Audit, Risk and Improvement Advisory Committee Meeting

An Audit, Risk and Improvement Advisory

Committee Meeting of Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 17 August 2017

|

|

Time

|

11.30am

|

Mark Arnold

Director Corporate and Community Services I2017/1099

Distributed 11/08/17

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of maintaining

the register, a division is required to be called whenever a motion for a

planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Audit, Risk and Improvement Advisory Committee

Meeting

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Internal

Audit Advisory Committee Meeting held on 18 May 2017

4. Staff Reports

Corporate and Community Services

4.1 Internal

audit service provider introduction ...................................................................... 4

4.2 Audit,

Risk and Improvement Committee - overview ...................................................... 6

4.3 Summary

of Internal Audit Program 2013 - 2017 .......................................................... 19

4.4 2017

Interim Audit Management Letter........................................................................... 24

4.5 Costings

associated with Land and Environment Court proceedings Byron Shire Council ats

Butler Street Community Network Inc. .................................................................................... 27

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

Report No. 4.1 Internal

audit service provider introduction

Directorate: Corporate

and Community Services

Report

Author: Jessica

Orr, Project Manager - Special Projects

File No: I2017/1037

Theme: Corporate Management

Governance Services

Summary:

At Council’s Ordinary meeting on 22 June 2017, Council

resolved (17-252) to appoint O’Connor Marsden and Associates (OCM) as the

incoming internal audit, risk and improvement service provider for the four

year contract period 2017 – 2021.

This report tables an introductory

presentation from OCM outlining background information on the company, its

services and in particular the approach OCM proposes to take in delivering

internal audit services to the committee and Council as per the contract

(Contract ref 2017-0004).

|

RECOMMENDATION:

That the Committee note the introductory

presentation and welcome O’Connor Marsden and Associates as

Council’s internal audit, risk and improvement services provider for

the four year contract period.

|

Attachments:

1 Confidential

- Byron Shire Council Introduction - presentation from OCM, E2017/79654

Report

At Council’s Ordinary meeting on 22 June 2017, Council

resolved (17-252) to appoint O’Connor Marsden and Associates (OCM) as the

incoming internal audit, risk and improvement service provider for the four

year contract period 2017 – 2021.

OCM offers extensive experience in the fields of internal

audit, probity audit, procurement, risk management, governance and workplace

conduct. It employs over 90 staff and the team dedicated to Byron Shire

Councils internal audit services offers over 10 years work experience.

OCM offer a transition plan from the outgoing internal audit

service provider, Grant Thornton, which initially includes the development of

the strategic and annual internal audit plans, risk assurance maps, an internal

audit charter and identifying and following up audit recommendations.

Financial Implications

The engagement of OCM is contained within the 2017/18

budget.

Statutory and Policy Compliance Implications

The performance of the Internal Audit Services is required

to be undertaken in accordance with the terms and conditions of previous

Internal Audit Services Contract 2017-0004. These terms and conditions require

consideration of the NSW Department of Premier and Cabinet, Division of Local

Government, Internal Audit Guidelines and compliance with the associated

professional accounting and audit standards.

Staff Reports - Corporate and Community Services 4.2

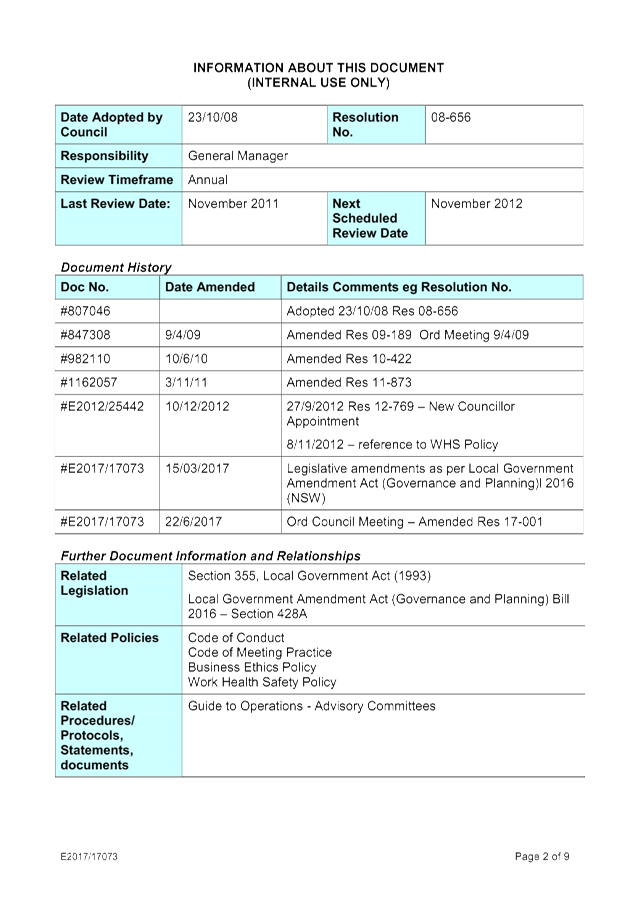

Report No. 4.2 Audit,

Risk and Improvement Committee - overview

Directorate: Corporate

and Community Services

Report

Author: Jessica

Orr, Project Manager - Special Projects

File No: I2017/1038

Theme: Corporate Management

Governance Services

Summary:

Council’s Audit, Risk and Improvement Committee

(Committee) provides professional, independent

advice and assistance in assessing the organisation’s audit, compliance,

risk and improvement performance.

There have been recent

changes to the Committee’s constitution, membership and service provider

which provides the opportunity to outline the Committee’s role and

function. At Council’s June 2017 ordinary meeting a revised constitution

was adopted (17-233) and a new audit service provider appointed (17-252).

At the 3 August 2017 ordinary meeting new community

members were appointed (17-304).

This report outlines the Committee’s constitution,

member’s obligations and secretariat. It also

highlights the next steps for the Committee and the newly

appointed internal audit service provider in developing the scope for the

four-year internal audit program, establishing Council’s audit universe

and agreeing on audit reviews and priorities.

|

RECOMMENDATION:

That the Audit, Risk and Improvement Committee:

1. Appoint

_____ as the Committee’s Chairperson

2. a) Note

the Audit, Risk and Improvement Committee’s constitution

b) Request

Committee community members to complete acknowledgment of the Code

of Conduct

|

Attachments:

1 Constitution

of Audit, Risk and Improvement Committee (IARIC) final, E2017/78923 , page 10⇩

Report

Terms of Reference

The terms of reference of the Committee are contained in the

Constitution of the Audit, Risk and Improvement Committee, as per attached. The

Constitution is the governing document for the Committee, establishing the

authority and responsibilities conferred on the Committee by Council and its

role within Council. The Constitution confirms the function of the Committee as

an advisory Committee of the Council, stating that it does not have executive

power or authority to implement actions however, the Committee will at times

make recommendations to Council.

The role of the Committee is, independently of management,

to report to Council and provide appropriate advice and recommendations on

matters concerning the good corporate governance of Council including

performance improvement and risk management.

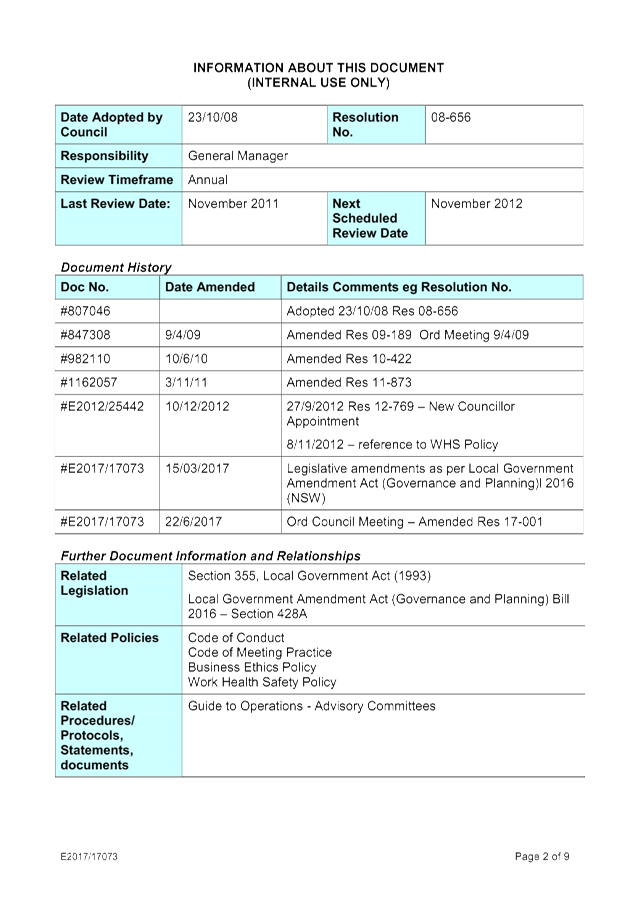

The Constitution was reviewed in early 2017 to take into

account recent changes contained in the Local Government Amendment

(Governance and Planning) Act 2016 (NSW). The Constitution outlines at item

3.2 the functions of the Secretariat services provided by Council staff:

3.2 Secretariat

Corporate and Community Services

Directorate will provide Secretariat support to the Committee through

undertaking tasks including ensuring the agenda for each meeting and supporting

papers are circulated at least one week period to the meeting and ensuring

minutes are prepared and circulated.

Meetings

As per item 7 of the Constitution, the Committee will meet

five times per year, based on the audit review program (four audit reviews each

year) and one extraordinary meeting to review Council’s financials.

Quorum for each meeting is four committee members.

Matters that must be discussed at a meeting include:

a) Review and recommendation of the Annual Internal and

External Audit Plan;

b) Review the Annual General Purpose and Special Purpose

Financial Reports;

c) Review and assess Internal Audit Progress Reports;

d) Review and assess External Audit management letters;

e) Review and monitor Councils Risk Management Framework;

and

f) Any other matters within the responsibility of the

Committee.

The Chairperson may call a meeting if requested to do so by

the General Manager, Committee member, the Internal or the External Auditor.

Meeting agendas will be prepared and provided in advance to

members, along with appropriate briefing materials. Agenda items for

consideration at a Committee meeting can be referred to the Chairperson of the

Committee by Council, the General Manager, Committee members, the Internal or

External Auditor.

Minutes will be taken by Council Secretariat at these

meetings, detailing matters discussed and action agreed.

Obligations of members of the Committee

Members are reminded that at all times in participating as a

member of the Committee, must discharge their duties and responsibilities by

exercising honesty, objectivity and probity and not engage knowingly in acts or

activities that have the potential to bring discredit to the Council or the

Committee.

Item 4.4 of the Constitution states that members must also

refrain from entering into any activity that that may prejudice their ability

to carry out their duties and responsibilities objectively and must at all

times act in a proper and prudent manner in the use of information acquired in

the course of their duties. Members must not use Council information for any

personal gain for themselves or their immediate families or any manner that

would be contrary to law or detrimental to the welfare of the Council.

Committee members must not publicly comment on matters

relative to activities of the Committee other than as authorised by Council.

Appointment of Chairperson

The Committee should discuss and agree on the appointment of

a Chairperson for all meetings as per item 4.3 of the Constitution as outlined

below:

4.3 Independent member

appointment process

The Chairperson shall be an

external member elected by a majority vote by the members of the Committee. The

Committee is required to adhere to Council’s Code of Conduct and Code of

Meeting Practice.

The Committee should note that if the Chairperson is absent

from a meeting, the first business of the meeting will be to elect a

Chairperson for that meeting from the independent members present.

This should be the first item of business for this meeting.

Sign acknowledgement of Code of Conduct forms

All members of the Committee are required to complete

acknowledgement of Code of Conduct forms as part of the requirements to be a

member of any Council committee.

Next steps

Developing scope of audit review program

Between August and September 2017, the internal audit

service provider will work with Council staff and executive to develop and

scope the internal audit review program for the four year contract period,

based on identifying key risks and priorities for management and improvement.

The process of developing the audit program will include

undertaking a review of the past four years of audit reports, risk

identification and ranking, and setting strategic corporate priorities.

This process will involve conversations with relevant Council staff and

executive, and considering the strategic objectives of the organisation

outlined in Councils integrated planning and reporting documents.

The key points of contact for all independent Committee

members and the internal audit service provider will be Jessica Orr, Project

Manager – Special Projects and Anna Vinfield, Manager Governance

Services.

Financial Implications

Council’s audit program will be accommodated within

the 2017/18 budget.

Statutory and Policy Compliance Implications

The performance of the Internal Audit Services is required

to be undertaken in accordance with the terms and conditions of Internal Audit

Services Contract 2017-0004. These terms and conditions require consideration

of the NSW Department of Premier and Cabinet, Division of Local Government,

Internal Audit Guidelines and compliance with the associated professional

accounting and audit standards.

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.3

Report No. 4.3 Summary

of Internal Audit Program 2013 - 2017

Directorate: Corporate

and Community Services

Report Author: Jessica

Orr, Project Manager - Special Projects

File No: I2017/1083

Theme: Corporate Management

Governance Services

Summary:

This report has been prepared to allow the Audit, Risk and

Improvement Committee to consider the Internal Audit Summary Report (August

2017) prepared by the outgoing internal auditor Grant Thornton.

This report highlights the findings and related management comments

and actions for each audit review conducted during 2013 – 2017 by Grant

Thornton as Council’s internal audit service provider during this period.

|

RECOMMENDATION:

That the Audit, Risk and Improvement Committee:

1. Note

the report from outgoing auditor Grant Thornton

2. Consider

the report conclusions in developing the audit, risk and improvement delivery

program for 2017 – 2021.

|

Attachments:

1 Confidential

- Byron Shire Council Internal Audit Summary Report - August 2017, E2017/79482

Report

Grant Thornton was Council’s appointed internal

auditors from 2013 to 2017. During this time Grant Thornton conducted 17

reviews (15 within corresponding Internal Audit Plans and two outside of

Internal Audit Plans):

· Contract Management and Project Management Review

· Water Supply and Sewer Infrastructure

· Dealing with Emergencies Review 2014

· Section 603 & 149 Certificates Review

· Regulatory Enforcement Review

· Billings and Collections Review

· Work Health & Safety Review

· Inventory Control Review

· Governance and Complaints Handling Review

· Development Assessments Review

· Procurement Review

· Developer Contributions Review

· Training, Recruitment and Succession Review

· Business Continuity Plan (BCP) / Disaster Recover Plan

(DRP)

· Asset Management – Key Asset Infrastructure

Of the 15 conducted within the Internal Audit Plan, seven

were given an overall rating of 'Acceptable', seven were rated 'Needs

Improvement' and one was not provided with an overall rating.

From these reviews, there were 74 findings. Of the 74

findings, 12 were rated 'High'; 33 'Moderate'; 17 'Low' and 12 'Performance

Improvement'. Further details of the results of completed audits are contained

in Parts B and C of the attached report. As at 18 May 2017, there were 12

outstanding recommendations that haven't been implemented, details of which can

be found in Part D of the attached report.

Audit reviews conducted 2013

– 2017

The previous internal audit

strategy was developed on the consideration of a number of factors including:

· Discussions with the Executive Management Team as part

of a Enterprise Risk Management (ERM) process

· Council’s risk profile as developed from the ERM

workshop in January 2012

· Known high risk areas within the Local Government

sector

· Council’s core business processes, values and

objectives

· Annual internal audit budget at the time.

In accordance with the Internal

Audit program agreed to between Council and the internal auditors, the

following reviews were completed during the 2013 - 2017 period:

|

Review

|

Internal Audit Plan &

Overall Rating

|

|

Contract Management and

Project Management Review

Scope of review:

§ Contract and Execution Monitoring.

§ Project Management across Council.

§ Insurances.

§ Record Management.

|

2013-2014

Overall rating:

Needs improvement.

|

|

Water Supply and Sewer

Infrastructure

Scope of review:

§ Water and Sewerage network.

§ Key water and sewer assets and related systems.

§ Capital works program.

§ Legislative and regulatory requirements.

§ Drinking water quality management plan.

|

2013-2014

Overall rating:

Acceptable.

|

|

Dealing with Emergencies

Review 2014

Scope of review:

§ Testing of the Disaster Plan and Standing Operating

Procedures.

§ Disaster Plan and Standing Operating Procedures

|

2013-2014

Overall rating:

Acceptable.

|

|

Section 603 & 149

Certificates Review

Scope of review:

§ 603 certificates – statistics and fees.

§ 149 certificates – statistics and fees.

§ Recording, monitoring and tracking of certificates.

§ Fee collection and authority receipting.

§ Review of certificates generated.

|

2013-2014

Overall rating:

Needs improvement.

|

|

Regulatory Enforcement

Review

Scope of review:

§ Inspections of specific sites – swimming

pools, onsite sewerage management systems.

§ Food outlets register.

§ Actioning and responding to CRM tasks.

§ Policies and Procedures.

|

2014-2015

Overall rating:

Needs improvement.

|

|

Billings and Collections

Review

Scope of review:

§ Outsourced service providers – agreements.

§ Appropriate systems, processes for collecting and

recording.

§ Revenue and outsourced functions.

§ Annual rate levies.

|

2014-2015

Overall rating:

Acceptable.

|

|

Work Health & Safety

Review

Scope of review:

§ Framework for the management of WHS

§ Reporting process adopted and implemented to manage

and monitor compliance with WHS

§ WHS Induction Training

§ Return to Work

§ Incident Reporting

§ WHS Committee

§ Risk Assessments

§ Contractors.

|

2014-2015

Overall rating:

Needs improvement.

|

|

Inventory Control Review

Scope of review:

§ Inventory store and inventory value.

§ Authority.

§ Stock and fuel monitoring.

§ Segregation of duties, procedures, requisitions,

improvement plan and user access.

|

2015-2016

Overall rating: Needs

improvement.

|

|

Governance and Complaints

Handling Review

Scope of review:

§ Council meetings, business papers and Councillor

corporate support.

§ Establishment and maintenance of risk management

framework addressing strategic and operational risk.

§ Council committees.

§ Continuous improvement of Council policy, guidelines

and procedures.

|

2015-2016

Overall rating:

Acceptable.

|

|

Development Assessments

Review

Scope of review:

§ Compliance with legislative / regulatory

requirements.

§ Fee / Levies Calculation and Collection thereof.

§ Assessment Process.

§ Fraud Prevention Controls / Measures.

§ Private Certifiers.

§ On-site Sewer Management Inspections.

§ Regulatory Inspections.

|

2015-2016

Overall rating:

Acceptable.

|

|

Procurement Review

Scope of review:

§ Procurement policy, guidelines and framework –

appropriate training.

§ Purchasing process – electronic systems and

delegations.

§ Delegations of authority.

|

2015-2016

Overall rating:

Needs improvement.

|

|

Developer Contributions

Review

Scope of review:

§ Documentation of key developer contributions

process.

§ Determination of contributions.

§ Contributions register and calculators.

|

2016-2017

Overall rating:

Acceptable.

|

|

Training, Recruitment and

Succession Review

Scope of review:

§ Recruitment methodology and development of

recruitment policy.

§ Training opportunities and development of training

policy and framework.

§ Staff engagement and culture – reporting.

§ Code of Conduct training (Council values).

§ Learning and development of staff.

§ Succession planning – talent management

framework.

§ Talent retention – identify and

maintain.

§ Performance management policy and procedures.

|

2016-2017

Overall rating:

Needs improvement.

|

|

Business Continuity Plan

(BCP) / Disaster Recover Plan (DRP)

Scope of review:

§ Consideration of existing documents and resources

across the organisation addressing business continuity.

§ Adequacy and effectiveness of current Business

Continuity Plan and Disaster Recovery Plan.

§ Establishment of crisis management team.

§ Training and education for crisis management team and

all staff on BCP/DR.

§ Regular review of BCP and disaster recovery plans

(including regional) and pilot testing.

|

2016-2017

Overall rating:

Not applicable. See Project

Manager – Special Projects.

|

|

Asset Management –

Key Asset Infrastructure

Scope of review:

§ Asset register – completeness and accuracy.

§ Maintenance plans, inspection reports and defect

recording.

§ Appropriate systems and recording and statistics in

place for roads, drainage and building assets.

§ Asset Management Framework.

§ Special Rates Variation.

§ Capital Works Program.

§ Grants / external funding.

§ Financial and geographical information within the

asset register.

|

2016-2017

Overall rating:

Acceptable.

|

Financial Implications

The audit program was conducted within allocated budgets.

Statutory and Policy Compliance Implications

The performance of the Internal Audit Services was

undertaken in accordance with the terms and conditions of previous Internal

Audit Services Contract 2013-0024. These terms and conditions require

consideration of the NSW Department of Premier and Cabinet, Division of Local

Government, Internal Audit Guidelines and compliance with the associated

professional accounting and audit standards.

Staff Reports - Corporate and Community Services 4.4

Report No. 4.4 2017

Interim Audit Management Letter

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/1087

Theme: Corporate Management

Financial Services

Summary:

Council has received an Interim Audit Management Letter from

the External Auditor, the Audit Office of NSW relating to the 2017 audit. The

Audit Management Letter details fifteen items for management to consider and

provides recommendations to improve internal controls and systems.

Each of the audit matters raised in the Interim Audit

Management Letter 2017 have been identified in this report for consideration by

the Internal Audit Advisory Committee.

|

RECOMMENDATION:

That the comments provided by Management in response to

matters raised in the 2017 Interim Audit Management Letter be noted by

Council.

|

Attachments:

1 Confidential

- Draft Interim Audit Management Letter 2017, E2017/79705

Report

Council has received an Interim Audit Management Letter

following the interim audit for 2017 by the External Auditor, the Audit Office

of NSW. At the time of preparing this report, the Interim Audit

Management Letter has not been formally issued by the NSW Audit Office. A

draft of the Interim Audit Management Letter containing full details is

contained at Confidential Attachment 1 along with comments provided by

Management.

It is expected the formal Interim Audit Management Letter

will be issued by the NSW Audit Office prior to the Internal Audit Advisory

Committee Meeting of 17 August 2017 and arrangements can be made to distribute

the letter to Committee Members prior to the Meeting if that occurs.

The audit findings identified in the Interim Audit

Management Letter 2017 are summarised in the table below:

|

Item

|

Audit Finding

|

|

1

|

Business Continuity Management

|

|

2

|

Goods Receipt Recording in Authority

|

|

3

|

Centralised Contract Register

|

|

4

|

IT Policy Framework

|

|

5

|

Activity Logs

|

|

6

|

User Access Rights

|

|

7

|

Generic Authority User with Elevated Privileges

|

|

8

|

IT Risk Management

|

|

9

|

Monitoring and Management Compliance with Key Laws and

Regulations

|

|

10

|

Backup Testings

|

|

11

|

Maintenance of Delegated Authorities in Authority

|

|

12

|

Cloud Services

|

|

13

|

Temporary Employee Timesheets Not Always Reviewed

|

|

14

|

EFT Payment Authorisation Evidence

|

|

15

|

User On-Boarding/Off-Boarding Processes

|

If reference is made to Confidential Attachment 1, there is

a description of each audit finding, the implication of the finding, a

recommendation for improvement and a management response from Council for the

Internal Audit Advisory Committee to consider. In addition each audit

finding has been assigned a likelihood and consequence level along with a risk

level.

Financial Implications

There are no financial implications associated with this

report. It is expected the adoption of the recommendations suggested in

this report and their implementation would be met from existing budget

allocations.

Statutory and Policy Compliance Implications

In regard to keeping accounting

records, Section 412 of the Local Government Act 1993 requires Council to do

the following:

(1) A council must keep such

accounting records as are necessary to correctly record and explain its

financial transactions and its financial position.

(2) In particular, a council must

keep its accounting records in a manner and form that facilitate:

(a) the preparation of

financial reports that present fairly its financial position and the results of

its operations, and

(b) the convenient and proper

auditing of those reports.

The issue of an Audit Management Letter provides an

independent view on the controls and systems in place surrounding its

accounting records.

Staff Reports - Corporate and Community Services 4.5

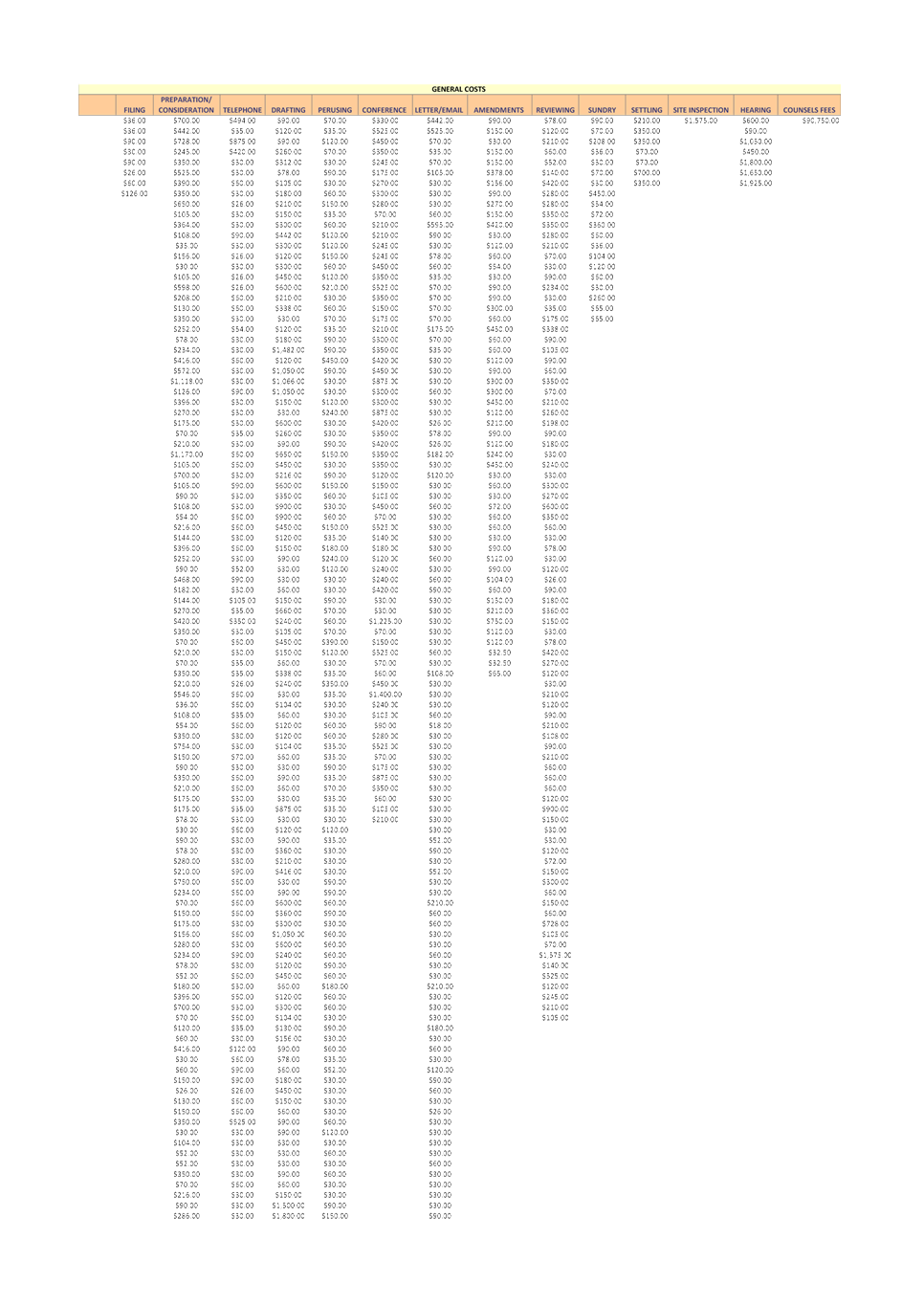

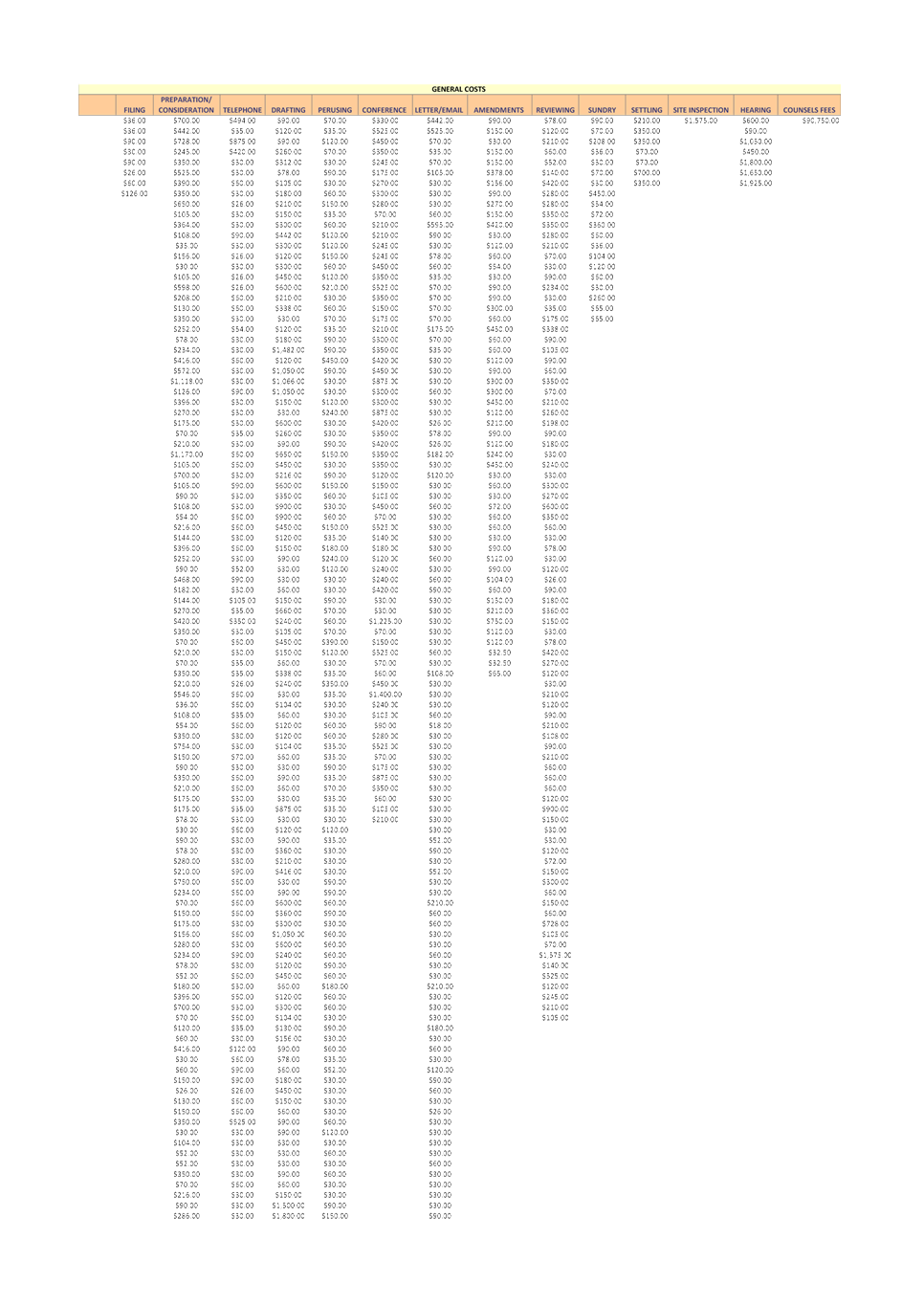

Report No. 4.5 Costings

associated with Land and Environment Court proceedings Byron Shire Council ats

Butler Street Community Network Inc.

Directorate: Corporate

and Community Services

Report

Author: Ralph

James, Legal Services Coordinator

File No: I2017/1091

Theme: Corporate Management

Governance Services

Summary:

On 20 July 2016 a Class 1 objector

appeal pursuant to s 98(1) of

the Environmental Planning and Assessment Act 1979 (NSW) was lodged in the NSW Land Environment court seeking that

development consent be refused to Development Application number 10.2016.77.1 for the

construction of a bypass road and associated works (‘the Byron Bay

Bypass’).

On 2 June 2017 the Commissioner

made the following orders:

1. Development Consent

is granted to Development Application No. 10.2016.77.1 for construction of a

road and associated works subject to conditions of consent.

2. The appeal is

otherwise dismissed.

This report sets out the legal

costs and disbursements associated with Council’s participation in the

proceedings in its capacity as a Respondent.

|

RECOMMENDATION:

That this report be noted.

|

Attachments:

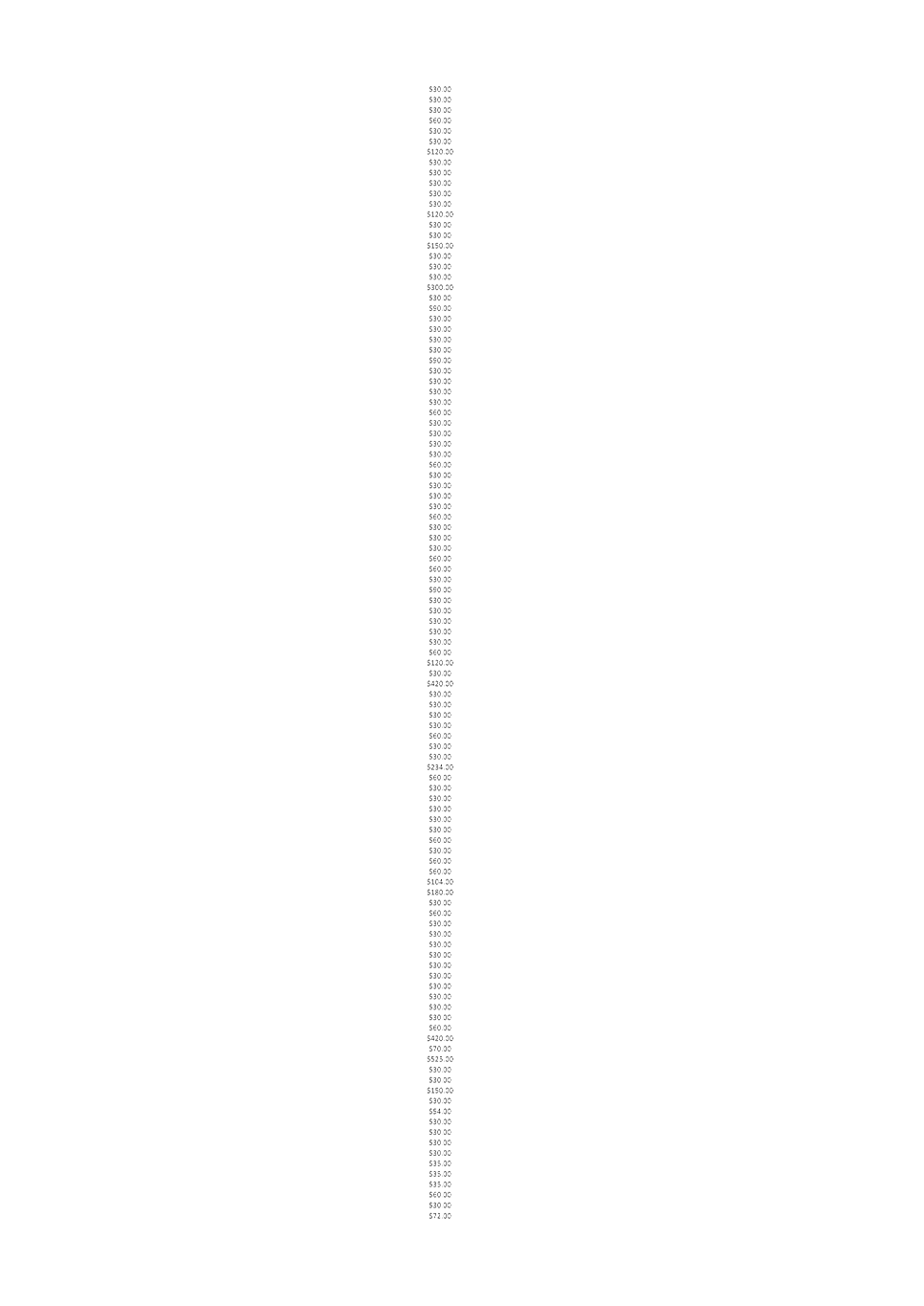

1 Breakdown

of Butler Street Costs - General, E2017/80736

, page 30⇩

2 A

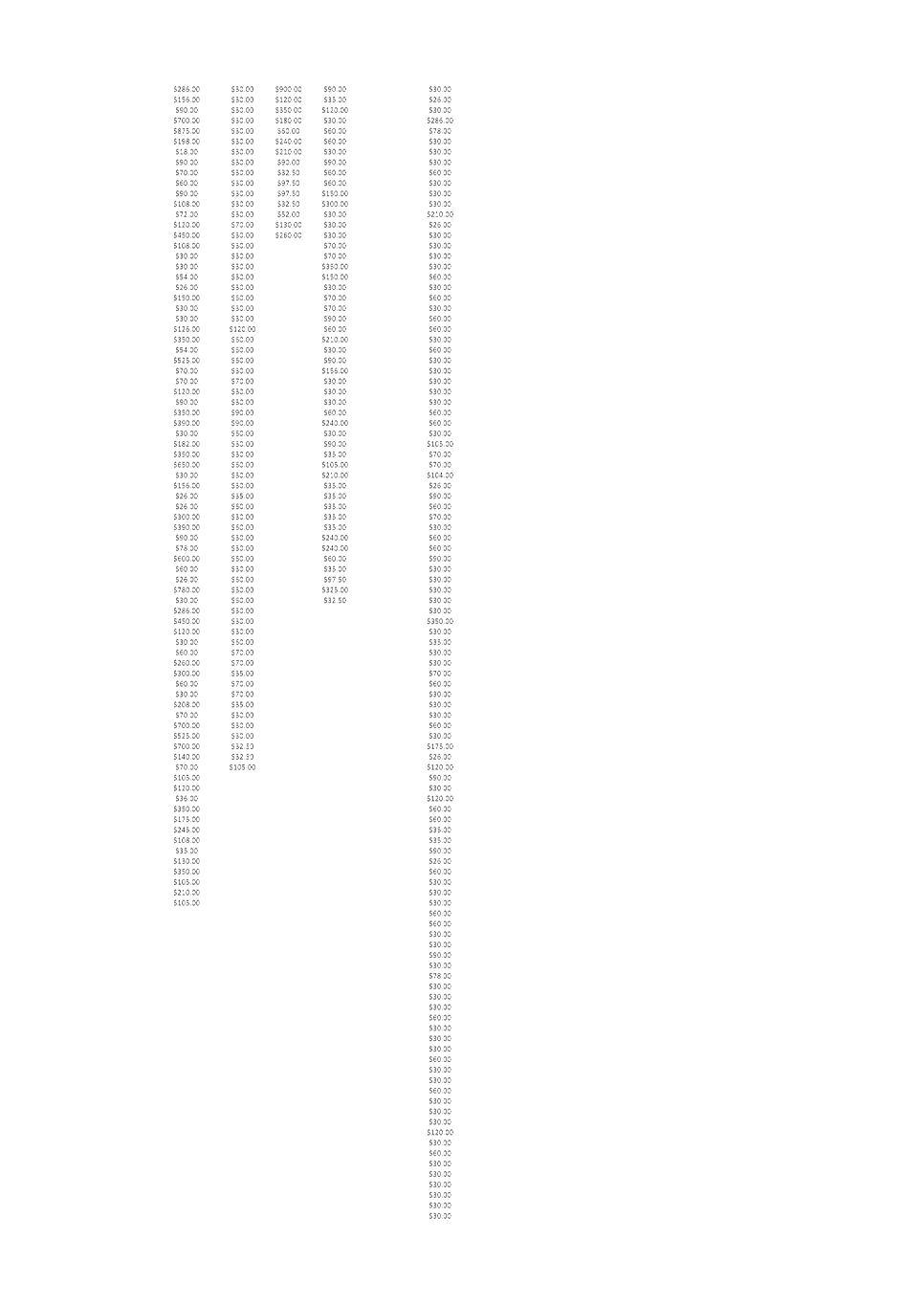

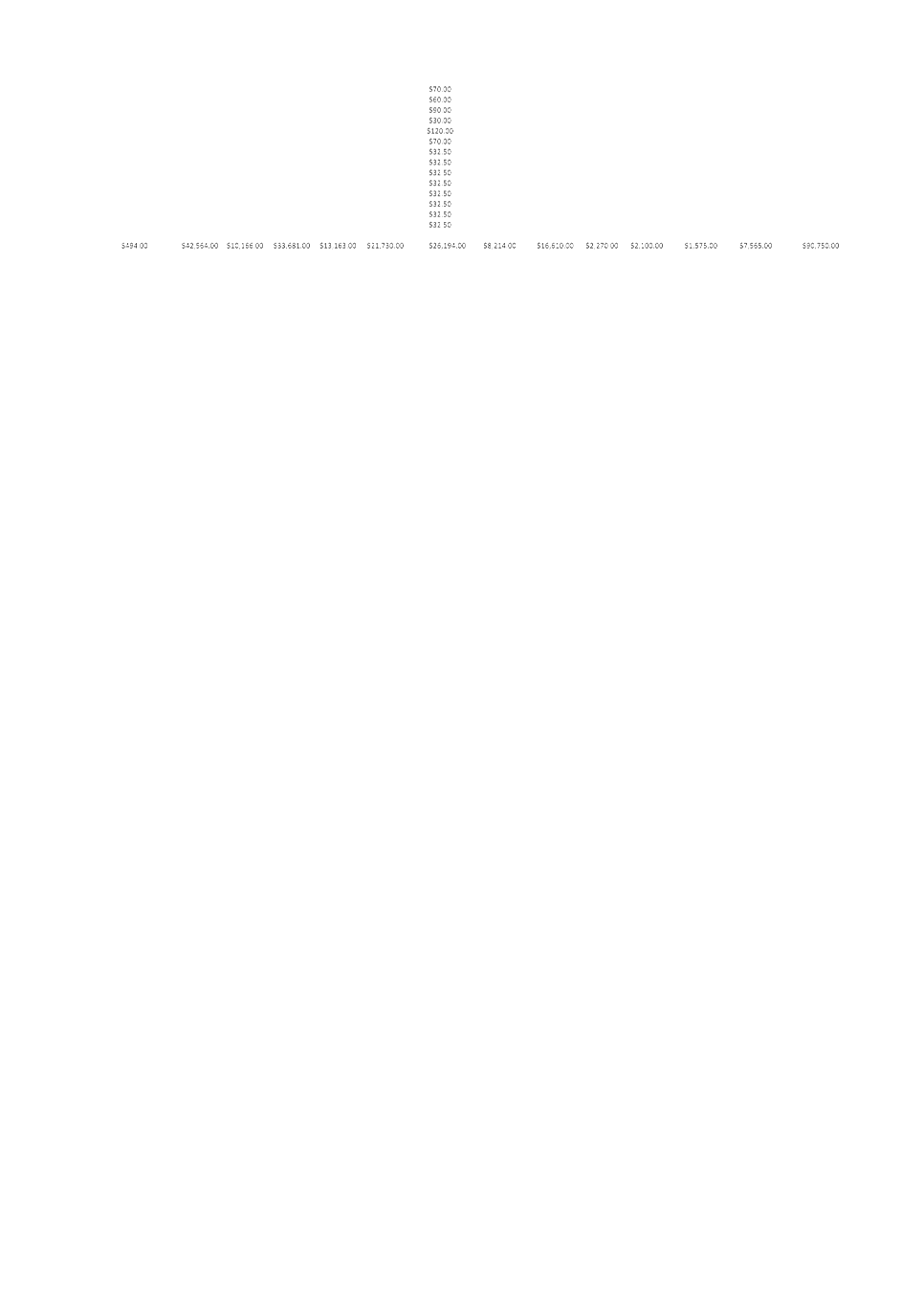

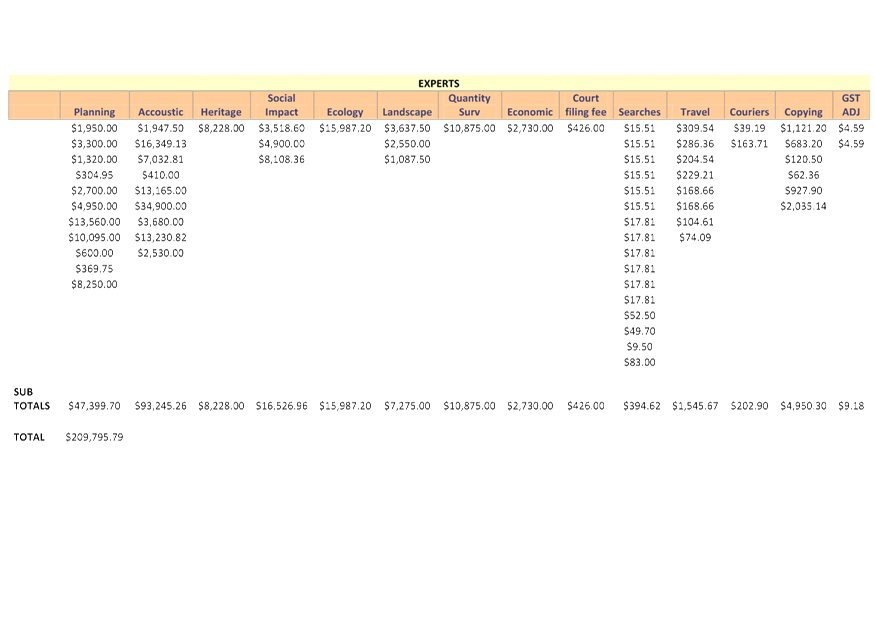

spreadsheet setting out costs and disbursements relating to expert evidence, E2017/80727 ,

page 35⇩

Report

On 20 July 2016 a Class 1 objector

appeal pursuant to s 98(1) of

the Environmental Planning and Assessment Act 1979 (NSW) was lodged in the NSW Land Environment court seeking that

development consent be refused to Development Application number 10.2016.77.1 for the

construction of a bypass road and associated works (‘the Byron Bay

Bypass’). Development consent had been granted by the Northern Region

Joint Regional Planning Panel (JRPP).

The proceedings were brought by

the Butler Street Community Network Incorporated against

the JRPP, GHD Pty Ltd and Byron Shire Council.

Both the JRPP and GHD filed submitting appearances.

Council’s active role in the proceedings was authorised by the General

Manager under delegation.

The proceedings were the subject

of a conciliation conference on site and then in Byron Bay on Friday 2 December

2016. No agreement was reached.

The matter was heard on 17-19 May

2017. Day 1 of the hearing was on-site. Days 2 and 3 were at the Land and

Environment Court in Sydney.

On 2 June 2017 the Commissioner

made the following orders:

1. Development Consent

is granted to Development Application No. 10.2016.77.1 for construction of a

road and associated works subject to conditions of consent.

2. The appeal is

otherwise dismissed.

Council was

represented by Mr A Galasso SC instructed by HWL Ebsworth Lawyers (from Council’s legal

services panel)

Council relied on the expert

evidence of Mr Paul Grech (planning), Dr Renzo Tonin (acoustic), Mr Robert

Staas (heritage), Professor Roberta Ryan (social planning) and Mr Daniel

Williams (ecology).

Legal representatives and experts

were required to attend both the Conciliation Conference and the hearing.

In addition to the experts who

gave evidence it was necessary to obtain evidence which fed into the evidence

of the experts who did it give evidence. For example the evidence of the

quantity surveyor and that of the landscape architect fed into the acoustic

evidence.

The economic expert provided

evidence in respect of a contention in the proceedings advanced by the

applicant but later abandoned.

It was also necessary to compile

other expert evidence which was not ultimately relied upon given that the

applicant did not raise, or abandoned, contentions in those fields.

For cases in Class 1 of

the Court’s jurisdiction, the Court rules (Pt 3 rule 3.7 of

the Land and

Environment Court Rules 2007) provide that the Court is not to

order payment of costs unless the Court considers that an order for the whole

or any part of the costs is fair and reasonable in the circumstances. What

is ‘fair and reasonable’ depends on the circumstances of each individual

case. No costs order has been made.

Council is seeking to recover the legal costs incurred

relating to an unsuccessful Notice of Motion brought by the Butler Street

Community Network. The total of these legal costs is $22,665 (ex GST). In

delivering judgement on the Notice of Motion the Judge reserved the question of

costs.

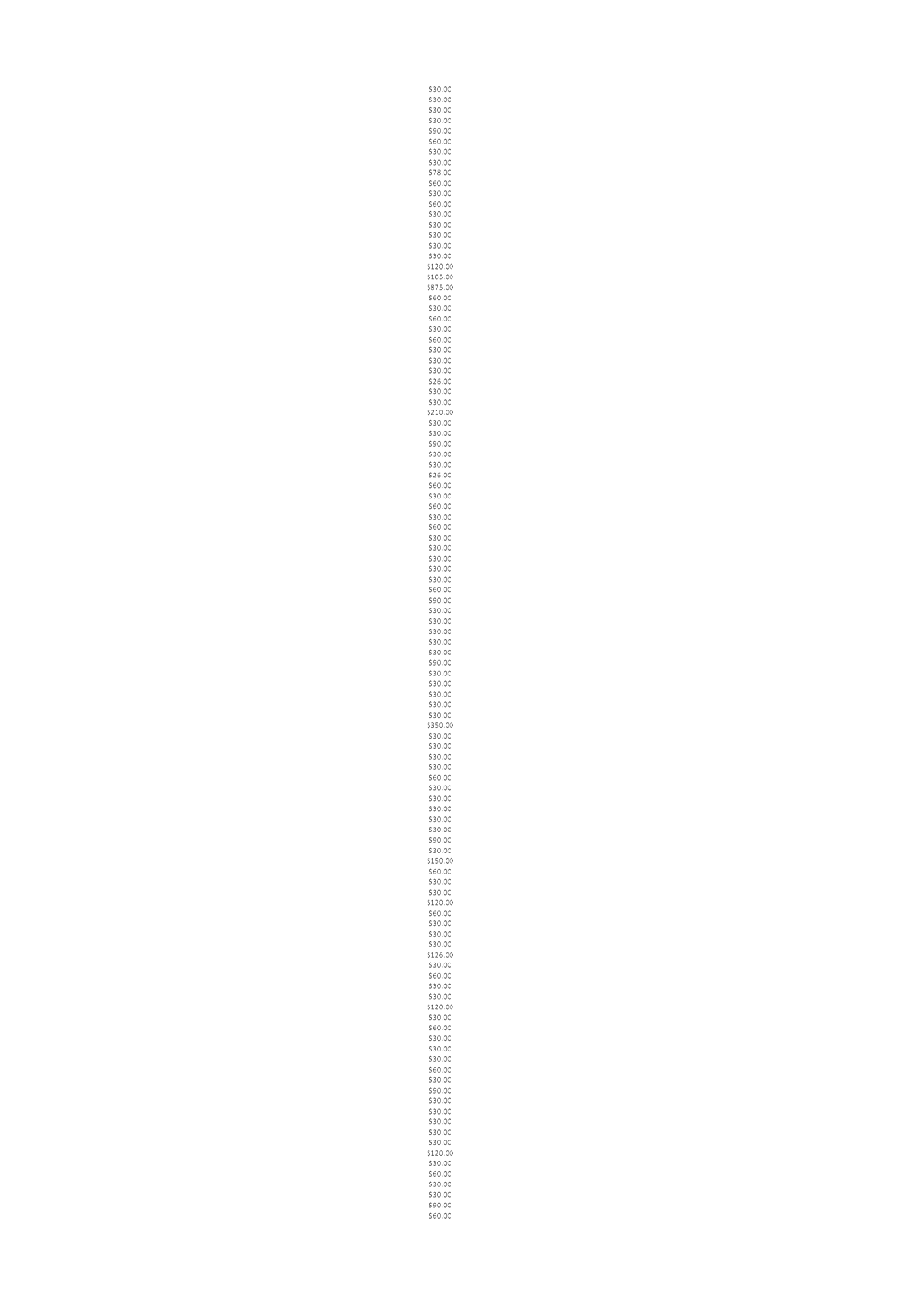

Financial Implications

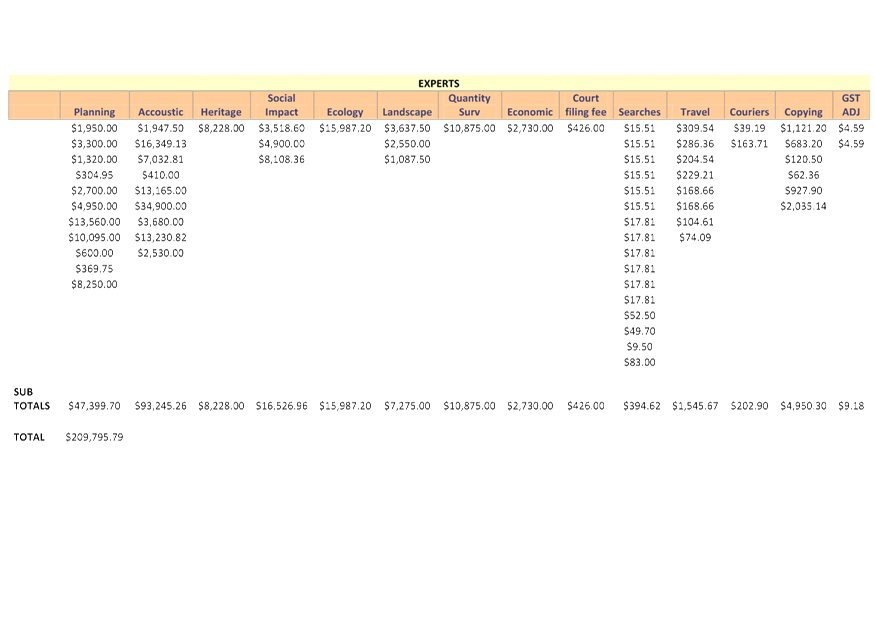

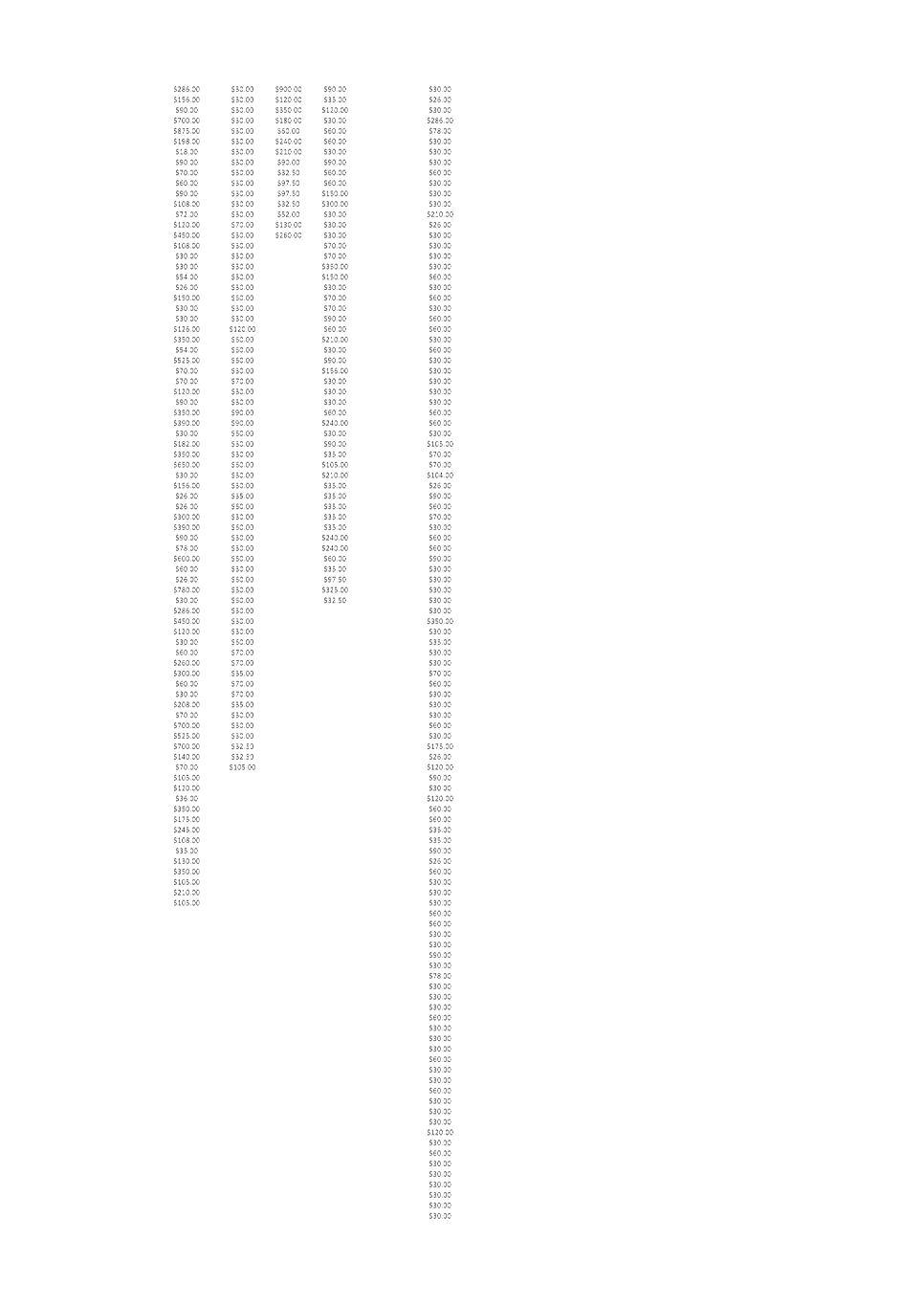

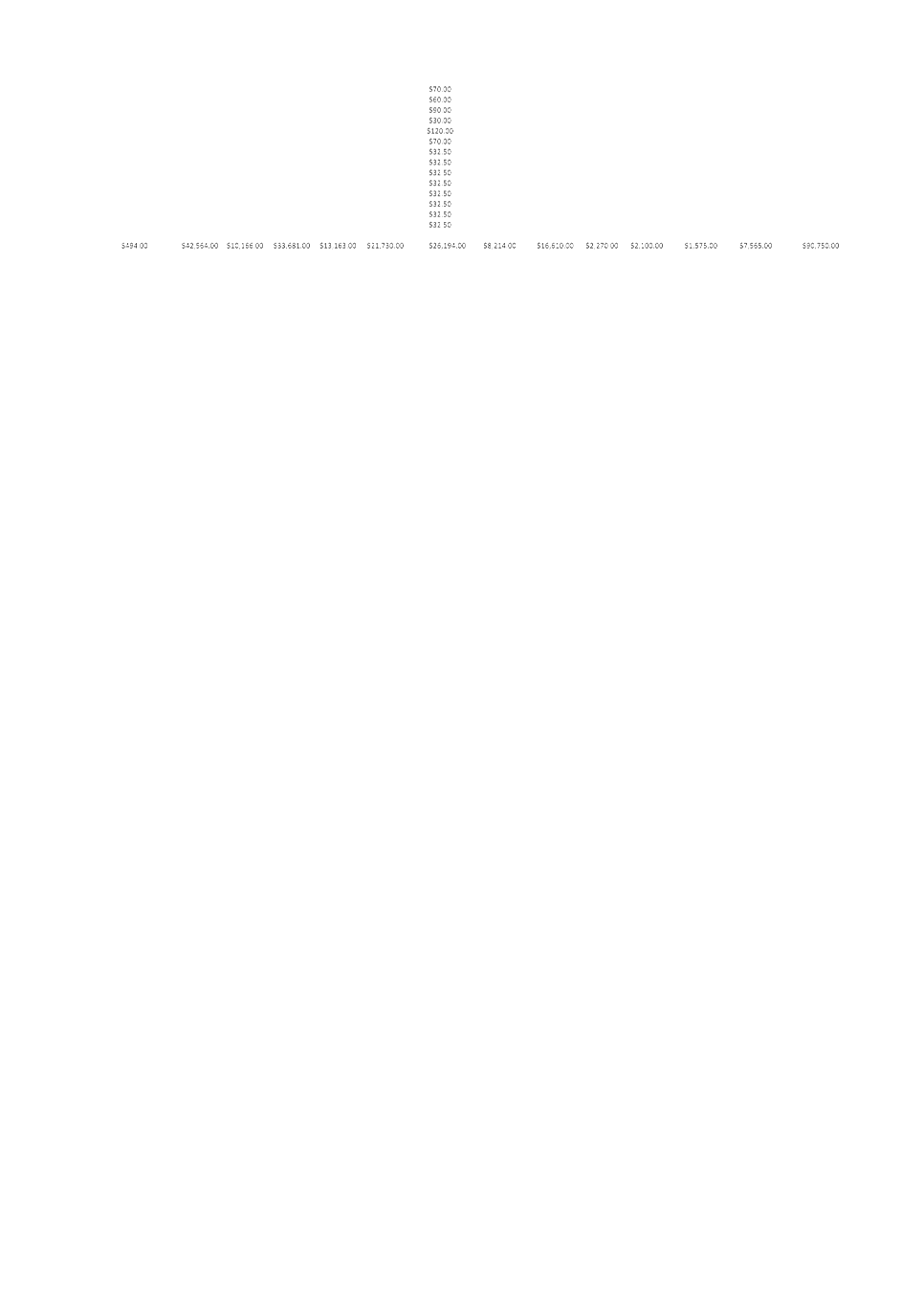

A breakdown of the costs incurred is as follows:

Solicitor’s

$149,002.00

Fees

(spreadsheet columns C, D, F,

G, I, J, K, L, M and N)

Solicitor’

disbursements

$36,854.00

(spreadsheet columns B, D and

H)

Sub

total

$185,856.00

Counsel

Fees

$90,750.00

Experts

Fees

$202,267.12

Expert’s

disbursements

$7528.67

Sub total

experts

$209795.79

TOTAL

$486,401.79

The most complex area of expertise in the proceedings was in

respect of acoustics. That explains the amount of fees paid in that discipline

as opposed to other disciplines.

Statutory and Policy Compliance Implications

Nil

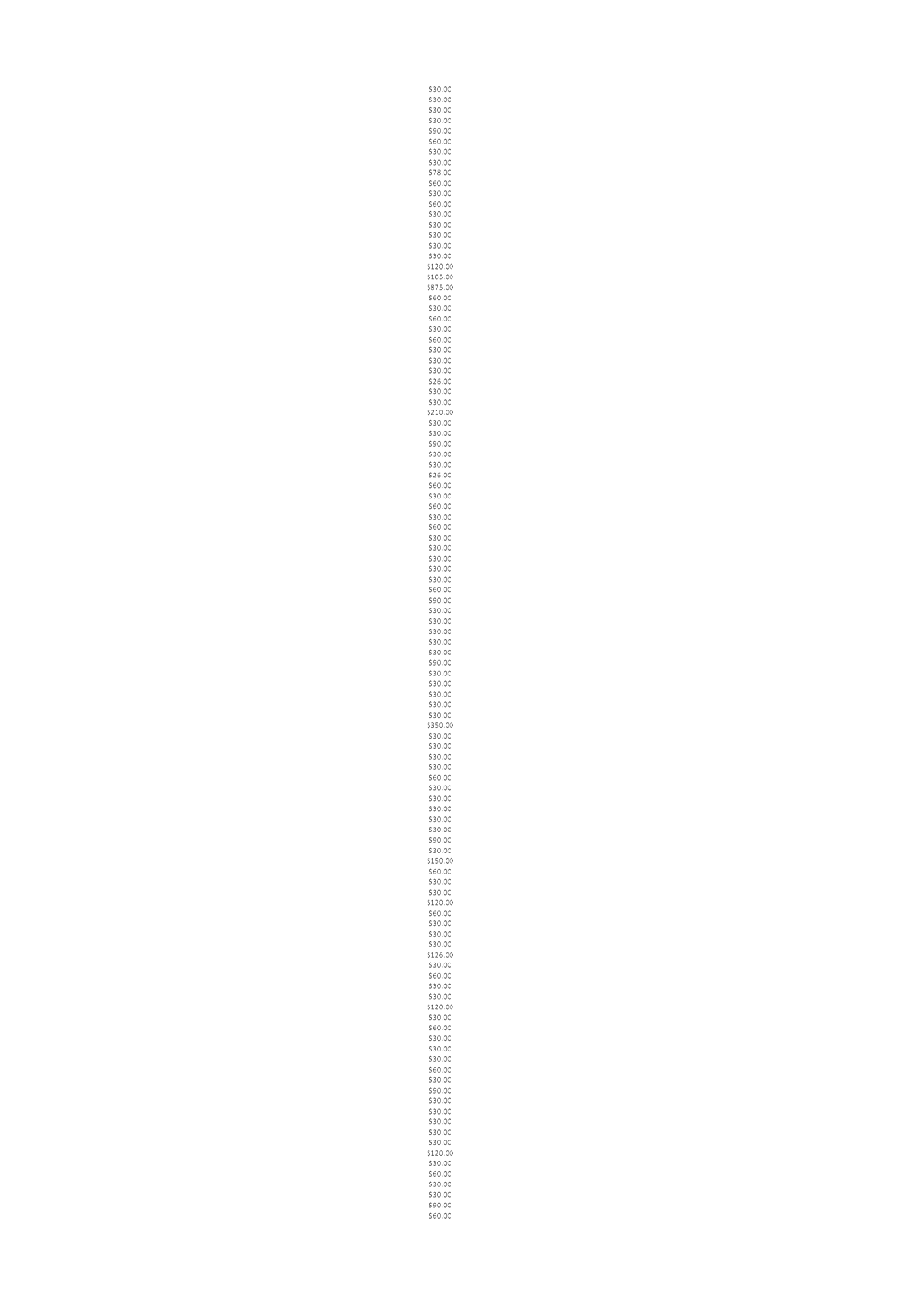

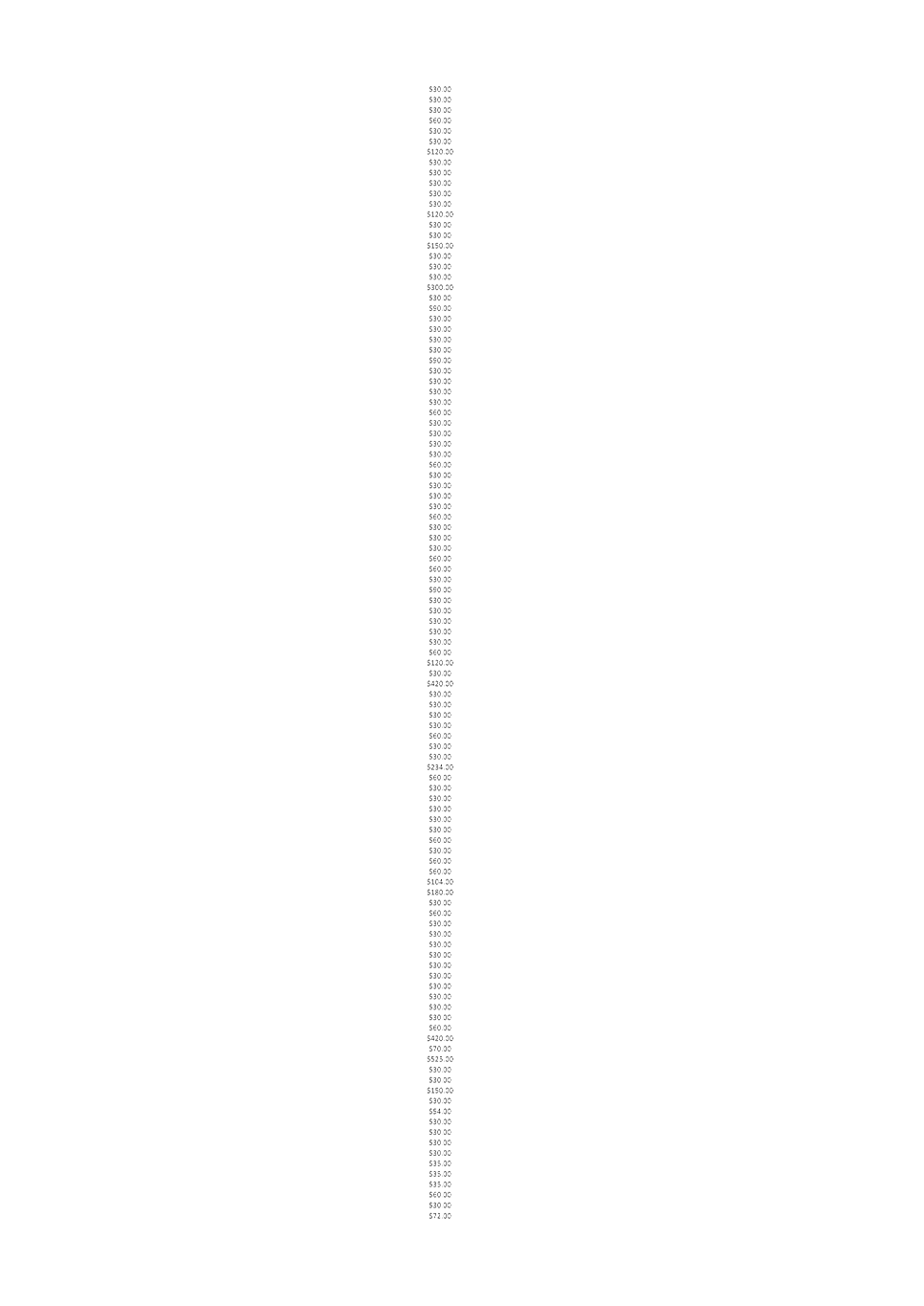

Staff Reports - Corporate and Community Services 4.5 - Attachment 1

Staff Reports - Corporate and Community Services 4.5 - Attachment 2