Finance Advisory Committee Meeting

A Finance Advisory Committee Meeting of

Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 16 November 2017

|

|

Time

|

2.00pm

|

Mark Arnold

Director Corporate and Community Services I2017/1738

Distributed 10/11/17

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a member

of a Council Committee who has a pecuniary interest in any matter with which

the Council is concerned and who is present at a meeting of the Council or

Committee at which the matter is being considered must disclose the nature of

the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

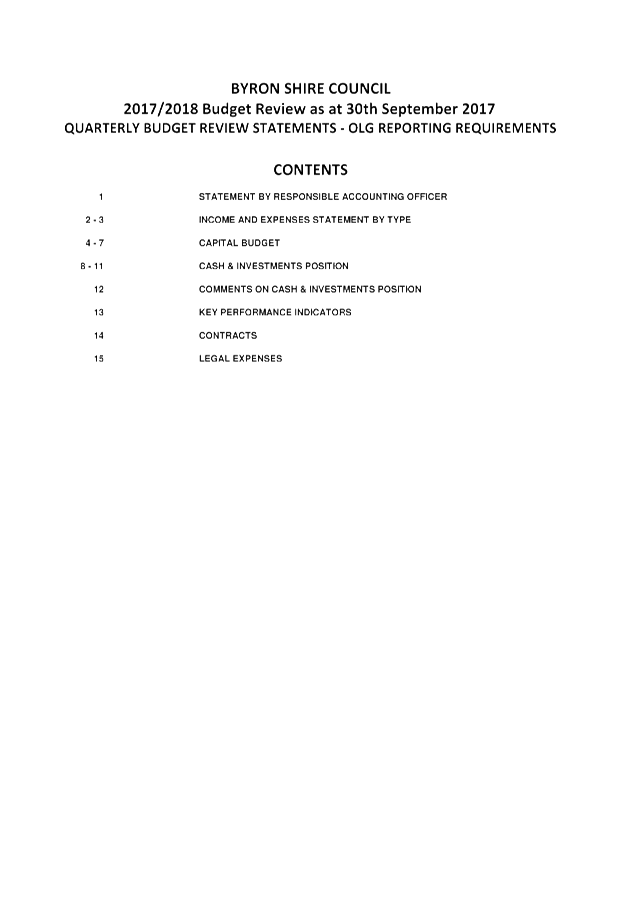

Finance Advisory Committee Meeting

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Finance

Advisory Committee Meeting held on 17 August 2017

4. Staff Reports

General Manager

4.1 Notice

of Motion - Distribution of Paid Parking Income for the Benefit of Rural Communities 4

Corporate and Community Services

4.2 Draft

Financial Sustainability Plan 2017/2018................................................................... 5

4.3 Unrestricted

Cash and Reserves at 30 June 2017......................................................... 46

4.4 Quarterly

Update - Implementation of Special Rate Variation (SRV)............................ 53

4.5 Council

Budget Review - 1 July 2017 to 30 September 2017........................................ 57

Staff Reports - General Manager 4.1

Staff Reports - General Manager

Report No. 4.1 Notice

of Motion - Distribution of Paid Parking Income for the Benefit of Rural

Communities

Directorate: General

Manager

Report

Author: David

Royston-Jennings, Corporate Governance Officer

File No: I2017/1737

Theme: Corporate Management

Financial Services

|

I move that Council determine an equitable methodology

for distribution of paid parking income for the benefit of rural communities.

|

Signed: Cr

Basil Cameron

Staff Reports - Corporate and Community Services 4.2

Staff Reports - Corporate and Community

Services

Report No. 4.2 Draft

Financial Sustainability Plan 2017/2018

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/1719

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary meeting held on 9 May

2013 adopted a Financial Sustainability Plan (“FSP”) for the

2013/2014 financial period (refer Resolution 13-238).

This was the initial FSP developed and adopted

by Council, and was prepared in accordance with part 3 of Council Resolution

13-148, to provide a strategic approach to the management of the Financial

Sustainability of Council.

Resolution 13-148, adopted by the

Strategic Planning Committee Resolution at its meeting held on 28 March 2013,

provided the framework for the development the FSP.

The FSP provides a means for Council to

communicate with the community on proposed reforms and actions to manage the financial sustainability of the organisation in the

short, medium and long term.

This report has been prepared to allow the Finance Advisory

Committee to consider the fifth version of the Financial

Sustainability Plan for the 2017/2018 financial period.

|

RECOMMENDATION:

That the Finance Advisory Committee recommend to

Council:

That Council adopt the Draft Financial Sustainability

Plan 2017/2018 (#E2017/104429)

|

Attachments:

1 DRAFT

Financial Sustainability Plan 2017 18, E2017/104429

, page 9⇩

Report

This report has been prepared to allow the Finance Advisory

Committee to consider the draft “Financial

Sustainability Plan 2017/2018” (“FSP 2017/2018”).

The FSP 2017/2018 is the fifth version of

the FSP prepared for consideration by Council.

The first version of the FSP, FSP 2013/2014

was adopted by Council on 9 May 2013 via Resolution 13-238.

The second version of the FSP, FSP

2014/2015 was adopted by Council on 7 August 2014 via Resolution 14-326.

The third version of the FSP, FSP 2015/2016

was adopted by Council on 15 December 2015 via Resolution 15-606.

The fourth version of the FSP, FSP

2016/2017 was adopted by Council on 2 February 2017 via resolution 17-011.

During the course of the 2016/2017

financial year, work on the implementation of the actions detailed in the

individual chapters of the 2016/2017 FSP was undertaken, with the outcomes

progressively reported to the Finance Advisory Committee on a quarterly basis

on 16 February 2017 and 18 May 2017, with the final report for the 2016/2017

financial year submitted to the FAC meeting held 17 August 2017.

The FSP 2017/2018 has been developed using

a similar format to that of FSP 2016/2017 but has been amended to reflect the

actions undertaken and the impact of the outcomes from these actions on the

future strategic management of Council’s financial sustainability.

The relevant chapters in the FSP 2017/2018

have been prepared to capture the outcomes from the 2016/2017 financial year as

well detail what is proposed for the 2017/2018 financial year.

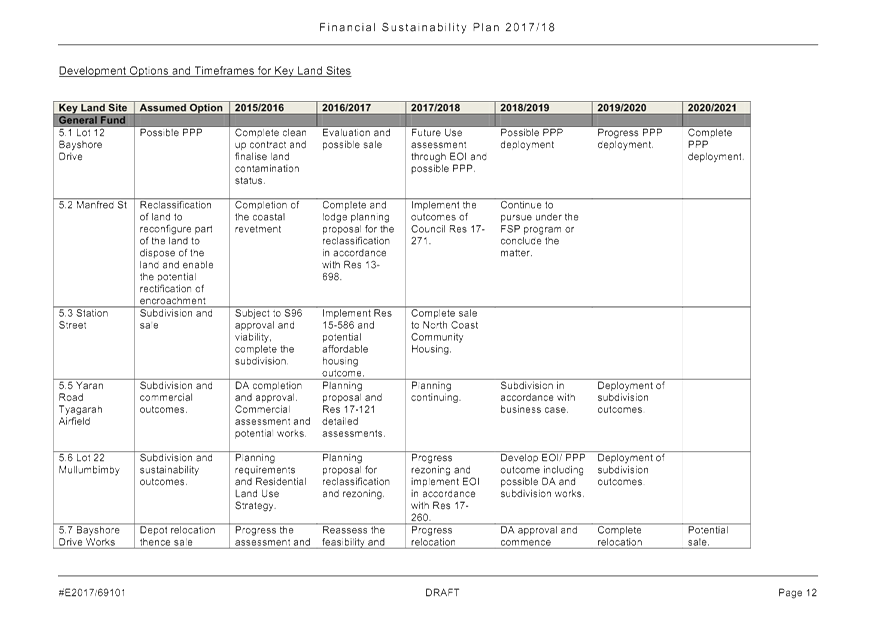

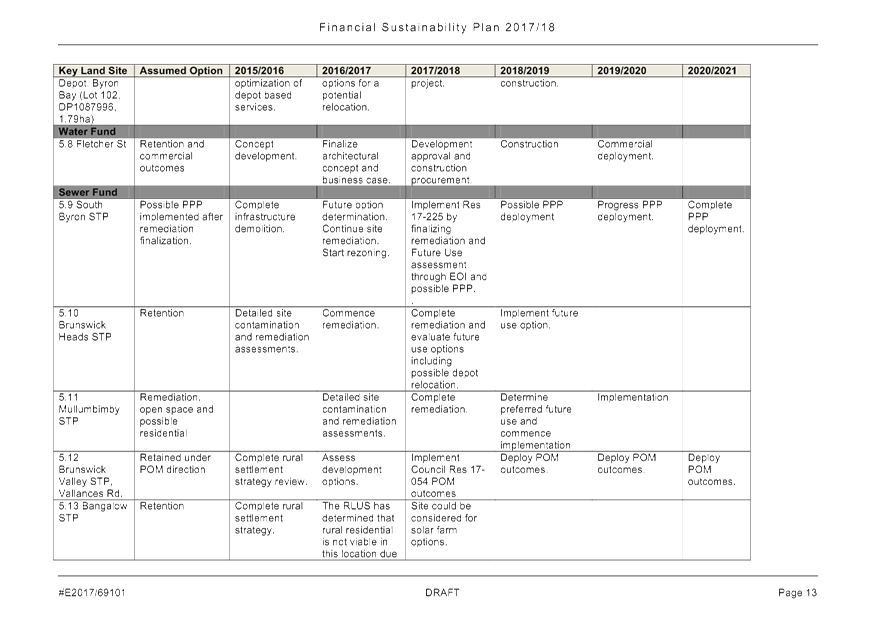

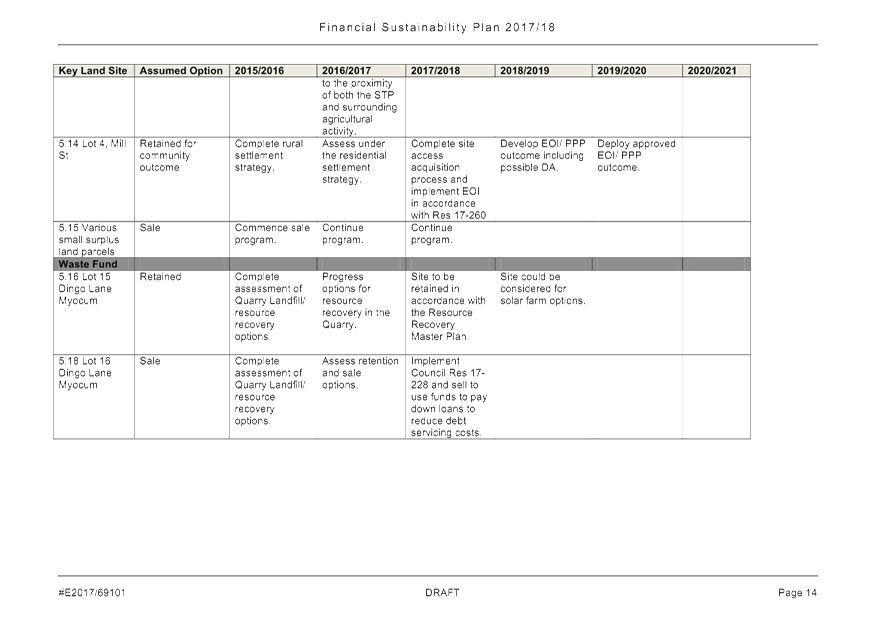

The Action Plan is a summary of the actions

detailed in the FSP for the following chapter areas:

· Expenditure

Review

· Revenue

Review

· Land Review

and Property Development

· Strategic

Procurement

· Policy and

Decision Making

· Volunteerism

· Collaborations,

Partnerships and Commercial Opportunities

· Asset

Management

· Long Term

Financial Planning

· Environmental

Projects

· Continuous

Improvement

· Financial

Performance Indicators

The Action Plan will be completed and included in the

2017/2018 FSP when adopted by Council and will be developed from the Actions

included in each Chapter. The Action Plan will then be reported to the FAC each

quarter starting with the December quarter.

Financial Implications

The draft “Financial

Sustainability Plan 2017/2018” forms part of the strategic approach

adopted by Council in managing the short, medium long term sustainability of

Council.

The Plan needs to be considered in context

with the adopted annual Operational Plan, the Quarterly Budget Reviews and the

Long Term Financial Plan when Council is considering the financial impacts of

specific activities, projects and Services.

Part 2 of Resolution 13-148 requires

the General Manager to prepare reports on specific elements of sustainability reform package detailed in the FSP, including any rationalisation

of Council's property portfolio and the associated establishment of an

Infrastructure Renewal Fund. The Infrastructure Renewal Fund was established by

Council by Resolution 13-170 and the terms of operation for this Reserve

were adopted by Council on 9 May 2013 via Resolution 13-239.

In accordance with Part 4 of Resolution 13-148

the General Manager will continue to prepare and submit progress reports on the

implementation of the draft “Financial

Sustainability Plan 2017/2018” to the Council's Finance Committee on

a quarterly basis.

Statutory and Policy Compliance Implications

The FSP has been developed as a tool to assist Council in

its ongoing obligations as defined in Chapter 3 (Principles for local

government) of the Local Government Act 1993.

Section 8A of the Local Government 1993 provides that

Council as part of its Guiding Principles consider the following:

(1) Exercise of functions

generally

The following general principles apply to the exercise of functions by

councils:

(a) Councils should

provide strong and effective representation, leadership, planning and

decision-making.

(b) Councils should

carry out functions in a way that provides the best possible value for

residents and ratepayers.

(c) Councils should

plan strategically, using the integrated planning and reporting framework, for

the provision of effective and efficient services and regulation to meet the diverse

needs of the local community.

(d) Councils should

apply the integrated planning and reporting framework in carrying out their

functions so as to achieve desired outcomes and continuous improvements.

(e) Councils should

work co-operatively with other councils and the State government to achieve

desired outcomes for the local community.

(f) Councils should

manage lands and other assets so that current and future local community needs

can be met in an affordable way.

(g) Councils should

work with others to secure appropriate services for local community needs.

(h) Councils should act

fairly, ethically and without bias in the interests of the local community.

(i) Councils should be

responsible employers and provide a consultative and supportive working

environment for staff.

(2) Decision-making

The following principles apply to decision-making by councils (subject to any

other applicable law):

(a) Councils should

recognise diverse local community needs and interests.

(b) Councils should consider

social justice principles.

(c) Councils should

consider the long term and cumulative effects of actions on future generations.

(d) Councils should

consider the principles of ecologically sustainable development.

(e) Council

decision-making should be transparent and decision-makers are to be accountable

for decisions and omissions.

(3) Community participation

Councils should actively engage with their local communities, through the use

of the integrated planning and reporting framework and other measures.

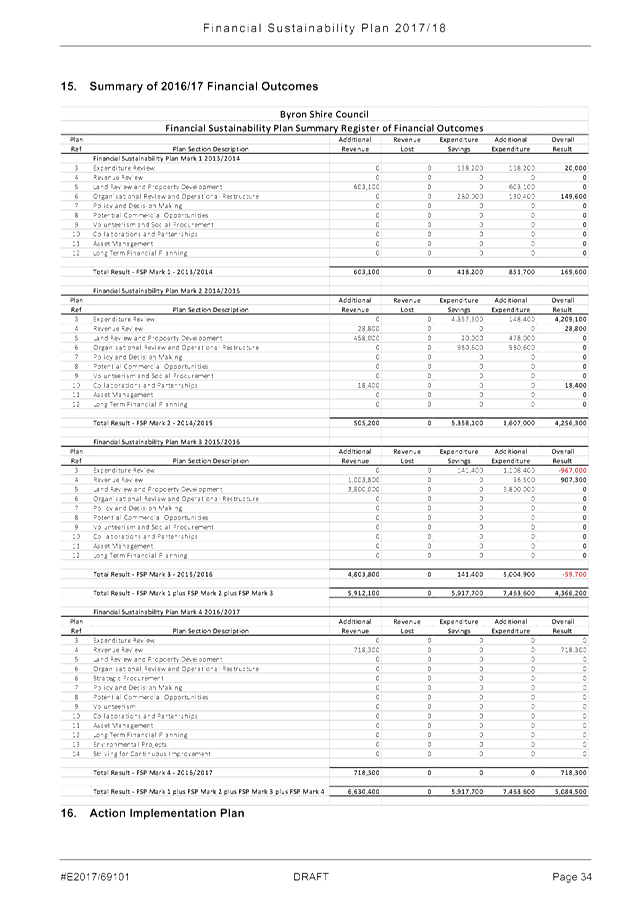

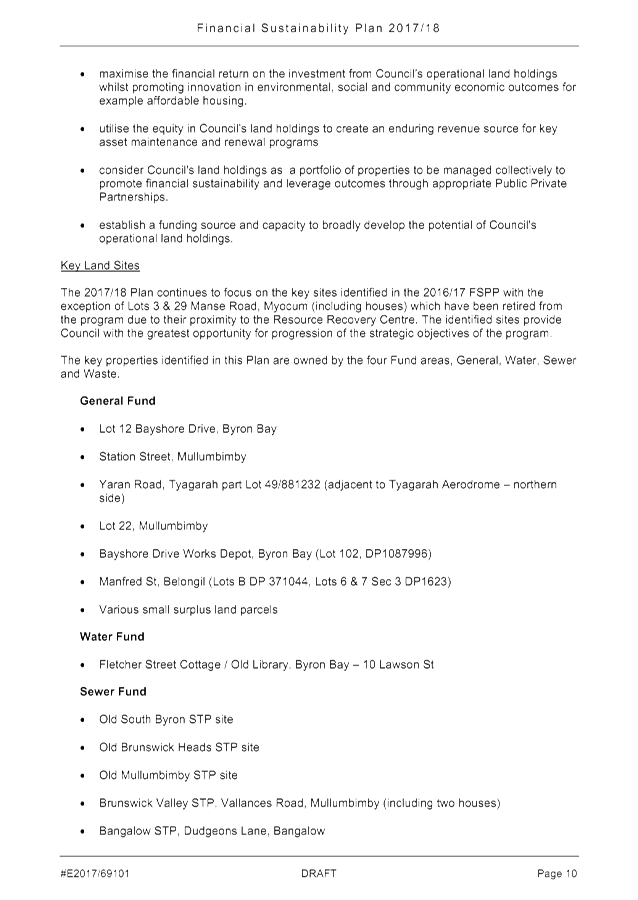

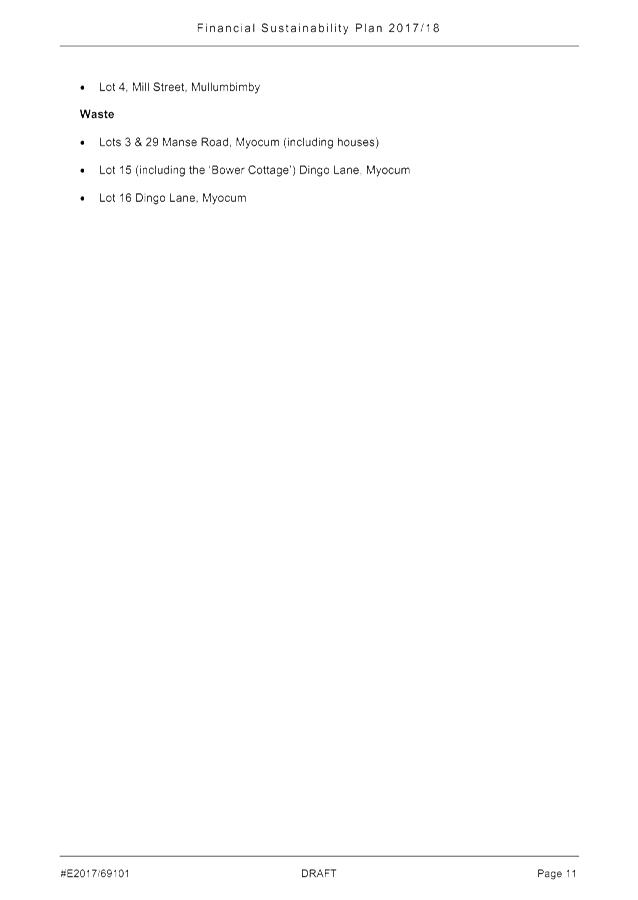

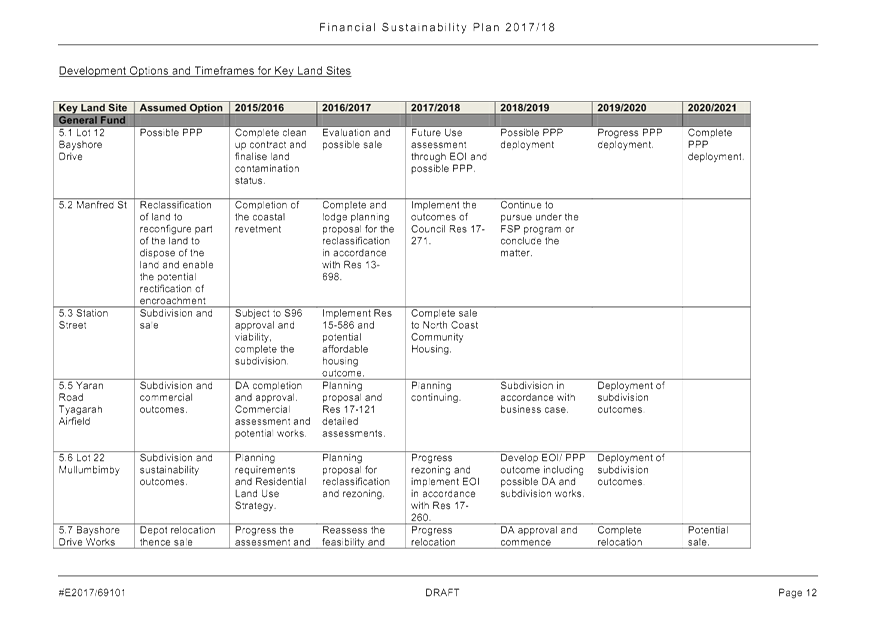

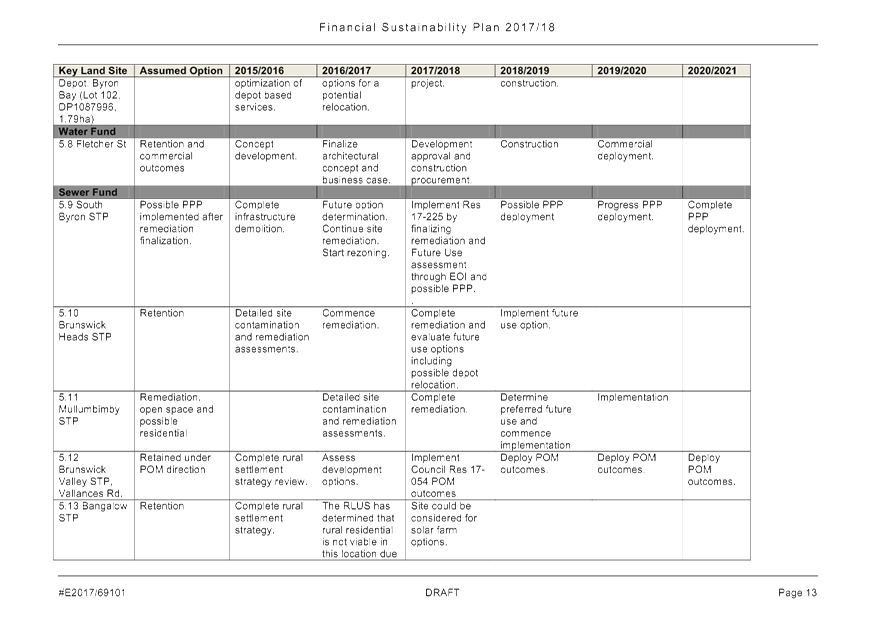

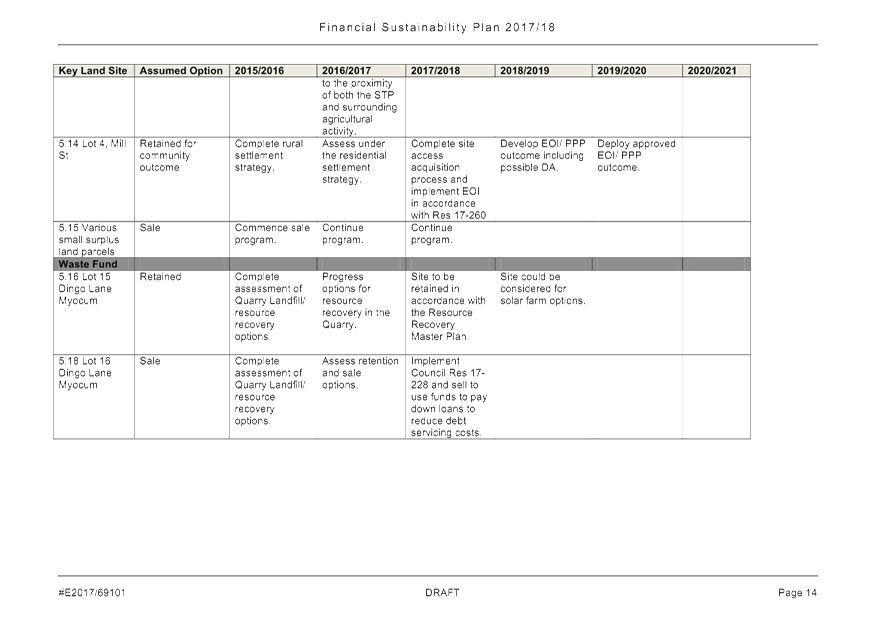

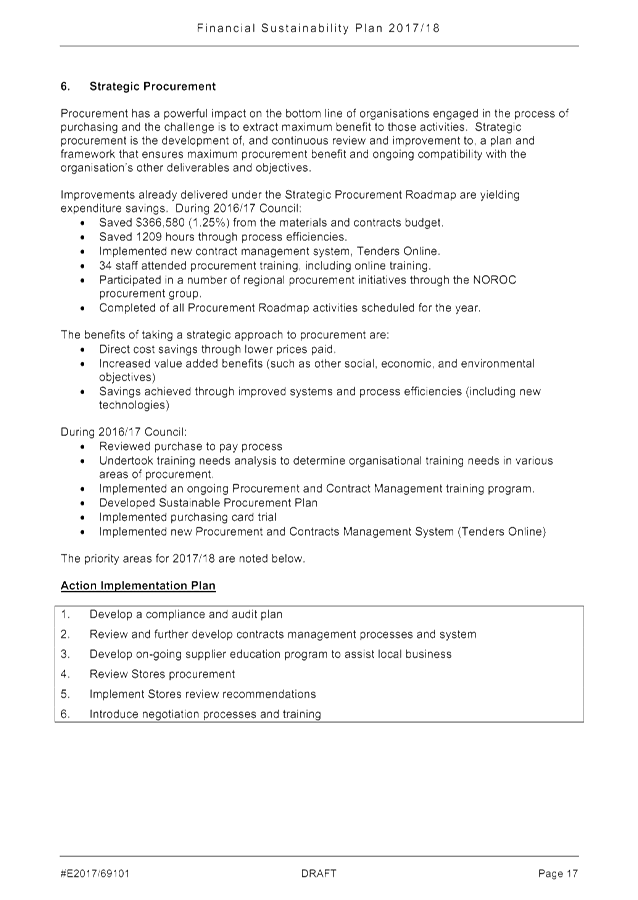

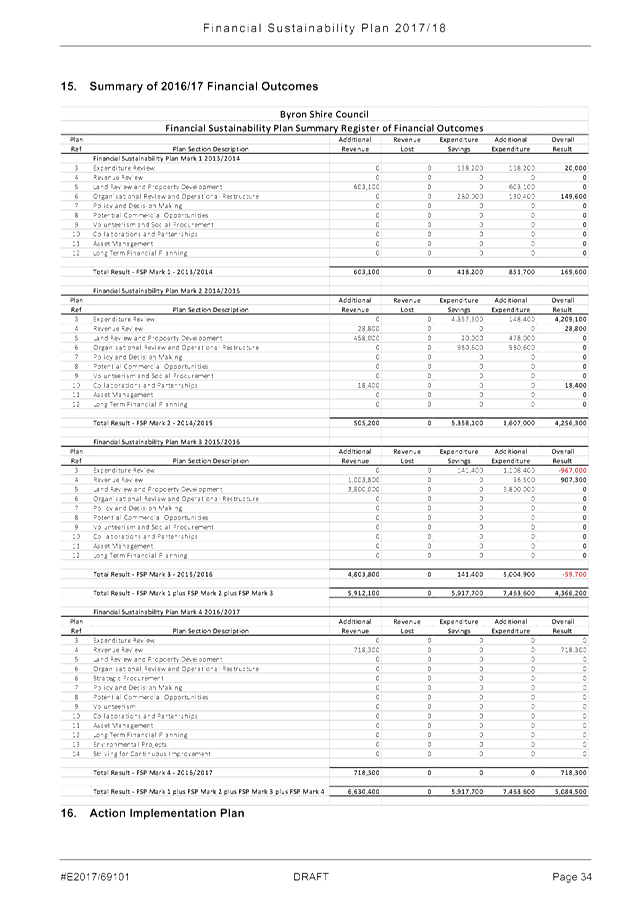

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

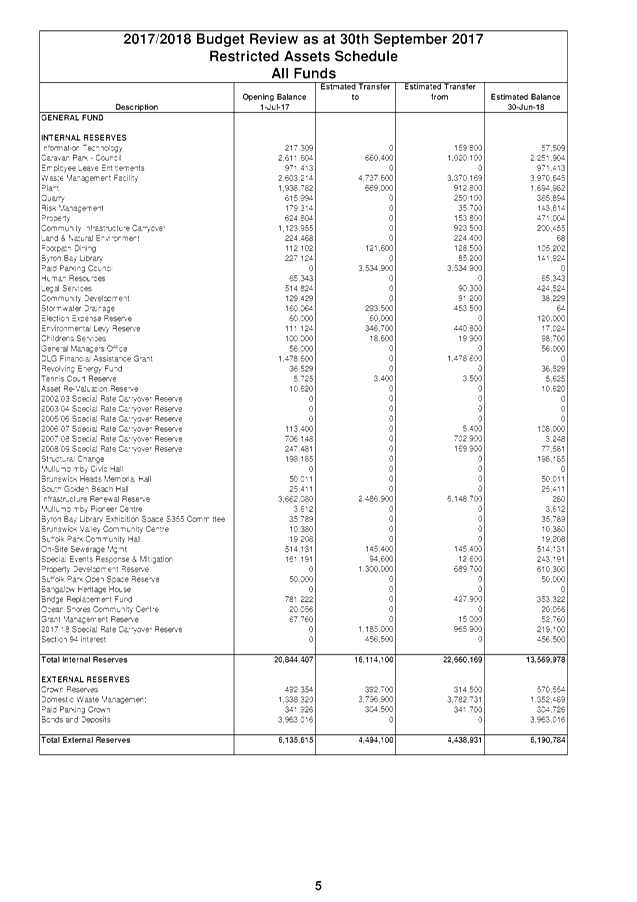

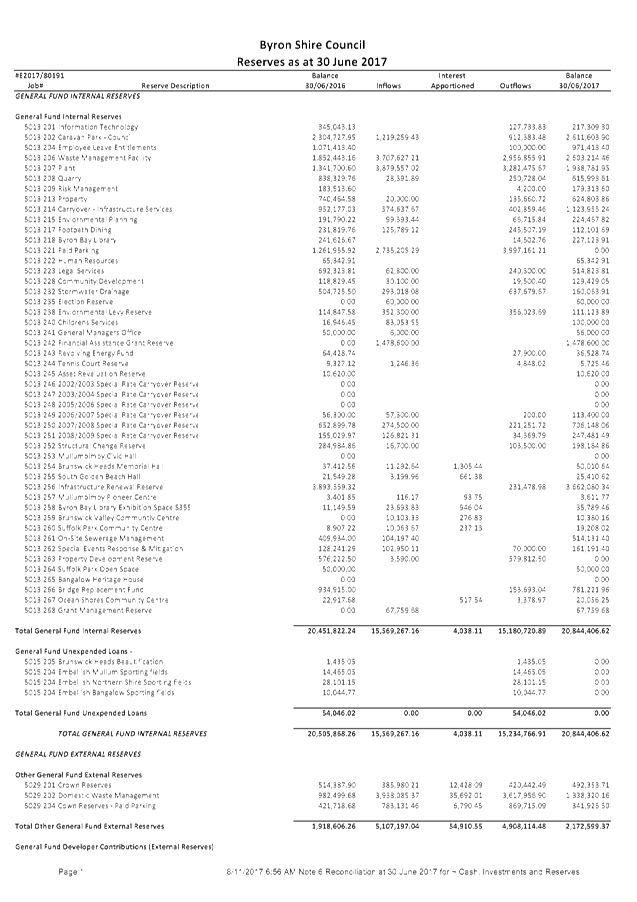

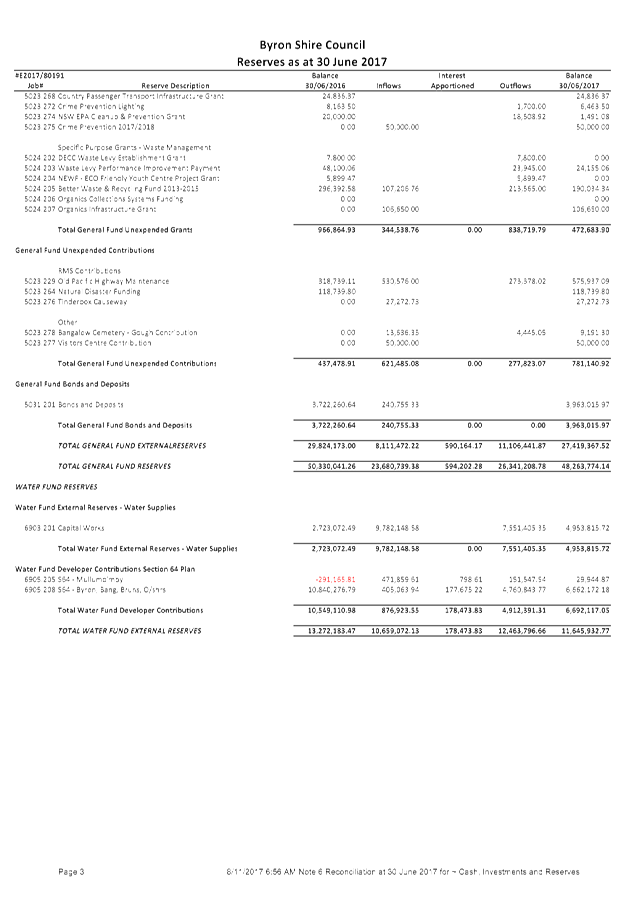

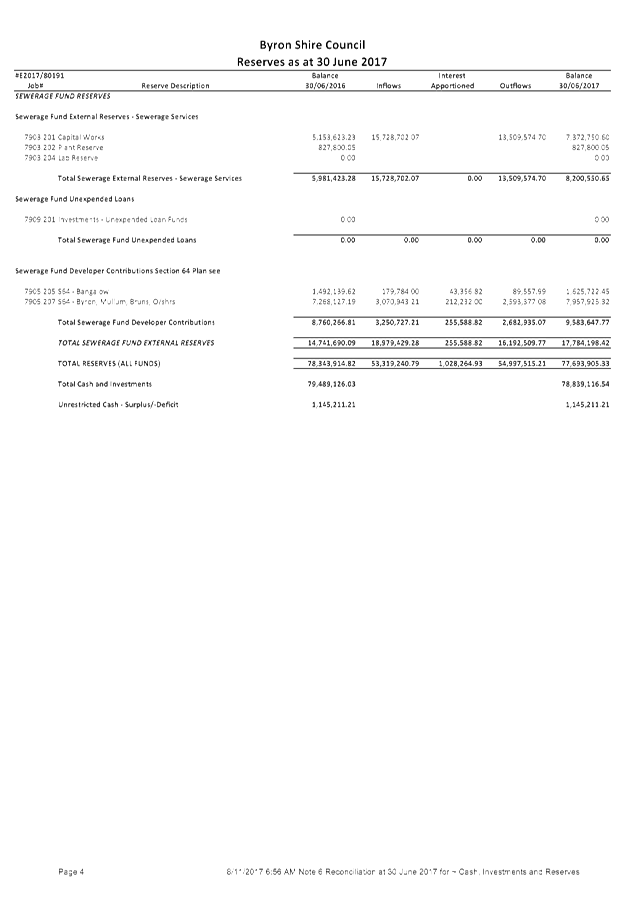

Staff Reports - Corporate and Community Services 4.3

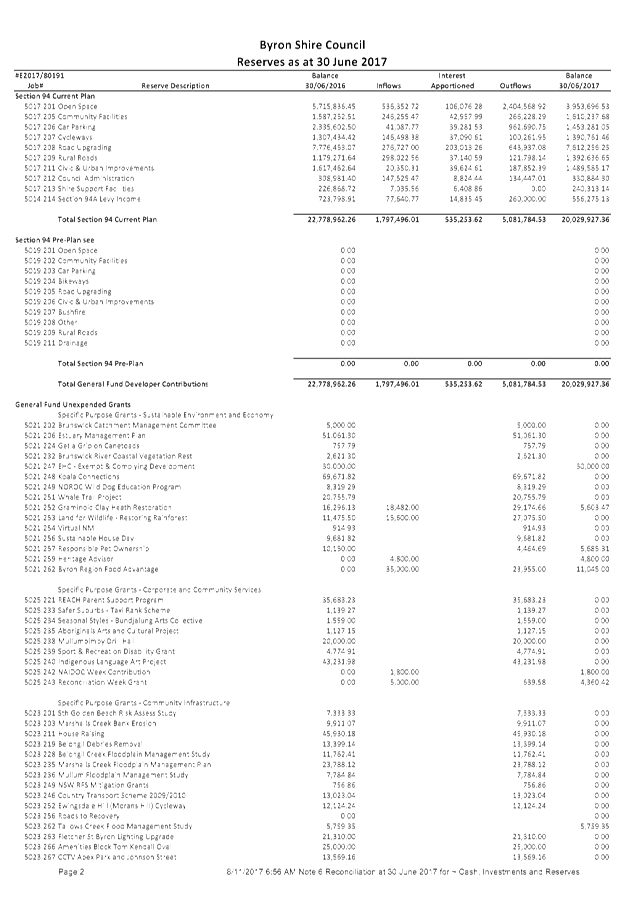

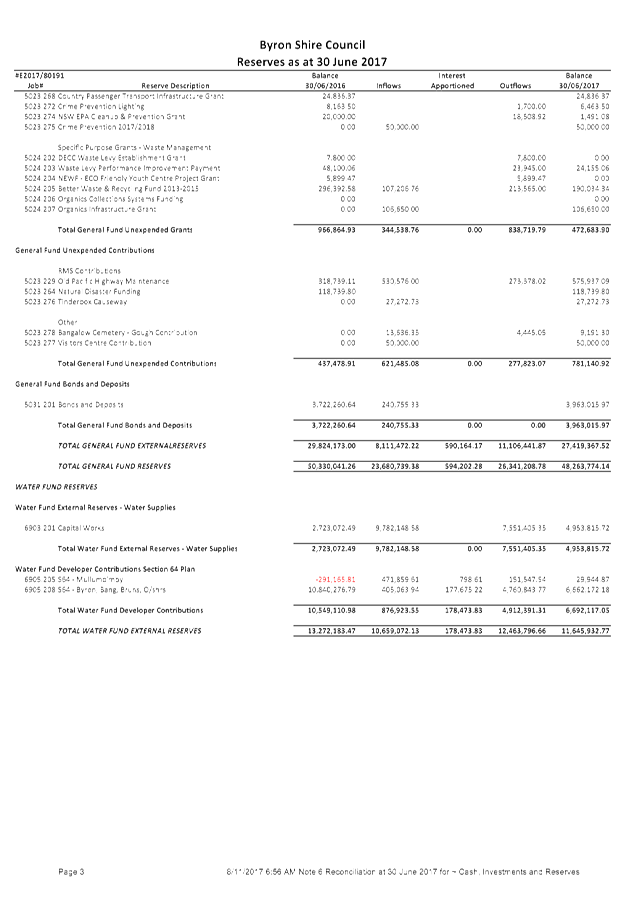

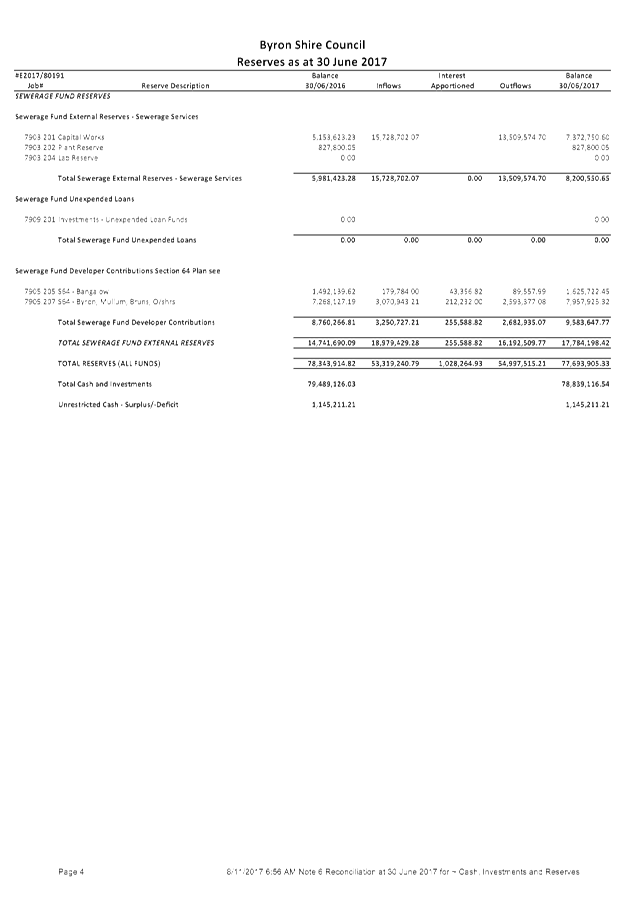

Report No. 4.3 Unrestricted

Cash and Reserves at 30 June 2017

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/1720

Theme: Corporate Management

Financial Services

Summary:

This report has been prepared to allow the Finance Advisory

Committee to note the Reserve Balances as at 30 June 2017.

Council at its Ordinary Meeting held on 26 October 2017

adopted the 2016/2017 Financial Statements (Resolution: 17-449) that

incorporate the results indicated in this report.

|

RECOMMENDATION:

1. That

the Reserve Balances as outlined in Attachment 1 (#E2017/103622) at 30

June 2017 be noted by the Finance Advisory Committee.

2. That

the Unrestricted Cash Balance of $1,145,200 as at 30 June 2017 be noted by

the Finance Advisory Committee.

|

Attachments:

1 2016/2017

Reserves Schedule, E2017/103622 ,

page 49⇩

Report

This report has been prepared to allow the Finance Advisory

Committee to note the Reserve Balances as at 30 June 2017 and the Unrestricted

Cash Balance at 30 June 2017 as an indicator of Council’s liquidity

position.

Council at its Ordinary Meeting held on 26 October 2017

adopted the 2016/2017 Financial Statements (Resolution 17-449) that

incorporate the results indicated in this report.

Liquidity in terms of Council being able to fulfil its short

term financial commitments is critical and an indicator in the short term of

Council’s financial health. There is no set indicator that is

absolutely used to identify the liquidity position of a Council, however there

are the following indicators:

· Unrestricted Cash

– this represents the total available cash and investments Council has,

that is not restricted for any reason either by legislation, condition or

Council resolution. This amount is determined at 30 June each year and

disclosed at note 6(c) of Council’s annual Financial Statements. It is

calculated by deducting from total cash and investments held the total amount

of internal and external restrictions or reserves.

· Unrestricted

Current Ratio – this ratio assesses the short term adequacy of working

capital. It compares unrestricted current assets to unrestricted current

liabilities. Any ratio that has at least $1.50 of unrestricted current

assets to each $1 of unrestricted current liabilities is generally considered

satisfactory. This indicator is determined at 30 June each year and

disclosed at note 13(a) of Council’s annual Financial Statements.

This indicator is usually provided on a consolidated basis ie amalgamating all

of Council’s General, Water and Sewerage Funds. However since the

2009/2010 financial year, Councils are now required to calculate this ratio and

other ratios by Fund for additional disclosure as outlined in note 13(b) of

Council’s annual Financial Statements. On a consolidated basis at 30 June

2017, Council had $3.20 of unrestricted current assets to each $1 of unrestricted

current liabilities.

· Cash Expense Cover

Ratio – this indicator commenced disclosure from the 2013/2014 financial

year that is disclosed at note 13(a) of Council’s annual Financial

Statements. It measures the number of months Council would be able to pay

its immediate expenses without additional cash inflow. The benchmark for

this ratio is 3 months and at 30 June 2017, Council was at 14.32 months.

Unrestricted Cash Balance

The Unrestricted Cash Balance disclosed in the Financial

Statements indicates that as at 30 June 2017 an amount of $1,145,211, the same

amount that was available in 2015/2016. This means that all cash and

investments held by Council of $78,839,117 as at 30 June 2017 were restricted

for a purpose by legislation, funding condition or Council resolution except

for $1,145,211.

Council at its Ordinary Meeting held on 8 August 2013

adopted an Unrestricted Cash Balance target of $1,000,000 for the General Fund

as a measure of its short term unrestricted liquidity from 1 July 2013

(Resolution: 13-378). Council’s other funds being Water and

Sewerage will always have a $0 (Nil) Unrestricted Cash Balance given the

legislative requirements of water and sewerage revenues which requires and

unexpended funds to be reserved as an external restriction. Any reported

Unrestricted Cash Balance will always relate to the General Fund.

It was a pleasing outcome that Council was able to maintain

an Unrestricted Cash Balance in the General Fund at 30 June 2017 that exceeded

its adopted target of $1,000,000.

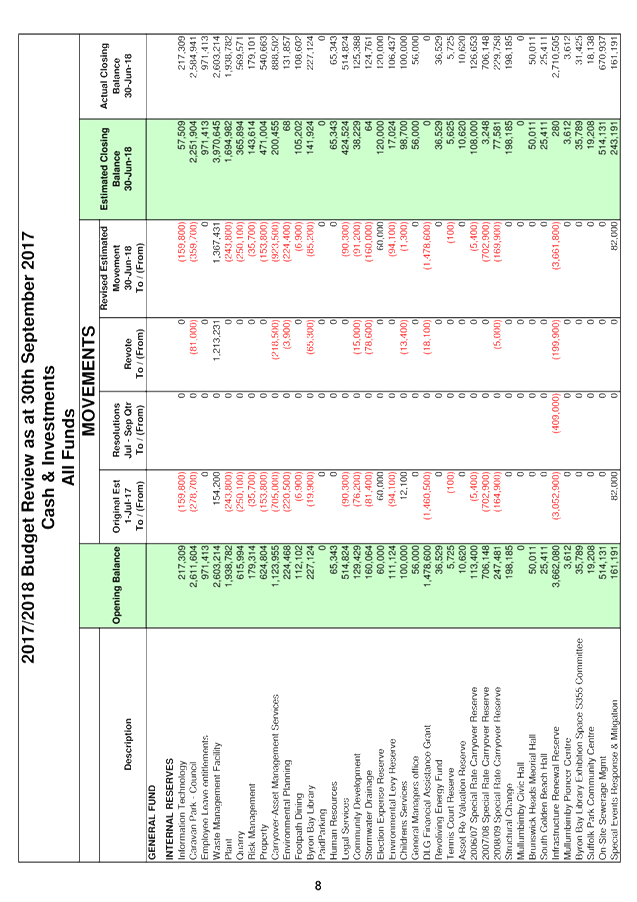

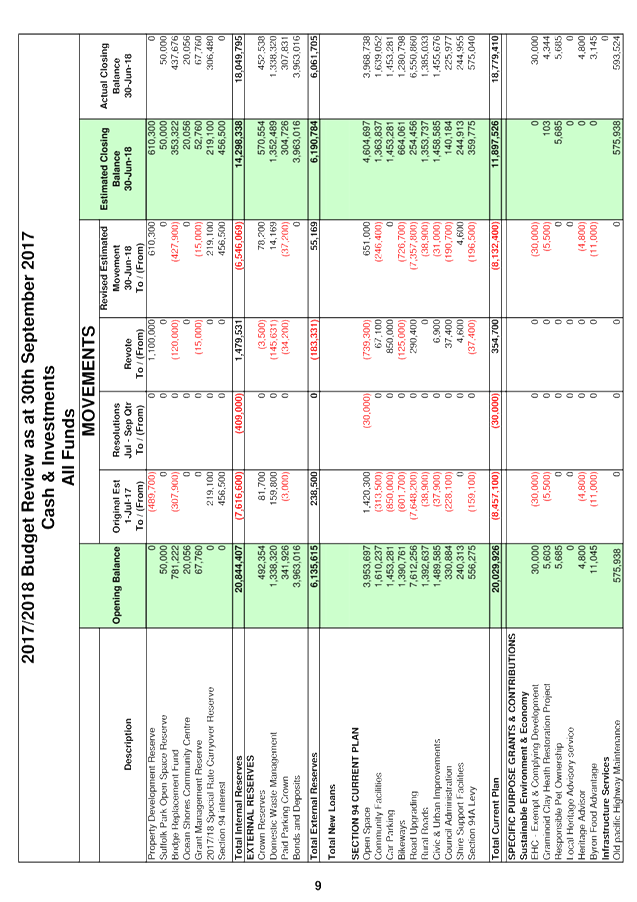

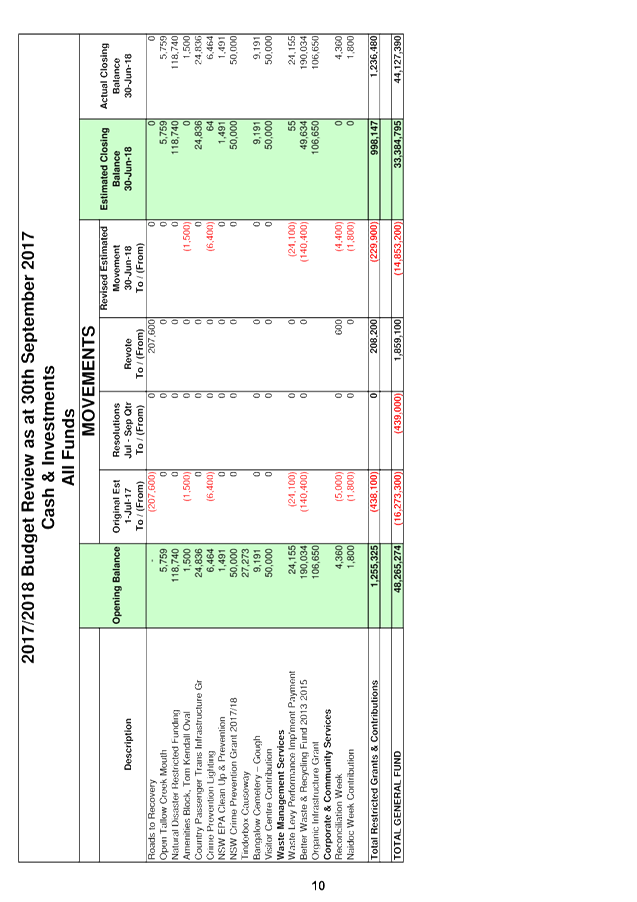

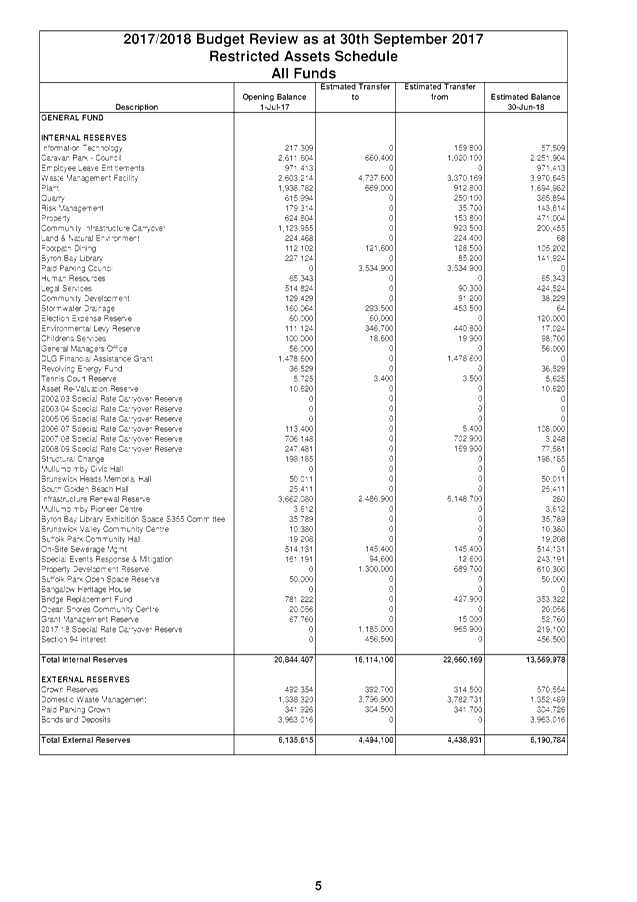

Reserves

Detailed at Attachment 1 is a listing of Council’s

cash funded reserves. Contained in this listing is the detail of and

value as at 30 June 2017 of the various reserve types. Reserve types are

broken down into the following components:

· External

Restrictions – these reserves relate to unexpended grants, developer

contributions, bonds and deposits, unexpended loans (non-General Fund), Crown

reserves, domestic waste management, water, sewerage and Roads and Maritime

Services (RMS) contributions unexpended.

· Internal

restrictions – these are reserves set by Council for specific purposes

that are not required to be restricted for external reasons ie legislation,

condition etc. These reserves though are generally created to isolate

self-financing activities and their accumulated funds or if Council by

resolution wants funds specifically set aside. Examples of internal

restrictions are also listed in Attachment 1 and also in note 6(c) to

Council’s annual Financial Statements.

In summary, as at 30 June 2017 detailed in Note 6(c) to the

annual Financial Statements are the following values relating to reserves

restricted against available cash and investments:

· Total available cash and

investments $78,839,117

· Total external restrictions

(reserves) $56,849,499

· Total internal restrictions

(reserves) $20,844,407

· Total unrestricted cash and

investments $1,145,211.

It is appropriate that Council consider its reserves which

are restricted against available cash and investments and resolve by resolution

to adopt their description and value. By default this occurred when

Council adopted the 2016/2017 Financial Statements at its Ordinary Meeting held

on 26 October 2017. Council further reviews the position of held reserves

through setting the annual budget and subsequent reviews of the budget at each

quarterly budget review.

Financial Implications

There are no direct financial implications associated with

this report. the report is identifying to the Finance Advisory Committee the

overall liquidity and reserves position of Council at 30 June 2017 for

information.

Statutory and Policy Compliance Implications

The requirement of Council to restrict aspects of its

available cash and investments follows from the requirement to maintain

appropriate accounting records to verify the expenditure of funds and

recognition of funds required to be detailed as unexpended. This is a

canvassed by the Local Government Code of Accounting Practice and Financial

Reporting (as amended) upon which Council must adhere to as outlined Section

413(3) of the Local Government Act 1993 and Regulation 214 of the Local

Government (General) Regulation 2005.

Section 409 of the Local Government Act 1993 and Regulation

205 of the Local Government (General) Regulation also outline conditions on the

use of funds received by Council.

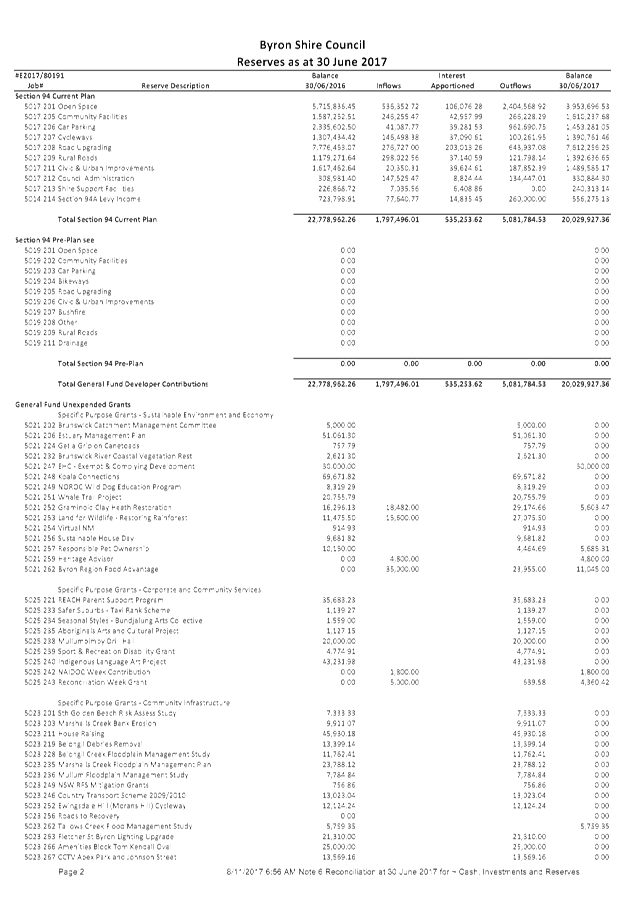

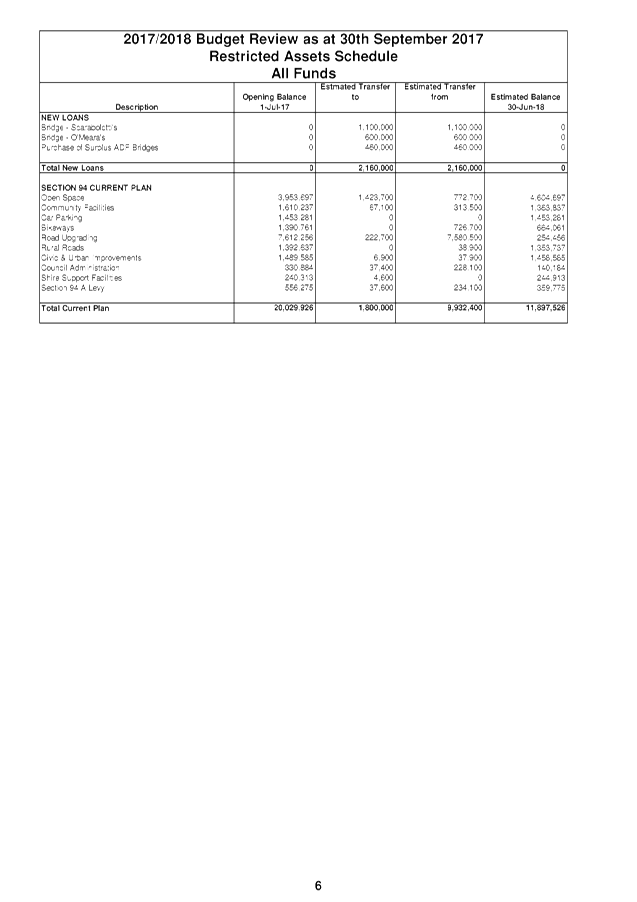

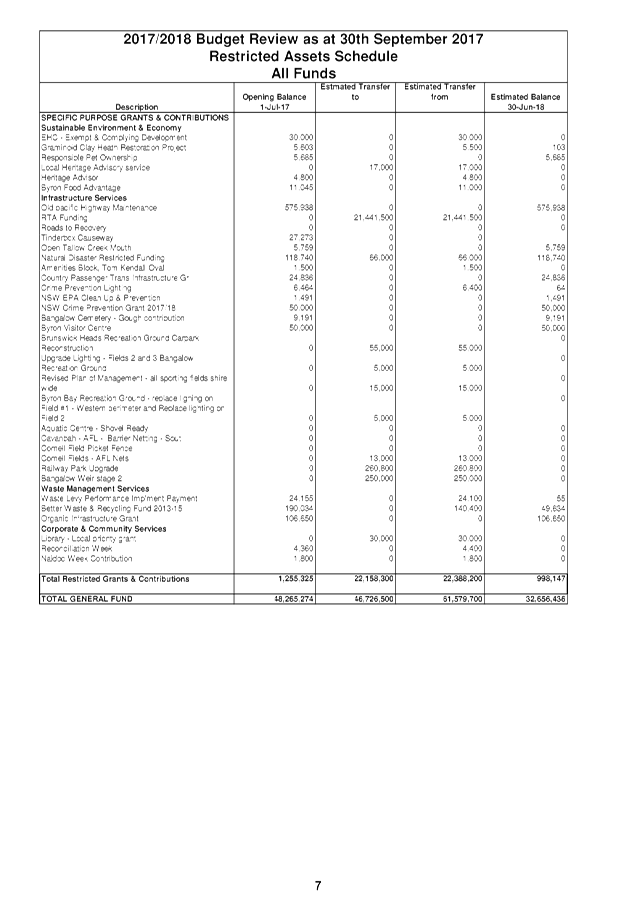

Staff Reports - Corporate and Community Services 4.3 - Attachment 1

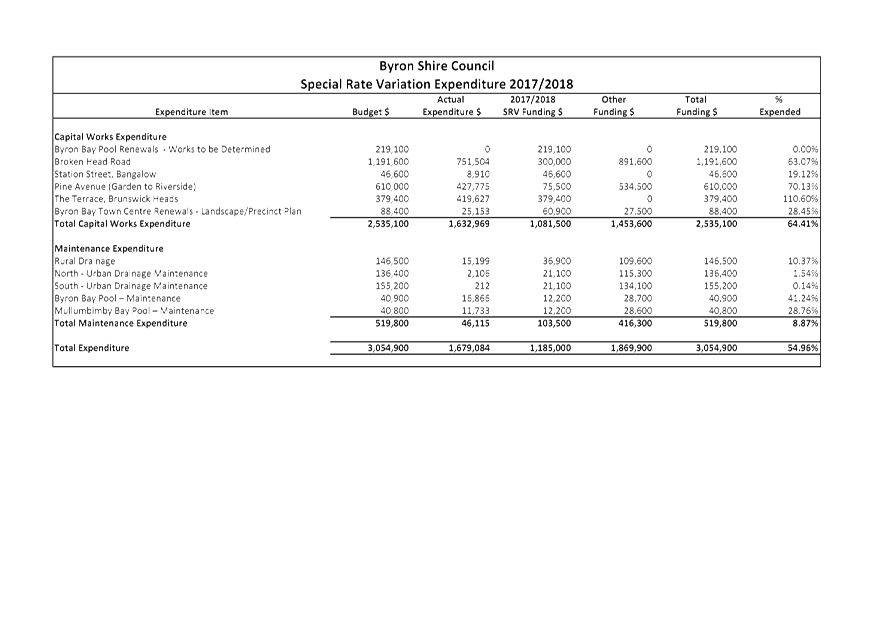

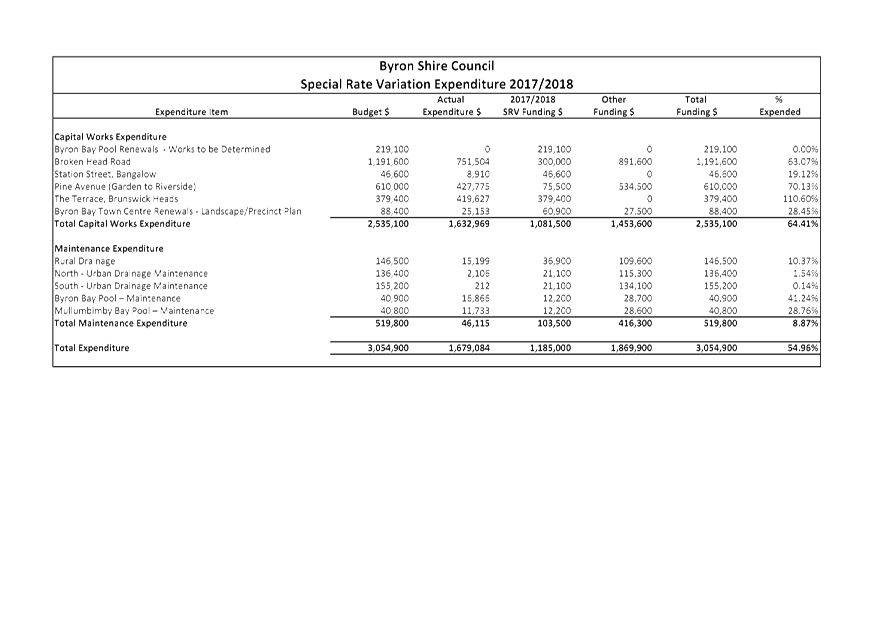

Staff Reports - Corporate and Community Services 4.4

Report No. 4.4 Quarterly

Update - Implementation of Special Rate Variation (SRV)

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/1731

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary Meeting held on 2 February 2017

resolved to apply for a Special Rate Variation (SRV) of 7.50% per annum for

four years commencing from the 2017/2018 financial year (Resolution 17-020

part 5).

Following approval of Council’s SRV by the Independent

Pricing and Regulatory Tribunal (IPART) received on 9 May 2017, Council

resolved to implement the SRV at its Ordinary Meeting held 22 June 2017

(Resolution 17-268 part 1).

Council at the same Ordinary Meeting held on 22 June 2017

resolved (Resolution 17-222 part 2) to incorporate reporting on the

Special Rate Variation into the development of the 2017/2018 Financial

Sustainability Plan and quarterly updates to Council through the Finance

Advisory Committee on the implementation of the adopted Financial

Sustainability Plan.

The purpose of this report is to provide the Finance

Advisory Committee with the first quarterly update on implementation of the SRV

and expenditure up to 30 September 2017.

|

RECOMMENDATION:

That the Finance Advisory Committee note the quarterly

update on the Special Rate Variation implementation as at 30 September 2017.

|

Attachments:

1 2017-2018

Special Rate Variation Expenditure at 30 September 2017, E2017/104211 , page 56⇩

Report

Council at its Ordinary Meeting held 2 February 2017

resolved to apply for a Special Rate Variation (SRV) as follows:

Resolution 17-020 part 5

Lodge a Section 508A permanent Special Rate Variation

application to the Independent Pricing and Regulatory Tribunal, for increases

to the ordinary rate income (general revenue) of 7.5% (including rate peg) in

2017/18, 7.5% (including rate peg) in 2018/19, 7.5% (including rate peg) in

2019/20 and 7.5% (including rate peg) in 2020/21.

After lodging the Special Rate Variation application with

the Independent Pricing and Regulatory Tribunal (IPART), Council received

approval to increase its ordinary rate income as per resolution 17-020.

This approval was granted on 9 May 2017. Council resolved to implement

the SRV through adoption of the 2017/2018 Operational Plan and Revenue Policy

at its Ordinary Meeting held on 22 June 2017 (Resolution 17-268 part 1).

Council at its Ordinary Meeting held 22 June 2017 received

Report 13.13 confirming the outcome of the SRV application and its subsequent

approval. Council resolved resolution 17-222 as follows:

1. That

Council note the determination from IPART in relation to its 2017/2018

Special Rate Application including the following conditions imposed by IPART on

Council for the:-

a) use

of the additional income derived from the special variation for the purposes of

reducing its infrastructure backlog and improving financial sustainability;

and

b)

reporting on this use against the forecasts included in the Council’s

application as part the Council’s annual report for each year from

2017-18 to 2026-27.

2. That

Council adopt as a Policy Framework the use and reporting conditions imposed by

IPART in the SRV determination and further incorporate reporting on the Special

Rate Variation into the development of the 2017/2018 Financial Sustainability

Plan and the quarterly updates to Council through the Finance Advisory

Committee on the implementation of the adopted Financial Sustainability Plan.

3. That

Council establish as a policy framework that funding for infrastructure renewal

and maintenance from general revenue sources is not ever lower then the general

revenue baseline indicator established in the 2016/2017 Budget.

4.That

Council establish as a policy framework that any funds generated by the SRV

that remain unexpended at the end of each financial year are to be restricted

and held in a internal reserve, to be carried forward to subsequent financial

year, for expenditure in accordance with the uses imposed in the SRV approval.

5. That

Council incorporate the research of potential non resident revenue sources (if

any) as part of the Revenue Review chapter in the development of the 2017/2018

Financial Sustainability Plan, and provide quarterly updates to Council through

the Finance Advisory Committee.

6.

That Council not proceed with the implementation of part 9 and part 11

of resolution 17-020.

The 2017/2018 Draft Financial Sustainability Plan subject to

another report to this Meeting of the Finance Advisory Committee has been

developed to incorporate future quarterly reporting on the SRV as outlined in

Chapter 7 ‘Policy and Decision Making’.

This report is provided to the Finance Advisory Committee to

advise on the implementation of the SRV and the current status of expenditure

from 1 July 2017 to 30 June 2017.

The levy of Council’s annual rates and charges was

completed in accordance with Resolution 17-268 prior to 31 July 2017 and

this included applying the first tranche of the 7.5% ordinary rate increase for

2017/2018 and revised ordinary rating structure adopted by Council. The

estimated yield from the SRV for 2017/2018 being the first year of the increase

is $1,185,000.

Upon adoption of the 2017/2018 Budget Estimates, Council

resolved to undertake the following program of capital and maintenance works

including the additional SRV revenue and other funding as outlined in

Attachment 1. During the course of the 2017/2018 financial year, there

may be adjustments required to the expenditure budgets identified in the

schedule of capital and maintenance works currently funded by the SRV revenue

which will be presented to Council for approval via the Quarterly Budget Review

process.

The expenditure program adopted for 2017/2018 financial year

is consistent with Council’s SRV application and approval from IPART to

use the funding to improve financial sustainability and reduce infrastructure

backlog.

Financial Implications

There are no direct financial implications associated with

this report. The table included at Attachment 1 provides information to the

Finance Advisory Committee as to the expenditure of the Special Rate Variation

Funds up to the first quarter of the 2017/2018 financial year.

Statutory and Policy Compliance Implications

Approval and conditions received

from the Independent Pricing and Regulatory Tribunal (IPART) regarding the

Byron Shire Council Special Rate Application 2017-2018 received 9 May 2017.

Council Resolution 17-268 and 17-222.

Staff Reports - Corporate and Community Services 4.4 - Attachment 1

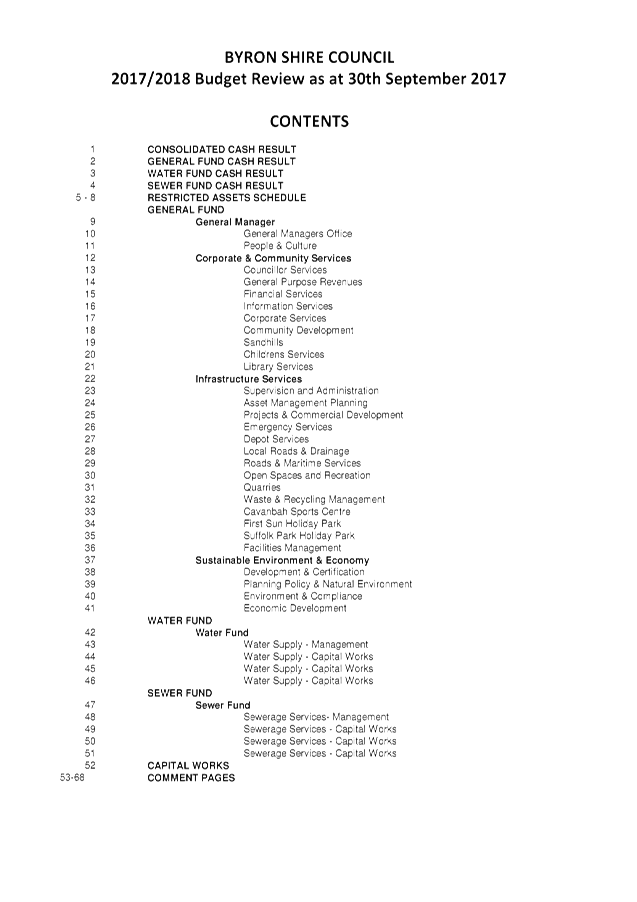

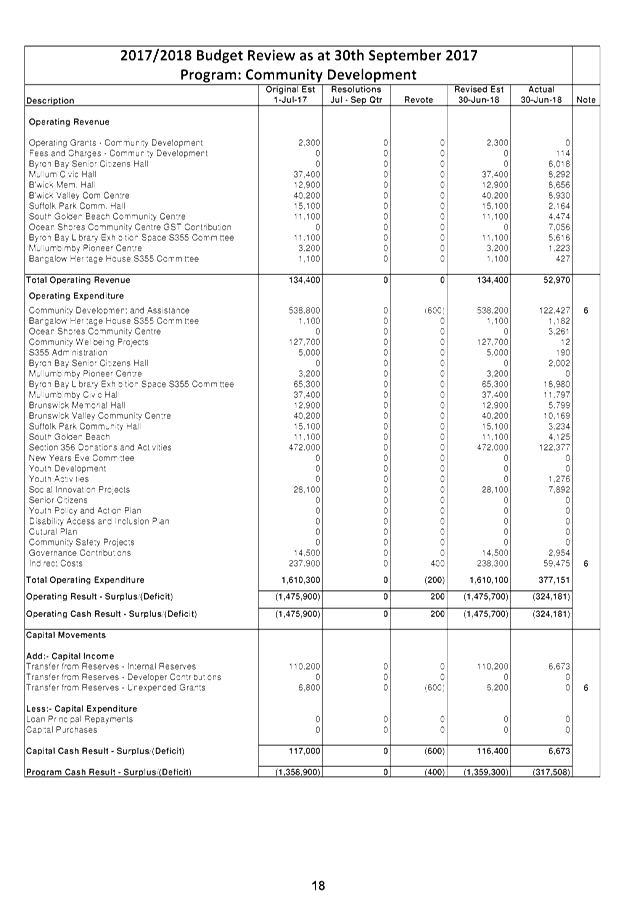

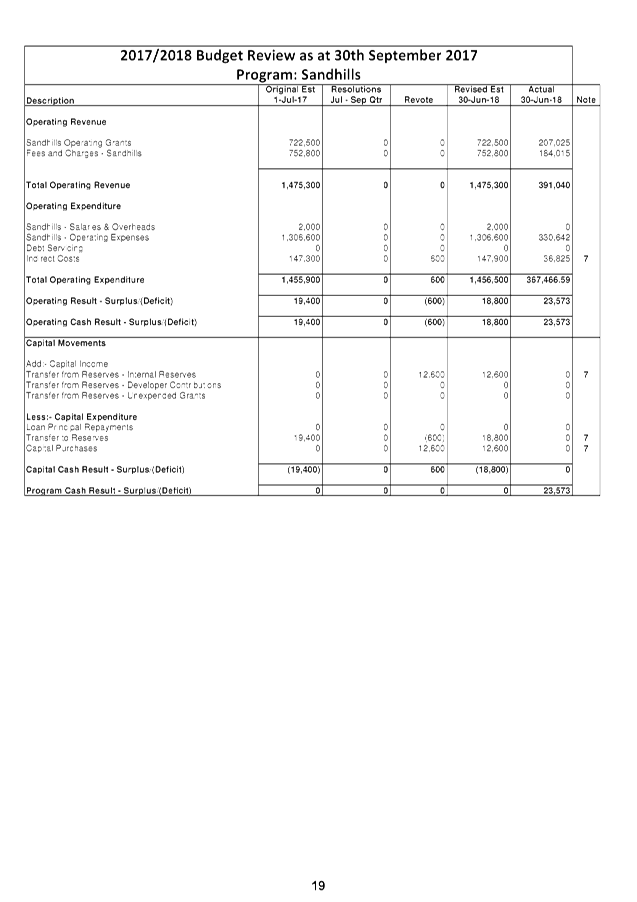

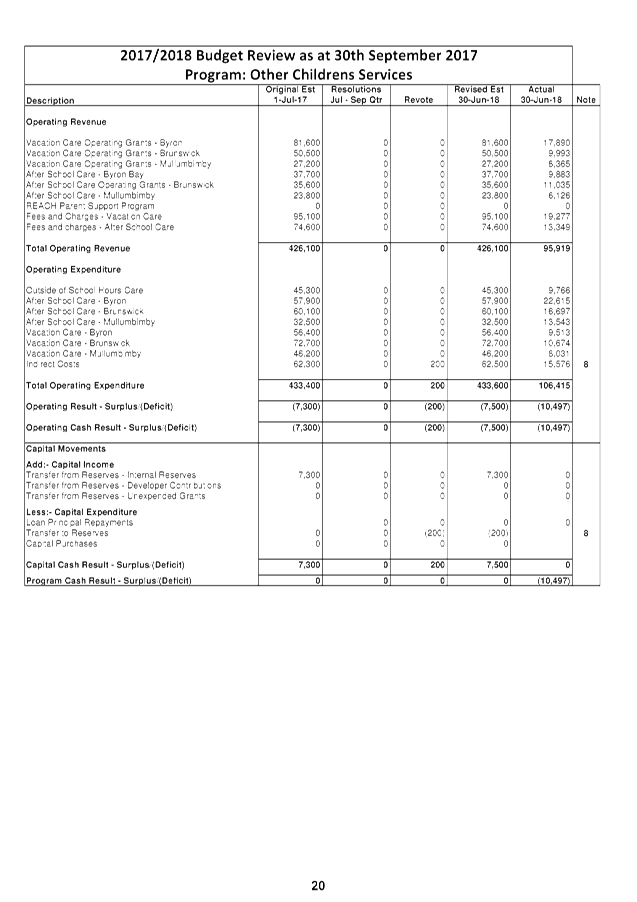

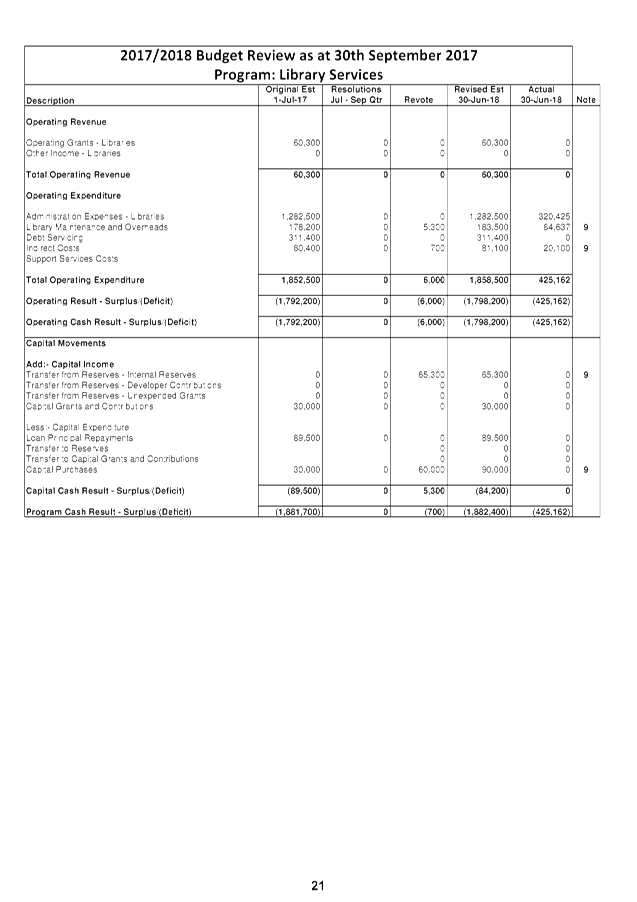

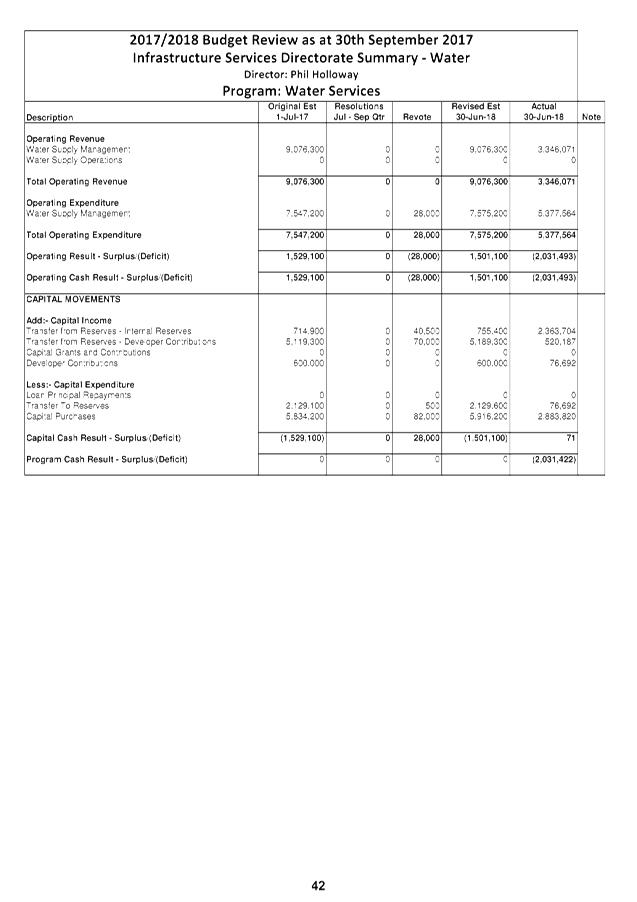

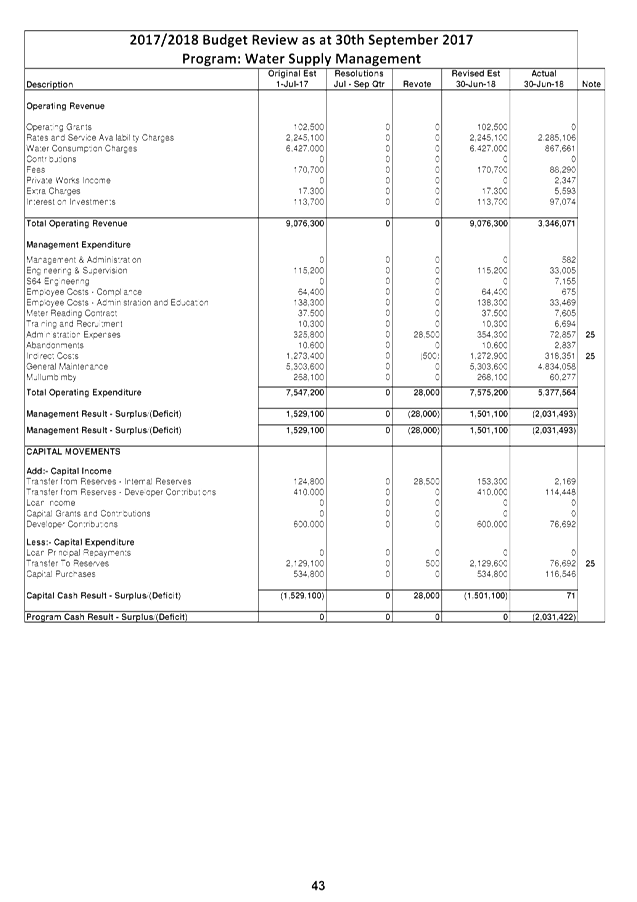

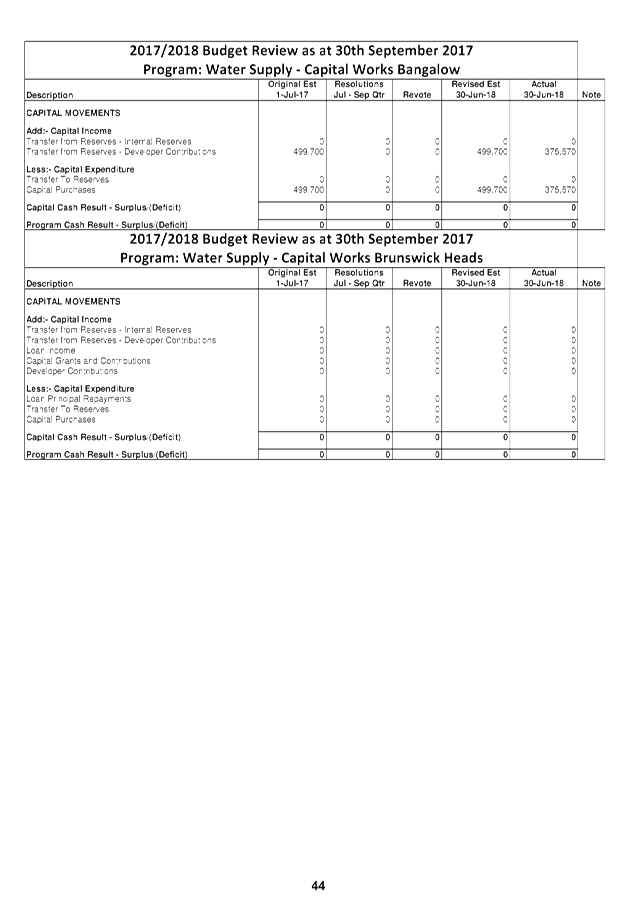

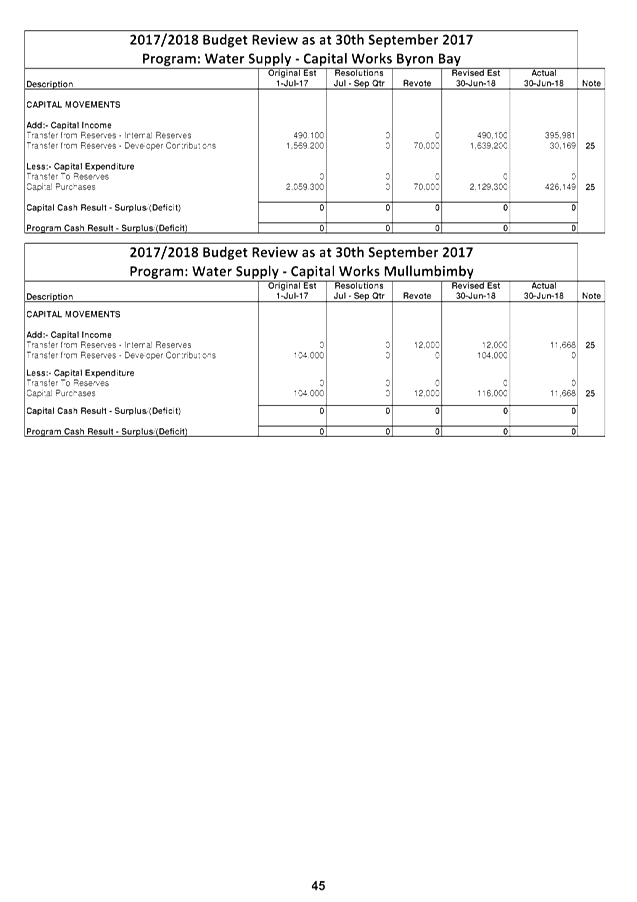

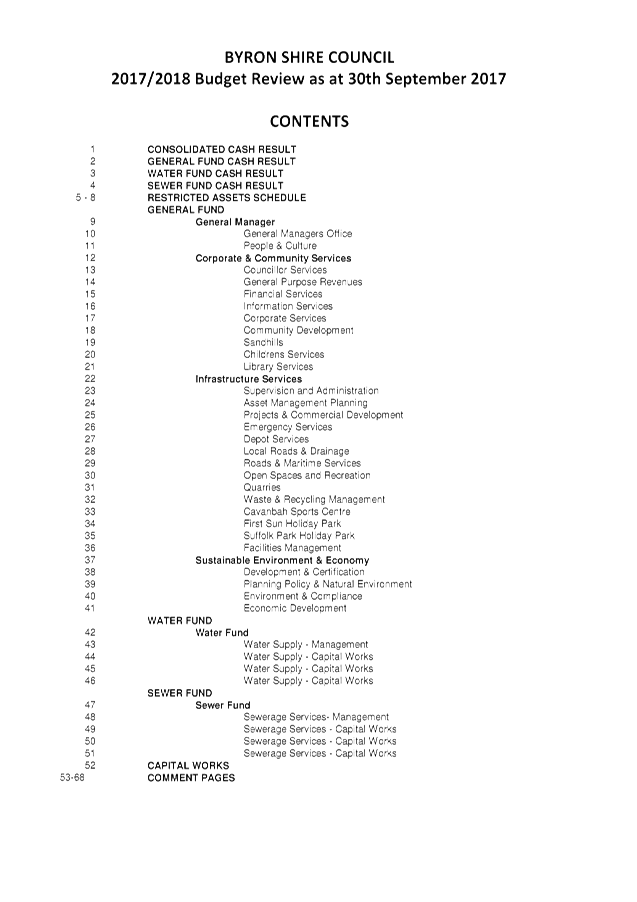

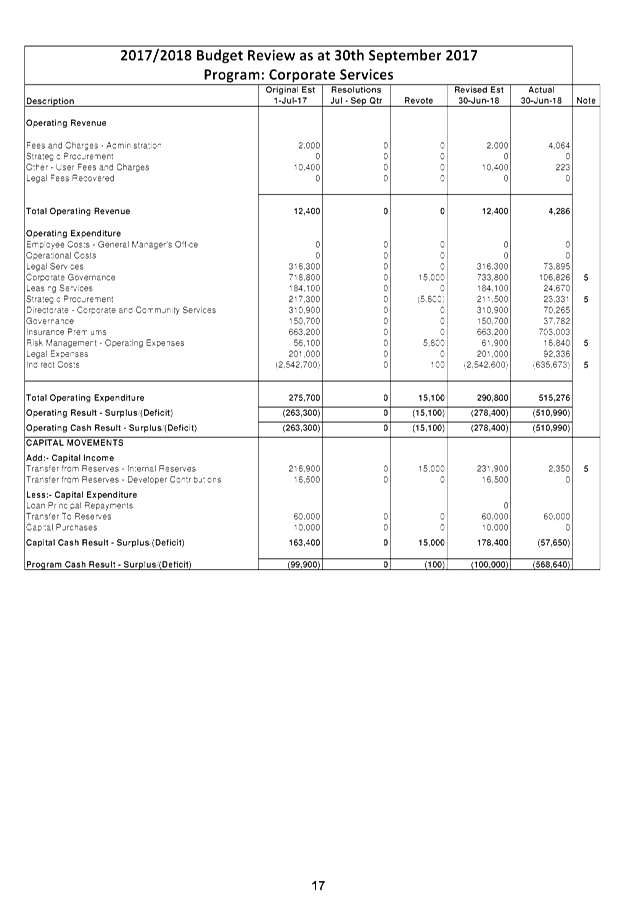

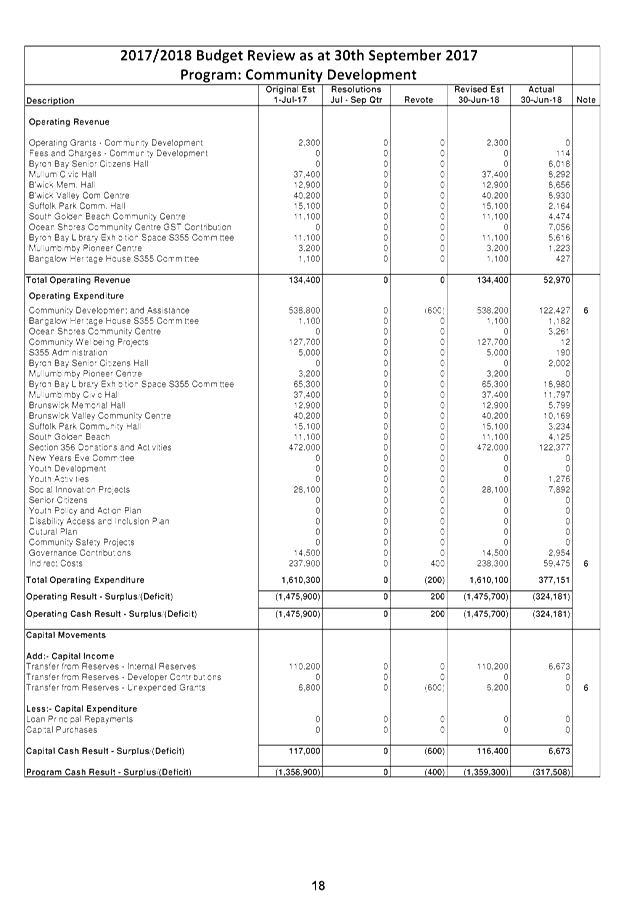

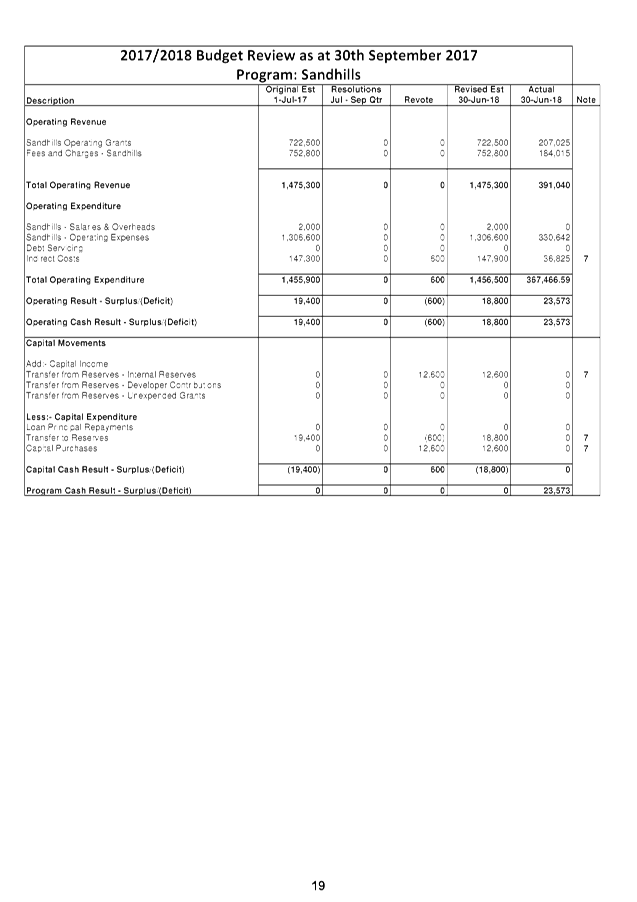

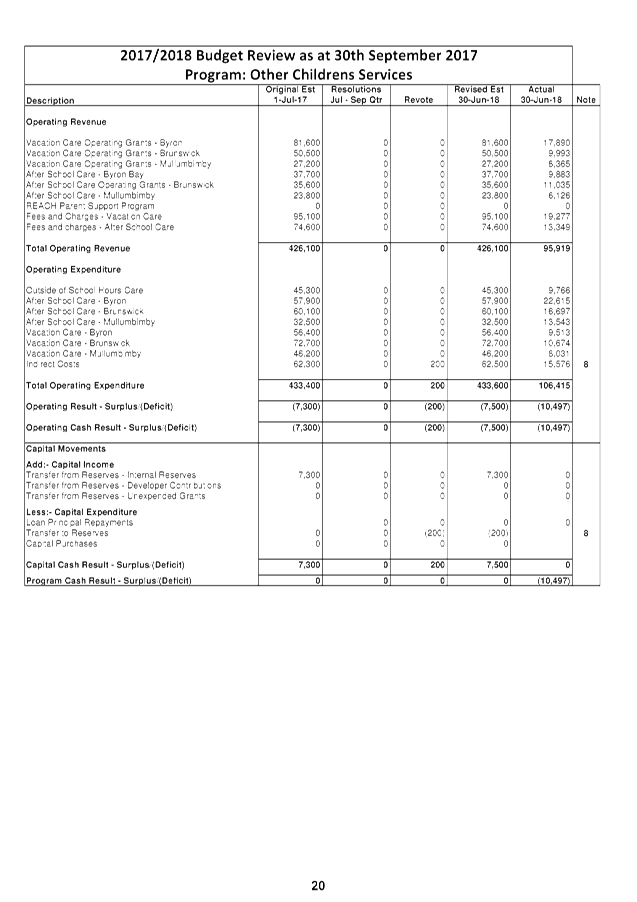

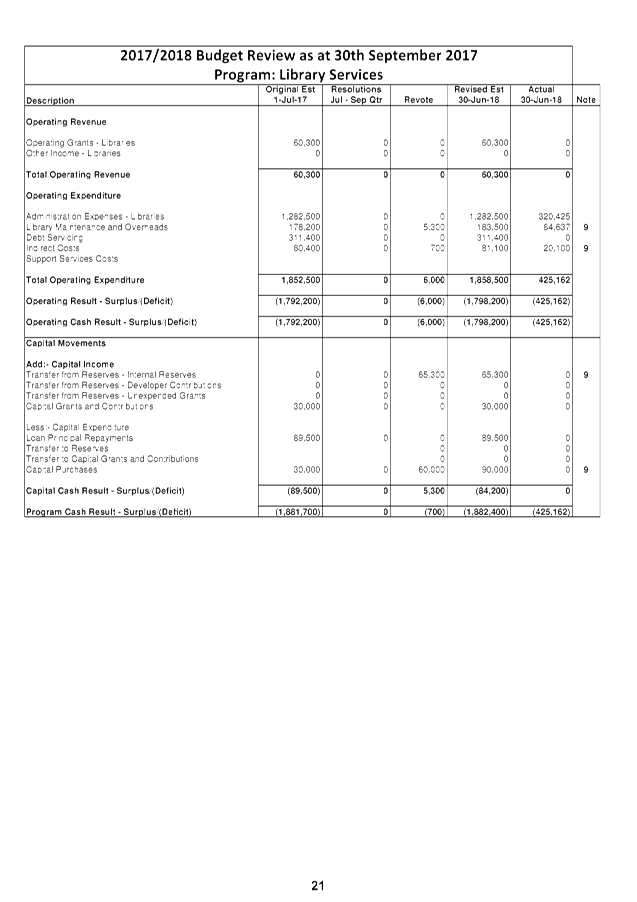

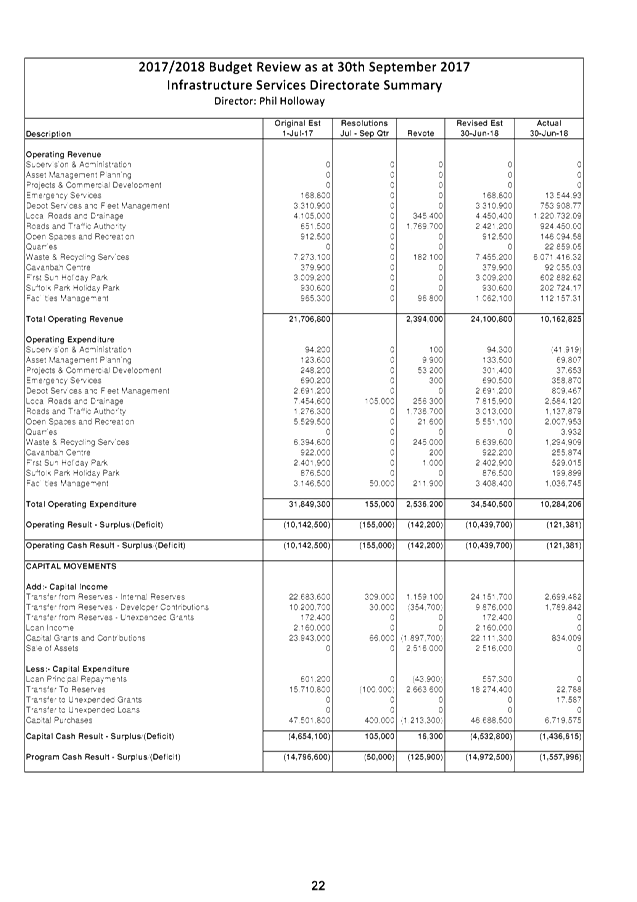

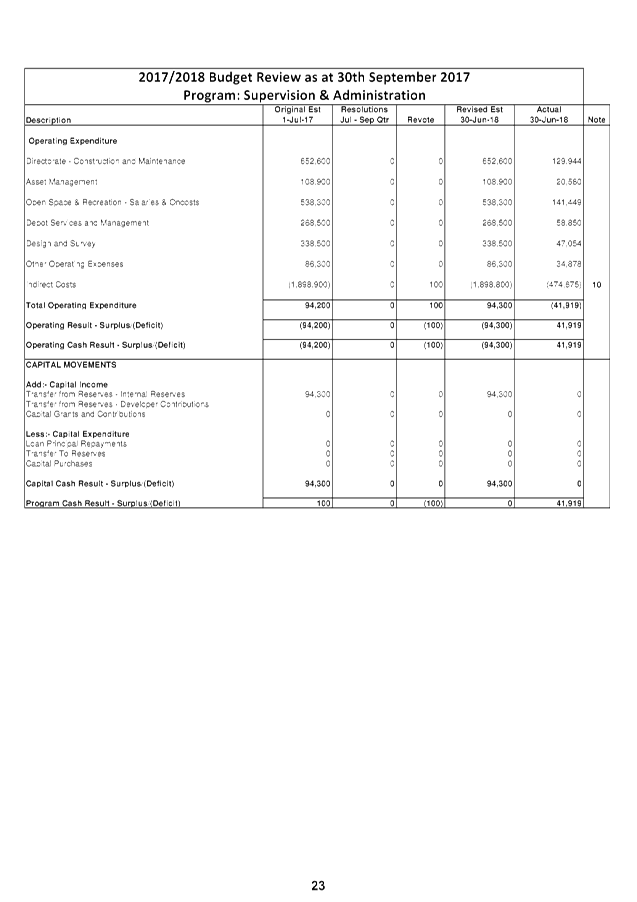

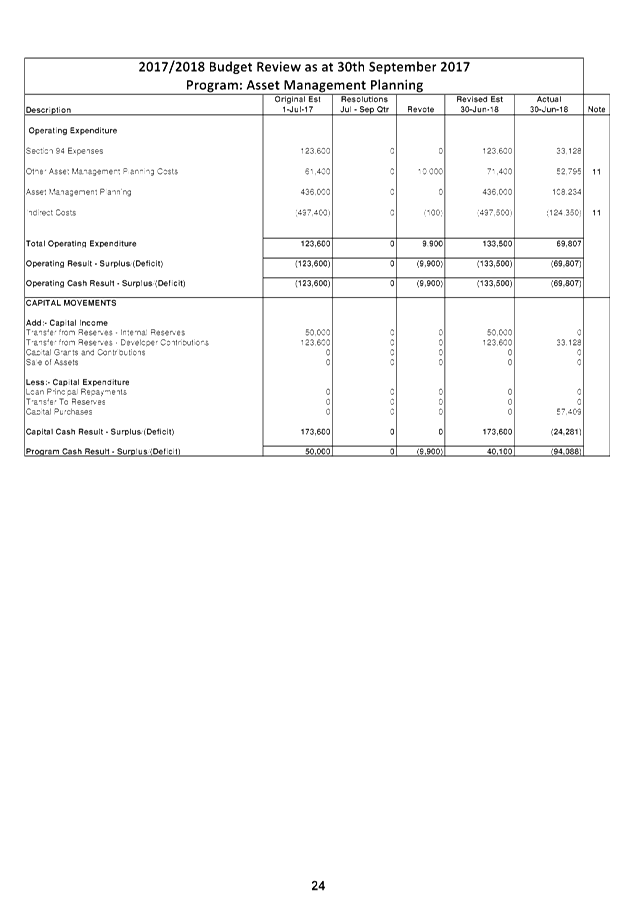

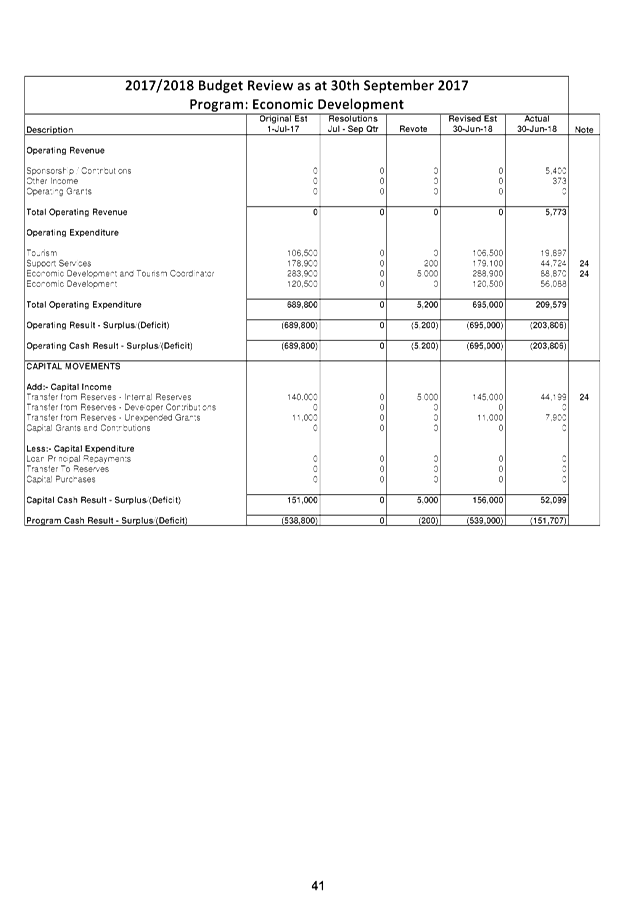

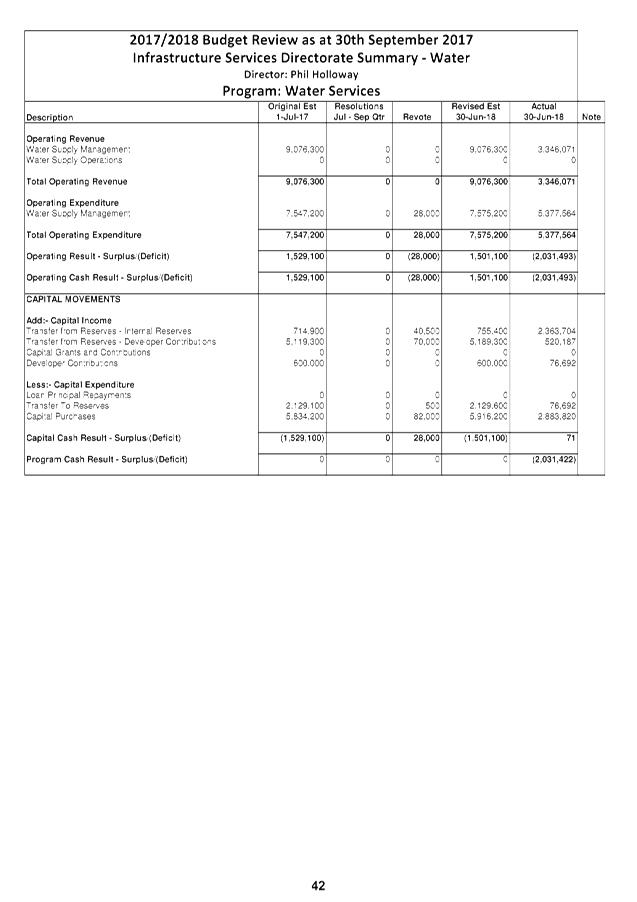

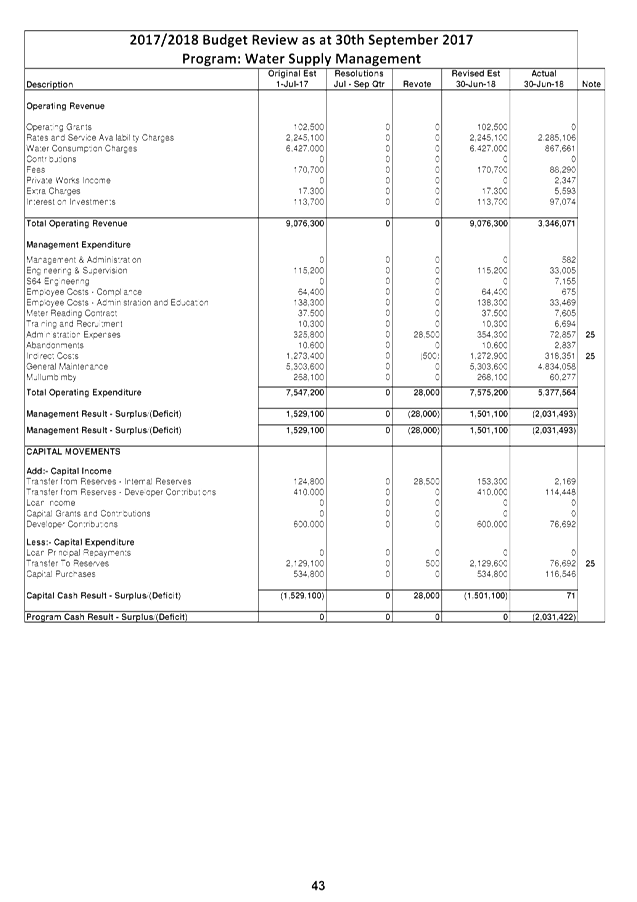

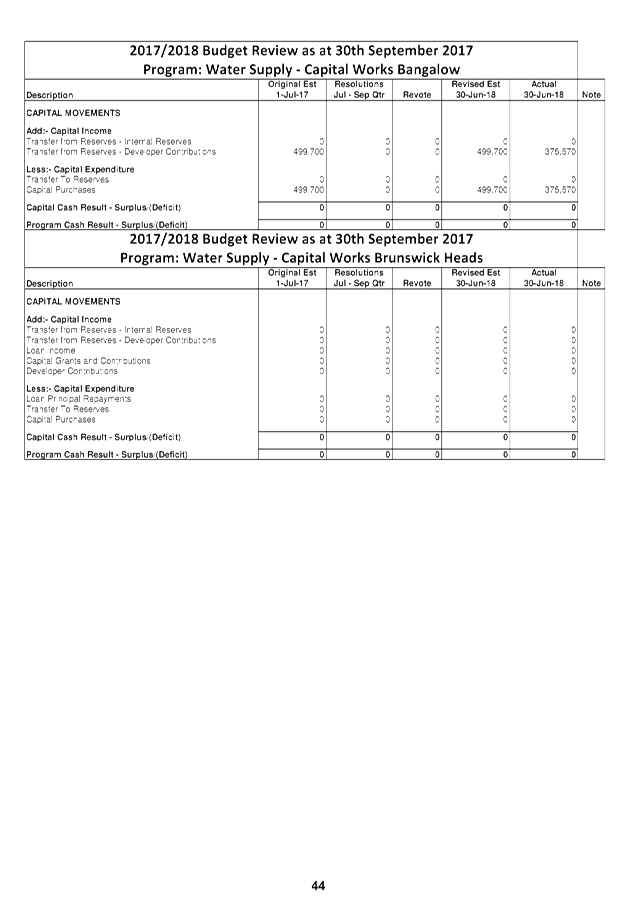

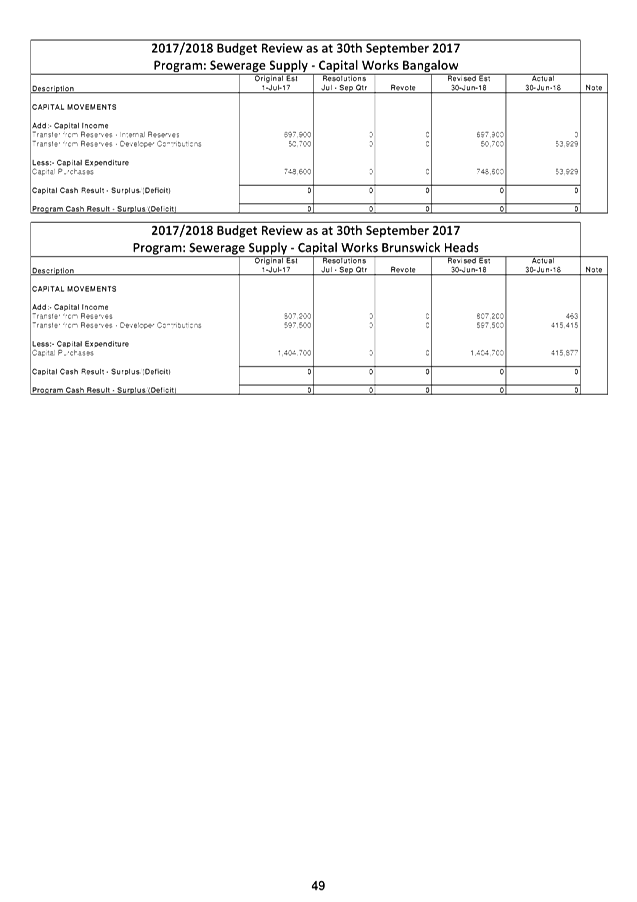

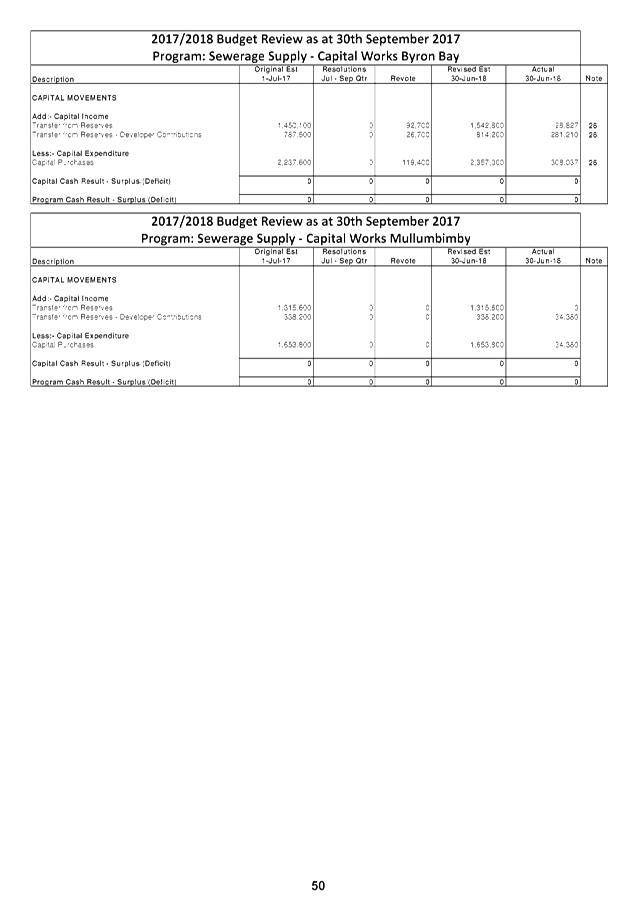

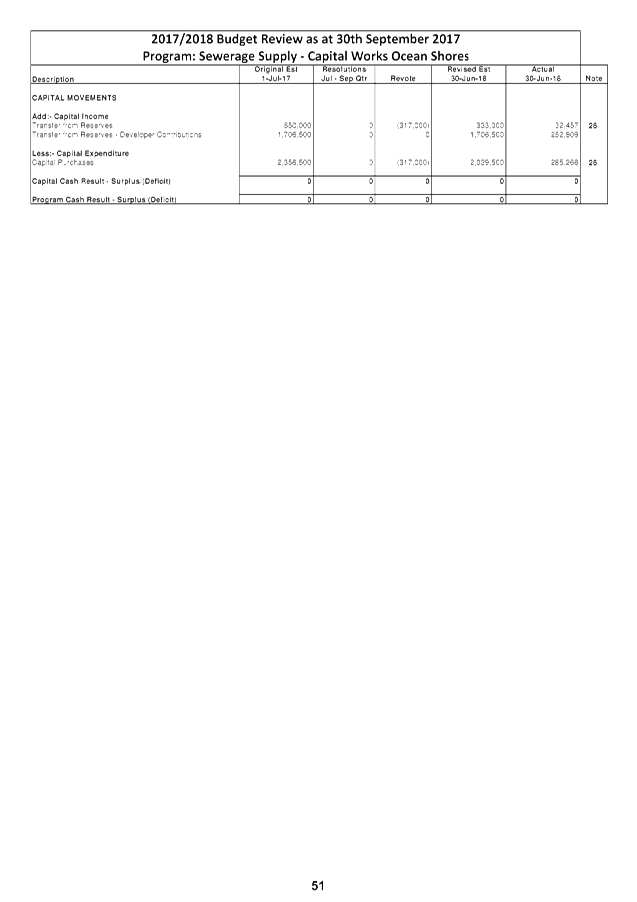

Staff Reports - Corporate and Community Services 4.5

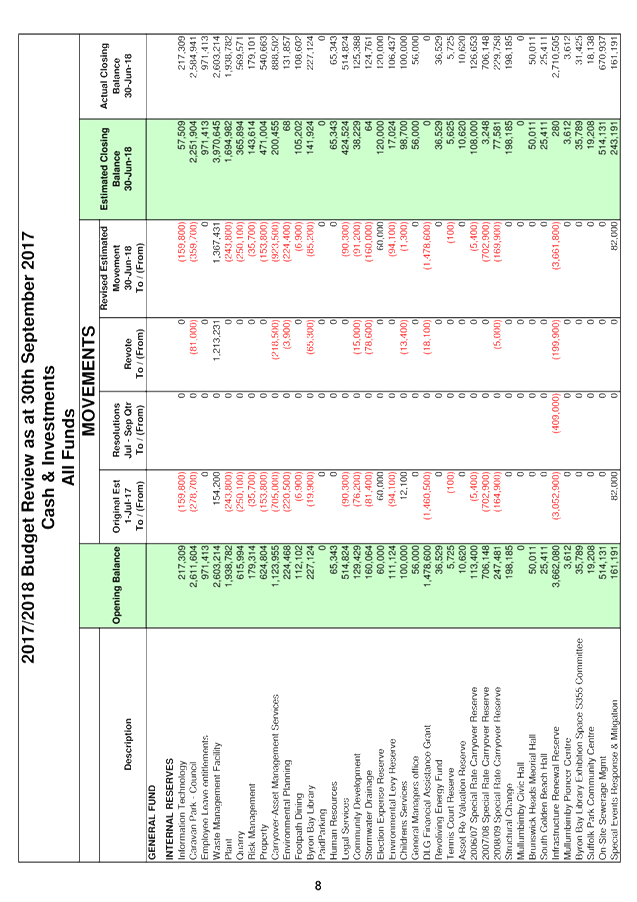

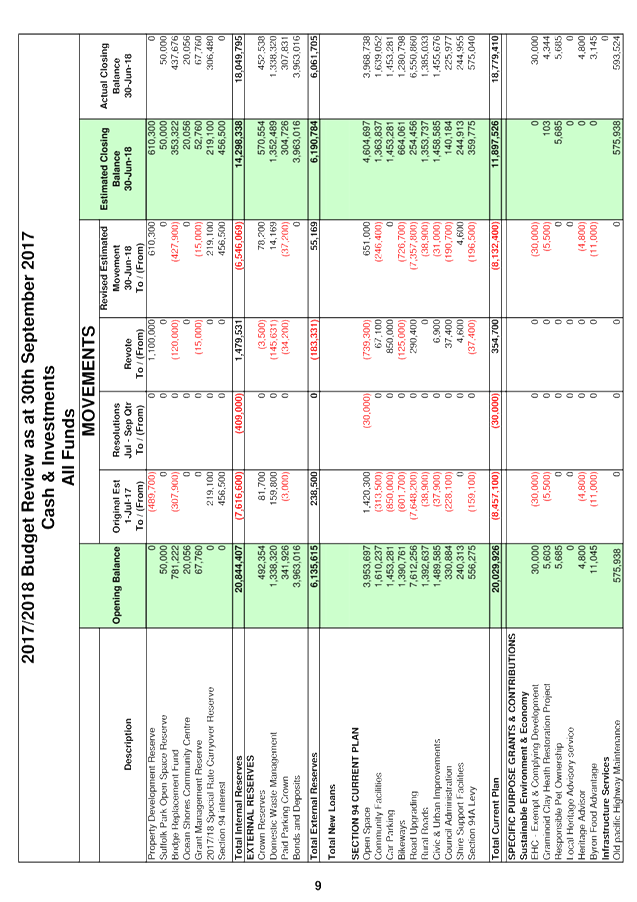

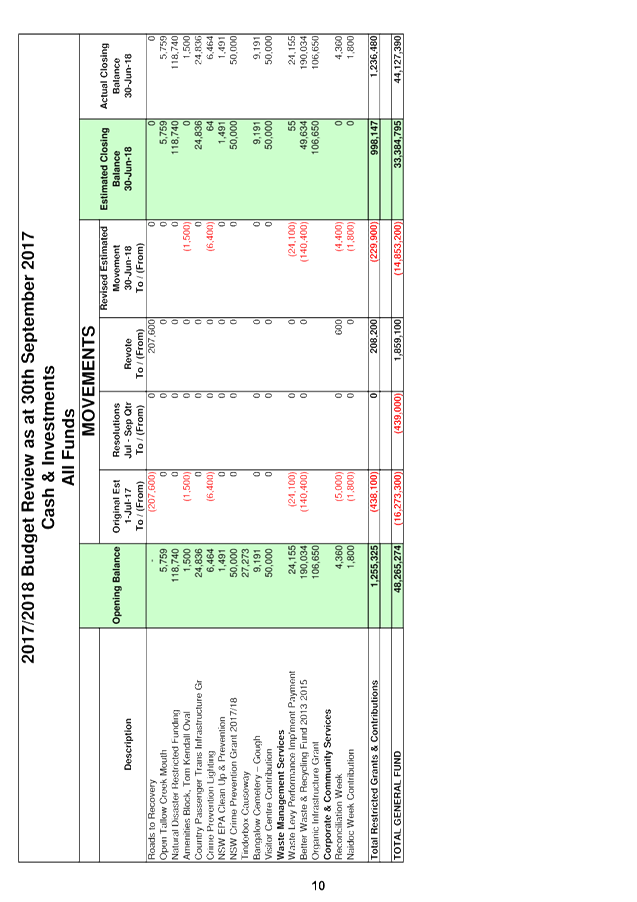

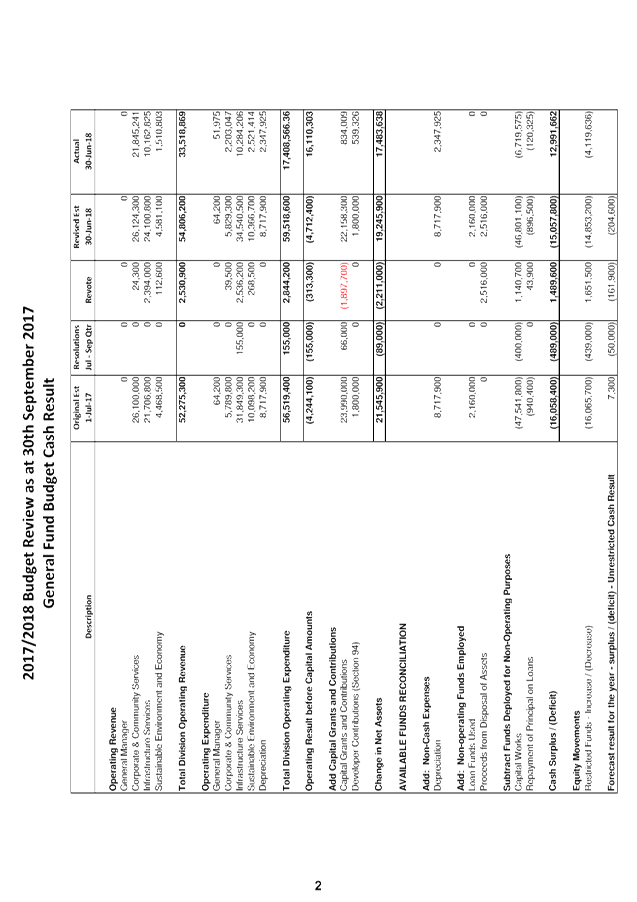

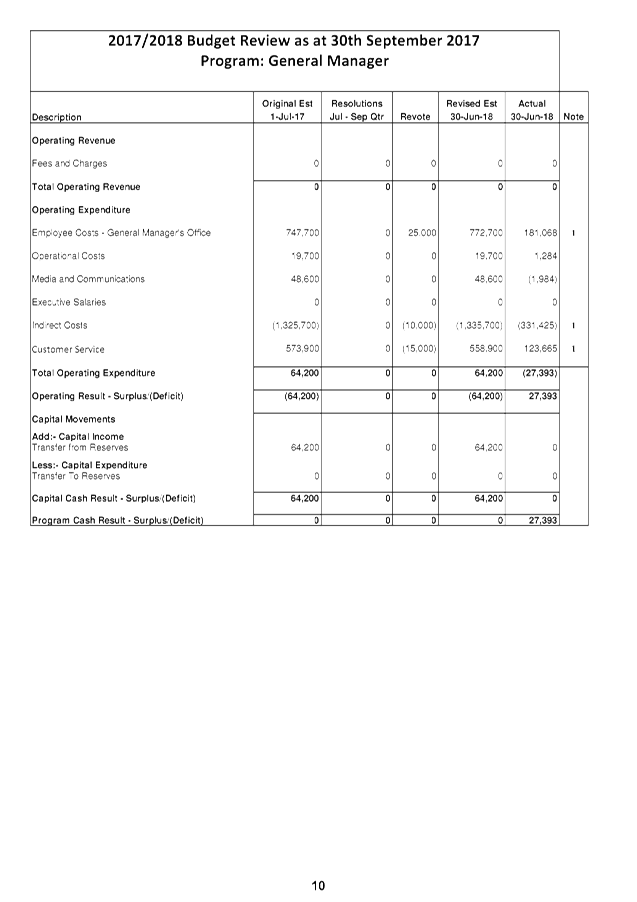

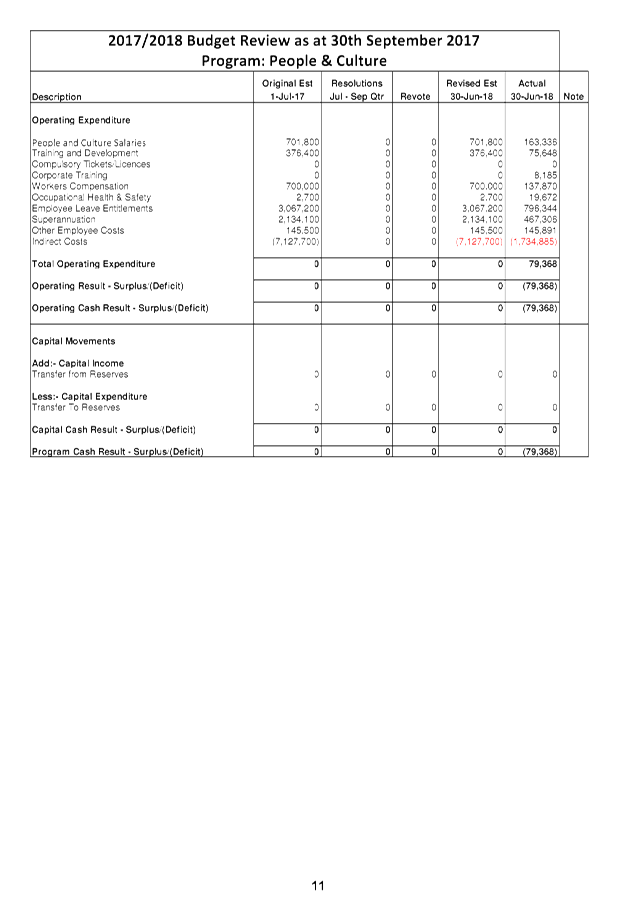

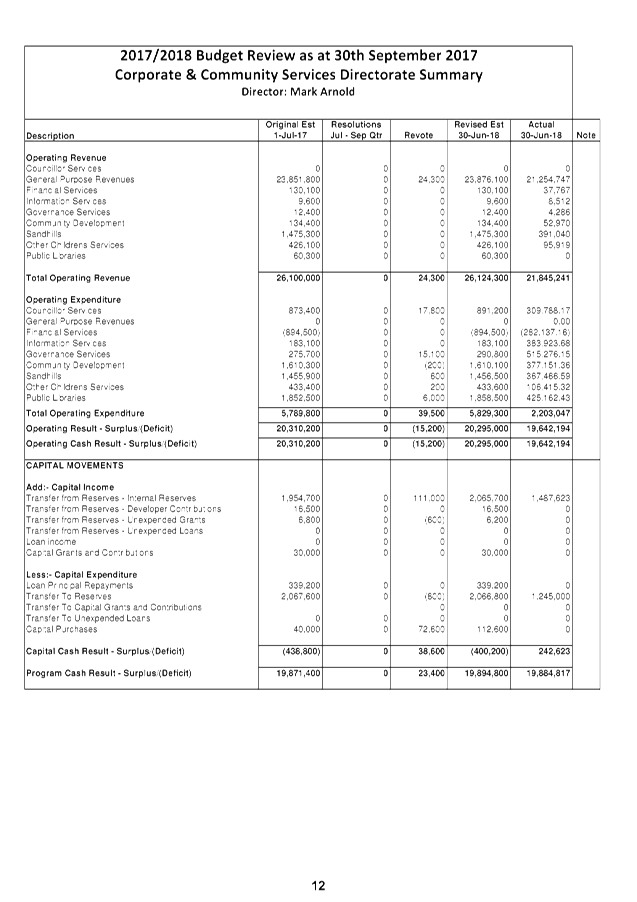

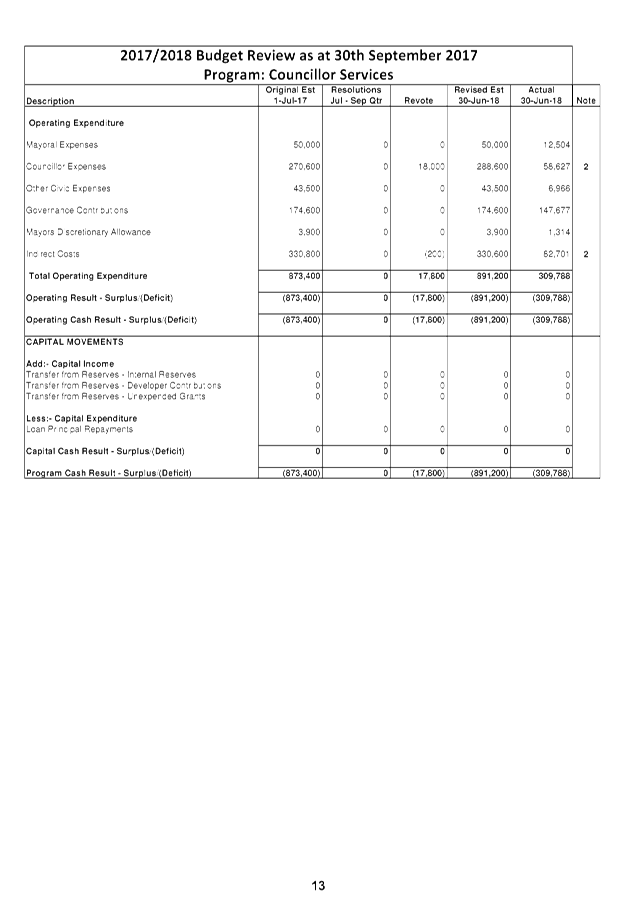

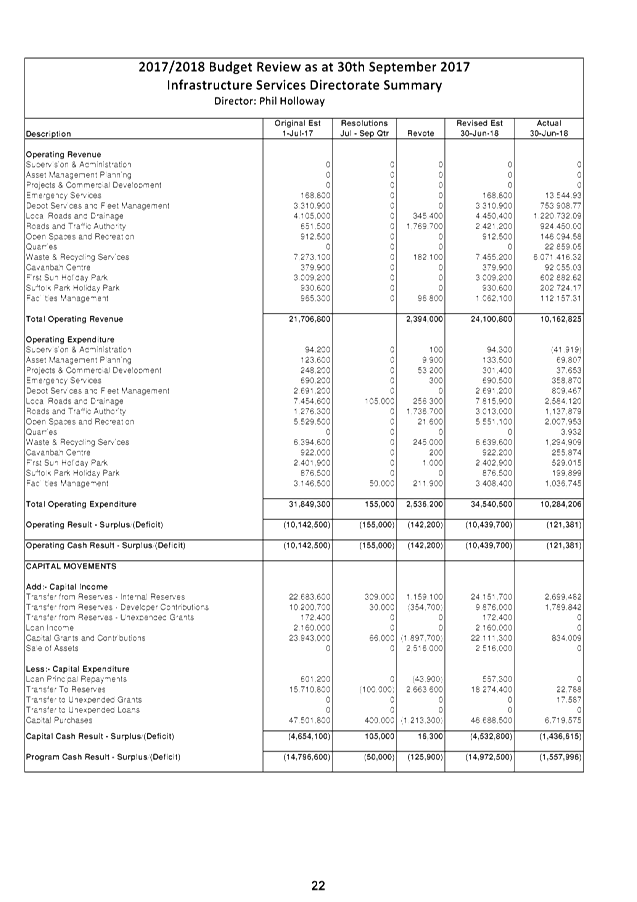

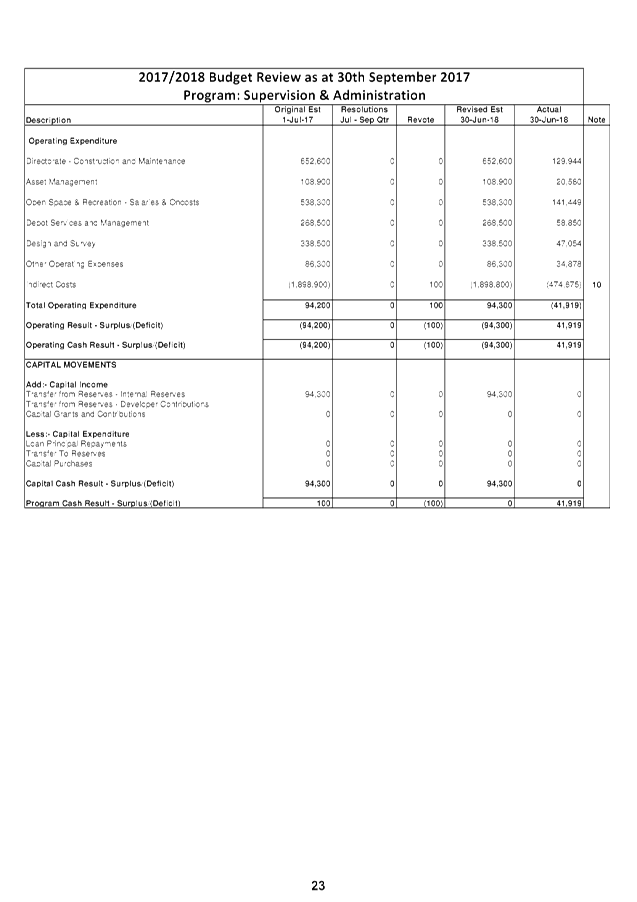

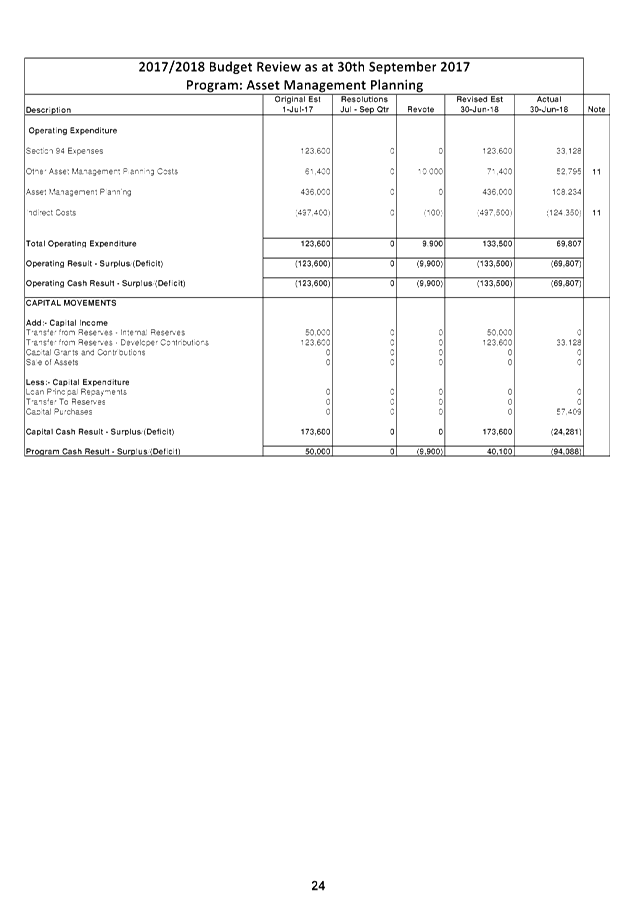

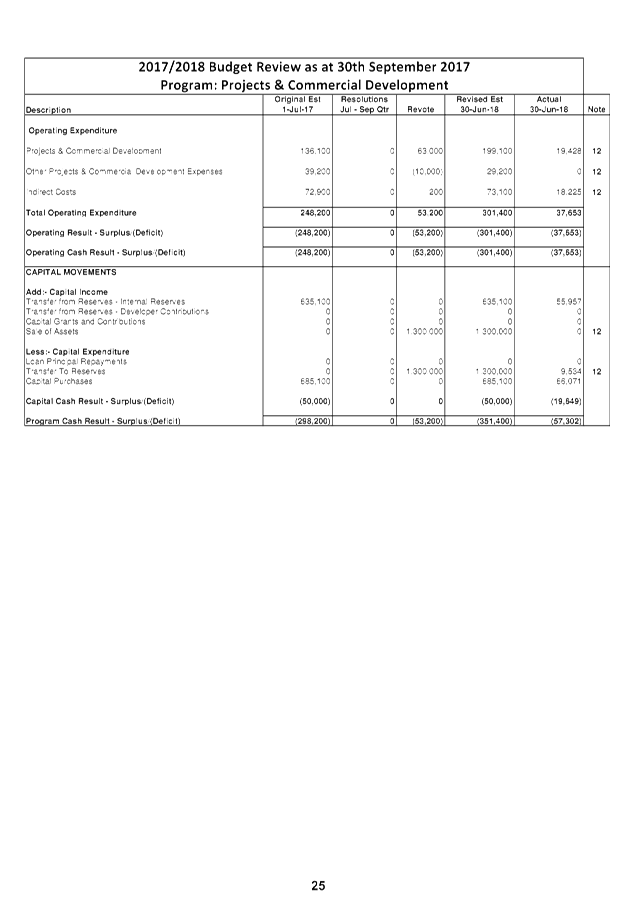

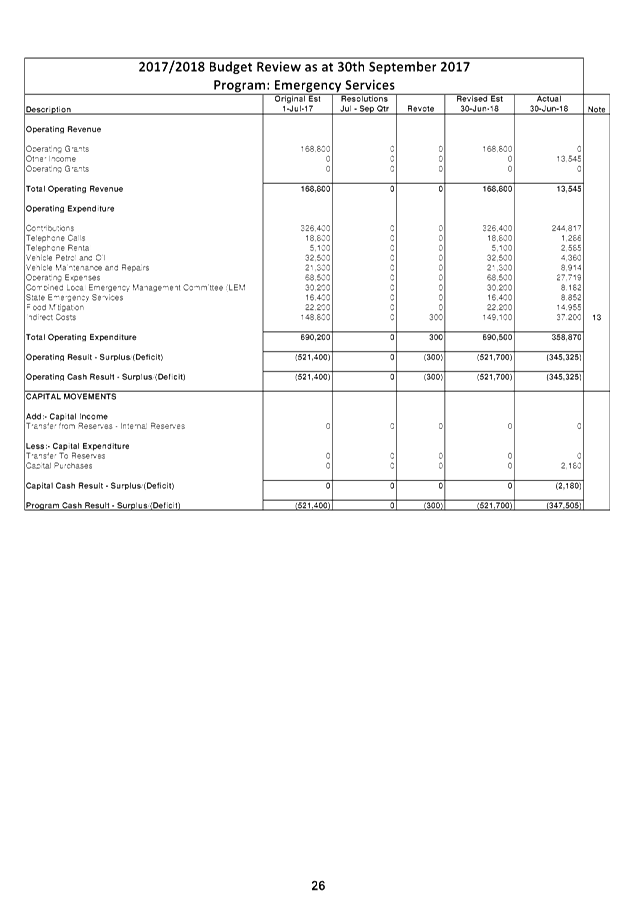

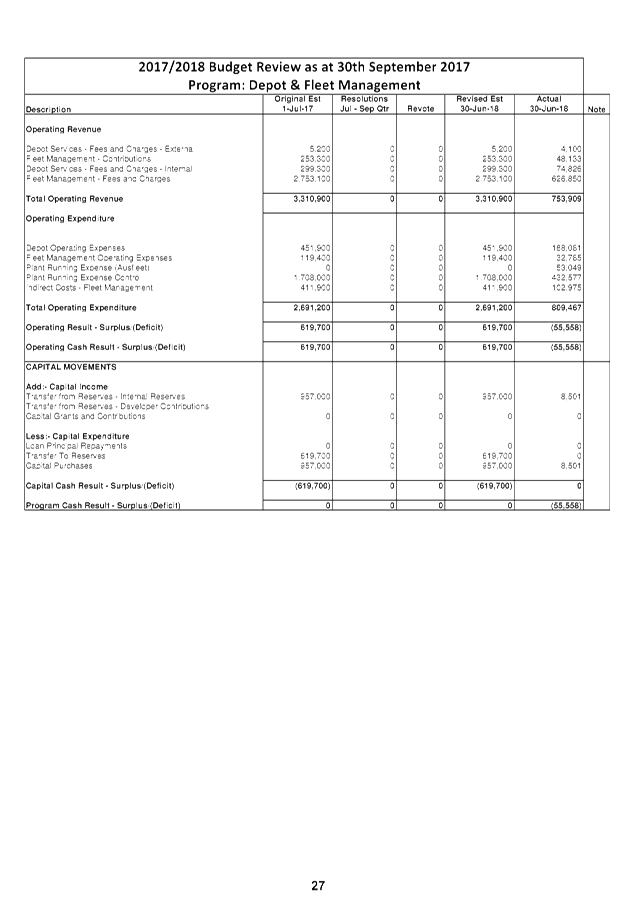

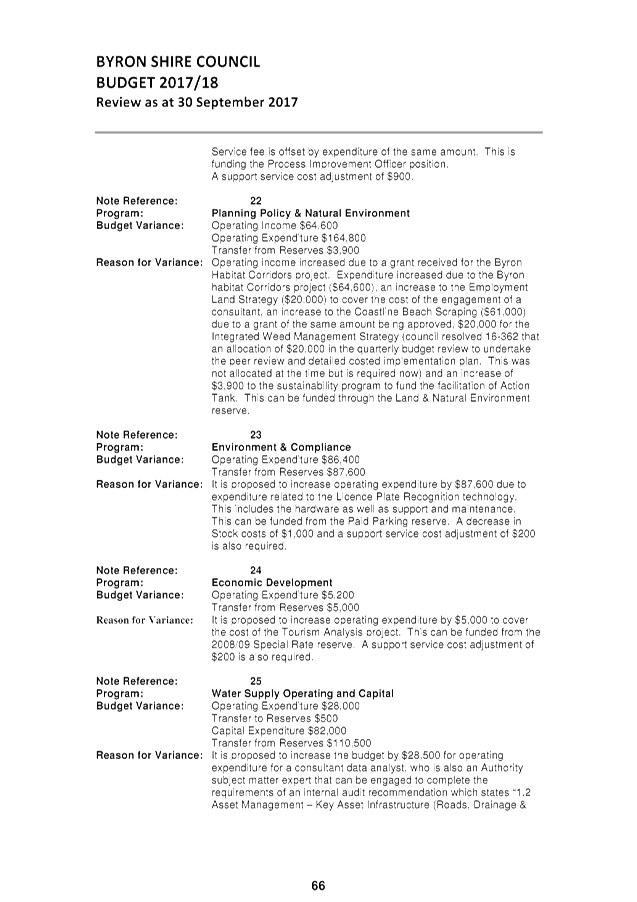

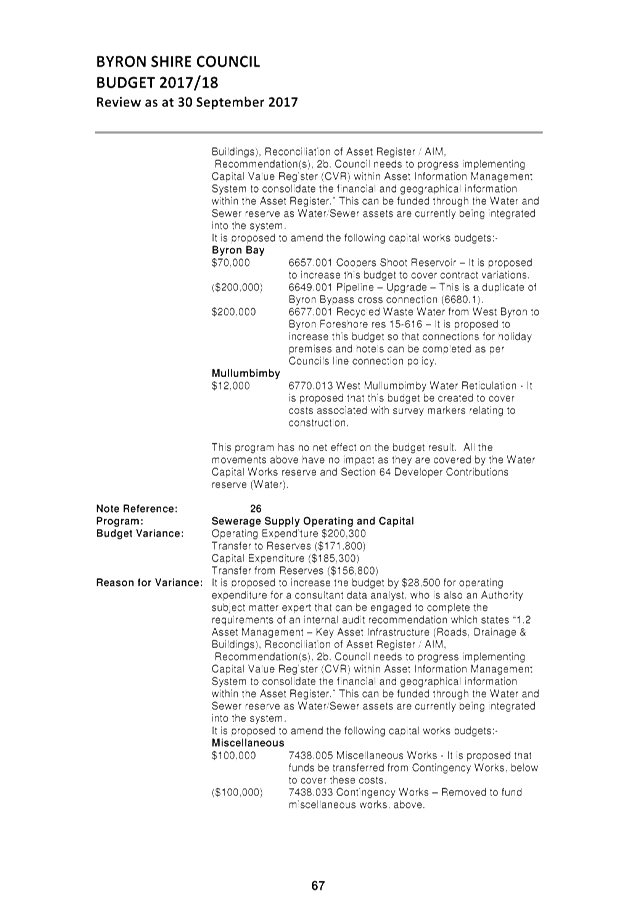

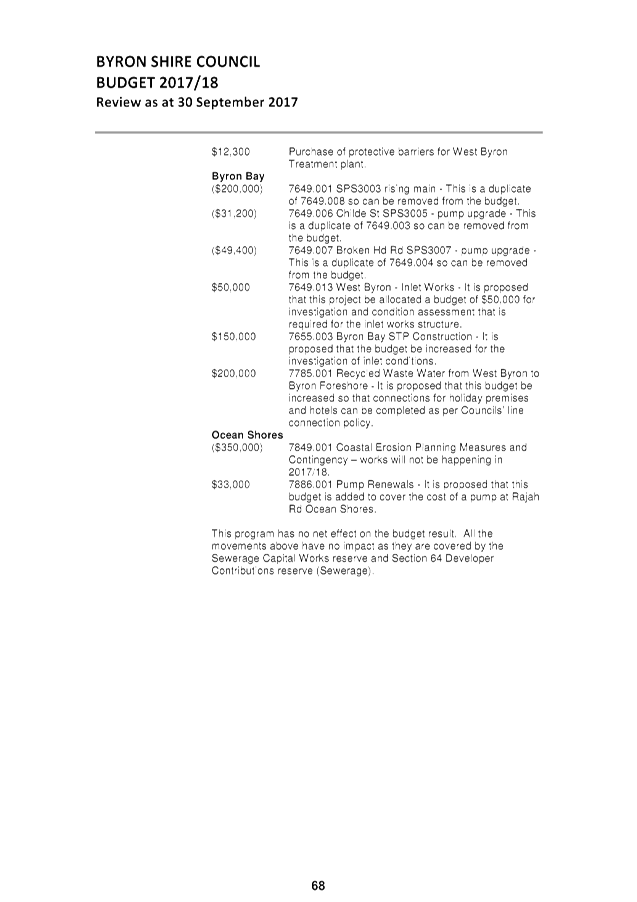

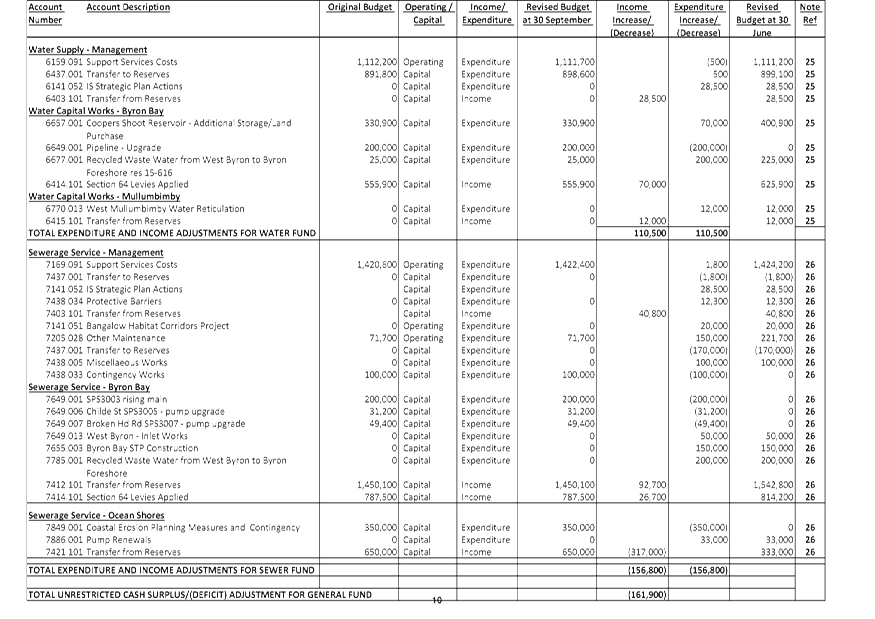

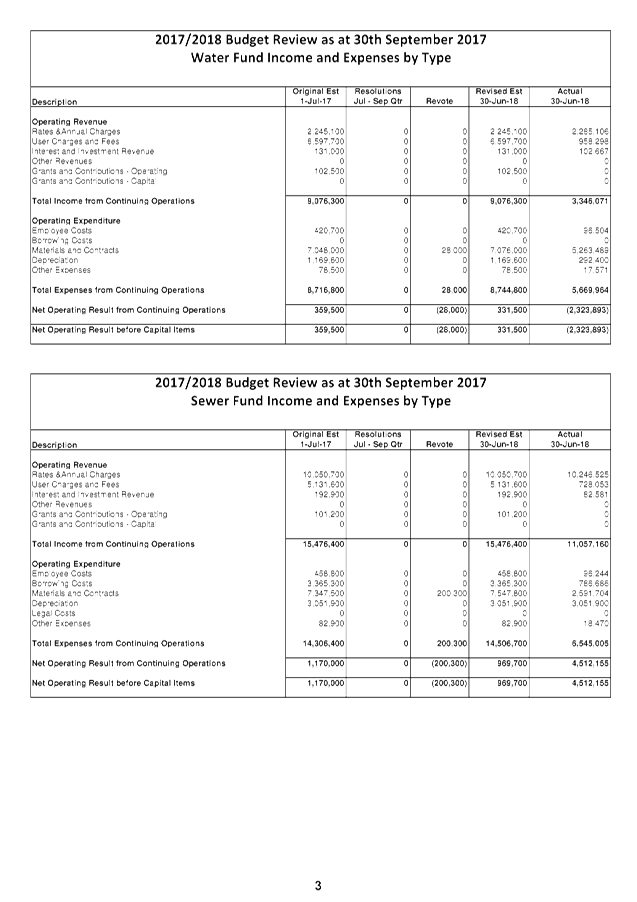

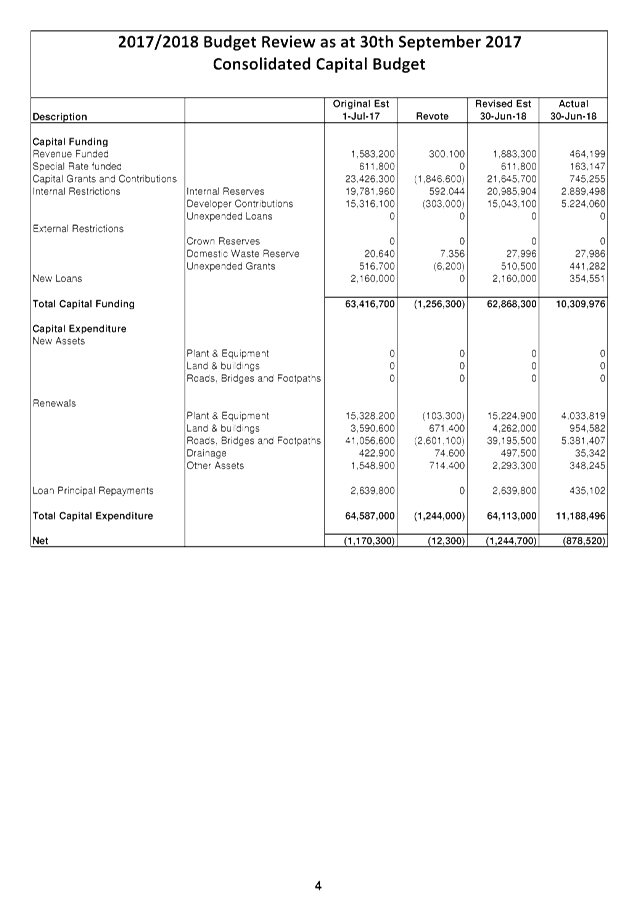

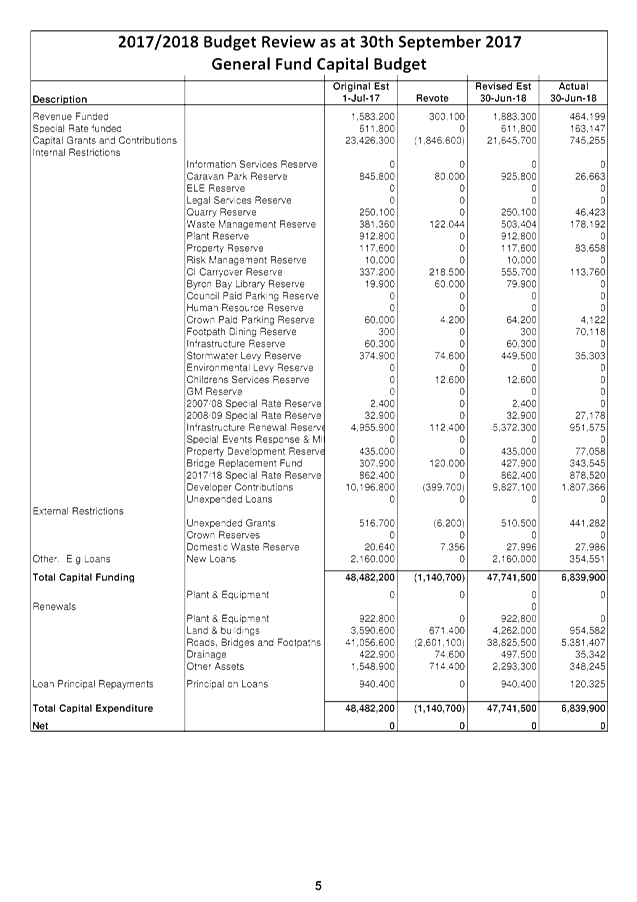

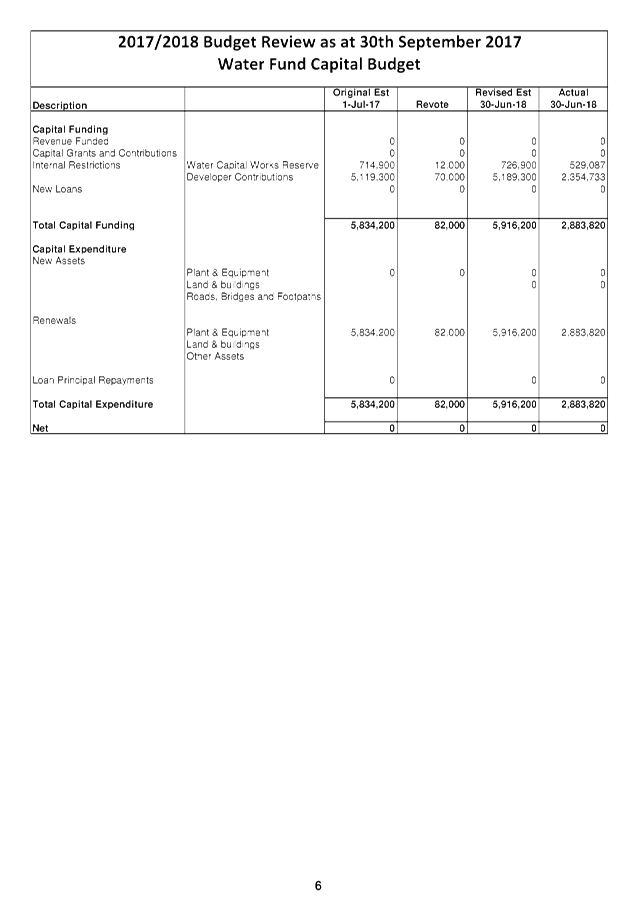

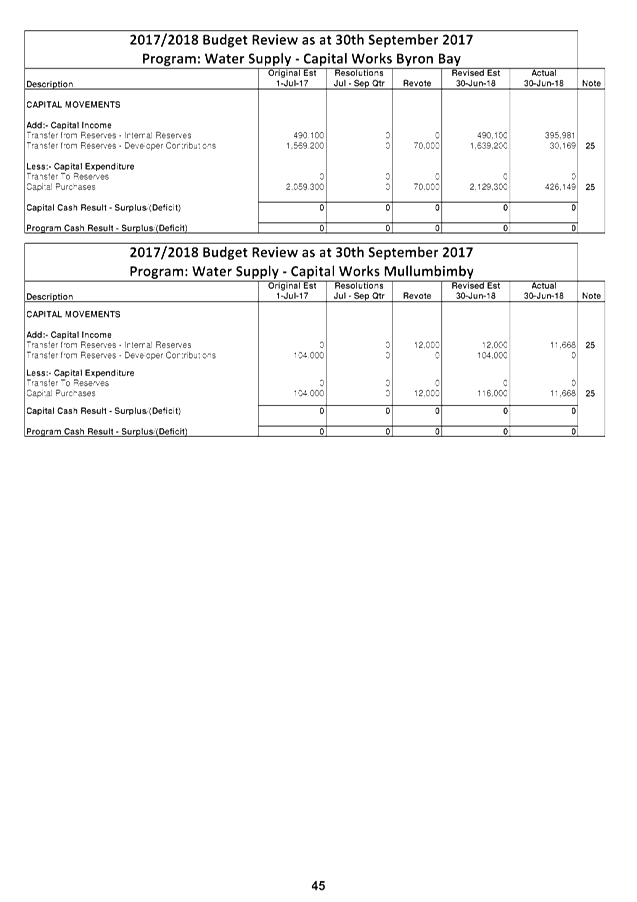

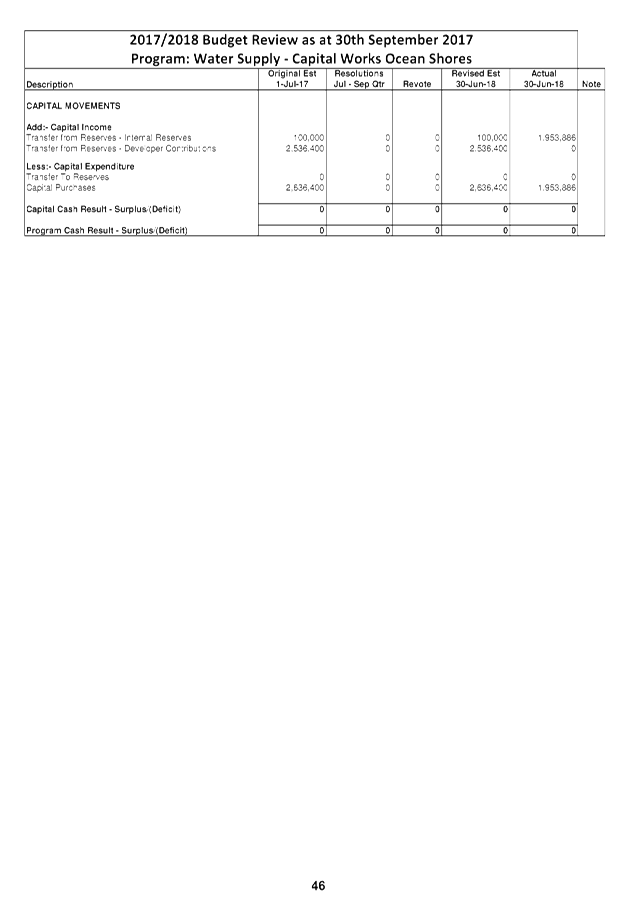

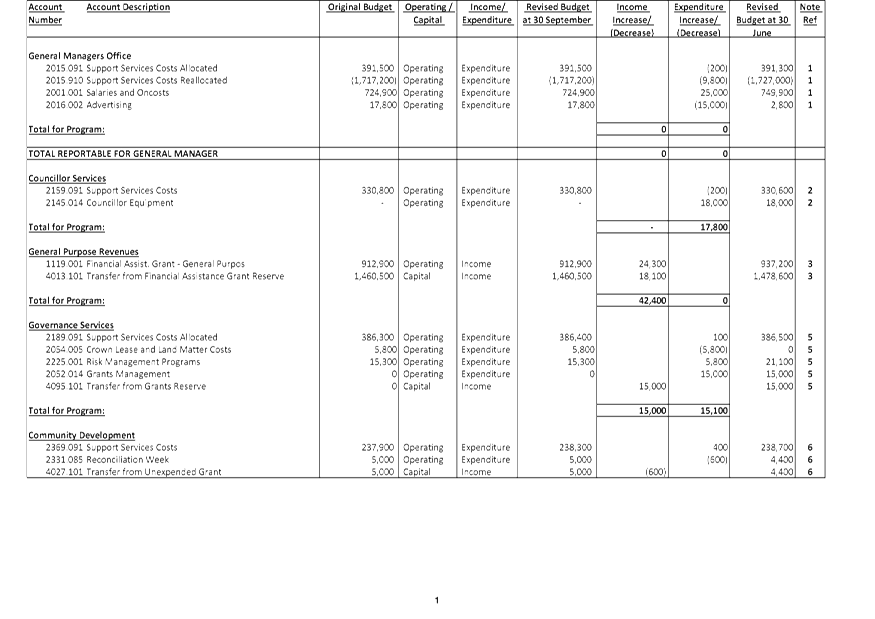

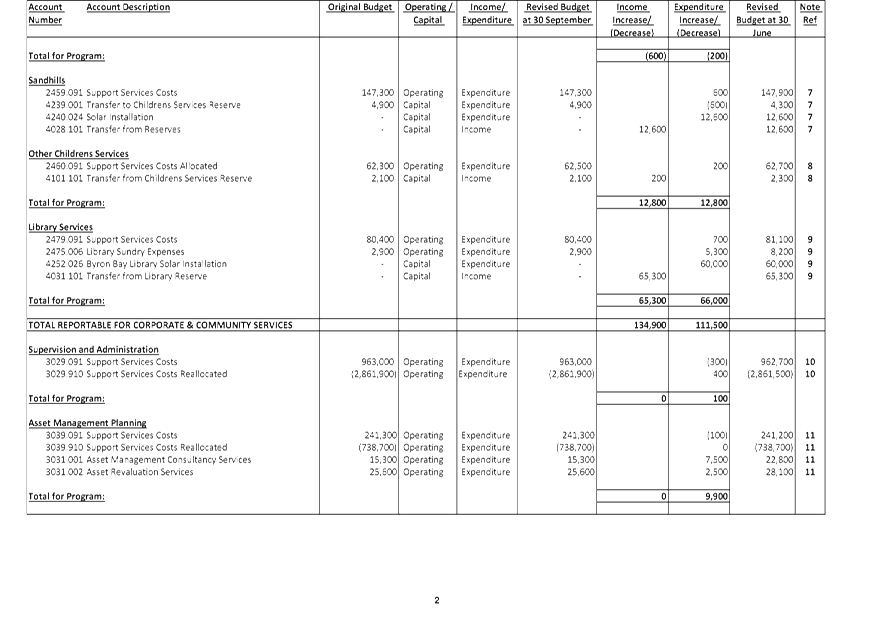

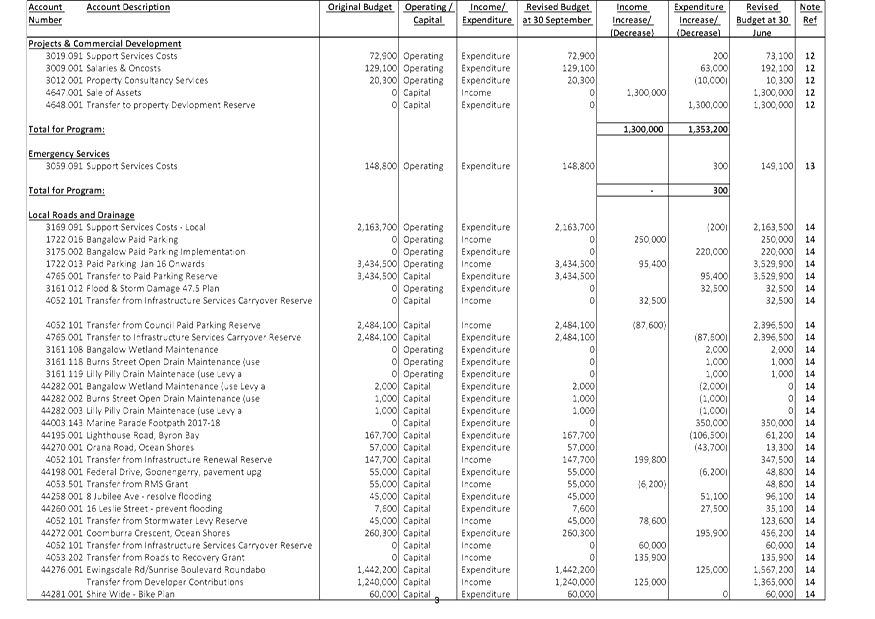

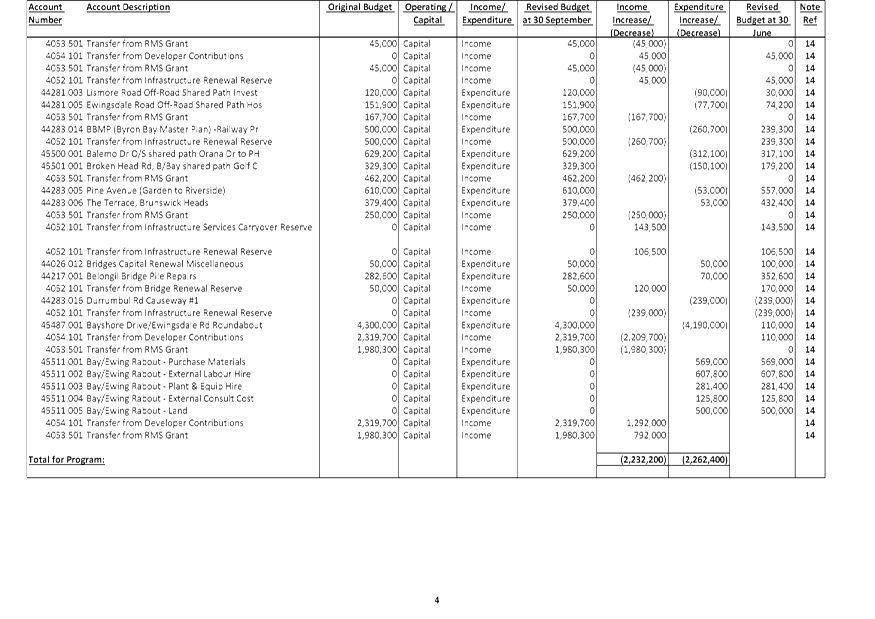

Report No. 4.5 Council

Budget Review - 1 July 2017 to 30 September 2017

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2017/1736

Theme: Corporate Management

Financial Services

Summary:

This report is prepared to comply with Regulation 203 of the

Local Government (General) Regulation 2005 and to inform Council and the

Community of Council’s estimated financial position for the 2017/2018

financial year, reviewed as at 30 September 2017.

This report contains an overview of the proposed budget

variations for the General Fund, Water Fund and Sewerage Fund. The

specific details of these proposed variations are included in Attachment 1 and 2

for Council’s consideration and authorisation.

Attachment 3 contains the Integrated Planning and Reporting

Framework (IP&R) Quarterly Budget Review Statement (QBRS) as outlined by

the Division of Local Government in circular 10-32.

|

RECOMMENDATION:

That the Finance Advisory Committee recommend to

Council:

1. That

Council authorise the itemised budget variations as shown in Attachment 2

(#E2017/104035) which includes the following results in the 30 September 2017

Quarterly Review of the 2017/2018 Budget:

a) General

Fund – $161,900 decrease to the Estimated Unrestricted Cash Result

b) General

Fund - $1,651,500 increase in reserves

c) Water

Fund - $110,000 decrease in reserves

d) Sewerage

Fund - $15,000 decrease in reserves

2. That Council

adopt the revised General Fund Estimated Unrestricted Cash Result of

$940,600 for the 2017/2018 financial year as at 30 September 2017.

|

Attachments:

1 Budget

Variations for General, Water and Sewerage Funds, E2017/104033 , page 67⇩

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2017/104035 ,

page 137⇩

3 Integrated

Planning and Reporting Framework (IP&R) required Quarterly Review

Statement, E2017/104034 , page 147⇩

Report

Council adopted the 2017/2018 budget on 22 June 2017 via

Resolution 17-268. It also considered and adopted the budget

carryovers from the 2016/2017 financial year, to be incorporated into the

2017/2018 budget at its Ordinary Meeting held on 24 August 2017 via Resolution 17-322.

Since that date, Council has reviewed the budget taking into consideration the

2016/2017 Financial Statement results and progress through the first quarter of

the 2017/2018 financial year. This report considers the September 2017

Quarter Budget Review.

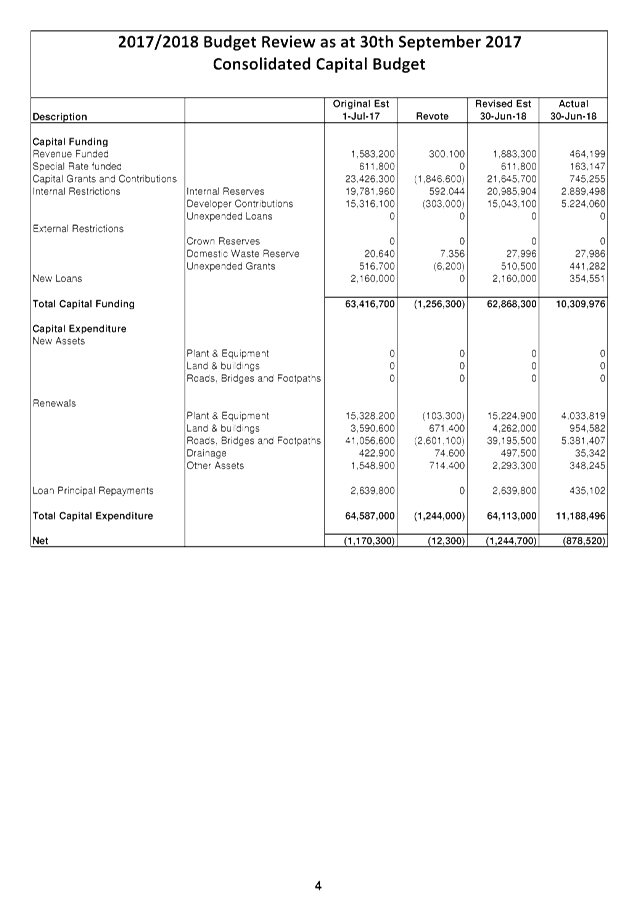

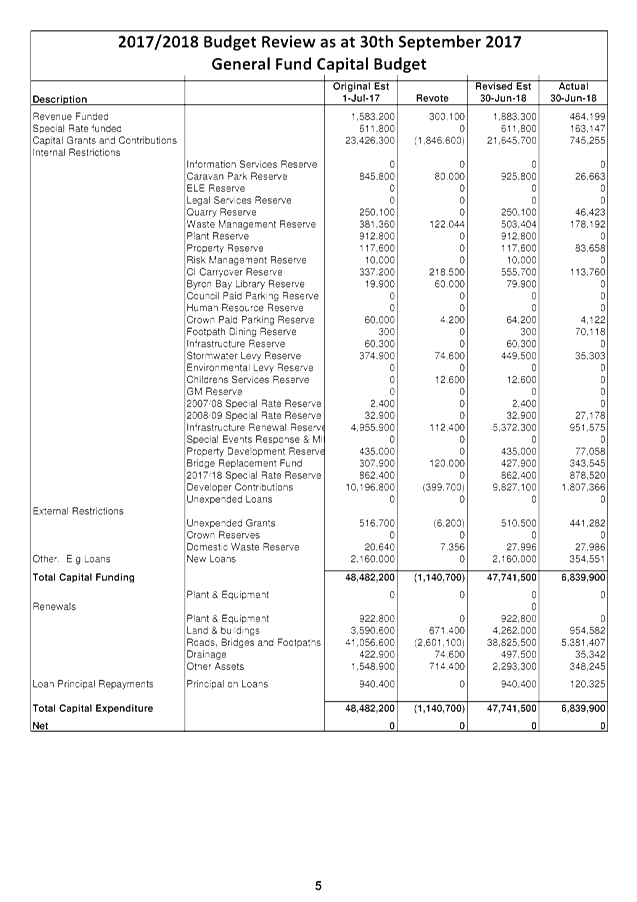

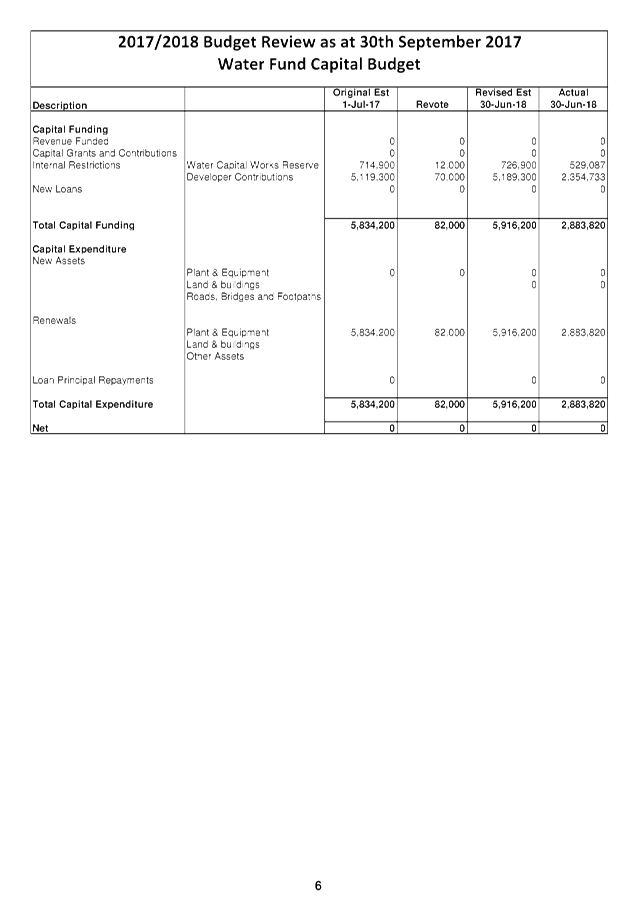

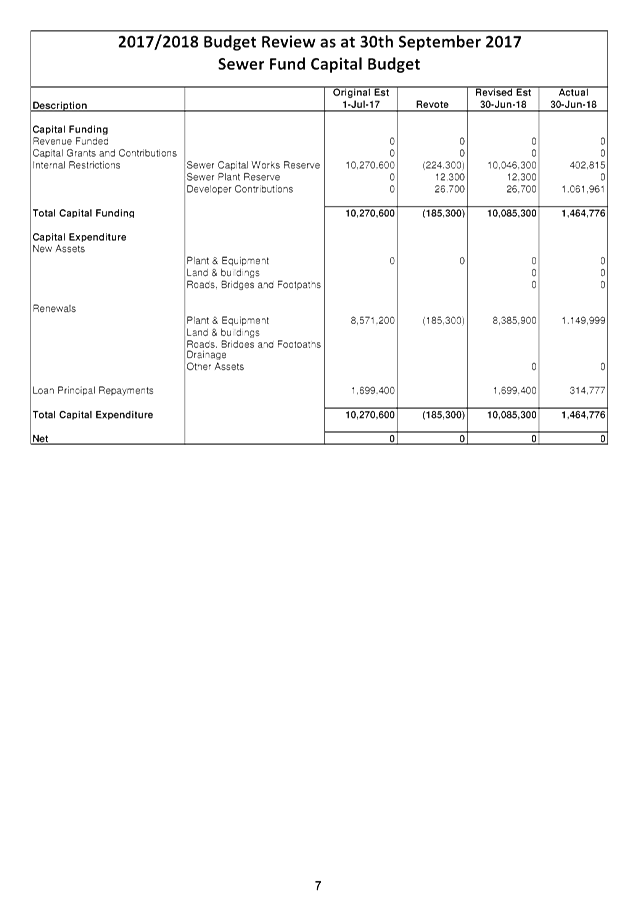

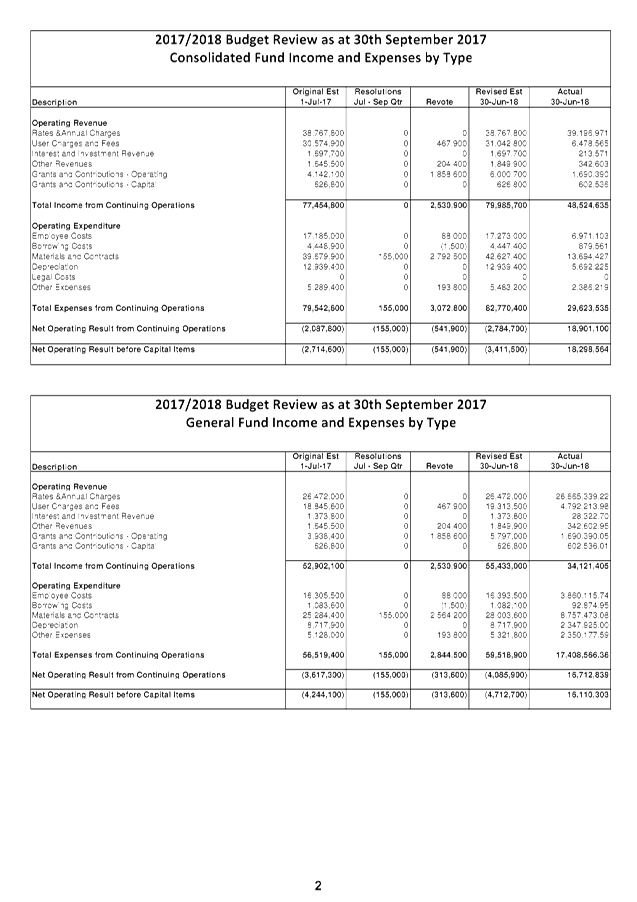

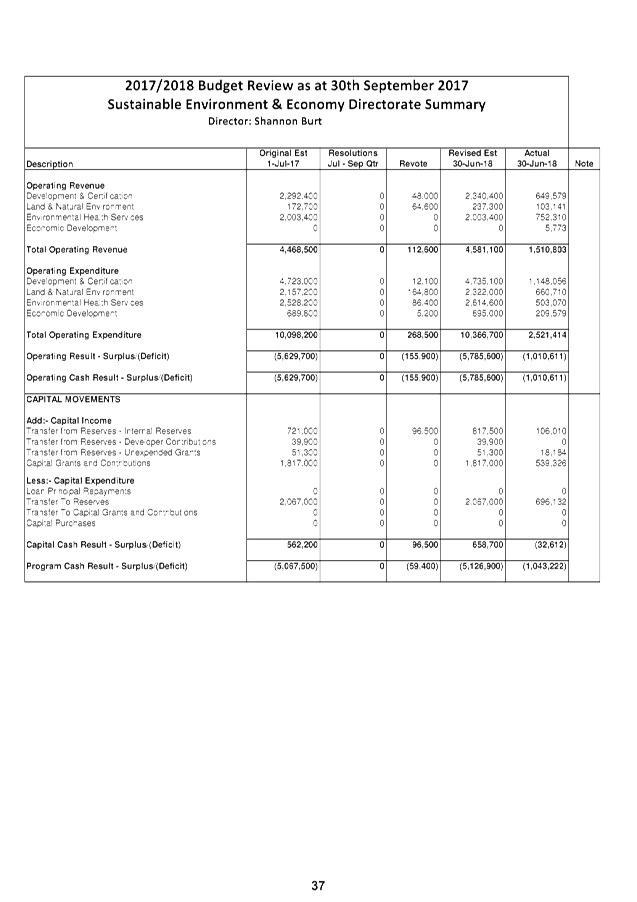

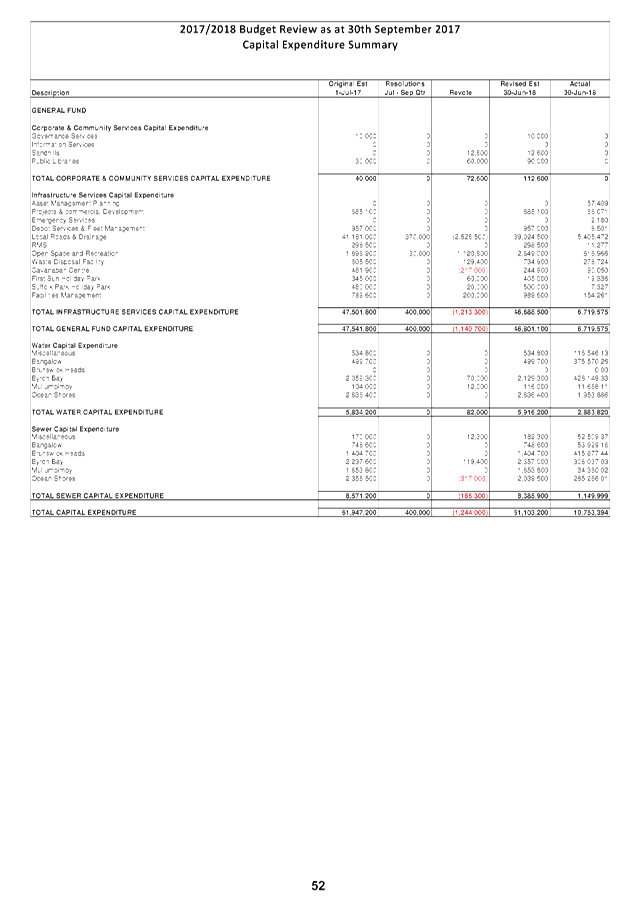

The details of the budget review for the Consolidated,

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget

position of Council, as well as a breakdown by Fund and Principal Activity. The

document in Attachment 1 is also effectively a publication outlining a review

of the budget and is intended to provide Councillors with more detailed

information to assist with decision making regarding Council’s finances.

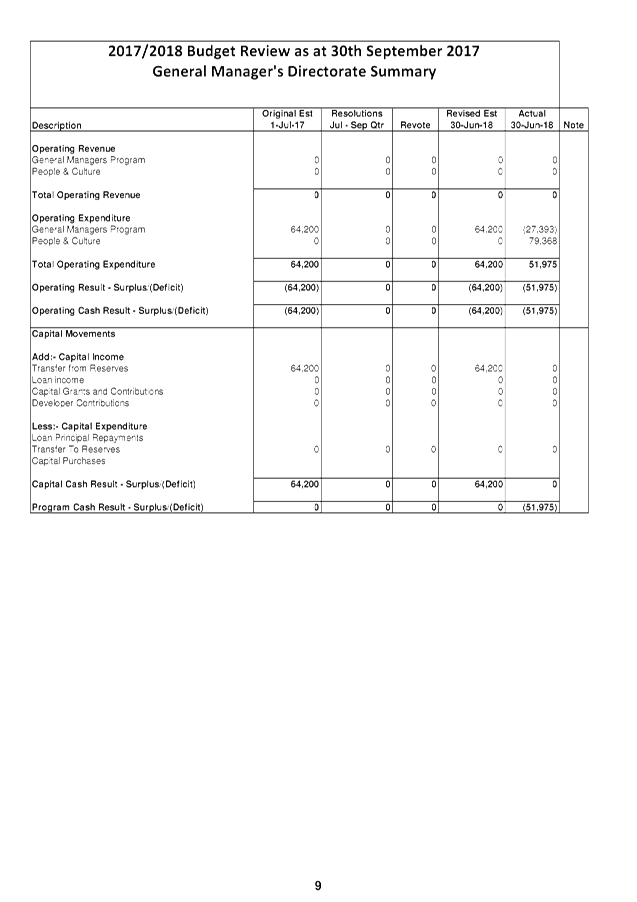

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

The pages within Attachment 1 are presented (from left to

right) by showing the original budget as adopted by Council on 22 June 2017

plus the adopted carryover budgets from 2016/2017 followed by the resolutions

between July and September and the revote (or adjustment for this review) and

then the revised position projected for 30 June 2018 as at 30 September 2017.

On the far right of the Principal Activity, there is a

column titled “Note”. If this is populated by a number, it

means that there has been an adjustment in the quarterly review. This

number then corresponds to the notes at the end of the Attachment 1 which

provides an explanation of the variation.

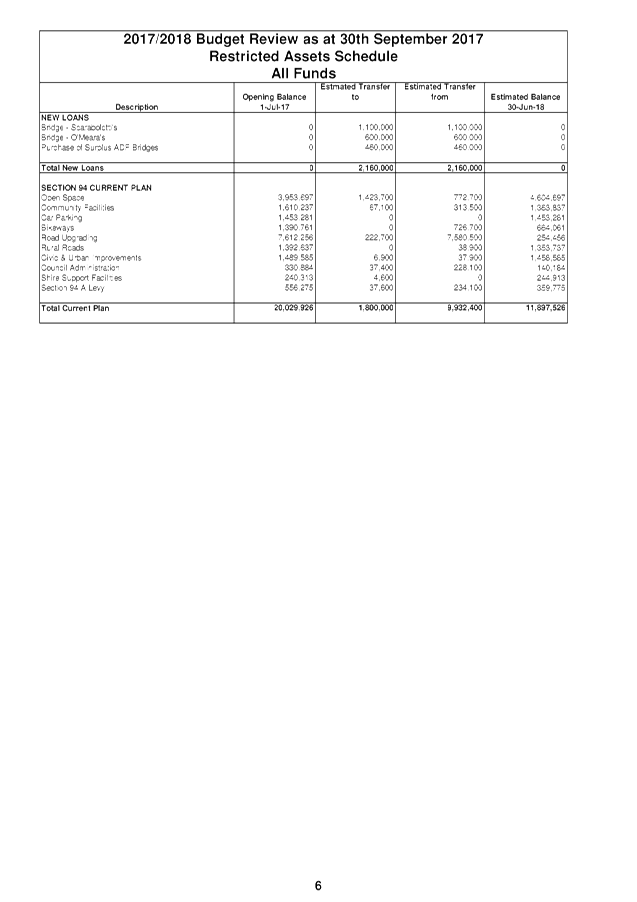

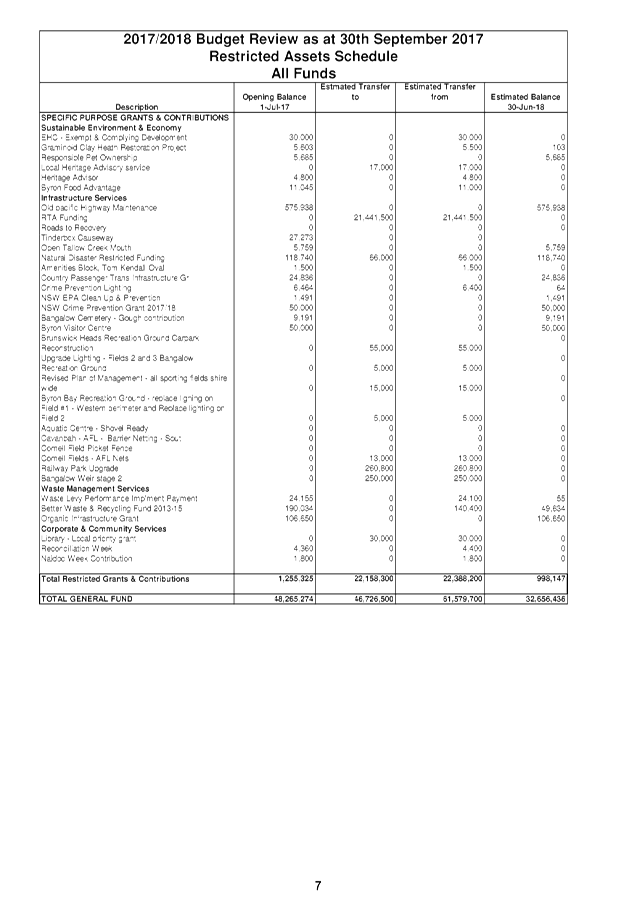

There is also information detailing restricted assets

(reserves) to show Council estimated balances as at 30 June 2018 for all

Council’s reserves.

A summary of Capital Works is also included by Fund and

Principal Activity.

Office of Local Government Budget Review Guidelines:-

The Office of Local Government on 10 December 2010 issued

the new Quarterly Budget Review Guidelines via Circular 10-32, with the

reporting requirements to apply from 1 July 2011. This report includes a

Quarterly Budget Review Statement (refer Attachment 3) prepared by Council in

accordance with the guidelines.

The Quarterly Budget Review Guidelines set a minimum

standard of disclosure, with these standards being included in the Local

Government Code of Accounting Practice and Financial Reporting as mandatory

requirements for Council’s to address.

Since the introduction of the new planning and reporting

framework for NSW Local Government, it is now a requirement for Councils to

provide the following components when submitting a Quarterly Budget Review

Statement (QBRS):-

· A signed statement

by the Responsible Accounting Officer on Councils financial position at the end

of the year based on the information in the QBRS

· Budget review

income and expenses statement in one of the following formats:

o Consolidated

o By fund (e.g General, Water,

Sewer)

o By function, activity, program

etc to align with the management plan/operational plan

· Budget Review

Capital Budget

· Budget Review Cash

and Investments Position

· Budget Review Key

performance indicators

· Budget Review

Contracts and Other Expenses

The above components are included in Attachment 3:-

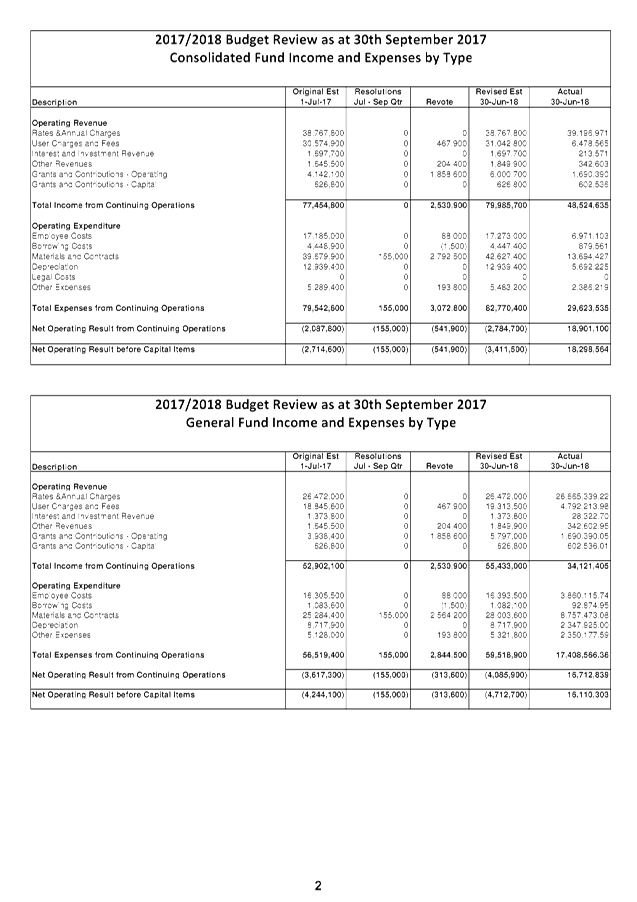

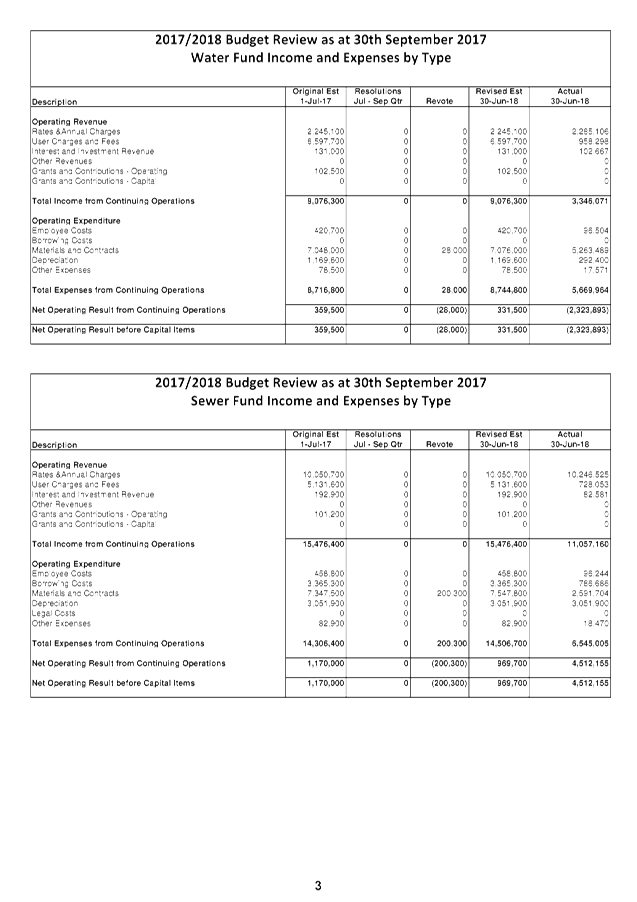

Income and Expenditure Budget

Review Statement by Type – This shows Councils income and Expenditure

by type. This has been split by Fund. Adjustments are shown,

looking from left to right. These adjustments are commented on through

the last 16 pages of Attachment 1.

Capital Budget Review Statement

– This statement identifies in summary Council’s capital works

program on a consolidated basis and then split by Fund. It also

identifies how the capital works program is funded. As this is the first

quarterly review for the reporting period, the Statement may not necessarily

indicate the total progress achieved on the delivery of the capital works

program.

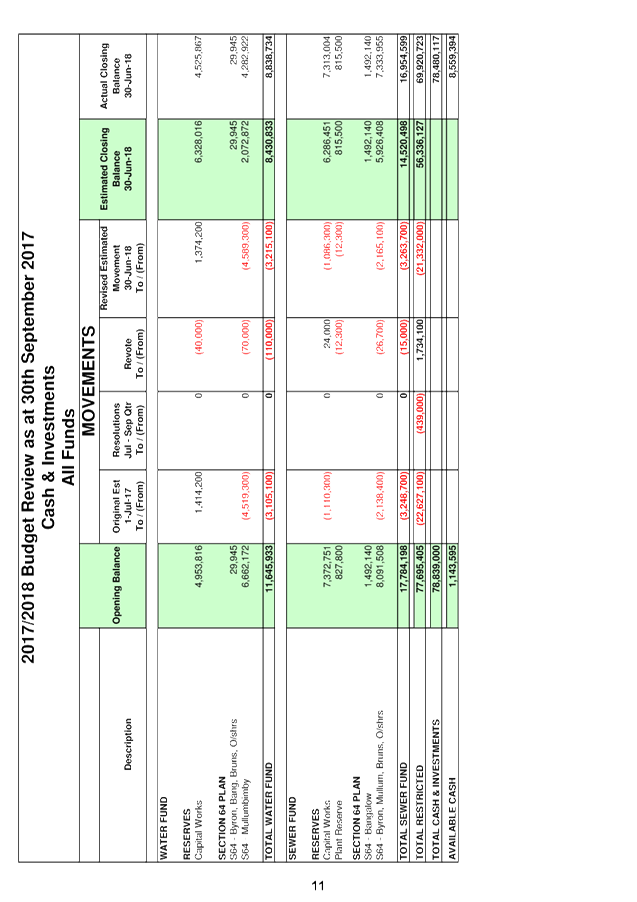

Cash and Investments Budget

Review Statement – This statement reconciles Council’s

restricted funds (reserves) against available cash and investments.

Council has attempted to indicate an actual position as at 30 September 2017 of

each reserve to show a total cash position of reserves with any difference

between that position and total cash and investments held as available cash and

investments. It should be recognised that the figure is at a point in

time and may vary greatly in future quarterly reviews pending on cash flow

movements.

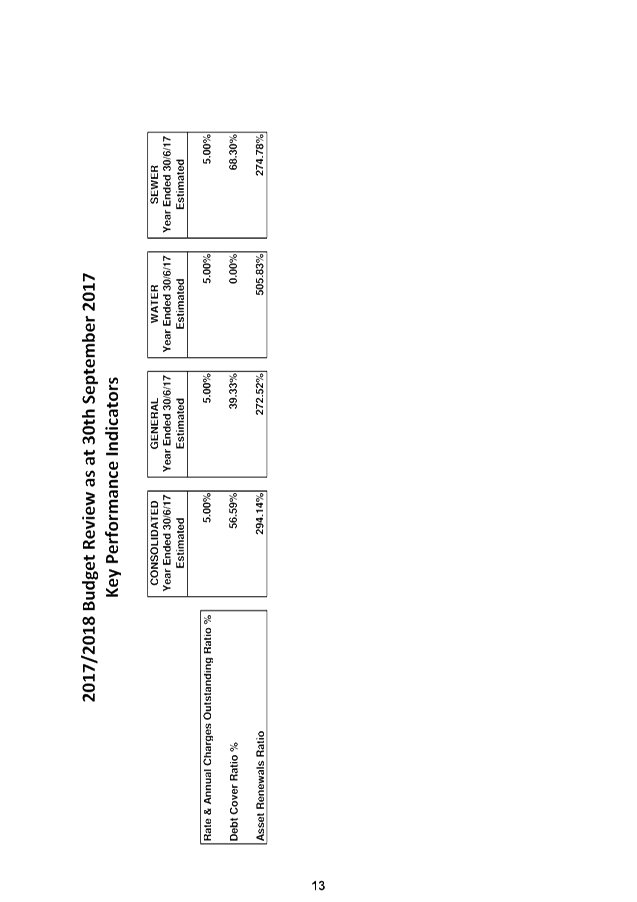

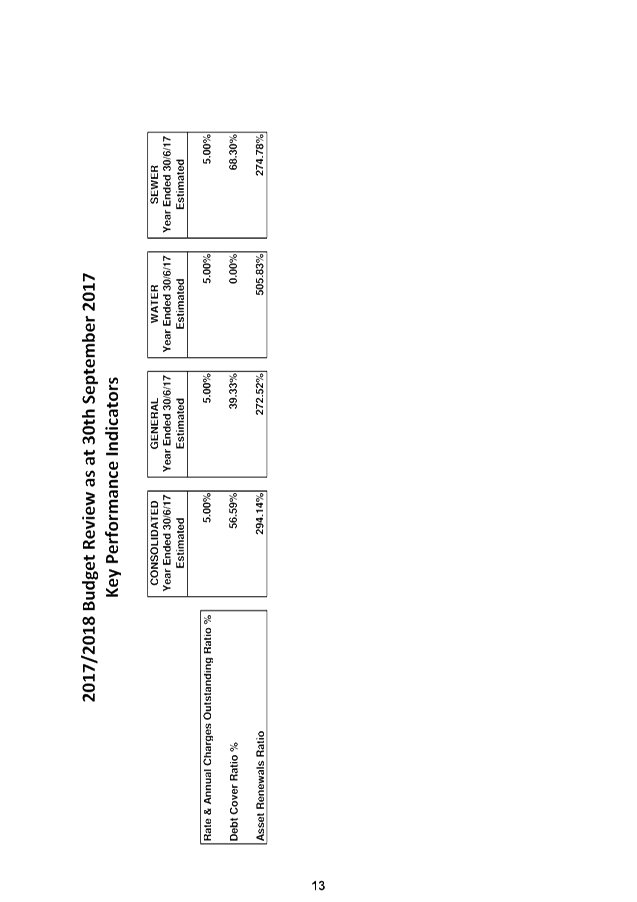

Key Performance Indicators

(KPI’s) – At this stage, the KPI’s within this

report are:-

o Debt Service Ratio -

This assesses the impact of loan principal and interest repayments on the

discretionary revenue of Council.

o Rates and Annual Charges

Outstanding Ratio – This assesses the impact of uncollected rates and

annual charges on Councils liquidity and the adequacy of recovery efforts

o Asset Renewals Ratio

– This assesses the rate at which assets are being renewed relative

to the rate at which they are depreciating.

These may be expanded in future

to accommodate any additional KPIs that Council may adopt to use in the Long

Term Financial Plan (LTFP.)

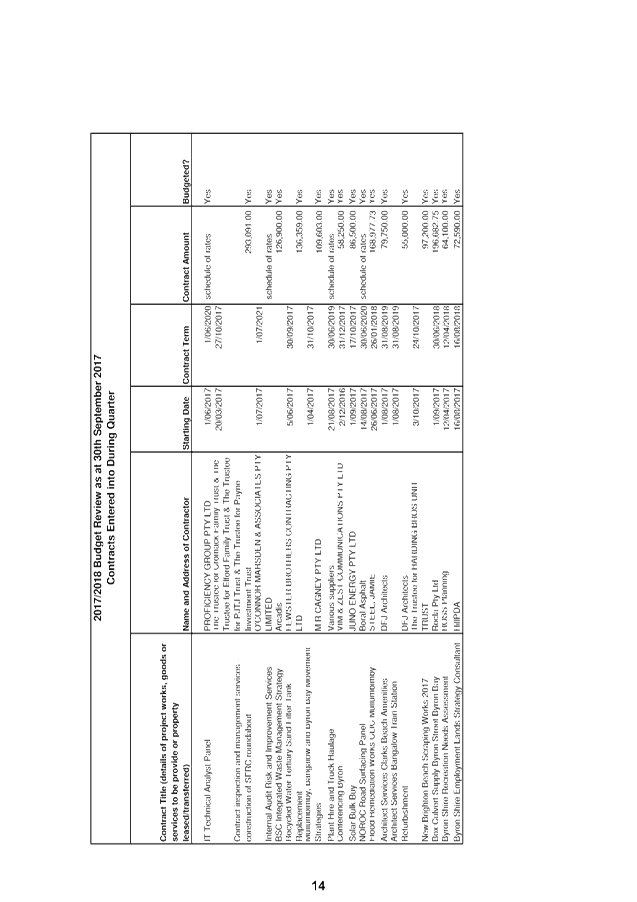

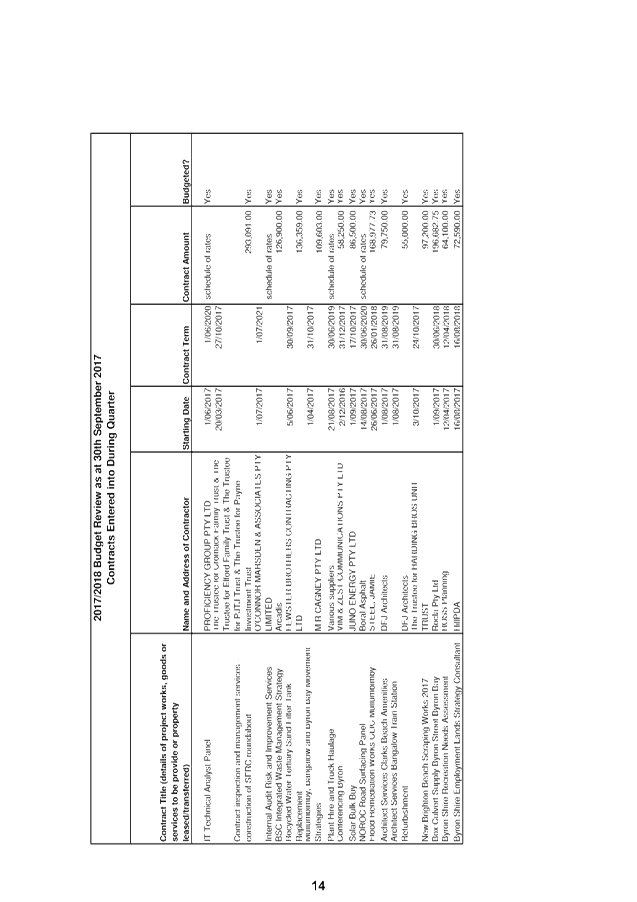

Contracts and

Other Expenses - This report highlights any contracts Council entered into

during the July to September quarter that are greater then $50,000.

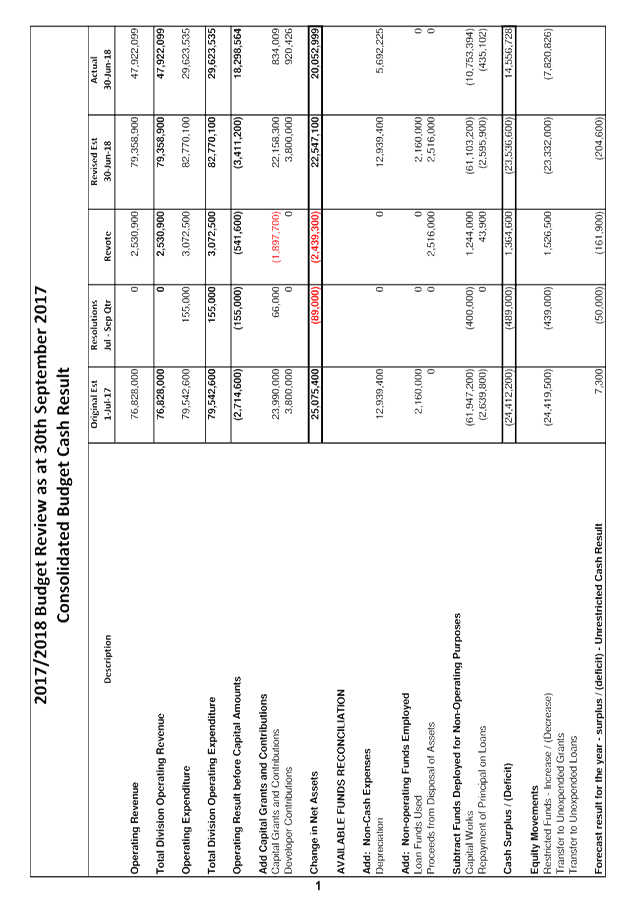

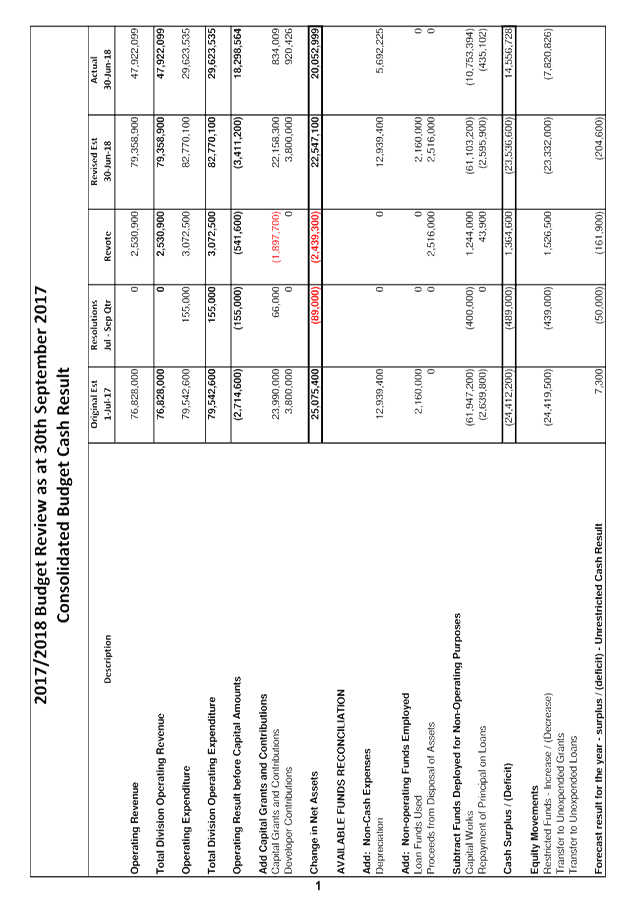

CONSOLIDATED RESULT

The following table provides a summary of the overall

Council budget on a consolidated basis inclusive of all Funds budget movements

for the 2017/2018 financial year projected to 30 June 2018 but revised as at 30

September 2017.

|

2017/2018 Budget Review Statement as at 30 September 2017

|

Original Estimate (Including Carryovers)

1/7/2017

|

Adjustments to 30 Sept 2017 including Resolutions*

|

Proposed 30Sept 2017 Review Revotes

|

Revised Estimate 30/6/2018 at 30/9/2017

|

|

Operating Revenue

|

76,828,000

|

0

|

2,530,900

|

79,358,900

|

|

Operating Expenditure

|

79,542,600

|

155,000

|

3,072,500

|

82,770,100

|

|

Operating Result –

Surplus/Deficit

|

(2,714,600)

|

(155,000)

|

(541,600)

|

(3,411,200)

|

|

Add: Capital Revenue

|

27,790,000

|

66,000

|

(1,897,700)

|

25,958,300

|

|

Change in Net Assets

|

25,075,400

|

(89,000)

|

(2,439,300)

|

22,547,100

|

|

Add: Non Cash Expenses

|

12,939,400

|

0

|

0

|

12,939,400

|

|

Add: Non-Operating Funds

Employed

|

2,160,000

|

0

|

2,516,000

|

4,676,000

|

|

Subtract: Funds Deployed for

Non-Operating Purposes

|

(64,587,000)

|

(400,000)

|

1,287,900

|

(63,699,100)

|

|

Cash Surplus/(Deficit)

|

(24,412,200)

|

(489,000)

|

1,364,600

|

(23,536,600)

|

|

Restricted Funds –

Increase / (Decrease)

|

(24,419,500)

|

(439,000)

|

1,526,500

|

(23,332,000)

|

|

Forecast Result for the

Year – Surplus/(Deficit) – Unrestricted Cash Result

|

7,300

|

(50,000)

|

(161,900)

|

(204,600)

|

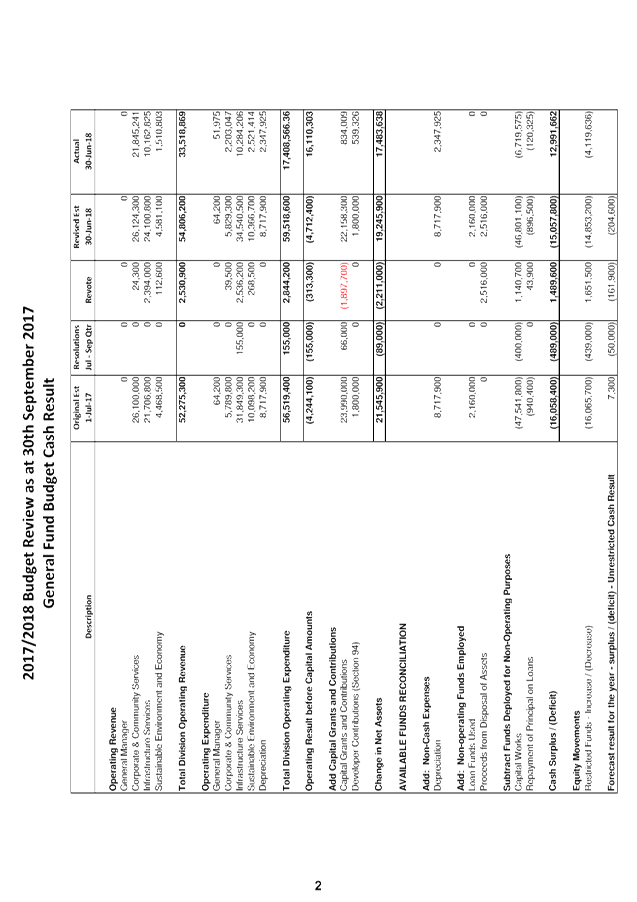

GENERAL FUND

In terms of the General Fund projected Unrestricted Cash

Result the following table provides a reconciliation of the estimated position

as at 30 September 2016:

|

Opening Balance – 1

July 2017

|

$1,145,200

|

|

Plus original budget

movement and carryovers

|

$7,300

|

|

Council Resolutions July

– September Quarter

|

(50,000)

|

|

Recommendations within this

Review – increase/(decrease)

|

($161,900)

|

|

Forecast Unrestricted

Cash Result – Surplus/(Deficit) – 30 June 2018

|

($204,600)

|

|

Estimated Unrestricted

Cash Result Closing Balance – 30 June 2018

|

$940,600

|

The General Fund financial position overall has decreased by

$161,900 as a result of this budget review. The proposed budget changes

are detailed in Attachment 1 and summarised further in this report below.

Council Resolutions

Resolution 17-269 for the Mullumbimby Hospital Acquisition

in part 3 stated “That a budget of $50,000 be approved by the Council to

fund the independent peer review and that any remaining funds be used for

the forward planning process”. There was no suggested funding

source for this resolution and at this point no funding source has been

identified.

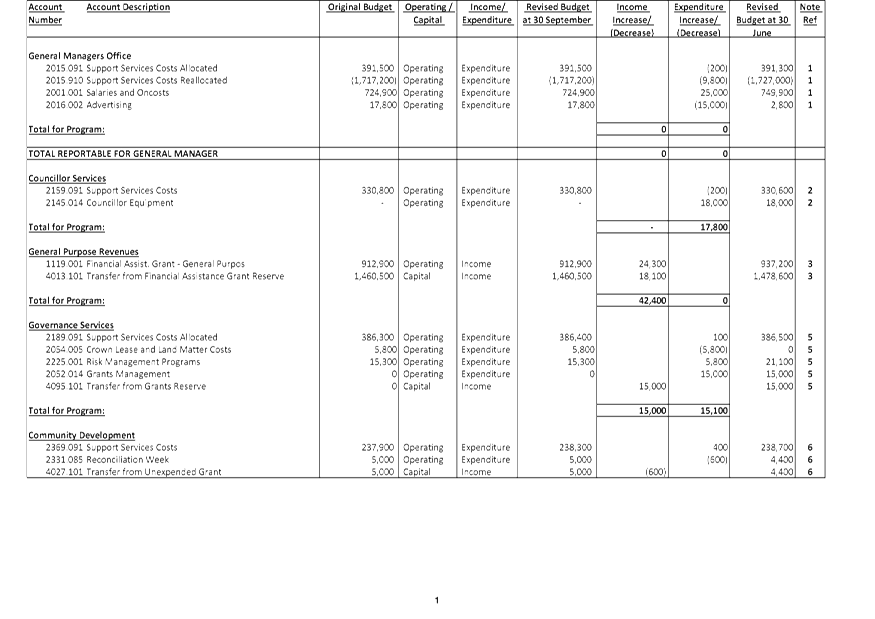

Budget Adjustments

The budget adjustments identified in Attachments 1 and 2 for

the General Fund have been summarised by Budget Directorate in the following

table:

|

Budget Directorate

|

Revenue

Increase/

(Decrease) $

|

Expenditure

Increase/

(Decrease) $

|

Accumulated

Surplus (Working Funds) Increase/ (Decrease) $

|

|

General Manager

|

0

|

0

|

0

|

|

Corporate & Community Services

|

134,900

|

111,500

|

23,400

|

|

Infrastructure Services

|

3,721,300

|

3,847,200

|

(125,900)

|

|

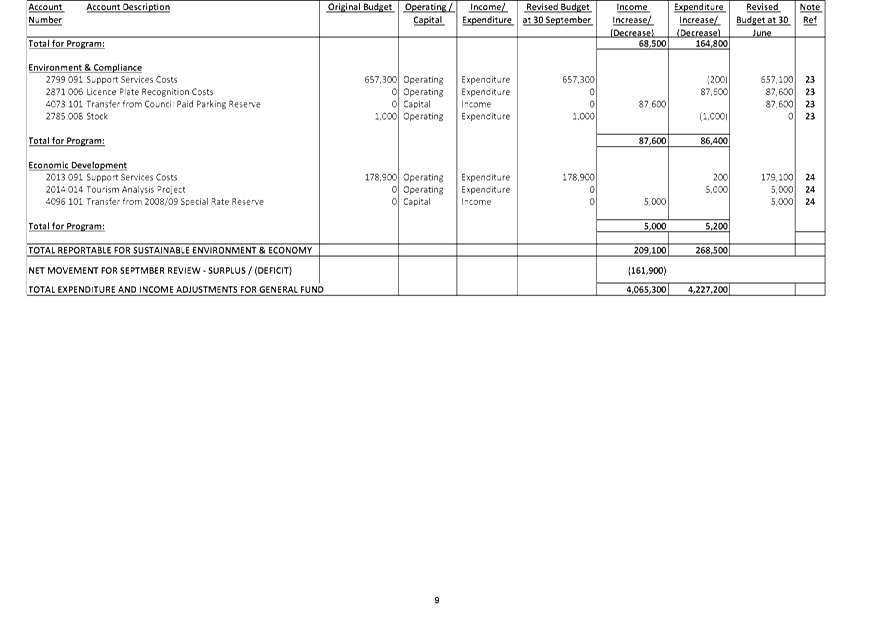

Sustainable Environment & Economy

|

209,100

|

268,500

|

(59,400)

|

|

Total Budget Movements

|

4,065,300

|

4,227,200

|

(161,900)

|

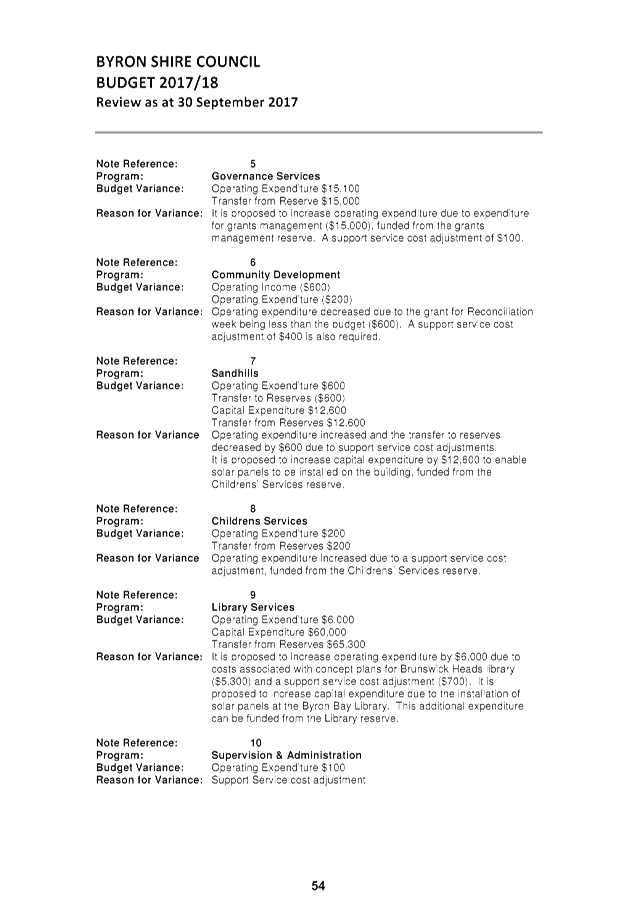

Budget Adjustment Comments

Within each of the Budget Directorates of the General Fund,

are a series of budget adjustments identified in detail at Attachment 1 and

2. More detailed notes on these are provided in Attachment 1 but in

summary the major additional items included are summarised below by Directorate

and are included in the overall budget adjustments table above:

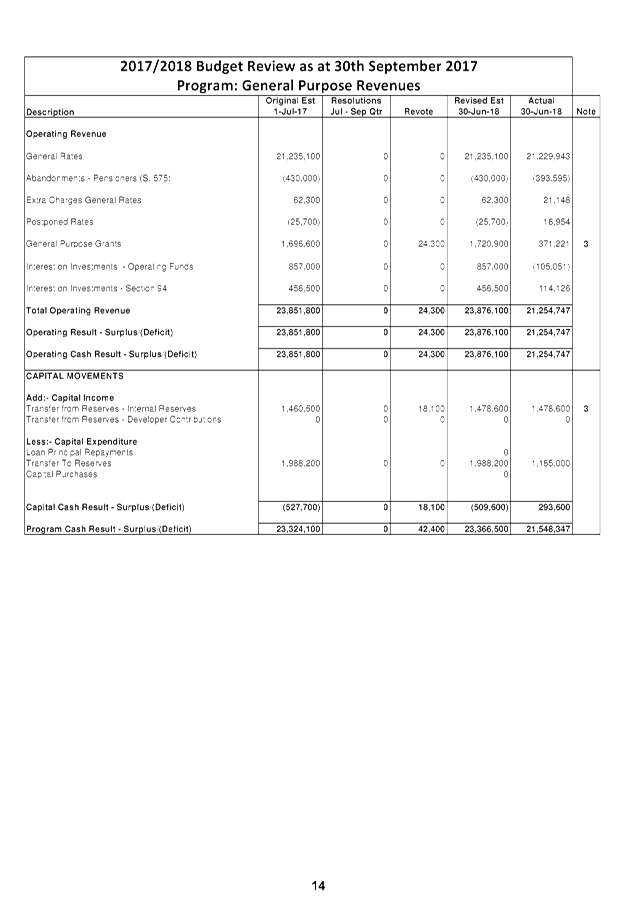

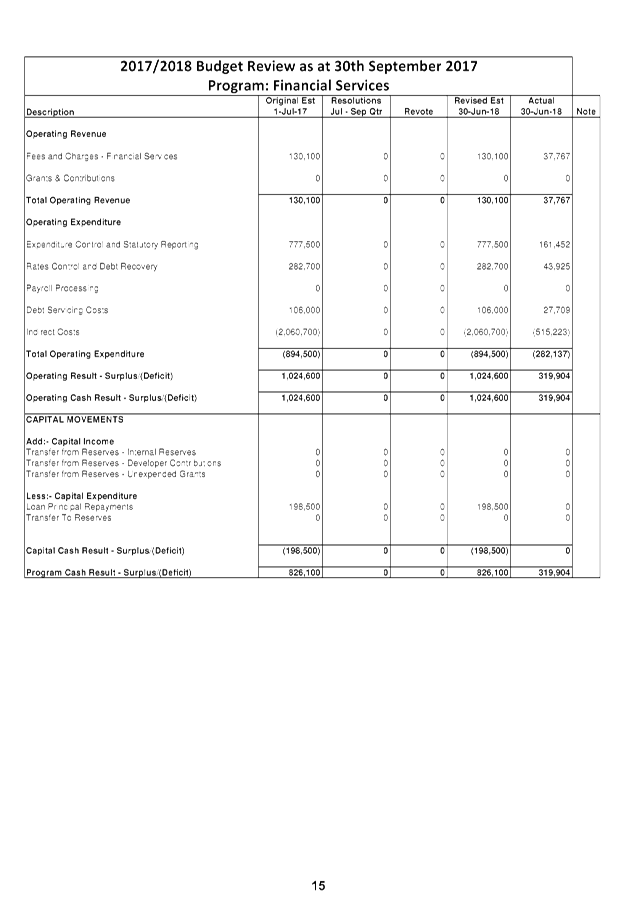

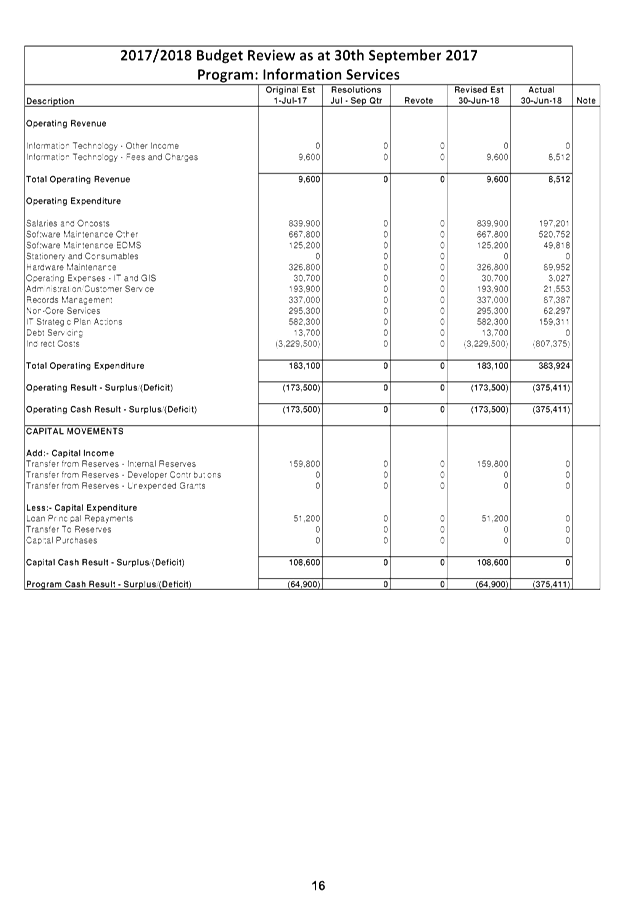

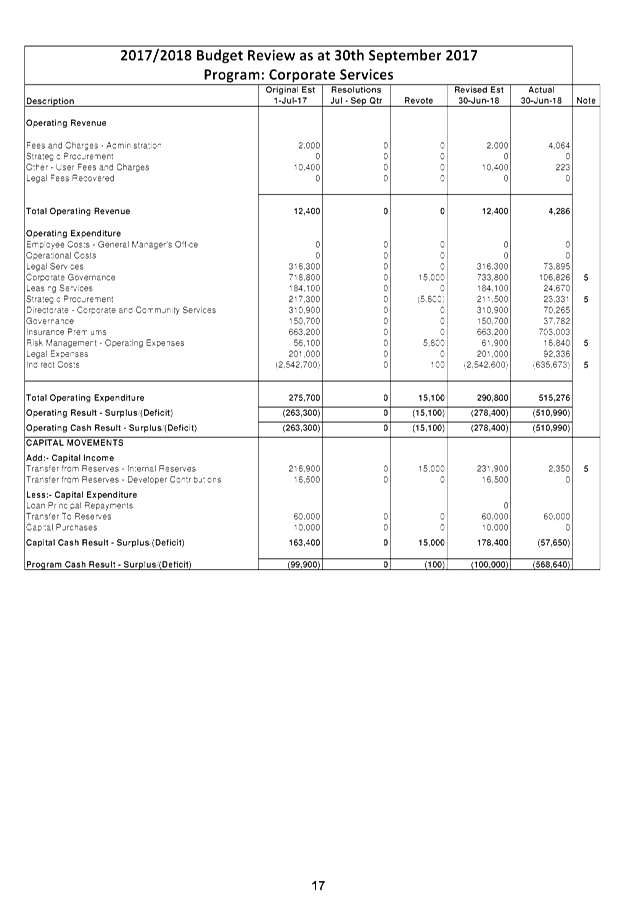

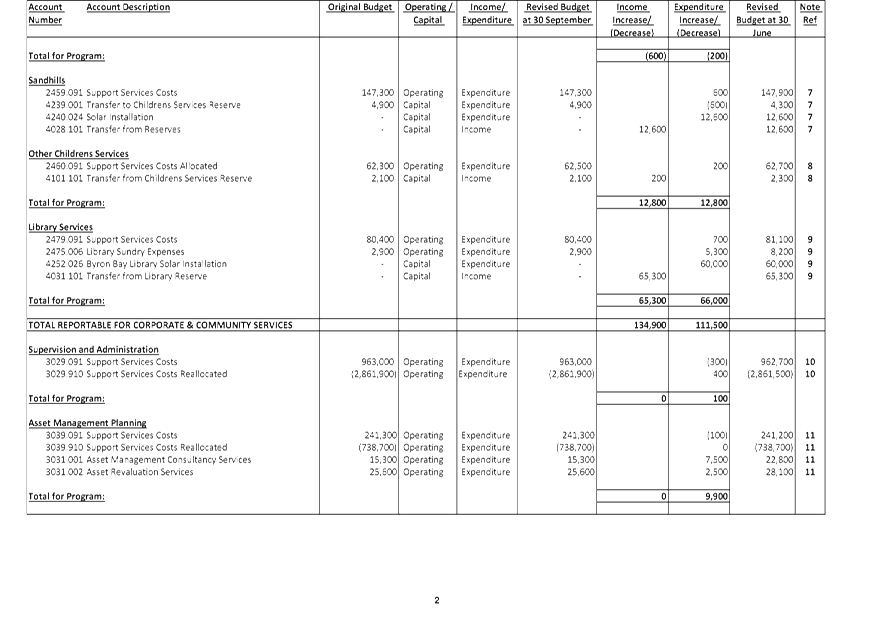

Corporate and Community Services

· In the General

Purpose Revenues Program an additional $42,400 in revenue has been recognised

as the allocation for Council’s 2017/2018 Financial Assistance Grant is

more than budgeted.

· In the Governance

Services Program it is proposed to increase expenditure by $15,000 for grant

management costs. This can be funded through the Grants Management

reserve.

· In the Sandhills

program, it is proposed to increase the budget for the installation of solar

panels ($12,600). This has no net effect on the result as all movements

are taken up through the Childrens’ Service reserve.

· In the Pubic

Libraries program, it is proposed to increase the budget for the installation

of solar panels ($60,000) and costs for concept plans for Brunswick Heads

library ($5,300).

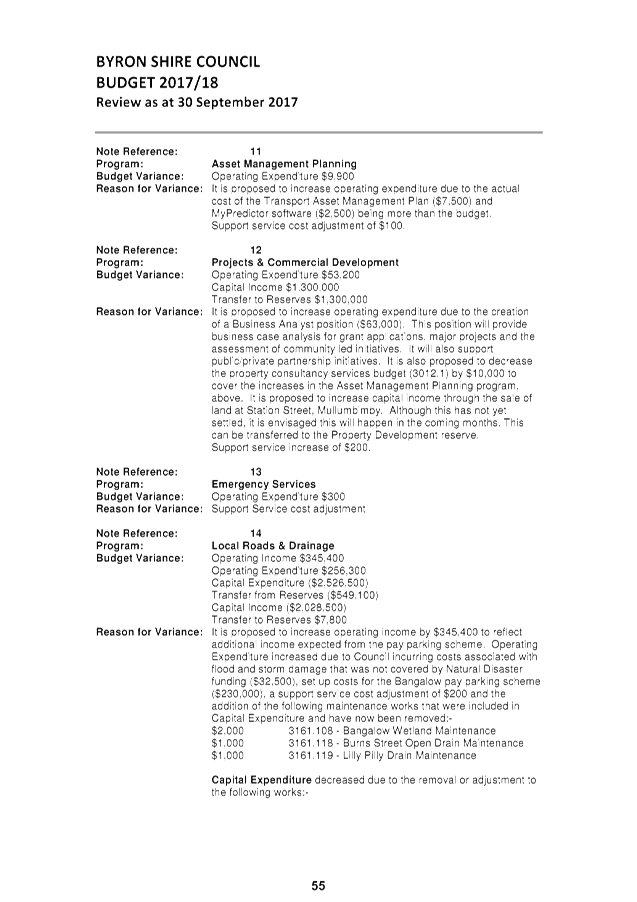

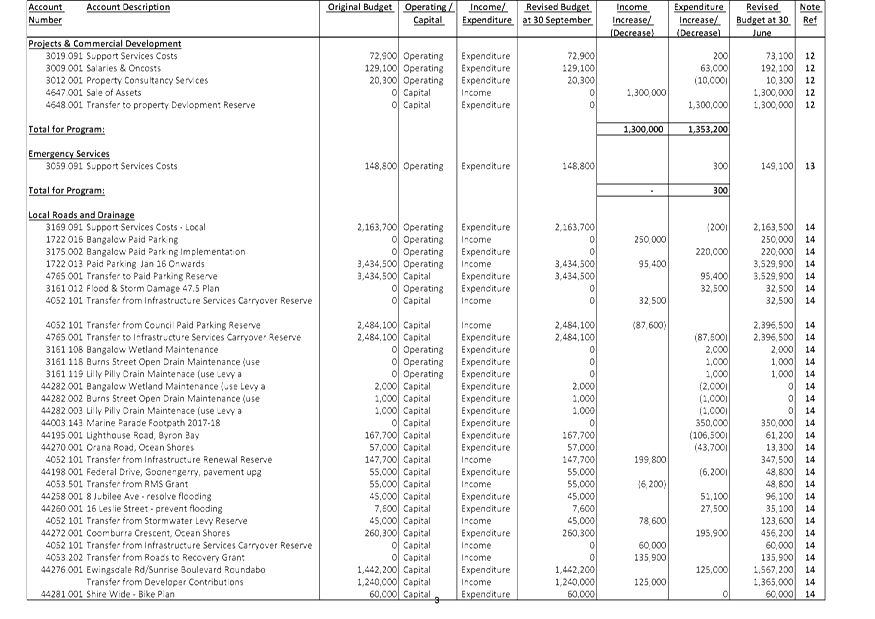

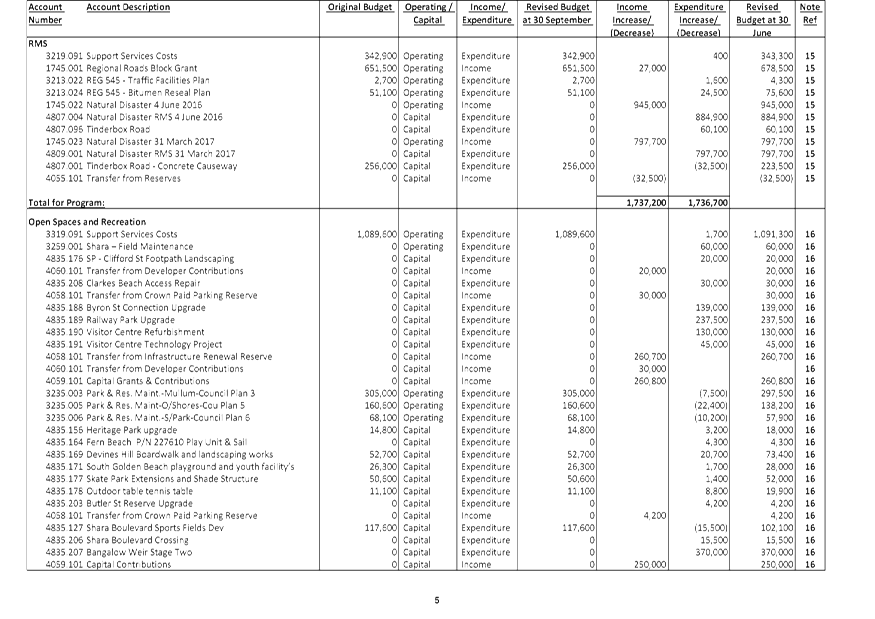

Infrastructure Services

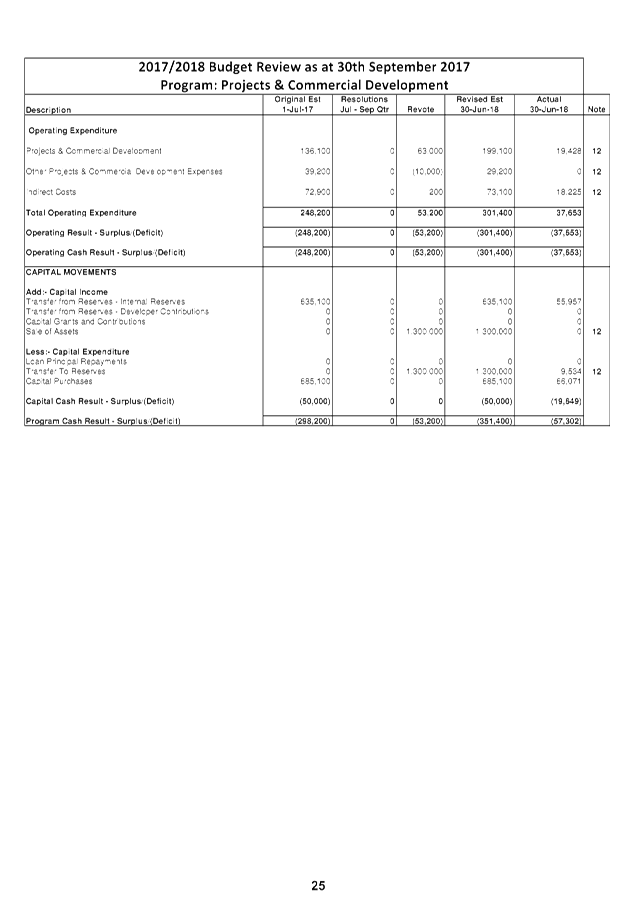

· In the Projects

& Commercial Development program, it is proposed to increase capital income

due to the sale of land at Station Street Mullumbimby for $1,300,000.

This can be transferred to the Property Development reserve.

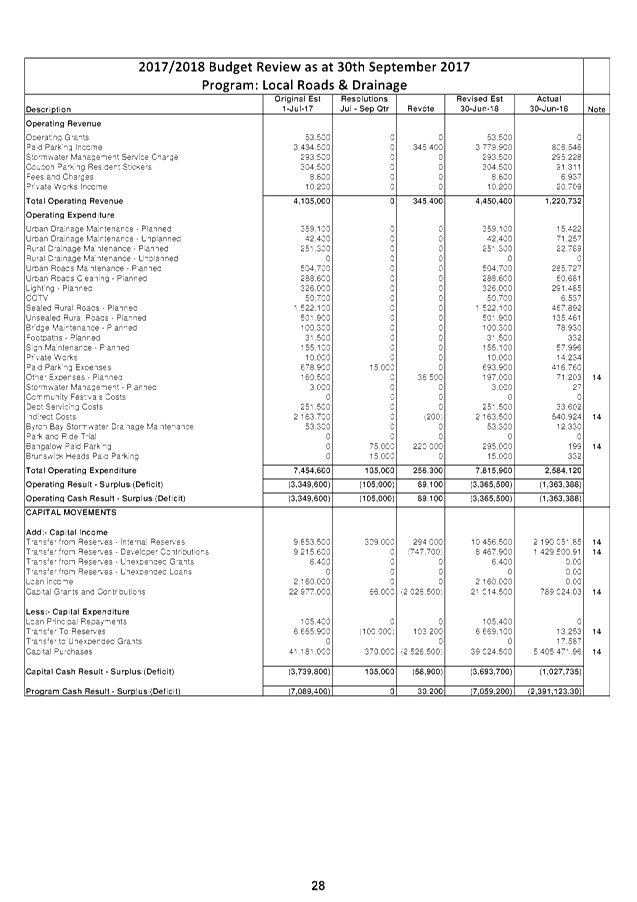

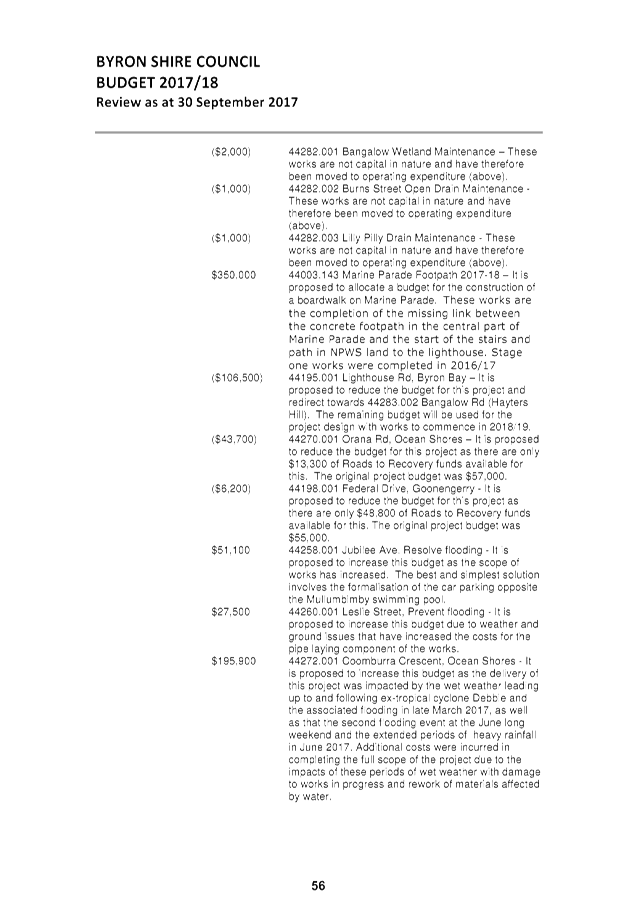

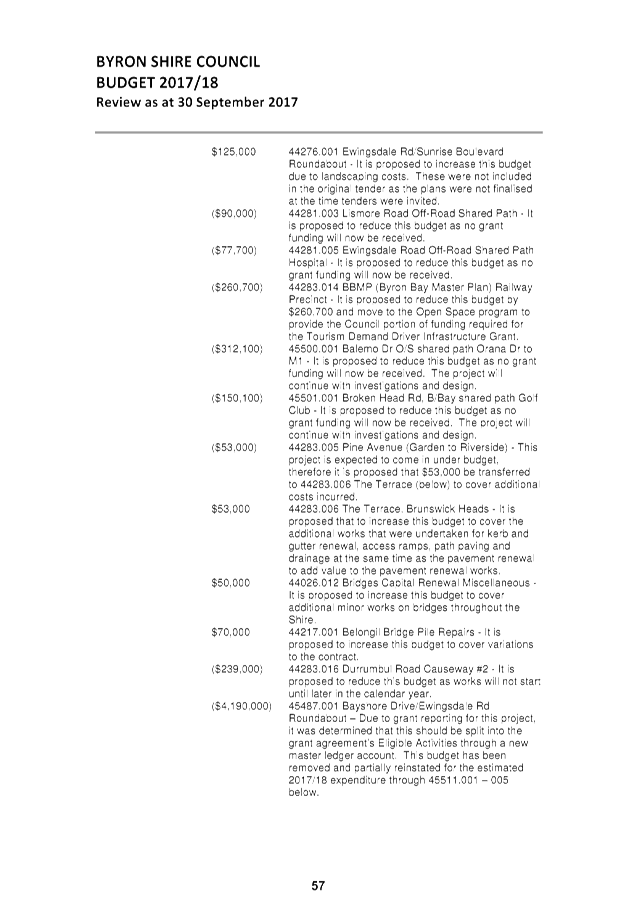

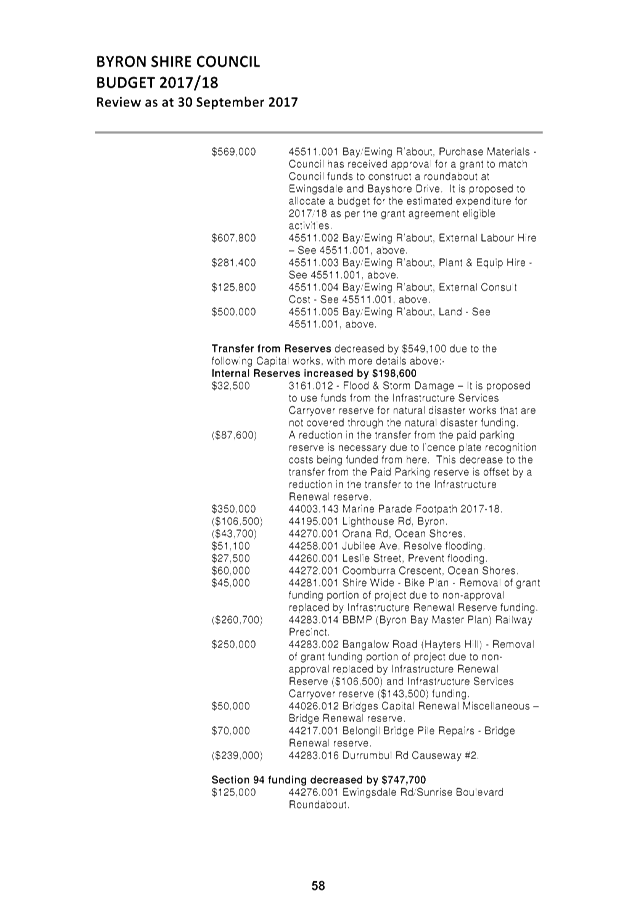

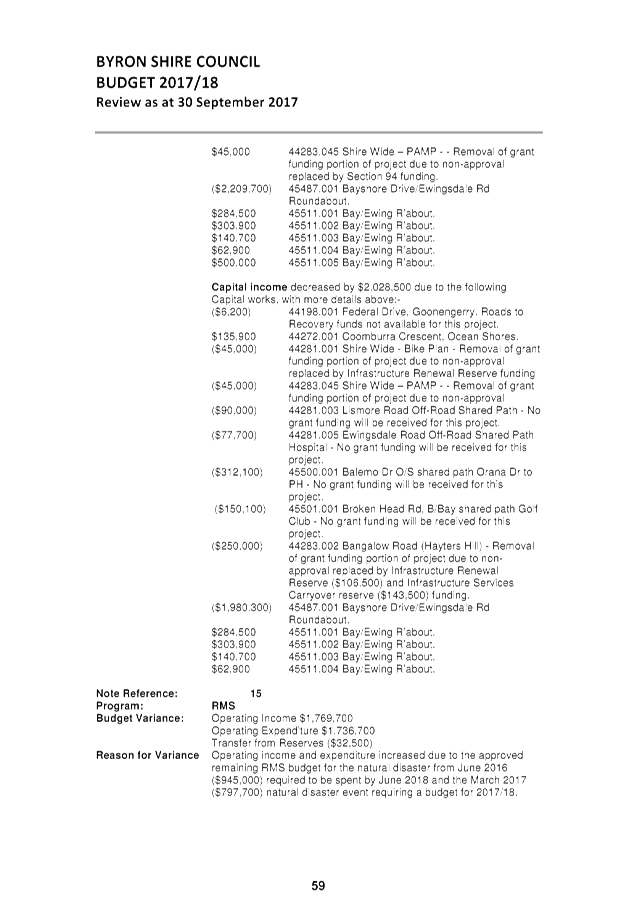

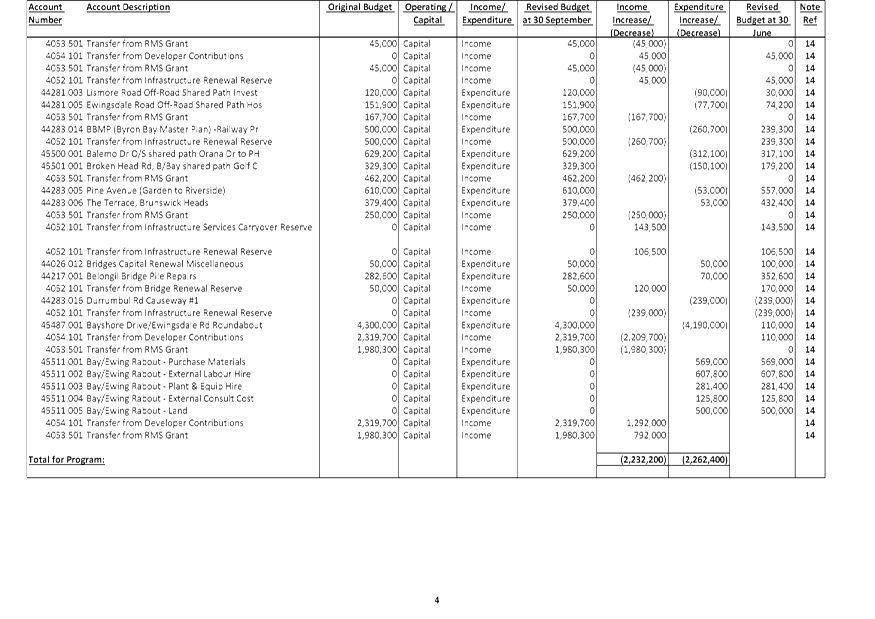

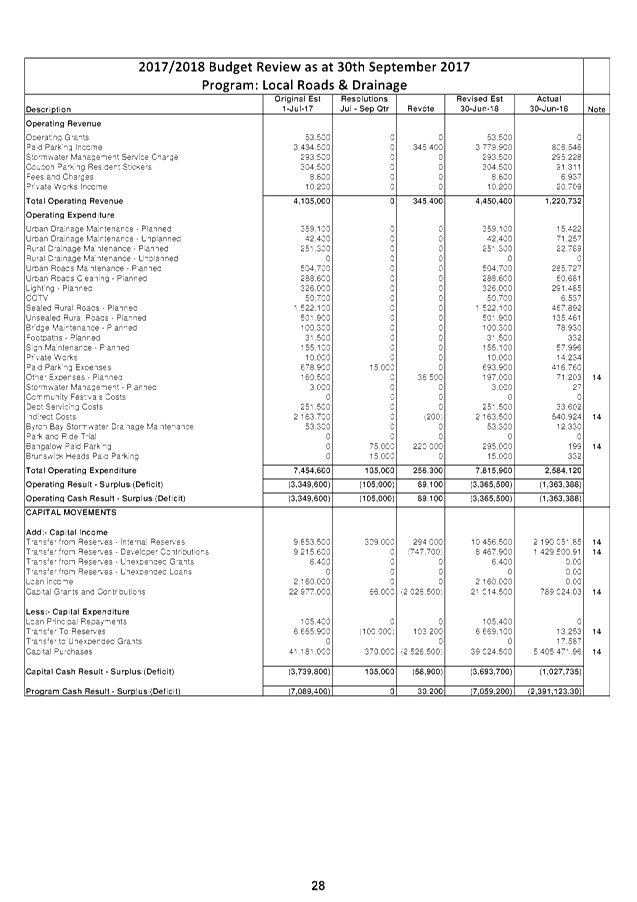

· In the Local Roads

and Drainage program, there are a number of adjustments outlined under Note 14

in the Budget Variations explanations section of Attachment 1. Further

disclosure is included in the second page of Attachment 2 under the budget

program heading Local Roads and Drainage.

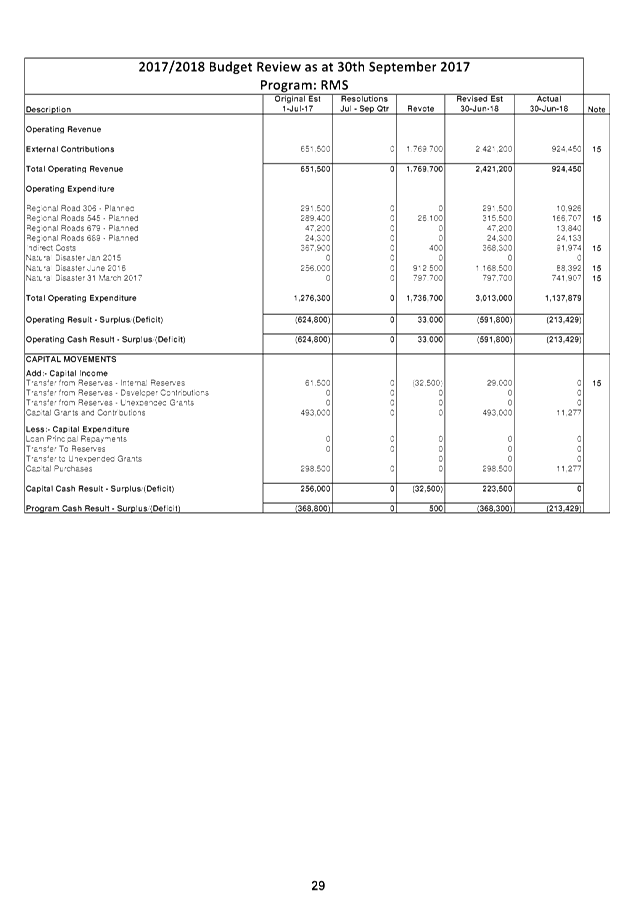

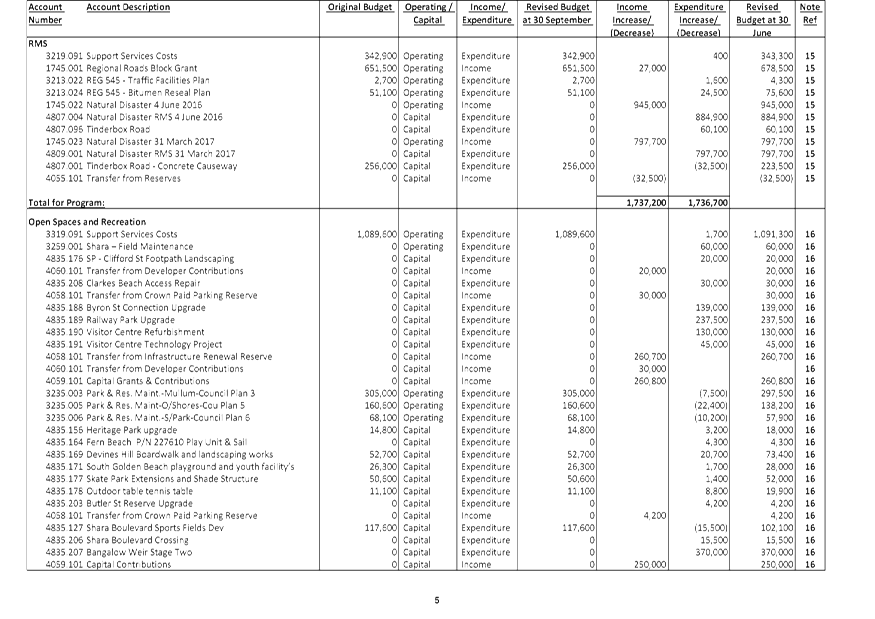

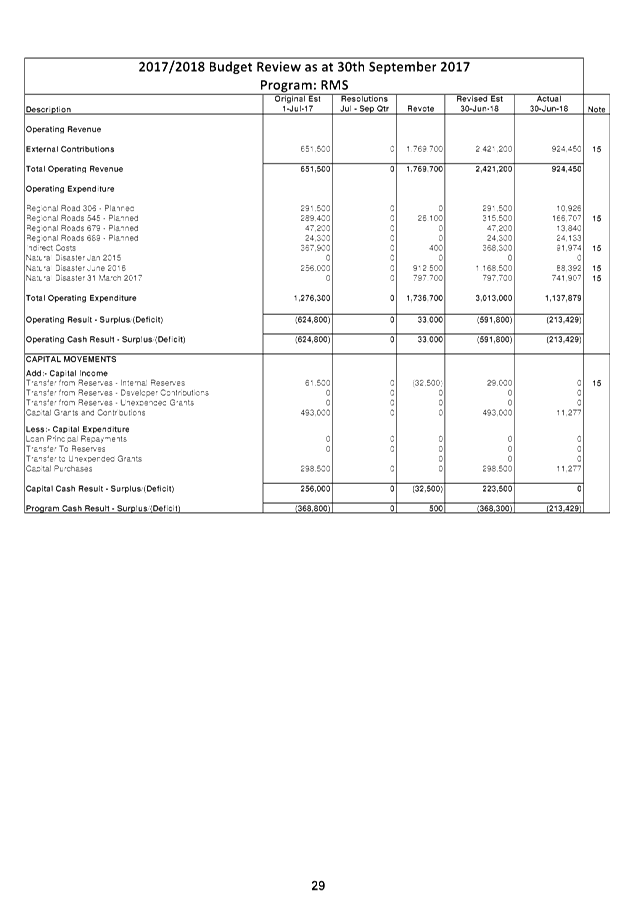

· In the Roads and Maritime

Services program (RMS) it is proposed to increase operating income and

expenditure by $1,742,700 to account for Natural disaster works from June 2016

($945,000) and March 2017 ($797,700).

· In the Open Space

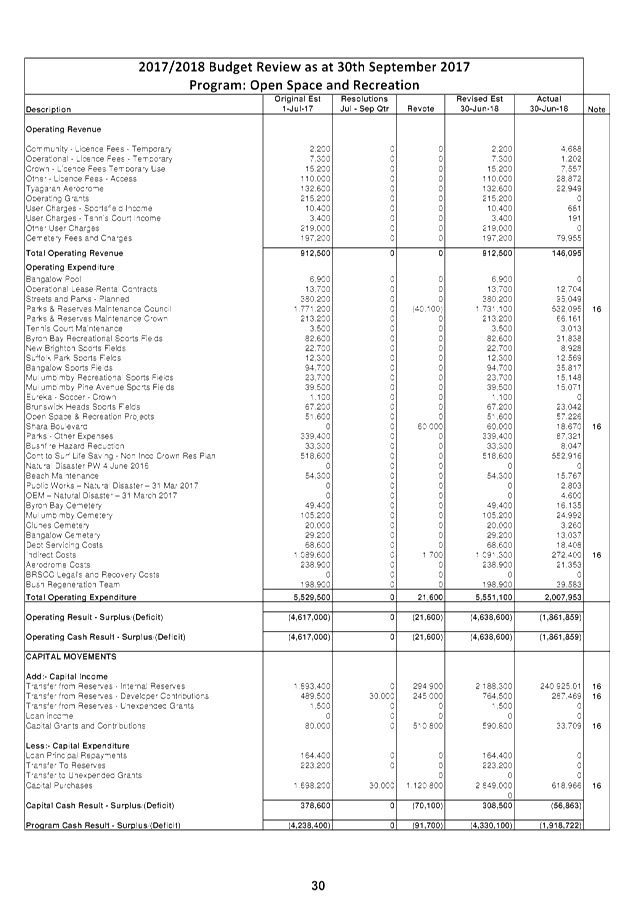

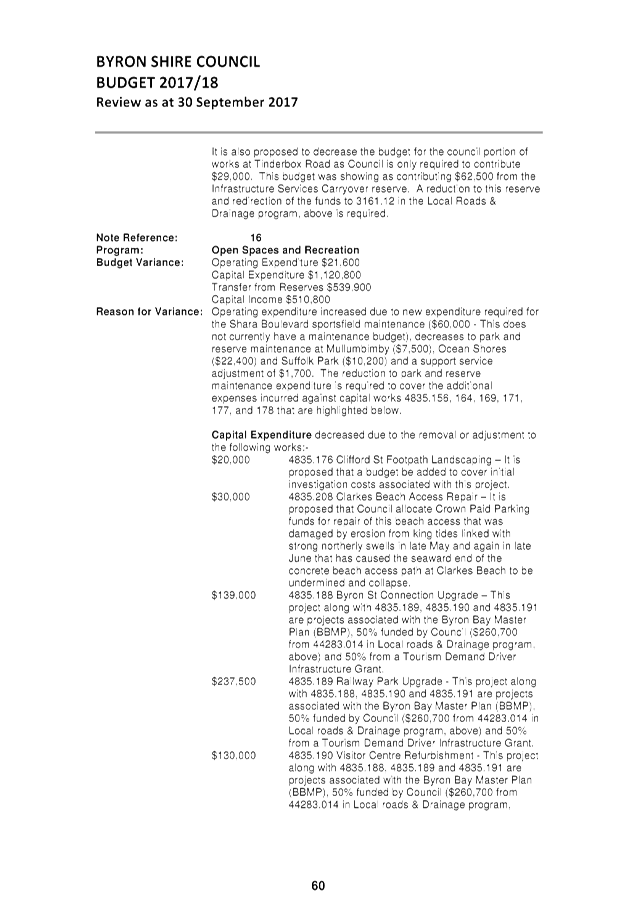

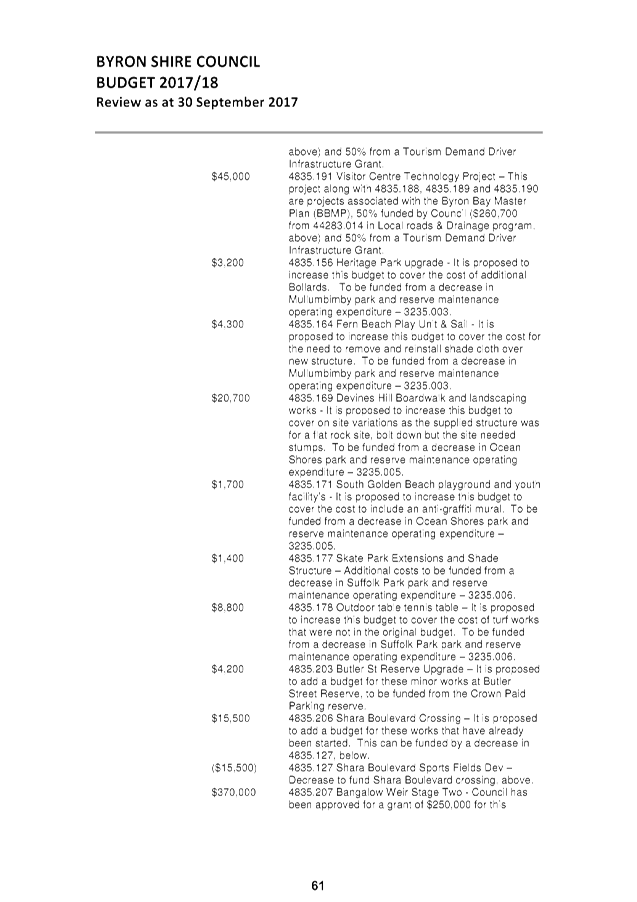

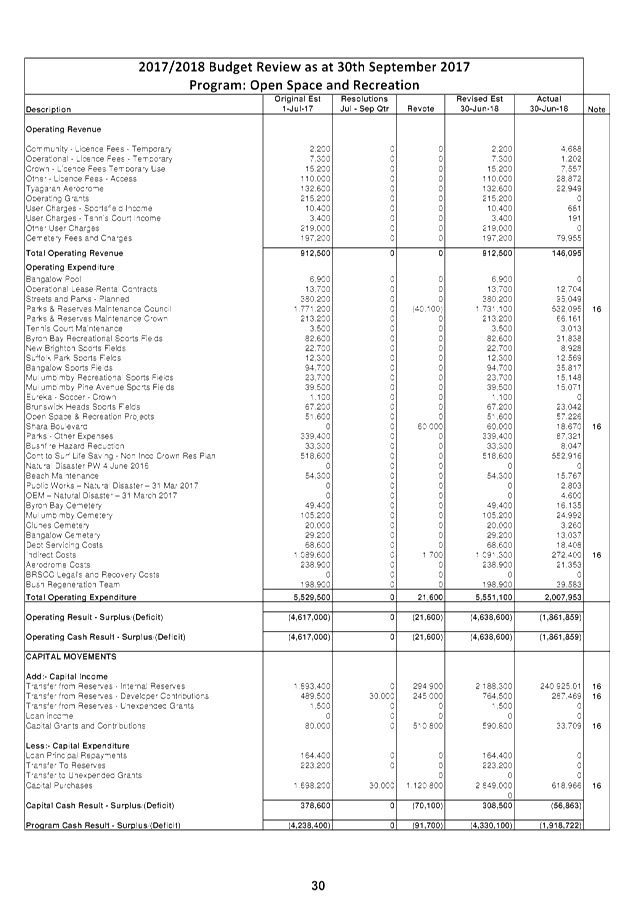

and Recreation program, operating expenditure increased by $21,600 due to a

request for a budget for Shara Boulevard sportsfield maintenance of $60,000,

reductions of $40,100 against various park and reserve maintenance budgets and

a support service cost adjustment of $1,700. There are a number of

capital expenditure adjustments outlined under Note 16 in the Budget Variations

explanations section of Attachment 1. Further disclosure is included in

the third page of Attachment 2 under the budget program heading Open Space

& Recreation.

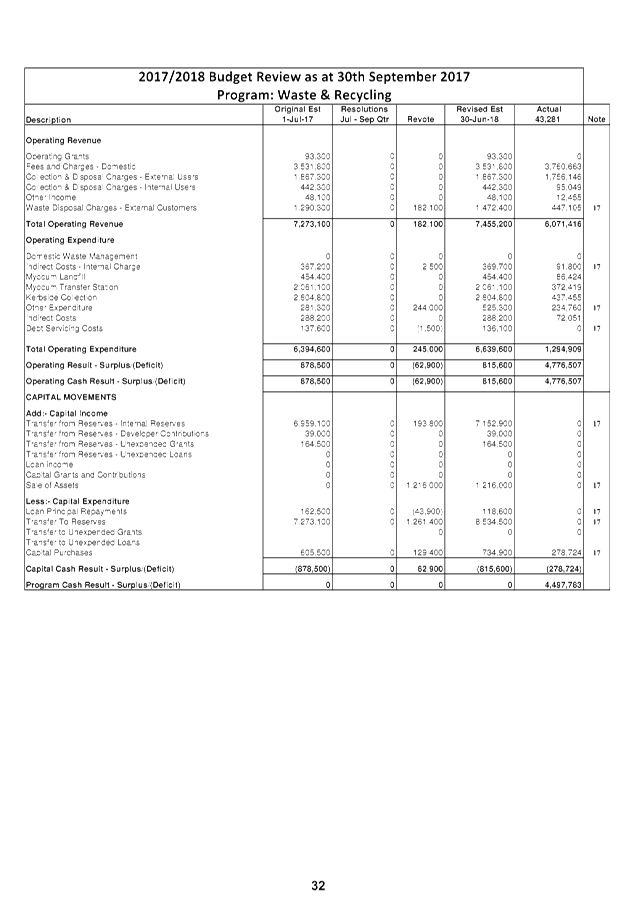

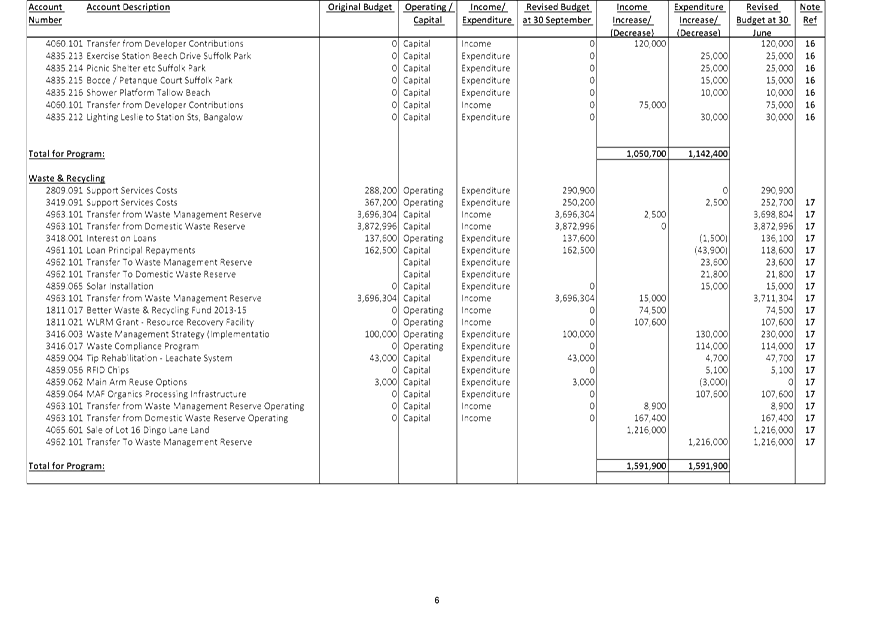

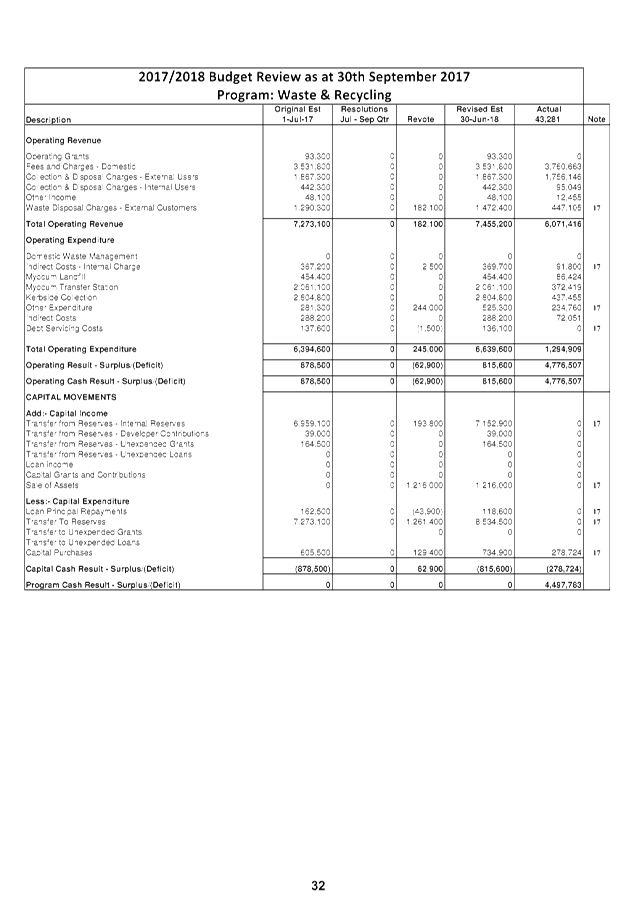

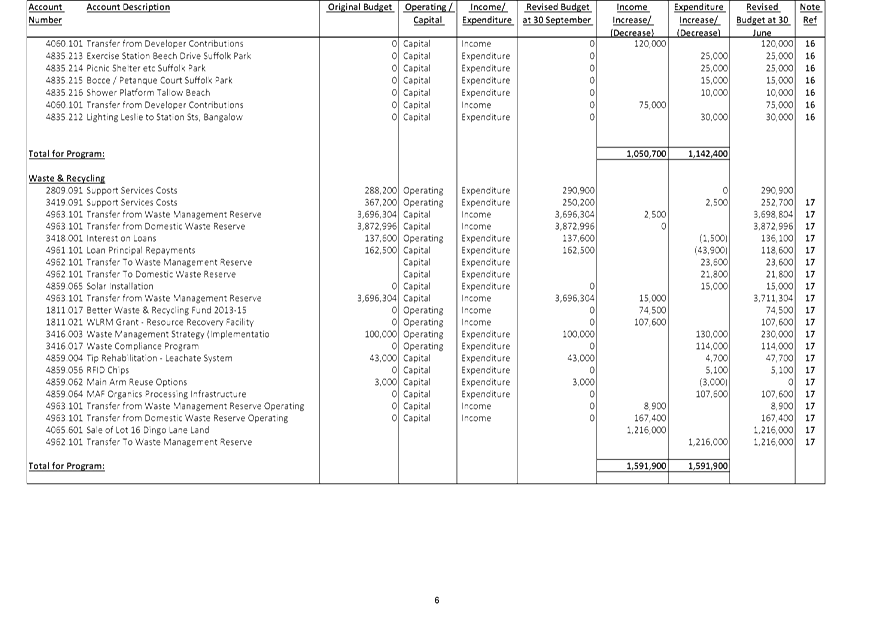

· In the Waste &

Recycling program It is proposed to increase operating income by $182,100 due

to the receipt of the Better Waste and Recycling grant ($74,500) and a grant

for the enhancement of the Resource Recovery Centre ($107,600). It is

proposed to increase operating expenditure by $245,000 for the Waste Management

Strategy ($130,000) and the Waste Compliance program ($114,000). It is

also proposed to make a support service adjustment of $2,500. It is

proposed to allocate a budget of $1,216,000 for capital income due to the sale

of land at Dingo Lane. This will be transferred to the Waste Management

reserve.

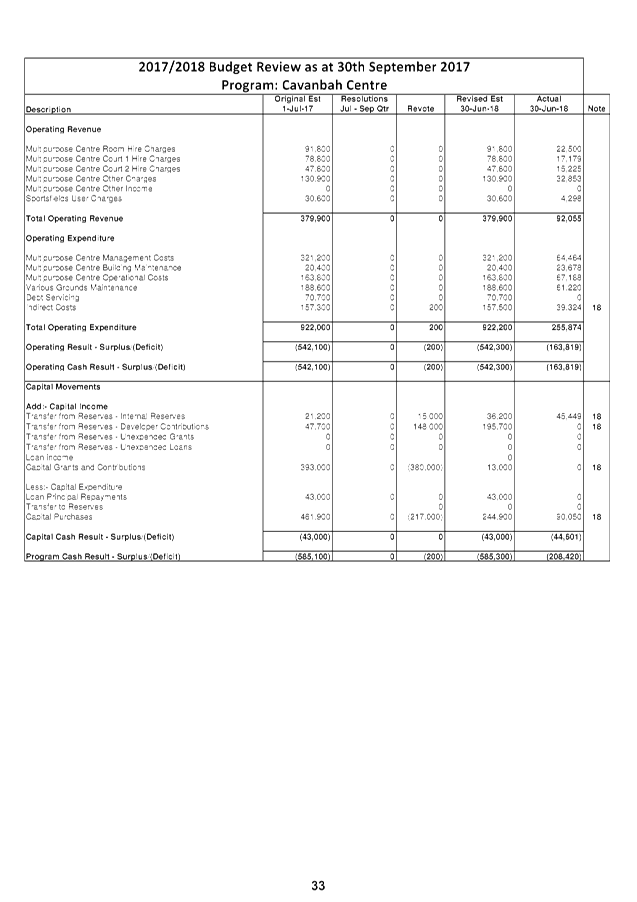

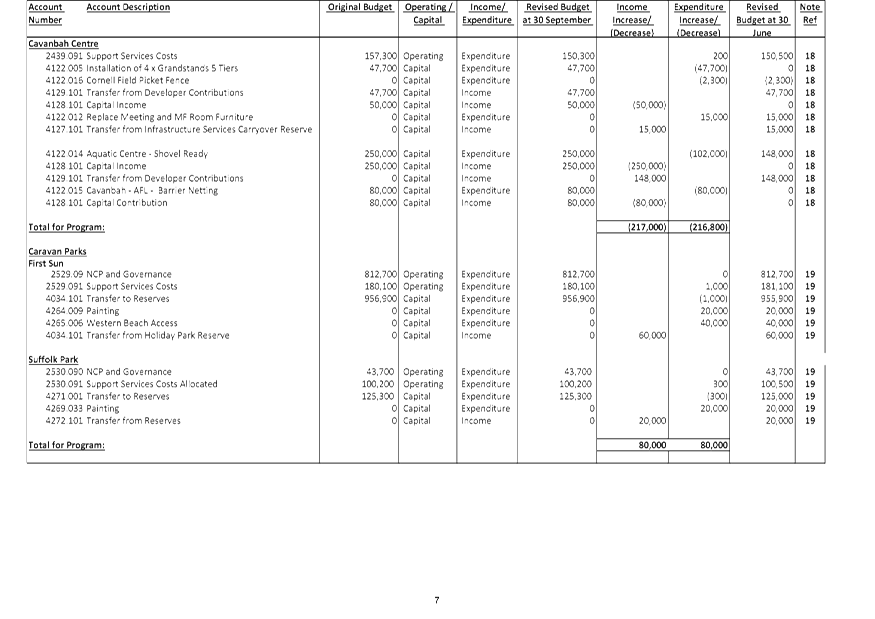

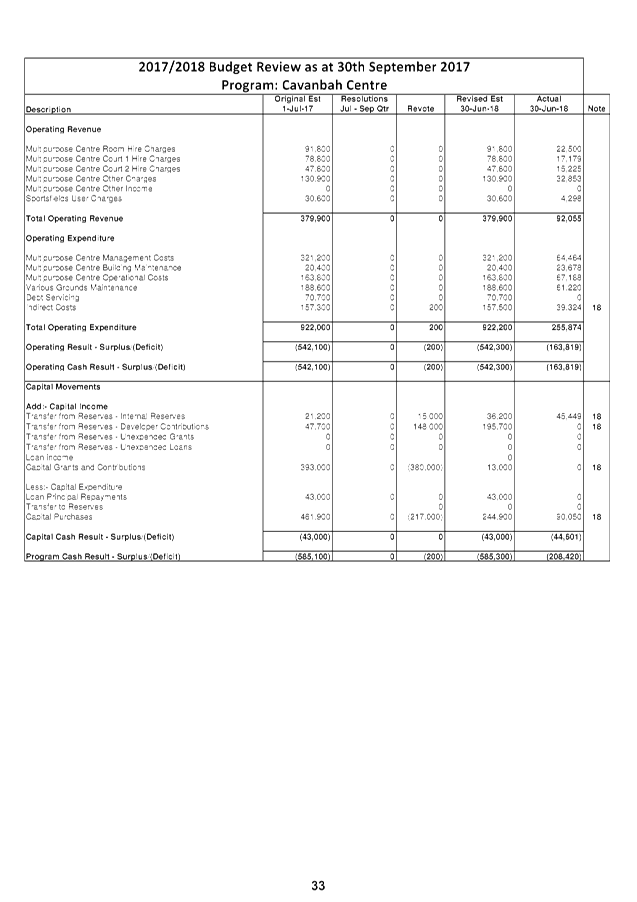

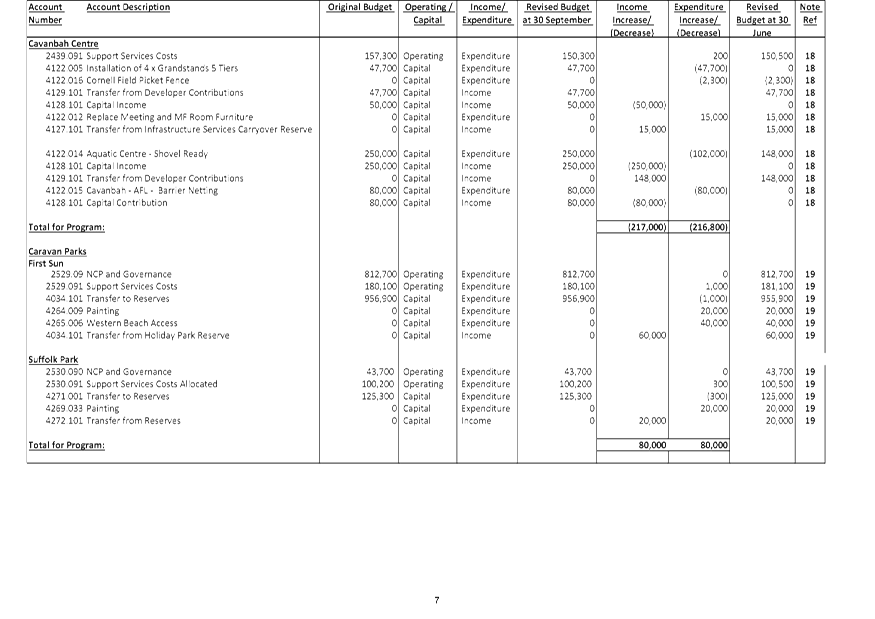

· In the Cavanbah

Centre program, it is proposed to decrease capital expenditure overall by

$217,000 due to estimated grant revenues for projects such as AFL Barrier

Netting and Grandstands and Aquatic Centre project as explained in Attachment 1

at Note 18.

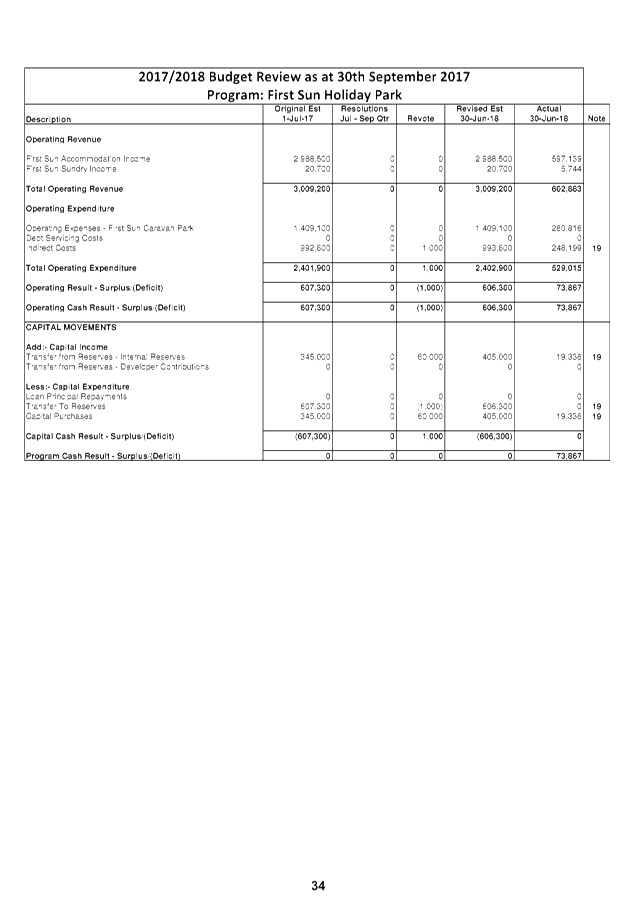

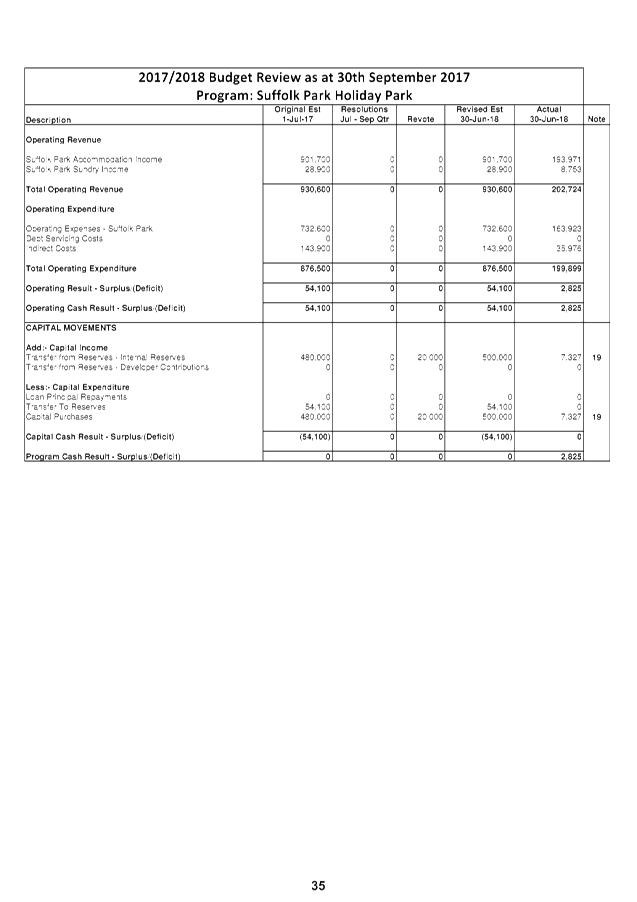

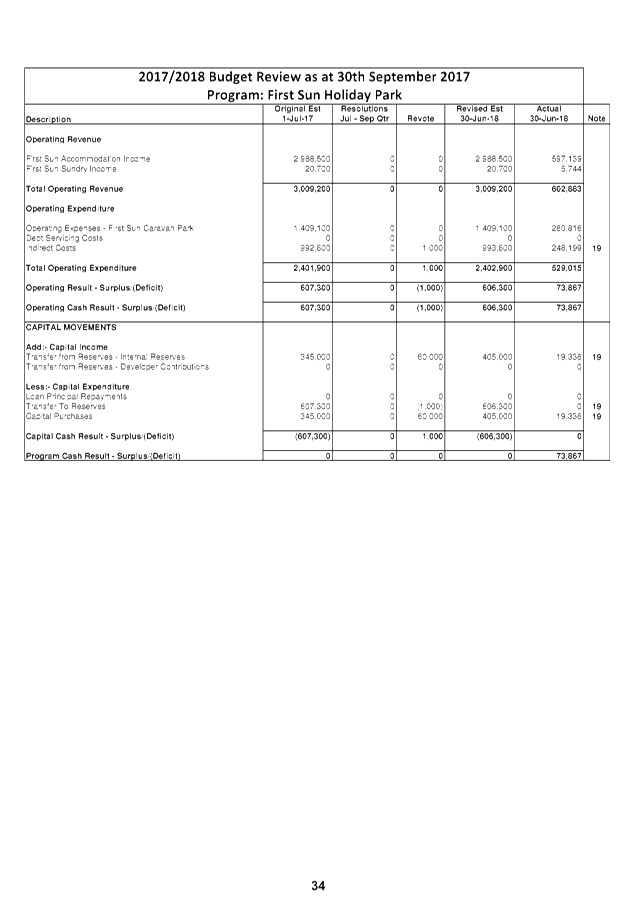

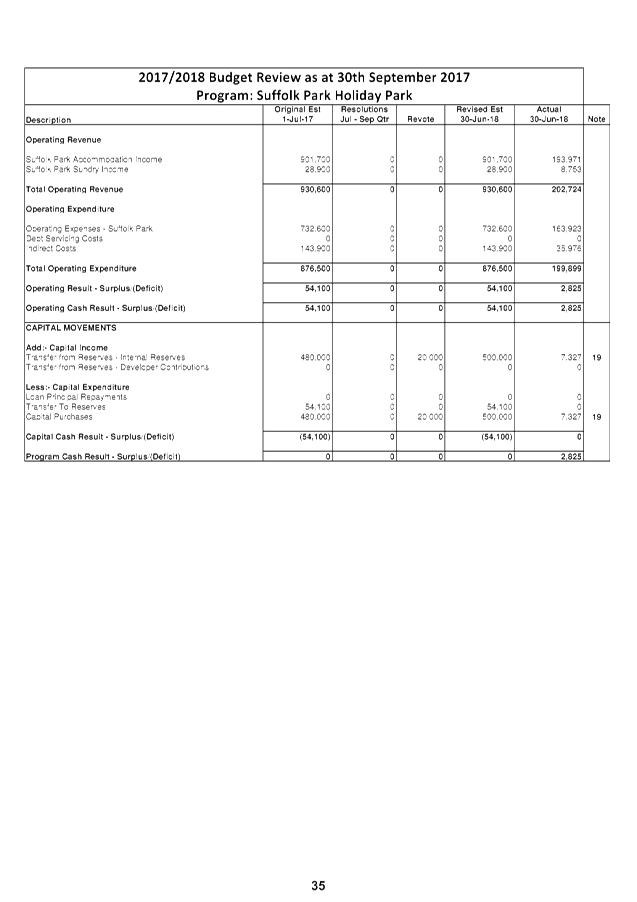

· In the First Sun

and Suffolk Beachfront Holiday Parks program, it is proposed to increase the

budget by $20,000 at each site to continue painting for the year and $40,000 at

First Sun for Western Beach access. All adjustments are through the

Holiday Park reserve.

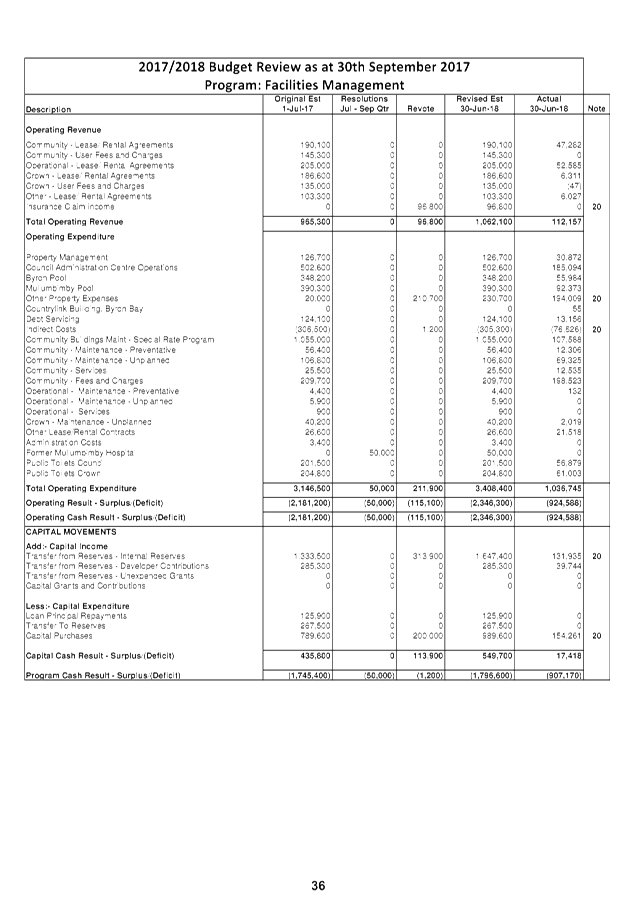

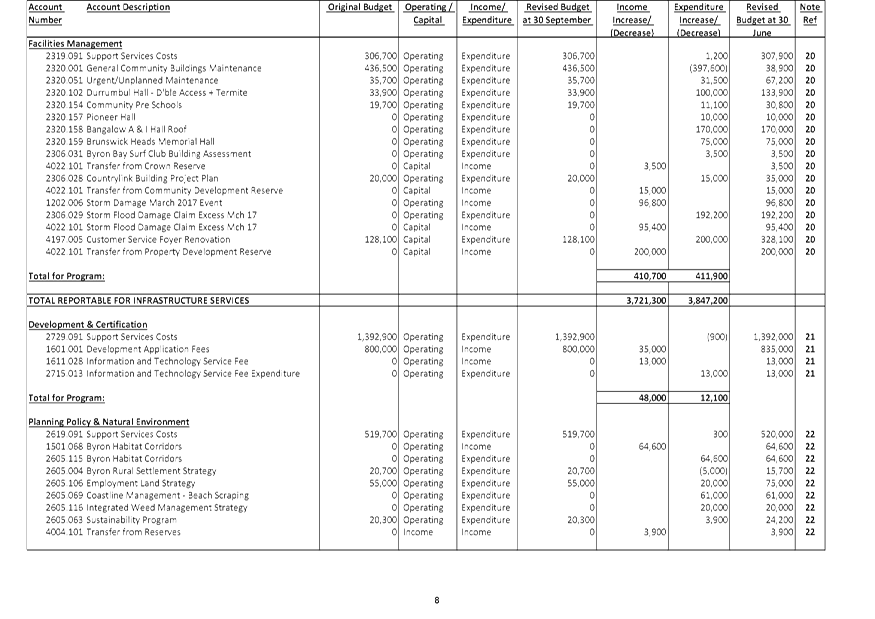

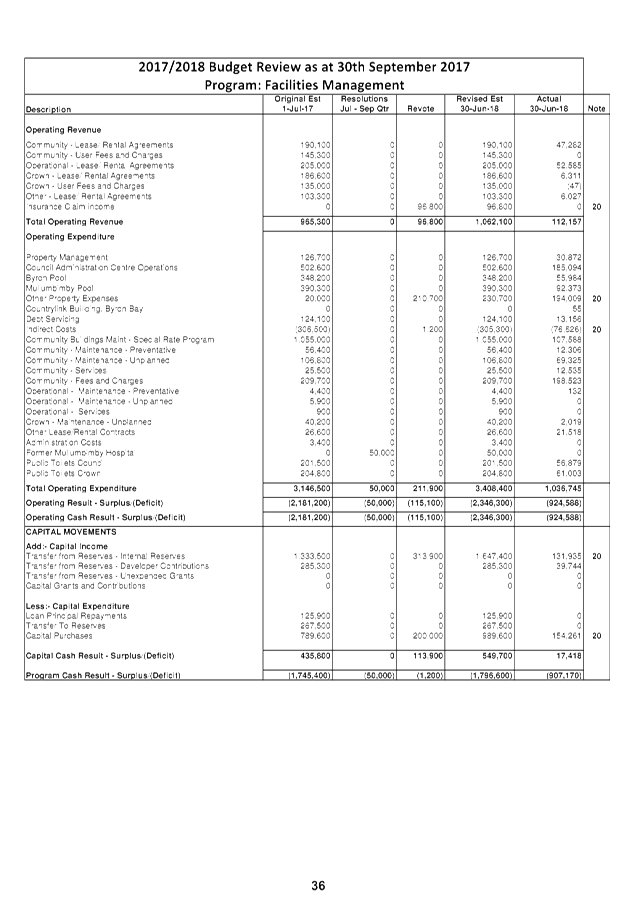

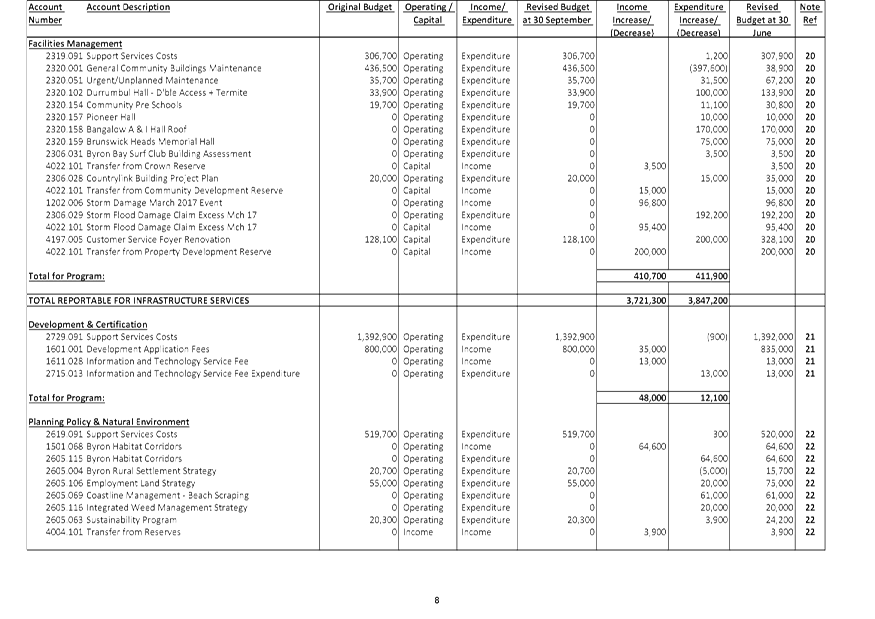

· In the Facilities

Management program it is proposed to increase operating expenditure by

$96,800. This is the excess that Council must pay relating to the flood

damage from March 2017

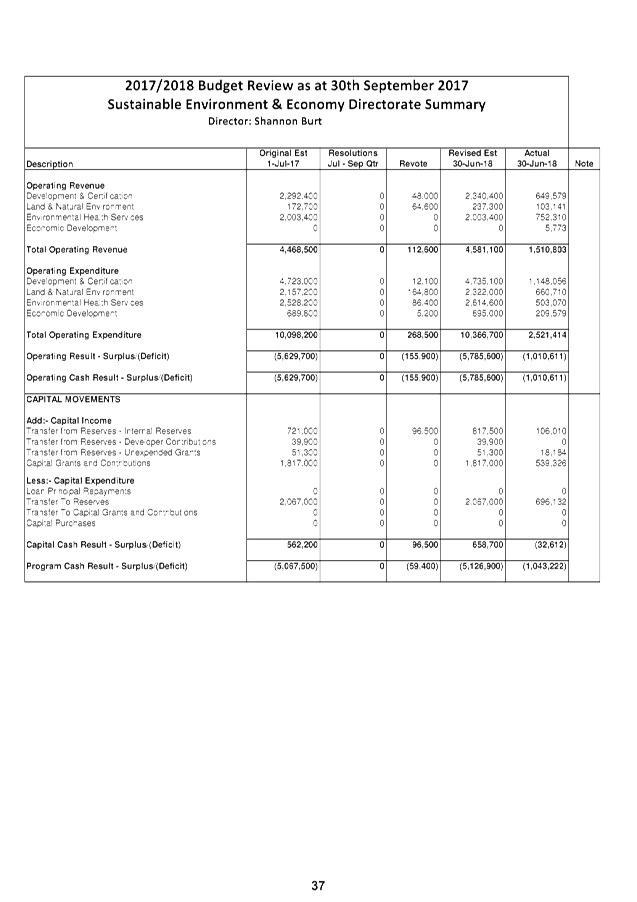

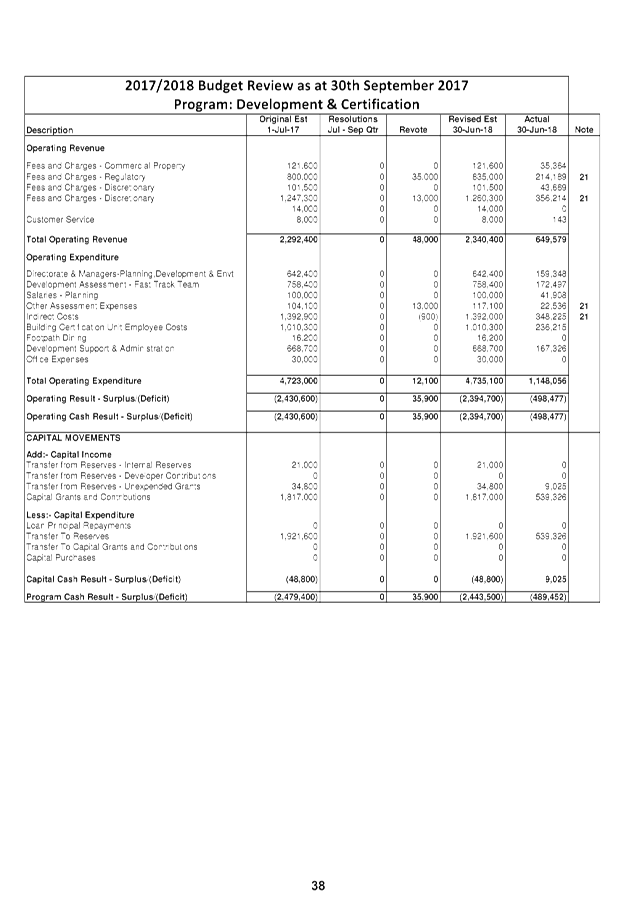

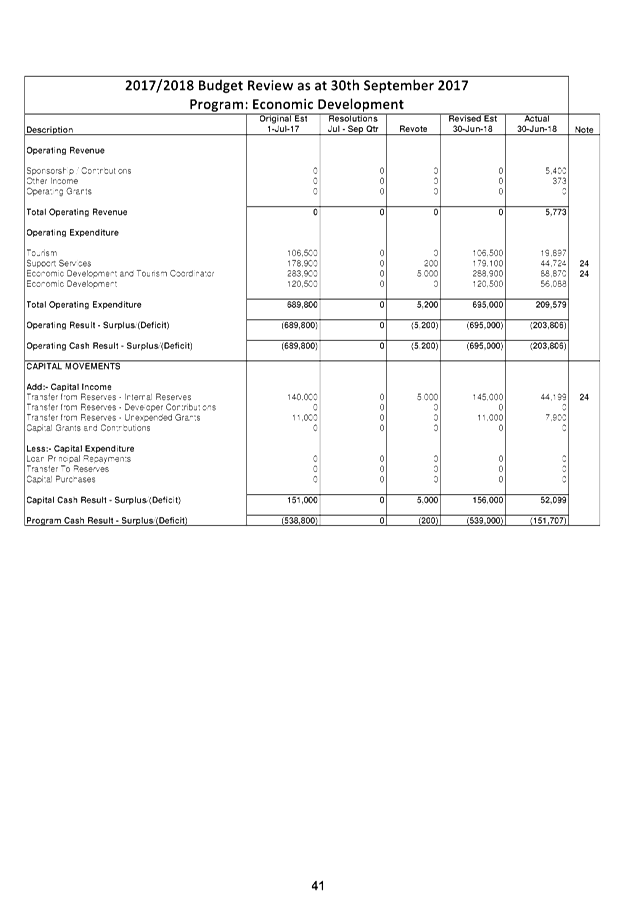

Sustainable Environment and Economy

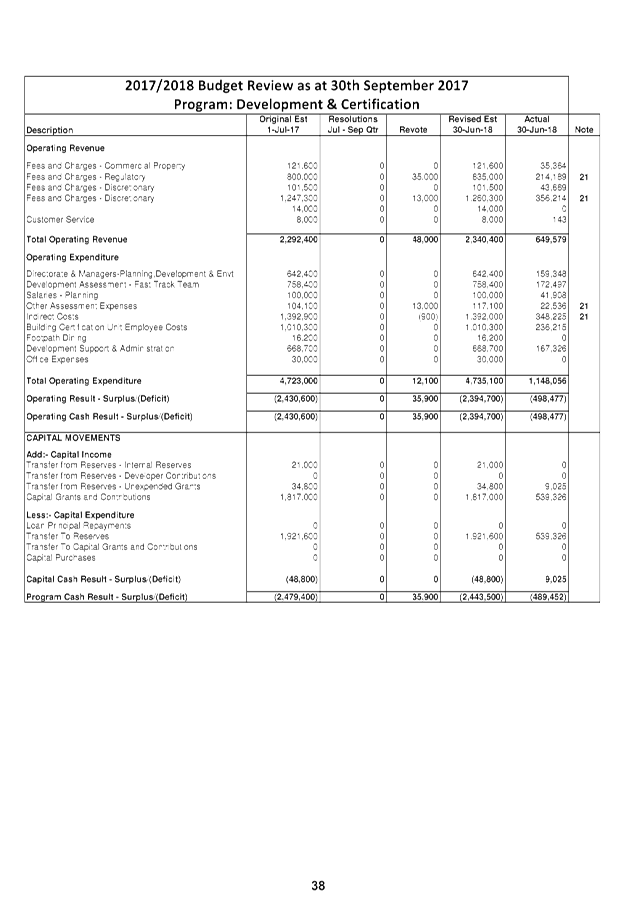

· In the Development

and Certification program, it is proposed to increase income and expenditure by

$13,000 to budget for the Information and Technology Service fee. This

will fund the Process Improvement Officer. It is propose to add an

additional $35,000 to the DA fees received.

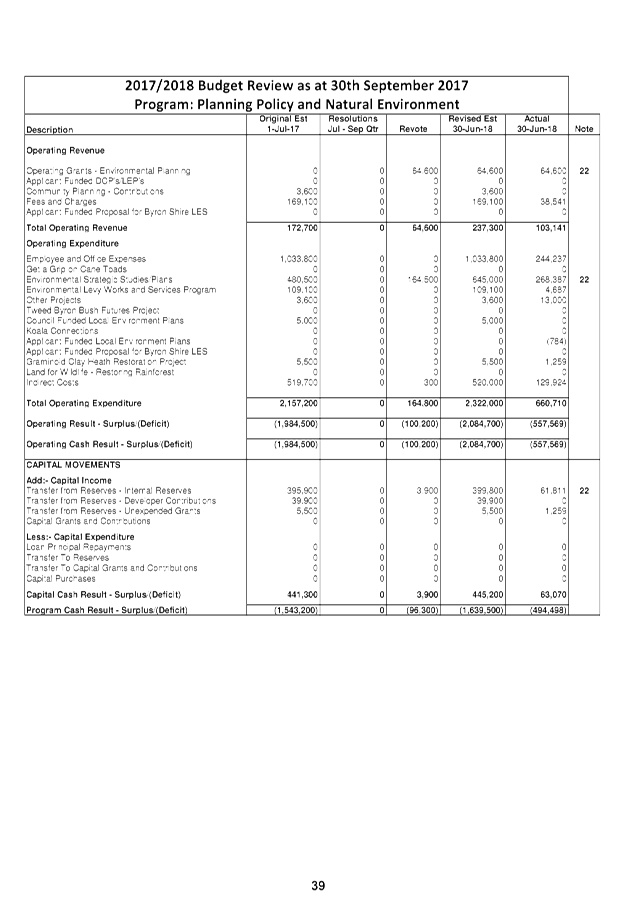

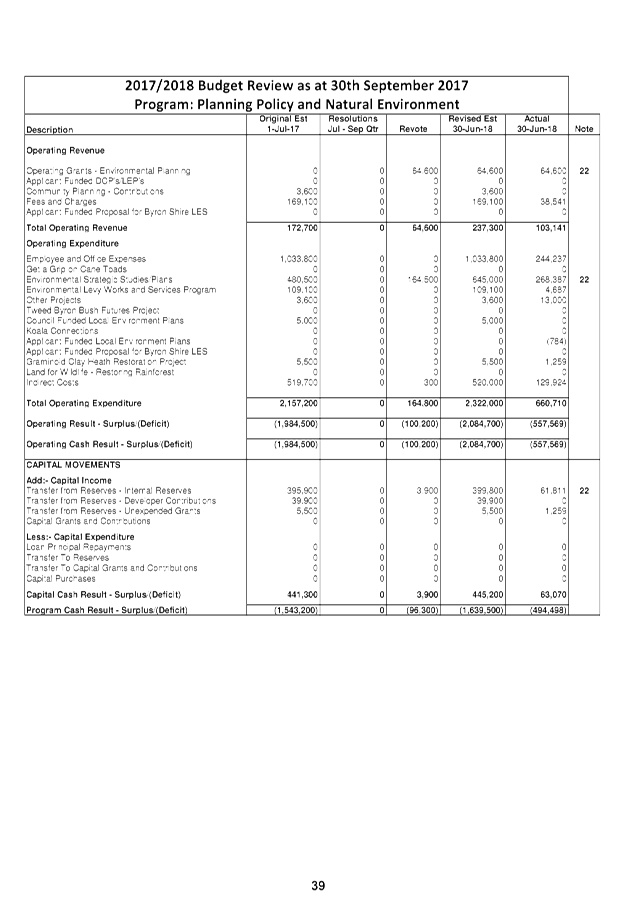

· In the

Planning Policy and Natural Environment Program, It is proposed to increase

income and expenditure to accommodate the Byron Habitat Corridors grant

($64,600), an increase to the Employment Land Strategy ($20,000), an increase

to Coastline Beach Scraping ($61,000 – to match grant funding) and an

increase for the Integrated Weed management Strategy ($20,000).

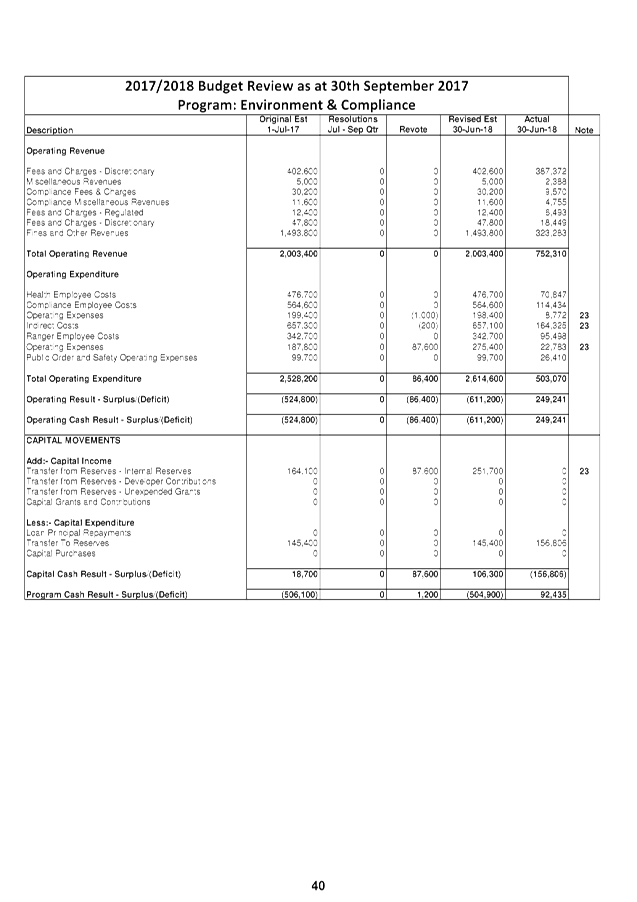

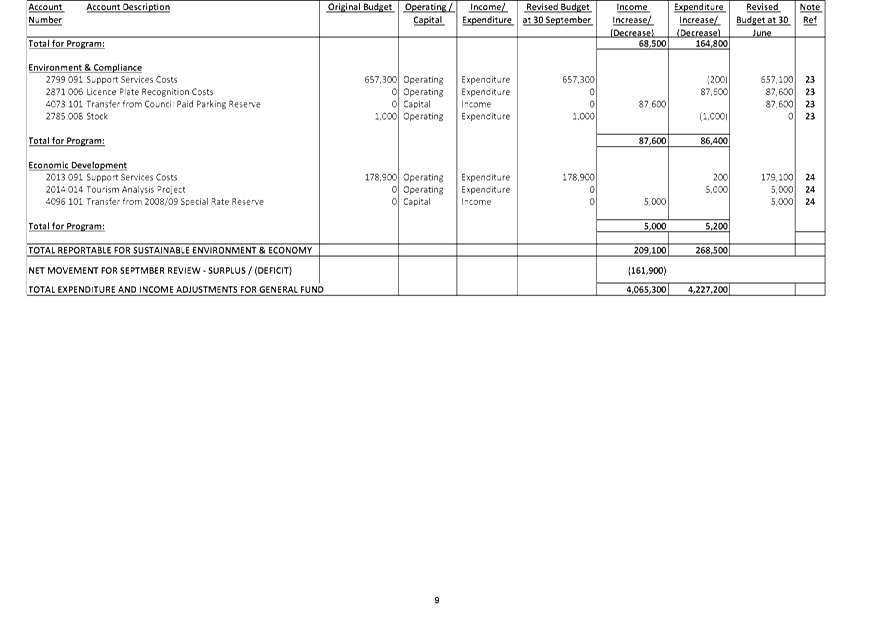

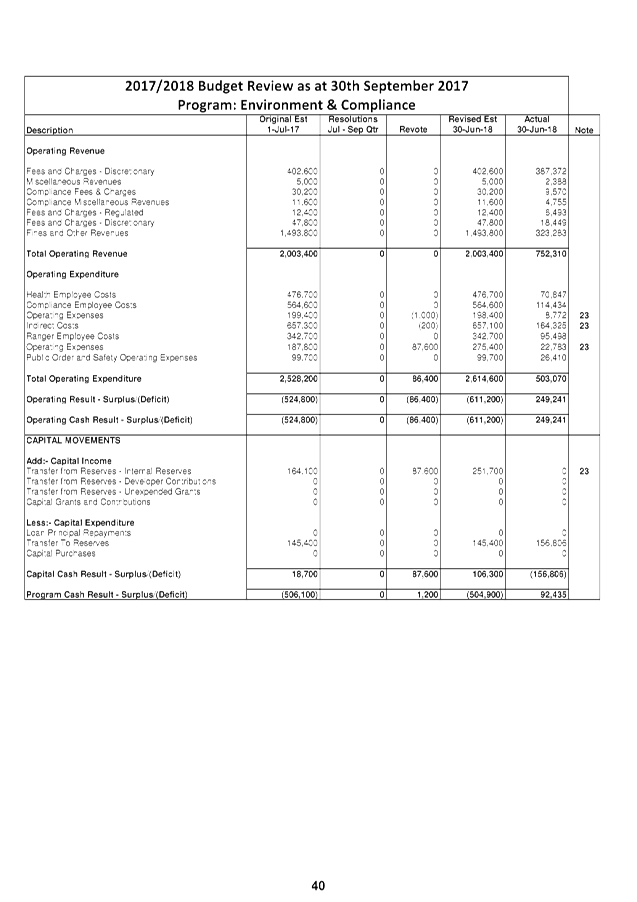

· In the Environment & Compliance program it is proposed

to increase the budget for licence plate recognition costs of $87,600.

This can be funded through the Paid Parking reserve.

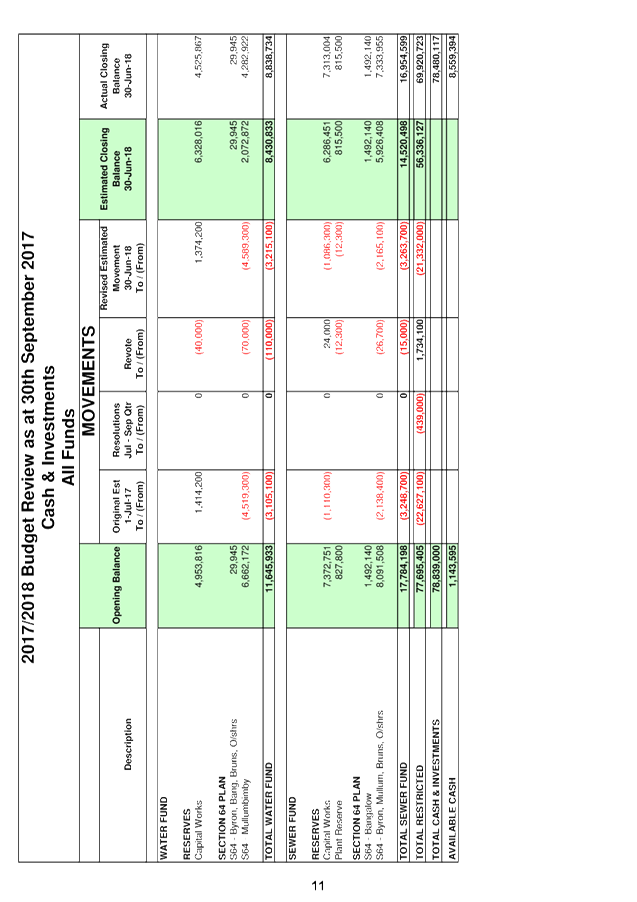

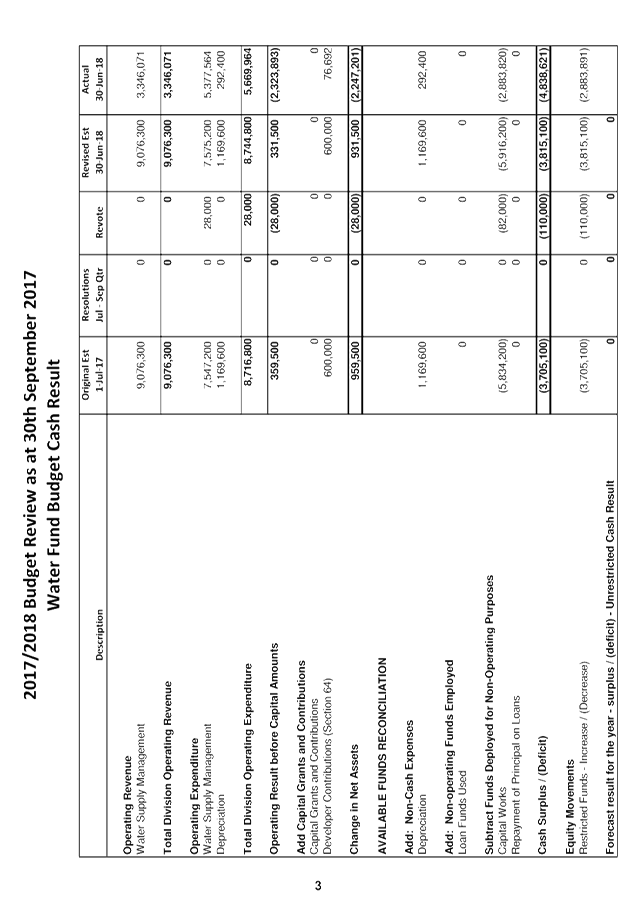

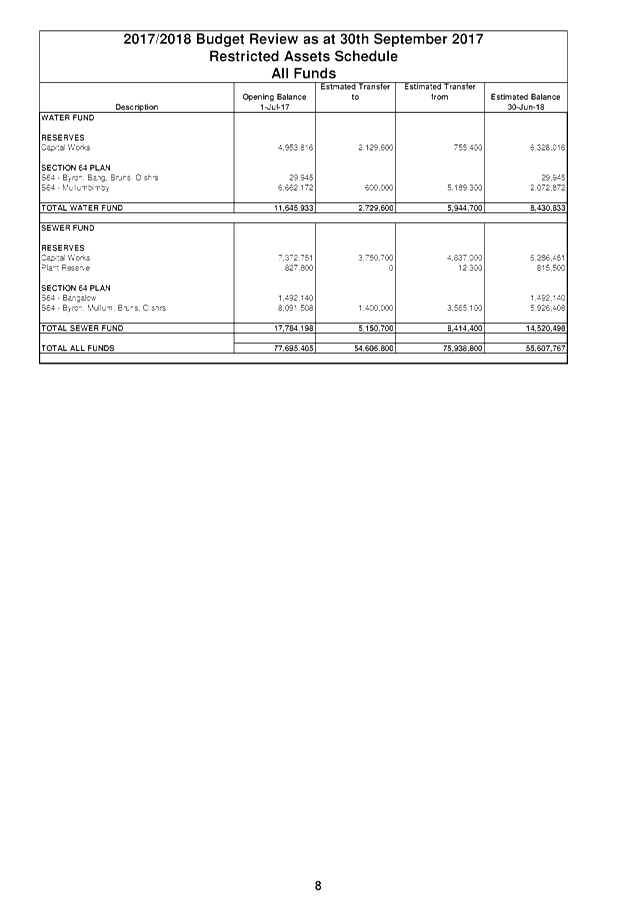

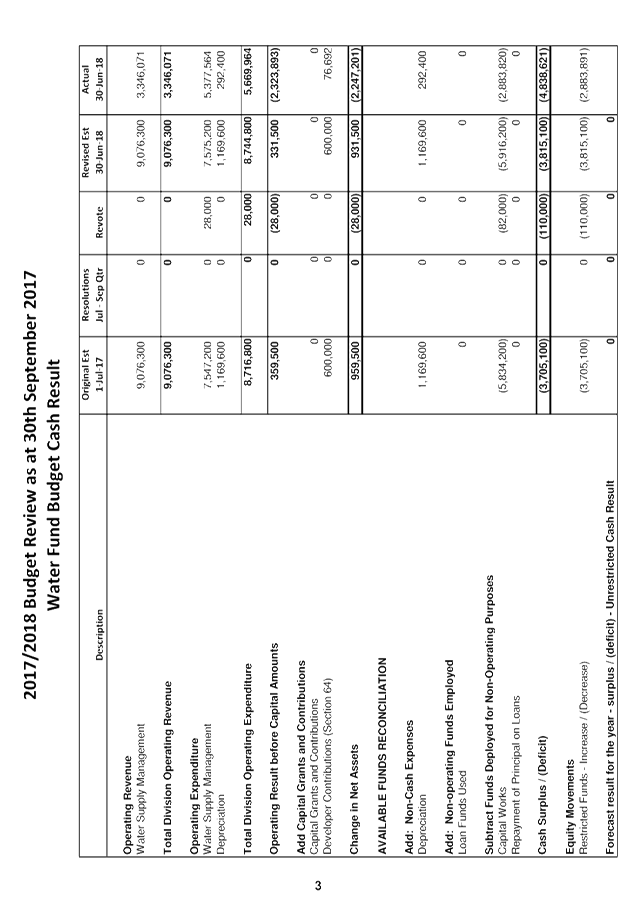

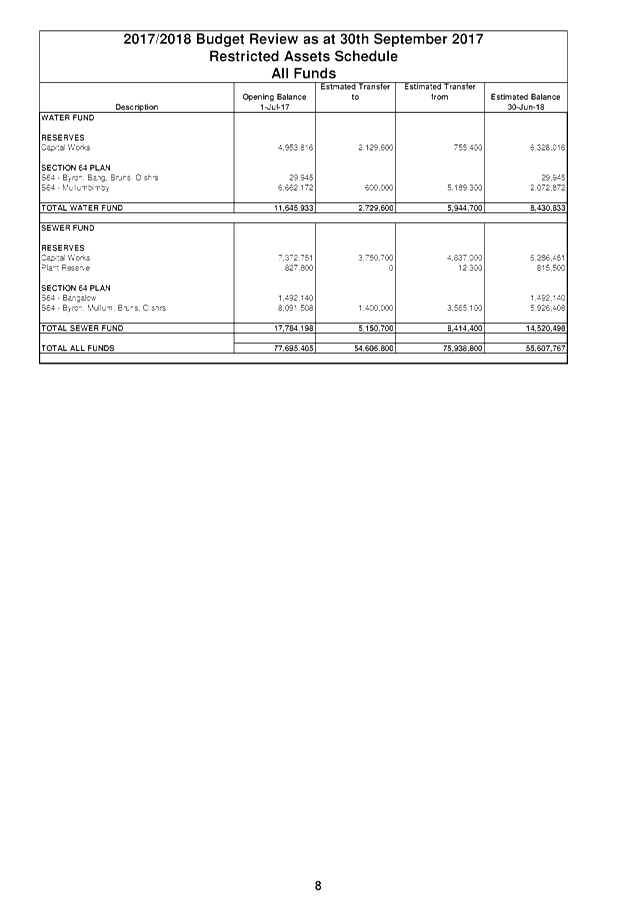

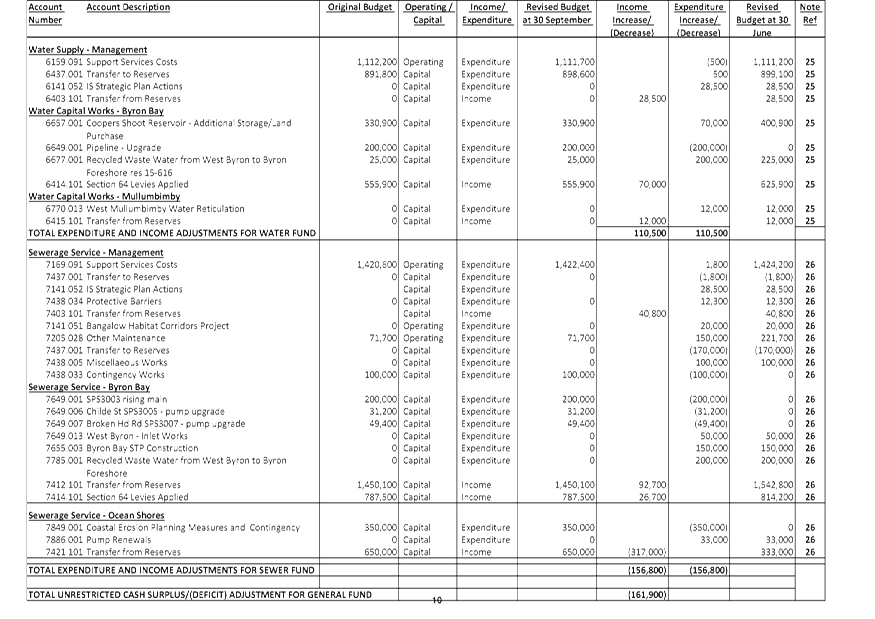

WATER FUND

After completion of the 2016/2017

Financial Statements the Water Fund as at 30 June 2017 has a capital works

reserve of $4,953,000 and held $6,692,100 in section 64 developer

contributions.

The estimated Water Fund reserve

balances as at 30 June 2018, and forecast in this Quarter Budget Review, are

derived as follows:

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2017

|

$4,953,800

|

|

Plus original budget reserve

movement

|

1,539,000

|

|

Less reserve funded carryovers

from 2016/2017

|

(124,800)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(40,000)

|

|

Forecast Reserve Movement for

2017/2018 – Increase / (Decrease)

|

1,374,200

|

|

Estimated Reserve Balance at

30 June 2018

|

$6,328,000

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2017

|

$6,692,100

|

|

Plus original budget reserve

movement

|

(1,874,000)

|

|

Less reserve funded carryovers

from 2016/2017

|

(2,645,300)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(70,000)

|

|

Forecast Reserve Movement for

2017/2018 – Increase / (Decrease)

|

(4,589,300)

|

|

Estimated Reserve Balance at

30 June 2018

|

$2,102,800

|

Movements for Water Fund can be seen in Attachment 1 with a

proposed estimated decrease to reserves (including S64 Contributions) overall

of $110,000 from the 30 September 2017 Quarter Budget Review.

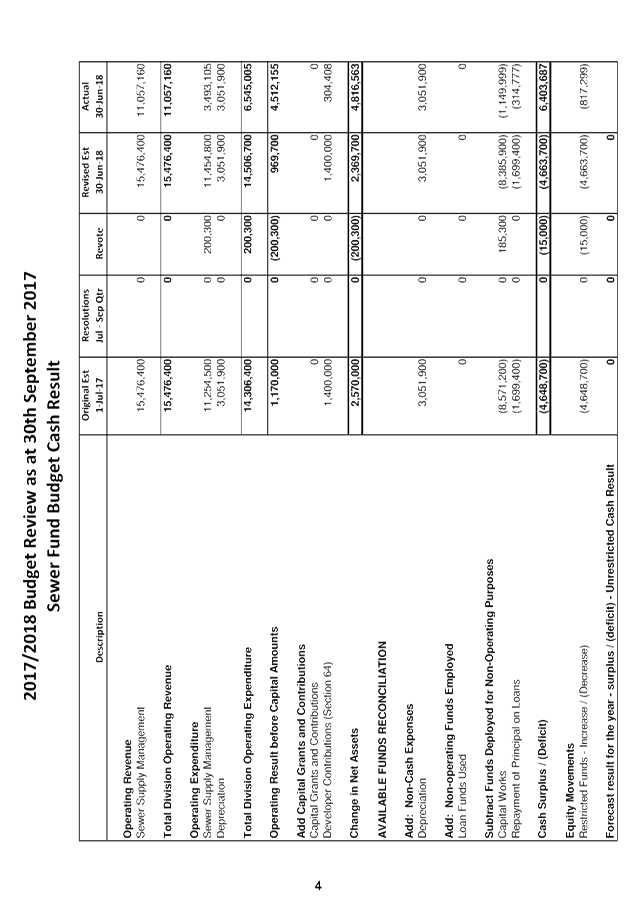

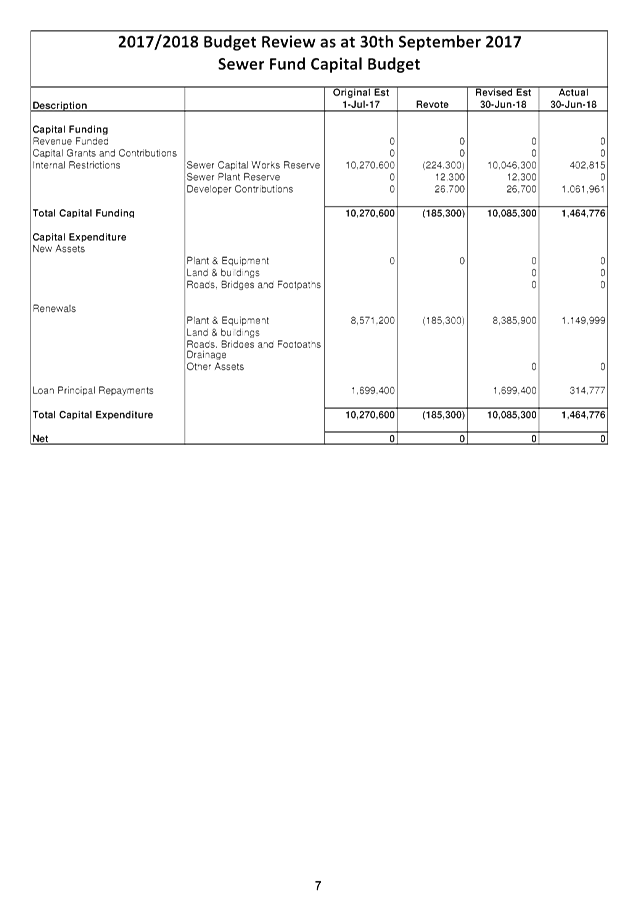

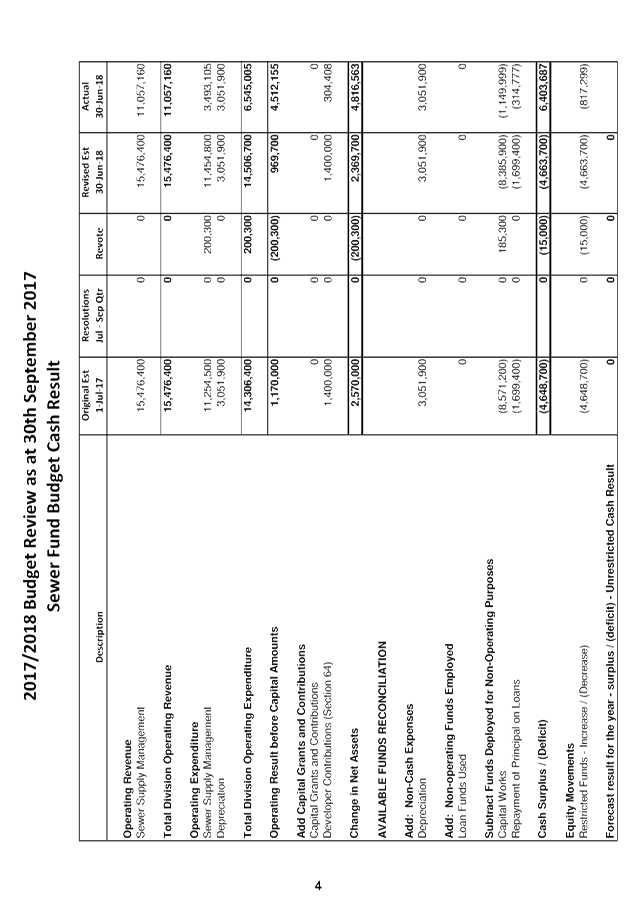

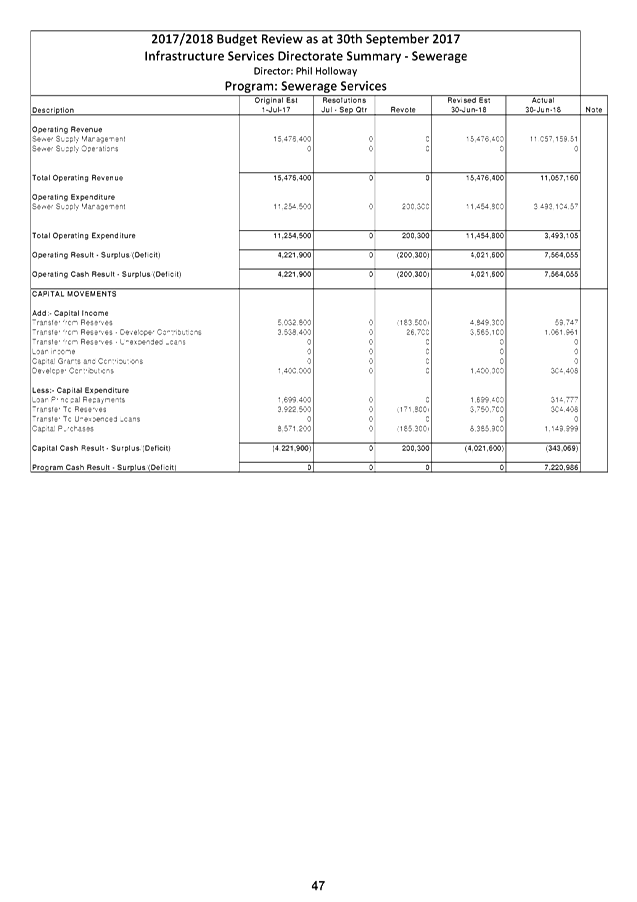

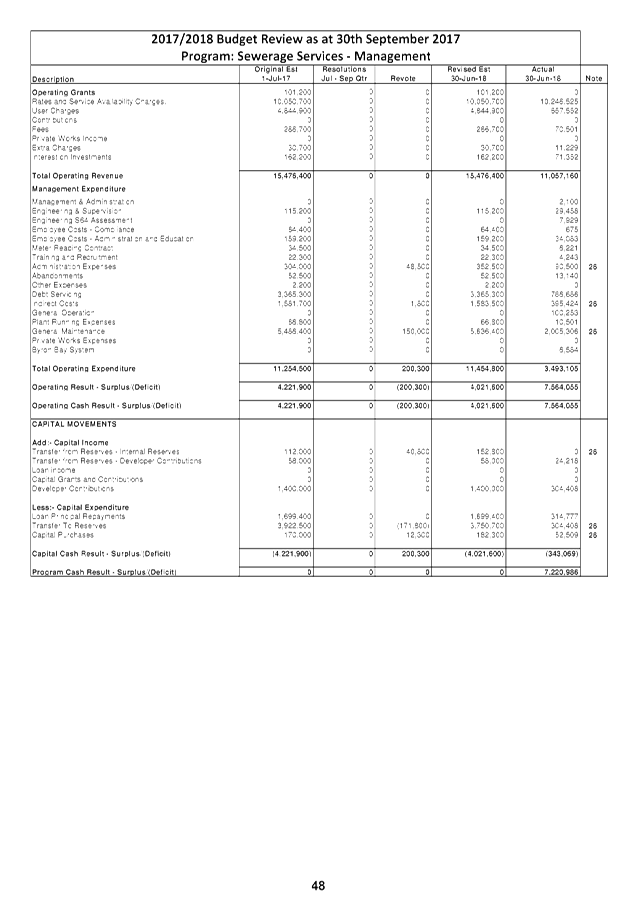

SEWERAGE FUND

After completion of the 2016/2017

Financial Statements the Sewer Fund as at 30 June 2017 has a capital works

reserve of $7,372,800 and plant reserve of $827,800. It also held

$9,583,600 in section 64 developer contributions.

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2017

|

$7,372,800

|

|

Plus original budget reserve

movement

|

(1,008,100)

|

|

Less reserve funded carryovers

from 2016/2017

|

(102,200)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

24,000

|

|

Forecast Reserve Movement for

2017/2018 – Increase / (Decrease)

|

(1,086,300)

|

|

Estimated Reserve Balance at

30 June 2018

|

$6,286,500

|

Plant Reserve

|

Opening Reserve Balance at 1

July 2017

|

$827,800

|

|

Plus original budget reserve

movement

|

0

|

|

Less reserve funded carryovers

from 2016/2017

|

0

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(12,300)

|

|

Forecast Reserve Movement for

2017/2018 – Increase / (Decrease)

|

(12,300)

|

|

Estimated Reserve Balance at

30 June 2018

|

$815,500

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2017

|

$9,583,600

|

|

Plus original budget reserve

movement

|

(188,800)

|

|

Less reserve funded carryovers

from 2016/2017

|

(1,949,600)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(26,700)

|

|

Forecast Reserve Movement for

2017/2018 – Increase / (Decrease)

|

(2,165,100)

|

|

Estimated Reserve Balance at

30 June 2018

|

$7,418,500

|

Movements for the Sewerage Fund can be seen in Attachment 1

with a proposed estimated overall decrease to reserves (including S64

Contributions) of $15,000 from the 30 September 2017 Quarter Budget Review.

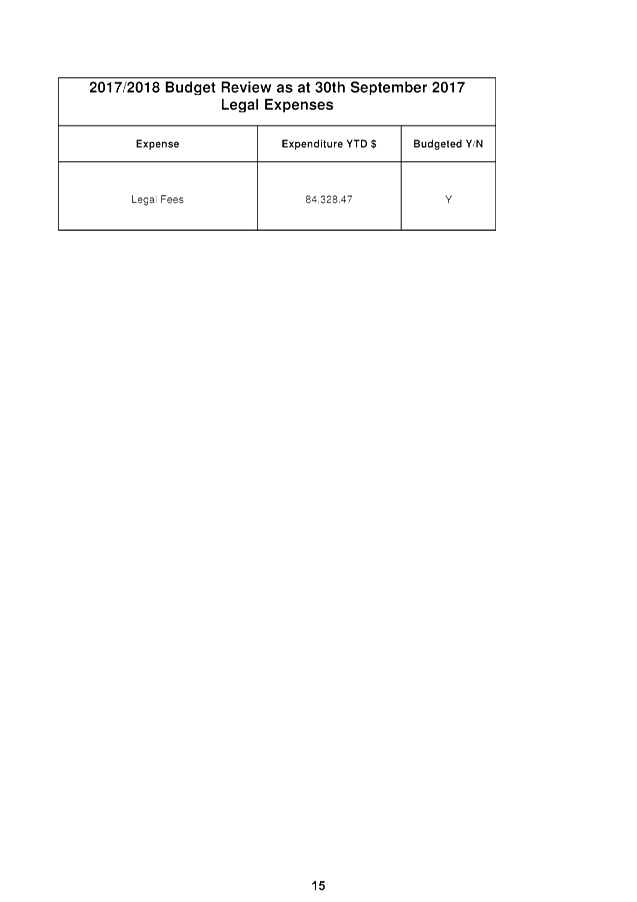

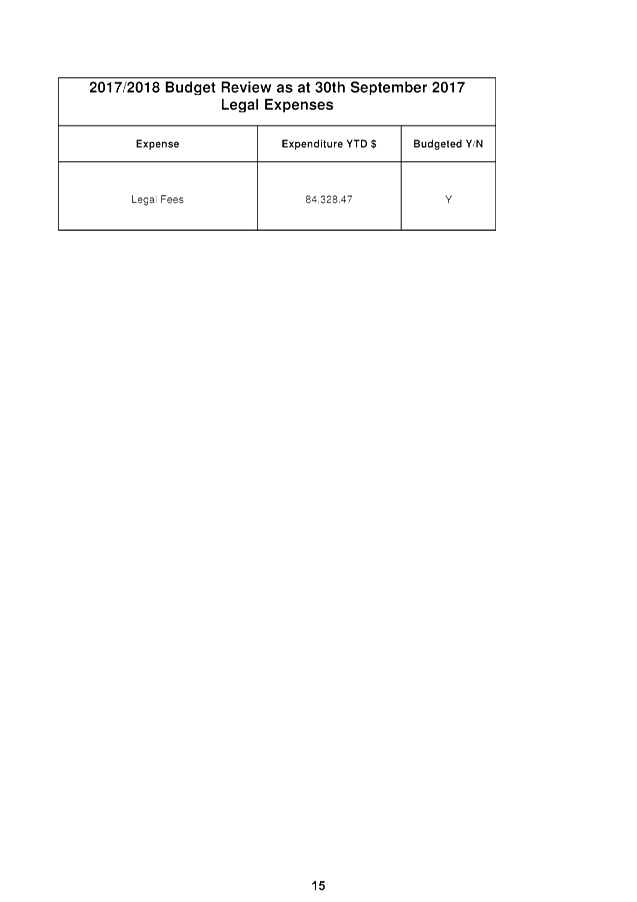

Legal Expenses

One of the major financial concerns for Council over

previous years has been legal expenses. Not only does this item represent a

large expenditure item funded by general revenue, but can also be susceptible

to large fluctuations.

The table that follows indicates the allocated budget and

actual legal expenditure within Council on

a fund basis as at 30 September 2017.

Total Legal Income & Expenditure as at 30 September

2017

|

Program

|

2017/2018

Budget ($)

|

Actual ($)

|

Percentage To

Revised Budget

|

|

Income

|

|

|

|

|

Legal Expenses Recovered

|

0

|

0

|

0%

|

|

Total Income

|

0

|

0

|

0%

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

General Legal Expenses

|

201,000

|

84,328

|

41.9%

|

|

Total Expenditure General Fund

|

201,000

|

84,328

|

41.9%

|

Note: The above table does not include costs incurred

by Council in proceedings after 30 September 2017 or billed after this

date. At the time of writing this report, Council has incurred an

additional $57,247 of expenditure in October and November 2017.

Byron Railway Precinct Projects

The adopted 2017/2018 Budget Estimates currently provides an

allocation of $500,000 funded from the Infrastructure Renewal Reserve for

projects related to the Byron Bay Master Plan – Railway Precinct. The 30

September 2017 Quarter Budget Review contains a proposal to reduce this allocation

by $260,700 to enable Council to match its contribution to the projects funded

by the $260,700 Tourism Demand Driver Infrastructure (TDDI) grant provided to

Council.

A summary of the current projects with proposed funded

budgets associated with the Byron Railway Precinct should Council adopt this

Quarterly Budget Review are outlined in the table below:

|

Job No

|

Project

|

Proposed Budget

2017/2018 $

|

Funding from

TDDI Grant $

|

Funding from

Infrastructure Renewal Reserve $

|

Funding from

Section 94

$

|

|

44283.014

|

Byron Bay Masterplan – Railway Precinct

|

239,300

|

0

|

239,300

|

0

|

|

4835.188

|

Byron St Connection Upgrade

|

139,000

|

69,500

|

69,500

|

0

|

|

4835.189

|

Railway Park Upgrade

|

237,500

|

118,700

|

118,700

|

0

|

|

4835.190

|

Visitor Centre Refurbishment

|

130,000

|

50,000

|

50,000

|

30,000

|

|

4835.191

|

Visitor Centre Technology Project

|

45,000

|

22,500

|

22,500

|

0

|

|

|

Total

|

790,800

|

260,700

|

500,000

|

30,000

|

With the addition of the TDDI grant revenue to

Council’s existing budget allocation of $500,000, there is now $790,800

available towards projects in the Byron Railway Precinct.

In relation to any further projects relating to the Byron

Railway Precinct in terms of budget allocation, these will be reported to

Council for consideration through the Budget Review process as they arise.

Financial Implications

The 30 September 2017 Quarter Budget Review of the 2017/2018

Budget has decreased the overall budget result by $161,900. As a result

there is a reduction of $161,900 to the estimated unrestricted cash balance

attributable to the General Fund, with this becoming an estimated $940,600 at

30 June 2018. This is below the adopted target of Council of

$1,000,000. It is recommended that Council will need to recover the

2017/2018 budget result to at least a balanced outcome over the remainder of

the 2017/2018 financial year and be conscious of this when considering matters

with financial implications.

Statutory and Policy

Compliance Implications

In accordance with Regulation 203

of the Local Government (General) Regulation 2005 the Responsible Accounting

Officer of a Council must:-

(1) Not later than 2 months after the end of each quarter

(except the June quarter), the responsible accounting officer of a council must prepare and submit to the council a budget review statement that shows, by reference

to the estimate of income and expenditure set out in the statement of the council’s revenue policy included in the operational plan for the relevant year, a revised

estimate of the income and expenditure for that year.

(2) A budget review statement must include or be

accompanied by:

(a) a report as to whether or not the responsible

accounting officer believes that the statement indicates that the financial

position of the council is satisfactory, having regard to the original estimate

of income and expenditure, and

(b) if that position is unsatisfactory, recommendations

for remedial action.

(3) A budget review statement must also include any

information required by the Code to be included in such a statement.

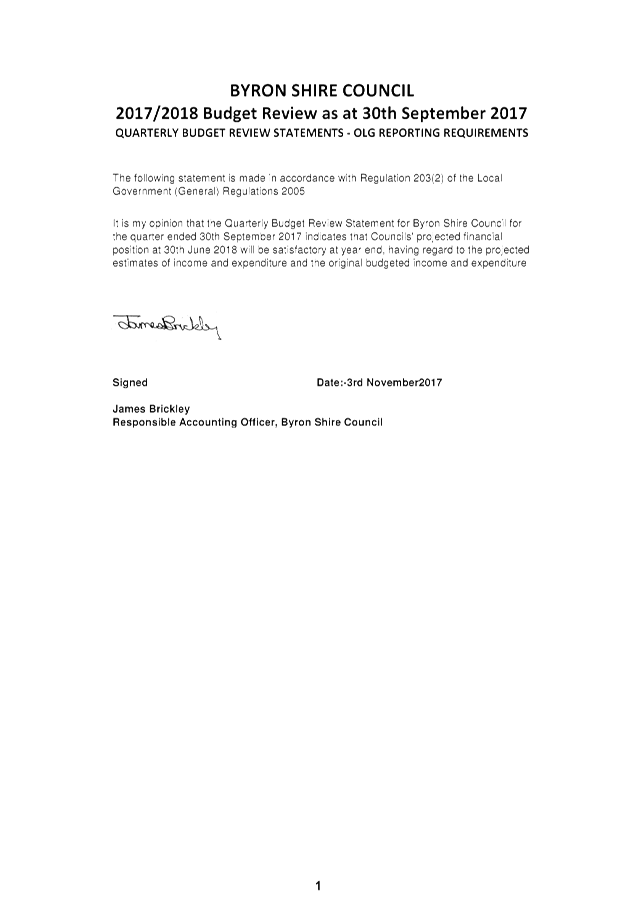

Statement by Responsible Accounting Officer

This report indicates that the short term financial position

of the Council is still satisfactory for the 2017/2018 financial year, having

consideration of the original estimate of income and expenditure at the 30

September 2017 Quarter Budget Review.

This opinion is based on the estimated General Fund

Unrestricted Cash Result position and that the current indicative budget

position for 2017/2018 outlined in this Budget Review is recovered during the

remainder of the 2017/2018 financial year. It is most important this

occurs and the current projected budget deficit of $204,600 does not

deteriorate further.

There needs to be an awareness that any modifications

proposed for Council’s budget are not approved without consideration of

funding if additional expenditure is proposed through either reallocation of

existing budgets, additional revenue or available reserves.

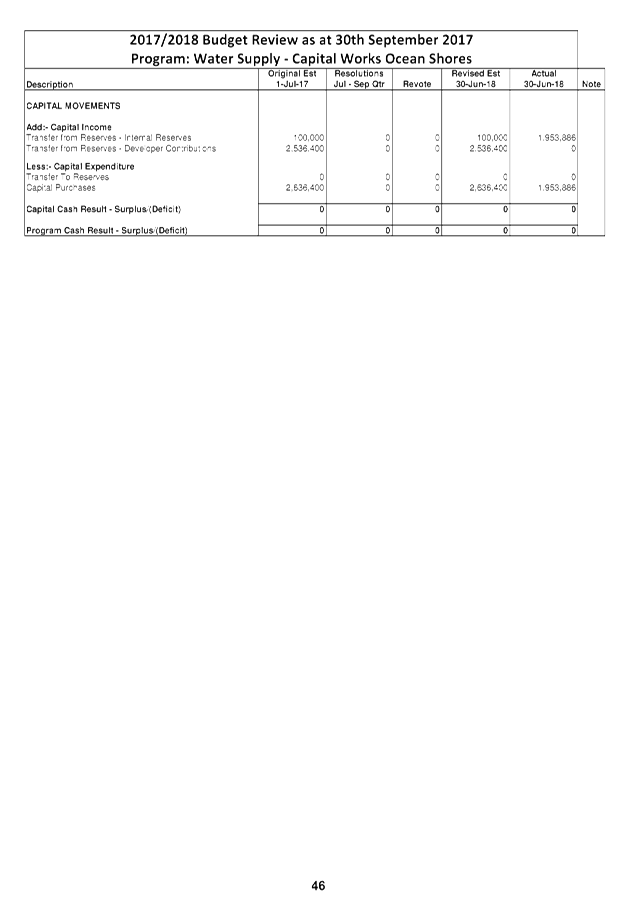

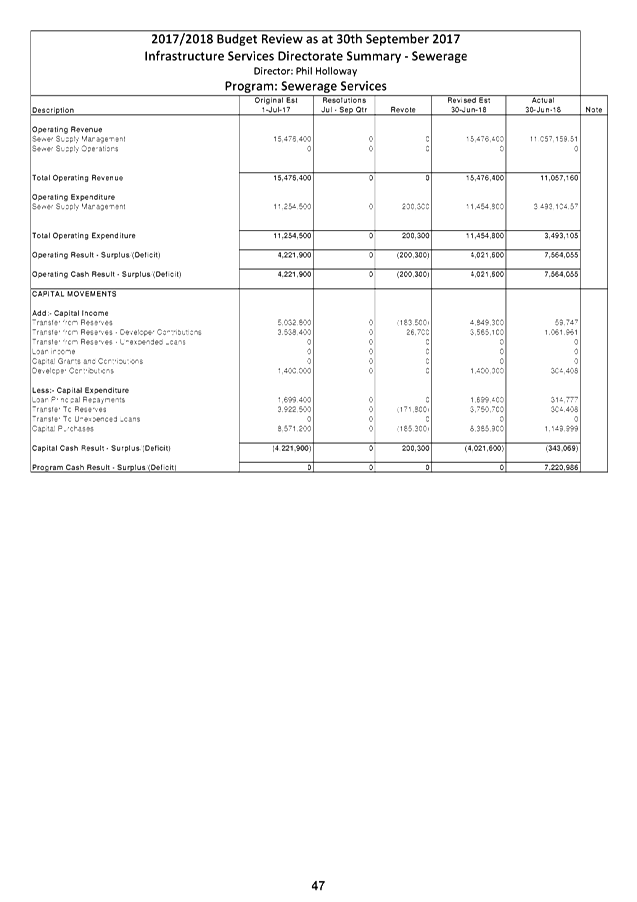

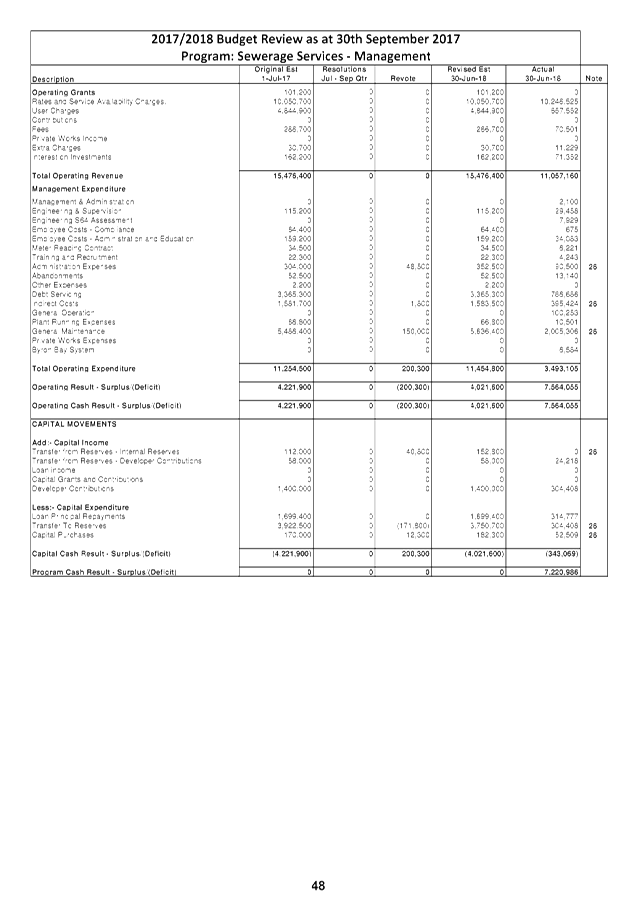

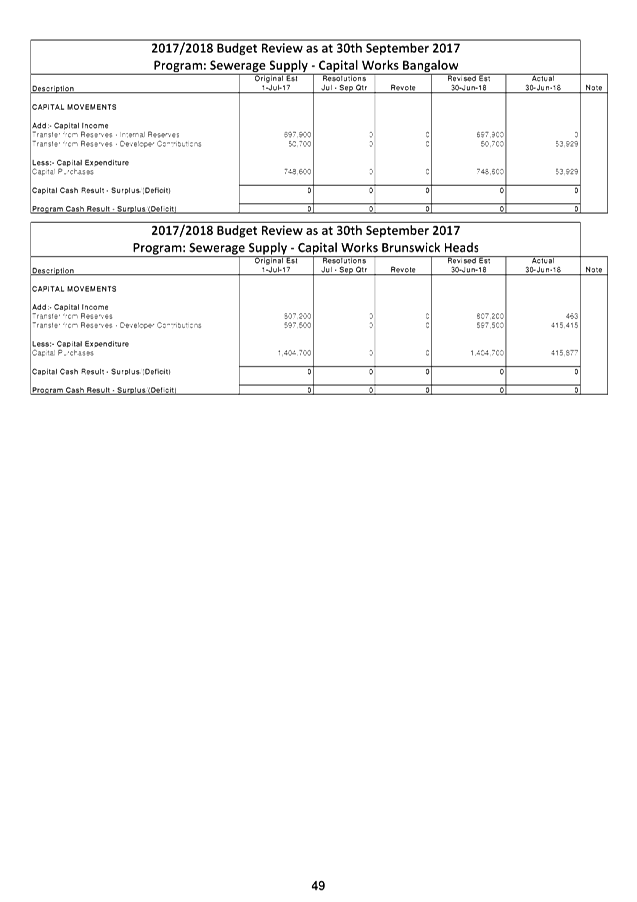

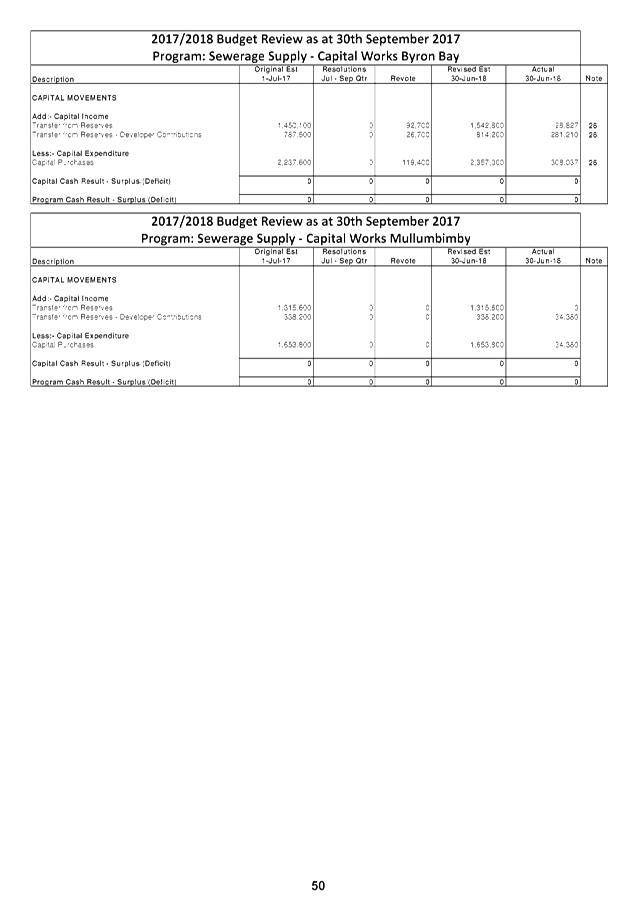

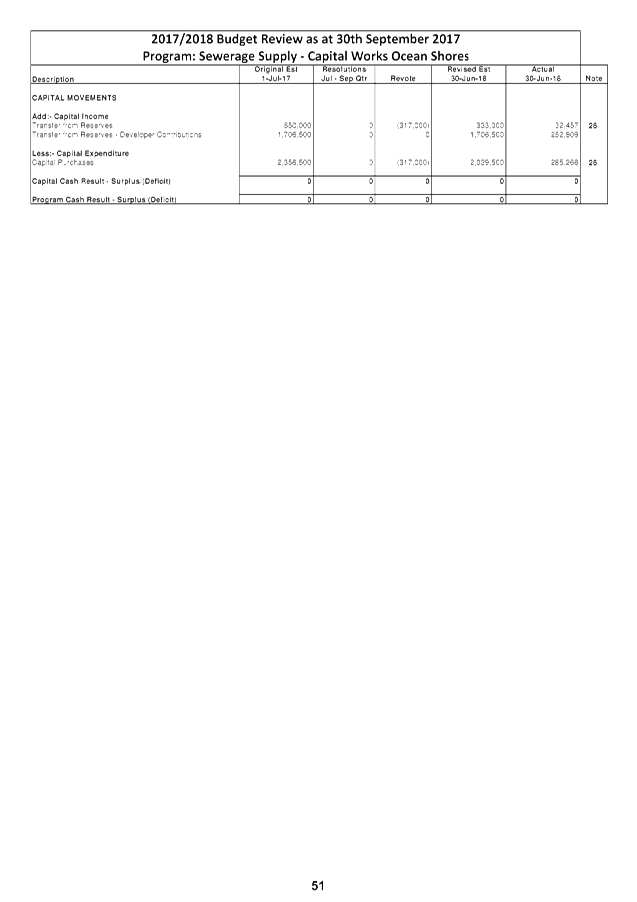

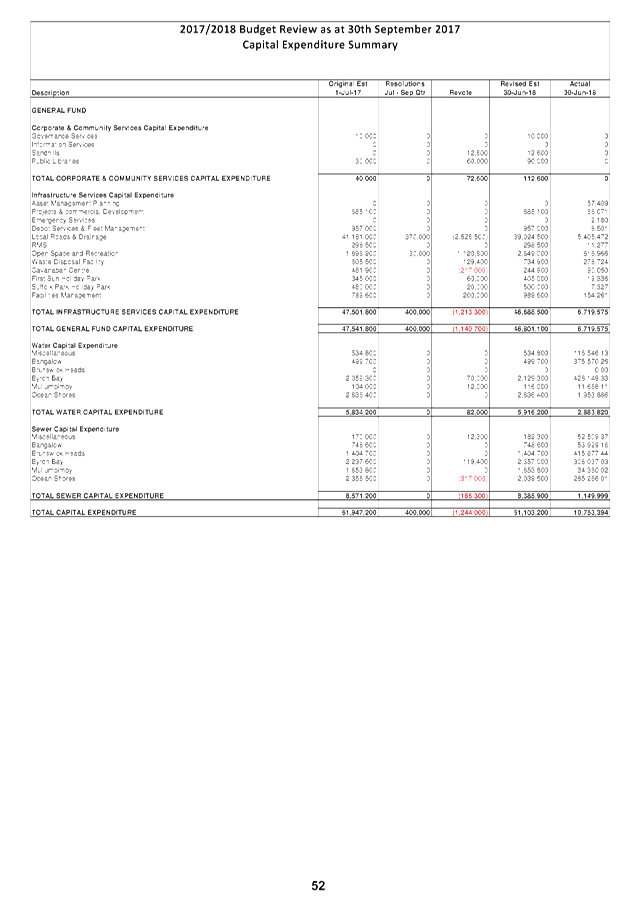

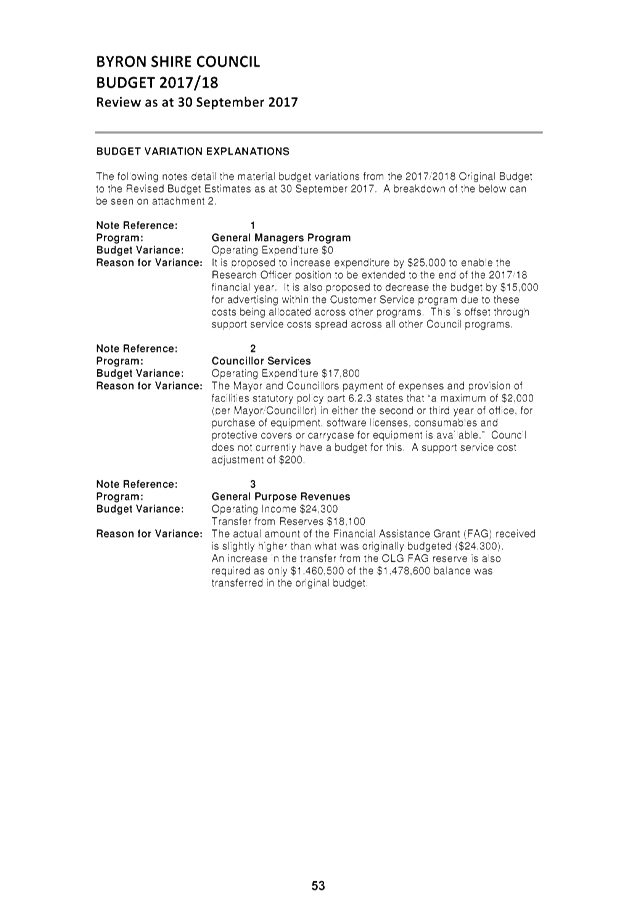

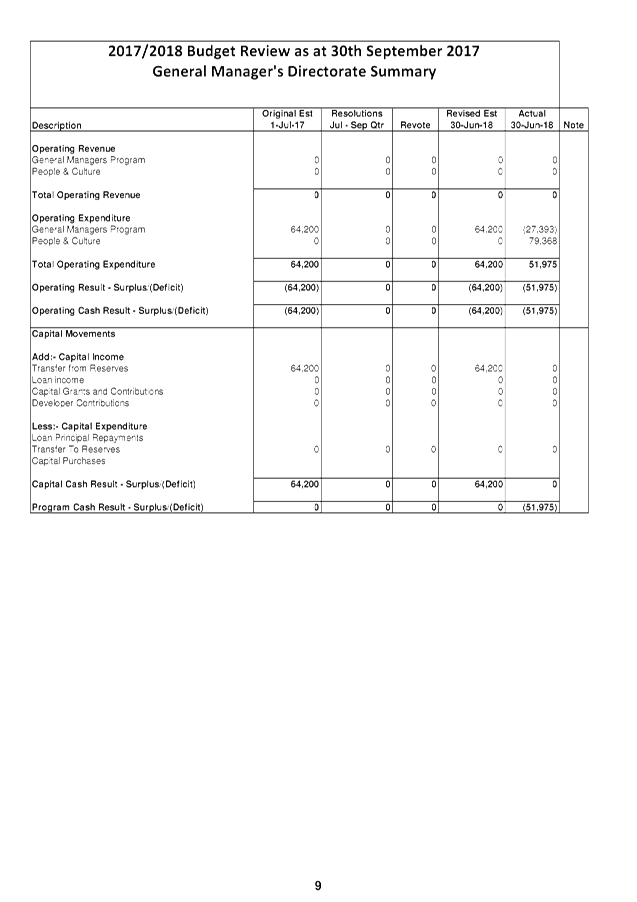

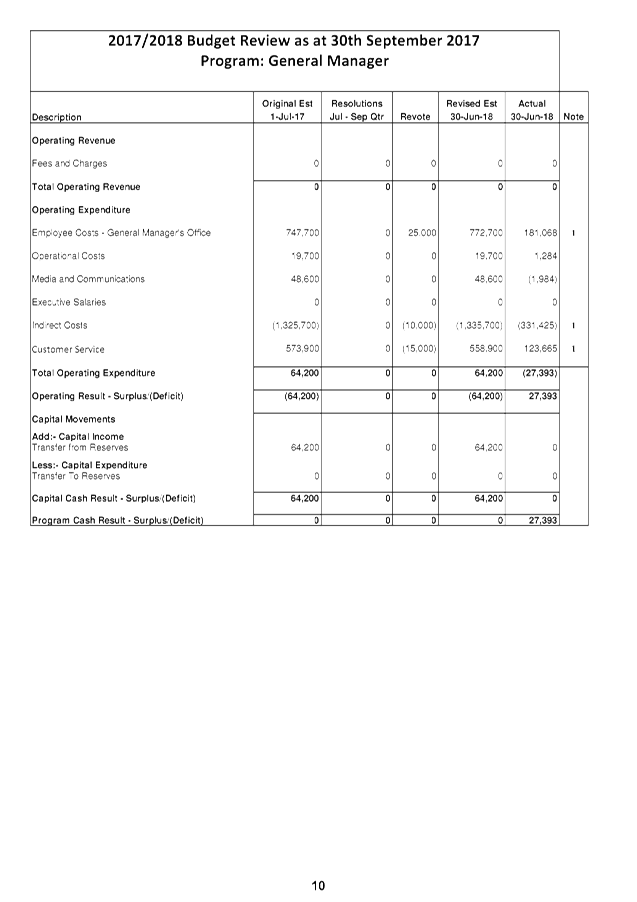

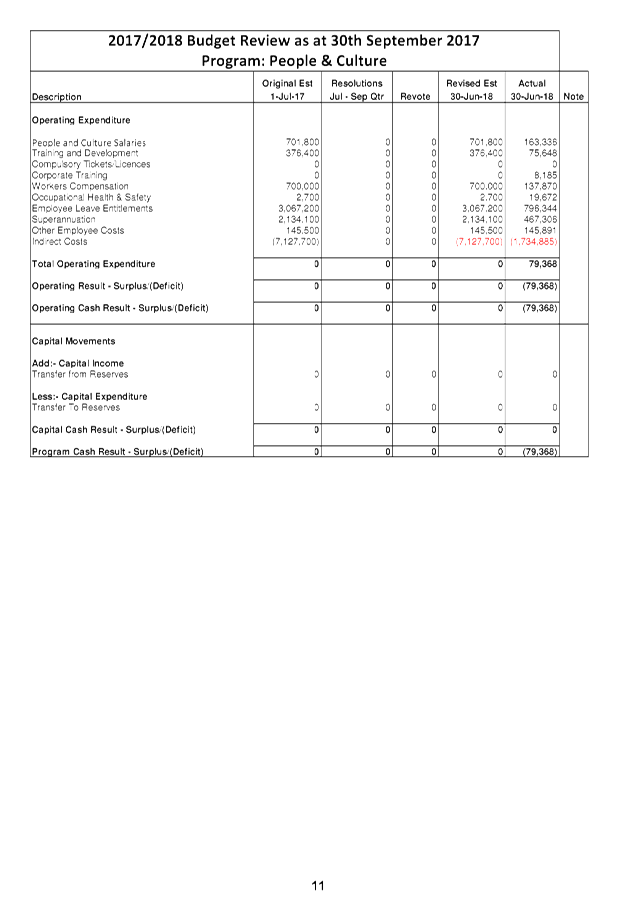

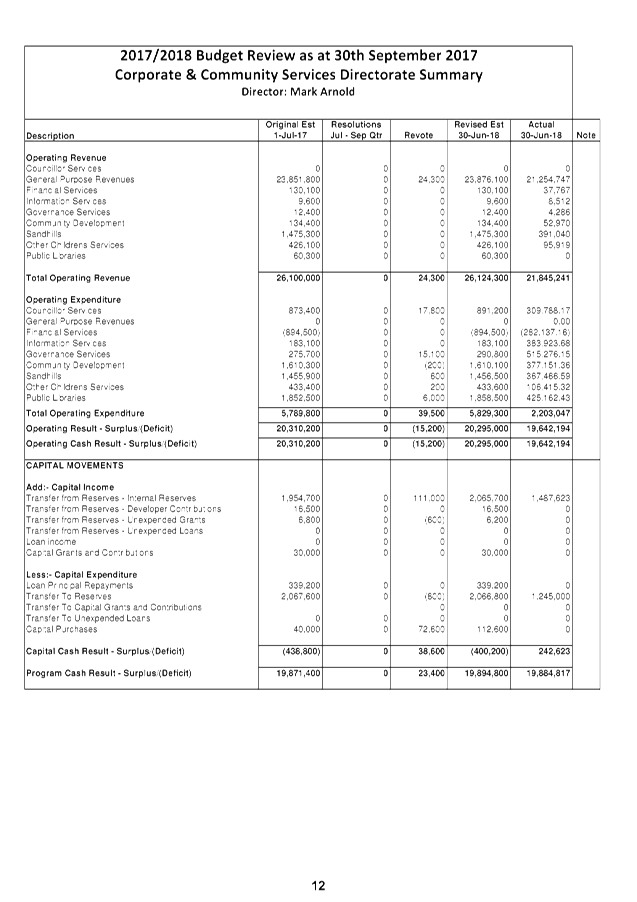

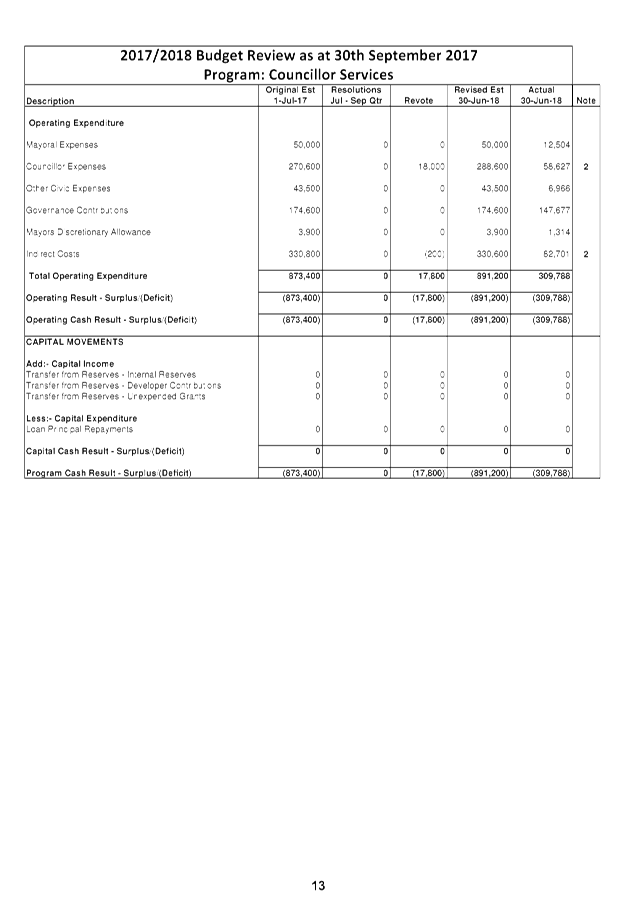

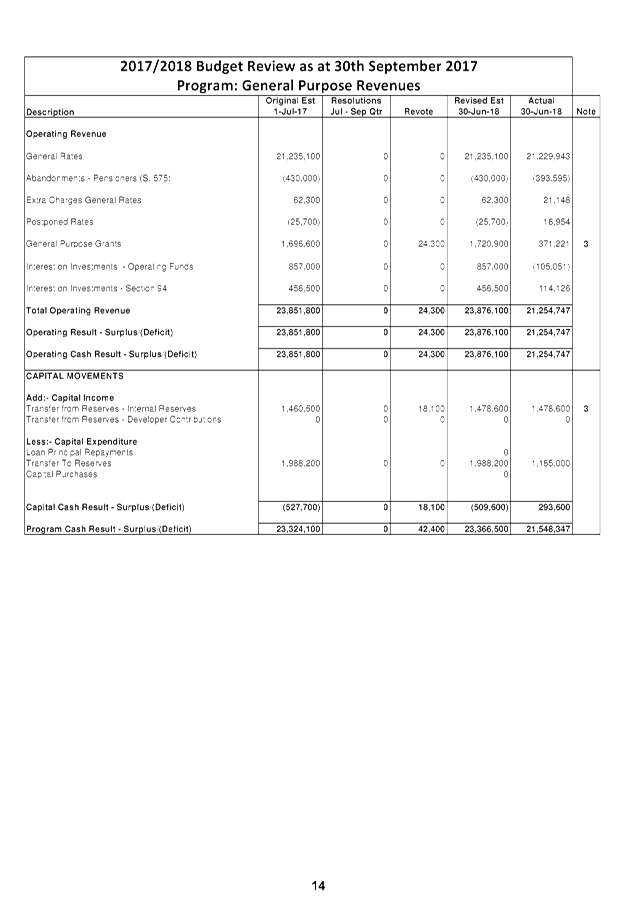

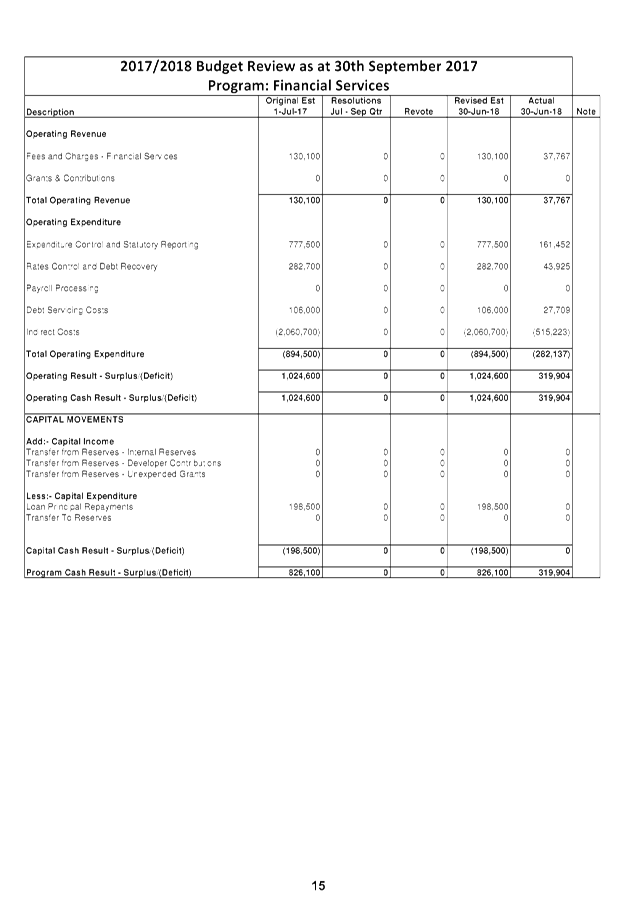

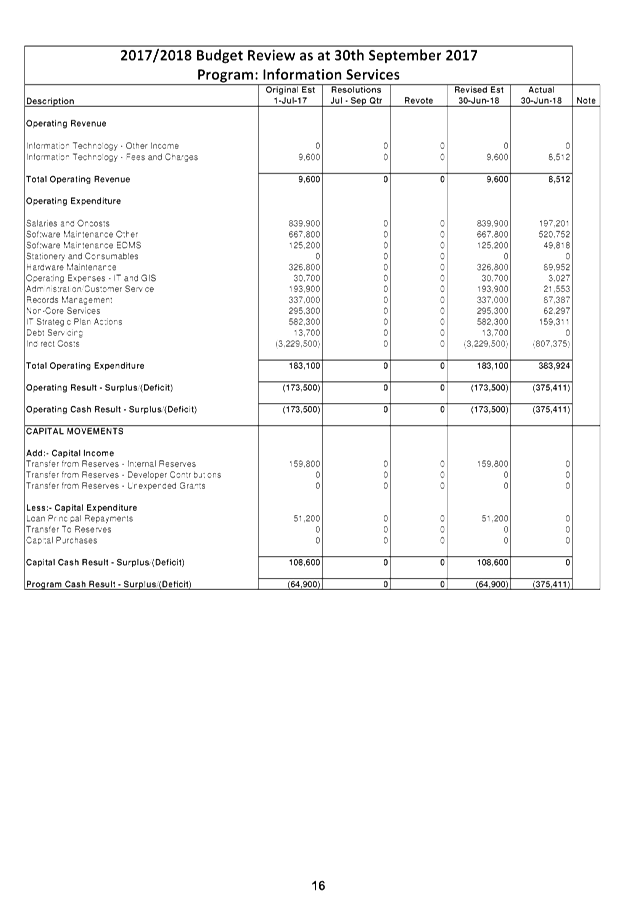

Staff Reports - Corporate and Community Services 4.5 - Attachment 1

Staff Reports - Corporate and Community Services 4.5 - Attachment 2

Staff Reports - Corporate and Community Services 4.5 - Attachment 3