Finance Advisory Committee Meeting

A Finance Advisory Committee Meeting of

Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 8 August 2019

|

|

Time

|

2.00pm

|

Vanessa Adams

Director Corporate and Community Services I2019/1175

Distributed 01/08/19

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

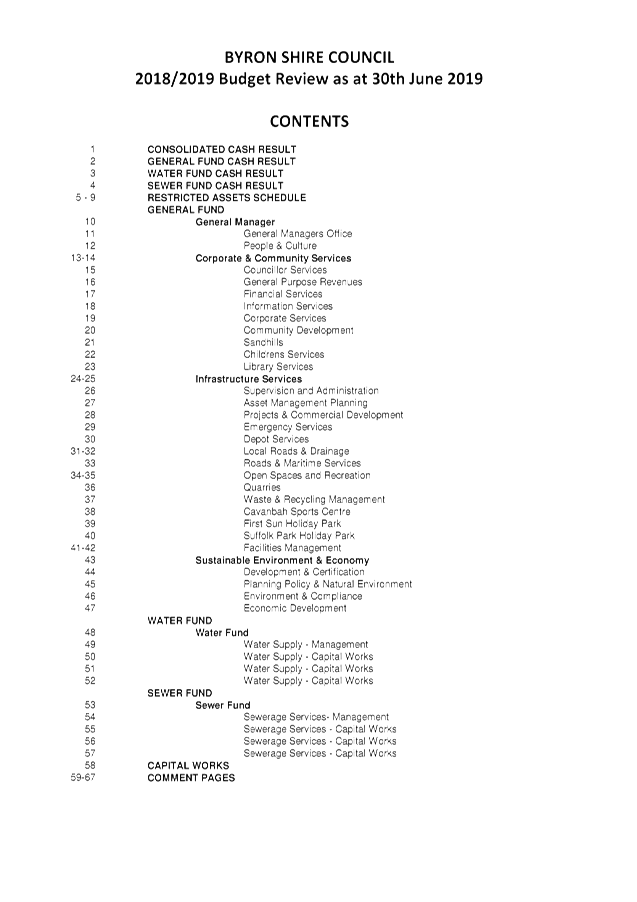

Finance Advisory Committee Meeting

BUSINESS OF MEETING

1. Apologies

2. Declarations of Interest

– Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Finance

Advisory Committee Meeting held on 9 May 2019

4. Staff Reports

Corporate and Community Services

4.1 Quarterly

Update - Implementation of Special Rate Variation......................................... 4

4.2 Carryovers

for Inclusion in the 2019-2020 Budget......................................................... 10

4.3 Budget

Review - 1 April 2019 to 30 June 2019............................................................... 20

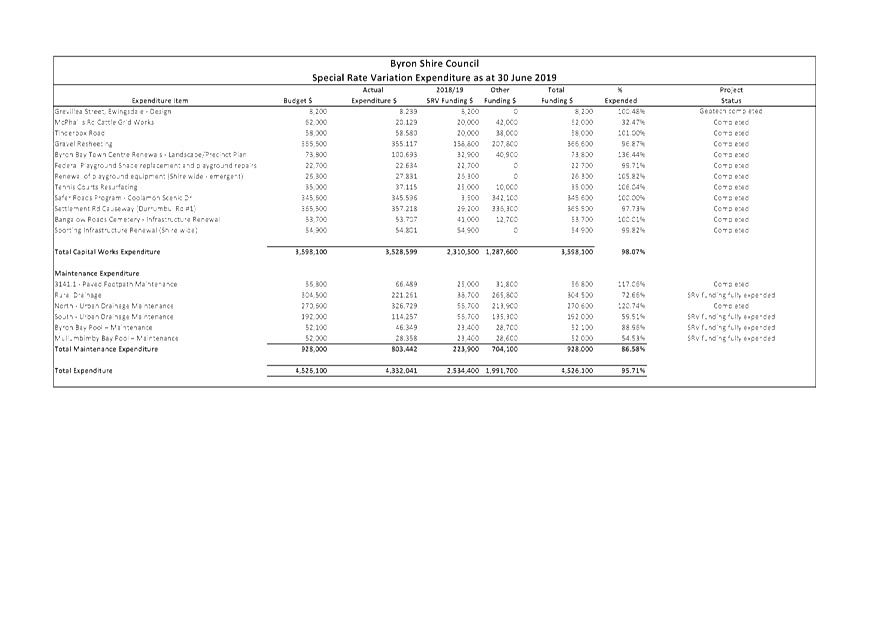

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

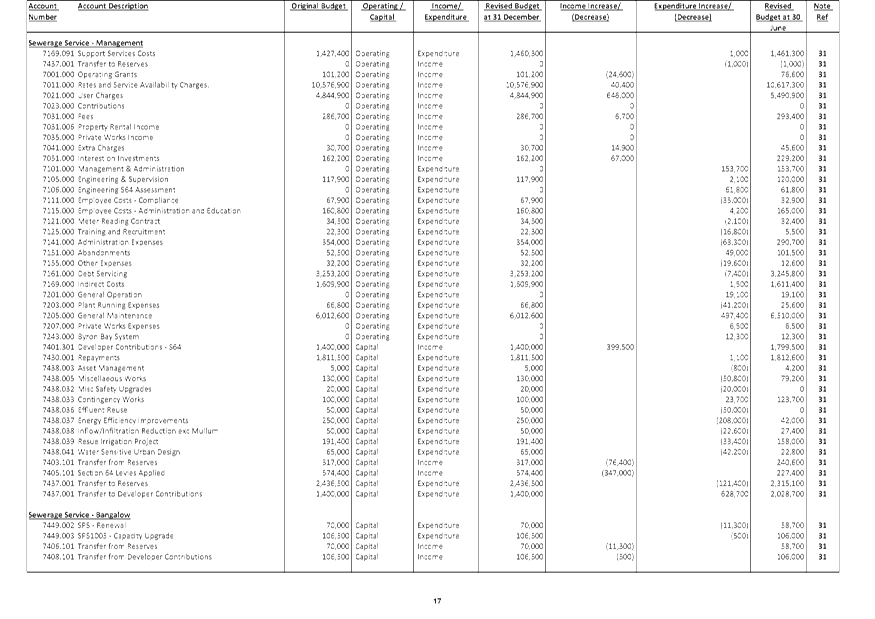

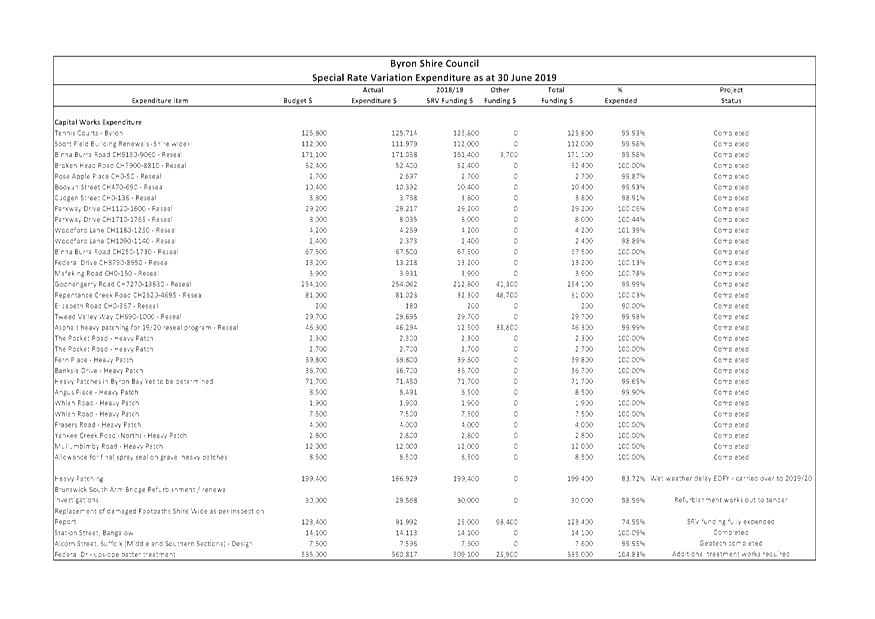

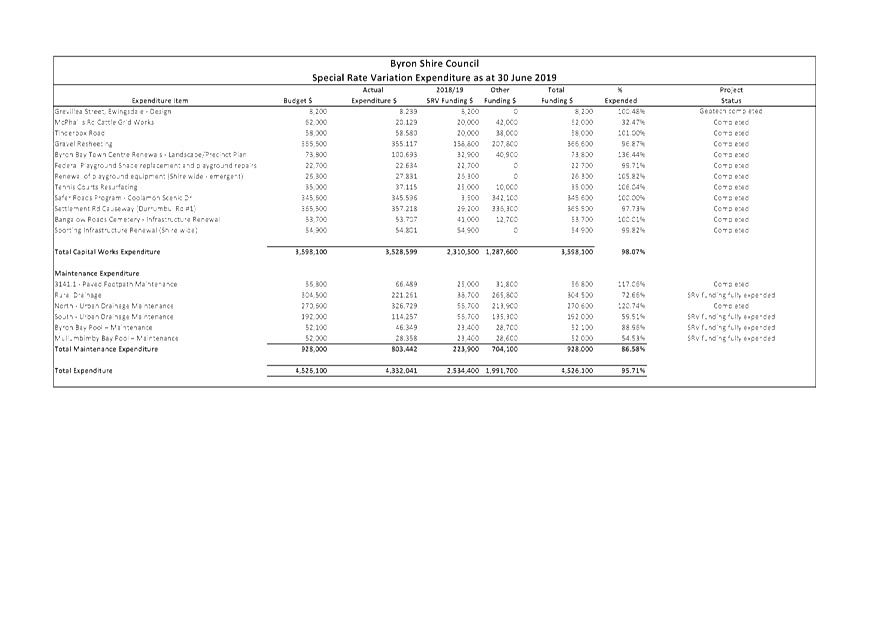

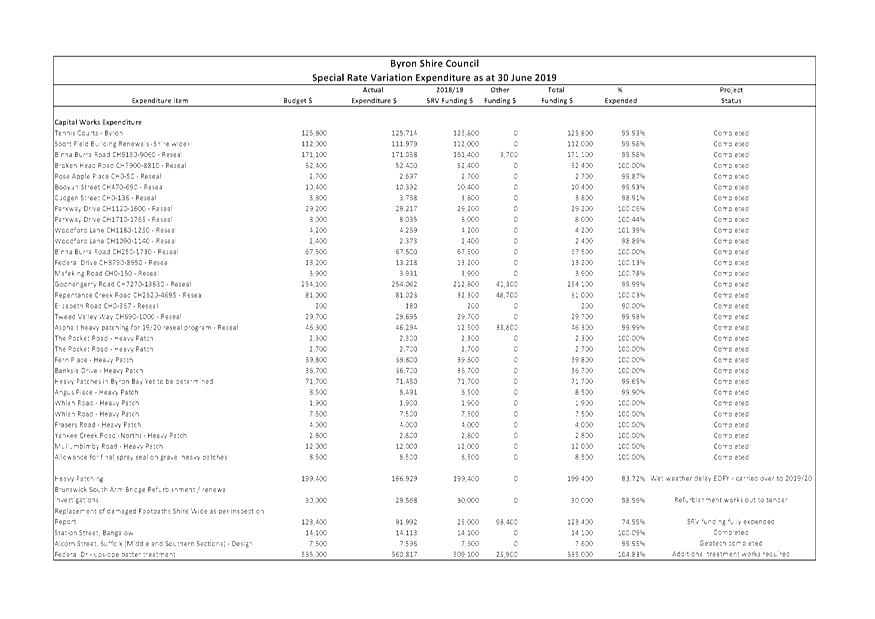

Report No. 4.1 Quarterly

Update - Implementation of Special Rate Variation

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2019/1166

Summary:

At its Ordinary Meeting held on 2 February 2017 Council resolved

to apply for a Special Rate Variation (SRV) of 7.50% per annum for four years

commencing from the 2017/2018 financial year (Resolution 17-020 part 5).

Following approval of Council’s SRV by the Independent

Pricing and Regulatory Tribunal (IPART) received on 9 May 2017, Council

resolved to implement the SRV at its Ordinary Meeting held on 22 June 2017

(Resolution 17-268 part 1).

At the same Ordinary Meeting Council resolved (Resolution 17-222

part 2) to incorporate reporting on the Special Rate Variation into the

development of the 2017/2018 Financial Sustainability Plan, and quarterly

updates to Council through the Finance Advisory Committee on the implementation

of the adopted Financial Sustainability Plan. Whilst Council is no longer

developing an annual Financial Sustainability Plan (from 2018/2019 onwards), it

is important to provide progressive reporting on the implementation of the SRV.

The purpose of this report is to provide the Finance

Advisory Committee with a quarterly update on implementation of the SRV and expenditure

up to 30 June 2019.

|

RECOMMENDATION:

That the Finance Advisory Committee notes the quarterly

update on the Special Rate Variation Implementation as at 30 June 2019.

|

Attachments:

1 2017-18

Special Rate Management Report as at 30 June 2019 Reported to Finance Advisory

Committee 8 August 2019, E2019/55837

, page 8⇩

REPORT

At its Ordinary Meeting held on 2 February 2017 Council resolved

to apply for a Special Rate Variation (SRV) as follows:

Resolution 17-020 part 5:

Lodge a Section 508A permanent Special Rate Variation

application to the Independent Pricing and Regulatory Tribunal, for increases

to the ordinary rate income (general revenue) of 7.5% (including rate peg) in

2017/18, 7.5% (including rate peg) in 2018/19, 7.5% (including rate peg) in

2019/20 and 7.5% (including rate peg) in 2020/21.

After lodging the Special Rate Variation application with

the Independent Pricing and Regulatory Tribunal (IPART), Council received

approval to increase its ordinary rate income as per resolution 17-020.

This approval was granted on 9 May 2017. Council resolved to implement

the SRV through adoption of the 2017/2018 Operational Plan and Revenue Policy

at its Ordinary Meeting held on 22 June 2017 (Resolution 17-268 part 1).

At its Ordinary Meeting held on 22 June 2017 Council received

Report 13.13 confirming the outcome of the SRV application and its subsequent

approval. Council resolved resolution 17-222 as follows:

1. That

Council note the determination from IPART in relation to its 2017/2018

Special Rate Application including the following conditions imposed by IPART on

Council for the:

a) use

of the additional income derived from the special variation for the purposes of

reducing its infrastructure backlog and improving financial sustainability;

and

b) reporting

on this use against the forecasts included in the Council’s application as

part the Council’s annual report for each year from 2017-18 to 2026-27.

2. That

Council adopt as a Policy Framework the use and reporting conditions imposed by

IPART in the SRV determination and further incorporate reporting on the Special

Rate Variation into the development of the 2017/2018 Financial Sustainability

Plan and the quarterly updates to Council through the Finance Advisory

Committee on the implementation of the adopted Financial Sustainability Plan.

3. That

Council establish as a policy framework that funding for infrastructure renewal

and maintenance from general revenue sources is not ever lower then the general

revenue baseline indicator established in the 2016/2017 Budget.

4. That

Council establish as a policy framework that any funds generated by the SRV

that remain unexpended at the end of each financial year are to be restricted

and held in a internal reserve, to be carried forward to subsequent financial

year, for expenditure in accordance with the uses imposed in the SRV approval.

5. That

Council incorporate the research of potential non resident revenue sources (if

any) as part of the Revenue Review chapter in the development of the 2017/2018

Financial Sustainability Plan, and provide quarterly updates to Council through

the Finance Advisory Committee.

6. That

Council not proceed with the implementation of part 9 and part 11 of

resolution 17-020.

This report is provided to the Finance Advisory Committee to

advise on the implementation of the SRV and the current status of expenditure

from 1 July 2018 to 30 June 2019 as detailed in Attachment 1, being the second

year of the SRV.

The levy of Council’s annual rates and charges was

completed in accordance with Resolution 18-429 prior to 31 July 2018 and

this included applying the second tranche of the 7.5% ordinary rate increase

for 2018/2019, continuing the revised ordinary rating structure adopted by

Council for 2017/2018.

The yield from the SRV for 2017/2018 (the first year of the

increase) was $1,185,000 with the yield for 2018/2019 being $2,276,400.

Upon adoption of the 2018/2019 Budget Estimates, Council

resolved to undertake the program of capital and maintenance works, including

the additional SRV revenue and other funding, outlined in Attachment 1.

During the course of the 2018/2019 financial year, any adjustments required to

the expenditure budgets identified in the schedule of capital and maintenance

works funded by the SRV revenue were presented to Council for approval via the

Quarterly Budget Review process.

The expenditure program adopted for the 2018/2019 financial

year was consistent with Council’s SRV application and approval from

IPART to use the funding to improve financial sustainability and reduce

infrastructure backlog.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.2

|

Create a

culture of trust with the community by being open, genuine and transparent

|

5.2.1

|

Provide timely,

accessible and accurate information to the community

|

5.2.1.3

|

Report on

progress of Delivery Program actions

|

Legal/Statutory/Policy Considerations

Approval and conditions received from the Independent Pricing and

Regulatory Tribunal (IPART) regarding the Byron Shire Council Special Rate

Application 2017-2018 received 9 May 2017.

Council Resolution 17-268, 18-429 and 17-222.

Financial Considerations

There are no direct financial implications associated with

this report. The table included at Attachment 1 provides information to the

Finance Advisory Committee on the expenditure of the Special Rate Variation

Funds up to the end of the fourth quarter of the 2018/2019 financial year.

The total 2017/2018 SRV Allocation for 2018/2019 as

indicated in Attachment 1 is $2,534,400.

Note that whilst the 2018/2019 SRV levy is $2,276,400, the

difference of $258,000 is unexpended funds from 2017/2018 that were carried

forward to the 18/19 financial year.

For the 2018/2019 financial year, as indicated in Attachment

1, all the SRV funding has been expended except for $33,300 relating to heavy

patching that is being carried forward to the 2019/2020 financial year and is

subject to a further report to this meeting of the Finance Advisory Committee.

Consultation and Engagement

Prior to the approval of the SRV, Council undertook

extensive community consultation. This report also provides an opportunity for

the community to receive a quarterly update on the implementation of the SRV

for the current financial year. Final outcomes for the 2018/2019 financial year

will also be published in Council’s Annual Report in accordance with the

approval conditions set by IPART.

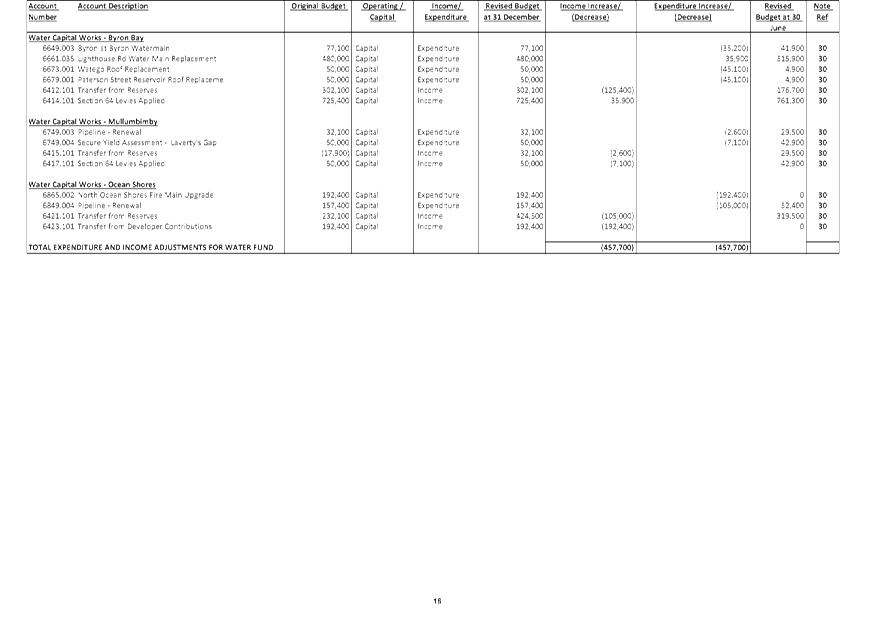

Staff Reports - Corporate and Community Services 4.1 - Attachment 1

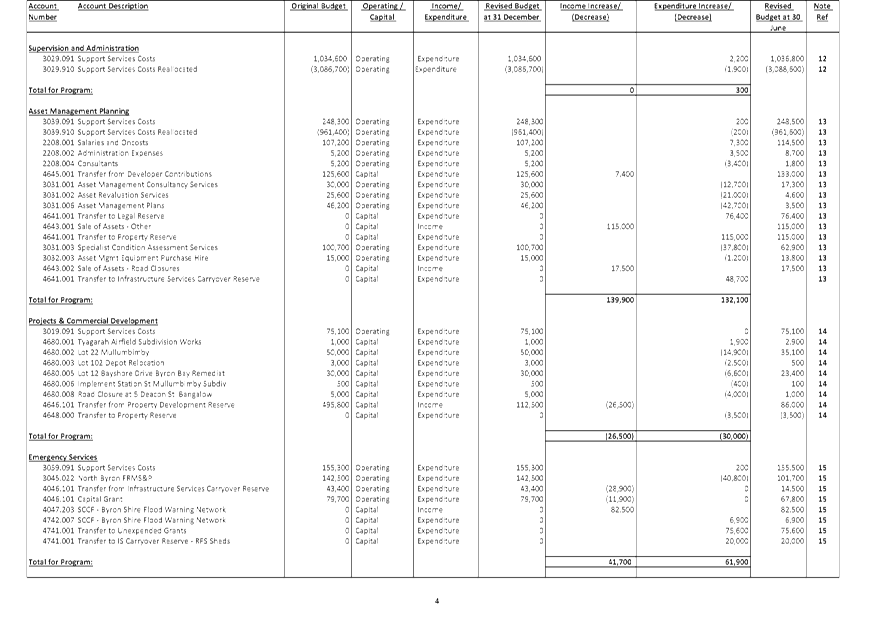

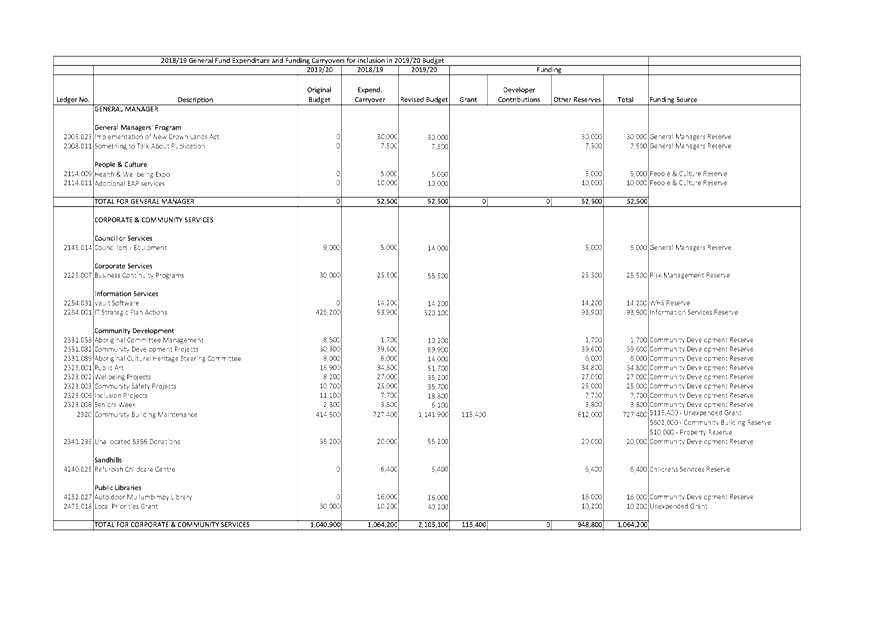

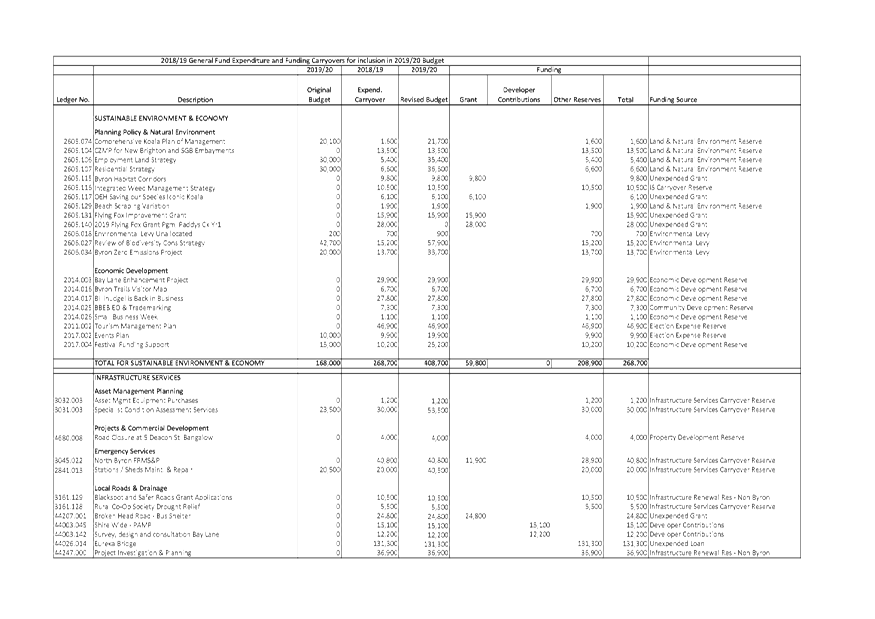

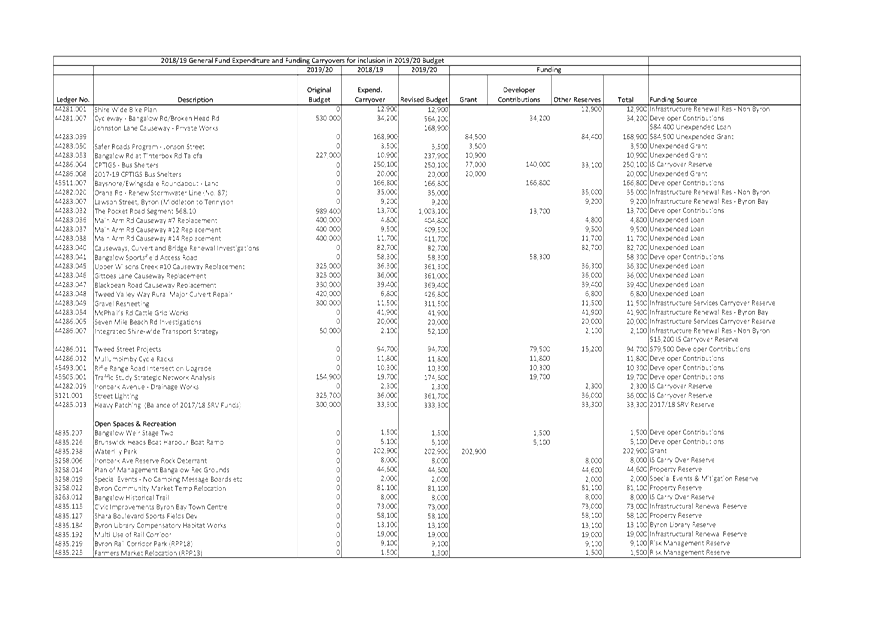

Staff Reports - Corporate and Community Services 4.2

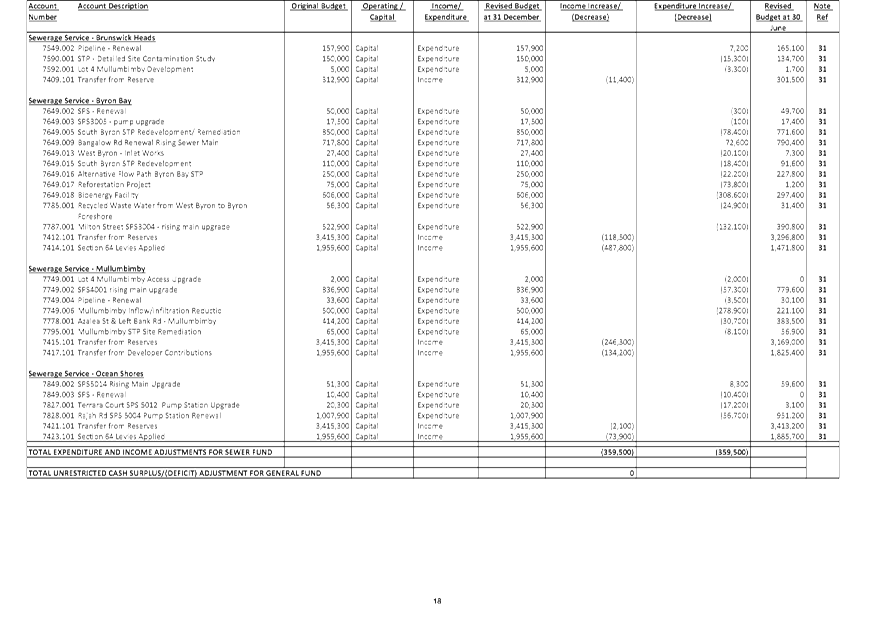

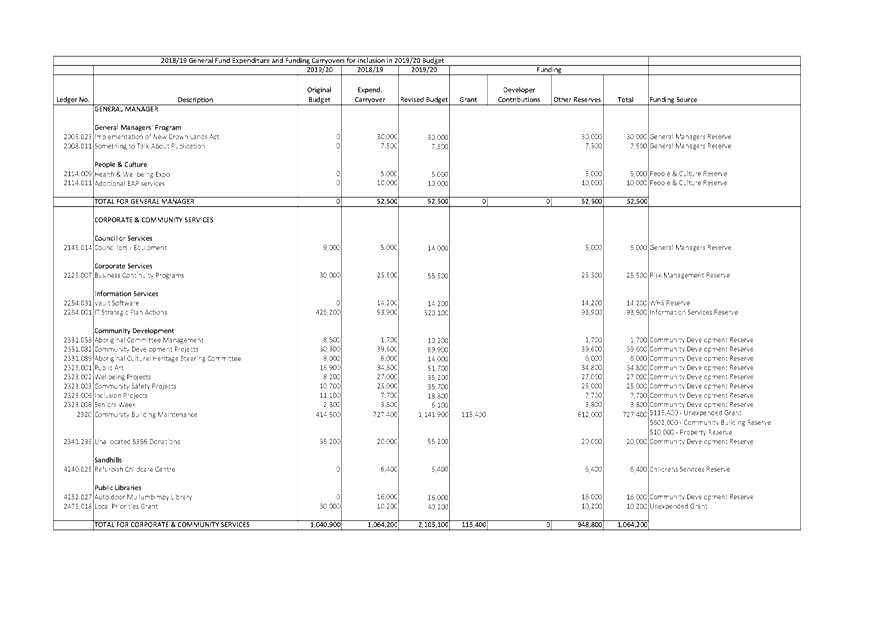

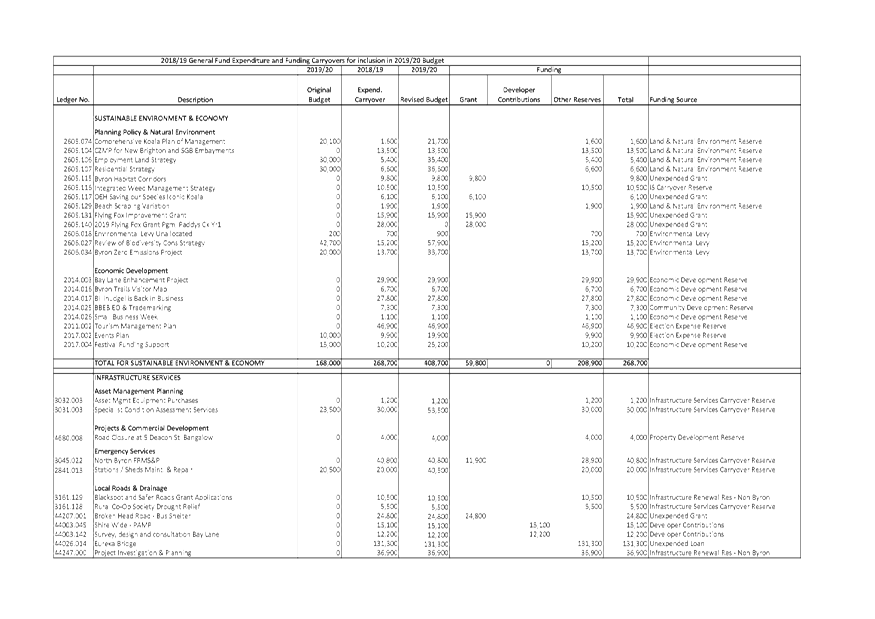

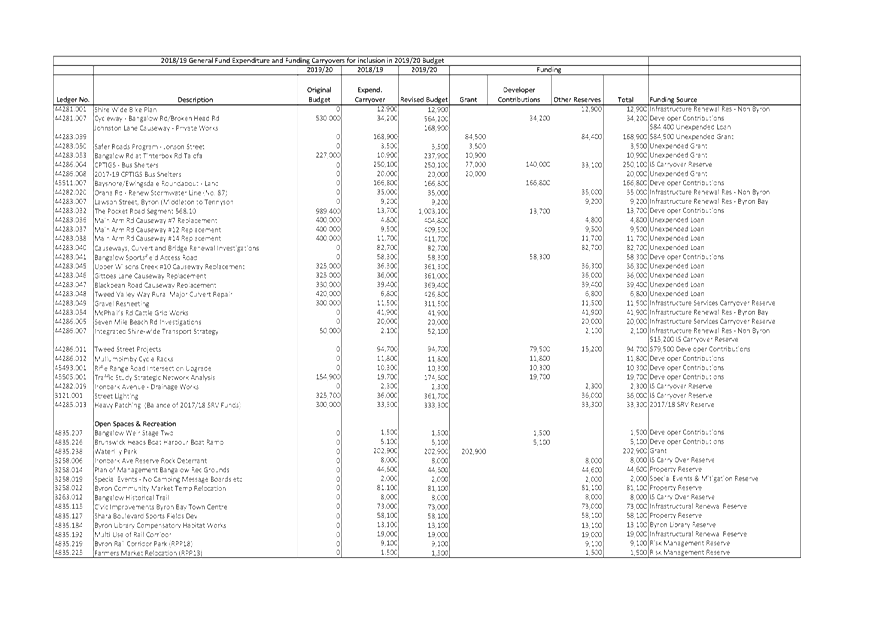

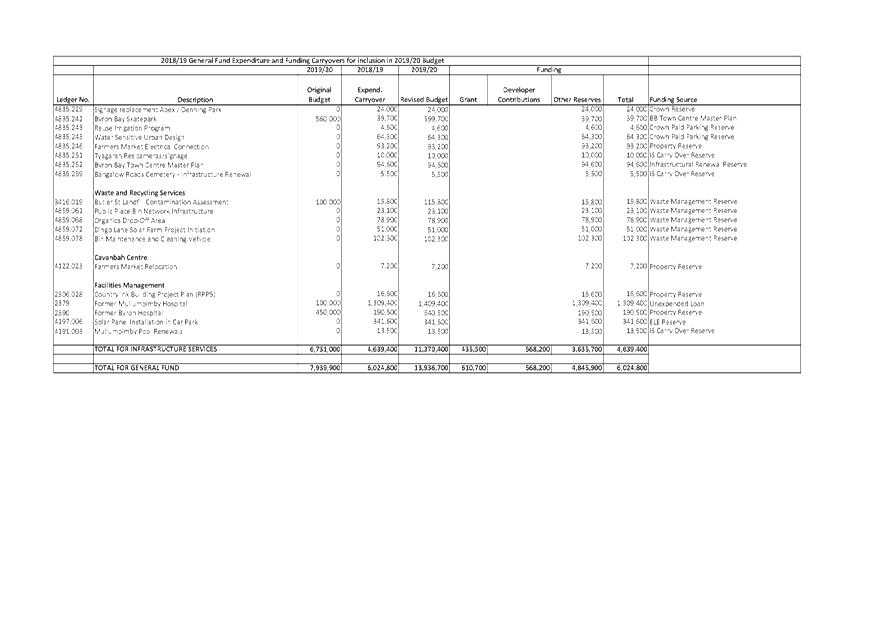

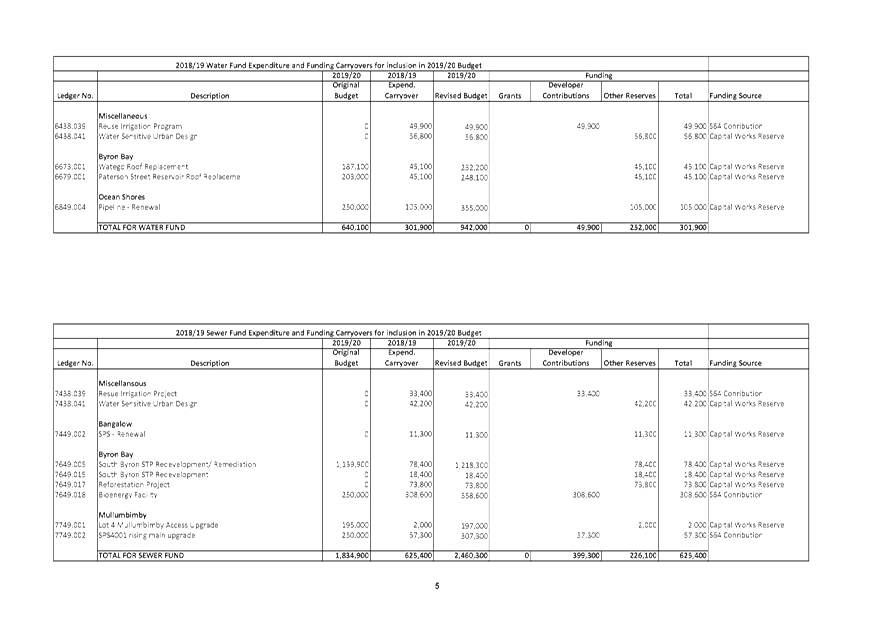

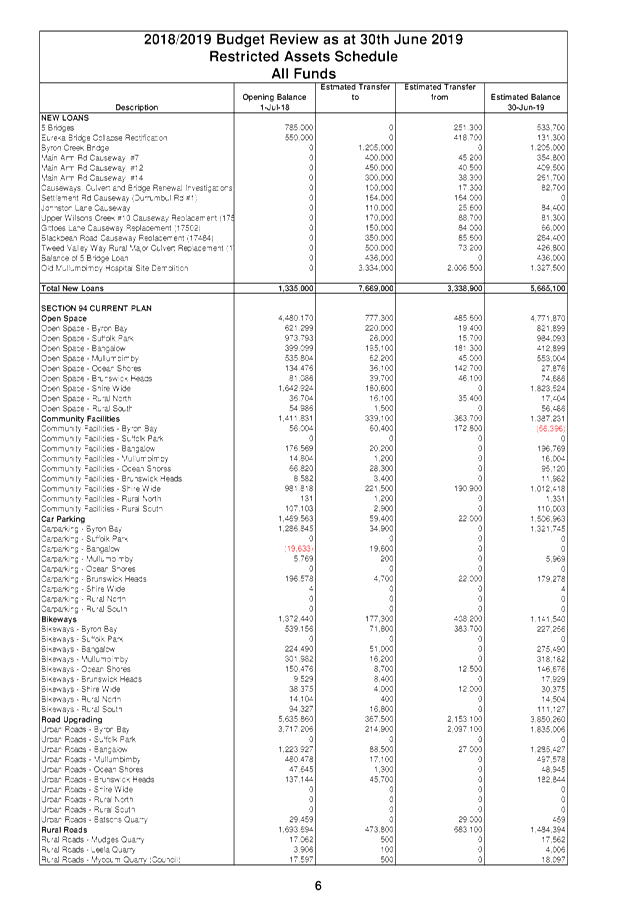

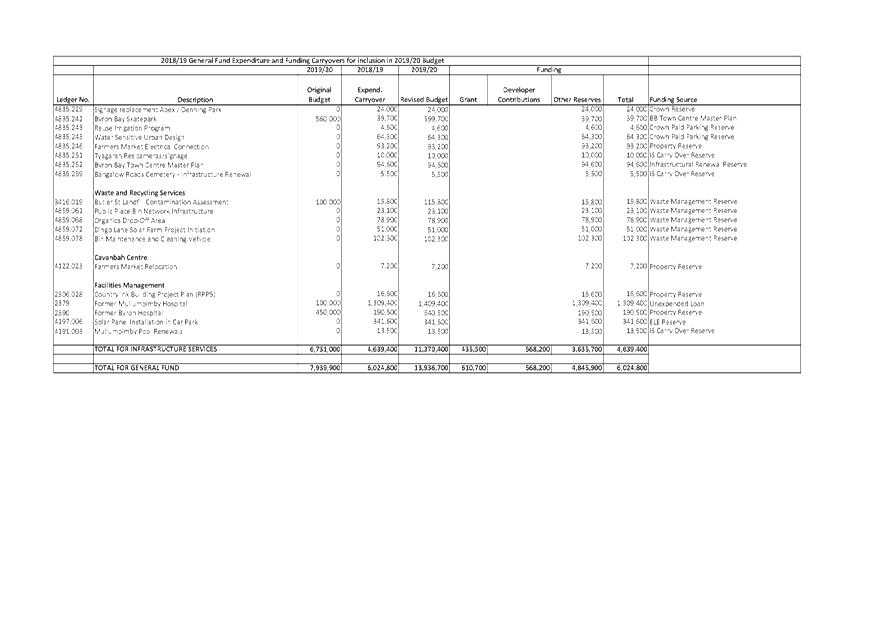

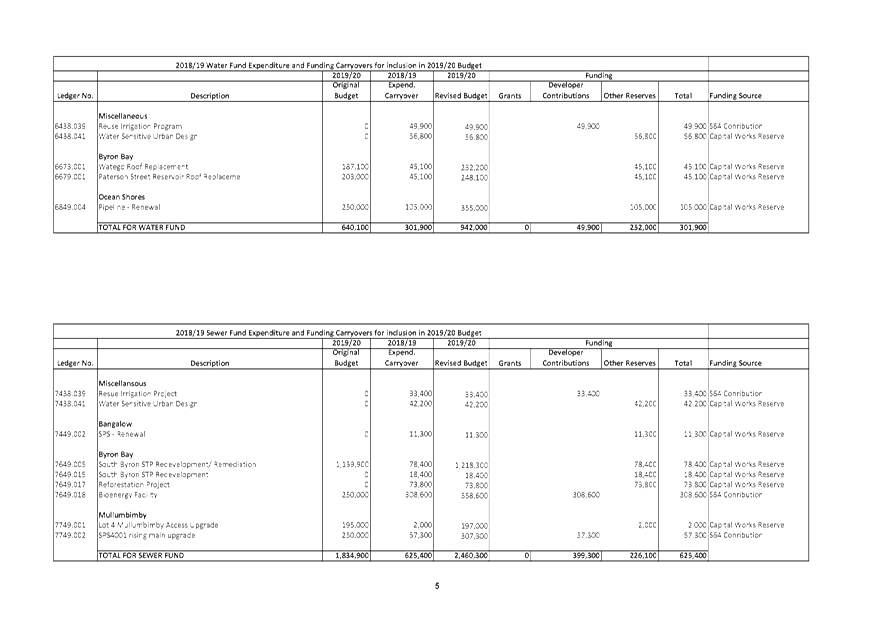

Report No. 4.2 Carryovers

for Inclusion in the 2019-2020 Budget

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2019/1170

Summary:

This report is prepared

for Council to consider and to adopt the carryover Budget allocations for works

and services, either commenced and not completed, or not commenced in the 2018/2019

financial year for inclusion in the 2019/2020 Budget Estimates.

Each year Council allocates funding for works and services

across all programs. For various reasons, some of these works and services are

incomplete at the end of the financial year. The funding for these works is

restricted at the end of the financial year, and is carried over as a budget

allocation revote to the following year, to fund the completion of the work or

service.

This report identifies all the works and services

recommended to be carried over from the 2018/2019 financial year to the

2019/2020 Budget Estimates. The report also identifies the funding for each

recommended budget allocation carryover.

|

RECOMMENDATION:

That the Finance Advisory

Committee recommends to Council:

That the works and services, and the respective funding

shown in Attachment 1 (#E2019/55476), be carried over from the 2018/2019

financial year and that the carryover budget allocations be adopted as budget

allocation revotes for inclusion in the 2019/2020 Budget Estimates.

|

Attachments:

1 Carryovers

for Inclusion in the 2019-2020 Budget General, Water and Sewerage Funds, E2019/55476 , page 15⇩

REPORT

Each year Council allocates funding for works and services

across all programs. For various reasons, some of these works and services are

incomplete at the end of the financial year. The funding for these works and

services is restricted at the end of the financial year to be carried over to

the following year for completion.

This report identifies all the works and services to be

carried over to the 2019/2020 Budget Estimates and the respective funding of

each, relating to works and services not completed during the course of the

2018/2019 financial year. The specific details of all carryover works and

services that are the subject of this report are outlined in Attachment 1.

The works and services included in Attachment 1 are fully

funded and have no impact on Council’s Unrestricted Cash Result or the

2019/2020 Budget Estimates result.

As in previous years there is a significant amount of

carryovers o be brought forward to the current financial year. Table 1 below

outlines carryovers in recent years.

Table 1 - Value of

budget carryovers 2015/16 – 2019/20

|

Fund

|

2015/16 ($)

|

2016/17 ($)

|

2017/18 ($)

|

2018/19 ($)

|

2019/20 ($)

|

|

General

|

10,550,300

|

5,022,100

|

7,102,100

|

9,004,500

|

6,024,800

|

|

Water

|

1,671,900

|

729,900

|

2,770,100

|

879,500

|

301,900

|

|

Sewer

|

1,929,000

|

600,100

|

2,051,800

|

2,473,500

|

625,400

|

|

Total

|

14,151,200

|

6,352,100

|

11,924,000

|

12,357,500

|

6,952,100

|

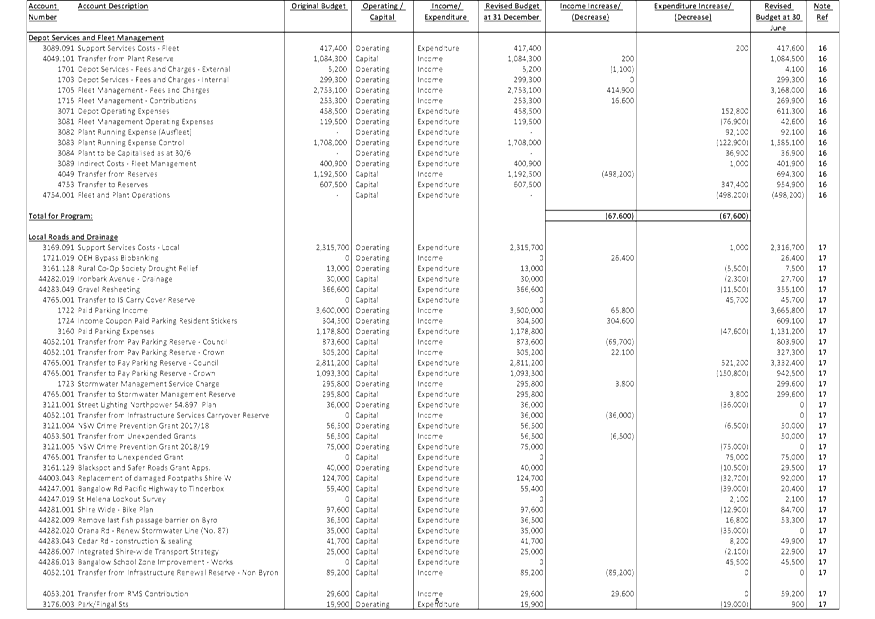

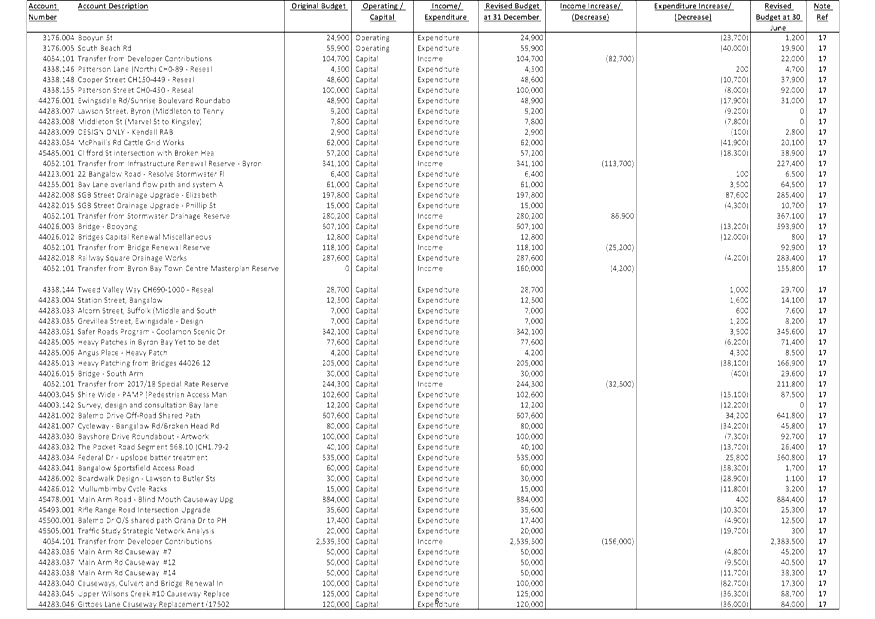

General Fund

The value of works carried over to 2019/2020 for the General

Fund is significantly less ($2,979,700) than that carried over for 2018/2019.

Of the $6,024,800 of General Fund carryovers, approximately 25% ($1,530,600) is

attributable to Local Roads and Drainage projects not completed in 2018/2019 to

be carried forward to 2019/2020.

Major carryover items in this fund are as follows:

|

· Eureka

Bridge

|

$131,300

|

|

· Johnston

Lane Causeway

|

$168,900

|

|

· Waterlily

Park

|

$202,900

|

|

· Former

Mullumbimby Hospital Site

|

$1,309,400

|

|

· Solar

Panel Installation in Admin Car Park

|

$341,600

|

|

· CPTIGS

- Bus Shelters

|

$250,100

|

|

· Bin

Maintenance and Cleaning Vehicle

|

$102,300

|

|

· Community

Buildings Maintenance (2008/2009 SRV)

|

$727,400

|

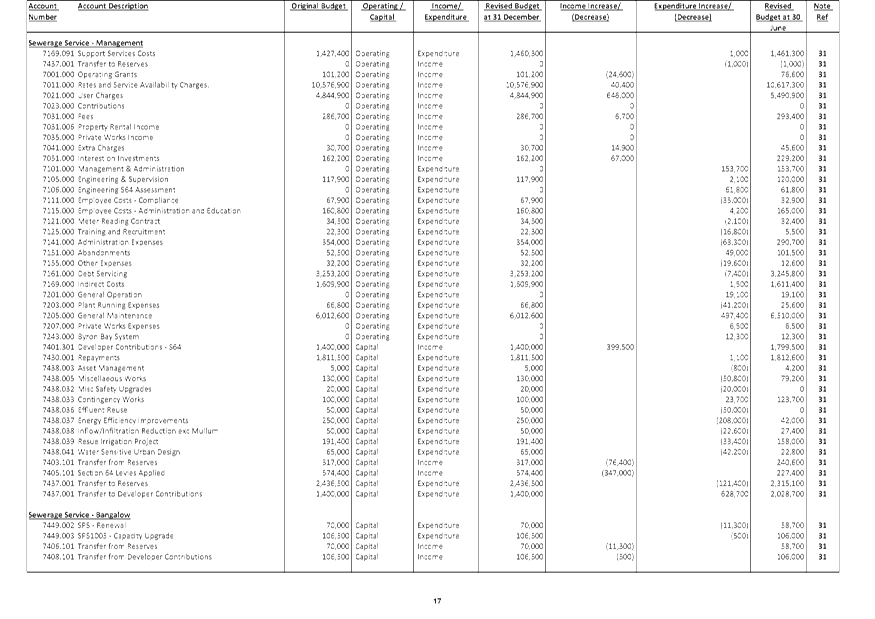

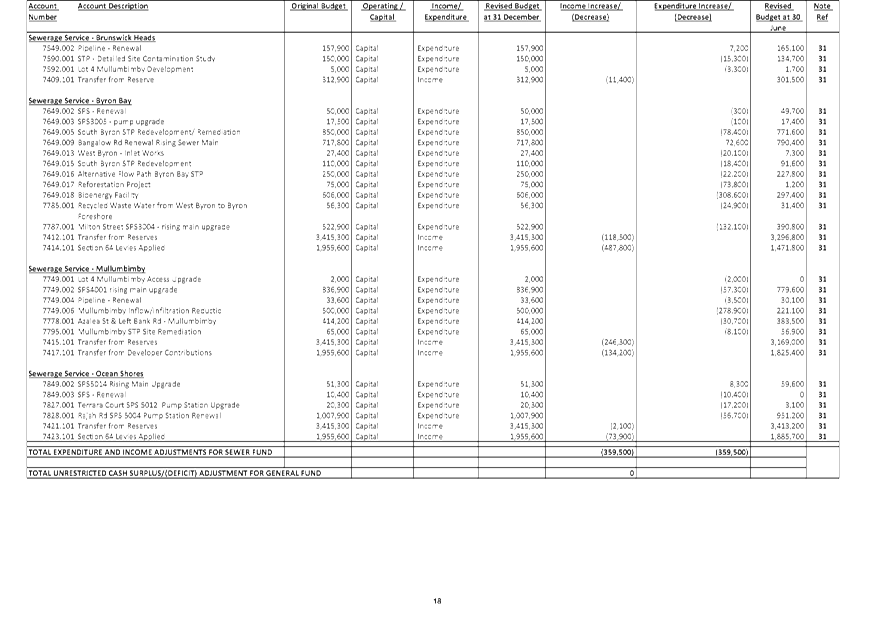

Water and Sewer Funds

Carryovers for the Water Fund have decreased by $577,600 and

for the Sewer Fund by $1,848,100 compared to the carryover applicable for the

2018/2019 financial year.

The following table outlines the project status of Local

Roads & Drainage capital works carryovers for Councillors’

information, where works are in progress or contracts have been awarded at the

time of writing this report.

Table 2 –

Schedule of Carryover works current status

|

Project

|

Carryover $

|

Project Status

|

|

Blackspot and Safer Roads Grant Applications

|

10,500

|

Application preparation to be finalised and lodged 31 July

2019

|

|

Rural Co-Op Society Drought Relief

|

5,500

|

To be completed 2019/20

|

|

Broken Head Road - Bus Shelter

|

24,800

|

Works in progress to be completed by December 2019

|

|

Shire Wide - PAMP (Pedestrian Access Man

|

15,100

|

Works in progress to be completed by December 2019

|

|

Survey, design and consultation Bay Lane

|

12,200

|

Works in progress to be completed by December 2019

|

|

Bridge at Eureka

|

131,300

|

Works under contract to be completed by December 2019

|

|

Project Investigation & Planning

|

36,900

|

Works in progress to be completed 2019/20

|

|

Shire Wide Bike Plan

|

12,900

|

Works in progress to be completed by December 2019

|

|

Cycleway - Bangalow Rd/Broken Head Rd

|

34,200

|

Works in progress to be completed 2019/20

|

|

Johnston Lane Causeway - Private Works

|

168,900

|

Works to be undertaken 2019/20

|

|

Safer Roads Program - Jonson Street

|

3,500

|

Works in progress to be completed 2019/20

|

|

Bangalow Rd at Tinderbox Rd Talofa

|

10,900

|

Works in progress to be completed 2019/20

|

|

CPTIGS - Bus Shelters

|

250,100

|

Works in progress to be completed 2019/20

|

|

2017-19 CPTIGS Bus Shelters

|

20,000

|

Works in progress to be completed 2019/20

|

|

Bayshore/Ewingsdale Roundabout – Land

|

166,800

|

Works in progress to be completed 2019/20

|

|

Orana Rd - Renew Stormwater Line (No. 87)

|

35,000

|

Works to be undertaken 2019/20

|

|

Lawson Street, Byron (Middleton to Tennyson

|

9,200

|

Works in progress to be completed 2019/20

|

|

The Pocket Road Segment 568.10

|

13,700

|

Works in progress to be completed 2019/20

|

|

Main Arm Rd Causeway #7 Replacement

|

4,800

|

Works in progress to be completed 2019/20

|

|

Main Arm Rd Causeway #12 Replacement

|

9,500

|

Works in progress to be completed 2019/20

|

|

Main Arm Rd Causeway #14 Replacement

|

11,700

|

Works in progress to be completed 2019/20

|

|

Causeways, Culvert and Bridge Renewal Investigation

|

82,700

|

Works in progress to be completed 2019/20

|

|

Bangalow Sportsfield Access Road

|

58,300

|

Works in progress to be completed 2019/20

|

|

Upper Wilsons Creek #10 Causeway Replacement

|

36,300

|

Works in progress to be completed 2019/20

|

|

Gittoes Lane Causeway Replacement

|

36,000

|

Works in progress to be completed 2019/20

|

|

Blackbean Road Causeway Replacement

|

39,400

|

Works in progress to be completed 2019/20

|

|

Tweed Valley Way Rural Major Culvert Repair

|

6,800

|

Works in progress to be completed 2019/20

|

|

Gravel Resheeting

|

11,500

|

Works in progress to be completed 2019/20

|

|

McPhail’s Rd Cattle Grid Works

|

41,900

|

Works to be undertaken 2019/20

|

|

Seven Mile Beach Rd Investigations

|

20,000

|

Works in progress to be completed 2019/20

|

|

Integrated Shire-wide Transport Strategy

|

2,100

|

Works in progress to be completed 2019/20

|

|

Tweed Street Projects

|

94,700

|

Works to be undertaken 2019/20

|

|

Mullumbimby Cycle Racks

|

11,800

|

Works in progress to be completed 2019/20

|

|

Rifle Range Road Intersection Upgrade

|

10,300

|

Works in progress to be completed 2019/20

|

|

Traffic Study Strategic Network Analysis

|

19,700

|

Works in progress to be completed 2019/20

|

|

Ironbark Avenue - Drainage Works

|

2,300

|

Works in progress to be completed 2019/20

|

|

Street Lighting

|

36,000

|

Works in progress to be completed 2019/20

|

|

Heavy Patching (Balance of SRV Funds)

|

33,300

|

Works in progress to be completed 2019/20

|

|

Total

|

1,530,600

|

|

In accordance with Clause 211 of the Local Government

(General) Regulation 2005, Council conducted its annual meeting to approve

expenditure and voting of money on 27 June 2019 via Resolution 19-325. The

expenditure items subject of this report were not included in the 2019/2020

Budget Estimates but now need to be. The intent of this report is to seek

Council approval to revote the carryovers from the 2018/2019 financial year and

to adopt the budget allocation carryovers for inclusion in the 2019/2020 adopted

Budget Estimates.

At its meeting held on 28 March 2013, the Strategic Planning

Committee considered Report 4.3 on Council’s financial position for the

2012/2013 financial year. The recommendations from this meeting were

adopted by Council at its Ordinary Meeting held on 18 April 2013 through

resolution 13-164. Committee recommendation SPC 4.3 in part 5 included

the following process to be applied to the consideration of any amount

identified as a carryover to the 2013/14 and future Budgets and funded from

general revenues:

That

Council determines that any general revenue funded allocated expenditure, not

expended in

a current financial year NOT be automatically carried over to the next

financial year before it is

reviewed and priorities established.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective

5: We have community led decision making which is open and inclusive

|

5.5

|

Manage

Council’s finances sustainably

|

5.5.1

|

Enhance the

financial capability and acumen of Council

|

5.5.1.2

|

Support the

organisation in identifying financial implications of projects, proposals and

plans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Regulation 211 of the Local Government (General) Regulation

2005 outlines the requirements of Council relating to authorisation of

expenditure. Specifically the Regulation 211 states:

(1) A

council, or a person purporting to act on behalf of a council, must not incur

a liability for the expenditure of money unless the council at the annual

meeting held in accordance with subclause (2) or at a later ordinary meeting:

(a) has approved the

expenditure, and

(b) has voted the money

necessary to meet the expenditure.

(2) A

council must each year hold a meeting for the purpose of approving expenditure

and voting money.

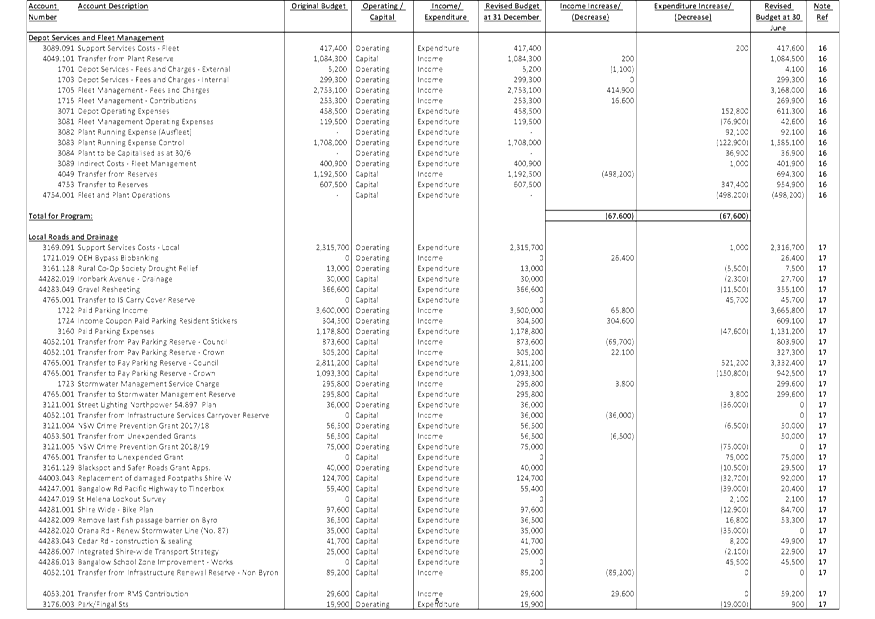

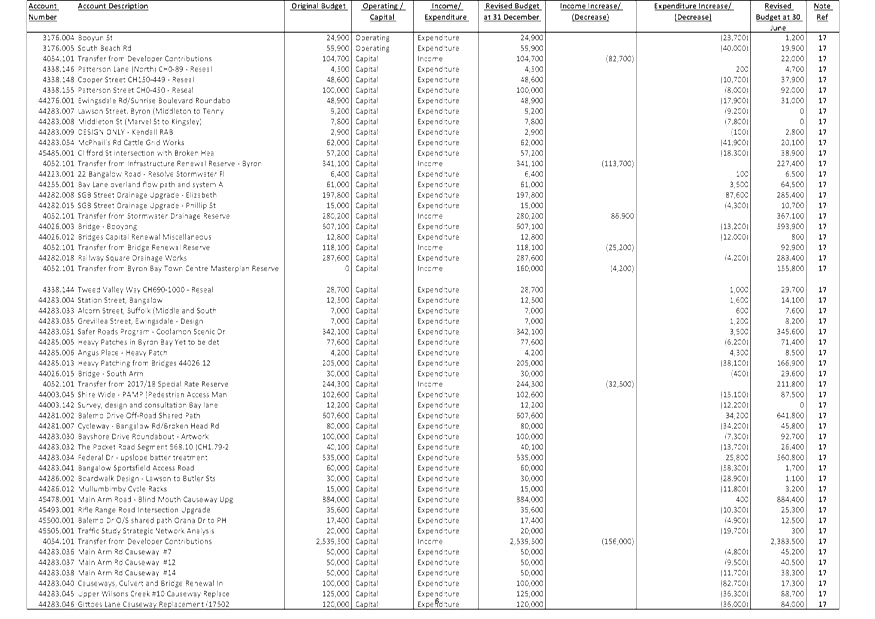

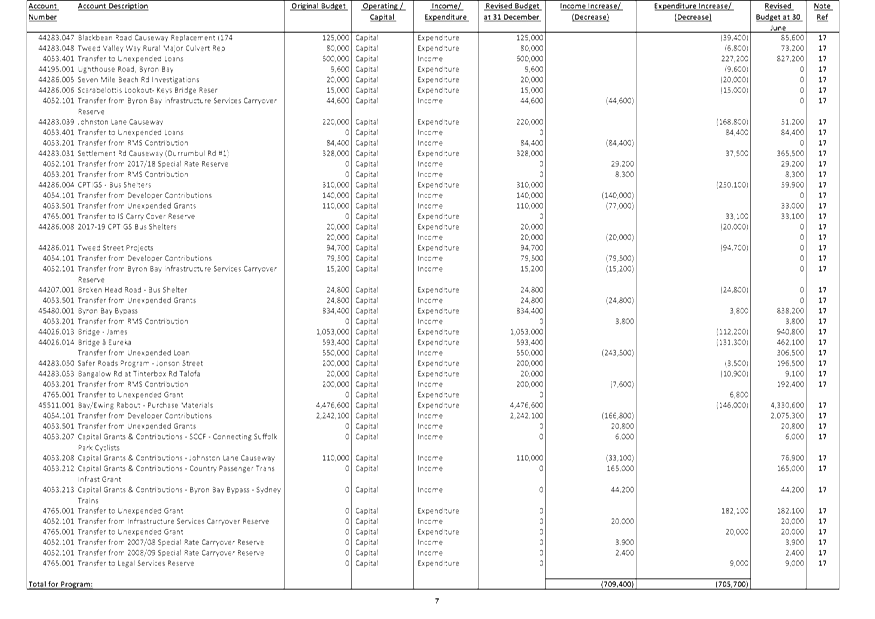

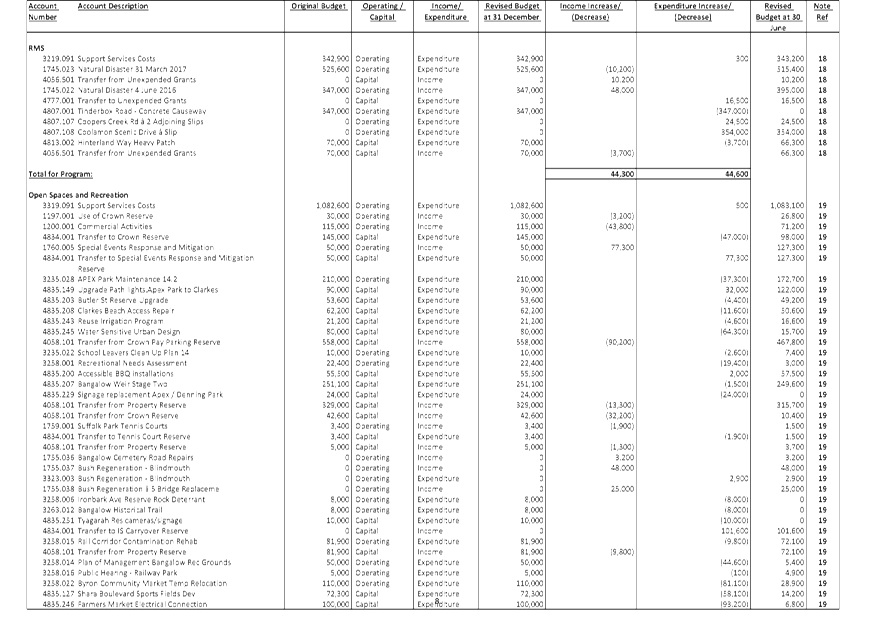

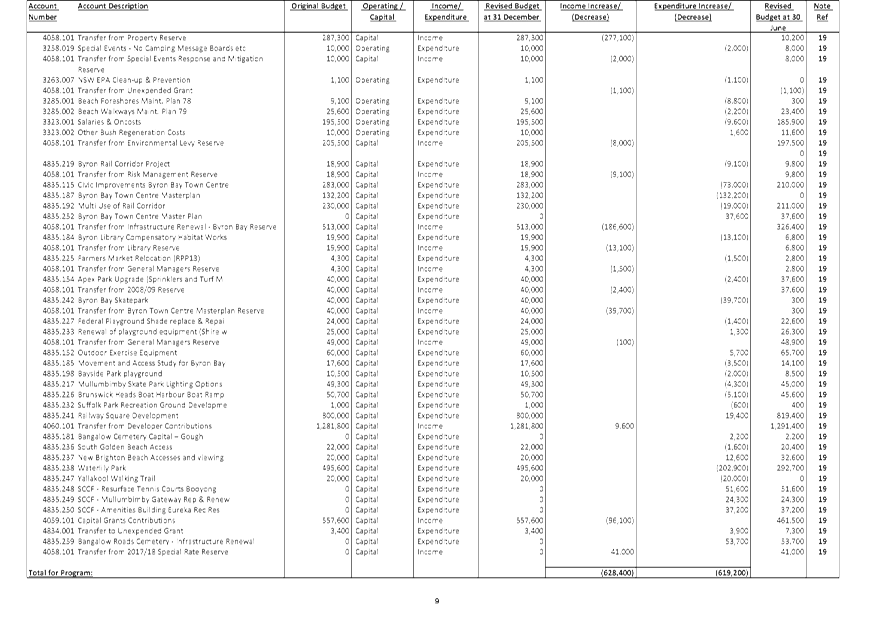

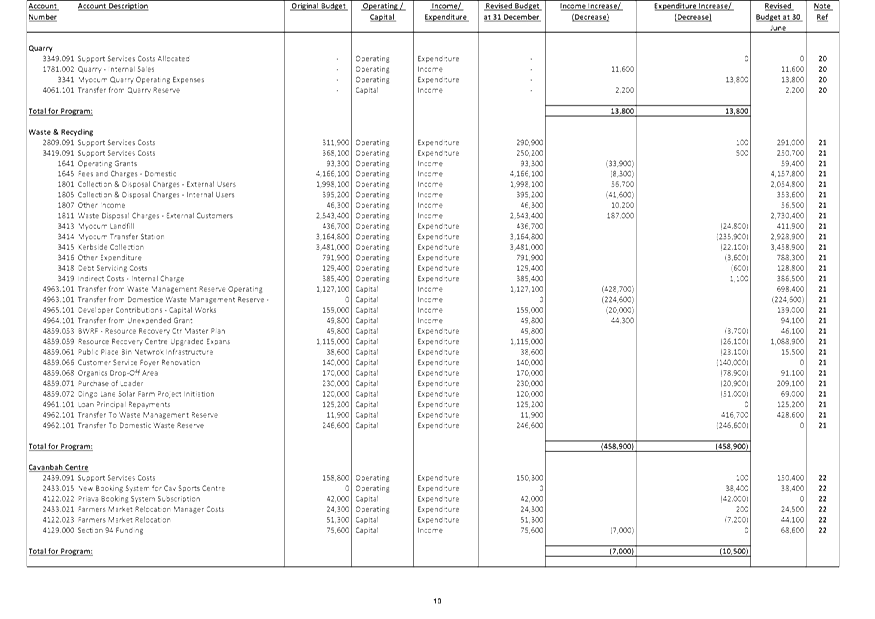

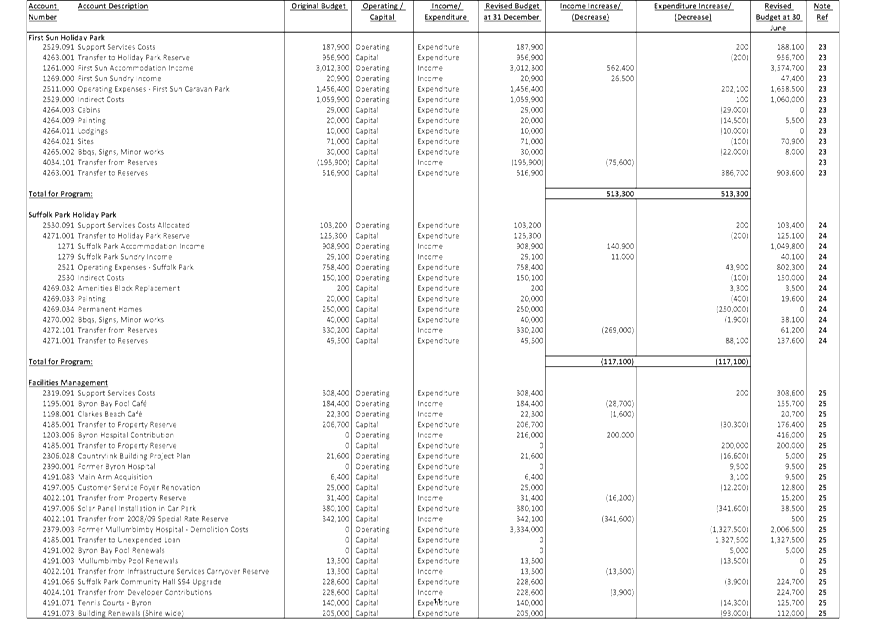

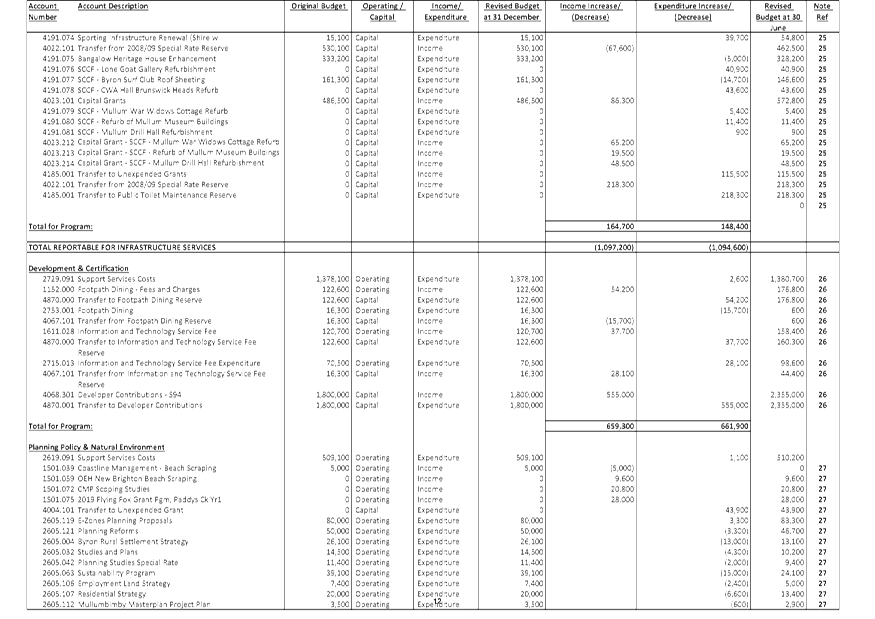

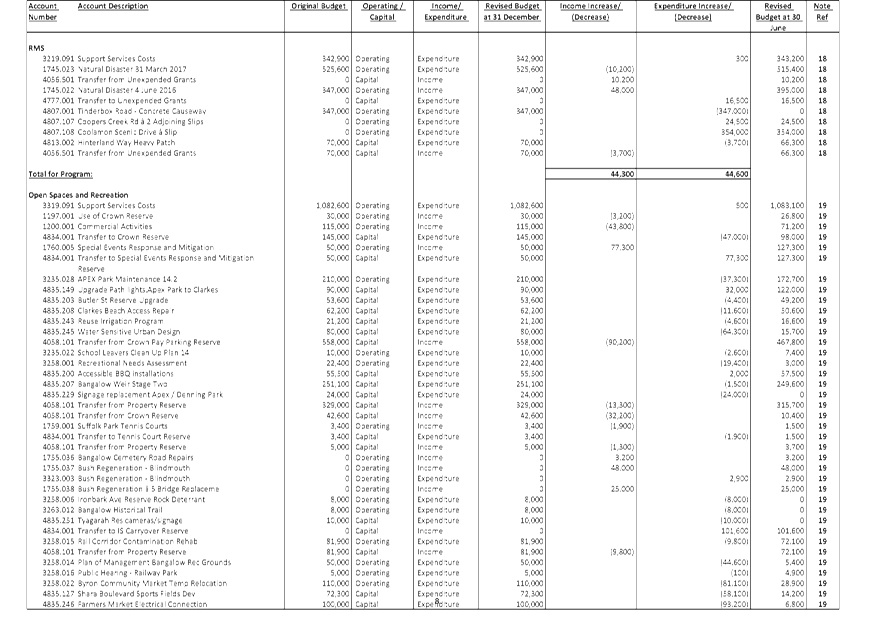

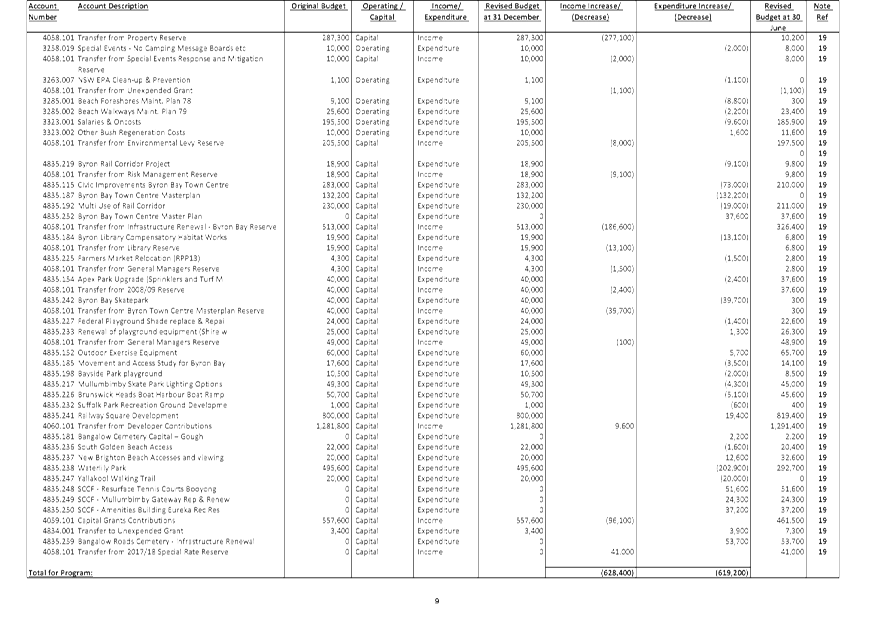

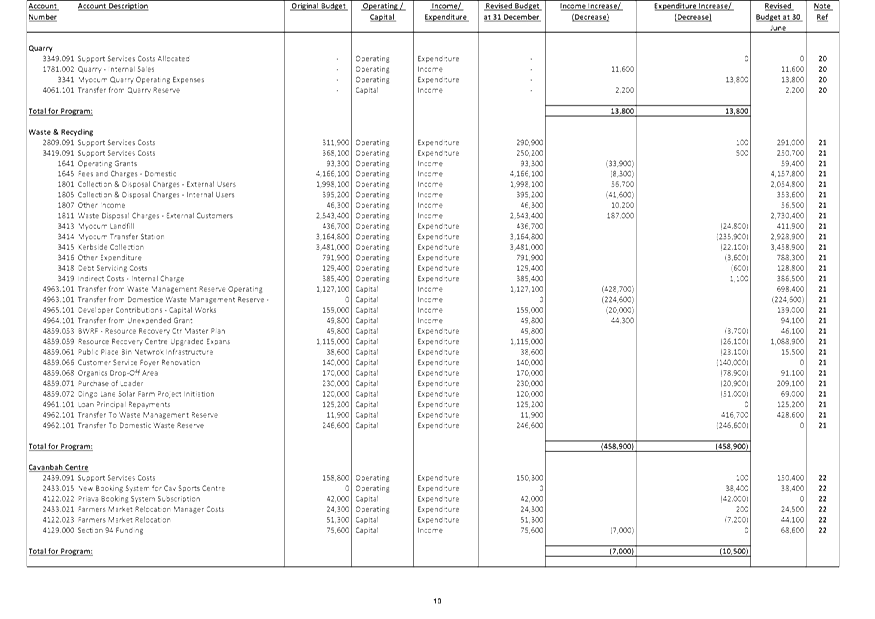

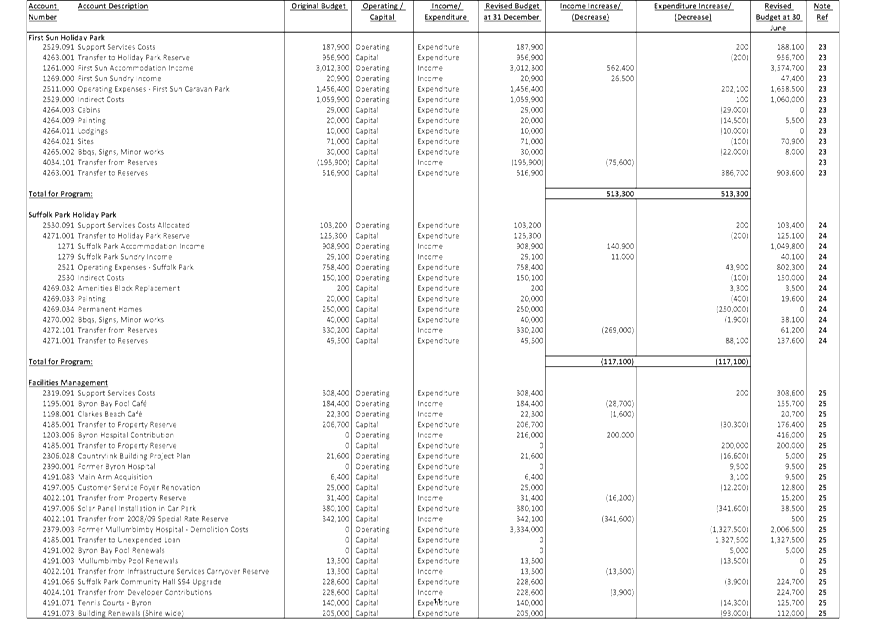

Staff Reports - Corporate and Community Services 4.2 - Attachment 1

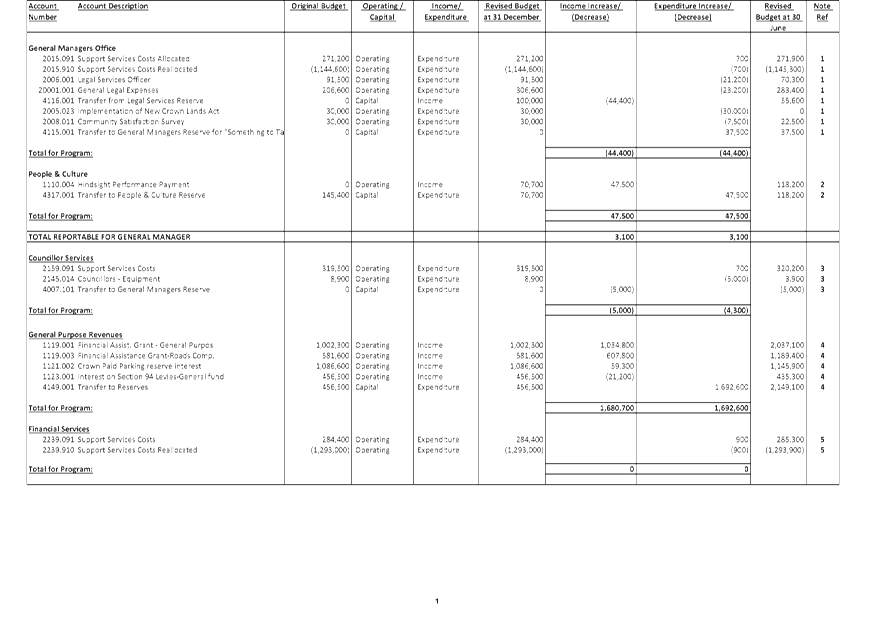

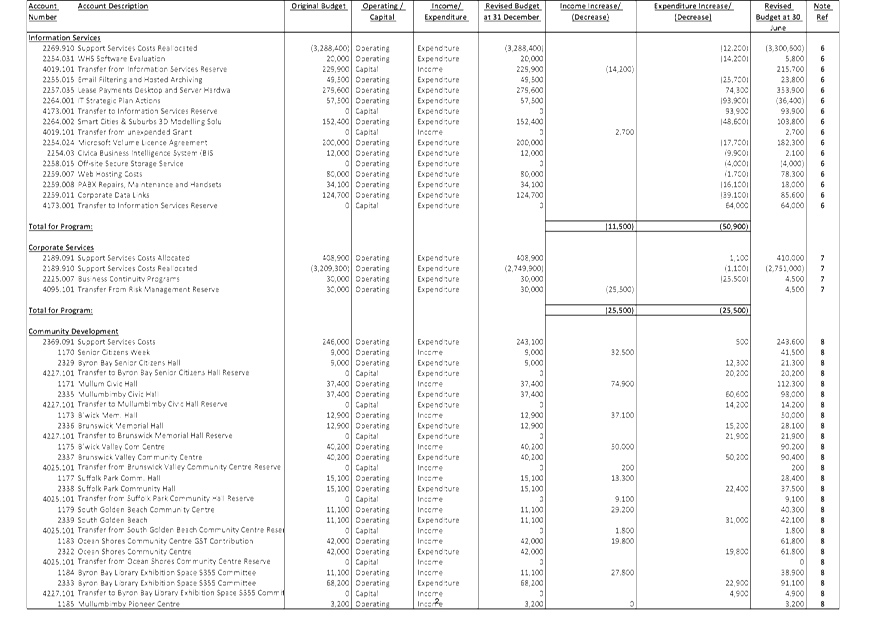

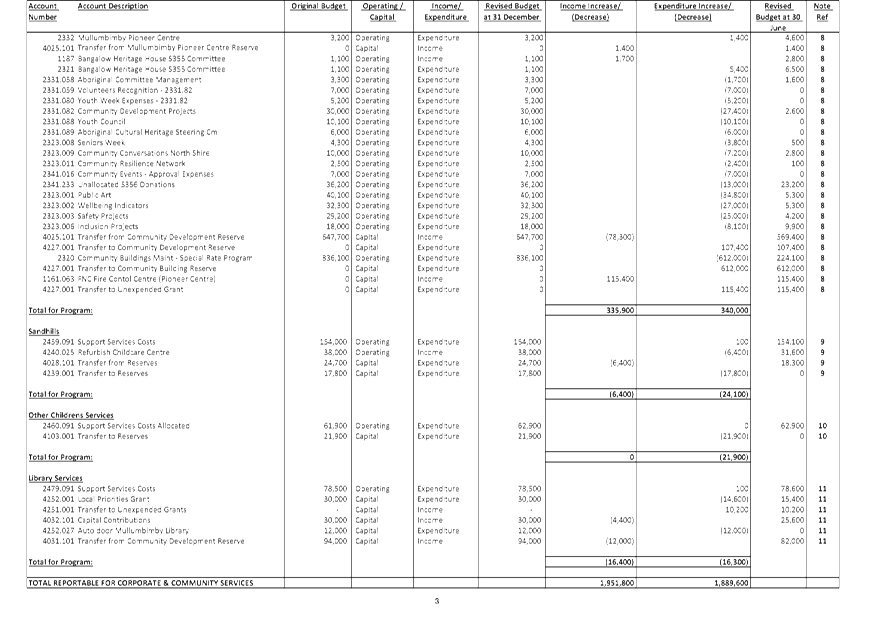

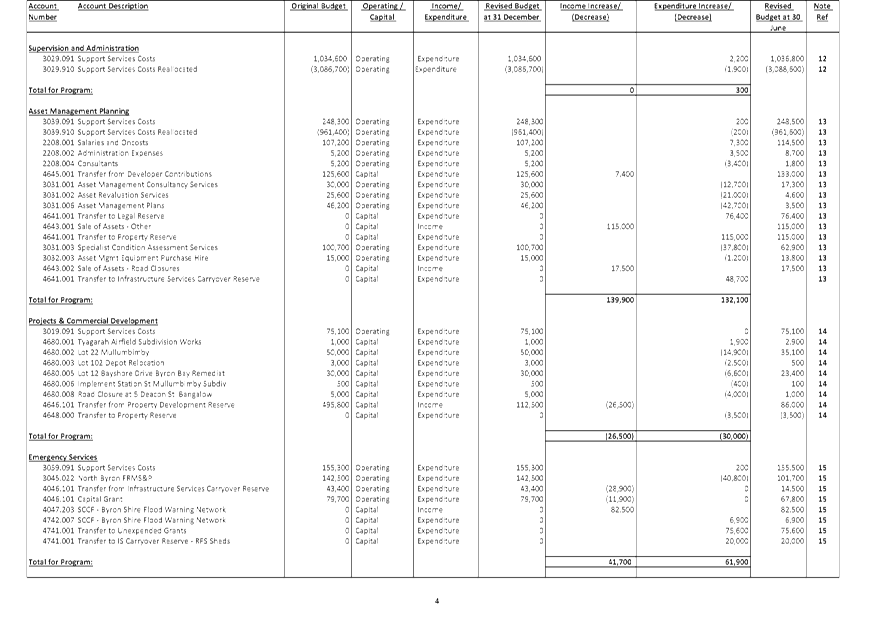

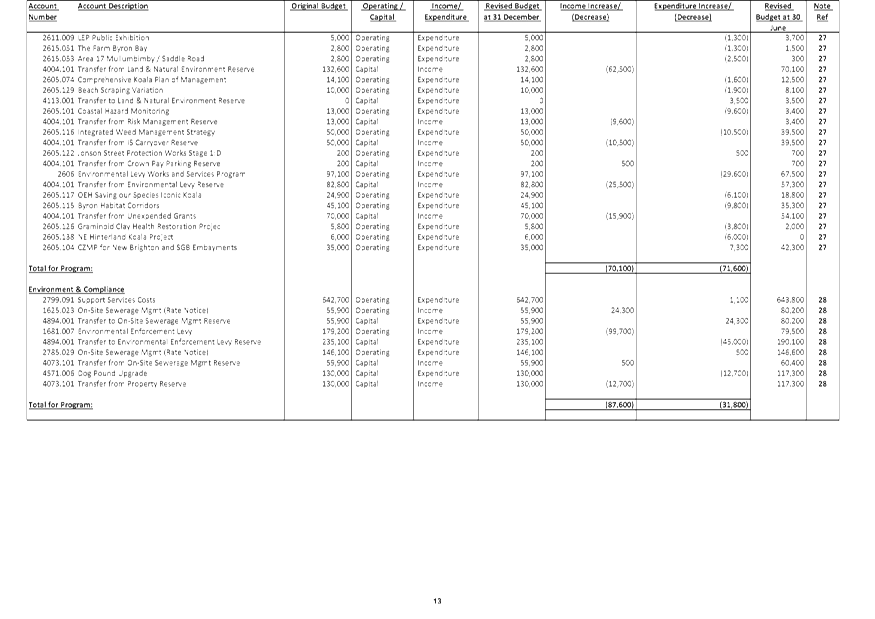

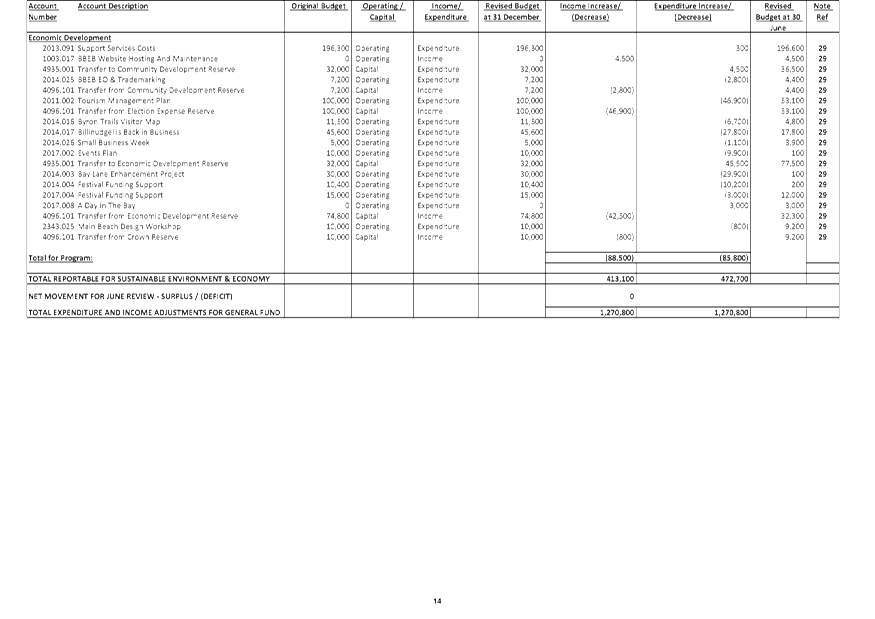

Staff Reports - Corporate and Community Services 4.3

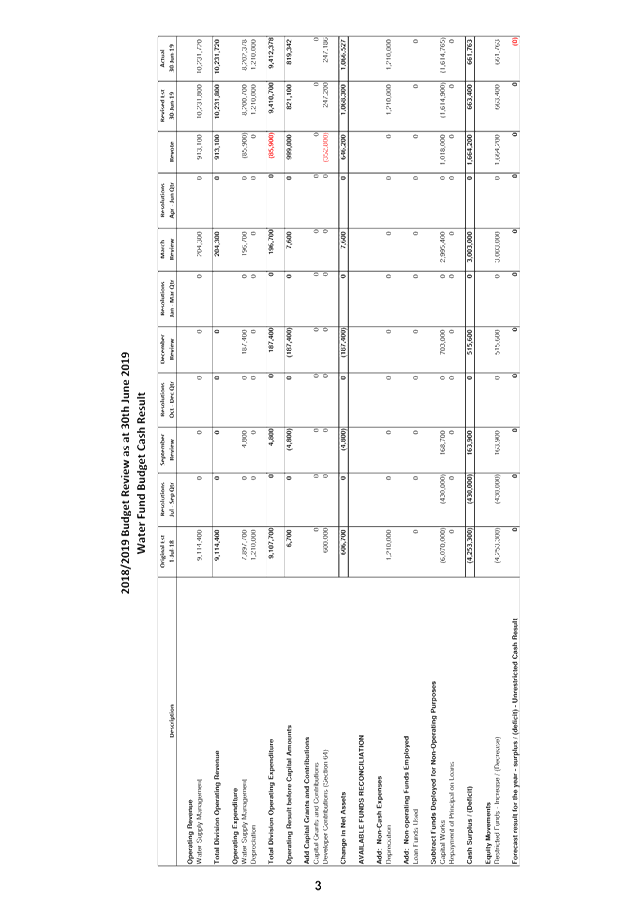

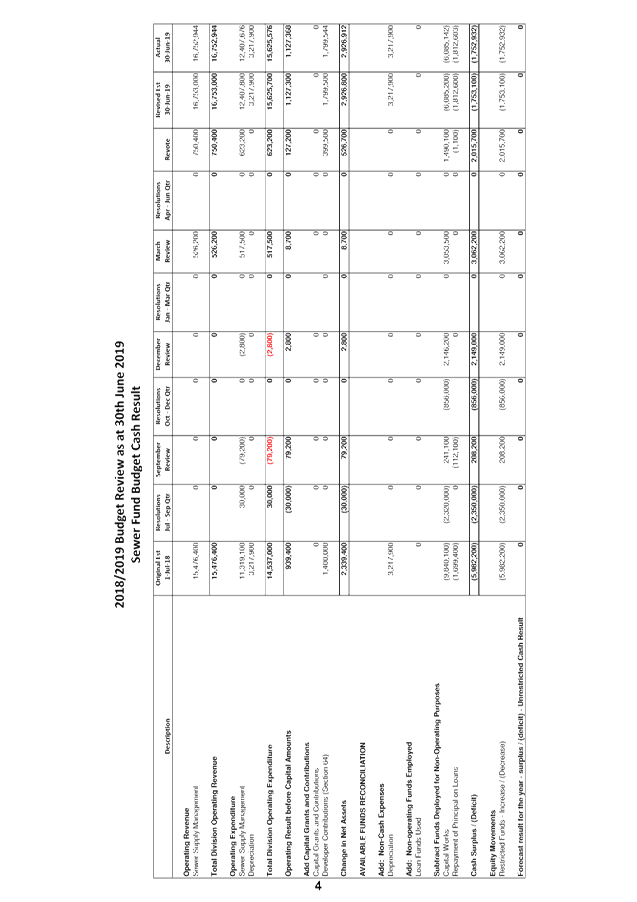

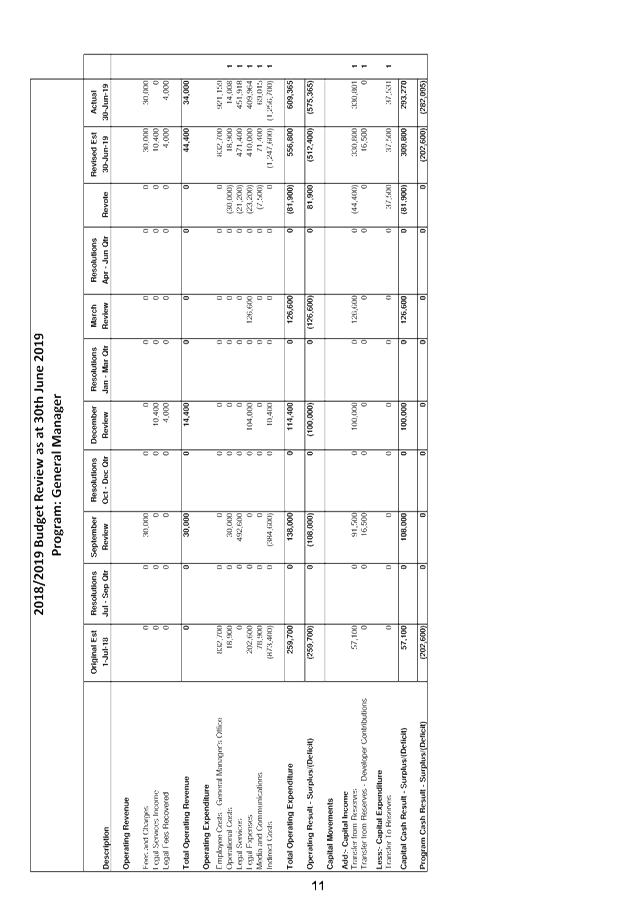

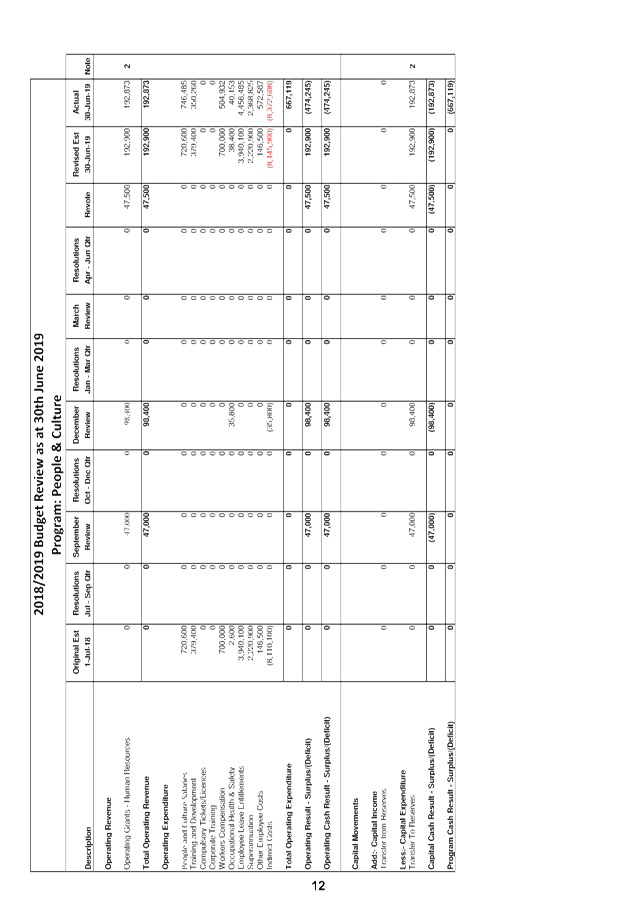

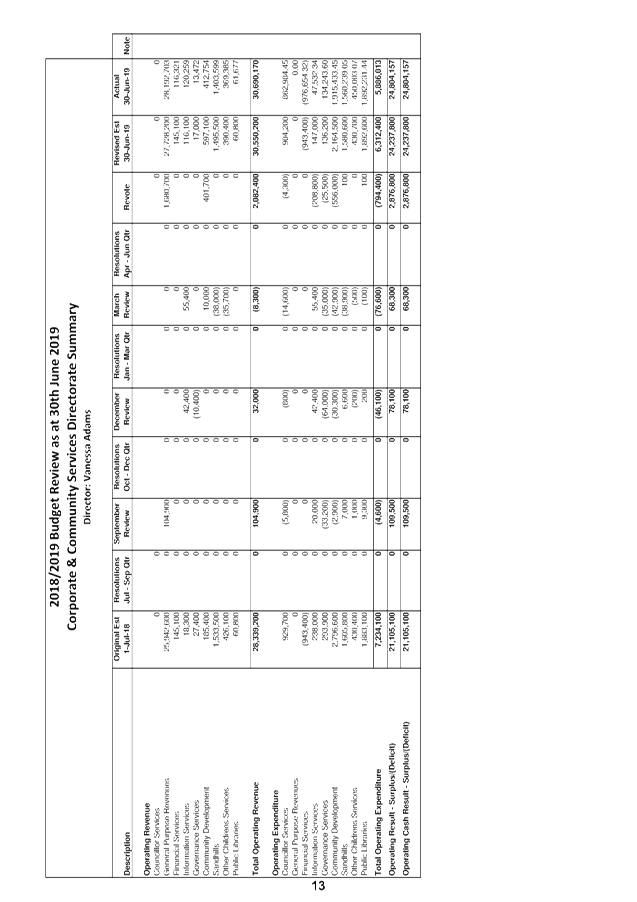

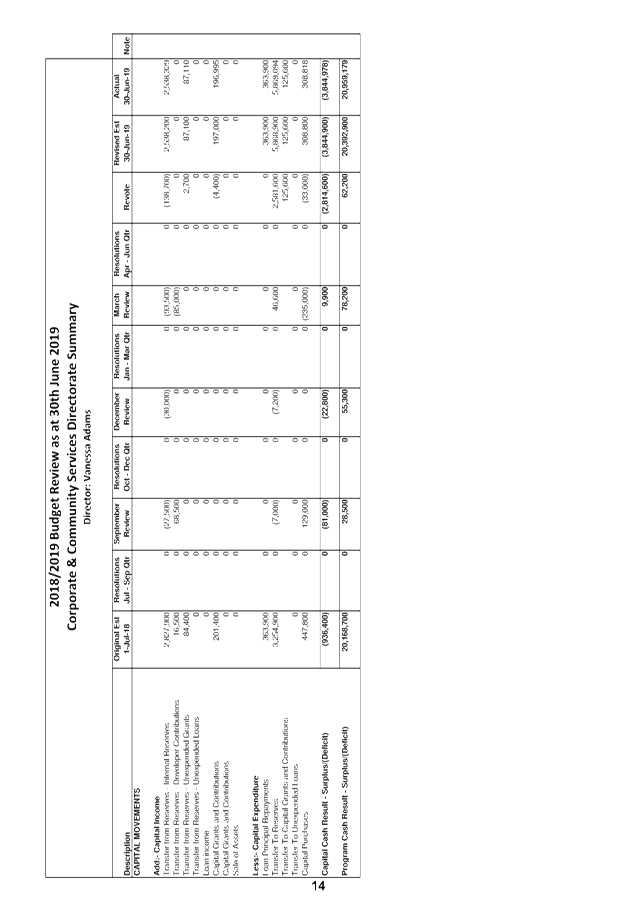

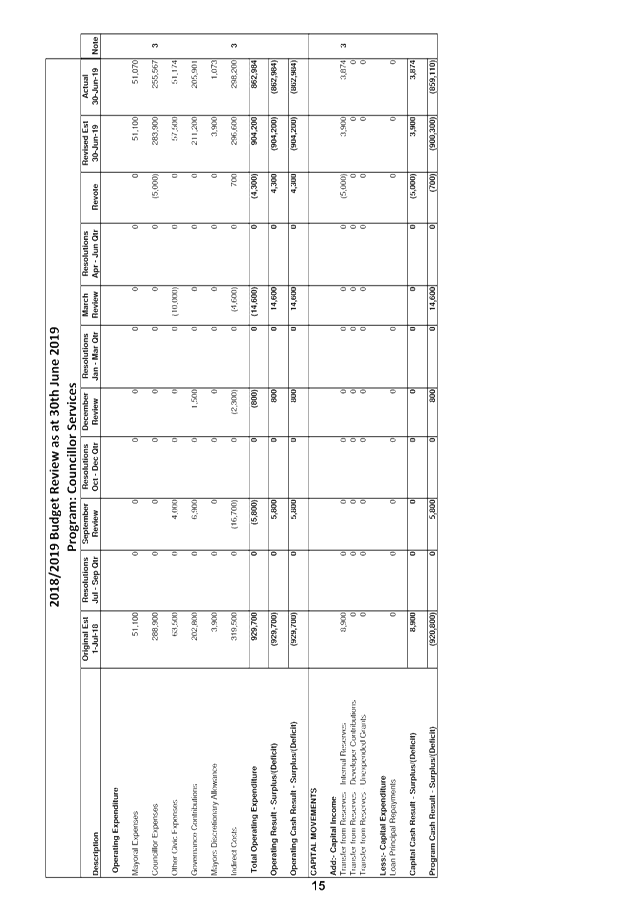

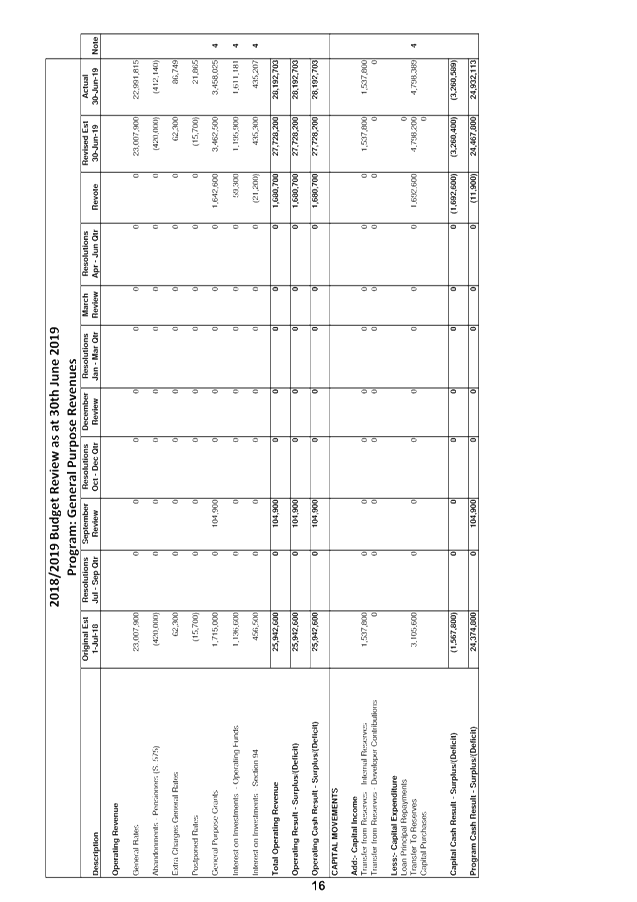

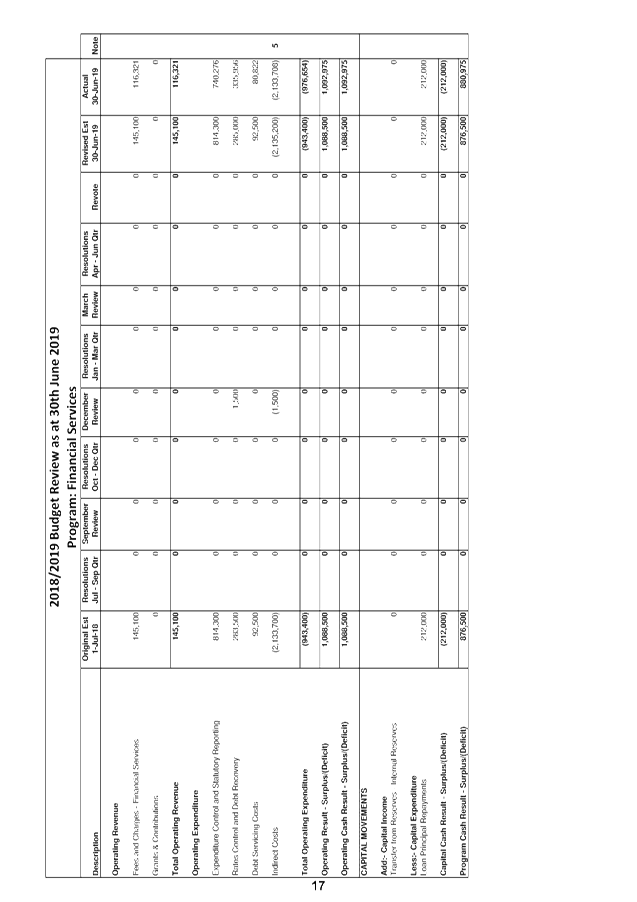

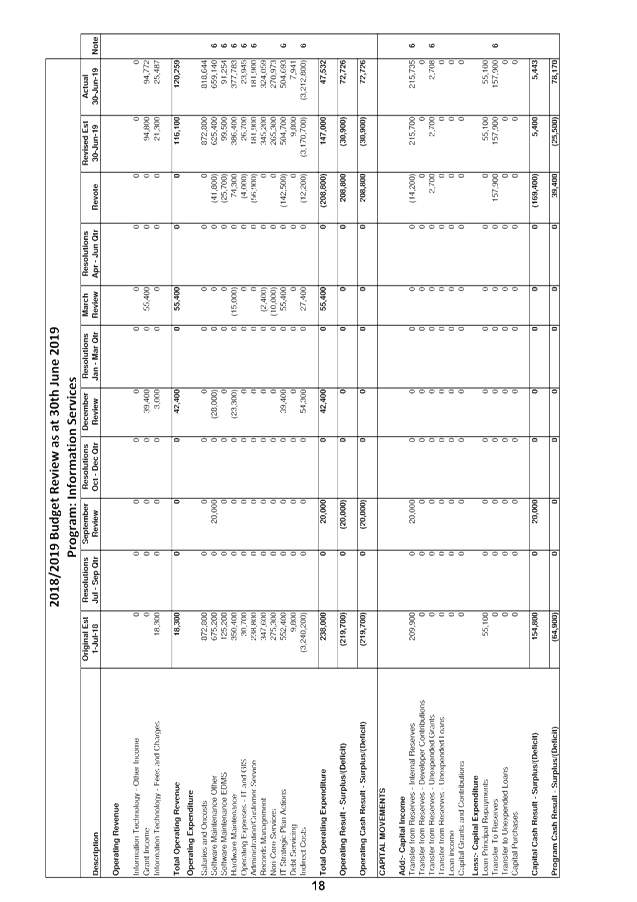

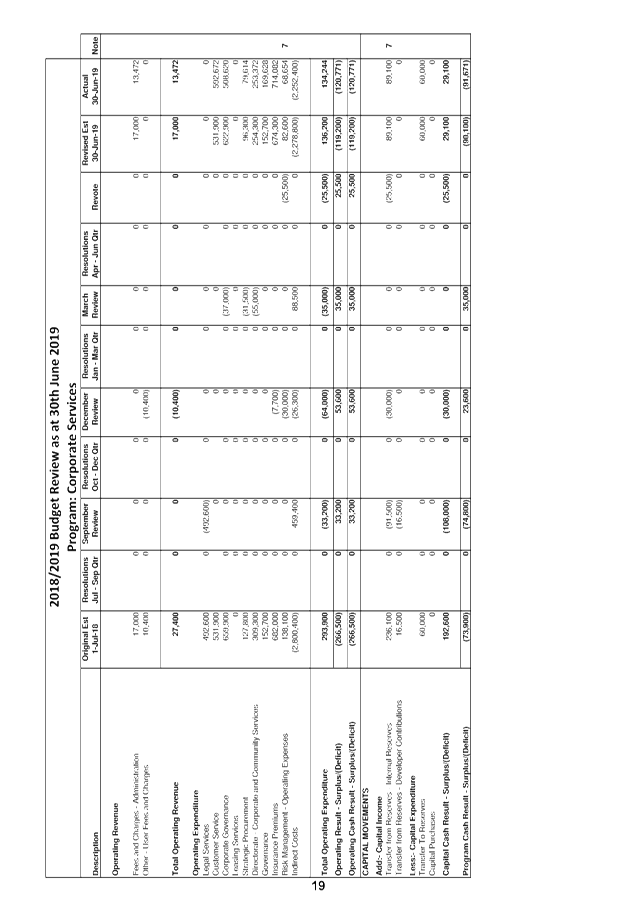

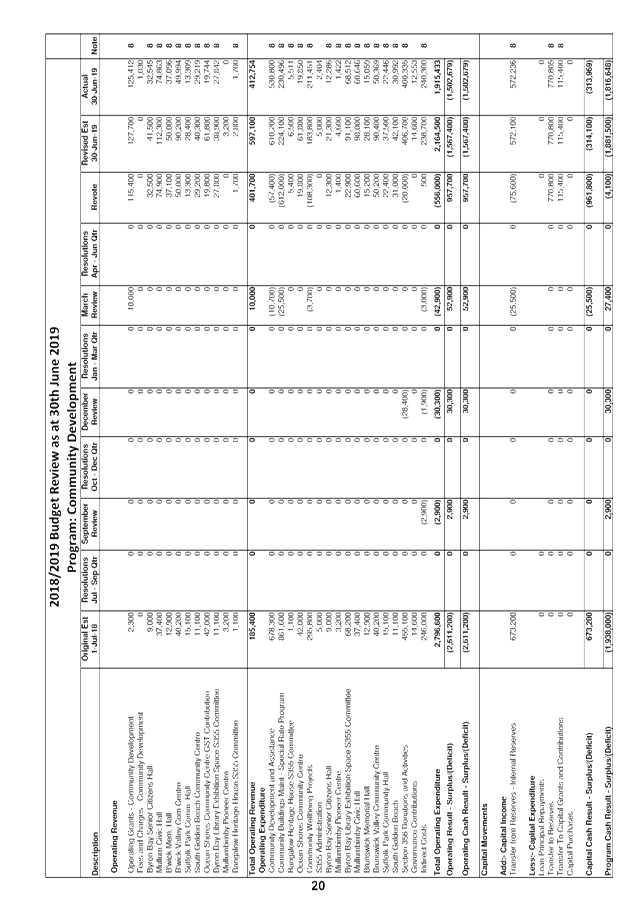

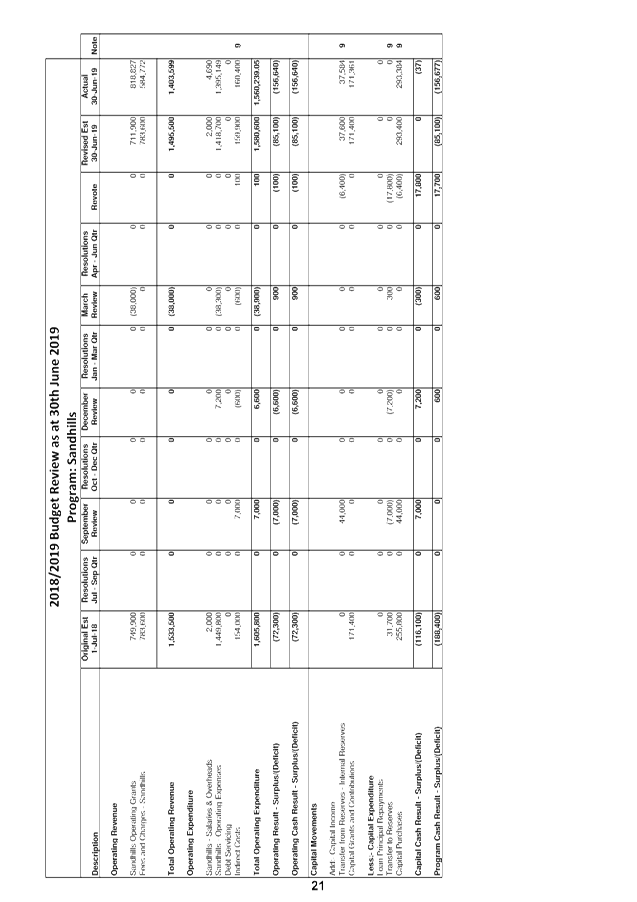

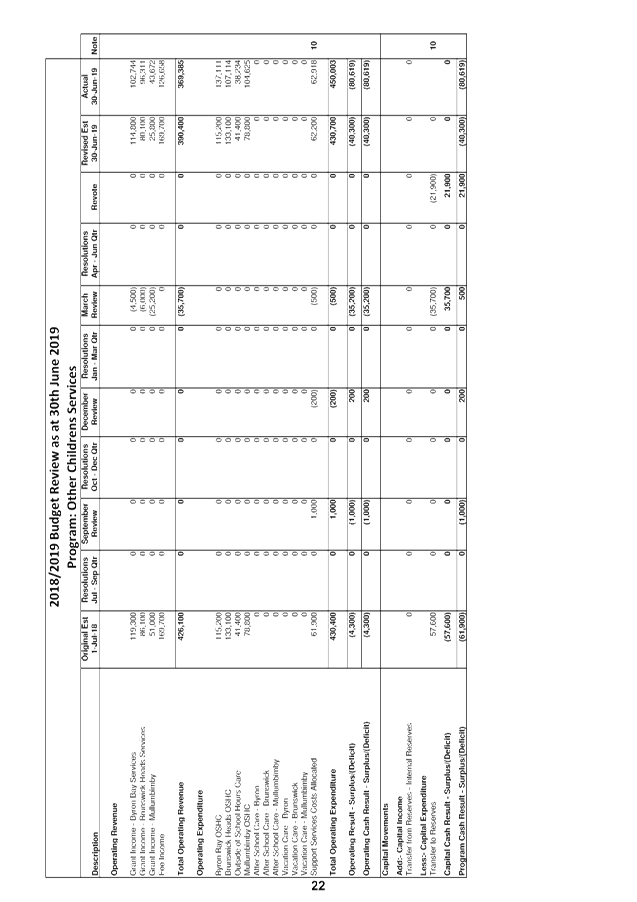

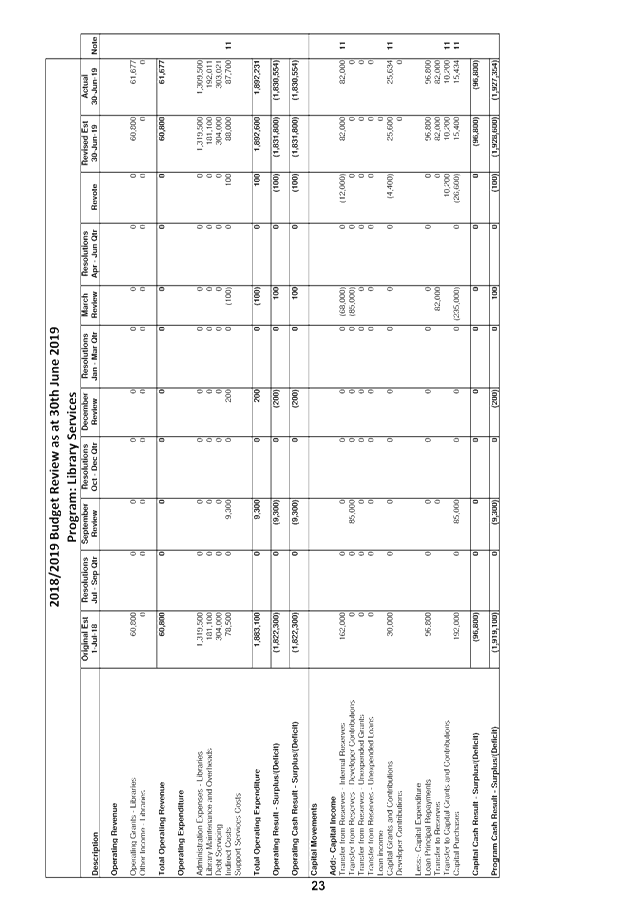

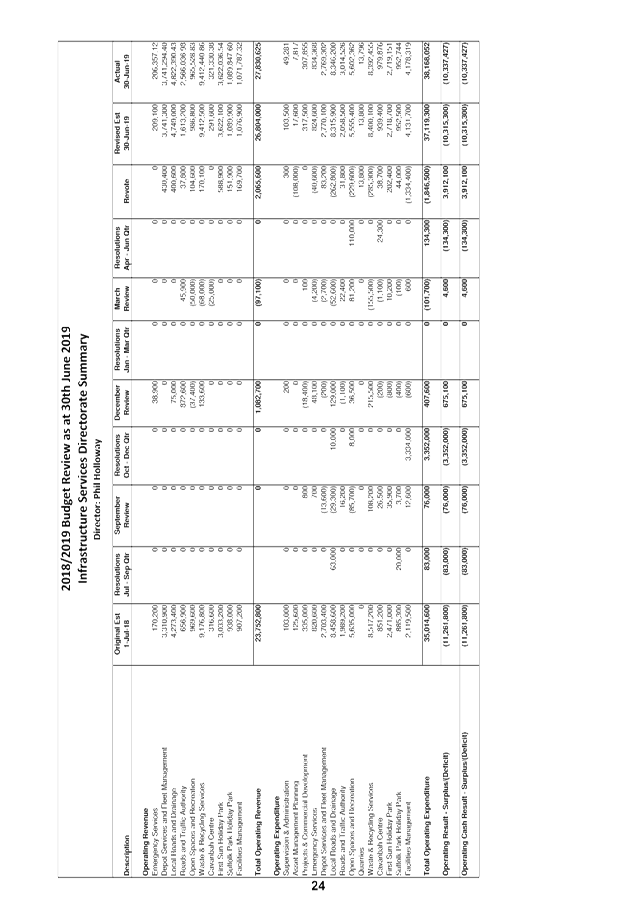

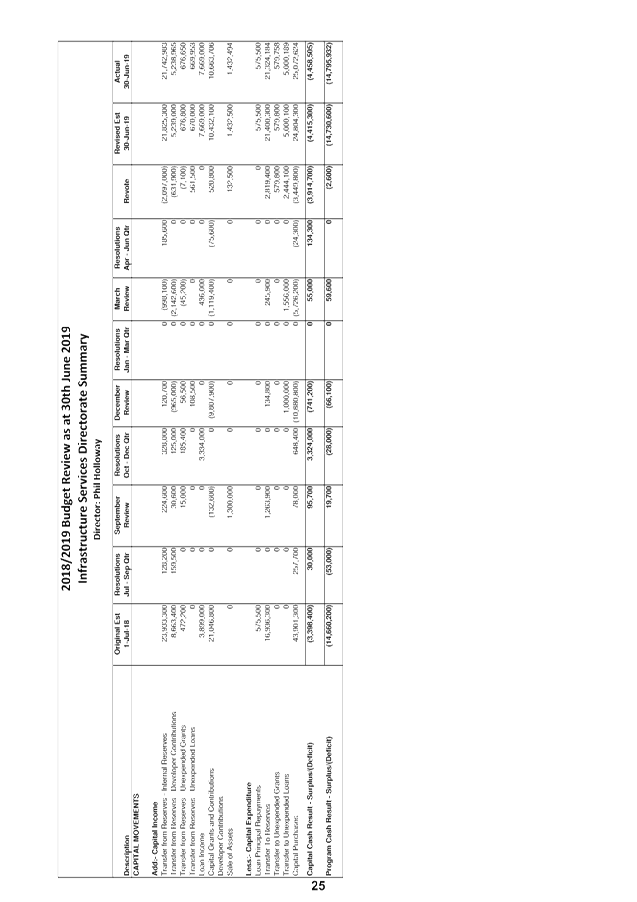

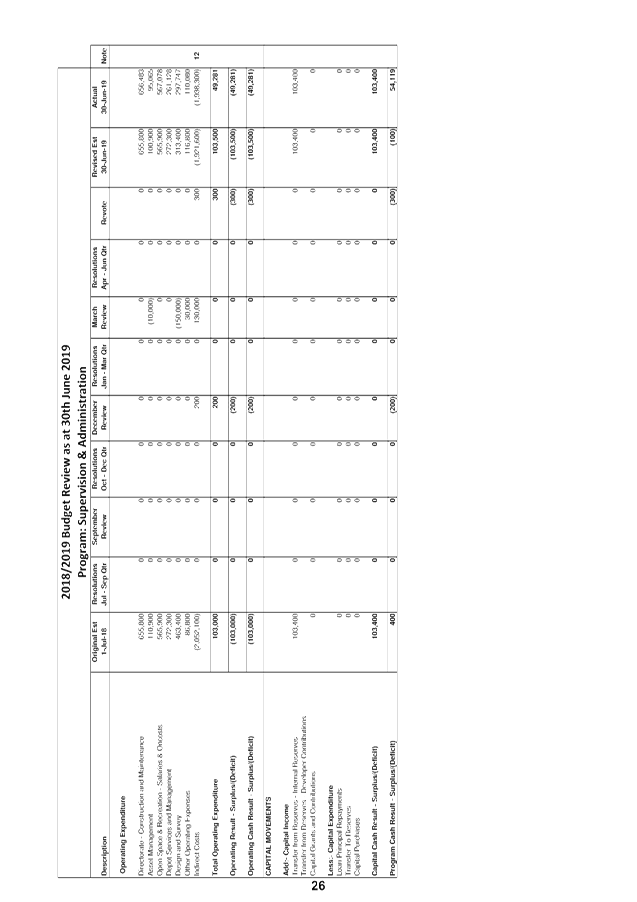

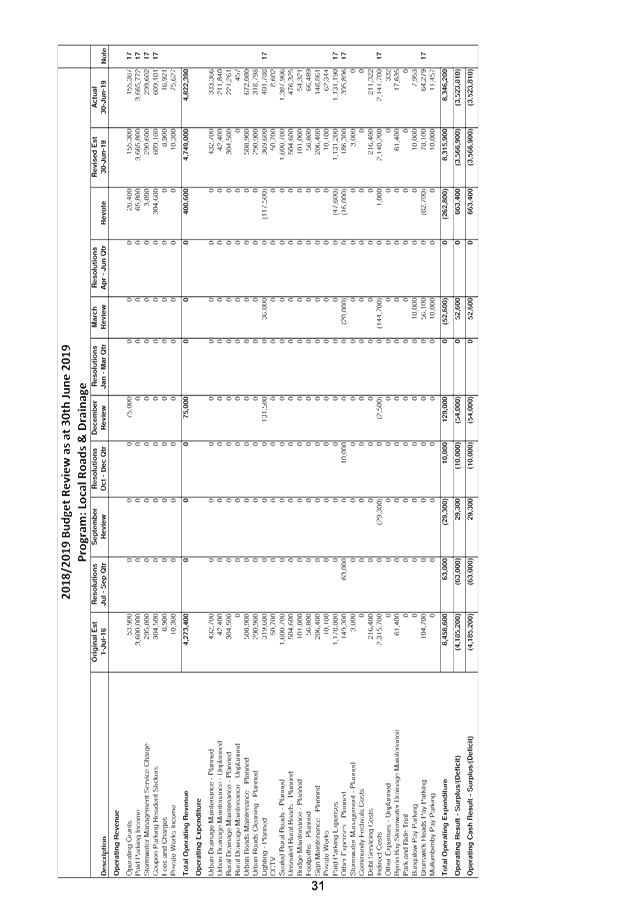

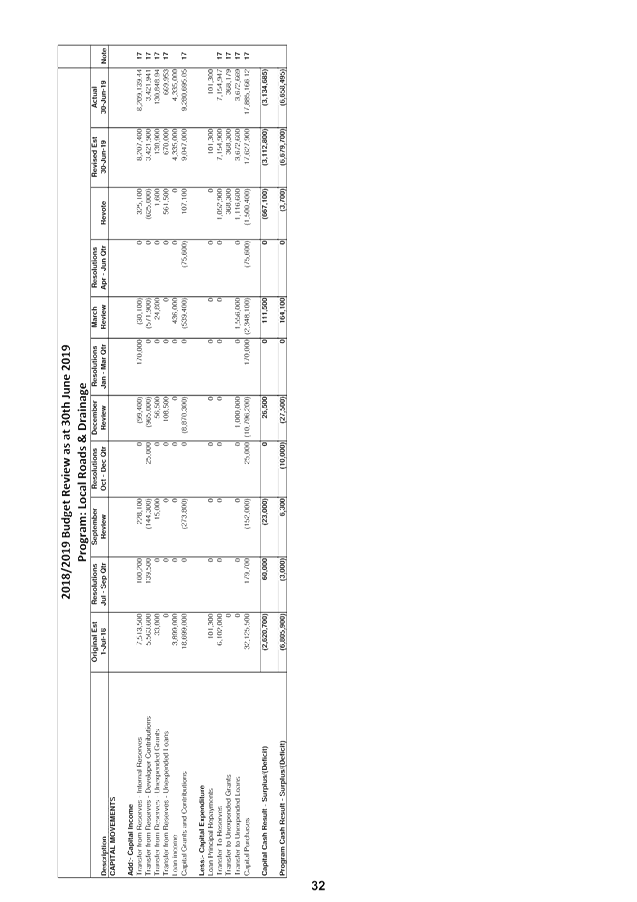

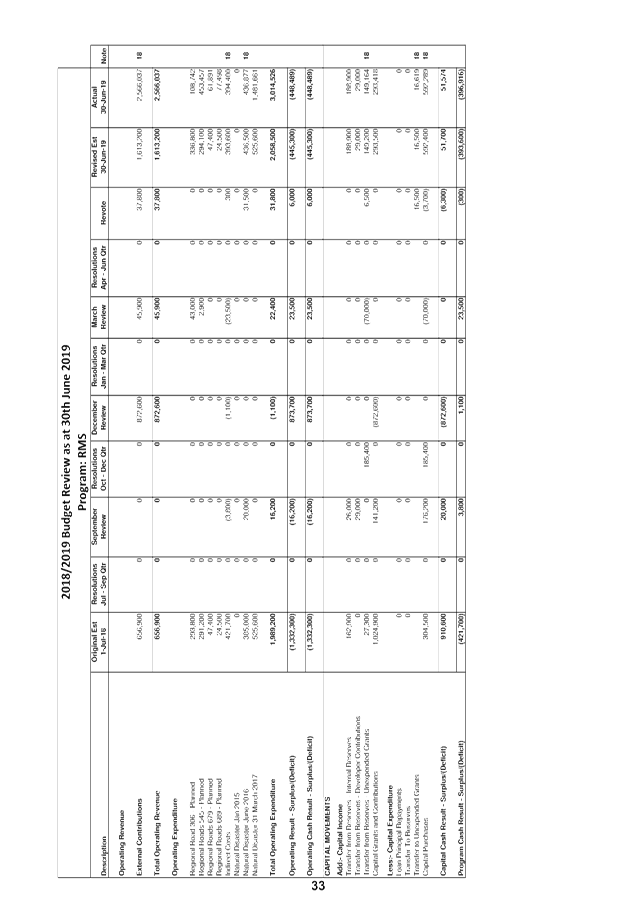

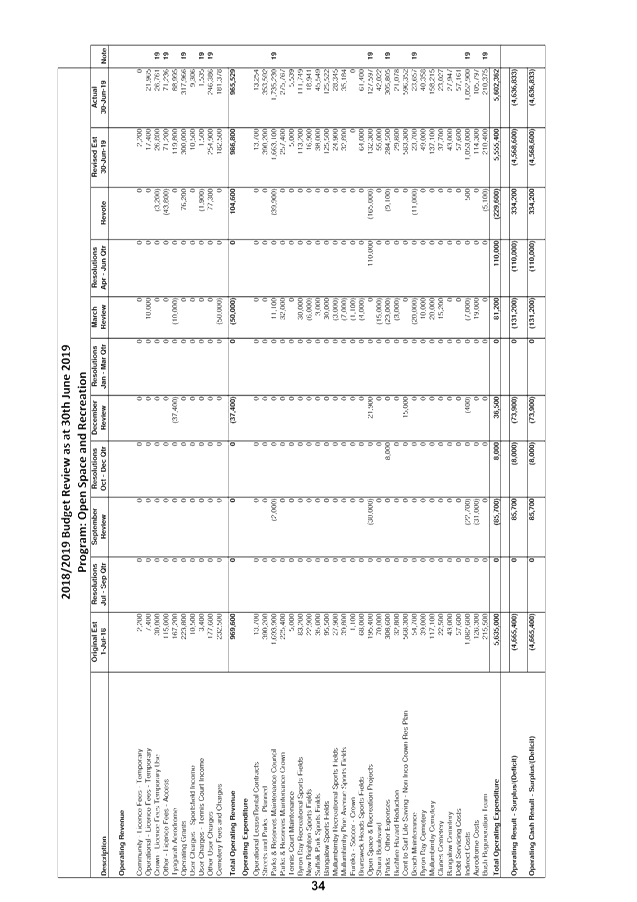

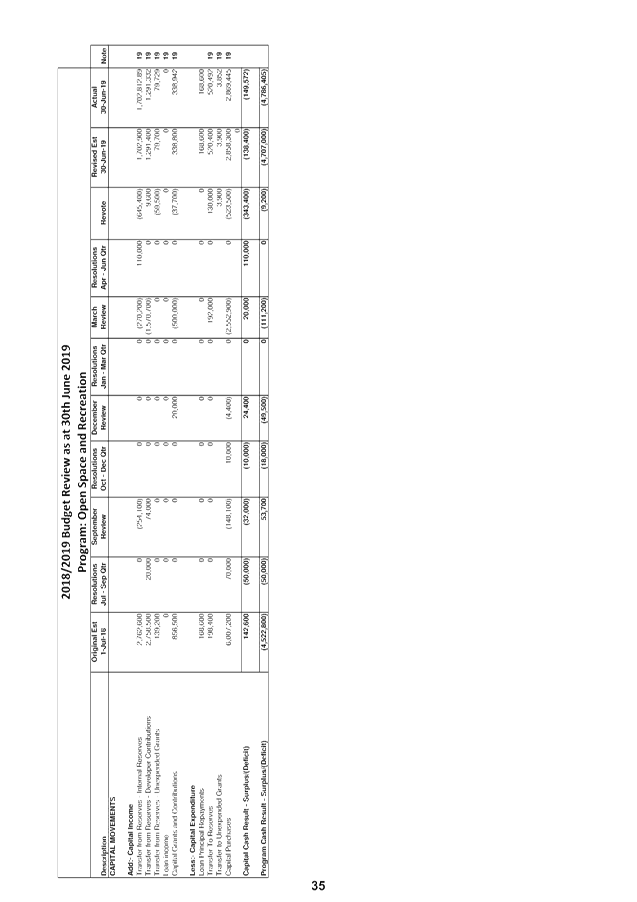

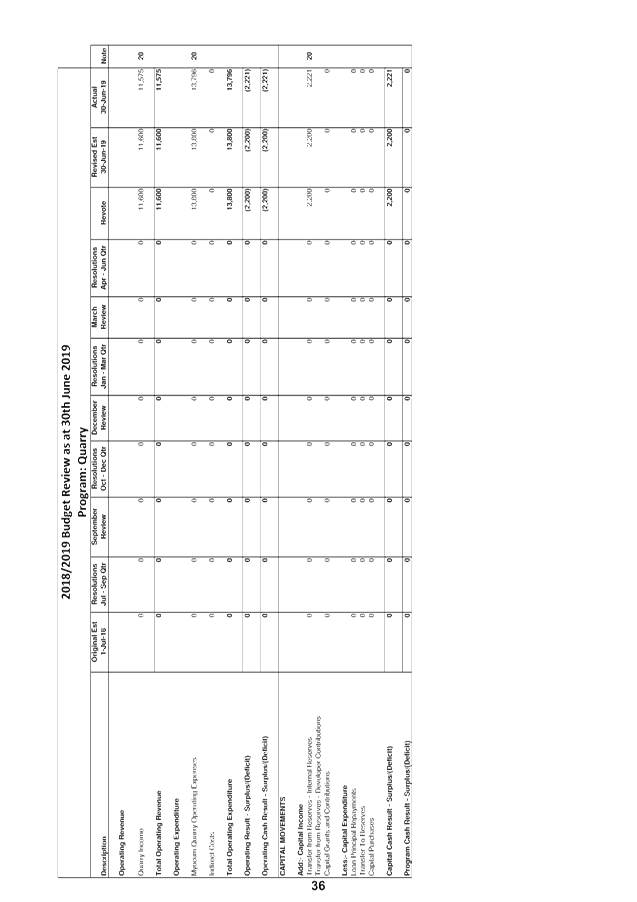

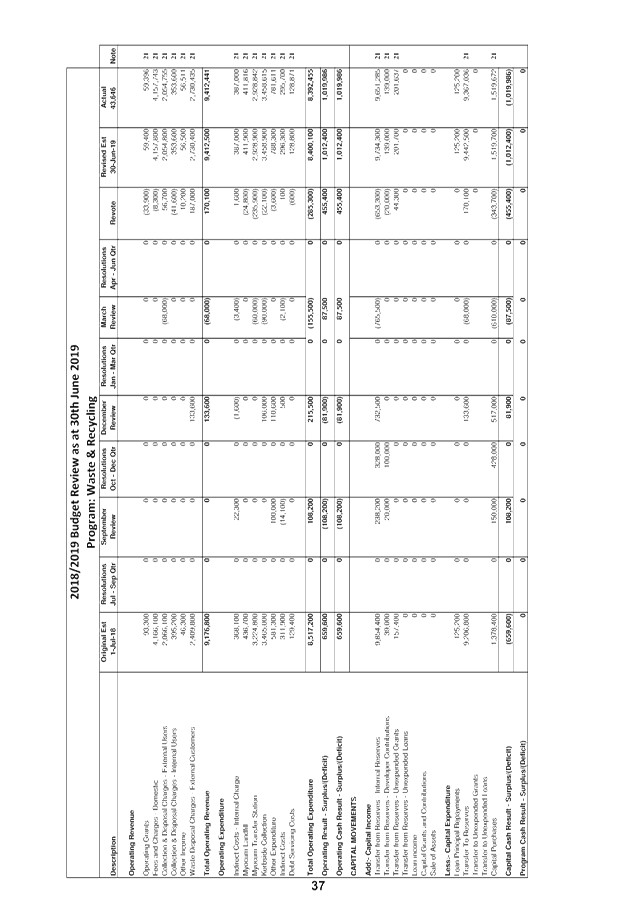

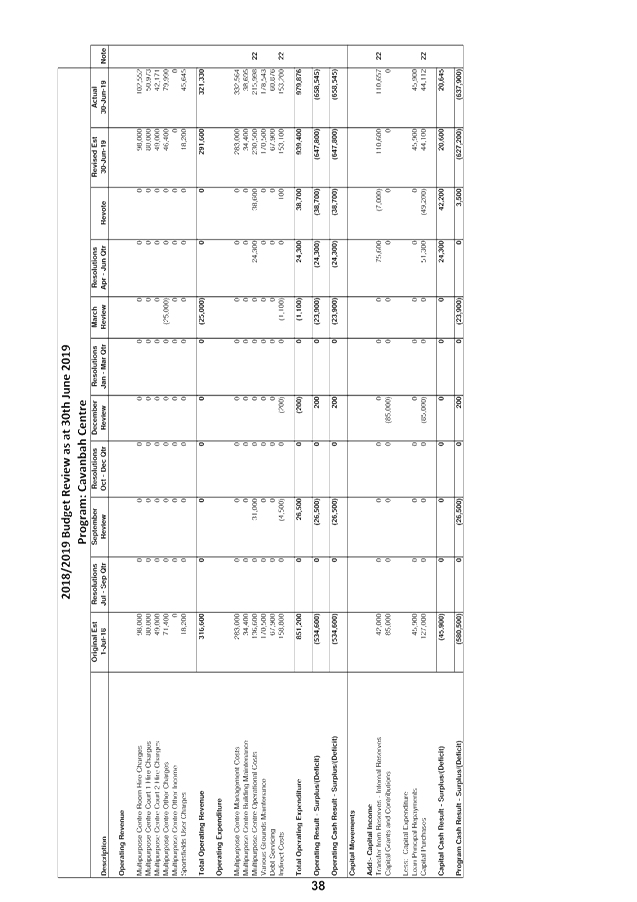

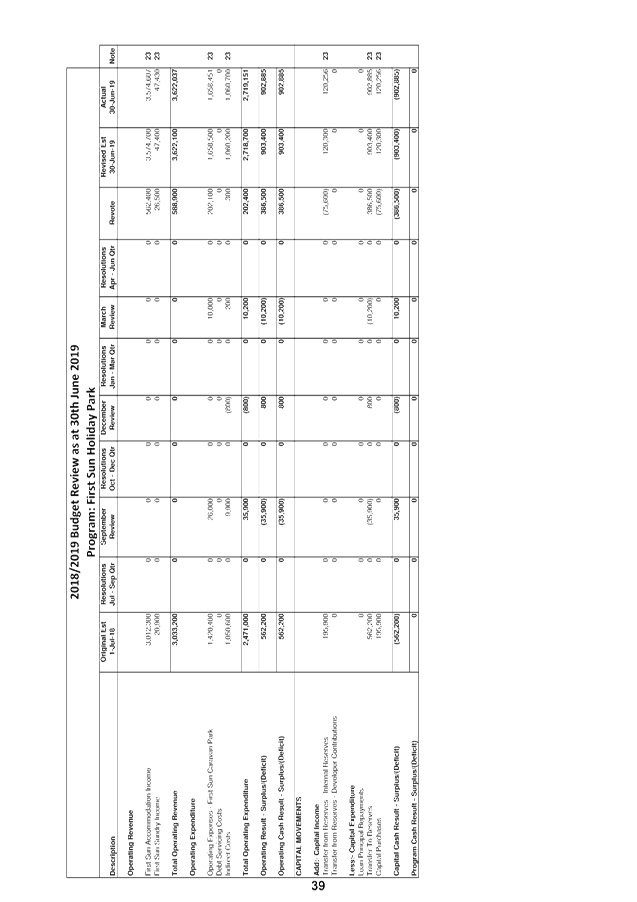

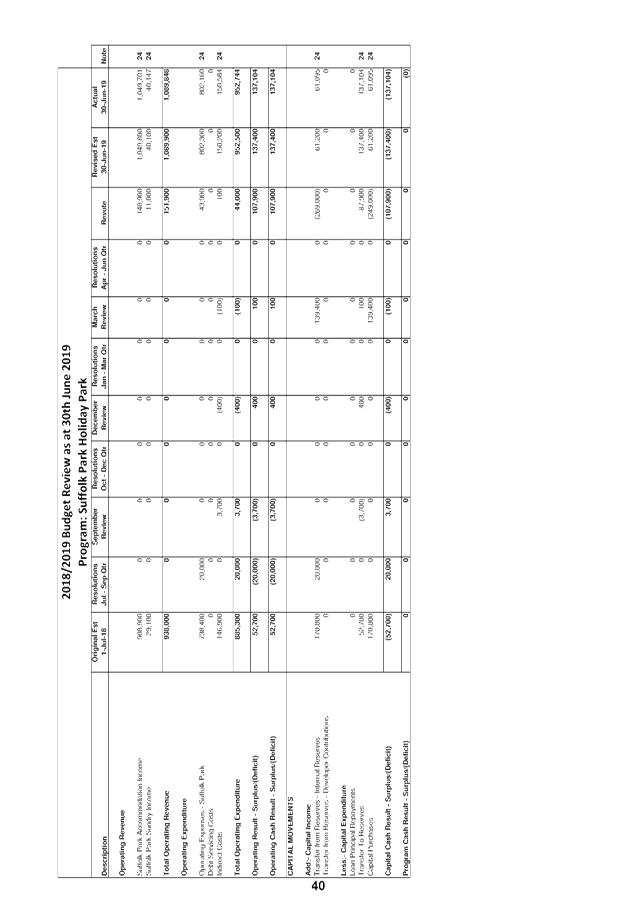

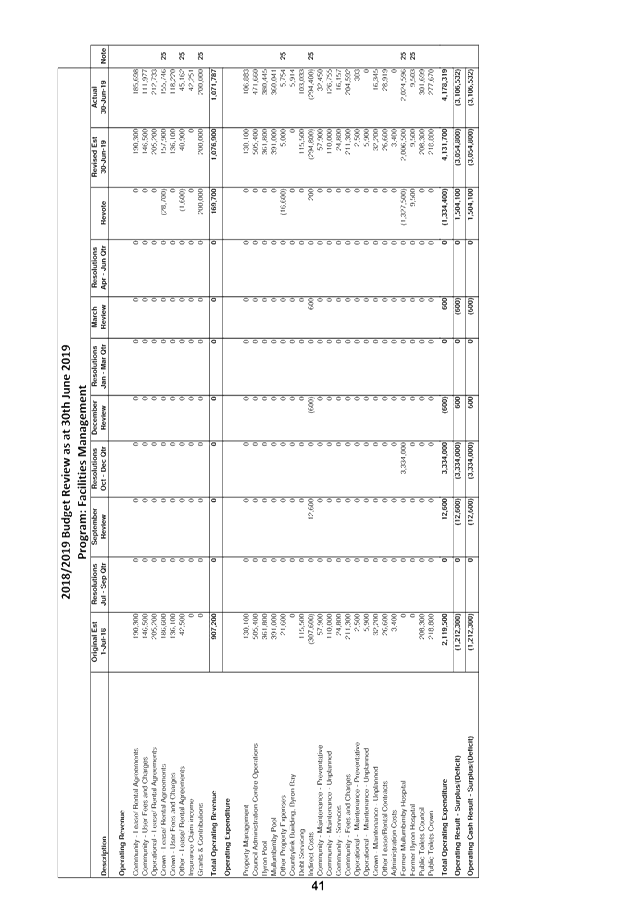

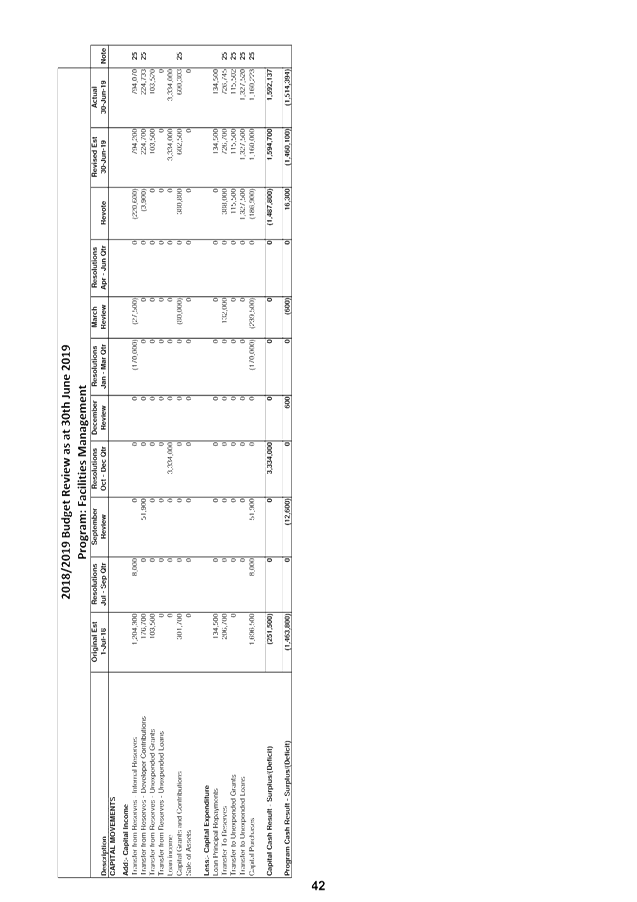

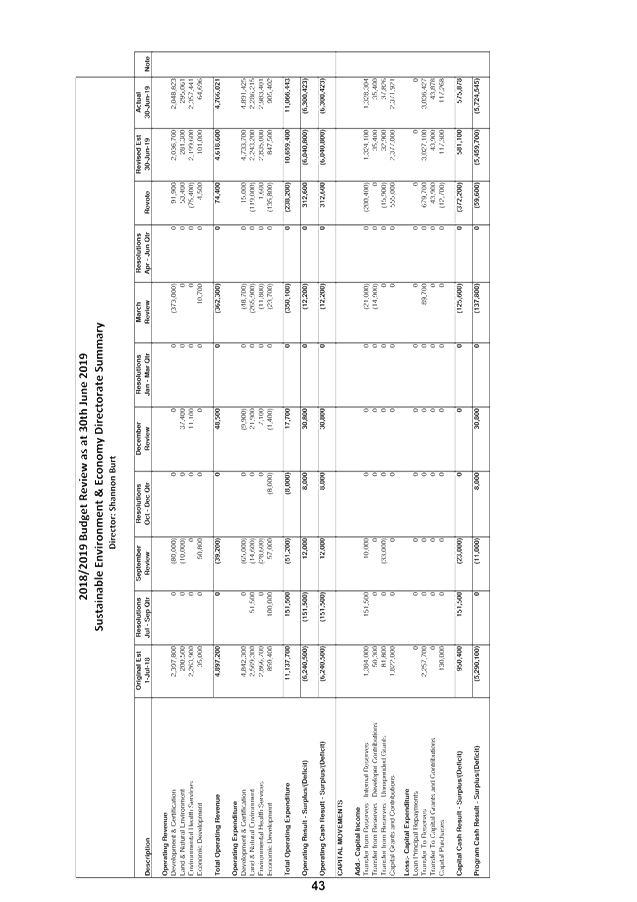

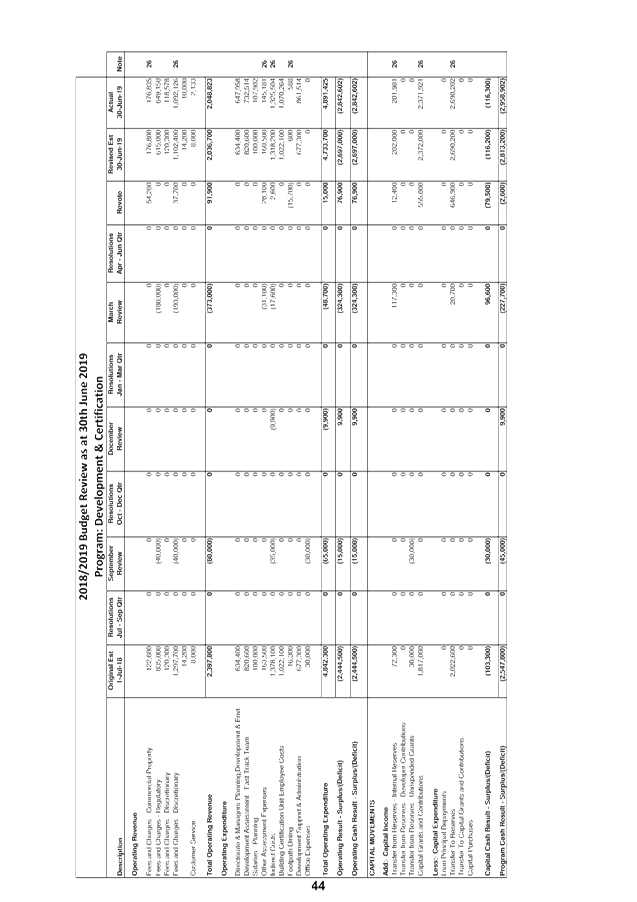

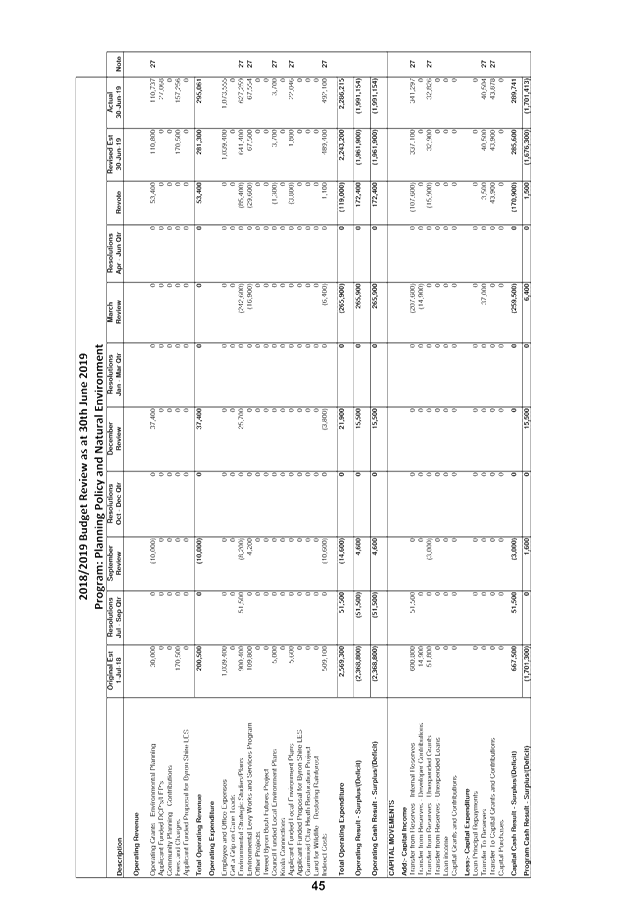

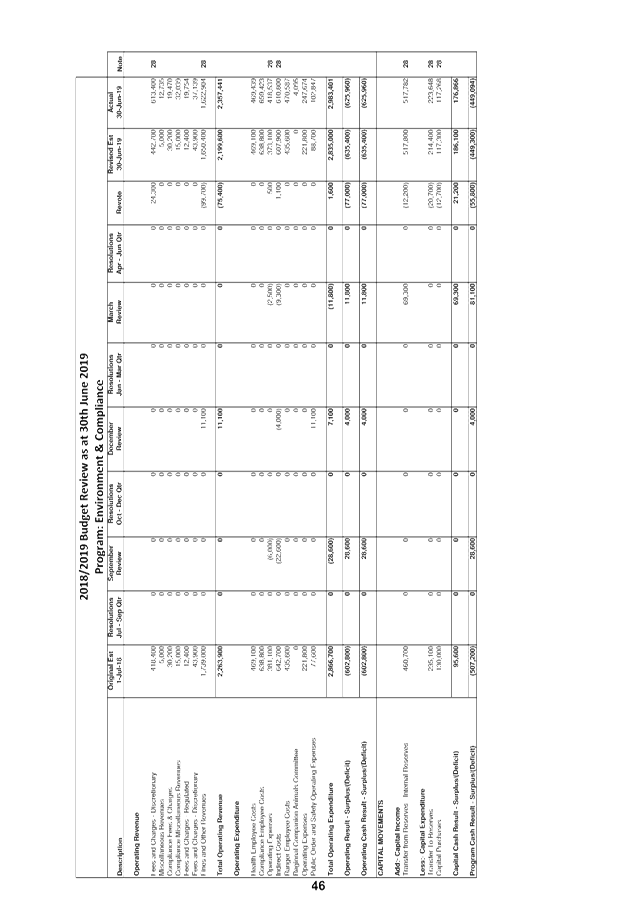

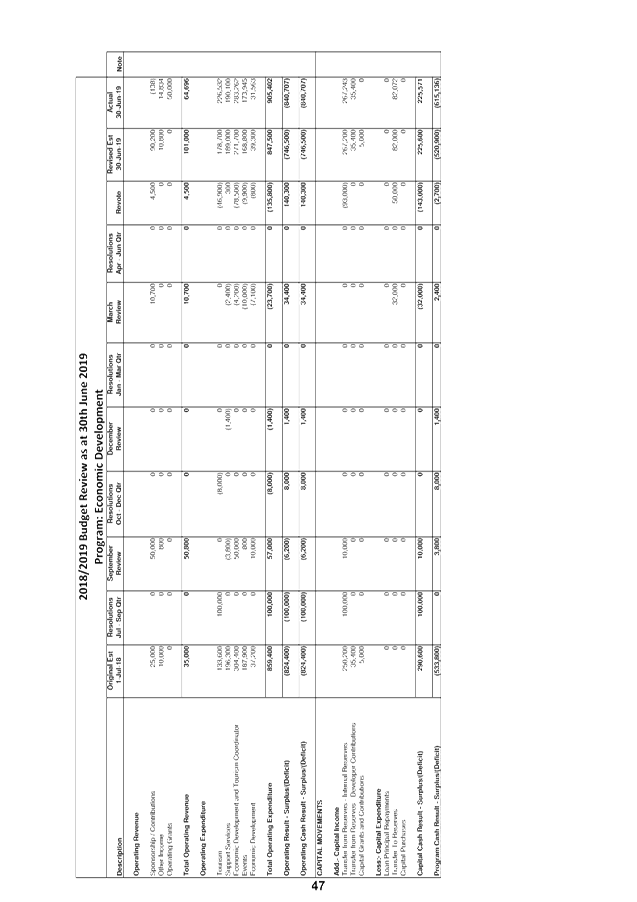

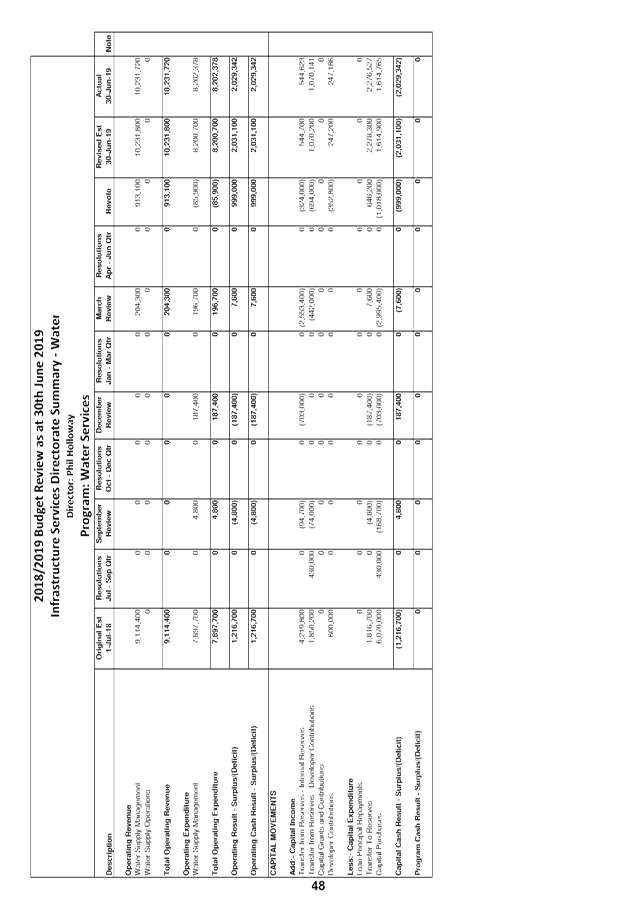

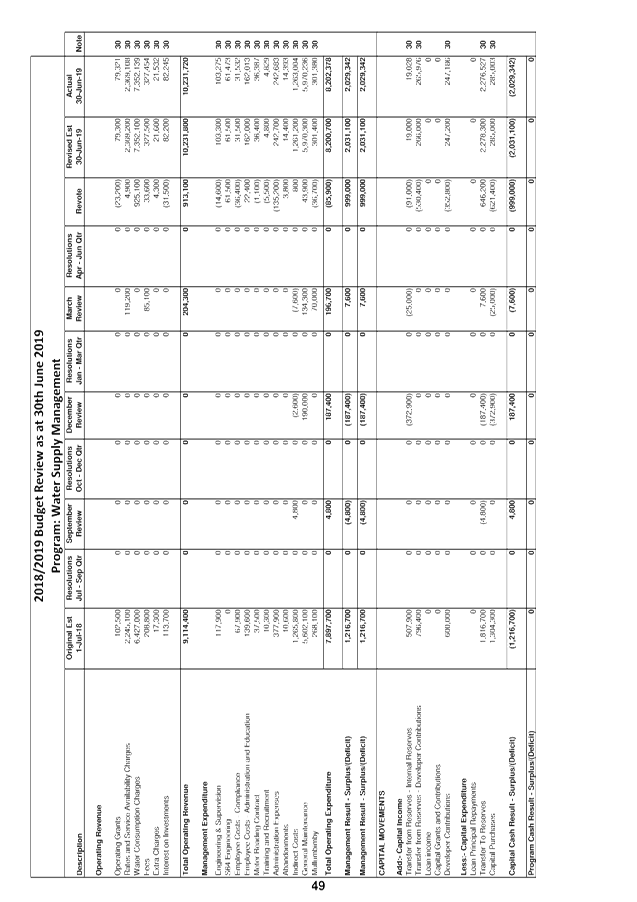

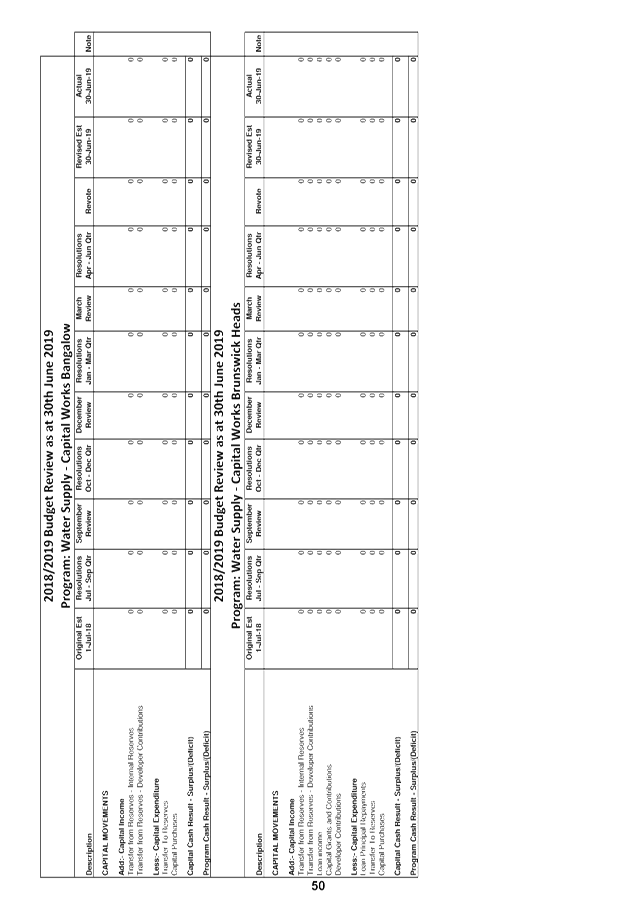

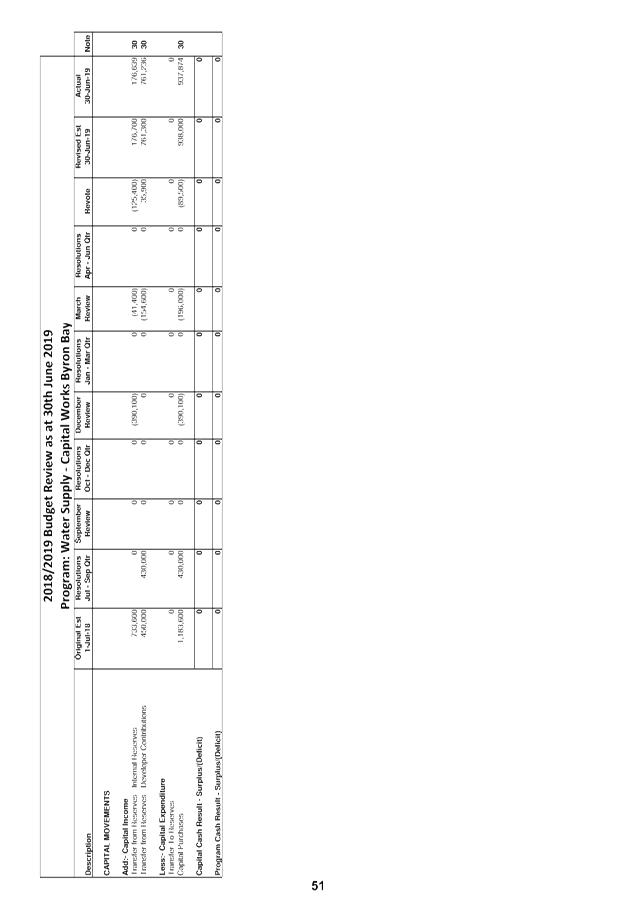

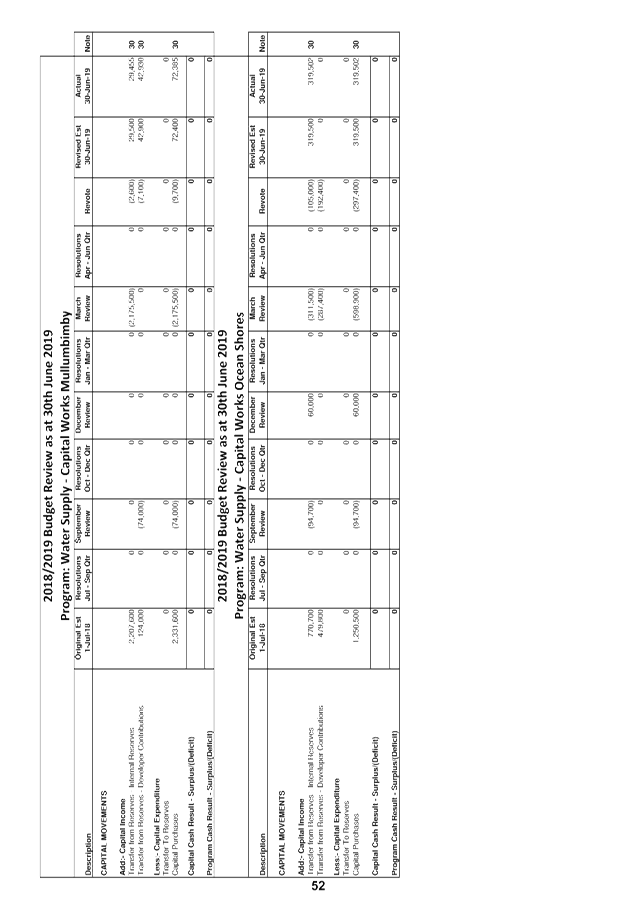

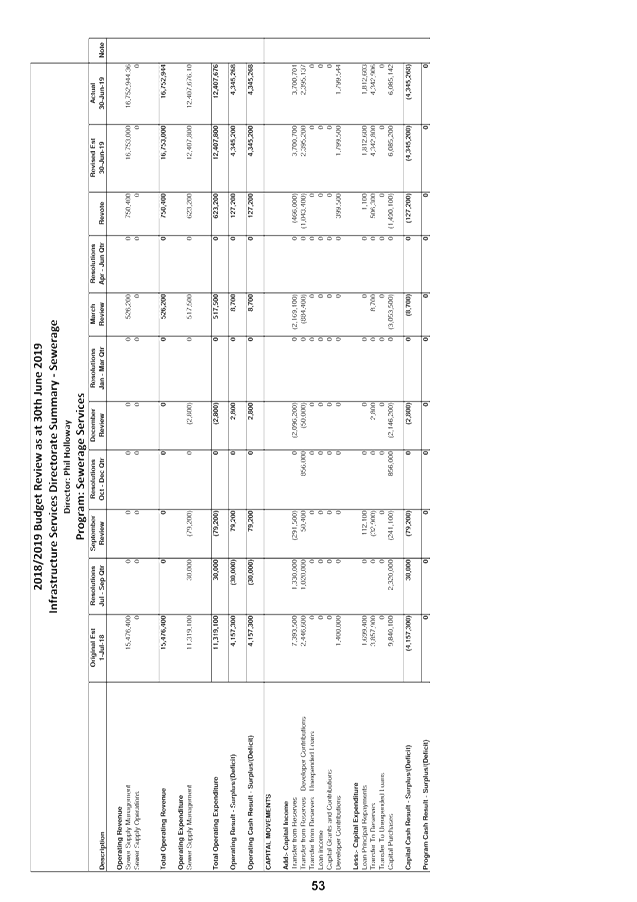

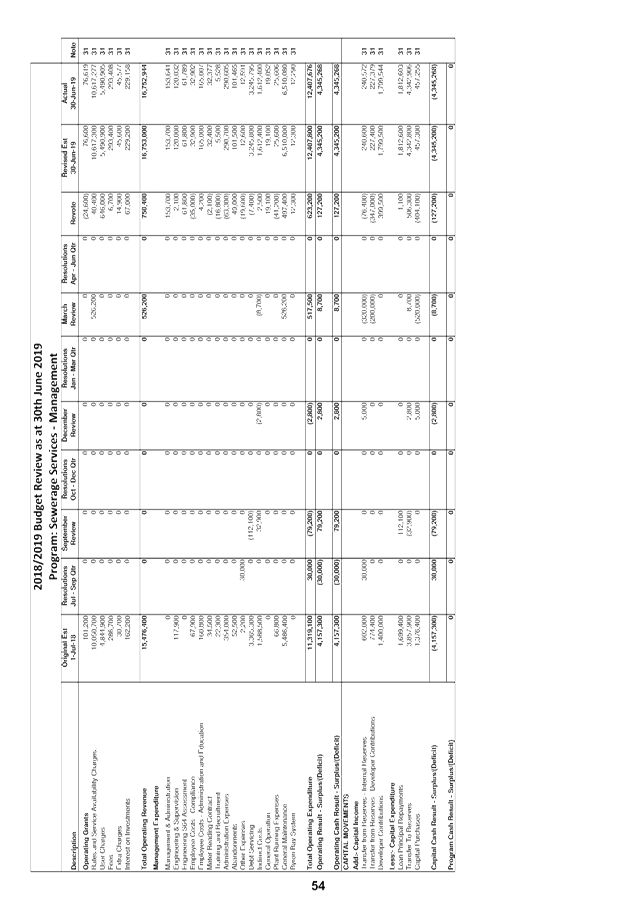

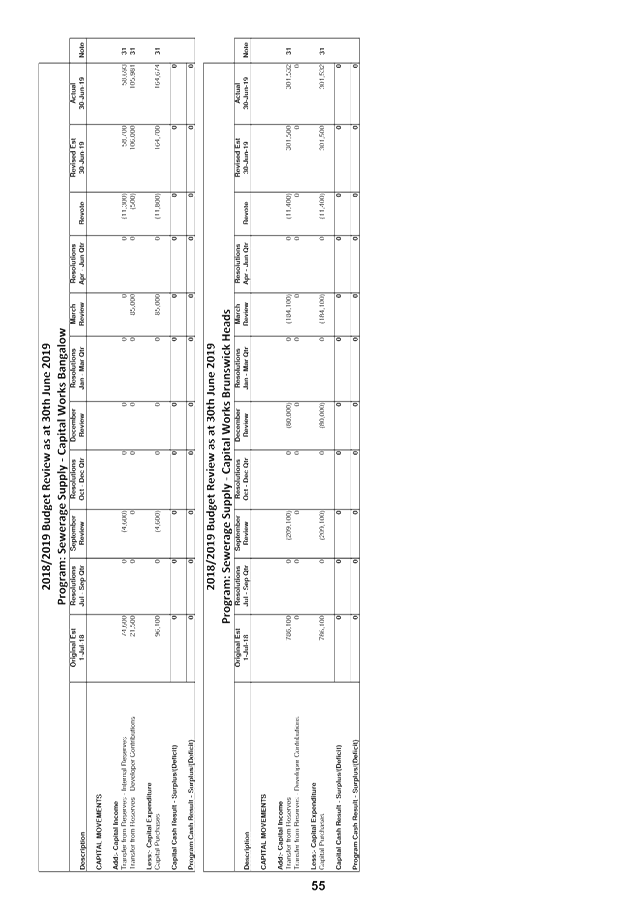

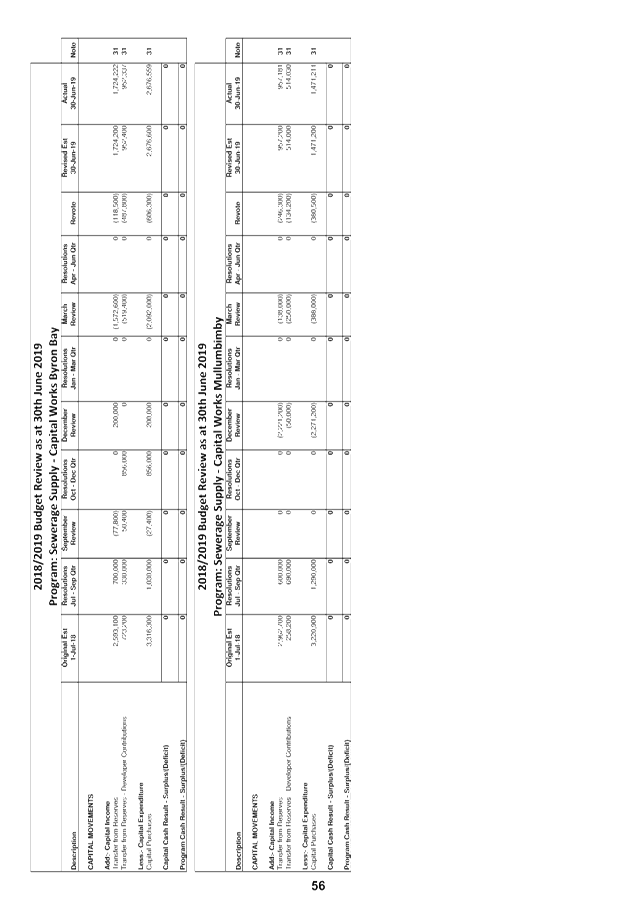

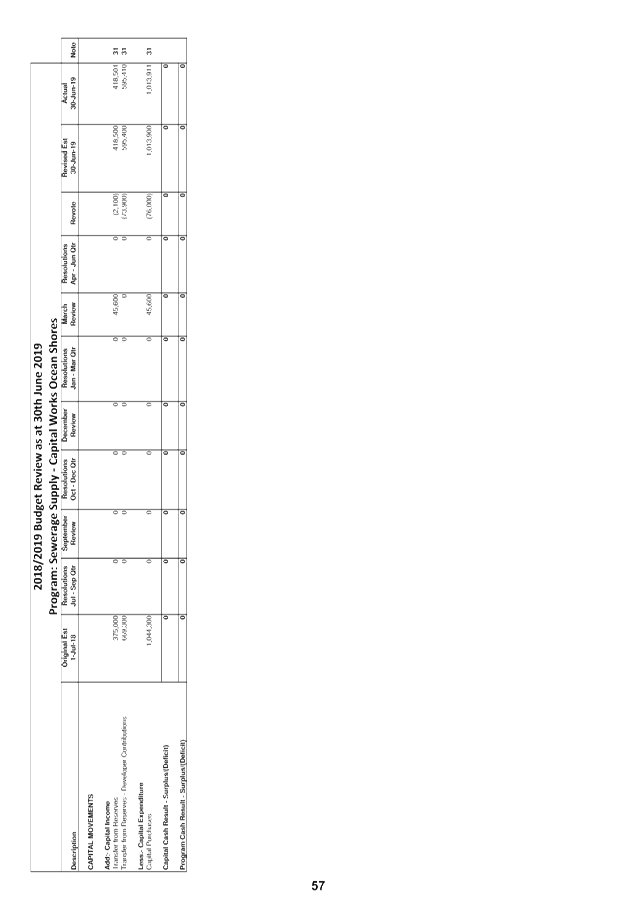

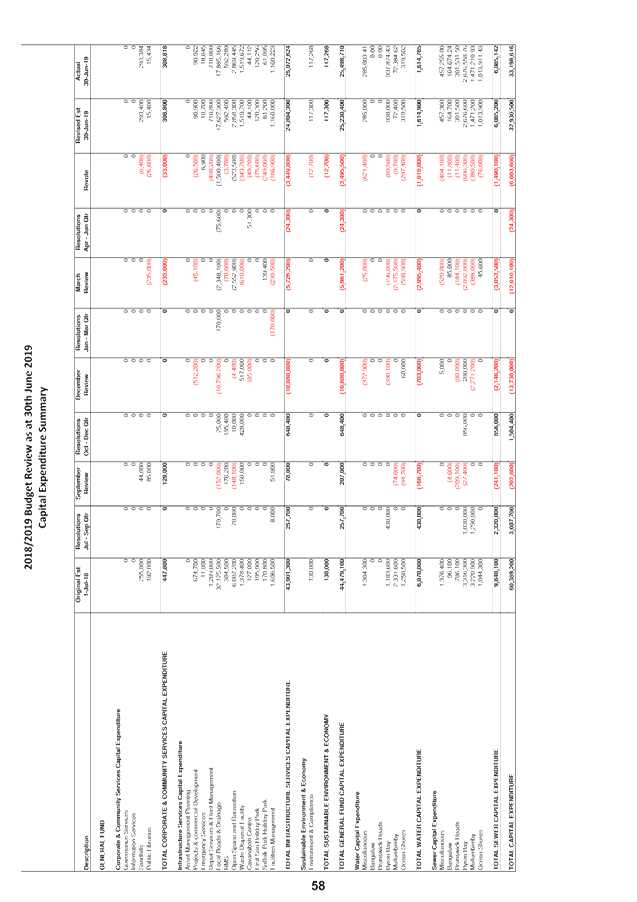

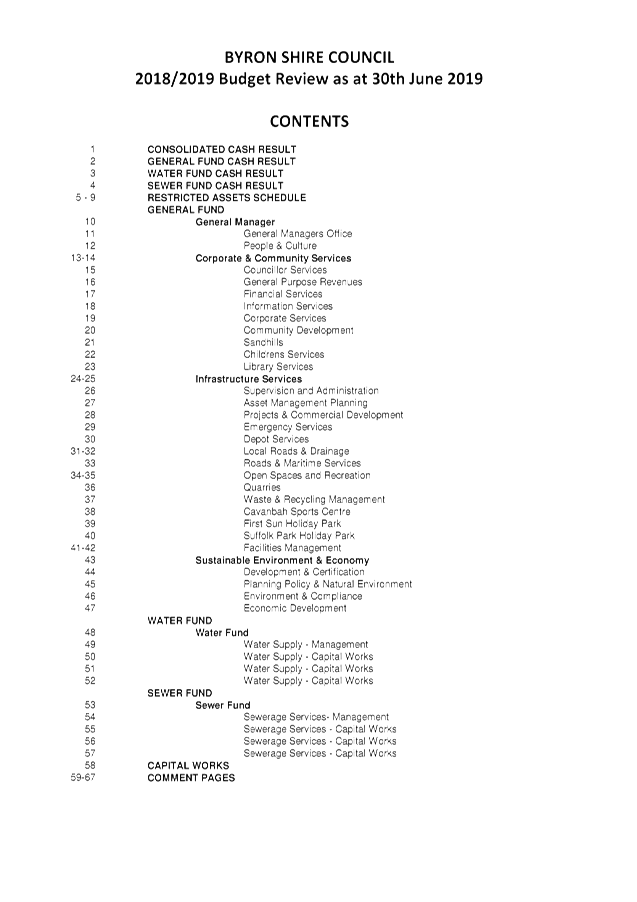

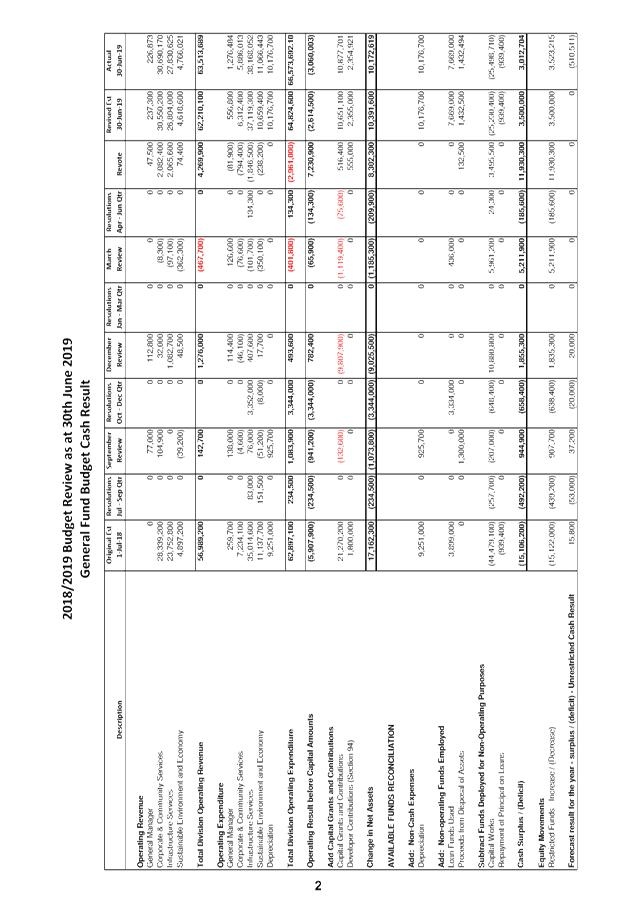

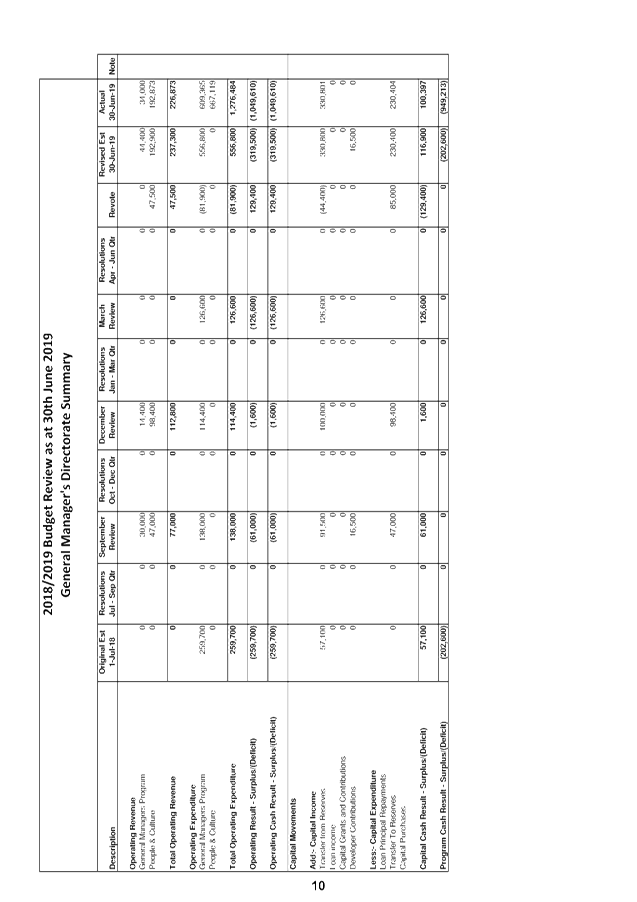

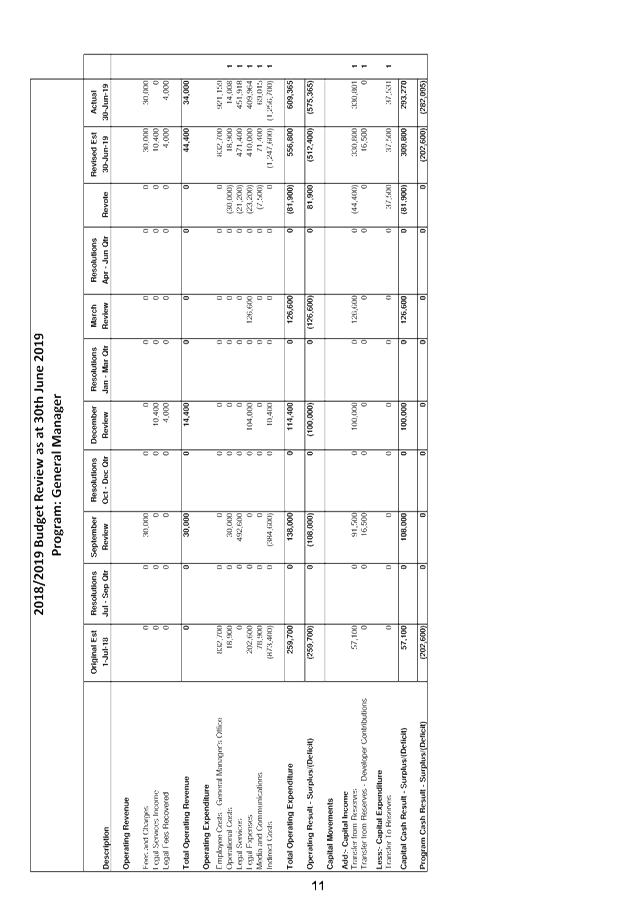

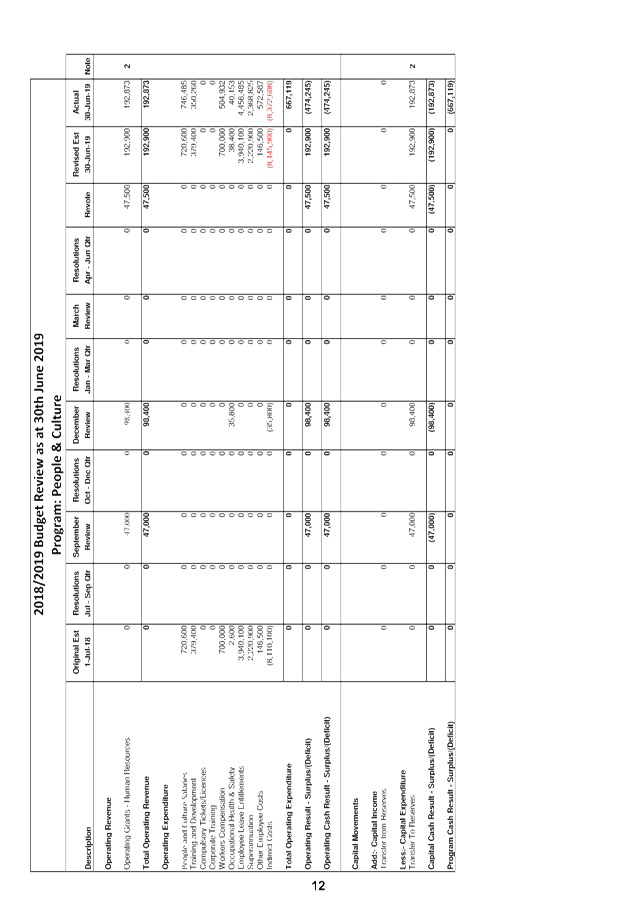

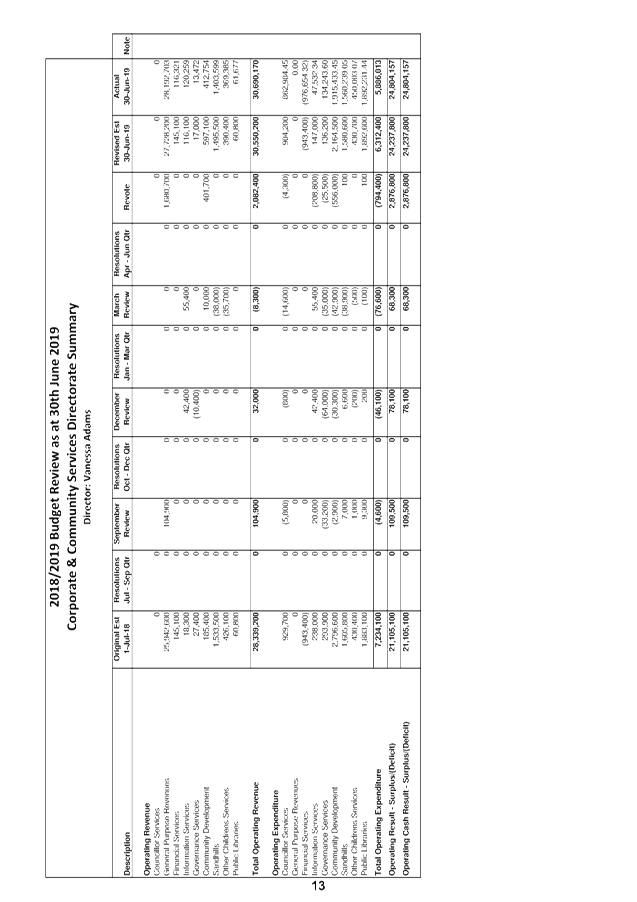

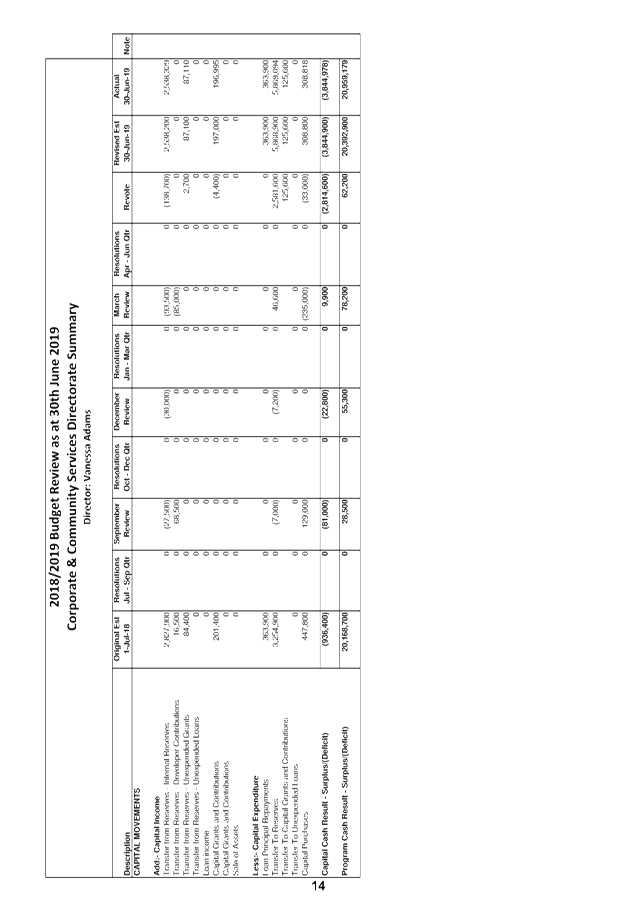

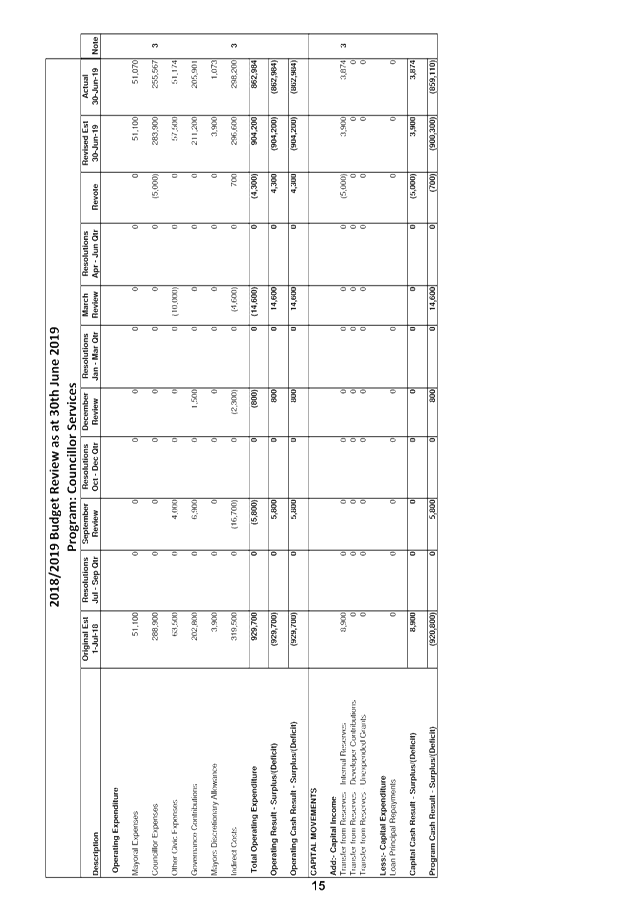

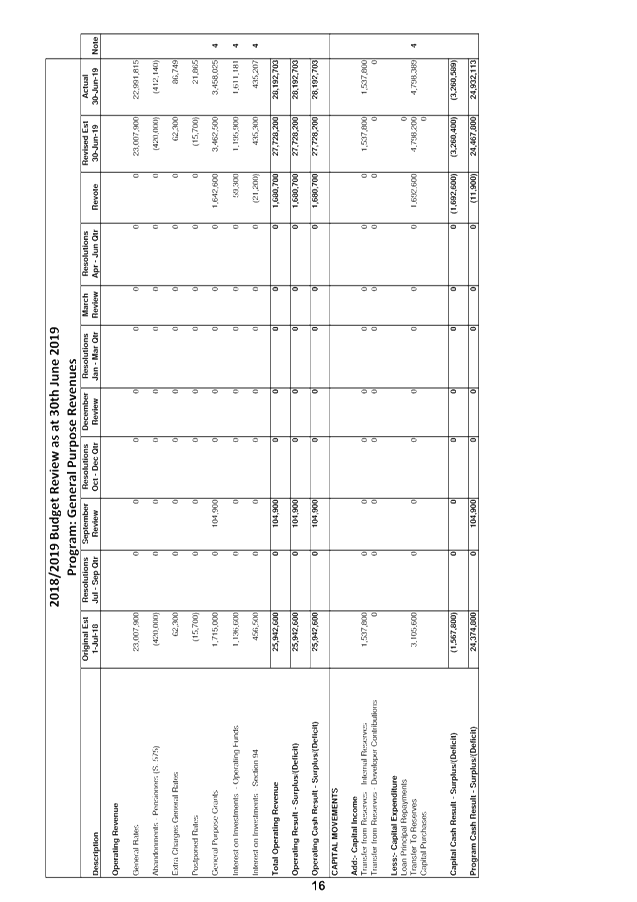

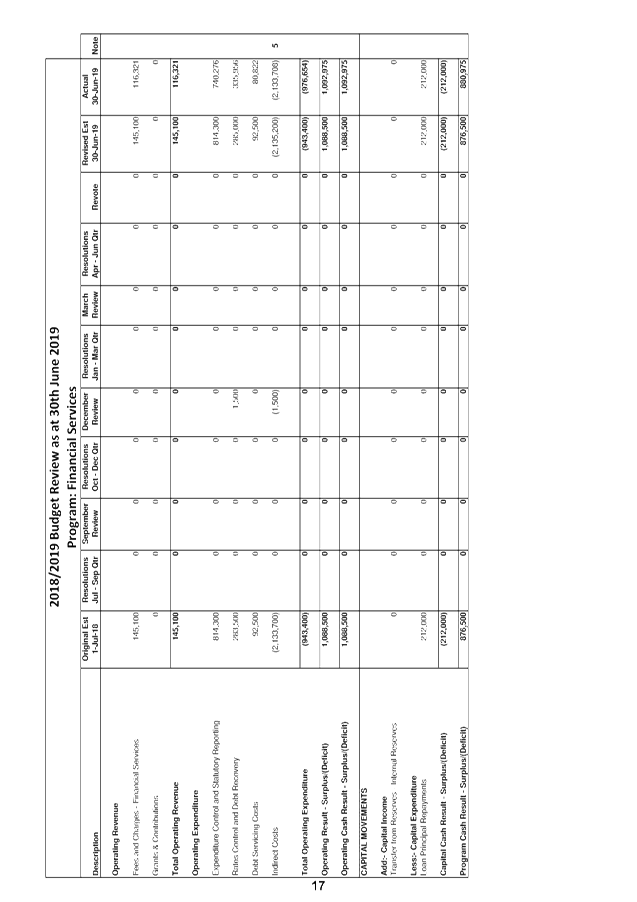

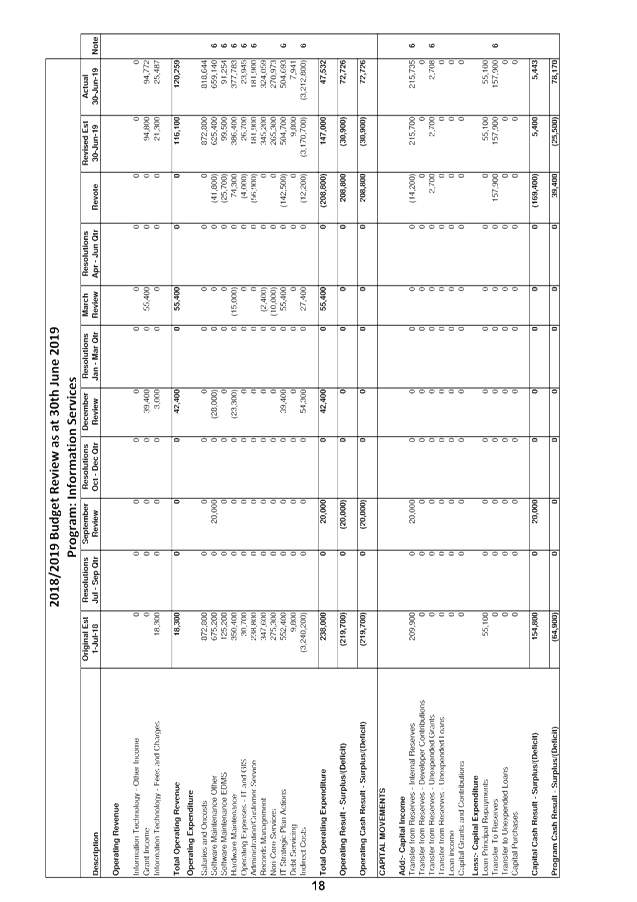

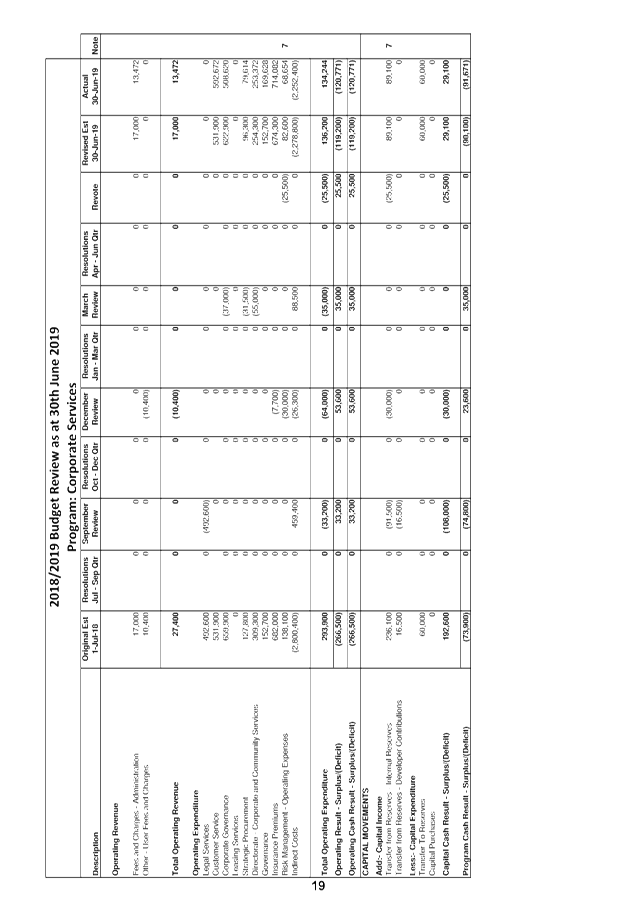

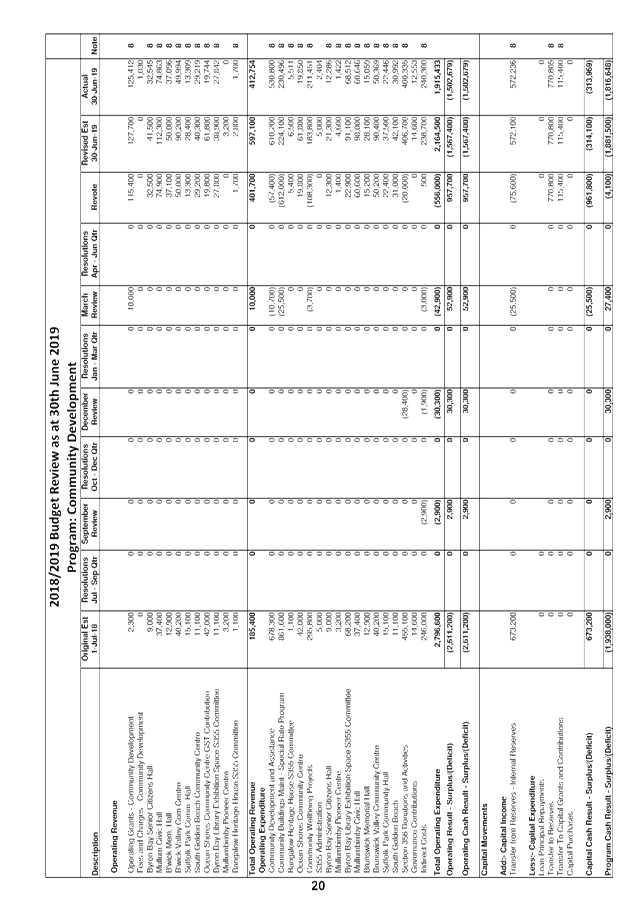

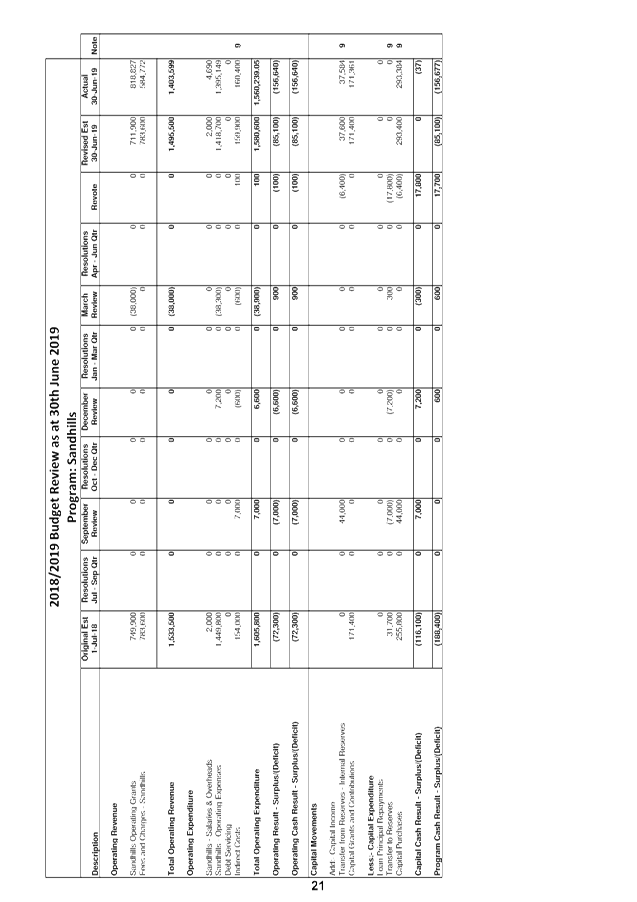

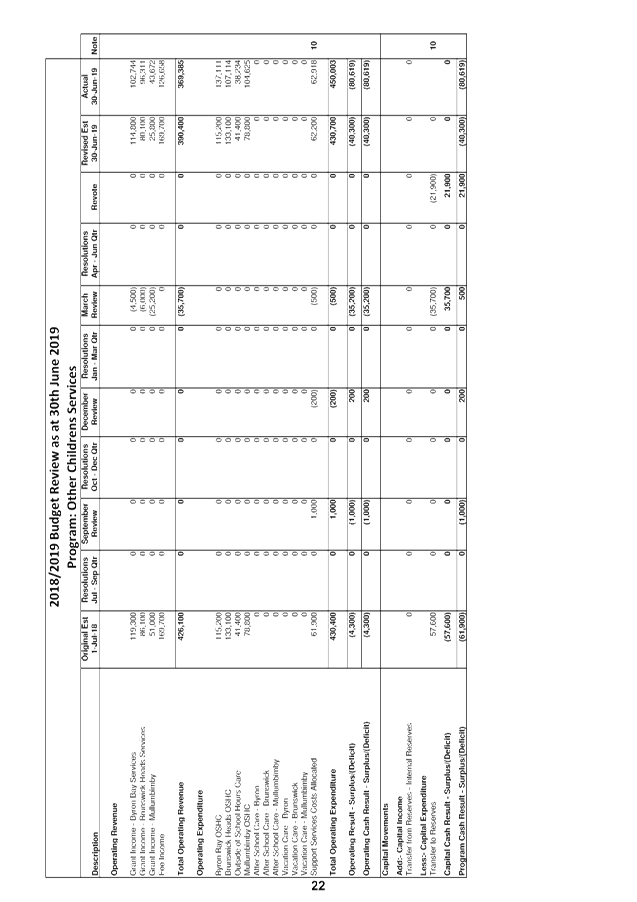

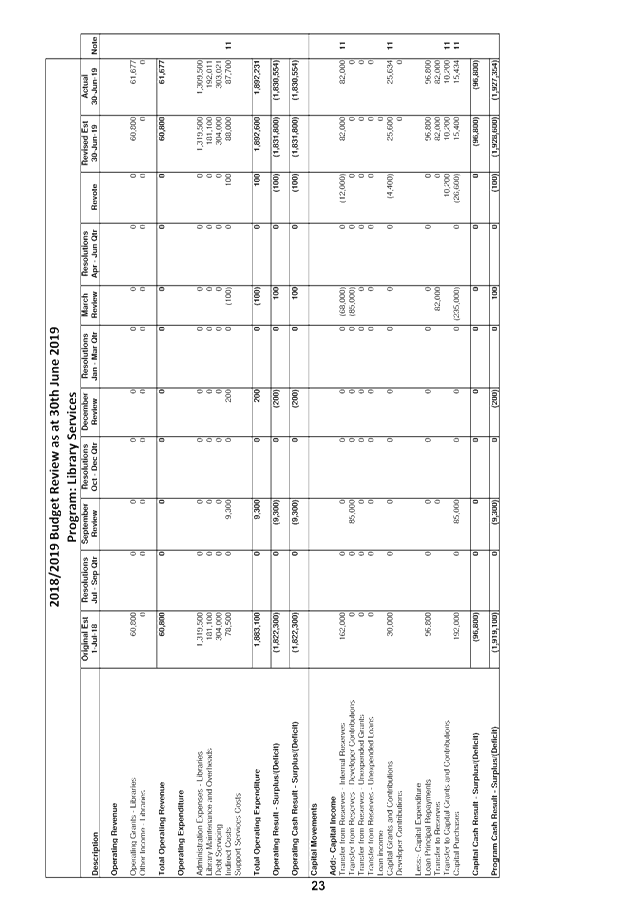

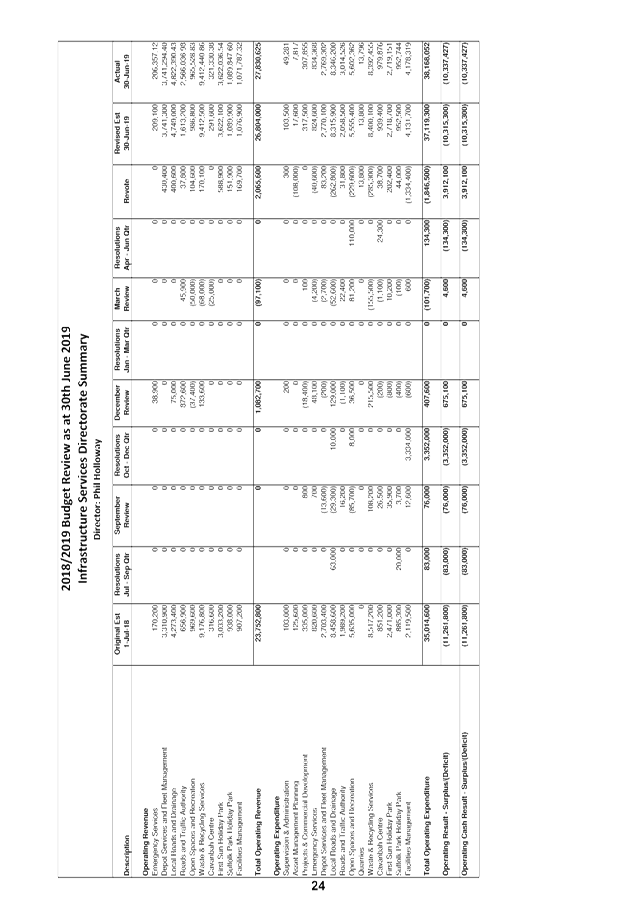

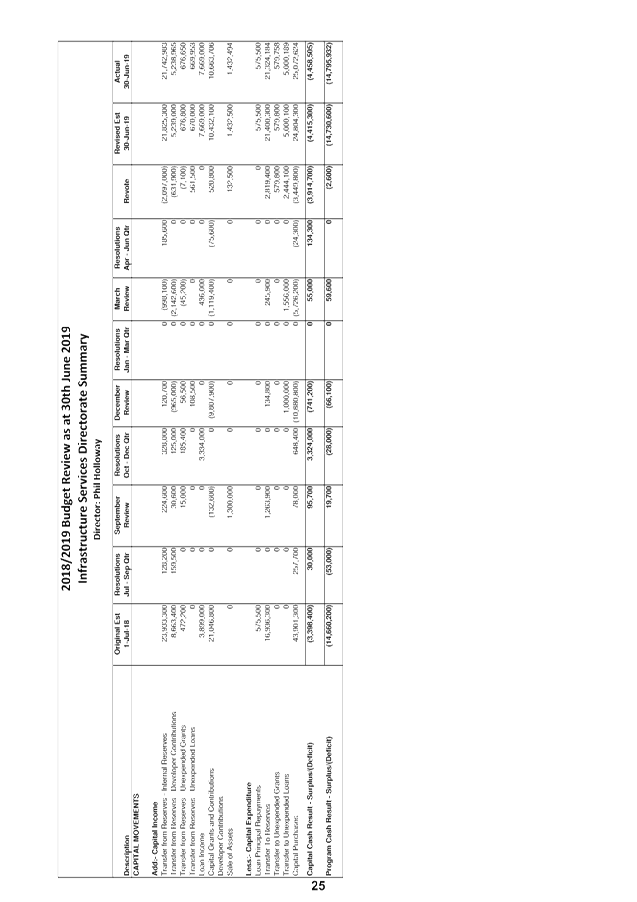

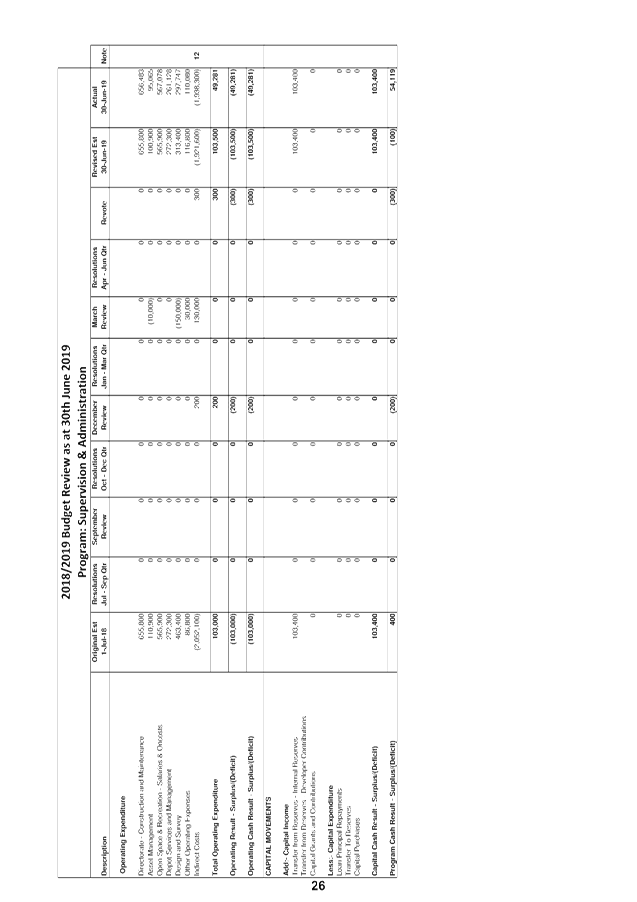

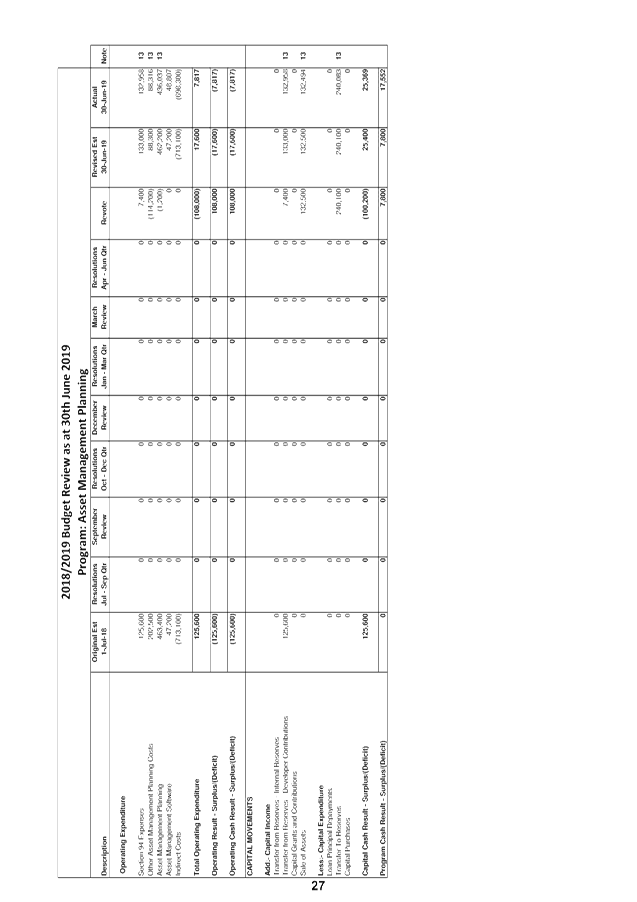

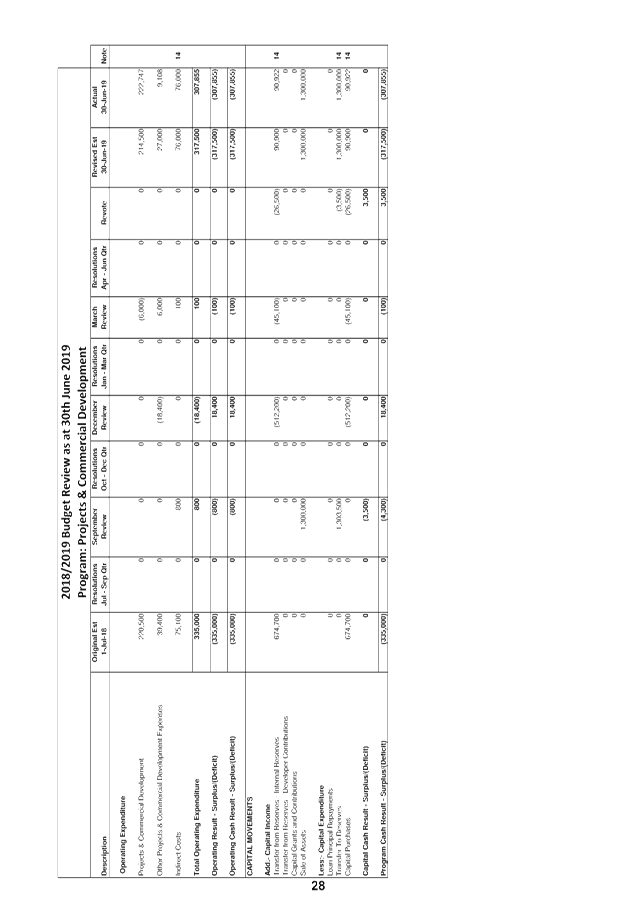

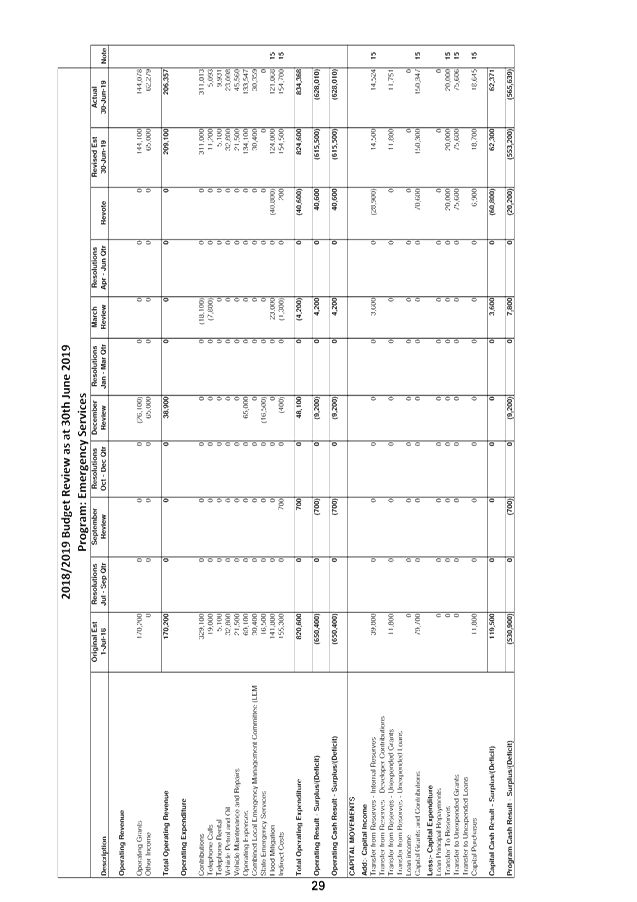

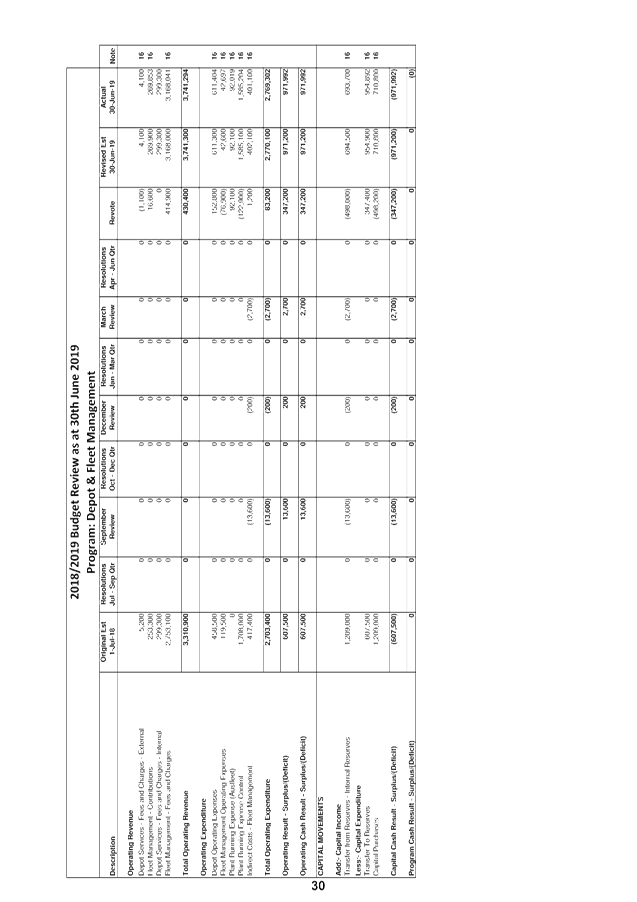

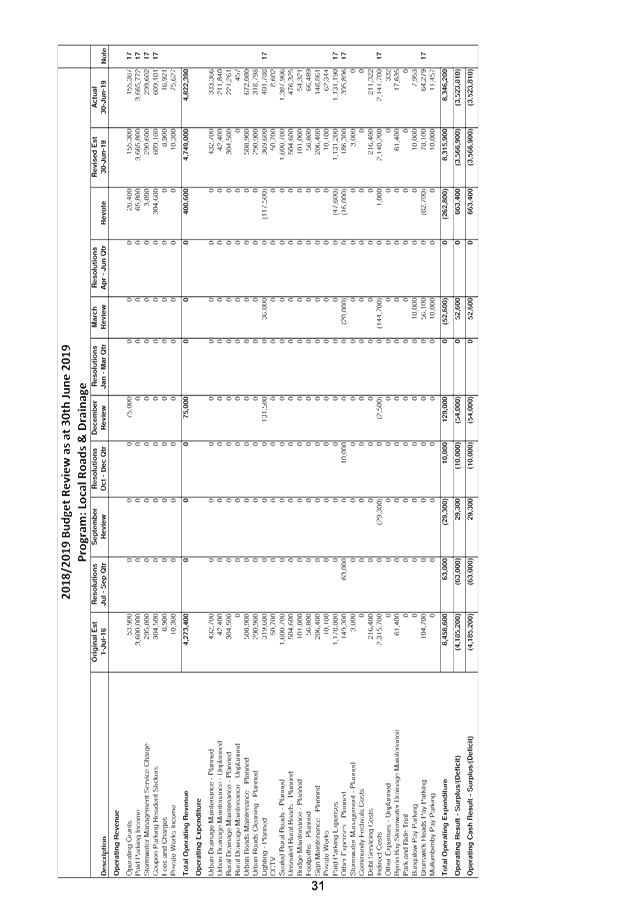

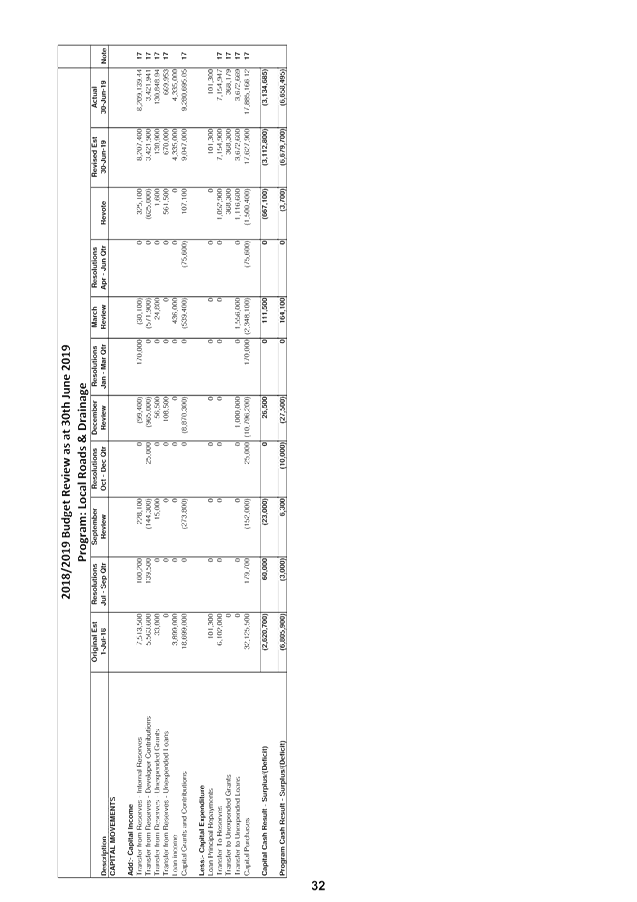

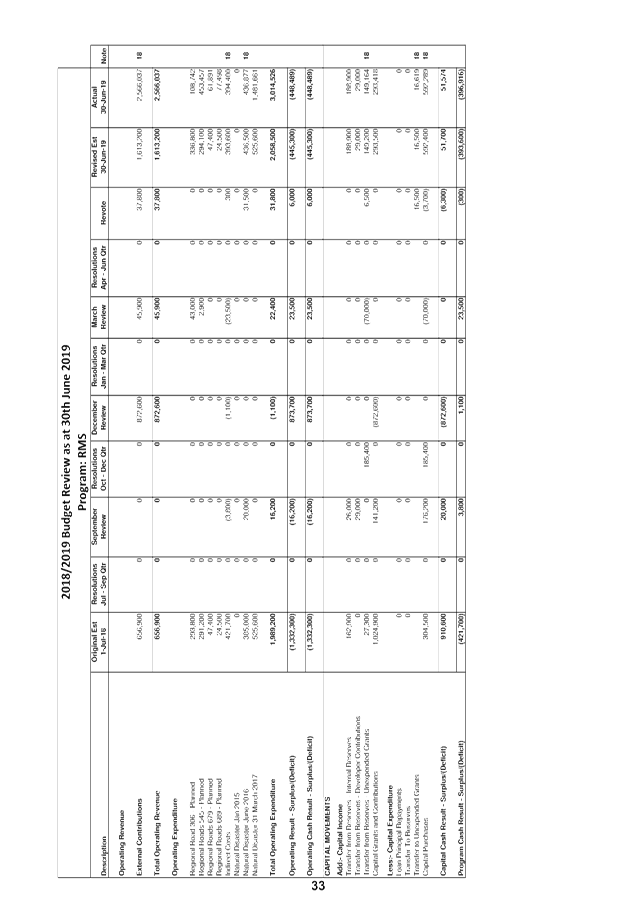

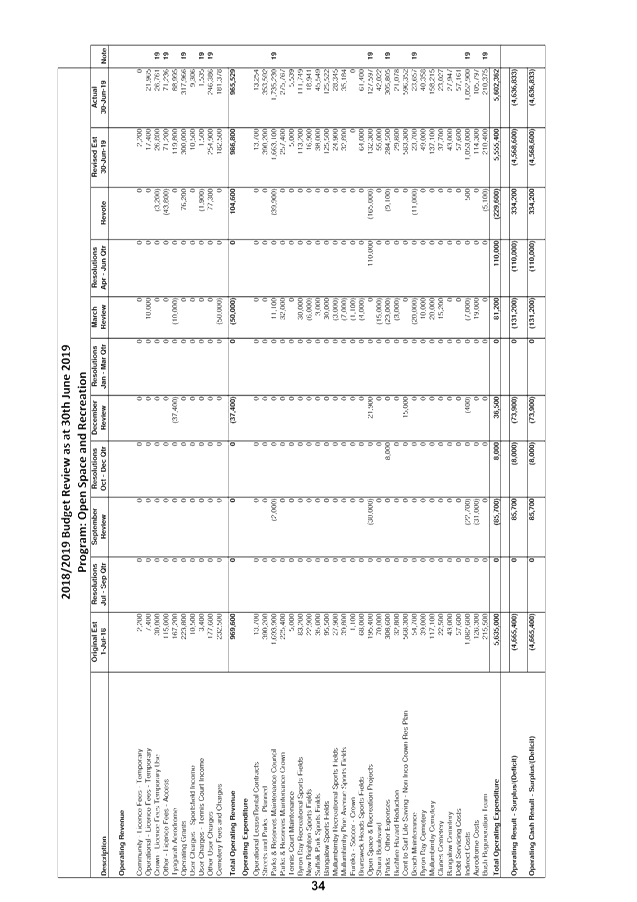

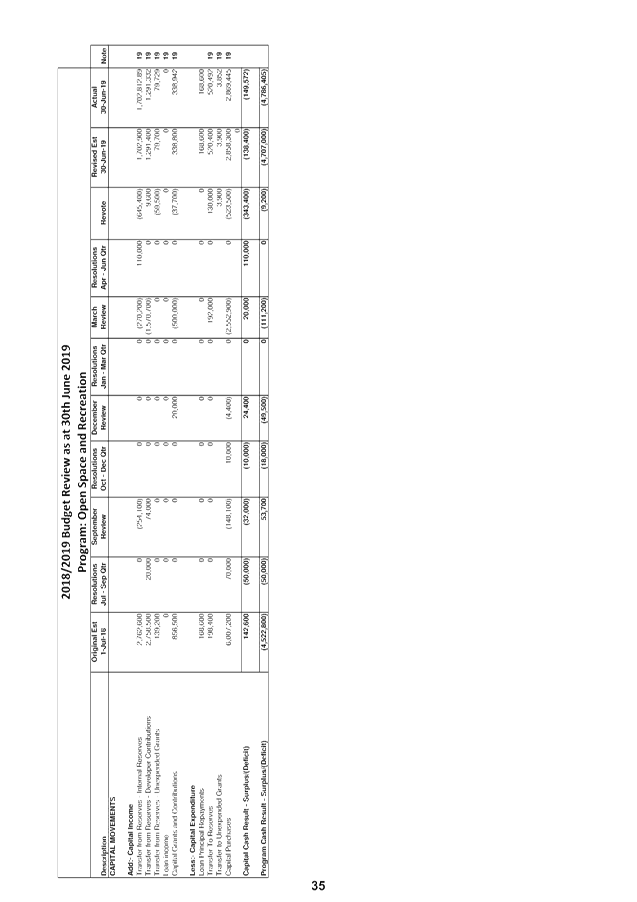

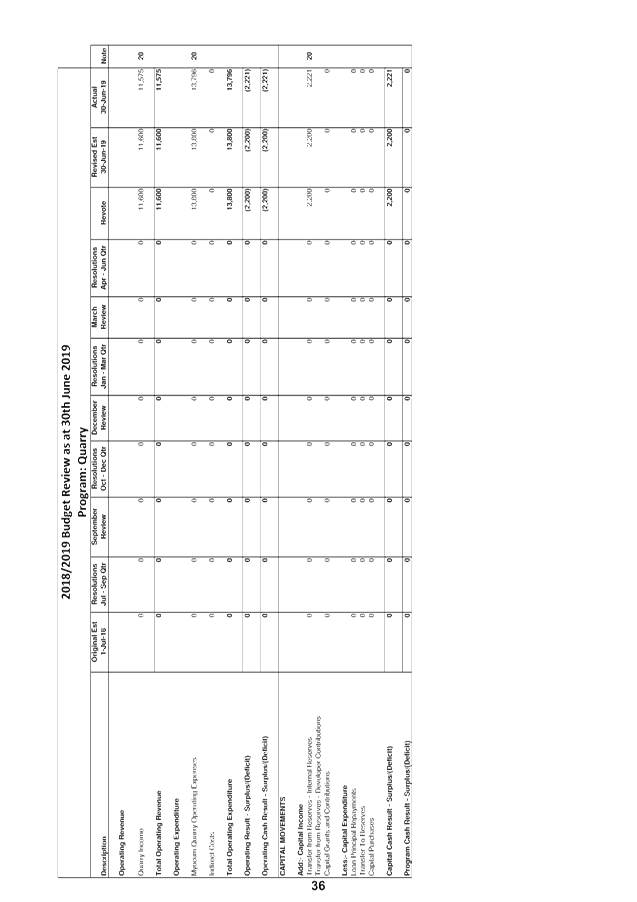

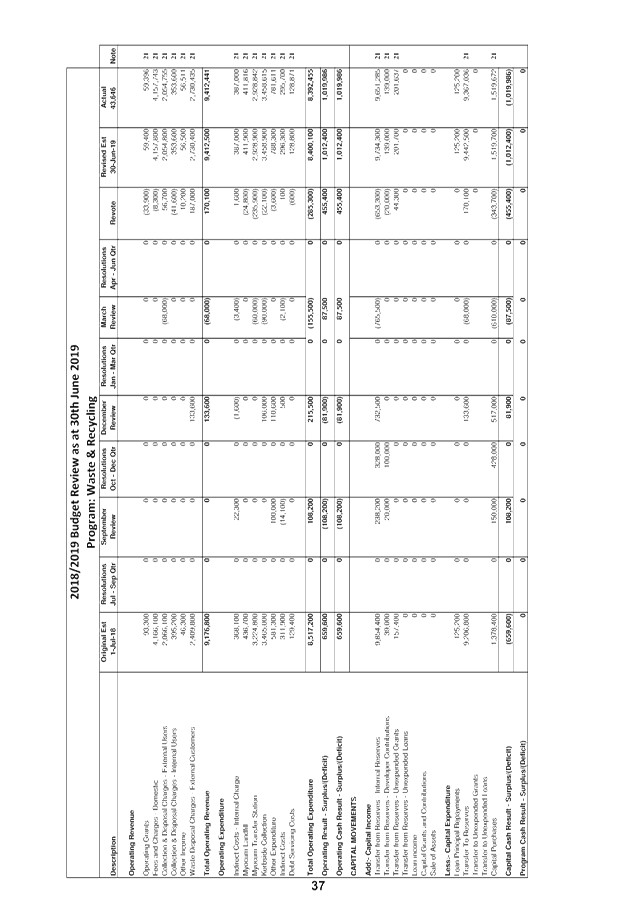

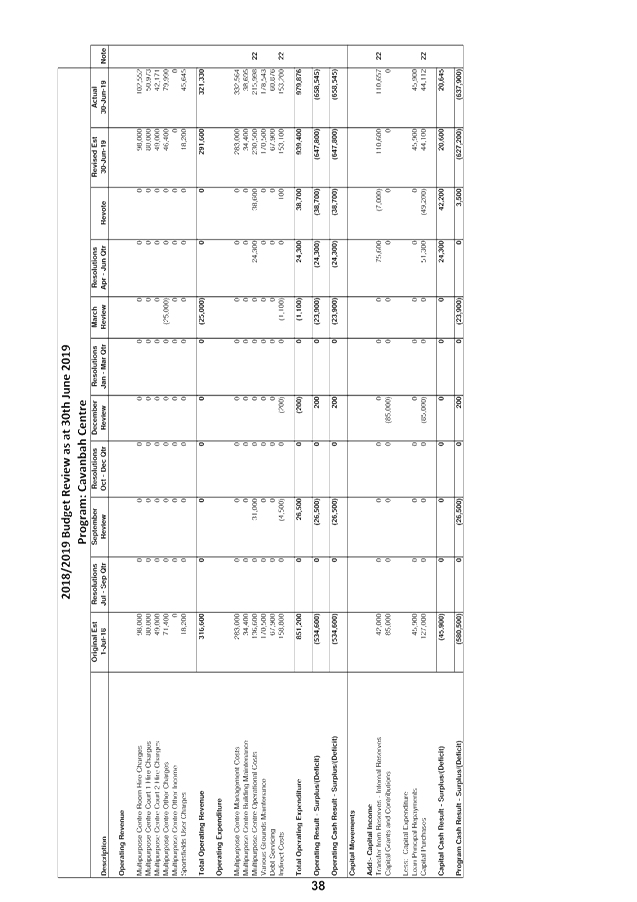

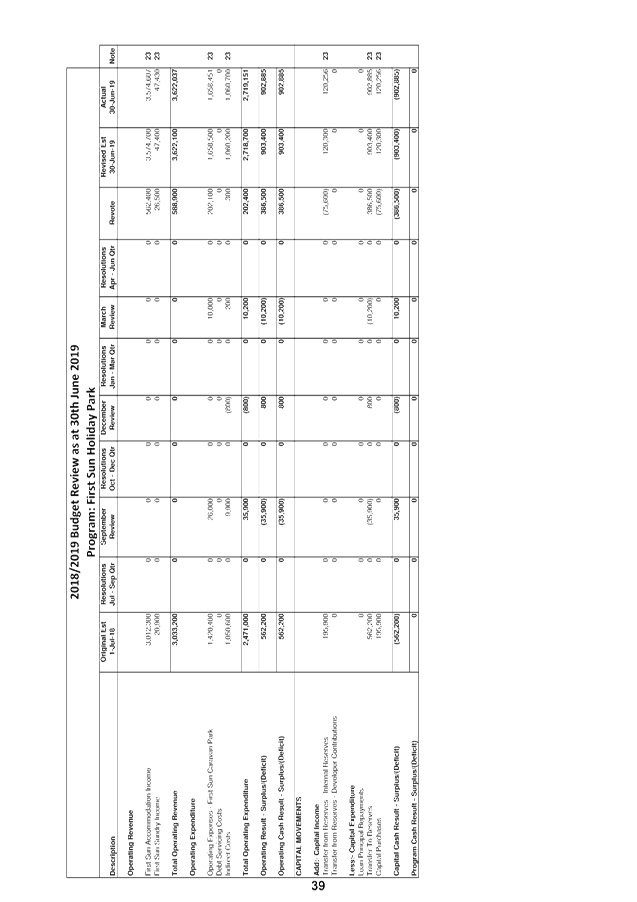

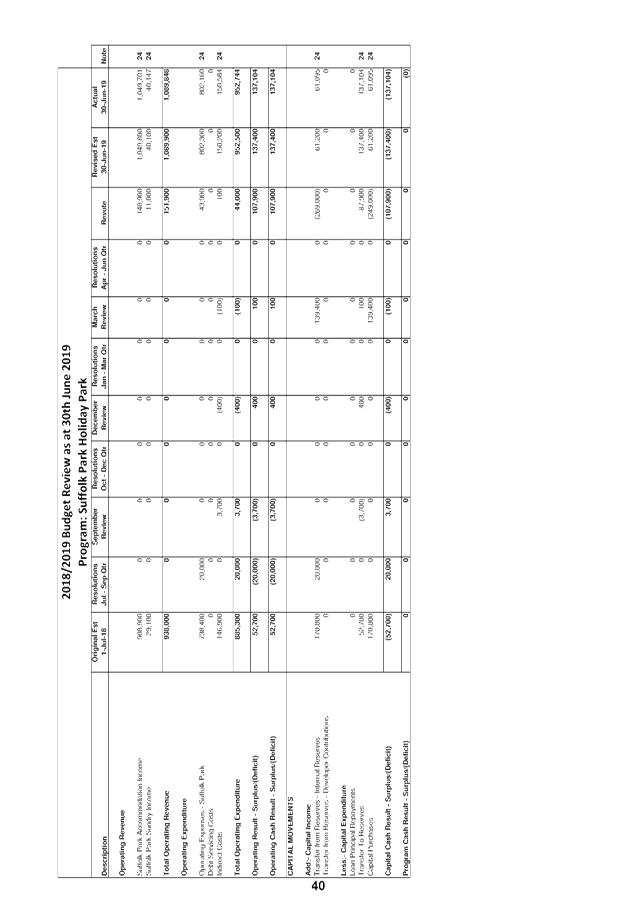

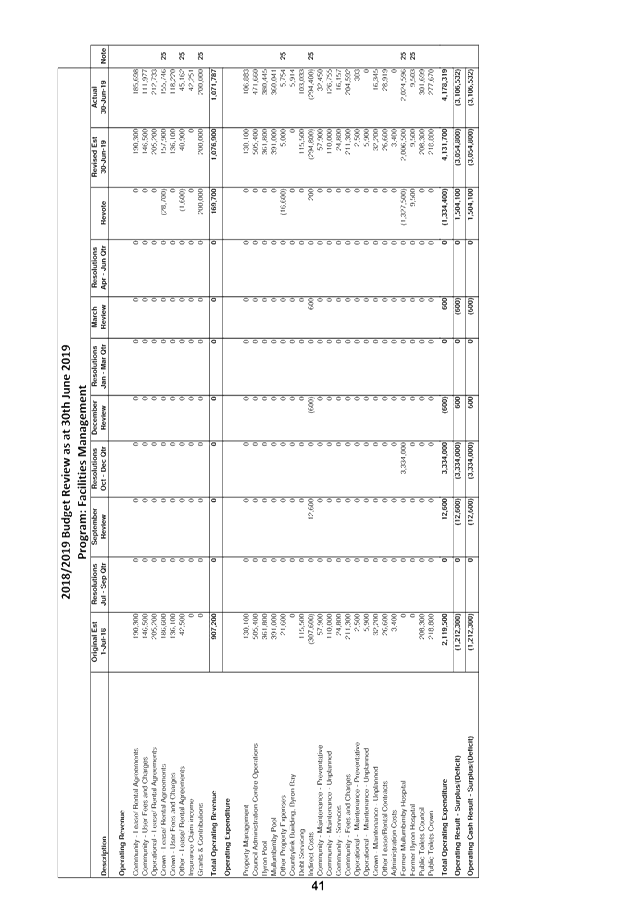

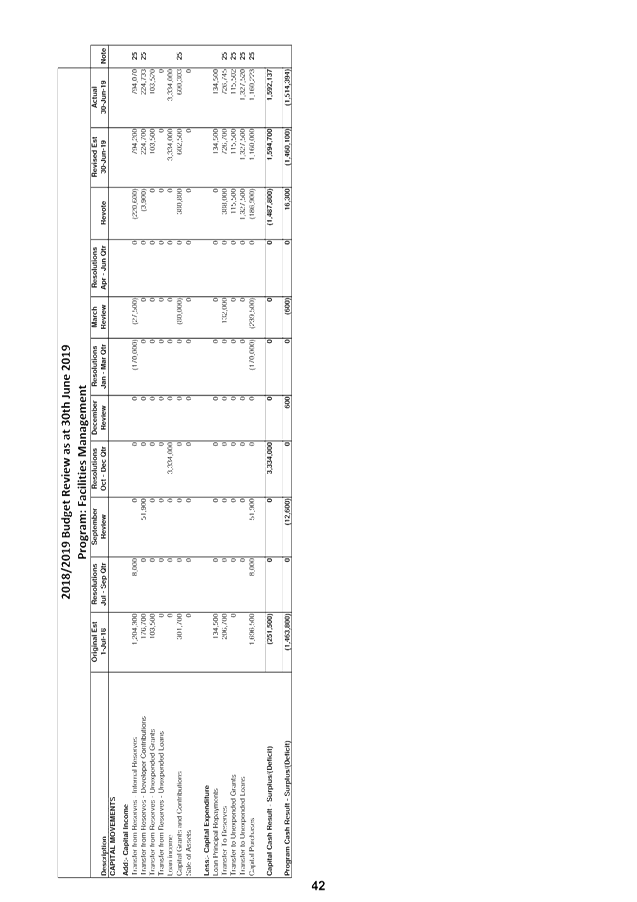

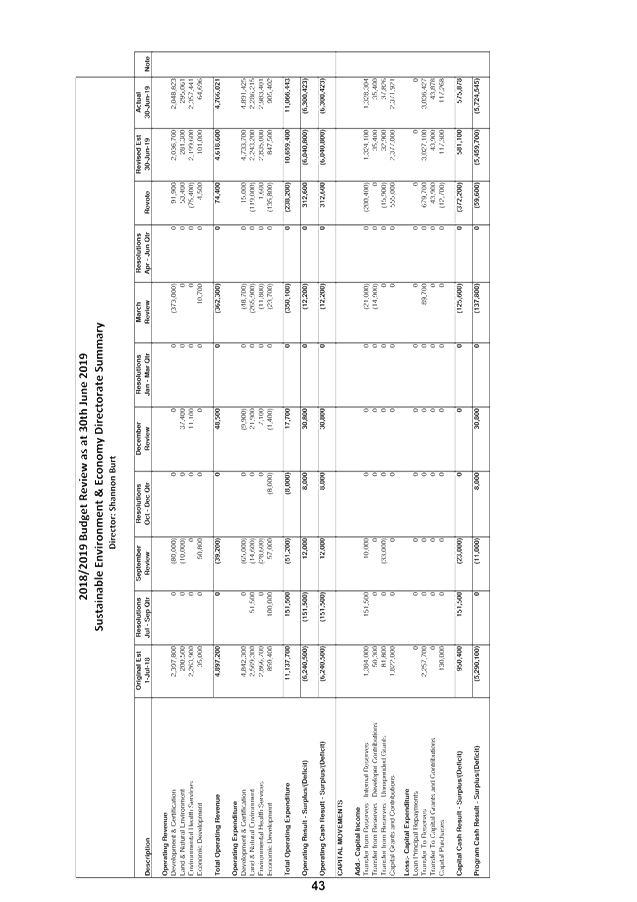

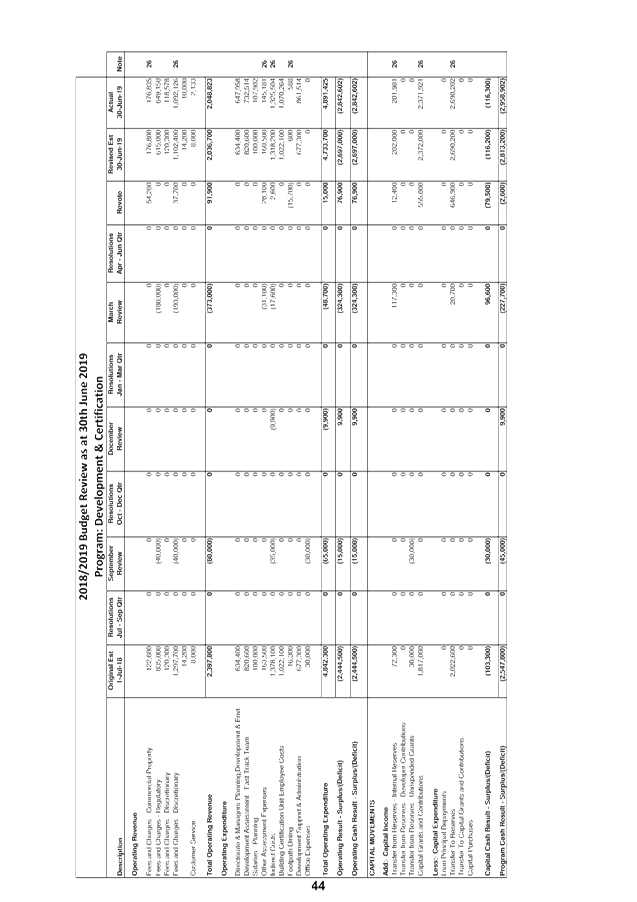

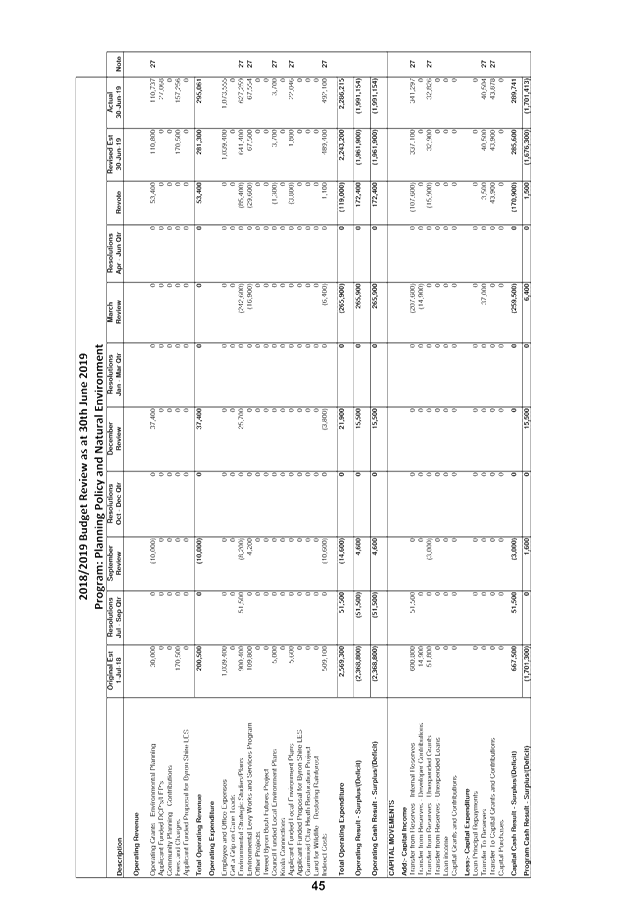

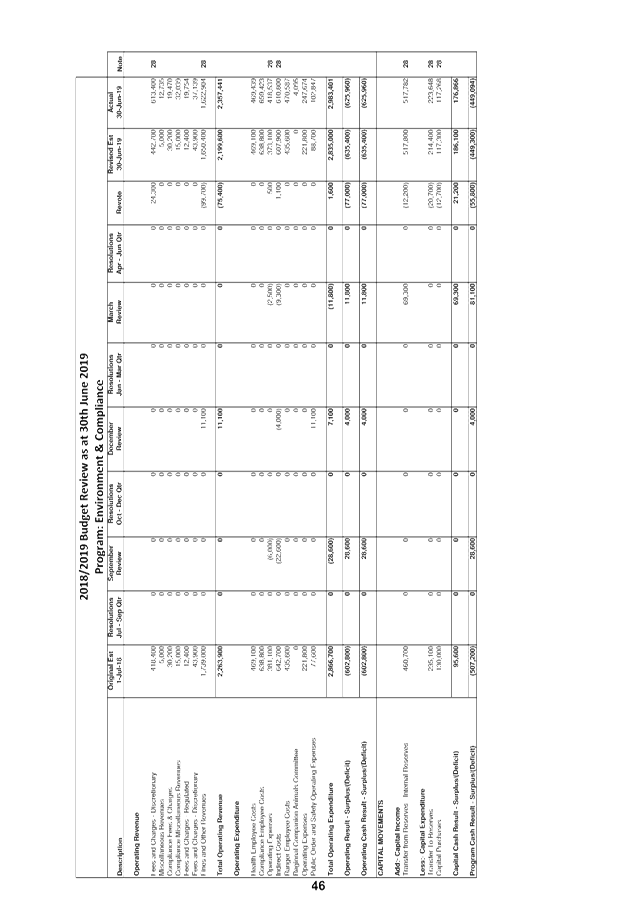

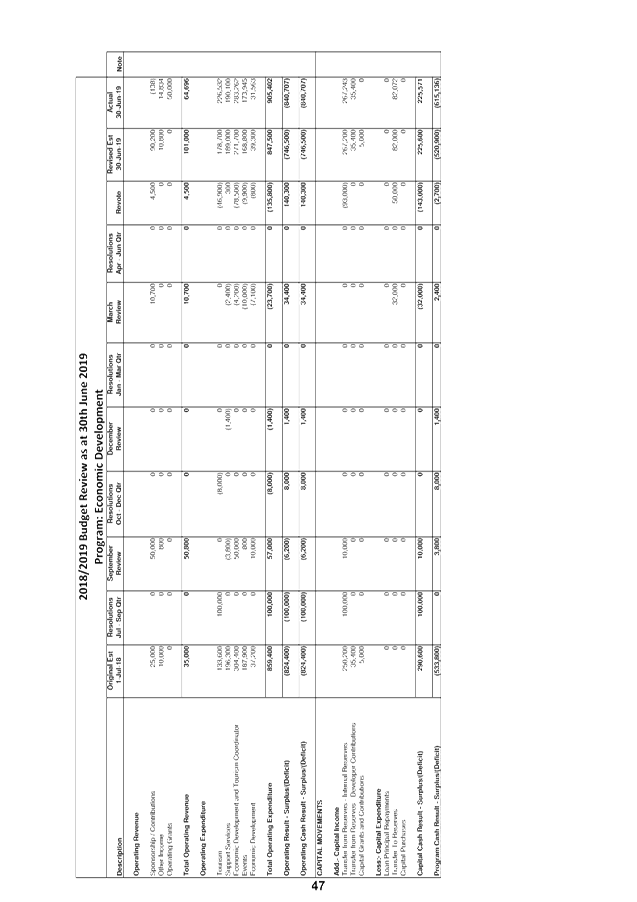

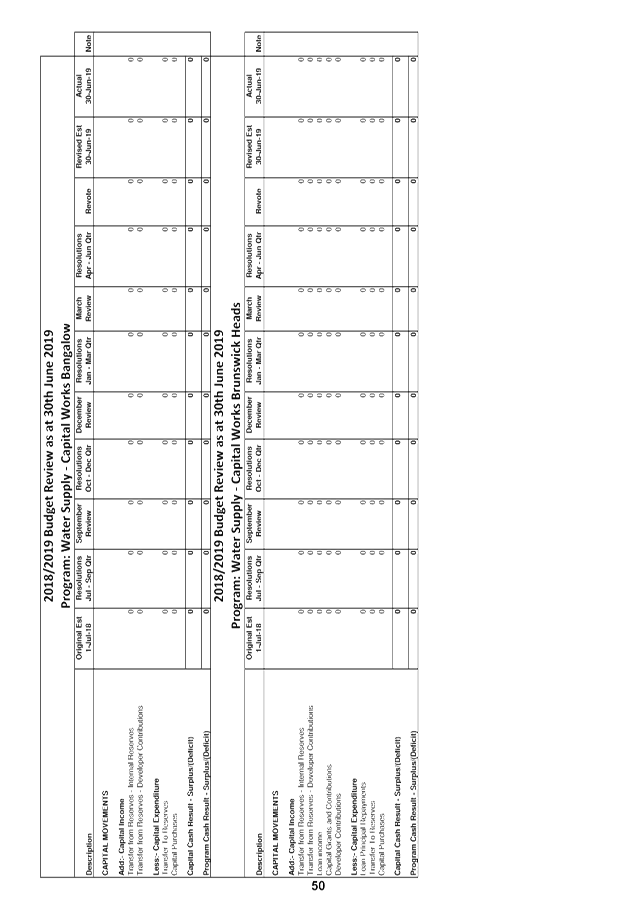

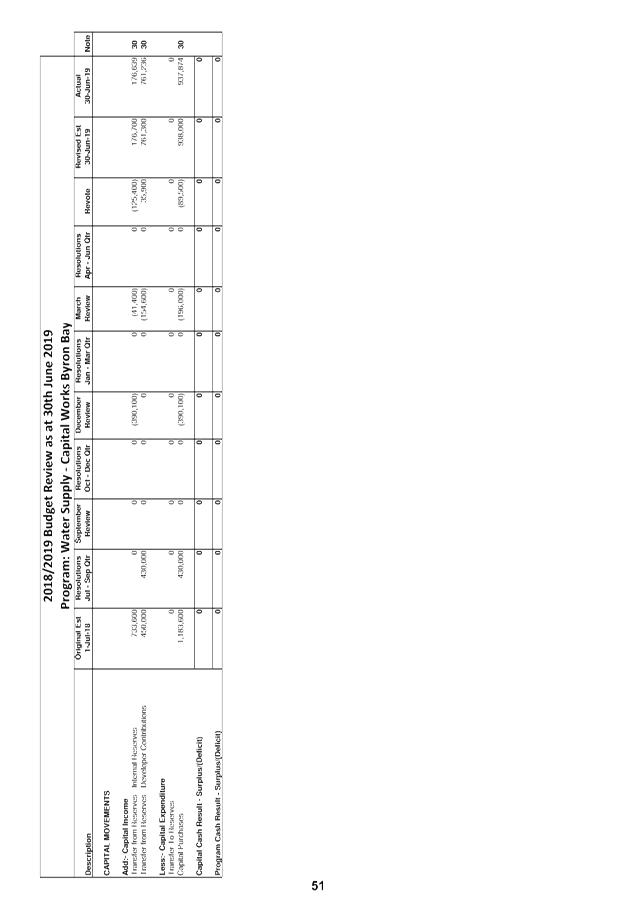

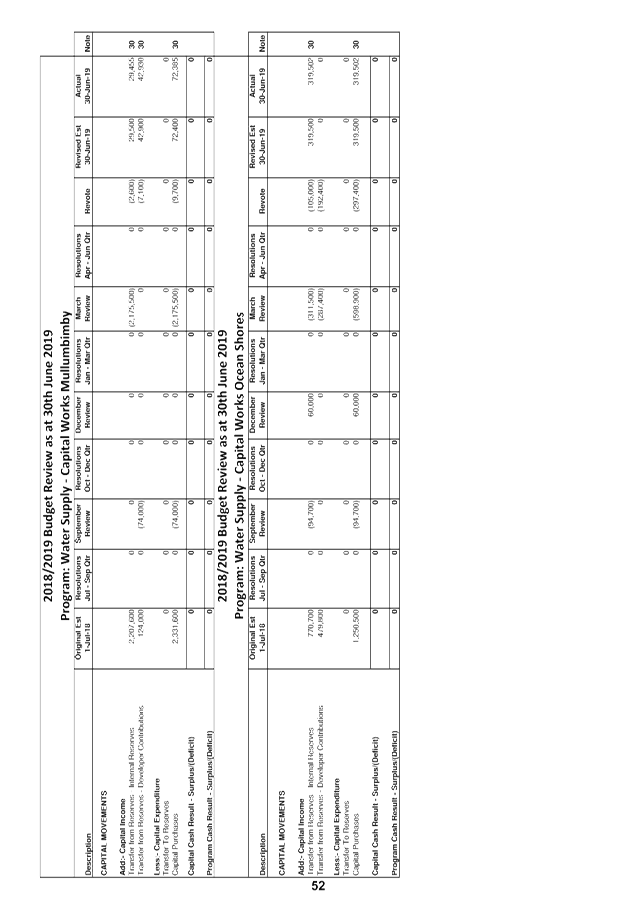

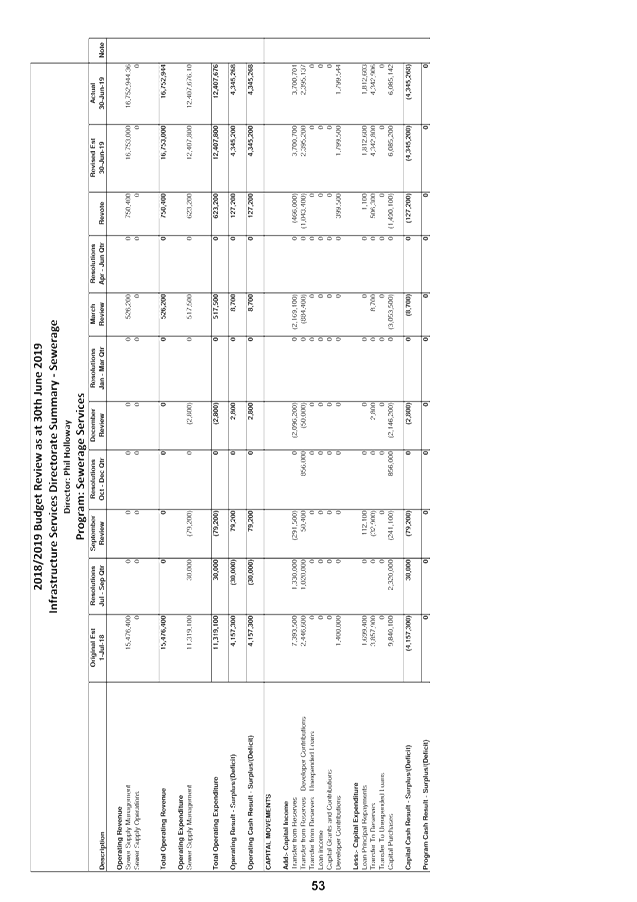

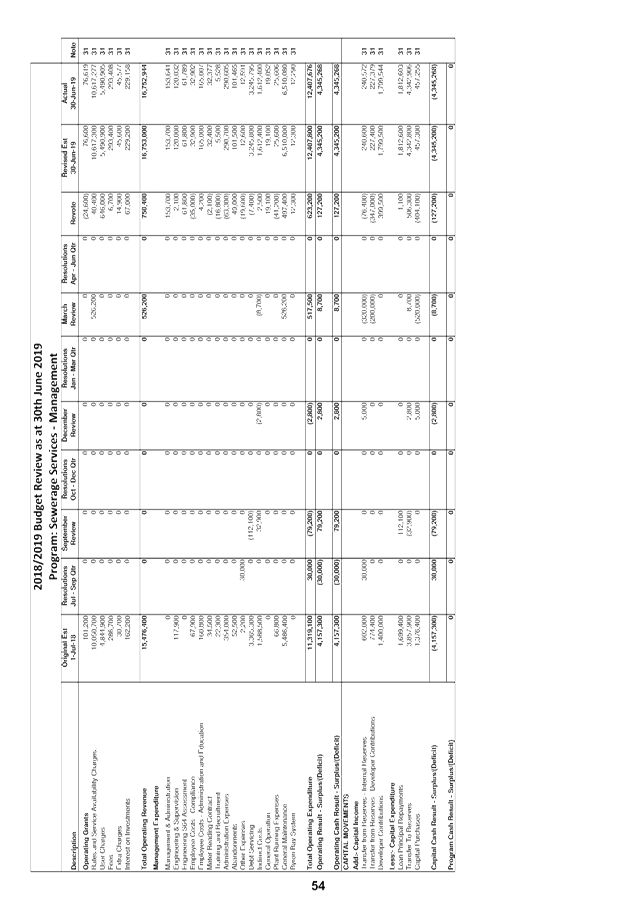

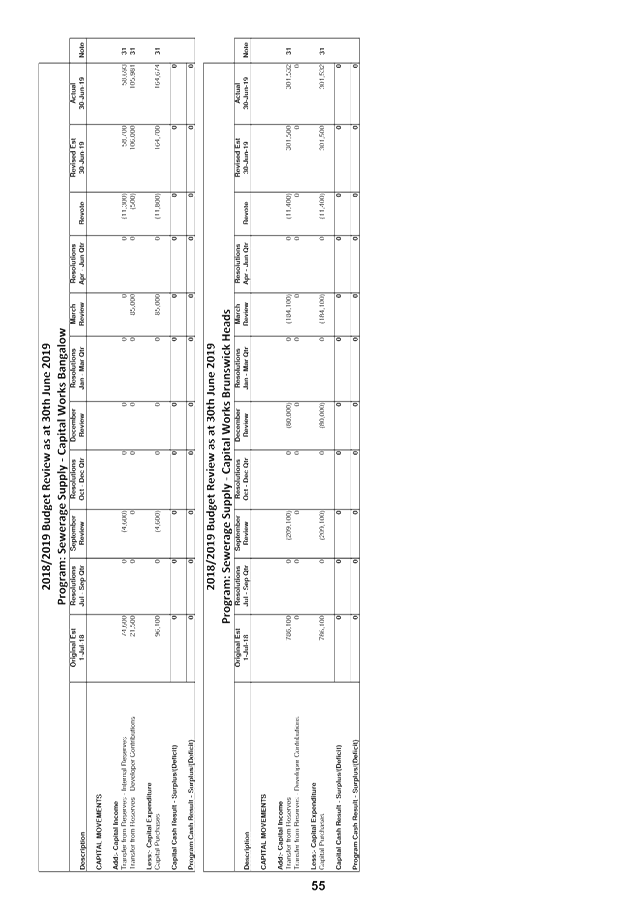

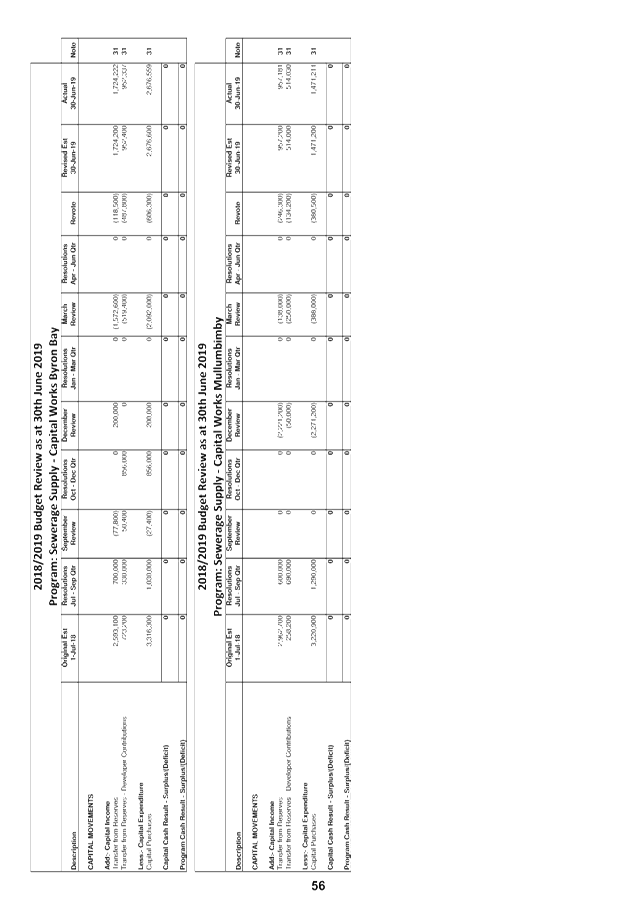

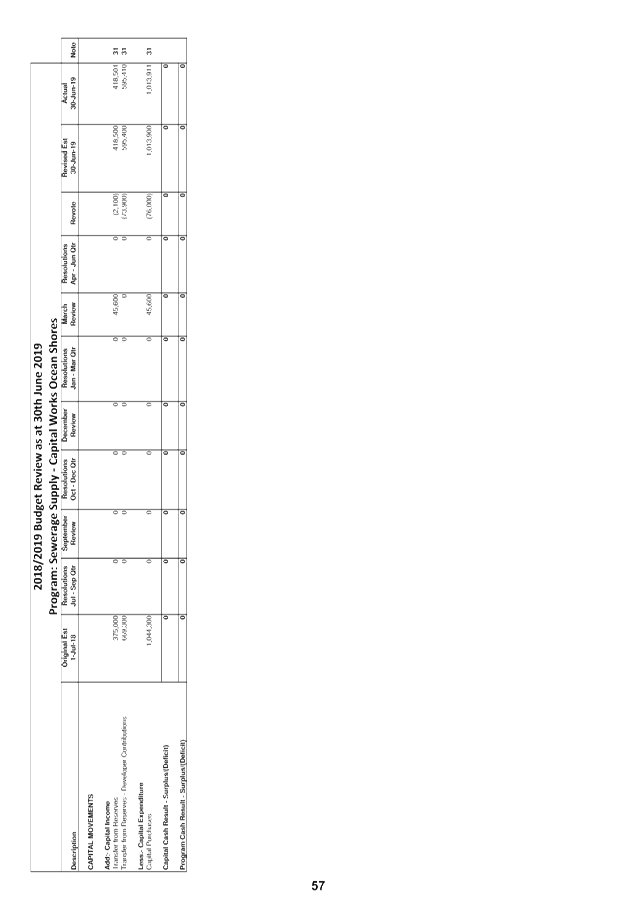

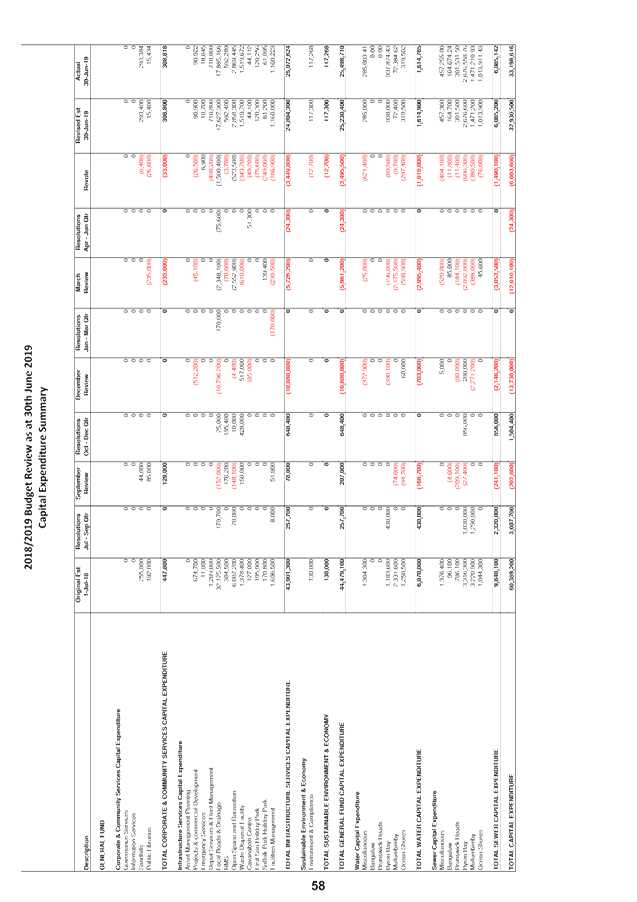

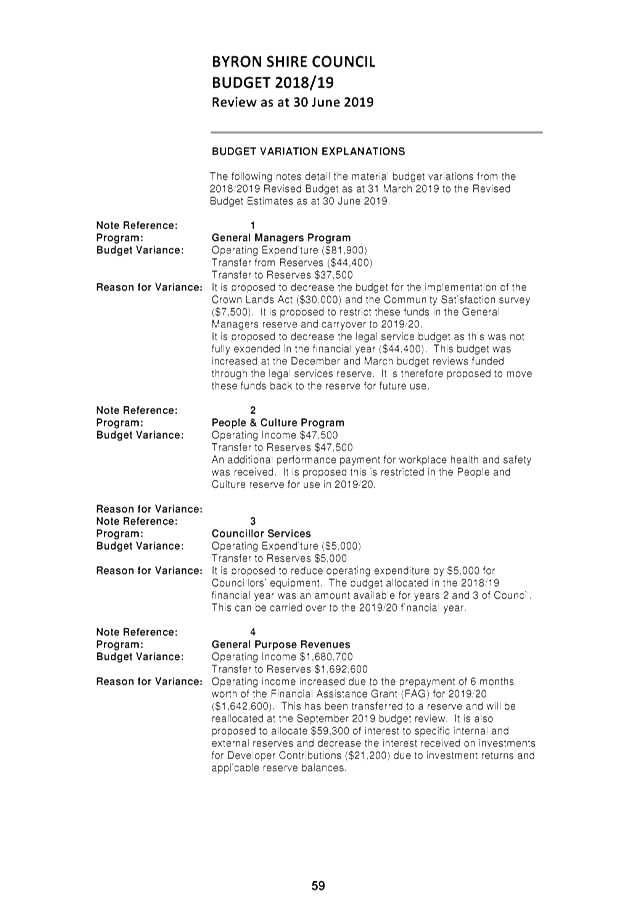

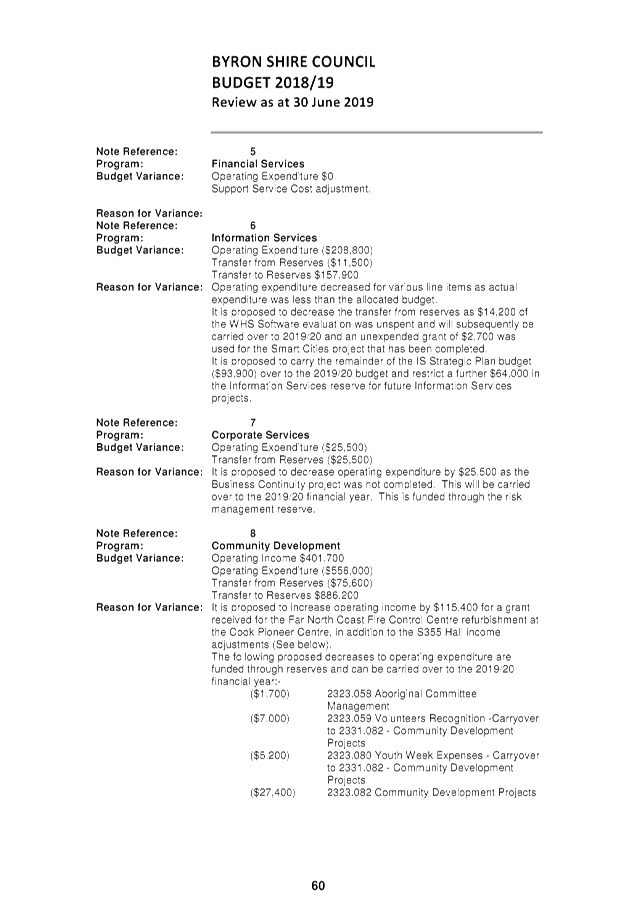

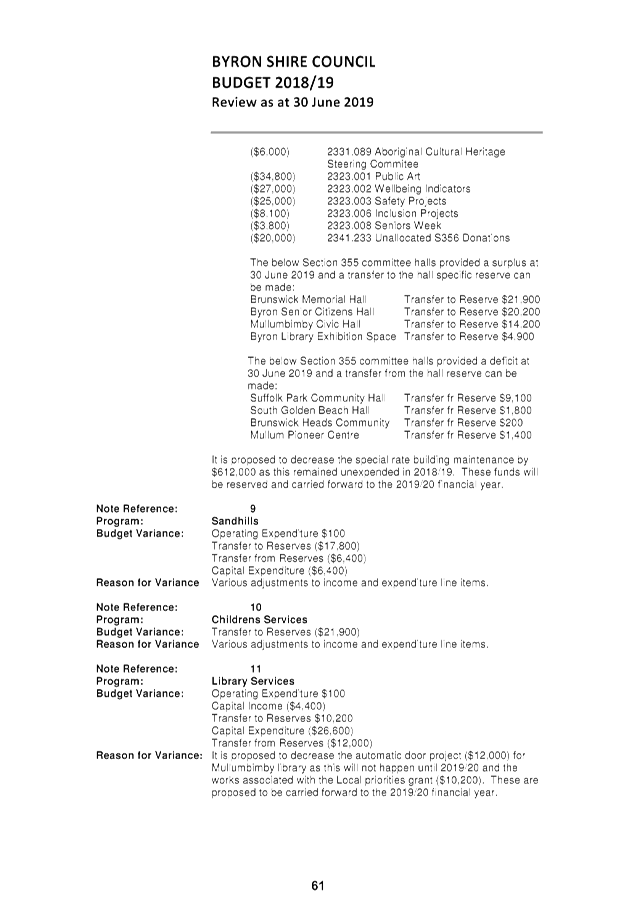

Report No. 4.3 Budget

Review - 1 April 2019 to 30 June 2019

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2019/1173

Summary:

This report is prepared in accordance with the format

required by Clause 203 of the Local Government (General) Regulation 2005

to inform Council and the Community of Council’s estimated financial

position for the 2018/2019 financial year, reviewed as at 30 June 2019.

The Quarterly Budget Review for the June 2019 Quarter has

been prepared to assist Council with policy and decision making on matters that

could have short, medium and long term implications on financial

sustainability.

This report contains an overview of the proposed budget

variations for the General Fund, Water Fund and Sewerage Fund. The specific

details of these proposed variations are included in Attachments 1 and 2 for

Council’s consideration and authorisation.

The report also provides an indication of Council’s

financial position at 30 June 2018. It should be noted that the figures

provided are subject to completion and audit of the Council’s Financial

Statements for 2018/2019. Any major variances will be included as part of the

report adopting the financial statements in October 2019.

|

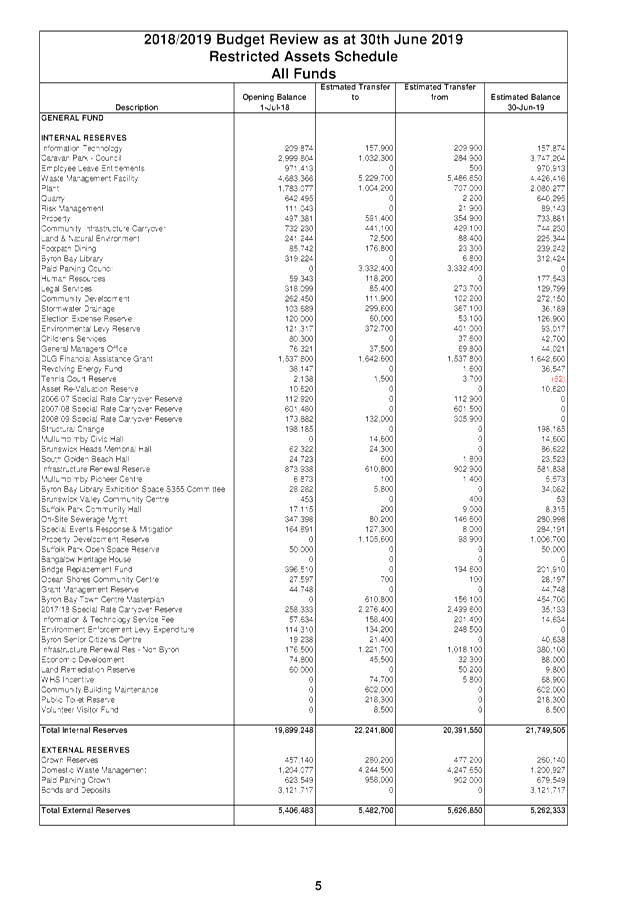

RECOMMENDATION:

That the Finance Advisory Committee recommends to

Council:

1. That Council

authorises the itemised budget variations as shown in Attachment 2 (#E2019/56200)

which include the following results in the 30 June 2019 Quarterly Review

of the 2018/2019 Budget:

a) General

Fund - $0 change in Unrestricted Cash Result

b) General

Fund - $11,930,300 increase in reserves

c) Water

Fund - $1,664,200 increase in

reserves.

d) Sewerage

Fund - $2,015,700 increase in reserves

2. That

Council adopts the revised General Fund Estimated Unrestricted Cash Result of

$1,145,200 for the 2018/2019 financial year.

|

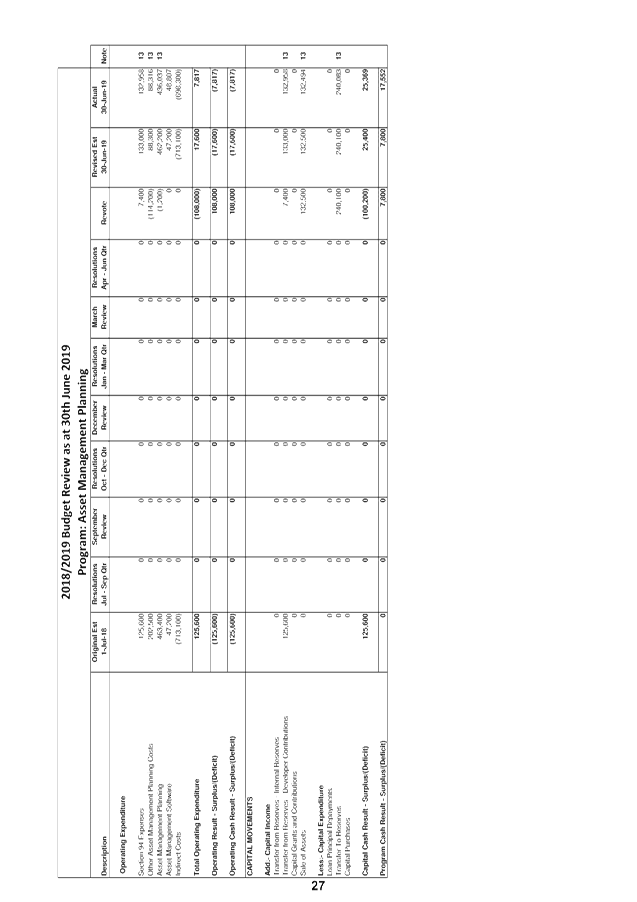

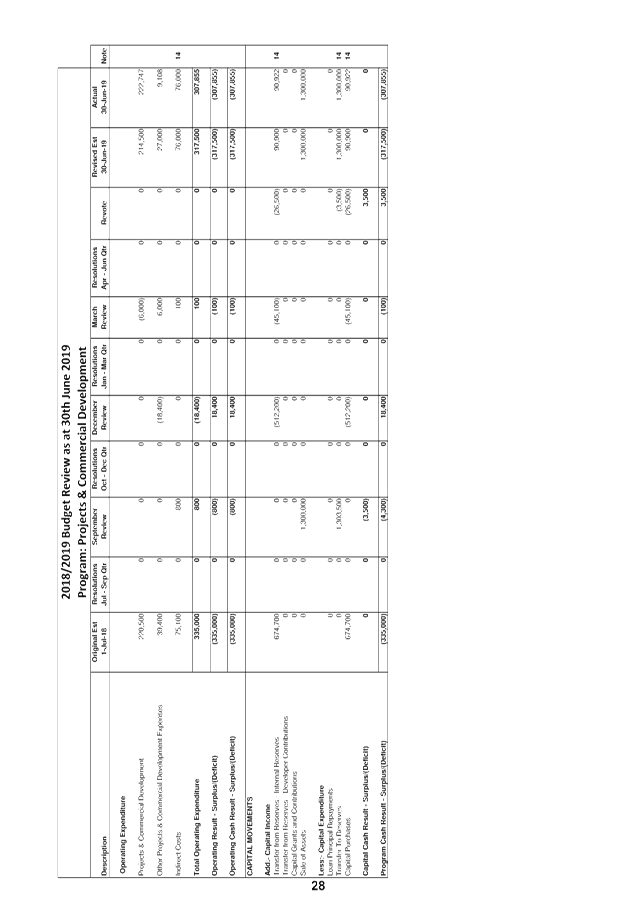

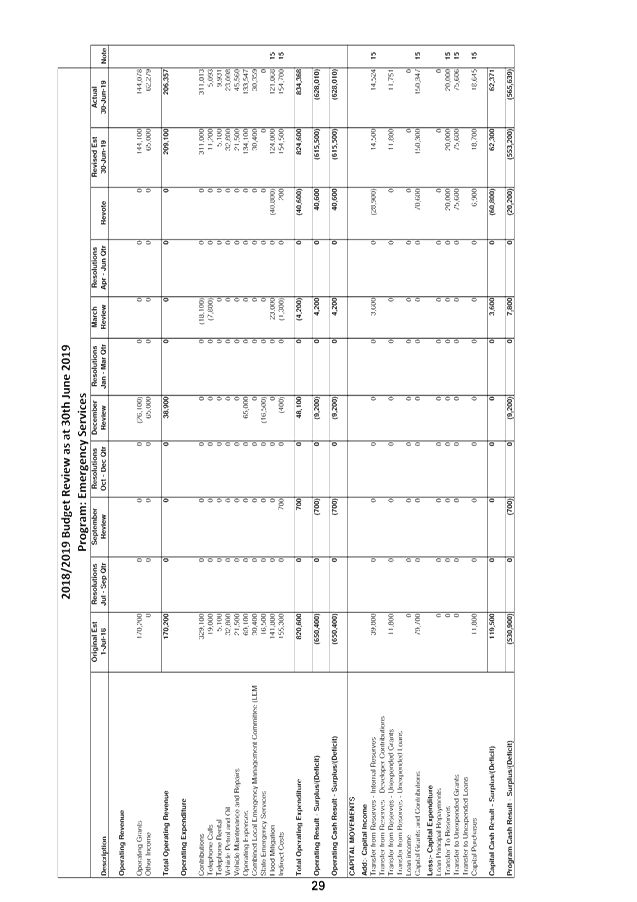

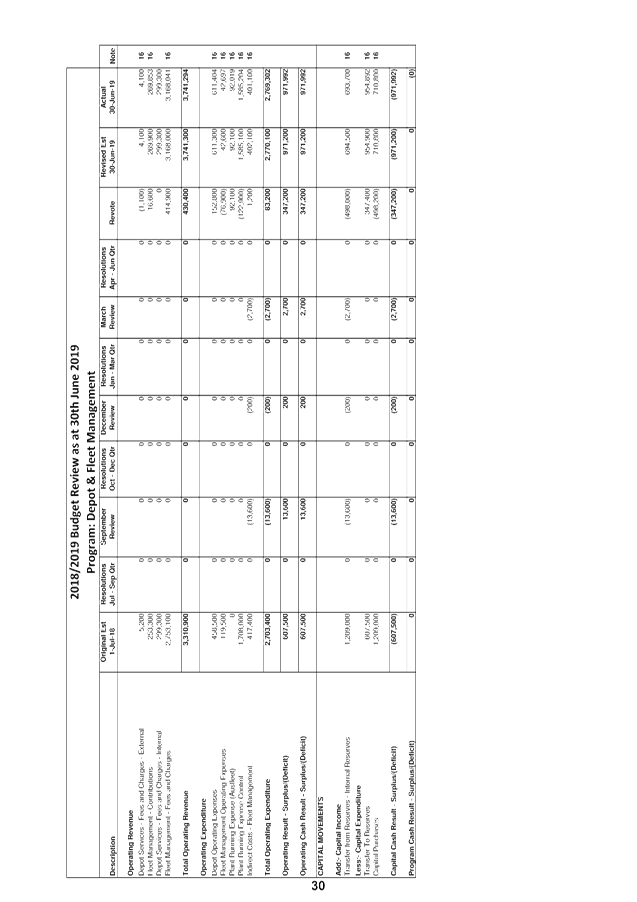

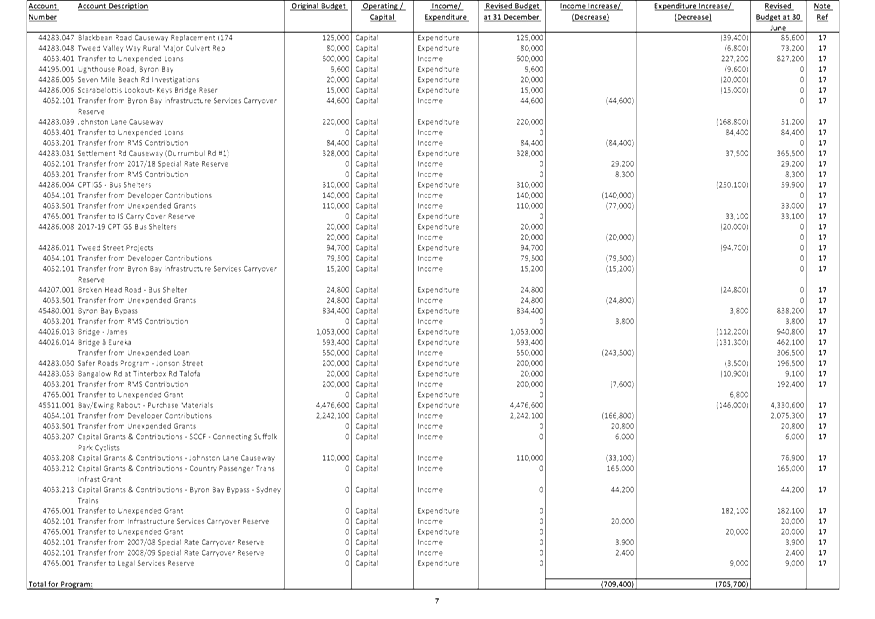

Attachments:

1 Budget

Variations for General, Water and Sewerage Funds, E2019/56197 , page 28⇩

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2019/56200 ,

page 97⇩

REPORT

Council adopted the 2018/2019 budget on 28 June 2018 via

Resolution 18-429. It also considered and adopted the budget carryovers

from the 2017/2018 financial year, to be incorporated into the 2018/2019 budget

at its Ordinary Meeting held on 23 August 2018 via Resolution 18-522.

Since that date Council has reviewed the budget, taking into consideration the

2017/2018 Financial Statement results and progress through the 2018/2019

financial year. This report considers the June 2019 Quarter Budget

Review.

The details of the budget review for the Consolidated,

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget

position, as well as a breakdown by Fund and Principal Activity. The document

in Attachment 1 is intended to provide Councillors with more detailed

information to assist with decision making regarding Council’s finances.

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

Attachment 1 shows (from left to right) the original budget

as adopted by Council on 28 June 2018 plus the adopted carryover budgets from

2017/2018, followed by resolutions that had budget impact for each Quarter,

followed by the relevant quarterly review and the revote (or adjustment) and

then the revised position projected for 30 June 2019.

On the far right of the Principal Activity, there is a

column titled “Note”. If this is populated by a number, it

means that there has been an adjustment in the quarterly review. This

number corresponds to the notes at the end of the Attachment 1 which

explain the variation.

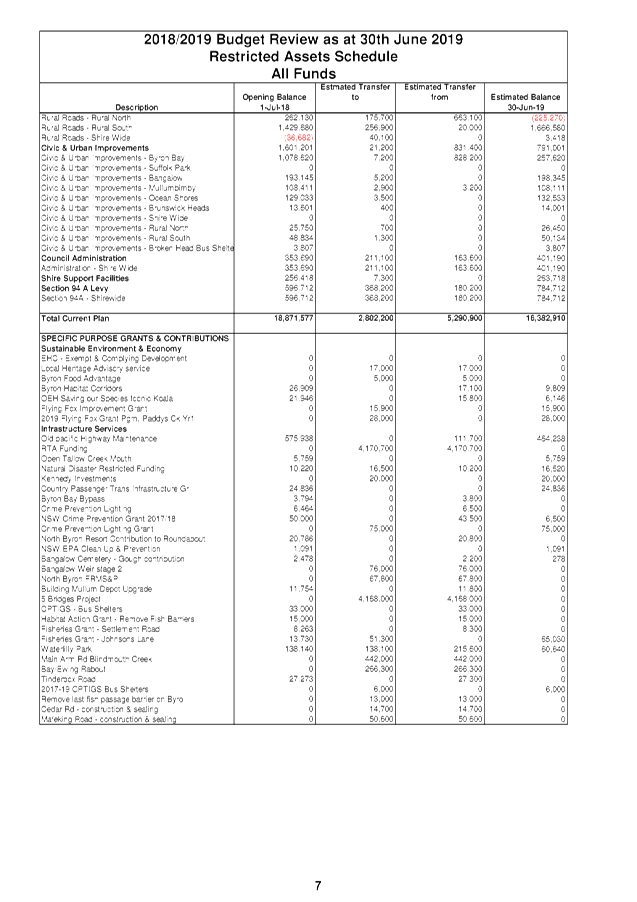

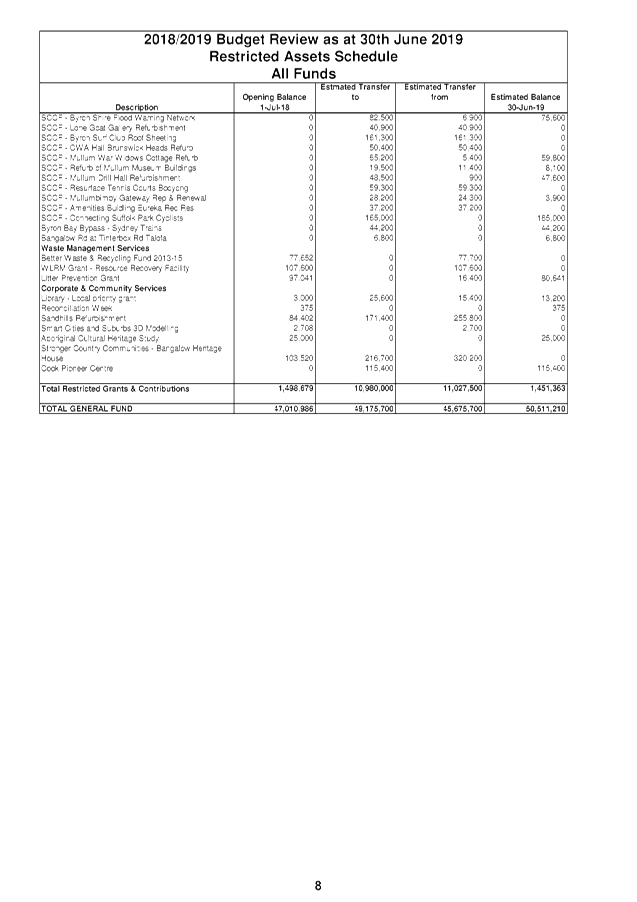

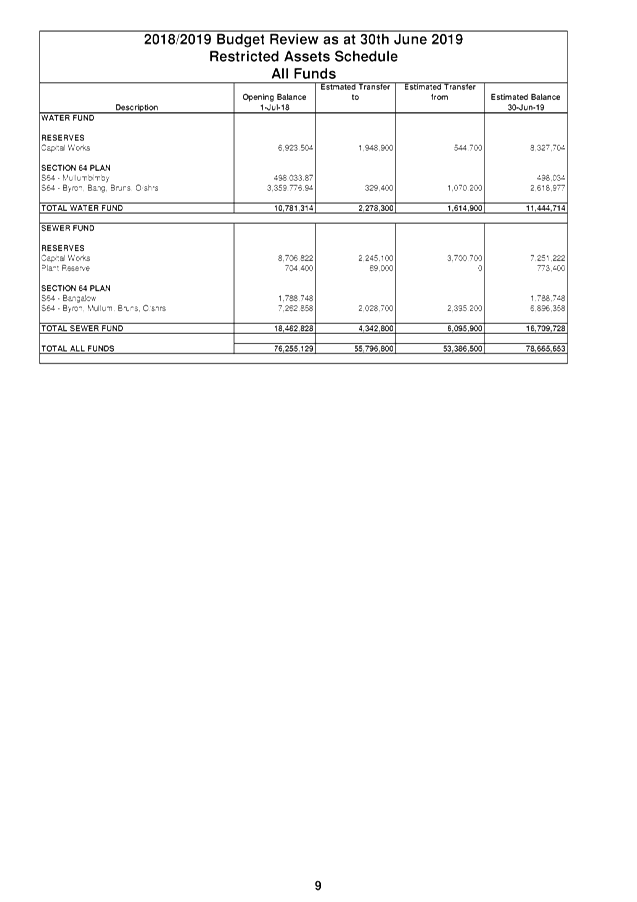

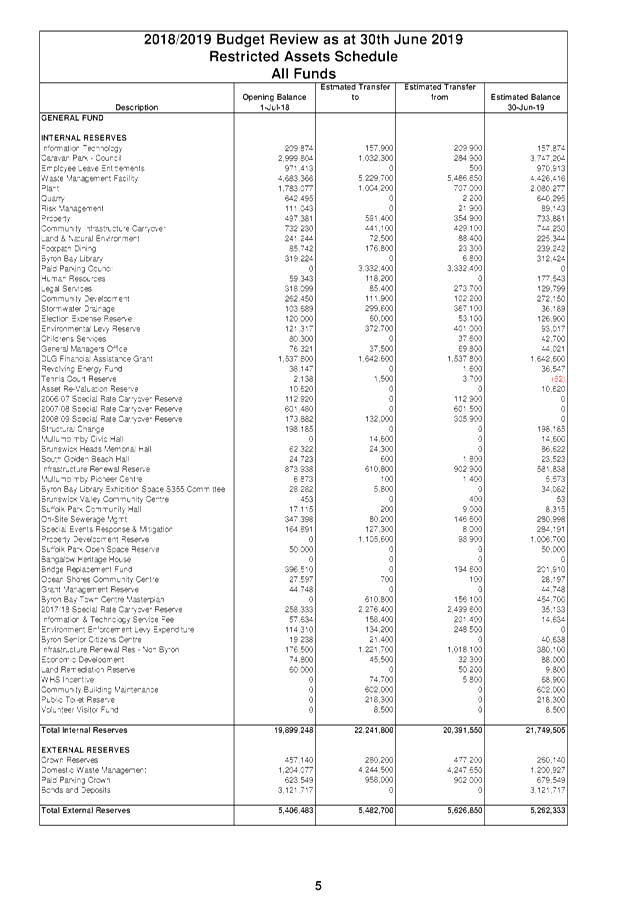

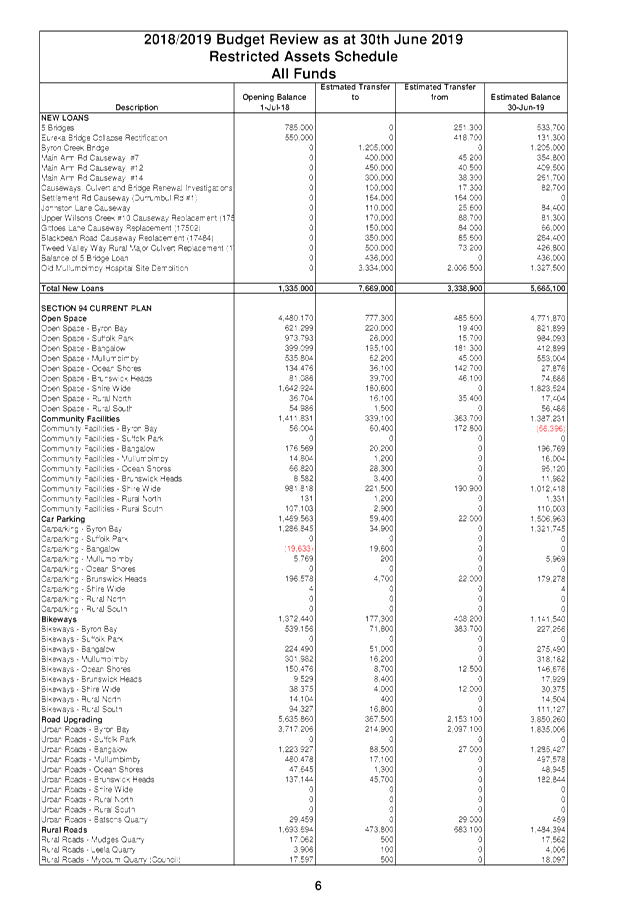

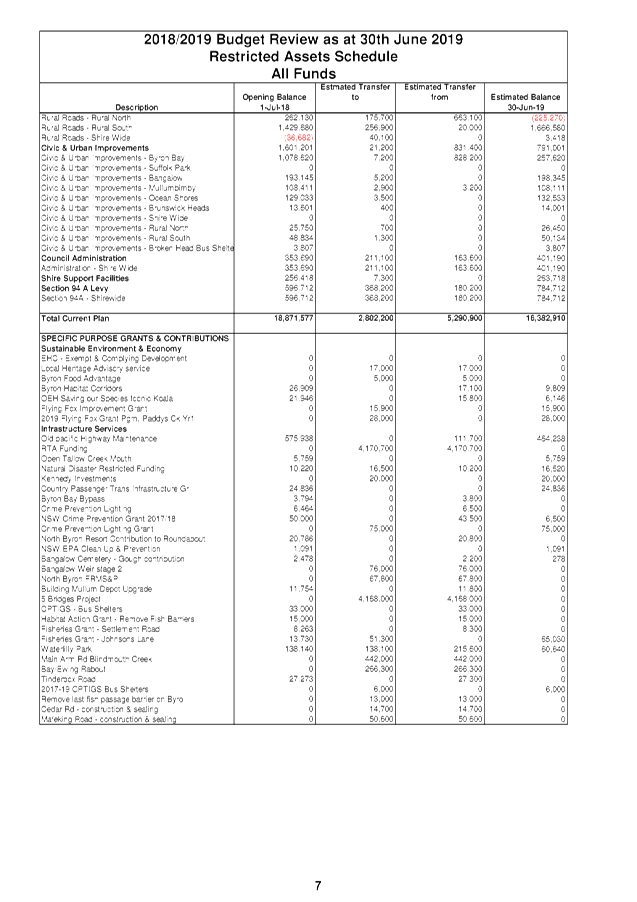

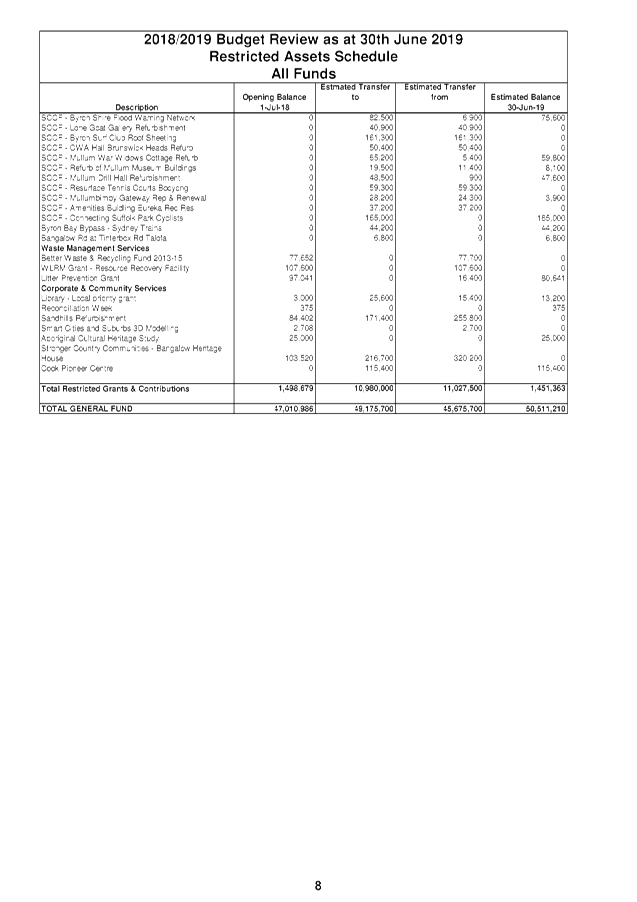

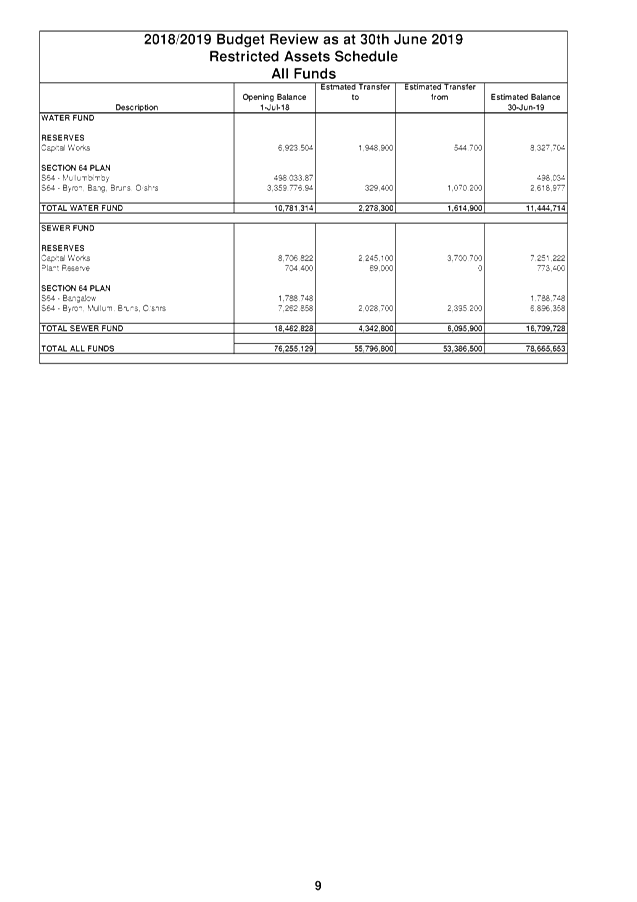

There is also information detailing restricted assets (reserves)

to show estimated balances as at 30 June 2019 for all reserves.

A summary of Capital Works is also included by Fund and

Principal Activity.

Office of Local Government Budget Review Guidelines:

On 10 December 2010, the Office of Local Government issued

Quarterly Budget Review Guidelines via Circular 10-32. Reports to Council

concerning Quarterly Budget Reviews normally provide statements in accordance

with these guidelines as a separate attachment. Given that there is no

statutory obligation for Council to produce a Quarterly Budget Review as at 30

June each financial year, the statements required by the guidelines have not

been produced for this specific report.

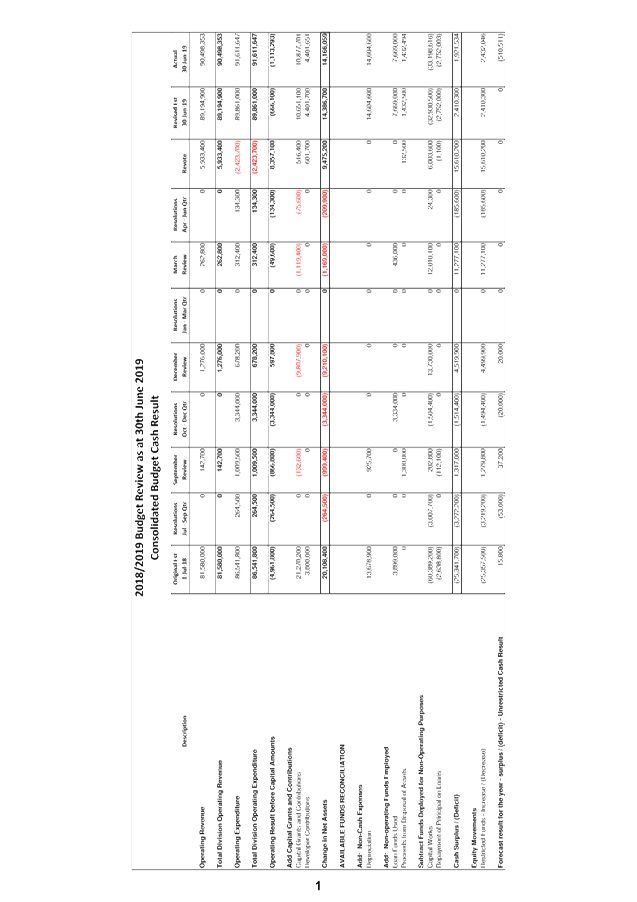

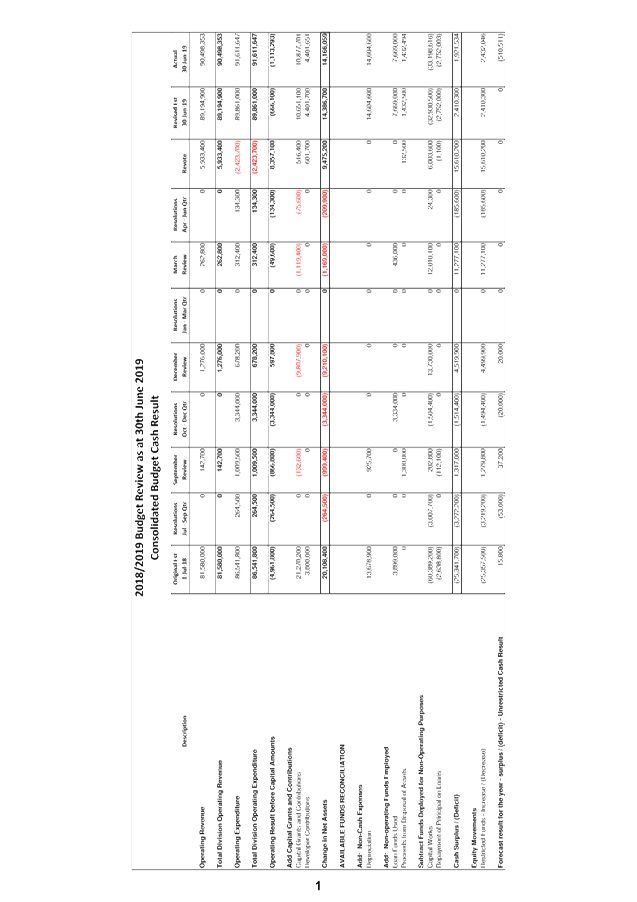

CONSOLIDATED RESULT

The following table provides a summary of the overall

Council budget on a consolidated basis inclusive of all Funds’ budget

movements for the 2018/2019 financial year projected to 30 June 2019.

|

2018/2019 Budget Review Statement as at 30 June 2019

|

Original Estimate (Including Carryovers)

1/7/2018

|

Adjustments to 30 June 2019 including Resolutions*

|

Proposed 30 June 2019 Review Revotes

|

Revised Estimate 30/6/2019

|

|

Operating Revenue

|

81,580,000

|

1,681,500

|

5,933,400

|

89,194,900

|

|

Operating Expenditure

|

86,541,800

|

5,742,900

|

(2,423,700)

|

89,861,000

|

|

Operating Result – Surplus/Deficit

|

(4,961,800)

|

(4,061,400)

|

8,357,100

|

(666,100)

|

|

Add: Capital Revenue

|

25,070,200

|

(11,135,500)

|

1,118,100

|

15,052,800

|

|

Change in Net Assets

|

20,108,400

|

(15,196,900)

|

9,475,200

|

14,386,700

|

|

Add: Non Cash Expenses

|

13,678,900

|

925,700

|

0

|

14,604,600

|

|

Add: Non-Operating Funds

Employed

|

3,899,000

|

5,070,000

|

132,500

|

9,101,500

|

|

Subtract: Funds Deployed for

Non-Operating Purposes

|

(63,028,000)

|

21,343,000

|

6,002,500

|

(35,682,500)

|

|

Cash Surplus/(Deficit)

|

(25,341,700)

|

12,141,800

|

15,610,200

|

2,410,300

|

|

Restricted Funds – Increase

/ (Decrease)

|

(25,357,500)

|

12,157,600

|

15,610,200

|

2,410,300

|

|

Forecast Result for the

Year – Surplus/(Deficit) – Unrestricted Cash Result

|

15,800

|

(15,800)

|

0

|

0

|

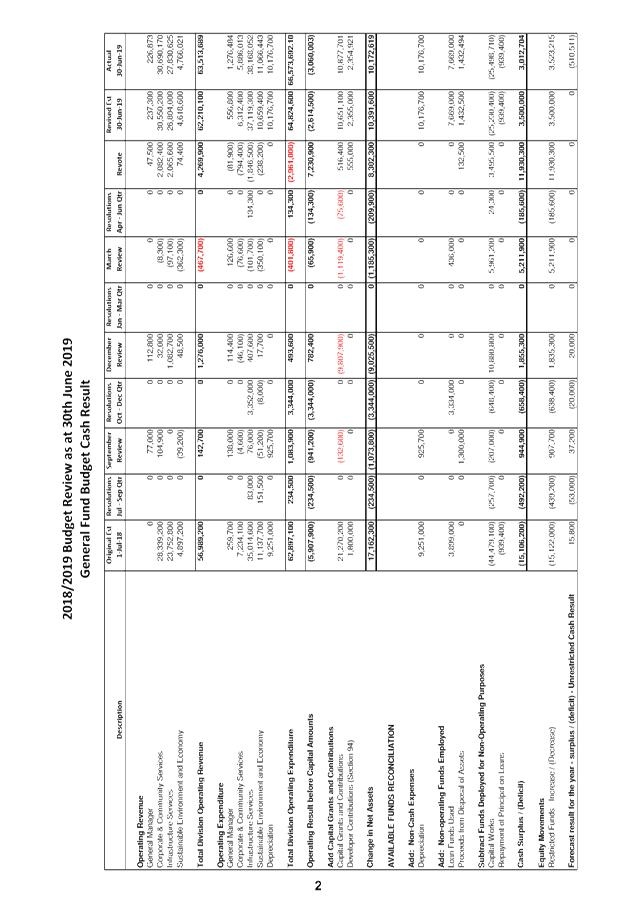

GENERAL FUND

In terms of the General Fund projected Unrestricted Cash

Result the following table provides a reconciliation of the estimated position

as at 30 June 2019:

|

Opening Balance – 1

July 2018

|

$1,145,200

|

|

Plus original budget

movement and carryovers

|

15,800

|

|

Council Resolutions July

– September Quarter

|

(53,000)

|

|

Recommendations September

Budget Review – increase/(decrease)

|

37,200

|

|

Council Resolutions October

– December Quarter

|

($20,000)

|

|

Recommendations December

Budget Review – increase/(decrease)

|

20,000

|

|

Council Resolutions January

– March Quarter

|

0

|

|

Recommendations within this Review

– increase/(decrease)

|

0

|

|

Council Resolutions April

– June Quarter

|

0

|

|

Recommendations within this

Review – increase/(decrease)

|

0

|

|

Forecast Unrestricted

Cash Result – Surplus/(Deficit) – 30 June 2019

|

0

|

|

Estimated Unrestricted

Cash Result Closing Balance – 30 June 2019

|

$1,145,200

|

The General Fund financial position overall has remained at

a balanced result as a result of this budget review. The proposed budget

changes are detailed in Attachment 1.

Council Resolutions impacting the Budget Result

There were no resolutions of Council during the April to

June quarter that affected the budget result.

Budget Adjustments

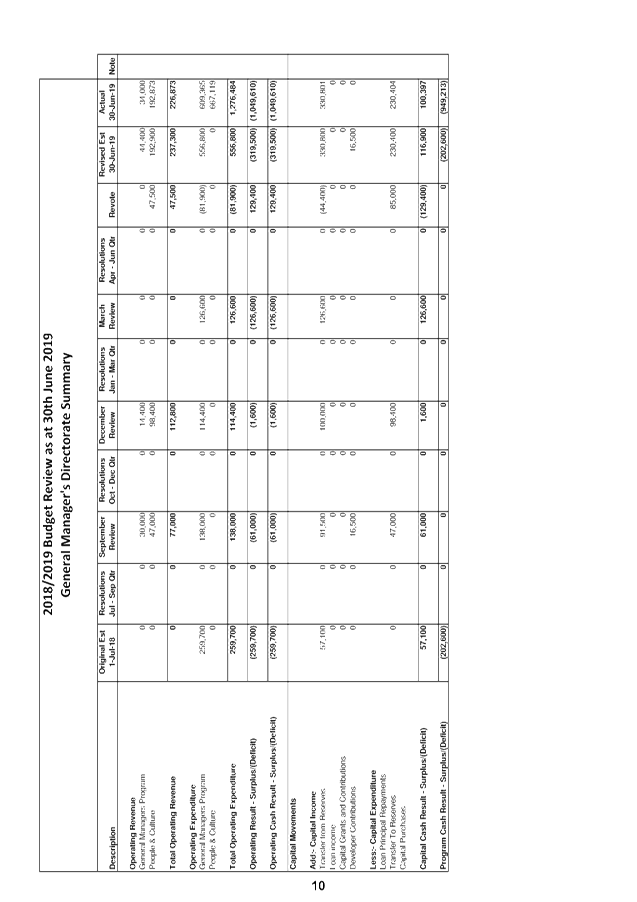

The budget adjustments identified in Attachments 1 and 2 for

the General Fund have been summarised by Directorate in the following table:

|

Budget Directorate

|

Revenue

Increase/

(Decrease) $

|

Expenditure

Increase/

(Decrease) $

|

Budget Result

Increase/ (Decrease) $

|

|

General Manager

|

3,100

|

3,100

|

0

|

|

Corporate & Community Services

|

1,951,800

|

1,889,600

|

62,200

|

|

Infrastructure Services

|

(1,097,200)

|

(1,094,600)

|

(2,600)

|

|

Sustainable Environment & Economy

|

413,100

|

472,700

|

(59,600)

|

|

Total Budget Movements

|

1,270,800

|

1,270,800

|

0

|

Budget Adjustment Comments

General Fund budget adjustments are identified in detail at

Attachment 1 and 2. More detailed notes on these are provided in

Attachment 1 with the majority of budget revotes proposed to reflect actual

results achieved.

The major consideration with this budget review is the

reduction in expenditure associated with projects not completed and under-expenditure.

Council will also be considering a report to this Ordinary Council

Meeting regarding carryover items from the 2018/2019 financial year for work

not completed, to be added to the 2019/2020 Budget Estimates. This report also

considers the implications of that report.

Specific Cash Position

On reconciling Council’s total cash and investment

position at 30 June 2019 compared to the reserve movements outlined in this

Budget Review, there is an indication that Council may have total unrestricted

cash and investments of $1,145,200 – the same level as 2018.

Council commenced the 2018/2019 financial year with unrestricted cash of

$1,145,200 which was an attainment of one of Council’s short term

financial goals. The actual amounts eventually allocated are contingent on

finalisation of the 2018/2019 financial statements. These are subject to

external audit and further reporting to Council.

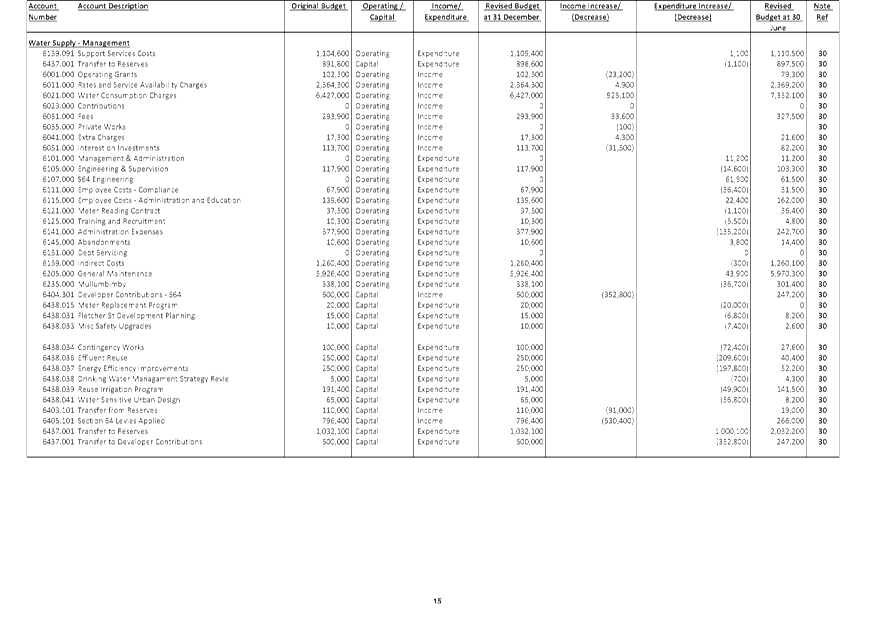

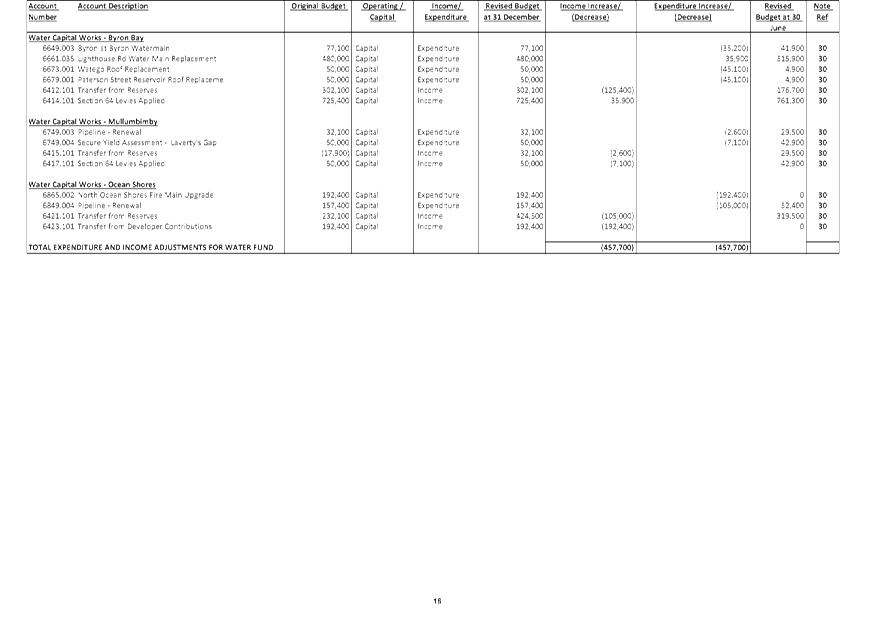

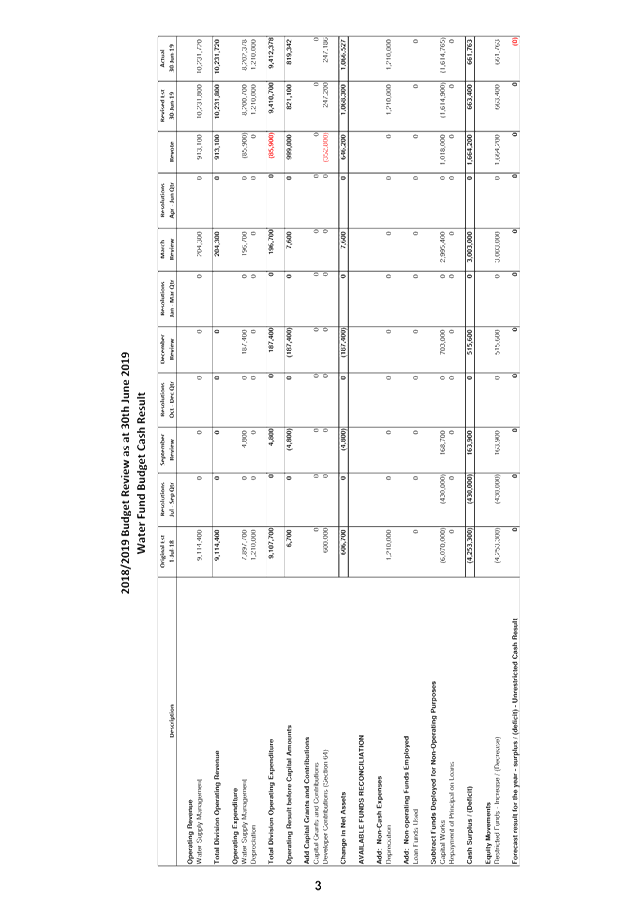

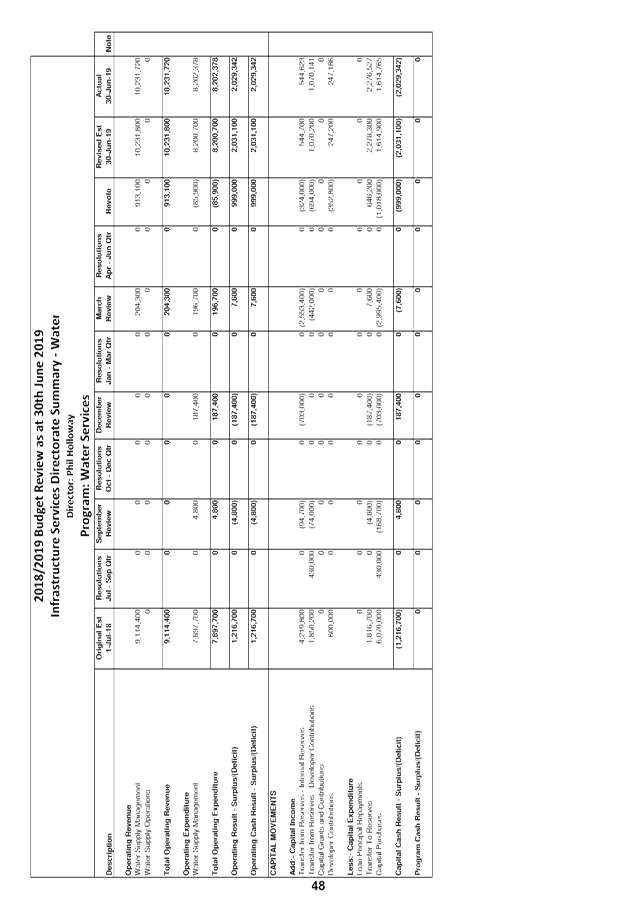

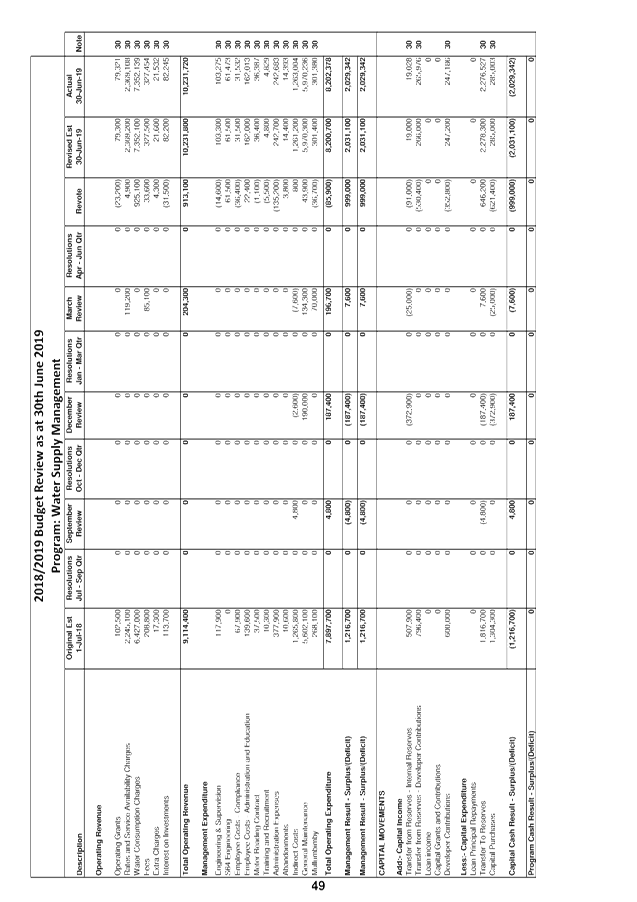

WATER FUND

After completion of the 2017/2018

Financial Statements the Water Fund as at 30 June 2018 had a capital works

reserve of $6,923,500 and held $3,857,800 in section 64 developer

contributions.

The estimated Water Fund reserve

balances as at 30 June 2019, and forecast in this Quarter Budget Review, are

derived as follows:

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2018

|

$6,923,500

|

|

Plus original budget reserve

movement

|

(2,627,400)

|

|

Less reserve funded carryovers

from 2017/2018

|

(375,700)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review Adjustments

– increase / (decrease)

|

89,900

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

515,600

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

2,561,000

|

|

Resolutions April - June Quarter

– increase / (decrease)

|

0

|

|

June Quarterly Review

Adjustments – increase / (decrease)

|

1,240,800

|

|

Forecast Reserve Movement for

2018/2019 – Increase / (Decrease)

|

1,404,200

|

|

Estimated Reserve Balance at

30 June 2019

|

$8,327,700

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2018

|

$3,857,800

|

|

Plus original budget reserve

movement

|

(746,400)

|

|

Less reserve funded carryovers

from 2017/2018

|

(503,800)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

(430,000)

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

74,000

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review Adjustments

– increase / (decrease)

|

0

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

442,000

|

|

Resolutions April - June Quarter

– increase / (decrease)

|

0

|

|

June Quarterly Review Adjustments

– increase / (decrease)

|

423,400

|

|

Forecast Reserve Movement for

2018/2019 – Increase / (Decrease)

|

(740,800)

|

|

Estimated Reserve Balance at

30 June 2019

|

$3,117,000

|

Movements for Water Fund can be seen in Attachment 1 with a

proposed estimated increase to reserves (including S64 Contributions) overall

of $1,664,200 from this review.

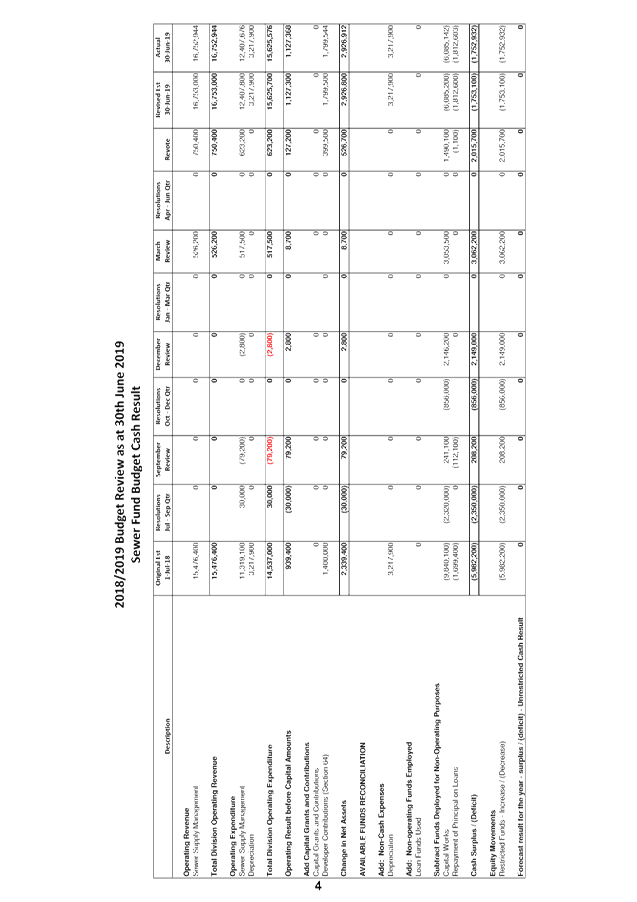

SEWERAGE FUND

After completion of the 2017/2018

Financial Statements the Sewer Fund as at 30 June 2018 had a capital works

reserve of $8,706,800 and plant reserve of $704,400. It also held

$9,051,600 in section 64 developer contributions.

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2018

|

$8,706,800

|

|

Plus original budget reserve

movement

|

(3,480,800)

|

|

Less reserve funded carryovers

from 2017/2018

|

(1,454,800)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

(1,330,000)

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

258,600

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

2,099,000

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

2,177,800

|

|

Resolutions April - June Quarter

– increase / (decrease)

|

0

|

|

June Quarterly Review Adjustments

– increase / (decrease)

|

274,600

|

|

Forecast Reserve Movement for

2018/2019 – Increase / (Decrease)

|

(1,455,600)

|

|

Estimated Reserve Balance at

30 June 2019

|

$7,251,200

|

Plant Reserve

|

Opening Reserve Balance at 1

July 2018

|

$704,400

|

|

Plus original budget reserve

movement

|

0

|

|

Less reserve funded carryovers

from 2017/2018

|

0

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions April - June Quarter

– increase / (decrease)

|

0

|

|

June Quarterly Review

Adjustments – increase / (decrease)

|

69,000

|

|

Forecast Reserve Movement for

2018/2019 – Increase / (Decrease)

|

69,000

|

|

Estimated Reserve Balance at

30 June 2019

|

$773,400

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2018

|

$9,051,600

|

|

Plus original budget reserve

movement

|

(27,900)

|

|

Less reserve funded carryovers

from 2017/2018

|

(1,018,700)

|

|

Resolutions July -

September Quarter – increase / (decrease)

|

(1,020,000)

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(50,400)

|

|

Resolutions October -

December Quarter – increase / (decrease)

|

(856,000)

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

50,000

|

|

Resolutions January -

March Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review

Adjustments – increase / (decrease)

|

884,400

|

|

Resolutions April - June Quarter

– increase / (decrease)

|

0

|

|

June Quarterly Review

Adjustments – increase / (decrease)

|

1,672,100

|

|

Forecast Reserve Movement for

2018/2019 – Increase / (Decrease)

|

(366,500)

|

|

Estimated Reserve Balance at

30 June 2019

|

$8,685,100

|

Movements for the Sewerage Fund can be seen in Attachment 1

with a proposed estimated overall increase to reserves (including S64

Contributions) of $2,015,700 from this Budget Review.

Legal Expenses

Legal expenses are funded by general revenue and can potentially

be a significant cost and also one which is subject to fluctuation.

The table that follows indicates the allocated budget and

actual legal expenditure within Council on

a fund basis as at 30 June 2019.

Total Legal Income & Expenditure as at 30 June 2019

|

Program

|

2018/2019

Budget ($)

|

Actual ($)

|

Percentage To

Revised Budget

|

|

Income

|

|

|

|

|

Legal Expenses Recovered

|

4,000

|

4,000

|

100%

|

|

Total Income

|

4,000

|

4,000

|

100%

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

General Legal Expenses

|

433,200

|

409,964

|

94.64%

|

|

Total Expenditure General Fund

|

429,200

|

405,964

|

94.59%

|

Note: The above table does not include costs incurred by

Council in proceedings after 30 June 2019 or billed after this date.

During the financial year, an additional $230,600 was added to the original

budget of $202,600. This was allocated at the 31 December 2019 and March

2019 Quarterly Budget Reviews with funding from the legal services reserve.

The current status of the Legal Services Reserve is shown

below:

Legal Reserve

|

Opening Reserve Balance at 1

July 2018

|

$318,100

|

|

Less:-

|

|

|

Legal Services Officer

|

(70,300)

|

|

General Legal Expenses (December

2018 QBR)

|

(104,000)

|

|

General Legal Expenses (March

2019 QBR)

|

(99,400)

|

|

Proposed 30 June 2019 Quarter Budget

Review Adjustment

|

76,400

|

|

Estimated Reserve Balance at

as at 30 June 2019

|

$120,800

|

Financial Implications

The 30 June 2019 Quarter Budget Review of the 2018/2019

Budget Estimates forecasts no change to the estimated budget attributable to

the General Fund, assuming all revotes of income and expenditure reported for

Council’s consideration are approved. Overall, the short term financial

position still needs to be carefully monitored on an ongoing basis but maintaining

this result through the financial year is a good outcome.

It is expected, given the level of reserve funds compared to

total cash and investments at 30 June 2019, that Council may have succeeded in maintaining

an unrestricted cash balance, currently estimated as at least $1,145,200. This

is another positive achievement.

Notwithstanding that Council has maintained its short term

funding liquidity goal, longer term financial sustainability

requirements, such as the provision of adequate funding for the maintenance and

renewal of infrastructure assets, still need careful monitoring and management.

Note that the financial outcomes outlined in this Budget

Review should be considered in the context that they are indicative. Council is

yet to finalise its financial statements for the year ended 30 June 2019 which

will also be subject to external independent audit.

It is expected that Council will receive a report regarding

the formal adoption of its financial statements for the year ended 30 June 2019

at its Ordinary Meeting on 24 October 2019.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.5

|

Manage

Council’s finances sustainably

|

5.5.1

|

Enhance the

financial capability and acumen of Council

|

5.5.1.1

|

Financial

reporting as required provided to Council and Management

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy

Considerations

In accordance with Regulation 203

of the Local Government (General) Regulation 2005 the Responsible Accounting

Officer of a Council must:-

(1) Not

later than 2 months after the end of each quarter (except the June quarter),

the responsible accounting officer of a council must prepare and submit to the council a budget review statement that shows, by reference to the estimate of income and

expenditure set out in the statement of the council’s revenue policy

included in the operational plan for the relevant year, a revised estimate of

the income and expenditure for that year.

(2) A

budget review statement must include or be accompanied by:

(a) a

report as to whether or not the responsible accounting officer believes that

the statement indicates that the financial position of the council is

satisfactory, having regard to the original estimate of income and expenditure,

and

(b)

if that position is unsatisfactory, recommendations for remedial action.

(1) A

budget review statement must also include any information required by the Code

to be included in such a statement

Statement by Responsible Accounting Officer

This report indicates that the short term financial position

of the Council is still satisfactory for the 2018/2019 financial year, having

consideration to the original estimate of income and expenditure at the 30 June

2019 Quarter Budget Review.

This opinion is based on the estimated Unrestricted Cash

Result position and the maintenance overall of a balanced budget result for the

2018/2019 financial year.

Staff Reports - Corporate and Community Services 4.3 - Attachment 1

Staff Reports - Corporate and Community Services 4.3 - Attachment 2