Agenda

Extraordinary

Meeting

Thursday,

28 June 2018

held

at Council Chambers, Station Street, Mullumbimby

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 4.30pm

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Mark

Arnold

Acting

General Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Extraordinary Meeting

BUSINESS OF Extraordinary Meeting

1. Public Access

2. Apologies

3. Declarations of Interest

– Pecuniary and Non-Pecuniary

4. Staff Reports

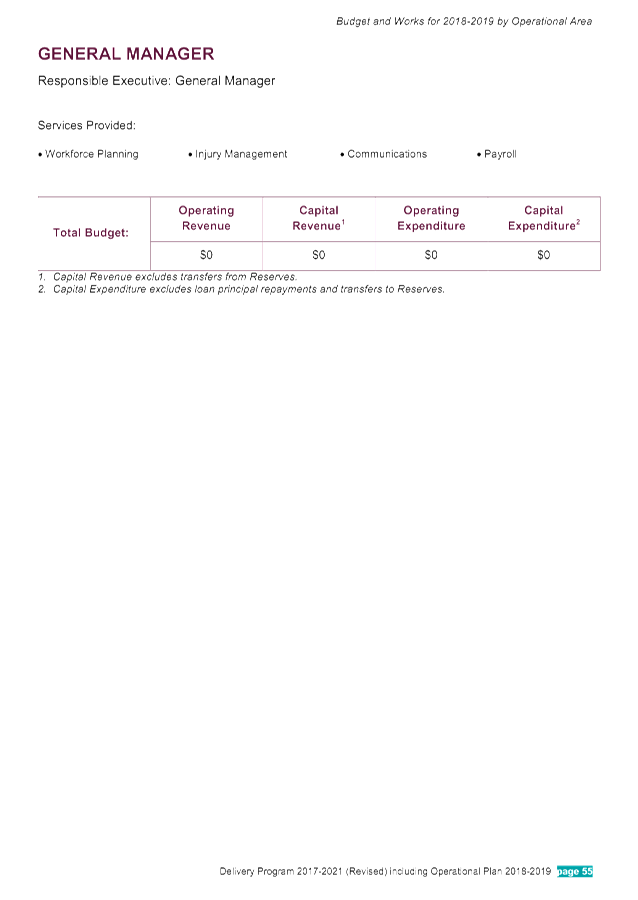

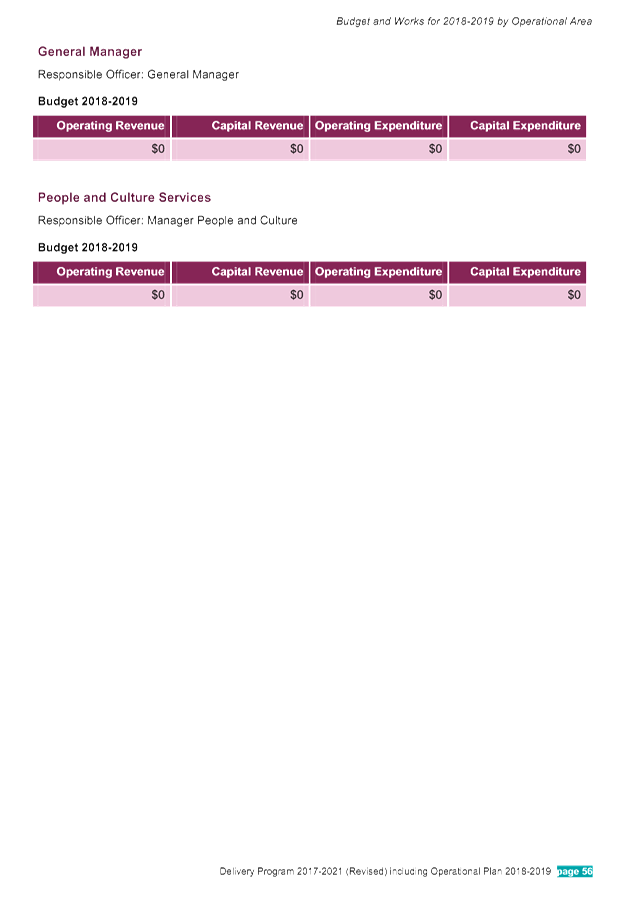

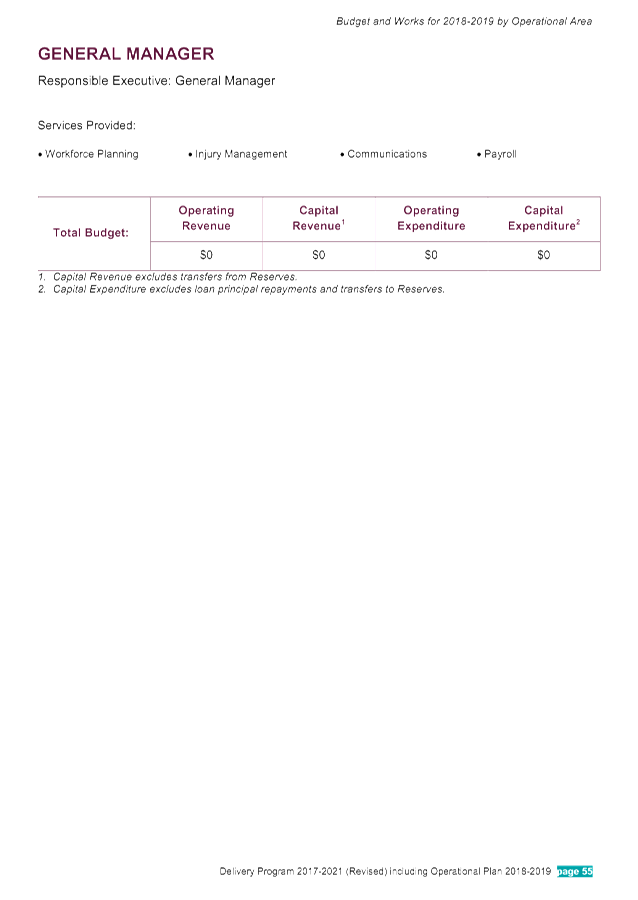

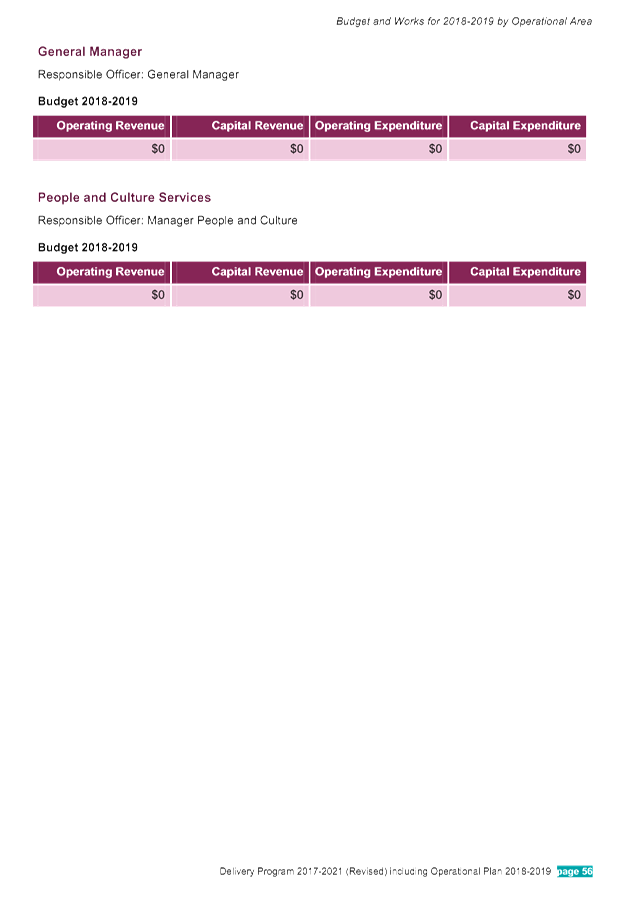

General Manager

4.1 Repurposing

of the old Byron Hospital site....................................................................... 4

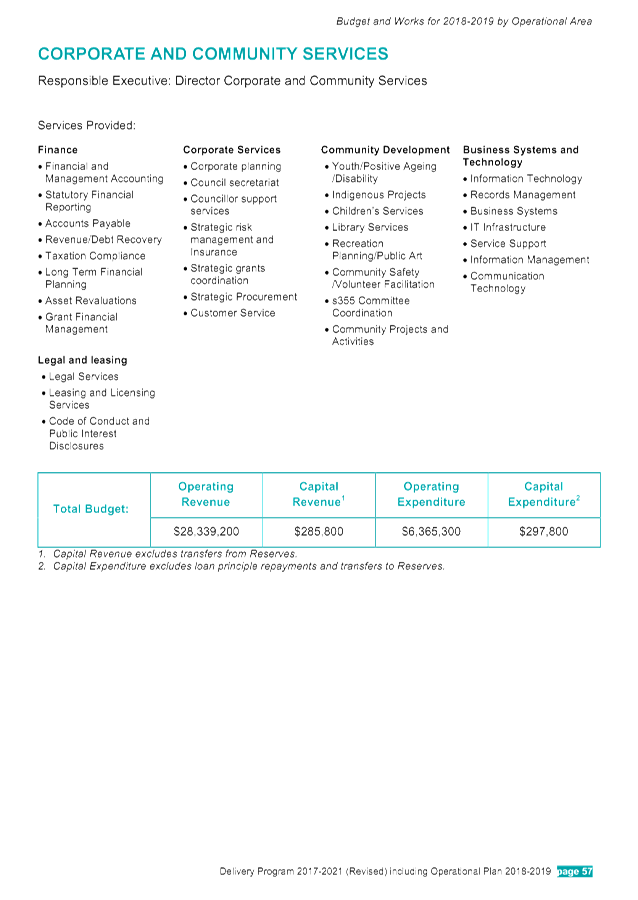

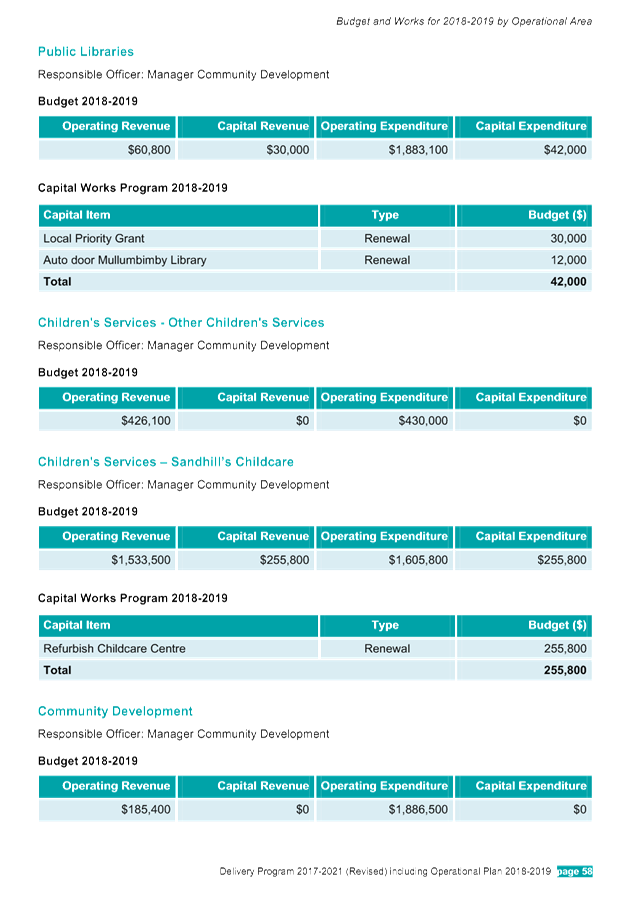

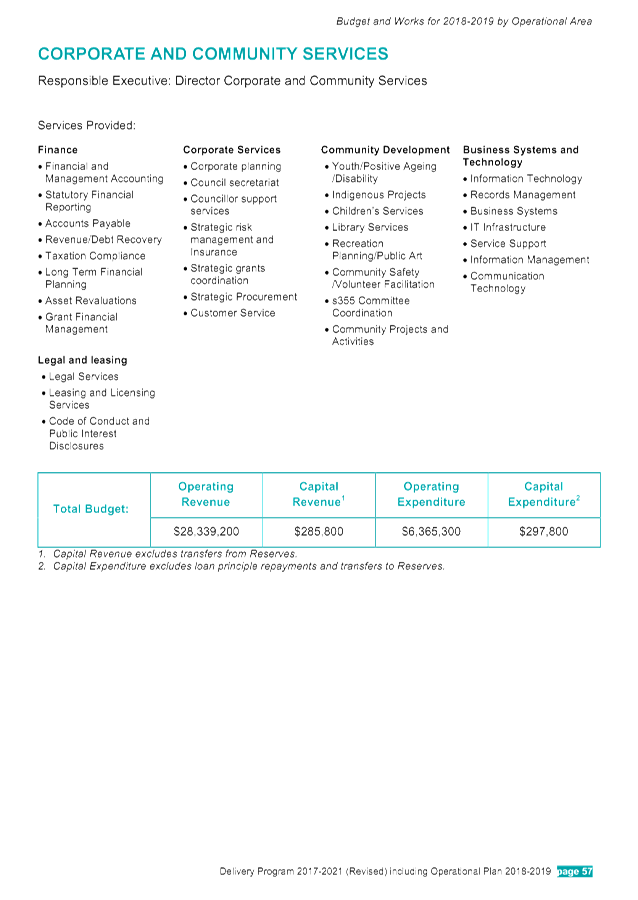

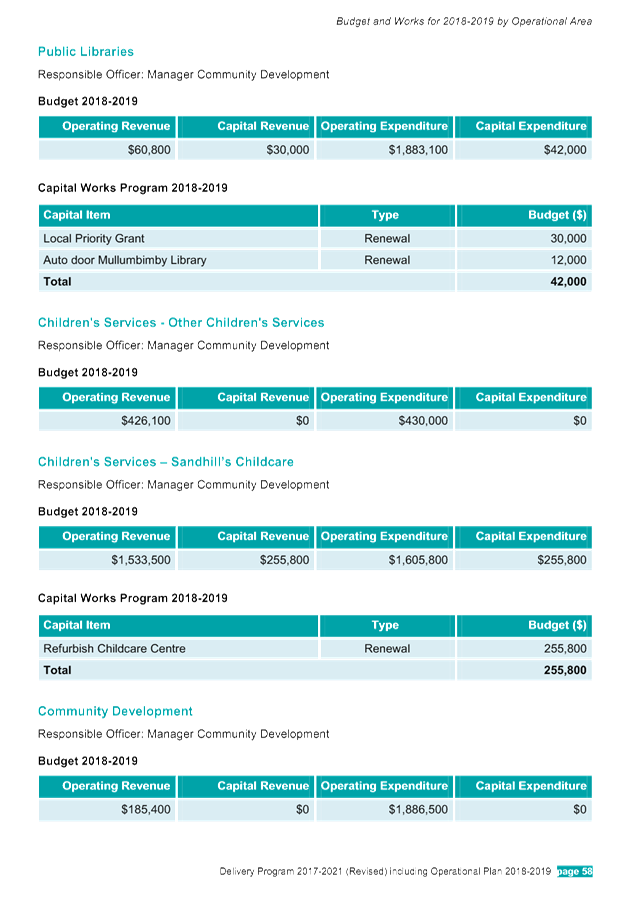

Corporate and Community Services

4.2 Adoption

of the Delivery Program 2017-2021 (Revised) and Operational Plan 2018-2019,

including Statement of Revenue Policy, Budget, Fees and Charges.............................................. 7

4.3 Making

of the 2018/2019 Ordinary Rates and Charges .............................................. 172

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Executive Manager prior to the meeting. Any suggested amendments to

the recommendations should be provided to the Administration section prior to

the meeting to allow the changes to be typed and presented on the overhead

projector at the meeting.

Staff Reports - General Manager 4.1

Staff Reports - General Manager

Report No. 4.1 Repurposing

of the old Byron Hospital site

Directorate: General

Manager

Report

Author: Claire

McGarry, Place Manager - Byron Bay

File No: I2018/1149

Theme: Corporate Management

Community Development

Summary:

In December 2017, Council resolved to work alongside the

Byron Bay community to provide a community focused use of the old Byron Bay

hospital site.

This report provides an update on the project and outlines

next steps.

|

RECOMMENDATION:

1. That

Council write to the NSW Health Minister to support the proposal for the

repurposing of the old Byron Hospital site into the Byron Community Hub.

2. That

staff continue to work with NSW Health and the Byron Community Hub

Steering Committee to progress the project, providing updates to Council as

required.

|

Attachments:

1 Confidential

- Proposal - Byron Hospital Site, E2018/51938

2 Confidential

- Appendix A - Architectural Drawings Byron Hospital Site.pdf, E2018/52822

3 Confidential

- Appendix B - Cost Estimates for building reparation.pdf, E2018/52823

4 Confidential

- Appendix C - Hospital Site financial modelling - Income.pdf, E2018/52820

5 Confidential

- Appendix D - Property NSW Remediation Options for Former Byron Bay District

Hospital Site.pdf, E2018/52821

Report

In December 2017, Council resolved:

That

Council write to NSW Health and Health Minister to:

1.

outline Council’s interest in working alongside the Byron

Bay community to provide a community focused use of the old Byron Bay hospital

site.

2. request

NSW Health to defer any decision on any potential sale of the site for six

months, in order for Council and a partnership with the community to form and

develop a proposal to either purchase the site or pursue a long term lease

arrangement.

Staff have been working with the local Steering Committee to

develop a proposal to be tabled for consideration by the State Government.

The proposal (attached) is for the repurposing of the old

Byron Hospital site into the Byron Community Hub providing vital and currently

lacking welfare, social, cultural and educational services. The Proposal and

the Appendices have been made confidential for the purpose of this report, as

these documents contain information that is considered to be commercial in

confidence.

In summary, the proposal is that:

· The NSW Government

retains the Byron Bay Hospital asset

· A $2.5m reparation

project is funded by the NSW Government (+$200,000 site remediation)

· The asset is

re-purposed to provide office and open space for the provision of welfare,

health, education and cultural services to the Byron Bay Community in a 40 year

lease agreement on a peppercorn rent with the option to purchase at market

value at any time during the lease or as the Trustee for the site

· Byron Shire Council is appointed as Lessee / Trustee on behalf of

the Byron Community subject to conditions agreed upon by both parties, and is

responsible for overseeing a facilities team to manage and maintain the

facility, its tenants and its relationship with the community

· Affordable (below

market) rental accommodation is offered to organisations representing the welfare,

health, education and cultural sectors to create a vibrant community hub of

complimentary offerings

· Rents are

structured in three tiers – Tier 1 highest being for commercial

organisations with Tier 3 being zero cost space for community projects

· Following a

transition period to full occupancy, income from the facility will be

distributed back to community organisations on a merit basis.

The proposal has broad community and political support, with

over 85 letters of support being submitted to Council during the consultation

process. Once collated, these will be attached to the proposal.

The proposal will be delivered to Ben Franklin MLC by the 30th

June 20108 for consideration by the NSW Government.

Financial Implications

The proposal is for a long-term peppercorn lease on the site

or to have Council appointed as the Trustee, with a $2.5m reparation project

funded by the NSW Government.

Council staff resources will be required for initial

establishment of the governance and financial operations of the project, as

well as potentially project management of the site and building remediation.

Statutory and Policy Compliance Implications

N/A

Staff Reports - Corporate and Community Services 4.2

Staff Reports - Corporate and Community

Services

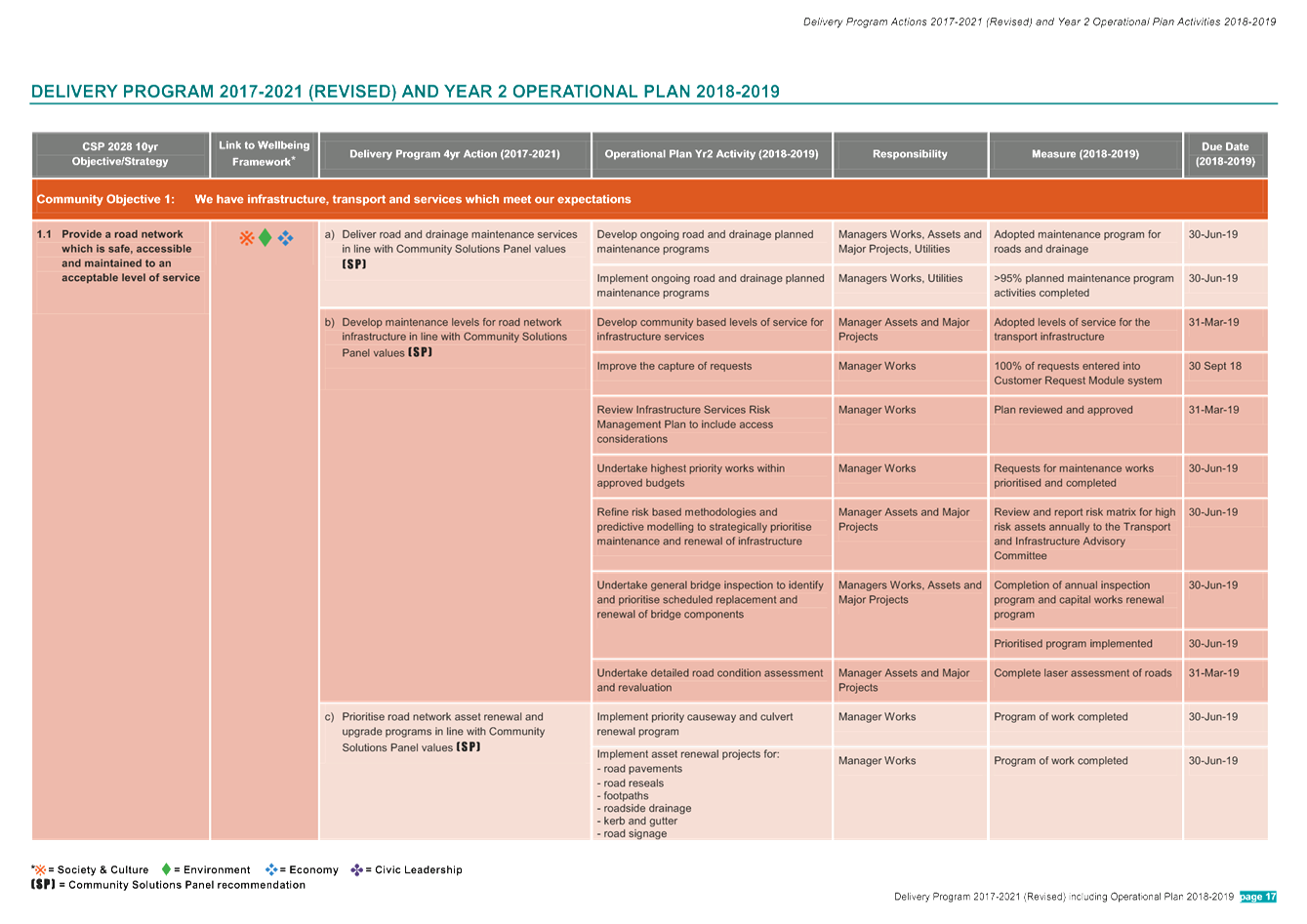

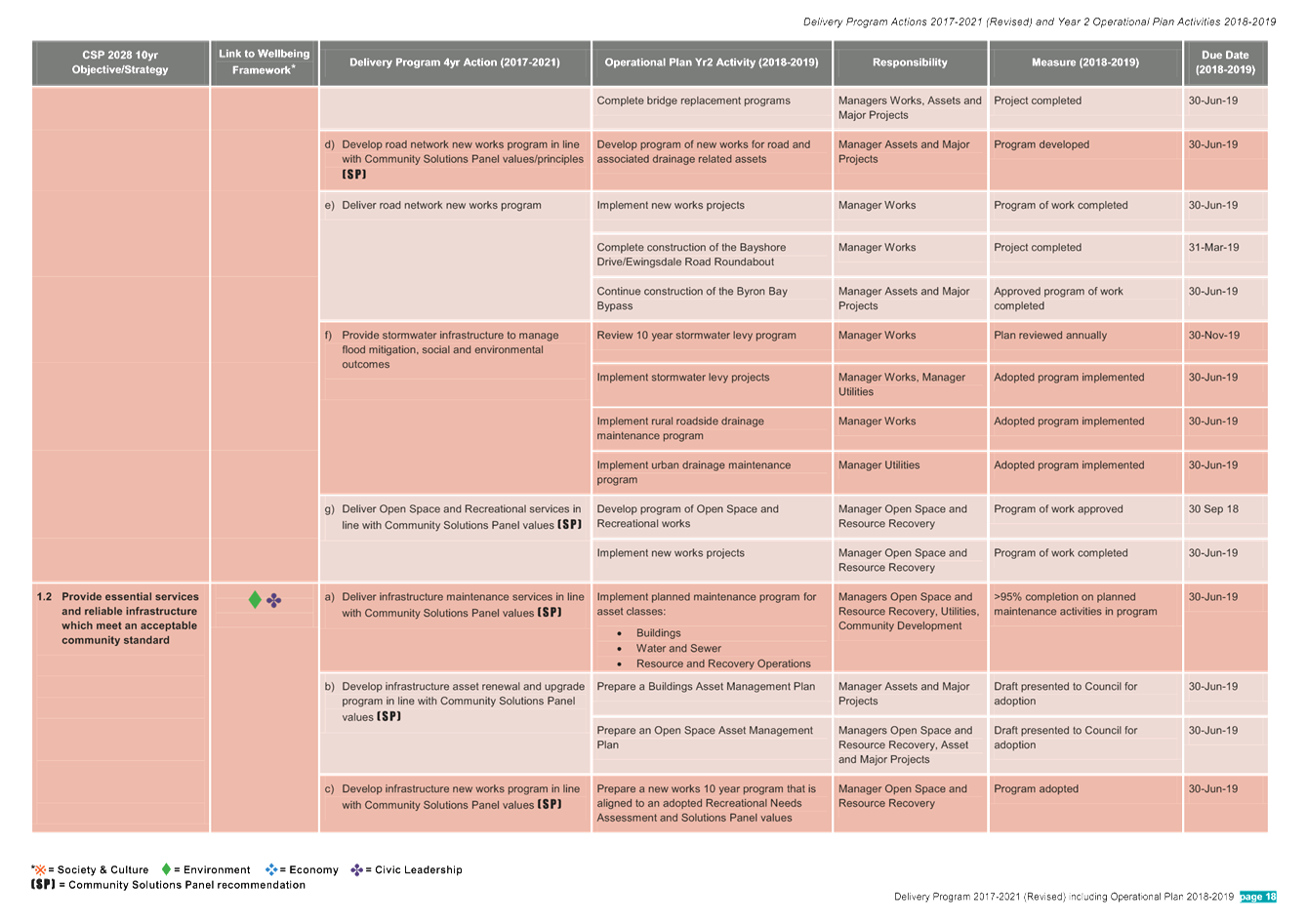

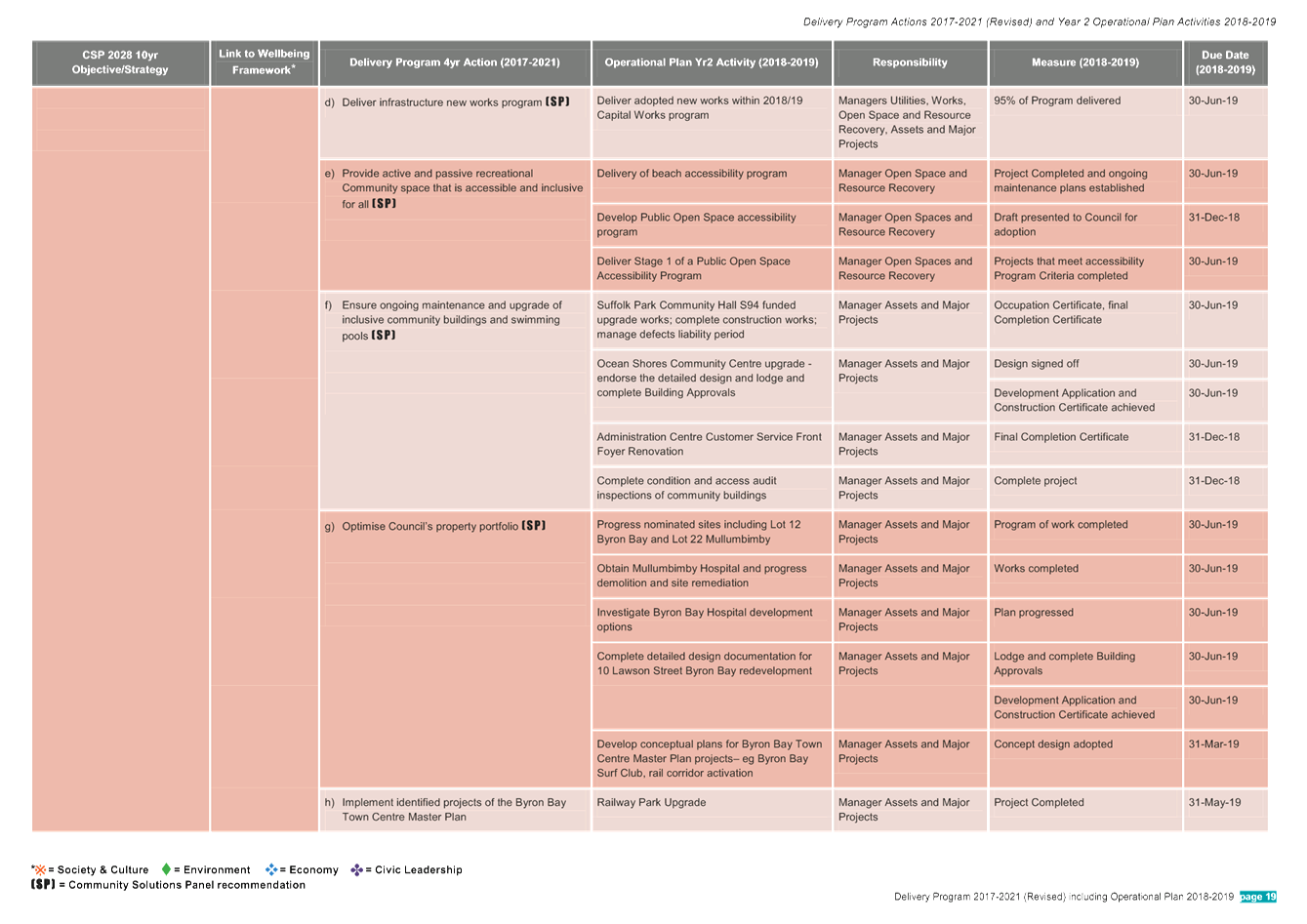

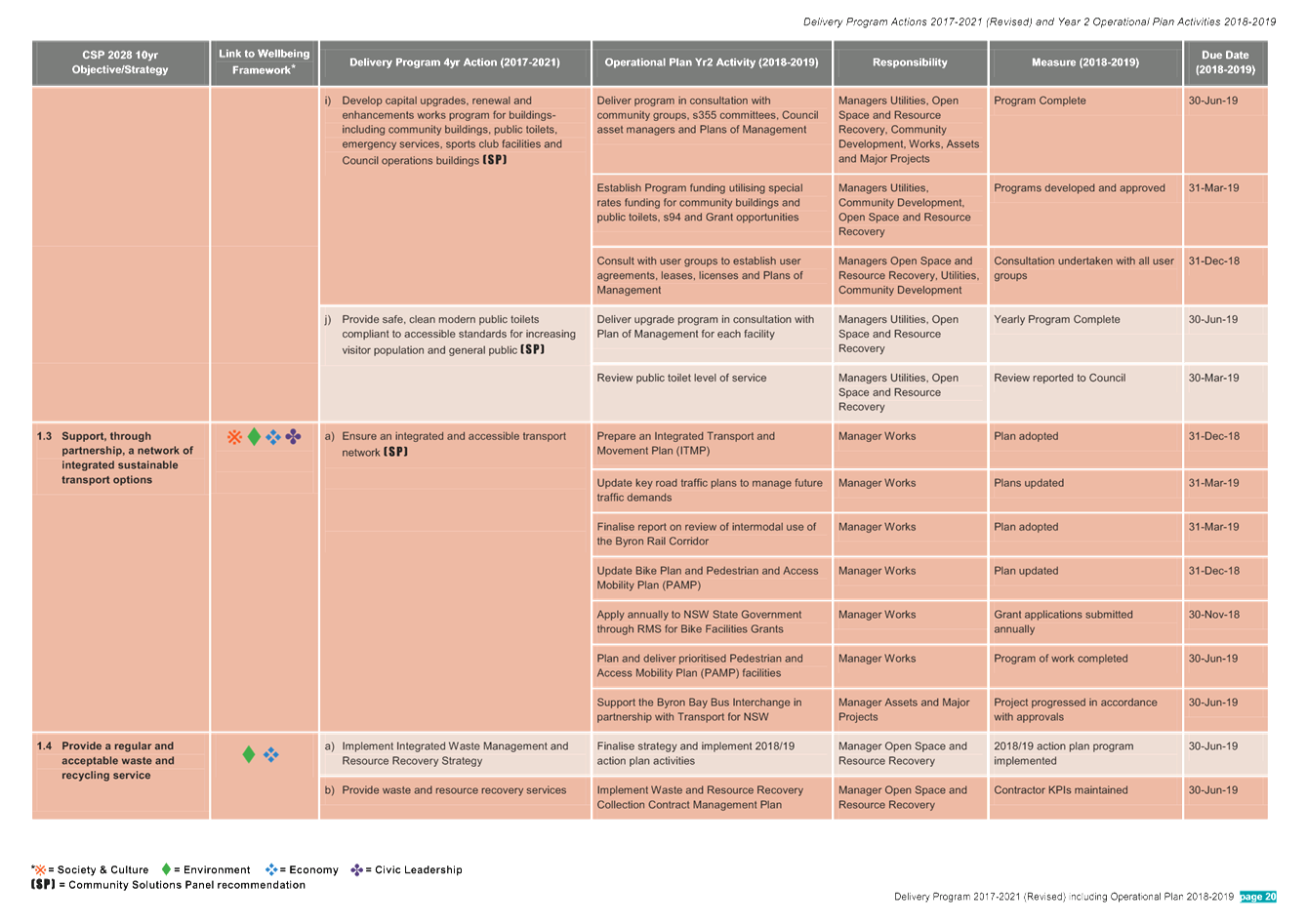

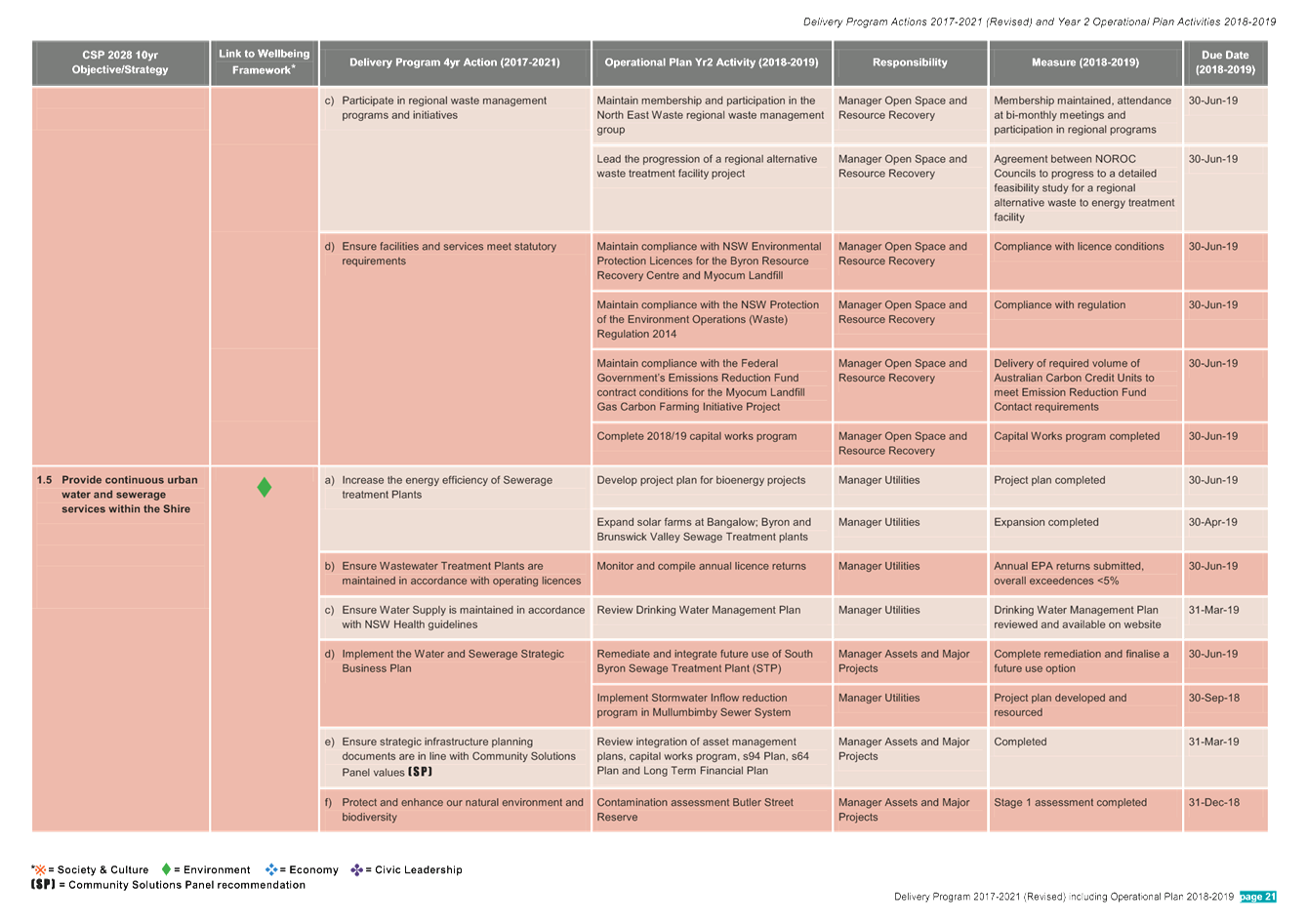

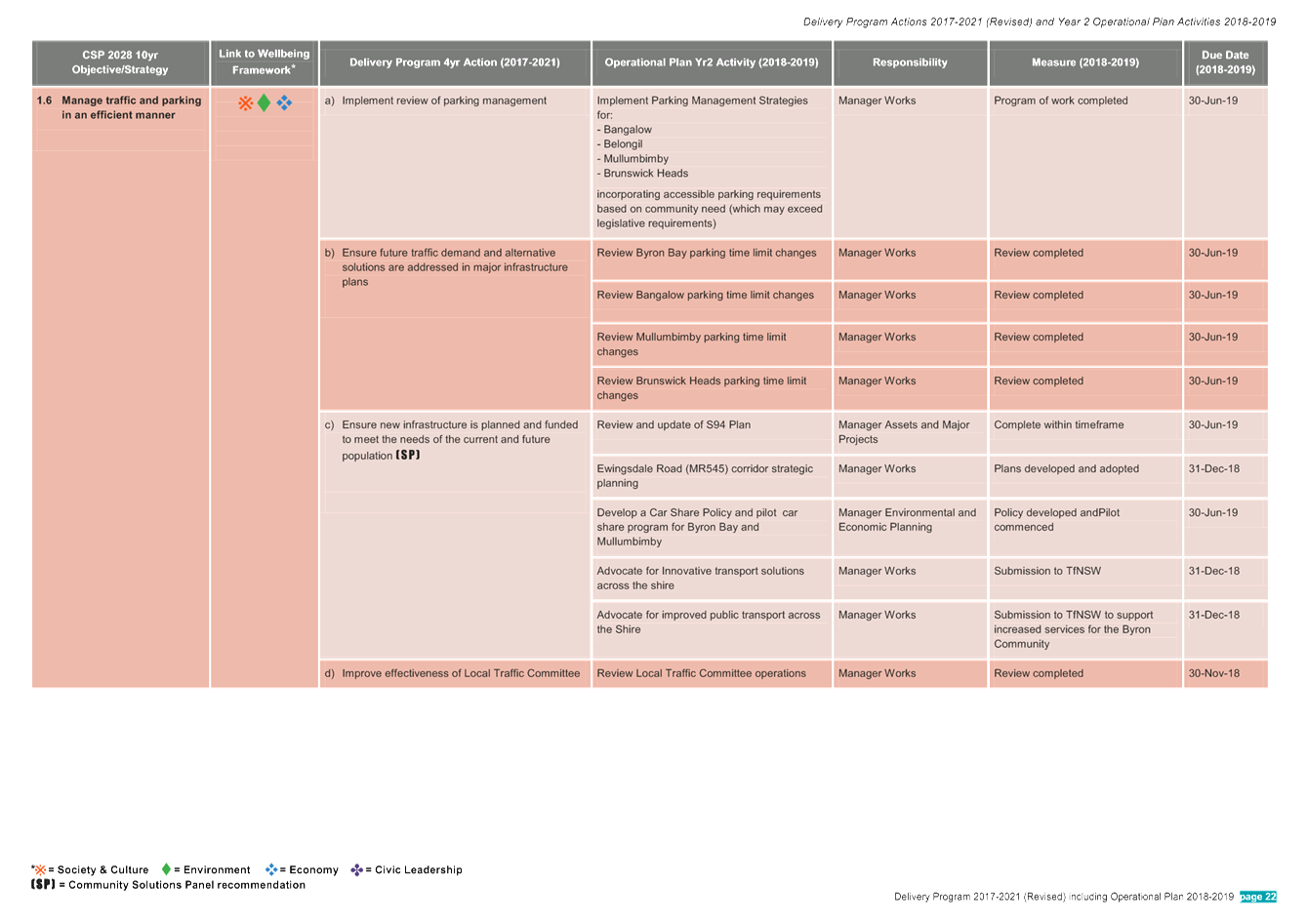

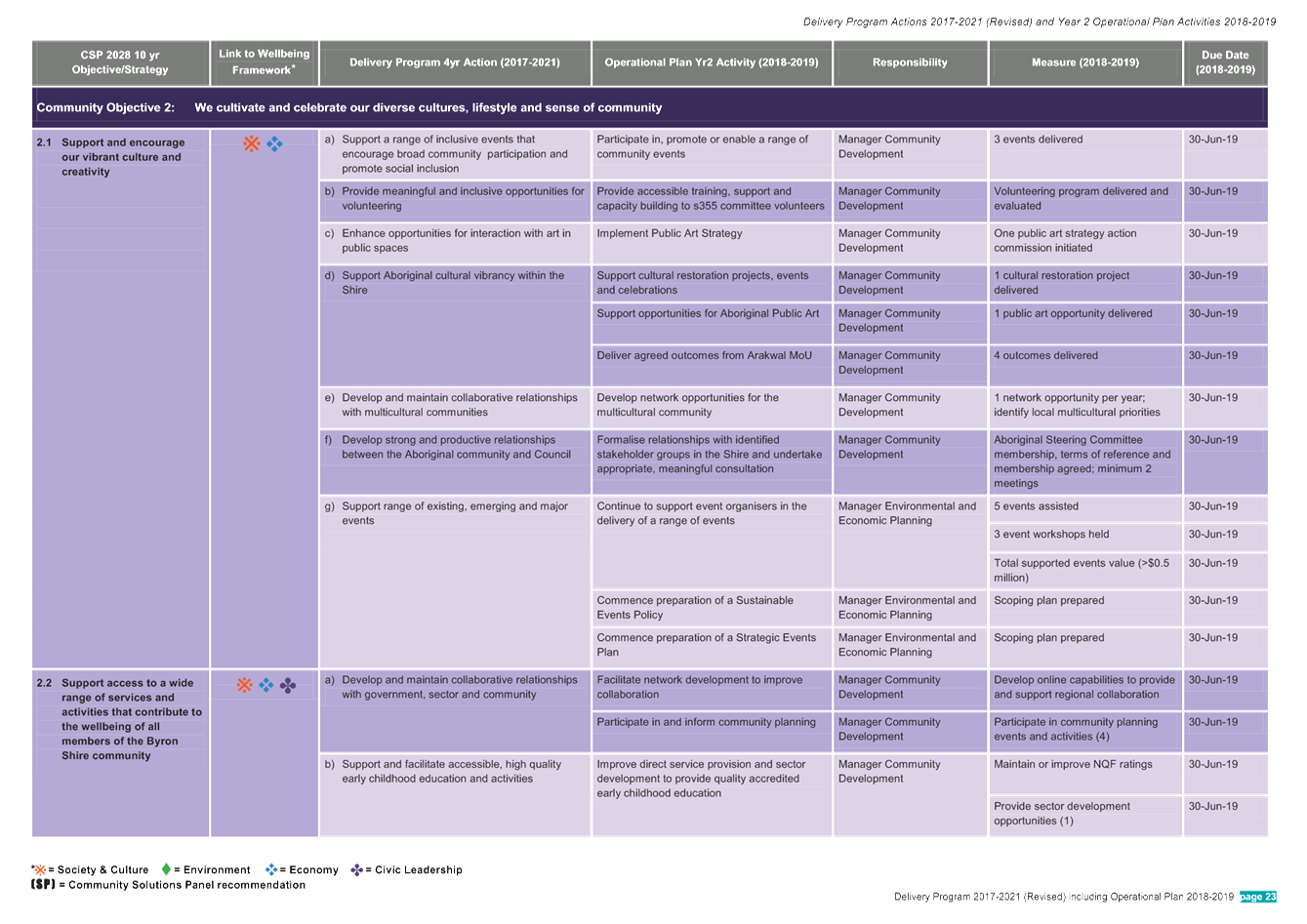

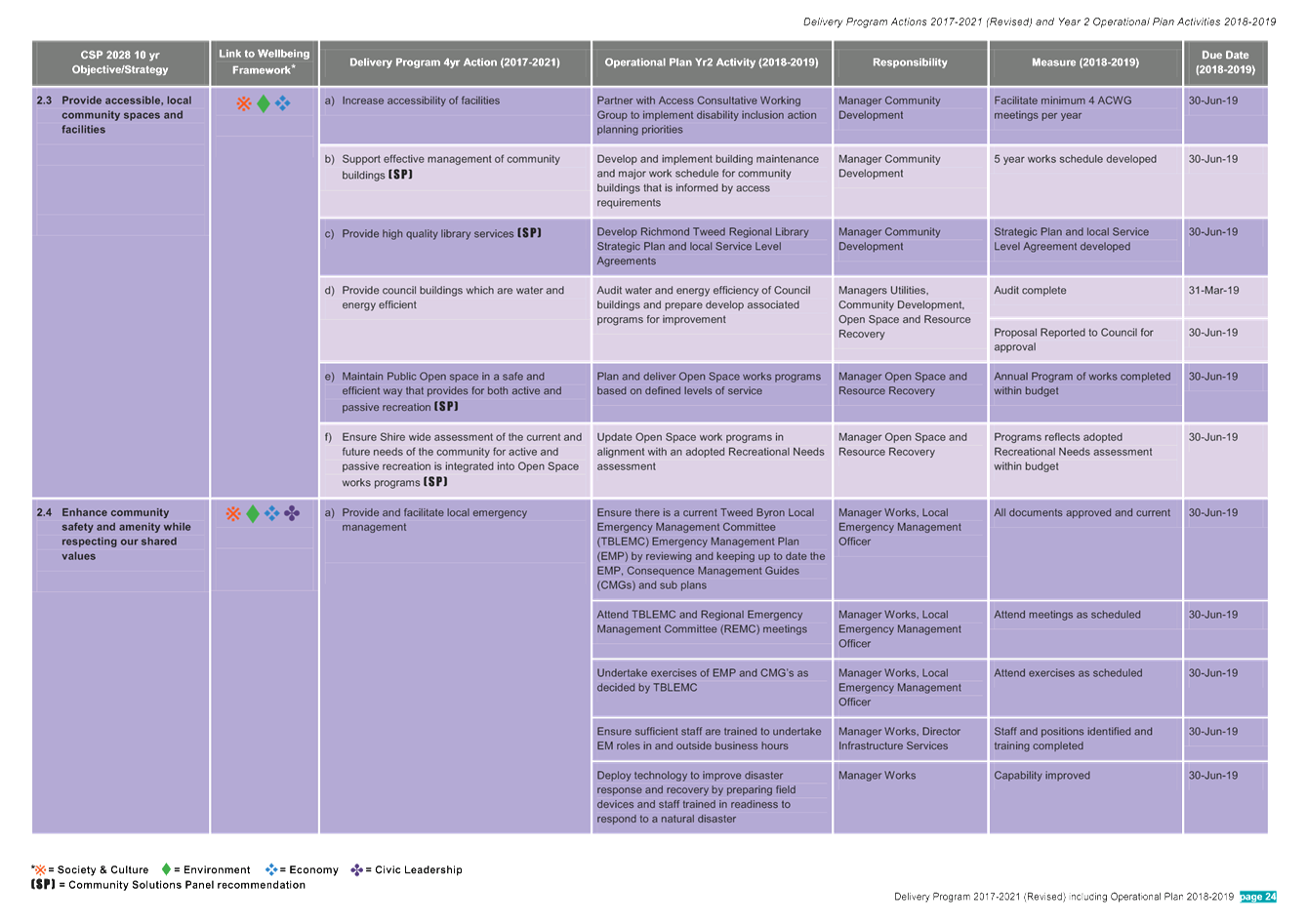

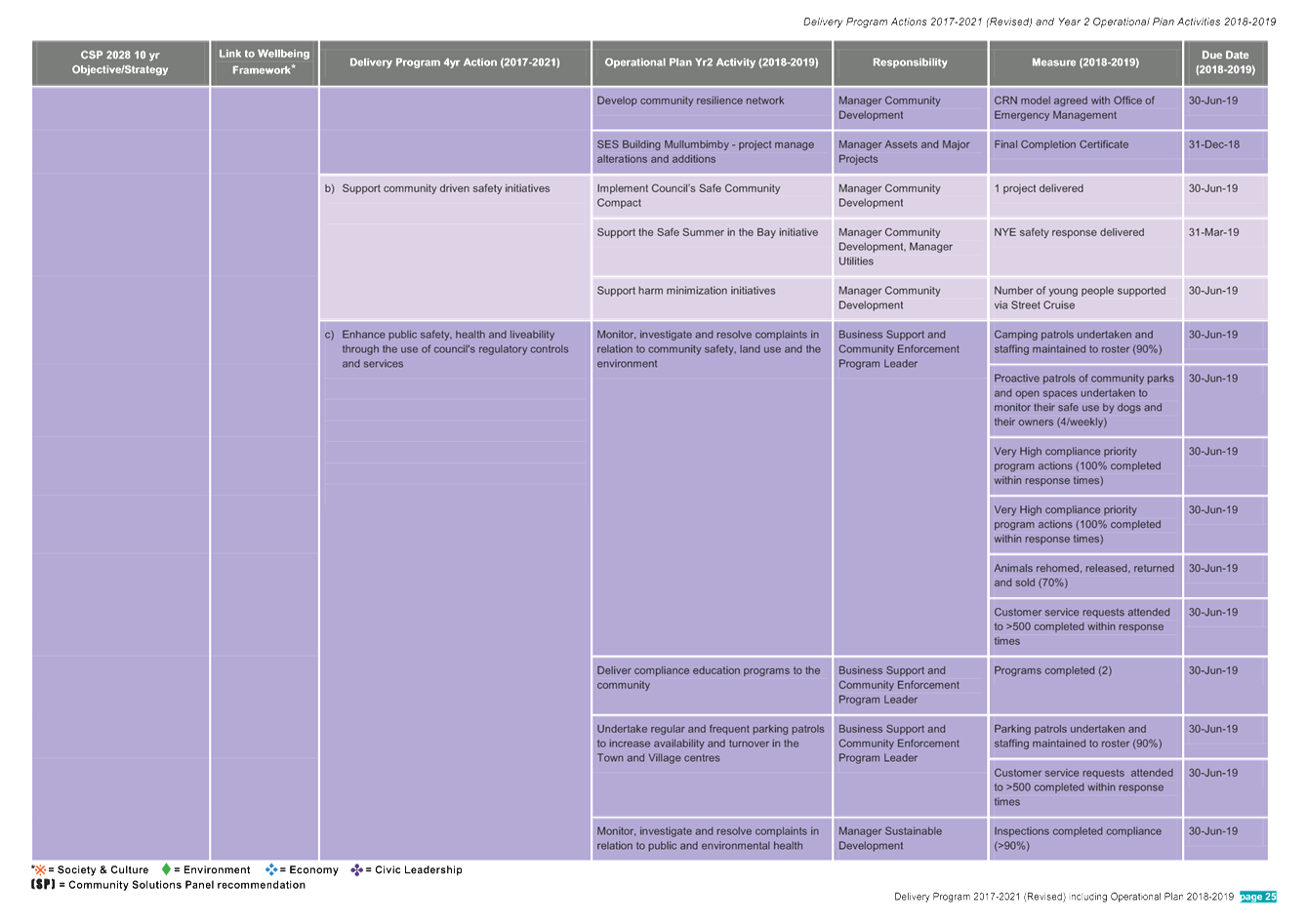

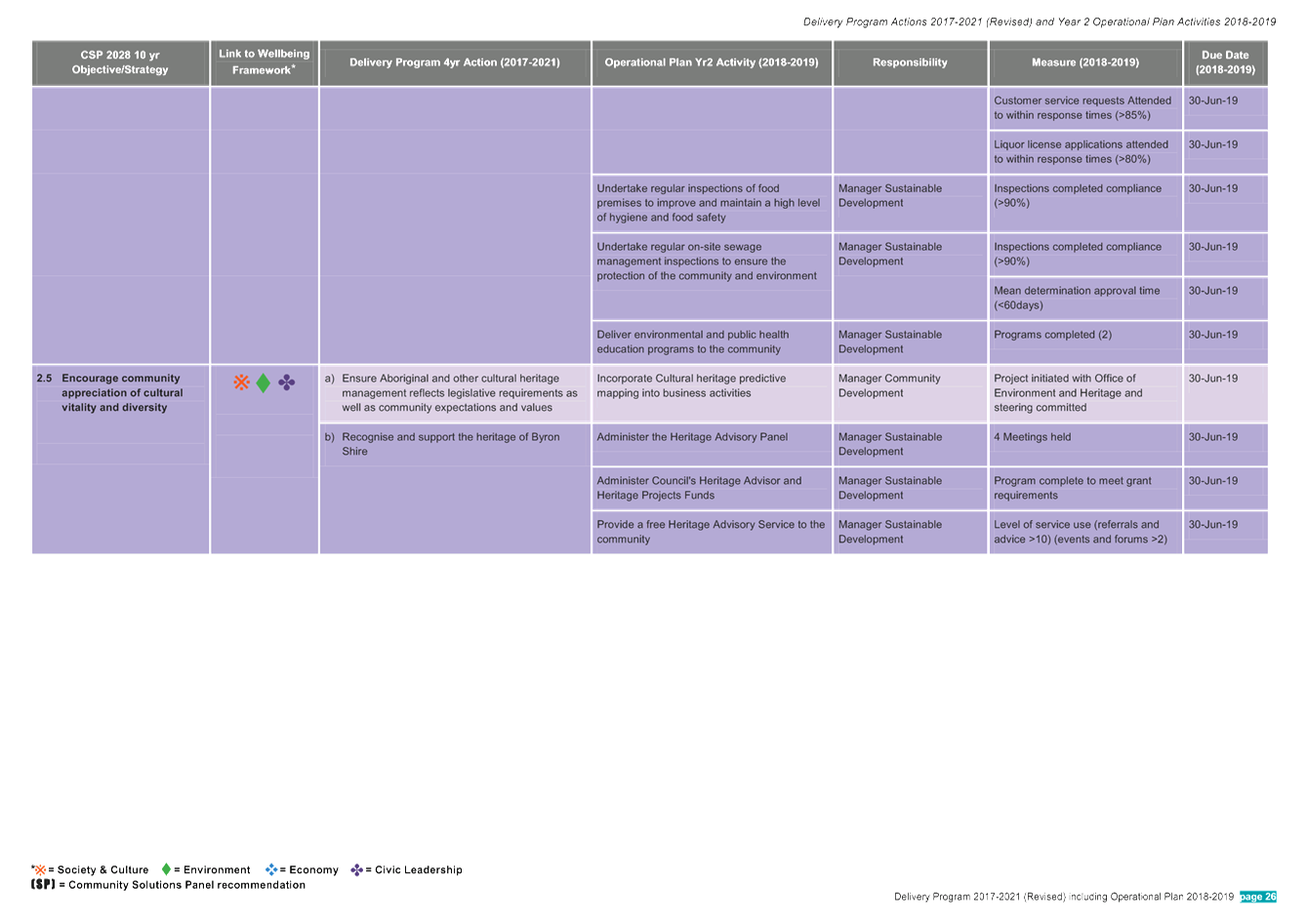

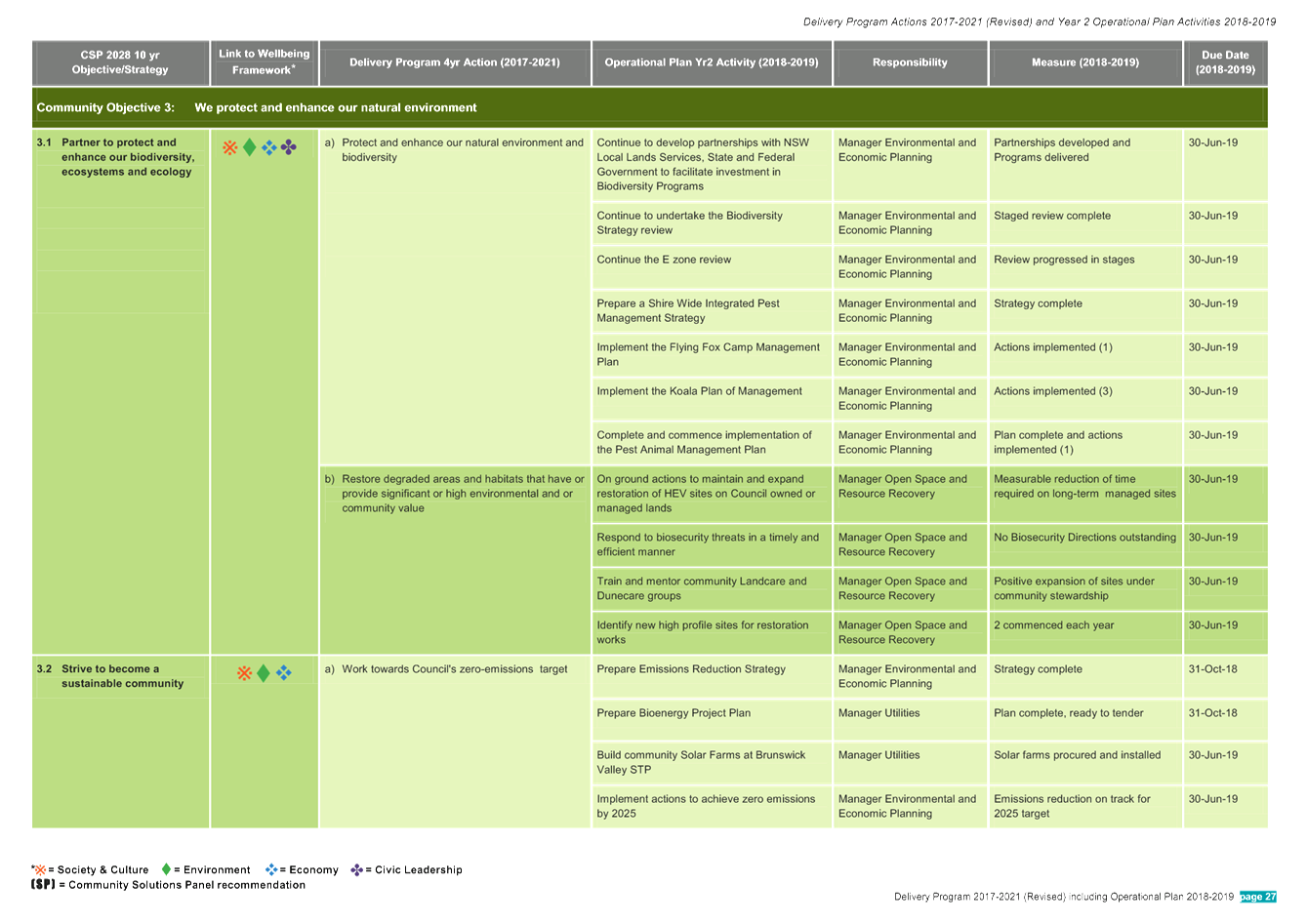

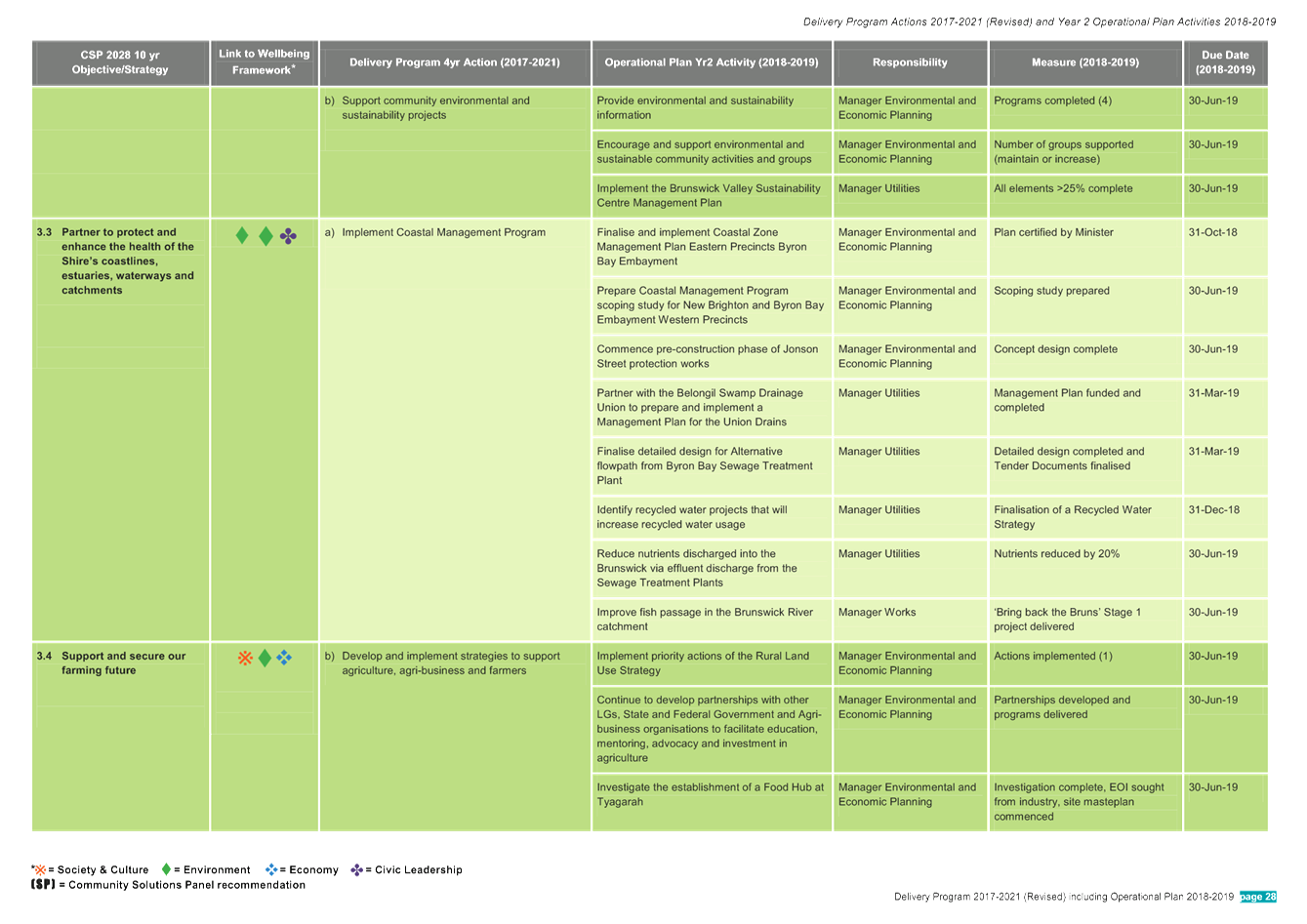

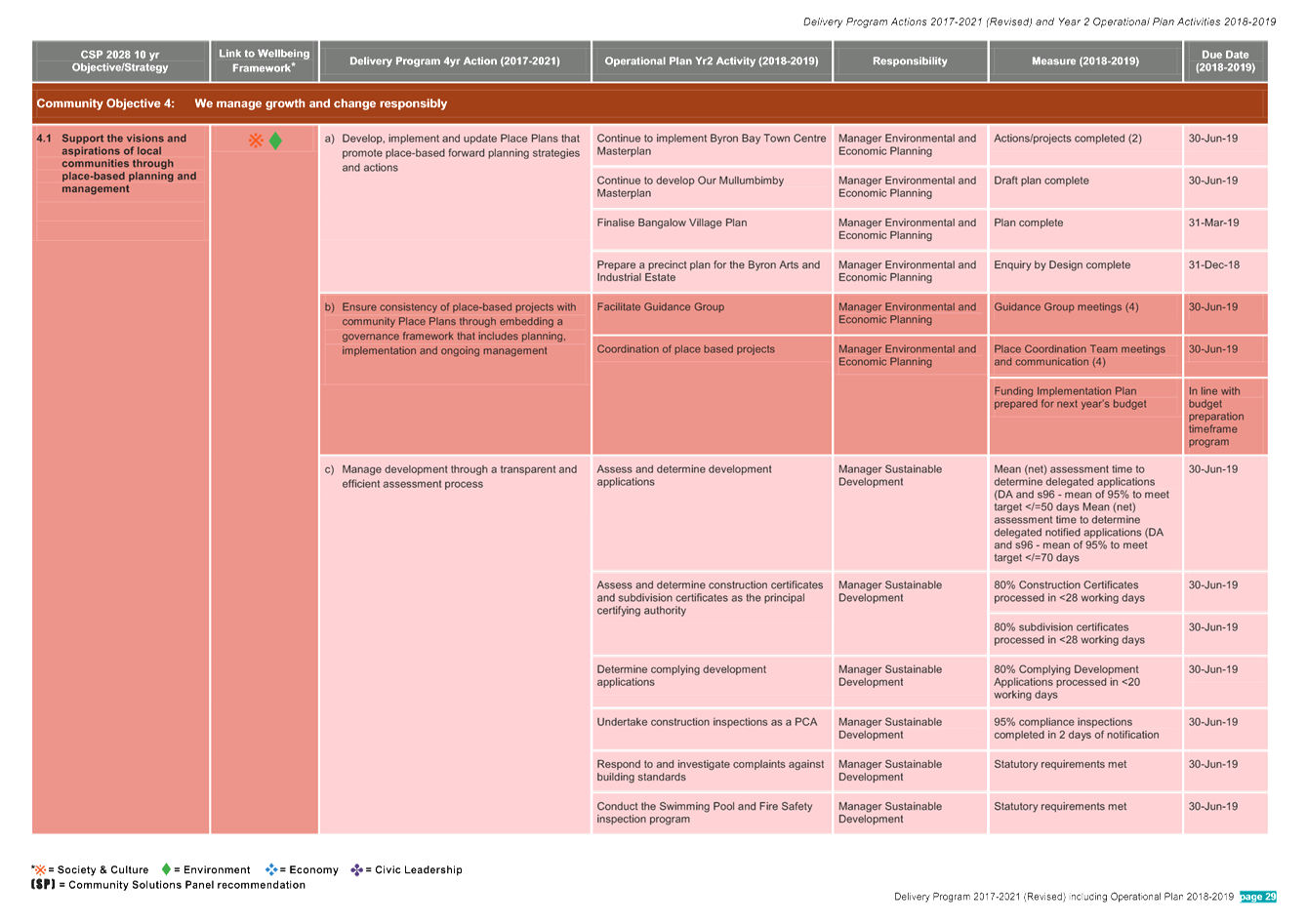

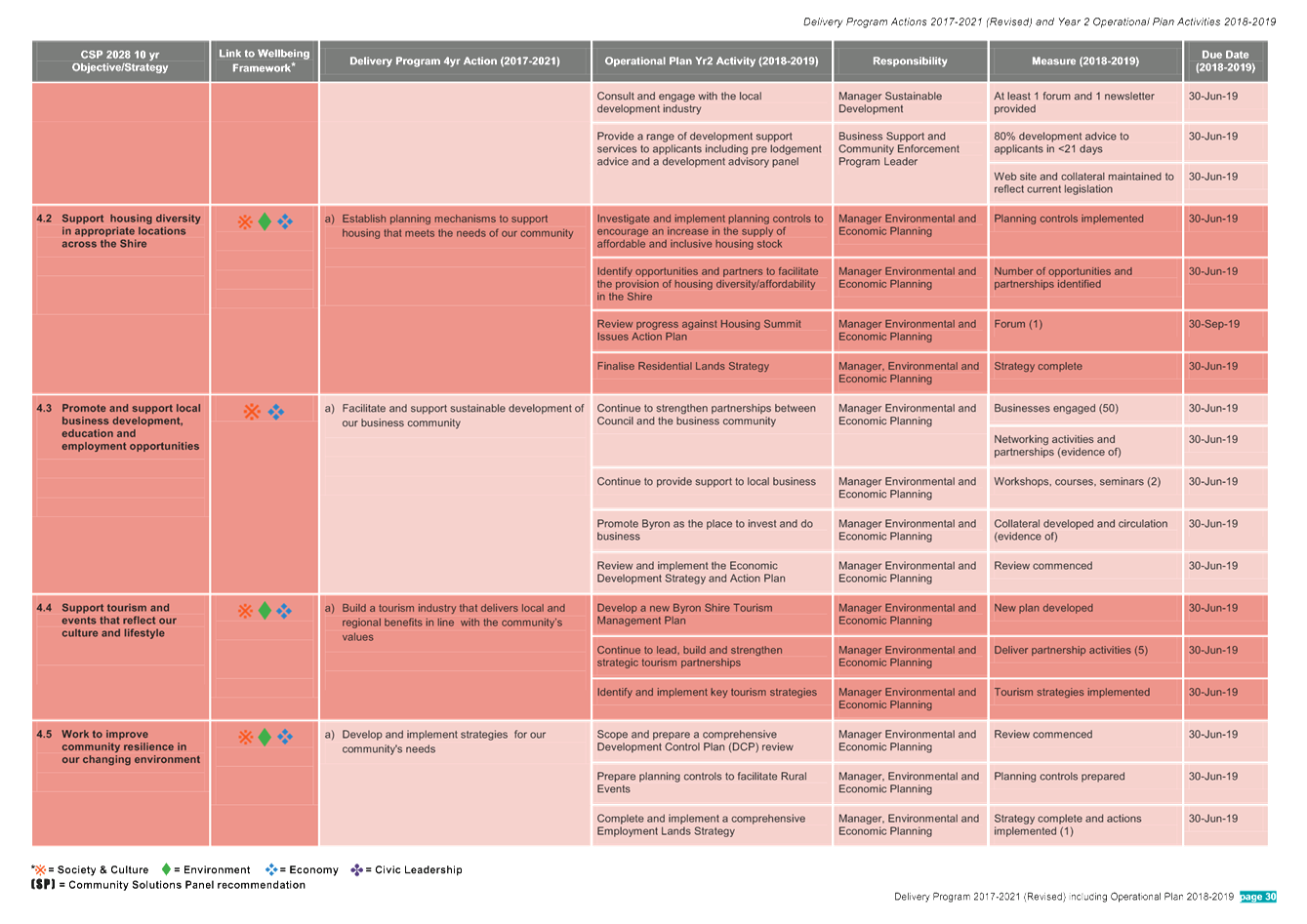

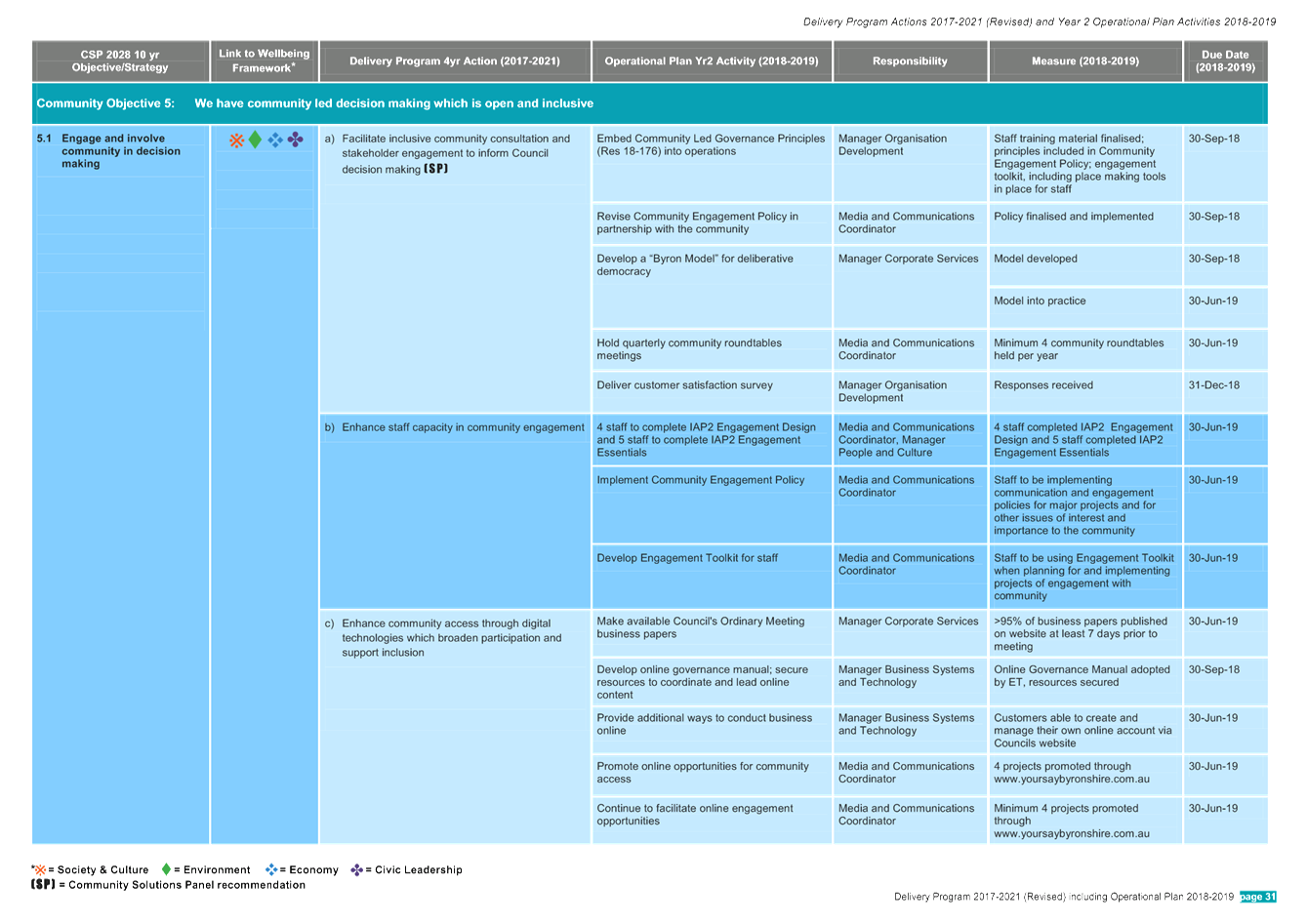

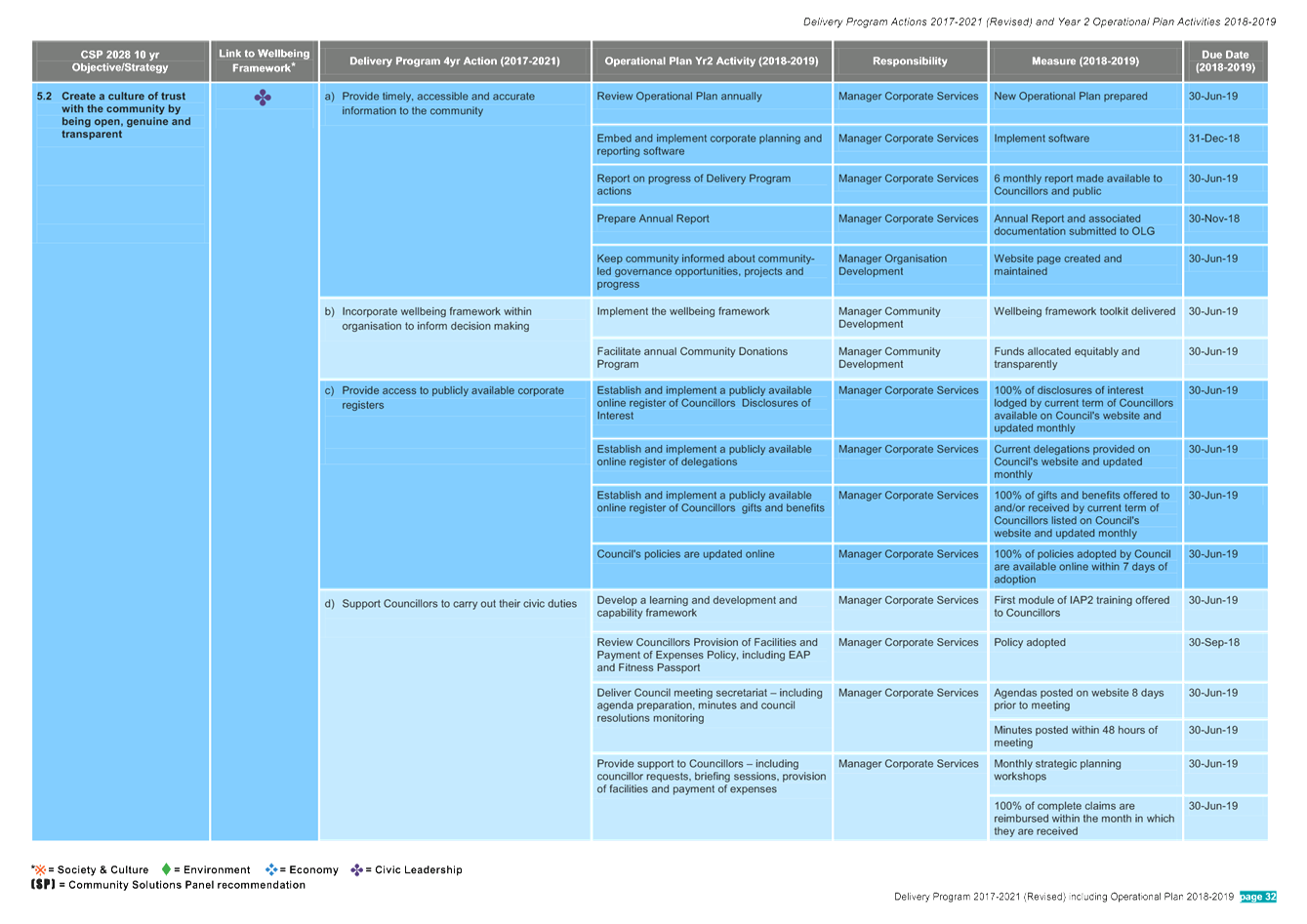

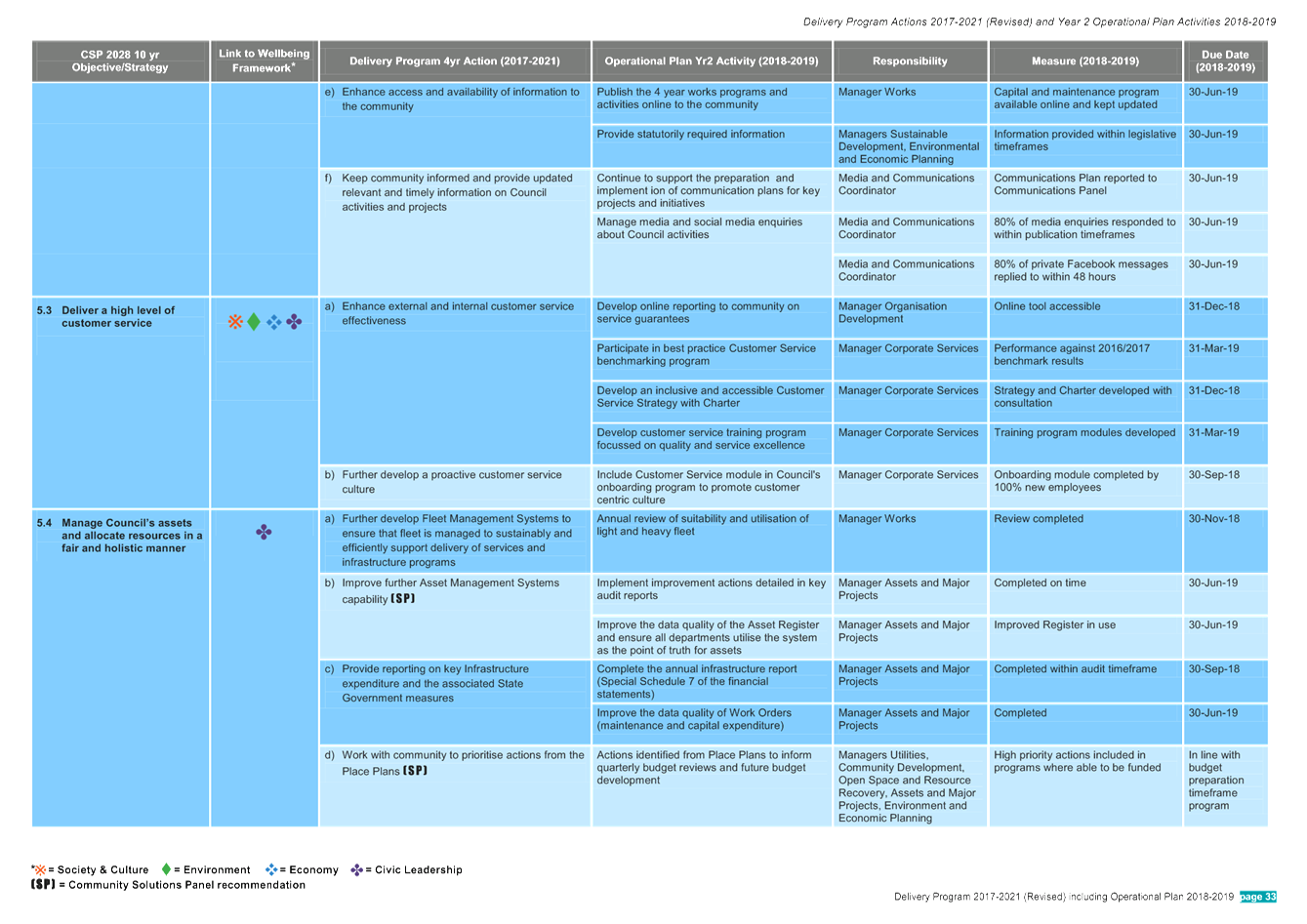

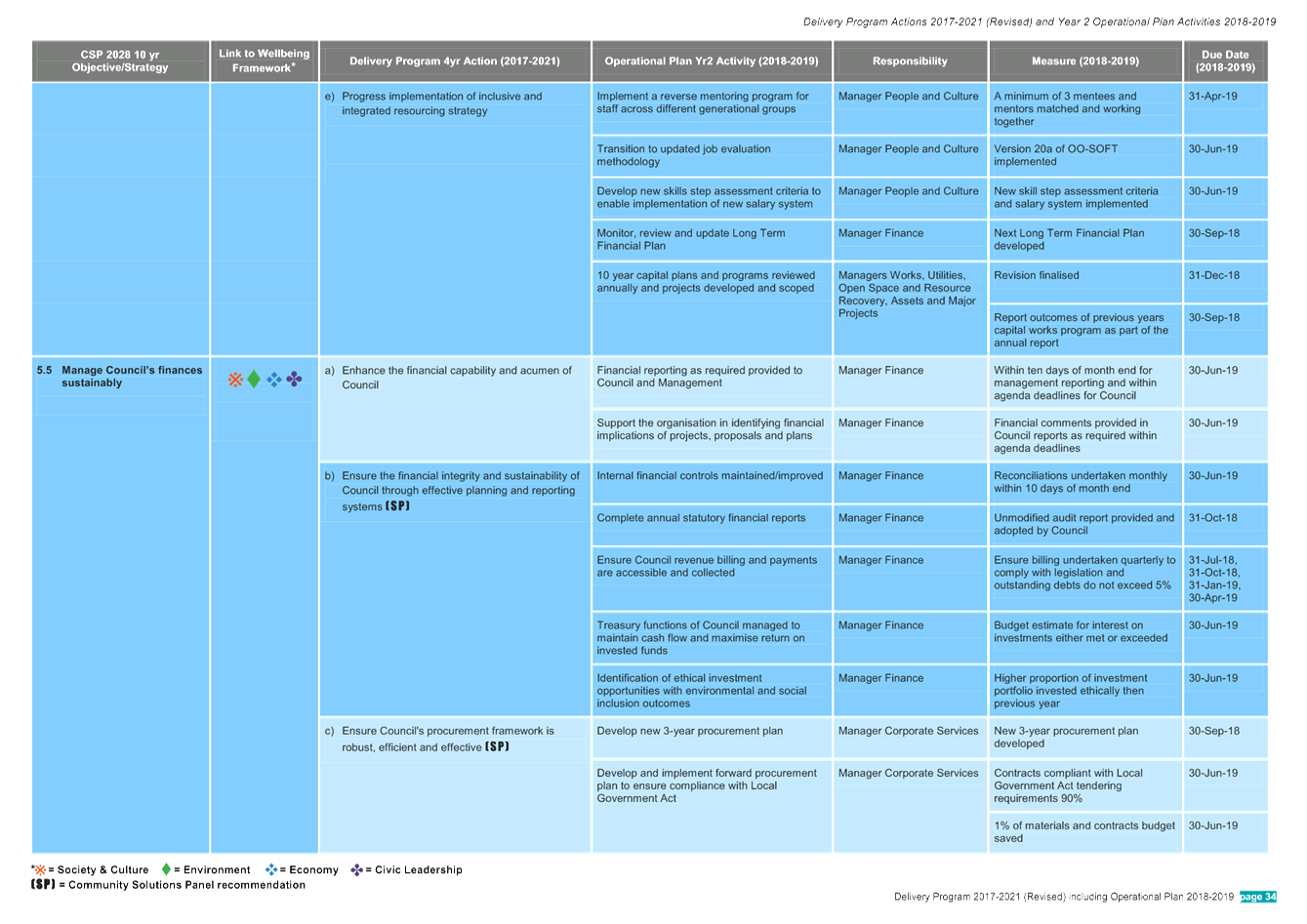

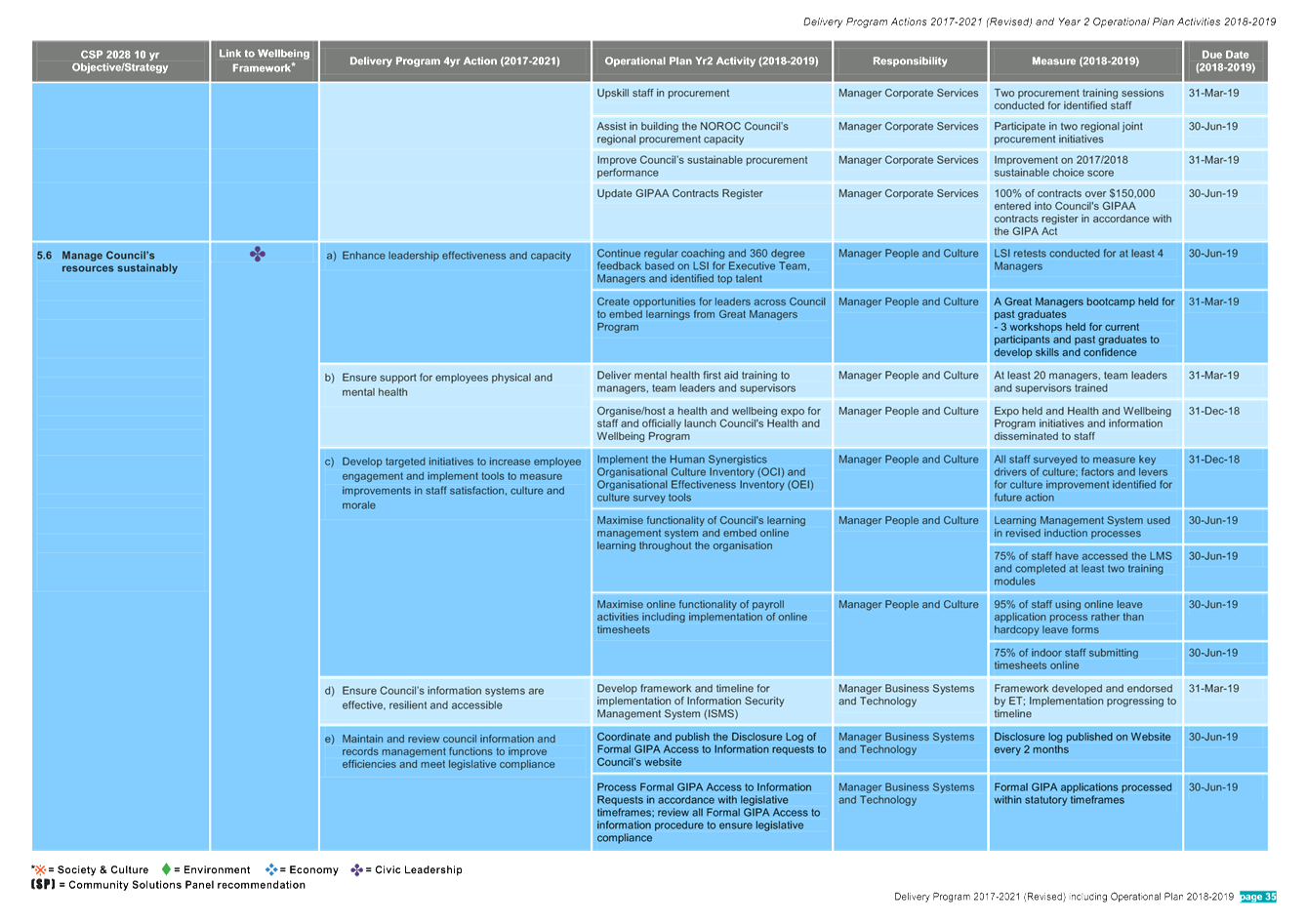

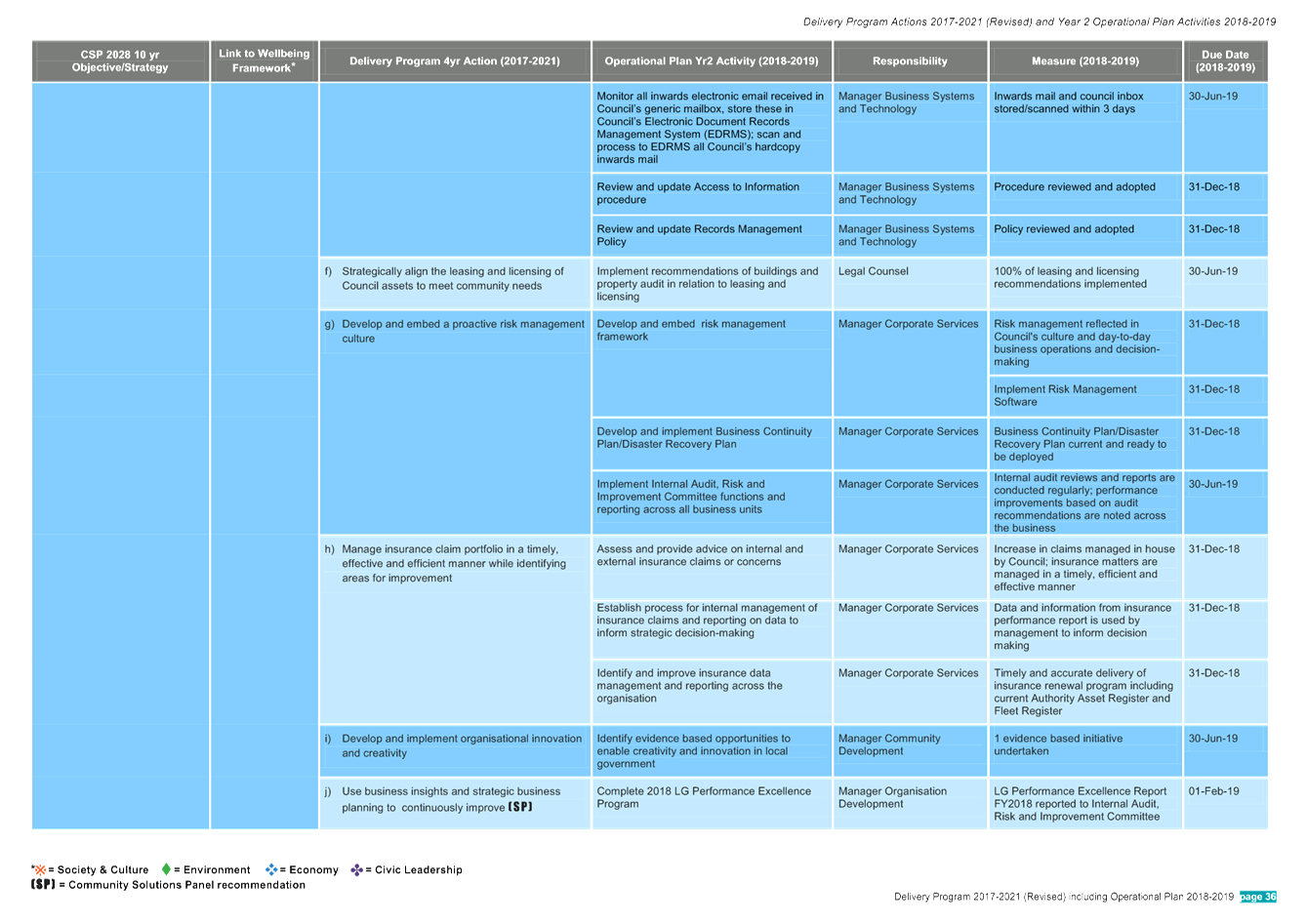

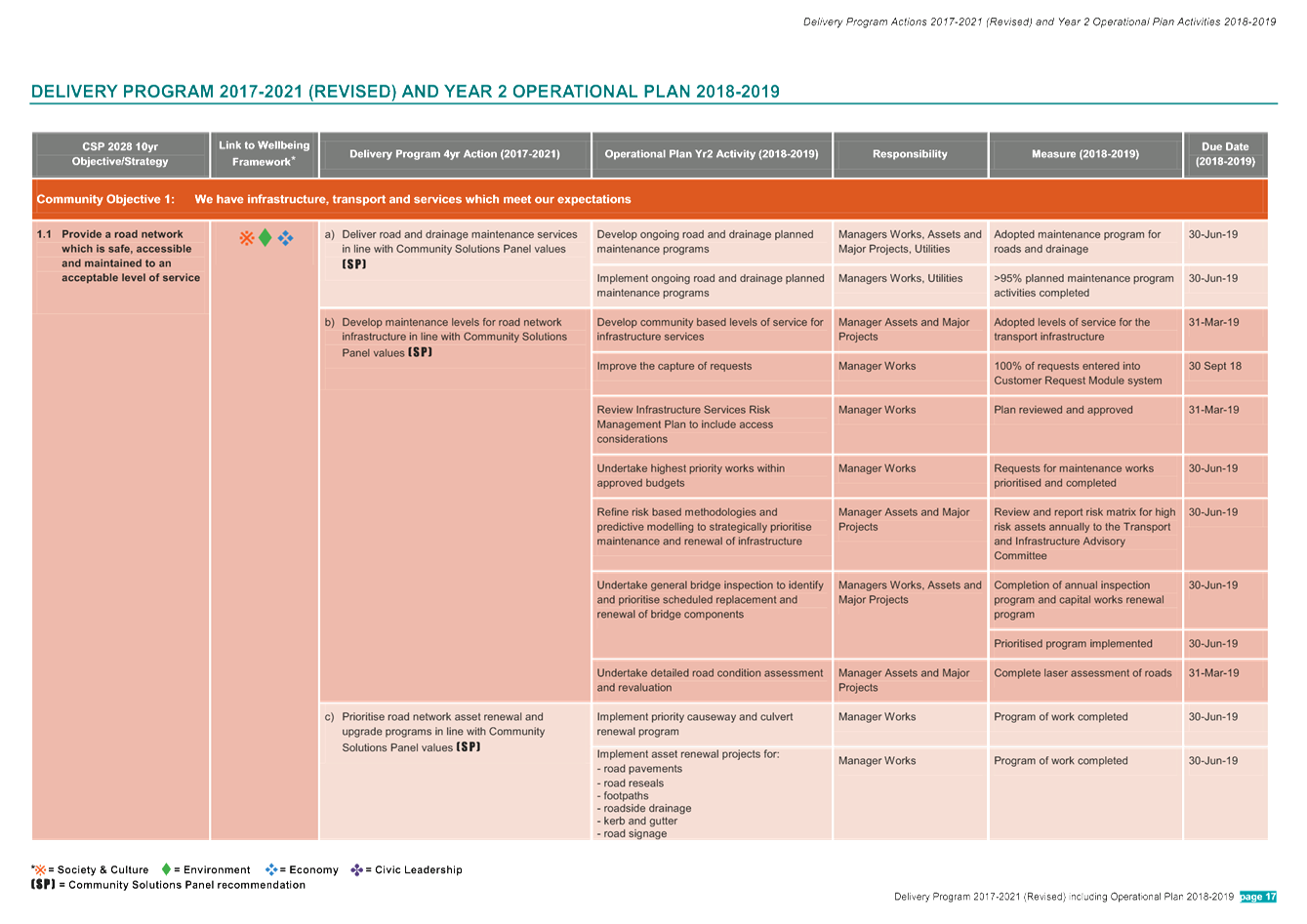

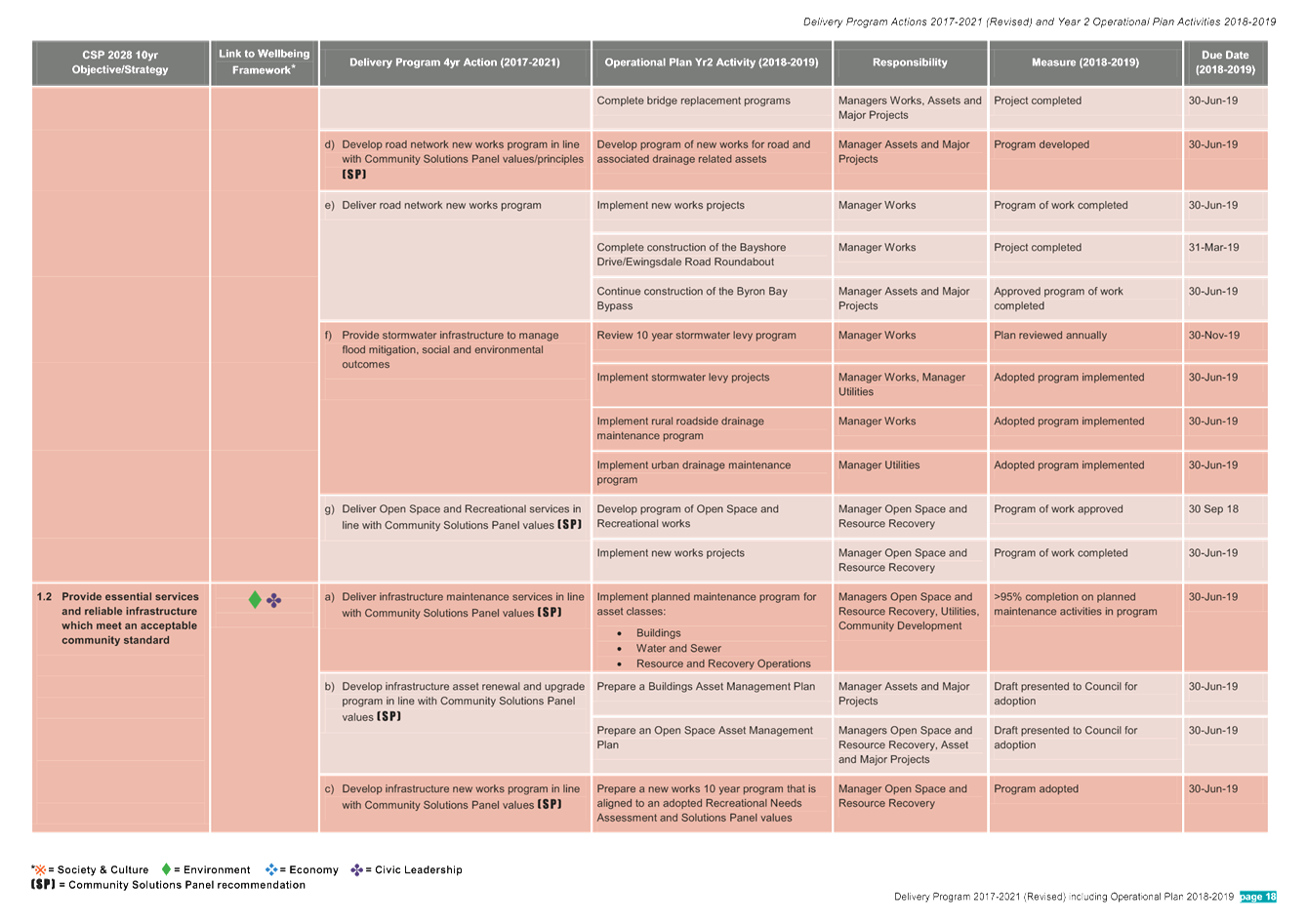

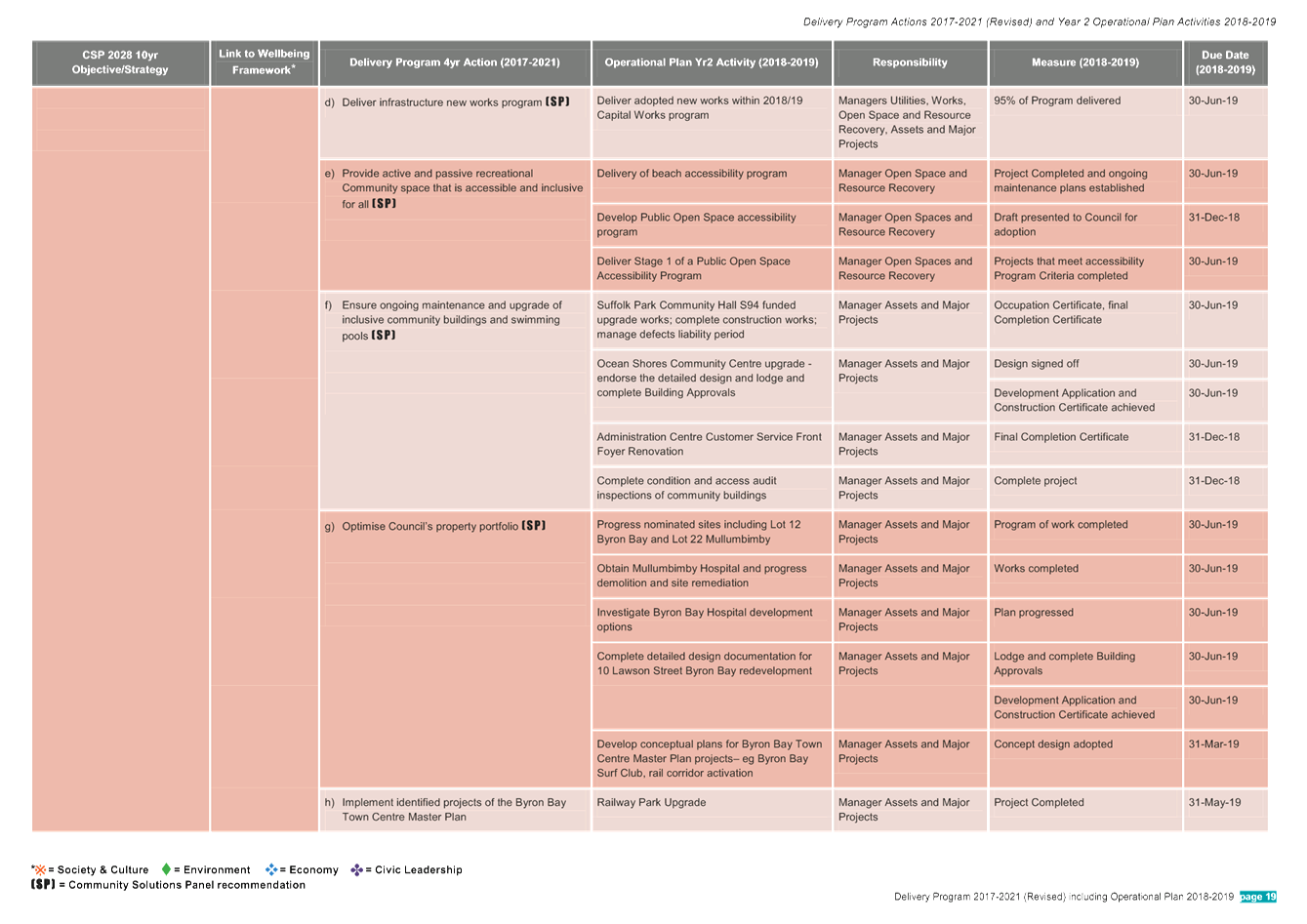

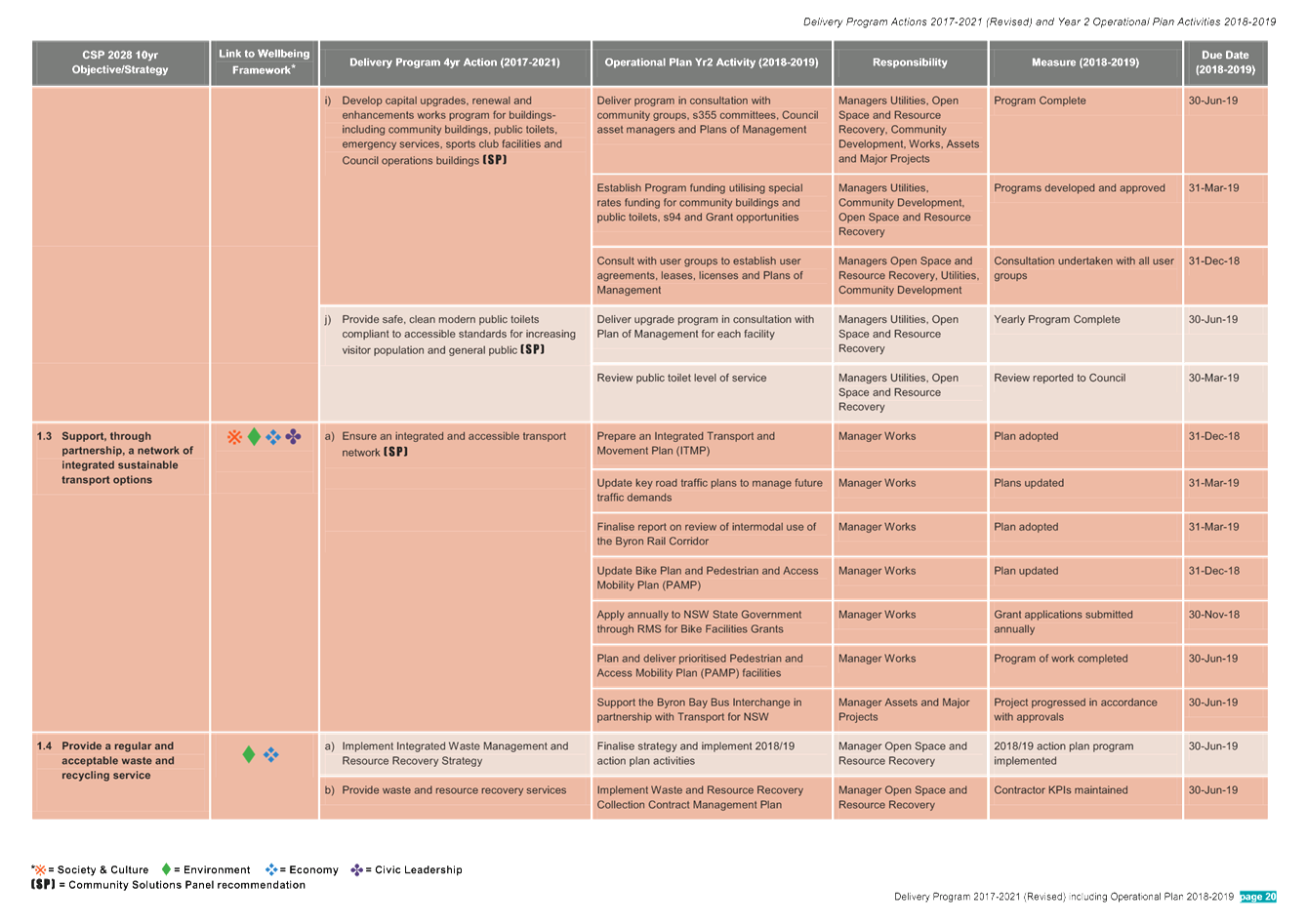

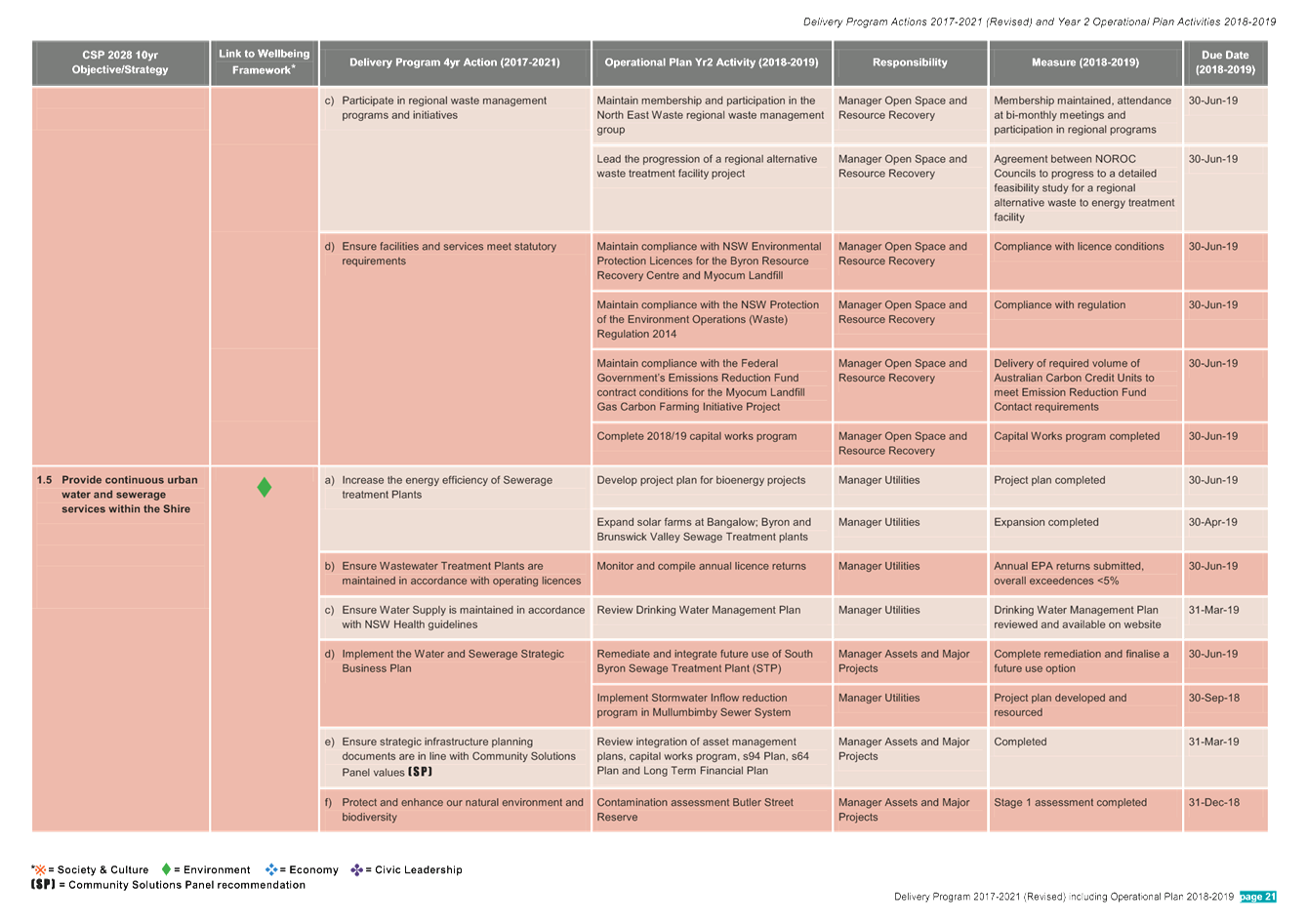

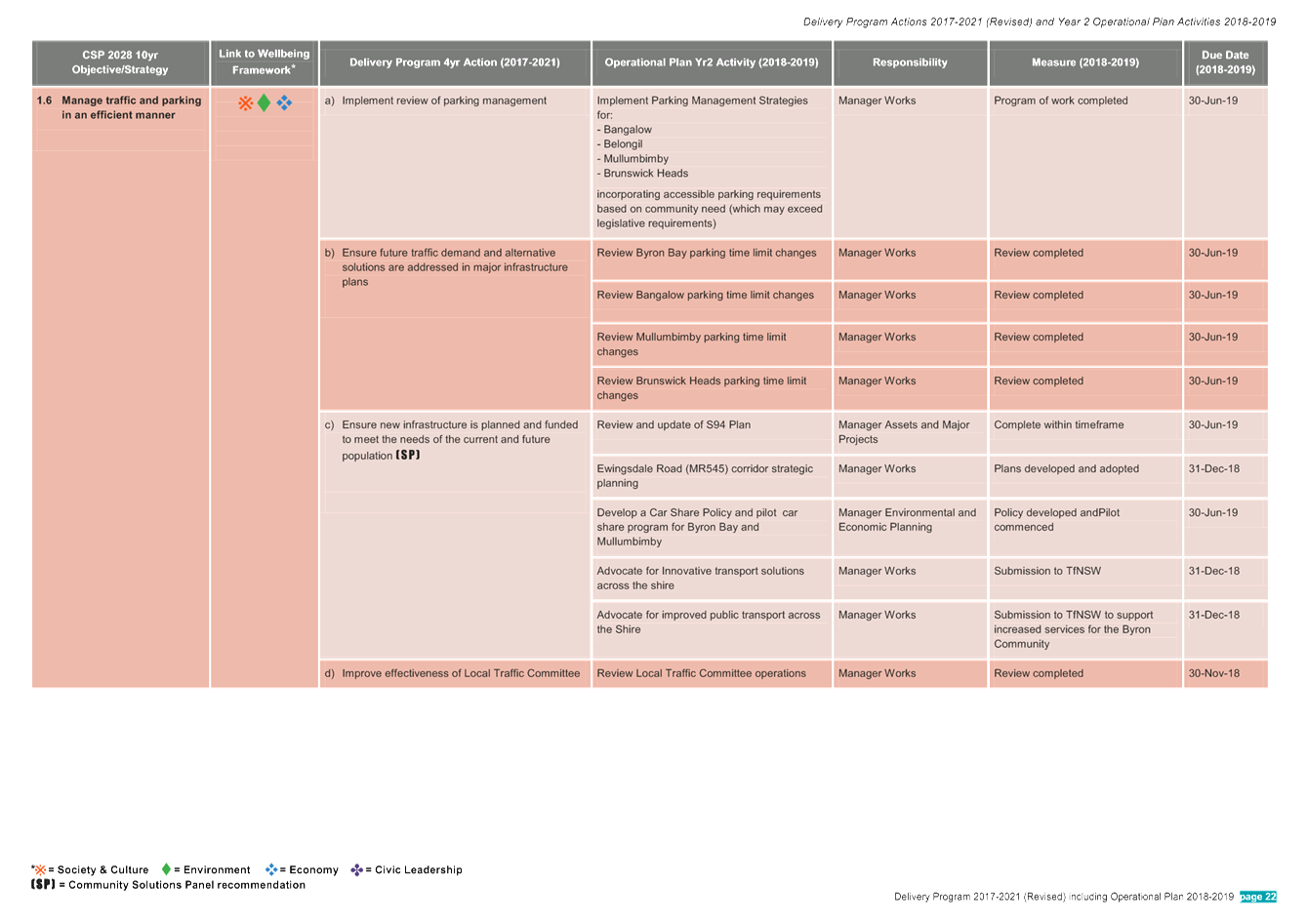

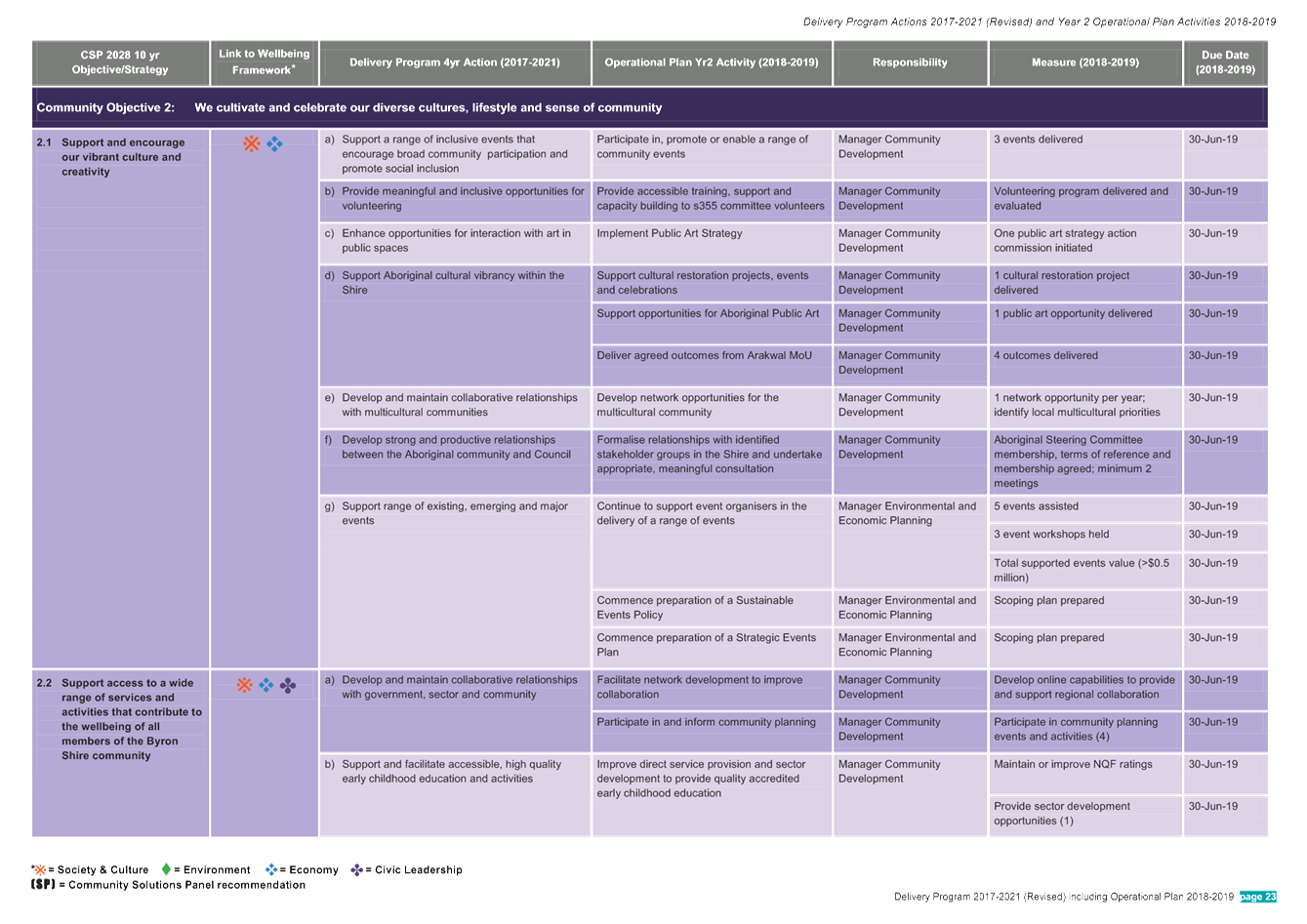

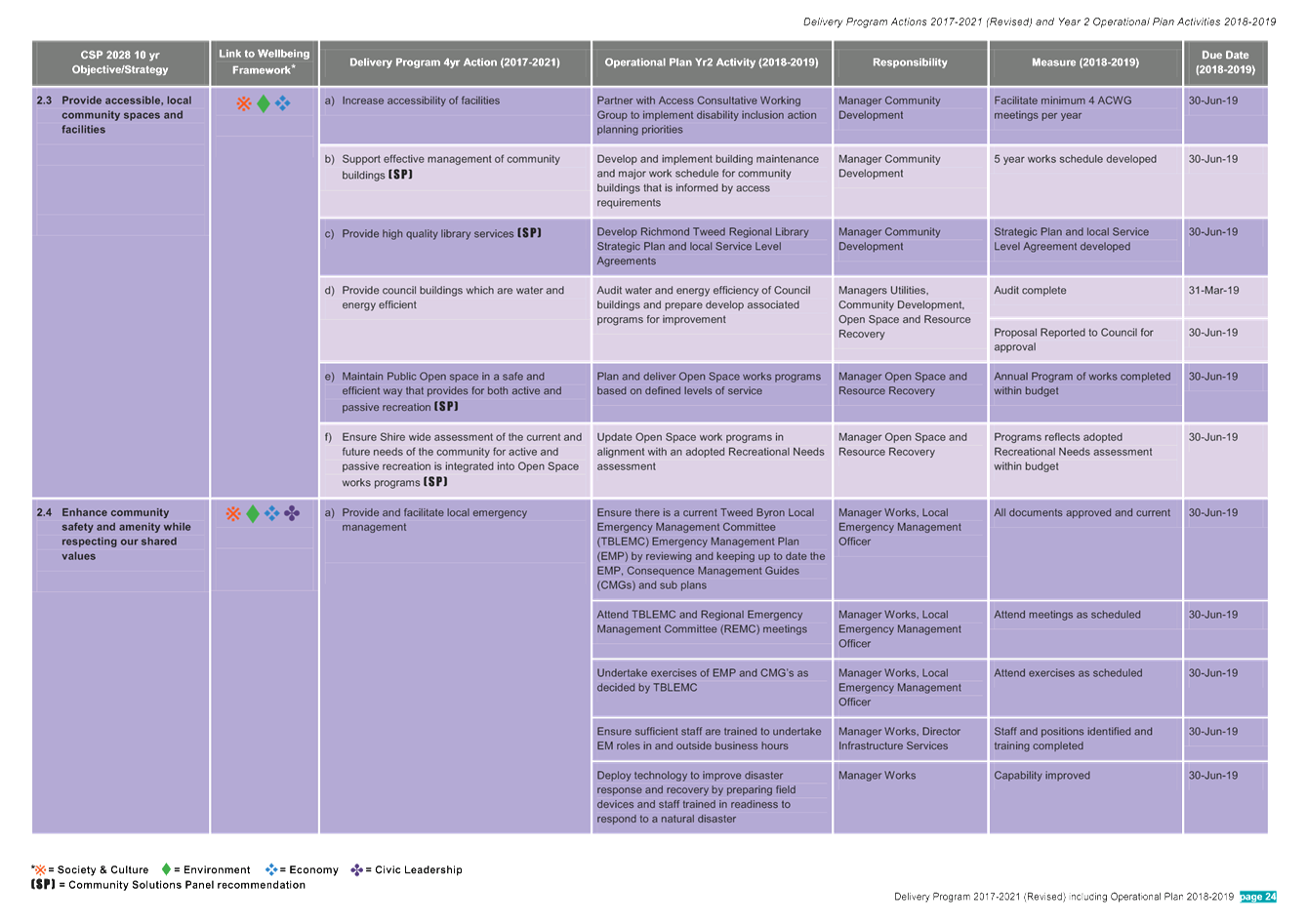

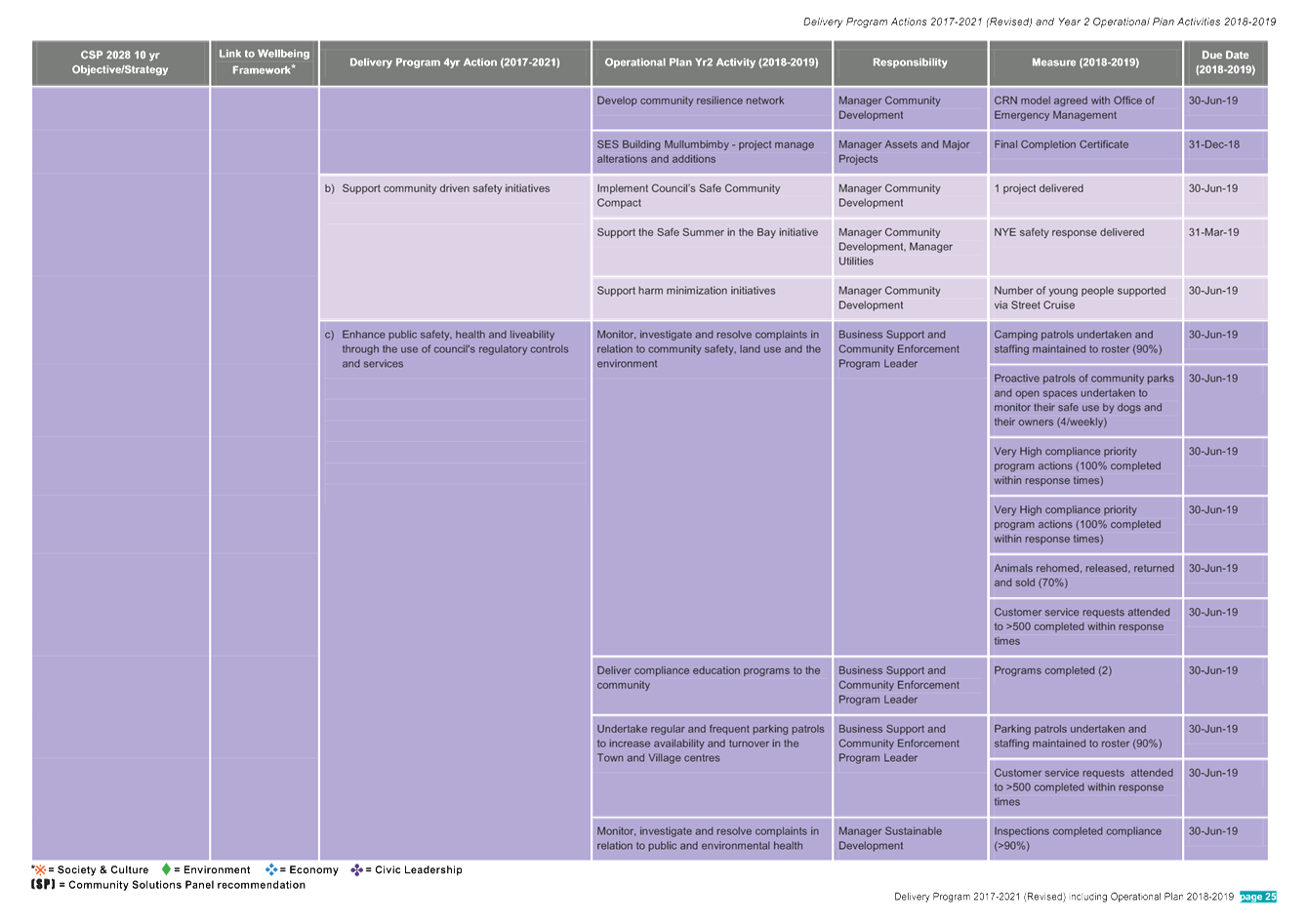

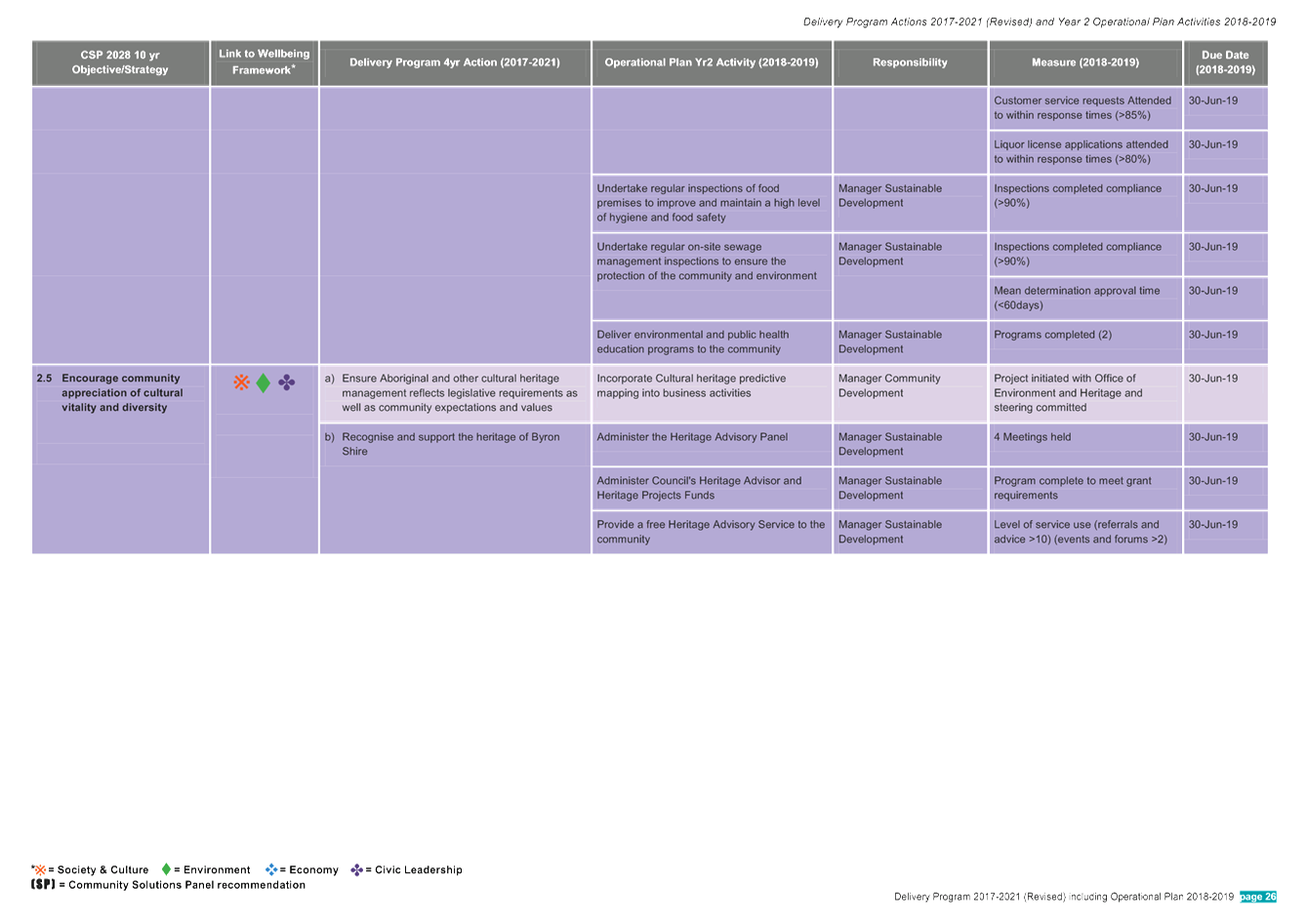

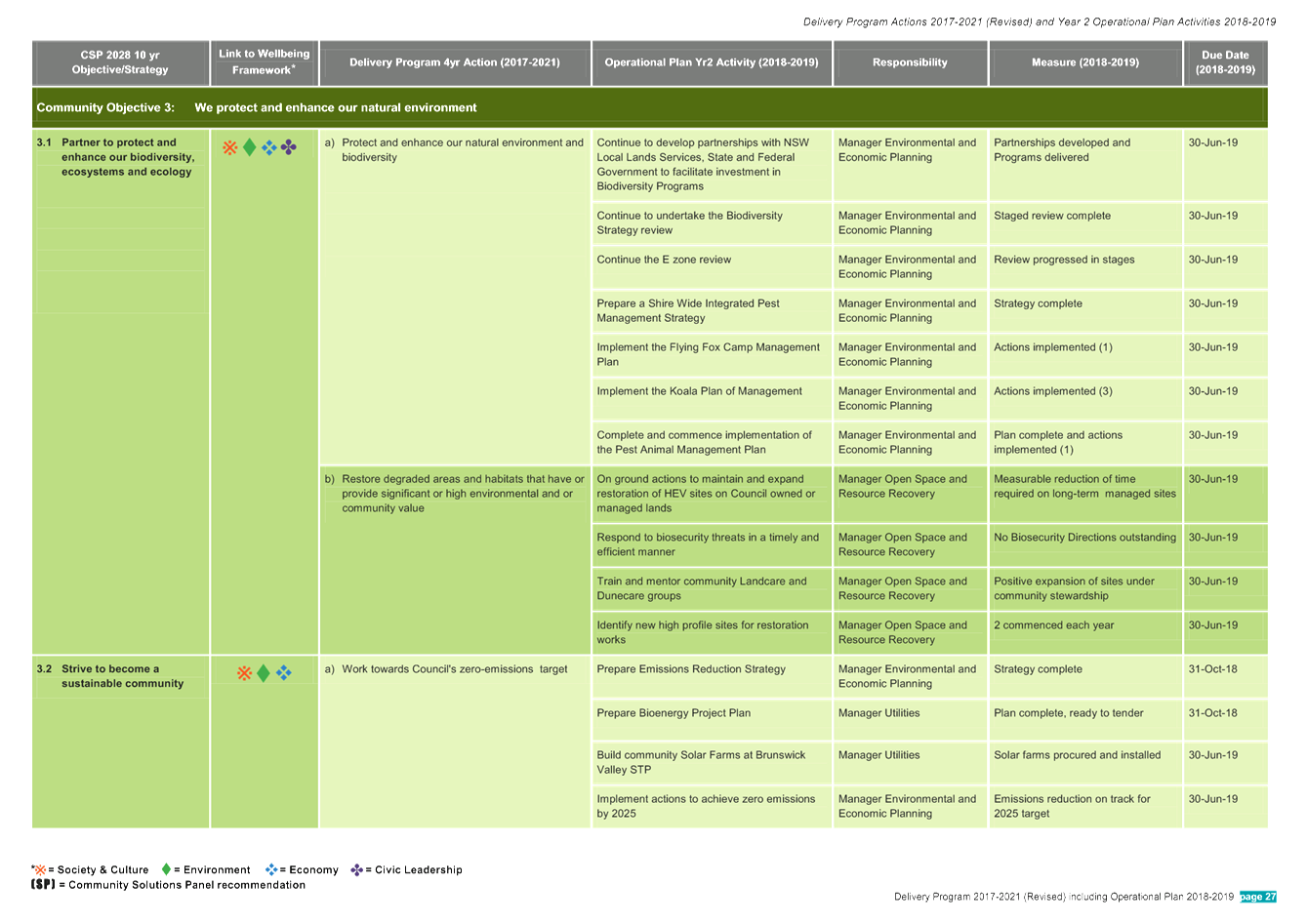

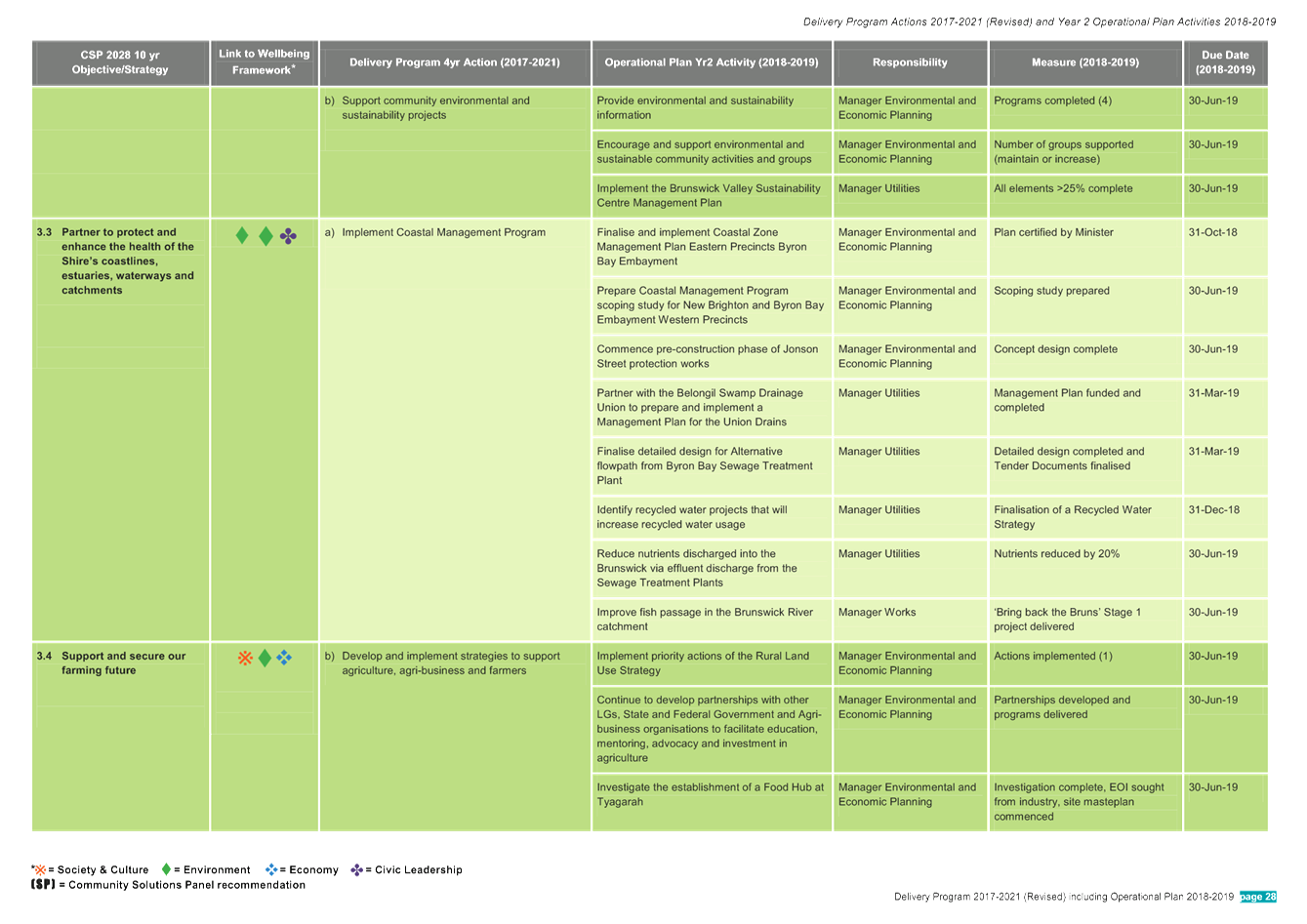

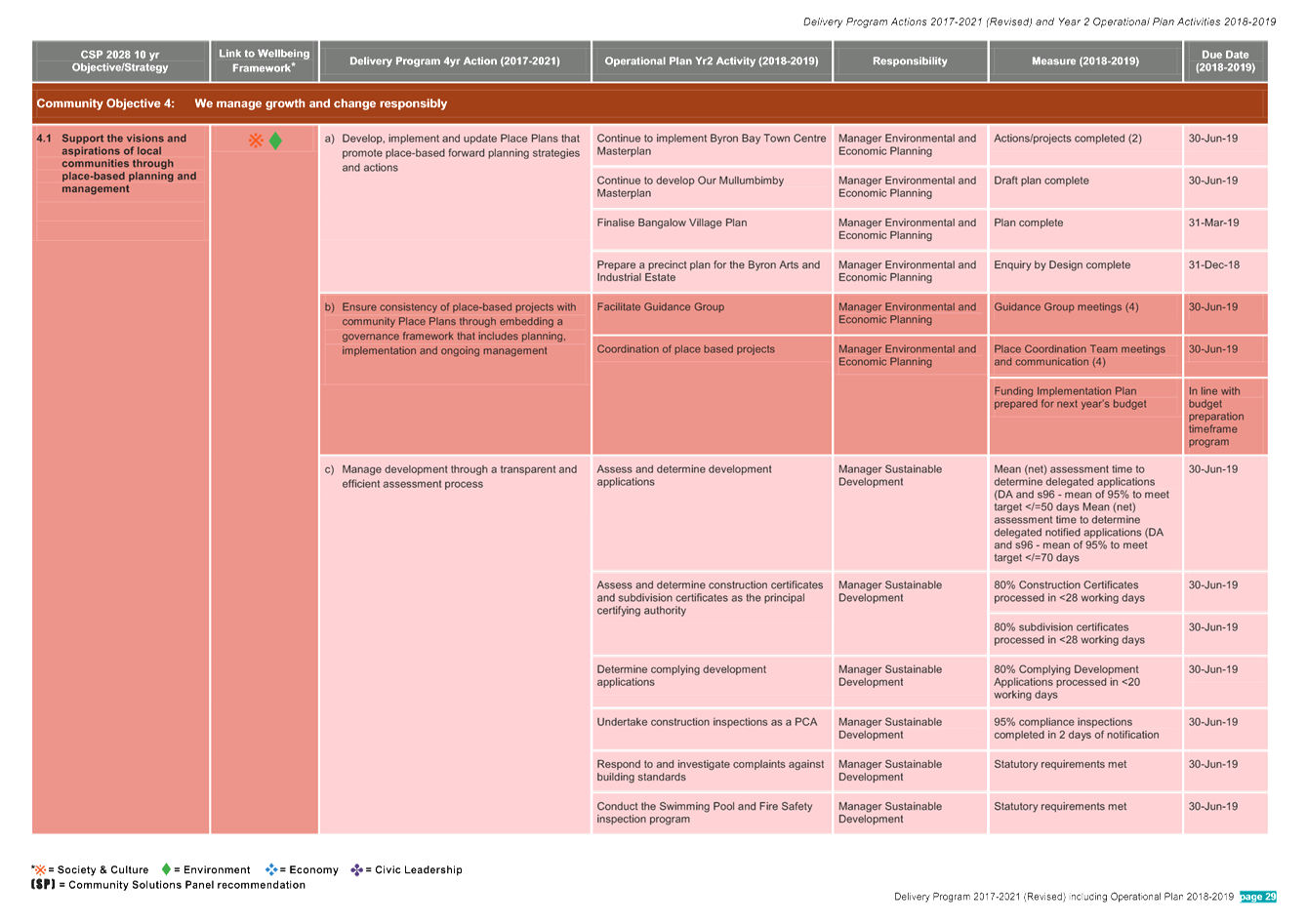

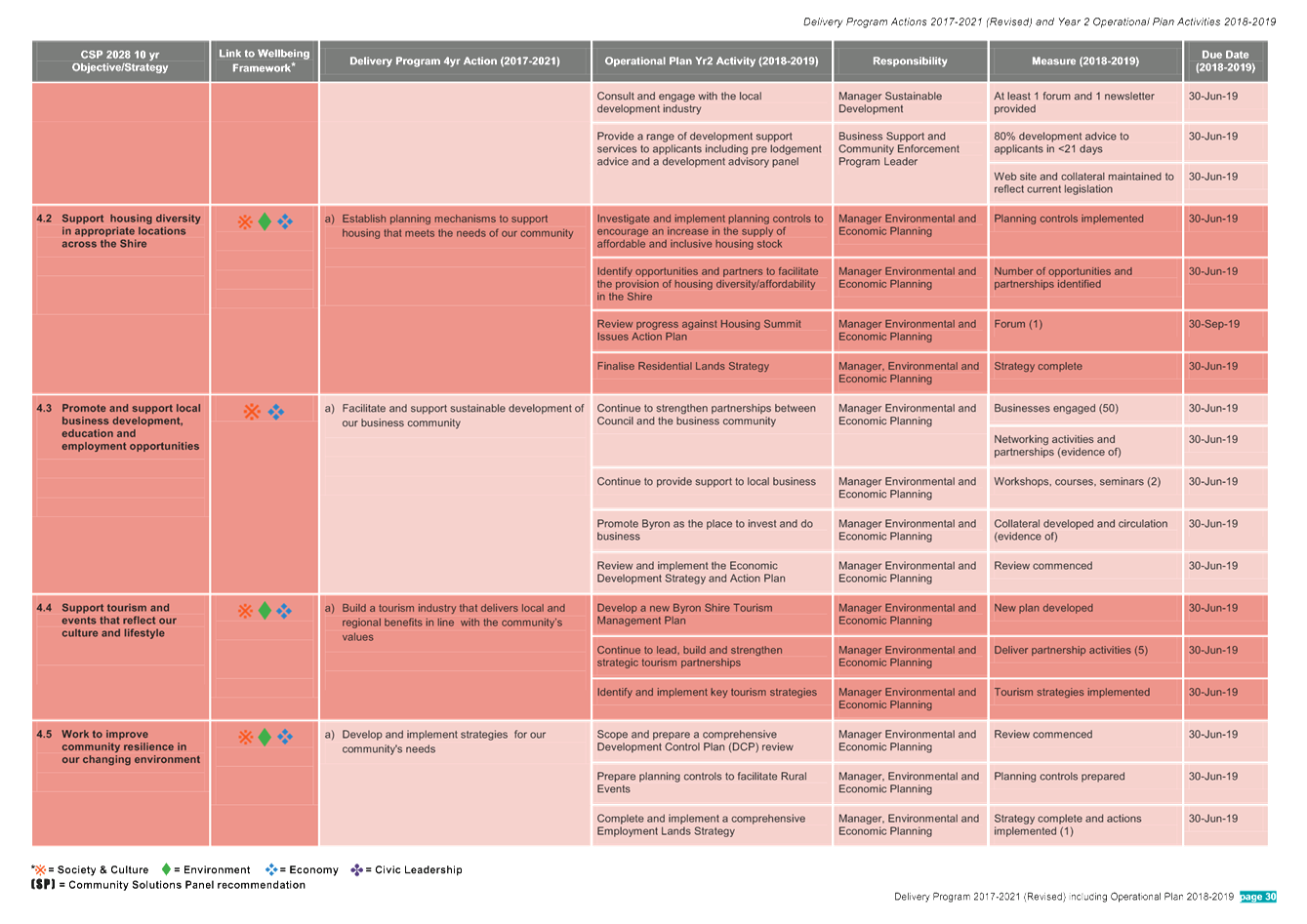

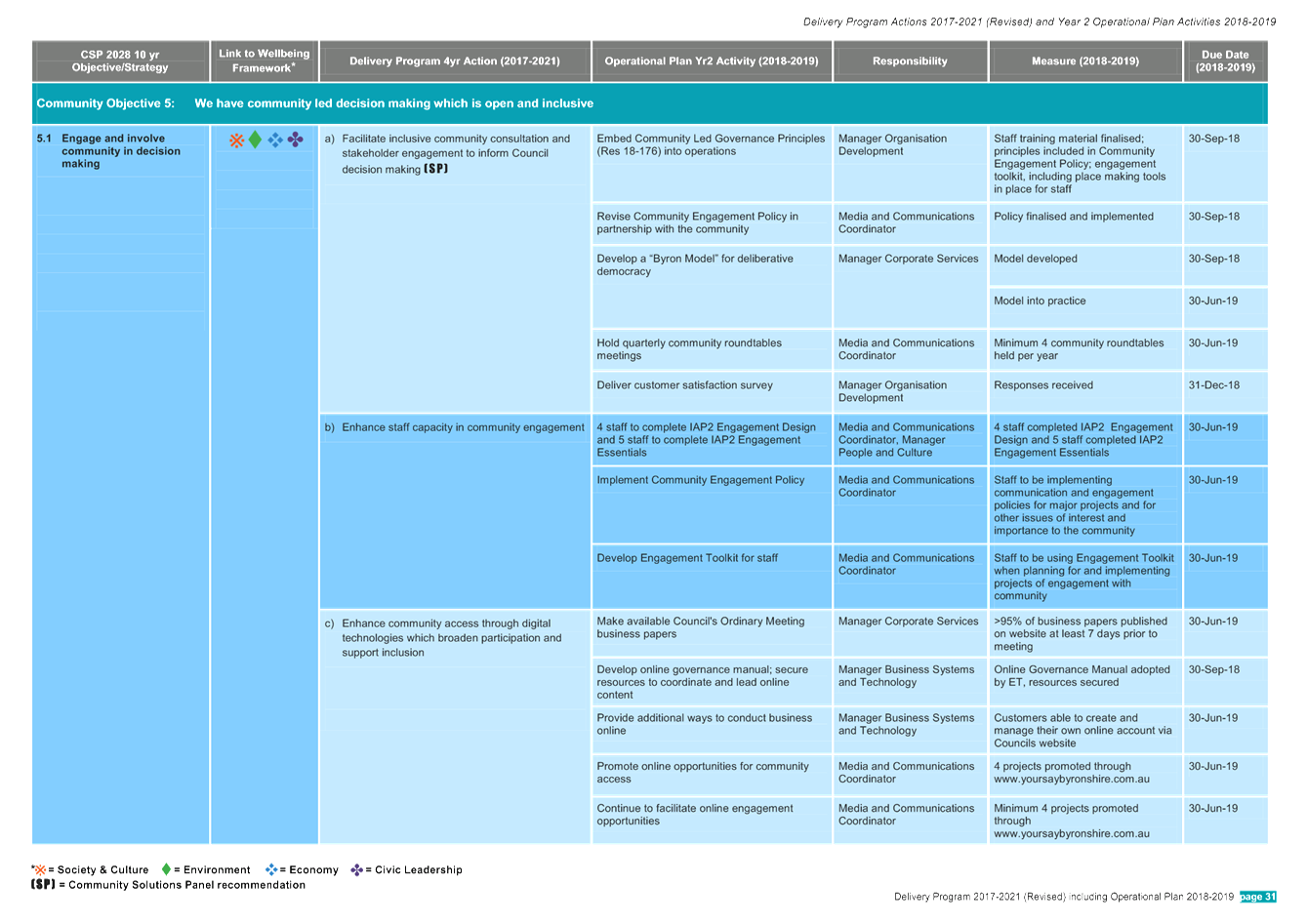

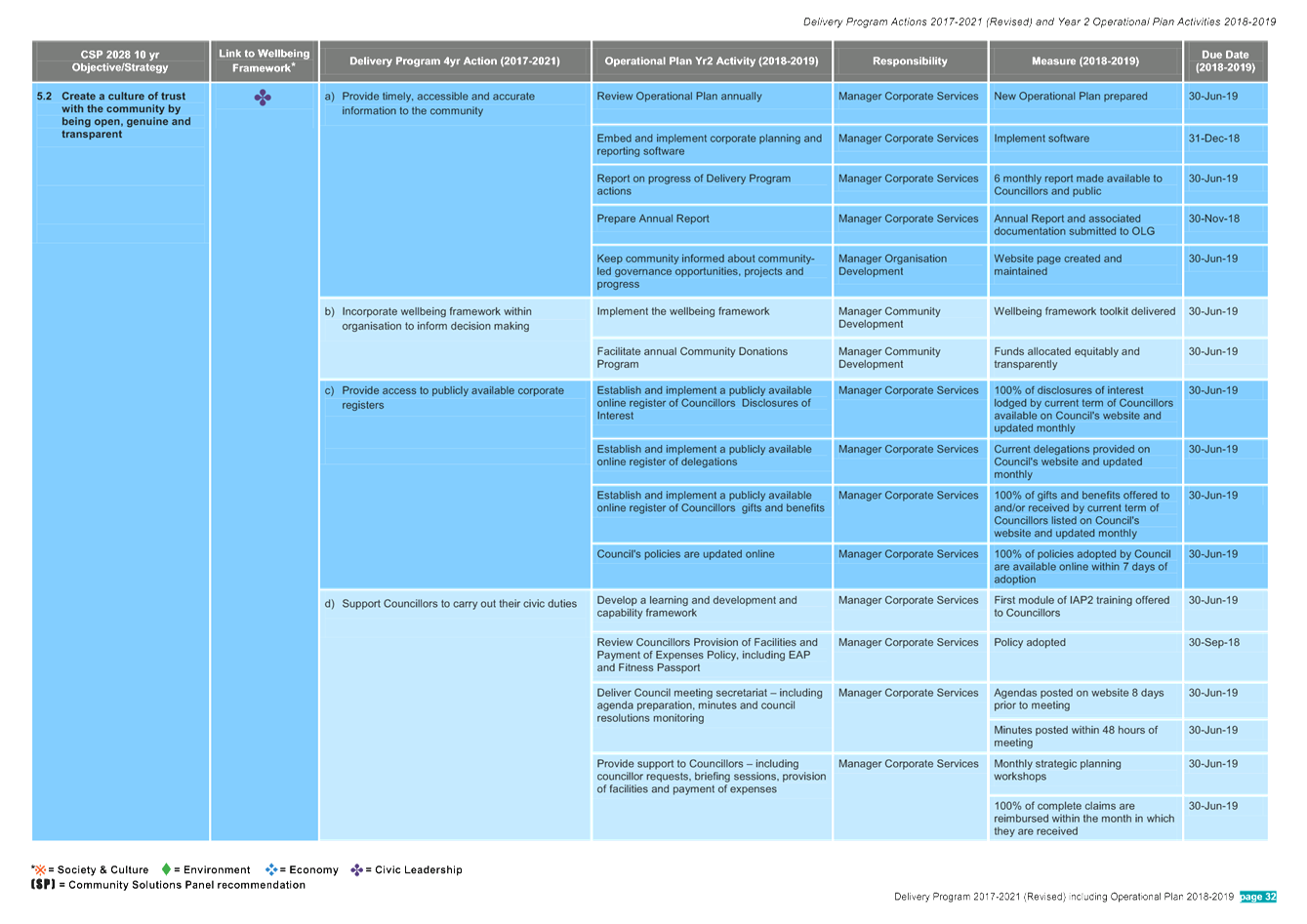

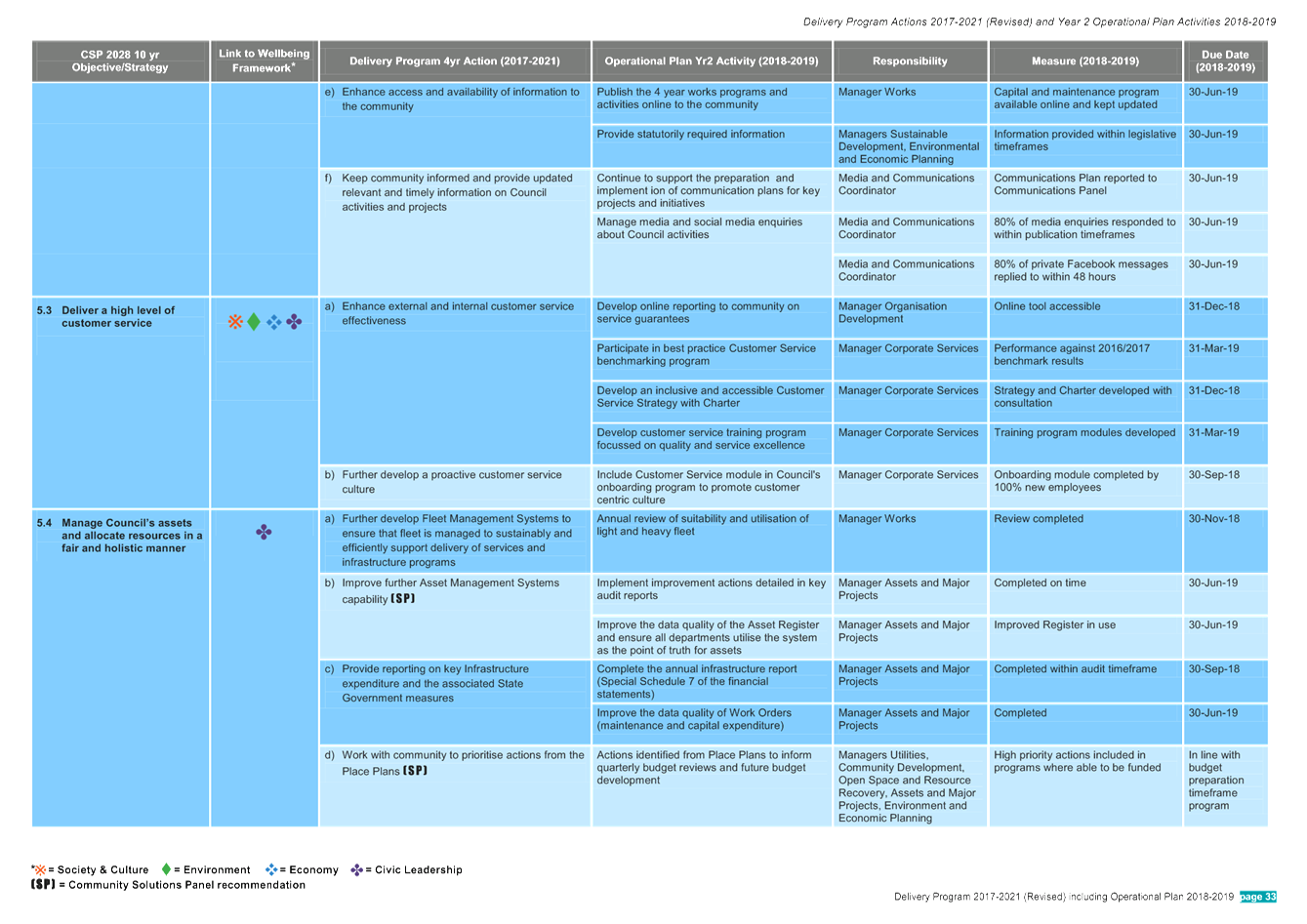

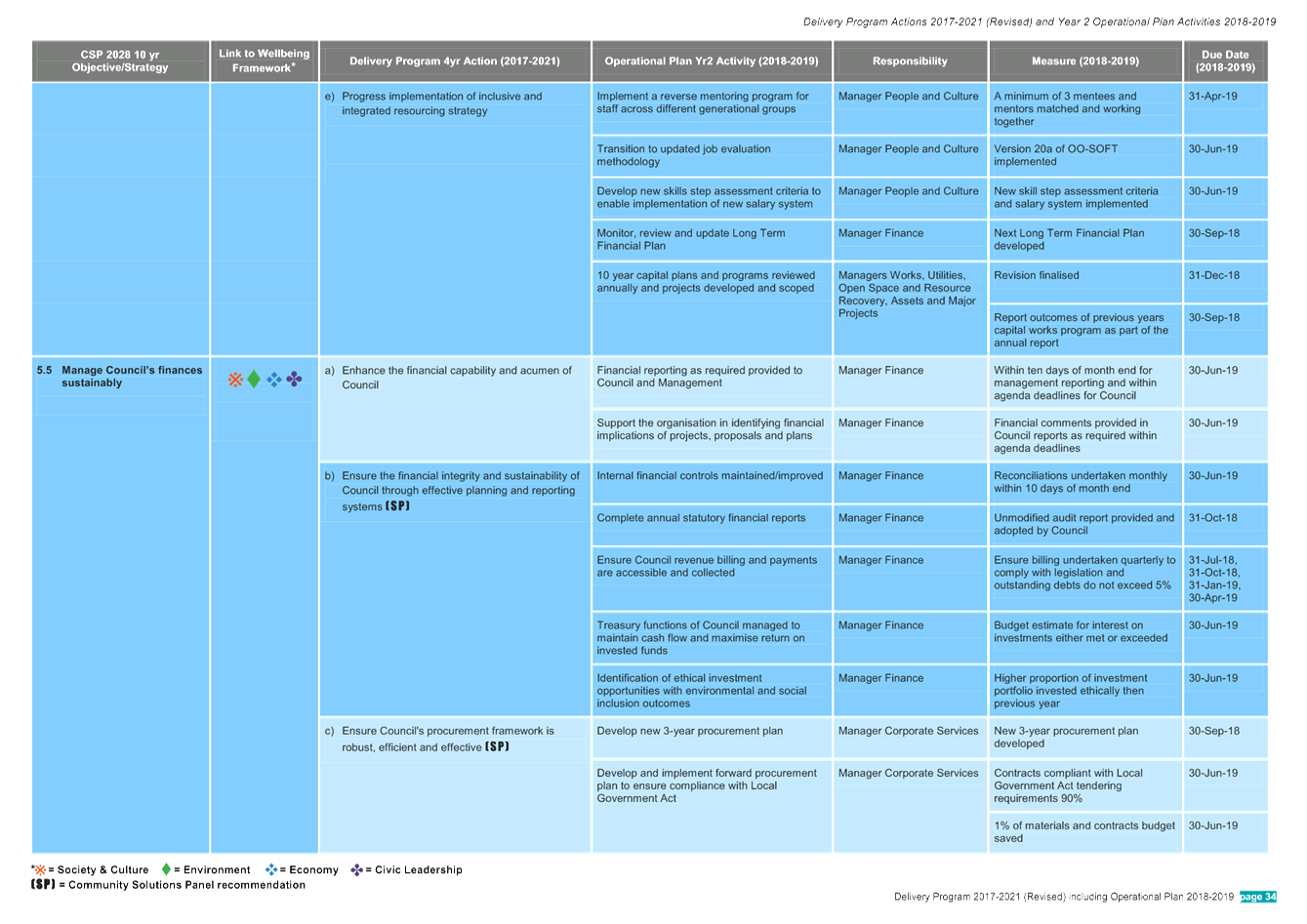

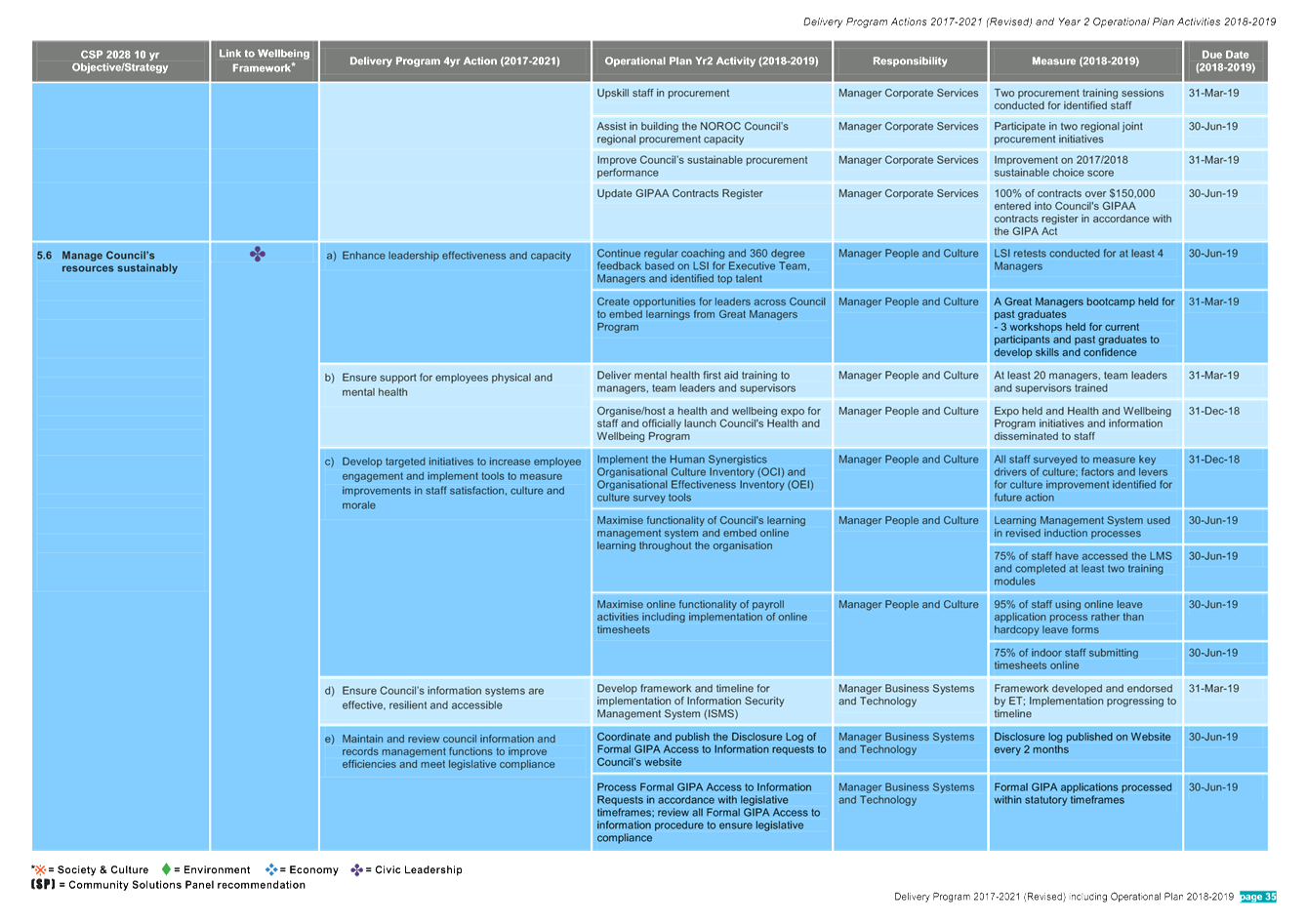

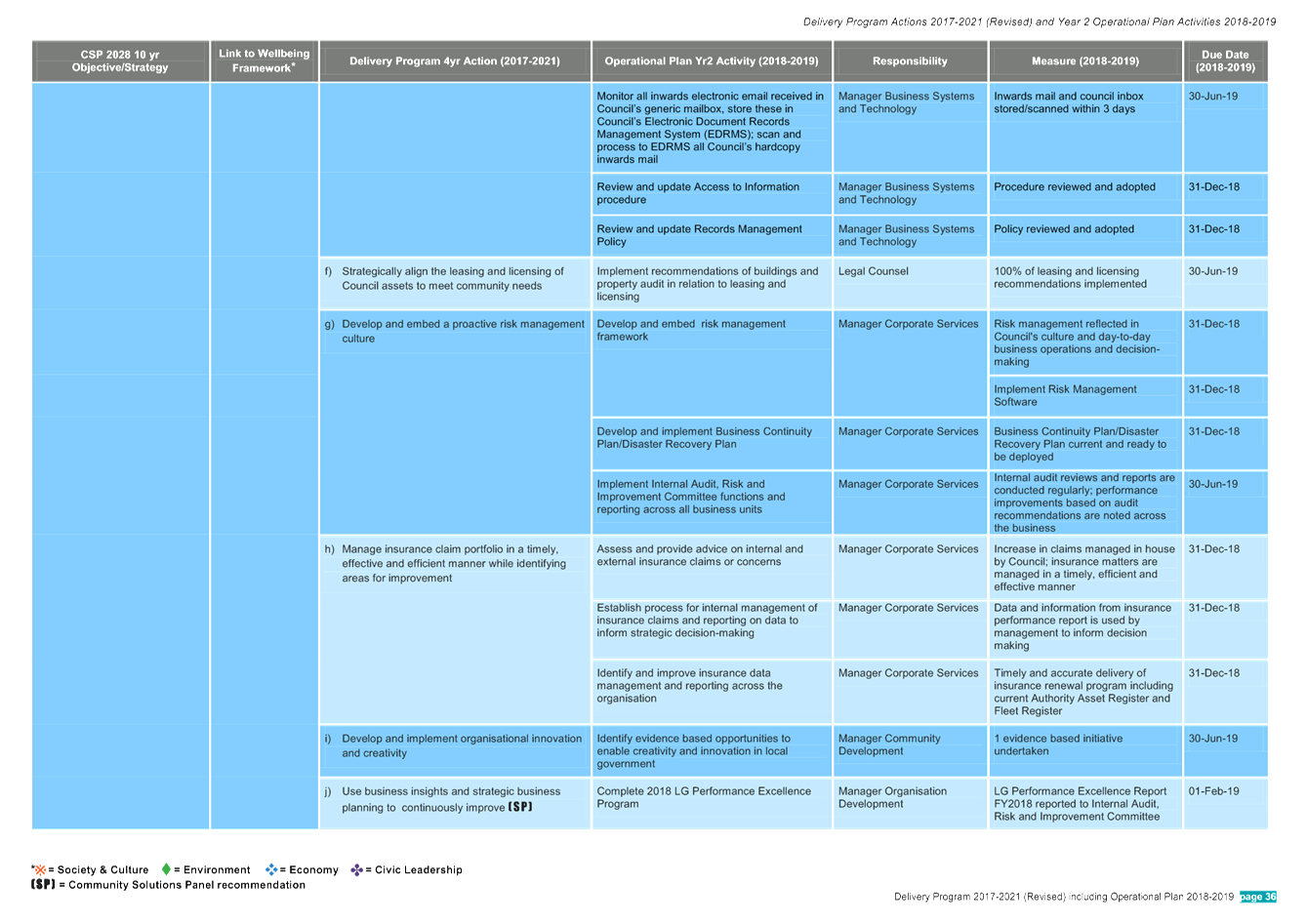

Report No. 4.2 Adoption

of the Delivery Program 2017-2021 (Revised) and Operational Plan 2018-2019,

including Statement of Revenue Policy, Budget, Fees and Charges

Directorate: Corporate

and Community Services

Report

Author: Mila

Jones, Corporate Governance Coordinator

Anna Vinfield, Manager Corporate

Services

James Brickley, Manager Finance

File No: I2018/1060

Theme: Corporate Management

Governance Services

Summary:

Council at its 17 May 2018 Extraordinary Meeting, endorsed

the Draft Delivery Program 2017-2021(Revised) and Operational Plan 2018-2019

(including the Statement of Revenue Policy, 2018-2019 Budget and 2018-2019 Fees

and Charges) for public exhibition (Resolution 18-285 and Resolution 18-282).

The report includes the submissions received during public

exhibition for Council’s consideration and recommends a number of

proposed amendments. It also recommends that Council adopt the revised

documents. Further, the report provides information for Council to

consider in relation to resolution 18-282 part 1(b) concerning the

Better Byron Crew as resolved by Council at the 17 May 2018 Extraordinary

Meeting.

|

RECOMMENDATION:

That Council:

1. Note

the submissions received during the public exhibition period for the

Delivery Program 2017-2021(Revised) and Operational Plan 2018-2019 (including

the Statement of Revenue Policy, 2018-2019 Budget and 2018-2019, Fees and

Charges) (Attachments 2 to 4).

2. Adopt

the following documents:

a) Delivery

Program 2017-2021 (Revised) and Operational Plan 2018-2019 as

exhibited with amendments (Attachment 1 E2018/52819) and discussed in

this report under the heading ‘Management Comments – Delivery

Program/Operational Plan’.

b) 2018-2019

Statement of Revenue Policy as exhibited with amendments (included in

Attachment 1 #E2018/52819) discussed in the report under the

heading ‘Management Comments – 2018/2019 Revenue Policy’.

c) 2018-2019

Budget Estimates as exhibited with amendments discussed in the report under

the heading ‘Management Comments – 2018-2019 Budget

Estimates’.

c) 2018-2019

Fees and Charges as exhibited with amendments discussed in the report under

the heading ‘Management Comments – 2018-2019 Fees and Charges’.

|

Attachments:

1 Delivery

Program 2017-2021 (revised) and Operational Plan 2018-19, E2018/52819 ,

page 31⇩

2 Survey

responses, E2018/51517 , page 137⇩

3 Submissions

(redacted), E2018/52902 , page 145⇩

4 Budget

estimates public access - Question and Answers, E2018/51013 , page 160⇩

5 Better

Byron crew - additional information for implementation of Res 181-282 1b, E2018/52824 ,

page 165⇩

Report

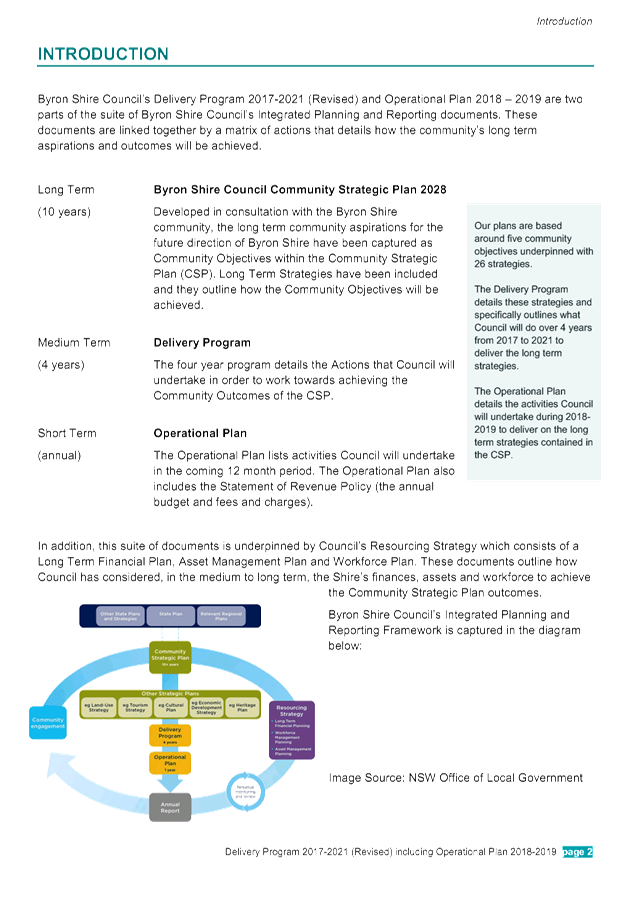

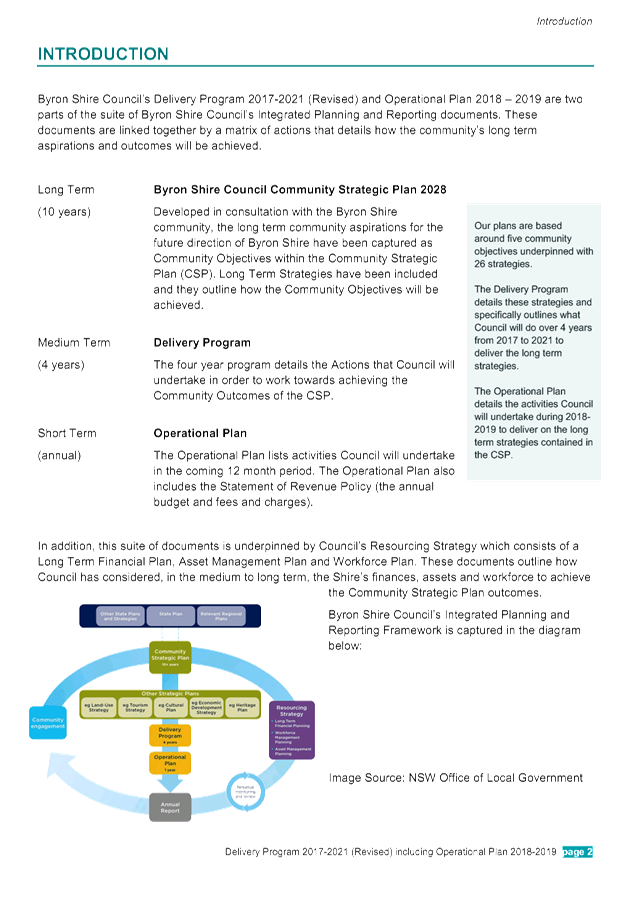

Integrated Planning and Reporting provides a framework that

sets out the community’s main priorities and aspirations for

the future and outlines how these will be achieved. The framework is led

by the Community Strategic Plan (adopted 17 May 2018 Resolution 18-286)

and supported by a series of plans and strategies.

The Community Strategic Plan sets out the 10-year vision and

is developed in partnership between council, government agencies, community

groups and individuals. The Delivery Program is a statement of commitment

outlining the priorities for the next four years and how these will be

achieved. The annual Operational Plan further details the Delivery Program and

outlines what individual projects and activities will be undertaken during the

year.

At the Extraordinary Meeting

on 17 May 2018 Council resolved (18-286) and (18-282) to place

the Delivery Program 2017-2021 (Revised) and Operational Plan 2018-2019

(including the Statement of Revenue Policy, 2018-2019 Budget and 2018-2019 Fees

and Charges) on public exhibition.

This report presents the submissions received during the

exhibition period and seeks Council’s consideration of any proposed

amendments from the submissions, Council resolutions adopted during the public

exhibition period and the accompanying management comments. Following that

consideration and the inclusion of any further amendments endorsed by Council,

it is recommended Council adopt the documents as outlined in this report.

Further, the report provides information for Council to

consider in relation to resolution 18-282 part 1(b) concerning the

Better Byron Crew as resolved by Council at the 17 May 2018 Extraordinary

Meeting under the heading Council Resolutions within the Financial Implications

section of this report.

Resourcing

Strategy – Long Term Financial Plan

During the public exhibition period, Council also had on

public exhibition the Transport Asset Management Plan (TAMP). Given the

feedback received on this Plan, it is expected this will be reported to the 23

August 2018 Ordinary Council Meeting for consideration. It is also an

opportune time to ensure the Long Term Financial Plan (LTFP) reflects the

outcomes of the TAMP to demonstrate integration as a scenario from the base

case. The base case of the LTFP will be formed also from the formal

adoption of the 2018-2019 Budget Estimates as the starting point. Whilst

it was expected the LTFP was to be provided to this Meeting of Council, it is

suggested it will be more meaningful incorporating the TAMP.

Consultation

and public exhibition

All of

the documents were placed on public exhibition from 18 May 2018 to 15

June 2018. Key engagement activities included:

· Budget Estimates Pubic Access Session

· Online survey

· Direct

email, including documents to various community and sporting groups, schools,

Byron Youth Service, people with lived experience of disability and chambers of

commerce

· Advertisement in the Byron Shire News

· Council’s e-newsletter

· Media release

· Council’s website www.byron.nsw.gov.au

· Facebook

The

Integrated Planning and Reporting documents endorsed by Council at the 17 May

2018 Extraordinary Meeting for public exhibition can be viewed using the

following link:

https://www.byron.nsw.gov.au/Home/Tabs/Public-Notices/Delivery-Program-and-Operational-Plan

Budget

Estimates Public Access Session:

A

public access session was held on 6 June 2018 to allow for members of the

public to address Councillors and staff on budget matters. Session ran

from 9.30am to 5pm with approximately 15 members of the public attending

throughout the day. An overview of the budget was provided and attendees

given an opportunity to discuss key budget programs. Questions that were

submitted on the day and their answers have been provided at Attachment 4.

Summary of survey responses:

Council published a survey online (yoursaybyronshire.com.au)

and 17 survey responses were received. The full survey report is provided

at Attachment 2. A summary of the responses is provided here.

|

Q1. What are your top five priority actions from Council’s

draft Delivery Program?

|

There were 17 responses to this question with the

following items topping the list of priorities:

Priority 1: Fixing

roads and drainage

Priority 2: Cycle

paths and improved footpaths and road crossing

Priority 3: Bridge

replacement

Priority 4: Upgrades

to open spaces and recreational works

Priority 5: a)

Public toilet upgrades; b) Building a bypass

|

|

Q2. What are your top five activities from Council’s

draft Operational Plan?

|

There were 13 responses to this question with the

following items topping the list of priorities:

Priority 1: Road

works

Priority 2: Programs

for drainage, kerb and gutter, footpaths, stormwater, causeways and culverts

Priority 3: Safe

environment such as roads, bridges, community and land use, cycle paths and

pedestrian accessibility

Priority 4: Bypass

Priority 5: Develop

program of open space and recreational works

|

|

Q3. Is there anything else you would like to see included

in the program/plan?

|

There were 17 responses to this question that related to:

· More

funding for roads and road works

· Clifford

Street roundabout

· Prioritisation

of safety and full completion of actions from the 2017 Road Safety Audit on

Coolamon Scenic Drive

· Increase

bikeways, futurist green transport, transport alternatives and government

funding for public train service

· Medium

density living model for development

· More cycle

ways and open space and recreation funding for Mullumbimby

· Flexibility

to cope with unforeseen events or issues

· Skate park

in Byron Bay

· More public

toilets in the centre of Byron Bay

· Repair and

upgrade the Bangalow weir and adjacent park

· Liaise

with other NSW local government authorities and pressure state government to

allow levying of a bed tax

|

|

Q4. Is there anything you think should not be included in

the program/plan?

|

There were 14 responses to this question that related to:

· Less, or

no funding for:

o open space and

recreation budget, that budget to be used for road works

o rezoning of Lot 22 or

for trophy cabinet at the Cavanbah Centre

o Railway Park

· Art

programs not to be included

|

|

Q5. Do you have any other comments about Council’s

draft Delivery Program, Operational Plan, Budget, Fees and Charges?

|

There were 14 responses to this question that related to:

· Fixing

roads to be main priority

· Recreation,

sports and arts to be put on hold until basic safety on roads is fixed

· Leave

rural open land as is and medium-density living

· Public

exhibition before adopting the Byron Shire Open Space and Recreation Needs

Assessment and Action Plan

· Include

whole of river catchment management plan into in infrastructure design

· Feasibility

study for the “Byron Line”

· Quality

controlled road maintenance and construction

· Works

should be performed by Council staff rather than contractors to keep money in

the Shire

|

Submissions received:

Council received 13 written submissions. Council is required to

consider any submissions received during the exhibition period prior to the

Council’s endorsement and/or adoption of these documents.

Full copies of the submissions are provided at Attachment 3.

A summary of the submissions and staff comments are provided in tables 1 to 4

of this report.

Table 1 –

Summary of submissions to the Draft Delivery Program 2017-2021 (Revised) and

Operational Plan 2018-2019

|

Doc No

|

Regarding

|

Staff comment

|

|

E2018/48454

|

1. Fix Coopers Creek Road -

terrible state full of dangerous corrugations and potholes

2. Work with NBN and other

internet providers to build more internet capability to Upper Coopers Creek

|

1. This road is currently not

listed for renewal in 2018/19 or a future Works Program as other roads have

been included that are considered to have a higher need. Council currently

has approx 200km of road in poor condition. It is not recommended to allocate

funding to this road for 2018/19.

2. The NSW State Government liaises with NBN the roll out of services.

The Department of Premier and Cabinet – Regional Development, is the

appropriate department for the advocating of new NBN towers. Council is

not consulted on the roll out of NBN towers or NBN fibre to the node

services.

|

|

E2018/48450

|

Request for fenced in off-leash

dog exercise park

|

In response to feedback received through the recent

Community Strategic Plan engagement; it is proposed to prepare a Dogs in Public

Spaces Strategy (DiPS) to develop a balanced policy approach for the

management of dogs in Council’s public spaces.

It is proposed that the DiPS will replace the Byron

Shire Council Policy 5.31 Companion Animal Exercise Areas – which was

last reviewed in 2011.

This is captured under 2.4.c “Enhance public

safety, health and liveability through the use of council's regulatory

controls and services”

|

|

E2018/50261

|

Protecting environment and

wildlife

|

Council is committed to protecting the environment and

wildlife. This is captured under the overarching objective “we

protect and enhance our natural environment” and specifically in

strategies 3.1 “Partner to protect and enhance our biodiversity,

ecosystems and ecology”, 3.2 “Strive to become a sustainable

community”, 3.3 “Partner to protect and enhance the health of the

Shire’s coastlines, estuaries, waterways and catchments” and 3.4

“Support and secure our farming future”.

|

|

E2018/51086

|

1. Competence of the Community

Solutions Panel

2. Major rate-payer funded new

projects must be indefinitely deferred

3. There is no long term road

resealing plan published with the budget

4. The emphasis on pothole

patching must stop

5. The expenditure split between

rural and town roadworks/bridgeworks is not equitable

6. Railway park development

7. Open spaces operating

expenditure

8. Footpaths, especially Byron

Bay

9. Abandon Byron Bay Masterplan

|

1. The Community Solutions Panel was a randomly

selected group of 31 residents brought together to deliberate on

infrastructure priorities. The panel identified a framework and set of values to apply – risk and safety was their number

one consideration.

2. Revenue from the Special Rate Variation is dedicated to

infrastructure renewal and maintenance. Major projects such as the Bayshore

Drive Roundabout have been granted funded and also projects have been funded

wholly or in part by Section 94 development contributions. S94 funds can only

be spent on new works.

3. It is intended to develop

and publish a 4 year rolling bitumen resealing program in future budget

documents after the next collection of condition data for our sealed road

network in the 2018/19 financial year. Until this data has been collected the

bitumen resealing program will be prepared and published for one financial

year at a time.

4. The under investment by

Council in our road pavements in the past has resulted in a substantial

increase in costs for pothole patching. Council has a strategy for the future

to continue to make the roads safe by pothole patching; increasing the

resealing budget; and introduction of a heavy patching program to repair the

defects in the sealed roads. This is proposed for 2018/19. This is a change

in strategy for Council and an investment of funds to change the condition of

our road network in the future, however, noting that this will be a lengthy

period of time due to the condition of our road network and the available

funds. The proposed resealing budget for 2018/19 has been increased

substantially to that normally provided in the past.

5. The works proposed for

2018/19 and in the future are based on need not an equitable distribution of

funds between urban/rural or each town and village, noting the limited

available funds and the overwhelming need for road pavement renewal of 40% of

our road network, which is in poor condition.

6. Work on the Railway Park upgrade and adjacent integrated projects

such as the proposed Byron Bus Interchange are majority funded through grants

and S94 contributions.

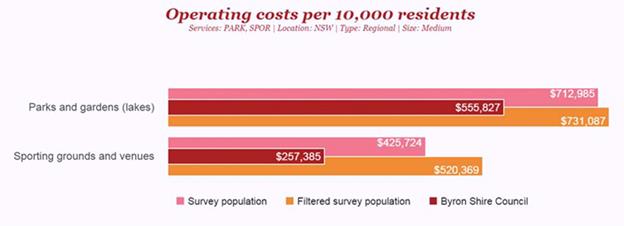

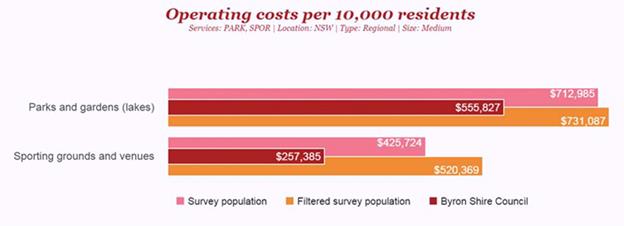

7. The Australasian LG Performance Excellence Program

FY17 Report (insert web link)

indicates that

Byron’s level of operating expenditure allocated to Open Space

Community assets is comparatively low. Byron’s per capita spending on

operating costs for Parks and Gardens and Sports Grounds and Venues

shire-wide is significantly lower than the average for the participating NSW

medium sized regional councils.

Apex park is valued by the Byron

community and the level of maintenance required reflects the heavy use by

both local community members and visitors. All

maintenance and capital improvements are solely funded from Crown reserves

that are not transferable to other Community assets. Any

reduction in funding for this reserve would be returned to this reserve.

8. Council has allocated

funding in 2017/18 for the revision of our Bike Plan and the preparation of a

pedestrian and access mobility plans (PAMP), which will involve consultation

with key stakeholders and exhibition of draft plans inviting submissions from

the general public. In the course of the preparation of both plans,

there will be opportunity to propose routes for footpath’s and bike

parts from locations within Byron Bay into the town centre. This

engagement with stakeholders and the wider public will occur in the latter

half of 2018 and the early part of 2019.

9. The Byron Bay Masterplan was developed through a process

of extensive community consultation and participation. The Plan has been

adopted by Council and is being implemented with the support of the Byron Bay

Town Centre Masterplan Leadership Group. The Plan is progressively being

implemented as funding is allocated and grants secured.

|

Table 2 – 2018-2019

Budget

|

Doc No.

|

Regarding

|

Staff comment

|

|

E2018/50967

|

Funding allocations for the Brunswick Visitor Centre

|

Council will review this submission for funding as

part of the Tourism Management Planning Process which will be undertaken in

2018 and released in 2019.

|

Table 3 –

2018-2019 Fees and Charges

|

Doc No.

|

Regarding

|

Staff comment

|

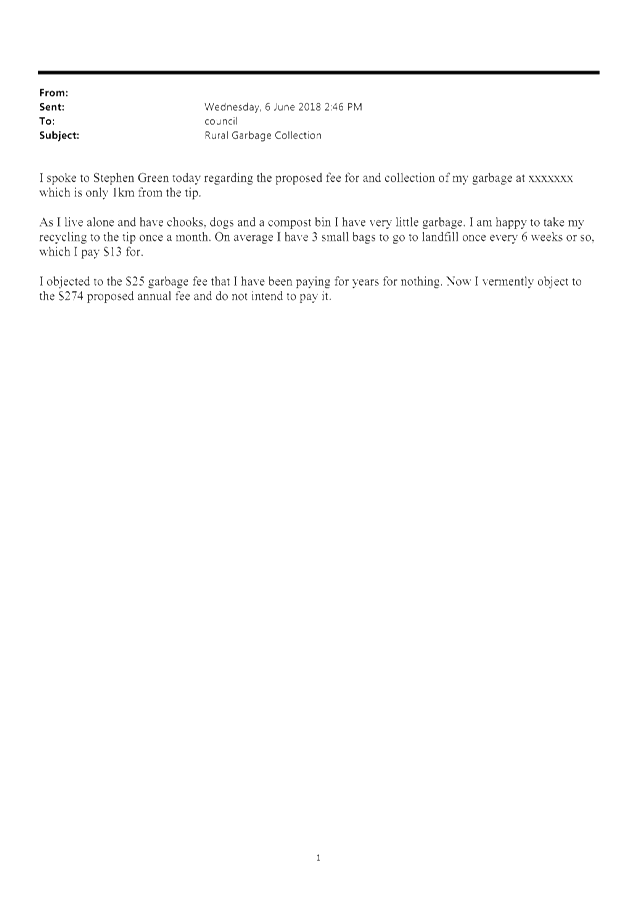

|

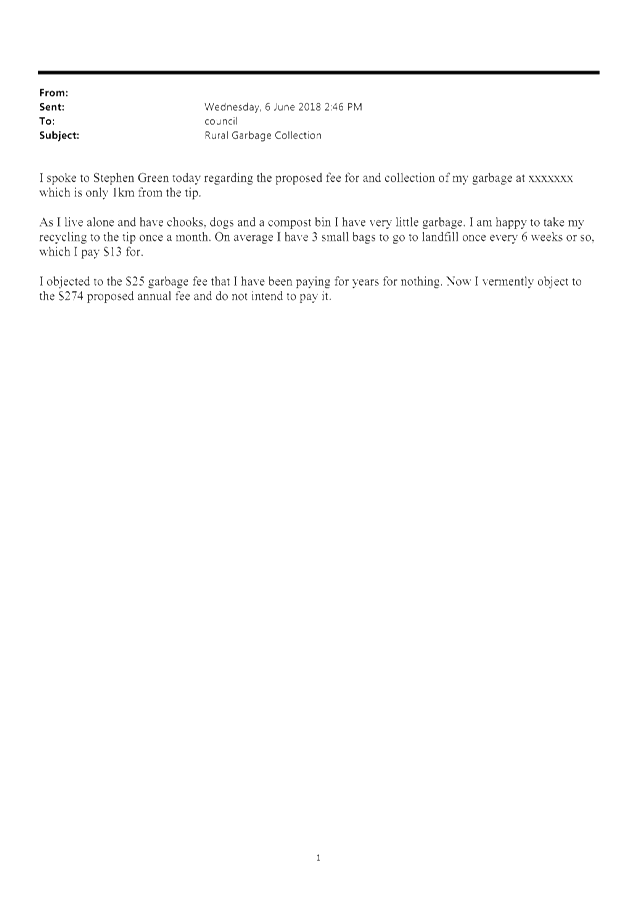

E2018/48463

|

Intention to levy a garbage

collection fee on 390 rural residents

|

The application of a rural domestic waste management

bin collection charge on each parcel of rateable land on which a dwelling

house is situated and for which a service is available was recommended by the

Water Waste and Sewer Advisory Committee (WWSAC) as part of the Rural Waste

Services Review report considered at the 1 March Committee meeting. This

recommendation was subsequently adopted by Council during the 19 April 2018

Council Meeting (Res 18-278). A further report detailing information on the

relevant legislation associated with the introduction of this charge was

considered at the 31 May WWSAC meeting, with the committee recommending

Council note the report at the 21 June 2018 Council meeting.

The introduction a rural domestic waste management

charge on each parcel of rateable land for which a service is available will

deliver the following beneficial waste management objectives for the Shire:

• It will encourage responsible household waste

management practices resulting in environmental benefits such as reduced

waste to landfill and increased recycling. This is an important objective of

Council’s ongoing commitment to improving its waste management and

resource recovery.

• It results in a more equitable financial

contribution by ratepayers to Council’s operational waste management

costs.

• The domestic waste bin collection charge has

been compulsory for dwellings within the urban collection area for many years

so now the rural collection area charging policy is consistent with the urban

charging policy.

• It will reduce the likelihood of illegal

dumping or residential waste in public place bins and other residents bins

Section 496 of the Local Government Act 1993 (LGA)

states that council must make and levy an annual charge for the provision of

domestic waste management services for each parcel of rateable land for which

the service is available.

Section 539 of the LGA states that in determining the

amount of a charge for a service, the council may have regard to (but is not

limited to) the following:

• the purpose for which the service is provided

• the nature, extent and frequency of the

service

• the cost of providing the service

• the categorisation for rating purposes of the

land to which the service is provided

• the nature and use of premises to which the

service is provided

• the area of land to which the service is

provided

Domestic waste management services is defined by the

LGA as meaning services comprising the periodic collection of domestic waste

from individual parcels of rateable land and services that are associated

with those services.

Council carefully considered the above legislative

requirements before determining its proposed domestic waste charging

structure for 2018/19. Council believes the charging structure is equitable

and compliant with legislative requirements for the reasons provided earlier.

Other Councils in NSW have also adopted compulsory domestic waste bin

collection service charges for similar reasons. In response to legislative

interpretations;

• Council acknowledges that it could apply a

lesser charge for customers that choose not to present bins kerbside for

collection however, this would conflict with the waste management objectives

for the shire detailed earlier.

• Council considers that the statement service is

available within section 496 to mean that our collection vehicle performs (or

attempts to perform) on an ongoing basis, the regular periodic collection of

bins adjacent to the kerbside of a property which is located along the usual

route taken by the collection vehicle. Council consider that the service has

been made available by virtue of the collection vehicle visiting the property

regardless of whether bins are seldom presented for collection or not at all.

Council also provides bins to customers free of charge (except for wilful

damage and excessive bin capacity changeovers) and performs maintenance as

requested, meaning that bins are readily available for use by our customers

upon request. Council rejects the claim that the service is not available just

because a customer choose not to utilise the service that is made available

to the property.

Whilst Council appreciates some customers may dispose

of the waste and recyclables generated at their property diligently and

possibly without the requirement of a kerbside domestic waste collection

service, introducing a charging system to cater for the wide and varied range

of waste disposal habits of our customers is unrealistic and would be cost

inhibitive due to the resources required for its administration.

Council rejects the claim to impose a bin storage fee

upon Council.

|

|

E2018/48460

|

Proposed construction certificate and complying

development charges listed as “POA”

|

Council has provided a Price On Application

("POA") option in lieu of a standard set of fees. This

enables staff to tailor an application and inspection fee package for each

customer based upon the development proposed. This is the same as what

private certifiers are currently able to do and also what some other Councils

do. It evens the playing field up for council service delivery in that

regard. Having said that Certification fees have remained the same and will

continue at the hourly rate of $180.00 per hour. A full quote will be

provided to an applicant upon request based on the cost of works and type of

proposal.

|

|

E2018/40623

|

Free or discounted entry sought for volunteer Surf

Life Savers from Council Pools

|

Whilst Council acknowledges the great value that

volunteer Surf Life Savers provide to our community and visitors we are

unable to coater for this request. Council Pools are already heavily

discounted to users with net operating losses having been paid for by the

General Fund. Council provides a Concession rates (season tickets and

single entry) for Holders of Senior Cards, Student Cards, Pensioners / Health

Care Cards and family discounts. Council also provide discounted books

as an option to all users.

|

|

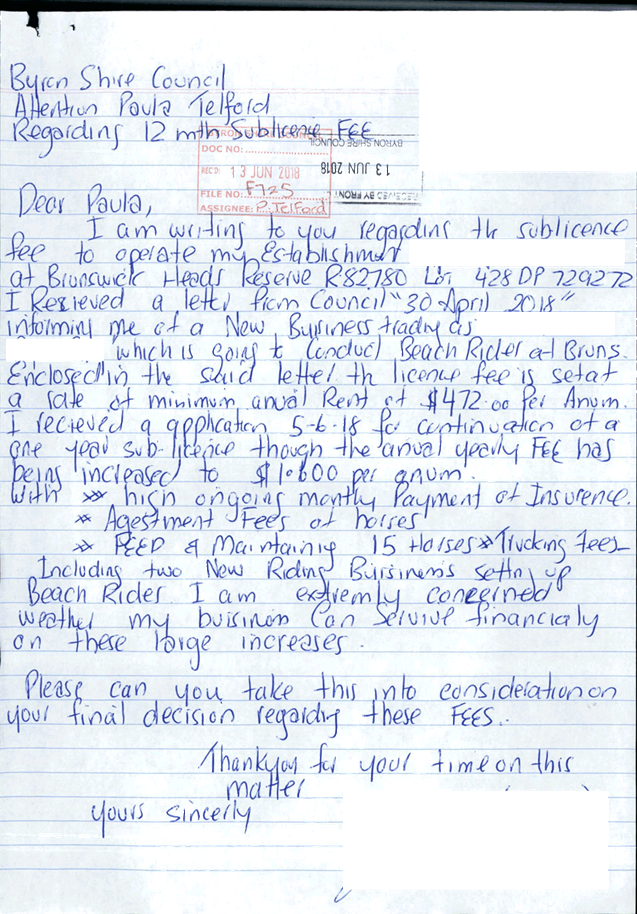

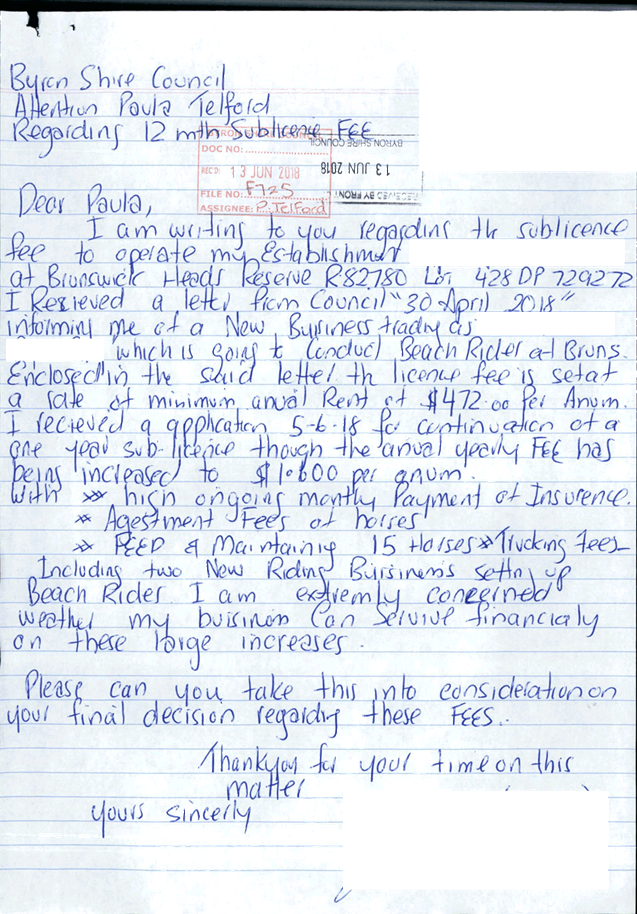

S2018/7881

|

New Sub-licence fee – Beach access commercial

horse riding

|

During review of this fee and charge for issuing of

sub-licences under Councils Crown licence, it was identified that adjustment

was necessary after consideration of Councils annual fee payment to Crown in

order for Council to have the authority to grant these sub-licences and

enable these businesses to operate on Crown Land. The new fees as

proposed are in line with neighbouring Council fees for sub-licences of this

type of Commercial activity.

|

|

E2018/49977

E2018/48867

S2018/8058)

|

Compulsory rural waste charge

|

The

application of a rural domestic waste management charge on each parcel of

rateable land for which a service is available was recommended by the Water

Waste and Sewer Advisory Committee (WWSAC) as part of the Rural Waste

Services Review report considered at the 1 March Committee meeting. This

recommendation was subsequently adopted by Council during the 19 April 2018

Council Meeting (Res 18-278). A further report detailing information on the

relevant legislation associated with the introduction of this charge was

considered at the 31 May WWSAC meeting, with the committee recommending

Council note the report at the 21 June 2018 Council meeting.

The

introduction of a rural domestic waste management charge on each parcel of

rateable land for which a service is available will deliver the following

beneficial waste management objectives for the Shire:

· It will encourage responsible household waste management

practices resulting in environmental benefits such as reduced waste to

landfill and increased recycling. This is an important objective of

Council’s ongoing commitment to improving its waste management and

resource recovery.

· It results in a more equitable financial contribution by

ratepayers to Council’s operational waste management costs.

· The domestic waste bin collection charge has been

compulsory for dwellings within the urban collection area for many years so

now the rural collection area charging policy is consistent with the urban

charging policy.

· It will reduce the likelihood of illegal dumping or

residential waste in public place bins and other residents bins

|

Table 4 –

General Comments

|

Doc No.

|

Regarding

|

Staff comment

|

|

E2018/48457

|

Loud music at restaurants

|

Development Consent conditions including hours of

operation, noise management and local amenity are included in any new

restaurant approvals. Where complaints are registered as CRMs about a

development, Council's Community Enforcement Team take the appropriate course

of action as per the Enforcement Policy.

|

Facebook comments

received:

Council received 28 comments on social media with more than 7,898

people reached. The comments related to roads, potholes, Bangalow

memorial park, works management and establishing regional credit union.

Management Comments – Delivery Program/Operational

Plan

The feedback received during public exhibition reinforces

the commitments in the Delivery Program and Operational Plan, especially with

regard to infrastructure improvements.

Officers have identified an action which should be included

as referenced below:

· 5.1.a deliver

customer satisfaction survey – responses received by 31 Dec 2018

No other amendments are proposed.

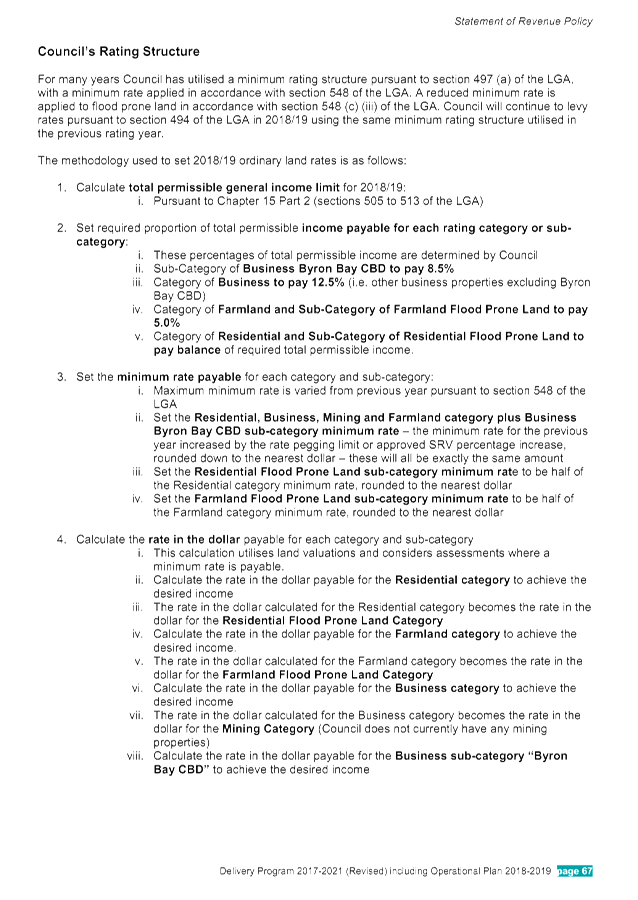

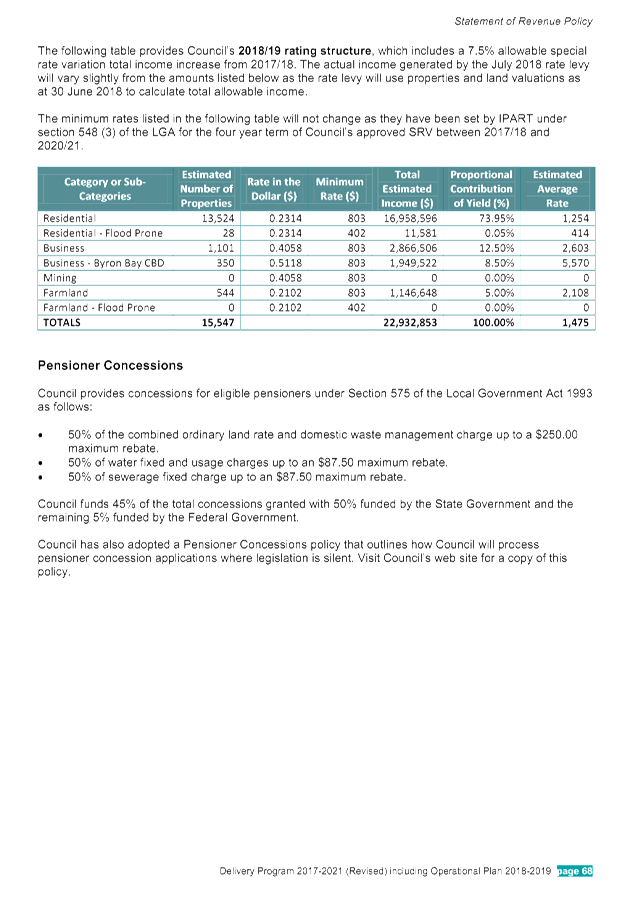

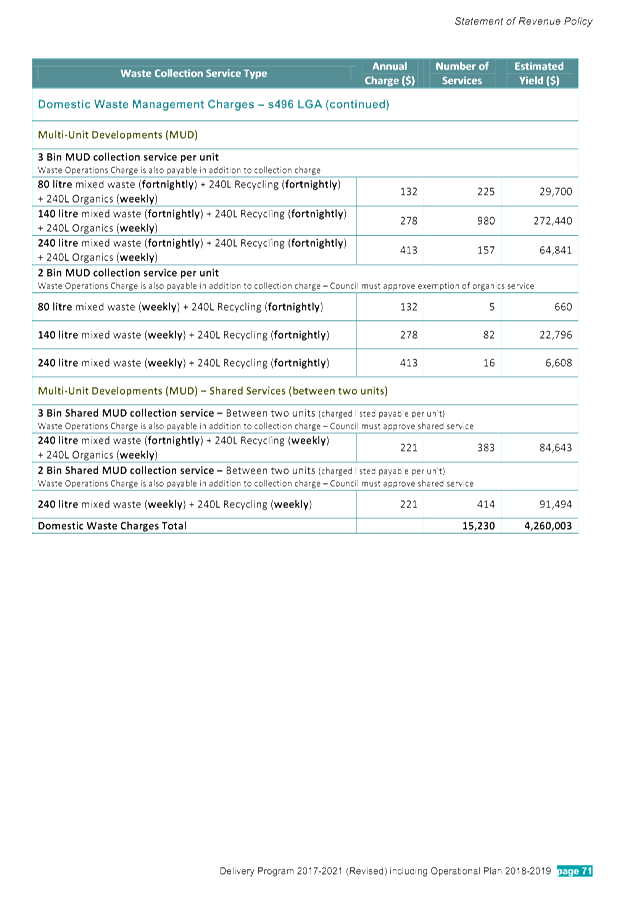

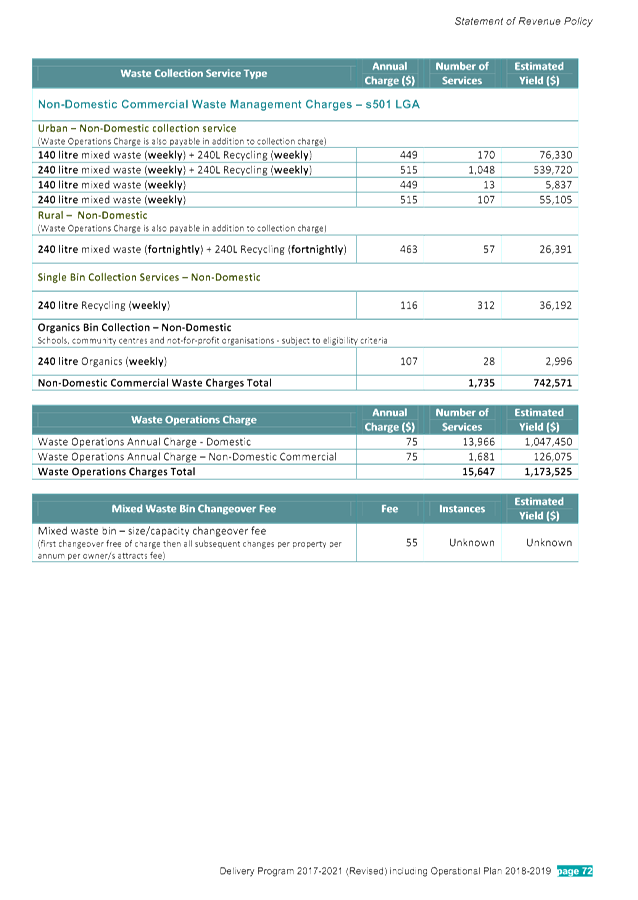

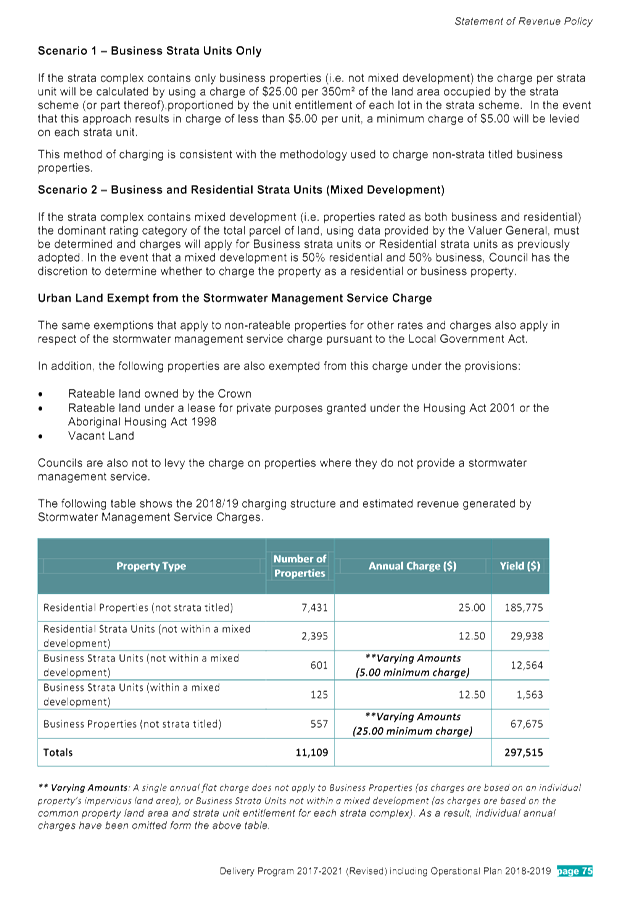

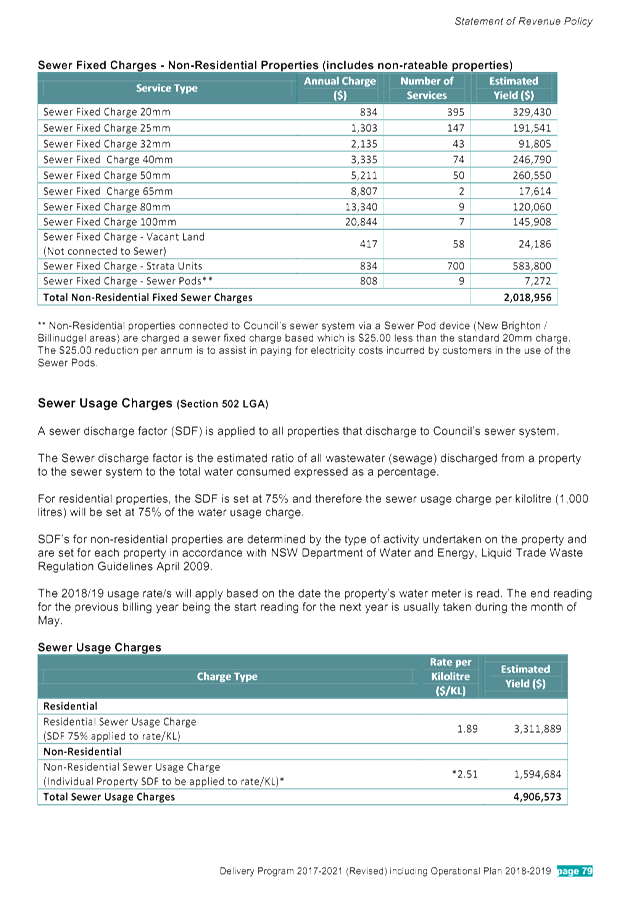

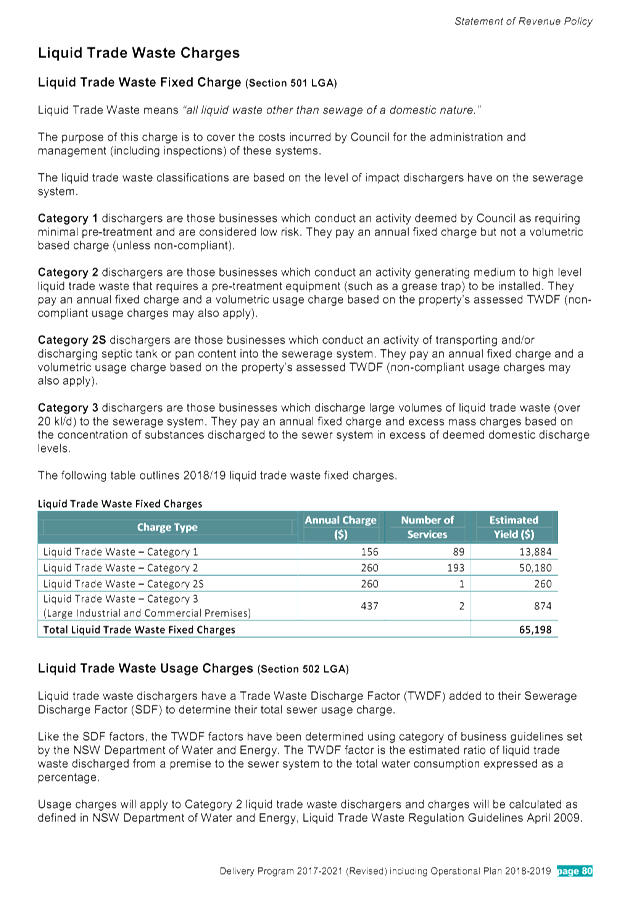

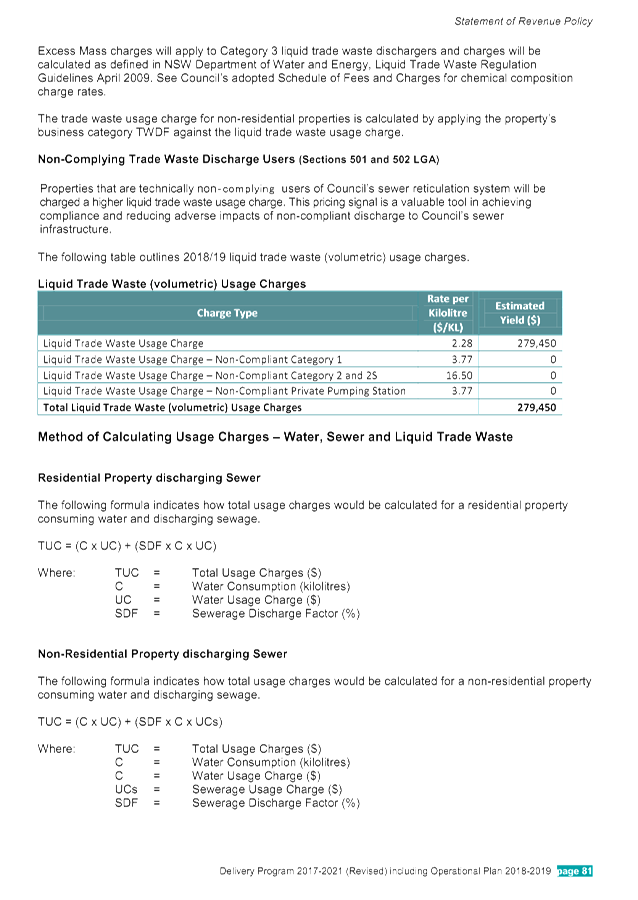

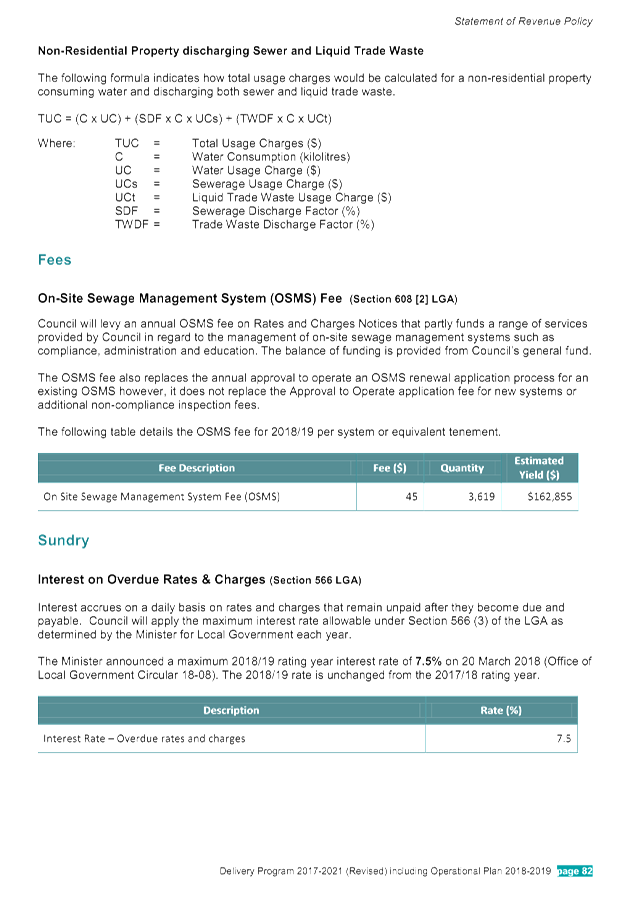

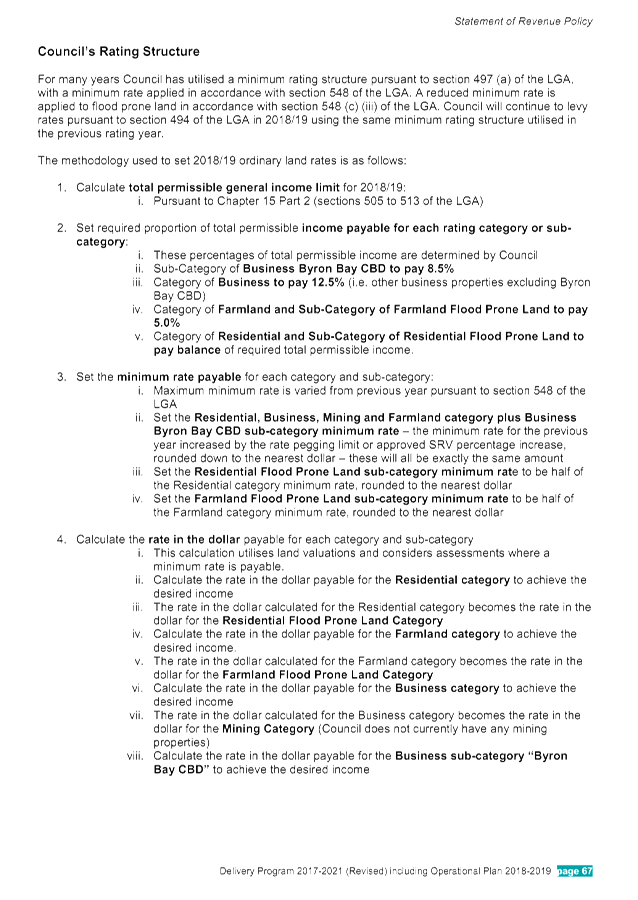

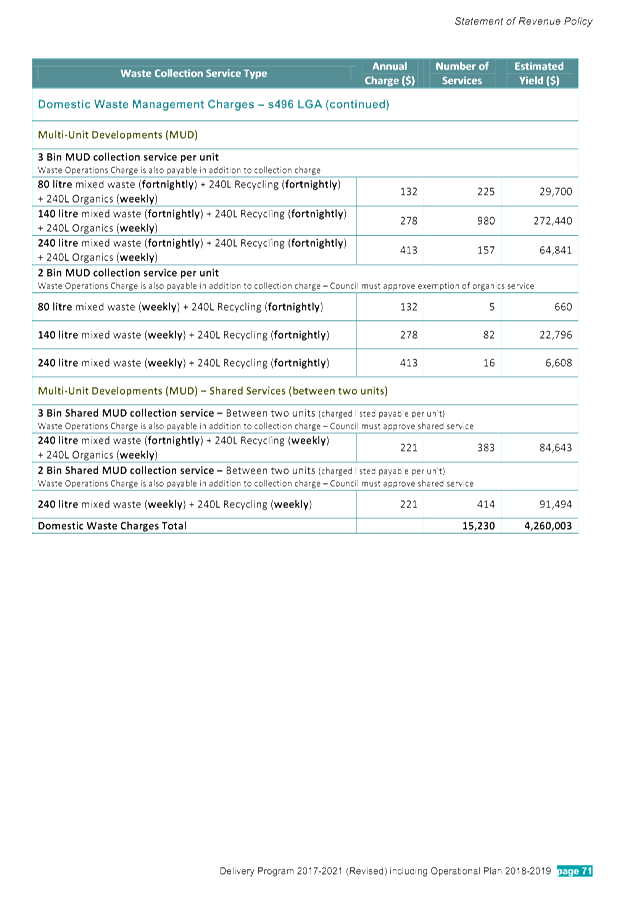

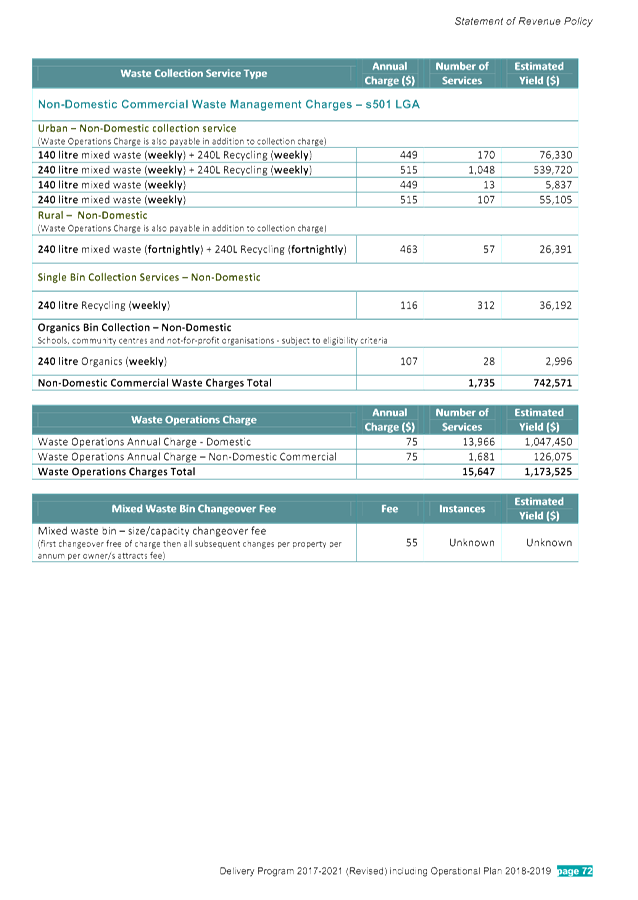

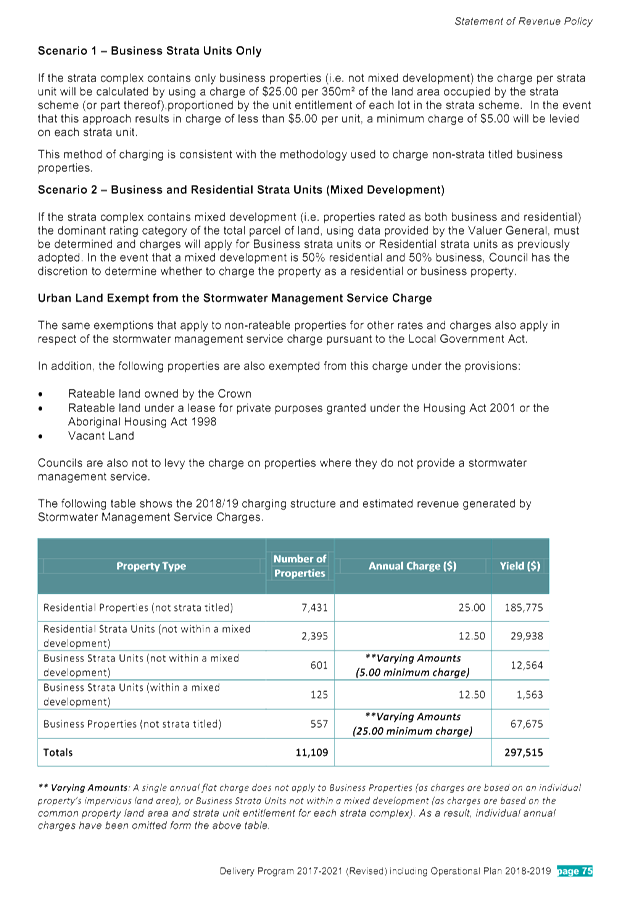

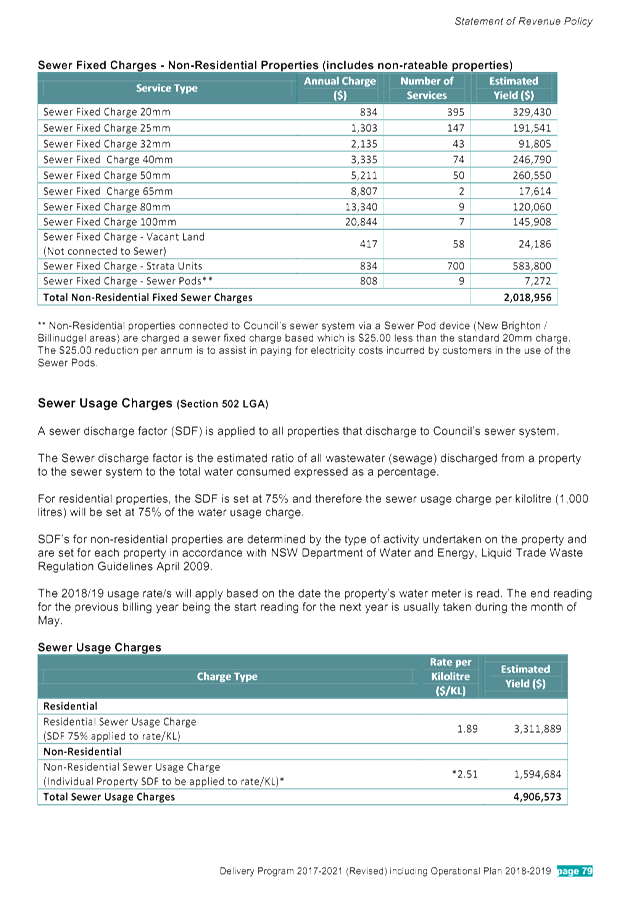

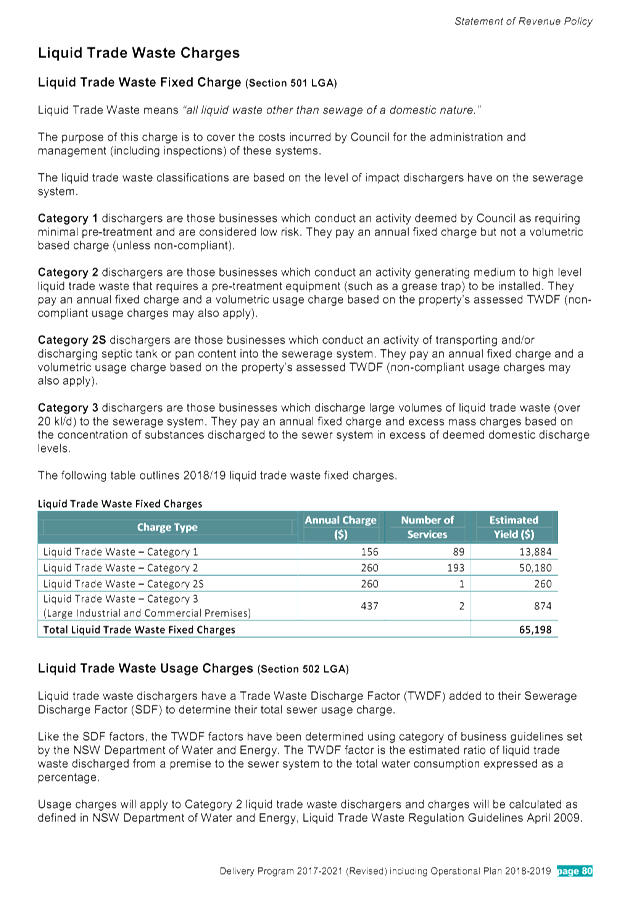

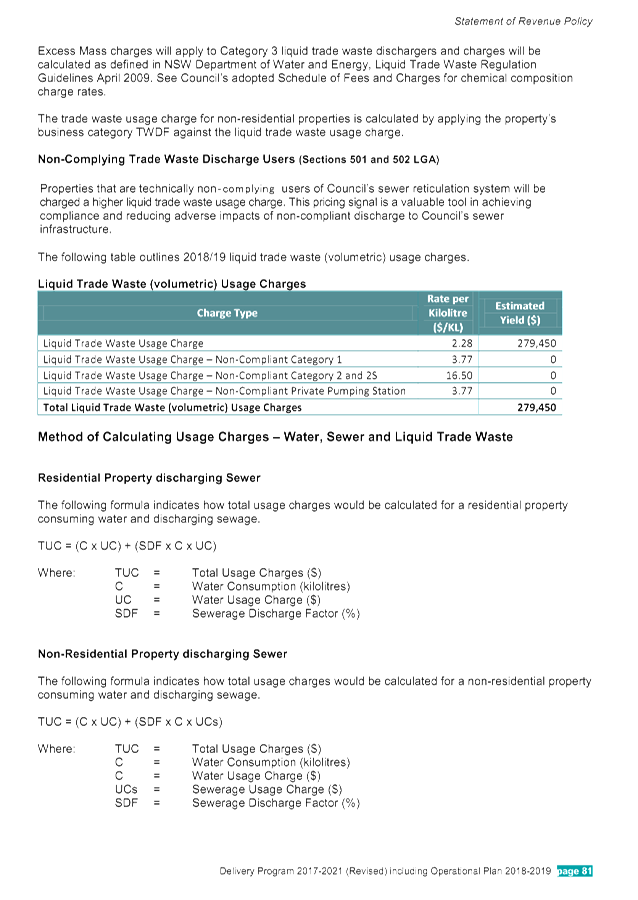

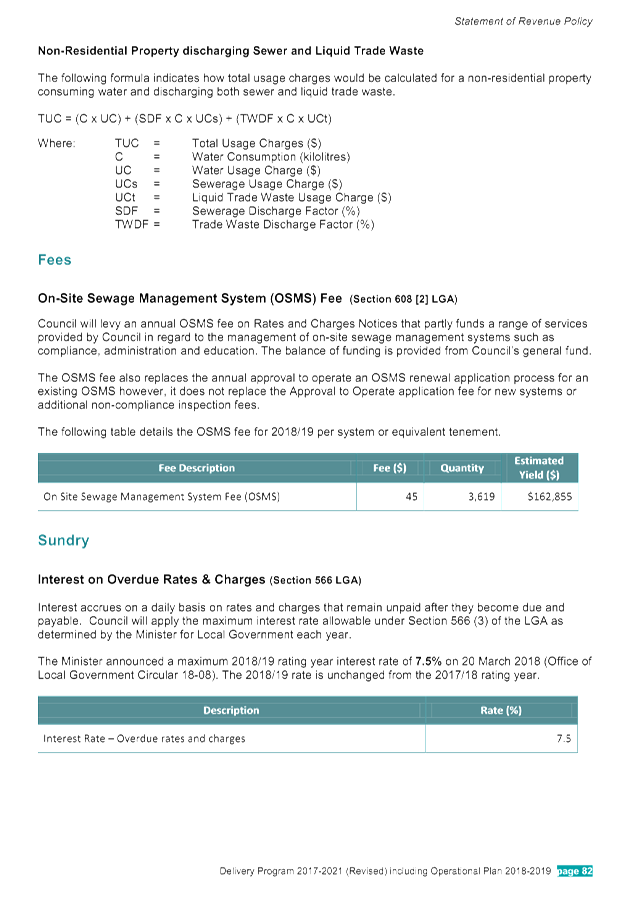

Management Comments – 2018-2019 Revenue Policy

Subject to another report to this Extraordinary Meeting of

Council concerning the making of Rates and Charges and two submissions received

in Table 3 above, the 2018/2019 Revenue Policy is proposed to be adopted as

publicly exhibited. This includes the following:

· Continuation of

the rating structure that was significantly revised by Council for the

2017-2018 financial year. The rating structure incorporates the second year of

the approved 2017/2018 Special Rate Variation (SRV) with the overall rate yield

for 2018-2019 being increased by 7.50% including rate pegging of 2.30%.

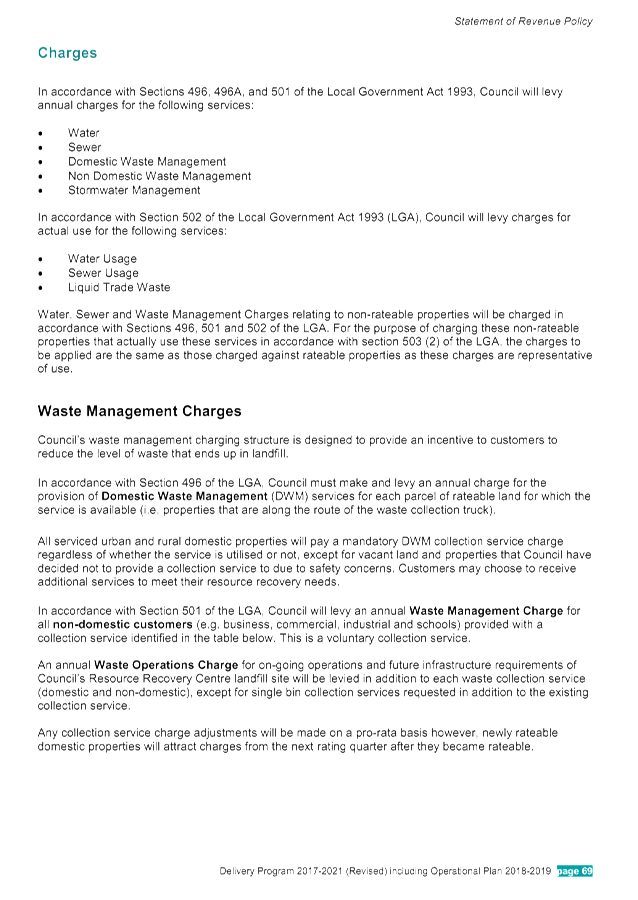

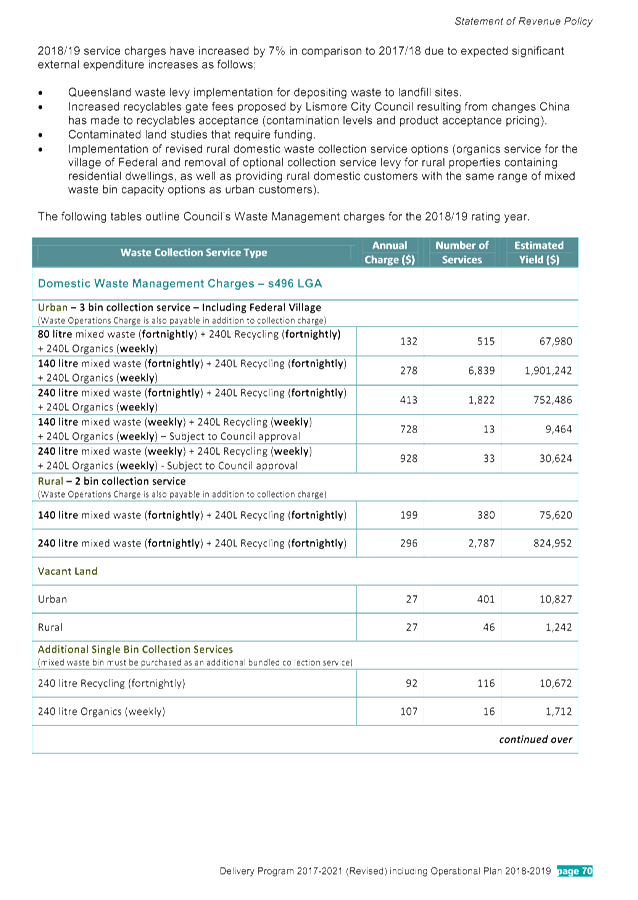

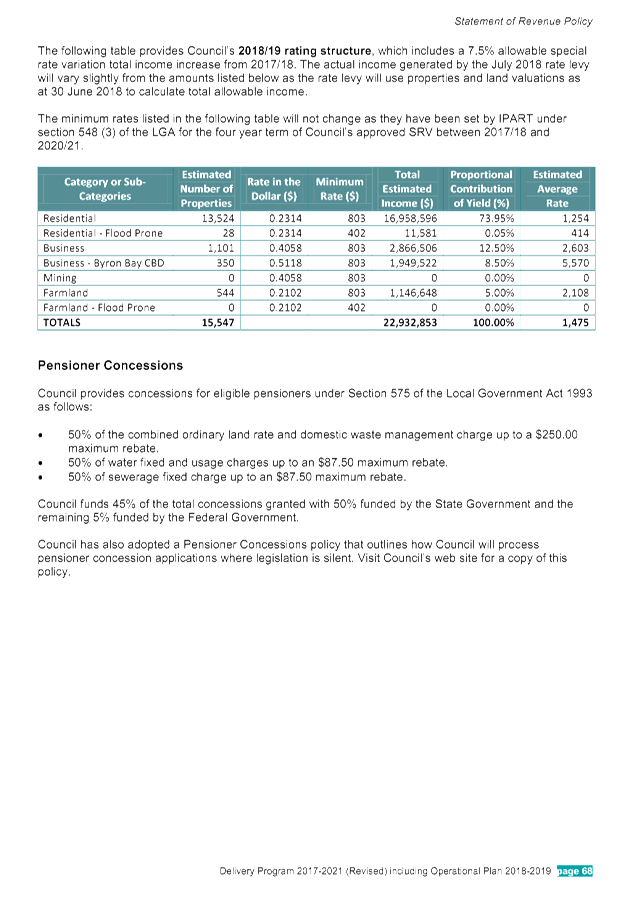

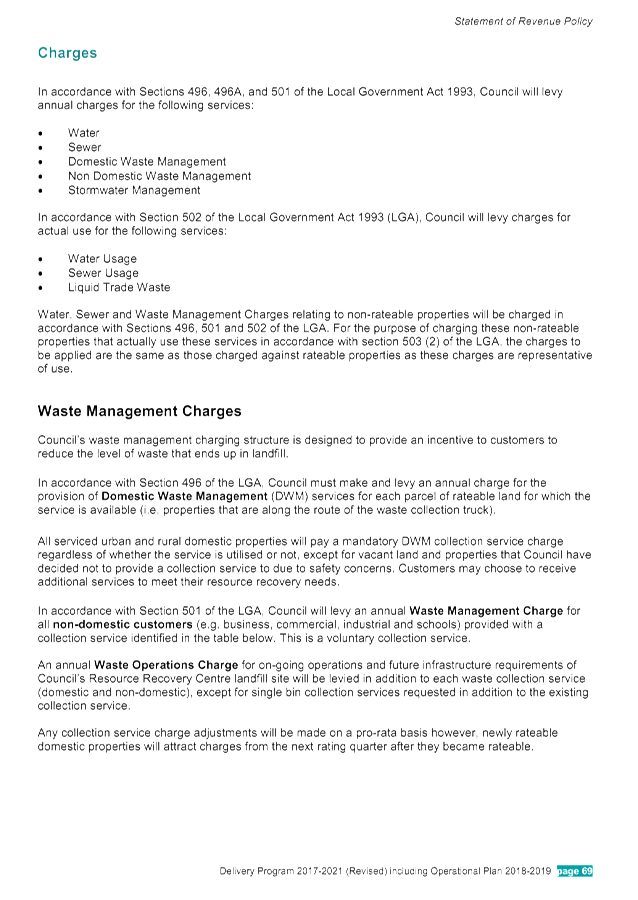

· Waste Charges

– increases of 7.0% to apply due to:

o Queensland waste

levy implementation for depositing waste to landfill sites.

o Increased

recyclables gate fees proposed by Lismore City Council resulting from changes

China has made to recyclables acceptance (contamination levels and product

acceptance pricing).

o Contaminated land

studies that require funding.

o Implementation of

revised rural domestic waste collection service options (organics service for

the village of Federal and removal of optional collection service levy for

rural properties containing residential dwellings, as well as providing rural

domestic customers with the same range of mixed waste bin capacity options as

urban customers).

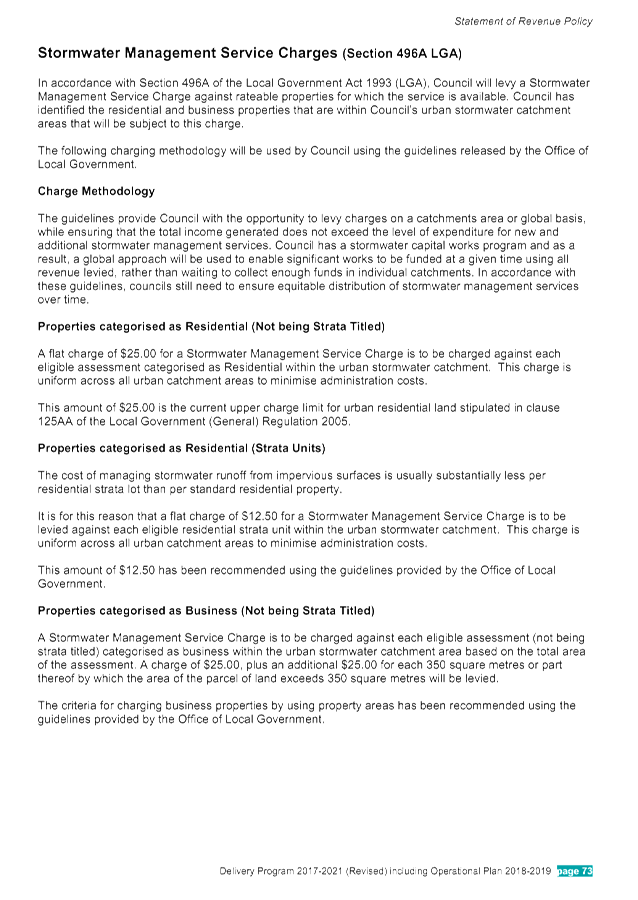

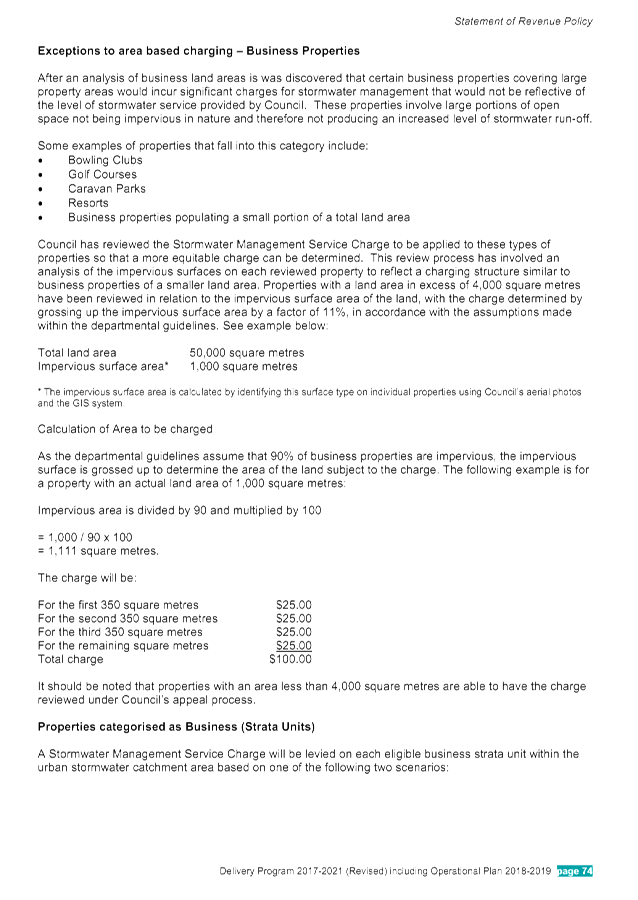

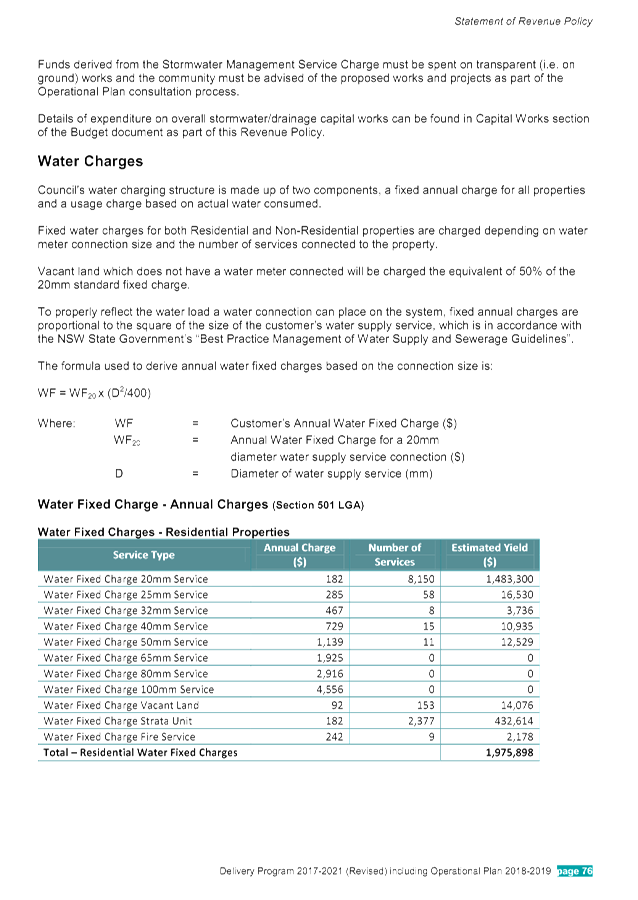

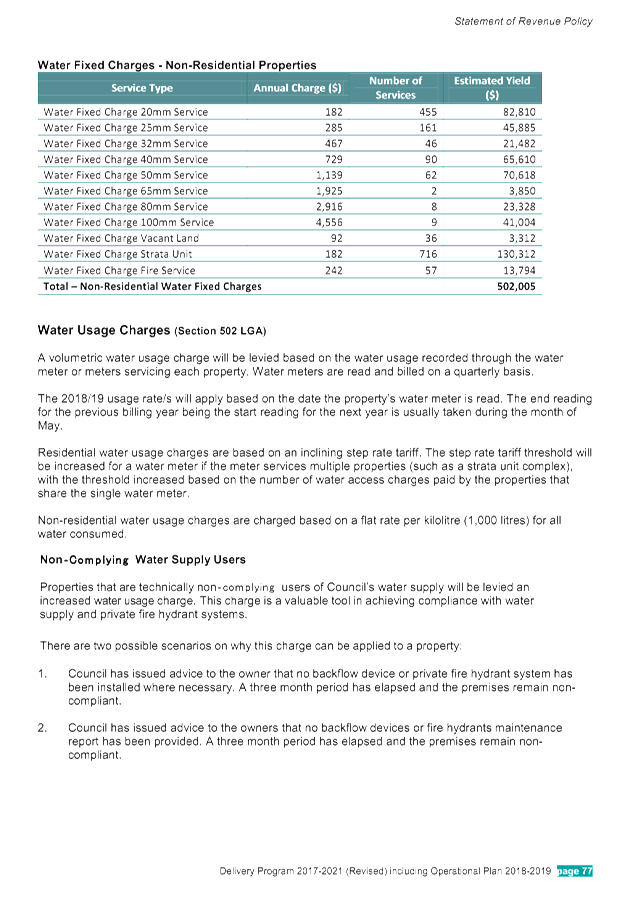

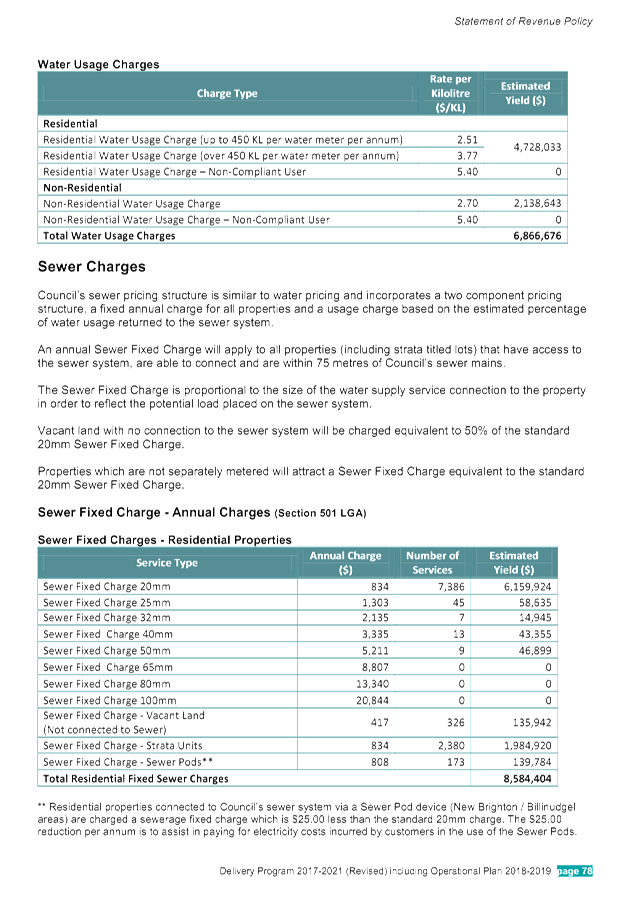

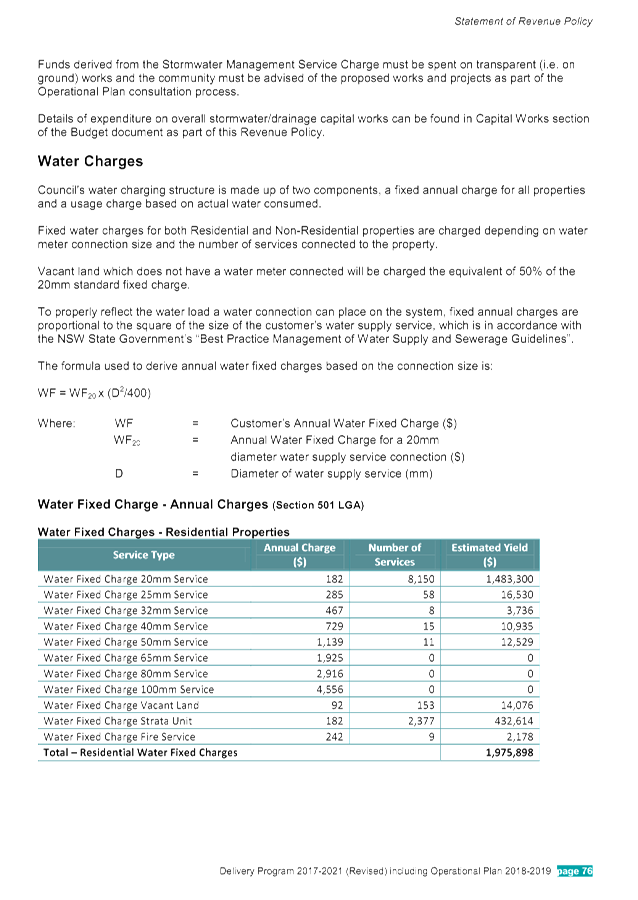

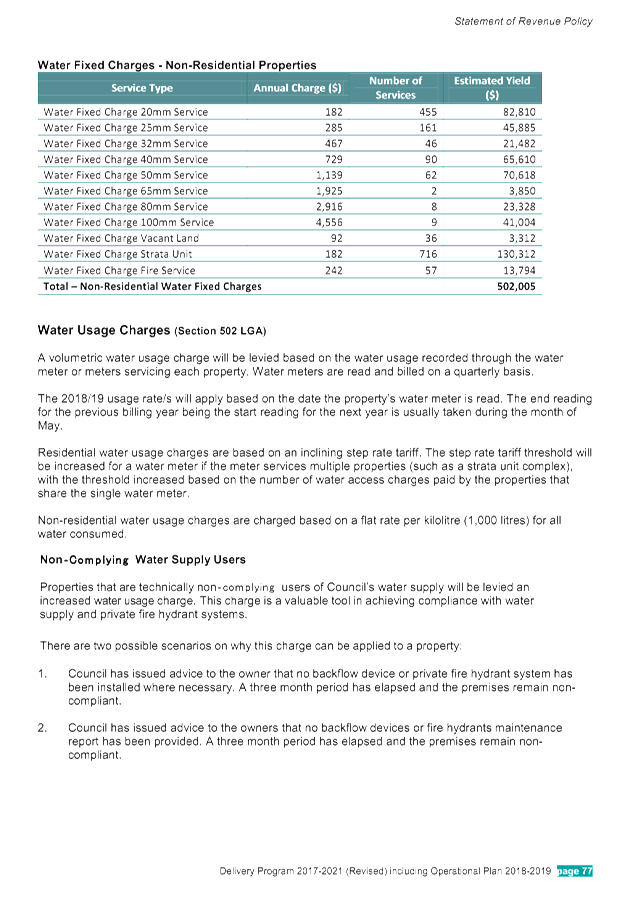

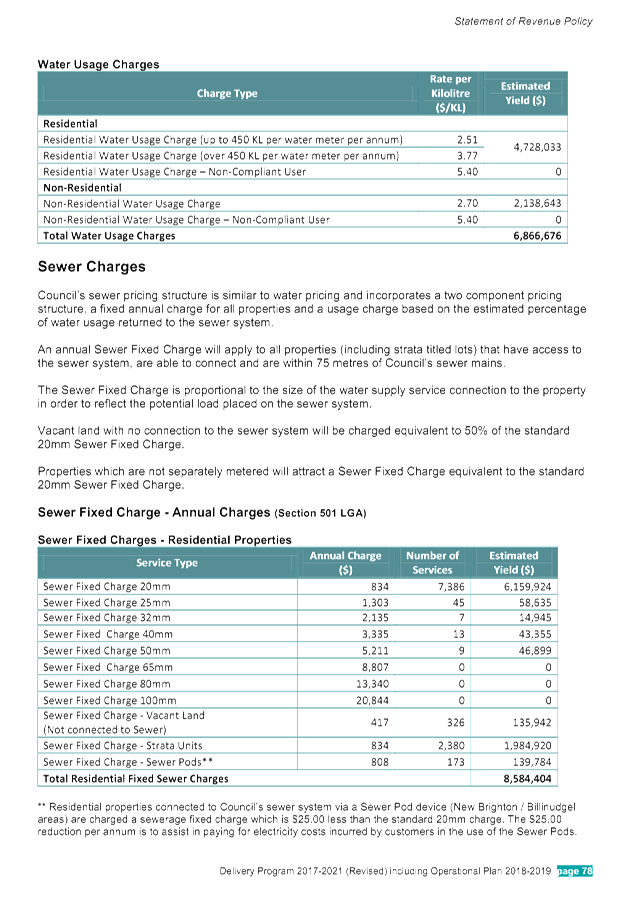

· Water

and Sewerage charges increased in line with the Consumer Price Index of 1.80%.

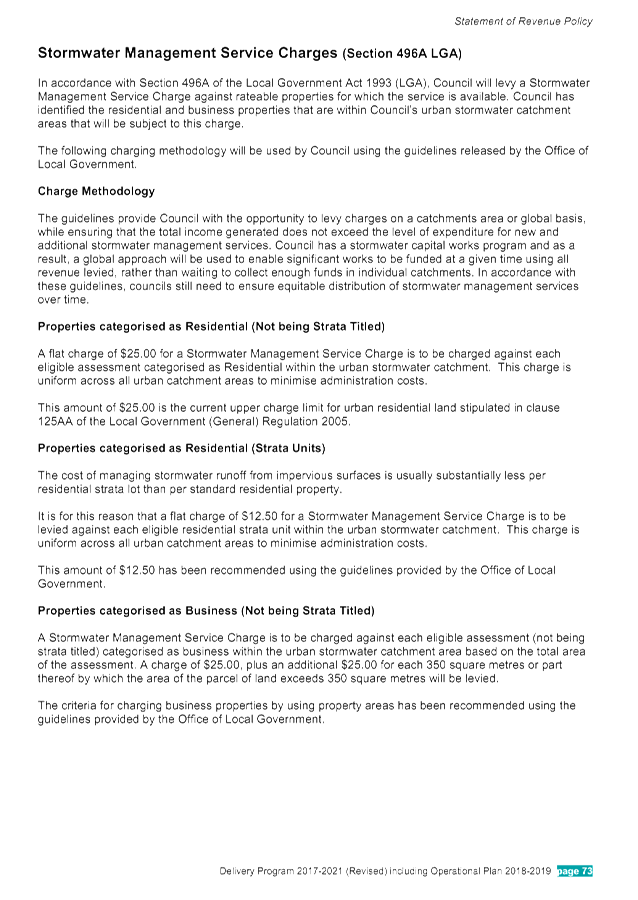

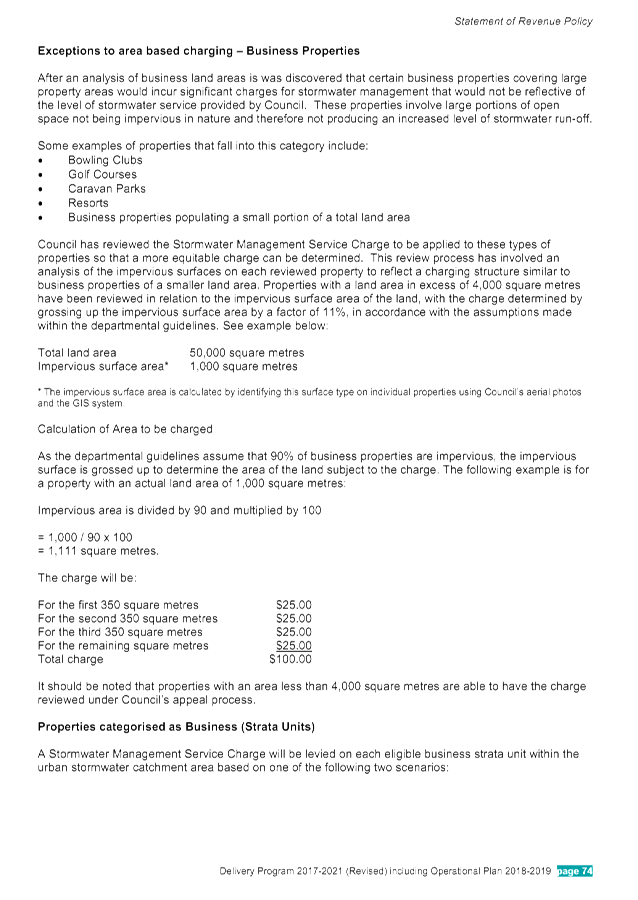

· The stormwater

charge has not increased given it is a regulated charge that has not changed

over the last eleven years.

Management Comments – 2018-2019 Fees and Charges

Aside from the public submissions received regarding the

proposed fees and charges outlined in Table 3 to this report, there are further

proposed amendments to the fees and charges that will not require further

advertisement for the following reasons:

· During the public

exhibition period, an external review of Council’s proposed 2018-2019

fees and charges was undertaken which resulted in 33 fees having the wrong

Goods and Services Tax (GST) treatment applied. This requires 6 fees to

be increased as GST needs to be applied and 27 fees to be reduced because GST

does not apply. Council discloses in its fees and charges that they may

be altered depending upon the application of GST.

· The Office of

Local Government via Circular 18-16 on 1 June 2018 have advised that Companion

Animals fees are to be increased by the Consumer Price Index. These fees

will be changed but not advertised given they are a statutory fee not set by

Council.

· Clarification of

wording in respect of Interim Parking Permits to comply with Council resolution

18-132 from the 22 March 23018 Ordinary Meeting.

· Updated wording

and legislative references for Development Assessment construction certificates

and complying development, planning certificates, development certification,

subdivision/strata certificates, on-site sewerage fees and planning

information fees, temporary food business operation approval.

· Some planning fees

have been clarified in terms of Price on Application (POA) status and changed

where a statutory fee to the amount or further explanation provided as raised

by the submission in Table 3.

Otherwise the fees and charges presented to Council at the

Extraordinary Council Meeting held on 17 May 2018 that were adopted for public

exhibition remain unchanged.

Management Comments – 2018-2019 Budget Estimates

Refer to Financial Implications Section below:

Financial Implications

The Draft 2018-2019 Statement of Revenue Policy placed on

public exhibition in accordance with resolution 18-282 is based on the

2017-2018 budget reviewed at 31 March 2018 with various changes to reflect the

increased price of service delivery across all programs developed from the

input received from each Council Directorate.

The Draft 2018-2019 Budget Result placed on public

exhibition on a Consolidated (All Funds) basis forecast a surplus result of

$15,800 with details of that result being included below at Table 5

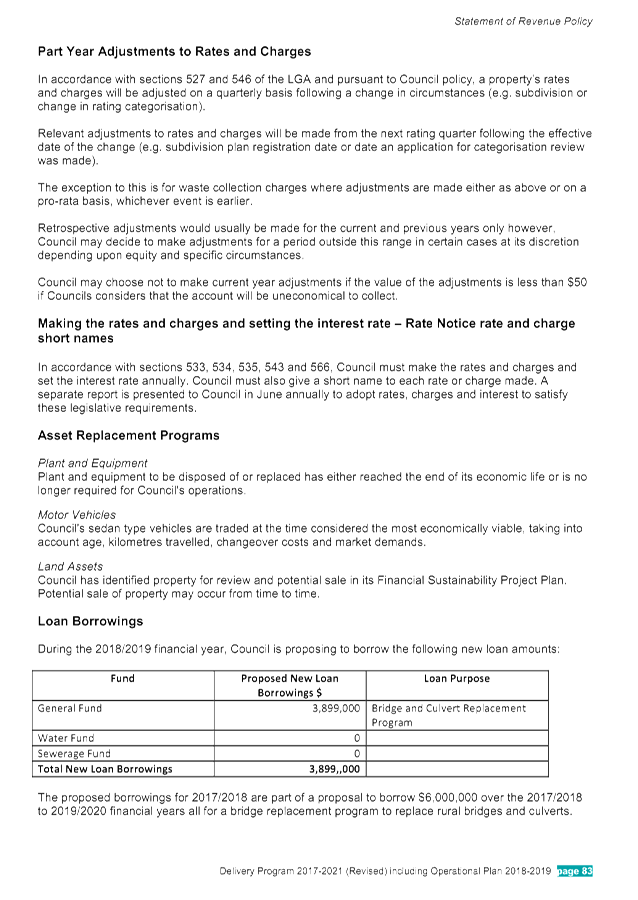

Table 5 –

Forecast Budget Result 2018-2019 Consolidated (All Funds)

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

80,318,500

|

|

Less: Operating Expenditure

|

80,748,400

|

|

Operating Result – Surplus/(Deficit)

|

(429,900)

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

(429,900)

|

|

Add: Non cash expenses – Depreciation

|

13,177,900

|

|

Add: Capital Grants and Contributions

|

19,235,500

|

|

Add: Loan Funds Used

|

3,899,000

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(50,920,000)

|

|

Less: Loan Principal Repayments

|

(2,638,800)

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(13,876,300)

|

|

Reserves Movement – Increase/(Decrease)

|

(13,892,100)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

15,800

|

Table 6 below provides the indicated unrestricted cash

balance of Council estimated at 30 June 2018 based on the Draft 2018-2019

Budget Estimates placed on public exhibition.

Table 6 –

Forecast General Fund Unrestricted Cash Balance

|

Item

|

Amount $

|

|

Forecast unrestricted cash balance to 30 June 2018 at 31

March 2018 Budget Review

|

1,145,200

|

|

Add: Estimated initial draft 2018-2019 budget result

|

15,800

|

|

Forecast unrestricted cash balance at 30 June 2019

|

1,161,000

|

During the public exhibition period, the Draft 2018-2019

Statement of Revenue Policy incorporating the Draft 2018-2019 Budget Estimates

has been further reviewed. The revised budget position is summarised in

Table 7 below:

Table 7 –

Forecast Budget Result 2018-2019 Consolidated (All Funds) revised during public

exhibition period

|

Item

|

Amount $

|

|

Operating Result

|

|

|

Operating Revenue

|

78,826,900

|

|

Less: Operating Expenditure

|

81,271,700

|

|

Operating Result – Surplus/(Deficit)

|

(2,444,800)

|

|

|

|

|

Funding Result

|

|

|

|

|

|

Operating Result – Surplus/ (Deficit)

|

(2,444,800)

|

|

Add: Non cash expenses – Depreciation

|

13,678,900

|

|

Add: Capital Grants and Contributions

|

23,577,600

|

|

Add: Loan Funds Used

|

3,899,000

|

|

Add: Asset Sales

|

0

|

|

Less: Capital Works

|

(50,064,200)

|

|

Less: Loan Principal Repayments

|

(2,638,800)

|

|

Funding Result – Surplus/(Deficit) (Cash

Movement)

|

(13,992,300)

|

|

Reserves Movement – Increase/(Decrease)

|

(14,008,100)

|

|

Overall Budget Result – Surplus/(Deficit)

(Operating + Funding)

|

15,800

|

Table 7 indicates a forecasted surplus budget result and

this relates to the General Fund. The forecast General Fund Unrestricted

Cash Balance position based on the Draft Budget included at Table 7 is outlined

in Table 8 below:

Table 8 –

Forecast General Fund Unrestricted Cash Balance

|

Item

|

Amount $

|

|

Forecast unrestricted cash balance to 30 June 2018 at 31

March 2018 Budget Review

|

1,145,200

|

|

Add: Estimated initial draft 2018-2019 budget result

|

15,800

|

|

Forecast unrestricted cash balance at 30 June 2019

|

1,161,000

|

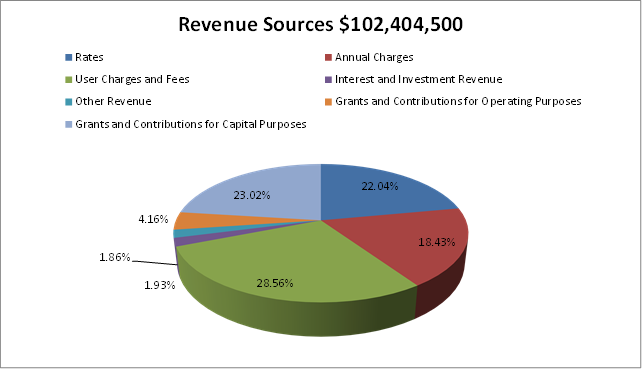

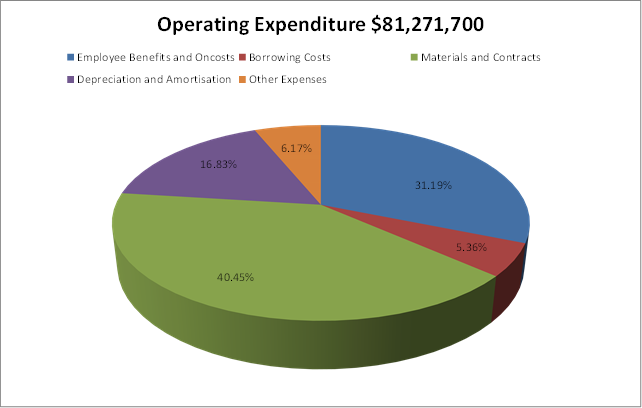

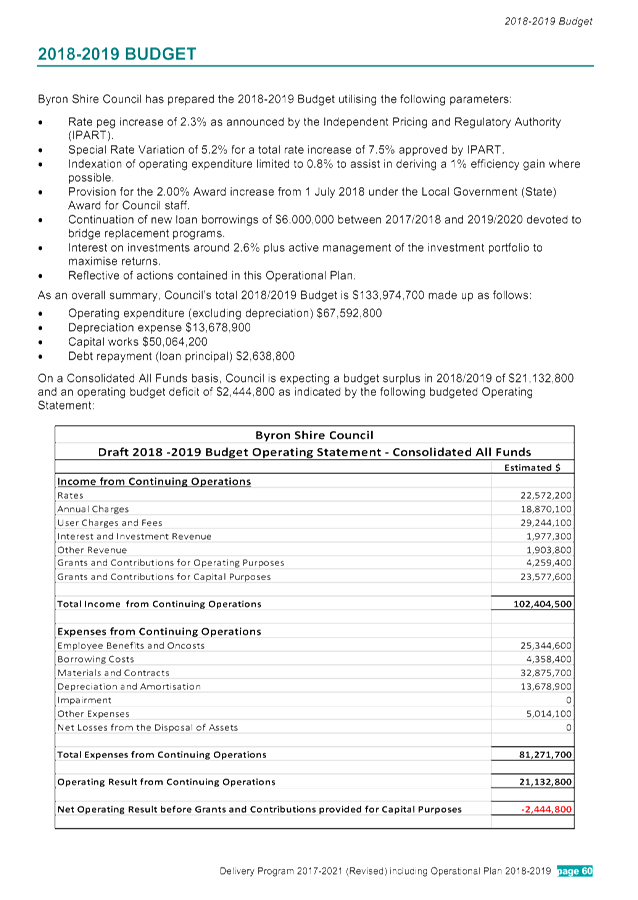

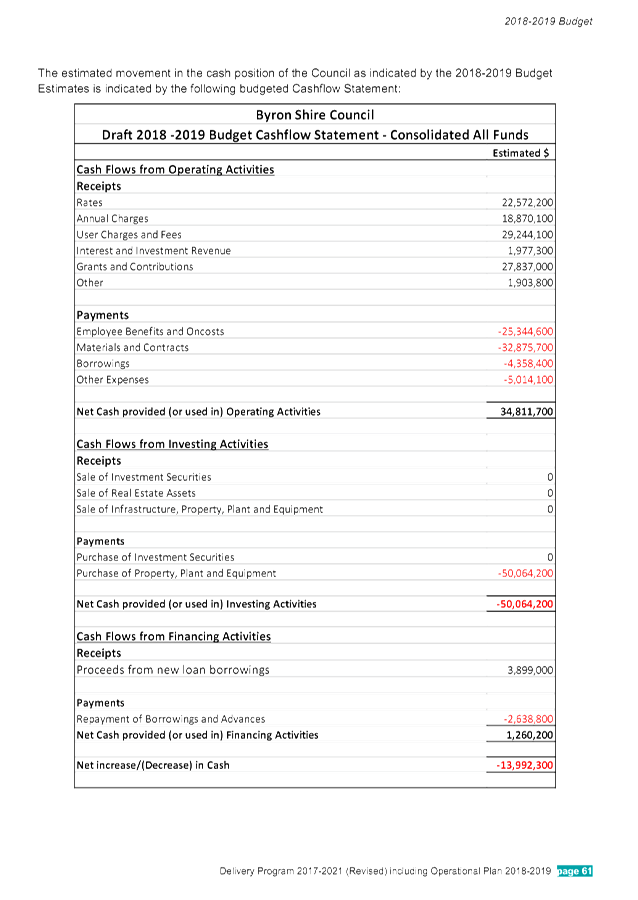

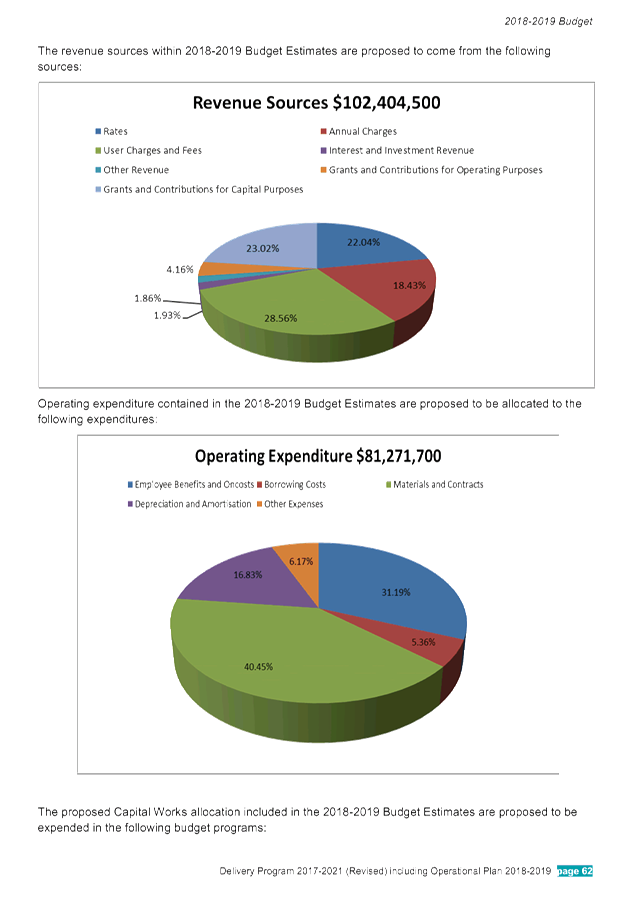

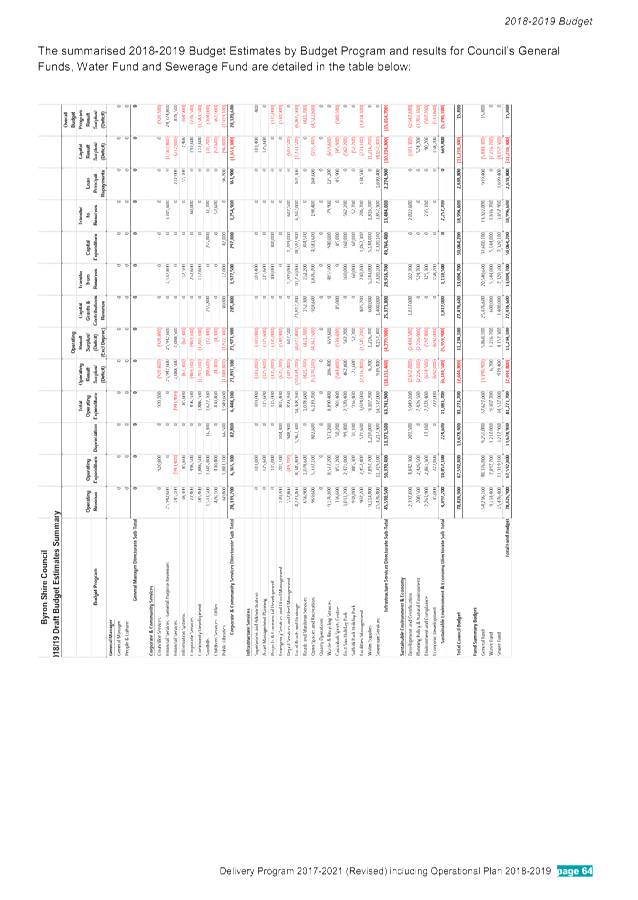

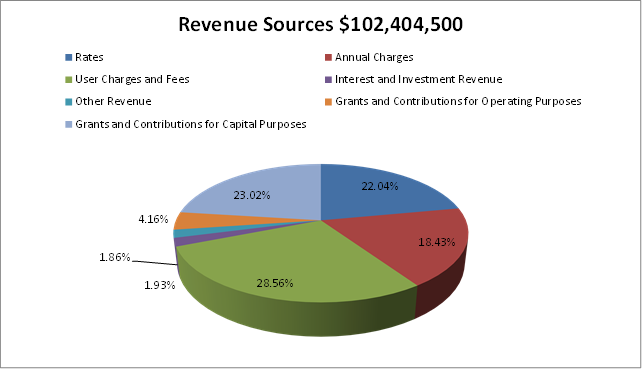

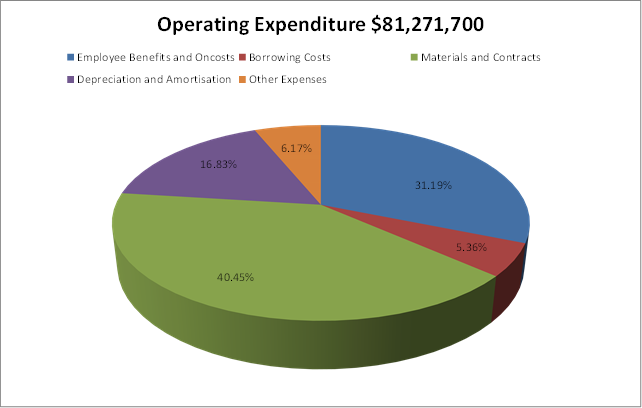

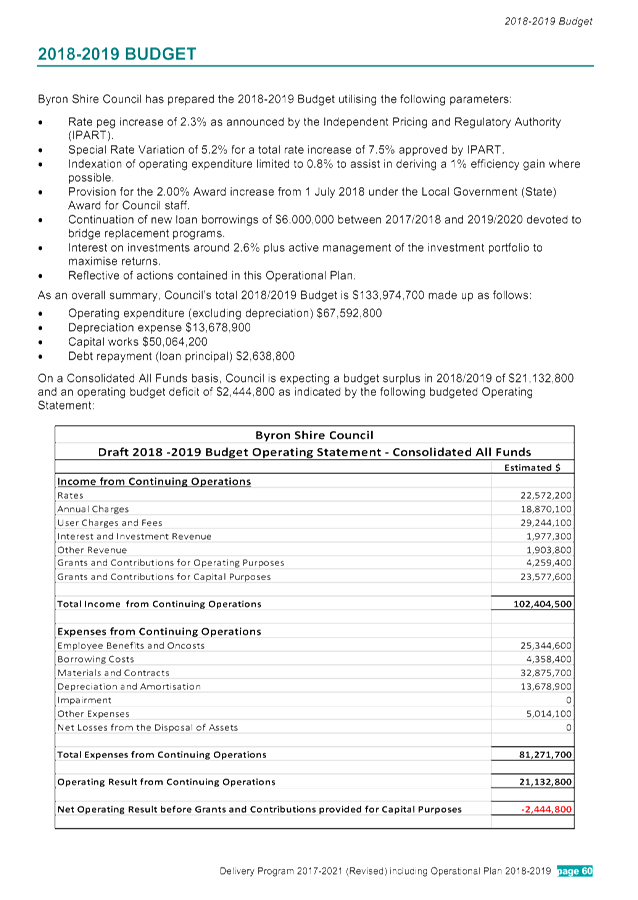

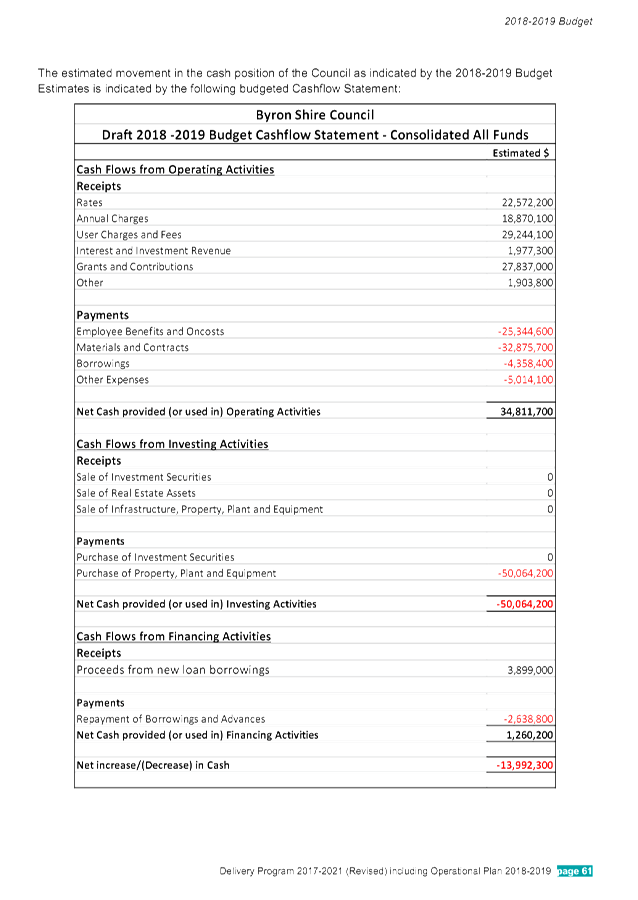

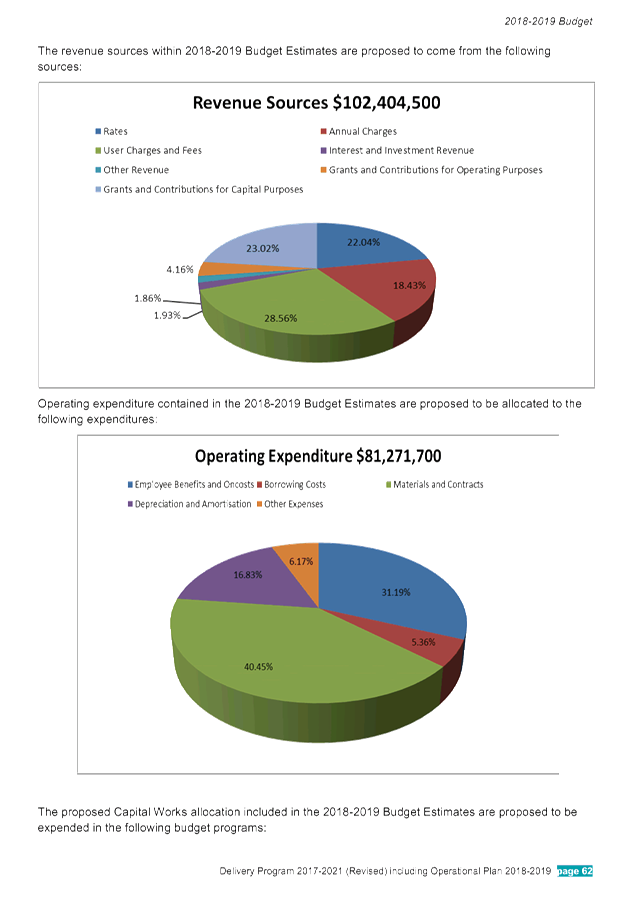

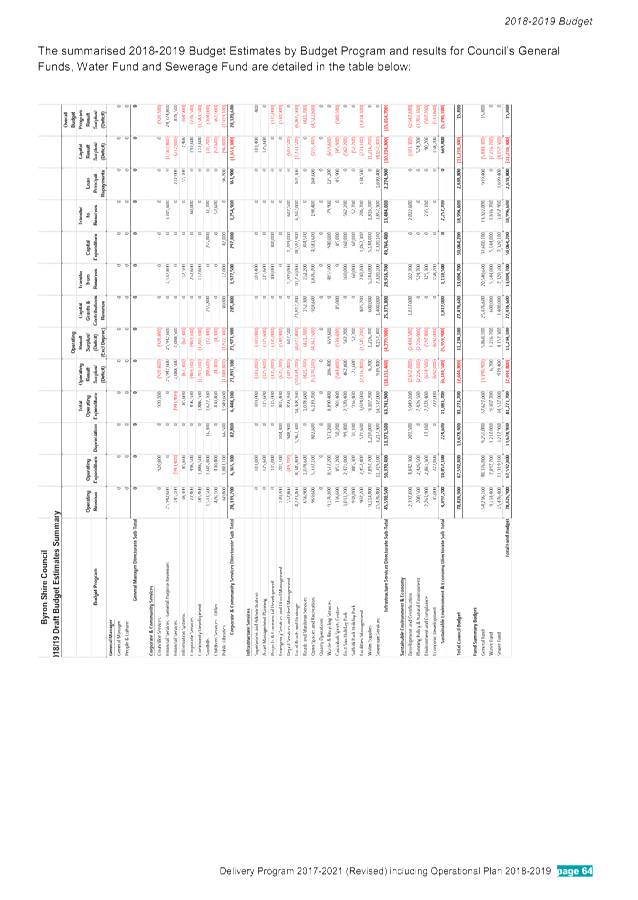

The revised Draft 2018-2019 Budget Estimates are also

suggesting that Council’s overall revenue and operational expenses are

expected to be derived from the following sources and allocated respectively as

outlined in the graphs below:

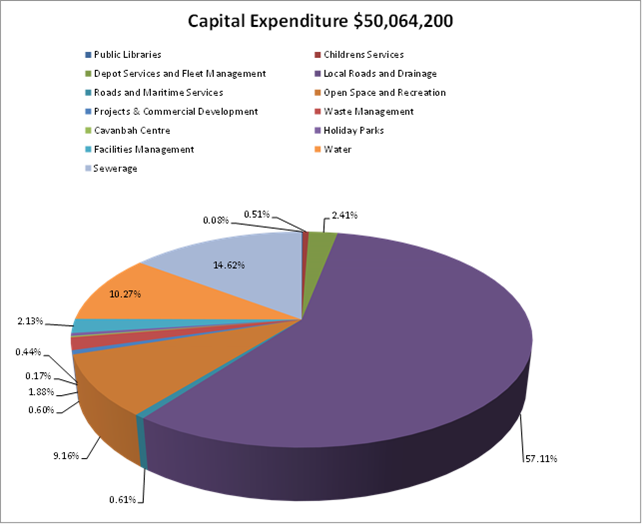

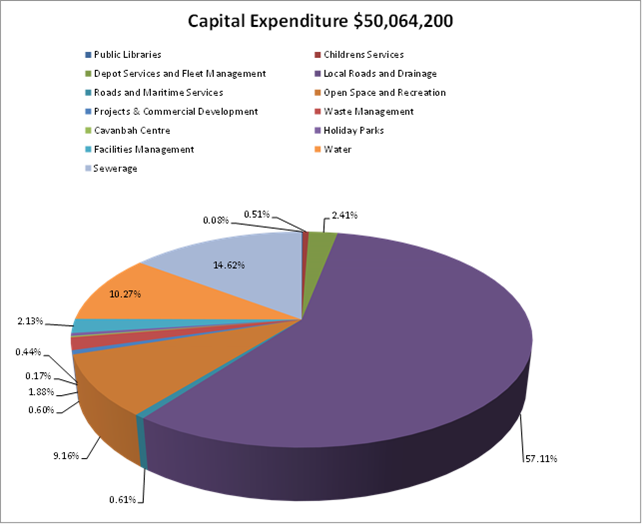

In addition to the operational aspects of the Draft

2018-2019 Budget Estimates as revised during the public exhibition period,

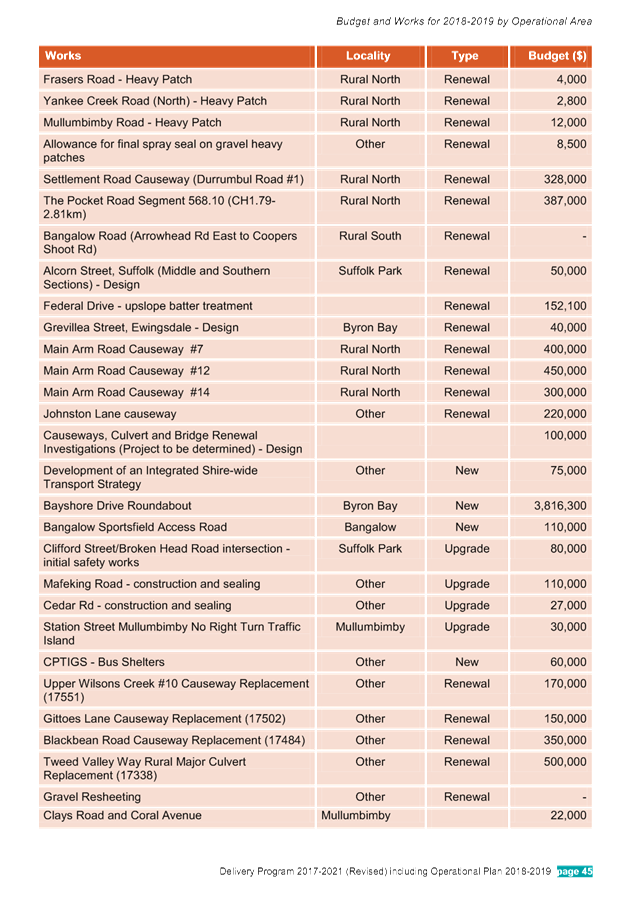

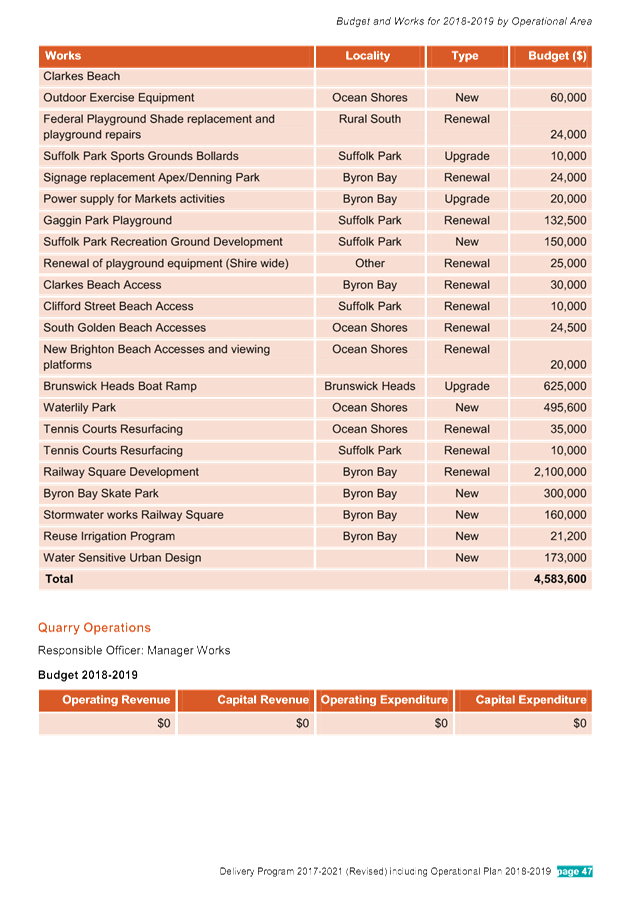

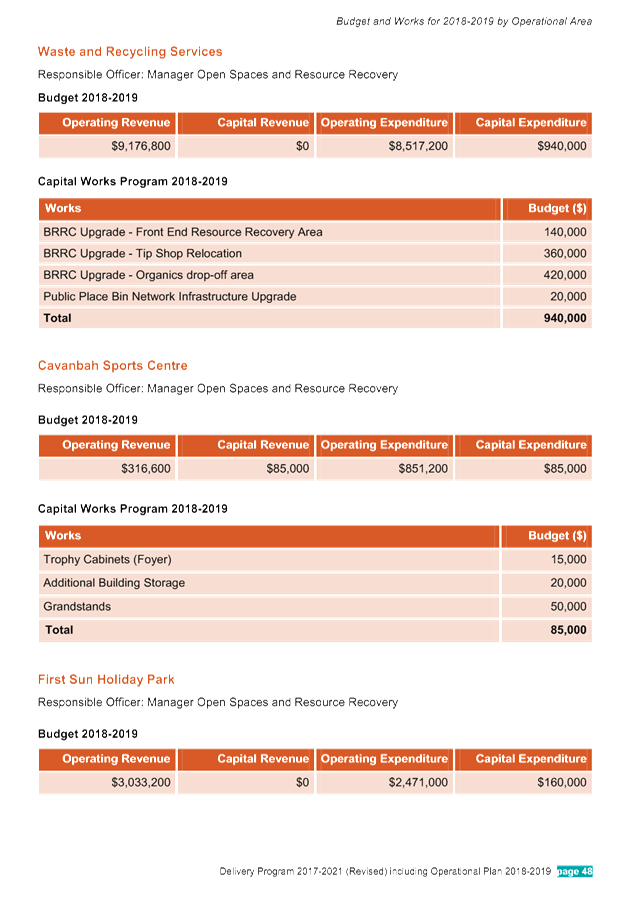

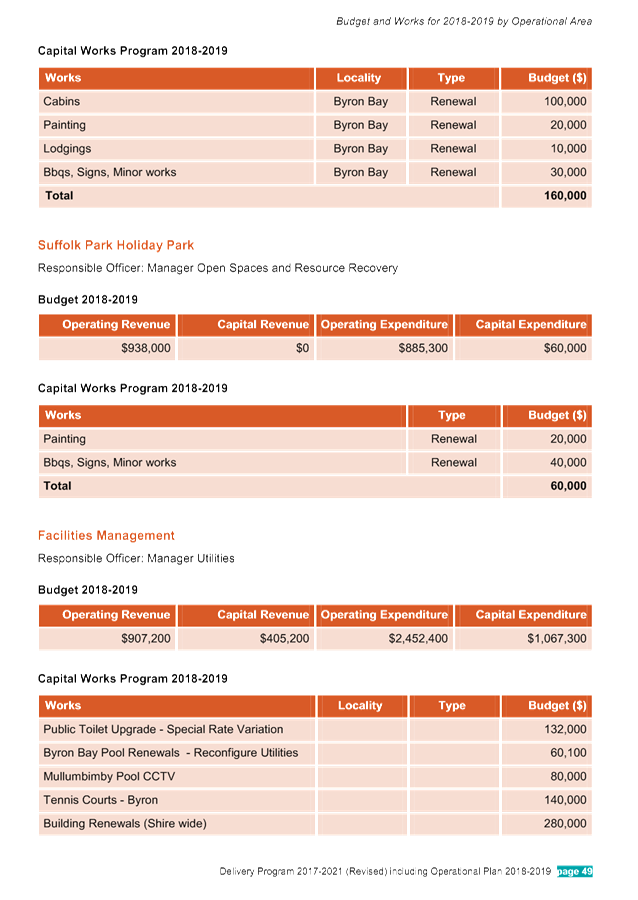

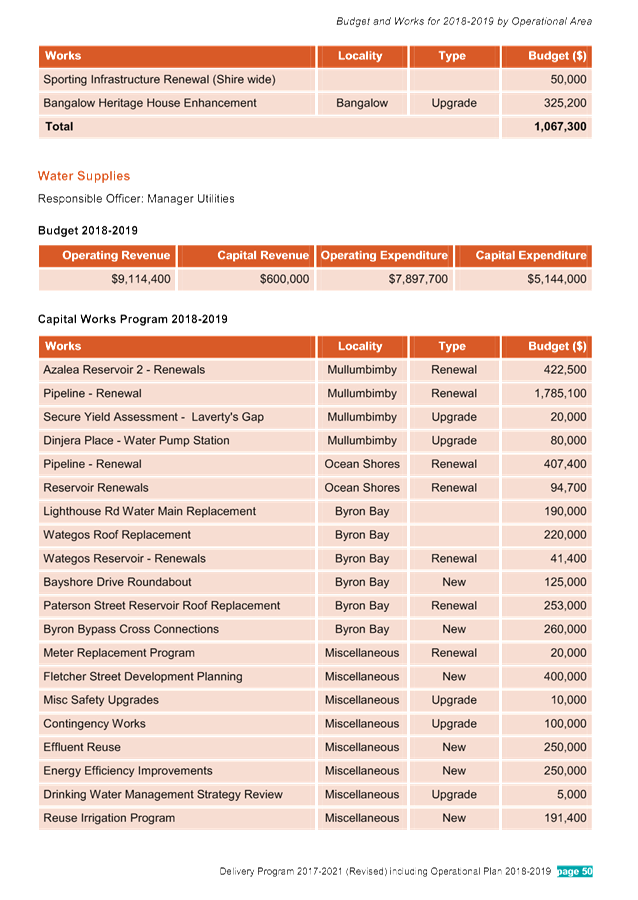

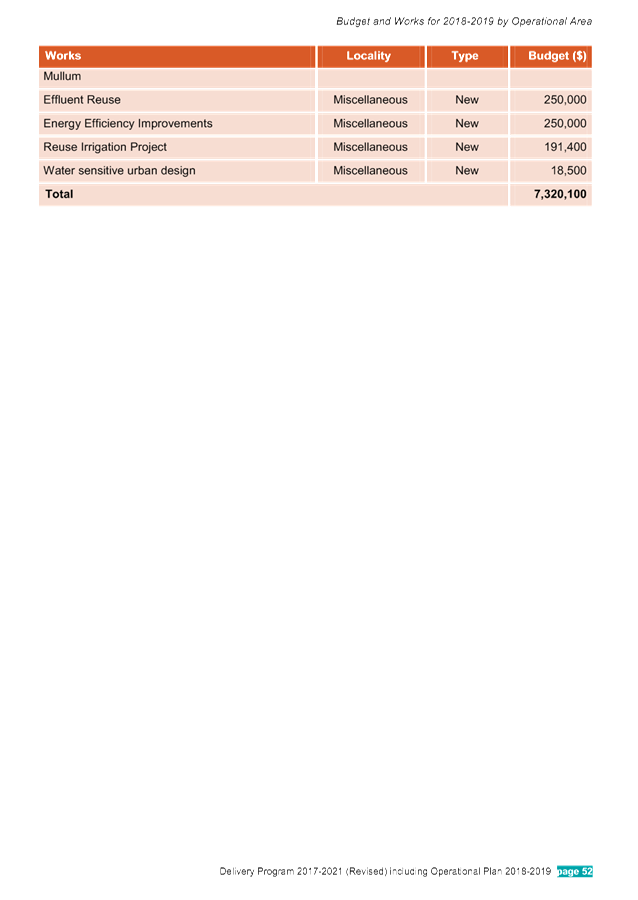

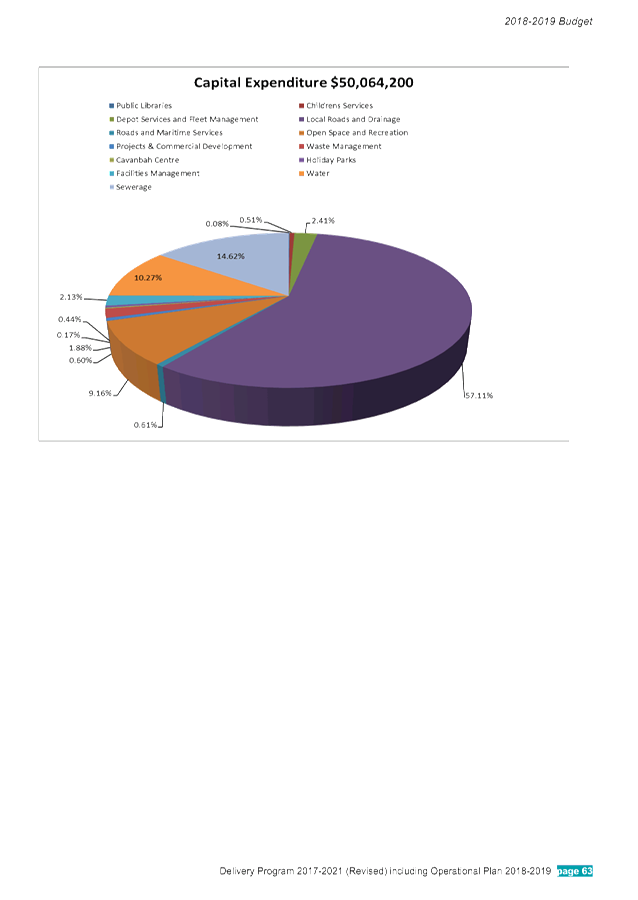

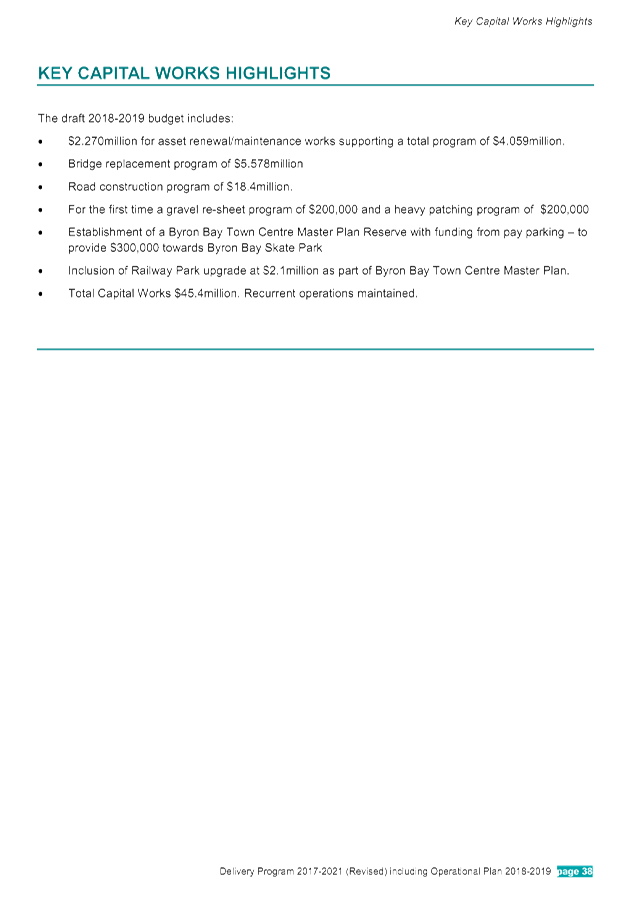

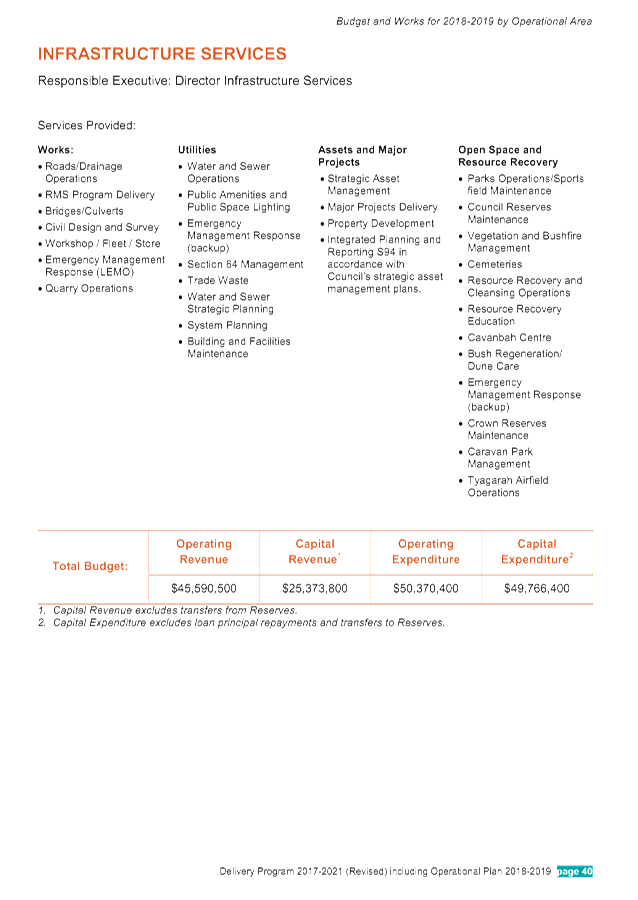

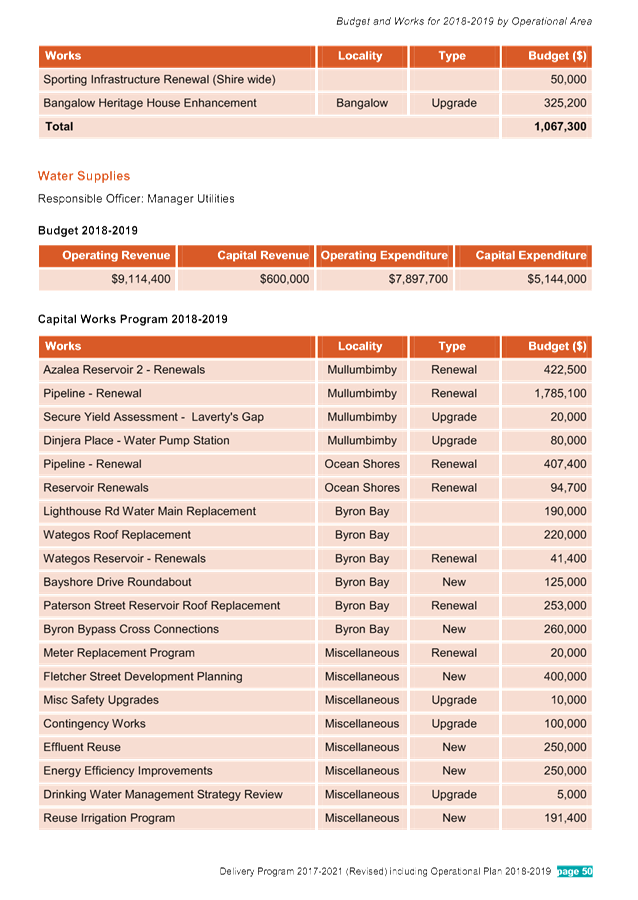

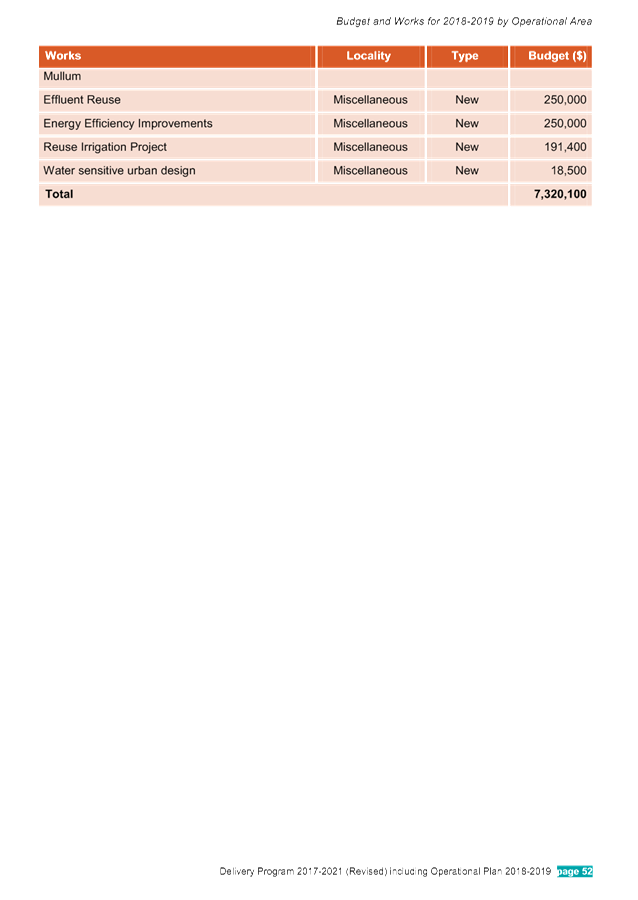

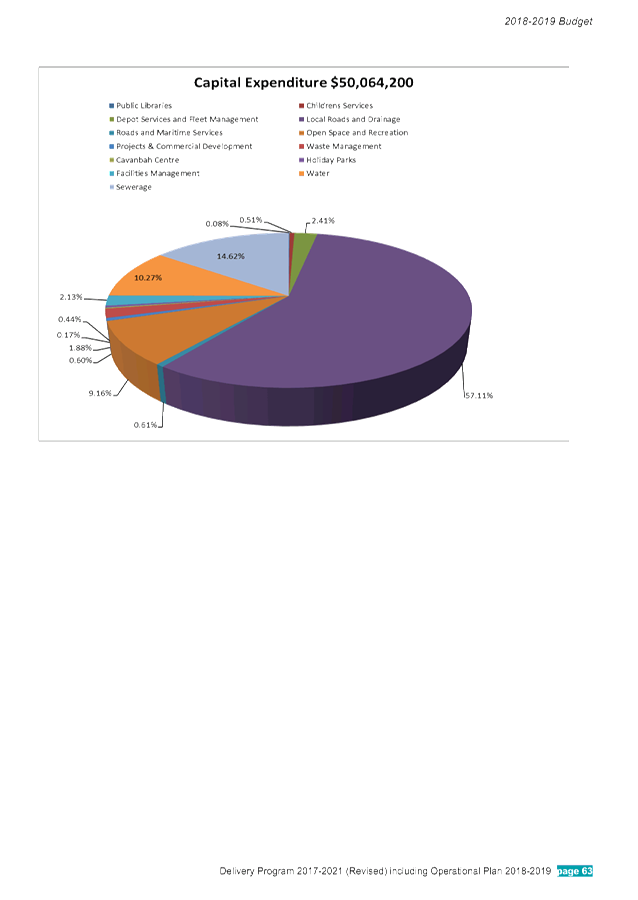

Council is now preparing a capital works program of $50.064million. This amount

includes $37.600million in the General Fund, $5.144 million in the Water Fund

and $7.320million in the Sewerage Fund. In terms of overall proposed

capital works expenditure, the graph below indicates the proportionate

allocation by Budget Program:

The major changes to the proposed Draft 2018-2019 Budget

Estimates have been realised by the following factors:

Council Resolutions:

Funding of $75,000 for the Byron Reforestation Project has

been included with funding from the Sewer Fund Capital Works Reserve

(Resolution 18-301).

Funding of $25,000 for Water Sensitive Urban Design has been

included with funding from the Water Fund Capital Works Reserve (Resolution 18-178).

Resolution 18-282 part 1(b)

At the 17 May 2018 Extraordinary Meeting, Council resolved

“the Better Byron Crew wages including on-costs for labour activities

for services performed within the Better Byron Crew Service area be capped at

$200,000 or as near as practicable… with the additional $210,000 proposed

to be drawn for these services be instead used for implementing water sensitive

urban design upgrades to the Byron Bay stormwater system.”

The following summary comments are provided with respect to

implementing this resolution – and are further detailed at Attachment 5:

· It is acknowledged

that there are programs and services in Byron Bay which require improvement and

an independent service review will be undertaken in the coming months.

This will look at service costs, maintenance activities efficiencies and

improvement opportunities.

· It is also important

to note that Byron Bay faces a number of other challenges not experienced by

other regional councils, including tourism volume, associated infrastructure

pressure, more open space per capita than that prescribed by standards (draft

Open Space and Recreation Needs Study), weed management approach diverted

labour resources to hand weeding of 151 garden beds at the cost of not

performing other services.

· The crew consists

of five full time staff plus one full time horticultural trainee. Council

has a contractual obligation to retain this trainee until 20 August 2018 and it

is recommended that they are retained to provide employment and training

opportunities for young people

· To achieve the

salary cap of $200,000, the crew will need to be reduced by three full time

equivalents and these officers will be redeployed elsewhere within Council (as

per Local Government Act and State Award). Should no opportunities be

available, redundancy will need to be implemented and this is not currently

budgeted for.

· The crew is funded

from a number of line items, including Crown Reserve, as works are undertaken

on Council managed Crown land. These funds are not transferable to other

lands or assets. Therefore the expenditure reduction will be from the Parks

and Reserves Maintenance line item (3235.2)

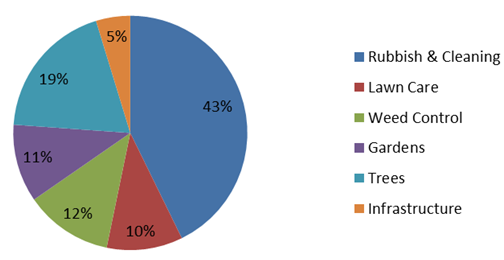

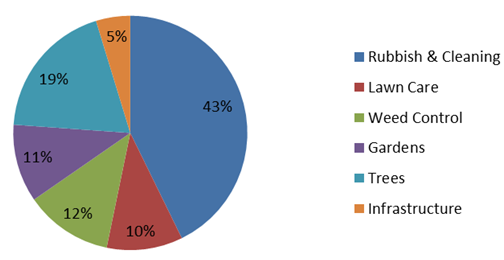

· In reducing the

budget allocation, it is acknowledged that service levels will change:

o Reduced maintenance services

in the Byron Bay Township during non peak periods. Services including

litter collection and cleaning, lawn care and weed control, tree and

infrastructure maintenance, gardens and maintenance of soft scape elements of

traffic control devices will be reduced. A direct reduction in

services within Byron Bay Township of $154,500.

o Reduced levels of services for

assets such as Railway Square precinct, anticipated to require additional

servicing to achieve a minimum desirable level of presentation to meet

anticipated increased usage as each stage is commissioned.

o Reduced levels of service

shire-wide during Byron Bay township peak times. This is due to the

anticipated need to reallocate resources to Byron Bay in response to safety

requirements and to provide a basic level of amenity in peak times (reactive

works).

The reduction in staff wages has been included in the Draft

Budget at Table 7 to comply with the resolution:

|

Water Sensitive

Urban Design Application

|

Funding allocation

Source

|

Amount

|

Finance Restriction

/ Comment

|

|

Water network including ancillary infrastructure

|

Water Fund

|

$18,500

|

Meets Water Fund expenditure criteria

|

|

Sewer Network including ancillary infrastructure

|

Sewer Fund

|

$18,500

|

Meets Sewer Fund expenditure criteria

|

|

Crown Reserve

|

Crown Paid Parking

|

$18,500

|

If applied to adopted projects within Crown Reserve it

will meet expenditure criteria

|

|

General Fund

|

Parks and Reserves Maintenance Byron Bay

|

$154,500

|

Retains Traineeship until 20 August 18.

Reduces Parks and Reserves Maintenance Byron Bay (3235.2)

to $283,748

|

|

Total Funding WSUD

|

|

$210,000

|

Note Res 18-178

|

Alternative option to Resolution 18-282 part 1(b)

An alternative option identified by management is to

preserve the Better Byron Crew as is until the above mentioned service review

has been undertaken and reported to Council by December 2018.

The water sensitive urban design upgrades can be funded from

alternative sources, and should Council endorse this approach, a new reserve

could be established. This could be established through:

|

Water Sensitive

Urban Design Application

|

Funding allocation

Source

|

Amount

|

Finance Restriction

|

|

Water network including ancillary infrastructure

|

Water Fund

|

$65,000

|

Meets Water Fund expenditure criteria

|

|

Sewer Network including ancillary infrastructure

|

Sewer Fund

|

$65,000

|

Meets Sewer Fund expenditure criteria

|

|

Crown Reserve

|

Crown Paid Parking

|

$80,000

|

If applied to adopted projects within Crown Reserve it

will meet expenditure criteria

|

|

Total Funding WSUD

|

|

$210,000

|

|

Should Council endorse the alternative option, the below

points could be included in the resolution:

1. That

an independent service review to be undertaken of service costs and

efficiencies for all maintenance activities within the Byron Bay Township.

2. That

a reallocation of $154,552 from WSUD budget to Parks and Reserves Maintenance

Byron Bay (3235.2).

3. WSUD

funding sources be adjusted in accordance with Table 2, that being;

|

Water Sensitive

Urban Design Application

|

Funding allocation

Source

|

Amount

|

Finance Restriction

|

|

Water network including ancillary infrastructure

|

Water Fund

|

$65,000

|

Meets Water Fund expenditure criteria

|

|

Sewer Network including ancillary infrastructure

|

Sewer Fund

|

$65,000

|

Meets Sewer Fund expenditure criteria

|

|

Crown Reserve

|

Crown Paid Parking

|

$80,000

|

If applied to adopted projects within Crown Reserve it

will meet expenditure criteria

|

|

Total Funding WSUD

|

|

$210,000

|

|

Other Adjustments:

Aside from the resolutions of Council outlined above, there

are proposed adjustments to the Draft 2018/2019 Budget Estimates that are

reflected in the Budget result presented in Table 7 of this report. These

adjustments include:

· Council

has received advice from the NSW Grants Commission on 21 June 2018 via Circular

GC147 that the Federal Government have again determined to advance 50% of the

Financial Assistance Grants for the 2018/2019 financial year prior to the end of

the 2017/2018 financial year. This will require Council to reduce its

Financial Assistance Grant revenue in 2018/2019 by an estimated

$1,537,800. This will have no impact on the overall budget result as the

advance funding received in 2017/2018 will be restricted in reserve and carried

forward to the 2018/2019 financial year. The Draft 2018-2019 Budget

contained the full grant revenue as operating revenue but this needs to be

reduced to reflect the advance payment.

· Whilst

not influencing the budget result in terms of a funding perspective, a review

of the Depreciation expense budgets has been undertaken reflective of current

asset values and expected depreciation expense that was not completed prior to

the Draft 2018-2019 Budget being adopted for public exhibition. This

requires the overall expenditure for Depreciation to be increased by $501,000

to $13,678,900.

· Adjustment

to Councillor and Mayoral Fees to provide for the maximum remuneration provided

from the determination of the Local Government Remuneration Tribunal reported

to Council on 21 June 2018. This requires an adjustment of $1,200.

· Provision

of $5,000 to fund Council’s contribution to the Byron Writers Festival in

accordance with the current funding agreement. This funding was not

included in the Draft 2018-2019 Budget.

· Reallocation

of the new funding provided for gravel resheeting $200,000 to specific gravel

resheeting works.

· Inclusion

of funding and expenditure of $542,000 to be provided by Roads and Maritime

Services for the Safer Roads Program.

· Inclusion

of funding for the drainage works adjacent to Railway Park of $160,000 as

endorsed by the Finance Advisory Committee at its Meeting held on 17 May 2018

with funding provided by the Byron Bay Town Centre Masterplan Reserve.

· Inclusion

of funding for a trainee position in the Information Services Branch that was

not included in the Draft 2018-2019 Budget but is an approved position.

This has a budget impact of $34,800.

· Funding

of $50,000 for the Accessible Housing Project and $39,500 for operational costs

for the Plant Fund not budgeted for Compliance and Enforcement staff with

funding provided from the On-site Sewerage Management Reserve for one year

only.

· Increase

expected interest on investment revenue by $46,200. This will raise the

total interest revenue budget estimate in the General Fund to $1,086,600.

Ongoing management of the investment portfolio to pursue investment

opportunities within cash flow requirements will hope to achieve this additional

revenue.

· Removal

of capital expenditure in the Water Fund of $1,849,500 that was included in the

Draft 2018-2019 associated with the Fletcher Street development as this project

has been placed on hold.

Council in the preparation of its Operational Plan is required

to include a number of statements in relation to its Revenue Policy for

2018-2019. This includes a statement containing the estimate of

Council’s Income and Expenditure or Budget for this period. The

other statements identified in Clause 201 of the Local Government (General)

Regulation 2005 are in the main dependant upon the rate pegging limits approved

by the Minister for Local Government (now the Independent Pricing and

Regulatory Tribunal (IPART)), any application for a special rate variation and

Council’s decisions in relation to expenditure, income and the associated

fees and charges.

The assumptions/parameters used in preparing the Draft

2018-2019 Budget Estimates as presented in this report for Council’s

consideration include the following:

· Second

year of the Special Rate Variation of 7.5% per annum for four years as approved

by the Independent Pricing and Regulatory Tribunal (IPART) inclusive of the

2.3% rate peg increase determined previously by IPART for 2018/2019.

· Consumer

Price Index assumption of 1.8%.

· Indexation

of expenditure limited to 0.8% where possible to assist in deriving a 1%

efficiency gain.

· Allowance

of the 2.5% pay increase applicable in 2018/2019 under the Local Government

(State) Award 2017.

· Continuation

of new loan borrowings of $6million between 2017/2018 to 2019/2020 devoted to

bridge/culvert replacement programs. Specifically $3.899million is the

required borrowings for 2018/2019.

· Interest

on investments around 2.6% plus active management of the investment portfolio

to keep it short around three month maturities to take opportunities of market

offerings or longer term investments to follow Council’s resolution

regarding Environmental and Socially Responsible Investments.

· Reflective

of the Actions contained in the Draft 2018/2019 Operational Plan.

The immediate financial forecast of the General Fund has

been discussed in detail in this report, however it is suggested Council needs

to look at its longer term financial position, especially in the area of infrastructure

maintenance and renewal in comparison to other areas of service

provided. This is especially so given the requirements stipulated

by the NSW State Government as part of its ‘Fit for the Future’

reform, and the focus for Council of it approved Special Rate Variation (SRV)

for 2017/2018 to 2020/2021 financial years.

The Water and Sewer budgets have been prepared with pricing

to generate the required revenue to repay debt (Sewer), to address capital

works and ongoing maintenance works in these Funds.

Whilst this report is concerned with the oncoming 2018/2019

financial year, Council also needs to consider its longer term financial

projections. The budget projections realistically still demonstrate the

difficulty Council has absorbing additional costs without corresponding

revenue. It can only be emphasised that Council must consider carefully

the long term implications on its finances, in any consideration to add a new

asset/service.

Statutory and Policy

Compliance Implications

In regard to Strategic

Planning, Chapter 13, Part 2 of the Local Government Act 1993 states:

402 Community strategic plan

(1) Each local government area must have

a community strategic plan that has been developed and endorsed by the council.

A community strategic plan is a plan that identifies the main priorities and

aspirations for the future of the local government area covering a period of at

least 10 years from when the plan is endorsed.

(2) A community strategic plan is to

establish strategic objectives together with strategies for achieving those

objectives.

(3) The council must ensure that the

community strategic plan:

(a) addresses civic leadership, social,

environmental and economic issues in an integrated manner, and

(b) is based on social justice principles

of equity, access, participation and rights, and

(c) is adequately informed by relevant

information relating to civic leadership, social, environmental and economic

issues, and

(d) is developed having due regard to

the State government’s State Plan and other relevant State and regional

plans of the State government.

(4) The council must establish and

implement a strategy (its community engagement strategy),

based on social justice principles, for engagement with the local community

when developing the community strategic plan.

(5) Following an ordinary election of

councillors, the council must review the community strategic plan before 30

June following the election. The council may endorse the existing plan, endorse

amendments to the existing plan or develop and endorse a new community

strategic plan, as appropriate to ensure that the area has a community

strategic plan covering at least the next 10 years.

(6) A draft community strategic plan or

amendment of a community strategic plan must be placed on public exhibition for

a period of at least 28 days and submissions received by the council must be

considered by the council before the plan or amendment is endorsed by the

council.

(7) Within 28 days after a community

strategic plan is endorsed, the council must post a copy of the plan on the

council’s website and provide a copy to the Departmental Chief Executive.

A copy of a community strategic plan may be provided to the Departmental Chief

Executive by notifying the Minister of the appropriate URL link to access the

plan on the council’s website.

403 Resourcing

strategy

(1) A council must have a long-term

strategy (called its resourcing strategy) for the provision

of the resources required to implement the strategies established by the

community strategic plan that the council is responsible for.

(2) The resourcing strategy is to

include long-term financial planning, workforce management planning and asset

management planning.

404 Delivery

program

(1) A council must have a program

(its delivery program) detailing the principal activities to

be undertaken by the council to implement the strategies established by the

community strategic plan within the resources available under the resourcing

strategy.

(2) The delivery program must include a

method of assessment to determine the effectiveness of each principal activity

detailed in the delivery program in implementing the strategies and achieving

the strategic objectives at which the principal activity is directed.

(3) The council must establish a new delivery

program after each ordinary election of councillors to cover the principal

activities of the council for the 4-year period commencing on 1 July following

the election.

(4) A draft delivery program must be

placed on public exhibition for a period of at least 28 days and submissions

received by the council must be considered by the council before the delivery

program is adopted by the council.

(5) The general manager must ensure that

regular progress reports are provided to the council reporting as to its

progress with respect to the principal activities detailed in its delivery

program. Progress reports must be provided at least every 6 months.

405 Operational

plan

(1) A council must have a plan

(its operational plan) that is adopted before the beginning

of each year and details the activities to be engaged in by the council during

the year as part of the delivery program covering that year.

(2) An operational plan must include a

statement of the council’s revenue policy for the year covered by the

operational plan. The statement of revenue policy must include the statements

and particulars required by the regulations.

(3) A council must prepare a draft

operational plan and give public notice of the draft indicating that

submissions may be made to the council at any time during the period (not less

than 28 days) that the draft is to be on public exhibition. The council must

publicly exhibit the draft operational plan in accordance with the notice.

(4) During the period of public

exhibition, the council must have for inspection at its office (and at such

other places as it may determine) a map that shows those parts of its area to

which each category and sub-category of the ordinary rate and each special rate

included in the draft operational plan applies.

(5) In deciding on the final operational

plan to be adopted, a council must consider any submissions that have been made

concerning the draft plan.

(6) The council must post a copy of its

operational plan on the council’s website within 28 days after the plan

is adopted.

406 Integrated

planning and reporting guidelines

(1) The Departmental Chief Executive is

to establish integrated planning and reporting guidelines (referred to in this

Chapter as the guidelines) for the purposes of this Chapter.

(2) The guidelines can impose

requirements in connection with the preparation, development and review of, and

the contents of, the community strategic plan, resourcing strategy, delivery

program, operational plan, community engagement strategy, annual report and

state of the environment report of a council.

(3) In particular (but without limiting

subsection (2)), the guidelines can impose requirements in relation to any of

the following:

(a) the procedures to be followed in the

preparation, development or review of plans, strategies, programs and reports,

(b) the matters to be addressed or

provided for by plans, strategies, programs and reports,

(c) requirements for consultation in

connection with the preparation, development or review of plans, strategies and

programs,

(d) the matters to be taken into account

or to which regard is to be had in connection with the preparation, development

or review of plans, strategies, programs and reports.

(4) A council must ensure that the

requirements of the guidelines are complied with.

(5) The guidelines can include other

material for the guidance of councils in connection with the plans, strategies,

programs and reports to which this section applies.

(6) The Departmental Chief Executive may

review and amend the guidelines from time to time.

(7) The guidelines and any amendment of

the guidelines must be posted on the Department’s website and notified in

writing to each council by the Departmental Chief Executive.

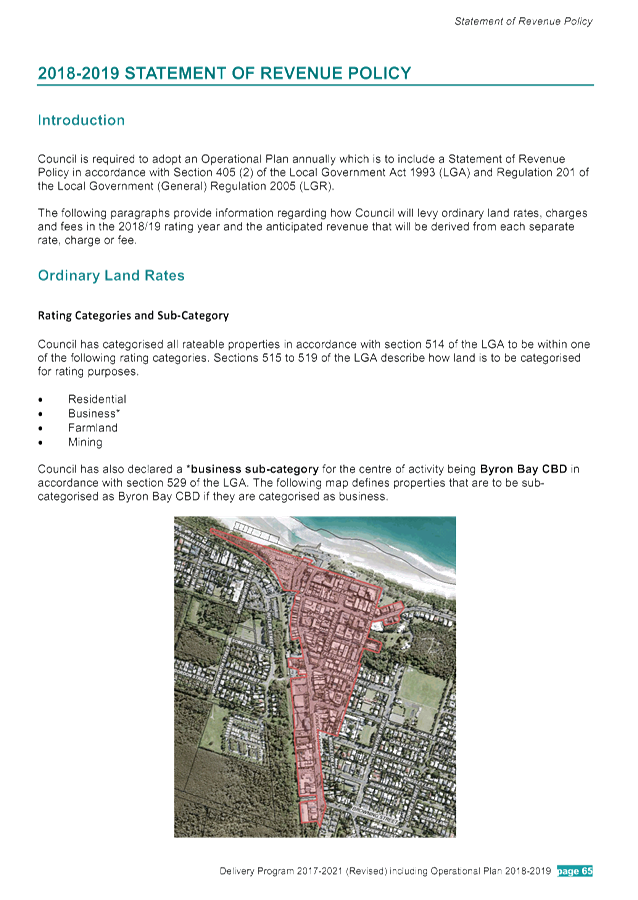

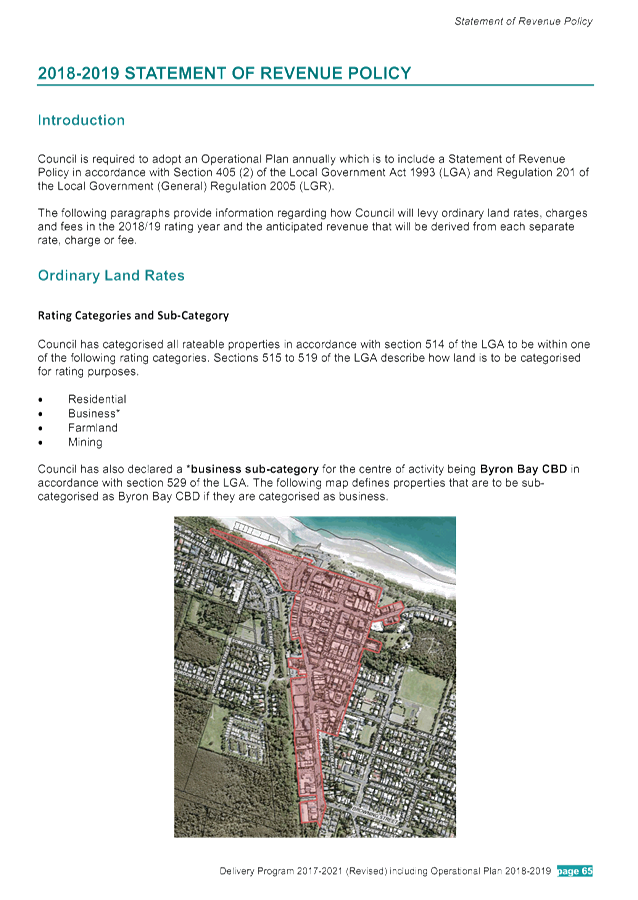

Section 405(2) of the Local Government Act requires that the

Statement of the Council’s Revenue Policy that must be included on the

Operational Plan. Clause 201 of the Local Government (General) Regulation 2005

details the statements and information that must be included in the Revenue

Policy and has been reproduced below:

201 Annual statement of council’s revenue policy

(1) The

statement of a council’s revenue policy for a year that is required to be

included in an operational plan under section 405 of the Act must include the following

statements:

(a) a

statement containing a detailed estimate of the council’s income and

expenditure,

(b) a

statement with respect to each ordinary rate and each special rate proposed to

be levied,

Note: The annual statement

of revenue policy may include a note that the estimated yield from ordinary

rates is subject to the specification of a percentage variation by the Minister

if that variation has not been published in the Gazette when public notice of

the annual statement of revenue policy is given.

(c) a

statement with respect to each charge proposed to be levied,

(d) a

statement of the types of fees proposed to be charged by the council and, if

the fee concerned is a fee to which Division 3 of Part 10 of Chapter 15 of the Act applies, the amount of each such

fee,

(e) a

statement of the council’s proposed pricing methodology for determining

the prices of goods and the approved fees under Division 2 of Part 10 of

Chapter 15 of the Act for services provided by it, being

an avoidable costs pricing methodology determined by the council in accordance

with guidelines issued by the Director-General,

(f) a

statement of the amounts of any proposed borrowings (other than internal

borrowing), the sources from which they are proposed to be borrowed and the

means by which they are proposed to be secured.

(2) The

statement with respect to an ordinary or special rate proposed to be levied

must include the following particulars:

(a) the

ad valorem amount (the amount in the dollar) of the rate,

(b) whether

the rate is to have a base amount and, if so:

(i) the

amount in dollars of the base amount, and

(ii) the

percentage, in conformity with section 500 of the Act, of the total amount payable by the

levying of the rate, or, in the case of the rate, the rate for the category or

sub-category concerned of the ordinary rate, that the levying of the base

amount will produce,

(c) the

estimated yield of the rate,

(d) in

the case of a special rate-the purpose for which the rate is to be levied,

(e) the

categories or sub-categories of land in respect of which the council proposes

to levy the rate.

(3) The

statement with respect to each charge proposed to be levied must include the

following particulars:

(a) the

amount or rate per unit of the charge,

(b) the

differing amounts for the charge, if relevant,

(c) the

minimum amount or amounts of the charge, if relevant,

(d) the

estimated yield of the charge,

(e) in

relation to an annual charge for the provision by the council of coastal

protection services (if any)-a map or list (or both) of the parcels of rateable

land that are to be subject to the charge.

(4) The

statement of fees and the statement of the pricing methodology need not include

information that could confer a commercial advantage on a competitor of the

council.

In accordance with clause 406 of the Local Government

(General) Regulation 2005 the following provision applies in relation to the

authorisation of expenditure.

211 Authorisation of expenditure

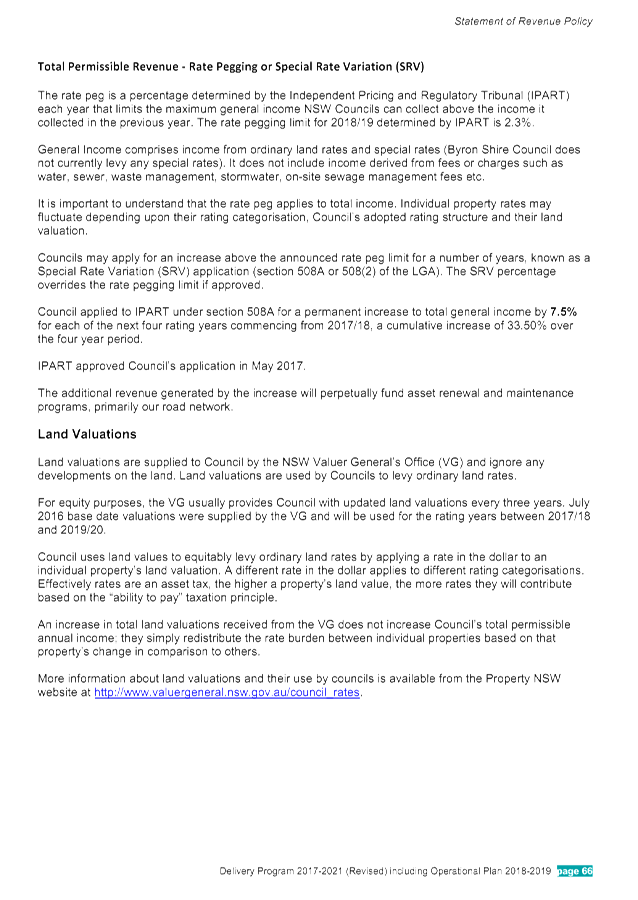

(1) A