Finance Advisory Committee Meeting

A Finance Advisory Committee Meeting of

Byron Shire Council will be held as follows:

|

Venue

|

Council Chamber, Station Street, Mullumbimby

|

|

Date

|

Thursday, 15 February 2018

|

|

Time

|

2.00pm

|

Anna Vinfield

Acting Director Corporate and Community Services I2018/211

Distributed 09/02/18

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of maintaining

the register, a division is required to be called whenever a motion for a

planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Finance Advisory Committee Meeting

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Finance

Advisory Committee Meeting held on 16 November 2017

4. Staff Reports

Corporate and Community Services

4.1 2017/18

Financial Sustainability Plan - Update on the Action Implementation Plan as at

31 December 2017................................................................................................................................... 4

4.2 Quarterly

Update - Implementation of Special Rate Variation....................................... 25

4.3 Rural

Roads Expenditure................................................................................................ 29

4.4 Council

Budget Review - 1 October 2017 to 31 December 2017.................................. 32

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

Report No. 4.1 2017/18

Financial Sustainability Plan - Update on the Action Implementation Plan as at

31 December 2017

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2018/20

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary meeting held on 14 December 2017

adopted the 2017/18 Financial Sustainability Plan (FSP) via Resolution 17-647

without change, following endorsement of the Draft 2017/18 FSP by the Finance

Advisory Committee at its Meeting held on 16 November 2017.

The FSP adopted by Council is for the 2017/18 Financial Year

and details the strategic approach adopted by Council for managing the

Financial Sustainability of the Council as an organisation.

The Council

via Resolution 13-148 resolved to develop the FSP as a

means of communicating with the community on proposed reforms.

Council in Resolution 13-148 also determined that progress

reports on the implementation of the actions within the FSP be submitted to the

Council's Finance Advisory Committee.

This report has been prepared to provide the Finance

Advisory Committee with an update report on the implementation of the actions

in the 2017/18 FSP, for the period to 31 December 2017.

|

RECOMMENDATION:

That the update report to

31 December 2017 on the 2017/2018 Financial Sustainability Plan Action

Implementation Plan (E2018/1508) be received and noted.

|

Attachments:

1 FSP Action

Implementation Plan as at 31 December 2017, E2018/1508

, page 7⇩

Report

Council at its Ordinary meeting held on 14 December 2017

adopted the 2017/18 Financial Sustainability Plan (FSP) via Resolution 17-647

without change, following endorsement of the Draft 2017/18 FSP by the Finance

Advisory Committee at its Meeting held on 16 November 2017.

The FSP adopted by Council is for the 2017/18 Financial Year

and details the strategic approach adopted by Council for managing the

Financial Sustainability of the Council as an organisation.

The Council

via Resolution 13-148 resolved to develop the FSP as a

means of communicating with the community on proposed reforms.

Council in Resolution 13-148 also determined that progress

reports on the implementation of the actions within the FSP be submitted to the

Council's Finance Advisory Committee.

This report has been prepared to provide the Finance

Advisory Committee with an update report on the implementation of the actions

in the 2017/18 FSP, for the period to 31 December 2017.

A summary of the actions detailed in the FSP has been

prepared and attached to this Report at Attachment 1. A comment has been

included in the summary against each of the identified actions for the main

areas or elements being:

· Expenditure

Review

· Revenue

Review

· Land Review

and Property Development

· Strategic

Procurement

· Policy and

Decision Making

· Volunteerism

· Collaborations

and Partnerships

· Asset

Management

· Long Term

Financial Planning

· Environmental

Projects

· Continuous

Improvement

· Finance

Performance Indicators

Financial Implications

The Finance Advisory Committee by referencing Attachment 1

will see progress against various action items associated with the FSP.

At this stage up to 31 December 2017, there have not been any positive

financial outcomes derived from the 2017/18 FSP at this point.

As a general comment, Council may recall at the 2 February

2017 Ordinary Council Meeting, Council resolved to increase effective from 1

July 2017 pay parking hour charges by $1 and the capped fee for four hours by

$2. This fee increase has been applicable since 1 July 2017 and as a

result pay parking meter revenue at 31 December 2017 is $1,622,348 whereas at

31 December 2016 it was $1,361,879. This represents an increase of

$260,469 and excludes meter revenue from Wategoes that commenced in December

2016 for complete comparison. Whether the revenue increase is due simply

to the fee increase, greater use of the pay parking scheme or a combination of

both, there is additional revenue for Council to utilise.

It is also prudent that any positive financial outcomes

derived from actions of the FSP be based on actual outcomes and not estimated

outcomes. In that regard, the financial reporting of outcomes of the FSP

will be in arrears, once the outcomes are known and actions in the FSP are

completed.

Further reporting will be provided to the Finance Advisory

Committee at future meetings on financial outcomes. This will be done in

conjunction with the Quarterly Budget Review (QBR) reporting process over the

2017/2018 financial year according to Resolution 14-326. A register has

been developed to track the financial outcomes of the FSP actions that is

envisaged will derive an improved quantifiable financial sustainability outcome

overall to Council.

Statutory and Policy Compliance Implications

Council Resolutions 13-148, 13-238, 14-326, 15-606 and

17-011.

The development of the FSP can also be considered as a tool

to assist Council in its ongoing obligations as defined in Section 9 (The

Council’s charter), Section 8 of the Local Government Act 1993.

Staff Reports - Corporate and Community Services 4.1 - Attachment 1

Strategy Element: Expenditure

Review

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Recommendations

on expenditure savings or efficiency gains identified by responsible staff

reported to the Executive Team.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Reports are prepared following

the quarterly Strategic Procurement Steering Committee meetings to the

Executive Team and responsible Managers. The reports include

recommendations for potential savings or efficiency gains from Contracts

tendered by Council or the NOROC Procurement Group, and recommendations on

Contracts that should be developed and Tendered by Council.

|

|

2. Monthly

Management Finance Reports provided to the Executive Team.

|

DC&CS

|

Monthly

|

Progress Update 31

December 2017

Monthly Management Finance

Reports are prepared by the Manager Finance and considered by the Executive

Team at the monthly Performance Management meeting held on the second

Wednesday of each month.

|

|

3. Monthly

Management Finance Reports provided to Councillors.

|

DC&CS

|

Monthly

|

Progress Update 31

December 2017

A copy of the Monthly

Management Finance Report is distributed by the Director of Corporate and

Community Services to Councillors on the Friday following the Executive Team

Performance Management Meeting. The version of the Monthly Management

Finance Report distributed to Councillors is in accordance with the template

adopted by Council for the monthly report.

|

|

4. Progress

reports to the Finance Committee on the implementation of the adopted FSP

actions.

|

DC&CS

|

Quarterly

|

Progress Update 31 December

2017

The 2017/18 FSP was adopted

by Council at its Ordinary Meeting held on 14 December 2017 (Res

17-647). This is the first progress report prepared for the Finance

Advisory Committee updating the Committee on the progress of implementing the

adopted actions.

|

|

5. Report

to Council through the Quarterly Budget Review any identified expenditure

savings.

|

DC&CS

|

Quarterly

|

Progress Update 31

December 2017

There were no identified

expenditure savings in the 30 September 2017 Quarter Budget Review presented

to Council in November 2017.

Any identified expenditure

savings will be included in the 31 December 2017 Quarter Budget Review report

to this meeting of the Finance Advisory Committee Meeting.

|

|

6. Report

to Council any recommendations regards policy changes.

|

DC&CS

|

As required

|

Progress Update 31

December 2017

Reported to Council as

required.

|

Strategy Element: Revenue

Review

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Internal

Staff Working Groups to report to the Executive Team on the progress achieved

on the implementation of their specific initiative/s.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

The Internal Working Group

has continued to operate and report to the Executive Team as required.

A weekly status update for

identified critical projects is provided in the internal weekly Critical

Project Status Update Report to the Executive Team.

|

|

2. Internal

Staff Working Group/staff to report to the Executive Team any proposed

opportunities for deriving new/additional revenue.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Reported as required.

|

|

3. Report

to the Finance Committee and/or the Council any proposed opportunities for

deriving new/additional revenue.

|

DC&CS

|

Quarterly

|

Progress Update 31

December 2017

Reported as required.

|

|

4. Report

to Council any recommendations regarding policy change and/or increases to

existing or new revenue sources.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Reported as required.

|

|

5. Prepare

submissions and lobby for grant funding for significant infrastructure

projects.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

The Grant applications

submitted by Council have been supported, where appropriate, with submissions

to Local Members and the responsible State or Federal Minister. The

Grant applications submitted are detailed in the monthly Grants Report to

Council.

|

|

6. Research

non-residential revenue sources (if any) and report to the Finance Advisory

Committee quarterly.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Reported as required.

|

Strategy Element: Land

Review and Property Development

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

General Fund

|

|

1. Lot

12 Bayshore Drive – Future use assessment through EoI and possible PPP.

|

DIS

|

June

2018

|

Progress Update 31

December 2017

Council has placed the

proposed EOI on a temporary hold while potential sources of government

funding are being explored.

|

|

2. Station

Street – Complete sale to North Coast Community Housing.

|

DIS

|

June

2018

|

Progress Update 31

December 2017

DA assessment and

subdivision registration are nearing completion.

|

|

3. Yaran

Road, Tyagarah Airfield – Planning continuing.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Planning proposal being

progressed in accordance with resolution.

|

|

4. Lot

22 Mullumbimby – Progress rezoning and implement EoI in accordance with

Res 17-260.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Planning proposal lodged

and responses to DoP continuing. Options regarding an EOI process are been

considered.

|

|

5. Bayshore

Drive Works Depot,

Byron Bay (Lot 102, DP1087996, 1.79ha) – Progress relocation project.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Consultants Complete Urban

are working on additional assessments before completing their options report.

|

|

6. Various

small surplus land parcels – Continue program.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Ongoing assessment and

sales

|

|

Water Fund

|

|

7. Fletcher

Street –Development approval and construction procurement.

|

DIS

|

June 2018

|

Progress Update 31 December

2017

Architects progressing the

detail and the preparation of a DA.

|

|

Sewer Fund

|

|

8. South

Byron STP – Implement Res 17-225 by finalising remediation and Future

Use assessment through EoI and possible PPP.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Council has resolved to

complete the remediation in 2018 and jointly go out to future use EOI in

February.

|

|

9. Brunswick

Heads STP – Complete remediation and evaluate future use options

including possible depot relocation.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

A further stage of

remediation is required as recovered fill volumes were insufficient to

complete the works. The site is being assessed for a potential depot

relocation.

|

|

10. Mullumbimby

STP – Complete remediation.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

A project management

agreement has been prepared with DPWS to progress the remediation based on

the GHD contamination report.

|

|

11. Brunswick

Valley STP, Vallances Road – Implement Res 17-054 PoM outcomes.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

The POM and associated

actions are being progressed.

|

|

12. Bangalow

STP – Site could be considered for solar farm options.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

The focus of solar options

has been Lot 15 Dingo Lane. The site will also be used for the storage of

recovered timbers from the five bridge replacement project.

|

|

13. Lot

4 Mill Street – Complete site access acquisition process and implement

EoI in accordance with Res 17-260.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Land acquisition

progressing.

|

|

Waste Fund

|

|

14. Lot

15 Dingo Lane, Myocum – Site to be retained in accordance with the

Resource Recovery Master Plan.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Site being assessed for a

potential solar farm.

|

|

15. Lot

16 Dingo Lane, Myocum – Implement Res 17-228 and sell to use funds to

pay down loans to reduce debt servicing costs.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Sold

|

Strategy Element: Strategic

Procurement

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Develop

a compliance and audit plan.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Procurement audit included

in current internal audit plan.

|

|

2. Review

and further develop contracts management processes and system.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Contract management system

has been implemented. This action is now complete.

|

|

3. Develop

ongoing supplier education program to assist local business.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Not started.

|

|

4. Review

Stores procurement.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Permanent Stores Officer

recruited. Scope of review to be defined by Strategic Procurement Committee

first quarter of 2018.

|

|

5. Implement

Stores review recommendations.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Not started.

|

|

6. Introduce

negotiation processes and training.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

Training course and

relevant staff members to be identified.

|

Strategy Element: Policy

and Decision Making

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Council

continue to consider the short, medium and long term financial impacts and

the context of Council’s long term financial sustainability in its

ongoing policy and decision making processes.

|

Manager

Finance

|

June 2018

|

Progress Update 31

December 2017

The Manager Finance undertakes a

review of the reports to Council on a monthly basis and provides comments to

Report Writers and the Executive Team on the financial implications.

Comments are included in the reports for consideration of Council in the

decision making process. Resolutions impacting on budgets are

considered in the QBR process and then included in the financial modelling

used for the preparation of the LTFP.

|

|

2. That

any unspent budget votes from the 2016/17 budget recommended to be carried

over to the 2017/18 Budget be reported to Council following the end of the

2016/17 Financial Year.

|

Council

|

June 2018

|

Progress Update 31

December 2017

This item is

complete. Carryovers from the 2016/2017 to be added to the 2017/2018

budget were considered by the Finance Advisory Committee at its Meeting held

on 17 August 2017. These were later adopted by Council at its Ordinary

Meeting held on 24 August 2017 (Res 17-322).

|

|

3. That

the monthly Finance Report be distributed to Councillors on a monthly basis.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

Monthly finance reports are being

circulated to Councillors.

|

|

4. That

policies that contain wording or provisions that are considered to be

restrictive be reviewed to incorporate enabling wording and guidelines for

Council’s consideration and approval.

|

DC&CS

|

June 2018

|

Progress Update 31

December 2017

This project is ongoing and

if applicable, policies once reviewed will be submitted to Council for

consideration.

|

|

5. That

the Special Rate Variation (SRV) and policy frameworks established through

Res 17-222 be implemented and reported quarterly to the Finance Advisory

Committee.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

The first quarterly update to the

Finance Advisory Committee occurred on 16 November 2017 and

included an expenditure table detailing how SRV funds have been expended for

the first quarter of the 2017/2018 financial year. There is a

subsequent provided to the 15 February 2018 Finance Advisory Committee

Meeting.

|

Strategy Element: Volunteerism

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Review

the Volunteer Policy and framework to ensure that it meets the National

Standards for volunteer involvement, and supports the organisation in

delivering volunteer activities.

|

Manager Community

Development

|

June 2018

|

Progress Update 31

December 2017

Draft Volunteer Policy and

Guidelines completed und expected to report to ET in February 2018.

|

|

2. Undertake

an organisation wide audit of current volunteer activities.

|

ET

|

June 2018

|

Progress Update 31

December 2017

Not commenced.

|

|

3. Recognition

of current volunteers.

|

ET

|

June 2018

|

Progress Update 31

December 2017

Volunteer recognition event

scheduled in National Volunteer Week May 2018

|

|

4. Undertake

a capacity building project with Council S355 Committees.

|

Manager Community

Development

|

June 2018

|

Progress Update 31

December 2017

Grant funded project

“Love Byron Halls” has been awarded. Grant funds allow for

capacity building workshops in relation to marketing and promotion.

Contractor for project has been engaged. Delivery of full project by June 31

2018

|

Strategy Element: Collaborations

and Partnerships

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Progress

investigation of potential commercial opportunity projects currently underway

such as:

a) Redevelopment

of the Fletcher Street (former Library Building) site;

b) Management

and development of the Tyagarah Aerodrome;

c) Redevelopment

of Byron Bay Swimming Pool/Café.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Briefings and reports

provided to Council as required.

|

2. Progress

with calling Expressions of Interest (or another type of competitive

processes) currently underway, to investigate potential partnership

opportunity on the following valuable community land sites:

a) Lot 12 Bayshore Drive,

Byron Bay.

b) 156 (Lot 22) Stuart Street,

Mullumbimby.

c) 3 Broken Head Road,

Suffolk Park (former South Byron Sewerage Treatment Plant site).

d) Lot 4 Mill Street, Mullumbimby.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

In progress.

|

|

3. For

the Supporting Partnerships Policy, develop:

a) tools,

guides and information for community and future partners on Council’s

Partnership Policy;

b) a

public web-based register to provide community with information on upcoming

or potential partnerships and partnership projects;

c) a

Communications Strategy to support the community becoming and remaining

informed about all things ‘Partnership’;

d) internal

procedures and processes for management of potential collaboration and

partnership opportunities.

|

Manager Corporate Services

|

June 2018

|

Progress Update 31

December 2017

In progress.

|

|

4. Provide

reports to ET on potential collaboration, partnership and commercial

opportunities when they are identified.

|

ET/Managers

|

June 2018

|

Progress Update 31 December

2017

Reported as required.

|

Strategy Element: Asset

Management

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Update

the Strategic Asset Management Plan including access considerations and other

emerging issues.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

The TAMP has been completed

to draft stage and will be reported to the 13 Feb TIAC meeting.

|

|

2. Improve

the integrity of the Asset Management system by implementing actions detailed

in key audit reports.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Actions being addressed and

tracked.

|

|

3. Implement

asset modelling in accordance with Special Rate Variation requirements.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

MyPredictor software has

bee used in the preparation of the TAMP.

|

|

4. Review

annually integration of asset management plans, capital works program, S94

Plan, S64 Plan and LTFP.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

This has occurred in the

development of the 2018/19 budget.

|

|

5. Engage

with the community to determine the customer LOS for accessible transport.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

This is occurring as part

of the TAMP and also as part of the proposed work by New Democracy.

|

|

6. Complete

the annual infrastructure report (SS7).

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Completed

|

|

7. Complete

condition and access audit inspections of community buildings.

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Quotes for the work have been

obtained.

|

|

8. Implement

replacement of high priority road bridges across the Shire

|

DIS

|

June 2018

|

Progress Update 31

December 2017

Tenders have closed for the

five bridge replacement program. The recommendations report will go to

Council in March.

|

Strategy Element: Long

Term Financial Planning

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Develop

the 2017-2028 Long Term Financial Plan following adoption of the 2017/18

Operational Plan and report to the Finance Advisory Committee/Council prior

to 16 November 2017.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

The next version of the

Long Term Financial Plan is yet to be commenced and is behind schedule.

It is anticipated this will be completed to be reported to the 17 May 2018

Finance Advisory Committee Meeting.

|

|

2. Further

update the 2017-2028 Long Term Financial Plan to incorporate outcomes from

the development of the new Community Strategic Plan in conjunction with the

adoption of the 2018/19 Operational Plan and Budget Estimates to be reported

to Council in June 2018.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

To be undertaken following

the adoption of the 2018/2019 Budget Estimates.

|

Strategy Element: Environmental

Projects

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Implement

actions from the Low Carbon Strategy as per scheduled timeframes.

Example of actions that meet the FSP include energy efficiency measures,

installation of solar power and solar hot water, energy data optimisation,

electric fleet vehicles and installation of smart meters.

|

DSEE

|

June 2018

|

Progress

Update 31 December 2017

Council

endorsed 3 reports 14 Dec meeting:

· Council Emissions Reduction Strategy

· GHG annual report / baseline emissions of Council operations

· BE19 and council project update

The

Emissions Reduction Strategy will transition from the existing Low Carbon

Strategy to a net zero target by 2025, with the recently established 2015/16

baseline of Council operations, and identify measures required to move

council towards this goal. Any ongoing actions from the Low Carbon Strategy

will be reviewed and carried forward into the new Emissions Reduction

Strategy if applicable.

Actions

progressed between 1/7/17 & 31/12/17 include: progression of

cumulative ~99kW solar installs on the Byron Library, Sandhills Childcare

Centre and Byron Resource and Recovery Centre; launch of Electric Vehicle

Strategy; ongoing feasibility of Bio-Energy facilities; preparation of

Bruswick Valley Sustainability Centre Management Plan; ongoing feasibility of

ground mounted solar farm at Dingo Lane; ongoing analysis of EV charge

station and solar covered car park at Mullumbimby administration building;

partnering with ongoing procurement process of new electricity contracts

(with intention of including green power and local electricity trading as a

requirement); ongoing fit-out of Solar Analytics technology to provide

real-time monitoring of solar systems on Council assets; Council

collaborating with ISF:UTS (Solar Gardens Project) in application for

ARENA grant; and the employment of the Sustainability and Emissions

Reduction Officer.

|

|

2. Work

collaboratively with the Zero Emissions Byron project to identify actions

that go beyond the Byron Shire Low Carbon Strategy.

|

DSEE

|

June 2018

|

Progress

Update 31 December 2017

Zero

Emissions Byron (ZEB) have produced the Baseline Emissions Report, which

details the current emissions and emission reduction strategies, for the

Byron community. ZEB have also developed a draft strategic plan and have

produced their Energy Emissions Reduction Plan.

Council’s

Emissions Reduction strategy will be developed in consultation with Zero

Emissions Byron and the community. Council staff have initiated monthly

meetings with ZEB, with the first meeting held 11/12/17, to collaboratively

share information on a regular basis

|

Strategy Element: Continuous

Improvement

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

Workforce

|

|

1. Management

of excessive annual and long service leave, supported by introduction of

online leave processes.

|

Managers & Manager

P&C

|

June 2018

|

Progress Update 31

December 2017

On-line leave functionality

implemented across 75% of work teams. Approximately 50% of leave applications

now being lodged online.

Management of excessive

leave by Managers is ongoing and performance continues to improve and exceed

benchmarks.

FY17 Performance Excellence

Program results show at 30/6/17:

- 18% has excessive long

service leave. This is favourable compared to a NSW average of 28% and is an

improvement on FY16 results of 22%.

- 10% of workforce has

excessive annual leave. This is favourable, compared to a NSW average of 12%

and was the same as FY16 result (which is good bearing in mind the

significant improvement in excessive long service leave has been achieved

without a corresponding negative impact on annual leave results).

|

|

2. Management

of sick leave – improvement effort to be focused on staff taking 10.5

days or more p/a.

|

Managers

|

June 2018

|

Progress Update 31 December

2017

Manager P&C to provide

report to all Managers by end January 2018 on staff who have taken 10.5 days

or more sick leave during 2017.

|

|

3. Ongoing

monitoring of overtime costs as a percentage of total employee costs.

|

Manager Organisation Development

|

June 2018

|

Progress Update 31

December 2017

Overtime costs are reported

to the Executive Team, with the information available to Managers, monthly.

Total overtime cost of

itself is not an indicator of performance, as some overtime arises because of

the nature of services (24/7 for some), to meet community needs (for example

adjusting starting or finishing times for works to reduce impact on businesses)

or as an efficiency measure in itself (eg managing spans of work to reduce

site establishment/management costs). Purpose of monitoring and reporting is

to give Managers business insights for management of their operations and

resources.

|

|

4. Review

and improve mapping of workforce to services (consistent with a review of

Special Schedule 1).

|

Manager Organisation

Development &

Manager Finance

|

June 2018

|

Progress Update 31

December 2017 - Complete

A complete review of

workforce mapping was conducted in July/Aug 2017 resulting in much improved

data.

In addition, a regional

practitioners group has been established which will give Byron an opportunity

to compare the business rules we have used to establish mapping to those of

adjoining councils.

|

|

Finance

|

|

5. Continue

to invest in Finance Team members gaining qualifications and building

capacity.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

There are currently two members

undertaking long term study to gain qualifications of a tertiary nature, enabling

capacity for current staff to broaden their knowledge and assist in

strengthening the Finance teams ability to step into various roles.

|

|

6. Review

Manager Finance Position Description to confirm focus on strategic

transformation and increased focus on business insight activities.

|

DC&CS and Manager

Finance

|

June 2018

|

Progress Update 31

December 2017

Position description not

yet reviewed, however the expectation of providing a greater emphasis on

business insight is understood.

|

|

7. Finance

Team to review operations and act on improvement opportunities with a focus

on increasing business insight activity.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

Not commenced but proposed

to review BIS Management Reporting system available through Council’s

Authority software.

|

|

8. Directorate

nominees with Finance Team to review Cost Centres and Allocation under

Special Schedule 1 categories.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

Finance continue to make

progress with mapping of Special Schedule 1 in conjunction with each

directorate.

|

|

Operations

|

|

9. Review

IT spend to identify total IT spend and map capital and recurrent costs

drivers to increase business understanding and assist with future budgeting

|

Manager Business Systems

and Technology

|

June 2018

|

Progress Update 31

December 2017

Undertaken in setting

annual budget and quarterly budget reviews.

|

|

Service Delivery

|

|

10. IS Managers, working with People and

Culture Team, will develop actions focused on succession planning and increasing

workforce diversity.

|

IS Managers

|

June 2018

|

Progress Update 31

December 2017

In progress.

|

|

11. SEE Managers, working with People and

Culture Team, will develop actions focused on succession planning

|

SEE Managers

|

June 2018

|

Progress Update 31 December

2017

In progress.

|

|

12. Roads Services (Operating) – Working

with Finance Team and benchmarking with comparable councils, Manager to

critically review data, ascertain key drivers and develop an action plan to:

1. fully articulate and explain results;

2. develop a methodology to consistently

measure genuine operating (non capital) expenditure.

Including

a focus on:

a. Cost coding and accuracy of expense

allocation;

b. Depreciation expenses;

c. Internal charging (including on-cost

calculations and fleet charges);

d. Capital expenditure required to be

accounted for as operating expenditure (as per the Code of Accounting

Practice).

|

Manager Works & Manager

Finance

|

June 2018

|

Progress Update 31

December 2017

In progress.

|

|

13. Sewerage Services (Operating) –

Working with Finance Team and benchmarking with comparable councils, Manager

to critically review data, ascertain key drivers and develop an action plan

to:

1. fully articulate and explain results;

2. develop a methodology to consistently

measure genuine operating (non capital) expenditure.

Including

a focus on:

a) Debt servicing impact on expenses;

b) Position in lifecycle of plants;

c) Impacts from environmental initiatives;

d) Internal charging (on-cost calculations).

|

Manager Utilities

|

June 2018

|

Progress Update 31

December 2017

In progress.

|

|

Corporate Leadership

|

|

14. Include

measurement of Customer Satisfaction in the biennial CATI Community

Satisfaction Survey going forward.

|

Manager Organisation

Development

|

June 2018

|

Progress Update 31

December 2017

Noted. Can be included but

development of the survey is not due to start yet.

|

|

15. Council meetings – Council continues

to have some of the longest meetings and one of the top half a dozen councils

with the highest number of resolutions.

Councillors

can review information provided and meeting procedures. Some considerations

suggested in the Performance Excellence Report to help review meeting

practices include:

• Are our Council meetings

passing resolutions in an efficient manner?

• Are our meeting papers

clear and concise?

• Are agendas provided to

Councillors well in advance to allow a timely review prior to the meeting?

• Does Council conduct

meeting performance reviews at the end of the year or end of the term?

• Is Council up to date with

best practice when it comes to council meetings?

• Did the complexity of

issues match the time taken to resolve them?

|

Manager Corporate Services

|

June 2018

|

Progress Update 31

December 2017

Council will be receiving a

workshop in February 2018 regarding a review of the Code of Meeting

Practice. This is also linked to a new Model Code of Meeting Practice

being developed by the Office of Local Government.

|

Strategy Element: Finance

Performance Indicators

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1.

Ongoing quarterly reporting to the Finance Advisory Committee and

Council on Financial Sustainability Plan (FSP) outcomes.

|

Manager Finance

|

Quarterly

|

Progress Update 31

December 2017

Reporting for the quarter ended 30

Sept 2017 reported to the FAC 16 November 2017. The December 2017

update will be reported at meeting on 15 February 2018.

|

|

2. Recognition

through the QBR process of financial outcomes delivered by the FSP.

|

Manager Finance

|

Quarterly

|

Progress Update 31

December 2017

30 September 2017 QBR

reported to FAC on 16 November 2017 and 31 December 2017 QBR will be reported

to the 15 February 2018 FAC.

|

|

3. Structural

changes to both revenue sources and expenditure will be updated in the base

budget during the preparation of the 2018/19 Budget.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

2018/2019 Budget Estimates

currently under development. Will be reported to Finance Advisory

Committee and Council in May and June 2018.

|

|

4. The

financial outcomes delivered by the FSP updated into the Council’s Long

Term Financial Plan and modelled in the Long Term Financial Plan Scenarios.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

To be included in the next

version of the Long Term Financial Plan to be reported to the Finance

Advisory Committee in May 0218.

|

|

5 Assessment

of the Note 13 and Special Schedule 7 performance ratios disclosed annually

in Council’s audited financial statements which should indicate a trend

improvement from FSP outcomes.

|

Manager Finance

|

June 2018

|

Progress Update 31

December 2017

Assessment was completed as

part of finalisation of 2016/2017 Financial Statements reported to Council in

October 2017.

|

|

6. Assessment

of the seven ‘Fit for Future’ benchmarks on an ongoing basis to

ensure Council maintains the ‘Fit’ outcome.

|

Manager Financer

|

June 2018

|

Progress Update 31

December 2017

Not yet commenced but to be

included in the development of the next version of the Long Term Financial

Plan to be reported to the Finance Advisory Committee in May 2018.

|

Staff Reports - Corporate and Community Services 4.2

Report No. 4.2 Quarterly

Update - Implementation of Special Rate Variation

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2018/105

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary Meeting held on 2 February 2017

resolved to apply for a Special Rate Variation (SRV) of 7.50% per annum for

four years commencing from the 2017/2018 financial year (Resolution 17-020 part

5).

Following approval of Council’s SRV by the Independent

Pricing and Regulatory Tribunal (IPART) received on 9 May 2017, Council resolved

to implement the SRV at its Ordinary Meeting held 22 June 2017 (Resolution

17-268 part 1).

Council at the same Ordinary Meeting held on 22 June 2017

resolved (Resolution 17-222 part 2) to incorporate reporting on the Special

Rate Variation into the development of the 2017/2018 Financial Sustainability

Plan and quarterly updates to Council through the Finance Advisory Committee on

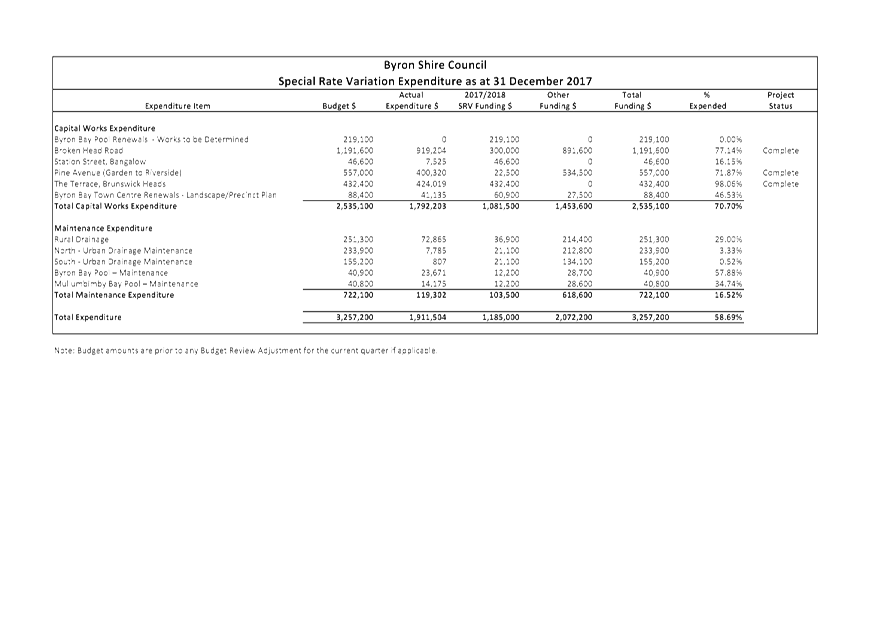

the implementation of the adopted Financial Sustainability Plan.

The purpose of this report is to provide the Finance Advisory

Committee with a quarterly update on implementation of the SRV and expenditure

up to 31 December 2017.

|

RECOMMENDATION:

That the Finance Advisory Committee note the quarterly

update on the Special Rate Variation Implementation as at 31 December 2017

|

Attachments:

1 2017-2018

Special Rate Variation Expenditure at 31 January 2018, E2018/8204 , page 30⇩

Report

Council at its Ordinary Meeting held 2 February 2017

resolved to apply for a Special Rate Variation (SRV) as follows:

Resolution 17-020 part 5

Lodge a Section 508A permanent

Special Rate Variation application to the Independent Pricing and Regulatory

Tribunal, for increases to the ordinary rate income (general revenue) of 7.5%

(including rate peg) in 2017/18, 7.5% (including rate peg) in 2018/19, 7.5%

(including rate peg) in 2019/20 and 7.5% (including rate peg) in 2020/21.

After lodging the Special Rate Variation application with

the Independent Pricing and Regulatory Tribunal (IPART), Council received

approval to increase its ordinary rate income as per resolution 17-020. This

approval was granted on 9 May 2017. Council resolved to implement the SRV

through adoption of the 2017/2018 Operational Plan and Revenue Policy at its

Ordinary Meeting held on 22 June 2017 (Resolution 17-268 part 1).

Council at its Ordinary Meeting held 22 June 2017 received

Report 13.13 confirming the outcome of the SRV application and its subsequent

approval. Council resolved resolution 17-222 as follows:

1. That

Council note the determination from IPART in relation to its 2017/2018 Special

Rate Application including the following conditions imposed by IPART on Council

for the:-

a) use

of the additional income derived from the special variation for the purposes of

reducing its infrastructure backlog and improving financial sustainability;

and

b)

reporting on this use against the forecasts included in the Council’s

application as part the Council’s annual report for each year from

2017-18 to 2026-27.

2. That

Council adopt as a Policy Framework the use and reporting conditions imposed by

IPART in the SRV determination and further incorporate reporting on the Special

Rate Variation into the development of the 2017/2018 Financial Sustainability

Plan and the quarterly updates to Council through the Finance Advisory

Committee on the implementation of the adopted Financial Sustainability Plan.

3. That

Council establish as a policy framework that funding for infrastructure renewal

and maintenance from general revenue sources is not ever lower then the general

revenue baseline indicator established in the 2016/2017 Budget.

4.That

Council establish as a policy framework that any funds generated by the SRV

that remain unexpended at the end of each financial year are to be restricted

and held in a internal reserve, to be carried forward to subsequent financial

year, for expenditure in accordance with the uses imposed in the SRV approval.

5. That

Council incorporate the research of potential non resident revenue sources (if

any) as part of the Revenue Review chapter in the development of the 2017/2018

Financial Sustainability Plan, and provide quarterly updates to Council through

the Finance Advisory Committee.

6.

That Council not proceed with the implementation of part 9 and part 11

of resolution 17-020.

The 2017/2018 Financial Sustainability Plan has been

developed to incorporate future quarterly reporting on the SRV as outlined in

Chapter 7 ‘Policy and Decision Making’.

This report is provided to the Finance Advisory Committee to

advise on the implementation of the SRV and the current status of expenditure

from 1 July 2017 to 31 December 2017 which is

detailed in Attachment 1 (E2018/8204).

The levy of Council’s annual rates and charges was

completed in accordance with Resolution 17-268 prior to 31 July 2017 and this

included applying the first tranche of the 7.5% ordinary rate increase for

2017/2018 and revised ordinary rating structure adopted by Council. The

estimated yield from the SRV for 2017/2018 being the first year of the increase

is $1,185,000.

Upon adoption of the 2017/2018 Budget Estimates, Council

resolved to undertake the following program of capital and maintenance works

including the additional SRV revenue and other funding as outlined in

Attachment 1. During the course of the 2017/2018 financial year, there may

be adjustments required to the expenditure budgets identified in the schedule

of capital and maintenance works currently funded by the SRV revenue which will

be presented to Council for approval via the Quarterly Budget Review process.

The expenditure program adopted for 2017/2018 financial year

is consistent with Council’s SRV application and approval from IPART to

use the funding to improve financial sustainability and reduce infrastructure

backlog.

Financial Implications

There are no direct financial implications associated with

this report. The table included at Attachment 1 (E2018/8204) provides

information to the Finance Advisory Committee as to the expenditure of the

Special Rate Variation Funds up to the second quarter of the 2017/2018 financial

year.

Statutory and Policy Compliance Implications

Approval and conditions

received from the Independent Pricing and Regulatory Tribunal (IPART) regarding

the Byron Shire Council Special Rate Application 2017-2018 received 9 May 2017.

Council Resolution 17-268 and 17-222.

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

Staff Reports - Corporate and Community Services 4.3

Report No. 4.3 Rural

Roads Expenditure

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2018/170

Theme: Corporate Management

Financial Services

Summary:

At the 16 November 2017

Finance Advisory Committee Meeting, the following recommendation was adopted by

the Committee:

“That the Finance

Advisory Committee receive a report detailing expenditure on rural roads

(maintenance and capital) over the last three to five years identifying funding

sources to inform the 2018/2019 Budget Estimates’

Council subsequently adopted

the Committee recommendation at the 14 December 2017 Ordinary Meeting via

resolution 17-646. The purpose of this report is to provide information as per

the adopted Committee recommendation and Council resolution.

|

RECOMMENDATION:

That Council note the information on rural roads

expenditure (both maintenance and capital) over the last five full financial

years 2012/2013 to 2016/2017.

|

Report

At the 16 November 2017

Finance Advisory Committee Meeting, the following recommendation was adopted by

the Committee:

“That

the Finance Advisory Committee receive a report detailing expenditure on rural

roads (maintenance and capital) over the last three to five years identifying

funding sources to inform the 2018/2019 Budget Estimates’

Council subsequently adopted

the Committee recommendation at the 14 December 2017 Ordinary Meeting via

resolution 17-646. The purpose of this report is to provide information as per

the adopted Committee recommendation and Council resolution.

Provided below in summary is

a table outlining the expenditure or spend of both a maintenance and capital

nature on rural roads over the last five financial years from 2012/2013 to

2016/2017 along with the identification of funding sources:

|

Item

|

2012/2013

$

|

2013/2014

$

|

2014/2015

$

|

2015/2016

$

|

2016/2017

$

|

|

Maintenance Spend

|

|

|

|

|

|

|

Sealed Rural Roads

|

888,008

|

1,231,206

|

1,187,878

|

1,182,000

|

1,109,475

|

|

Unsealed Rural Roads

|

232,124

|

205,225

|

289,173

|

547,055

|

375,034

|

|

Total Maintenance Spend

|

1,120,132

|

1,436,430

|

1,477,051

|

1,729,055

|

1,484,509

|

|

|

|

|

|

|

|

|

Maintenance Funding

|

|

|

|

|

|

|

Revenue

|

888,008

|

1,209,430

|

1,250,051

|

1,472,055

|

1,257,509

|

|

Special Rate Variations

|

227,000

|

227,000

|

227,000

|

227,000

|

227,000

|

|

Total Maintenance

Funding

|

1,120,132

|

1,436,430

|

1,477,051

|

1,729,055

|

1,484,509

|

|

|

|

|

|

|

|

|

Capital Spend

|

|

|

|

|

|

|

Rural Roads and Bridges

|

1,304,648

|

1,095,480

|

2,036,309

|

4,311,458

|

3,168,760

|

|

Total Capital Spend

|

1,304,648

|

1,095,480

|

2,036,309

|

4,311,458

|

3,168,760

|

|

|

|

|

|

|

|

|

Capital Funding

|

|

|

|

|

|

|

Capital Grants &

Contributions

|

330,888

|

246,785

|

1,037,403

|

1,216,920

|

1,743,275

|

|

Holiday Park Reserve

|

0

|

0

|

0

|

0

|

205,110

|

|

IS Carryover Reserve

|

6,393

|

77,126

|

62,010

|

7,783

|

51,200

|

|

Council Pay Parking Reserve

|

0

|

119,180

|

0

|

0

|

0

|

|

Developer Contributions

|

335,577

|

289,896

|

695,306

|

423,129

|

121,798

|

|

ELE Reserve

|

0

|

0

|

0

|

99,970

|

100,000

|

|

Footpath Dining Reserve

|

0

|

0

|

0

|

102,843

|

100,000

|

|

Infrastructure Renewal

Reserve

|

0

|

0

|

0

|

796,851

|

279,107

|

|

Legal Services Reserve

|

0

|

0

|

0

|

1,803

|

175,000

|

|

Revenue Funding

|

378,412

|

257,690

|

236,656

|

939,496

|

241,412

|

|

Special Rate Variations

|

97,797

|

84,848

|

4,935

|

258,765

|

123,166

|

|

Unexpended Grants

|

81,516

|

0

|

0

|

218,815

|

12,500

|

|

Unexpended Loans

|

0

|

13,100

|

0

|

0

|

0

|

|

Other Waste Reserve

|

74,067

|

6,855

|

0

|

0

|

0

|

|

Bridge Replacement Reserve

|

0

|

0

|

0

|

245,085

|

16,193

|

|

Total Capital Funding

|

1,304,648

|

1,095,480

|

2,036,309

|

4,311,458

|

3,168,760

|

|

Item

|

2012/2013

$

|

2013/2014

$

|

2014/2015

$

|

2015/2016

$

|

2016/2017

$

|

|

Total Rural Roads Spend

|

2,424,780

|

2,531,911

|

3,513,360

|

6,040,513

|

4,653,269

|

|

Total Roads Spend

|

3,461,634

|

3,454,149

|

5,469,264

|

10,270,134

|

13,619,466

|

|

% Allocated to Rural

Roads

|

70.05%

|

73.30%

|

64.24%

|

58.82%

|

34.17%

|

In the above table a

comparison is also provided for each year of how much of the overall roads budget

Council is allocating to the rural area. It has also been assumed that the

expenditure disclosed constitutes expenditure for roads (maintenance and

capital) and bridges (capital). It does not include footpaths, cycleways,

drainage maintenance, natural disaster restoration and bridge maintenance

(bridge maintenance is not separated into urban and rural expenditure).

Whilst the data above is

summarised, a spread sheet has been developed that has captured the information

in detail, that detail can be provided to Committee Members should it be

required. The detailed spread sheet identifies the funding source of the

expenditure and details the specific capital expenditure projects and costs

undertaken each financial year.

As indicated in the table

above, over the last five full financial years, the following summary

information is realised:

|

Item

|

Amount $/Value

|

|

Total Rural Roads

Expenditure

|

19,163,883

|

|

Total Roads Expenditure

|

36,274,648

|

|

% Allocated to Rural Roads

|

52.83%

|

|

Average Annual Rural Roads

Total Spend

|

3,832,767

|

Financial Implications

There are no financial implications associated with this

report as the report identifies past expenditures incurred by Council for rural

roads and bridges in terms of maintenance and capital expenditure.

Statutory and Policy Compliance Implications

Each financial year, Council adopts an Operational Plan

(Section 405 of the Local Government Act 1993) including a Revenue Policy

containing Budget Estimates to fund the activities outlined in the Operational

Plan. The expenditure contained in this report are the results achieved

by Council as per the adopted Budget Estimates and subsequent Quarterly Budget

Reviews for the last five full financial years.

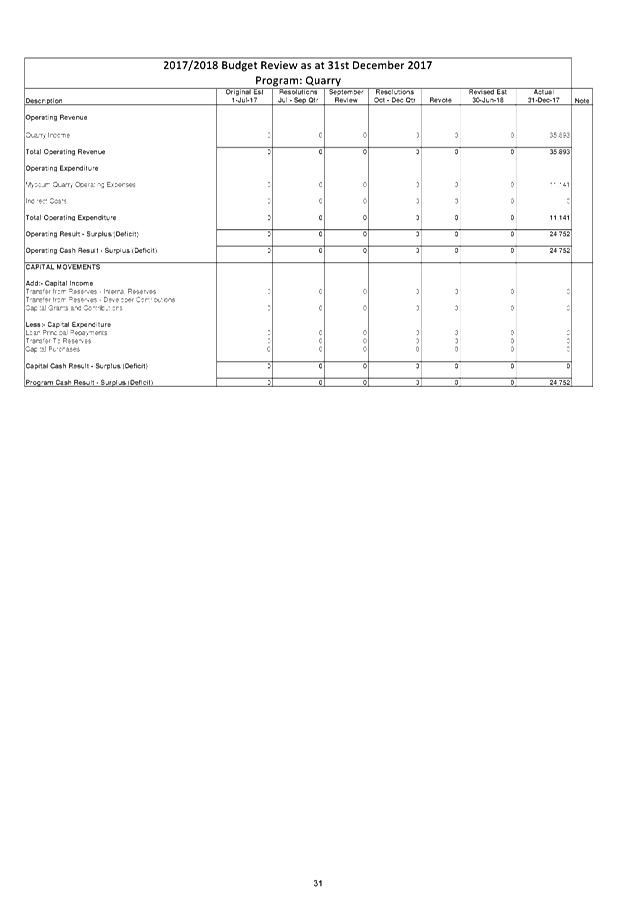

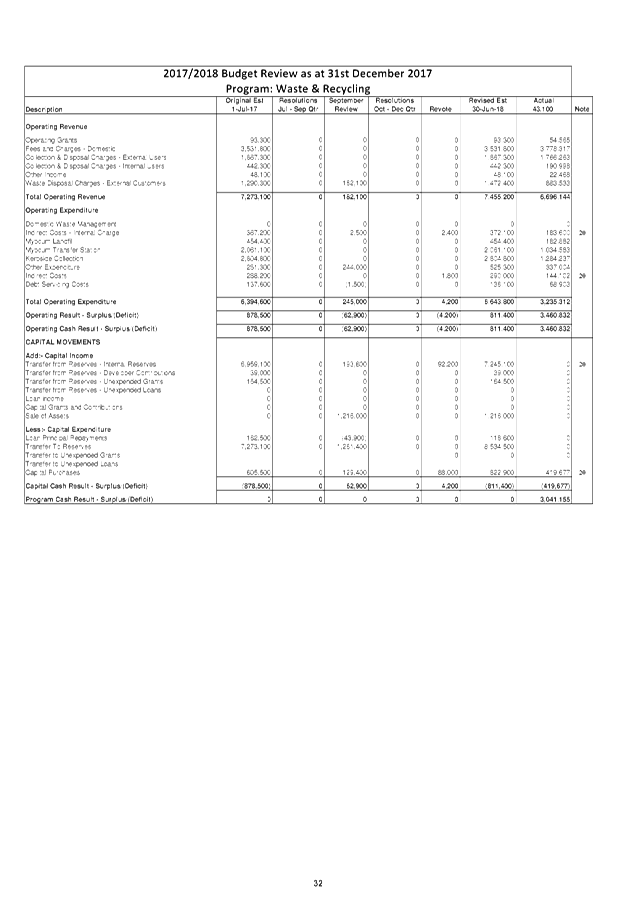

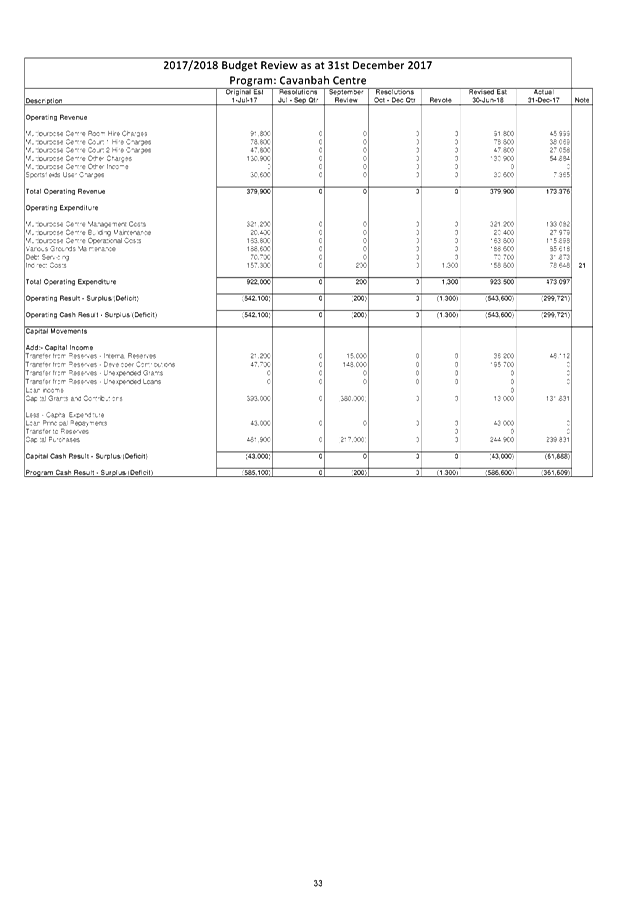

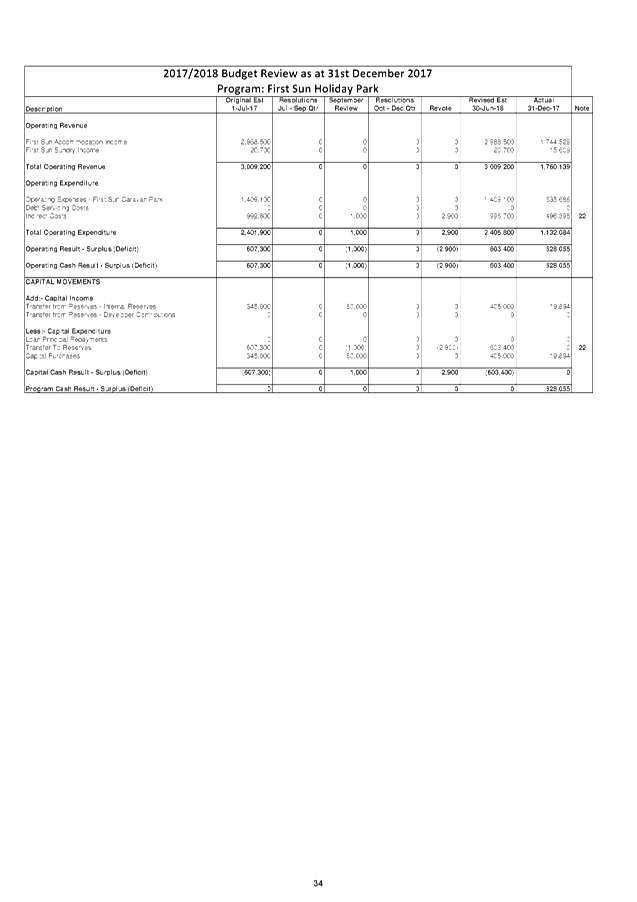

Staff Reports - Corporate and Community Services 4.4

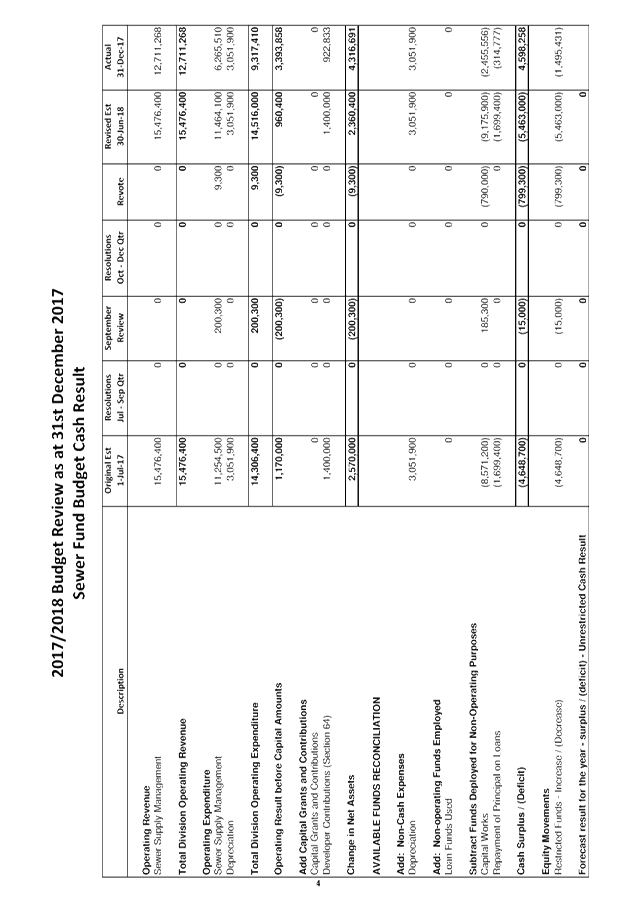

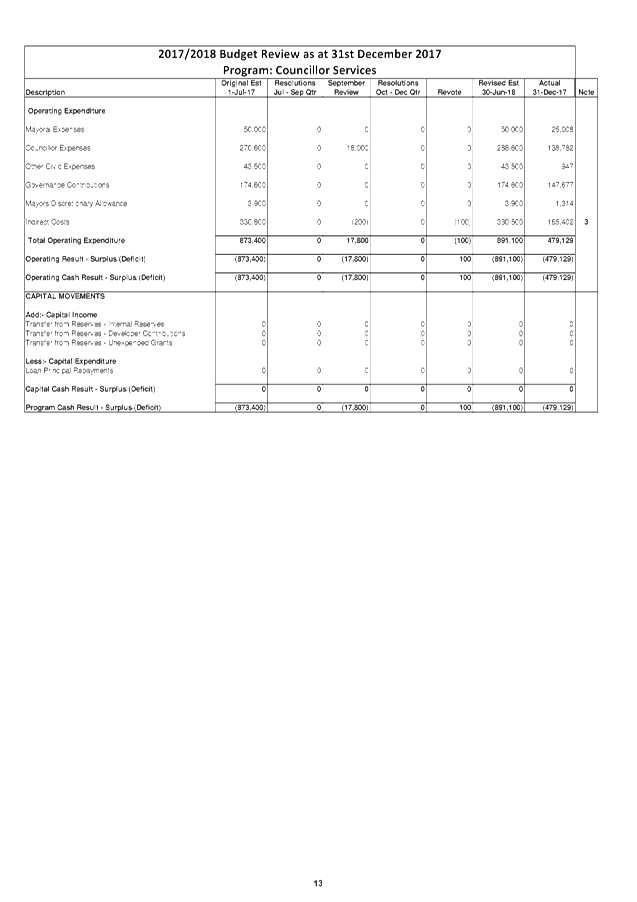

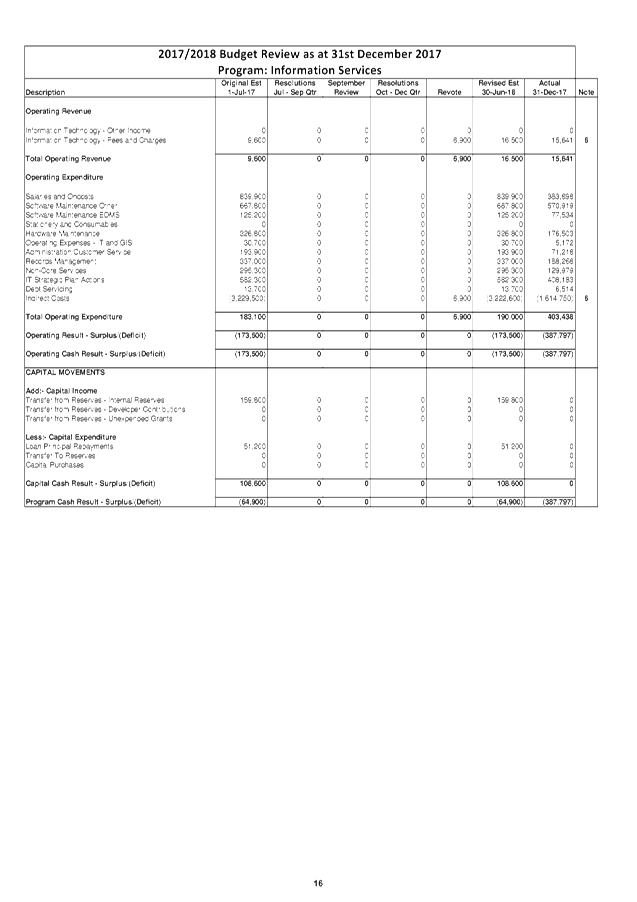

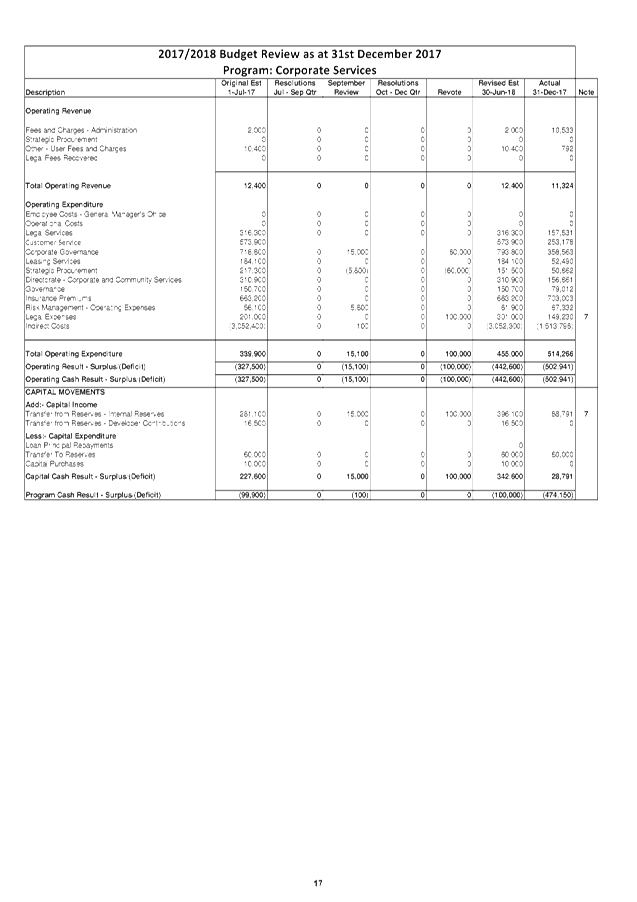

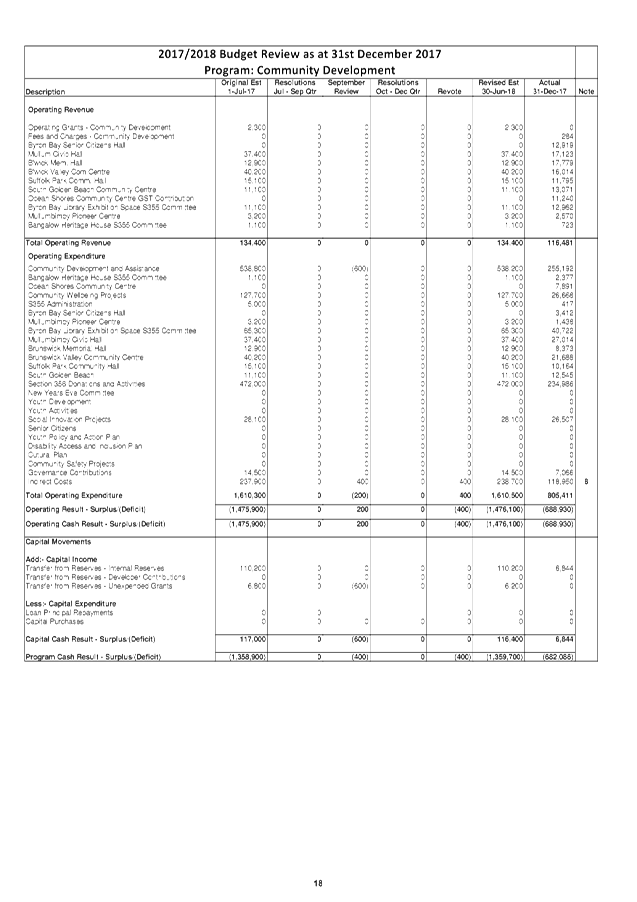

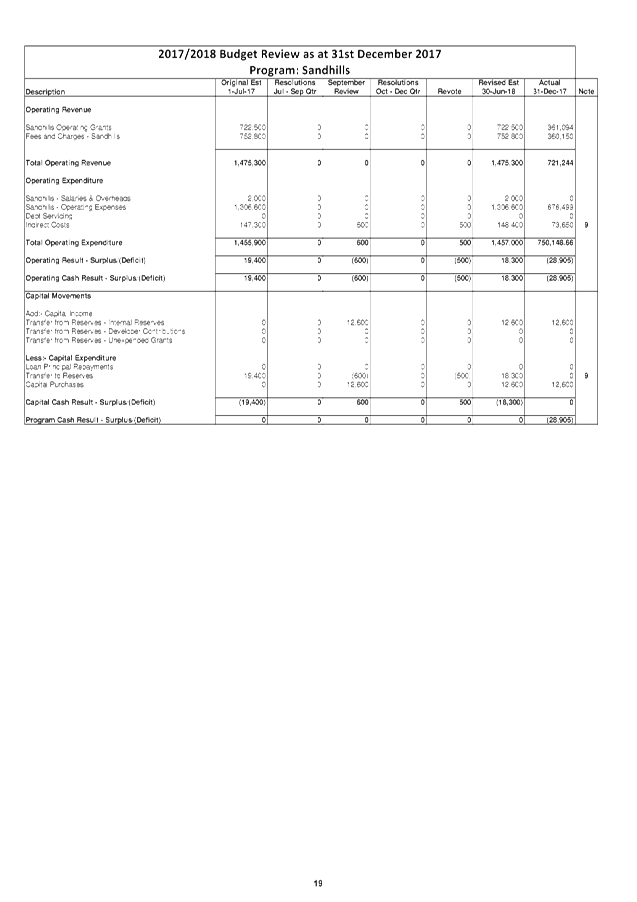

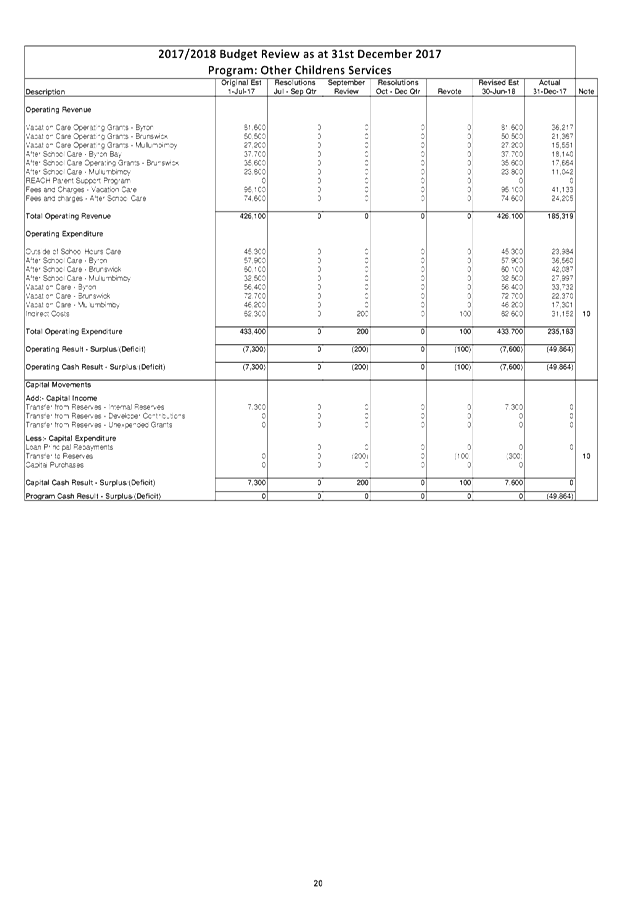

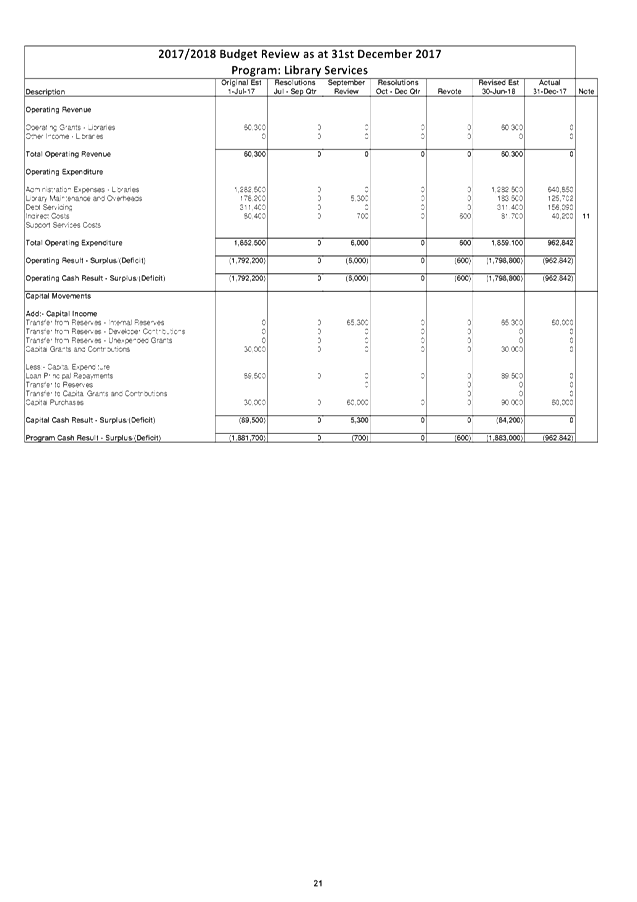

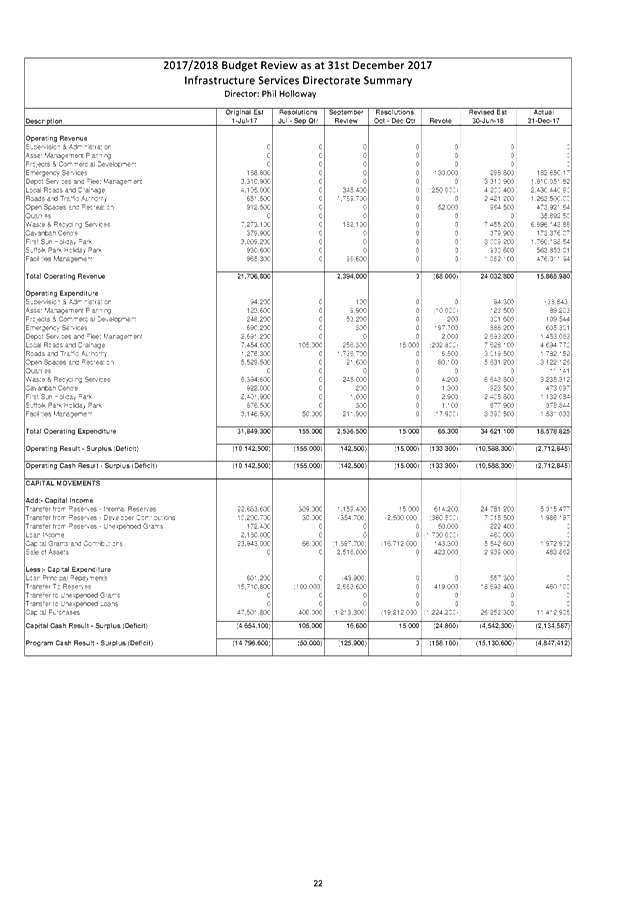

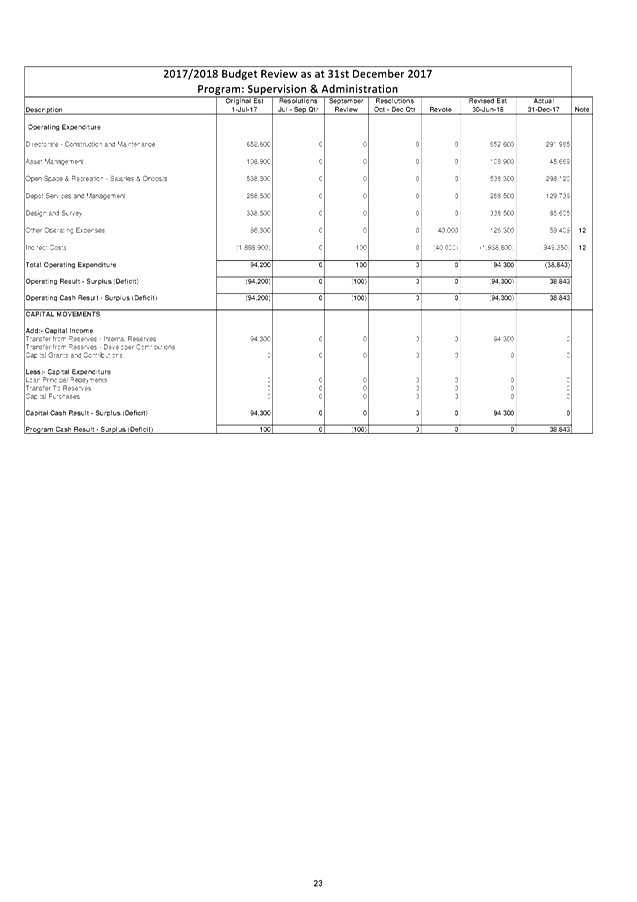

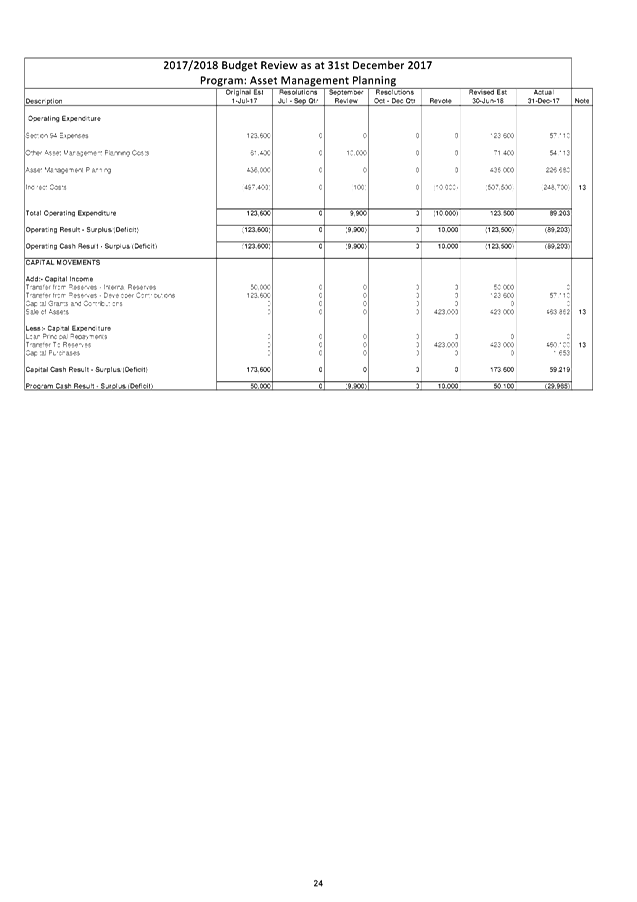

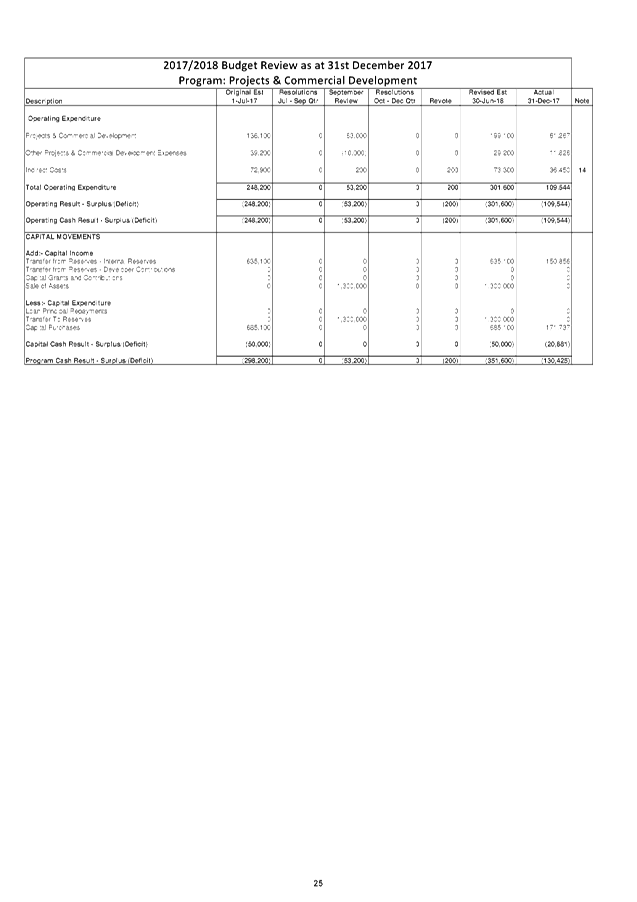

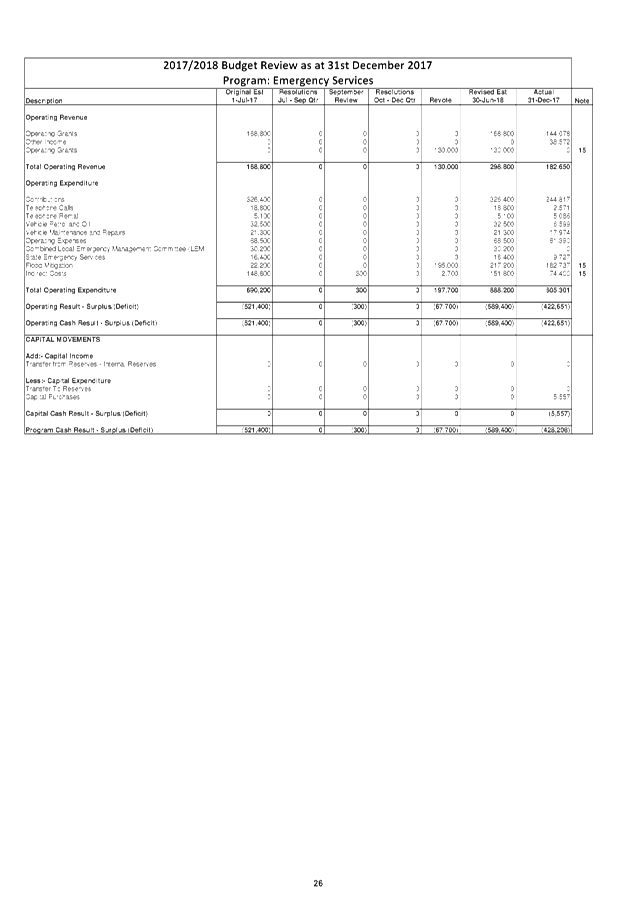

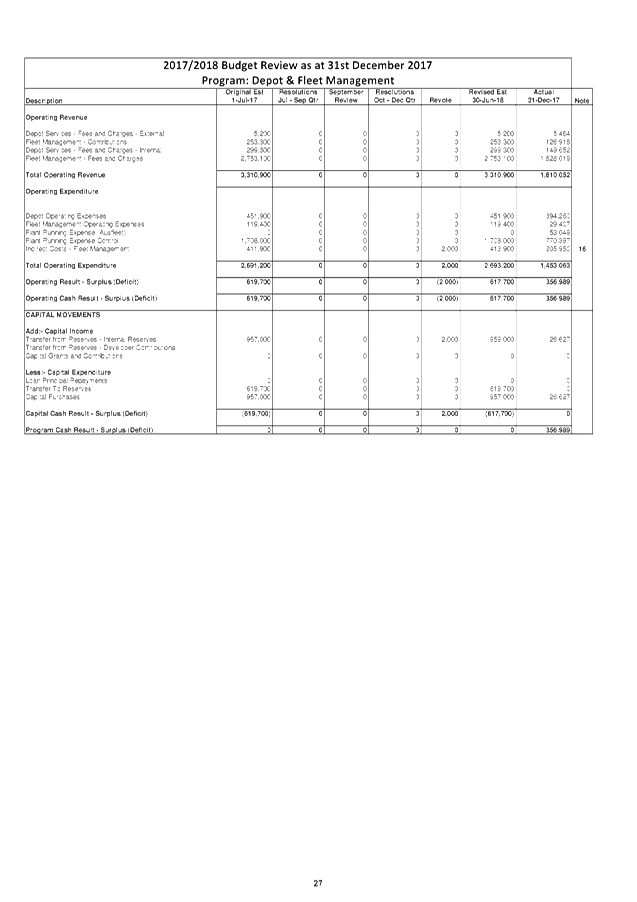

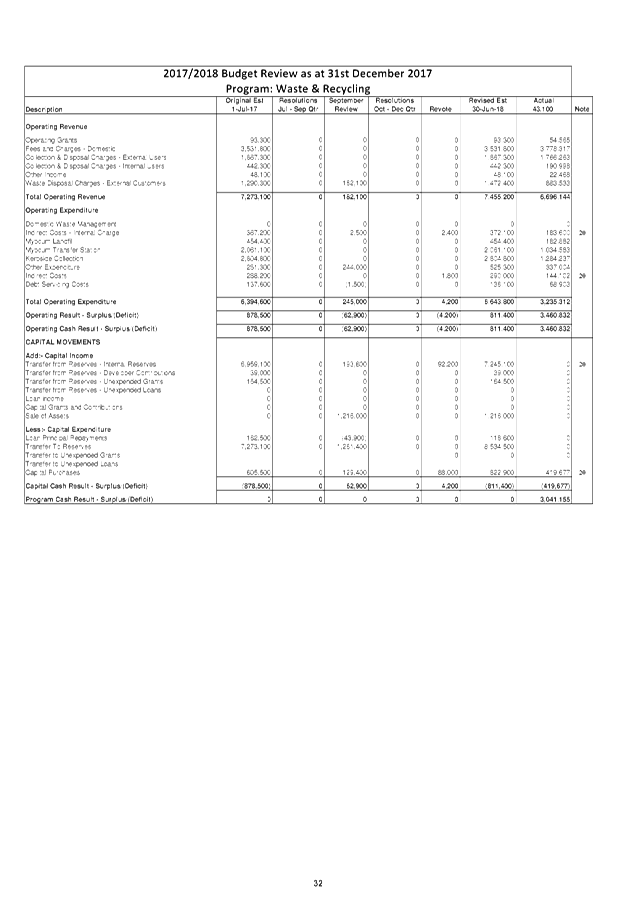

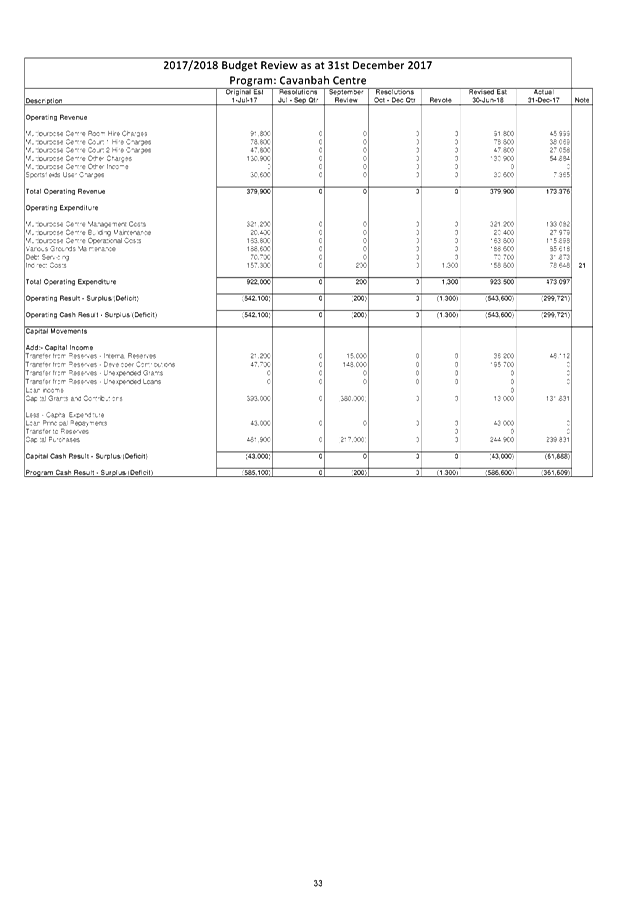

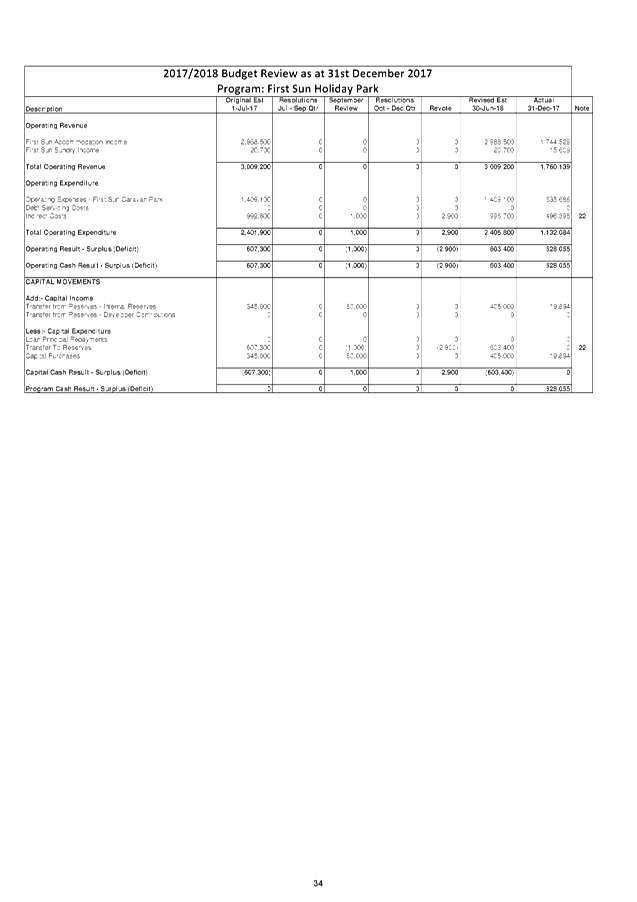

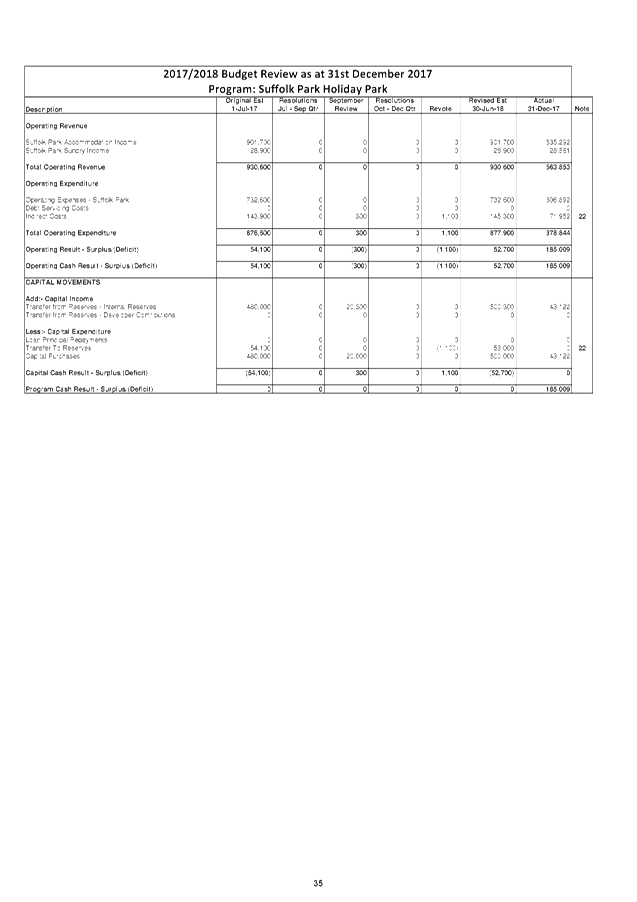

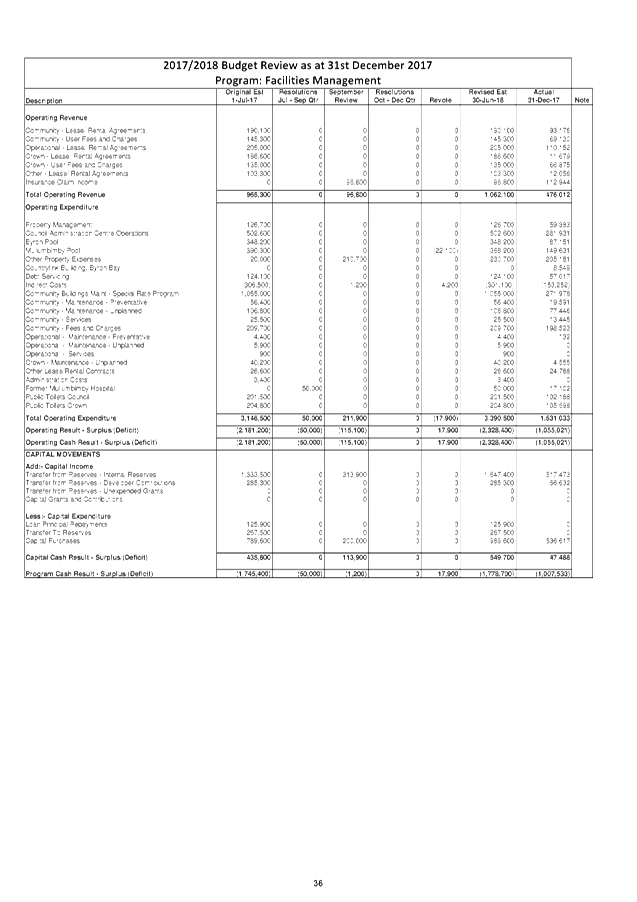

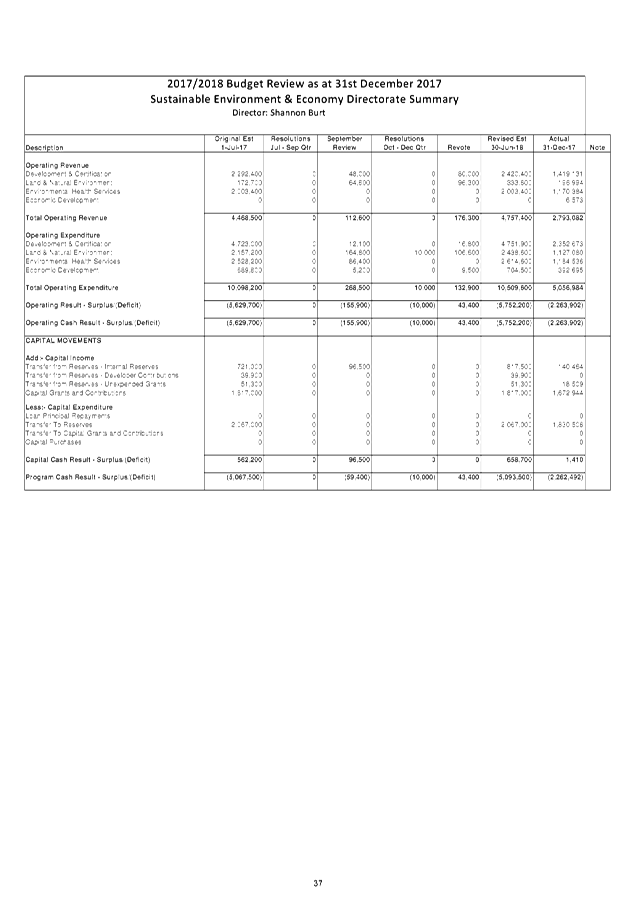

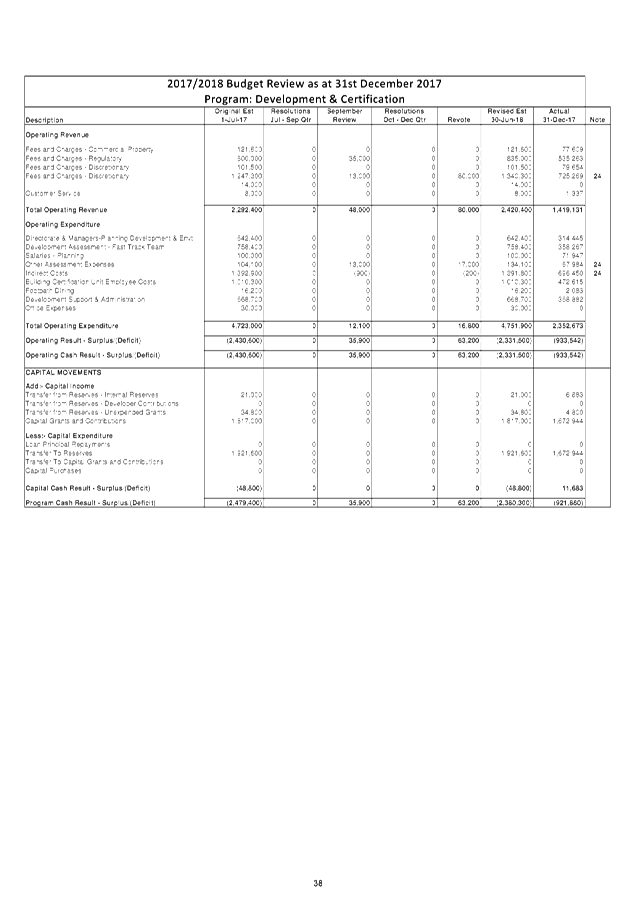

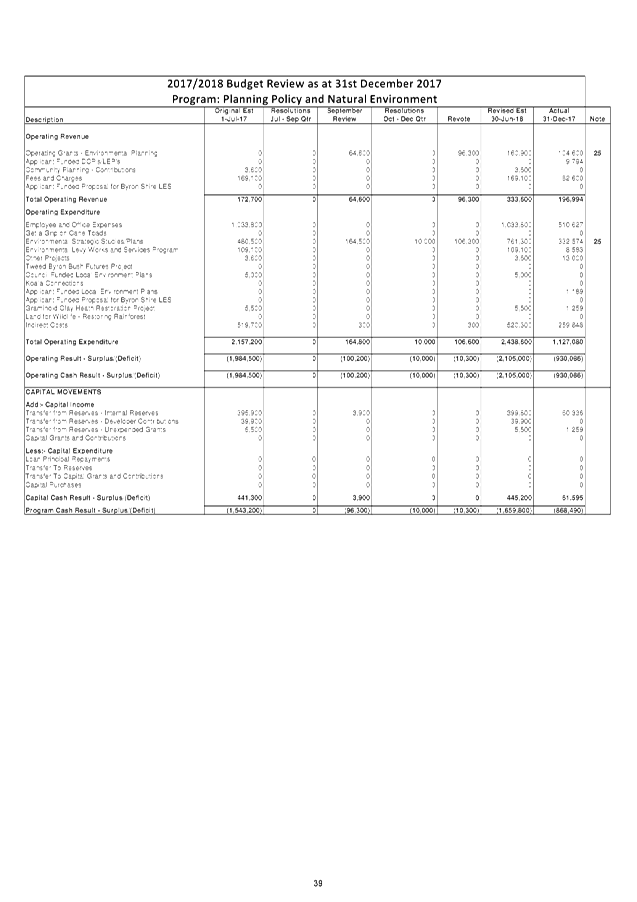

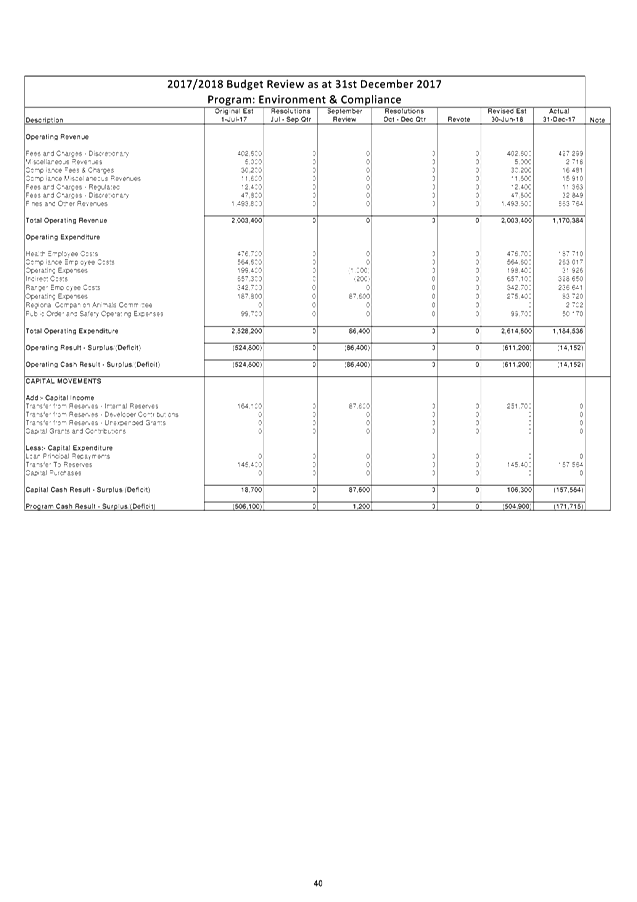

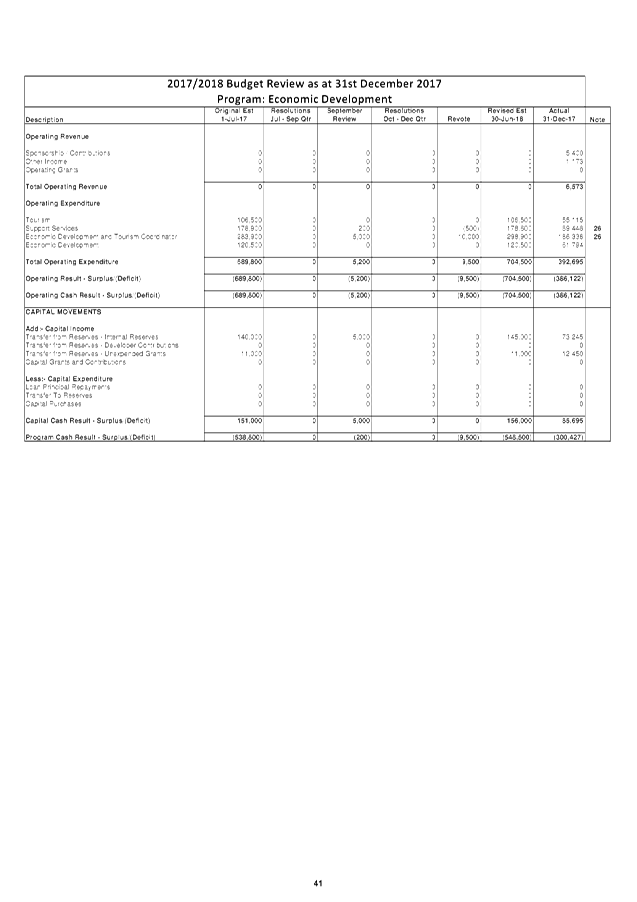

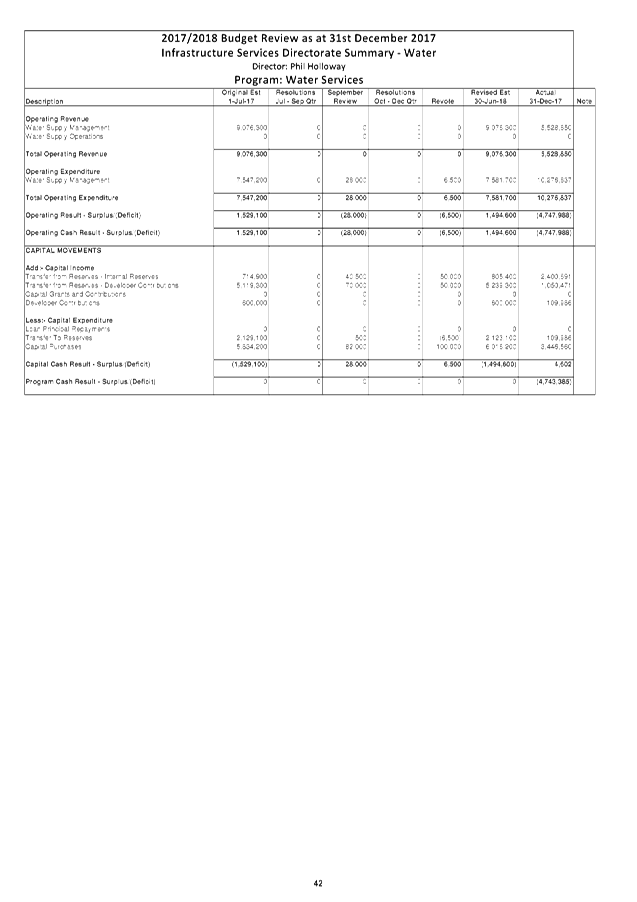

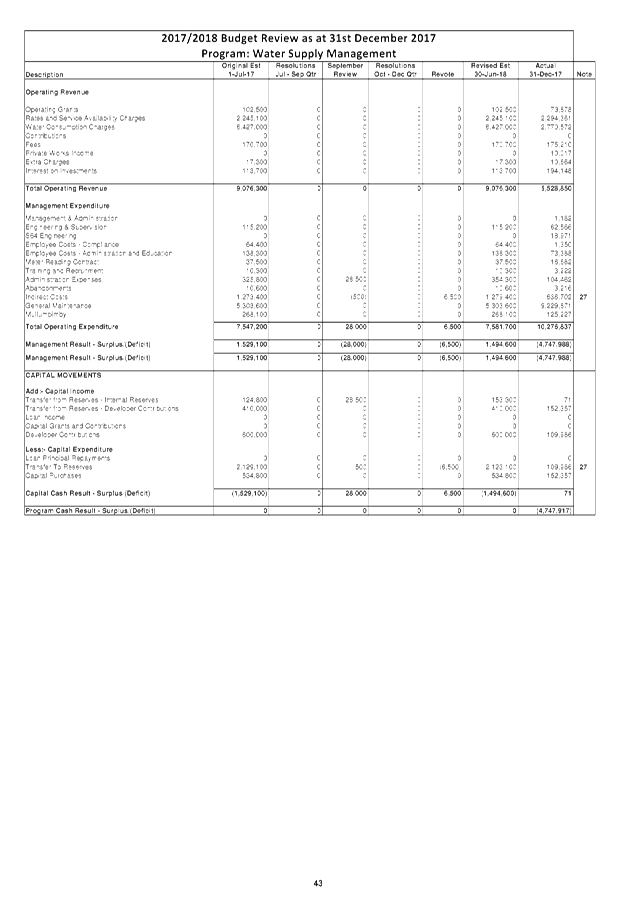

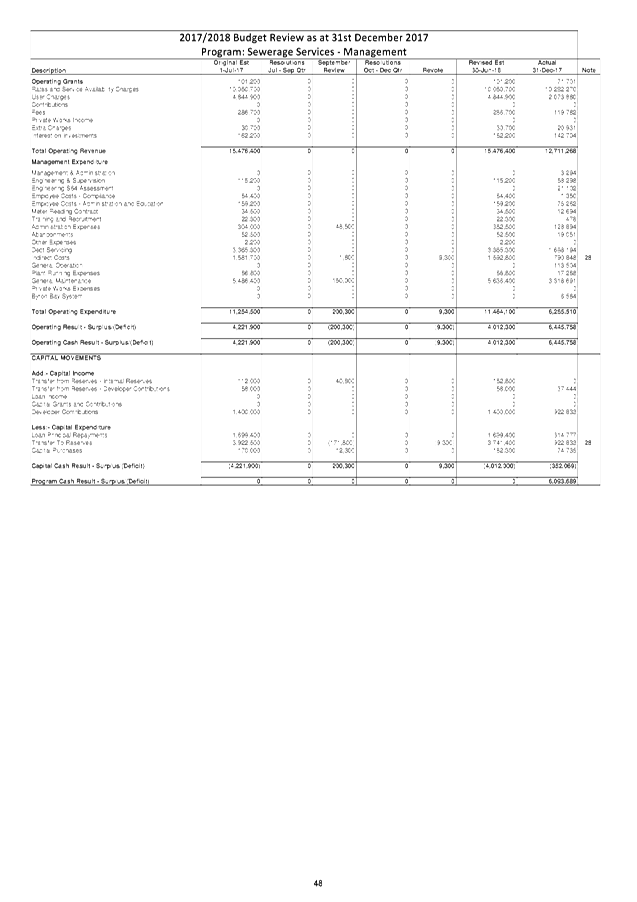

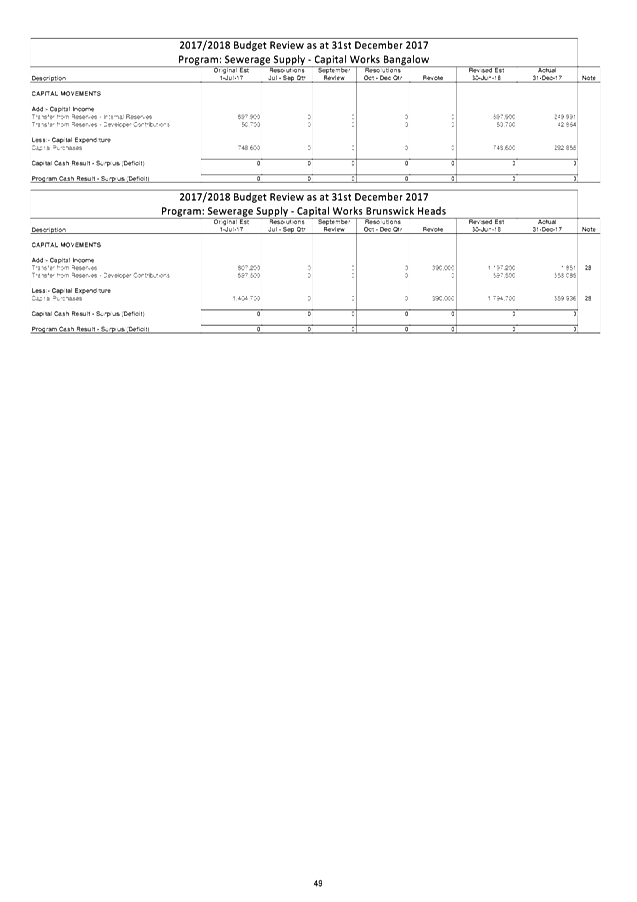

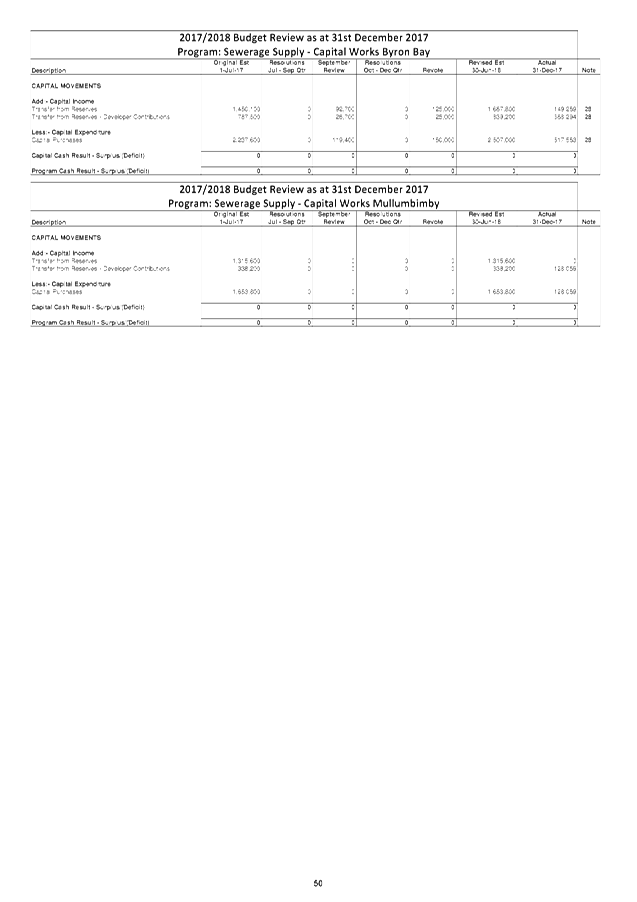

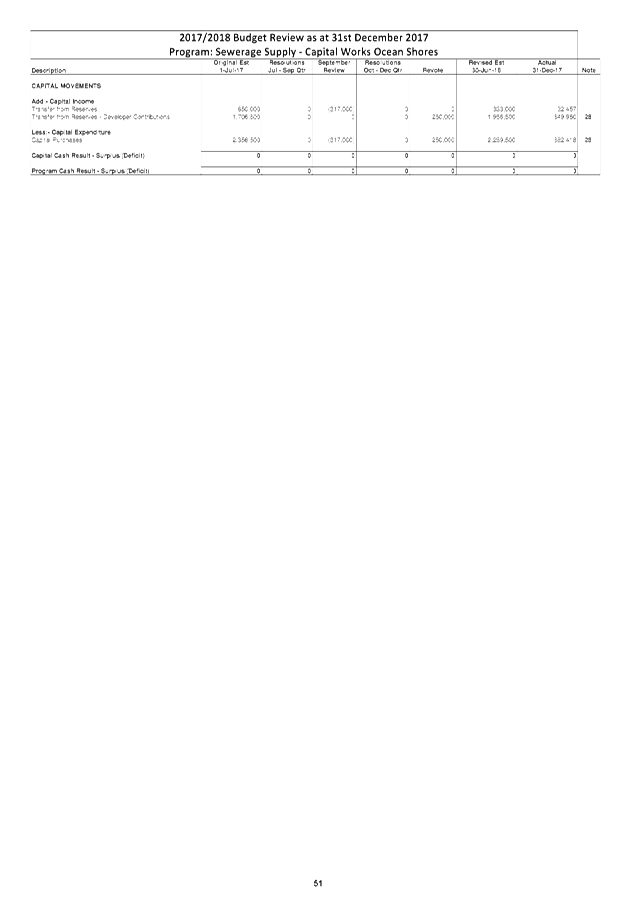

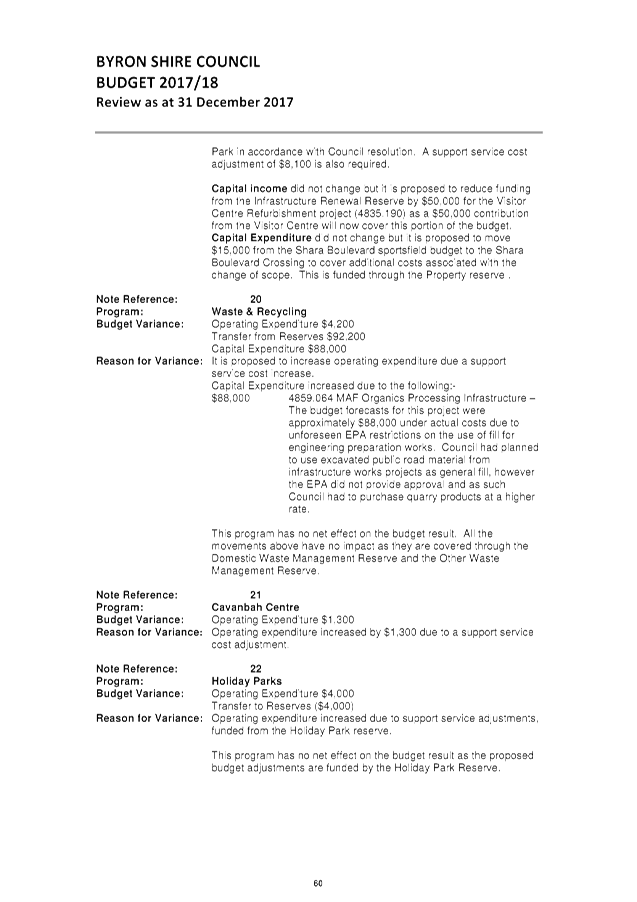

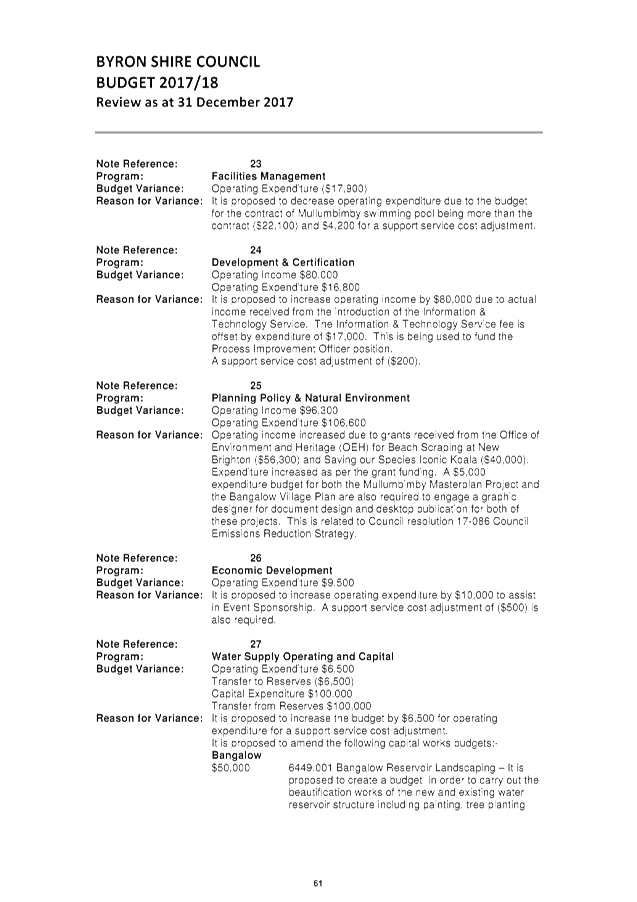

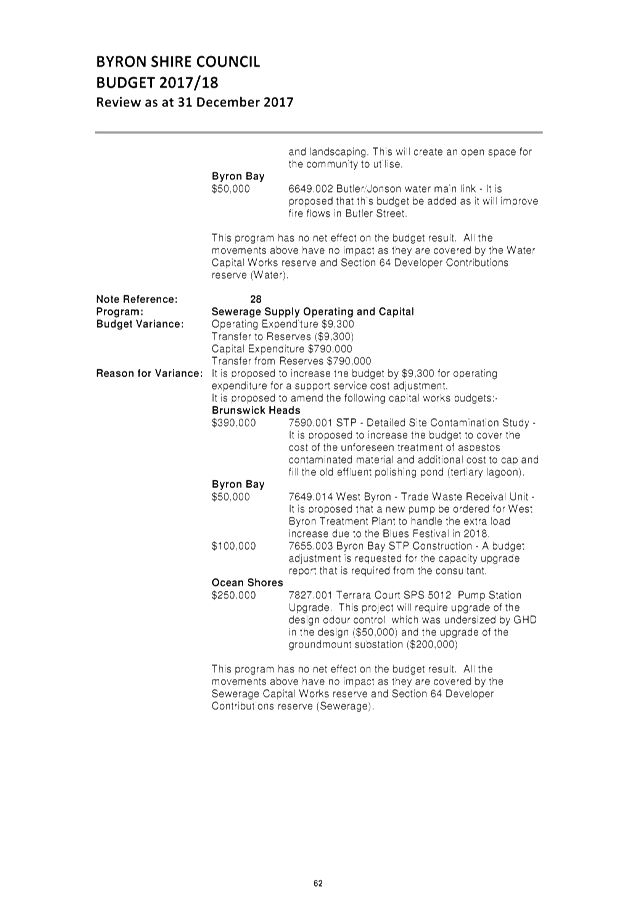

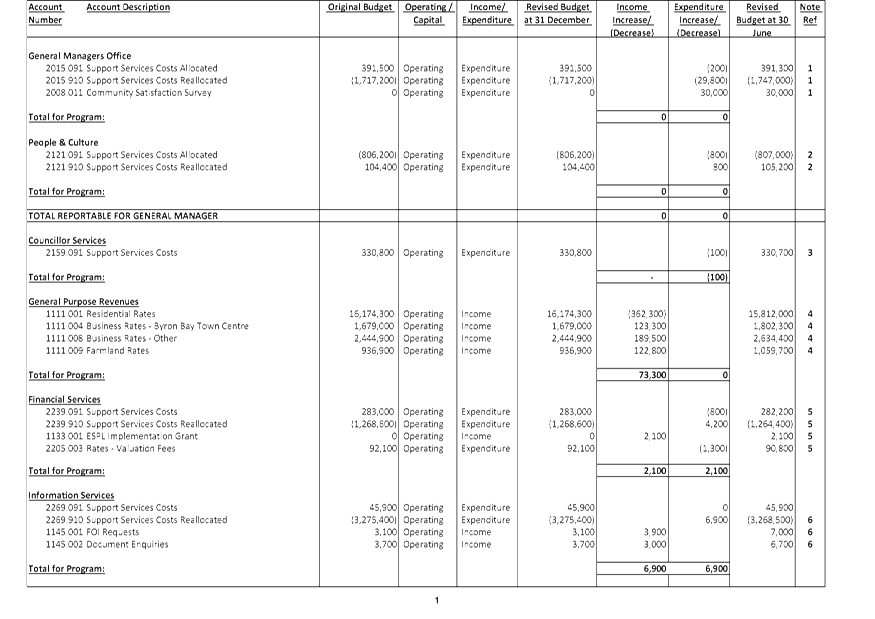

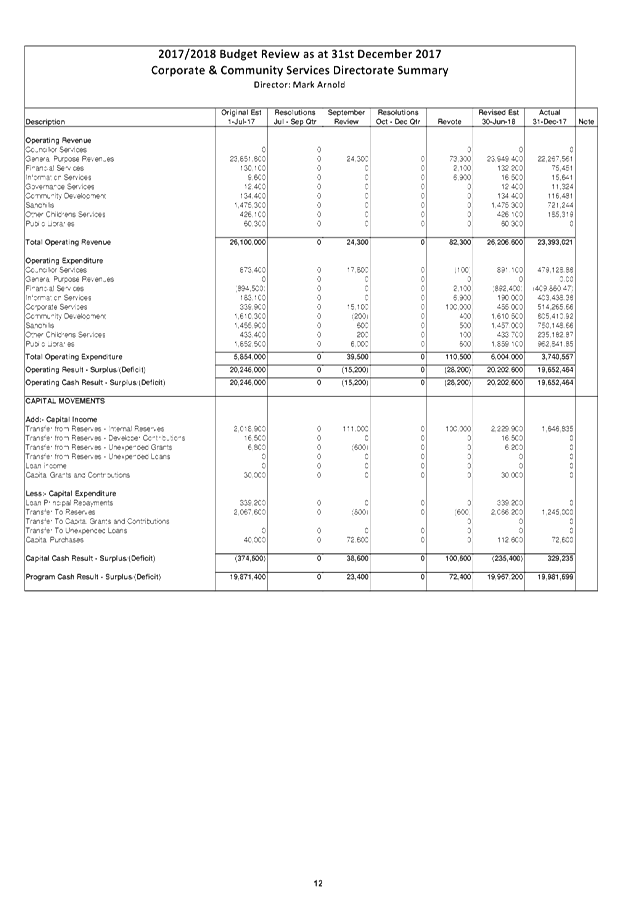

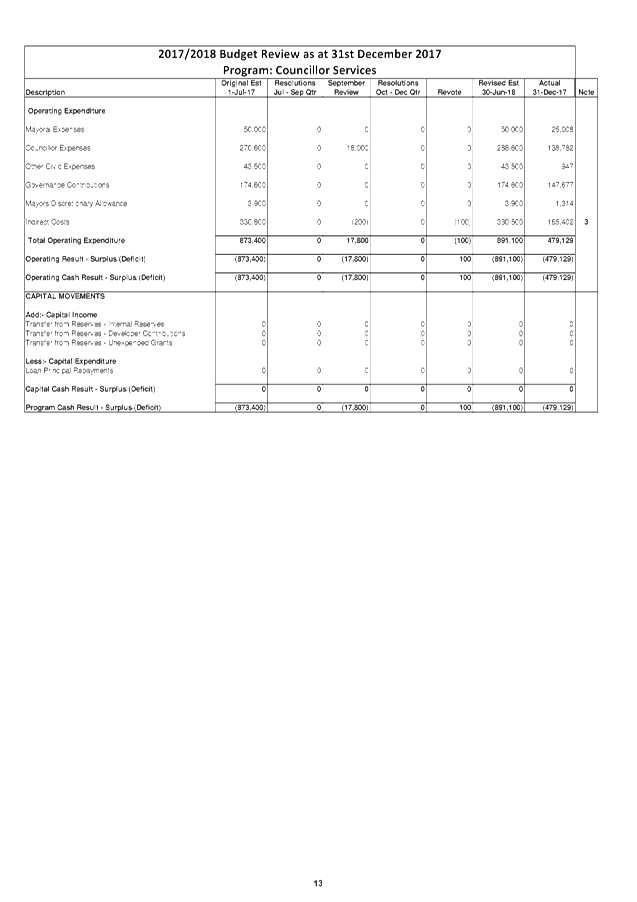

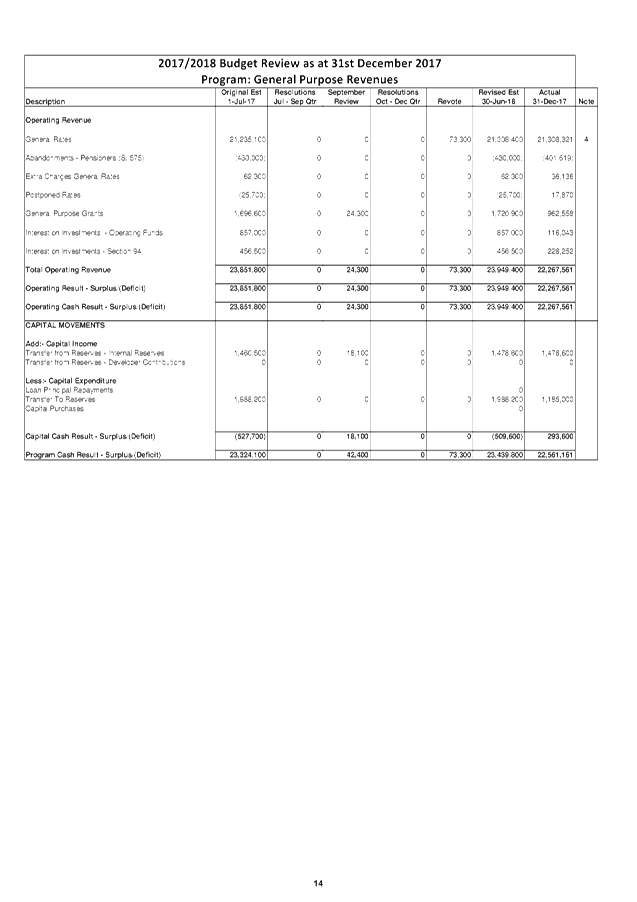

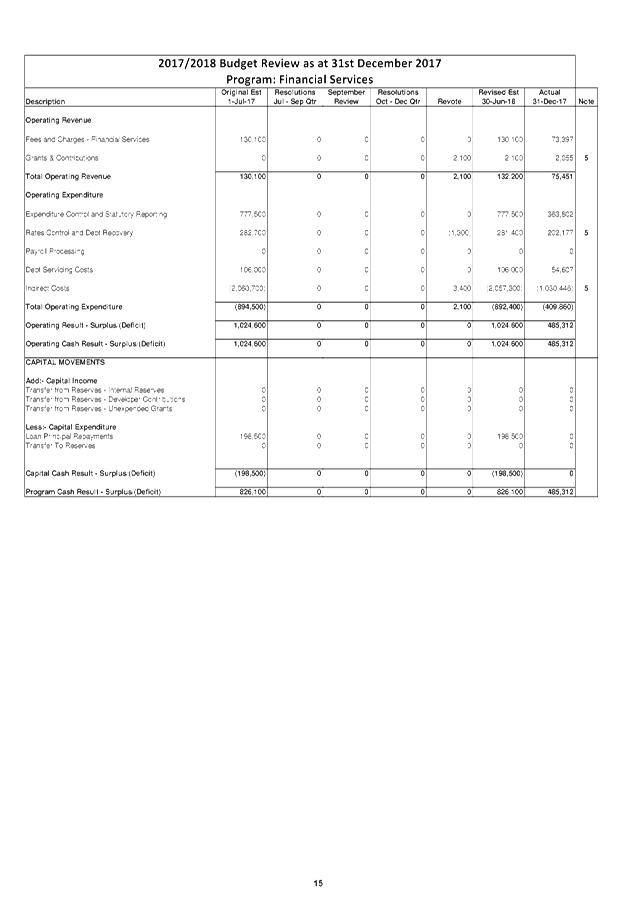

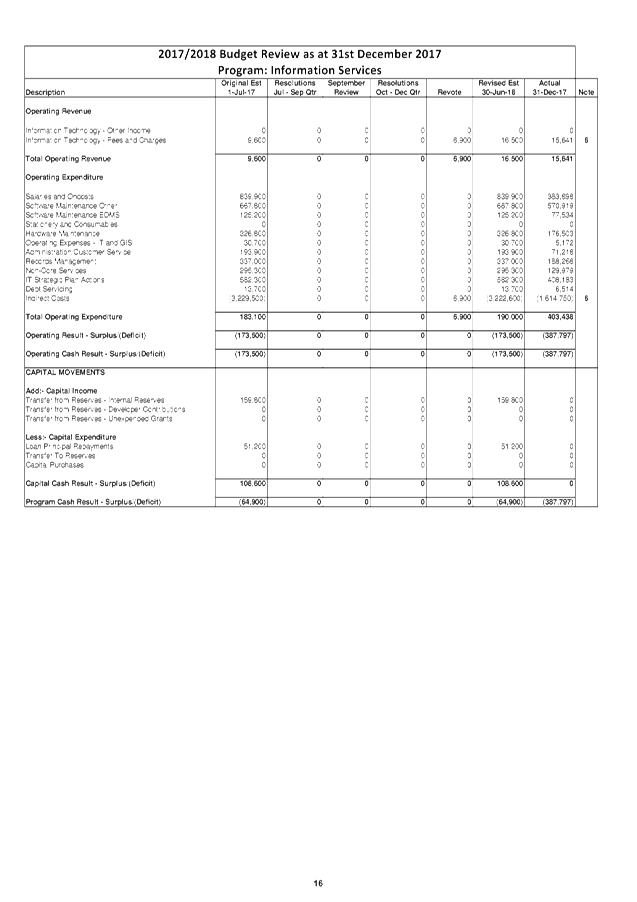

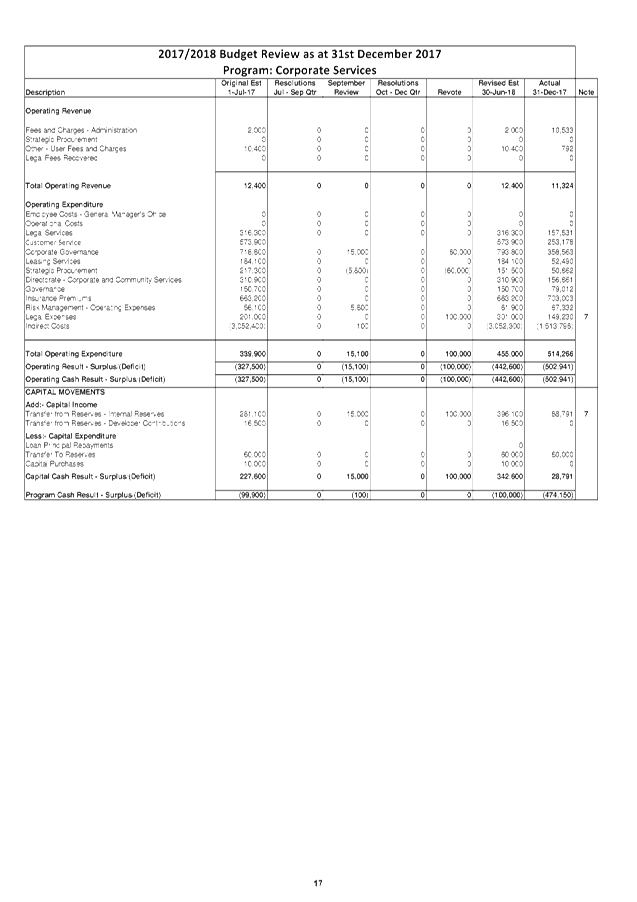

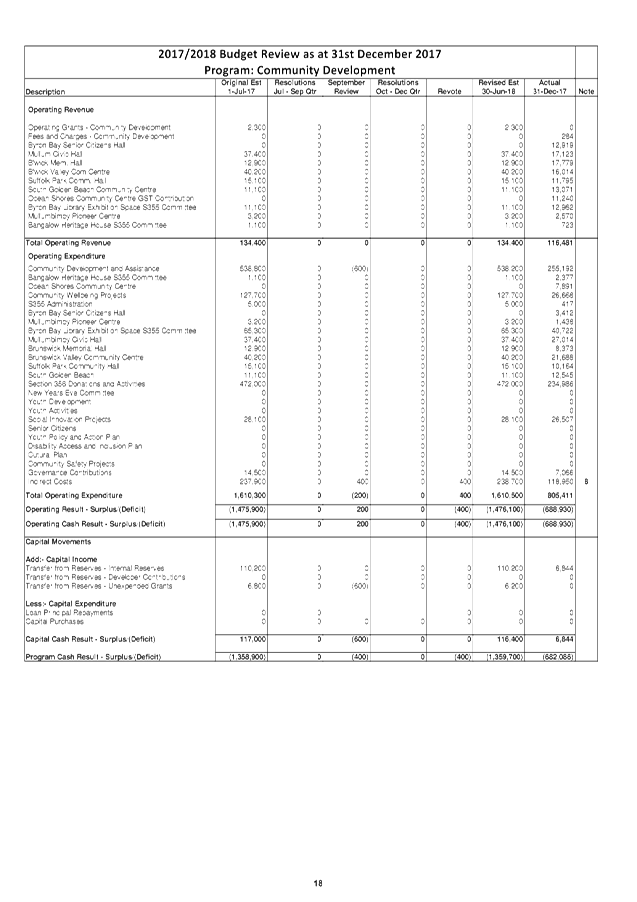

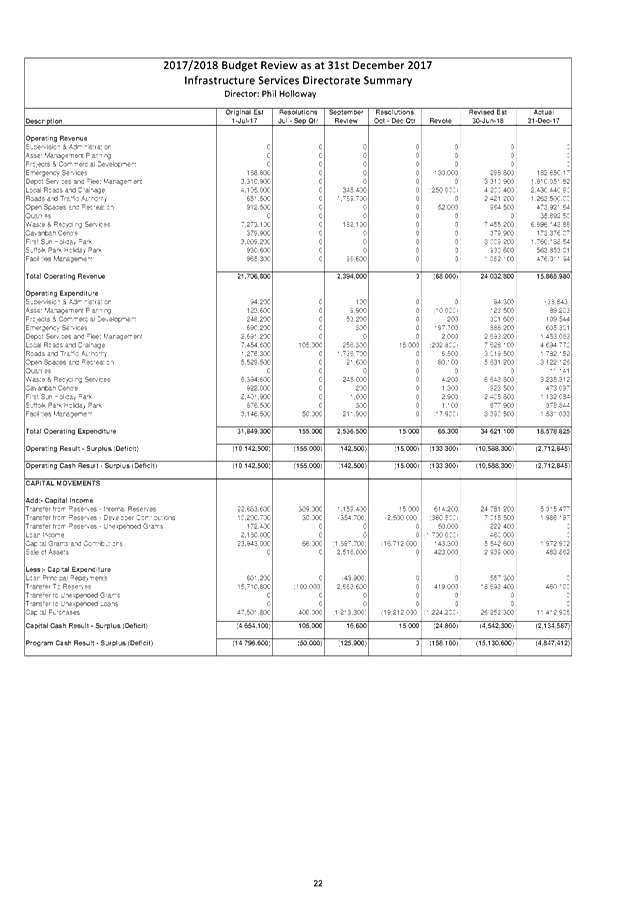

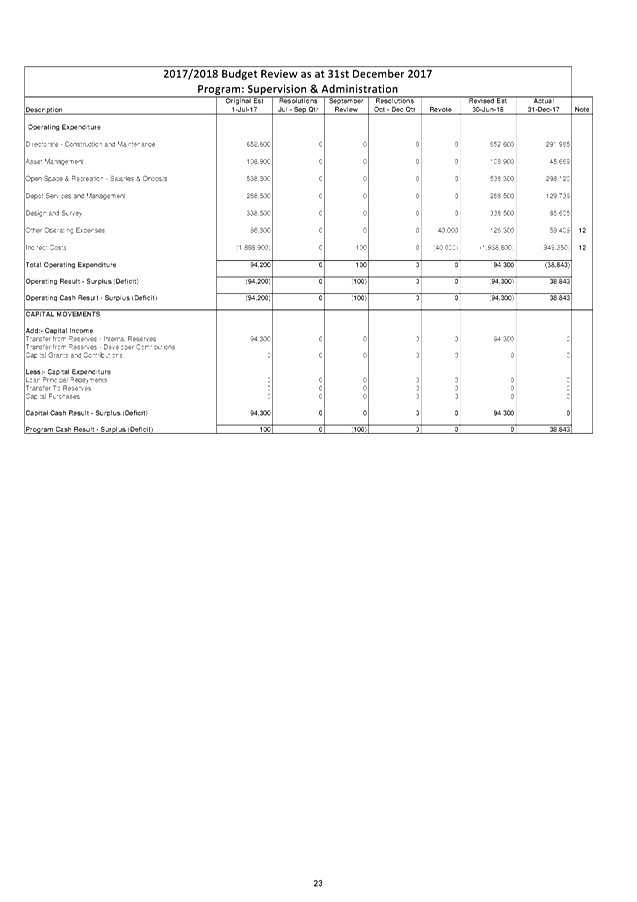

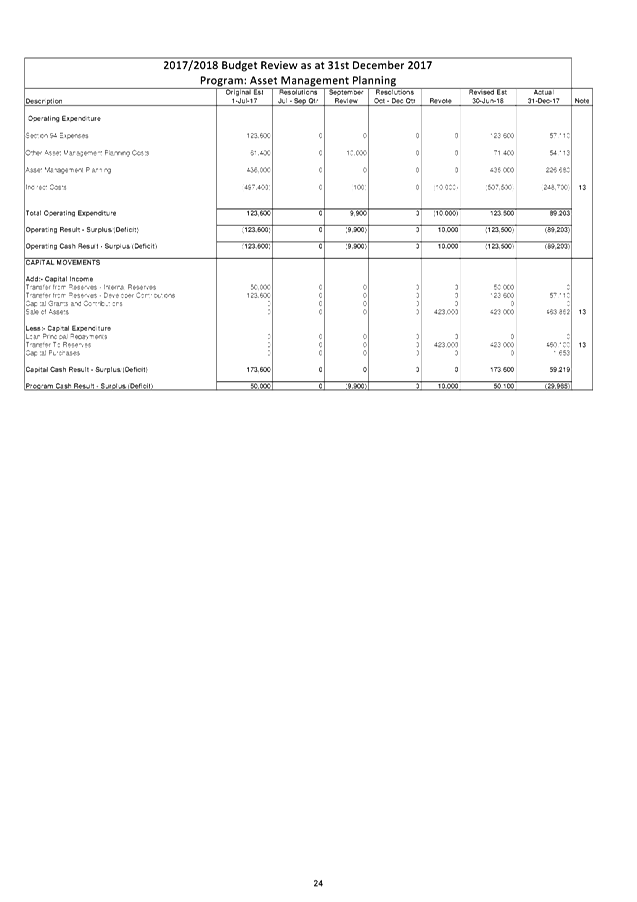

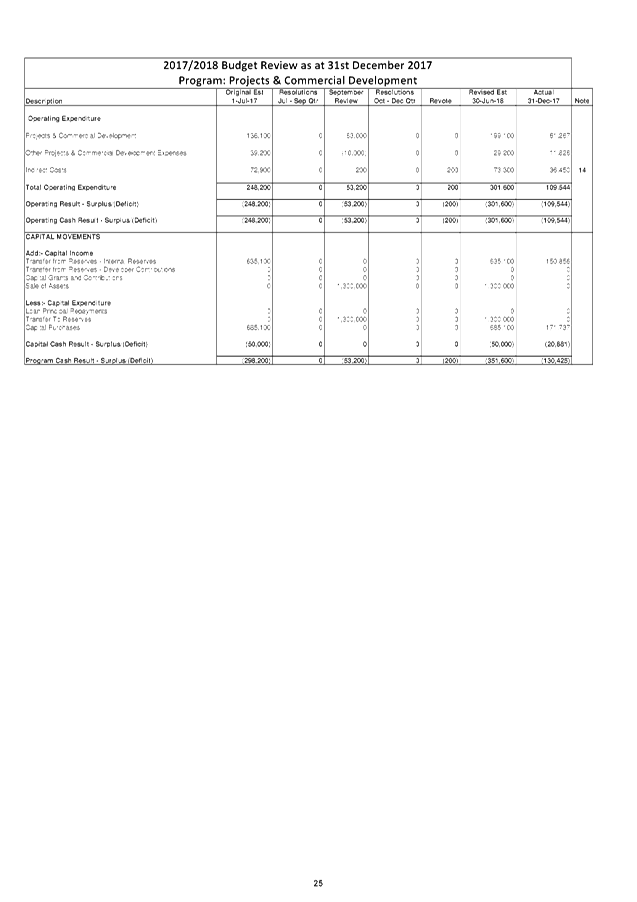

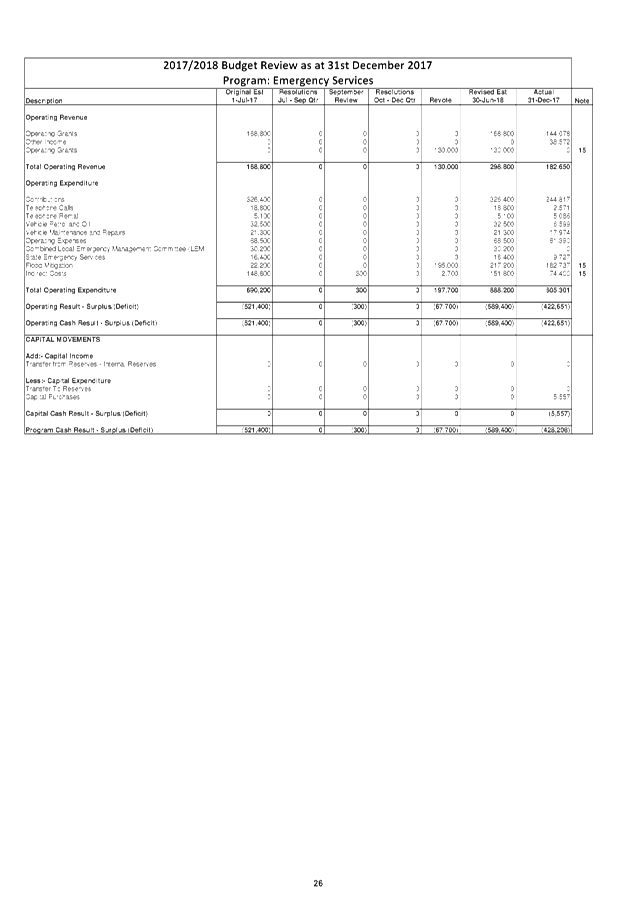

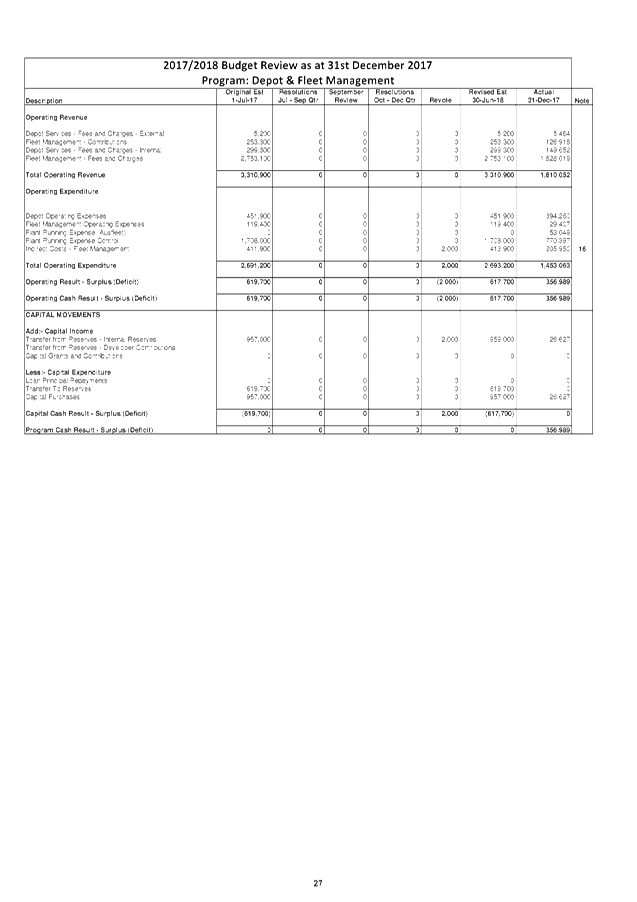

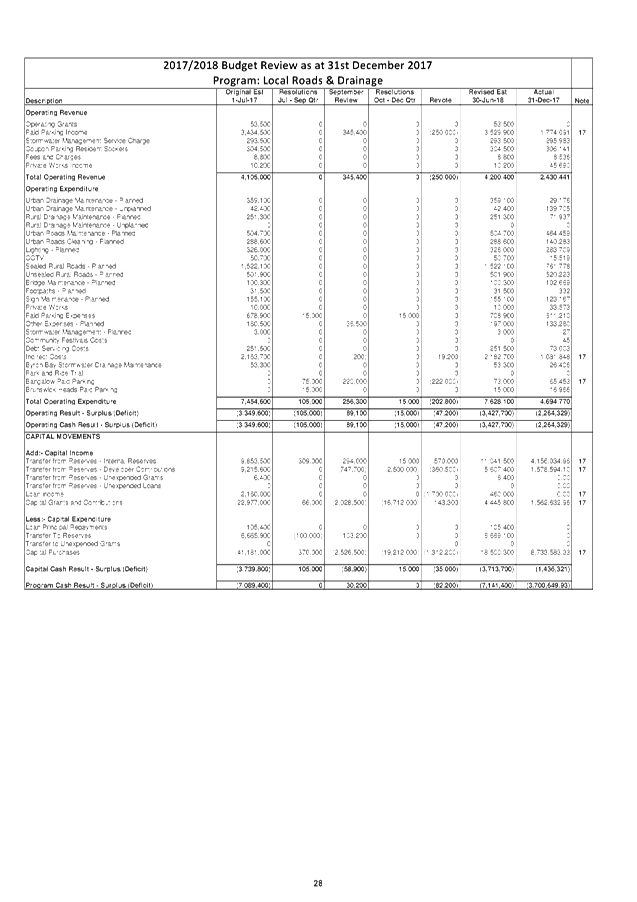

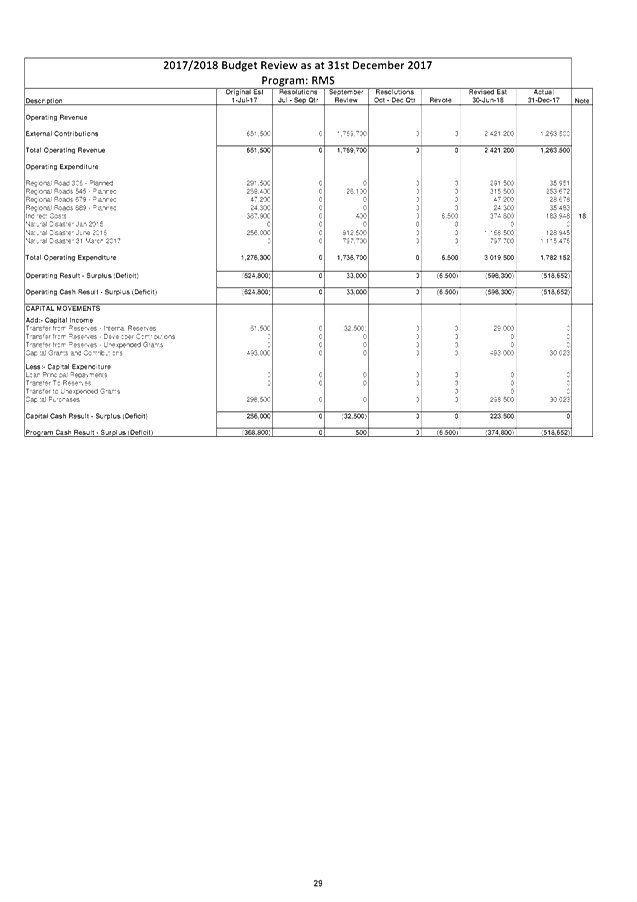

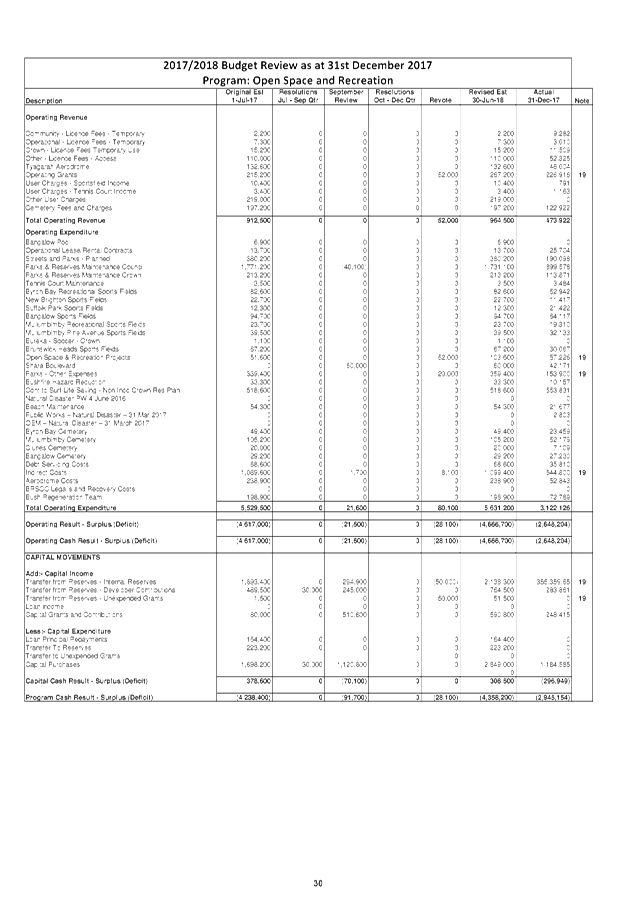

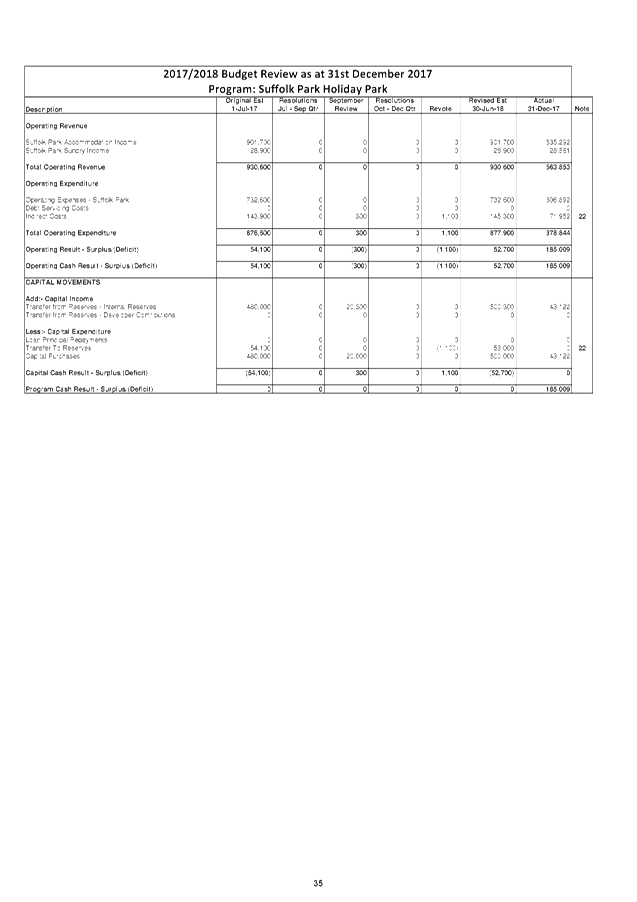

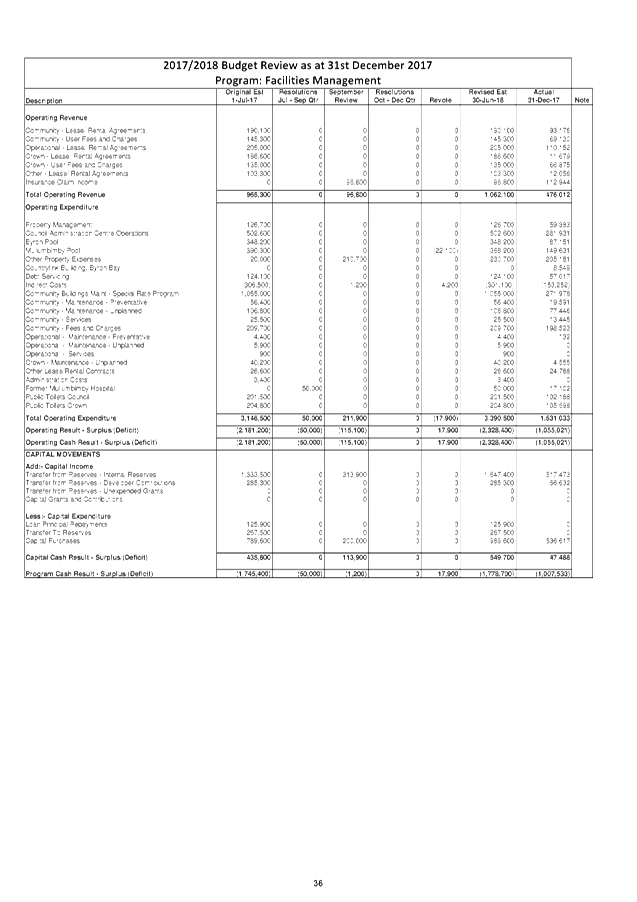

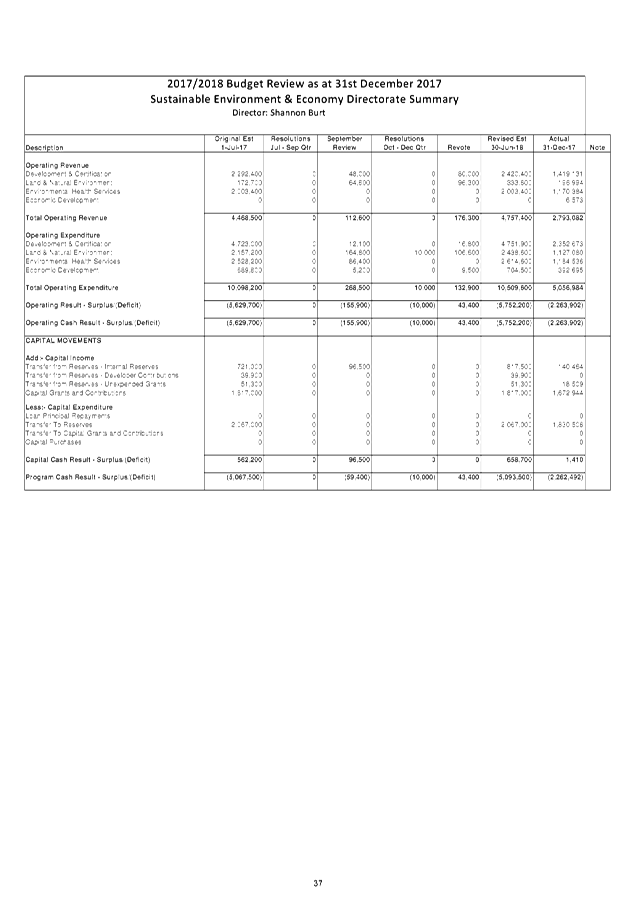

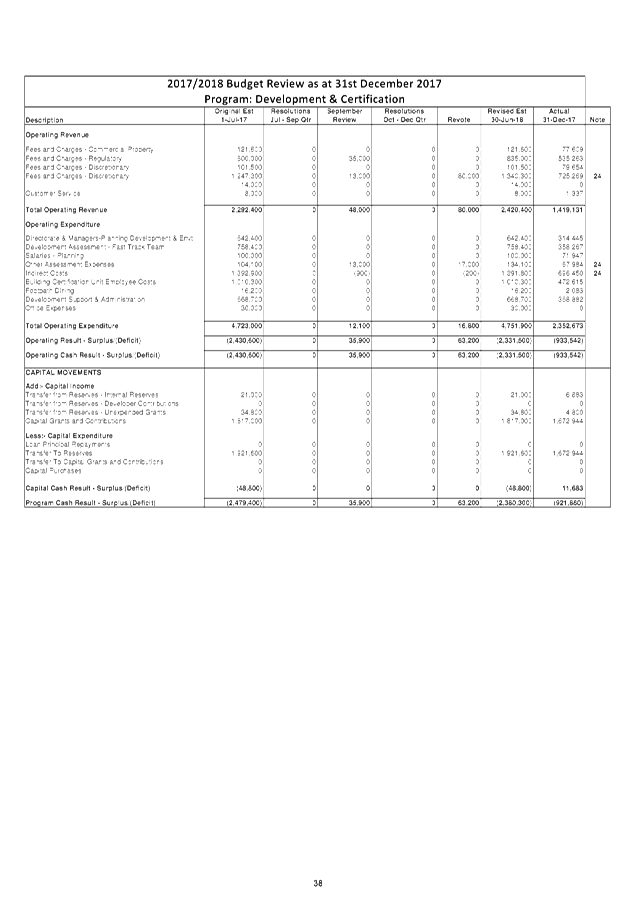

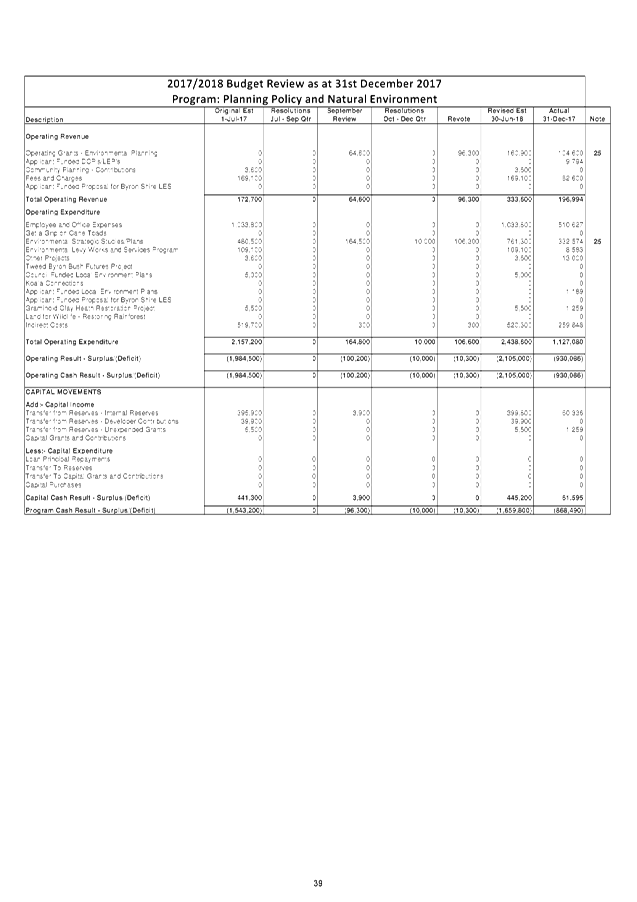

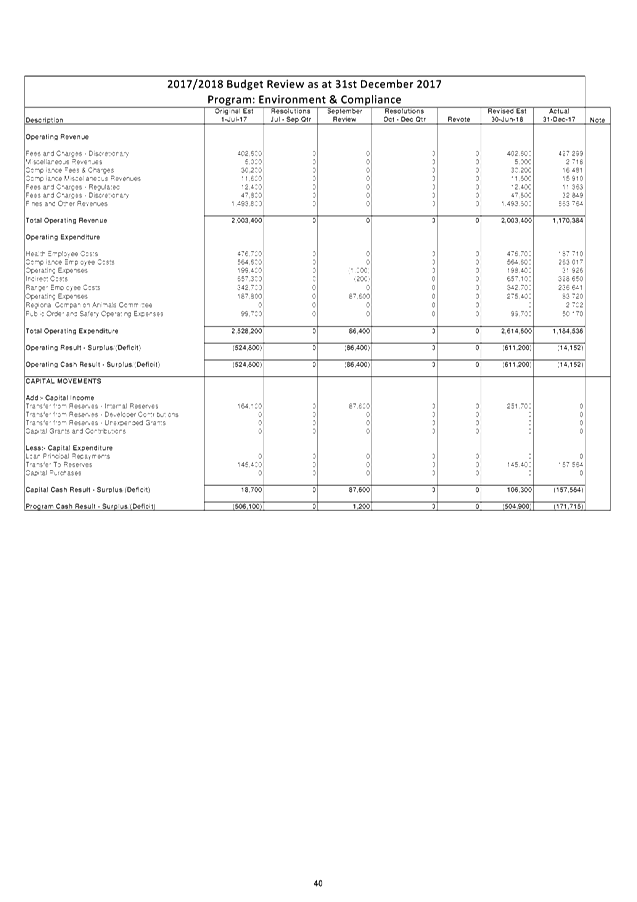

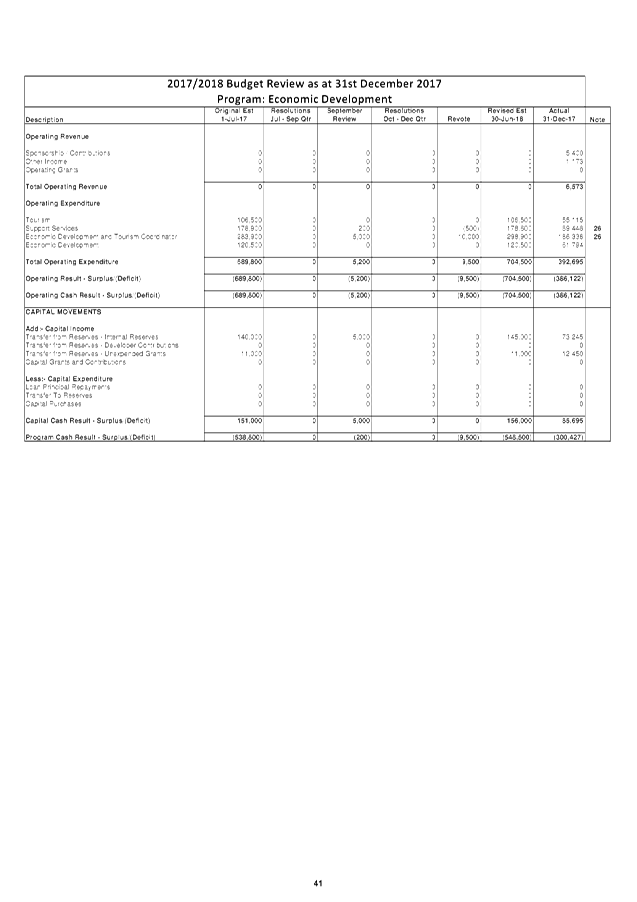

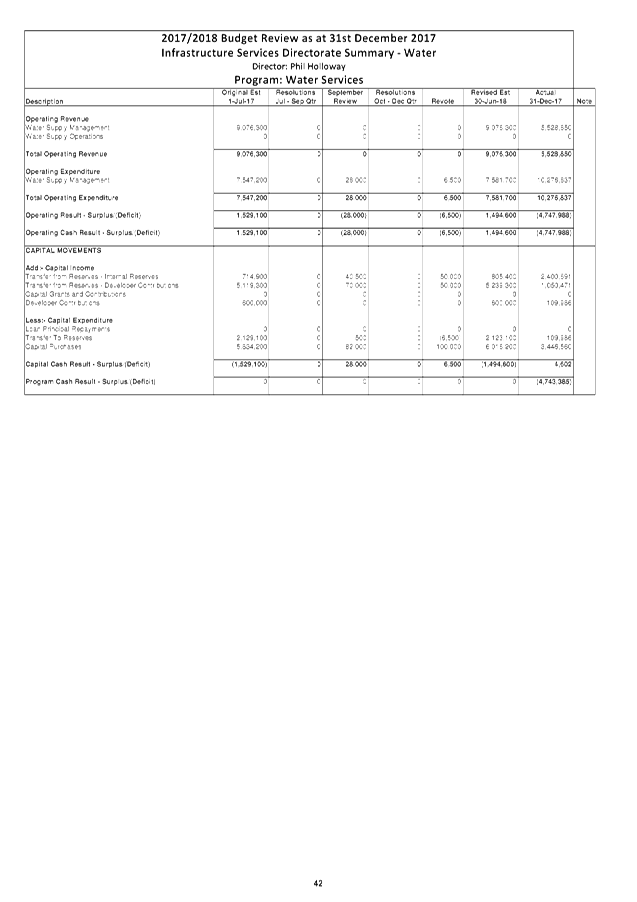

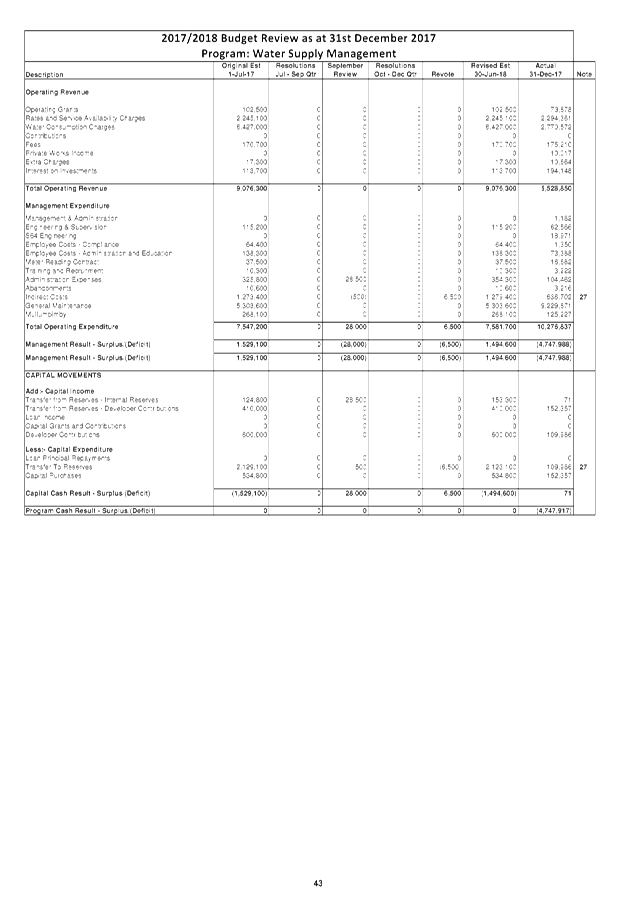

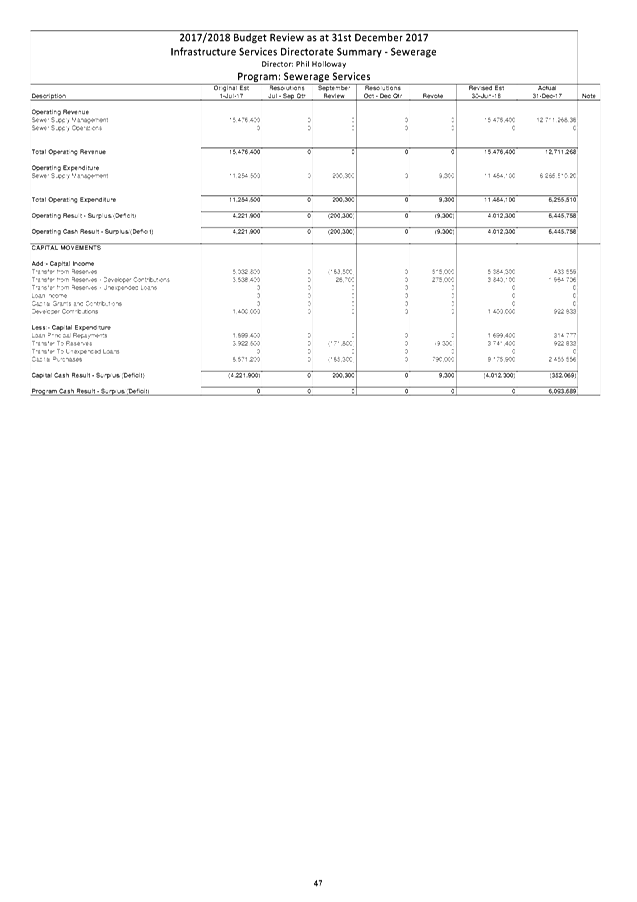

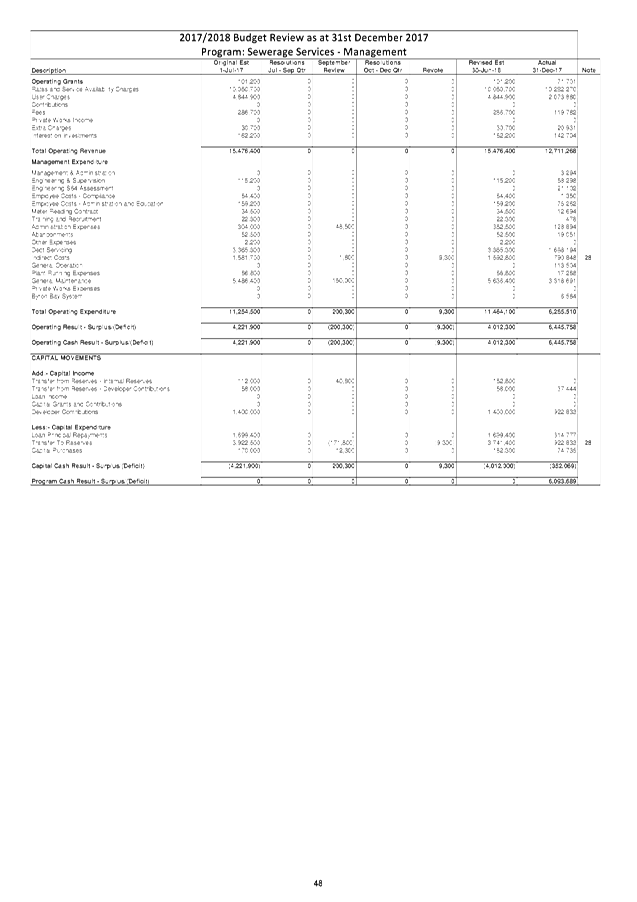

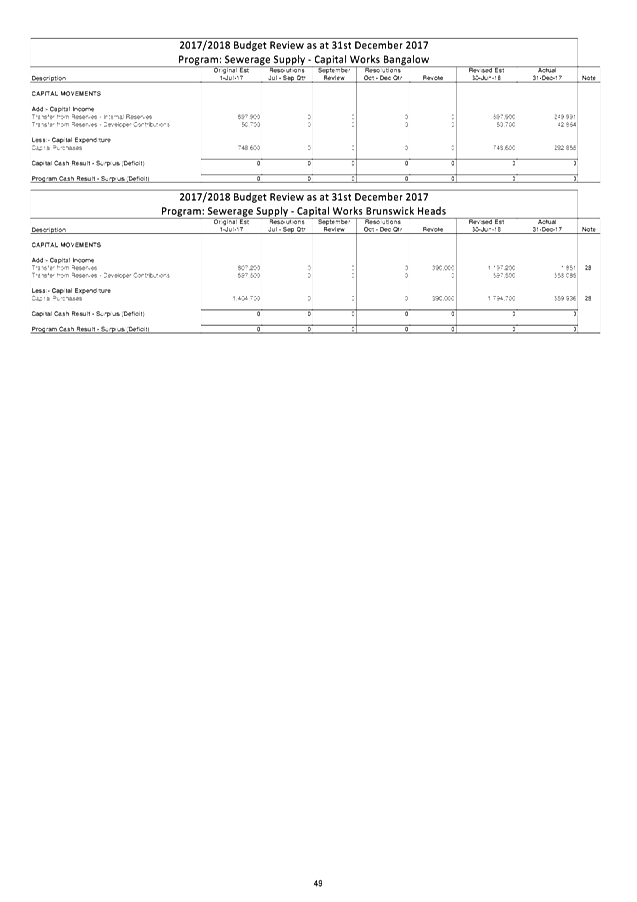

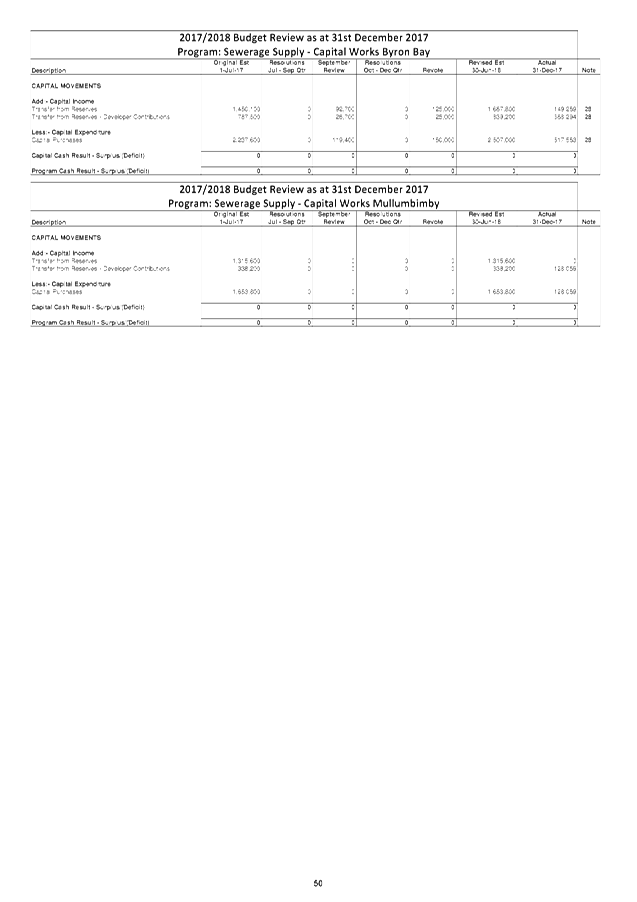

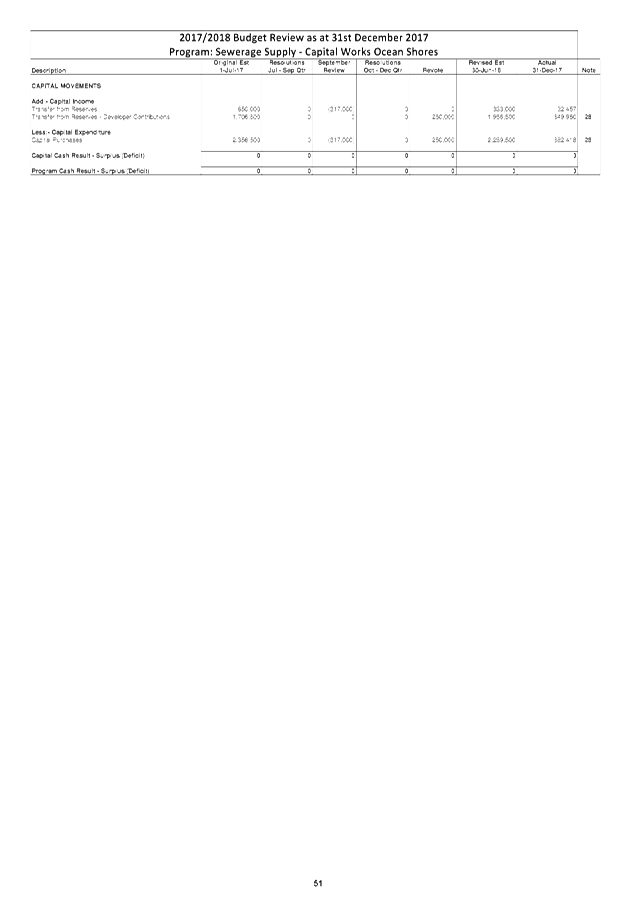

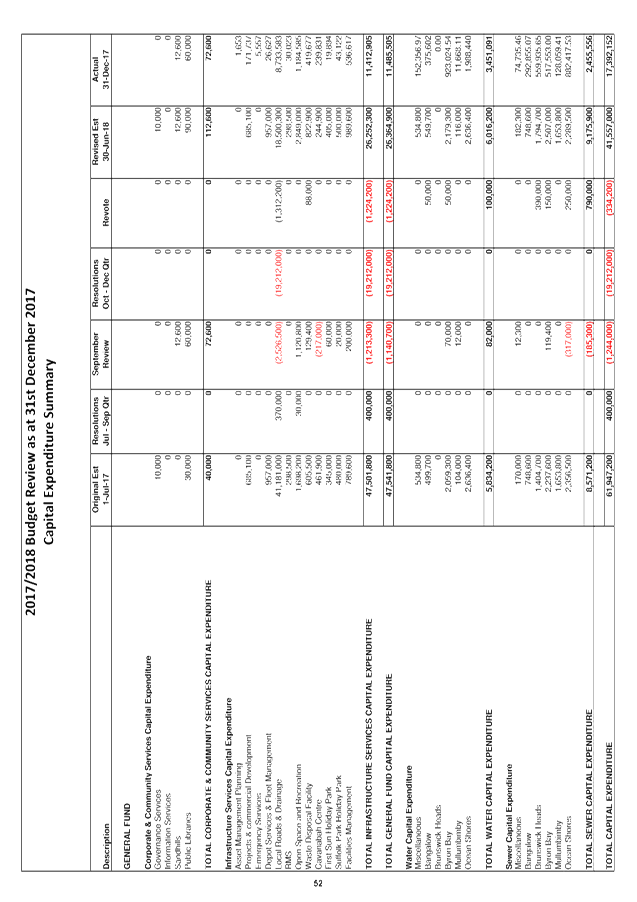

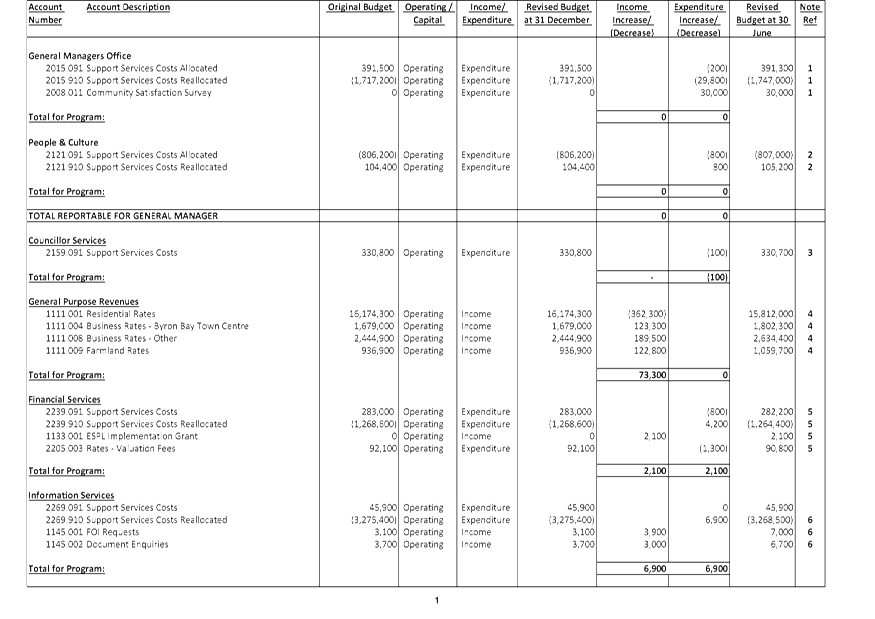

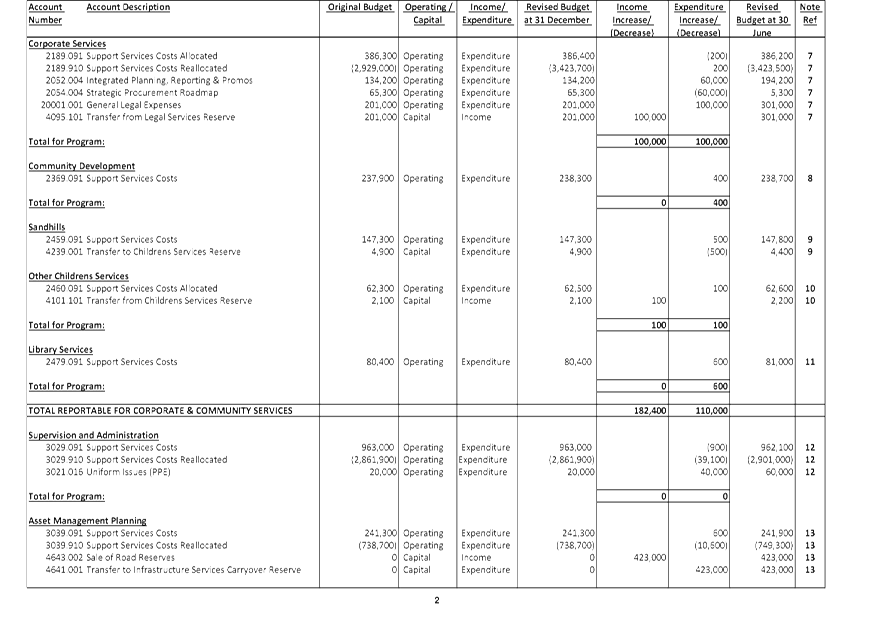

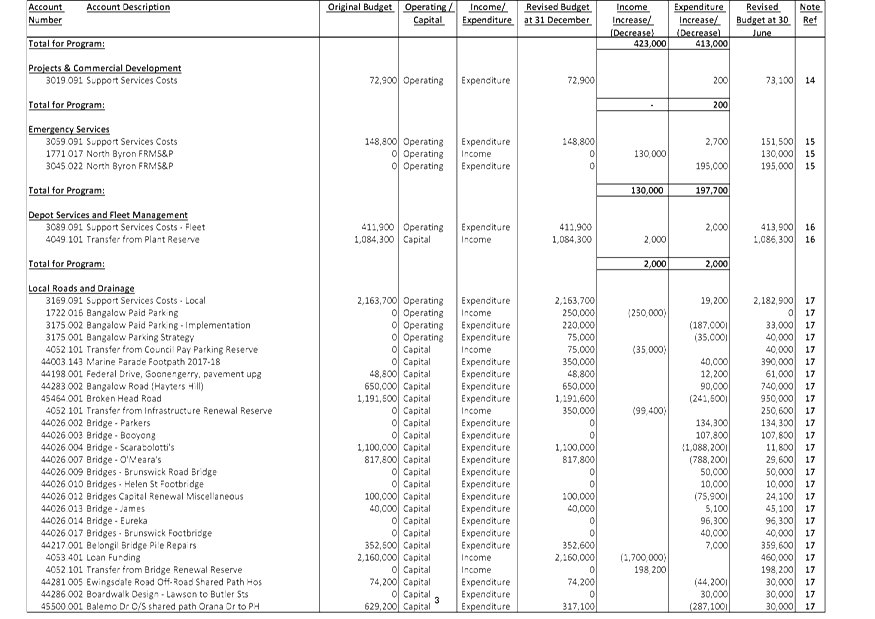

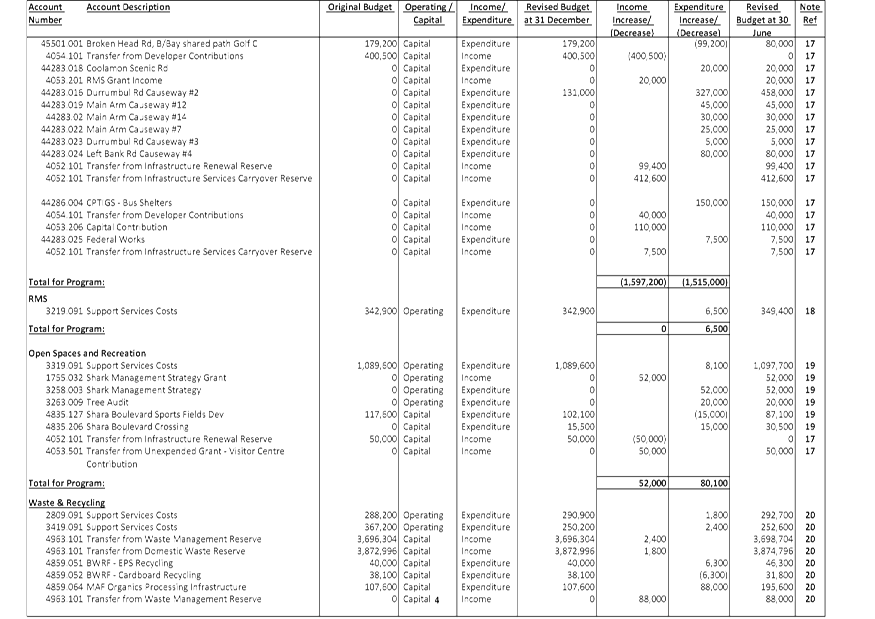

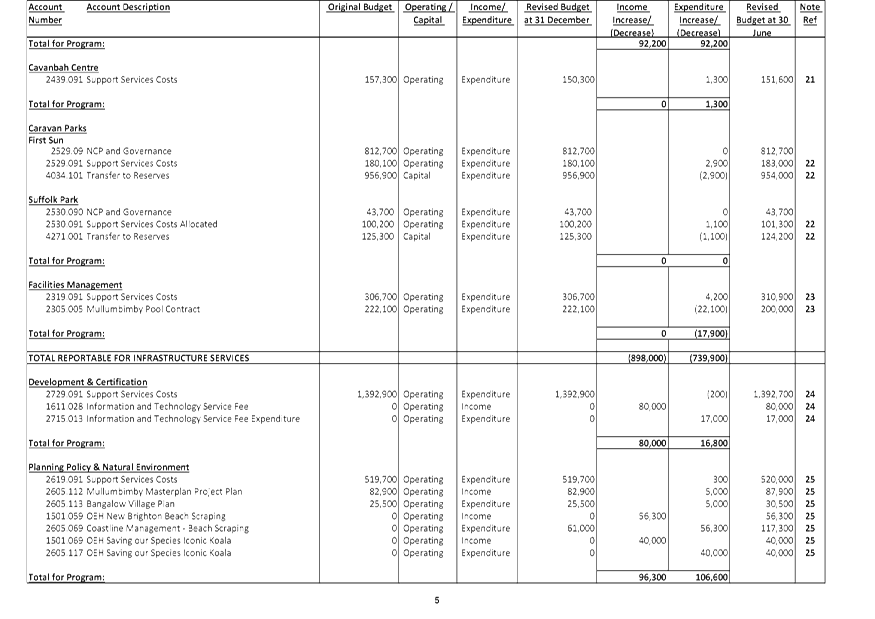

Report No. 4.4 Council

Budget Review - 1 October 2017 to 31 December 2017

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2018/195

Theme: Corporate Management

Financial Services

Summary:

This report is prepared to comply with Regulation 203 of the

Local Government (General) Regulation 2005 and to inform Council and the

Community of Council’s estimated financial position for the 2017/2018

financial year, reviewed as at 31 December 2017.

This report contains an overview of the proposed budget

variations for the General Fund, Water Fund and Sewerage Fund. The

specific details of these proposed variations are included in Attachment 1 and 2

for Council’s consideration and authorisation.

Attachment 3 contains the Integrated Planning and Reporting Framework

(IP&R) Quarterly Budget Review Statement (QBRS) as outlined by the Division

of Local Government in circular 10-32.

|

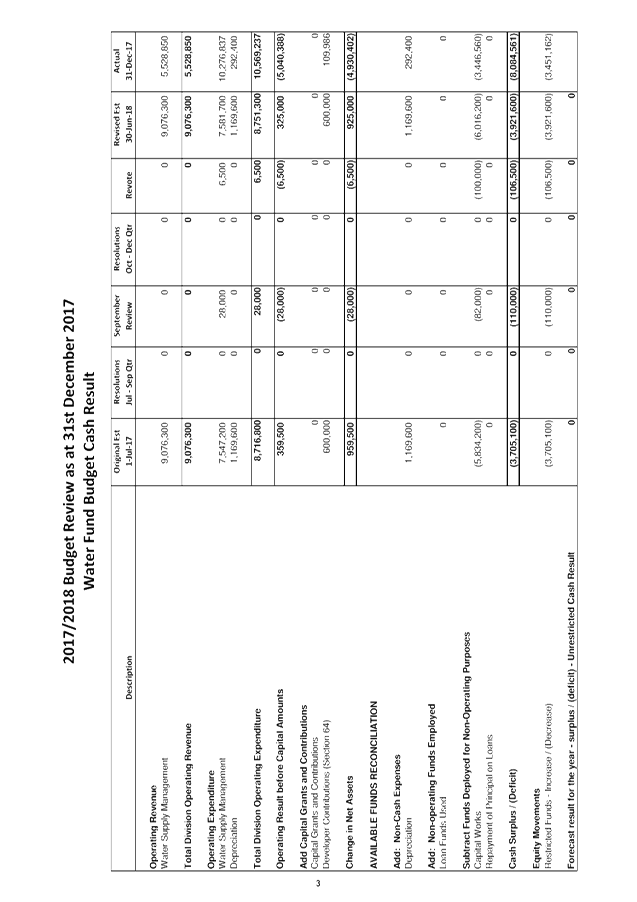

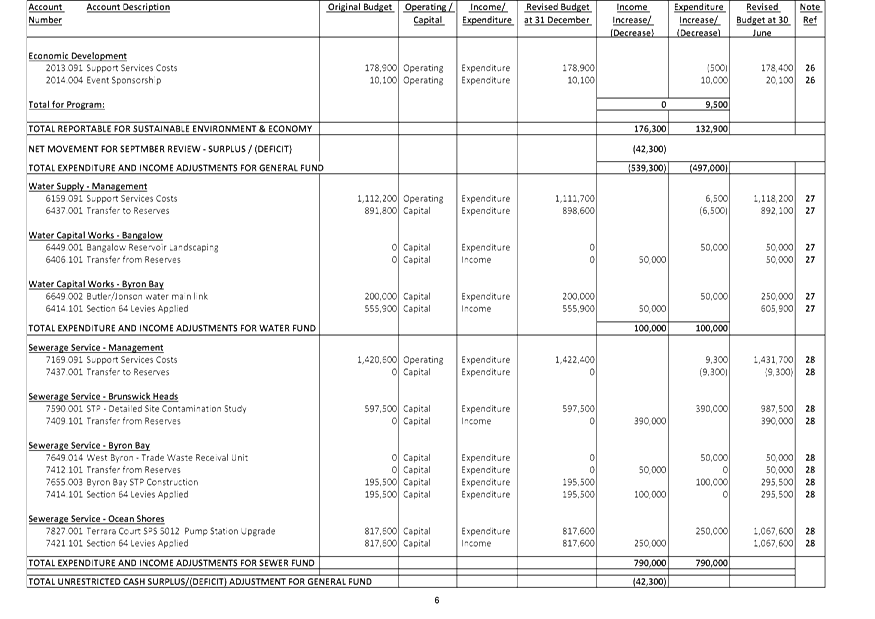

RECOMMENDATION:

That the Finance Advisory

Committee recommend to Council:

1. That

Council authorise the itemised budget variations as shown in Attachment 2

(#E2018/9537) which includes the following results in the 31 December 2017

Quarterly Review of the 2017/2018 Budget:

a) General

Fund – $42,300 decrease to the Estimated Unrestricted Cash Result

b) General

Fund - $14,700 increase in reserves

c) Water

Fund - $106,500 decrease in reserves

d) Sewerage

Fund - $799,300 decrease in reserves

2. That

Council adopt the revised General Fund Estimated Unrestricted Cash Result of

$888,300 for the 2017/2018 financial year as at 31 December 2017

|

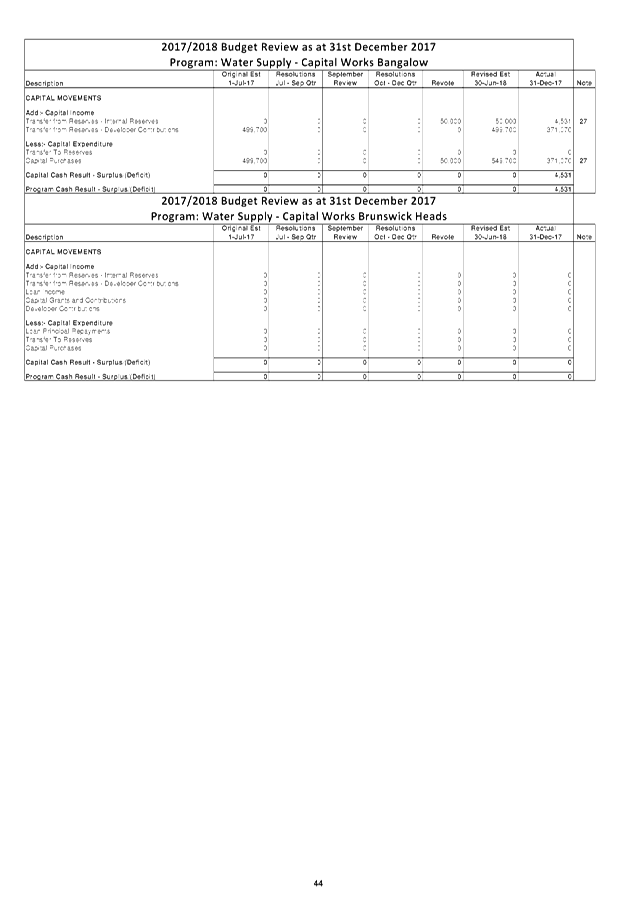

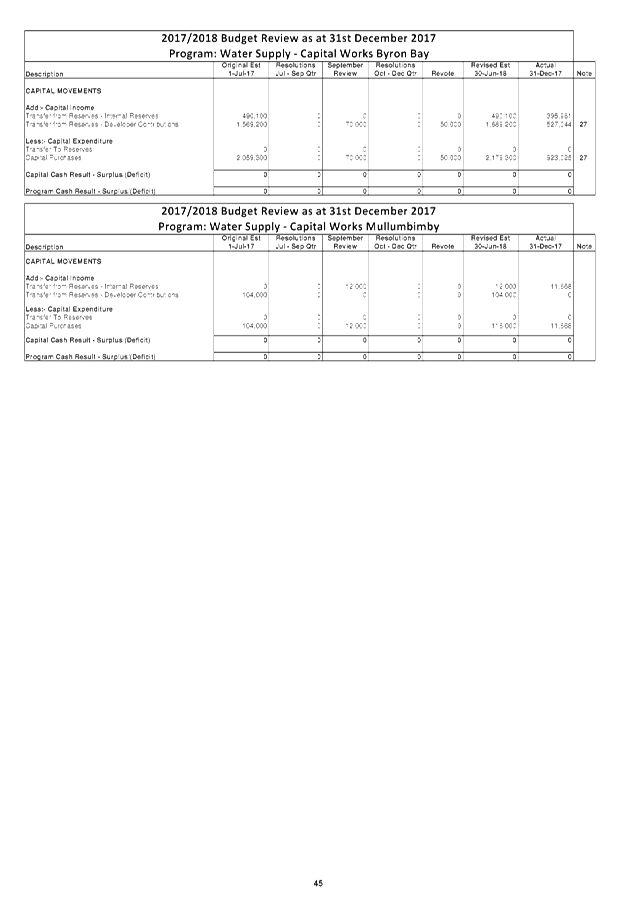

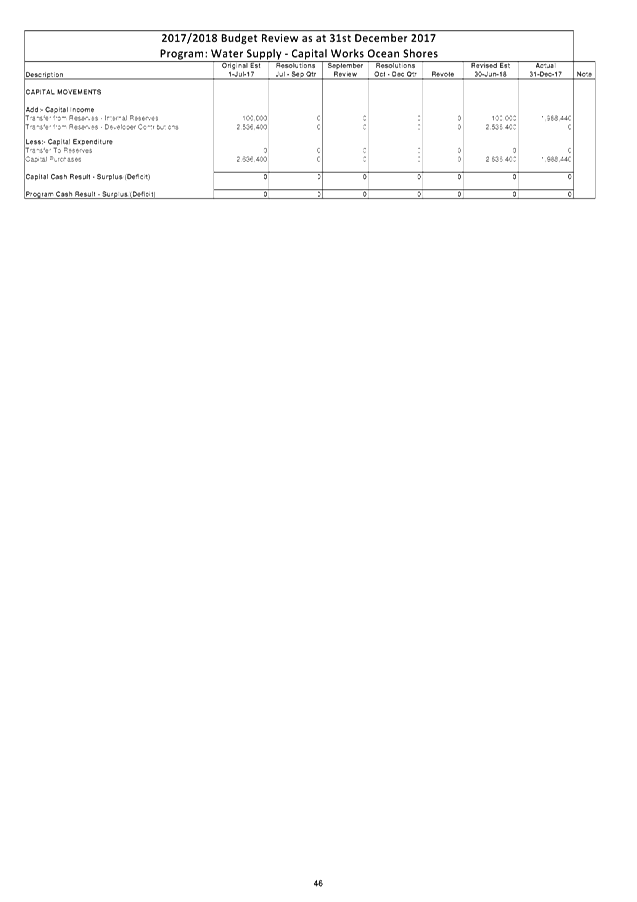

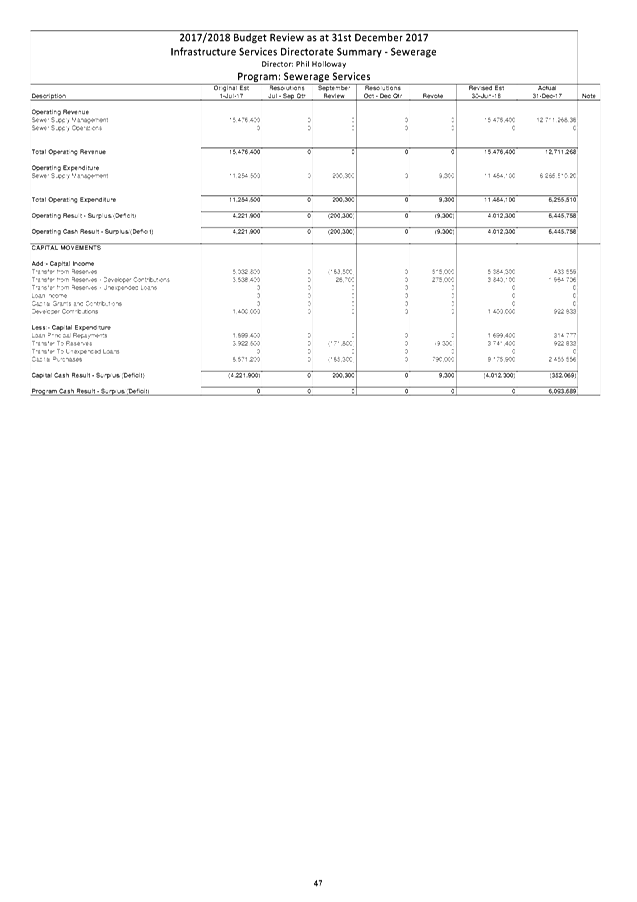

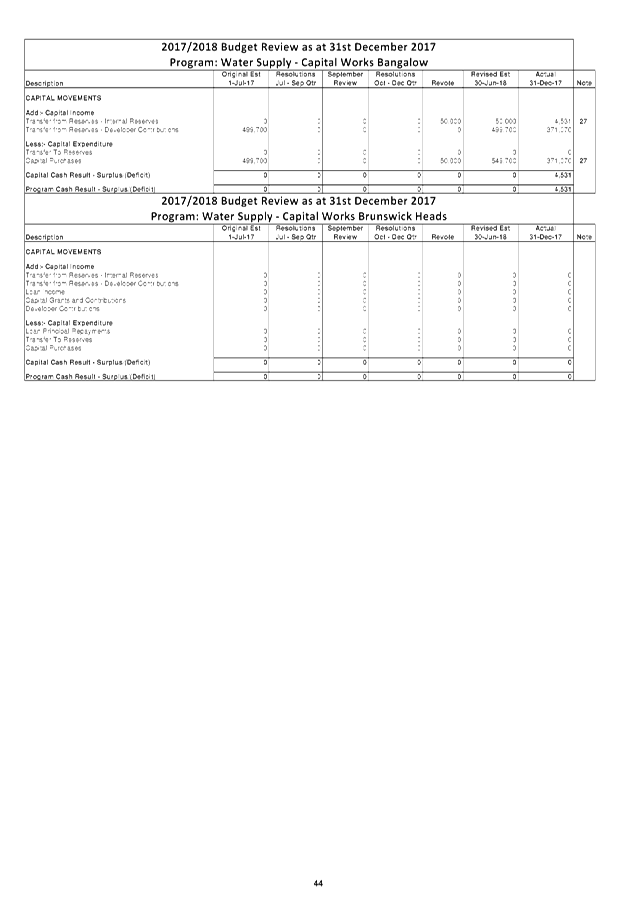

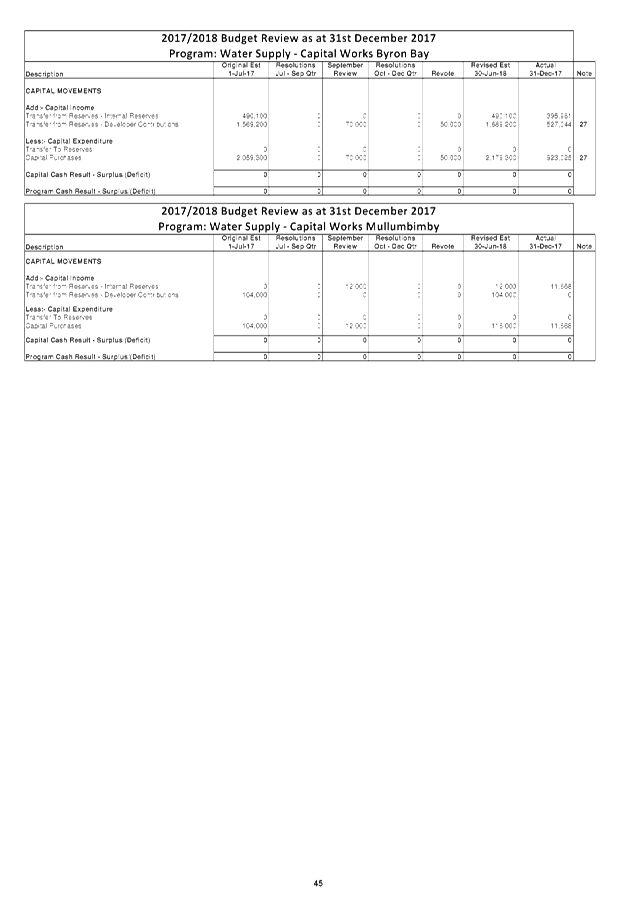

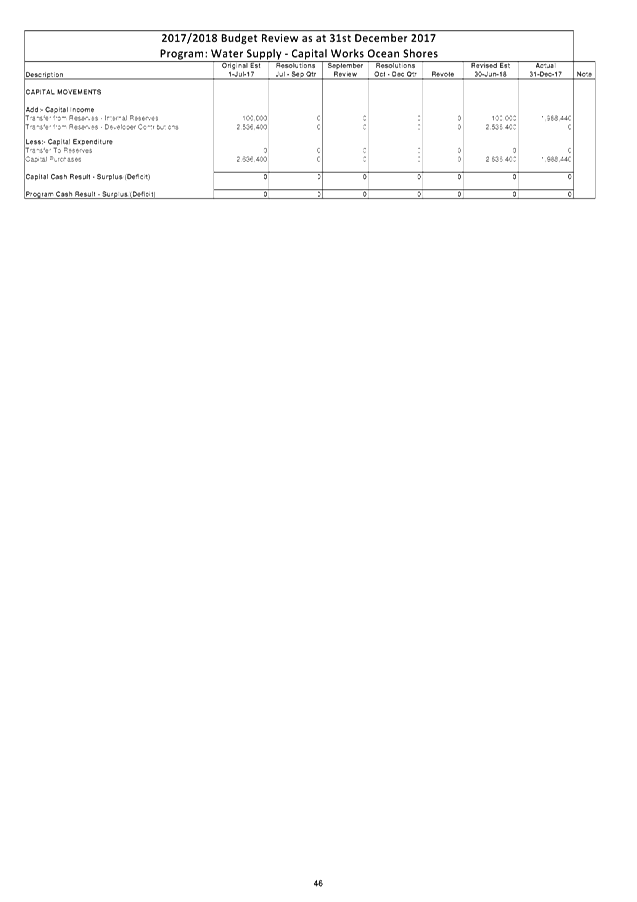

Attachments:

1 Budget

Variations for General, Water and Sewerage Funds, E2018/9612 , page 44⇩

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2018/9537 ,

page 108⇩

3 Integrated

Planning and Reporting Framework (IP&R) required Quarterly Review

Statement, E2018/9550 , page 114⇩

Report

Council adopted the 2017/2018 budget on 22 June 2017 via

Resolution 17-268. It also considered and adopted the budget

carryovers from the 2016/2017 financial year, to be incorporated into the

2017/2018 budget at its Ordinary Meeting held on 24 August 2017 via Resolution 17-322.

Since that date, Council has reviewed the budget taking into consideration the

2016/2017 Financial Statement results and progress through the first half of

the 2017/2018 financial year. This report considers the December 2017

Quarter Budget Review.

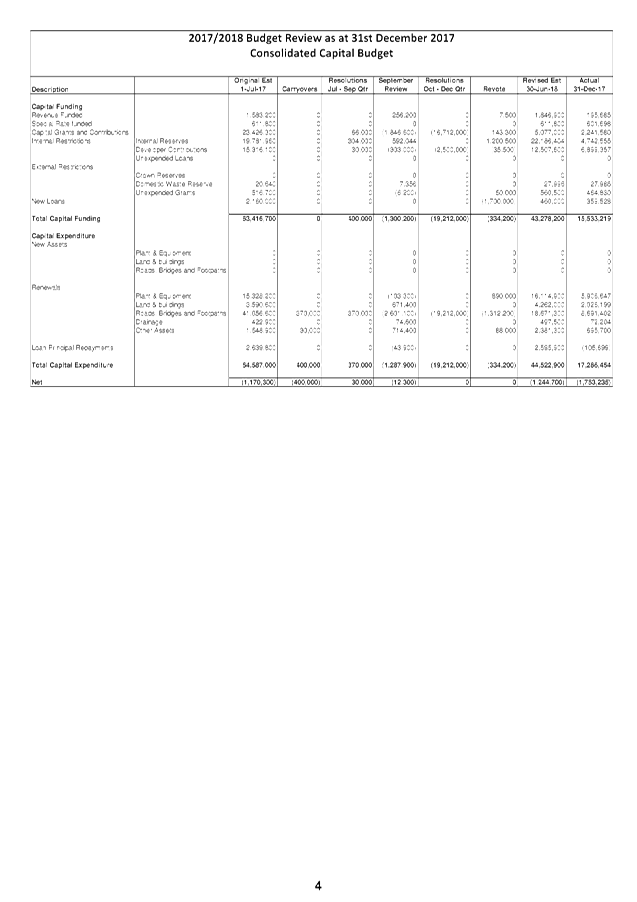

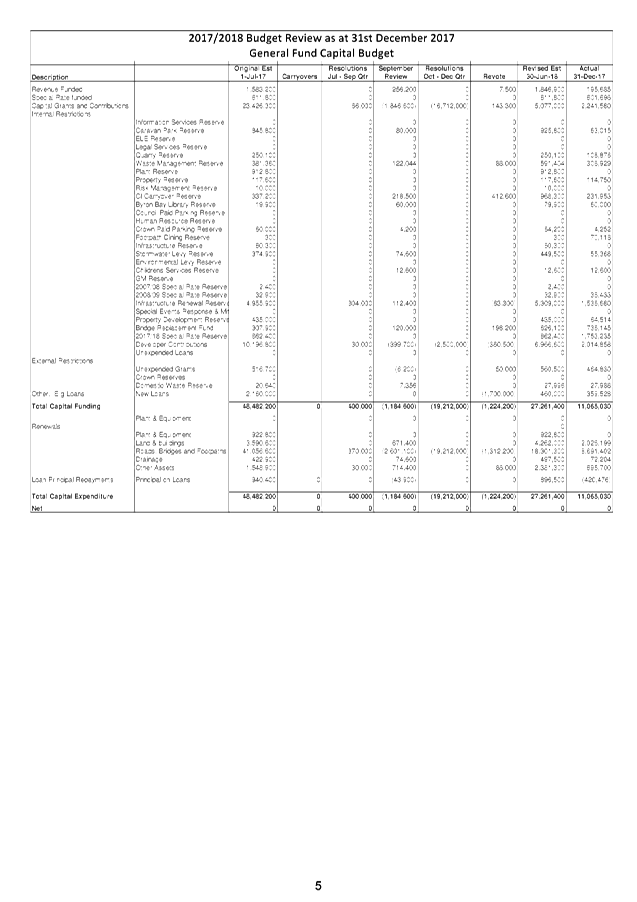

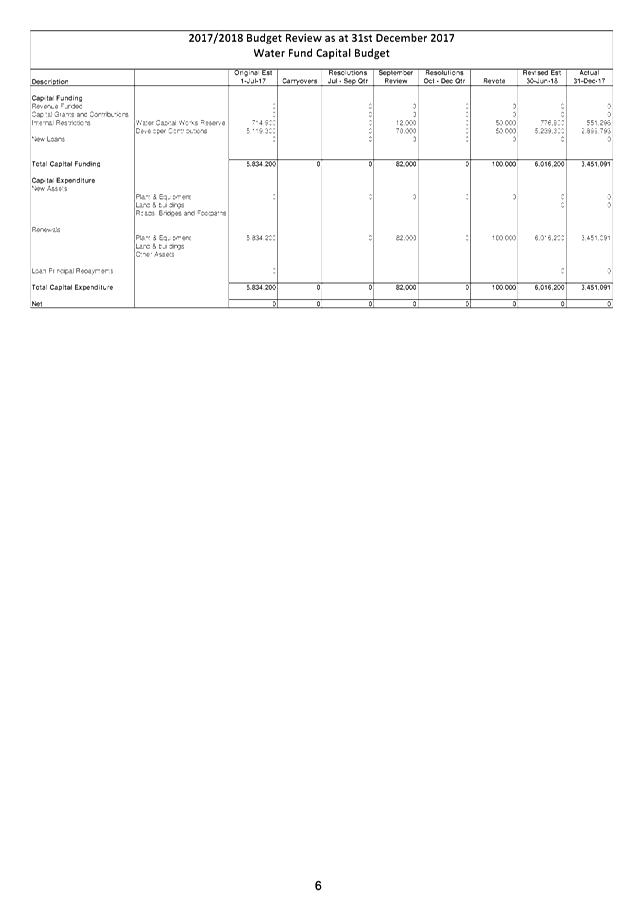

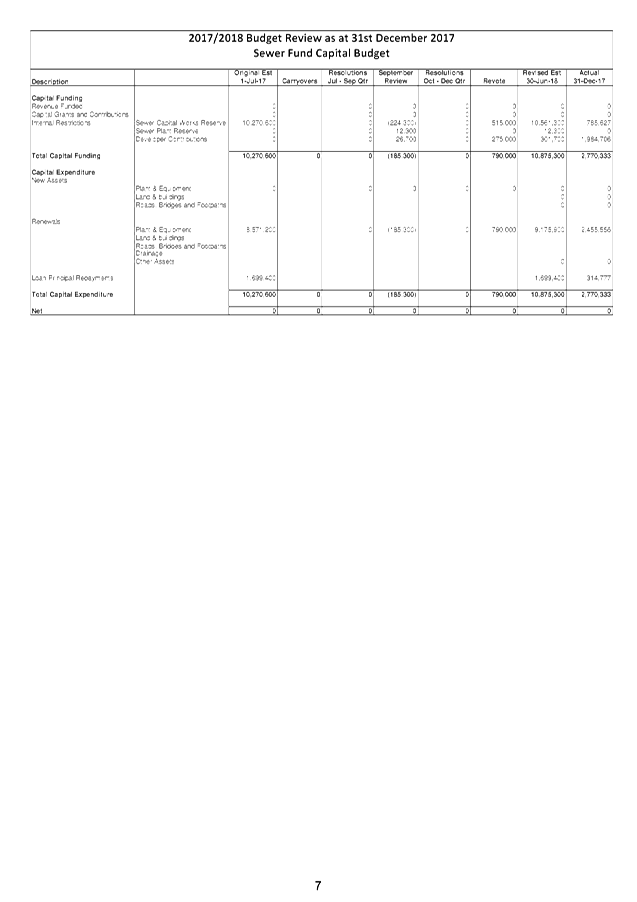

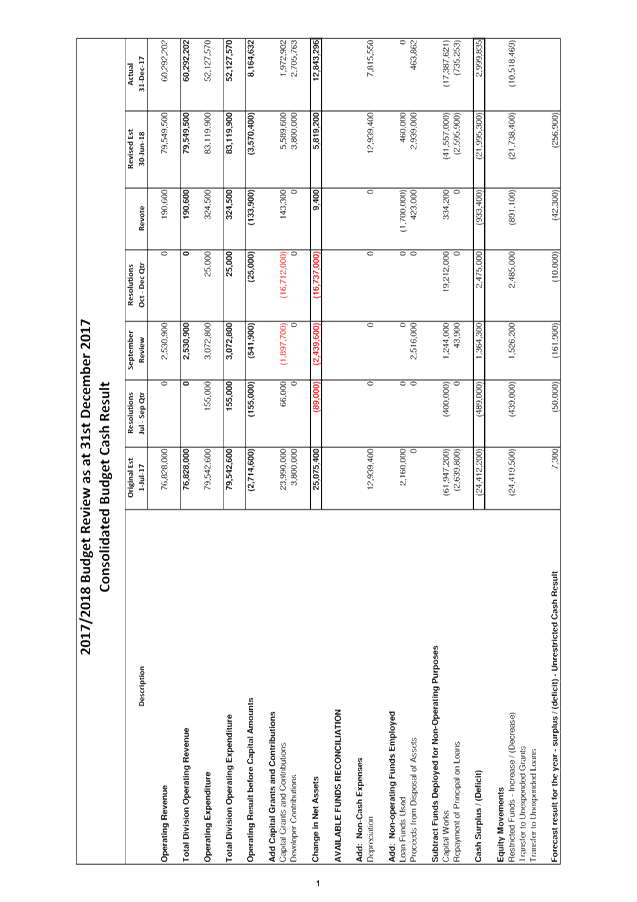

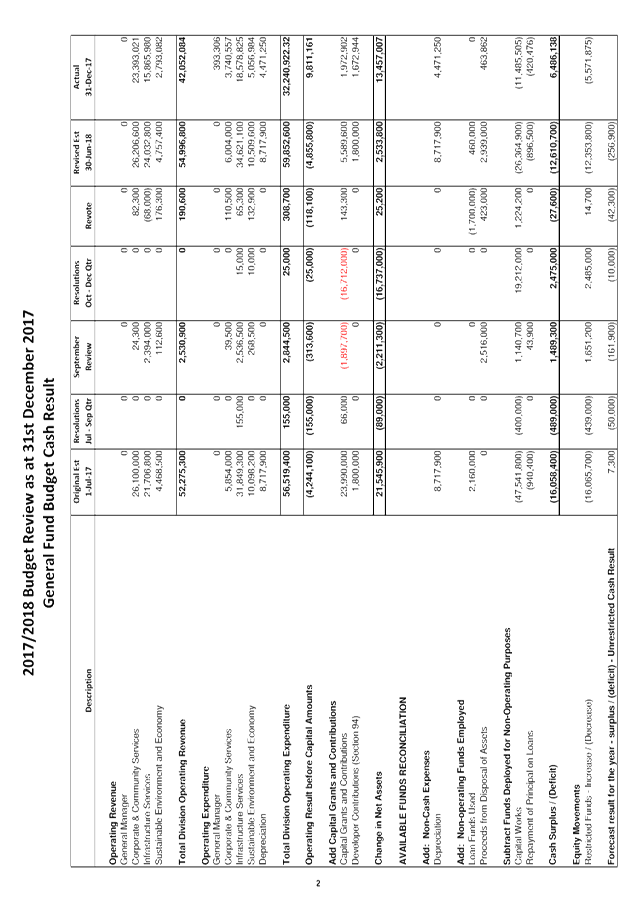

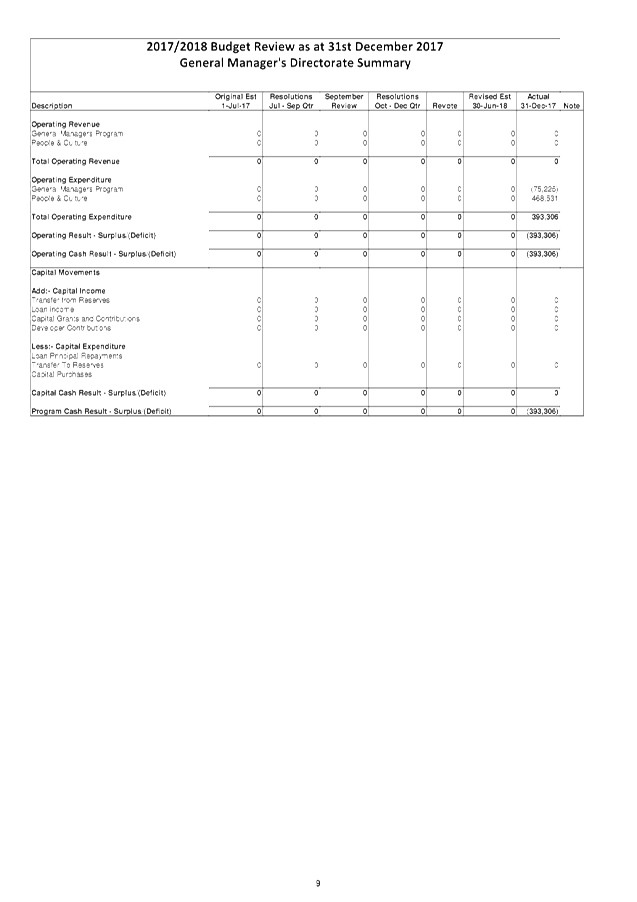

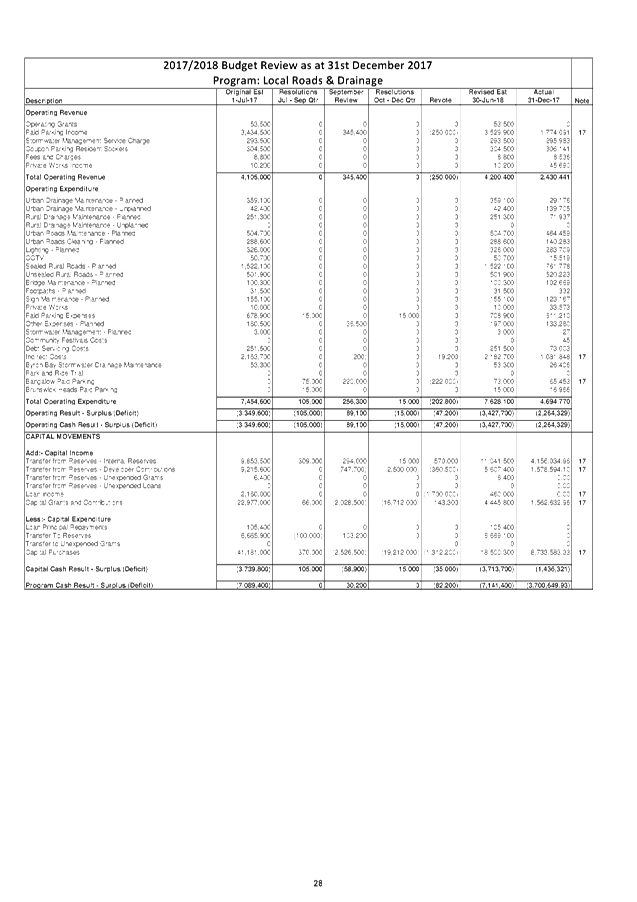

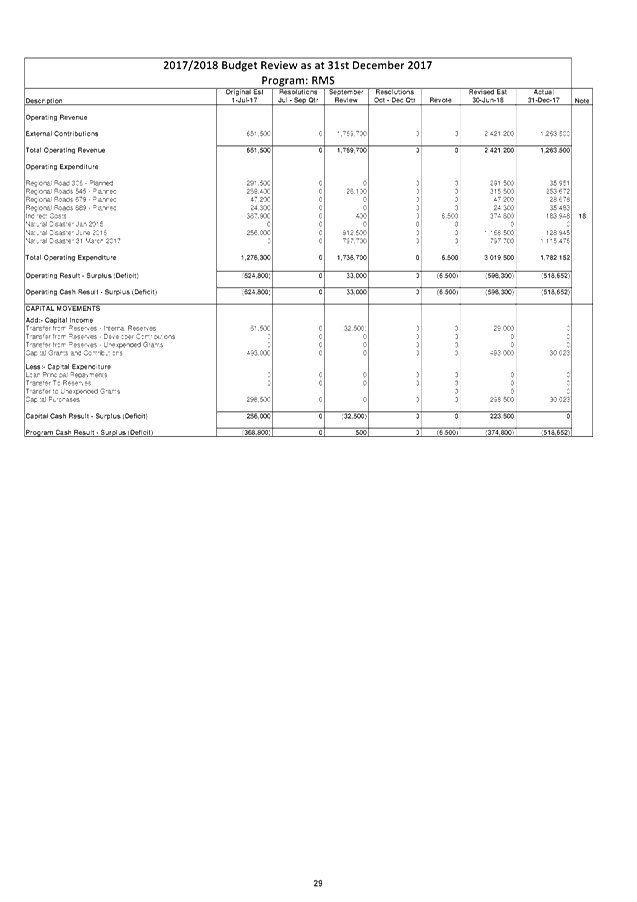

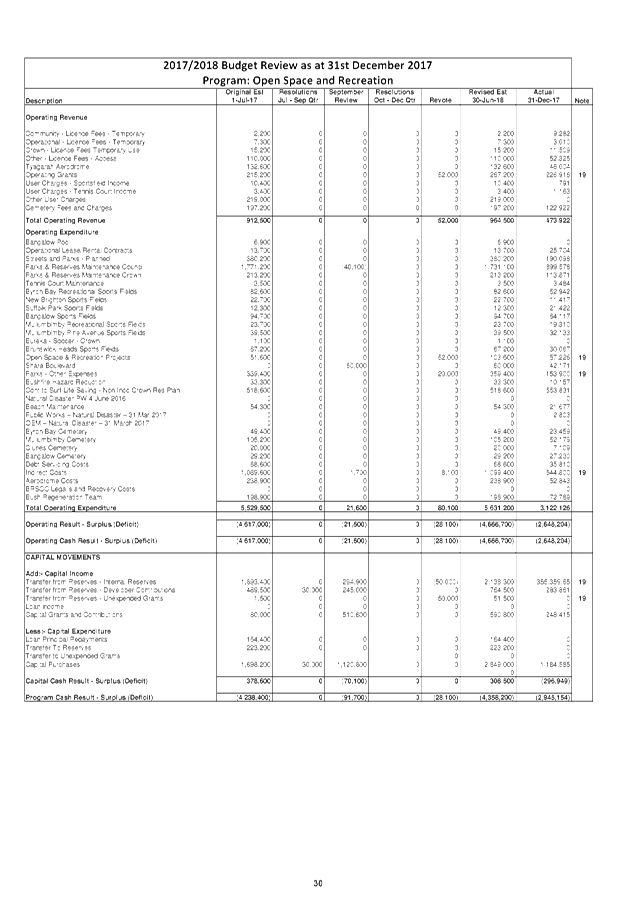

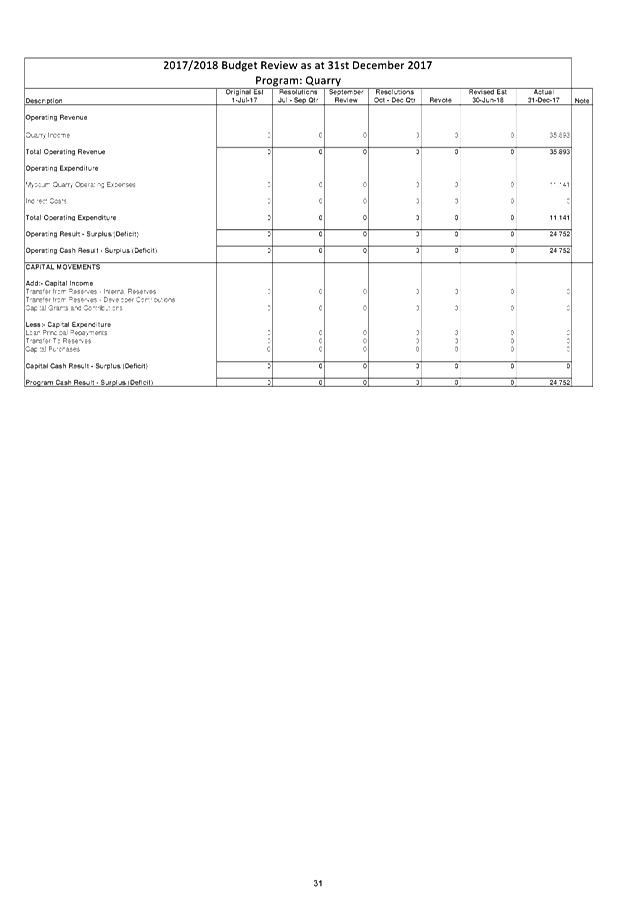

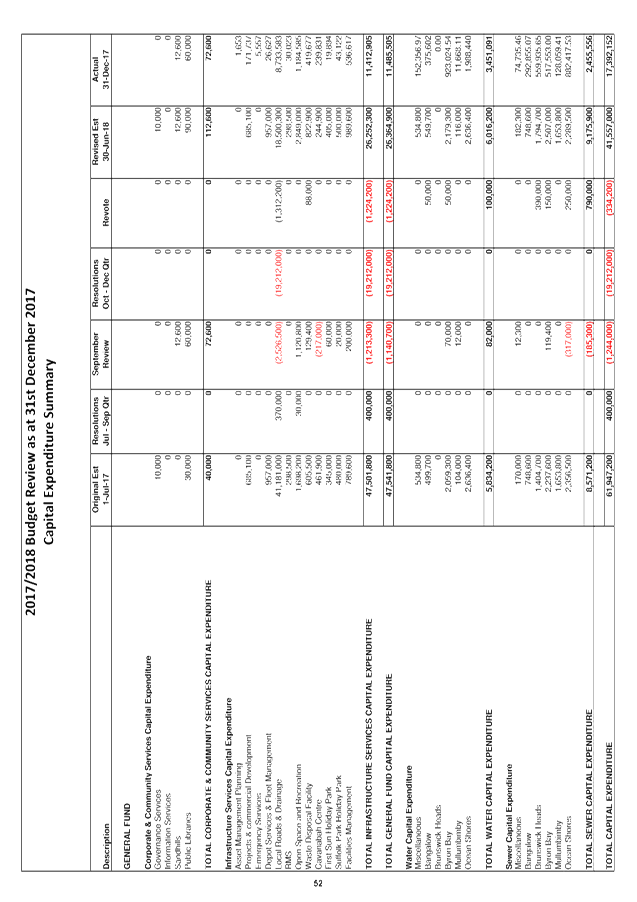

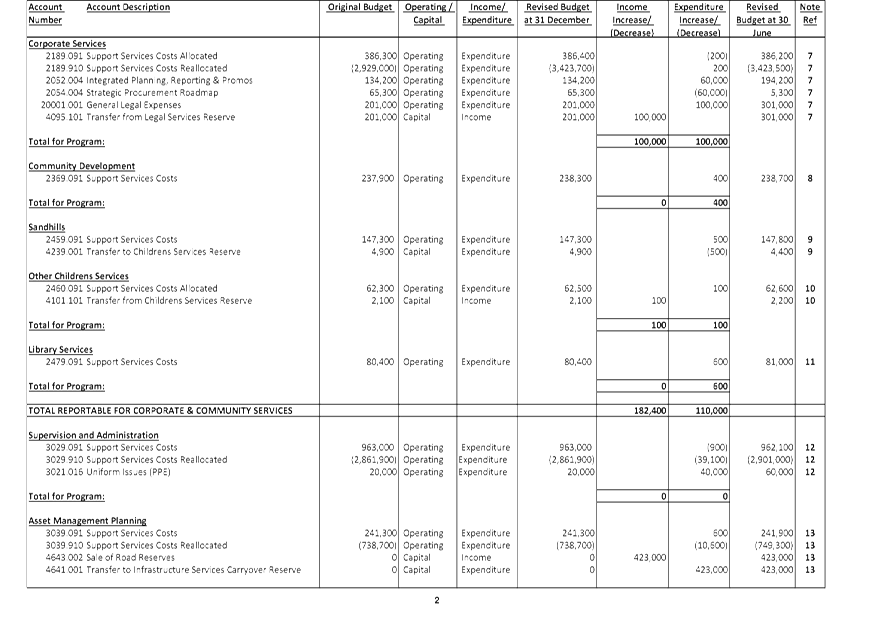

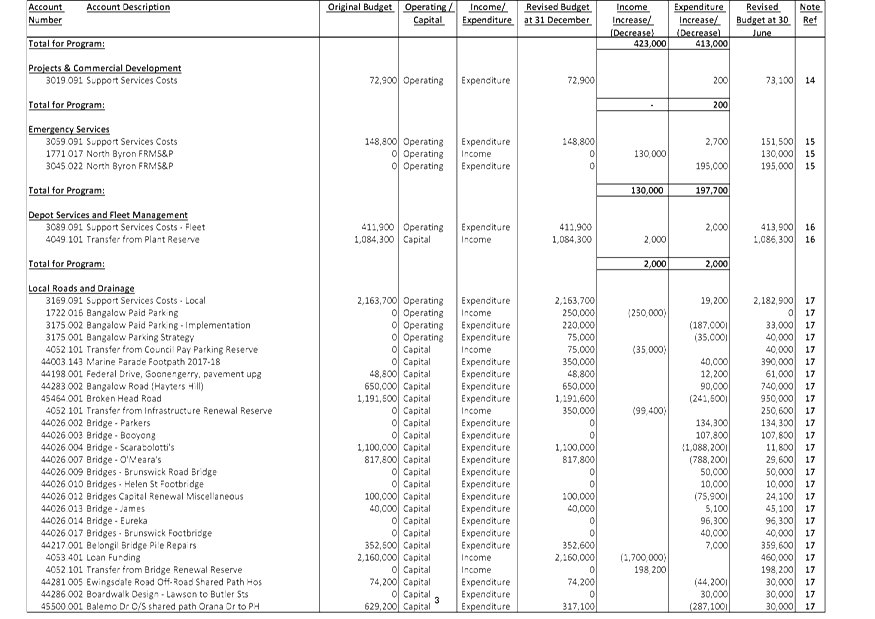

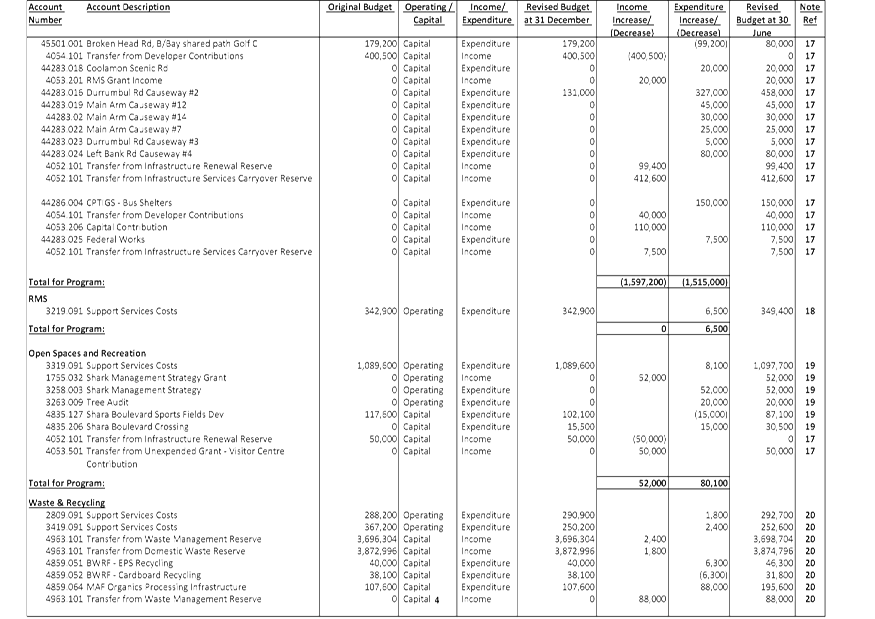

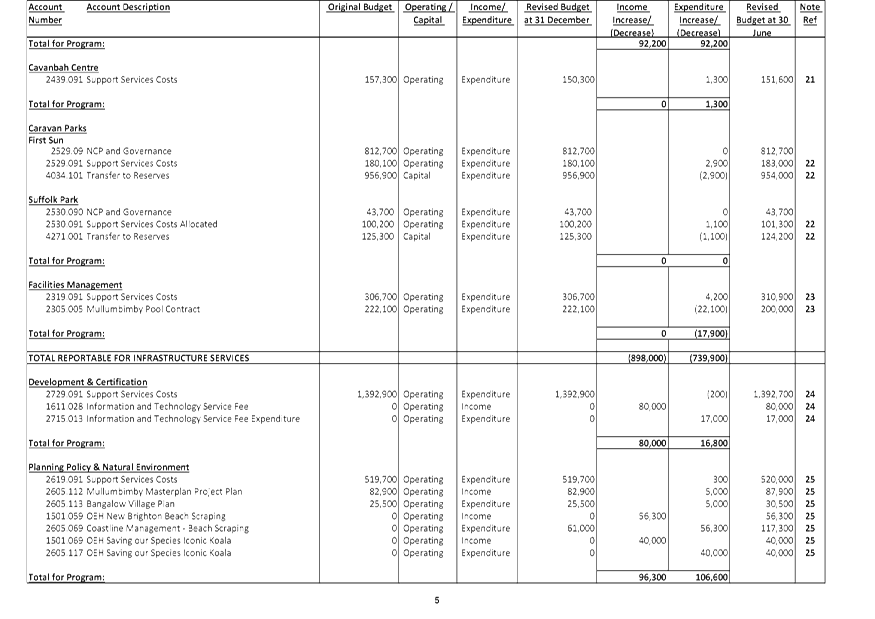

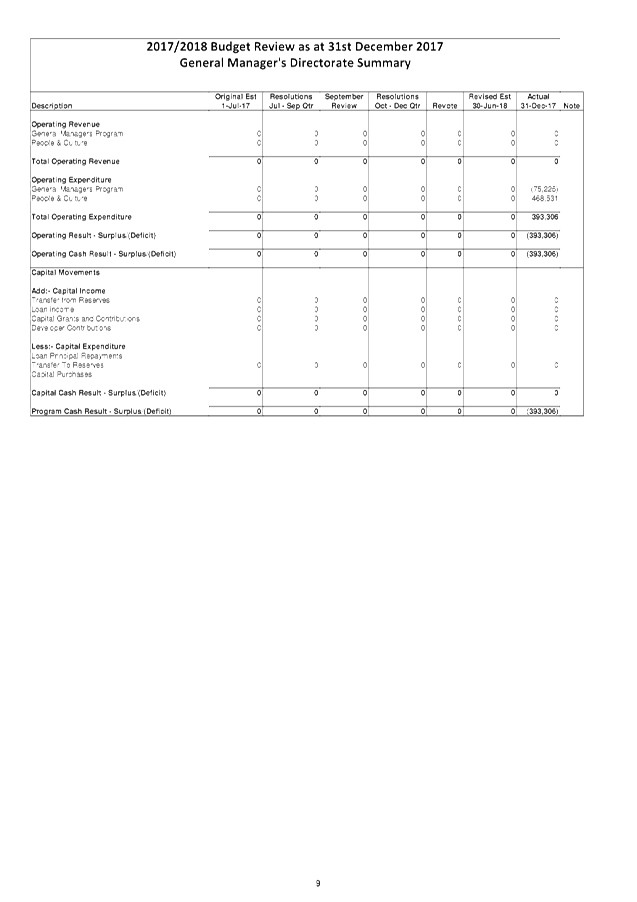

The details of the budget review for the Consolidated,

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget

position of Council, as well as a breakdown by Fund and Principal Activity. The

document in Attachment 1 is also effectively a publication outlining a review

of the budget and is intended to provide Councillors with more detailed

information to assist with decision making regarding Council’s finances.

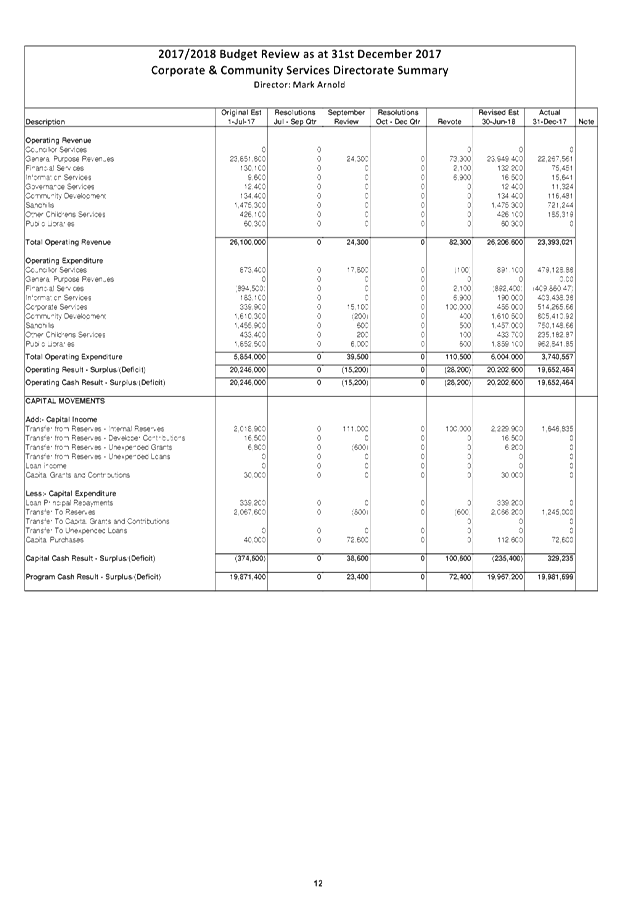

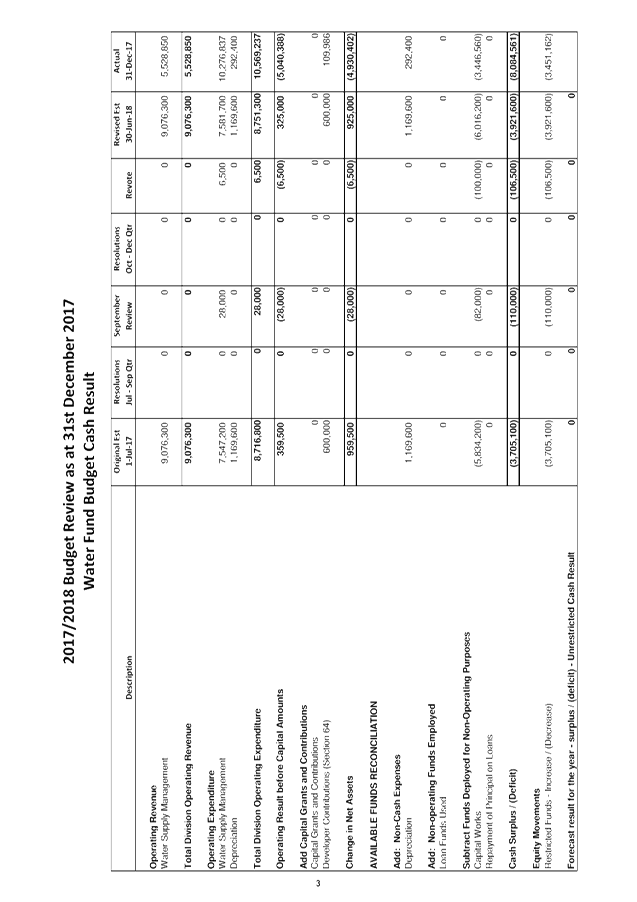

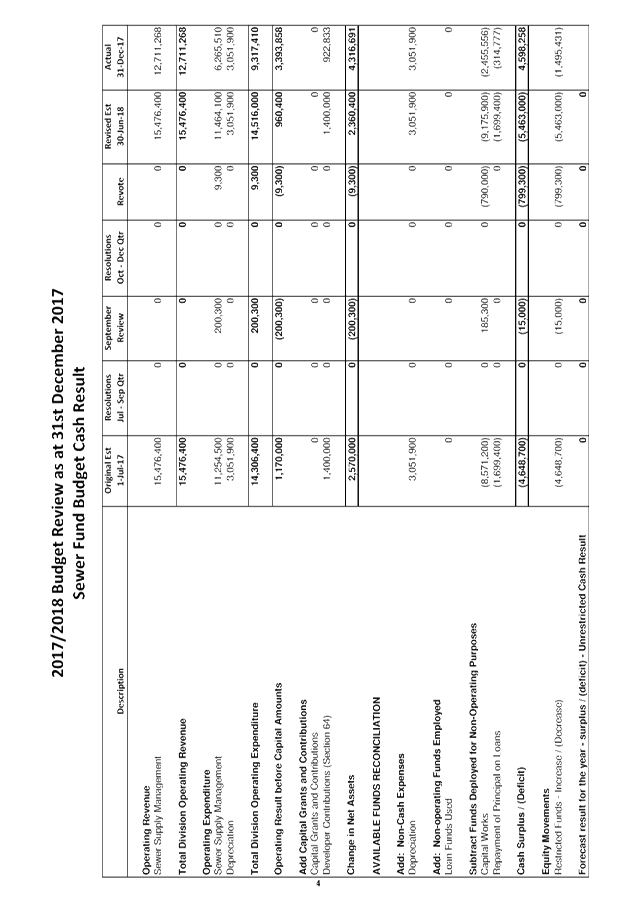

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

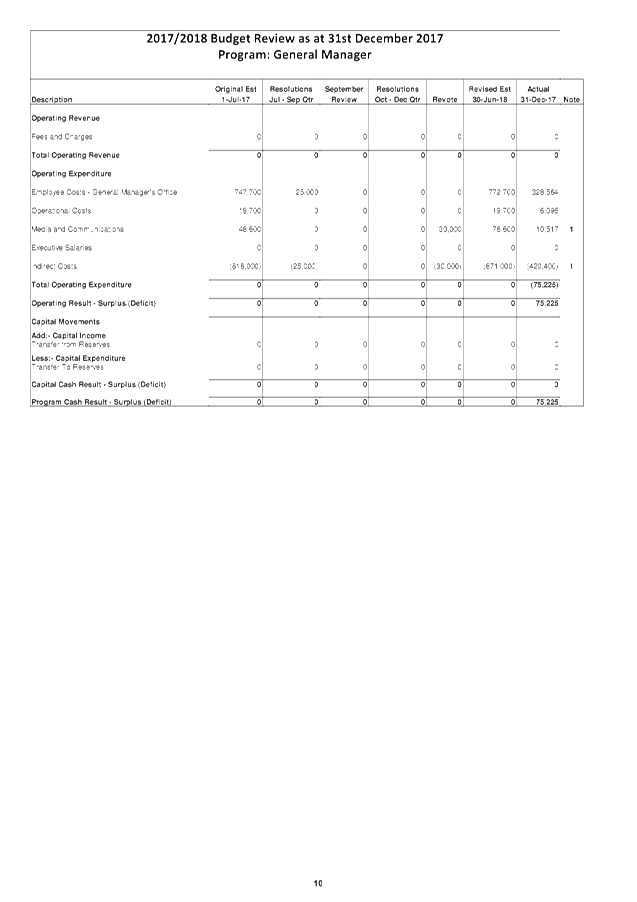

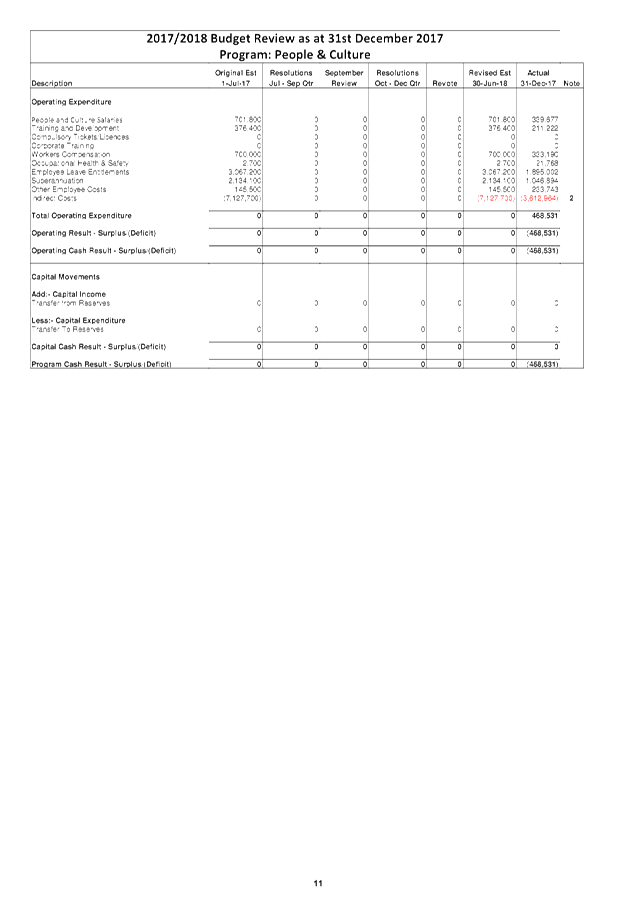

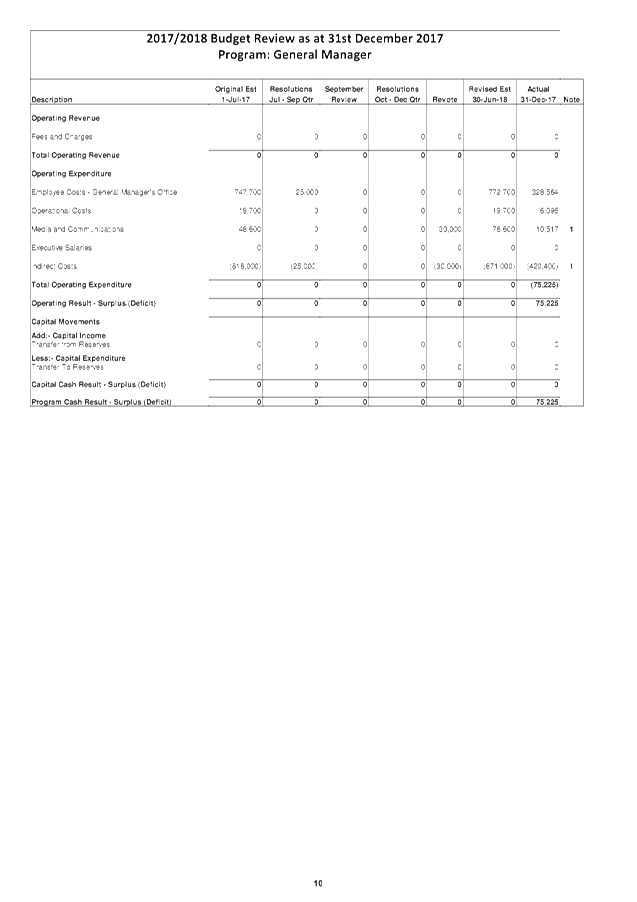

The pages within Attachment 1 are presented (from left to

right) by showing the original budget as adopted by Council on 22 June 2017

plus the adopted carryover budgets from 2016/2017 followed by the resolutions

between July and September, the September Review, resolutions between October

and December and the revote (or adjustment for this review) and then the

revised position projected for 30 June 2018 as at 31 December 2017.

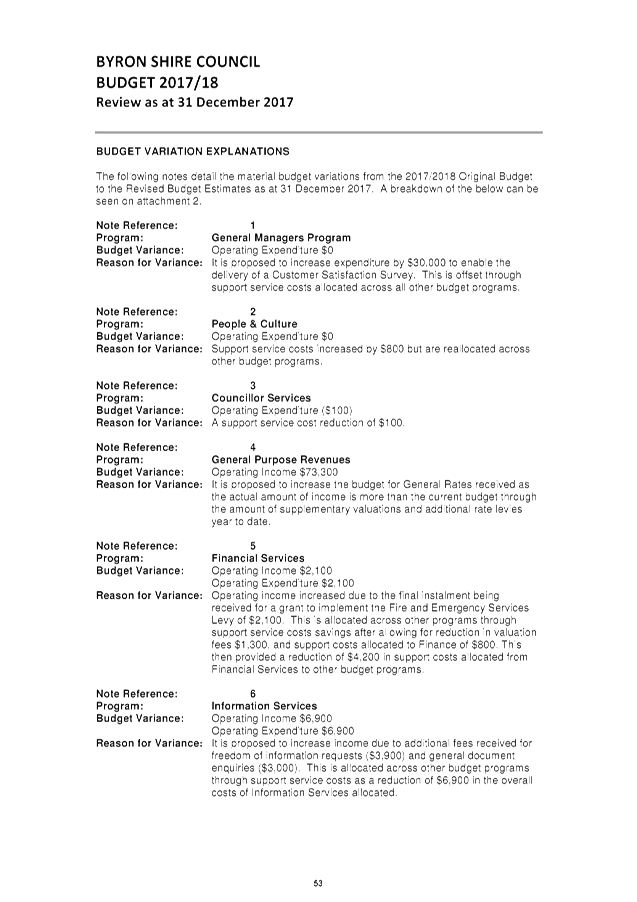

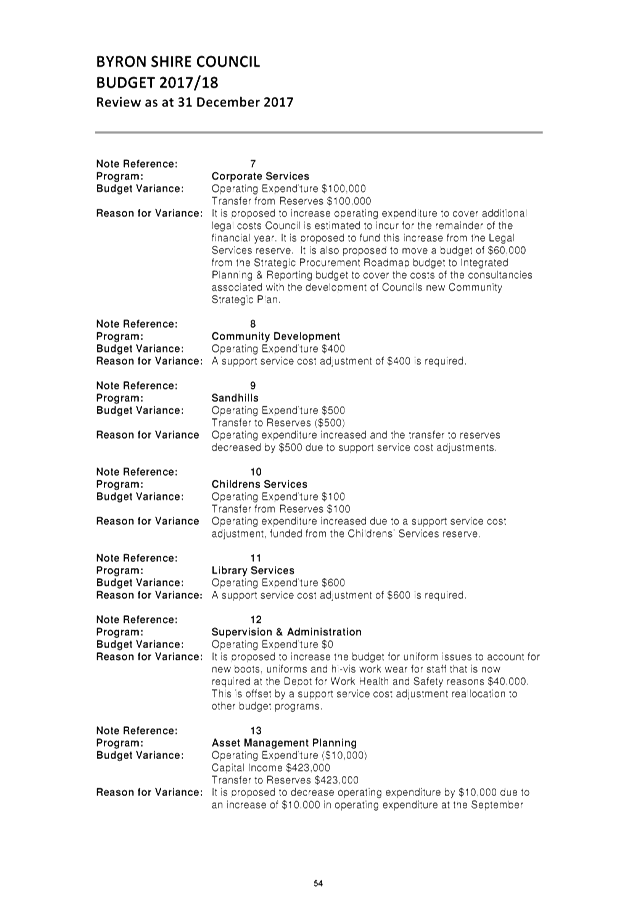

On the far right of the Principal Activity, there is a column

titled “Note”. If this is populated by a number, it means

that there has been an adjustment in the quarterly review. This number

then corresponds to the notes at the end of the Attachment 1 which provides an

explanation of the variation.

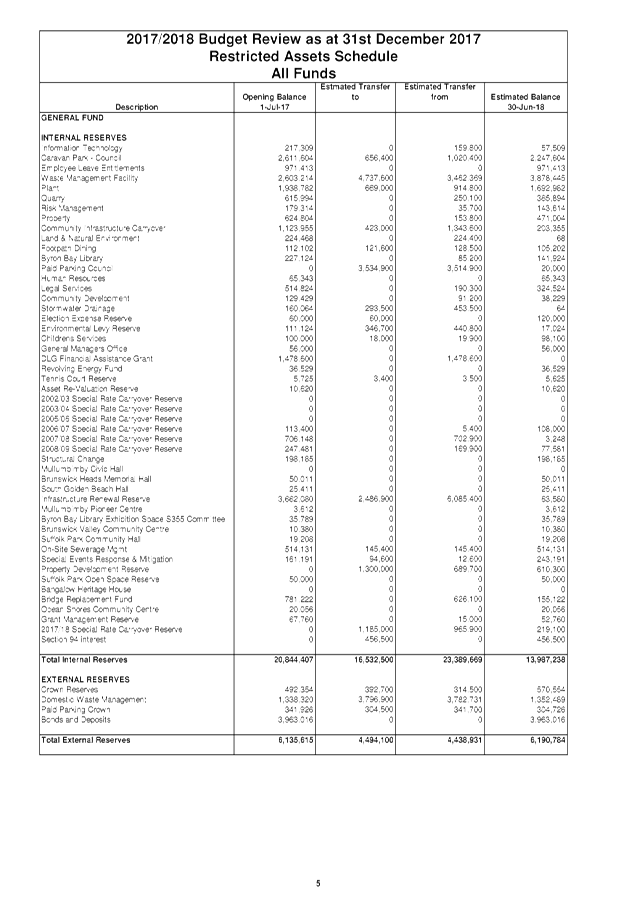

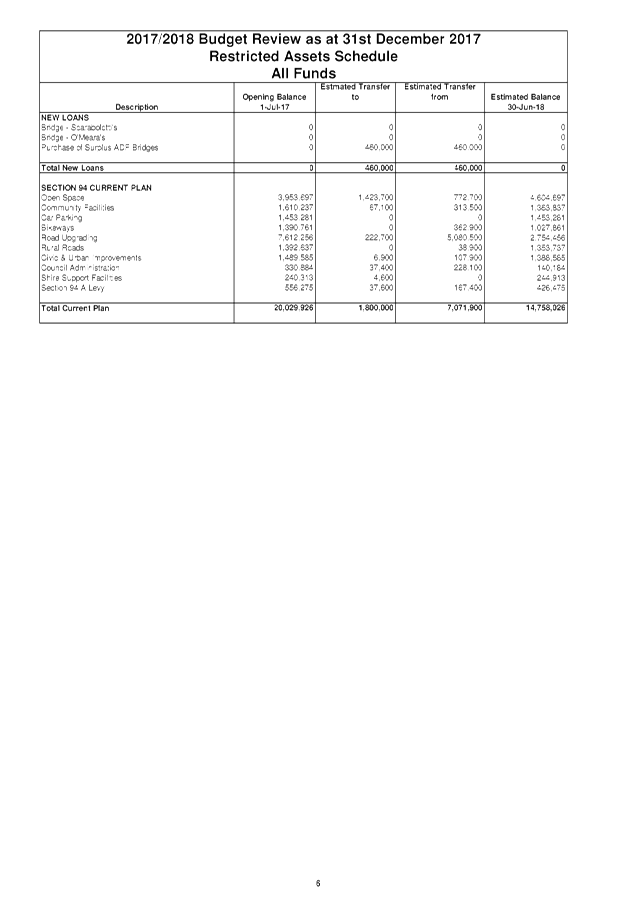

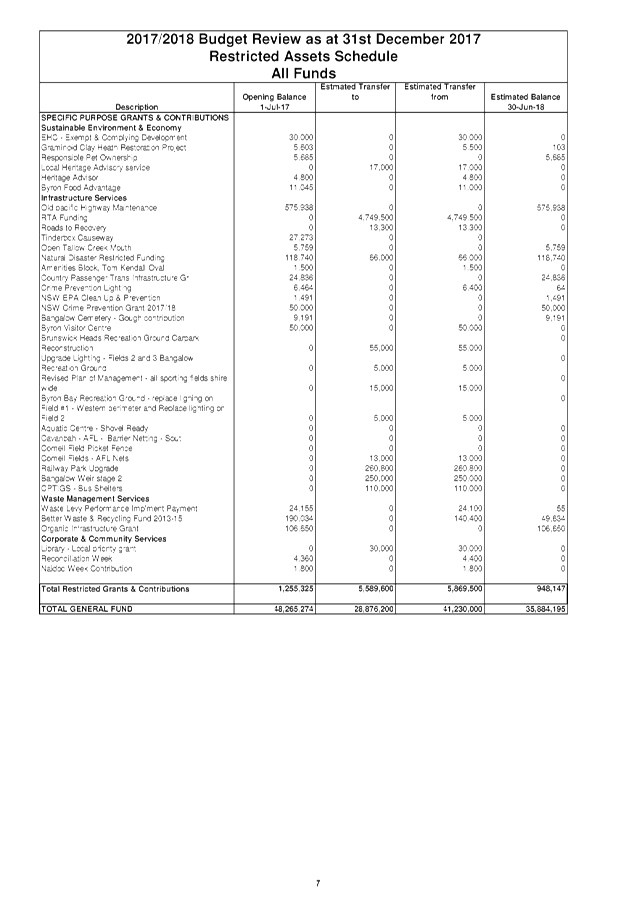

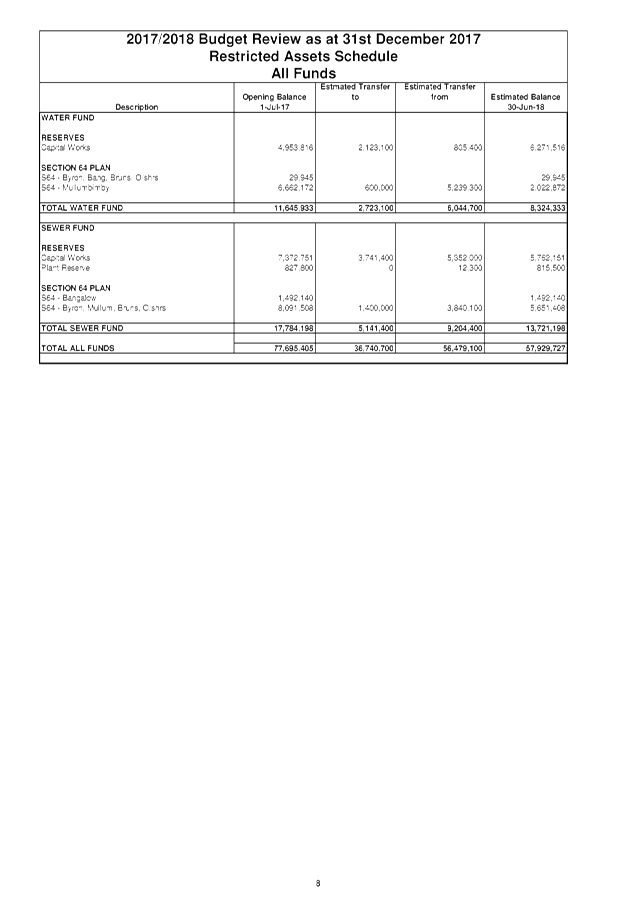

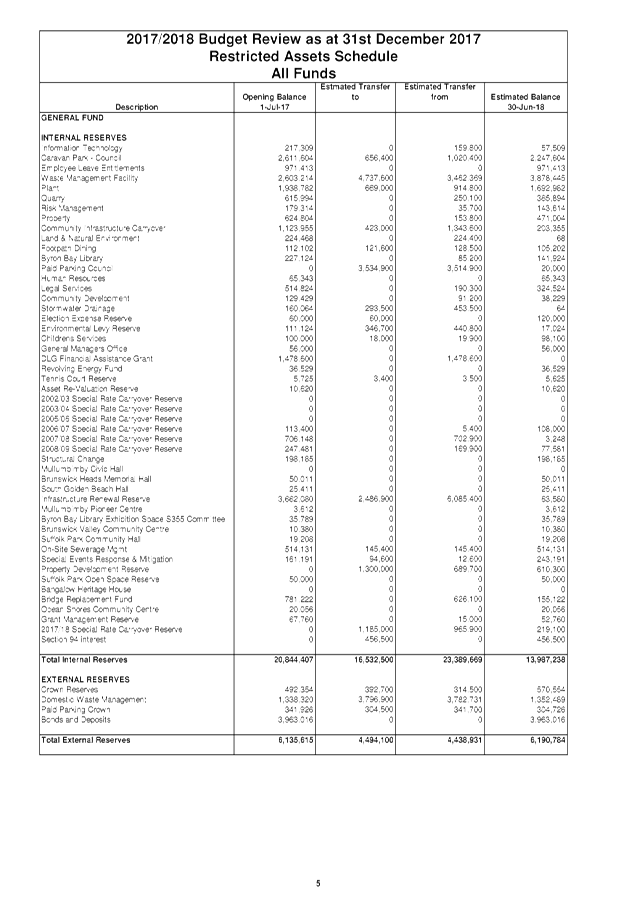

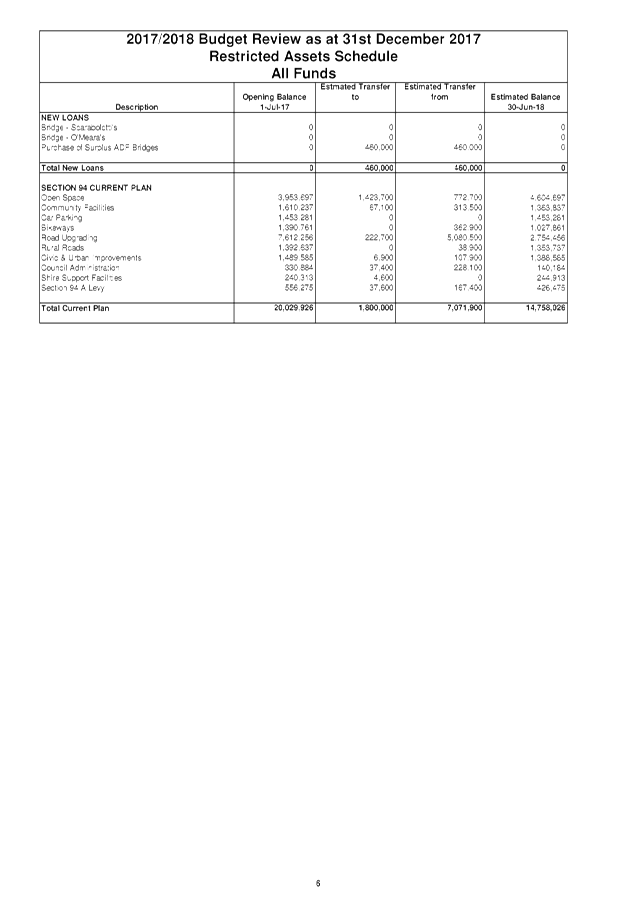

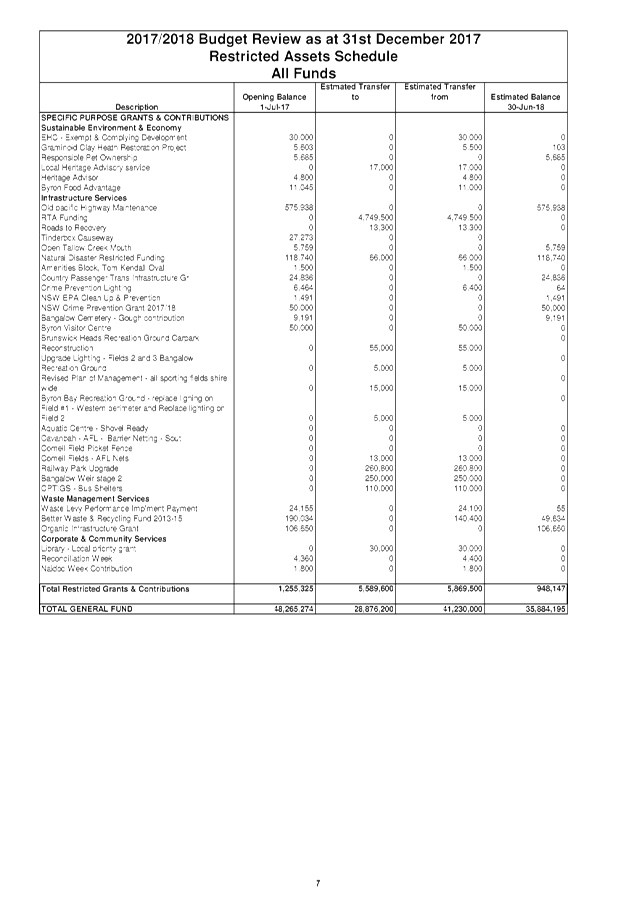

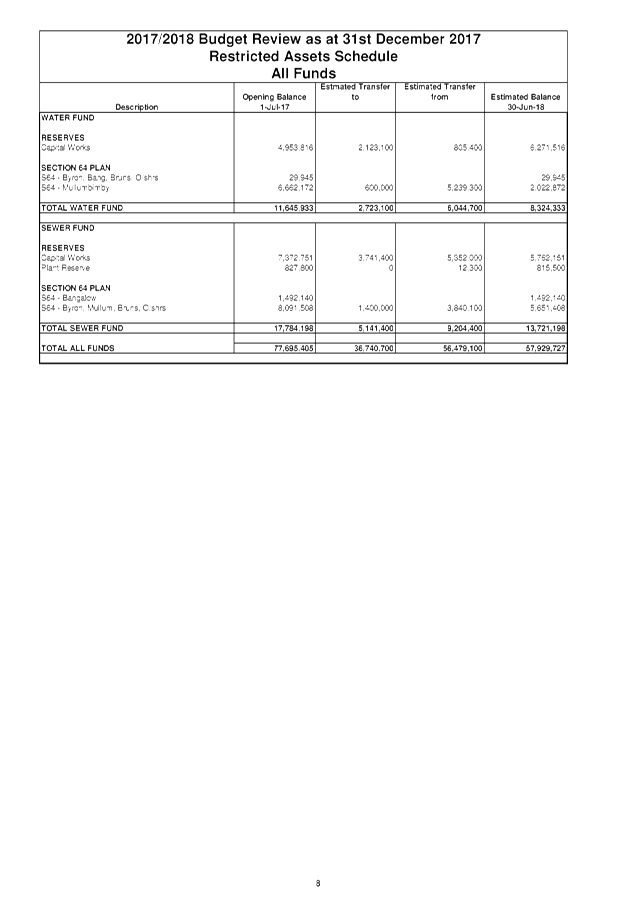

There is also information detailing restricted assets

(reserves) to show Council estimated balances as at 30 June 2018 for all

Council’s reserves.

A summary of Capital Works is also included by Fund and

Principal Activity.

Office of Local Government Budget Review Guidelines:-

The Office of Local Government on 10 December 2010 issued

the new Quarterly Budget Review Guidelines via Circular 10-32, with the

reporting requirements to apply from 1 July 2011. This report includes a

Quarterly Budget Review Statement (refer Attachment 3) prepared by Council in

accordance with the guidelines.

The Quarterly Budget Review Guidelines set a minimum

standard of disclosure, with these standards being included in the Local

Government Code of Accounting Practice and Financial Reporting as mandatory

requirements for Council’s to address.

Since the introduction of the new planning and reporting

framework for NSW Local Government, it is now a requirement for Councils to

provide the following components when submitting a Quarterly Budget Review

Statement (QBRS):-

· A signed statement by

the Responsible Accounting Officer on Councils financial position at the end of

the year based on the information in the QBRS

· Budget review income and

expenses statement in one of the following formats:

o Consolidated

o By fund (e.g General, Water, Sewer)

o By function, activity, program etc

to align with the management plan/operational plan

· Budget Review Capital

Budget

· Budget Review Cash and

Investments Position

· Budget Review Key performance

indicators

· Budget Review Contracts

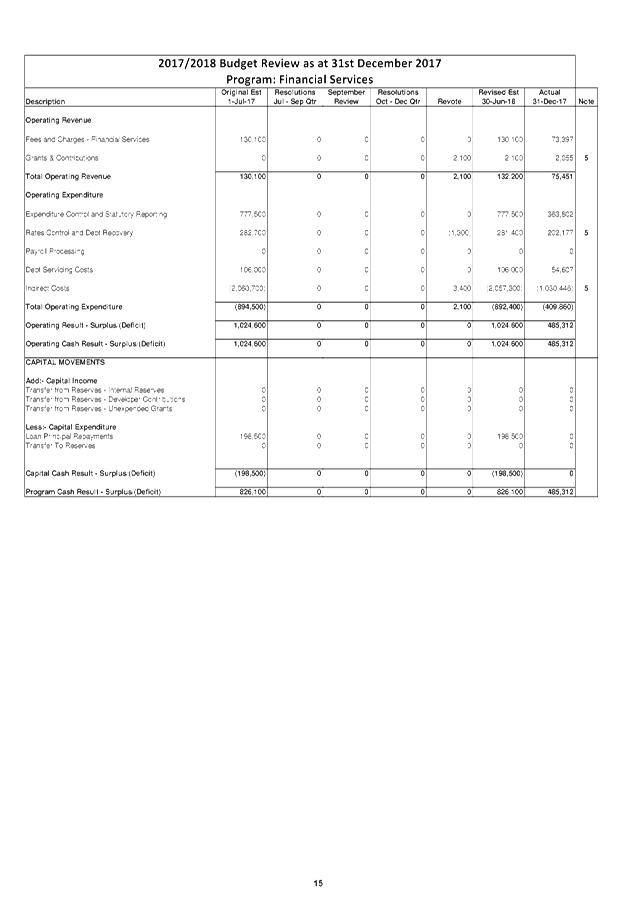

and Other Expenses

The above components are included in Attachment 3:-

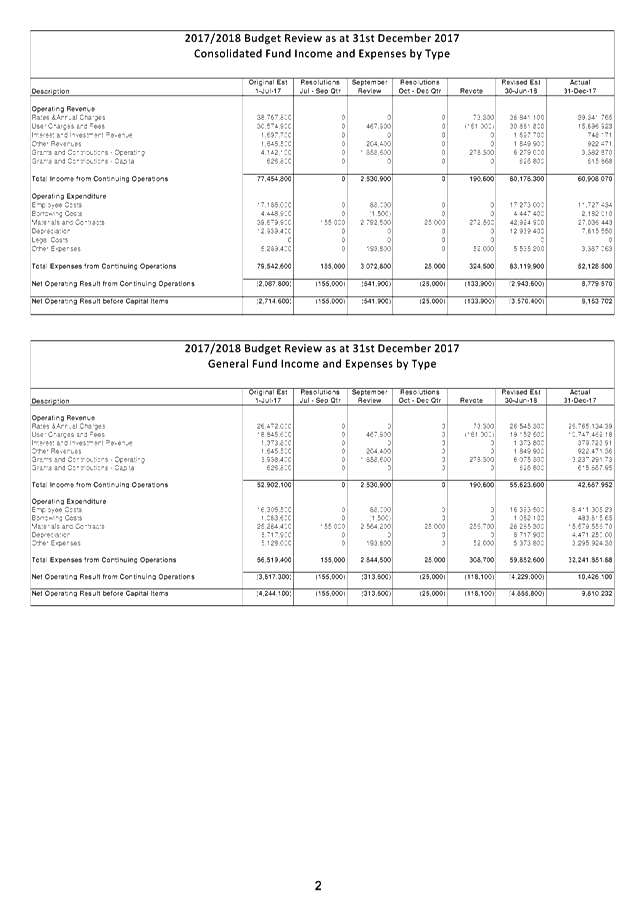

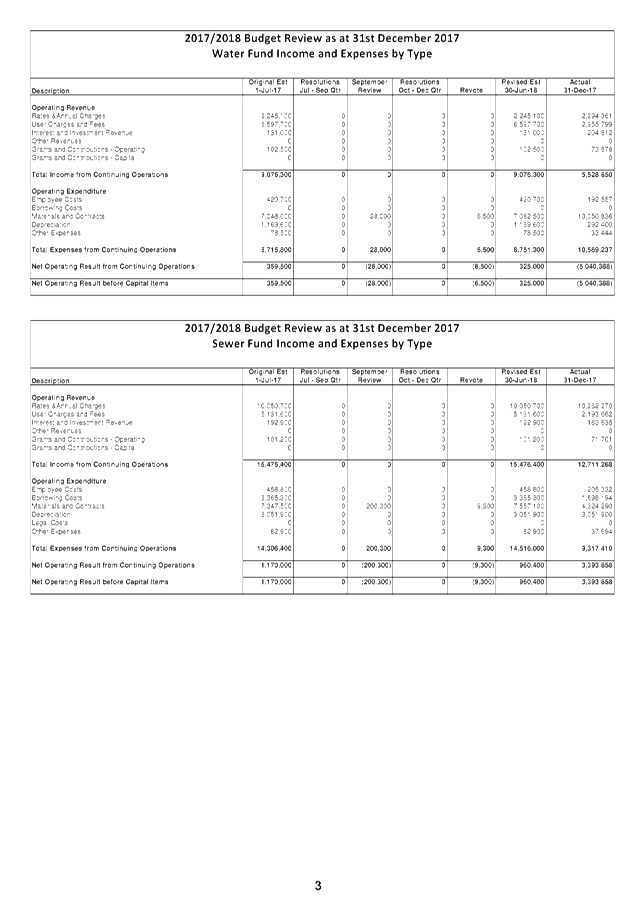

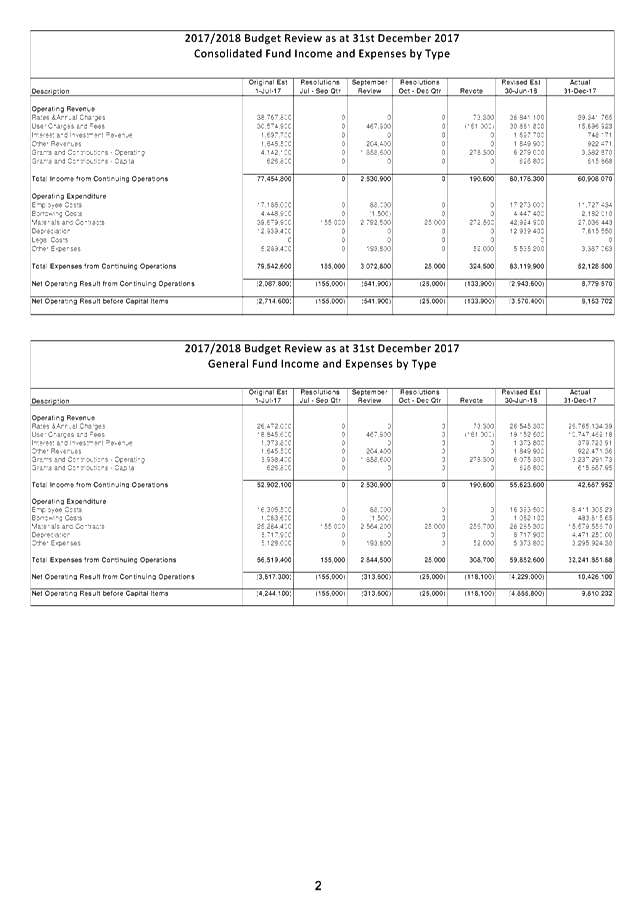

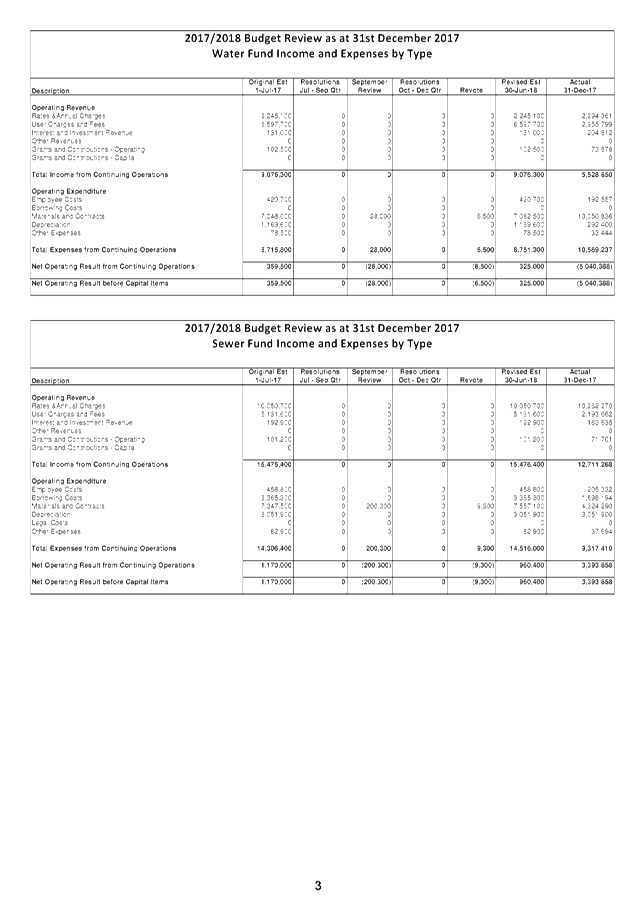

Income and Expenditure Budget Review Statement by Type

– This shows Councils income and Expenditure by type. This has been

split by Fund. Adjustments are shown, looking from left to right.

These adjustments are commented on through the last 16 pages of Attachment 1.

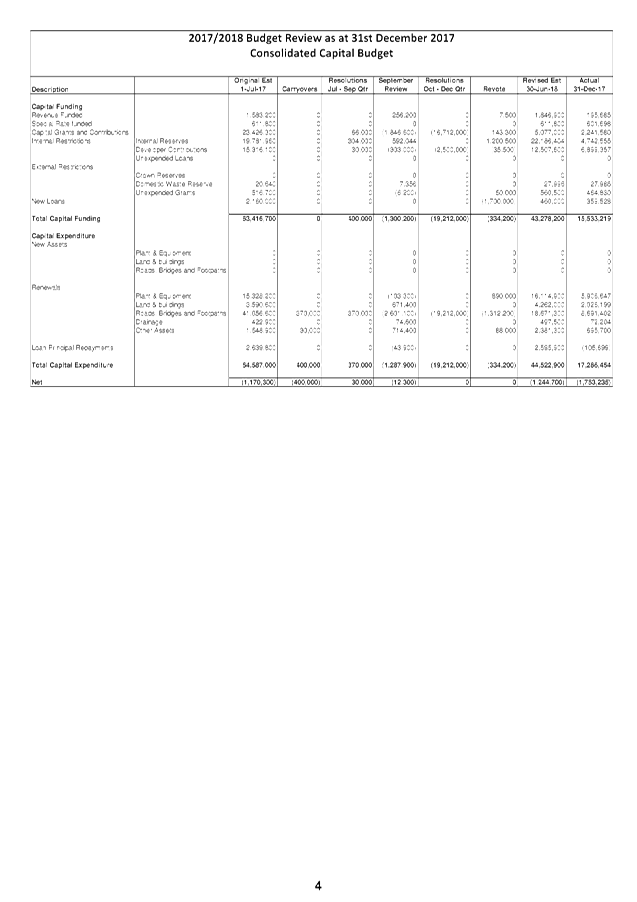

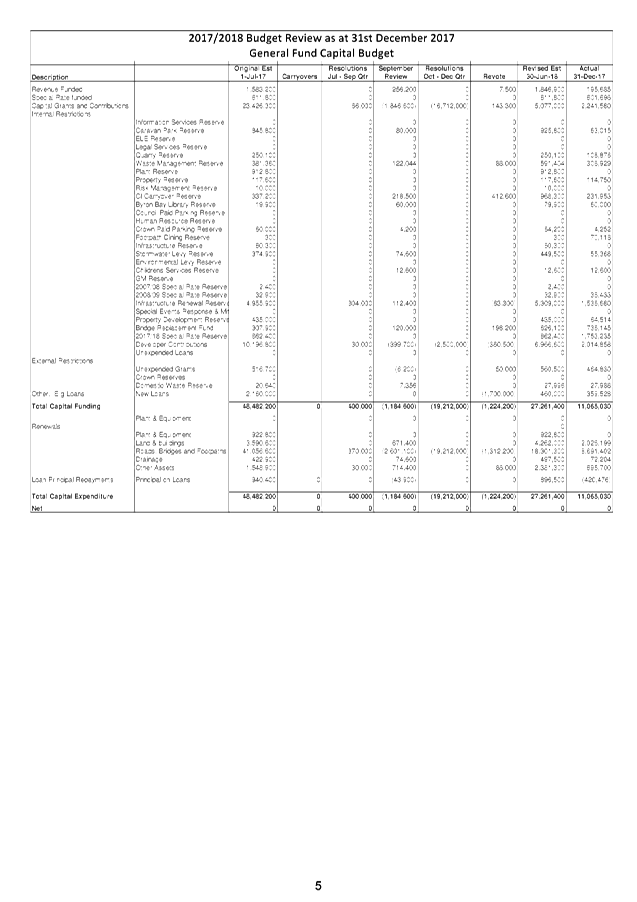

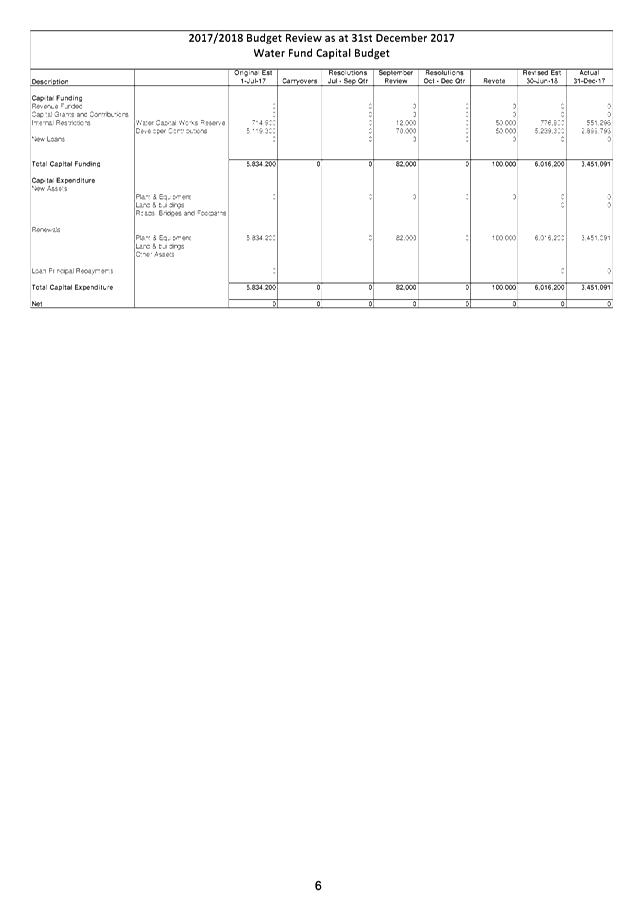

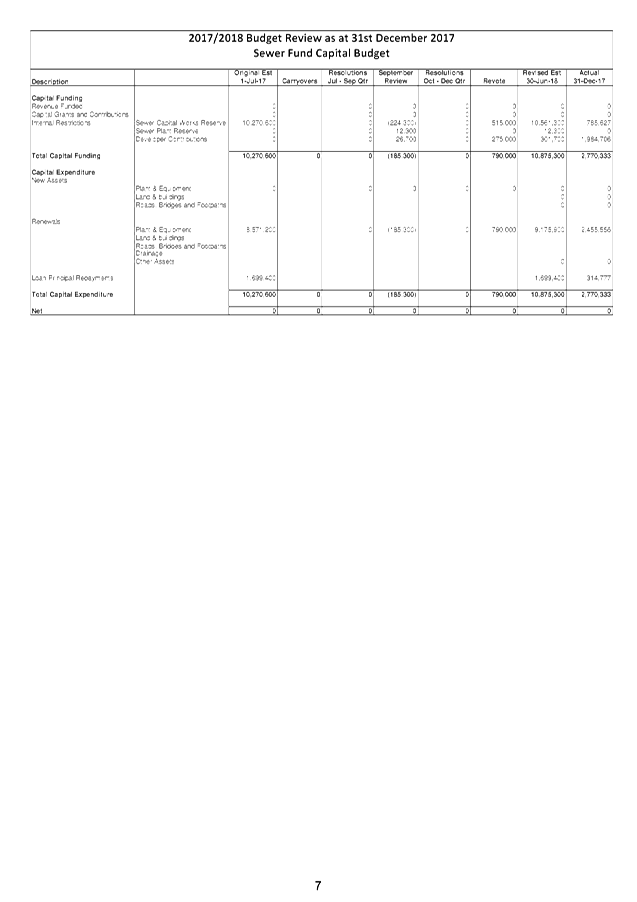

Capital Budget Review Statement – This

statement identifies in summary Council’s capital works program on a

consolidated basis and then split by Fund. It also identifies how the

capital works program is funded.

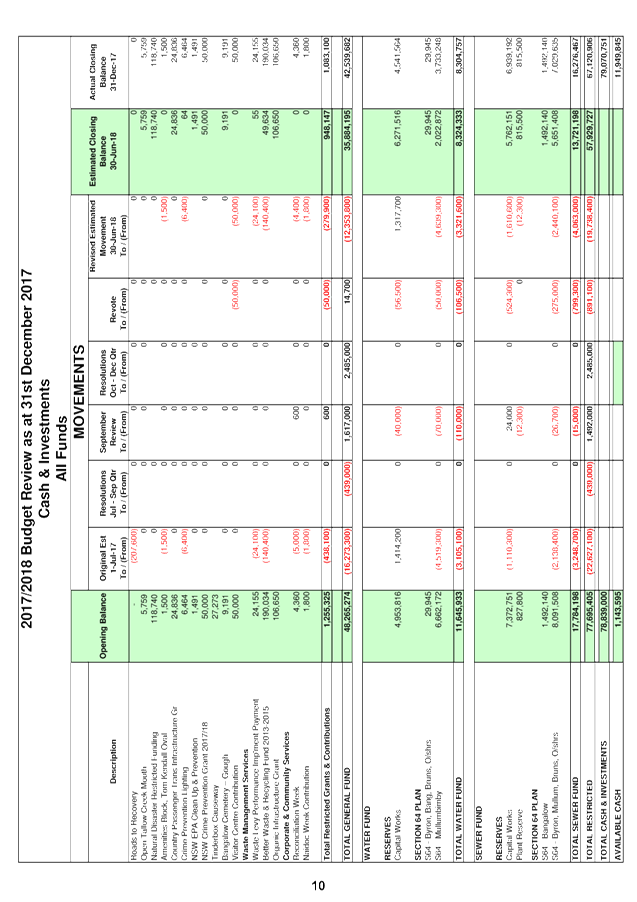

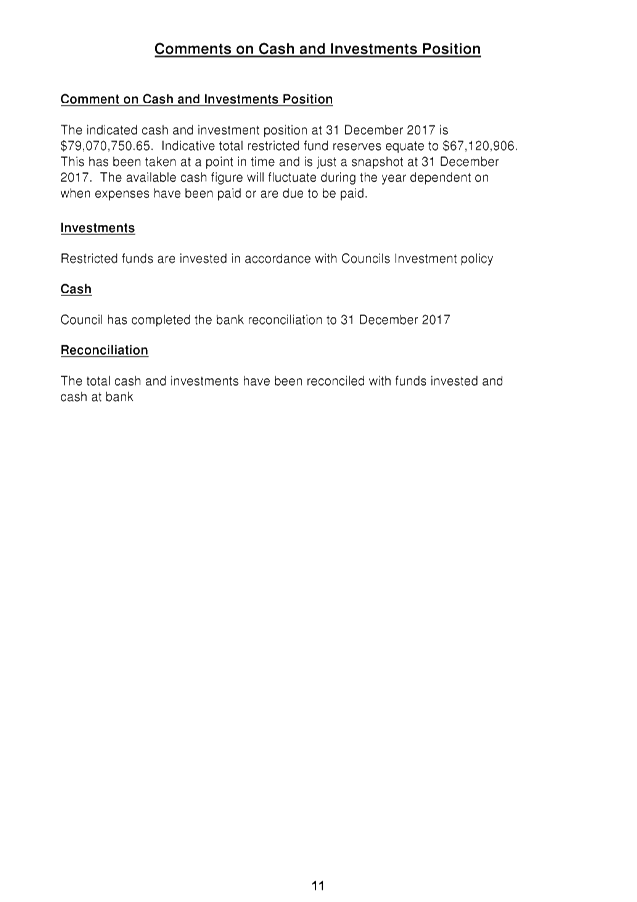

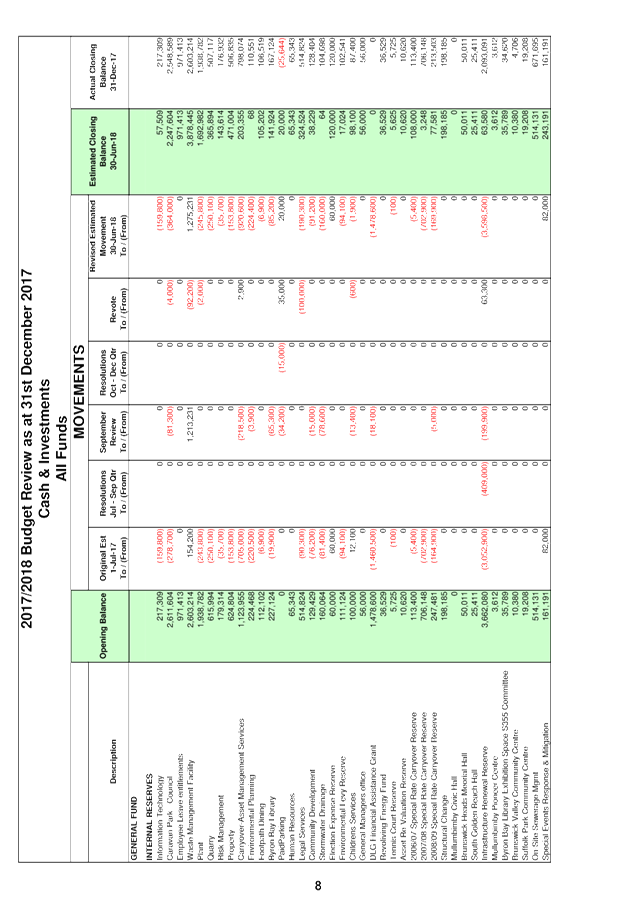

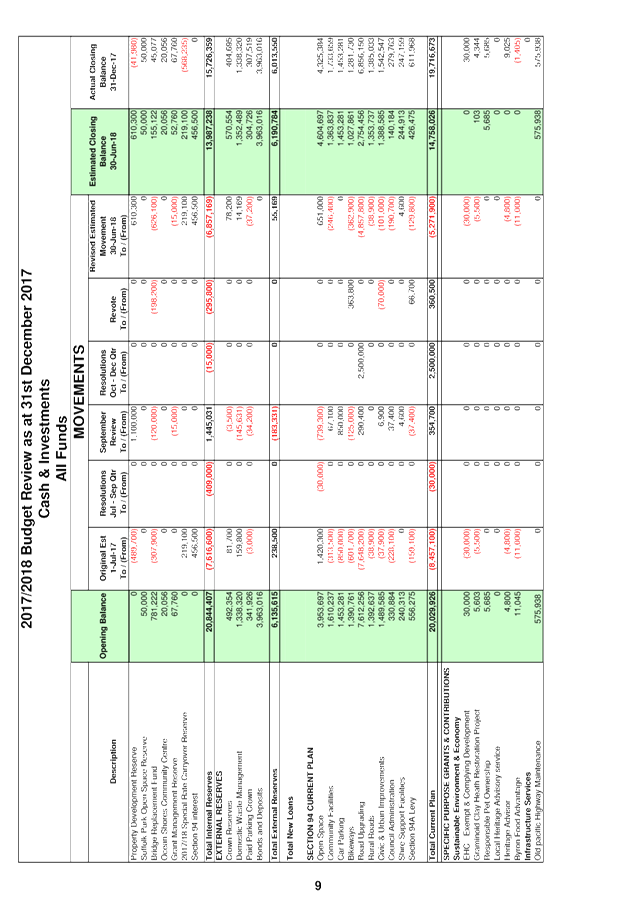

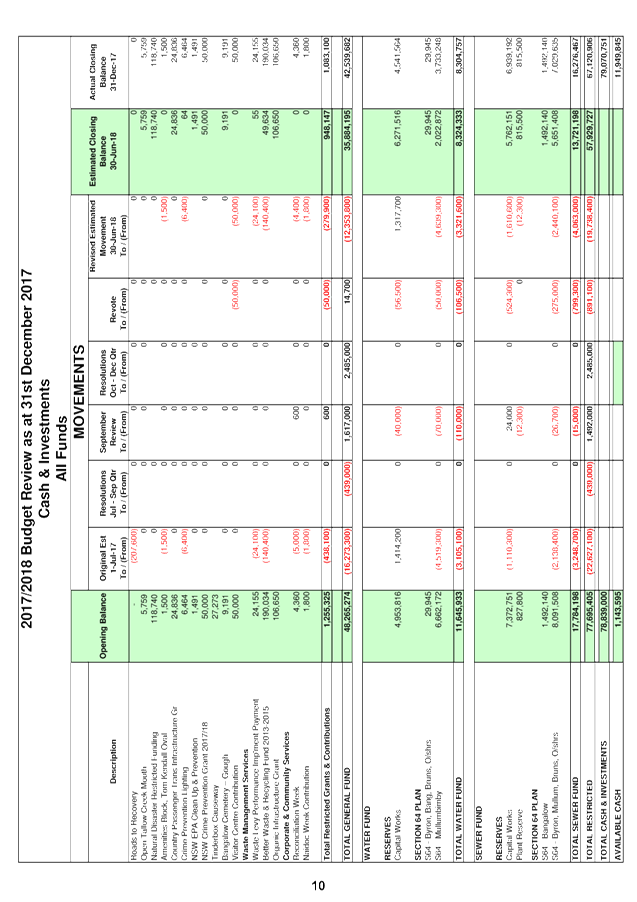

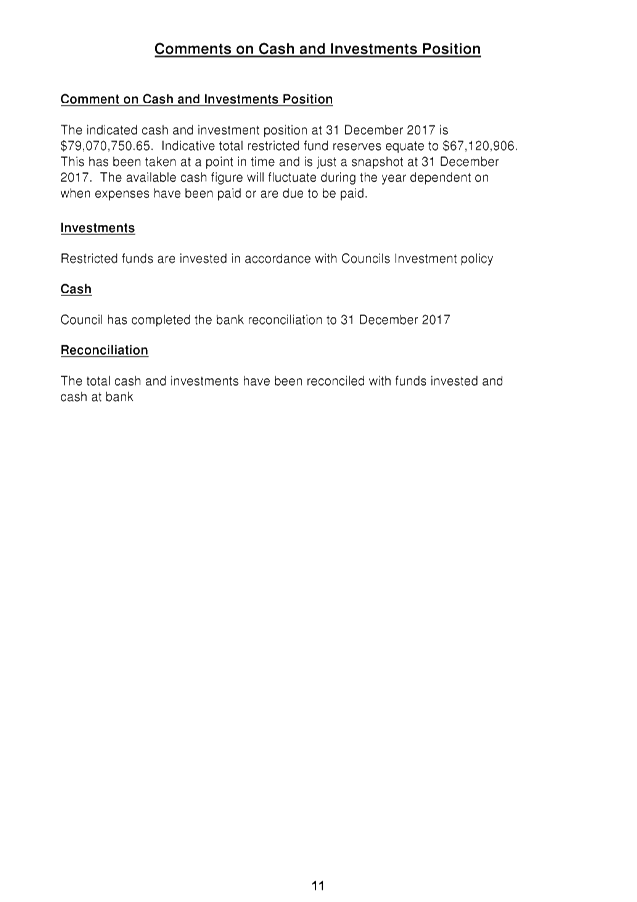

Cash and Investments Budget Review Statement – This

statement reconciles Council’s restricted funds (reserves) against

available cash and investments. Council has attempted to indicate an

actual position as at 31 December 2017 of each reserve to show a total cash

position of reserves with any difference between that position and total cash

and investments held as available cash and investments. It should be recognised

that the figure is at a point in time and may vary greatly in future quarterly

reviews pending on cash flow movements.

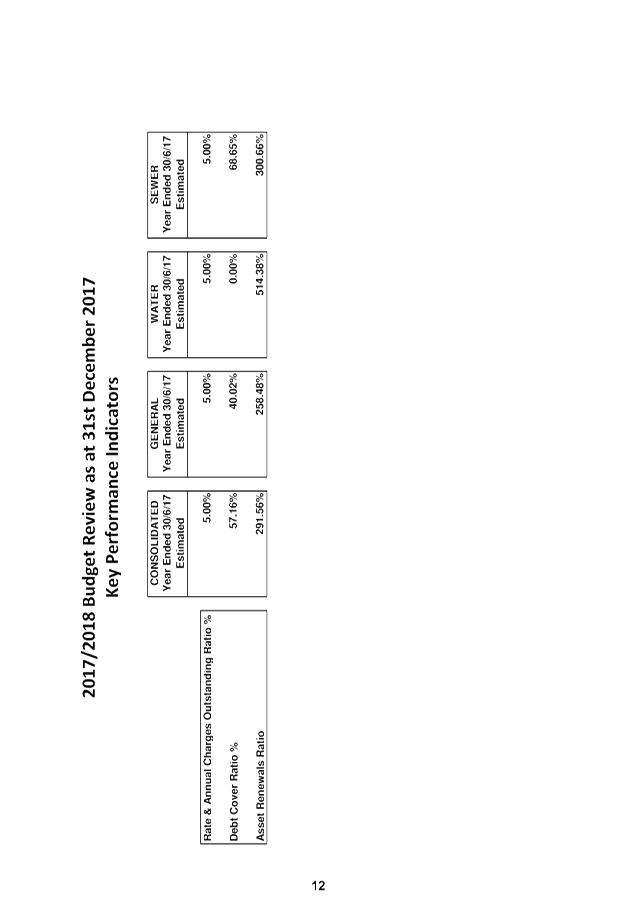

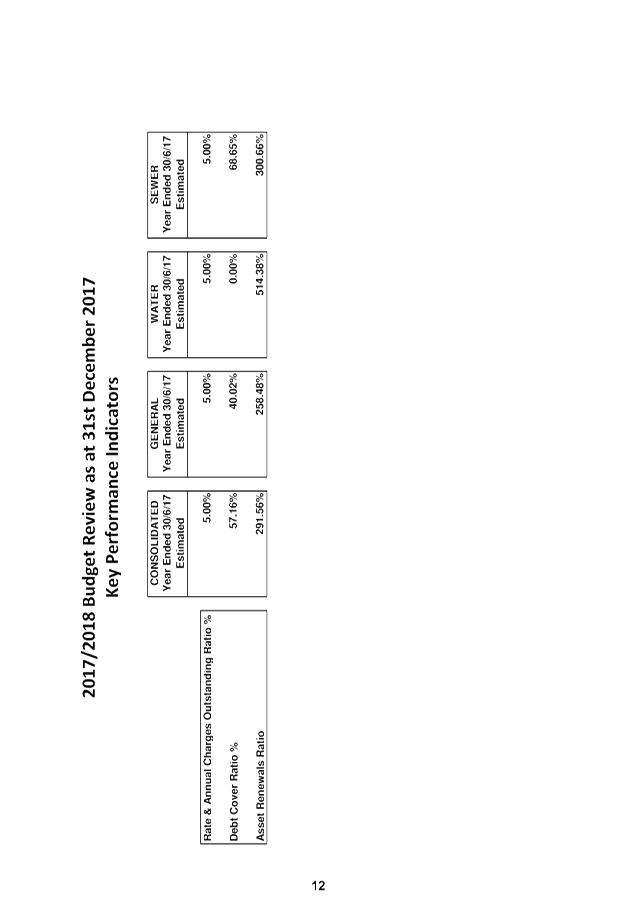

Key Performance Indicators (KPI’s) –

At this stage, the KPI’s within this report are:-

o Debt Service Ratio - This

assesses the impact of loan principal and interest repayments on the

discretionary revenue of Council.

o Rates and Annual Charges

Outstanding Ratio – This assesses the impact of uncollected rates and

annual charges on Councils liquidity and the adequacy of recovery efforts

o Asset Renewals Ratio – This

assesses the rate at which assets are being renewed relative to the rate at

which they are depreciating.

These may be expanded in future to accommodate any

additional KPIs that Council may adopt to use in the Long Term Financial Plan

(LTFP.)

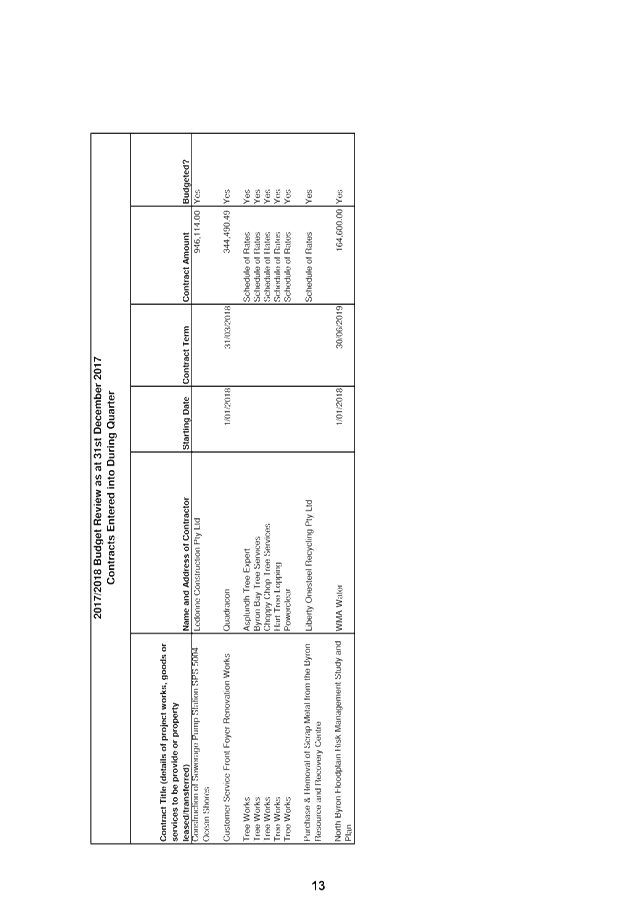

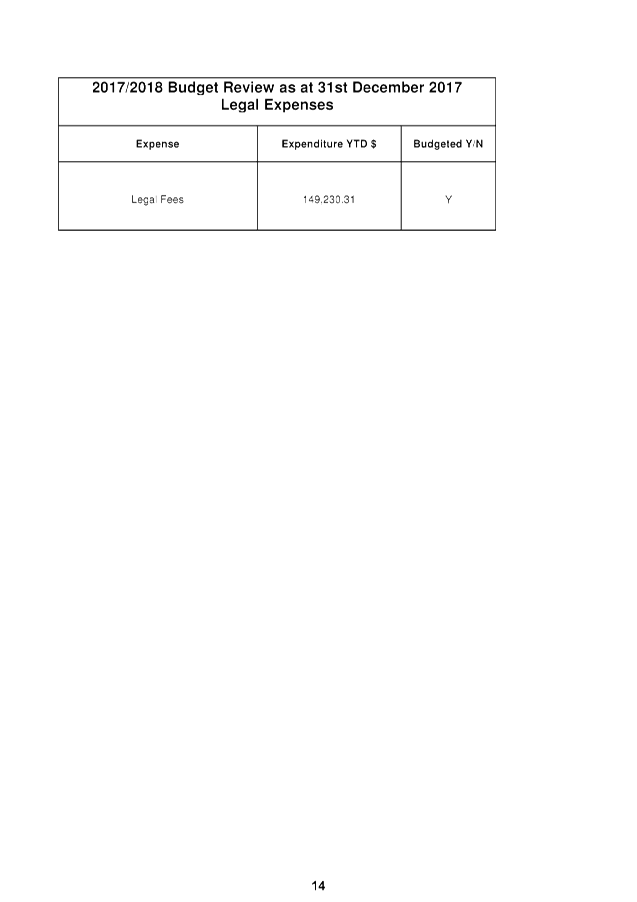

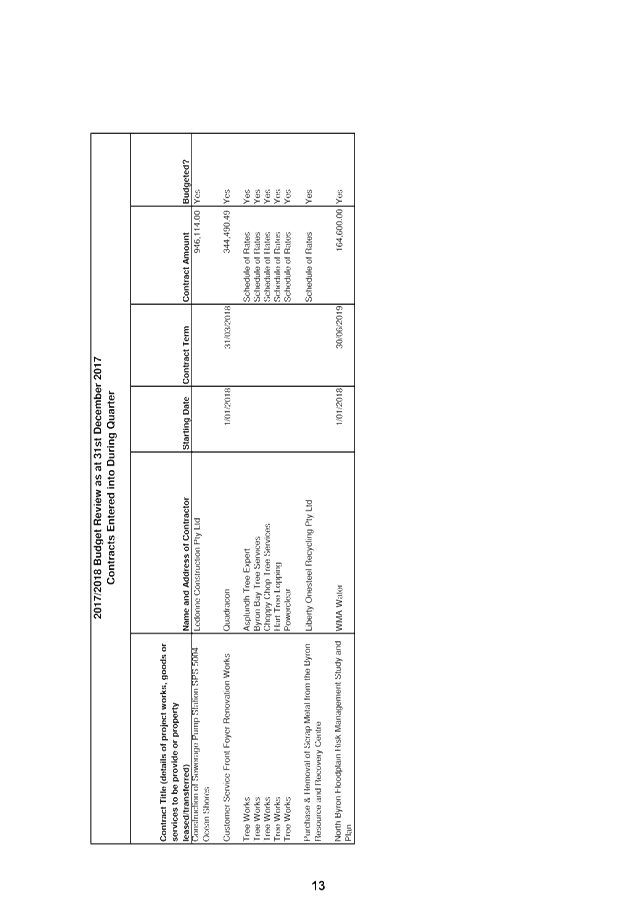

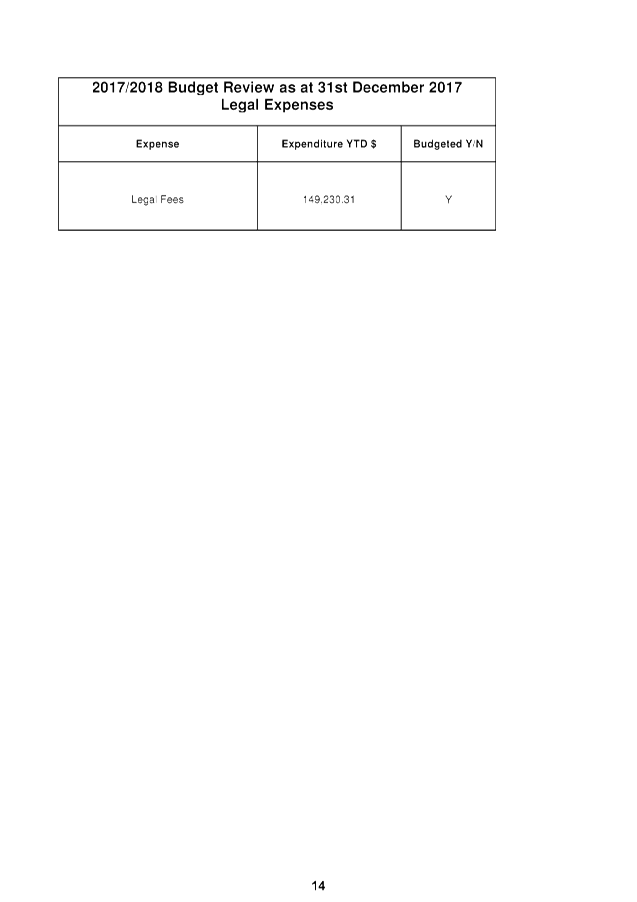

Contracts and Other Expenses - This report highlights any

contracts Council entered into during the October to December quarter that are

greater then $50,000.

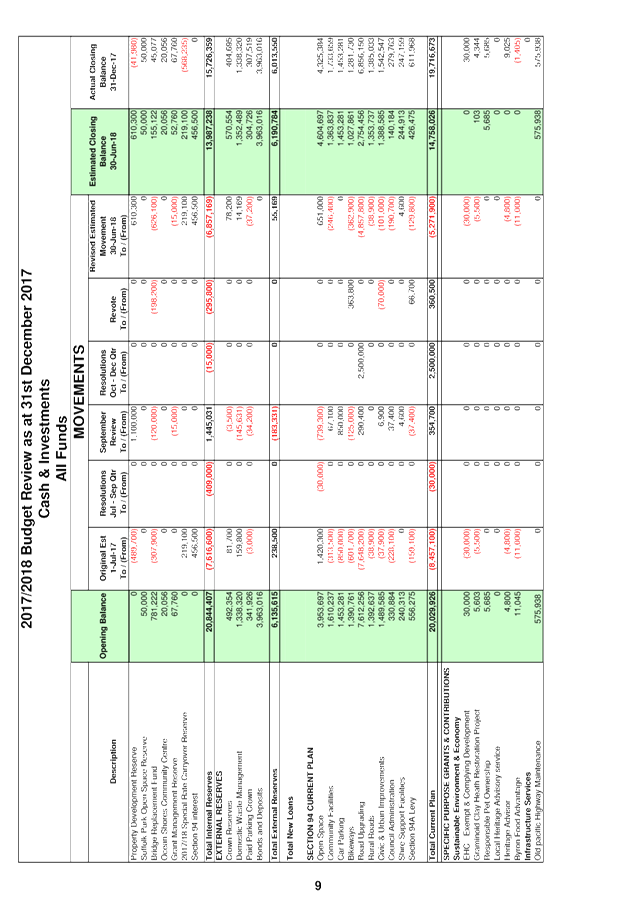

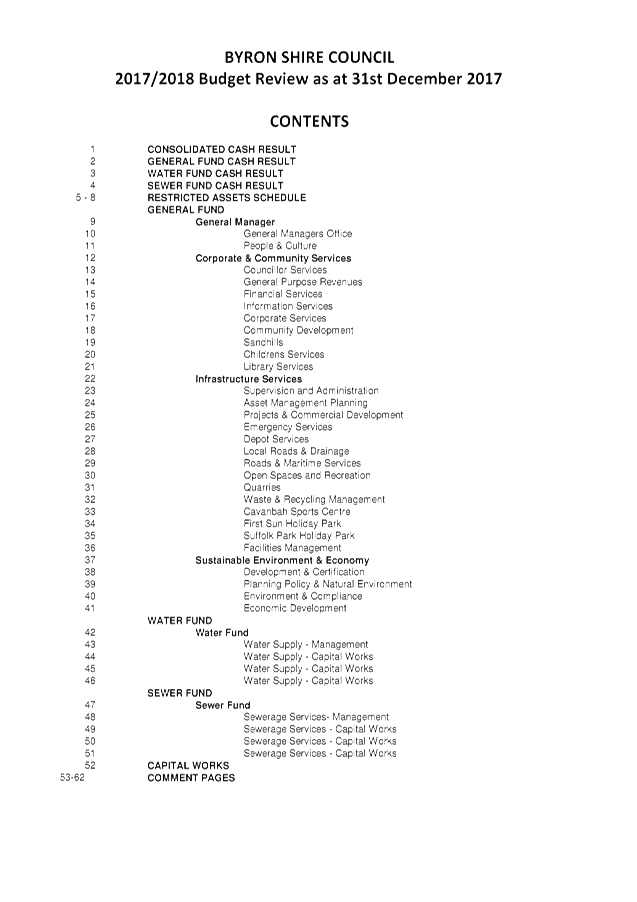

CONSOLIDATED RESULT

The following table provides a summary of the overall

Council budget on a consolidated basis inclusive of all Funds budget movements

for the 2017/2018 financial year projected to 30 June 2018 but revised as at 31

December 2017.

|

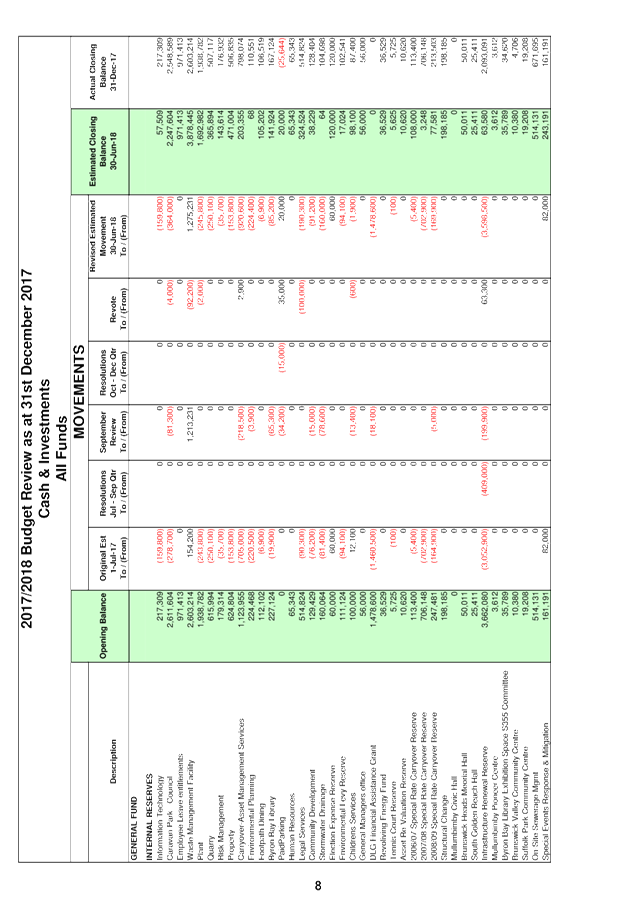

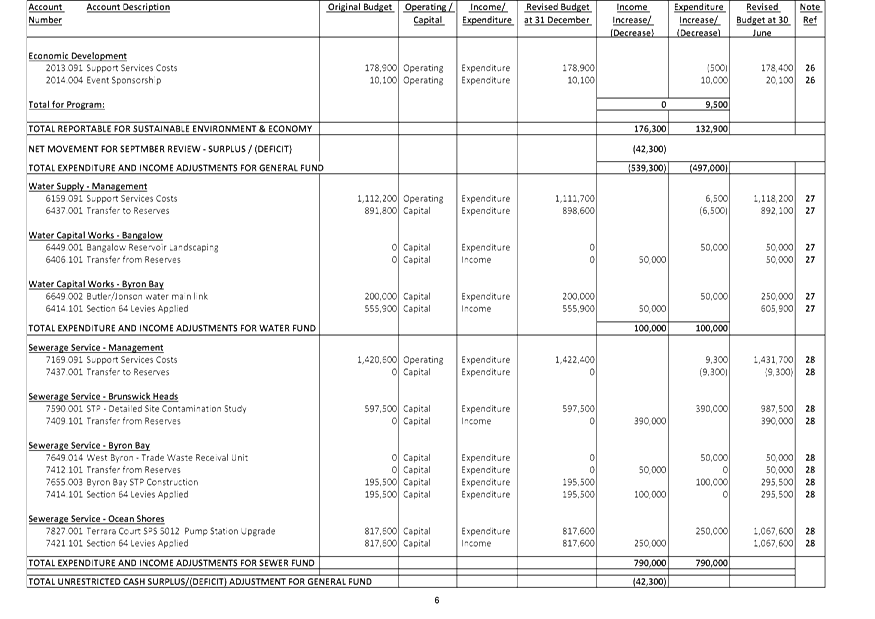

2017/2018 Budget Review Statement as at 31 December 2017

|

Original Estimate (Including Carryovers)

1/7/2017

|

Adjustments to 31 Dec 2017 including Resolutions*

|

Proposed 31 Dec 2017 Review Revotes

|

Revised Estimate 30/6/2018 at 31/12/2017

|

|

Operating Revenue

|

76,828,000

|

2,530,900

|

190,600

|

79,549,500

|

|

Operating Expenditure

|

79,542,600

|

3,252,800

|

324,500

|

83,119,900

|

|

Operating Result –

Surplus/Deficit

|

(2,714,600)

|

(721,900)

|

(133,900)

|

(3,570,400)

|

|

Add: Capital Revenue

|

27,790,000

|

(18,543,700)

|

143,300

|

9,389,600

|

|

Change in Net Assets

|

25,075,400

|

(19,265,600)

|

9,400

|

5,819,200

|

|

Add: Non Cash Expenses

|

12,939,400