Agenda

Agenda

Ordinary Meeting

Thursday, 24 November 2022

Agenda

Agenda

Ordinary Meeting

Thursday, 24 November 2022

Agenda Ordinary Meeting

held at Conference Room, Station Street, Mullumbimby

commencing at 9.00am

Public access relating to items on this agenda can be made between 9:00 and 10:30 am on the day of the meeting. Requests for public access should be made to the General Manager or Mayor no later than 12:00 midday on the day prior to the meeting.

Mark Arnold

General Manager

CONFLICT OF INTERESTS

What is a “Conflict of Interests” - A conflict of interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council official has that does not amount to a pecuniary interest as defined in the Code of Conduct for Councillors (eg. A friendship, membership of an association, society or trade union or involvement or interest in an activity and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter if the interest is so remote or insignificant that it could not reasonably be regarded as likely to influence any decision the person might make in relation to a matter or if the interest is of a kind specified in the Code of Conduct for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a matter if the pecuniary interest is the interest of the person, or another person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a matter if:

· The person’s spouse or de facto partner or a relative of the person has a pecuniary interest in the matter, or

· The person, or a nominee, partners or employer of the person, is a member of a company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the following:

(a) the parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or adopted child of the person or of the person’s spouse;

(b) the spouse or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary interest in a matter:

· If the person is unaware of the relevant pecuniary interest of the spouse, de facto partner, relative or company or other body, or

· Just because the person is a member of, or is employed by, the Council.

· Just because the person is a member of, or a delegate of the Council to, a company or other body that has a pecuniary interest in the matter provided that the person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

· A Councillor or a member of a Council Committee who has a pecuniary interest in any matter with which the Council is concerned and who is present at a meeting of the Council or Committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

· The Councillor or member must not be present at, or in sight of, the meeting of the Council or Committee:

(a) at any time during which the matter is being considered or discussed by the Council or Committee, or

(b) at any time during which the Council or Committee is voting on any question in relation to the matter.

No Knowledge - a person does not breach this Clause if the person did not know and could not reasonably be expected to have known that the matter under consideration at the meeting was a matter in which he or she had a pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts & the option chosen will depend on an assessment of the circumstances of the matter, the nature of the interest and the significance of the issue being dealt with. Non-pecuniary conflicts of interests must be dealt with in at least one of the following ways:

· It may be appropriate that no action be taken where the potential for conflict is minimal. However, Councillors should consider providing an explanation of why they consider a conflict does not exist.

· Limit involvement if practical (eg. Participate in discussion but not in decision making or vice-versa). Care needs to be taken when exercising this option.

· Remove the source of the conflict (eg. Relinquishing or divesting the personal interest that creates the conflict)

· Have no involvement by absenting yourself from and not taking part in any debate or voting on the issue as of the provisions in the Code of Conduct (particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993 – Recording of voting on planning matters

(1) In this section, planning decision means a decision made in the exercise of a function of a council under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development application, an environmental planning instrument, a development control plan or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register containing, for each planning decision made at a meeting of the council or a council committee, the names of the councillors who supported the decision and the names of any councillors who opposed (or are taken to have opposed) the decision.

(3) For the purpose of maintaining the register, a division is required to be called whenever a motion for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described in the register or identified in a manner that enables the description to be obtained from another publicly available document, and is to include the information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are reminded of the oath of office or affirmation of office made at or before their first meeting of the council in accordance with Clause 233A of the Local Government Act 1993. This includes undertaking the duties of the office of councillor in the best interests of the people of Byron Shire and the Byron Shire Council and faithfully and impartially carrying out the functions, powers, authorities and discretions vested under the Act or any other Act to the best of one’s ability and judgment.

BYRON SHIRE COUNCIL

1. Public Access

3. Attendance by Audio-Visual Link / Requests for Leave of Absence

4. Declarations of Interest – Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary Interest Returns (Cl 4.9 Code of Conduct for Councillors)

6. Adoption of Minutes from Previous Meetings

6.1 Ordinary Meeting held on 27 October 2022

7. Reservation of Items for Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 Backzoning Linnaeus..................................................................................................... 8

9.2 Mayoral Fund 2022/2023 - Allocation of Funding................................................... 12

9.3 Support for the draft Bill to establish a Commonwealth Postal Savings Bank... 14

10. Petitions

11. Submissions and Grants

12. Delegates' Reports

12.1 Far North Coast BFMC meeting 8 November 2022............................................... 19

13. Staff Reports

Corporate and Community Services

13.1 Meeting Schedule 2023 - Council Meetings, Committee Meetings, and Councillor Workshops.................................................................................................................... 20

13.2 Annual Report 2021/22............................................................................................... 25

13.3 Draft 2021/2022 Financial Statements..................................................................... 28

13.4 2022/23 Operational Plan Report - Q1 - September 2022.................................... 41

13.5 Budget Review - 1 July 2022 to 30 September 2022............................................. 45

13.6 Council Resolutions Quarterly Review - Q1 - 1 July to 30 September 2022..... 58

13.7 Council Investments - 1 October 2022 to 31 October 2022.................................. 61

13.8 Grants October 2022................................................................................................... 70

13.9 Recovery Action Plan.................................................................................................. 79

13.10 Refinance of Waste Loan No 66................................................................................ 85

Sustainable Environment and Economy

13.11 Byron Shire Local Heritage Grants Program 2022-23........................................... 89

Infrastructure Services

13.12 Byron Shire Natural Burial Ground - Next Steps.................................................... 94

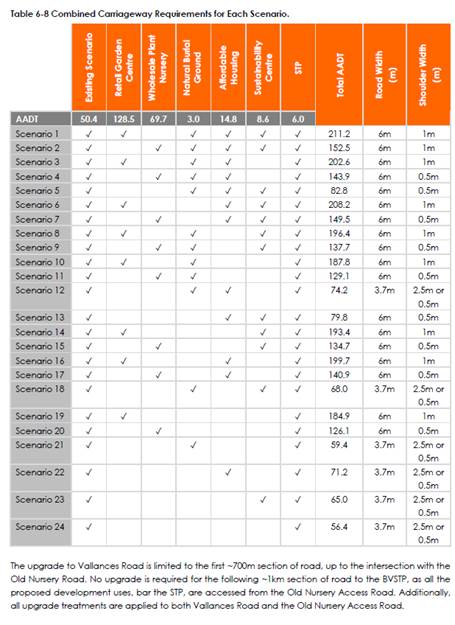

13.13 Vallances Road Options and Next Steps................................................................. 98

13.14 Detention Basin Lot 12 Bayshore Drive................................................................. 102

14. Reports of Committees

Corporate and Community Services

14.1 Report of the Arts and Creative Industries Advisory Committee Meeting held on 20 October 2022.............................................................................................................. 109

Sustainable Environment and Economy

14.2 Report of the Coast and ICOLL Advisory Committee Meeting held on 20 October 2022...................................................................................................................................... 112

Infrastructure Services

14.3 Report of the Water and Sewer Advisory Committee Meeting held on 20 October 2022...................................................................................................................................... 114

14.4 Report of the Local Traffic Committee Meeting held on 15 November 2022*. 117

*To be provided in a supplementary agenda.

15. Questions With Notice

Nil

Questions with Notice: A response to Questions with Notice will be provided at the meeting if possible, that response will be included in the meeting minutes. If a response is unable to be provided the question will be taken on notice, with an answer to be provided to the person/organisation prior to the next Ordinary Meeting and placed on Councils website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

Councillors are encouraged to ask questions regarding any item on the business paper to the appropriate Director prior to the meeting. Any suggested amendments to the recommendations should be provided to Councillor Support prior to the meeting to allow the changes to be typed and presented on the overhead projector at the meeting.

BYRON SHIRE COUNCIL

Notices of Motion 9.1

Notice of Motion No. 9.1 Backzoning Linnaeus

File No: I2022/1642

1. Council requests staff to commence preparation of a planning proposal to rezone the Linnaeus site (Lot 1 DP1031848 ) from its current SP1 Mixed Use Development Zone to a C4 Environmental Living Zone, such that no additional development can be undertaken on the site other than the existing approved land uses;

2. Staff advise the landowners of point ‘1’ above;

3. The landowners be requested to submit any required technical studies for the site to support the proposed rezoning and at a standard to Council’s satisfaction, to enable an assessment to be undertaken by or before April 2023;

4. A gateway assessment report be presented to Council following completion of point ‘3’;

5. Consultation for the planning proposal by Council will be undertaken following the issue of, and in accordance with the gateway determination.

Signed: Cr Michael Lyon

Councillor’s supporting information:

Linnaeus is one of these legacy items that we were landed with in the last term of Council. We have had several goes at trying to draw a line under it without success. The latest DA approval from the Northern Rivers Planning Portal has created a use on the site that had not been approved under the 1988 LEP and was not envisioned as part of the transfer into the 2014 LEP.

The environmental values of the site are undisputed, as is the need to do everything we can to protect the unique biodiversity on this site and in the broader Broken Head area. The intention of the notice of motion is to again attempt to draw a line under this site at the current levels of approval and shift the zoning of the land to ensure this happens.

Whilst it is clear that there has been disagreement between various landowners and parties involved, both internal and external, it is my hope that a resolution can be reached such that future Councils are not burdened with trying to sort it out.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy:

The Linneaus Site has a recent history of application and reports.

Council considered Report No 13.3 - PLANNING - 26.2018.2.1 The Linnaeus Estate - Options for proceeding with Community Title Subdivision at its Agenda of Ordinary (Planning) Meeting - 21 May 2020 (infocouncil.biz) and resolved as follows:

Resolved 20-203:

1. That Council:

a) Note the report PLANNING - 26.2018.2.1 The Linnaeus Estate - Options for proceeding with Community Title Subdivision.

b) Support the preparation of an amended planning proposal for Lot 1 DP 1031848, Broken Head Road, Broken Head (The Linnaeus Estate) that rectifies the issues noted in this report.

c) Require the proponent to provide a current coastal hazard study that informs the amended planning proposal to Council’s satisfaction.

d) Receive a further report that considers (i) proposed amendments to the planning proposal, (ii) the outcomes of the coastal hazard study, and (iii) submissions that were received during the public exhibition period.

2. That any planning proposal and/or development application consultation and engagement period reflects the Community Participation Plan namely that:

“Before the lodgement of a planning proposal and/or development application for community significant development, the applicant must:

· carry out a community meeting or workshop to be facilitated by Council;

· notify adjoining and surrounding landowners and known community groups; and

· ensure the community has adequate time to consider and comment on the proposal. “

3. That Council request the proponent to submit a current audit of buildings, structures and works on site to enable Council staff to review against existing consents and approvals to assess compliance. This audit is to be submitted within three months.

Council considered an update on the status of the above resolution at the Agenda of Ordinary (Planning) Meeting - Thursday, 4 November 2021 (infocouncil.biz) and resolved as follows:

21-495 Resolved that Council:

1. Notes the staff update on Resolution 20-203 The Linneaus Estate - Options for proceeding with Community Title Subdivision.

2. In noting the site inspection findings (section 5 of the audit), understands that staff will do the follow up with the landowner (and do a site inspection if deemed necessary) to clarify the nature of the minor inconsistencies identified between some of the building forms on site as they appear in the various approval documentation on file.

DA10.2021.170.1 (PPSNTH-83) Mixed Use Development comprising Twenty-Seven (27) New Eco Tourist Facility Cabins, Seven (7) Ancillary Buildings including Wellness Facility, Refuges, Depot, Addition of Deck to Existing Centre and Associated Earthworks and Vegetation Removal, and Change of Use of Fourteen (14) Private Education Accommodation Units to Eco Tourist Facility Units was granted development consent by the Northern Region Planning Panel on 8 November 2022.

Mixed Use Development | Planning Portal - Department of Planning and Environment (nsw.gov.au)

The way forward is for a Council initiated (or landowner initiated) planning proposal being progressed to rezone that part of the land zoned SP1 Mixed Use Development to a C4 Environmental Living zone and include an Additional Permitted Uses clause to manage land use. Consequential amendments will also be required to certain clauses in Byron LEP 2014 to provide for any community title subdivision sought thereafter as per the Rural Land Use Strategy 2017.

As the site has an area of deferred matter (DM) land also, a coastal study that informs the planning proposal for that part of the land will also be required. Work has significantly progressed on council’s Coastal Management Program Southern Coastline including Estuaries - Byron Shire Council (nsw.gov.au) which can be used to inform the planning proposal, and application of appropriate land use zones to it. It is anticipated that the planning proposal will as such include provisions that enable Council to manage future land use zoning and land use in accordance with the coastal erosion risks identified in the study.

Financial/Resource/Legal Implications:

If a Council initiated planning proposal it will be funded from the existing operational budget.

If a landowner-initiated planning proposal it will be subject to Council’s fees and charges.

Is the proposal consistent with any Delivery Program tasks?

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

4:

Ethical Growth |

4.1: Manage responsible development through effective place and space planning |

4.1.4: LEP & DCP - Review and update the Local Environmental Plan and Development Control Plans |

4.1.4.1 |

Assess requests to amend Local Environmental Plans and/or Development Control Plans including maps in accordance with legislative requirements. |

BYRON SHIRE COUNCIL

Notices of Motion 9.2

Notice of Motion No. 9.2 Mayoral Fund 2022/2023 - Allocation of Funding

File No: I2022/1643

I move:

That Council confirms the donations from the Mayor’s Discretionary Allowance 2022/2023 as per the recommendation in Confidential Attachment 1 (E2022/111103), including applications partially supported.

Attachments:

1 Confidential - Mayoral Fund 2022/2023 Applications Received, E2022/111103

Signed: Cr Michael Lyon

Councillor’s supporting information:

One method that Council uses to support community groups, organisations and local schools is through the provision of funding by way of the “Mayor’s Discretionary Allowance”.

Following a review in March 2021 (Res 21-075) of how the Mayor’s Discretionary Allowance is considered and determined, community groups, organisations and local schools were invited to apply for funding, including justification for the request, with the Mayor’s decision to be reported to Council for confirmation in accordance with the Act and Res 09-349.

On 30 August 2022 Council announced the Mayoral Fund for 2022/2023 was open for applications via Council’s website, with applications closing on 7 October 2022. Seventeen applications were received with a total of $18,799.00 funding requested. This year’s total available budget is $3,900.00.

Applications received are for multiple locations across the Shire, including a variety of community groups, organisations, and local schools, and align with the following themes of the Community Strategic Plan:

· Community - We have an inclusive and active community where diversity is embraced and everyone is valued.

· Environment - We nurture and enhance the natural environment.

· Infrastructure – We have connected infrastructure, transport, and facilities that are safe, and reliable.

· Leadership – We have effective decision making and community leadership that is open and informed.

Staff comments

by Esmeralda Davis, Director Corporate and Community Services:

There is sufficient funding available to allocate as per the recommendations in Confidential Attachment 1 (E2022/111103), including partial allocations for five of the requests. If the Notice of Motion is supported, staff will process accordingly.

Financial/Resource/Legal Implications:

The 2022/2023 Budget adopted by Council included an allocation of $3,900 for budget item Mayor – Discretionary Allowance. Sufficient funds are available for making the nominated donations of $3,900.

In relation to the making of Section 356 Donations from Mayor – Discretionary Allowance, Council at its Ordinary meeting held on 14 May 2009 resolved as follows:

“09-349 Resolved that Council confirm that all s356 donations, to be made from the budget allocation “Mayor – Discretionary Allowance”, must be the subject of a resolution of the Council at Ordinary or Extraordinary meeting.”

The Section 356 Donation will be advertised, and public notice of financial assistance provided in accordance with Section 356 of the Local Government Act 1993.

Is the proposal consistent with any Delivery Program tasks?

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.5: Empower community leadership through collaboration, capacity building, and cultivating community driven initiatives |

1.5.1: Community grant programs - Provide financial assistance and grants to empower community groups and organisations to deliver priority projects |

1.5.1.2 |

Deliver funding and support for community groups |

BYRON SHIRE COUNCIL

Notices of Motion 9.3

Notice of Motion No. 9.3 Support for the draft Bill to establish a Commonwealth Postal Savings Bank

File No: I2022/1644

I move:

1. That Council notes that:

a) Bank branch and ATM closures are leaving many communities without access to financial services, especially in regional Australia;

b) Since 1975 the number of bank branches in regional Australia has fallen by more than 60 per cent, and there are more than 1,500 communities across Australia with no bank branches at all;

c) A large proportion of the population, including the elderly, disabled, small businesses, and local schools and charities, will always have a need for face-to-face financial services, despite advances in technology;

d) For hundreds of communities, their only access to cash and financial services is through Bank@Post at their local post office;

e) Bank@Post is an essential service to all communities, but is vulnerable to commercial decision-making by the banks, which can choose to withdraw their participation, and charge excessive fees on transactions; and

f) With four major banks controlling 80 per cent of the financial system, Australian consumers suffer from a lack of real banking competition.

2. That Council calls on the Commonwealth Parliament to pass the Commonwealth Postal Savings Bank Bill to establish a post office people’s bank, fully guaranteed by the Commonwealth, as a dedicated postal savings bank, operating exclusively through Australia Post’s corporate and licensed post offices, which will ensure basic banking services—including deposit-taking, business and personal lending, and access to cash—and be available to all Australians, and will contribute to Australia’s national economic development.

3. That Council writes to our State and Federal Members of Parliament, to inform them of Council’s desire to support the passage of the Commonwealth Postal Savings Bank Bill through Parliament.

4. That the Mayor, on behalf of Council, moves a resolution at Northern Rivers Joint Organisation ( NRJO) as per the above to lend regional weight to the campaign.

Signed: Cr Michael Lyon

Councillor’s supporting information:

We received correspondence regarding this last year and there have been follow-ups from Robert Barwick from the Australian Citizens Party recently. I had a chat with him and he has convinced me that this is a good initiative and it seems to have good support from many in Parliament. I would like us to add our weight to the campaign and take this to NRJO to do the same.

Further Background: Text of email received in October:

“Dear Mayor Lyon,

I am writing to ask you and your Council for your support for the growing campaign for a public post office bank in Australia, like those which operate successfully in many countries around the world.

As a local councillor, you would know the impact that the wave of closures of bank branches is having on communities, especially regional communities.

This impact is compounded by the reduction in bank lending into regional communities.

The Australian Citizens Party is part of a nationwide campaign to establish a new government bank, like the original Commonwealth Bank, to operate in post offices, which would guarantee face-to-face financial services for all communities, and force the Big Four banks to compete on both cost and service.

The post office bank would also:

• Guarantee deposits, because it is a government bank;

• Maintain cash payments and processing, which the private banks are trying to do away with;

• Increase lending to individuals and small businesses in regional communities;

• Invest in more infrastructure, including through local government.

Please note: This policy is different to the existing banking service in post offices, Bank@Post, because it is a dedicated postal bank that will increase competition, whereas Bank@Post is just an agency service for the existing banks which can withdraw any time. It is also different to community banks, which do an admirable job, but, again, they don't increase competition.

This campaign is supported by the Licensed Post Office Group (LPOG), which represents the interests of the almost 3,000 community post offices which are run as small businesses, the majority of the Australia Post network.

And it is supported by Katter’s Australian Party, One Nation, the Greens, senior members of the National Party, and members of the Liberal and Labor parties.

On 7 September, the LPOG hosted a public forum in Parliament House on the postal bank policy, which was attended by Member for Kennedy Bob Katter, Liberal Senator Gerard Rennick, Nationals Senator Ross Cadell, One Nation Senator Malcolm Roberts, and staffers representing MPs from all the parties in Parliament. You can view the entire forum at this link: https://www.youtube.com/watch?v=yWizMx7BgJs

The featured speaker was former New Zealand Cabinet Minister Matt Robson, whose party started NZ’s postal bank, called Kiwibank, in 2002.

Mr Robson recounted Kiwibank’s immediate success, including how New Zealanders flocked to open accounts, and how the private banks, suddenly having to compete, announced a moratorium on branch closures.

A public postal bank would have a similar impact in Australia.

We are seeking local government support for this campaign, to send a message to Canberra that this policy is what local communities need to improve essential services and investment.

The Citizens Party has produced the following short videos to explain benefits of the policy:

1. CREATE A PUBLIC POST OFFICE BANK! – The solution to the closure of local bank branches (https://www.youtube.com/watch?v=eMiwrvvNnP0).The major banks have closed more than 350 bank branches in the last two years and research shows that since 1975, regional Australia has lost 62% of its banks!

2. CREATE A PUBLIC POST OFFICE BANK! The solution to the financing needs of local government. This second video shows how a postal bank, because it is a public bank, could be a source of long-term, low-interest, flexible credit for local governments to meet their infrastructure responsibilities, as the Commonwealth Bank was when it started in post offices in 1912. (https://www.youtube.com/watch?v=oNve8bPPNAM)

How Councils can support

Bob Katter MP is preparing a bill to introduce into Parliament, called the Commonwealth Postal Savings Bank Bill.

We are asking local Councils to pass motions to endorse the bill, and communicate the endorsement to your local federal Member of Parliament.

Five Councils have now passed motions:

1. Narrabri Shire Council (NSW)

2. Banana Shire Council (QLD)

3. Yilgarn Shire Council (WA)

4. Cobar Shire Council (NSW)

5. Strathfield City Council (NSW)

You can see the motions on our website: https://citizensparty.org.au/campaigns/public-post-office-bank/post-bank-resolutions.

Alternatively, download a PDF of the five motions: https://citizensparty.org.au/sites/default/files/2022-09/202209-Post-Office-Bank-PASSED-Council-Motions.pdf

Please raise this policy for consideration by your council, with a view to passing a motion of support.

I am available for a phone call and to address your council and answer questions on the policy. Please don’t hesitate to contact me on the numbers below. Yours sincerely,

Robert Barwick

Research Director

Australian Citizens Party”

Staff comments

by Esmeralda Davis, Director Corporate and Community Services:

This approach to Council has emerged from the Australian Citizen’s Party ‘Resolution Campaign’ to promote and build support for the Commonwealth Postal Savings Bank (CPSB).

It is open to Council to receive and debate the Motion and to resolve as moved or in some alternate form. If the motion is supported, staff can prepare the required correspondence.

Financial/Resource/Legal Implications:

Staff time.

Is the proposal consistent with any Delivery Program tasks?

No

BYRON SHIRE COUNCIL

Delegates' Reports 12.1

Delegate's Report No. 12.1 Far North Coast BFMC meeting 8 November 2022.

File No: I2022/1647

The meeting dealt with many issues within Byron Shire, one of the three Shires in this Bush Fire Management Committee’s area. I attended via Teams, so my notes may be a bit wonky:

1. Community managed Dwarf Graminoid Heath at the eastern end of Ruskin Street (Frank Mills Lookout) Byron Bay - the burn was done, two months late due to wet weather.

2. Wategos Beach – the local community has received training and a small trailer mounted Fire Unit that it will operate. Factors for this local approach include that Wategos can get cut off by bushfire. Fire & Rescue NSW are considering other communities where such an approach might apply.

3. North Rocks Road fire trail was heavily damaged by landslip in the 2022 flood events, maintenance of this trail is shared between NPWS and Council, NPWS is now considering the strategic importance of the trail and whether reconstruction is justified.

4. Council bush regenerators are working in the reserve north of Tongarra Drive & Coomburra Crescent Ocean Shores. Farming ceased in the 1970’s and regrowth in the reserve and its surrounds has included garden and weed species. Council’s objectives are to encourage natural regeneration of local species while reducing volatile fuel loads, including those of exotic grasses and lantana.

5. Similar work is happening in Suffolk Park.

6. Bush at the end of Jones Road Yelgun has received annual treatments to ensure safe egress in this highly volatile and vulnerable area. Jones Road lies between North Byron Parklands and Billinudgel Nature Reserve.

7. Rural Fire Service’s Federal-Goonengerry Brigade is proposing tank storage as a Static Water Supply (SWS) for events in the village. A 25,000-litre tank is proposed, to be topped up by solar-pumped water from Stony Creek to the south-west.

Signed: Cr Duncan Dey

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.1

Staff Reports - Corporate and Community Services

Report No. 13.1 Meeting Schedule 2023 - Council Meetings, Committee Meetings, and Councillor Workshops

Directorate: Corporate and Community Services

Report Author: Amber Evans Crane, Governance Support Officer

File No: I2022/1445

Summary:

This report seeks to determine the schedule of Ordinary and Planning Council Meetings and Councillor Workshops for the 2023 calendar year. The approximate pattern of committee meetings is also given prior to the detailed scheduled being reported to Council in December.

A proposed schedule of dates, times, and places for the meetings in 2023 is recommended for adoption. Following Council endorsement, the meeting schedule will be publicly available to view on Council’s website.

Where possible, consistency with the 2022 meeting schedule has been prioritised to minimise disruption.

RECOMMENDATION:

1. That Council endorses the meeting frequency and cycle to generally follow the monthly pattern of:

1st Thursday – Councillor Workshop & Planning Review Committee

2nd Thursday - Planning Meeting

3rd Tuesday – Committee meetings

3rd Thursday - Committee meetings

4th Thursday - Ordinary Meeting

5th Thursday (where applicable) – Committee meetings or Councillor Workshop

2. That Council continues to support a recess in January and July each year, where no meetings are scheduled.

3. That

Council adopts the following schedule of Ordinary and Planning Council

Meetings, Councillor Workshops, and Committee Meetings for 2023:

|

Meeting/Workshop (Thursday & Tuesday) |

|

Jan-23 |

RECESS |

|

2-Feb-23 |

Workshop |

|

9-Feb-23 |

Planning |

|

14-Feb-23 |

Committee |

|

16-Feb-23 |

Committee |

|

23-Feb-23 |

Ordinary |

|

02-Mar-23 |

Workshop |

|

9-Mar-23 |

Planning |

|

14-Mar-23 |

Committee |

|

16-Mar-23 |

Committee |

|

23-Mar-23 |

Ordinary |

|

30-Mar-23 |

Committee |

|

06-Apr-23 |

Workshop |

|

13-Apr-23 |

Planning |

|

18-Apr-23 |

Committee |

|

20-Apr-23 |

Committee |

|

27-Apr-23 |

Ordinary |

|

04-May-23 |

Workshop |

|

11-May-23 |

Planning |

|

16-May-23 |

Committee |

|

18-May-23 |

Committee |

|

25-May-23 |

Ordinary |

|

01-Jun-23 |

Workshop |

|

08-Jun-23 |

Planning |

|

13-Jun-23 |

Committee |

|

15-Jun-23 |

Committee |

|

22-Jun-23 |

Ordinary |

|

29-Jun-23 |

Committee |

|

Jul-23 |

RECESS |

|

03-Aug-23 |

Workshop |

|

10-Aug-23 |

Planning |

|

15-Aug-23 |

Committee |

|

17-Aug-23 |

Committee |

|

24-Aug-23 |

Ordinary |

|

31-Aug-23 |

Committee |

|

07-Sep-23 |

Workshop |

|

14-Sep-23 |

Planning |

|

19-Sep-23 |

Committee |

|

21-Sep-23 |

Committee |

|

28-Sep-23 |

Ordinary |

|

05-Oct-23 |

Workshop |

|

12-Oct-23 |

Planning |

|

17-Oct-23 |

Committee |

|

19-Oct-23 |

Committee |

|

26-Oct-23 |

Ordinary |

|

02-Nov-23 |

Workshop |

|

09-Nov-23 |

Planning |

|

16-Nov-23 |

Committee |

|

21-Nov-23 |

Committee |

|

23-Nov-23 |

Ordinary |

|

30-Nov-23 |

Workshop |

|

07-Dec-23 |

Planning |

|

12-Dec-23 |

Committee |

|

14-Dec-23 |

Ordinary |

4. That the Ordinary and Planning Council Meetings commence at 9.00am.

5. That Ordinary and Planning Council Meetings are held in the Conference Room, Mullumbimby, until the restoration and renovation of the Council Chambers is complete, at which point Meetings will resume being held in the Council Chambers.

1 2023

Council Meeting schedule - PDF attachment, E2022/99429

![]()

Report

Council meetings are generally held each Thursday, and Committees generally on Tuesdays and Thursdays. Meetings following an estimated monthly pattern of:

· 1st Thursday – Councillor Workshop and Planning Review Committee

· 2nd Thursday - Planning Meeting

· 3rd Tuesday – Committee Meeting

· 3rd Thursday - Committee meetings

· 4th Thursday - Ordinary Meeting

· 5th Thursday (where applicable) – committee meetings or Councillor Workshop

It is recommended that both Ordinary and Planning Council Meetings commence at 9am. As a result, site inspections will be scheduled on the Tuesday before the meeting commencing at 3.30pm. This option was tested on 11 November 2022 and proved beneficial. This will also bring about consistency to starting times for Councillors and members of the public.

Following discussion with Councillors at the 3 November Councillor Workshop, an additional committee day is required to accommodate the number of committees that are required to meet quarterly. This is proposed for the 3rd Tuesday of each month, in the same week as the Thursday committee meetings. The committee meeting schedules are in development and will constitute a report to Council in December 2022.

Other considerations

The meeting schedule deviates from the usual pattern slightly for the month of December to accommodate the holiday period.

The schedule has also been prepared with consideration to events such as public holidays and conferences, noted impacts are:

· The Local Government NSW 2023 Annual Conference is scheduled to be held from 12 to 14 November 2023 in Parramatta. Committee meetings have been rescheduled to avoid a clash.

· The 2023 National General Assembly of Local Government is scheduled to be held from 18 to 21 June 2023 in Canberra. Although there is no meeting during this time, there is an Ordinary Meeting scheduled the day after the Assembly.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.1: Enhance trust and accountability through open and transparent leadership |

1.1.2: Governance - Ensure legislative compliance and support Councillors to carry out their civic duties |

1.1.2.4 |

Deliver Council meeting secretariat – including agenda preparation, minutes and council resolutions monitoring |

Legal/Statutory/Policy Considerations

Clause 3.2 of Council’s Code of Meeting Practice states that “The council shall, by resolution, set the frequency, time, date and place of its Ordinary meetings.”

The setting of the 2022 meeting schedule complies with Council’s obligations under the various sections of the Local Government Act 1993 that apply to meeting dates, namely:

· Section 9 notes that a council must give notice to the public of the times and places of its meetings

· Section 365 notes that Council is required to meet at least 10 times each year, each in a different month

· Section 367 outlines the required notice period of business papers for Councillors.

Financial Considerations

There are no financial implications with this meeting schedule.

Consultation and Engagement

Public notice of the 2023 meeting schedule will be given on Council’s website.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.2

Report No. 13.2 Annual Report 2021/22

Directorate: Corporate and Community Services

Report Author: Heather Sills, Manager Corporate Services

File No: I2022/1612

Summary:

Each NSW Local Government Authority is required under S428 of the Local Government Act 1993 to prepare and submit to the Minister of Local Government an Annual Report.

The preparation of an Annual Report is an opportunity for a Council to provide feedback back to the community on how the Council has implemented its operational plan and delivered outcomes for the community.

Council is asked to note the Annual Report 2021/22 and its submission to the Minister for Local Government.

A separate report on the 2021/22 Financial Statements will be prepared for the consideration of Council.

RECOMMENDATION:

That Council notes the Annual Report 2021/22 (#E2022/89378), included as Attachment 1 to this report, and its submission to the Minister for Local Government.

Attachments:

1 Byron

Shire Council Annual Report 2021/22, E2022/89378

![]()

Report

Each Council in NSW has an obligation to prepare and submit an Annual Report. It is an opportunity to report back to the community on Council’s progress.

The attached Annual Report has been prepared in accordance with the Local Government Act 1993 and includes the information prescribed in the Local Government (General) Regulation 2021. Information that is required by the Local Government Act and Regulation, or any other legislative requirement is noted with reference to the relevant legislation in bold.

In addition to the prescribed information, this Annual Report is one of the key points of accountability between Council and our community. The Annual Report highlights some of our achievements in implementing the 2018-2022 Delivery Program over the last year and the ways in which these activities contribute to the overarching objectives in the Community Strategic Plan 2028:

· INFRASTRUCTURE - We have infrastructure, transport and services which meet our expectations

· COMMUNITY - We cultivate and celebrate our diverse cultures, lifestyle and sense of community

· ENVIRONMENT - We protect and enhance our natural environment

· GROWTH - We manage growth and change responsibly

· GOVERNANCE - We have community led decision making which is open and inclusive

This is the final year of reporting on the Our Byron Our Future Community Strategic Plan 2028. A new Byron Shire Community Strategic Plan 2032 has been developed in consultation with community and Councillors following the 2021 Local Government election. The new plan will be the subject of future Annual Reports.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.1: Enhance trust and accountability through open and transparent leadership |

1.1.2: Governance - Ensure legislative compliance and support Councillors to carry out their civic duties |

1.1.2.5 |

Prepare and submit the 2021/22 Annual Report |

Legal/Statutory/Policy Considerations

Section 428 of the Local Government Act 1993 requires Council to prepare an annual report within 5 months after the end of each year and to detail its achievements in implementing its delivery program and the effectiveness of the principal activities undertaken in achieving the objectives at which those principal activities are directed.

The Local Government (General) Regulation 2021

The report must include a copy of the council's audited financial reports prepared in accordance with the Local Government Code of Accounting Practice and Financial Reporting published by the Department, as in force from time to time, and such other information or material as the regulations or the guidelines under section 406 may require. A copy of the council's Annual Report must be posted on the council's website and provided to the Minister.

Financial Considerations

The preparation of the document was funded within existing budget allocations.

Consultation and Engagement

The Annual Report will be published on Council’s website.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.3

Report No. 13.3 Draft 2021/2022 Financial Statements

Directorate: Corporate and Community Services

Report Author: James Brickley, Manager Finance

File No: I2022/1687

Summary:

The Draft 2021/2022 Financial Statements have been prepared, and at the time of writing, are subject to external audit still in progress, albeit close to finalisation. Council’s file has been lodged with the NSW Audit Office for review and has been subject to audit review by the contracted auditor, Thomas Noble and Russell.

This report to Council recommends the adoption of the Draft 2021/2022 Financial Statements as prepared and the completion of the statutory steps outlined in Section 418 to 420 of the Local Government Act 1993.

RECOMMENDATION:

1. That Council adopts the Draft 2021/2022 Financial Statements incorporating the General Purpose Financial Statements (#E2022/112363) and Special Purpose Financial Statements (#E2022/112364).

2. That Council approves the signing of the “Statement by Councillors and Management” in accordance with Section 413(2)(c) of the Local Government Act 1993 and Section 215 of the Local Government (General) Regulation 2021 in relation to the 2021/2022 Draft Financial Statements.

3. That the Audited Financial Statements and Auditors Report be presented to the public at the Ordinary Meeting of Council scheduled for 15 December 2022 in accordance with Section 418(1) of the Local Government Act 1993.

1 Draft

2021-2022 General Purpose Financial Statements, E2022/112363 ![]()

2 Draft

2021-2022 Special Purpose Financial Statements, E2022/112364 ![]()

Report

The Draft 2021/2022 Financial Statements have been prepared, and at the time of writing this report, are subject to external audit still in progress, albeit close to finalisation. Council’s file has been lodged with the NSW Audit Office for review and has been subject to audit review by the contracted auditor, Thomas Noble and Russell.

This report recommends to Council, following consideration, the adoption of the Draft 2021/2022 Financial Statements as prepared and the completion of the statutory steps outlined in Section 418 to 420 of the Local Government Act 1993. The Audit, Risk and Improvement Committee will also be considering the Draft 2021/2022 Financial Statements their Committee Meeting held on 17 November 2022 anticipated to be a late report.

The Financial Statements are a statutory requirement and provide information on the financial performance of Council over the previous twelve-month period.

The Draft 2021/2022 Financial Statements provided in the attachments are broken down into:

- General Purpose Financial Statements – Attachment 1

- Special Purpose Financial Statements – Attachment 2

As in previous years, Council produces Special Schedules that are not audited (except Permissible Income for General Rates). However, since the 2018/2019 financial year, they are no longer required to be published as part of Council’s Financial Statements, except for the Special Schedules relating to Permissible Income for General Rates and Report on Infrastructure Assets. The Special Schedules are still produced and submitted to the Office of Local Government.

Brief explanations for each item follow:

General Purpose

Financial Statements

These Statements provide an overview of the operating result,

financial position, changes in equity and cash flow movement of Council as at

30 June 2022 on a consolidated basis with internal transactions between

Council’s General, Water and Sewerage Funds eliminated. The notes

included with these reports provide details of major items of income and

expenditure with comparisons to the previous financial year. The notes also

highlight the cash position of Council and indicate which funds are externally restricted

(i.e., may be used for a specific purpose only), and those that may be used at

Council’s discretion.

Special Purpose Financial Statements

These Statements are a result of the implementation of the National

Competition Policy and relate to those aspects of Council’s operations

that are business oriented and compete with other businesses with similar

operations. Mandatory disclosures in the Special Purpose Financial Reports are

Water and Sewerage.

Additional disclosures relate to Council business units that Council deems ‘commercial’. In this regard Council has traditionally reported its caravan park operations, being Suffolk Beachfront Holiday Park and First Sun Holiday Park, on a combined basis. These financial reports must also classify business units in the following categories:

· Category 1 – operating turnover is greater than $2million

· Category 2 – operating turnover is less than $2million

All Council’s business units are classed as Category 1 with all having operating turnover greater than $2 million.

Another feature of the Special Purpose Financial Reports is to build taxes and charges, where not physically incurred, into the financial results in order that the results can be measured on a level playing field with other organisations operating similar businesses, who are required to pay these additional taxes and charges. These taxes and charges include:

· Land tax – Council is normally exempt from this tax, so notional land tax is applied.

· Income tax – Council is exempt from income tax and in regard to these reports, company tax. Any surplus generated has a notional company tax applied to it.

· Debt guarantee fees – Generally due to the low credit risk associated with Councils, Councils can often borrow loan funds at lower interest rates then the private sector. A debt guarantee fee inflates the borrowing costs by incorporating a notional cost between interest payable on loans at the interest rate borrowed by Council and one that would apply commercially.

The Special Purpose Financial Reports are prepared on a non-consolidated basis - in other words they are grossed up to include any internal transactions with the General Fund.

Specific Items relating to 2021/2022 Draft Financial Statements

Before consideration is given to actual financial outcome, it needs to be pointed out that the Office of Local Government restructured the Local Government Code of Accounting Practice and Financial Reporting from the 2020/2021 financial year onwards. This means that the notes to the General Purpose Financial Statements are now broken into Sections as follows:

· Section A – About Council and these Financial Statements

· Section B – Financial Performance

· Section C – Financial Position

· Section D – Council Structure

· Section E – Risks and Accounting Uncertainties

· Section F – People and Relationships

· Section G – Other Matters

· Section H – Additional Council Disclosures

Some line items previously within certain notes have been moved to other notes.

The Draft 2021/2022 Financial Statement results have been impacted by the following items that require explanation:

· Overall Audit Outcome

Council for the 2021/2022 financial year will receive a ‘modified’ or ‘qualified’ audit opinion from the NSW Audit Office. This relates to the General Purpose Financial Statements and is due to the non-recognition of Rural Fire Service ‘Red Fleet’ assets by Council.

The Rural Fire Service (RFS) does not recognise ‘Red Fleet’ assets in their accounts as there is a provision in the Rural Fire Service Act 1997 that these assets ‘vests’ in Council. However, under Australian Accounting Standard AASB 116 “Property, Plant and Equipment’ the Local Government Code of Accounting Practice, Council must assess whether it is of the view it ‘controls’ these assets in order to recognise them in the Statement of Financial Position. Council has passed resolution 22-272 not to recognise these assets and provided a written response to the NSW Auditor General in June 2022 as to why it formed that view. This matter was also considered by the Audit, Risk and Improvement Committee at their 19 May 2022 Meeting where the Committee recommended to Council not to recognise these assets.

Nevertheless, there is a distinct difference of opinion as to who ‘controls’ Rural Fire Service ‘Red Fleet’ assets and it is Council’s adopted view it does not. From Council’s perspective only, if it was to include them it would be mis-stating its financial position. Whilst this view is not accepted by the Audit Office, Council reviewed assets data provided by the Rural Fire Service, given it has all the records regarding fleet assets as it purchases, maintains, uses and disposes of these assets without consultation with Council, and calculated the carrying value of these assets was around $677,000. The carrying value of Council’s overall assets at 30 June 2022 was $1.278billion so the value as a percentage has meant Council has not recognised assets equating to 0.05% of its overall infrastructure, property, plant and equipment assets carrying value.

The Audit Office has not accepted Council’s assessment further because Council has not undertaken procedures to confirm the completeness, accuracy, existence or condition of the Rural Fire Service assets or performed procedures to identify the value of assets vested in it during the year.

The issuance of a ‘modified’ or ‘qualified’ audit opinion is not unique to Byron Shire Council and as at 30 June 2022 Council is aware of at least twenty other Councils which received the same outcome for non-recognition of RFS ‘Red Fleet’ assets. It is possible this will continue for future financial years whilst Council continues to not recognise the RFS ‘Red Fleet’ assets.

· Operating Result from Continuing Operations

The 2021/2022 financial year has seen a positive overall financial result. Council recorded a $11.073million surplus compared to the $9.468million surplus in 2020/2021. This result incorporates the recognition of capital revenues such as capital grants and contributions for specific purposes and asset dedications amounting to $20.984 million, compared to $23.130million in 2020/2021.

A more important indicator is the operating result before capital grants and contributions. This result was a deficit of $9.911 million in 2021/2022 compared to a deficit of $13.662million in 2020/2021, representing a decrease of $3.751million between financial years. Whilst an improvement, this indicates on an ongoing basis Council’s operating expenditures continue to exceed operating revenues. Whilst operating revenues, excluding capital grants and contributions, grew by $13.872million, overall operating expenses grew by $10.121million.

With reference to the Income Statement to the General Purpose Financial Reports included at Attachment 1, the following table indicates the major changes between 2021/2022 and 2020/2021 by line item:

|

Item |

Change between 2021/2022 and 2020/2021 $’000 |

Change Outcome |

Comment |

|

Income

|

|

|

|

|

Rates & Annual Charges |

+$2,586 |

Increase |

Reflects imposition of the 2021/2022 rate peg of 2.3% and changes in annual charges from Council’s adopted 2021/2022 Revenue Policy. |

|

User Charges and Fees |

-$1,930 |

Decrease |

A contributor to this change was a decline in holiday park and pay parking revenues. Further information is available in Note B2-2 to Attachment 1. |

|

Other Revenues |

-$295 |

Decrease |

The major decrease in this item relates to fine revenues. |

|

Grants & Contributions – Operating |

+$13,796 |

Increase |

Overall operating grants and contributions increased significantly due to 75% advance payment of Financial Assistance Grant, Flood recovery grants $3.375million, $1.7million from Public Works Advisory for clean up works for waste, water and sewerage from flood event along with $5million from Transport for NSW for emergency repairs to flood damaged infrastructure were the main contributors. Further information is available in Note B2-4 to Attachment 1.

|

|

Grants & Contributions – Capital |

-$2,146 |

Decrease |

Revenue decrease in this item mainly relates to the reduced developer contributions received. Further information is available in Note B2-4 to Attachment 1. |

|

Interest and Investment Revenue |

-$316 |

Decrease |

Interest rates during 2021-2022 have remained at historic lows, only starting to increase late in the financial year have reduced investment rates significantly, lowering the return on Council’s investments. Cashflow around scale of works and recovering grant payments has also been an influence especially the flood recovery. |

|

Other Income |

+$31 |

Increase |

Principally relates to change in revenues from property leases. |

|

Total Income Change |

+11,726 |

Increase |

|

|

|

|

|

|

|

Expenditure |

|

|

|

|

Employee Benefits and Oncosts |

+$2,022 |

Increase |

Increased leave entitlement expenses of $420k reflect an emphasis on controlling leave balances and the impact of increasing interest rates on present value of liability calculations. A decrease of $973k of employee costs capitalised on capital works in 2021/2022 compared to 2020/2021 and gross salary and wages increased $712k. More information is provided at Note B3-1 to Attachment 1. |

|

Borrowing Costs |

-$141 |

Decrease |

Reduction due to ongoing repayment of existing loans and borrowing of new loans at good interest rates given current market conditions. |

|

Materials & Services |

+$10,136 |

Increase |

Materials and Services increased $10,136k overall. Raw materials and consumables increased significantly due to expenditure on flood recovery. Further changes include a reduction of $491K in legal expenses, increase of $154k in insurance costs, increase of $129k for IT software costs, increase of $363k in waste contract costs, $668k decrease in temporary employment costs. Other changes can be found at Note B3-2 to Attachment 1. |

|

Depreciation |

+$1,605 |

Increase |

Respective changes between asset classes are outlined at Note B3-4 to Attachment 1. Essentially major increase is due to the ongoing revaluation and indexation of assets each year now flowing through with increased depreciation expense. |

|

Other Expenses |

+$433 |

Increase |

Overall variations in line items as disclosed at Note B3-5 to Attachment 1. The major item is the fair value decrement on Council’s investments. This is a changed disclosure. |

|

Net Losses from Disposal of Assets |

-$3,934 |

Decrease |

Reflects the written down value of assets disposed of at the end of financial year and is contingent upon the extent of assets disposed and their written down value at the time of disposal which can vary. For 2022/2023, Council has significantly more disposals than gains, including the disposal of infrastructure $4,117k, reflecting the level of capital works and flood damage disposals with plant and equipment obtaining a $600k gain. Further details can be found at Note B4-1 to Attachment 1 |

|

Total Expenditure Change |

+$10,121 |

Increase |

|

|

|

|

|

|

|

Change in Result |

+$1,605 |

Increase |

Increase in overall surplus between financial years. |

Following from the operating results, are the performance ratios at Note H1-1 to the General Purpose Financial Statements. These have been derived following the financial assessments undertaken by NSW Treasury Corporation on all NSW Councils in 2012 and are now incorporated into the latest update to the Code of Accounting Practice and Financial Reporting that determines the content of Council’s Financial Statements.

These ratios present either a stable or improving result for Council except for the following:

Operating Performance Ratio reflects Council’s operating result. The benchmark is to be greater than 0% but in 2021/2022 Council’s ratio was -5.41% and in 2020/2021 it was -6.55%, a slight improvement. This ratio was impacted by expenditure associated with the flood recovery for which Council is yet to be reimbursed. The ratio will fluctuate with revenue recognition accounting standards now in place in that grant revenues cannot be matched against expenditure but only in accord with firstly grant approvals i.e. natural disaster funding and milestone achievement. Council needs to improve this result back towards the benchmark as it is a key financial sustainability indicator.

Outstanding, Rates and Annual Charges – Whilst still just within the industry benchmark, Council’s ratio has increased to 9.60% in 2021/2022 from 8.33% in 2020/2021. The increase can be attributable to rates and charges increases, the impact of the COVID-19 pandemic in the first half of the financial year and then the February/March 2022 flood events. Through its assistance program to the community, Council has continued to offer ratepayers extended payment arrangements and suspended debt recovery for the whole financial year. It further set interest on outstanding rates and charges to 0% which was to end at the end of February 2022 but following the February/March flood events, this was extended to 30 June 2022. Whilst providing assistance to ratepayers, it also reduced the incentive for people to pay and as a consequence the rates and charges outstanding percentage has increased.

· Asset Revaluations

During 2021/2022, a revaluation of assets relating to Water and Sewerage Infrastructure was undertaken. These revaluations have increased Council’s asset values by the following amounts:

· Water Infrastructure – a decrement or reduction of $2.716million

· Sewerage Infrastructure – an increase of $8.810million

In addition the water and sewerage revaluation identified assets described as ‘found’. These were assets identified via inspection and development that had not previously been valued or recorded totalling $5.191million being $2.518million for water and $2.673million for sewerage. As a result Council has been required to recognise a ‘prior-period error’ as these assets should have been disclosed but were not and details of this are provided at Note G3-1. Further disclosure is provided in the Special Purpose Financial Statements as Water and Sewerage functions are declared business units.

For the upcoming 2022/2023 financial year, Council does not need to do any specific asset class revaluation but may consider a revaluation of operational land given the significant indexation applied in 2021/2022 and valuation movements in the property market

· Asset Recognition, Indexation and Impairment

As indicated at Note C1-7 to Council’s financial statements, Council expended $23.121million on asset renewals and $7.902million on new assets. The extent of asset renewals is still significant and demonstrates ongoing commitment in that area. The depreciation expense of Council’s assets for 2021/2022 was $19.134million so it is pleasing to see that asset renewal was more than the financial depreciation of Council’s assets.

The economic climate inclusive of inflationary pressures, low unemployment, supply chain issue and a booming property market prior to recent interest rate increases has meant Council needed to reassess the fair value of assets not subject to a specific revaluation. Consequently across all asset class excluding the revaluation of water and sewerage, indexation has added around $169million to the value of Council’s infrastructure, property, plant and equipment. Land overall increased by around $110million with roads and bridges increasing close to $29million and stormwater drainage nearly $16million as major contributors. With the exception of land that is not depreciated, the indexation will inflate depreciation expense further in future reporting periods that will make the ability to reduce operational deficits especially in the General Fund harder to reduce.

The February/March 2022 flood events has also required Council to consider any impairment on its assets. Impairment is the reflection of writing down the fair value of an asset to reassess its value following events that have a negative impact on the asset’s ability to deliver its economic benefits or perform its function completely. In terms of the February/March 2022 flood events, any Council infrastructure completely destroyed has been disposed of fully writing off any carrying value. Other assets that were damaged not totally destroyed were assessed for impairment which has meant Council has reduced the carrying value of its assets by $2.157million ranging from buildings, roads, bridges, drainage, and swimming pool assets. These impairment charges will be reversed as and when the impaired assets are later repaired and restored.

· Cash and Investments

As at 30 June 2022 as detailed at Note C1-3 to the financial statements, Council has maintained no unrestricted cash and investments being a reduction of $0.518million compared to 2020/2021. Council’s goal of maintaining a $1million unrestricted cash balance has not been able to be achieved which has been exacerbated by the impact of the February/March 2022 flood events and response to the recovery to 30 June 2022.

Council has established a flood recovery reserve, in an effort to track its expenditure for the recovery works. As at 30 June 2022, this reserve has a balance of negative $6.3million and is indicative of expenditure incurred by Council that is yet to be reimbursed by the NSW Government through Natural Disaster funding. It needs to be clearly articulated, as it was when the 30 June 2022 Quarterly Budget Review was considered by the Finance Advisory Committee and subsequently recommended to Council, that in establishing this reserve the short term funding to the flood recovery has come from Council’s overall internal reserve allocations and that no externally restricted funds have been used for this purpose. It is expected that the flood recovery reserve will cease to exist when Council has completed all flood recovery works and been reimbursed fully for natural disaster funding eligible expenditure over the next few years.

All other cash and investments totalling $78.306million at 30 June 2022 are restricted for specific purposes. Overall, the cash and investment position of Council increased by $5.833million during the year.

· Receivables and Contract Assets

As at 30 June 2022, as detailed at Note C1-4 and C1-6 to the financial statements, Council was due $14.712million in receivables and contract assets. Of this amount $3.465million was due from other levels of Government for grants, $1.327million from the Commonwealth Government for Goods and Services Tax and $0.740million in Government grants and subsidies. Outstanding rates and charges were $5.701million. Overall receivables and contract assets increased by $1.585million compared to the 2020/2021 financial year.

· Payables, Contract Liabilities and Provisions

At 30 June 2022, as detailed at Note C3-1 for payables, Note C3-2 for Contract Liabilities, Note C3-4 for Employee Benefit Provisions and Note C3-5 for Provisions, total payables by Council were $13.276million including $4.845million held in security bonds, deposits and retentions, $1.497million in accrued expenses and $6.200million payable to suppliers. In addition at 30 June 2022, Council has accrued employee leave entitlements valued at $7.536million. Specific employee leave entitlements include $3.070million for annual leave, $4.339million for long service leave and $0.127million for gratuities. At 30 June 2022 Council also had $12.496million in contract liabilities relating to unexpended capital grants and advance bookings for its holiday parks. It has also made provisions of $7.439million for the restoration of landfill and quarry assets. In comparison to 2020/2021, total liabilities have increased $2.882million.

· Loan Borrowings

During 2021/2022 Council borrowed new loans of $1.500million and continued to make normal loan repayments.

Council’s outstanding loans as at 30 June 2022 are $58.769million. Total loan expenditure for 2021/2022 included interest of $2.891million and principal payments of $3.789million. Total expenditure in 2021/2022 related to loan repayments was $6.573million or 8.07% of Council’s revenue, excluding all grants and contributions.

The outstanding loans by Fund totalling $58.769million are as follows:

· General Fund $23.100million

· Water Fund $0 – Water Fund is debt free

· Sewerage Fund $35.669million

· New Accounting Standards

The 2021-2022 financial year did not require Council to implement any new accounting standards that impacted the financial statements.

· Liquidity

Council’s Statement of Financial Position (balance sheet) indicates net current assets of $47.928million. It is on this basis, in the opinion of the Responsible Accounting Officer, that the short term financial position of Council remains in a satisfactory position and that Council can be confident it can meet its payment obligations as and when they fall due. That is, there is no uncertainty as to Council being considered a ‘going concern’. In addition, Council’s cash expense cover ratio is at 8.89 months whereas the minimum benchmark is 3 months. Council exceeds this benchmark by nearly three times.

Council’s Unrestricted Current Ratio improved to 3.52, demonstrating Council has $3.52 in unrestricted current assets compared to every $1.00 of unrestricted current liabilities. This exceeds the benchmark of $1.50.

On a longer term basis Council will need to consider its financial position carefully. Nevertheless, in isolation, the financial results for 2021/2022 continue to present a ‘stable’ financial position especially given the initial impacts of COVID-19 in the first half of the financial year followed by the impact of the February/March 2022 flood events.

Effort is needed to manage the trend towards reducing operational deficits before capital grants and contributions. Furthermore, Council needs to commence restoration of the unrestricted cash balance back towards $1million during the 2022/2023 financial year, which could not be achieved during 2021/2022. Council will especially need to carefully manage its cash flow obligations as it starts to commit further significant expenditure in the flood recovery for Essential Public Asset Restoration (EPAR) works and the time delay for reimbursement from the NSW Government via Natural Disaster funding for the AGRN 1012 event.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

||

|

1:

Effective Leadership |

1.3: Ethical and efficient management of resources |

1.3.1: Financial Management - Ensure the financial integrity and sustainability of Council through effective financial management |

1.3.1.3 |

Provide completion of Council's statutory annual financial statements for 2021/2022. |

|||

Legal/Statutory/Policy Considerations

Section 413(2)(c) of the Local Government Act 1993 and Section 215 of the Local Government (General) Regulation 2021 requires Council to specifically form an opinion on the financial statements. Specifically Council needs to sign off an opinion on the Financial Statements regarding their preparation and content as follows:

In this regard the Financial Statements have been prepared in accordance with:

· The Local Government Act 1993 (as amended) and the Regulations made thereunder.

· The Australian Accounting Standards and professional pronouncements.

· The Local Government Code of Accounting Practice and Financial Reporting.

And the content to the best of our knowledge and belief:

· Presents fairly the Council’s operating result and financial position for the year.

· Accords with Council’s accounting and other records.

· Management is not aware of any matter that would render the Financial Statements false or misleading in any way.

Section 416(1) of the Local Government Act 1993, requires a Council’s annual Financial Statements to be prepared and audited within four (4) months of the end of that financial year i.e. on or before 31 October 2021. Given the impact of the February/March 2022 flood events, Council sought and was granted an extension to complete its financial statements by 15 December 2022. However, Council must lodge its Annual Report by 30 November 2022 that must include the Financial Statements so the effective date of the extension is 30 November 2022.

Section 417(4) of the Local Government Act 1993 requires, as soon as practicable after completing the audit, the Auditor must send a copy of the Auditor’s Reports to the Departmental Chief Executive and to the Council.

Section 417(5) of the Local Government Act 1993 requires Council, as soon as practicable after receiving the Auditor’s Reports, to send a copy of the Auditor’s Reports on the Council’s Financial Statements, together with a copy of the Council’s audited Financial Statements, to the Departmental Chief Executive before 7 November 2022. For 2021/2022 this will be 7 December 2022 given the extension granted.

Section 418(1) of the Local Government Act 1993 requires Council to fix a date for the Meeting at which it proposes to present its audited Financial Statements, together with the Auditor’s Reports, to the public, and must give public notice of the date so fixed. This requirement must be completed within five weeks after Council has received the Auditor’s Reports.

Financial Considerations

There are no direct financial implications associated with this report as the report does not involve any future expenditure of Council funds but rather, advises on Council’s draft financial outcomes during the 2021/2022 financial year, which are identified in this report and attachments. These financial outcomes are also still subject to final review by the NSW Audit Office at the time of report preparation and may change.

Consultation and Engagement

Section 420 of the Local Government Act 1993 requires Council to provide the opportunity for the public to submit submissions on the Financial Statements. Submissions are to be made within seven days of the Financial Statements being presented to the public. In the case of the 2021/2022 Financial Statements, the closing date for submissions is expected to be 22 December 2022.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.4

Report No. 13.4 2022/23 Operational Plan Report - Q1 - September 2022

Directorate: Corporate and Community Services

Report Author: Heather Sills, A/ Manager Corporate Services

File No: I2022/1550

Summary:

Council’s Operational Plan outlines its projects and activities to achieve the commitments in its four-year Delivery Program. In accordance with the Local Government Act 1993 progress reports must be provided at least every six months.

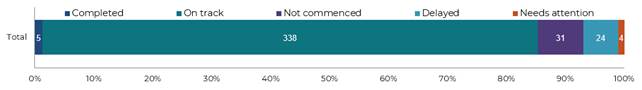

This report represents the progress toward the activities in the 2022/23 Operational Plan at the end of the first quarter, being 30 September 2022. A summary of the status is provided in the graph below:

RECOMMENDATION:

1. That Council notes the 2022/23 Operational Plan Quarter 1 Report for the period ending 30 September 2022 (Attachment 1 #E2022/102504).

2. That Council adopts the proposed amendments to the Operational Plan 2022/23 outlined in Attachment 2 (#E2022/84682).

1 Operational

Plan 2022/23 - Quarterly Report - Q1 - 1 July to 30 September 2022, E2022/102504 ![]()

2 Quarter

1 Report - Proposed Amendments to Operational Plan 2022/23, E2022/84682 ![]()

Report

The Delivery Program and Operational Plan are two key corporate documents that establish Council’s goals and priorities for the term of the Council and the current financial year. The Delivery Program is supported by the annual Operational Plan, which identifies the individual projects and activities that will be undertaken for the year to achieve the commitments made in the Delivery Program.

The General Manager is required to provide six monthly progress reports to the Council on the progress toward the delivery program, in accordance with the Local Government Act 1993 s404 which states:

“The general manager must ensure that regular progress reports are provided to the council reporting as to its progress with respect to the principal activities detailed in its delivery program. Progress reports must be provided at least every six months”

While the requirement is six monthly reporting, the Council is provided with a Quarterly Report on the activities in the Operational Plan, to promote effective and efficient reporting and decision making.

Strategic Objectives

The report (#E2022/102504) is structured by the five Community Objectives in the Byron Shire Community Strategic Plan:

· Effective Leadership: We have effective decision making and community leadership that is open and informed

· Inclusive Community: We have an inclusive and active community where diversity is embraced and everyone is valued

· Nurtured Environment: We nurture and enhance the natural environment

· Ethical Growth: We manage growth and change responsibly

· Connected Infrastructure: We have connected infrastructure, transport, and facilities that are safe, accessible, and reliable

Q1 Status by Community Objective:

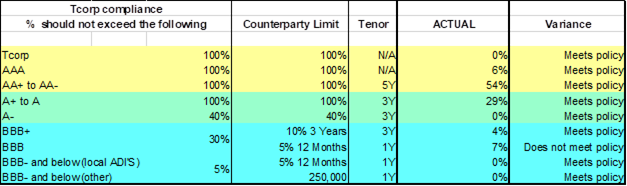

Report Details