Agenda

Agenda

Ordinary Meeting

Thursday, 23 February 2023

Agenda

Agenda

Ordinary Meeting

Thursday, 23 February 2023

Agenda Ordinary Meeting

held at Conference Room, Station Street, Mullumbimby

commencing at 9:00am

Public access relating to items on this agenda can be made between 9:00 and 10:30 am on the day of the meeting. Requests for public access should be made to the General Manager or Mayor no later than 12:00 midday on the day prior to the meeting.

Mark Arnold

General Manager

CONFLICT OF INTERESTS

What is a “Conflict of Interests” - A conflict of interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council official has that does not amount to a pecuniary interest as defined in the Code of Conduct for Councillors (eg. A friendship, membership of an association, society or trade union or involvement or interest in an activity and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter if the interest is so remote or insignificant that it could not reasonably be regarded as likely to influence any decision the person might make in relation to a matter or if the interest is of a kind specified in the Code of Conduct for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a matter if the pecuniary interest is the interest of the person, or another person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a matter if:

· The person’s spouse or de facto partner or a relative of the person has a pecuniary interest in the matter, or

· The person, or a nominee, partners or employer of the person, is a member of a company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the following:

(a) the parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or adopted child of the person or of the person’s spouse;

(b) the spouse or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary interest in a matter:

· If the person is unaware of the relevant pecuniary interest of the spouse, de facto partner, relative or company or other body, or

· Just because the person is a member of, or is employed by, the Council.

· Just because the person is a member of, or a delegate of the Council to, a company or other body that has a pecuniary interest in the matter provided that the person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

· A Councillor or a member of a Council Committee who has a pecuniary interest in any matter with which the Council is concerned and who is present at a meeting of the Council or Committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

· The Councillor or member must not be present at, or in sight of, the meeting of the Council or Committee:

(a) at any time during which the matter is being considered or discussed by the Council or Committee, or

(b) at any time during which the Council or Committee is voting on any question in relation to the matter.

No Knowledge - a person does not breach this Clause if the person did not know and could not reasonably be expected to have known that the matter under consideration at the meeting was a matter in which he or she had a pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts & the option chosen will depend on an assessment of the circumstances of the matter, the nature of the interest and the significance of the issue being dealt with. Non-pecuniary conflicts of interests must be dealt with in at least one of the following ways:

· It may be appropriate that no action be taken where the potential for conflict is minimal. However, Councillors should consider providing an explanation of why they consider a conflict does not exist.

· Limit involvement if practical (eg. Participate in discussion but not in decision making or vice-versa). Care needs to be taken when exercising this option.

· Remove the source of the conflict (eg. Relinquishing or divesting the personal interest that creates the conflict)

· Have no involvement by absenting yourself from and not taking part in any debate or voting on the issue as of the provisions in the Code of Conduct (particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993 – Recording of voting on planning matters

(1) In this section, planning decision means a decision made in the exercise of a function of a council under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development application, an environmental planning instrument, a development control plan or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register containing, for each planning decision made at a meeting of the council or a council committee, the names of the councillors who supported the decision and the names of any councillors who opposed (or are taken to have opposed) the decision.

(3) For the purpose of maintaining the register, a division is required to be called whenever a motion for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described in the register or identified in a manner that enables the description to be obtained from another publicly available document, and is to include the information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are reminded of the oath of office or affirmation of office made at or before their first meeting of the council in accordance with Clause 233A of the Local Government Act 1993. This includes undertaking the duties of the office of councillor in the best interests of the people of Byron Shire and the Byron Shire Council and faithfully and impartially carrying out the functions, powers, authorities and discretions vested under the Act or any other Act to the best of one’s ability and judgment.

1. Public Access

3. Attendance by Audio-Visual Link / Requests for Leave of Absence

4. Declarations of Interest – Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary Interest Returns (Cl 4.14 Code of Conduct for Councillors)

6. Adoption of Minutes from Previous Meetings

6.1 Ordinary Meeting held on 15 December 2022

7. Reservation of Items for Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 Including Left Bank Road properties in hospital site rezoning................................ 8

9.2 Extend non-disruption by roadworks........................................................................ 16

10. Petitions

11. Submissions and Grants

11.1 Grants January 2023................................................................................................... 19

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Request to change market day.................................................................................. 27

Corporate and Community Services

13.2 Council Investments - 1 January 2023 to 31 January 2023.................................. 30

13.3 Update to Council's Business Ethics Statement..................................................... 39

13.4 Conduct of the 2024 Local Government Election................................................... 43

13.5 Council Investments - 1 December 2022 to 31 December 2022......................... 47

13.6 Richmond Tweed Regional Library Deed of Agreement 2023 - 2027................ 55

13.7 Budget Review - 1 October 2022 to 31 December 2022...................................... 61

13.8 Council Resolutions Quarterly Review - Q2 - 1 October to 31 December 2022 74

13.9 Delivery Program 6-monthly Report and Operational Plan 2022/23 - Q2 - to December 2022............................................................................................................................... 77

13.10 Submission - Councillor Misconduct Framework.................................................... 81

Sustainable Environment and Economy

13.11 Application for Revocation of Menacing Dog Order............................................... 84

13.12 Companion Animal Exercise Area Policy................................................................. 88

Infrastructure Services

13.13 Fees and Charges - Use of car parking spaces for construction purposes....... 91

14. Reports of Committees

Sustainable Environment and Economy

14.1 Report of the Coast and ICOLL Advisory Committee Meeting held on 20 October 2022........................................................................................................................................ 96

Infrastructure Services

14.2 Report of the Local Traffic Committee Meeting held on 7 February 2023.......... 98

15. Questions With Notice

Nil

16. Confidential Reports

Sustainable Environment and Economy

16.1 Confidential - Compliance at 8 Grays Lane, Tyagarah............................... 104

Questions with Notice: A response to Questions with Notice will be provided at the meeting if possible, that response will be included in the meeting minutes. If a response is unable to be provided the question will be taken on notice, with an answer to be provided to the person/organisation prior to the next Ordinary Meeting and placed on Councils website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

Councillors are encouraged to ask questions regarding any item on the business paper to the appropriate Director prior to the meeting. Any suggested amendments to the recommendations should be provided to Councillor Support prior to the meeting to allow the changes to be typed and presented on the overhead projector at the meeting.

BYRON SHIRE COUNCIL

Notices of Motion 9.1

Notice of Motion No. 9.1 Including Left Bank Road properties in hospital site rezoning

File No: I2023/164

I move that Council:

1. Recognises that rezoning of the ex-hospital site, on the corner of Azalea Street and Left Bank Road Mullumbimby, will enable development that is likely to heavily impact amenity of properties bordering the site to its south; and

2. brings four properties (2, 4, 12 and 16 Left Bank Road Mullumbimby; currently zoned R5) into the rezoning process that is underway for the ex-hospital site (currently zoned SP2) with the aim of zoning all properties R1.

1 Map

with adjoining 4 properties R5 to R1 L B Road, E2023/15160 ![]()

Signed: Cr Duncan Dey

Councillor’s supporting information:

Four properties border the Mullumbimby ex-hospital site to its south. Council intends to ‘upzone’ the ex-hospital site to R1 zone and thus enable affordable housing amongst other uses on the site. This implies housing density and height that differs greatly from Council’s neighbours to the south. Such development is likely to overshadow those neighbours, as well as overlook them.

One of the property owners addressed Council at our meeting of 15 December.

Action 21 of the Byron Rural Land Use Strategy flags them along with many other R5-zoned properties in the Shire for consideration for a change of zone to allow urban development. However, that process could take years longer than the process for the hospital site.

An equitable way of sharing the burdens and the benefits of development is to examine precincts rather than just properties. Recognising cross-boundary impacts south of the ex-hospital site points towards a zone boundary as proposed in this motion. These four properties are the most impacted. A fifth property west of these four has a different aspect, is vacant and drains westward. It is not heavily impacted by the hospital proposal.

The benefits to community of including the four properties include the additional housing that these large Lots can provide once zoned R1. That is an urban zoning, which would include them being sewered. Consideration of this expansion of the sewer network is implied by the Motion, if carried. As these properties drain eastward, including them in consideration of the sewer needs of the ex-hospital site makes sense. I do not believe this inclusion to be more complex that many other expansions seen over recent years.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy:

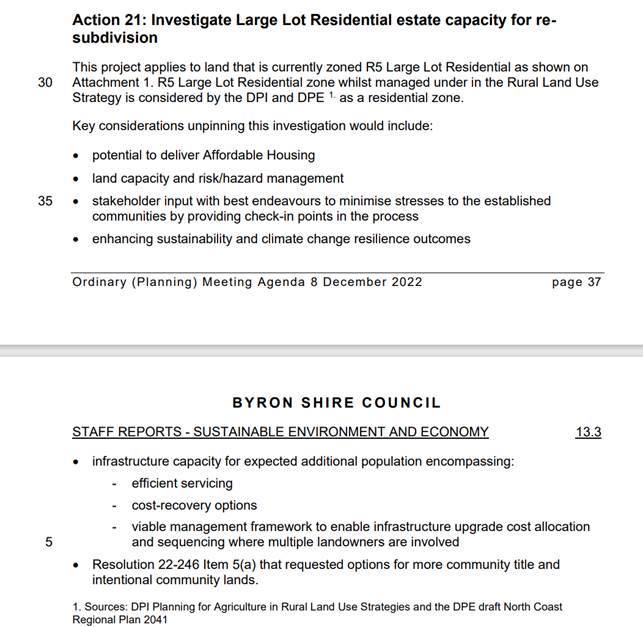

Report No. 13.3 PLANNING - Rural Land Use Strategy Review Scoping Report was presented to Council Agenda of Ordinary (Planning) Meeting - Thursday, 8 December 2022 (infocouncil.biz)

This report provided an update on a previous report resolution where Council resolved 22-246 several actions including:

· 22-246 Item 2 to receive a report by end of November 2022 that details the scope of works and budget estimate needed to undertake a comprehensive five-year Rural Land Use Strategy review, with this report to inform a forward budget bid for this work to progress.

· 22-246 Item 3 prioritise delivery of Rural Land Use Strategy Action 21 in the 2022/23 financial year, being: Investigate capacity for re-subdivision within existing Large Lot Residential estates.

· 22-246 Item 4 requesting an options paper on the potential for additional 20 land to be nominated for rural lifestyle living opportunities and/or other emerging housing types in peri-urban areas e.g. villages

Extract from the report below:

Resolution from 8 December 2022 meeting:

Consideration of the R5 Large Lot Residential land including the four private lots for future development is being progressed by staff as per the above resolution/s of Council.

Image – R5 Large Lot Residential Zone Mullumbimby

Report No. 13.16 Former Mullumbimby Hospital - Land Use and Development Planning Update was considered Agenda of Ordinary Meeting - Thursday, 15 December 2022 (infocouncil.biz), it noted the below in relation to this matter:

“There were also three requests to add some adjoining large-lot residential properties to the planning proposal process. This land is part of the Left Bank Road R5 Large Lot Residential area. In June 2022, Council resolved to progress Rural Land Use Strategy action 21 to investigate the capacity for re-subdivision of large lot residential areas. A separate report to the 8 December 2022 Council Planning meeting outlined a program for this work to align with the Residential Strategy refresh. This will facilitate an open and transparent consideration of options and issues such as infrastructure capacity. Another consideration will be the suitability for an affordable housing contribution scheme to be applied on possible land value uplifts resulting from an urban residential zoning and or further subdivision/densification.”

In the circumstances, staff do not support the NOM for the following reasons:

· Incorporating the four private lots as proposed into the planning proposal process for the Mullumbimby Hospital Site will complicate and significantly delay (stall) the rezoning of the site.

· Unlike the Mullumbimby Hospital Site, these private lots are not serviced or within a current urban servicing plan. Significant work needs to be done on land and servicing capability, and servicing augmentation, costs and sequencing needed to convert it to urban land before a decision can be made on what urban zone to apply to the land.

· Unlike the Mullumbimby Hospital Site, these private lots are not identified in the Affordable Housing Contributions Scheme No 1. To rezone them as proposed would create an uplift in their value that would not be able to be captured for affordable housing in the Shire like other lands in the vicinity of the hospital site which have. Private land contributions are 20% under Scheme 1.

· Unlike the Mullumbimby Hospital Site, planning and environmental assessments have been completed or are significantly progressed to meet the requirements for a planning proposal.

· Unlike the Mullumbimby Hospital Site, an urban design protocol and site strategy have been endorsed by Council and publicly exhibited. The purpose of which being to inform a fast-tracked planning proposal for the site.

Other complications and risk to the Mullumbimby Hospital site project from the proposal could include:

· Whether private landowners contribute to the significant costs associated with the planning proposal - how this would be arranged and managed?

· Whether private landowners have a say in the proposed LEP changes? If there are any disagreements – how will these be managed? Will they have a perceived larger influence on the overall design?

· Whether there will be a perception in the community that Council’s work is especially benefiting a small number of private landowners?

· Because of the above, whether the proposal creates a public private partnership arrangement which is not appropriate or desirable in the circumstances.

Financial/Resource/Legal Implications:

As highlighted in the staff response.

Is the proposal consistent with any Delivery Program tasks?

There are separate actions in the Delivery Program and Operational Plan for both the Mullumbimby Hospital Site and Action 21 in the Rural Land Use Strategy.

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

4:

Ethical Growth |

4.1: Manage responsible development through effective place and space planning |

4.1.3: Town / Village Masterplans - Develop, implement and update Place Plans that promote place-based forward planning strategies and actions |

4.1.3.7 |

Amend Local Environmental Plan and Development Control Plan in accordance with Mullumbimby Hospital Precinct Plan |

|

4:

Ethical Growth |

4.1: Manage responsible development through effective place and space planning |

4.1.2: Growth Management Strategies - Implement Local Growth Management Strategies |

4.1.2.2 |

Investigate capacity for resubdivision within existing Large Lot Residential estates (Action 21). |

BYRON SHIRE COUNCIL

Notices of Motion 9.2

Notice of Motion No. 9.2 Extend non-disruption by roadworks

File No: I2023/172

I move that Council:

1. Remembers its Resolution 22-741 of December 2022 adopting “policy” not to conduct disruptive roadworks during heavy traffic times on various important non-motorway routes in the Shire, recommits to the two routes named in that Resolution (listed as 1 and 2 below) and adds a third route (listed as 3 below):

a) Ewingsdale Road, during daylight hours,

b) Bangalow / Broken Head Roads, during morning and afternoon peak hours; and

c) Mullumbimby from Jubilee Avenue to the Showground, on Mullumbimby Farmers Market mornings.

2. Also recommits to:

a) writing to all relevant authorities, such as Essential Energy, requesting that they adhere to the same policies for work within the road corridor

b) noting that emergency road works are exempt from the above policies.

Signed: Cr Duncan Dey

Councillor’s supporting information:

On 15 December 2022 Council resolved (Res 22-741):

1. That Council implements a policy of only conducting roadworks on Ewingsdale Road at night noting that minor maintenance works that can be easily ceased is not to be included in this prohibition.

2. That Council implements a policy of not conducting roadworks on Bangalow Road and Broken Head Road during morning and afternoon peak hours.

3. That Council writes to all relevant authorities, such as Essential Energy, requesting that they adhere to the same policies for work within the road corridor.

4. That Council receives a report to update Council on Transport for NSW plans to fix the Ewingsdale Highway interchange.

On Friday 27 January roadworks were carried out on Main Arm Road to add Armco rails on the approaches to the narrow concrete bridge over Chinbible Creek. The nearby intersection of Main Arm Road with Murwillumbah Road is a crunch-point of the route to and from the Showground. The intersection is always impacted with delays up to five minutes on most Friday mornings. On the morning of 27 January, the delays were even longer. On 3 February, things got even worse.

On 27 January, work was over by lunchtime. That day’s work could have started at midday and been over by close of business for most businesses in the Shire.

Far better however would have been for the contract for the guardrails to have excluded disruptive roadworks on all Friday mornings.

Road closures on the route from Mullumbimby to the Showground have caused headaches previously. These two occasions were the worst to date.

Staff comments

by Phillip Holloway, Director Infrastructure Services:

Staff are committed to Res 22- 741 and to date there have not been significant operational issues or significant cost implications.

It is expected that when more significant work is required that this will impact on costs to Council with increased labour costs and additional WHS requirements due to works being undertaken as night works.

In relation to extending the requirements of Res 22-741 to include “Mullumbimby from Jubilee Avenue to the Showground, on Mullumbimby Farmers Market mornings.”, staff interpret this as applying to the following roads/streets:

· Dalley Street (Burringbar Street to Tincogan Street)

· Tincogan Stree (Dalley Street to Brunswick Terrace)

· Murwillumbah Road (Brunswick Terrace to Coolamon Scenic Drive)

· Main Arm Road (Coolamon Scenic Drive to Coral Ave)

Financial/Resource/Legal Implications:

If night works are required there will be a significant increase cost and reduce the amount of work achievable within current budgets.

Additional costs are not known at this time.

There are works planned on these sections within the current program and if the Notice of Motion is successful contractors and staff will be directed accordingly to abide by the changes.

Is the proposal consistent with any Delivery Program tasks?

Yes, Section 5.1 of CSP, however there is no specific Operational Plan activity.

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

5:

Connected Infrastructure |

5.1: Provide a safe, reliable, and accessible transport network |

5.1.1: Road network maintenance - Undertake road and transport network maintenance to meet the standards identified in the Asset Management Plan |

|

|

BYRON SHIRE COUNCIL

Submissions and Grants 11.1

Report No. 11.1 Grants January 2023

Directorate: Corporate and Community Services

Report Author: Donna Johnston, Grants Coordinator

File No: I2023/184

Summary:

Council has submitted applications for seventeen grant programs which, if successful, would provide funding to enable the delivery of identified projects. This report provides an update on grant applications.

RECOMMENDATION:

Council notes the report and Attachment 1 (#E2023/14683) for Byron Shire Council’s grant submissions as at 31 January 2023.

1 Grant

submissions as at 31 January 2023, E2023/14683

![]()

Report

Currently Council has 17 grant submissions awaiting determination (refer to Grants Submissions as at 31 January 2023 (Attachment 1 E2023/14683).

Successful applications

Council has been advised that it has been awarded the following projects:

Floodplain Management Program 2022

· Byron Shire Overland Flow Path Study – grant funding $166,666; Council contribution $83,334

· Belongil and Tallow Flood Risk Management Study and Plan Update – grant funding $100,001; Council contribution $49,999

Stronger Country Communities Fund

· Byron Community Hub additional funding – grant funding $1,236,956

Fixing Local Roads R5

· Pothole repair round – grant funding $223,554

· Regional and Local Repair Program (Potholes) 2023 – grant funding $1,110,677

Australia Day 2023

· Australia Day – grant funding $30,000

Unsuccessful / withdrawn applications

Notification has been received on the following unsuccessful applications:

Floodplain Management Program 2022

· Voluntary House Raising – grant funding $500,000. This program is now being rolled out under the Resilient Homes Program | NSW Government program.

Crown Reserve Improvement Fund 2022-23

· South Beach Road (Brunswick Heads) public amenities – grant funding $280,000. Program was oversubscribed.

Regional Housing Strategic Fund

· Former Mullumbimby Hospital site – grant funding $250,000

Applications submitted

The following applications were submitted during December 2022 and January 2023.

|

Funding Body |

Funding scheme |

Project name |

Total project |

Amount requested |

Council |

|

Australian Government |

Extension and Adoption of Drought Resilience Farming Practices Grants Program |

Increasing drought resilience in Byron Shire through Regenerative Agriculture |

$177,140 |

$177,140 |

$0 |

|

NSW Department of Planning |

NSW Department of Planning |

Koala Vehicle Strike Hotspots |

$185,028 |

$185,028 |

$0 |

|

NSW DPE |

Local Government Heritage Grant |

Local Government Heritage Grant |

$15,000 |

$15,000 |

$0 |

|

NSW Office of Sport |

Essential Sports Priority Program |

Bangalow Sports Field Lighting |

$795,350 |

$795,350 |

$0 |

|

Transport for NSW |

Regional and Local Repair Program (Potholes) 2023 |

Pothole funding |

$1,110,677 |

$ - |

$0 |

|

Transport for NSW |

Infrastructure Betterment Fund |

Sandhills Wetlands stormwater retention basin |

$7,090,500 |

$4,090,500 |

$0 |

|

Transport for NSW |

Infrastructure Betterment Fund |

Byron Bay drainage - stage 1 |

$8,929,880 |

$8,929,880 |

$0 |

|

Transport for NSW |

Infrastructure Betterment Fund |

Avocado Court & New City Road Mullumbimby drainage |

$1,728,264 |

$1,728,264 |

$0 |

|

Transport for NSW |

Infrastructure Betterment Fund |

Automated Flood Signage |

$3,697,612 |

$3,697,612 |

$0 |

|

Transport for NSW |

Regional Roads Transport Recovery (Betterment) |

Main Arm Road |

$8,077,322 |

$8,077,322 |

$0 |

|

Transport for NSW |

Regional Roads Transport Recovery (Betterment) |

Mullumbimby Road |

$2,770,609 |

$2,770,609 |

$0 |

|

Transport for NSW |

Regional Roads Transport Recovery (Betterment) |

Wilsons Creek Road |

$3,413,385 |

$3,413,385 |

$0 |

|

Transport for NSW |

Safer Roads |

Midgen Flat Road |

$964,555 |

$964,555 |

$0 |

|

Transport for NSW |

Fixing Local Roads R5 |

Pothole Repair Round |

$223,554 |

$223,554 |

$0 |

|

Transport for NSW |

Fixing Local Roads R4 |

Left Bank Road rehabilitation program |

$1,588,151 |

$1,588,151 |

$0 |

|

Transport for NSW |

Fixing Local Roads R4 |

Suffolk Park reseal program |

$958,076 |

$958,076 |

$0 |

|

Transport for NSW |

Fixing Local Roads R4 |

Bangalow reseal program |

$971,371 |

$971,371 |

$0 |

|

Australia Day Council |

Australia Day |

Australia Day |

$43,000 |

$30,000 |

$13,000 |

Upcoming grant opportunities

Flood Recovery and Resilience Grant Program | NSW Environment and Heritage – closes 8 March 2023.

Program will support the implementation of the NSW Flood Prone Land Policy, which aims to reduce the impacts of existing flooding and flood liability on communities and reduce private and public losses resulting from floods, using ecologically positive methods wherever possible.

Includes funding for investigation and design, and implementation. Voluntary House Raising is not available under this fund; these applications go direct to the Resilient Homes Program.

Assistance under the program is $3 from the government for every $1 provided by the applicant (from Council revenue), except where a Council is eligible for enhanced funding.

Staff are currently considering potential applications.

Community Assets Program | NSW Government – closes 27 March 2023

The CAP covers communities that were impacted by the severe weather and flood events of February and June 2022 (AGRN 1012 and AGRN 1025). The program provides funding for the repair, restoration and betterment of directly damaged local community infrastructure owned and/or managed by Councils.

The repair, restoration or betterment of directly impacted local community infrastructure that does not provide a function to an essential public asset including:

· recreational and services buildings including libraries, youth and senior citizen facilities and tourism

· parks and playgrounds including equipment, furniture, fencing, shades, facilities and amenities

· holiday and caravan park facilities, boardwalks, footpaths, walking trails, community club structures including surf lifesaving

· amenities and community/service buildings that complement and support multiple social and recreation facilities

· cultural heritage and identity of place assets

· wharves, jetties and boat ramps

· pedestrian bridges, car parks, electric vehicle charging stations, retaining walls, landscaping, river/creek banks and signage in public spaces.

Projects under consideration include:

· Lighting at Bangalow Sports Fields

· Cavanbah car park restoration

· Council Chambers betterment funding

· Mullumbimby Recreation Grounds car park

Litter Prevention Grants Program: grants available (nsw.gov.au) – EOI closes 8 March 2024

The NSW Government has opened the Waste and Sustainable Materials Strategy 2041 (WASM) Litter Prevention Grants Program for Councils, community groups and other key stakeholders to deliver litter prevention projects and develop strategic plans to address litter in their local environments.

Staff are considering potential projects.

Disaster Ready Fund | NSW Government – EOI closes 14 February 2023

Only Australian state and territory governments are eligible under the Disaster Ready Fund to apply for funding via an overarching Application comprising all Project proposals. Applications for New South Wales will be managed by the NSW Reconstruction Authority.

Co-contribution of 50% is required. A reduction or exemption can be requested.

Staff are preparing an EOI for the Sandhills Stormwater Retention Basin remaining construction funding require; approximately $4 million. This project is central to the Preferred Byron Drainage Strategy identified under the Belongil Risk Management Plan.

Growing Regional Economies Fund | NSW Government – closes 23 May 2023

The Growing Regional Economies Fund aims to accelerate economic development and prosperity in regional NSW, increase the appeal of investing in regional NSW, support investment in major transformational projects that increase employment opportunities in regional areas and ensure that regional communities have the infrastructure and services required for sustainable growth.

The Fund also has a focus on enabling infrastructure that will support investment in regional housing projects to meet demand generated by growth in employment and economic activity.

Only one application can be submitted.

Staff are currently reviewing the guidelines and project eligibility and readiness for:

· Byron Bioenergy Facility OR

· Former Mullumbimby Hospital site access works

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1: Effective Leadership |

1.3: Ethical and efficient management of resources |

1.3.1: Financial Management - Ensure the financial integrity and sustainability of Council through effective financial management |

1.3.1.9 |

Coordinate grant applications to support the delivery of Council projects and services within management plans, masterplans, strategic plans, Council resolutions and high priority actions from feasibility studies; and support the management of successful grants |

Legal/Statutory/Policy Considerations

Under section 409 3(c) of the Local Government Act 1993 Council is required to ensure that ‘money that has been received from the Government or from a public authority by way of a specific purpose advance or grant, may not, except with the consent of the Government or public authority, be used otherwise than for that specific purpose’. This legislative requirement governs Council’s administration of grants.

Financial Considerations

If Council is successful in obtaining the identified grants, this would bring funding sought to approximately $38 million which would provide significant funding for Council projects. Some of the grants require a contribution from Council (either cash or in-kind) and others do not. Council’s contribution is funded.

The potential funding is detailed below:

Successful applications $8,356,215 (total project value)

Unsuccessful/withdrawn applications $1,380,000 (total project value)

Requested funds from funding bodies $38,362,864

Council Contribution Cash $173,503

Other contributions $3,250,000

Funding applications submitted and

awaiting notification (total value) $41,423,367

Consultation and Engagement

Cross-organisational consultation has occurred in relation to the submission of relevant grants, and the communication of proposed grant applications.

BYRON SHIRE COUNCIL

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Request to change market day

Directorate: General Manager

Report Author: Paula Telford, Leasing and Licensing Coordinator

File No: I2022/1733

Summary:

The Byron Bay Community Association Incorporated requests a variation to its Railway Park Artisan Market Licence to move the scheduled market day from Saturday 8 April to Friday 7 April 2023.

RECOMMENDATION:

That Council, following no submissions received during the public notice of the proposal, authorises a variation to the Railway Park Artisan Market Licence held by the Byron Bay Community Association Incorporation to move the scheduled Railway Park Artisan Market Day from 8 April 2023 to 7 April 2023.

Report

Council resolved (21-147) to grant a Market Licence to the Byron Bay Community Association Incorporated (‘the BBCA’) to operate a weekly artisan market on each Saturday in Railway Park.

Council has previously approved by resolution (22-696), (20-377), (21-311) and (21-510) a one-off change in the date of a Railway Park Artisan Market to avoid a clash with another market in the Shire on the same day.

Request to move market day for one market only

The BBCA requests that Council consider varying the Railway Park Market Licence once again, to move the scheduled Artisan Market from Saturday 8 April 2023 to Friday 7 April 2023 to avoid a clash with the BBCA scheduled Dening Park Artisan Market on 8 April 2023.

Public Notice

In accordance with the Local Government Act, Council publicly advertised the proposed the change of market day from Saturday 8 April to prior Friday 7 April 2023 for twenty-eight days between 2 and 30 January 2023. No submissions were received.

As a result, this Report makes a to recommendation to allow the one-off change to the Railway Park Artisan Market Day from 8 April to 7 April 2023, by a licence variation.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

2:

Inclusive Community |

2.1: Foster opportunities to express, celebrate and participate in arts and cultural activity |

2.1.3: Events and festivals - Support and enable arts & cultural activity, festivals, projects, and events |

2.1.3.8 |

Administer licences for weddings, events, activities and filming on council and crown land |

Recent Resolutions

· (22-696), (20-377), (21-311) and (21-510).

Legal/Statutory/Policy Considerations

Local Government Act

s47A Leases, licences and other estates in respect of community land—terms of 5 years or less

(1) This section applies to a lease, licence or other estate in respect of community land granted for a period that (including any period for which the lease, licence or other estate could be renewed by the exercise of an option) does not exceed 5 years, other than a lease, licence or other estate exempted by the regulations.

(2) If a council proposes to grant a lease, licence or other estate to which this section applies—

(a) the proposal must be notified and exhibited in the manner prescribed by section 47, and

(b) the provisions of section 47(3) and (4) apply to the proposal, and

(c) on receipt by the council of a written request from the Minister, the proposal is to be referred to the Minister, who is to determine whether or not the provisions of section 47(5)–(9) are to apply to the proposal.

(3) If the Minister, under subsection (2)(c), determines that the provisions of section 47(5)–(9) are to apply to the proposal—

(a) the council, the Minister and the Director of Planning are to deal with the proposal in accordance with the provisions of section 47(1)–(8), and

(b) section 47(9) has effect with respect to the Minister’s consent.

s47 Leases, licences and other estates in respect of community land--terms greater than 5 years

(3) Any person may make a submission in writing to the council during the period specified for the purpose in the notice.

(4) Before granting the lease, licence or other estate, the council must consider all submissions duly made to it.

Financial Considerations

Nil.

Consultation and Engagement

Public notice of proposed change in one Artisan Market Day was conducted between 2 and 30 January 2023. No submissions were received.

Staff Reports - Corporate and Community Services 13.2

Staff Reports - Corporate and Community Services

Report No. 13.2 Council Investments - 1 January 2023 to 31 January 2023

Directorate: Corporate and Community Services

Report Author: James Brickley, Manager Finance

File No: I2023/141

Summary:

This report includes a list of investments and identifies Council’s overall cash position for the period 1 January 2023 to 31 January 2023 for information.

This report is prepared to comply with Section 212 of the Local Government (General) Regulation 2021.

RECOMMENDATION:

That Council notes the report listing Council’s investments and overall cash position as of 31 January 2023.

Report

Council has continued to maintain a diversified portfolio of investments. As of 31 January 2023, the average 90-day bank bill rate (BBSW) for the month was 3.37%. Council’s performance for January 2023 was 2.82%.

As investments mature Council should begin to see increased rates due to the recent Reserve bank increase in cash rates. The table below identifies the investments held by Council as at 31 January 2023

Schedule of Investments held as at 31 January 2023

|

Purch Date |

Principal ($) |

Description |

CP* |

Rating |

Maturity Date |

No Fossil Fuel |

Type |

Int. Rate |

Current Value ($) |

|

15/11/18 |

1,000,000.00 |

NSW Treasury Corp (Green Bond) |

N |

AAA |

15/11/28 |

Y |

B |

3.00% |

957,250.00 |

|

20/11/18 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

22/03/24 |

Y |

B |

1.78% |

994,940.00

|

|

28/03/19 |

1,000,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

28/03/29 |

Y |

B |

2.38% |

923,220.00

|

|

21/11/19 |

1,000,000.00 |

NSW Treasury Corp (Sustainability Bond) |

N |

AAA |

20/03/25 |

Y |

B |

1.25% |

951,260.00

|

|

27/11/19 |

500,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

27/05/30 |

Y |

B |

1.52% |

422,065.00

|

|

15/06/21 |

500,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

01/07/31

|

Y |

FRN |

1.99% |

501,910.00

|

|

06/09/21 |

1,000,000.00 |

Northern Territory TCorp |

N |

Aa3 |

15/12/26 |

Y |

B |

1.40% |

1,000,000.00 |

|

16/09/21 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

02/03/32 |

Y |

B |

1.83% |

928,180.00 |

|

17/12/21 |

2,000,000.00 |

NAB |

P |

AA- |

01/02/23 |

N |

TD |

3.75% |

2,000,000.00 |

|

23/08/22 |

2,000,000.00 |

AMP Bank |

P |

BBB |

23/02/23 |

N |

TD |

3.70% |

2,000,000.00 |

|

29/09/22 |

2,000,000.00 |

AMP Bank |

N |

BBB |

01/02/23 |

N |

TD |

3.95% |

2,000,000.00 |

|

21/10/22 |

1,000,000.00 |

AMP Bank |

N |

BBB |

21/02/23 |

N |

TD |

3.90% |

1,000,000.00 |

|

26/10/22 |

1,000,000.00 |

AMP Bank |

N |

BBB |

23/02/23 |

N |

TD |

3.85% |

1,000,000.00 |

|

16/11/22 |

1,000,000.00 |

AMP Bank |

N |

BBB |

16/03/23 |

N |

TD |

3.95% |

1,000,000.00 |

|

12/12/22 |

2,000,000.00 |

NAB |

N |

AA- |

13/03/23 |

N |

TD |

3.80% |

2,000,000.00 |

|

22/12/22 |

1,000,000.00 |

Macquarie Bank Ltd |

P |

AA- |

27/04/23 |

N |

TD |

3.97% |

1,000,000.00 |

|

22/12/22 |

1,000,000.00 |

Macquarie Bank Ltd |

N |

AA- |

23/03/23 |

N |

TD |

3.97% |

1,000,000.00 |

|

04/01/23 |

2,000,000.00 |

NAB |

N |

AA- |

04/05/23 |

N |

TD |

3.97% |

2,000,000.00 |

|

05/01/23 |

2,000,000.00 |

NAB |

N |

AA- |

05/05/23 |

N |

TD |

4.07% |

2,000,000.00 |

|

05/01/23 |

1,000,000.00 |

NAB |

N |

AA- |

05/04/23 |

N |

TD |

3.95% |

1,000,000.00 |

|

09/01/23 |

2,000,000.00 |

NAB |

N |

AA- |

11/04/23 |

N |

TD |

3.32% |

2,000,000.00 |

|

24/01/23 |

1,000,000.00 |

Macquarie Bank Ltd |

N |

AA- |

26/04/23 |

N |

TD |

3.68% |

1,000,000.00 |

|

N/A |

28,770,669.62

|

CBA Business Saver |

P |

AA- |

N/A |

N |

CALL |

3.20% |

28,770,669.62

|

|

N/A |

4,705,716.95

|

CBA Business Saver – Tourism Infrastructure Grant |

N |

AA- |

N/A |

N |

CALL |

3.20% |

4,705,716.95

|

|

N/A |

10,219,688.94 |

Macquarie Accelerator Call |

N |

A |

N/A |

N |

CALL |

2.00% |

10,219,688.94 |

|

Total |

71,696,075.51 |

|

|

|

|

|

AVG |

2.82% |

71,374,900.51 |

|

Note 1. |

CP = Capital protection on maturity |

|||

|

|

|

|||

|

|

N = No Capital Protection |

|||

|

|

Y = Fully covered by Government Guarantee |

|||

|

|

P = Partial Government Guarantee of $250,000 (Financial Claims Scheme) |

|||

|

|

|

|||

|

Note 2. |

No Fossil Fuel ADI |

|||

|

|

Y = No investment in Fossil Fuels |

|||

|

|

N = Investment in Fossil Fuels |

|||

|

|

U = Unknown Status |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 3. |

Type |

Description |

|

|

|

|

B |

Bonds |

Principal can vary based on valuation, interest payable via a fixed interest, payable usually each quarter. |

|

|

|

FRN |

Floating Rate Note |

Principal can vary based on valuation, interest payable via a floating interest rate that varies each quarter. |

|

|

|

TD |

Term Deposit |

Principal does not vary during investment term. Interest payable is fixed at the rate invested for the investment term. |

|

|

|

CALL |

Call Account |

Principal varies due to cash flow demands from deposits/withdrawals. Interest is payable on the daily balance. |

|

Environmental and Socially Responsible Investing (ESRI)

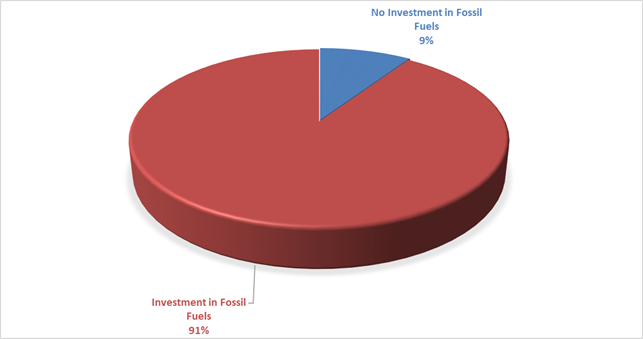

An additional column has been added to the schedule of Investments to identify if the financial institution holding the Council investment has been assessed as a ‘No Fossil Fuel’ investing institution. This information has been sourced through www.marketforces.org.au and identifies financial institutions that either invest in fossil fuel related industries or do not. The graph below highlights the percentage of each classification across Council’s total investment portfolio in respect of fossil fuels only.

The notion of Environmental and Socially Responsible Investing is much broader than whether a financial institution as rated by ‘marketforces.org.au’ invests in fossil fuels or not. Council’s current Investment Policy defines Environmental and Socially Responsible Investing at Section 4.1 of the Policy which can be found on Council’s website.

Council may from time to time have an investment with a financial institution that invests in fossil fuels but is nevertheless aligned with the broader definition of Environmental and Socially Responsible investments.

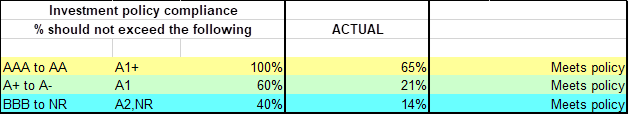

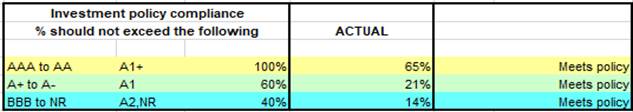

The below table identifies compliance with Council’s Investment Policy by the proportion of the investment portfolio invested with financial institutions, along with their associated credit ratings compared to parameters in the Investment Policy. The parameters are designed to support prudent short and long-term management of credit risk and ensure diversification of the investment portfolio. Note that the financial institutions currently offering investments in the ‘ethical’ area are still mainly those with lower credit ratings (being either BBB or not rated at all i.e., credit unions).

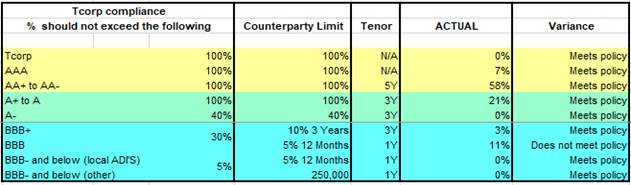

NSW Treasury Corporation Compliance – Loan Borrowing Conditions

Council has borrowed loans through NSW Treasury Corporation under the Local Government Low Cost Loans Initiative. As part of these loan borrowings, NSW Treasury Corporation has placed restrictions on where Council can invest based on the credit rating of the financial institution, the term of the investment and counterparty limit.

NSW Treasury Corporation has reviewed Council’s Investment Portfolio and reminded Council it needs to remain within the investment parameters outlined in the accepted loan agreements. Council currently complies with T Corp Borrowing conditions as indicated in the table below:

Council had discussions with NSW Treasury Corporation and indicated it would start reporting the compliance in the monthly investment report to Council. Council is able to hold existing investments not in compliance until maturity but must ensure new investments meet the compliance requirements.

Meeting the NSW Treasury Corporation compliance means Council will be limited in taking up investments that may be for purposes associated with Environmental and Socially Responsible outcomes. Investments which do not comply with NSW Treasury Corporation requirements and investments with financial institutions that do not support fossil fuels will have to be decreased due to their credit rating status or lack of credit rating.

The investment portfolio is outlined in the table below by investment type for the period 1 January 2023 to 31 January 2023:

Dissection of Council Investment Portfolio as at 31 January 2023

|

Investment Linked to: |

Current Market Value ($) |

Cumulative Unrealised Gain/(Loss) ($) |

|

|

21,000,000.00 |

Term Deposits |

21,000,000.00 |

0.00 |

|

1,500,000.00 |

Floating Rate Note |

1,496,850.00 |

(3,150.00) |

|

28,770,669.62

|

CBA Business Saver |

28,770,669.62

|

0.00 |

|

4,705,716.95

|

CBA Business Saver – Tourism Infrastructure Grant |

4,705,716.95

|

0.00 |

|

10,219,688.94 |

Macquarie Accelerator |

10,219,688.94 |

0.00 |

|

5,500,000.00 |

Bonds |

5,181,975.00 |

(318,025.00) |

|

71,696,075.51 |

|

71,374,900.51 |

(321,175.00) |

Council’s overall ‘cash position’ is not only measured by funds invested but also by the funds retained in its consolidated fund or bank account for operational purposes. The table below identifies Council’s overall cash position for the month of January 2023 as follows:

Dissection of Council’s Cash Position as at 31 January 2023

|

Principal Value ($) |

Current Market Value ($) |

Cumulative Unrealised Gain/(Loss) ($) |

|

|

Investments Portfolio |

|||

|

Term Deposits |

22,000,000.00 |

22,000,000.00 |

0.00 |

|

Floating Rate Note |

1,500,000.00 |

1,496,850.00 |

(3,150.00) |

|

CBA Business Saver |

28,770,669.62

|

28,770,669.62

|

0.00 |

|

CBA Business Saver – Tourism Infrastructure Grant |

4,705,716.95

|

4,705,716.95

|

0.00 |

|

Macquarie Accelerator |

10,219,688.94 |

10,219,688.94 |

0.00 |

|

Bonds |

5,500,000.00 |

5,181,975.00 |

(318,025.00) |

|

Total Investment Portfolio |

72,696,075.51 |

72,374,900.51 |

(321,175.00) |

|

Cash at Bank |

|||

|

Consolidated Fund |

2,515,272.38 |

2,515,272.38 |

0.00 |

|

Total Cash at Bank |

2,515,272.38 |

2,515,272.38 |

0.00 |

|

Total Cash Position |

75,211,347.89 |

74,890,172.89 |

(321,175.00) |

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1: Effective Leadership |

1.3: Ethical and efficient management of resources |

1.3.1: Financial Management - Ensure the financial integrity and sustainability of Council through effective financial management |

1.3.1.6 |

Maintain Council's cash flow |

Legal/Statutory/Policy Considerations

In accordance with Section 212 of the Local Government (General) Regulation 2021, the Responsible Accounting Officer of Council must provide Council with a monthly report detailing all monies it has invested under section 625 of the Local Government Act 1993.

The Report must be presented at the next Ordinary Meeting of Council after the end of the month being reported. The current Council Meeting cycle does not always allow this to occur, especially as investment valuations required for the preparation of the report are often received after the deadline for the submission of reports. Endeavours are being made to achieve a better alignment and for some months this will require reporting for one or more months.

Council’s investments are made in accordance with section 625(2) of the Local Government Act 1993 and Council’s Investment Policy. The Local Government Act 1993 allows Council to invest money as per the Minister’s Order – Forms of Investment, last published in the Government Gazette on 11 March 2011.

Council’s Investment Policy includes the objective of maximising earnings from authorised investments and ensuring the security of Council Funds.

Financial Considerations

Council uses a diversified mix of investments to achieve short, medium, and long-term results.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.3

Report No. 13.3 Update to Council's Business Ethics Statement

Directorate: Corporate and Community Services

Report Author: Alexandra Keen, Strategic Contracts & Procurement Coordinator

File No: I2022/1815

Summary:

Council’s endorsement is sought of the Business Ethics Statement 2022 (Attachment 1).

The Business Ethics Statement 2020 is published on Council’s website, and provides a statement to the community and potential suppliers about Council’s expectations when seeking to deal with Council. The proposed changes reflect legislative amendments to reporting obligations by councils regarding modern slavery, sustainability and carbon neutrality goals, as well as other minor updates.

RECOMMENDATION:

That Council endorses the updated Business Ethics Statement 2022 (E2022/122254).

1 Business

Ethics Statement 2022, e2022/122254

![]()

Report

The Business Ethics Statement (Statement) is reviewed every two years and following the most recent review some updates are proposed (Attachment 1).The Business Ethics Statement 2020 is published on Council’s website, and provides a statement to the community and potential suppliers about Council’s expectations of integrity and ethical behaviour when seeking to deal with Council. Council’s approval is sought for the updated Statement.

Key issues

There are a number of minor amendments made to the Statement to ensure it references current policies and legislation. The other changes made concern Clause 5, and are:

· The provision of information to Council when requested (not just required).

· Expand the expectation that suppliers also not lobby or canvass Council staff during a request for quote process.

· A new point to reiterate that suppliers should refrain from engaging in practices which cause, involve or contribute to modern slavery and when requested respond to questionnaires, procurement and contract criteria in respect of this issue.

· Expand the provision that suppliers will respond to Council requests for information about carbon emissions of goods and services.

· Include a new requirement that suppliers will eliminate, reduce, or reuse waste where possible in relation to providing goods and services, their manufacture, supply chains and maintenance to reduce landfill.

Next steps

Should Council approve the updates to the Statement it will be published on Council’s website.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.1: Enhance trust and accountability through open and transparent leadership |

1.1.1: Leadership - Enhance leadership effectiveness, capacity, and ethical behaviour |

1.1.1.1 |

Coordinate Council's annual policy review program, update and publish adopted policies |

|

3:

Nurtured Environment |

3.4: Support and empower our community to adapt to, and mitigate our impact on climate change |

3.4.4: Net Zero - Work towards achieving Council's 100% net zero-emissions target |

3.4.4.1 |

Develop a carbon offset policy and procedure for Council in order to achieve net zero emissions. |

|

3:

Nurtured Environment |

3.5: Minimise waste and encourage recycling and resource recovery practices |

3.5.1: Waste management and resource recovery strategy - Implement Integrated Waste Management and Resource Recovery Strategy - Towards Zero |

3.5.1.3 |

Improve management of Council generated waste |

Recent Resolutions

Nil.

Legal/Statutory/Policy Considerations

The express inclusion of modern slavery expectations will assist Council with complying with its obligations under sections 428(4)(d) and 438ZE Local Government Act 1993, which commenced on 1 July 2022.

The refinement of expectations of suppliers or parties doing business with Council regarding sustainability and carbon emissions aligns with Net Zero Emissions Strategy for Council Operations 2025, and Towards Zero Integrated Waste Strategy 2019-2029.

Financial Considerations

Nil.

Consultation and Engagement

Consultation with internal stakeholders occurred with respect to the proposed updates.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.4

Report No. 13.4 Conduct of the 2024 Local Government Election

Directorate: Corporate and Community Services

Report Author: Amber Evans Crane, Governance Support Officer

File No: I2022/1838

Summary:

Council has until 13 March 2023 to resolve to enter into arrangements with the Electoral Commission, or an electoral services provider, to administer the 2024 ordinary council elections.

This report recommends that Council enters into an arrangement with the NSW Electoral Commissioner to administer the 2024 Local Government Election, and any associated Council polls and constitutional referenda.

RECOMMENDATION:

That Council resolves:

1. Pursuant to s. 296(2) and (3) of the Local Government Act 1993 (NSW) (“the Act”) that an election arrangement be entered into by contract for the Electoral Commissioner to administer all elections of the Council.

2. Pursuant to s. 296(2) and (3) of the Act, as applied and modified by s. 18, that a Council poll arrangement be entered into by contract for the Electoral Commissioner to administer all Council polls of the Council.

3. Pursuant to s. 296(2) and (3) of the Act, as applied and modified by s. 18, that a constitutional referendum arrangement be entered into by contract for the Electoral Commissioner to administer all constitutional referenda of the Council.

Report

Under section 296AA of the Local Government Act 1993 (the Act), councils are required to determine how their ordinary elections in September 2024 are to be administered by 13 March 2023.

Each Council must resolve to either:

· enter into an election arrangement with the NSW Electoral Commissioner (NSWEC) to administer all the Council’s elections, polls and constitutional referenda; or

· that the Council’s elections are to be administered by another electoral services provider engaged by the Council.

If a Council does not resolve to engage the NSWEC to administer its elections by 13 March 2023, it must engage another electoral services provider to do so.

A Council that fails to make a decision on the administration of its elections by 13 March 2023 will be required to publish a notice of that failure on its website.

Councils, in making a determination on the conduct of the election, must do so by resolution and that resolution should include the arrangement that is to be entered into.

This report recommends that Council enters into an arrangement with the Electoral Commissioner to conduct the 2024 Local Government Election and any associated Council polls and constitutional referenda.

The recommended resolution uses text provided by the Office of Local Government in its model resolution for councils wishing to arrange for the Electoral Commissioner to administer their elections and associated polls/referenda.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.1: Enhance trust and accountability through open and transparent leadership |

1.1.2: Governance - Ensure legislative compliance and support Councillors to carry out their civic duties |

A new activity is proposed to be included in the 2023/24 Operational Plan. |

|

Legal/Statutory/Policy Considerations

The Local Government Amendment Act 2019 was assented to on 24 June 2019, which provided for the extension of the ‘cut-off’ date for Council to make a decision on the administration of elections, and to require Councils that do not enter into an arrangement with the Electoral Commissioner to engage an electoral services provider to administer elections. Further details regarding the recent amendments to the Local Government Act 1993 are outlined in the Office of Local Government Circular 19-14.

Section 55(3) of the Act provides that a Council need not invite tenders before entering into a contract with the Electoral Commissioner for the administration of the council’s elections, constitutional referendums and polls.

Where a Council decides to engage an electoral services provider to conduct its elections, constitutional referendums and polls, section 296A of the Act outlines that the provider is to appoint a returning officer and a substitute returning officer, and that neither of these positions can be employees of the Council. The returning officer is to appoint one or more electoral officials, who may or may not be employees of the Council.

Section 296A also provides that the General Manager cannot be appointed as a returning officer, substitute returning officer or electoral official for any area.

Financial Considerations

Council will require a budget allocation in its 2023/24 budget for administration expenses and 2024/25 budget for payment for administering the election. To assist with this as part of the annual budget process, Council sets aside an allocation into the Election Reserve.

For 2022/2023 financial year, Council allocated $80,000 with a projected reserve balance at 30 June 2023 of $115,700. Given the short turn around from the election expenditure in the 2021/2022 financial year, there has not been the opportunity to rebuild the reserve over a four year term so Council will need to budget over the course of the 2023/2024 and 2024/2025 financial year funds to the Election Reserve to cater for the anticipated cost of the election in September 2024.

The cost estimate for the NSW

Electoral Commission (Electoral Commission) to conduct Council’s 2024

ordinary election is given in the following table.

|

Projects/ Deliverables |

Amount ($) |

|

Ballot Papers |

5,097 |

|

Call Centre |

8,703 |

|

Counting and Results - Centralised |

- |

|

Counting and Results - Declaration Voting |

6,358 |

|

Event Staffing |

157,209 |

|

Information Technology |

9,491 |

|

Logistics |

18,577 |

|

Postal Voting Services |

10,819 |

|

Venues |

39,716 |

|

Voter Awareness |

15,669 |

|

Financial Services |

2,565 |

|

Constitutional Referendum |

- |

|

Council Poll |

- |

|

TOTAL (excluding GST) |

274,205 |

The Electoral Commission does not apply any margin to the cost. Costs have risen since the December 2021 elections and are likely to continue to rise between the date of this estimate and the holding of the election. The electoral commission has named the key cost increases as:

1. Early voting centre rental costs have significantly increased since LGE21

2. Logistics costs are increasing by 10% year-on-year

3. The fuel levy for material deliveries and collections has increased by 24%

4. The 3-year CPI increase is 13.12%

5. Staff costs have risen by 2.83% pa

6. Growth in the number of electors is 3.34% over 3 years

7. Paper costs have risen (affecting ballot papers and printed rolls)

By way of comparison, the following election expenses were incurred in prior years:

|

Election Year |

Electoral Commission Costs |

Other Costs |

Total Election Costs |

|

2008 |

$122,900 |

$4,290 |

$127,190 |

|

2012 |

$140,854 |

$2,979 |

$143,833 |

|

2016 |

$177,621 |

$9,575 |

$187,196 |

|

2021 |

$220,029 |

$7,252 |

$227,280

|

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.5

Report No. 13.5 Council Investments - 1 December 2022 to 31 December 2022

Directorate: Corporate and Community Services

Report Author: James Brickley, Manager Finance

File No: I2023/8

Summary:

Summary:

This report includes a list of investments and identifies Council’s overall cash position for the period 1 December 2022 to 31 December 2022 for information.

This report is prepared to comply with Section 212 of the Local Government (General) Regulation 2021.

RECOMMENDATION:

That Council notes the report listing Council’s investments and overall cash position as of 31 December 2022.

Report

Council has continued to maintain a diversified portfolio of investments. As of 31 December 2022, the average 90-day bank bill rate (BBSW) for the month was 3.16%. Council’s performance for December 2022 was 2.91%.

As investments mature Council should begin to see increased rates due to the recent Reserve bank increase in cash rates. The table below identifies the investments held by Council as at 31 December 2022:

Schedule of Investments held as at 31 December 2022

|

Purch Date |

Principal ($) |

Description |

CP* |

Rating |

Maturity Date |

No Fossil Fuel |

Type |

Int. Rate |

Current Value ($) |

|

15/11/18 |

1,000,000.00 |

NSW Treasury Corp (Green Bond) |

N |

AAA |

15/11/28 |

Y |

B |

3.00% |

957,250.00 |

|

20/11/18 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

22/03/24 |

Y |

B |

1.78% |

994,940.00

|

|

28/03/19 |

1,000,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

28/03/29 |

Y |

B |

2.38% |

923,220.00

|

|

21/11/19 |

1,000,000.00 |

NSW Treasury Corp (Sustainability Bond) |

N |

AAA |

20/03/25 |

Y |

B |

1.25% |

951,260.00

|

|

27/11/19 |

500,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

27/05/30 |

Y |

B |

1.52% |

422,065.00

|

|

15/06/21 |

500,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

01/07/31

|

Y |

FRN |

1.99% |

501,910.00

|

|

06/09/21 |

1,000,000.00 |

Northern Territory TCorp |

N |

Aa3 |

15/12/26 |

Y |

B |

1.40% |

1,000,000.00 |

|

16/09/21 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

02/03/32 |

Y |

B |

1.50% |

928,180.00 |

|

17/12/21 |

2,000,000.00 |

NAB |

P |

AA- |

01/02/23 |

N |

TD |

3.75% |

2,000,000.00 |

|

20/01/22 |

1,000,000.00 |

Westpac (Tailored) |

P |

AA- |

20/01/23 |

N |

TD |

0.79% |

1,000,000.00 |

|

15/06/22 |

2,000,000.00 |

NAB |

N |

AA- |

13/03/23 |

N |

TD |

3.80% |

2,000,000.00 |

|

23/08/22 |

2,000,000.00 |

AMP Bank |

P |

BBB |

23/02/23 |

N |

TD |

3.70% |

2,000,000.00 |

|

06/09/22 |

2,000,000.00 |

MyState Bank |

P |

BBB |

05/01/23 |

Y |

TD |

3.30% |

2,000,000.00 |

|

09/09/22 |

2,000,000.00 |

NAB |

N |

AA- |

09/01/23 |

N |

TD |

3.32% |

2,000,000.00 |

|

29/09/22 |

2,000,000.00 |

AMP Bank |

N |

BBB |

27/01/23 |

N |

TD |

3.95% |

2,000,000.00 |

|

21/10/22 |

1,000,000.00 |

AMP Bank |

N |

BBB |

21/02/23 |

N |

TD |

3.90% |

1,000,000.00 |

|

26/10/22 |

1,000,000.00 |

AMP Bank |

N |

BBB |

23/02/23 |

N |

TD |

3.85% |

1,000,000.00 |

|

26/10/22 |

1,000,000.00 |

Macquarie Bank Ltd |

N |

AA- |

24/01/23 |

N |

TD |

3.68% |

1,000,000.00 |

|

16/11/22 |

1,000,000.00 |

AMP Bank |

N |

BBB |

16/03/23 |

N |

TD |

3.95% |

1,000,000.00 |

|

22/12/22 |

1,000,000.00 |

Macquarie Bank Ltd |

N |

AA- |

27/04/23 |

N |

TD |

3.97% |

1,000,000.00 |

|

22/12/22 |

1,000,000.00 |

Macquarie Bank Ltd |

N |

AA- |

23/03/23 |

N |

TD |

3.97% |

1,000,000.00 |

|

N/A |

22,692,775.83

|

CBA Business Saver |

P |

AA- |

N/A |

N |

CALL |

3.20% |

22,692,775.83

|

|

N/A |

4,692,962.38

|

CBA Business Saver – Tourism Infrastructure Grant |

N |

AA- |

N/A |

N |

CALL |

3.20% |

4,692,962.38

|

|

N/A |

10,192,269.20 |

Macquarie Accelerator Call |

N |

A |

N/A |

N |

CALL |

2.00% |

10,192,269.20 |

|

Total |

63,578,007.41 |

|

|

|

|

|

AVG |

% |

63,256,832.41 |

|

Note 1. |

CP = Capital protection on maturity |

||

|

|

|

||

|

|

N = No Capital Protection |

||

|

|

Y = Fully covered by Government Guarantee |

||

|

|

P = Partial Government Guarantee of $250,000 (Financial Claims Scheme) |

||

|

|

|

||

|

Note 2. |

No Fossil Fuel ADI |

||

|

|

Y = No investment in Fossil Fuels |

||

|

|

N = Investment in Fossil Fuels |

||

|

|

U = Unknown Status |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 3. |

Type |

Description |

|

|

|

B |

Bonds |

Principal can vary based on valuation, interest payable via a fixed interest, payable usually each quarter. |

|

|

FRN |

Floating Rate Note |

Principal can vary based on valuation, interest payable via a floating interest rate that varies each quarter. |

|

|

TD |

Term Deposit |

Principal does not vary during investment term. Interest payable is fixed at the rate invested for the investment term. |

|

|

CALL |

Call Account |

Principal varies due to cash flow demands from deposits/withdrawals. Interest is payable on the daily balance. |

Environmental and Socially Responsible Investing (ESRI)

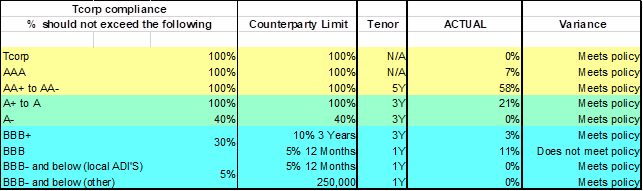

An additional column has been added to the schedule of Investments to identify if the financial institution holding the Council investment has been assessed as a ‘No Fossil Fuel’ investing institution. This information has been sourced through www.marketforces.org.au and identifies financial institutions that either invest in fossil fuel related industries or do not. The graph below highlights the percentage of each classification across Council’s total investment portfolio in respect of fossil fuels only.

The notion of Environmental and Socially Responsible Investing is much broader than whether a financial institution as rated by ‘marketforces.org.au’ invests in fossil fuels or not. Council’s current Investment Policy defines Environmental and Socially Responsible Investing at Section 4.1 of the Policy which can be found on Council’s website.

Council has one investment with a financial institution that invests in fossil fuels but is nevertheless aligned with the broader definition of Environmental and Socially Responsible investments i.e.:

1. $1,000,000 investment with Westpac Bank maturing on 20 January 2023 is a tailored term deposit and certfied green investment.

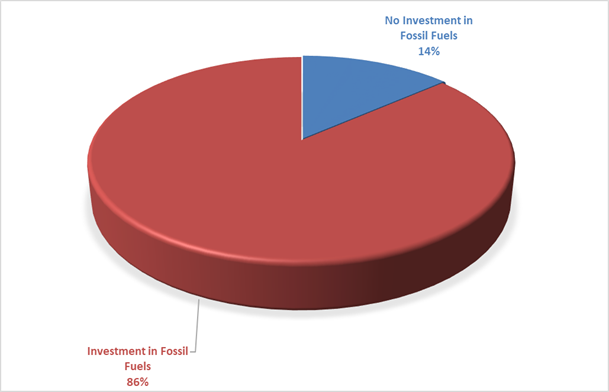

Investment Policy Compliance

The below table identifies compliance with Council’s Investment Policy by the proportion of the investment portfolio invested with financial institutions, along with their associated credit ratings compared to parameters in the Investment Policy. The parameters are designed to support prudent short and long-term management of credit risk and ensure diversification of the investment portfolio. Note that the financial institutions currently offering investments in the ‘ethical’ area are still mainly those with lower credit ratings (being either BBB or not rated at all i.e., credit unions).

NSW Treasury Corporation Compliance – Loan Borrowing Conditions

Council has borrowed loans through NSW Treasury Corporation under the Local Government Low Cost Loans Initiative. As part of these loan borrowings, NSW Treasury Corporation has placed restrictions on where Council can invest based on the credit rating of the financial institution, the term of the investment and counterparty limit.

NSW Treasury Corporation has reviewed Council’s Investment Portfolio and reminded Council it needs to remain within the investment parameters outlined in the accepted loan agreements. Council currently complies with T Corp Borrowing conditions as indicated in the table below:

Council had discussions with NSW Treasury Corporation and indicated it would start reporting the compliance in the monthly investment report to Council. Council is able to hold existing investments not in compliance until maturity but must ensure new investments meet the compliance requirements.

Meeting the NSW Treasury Corporation compliance means Council will be limited in taking up investments that may be for purposes associated with Environmental and Socially Responsible outcomes. Investments which do not comply with NSW Treasury Corporation requirements and investments with financial institutions that do not support fossil fuels will have to be decreased due to their credit rating status or lack of credit rating.

The investment portfolio is outlined in the table below by investment type for the period 1 December 2022 to 31 December 2022:

Dissection of Council Investment Portfolio as at 31 December 2022

|

Principal Value ($) |

Investment Linked to: |

Current Market Value ($) |

Cumulative Unrealised Gain/(Loss) ($) |

|

19,000,000.00 |

Term Deposits |

19,000,000.00 |

0.00 |

|

1,500,000.00 |

Floating Rate Note |

1,496,850.00 |

(3,150.00) |

|

22,692,775.83

|

CBA Business Saver |

22,692,775.83

|

0.00 |

|

4,692,962.38

|

CBA Business Saver – Tourism Infrastructure Grant |

4,692,962.38

|

0.00 |

|

10,192,269.20 |

Macquarie Accelerator |

10,192,269.20 |

0.00 |

|

5,500,000.00 |

Bonds |

5,181,975.00 |

(318,025.00) |

|

63,578,007.41 |

|

63,256,832.41 |

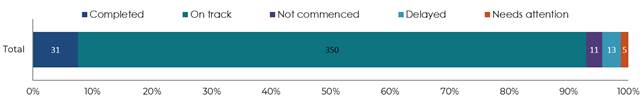

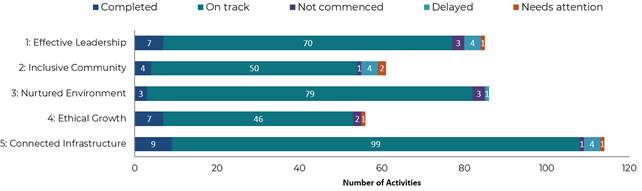

(321,175.00) |