Extraordinary Audit, Risk and Improvement Committee Meeting

An Extraordinary Audit, Risk and Improvement Committee

Meeting of Byron Shire Council will be held as follows:

|

Venue

|

Conference Room, Station Street, Mullumbimby

|

|

Date

|

Thursday, 21 October 2021

|

|

Time

|

2.00pm

|

Vanessa Adams

Director Corporate and

Community Services

I2021/1645

Distributed

14/10/21

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Code of Conduct for Councillors (eg. A friendship, membership of an

association, society or trade union or involvement or interest in an activity

and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to

a development application, an environmental planning instrument, a development

control plan or a development contribution plan under that Act, but

(b) not including the making of an

order under that Act.

(2) The general manager is required

to keep a register containing, for each planning decision made at a meeting of

the council or a council committee, the names of the councillors who supported

the decision and the names of any councillors who opposed (or are taken to have

opposed) the decision.

(3) For the purpose of maintaining

the register, a division is required to be called whenever a motion for a

planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the

register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a meeting

that is closed to the public.

BUSINESS OF MEETING

1. Apologies

2. Declarations

of Interest – Pecuniary and Non-Pecuniary

3. Adoption of Minutes from

Previous Meetings

3.1 Adoption

of Minutes from Audit, Risk, and Improvement Committeee meeting of 19 August

2021.................................................................................................................... 5

4. Staff Reports

Corporate and Community

Services

4.1 Proposed

ARIC Work Plan for 2022......................................................................... 19

4.2 Office

of Local Government - Risk Management and Internal Audit for Local Councils in

NSW: Guidelines...................................................................................................... 25

4.3 Draft

2020/2021 Financial Statements................................................................... 152

Adoption of Minutes from Previous Meetings 3.1

Adoption of Minutes from Previous Meetings

Report No. 3.1 Adoption of Minutes from Audit, Risk, and Improvement

Committeee meeting of 19 August 2021

Directorate: Corporate and Community Services

Report Author: Alexandra

Keen, Audit, Risk & Improvement Coordinator

File No: I2021/1452

RECOMMENDATION:

That the minutes of the Audit, Risk and Improvement

Committee Meeting held on 19 August 2021 be confirmed.

Attachments:

1 Minutes

of ARIC meeting 19 August 2021, i2021/1313

, page 9⇩

Report

The attachment to this report provides the minutes of the

Audit, Risk and Improvement Committee Meeting of 19 August 2021 .

Report to Council

The minutes were reported to Council on Comments

In accordance with the Committee Recommendations, Council

resolved the following:

|

21-390

|

Resolved that Council notes the minutes of the Audit, Risk

and Improvement Committee Meeting held on 19 August 2021 at Attachment 1

(I2021/1313).

|

|

21-391

|

Resolved that Council adopts the following Committee Recommendation:

Committee Recommendation 3.1.1

That the minutes of the Audit,

Risk and Improvement Committee Meeting held on 20 May 2021 be confirmed.

|

|

21-392

|

Resolved that

Council adopts the following Committee Recommendation:

Report No.

4.2 NSW Auditor-General Annual Work Program 2021-2024

File No: I2021/1292

Committee Recommendation 4.2.1

That ARIC note the NSW

Auditor-General’s Annual Work Program for 2021-2024 (#e2021/100974).

|

|

21-393

|

Resolved that

Council adopts the following Committee Recommendation:

Report No.

4.4 Delivery Program 6-monthly Report and 2020/21 Operational Q4 Report - to

20 June 2021

File No: I2021/1234

Committee Recommendation 4.4.1

That the Audit, Risk, and Improvement

Committee notes the Delivery Program 6-monthly Report and 2020/21 Operational

Plan Fourth Quarter Report for the period ending 30 June 2021 (#E2021/97874).

|

|

21-394

|

Resolved that Council adopts the following Committee Recommendation:

Report No. 4.5 AASB1059 - Service Concession

Arrangements: Grantors

File No:

I2021/1241

Committee

Recommendation 4.5.1

That the Audit,

Risk and Improvement Committee consider the requirements of AASB1059 Service

Concession Arrangements: Grantors and concur with the view that the

requirements of AASB 1059 have no application to Byron Shire Council and therefore

no disclosure obligations in the financial statements.

|

|

21-395

|

Resolved that

Council adopts the following Committee Recommendation:

Report No.

5.1 Internal Audit Report - June 2020-21

File No: I2021/1192

Committee

Recommendation 5.1.1

That the Audit, Risk and

Improvement Committee:

1. Notes

the Internal Audit Status Report – June 2021 (#E2021/95033)

2. Endorses

the recommendations from the Executive Team to close off 10 recommendations

in Appendices A and B of the Internal Audit Status Report (#E2021/95033)

2. Requests

management to implement the recommendations made in

the

Internal Audit of Procurement (Tendering) – June 2021 (#E2021/76376)

|

|

21-396

|

Resolved that

Council adopts the following Committee Recommendation:

Report No.

5.2 Internal Audit Plan 2021-2024

File No: I2021/1096

Committee Recommendation 5.2.1

That the Committee endorses the

Internal Audit Plan for 2021 - 2024 (#E2021/97611) for approval by Council.

|

|

21-397

|

Resolved that

Council adopts the following Committee Recommendation:

Report No.

5.3 Risk Management Update

File No: I2021/1097

Committee Recommendation 5.3.1

That the Audit, Risk and Improvement

Committee notes the strategic and operational risk reports for the quarter

ending 30 June 2021 (#E2021/88532).

|

|

21-398

|

Resolved that

Council adopts the following Committee Recommendation:

Report No.

5.4 2020-2021 Continuous Improvement Pathway Program

File No: I2021/1106

Committee Recommendation 5.4.1

That Audit Risk and Improvement

Committee notes the results of the CIP 2020-2021 workbook (#E2021/86609).

|

|

21-399

|

Resolved that

Council adopts the following Committee Recommendations:

Report

No. 5.5 Cyber Security and System Outages Quarterly Update

File No: I2021/1196

Committee Recommendation

5.5.1

That the Audit Risk and Improvement Committee:

1. Notes

the report and attached security reports:

a) ARIC Security Incident

Report 2021 Q2. (#E2021/95614)

b) ARIC Incident Outage

Report 2021 Q2. (#E2021/95613)

2. Receives

ongoing cyber security and system outage status reports.

|

|

21-400

|

Resolved that

Council adopts the following Committee Recommendation:

Report

No. 5.6 External Audit Actions Quarter 4 2020-2021 Update

File No: I2021/1246

Committee Recommendation 5.6.1

That the Audit, Risk and Improvement

Committee notes the external audit update (including the closure of four

issues) for the quarter ending 30 June 2021 (#E2021/100193).

|

Adoption

of Minutes from Previous Meetings 3.1 - Attachment 1

Staff Reports - Corporate and Community Services 4.1

Staff Reports - Corporate and Community

Services

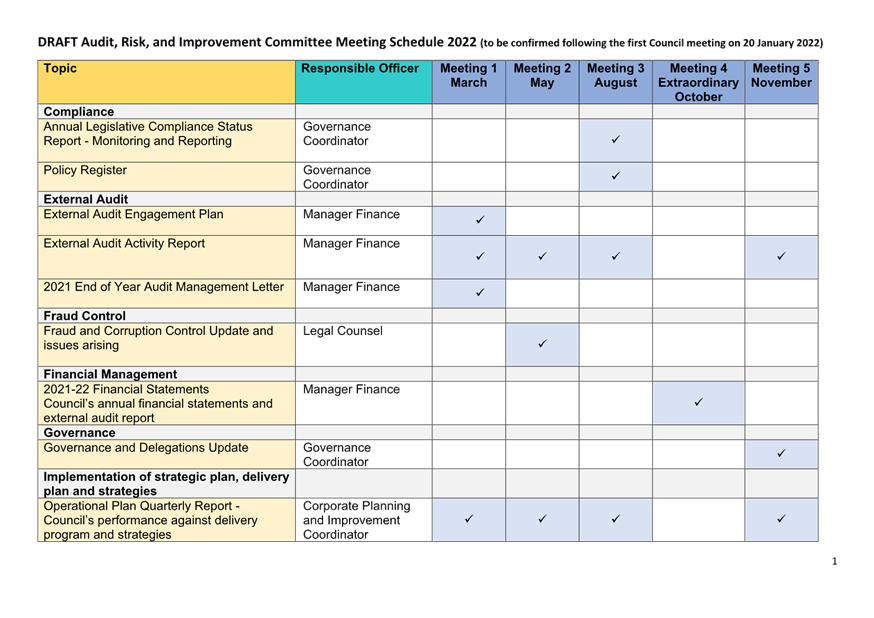

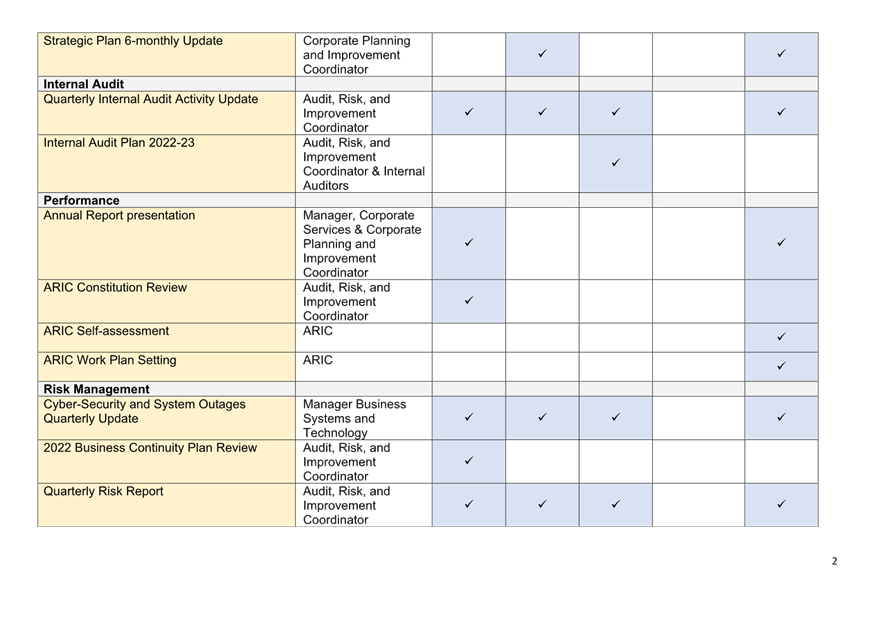

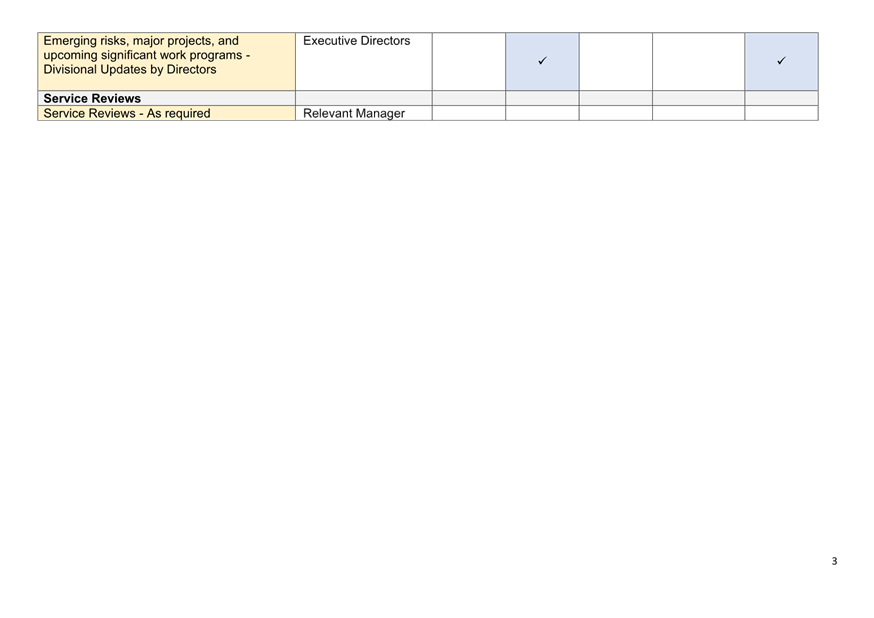

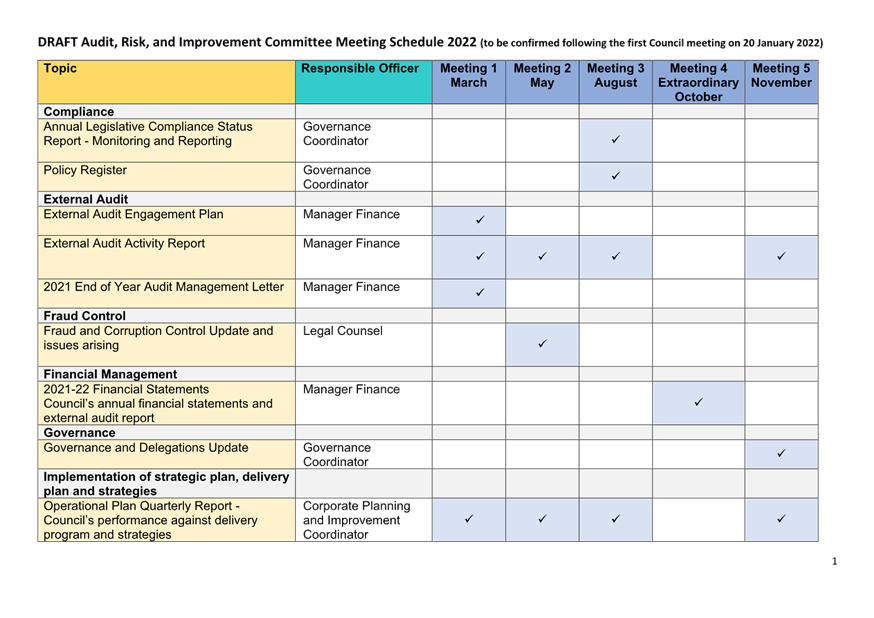

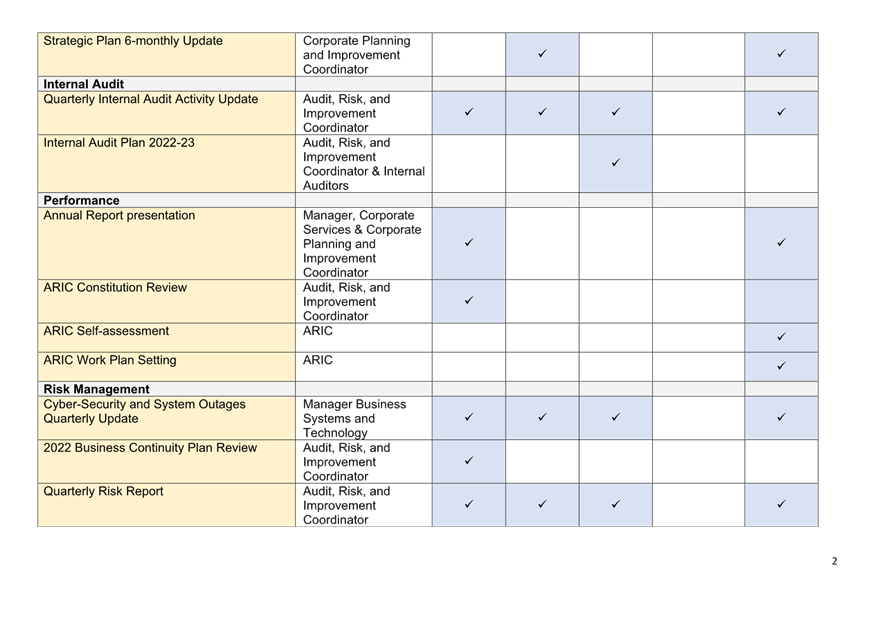

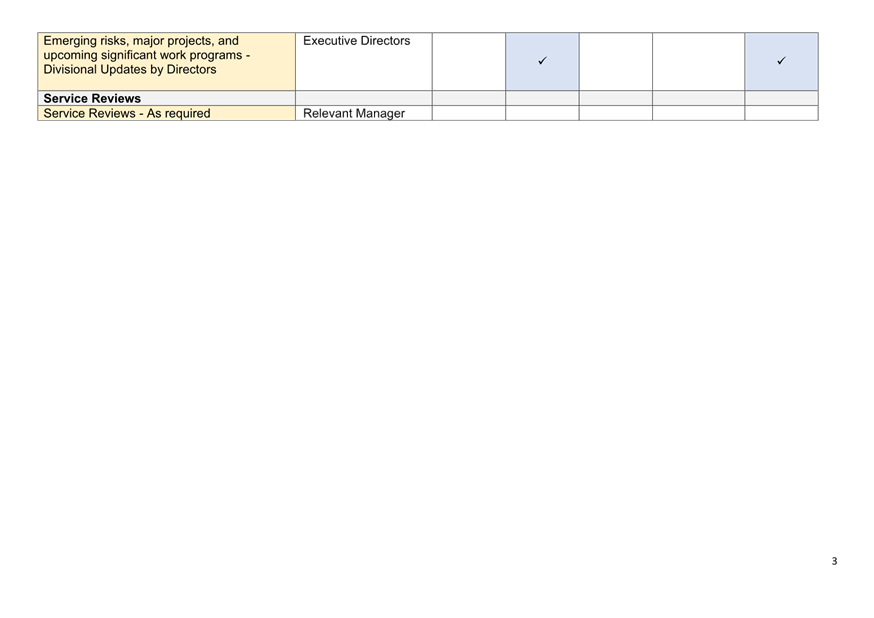

Report No. 4.1 Proposed

ARIC Work Plan for 2022

Directorate: Corporate

and Community Services

Report Author: Alexandra

Keen, Audit, Risk & Improvement Coordinator

File No: I2021/1578

Summary:

A proposed Audit, Risk, and Improvement Committee (ARIC) Work

Plan has been prepared for 2022 for ARIC’s consideration and approval.

RECOMMENDATION:

That the Audit, Risk and Improvement Committee

approve the draft Audit Risk and Improvement Committee Work Plan for 2022 at

Attachment 1 (E2021/120219).

Attachments:

1 Draft

ARIC Work Plan 2022, E2021/120219

, page 22⇩

Report

A draft Work Plan for 2022 (Work

Plan) has been prepared at Attachment 1 to assist in guiding the Audit, Risk,

and Improvement Committee (ARIC) deliberations for 2022.

The Work Plan provides for a

minimum of four meetings per year (as per the Constitutional requirements of

ARIC) and has allocated reports and updates to be provided to the ARIC at each

meeting. A fifth, extraordinary, meeting has been proposed in order for ARIC to

consider and review the externally audited financial reports which Council has

experienced delays in receiving in the past.

The preparation and review by ARIC of the Work Plan

addresses the request of ARIC members raised at the ARIC meeting of 19

August 2021.

Due to the timing of the Local Government elections

occurring on 4 December 2021, and the need to reconvene the ARIC with new

membership, it is expected the first ARIC meeting for 2022 will be held in

March.

Key issues

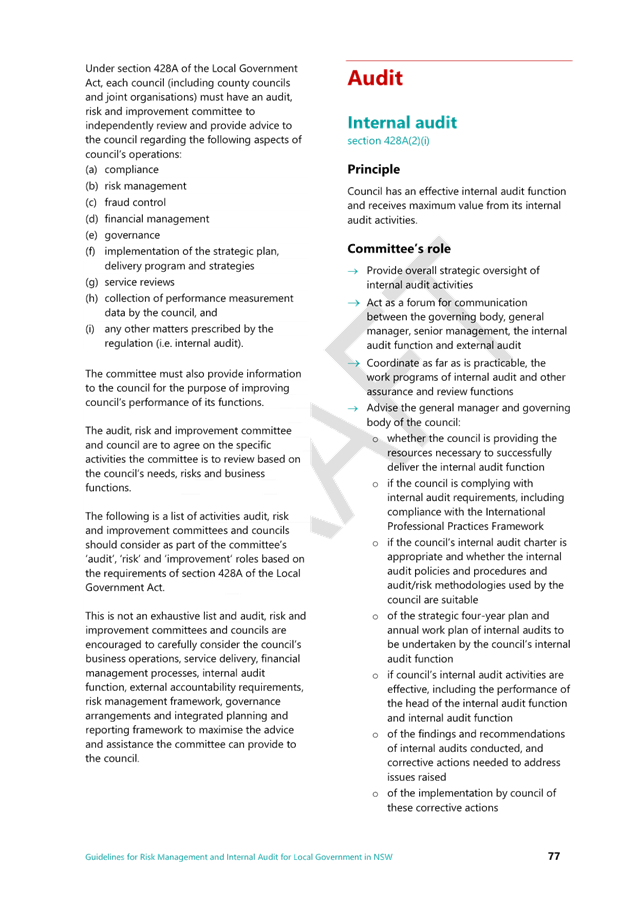

The Work Plan has been prepared to meet the minimum topics

within ARIC’s remit in accordance with s428A(2) of the Local

Government Act 1993, which is expected to commence by June 2022, being:

The

Committee must keep under review the following aspects of the council’s

operations—

(a) compliance,

(b) risk

management,

(c) fraud

control,

(d) financial

management,

(e) governance,

(f) implementation

of the strategic plan, delivery program and strategies,

(g) service

reviews,

(h) collection

of performance measurement data by the council,

(i) any

other matters prescribed by the regulations.

(3) The Committee

is also to provide information to the council for the purpose of improving the

council’s performance of its functions.

Next steps

ARIC to consider the Work Plan and advise of any proposed

amendments. The Work Plan will then be used by ARIC and Council staff to guide

their work and reporting timeframes for 2022.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.6:

Manage Council’s resources sustainably

|

5.6.7:

Develop and embed a proactive risk management culture

|

5.6.7.4

|

Coordinate

the Audit Risk and Improvement program

|

Consultation

and Engagement

· Manager Finance

· Governance

Coordinator

· Manager Corporate

Services

· Corporate Planning

and Improvement Coordinator.

Staff

Reports - Corporate and Community Services 4.1 - Attachment 1

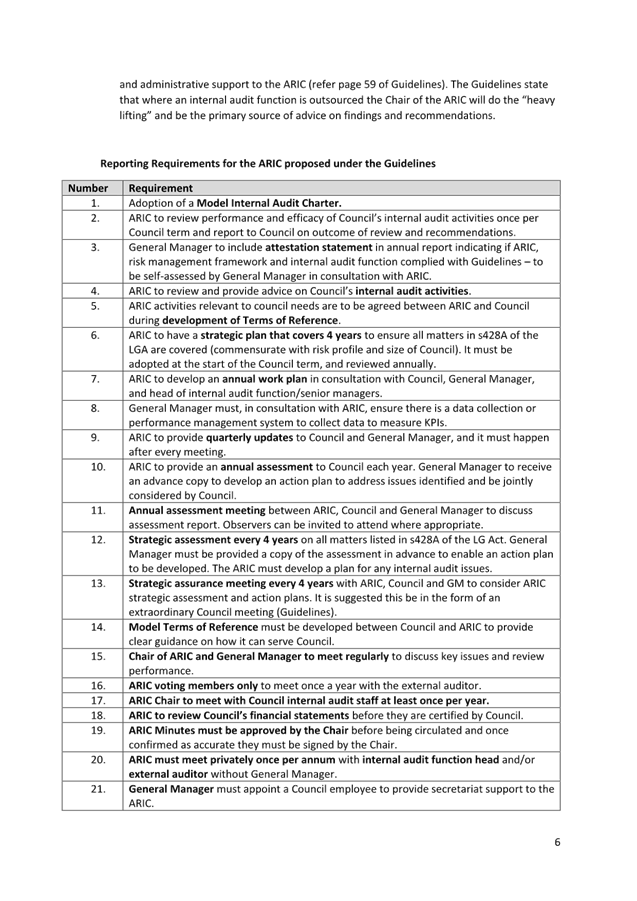

Staff Reports - Corporate and Community Services 4.2

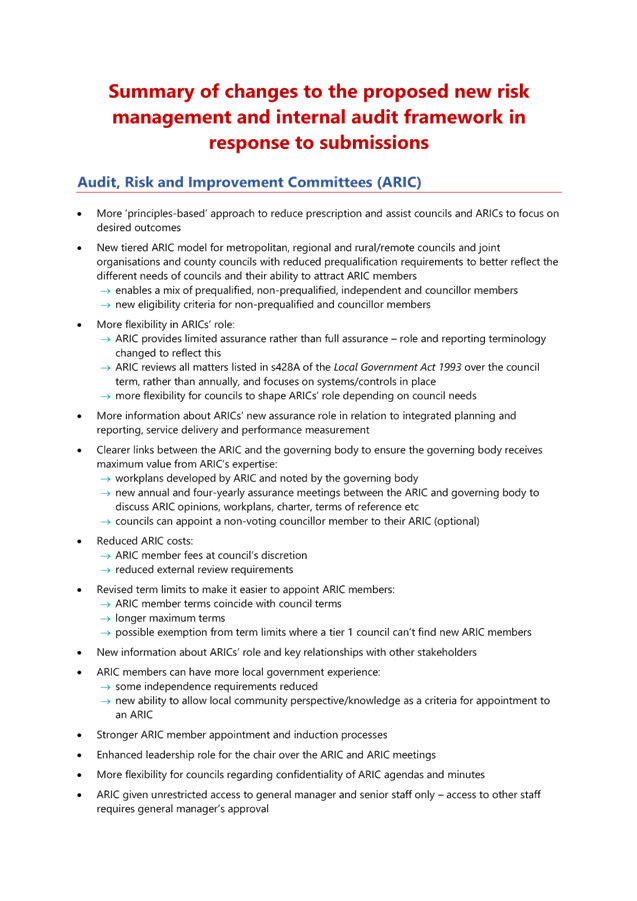

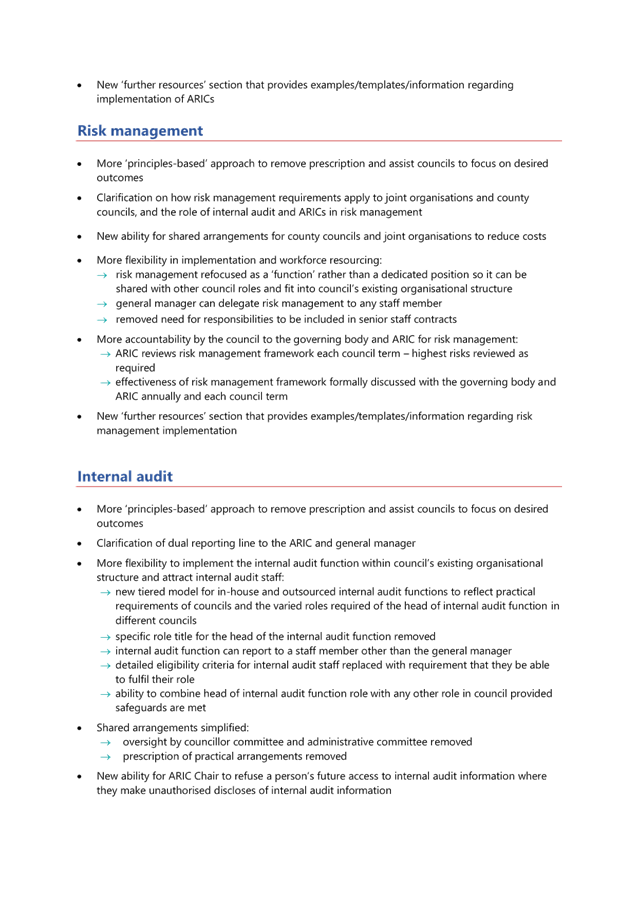

Report

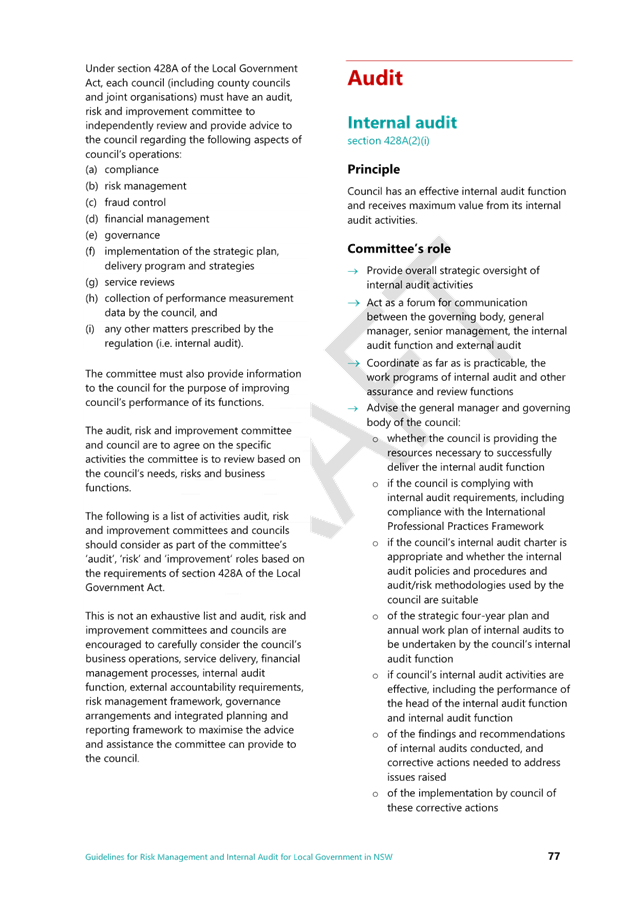

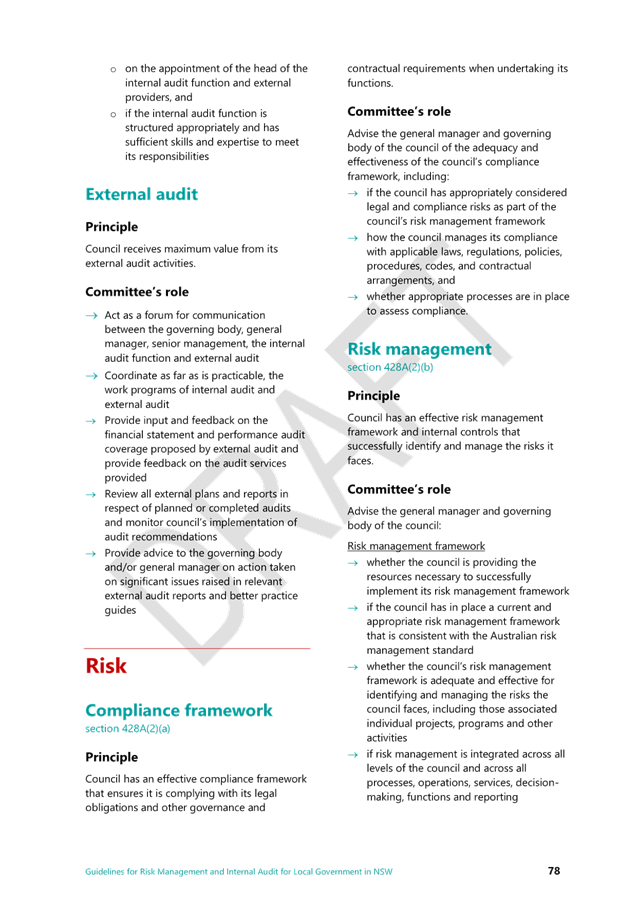

No. 4.2 Office of Local

Government - Risk Management and Internal Audit for Local Councils in NSW:

Guidelines

Directorate: Corporate

and Community Services

Report Author: Alexandra

Keen, Audit, Risk & Improvement Coordinator

File No: I2021/1451

Summary:

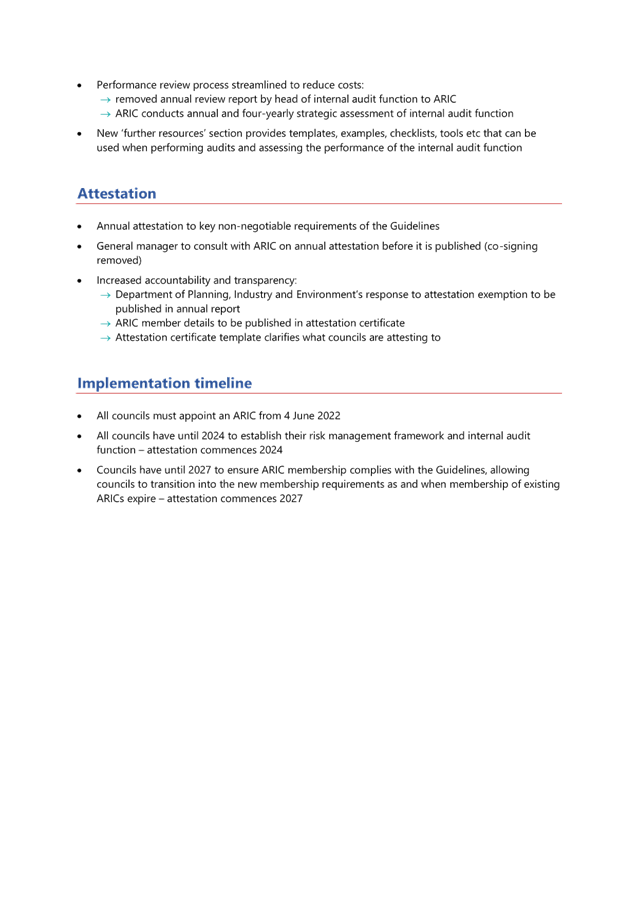

This report provides options for the Audit, Risk and

Improvement Committee to consider with respect to making a submission to the

Office for Local Government on the draft Risk Management and Internal Audit

for Local Councils in NSW: Guidelines.

RECOMMENDATION:

That the

Audit, Risk and Improvement Committee approves:

i) the

drafting of a submission to the Office of the Local Government on the Draft

Risk Management and Internal Audit for Local Councils in NSW - Guidelines

on behalf of Byron Shire Council, based on the matters at Attachment 3

(E2021/115947)

ii) the

consideration of the draft submission at the next Audit, Risk, and Improvement

Committee meeting on 11 November 2021 prior to going to Council for endorsement

on 25 November 2021.

Attachments:

1 Draft

Risk Management and Internal Audit Framework for Local Councils in NSW:

Guidelines, e2021/112230 , page 29⇩

2 Summary

Guide of the Discussion Paper, E2021/112229

, page 142⇩

3 Proposed

issues for inclusion in a submission to the Office for Local Government, E2021/115947 ,

page 145⇩

Report

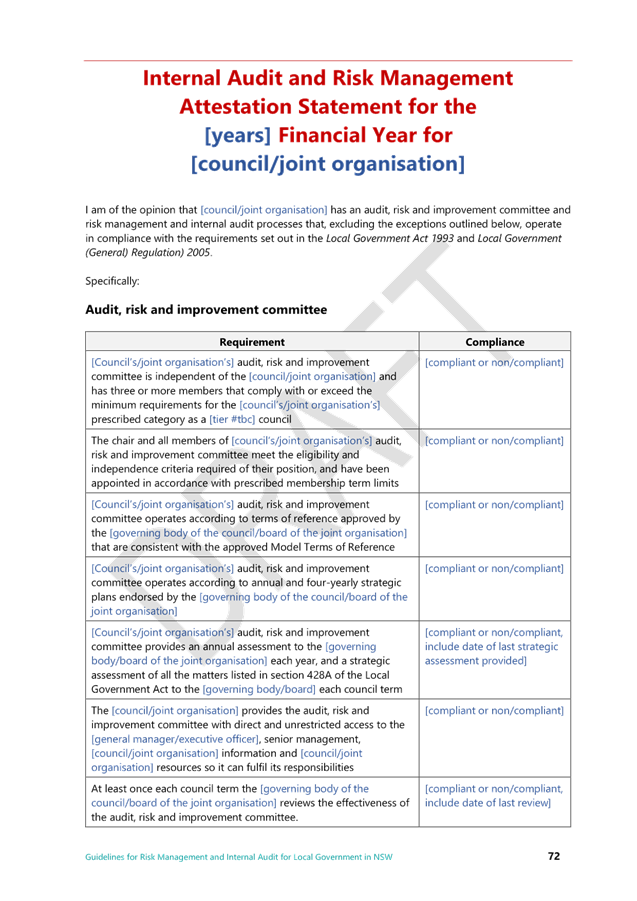

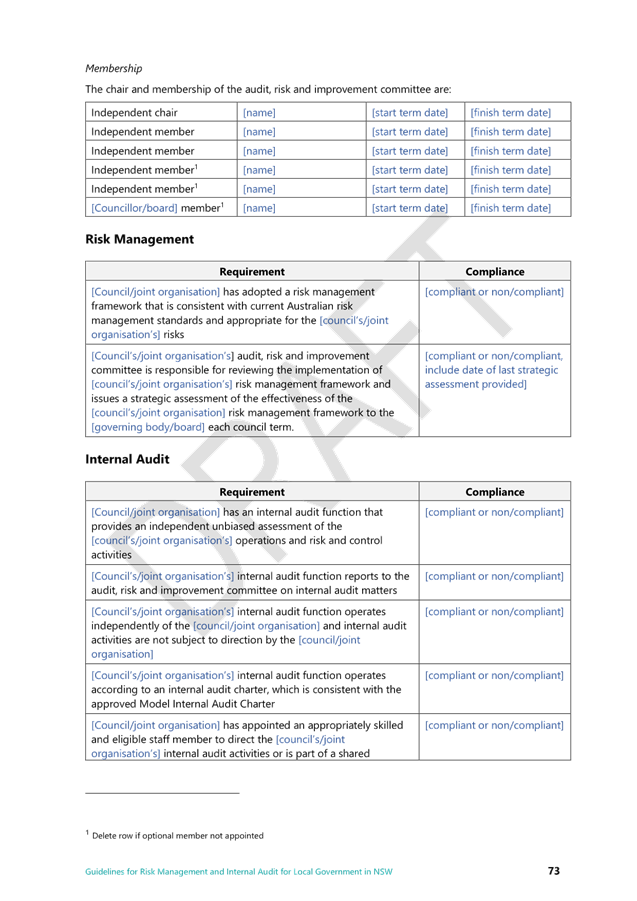

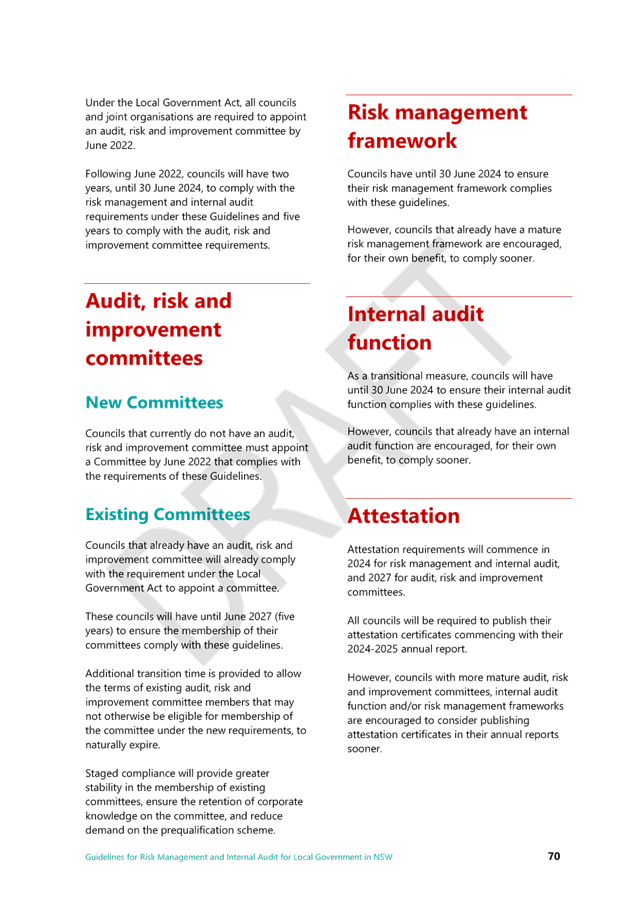

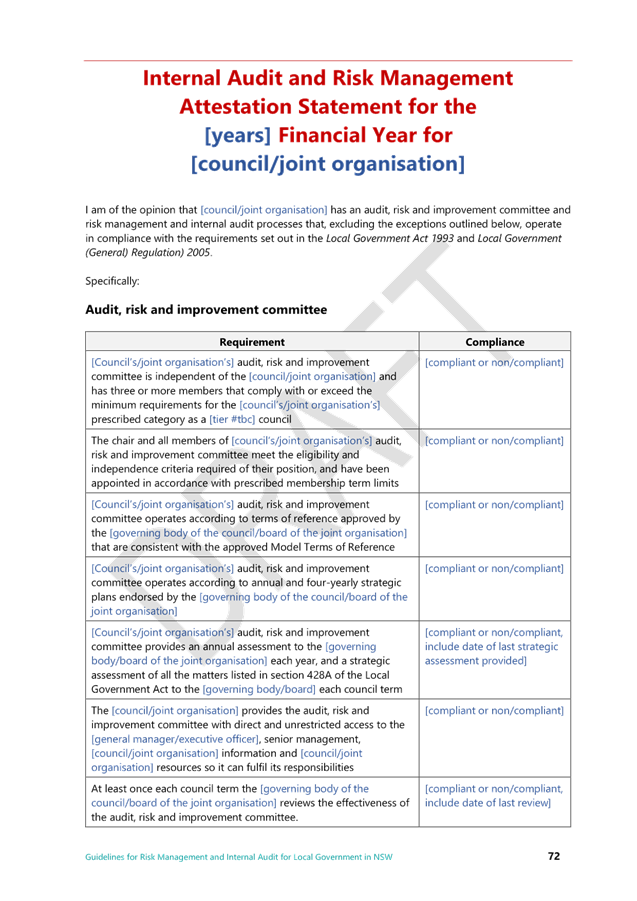

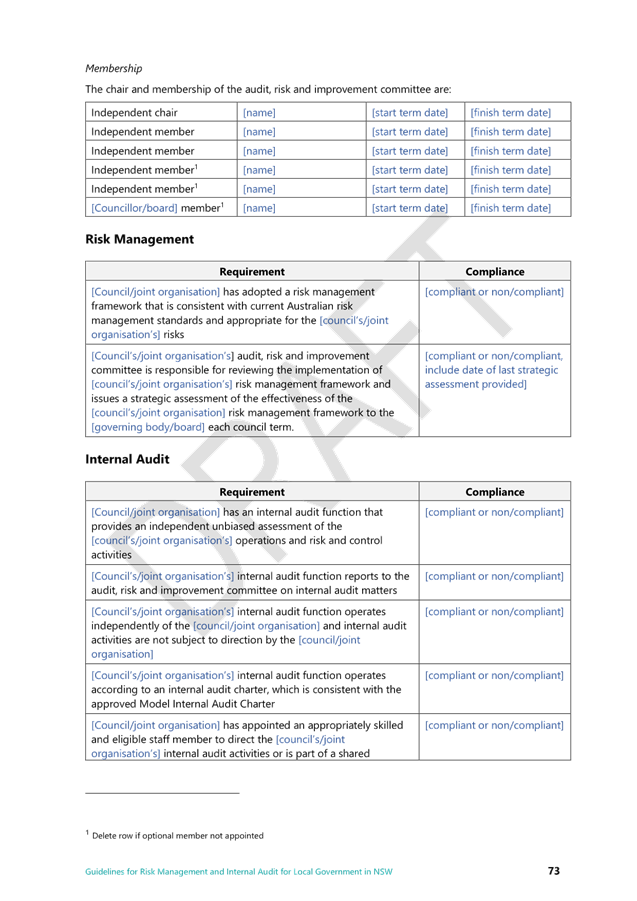

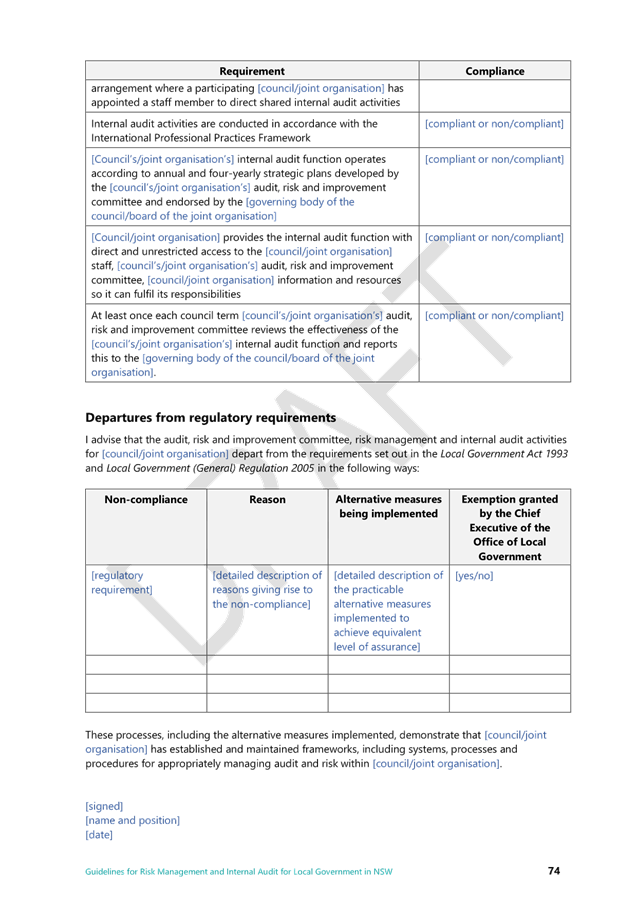

The Office of Local Government

(OLG) issued the third draft of the Risk Management and Internal Audit for

Local Councils in NSW: Guidelines (the Guidelines) (refer Attachment 1) on

24 August 2021. The Guidelines are out for consultation and feedback until

close of business 26 November 2021. The Guidelines will form part of the Local

Government Act Regulations pursuant to section 428A of the Local

Government Act 1993. The summary document which accompanied the Guidelines

is at Attachment 2. Both documents were circulated to ARIC members via email on

30 August 2021.

The OLG advises that it is

expected the Guidelines will be proclaimed for commencement by June 2022.

Key issues

The Guidelines set out a new

framework for local councils in NSW for internal audit, risk management, and

the establishment of Audit, Risk, Improvement Committees (ARIC). The intent

appears to be to ensure there is greater oversight, consistency, and process

around these core functions. The Guidelines propose a staged approach to the

implementation of key requirements by councils, namely:

· 4 June 2022 –

establish an ARIC

· 30 June 2024 –

adoption of risk management framework and internal audit functions

· June 2027 – ARIC

compliance with membership and reporting requirements

It should be noted that Byron

Shire Council currently broadly complies with several of the proposed

requirements including for example having an ARIC, a risk management framework,

and internal audit functions. There are a number of specific processes and

requirements which will need to be implemented by Council over the next six

years to ensure full compliance with the Guidelines.

Options

There are several options

available to Council and ARIC with respect to the Guidelines:

Option

1: Prepare a submission to the OLG to

raise key issues or concerns in respect of the Guidelines based on suggestions

at Attachment 3. This is the recommended option.

Option

2: Accept the Guidelines as currently

drafted, and not provide a submission.

Option

3: Reject the Guidelines as currently

drafted and provide a submission to this effect.

Next steps

A draft submission to the OLG will

be presented to the ARIC meeting of 11 November 2021, with a view to

providing the submission to Council for endorsement at its meeting of 25

November 2021.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.6:

Manage Council’s resources sustainably

|

5.6.7:

Develop and embed a proactive risk management culture

|

5.6.7.4

|

Coordinate

the Audit Risk and Improvement program

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.6:

Manage Council’s resources sustainably

|

5.6.7:

Develop and embed a proactive risk management culture

|

5.6.7.1

|

Evaluate

and improve risk management framework

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.6:

Manage Council’s resources sustainably

|

5.6.7:

Develop and embed a proactive risk management culture

|

5.6.7.2

|

Implement

training and development program to improve the risk management culture in

the organisation

|

Financial Considerations

The Guidelines in their current form have the potential to

impose a significant increase in financial costs to Council associated with

member fees, resourcing of the ARIC (including the requirement for a budget or

process to obtain external expertise when required), and to meet increased

reporting requirements.

Consultation and

Engagement

The Audit, Risk and Improvement Coordinator canvassed the

views of other Northern Rivers Councils at the Northern Rivers Risk Management

Group (NRRMG) meeting on 21 September 2021.

Most member councils had not had sufficient opportunity to

digest the changes to the Guidelines, however, Rous County Council indicated it

would be providing a submission which would likely focus on the practical

application of the Guidelines, rather than seeking changes.

Internal consultation has occurred with the Executive Team

and Manager Corporate Services who are supportive of tabling the list of

potential issues (Attachment 3) at this ARIC meeting for further consideration.

Staff

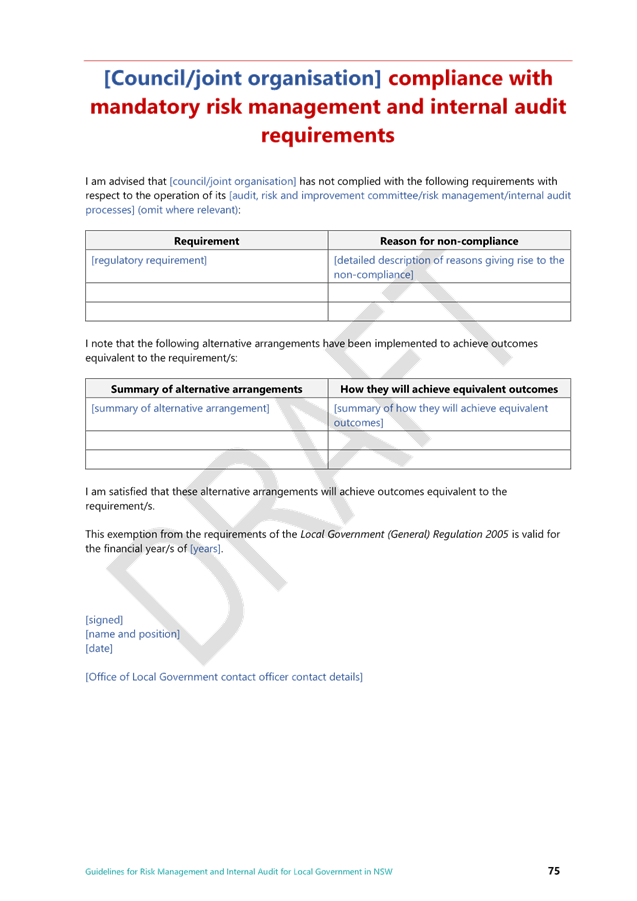

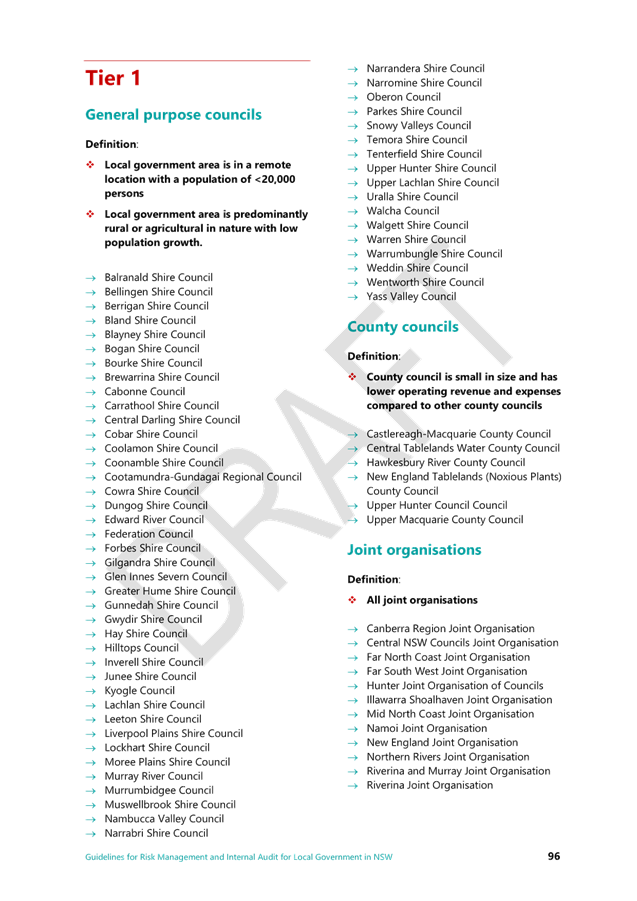

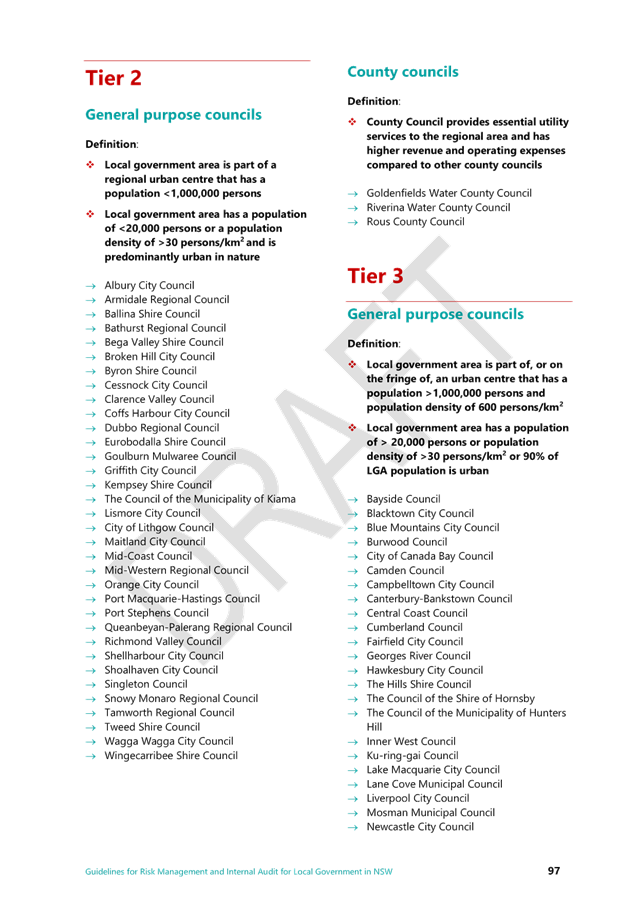

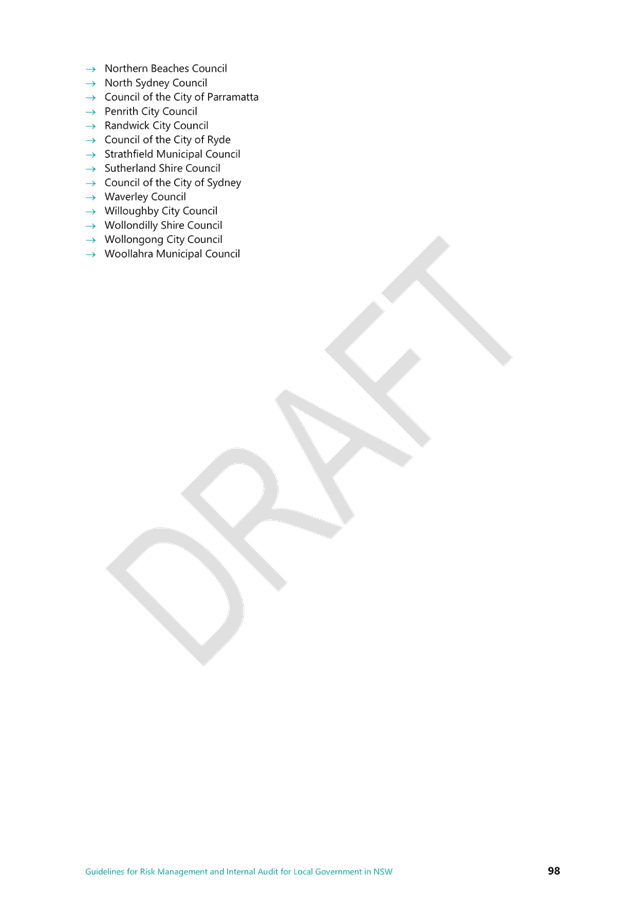

Reports - Corporate and Community Services 4.2 - Attachment 1

Staff

Reports - Corporate and Community Services 4.2 - Attachment 2

Staff

Reports - Corporate and Community Services 4.2 - Attachment 3

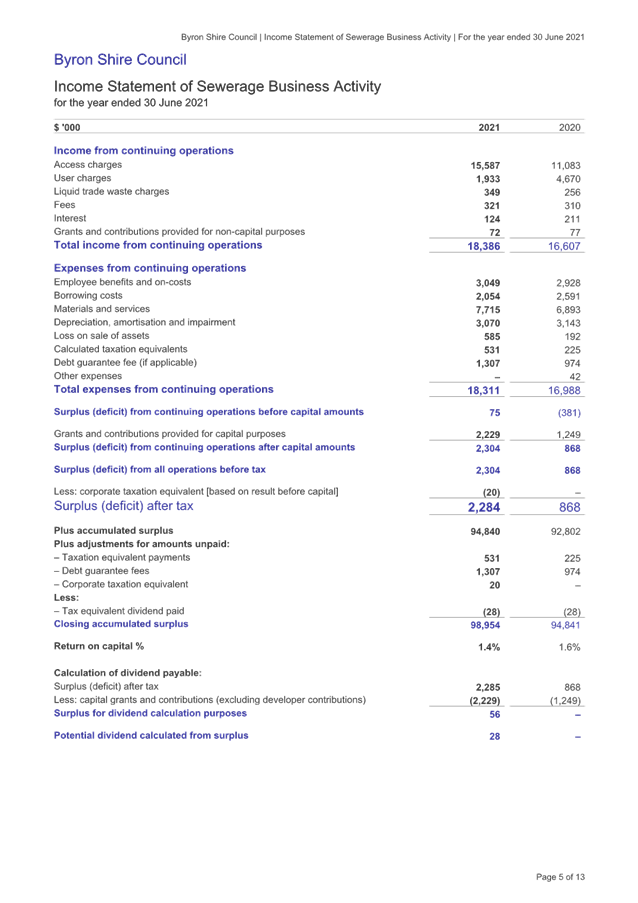

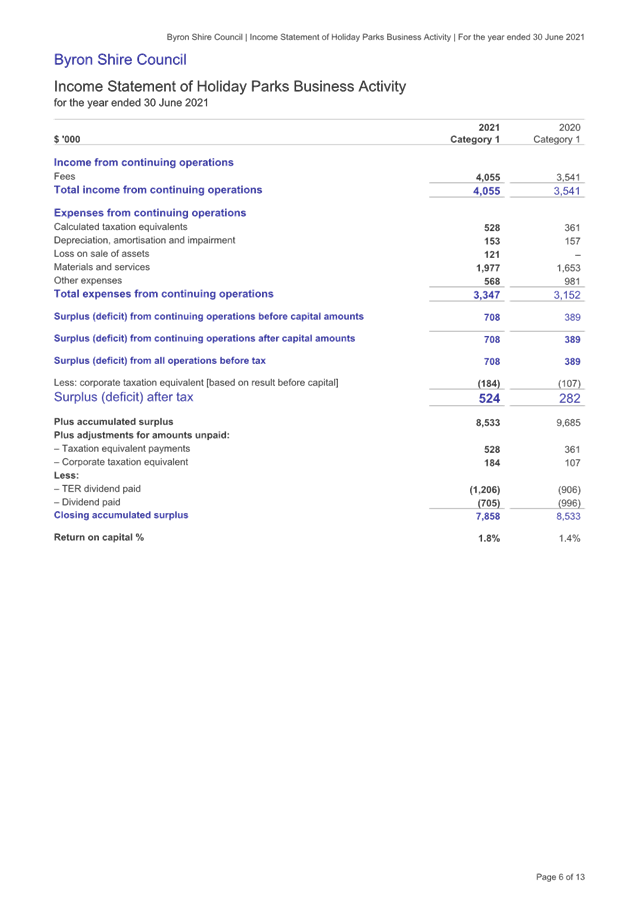

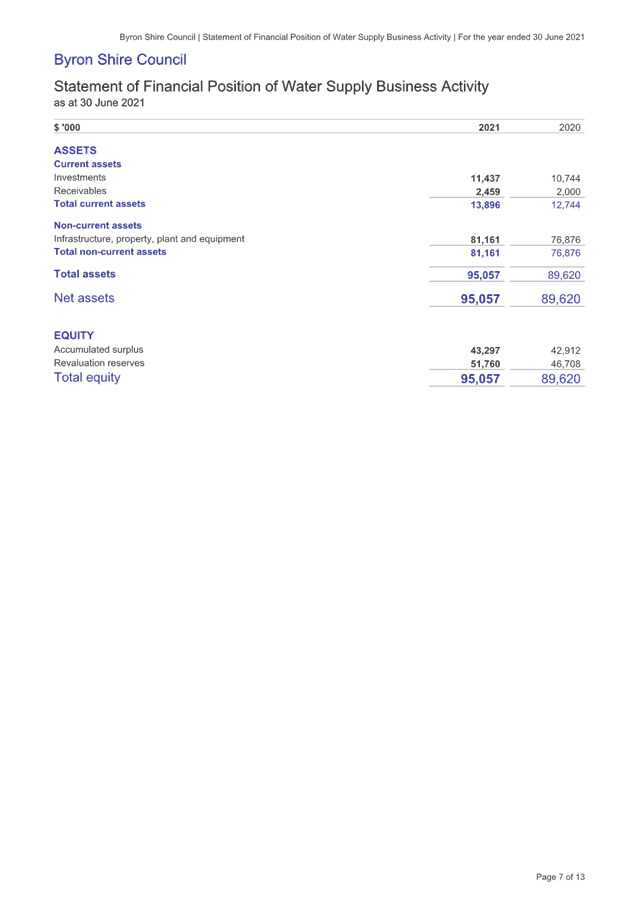

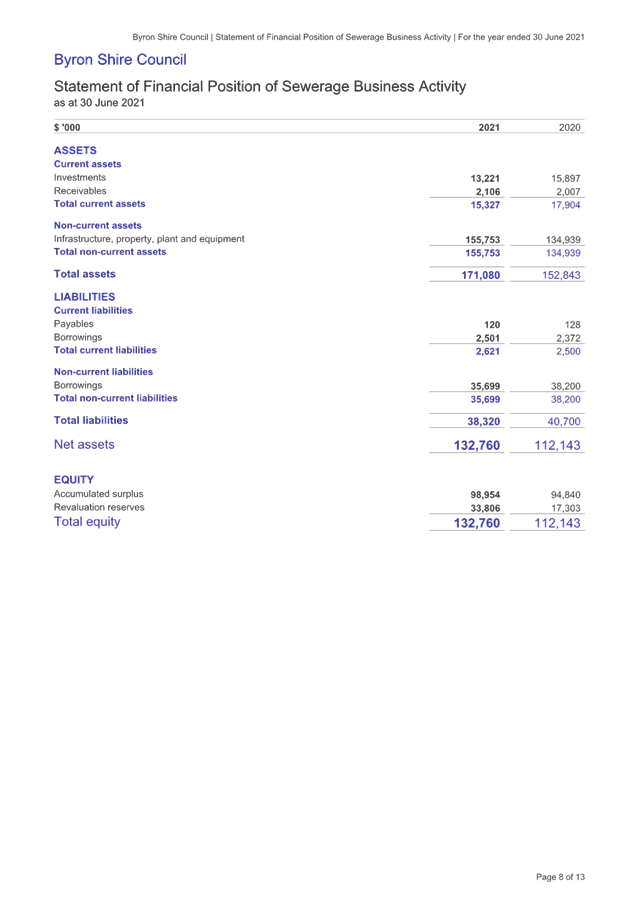

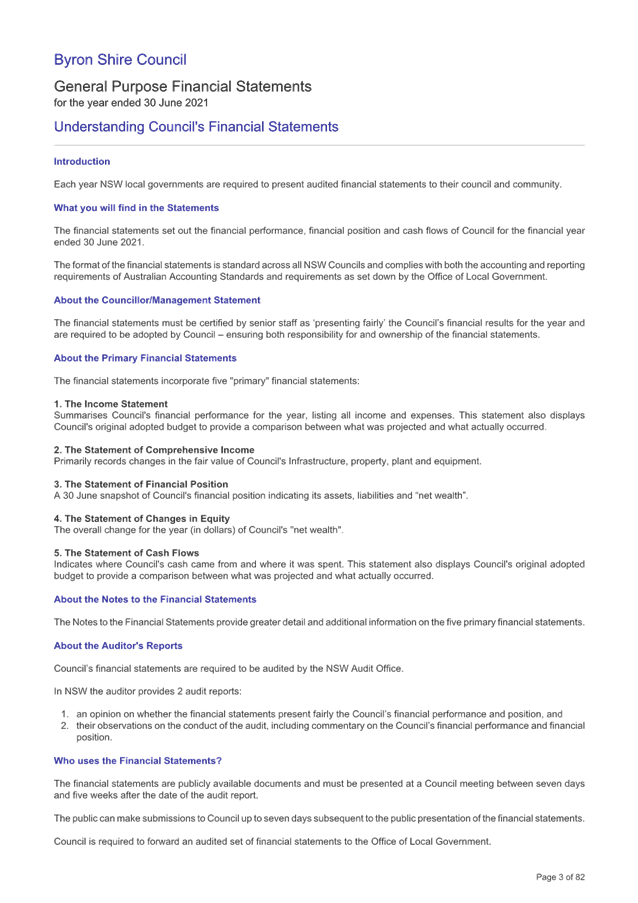

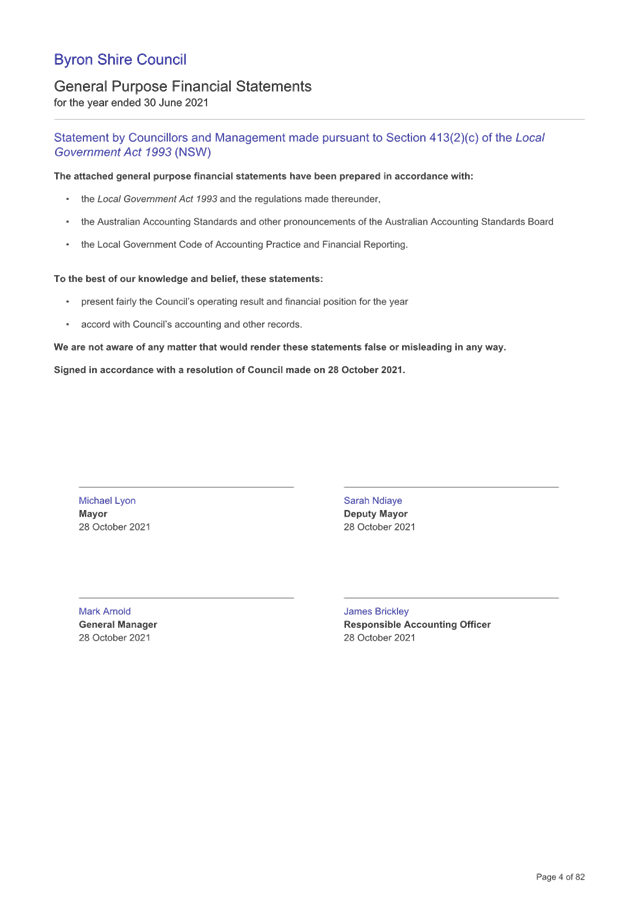

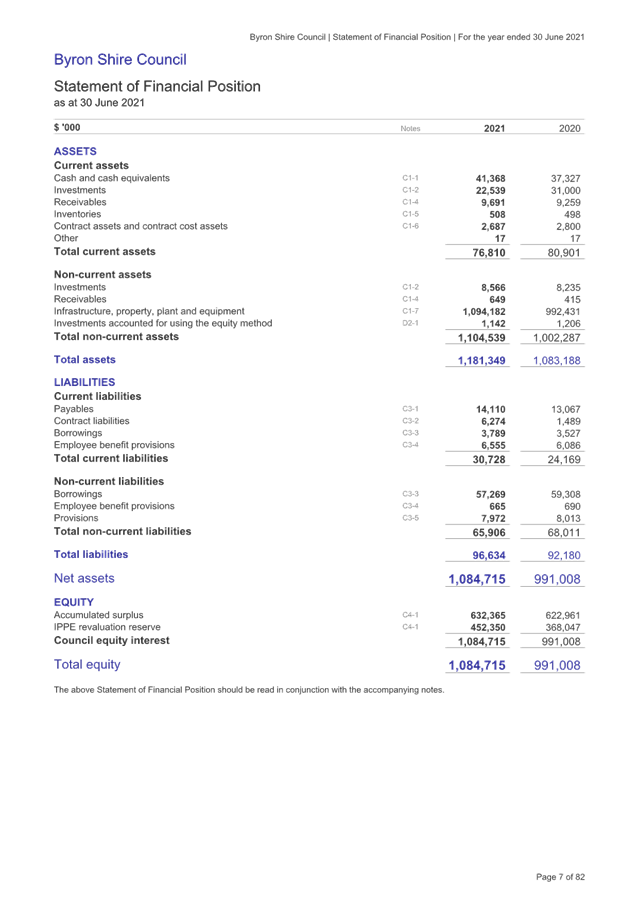

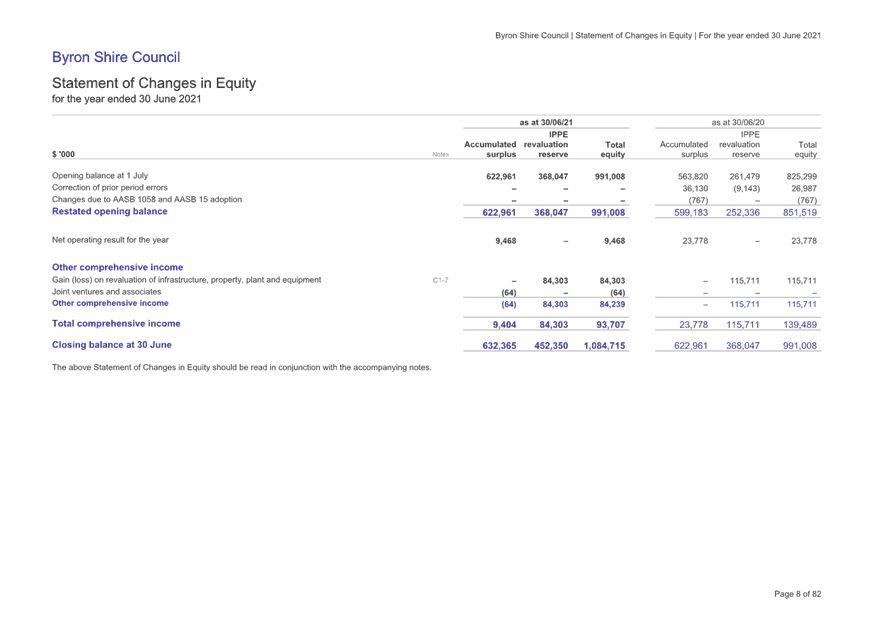

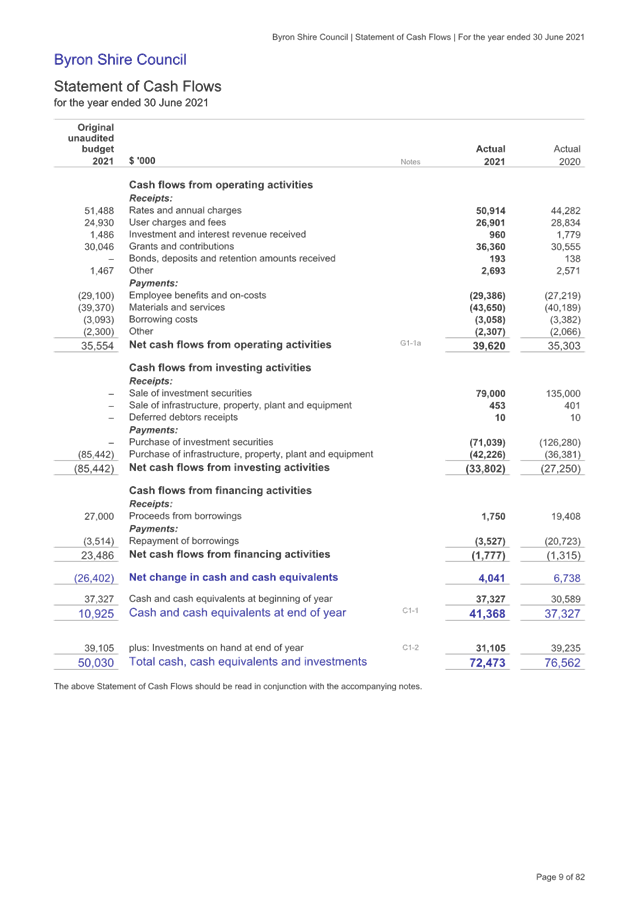

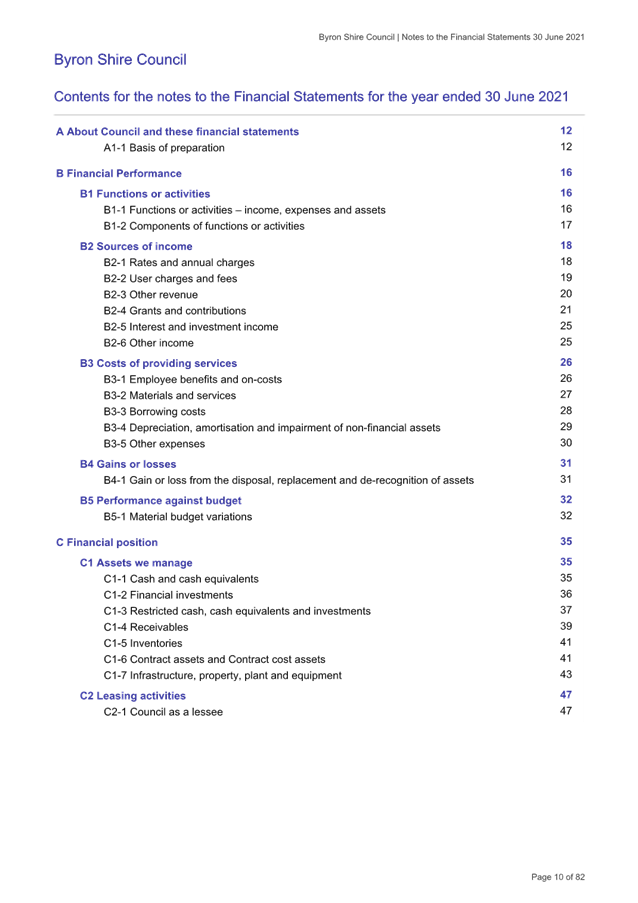

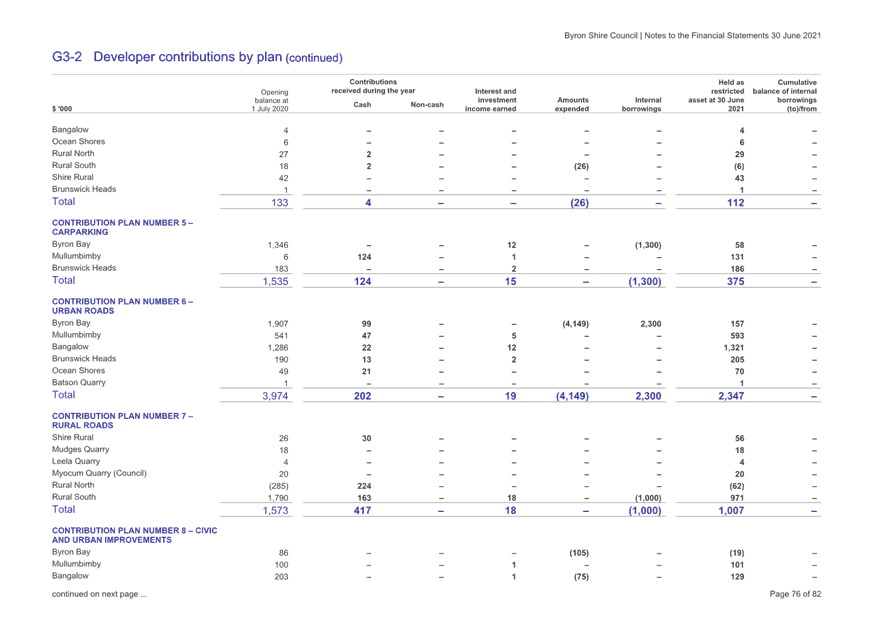

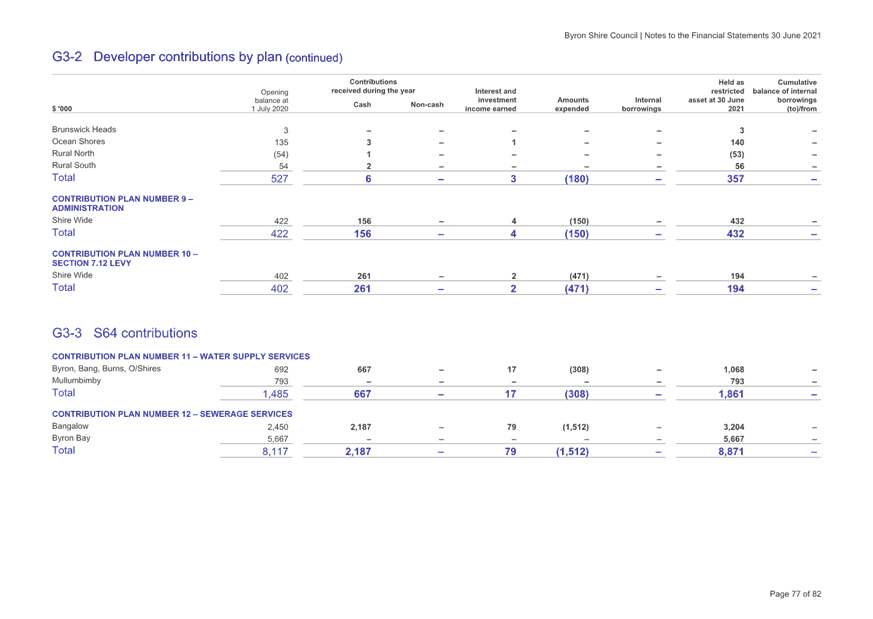

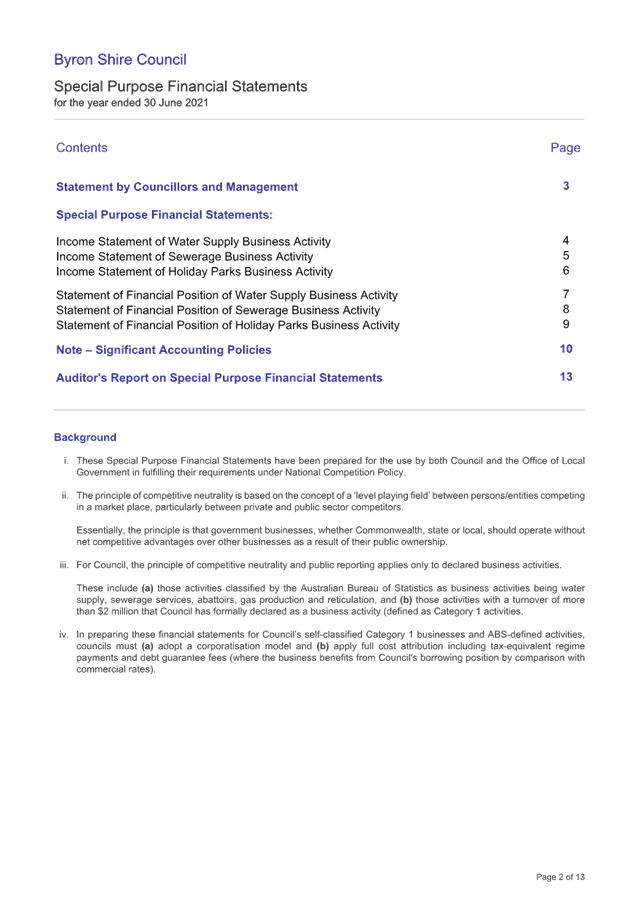

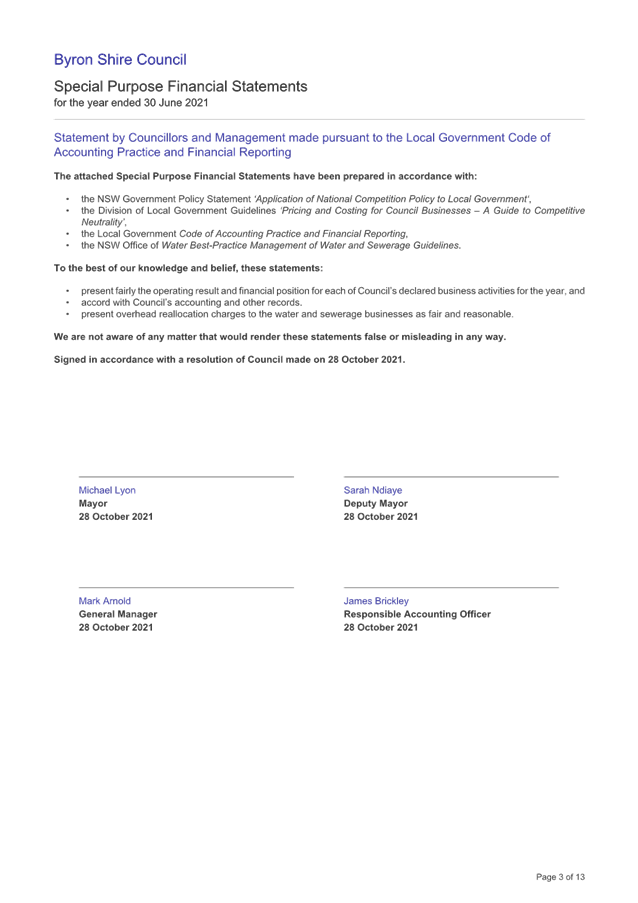

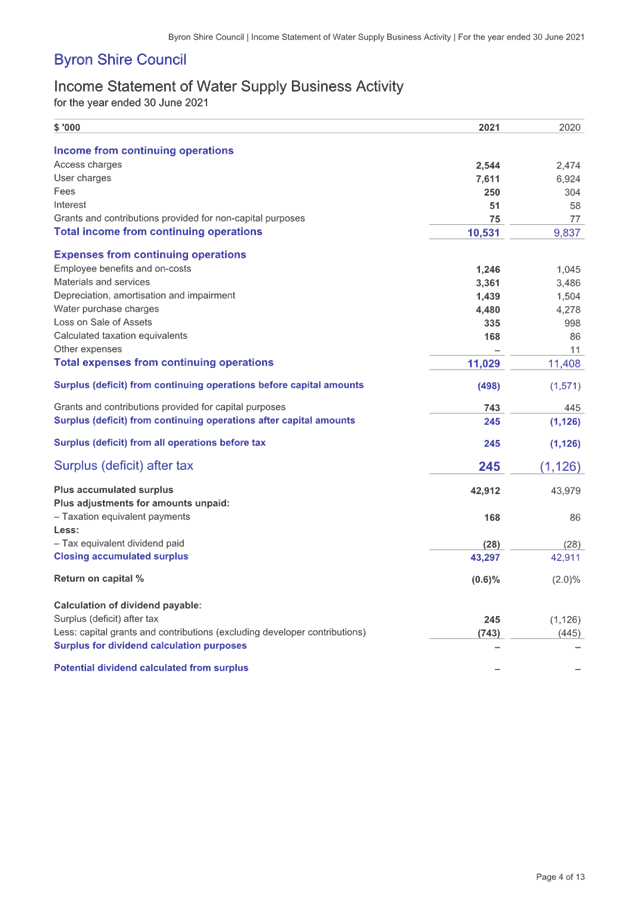

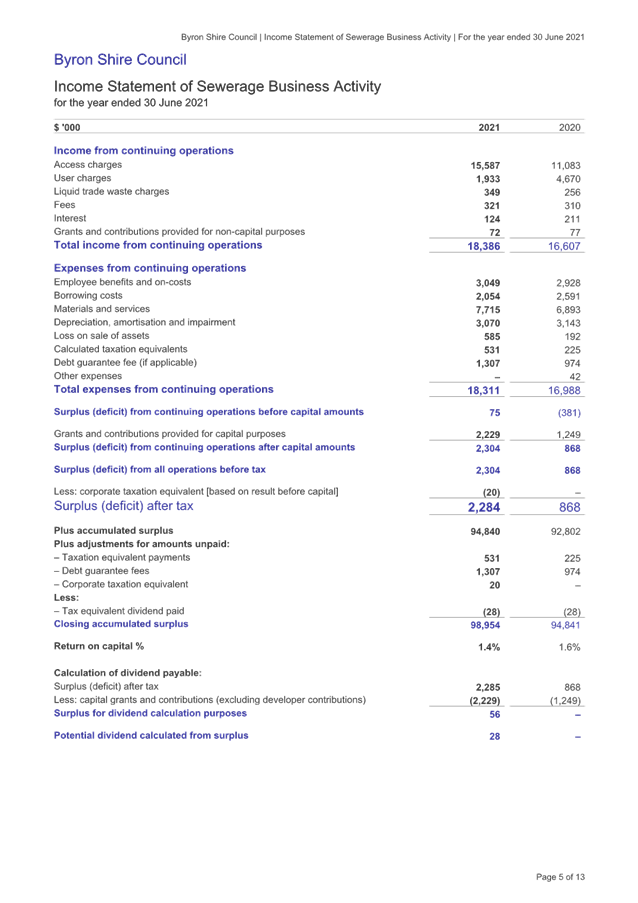

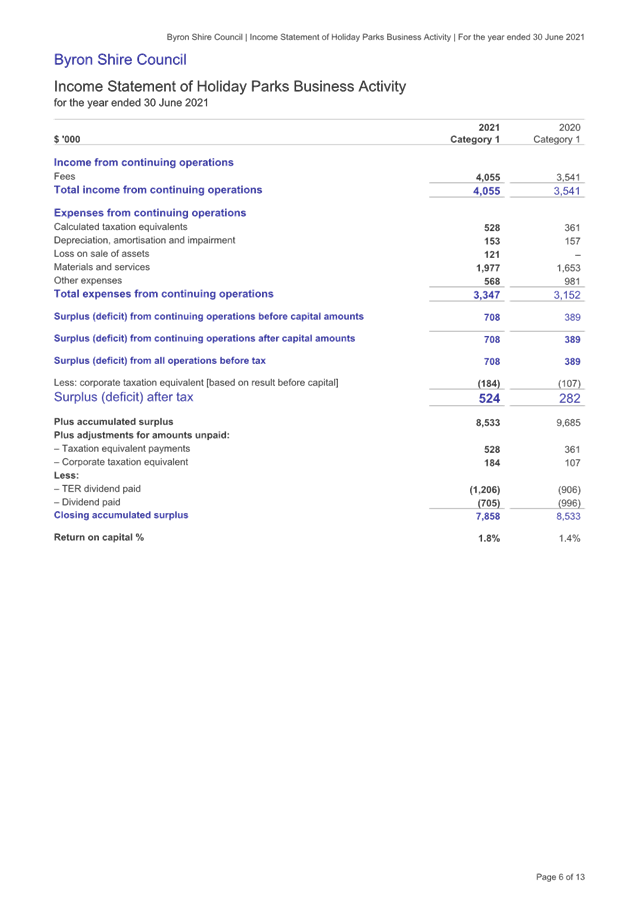

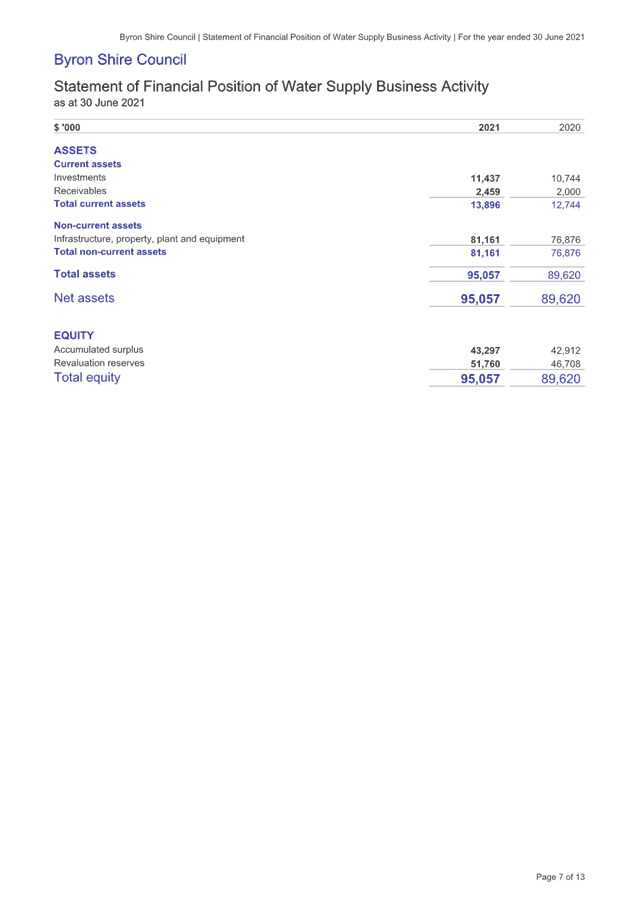

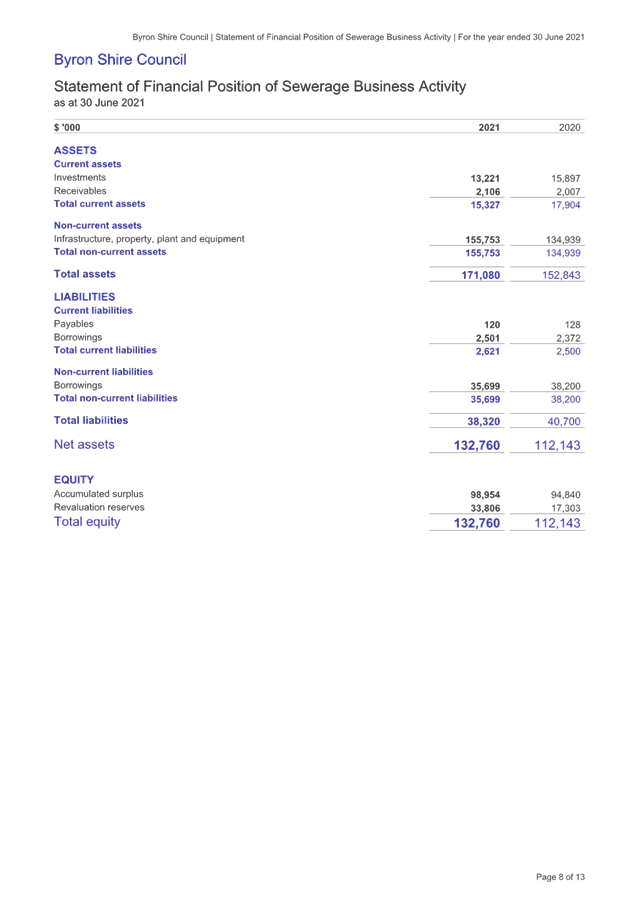

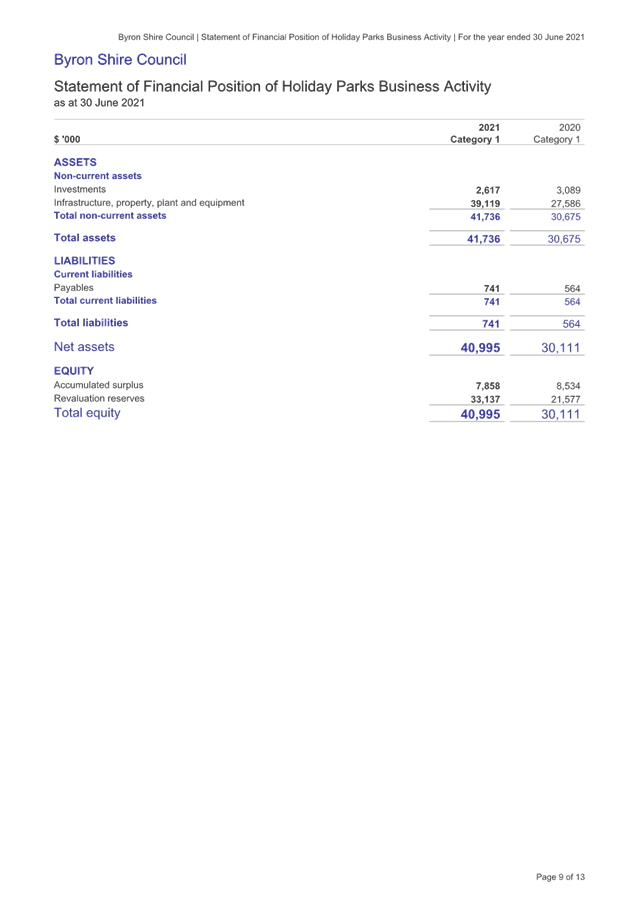

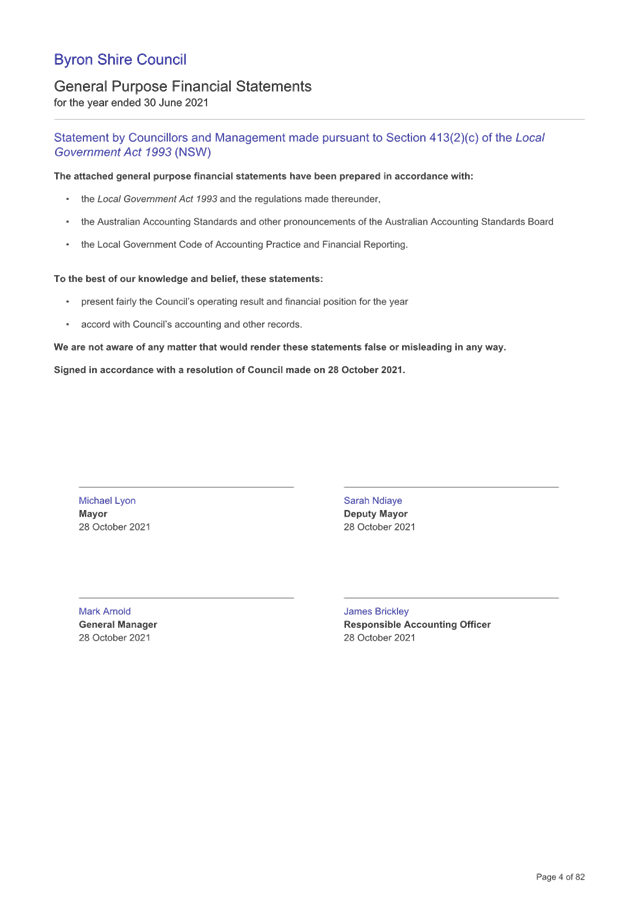

Staff Reports - Corporate and Community Services 4.3

Report

No. 4.3 Draft 2020/2021

Financial Statements

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2021/1642

Summary:

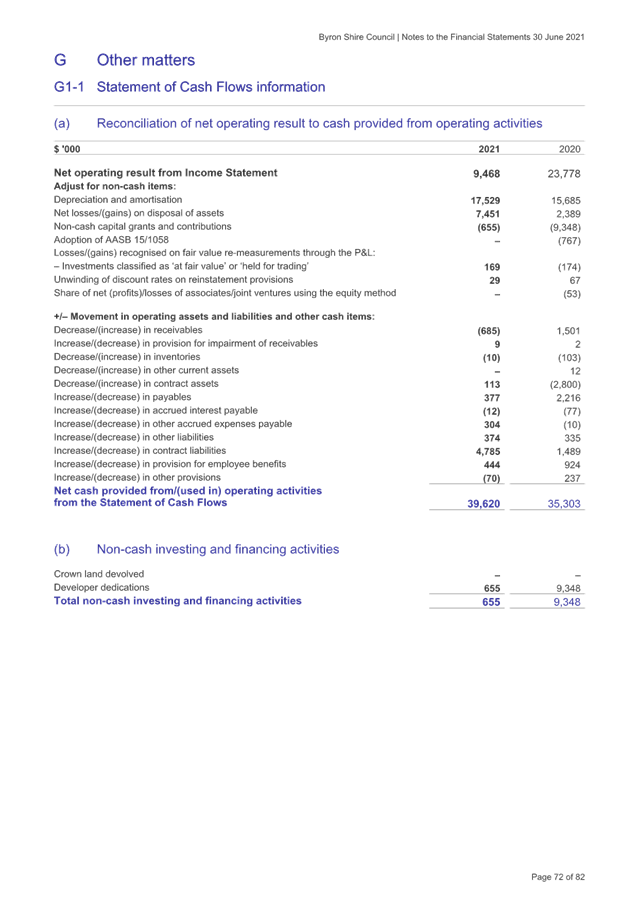

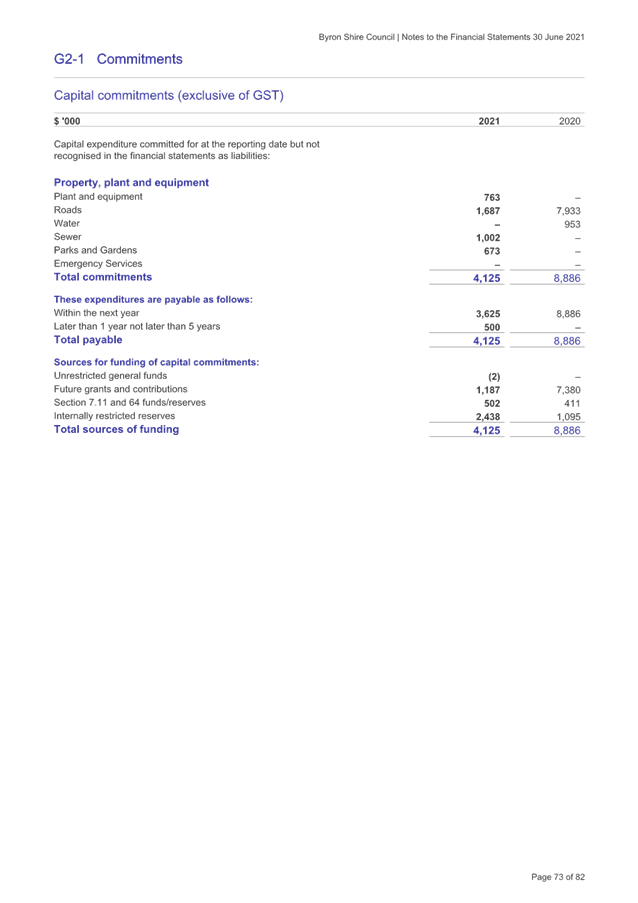

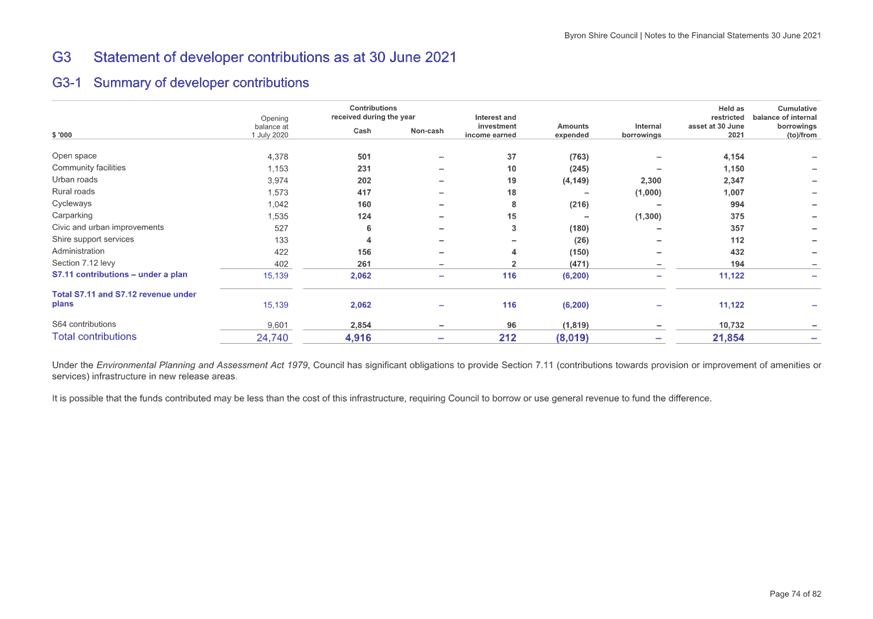

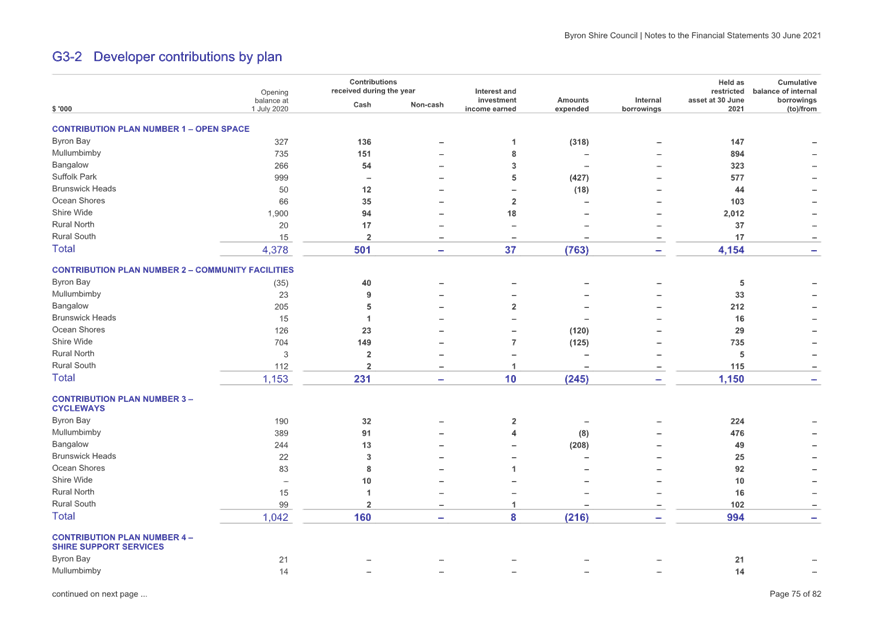

The Draft 2020/2021 Financial Statements have been prepared,

and at the time of writing this report, subject to external audit, which is

still in progress, albeit close to finalisation. Council’s file has

been lodged with the NSW Audit Office for review and has been subject to audit

review by the contracted auditor, Thomas Noble and Russell.

This report recommends that the Audit, Risk and Improvement

Committee recommends to Council the adoption of the Draft 2020/2021 Financial

Statements as prepared and the completion of the statutory steps outlined in

Section 418 to 420 of the Local Government Act 1993.

RECOMMENDATION:

That the Audit, Risk and Improvement Committee recommend

to Council:

1. That Council adopts the Draft

2020/2021 Financial Statements incorporating the General Purpose Financial

Statements (#E2021/127421) and Special Purpose Financial Statements

(#E2021/127426).

2.

That Council approves the signing of the

“Statement by Councillors and Management” in accordance with

Section 413(2)(c) of the Local Government Act 1993 and Section 215 of the Local

Government (General) Regulation 2021 in relation to the 2020/2021 Draft

Financial Statements.

3. That

the Audited Financial Statements and Auditors Report be presented to the public

at the Ordinary Meeting of Council scheduled for 25 November 2021 in

accordance with Section 418(1) of

the Local Government Act 1993.

Attachments:

1 Draft

2020-2021 General Purpose Financial Statements, E2021/127421 , page 163⇩

2 Draft

2020-2021 Special Purpose Financial Statements, E2021/127426 , page 245⇩

Report

The Draft 2020/2021 Financial Statements have been prepared,

and at the time of writing this report, subject to external audit which is

still in progress. Council’s file has been lodged with the NSW

Audit Office for review and has been subject to prior audit review by the

contracted auditor to the NSW Audit Office, Thomas Noble and Russell.

This report recommends that the Audit,

Risk and Improvement Committee recommends to Council, following consideration,

the adoption of the Draft 2020/2021 Financial Statements as prepared and the

completion of the statutory steps outlined in Section 418 to 420 of the Local

Government Act 1993. It is anticipated that the report on the Conduct of

the Audit will also be made available prior to this Committee Meeting and will

be distributed by separate cover.

The Financial Statements are a statutory

requirement and provide information on the financial performance of Council

over the previous twelve-month period.

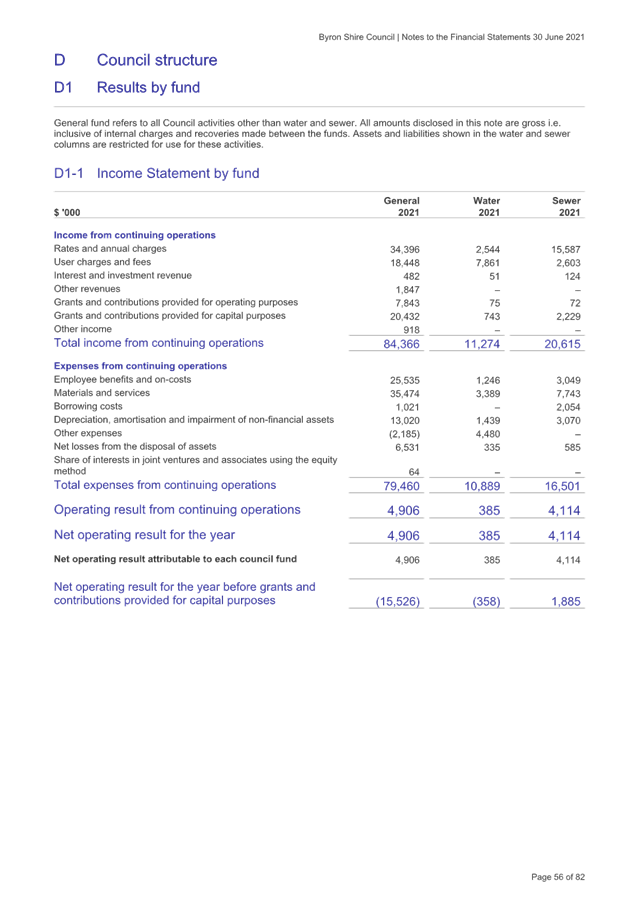

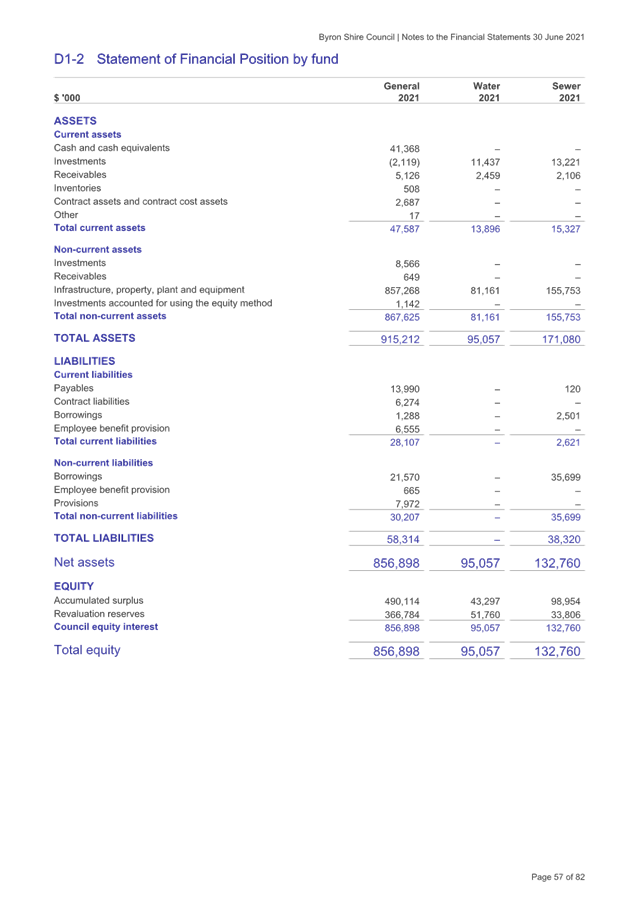

The Draft 2020/2021 Financial Statements

provided in the attachments are broken down into:

- General Purpose

Financial Statements – Attachment 1

- Special Purpose

Financial Statements – Attachment 2

As in previous years, Council produces

Special Schedules that are not audited (except Permissible Income for General

Rates). However, from the 2018/2019 financial year, whilst the Special

Schedules are still produced and submitted to the Office of Local Government,

they are no longer required to be published as part of Council’s

Financial Statements, except for the Special Schedules relating to Permissible

Income for General Rates and Report on Infrastructure Assets.

Brief explanations for each item follow:

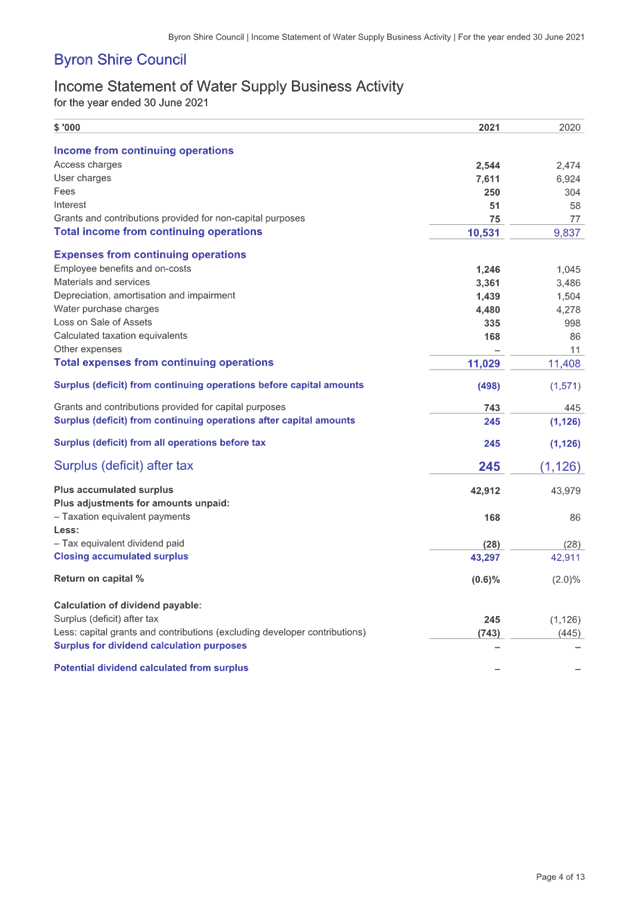

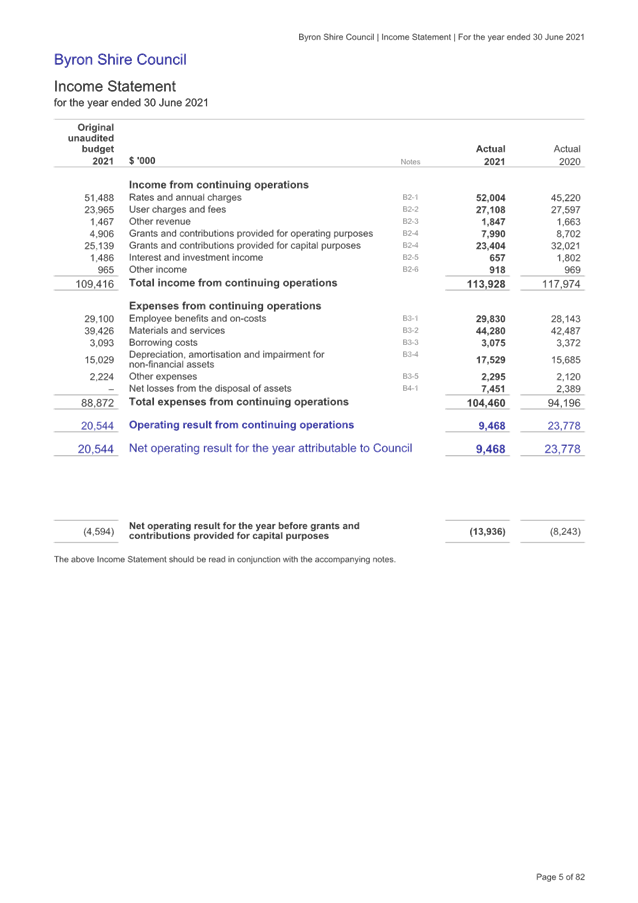

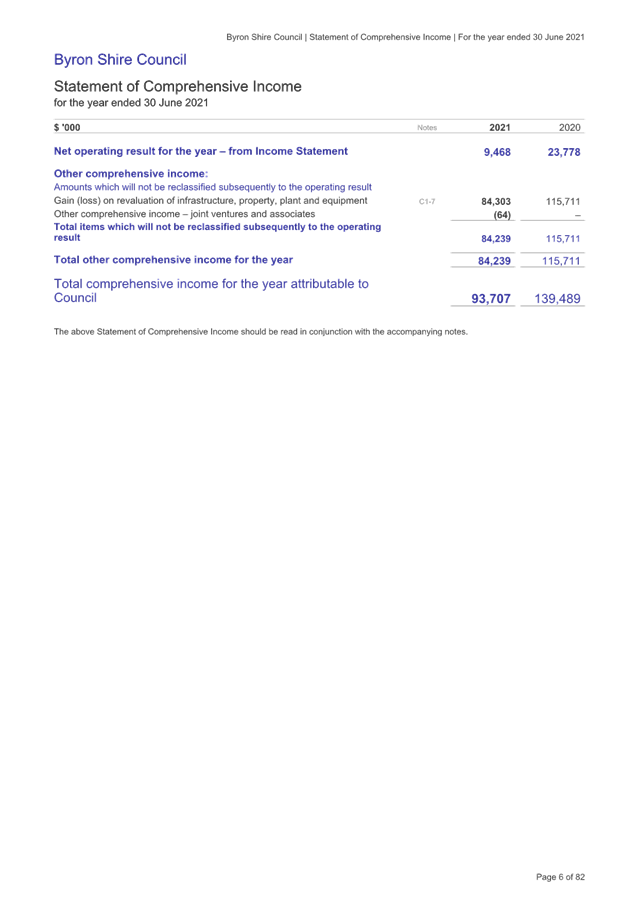

General Purpose

Financial Statements

These Statements provide an overview of the operating result, financial

position, changes in equity and cash flow movement of Council as at 30 June

2021 on a consolidated basis with internal transactions between Council’s

General, Water and Sewerage Funds eliminated. The notes included with these

reports provide details of major items of income and expenditure with

comparisons to the previous financial year. The notes also highlight the cash

position of Council and indicate which funds are externally restricted (i.e.,

may be used for a specific purpose only), and those that may be used at

Council’s discretion.

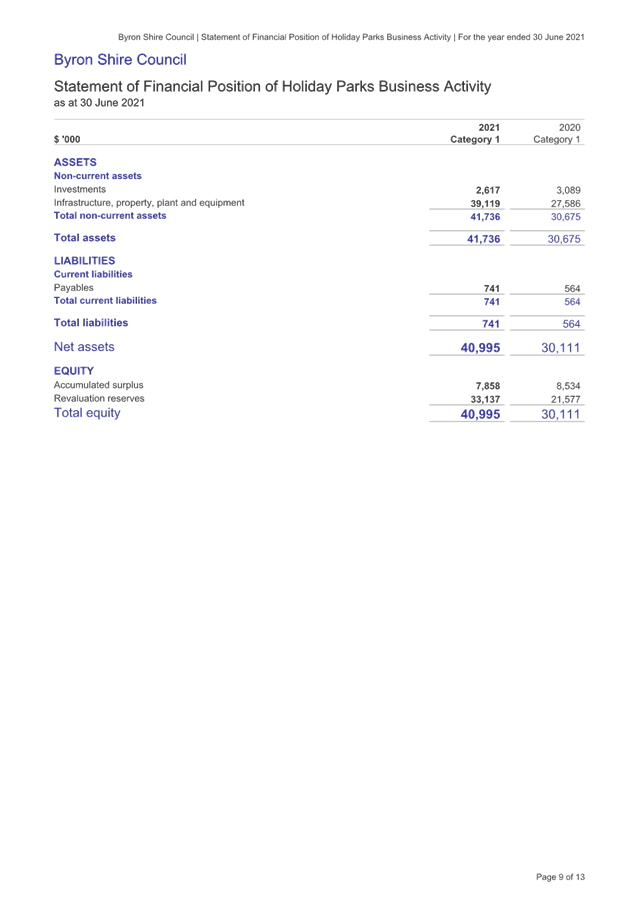

Special Purpose Financial Statements

These Statements are a result of the implementation of the National

Competition Policy and relate to those aspects of Council’s operations

that are business oriented and compete with other businesses with similar

operations.

Mandatory disclosures in the Special

Purpose Financial Reports are Water and Sewerage.

Additional disclosures relate to Council

business units that Council deems ‘commercial’. In this

regard Council has traditionally reported its caravan park operations, being

Suffolk Beachfront Holiday Park and First Sun Holiday Park, on a combined

basis. These financial reports must also classify business units in the

following categories:

· Category

1 – operating turnover is greater than $2million

· Category

2 – operating turnover is less than $2million

All Council’s business units are

classed as Category 1 with all having operating turnover greater than $2

million.

Another feature of the Special Purpose

Financial Reports is to build taxes and charges, where not physically incurred,

into the financial results in order that the results can be measured on a level

playing field with other organisations operating similar businesses, who are

required to pay these additional taxes and charges. These taxes and

charges include:

· Land

tax – Council is normally exempt from this tax, so notional land tax is

applied.

· Income

tax – Council is exempt from income tax and in regard to these reports,

company tax. Any surplus generated has a notional company tax applied to it.

· Debt

guarantee fees – Generally due to the low credit risk associated with

Councils, Councils can often borrow loan funds at lower interest rates then the

private sector. A debt guarantee fee inflates the borrowing costs by

incorporating a notional cost between interest payable on loans at the interest

rate borrowed by Council and one that would apply commercially.

The Special Purpose Financial Reports are

prepared on a non-consolidated basis - in other words they are grossed up to

include any internal transactions with the General Fund.

Specific Items relating to 2020/2021

Draft Financial Statements

Before consideration is given to actual

financial outcome, it needs to be pointed out that the Office of Local

Government restructured the Local Government Code of Accounting Practice and

Financial Reporting for the 2020/2021 financial year. This means that the notes

to the General Purpose Financial Statements are now broken into Sections as

follows:

· Section

A – About Council and these Financial Statements

· Section

B – Financial Performance

· Section

C – Financial Position

· Section

D – Council Structure

· Section

E – Risks and Accounting Uncertainties

· Section

F – People and Relationships

· Section

G – Other Matters

· Section

H – Additional Council Disclosures

Some line items previously within certain

notes have been moved to other notes.

The Draft 2020/2021 Financial Statement

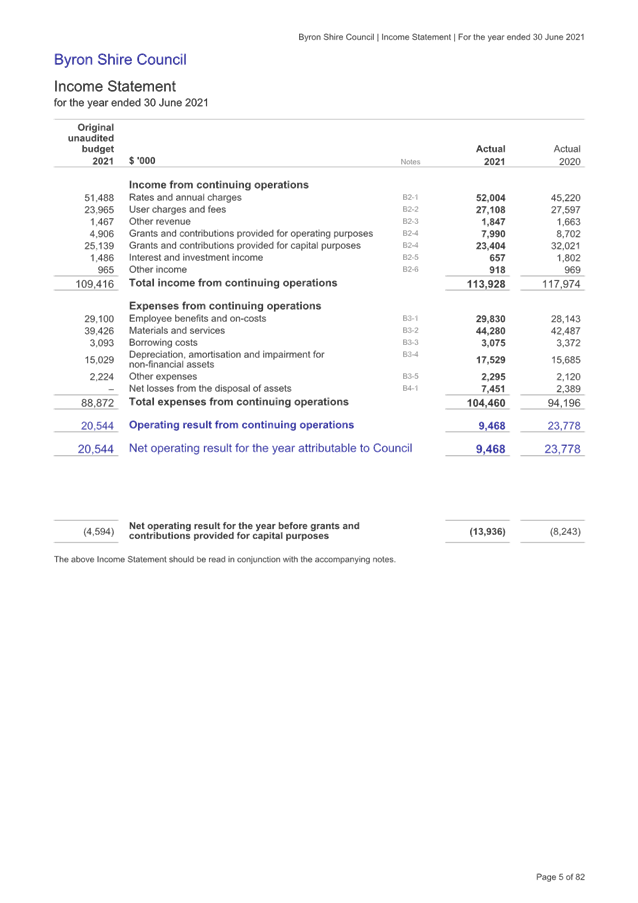

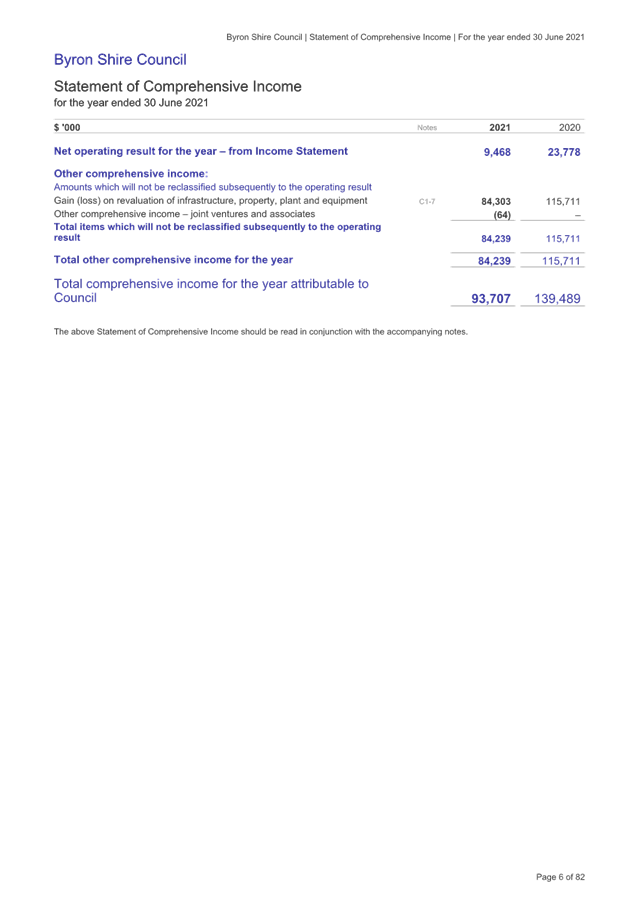

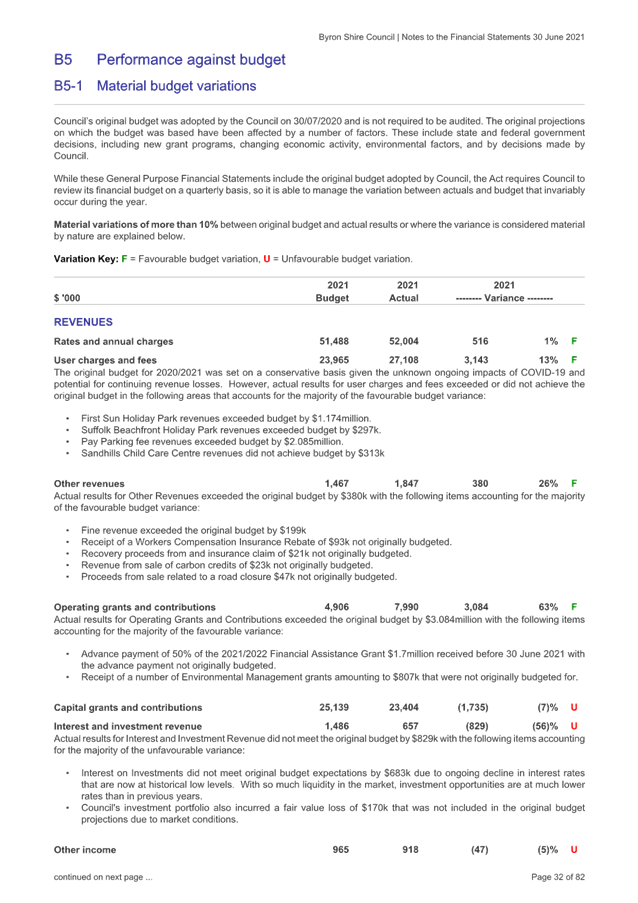

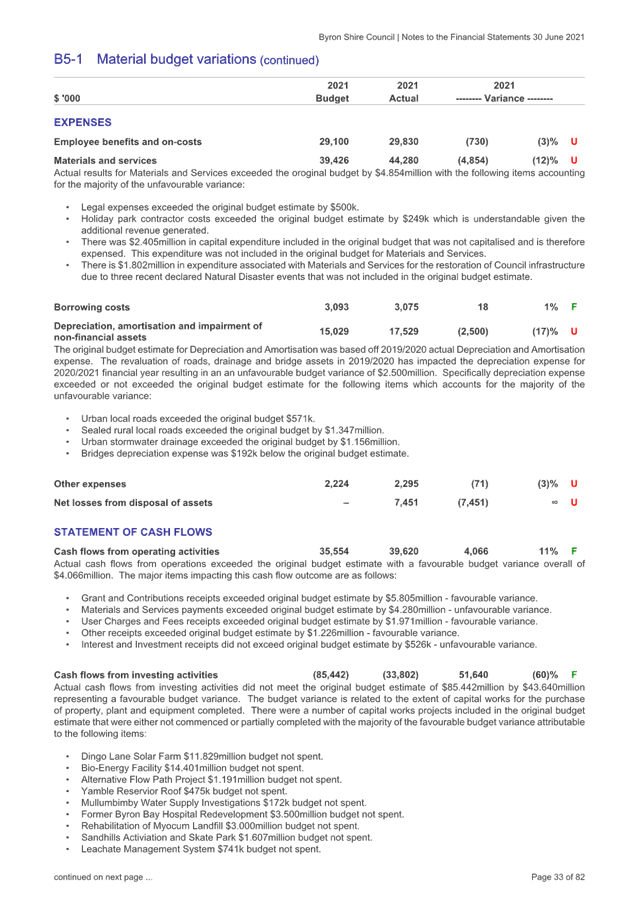

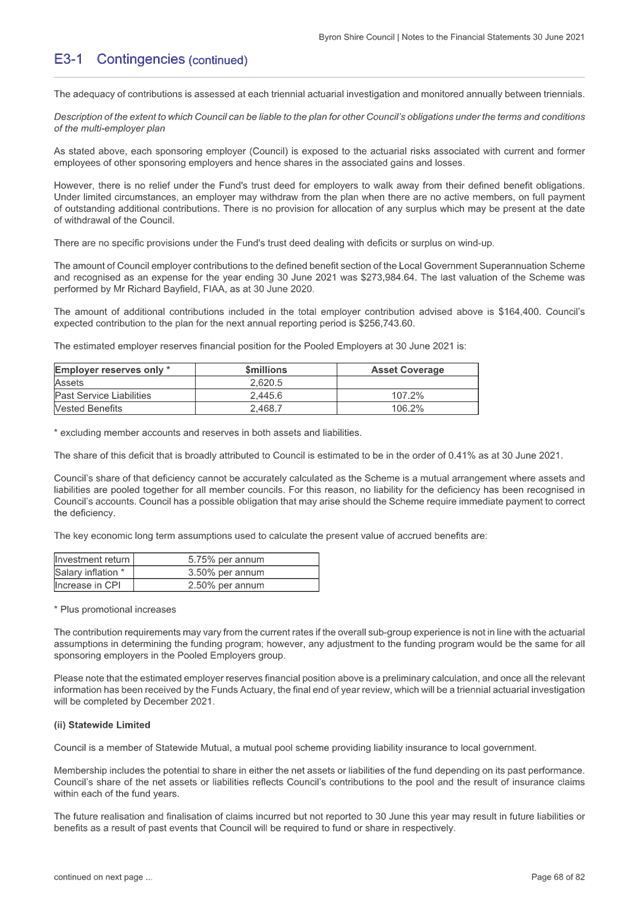

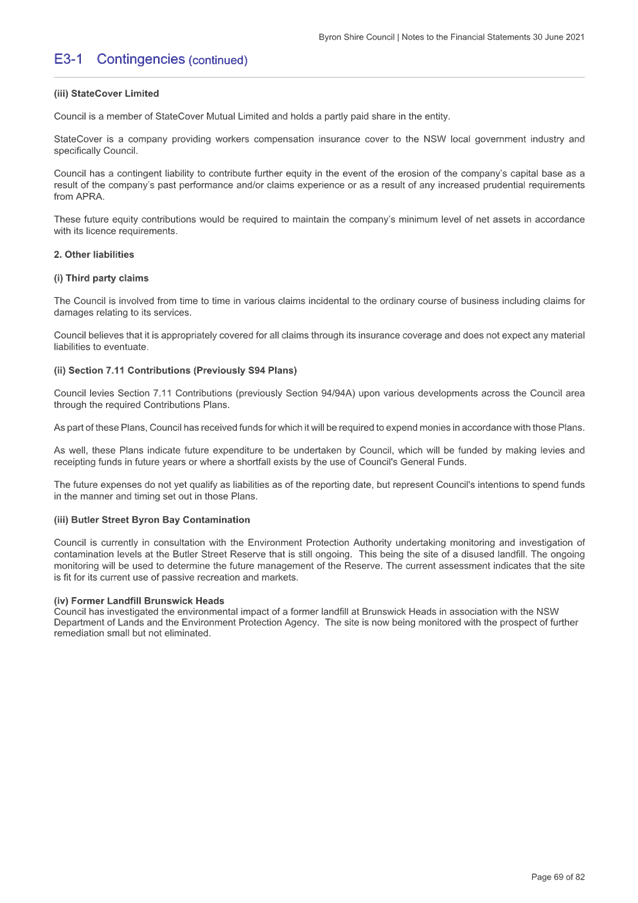

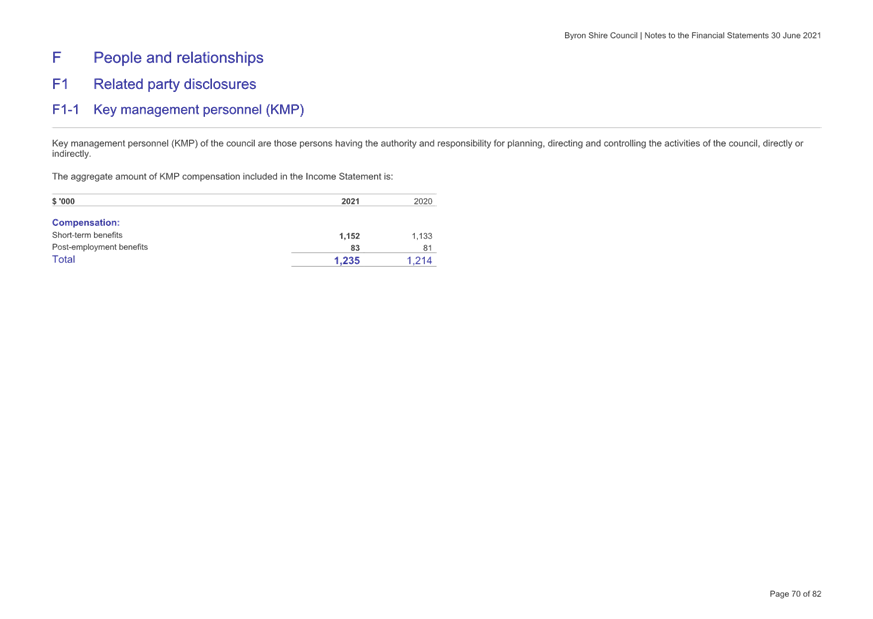

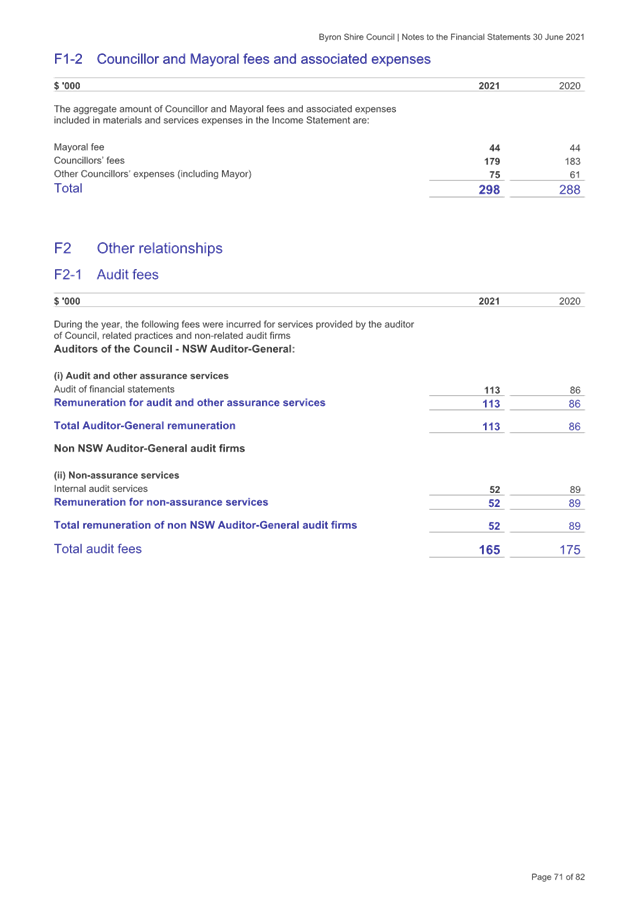

results have been impacted by the following items that require explanation:

· Operating

Result from Continuing Operations

The 2020/2021 financial year has seen a

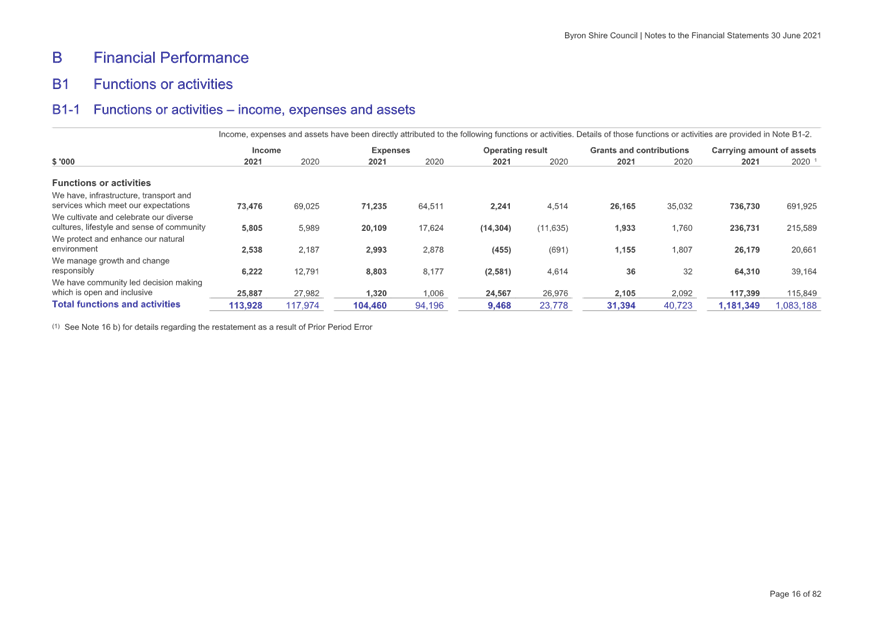

positive overall financial result. Council recorded a $9.468million surplus

compared to the $23.778million surplus in 2019/2020. This result incorporates

the recognition of capital revenues such as capital grants and contributions

for specific purposes and asset dedications amounting to $23.404 million, compared

to $32.021million in 2019/2020. Capital grants and contributions in 2019/2020

were significantly influenced by additional grant funding i.e., from the

Election Commitment Grant which has continued in 2020/2021 and recognising

asset values for the former Byron Hospital over and above the $1 purchase

price.

A more important indicator is the

operating result before capital grants and contributions. This result was a

deficit of $13.936 million in 2020/2021 compared to a deficit of $8.243million

in 2019/2020, representing an increase of $5.693million between financial

years. This indicates Council’s operating expenditures exceeded its

operating revenues. Whilst operating revenues, excluding capital grants and

contributions, grew by $4.571million, overall operating expenses grew by

$10.264million. Major contributors to additional operating expenditure as

non-cash expenses were due to the increase in depreciation expense

($1.844million) and increase in net losses from disposal of assets

($5.062million).

With reference to the Income Statement to

the General Purpose Financial Reports included at Attachment 1, the following

table indicates the major changes between 2020/2021 and 2019/2020 by line item:

|

Item

|

Change

between 2020/2021 and 2019/2020 $’000

|

Change

Outcome

|

Comment

|

|

Income

|

|

|

|

|

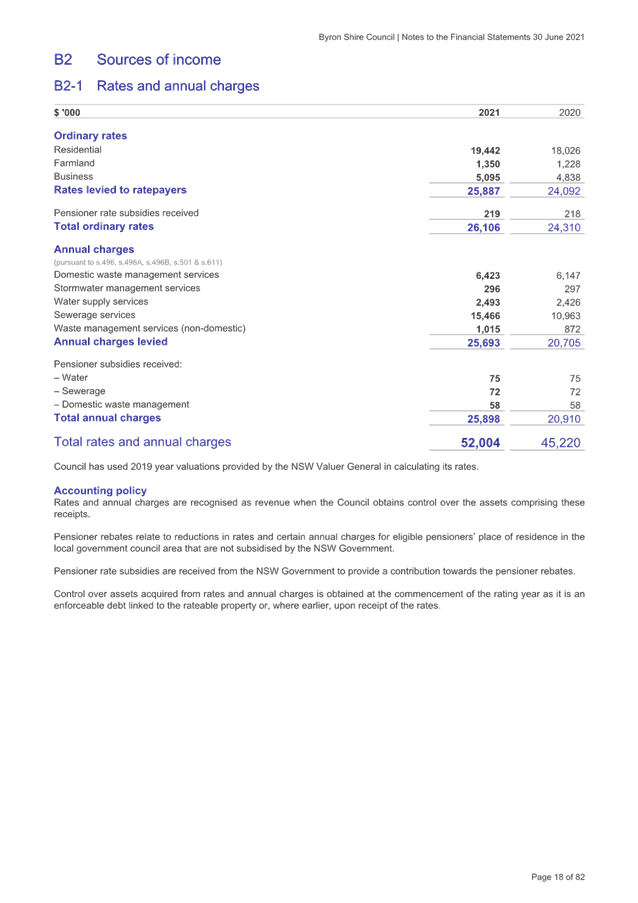

Rates & Annual Charges

|

+$6,784

|

Increase

|

Reflects imposition of the final year

of the 7.50% Special Rate Variation and changes in annual charges from

Council’s adopted 2020/2021 Revenue Policy.

|

|

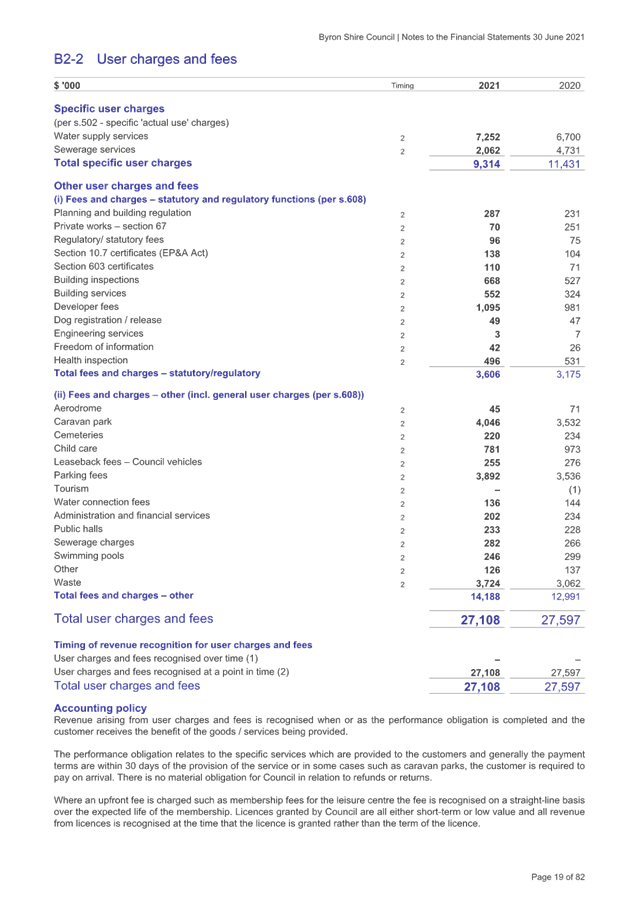

User Charges and Fees

|

-$489

|

Decrease

|

A contributor to this change was the

change in residential sewerage charging to remove the volumetric charge in

favour of a fixed charge. The volumetric charge was classified as a user

charge and fee. Further information is available in Note B2-2 to Attachment

1.

|

|

Other Revenues

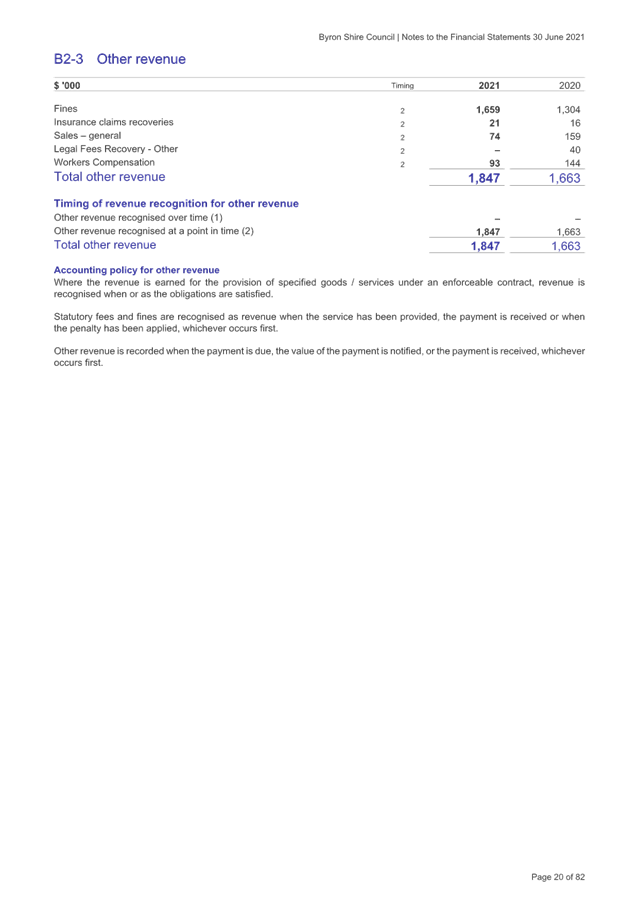

|

+$184

|

Increase

|

The major increase in this item relates

to fine revenues.

|

|

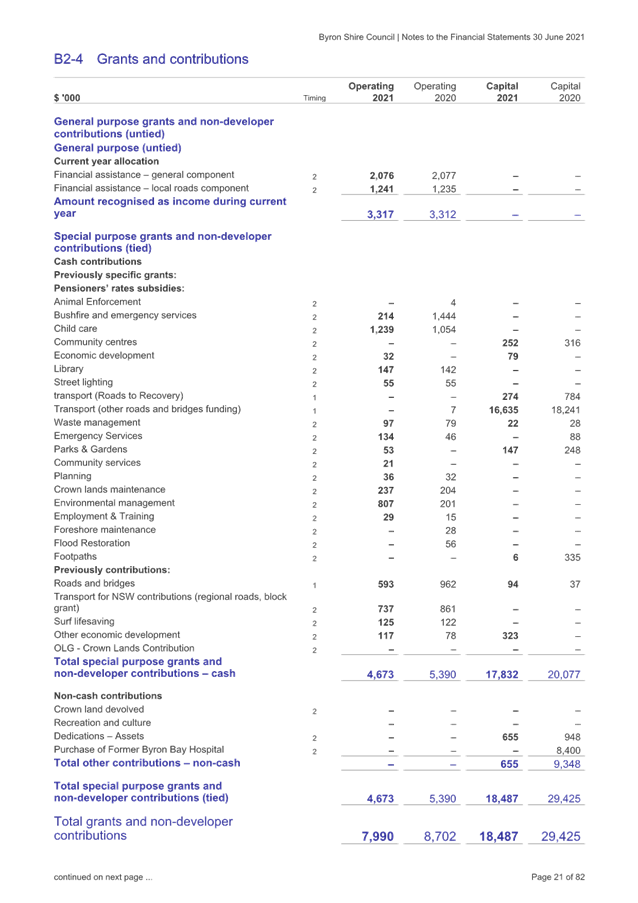

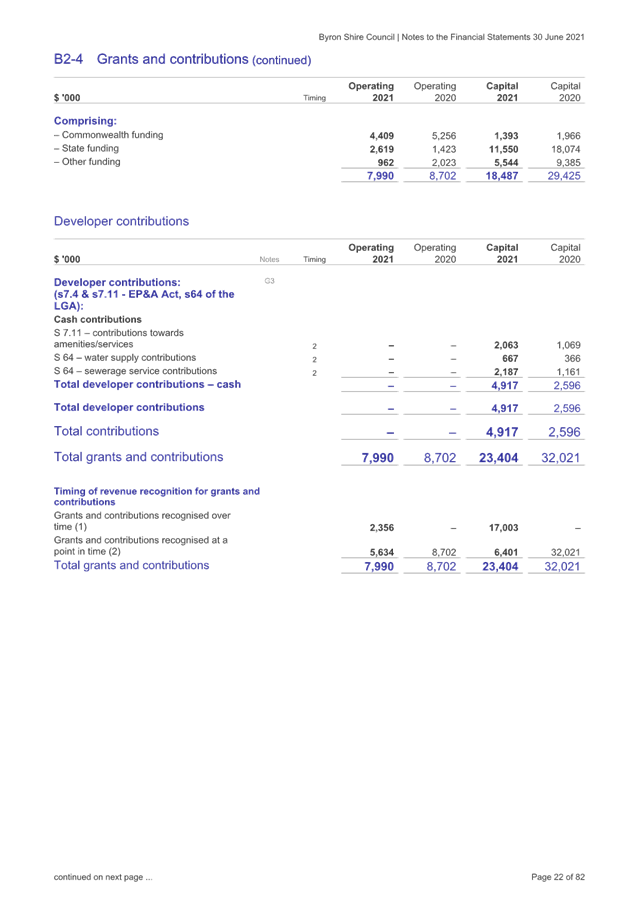

Grants & Contributions –

Operating

|

-$712

|

Decrease

|

Overall operating grants and

contributions decreased by $712k. Major difference is one-off stimulus

funding Council received in 2019/2020 following the 2020 Bushfires. Further

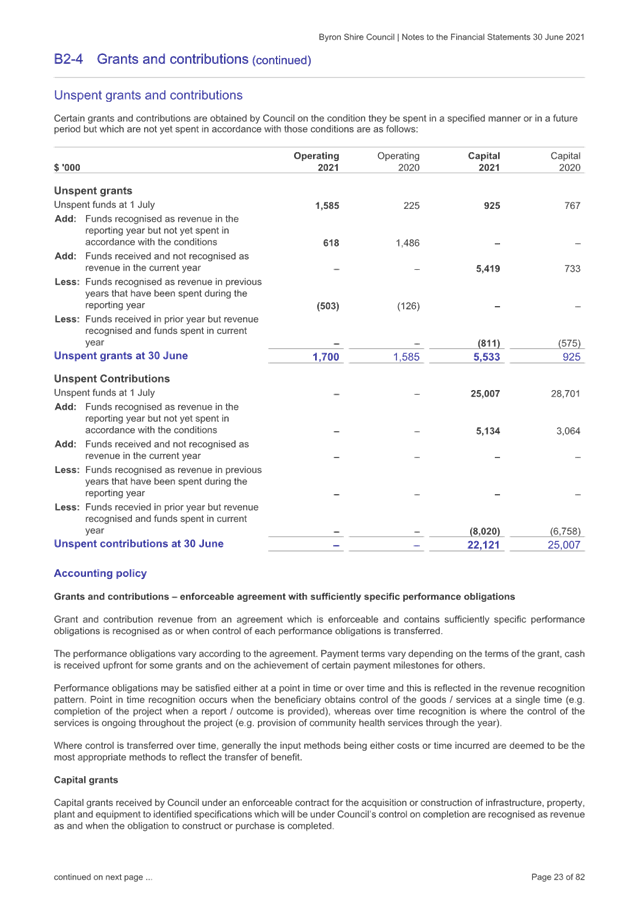

information is available in Note B2-4 to Attachment 1.

|

|

Grants & Contributions –

Capital

|

-$8,617

|

Decrease

|

Revenue decrease in this item mainly

relates to the fact that in 2019/2020 Council recognised former Byron

Hospital assets at fair value compared to the purchase price of $1

($8.4million). Other than that capital grants and contributions have

remained consistent. Further information is available in Note B2-4 to

Attachment 1.

|

|

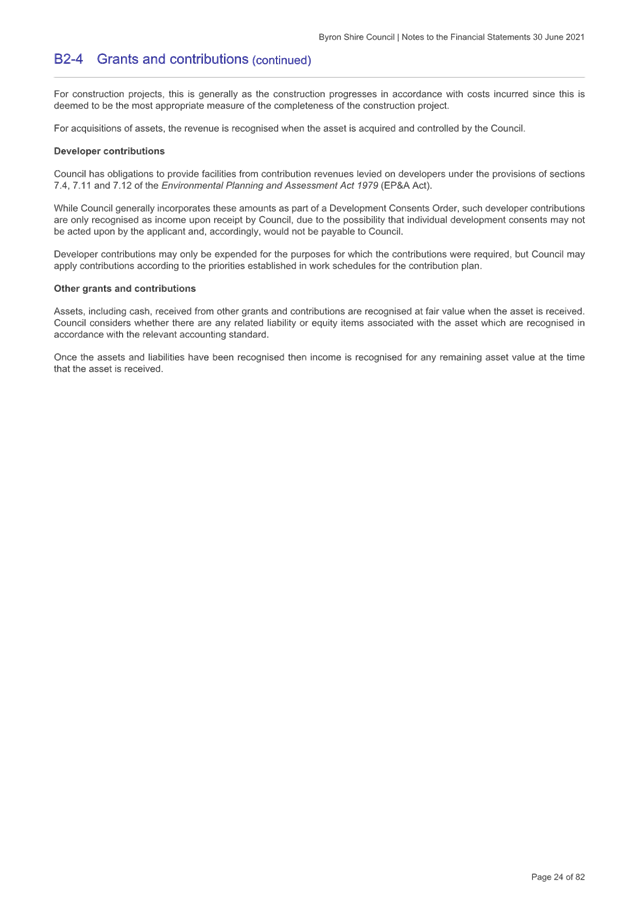

Interest and Investment Revenue

|

-$1,145

|

Decrease

|

Interest rates during 2020-2021 have

remained at historic lows, plus liquidity measures by the Reserve Bank during

COVID-19 have reduced investment rates significantly, lowering the return on

Council’s investments. Cashflow around scale of works and recovering

grant payments has also been an influence.

|

|

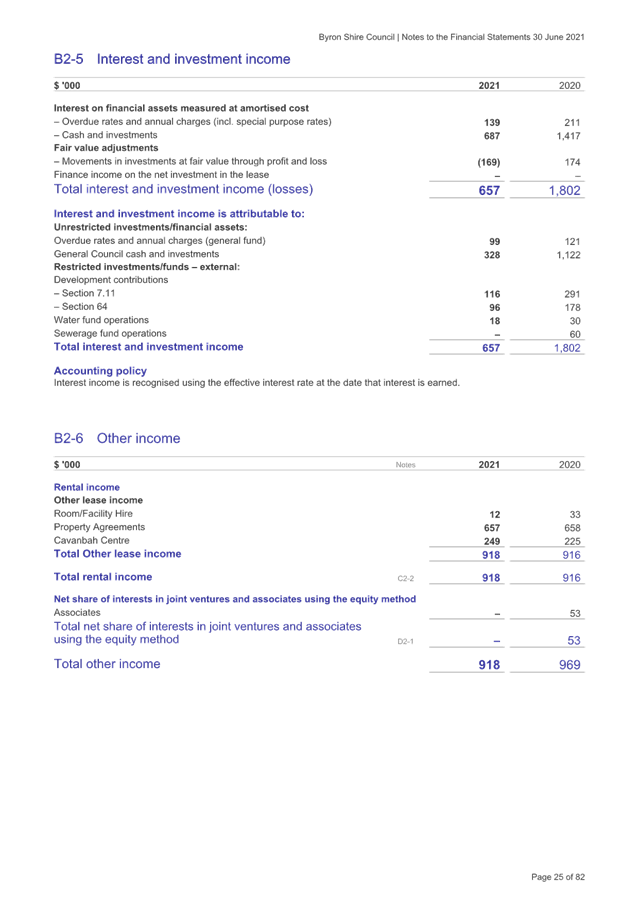

Other Income

|

-$51

|

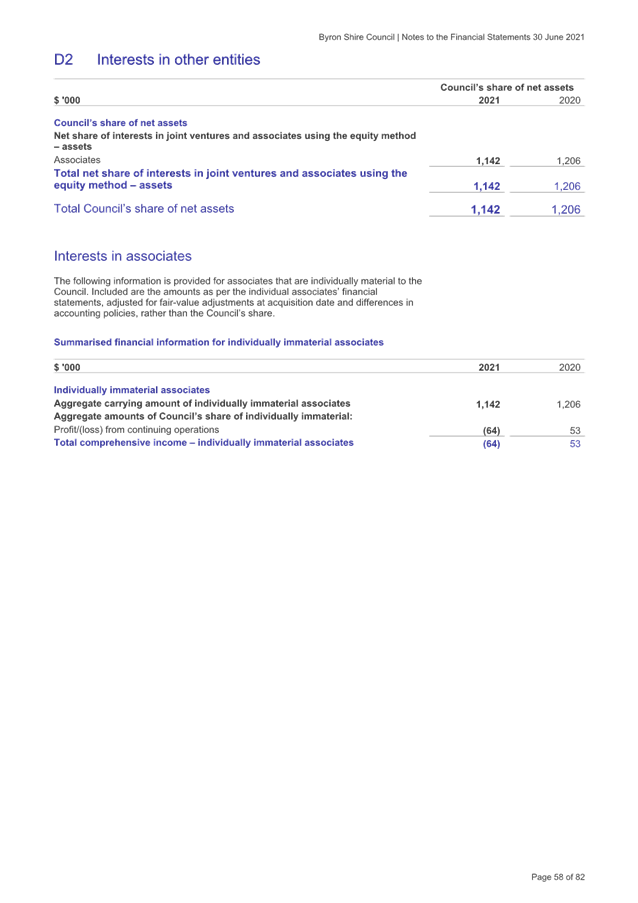

Decrease

|

Principally relates to change in

disclosure regarding Byron Shire Council’s share of a surplus for

Richmond Tweed Regional Library for 2019/2020. For 2020/2021 this is

allocated straight to the Statement of Comprehensive Income and Statement of

Changes in Equity and was a loss of $64k.

|

|

Total Income Change

|

-$4,046

|

Decrease

|

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

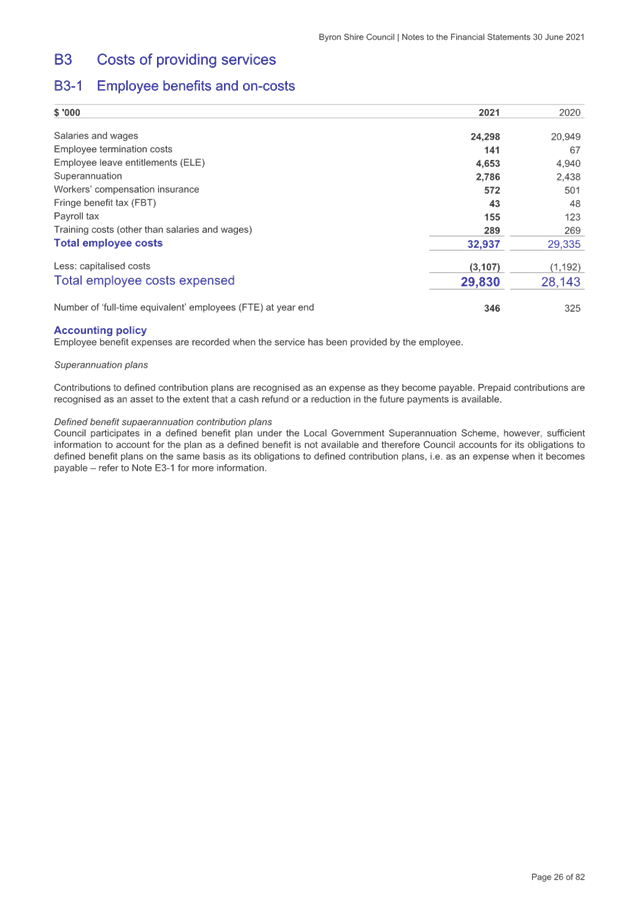

Employee Benefits and Oncosts

|

+$1,687

|

Increase

|

Decreased leave entitlement expenses of

$287k reflect an emphasis on controlling leave balances and the impact of

declining interest rates on present value of liability calculations. A $348k

increase on superannuation payments. An increase of $1,915k of employee costs

capitalised on capital works in 2020/2021 compared to 2019/2020 and gross

salary and wages increased $3,349k. More information is provided at Note B3-1

to Attachment 1.

|

|

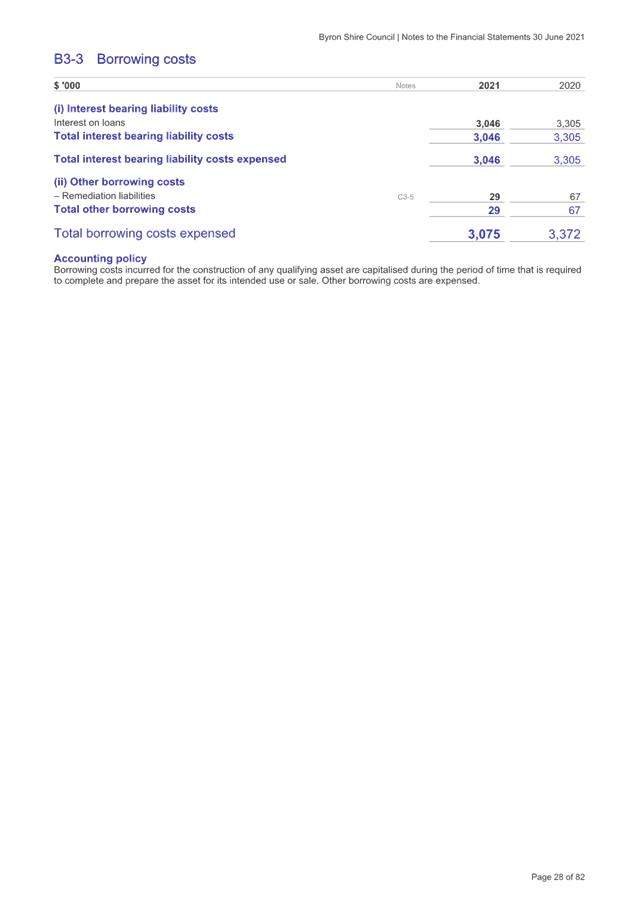

Borrowing Costs

|

-$297

|

Decrease

|

Reduction due to ongoing repayment of

existing loans and borrowing of new loans at lower interest rates given

current market conditions.

|

|

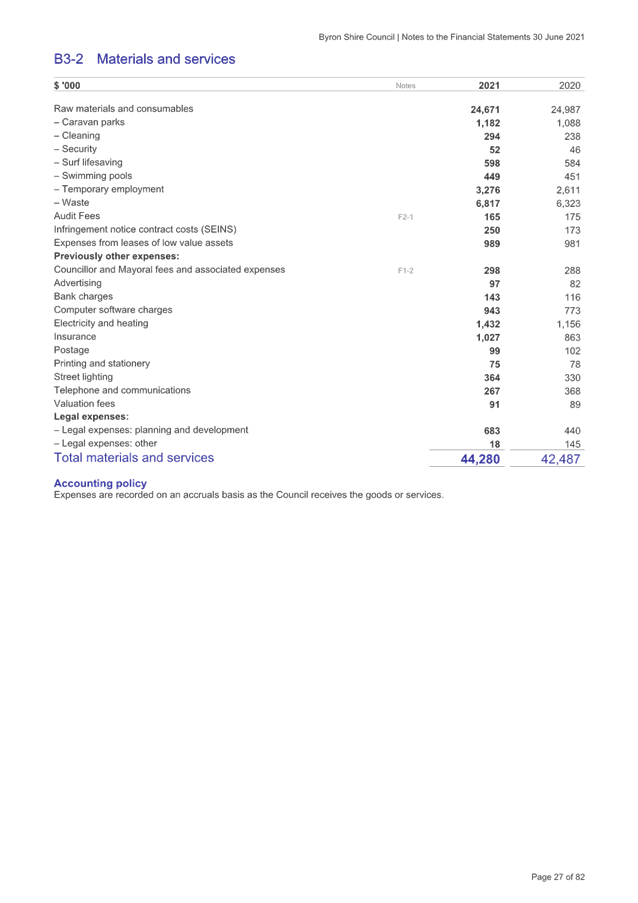

Materials & Services

|

+$1,793

|

Increase

|

Materials and Services increased

$1,793k overall. Changes include an additional $116k in legal expenses ($701k

for the year), $164k in insurance costs, $170k for IT software costs, $494k

in waste contract costs, $665k increase in temporary employment costs. Other

changes can be found at Note B3-2 to Attachment 1.

|

|

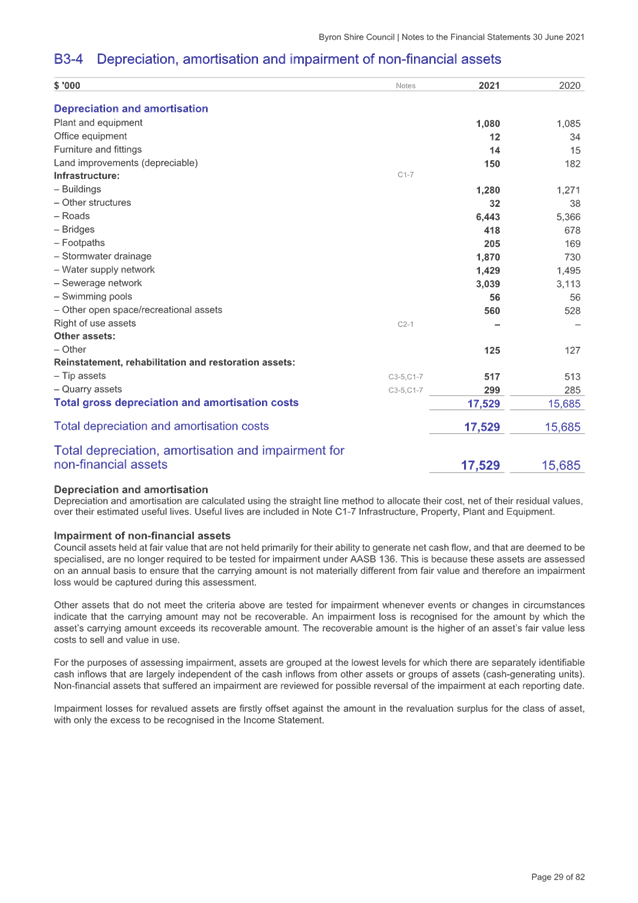

Depreciation

|

+$1,844

|

Increase

|

Respective changes between asset

classes are outlined at Note B3-4 to Attachment 1. Essentially major increase

is due to the revaluation of transport assets in 2019/2020 now flowing

through with increased depreciation expense.

|

|

Other Expenses

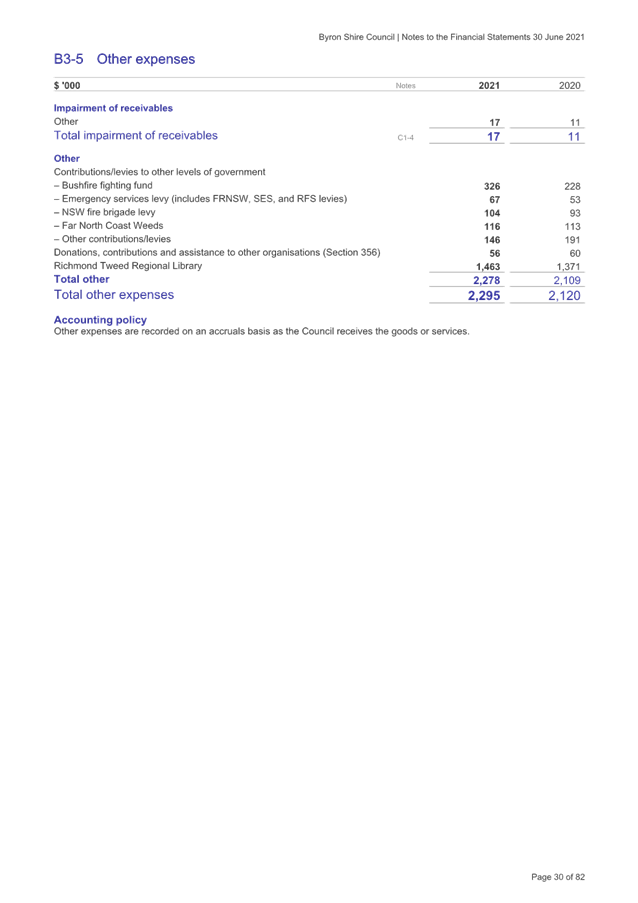

|

+$175

|

Increase

|

Overall small but there were variations

in line items as disclosed at Note B3-5 to Attachment 1. The major item is an

increased contribution to Richmond Tweed Regional Library of $92k.

|

|

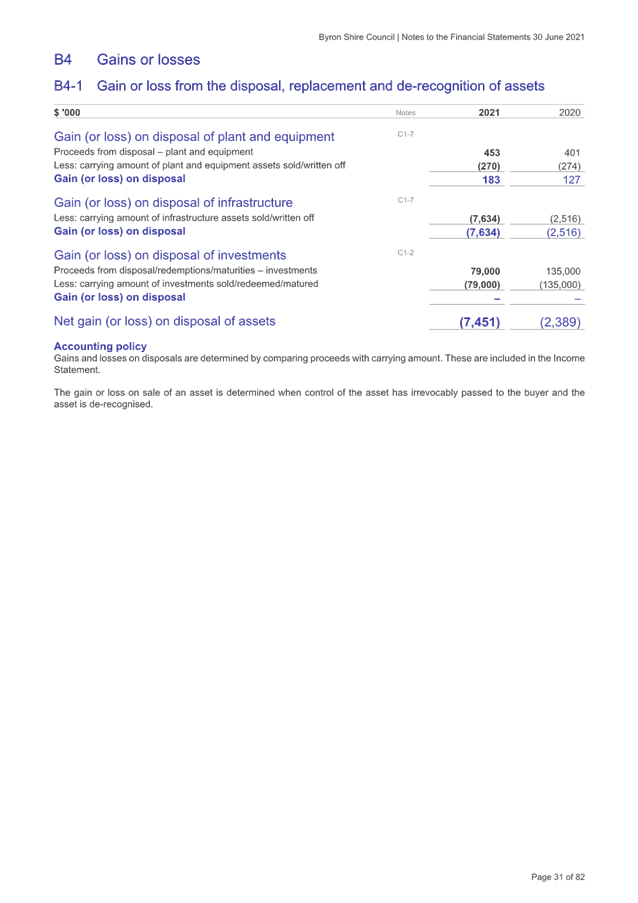

Net Losses from Disposal of Assets

|

+$5,062

|

Increase

|

Reflects the written down value of

assets disposed of at the end of financial year and is contingent upon the

extent of assets disposed and their written down value at the time of

disposal which can vary. For 2020/2021, Council has significantly more disposals

than gains, including the disposal of infrastructure $7,634k, reflecting the

level of capital works, plant and equipment $183k gain. Further details can

be found at Note B4-1 to Attachment 1

|

|

Total Expenditure Change

|

+$10,264

|

Increase

|

|

|

|

|

|

|

|

Change in Result

|

-$14,310

|

Decrease

|

Decrease in overall surplus between

financial years.

|

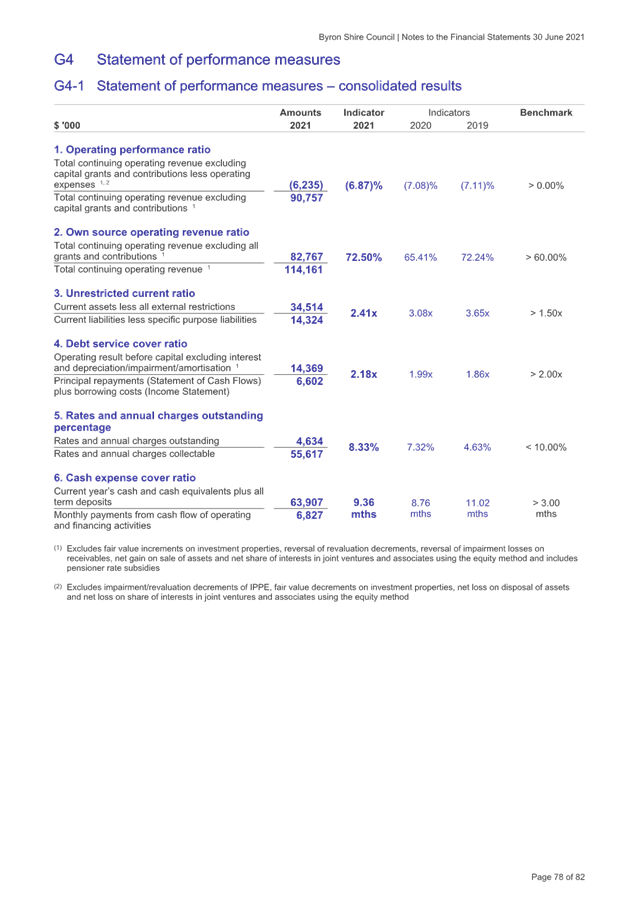

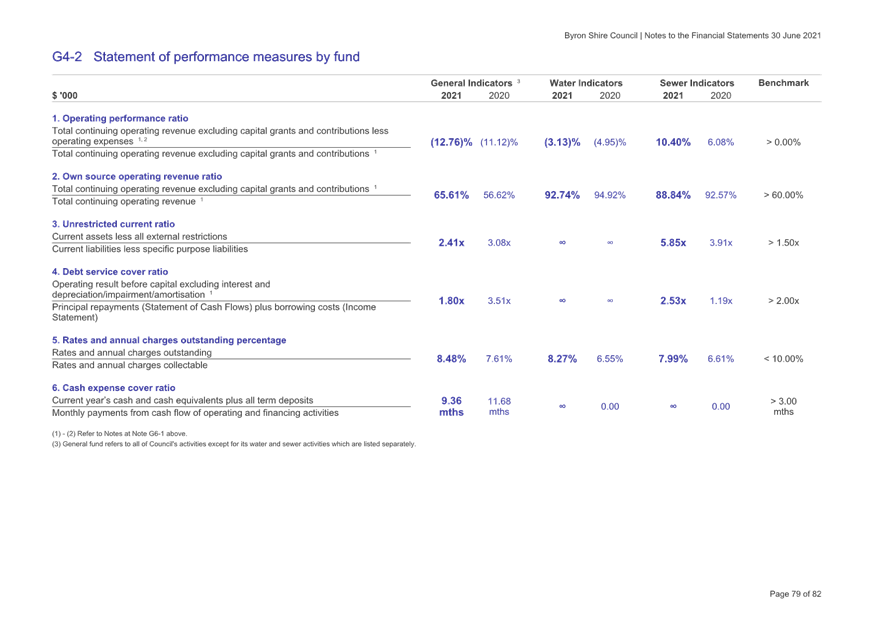

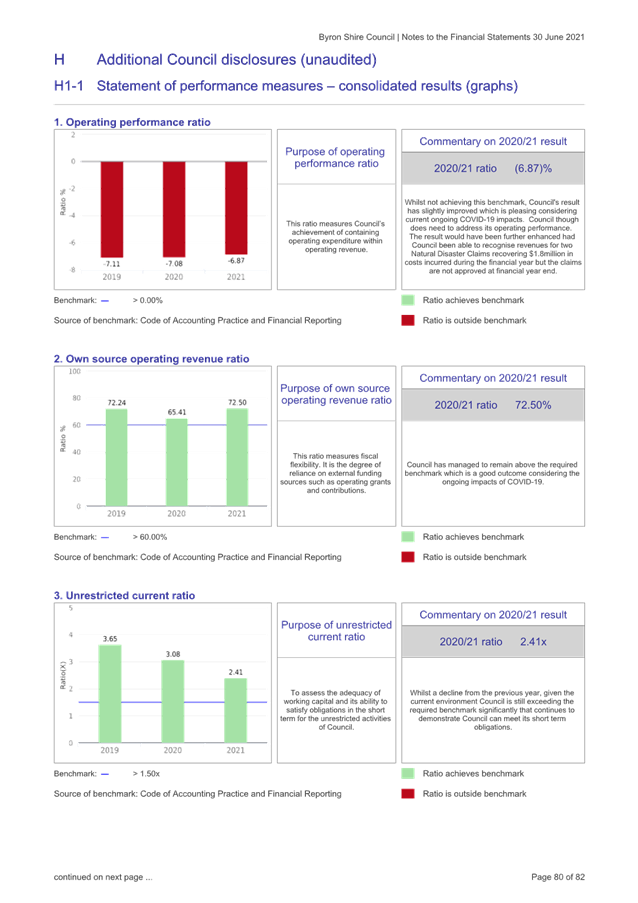

Following from the operating

results, are the performance ratios at Note H1-1 to the General Purpose

Financial Statements. These have been derived following the financial

assessments undertaken by NSW Treasury Corporation on all NSW Councils in 2012

and are now incorporated into the latest update to the Code of Accounting

Practice and Financial Reporting that determines the content of Council’s

Financial Statements. These ratios present either a stable or improving result

for Council except for the following:

1. Operating Performance

Ratio reflects Council’s operating result. The benchmark is to be greater

than 0% but in 2019/2020 Council’s ratio was -7.08% and in 2020/2021 it

was -6.87%, a slight improvement. This ratio was impacted by some one-off items

i.e., demolition costs of the former Mullumbimby Hospital and revenue losses

due to COVID-19. Additionally in 2020/2021 it was significantly

influenced by Council recognising over $1.8million in expenditure restoring

damaged infrastructure from the December 2020 and March 2021 natural disaster

events but not recognising any corresponding revenues. Council has not gained

funding approval for this expenditure at 30 June 2021 and therefore cannot

recognise it even though the Council area was included in the declaration by

State. Council needs to improve this result back towards the benchmark.

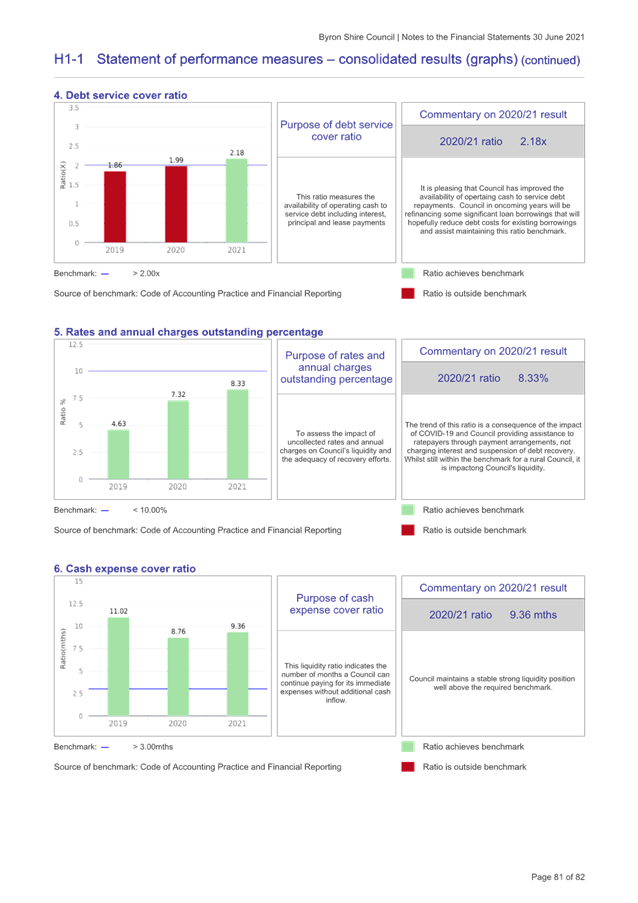

2. Outstanding, Rates and

Annual Charges – Whilst still within the industry benchmark,

Council’s ratio has increased to 8.33% in 2020/2021 from 7.32% in

2019/2020. The increase can be attributable not only to the last year of

the special rate variation, and increases to rates plus annual charge increases

but also to the impact of the COVID-19 pandemic. Through its assistance program

Council has offered ratepayers extended payment arrangements and suspended debt

recovery. Six months of the financial year also had interest on

outstanding rates and charges set to 0% which whilst providing assistance, also

reduces the incentive for people to pay.

· Asset

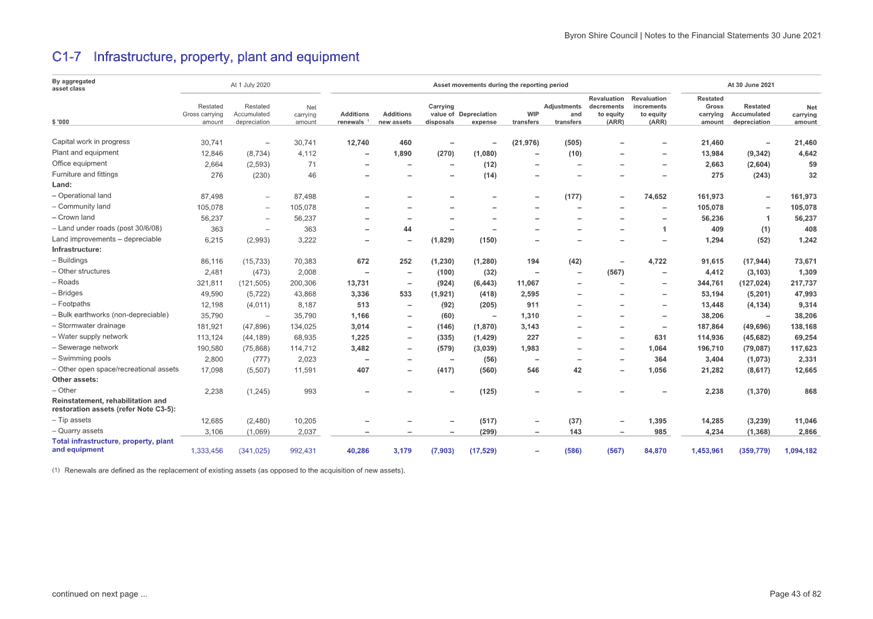

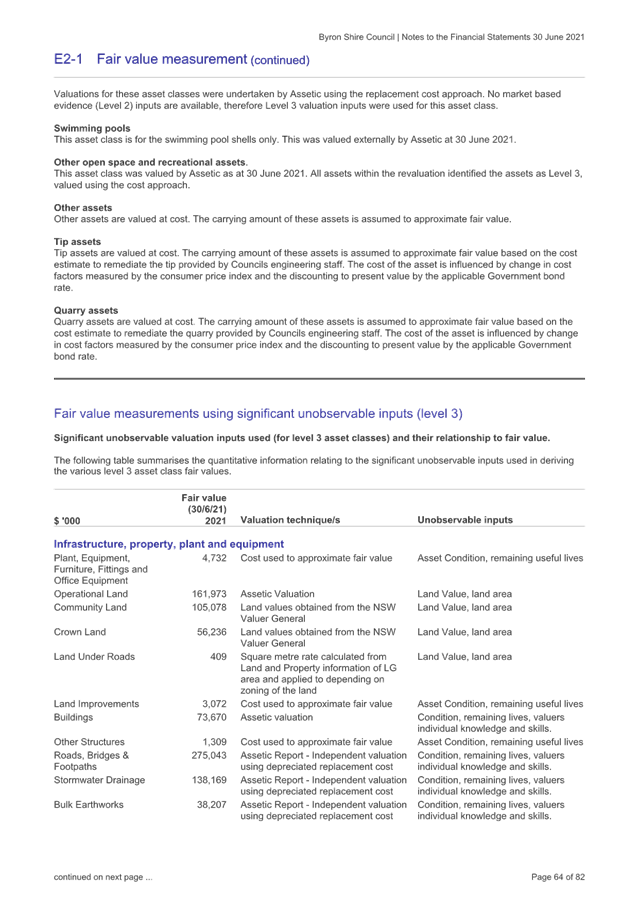

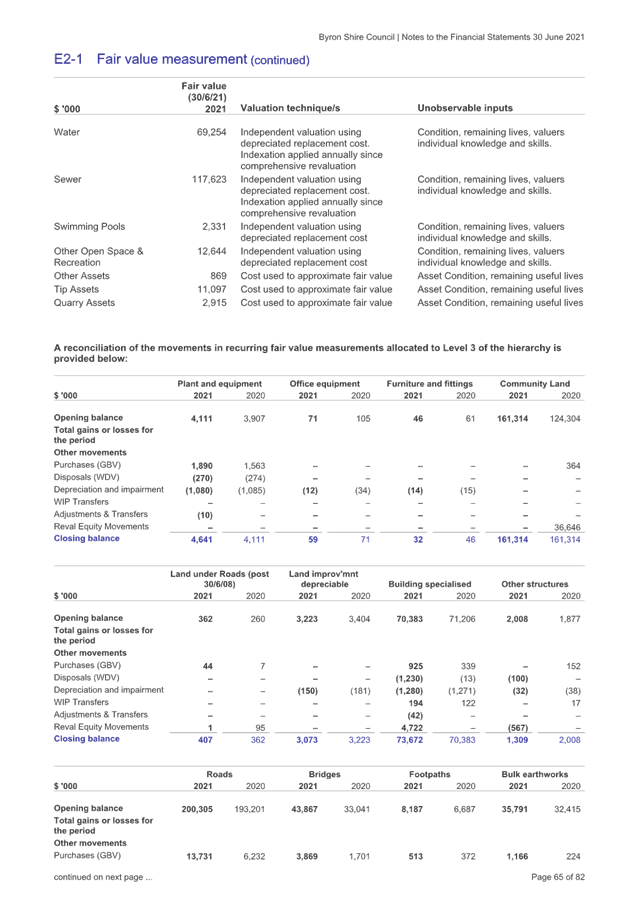

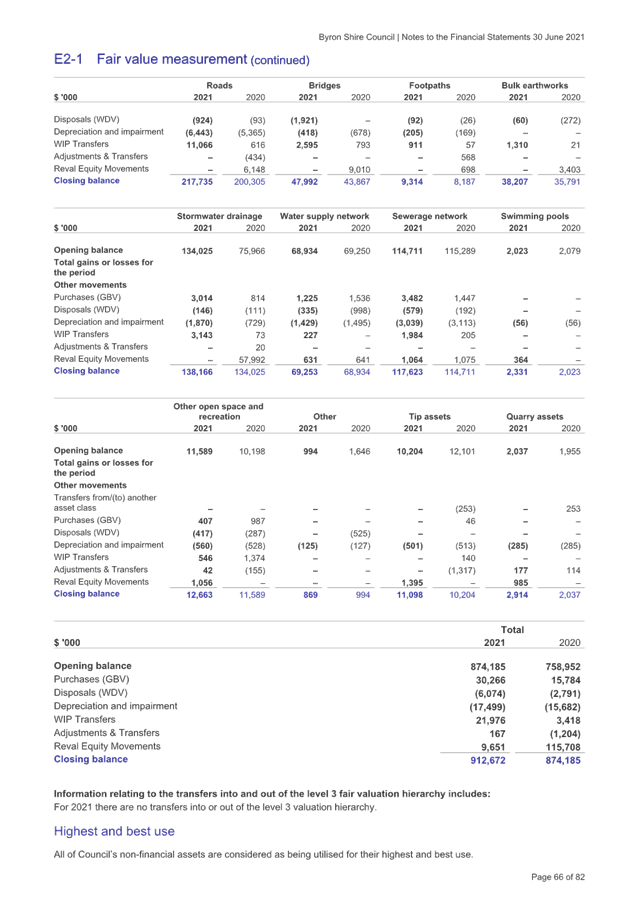

Revaluations

During 2020/2021, a revaluation of assets

relating to Operational Land, Buildings, Other Structures and Open Space Assets

was undertaken. These revaluations have increased Council’s asset values

by the following amounts:

· Operational

Land – $74.652million

· Buildings

– $4.722million

· Other

Structures and Open Space Assets - $1.420million

For the upcoming 2021/2022 financial

year, Council will need to consider the revaluation of Water and Sewerage

Infrastructure assets given these assets have not been revalued since 2017 and

are due for revaluation, albeit they are indexed annually between revaluations.

· Asset

Recognition

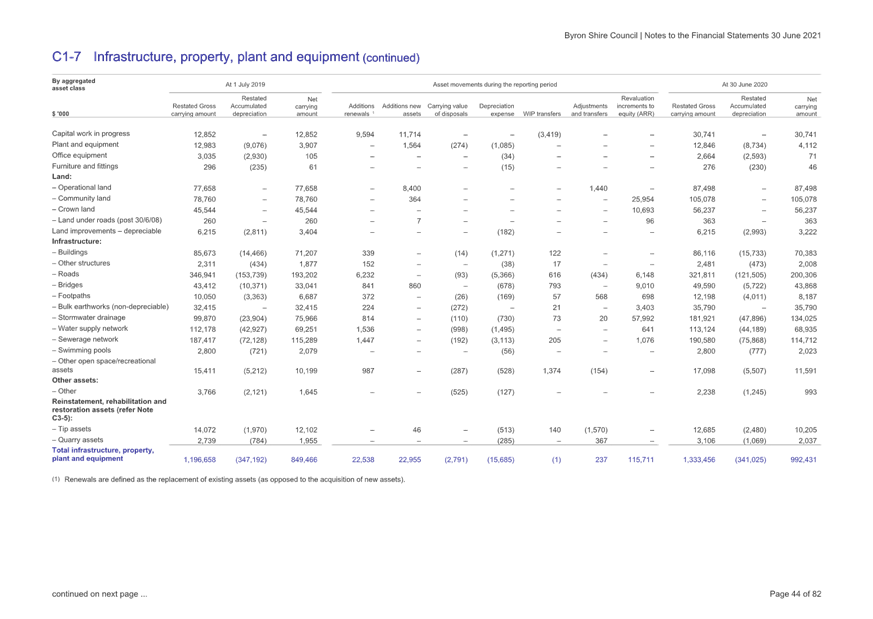

As indicated at Note C1-7 to

Council’s financial statements, Council expended $40.286million on asset

renewals and $3.179million on new assets. The extent of asset renewals is

significant and demonstrates ongoing commitment in that area. The depreciation

expense of Council’s assets for 2020/2021 was $17.529million so it is

pleasing to see that asset renewal was significantly more than the financial

depreciation of Council’s assets.

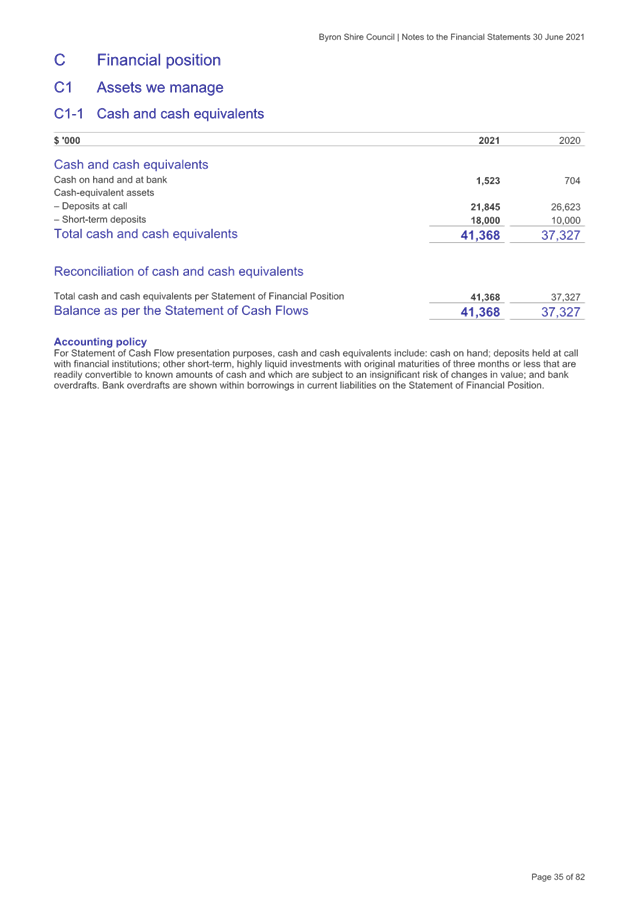

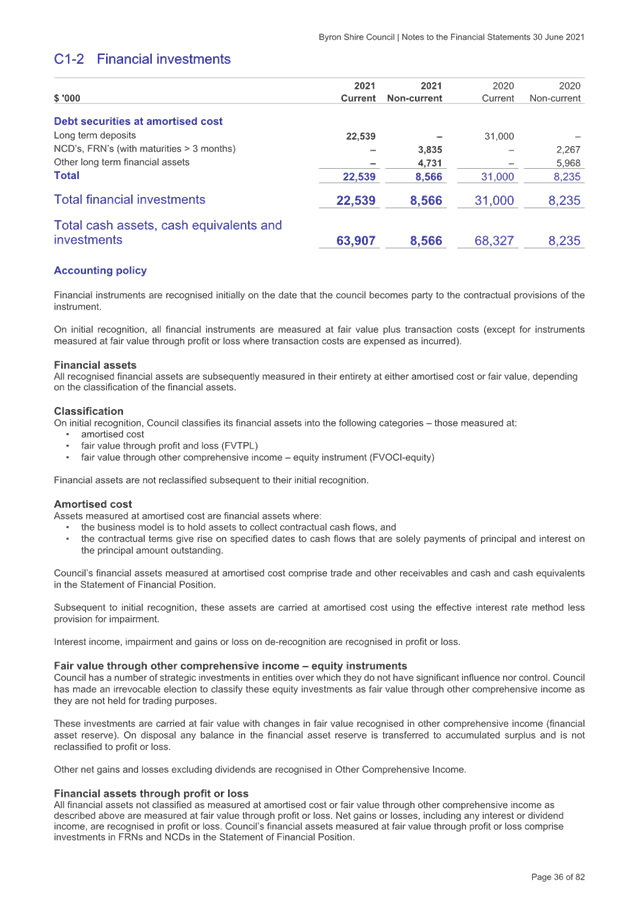

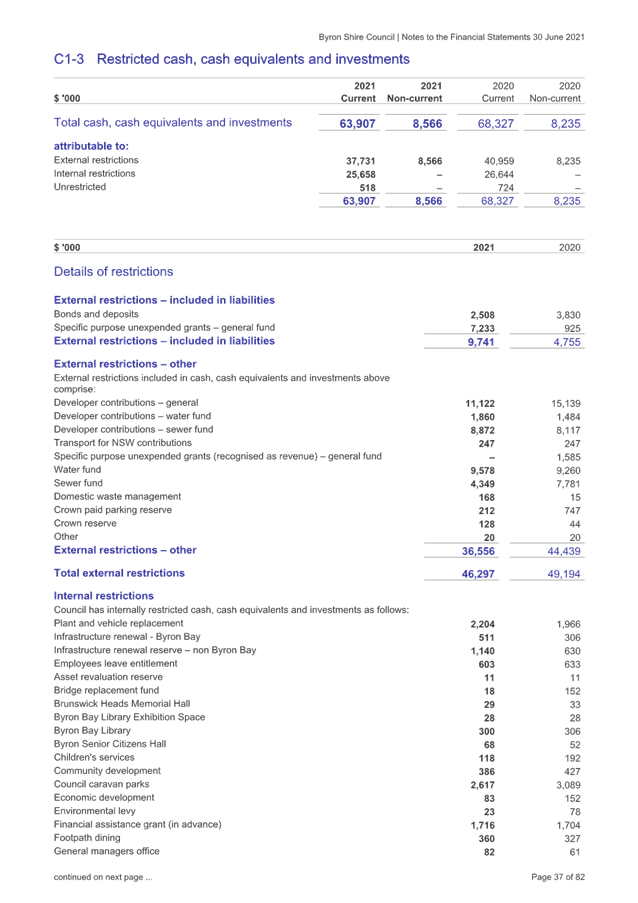

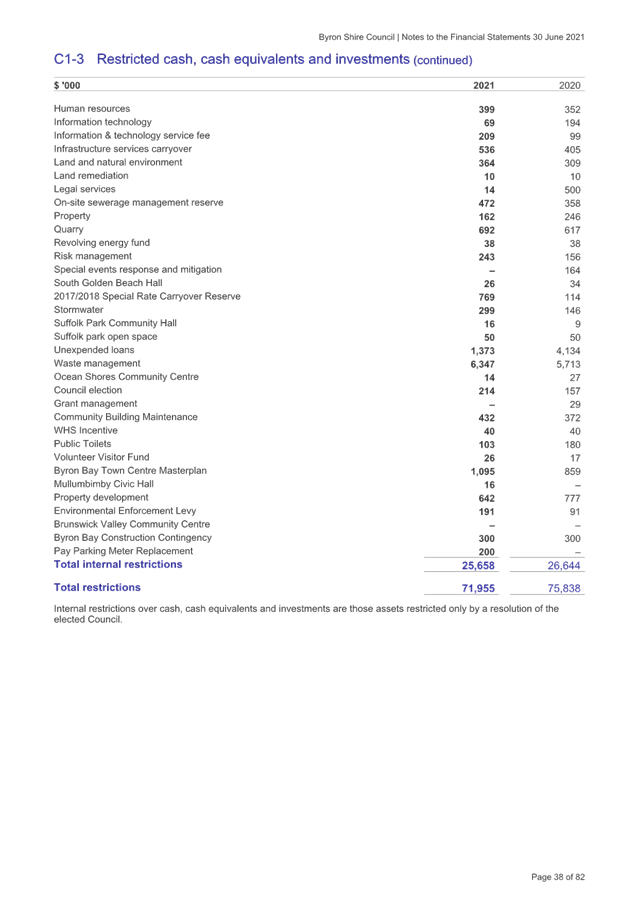

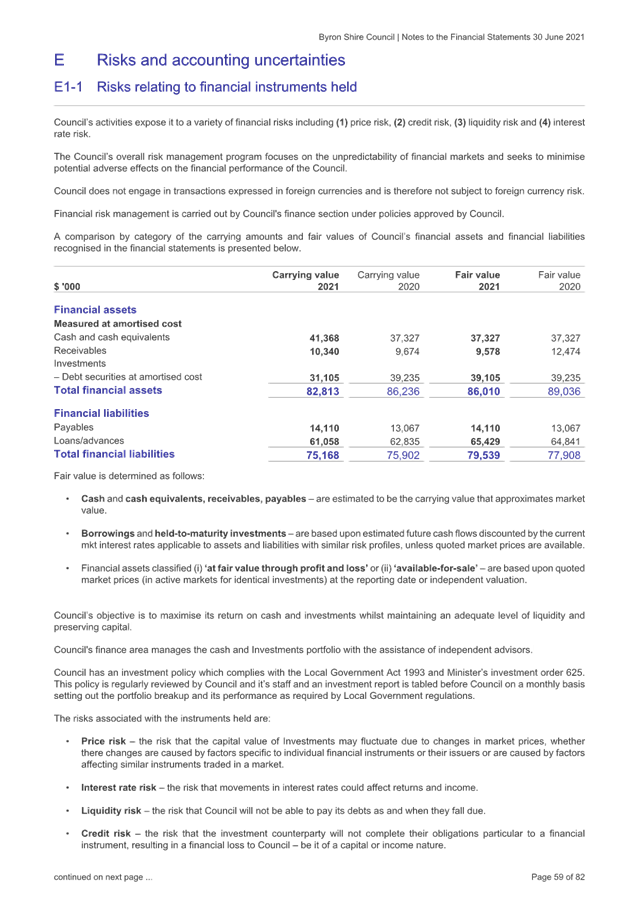

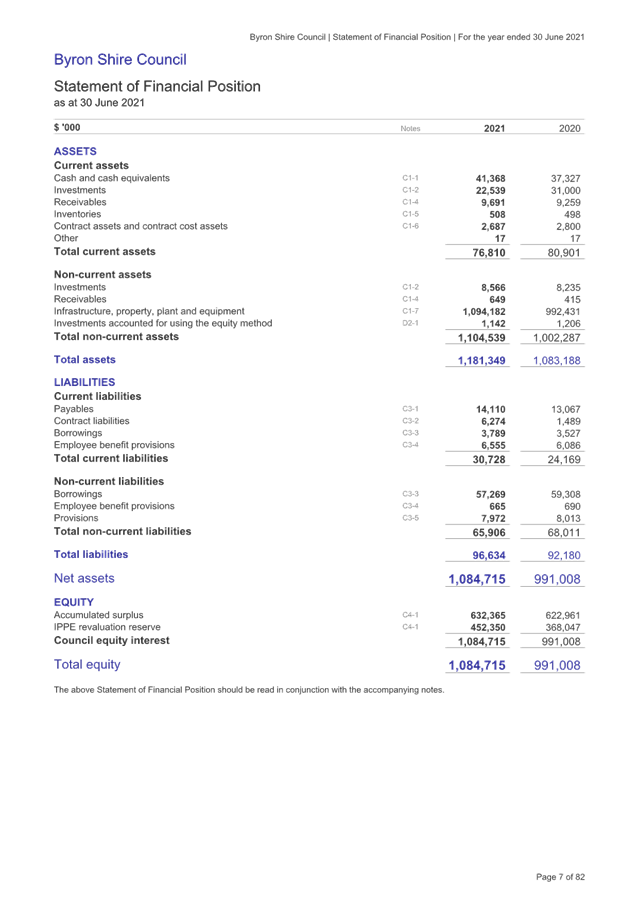

· Cash

and Investments

As at 30 June 2021 as detailed at Note

C1-3 to the financial statements, Council has maintained $0.518million in

unrestricted cash and investments being a reduction of $0.206million compared

to 2019/2020. This is a satisfactory result given the ongoing impacts of

COVID-19 and the assistance Council has endeavoured to provide the community

during these uncertain times.

Whilst still dealing with COVID-19

Council was not able to restore one of its short term financial goals of

reaching an unrestricted cash balance of $1million by the end of

2020/2021. All other cash and investments totalling $71.955million at 30

June 2021 are restricted for specific purposes. Overall, the cash and

investment position of Council decreased by $4.089million during the year.

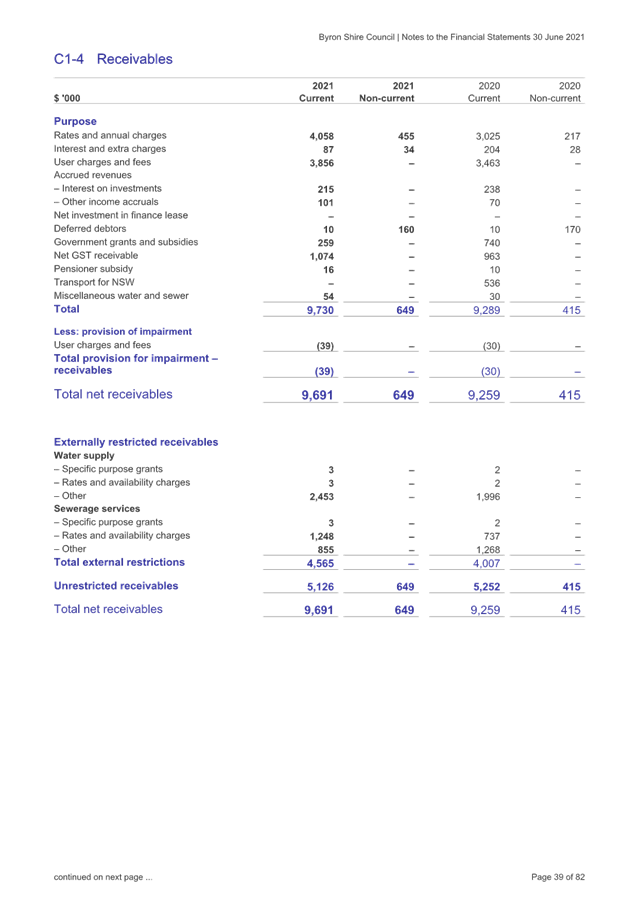

· Receivables

and Contract Assets

As at 30 June 2021 as detailed at Note

C1-4 and C1-6 to the financial statements, Council was due $13.027million in

receivables and contract assets. Of this amount $2.946million was due from

other levels of Government for grants, $1.074million from the Commonwealth

Government for Goods and Services Tax and $0.740million in Government grants

and subsidies. Overall receivables and contract assets increased by

$0.553million compared to the 2019/2020 financial year.

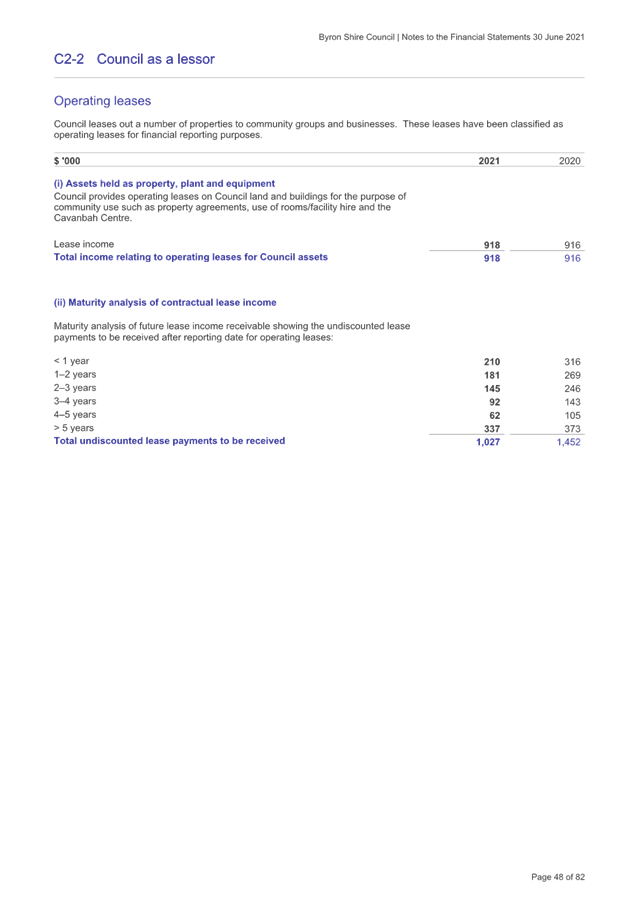

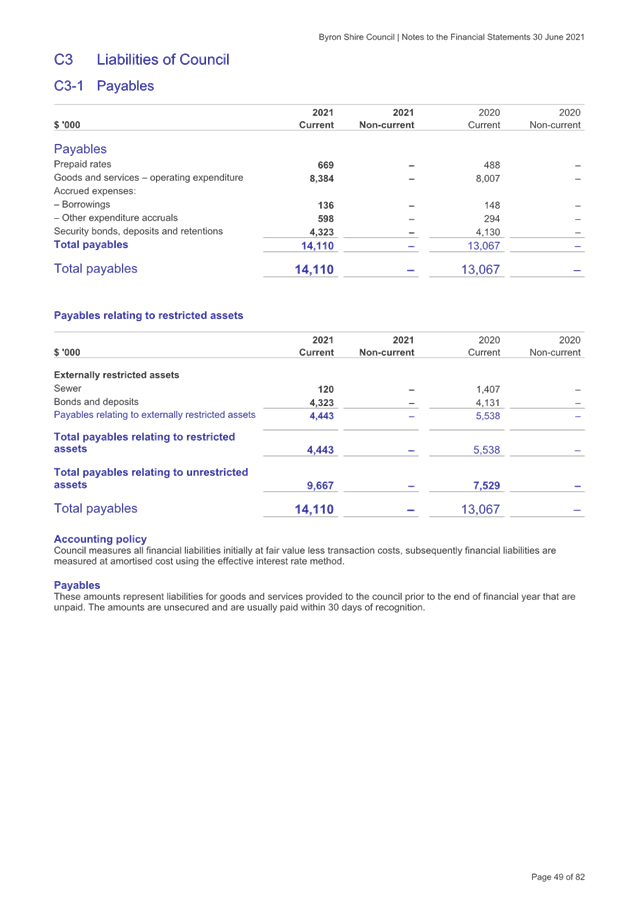

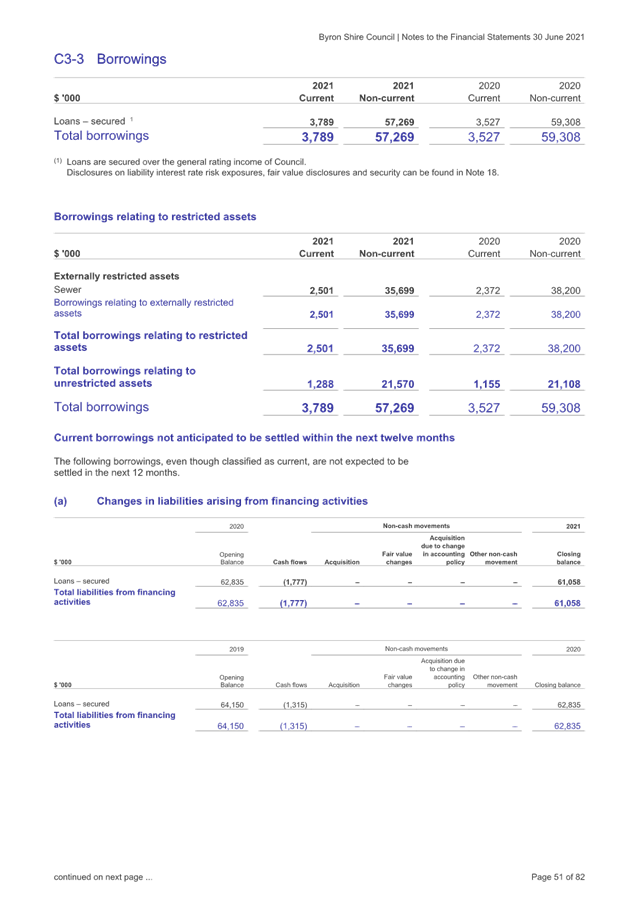

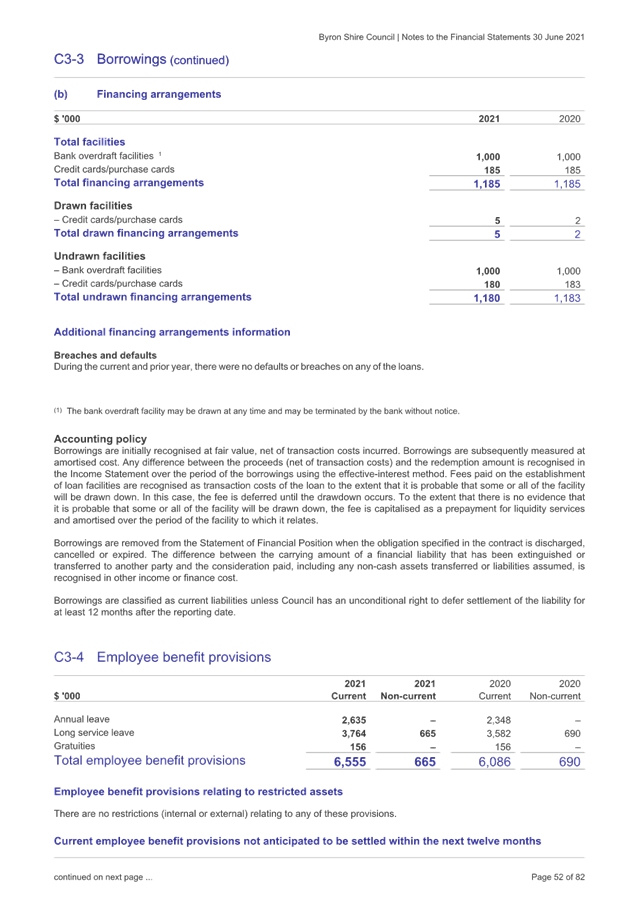

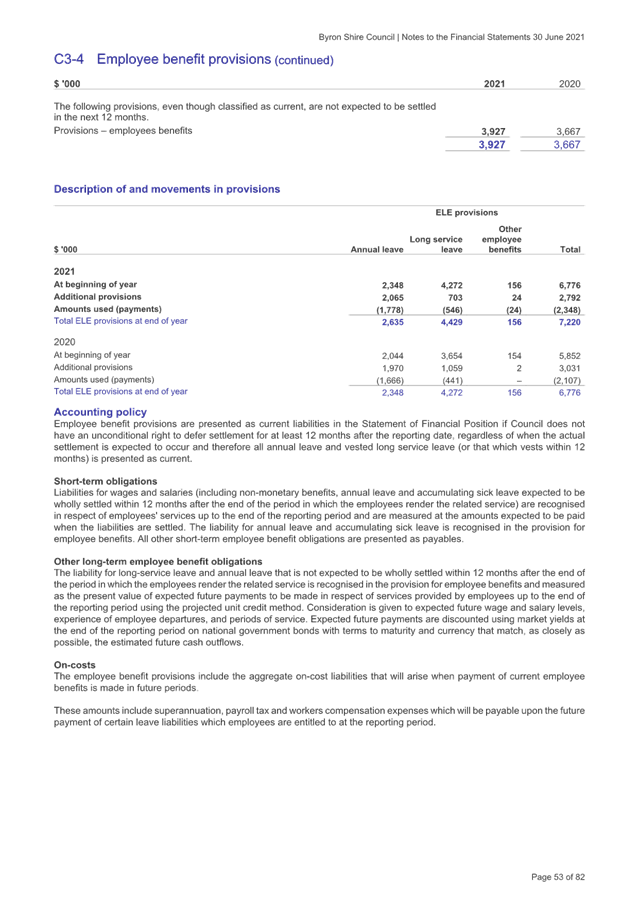

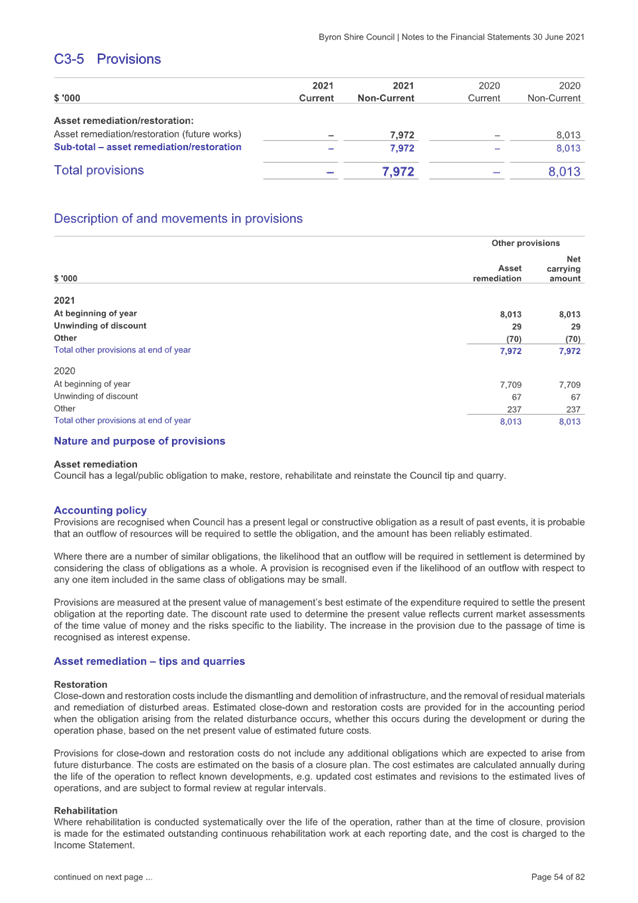

· Payables,

Contract Liabilities and Provisions

At 30 June 2021 as detailed at Note C3-1

for payables, Note C3-2 for Contract Liabilities, Note C3-4 for Employee

Benefit Provisions and Note C3-5 for Provisions, total payables by Council were

$14.110million including $4.323million held in security bonds, deposits and

retentions, $0.734million in accrued expenses and $8.384million payable to

suppliers. In addition at 30 June 2021, Council has accrued employee leave

entitlements valued at $7.220million. Specific employee leave entitlements

include $2.635million for annual leave, $4.429million for long service leave

and $0.156million for gratuities. At 30 June 2021 Council also had

$6.274million in contract liabilities relating to unexpended capital grants and

advance bookings for its holiday parks. It has also made provisions of

$7.972million for the restoration of landfill and quarry assets. In

comparison to 2019/2020, total liabilities have increased $4.454million.

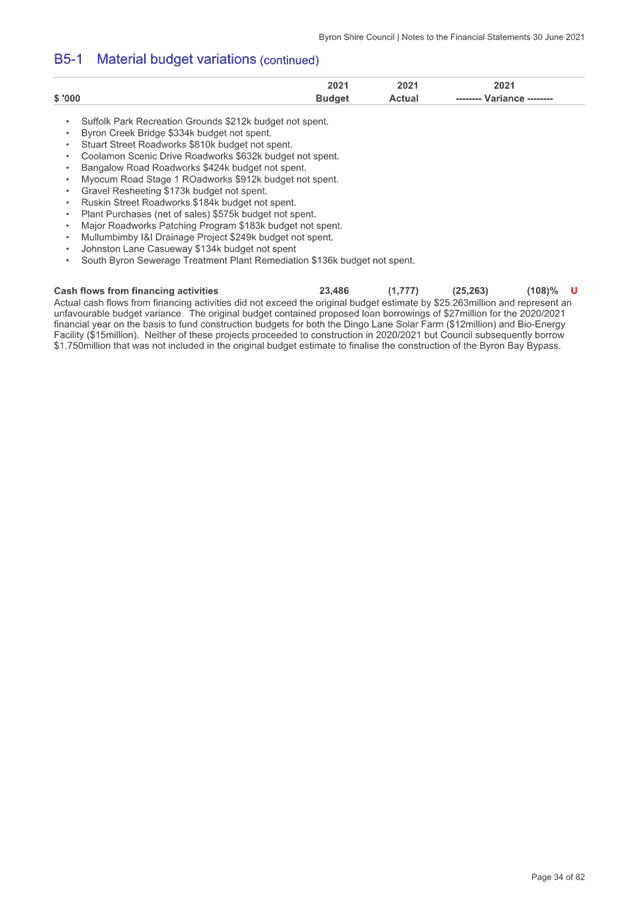

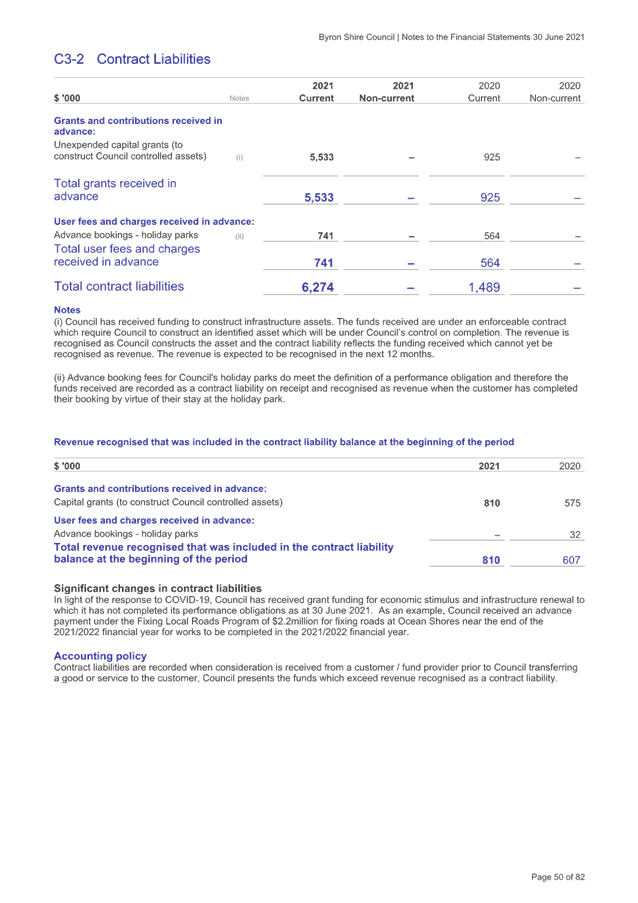

· Loan Borrowings

During 2020/2021

Council borrowed new loans of $1.750million and continued to make normal loan

repayments.

Council’s outstanding loans as at

30 June 2021 are $61.058million. Total loan expenditure for 2019/2021 included

interest of $3.046million and principal payments of $3.527million. Total expenditure

in 2020/2021 related to loan repayments was $6.573million or 7.96% of

Council’s revenue, excluding all grants and contributions.

The outstanding loans by Fund totalling

$61.058million are as follows:

· General

Fund $22.858million

· Water

Fund $0 –

Water Fund is debt free

· Sewerage

Fund $38.200million

· New

Accounting Standards

The 2020-2021 financial year has required

Council to implement the following new accounting standard:

· AASB

1059 – Service Concession Arrangements: Grantors

A position paper was presented to the

Audit, Risk and Improvement Committee on 19 August 2021 suggesting after review

that this new Accounting Standard had no impact on the financial reporting or

results for Byron Shire Council.

Liquidity

Council’s Statement of Financial

Position (balance sheet) indicates net current assets of $46.082million. It is

on this basis, in the opinion of the Responsible Accounting Officer, that the

short term financial position of Council remains in a satisfactory position and

that Council can be confident it can meet its payment obligations as and when

they fall due. That is, there is no uncertainty as to Council being considered

a ‘going concern’. In addition, Council’s cash expense

cover ratio is at 9.36 months whereas the minimum benchmark is 3 months.

Council exceeds this benchmark by three times.

Council’s Unrestricted Current

Ratio has declined to 2.41, demonstrating Council has $2.41 in unrestricted

current assets compared to every $1.00 of unrestricted current liabilities.

This exceeds the benchmark of $1.50.

On a longer term basis Council will need

to consider its financial position carefully. Nevertheless, in isolation, the

financial results for 2020/2021 continue to present a ‘stable’

financial position especially given the ongoing impacts of COVID-19. Effort

will need to be made to manage the trend towards reducing operational deficits

before capital grants and contributions. Furthermore, it will be a goal

to endeavour to restore the unrestricted cash balance back to $1million during

the 2021/2022 financial year which could not be achieved during 2020/2021.

Strategic

Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 5: We have community led decision making which is open and

inclusive

|

5.5

|

Manage

Council’s finances sustainably

|

5.5.2

|

Ensure the

financial integrity and sustainability of Council through effective planning

and reporting systems (SP)

|

5.5.2.2

|

Complete

annual statutory financial reports

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

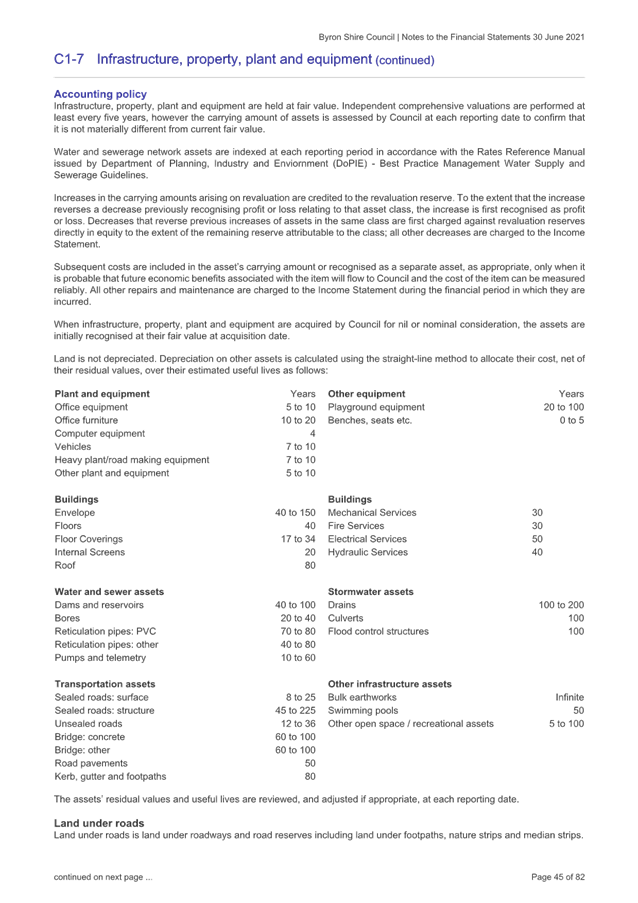

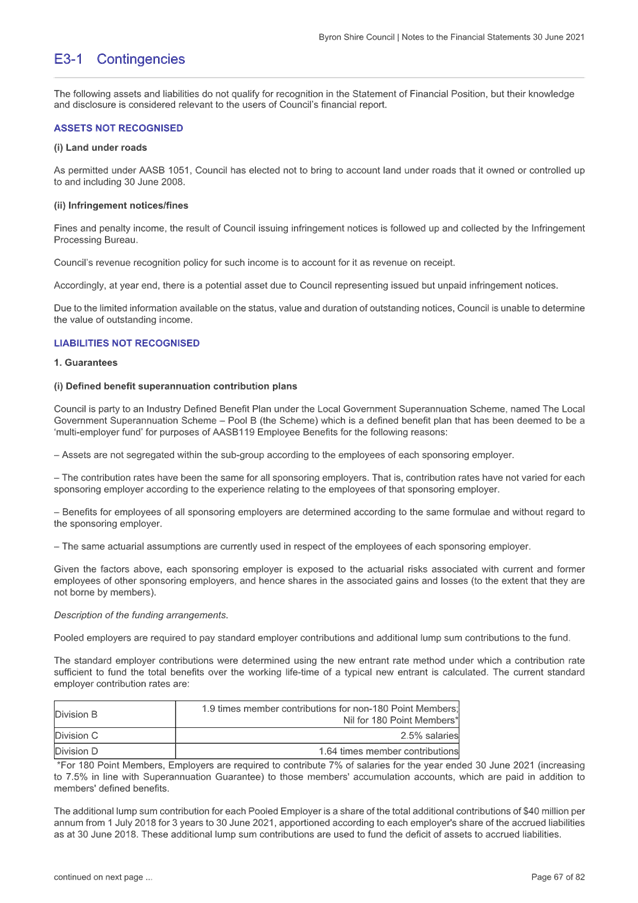

Legal/Statutory/Policy Considerations

Section 413(2)(c) of the Local Government

Act 1993 and Section 215 of the Local Government (General) Regulation 2021

requires Council to specifically form an opinion on the financial

statements. Specifically Council needs to sign off an opinion on the

Financial Statements regarding their preparation and content as follows:

In this regard the Financial Statements

have been prepared in accordance with:

· The

Local Government Act 1993 (as amended) and the Regulations made thereunder.

· The

Australian Accounting Standards and professional pronouncements.

· The

Local Government Code of Accounting Practice and Financial Reporting.

And the content to the best of our

knowledge and belief:

· Presents

fairly the Council’s operating result and financial position for the

year.

· Accords

with Council’s accounting and other records.

· Management

is not aware of any matter that would render the Financial Statements false or

misleading in any way.

Section 416(1) of the Local Government

Act 1993, requires a Council’s annual Financial Statements to be prepared

and audited within four (4) months of the end of that financial year i.e. on or

before 31 October 2021.

Section 417(4) of the Local Government Act 1993 requires, as

soon as practicable after completing the audit, the Auditor must send a copy of

the Auditor’s Reports to the Departmental Chief Executive and to the

Council.

Section 417(5) of the Local Government Act 1993 requires

Council, as soon as practicable after receiving the Auditor’s Reports, to

send a copy of the Auditor’s Reports on the Council’s Financial

Statements, together with a copy of the Council’s audited Financial

Statements, to the Departmental Chief Executive before 7 November 2021.

Section 418(1) of the Local Government

Act 1993 requires Council to fix a date for the Meeting at which it proposes to

present its audited Financial Statements, together with the Auditor’s

Reports, to the public, and must give public notice of the date so fixed. This

requirement must be completed within five weeks after Council has received the

Auditor’s Reports.

Financial

Considerations

There are no direct financial

implications associated with this report as the report does not involve any

future expenditure of Council funds but is a report advising on Council’s

draft financial outcomes during the 2020/2021 financial year, which are

identified in this report and attachments. These financial outcomes are also

still subject to final review by the NSW Audit Office and may change.

Consultation

and Engagement

Section 420 of the Local Government Act

1993 requires Council to provide the opportunity for the public to submit

submissions on the Financial Statements. Submissions are to be submitted

within seven days of the Financial Statements being presented to the

public. In the case of the 2020/2021 Financial Statements, the closing

date for submissions is expected to be 3 December 2021.

Staff

Reports - Corporate and Community Services 4.3 - Attachment 1

Staff

Reports - Corporate and Community Services 4.3 - Attachment 2