What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the Code

of Conduct for Councillors (eg. A friendship, membership of an association,

society or trade union or involvement or interest in an activity and may

include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

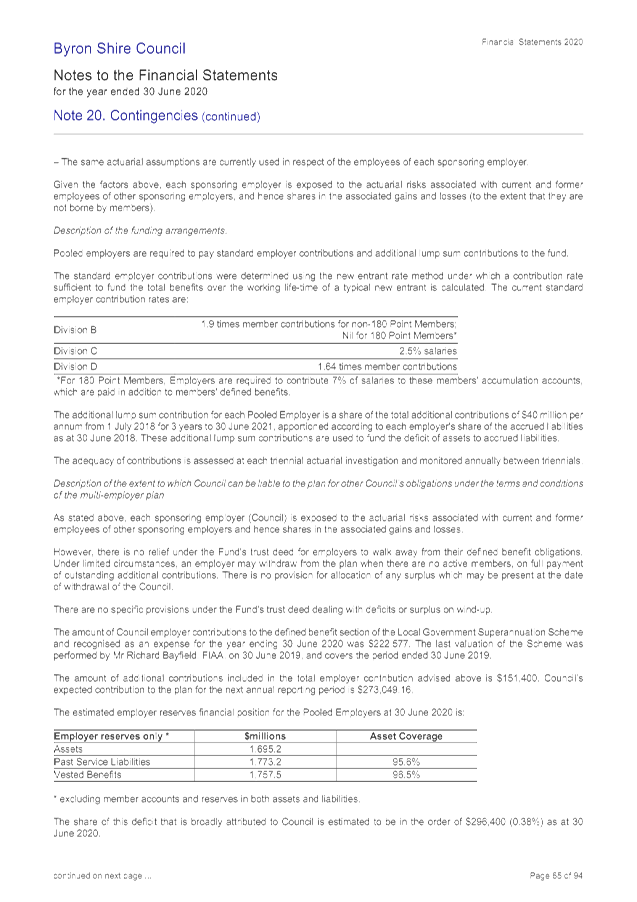

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or vice-versa).

Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as of the provisions in the Code of Conduct (particularly if you have a significant

non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a meeting

of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

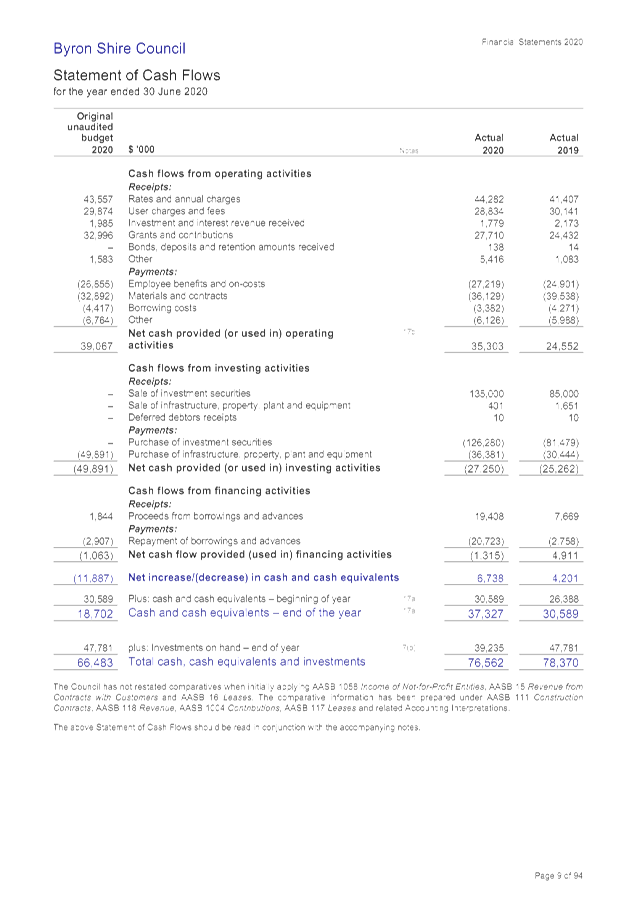

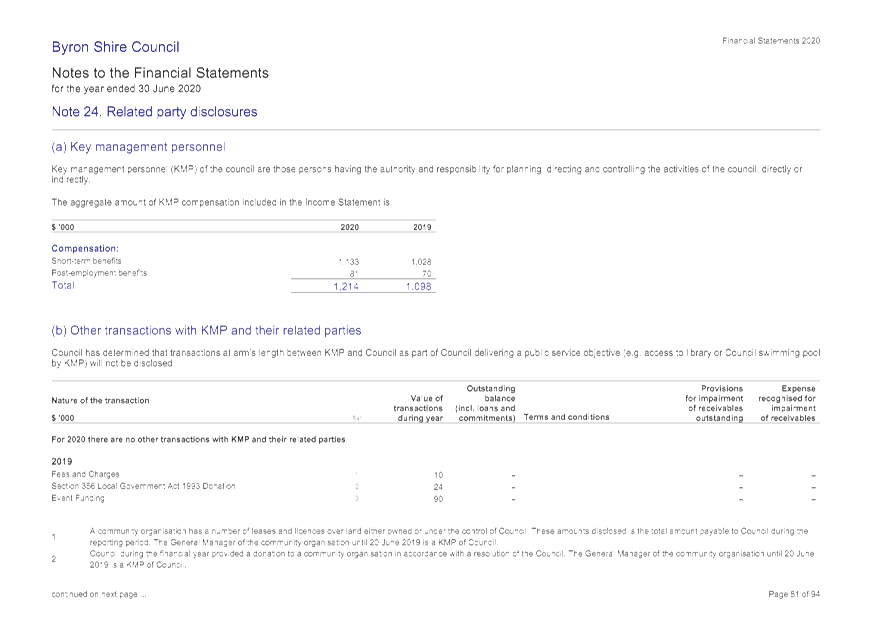

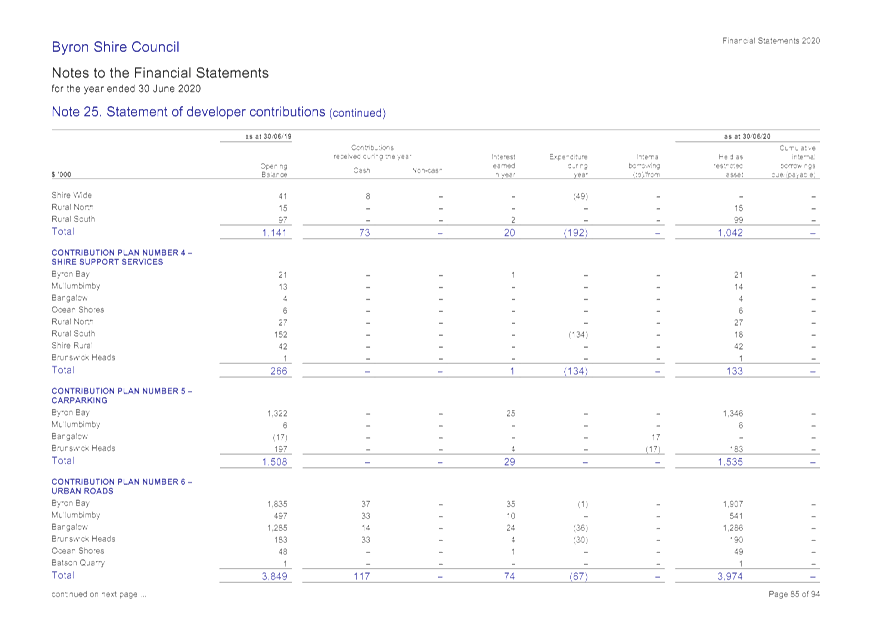

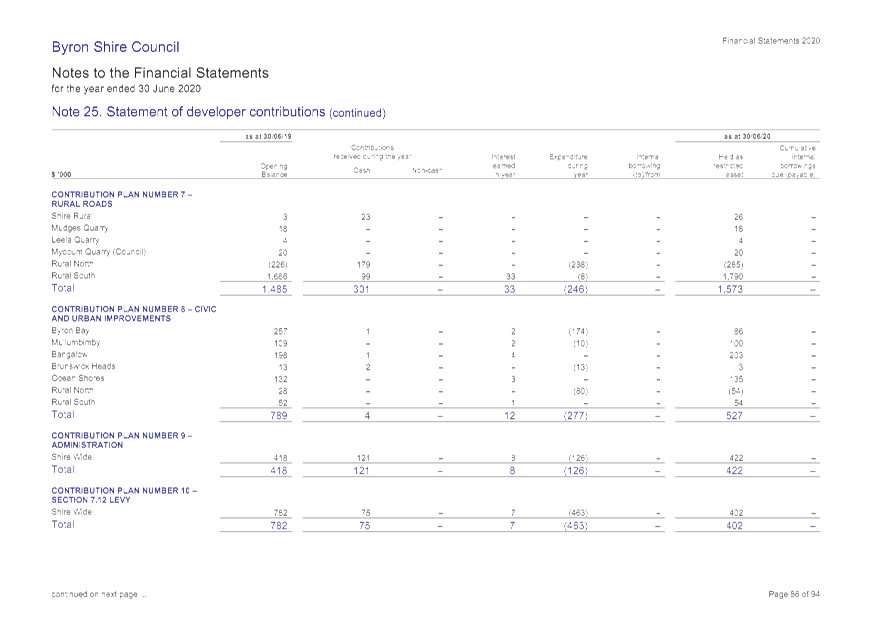

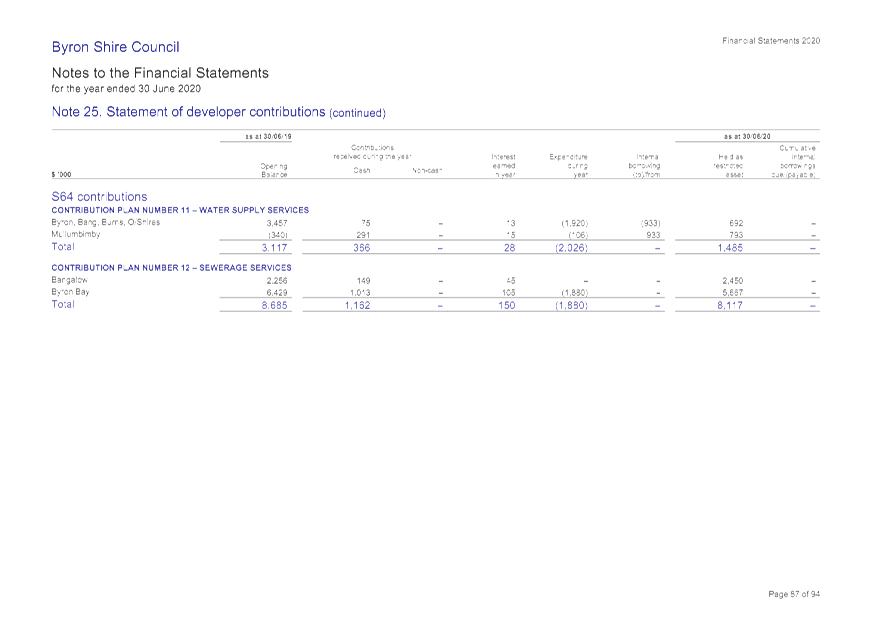

Late Reports 17.1

Late Reports

Report

No. 17.1 Draft

2019/2020 Financial Statements

Directorate: Corporate

and Community Services

Report

Author: James

Brickley, Manager Finance

File No: I2020/1799

Summary:

At its 22 October 2020 Ordinary Meeting Council adopted the

Draft 2019/2020 Financial Statements (Resolution: 20-549) and referred

the statements to external audit. The audit of the financial statements

had not been completed by the time of agenda delivery for the 26 November 2020

Ordinary Meeting due to the significant asset revaluations undertaken by

Council and their outcome, requiring this late report given there is a deadline

of 30 November 2020 to lodge the Financial Statements with the Office of Local

Government.

Given the change (primarily around prior period error

reporting) in the financial statements from those presented at the 22 October

2020 Ordinary Meeting, this report recommends to Council the readoption of the

Draft 2019/2020 Financial Statements as prepared, and the completion of the

statutory steps outlined in Section 418 to 420 of the Local Government Act

1993.

A representative from the NSW Auditor General contracted

audit firm, Thomas Noble and Russell, will be attending the 17 December

2020 Ordinary Meeting to make a presentation to Council on the financial

outcomes for 2019/2020.

|

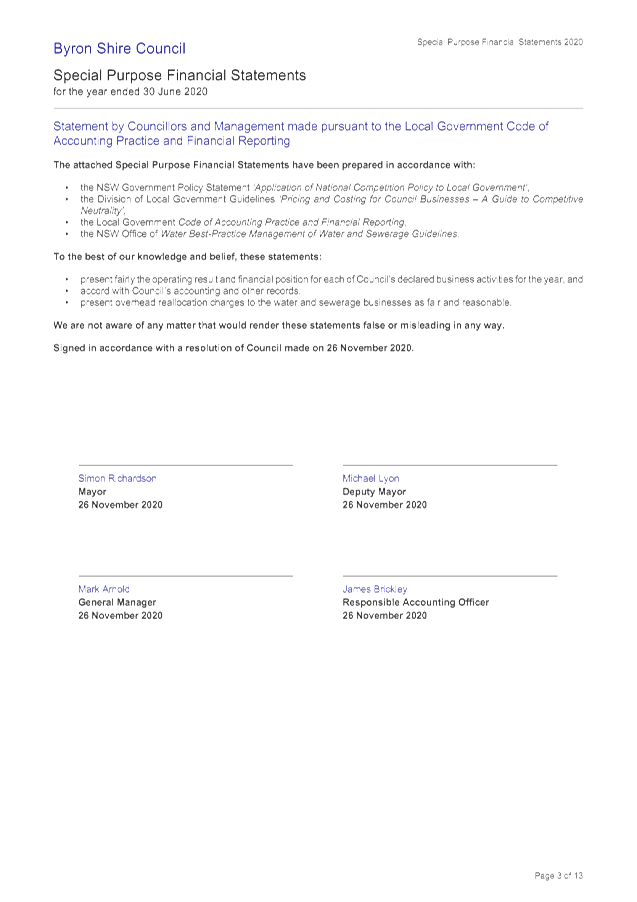

RECOMMENDATION:

1. That

Council adopts the Draft 2019/2020 Financial Statements incorporating the

General Purpose Financial Statements (#E2020/94746) and Special Purpose

Financial Statements (#E2020/94699).

2. That

Council reapproves the signing of the “Statement by Councillors and

Management” in accordance with Section 413(2)(c) of the Local Government

Act 1993 and Clause 215 of the Local Government (General) Regulation 2005 in

relation to the 2019/2020 Draft Financial Statements.

3. That the Audited

Financial Statements and Auditors Report be presented to the public at

the Ordinary Meeting of Council scheduled for 17 December 2020 in accordance with

Section 418(1) of the Local Government Act 1993.

|

Attachments:

1 Draft

2019-2020 General Purpose Financial Statements, E2020/94746 , page 14⇩

2 Draft

2019-2020 Special Purpose Financial Statements, E2020/94699 , page 108⇩

3 Draft

2019-2020 Special Schedules, E2020/94700

, page 121⇩

REPORT

At its 22 October 2020 Ordinary Meeting Council adopted the

Draft 2019/2020 Financial Statements (Resolution: 20-549) and referred

the statements to external audit. The audit of the financial statements

had not been completed by the time of agenda delivery for the 26 November 2020

Ordinary Meeting due to the significant asset revaluations undertaken by

Council and their outcome, requiring this late report given there is a deadline

of 30 November 2020 to lodge the Financial Statements with the Office of Local

Government.

Given the change (primarily around prior period error

reporting) in the financial statements from those presented at the 22 October

2020 Ordinary Meeting, this report recommends to Council the readoption of the

Draft 2019/2020 Financial Statements as prepared, and the completion of the

statutory steps outlined in Section 418 to 420 of the Local Government Act

1993.

The Draft 2019/2020 Financial Statements were to be

considered by the Audit, Risk and Improvement Committee on 14 November

2020. A verbal update was provided to that Meeting and it is expected a

copy of this report and attachments will be provided to the Committee prior to

this Ordinary Meeting of Council.

The Draft 2019/2020 Financial Statements will be considered

again by Council at its Ordinary Meeting on 17 December 2020 where they will be

presented to the public. At that Ordinary Meeting, a representative from

the NSW Auditor General contracted audit firm, Thomas Noble and Russell,

will be present to discuss the financial outcomes for 2019/2020 and answer any

questions Councillors may have.

Council received a report on this matter at its 22 October

2020 Ordinary Meeting and whilst the financial results overall have not

changed, there have been disclosure adjustments made following audit,

particularly surrounding the recording of a prior period error regarding the

revaluation of assets conducted in the 2019/2020 financial year as discussed

further in this report.

The attachments provided with this report have had an

initial review by the NSW Audit Office following review and audit by their

contracted Audit firm, Thomas Noble and Russell. It is expected they will be

the finalised results and should not change to an extent that will not enable

Council to sign off the Draft 2019/2020 Financial Statements.

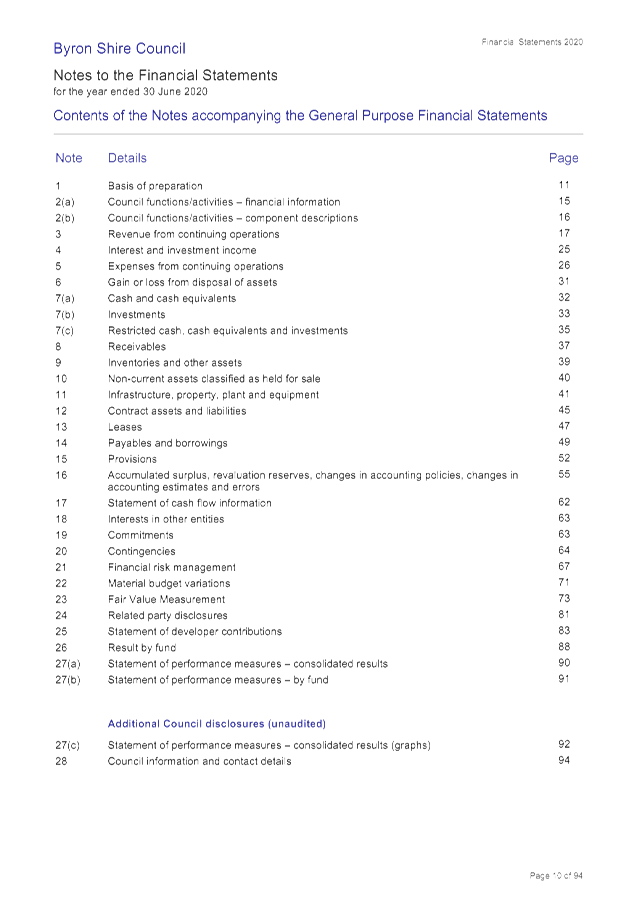

The Draft 2019/2020 Financial Statements provided in the

attachments are broken down into:

- General

Purpose Financial Statements – Attachment 1

- Special

Purpose Financial Statements – Attachment 2

- Special

Schedules – Attachment 3

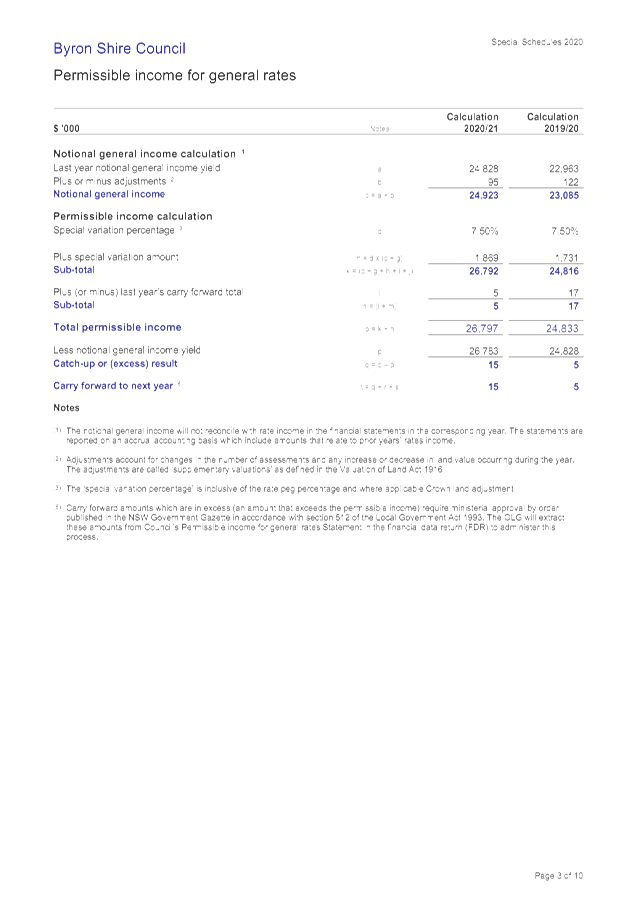

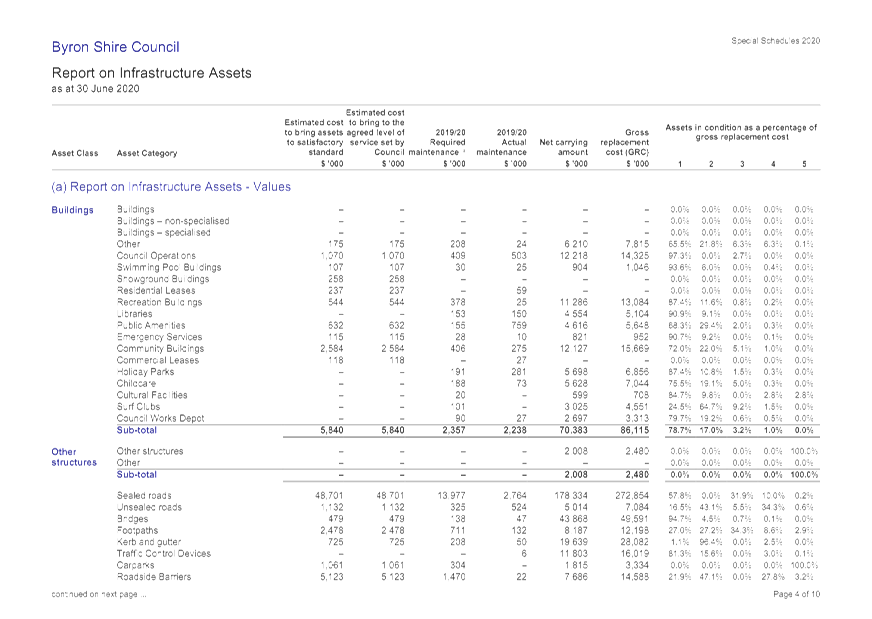

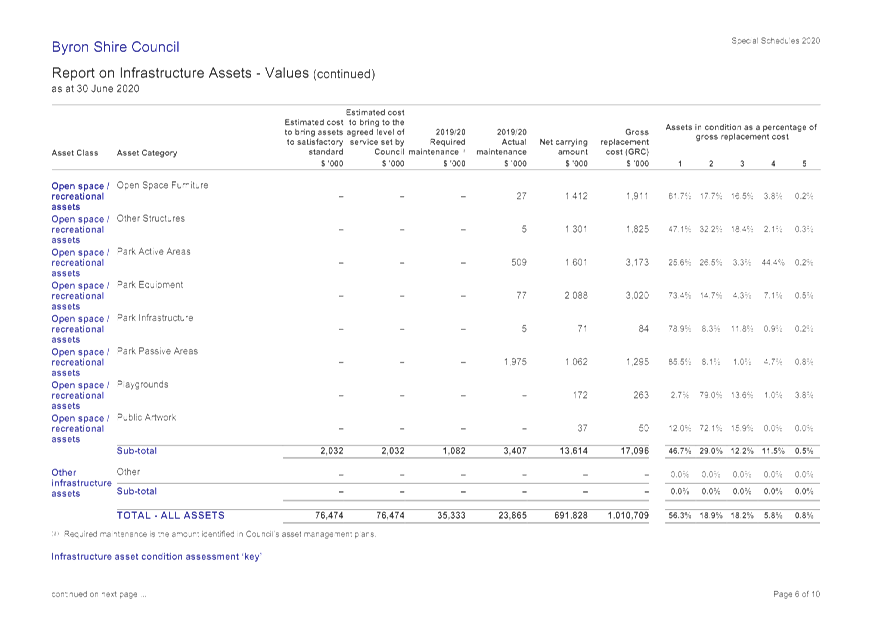

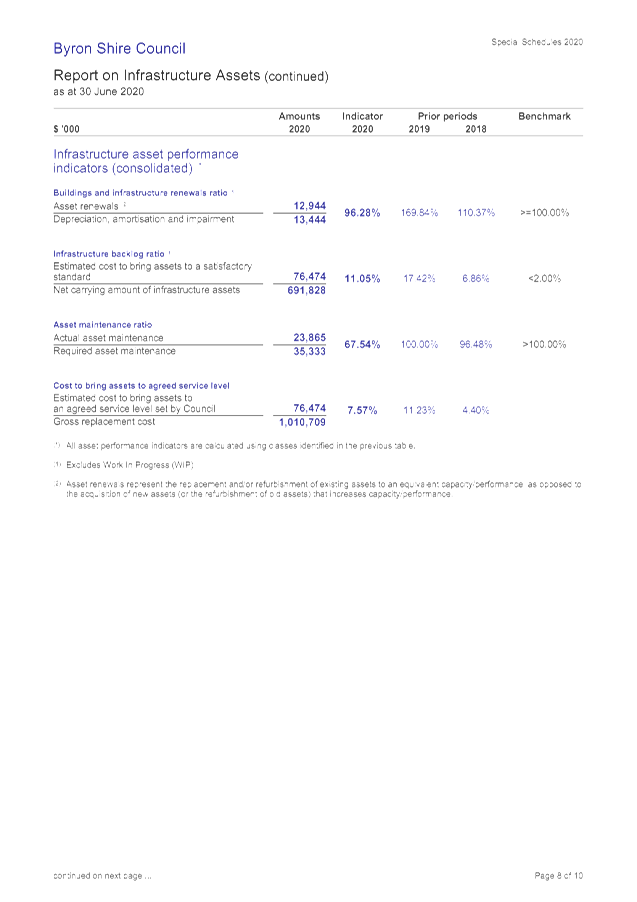

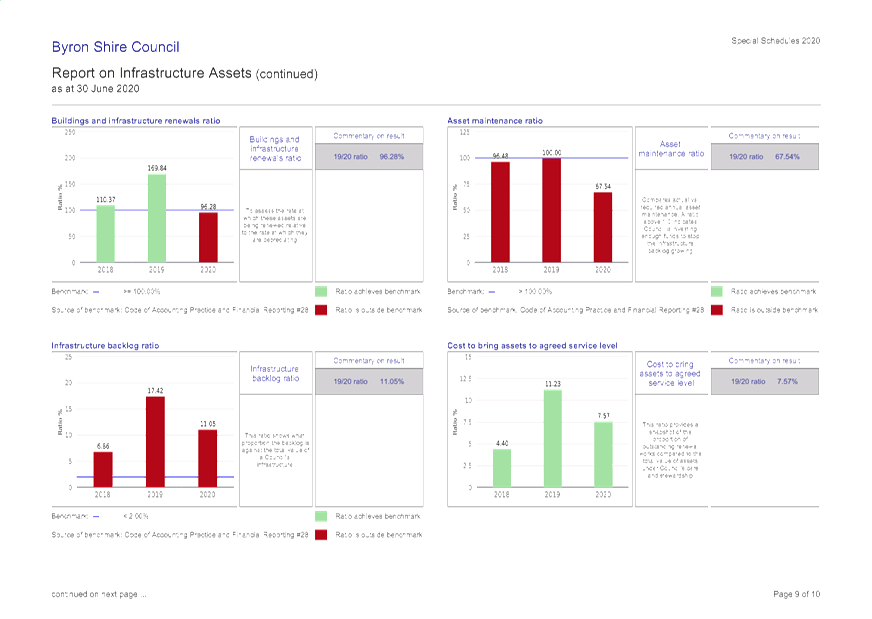

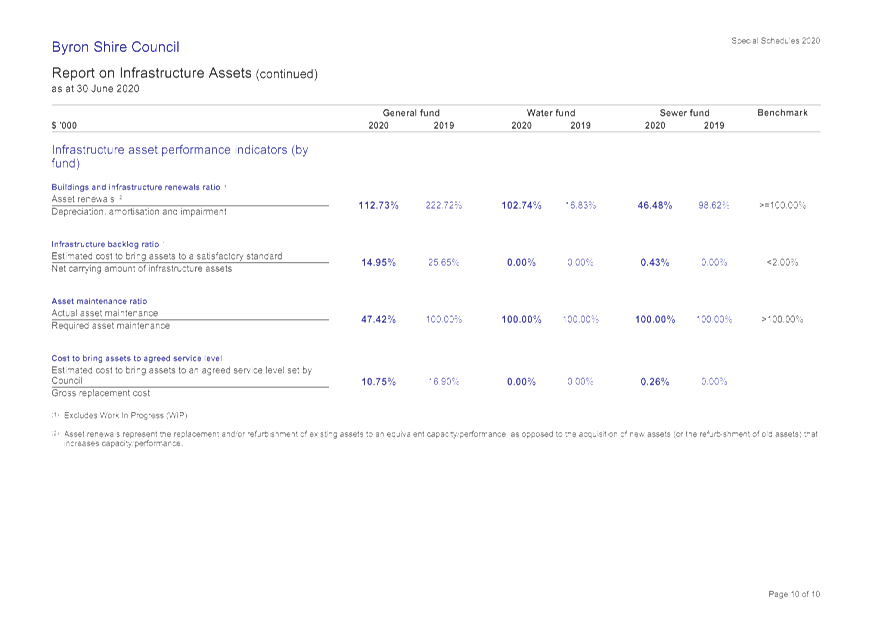

As in previous years, Council produces Special Schedules

that are not audited (except Permissible Income for General Rates). However

from the 2018/2019 financial year, whilst the Special Schedules are still

produced and submitted to the Office of Local Government, they are no longer

required to be published as part of Council’s Financial Statements,

except for the Special Schedules relating to Permissible Income for General

Rates and Report on Infrastructure Assets.

Brief explanations for each item follow:

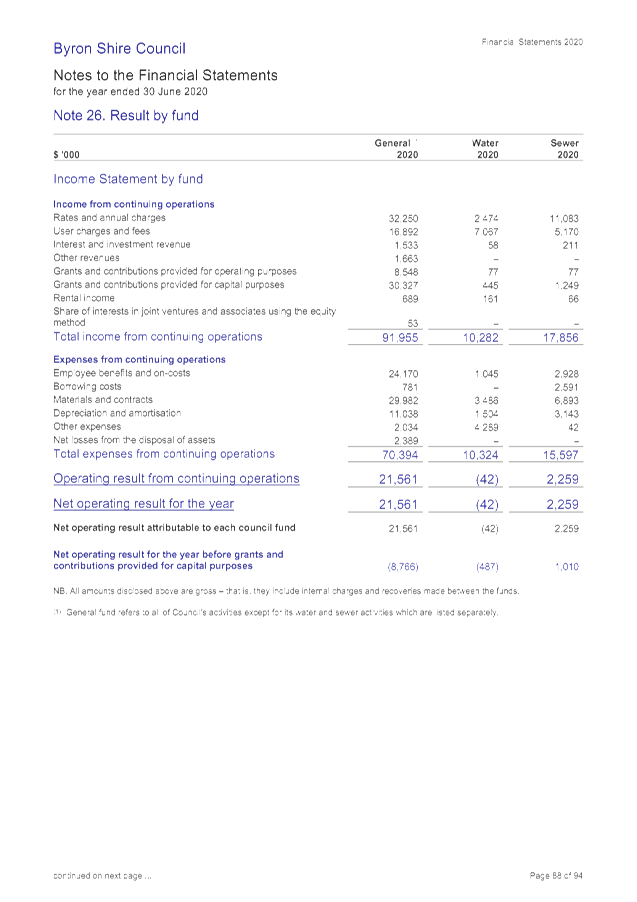

General Purpose Financial

Statements

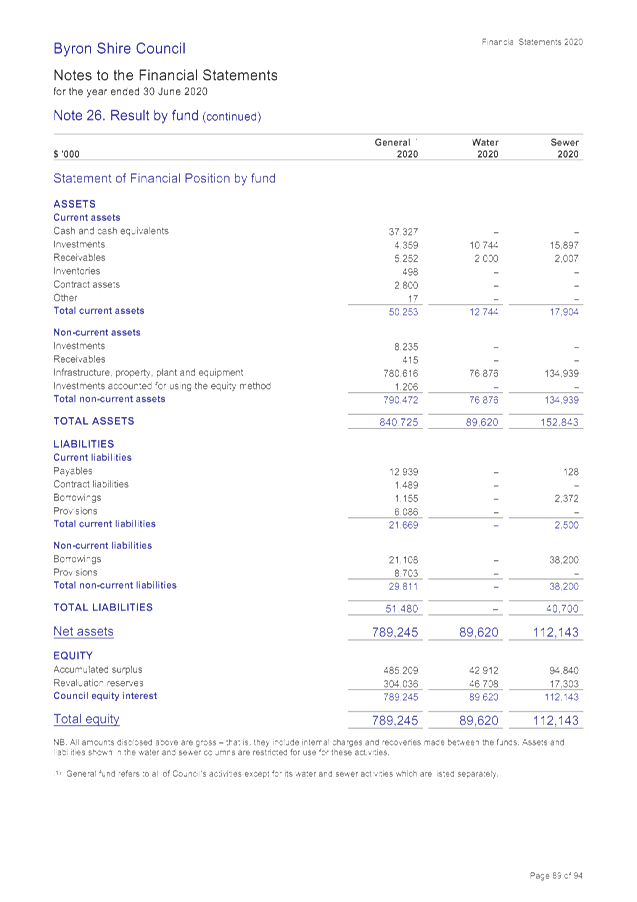

These Statements provide an overview of the operating result, financial

position, changes in equity and cash flow movement of Council as at 30 June

2020 on a consolidated basis with internal transactions between Council’s

General, Water and Sewerage Funds eliminated. The notes included with these

reports provide details of major items of income and expenditure with

comparisons to the previous financial year. The notes also highlight the cash

position of Council and indicate which funds are externally restricted (i.e.

may be used for a specific purpose only), and those that may be used at

Council’s discretion.

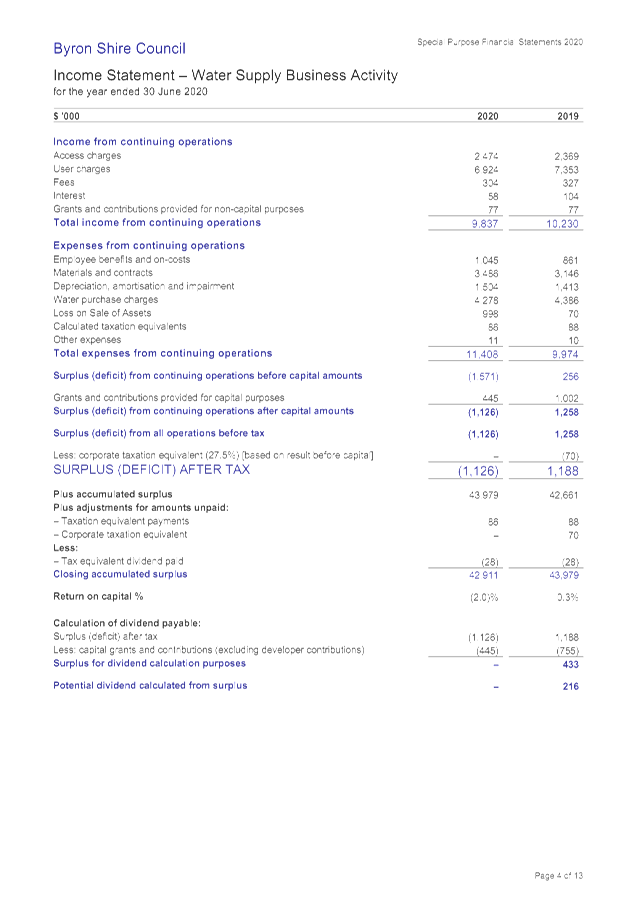

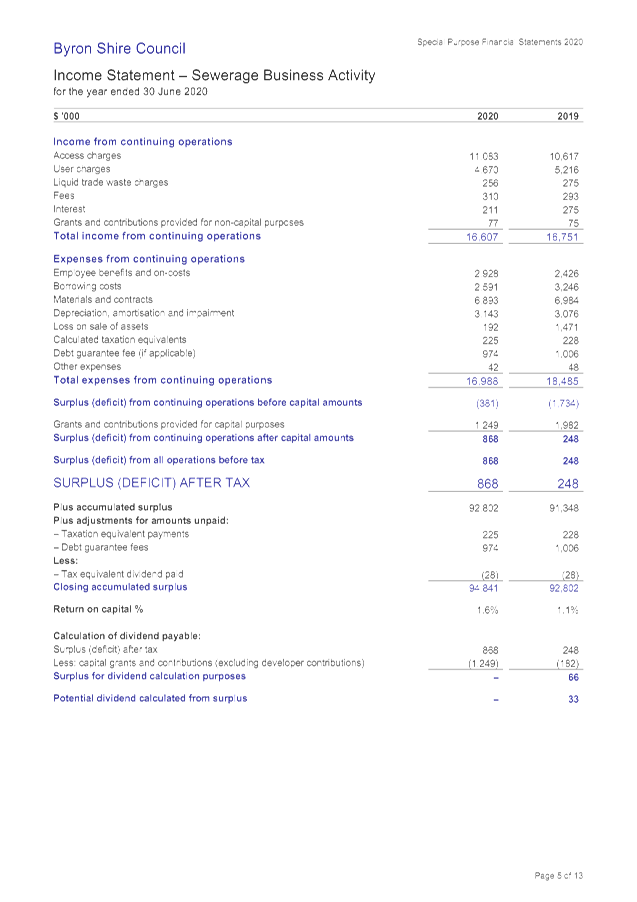

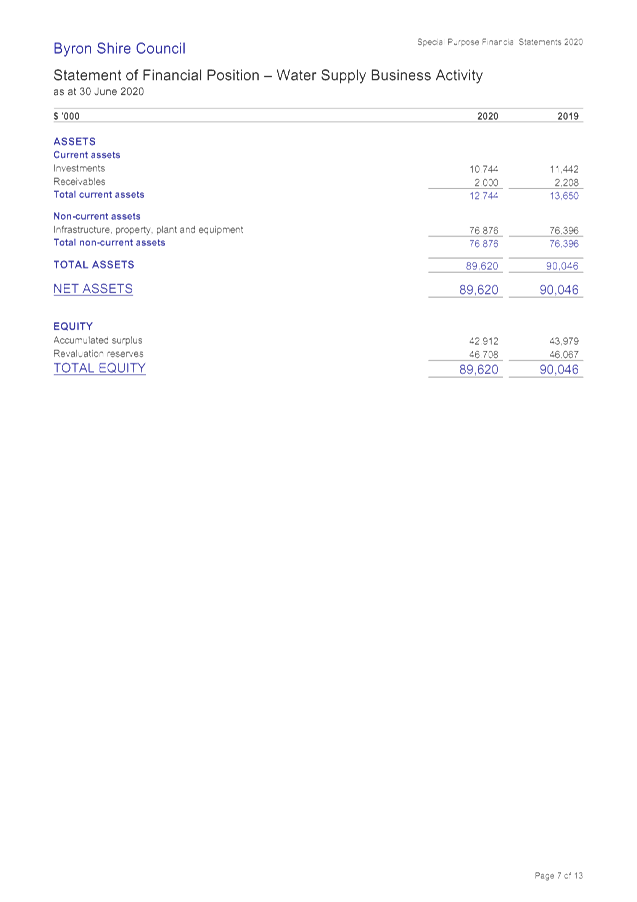

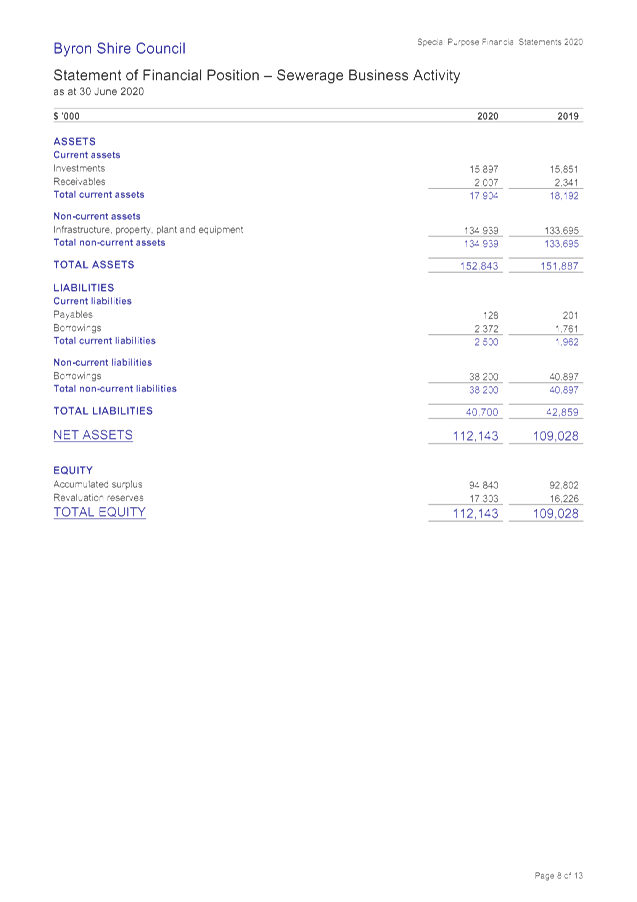

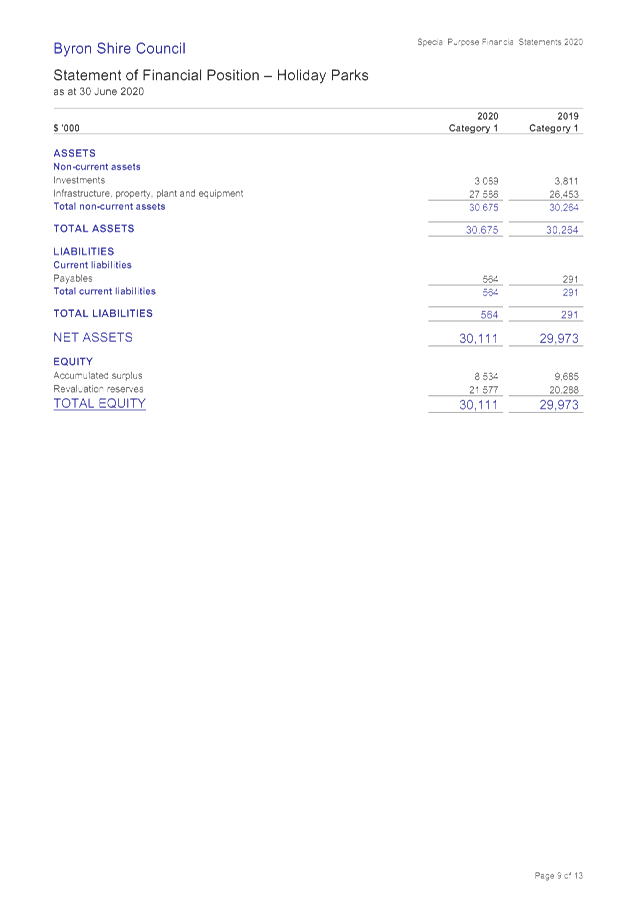

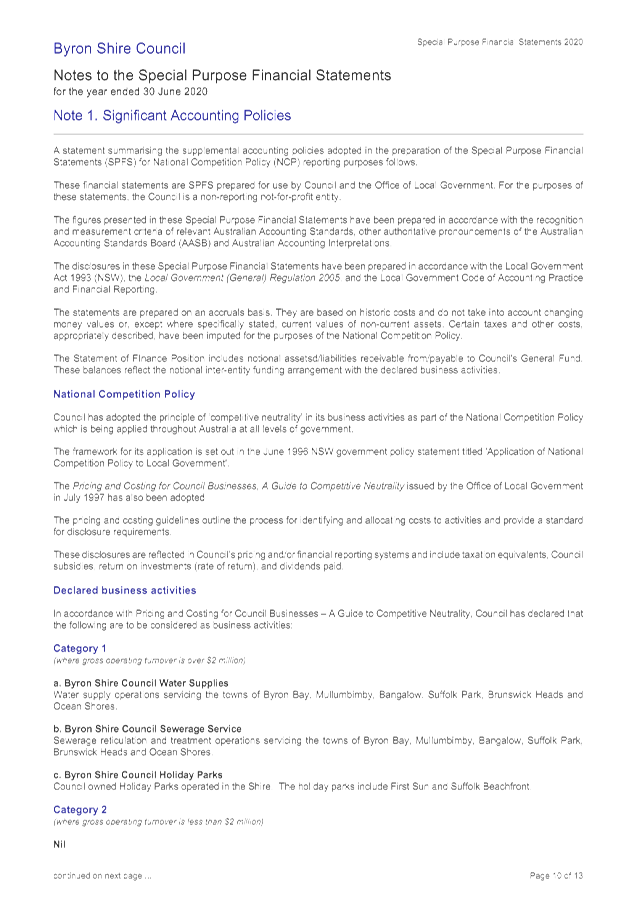

Special Purpose Financial Statements

These Statements are a result of the implementation of the National

Competition Policy and relate to those aspects of Council’s operations

that are business oriented and compete with other businesses with similar

operations.

Mandatory disclosures in the Special Purpose Financial

Reports are Water and Sewerage.

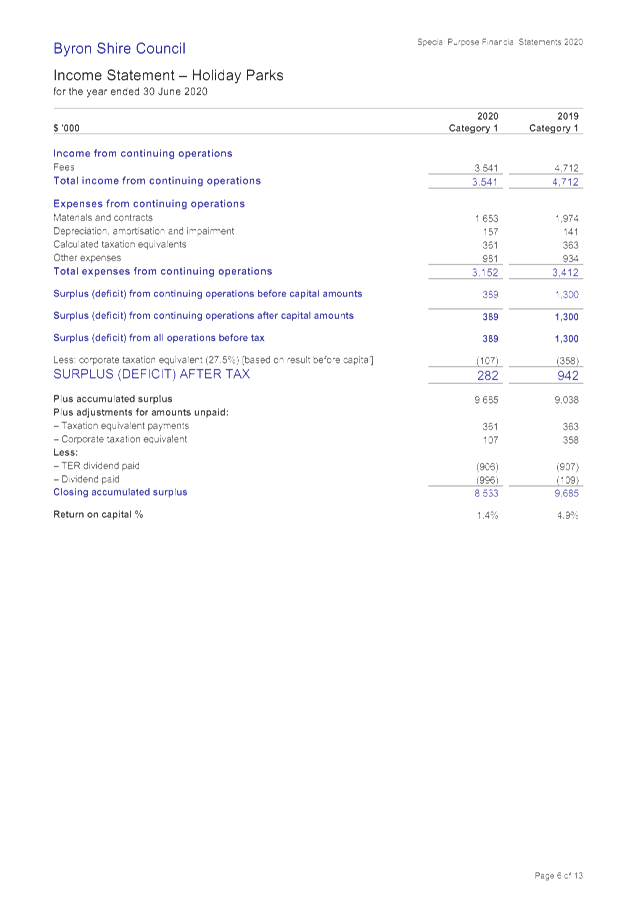

Additional disclosure relate to Council business units that

Council deems ‘commercial’. In this regard Council has

traditionally reported its Caravan Park Operations, being Suffolk Beachfront

Holiday Park and First Sun Holiday Park, on a combined basis. These

financial reports must also classify business units in the following

categories:

· Category 1 –

operating turnover is greater than $2million

· Category 2 –

operating turnover is less than $2million

AllCouncil’s business units are classed as Category 1

with all having operating turnover greater than $2 million.

Another feature of the Special Purpose Financial Reports is

to build taxes and charges, where not physically incurred, into the financial

results in order that the results can be measured on a level playing field with

other organisations operating similar businesses, who are required to

pay these additional taxes and charges. These taxes and charges include:

· Land tax – Council

is normally exempt from this tax, so notional land tax is applied.

· Income tax –

Council is exempt from income tax and in regard to these reports, company

tax. Any surplus generated has a notional company tax applied to it.

· Debt guarantee fees

– Generally due to the low credit risk associated with Councils, Councils

can often borrow loan funds at lower interest rates then the private sector. A

debt guarantee fee inflates the borrowing costs by incorporating a notional

cost between interest payable on loans at the interest rate borrowed by Council

and one that would apply commercially.

The Special Purpose Financial Reports are prepared on a

non-consolidated basis - in other words they are grossed up to include any

internal transactions with the General Fund.

Specific Items relating to 2019/2020 Draft Financial

Statements

The Draft 2019/2020 Financial Statement results have been

impacted by the following items that require explanation:

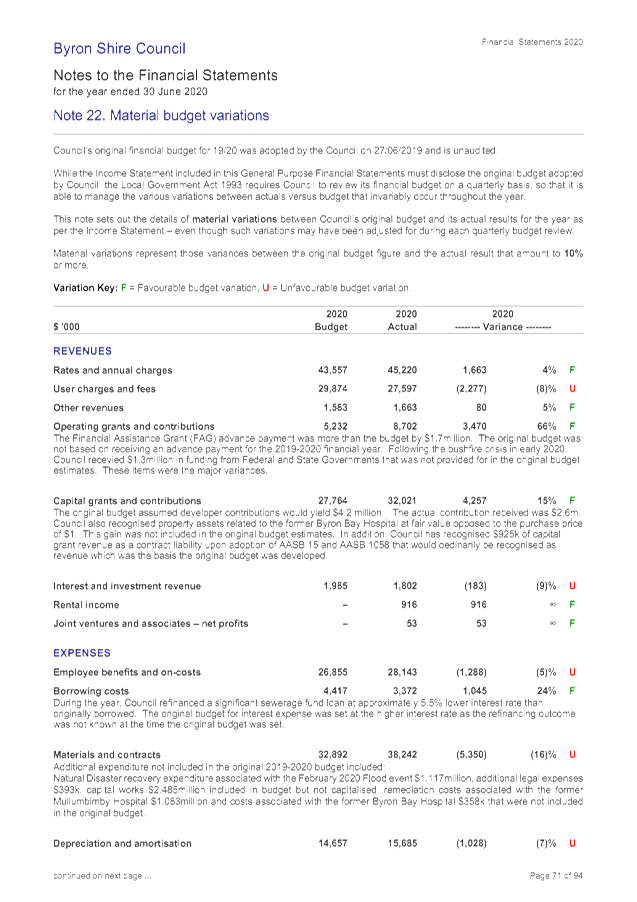

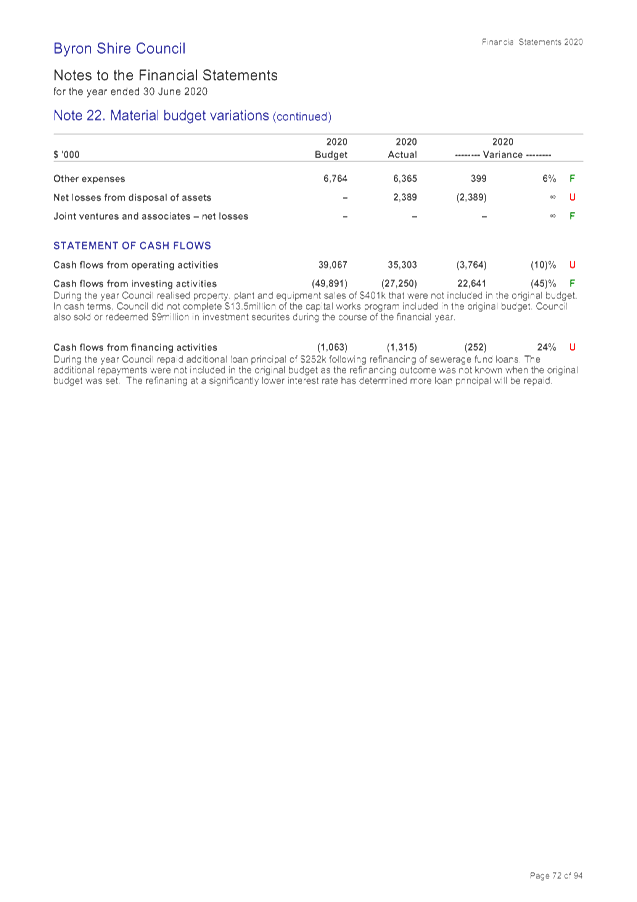

· Operating

Result from Continuing Operations

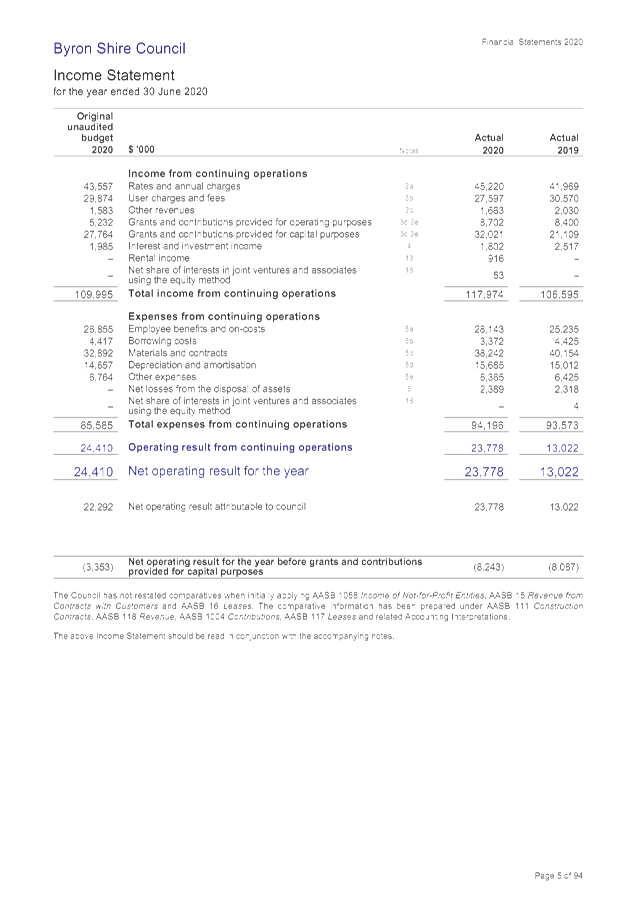

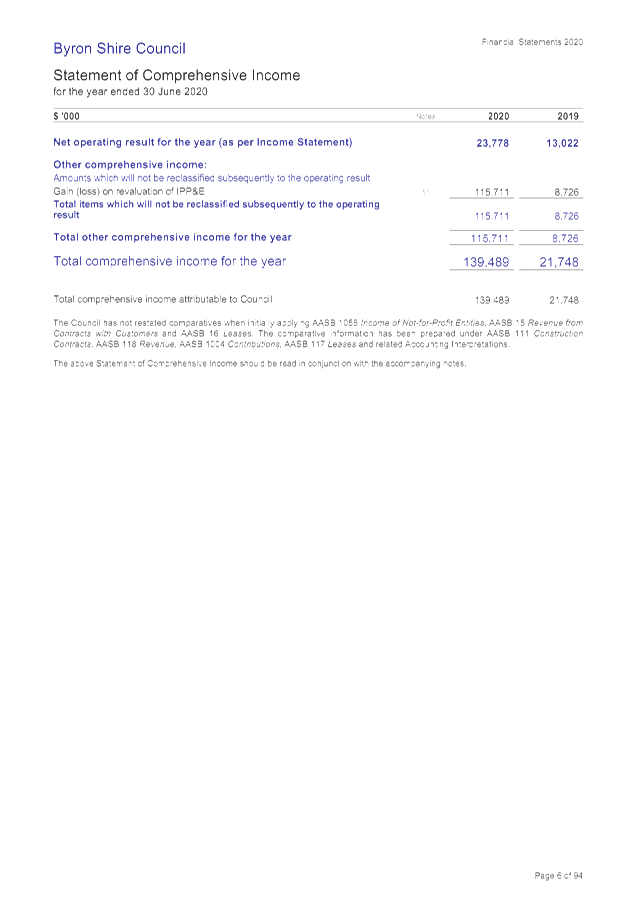

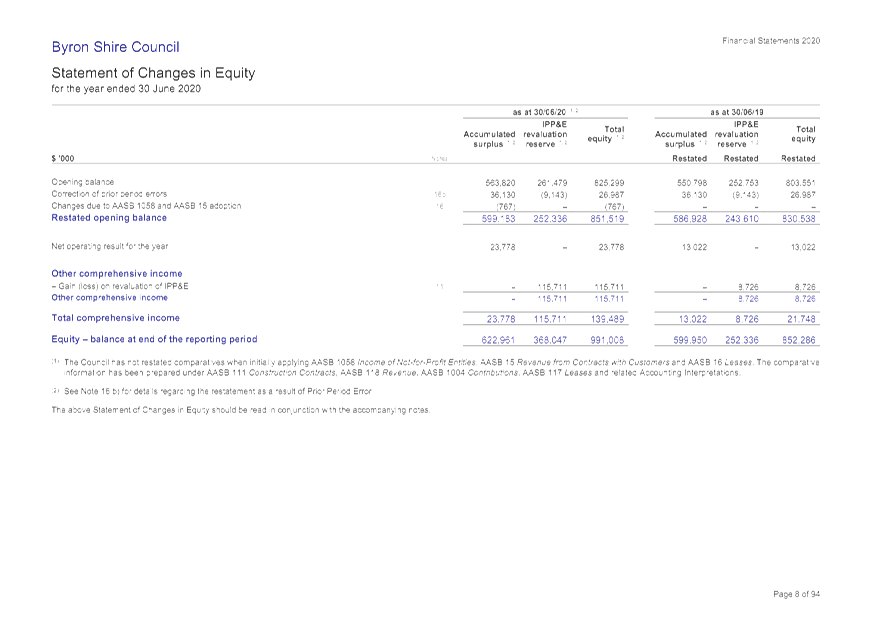

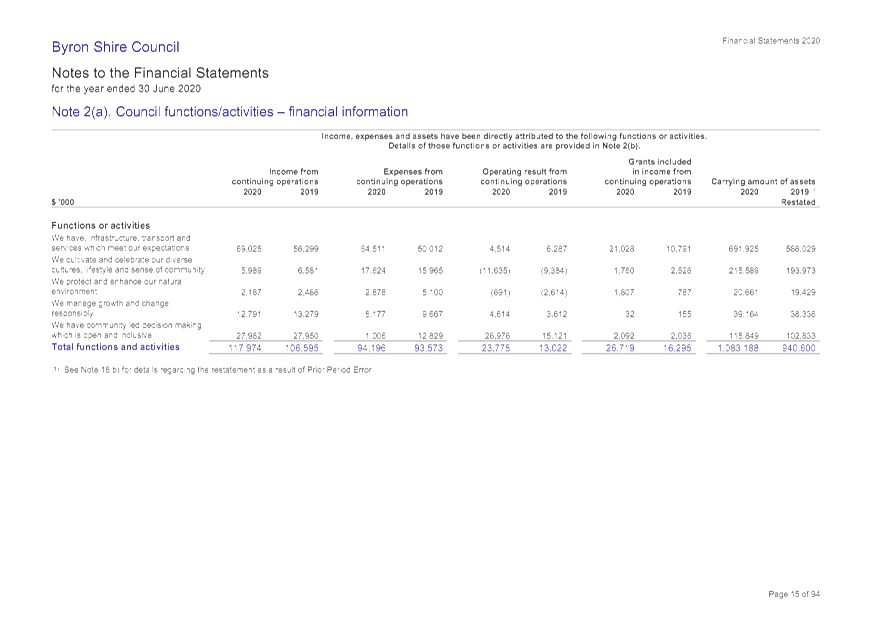

The 2019/2020 financial year has seen a positive overall

financial result. Council recorded a $23.778million surplus compared to the $13.022million

surplus in 2018/2019. This result incorporates the recognition of capital

revenues such as capital grants and contributions for specific purposes and

asset dedications amounting to $32.021 million, compared to $21.109million in

2018/2019. Capital grants and contributions in 2019/2020 were significantly

influenced by additional grant funding i.e. from the Election Commitment Grant,

and recognising asset values for the former Byron Hospital over and above the

$1 purchase price.

A more important indicator is the operating result before

capital grants and contributions. This result was a deficit of $8.243 million

in 2019/2020 compared to a deficit of $8.087million in 2018/2019, representing

an increase of $0.156million between financial years. This indicates

Council’s operating expenditures exceeded its operating revenues. Whilst

operating revenues, excluding capital grants and contributions, grew by

$0.467million, overall operating expenses grew by $0.623million. Considering

the impacts of the COVID-19 pandemic during the later half of the 2019-2020

financial year, it could be considered that this is a reasonable outcome.

With reference to the Income Statement to the General

Purpose Financial Reports included at Attachment 1, the following table

indicates the major changes between 2019/2020 and 2018/2019 by line item:

|

Item

|

Change between 2019/2020 and 2018/2019 $’000

|

Change

Outcome

|

Comment

|

|

Income

|

|

|

|

|

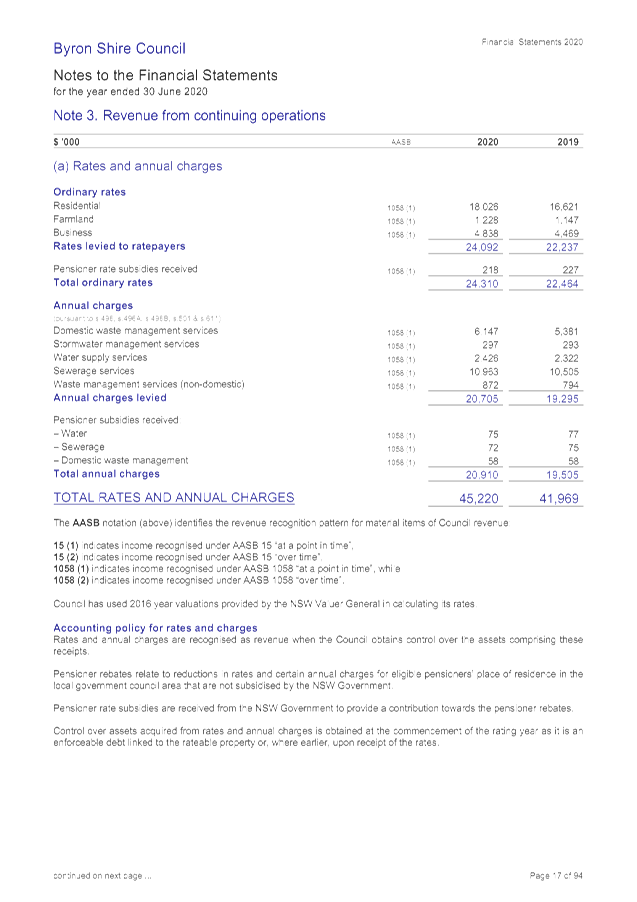

Rates & Annual Charges

|

+$3,251

|

Increase

|

Reflects imposition of the

third year of the 7.50% Special Rate Variation and changes in annual charges

from Council’s adopted 2019/2020 Revenue Policy

|

|

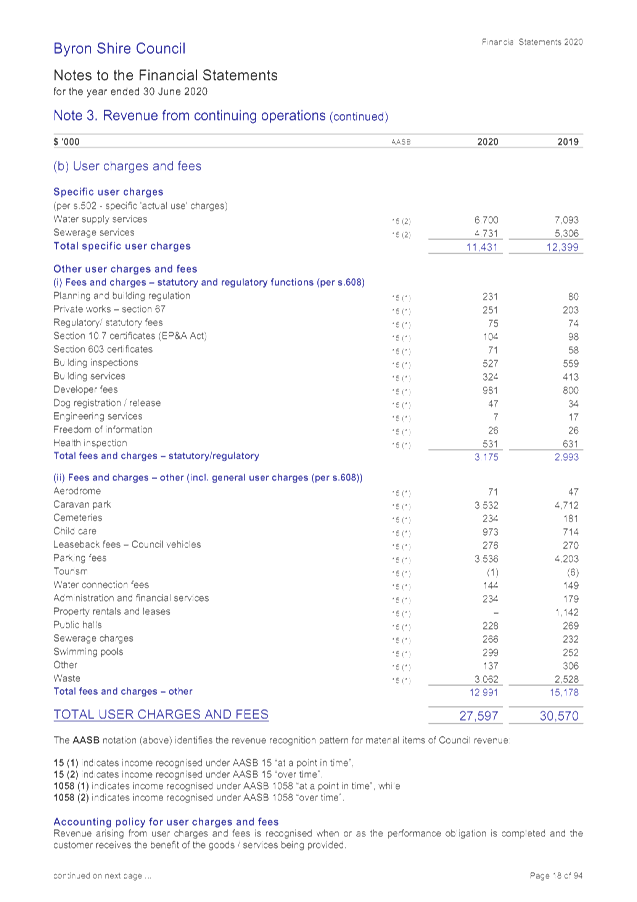

User Charges and Fees and

Rental Income

|

-$2,057

|

Decrease

|

Incorporating the new line

item of rental income to provide comparison to previous year, there has been

a reduction of $2.057million. It is in this area that Council has

realised most revenue losses from COVID-19. Revenue reductions include

holiday parks $1.180million and pay parking fees $0.667million Further

information is available in Note 3(b) to Attachment 1.

|

|

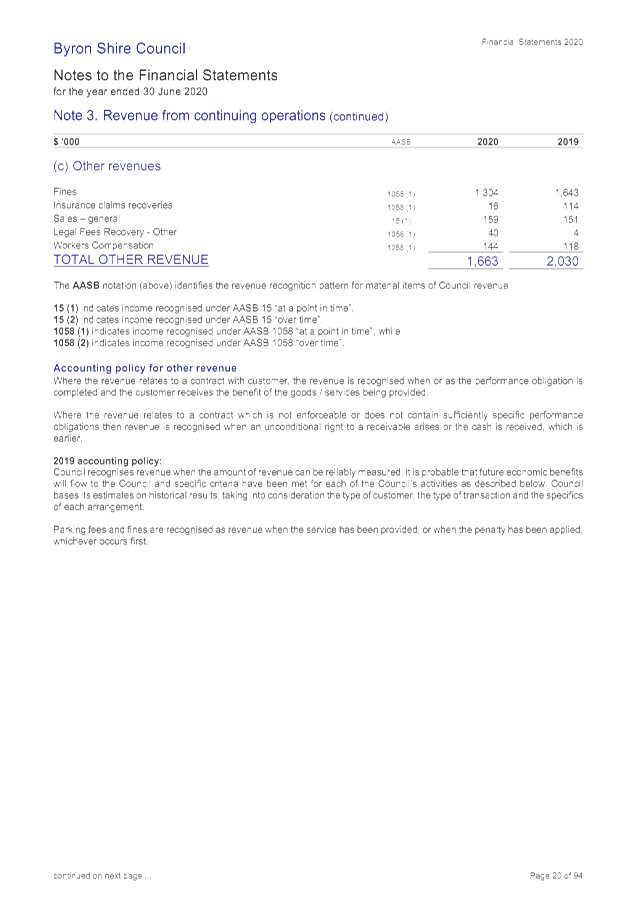

Other Revenues

|

-$367

|

Decrease

|

The major reduction in this

item relates to fine revenues.

|

|

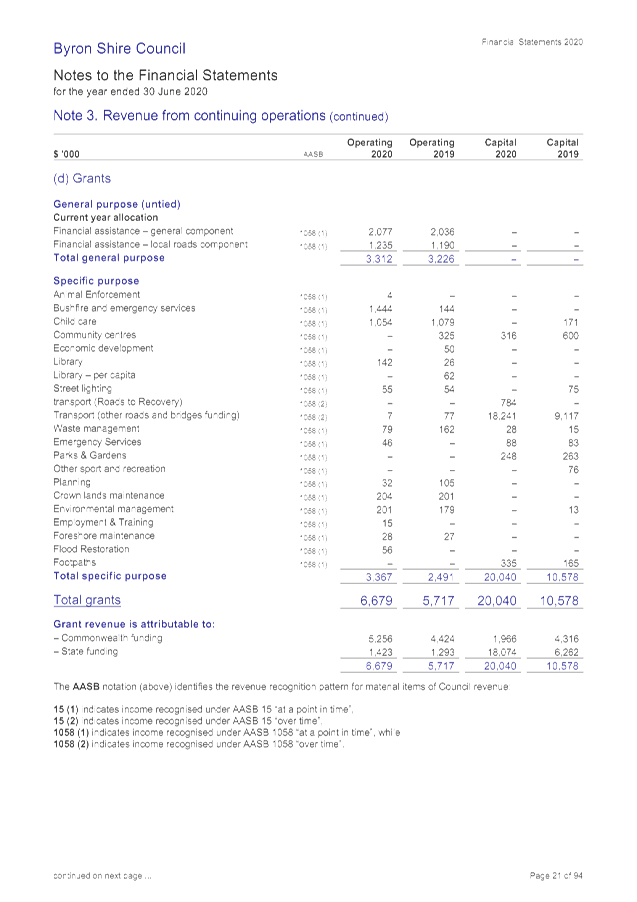

Grants & Contributions

– Operating

|

+$302

|

Increase

|

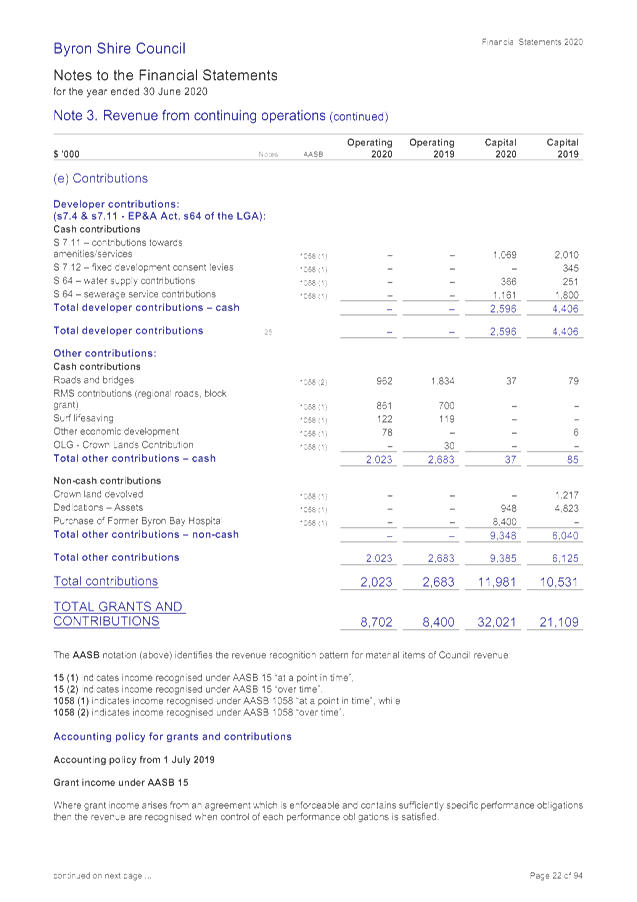

Overall operating grants

increased by $257k including $205k increase in the Financial Assistance Grant

but contributions reduced by $325k. Further information is available in Note

3€ and Note 3(f) to Attachment 1.

|

|

Grants & Contributions

– Capital

|

+$10,912

|

Increase

|

Revenue increases in this

item are associated with grant funding for the Byron Bay Bypass and Election

Commitment Grant. Additionally Council recognised former Byron Hospital

assets at fair value compared to the purchase price of $1.

|

|

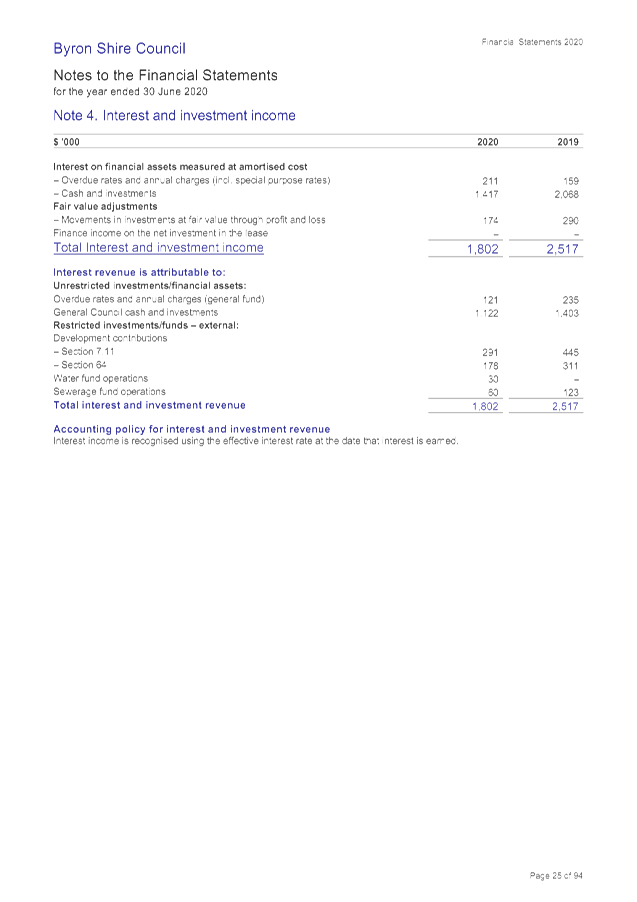

Interest and Investment

Revenue

|

-$715

|

Decrease

|

Interest rates during

2019-2020 have fallen to historic lows plus liquidity measures by Reserve

Bank during COVID-19 have reduced investment rates significantly, lowering

the return on Council’s investments.

|

|

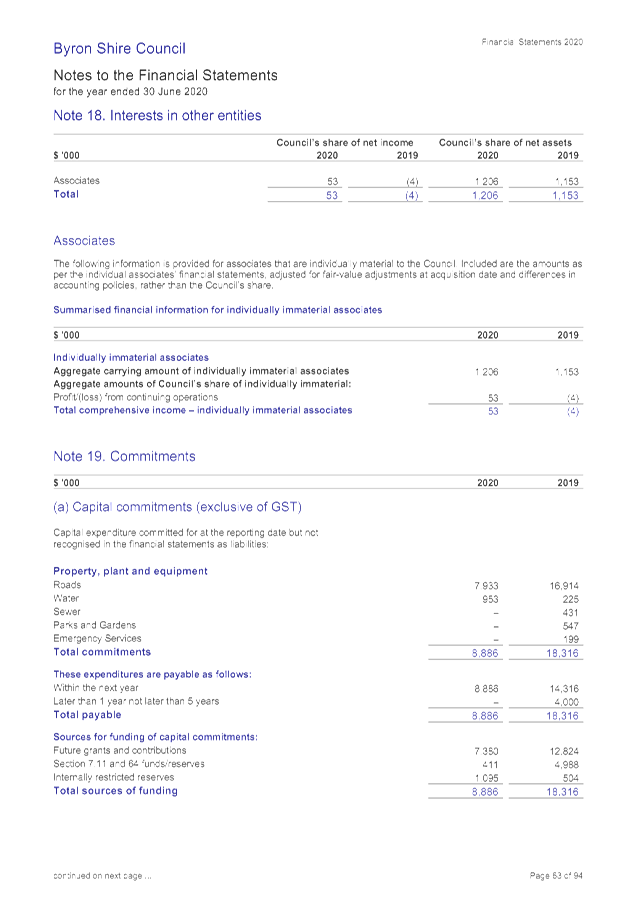

Net share of interests in

associates

|

+53

|

Increase

|

Recognition of Byron Shire

Council’s share of a surplus for Richmond Tweed Regional Library for

2019/2020

|

|

Total Income Change

|

+$11,379

|

Increase

|

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

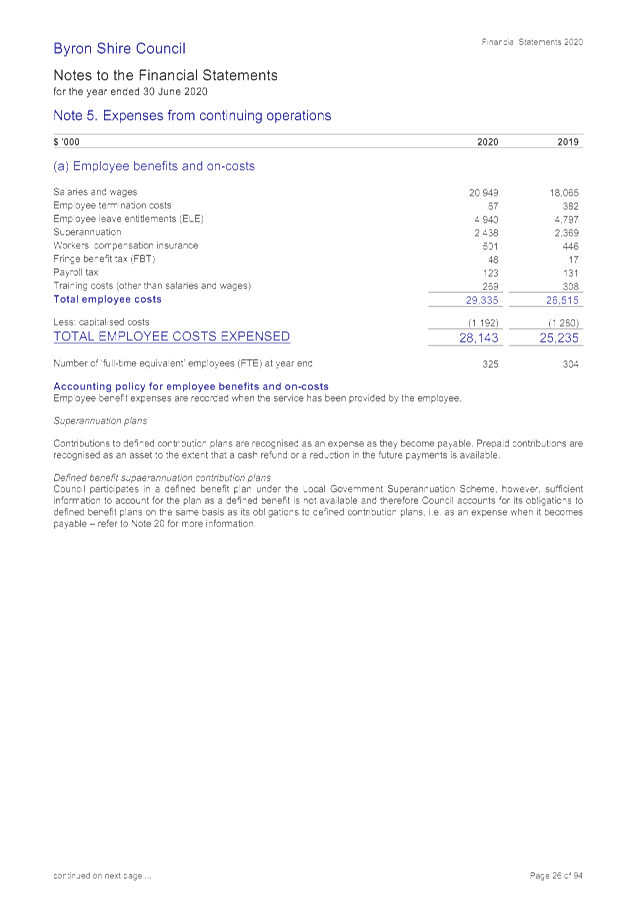

Employee Benefits and

Oncosts

|

+$2,908

|

Increase

|

Increased leave entitlement

expenses of $143k reflecting emphasis on controlling leave balances and impact

of declining interest rates on present value of liability calculations. There

was a decrease of $88k of employee costs capitalised on capital works in

2019/2020 compared to 2018/2019 and gross salary and wages increased $2,884k.

More information is provided at Note 5(a) to Attachment 1.

|

|

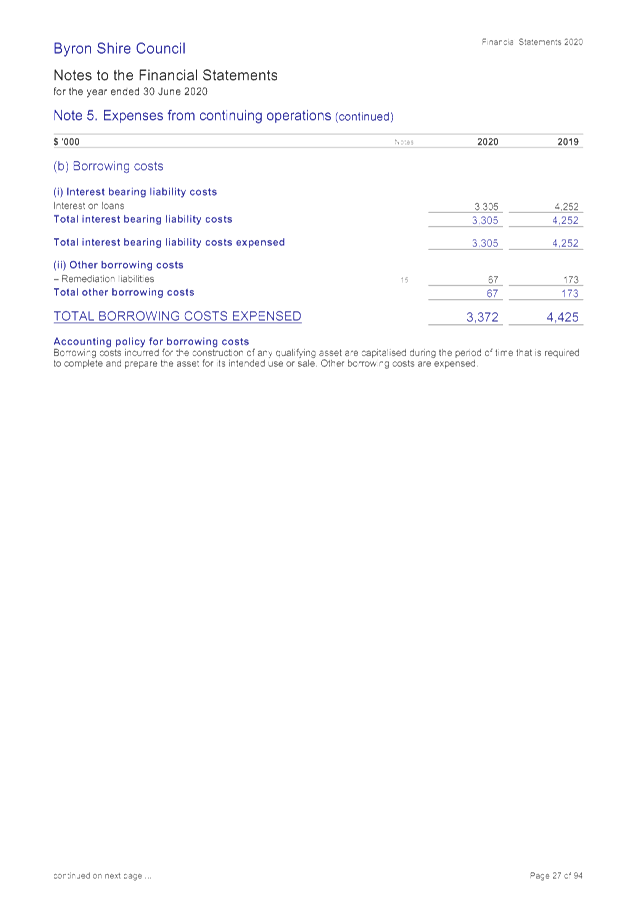

Borrowing Costs

|

-$1,053

|

Decrease

|

Reduction due to

significant refinancing of sewerage loan in 2019/2020, ongoing repayment of

existing loans and borrowing of new loans at lower interest rates given

current market conditions.

|

|

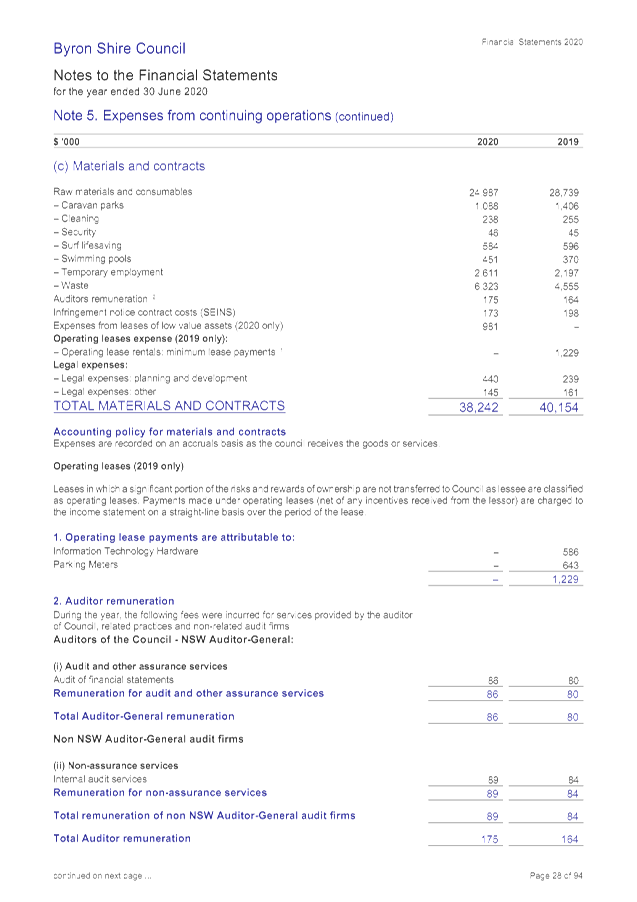

Materials & Contracts

|

-$1,912

|

Decrease

|

Raw materials and contracts

decreased overall as a result of increasing capital works spending along with

reduction in the cost of the former Mullumbimby Hospital remediation of

$0.942million compared to previous year. Other changes can be found at Note

5(c) to Attachment 1.

|

|

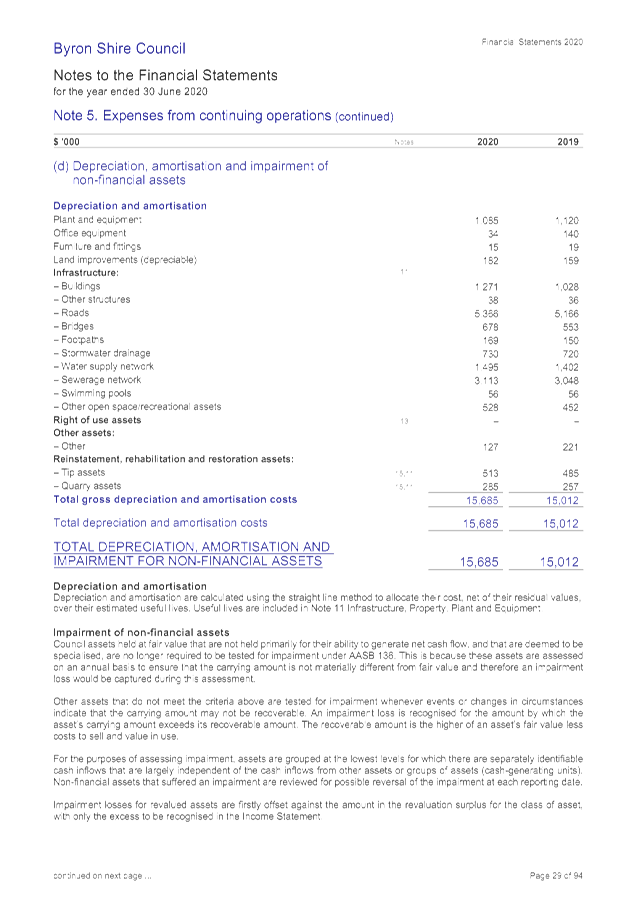

Depreciation

|

+$673

|

Increase

|

Respective changes between

asset classes are outlined at Note 5(d) to Attachment 1. Essentially small

incremental increases in each asset class.

|

|

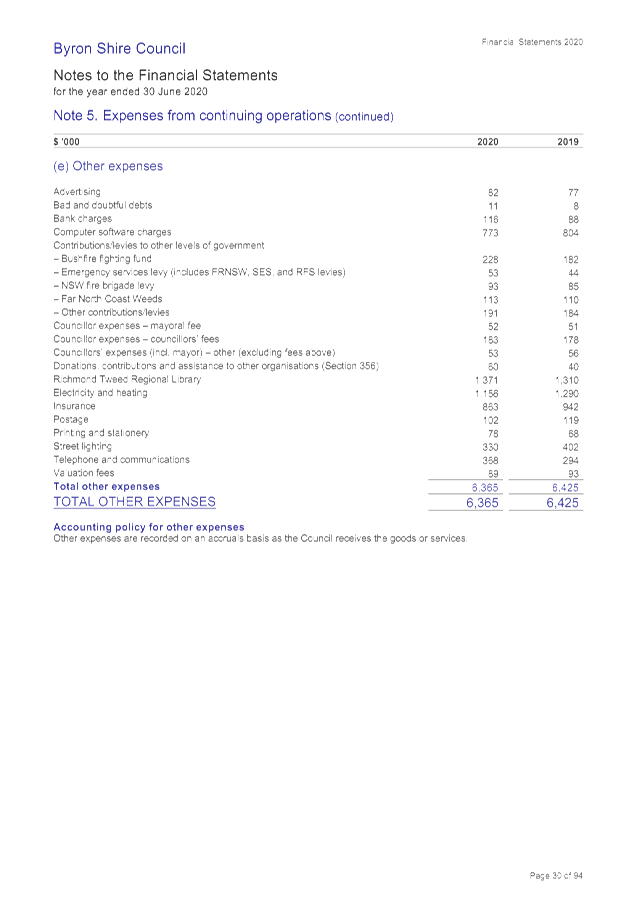

Other Expenses

|

-$60

|

Decrease

|

Overall small but there

were variations in line items as disclosed at Note 5(e) to Attachment 1.

|

|

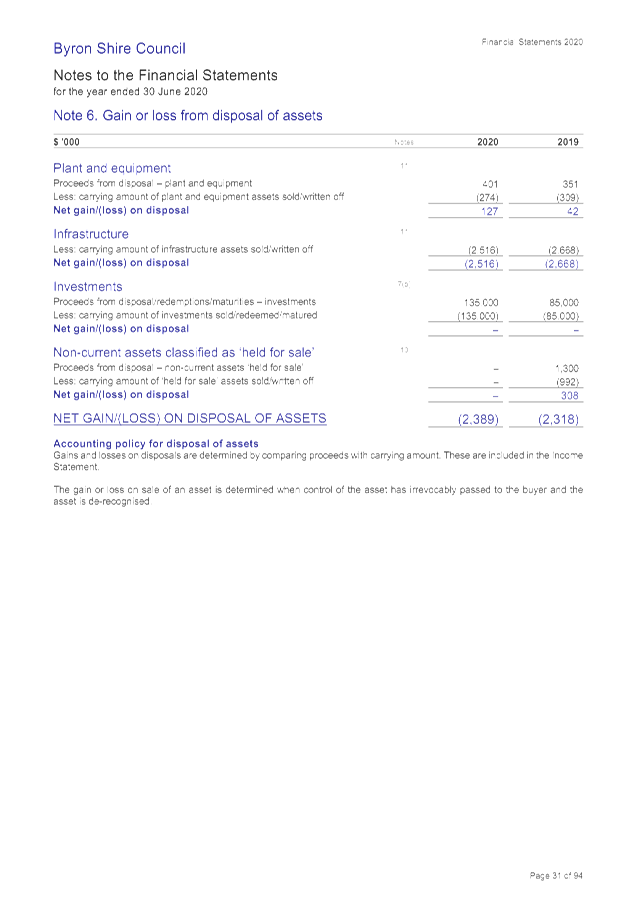

Net Losses from Disposal of

Assets

|

+$71

|

Increase

|

Reflection of the written

down value of assets disposed of at the end of financial year and is

contingent upon the extent of assets disposed and their written down value at

the time of disposal which can vary. For 2019/2020, Council has more

disposals than gains, including the disposal of infrastructure $2,516k,

against plant and equipment $127k gain. Further details can be found at Note

6 to Attachment 1

|

|

Net share of interests in

associates

|

-$4

|

Decrease

|

Recognition of

Council’s share of the operating result of Richmond Tweed Regional

Library for 2019/2020 was a surplus, not a deficit as it was in the previous

year.

|

|

Total Expenditure Change

|

+$623

|

Increase

|

|

|

|

|

|

|

|

Change in Result

|

+$10,756

|

Increase

|

Increase in overall surplus

between financial years.

|

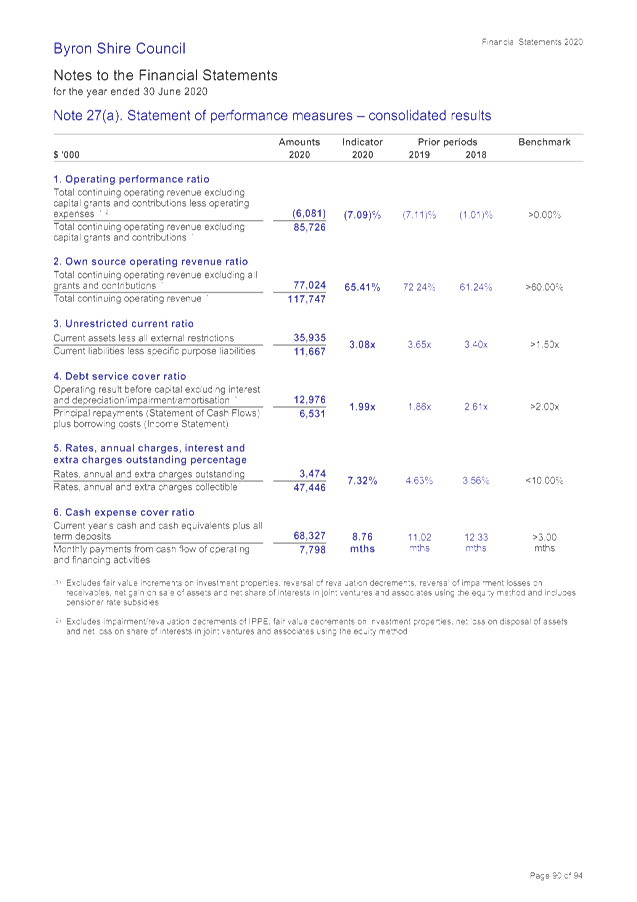

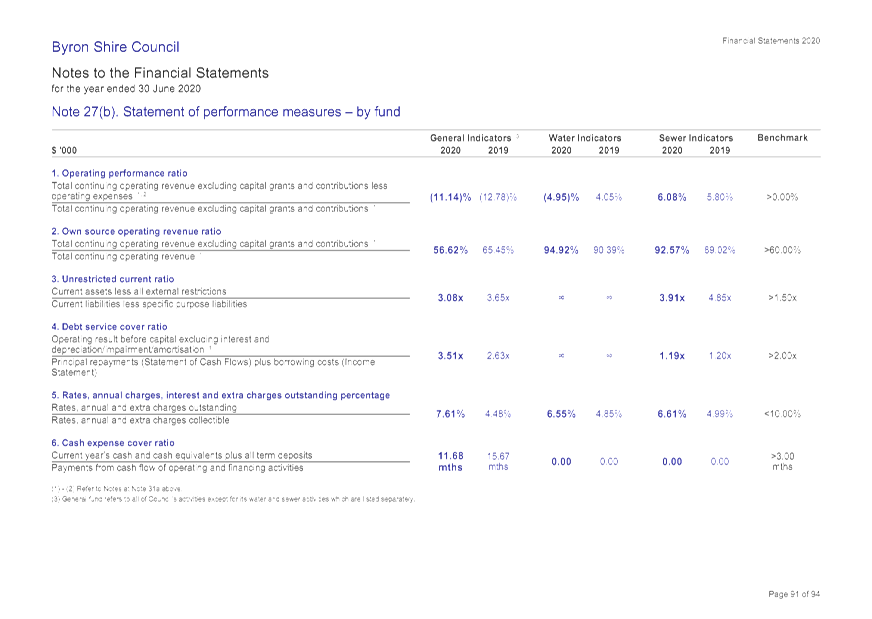

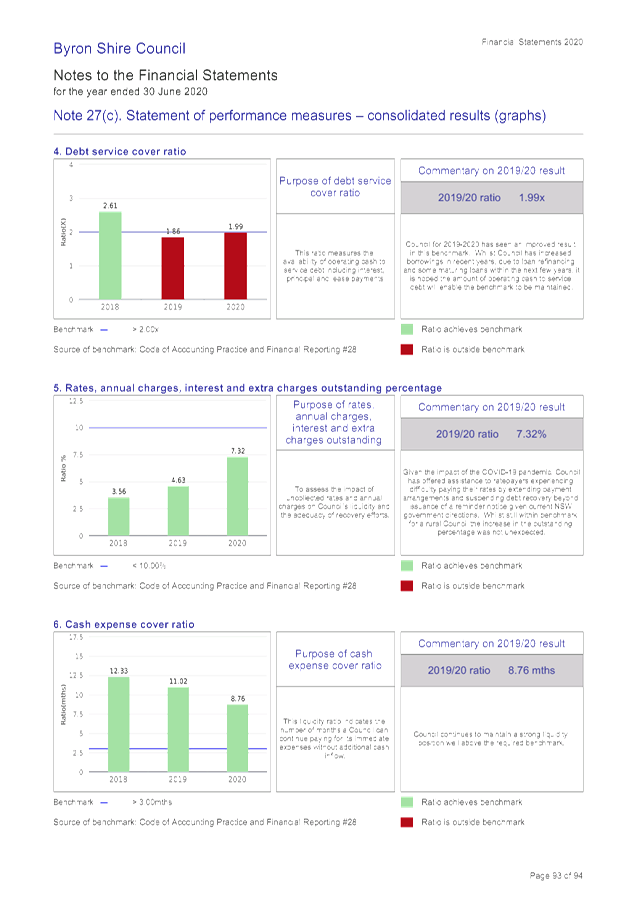

Following from the operating

results, are the performance ratios at Note 27(a) to the General Purpose

Financial Statements. These have been derived following the financial

assessments undertaken by NSW Treasury Corporation on all NSW Councils in 2012,

and are now incorporated into the latest update to the Code of Accounting

Practice and Financial Reporting that determines the content of Council’s

Financial Statements. These ratios present either a stable or improving result

for Council except for the following:

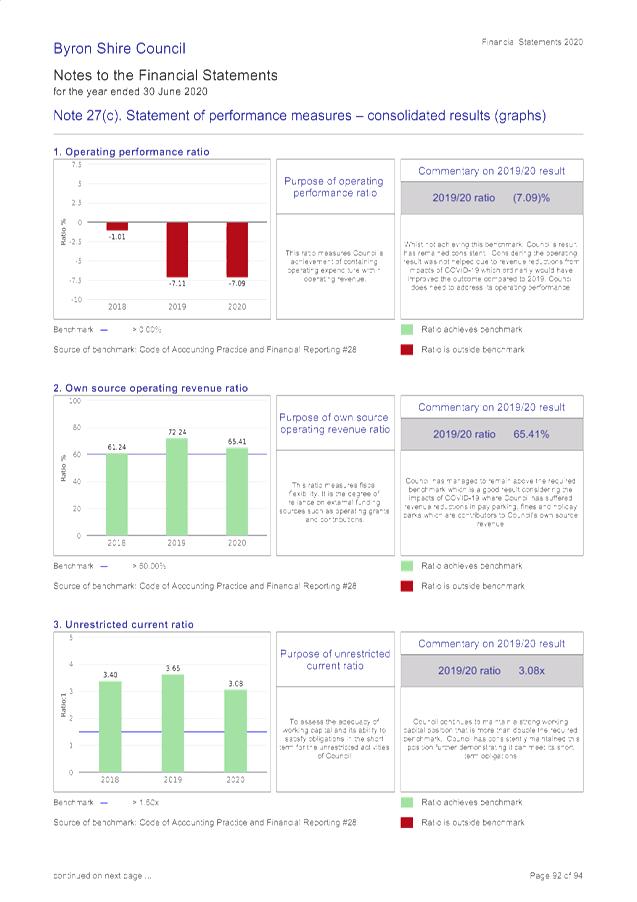

1. Operating

Performance Ratio is a reflection of Council’s operating result. The

benchmark is to be greater than 0% but in 2018/2019 Council’s ratio was

-7.11% and in 2019/2020 it was -7.09%, a very slight improvement. This ratio

was impacted by some one-off items i.e. demolition costs of the former

Mullumbimby Hospital and revenue losses due to COVID-19, however Council will

look to improve this result back towards the benchmark.

2. Outstanding,

Rates and Annual Charges – Whilst still within the industry benchmark,

Council’s ratio has increased to 7.32% in 2019/2020 from 4.63% in 2018/2019.

The increase can be attributable not only to the third year of the special rate

variation increases to annual charges but also the impact of the COVID-19

Pandemic. Through its assistance program Council has offered ratepayers

extended payment arrangements and suspended debt recovery.

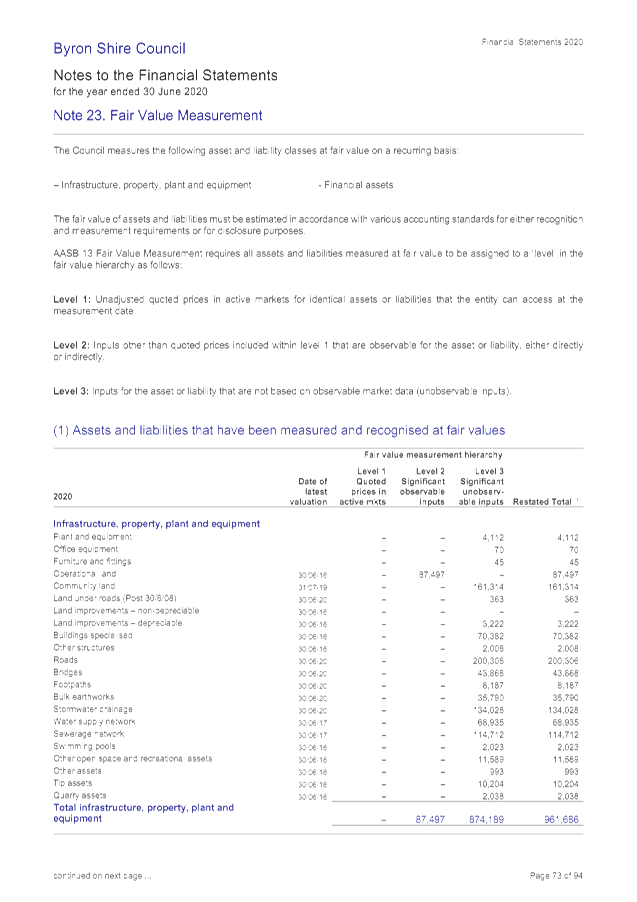

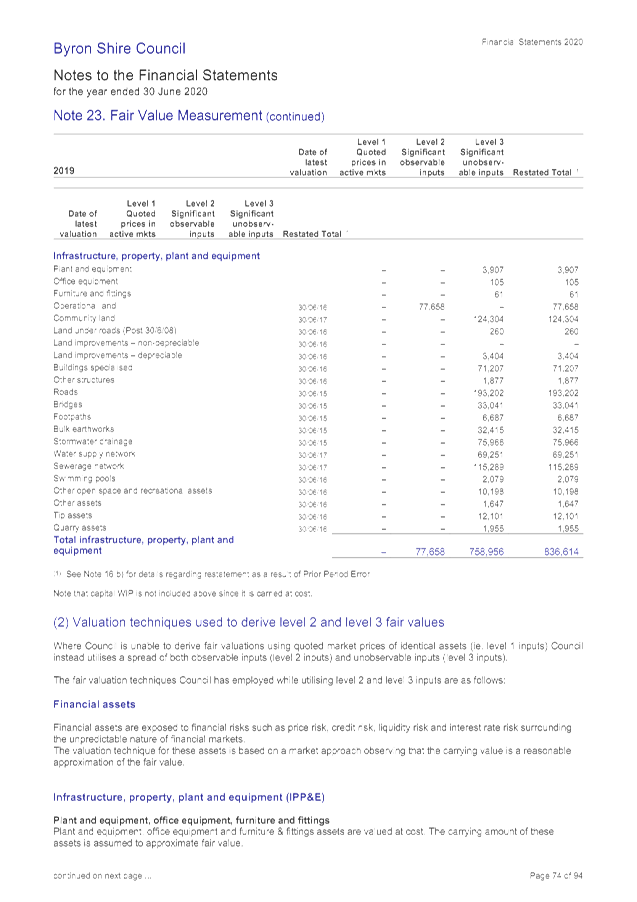

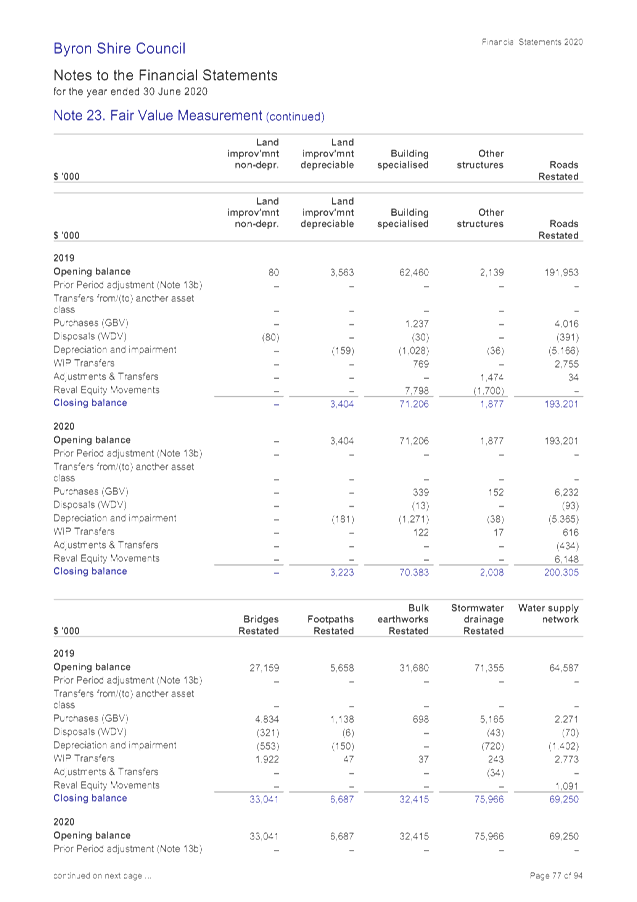

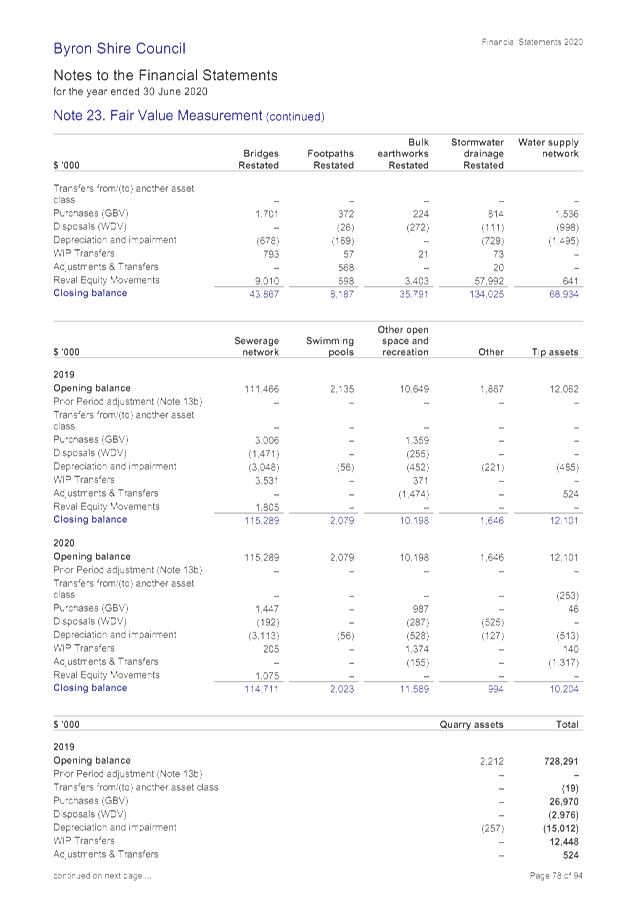

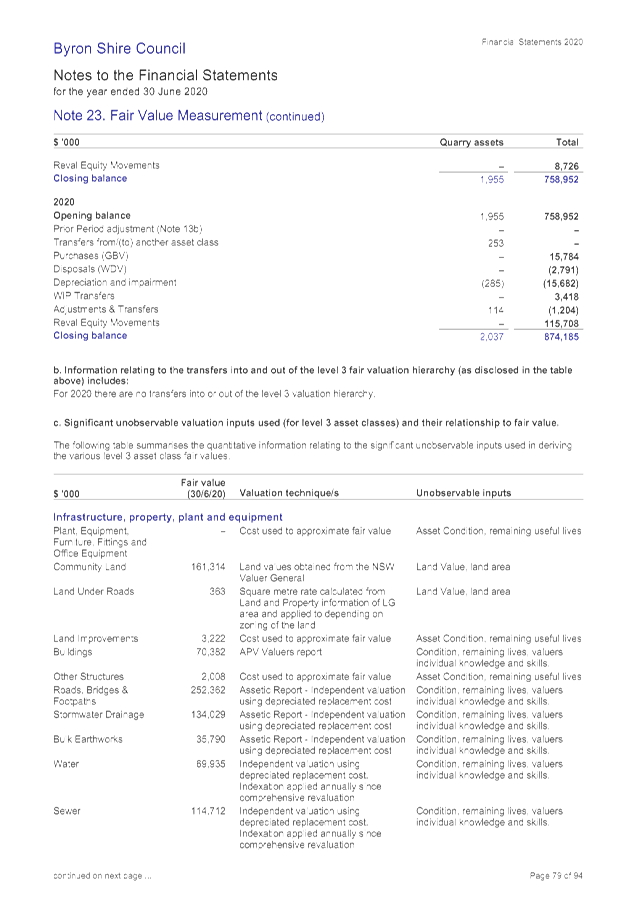

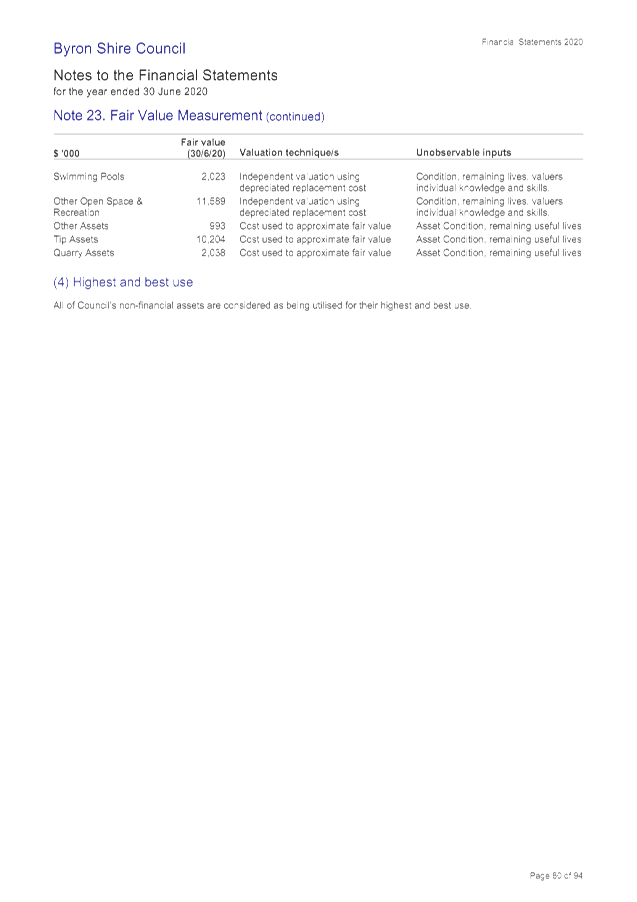

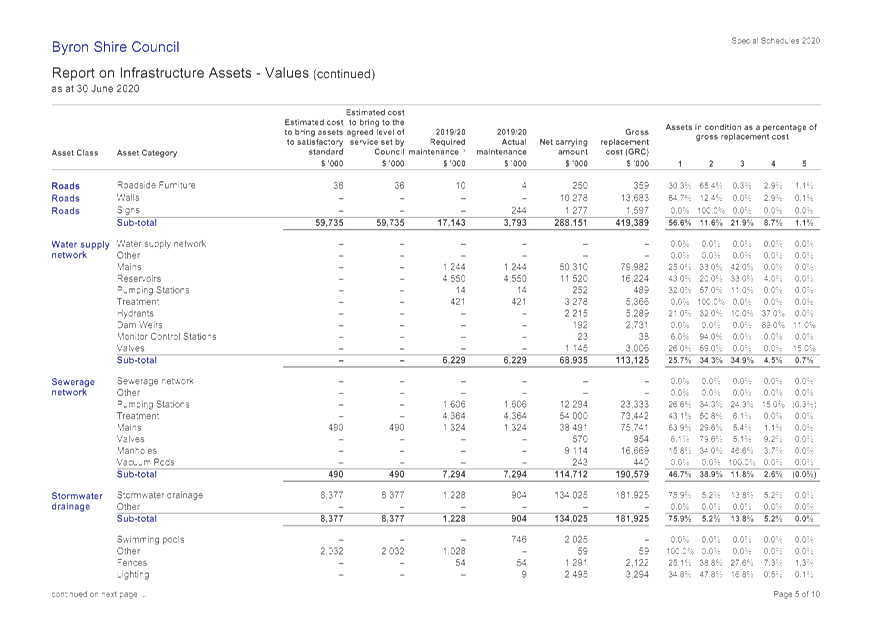

· Asset

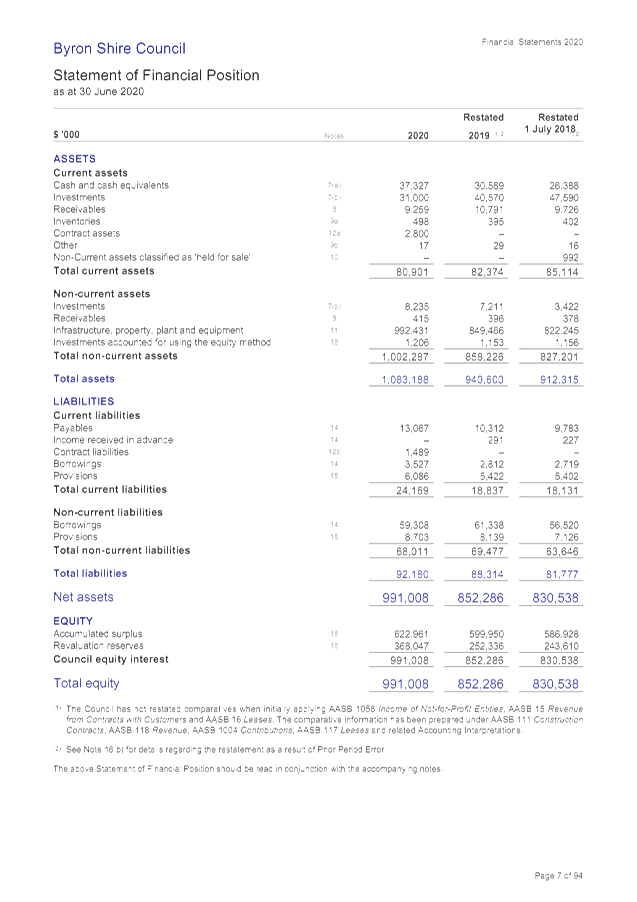

Revaluations

During 2019/2020, a revaluation of assets relating to Roads,

Bridges, Stormwater Drainage and Community Land was undertaken. These

revaluations have increased Council’s asset values by the following

amounts:

· Roads – $6.148million

· Bridges – $9.010million

· Bulk Earthworks -

$3.403million

· Footpaths - $0.698million

· Stormwater Drainage -

$57.992million

· Community Land -

$25.594million

· Crown Land - $10.693million

For the upcoming 2020/2021 financial year, Council will need

to consider the revaluation of Operational Land and Building along with Open

Space and Recreation assets given these assets have not been revalued since

2016.

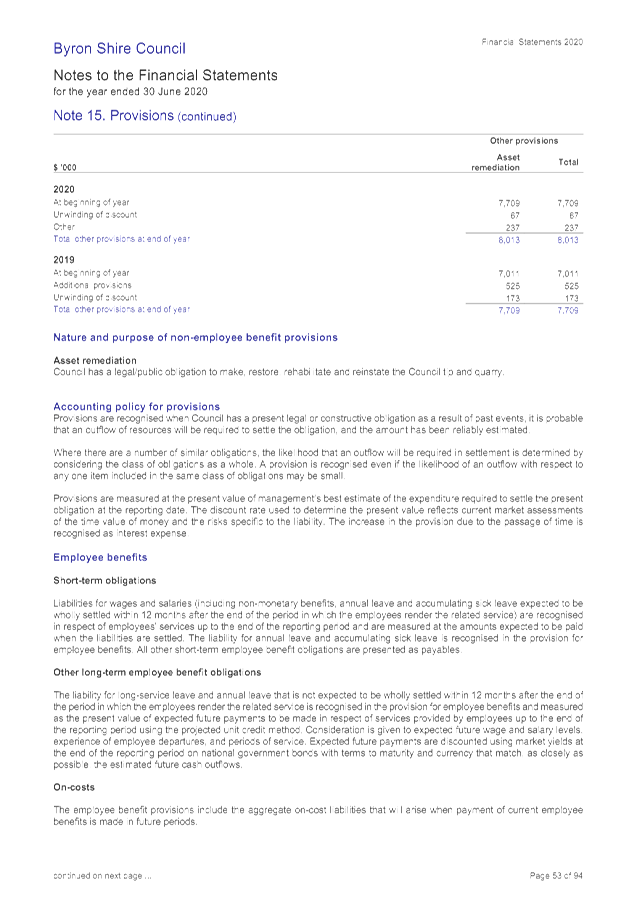

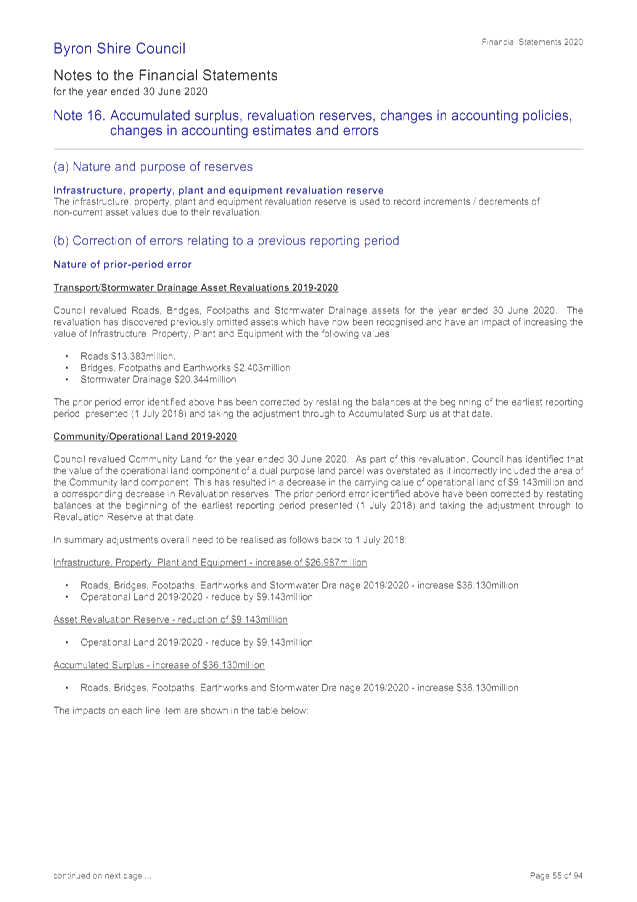

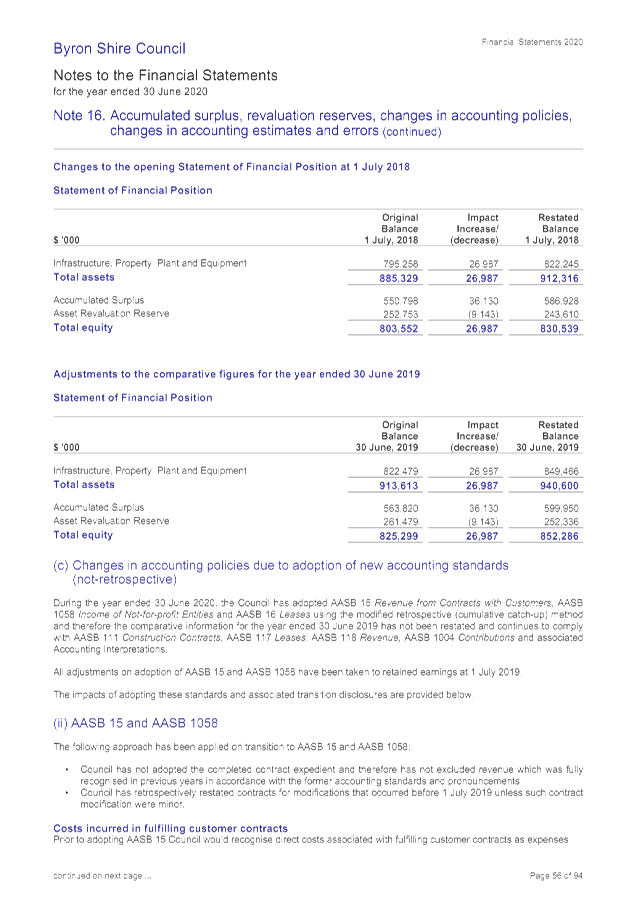

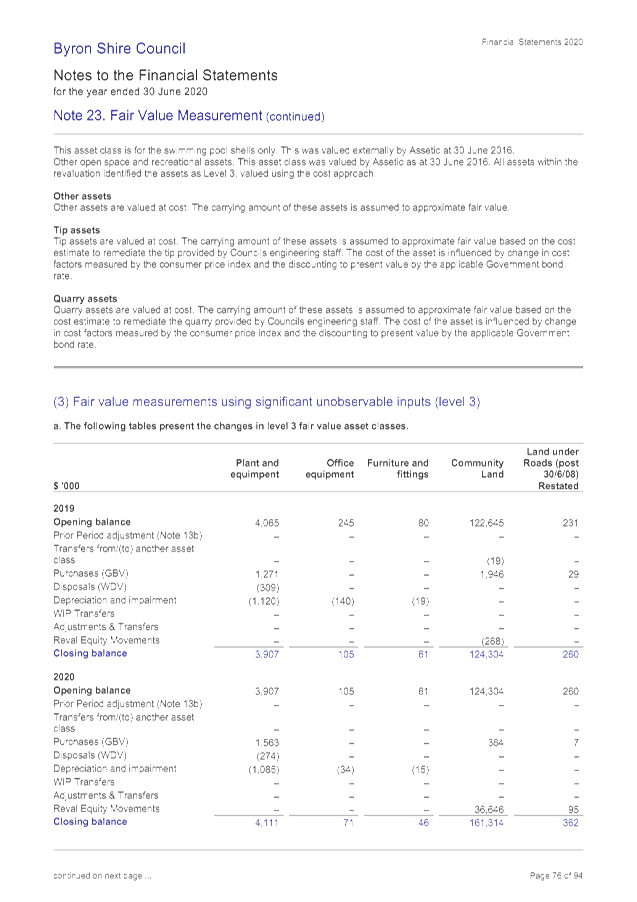

· Prior Period

Error Adjustment

The asset revaluation carried out during the 2019/2020

financial year also resulted in the recognition of prior period errors relating

to roads, bridges, footpaths and stormwater drainage assets previously omitted

being recognised, totalling $36.130million. The revaluation of Community

Land also revealed overstatement of operational land related to a parcel of

land with a dual classification of operational and community land valued at

$9.143million. The net effect of this is recognition of a further

$26.987million in asset values not previously recognised. Details of the

prior period error are contained at Note 16(b) to the Draft 2019/22020

Financial Statements.

This error has occurred due to the following reasons:

1. The

last comprehensive revaluations were carried out in 2015 for transport and

drainage assets along with 2016 for community land.

2. Over

this four to five year period Council has undertaken extensive asset

inspections and data review, condition assessment of the entire road network,

improved segmentation of the road network and reassessed stormwater drainage

data.

3. Implementation

of new capital value register system, removing asset financial data from being

retained in spreadsheets to be now identified by distinct asset records in the

Authority financial systems linked to the Authority Asset Management module.

4. Greater

componentisation of assets able to be undertaken due to improved data

collection following on from audit outcomes.

5. The

previous revaluation undertaken in 2015 appears to have listed a significant

number of existing assets with no value but without adequate explanation.

The ongoing effort Council is putting into asset management

has shown the gains made in terms of understanding the quantum of

Council’s assets, massively improving the quality of the asset

data. Whilst the prior period error has required restatement of

Council’s financial position back to 1 July 2018, it should be seen as a

result of ongoing improvement in Council’s asset information. It is

acknowledged that although the revaluation and recognition of assets previously

omitted has increased the value of Council’s asset by in excess of

$135million, which may seem difficult to grasp, substantial work has been

undertaken to verify the asset data and to ensure assets are not duplicated.

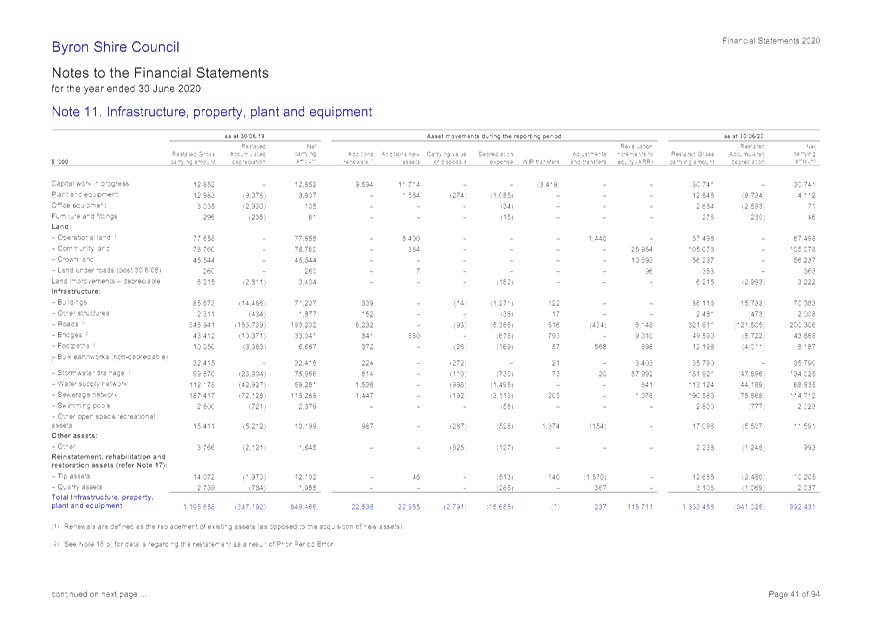

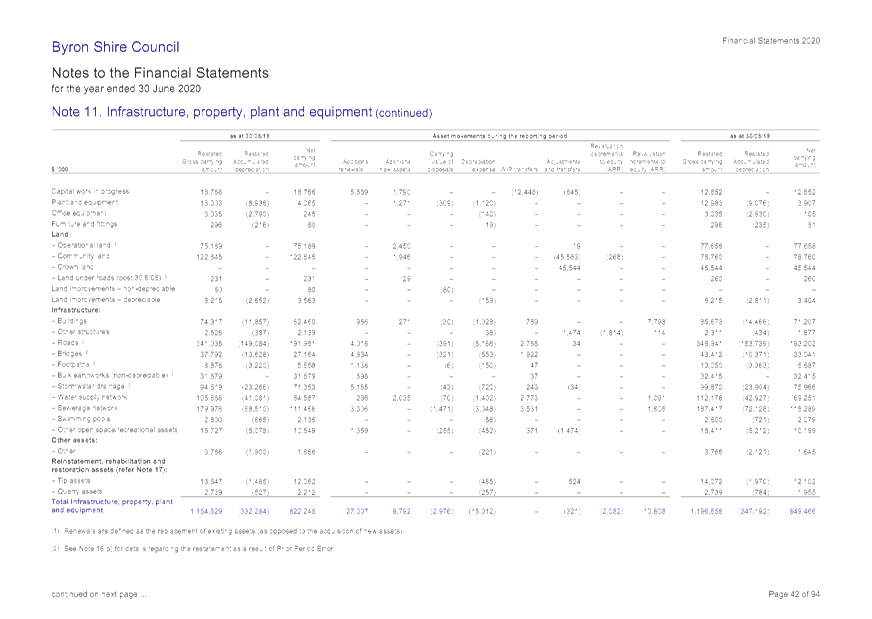

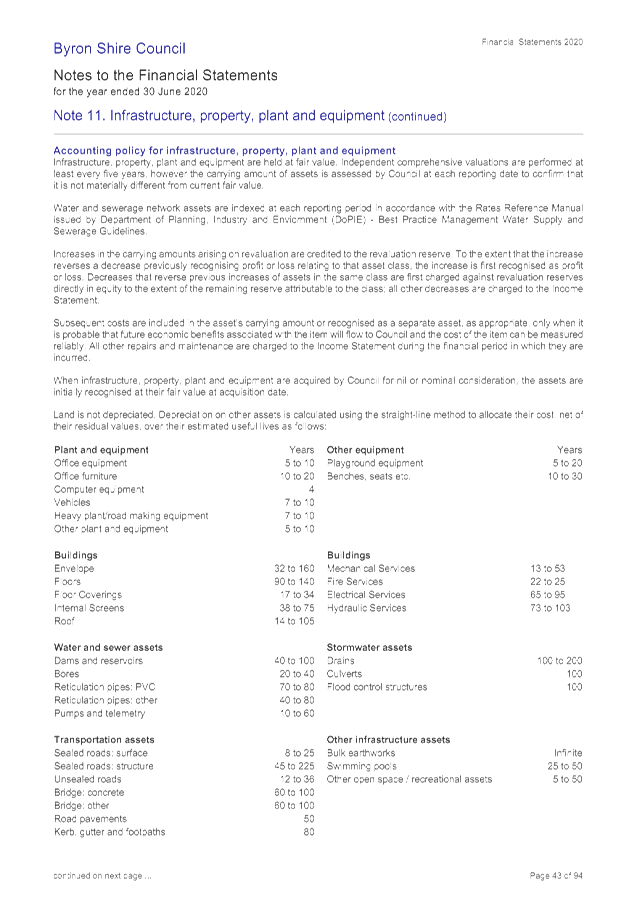

· Asset

Recognition

As indicated at Note 11 to Council’s financial

statements, Council recognised $22.538million on asset renewals and

$22.955million on new assets aside from any asset revaluations. The extent of

asset renewals is significant and demonstrates ongoing commitment in that area.

The depreciation expense of Council’s assets for 2019/2020 was

$15.685million so it is pleasing to see that asset renewal was significantly

more then the financial depreciation of Council’s assets. The draft

2019/2020 Financial Statements at Note 11(a) indicates $8.4million in new

assets for Operational Land. This represents the value of land associated with

the former Byron Bay Hospital. No value related to the buildings for the

former Byron Bay Hospital has been included, as these assets would

automatically then need to be impaired, as they are not able to be used for

their intended purpose without redevelopment.

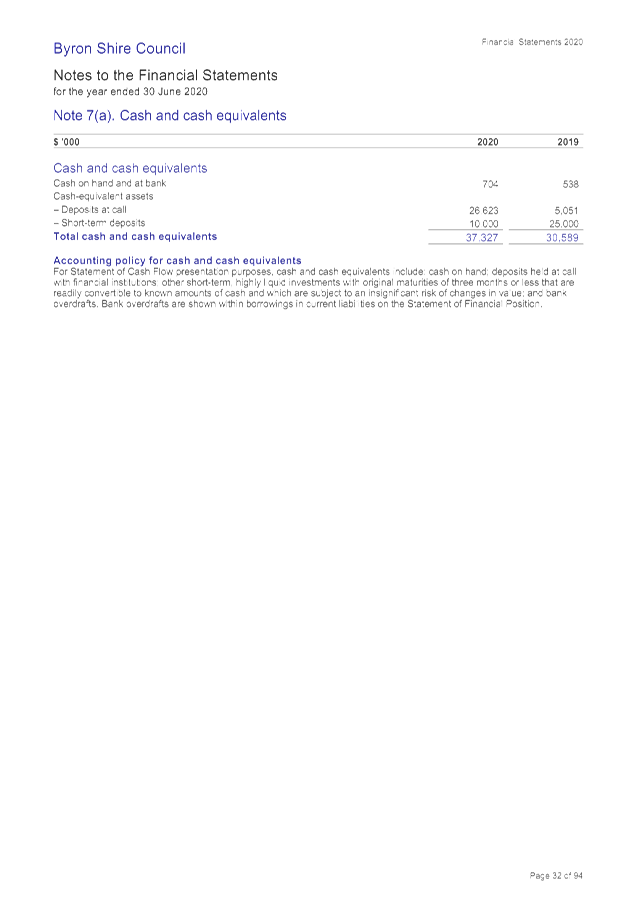

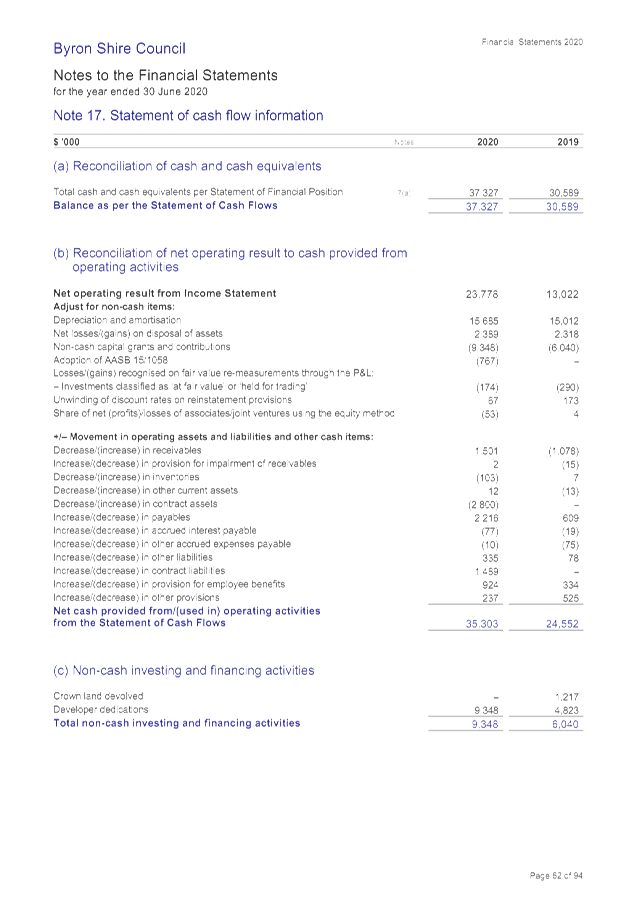

· Cash and

Investments

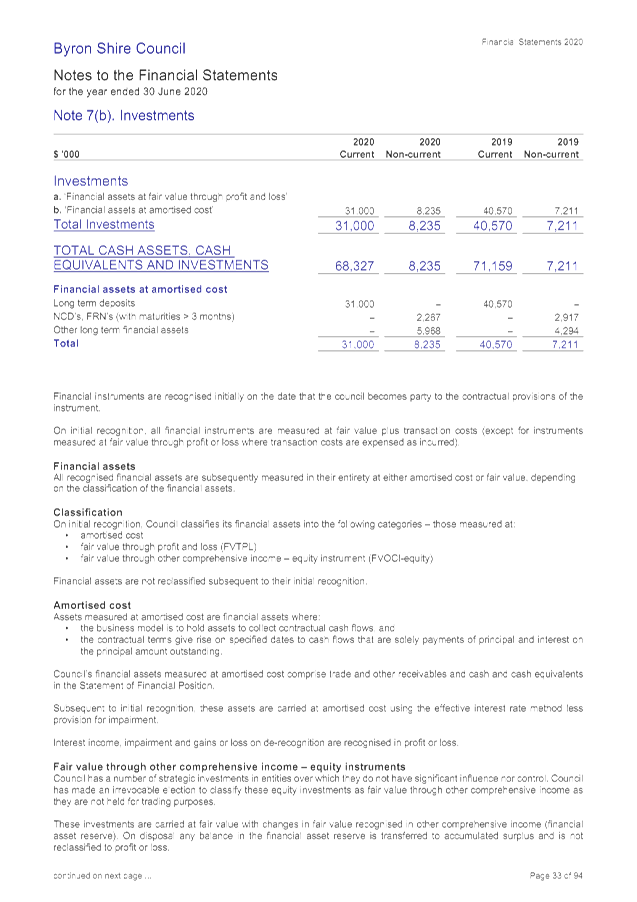

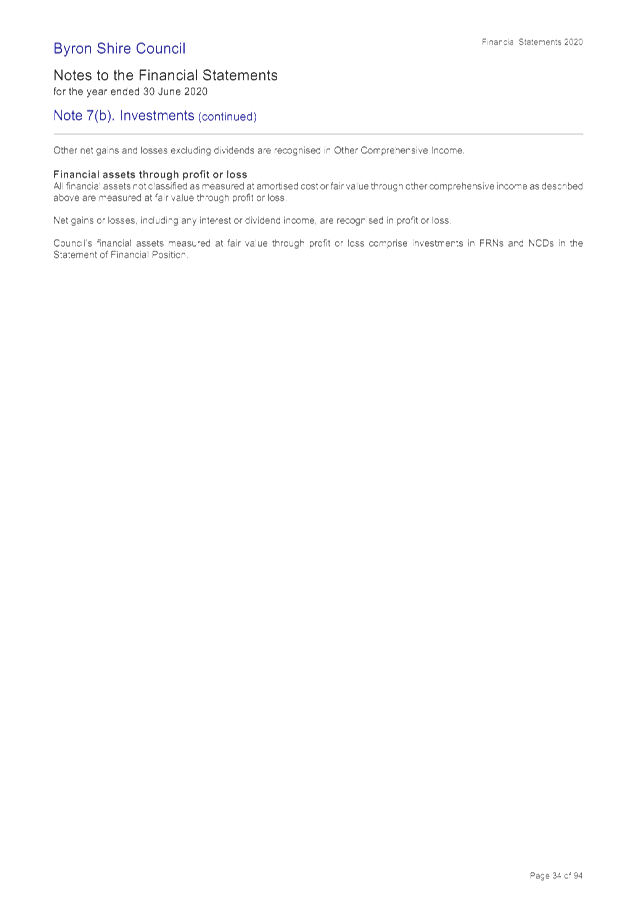

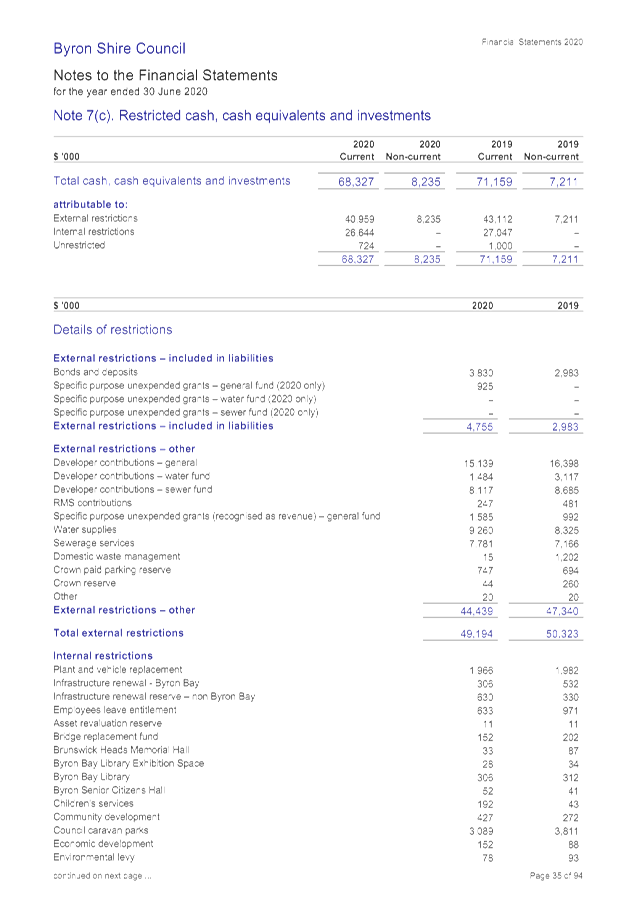

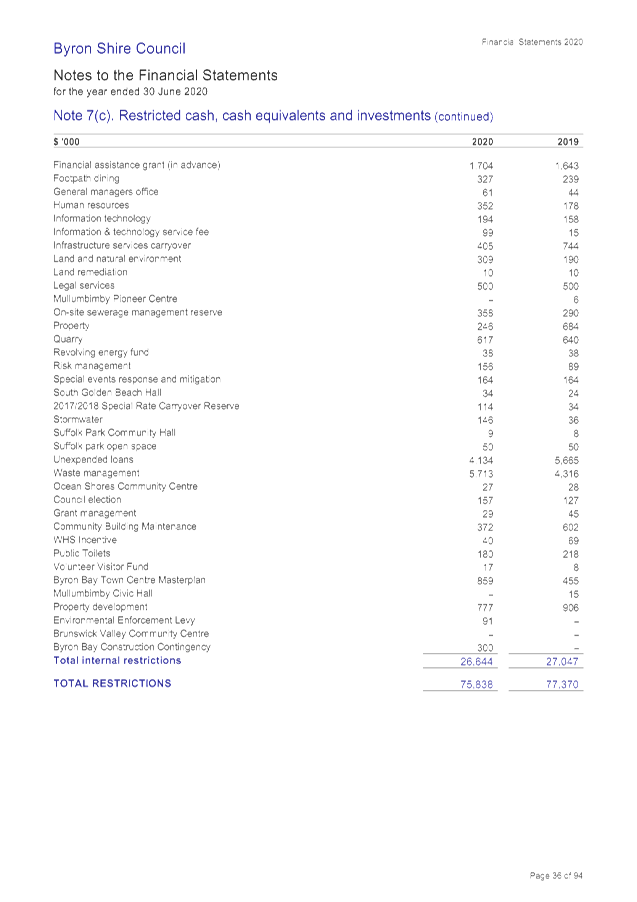

As at 30 June 2020 (detailed at Note 7 to the financial

statements), Council has maintained $0.724million in unrestricted cash and

investments being a reduction of $0.276million compared to 2018/2019. This is a

satisfactory result given the impacts of COVID-19 and the assistance Council

has endeavoured to provide the community during these uncertain times.

Whilst still dealing with COVID-19 Council aims to restore

one of its short term financial goals of reaching an unrestricted cash balance

of $1million by the end of 2020/2021. All other cash and investments

totalling $75.838million at 30 June 2020 are restricted for specific purposes.

Overall the cash and investment position of Council decreased by $1.808million

during the year.

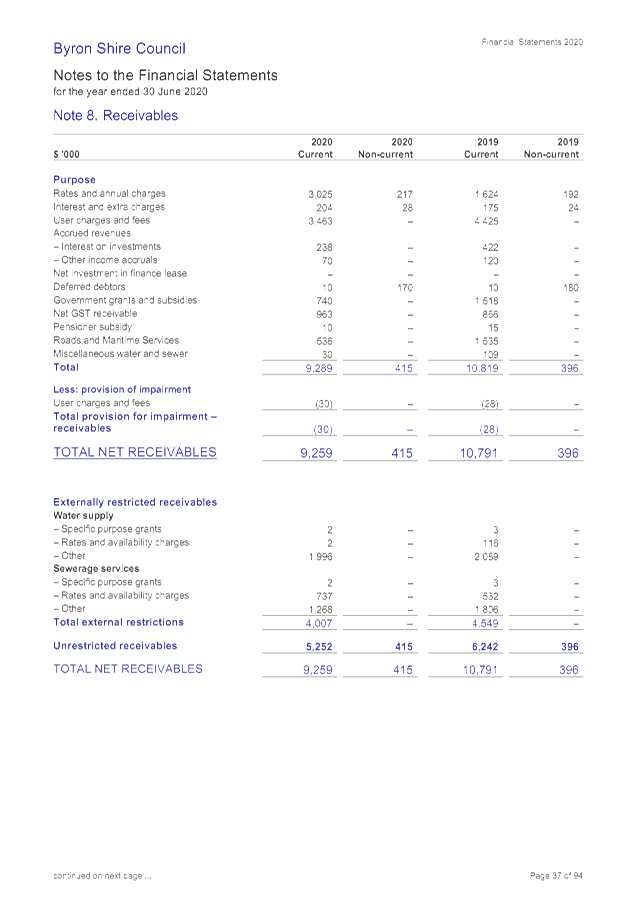

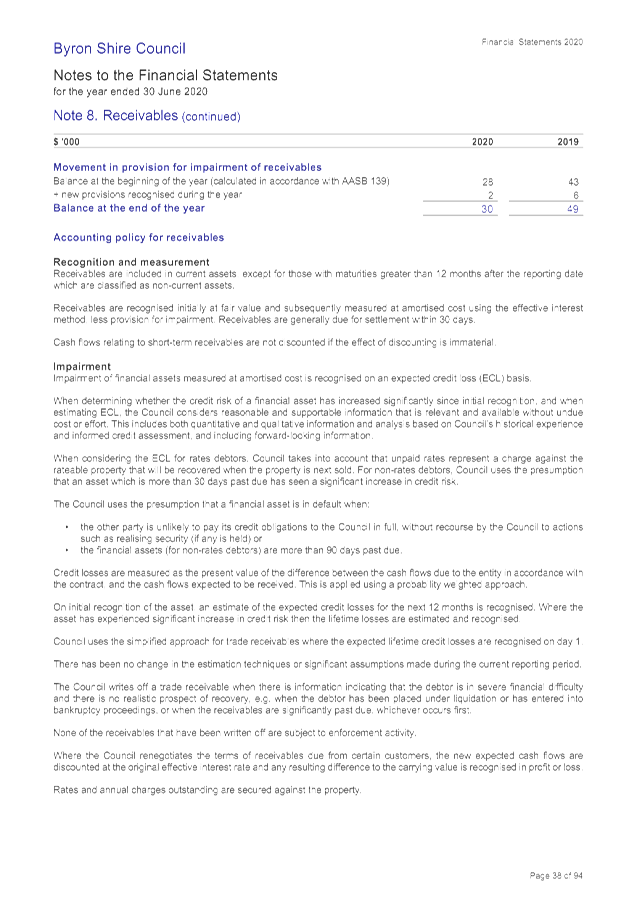

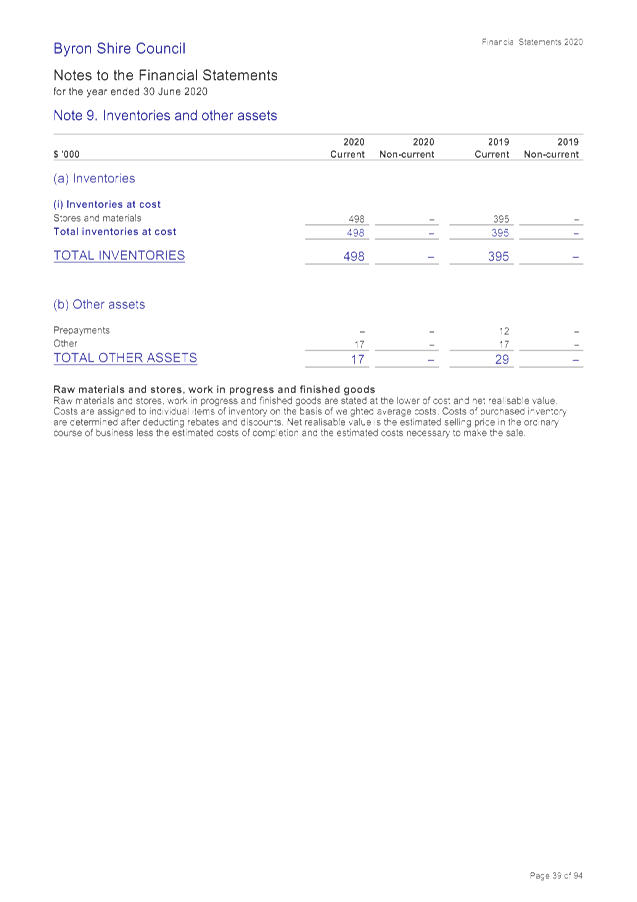

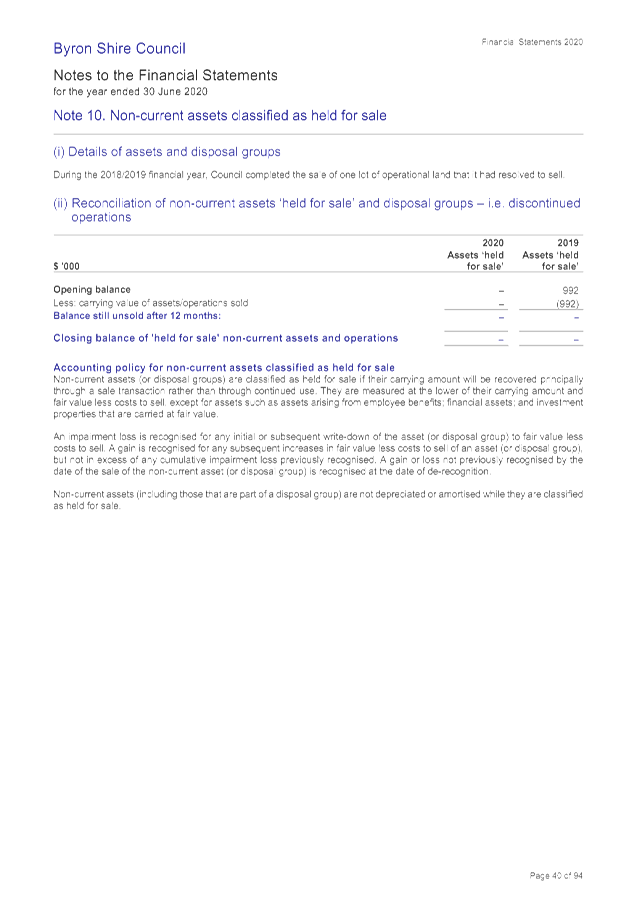

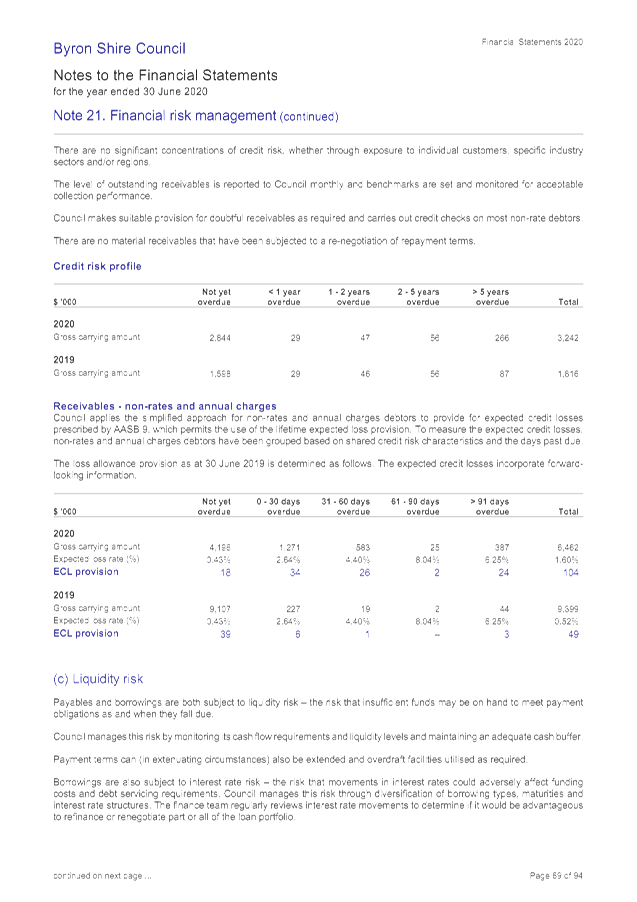

· Receivables

As at 30 June 2020 (detailed at Note 8 to the financial

statements), Council was due $9.674million in receivables. Of this amount

$1.276million was due for Government Grants, $0.963million from the

Commonwealth Government for Goods and Services Tax. Overall receivables

increased by $1.287million compared to the 2018/2019 financial year if

including Contract Assets disclosed at Note 12 of $2.8million that would have

been classified as a receivable in 2018/2019.

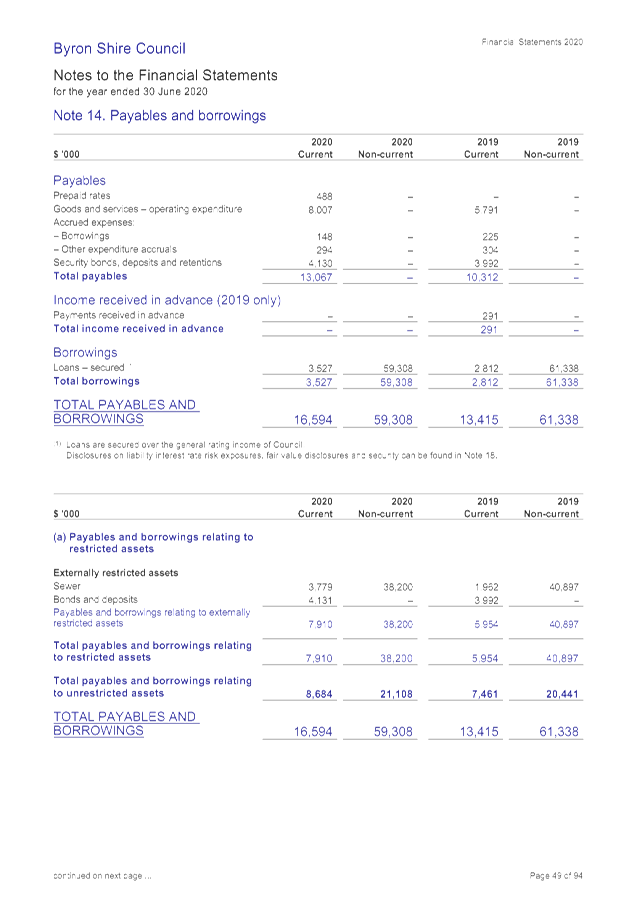

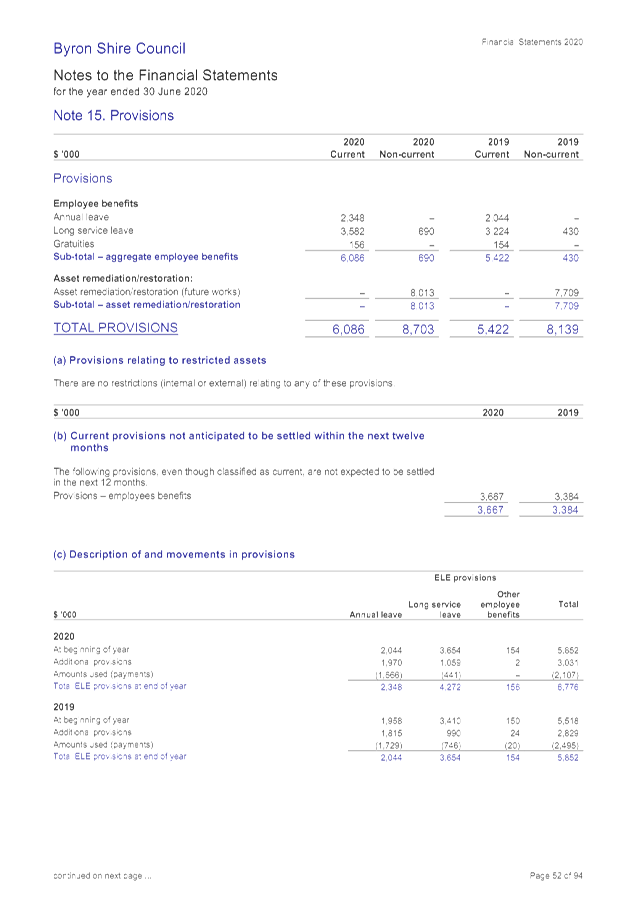

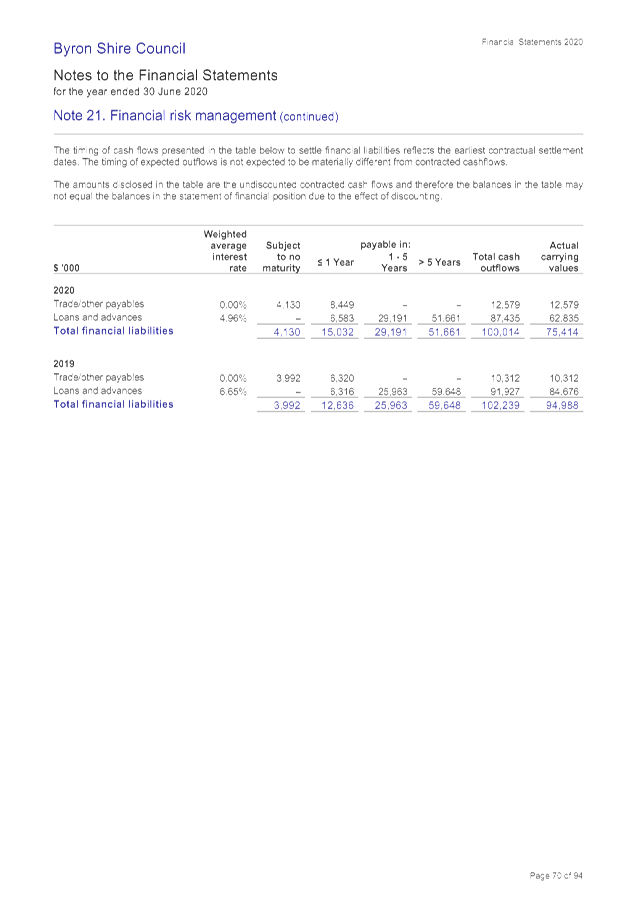

· Payables and

Provisions

At 30 June 2020 (detailed at Note 14 for payables and Note

15 for provisions), total payables by Council were $13.067million including

$4.130million held in security bonds, deposits and retentions, $0.442million in

accrued expenses and $8.007million payable to suppliers. In addition at 30 June

2020, Council has accrued employee leave entitlements valued at $6.776million.

Specific employee leave entitlements include $2.348million for annual leave,

$4.272million for long service leave and $0.156million for gratuities. In

comparison to 2018/2019, total payables have increased by $1.149million whereas

total provisions for employee leave entitlements increased by $0.924million.

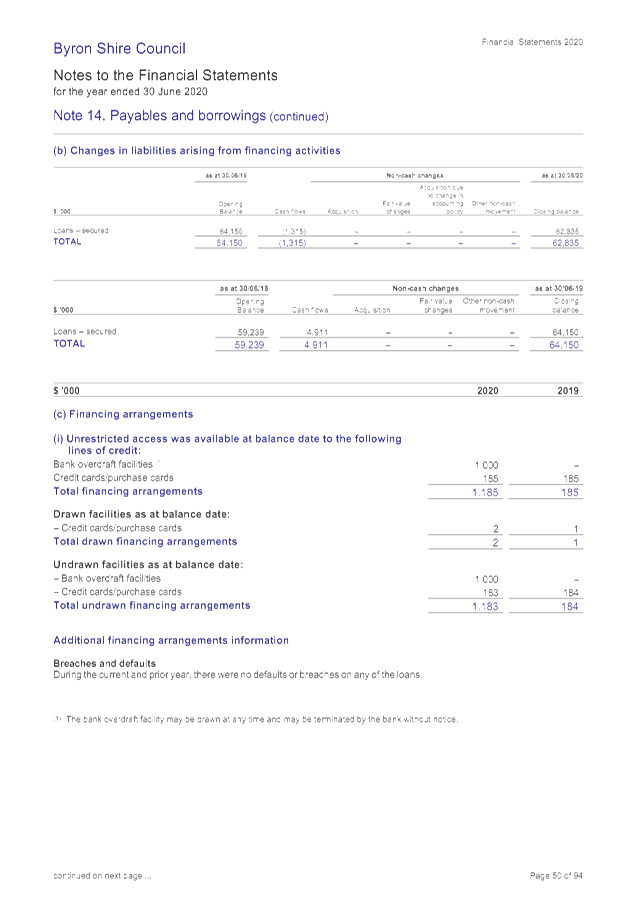

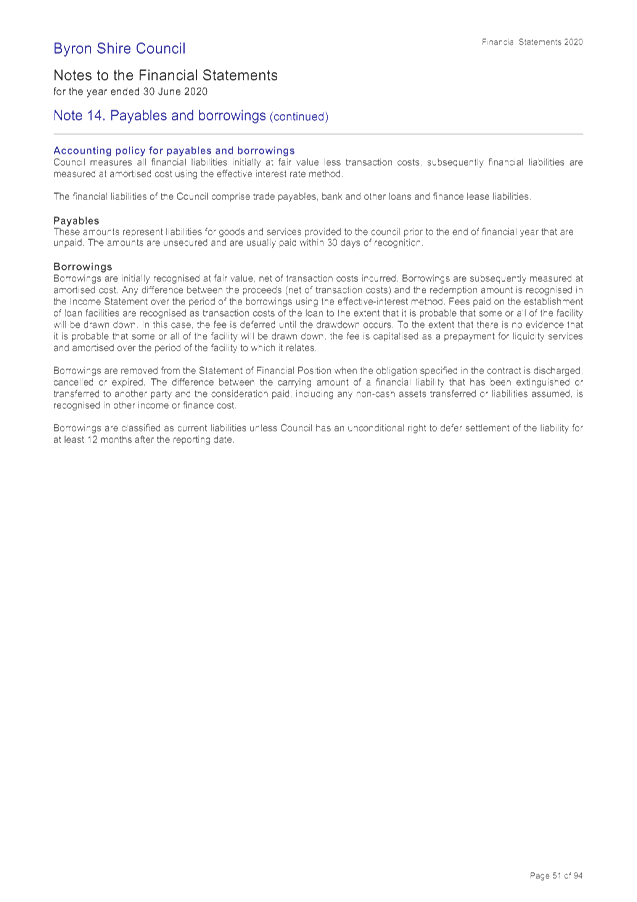

· Loan

Borrowings

During 2019/2020 Council

borrowed new loans of $1.884million and continued to make normal loan

repayments. Council has now borrowed the full $6million in loan funds it

committed to as part of the 2017/2018 Special Rate Variation application to

provide additional funding to infrastructure renewal.

Council’s outstanding loans as at 30 June 2020 are

$62.835million. Total loan expenditure for 2019/2020 included interest of

$3.305million and principal payments of $2.372million. Total expenditure in

2019/2020 related to loan repayments was $5.677million or 6.60% of Council’s

revenue, excluding all grants and contributions.

The outstanding loans by Fund totalling $62.835million are

as follows:

· General Fund $22.263million

· Water Fund $0

– Water Fund is debt free

· Sewerage Fund $40.572million

· New

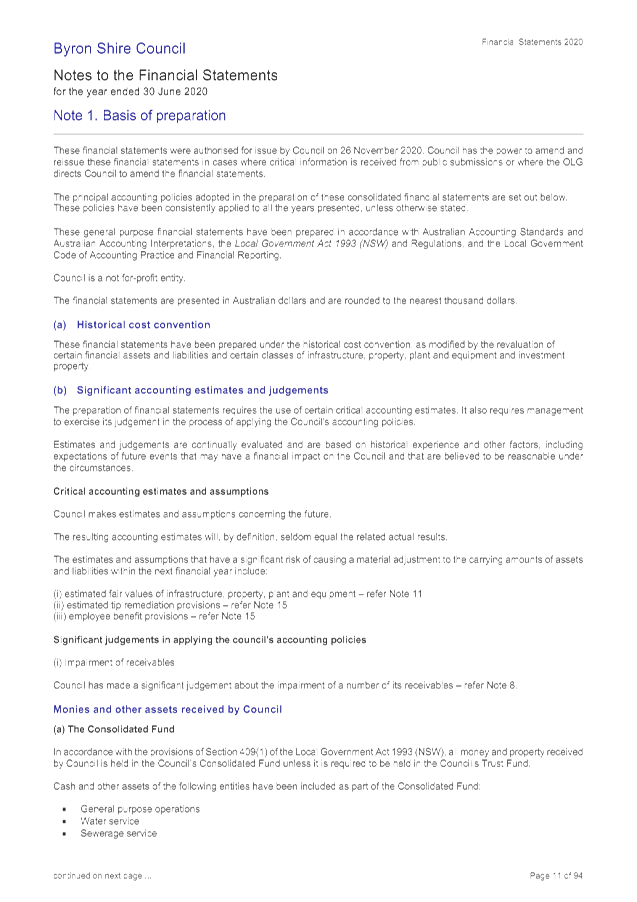

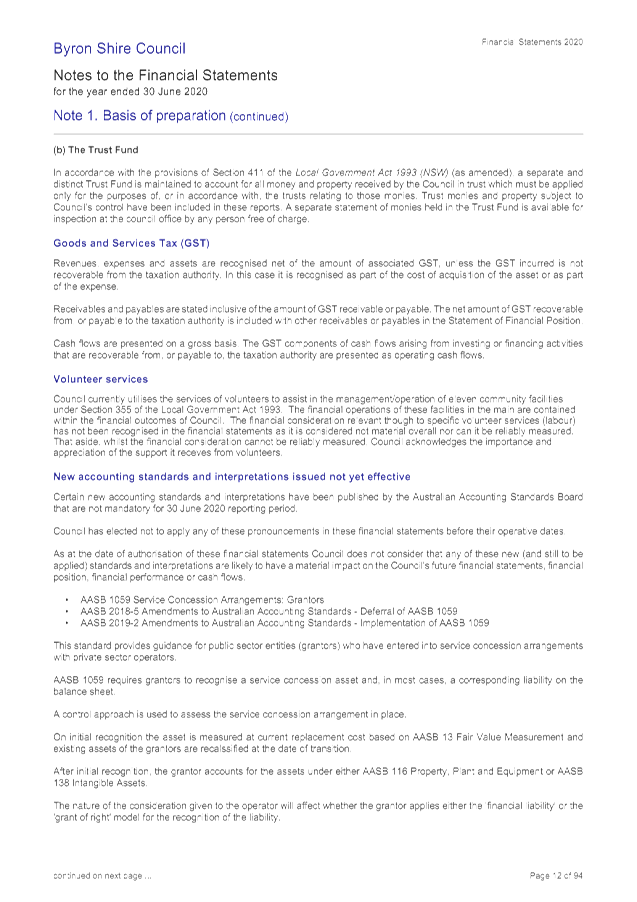

Accounting Standards

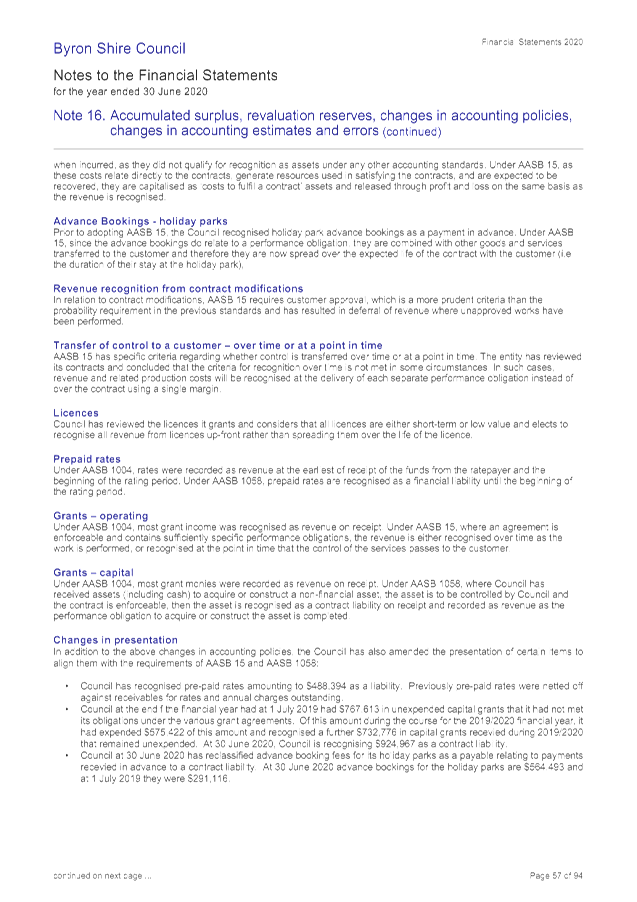

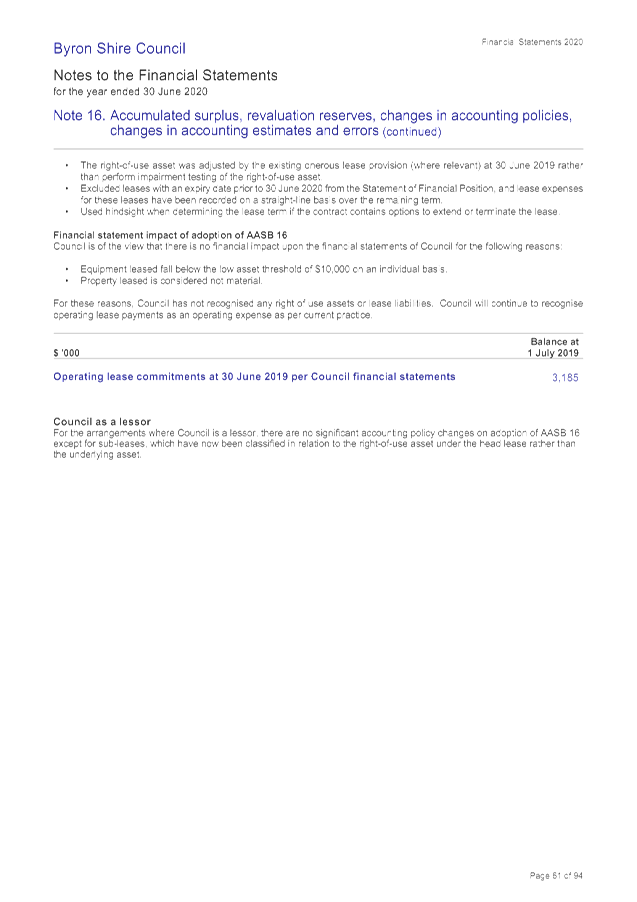

The 2019-2020 financial year has required Council to

implement the following new accounting standards:

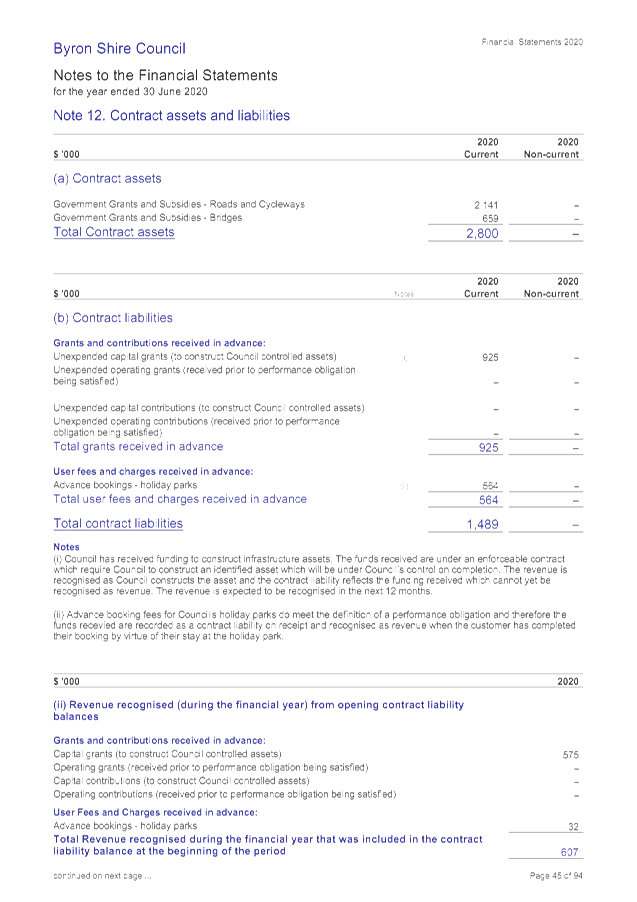

· AASB 15/AASB 1058

– Revenue from Contracts with Customers and Income of Not for Profit

Entities

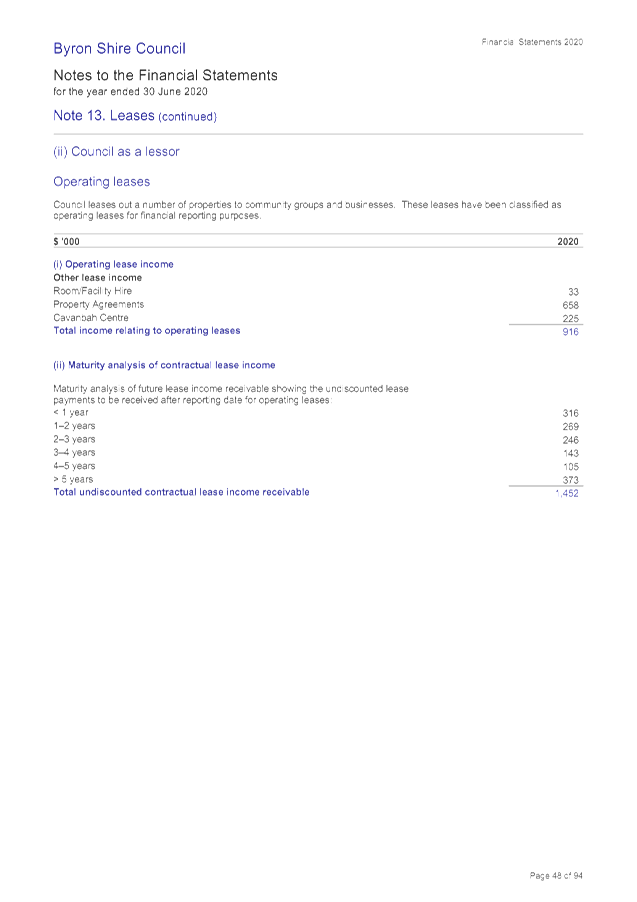

· AASB 16 –

Leases

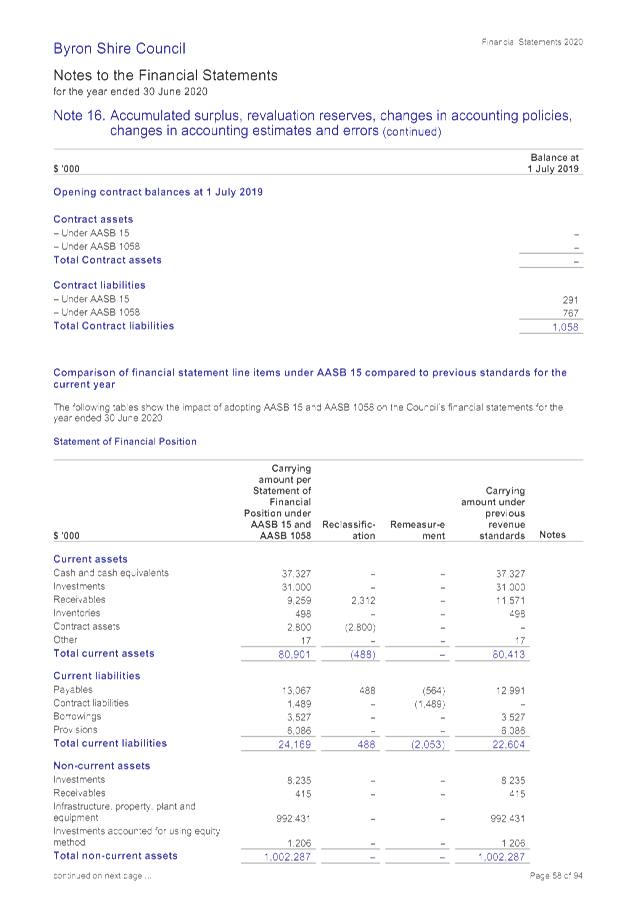

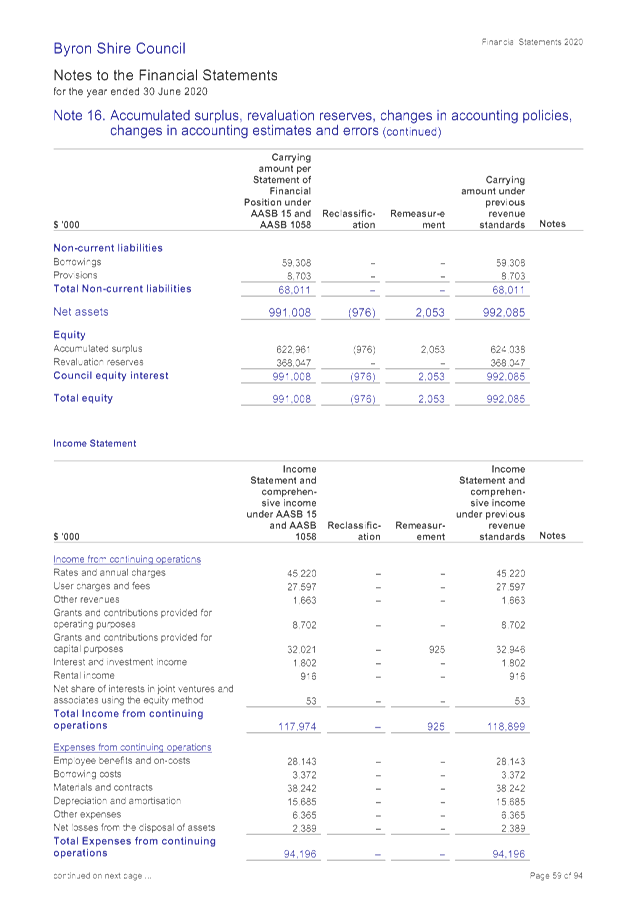

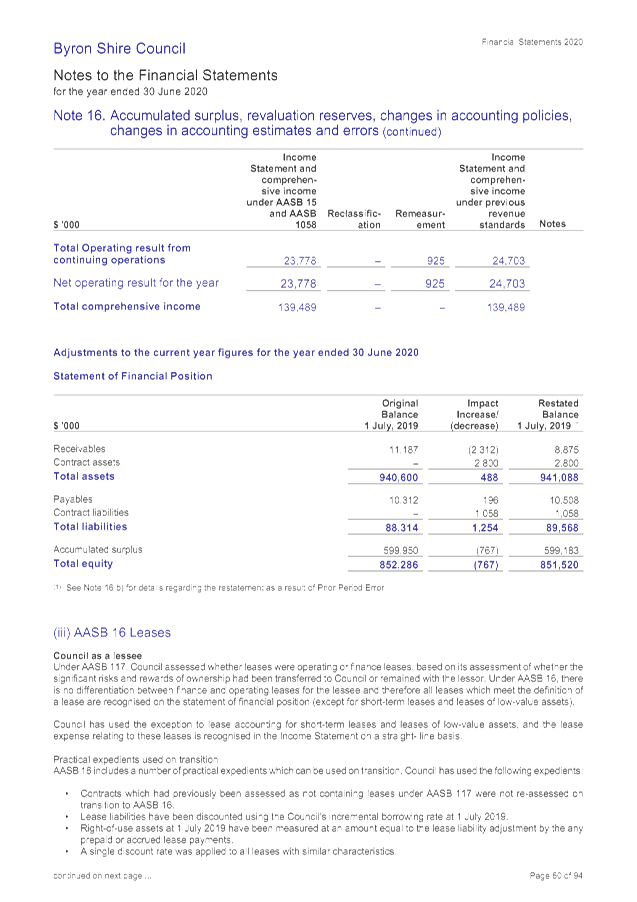

AASB15 and AASB 1058 have had the most impact on

Council’s reported results. Council now has to disclose rates received in

advance as a liability. Previously these were reported in receivables,

effectively reducing receivables outstanding. At 30 June 2020 Council has $488k

in prepaid rates which are now shown as a liability.

Council now also has to show advance bookings for its

holiday parks as a contract liability instead of a payment in advance. Whilst

ultimately still a liability, the change reflects the requirements of AASB15.

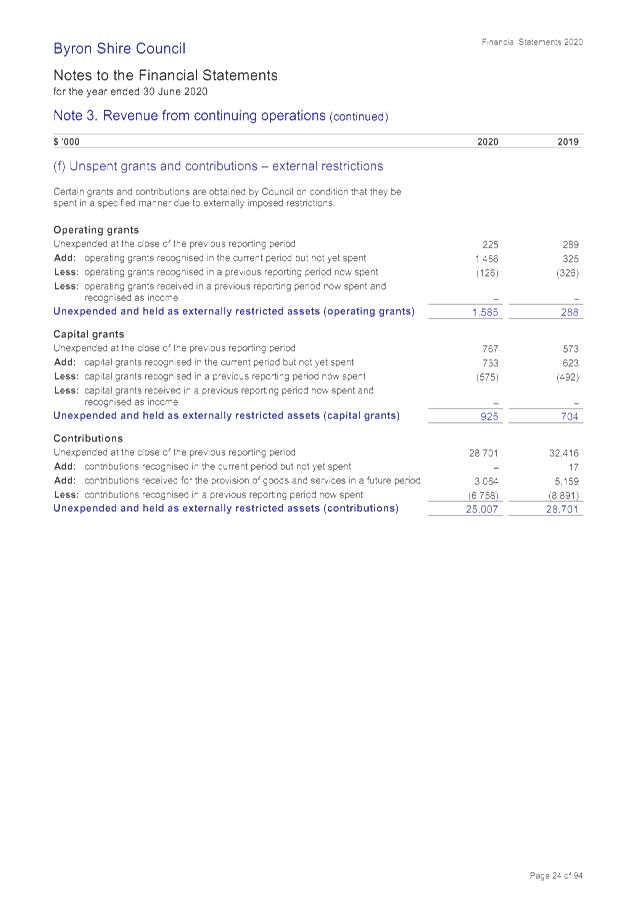

Council historically has recognised grant revenues as revenue when received.

The implications of AASB 15/AASB1058 now require revenue recognition when the

obligations of the grant have been performed. At 30 June 2020, Council has

$925k in unexpended capital grants now recognised as a contract liability.

Previously this would have been recognised as revenue.

Council is also now identifying and disclosing contract

assets at Note 12 of $2.8million relating to recognition of grant revenues

based off expenditure but not shown as a receivable at Note 8 as Council has

not yet reached the relevant milestone in the grant agreement in terms of

timing or performance that prevents these amounts being shown as

receivable. Once the milestone is reached the contract asset becomes a

receivable.

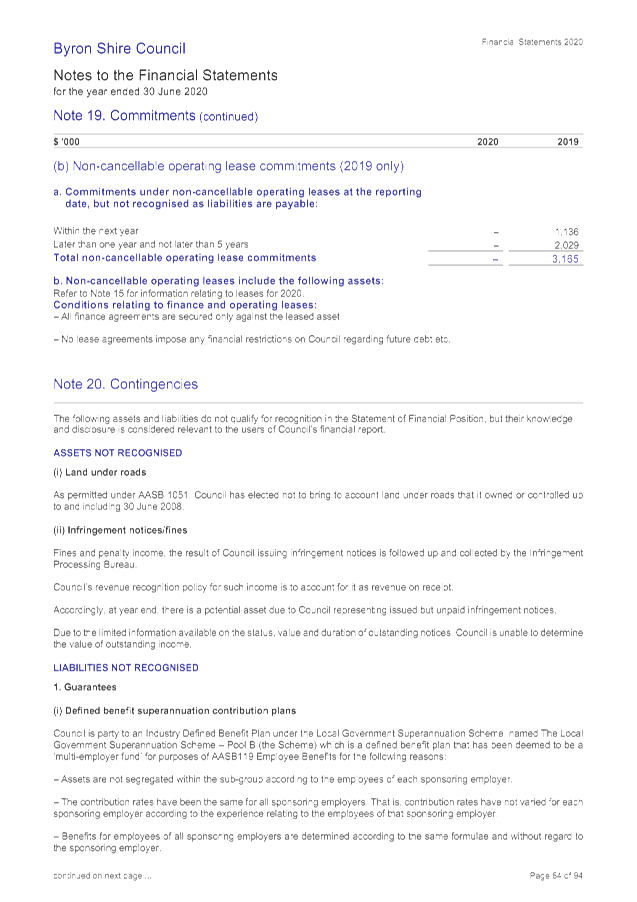

Council is of the view that the implications of AAASB 16

concerning leases have an immaterial impact and therefore Council does not have

any disclosure requirements.

The implementation of these new accounting standards does

not require restating the previous year comparative and therefore this is not

provided.

Liquidity

Council’s Statement of Financial Position (balance

sheet) indicates net current assets of $58.161million. It is on this basis, in

the opinion of the Responsible Accounting Officer, that the short term

financial position of Council remains in a satisfactory position and that

Council can be confident it can meet its payment obligations as and when they

fall due. That is, there is no uncertainty as to Council being considered a

‘going concern’. In addition, Council’s cash expense

cover ratio is at 8.76 months whereas the minimum benchmark is 3 months.

Council exceeds this benchmark by nearly three times.

Council’s Unrestricted Current Ratio has declined from

3.65 to 3.08, demonstrating Council has $3.08 in unrestricted current assets

compared to every $1.00 of unrestricted current liabilities. Whilst a

slight decline on the previous year, Council is exceeding this benchmark by

2.05 times.

On a longer term basis Council will need to consider its

financial position carefully. Nevertheless in isolation, the financial results

for 2019/2020 continue to present a ‘stable’ financial position

especially given the impacts of COVID-19. Every effort will be made to manage

the trend towards operational deficits before capital grants and

contributions. Furthermore, it will be a goal to endeavour to restore the

unrestricted cash balance back to $1million during the course of the 2020-2021

financial year.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.5

|

Manage

Council’s finances sustainably

|

5.5.2

|

Ensure the financial

integrity and sustainability of Council through effective planning and

reporting systems (SP)

|

5.5.2.2

|

Complete annual

statutory financial reports

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy

Considerations

Section 413(2)(c) of the Local Government Act 1993 and Regulation

215 of the Local Government (General) Regulation 2005 requires Council to

specifically form an opinion on the financial statements. Specifically

Council needs to sign off an opinion on the Financial Statements regarding

their preparation and content as follows:

In this regard the Financial Statements have been prepared

in accordance with:

· The Local Government Act

1993 (as amended) and the Regulations made thereunder.

· The Australian

Accounting Standards and professional pronouncements.

· The Local Government

Code of Accounting Practice and Financial Reporting.

And the content to the best of knowledge and belief:

· Presents fairly the

Council’s operating result and financial position for the year.

· Accords with

Council’s accounting and other records.

· Management is not aware

of any matter that would render the Financial Statements false or misleading in

any way.

Section 416(1) of the Local Government Act 1993, requires a

Council’s annual Financial Statements to be prepared and audited within

four (4) months of the end of that financial year i.e. on or before 31 October

2020. Due to the COVID-19 Pandemic, all Councils in NSW have been granted an

extra month ie on or before 30 November 2020 for the 2019/2020 financial year.

Section 417(4) of the Local

Government Act 1993 requires, as soon as practicable after completing the

audit, the Auditor must send a copy of the Auditor’s Reports to the

Departmental Chief Executive and to the Council.

Section 417(5) of the Local

Government Act 1993 requires Council, as soon as practicable after receiving

the Auditor’s Reports, to send a copy of the Auditor’s Reports on

the Council’s Financial Statements, together with a copy of the

Council’s audited Financial Statements, to the Departmental Chief Executive

before 7 November 2020. Due to the COVID-19 Pandemic, all Councils in NSW

have been granted an extra month ie on or before 7 December 2020 for the

2019/2020 financial year.

Section 418(1) of the Local Government Act 1993 requires

Council to fix a date for the Meeting at which it proposes to present its

audited Financial Statements, together with the Auditor’s Reports, to the

public, and must give public notice of the date so fixed. This

requirement must be completed within five weeks after Council has received the

Auditors Reports.

Financial Considerations

There are no direct financial implications associated with

this report as the report does not involve any future expenditure of Council

funds but is a report advising on Council’s draft financial outcomes

during the 2019/2020 financial year, which are identified in this report and

attachments. It is expected the financial outcomes in this report will

not change and the progress of the external audit that has been

undertaken. Council is expecting the financial statements to be signed

off by the NSW Audit Office on 27 November 2020.

Consultation and Engagement

Section 420 of the Local Government Act 1993 requires

Council to provide the opportunity for the public to submit submissions on the

Financial Statements. Submissions are to be submitted within seven days

of the Financial Statements being presented to the public. In the case of

the 2019/2020 Financial Statements, the closing date for submissions is

expected to be 24 December 2020.

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.