Finance Advisory Committee Meeting

A Finance Advisory Committee Meeting of

Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 16 August 2018

|

|

Time

|

2.00pm

|

Anna Vinfield

Acting Director Corporate and Community Services I2018/1542

Distributed 09/08/18

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a member

of a Council Committee who has a pecuniary interest in any matter with which

the Council is concerned and who is present at a meeting of the Council or

Committee at which the matter is being considered must disclose the nature of

the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

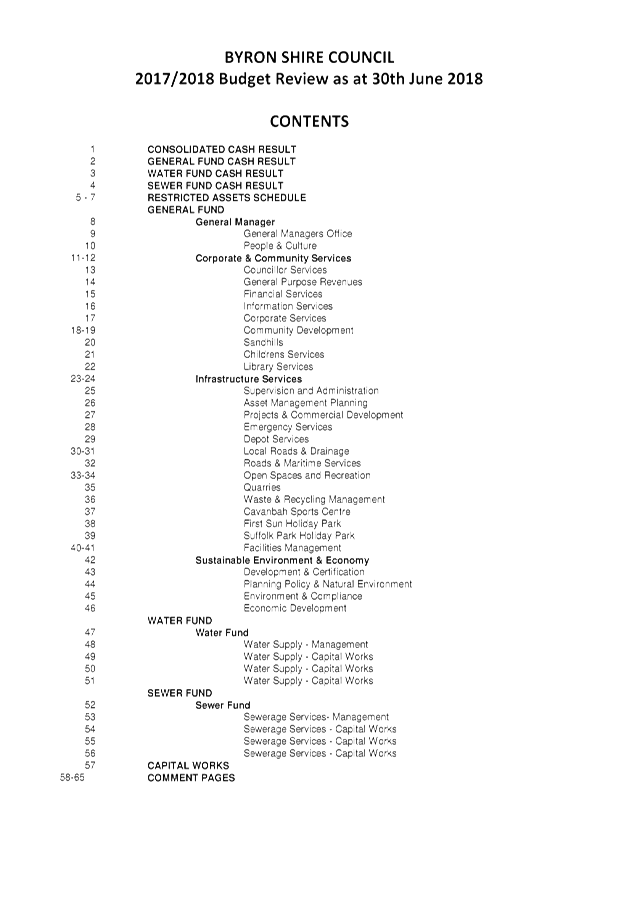

Finance Advisory Committee Meeting

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Finance

Advisory Committee Meeting held on 17 May 2018

4. Staff Reports

Corporate and Community Services

4.1 2017/18

Financial Sustainability Plan - Update on the Action Implementation Plan as at

30 June 2018........................................................................................................................................... 4

4.2 Quarterly

Update - Implementation of Special Rate Variation....................................... 24

4.3 Carryovers

for inclusion in the 2018/19 Budget.............................................................. 28

4.4 Budget

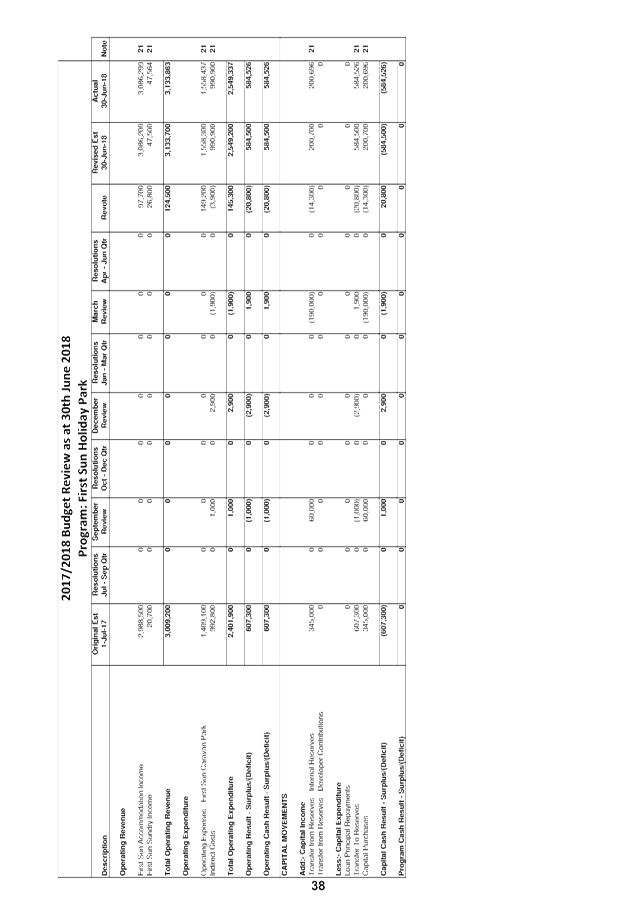

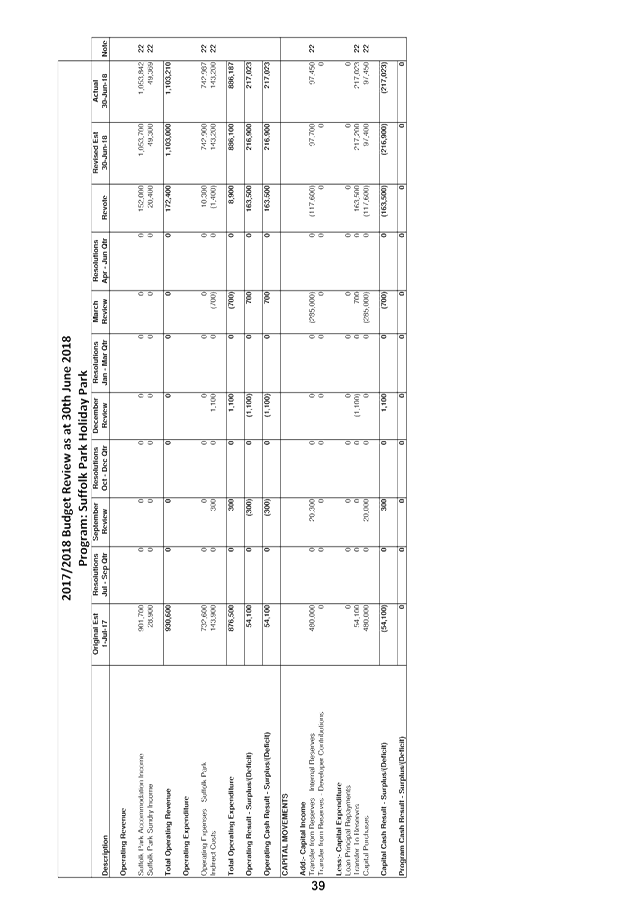

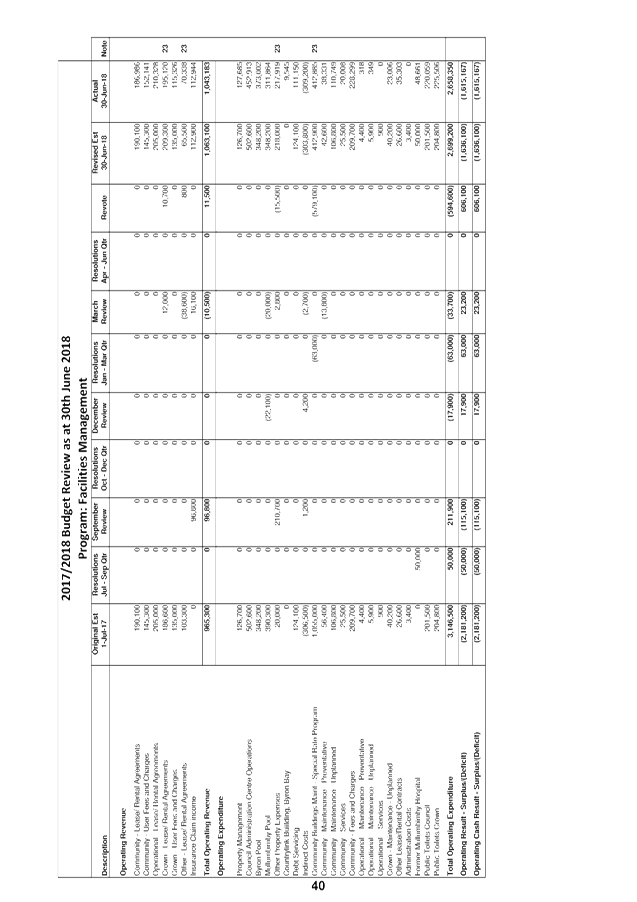

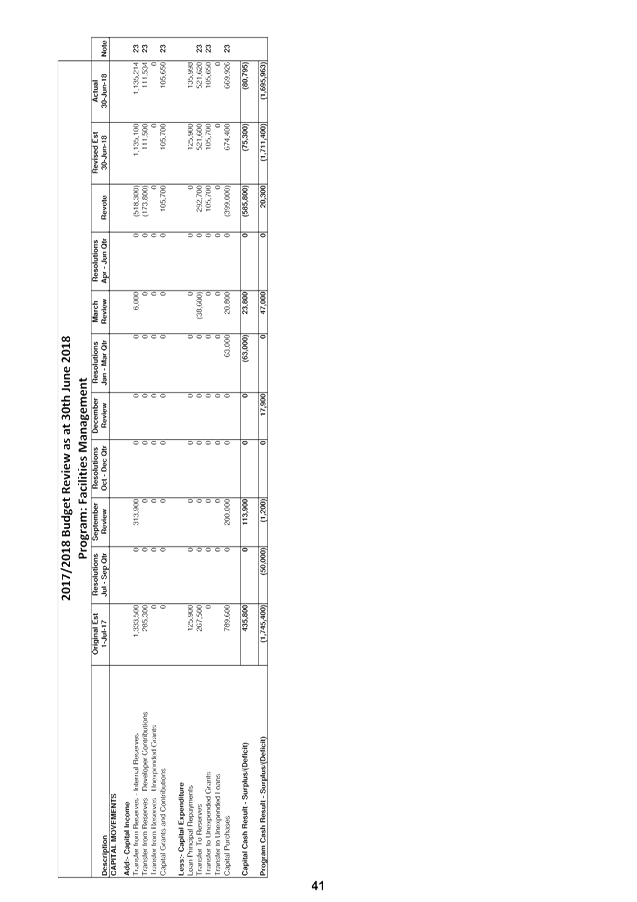

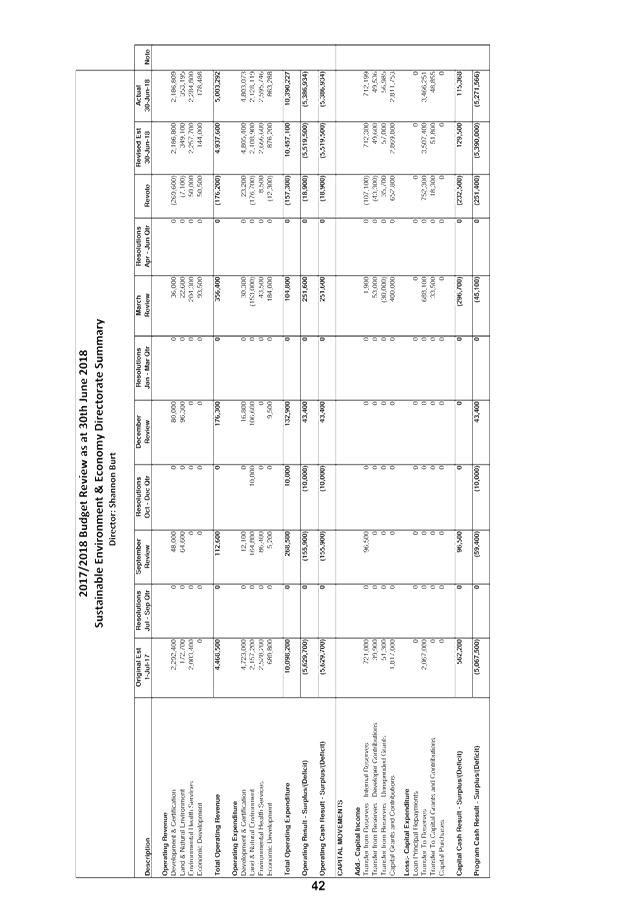

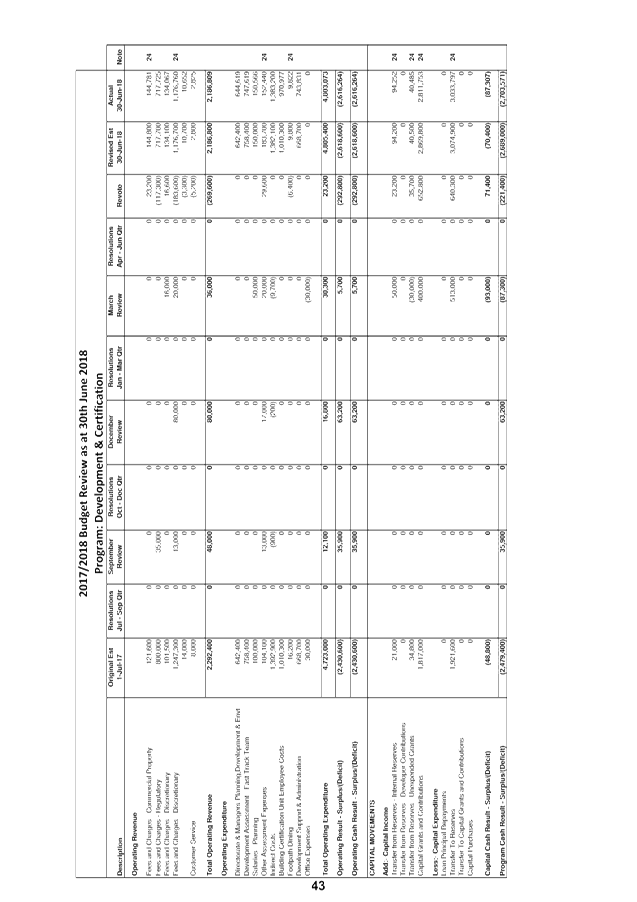

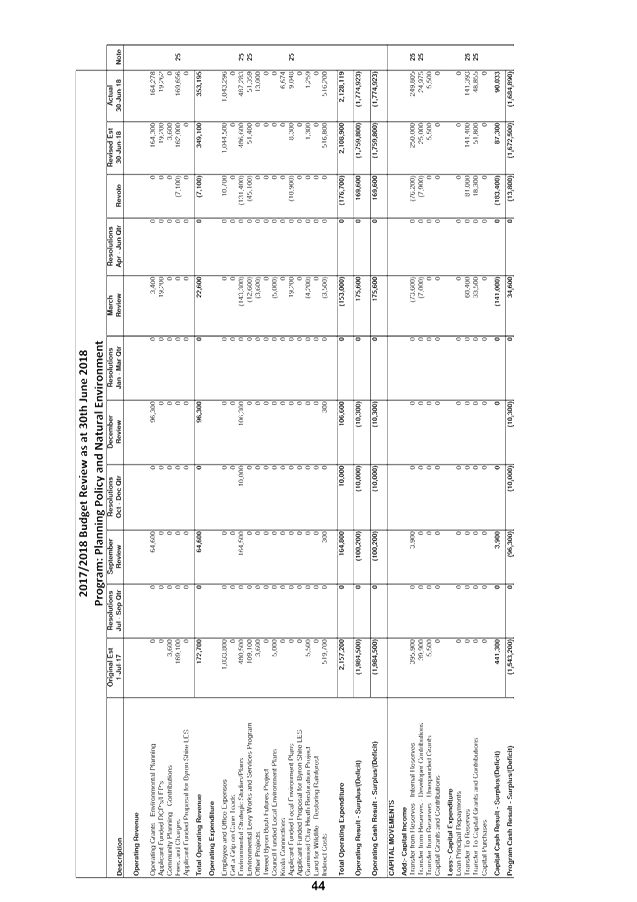

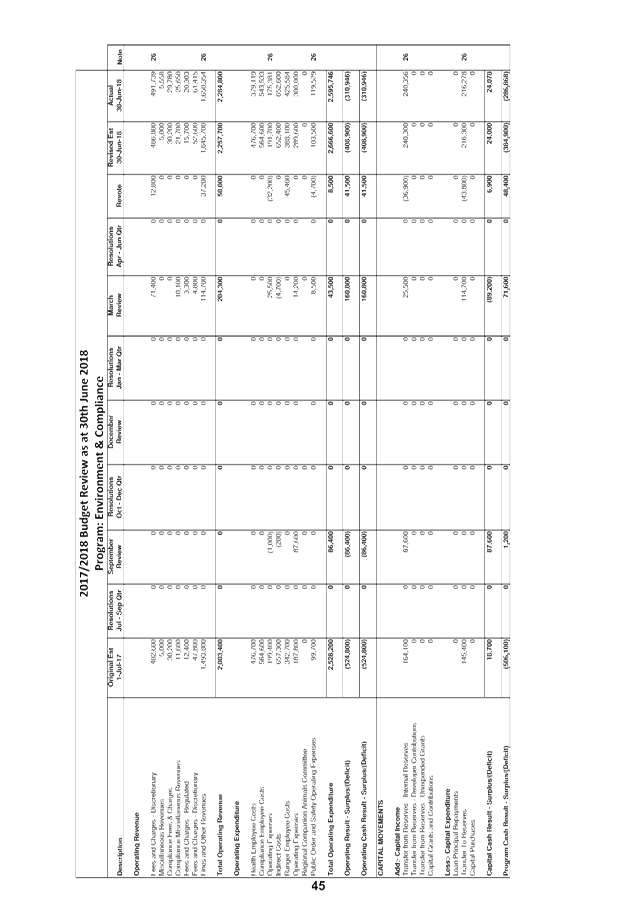

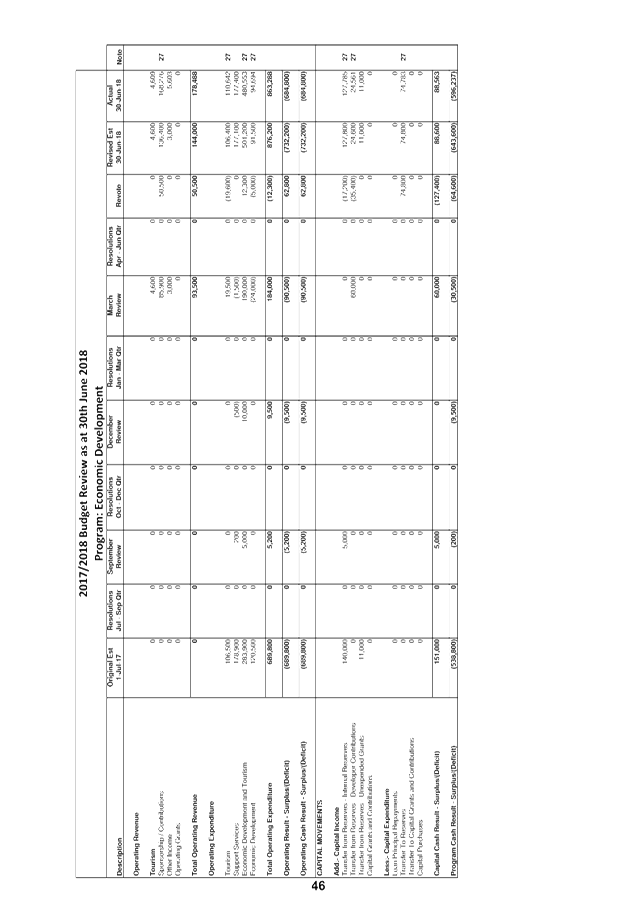

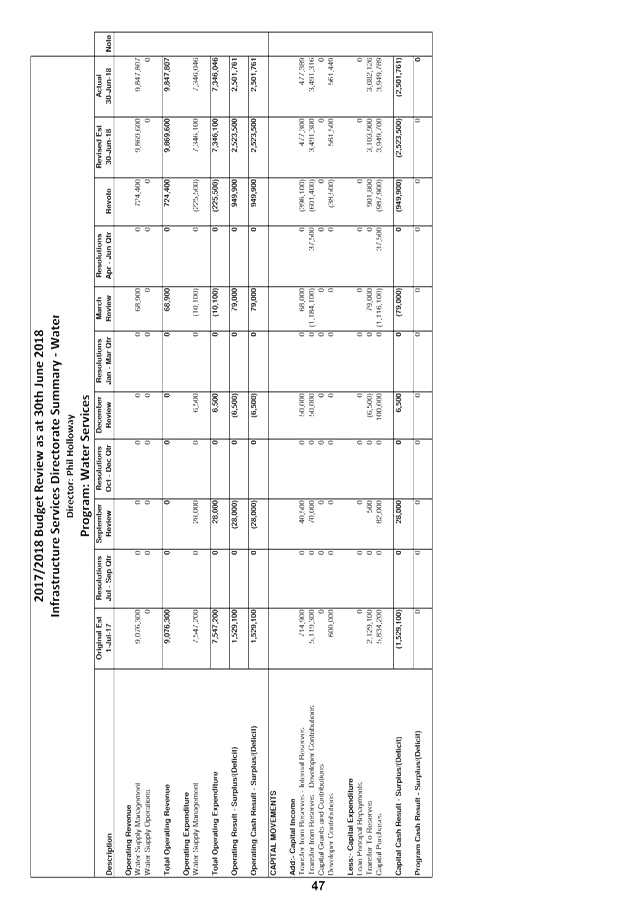

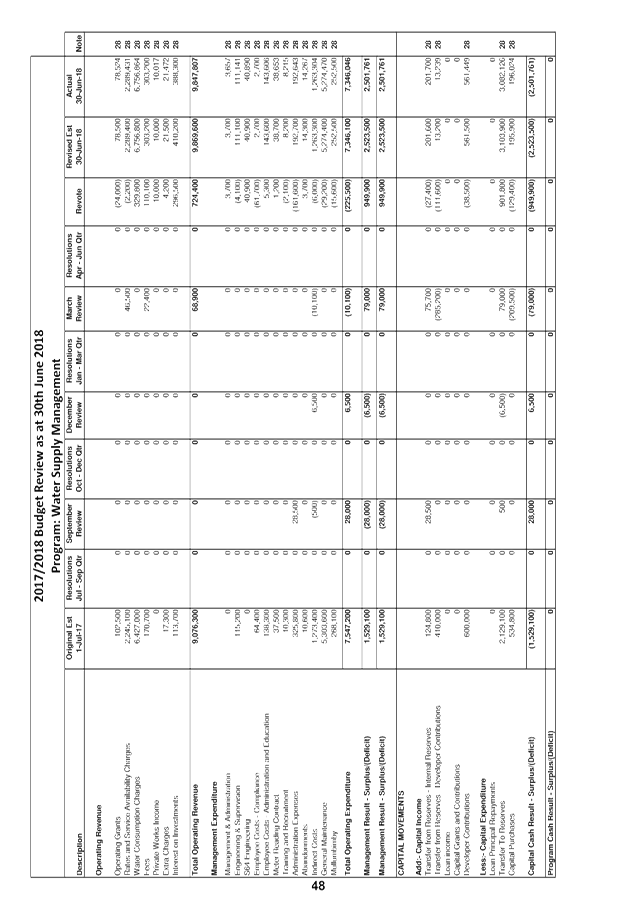

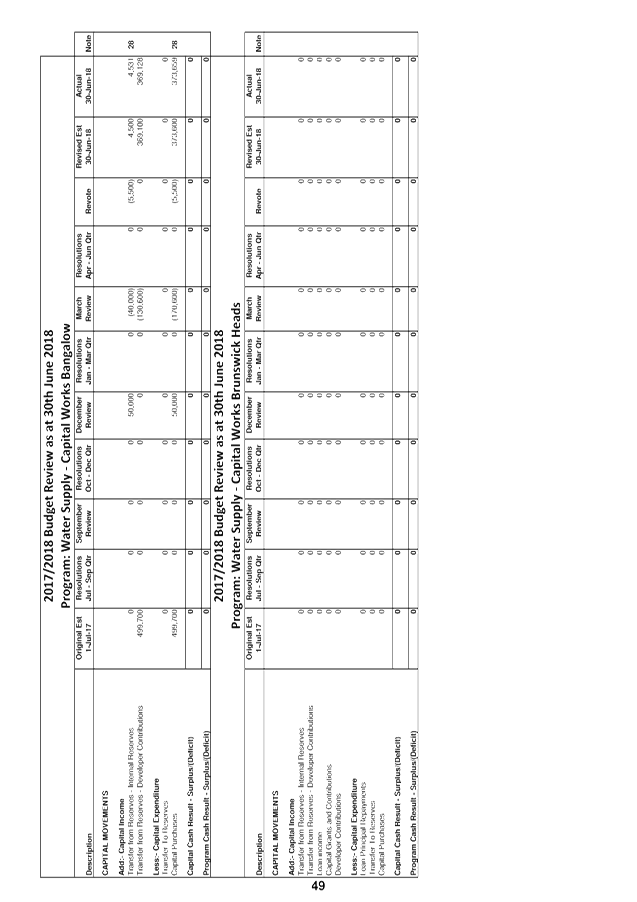

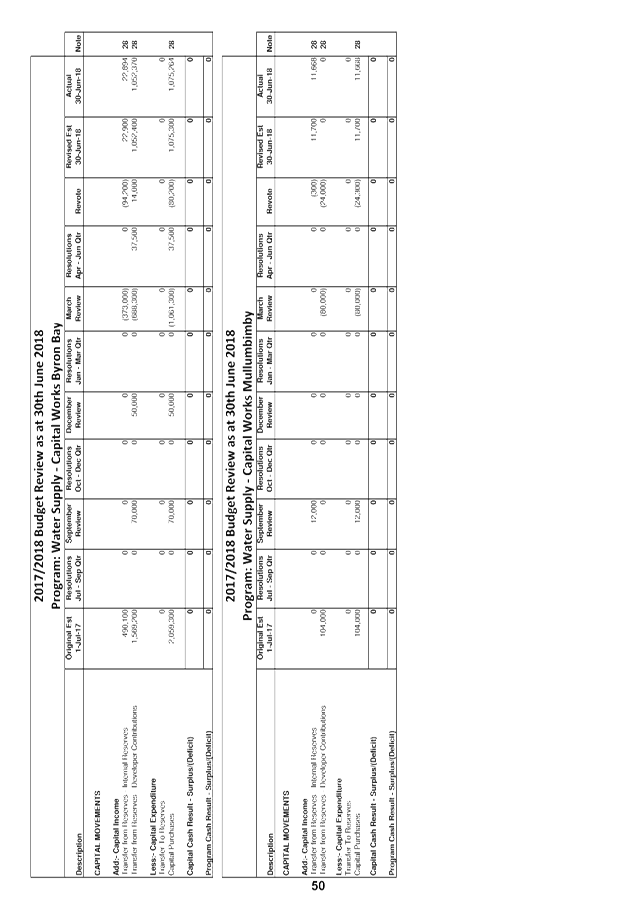

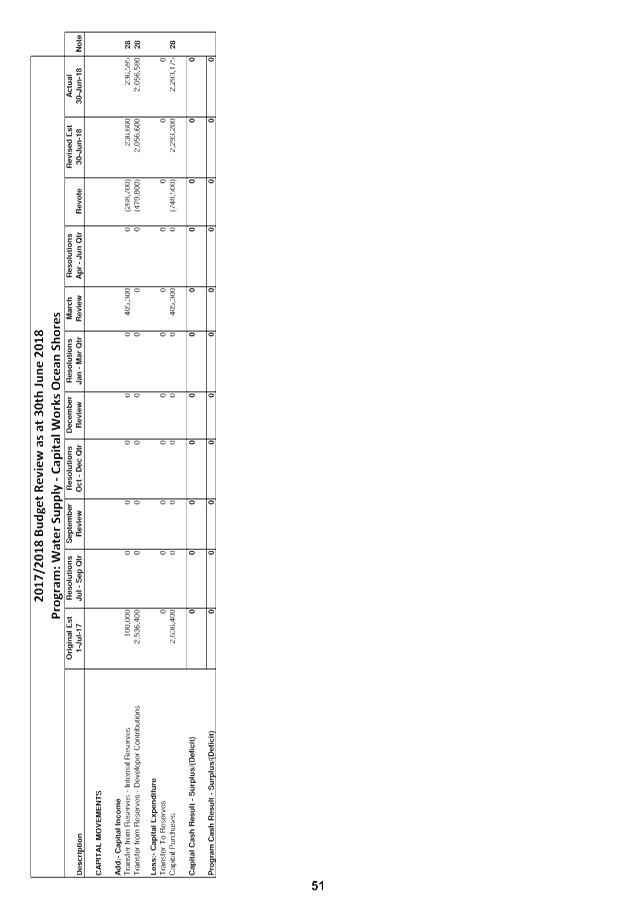

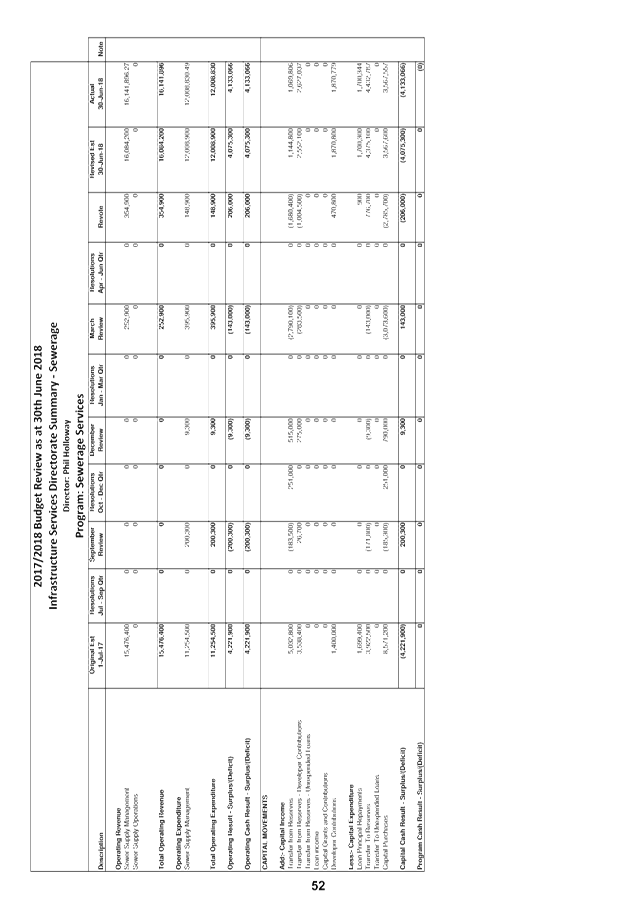

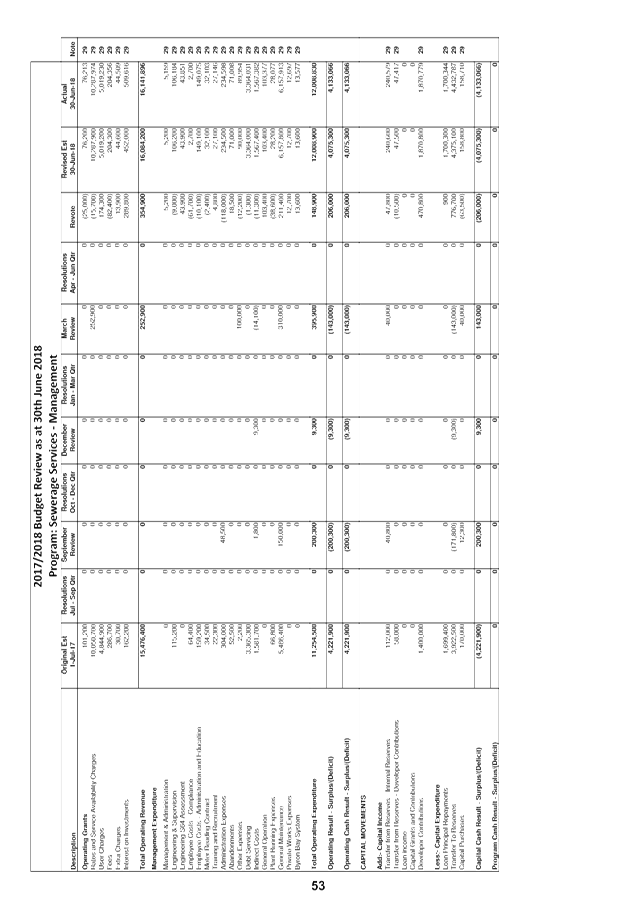

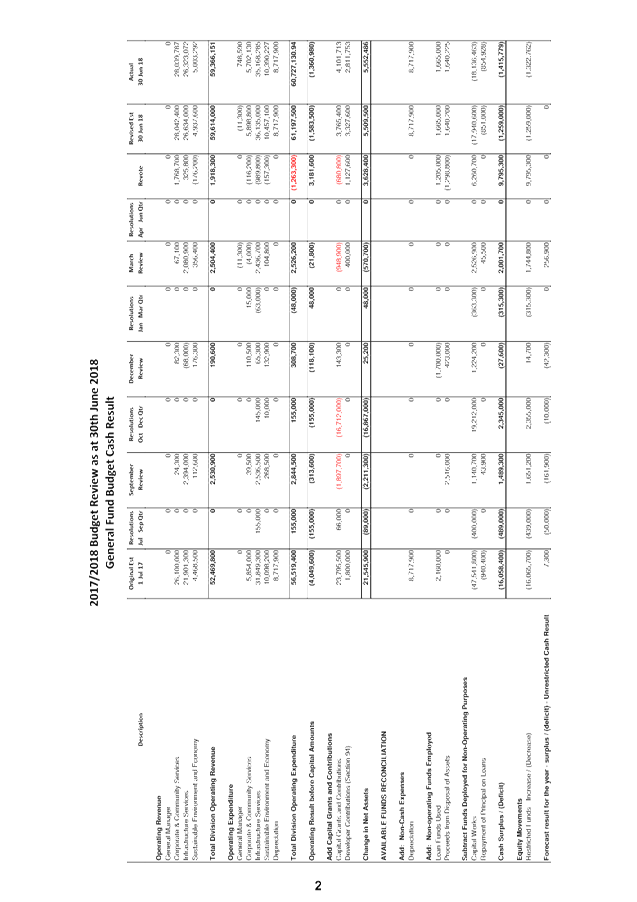

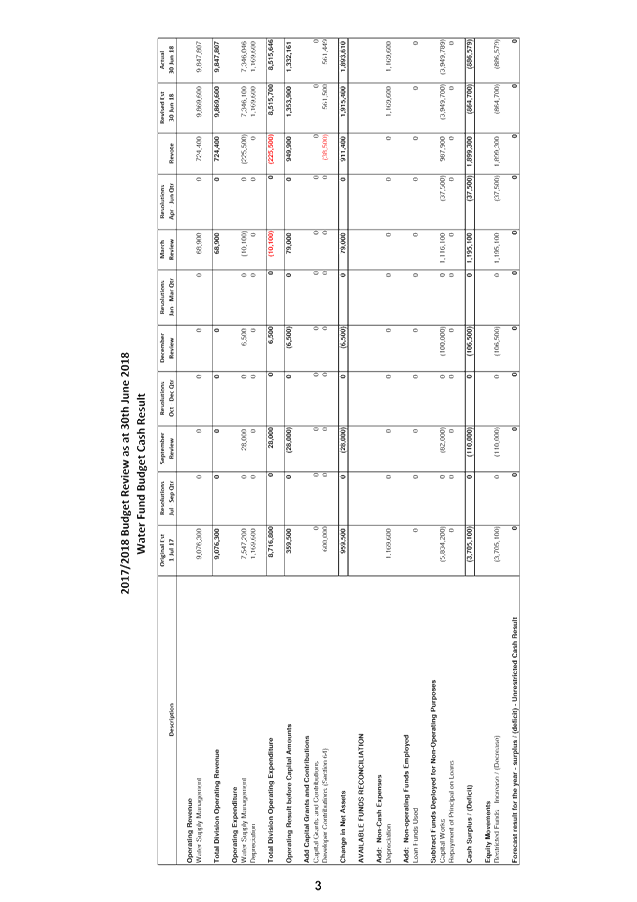

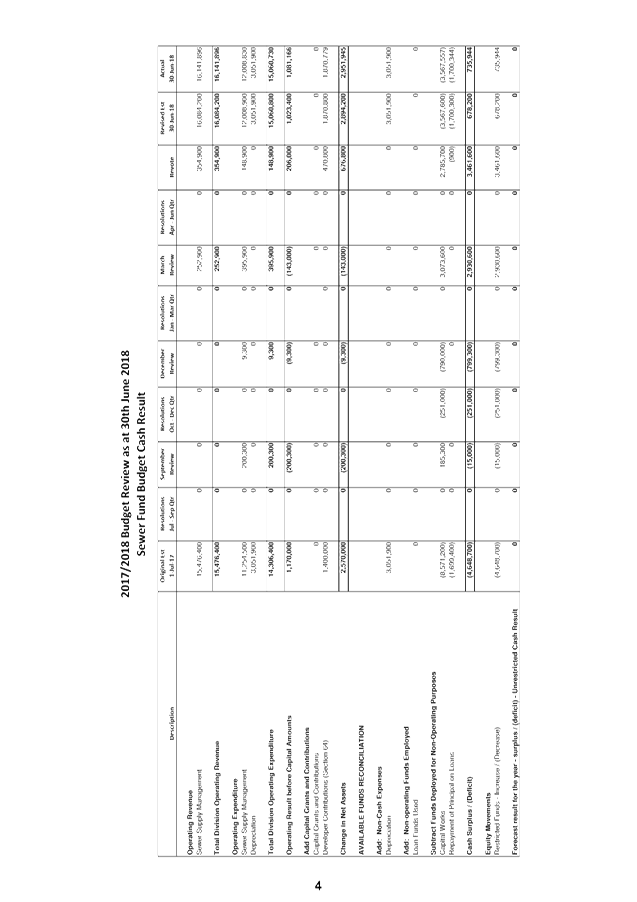

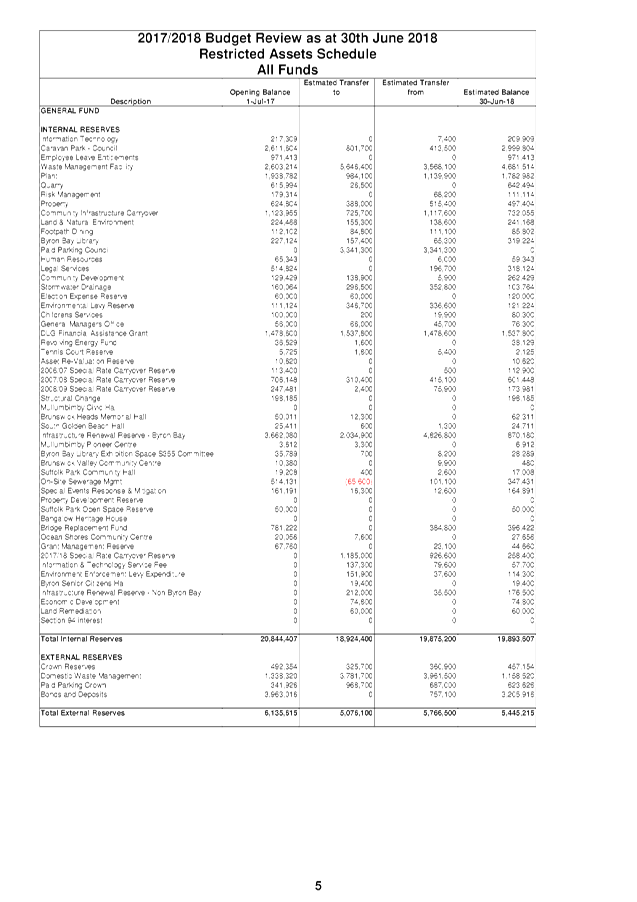

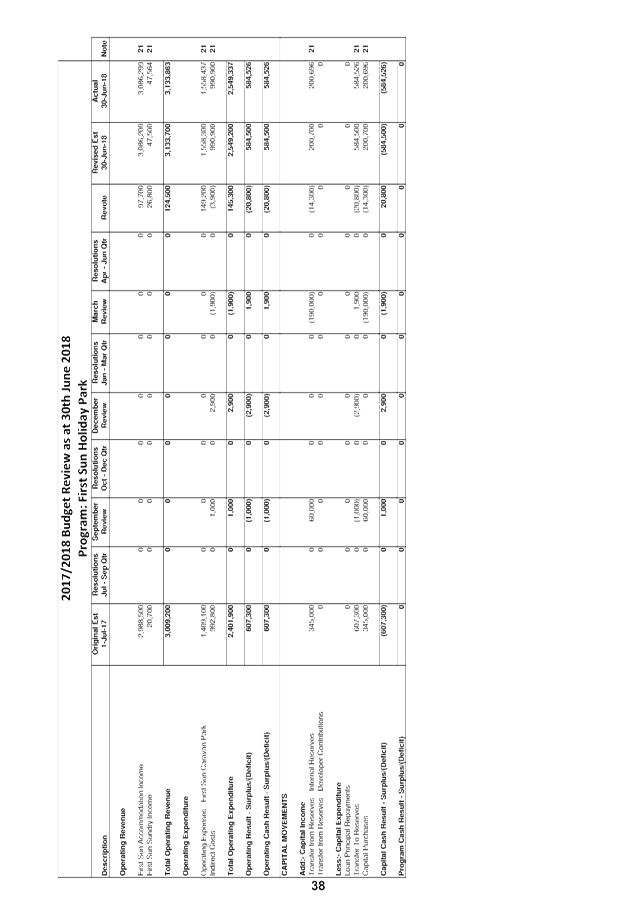

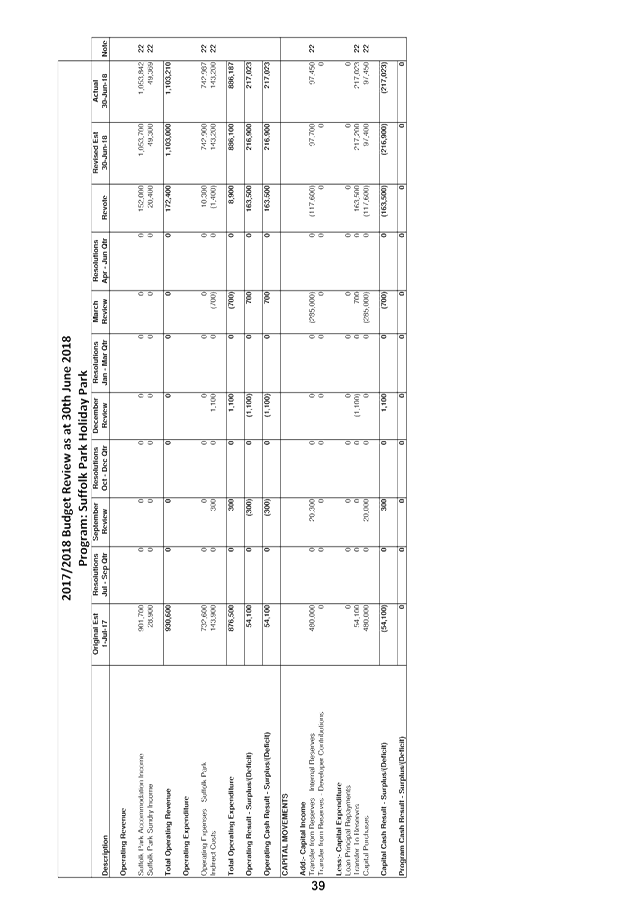

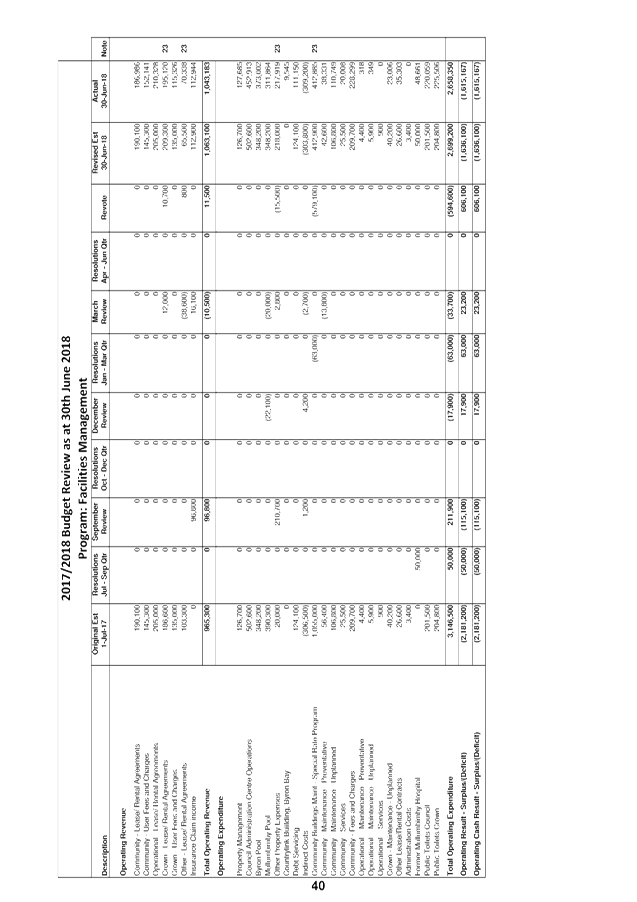

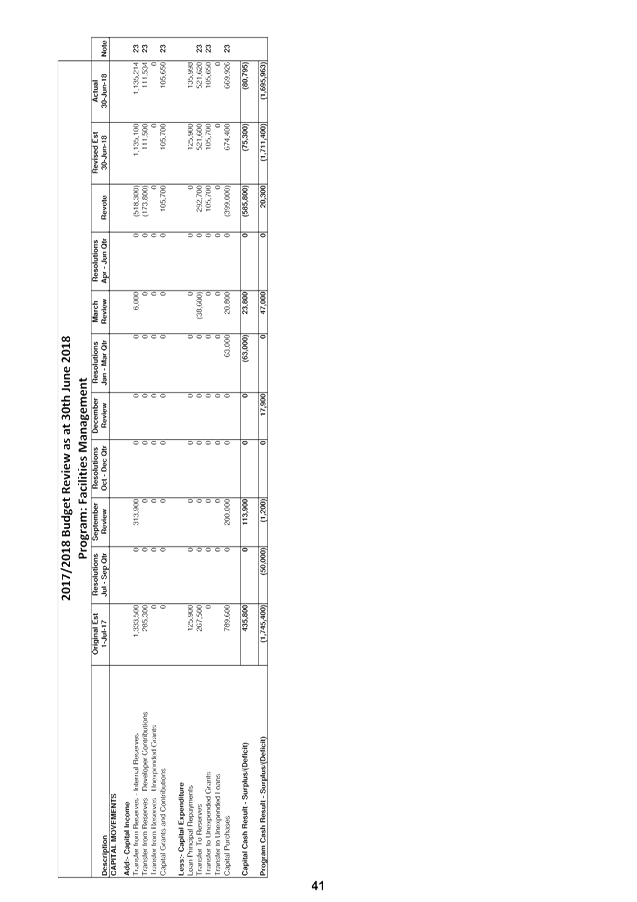

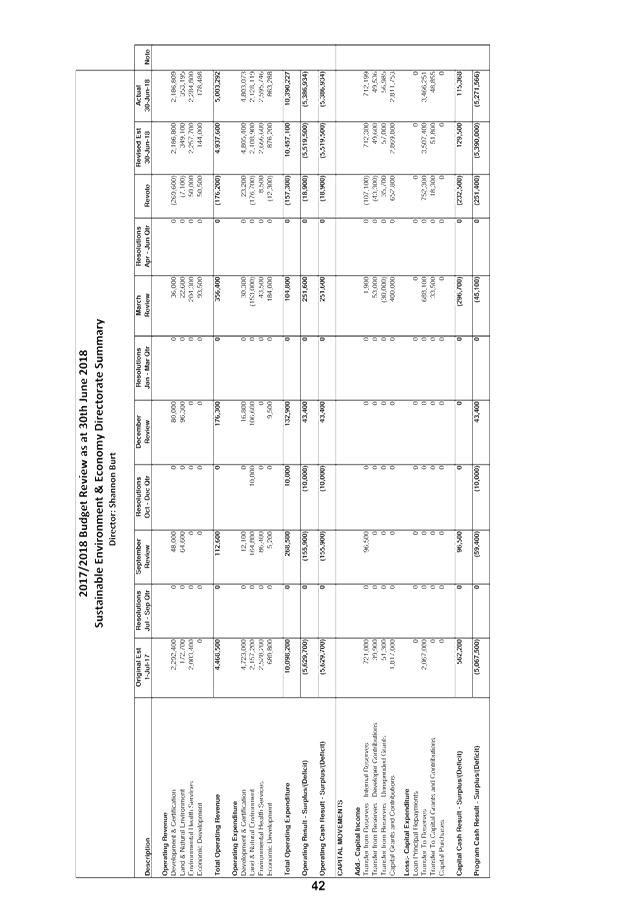

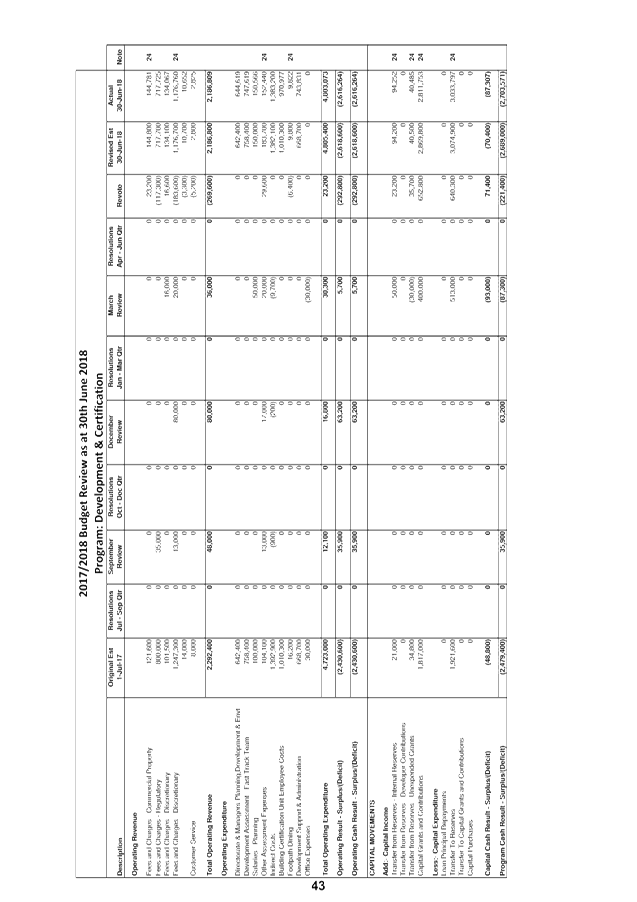

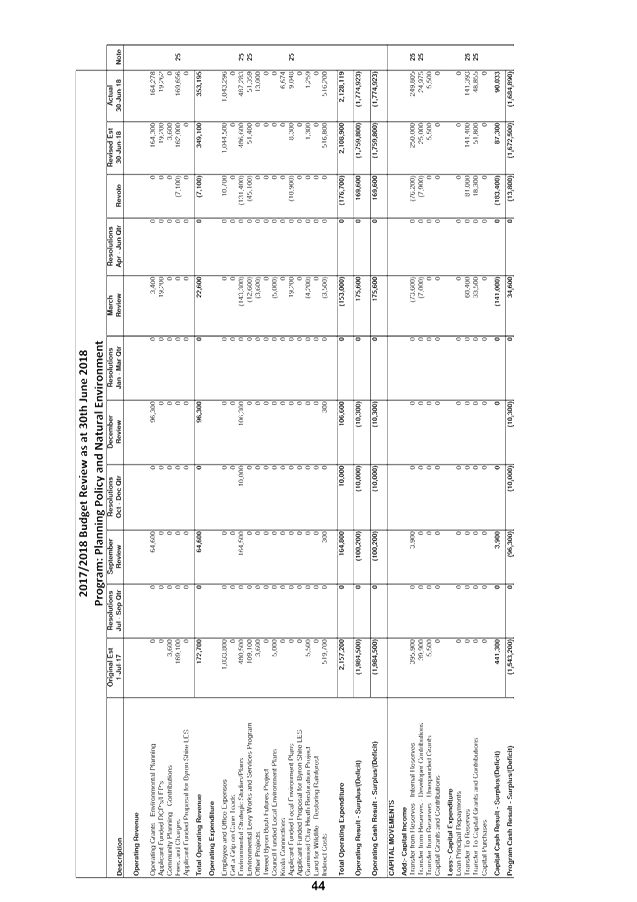

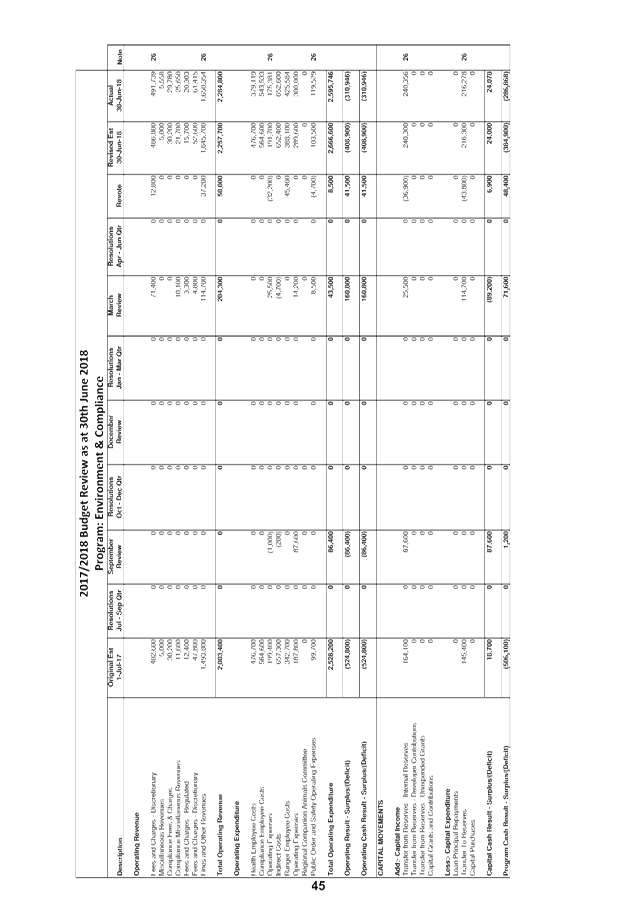

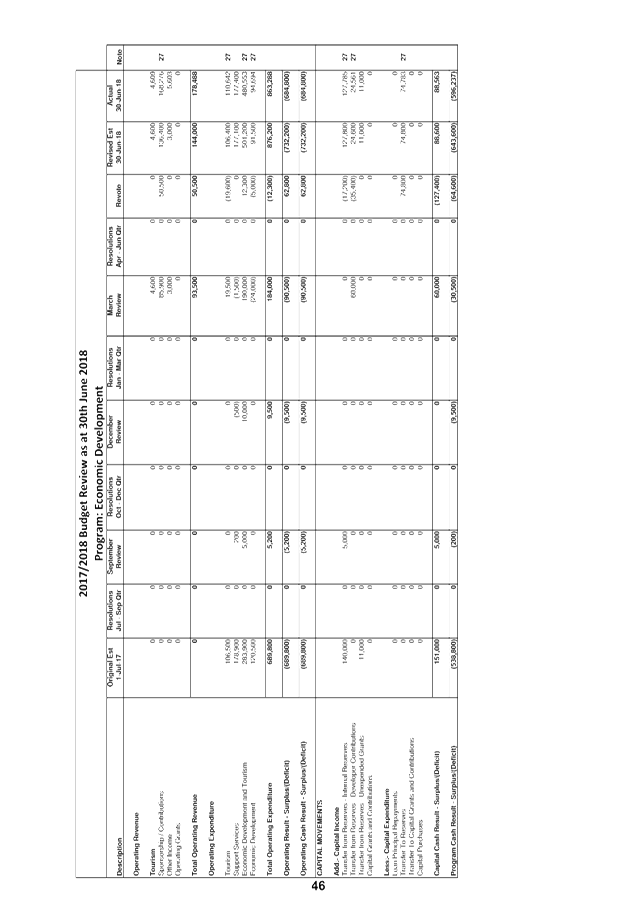

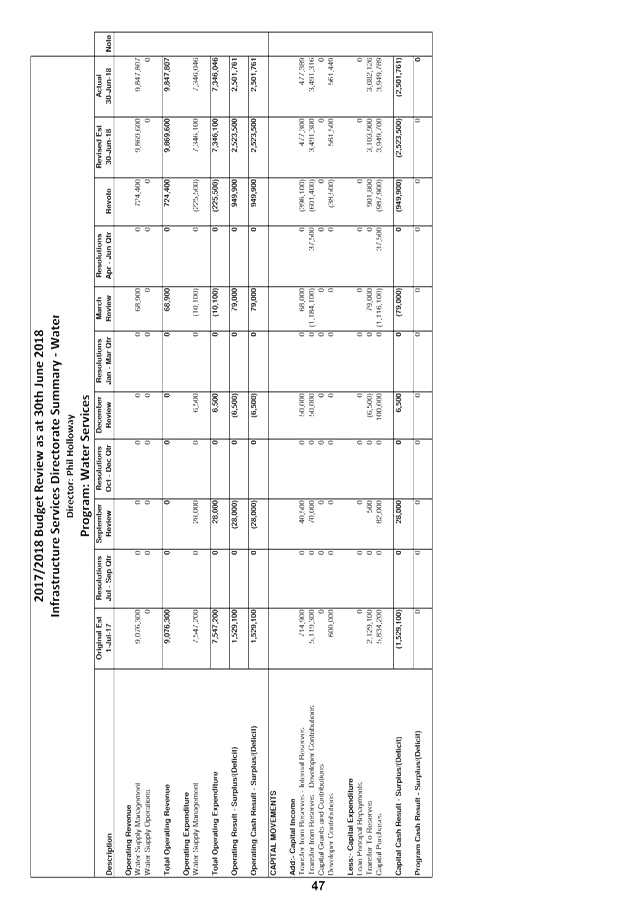

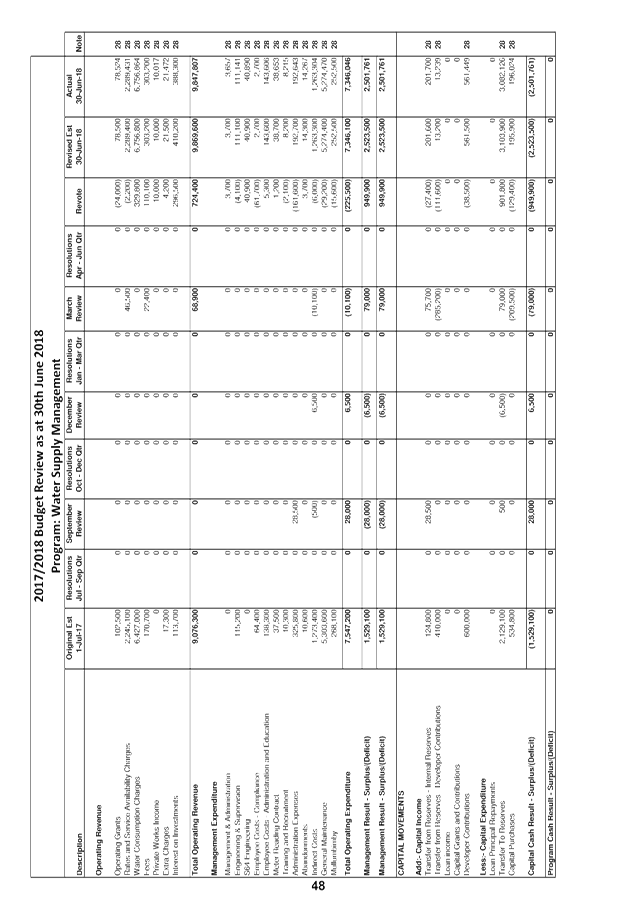

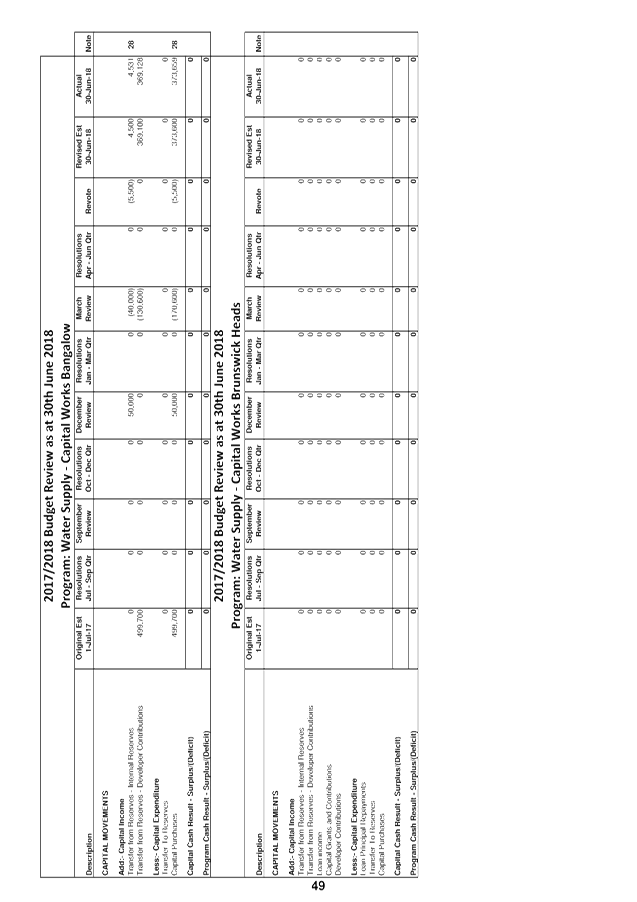

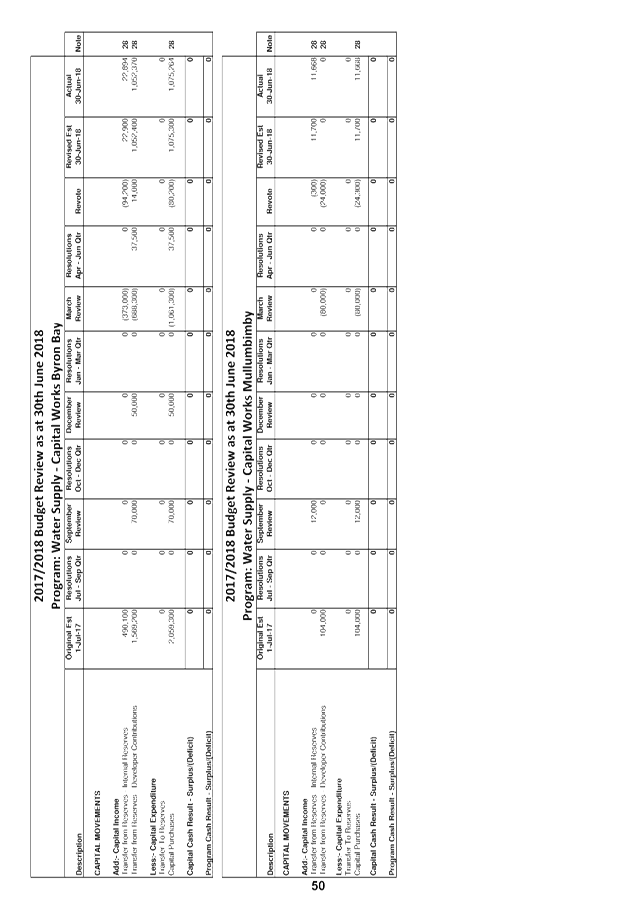

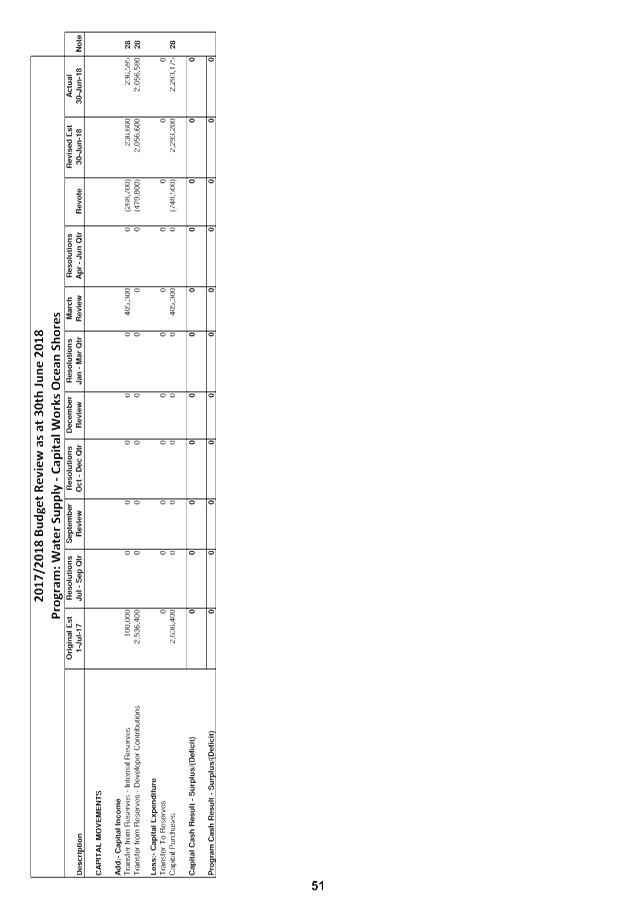

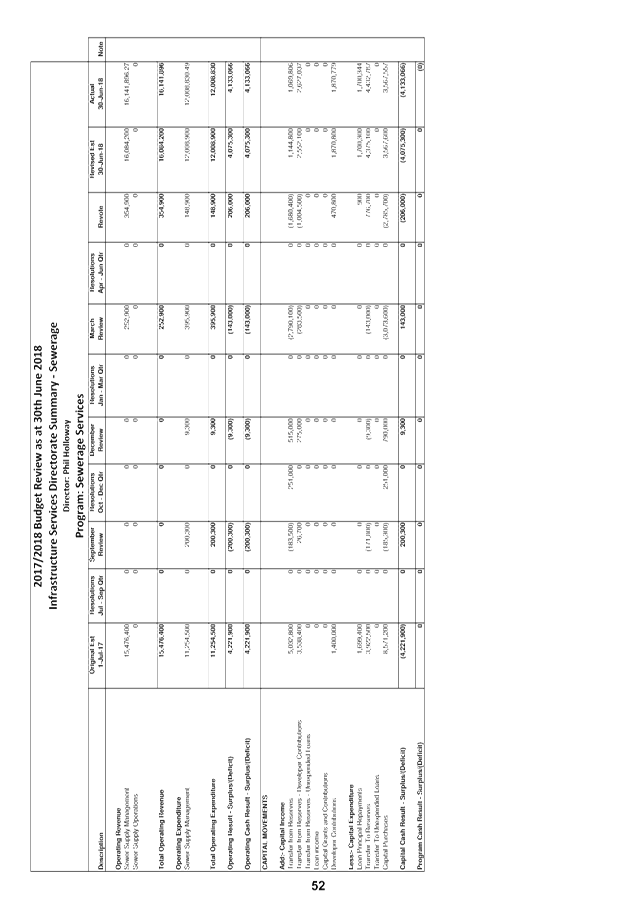

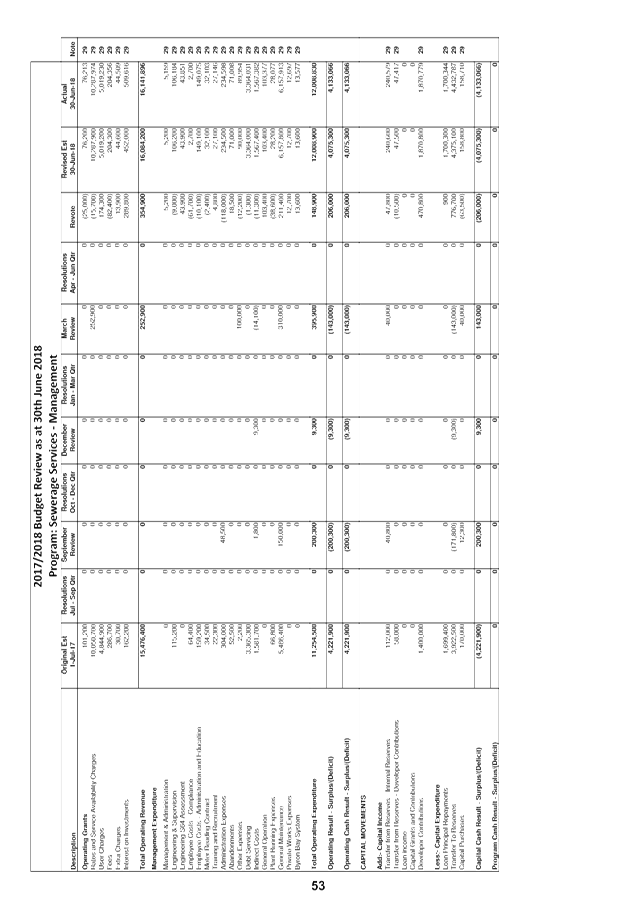

Review 1 April 2018 to 30 June 2018................................................................. 41

4.5 2018/19

Annual Procurement Plan............................................................................... 139

4.6 Long

Term Financial Plan 2018-2028........................................................................... 141

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

Report No. 4.1 2017/18

Financial Sustainability Plan - Update on the Action Implementation Plan as at

30 June 2018

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2018/942

Theme: Corporate Management

Financial Services

Summary:

Council at its Ordinary meeting held on 14 December 2017

adopted the 2017/18 Financial Sustainability Plan (FSP) via Resolution 17-647

without change, following endorsement of the Draft 2017/18 FSP by the Finance

Advisory Committee at its Meeting held on 16 November 2017.

The FSP adopted by Council is for the 2017/18 Financial Year

and details the strategic approach adopted by Council for managing the

Financial Sustainability of the Council as an organisation.

The Council

via Resolution 13-148 resolved to develop the FSP as a

means of communicating with the community on proposed reforms.

Council in Resolution 13-148 also determined that progress

reports on the implementation of the actions within the FSP be submitted to the

Council's Finance Advisory Committee.

This report has been prepared to provide the Finance

Advisory Committee with an update report on the implementation of the actions

in the 2017/18 FSP, for the period to 30 June 2018.

It is also proposed that this will be the last quarterly

report on the Financial Sustainability Plan as it is proposed this be

incorporated into Council’s Long Term Financial Plan.

|

RECOMMENDATION:

1. That the update

report to 30 June 2018 on the 2017/2018 Financial Sustainability Plan Action

Implementation Plan (E2018/43656) be received and noted.

2. That a separate

Financial Sustainability Plan no longer be developed from the 2018/2019

financial year onwards as it will be incorporated into Council’s Long

Term Financial Plan.

|

Attachments:

1 FSP Action

Implementation Plan as at 30 June 2018, E2018/43656

, page 7⇩

Report

Background

Council at its Ordinary meeting held on 14 December 2017

adopted the 2017/18 Financial Sustainability Plan (FSP) via Resolution 17-647

without change, following endorsement of the Draft 2017/18 FSP by the Finance

Advisory Committee at its Meeting held on 16 November 2017.

The FSP adopted by Council is for the 2017/18 Financial Year

and details the strategic approach adopted by Council for managing the

Financial Sustainability of the Council as an organisation.

The Council

via Resolution 13-148 resolved to develop the FSP as a

means of communicating with the community on proposed reforms.

Council in Resolution 13-148 also determined that progress

reports on the implementation of the actions within the FSP be submitted to the

Council's Finance Advisory Committee.

2017/18 Financial Sustainability Plan

This report has been prepared to provide the Finance

Advisory Committee with an update report on the implementation of the actions

in the 2017/18 FSP, for the period to 30 June 2018.

A summary of the actions detailed in the FSP has been

prepared and attached to this Report at Attachment 1. A comment has been

included in the summary against each of the identified actions for the main

areas or elements being:

· Expenditure

Review

· Revenue

Review

· Land Review

and Property Development

· Strategic

Procurement

· Policy and

Decision Making

· Volunteerism

· Collaborations

and Partnerships

· Asset

Management

· Long Term

Financial Planning

· Environmental

Projects

· Continuous

Improvement

· Finance

Performance Indicators

Future reports

The principles and actions in the Financial Sustainability

Plan are incorporated in Council’s Delivery Program and Operational

Plans. Progress on actions in the Operational Plan are to be reported to

Council on a quarterly basis.

Council has implemented the majority of the reforms in plan

and it has served its purpose.

It is also proposed to incorporate the principles of the

Financial Sustainability Plan into the Council’s Long Term Financial Plan

(LTFP) document as a basis for formulation of the LTFP and remove the

duplication of items that exist in the Financial Sustainability Plan also

contained in the Delivery Plan/Operational Plan.

It is therefore proposed that the FSP is concluded and there

will be no further quarterly reporting of any status updates to the Finance

Advisory Committee.

Financial Implications

The Finance Advisory Committee by referencing Attachment 1

will see progress against various action items associated with the FSP.

At this stage up to 30 June 2018, there have not been any positive financial

outcomes derived from the 2017/18 FSP. This is essentially due that

whilst Council has been able to maintain financial discipline during the

2017/18 financial year, the focus has been more on delivering outcomes.

As a general comment, Council may recall at the 2 February

2017 Ordinary Council Meeting, Council resolved to increase effective from 1

July 2017 pay parking hour charges by $1 and the capped fee for four hours by

$2. This fee increase has been applicable since 1 July 2017 and as a result

pay parking meter revenue at 30 June 2018 is $3,391,214 whereas at 30 June 2017

it was $2,819,542. This represents an increase of $571,672 and excludes

meter revenue from Wategoes that commenced in December 2016 for complete

comparison. Whether the revenue increase is due simply to the fee

increase, greater use of the pay parking scheme or a combination of both, there

is additional revenue for Council to utilise.

Council was also expecting to realise the proceeds from the

sale of the Station Street Land to North Coast Community Housing to which part

of this revenue will fund projects in 2017/2018 and proposed to fund further

land development projects as part of the 2018/2019 budget. Unfortunately,

settlement has been delayed and is now scheduled for September 2018.

It is also prudent that any positive financial outcomes

derived from actions of the FSP be based on actual outcomes and not estimated

outcomes. In that regard, the financial reporting of outcomes of the FSP

will be in arrears, once the outcomes are known and actions in the FSP are

completed.

Statutory and Policy Compliance Implications

Council Resolutions 13-148, 13-238, 14-326, 15-606 and

17-011.

The development of the FSP can also be considered as a tool

to assist Council in its ongoing obligations as defined in Section 9 (The

Council’s charter), Section 8 of the Local Government Act 1993.

Staff Reports - Corporate and Community Services 4.1 - Attachment 1

Strategy Element: Expenditure

Review

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Recommendations

on expenditure savings or efficiency gains identified by responsible staff

reported to the Executive Team.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Reports are prepared

following the quarterly Strategic Procurement Steering Committee meetings to

the Executive Team and responsible Managers. The reports include

recommendations for potential savings or efficiency gains from Contracts

tendered by Council or the NOROC Procurement Group, and recommendations on

Contracts that should be developed and Tendered by Council.

|

|

2. Monthly

Management Finance Reports provided to the Executive Team.

|

DC&CS

|

Monthly

|

Progress Update 30 June

2018

Monthly Management Finance

Reports are prepared by the Manager Finance and considered by the Executive

Team at the monthly Performance Management meeting held on the second

Wednesday of each month.

|

|

3. Monthly

Management Finance Reports provided to Councillors.

|

DC&CS

|

Monthly

|

Progress Update 30 June

2018

A copy of the Monthly

Management Finance Report is distributed by the Director of Corporate and

Community Services to Councillors on the Friday following the Executive Team

Performance Management Meeting. The version of the Monthly Management

Finance Report distributed to Councillors is in accordance with the template adopted

by Council for the monthly report.

|

|

4. Progress

reports to the Finance Committee on the implementation of the adopted FSP

actions.

|

DC&CS

|

Quarterly

|

Progress Update 30 June

2018

The 2017/18 FSP was adopted

by Council at its Ordinary Meeting held on 14 December 2017 (Res

17-647). This is the third progress report prepared for the Finance

Advisory Committee updating the Committee on the progress of implementing the

adopted actions.

|

|

5. Report

to Council through the Quarterly Budget Review any identified expenditure

savings.

|

DC&CS

|

Quarterly

|

Progress Update 30 June

2018

Any identified expenditure

savings will be included in the 30 June 2018 Quarter Budget Review report to

this meeting of the Finance Advisory Committee Meeting.

|

|

6. Report

to Council any recommendations regards policy changes.

|

DC&CS

|

As required

|

Progress Update 30 June

2018

Reported to Council as

required.

|

Strategy Element: Revenue

Review

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Internal

Staff Working Groups to report to the Executive Team on the progress achieved

on the implementation of their specific initiative/s.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

The Internal Working Group

has continued to operate and report to the Executive Team as required. A weekly

status update for identified critical projects is provided in the internal

weekly Critical Project Status Update Report to the Executive Team.

|

|

2. Internal

Staff Working Group/staff to report to the Executive Team any proposed

opportunities for deriving new/additional revenue.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Reported as required.

|

|

3. Report

to the Finance Committee and/or the Council any proposed opportunities for

deriving new/additional revenue.

|

DC&CS

|

Quarterly

|

Progress Update 30 June 2018

Reported as required.

|

|

4. Report

to Council any recommendations regarding policy change and/or increases to

existing or new revenue sources.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Reported as required.

|

|

5. Prepare

submissions and lobby for grant funding for significant infrastructure

projects.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

The Grant applications

submitted by Council have been supported, where appropriate, with submissions

to Local Members and the responsible State or Federal Minister. The

Grant applications submitted are detailed in the monthly Grants Report to

Council.

|

|

6. Research

non-residential revenue sources (if any) and report to the Finance Advisory

Committee quarterly.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Reported as required.

|

Strategy Element: Land

Review and Property Development

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

General Fund

|

|

1. Lot

12 Bayshore Drive – Future use assessment through EOI and possible PPP.

|

DIS

|

June

2018

|

Progress Update 30 June

2018

No change - Council has

placed the proposed EOI on a temporary hold while potential sources of

government funding are being explored.

|

|

2. Station

Street – Complete sale to North Coast Community Housing.

|

DIS

|

June

2018

|

Progress Update 30 June

2018

Subdivision registered,

final settlement negotiations progressing.

|

|

3. Yaran

Road, Tyagarah Airfield – Planning continuing.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Planning on Council

resolution pertaining to a Food Hub progressing.

|

|

4. Lot

22 Mullumbimby – Progress rezoning and implement EoI in accordance with

Res 17-260.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Gateway approved.

Supporting studies for exhibition progressing eg heritage, ASS, geotech etc.

|

|

5. Bayshore

Drive Works Depot,

Byron Bay (Lot 102, DP1087996, 1.79ha) – Progress relocation project.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Consultants Complete Urban

are working on additional assessments before completing their options

report. This work is continuing.

|

|

6. Various

small surplus land parcels – Continue program.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Various land matters being

assessed and progressed.

|

|

Water Fund

|

|

7. Fletcher

Street –Development approval and construction procurement.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

No change –

architects on hold pending DCP project outcomes.

|

|

Sewer Fund

|

|

8. South

Byron STP – Implement Res 17-225 by finalising remediation and Future

Use assessment through EoI and possible PPP.

|

DIS

|

June 2018

|

Progress Update 30 June 2018

EOI reported to Council and

four proposals to progress to the selective tender stage. Remediation

progressing.

|

|

9. Brunswick

Heads STP – Complete remediation and evaluate future use options

including possible depot relocation.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Completed.

|

|

10. Mullumbimby

STP – Complete remediation.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

This project will now be

completed in 2018/19.

|

|

11. Brunswick

Valley STP, Vallances Road – Implement Res 17-054 PoM outcomes.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

POM actions included in

2018/19 Operations Plan.

|

|

12. Bangalow

STP – Site could be considered for solar farm options.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Storage of bridge timber

components commenced.

|

|

13. Lot

4 Mill Street – Complete site access acquisition process and implement

EoI in accordance with Res 17-260.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Liaison continuing with

John Holland Rail.

|

|

Waste Fund

|

|

14. Lot

15 Dingo Lane, Myocum – Site to be retained in accordance with the

Resource Recovery Master Plan.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Solar Farm project

progressing and will be included on the September SPW Agenda with Resource

Analytics attending to provide Councillors an update.

|

|

15. Lot

16 Dingo Lane, Myocum – Implement Res 17-228 and sell to use funds to

pay down loans to reduce debt servicing costs.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Sold.

|

Strategy Element: Strategic

Procurement

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Develop

a compliance and audit plan.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Completed.

|

|

2. Review

and further develop contracts management processes and system.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Contract management system

has been implemented. This action is now complete.

|

|

3. Develop

ongoing supplier education program to assist local business.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Supplier education program

to be included in 2018/19 Procurement Plan.

|

|

4. Review

Stores procurement.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

Stores Procurement Review

to be undertaken in 2018/19.

|

|

5. Implement

Stores review recommendations.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

To be completed after

Stores review is undertaken.

|

|

6. Introduce

negotiation processes and training.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

To be included in 2018/19

Procurement Plan.

|

Strategy Element: Policy

and Decision Making

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Council

continue to consider the short, medium and long term financial impacts and

the context of Council’s long term financial sustainability in its

ongoing policy and decision making processes.

|

Manager

Finance

|

June 2018

|

Progress Update 30 June

2018

The Manager Finance

undertakes a review of the reports to Council on a monthly basis and provides

comments to Report Writers and the Executive Team on the financial

implications. Comments are included in the reports for consideration of

Council in the decision making process. Resolutions impacting on

budgets are considered in the QBR process and then included in the financial

modelling used for the preparation of the LTFP.

|

|

2. That

any unspent budget votes from the 2016/17 budget recommended to be carried

over to the 2017/18 Budget be reported to Council following the end of the

2016/17 Financial Year.

|

Council

|

June 2018

|

Progress Update 30 June

2018

This item is

complete. Carryovers from the 2016/2017 to be added to the 2017/2018

budget were considered by the Finance Advisory Committee at its Meeting held

on 17 August 2017. These were later adopted by Council at its Ordinary

Meeting held on 24 August 2017 (Res 17-322).

|

|

3. That

the monthly Finance Report be distributed to Councillors on a monthly basis.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

Monthly finance reports are

being circulated to Councillors.

|

|

4. That

policies that contain wording or provisions that are considered to be

restrictive be reviewed to incorporate enabling wording and guidelines for

Council’s consideration and approval.

|

DC&CS

|

June 2018

|

Progress Update 30 June

2018

This project is ongoing and

if applicable, policies once reviewed will be submitted to Council for

consideration.

|

|

5. That

the Special Rate Variation (SRV) and policy frameworks established through

Res 17-222 be implemented and reported quarterly to the Finance Advisory

Committee.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

The first quarterly update

to the Finance Advisory Committee occurred on 16 November 2017 and

included an expenditure table detailing how SRV funds have been expended for

the first quarter of the 2017/2018 financial year. There is a

subsequent updates provided to the 15 February 2018, 17 May 2018 and 16

August 2018 Finance Advisory Committee Meetings.

|

Strategy Element: Volunteerism

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Review

the Volunteer Policy and framework to ensure that it meets the National

Standards for volunteer involvement, and supports the organisation in

delivering volunteer activities.

|

Manager Community

Development

|

June 2018

|

Progress Update 30 June

2018

Working group identified

and meetings commenced.

|

|

2. Undertake

an organisation wide audit of current volunteer activities.

|

ET

|

June 2018

|

Progress Update 30 June

2018

As part of the proposed

internal working group, an audit of current volunteering opportunities will

be undertaken.

|

|

3. Recognition

of current volunteers.

|

ET

|

June 2018

|

Progress Update 30 June

2018

Given limited take up of

volunteer recognition event in 2017, and limited staff resources, it is

proposed to not undertake a recognition event in 2018, rather to work towards

a volunteer engagement event later in the calendar year, which seeks to both

recognise the work of volunteers, and understand how Council can better

support current volunteers.

|

|

4. Undertake

a capacity building project with Council S355 Committees.

|

Manager Community

Development

|

June 2018

|

Progress Update 30 June

2018

Project completed.

|

Strategy Element: Collaborations

and Partnerships

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Progress

investigation of potential commercial opportunity projects currently underway

such as:

a) Redevelopment

of the Fletcher Street (former Library Building) site;

b) Management

and development of the Tyagarah Aerodrome;

c) Redevelopment

of Byron Bay Swimming Pool/Café.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

a) Architects on hold while DCP project

is progressed.

b) Planning on Council resolution

pertaining to a Food Hub progressing

|

2. Progress

with calling Expressions of Interest (or another type of competitive

processes) currently underway, to investigate potential partnership

opportunity on the following valuable community land sites:

a) Lot 12 Bayshore Drive,

Byron Bay.

b) 156 (Lot 22) Stuart Street,

Mullumbimby.

c) 3 Broken Head Road,

Suffolk Park (former South Byron Sewerage Treatment Plant site).

d) Lot 4 Mill Street, Mullumbimby.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

a) Council has placed the proposed EOI

on a temporary hold while potential sources of government funding are being

explored

b) Gateway approved. Supporting studies

for exhibition progressing eg heritage, ASS, geotech etc

c) EOI reported to Council and four

proposals to progress to the selective tender stage. Remediation progressing.

d) John Holland Rail have advised that

sale will be possible late 2018 early 2019. Liaison continuing with JHR.

|

|

3. For

the Supporting Partnerships Policy, develop:

a) tools,

guides and information for community and future partners on Council’s

Partnership Policy;

b) a

public web-based register to provide community with information on upcoming

or potential partnerships and partnership projects;

c) a

Communications Strategy to support the community becoming and remaining

informed about all things ‘Partnership’;

d) internal

procedures and processes for management of potential collaboration and

partnership opportunities.

|

Manager Corporate Services

|

June 2018

|

Progress Update 30 June

2018

Policy, guidelines and

register available online. Communications delivered in line with each

project.

|

|

4. Provide

reports to ET on potential collaboration, partnership and commercial

opportunities when they are identified.

|

ET/Managers

|

June 2018

|

Progress Update 30 June

2018

Reported as required. To

highlight just a couple of examples this quarter, Council[MS1] :

· Successfully developed the Conferencing Byron and

Byron Business Events Bureau and this quarter built a collaboration with

Destination North Coast to expand the program to include regional membership.

[MS2]

· Opened a branch office in Byron providing general

services to residents possible thanks to collaboration with operators of the

Byron Visitor Centre.[MS3]

· Partnered with Tweed Shire Council to develop and

others such as, Sustain Northern Rivers Energy Group to peer review, the

“Power Up – Northern Rivers Electric Vehicle Strategy”[MS4] .

· Entered into discussion with community members

over the establishment and ongoing maintenance of a community garden on

public land at Red Bean Close Suffolk Park[MS5]

· Agreed to be a partner in the Richmond River Governance

Project, to develop a governance and funding framework to address poor river

health issues affecting the Richmond River and its communities.[MS6]

|

Strategy Element: Asset

Management

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Update

the Strategic Asset Management Plan including access considerations and other

emerging issues.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

TAMP exhibited, report to

August meeting of Council for adoption.

|

|

2. Improve

the integrity of the Asset Management system by implementing actions detailed

in key audit reports.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Key progress being made on

implementation of the CVR.

|

|

3. Implement

asset modelling in accordance with Special Rate Variation requirements.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

My Predictor modelling

capacity being deployed on a as needs basis.

|

|

4. Review

annually integration of asset management plans, capital works program, S94

Plan, S64 Plan and LTFP.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

The 2018/19 budget includes

these requirements and has been adopted.

|

|

5. Engage

with the community to determine the customer LOS for accessible transport.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

CSP outcomes embedded in

the new CSP. Detailed LOS survey for Transport infrastructure completed and

to be reported to August TIAC.

|

|

6. Complete

the annual infrastructure report (SS7).

|

DIS

|

June 2018

|

Progress Update 31 March

2018

Completed.

|

|

7. Complete

condition and access audit inspections of community buildings.

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Work has progressed and has

now been funded in 2018/19.

|

|

8. Implement

replacement of high priority road bridges across the Shire

|

DIS

|

June 2018

|

Progress Update 30 June

2018

Works commenced in April

and are ahead of schedule.

|

Strategy Element: Long

Term Financial Planning

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Develop

the 2017-2028 Long Term Financial Plan following adoption of the 2017/18

Operational Plan and report to the Finance Advisory Committee/Council prior

to 16 November 2017.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

The next version of the

Long Term Financial Plan is yet to be commenced and is behind schedule.

It is anticipated this was to be completed and be reported to the 17 May 2018

Finance Advisory Committee Meeting. This has not been able to be

achieved and it is now expected to be reported to the 16 August 2018 Finance

Advisory Committee.

|

|

2. Further

update the 2017-2028 Long Term Financial Plan to incorporate outcomes from

the development of the new Community Strategic Plan in conjunction with the

adoption of the 2018/19 Operational Plan and Budget Estimates to be reported

to Council in June 2018.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

To be undertaken following

the adoption of the 2018/2019 Budget Estimates and expected to be reported to

the 16 August 2018 Finance Advisory Committee Meeting.

|

Strategy Element: Environmental

Projects

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1. Implement

actions from the Low Carbon Strategy as per scheduled timeframes.

Example of actions that meet the FSP include energy efficiency measures,

installation of solar power and solar hot water, energy data optimisation, electric

fleet vehicles and installation of smart meters.

|

DSEE

|

June 2018

|

Progress Update 30 June

2018

Projects underway include

Environmental Upgrade Agreements (EUAs) feasibility and partner

identification with the aim of getting more solar on business rooftops;

development of large scale solar farm at Dingos Lane; Discussions with other

councils about the prospect of entering into a PPA with a large centralised

solar farm; . working with COREM and Shoalhaven Council to determine the

feasibility of the Solar Gardens project in Byron Shire as part of the ARENA

grant funding; . ~99kW solar system on the Mullumbimby administration

carpark; EV charger expansion opportunities; car share feasibility in Byron

Bay; and the establishment of the Sustainability and Emissions Reduction

Advisory Committee.

|

|

2. Work

collaboratively with the Zero Emissions Byron project to identify actions

that go beyond the Byron Shire Low Carbon Strategy.

|

DSEE

|

June 2018

|

Progress Update 30 June

2018

Byron Shire Council was

successful in being selected by the NSW Office of Environment and Heritage to

have the Byron Shire Council Community Emissions Profile Report. This

report has been shared with ZEB and a workshop on the findings presented to

staff and ZEB.

Sourcing and analysis of

community GHG emissions data has long been a cause of frustration for

Australian councils. A decade ago, hundreds of councils had access to

“top-down” community data provided by ICLEI Oceania based on ABS

(Australian Bureau of Statistics) and ABARES (Australian Bureau of

Agricultural and Resource Economics and Sciences) data. However, the

development of this data ceased in 2009 with the closure of the Cities for

Climate Protection funding.

Over the last 3 years,

Ironbark Consulting have been working with Australian councils, ICLEI

Oceania, the Global Covenant of Mayors for Climate & Energy, Distribution

Network Service Providers (DNSPs) and other data providers to develop

community greenhouse gas profiles for Australian councils that are compliant

with international reporting standards. This has included the

development and submission of GPC-compliant community inventories for the

purpose of complying with the Global Covenant of Mayors.

ZEB is also a member of the

newly formed SERAC.

|

Strategy Element: Continuous

Improvement

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

Workforce

|

|

1. Management

of excessive annual and long service leave, supported by introduction of

online leave processes.

|

Managers & Manager

P&C

|

June 2018

|

Progress Update 30 June

2018

As at March 2018, 63% of

leave applications lodged across Council were online. On-line leave

functionality implemented across work teams remains at 75% due to IT issues

which are almost resolved. It is expected that on-line will be accessible by

all staff by September 2018.

|

|

2. Management

of sick leave – improvement effort to be focused on staff taking 10.5

days or more p/a.

|

Managers

|

June 2018

|

Progress Update 30 June

2018

In early July 2018, Manager

P&C will provide Managers with information on staff who have accessed

more than 6 days sick leave in the first 6 months of 2018.

|

|

3. Ongoing

monitoring of overtime costs as a percentage of total employee costs.

|

Manager Organisation

Development

|

June 2018

|

Progress Update 30 June

2018

Continuing as above.

Overtime costs are reported to the Executive Team, with the information

available to Managers, monthly.

|

|

4. Review

and improve mapping of workforce to services (consistent with a review of

Special Schedule 1).

|

Manager Organisation

Development &

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

Underway as part of FY2018

reporting process.

|

|

Finance

|

|

5. Continue

to invest in Finance Team members gaining qualifications and building

capacity.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

There are currently two

members undertaking long term study to gain qualifications of a tertiary

nature, enabling capacity for current staff to broaden their knowledge and

assist in strengthening the Finance team’s ability to step into various

roles.

|

|

6. Review

Manager Finance Position Description to confirm focus on strategic

transformation and increased focus on business insight activities.

|

DC&CS and Manager

Finance

|

June 2018

|

Progress Update 30 June

2018

Position description not

yet reviewed, however the expectation of providing a greater emphasis on

business insight is understood.

|

|

7. Finance

Team to review operations and act on improvement opportunities with a focus

on increasing business insight activity.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

Not able to be achieved but

proposed to review BIS Management Reporting system available through

Council’s Authority software.

|

|

8. Directorate

nominees with Finance Team to review Cost Centres and Allocation under

Special Schedule 1 categories.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

Finance continue to make

progress with mapping of Special Schedule 1 in conjunction with each

directorate.

|

|

Operations

|

|

9. Review

IT spend to identify total IT spend and map capital and recurrent costs drivers

to increase business understanding and assist with future budgeting

|

Manager Business Systems

and Technology

|

June 2018

|

Progress Update 30 June

2018

Undertaken in setting

annual budget and quarterly budget reviews.

|

|

Service Delivery

|

|

10. IS Managers, working with People and

Culture Team, will develop actions focused on succession planning and

increasing workforce diversity.

|

IS Managers

|

June 2018

|

Progress Update 30 June

2018

In progress, ongoing.

|

|

11. SEE Managers, working with People and

Culture Team, will develop actions focused on succession planning

|

SEE Managers

|

June 2018

|

Progress Update 30 June

2018

In progress, ongoing.

|

|

12. Roads Services (Operating) – Working

with Finance Team and benchmarking with comparable councils, Manager to

critically review data, ascertain key drivers and develop an action plan to:

1. fully articulate and explain results;

2. develop a methodology to consistently

measure genuine operating (non capital) expenditure.

Including

a focus on:

a. Cost coding and accuracy of expense

allocation;

b. Depreciation expenses;

c. Internal charging (including on-cost

calculations and fleet charges);

d. Capital expenditure required to be

accounted for as operating expenditure (as per the Code of Accounting

Practice).

|

Manager Works & Manager

Finance

|

June 2018

|

Progress Update 30 June

2018

Ongoing and part of normal

course of business.

|

|

13. Sewerage Services (Operating) –

Working with Finance Team and benchmarking with comparable councils, Manager

to critically review data, ascertain key drivers and develop an action plan

to:

1. fully articulate and explain results;

2. develop a methodology to consistently

measure genuine operating (non capital) expenditure.

Including

a focus on:

a) Debt servicing impact on expenses;

b) Position in lifecycle of plants;

c) Impacts from environmental initiatives;

d) Internal charging (on-cost calculations).

|

Manager Utilities

|

June 2018

|

Progress Update 30 June

2018

Ongoing and part of normal

course of business.

|

|

Corporate Leadership

|

|

14. Include

measurement of Customer Satisfaction in the biennial CATI Community

Satisfaction Survey going forward.

|

Manager Organisation

Development

|

June 2018

|

Progress Update 30 June

2018

Questions about

satisfaction with Council services have been included in question set

informing the procurement process. Survey will be conducted later this year.

|

|

15. Council meetings – Council continues

to have some of the longest meetings and one of the top half a dozen councils

with the highest number of resolutions.

Councillors

can review information provided and meeting procedures. Some considerations

suggested in the Performance Excellence Report to help review meeting

practices include:

• Are our Council meetings

passing resolutions in an efficient manner?

• Are our meeting papers

clear and concise?

• Are agendas provided to

Councillors well in advance to allow a timely review prior to the meeting?

• Does Council conduct

meeting performance reviews at the end of the year or end of the term?

• Is Council up to date with

best practice when it comes to council meetings?

• Did the complexity of

issues match the time taken to resolve them?

|

Manager Corporate Services

|

June 2018

|

Progress Update 30 June

2018

Corporate Services

continues to work with business units on effective reports for Council.

A revised report template will be implemented before 31 December 2018.

Councillors are provided

business papers in line with statutory timeframes.

Amendments have been made to the Code of Meeting Practice to reduce public

access time.

|

Strategy Element: Finance

Performance Indicators

|

Actions

|

Action Owner

|

Action Due Date

|

Management Comments

|

|

1.

Ongoing quarterly reporting to the Finance Advisory Committee and

Council on Financial Sustainability Plan (FSP) outcomes.

|

Manager Finance

|

Quarterly

|

Progress Update 30 June

2018

Reporting for the

quarter ended 30 Sept 2017 reported to the FAC 16 November 2017.

The December 2017 quarter reported at meeting on 15 February 2018. The 31

March 2018 quarter reported at meeting on 17 May 2018 and 30 June 2018

quarter to be reported at meeting on 16 August 2018.

|

|

2. Recognition

through the QBR process of financial outcomes delivered by the FSP.

|

Manager Finance

|

Quarterly

|

Progress Update 30 June

2018

30 September 2017 QBR

reported to FAC on 16 November 2017 and 31 December 2017 QBR reported to

the 15 February 2018 FAC.

31 March 2018 QBR reported

to the 17 May 2018 FAC.

30 June 2018 QBR will be

reported to the 16 August 2018 FAC.

|

|

3. Structural

changes to both revenue sources and expenditure will be updated in the base

budget during the preparation of the 2018/19 Budget.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

2018/2019 Budget Estimates

adopted by Council on 28 June 2018. Any structural changes required

were included.

|

|

4. The

financial outcomes delivered by the FSP updated into the Council’s Long

Term Financial Plan and modelled in the Long Term Financial Plan Scenarios.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

To be included in the

development of the next version of the Long Term Financial Plan expected to

be reported to the Finance Advisory Committee on 16 August 2018.

|

|

5 Assessment

of the Note 13 and Special Schedule 7 performance ratios disclosed annually

in Council’s audited financial statements which should indicate a trend

improvement from FSP outcomes.

|

Manager Finance

|

June 2018

|

Progress Update 30 June

2018

Assessment was completed as

part of finalisation of 2016/2017 Financial Statements reported to Council in

October 2017.

|

|

6. Assessment

of the seven ‘Fit for Future’ benchmarks on an ongoing basis to

ensure Council maintains the ‘Fit’ outcome.

|

Manager Financer

|

June 2018

|

Progress Update 30 June

2018

To be included in the

development of the next version of the Long Term Financial Plan expected to

be reported to the Finance Advisory Committee on 16 August 2018.

|

Staff Reports - Corporate and Community Services 4.2

Report No. 4.2 Quarterly

Update - Implementation of Special Rate Variation

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2018/1442

Theme: Corporate Management

Financial Services

Summary:

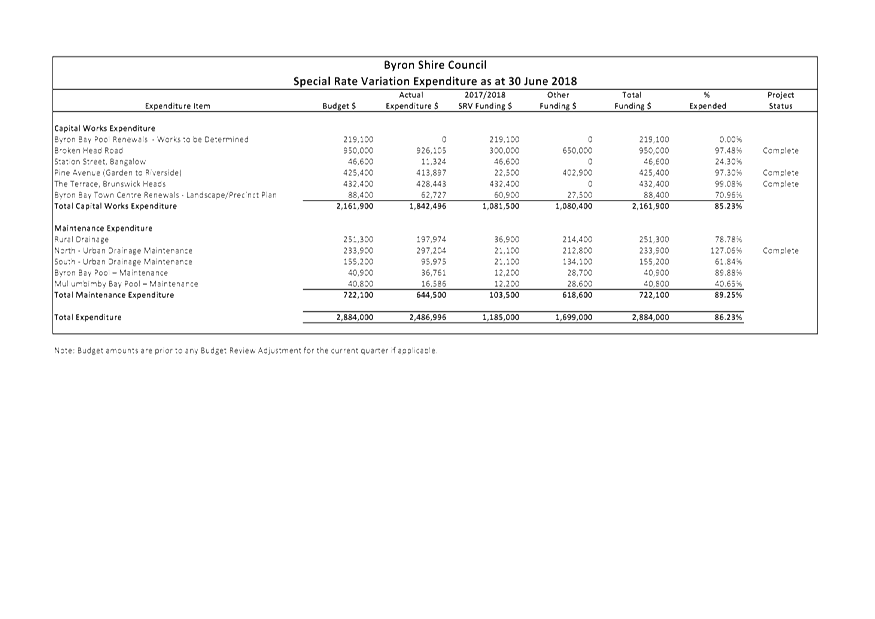

Council at its Ordinary Meeting held on 2 February 2017

resolved to apply for a Special Rate Variation (SRV) of 7.50% per annum for

four years commencing from the 2017/2018 financial year (Resolution 17-020 part

5).

Following approval of Council’s SRV by the Independent

Pricing and Regulatory Tribunal (IPART) received on 9 May 2017, Council

resolved to implement the SRV at its Ordinary Meeting held 22 June 2017

(Resolution 17-268 part 1).

Council at the same Ordinary Meeting held on 22 June 2017

resolved (Resolution 17-222 part 2) to incorporate reporting on the Special

Rate Variation into the development of the 2017/2018 Financial Sustainability

Plan and quarterly updates to Council through the Finance Advisory Committee on

the implementation of the adopted Financial Sustainability Plan.

The purpose of this report is to provide the Finance

Advisory Committee with a quarterly update on implementation of the SRV and expenditure

up to 30 June 2018.

|

RECOMMENDATION:

That the Finance Advisory Committee note the

quarterly update on the Special Rate Variation Implementation as at 30 June

2018.

|

Attachments:

1 2017-18

Special Rate Management Report at 30 June 2018 reported to Finance Advisory

Committee 16/08/2018, E2018/66523

, page 27⇩

Report

Council at its Ordinary Meeting held 2 February 2017

resolved to apply for a Special Rate Variation (SRV) as follows:

Resolution 17-020 part 5:

Lodge a Section 508A permanent

Special Rate Variation application to the Independent Pricing and Regulatory

Tribunal, for increases to the ordinary rate income (general revenue) of 7.5%

(including rate peg) in 2017/18, 7.5% (including rate peg) in 2018/19, 7.5%

(including rate peg) in 2019/20 and 7.5% (including rate peg) in 2020/21.

After lodging the Special Rate Variation application with

the Independent Pricing and Regulatory Tribunal (IPART), Council received

approval to increase its ordinary rate income as per resolution 17-020.

This approval was granted on 9 May 2017. Council resolved to implement

the SRV through adoption of the 2017/2018 Operational Plan and Revenue Policy

at its Ordinary Meeting held on 22 June 2017 (Resolution 17-268 part 1).

Council at its Ordinary Meeting held 22 June 2017 received

Report 13.13 confirming the outcome of the SRV application and its subsequent

approval. Council resolved resolution 17-222 as follows:

1. That

Council note the determination from IPART in relation to its 2017/2018

Special Rate Application including the following conditions imposed by IPART on

Council for the:-

a) use

of the additional income derived from the special variation for the purposes of

reducing its infrastructure backlog and improving financial sustainability;

and

b)

reporting on this use against the forecasts included in the Council’s

application as part the Council’s annual report for each year from

2017-18 to 2026-27.

2. That

Council adopt as a Policy Framework the use and reporting conditions imposed by

IPART in the SRV determination and further incorporate reporting on the Special

Rate Variation into the development of the 2017/2018 Financial Sustainability

Plan and the quarterly updates to Council through the Finance Advisory

Committee on the implementation of the adopted Financial Sustainability Plan.

3. That

Council establish as a policy framework that funding for infrastructure renewal

and maintenance from general revenue sources is not ever lower then the general

revenue baseline indicator established in the 2016/2017 Budget.

4.That

Council establish as a policy framework that any funds generated by the SRV

that remain unexpended at the end of each financial year are to be restricted

and held in a internal reserve, to be carried forward to subsequent financial

year, for expenditure in accordance with the uses imposed in the SRV approval.

5. That

Council incorporate the research of potential non resident revenue sources (if

any) as part of the Revenue Review chapter in the development of the 2017/2018 Financial

Sustainability Plan, and provide quarterly updates to Council through the

Finance Advisory Committee.

6.

That Council not proceed with the implementation of part 9 and part 11

of resolution 17-020.

The 2017/2018 Financial Sustainability Plan has been

developed to incorporate future quarterly reporting on the SRV as outlined in

Chapter 7 ‘Policy and Decision Making’.

This report is provided to the Finance Advisory Committee to

advise on the implementation of the SRV and the current status of expenditure

from 1 July 2017 to 30 June 2018 which is

detailed in Attachment 1 (E2018/66523).

The levy of Council’s annual rates and charges was

completed in accordance with Resolution 17-268 prior to 31 July 2017 and

this included applying the first tranche of the 7.5% ordinary rate increase for

2017/2018 and revised ordinary rating structure adopted by Council. The

estimated yield from the SRV for 2017/2018 being the first year of the increase

is $1,185,000.

Upon adoption of the 2017/2018 Budget Estimates, Council

resolved to undertake the following program of capital and maintenance works

including the additional SRV revenue and other funding as outlined in

Attachment 1. During the course of the 2017/2018 financial year, there

may be adjustments required to the expenditure budgets identified in the

schedule of capital and maintenance works currently funded by the SRV revenue

which will be presented to Council for approval via the Quarterly Budget Review

process.

The expenditure program adopted for 2017/2018 financial year

is consistent with Council’s SRV application and approval from IPART to

use the funding to improve financial sustainability and reduce infrastructure

backlog.

Financial Implications

There are no direct financial implications associated with

this report. The table included at Attachment 1 (E2018/66523) provides

information to the Finance Advisory Committee as to the expenditure of the

Special Rate Variation Funds up to the final quarter of the 2017/2018 financial

year.

Any funds unexpended will be presented to this Finance

Advisory Committee Meeting as a separate report concerning funds to be carried

over to the 2018/2019 financial year.

Statutory and Policy Compliance Implications

Approval and conditions

received from the Independent Pricing and Regulatory Tribunal (IPART) regarding

the Byron Shire Council Special Rate Application 2017-2018 received 9 May 2017.

Council Resolution 17-268 and 17-222.

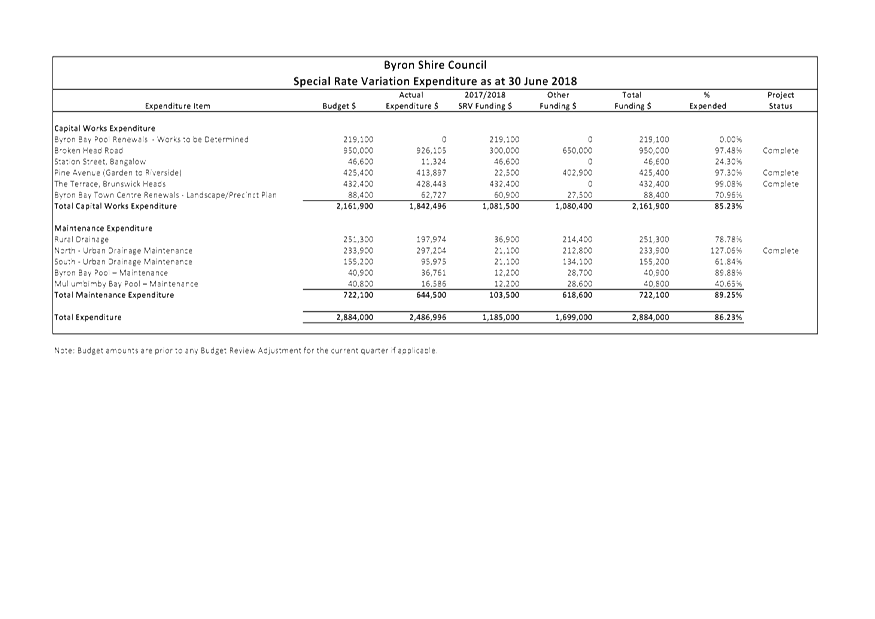

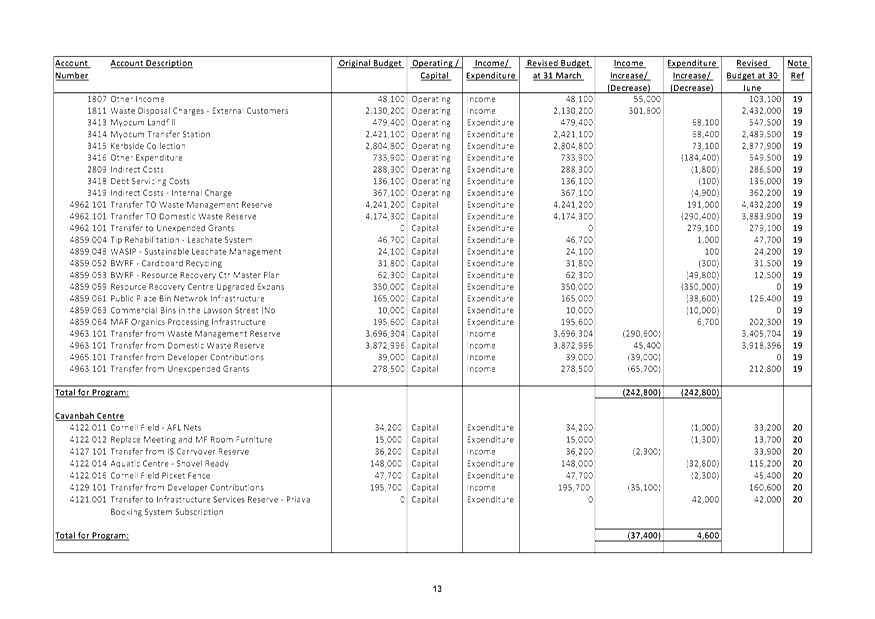

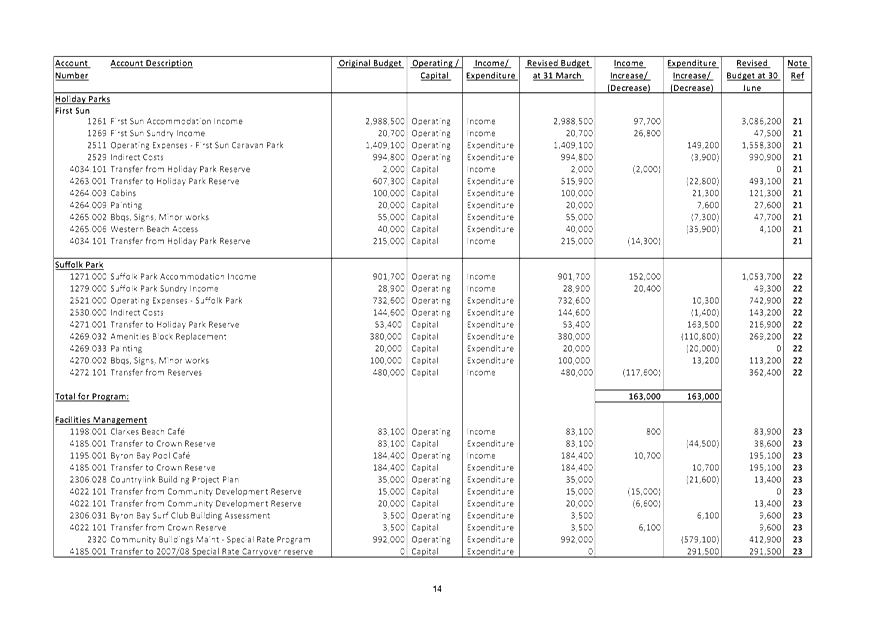

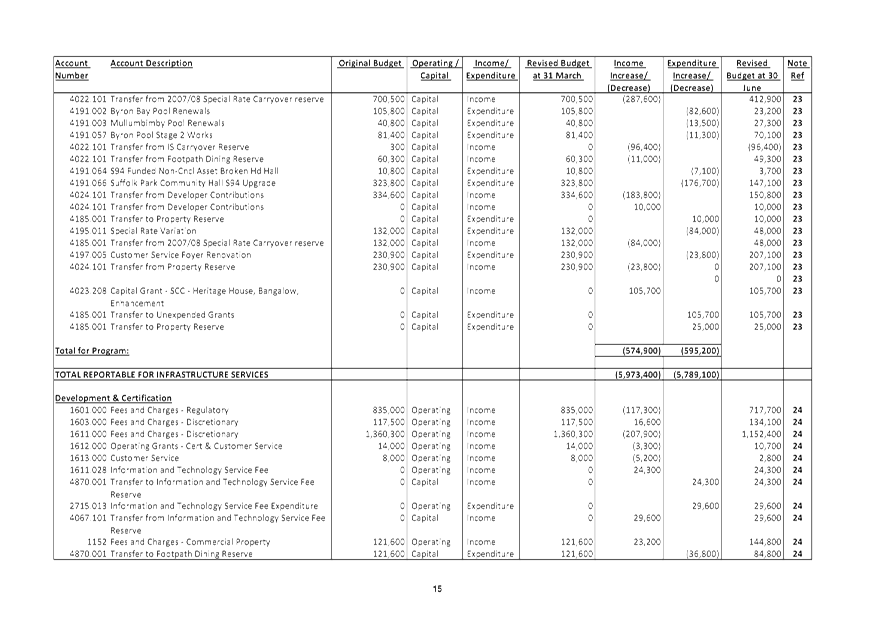

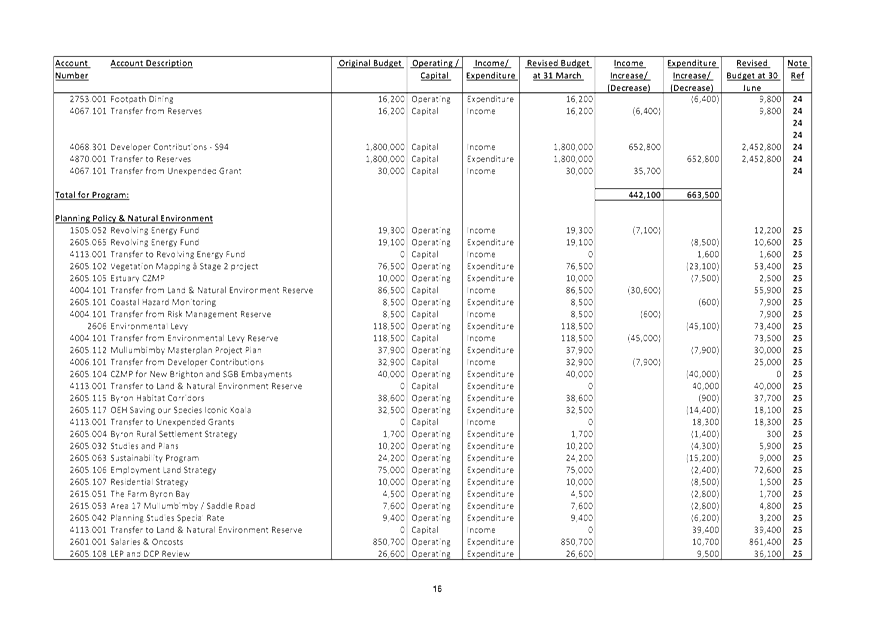

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

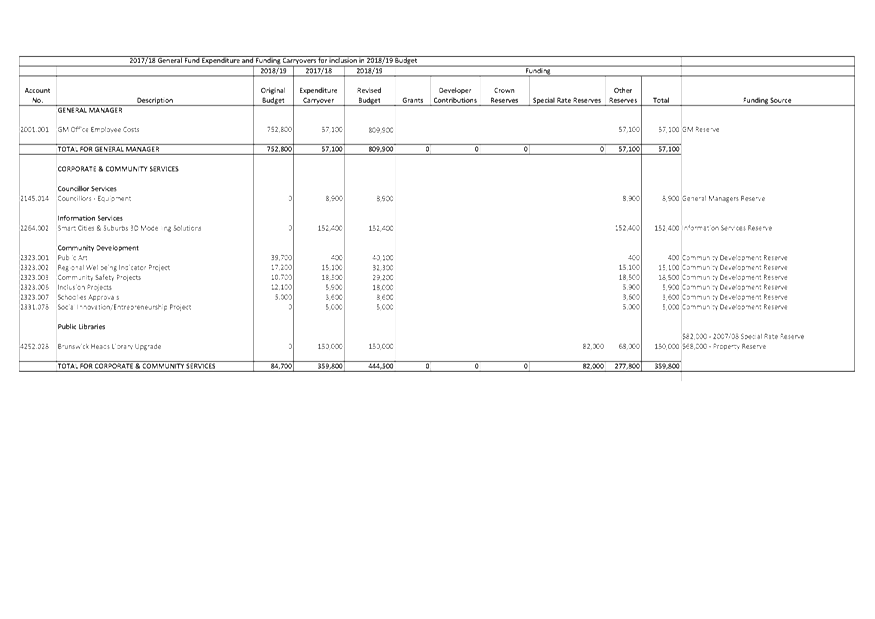

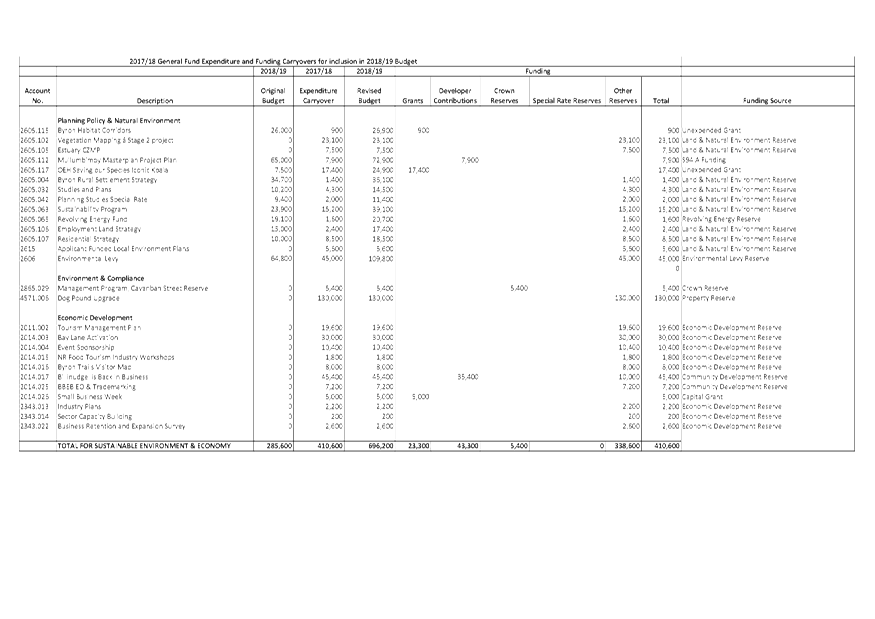

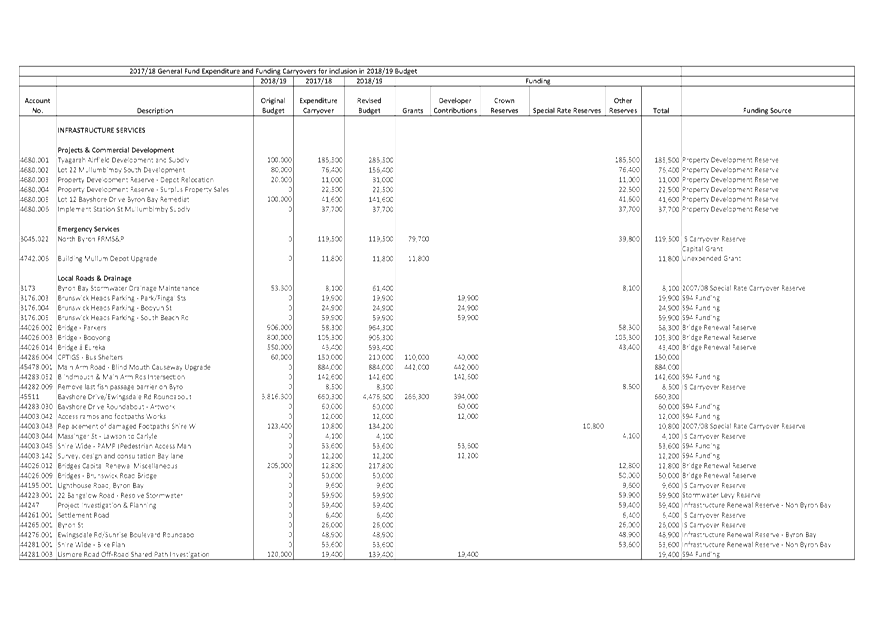

Staff Reports - Corporate and Community Services 4.3

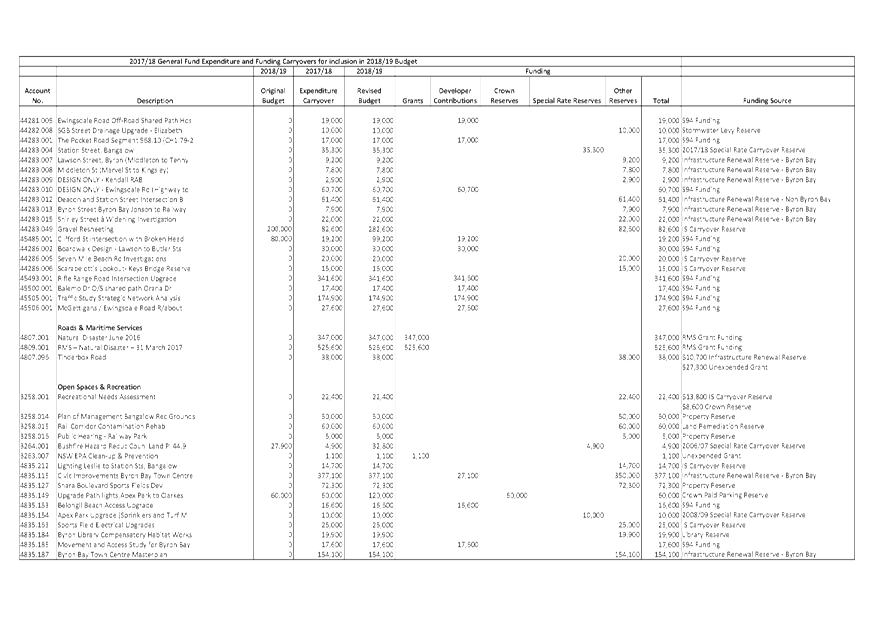

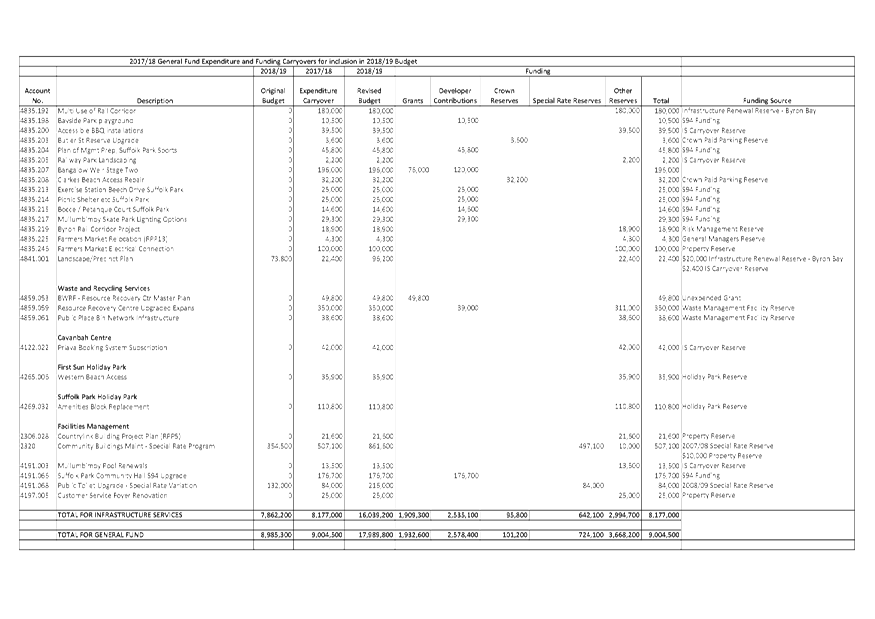

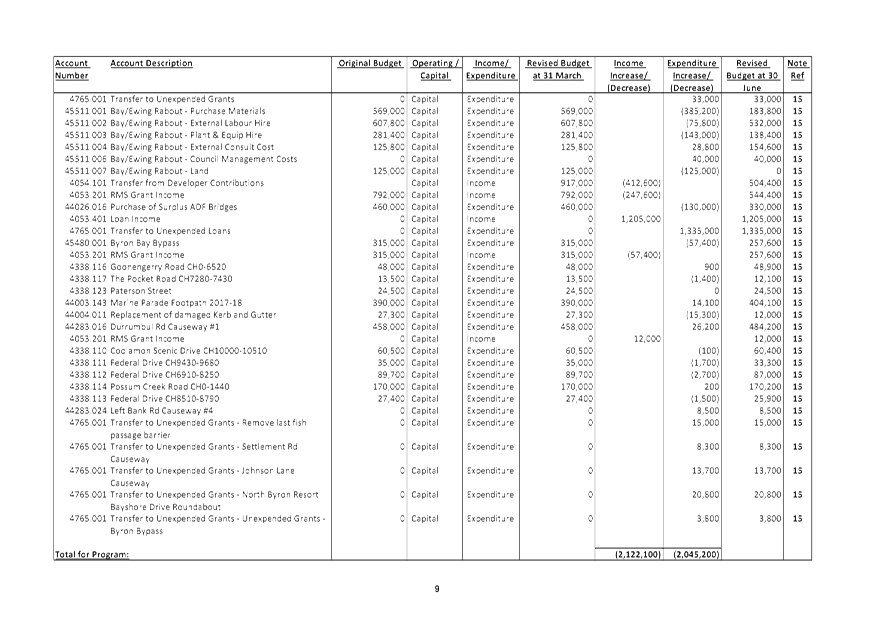

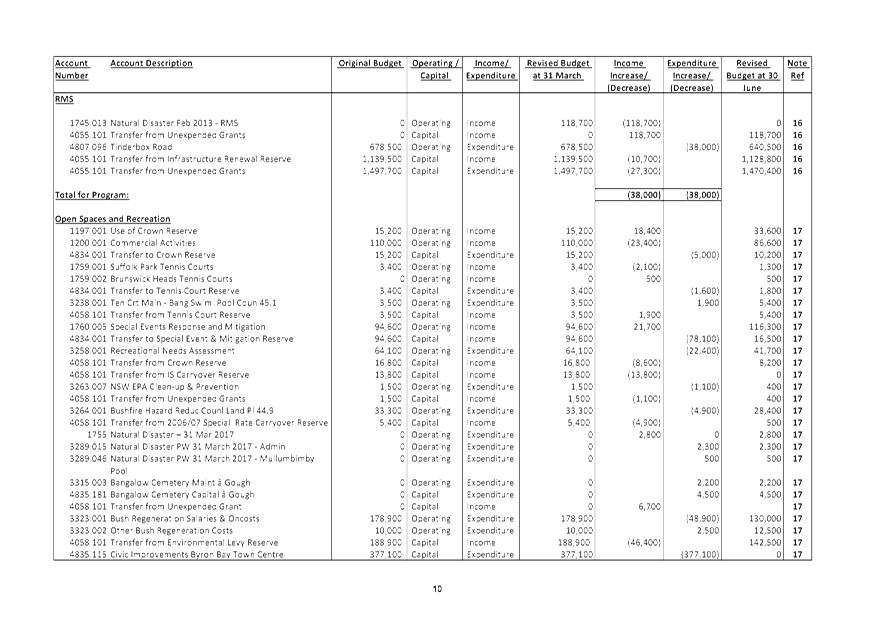

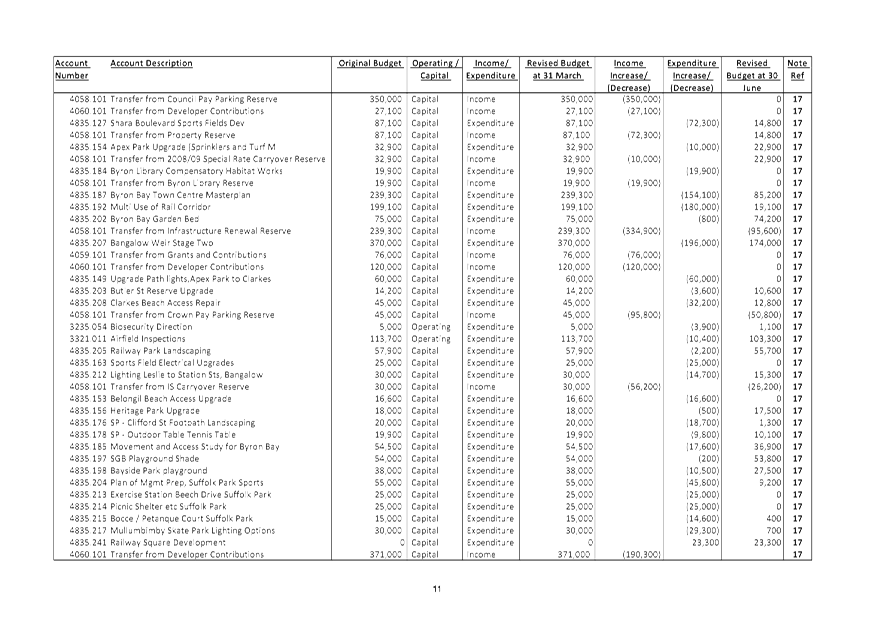

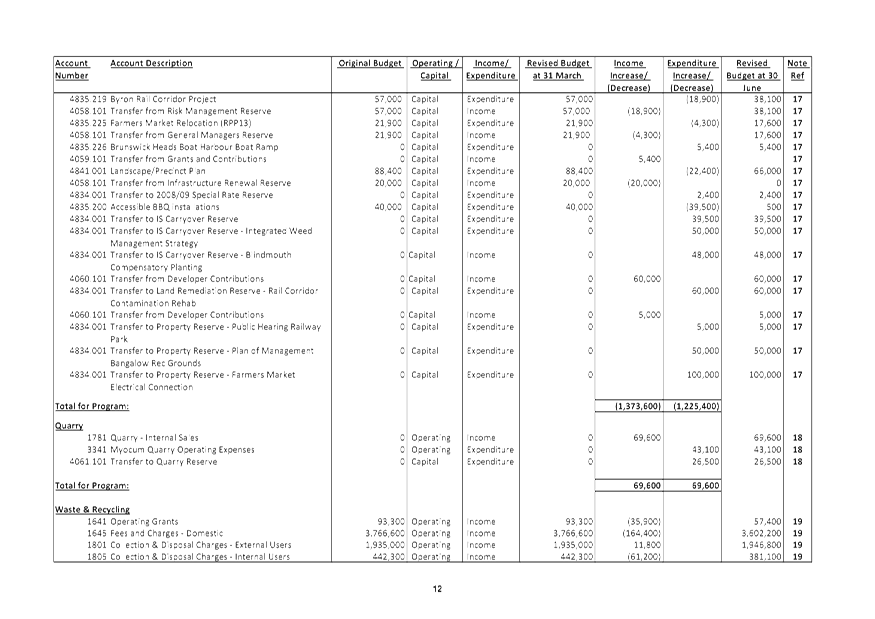

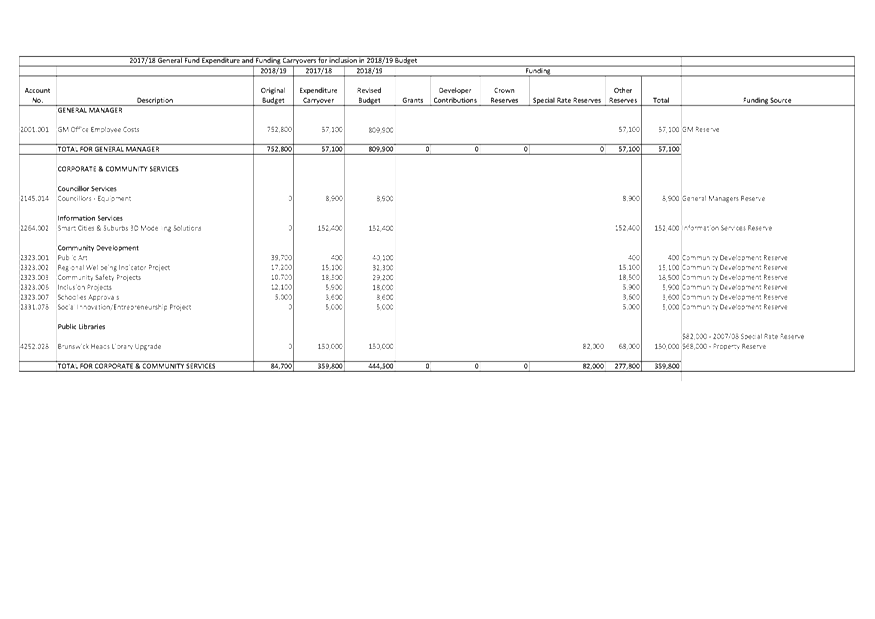

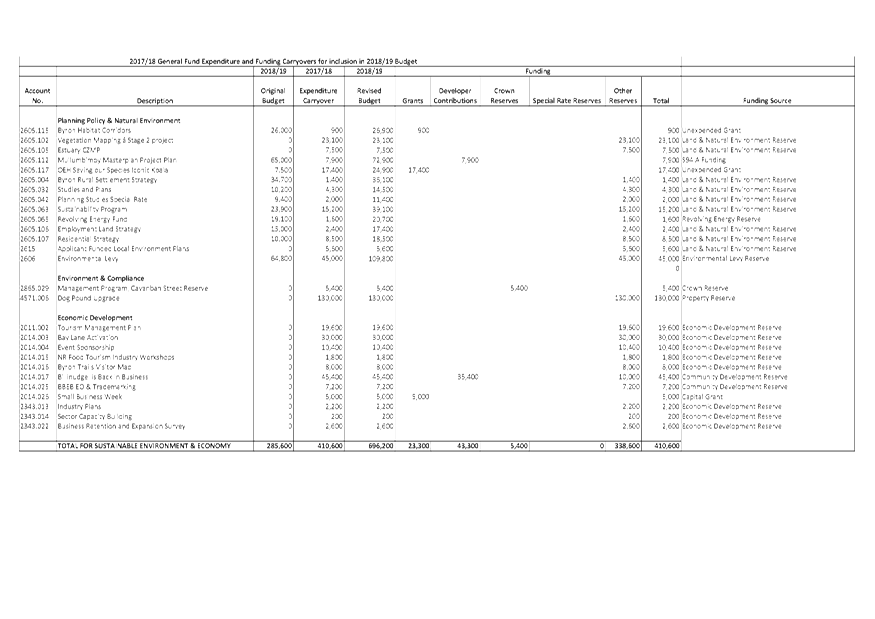

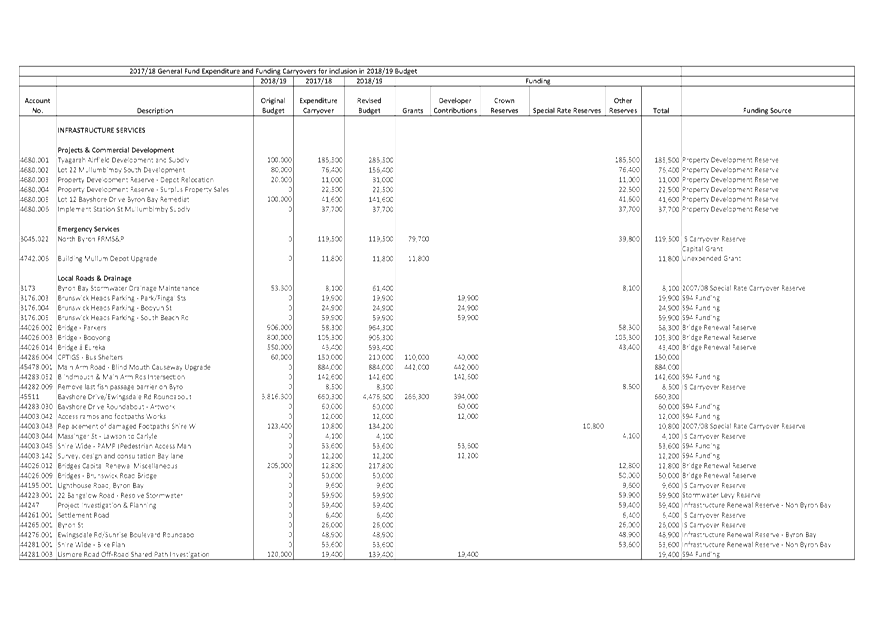

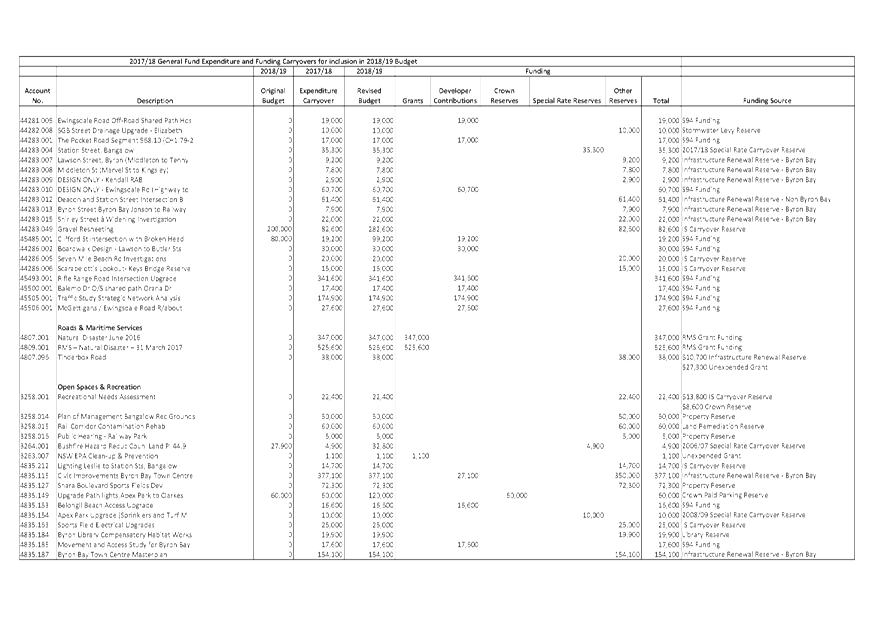

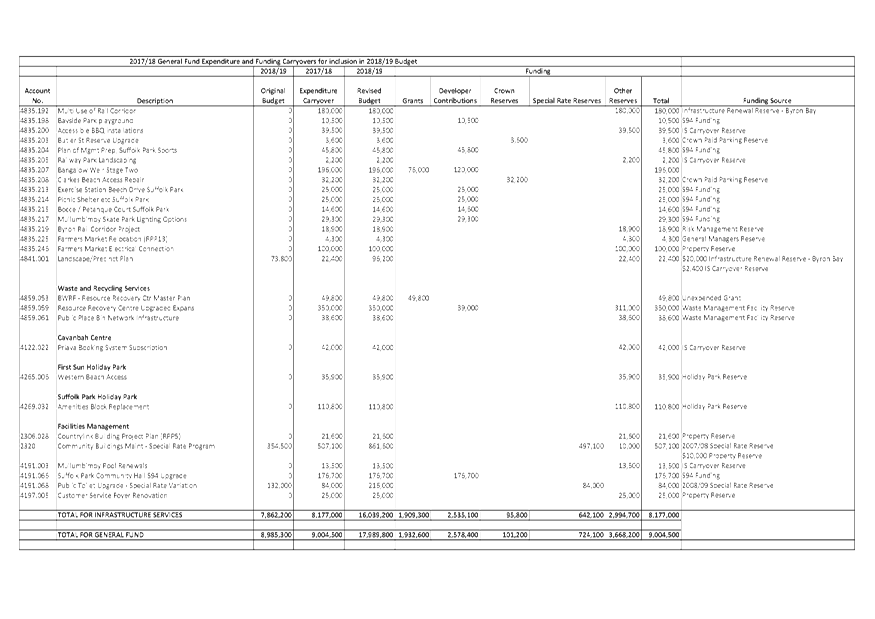

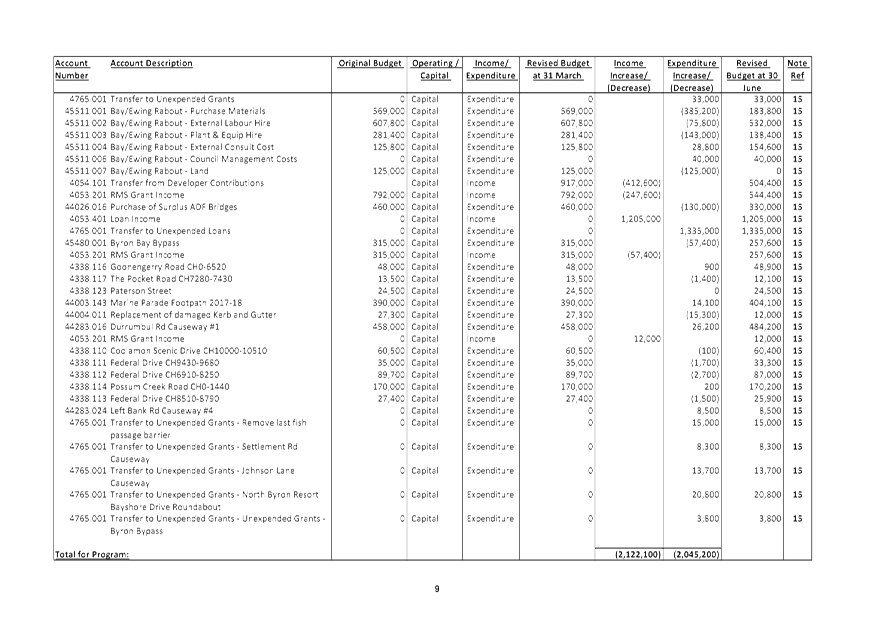

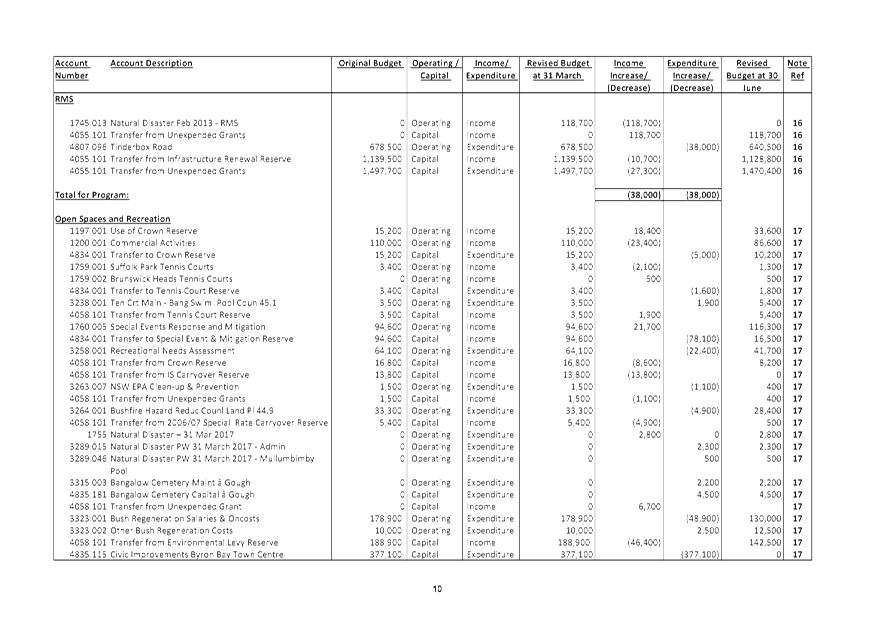

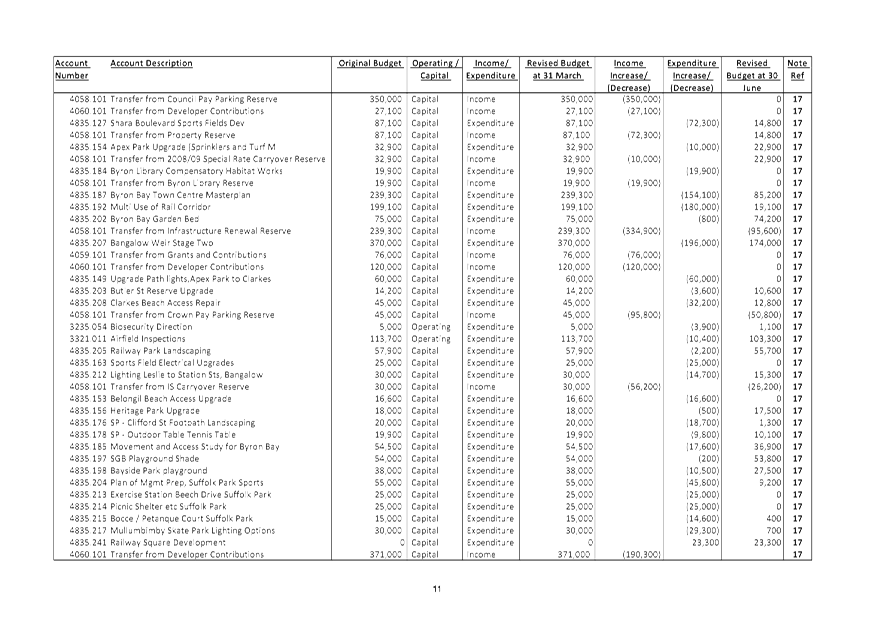

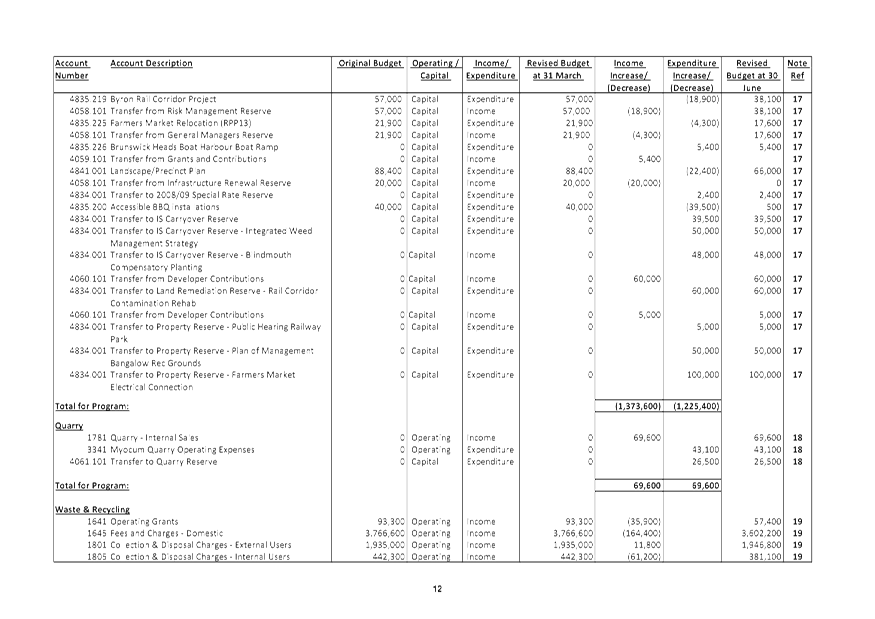

Report No. 4.3 Carryovers

for inclusion in the 2018/19 Budget

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2018/1522

Theme: Corporate Management

Financial Services

Summary:

This report is prepared

for Council to consider and to adopt the carryover Budget allocations for works

and services, either commenced and not completed, or not commenced in the 2017/2018

financial year for inclusion in the 2018/2019 Budget Estimates.

Each year Council allocates funding for works and services

across all programs. For various reasons, some of these works and services are

incomplete at the end of the financial year. The funding for these works is

restricted at the end of the financial year, and is carried over as a budget

allocation revote to the following year, to fund the completion of the work or

service.

This report identifies all the works and services

recommended to be carried over from the 2017/2018 financial year to the

2018/2019 Budget Estimates. The report also identifies the funding for each

recommended budget allocation carryover.

|

RECOMMENDATION:

That the Finance Advisory

Committee recommend to Council:

That the works and services, and the respective funding

shown in Attachment 1 (#E2018/66991) be carried over from the 2017/2018

financial year and that the carryover budget allocations be adopted as budget

allocation revotes for inclusion in the 2018/2019 Budget Estimates.

|

Attachments:

1 Carryovers

for inclusion in 2018-2019 Budget - General, Water and Sewerage Funds, E2018/66991 , page 34⇩

Report

Each year Council allocates funding for works and services

across all programs. For various reasons, some of these works and services are

incomplete at the end of the financial year. The funding for these works and

services is restricted at the end of the financial year to be carried over to

the following year for completion.

This report identifies all the works and services to be

carried over to the 2018/2019 Budget Estimates and the respective funding of

each, relating to works and services not completed during the course of the

2017/2018 financial year. The specific details of all carryover works and

services subject of this report are outlined for General, Water and Sewer Funds

in Attachment 1.

Financial Implications

The works and services included in Attachment 1 are fully

funded and have no impact on the Unrestricted Cash Result of Council or the

2018/2019 Budget Estimates result. As in previous years there is a significant amount

of carryovers to be brought forward to the current financial year. Table 1

below provides a history of the value of carryovers in recent years with the

proposed total carryovers for 2018/2019 $398,500 more then the carryovers

related to the 2017/2018 financial year. Council may recall that there

was also an earlier assessment of carryovers that was conducted before

finalisation of the 2018/2019 Budget Estimates with these being included at

that point and catered for through the 31 March 2018 Quarter Budget Review.

Table 1 - Value of

budget carryovers 2014/15 – 2018/19

|

Fund

|

2014/15 ($)

|

2015/16 ($)

|

2016/17 ($)

|

2017/18 ($)

|

2018/19 ($)

|

|

General

|

12,863,500

|

10,550,300

|

5,022,100

|

7,102,100

|

9,004,500

|

|

Water

|

586,200

|

1,671,900

|

729,900

|

2,770,100

|

879,500

|

|

Sewer

|

877,100

|

1,929,000

|

600,100

|

2,051,800

|

2,473,500

|

|

Total

|

14,326,800

|

14,151,200

|

6,352,100

|

11,924,000

|

12,357,500

|

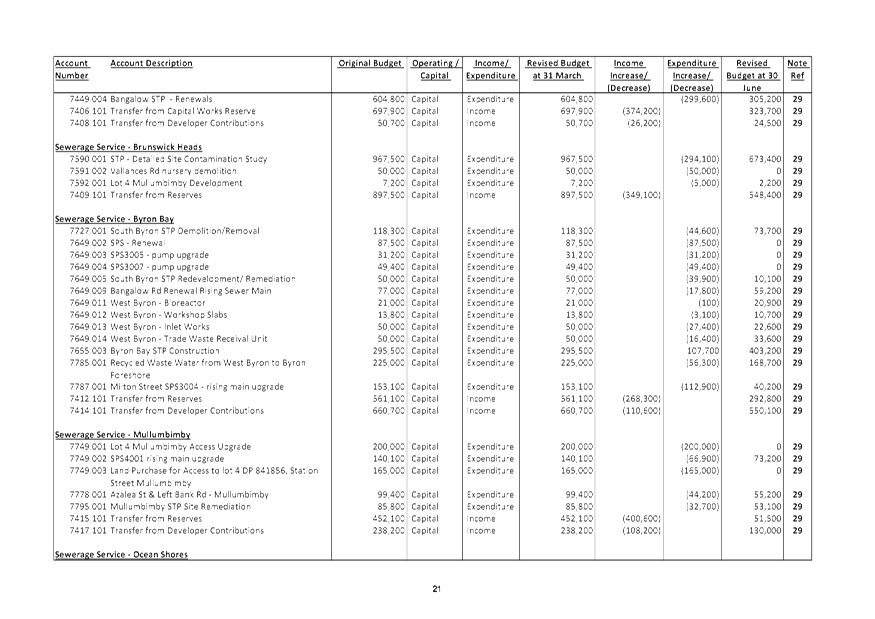

General Fund

The value of works carried over to 2018/2019 for the General

Fund are more ($1,902,400) than that carried over for the 2017/2018 year.

Of the $9,004,500 of General Fund carryovers, approximately 40% ($3,645,400) is

attributable to Local Roads and Drainage projects not completed in 2017/2018 to

be carried forward to 2018/2019.

Major carryover items in this program are as follows:

|

· Main

Arm Road – Blindmouth Causeway

|

$884,000

|

|

· Bayshore

Drive/Ewingsdale Rd Roundabout

|

$660,300

|

|

· Rifle

Range Road Intersection Upgrade

|

$341,600

|

|

· Traffic

Study Strategic Network Analysis

|

$174,900

|

|

· Smart

Cities and Suburbs 3D modelling solutions

|

$152,400

|

|

· Brunswick

Heads Library Upgrade

|

$150,000

|

|

· Tyagarah

Airfield Development and Subdivision

|

$185,500

|

|

· CPTIGS

- Bus Shelters

|

$150,000

|

|

· Natural

Disaster (June 2016) funding

|

$347,000

|

|

· RMS

Natural Disaster

|

$525,600

|

|

· Civic

Improvements Byron Bay Town Centre

|

$377,100

|

|

· Byron

Bay Town Centre Masterplan

|

$154,100

|

|

· Multiuse

of Rail Corridor

|

$180,000

|

|

· Bangalow

Weir stage 2

|

$196,000

|

|

· Resource

Recovery Centre Upgrade

|

$350,000

|

|

· Community

Buildings Maintenance (SRV)

|

$507,100

|

|

· Suffolk

Park Community Hall s94 upgrade

|

$176,700

|

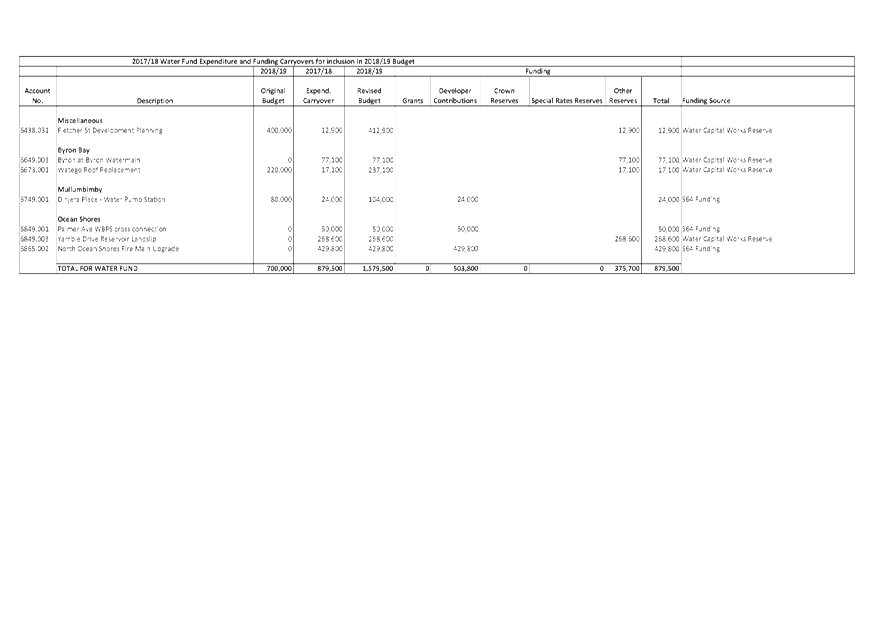

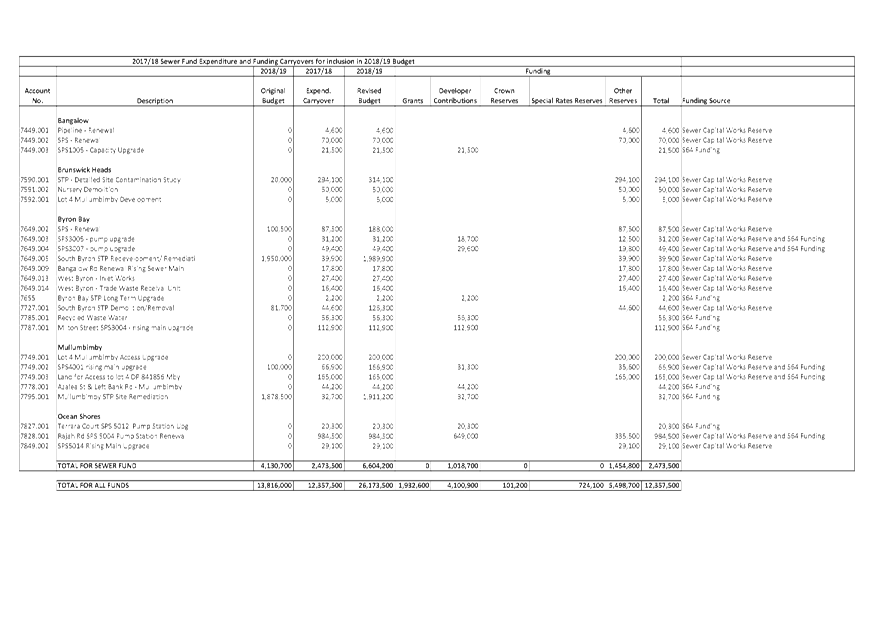

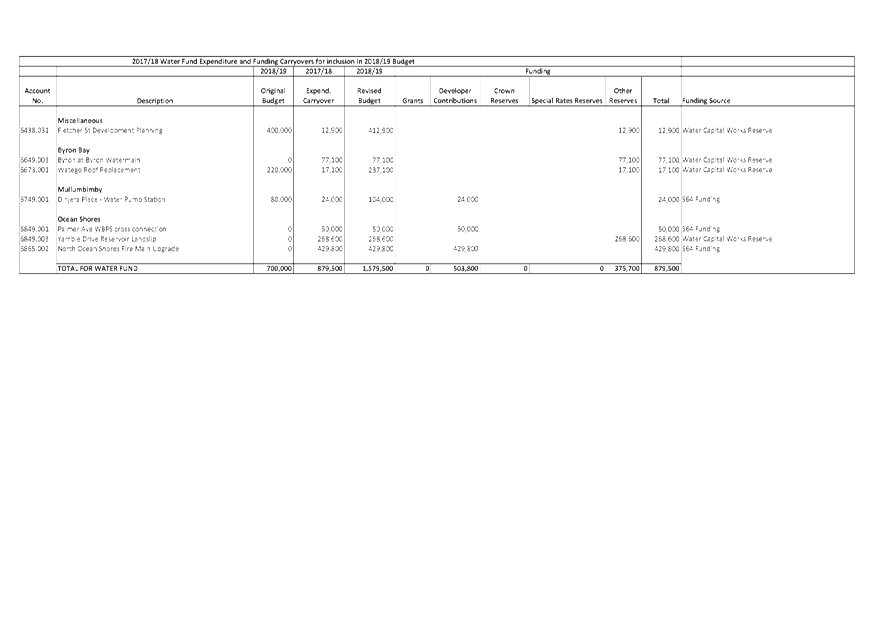

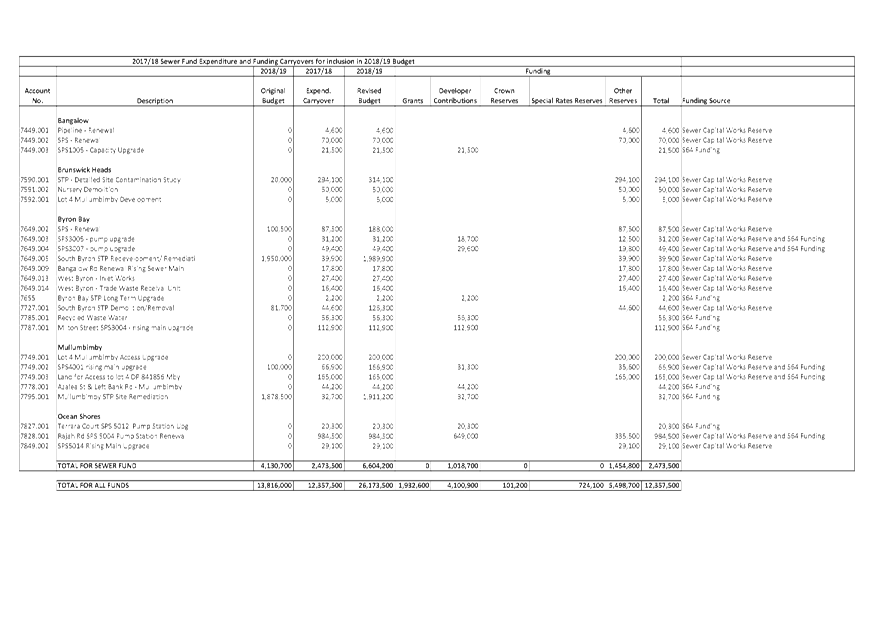

Water and Sewer Funds

Carryovers for the Water Fund have decreased by $1,890,600

and the Sewer Fund has increased by $421,700 compared to the carryover

applicable for the 2017/2018 financial year.

The following table outlines the project status of Local

Roads & Drainage capital works carryovers for Councillors information where

works are in progress or contracts awarded at the time this report has been

prepared:

Table

2 – Schedule of Carryover works current status

|

Project

|

Carryover $

|

Project Status

|

|

Byron Bay Stormwater

Drainage Maintenance

|

8,100

|

Works in progress that will

be completed in 18/19.

|

|

Brunswick Heads Parking

|

104,700

|

Design works in progress that will be completed in 18/19.

|

|

Bridge - Parkers

|

58,300

|

Works in progress that will be completed in 18/19.

|

|

Bridge - Booyong

|

105,300

|

Works in progress that will be completed in 18/19.

|

|

Bridge - Eureka

|

43,400

|

Works to be undertaken in 18/19.

|

|

CPTIGS - Bus Shelters

|

150,000

|

Public Art process to be undertaken in 18/19 for bus

shelter renewal as per Council resolution.

|

|

Main Arm Road - Blind Mouth

Causeway Upgrade

|

884,000

|

Contract awarded and works in progress. Will be completed

in 18/19.

|

|

Blindmouth & Main Arm

Rds Intersection

|

142,600

|

Works to be done in conjunction with Main Arm causeway

contract works

|

|

Remove last fish passage

barrier on Byron

|

8,500

|

Works in progress that will be completed in 18/19.

|

|

Bayshore Drive/Ewingsdale

Rd Roundabout

|

660,300

|

Contract awarded and works in progress. Will be completed

in 18/19.

|

|

Bayshore Drive Roundabout

– Artwork

|

60,000

|

Public Art works to be done in conjunction with contract

roundabout works.

|

|

Access ramps and footpaths

Works

|

12,000

|

Works to be done in conjunction with Railway Park upgrade

works in 18/19.

|

|

Replacement of damaged

Footpaths Shire

|

10,800

|

Works in progress that will be completed in 18/19.

|

|

Massinger St - Lawson to

Carlyle

|

4,100

|

Design works in progress that will be completed in 18/19.

|

|

Shire Wide - PAMP

(Pedestrian Access Man

|

53,600

|

Planning works in progress that will be completed in

18/19.

|

|

Survey, design and

consultation Bay lane

|

12,200

|

Design works in progress that will be completed in 18/19.

|

|

Bridges Capital Renewal

Miscellaneous

|

12,800

|

Works in progress that will be completed in 18/19.

|

|

Bridges - Brunswick Road

Bridge

|

50,000

|

Works to be undertaken in 18/19.

|

|

Lighthouse Road, Byron Bay

|

9,600

|

Design works in progress that will be completed in 18/19.

|

|

22 Bangalow Road - Resolve

Stormwater

|

59,900

|

Works to be undertaken in 18/19.

|

|

Project Investigation &

Planning

|

59,400

|

Design works in progress that will be completed in 18/19.

|

|

Settlement Road

|

6,400

|

Design works in progress that will be completed in 18/19.

|

|

Byron St

|

26,000

|

Design works in progress that will be completed in 18/19.

|

|

Ewingsdale Rd/Sunrise

Boulevard Roundabout

|

48,900

|

Land acquisition works to be completed in 18/19.

|

|

Shire Wide - Bike Plan

|

53,600

|

Planning works in progress that will be completed in

18/19.

|

|

Lismore Road Off-Road

Shared Path Invest

|

19,400

|

Design works in progress that will be completed in 18/19.

|

|

Ewingsdale Road Off-Road

Shared Path

|

19,000

|

Design works in progress that will be completed in 18/19.

|

|

SGB Street Drainage Upgrade

– Elizabeth

|

10,000

|

Design works in progress that will be completed in 18/19.

|

|

The Pocket Road Segment

568.10 (CH1.79-2

|

17,000

|

Design works in progress that will be completed in 18/19.

|

|

Station Street, Bangalow

|

35,300

|

Design works in progress that will be completed in 18/19.

|

|

Lawson Street, Byron

(Middleton to Tenny

|

9,200

|

Design works in progress that will be completed in 18/19.

|

|

Middleton St (Marvel St to

Kingsley)

|

7,800

|

Design works in progress that will be completed in 18/19.

|

|

DESIGN ONLY - Kendall RAB

|

2,900

|

Design works in progress that will be completed in 18/19.

|

|

DESIGN ONLY - Ewingsdale Rd

(Highway to

|

60,700

|

Design works in progress that will be completed in 18/19.

|

|

Deacon and Station Street

Intersection B

|

61,400

|

Design works in progress that will be completed in 18/19.

|

|

Byron Street Byron Bay

Jonson to Railway

|

7,900

|

Works in progress that will be completed in 18/19.

|

|

Shirley Street Widening

Investigation

|

22,000

|

Design works in progress that will be completed in 18/19.

|

|

Gravel Resheeting

|

82,600

|

Works to be undertaken in 18/19.

|

|

Clifford St intersection

with Broken Head

|

19,200

|

Design works in progress that will be completed in 18/19.

|

|

Boardwalk Design - Lawson

to Butler Sts

|

30,000

|

Works to be undertaken in 18/19.

|

|

Seven Mile Beach Rd

Investigations

|

20,000

|

Design works in progress that will be completed in 18/19.

|

|

Scarabelottis Lookout- Keys

Bridge Reserve

|

15,000

|

Design works in progress that will be completed in 18/19.

|

|

Rifle Range Road

Intersection Upgrade

|

341,600

|

Design works in progress that will be completed in 18/19.

|

|

Balemo Dr O/S shared path

Orana Dr

|

17,400

|

Design works in progress that will be completed in 18/19.

|

|

Traffic Study Strategic

Network Analysis

|

174,900

|

Design works in progress that will be completed in 18/19.

|

|

McGettigans / Ewingsdale

Road R/about

|

27,600

|

Works to be undertaken in 18/19.

|

|

Total

|

3,645,400

|

|

Whilst Council in accordance with Clause 211 of the Local

Government (General) Regulation 2005 conducted its annual meeting to approve

expenditure and voting of money on 28 June 2018 via Resolution 18-429,

the expenditure items subject of this report were not included in the 2018/2019

Budget Estimates but now need to be. The intent of this report is to seek

Council approval to revote the carryovers from the 2017/2018 financial year and

to adopt the budget allocation carryovers for inclusion in the 2018/2019

adopted Budget Estimates.

The Strategic Planning Committee at its meeting held on 28

March 2013 considered Report 4.3 on the Council’s financial position for

the 2012/2013 financial year. The recommendations from this meeting were

adopted by Council at its Ordinary Meeting held on 18 April 2013 through

resolution 13-164. Committee recommendation SPC 4.3 in part 5 included

the following process to be applied to the consideration of any amount

identified as a carryover to the 2013/14 and future Budgets and funded from

general revenues:

That

Council determines that any general revenue funded allocated expenditure, not

expended in

a current financial year NOT be automatically carried over to the next

financial year before it is

reviewed and priorities established.

Resolution 13-164 has also been incorporated into

Part 7 – ‘Policy and Decision Making’ of the Financial

Sustainability Plan (FSP) 2017/2018 considered by Council at its Ordinary

Meeting held on 14 December 2017 (Resolution 17-647).

This report will also be submitted to Council at its Meeting

held on 23 August 2018.

Statutory and Policy Compliance Implications

Regulation 211 of the Local Government (General) Regulation

2005 outlines the requirements of Council relating to authorisation of expenditure.

Specifically the Regulation 211 states:

(1) A

council, or a person purporting to act on behalf of a council, must not incur a

liability for the expenditure of money unless the council at the annual meeting

held in accordance with subclause (2) or at a later ordinary meeting:

(a) has approved the

expenditure, and

(b) has voted the money

necessary to meet the expenditure.

(2)

A council must each year hold a meeting for the purpose of approving

expenditure and voting money.

Council resolution 13-164

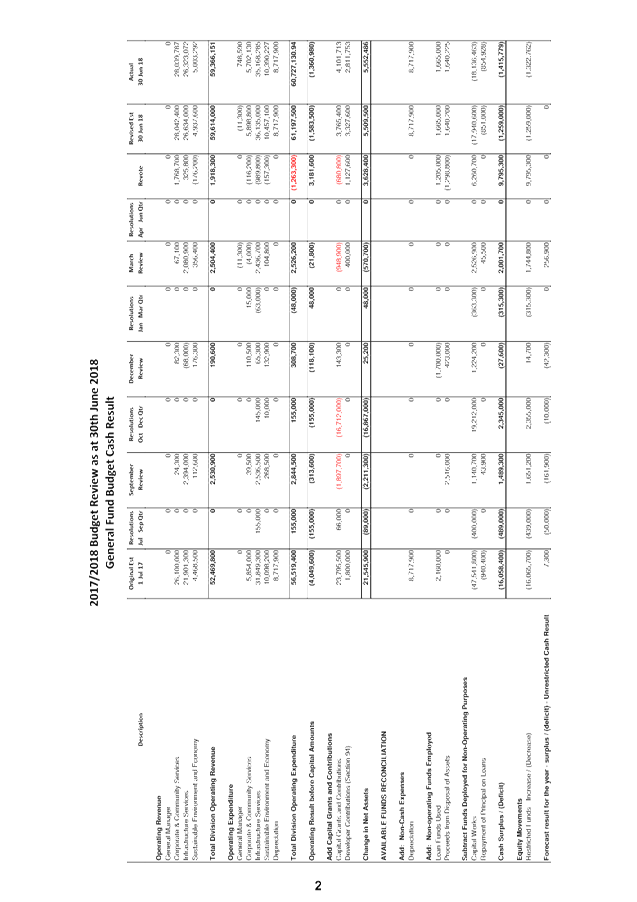

Part 7 – ‘Policy and Decision Making’ of

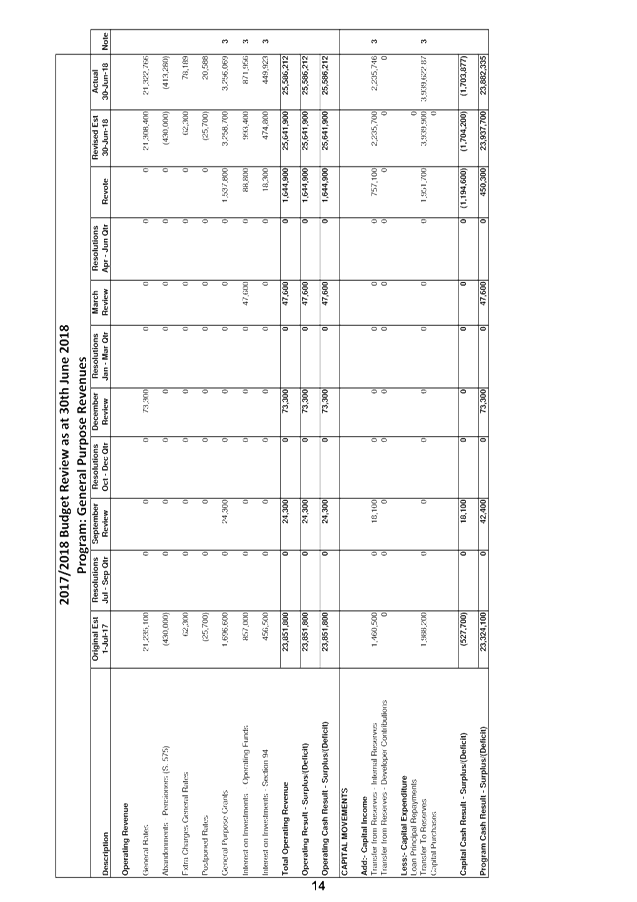

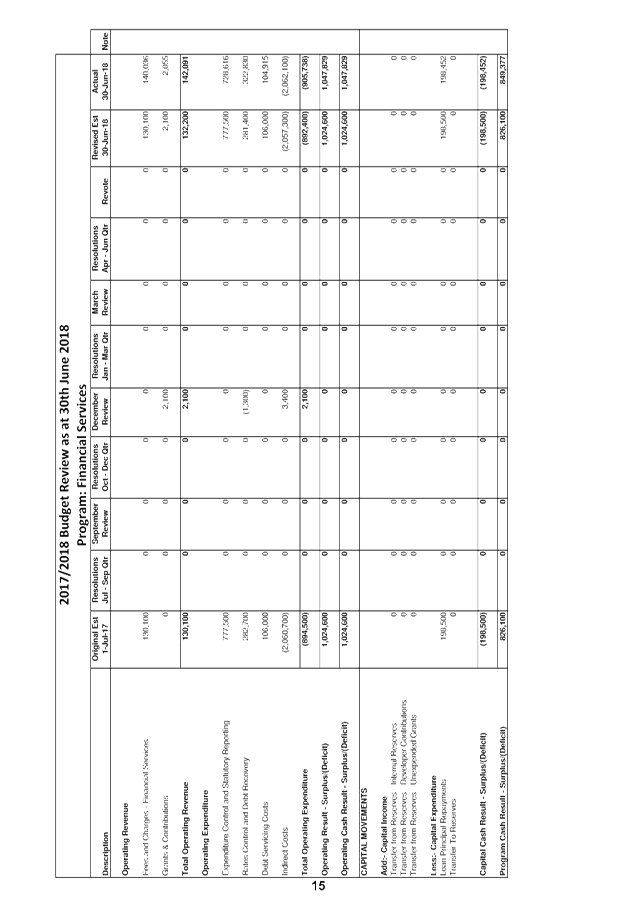

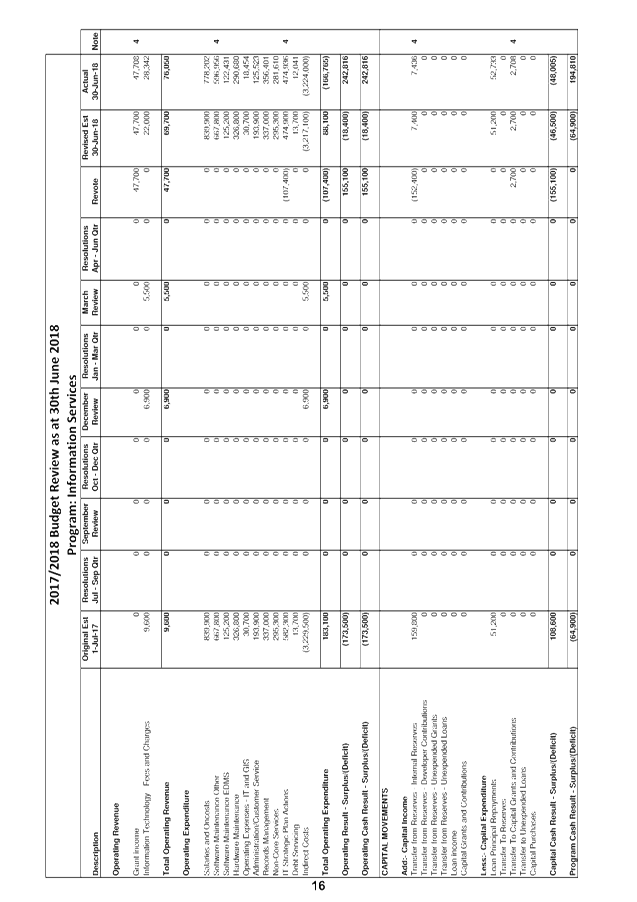

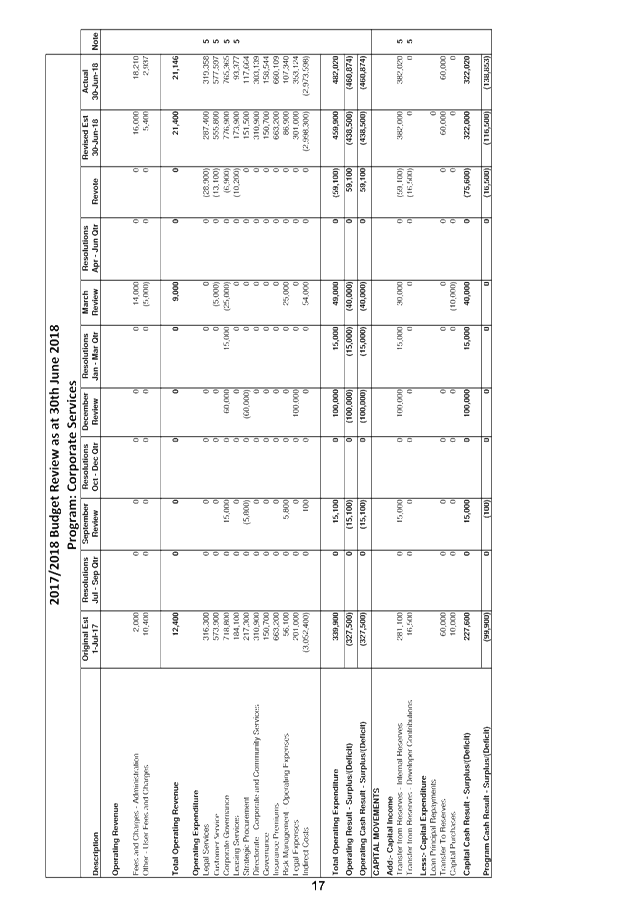

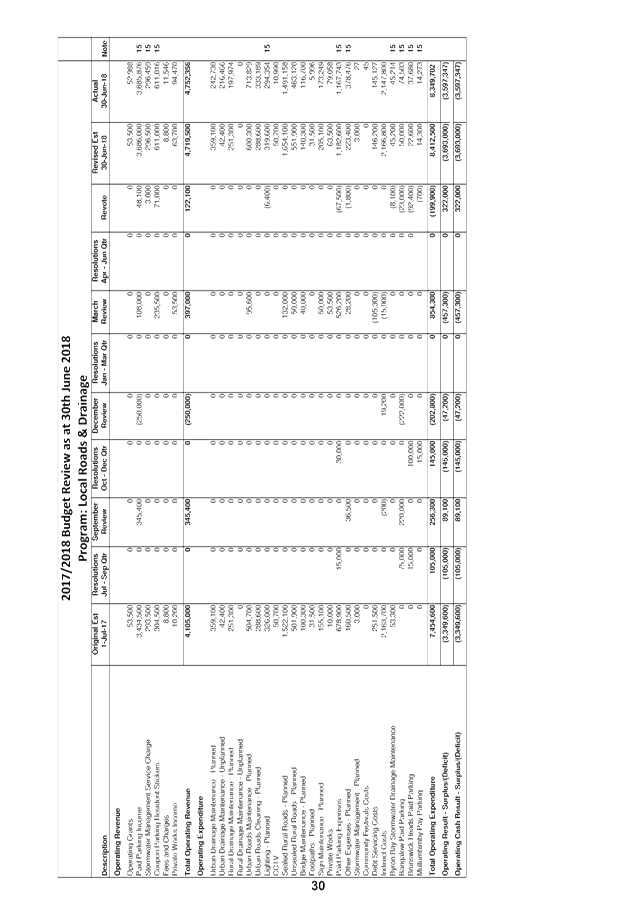

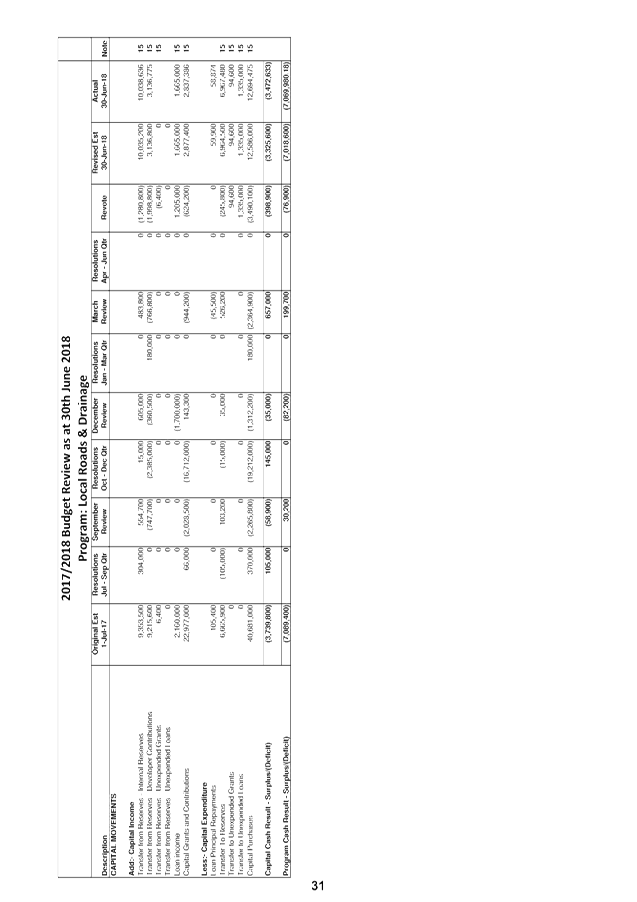

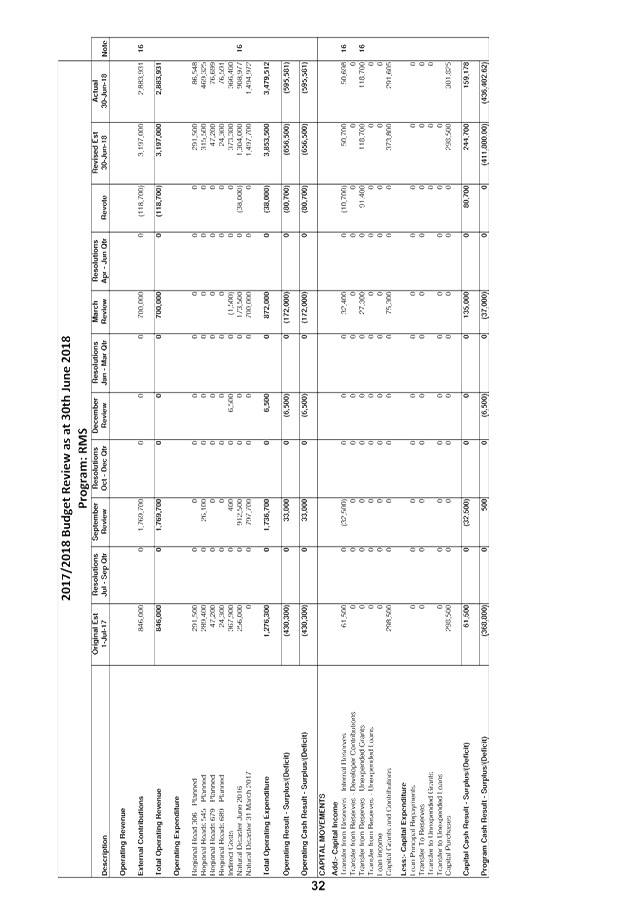

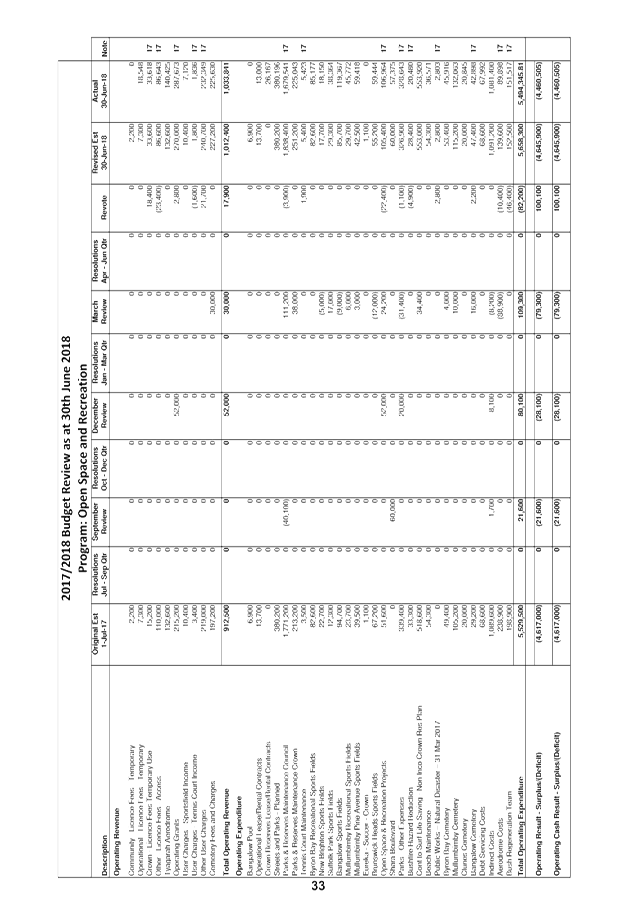

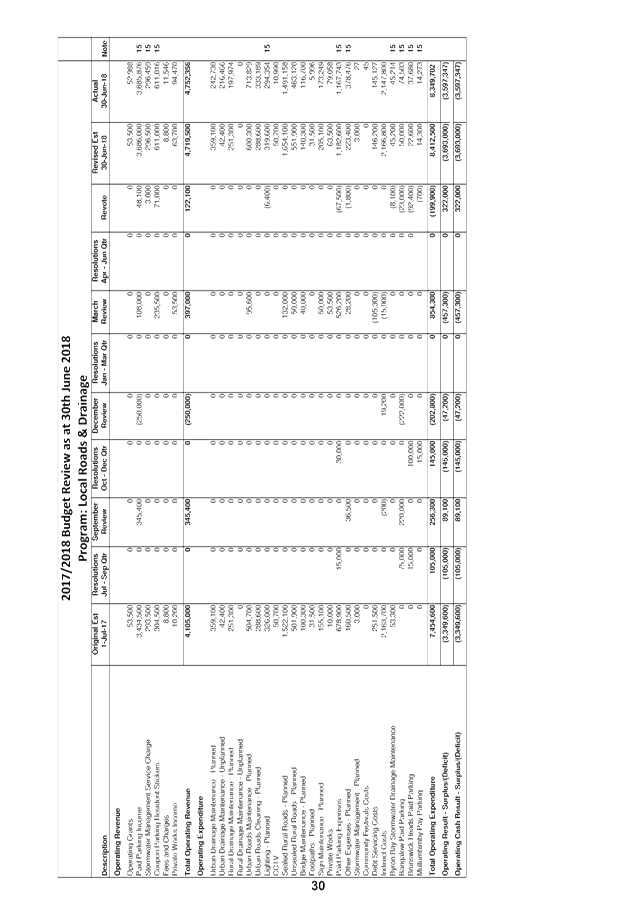

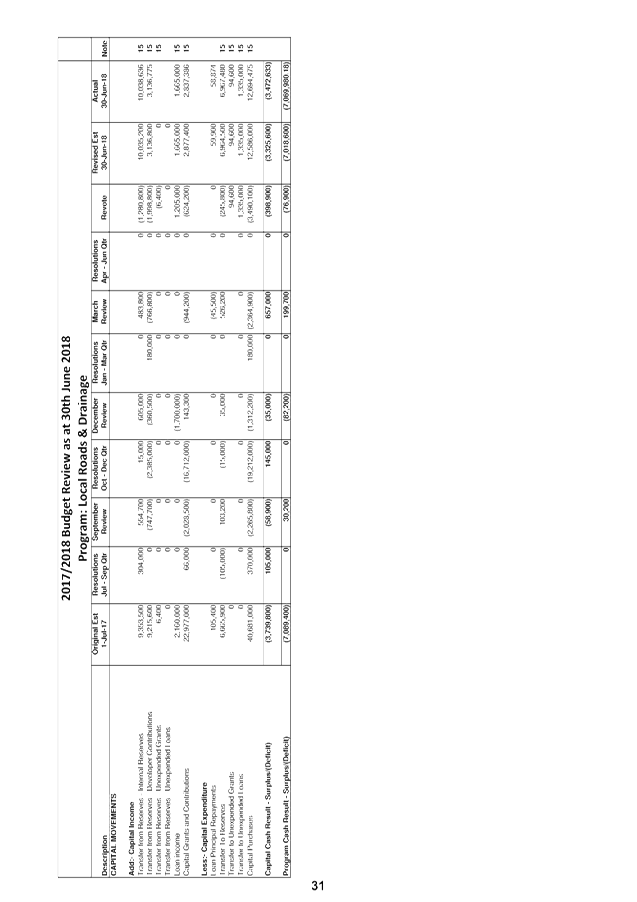

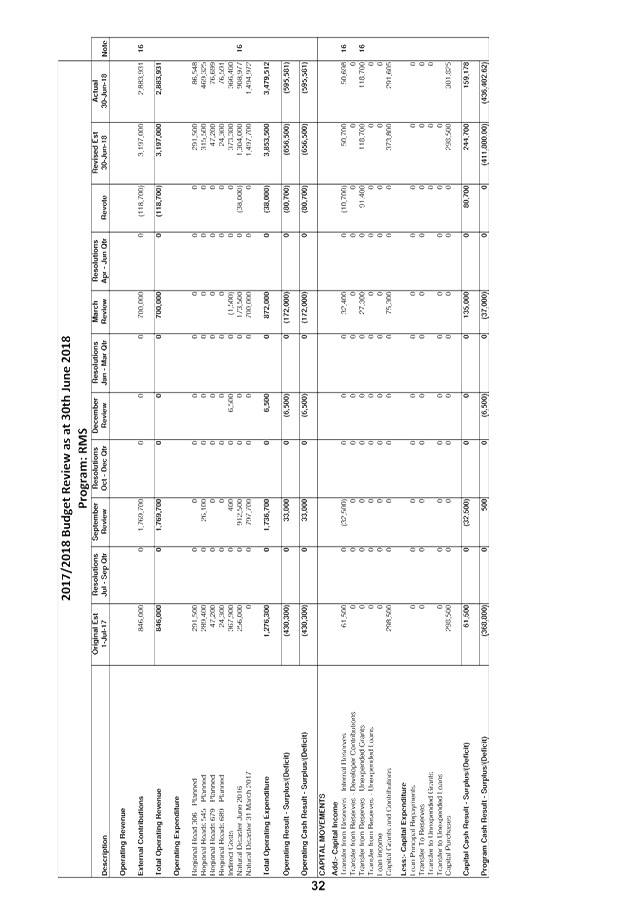

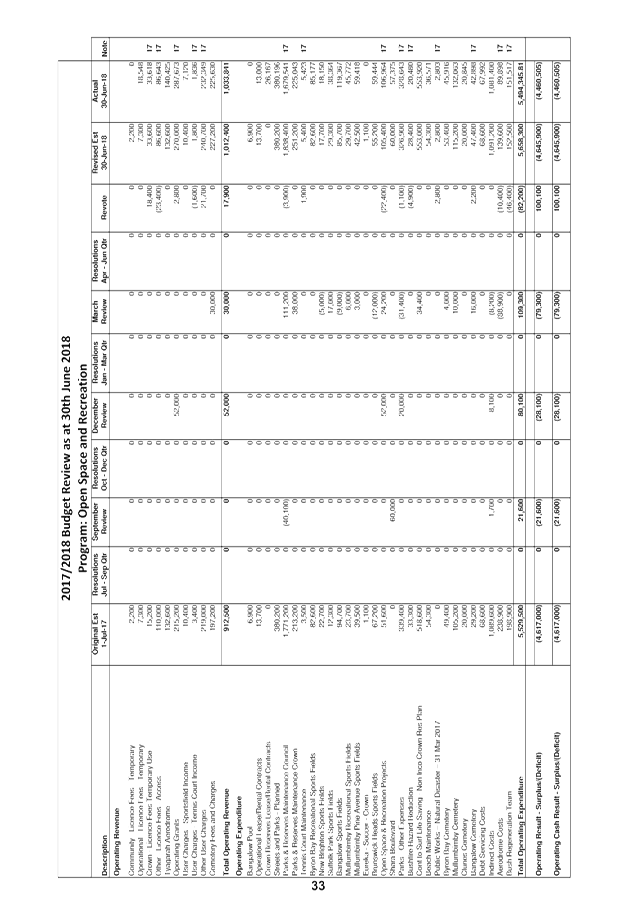

the Financial Sustainability Plan (FSP) 2017/2018.