Agenda

Ordinary

Meeting

Thursday,

22 June 2017

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 9.00am

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Ken

Gainger

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Ordinary Meeting

BUSINESS OF Ordinary Meeting

1. Public Access

2. Apologies

3. Requests for Leave of

Absence

4. Declarations of Interest

– Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary

Interest Returns (s450A Local Government Act 1993)

6. Adoption of Minutes from

Previous Meetings

6.1 Byron

Shire Reserve Trust Committee held on 25 May 2017

6.2 Ordinary

Meeting held on 25 May 2017

7. Reservation of Items for

Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 National

Housing Conference 2017.................................................................................. 6

9.2 Byron

Bay Bypass............................................................................................................. 8

10. Petitions

10.1 Flood

Mitigation and Response....................................................................................... 13

11. Submissions and Grants

11.1 Byron

Shire Council Current Grants and Submissions as at 31 May 2017.................... 20

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Competitive

Grant Funding............................................................................................. 23

13.2 Mullumbimby

Hospital Site Acquisition........................................................................... 33

13.3 Research

Report - Towards smoke-free and litter-free beaches in the Byron Shire..... 35

Corporate and Community Services

13.4 Council

Resolutions Quarterly Review - 1 January 2017 to 31 March 2017................. 37

13.5 Adoption

of the Community Strategic Plan 2027, Delivery Program 2017-2021 and

Operational Plan 2017-2018 (including Statement of Revenue Policy, Budget, Fees

and Charges)........ 41

13.6 Sub-lease

to Mullumbimby and District Neighbourhood Centre..................................... 69

13.7 Sub-lease

to the Byron Youth Service............................................................................ 72

13.8 Mayor

and Councillor Fees 2017/2018........................................................................... 75

13.9 Public

Art Panel - minutes of meetings held in March and May 2017............................ 78

13.10 Council

Investments May 2017....................................................................................... 81

13.11 Review

of Council Investment Policy............................................................................. 88

13.12 Making

of the 2017/2018 Ordinary Rates and Charges................................................. 92

13.13 2017/2018

Special Rate Variation Outcome................................................................... 99

13.14 Related

Party Disclosures............................................................................................. 105

Sustainable Environment and Economy

13.15 PLANNING

- 10.2016.663.1 Dual Occupancy (detached) swimming pool, strata subdivision 2

lots and tree removal 9 Trees at Granuaille Crescent Bangalow ....................................... 108

13.16 Byron

Affordable Housing Summit Issues Action Plan................................................ 125

13.17 Short

Term Rental Accommodation - Enforcement Options ...................................... 130

13.18 Road

Airspace Policy review........................................................................................ 138

13.19 PLANNING

- 26.2016.3.1 Reclassification of Council owned land - Manfred St, Belongil 141

13.20 PLANNING

- Proposed Amendments to Development Control Plan 2014 - E5.5 Bayshore Village....................................................................................................................................... 146

13.21 Council

Nominations for the Joint Regional Planning Panel......................................... 150

13.22 Peer

Review of Draft West Byron DCP ...................................................................... 153

Infrastructure Services

13.23 Bangalow

Parking Strategy........................................................................................... 160

13.24 Former

South Byron STP - Options for Redevelopment............................................. 170

13.25 Out

of Session Local Traffic Committee - Byron Bay to Ballina Coastal Charity Walk

for Westpac Rescue Helicopter......................................................................................................... 177

13.26 A

Further Report on Remediation of Dip Site at Lot 2 DP 747876 Bangalow.............. 180

13.27 Proposed

Smart Drum Lines - Byron Bay.................................................................... 182

13.28 Lot

16 Dingo Lane Myocum Sale.................................................................................. 188

13.29 Draft

Plan of Management - The Cavanbah Centre.................................................... 192

13.30 Byron

Bay Urban Recycled Water Connection Policy................................................. 195

Organisation Development

13.31 Supporting

Partnerships Policy..................................................................................... 197

14. Reports of Committees

Corporate and Community Services

14.1 Report

of the Internal Audit Advisory Committee Meeting held on 18 May 2017........ 200

14.2 Report

of the Finance Advisory Committee Meeting held on 18 May 2017................ 204

Infrastructure Services

14.3 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 18 May

2017 207

14.4 Report

of the Water, Waste and Sewer Advisory Committee Meeting held on 1 June 2017 210

15. Questions

With Notice

15.1 Flood

Response in Byron Shire .................................................................................... 213

15.2 Sewerage

..................................................................................................................... 215

15.3 NSW

Crown Holiday Parks Trust ................................................................................ 216

16. Confidential Reports

General Manager

16.1 Confidential - Senior Staff Positions..................................................................... 217

Corporate and Community Services

16.2 Confidential - Tender for Internal

Audit, Risk and Improvement Services Contract 219

Infrastructure Services

16.3 Confidential - Tender 2016-0018

Architectural Design of Mixed-use Building - 10 Lawson Street Redevelopment............................................................................................................. 221

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director prior to the meeting. Any suggested amendments to the

recommendations should be provided to Councillor Support prior to the meeting

to allow the changes to be typed and presented on the overhead projector at the

meeting.

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 National

Housing Conference 2017

File No: I2017/787

|

I move:

That Cr. Paul Spooner attend the National Housing

Conference 2017 as a Council representative to be held from 29 November to 1

December at the International Convention Centre, Sydney.

|

Signed: Cr

Paul Spooner

Councillor’s

supporting information:

Information on this

conference states:

“We

invite you to join us in Sydney for the 10th National Housing Conference

– the largest social and affordable housing event in Australasia.

Whatever your interest in the housing industry and whatever your preferred

style of conference participation, NHC 2017 in Sydney is an exceptional,

multi-faceted forum for the housing industry.

For 18 years, AHURI, in partnership with a

host state government has convened the biennial conference providing a forum

for the best minds, the most experienced practitioners and the leading policy

makers from Australia and abroad to come together to further progress the

biggest issues facing the sector.

We call on everyone with an interest in

the delivery of affordable housing to join us in Sydney – policy makers,

housing practitioners, homelessness and housing providers, advocacy

organisations, peak industry bodies, financiers, legal professionals, planners,

builders, developers, researchers and other interested groups must be part of

this important national conversation.

With Sydney as the destination and NSW

leading the way in social housing policy reform, NHC 2017 will be our biggest

conference ever. It will provide the opportunity to form meaningful connections

and expand the network to help build for better lives.”

Full information regarding the conference is available at: http://www.nhc.edu.au/

Staff comments by Mark

Arnold, Director Corporate and Community Services

(Management Comments must not include formatted

recommendations – resolution 11-979)

The National Housing Conference 2017 will be held at the

International Convention Centre, Sydney, NSW, from 29 November – 1

December 2017.

In accordance with Council’s Policy 14/010 Mayor and

Councillors Payment of Expenses and Provision of Facilities, clause

8.4.1states: “A resolution of Council is required to authorise

attendance of Councillors at (d) Any other discretionary conference,

seminar or training.”

Financial/Resource/Legal Implications:

Council has an allocation for conferences of $19,400 within the 2017/18 budget (2145.004). At this

stage there are no committed costs against this budget allocation.

Where: International

Convention Centre, Sydney, NSW

Dates: Wednesday

29 November - Friday 1 December 2017

Costs: Registration

Fee (early bird due 31 July) $1,310.00

Flights

(approx) $300.00

Conference

Functions (approx) $150.00

Accommodation (approx) $800.00

Total $2,560.00

Is the proposal consistent with any Delivery Program

tasks?

Yes.

EN2.1.2 -

Establish planning for and provision of inclusive and accessible housing that

can meet the needs of our community.

Notices of Motion 9.2

Notice of Motion No. 9.2 Byron

Bay Bypass

File No: I2017/788

|

I move:

1. That

Council

a) Provide

an updated estimate for the full construction costs of the proposed Byron Bay

bypass;

b) Provide

an estimate for the full construction costs of a roadway within the rail

corridor from Lawson Street to Browning Street Byron Bay; and

c)

Identify the available sources of funds to construct the Byron Bay bypass.

|

Attachments:

1 Letter

from Min Transport regarding Casino to Murwillumbah rail line dated 19 Dec

2014, E2017/61876 ⇨

2 Letter

from Parliamentary Sec for Transport and Infrastructure dated 1 June 2017, E2017/61934 ⇨

Signed: Cr

Paul Spooner

Councillor’s supporting information:

Tamara Smith MP received a

letter on 1 June 2017 (see attached) written on behalf of the NSW Minister for

Transport and Infrastructure that stated the following:

“…if Byron

Shire Council, the relevant road authority, wishes to propose the construction

of a road within a specific section of the rail corridor in the vicinity of

Byron Bay, the NSW Government would be happy to consider its proposal in

further detail.”

This letter provides

confirmation from the NSW Government that the unused rail corridor within Byron

Bay could be used as a roadway.

It would seem both prudent

and financially sensible for Council to be fully informed of the relevant costs

associated with the two viable options now possible for constructing a bypass

around the Byron Bay CBD.

This motion will inform

Council of both the costs and budget available to proceed with the construction

of the Byron Bay bypass.

Staff comments by Executive Team members in collaboration

(Management Comments must not include formatted recommendations

– resolution 11-979)

Responses to parts (a) and (c) of the motion can be

addressed as follows:

a. Current

estimate for the bypass built on the Butler Street alignment is $20M.

c. Available

funding sources at this time are $10.5M funding from the Roads

and

Maritime Services, and $4M

collected to date in Section 94 Developer Contributions specifically for the

bypass. Approximately $2M of these funds have already been spent in preparing

the EIS, BioBanking Statement and detailed design. A further $450K has been

spent defending the Land and Environment Court legal challenge instigated by

the Butler Street Community Network (BSCN). In order for the full bypass

project to proceed the shortfall in funding would have to be addressed and would

have to be sourced from either the State or Federal governments.

With respect to part b. of the motion the following

information is put forward:

· Transport

for NSW (TfNSW) has consistently advised Council that a roadway within the rail

corridor is not viable if the rail infrastructure is to be retained.

The previous member for

Ballina, the Honourable Don Page, sought advice from the General Manager,

Country Rail Contracts, TfNSW, Mr Terry Brady on 3 September 2014.

The advice from TfNSW was

that the corridor was unlikely to be wide enough for the existing operational

rail track, a two lane road with associated infrastructure and the proposed

rail Trail.

Mr Brady confirmed his

advice on 11 November 2014 regarding the feasibility of the rail corridor to

accommodate the combined needs of the necessary buffer for any return of

trains, a rail trail and the proposed bypass and associated infrastructure to

Mr Brady advised that the option for the return of rail services was not closed

and as such any proposal associated with the rail corridor needed to consider

the buffer requirement of operational trains.

This advice was supported

by the then NSW Minister for Transport, Gladys Berejiklian, who provided a

letter to Council on 19 December 2014 that advised the rail corridor was not

suitable for multimodal transport use. See attachment 1.

The letter

quoted by Cr Spooner in his motion from TfNSW to the Honourable Tamara Smith

reiterates this advice “I am advised the Casino to

Murwillumbah rail corridor

is not wide enough to support

multi-modal transport”.

See Attachment 2.

The request

made by Ms Smith was to “update a letter that you sent as Minister for

Transport in 2014 or ask the current Minister for Transport to do so”.

The update confirmed what had previously been advised.

· To construct a

roadway within the rail corridor would:

o require an Act of Parliament

to de-classify the land as a railway corridor. See section 99A of the Transport

Administration Act 1988.

99A(1) A rail infrastructure owner must

not, unless authorised by an Act of Parliament or an order under subsection

(1A) (which refers to the Greater Metropolitan Region) close a railway line.

99A(2) For the purposes of this

section, a railway line is closed if the land concerned is sold or otherwise

disposed of or the railway tracks and other works concerned are removed.

Until a rail

line is closed, and even if not operational, it is managed under relevant legislation

pertaining to the rail network.

o create heritage impacts

associated with works within the Railway Precinct Conservation Area. As to

this, the Land and Environment Court in its 2 June 2017 judgement said:

“According

to Mr Staas (Heritage Expert), locating the bypass road on the rail corridor

instead of joining the existing Butler Street would be a worse outcome in terms

of the impact on the heritage significance of the State listed Railway Station

and yard group heritage item, as such a proposal would have a major impact on

the setting of those heritage items… I accept Mr Staas’ evidence

that the alternative route through the centre of the Byron Bay Railway Station

and yard precinct would potentially have a significant impact on the setting of

the State listed heritage item”.

o create impacts on the 6

residential properties on the eastern side of Butler Street which would be more

difficult to manage than those impacts associated with the presently approved

route.

o require clearing of an

additional 0.8 ha of native vegetation which includes SEPP14 Wetland,

comprising Coastal Swamp forest heavily dominated with Paperbark trees.

The JRPP

Assessment Report included consideration of vegetation impacts in the context

of the options available. It said :

“(the

Grab the Rail route) would also require clearing of additional native

vegetation within the Railway Corridor within the Byron Bay Railway Yard

precinct and east of the dwellings in Butler Street. Council mapping shows this

to be predominantly Coastal Swamp Forest with a small area of Coastal Dune Dry

Sclerophyll Forest near the Water Tower. It is estimated that the additional

clearing would be more than half a hectare compared to using the existing

formed Butler Street.”

· It is anticipated

that construction of the bypass within the rail corridor would cost

substantially more than the bypass proposed on the Butler Street alignment for

the following reasons:

o Council would not invest

substantial community funds to construct a major piece of roads infrastructure

on land that it does not own – therefore Council would have to factor in

the purchase price of that section of the rail corridor. As the rail corridor land

abuts the Byron Town Centre it is likely that the market value of the land

would be substantial and run to millions of dollars.

o It is likely that the land

comprising the rail corridor would be substantially contaminated after many

years use as a railway and shunting yards. The cost of remediation of this land

prior to construction of a roadway would likely be several million dollars.

o If the roadway was to be

constructed within the rail corridor where the space was shared with a rail

trail and light rail (as proposed by the BSCN) substantial costs would be

incurred in constructing infrastructure to separate the competing uses to

ensure public safety.

o Traffic noise amelioration

requirements (and costs) would be exacerbated because the bypass would move

closer to the densely populated Byron CBD area.

o Council would not be able

to use the existing road formation on Butler St but would have to build up a

new and costly road profile for a significant distance along the rail corridor

· Previous investigations

of the comparative environmental impact of the two routes have indicated little

difference between the two, however the additional necessary vegetation

clearing in the rail corridor must be accounted for in the BioBanking process

and will require additional compensatory credits.

· In order for “full

construction costs of a roadway within the rail corridor from Lawson Street to

Browning Street” to be ascertained full construction drawings and

bill of quantities would have to be prepared and costed. This would take at

least 12 months and would cost of the order of $1M to prepare (see outline

below). In preparing these plans and associated costs details of costs

associated with potential site acquisition, contamination remediation, safety

separation, traffic noise amelioration etc would have to be accurately

assessed.

Extensive further investigation

and assessment is required including:

· Concept design

preparation to direct investigation and assessment

· Flooding impact

assessment to ensure the design does not result in adverse impacts.

· Noise assessment

to facilitate the design and costing of remediation measures.

· Survey to

facilitate the concept design, cross sections and bill of quantities.

· Land contamination

assessment to inform remediation costs.

· Geotechnical to

facilitate the road construction design.

· Heritage

assessment to ensure any proposed alignment does not impact on the Water Tower

and associated curtilage.

· Ecological

assessment particularly as it pertains to the increased amount of tree removal.

· Biobanking

assessment.

· Estimate of costs

associated with a new EIS and approval pathway through the JRPP

· Given the

complexity of negotiations and detailed design it is likely that Council would

not be in a position to construct the bypass within the rail corridor for at

least 5 years assuming that these matters could be successfully negotiated and

TfNSW could be convinced as to the viability of such a project.

· To proceed with a

roadway in the rail corridor would also mean:

o Forfeiture of the $10.5M in

RMS funding which was provided exclusively for a bypass constructed on the

Butler Street alignment;

o Wasting the $2.45M already

spent in getting the current proposal to the construction stage;

o A significant opportunity cost

due to thousands of hours of Council staff time spent on the project to date

having to be duplicated – this would have significant consequences for

the capacity of staff to focus on other significant Council projects and

service delivery.

Financial/Resource/Legal Implications:

As indicated in staff comments

Is the proposal consistent with any Delivery Program

tasks?

a. and c. Yes

b. No

Petitions 10.1

Petitions

Petition No. 10.1 Flood Mitigation and Response

Directorate: Sustainable Environment and Economy

Report

Author: Chloe

Dowsett, Coastal and Estuary Officer

File No: I2017/649

Theme: Ecology

Planning Policy and Natural Environment

At Council’s Ordinary meeting held on 25 May 2017 Cr Simon

Richardson tabled a petition containing 233 signatures which states:

“….We the

undersigned request the following action from Byron Shire Council in the

immediate

affect;

· A

Resident and Business Forum with the aim at re-evaluating our Flood Mitigation

Plan

and

discussion about ongoing viability of the area should work not be undertaken.

· The

Dredging of Marshal's Creek and Reading's Bay and possible outlets to the sea.

· Revision

of SES capacity to handle flood response and evacuation practice.

· The

maintenance of storm water drains to be undertaken and maintained regularly.

· Proper

consultation with the community regarding systems that are put in place and

transparent

action plans to be undertaken during future events.

· Council

to effectively lobby State Government as to the Shire's plight, so that we are

on

equal footing with

our neighbours’’

Comments from Director Sustainable Environment and

Economy and Director Infrastructure Services:

Resident and Business Forum

The petition presented to the 25 May 2017 Ordinary Council

meeting raised a number of issues regarding flood mitigation and response which

were raised following the March/April flooding experienced in the Shire.

It is understood that flood response is a key issue for the

community and Council has already taken a number of actions following the

recent event. These are summarised below:

· A business forum was

held on 26 April with flood affect business owners and operators. Some 30

businesses attended. Attachment 1 (E2017/28326) provides the unofficial

minutes of this meeting. In response to this forum the following key actions

have been undertaken:

- A

submission was made to the State Government in support of the NSW Government

Application to the Commonwealth for the declaration of Category C Disaster

Assistance for affected Businesses in Byron Shire Local Government Area. This

application was successful with notification on 25 May that Flood Recovery

grants of up to $10,000 are now available for small businesses in Billinudgel

and additional support also includes surrounding buffer zones: Mullumbimby,

Ocean Shores and The Pocket. Businesses in these areas are in the process

of being advised of the availability of this grant.

- At the

Business Roundtable on 17 March natural disaster resilience preparation was an

agenda item. Attachment 2 (E2017/34451) provides a summary of matters arising

from Discussion on Natural Disaster Resilience.

· A combined meeting with

residents and business community was held on 1st June with

approximately 100 people attending. Various issues were discussed,

including flood mitigation, flood planning processes, disaster management and

differences between Council and SES responsibilities.

Dredging of Marshal's

Creek and Reading's Bay and possible outlets to the sea

Flood mitigation options including dredging of Marshalls

Creek and Readings Bay, and consideration of creating floodwater outlets north

of Brunswick Heads were investigated in the Marshall Creek Floodplain

Management Plan (adopted by Council November 1997).

The following text is an extract from the complete report

document in relation to floodwater outlets:

10.4

Ocean Outlets

Three

sites have been identified for assessment for the construction of flood outlets

through the frontal dune to the Pacific Ocean. The sites are located at:

· Holiday Village" between New Brighton at South

Golden Beach;

· Ocean Shores North, north of the

"Fern Beach" subdivision; and

· Wooyung, some 3.5 km north of South Golden

Beach.

The

proposed outlets comprise the excavation of 75 m wide slots through the dune

with variable bed levels. The outlets at "Holiday Village" and Ocean

Shores North are to be some 1.7 m above high tide level, while the outlet at

Wooyung is proposed to be tidal. The proposed combinations of flood outlets

above was defined by the Floodplain Management Committee after the Value

Management Workshop (Reference 13) was completed.

The

coastal dynamic processes are discussed in detail in Chapter 4. The impact of

these processes on the performance of the ocean outlets is outlined below.

As

noted in Chapter 4, the ocean water levels can be seen as comprising of a

series of components principally:

· tidal variations;

· storm surge;

· coastal wind set-up;

· nearshore wave set-up; and

· possible addition to the above by

"Greenhouse" changes to ocean static levels .

The

various components of the "Steady" ocean water levels are indicated

on Figure 6.

It

is estimated that wave setup on the open beaches at the identified outlet sites

resulting from 5 m high offshore waves would effectively raise the ocean water

level on the beach by 0.8 m. By comparison, these waves would pass through the

Brunswick River entrance with minimal obstruction and dissipate as they

travelled up the main river channel.

As

a result, there would be a difference in water level of 0.8 m between the beach

and the river. This means that any outlets must be located where the flood

level in Marshalls Creek is at least 0.8 m higher than the ocean water level at

the entrance to the Brunswick River in order that floodwaters can discharge to

the ocean. If this condition is not satisfied, seawater from the ocean

will flow through the opening and increase flooding along Marshalls Creek.

The

identified outlet sites satisfy the water level differential constraint.

However, the Wooyung outlet in the early stages of a flood event would tend to

admit water from the ocean into the Marshalls Creek area. This would be the

direct opposite of the proposed function of the outlet, ie to discharge

floodwaters to the ocean.

The

outlets at "Holiday Village" and Ocean Shores North would discharge

floodwaters when the level of the floodwaters in Marshalls Creek exceeded the

water level on the beach and exceeded the level of any constructed weirs at the

outlets. This would depend on the magnitude of the creek flood, tidal phase and

ocean storm conditions.

The

ocean outlets would need to be located at a level which prevented ocean storm

waves from passing through the outlets and discharging seawater into the

Marshalls Creek system.

This

occurred in May 1975 when the ocean waves broke through the frontal dune at

"Sheltering Palms", the southern end of New Brighton and

north of New Brighton.

The

dune north of New Brighton had been overtopped in October 1972 and had not

built up to an adequate height. Earthmoving machinery was used to repair the

break in the dune following the 1974 event. The coastal processes have

continued the replenishment of the dune. The location of the break-through is

still evident in recent aerial photography, some 20 years after the event.

The

analysis of ocean storm water levels outlined in Chapter 4 recommends a minimum

crest level for the outlets at RL 4.0 m AHD. This level is 1.2 m above the 1%

AEP flood level in Marshalls Creek at the "Holiday Village" site.

There

are conflicting requirements for the dune heights. Prevention of ocean break

through into the Marshalls Creek floodplain requires the dunes to be kept high.

However, allowance for (or dependence on) a flood breakout through the dunes to

reduce flood levels requires the dunes to be kept low such that a natural break

can occur.

It

would be possible to adjust the dune height by earthmoving machinery by:

· maintaining the dune height to prevent ocean

inundation;

· maintaining a stockpile of material at the

break-out point;

· on receipt of flood warning,

cutting the beach dune such that a natural

erosion process can begin; and

· refilling the low level

break from the stock pile after the

flood recession to accelerate the natural re-building of the

dune.

It

is not considered prudent to undertake the alternative procedure of keeping the

dune low and building during ocean storms because of the dangers of operation

of machinery near a surf zone.

The

short time scale of Marshalls Creek flooding, the limited warning and the

occurrence of ocean storms would require earthmoving equipment to be on

virtually permanent standby to lower the outlet in advance of the creek flood

and to rebuild the outlet to withstand ocean storm conditions immediately

following the creek flood.

Large

volumes of sand would have to be excavated, stored and returned within a short

period of time. This is clearly not practical.

The

estimated reduction in 1% AEP flood levels which may be achieved with the ocean

outlets is 0.08 to 0.1 m at New Brighton and Ocean Shores (Ref.l6). There are 4

houses in New Brighton and 4 houses in Ocean Shores which are inundated in floodwaters

less than 0.1 m deep in the 1% AEP flood. This option may prevent

floodwaters entering some these houses.

Therefore,

construction of the ocean outlets is considered to be relatively ineffectual,

due to the small number of houses protected and impracticable due to the

management and operational requirements.

Therefore at this stage the construction of outlets is not

recommended.

The following text is an extract from the complete report

document in relation to dredging of Marshalls Creek and/or lowering/removal of

training walls:

Prior

to the construction of the Brunswick River training walls in the early 1960's,

the Marshalls Creek channel joined the Brunswick River channel at the eastern

edge of Reading Bay. The initial river works retained this channel

confluence.

Following

the severe ocean storm which washed over the beach dune and destroyed part of

the "Sheltering Palms" village in 1974, a new low level training wall

was constructed in Reading Bay in order to prevent a break-through from

Marshalls Creek to the ocean which could ultimately replace the Brunswick River

entrance.

At

this time, a section of the northern wall of the Brunswick River was removed at

the western end and the confluence with Marshalls Creek diverted 500 m upstream.

The

channel of Marshalls Creek between Capricornia Canal and the Orana Bridge has a

meandering alignment with a number of residual meander loops immediately

downstream of the canal.

A

number of options for dredging the channel of Marshalls Creek between the

Capricornia Canal

and

Reading Bay have been investigated in previous studies.

Lowering

the training walls was found to reduce the flood levels by 0.11 m at Orana

Bridge and

0.06

m at Capricornia Canal.

This

would reduce the number of houses inundated in the 1% AEP flood in New Brighton

by three with no alteration in the number of houses flooded elsewhere.

The

early dredging investigations assumed dredging to a bed level of RL -2.5 m AHD.

The preliminary EIS investigations indicated dredging of this magnitude would

yield some 330,000 cubic metres of material but that recognition of

environmental issues would reduce this volume by two thirds (that is a dredge

yield of less than 100,000 cubic metres). Thus, it is concluded that the full

reductions in flood levels quoted by dredging to RL -2.5 m AHD are unlikely to

be achieved.

As

discussed in Chapter 3, rock outcrops have been observed at a number of

locations along Marshalls Creek within the proposed dredging

limits. Therefore, it is considered unlikely that a significant

increase in channel capacity can be achieved by dredging.

Notwithstanding

the potential environmental impacts associated with the dredging option, the

estimated reduction in flood levels which could be achieved is 0.10 m in Ocean

Shores and New Brighton.

Thus,

dredging of Marshalls Creek and lowering the training walls in Reading Bay

would possibly save 4 houses in Ocean Shores and 4 houses in New Brighton from

being inundated in the 1% AEP flood.

The

channel of Marshalls Creek is a dynamic area with sediment transport being a

continuous process. Material eroded from the catchment is transported along the

creek during floods and discharged into the Brunswick River and carried out to

the ocean. Some of this material settles to the bed of Marshalls Creek

and does not reach the ocean. It is also likely that some of the bed material

in Marshalls Creek is a relic of past ocean breaks through the dune system

transferring dune material from the beach to the creek channel.

The

normal tidal cycle transports sand up and down the creek channel. The limit of

this active tidal sediment transport is considered to be located near the

Marshalls Creek/Brunswick River confluence.

Comparison of creek channel surveys in 1986 and 1991 indicates that

there is a relatively slow build-up of sediment in Marshalls Creek, downstream

of Capricornia Canal, under the current hydraulic regime.

Comparison of creek channel surveys in 1986 and 1991 indicates that

there is a relatively slow build-up of sediment in Marshalls Creek, downstream

of Capricornia Canal, under the current hydraulic regime.

It

should be noted that the time interval between surveys was short, when compared

to the time scale of the sedimentary processes. The apparent nett sediment

accumulation rate may well be distorted by the occurrence of a major flood (the

1987 event) in the period between surveys.

The

natural hydraulic processes determine the channel geometry and alignment. These

natural processes tend to respond to man-made changes in such a manner as to

return the channel to a "natural" condition. Thus, it can be

reasonably expected that sediment will build up in the dredged section of the

channel over a period of time until the channel returns to the quasi-stable

configuration existing at the present time.

The

time-scale for the filling of the dredged channel is dependent on a number of

factors, principally related to rainfall and oceanic factors. However it is

generally accepted that dredging of creek and river channels is not a

permanently effective flood mitigation works option unless regular maintenance

dredging is carried out to retain the improved hydraulic capacity of the

channel.

The

channel dredging and lowered training walls option is considered to be

relatively ineffectual due to the small reduction in flood levels achievable

and the small number of properties which would benefit from the works. The

option also requires on-going commitment to the maintenance of the dredged

channel in order that the benefits are not diminished as time goes by.

Therefore at this stage the dredging of Marshalls Creek

and/or the lowering/removal of training walls is not recommended.

Should Council wish to further pursue the above mitigation

options the most appropriate method is via a Floodplain Risk Management Study

and Plan.

Such a plan will scientifically investigate the effects of

such mitigation options on flood levels and complete a cost benefit analysis of

such a mitigation option.

Council is currently awaiting a grant approval from the

Office of Environment and Heritage for the purposes of preparing the North

Byron Floodplain Risk Management Study and Plan. This is the next step

following on from the North Byron Flood Study. A number of flood

mitigation options will be investigated in this study, included a fresh review

of the ocean outlet and dredging idea. The most cost effective options will be

included in the Floodplain Management Plan for action.

Without an adopted plan state government are very unlikely

to fund a flood mitigation scheme because it has not been investigated

appropriately and its likely success has not been proven.

Council simply does not have the budget to complete a flood

mitigation scheme without the support of state government; therefore, any flood

mitigation schemes for North Byron Shire will need to await the adoption of the

North Byron Floodplain Management Plan

Revision of SES capacity to handle flood management

The question of the capacity of the SES to handle flood

response and their evacuation practice is an internal SES matter and not one

for Council. SES are and will be having debrief meetings at local, regional and

state level within their organisation. Council staff have made SES aware of

these issues already. A local debrief meeting was held locally at the Ocean

Shores Country Club on 28 May 2017

There have already been multi agency debrief meetings held

at the regional level within our Region.

Stormwater Maintenance

On 29 May 2017 Council resolved the following. This

resolution addresses the petitions concerns regarding stormwater maintenance.

17-189 Resolved:

1.

That Council use the North Byron Floodplain Risk Management Study and Plans to

investigate potential methods for lowering flood levels in the Marshall’s

Creek floodplain through options such as floodwater outlets, dredging, rock

wall alterations and flood levies.

2.

That Council considers doubling the funding for north urban drainage

maintenance and rural drainage maintenance from all available resources to

speed up the flood mitigation works in the Marshalls Creek Floodplain

including:-

a.

Gutter maintenance

b.

drain and channel cleaning

c.

increasing pipe sizes where necessary

d.

road culverts maintenance; and

e.

causeways

3. That the maintenance program is reviewed

annually.

4. That to support items 1 & 2 above, staff provide

funding source options and wider financial implications to the 22 June 2017

Council meeting, to be considered as part of the adoption of the 2017/18

Operational Plan.

5. That Council establish a North Byron Floodplain

PRG for a 12 month period to examine the implications of the recent flood event

and review previous modelling and to invite community membership and notify

past members.

6. That parts 1 to 5 inclusive here of are resolved

without admissions and without prejudice.

(Hunter/Richardson)

In accordance with Part 4 of

the Resolution, Parts 1 and 2 are to be considered separately at this meeting

as part of the adoption of the 2017/2018 Operational Plan.

Consultation with the

community regarding actions to be taken during future events

This has been noted as part

of the questions Council has received from the community and during the community

forum on 1st June at Ocean Shores.

Council have relied upon the

SES’s education programs in the past to direct the community on what to

do during disaster events. Following this event Council will be considering the

option to have its own annual disaster education program.

The option for an app such as

the Sunshine Coasts SCC App will also be considered. See link for information

on this app. https://www.sunshinecoast.qld.gov.au/Site-Help/SCC-App

This issue will also be

considered as part of the North Byron Floodplain Risk Management Study and Plan

project.

Council to effectively

lobby State Government

Council has made two separate submissions through the State

Government to the Federal Government for financial assistance for flood

affected businesses and residents. The Federal Government Assistance sought is

the same as was announced for the neighbouring Local Government areas of Tweed

Shire and Lismore City.

Both submissions have been supported by lobbying from the Mayor

and staff to both State and Federal Local Members and the responsible State and

Federal Ministers, as well as lobbying by the State Local Members and Ministers

of their Federal counterparts.

The submissions made by Council were for:-

· Eligibility for affected Byron Shire residents

to receive the Australian

Government Disaster Recovery Payment/Disaster

Recovery Allowance

· Eligibility for Australian Government Category

C Natural Disaster Relief and Recovery arrangements for affected businesses

As indicated in the comments under the Resident

and Business Forum above, the latter submission and application was

successful, with notification on 25 May that Flood Recovery grants of up to

$10,000 are now available for small businesses in Billinudgel and additional

support also includes surrounding buffer zones: Mullumbimby, Ocean Shores

and The Pocket. Businesses in these areas are in the process of being

advised of the availability of this grant.

The first submission is yet to be determined by the Federal

Minister, and Council staff have provided additional information to the Office

Federal Minister for Justice in response to request from the Minister.

|

RECOMMENDATION:

1. That

the petition regarding flood mitigation and response be noted.

2. That action

taken to date with respect to the issues raised in the petition be noted

3. That the

petition be referred to the Director Sustainable Environment and

Economy and Director

Infrastructure Services for appropriate action.

|

Attachments:

1 Flood

Impact Business Meeting Minutes 26 April 24.2017.15.1, E2017/28326 ⇨

2 Byron

Shire Business Roundtable May 2017 Summary of Ideas for Natural Disaster

Resilience linked to presentation E2017/29189, E2017/34451 ⇨

Submissions and Grants 11.1

Submissions and Grants

Report No. 11.1 Byron

Shire Council Current Grants and Submissions as at 31 May 2017

Directorate: Corporate

and Community Services

Report

Author: Jodi

Frawley, Grants Co-ordinator

File No: I2017/703

Theme: Corporate Management

Governance Services

Summary:

Council have submitted applications for a number of grant

programs which, if successful, would provide significant funding to enable the

delivery of identified projects. This report provides an update on these

grant submissions.

|

RECOMMENDATION:

That Council note the report

|

Attachments:

1 Byron

Shire Council Current Grant Applications as at 31 May 2017, E2017/49852 ⇨

Report

This report provides an update on grant submissions

including funding applications submitted, potential funding opportunities and

those awaiting notification.

Funding Application Success

· Aboriginal School Based

Traineeship (Elsa Dixon Aboriginal Employment Program, NSW Government) –

$10,000

· Arakwal reconciliation

week events (National Reconciliation Week, Australian Government) - $5,000

Funding opportunities identified for consideration by

staff

· Blindmouth Creek Crossing

replacement (Bridges Renewal Programme, Australian Government)

· Replacement of the

Southern Shire Bridges (Bridges Renewal Programme, Australian Government)

· Byron App (Smart Cities

and Suburbs, Australian Government)

· 3D Mapping Tool (Smart

Cities and Suburbs, Australian Government)

· Safer Roads including

Black Spot Funding (Roads and Maritime Services, NSW Government)

· Active Transport (Roads

and Maritime Services, NSW Government)

· Regional Jobs and

Investment Package for North Coast NSW (Australian Government)

Funding submissions awaiting notification

· CPTED lighting for Byron

Bay (Crime Prevention Grants, NSW Government)

· CCTV stage two Byron Bay

(Community Safety Fund, NSW Government)

· Bayshore Drive Roundabout

(Building Better Regions Fund Infrastructure Stream, Australian Government)

· Fishing Platform

Brunswick River (Recreational Fishing Trust, NSW Government)

· Upgrade to Bangalow Weir

Parklands (Community Development Programme, Australian Government)

· Byron’s Young

Innovators (Churchill Fellowship, Winston Churchill Trust)

· Building capacity in

Byron’s Community Halls (Building Better Regions Fund Community

Investments, Australian Government)

· In Good Company

(Regional Growth Marketing and Promotion Fund, NSW Government)

· Tree Change (Regional

Growth Marketing and Promotion Fund, NSW Government)

It should also be noted that staff are actively working to

prepare major project submission for the following funding rounds as soon as

they are announced:

· ‘Poles and

Wires’ funding (NSW Government)

· Building Better Regions

Fund, Round 2 (Australian Government)

· Regional Growth Fund

(Australian Government)

Additional information on the grant submissions made and or

pending is provided in Attachment 1 – Grants report as at 31 May 2017

Financial Implications

If Council is successful in obtaining the identified grants

more than $3 million would be achieved which would provide significant funding

for Council projects. Some of the grants require a contribution from

Council (either cash or in-kind) and others do not. Council’s

contribution is funded. The potential funding and allocation is noted below:

Requested funds from funding bodies $3,434,922

Council cash contribution $2,763,254

Council in-kind contribution

$549,441

Funding applications submitted and awaiting notification

(total project value) $6,747,617

Statutory and Policy Compliance Implications

Council is required under Section 409 3(c) of the Local

Government Act 1993 to ensure that ‘money that has been received from

the Government or from a public authority by way of a specific purpose advance

or grant, may not, except with the consent of the Government or public

authority, be used otherwise than for that specific purpose’. This

legislative requirement governs Council’s administration of grants.

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Competitive

Grant Funding

Directorate: General

Manager

Report

Author: Ken

Gainger, General Manager

File No: I2017/749

Theme: Corporate Management

Organisation Development

Summary:

In accordance with Council’s adoption and adherence to

successive Financial Sustainability Plans since 2013, considerable effort has

been placed into focusing on improved grant funding from various sources but in

particular, State and Federal governments. Changes adopted by the Council in an

effort to improve grant funding performance include the employment of a

dedicated Grants Officer, adoption of a centre led organisational Grants team

comprising grants “champions” across Directorates, subscribing to

on-line grants information services, establishing active relationships with

Northern Rivers RDA and other funding agencies/facilitators, developing

networks of grants specialists and research capacity to learn from others and

build grants success.

Apart from a handful of recurrent annual grants such as

Financial Assistance Grants (FAGs) and Roads to Recovery which are

automatically received without a competitive application process, most grant

opportunities require councils to actively compete for funding pools where

demand significantly exceeds available funds and where grant funding

eligibility criteria is continually becoming more onerous and expectations are

that applicants must demonstrate that they are “shovel ready” to

deliver projects in a timely manner should funding applications be successful.

It is of growing concern that because of tightening state

government operating/capital budgets grant funding eligibility is being

increasingly broadened to include state agencies, i.e. local government is now

often having to compete for the grant funding dollar with hitherto ineligible

state government agencies in funding domains previously the exclusive province

of local government and/or community based organisations. Thus state government

agencies who would have previously placed budget bids for projects and programs

are now being forced to scrounge for grant funding opportunities to fund those

projects/programs effectively robbing already financially squeezed councils of

limited grant funding prospects.

This report seeks to highlight this growing problem and

encourage the Council to take the issue up with governments and peak local

government organisations.

|

RECOMMENDATION:

That Council notes the report and:

1. Writes

to the state Treasurer and Minister for Local Government and local members

seeking a reversal of the practice of including federal and state government

agencies among those eligible for grant funding opportunities/programs;

2. Writes

to adjoining councils, NOROC and LGNSW seeking their support.

|

Report

In accordance with Council’s adoption and adherence to

successive Financial Sustainability Plans since 2013, considerable effort has

been placed into focusing on improved grant funding from various sources but in

particular, State and Federal governments. Changes adopted by the Council in an

effort to improve grant funding performance include the employment of a

dedicated Grants Officer, adoption of a centre led organisational Grants team

comprising grants “champions” across Directorates, subscribing to

on-line grants information services, establishing active relationships with

Northern Rivers RDA and other funding agencies/facilitators, developing

networks of grants specialists and research capacity to learn from others and

build grants success.

Apart from a handful of recurrent annual grants such as

Financial Assistance Grants (FAGs) and Roads to Recovery which are

automatically received without a competitive application process, most grant

opportunities require councils to actively compete for funding pools where

demand significantly exceeds available funds and where grant funding

eligibility criteria is continually becoming more onerous and expectations are

that applicants must demonstrate that they are “shovel ready” to

deliver projects in a timely manner should funding applications be successful.

It is of growing concern that because of tightening state

government operating/capital budgets grant funding eligibility is being

increasingly broadened to include state government agencies, i.e. local

government is now often having to compete for the grant funding dollar with

hitherto ineligible state government agencies in funding domains previously the

exclusive province of local government and/or community based organisations.

Thus state government agencies who would have previously placed budget bids for

projects and programs are now being forced to scrounge for grant funding

opportunities to fund those projects/programs effectively robbing already

financially squeezed councils of limited grant funding prospects.

This growing practice is akin to a Council calling for

community applications for Section 356 grants then forcing staff to prepare

competing applications for those funds in order to fund projects that have been

excluded from the adopted Council budget. Council staff have become

increasingly aware of state government agencies competing for grant funding

pools with Council. A recent discussion with one state government department

referenced applications for regional transport infrastructure grant funding

that were being prepared by government officials which would be in direct

competition with BBTCMP project applications.

The below table reviews a random selection of grant schemes

and considers the eligibility criteria to ascertain competition. Results

indicate that State government departments do indeed compete with Local

Government Authorities and community groups for available funds. However, this

is not uniform and depends upon the context in which the grant programme is

being developed and offered.

The attached document reviews twelve grant schemes, with

thirty nine sub-programs, to ascertain whether Council is competing with the

NSW Government departments for grant funds. In thirteen cases, State government

departments were eligible to apply for funding.

One such area is in black spot funding. Australian Black

Spot funding is provided for both State and Local Government controlled roads.

The main schemes are the Australian Black Spot Programme (Australian

Government) and Safer Roads-State Black Spot (NSW RMS). At present, the

Australian Government Black Spot Programme is only for Councils, but NSW RMS

State Black Spot funding, assesses nominations for Local Government controlled

roads and state roads.

In other areas, such as many of the programs that deliver

funds for projects dealing with the environment, Local Government competes with

State departments for funds. This is an effect of budget cuts, and state

departments using grants to deliver projects that might have once been

delivered through central funding.

An important consideration is that community groups are also

provided opportunities to apply under many of these schemes.

For this reason, the table below outlines examples from

thirteen schemes and shows eligibility for Local Government (LG); State

Government (SG) and Community Groups (CG).

|

|

GRANT

SCHEME

|

ELIGIBILITY

|

LG

|

SG

|

CG

|

COMMENTS

|

|

1

|

Black

spot funding

|

Roads and Maritime Services

administer (on behalf of the Australian Government) the Australian Government

Black Spot Programme in NSW. This includes:

· Reviewing all NSW Black

Spot nominations received against the eligibility criteria

· Undertaking an economic

assessment of the proposed treatment

· Preparing a summary of the

nominations received to present to the NSW Black Spot Consultative Panel for

consideration

· Roads and Maritime advises

other road authorities within NSW of project approval and the process for

delivery and payment for works completed. This includes management of any

variation requests.

Nominations for the Australian

Government Black Spot Programme will be automatically considered for the NSW

Government’s Safer Roads Program. Other road authorities do not need to

re-submit their nomination again, but will need to indicate their willingness

to contribute to the funding of their project.

|

●

|

|

|

Australian

Government Black spot Programme is administered by NSW RMS.

Council

only has to apply with one nomination to be eligible for both state and

federal schemes.

This

year’s Federal Black Spot Progamme will be wholly for Councils. This is

likely to continue into the future.

Last year

the State/Council split was

2015/16

– 80%/20%

2014/2015

– 50%/50%

One

component of assessment is by BCR which must be very strong, but Feds

provide 100% funding if successful – up to $2M.

|

|

2

|

Safer

Roads

|

The NSW Government’s Safer

Roads Program is a key initiative of the NSW Road Safety Strategy, which aims

to make state roads safer and reduce crashes on the road network. This

program provides treatments where there are clusters of casualty crashes on

local and regional roads. This is achieved by implementing low cost

engineering treatments and countermeasures. The program is split into several

sub-programs, all targeting high severity crash types, locations and/or

vulnerable road users.

The sub-programs include:

· State Black Spot

· High Risk Curves

· Fatigue

· Safe Systems Pedestrian

Safety

· Vehicle Activated Signs

(VAS)

· Local Government Road

Safety

· Motorcycle Safety

· Intersection Safety

· Cycling Safety

· Fatal Crash Response

· Highway Route Review

· Aboriginal programs

|

●

|

●

|

|

Council

and RMS compete for this pool of black spot funds.

Councils

must provide matching funding, with total project cost up to $5M

One

component of assessment is by safety index.

|

|

3

|

NSW

Liquor and Gaming

Arts and Cultural Grants

Sport and Recreation Grants

Emergency Relief Grants

|

based in NSW

incorporated, not-for-profit

organisations, which are solvent (financially sound and not

in debt)

hold a current ABN

NSW local councils

|

●

|

|

|

|

|

5

|

Building

Better Regions Fund – Infrastructure and Community Investments

|

Your

project must:

· be located in regional Australia

outside the major capital cities of Sydney, Melbourne, Brisbane, Perth,

Adelaide, and Canberra

|

●

|

|

●

|

State not

specifically excluded, but projects that partner with State gov departments

are encouraged.

|

|

5

|

Community

War Memorials Fund

|

An

application may be made by any organisation or individual, provided the Owner

or Custodian of the Memorial, local RSL Sub-Branch and local council support

the bid, where applicable.

|

●

|

●

|

●

|

|

|

6

|

Elsa

Dixon Aboriginal Employment Program

|

Organisations

applying for funding must be:

▪

a NSW public service agency,

▪

a NSW local government authority operating under the Local Government Act

1993,

▪

an Aboriginal community organisation incorporated under the:

-

Aboriginal Land

Rights Act 1983,

-

Aboriginal Councils

and Associations Act 1976,

-

Corporations

(Aboriginal and Torres Strait Islander) Act 2006, or

and other Aboriginal incorporated

organisation under the:

-

Associations

Incorporation Act 2009,

-

Corporations (NSW)

Act 1990, or

-

Co-operatives Act

1992.

|

●

|

●

|

|

|

|

7

|

Environment

Trust

|

Eco

schools

|

|

●

|

|

|

|

|

|

Education

(Government)

Government

stream:

· state government agencies and/or

statutory committees

· local councils

· Local Land Services

· regional organisations of councils

other local government controlled organisations

· universities

|

●

|

●

|

|

|

|

|

|

Lead

Environmental Community Groups

|

|

|

|

|

|

|

|

Protecting

Our Places

|

|

|

|

|

|

|

|

Research

· The following organisations are

eligible to apply as the lead applicant: Universities

· State government agencies and/or

statutory committees

· Community organisations or groups

(see note below)

· Incorporated associations/non-

profit organisations

· Non–commercial Cooperatives

Councils

· Local Land Services

· Regional Organisations of Council

· Other local government controlled

organisations

· Local Aboriginal Land Councils

|

●

|

●

|

●

|

|

|

|

|

Restoration

and Rehabilitation

The

following organisations can apply for the government stream:

·

State government agencies and/or statutory committees

· Councils

· Regional organisations of

councils

· Other local government controlled

organisations

· Universities (only eligible to

apply for funding for projects on their own land)

|

●

|

●

|

●

|

|

|

|

|

Saving

our Species Partnership Grants Program

· encourage partnerships between

government, the community, non-government organisations and industry

|

●

|

●

|

●

|

|

|

|

|

Waste

Less, Recycle More Initiative

· Community Recycling Centres

· Recycling Innovation Fund

· Landfill Consolidation

· Organics Collection Systems

· Major resource recovery

infrastructure

· Organics Infrastructure

|

●

●

●

●

●

|

|

|

|

|

8

|

Floodplain

Management Program

|

The

following organisations are eligible to apply.

· local councils

· county councils

· other government bodies with

equivalent floodplain risk management responsibilities to local councils

(e.g. Lord Howe Island Board, Hunter Local Land Services (LLS)).

· Local councils can also work

together in a group, provided that:

· one council is the lead agency in

terms of signing of the funding agreement, managing monies and reporting on

the project, or

· a relevant Regional Organisation

of Councils applies for and manages the funding.

|

●

|

|

|

Local

Land Services are state authority

|

|

9

|

Flying-foxes

grant program

|

Grants

are open to NSW Local Government organisations including councils and ROCs.

Collaboration with NSW agencies, Aboriginal Land Councils, business, research

and community organisations is encouraged however each grant application must

be lodged by a Local Government organisation that will be responsible for

administering the grant.

|

●

|

|

|

|

|

10

|

NSW

Heritage Grants

|

Aboriginal

Heritage

To be

eligible for assistance applicants must be: a) an Aboriginal organisation /

community group, or

b) an

individual, consultant or organisation supported by an Aboriginal

organisation /community, or

c)

a NSW Local Council or group of Councils or

d) a

State Government Agency where heritage is not:

·

its core business or

· part of its development

obligations

|

●

|

●

|

●

|

|

|

|

|

Community

Heritage – Peak Organisations

5.1.1 an

applicant must have an ABN and

5.1.2 be

assessed by OEH as a recognised peak community group, association or

organisation including from the not for profit sector (excludes state or

federal Government bodies)

5.1.3 be

assessed as having capacity and commitment to undertake and complete the

project.

|

●

|

|

●

|

|

|

|

|

Community

Heritage Projects

|

|

|

|

No past

guidelines available

|

|

|

|

Major

Works

5.1.1 an

applicant must be the owner and manager of the State Heritage Register listed

item involved in the project

5.1.2

the applicant must agree to provide matching funding towards the project if

successful and

5.1.3

an applicant must be assessed as having capacity and commitment to undertake

and complete the project.

|

●

|

●

|

●

|

Must be a

state heritage item – this means can be competing against departments

like Public works, national parks and wildlife

|

|

|

|

Local

Government Heritage Advisors

|

●

|

|

|

|

|

|

|

Local

Heritage Places

the

applicant must be:

· a NSW Local Council (local

government entity/authority)

· a group of NSW Local Councils or

· an Agency acting upon behalf of

an unincorporated area

|

●

|

|

|

|

|

|

|

Emergency

Works

a) be an

individual, organisation, community group, trustee or a NSW Local Council

which is the owner (or perpetual lessee) and manager of a State Heritage

Register-listed item or item with a current Interim Heritage Order within

NSW, or

b)

be a State government agencies involved as a project partner assisting one of

the owners and managers noted at 5.1.1 a)

|

●

|

●

|

●

|

|

|

11

|

Heritage

Near Me

|

Activation

Grants

Applications

will only be accepted from owners or managers of heritage items that are:

•

listed on LEPs, and

•

regularly accessible to the public. Applicants must be holders of an

Australian Business Number (ABN), and may be individuals, companies,

not-for-profit organisations, or local government.

State

government owned assets may be eligible for activation projects that are

demonstrably outside core activities

|

●

|

●

|

●

|

|

|

|

|

Local

Heritage Strategic Projects

EOIs are

sought from a wide range of applicants, including owners and managers of

heritage items, local government, and businesses and organisations seeking to

develop projects that meet the program’s priorities.

|

|

|

|

|

|

12

|

Recreational

Fishing Trusts

|

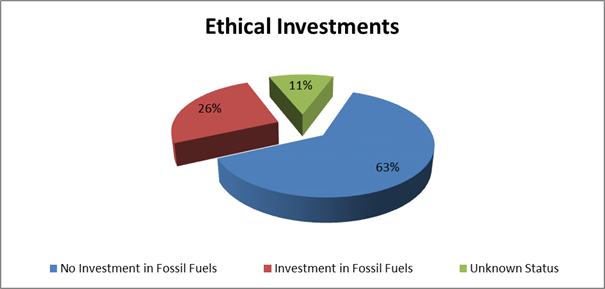

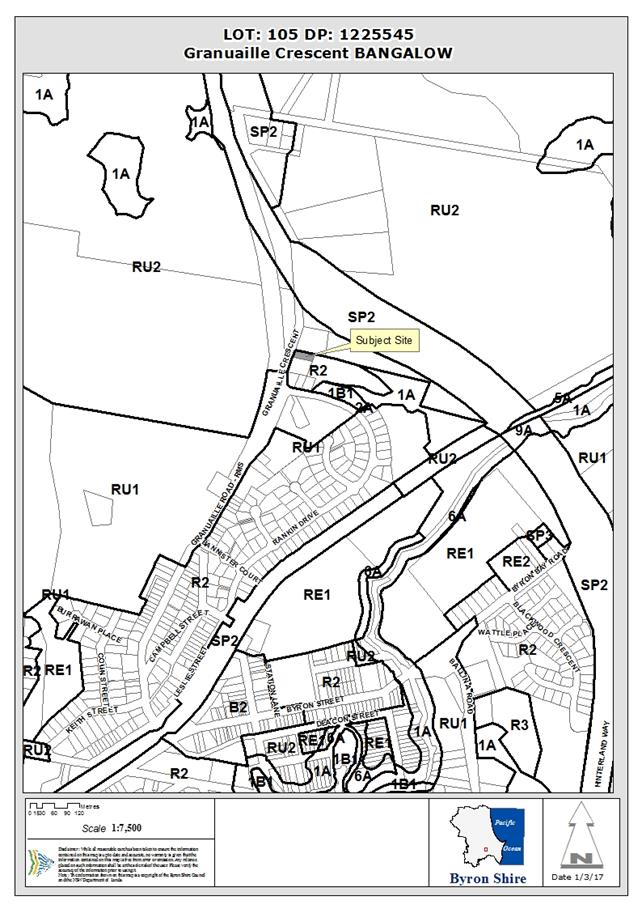

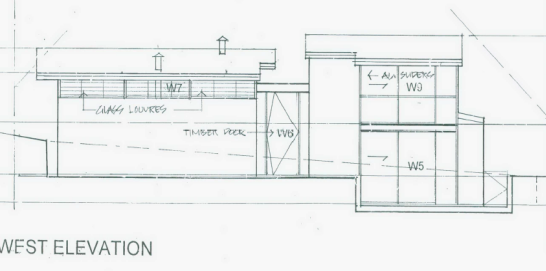

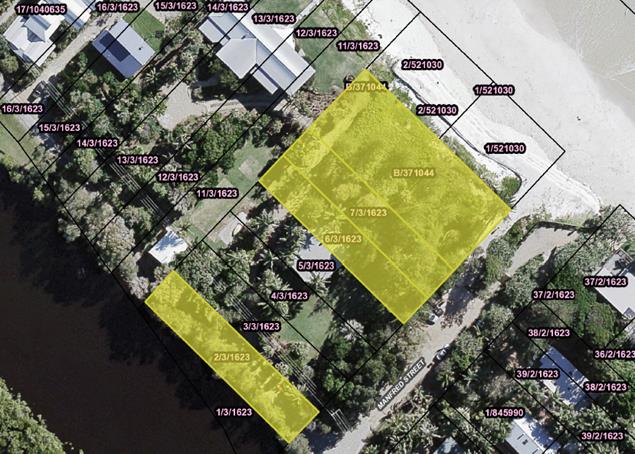

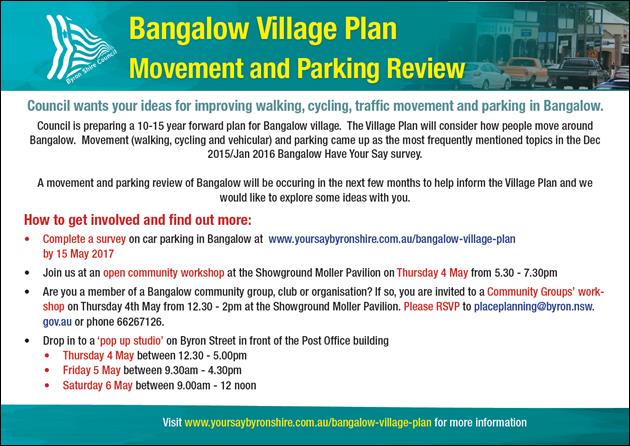

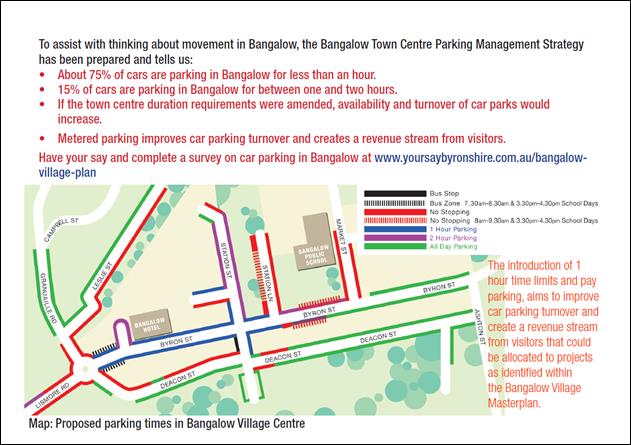

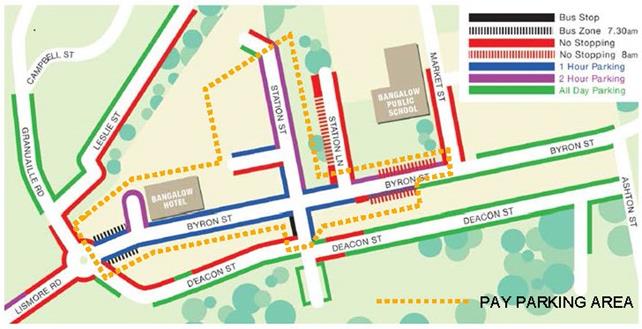

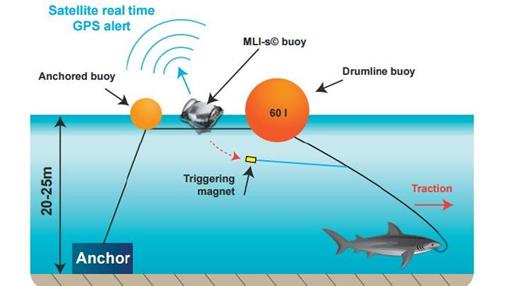

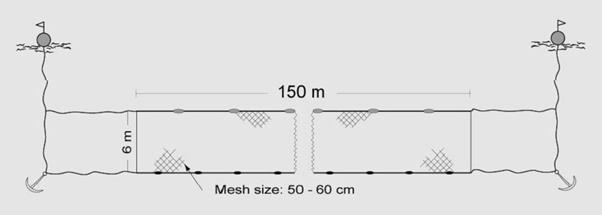

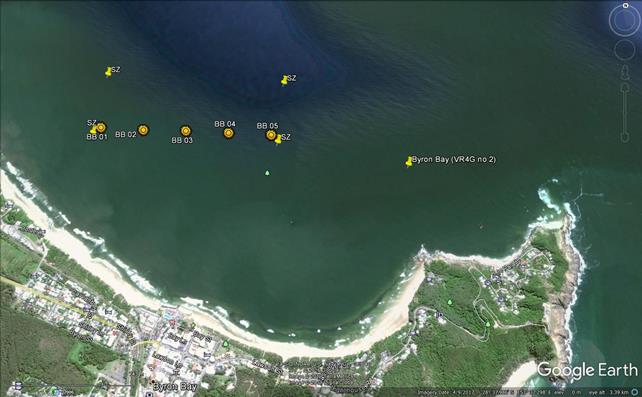

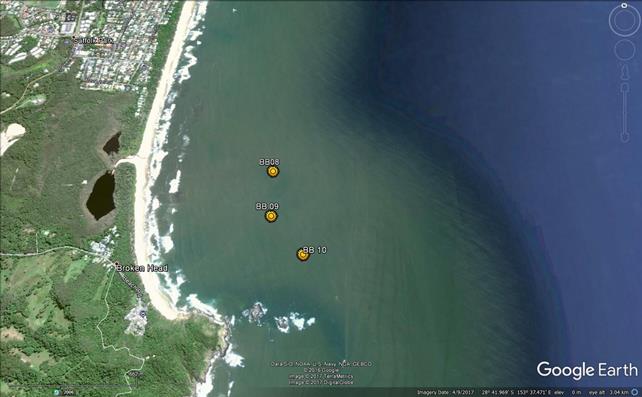

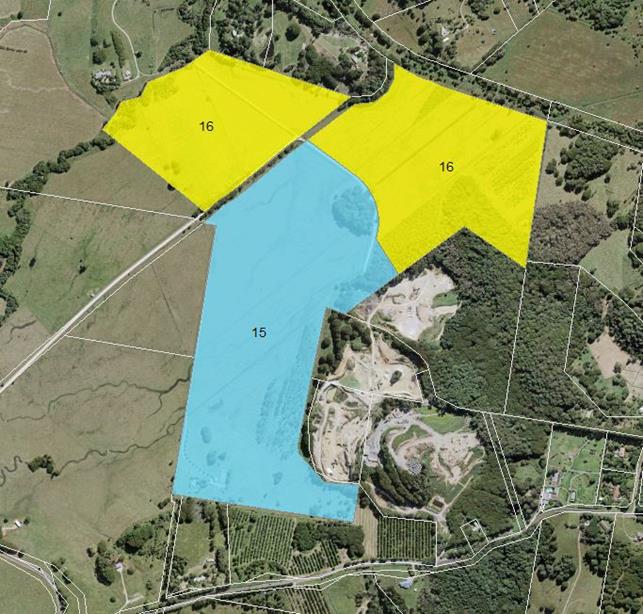

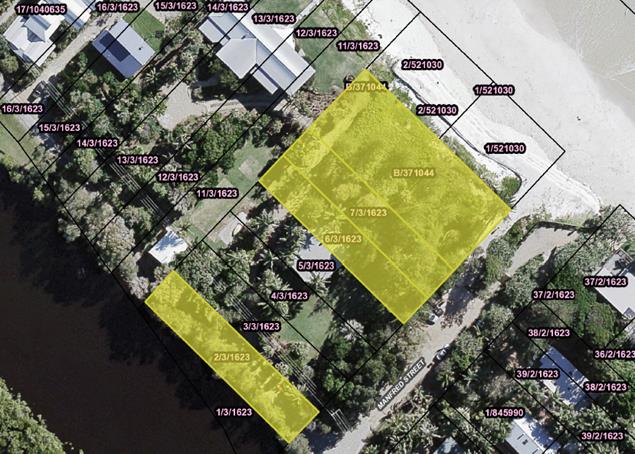

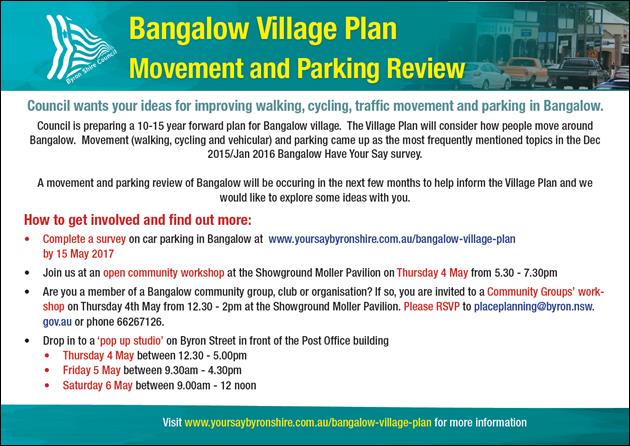

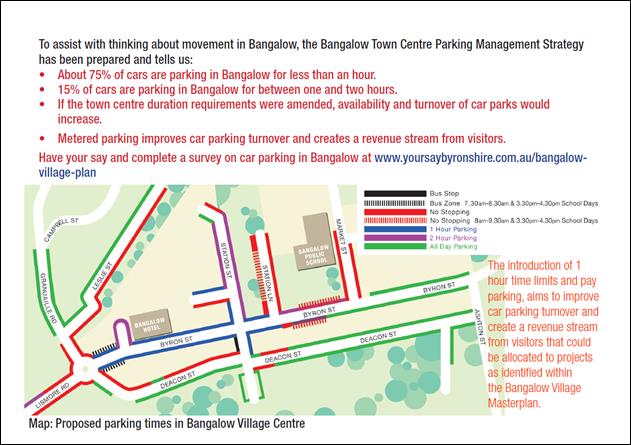

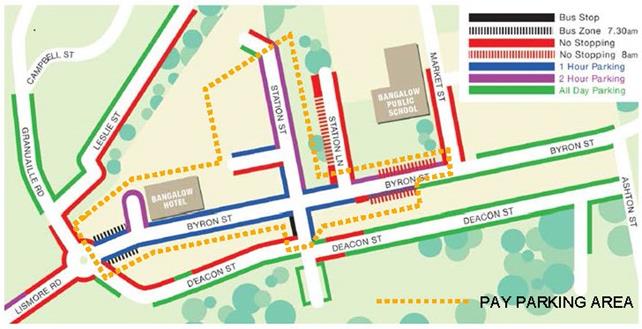

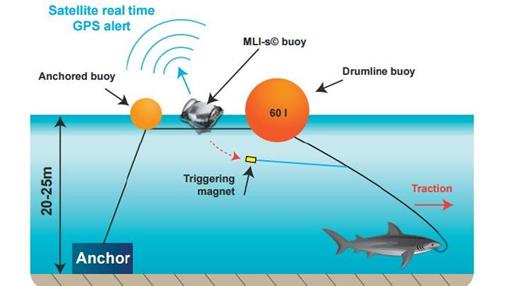

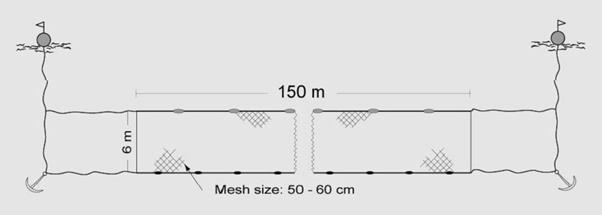

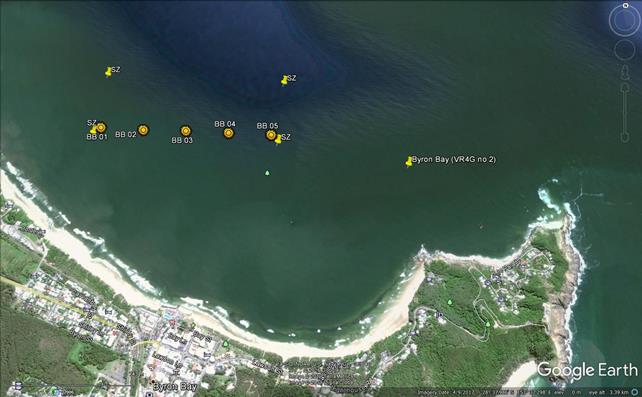

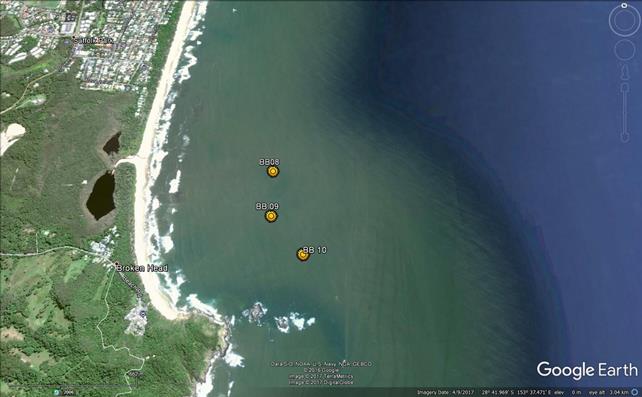

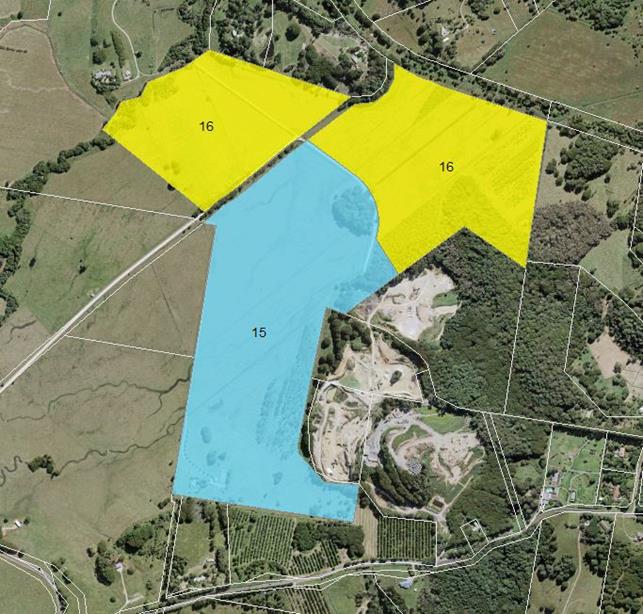

Anyone