What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Code of Conduct for Councillors (eg. A friendship, membership of an

association, society or trade union or involvement or interest in an activity

and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

Committee members are reminded that they should declare and manage all

conflicts of interest in respect of any matter on this Agenda, in accordance

with the Code of Conduct.

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development

application, an environmental planning instrument, a development control plan

or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register

containing, for each planning decision made at a meeting of the council or a

council committee, the names of the councillors who supported the decision and

the names of any councillors who opposed (or are taken to have opposed) the

decision.

(3) For the purpose of maintaining the register, a division

is required to be called whenever a motion for a planning decision is put at a

meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described

in the register or identified in a manner that enables the description to be

obtained from another publicly available document and is to include the

information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are

reminded of the oath of office or affirmation of office made at or before their

first meeting of the council in accordance with Clause 233A of the Local

Government Act 1993. This includes undertaking the duties of the office of

councillor in the best interests of the people of Byron Shire and the Byron

Shire Council and faithfully and impartially carrying out the functions,

powers, authorities and discretions vested under the Act or any other Act

to the best of one’s ability and judgment.

Late Reports 4.1

Late Reports

Report No. 6.1 Draft 2021/2022

Financial Statements

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2022/1701

Summary:

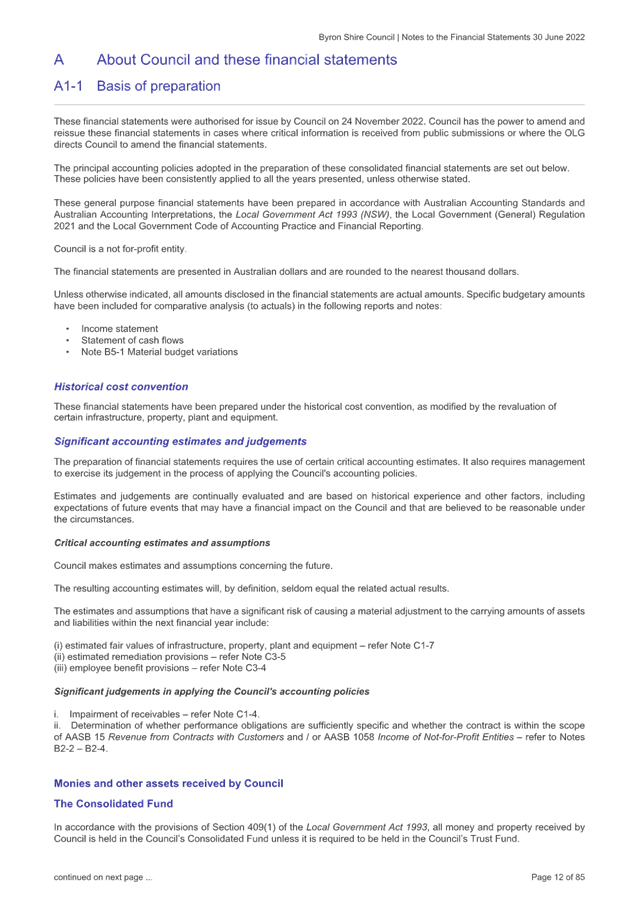

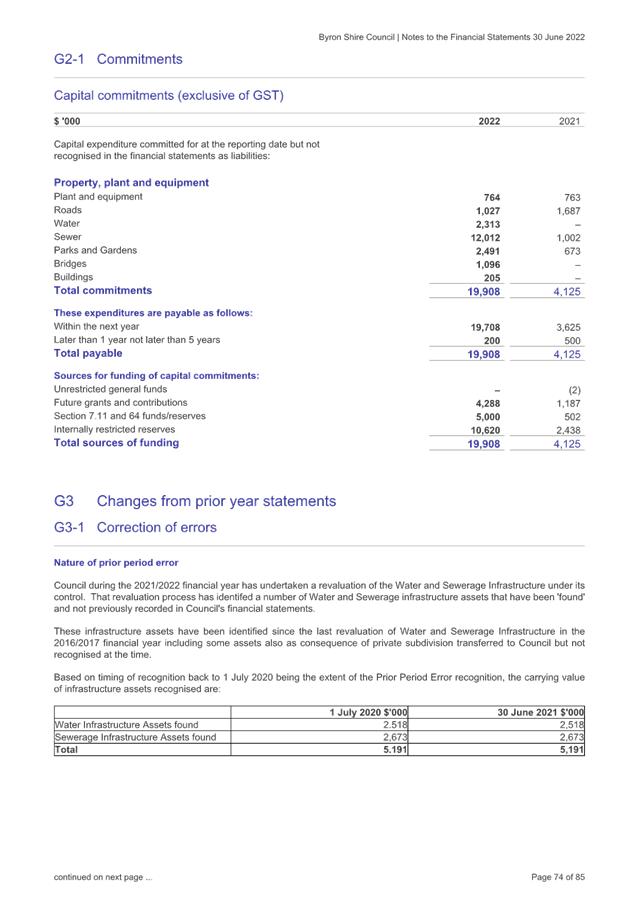

The Draft 2021/2022 Financial Statements have been prepared,

and at the time of writing, are subject to external audit still in progress,

albeit close to finalisation. Council’s file has been lodged with

the NSW Audit Office for review and has been subject to audit review by the

contracted auditor, Thomas Noble and Russell. The Audit Office of NSW has

now issued the Audit Engagement Closing Report on 16 November 2022.

The report to Council recommends the adoption of the Draft

2021/2022 Financial Statements as prepared and the completion of the statutory

steps outlined in Section 418 to 420 of the Local Government Act 1993.

RECOMMENDATION:

1. That

the Audit, Risk and Improvement Committee note the Audit Engagement Closing

Report for the year ended 30 June 2022 provided by the Audit Office of NSW

provided at Confidential Attachment 3 (#E2022/113308).

2. That the Audit, Risk and

Improvement Committee recommend to Council:

(a) That

Council adopts the Draft 2021/2022 Financial Statements incorporating the

General Purpose Financial Statements (#E2022/112363) and Special Purpose

Financial Statements (#E2022/112364).

(b) That

Council approves the signing of the “Statement by Councillors and

Management” in accordance with Section 413(2)(c) of the Local Government

Act 1993 and Section 215 of the Local Government (General) Regulation 2021 in

relation to the 2021/2022 Draft Financial Statements.

(c) That the

Audited Financial Statements and Auditors Report be presented to the public at

the Ordinary Meeting of Council scheduled for 15 December 2022 in accordance

with Section 418(1) of the Local Government Act 1993.

Attachments:

1 Draft

2021-2022 General Purpose Financial Statements, E2022/112363 , page 19⇩

2 Draft

2021-2022 Special Purpose Financial Statements, E2022/112364 , page 104⇩

3 Confidential

- External Audit Engagement Closing Report 30 June 2022, E2022/113308

Report

The Draft 2021/2022 Financial Statements have been prepared,

and at the time of writing this report, are subject to external audit still in

progress, albeit close to finalisation. Council’s file has been

lodged with the NSW Audit Office for review and has been subject to audit

review by the contracted auditor, Thomas Noble and Russell. The Audit Office of

NSW has now issued the Audit Engagement Closing Report on 16 November 2022.

External Audit Engagement Closing Report

Provided at Confidential Attachment 3 is the External Audit

Closing Report for the year ended 30 June 2022 by the Audit Office of

NSW. This report provides information to the Audit, Risk and Improvement

Committee about the audit outcome, audit findings and the audit process.

A representative on behalf of the Audit Office of NSW will also provide a

presentation regarding the Report to the Committee at the 17 November 2022

Meeting.

Financial Statements

This report recommends to Council,

following consideration, the adoption of the Draft 2021/2022 Financial

Statements as prepared and the completion of the statutory steps outlined in

Section 418 to 420 of the Local Government Act 1993. The Audit, Risk and

Improvement Committee will also be considering the Draft 2021/2022 Financial

Statements their Committee Meeting held on 17 November 2022 anticipated to be a

late report.

The Financial Statements are a statutory

requirement and provide information on the financial performance of Council

over the previous twelve-month period.

The Draft 2021/2022 Financial Statements

provided in the attachments are broken down into:

- General

Purpose Financial Statements – Attachment 1

- Special

Purpose Financial Statements – Attachment 2

As in previous years, Council produces

Special Schedules that are not audited (except Permissible Income for General

Rates). However, since the 2018/2019 financial year, they are no longer

required to be published as part of Council’s Financial Statements,

except for the Special Schedules relating to Permissible Income for General Rates

and Report on Infrastructure Assets. The Special Schedules are still

produced and submitted to the Office of Local Government.

Brief explanations for each item follow:

General Purpose

Financial Statements

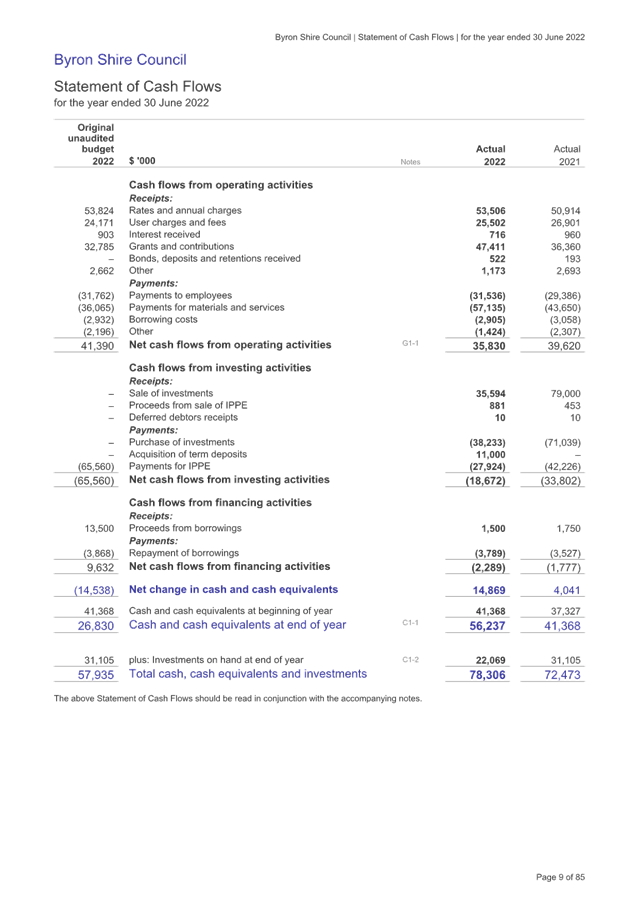

These Statements provide an overview of the operating result,

financial position, changes in equity and cash flow movement of Council as at

30 June 2022 on a consolidated basis with internal transactions between

Council’s General, Water and Sewerage Funds eliminated. The notes

included with these reports provide details of major items of income and

expenditure with comparisons to the previous financial year. The notes also

highlight the cash position of Council and indicate which funds are externally

restricted (i.e., may be used for a specific purpose only), and those that may

be used at Council’s discretion.

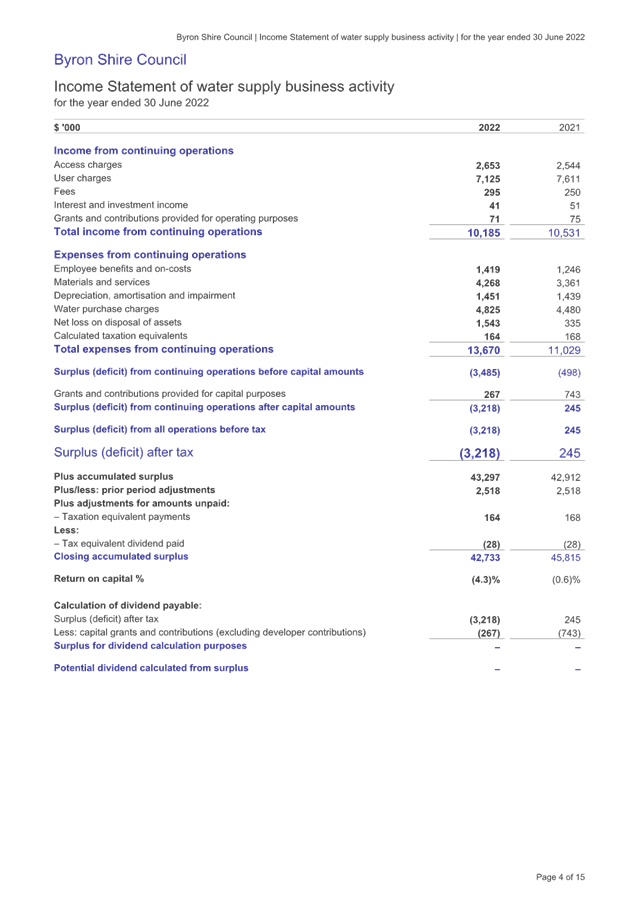

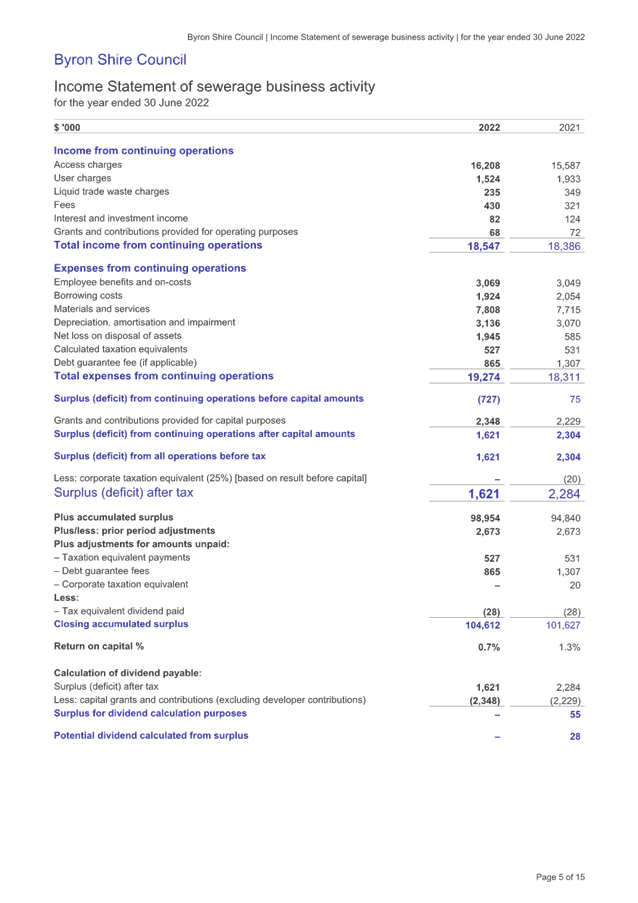

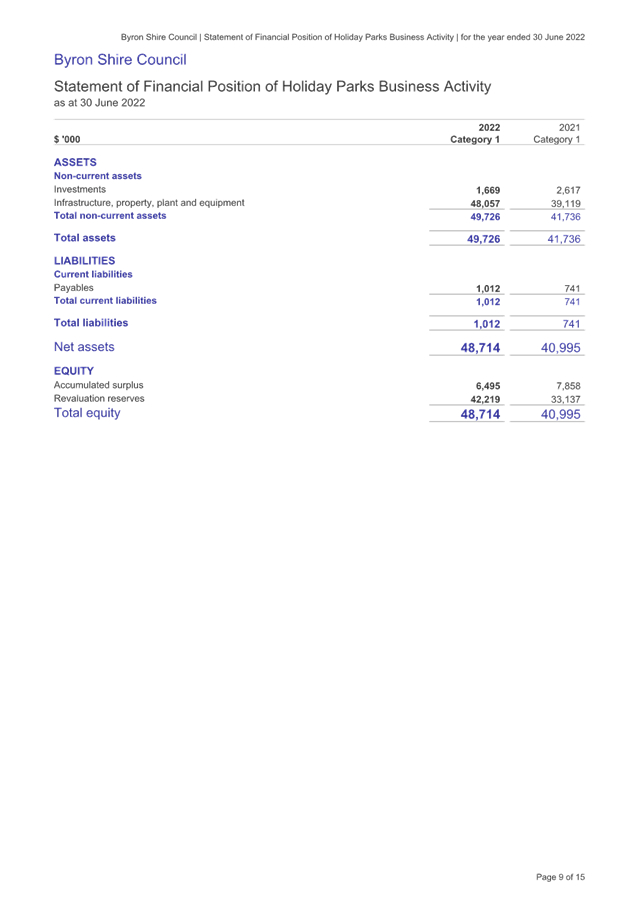

Special Purpose Financial Statements

These Statements are a result of the implementation of the National

Competition Policy and relate to those aspects of Council’s operations

that are business oriented and compete with other businesses with similar

operations. Mandatory disclosures in the Special Purpose Financial Reports are

Water and Sewerage.

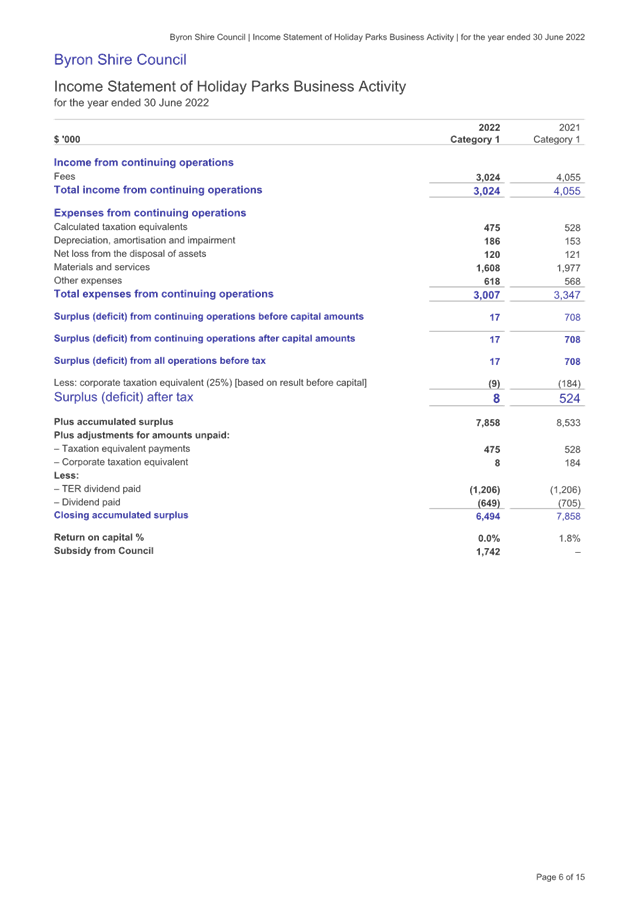

Additional disclosures relate to Council

business units that Council deems ‘commercial’. In this

regard Council has traditionally reported its caravan park operations, being

Suffolk Beachfront Holiday Park and First Sun Holiday Park, on a combined

basis. These financial reports must also classify business units in the

following categories:

· Category

1 – operating turnover is greater than $2million

· Category

2 – operating turnover is less than $2million

All Council’s business units are

classed as Category 1 with all having operating turnover greater than $2

million.

Another feature of the Special Purpose

Financial Reports is to build taxes and charges, where not physically incurred,

into the financial results in order that the results can be measured on a level

playing field with other organisations operating similar businesses, who are

required to pay these additional taxes and charges. These taxes and

charges include:

· Land

tax – Council is normally exempt from this tax, so notional land tax is

applied.

· Income

tax – Council is exempt from income tax and in regard to these reports,

company tax. Any surplus generated has a notional company tax applied to it.

· Debt

guarantee fees – Generally due to the low credit risk associated with

Councils, Councils can often borrow loan funds at lower interest rates then the

private sector. A debt guarantee fee inflates the borrowing costs by

incorporating a notional cost between interest payable on loans at the interest

rate borrowed by Council and one that would apply commercially.

The Special Purpose Financial Reports are

prepared on a non-consolidated basis - in other words they are grossed up to

include any internal transactions with the General Fund.

Specific Items relating to 2021/2022

Draft Financial Statements

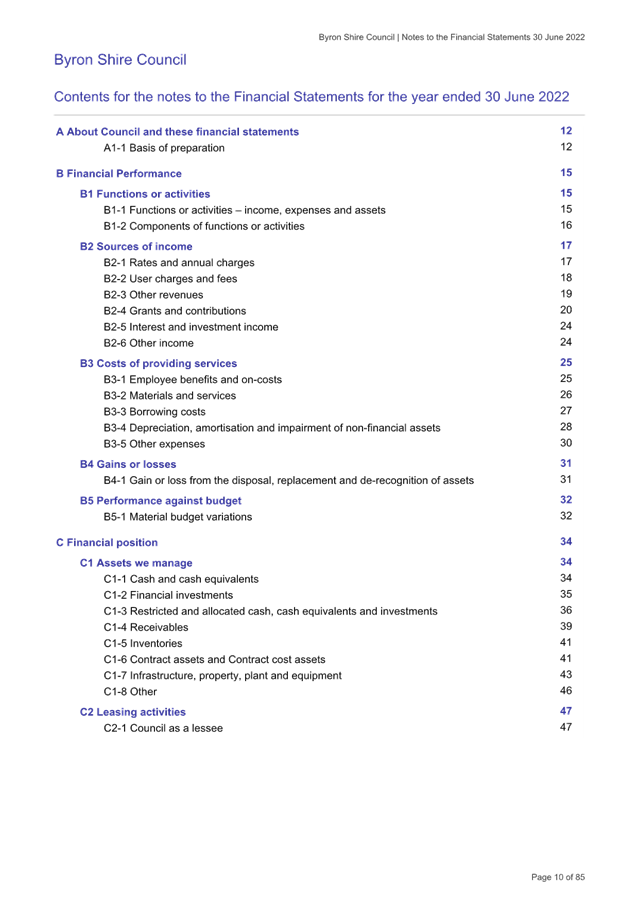

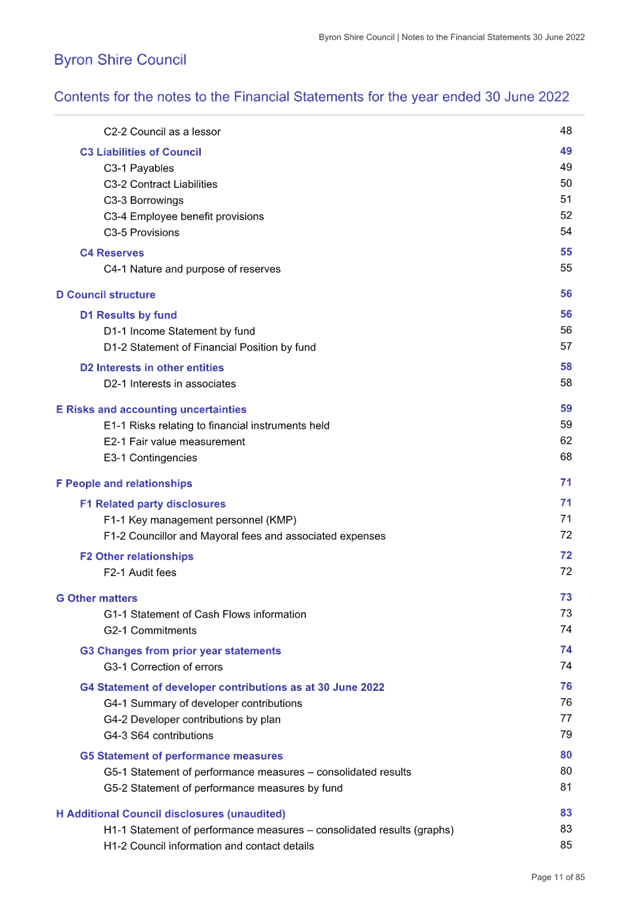

Before consideration is given to actual

financial outcome, it needs to be pointed out that the Office of Local

Government restructured the Local Government Code of Accounting Practice and Financial

Reporting from the 2020/2021 financial year onwards. This means that the notes

to the General Purpose Financial Statements are now broken into Sections as

follows:

· Section

A – About Council and these Financial Statements

· Section

B – Financial Performance

· Section

C – Financial Position

· Section

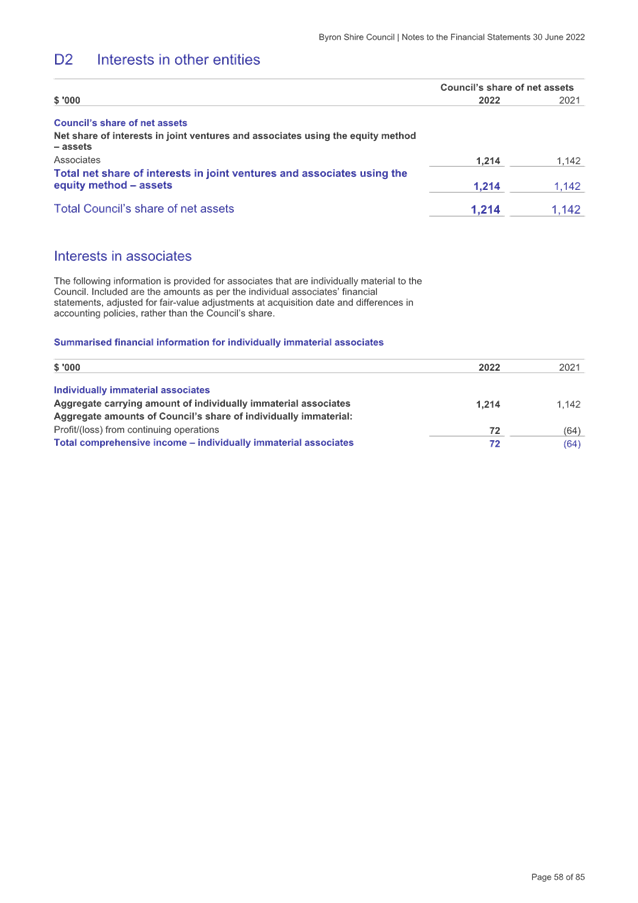

D – Council Structure

· Section

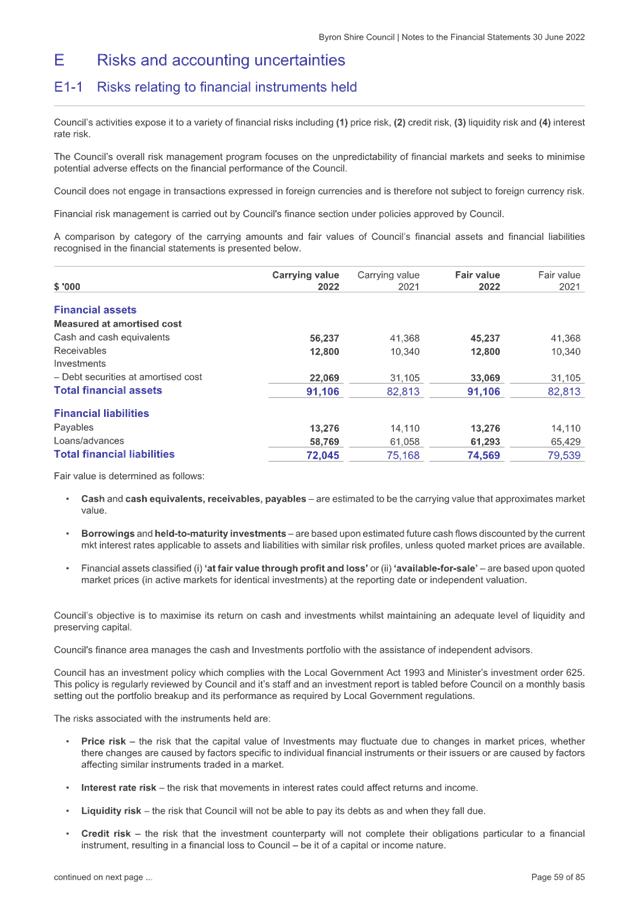

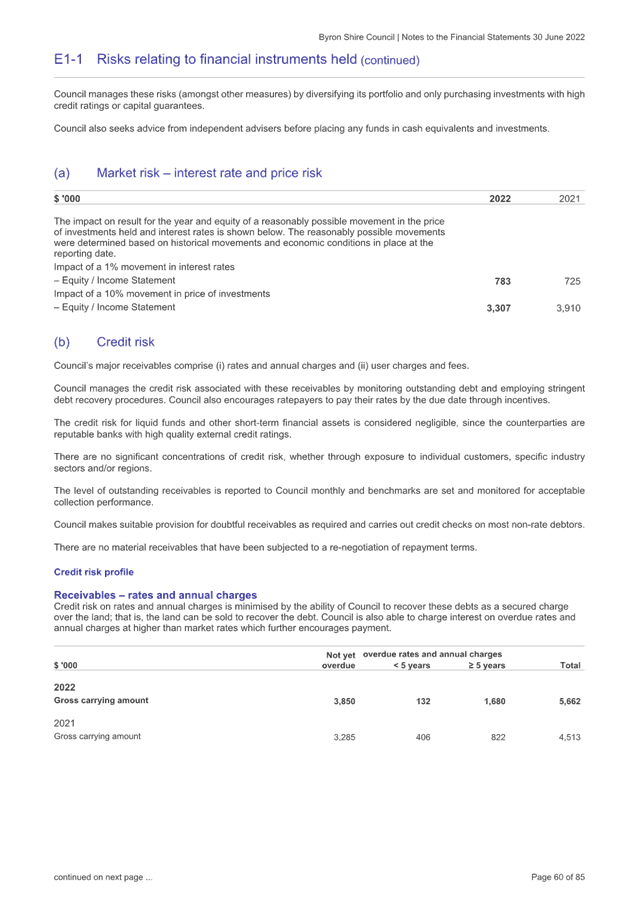

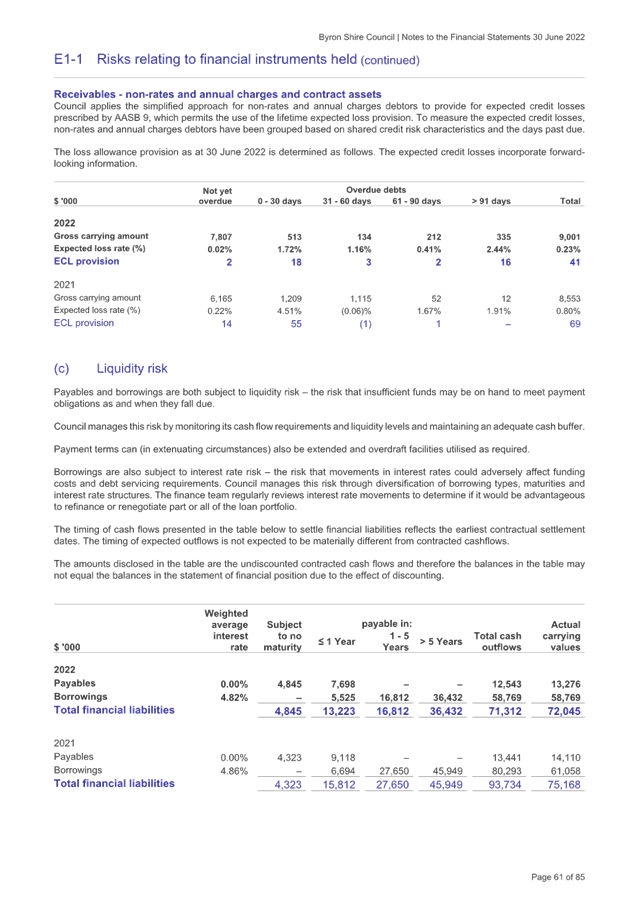

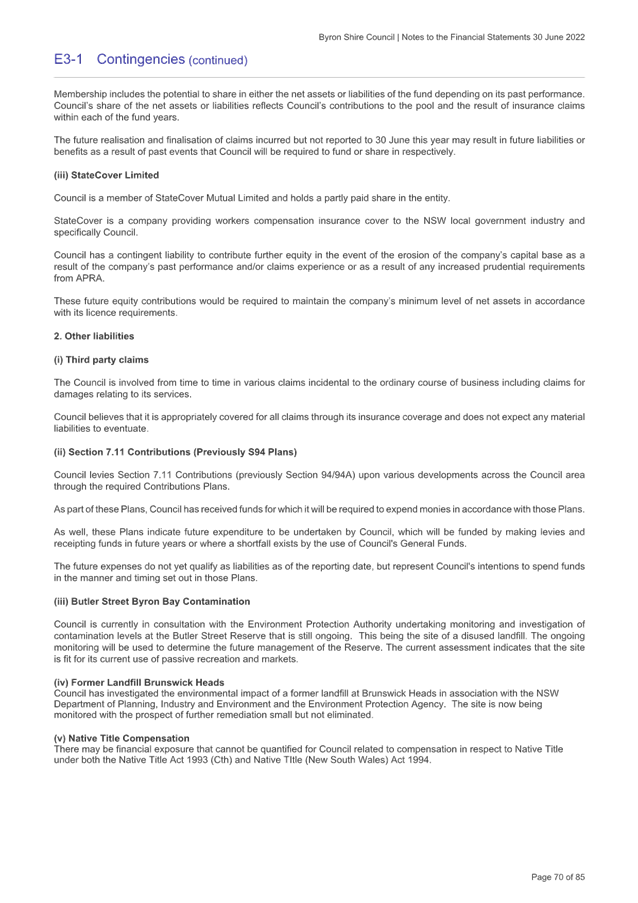

E – Risks and Accounting Uncertainties

· Section

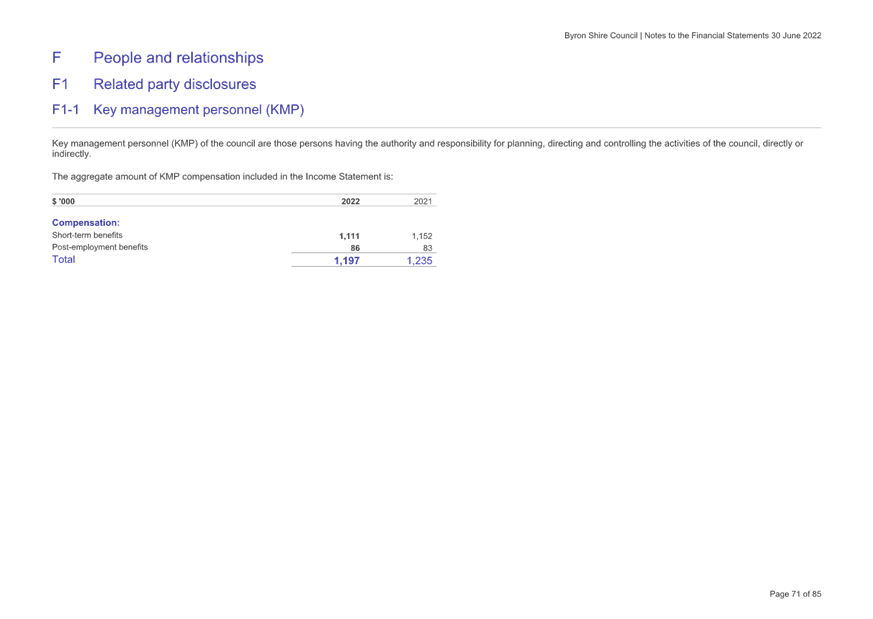

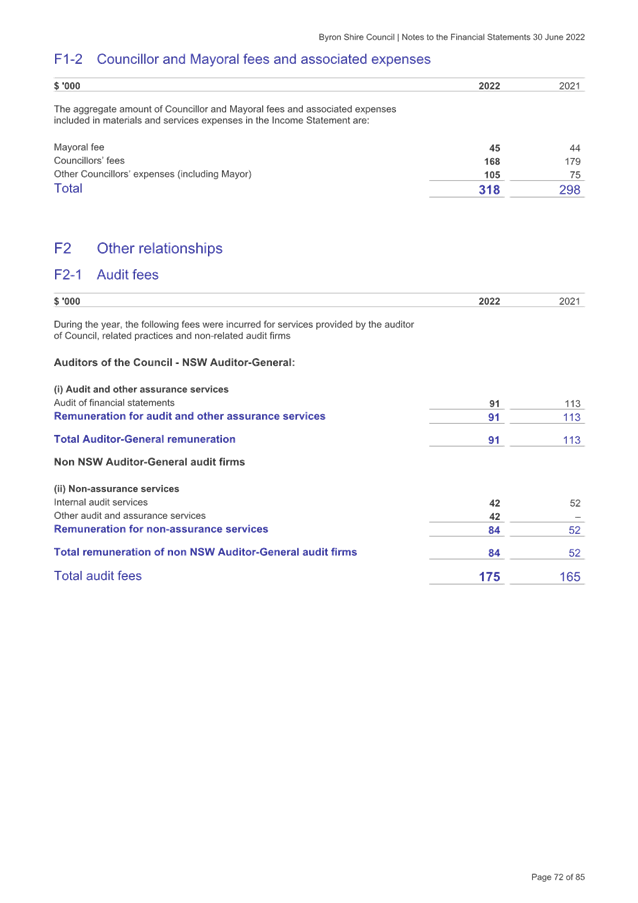

F – People and Relationships

· Section

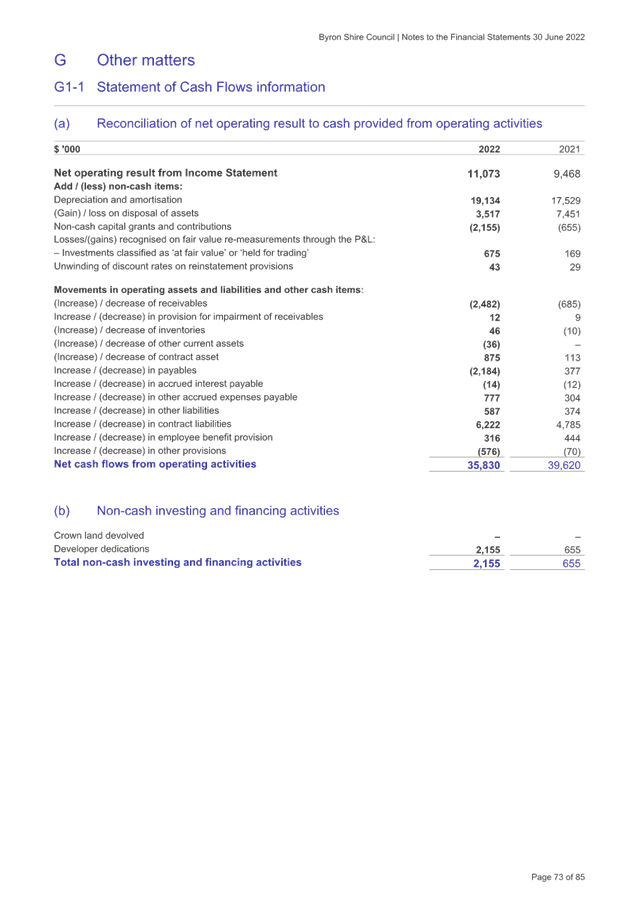

G – Other Matters

· Section

H – Additional Council Disclosures

Some line items previously within certain

notes have been moved to other notes.

The Draft 2021/2022 Financial Statement

results have been impacted by the following items that require explanation:

· Overall

Audit Outcome

Council for the 2021/2022 financial year

will receive a ‘modified’ or ‘qualified’ audit opinion

from the NSW Audit Office. This relates to the General Purpose Financial

Statements and is due to the non-recognition of Rural Fire Service ‘Red

Fleet’ assets by Council.

The Rural Fire Service (RFS) does not

recognise ‘Red Fleet’ assets in their accounts as there is a

provision in the Rural Fire Service Act 1997 that these assets

‘vests’ in Council. However, under Australian Accounting Standard

AASB 116 “Property, Plant and Equipment’ the Local Government Code

of Accounting Practice, Council must assess whether it is of the view it

‘controls’ these assets in order to recognise them in the Statement

of Financial Position. Council has passed resolution 22-272 not to

recognise these assets and provided a written response to the NSW Auditor

General in June 2022 as to why it formed that view. This matter was also

considered by the Audit, Risk and Improvement Committee at their 19 May 2022

Meeting where the Committee recommended to Council not to recognise these

assets.

Nevertheless, there is a distinct

difference of opinion as to who ‘controls’ Rural Fire Service

‘Red Fleet’ assets and it is Council’s adopted view it does

not. From Council’s perspective only, if it was to include them it

would be mis-stating its financial position. Whilst this view is not accepted

by the Audit Office, Council reviewed assets data provided by the Rural Fire

Service, given it has all the records regarding fleet assets as it purchases,

maintains, uses and disposes of these assets without consultation with Council,

and calculated the carrying value of these assets was around $677,000.

The carrying value of Council’s overall assets at 30 June 2022 was

$1.278billion so the value as a percentage has meant Council has not recognised

assets equating to 0.05% of its overall infrastructure, property, plant and

equipment assets carrying value.

The Audit Office has not accepted

Council’s assessment further because Council has not undertaken

procedures to confirm the completeness, accuracy, existence or condition of the

Rural Fire Service assets or performed procedures to identify the value of assets

vested in it during the year.

The issuance of a ‘modified’

or ‘qualified’ audit opinion is not unique to Byron Shire Council

and as at 30 June 2022 Council is aware of at least twenty other Councils which

received the same outcome for non-recognition of RFS ‘Red Fleet’

assets. It is possible this will continue for future financial years

whilst Council continues to not recognise the RFS ‘Red Fleet’

assets.

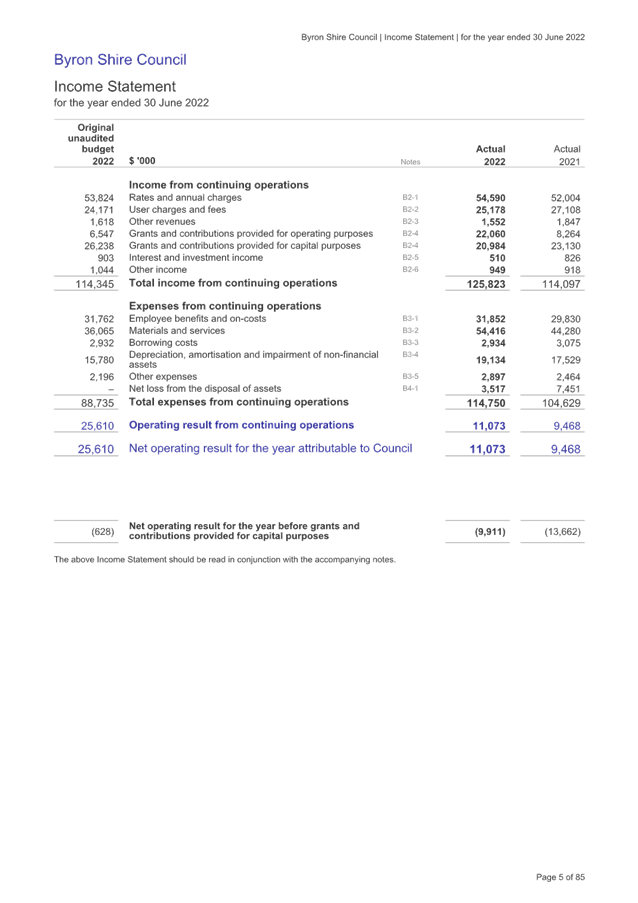

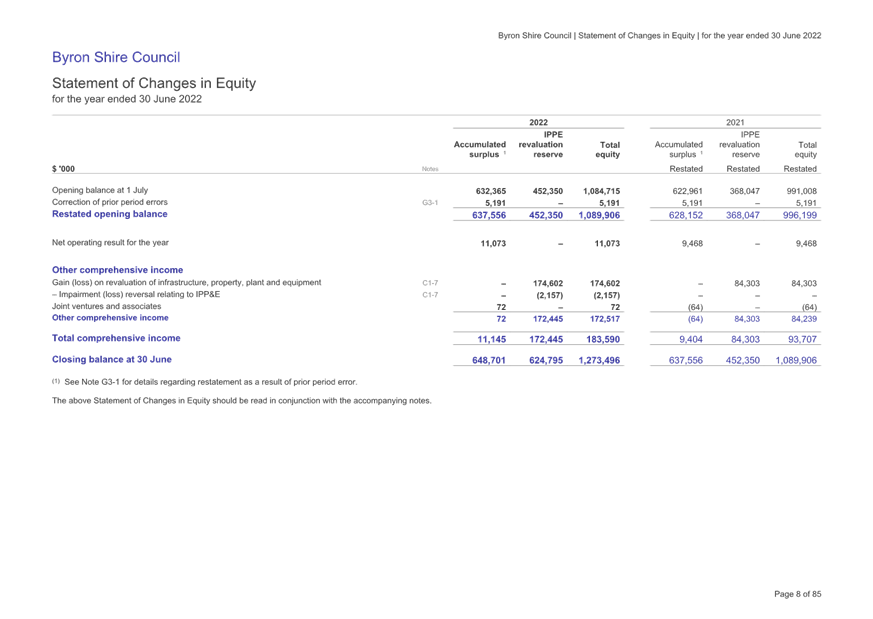

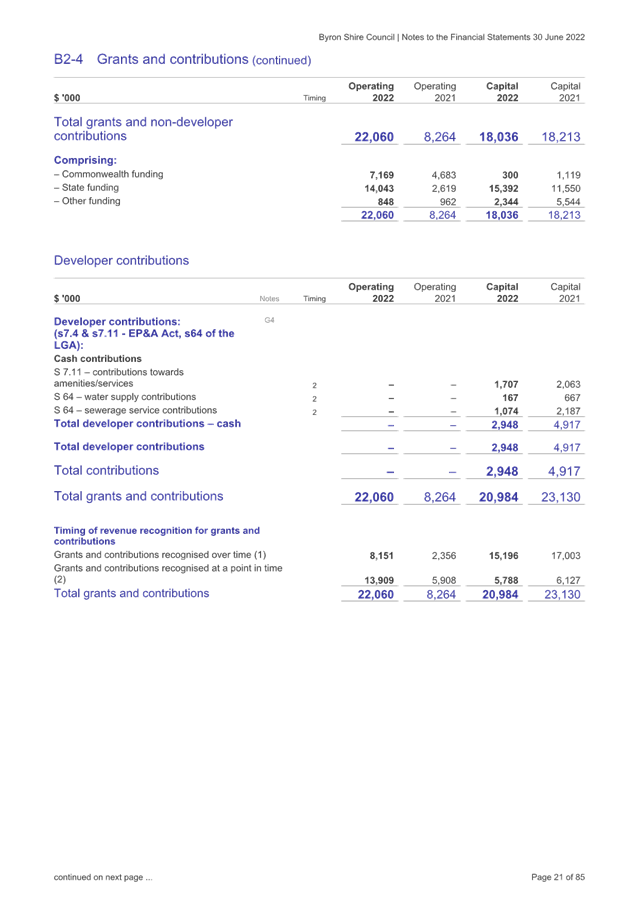

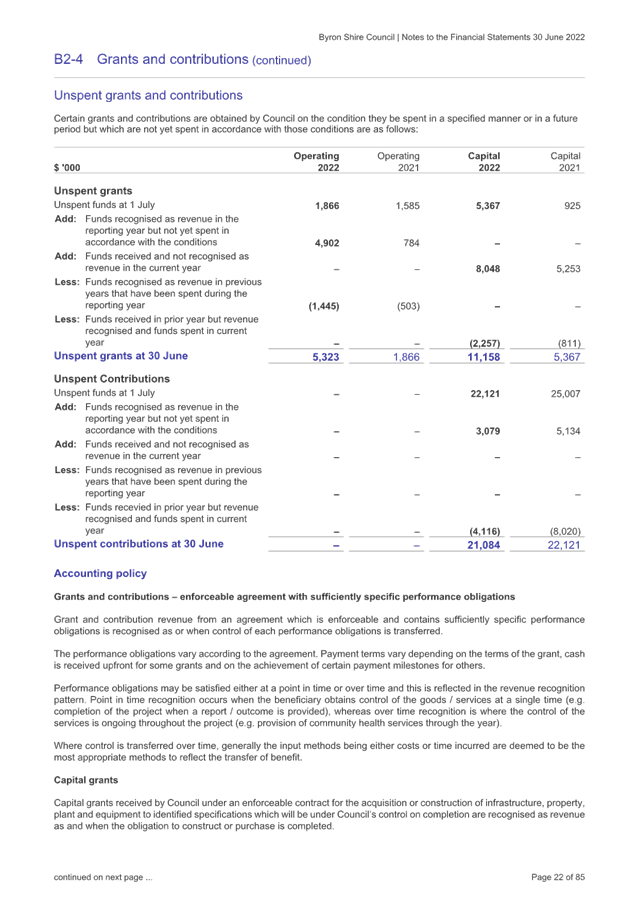

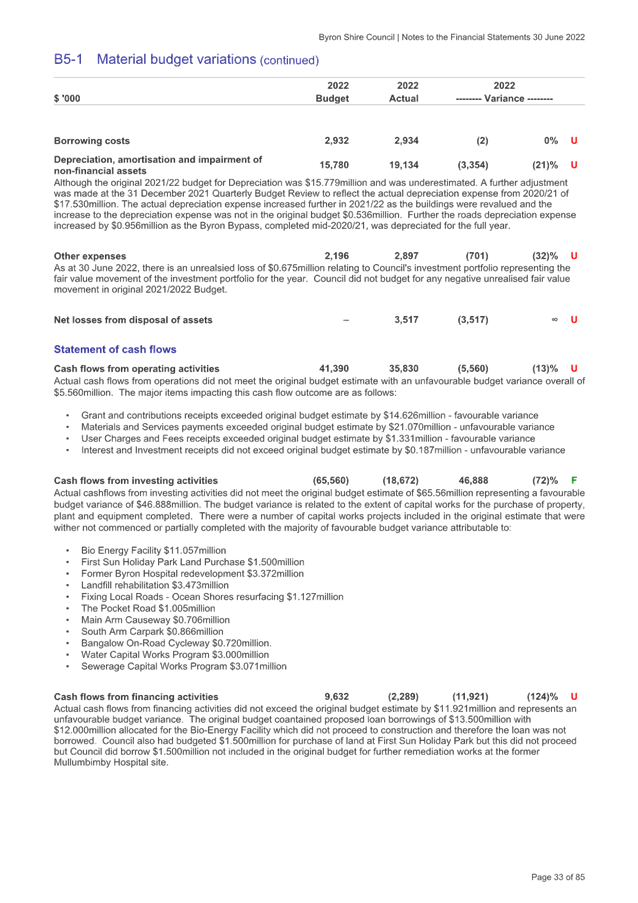

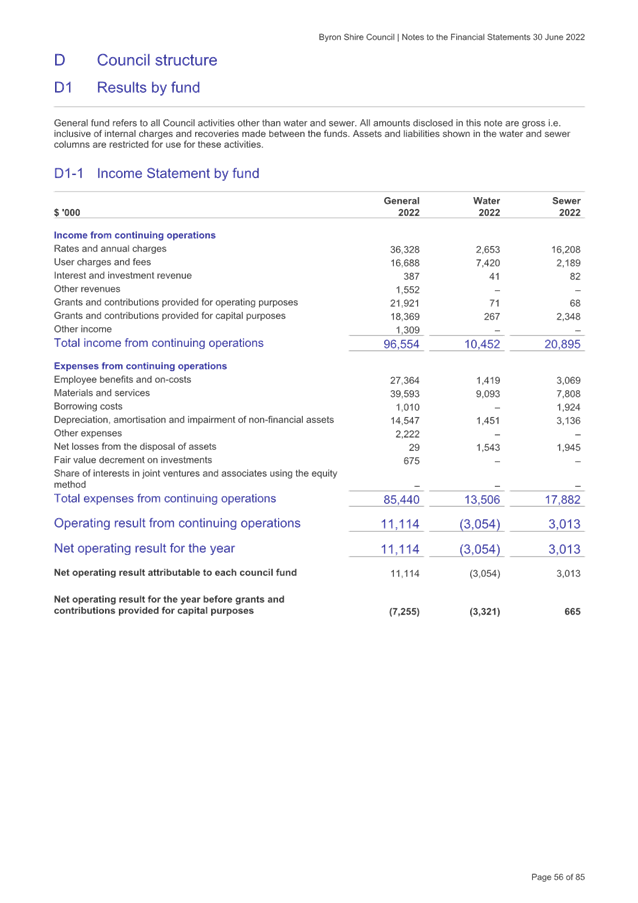

· Operating

Result from Continuing Operations

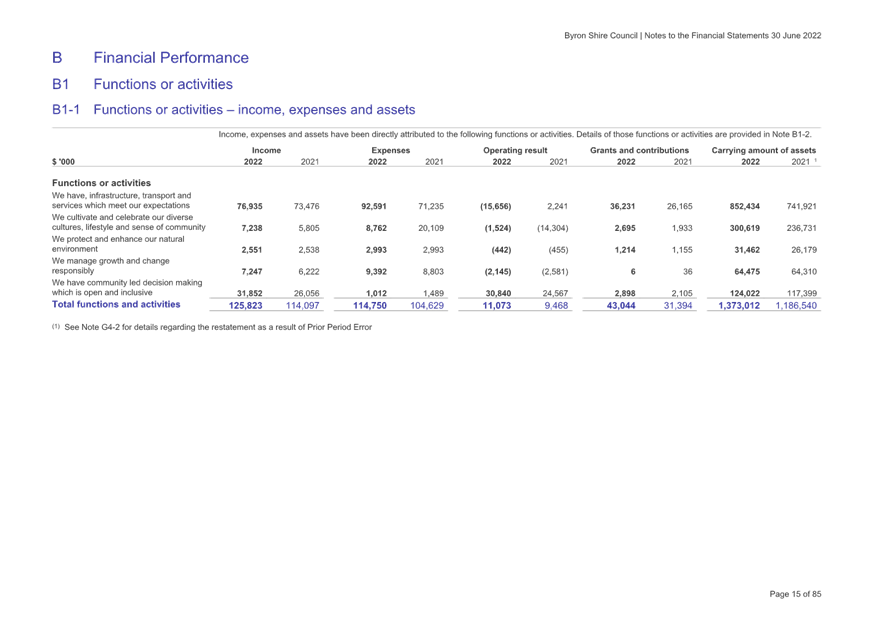

The 2021/2022 financial year has seen a

positive overall financial result. Council recorded a $11.073million surplus

compared to the $9.468million surplus in 2020/2021. This result incorporates

the recognition of capital revenues such as capital grants and contributions

for specific purposes and asset dedications amounting to $20.984 million,

compared to $23.130million in 2020/2021.

A more important indicator is the

operating result before capital grants and contributions. This result was a

deficit of $9.911 million in 2021/2022 compared to a deficit of $13.662million

in 2020/2021, representing a decrease of $3.751million between financial years.

Whilst an improvement, this indicates on an ongoing basis Council’s

operating expenditures continue to exceed operating revenues. Whilst operating

revenues, excluding capital grants and contributions, grew by $13.872million,

overall operating expenses grew by $10.121million.

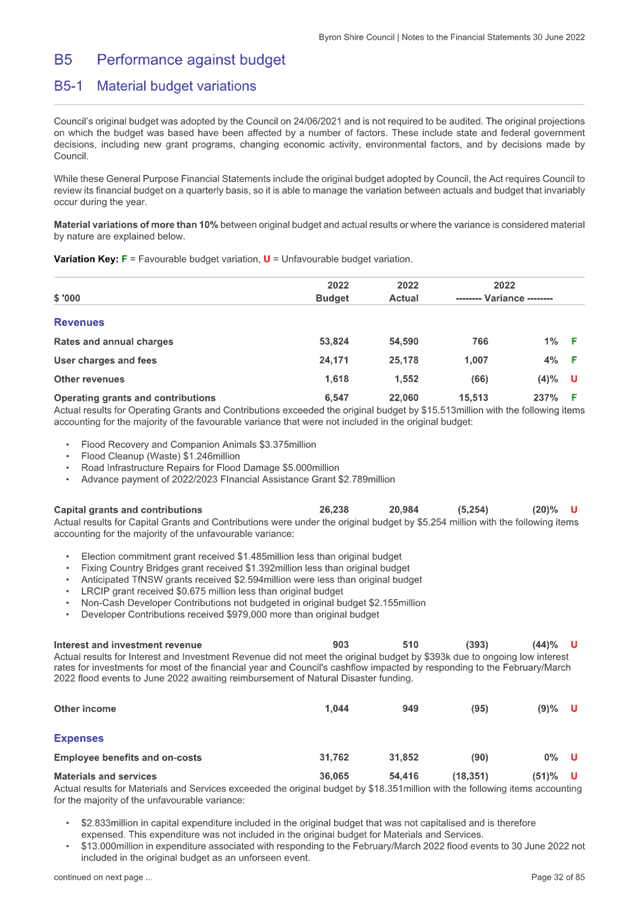

With reference to the Income Statement to

the General Purpose Financial Reports included at Attachment 1, the following

table indicates the major changes between 2021/2022 and 2020/2021 by line item:

|

Item

|

Change

between 2021/2022 and 2020/2021 $’000

|

Change

Outcome

|

Comment

|

|

Income

|

|

|

|

|

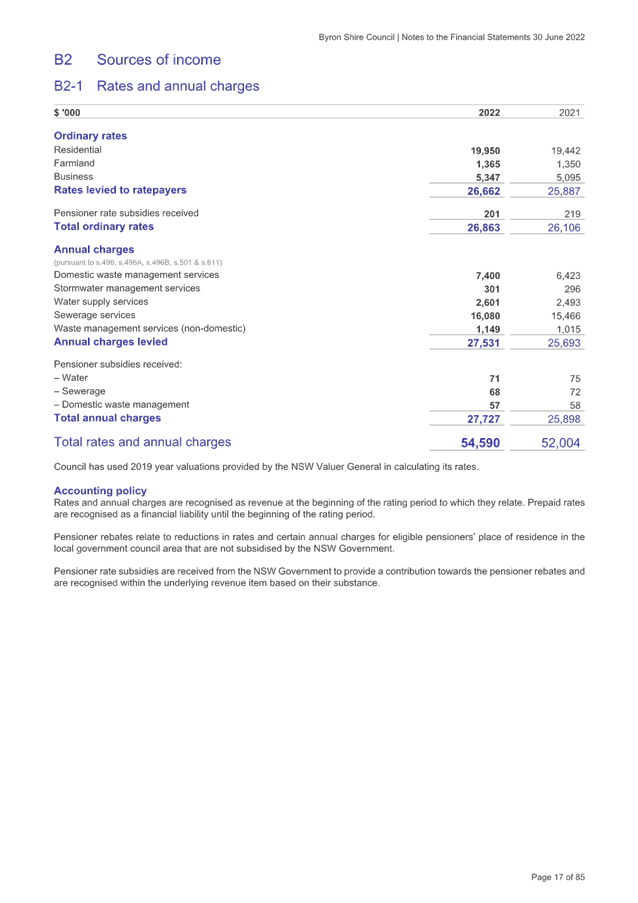

Rates & Annual Charges

|

+$2,586

|

Increase

|

Reflects imposition of the 2021/2022

rate peg of 2.3% and changes in annual charges from Council’s adopted

2021/2022 Revenue Policy.

|

|

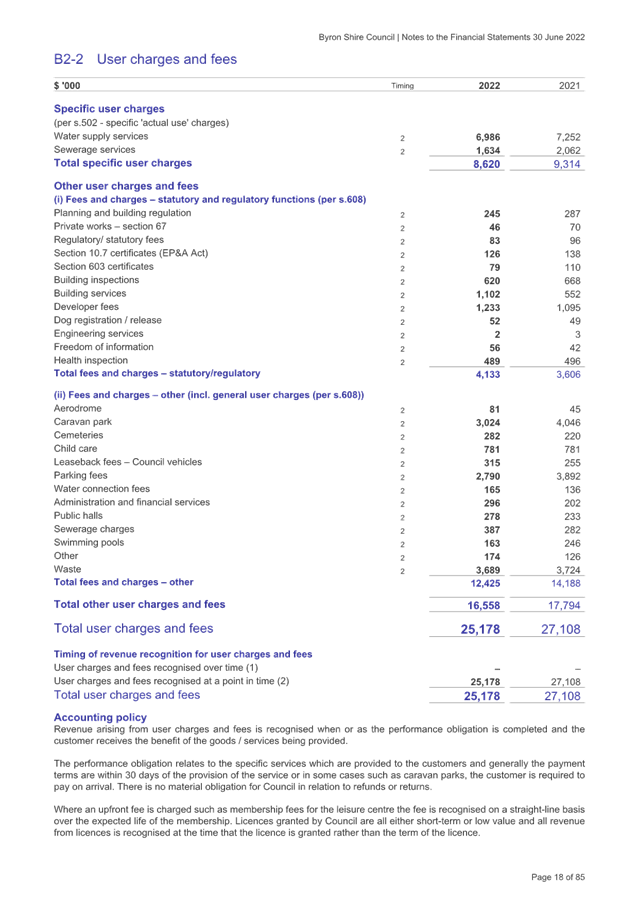

User Charges and Fees

|

-$1,930

|

Decrease

|

A contributor to this change was a

decline in holiday park and pay parking revenues. Further information is

available in Note B2-2 to Attachment 1.

|

|

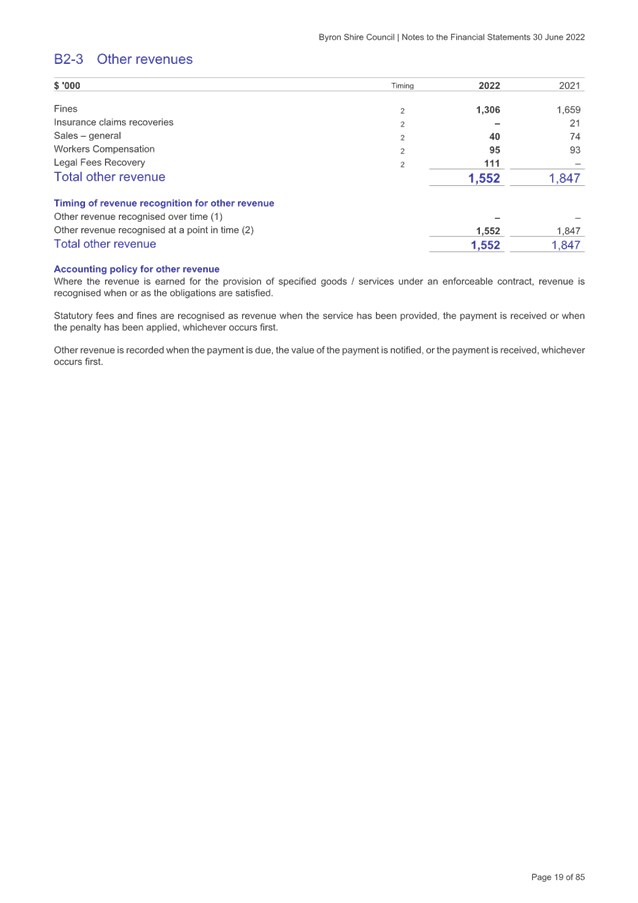

Other Revenues

|

-$295

|

Decrease

|

The major decrease in this item relates

to fine revenues.

|

|

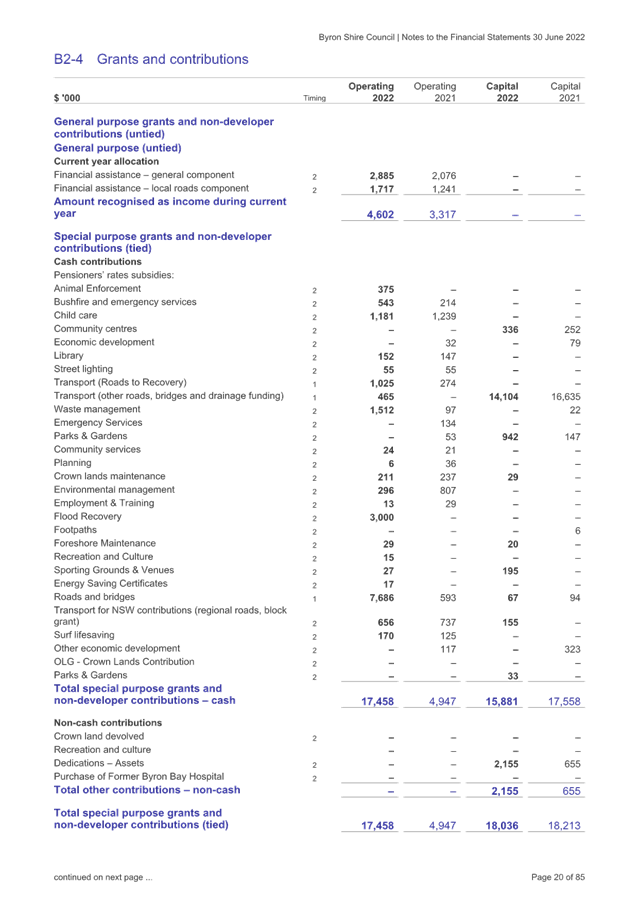

Grants & Contributions –

Operating

|

+$13,796

|

Increase

|

Overall operating grants and

contributions increased significantly due to 75% advance payment of Financial

Assistance Grant, Flood recovery grants $3.375million, $1.7million from

Public Works Advisory for clean up works for waste, water and sewerage from

flood event along with $5million from Transport for NSW for emergency repairs

to flood damaged infrastructure were the main contributors. Further

information is available in Note B2-4 to Attachment 1.

|

|

Grants & Contributions –

Capital

|

-$2,146

|

Decrease

|

Revenue decrease in this item mainly

relates to the reduced developer contributions received. Further information

is available in Note B2-4 to Attachment 1.

|

|

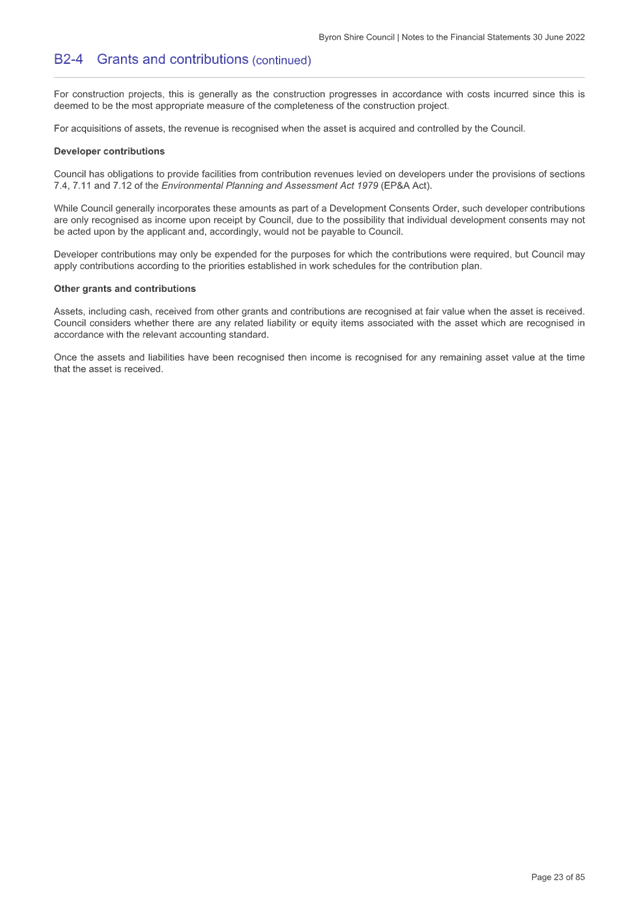

Interest and Investment Revenue

|

-$316

|

Decrease

|

Interest rates during 2021-2022 have

remained at historic lows, only starting to increase late in the financial

year have reduced investment rates significantly, lowering the return on

Council’s investments. Cashflow around scale of works and

recovering grant payments has also been an influence especially the flood

recovery.

|

|

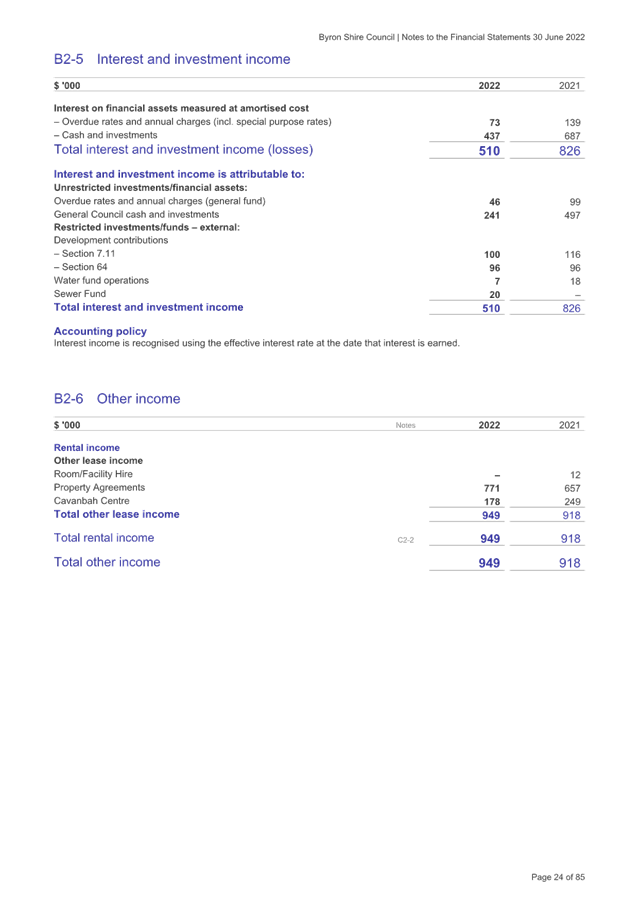

Other Income

|

+$31

|

Increase

|

Principally relates to change in

revenues from property leases.

|

|

Total Income Change

|

+11,726

|

Increase

|

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

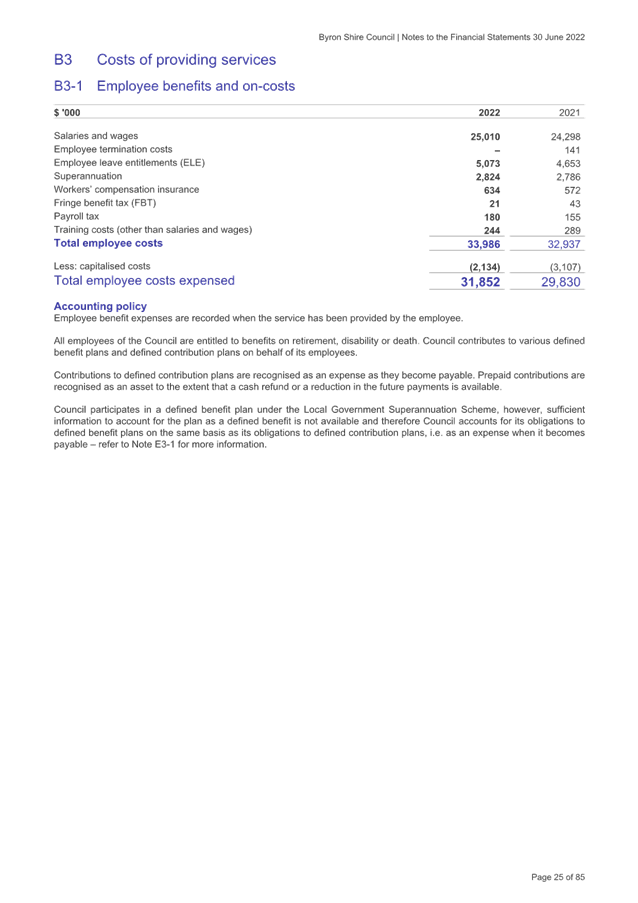

Employee Benefits and Oncosts

|

+$2,022

|

Increase

|

Increased leave entitlement expenses of

$420k reflect an emphasis on controlling leave balances and the impact of

increasing interest rates on present value of liability calculations. A

decrease of $973k of employee costs capitalised on capital works in 2021/2022

compared to 2020/2021 and gross salary and wages increased $712k. More

information is provided at Note B3-1 to Attachment 1.

|

|

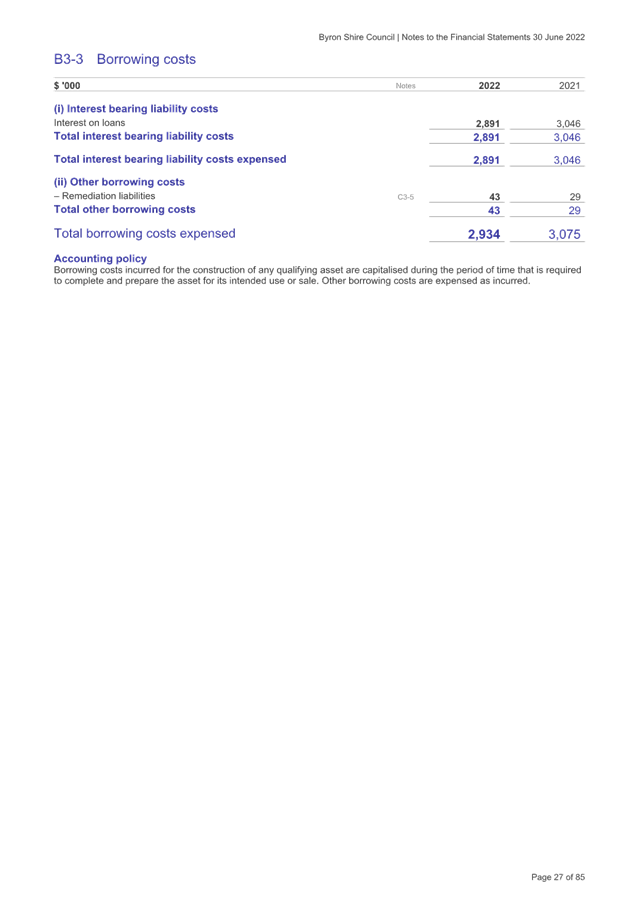

Borrowing Costs

|

-$141

|

Decrease

|

Reduction due to ongoing repayment of

existing loans and borrowing of new loans at good interest rates given

current market conditions.

|

|

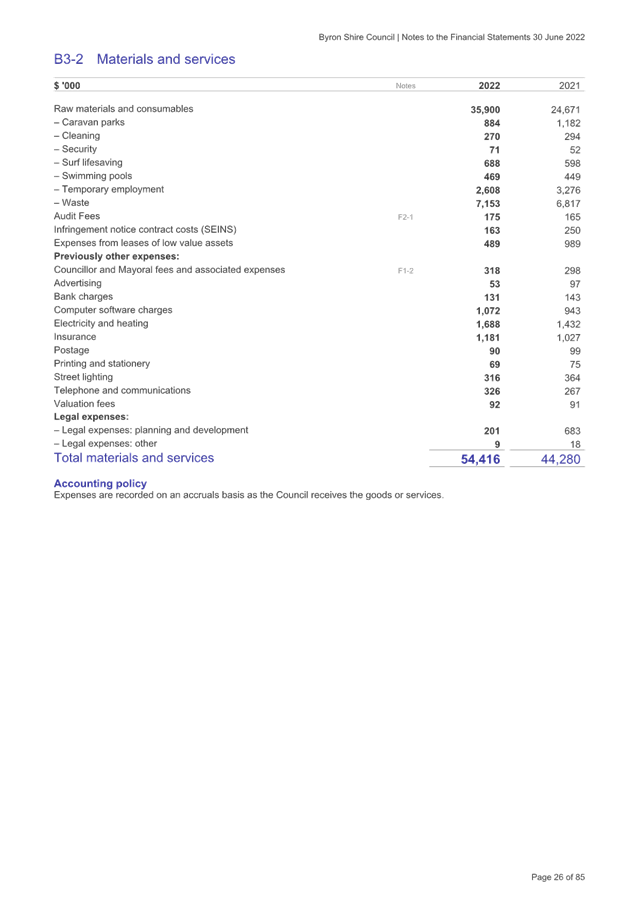

Materials & Services

|

+$10,136

|

Increase

|

Materials and Services increased

$10,136k overall. Raw materials and consumables increased significantly due

to expenditure on flood recovery. Further changes include a reduction of

$491K in legal expenses, increase of $154k in insurance costs, increase of

$129k for IT software costs, increase of $363k in waste contract costs, $668k

decrease in temporary employment costs. Other changes can be found at Note

B3-2 to Attachment 1.

|

|

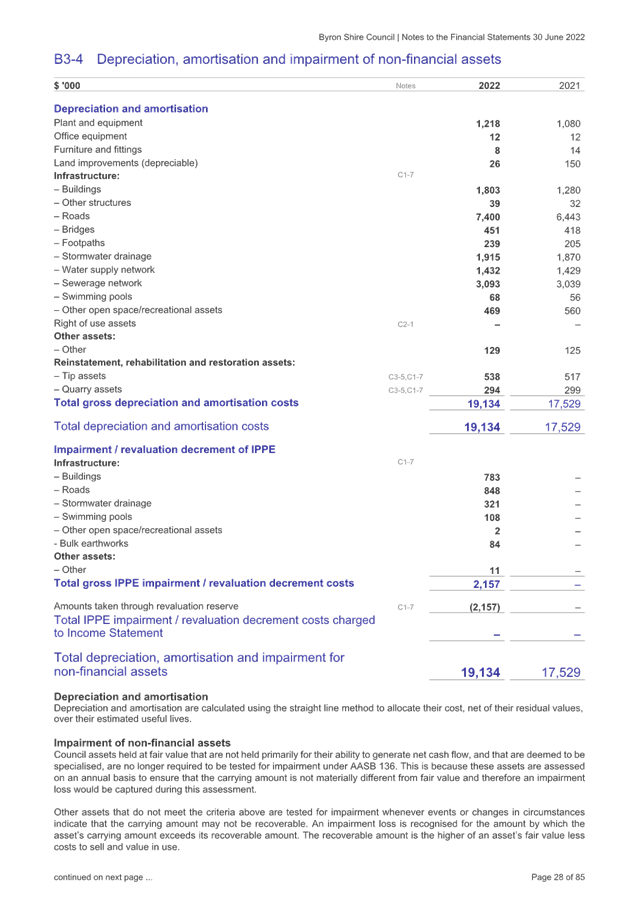

Depreciation

|

+$1,605

|

Increase

|

Respective changes between asset

classes are outlined at Note B3-4 to Attachment 1. Essentially major increase

is due to the ongoing revaluation and indexation of assets each year now

flowing through with increased depreciation expense.

|

|

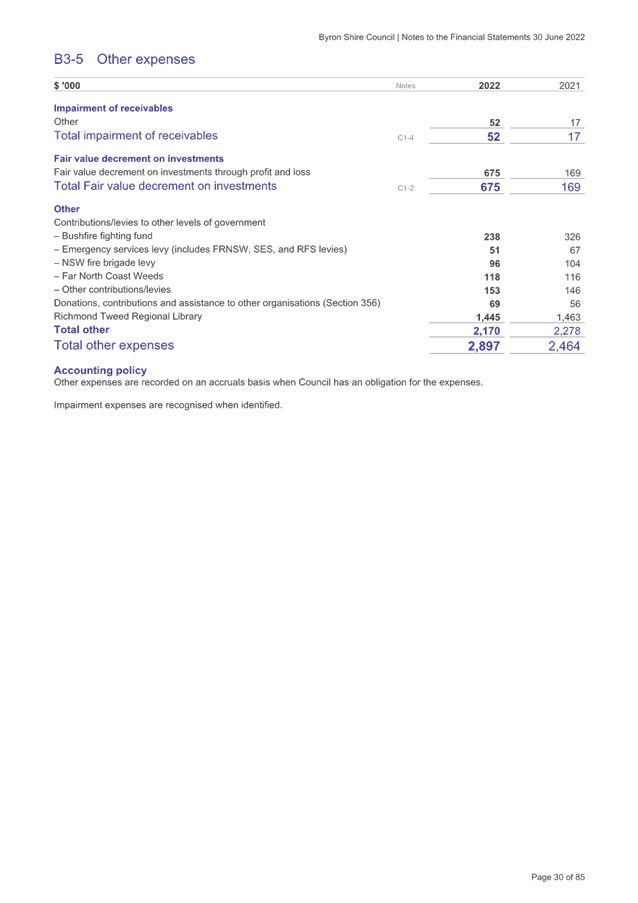

Other Expenses

|

+$433

|

Increase

|

Overall variations in line items as

disclosed at Note B3-5 to Attachment 1. The major item is the fair value

decrement on Council’s investments. This is a changed disclosure.

|

|

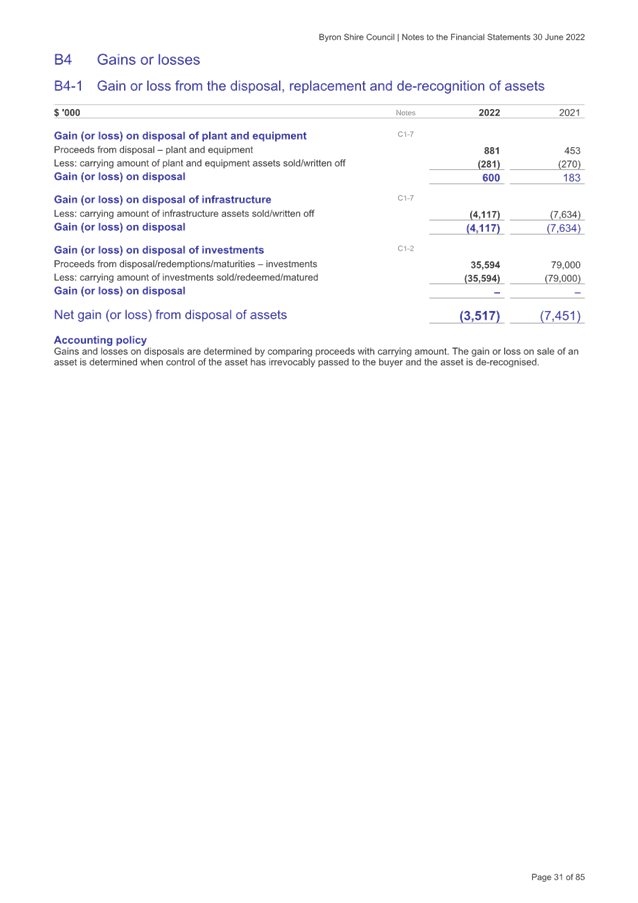

Net Losses from Disposal of Assets

|

-$3,934

|

Decrease

|

Reflects the written down value of

assets disposed of at the end of financial year and is contingent upon the

extent of assets disposed and their written down value at the time of

disposal which can vary. For 2022/2023, Council has significantly more

disposals than gains, including the disposal of infrastructure $4,117k,

reflecting the level of capital works and flood damage disposals with plant

and equipment obtaining a $600k gain. Further details can be found at Note

B4-1 to Attachment 1

|

|

Total Expenditure Change

|

+$10,121

|

Increase

|

|

|

|

|

|

|

|

Change in Result

|

+$1,605

|

Increase

|

Increase in overall surplus between

financial years.

|

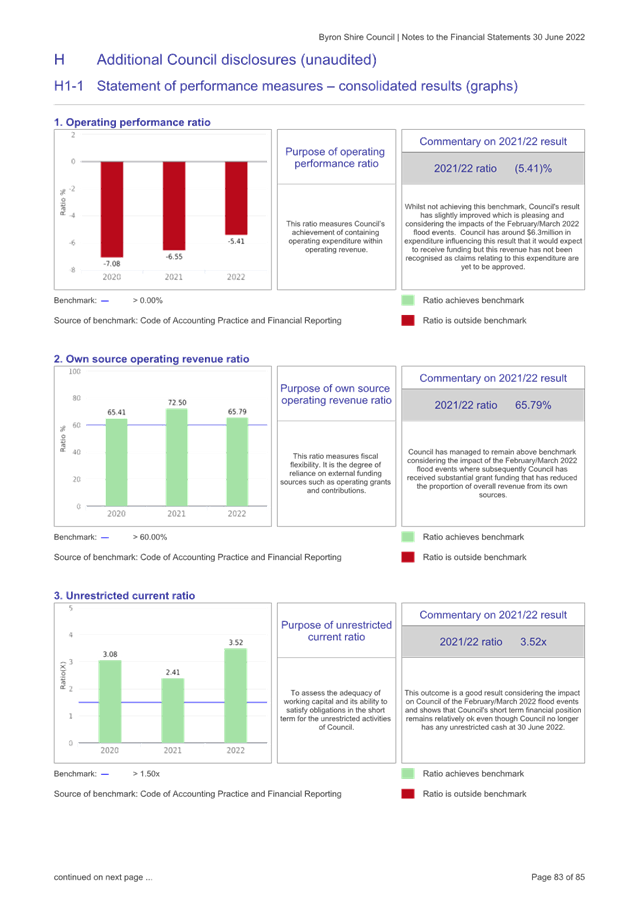

Following from the operating

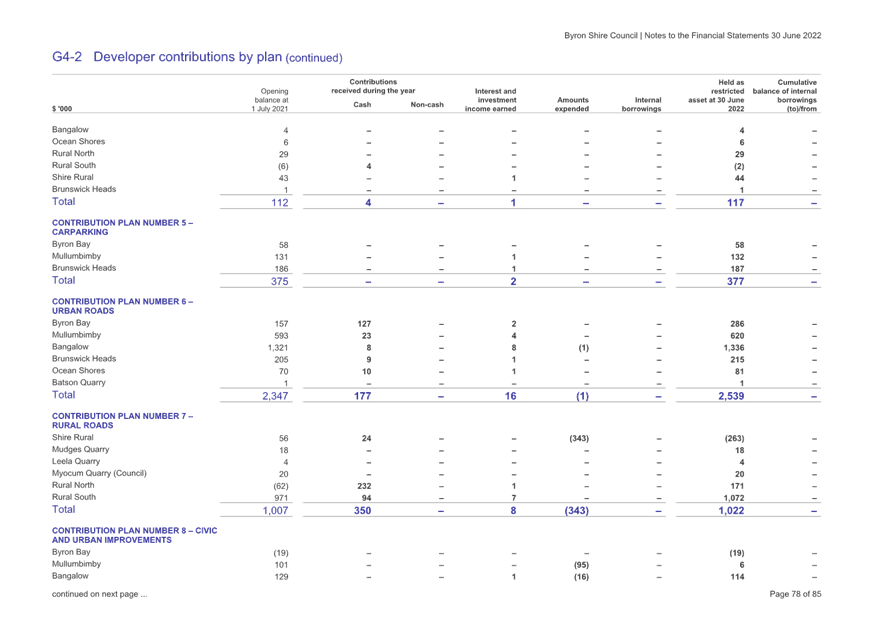

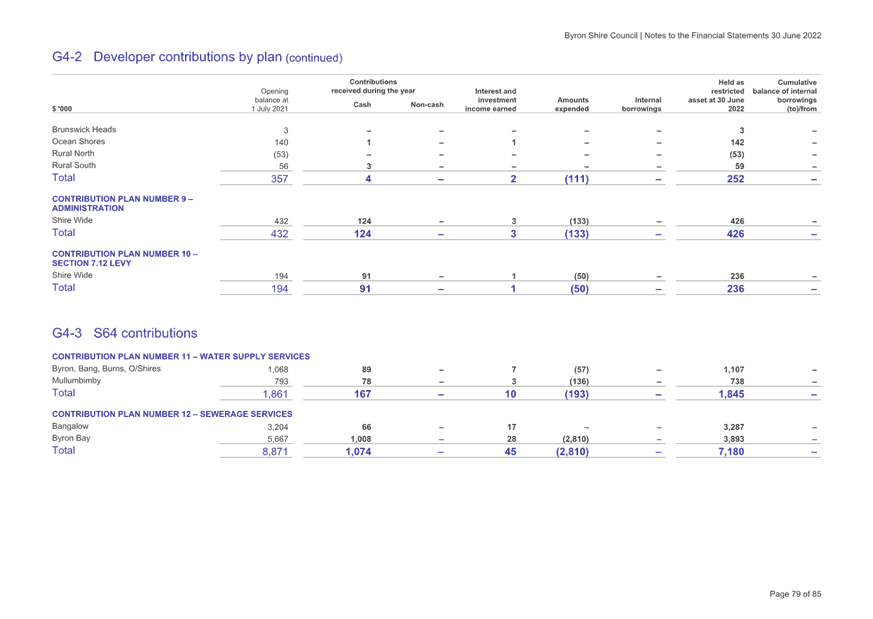

results, are the performance ratios at Note H1-1 to the General Purpose

Financial Statements. These have been derived following the financial

assessments undertaken by NSW Treasury Corporation on all NSW Councils in 2012

and are now incorporated into the latest update to the Code of Accounting

Practice and Financial Reporting that determines the content of Council’s

Financial Statements.

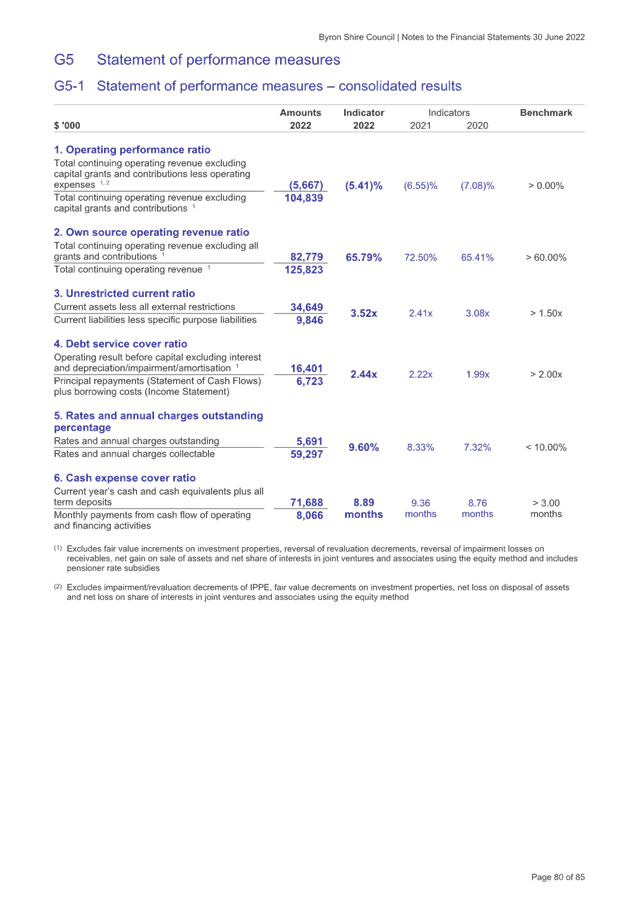

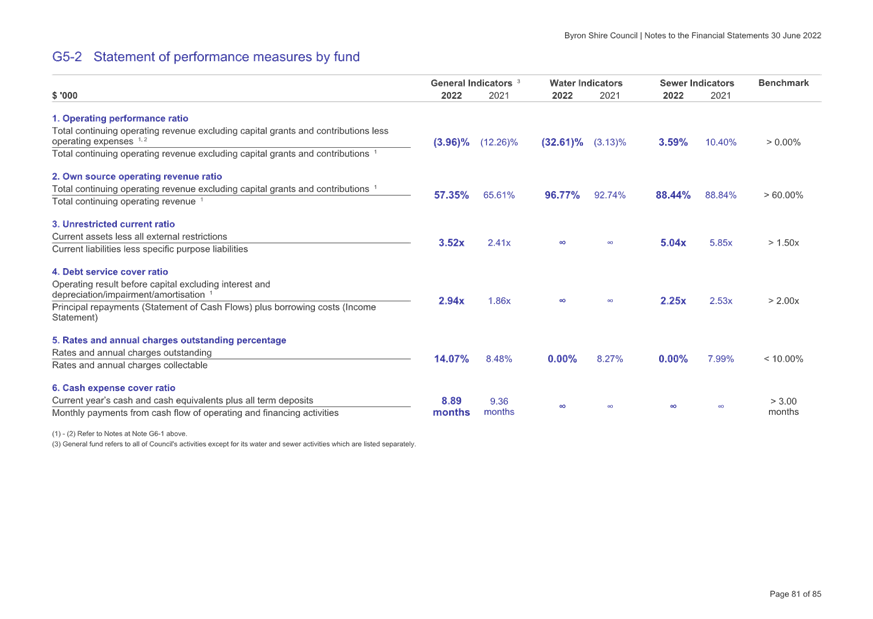

These ratios present either a

stable or improving result for Council except for the following:

Operating Performance Ratio reflects Council’s

operating result. The benchmark is to be greater than 0% but in 2021/2022

Council’s ratio was -5.41% and in 2020/2021 it was -6.55%, a slight

improvement. This ratio was impacted by expenditure associated with the flood

recovery for which Council is yet to be reimbursed. The ratio will

fluctuate with revenue recognition accounting standards now in place in that

grant revenues cannot be matched against expenditure but only in accord with

firstly grant approvals i.e. natural disaster funding and milestone

achievement. Council needs to improve this result back towards the benchmark as

it is a key financial sustainability indicator.

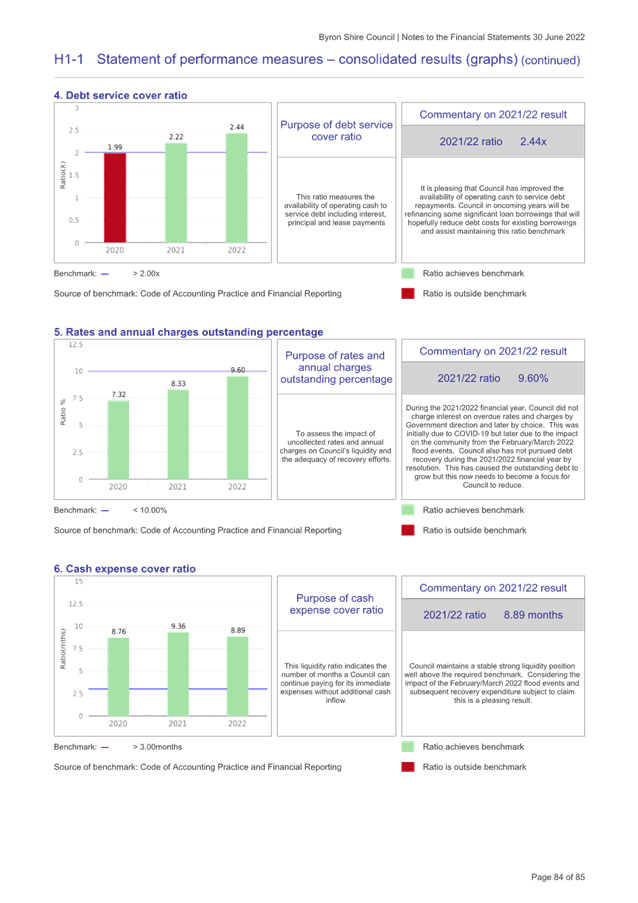

Outstanding, Rates and Annual

Charges – Whilst still just within the industry benchmark,

Council’s ratio has increased to 9.60% in 2021/2022 from 8.33% in

2020/2021. The increase can be attributable to rates and charges

increases, the impact of the COVID-19 pandemic in the first half of the

financial year and then the February/March 2022 flood events. Through its

assistance program to the community, Council has continued to offer ratepayers

extended payment arrangements and suspended debt recovery for the whole

financial year. It further set interest on outstanding rates and charges

to 0% which was to end at the end of February 2022 but following the

February/March flood events, this was extended to 30 June 2022. Whilst

providing assistance to ratepayers, it also reduced the incentive for people to

pay and as a consequence the rates and charges outstanding percentage has

increased.

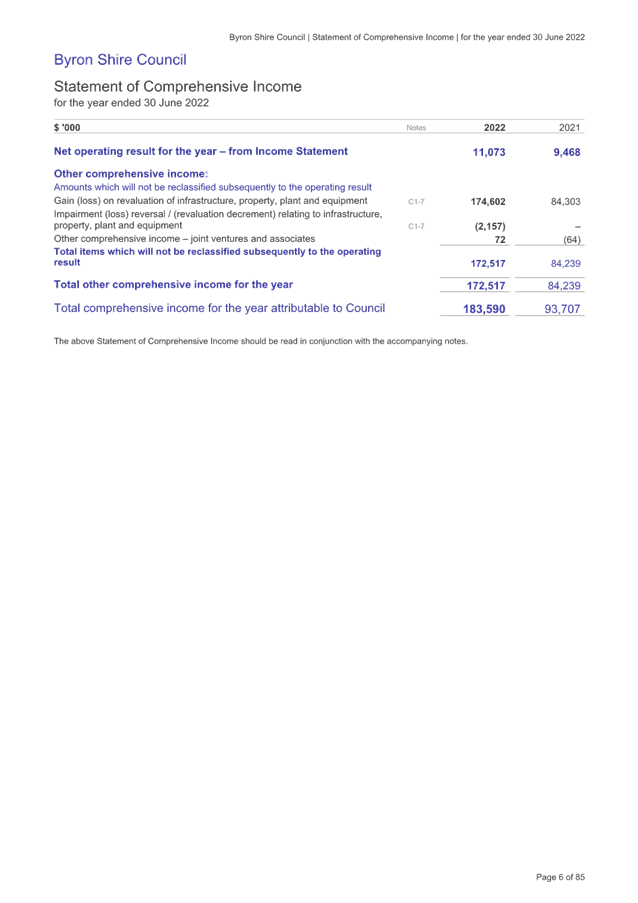

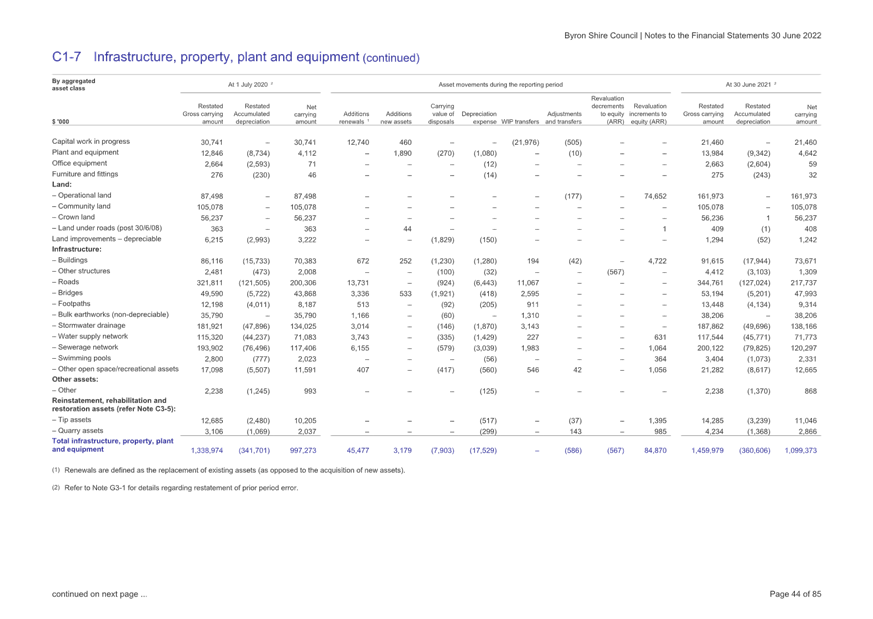

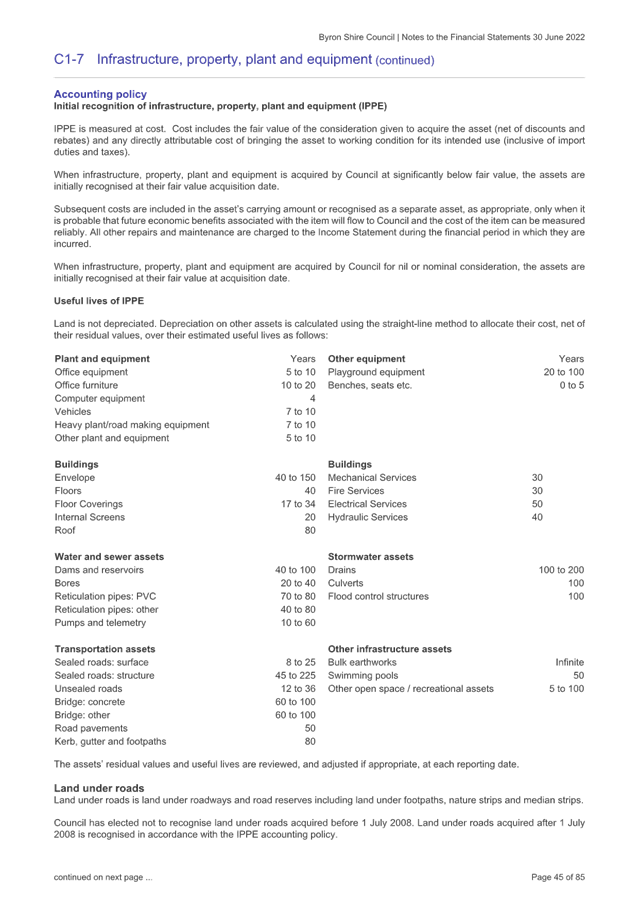

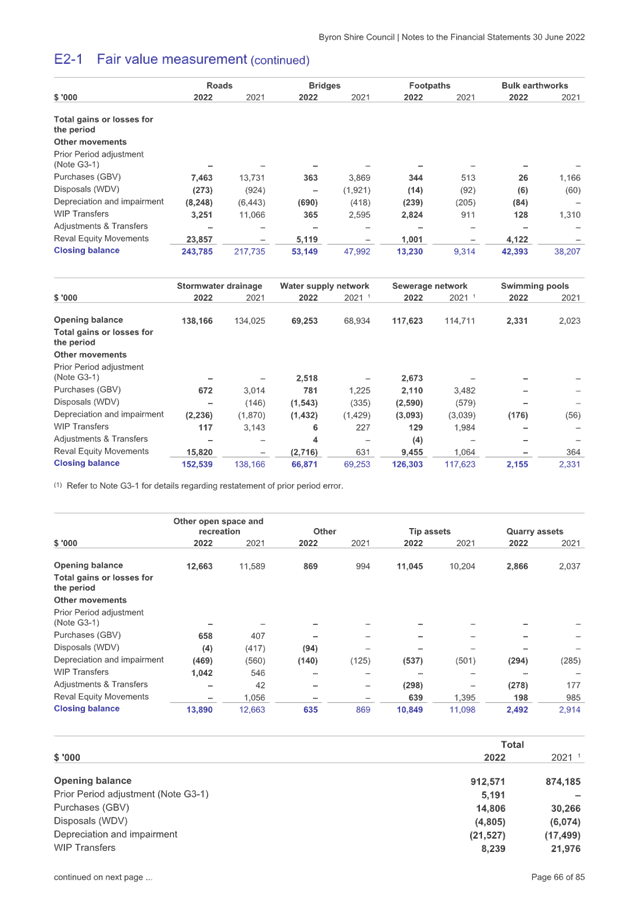

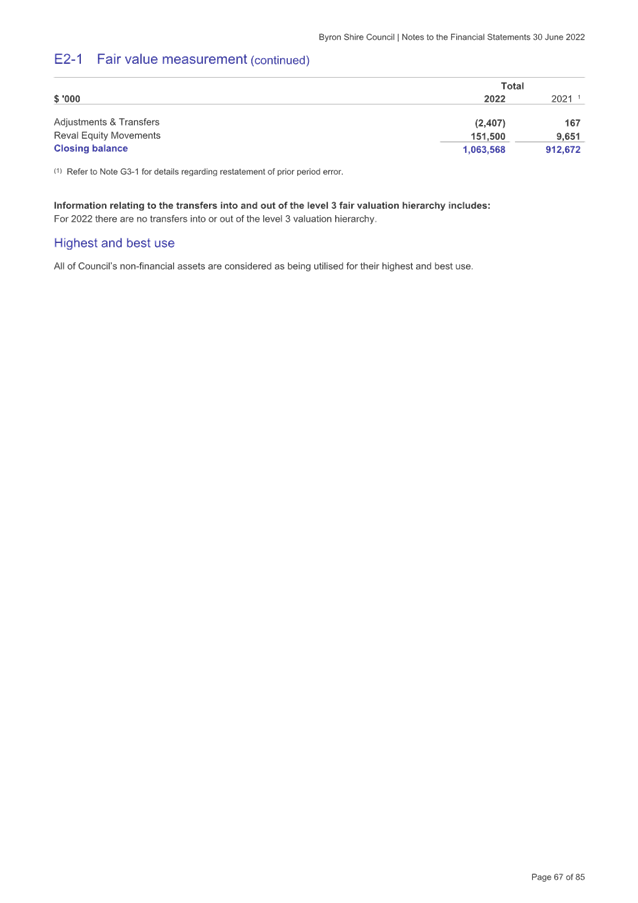

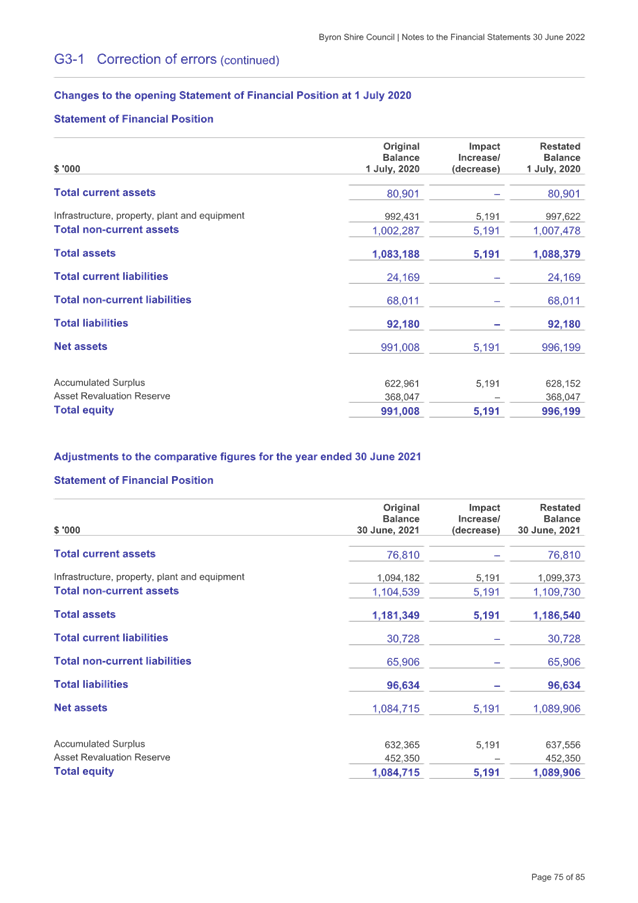

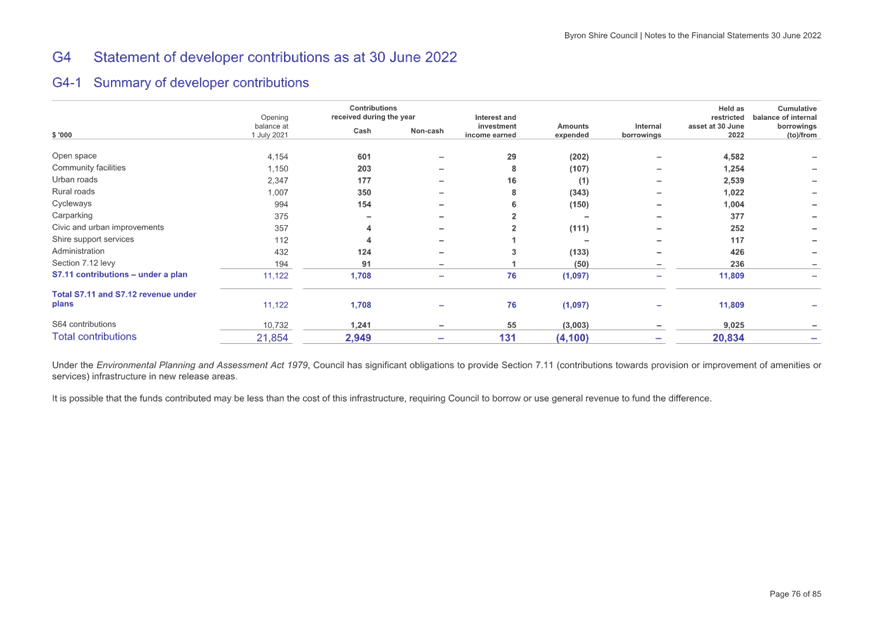

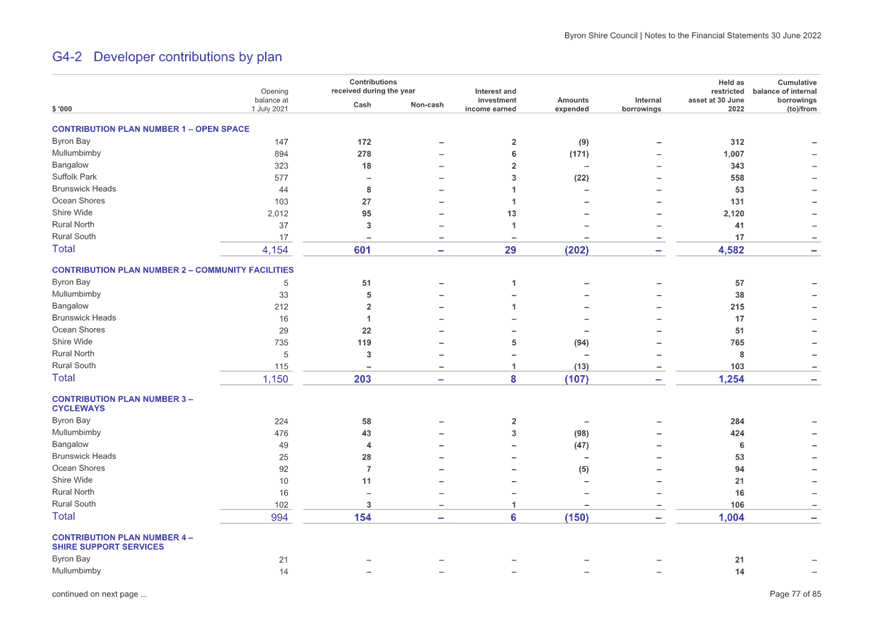

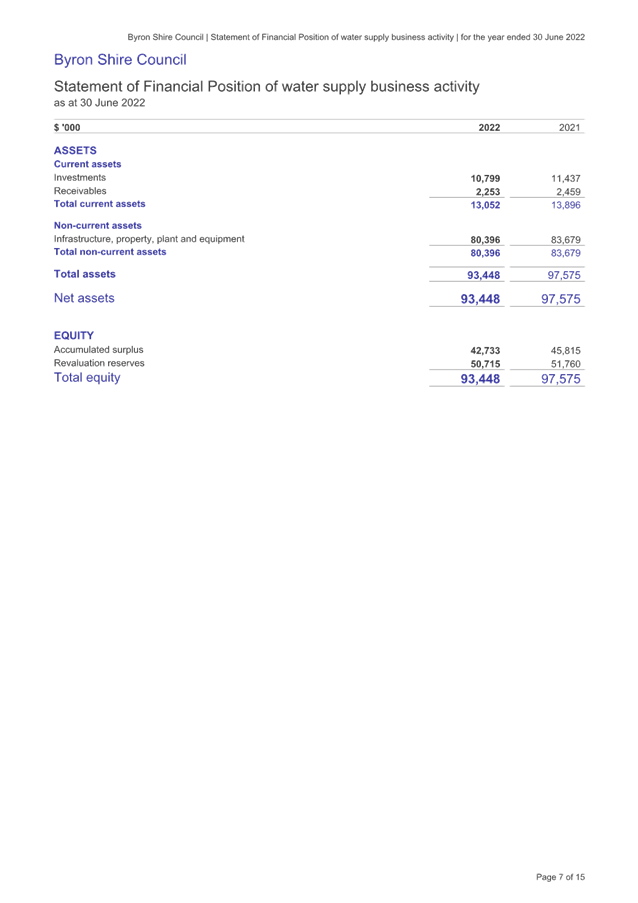

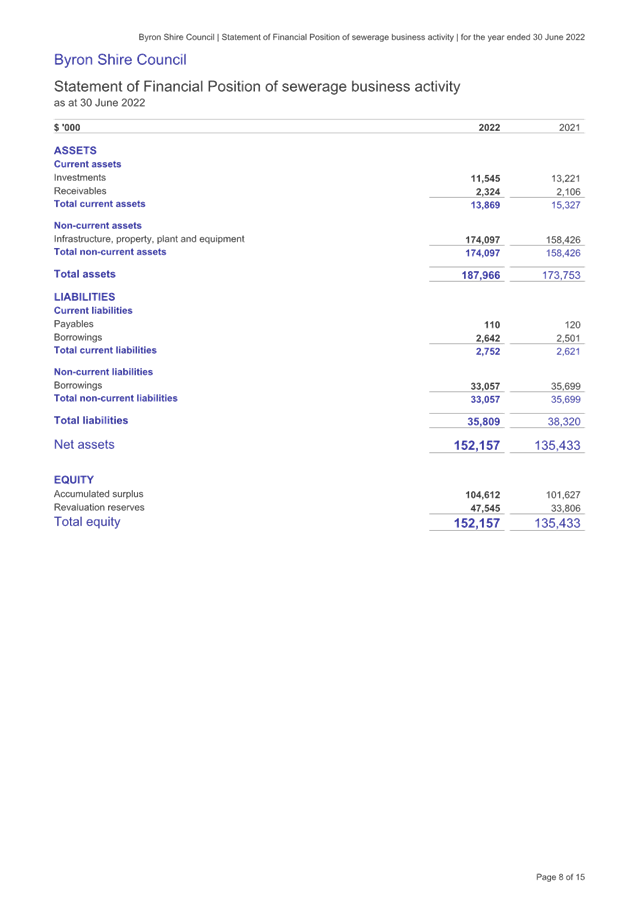

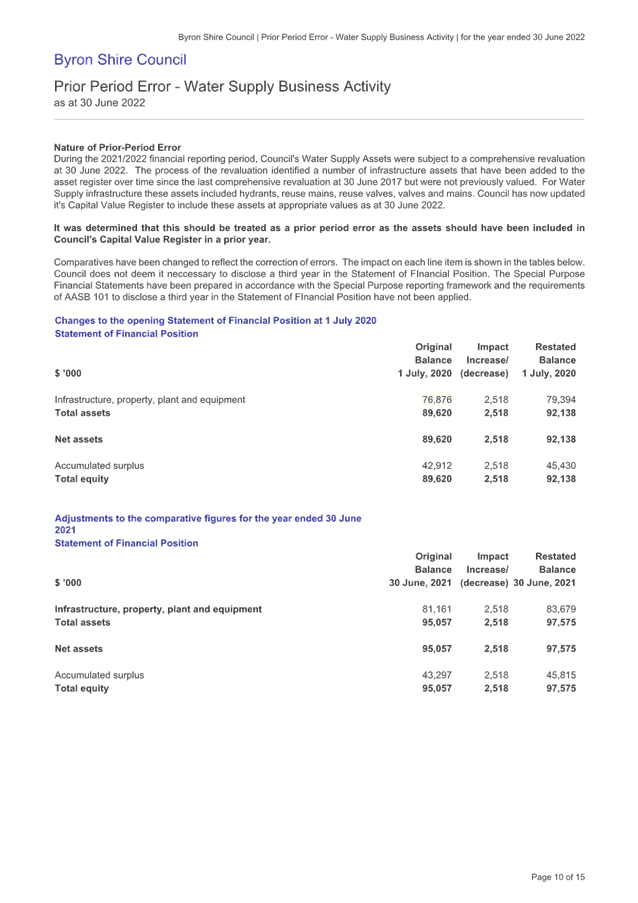

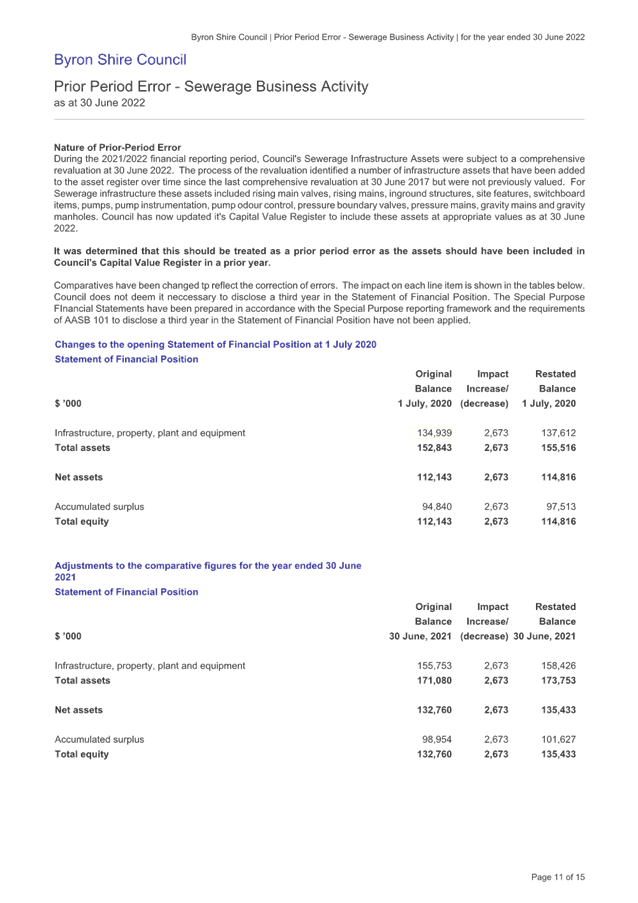

· Asset Revaluations

During 2021/2022, a revaluation of assets

relating to Water and Sewerage Infrastructure was undertaken. These

revaluations have increased Council’s asset values by the following

amounts:

· Water

Infrastructure – a decrement or reduction of $2.716million

· Sewerage

Infrastructure – an increase of $8.810million

In addition the water and sewerage

revaluation identified assets described as ‘found’. These

were assets identified via inspection and development that had not previously

been valued or recorded totalling $5.191million being $2.518million for water

and $2.673million for sewerage. As a result Council has been required to

recognise a ‘prior-period error’ as these assets should have been

disclosed but were not and details of this are provided at Note G3-1.

Further disclosure is provided in the Special Purpose Financial Statements as

Water and Sewerage functions are declared business units.

For the upcoming 2022/2023 financial

year, Council does not need to do any specific asset class revaluation but may

consider a revaluation of operational land given the significant indexation

applied in 2021/2022 and valuation movements in the property market

· Asset

Recognition, Indexation and Impairment

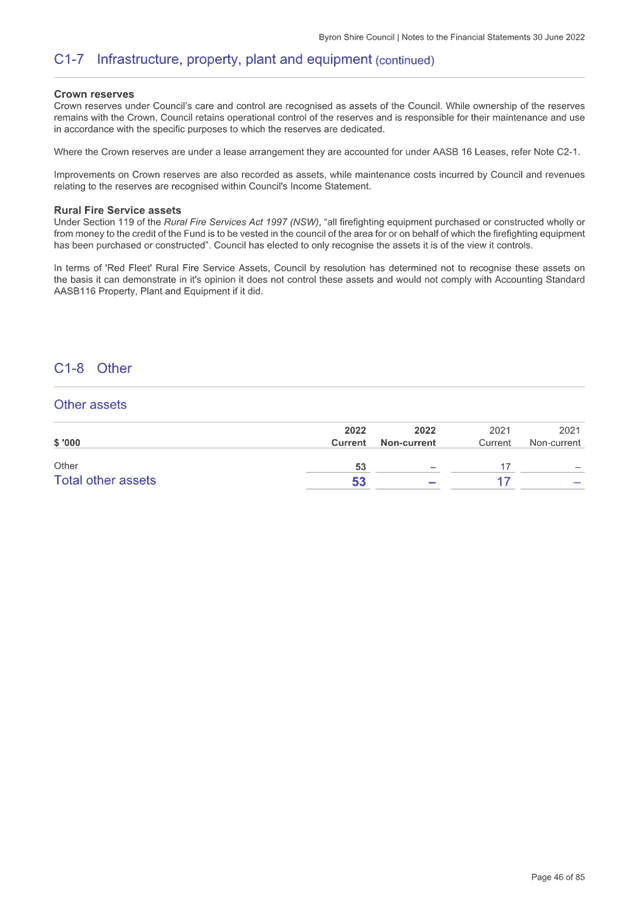

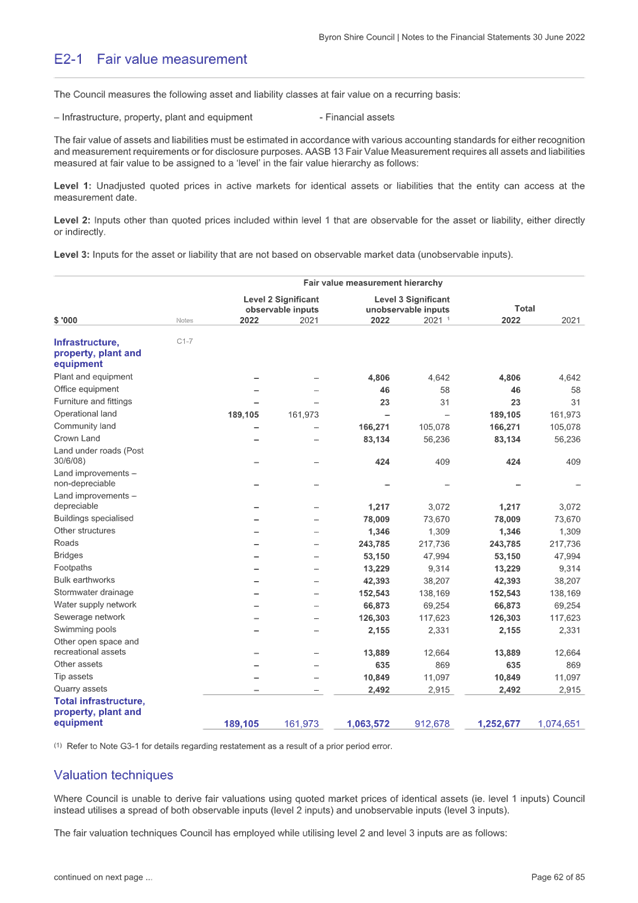

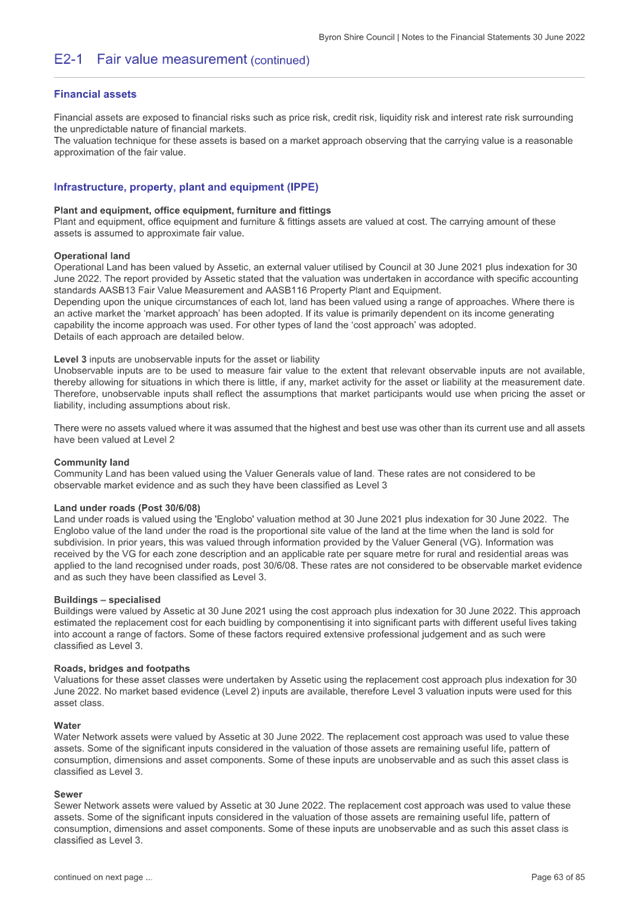

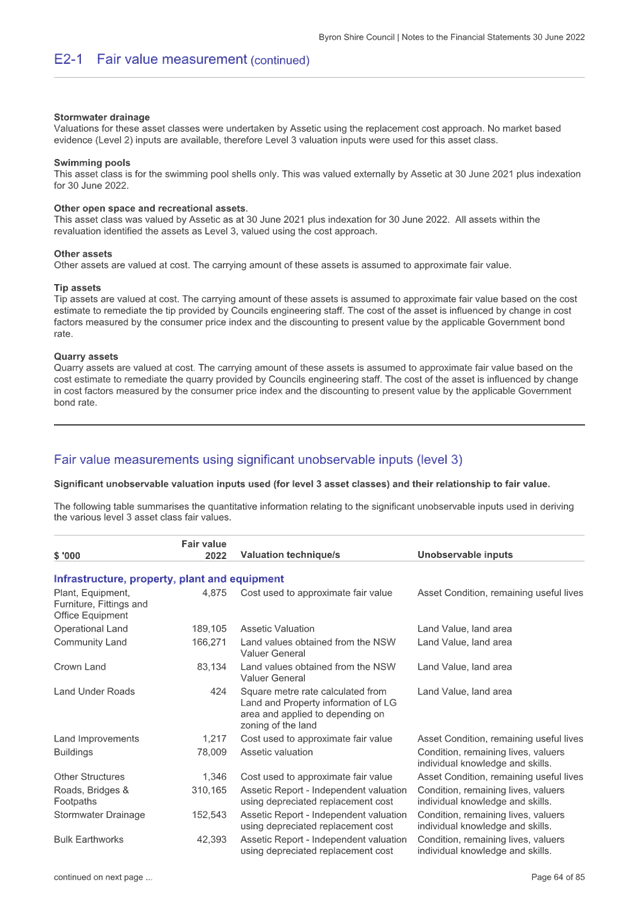

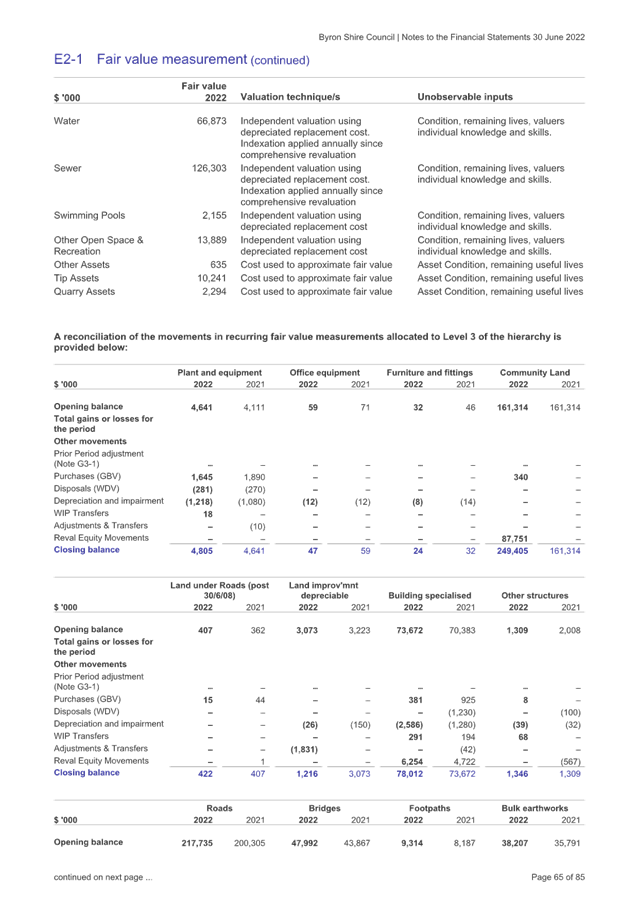

As indicated at Note C1-7 to

Council’s financial statements, Council expended $23.121million on asset

renewals and $7.902million on new assets. The extent of asset renewals is still

significant and demonstrates ongoing commitment in that area. The depreciation

expense of Council’s assets for 2021/2022 was $19.134million so it is

pleasing to see that asset renewal was more than the financial depreciation of

Council’s assets.

The economic climate inclusive of

inflationary pressures, low unemployment, supply chain issue and a booming

property market prior to recent interest rate increases has meant Council

needed to reassess the fair value of assets not subject to a specific

revaluation. Consequently across all asset class excluding the

revaluation of water and sewerage, indexation has added around $169million to

the value of Council’s infrastructure, property, plant and

equipment. Land overall increased by around $110million with roads and

bridges increasing close to $29million and stormwater drainage nearly

$16million as major contributors. With the exception of land that is not

depreciated, the indexation will inflate depreciation expense further in future

reporting periods that will make the ability to reduce operational deficits

especially in the General Fund harder to reduce.

The February/March 2022 flood events has

also required Council to consider any impairment on its assets.

Impairment is the reflection of writing down the fair value of an asset to

reassess its value following events that have a negative impact on the asset’s

ability to deliver its economic benefits or perform its function

completely. In terms of the February/March 2022 flood events, any Council

infrastructure completely destroyed has been disposed of fully writing off any

carrying value. Other assets that were damaged not totally destroyed were

assessed for impairment which has meant Council has reduced the carrying value

of its assets by $2.157million ranging from buildings, roads, bridges,

drainage, and swimming pool assets. These impairment charges will be

reversed as and when the impaired assets are later repaired and restored.

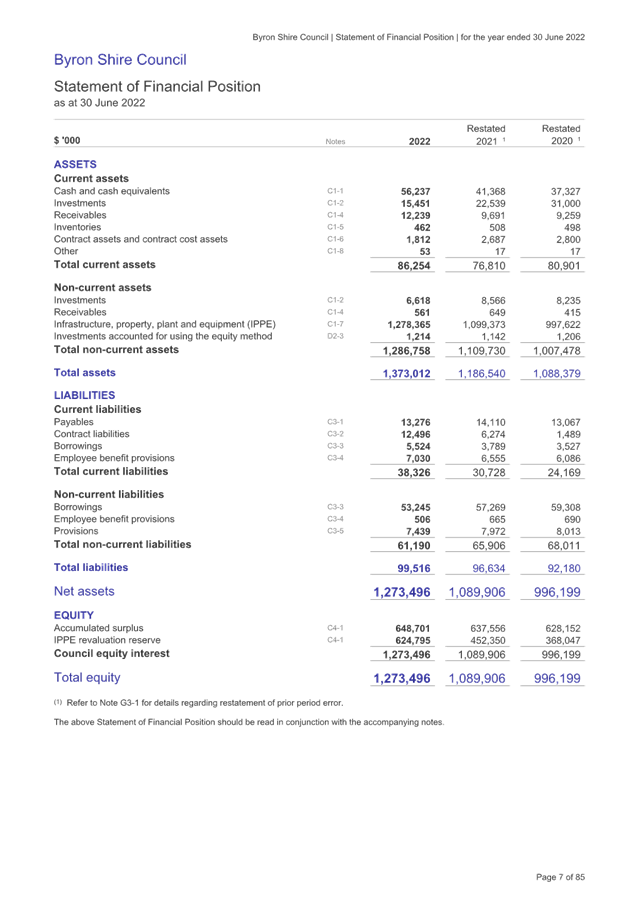

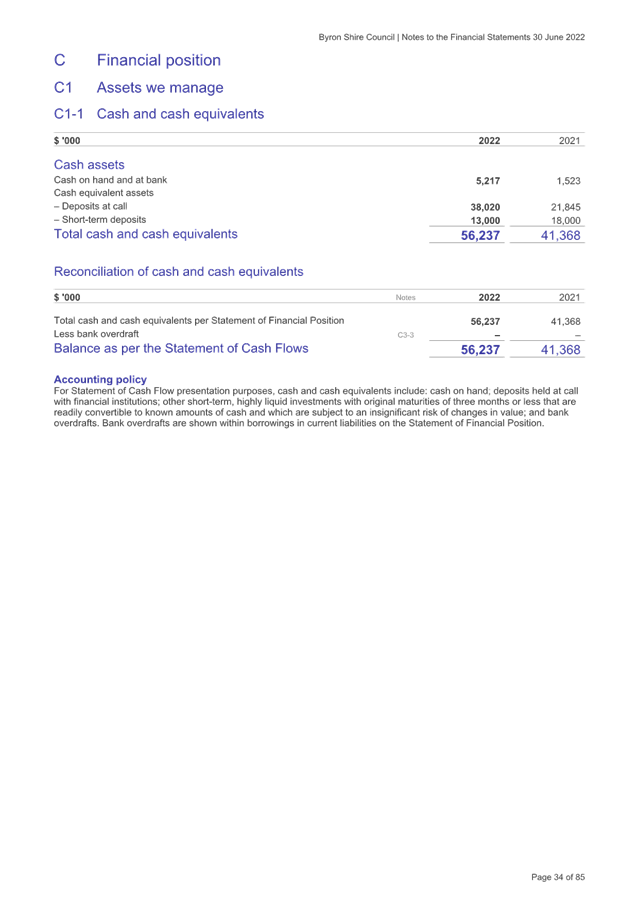

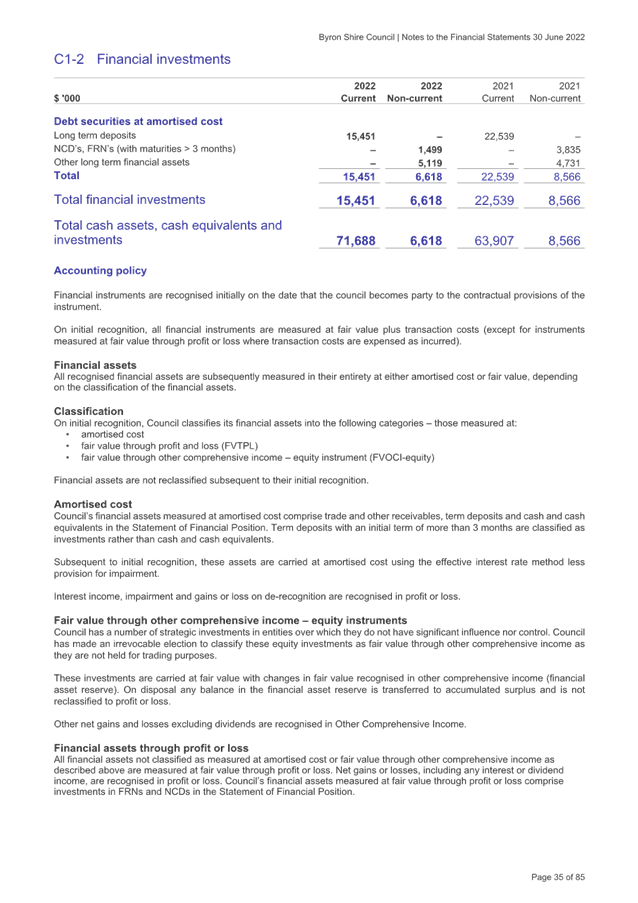

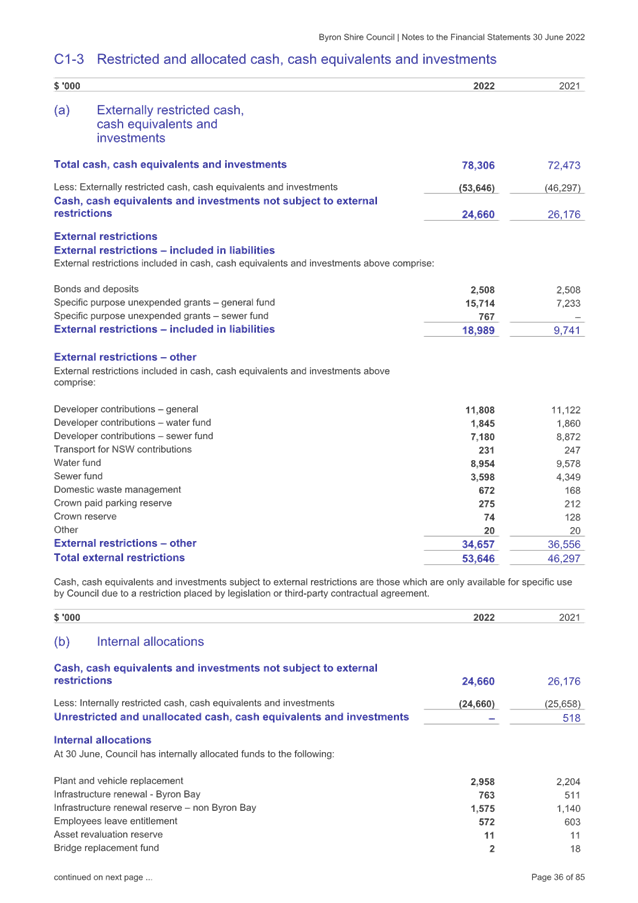

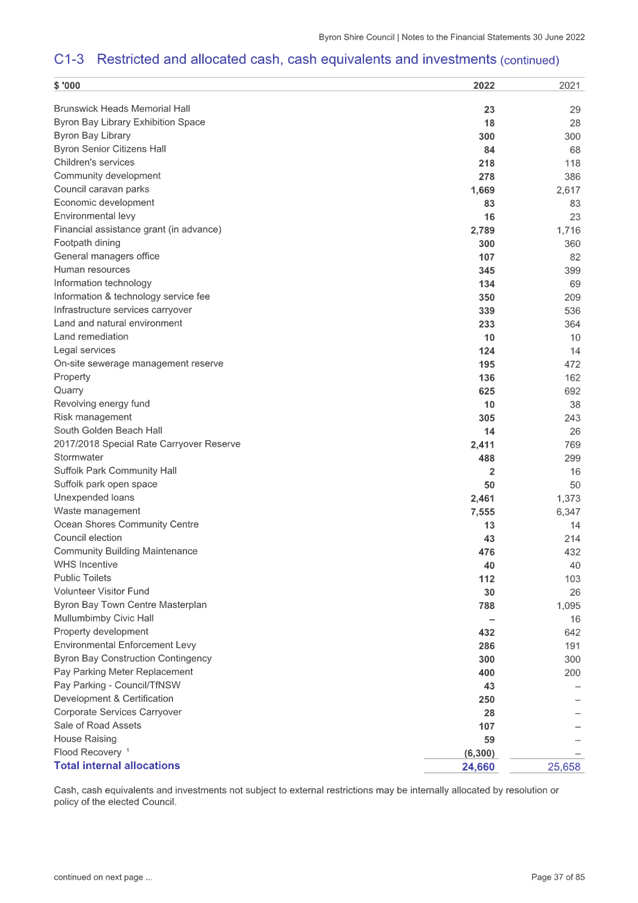

· Cash

and Investments

As at 30 June 2022 as detailed at Note

C1-3 to the financial statements, Council has maintained no unrestricted cash

and investments being a reduction of $0.518million compared to 2020/2021.

Council’s goal of maintaining a $1million unrestricted cash balance has

not been able to be achieved which has been exacerbated by the impact of the

February/March 2022 flood events and response to the recovery to 30 June

2022.

Council has established a flood recovery

reserve, in an effort to track its expenditure for the recovery works. As

at 30 June 2022, this reserve has a balance of negative $6.3million and is

indicative of expenditure incurred by Council that is yet to be reimbursed by

the NSW Government through Natural Disaster funding. It needs to be

clearly articulated, as it was when the 30 June 2022 Quarterly Budget Review

was considered by the Finance Advisory Committee and subsequently recommended

to Council, that in establishing this reserve the short term funding to the

flood recovery has come from Council’s overall internal reserve

allocations and that no externally restricted funds have been used for this

purpose. It is expected that the flood recovery reserve will cease to

exist when Council has completed all flood recovery works and been reimbursed

fully for natural disaster funding eligible expenditure over the next few

years.

All other cash and investments totalling

$78.306million at 30 June 2022 are restricted for specific purposes. Overall,

the cash and investment position of Council increased by $5.833million during

the year.

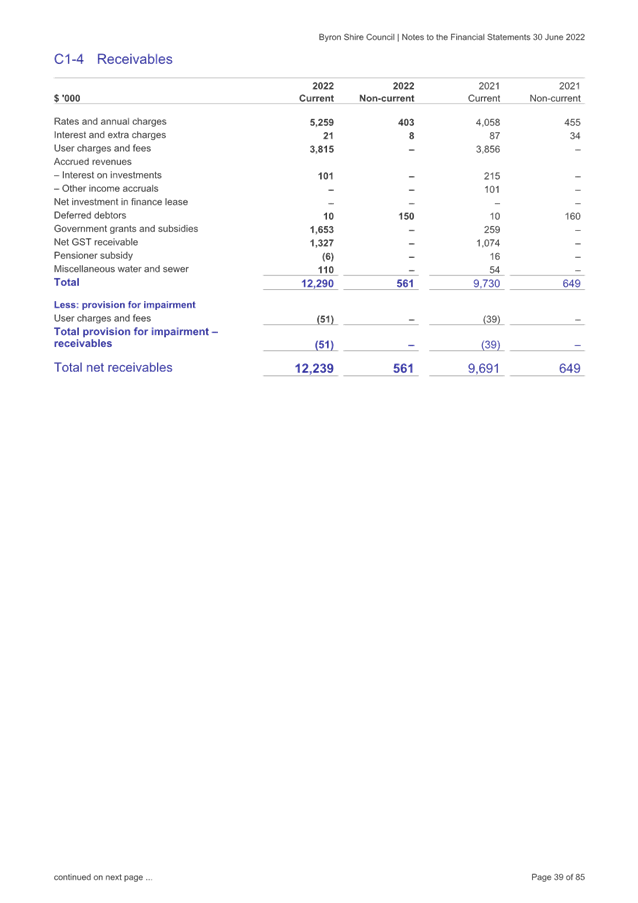

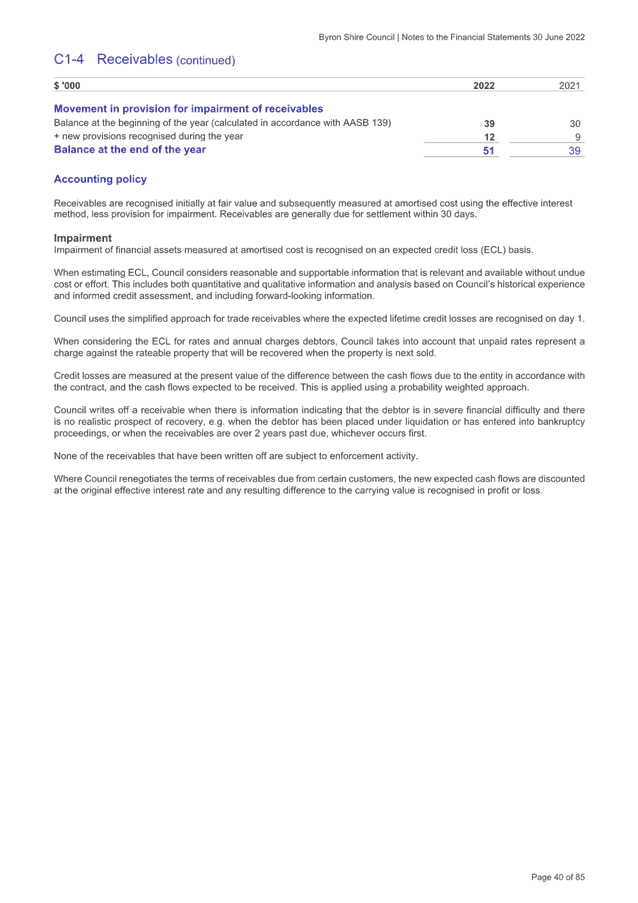

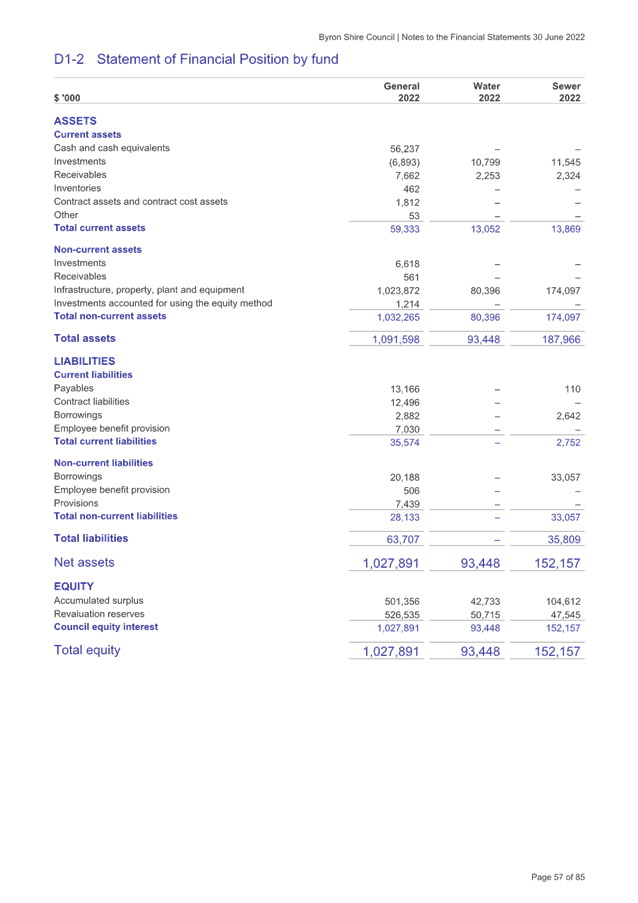

· Receivables

and Contract Assets

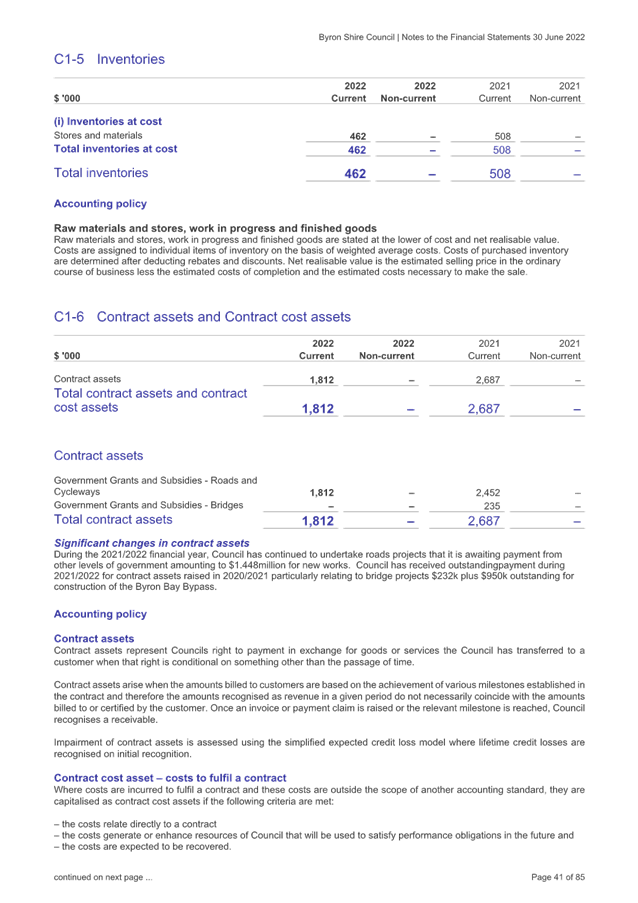

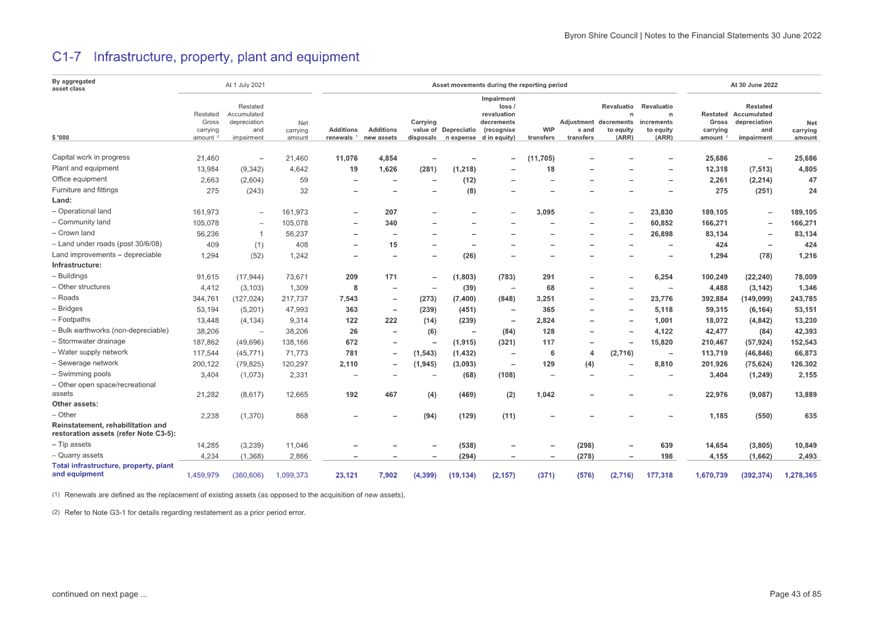

As at 30 June 2022, as detailed at Note C1-4 and C1-6 to the

financial statements, Council was due $14.712million in receivables and

contract assets. Of this amount $3.465million was due from other levels of

Government for grants, $1.327million from the Commonwealth Government for Goods

and Services Tax and $0.740million in Government grants and subsidies.

Outstanding rates and charges were $5.701million. Overall receivables and

contract assets increased by $1.585million compared to the 2020/2021 financial

year.

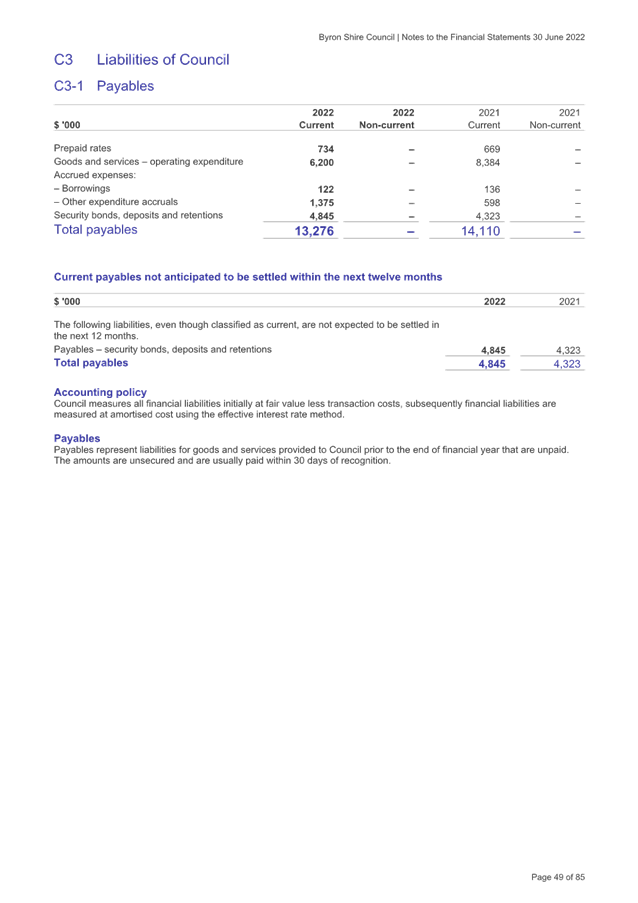

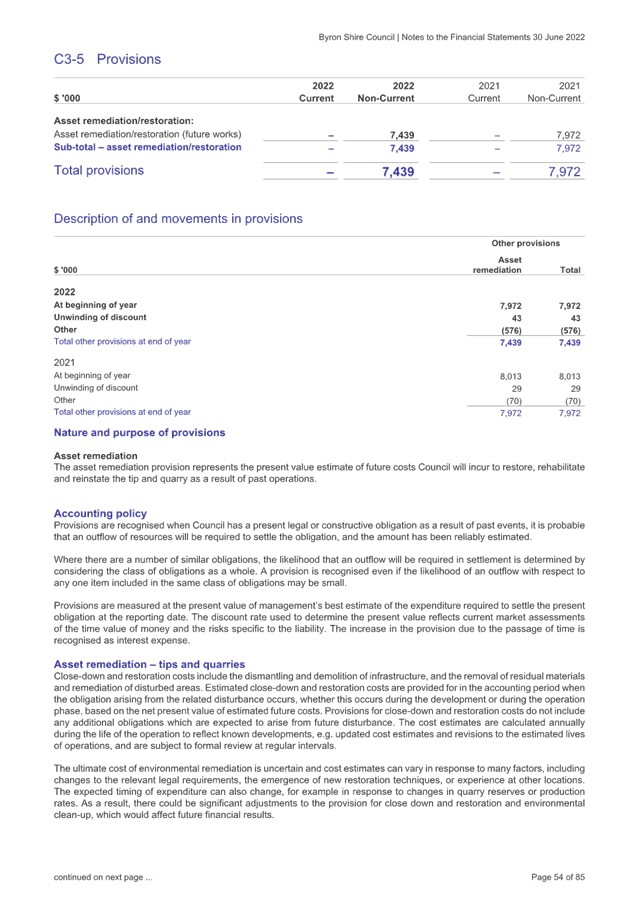

· Payables,

Contract Liabilities and Provisions

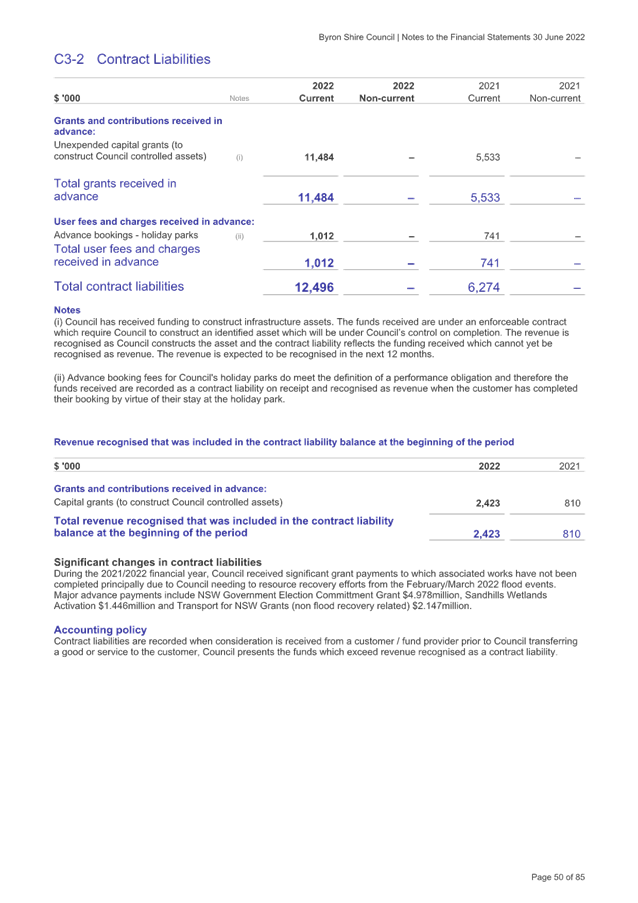

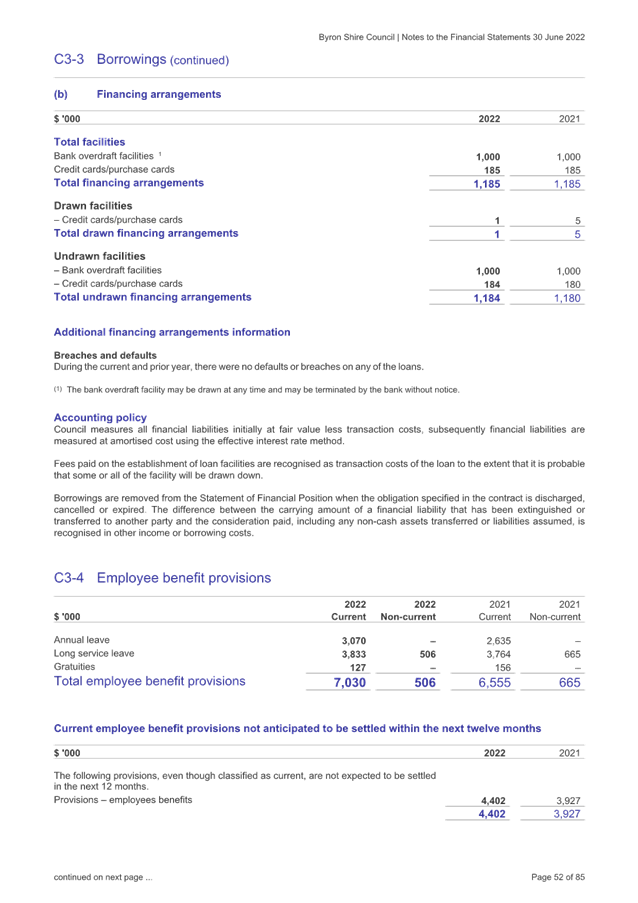

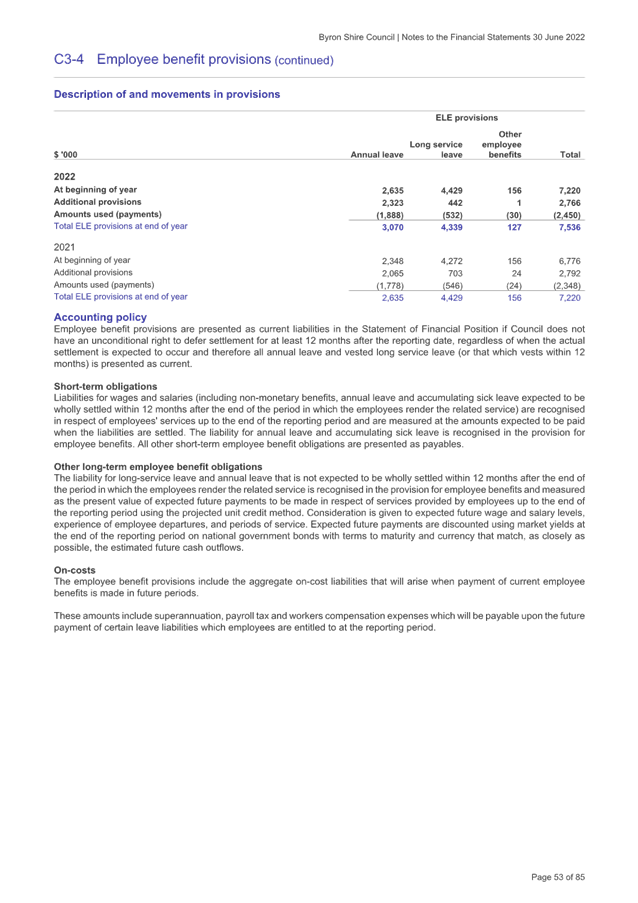

At 30 June 2022, as detailed at Note C3-1

for payables, Note C3-2 for Contract Liabilities, Note C3-4 for Employee

Benefit Provisions and Note C3-5 for Provisions, total payables by Council were

$13.276million including $4.845million held in security bonds, deposits and

retentions, $1.497million in accrued expenses and $6.200million payable to

suppliers. In addition at 30 June 2022, Council has accrued employee leave

entitlements valued at $7.536million. Specific employee leave entitlements

include $3.070million for annual leave, $4.339million for long service leave

and $0.127million for gratuities. At 30 June 2022 Council also had

$12.496million in contract liabilities relating to unexpended capital grants

and advance bookings for its holiday parks. It has also made provisions of $7.439million

for the restoration of landfill and quarry assets. In comparison to

2020/2021, total liabilities have increased $2.882million.

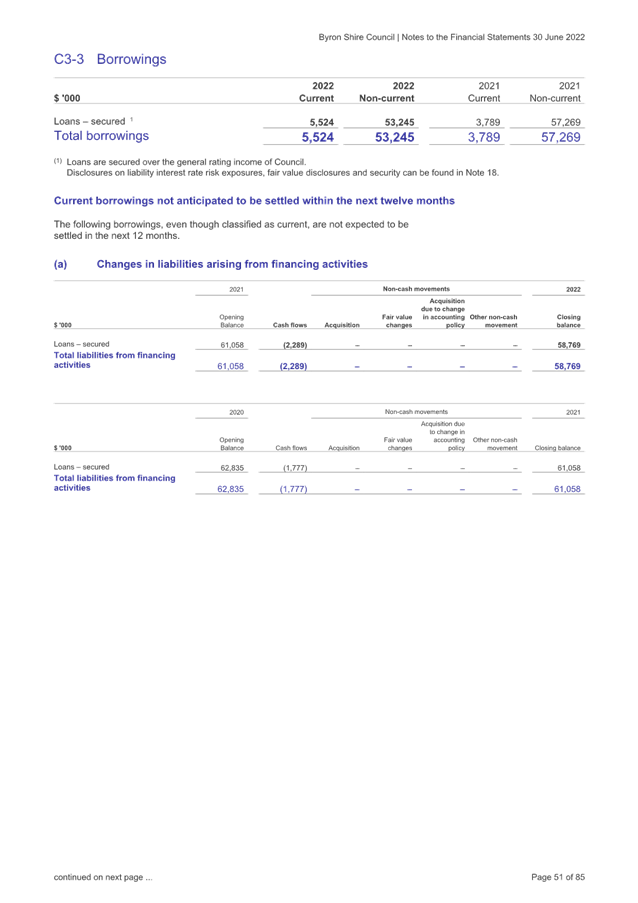

· Loan Borrowings

During 2021/2022

Council borrowed new loans of $1.500million and continued to make normal loan

repayments.

Council’s outstanding loans as at

30 June 2022 are $58.769million. Total loan expenditure for 2021/2022 included

interest of $2.891million and principal payments of $3.789million. Total

expenditure in 2021/2022 related to loan repayments was $6.573million or 8.07%

of Council’s revenue, excluding all grants and contributions.

The outstanding loans by Fund totalling

$58.769million are as follows:

· General

Fund $23.100million

· Water

Fund $0

– Water Fund is debt free

· Sewerage

Fund $35.669million

· New

Accounting Standards

The 2021-2022 financial year did not

require Council to implement any new accounting standards that impacted the

financial statements.

· Liquidity

Council’s Statement of Financial

Position (balance sheet) indicates net current assets of $47.928million. It is

on this basis, in the opinion of the Responsible Accounting Officer, that the

short term financial position of Council remains in a satisfactory position and

that Council can be confident it can meet its payment obligations as and when

they fall due. That is, there is no uncertainty as to Council being considered

a ‘going concern’. In addition, Council’s cash expense

cover ratio is at 8.89 months whereas the minimum benchmark is 3 months.

Council exceeds this benchmark by nearly three times.

Council’s Unrestricted Current

Ratio improved to 3.52, demonstrating Council has $3.52 in unrestricted current

assets compared to every $1.00 of unrestricted current liabilities. This

exceeds the benchmark of $1.50.

On a longer term basis Council will need

to consider its financial position carefully. Nevertheless, in isolation, the

financial results for 2021/2022 continue to present a ‘stable’

financial position especially given the initial impacts of COVID-19 in the

first half of the financial year followed by the impact of the February/March

2022 flood events.

Effort is needed to manage the trend

towards reducing operational deficits before capital grants and

contributions. Furthermore, Council needs to commence restoration of the

unrestricted cash balance back towards $1million during the 2022/2023 financial

year, which could not be achieved during 2021/2022. Council will

especially need to carefully manage its cash flow obligations as it starts to

commit further significant expenditure in the flood recovery for Essential

Public Asset Restoration (EPAR) works and the time delay for reimbursement from

the NSW Government via Natural Disaster funding for the AGRN 1012 event.

Strategic

Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

|

1:

Effective Leadership

We have effective decision making and

community leadership that is open and informed

|

1.3:

Ethical and efficient management of resources

|

1.3.1:

Financial Management - Ensure the financial integrity and sustainability of

Council through effective financial management

|

1.3.1.3

|

Provide

completion of Council's statutory annual financial statements for 2021/2022.

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Section 413(2)(c) of the Local Government

Act 1993 and Section 215 of the Local Government (General) Regulation 2021

requires Council to specifically form an opinion on the financial

statements. Specifically Council needs to sign off an opinion on the

Financial Statements regarding their preparation and content as follows:

In this regard the Financial Statements

have been prepared in accordance with:

· The

Local Government Act 1993 (as amended) and the Regulations made thereunder.

· The

Australian Accounting Standards and professional pronouncements.

· The

Local Government Code of Accounting Practice and Financial Reporting.

And the content to the best of our

knowledge and belief:

· Presents

fairly the Council’s operating result and financial position for the

year.

· Accords

with Council’s accounting and other records.

· Management

is not aware of any matter that would render the Financial Statements false or

misleading in any way.

Section 416(1) of the Local Government

Act 1993, requires a Council’s annual Financial Statements to be prepared

and audited within four (4) months of the end of that financial year i.e. on or

before 31 October 2021. Given the impact of the February/March 2022 flood

events, Council sought and was granted an extension to complete its financial

statements by 15 December 2022. However, Council must lodge its Annual

Report by 30 November 2022 that must include the Financial Statements so the

effective date of the extension is 30 November 2022.

Section 417(4) of the Local Government Act 1993 requires, as

soon as practicable after completing the audit, the Auditor must send a copy of

the Auditor’s Reports to the Departmental Chief Executive and to the

Council.

Section 417(5) of the Local Government Act 1993 requires

Council, as soon as practicable after receiving the Auditor’s Reports, to

send a copy of the Auditor’s Reports on the Council’s Financial

Statements, together with a copy of the Council’s audited Financial

Statements, to the Departmental Chief Executive before 7 November 2022. For

2021/2022 this will be 7 December 2022 given the extension granted.

Section 418(1) of the Local Government

Act 1993 requires Council to fix a date for the Meeting at which it proposes to

present its audited Financial Statements, together with the Auditor’s

Reports, to the public, and must give public notice of the date so fixed. This

requirement must be completed within five weeks after Council has received the

Auditor’s Reports.

Financial Considerations

There are no

direct financial implications associated with this report as the report does

not involve any future expenditure of Council funds but rather, advises on

Council’s draft financial outcomes during the 2021/2022 financial year,

which are identified in this report and attachments. These financial outcomes

are also still subject to final review by the NSW Audit Office at the time of

report preparation and may change.

Consultation

and Engagement

Section 420 of the Local Government Act

1993 requires Council to provide the opportunity for the public to submit

submissions on the Financial Statements. Submissions are to be made

within seven days of the Financial Statements being presented to the

public. In the case of the 2021/2022 Financial Statements, the closing

date for submissions is expected to be 22 December 2022.