Notice of Meeting

Finance Advisory Committee Meeting

A Finance Advisory Committee Meeting of Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 18 August 2022

|

|

Time

|

2.00pm

|

Esmeralda Davis

A/ Director Corporate and

Community Services

I2022/1040

Distributed

11/08/22

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Code of Conduct for Councillors (eg. A friendship, membership of an

association, society or trade union or involvement or interest in an activity

and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development

application, an environmental planning instrument, a development control plan

or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register

containing, for each planning decision made at a meeting of the council or a

council committee, the names of the councillors who supported the decision and

the names of any councillors who opposed (or are taken to have opposed) the

decision.

(3) For the purpose of maintaining the register, a division

is required to be called whenever a motion for a planning decision is put at a

meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described

in the register or identified in a manner that enables the description to be

obtained from another publicly available document, and is to include the

information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are

reminded of the oath of office or affirmation of office made at or before their

first meeting of the council in accordance with Clause 233A of the Local Government

Act 1993. This includes undertaking the duties of the office of councillor in

the best interests of the people of Byron Shire and the Byron Shire Council and

faithfully and impartially carrying out the functions, powers, authorities and

discretions vested under the Act or any other Act to the best of

one’s ability and judgment.

BUSINESS OF MEETING

1. Apologies

2. Declarations

of Interest – Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Adoption

of Minutes from 19 May Meeting................................................................ 6

4. Staff Reports

Corporate and Community

Services

4.1 Budget

Review - 1 April to 30 June 2022................................................................. 12

4.2 Carryovers

for inclusion in the 2022-2023 Budget................................................. 89

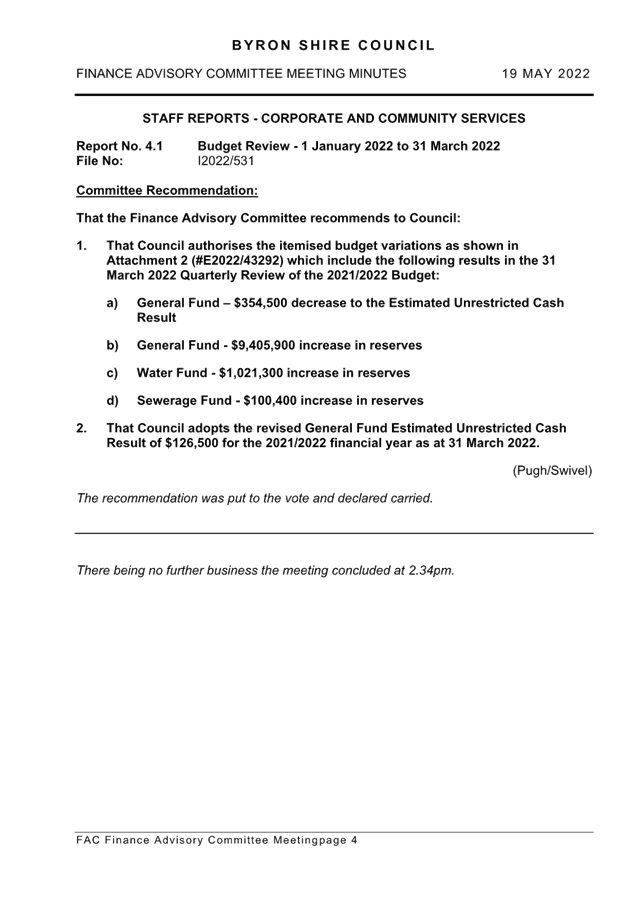

Adoption of Minutes from Previous Meetings 3.1

Adoption of Minutes from Previous Meetings

Report No. 3.1 Adoption of Minutes from 19 May Meeting

Directorate: Corporate and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2022/1025

RECOMMENDATION:

That the minutes of the Finance Advisory Committee

Meeting held on 19 May 2022 be confirmed.

Attachments:

1 Minutes

19/05/2022 Finance Advisory Committee, I2022/546

, page 8⇩

Report

The attachment to this report provides the minutes of the

Finance Advisory Committee Meeting of 19 May 2022 .

Report to Council

The minutes were reported to Council on 23 June 2022.

Adoption

of Minutes from Previous Meetings 3.1 - Attachment 1

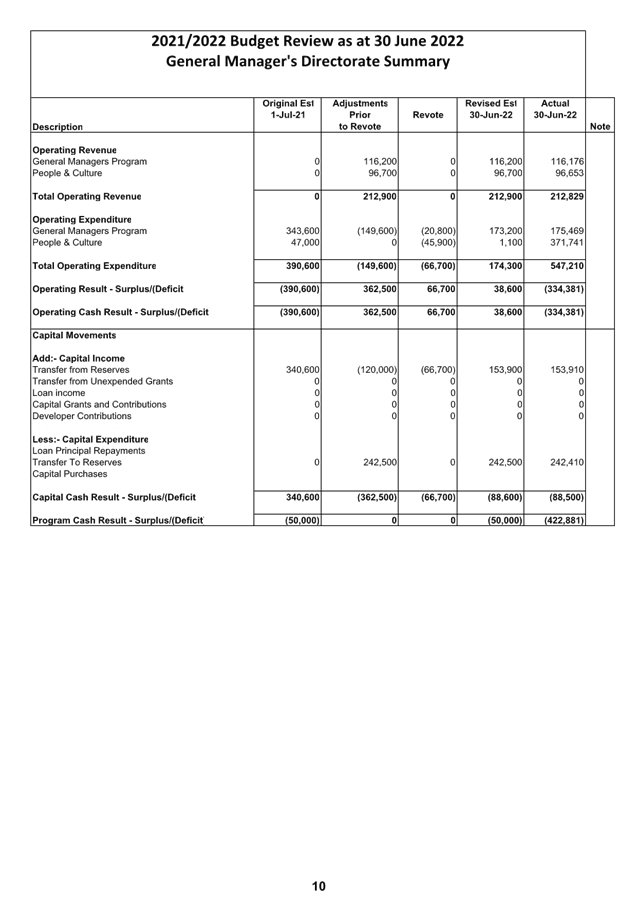

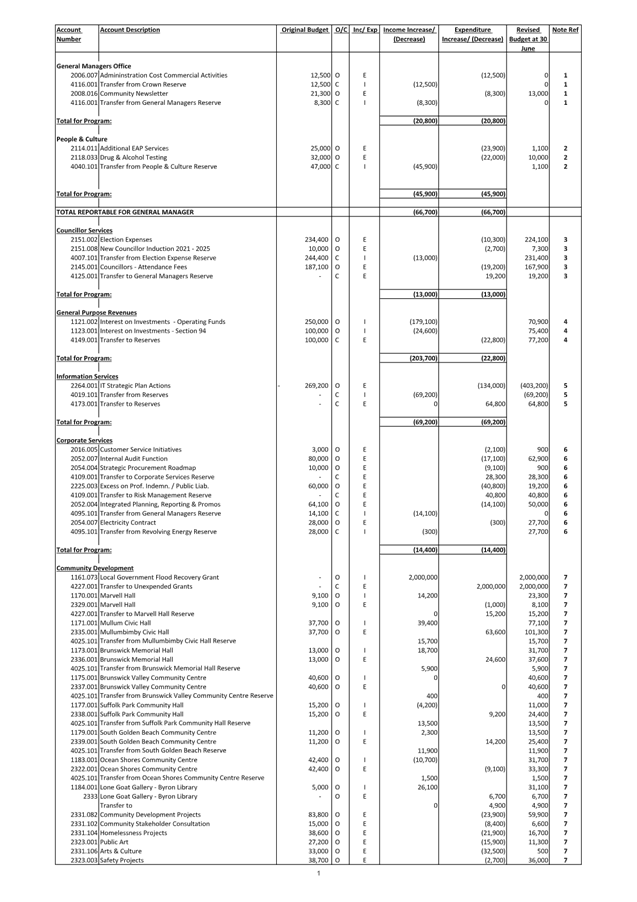

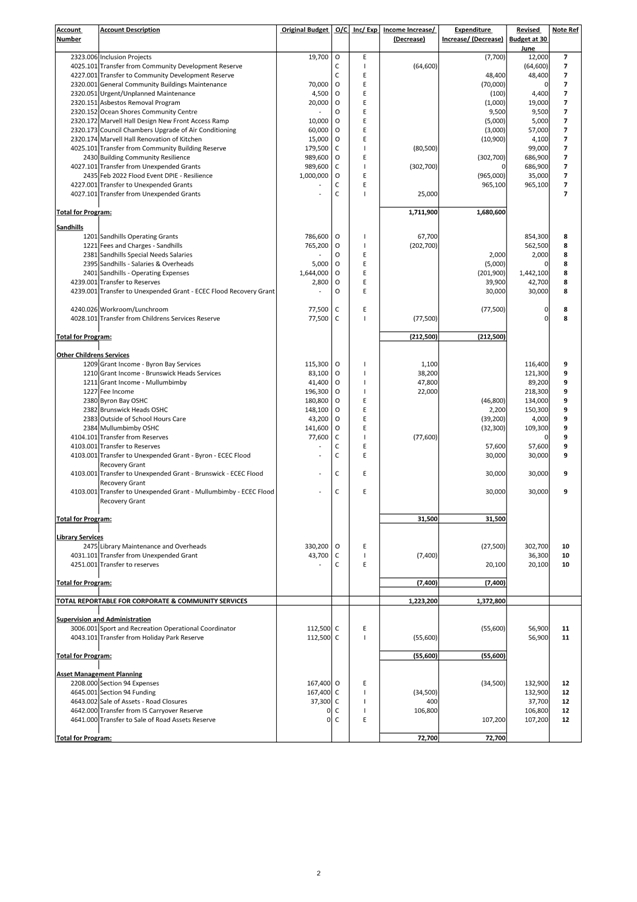

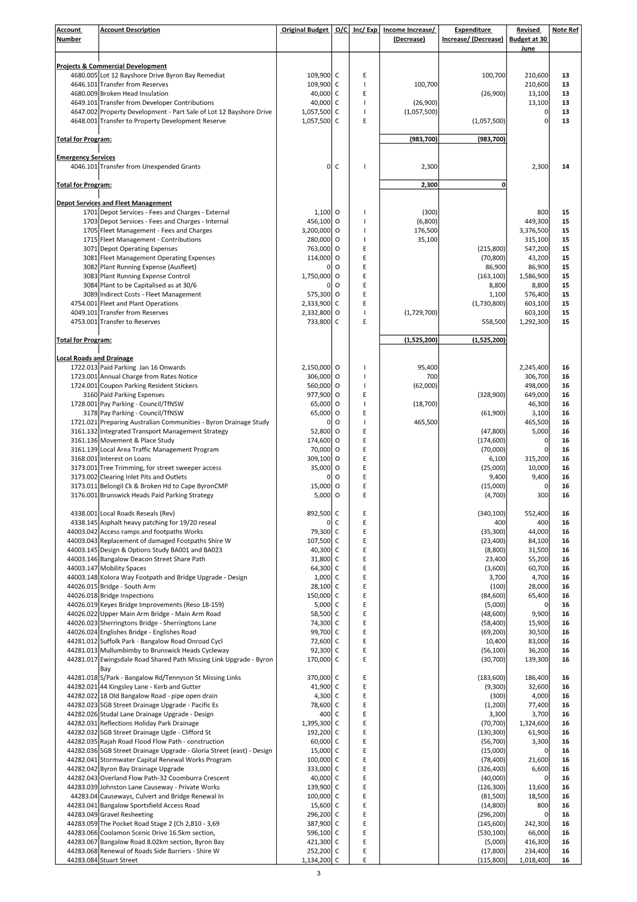

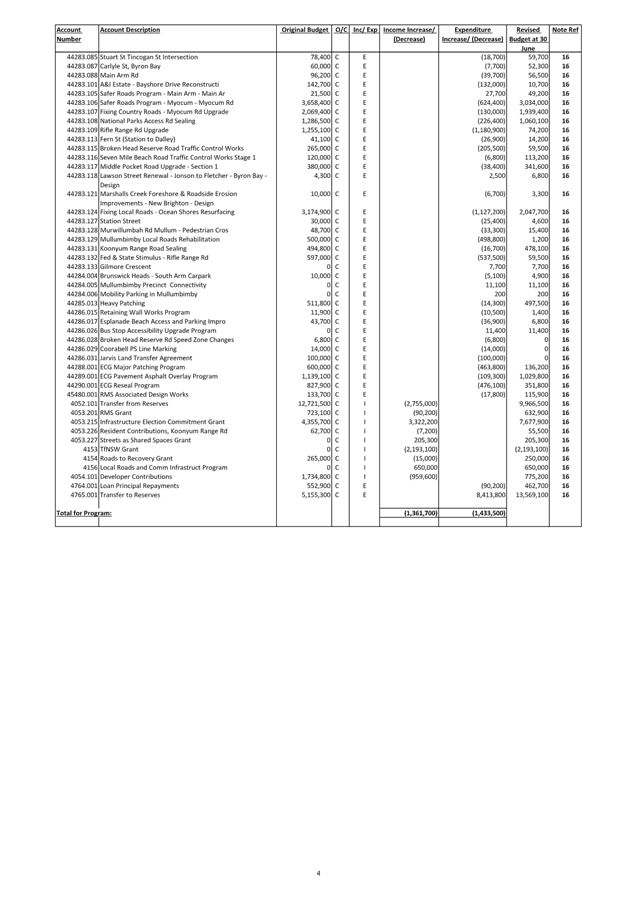

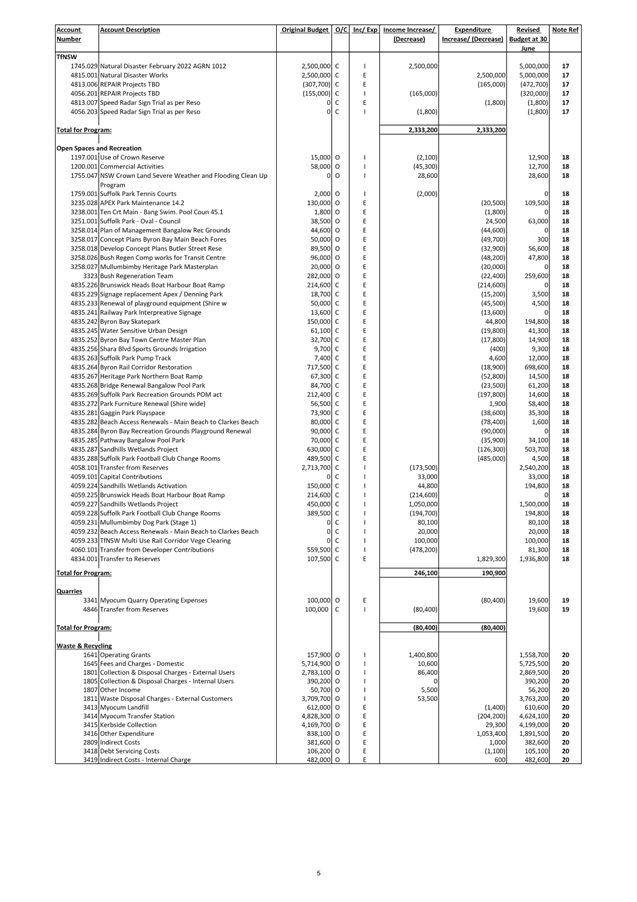

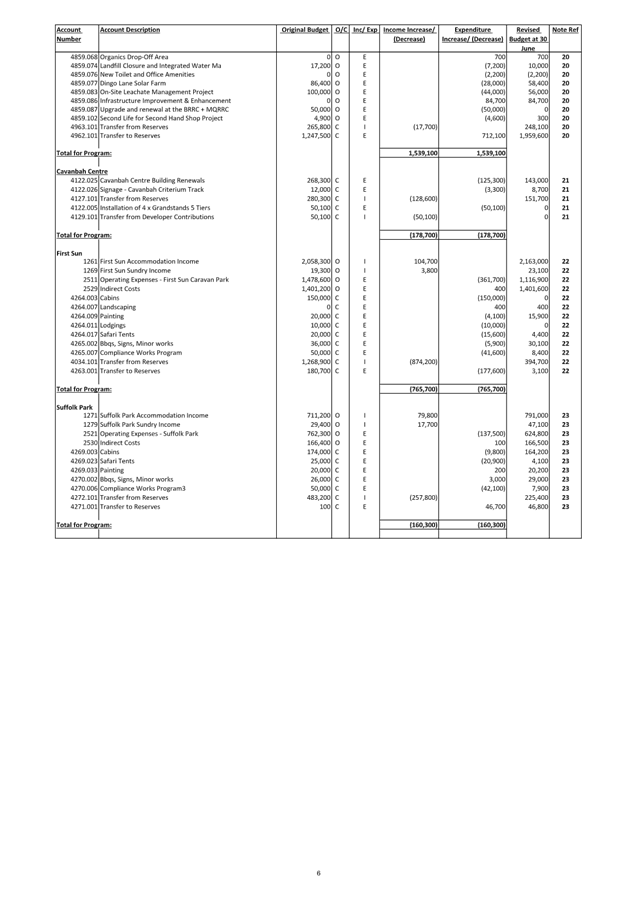

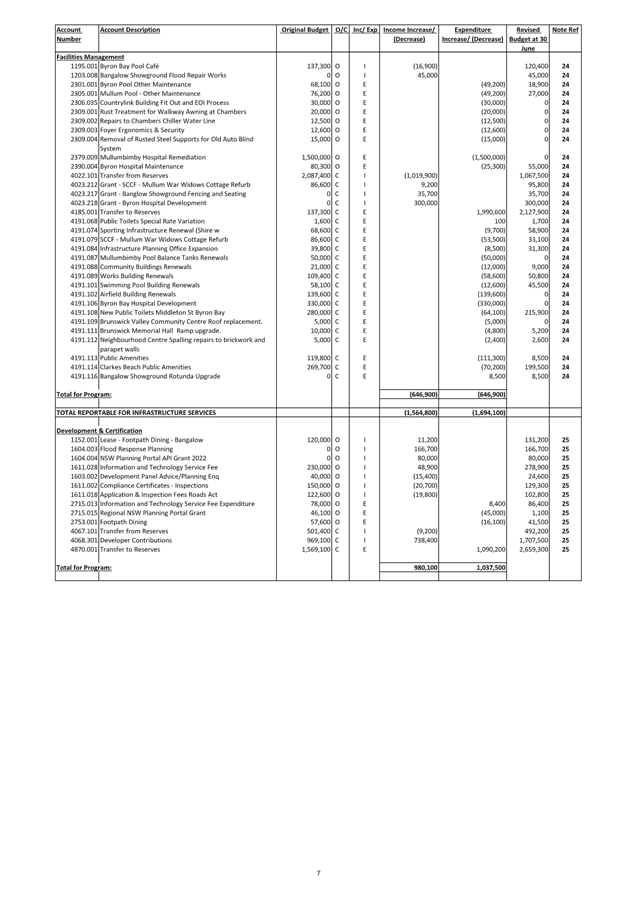

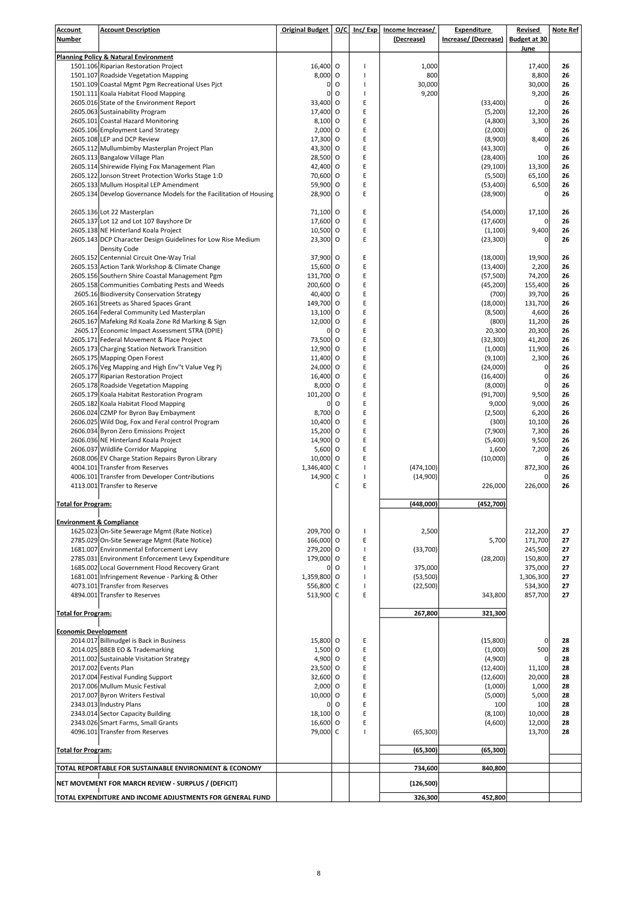

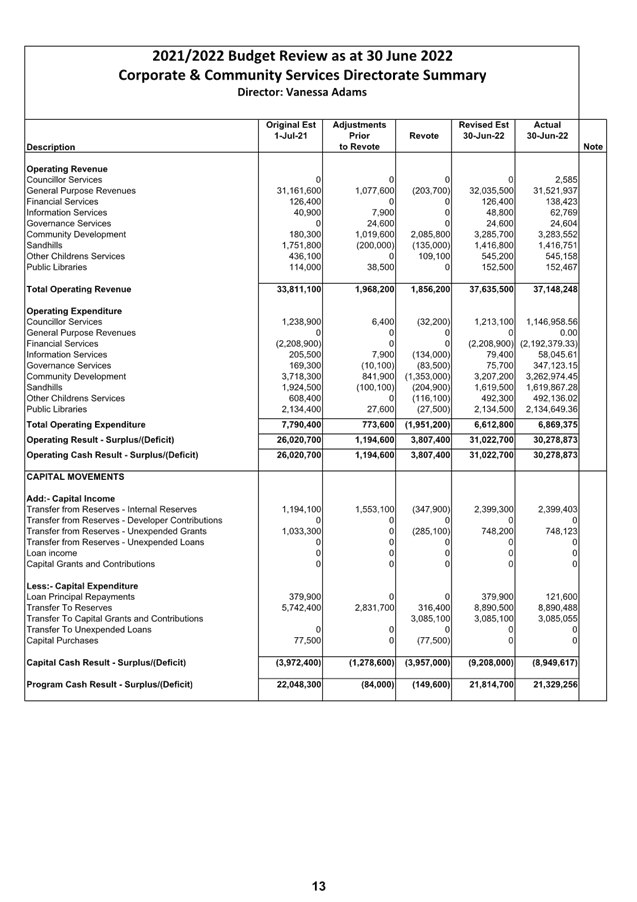

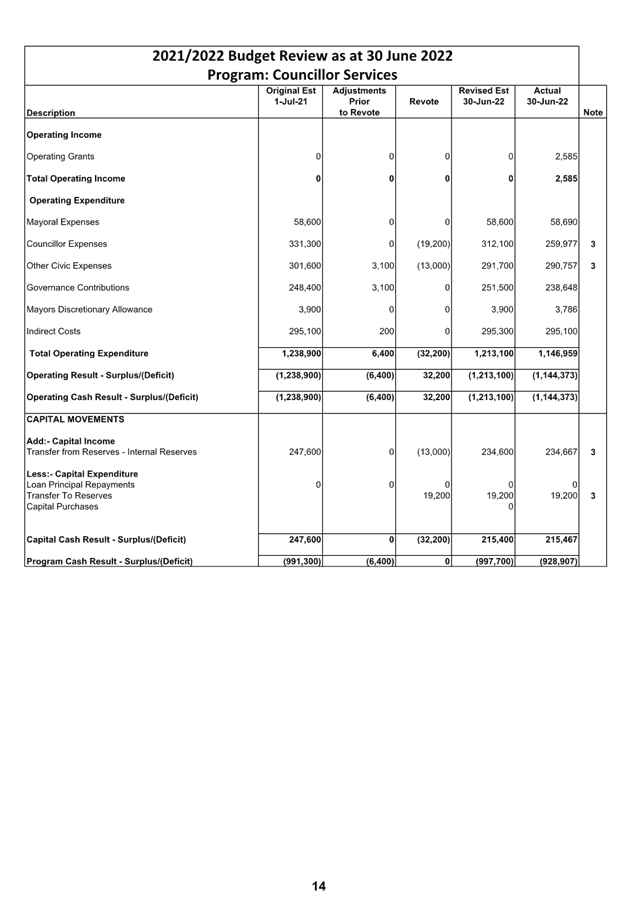

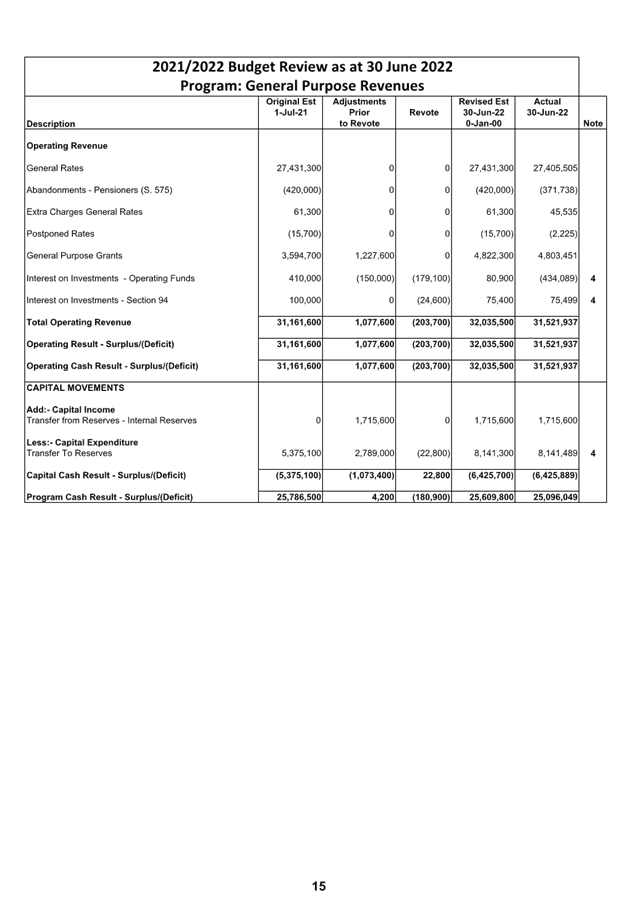

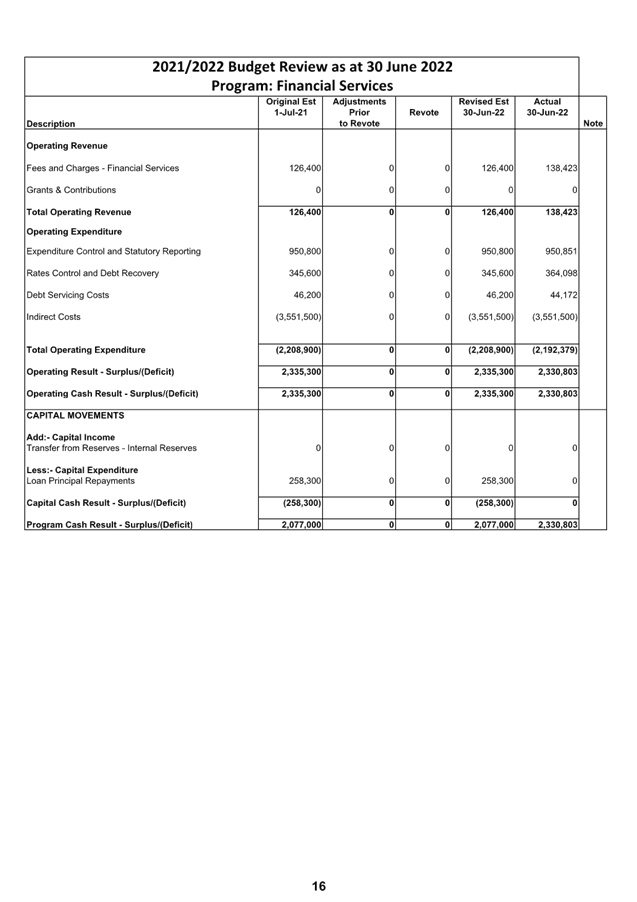

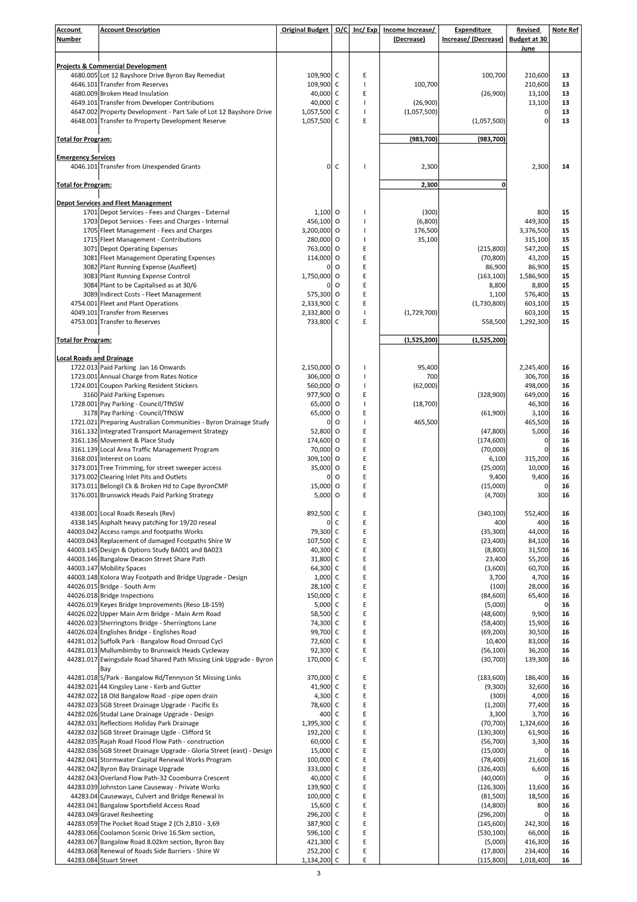

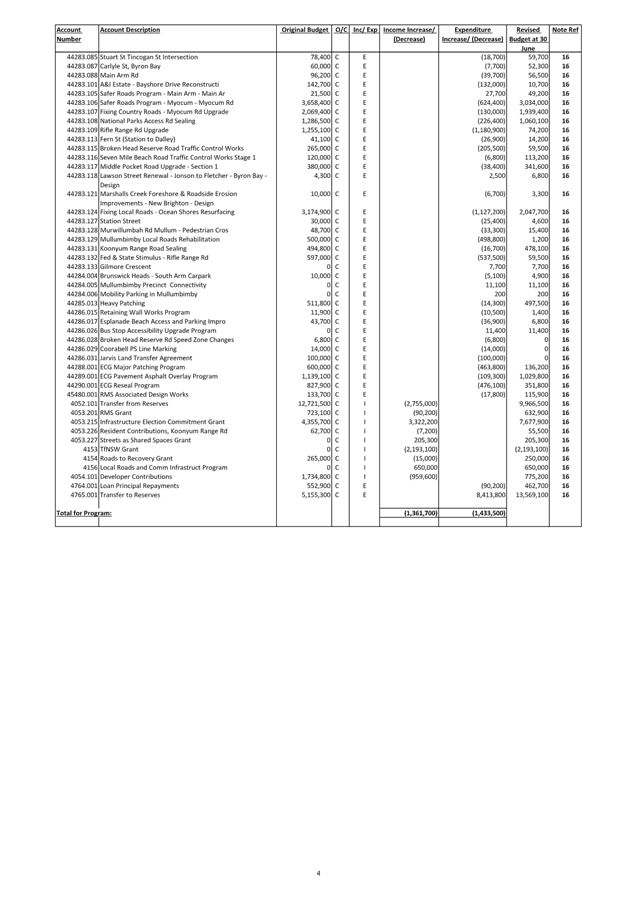

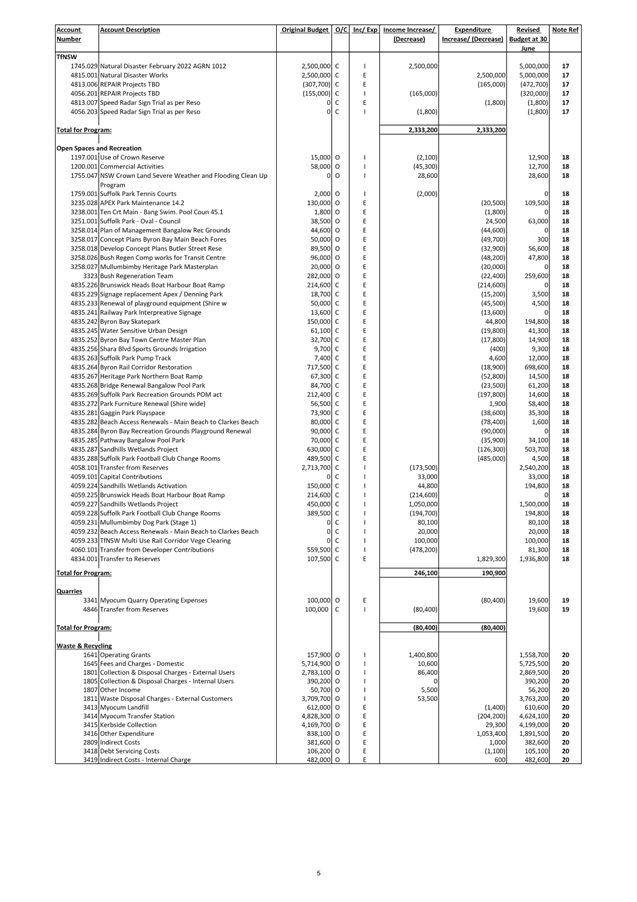

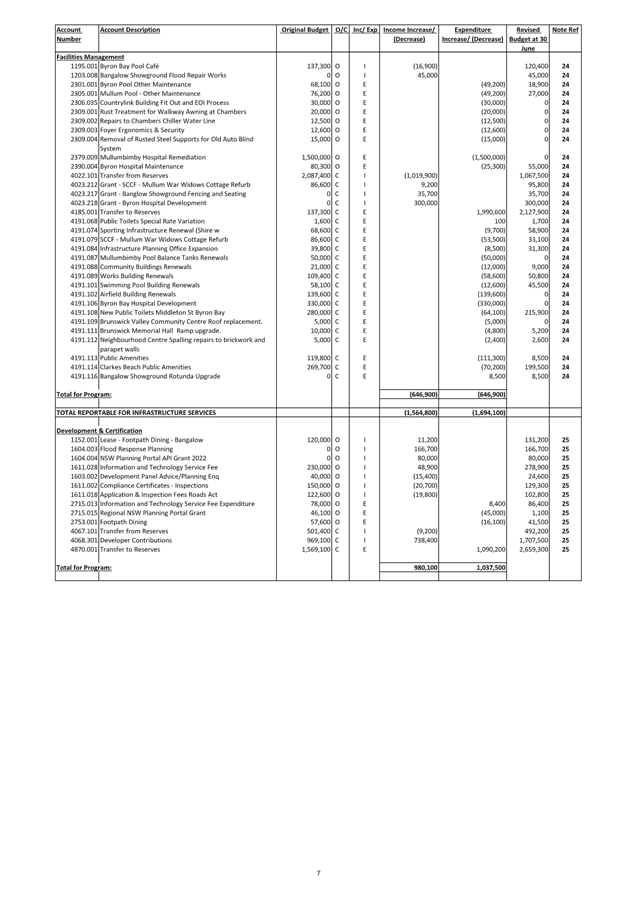

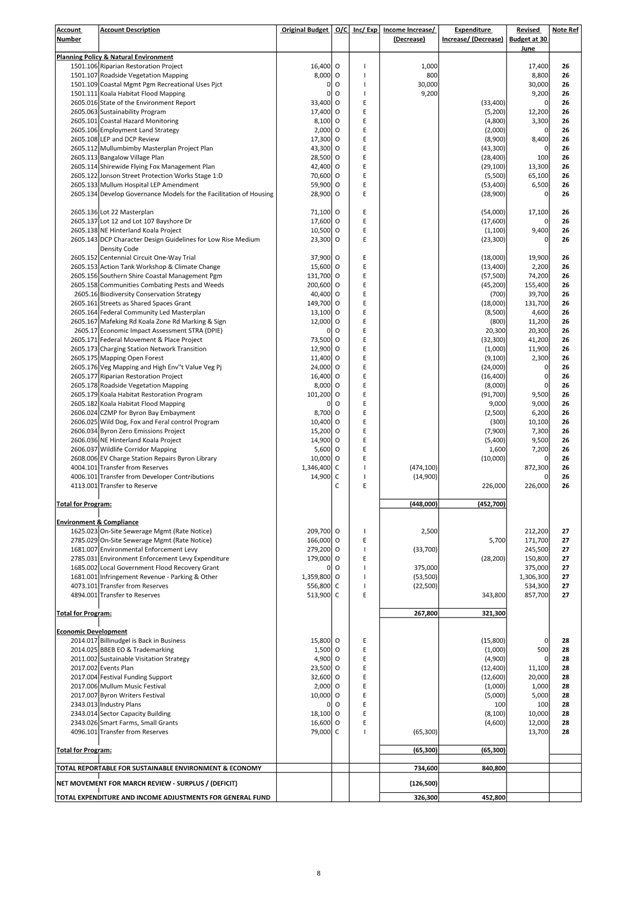

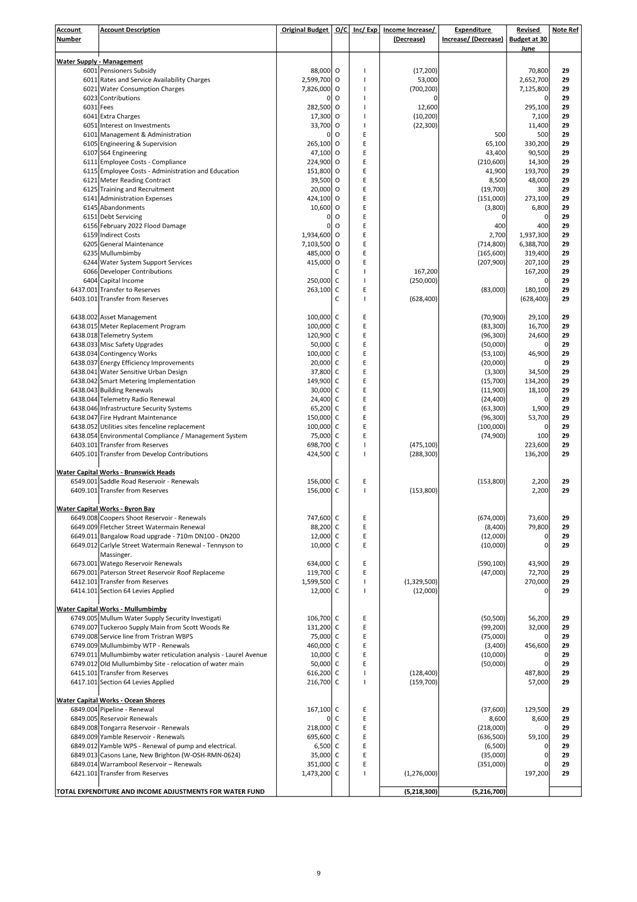

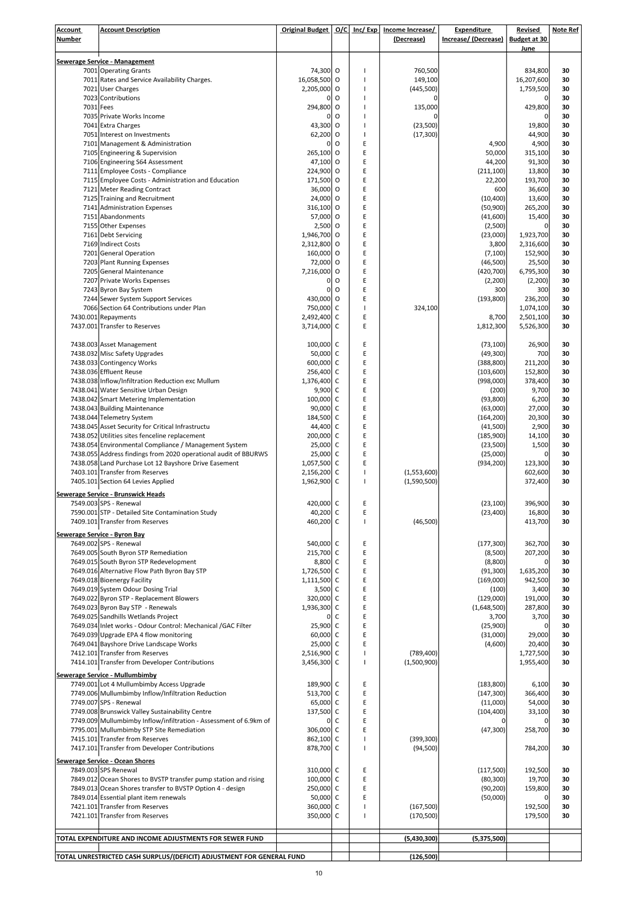

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

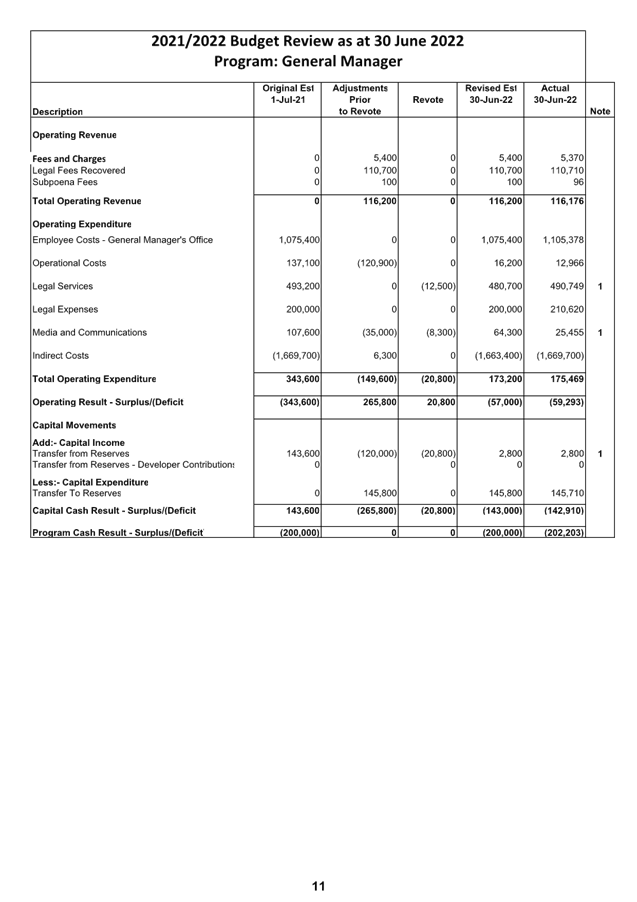

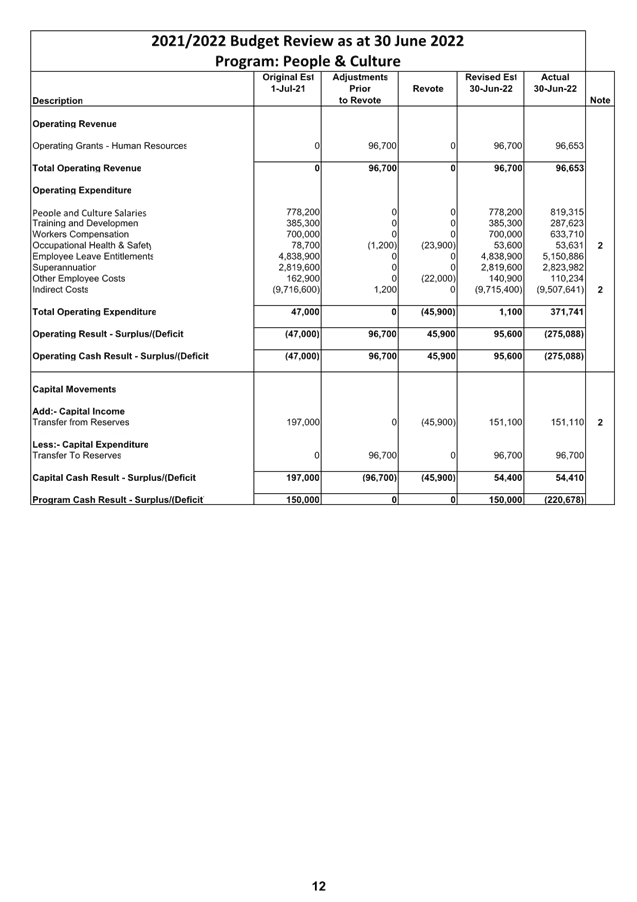

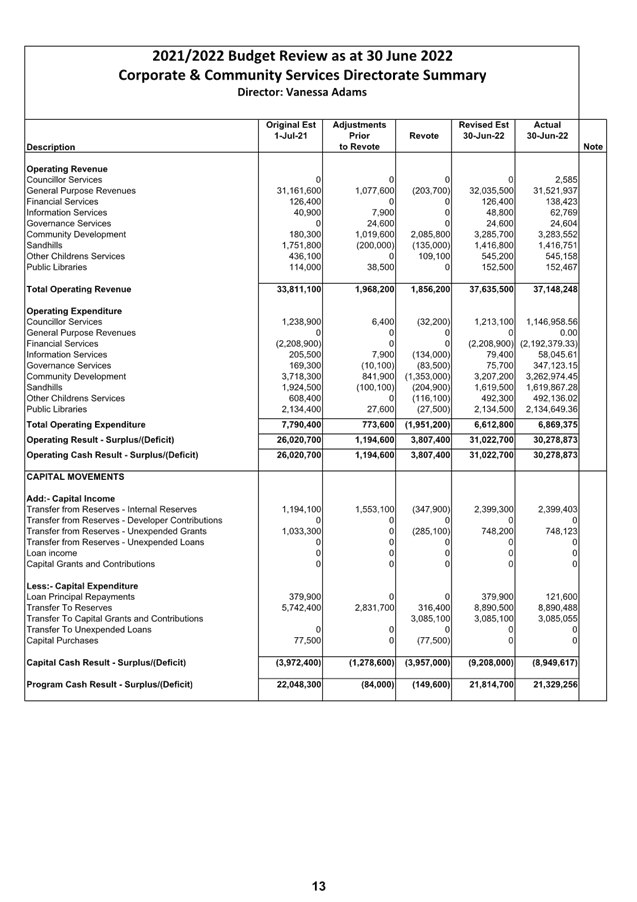

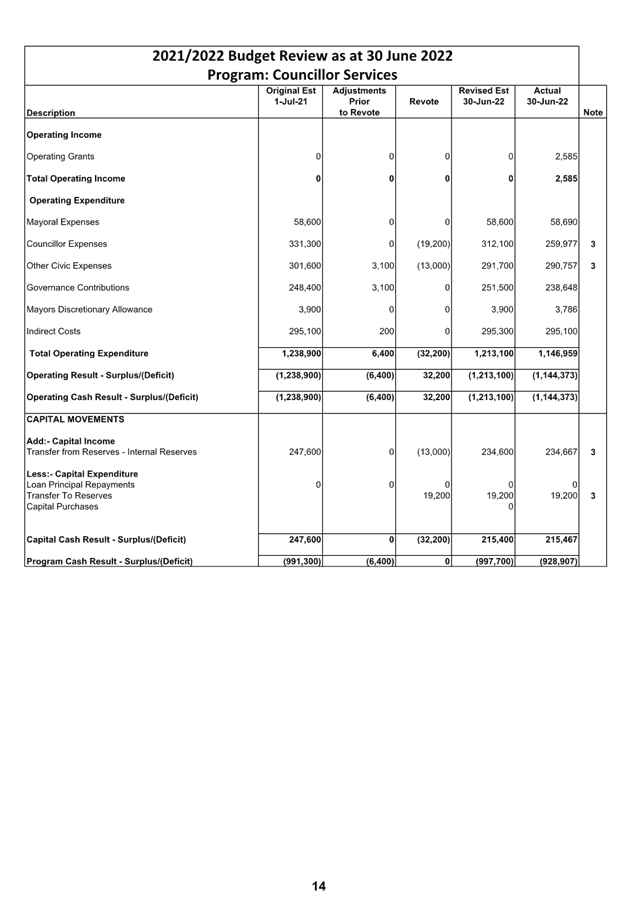

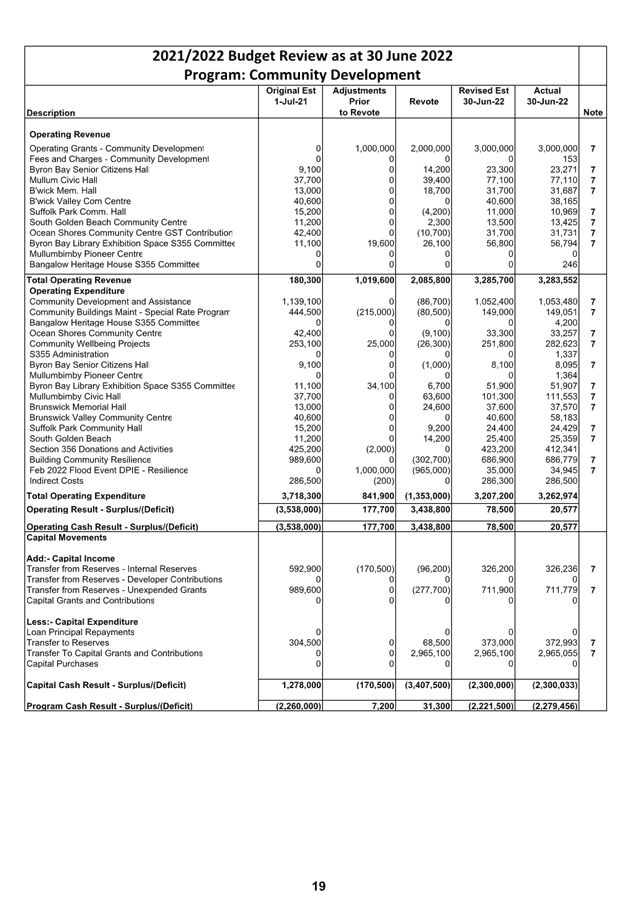

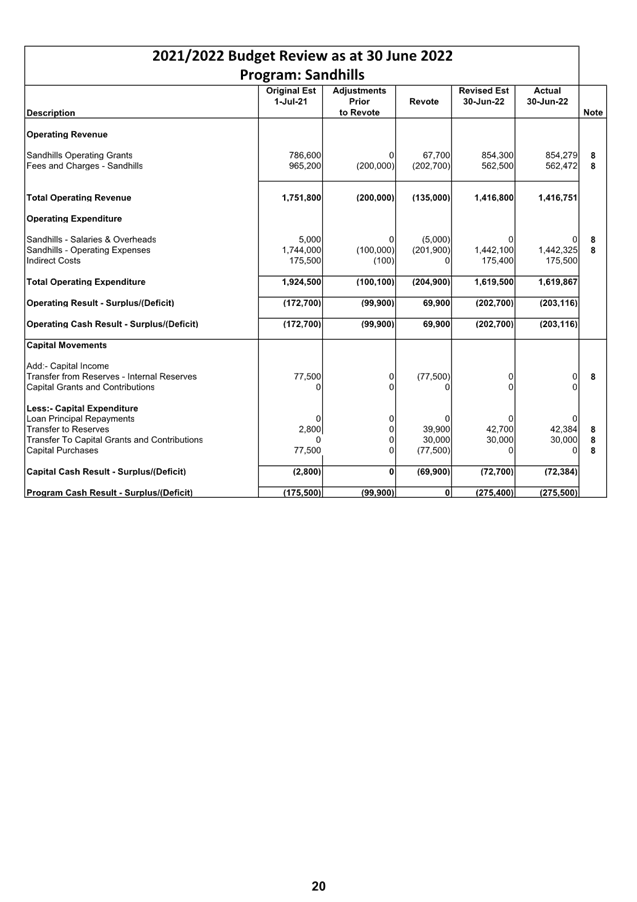

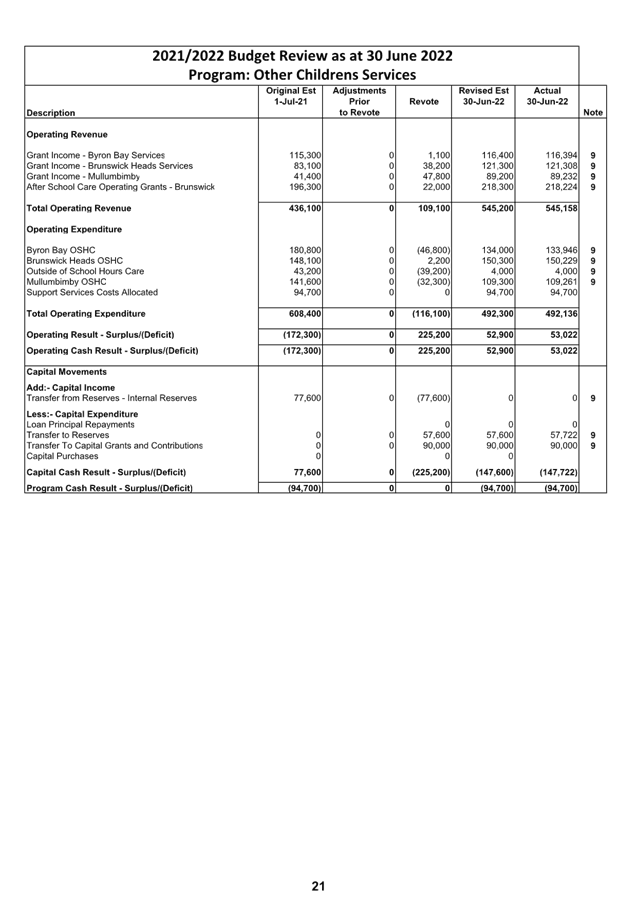

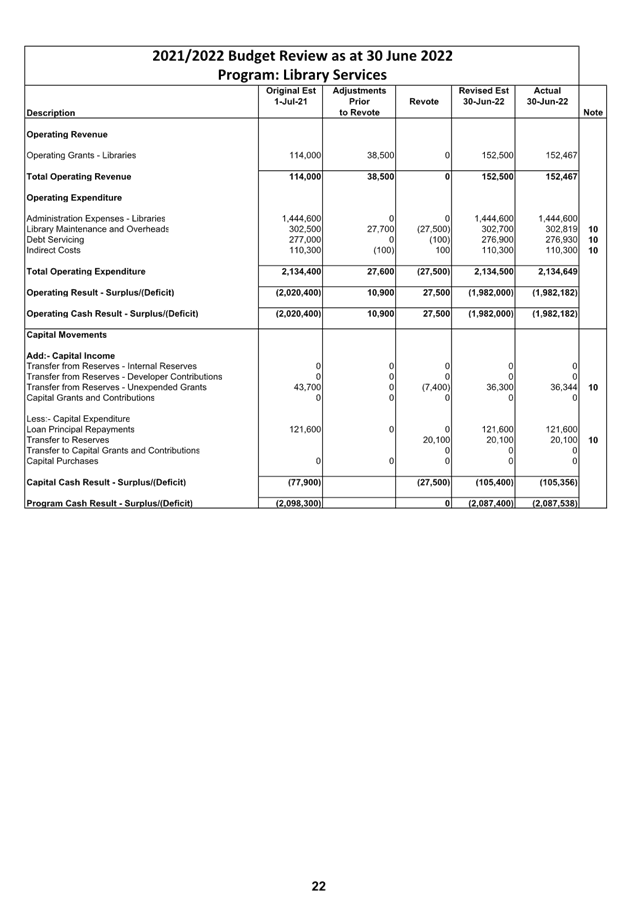

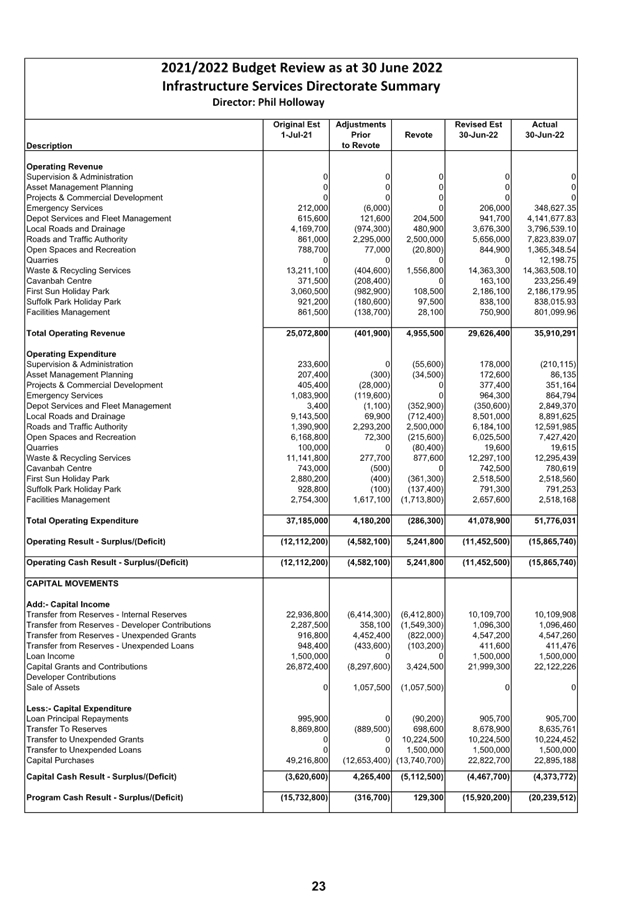

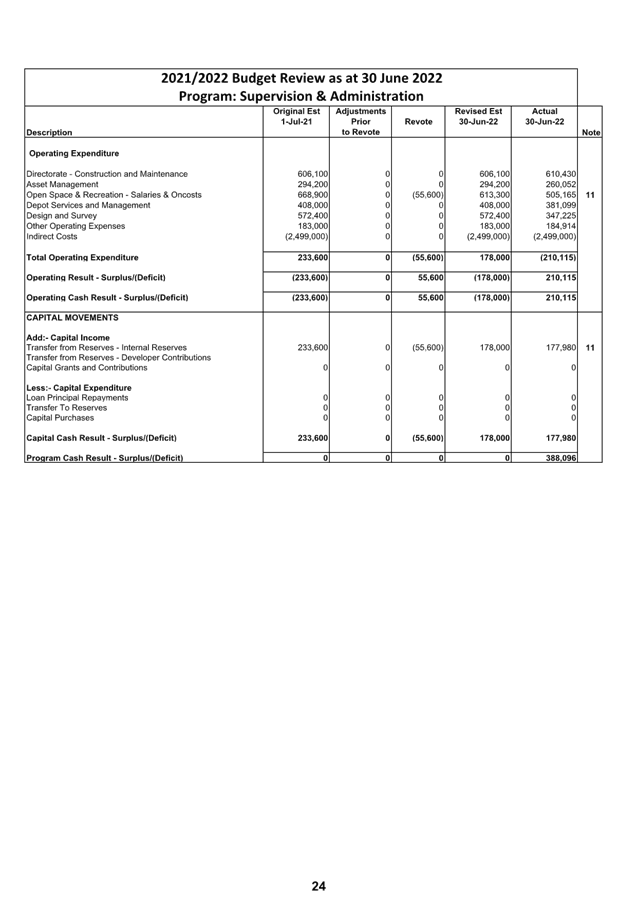

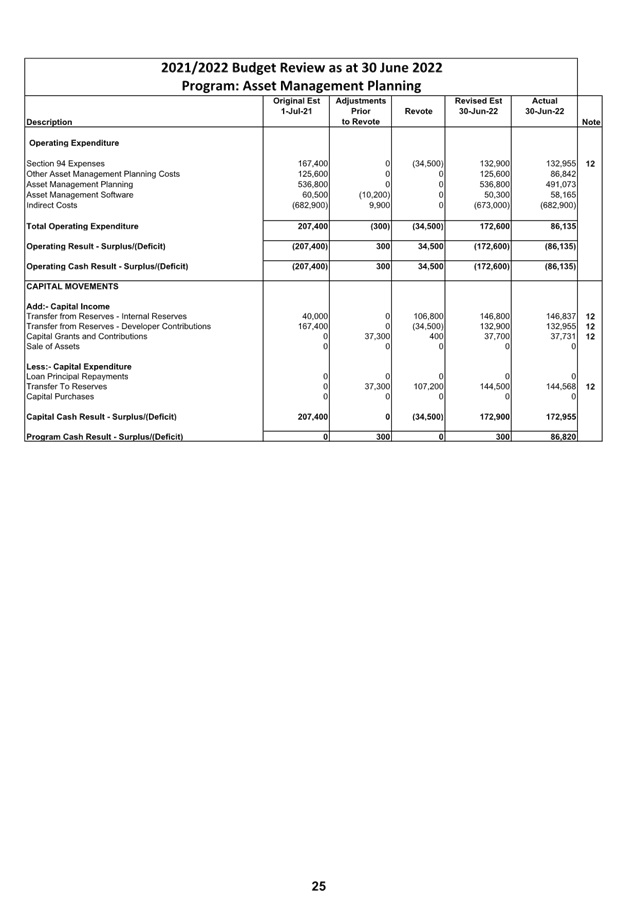

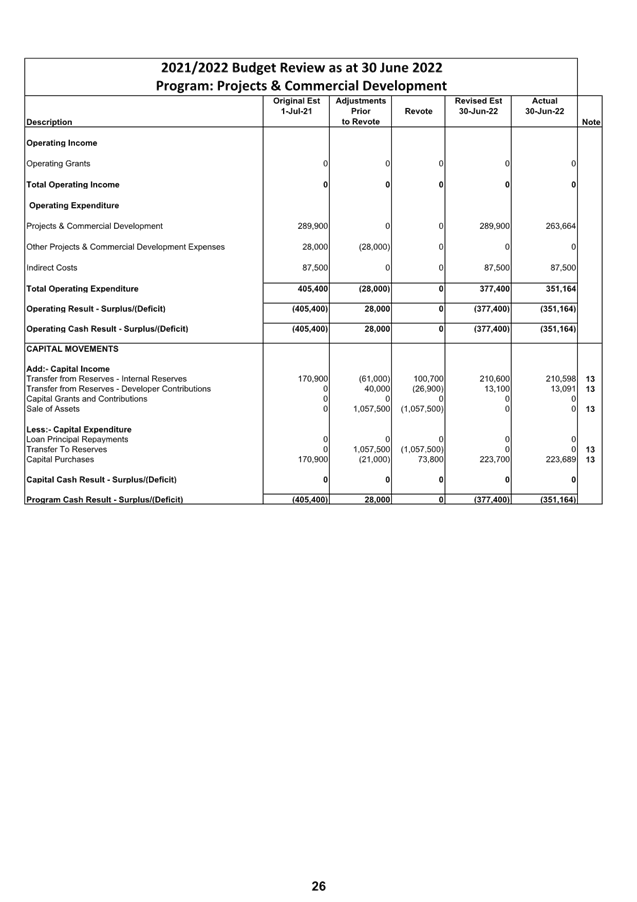

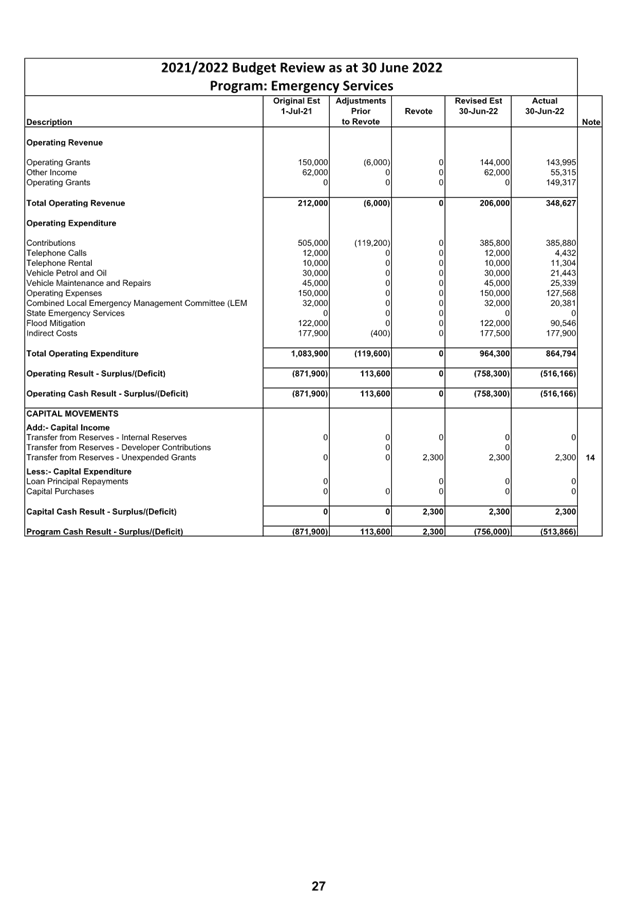

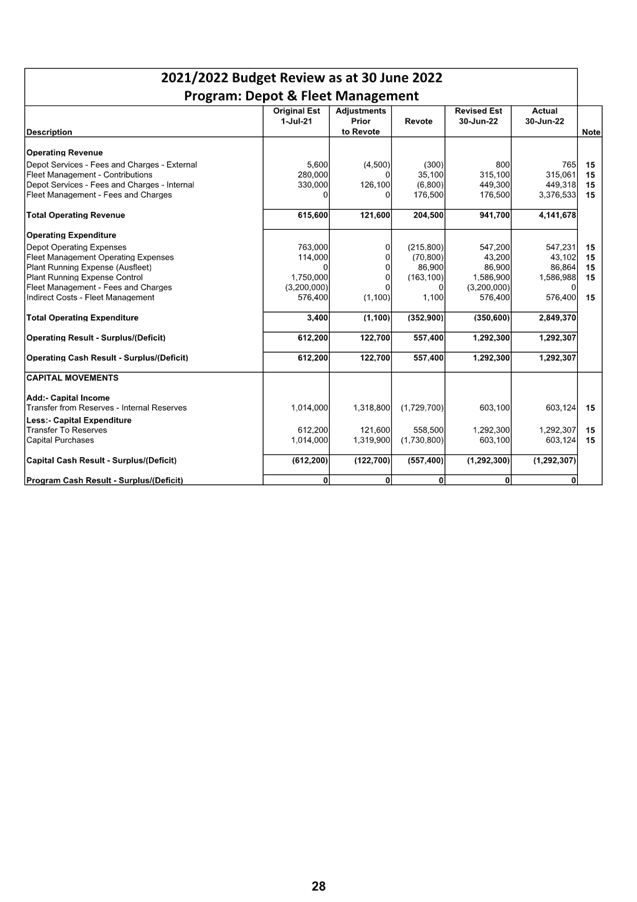

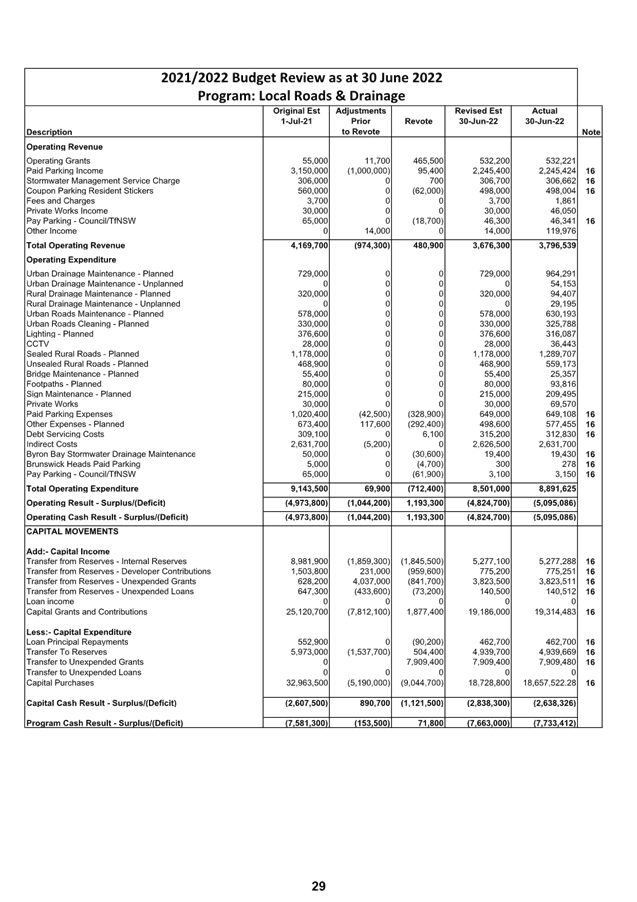

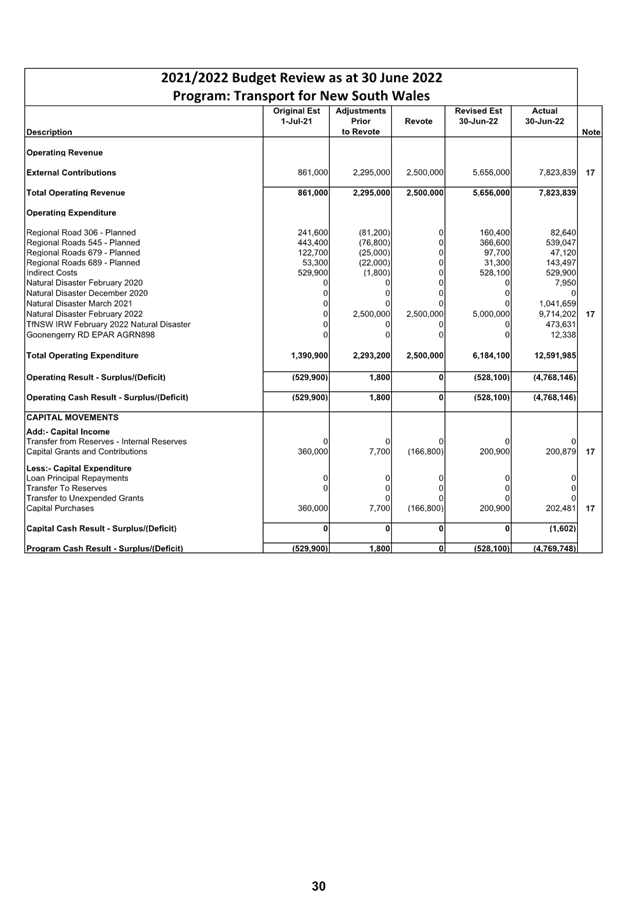

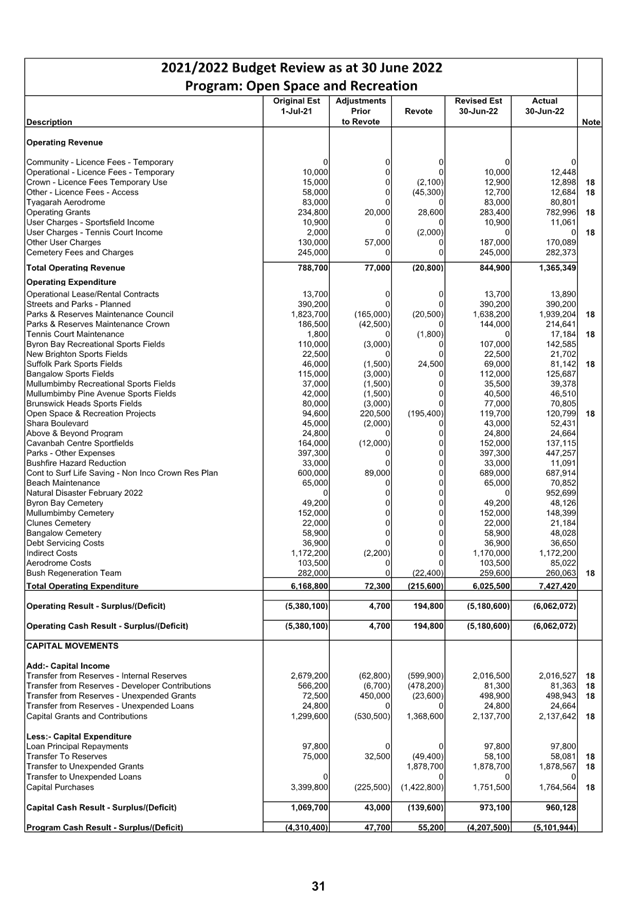

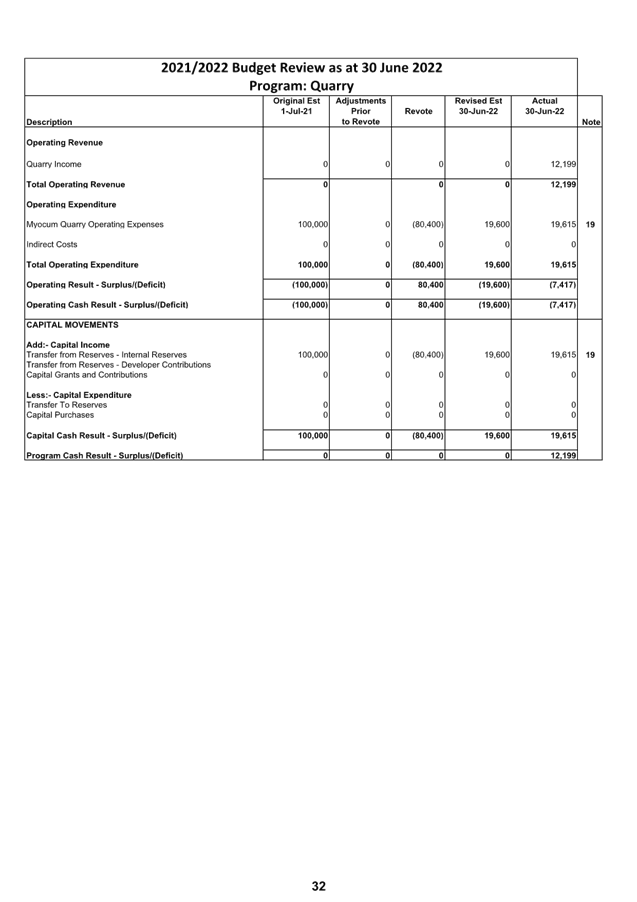

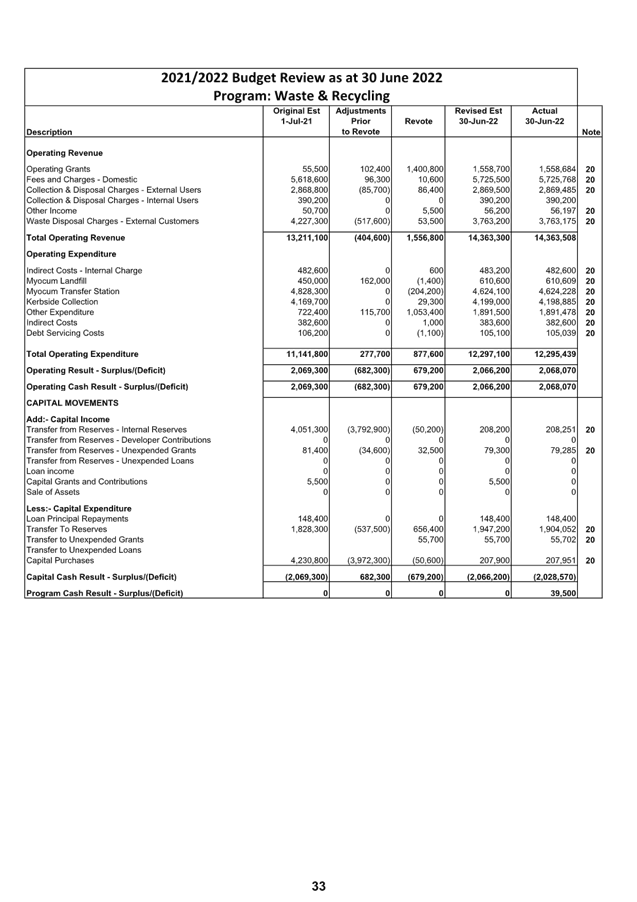

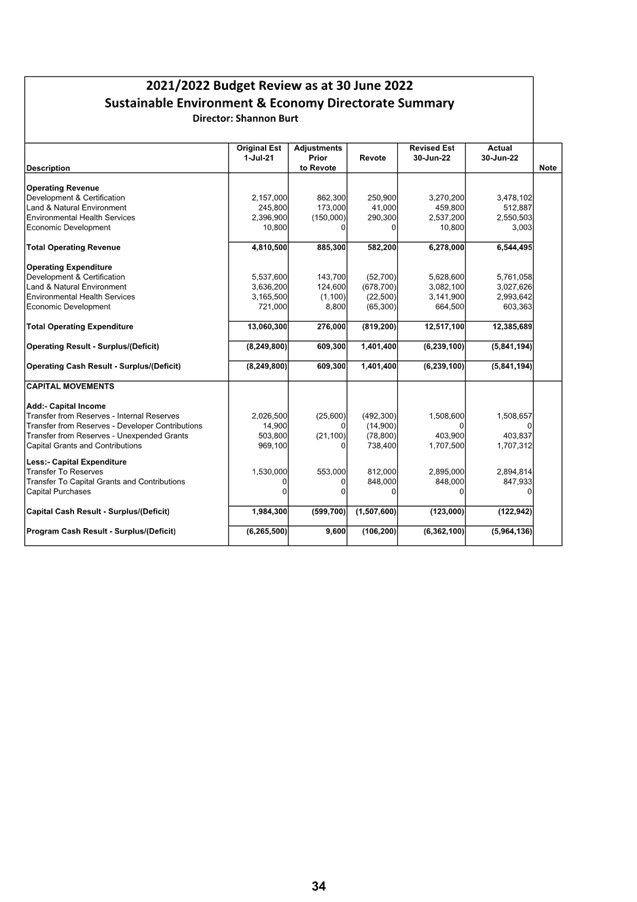

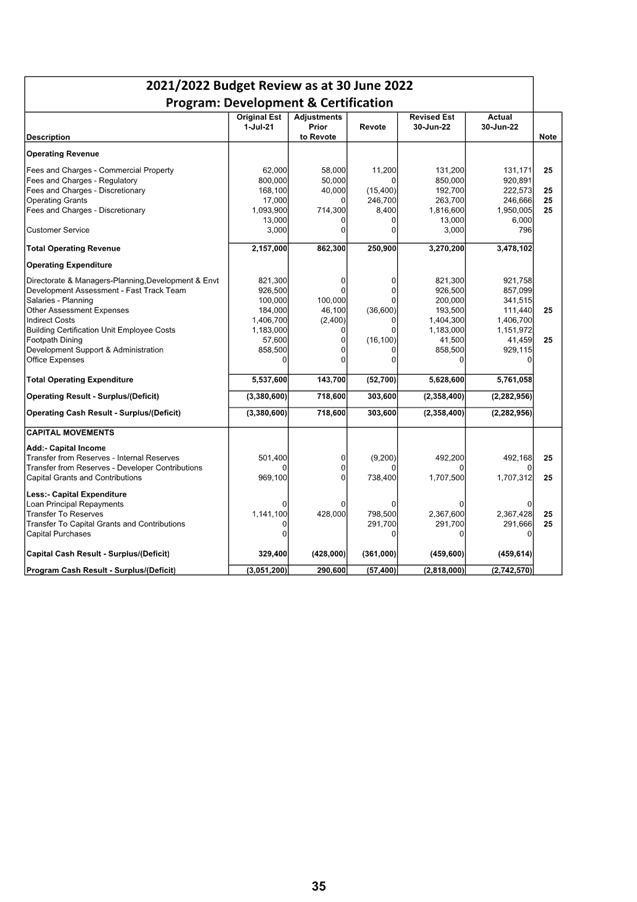

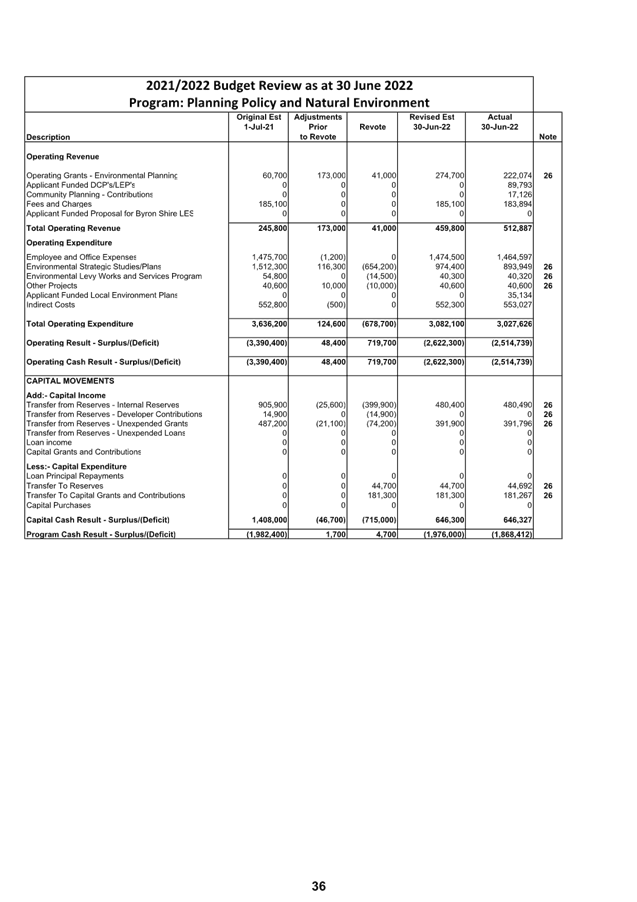

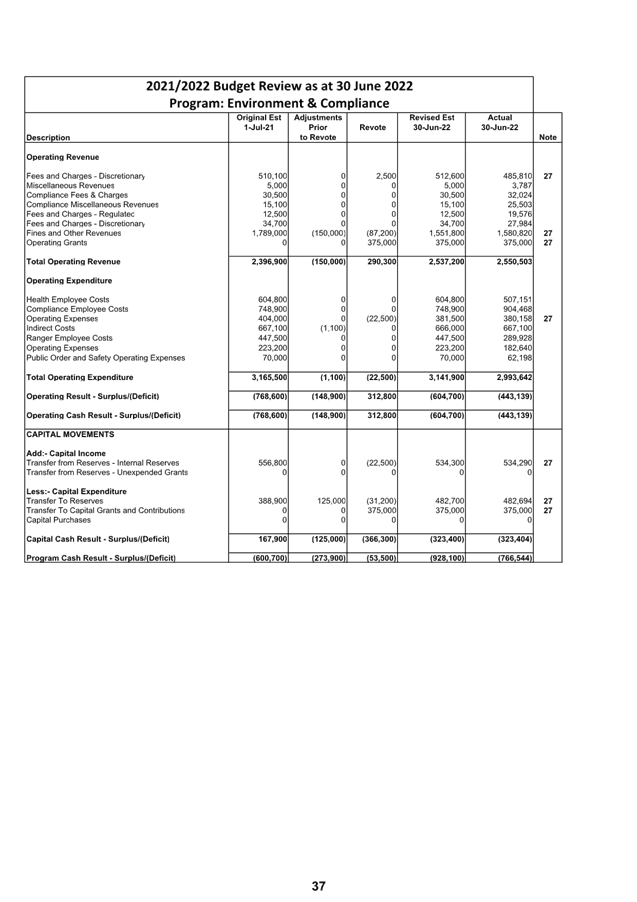

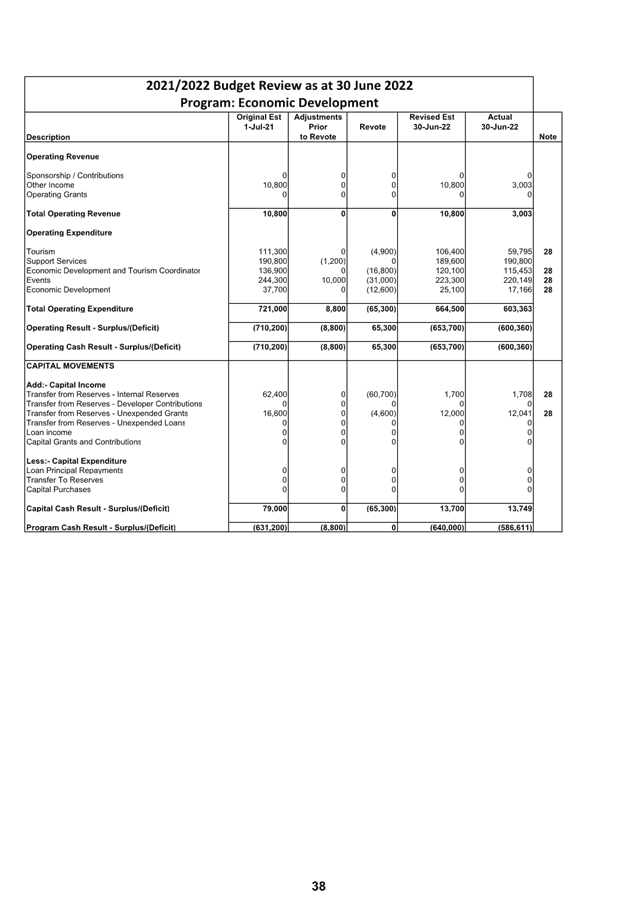

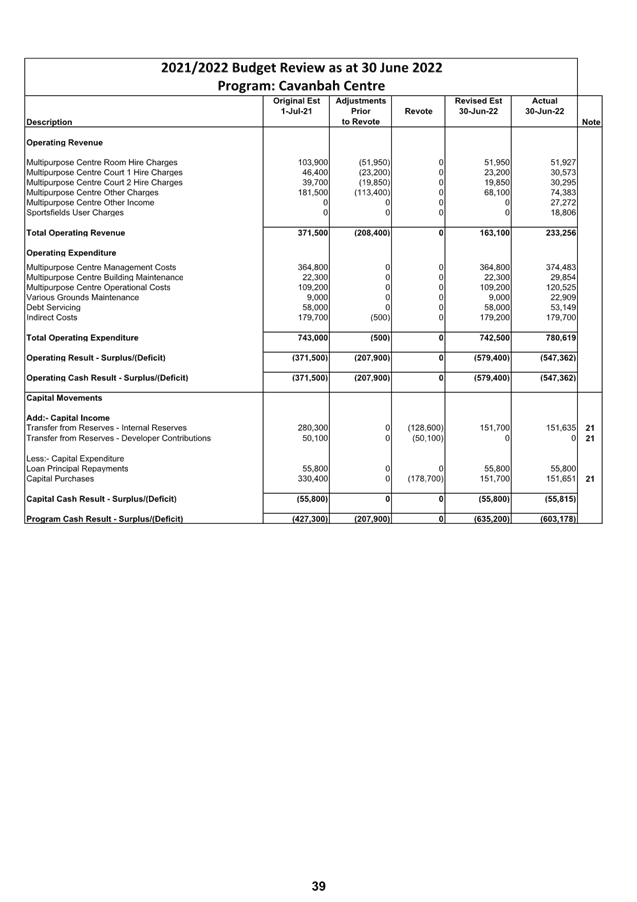

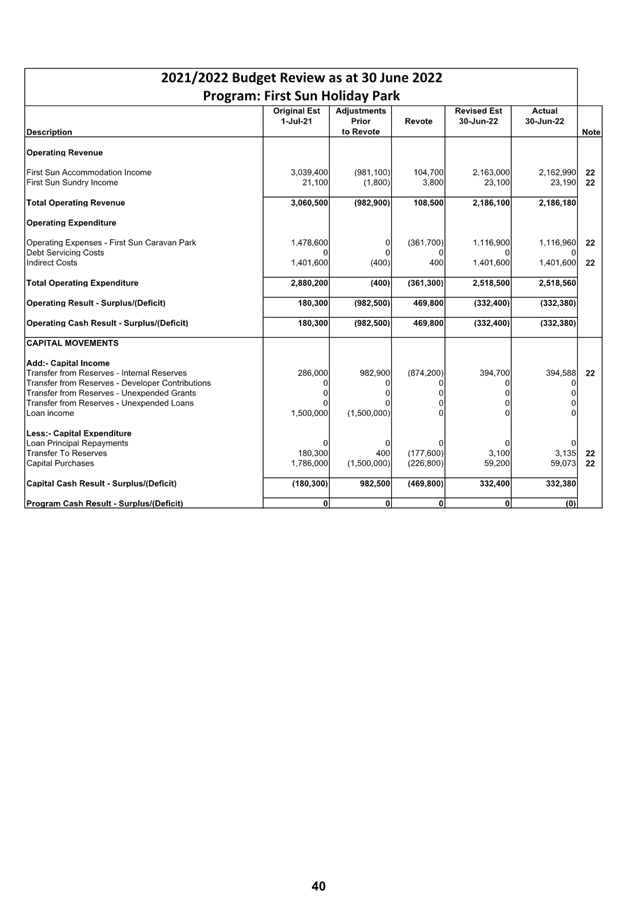

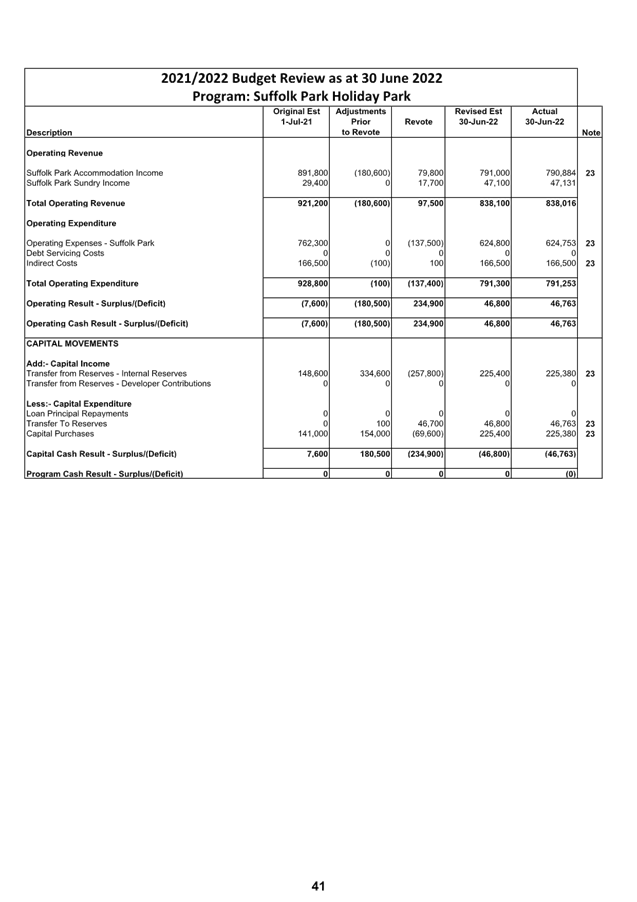

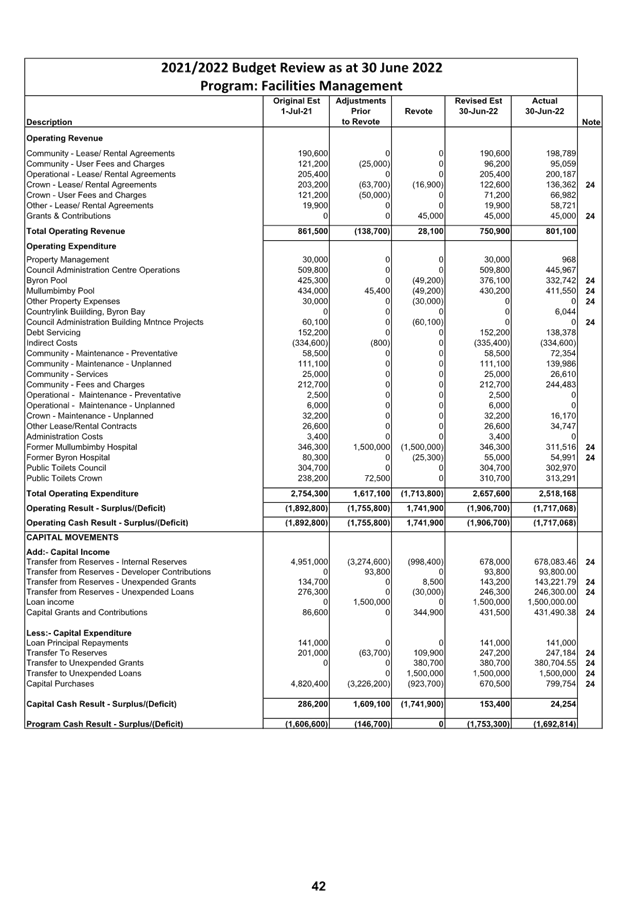

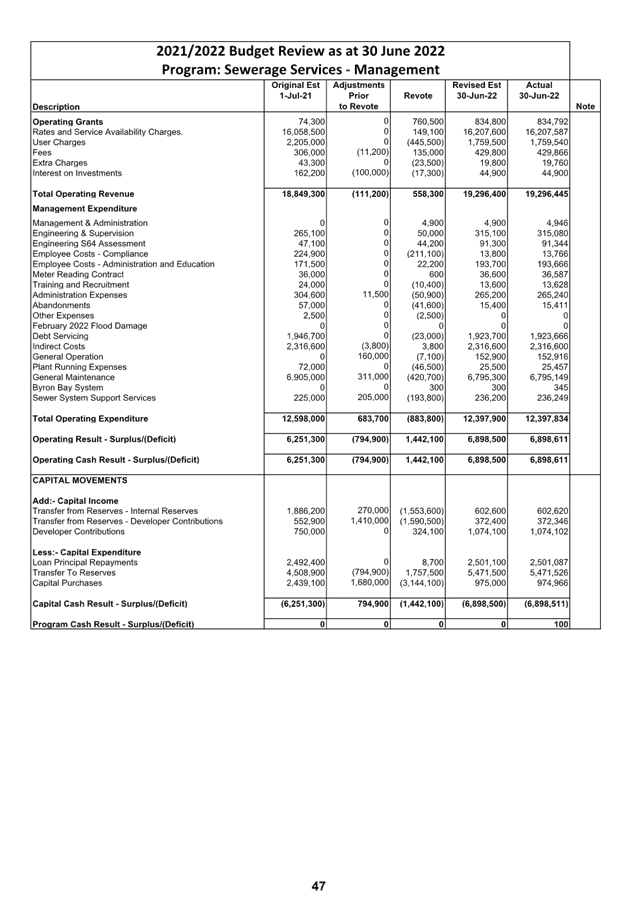

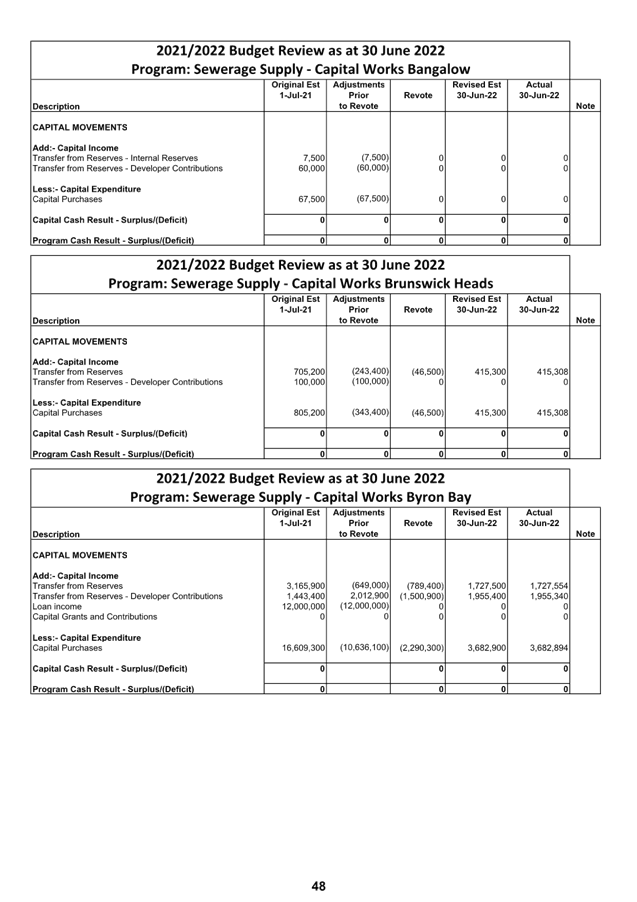

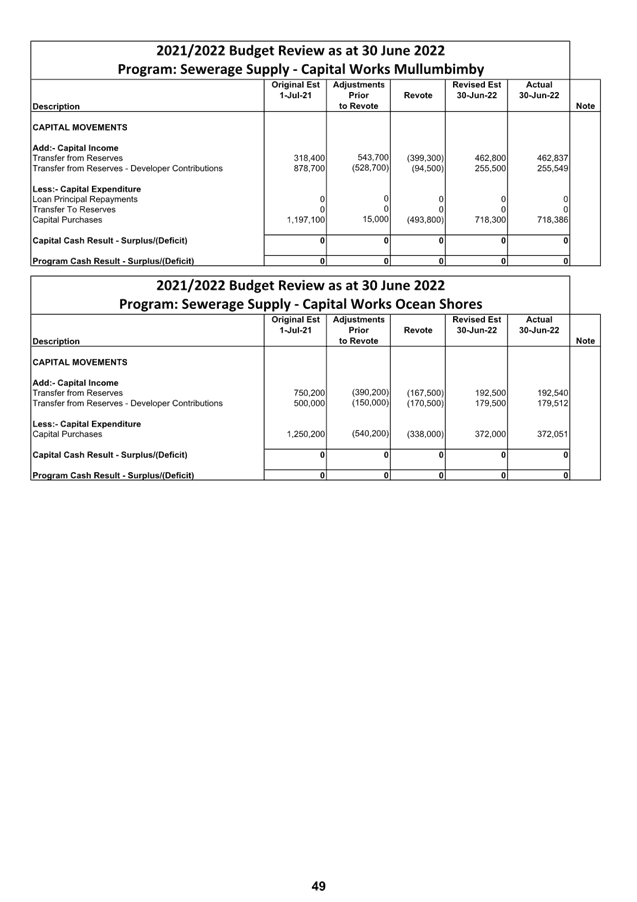

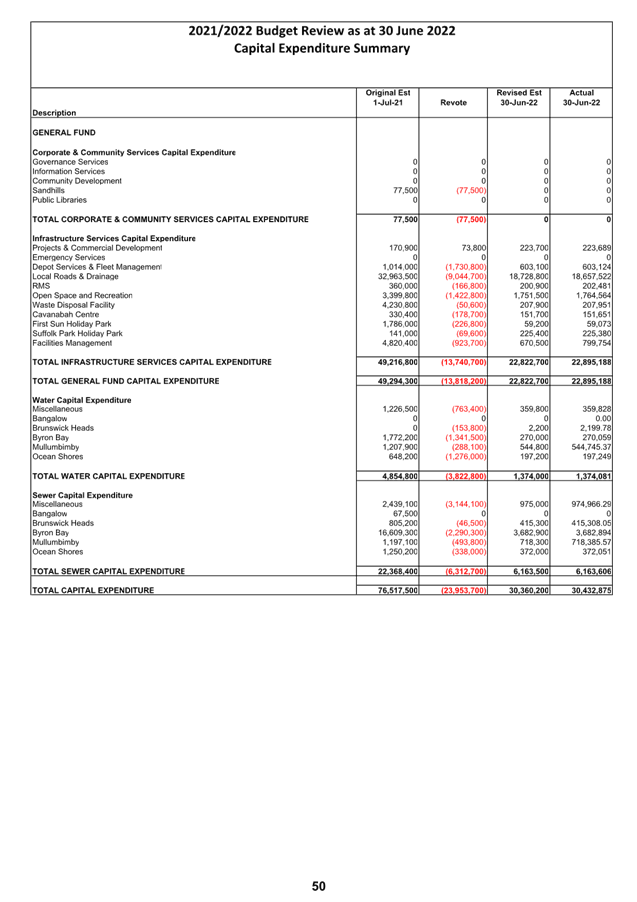

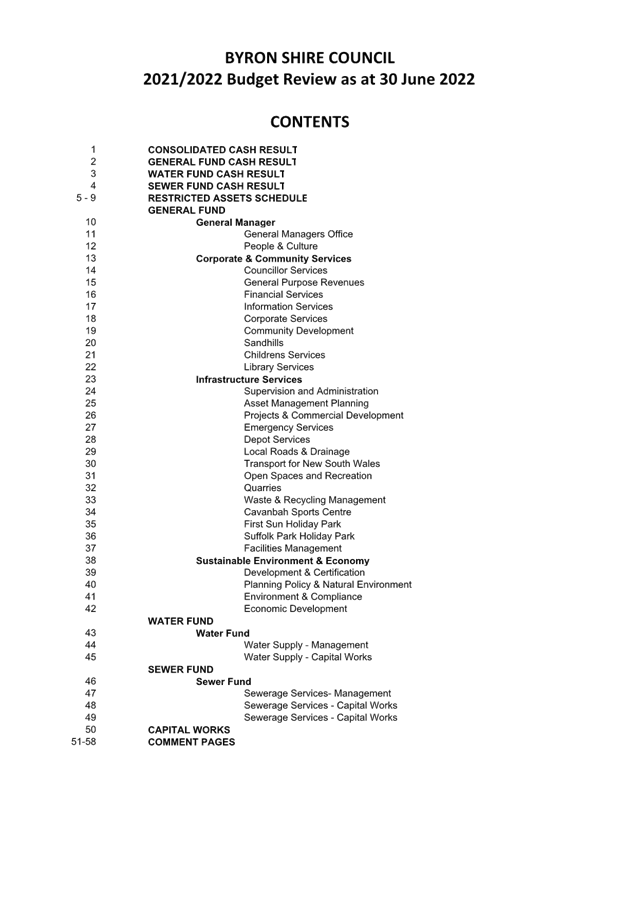

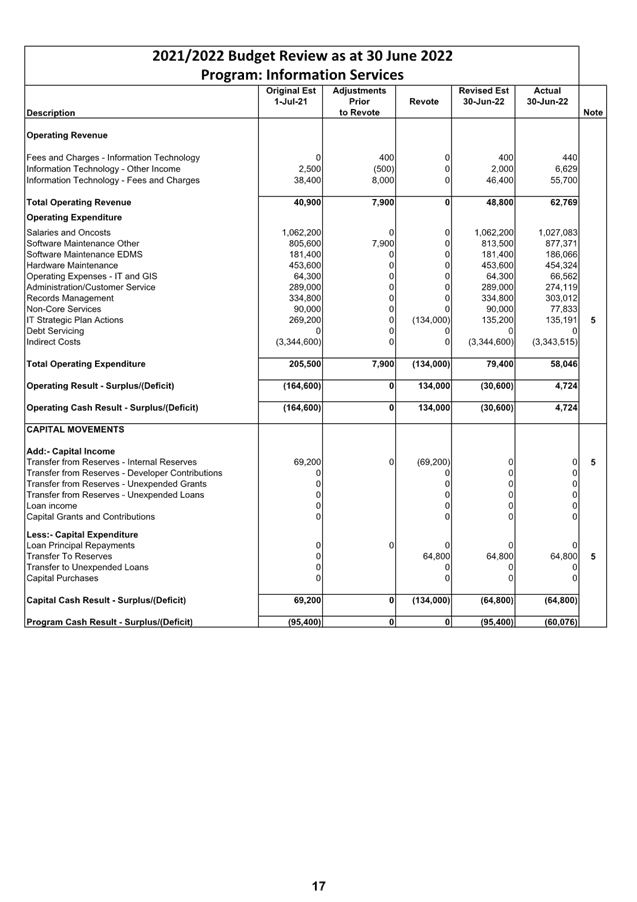

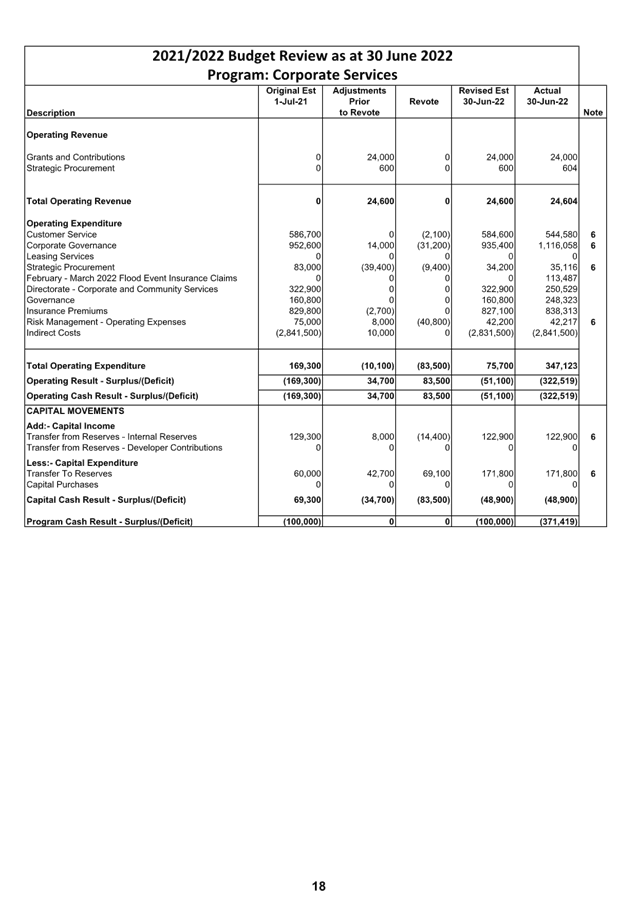

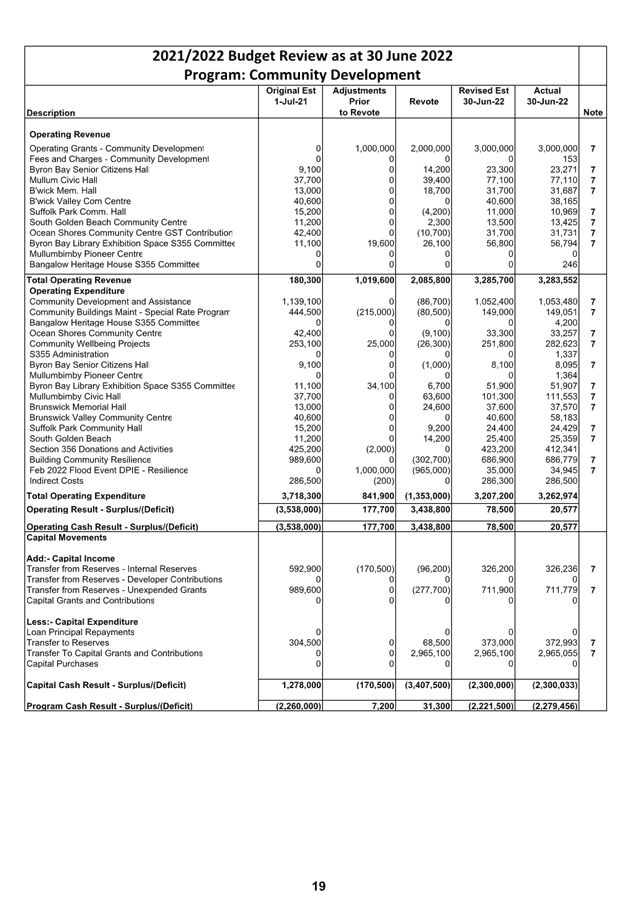

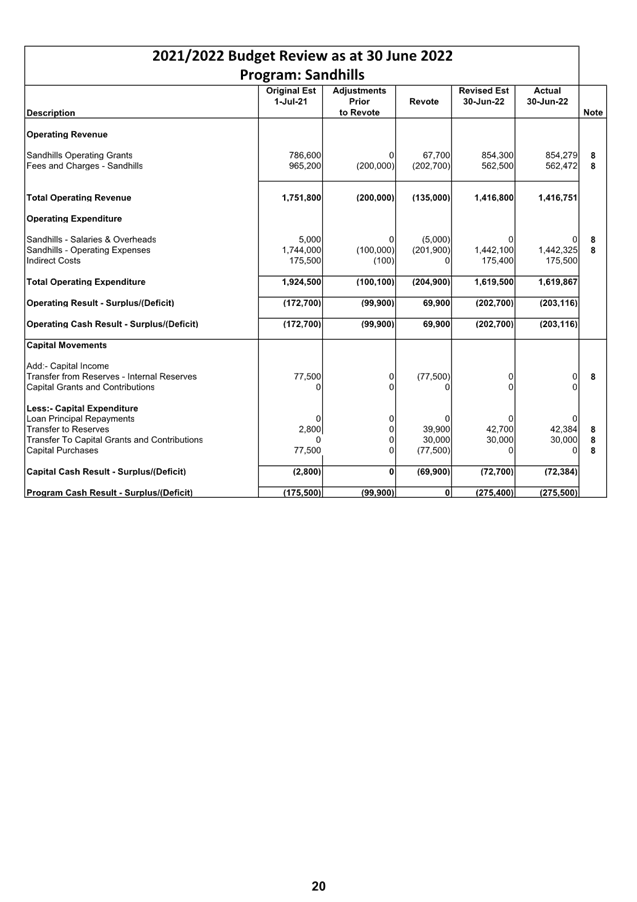

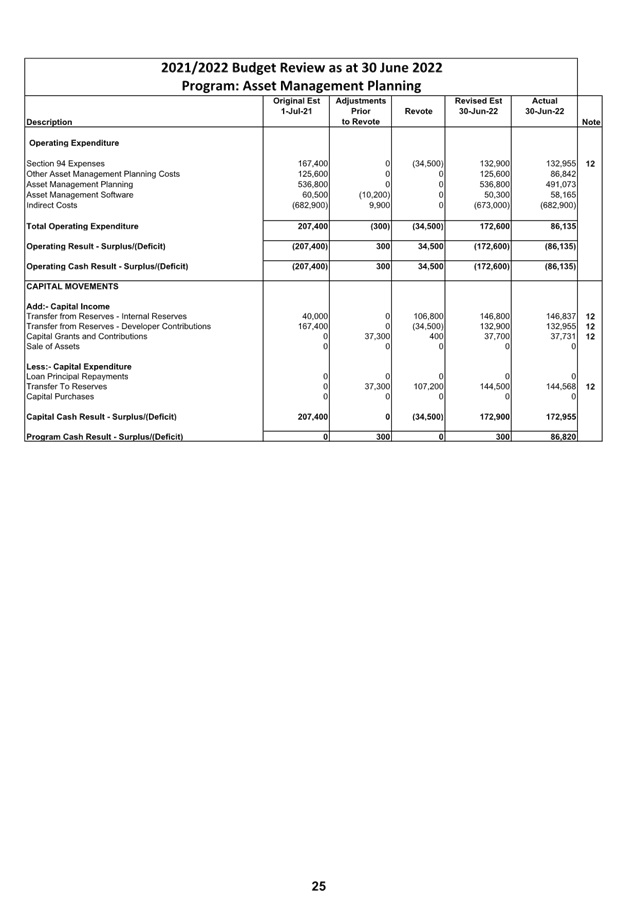

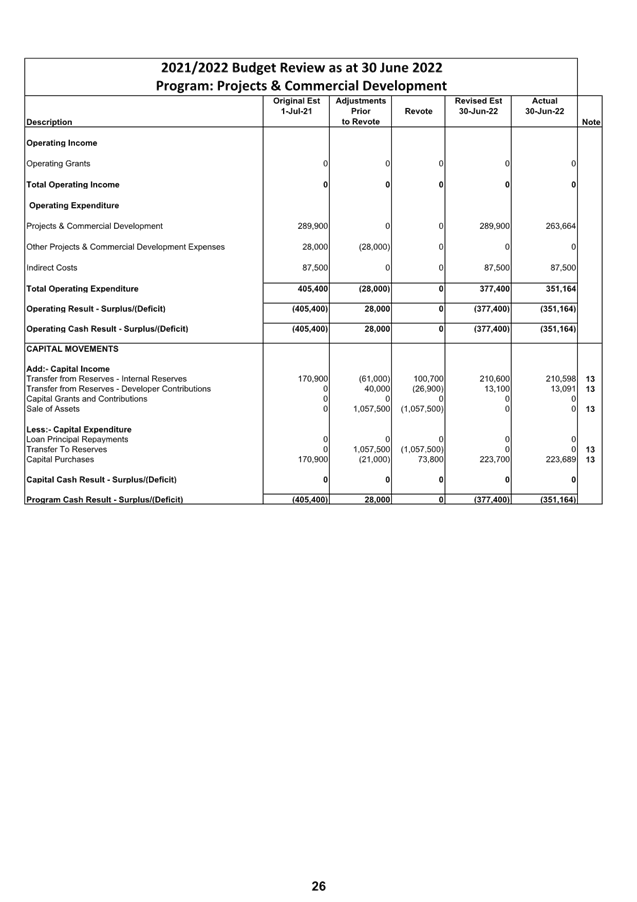

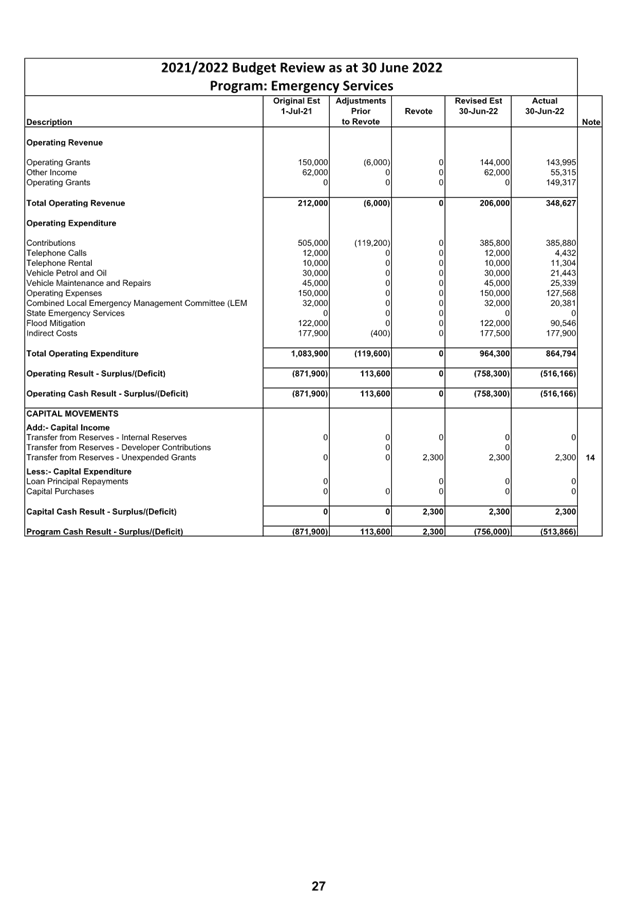

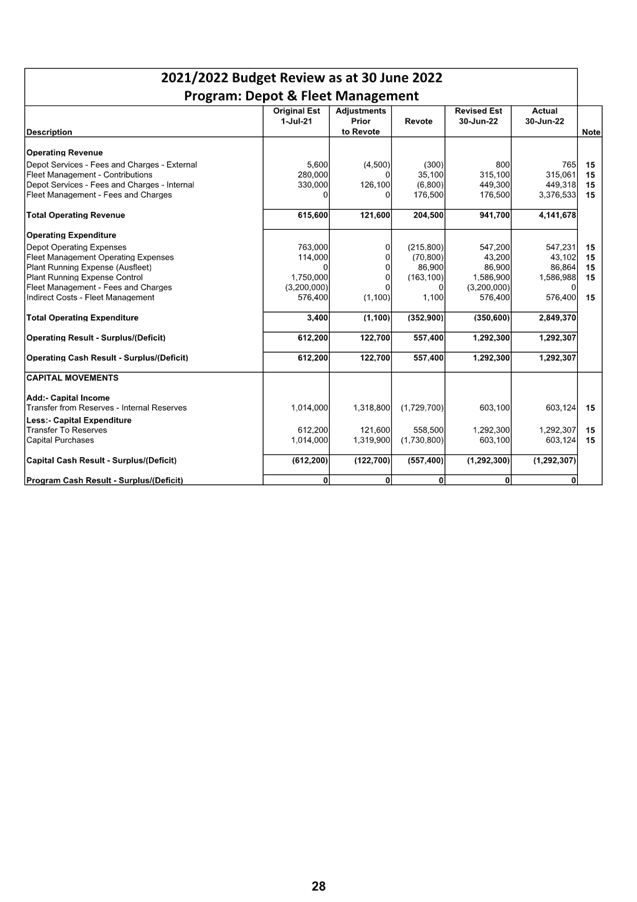

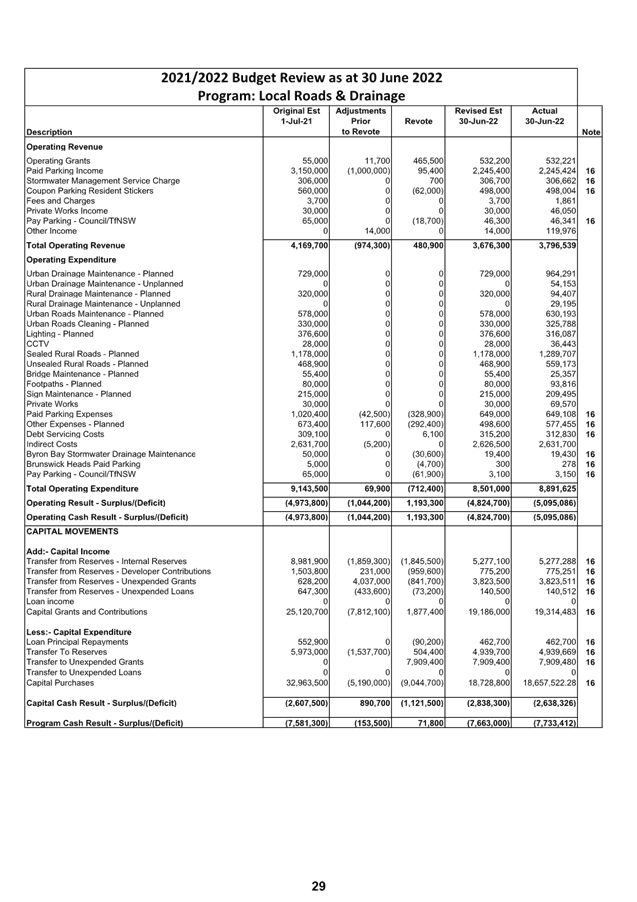

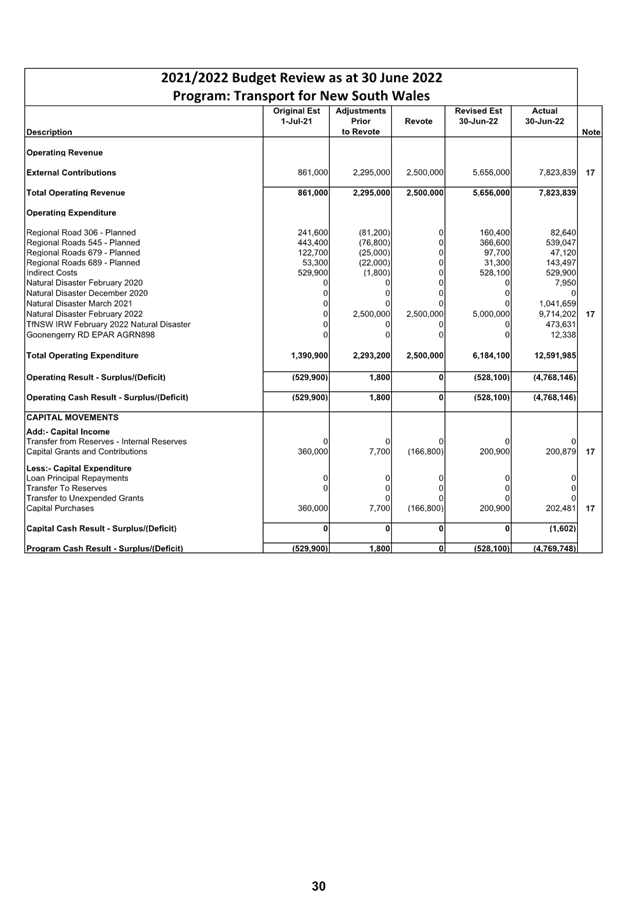

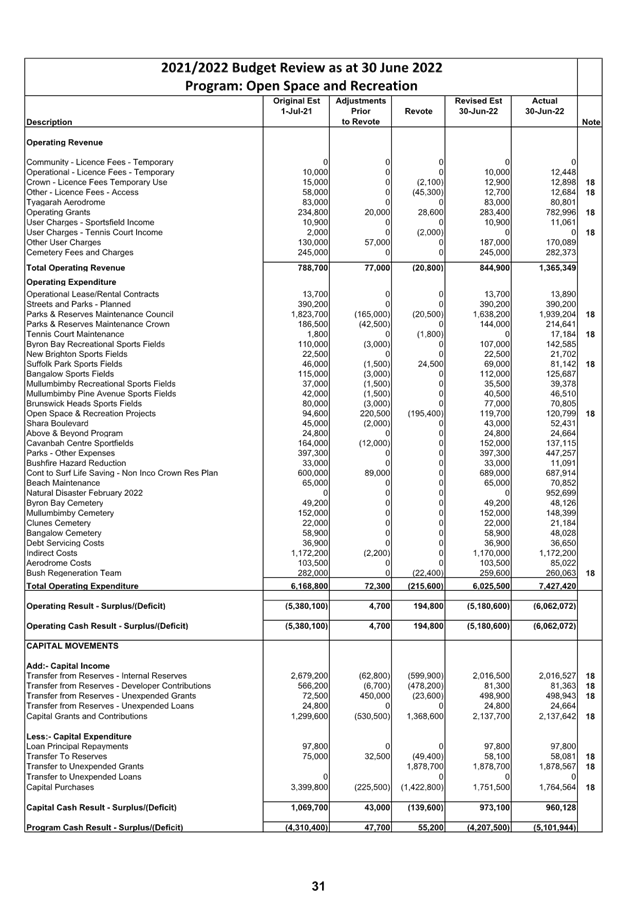

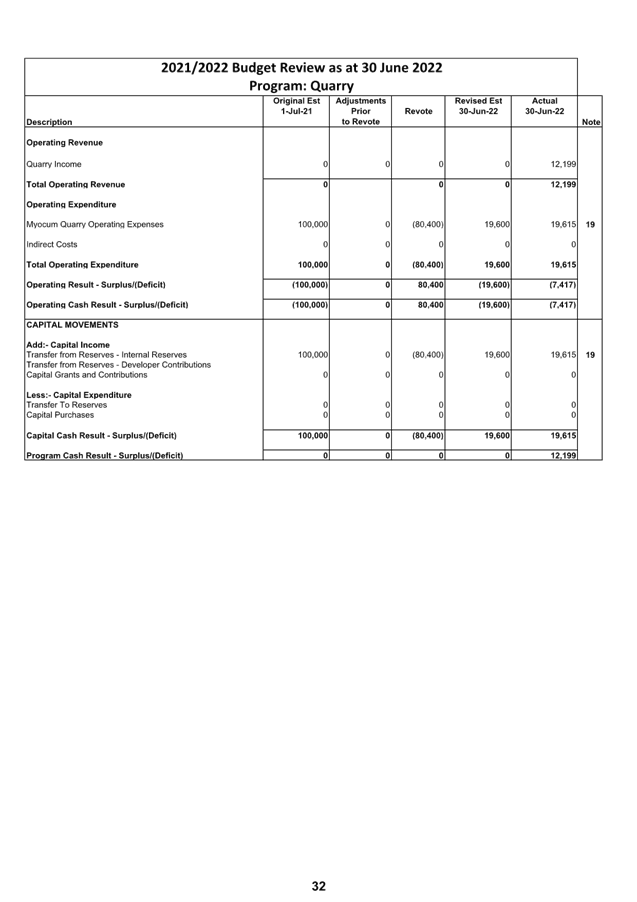

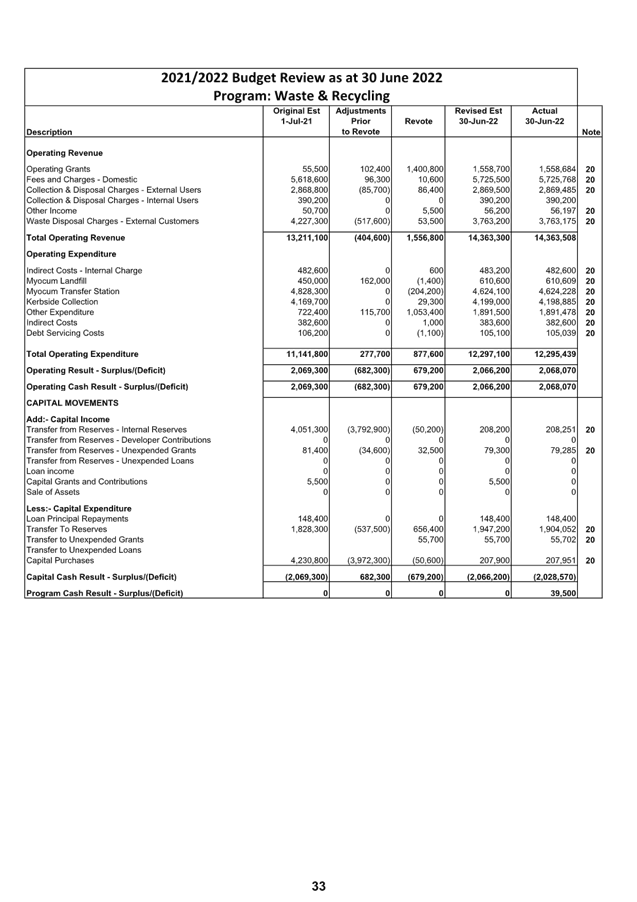

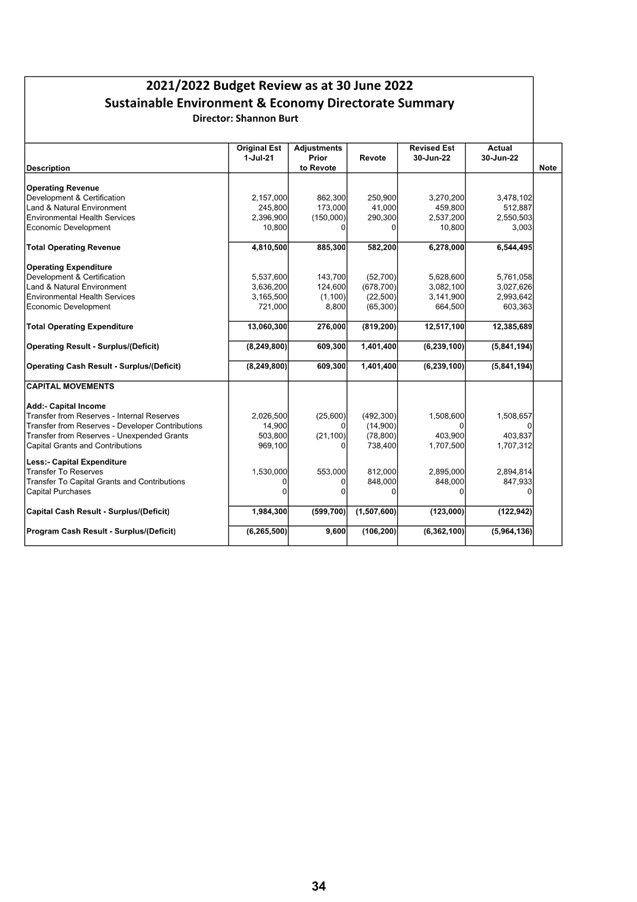

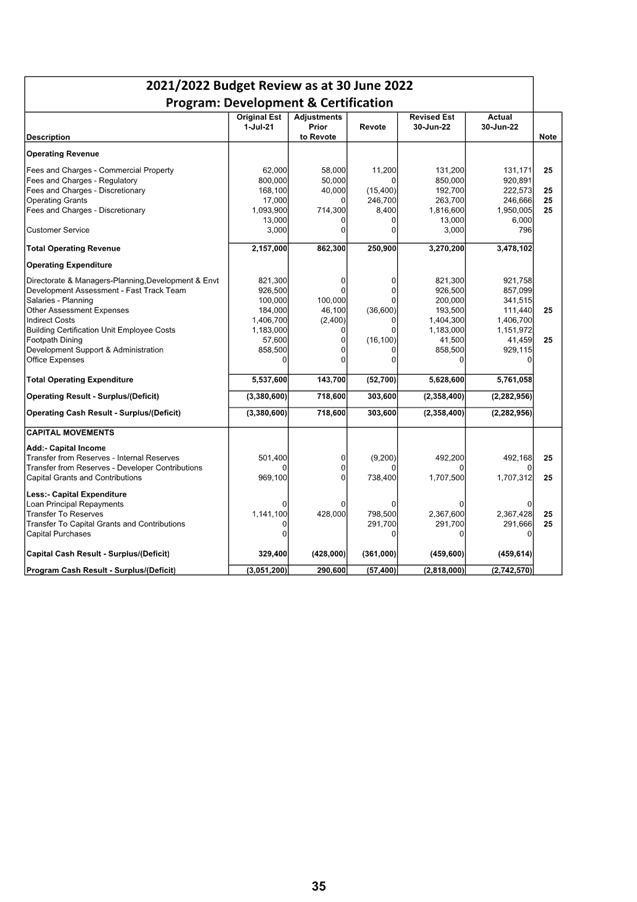

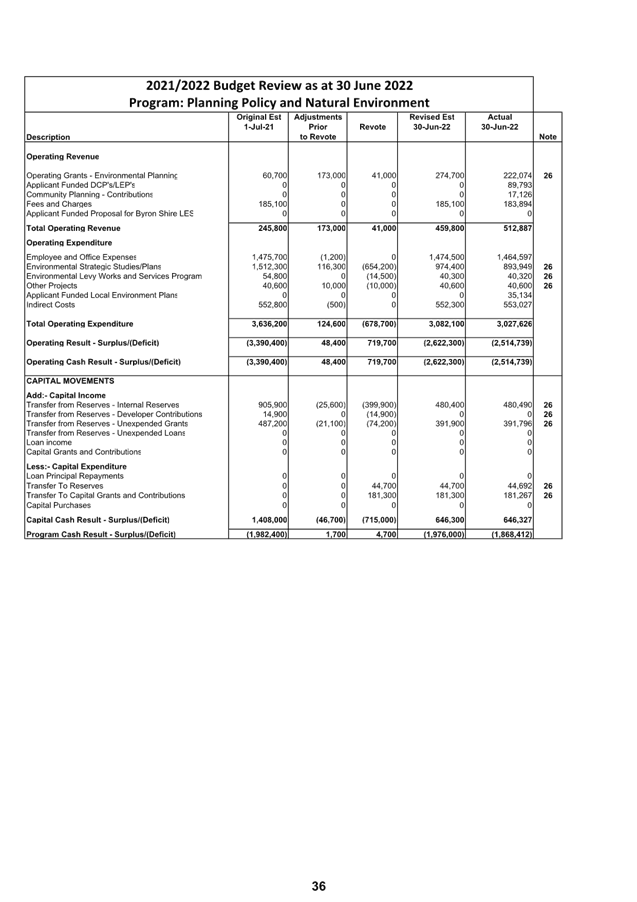

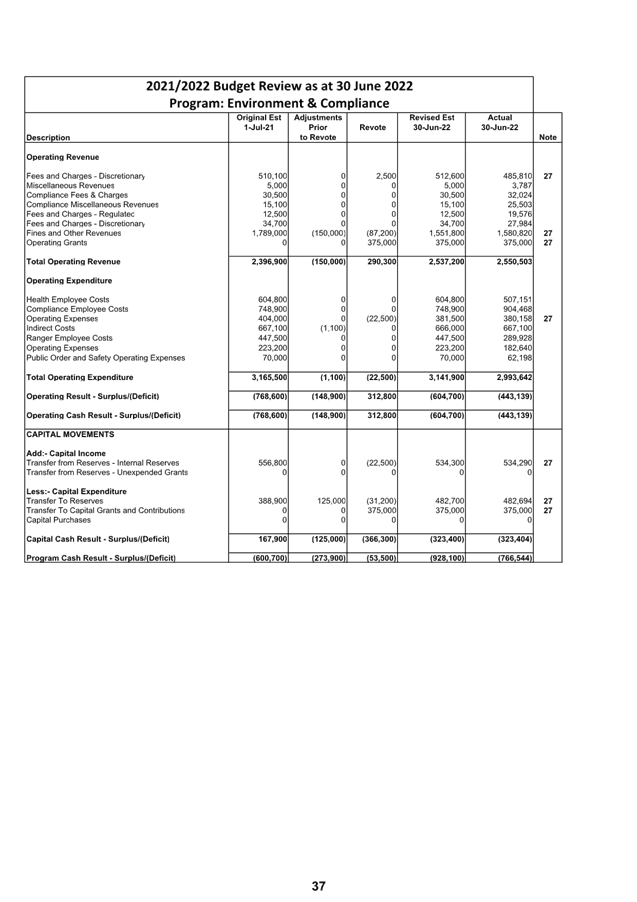

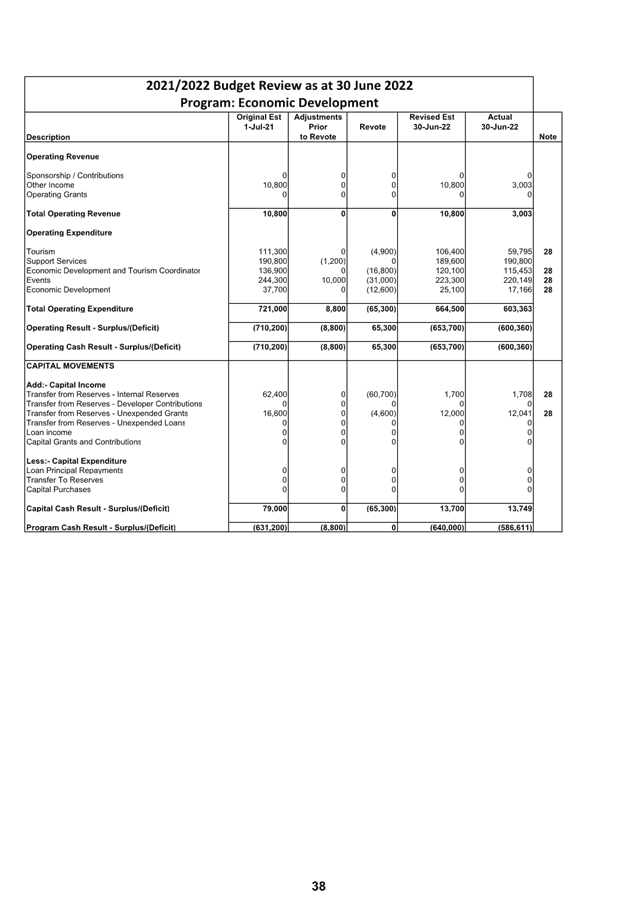

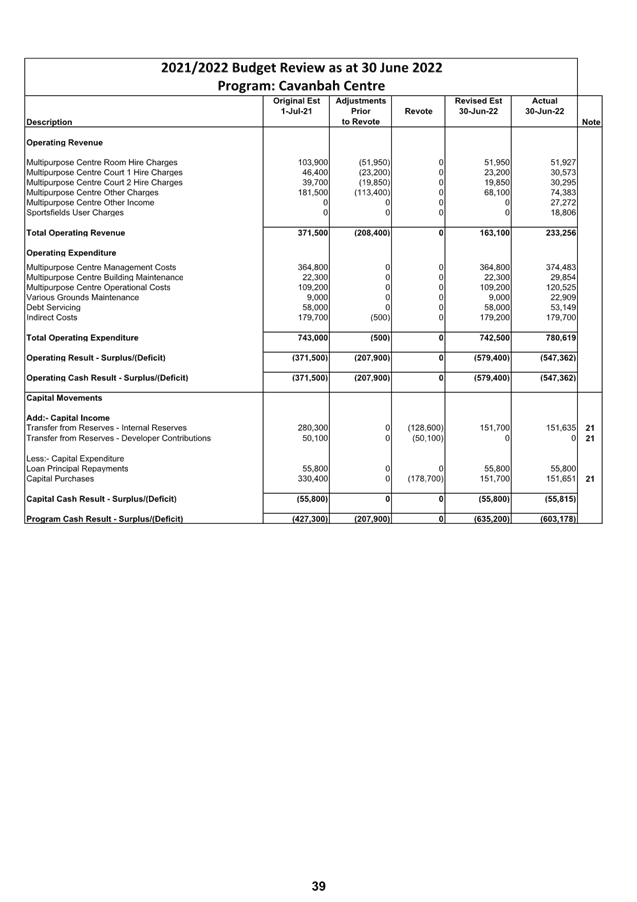

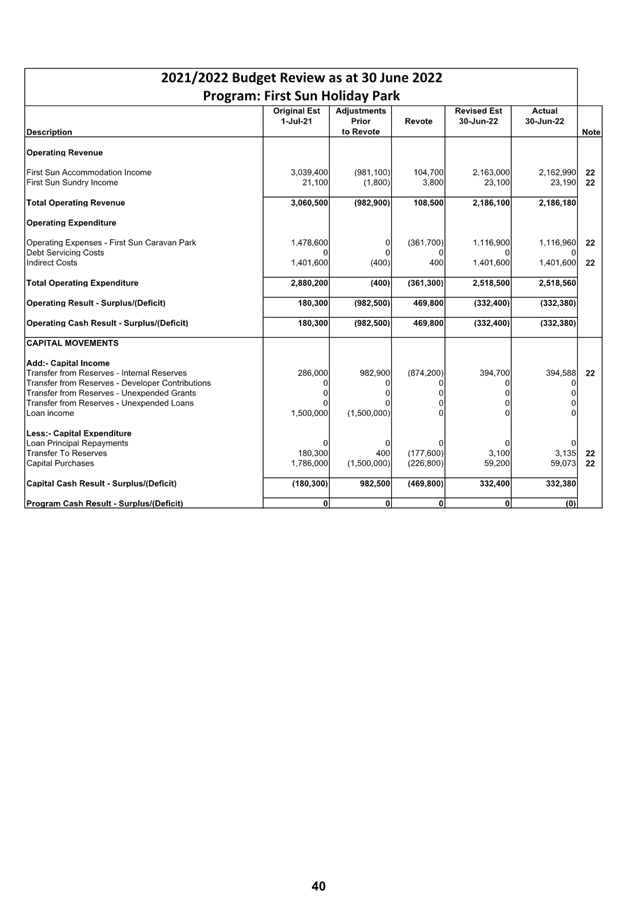

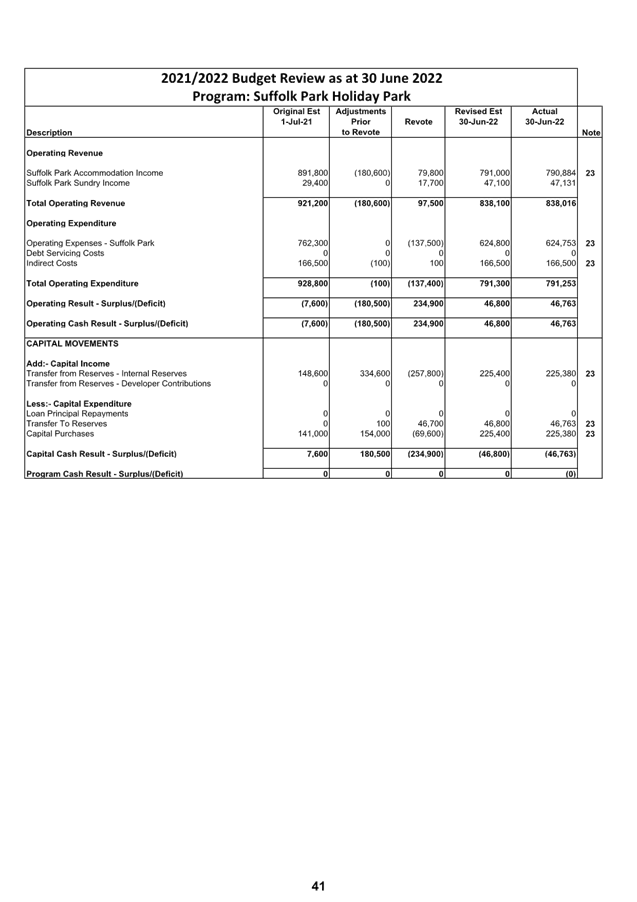

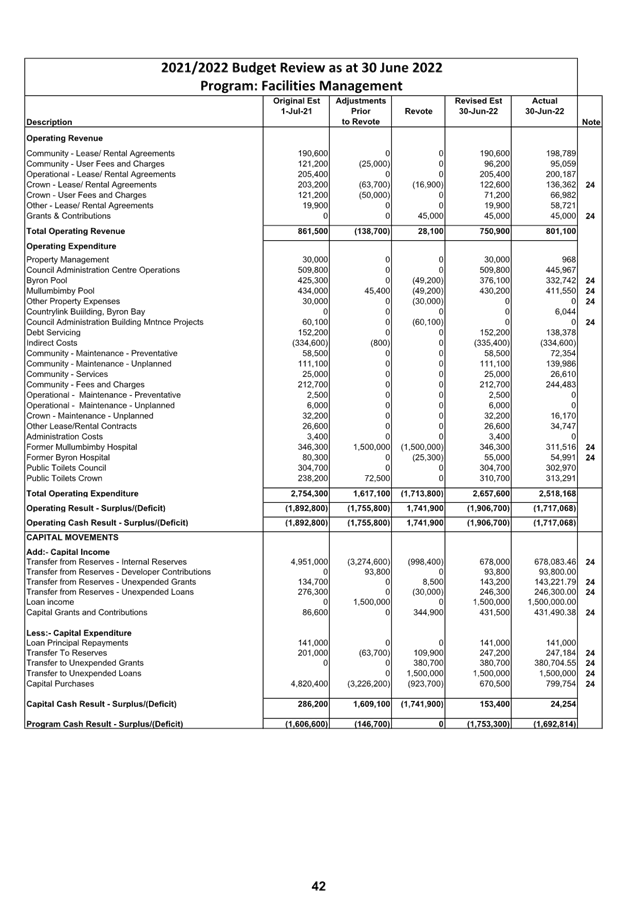

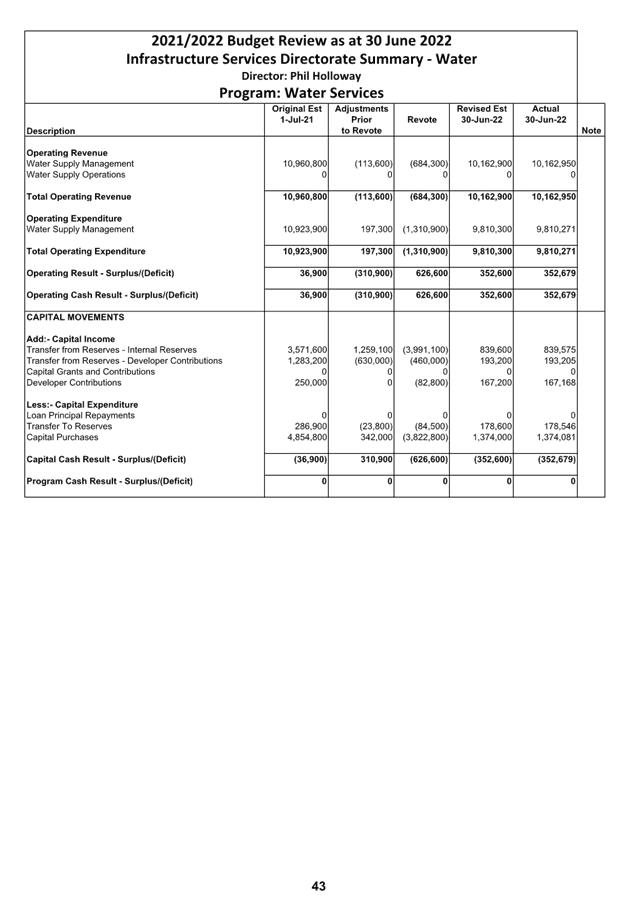

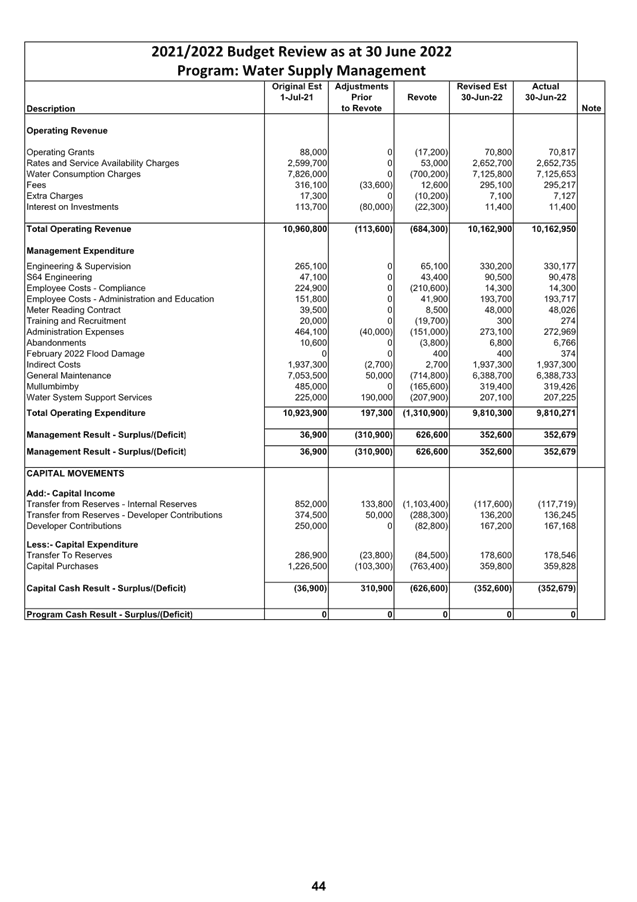

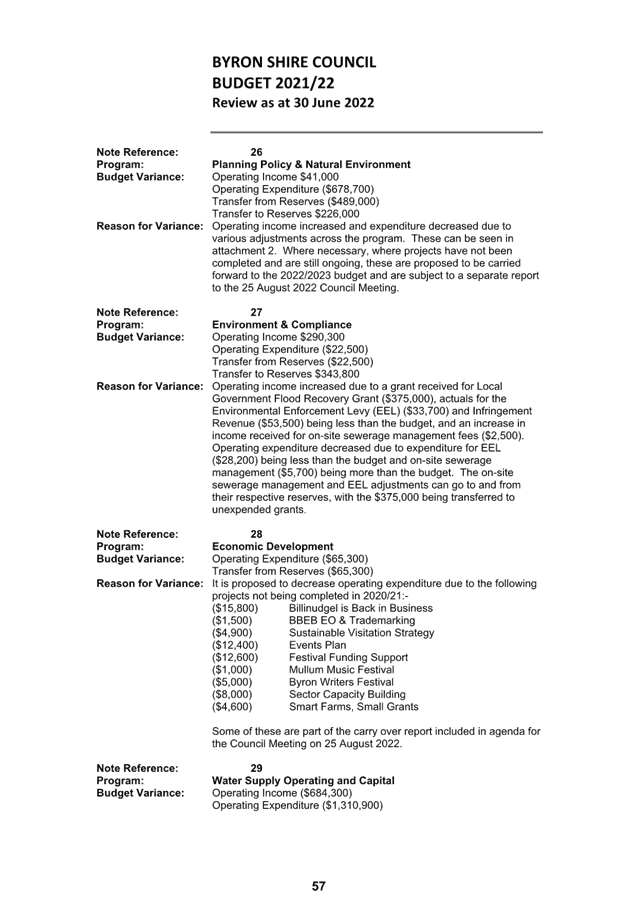

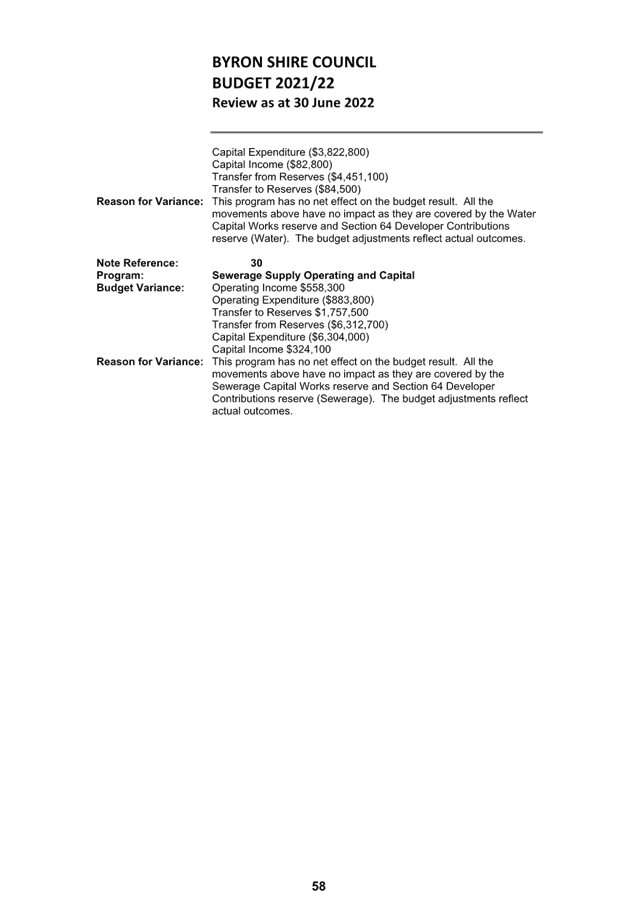

Report No. 4.1 Budget

Review - 1 April to 30 June 2022

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2022/990

Summary:

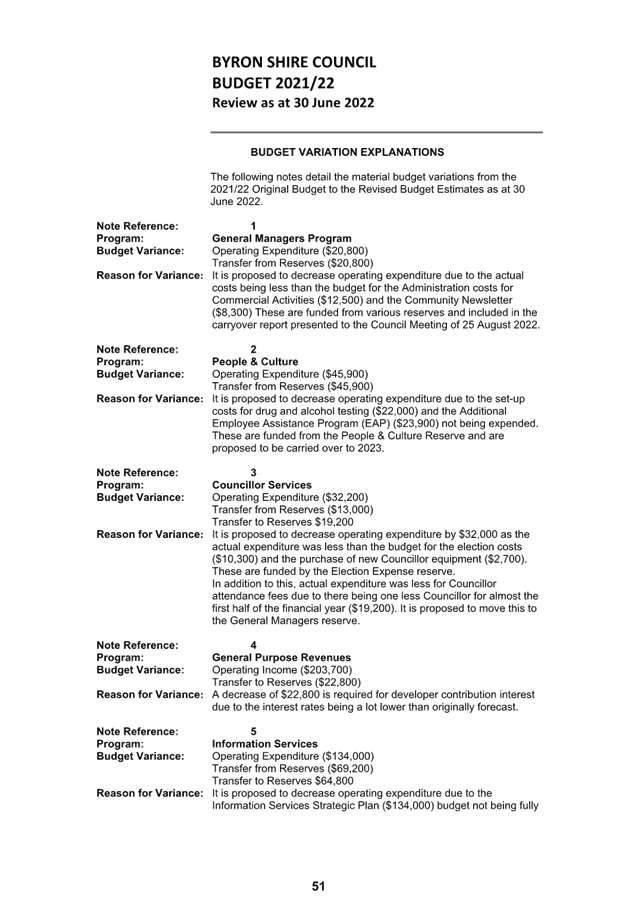

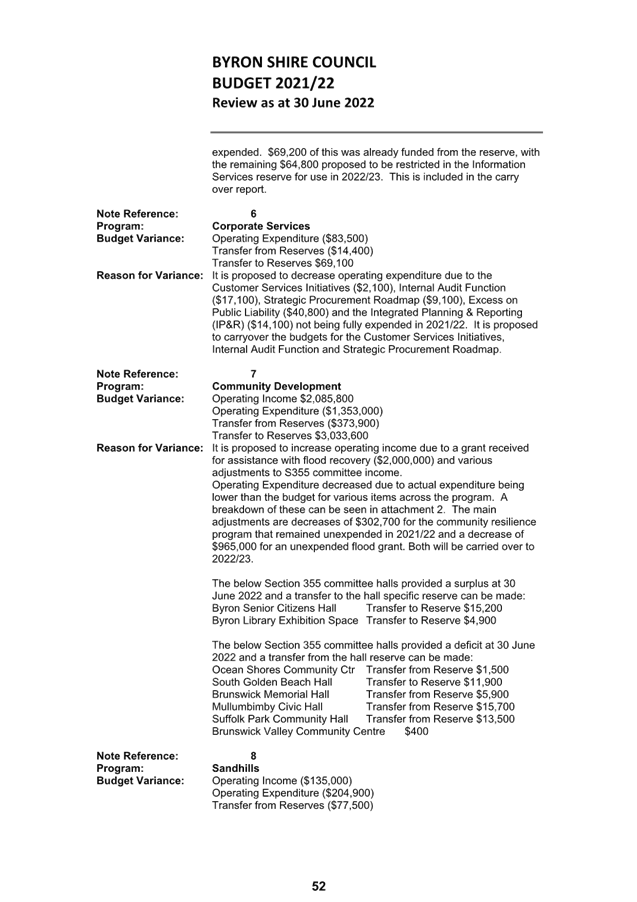

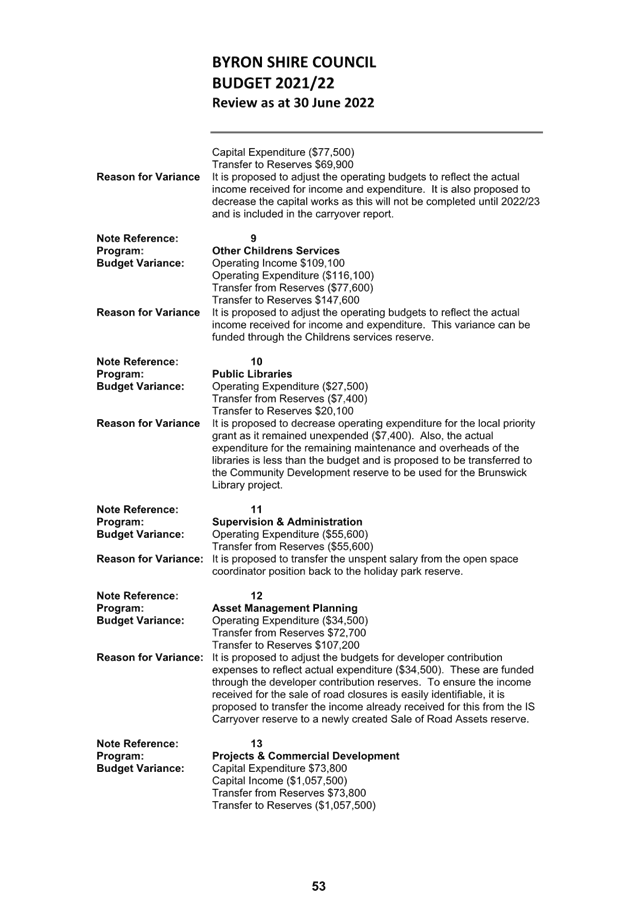

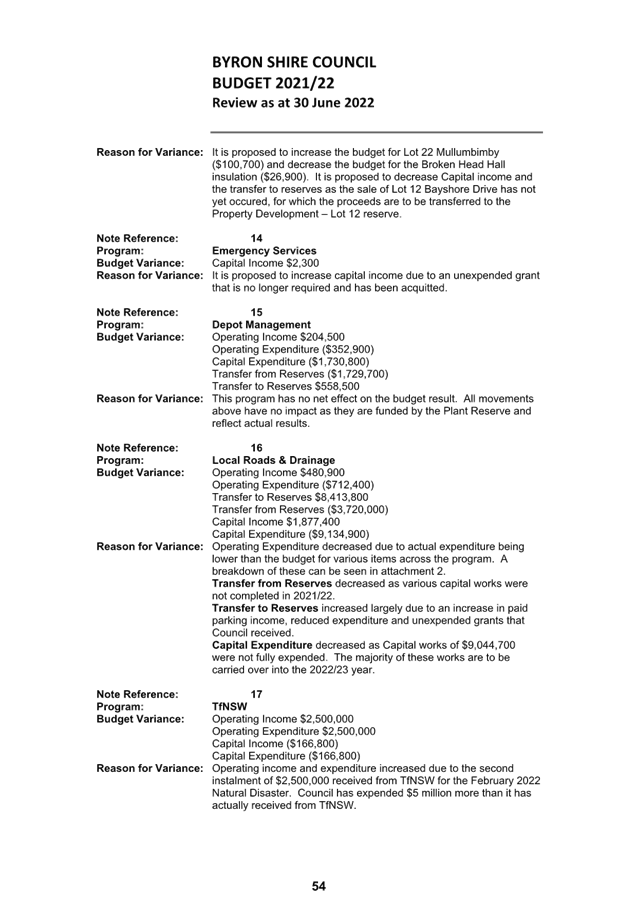

This report is prepared in accordance

with the format required by Regulation 203 of the Local Government (General)

Regulation 2021 to inform Council of the estimated financial position for

the 2021/2022 financial year, reviewed as at 30 June 2022. Whilst this

report has been prepared, it is not a statutory requirement to do so but

assists in the completion of the annual financial statements.

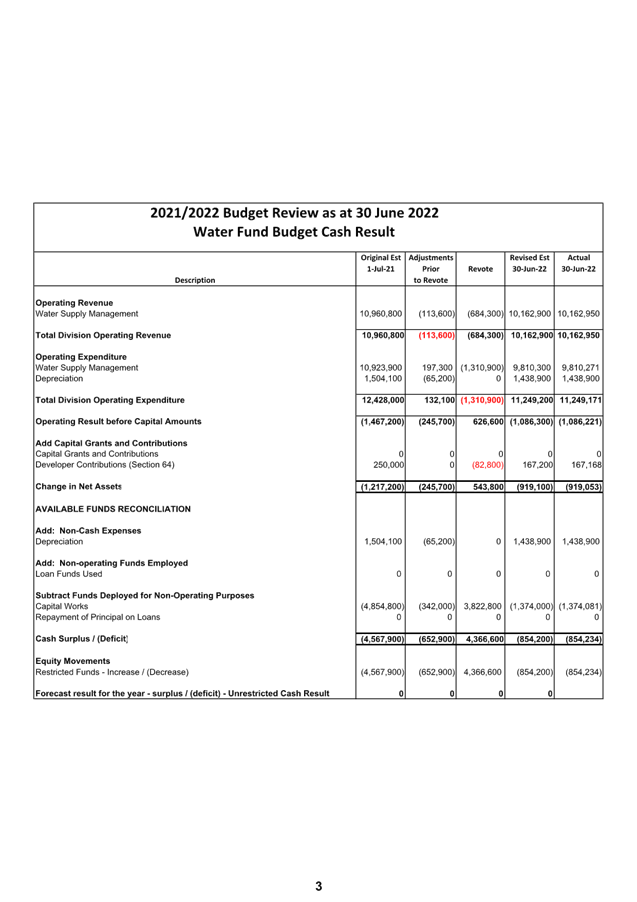

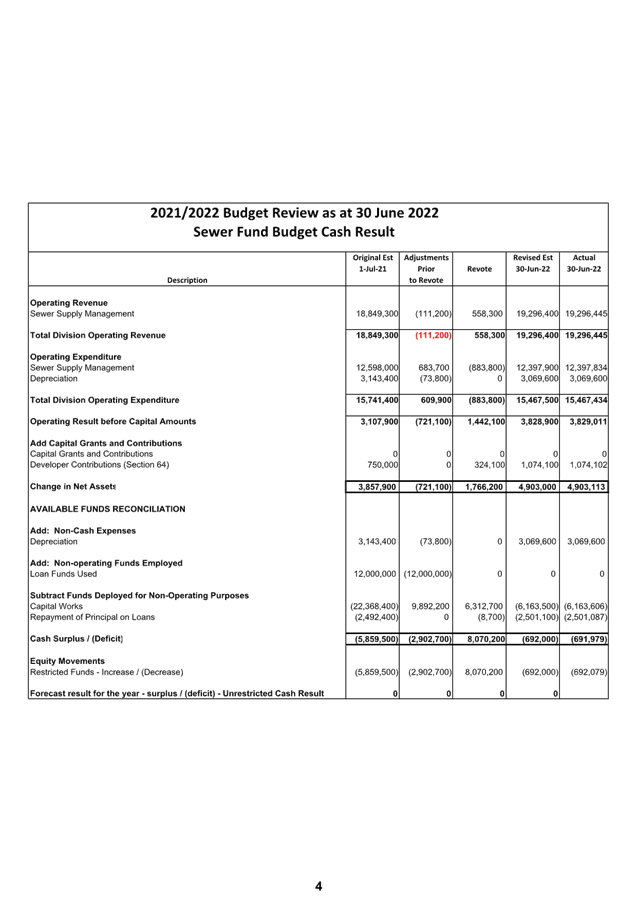

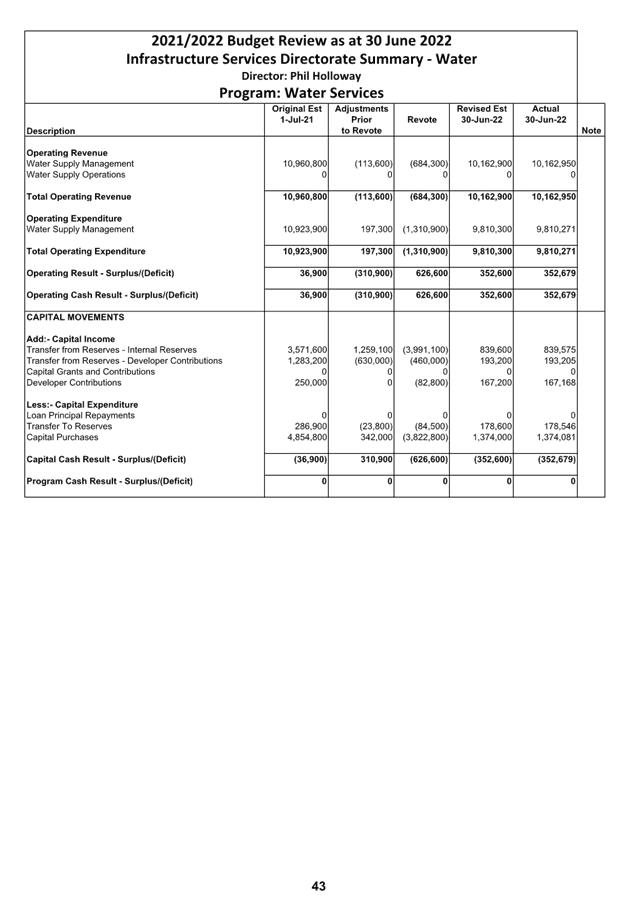

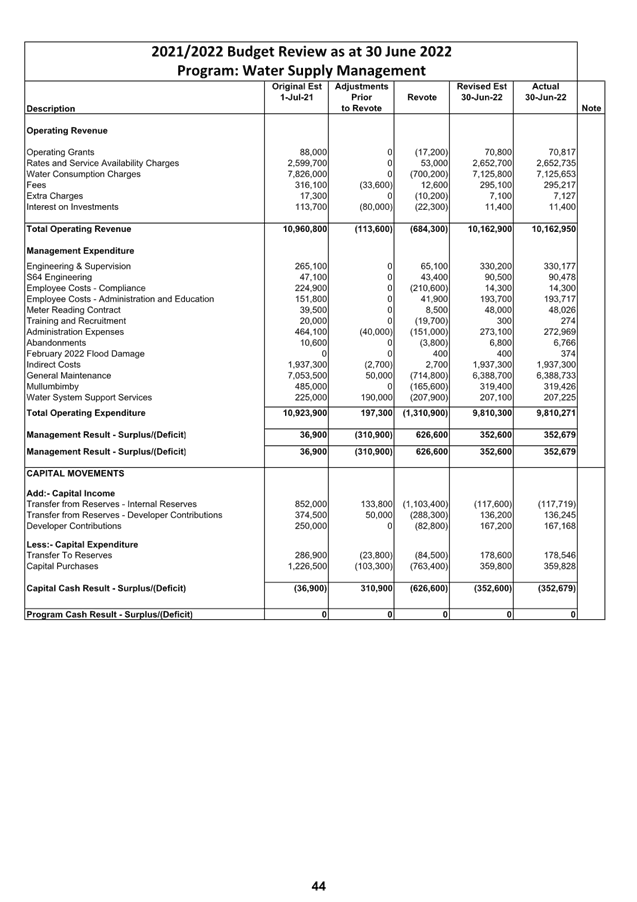

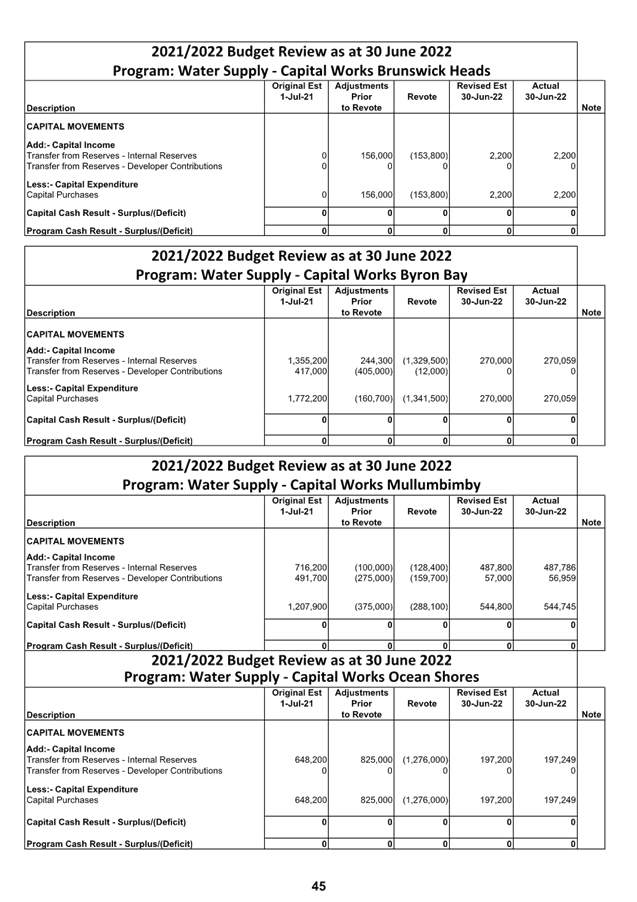

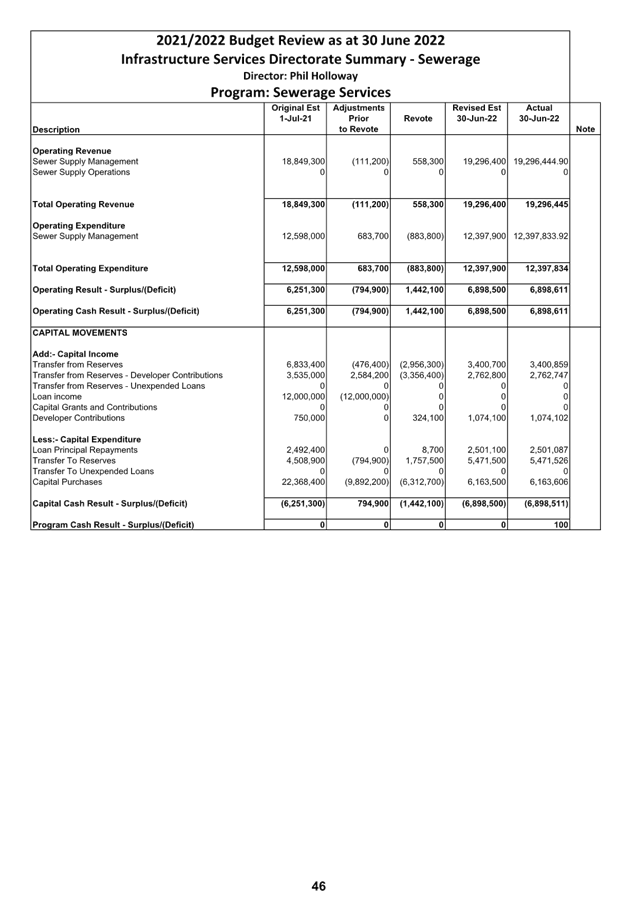

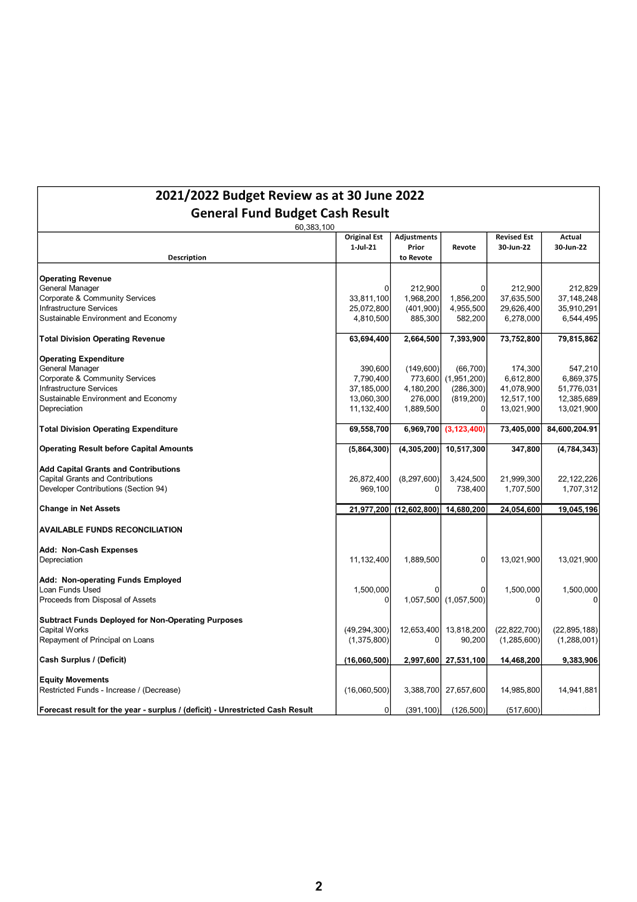

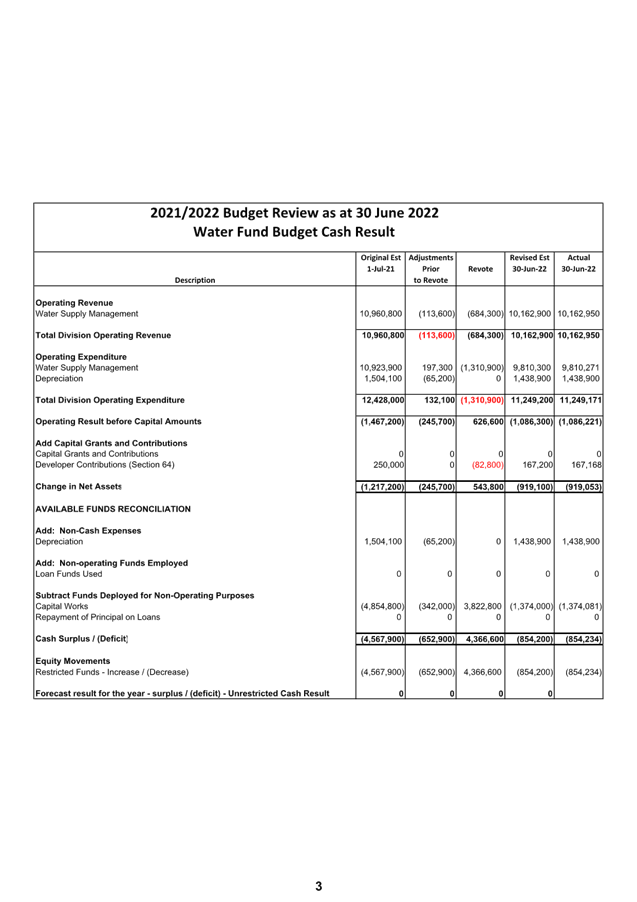

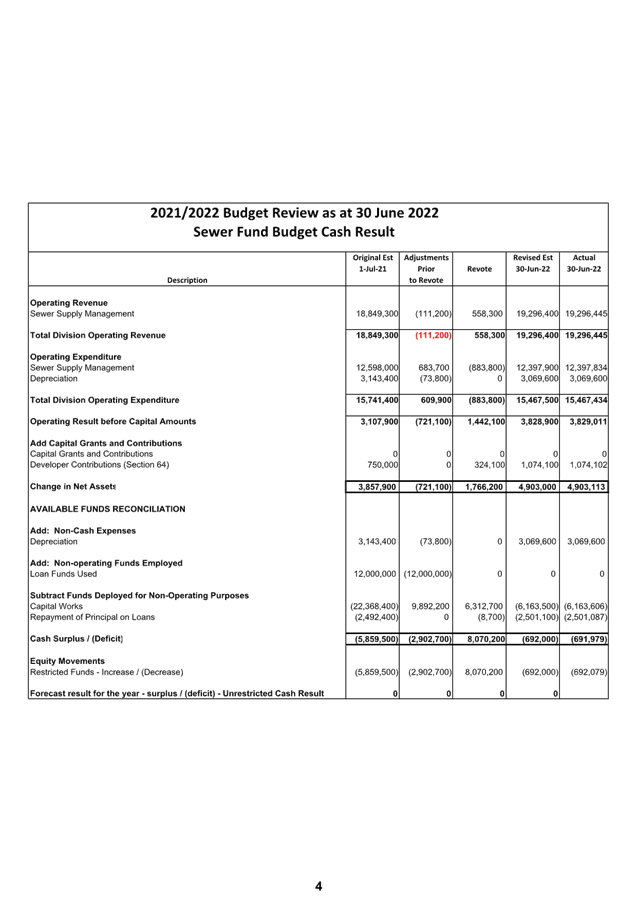

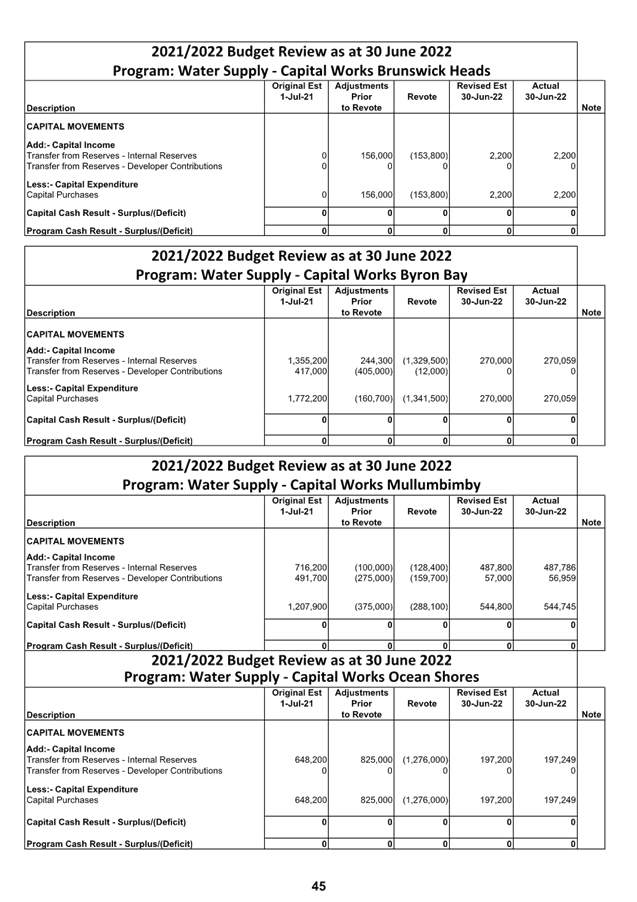

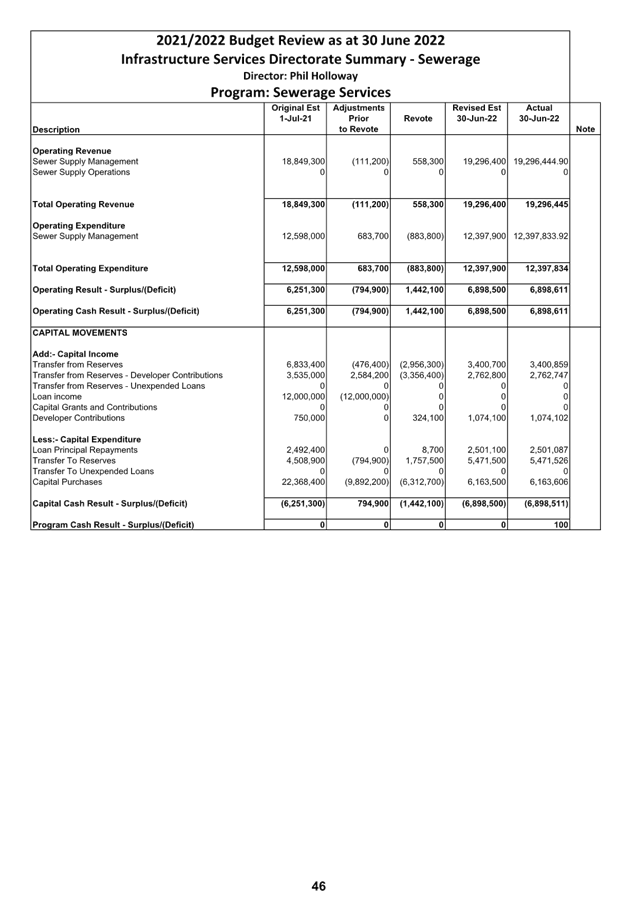

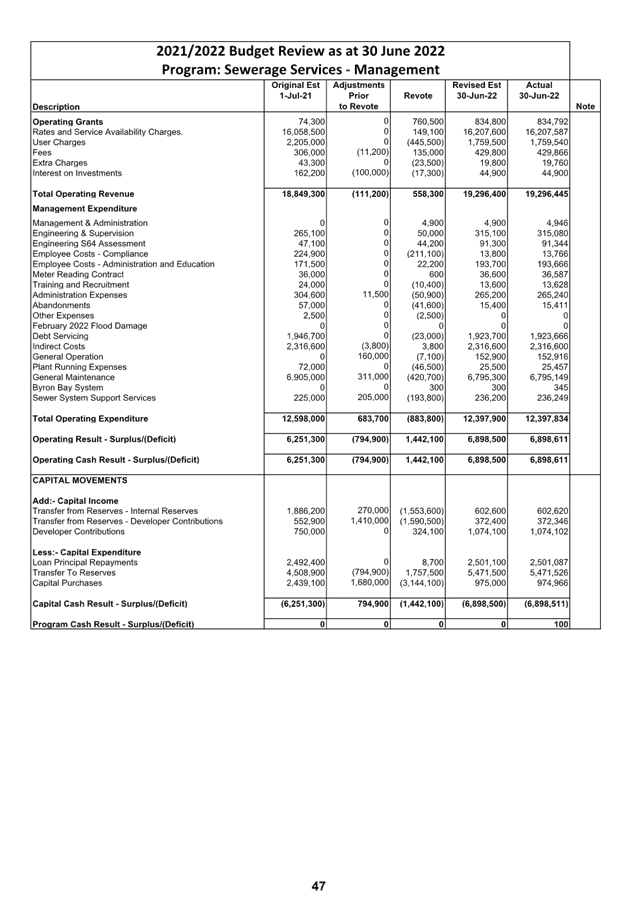

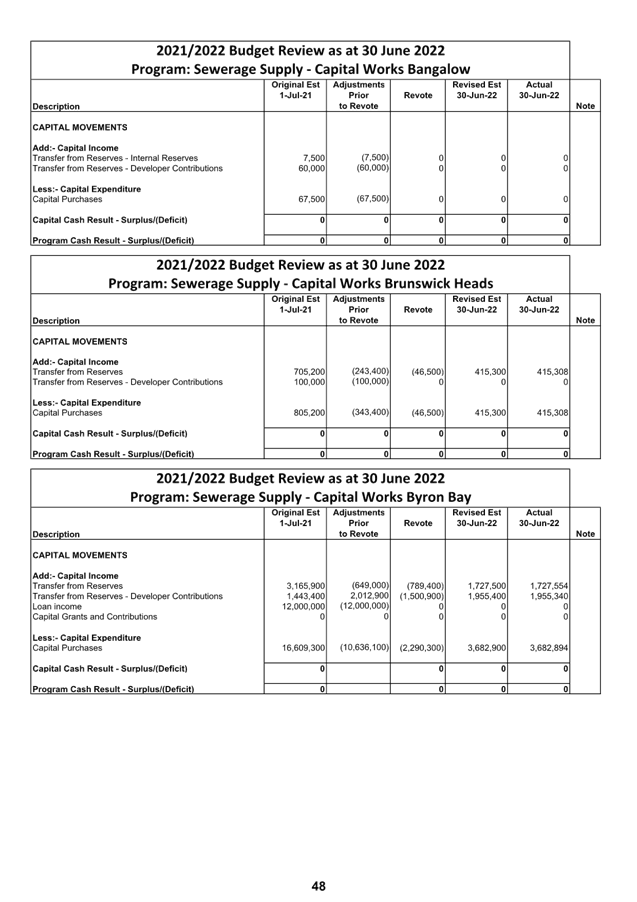

This report contains an overview of the

proposed budget variations for the General Fund, Water Fund and Sewerage Fund.

The specific details of these proposed variations are included in Attachments 1

and 2 for Council’s consideration and authorisation.

The report also provides an indication of

the financial position of Council at 30 June 2022. It should be noted that

the figures provided are subject to completion and audit of the Council’s

Financial Statements for 2021/2022. Any major variances will be included as

part of the report adopting the financial statements in November 2022.

RECOMMENDATION:

1. That

Council authorises the itemised budget variations as shown in Attachment 2

(#E2022/77197) which includes the following results in the 30 June 2022

Quarterly Review of the 2021/2022 Budget:

a) General

Fund - $126,500 decrease in Unrestricted Cash Result

b) General

Fund - $27,657,600 increase in reserves

c) Water

Fund - $4,366,600 increase in reserves

d) Sewerage

Fund - $8,070,200 increase in reserves.

2. That

Council adopts the revised General Fund Estimated Unrestricted Cash Result of

$0 for the 2021/2022 financial year.

Attachments:

1 Budget

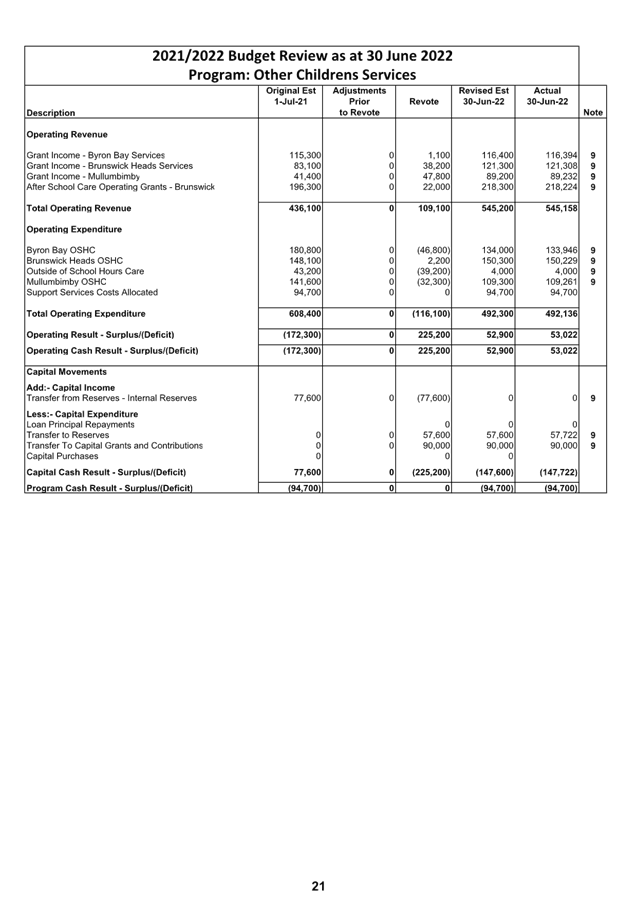

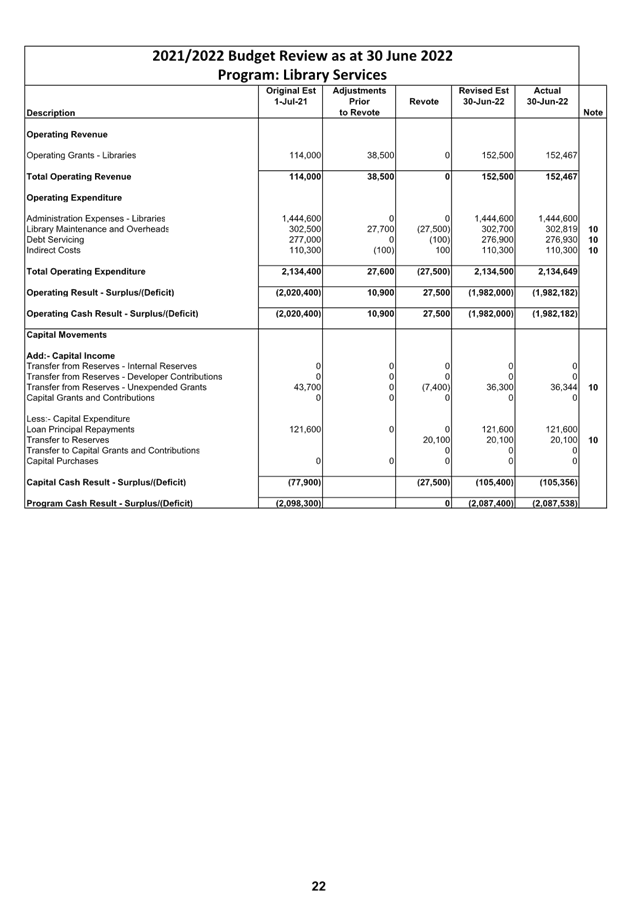

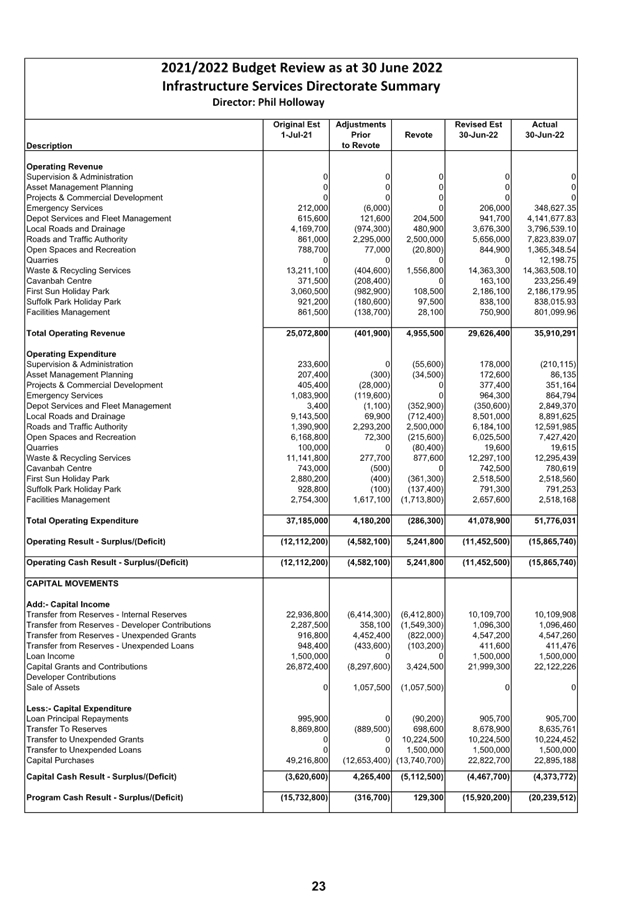

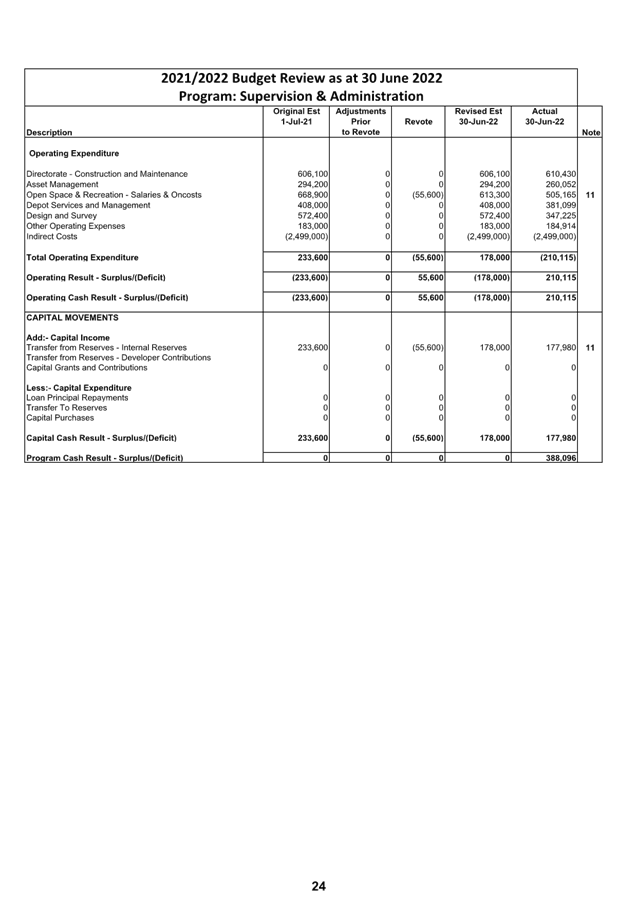

Variations for General, Water and Sewerage Funds, E2022/77196 , page 19⇩

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2022/77197 ,

page 79⇩

Report

Council adopted the 2021/2022 budget on 24 June 2021 via

Resolution 21-243. Council also considered and adopted the budget

carryovers from the 2020/2021 financial year, to be incorporated into the

2021/2022 budget at its Ordinary Meeting held on 26 August 2021 via Resolution 21-315.

Since that date, Council has reviewed the budget taking into consideration the

2020/2021 Financial Statement results and progress through all quarters of the

2021/2022 financial year. This report considers the June 2022 Quarter

Budget Review.

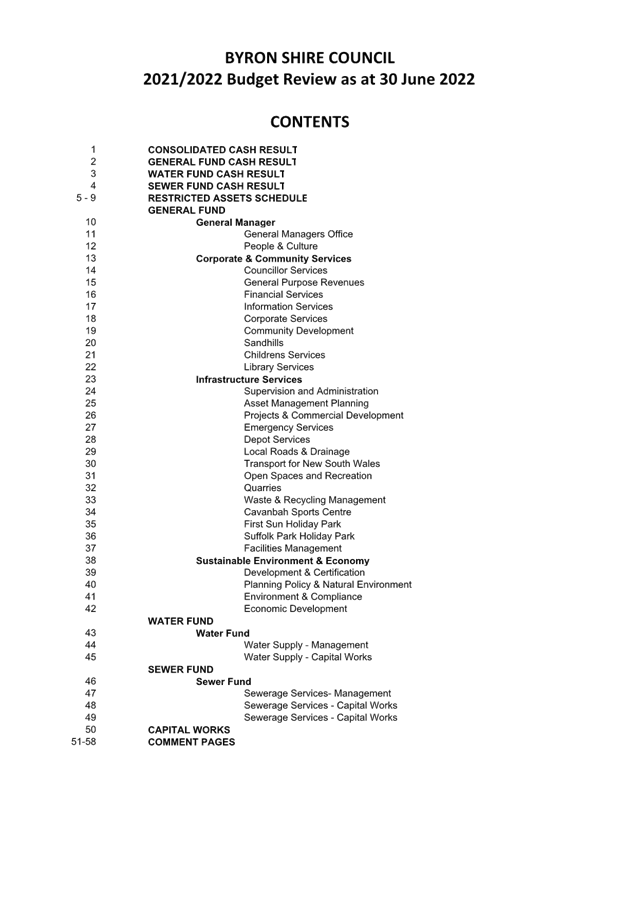

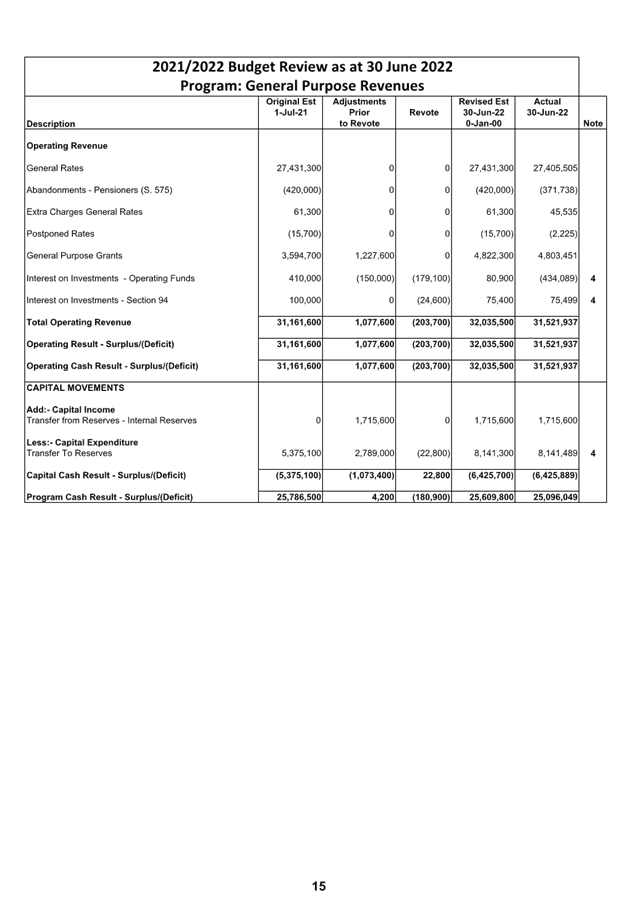

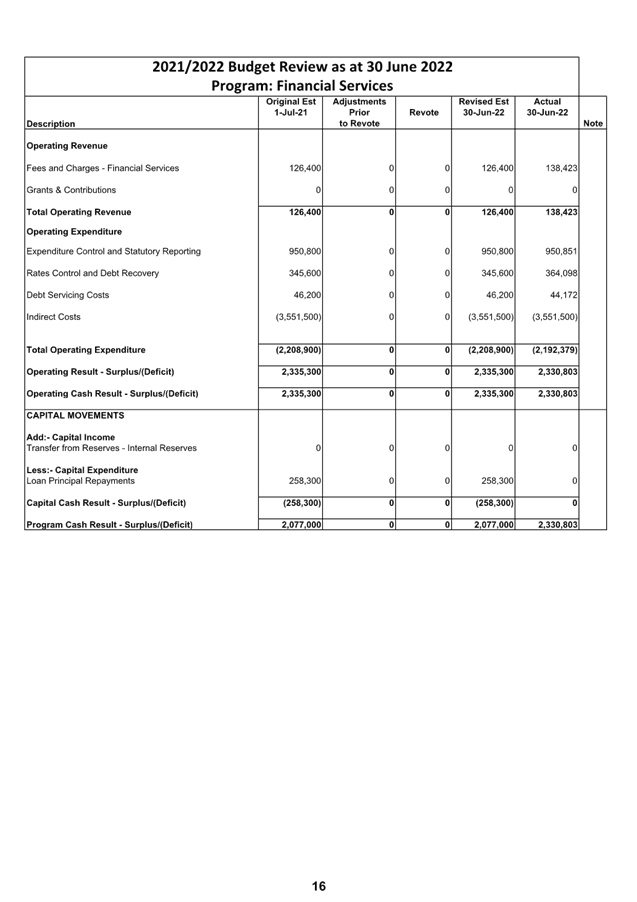

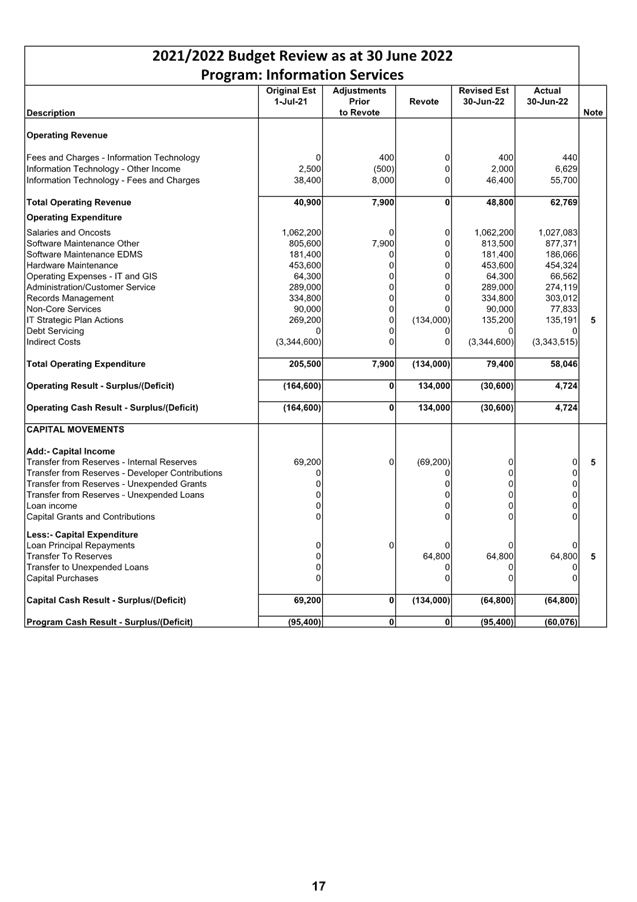

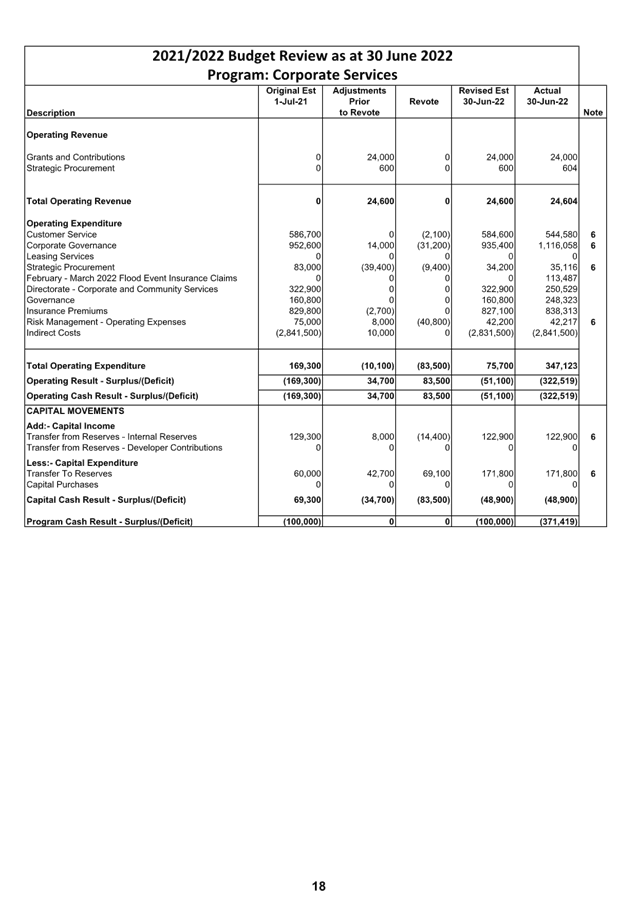

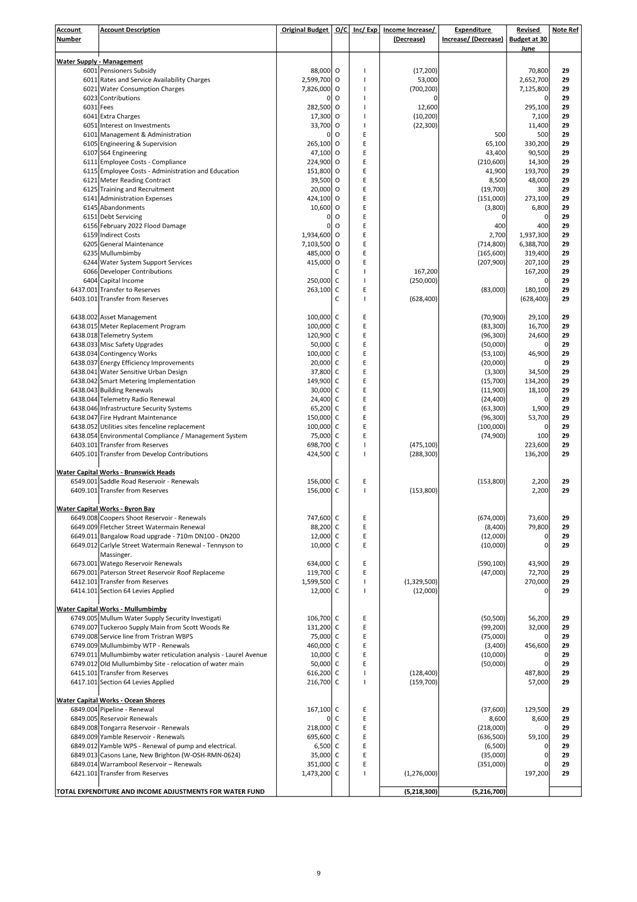

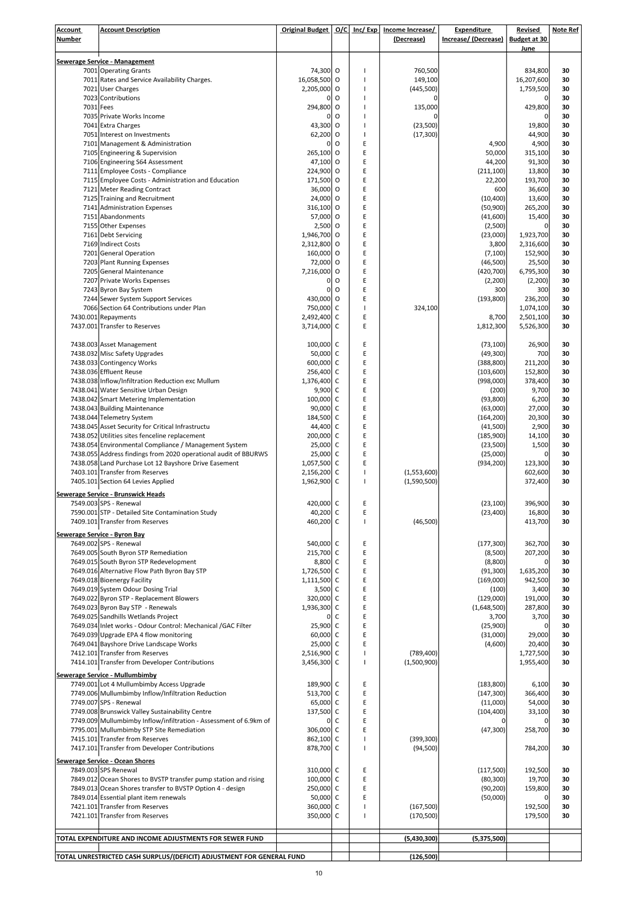

The details of the budget review for the Consolidated,

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget

position of Council, as well as a breakdown by Fund and Principal Activity. The

document in Attachment 1 is also effectively a publication outlining a review

of the budget and is intended to provide Councillors with more detailed

information to assist with decision making regarding Council’s finances.

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

The pages within Attachment 1 are presented (from left to

right) by showing the original budget as adopted by Council on 24 June 2021

plus the adopted carryover budgets from 2020/2021 followed by any budget

adjustments prior to this report and the revote (or adjustment for this review)

and then the revised position projected for 30 June 2022 as at 30 June 2022.

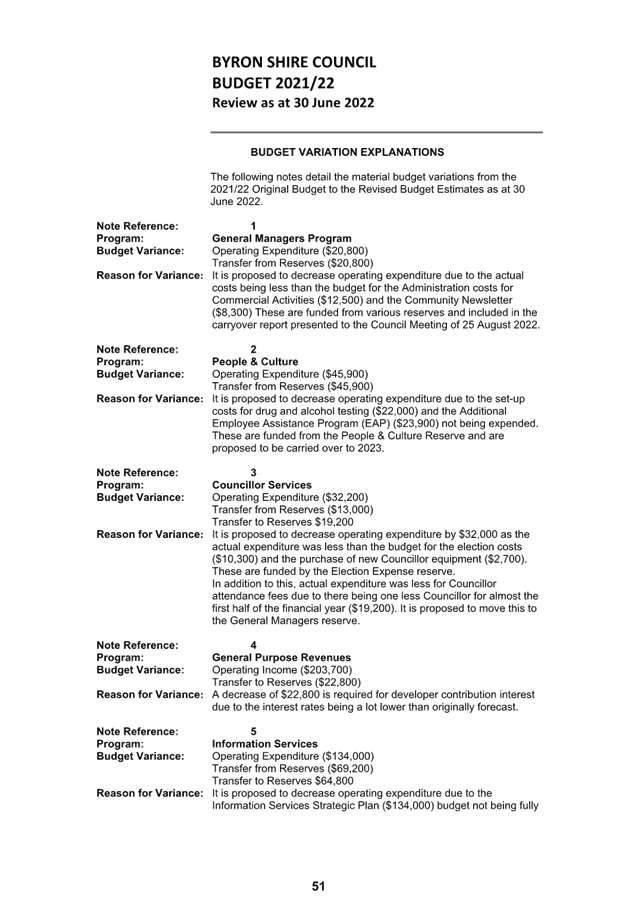

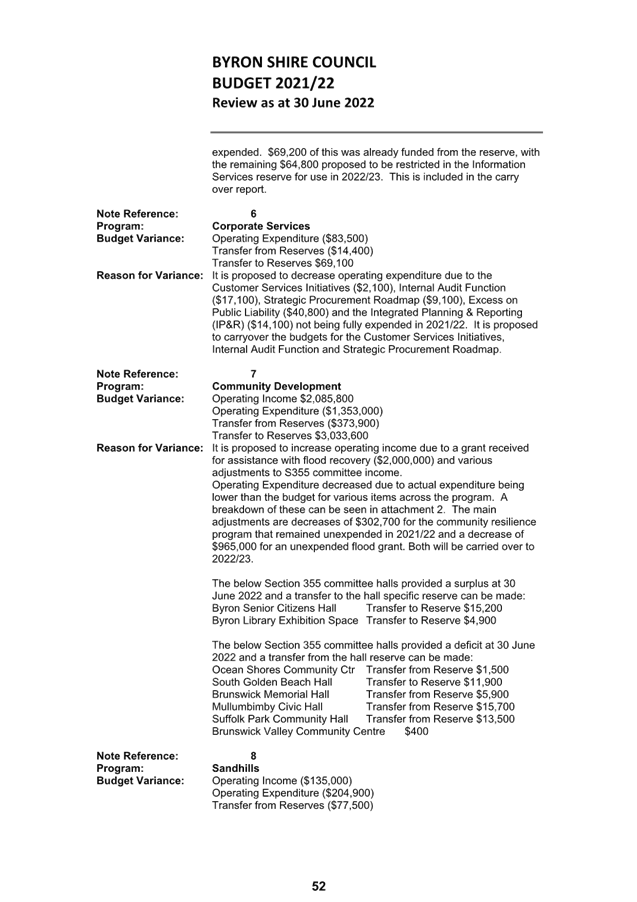

On the far right of the Principal Activity, there is a

column titled “Note”. If this is populated by a number, it

means that there has been an adjustment in the quarterly review. This

number then corresponds to the notes at the end of the Attachment 1 which provides

an explanation of the variation.

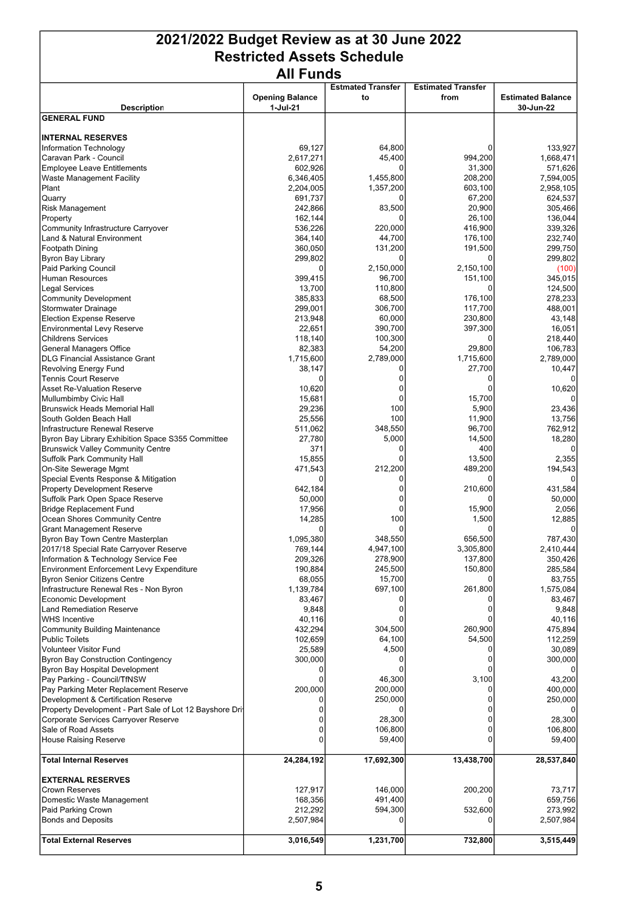

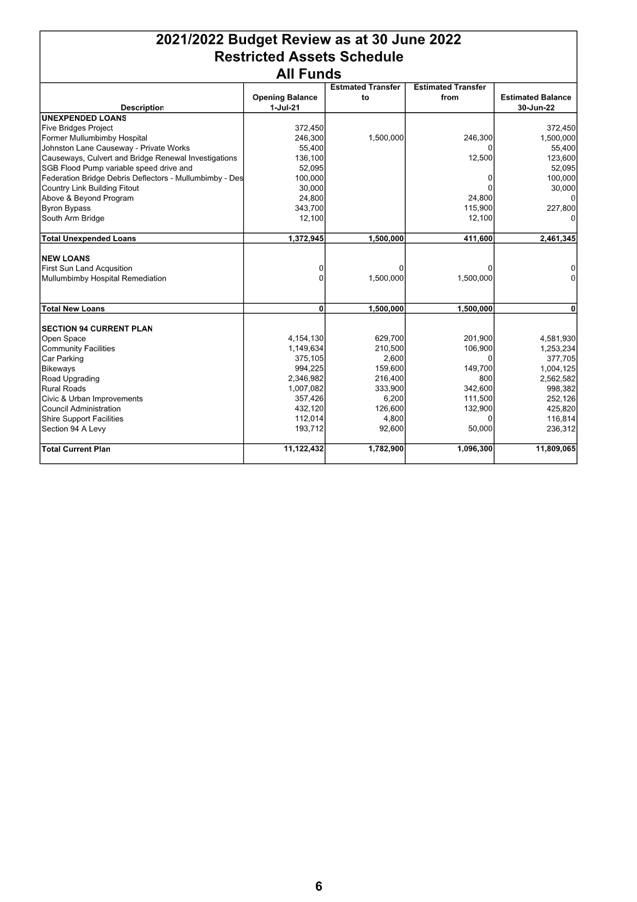

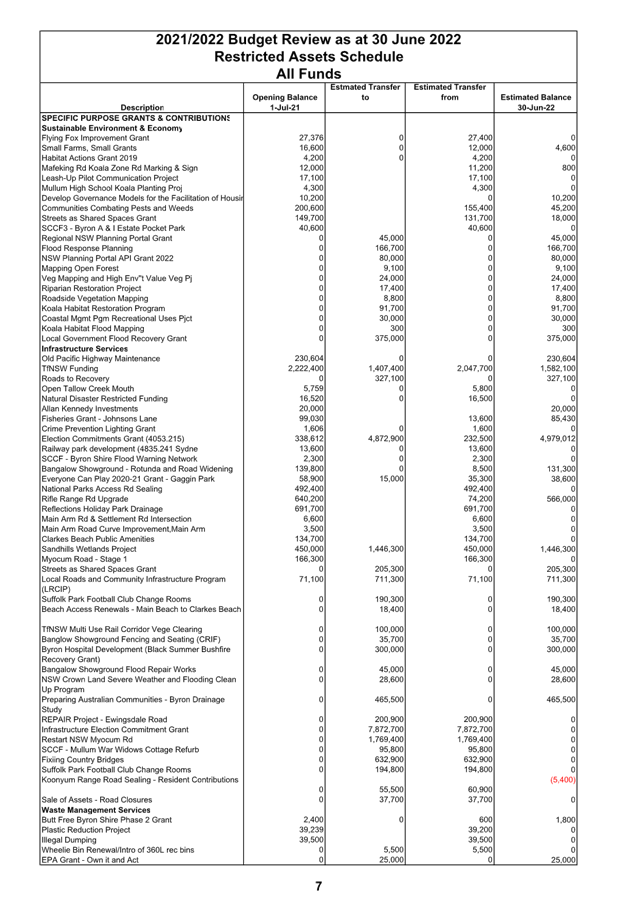

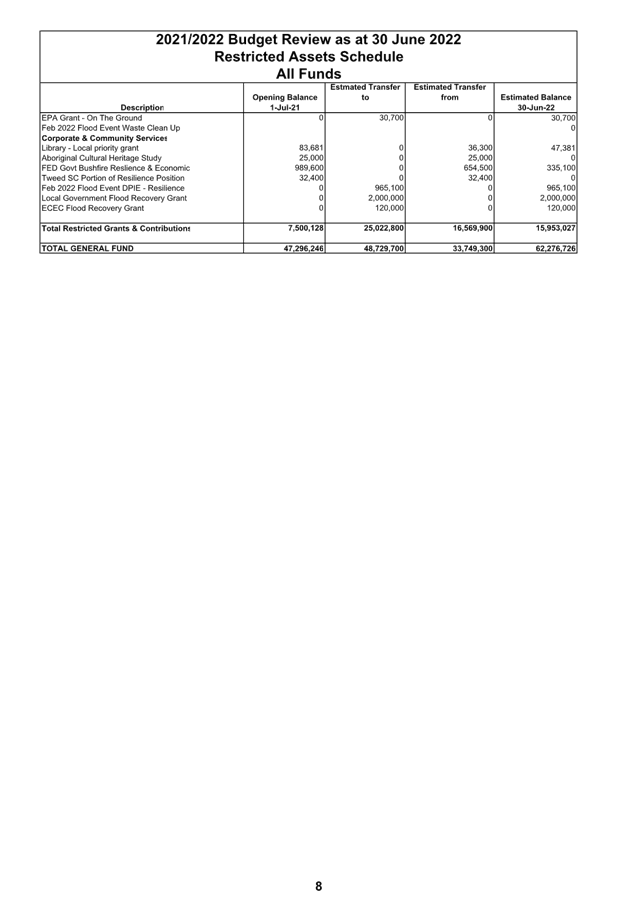

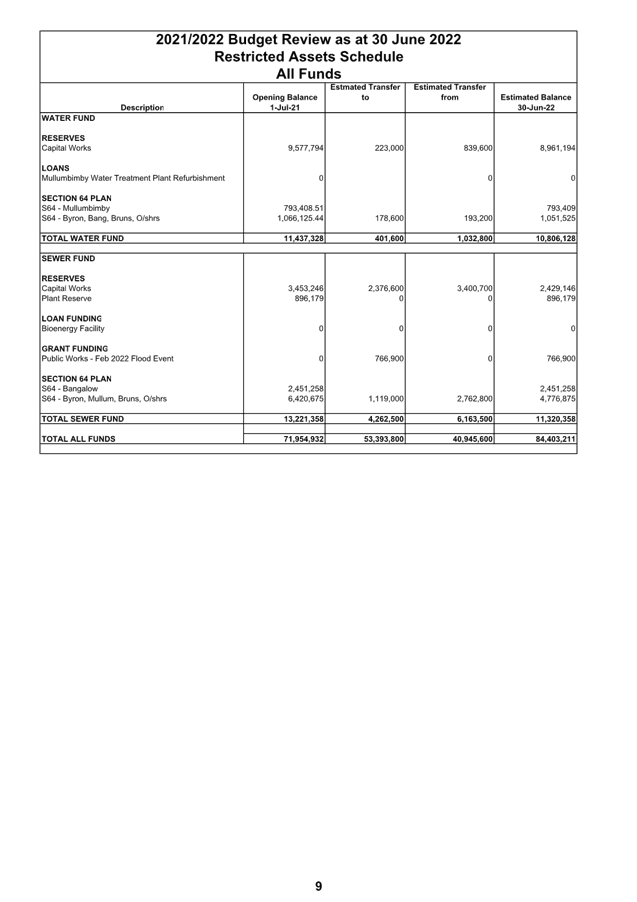

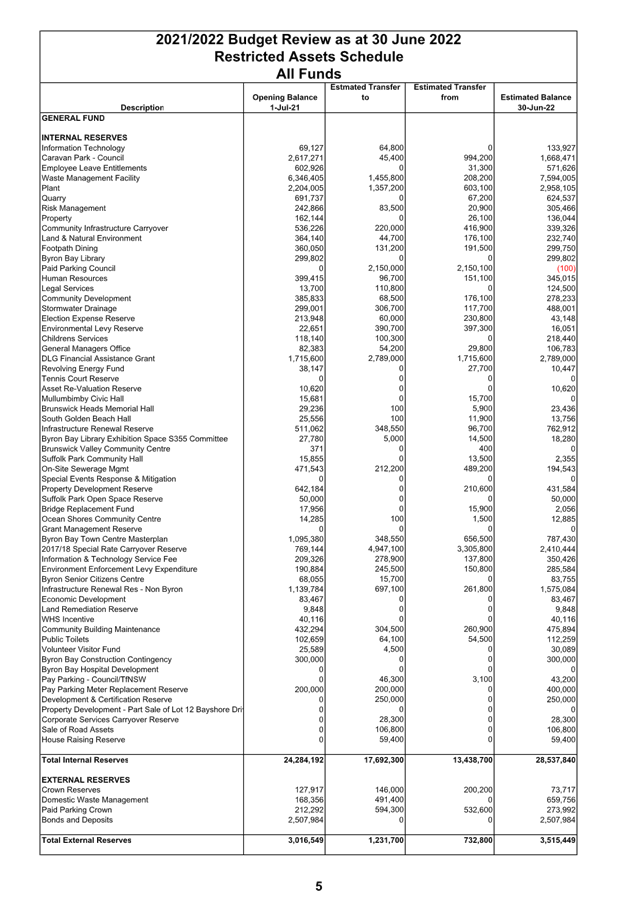

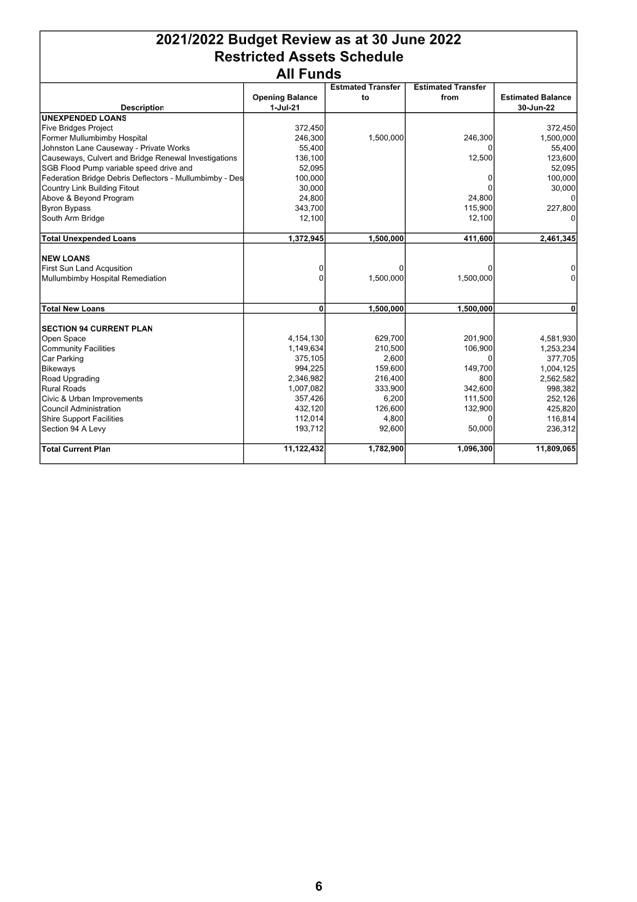

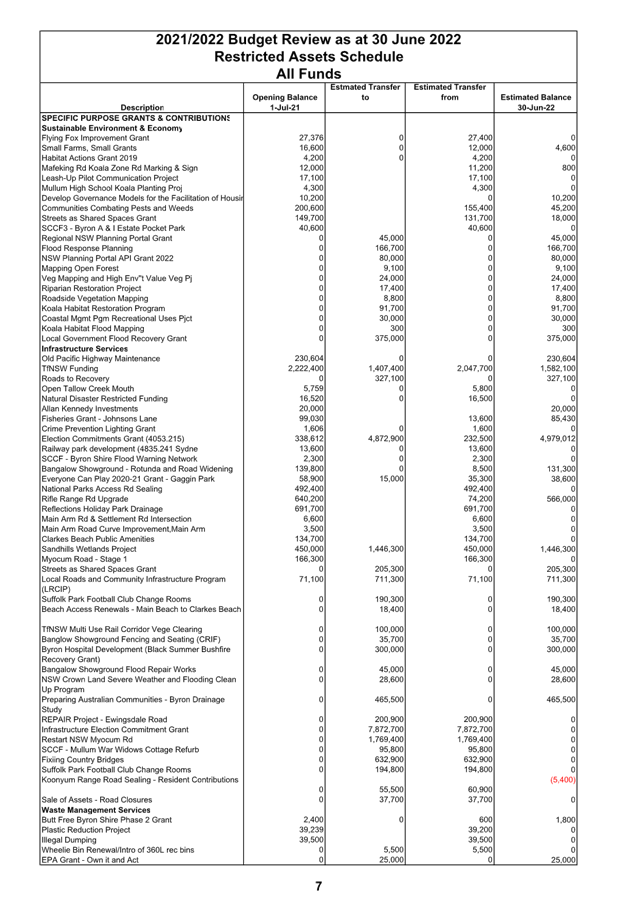

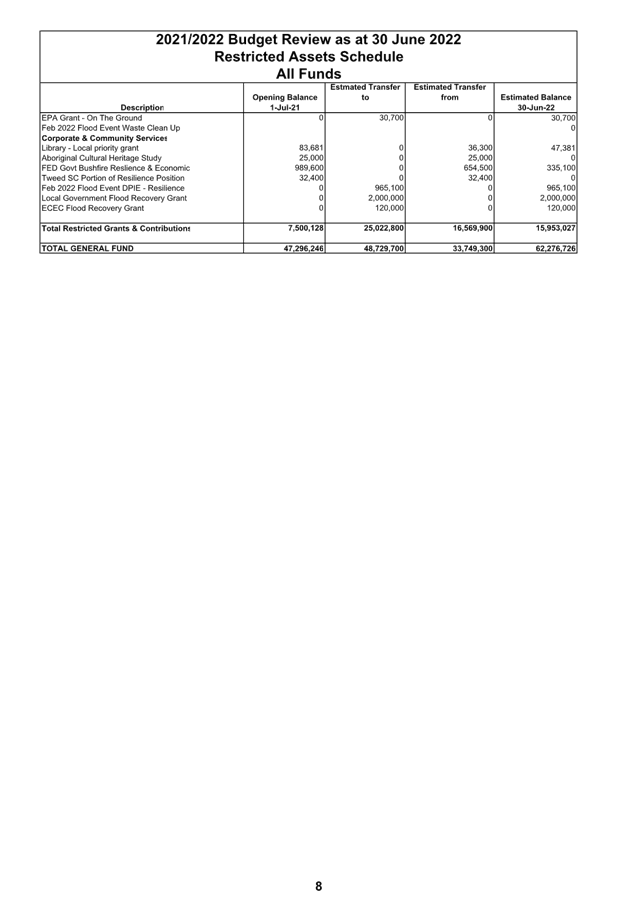

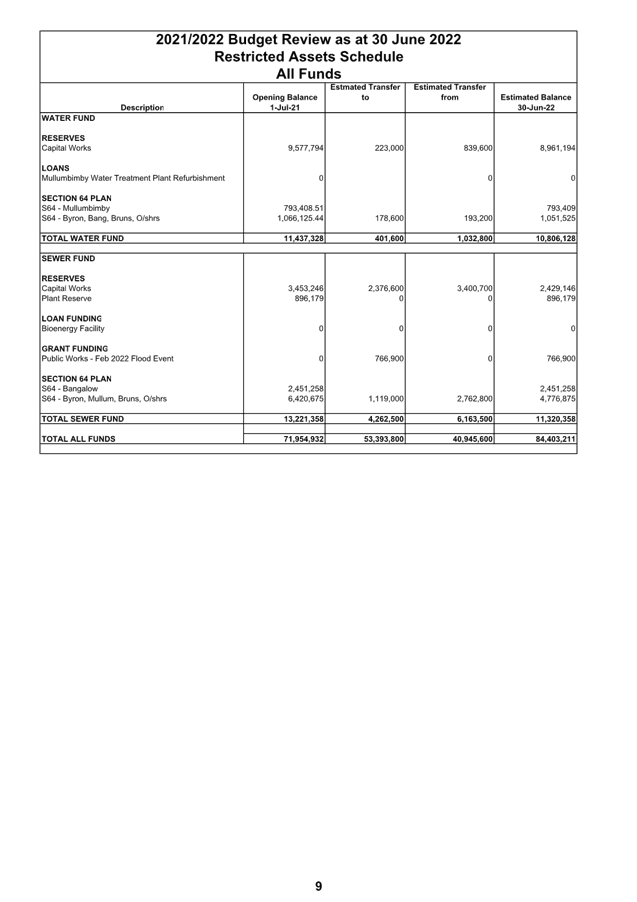

There is also information detailing restricted assets

(reserves) to show Council’s estimated balances as at 30 June 2022 for

all Council’s reserves.

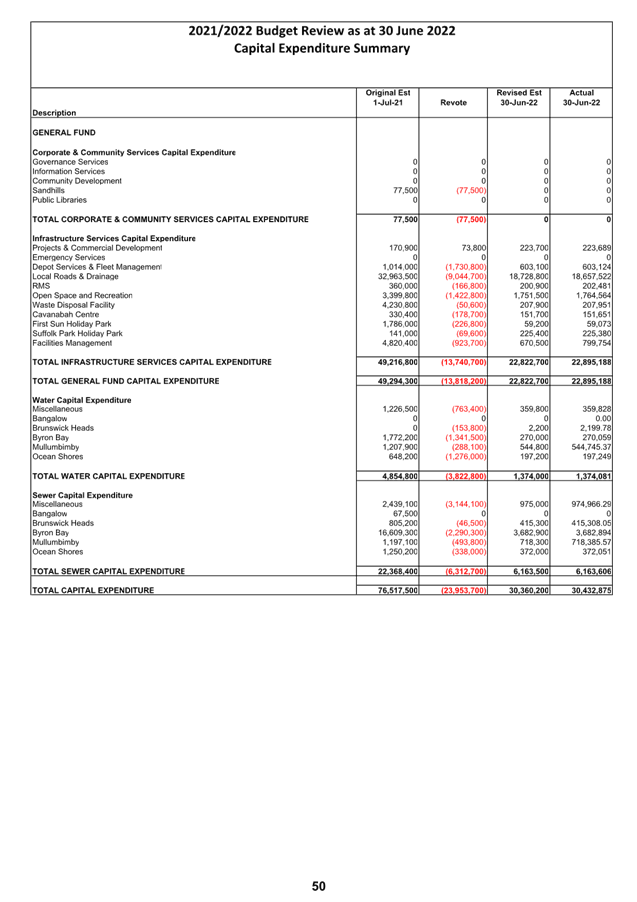

A summary of Capital Works is also included by Fund and

Principal Activity.

The additional budget schedules in the format issued by the

Office of Local Government usually included in the Quarterly Budget Review

reports as Attachment 3 have not been completed given this Quarterly Budget

Review is not a statutory requirement.

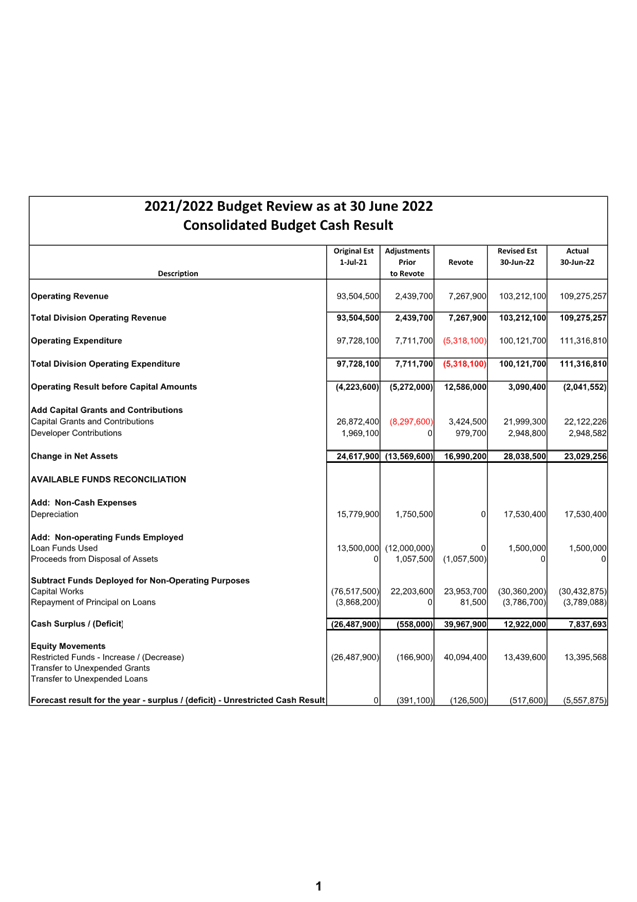

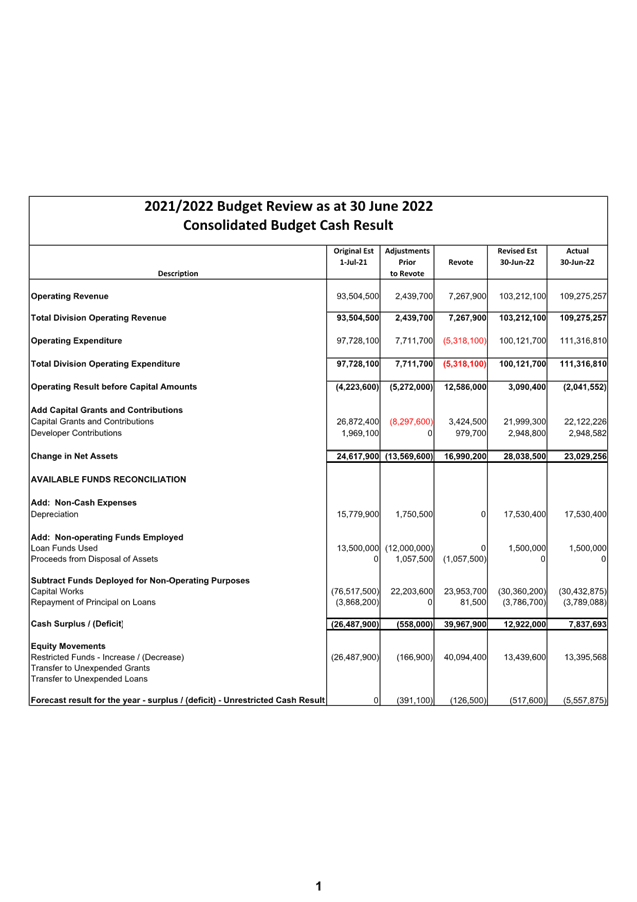

CONSOLIDATED RESULT

The following table provides

a summary of the overall Council budget on a consolidated basis inclusive of

all funds’ budget movements for the 2021/2022 financial year projected to

30 June 2022.

|

2021/2022 Budget Review Statement as at 30 June 2022

|

Original Estimate (Including Carryovers)

1/7/2021

|

Adjustments to 30 June 2022 including Resolutions*

|

Proposed 30 June 2022 Review Revotes

|

Revised Estimate 30/6/2022

|

|

Operating Revenue

|

93,504,500

|

2,439,700

|

7,267,900

|

103,212,100

|

|

Operating Expenditure

|

97,728,100

|

7,711,700

|

(5,318,100)

|

100,121,700

|

|

Operating Result –

Surplus/Deficit

|

(4,223,600)

|

(5,272,000)

|

12,586,000

|

3,090,400

|

|

Add: Capital Revenue

|

28,841,500

|

(8,297,600)

|

4,404,200

|

24,948,100

|

|

Change in Net Assets

|

24,617,900

|

(13,569,600)

|

16,990,200

|

28,038,500

|

|

Add: Non Cash Expenses

|

15,779,900

|

1,750,500

|

0

|

17,530,400

|

|

Add: Non-Operating Funds

Employed

|

13,500,000

|

(10,942,500)

|

(1,057,500)

|

1,500,000

|

|

Subtract: Funds Deployed for

Non-Operating Purposes

|

(80,385,700)

|

22,203,600

|

24,035,200

|

(34,146,900)

|

|

Cash Surplus/(Deficit)

|

(26,487,900)

|

(558,000)

|

39,967,900

|

12,922,000

|

|

Restricted Funds –

Increase / (Decrease)

|

(26,487,900)

|

(166,900)

|

40,094,400

|

13,439,600

|

|

Forecast Result for the

Year – Surplus/(Deficit) – Unrestricted Cash

|

0

|

(391,100)

|

(126,500)

|

(517,600)

|

In terms of the General Fund projected Unrestricted Cash

Result the following table provides a reconciliation of the estimated position

as at 30 June 2022:

|

Opening

Balance – 1 July 2021

|

$517,600

|

|

Plus

original budget movement and carryovers

|

0

|

|

Council

Resolutions July – September Quarter

|

0

|

|

September

Budget Review

|

271,800

|

|

Council

Resolutions October – December Quarter

|

0

|

|

December

Budget Review

|

(308,400)

|

|

Council

Resolutions January – March Quarter

|

0

|

|

March

Budget Review

|

(354.500)

|

|

Council

Resolutions April – June Quarter

|

0

|

|

Recommendations

within this Review – increase/(decrease)

|

(126,500)

|

|

Forecast

Unrestricted Cash Result – Surplus/(Deficit) – 30 June 2022

|

(517,600)

|

|

Estimated

Unrestricted Cash Result Closing Balance – 30 June 2022

|

$0

|

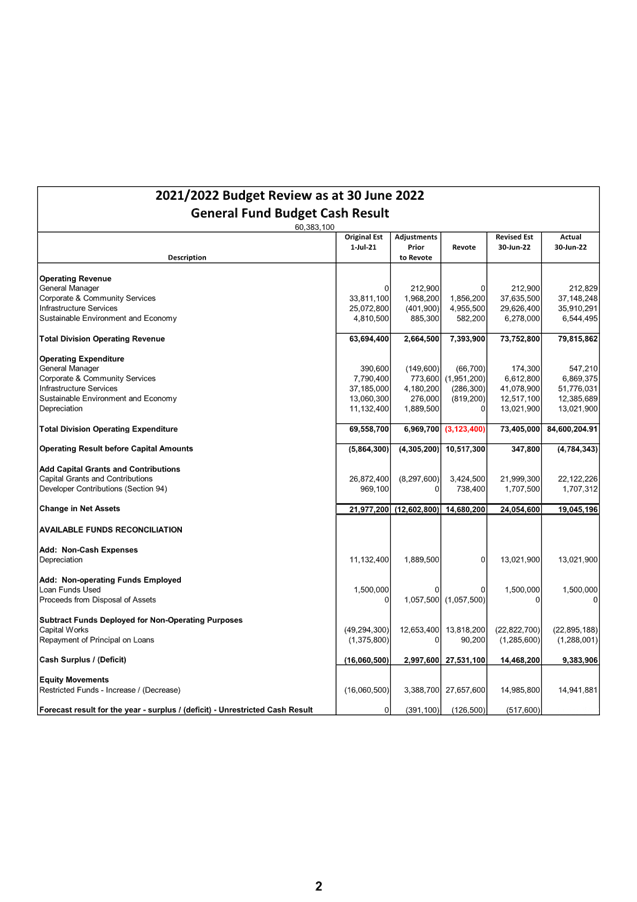

The General Fund financial position overall has decreased as

a result of this budget review, bringing the forecast unrestricted cash result

for the year to a deficit of $517,600. Essentially Council now has no

unrestricted cash. This is below Council’s target of $1,000,000 but given

the circumstances outlined below in the section ‘Specific Cash

Position’ is acceptable. The proposed budget changes are detailed in

Attachment 1.

Council Resolutions

There were no Council resolutions that impacted the budget

result in the April 2022 to June 2022 quarter.

Budget Adjustments

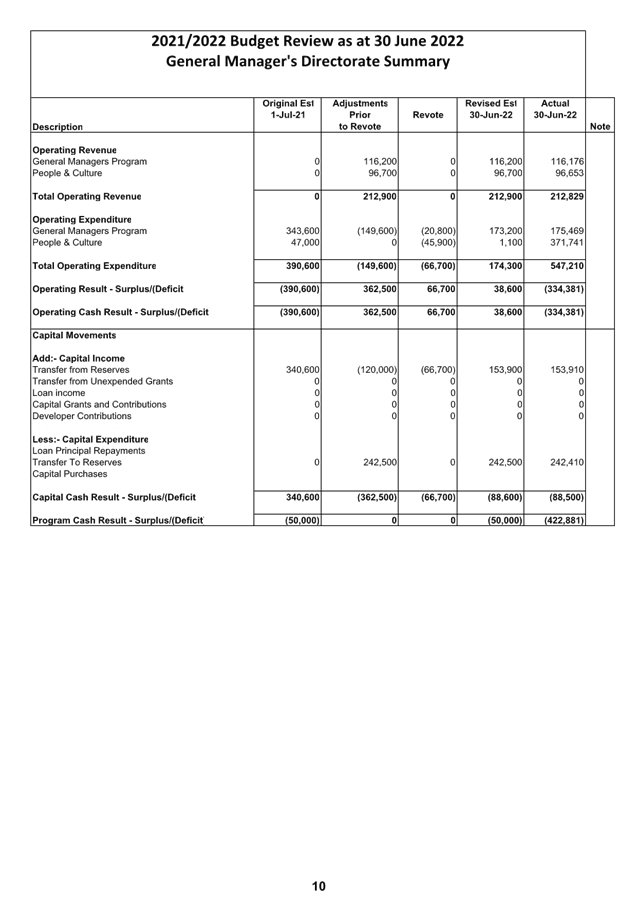

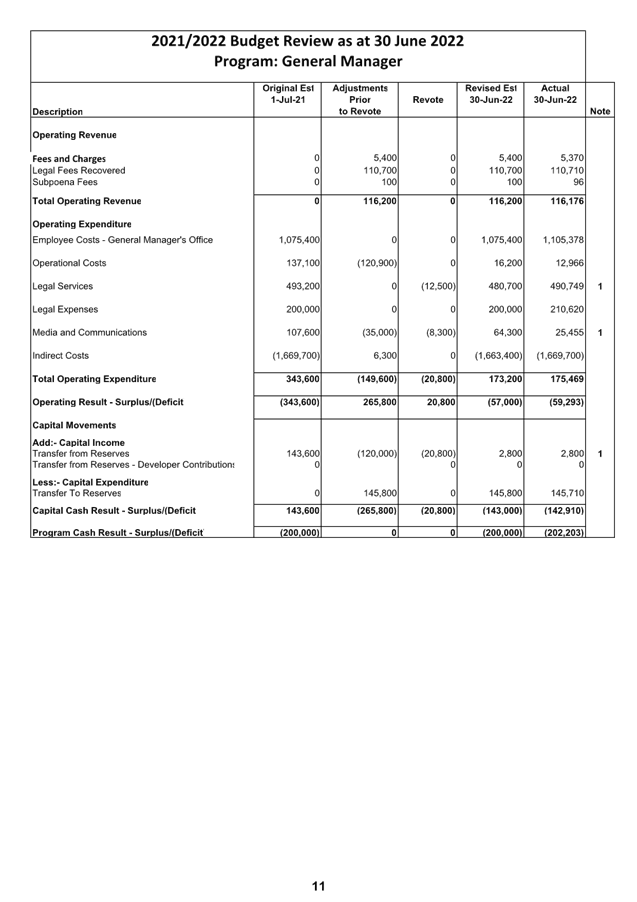

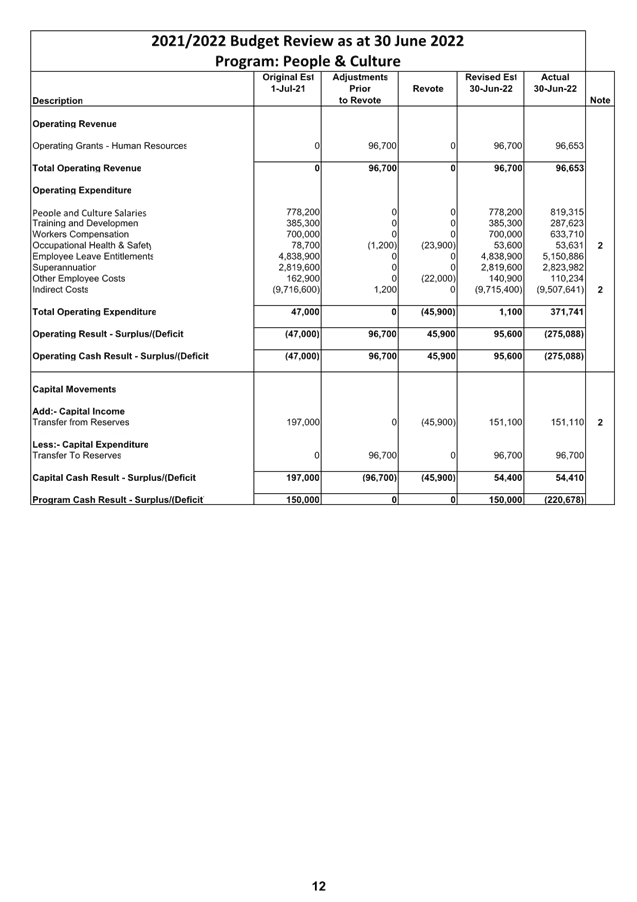

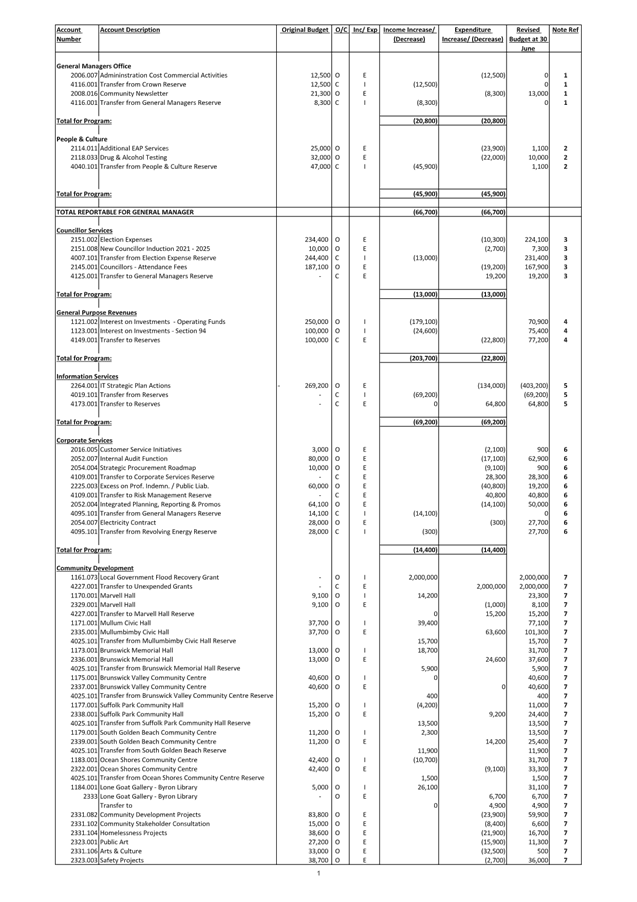

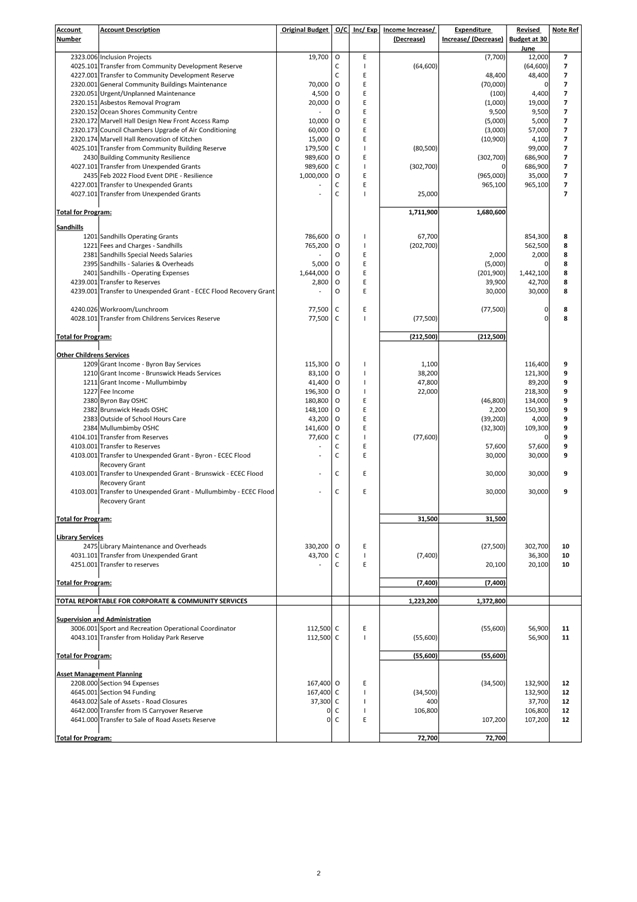

The budget adjustments identified in Attachments 1 and 2 for

the General Fund have been summarised by Council Directorate in the following

table:

|

Budget Directorate

|

Revenue

Increase/

(Decrease)

$

|

Expenditure

Increase/

(Decrease)

$

|

Unrestricted

Cash Increase/ (Decrease) $

|

|

General Manager

|

(66,700)

|

(66,700)

|

0

|

|

Corporate & Community Services

|

1,223,200

|

1,372,800

|

(149,600)

|

|

Infrastructure Services

|

(1,564,800)

|

(1,694,100)

|

129,300

|

|

Sustainable Environment & Economy

|

734,600

|

840,800

|

(106,200)

|

|

Total Budget Movements

|

326,300

|

452,800

|

(126,500)

|

Budget Adjustment Comments

General Fund budget adjustments are identified in detail at

Attachment 1 and 2. More detailed notes on these are provided in

Attachment 1 with the majority of budget revotes proposed to reflect actual

results achieved.

The major consideration with this budget review is the

reduction in expenditure associated with projects not completed and

under-expenditure. This report also considers the implications of carryover

items from the 2021/2022 financial year for work not completed to be added to

the 2022/2023 Budget Estimates.

Specific Cash Position

On reconciling Council’s total

cash and investment position at 30 June 2022 compared to the reserve movements

outlined in this Budget Review, there is an indication that Council will have

no unrestricted cash at year end. This can be attributed to the ongoing

effect of the COVID-19 Pandemic and ongoing support measures Council had in

place for the community, especially in the first half of the 2021/2022

financial year. Coupled with the Flood Events of February/March 2022 and

Council’s expenditure for the initial emergency response and subsequent

expenditure on repairing infrastructure which will take a number of years.

The nature of Natural Disaster Funding which, due to timing

of grant receipts and expenditure has required Council to act as a

‘Bank’ to a degree, has impacted Council’s cash flow at 30

June 2022. Specifically at 30 June 2022 Council has expended the

following amounts, yet to be reimbursed, associated with the February/March 2022

Flood Event totalling $7,178,924:

· Transport for NSW

($10,187,833 less payments of $5,000,000) $5,187,833

· Public Works

Advisory – Kerbside Waste Cleanup $1,403,570

· Public Works

Advisory – Buildings $113.487

· Public Works

Advisory – Open Spaces Cleanup $328,868

· Resilience NSW

– Recovery Centre $145,166

Since 30 June 2022, Council has received further payments

from Transport for NSW of $3,400,000 and from Public Works Advisory $1,370,280

in July.

Council is looking to have finalised the 2021/2022 financial

year with total cash and investments of $78,296,544. However it is

currently estimating based off this quarterly budget review to have total

reserves of $84,403,211. Essentially the overall cash position financial

year end means that Council cannot fund its overall reserve position by

$6,106,667. If Council had received the majority of funds due from flood

recovery associated works at financial year end, it would be able to fund the

overall reserve position.

It is a matter of timing of the cashflow but also highlights

the need to minimise the amount of claims outstanding for Natural Disaster

funding at financial year end. It is expected the cashflow position will

recover during the 2022/2023 financial year.

As Council cannot have reserve funds exceeding available cash

and investments, it is proposed not to reduce the notional reserve balances but

to create a new reserve called ‘Flood Recovery Reserve Cashflow’ as

a negative reserve to represent the difference between Council’s final

reserve position that will be presented in the Financial Statements and the

available cash and investments to demonstrate no unrestricted cash position at

30 June 2022 consistent with this Quarterly Budget Review. As the

cashflow position improves this reserve will move towards a zero balance which

should be the outcome no later than when Council has completed all works

associated with recovery from the February/March 2022 Flood Events over the

next few years.

It goes without saying from a financial perspective, the

2021/2022 financial year has been a difficult one for Council with its efforts

to maintain ‘business as usual’ amongst a Pandemic and two Natural

Disaster events.

Strategic Considerations

Community

Strategic Plan and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1:

Effective Leadership

We have effective decision making and

community leadership that is open and informed

|

1.3:

Ethical and efficient management of resources

|

1.3.1:

Financial Management - Ensure the financial integrity and sustainability of

Council through effective financial management

|

1.3.1.2

|

Provide

Quarterly Budget Reviews to Council for adoption.

|

|

|

|

|

|

|

|

Legal/Statutory/Policy

Considerations

In accordance with Section 203 of

the Local Government (General) Regulation 2021 the Responsible Accounting

Officer of a Council must:-

(1) Not

later than 2 months after the end of each quarter (except the June quarter),

the responsible accounting officer of a council must prepare and submit to the council

a budget review statement that shows, by reference to the estimate of income

and expenditure set out in the statement of the council’s revenue policy

included in the operational plan for the relevant year, a revised estimate of

the income and expenditure for that year.

(2) A

budget review statement must include or be accompanied by:

(a) a

report as to whether or not the responsible accounting officer believes that

the statement indicates that the financial position of the council is

satisfactory, having regard to the original estimate of income and expenditure,

and

(b)

if that position is unsatisfactory, recommendations for remedial action.

(1) A budget review statement must

also include any information required by the Code to be included in such a

statement.

As indicated above, Council is not

required to complete a budget review for the June quarter but one has been

completed to assist in the calculation of reserve funds, cash position, and to

provide initial financial outcomes for the year to assist the completion of the

annual financial statements.

Financial Considerations

The 30 June 2022 Quarter Budget Review of the 2021/2022

Budget Estimates forecasts a stable outcome to the estimated budget

attributable to the General Fund assuming all revotes of income and expenditure

reported for Council’s consideration are approved.

Overall, the short term financial position still needs to be

carefully monitored on an ongoing basis. Notwithstanding the issues outlined

under the section “Specific Cash Position’ and the impact of

funding reserves, cashflow management for Council is becoming more important as

it works to operate on a ‘business as usual’ footing whilst

initially spending significant amounts of money repairing infrastructure

damaged from the February/March 2022 flood events and then seeking

reimbursement from the NSW Government through Natural Disaster Funding

arrangements over the next few years.

Note that the financial outcomes outlined in this Budget

Review should be considered in the context that they are indicative. Council is

yet to finalise its financial statements for the year ended 30 June 2022 which

will also be subject to external independent audit.

It is expected that Council will receive a report regarding

the formal adoption of its financial statements for the year ended 30 June 2022

at its Ordinary Meeting on 24 November 2022.

Statement by Responsible Accounting Officer

This report indicates that the short term financial position

of the Council is satisfactory for the 2021/2022 financial year, having

consideration of the original estimate of income and expenditure at the 30 June

2022 Quarter Budget Review, the ongoing impacts of the COVID-19 Pandemic during

part of the 2021/2022 and the February/March 2022 Flood events with ongoing

recovery costs.

Staff

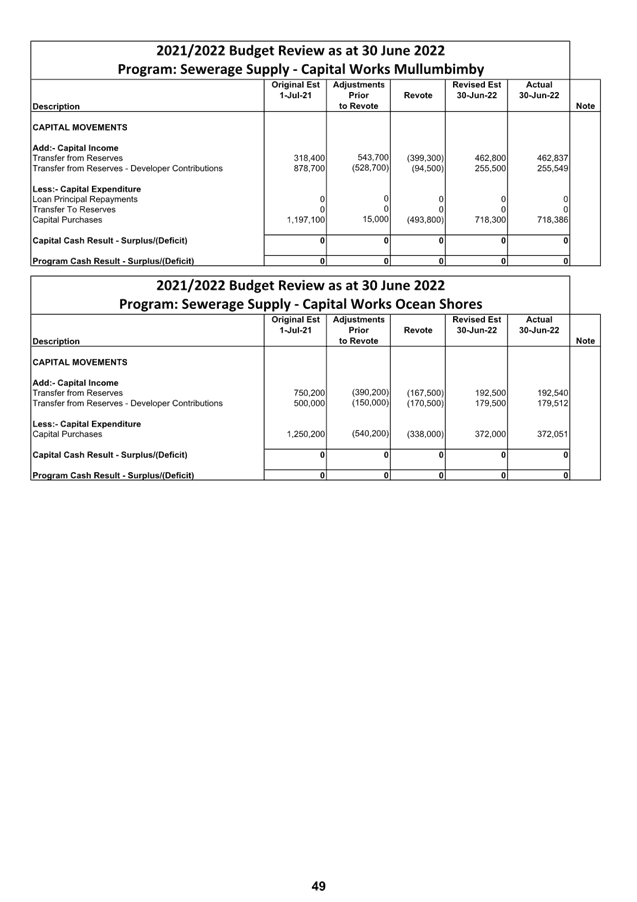

Reports - Corporate and Community Services 4.1 - Attachment 1

Staff

Reports - Corporate and Community Services 4.1 - Attachment 2

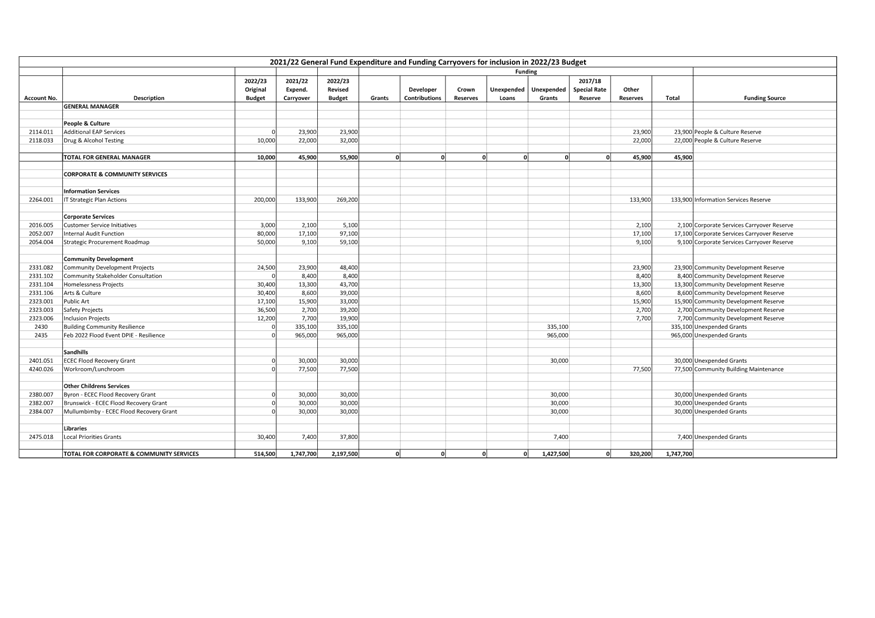

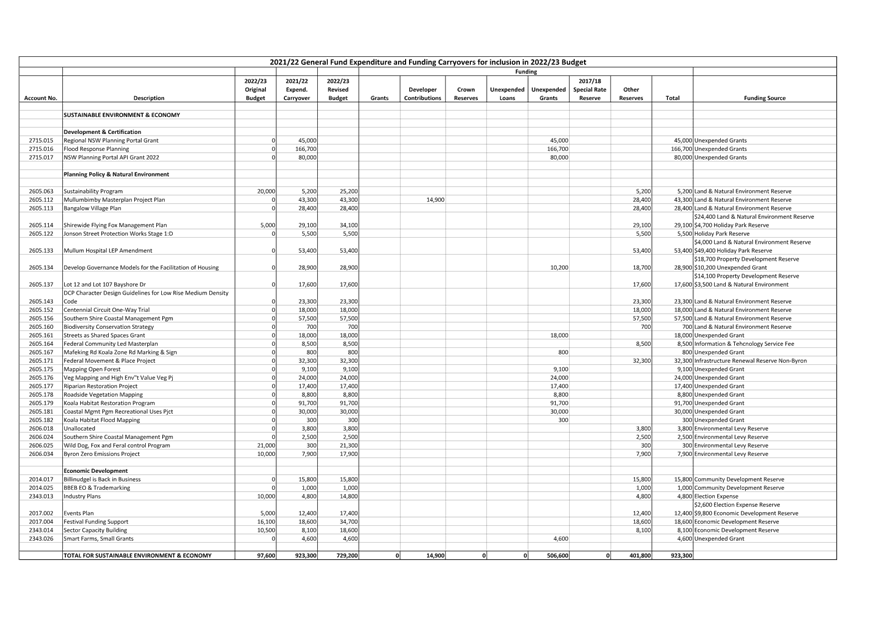

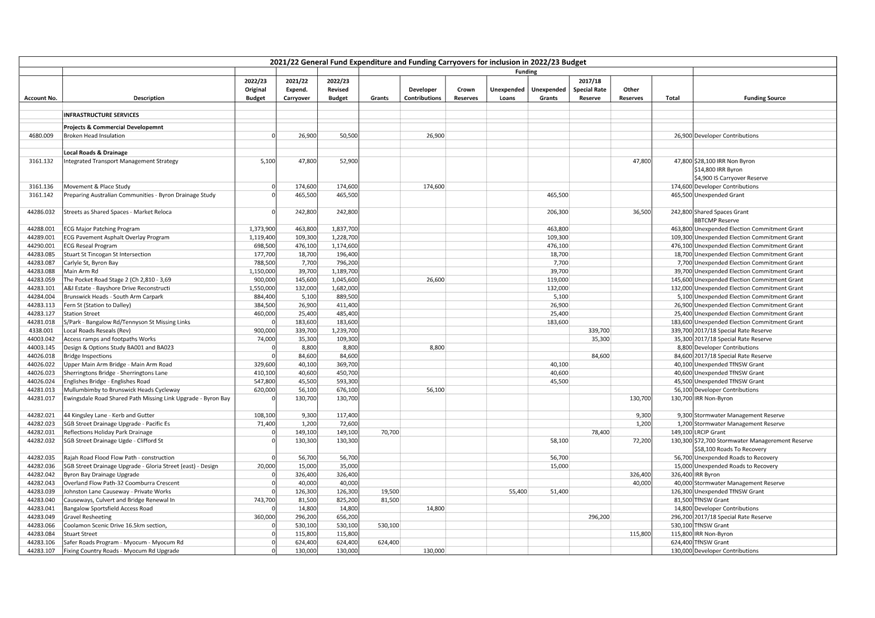

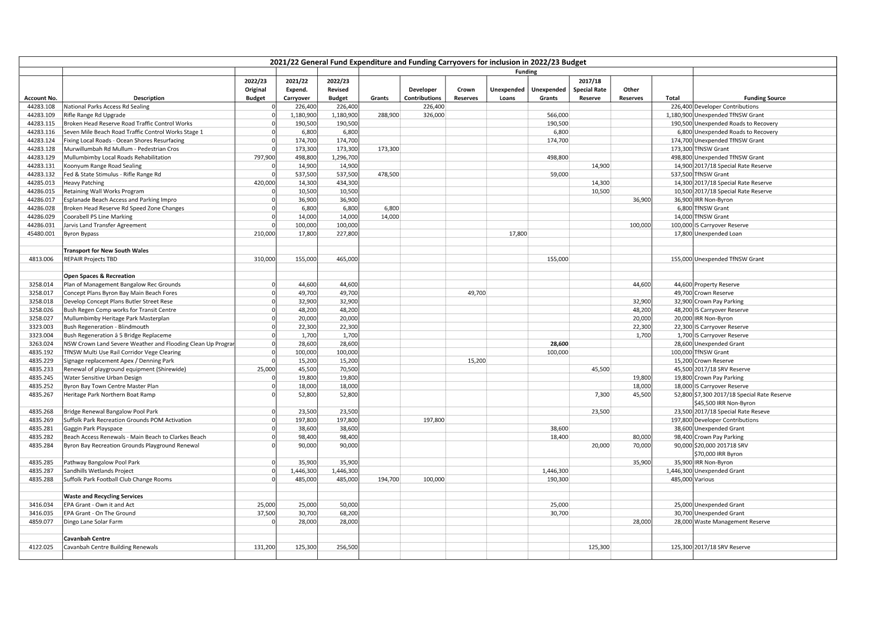

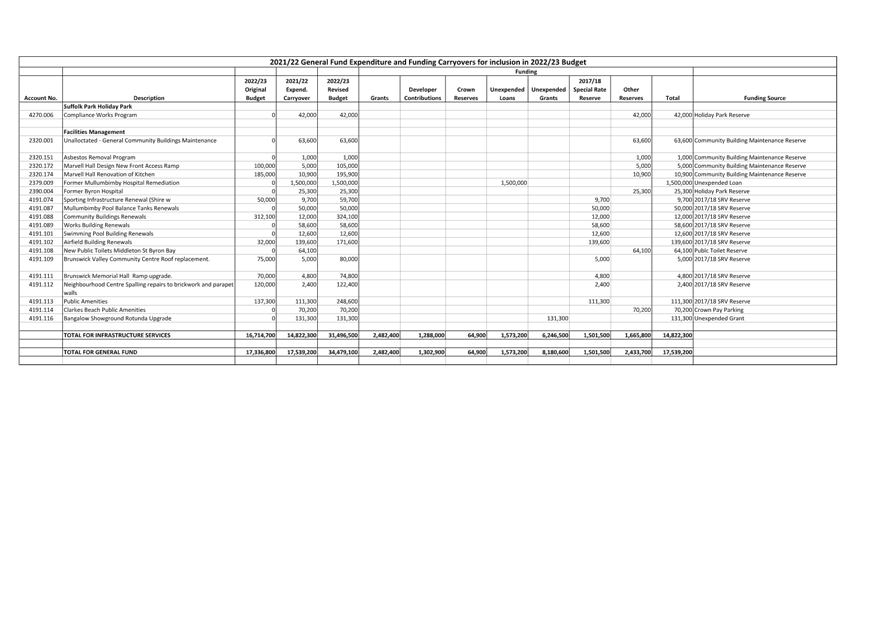

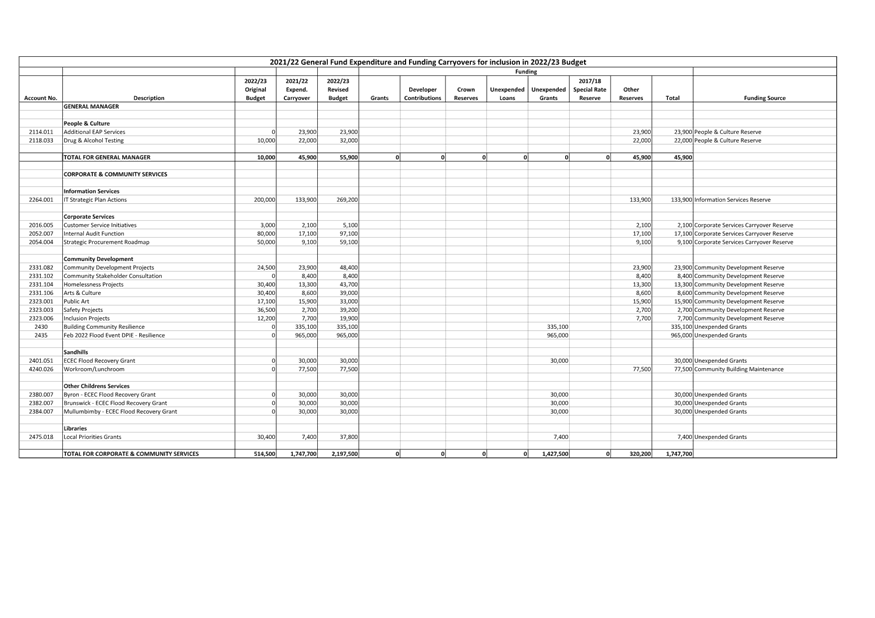

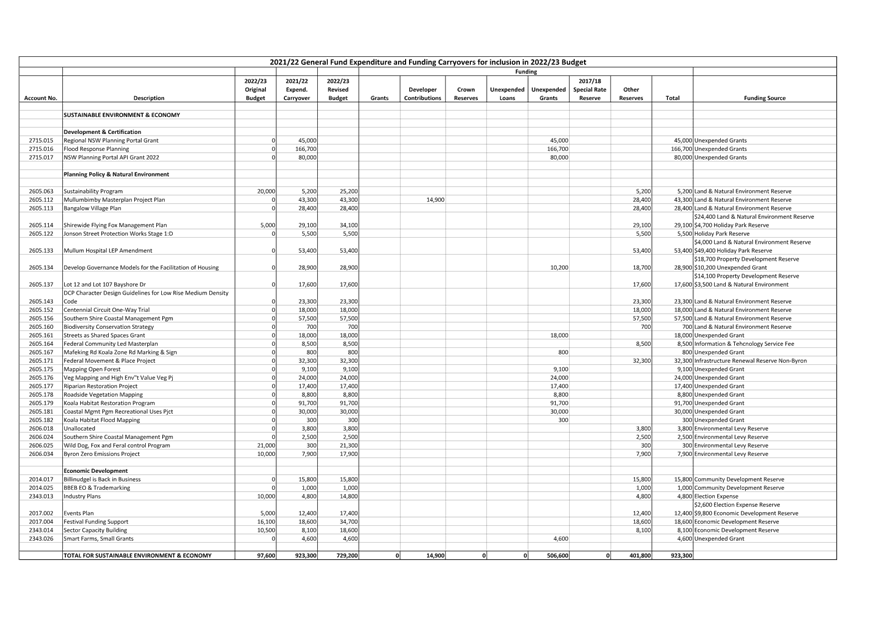

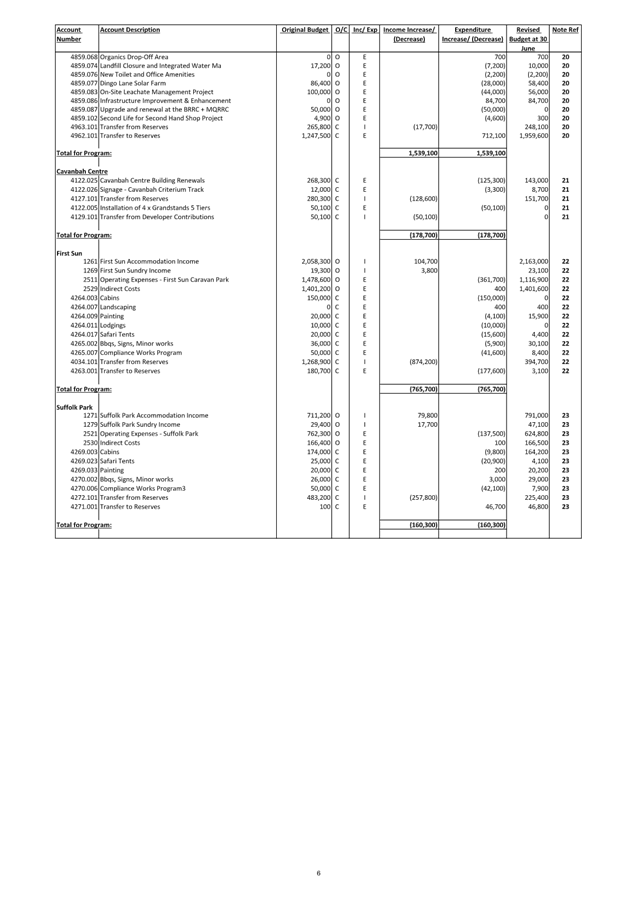

Staff Reports - Corporate and Community Services 4.2

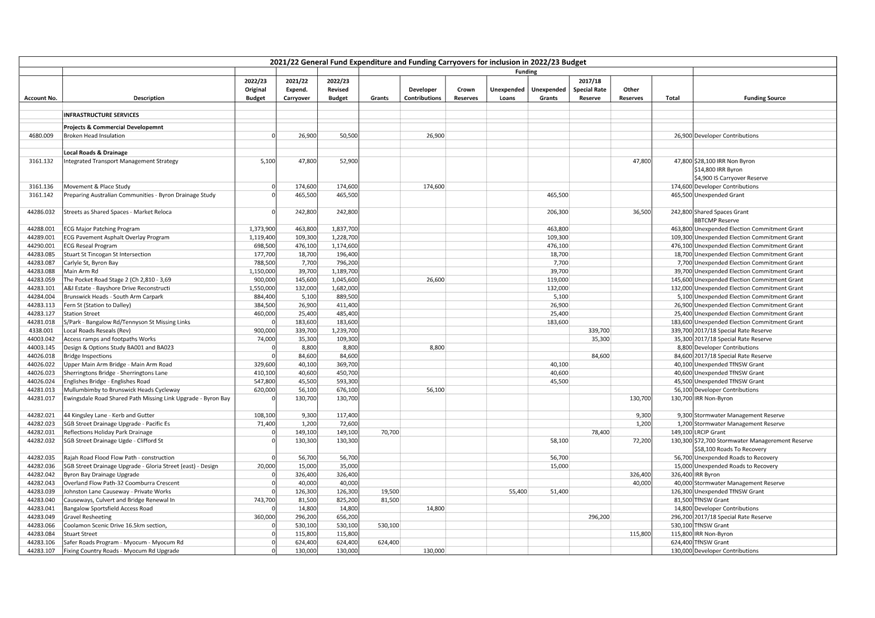

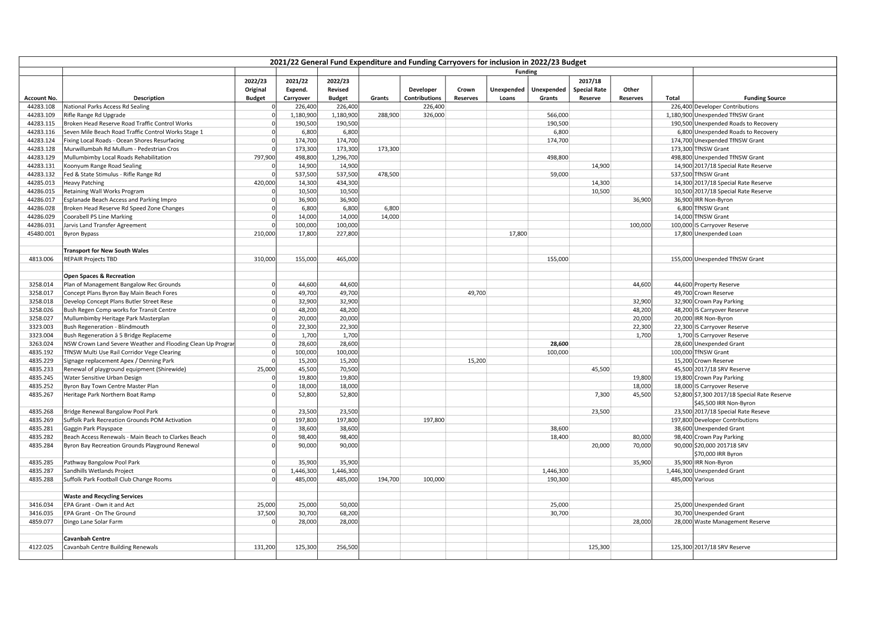

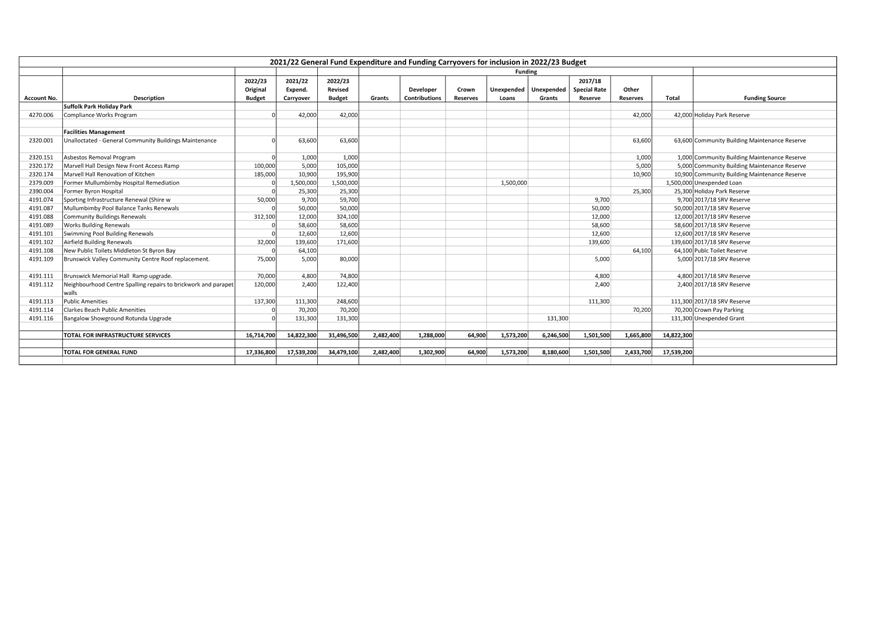

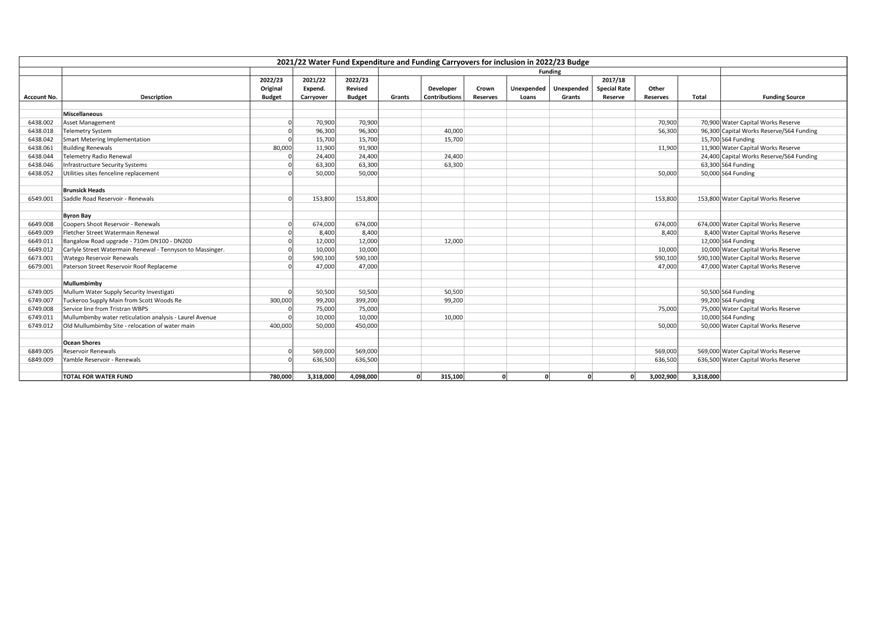

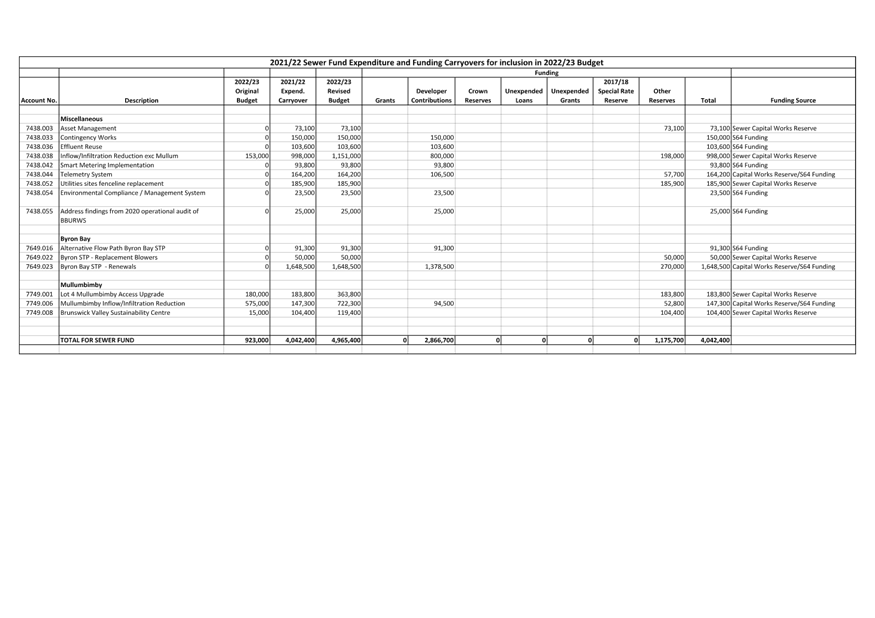

Report

No. 4.2 Carryovers for

inclusion in the 2022-2023 Budget

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2022/1032

Summary:

This report is

prepared for the Committee to consider in relation to the proposed carryover

Budget allocations for works and services, either commenced and not completed,

or not commenced but allocated in the 2021/2022 financial year for inclusion in

the 2022/2023 Budget Estimates.

This report will also be considered by Council at its

Meeting held on 25 August 2022.

RECOMMENDATION:

That the Committee recommends

Council approves the works and services (with respective funding) shown in

Attachment 1 (#E2022/76668) to be carried over from the 2021/2022 financial

year and that the carryover budget allocations be adopted as budget revotes for

inclusion in the 2022/2023 Budget Estimates.

Attachments:

1 Budget

Carryovers for inclusion in 2022-23 Budget, General, Water and Sewer Funds, E2022/76668 , page 100⇩

Report

Each year Council allocates funding for works and services

across all budget programs. For various reasons, some of these works and

services are incomplete at the end of the financial year. The funding for these

works and services is restricted or reserved at the end of the financial year

to be carried over to the following year for completion.

This report identifies all the works and services proposed

to be carried over to the 2022/2023 Budget Estimates and the respective funding

of each, relating to works and services not completed during the course of the

2021/2022 financial year. The specific details including funding sources of all

carryover works and services that are the subject of this report are outlined

in Attachment 1.

The works and services are fully funded and have no impact

on Council’s Unrestricted Cash Result or the 2022/2023 Budget Estimates

result.

As in previous years there is a significant amount of

carryovers with total carryovers for 2021/2022 amounting to $24,899,600.

This is a large increase when compared to previous years but is attributable to

the following:

· The disruption of

February/March 2022 flood events and subsequent recovery response.

· Council’s ongoing

receipt of grant funding not necessarily flood related.

Table 1 below outlines a comparison of carryovers from

previous financial years:

Table 1 - Value of

budget carryovers 2018/19 – 2022/23

|

Fund

|

2018/19 ($)

|

2019/20 ($)

|

2020/21 ($)

|

2021/22 ($)

|

2022/23 ($)

|

|

General

|

9,004,500

|

6,024,800

|

7,875,500

|

10,719,000

|

17,539,200

|

|

Water

|

879,500

|

301,900

|

1,118,800

|

840,300

|

3,318,000

|

|

Sewer

|

2,473,500

|

625,400

|

1,129,200

|

1,695,500

|

4,042,400

|

|

Total

|

12,357,500

|

6,952,100

|

10,123,500

|

13,254,800

|

24,899,600

|

General Fund

The value of works carried over to 2022/2023 for the General

Fund has increased by over 64% from the 2021/2022 amount ($6,820,200). Of the

$17,539,200 of General Fund carryovers, just over 52% ($9,197,200) is attributable

to Local Roads and Drainage projects not completed in 2021/2022 to be carried

forward to 2022/2023. This percentage is more than the carryovers

attributable to Local Roads and Drainage from 2021/2022 (40%). The extent

of carryovers in the General Fund is also relevant to the number of, and size

of grant funded works. Approximately $10.663 million of the General Fund

carryovers are funded from unexpended or approved grants.

Major carryover items in General Fund are as follows:

|

Item

|

Amount $

|

|

Feb 2022 Flood Event DPIE - Resilience

|

965,000

|

|

Preparing Australian Communities – Byron Drainage

Study

|

465,500

|

|

Election Commitment Grant Major Patching

|

463,800

|

|

Election Commitment Grant Reseal Program

|

476,100

|

|

Local Roads Reseals

|

339,700

|

|

Gilmore Crescent

|

492,300

|

|

Byron Bay Drainage Upgrade

|

326,400

|

|

Coolamon Scenic Drive 16.5km section

|

530,100

|

|

Safer Roads Program - Myocum - Myocum Rd

|

624,400

|

|

Rifle Range Rd Upgrade

|

1,180,900

|

|

Mullumbimby Local Roads Rehabilitation

|

498,800

|

|

Fed & State Stimulus - Rifle Range Rd

|

537,500

|

|

Sandhills Wetlands Project

|

1,446,300

|

|

Suffolk Park Football Club Change Rooms

|

485,000

|

|

Former Mullumbimby Hospital Remediation

|

1,500,000

|

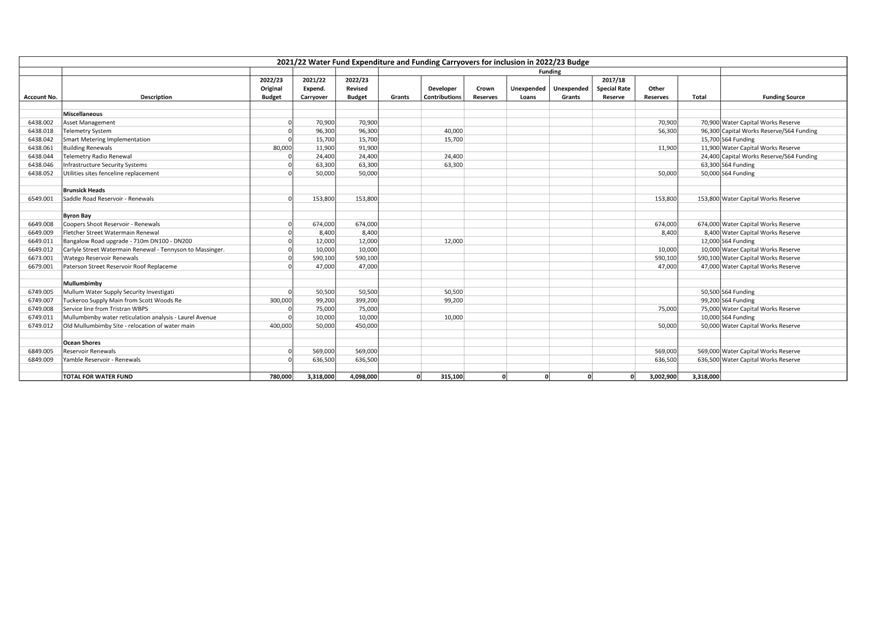

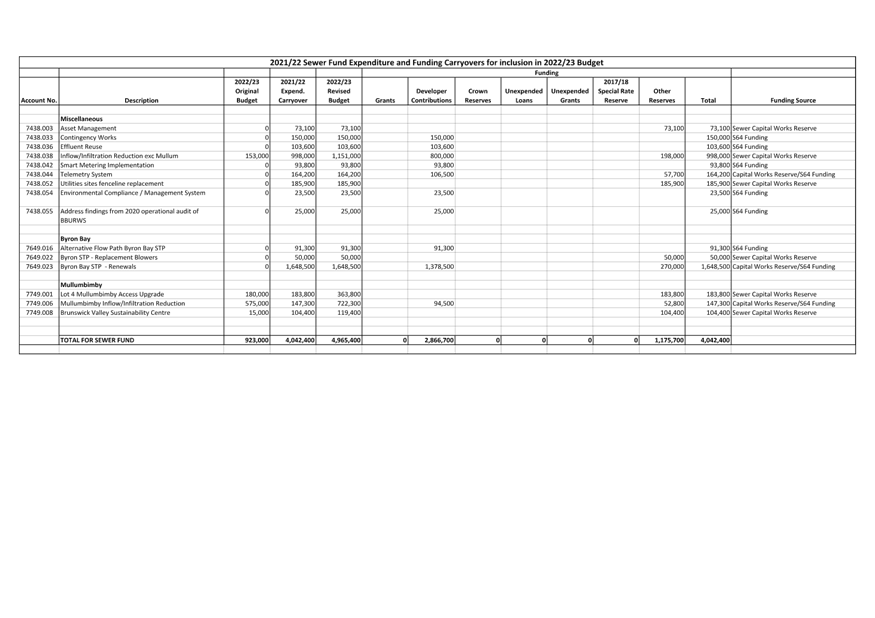

Water and Sewer Funds

Carryovers for the Water Fund have increased by $2,477,700

and increased for the Sewer Fund by $2,346,900 compared to the carryover for

the 2021/2022 financial year. Details of these carryovers are included in

Attachment 1.

The following table outlines the project status with

comments provided by Infrastructure Services of Local Roads & Drainage

capital works carryovers for Councillors’ information, where works are in

progress or contracts have been awarded at the time of writing this report.

Table 2 –

Schedule of Carryover works current status

|

Ledger #

|

Project

|

Carryover

$

|

Status

|

|

44286.032

|

Streets as Shared Spaces - Market Relocation

|

242,800.00

|

Grant funded project, design underway and construction of

stage 1 planned for October 2022.

|

|

44288.001

|

ECG Major Patching Program

|

463,800.00

|

Works programmed to be completed as per funding deadline

of August 2022.

|

|

44289.001

|

ECG Pavement Asphalt Overlay Program

|

109,300.00

|

Works programmed to be completed as per funding deadline

of August 2022.

|

|

44290.001

|

ECG Reseal Program

|

476,100.00

|

Works programmed to be completed as per funding deadline

of August 2022.

|

|

44283.085

|

Stuart St Tincogan St Intersection

|

18,700.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44283.087

|

Carlyle St, Byron Bay

|

7,700.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

Ledger #

|

Project

|

Carryover

$

|

Status

|

|

44283.088

|

Main Arm Rd

|

39,700.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44283.059

|

The Pocket Road Stage 2 (Ch 2,810 - 3,69

|

145,600.00

|

Construction works underway.

|

|

44283.101

|

A&I Estate - Bayshore Drive Reconstruction

|

132,000.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44284.004

|

Brunswick Heads - South Arm Carpark

|

5,100.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44283.113

|

Fern St (Station to Dalley)

|

26,900.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44283.127

|

Station Street

|

25,400.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44281.018

|

S/Park - Bangalow Rd/Tennyson St Missing Links

|

183,600.00

|

Invoices yet to be paid

|

|

4338.001

|

Local Roads Reseals (Rev)

|

339,700.00

|

Re-sheeting programmed for delivery in early 2022/23.

Other grant projects have funded works have taken priority in 2021/22.

|

|

44003.042

|

Access ramps and footpaths Works

|

35,300.00

|

Works programmed for delivery in early 2022/23.

|

|

Ledger #

|

Project

|

Carryover

$

|

Status

|

|

44003.145

|

Design & Options Study BA001 and BA023

|

8,800.00

|

Design currently being finalised.

|

|

44026.018

|

Bridge Inspections

|

84,600.00

|

Funds to be reallocated to 44026.026 in 2022/23 to achieve

efficiencies in completing essential bridge maintenance works.

|

|

44026.022

|

Upper Main Arm Bridge - Main Arm Road

|

40,100.00

|

Grant funded works awaiting outcome of variation request.

|

|

44026.023

|

Sherringtons Bridge - Sherringtons Lane

|

40,600.00

|

Grant funded works awaiting outcome of variation request.

|

|

44026.024

|

Englishes Bridge - Englishes Road

|

45,500.00

|

Carry over of grant funds already received. Now

funded by natural disaster funding.

|

|

44281.013

|

Mullumbimby to Brunswick Heads Cycleway

|

56,100.00

|

Grant funded works. Design works ongoing and construction

planned.

|

|

44281.017

|

Ewingsdale Road Shared Path Missing Link Upgrade - Byron Bay

|

130,700.00

|

Works mostly complete and will be finalised early in

2022/23.

|

|

44282.021

|

44 Kingsley Lane - Kerb and Gutter

|

9,300.00

|

Works mostly complete and will be finalised early in

2022/23.

|

|

44282.023

|

SGB Street Drainage Upgrade - Pacific Es

|

1,200.00

|

Works mostly complete and will be finalised early in

2022/23.

|

|

44282.031

|

Reflections Holiday Park Drainage

|

149,100.00

|

Works mostly complete and will be finalised early in

2022/23.

|

|

Ledger #

|

Project

|

Carryover

$

|

Status

|

|

44282.032

|

SGB Street Drainage Ugde - Clifford St

|

130,300.00

|

Works commenced and will be finalised early in 2022/23.

|

|

44282.035

|

Rajah Road Flood Flow Path - construction

|

56,700.00

|

Construction ready and programmed for construction in

2022/23.

|

|

44282.036

|

SGB Street Drainage Upgrade - Gloria Street (east) -

Design

|

15,000.00

|

Design has commenced and will be complete in 2022/23.

|

|

44282.042

|

Byron Bay Drainage Upgrade

|

326,400.00

|

Grant funded works. Design currently out to tender.

|

|

44282.043

|

Overland Flow Path-32 Coomburra Crescent

|

40,000.00

|

Design has commenced and will be complete in 2022/23.

|

|

44283.039

|

Johnston Lane Causeway - Private Works

|

126,300.00

|

Grant funded works awaiting outcome of variation request.

Construction ready.

|

|

44283.040

|

Causeways, Culvert and Bridge Renewal In

|

81,500.00

|

These funds are required to support the grant funded Upper

Main Arm Road Causeway No.2 renewal - funds to be moved into this project.

|

|

44283.041

|

Bangalow Sportsfield Access Road

|

14,800.00

|

Design ongoing and awaiting further information.

|

|

44283.049

|

Gravel Resheeting

|

296,200.00

|

Resheeting programmed for delivery in early 2022/23. Other

grant projects have funded works have taken priority in 2021/22.

|

|

Ledger #

|

Project

|

Carryover

$

|

Status

|

|

44283.066

|

Coolamon Scenic Drive 16.5km section,

|

530,100.00

|

Works commenced and will be finalised early in 2022/23.

|

|

44283.084

|

Stuart Street

|

115,800.00

|

Works mostly complete - Awaiting payment of final

invoices.

|

|

44283.106

|

Safer Roads Program - Myocum - Myocum Rd

|

624,400.00

|

Works mostly complete and will be finalised early in

2022/23.

|

|

44283.107

|

Fixing Country Roads - Myocum Rd Upgrade

|

130,000.00

|

Works mostly complete and will be finalised early in

2022/23.

|

|

44283.108

|

National Parks Access Rd Sealing

|

226,400.00

|

Works programmed for delivery in early 2022/23.

|

|

44283.109

|

Rifle Range Rd Upgrade

|

1,180,900.00

|

Grant funded works awaiting outcome of variation request.

Construction ready.

|

|

44283.115

|

Broken Head Reserve Road Traffic Control Works

|

190,500.00

|

Works programmed for delivery in early 2022/23. Funds to

be combined with budget in 2022/23.

|

|

44283.116

|

Seven Mile Beach Road Traffic Control Works Stage 1

|

6,800.00

|

Works programmed for delivery in early 2022/23. Funds to

be combined with budget in 2022/23.

|

|

44283.124

|

Fixing Local Roads - Ocean Shores Resurfacing

|

174,700.00

|

Grant funded works programmed for delivery in 2022/23.

|

|

44283.128

|

Murwillumbah Rd Mullum - Pedestrian Cros

|

173,300.00

|

Grant funded works programmed for delivery in 2022/23.

|

|

Ledger #

|

Project

|

Carryover

$

|

Status

|

|

44283.129

|

Mullumbimby Local Roads Rehabilitation

|

498,800.00

|

Grant funded works programmed for delivery in 2022/23.

|

|

44283.132

|

Fed & State Stimulus - Rifle Range Rd

|

537,500.00

|

Grant funded works awaiting outcome of variation request.

Construction ready.

|

|

44283.131

|

Koonyum Range Road Sealing

|

14,900.00

|

To be completed in 2022/23.

|

|

44285.013

|

Heavy Patching

|

14,300.00

|

Resheeting programmed for delivery in early 2022/23. Other

grant projects have funded works have taken priority in 2021/22.

|

|

44286.015

|

Retaining Wall Works Program

|

10,500.00

|

Resheeting programmed for delivery in early 2022/23. Other

grant projects have funded works have taken priority in 2021/22.

|

|

44286.017

|

Esplanade Beach Access and Parking Impro

|

36,900.00

|

Design underway and programmed for completion in 2022/23.

|

|

44286.028

|

Broken Head Reserve Rd Speed Zone Changes

|

6,800.00

|

Programmed for implementation as part of 44283.115.

|

|

44286.029

|

Coorabell PS Line Marking

|

14,000.00

|

Grant funded works programmed for delivery in 2022/23.

|

|

44286.031

|

Jarvis Land Transfer Agreement

|

100,000.00

|

Finalisation of transfer delayed but planned for 2022/23.

|

|

Total

|

8,491,500

|

|

In accordance with Section 211 of the Local Government

(General) Regulation 2021, Council conducted an Extraordinary Meeting to

approve expenditure on 30 June 2022 via Resolution 22-332 to create the

2022/2023 Budget. The expenditure items that are the subject of this report

were not included in the 2022/2023 Budget Estimates, but now need to be. The

intent of this report is to seek Council approval to revote the carryovers from

the 2021/2022 financial year and to adopt the budget carryovers for inclusion in

the 2022/2023 Budget Estimates.

At its meeting held on 28 March 2013 the Strategic Planning

Committee considered Report 4.3 on Council’s financial position for the

2012/2013 financial year. The recommendations from this meeting were adopted by

Council at its Ordinary Meeting held on 18 April 2013 through resolution 13-164.

Committee recommendation SPC 4.3 in part 5 included the following process

to be applied to the consideration of any amount identified as a carryover to

the 2013/14 and future Budgets and funded from general revenues:

That Council determines that

any general revenue funded allocated expenditure, not expended in a current

financial year NOT be automatically carried over to the next financial year

before it is reviewed, and priorities established.

This report will also be considered by Council at its

Meeting held on 25 August 2022.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1:

Effective Leadership

We have effective decision making and

community leadership that is open and informed

|

1.3:

Ethical and efficient management of resources

|

1.3.1:

Financial Management - Ensure the financial integrity and sustainability of

Council through effective financial management

|

1.3.1.2

|

Provide

Quarterly Budget Reviews to Council for adoption.

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Section 211 of the

Local Government (General) Regulation 2021 outlines the requirements of Council

relating to authorisation of expenditure. Specifically Section 211

states:

(1) A

council, or a person purporting to act on behalf of a council, must not incur

a liability for the expenditure of money unless the council at the annual

meeting held in accordance with subclause (2) or at a later ordinary meeting:

(a)

has approved the expenditure, and

(b) has voted the

money necessary to meet the expenditure.

(2) A council must each year hold

a meeting for the purpose of approving expenditure and voting money.

Financial Considerations

The Financial implications of this report have been outlined

above in that, should Council adopt the recommendation of the report, the

2022/2023 Budget result will not change, nor will the Unrestricted Cash Result.

Staff

Reports - Corporate and Community Services 4.2 - Attachment 1