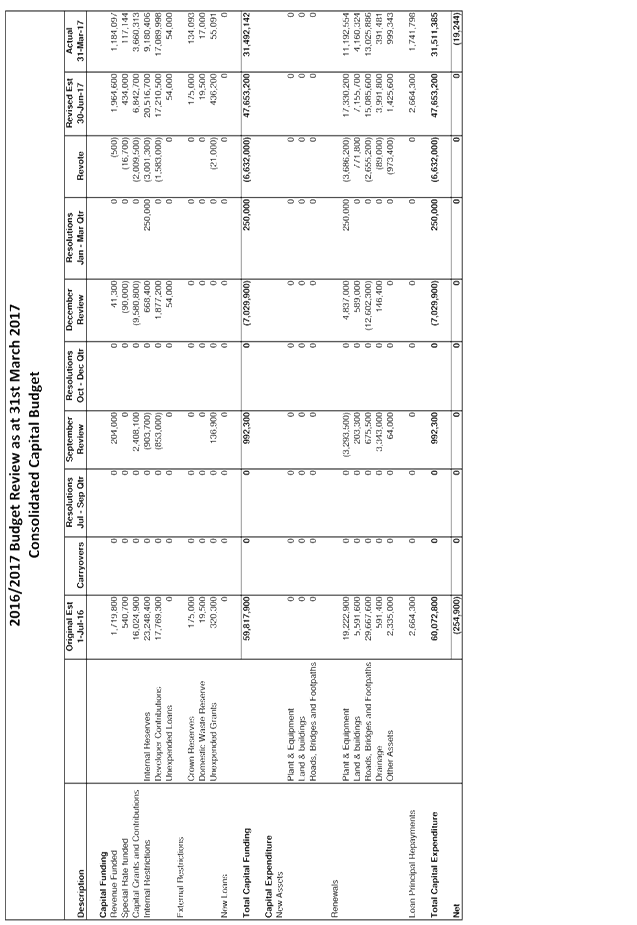

Capital Budget Review Statement – This

statement identifies in summary Council’s capital works program on a

consolidated basis and then split by Fund. It also identifies how the

capital works program is funded.

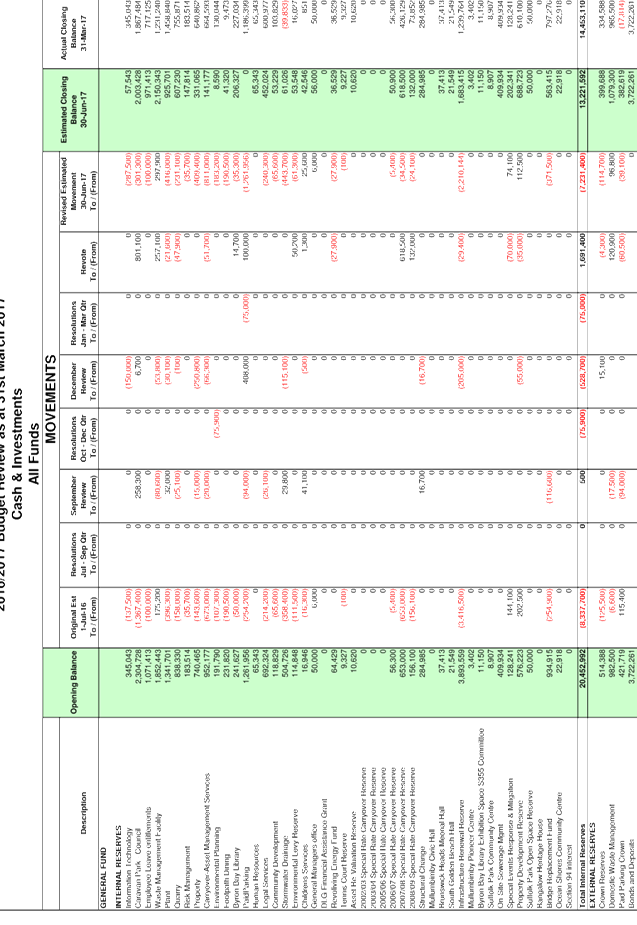

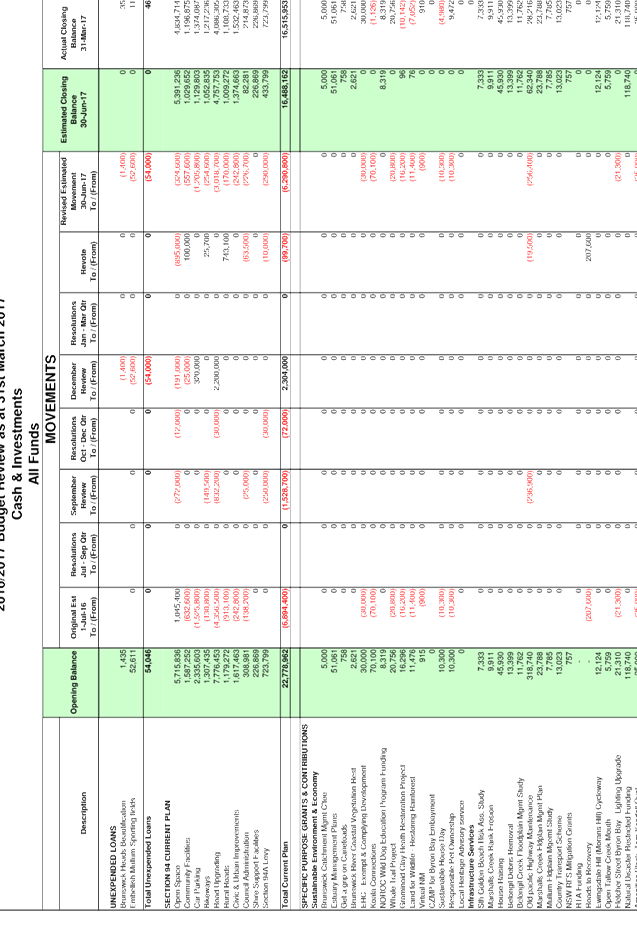

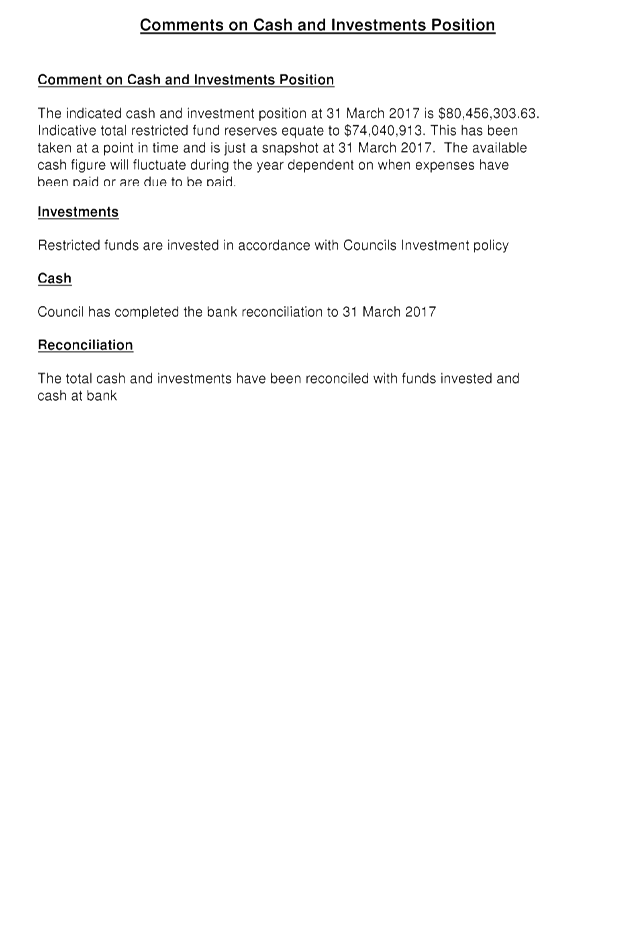

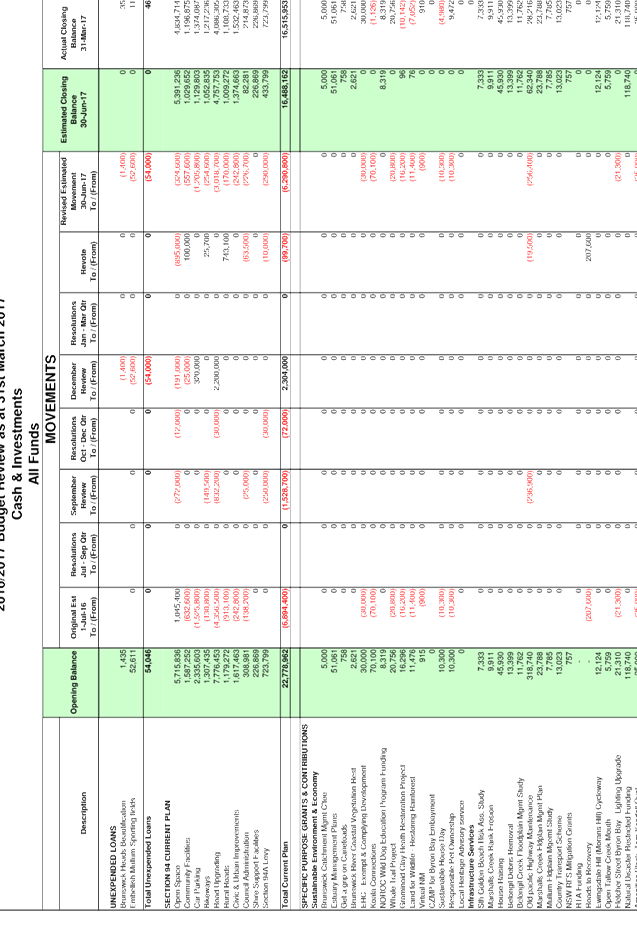

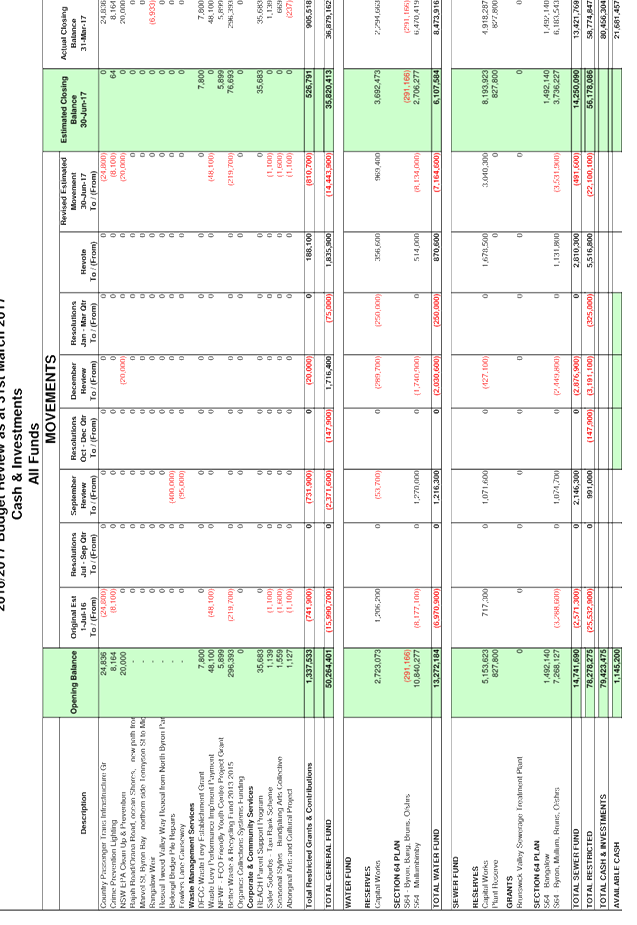

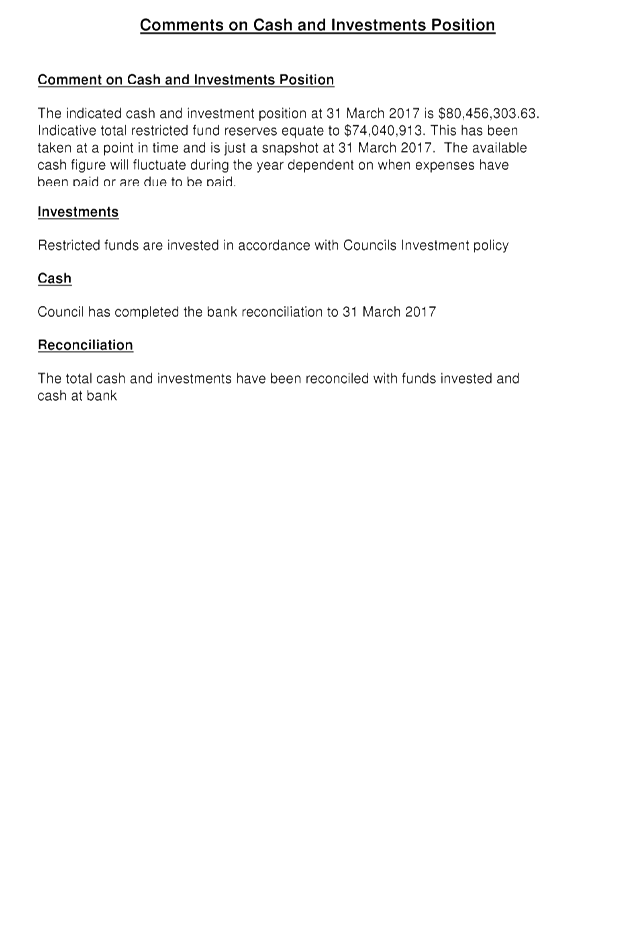

Cash and Investments Budget Review Statement – This

statement reconciles Council’s restricted funds (reserves) against

available cash and investments. Council has attempted to indicate an

actual position as at 31 March 2017 of each reserve to show a total cash

position of reserves with any difference between that position and total cash

and investments held as available cash and investments. It should be

recognised that the figure is at a point in time and may vary greatly in future

quarterly reviews pending on cash flow movements.

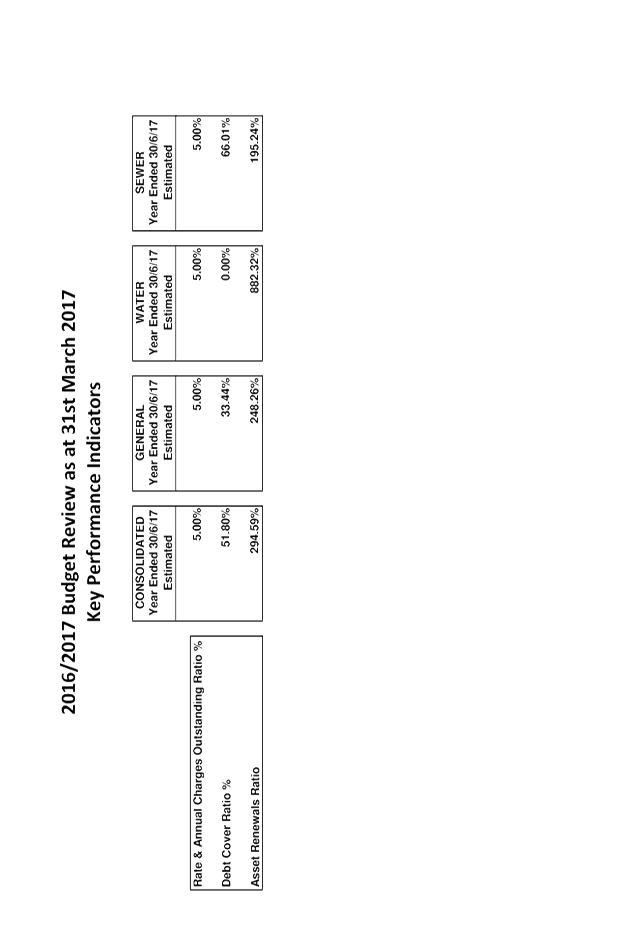

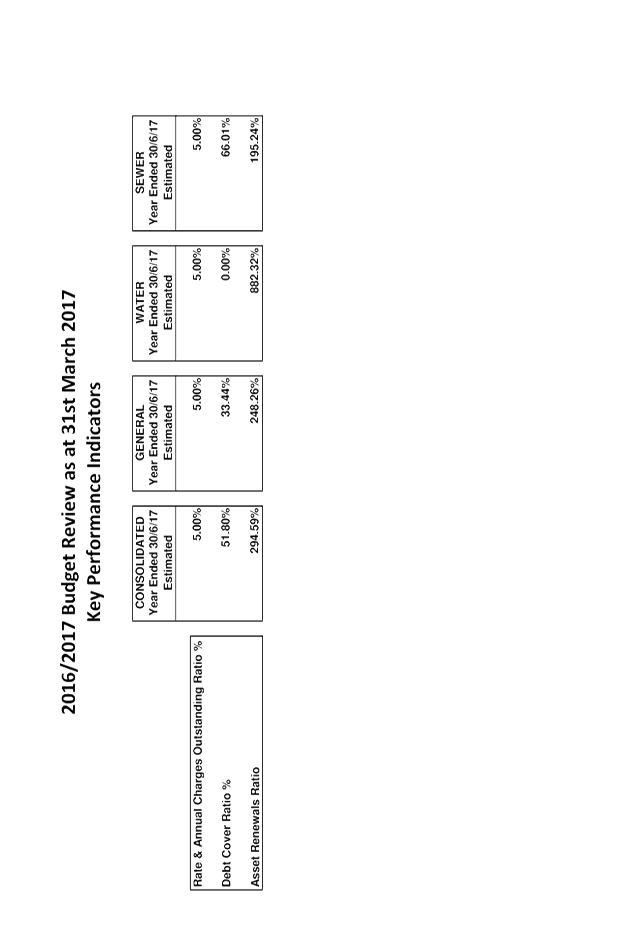

Key Performance Indicators (KPI’s) –

At this stage, the KPI’s within this report are:-

o Debt Service Ratio -

This assesses the impact of loan principal and interest repayments on the

discretionary revenue of Council.

o Rates and Annual Charges

Outstanding Ratio – This assesses the impact of uncollected rates and

annual charges on Councils liquidity and the adequacy of recovery efforts

o Asset Renewals Ratio

– This assesses the rate at which assets are being renewed relative

to the rate at which they are depreciating.

These may be expanded in future to accommodate any

additional KPIs that Council may adopt to use in the Long Term Financial Plan

(LTFP.)

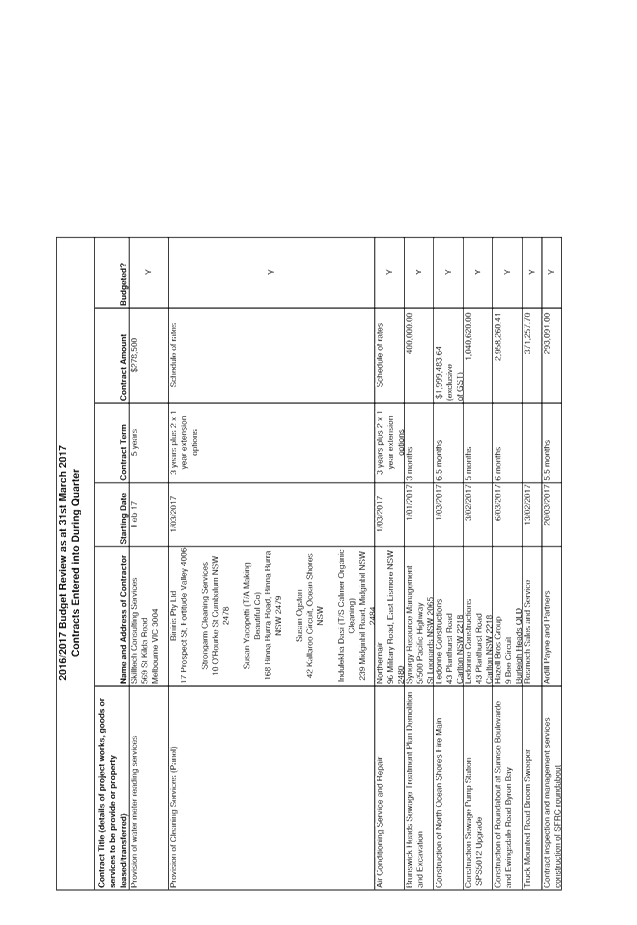

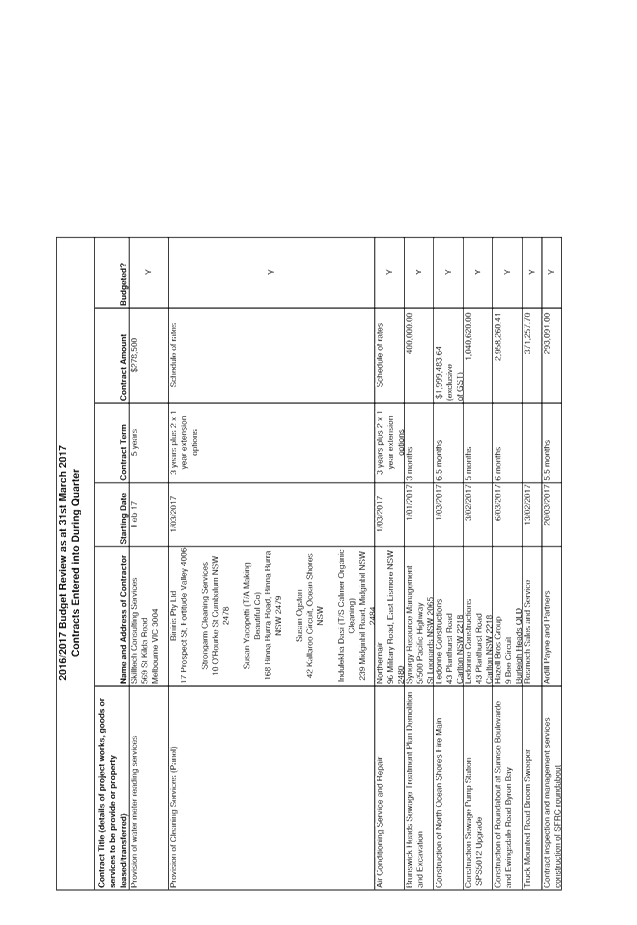

Contracts and Other Expenses - This report highlights any

contracts Council entered into during the January to March quarter that are

greater then $50,000.

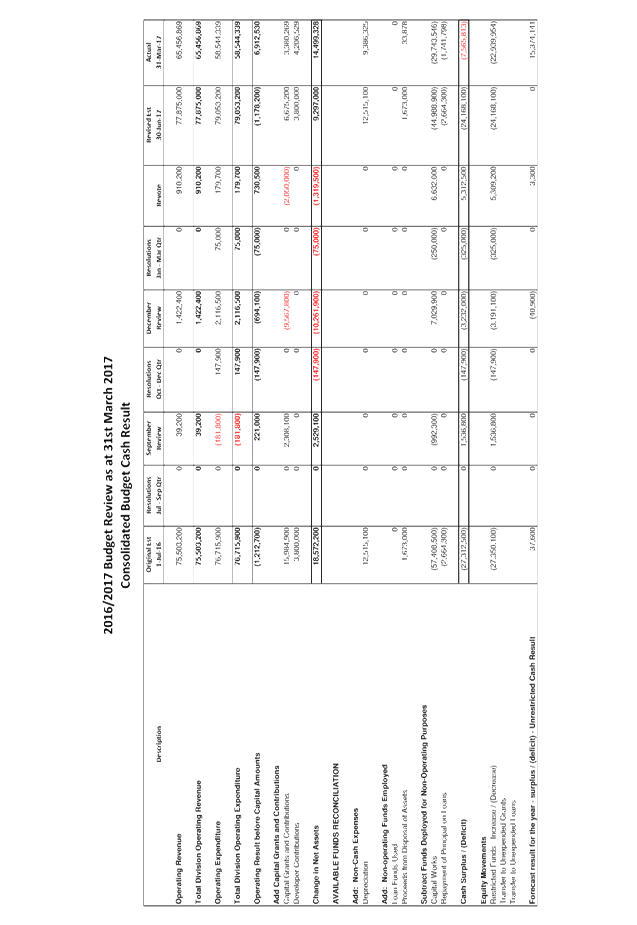

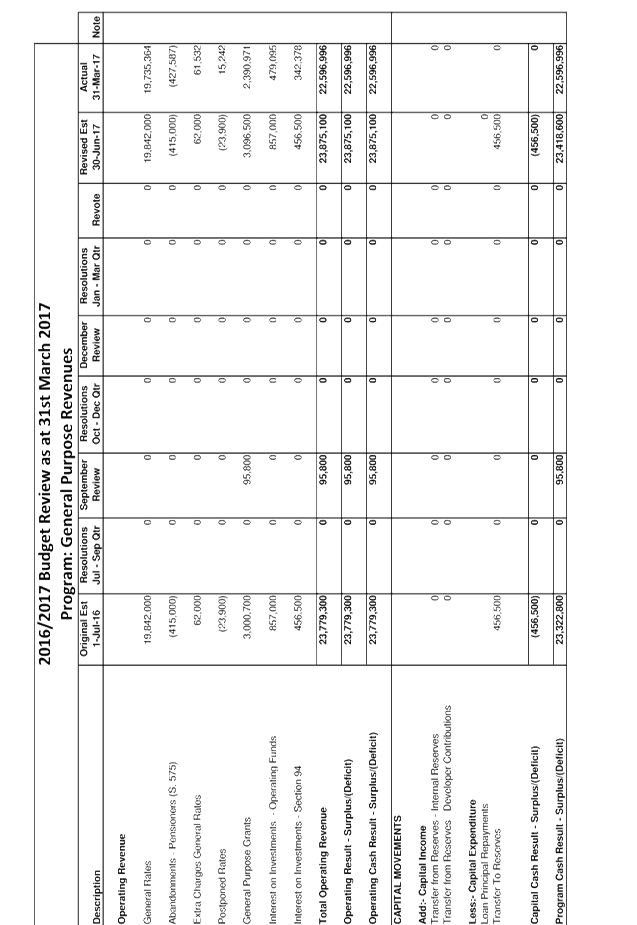

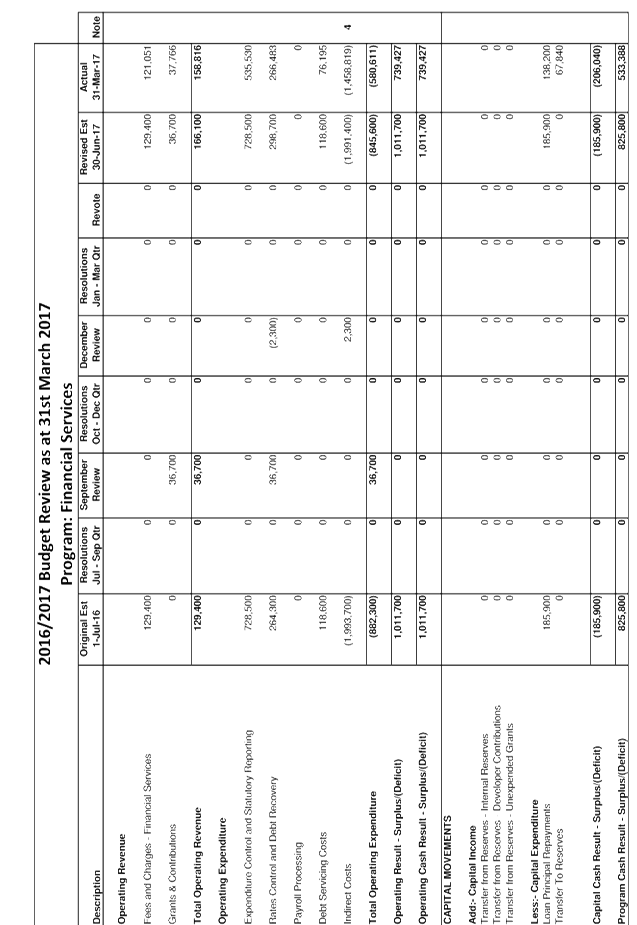

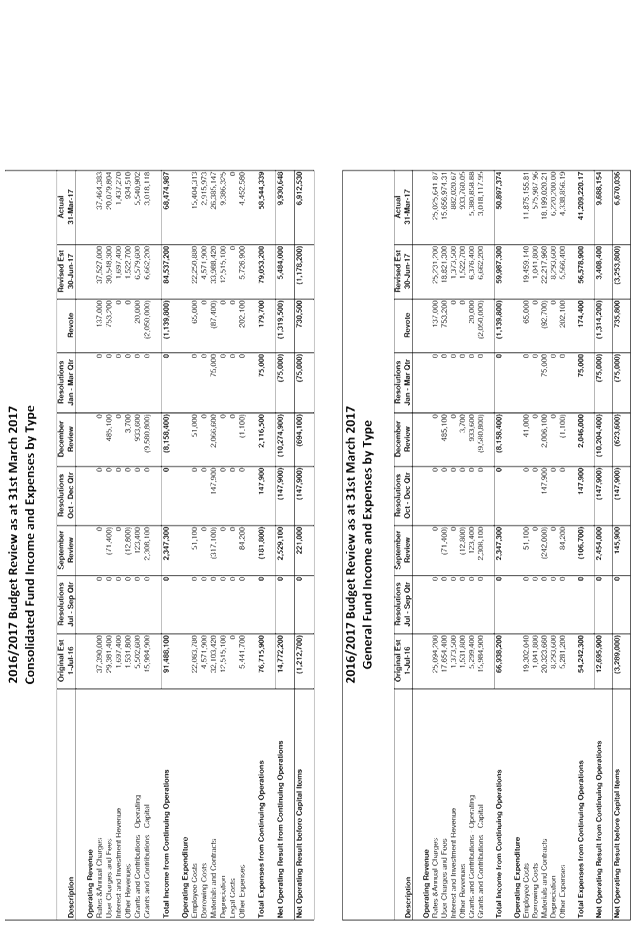

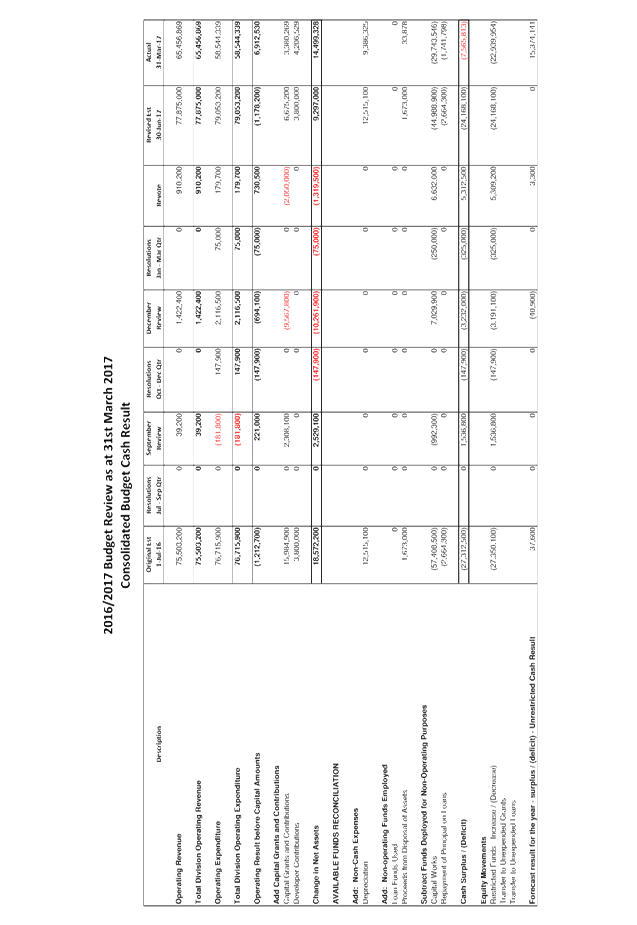

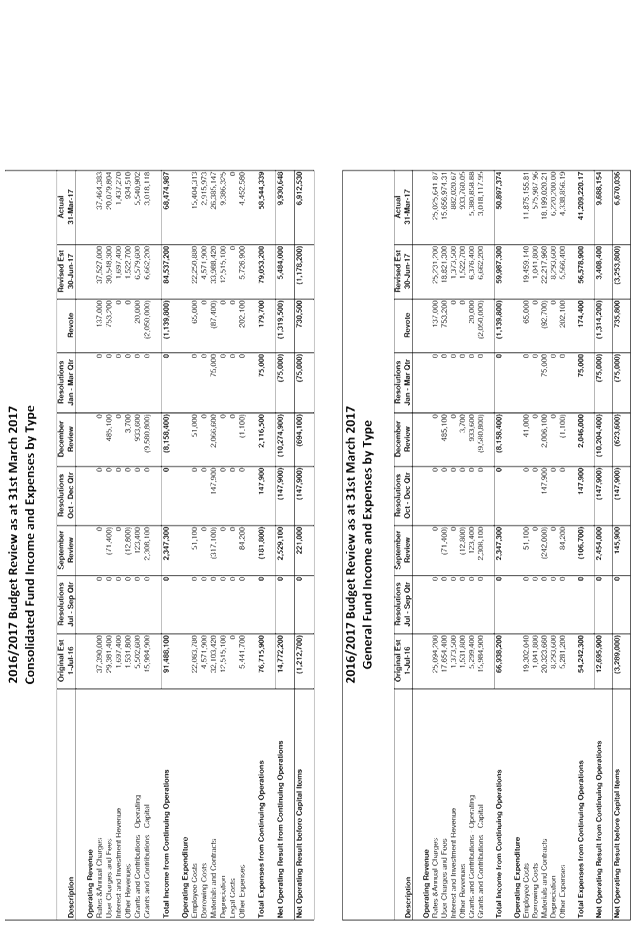

CONSOLIDATED RESULT

The following table provides a summary of the overall

Council budget on a consolidated basis inclusive of all Funds budget movements

for the 2016/2017 financial year projected to 30 June 2017 but revised as at 31

March 2017.

|

2016/2017 Budget Review Statement as at 31 March 2017

|

Original Estimate (Including Carryovers)

1/7/2016

|

Adjustments to March 2017 including Resolutions*

|

Proposed March 2017 Review Revotes

|

Revised Estimate 30/6/2017 at 31/03/2017

|

|

Operating Revenue

|

75,503,200

|

1,461,600

|

910,200

|

77,875,000

|

|

Operating Expenditure

|

76,715,900

|

2,157,600

|

179,700

|

79,053,200

|

|

Operating Result –

Surplus/Deficit

|

(1,212,700)

|

(696,000)

|

730,500

|

(1,178,200)

|

|

Add: Capital Revenue

|

19,784,900

|

(7,259,700)

|

(2,050,000)

|

10,475,200

|

|

Change in Net Assets

|

18,572,200

|

(7,955,700)

|

(1,319,500)

|

9,297,000

|

|

Add: Non Cash Expenses

|

12,515,100

|

0

|

0

|

12,515,100

|

|

Add: Non-Operating Funds

Employed

|

1,673,000

|

0

|

0

|

1,673,000

|

|

Subtract: Funds Deployed for

Non-Operating Purposes

|

(60,072,800)

|

5,787,600

|

6,632,000

|

(47,653,200)

|

|

Cash Surplus/(Deficit)

|

(27,312,500)

|

(2,168,100)

|

5,312,500

|

(24,168,000)

|

|

Restricted Funds –

Increase / (Decrease)

|

(27,350,100)

|

(2,127,200)

|

5,309,200

|

(24,168,000)

|

|

Forecast Result for the

Year – Surplus/(Deficit) – Unrestricted Cash Result

|

37,600

|

(40,900)

|

3,300

|

0

|

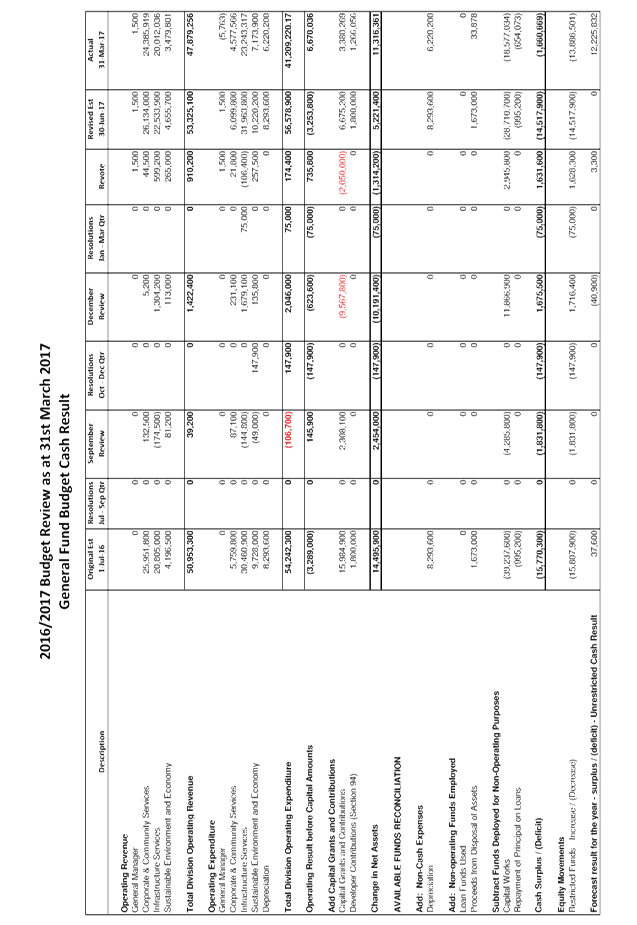

GENERAL FUND

In terms of the General Fund projected Unrestricted Cash

Result the following table provides a reconciliation of the estimated position

as at 31 March 2017:

|

Opening Balance – 1

July 2016

|

$1,145,200

|

|

Plus original budget

movement and carryovers

|

$37,600

|

|

Council Resolutions July

– September Quarter

|

0

|

|

September Review –

increase/(decrease)

|

0

|

|

Council Resolutions October

– December Quarter

|

0

|

|

December Review –

increase/(decrease)

|

(40,900)

|

|

Council Resolutions January

– March Quarter

|

0

|

|

March Review –

increase/(decrease)

|

3,300

|

|

Forecast Unrestricted

Cash Result – Surplus/(Deficit) – 30 June 2017

|

$0

|

|

Estimated Unrestricted

Cash Result Closing Balance – 30 June 2017

|

$1,145,200

|

The General Fund financial position overall has increased by

$3,300 as a result of this budget review. The proposed budget changes are

detailed in Attachment 1 and summarised further in this report below.

Council Resolutions

There were no Council resolutions during the January to

March 2017 quarter that impacted the overall 2016/2017 budget result.

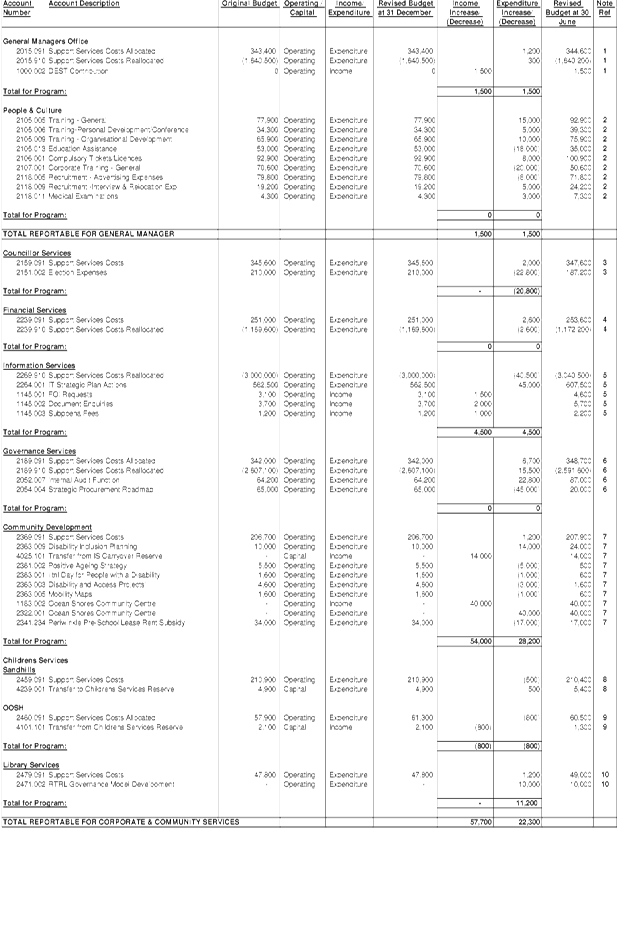

Budget Adjustments

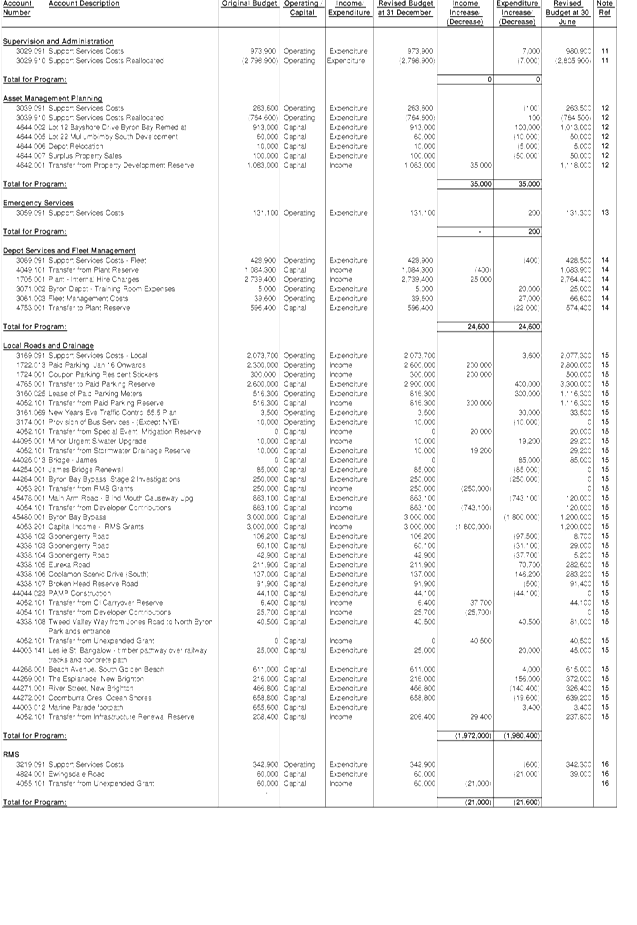

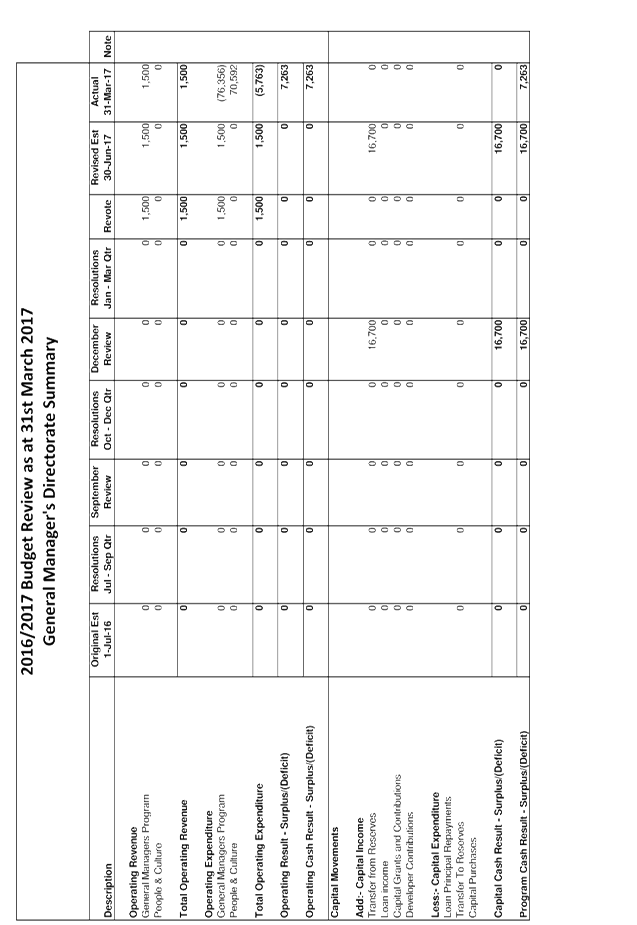

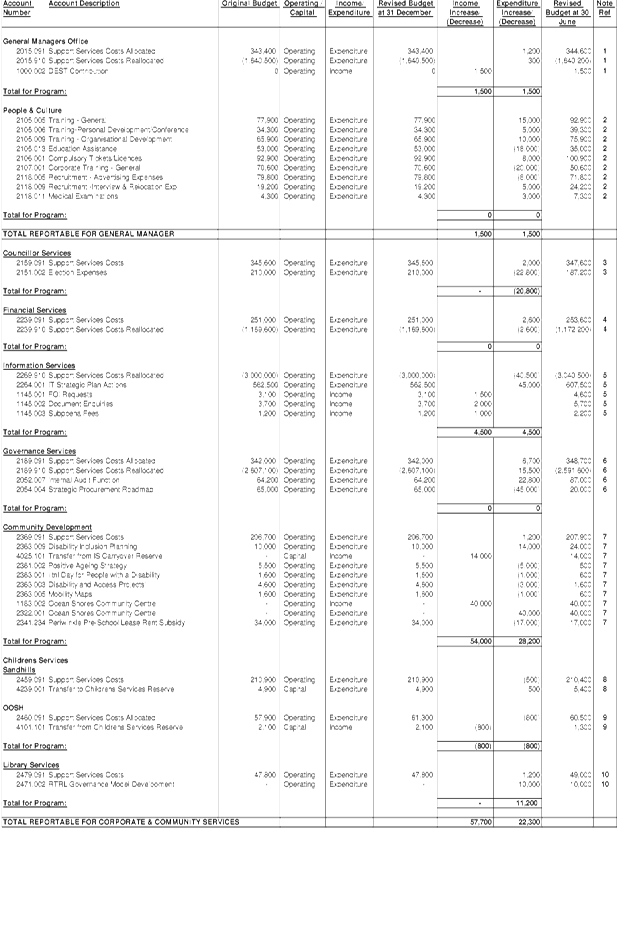

The budget adjustments identified in Attachments 1 and 2 for

the General Fund have been summarised by Budget Directorate in the following

table:

|

Budget Directorate

|

Revenue

Increase/

(Decrease) $

|

Expenditure

Increase/

(Decrease) $

|

Accumulated

Surplus (Working Funds) Increase/ (Decrease) $

|

|

General Manager

|

1,500

|

1,500

|

0

|

|

Corporate & Community Services

|

57,700

|

22,300

|

35,400

|

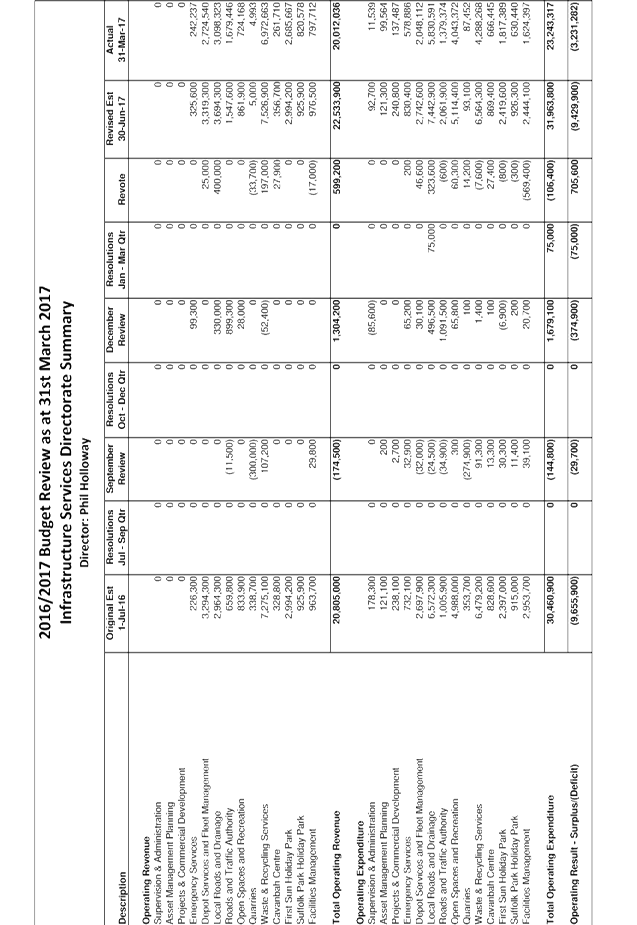

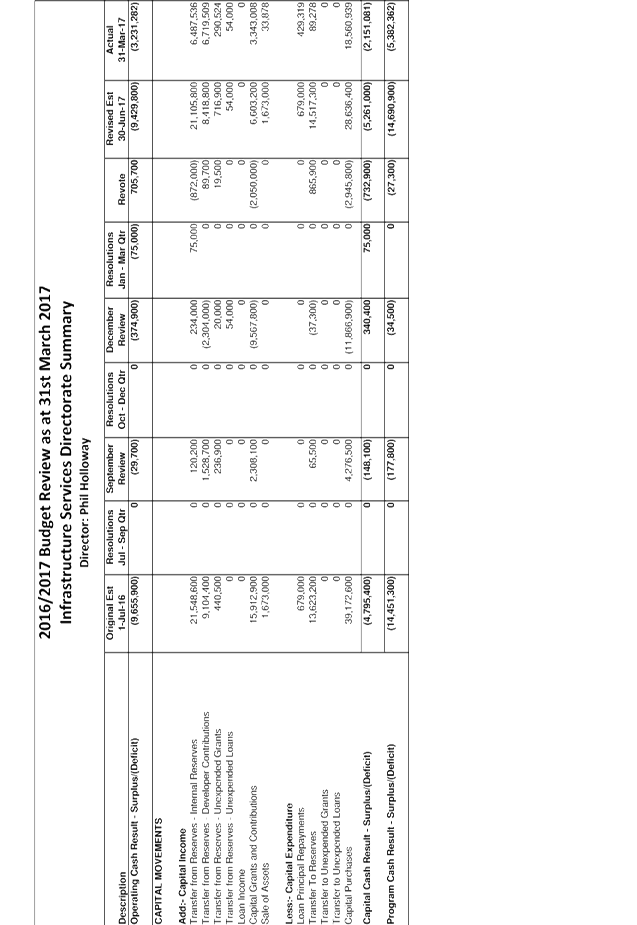

|

Infrastructure Services

|

(2,194,100)

|

(2,166,800)

|

(27,300)

|

|

Sustainable Environment & Economy

|

252,700

|

257,500

|

(4,800)

|

|

Total Budget Movements

|

(1,882,200)

|

(1,885,500)

|

3,300

|

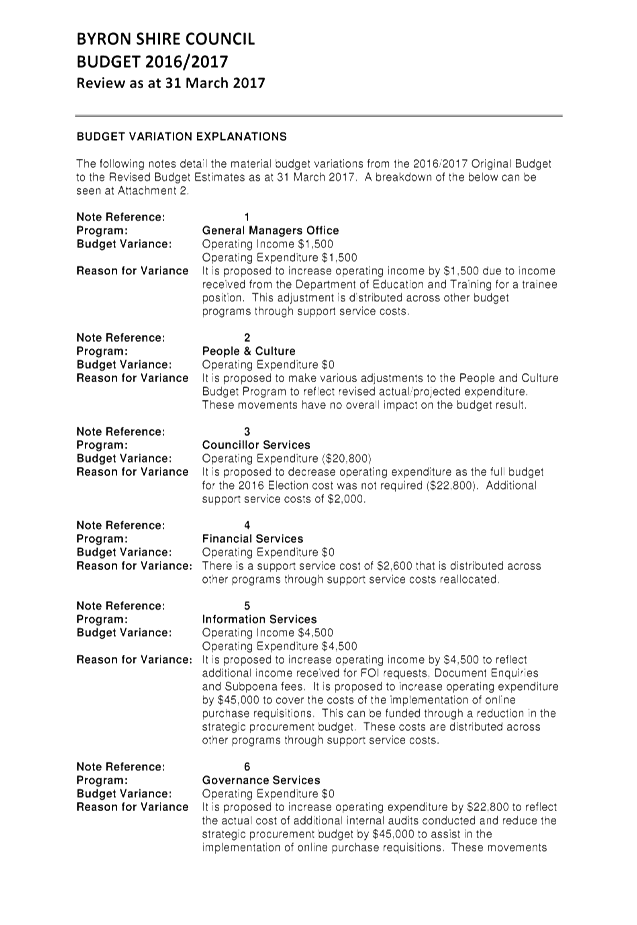

Budget Adjustment Comments

Within each of the Budget Directorates of the General Fund,

are a series of budget adjustments identified in detail at Attachment 1 and

2. More detailed notes on these are provided in Attachment 1 but in

summary the major additional items included are summarised below by Directorate

and are included in the overall budget adjustments table above:

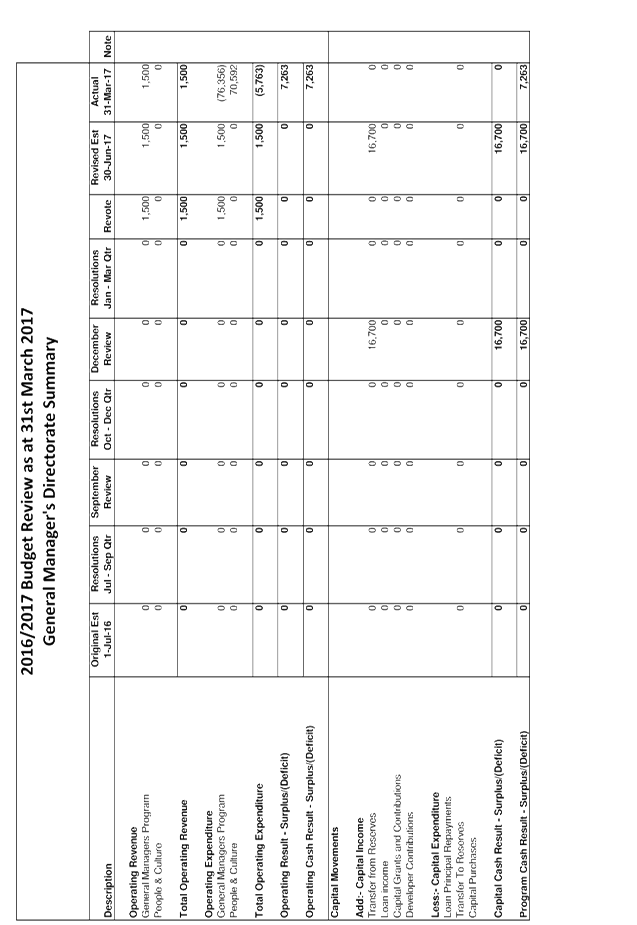

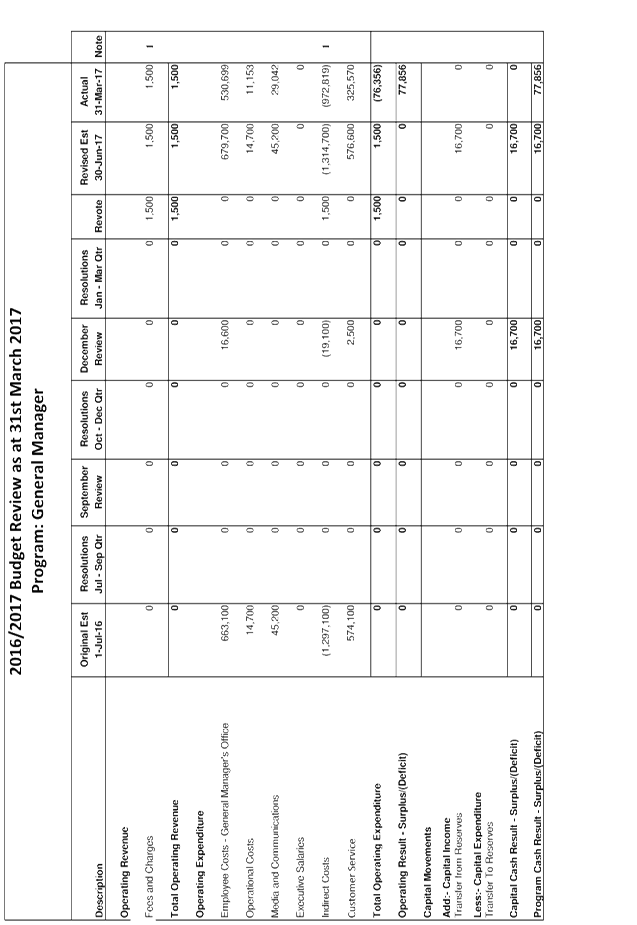

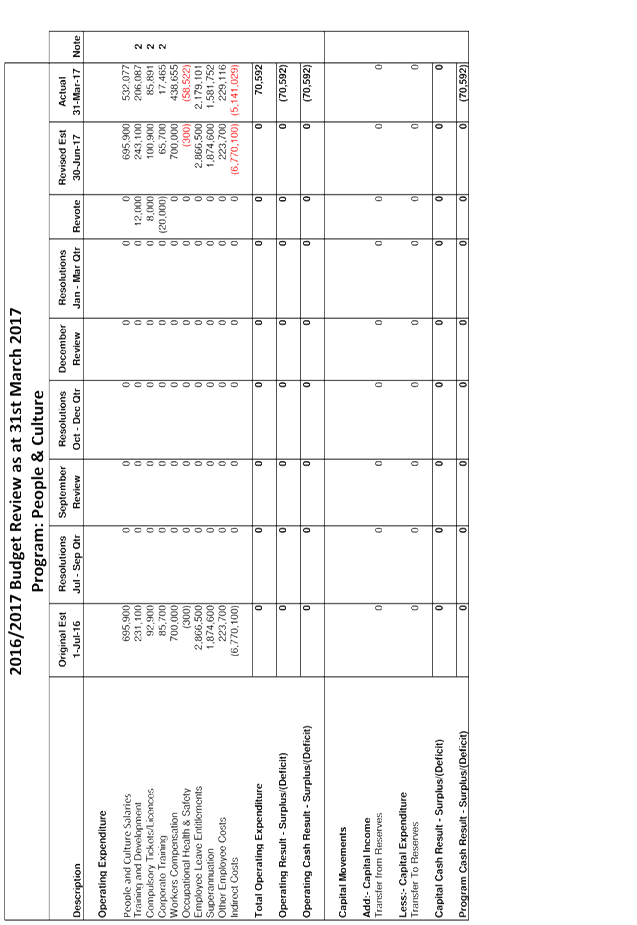

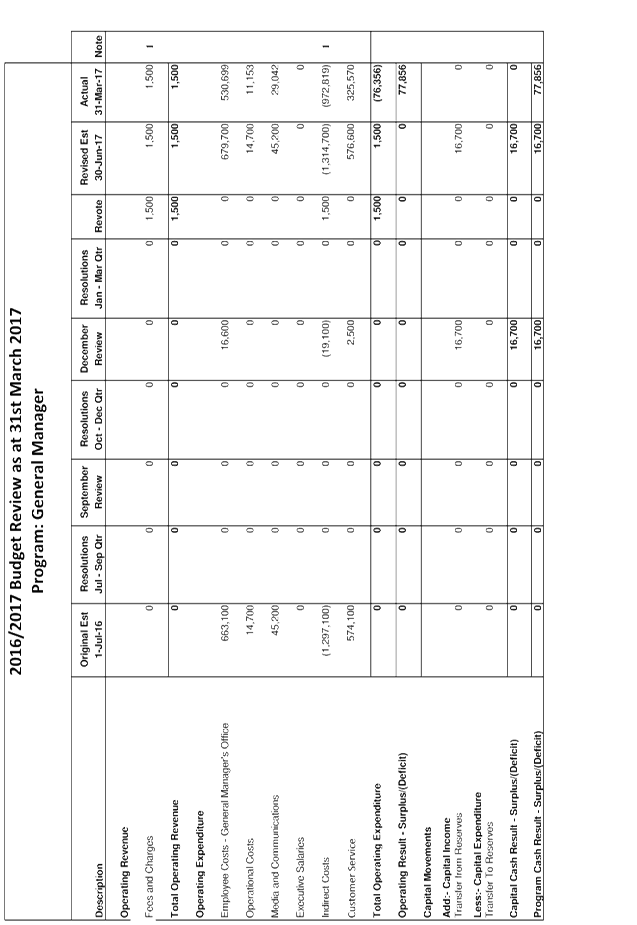

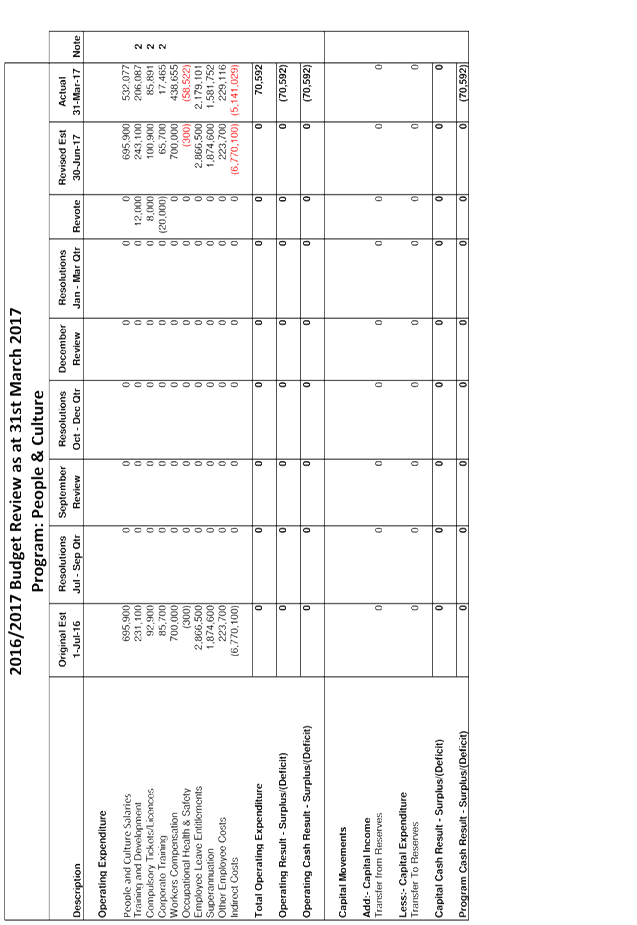

General Manager

· In the

People & Culture Budget Program various changes to budget items are

required to reflect revised actual/projected expenditure. These movements

have no overall impact on the budget result.

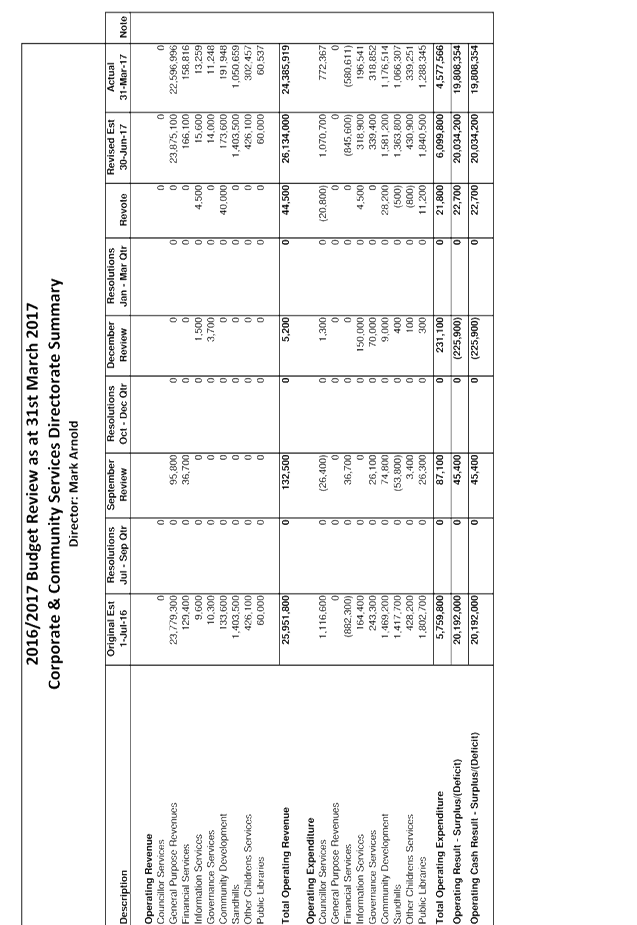

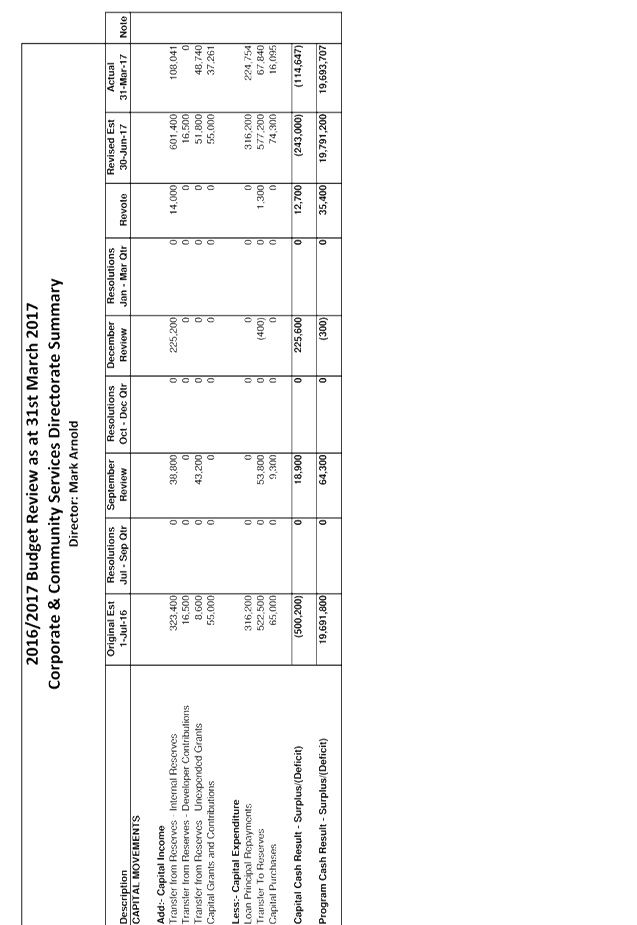

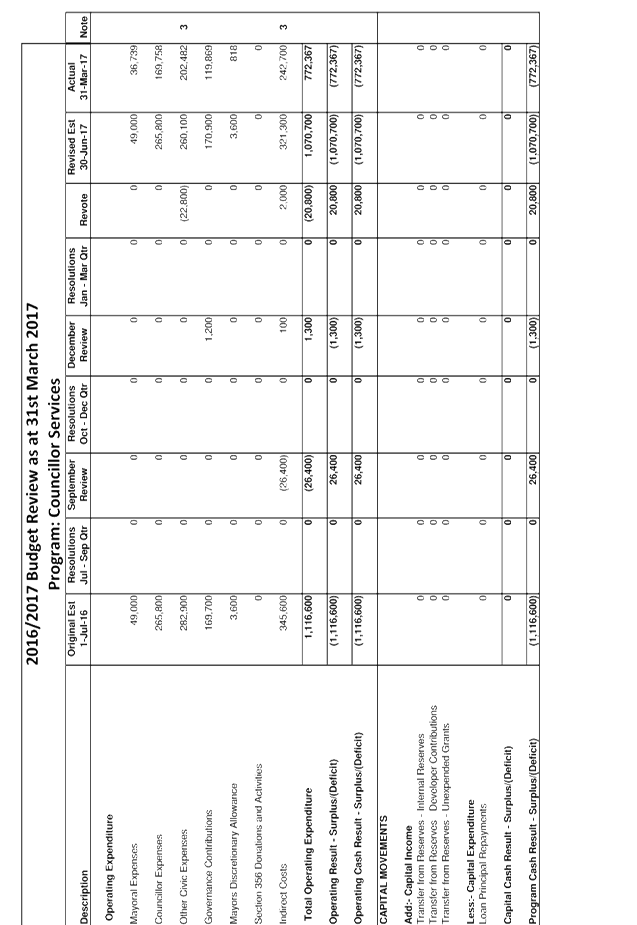

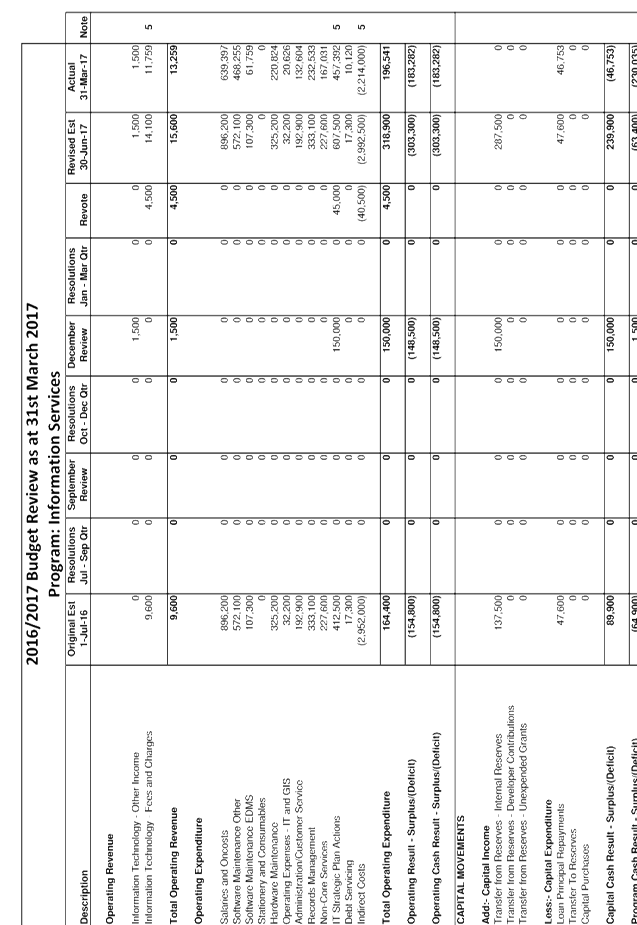

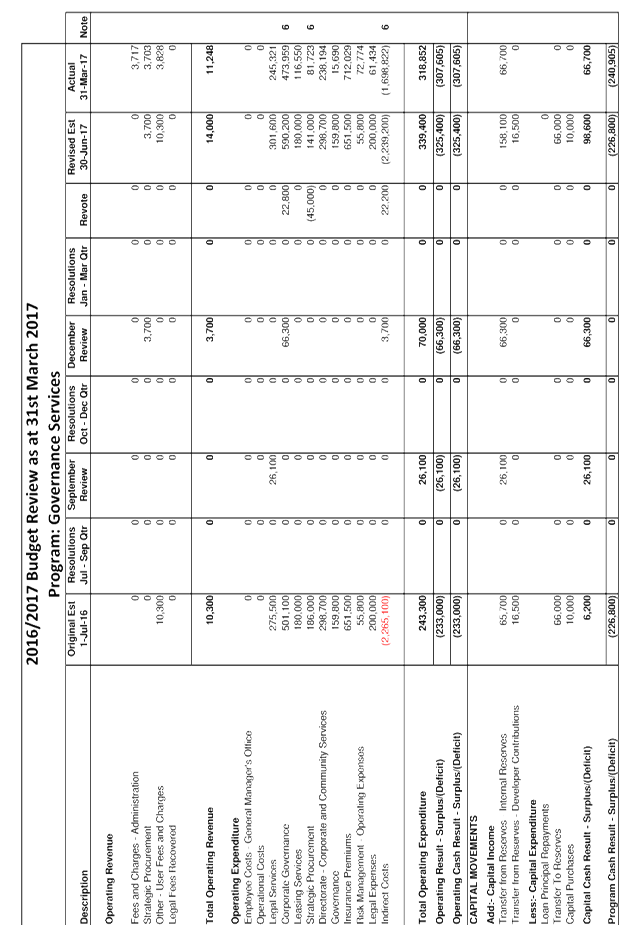

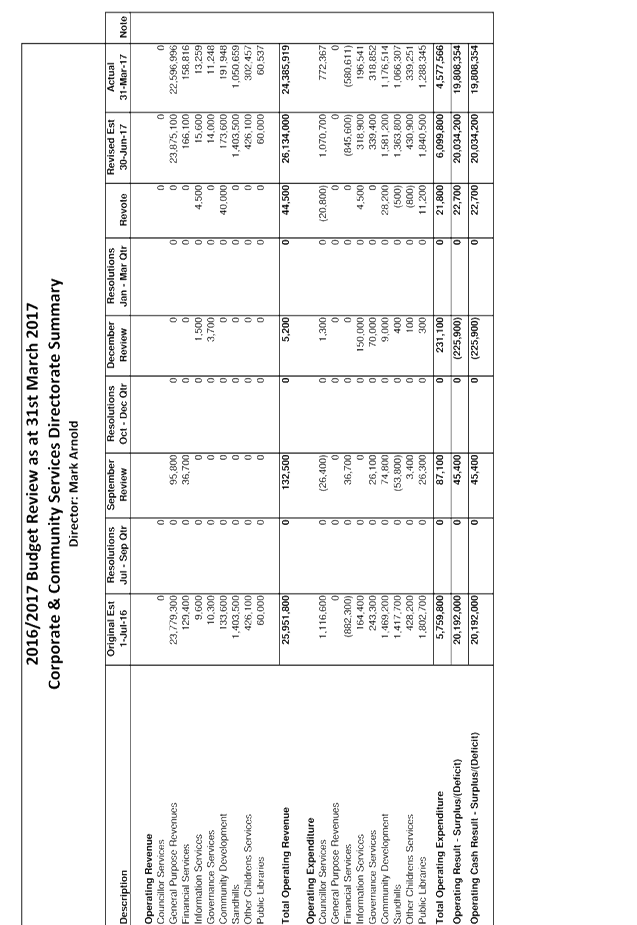

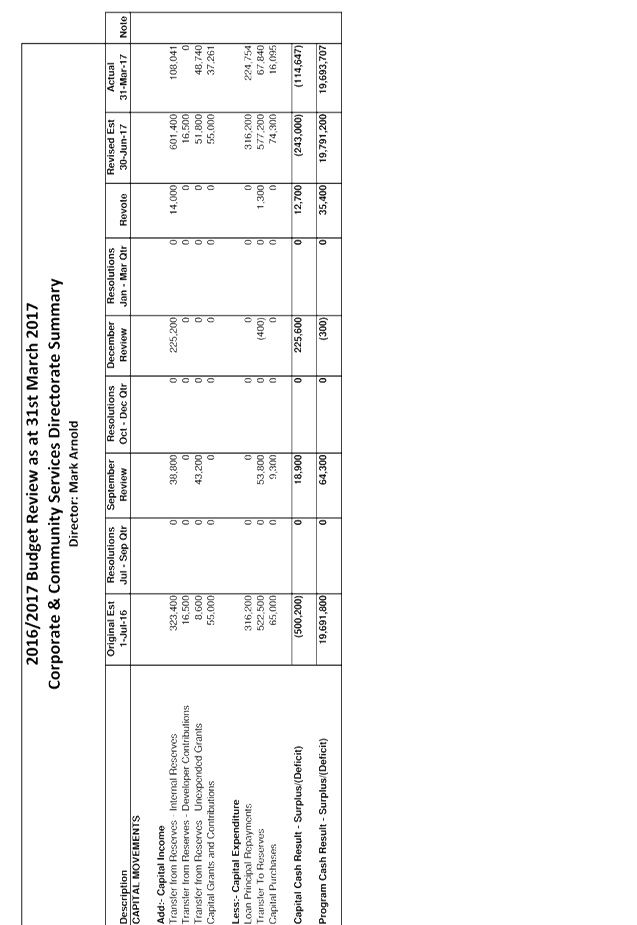

Corporate and Community Services

· In the

Councillor Services Budget Program a decrease in expenditure of $22,800 is

attributable to the final election expenses being under budget.

· In

the Information Services Budget Program it is proposed to increase operating

expenditure by $45,000 to cover the costs of the implementation of online

purchase requisitions. This cost is distributed across other programs

through support service costs.

· In

the Governance Services Budget Program it is proposed to decrease the Strategic

Procurement Roadmap budget by $45,000 to assist with the funding of the online

purchase requisitions (in Information Services Budget Program above), and an

increase in the Internal Audit budget to reflect the actual cost of the

additional internal audits conducted. These costs are distributed across

other programs through support service costs.

· In

the Community Development Budget Program, It is proposed to increase operating

expenditure due to additional costs for the Disability Inclusion Planning ($14,000)

offset by savings recognised against the positive ageing Strategy ($5,000),

International Day for People with a Disability ($1,000), Disability and Access

Project ($3,000) and mobility Maps ($1,000). It is proposed to increase

income and expenditure at the Ocean Shores Community Centre to reflect actuals

($40,000) and decrease expenditure for the Periwinkle Pre-school lease

($17,000). This building was sold and Council no longer receives rent for

this building.

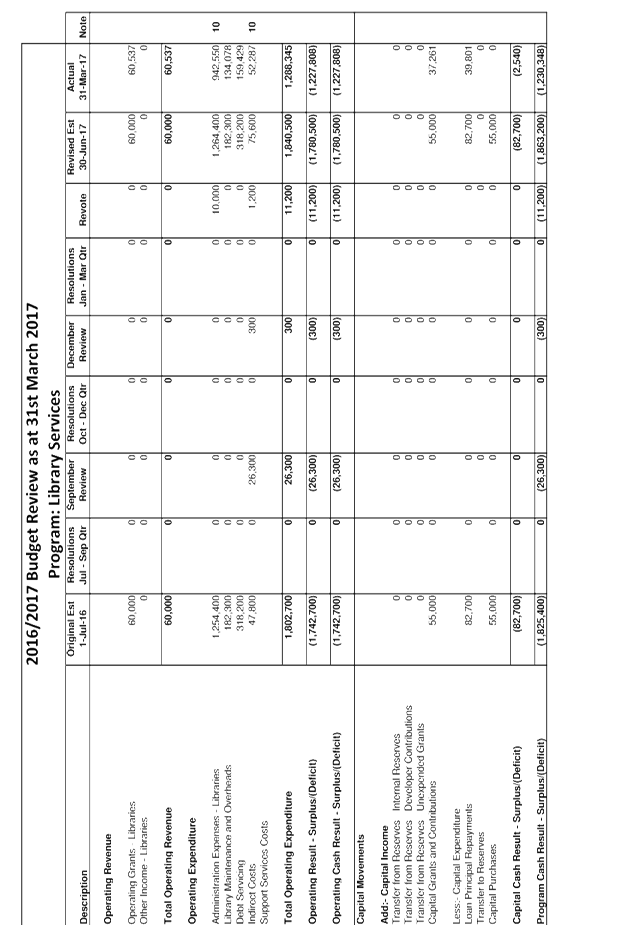

· In the

Library Services Budget Program, it is proposed to increase operating

expenditure by $10,000 to fund the Richmond Tweed Regional Library

(RTRL) Governance Model Development.

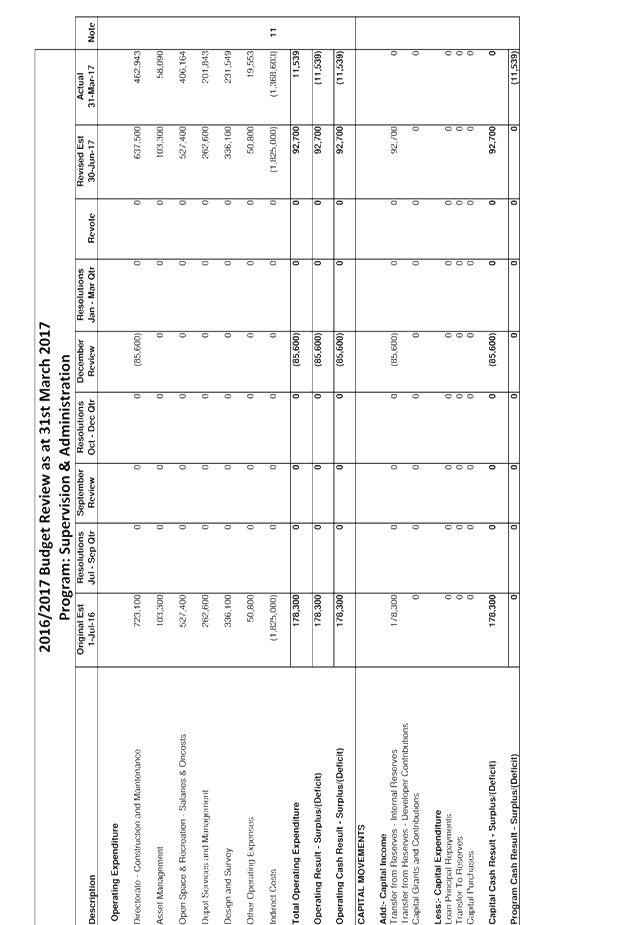

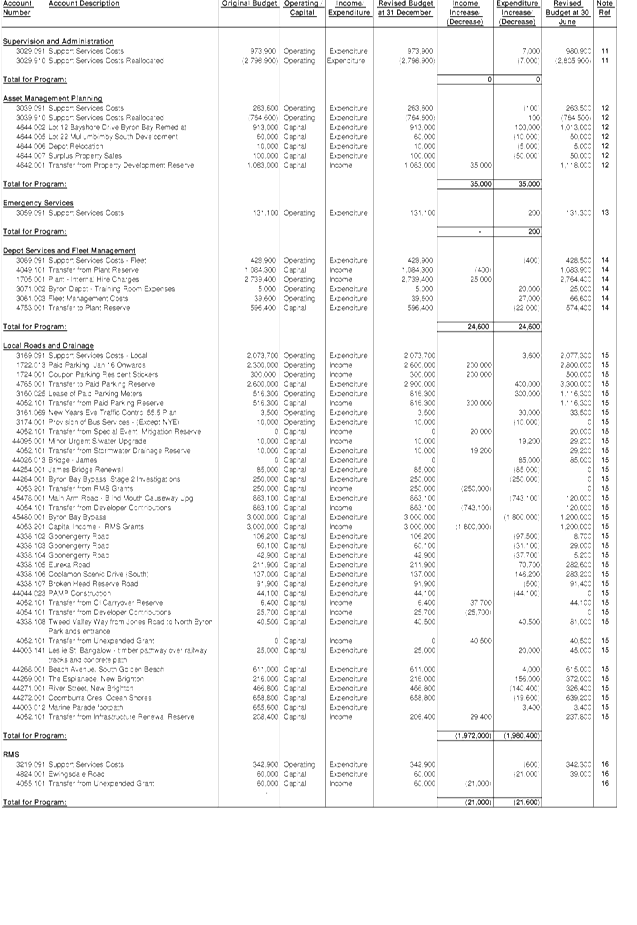

Infrastructure Services

· In the Asset Management

Planning Budget Program it is proposed to increase capital expenditure by

$35,000 due to an additional $100,000 required for Lot 12 Bayshore Drive Byron

Bay Remediation and a reduction in Lot 22 Mullumbimby South ($10,000), the

Depot Relocation ($5,000) and Surplus Property Sales ($50,000). These

adjustments are funded through the Property Development Reserve.

· In the Depot Services

and Fleet Management Budget Program it is proposed to increase operating income

by $25,000 to reflect actual income received from internal plant hire and

increase expenditure by $20,000 for additional Depot training room costs and

$27,000 for additional fleet management costs for the installation of GPS

tracking. The movements in this Budget Program have no impact on the

Budget result as funding is provided by the Plant Reserve.

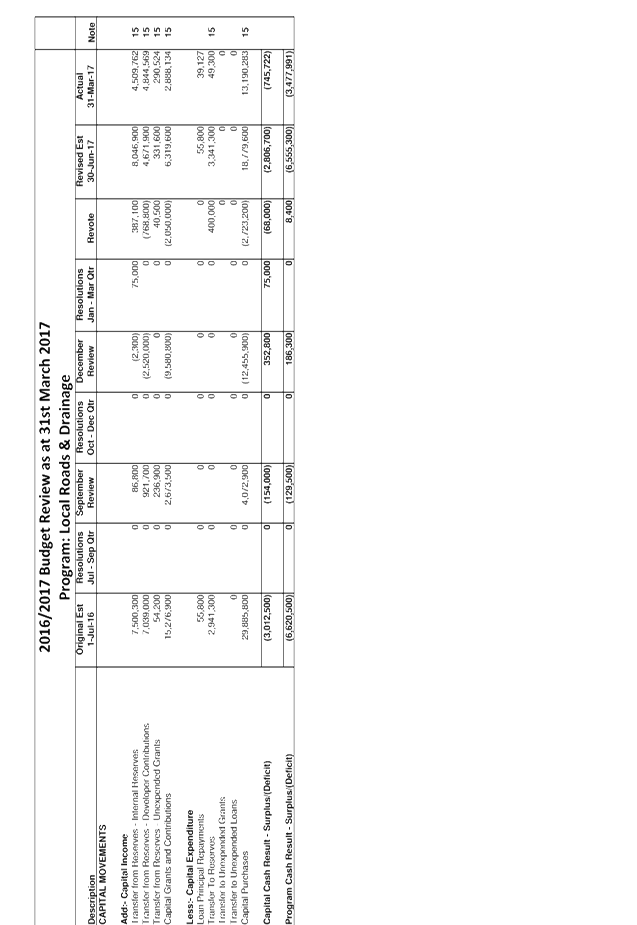

· In the Local Roads and

Drainage Budget Program, there are a number of adjustments outlined under Note

15 in the Budget Variations explanations section of Attachment 1. Further

disclosure is included in the second page of Attachment 2 under the budget program

heading Local Roads and Drainage.

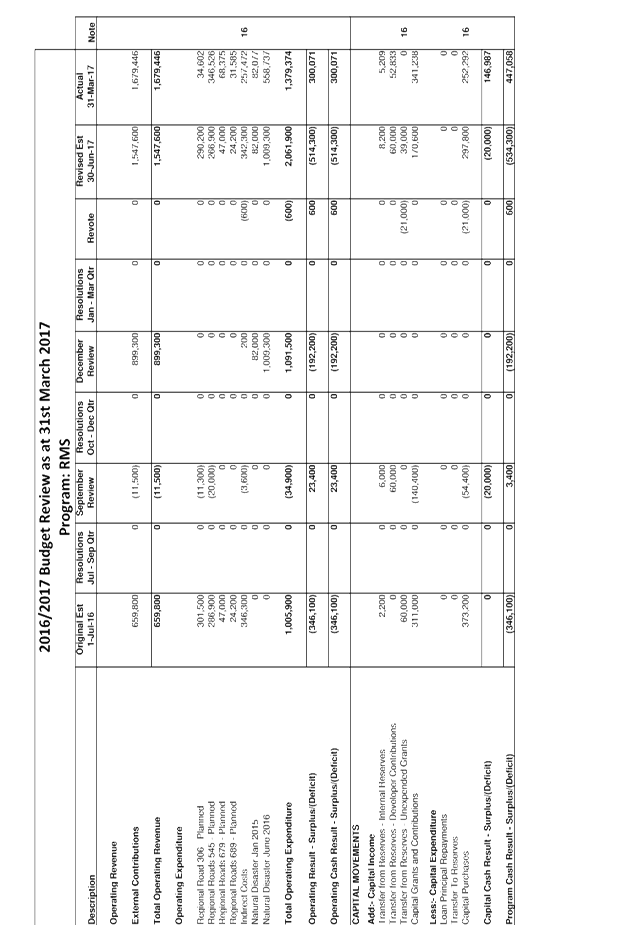

· In the Roads and

Maritime Services Budget Program (RMS) it is proposed to decrease capital

expenditure by $21,000 as the scale of works for Ewingsdale Road have been

reduced to provide RMS funding for the actual costs of reseal works at Tweed

Valley Way (In the Local Roads & Drainage program).

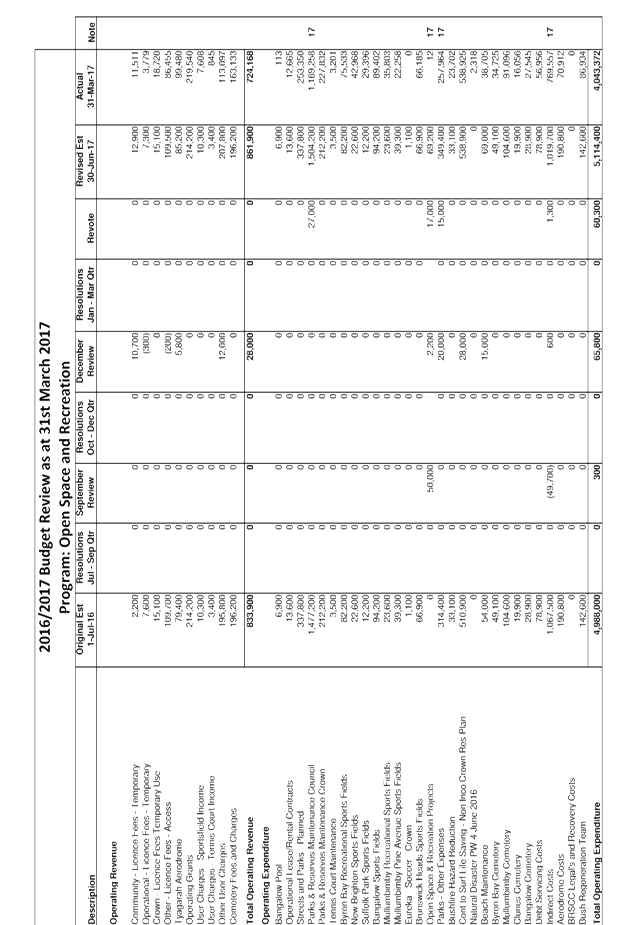

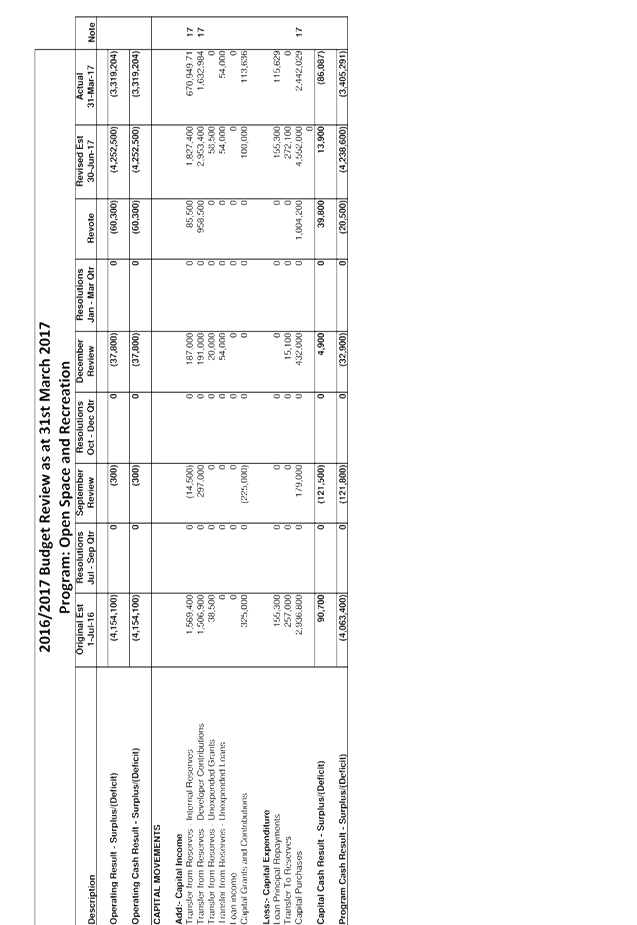

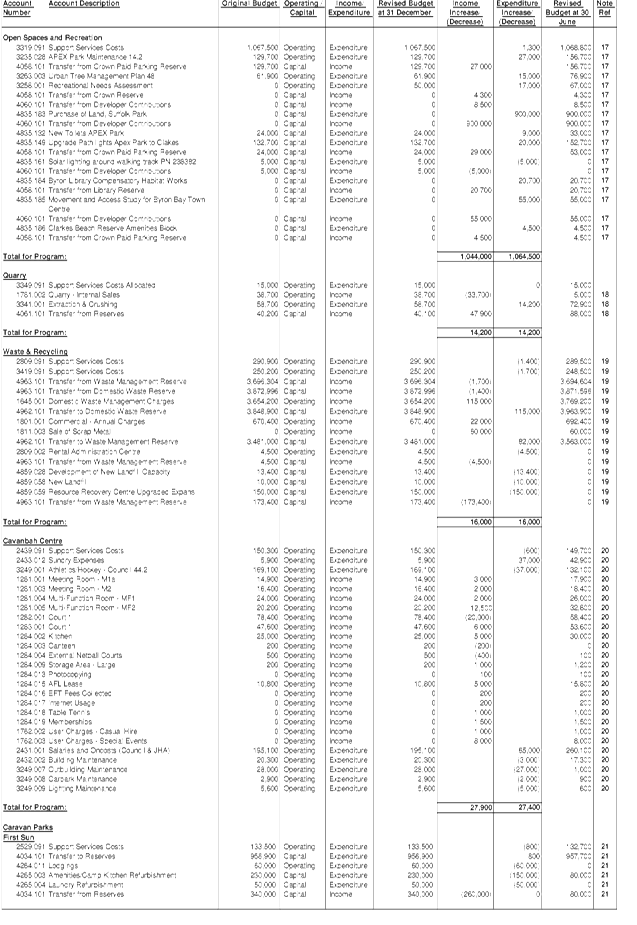

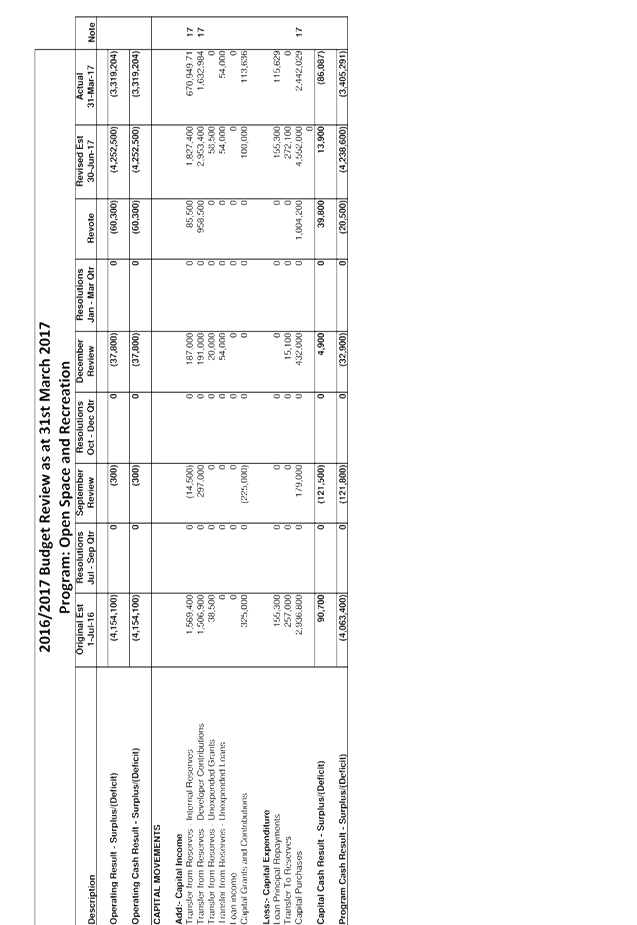

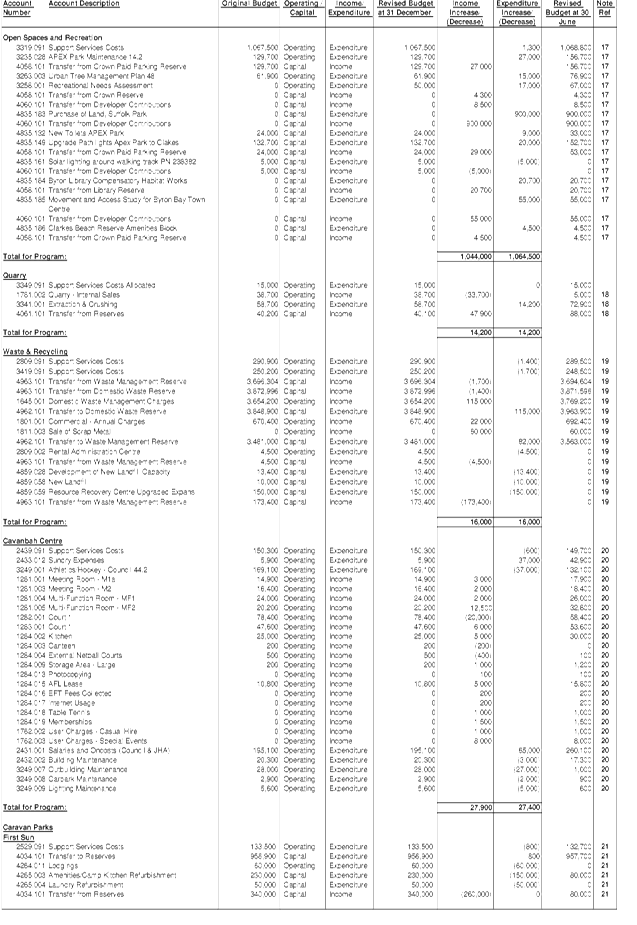

· In the Open Space and

Recreation Budget Program, there are a number of adjustments outlined under

Note 17 in the Budget Variations explanations section of Attachment 1. Further

disclosure is included in the third page of Attachment 2 under the budget

program heading Open Space and Recreation.

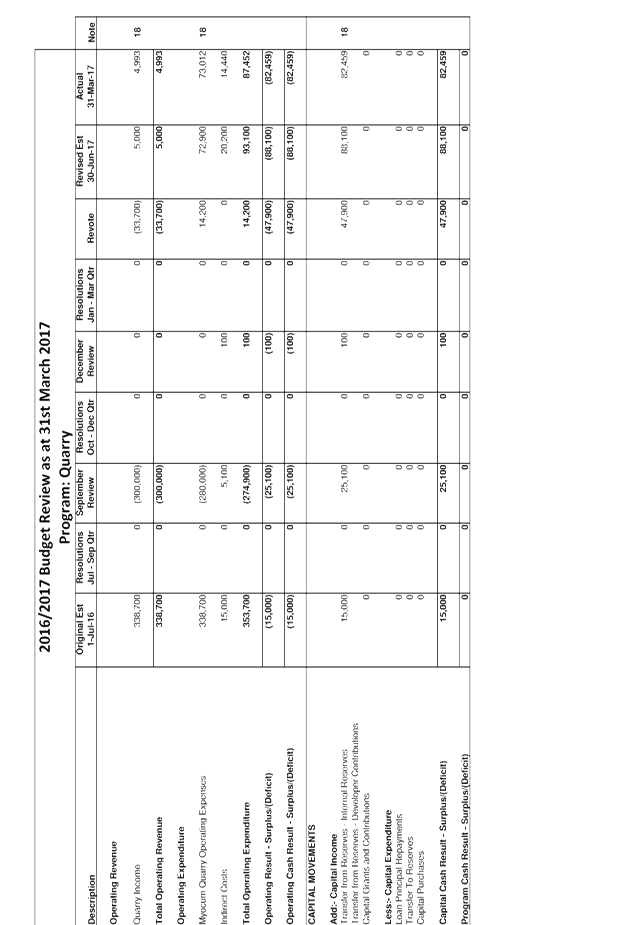

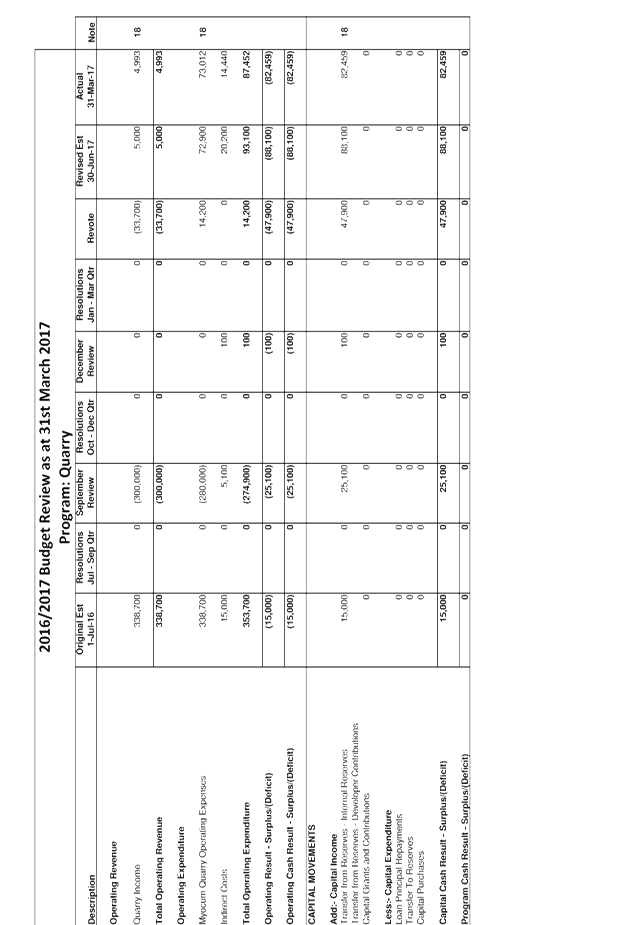

· In the Quarry Budget

Program it is proposed to decrease income by $33,700 and increase expenditure

by $14,200 to reflect the actuals. This is funded through the Quarry

reserve.

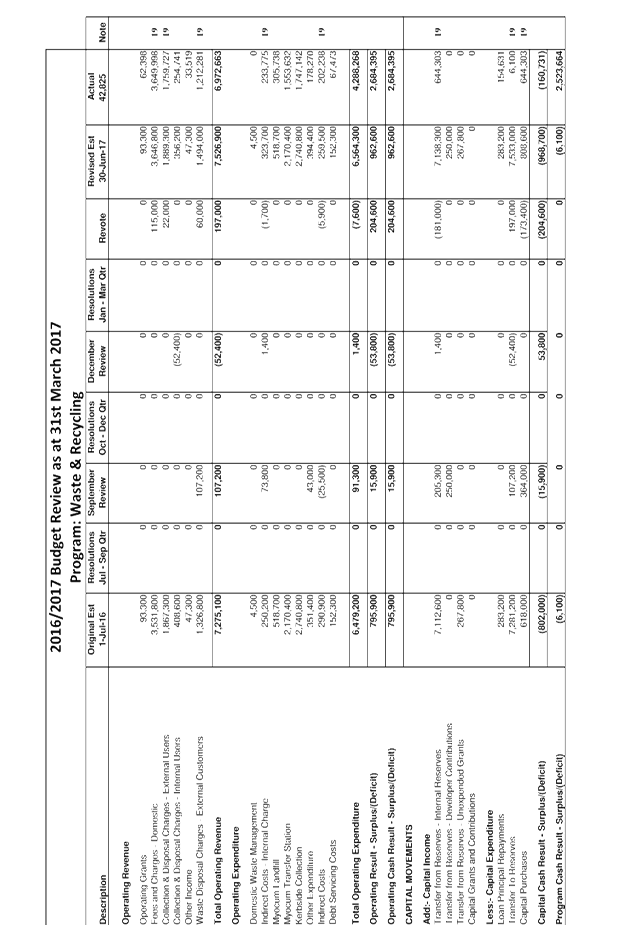

· In the Waste &

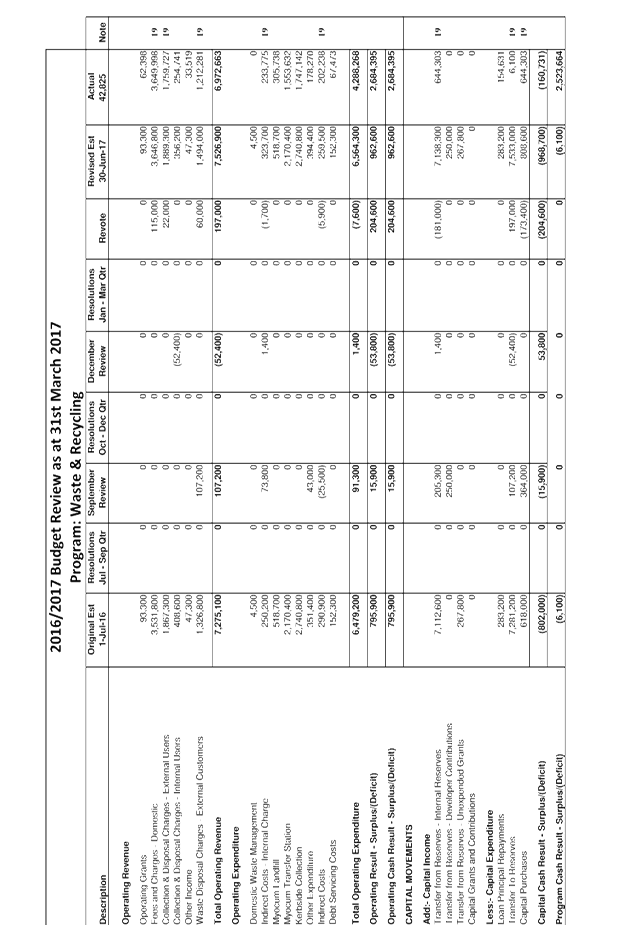

Recycling Budget Program it is proposed to increase the operating income budget

due to an increase in income for Domestic Waste Management Charges ($115,000),

Commercial - Annual Charges ($22,000) and Sale of Scrap Metal Income ($60,000 )

as the actual income received has exceeded the original budget. It is

proposed to reduce capital expenditure for the Development of New Landfill

Capacity ($13,400) and New Landfill ($10,000) as the strategic direction for

Council's waste disposal no longer involves progression of the Myocum Quarry

Landfill project as well as the Resource Recovery Centre Upgrade ($150,000) as

Council have submitted a grant application to enhance the delivery of this

project. The decision of the grant funding won’t be announced until May

or June 2017. Scope and delivery of the project is dependent on the result of

the grant application.

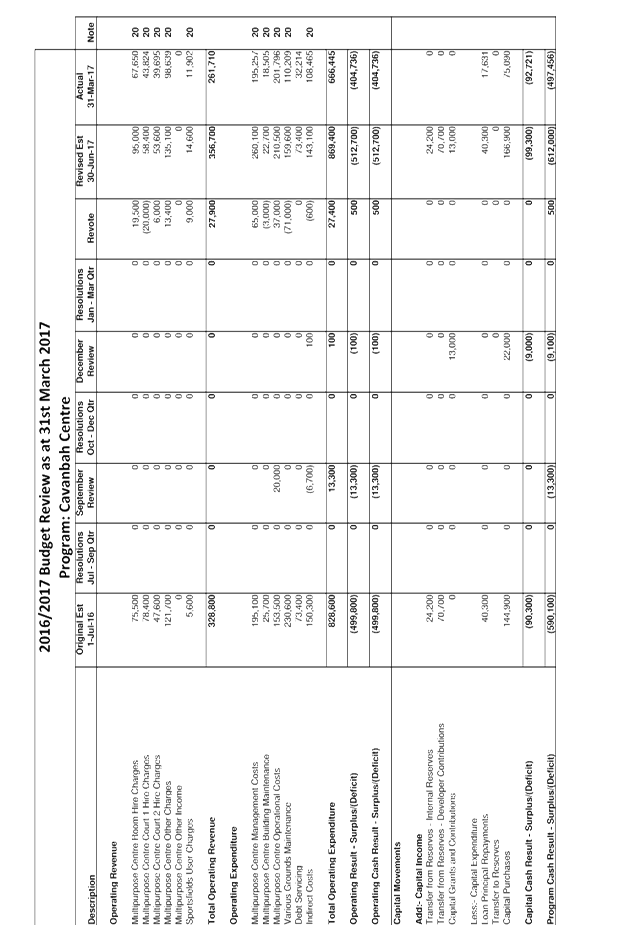

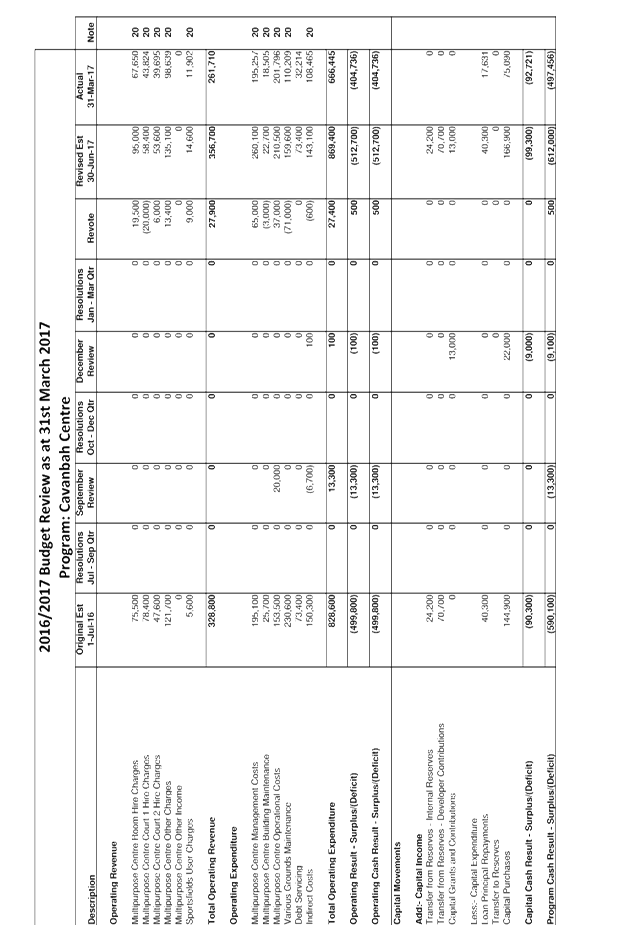

· In the Cavanbah Centre

Budget Program, there are a number of adjustments outlined under Note 20 in the

Budget Variations explanations section of Attachment 1. Further

disclosure is included in the third page of Attachment 2 under the budget

program heading Cavanbah Centre.

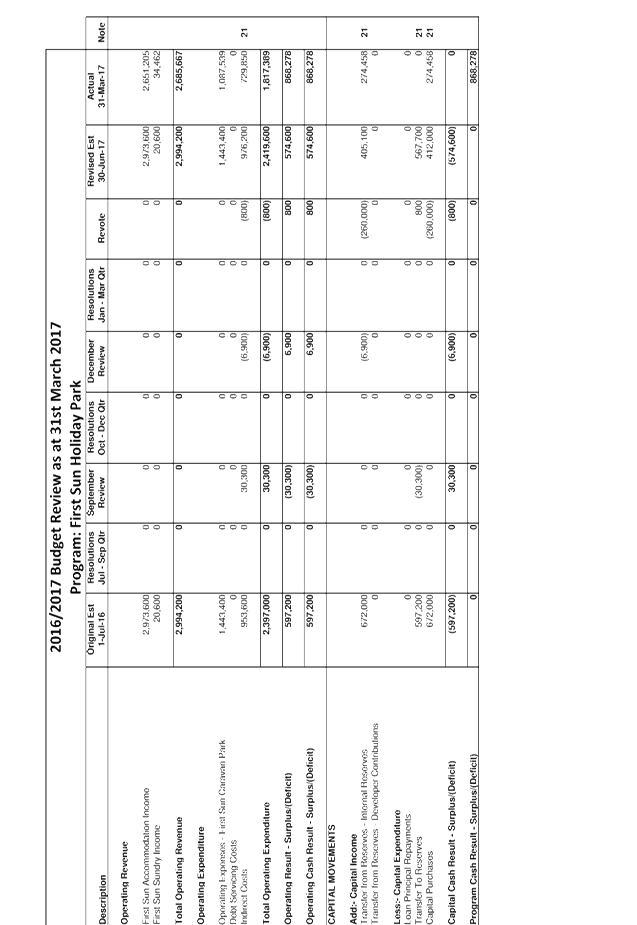

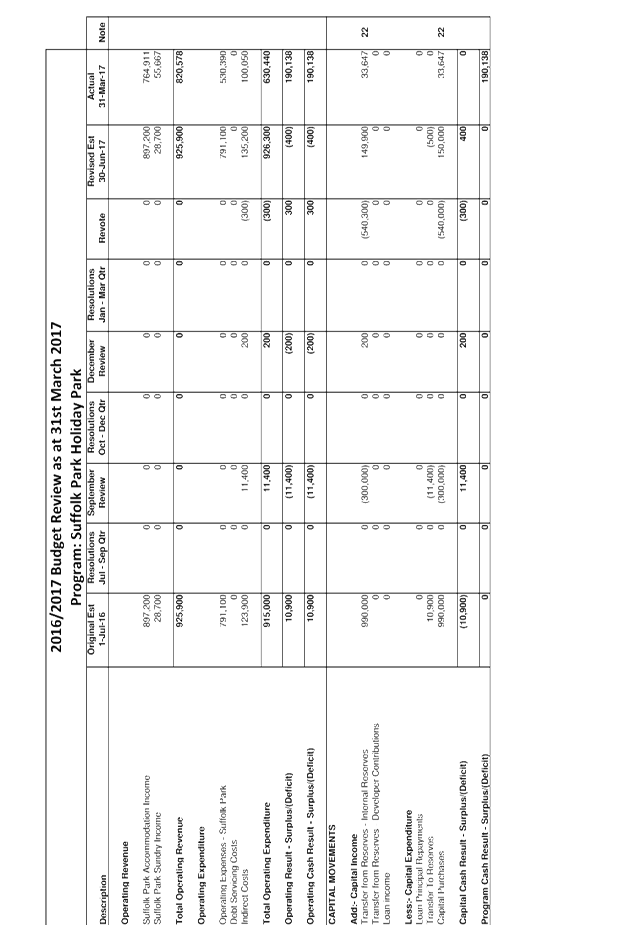

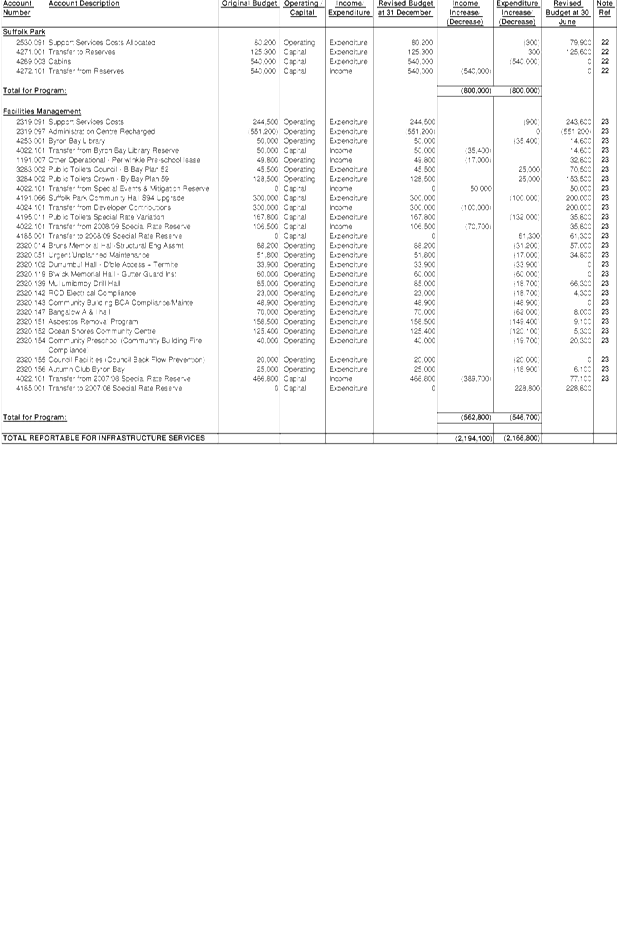

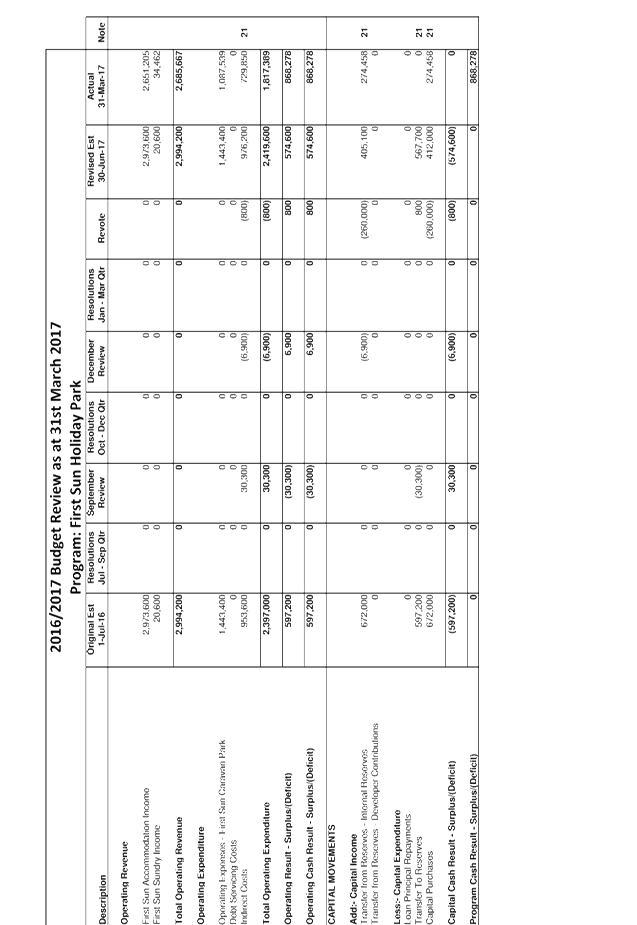

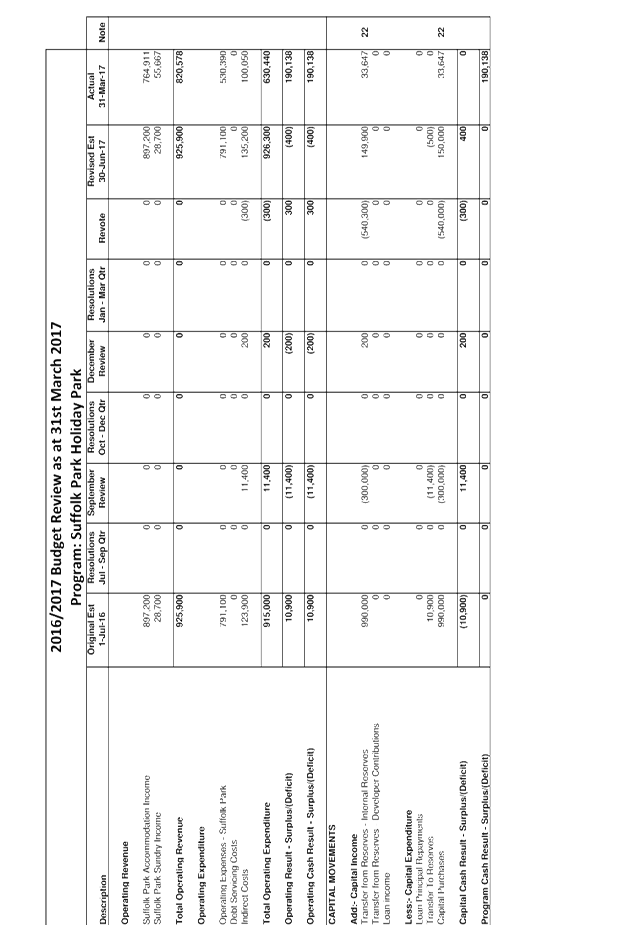

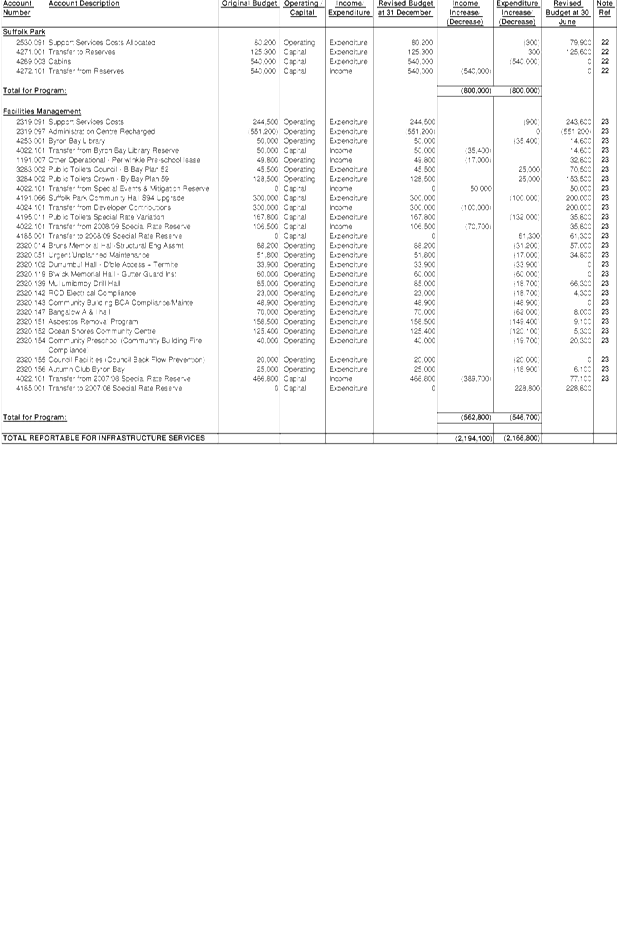

· In the Holiday Park

Budget Programs it is proposed to reduce capital expenditure at First Sun by

$260,000 as the current capital program is behind schedule due to unforeseen

delays with the Safari Tents and $540,000 at Suffolk Beachfront as the Cabins

budget is subject to land reclassification finalisation and also requires a

business case review.

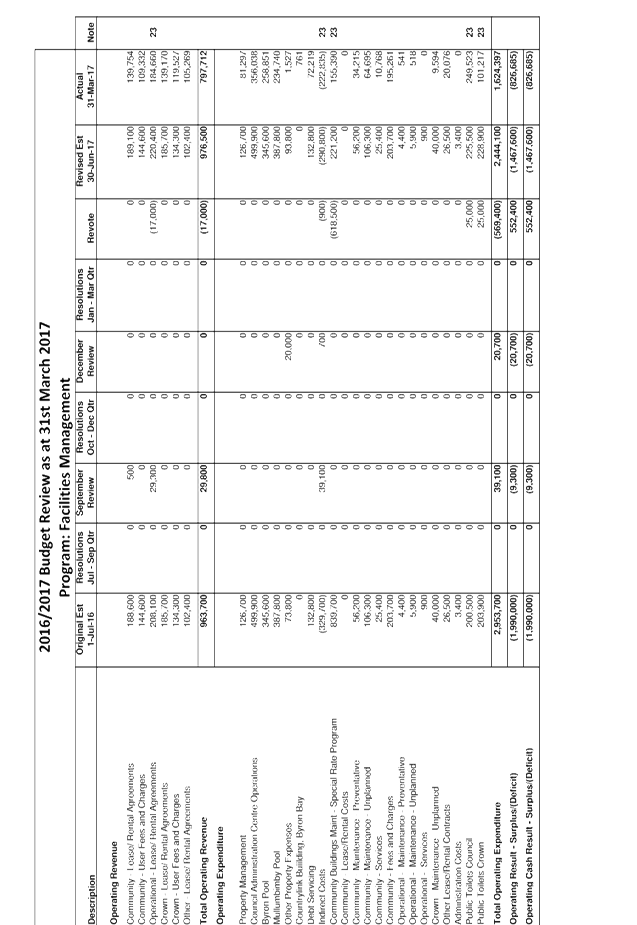

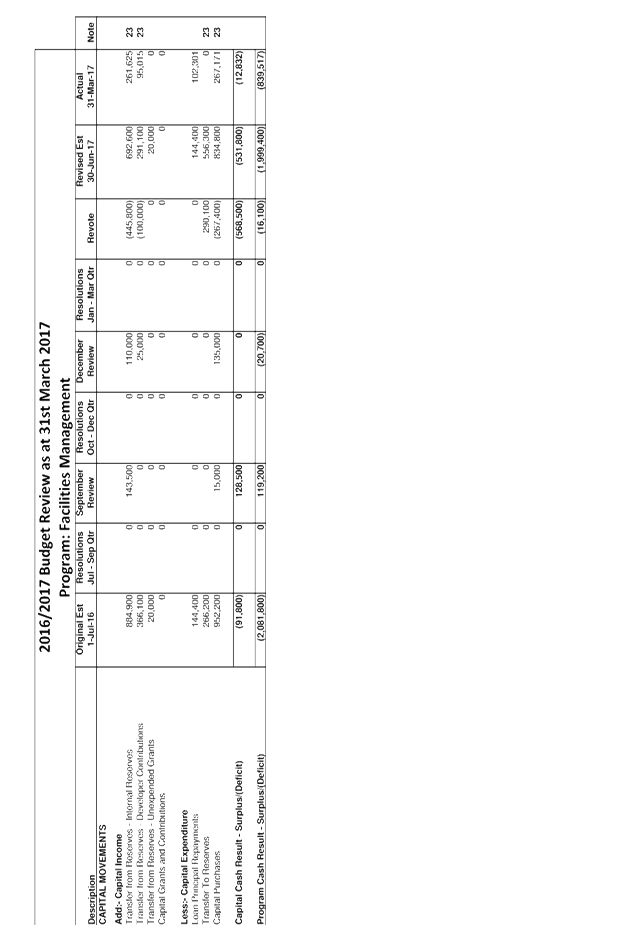

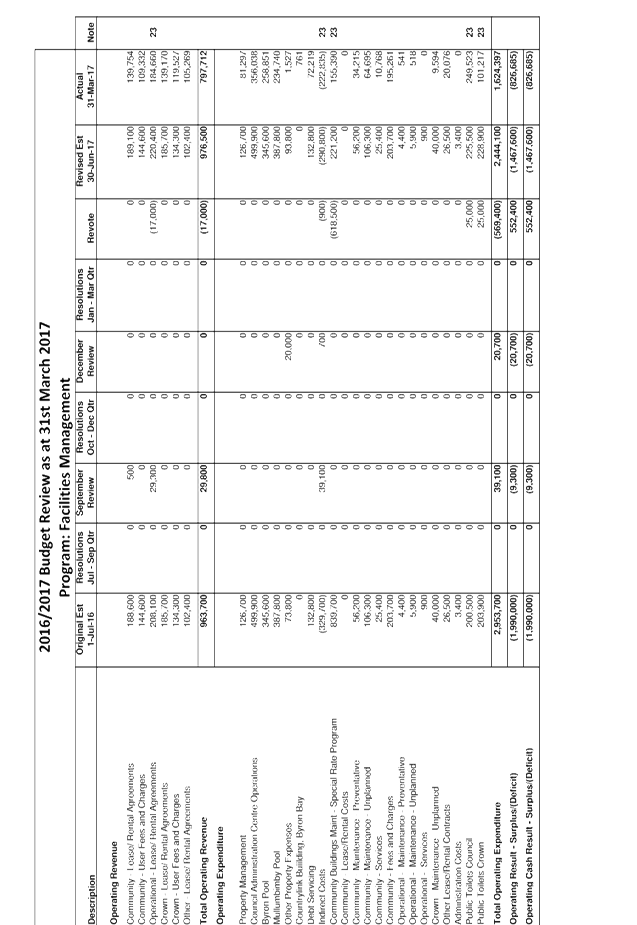

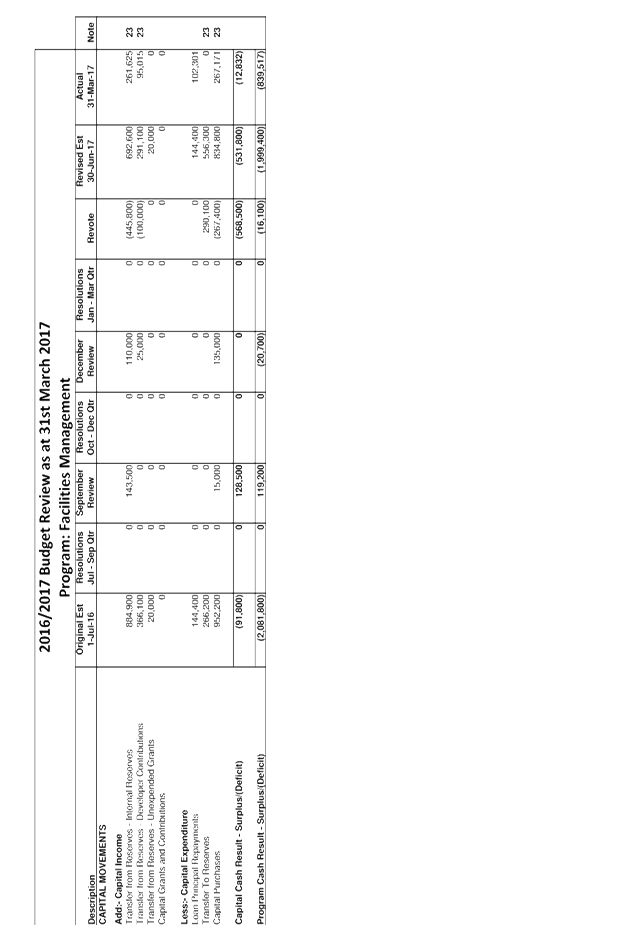

· In the Facilities

Management Budget Program it is proposed to decrease the Special rate funded

community building maintenance budget by $557,200 and move to 2017/18 as they

will not be expended this financial year. It is proposed to decrease

capital expenditure by $267,400 due to the Byron Bay Library project being

complete ($35,400) with the Suffolk Park Community hall upgrade ($100,000) and

the Public Toilet Maintenance ($132,000) being moved to the 2017/18 budget.

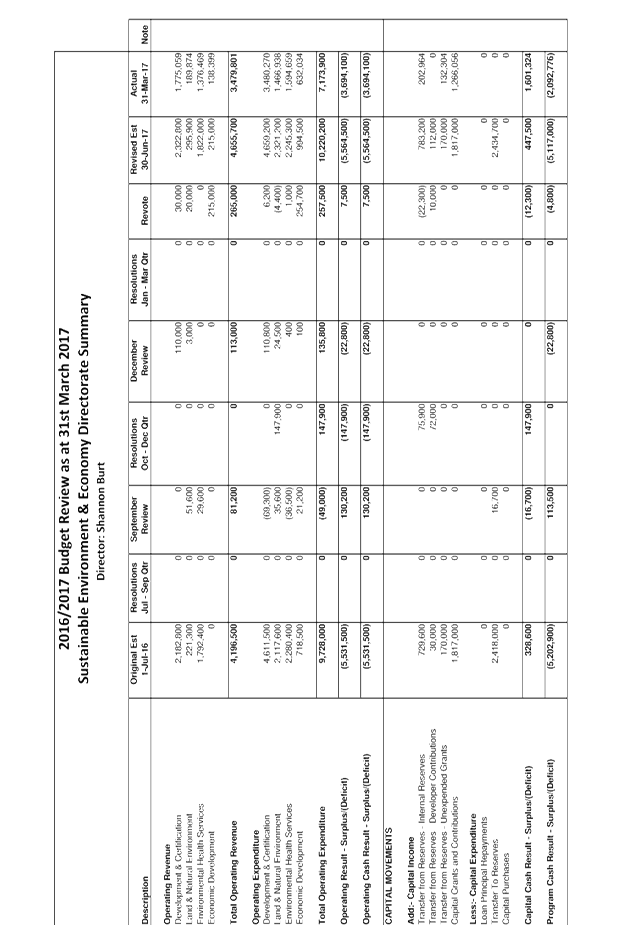

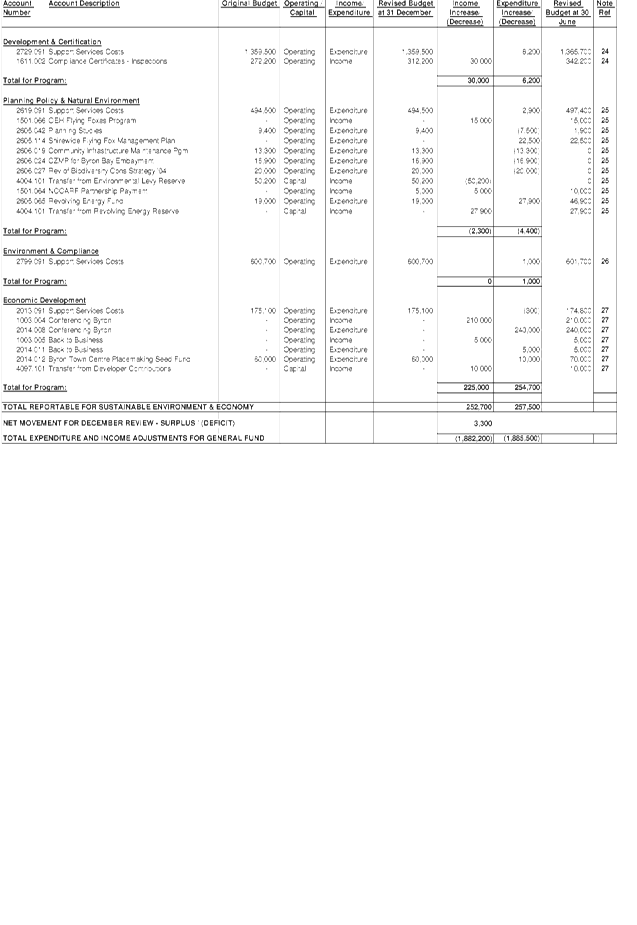

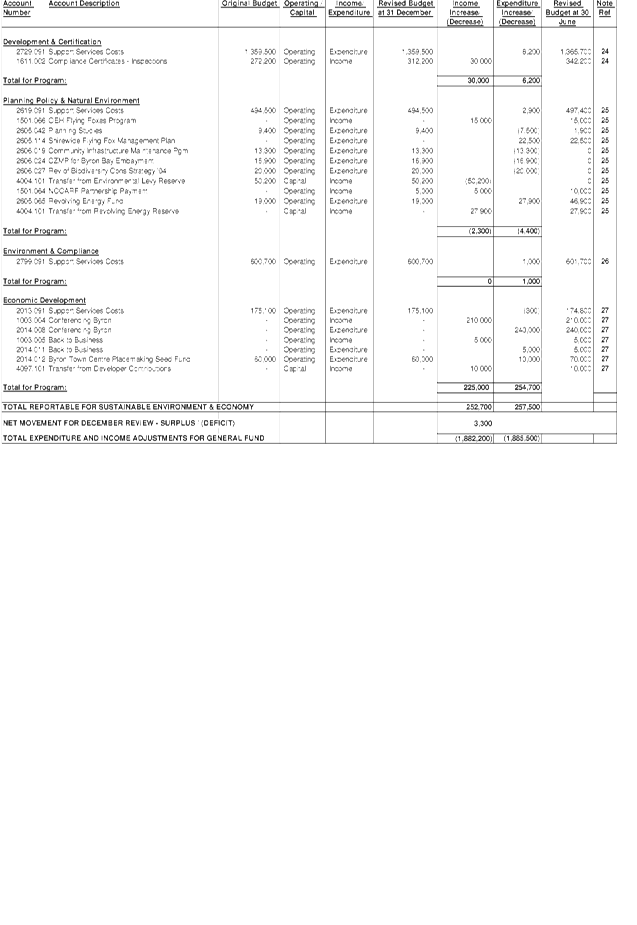

Sustainable Environment and Economy

· In the Development &

Certification Budget Program it is proposed to increase operating income by

$30,000 as there has been a steady and significant increase in compliance

certificate inspections.

· In the Planning Policy

and Natural Environment Budget Program, it is proposed to increase income by

$20,000 due to a $15,000 grant received from the Office of Environment and

Heritage for the Shire Wide Flying Fox Management Plan and $5,000 received from

the National Climate Change Adaptation Research Facility (NCCARF). It is

proposed to decrease operating expenditure due to a reduction against planning

studies ($7,500), an increase for the Shirewide Flying Fox Management Plan

($22,500), an increase for the revolving energy fund that relates to the supply

and installation of a lighting upgrade to the Depot ($27,900 funded from the

Revolving Energy reserve) and decreases against Community Infrastructure

Maintenance Program ($13,300), CZMP for Byron Bay Embayment ($16,900) and the

Review of the Biodiversity Conservation Strategy ($20,000) that will remain

unexpended this financial year and are all funded through the Environmental

Levy.

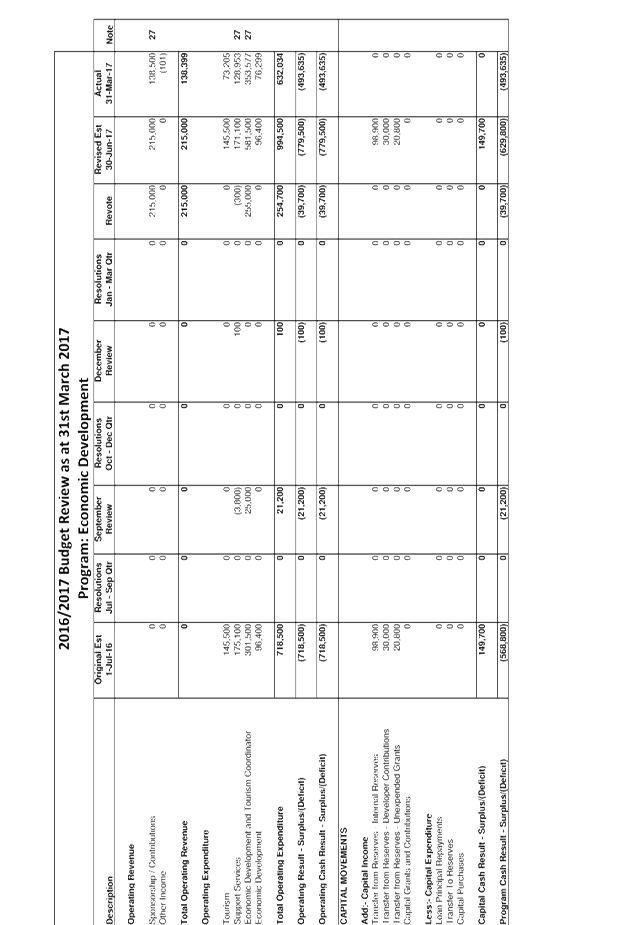

· In the Economic

Development Budget Program, it is proposed to increase operating income by

$215,000 due to the Conferencing Byron project ($210,000) and the Back to

Business project ($5,000). Operating expenditure increased due to

Conferencing Byron ($240,000), Back to business ($5,000) and the Byron

Placemaking Seed Fund ($10,000).

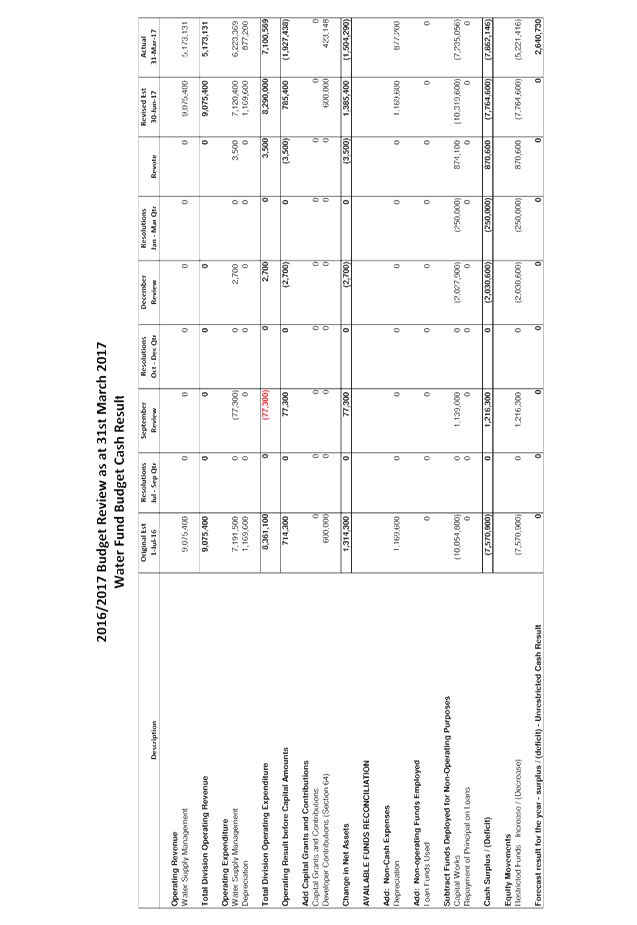

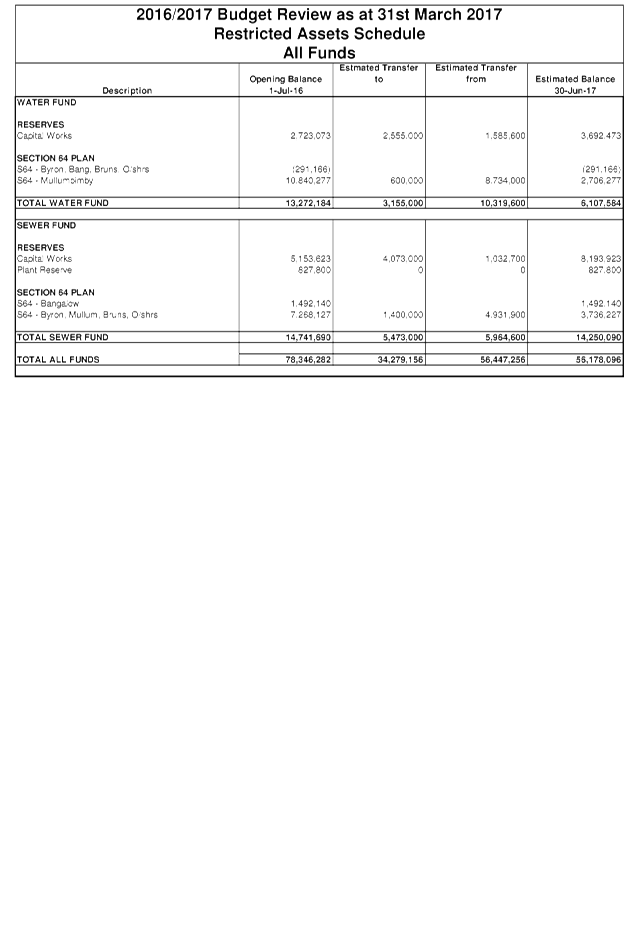

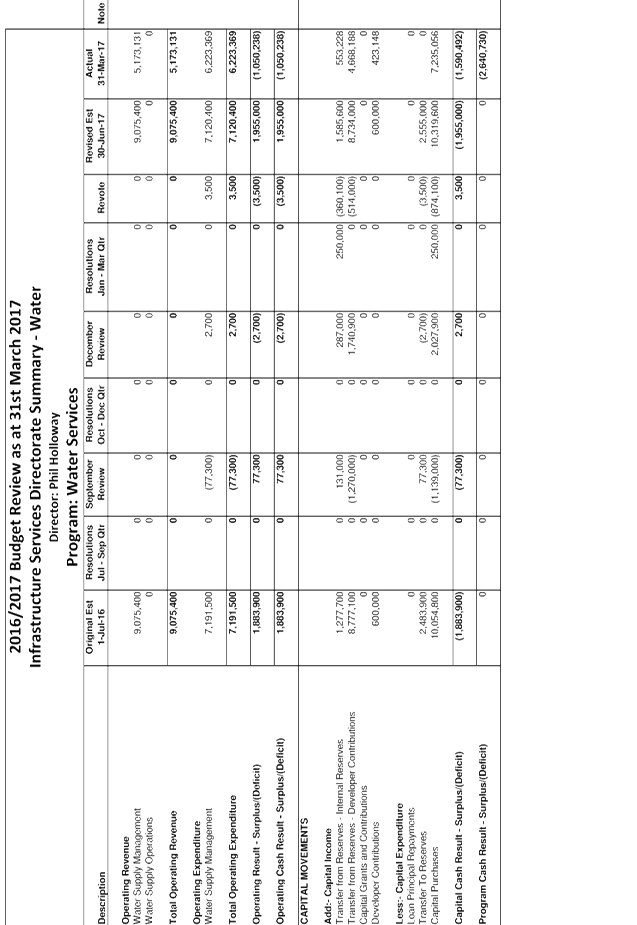

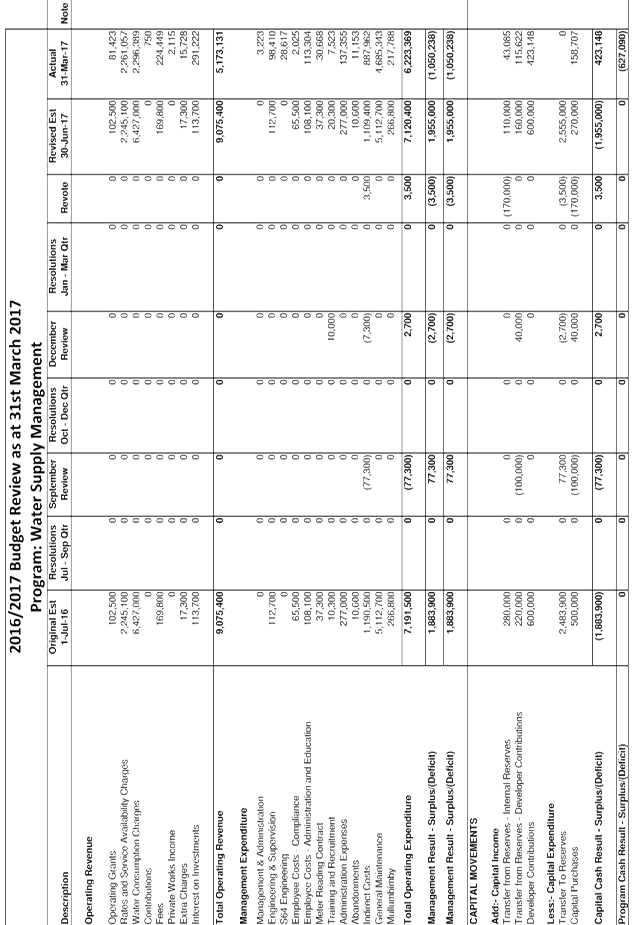

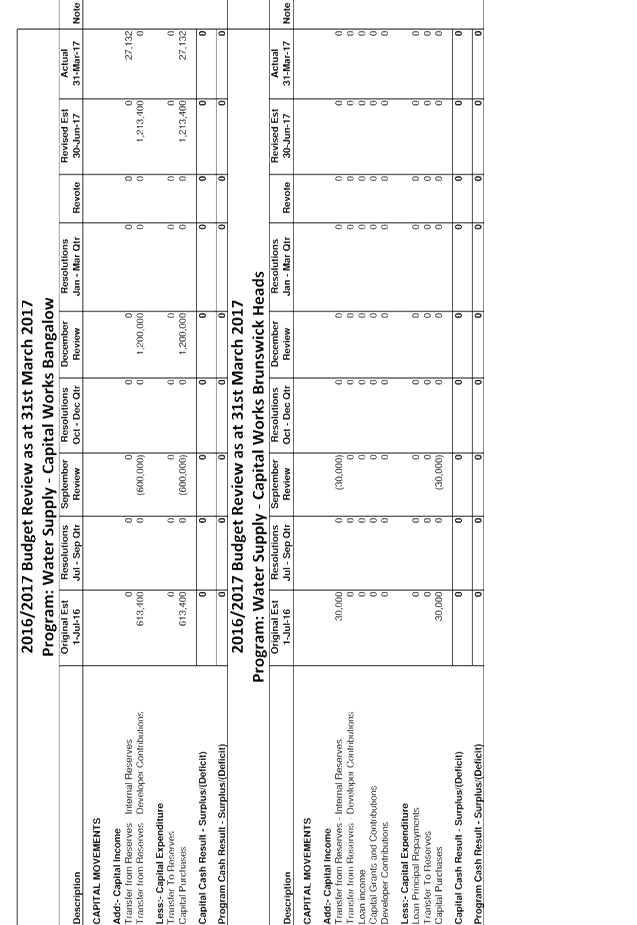

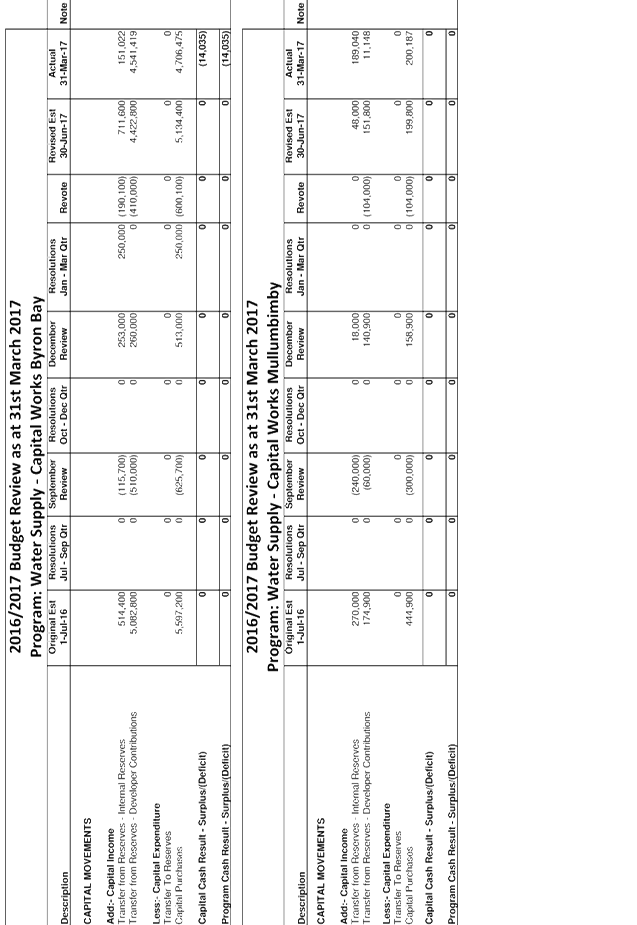

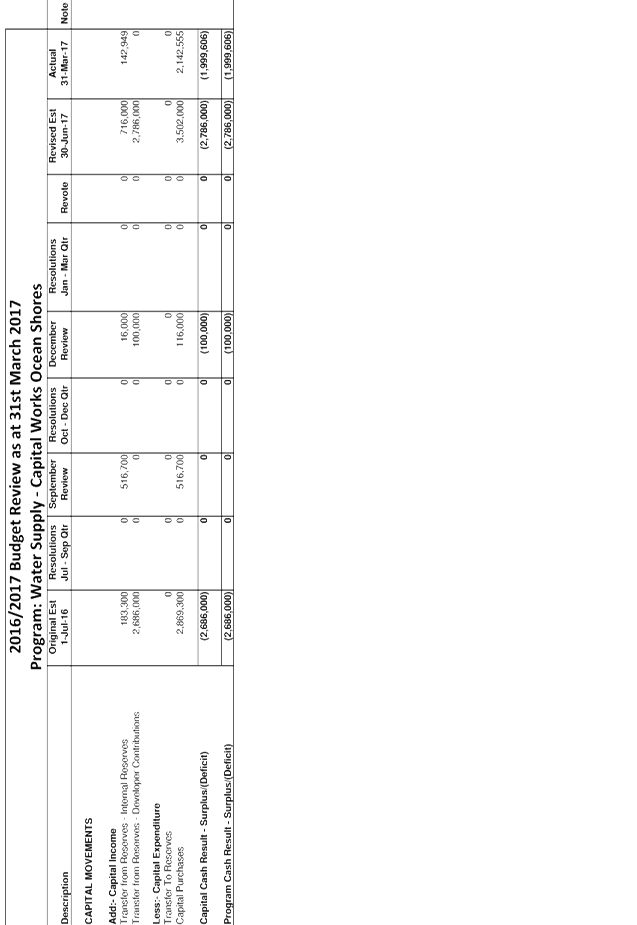

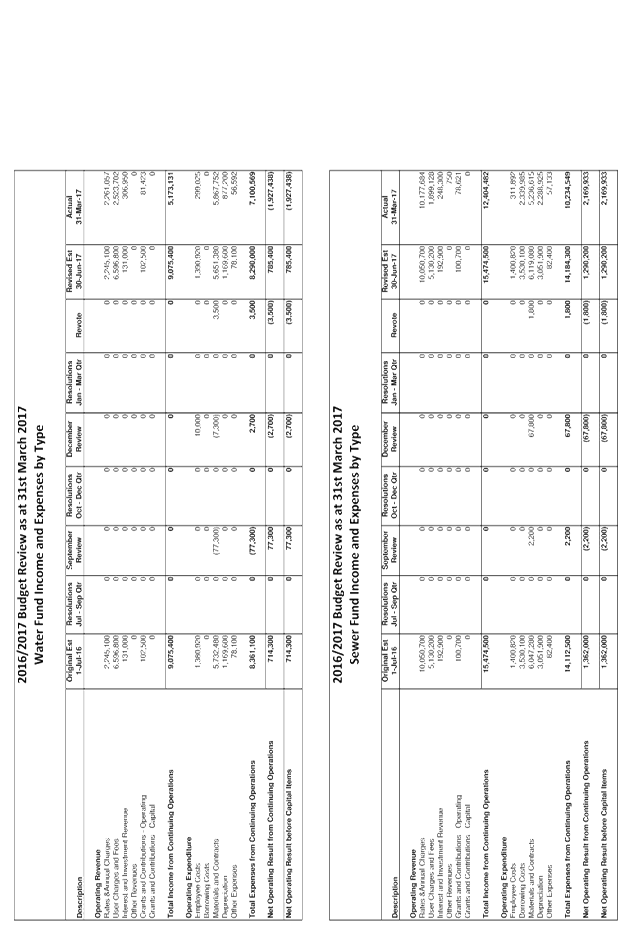

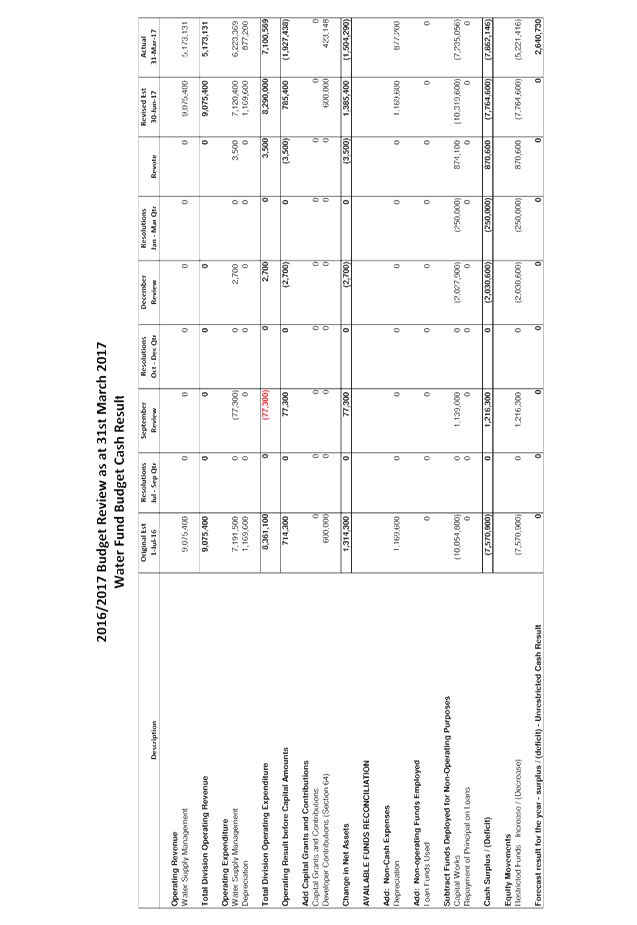

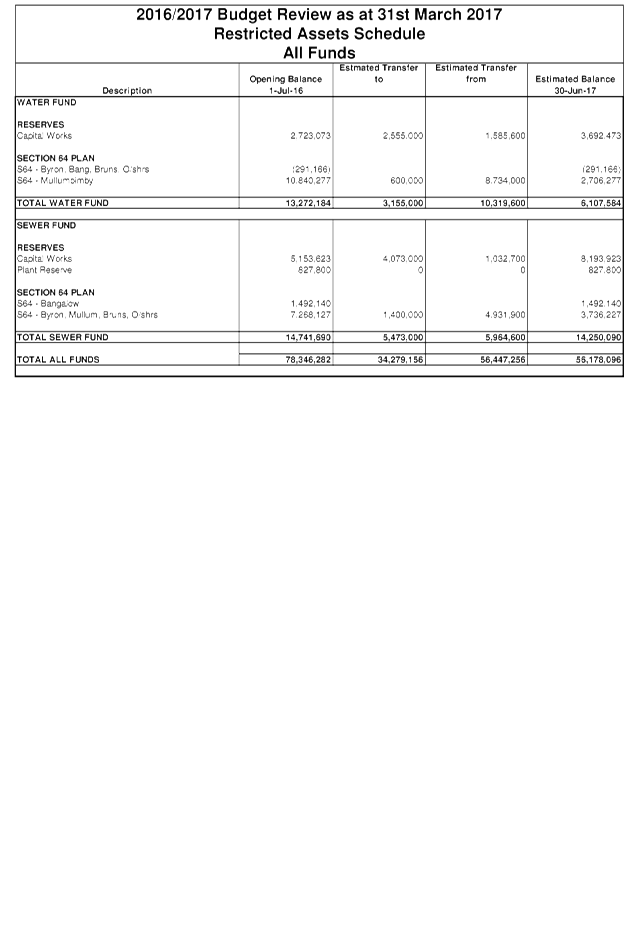

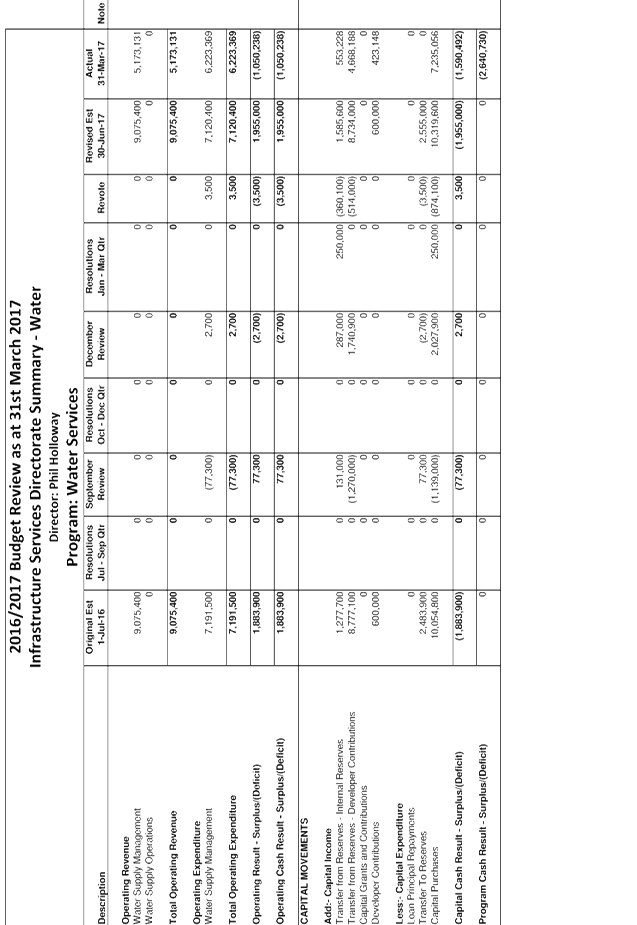

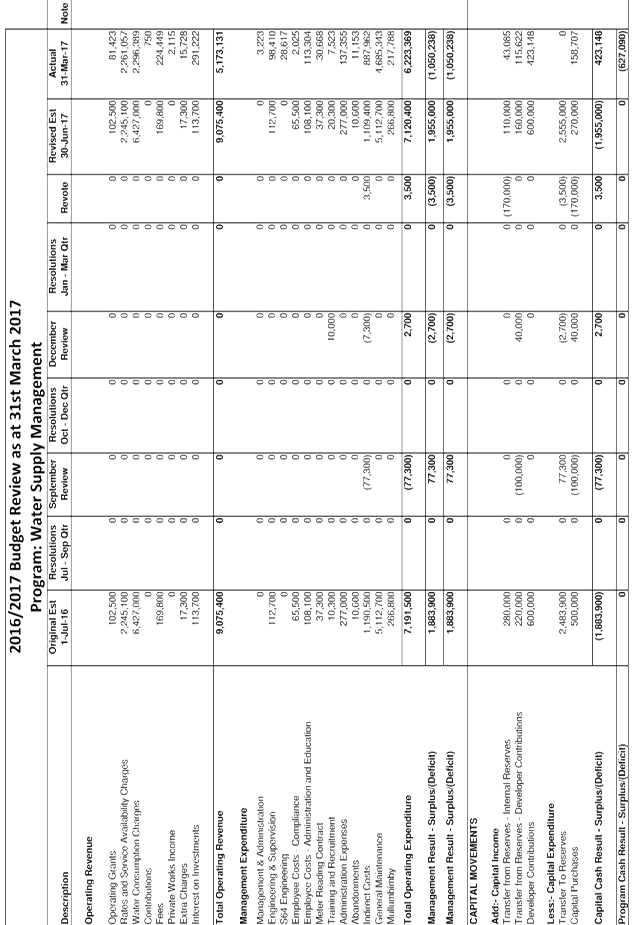

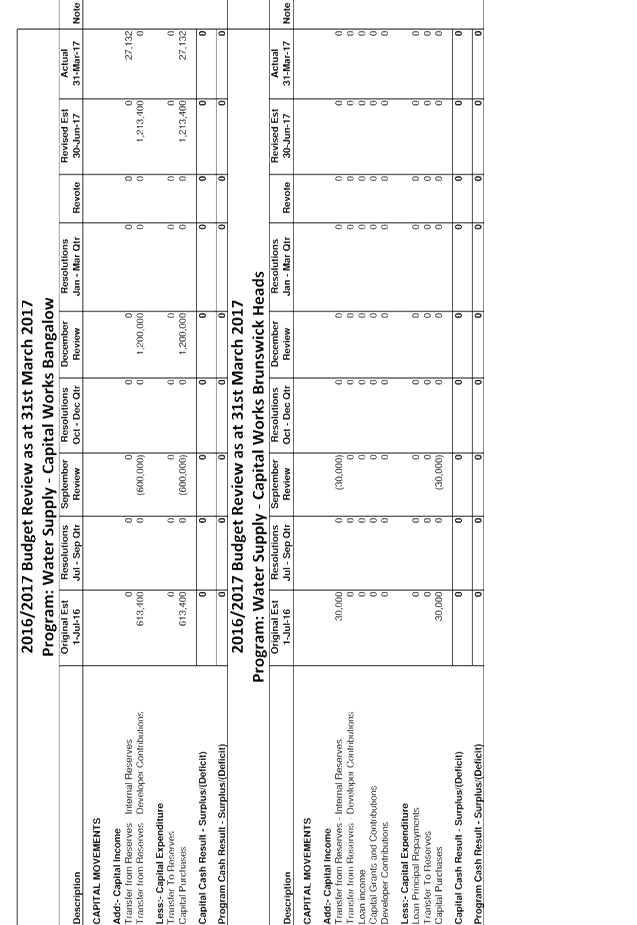

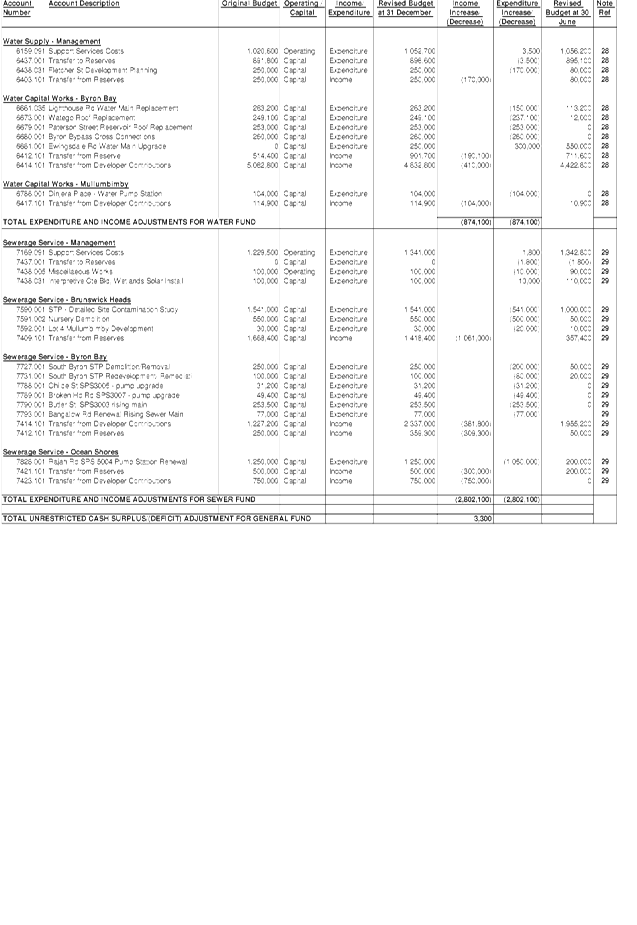

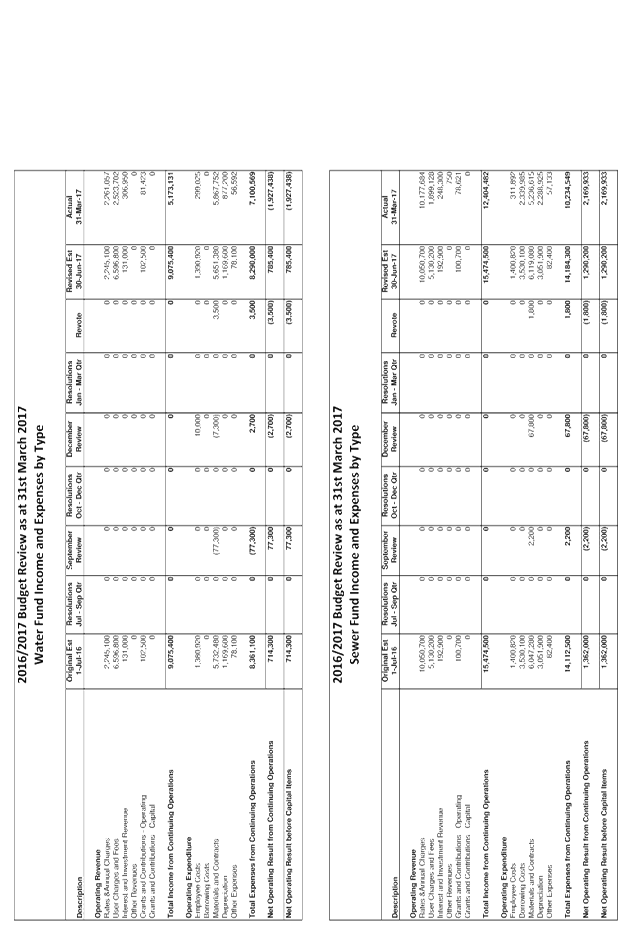

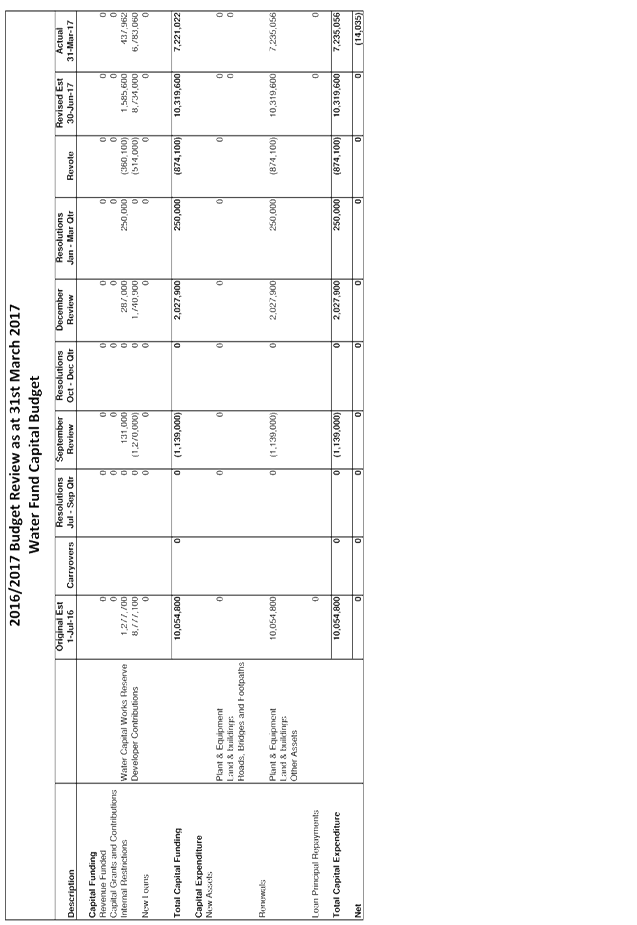

WATER FUND

After completion of the 2015/2016

Financial Statements the Water Fund as at 30 June 2016 has a capital works

reserve of $2,723,000 and held $10,549,100 in section 64 developer

contributions.

The estimated Water Fund reserve

balances as at 30 June 2017, and forecast in this Quarter Budget Review, are

derived as follows:

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2016

|

$2,723,000

|

|

Plus original budget reserve

movement

|

1,553,000

|

|

Less reserve funded carryovers

from 2015/2016

|

(346,800)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(53,700)

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(289,700)

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

(250,000)

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

356,600

|

|

Forecast Reserve Movement for

2016/2017 – Increase / (Decrease)

|

969,400

|

|

Estimated Reserve Balance at

30 June 2017

|

$3,692,400

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2016

|

$10,549,100

|

|

Plus original budget reserve

movement

|

(7,794,000)

|

|

Less reserve funded carryovers

from 2015/2016

|

(383,100)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

1,270,000

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(1,740,900)

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

514,000

|

|

Forecast Reserve Movement for

2016/2017 – Increase / (Decrease)

|

(8,134,000)

|

|

Estimated Reserve Balance at

30 June 2017

|

$2,415,100

|

Movements for Water Fund can be seen in Attachment 1 with a

proposed estimated increase to reserves (including S64 Contributions) overall

of $870,600 from the 31 March 2017 Quarter Budget Review.

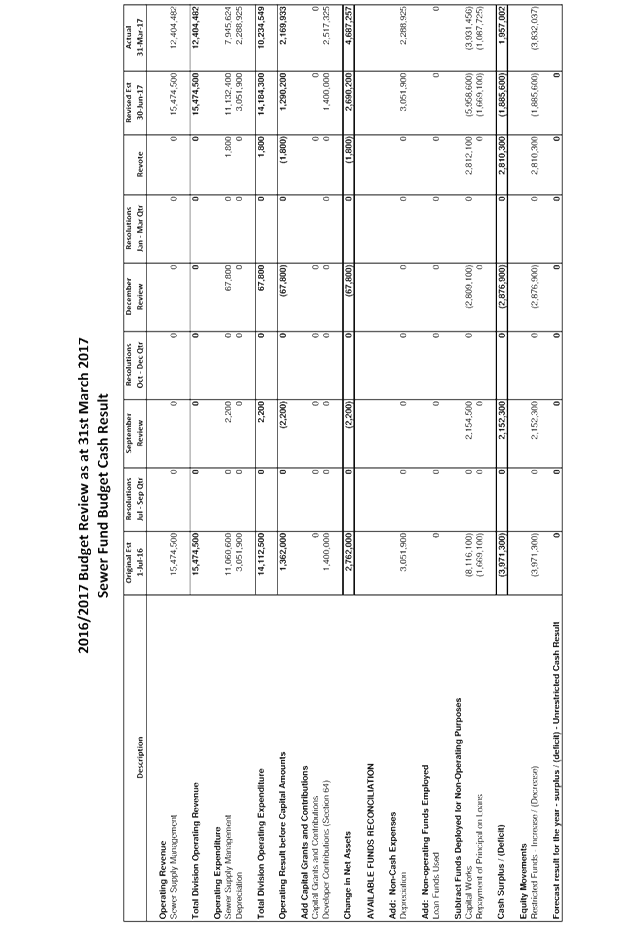

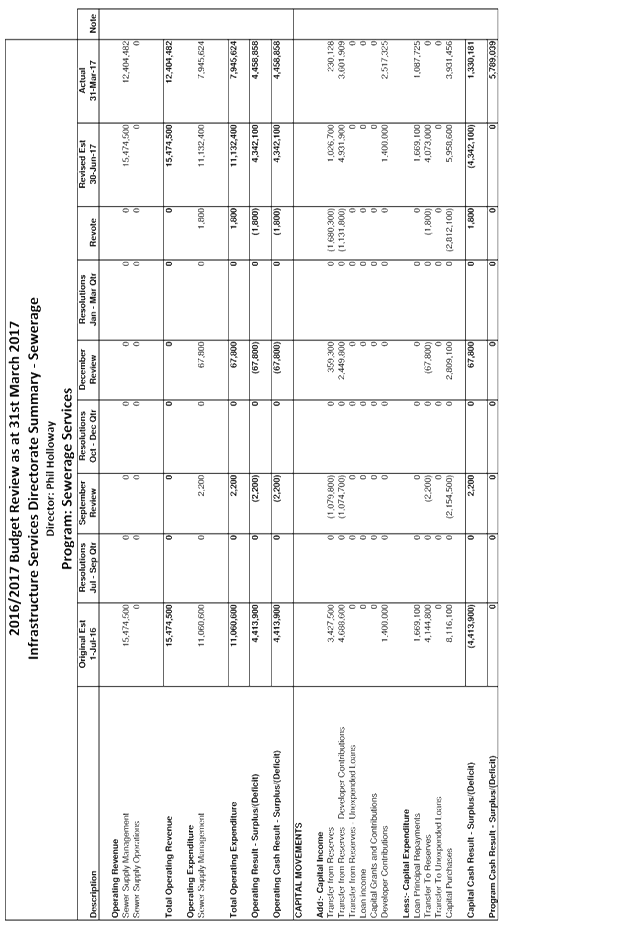

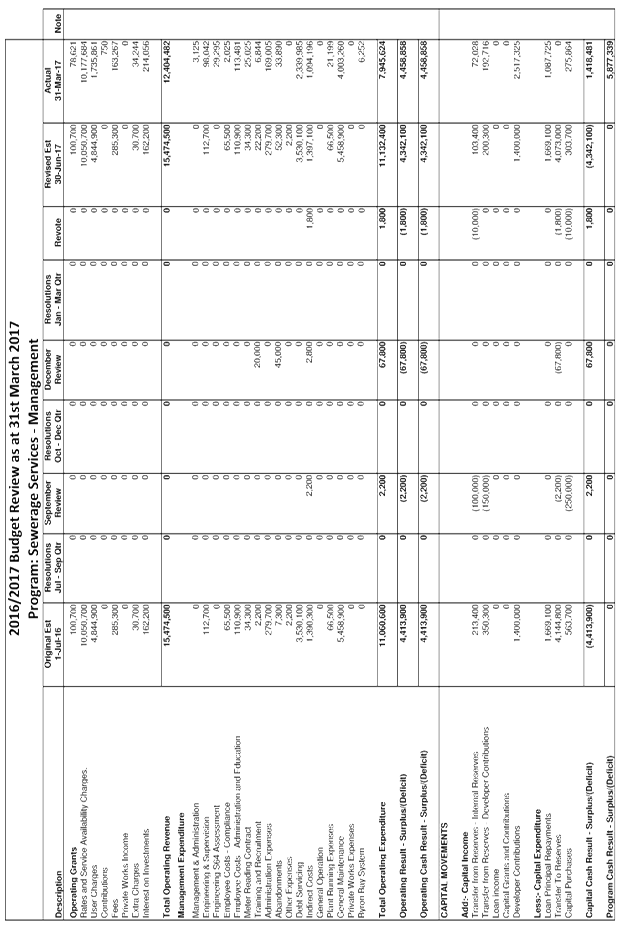

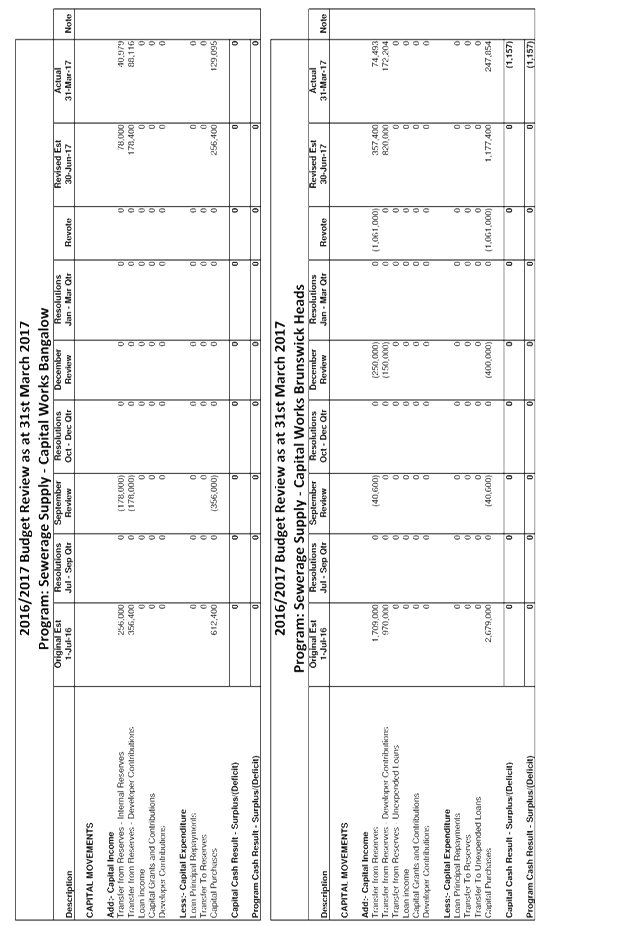

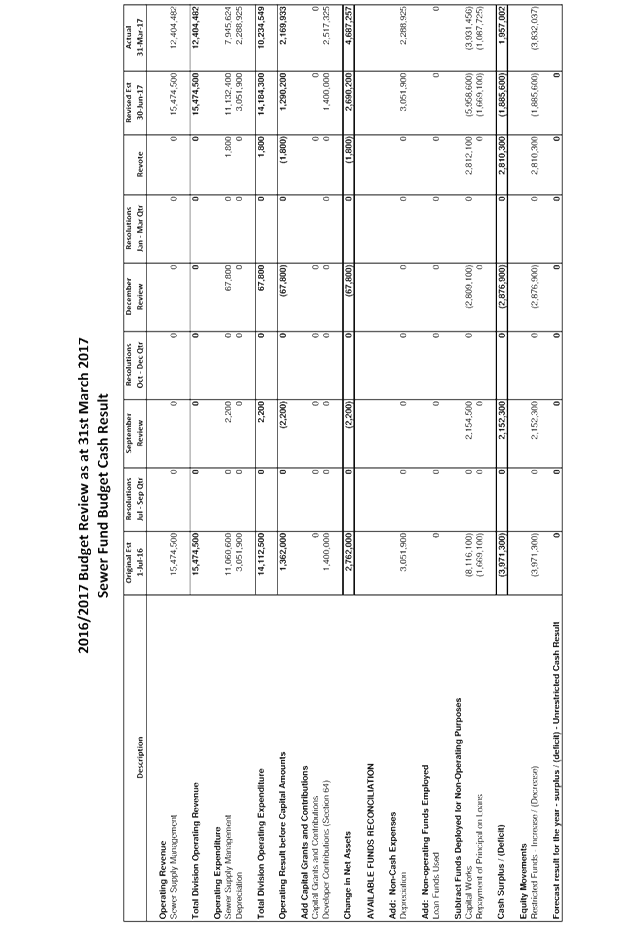

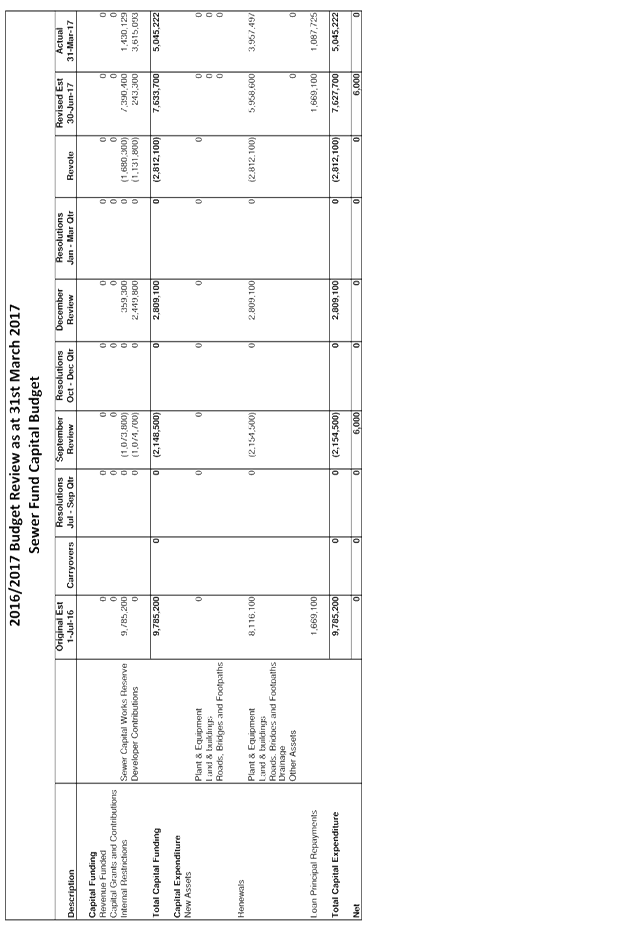

SEWERAGE FUND

After completion of the 2015/2016

Financial Statements the Sewer Fund has a capital works reserves of

$5,153,600 and plant reserve of $827,800. It also held $8,760,300 in section 64

developer contributions.

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2017

|

$5,153,600

|

|

Plus original budget reserve

movement

|

814,200

|

|

Less reserve funded carryovers

from 2015/2016

|

(96,900)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

1,071,600

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(427,100)

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

1,678,500

|

|

Forecast Reserve Movement for

2016/2017 – Increase / (Decrease)

|

3,040,300

|

|

Estimated Reserve Balance at

30 June 2017

|

$8,193,900

|

Plant Reserve

|

Opening Reserve Balance at 1

July 2016

|

$827,800

|

|

Plus original budget reserve

movement

|

0

|

|

Less reserve funded carryovers

from 2015/2016

|

0

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Forecast Reserve Movement for

2016/2017 – Increase / (Decrease)

|

0

|

|

Estimated Reserve Balance at

30 June 2017

|

$827,800

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2016

|

$8,760,300

|

|

Plus original budget reserve

movement

|

(2,785,400)

|

|

Less reserve funded carryovers

from 2015/2016

|

(503,200)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

1,074,700

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(2,449,800)

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

1,131,800

|

|

Forecast Reserve Movement for

2016/2017 – Increase / (Decrease)

|

(3,531,900)

|

|

Estimated Reserve Balance at

30 June 2017

|

$5,228,400

|

Movements for the Sewerage Fund can be seen in Attachment 1

with a proposed estimated overall increase to reserves (including S64

Contributions) of $2,810,300 from the 31 March 2017 Quarter Budget Review.

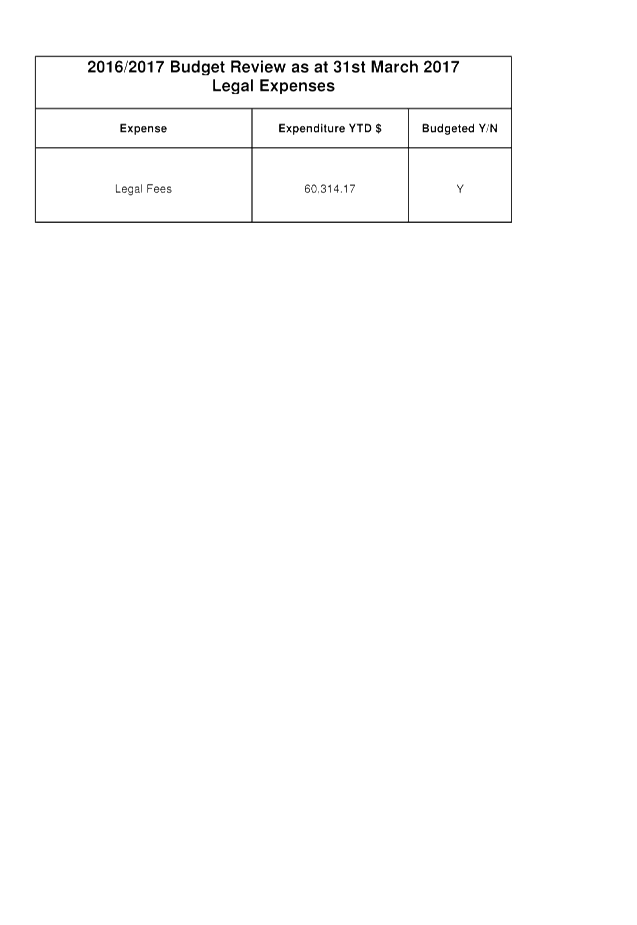

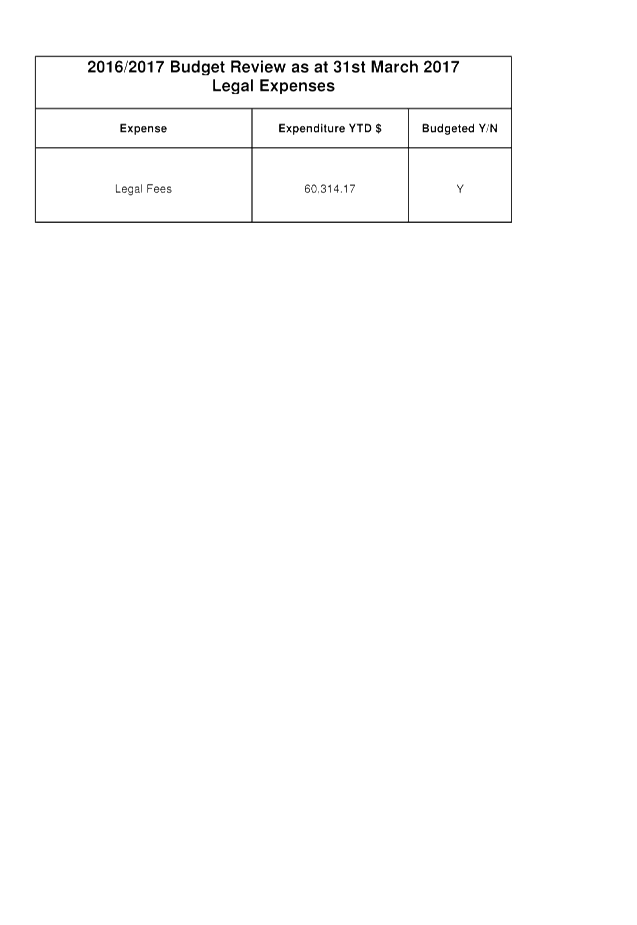

Legal Expenses

One of the major financial concerns for Council over

previous years has been legal expenses. Not only does this item represent a

large expenditure item funded by general revenue, but can also be susceptible

to large fluctuations.

The table that follows indicates the allocated budget and

actual legal expenditure within Council on

a fund basis as at 31 March 2017.

Total Legal Income & Expenditure as at 31 March 2017

|

Program

|

2016/2017

Budget ($)

|

Actual ($)

|

Percentage To

Revised Budget

|

|

Income

|

|

|

|

|

Legal Expenses Recovered

|

0

|

0

|

0%

|

|

Total Income

|

0

|

0

|

0%

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

General Legal Expenses

|

200,000

|

60,314

|

30.1%

|

|

Total Expenditure General Fund

|

200,000

|

60,314

|

30.1%

|

Note: The above table does not include costs incurred

by Council in proceedings after 31 March 2017 or billed after this date along

with legal costs incurred with the Byron Bay Bypass project that have currently

been charged to the project.

Financial Implications

The 31 March 2017 Quarter Budget Review of the 2016/2017

Budget has increased the overall budget result by $3,300. As a result the

estimated unrestricted cash balance attributable to the General Fund decreased

to an estimated $1,145,200 at 30 June 2017.

Statutory and Policy

Compliance Implications

In accordance with Regulation 203

of the Local Government (General) Regulation 2005 the Responsible Accounting

Officer of a Council must:-

(1) Not later than 2 months after the end of each quarter

(except the June quarter), the responsible accounting officer of a council must prepare and submit to the council a budget review statement that shows, by

reference to the estimate of income and expenditure set out in the statement of

the council’s revenue policy included in the operational plan for the

relevant year, a revised estimate of the income and expenditure for that year.

(2) A budget review statement must include or be

accompanied by:

(a) a report as to whether or not the responsible

accounting officer believes that the statement indicates that the financial

position of the council is satisfactory, having regard to the original estimate

of income and expenditure, and

(b) if that position is unsatisfactory, recommendations

for remedial action.

(3) A budget review statement must also include any

information required by the Code to be included in such a statement.

Statement by Responsible Accounting Officer

This report indicates that the short term financial position

of Council is satisfactory for the 2016/2017 financial year, having

consideration of the original estimate of income and expenditure at the 31

March 2017 Quarter Budget Review.

This opinion is based on the estimated General Fund

Unrestricted Cash Result position and that the current indicative budget

position for 2016/2017, whilst now a projected balanced result still provides

that the General Fund Unrestricted Cash Balance will remain above

Council’s adopted benchmark of $1,000,000. Not withstanding this,

Council will need to continue to carefully monitor the 2016/2017 budget over

the remainder of the financial year especially in the Local Roads &

Drainage Budget Programs and Open Space and Recreation Budget Programs that are

under pressure given recent weather events and expenditure to date.

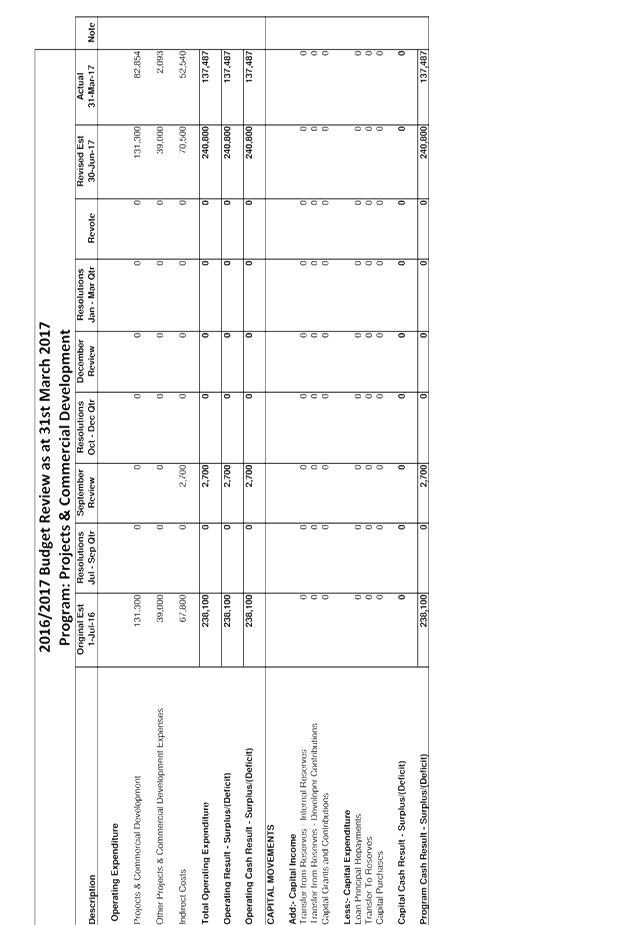

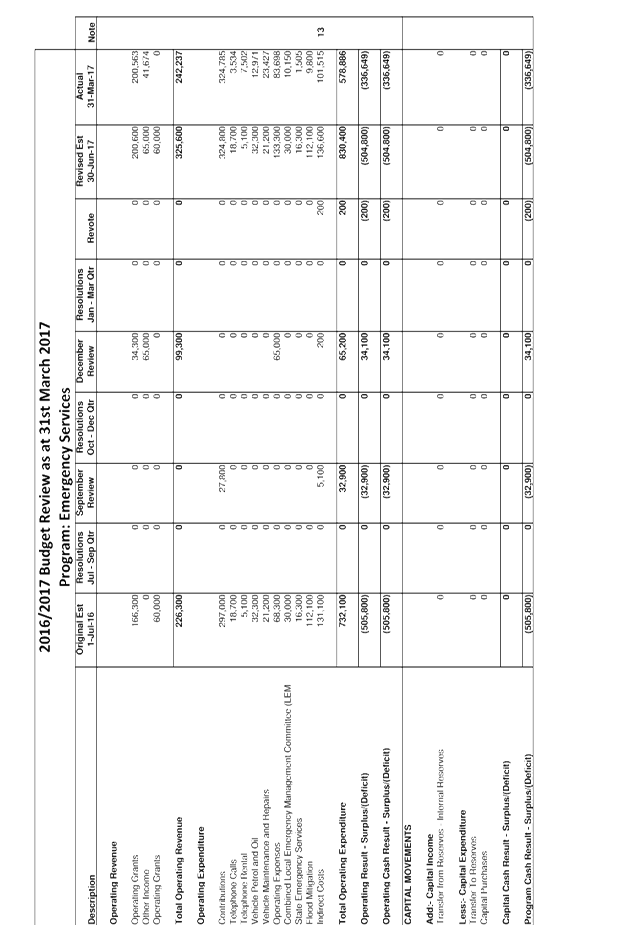

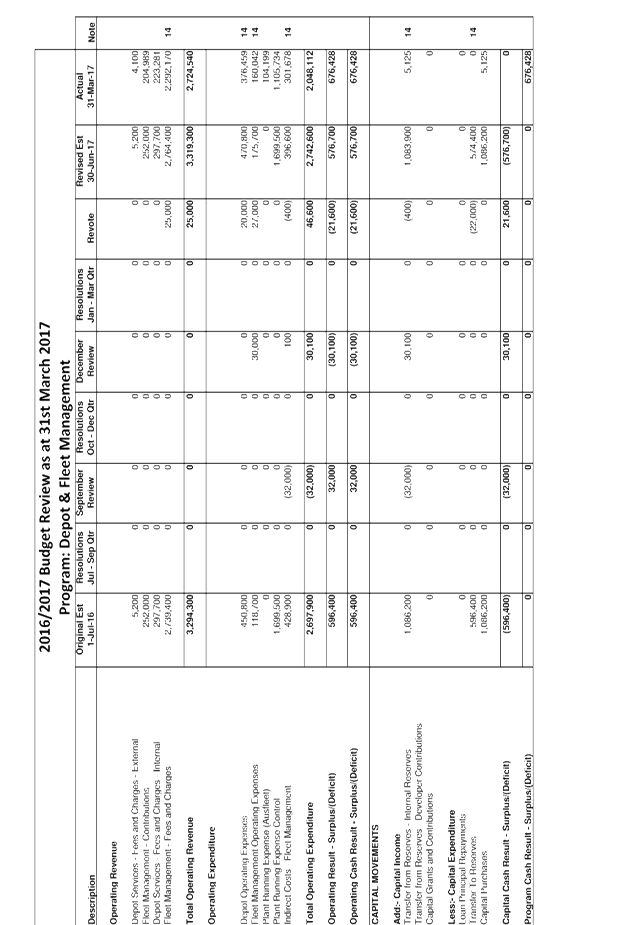

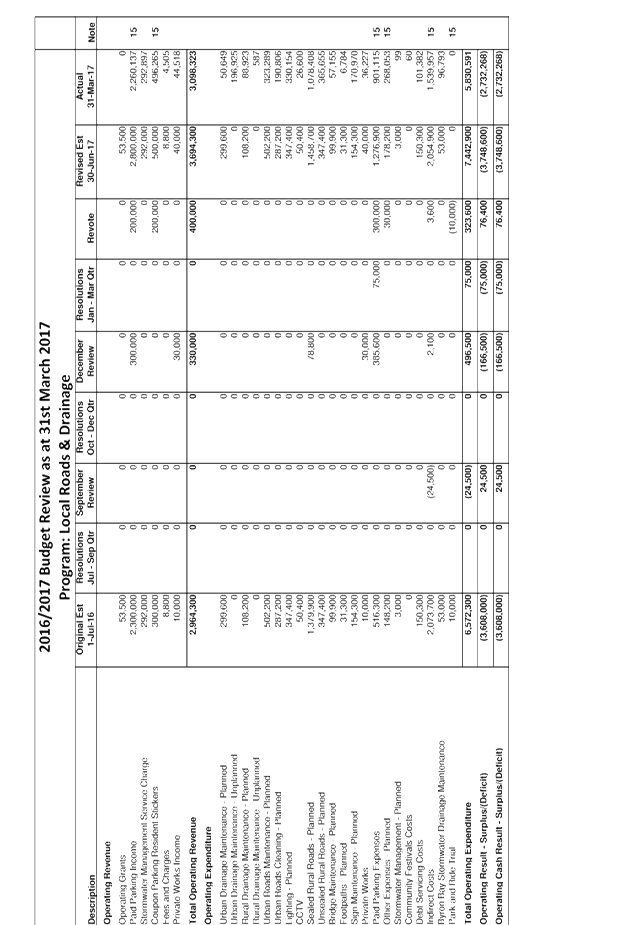

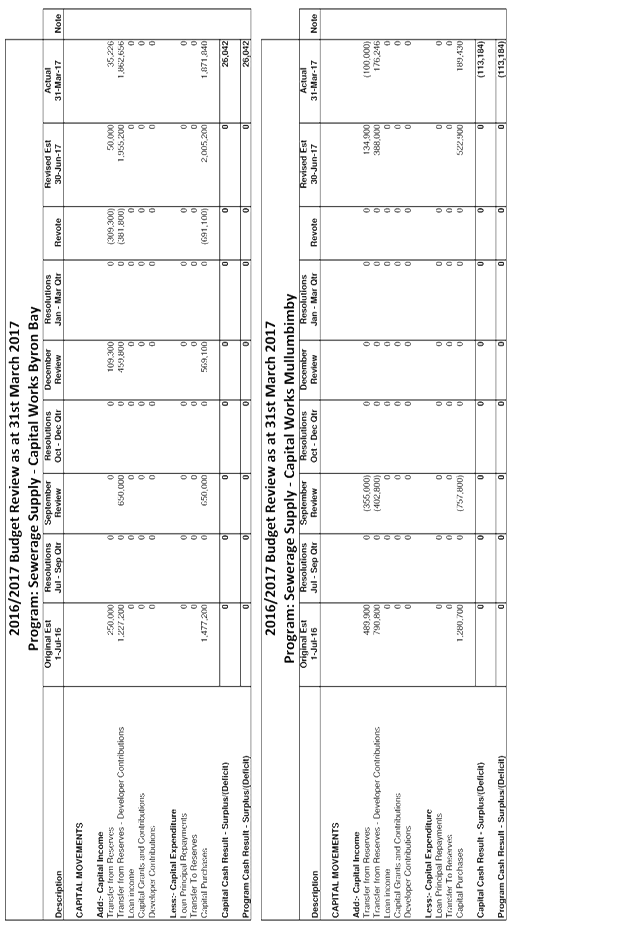

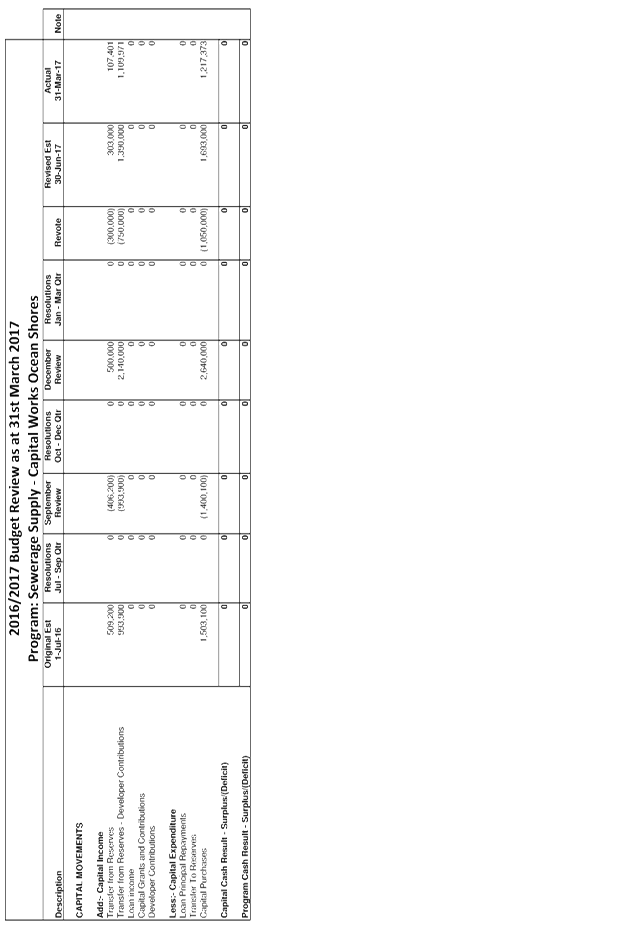

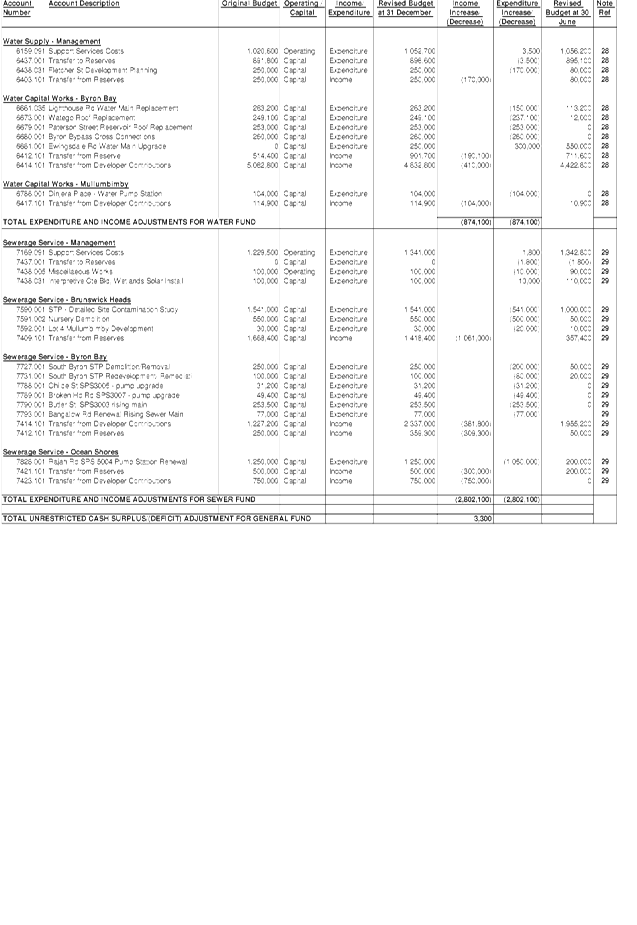

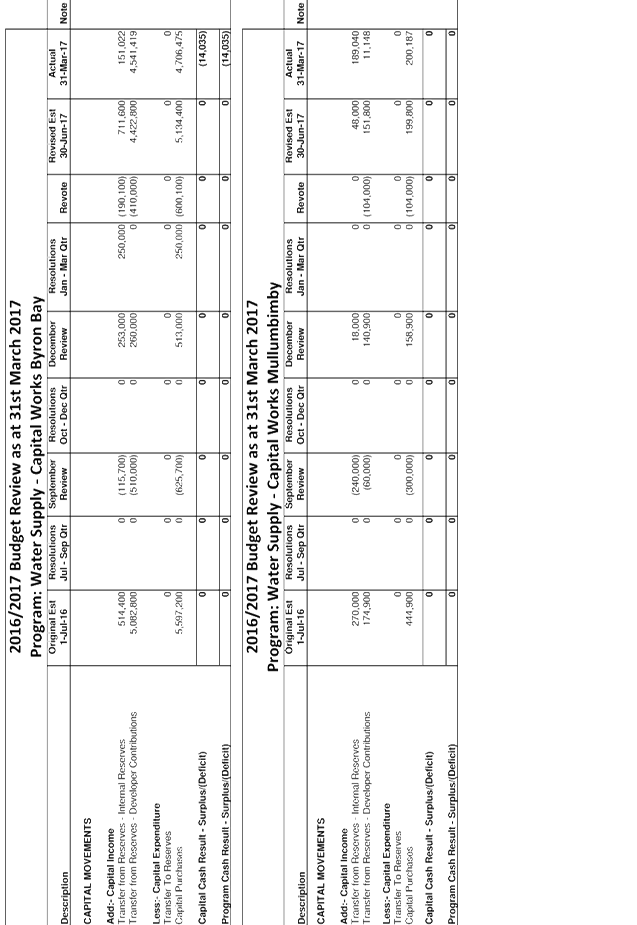

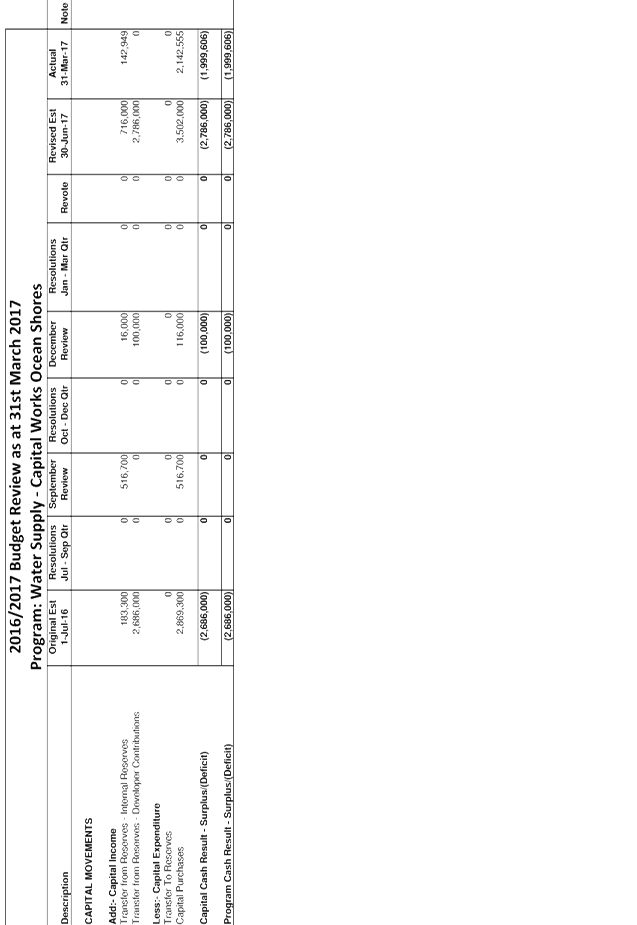

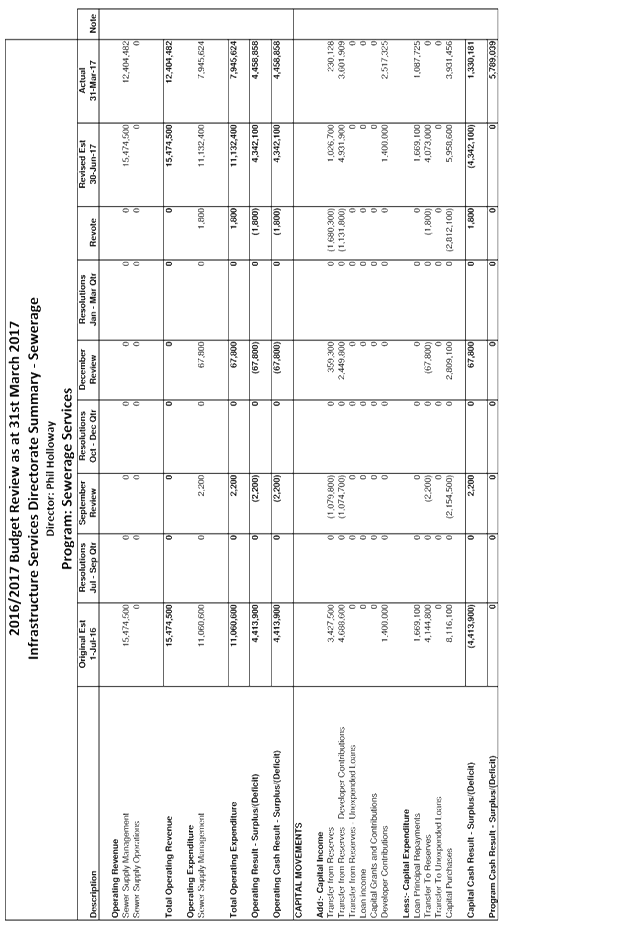

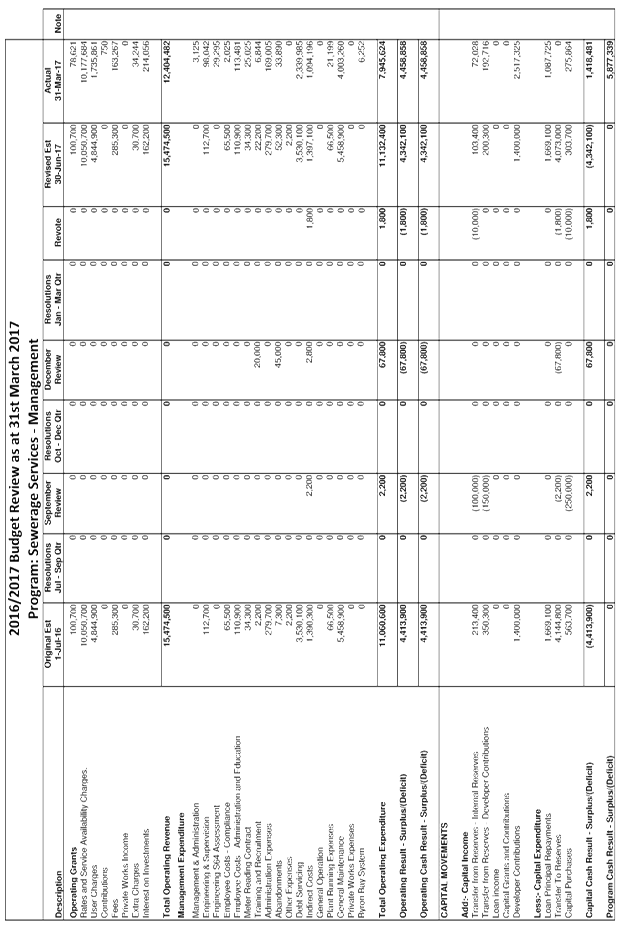

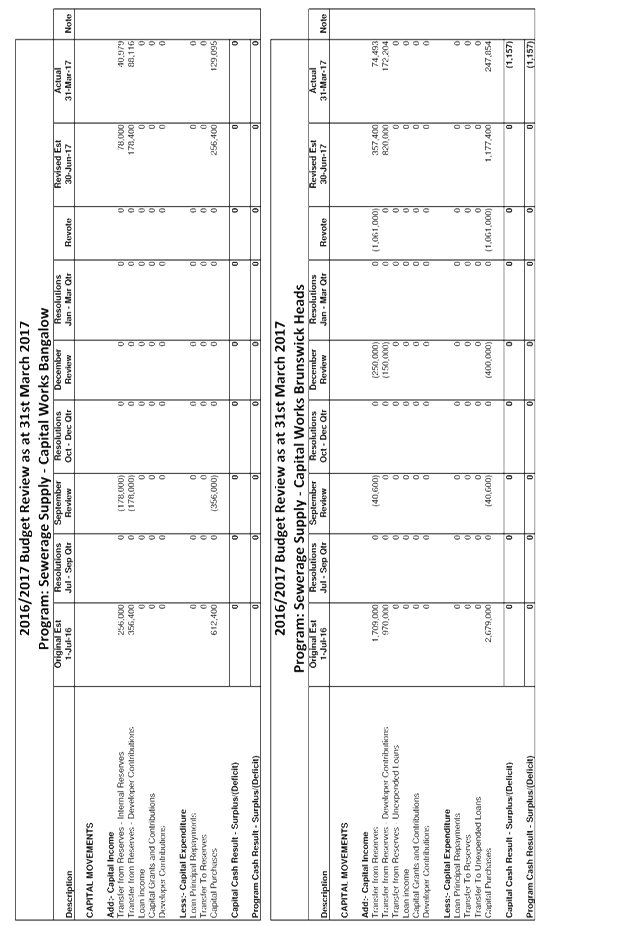

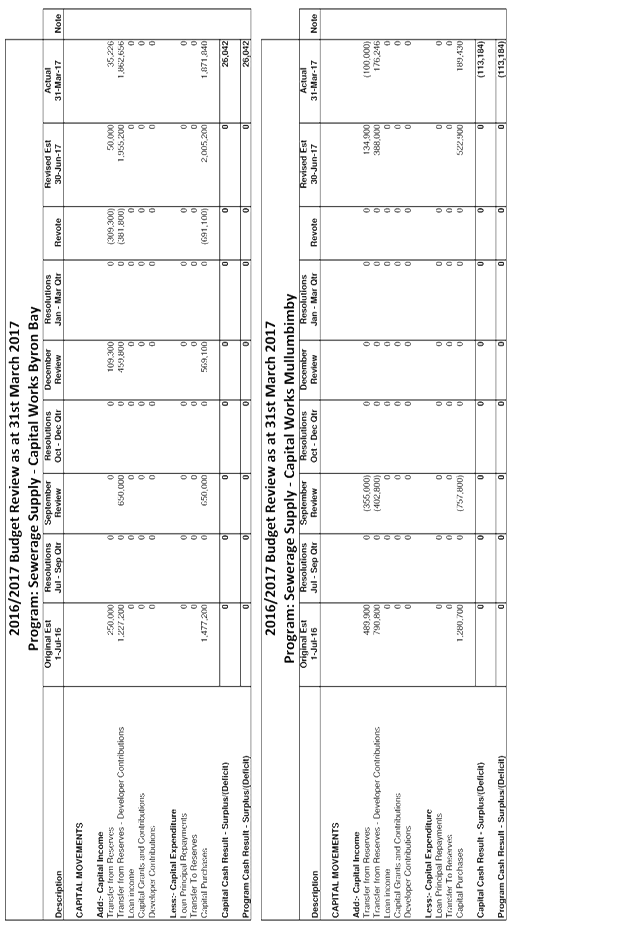

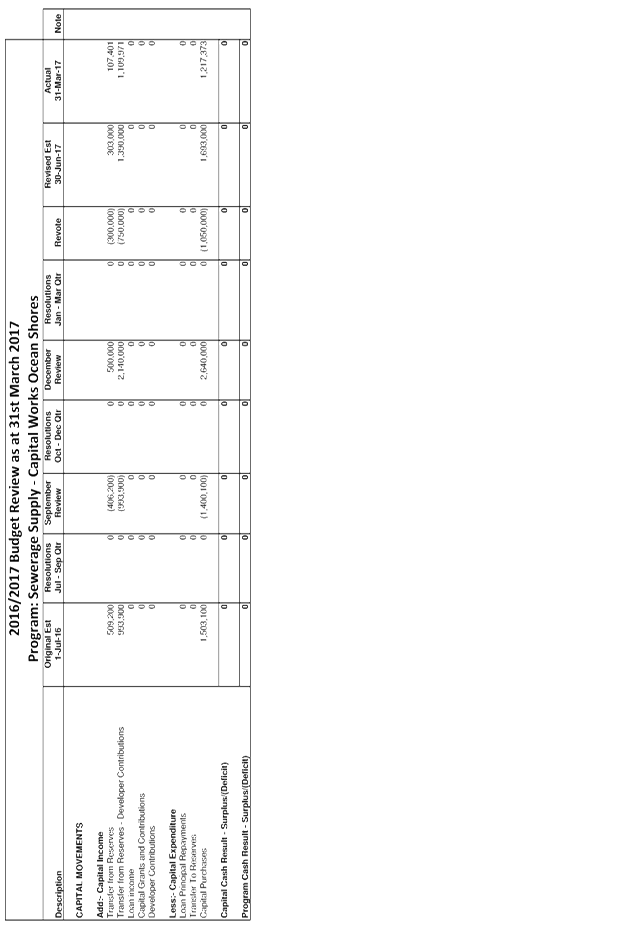

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.2 - Attachment 2

Staff Reports - Corporate and Community Services 4.2 - Attachment 3

Late Reports 5.1

Late Reports

Report No. 5.1 2016/17

Financial Sustainability Plan - Update on the Action Implementation Plan as at

31 March 2017

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/439

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary meeting held on 2 February 2017

adopted the 2016/17 Financial Sustainability Plan (FSP) via Resolution 17-011

without change following endorsement by the Finance Advisory Committee at its

Meeting held on 10 November 2016 of the Draft 2016/2017 FSP.

The FSP adopted by Council is for the 2016/17 Financial Year

and details the strategic approach adopted by Council for managing the

Financial Sustainability of the Council as an organisation.

The Council

via Resolution 13-148 resolved to develop the FSP as a

means of communicating with the community on proposed reforms.

Council in Resolution 13-148 also determined that progress

reports on the implementation of the actions within the FSP be submitted to the

Council's Finance Advisory Committee.

This report has been prepared to provide the Finance

Advisory Committee with an update report on the implementation of the actions

in the 2016/17 FSP, for the period to 31 March 2017.

|

RECOMMENDATION:

That the update report to

31 March 2017 on the 2016/2017 Financial Sustainability Plan Action

Implementation Plan (E2017/9113) be received and noted.

|

Attachments:

1 FSP Action

Implementation Plan as at 31 March 2017, E2017/9113

, page 129⇩

Report

Council at its Ordinary meeting held on 2 February 2017

adopted the 2016/17 Financial Sustainability Plan (FSP) via Resolution 17-011

without change following endorsement by the Finance Advisory Committee at its

Meeting held 10 November 2016 of the Draft 2016/2017 FSP.

The FSP adopted by Council is for the 2016/17 Financial Year

and details the strategic approach adopted by Council for managing the

Financial Sustainability of the Council as an organisation.

The Council

via Resolution 13-148 resolved to develop the FSP as a

means of communicating with the community on proposed reforms.

Council in Resolution 13-148 also determined that progress

reports on the implementation of the actions within the FSP be submitted to the

Council's Finance Advisory Committee.

This report has been prepared to provide the Finance Advisory

Committee with an update report on the implementation of the actions in the 2016/17

FSP Plan, for the period to 31 March 2017.

A summary of the actions detailed in the FSP has been

prepared and attached to this Report at Attachment 1. A comment has been

included in the summary against each of the identified actions for the main

areas or elements being:

· Expenditure

Review

· Revenue

Review

· Land Review

and Property Development

· Strategic

Procurement

· Policy and

Decision Making

· Potential

Commercial Opportunities

· Volunteerism

· Collaborations

and Partnerships

· Asset

Management

· Long Term

Financial Planning

· Performance

Indicators

· Environmental

Projects

Financial Implications

The Finance Advisory Committee by referencing Attachment 1

will see progress against various action items associated with the FSP.

At this stage up to 31 March 2017, there is a proposal in the 31 March 2017

Quarter Budget Review to increase revenue from paid parking above the original

estimate by $200,000 in addition to the $300,000 adjustment in the 31 December

2017 Budget Review. This was one of the new revenue sources identified in

Council’s Fit for the Future Response and is pleasing the outcomes from a

revenue perspective are higher then original estimated.

During the last quarter, there has been an emphasis on

finalising the Special Rate Variation (SRV) application to the Independent

Pricing and Regulatory Tribunal (IPART) and working on options for Council in

regards to the rating structure for 2017/2018 following Council’s

resolution in February 2017 to look at redistribution of the rating yield from

Residential to Business rating categories.

It is also prudent that any positive financial outcomes

derived from actions of the FSP be based on actual outcomes and not estimated

outcomes. In that regard, the financial reporting of outcomes of the FSP

will be in arrears, once the outcomes are known and actions in the FSP are

completed.

Further reporting will be provided to the Finance Advisory

Committee at future meetings on financial outcomes. This will be done in

conjunction the Quarterly Budget Review (QBR) reporting process over the

2016/2017 financial year according to Resolution 14-326. A register has

been developed to track the financial outcomes of the FSP actions that is

envisaged will derive an improved quantifiable financial sustainability outcome

overall to Council.

Statutory and Policy Compliance Implications

Council Resolutions 13-148, 13-238, 14-326, 15-606 and

17-011.

The development of the FSP can also be considered as a tool

to assist Council in its ongoing obligations as defined in Section 9 (The

Council’s charter), Section 8 of the Local Government Act 1993.

Late Reports 5.1 - Attachment 1

Strategy Element: Expenditure

Review

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Recommendations

on expenditure savings or efficiency gains identified by responsible staff

reported to the Executive Team.

|

DCCS

|

June 2017

|

Progress Update (31

March 2017)

Reports are prepared

following the quarterly Strategic Procurement Steering Committee meetings to

the ET and responsible Managers. The reports include recommendations for

potential savings or efficiency gains from Contracts tendered by Council or

the NOROC Procurement Group, and recommendations on Contracts that should be

developed and Tendered by Council.

|

|

2. Monthly

Management Finance Reports provided to the Executive Team.

|

DCCS

|

Monthly

|

Progress Update (31

March 2017)

Monthly Management Finance

Reports are prepared by the Finance Manager and considered by the Executive

Team at the monthly Performance Management meeting held on the second

Wednesday of each month.

|

|

3. Monthly

Management Finance Reports provided to Councillors.

|

DCCS

|

Monthly

|

Progress Update (31

March 2017)

A copy of the Monthly

Management Finance Report is distributed by the Director Corporate and

Community Services to Councillors on the Friday following the Executive Team

Performance Management meeting. The version of the Monthly Management Finance

Report distributed Councillors is in accordance with the template adopted by

Council for the monthly report.

|

|

4. Progress

reports to the Finance Committee on the implementation of the adopted FSP

actions.

|

DCCS

|

Quarterly

|

Progress Update (31

March 2017)

The 2016/17 FSP was adopted

by Council at its ordinary meeting held on 2 February. This is the second

progress report prepared for the Finance Committee updating the Committee on

the progress of implementing the adopted actions.

|

|

5. Report

to Council through the Quarterly Budget Review any identified expenditure

savings.

|

DCCS

|

Quarterly

|

Progress Update (31

March 2017)

Expenditure savings will be

included in the March 2017 Quarterly Budget Review Report to this meeting of