What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Code of Conduct for Councillors (eg. A friendship, membership of an

association, society or trade union or involvement or interest in an activity

and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

Committee members are reminded that they should declare and manage all

conflicts of interest in respect of any matter on this Agenda, in accordance

with the Code of Conduct.

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development

application, an environmental planning instrument, a development control plan

or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register

containing, for each planning decision made at a meeting of the council or a

council committee, the names of the councillors who supported the decision and

the names of any councillors who opposed (or are taken to have opposed) the

decision.

(3) For the purpose of maintaining the register, a division

is required to be called whenever a motion for a planning decision is put at a

meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described

in the register or identified in a manner that enables the description to be

obtained from another publicly available document and is to include the

information required by the regulations.

(5) This section extends to a meeting that is closed to the

public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are

reminded of the oath of office or affirmation of office made at or before their

first meeting of the council in accordance with Clause 233A of the Local

Government Act 1993. This includes undertaking the duties of the office of

councillor in the best interests of the people of Byron Shire and the Byron

Shire Council and faithfully and impartially carrying out the functions,

powers, authorities and discretions vested under the Act or any other Act

to the best of one’s ability and judgment.

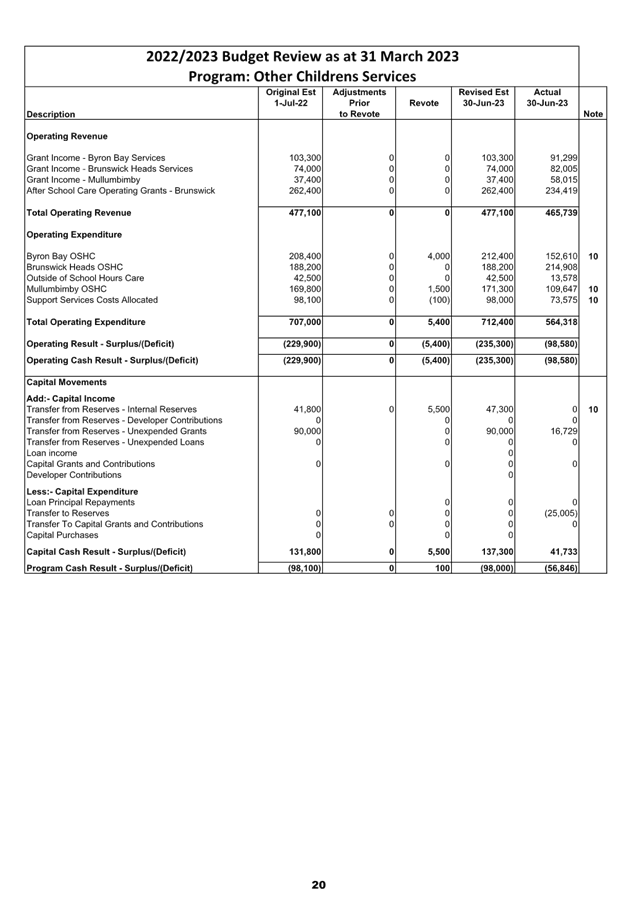

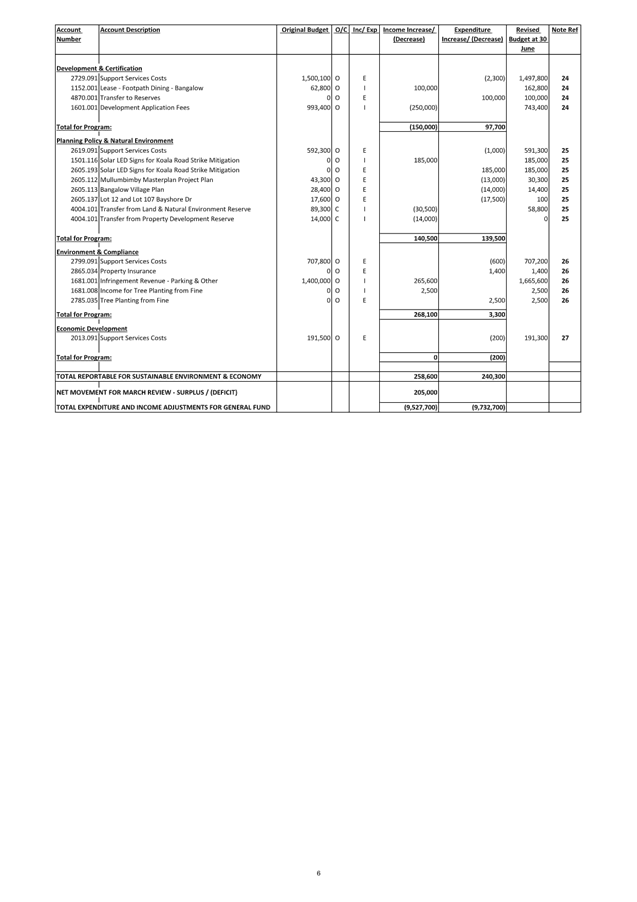

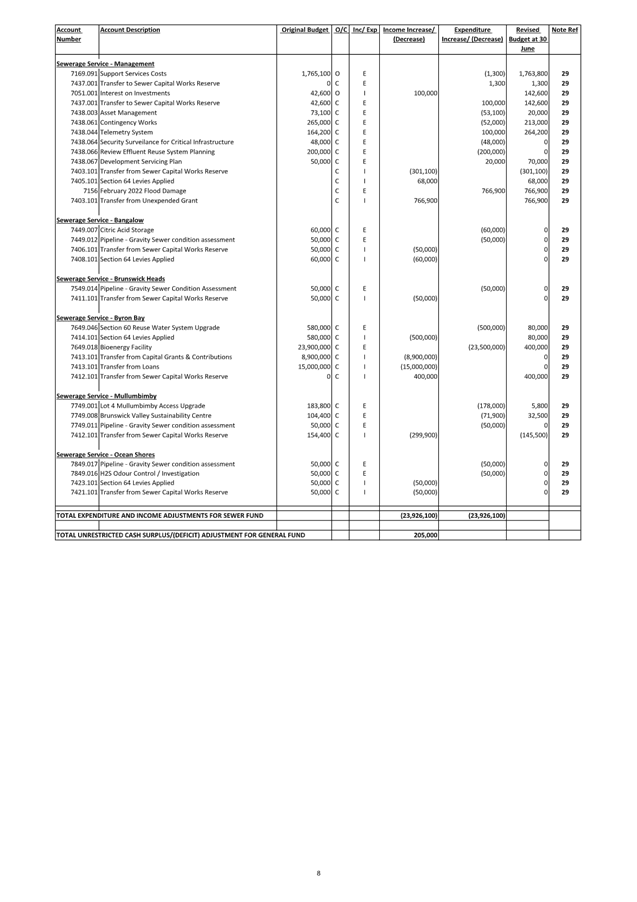

Staff Reports - Corporate and Community Services 4.2

Report

No. 4.2 Budget Review - 1

January 2023 to 31 March 2023

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2023/723

Summary:

This report has been prepared to comply with Section 203 of

the Local Government (General) Regulation 2021 and to inform Council and

the community of Council’s estimated financial position for the 2022/2023

financial year, reviewed as at 31 March 2023.

This report contains an overview of the proposed budget

variations for the General Fund, Water Fund and Sewerage Fund. The

specific details of these proposed variations are included in Attachment 1 and

2 for Council’s consideration and authorisation.

Attachment 3 contains the Integrated Planning and Reporting

Framework (IP&R) Quarterly Budget Review Statement (QBRS) as outlined by

the Office of Local Government in circular 10-32.

RECOMMENDATION:

1. That

Council authorises the itemised budget variations as shown in Attachment 2

(#E2023/45418) which include the following results in the 31 March 2023

Quarterly Review of the 2022/2023 Budget:

a) General

Fund – $205,000 increase to the Estimated Unrestricted Cash Result

b) General

Fund - $8,342,800 increase in reserves

c) Water

Fund - $658,900 increase in reserves

d) Sewerage

Fund - $227,400 increase in reserves

2. That

Council adopts the revised General Fund Estimated Unrestricted Cash Result of

$0 for the 2022/2023 financial year as at 31 March 2023

Attachments:

1 Budget

Variations for General, Water and Sewerage Funds, E2023/45417 , page 37⇩

2 Itemised

Listing of Budget Variations for General, Water and Sewerage Funds, E2023/45418 ,

page 103⇩

3 Integrated

Planning and Reporting Framework (IP&R) required Quarterly Review

Statements, E2023/45419 , page 111⇩

Report

Council adopted the 2022/2023 budget on 30 June 2022 via

Resolution 22-332. Council also considered and adopted the budget

carryovers from the 2021/2022 financial year, to be incorporated into the

2022/2023 budget at its Ordinary Meeting held on 25 August 2022 via Resolution 22-391.

Since that date, Council has reviewed the budget taking into consideration the

audited 2021/2022 Financial Statement results and progress through the first

three quarters of the 2022/2023 financial year. This report considers the

March 2023 Quarter Budget Review.

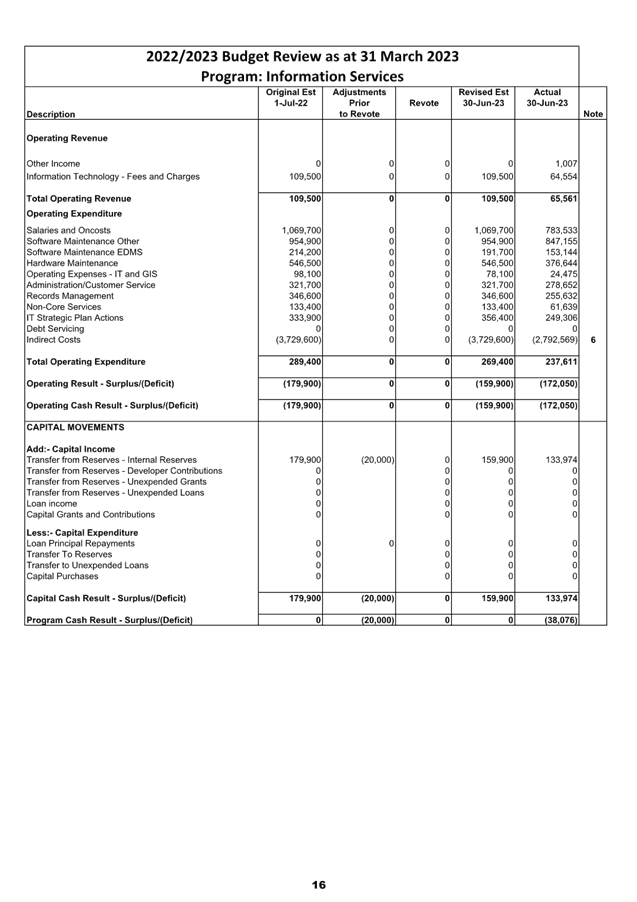

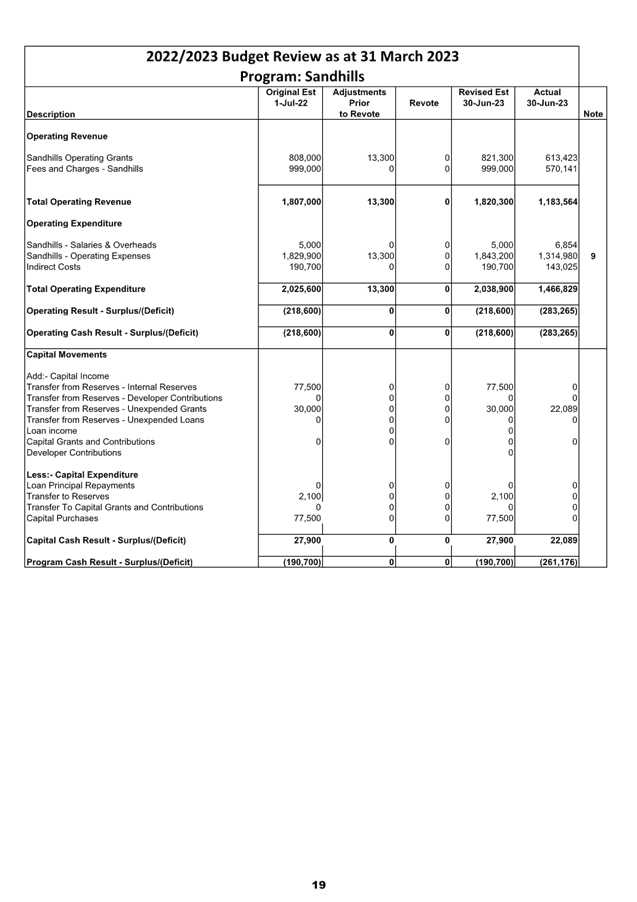

The details of the budget review for the Consolidated,

General, Water and Sewer Funds are included in Attachment 1, with an itemised

listing in Attachment 2. This aims to show the consolidated budget

position of Council, as well as a breakdown by Fund and Principal Activity. The

document in Attachment 1 is also effectively a publication outlining a review

of the budget and is intended to provide Councillors with more detailed

information to assist with decision making regarding Council’s finances.

Contained in the document at Attachment 1 is the following

reporting hierarchy:

Consolidated Budget

Cash Result

General Fund Cash

Result Water Fund Cash Result Sewer

Cash Result

Principal Activity Principal

Activity Principal

Activity

Operating Income Operating

Expenditure Capital income Capital

Expenditure

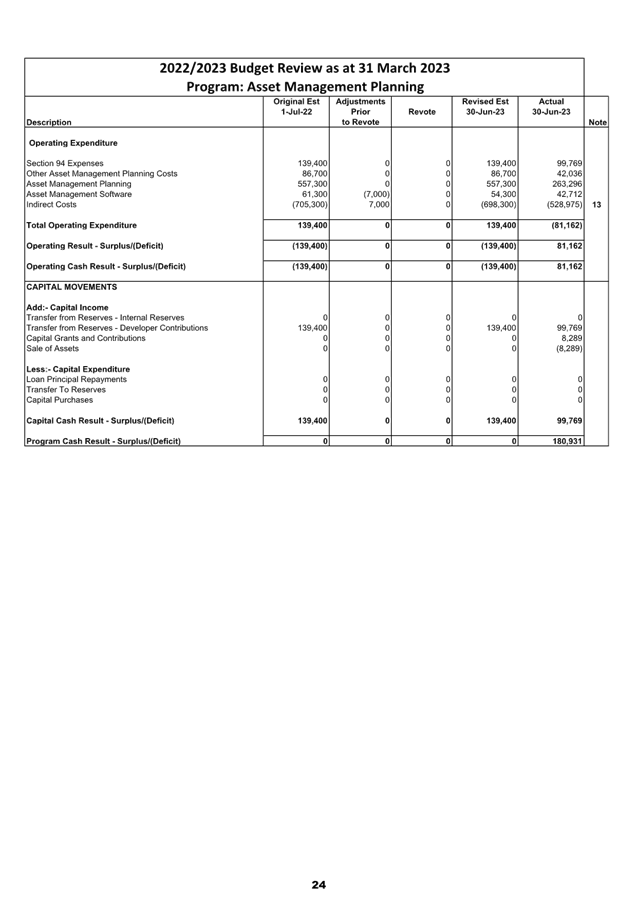

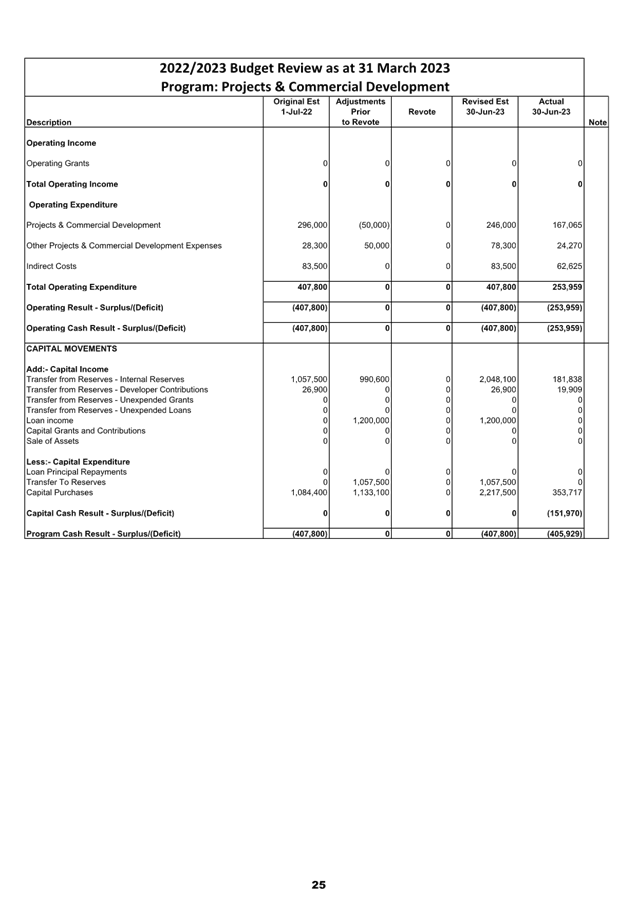

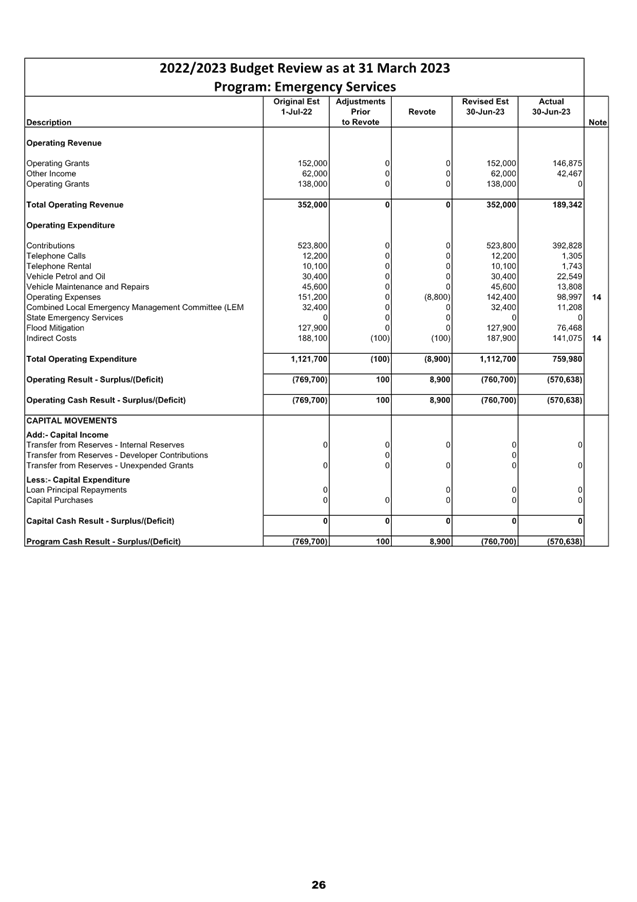

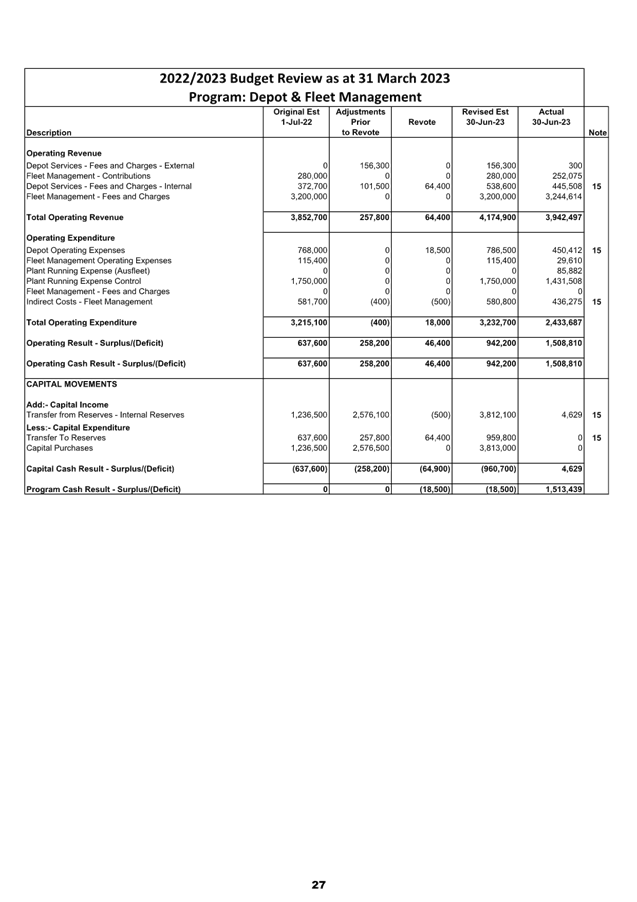

The pages within Attachment 1 are presented (from left to

right) by showing the original budget as adopted by Council on 30 June 2022

plus the adopted carryover budgets from 2021/2022 followed by the resolutions

between July and March and the revote (or adjustment for this review) and then

the revised position projected for 30 June 2023 as at 31 March 2023.

On the far right of the Principal Activity, there is a

column titled “Note”. If this is populated by a number, it

means that there has been an adjustment in the quarterly review. This

number then corresponds to the notes at the end of the Attachment 1 which

provides an explanation of the variation.

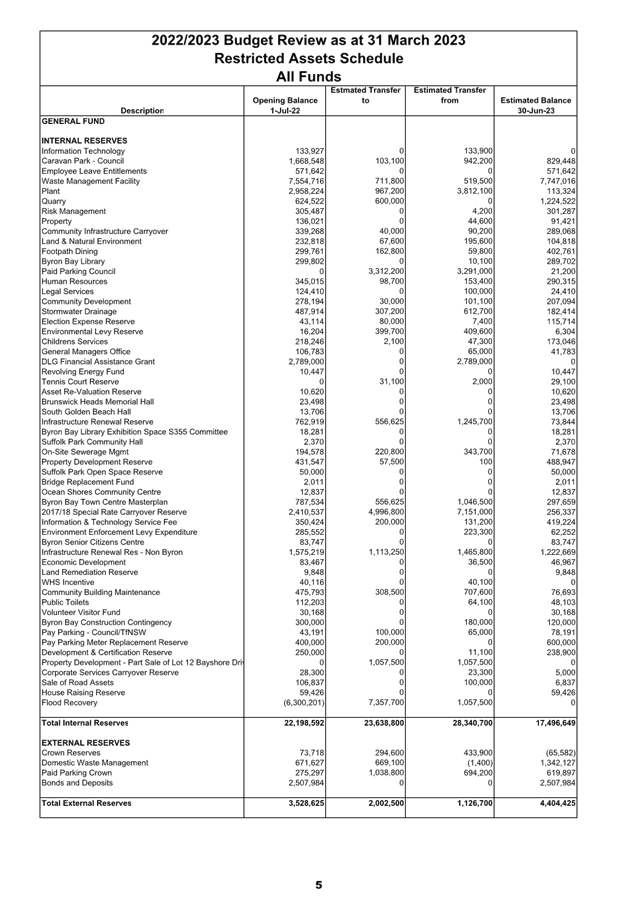

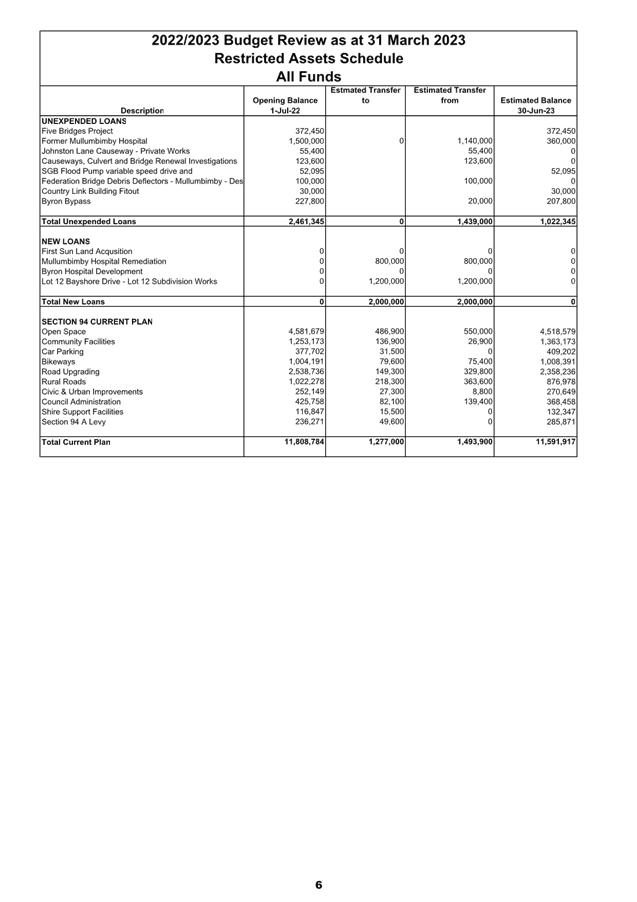

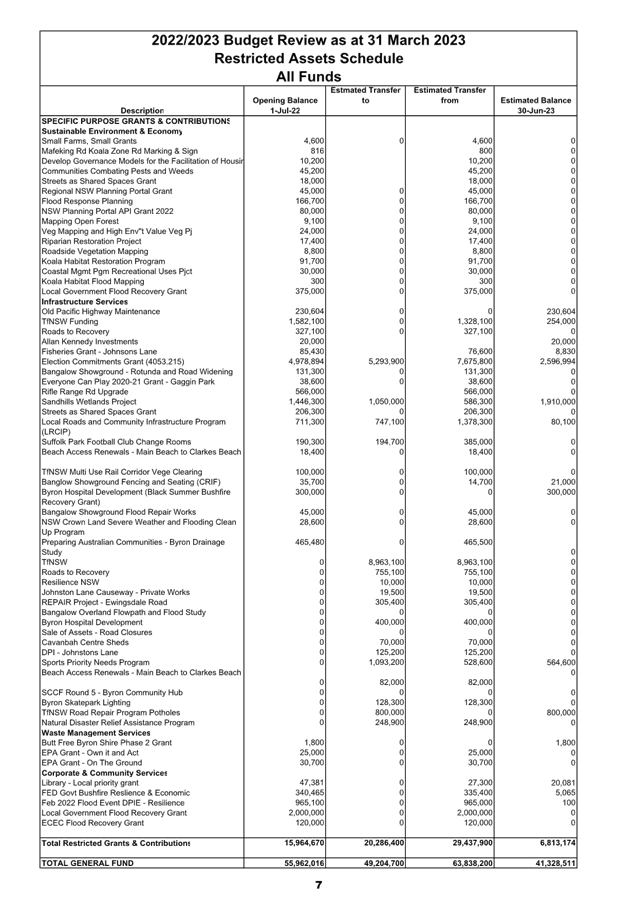

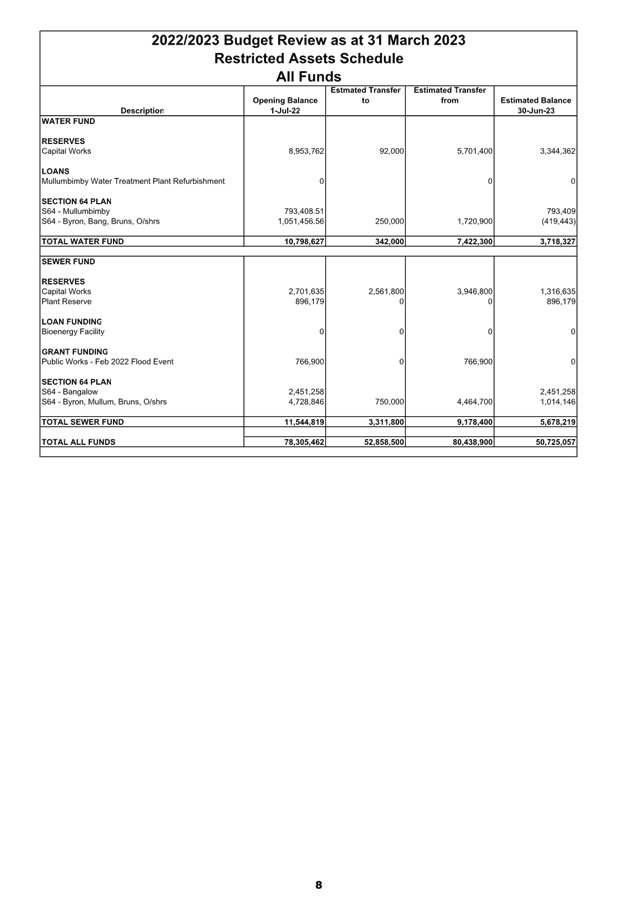

There is also information detailing restricted assets (reserves)

to show Council’s estimated balances as at 30 June 2023 for all

Council’s reserves.

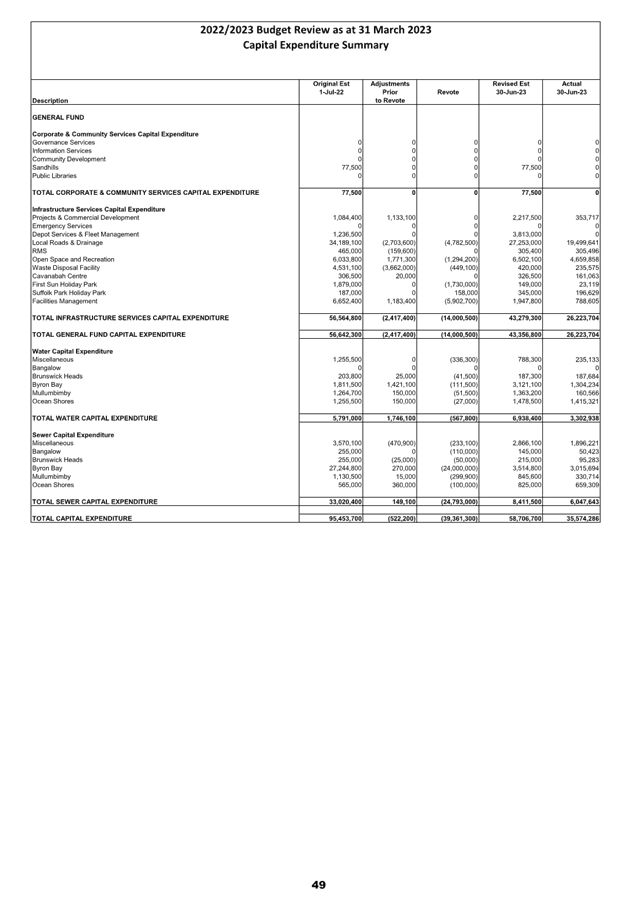

A summary of Capital Works is also included by Fund and

Principal Activity.

Office of Local Government Budget Review Guidelines:

The Office of Local Government on 10 December 2010 issued

the new Quarterly Budget Review Guidelines via Circular 10-32, with the

reporting requirements to apply from 1 July 2011. This report includes a

Quarterly Budget Review Statement (refer Attachment 3) prepared by Council in

accordance with the guidelines.

The Quarterly Budget Review Guidelines set a minimum

standard of disclosure, with these standards being included in the Local

Government Code of Accounting Practice and Financial Reporting as mandatory

requirements for Councils to address.

Since the introduction of the new planning and reporting

framework for NSW Local Government, it is now a requirement for Councils to

provide the following components when submitting a Quarterly Budget Review

Statement (QBRS):-

· A

signed statement by the Responsible Accounting Officer on Council’s

financial position at the end of the year based on the information in the QBRS

· Budget

review income and expenses statement in one of the following formats:

o Consolidated

o By

fund (e.g. General, Water, Sewer)

o By

function, activity, program etc. to align with the management plan/operational

plan

· Budget

Review Capital Budget

· Budget

Review Cash and Investments Position

· Budget

Review Key performance indicators

· Budget

Review Contracts and Other Expenses

The above components are included in Attachment 3 and

outlined below:

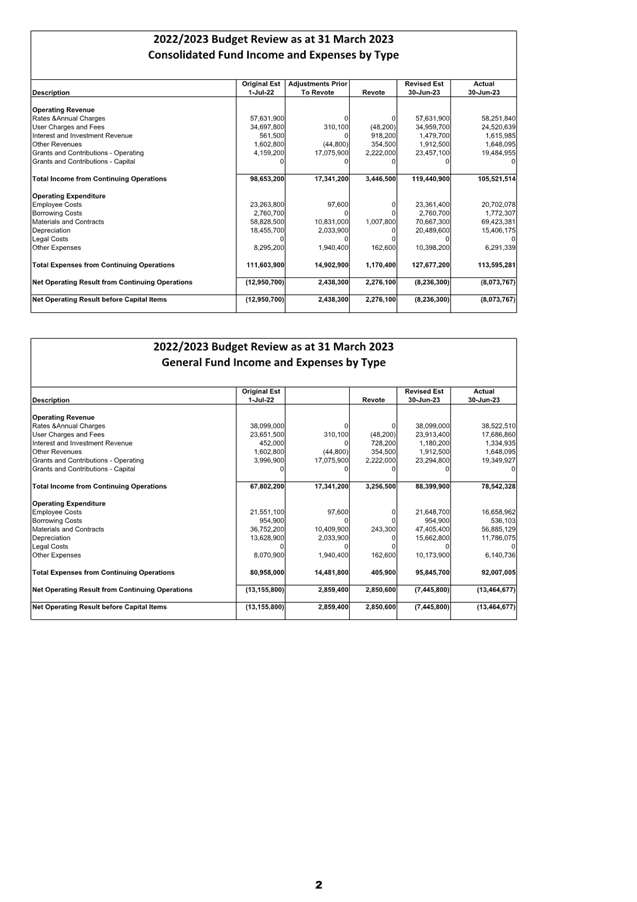

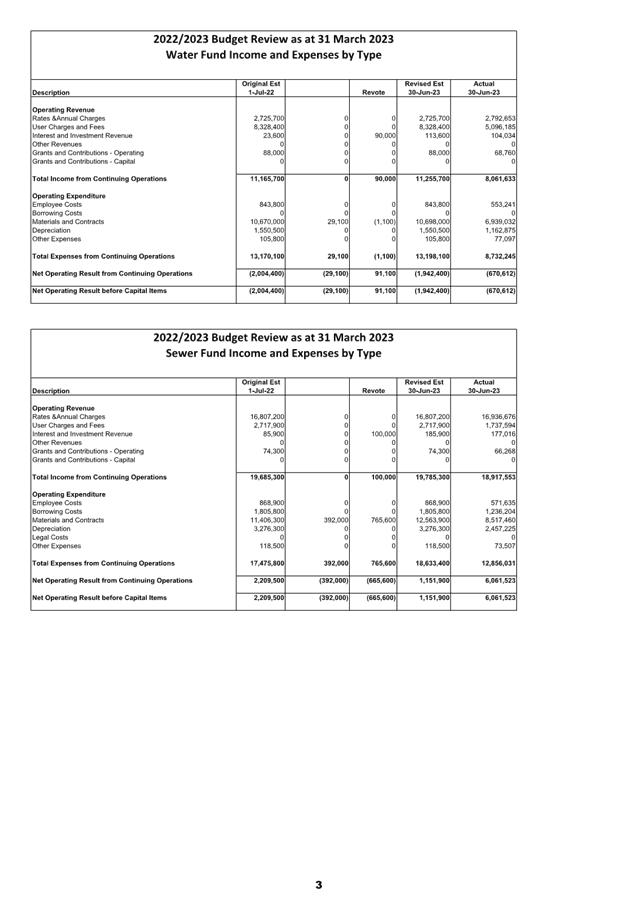

Income and Expenditure Budget Review Statement by Type

This shows Council’s income and Expenditure by

type. This has been split by Fund. Adjustments are shown, looking

from left to right. These adjustments are commented on through the last

14 pages of Attachment 1.

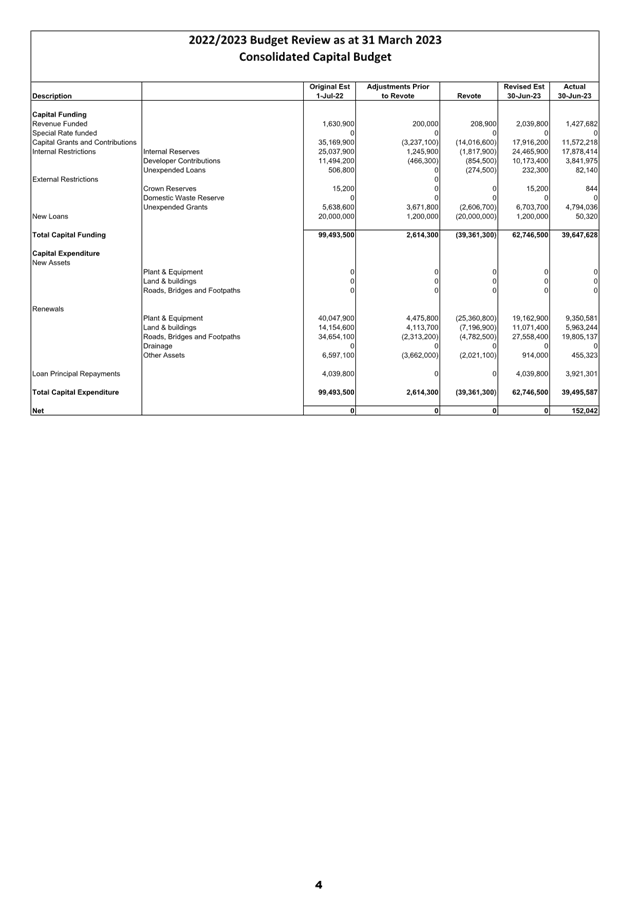

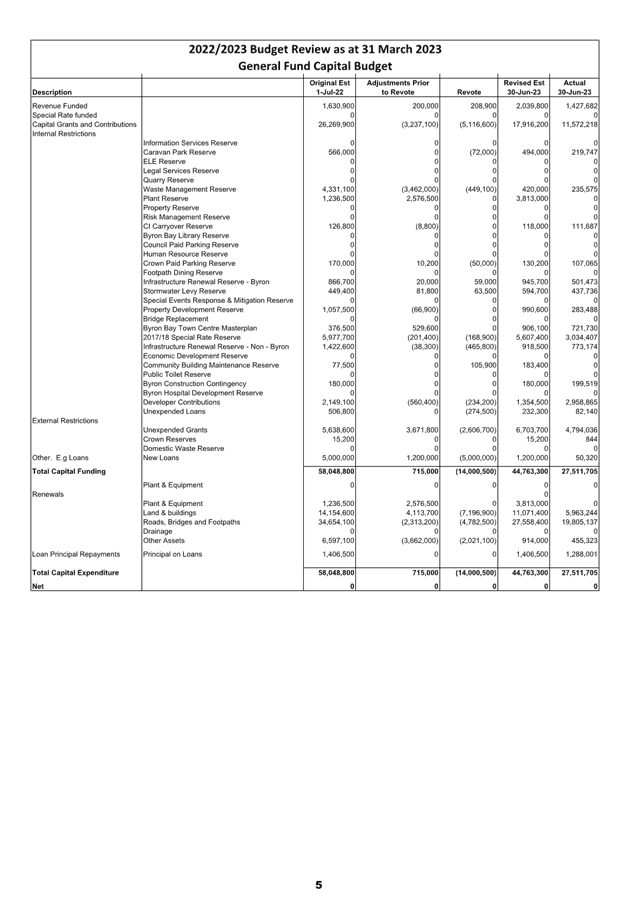

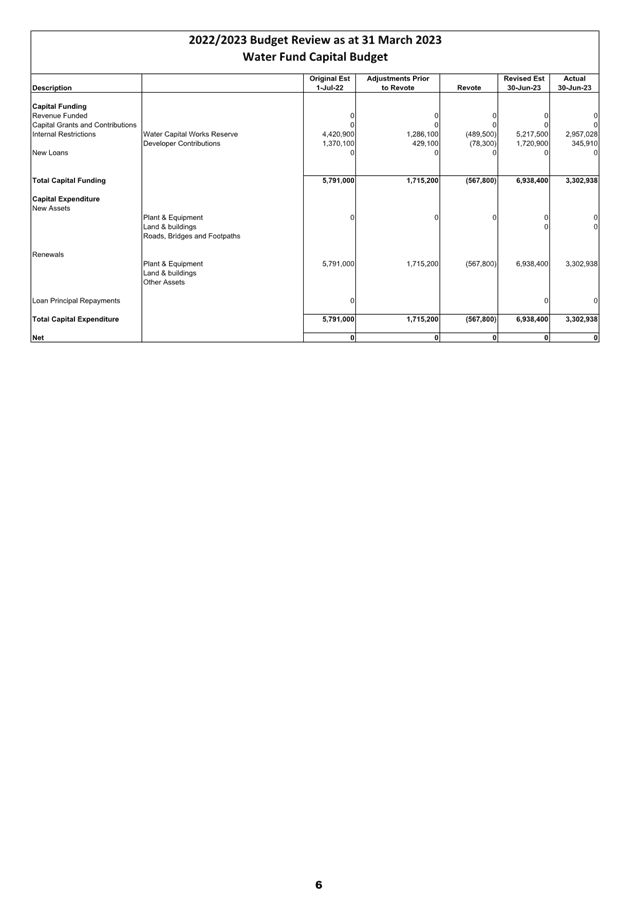

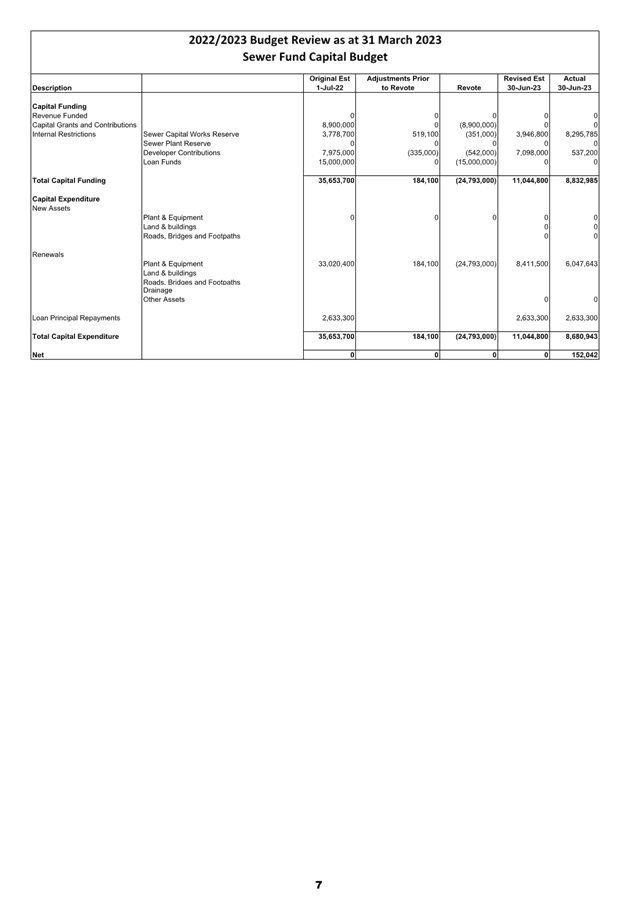

Capital Budget Review Statement

This statement identifies in summary Council’s capital

works program on a consolidated basis and then split by Fund. It also identifies

how the capital works program is funded. As this is the first quarterly review

for the reporting period, the Statement may not necessarily indicate the total

progress achieved on the delivery of the capital works program.

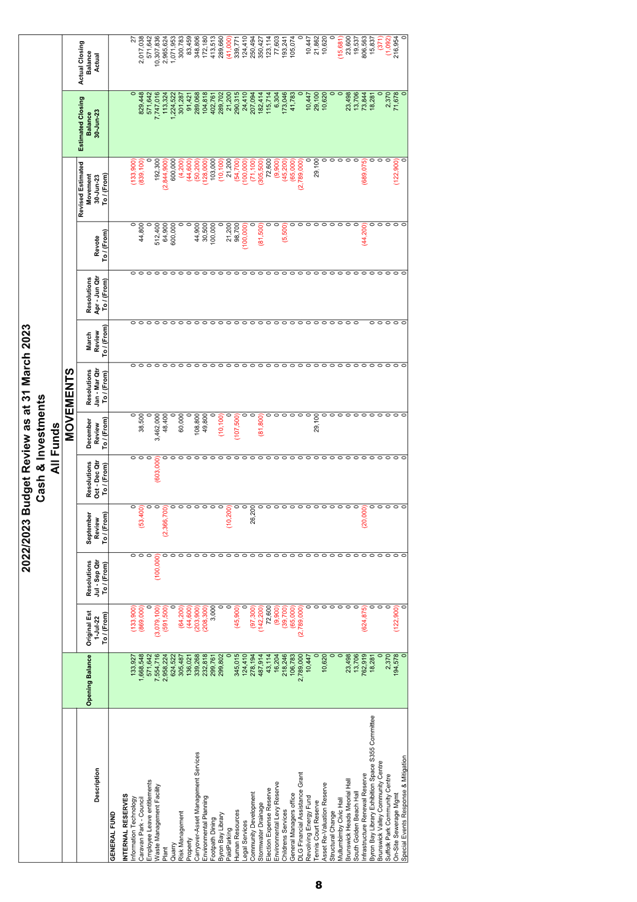

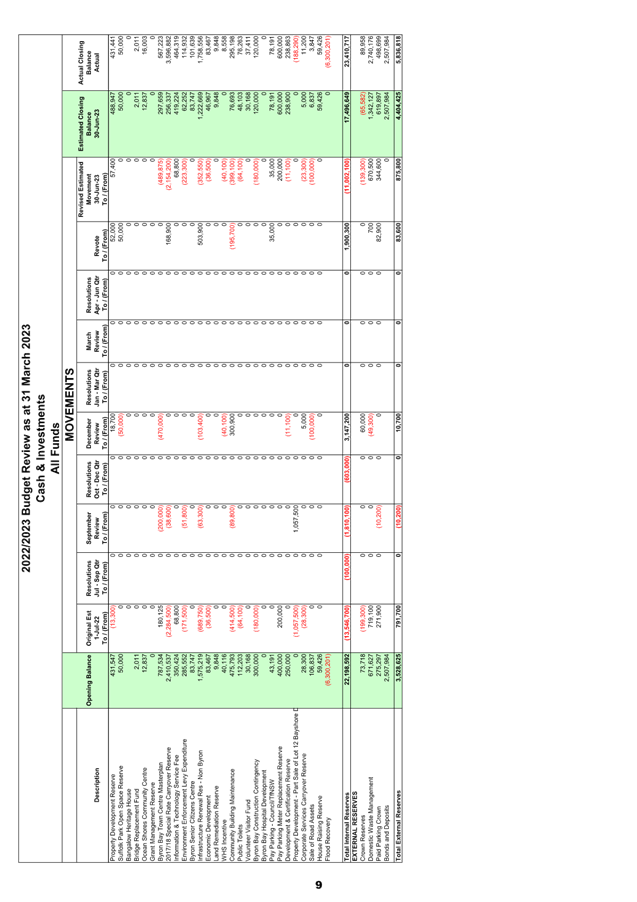

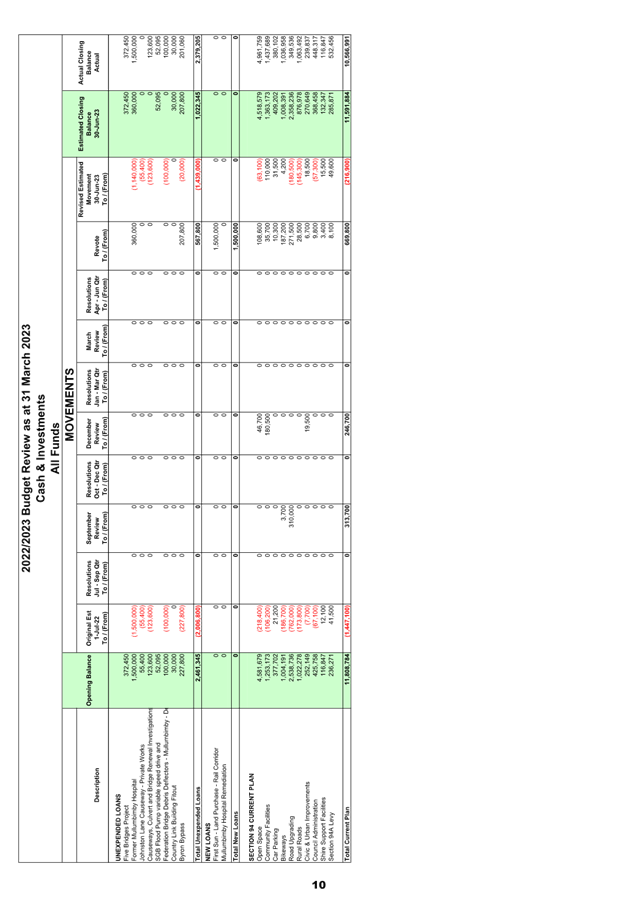

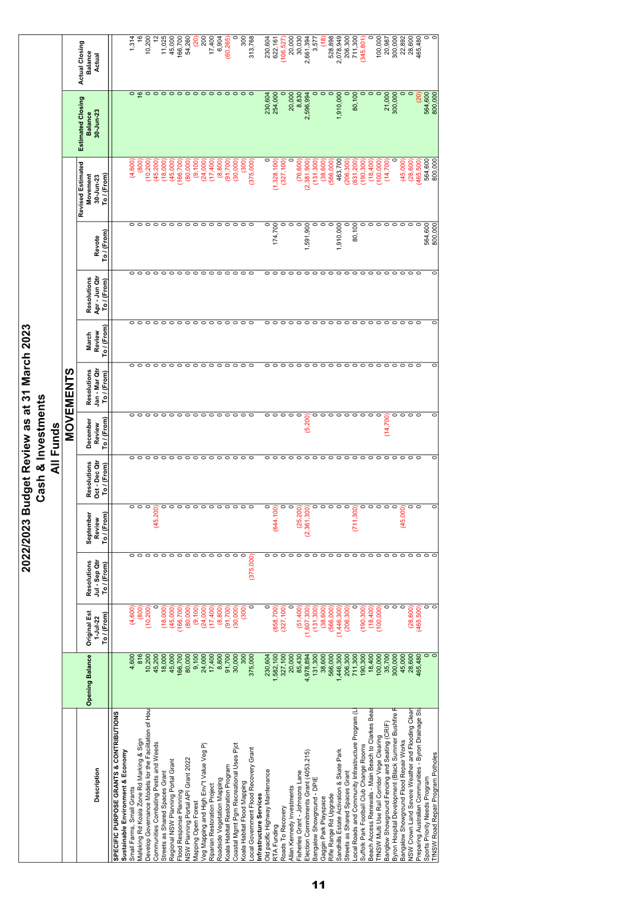

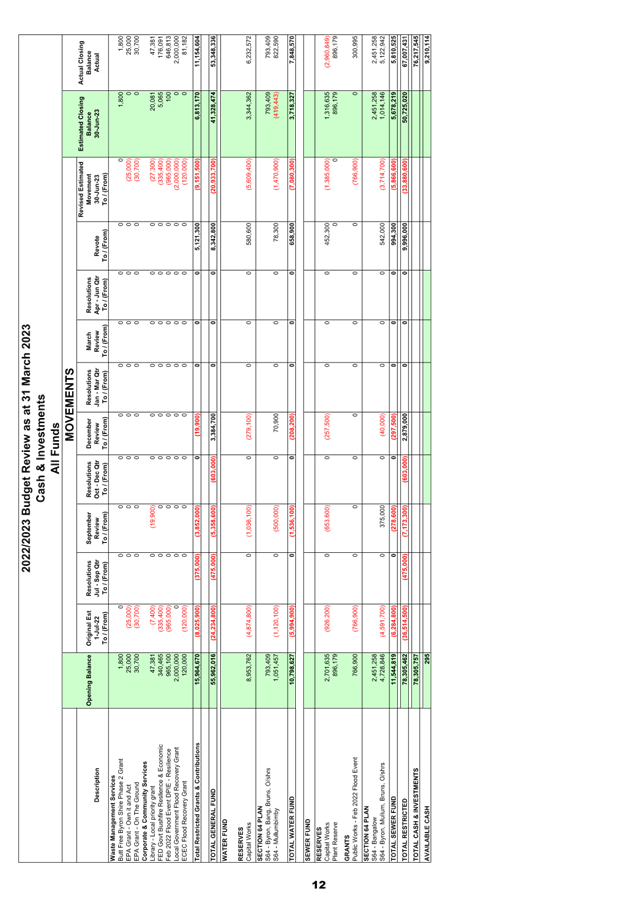

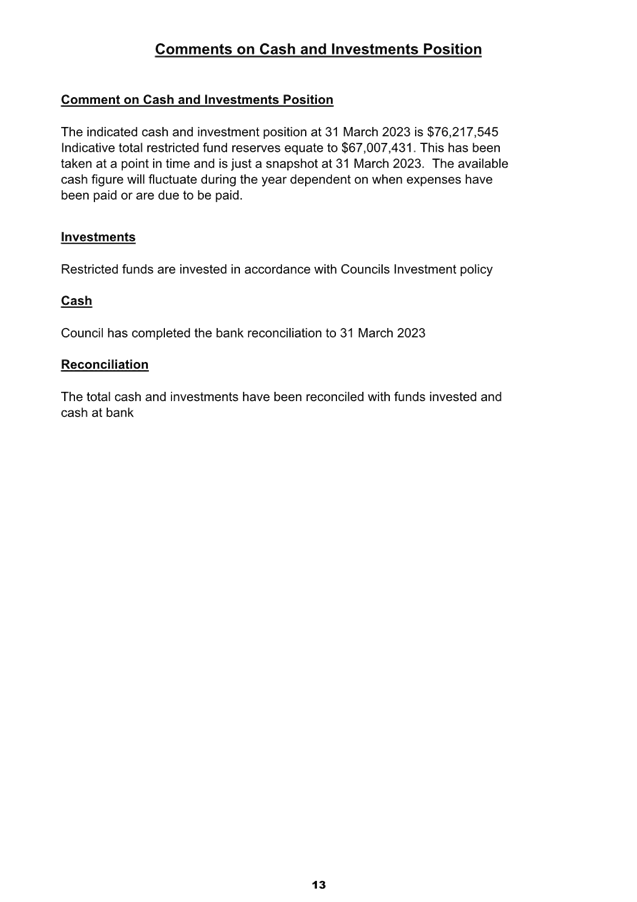

Cash and Investments Budget Review Statement

This statement reconciles Council’s restricted funds

(reserves) against available cash and investments. Council has attempted

to indicate an actual position as at 31 March 2023 of each reserve to show a

total cash position of reserves with any difference between that position and

total cash and investments held as available cash and investments. It

should be recognised that the figure is at a point in time and may vary greatly

in future quarterly reviews depending on cash flow movements.

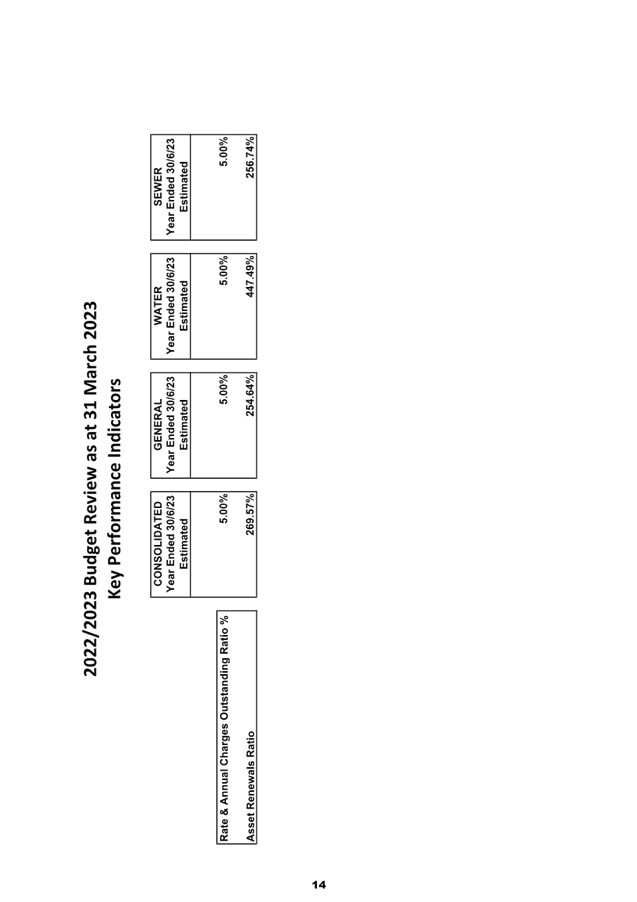

Key Performance Indicators (KPI’s)

At this stage, the KPI’s within this report are:

o Debt

Service Ratio - This assesses the impact of loan principal and interest

repayments on the discretionary revenue of Council.

o Rates

and Annual Charges Outstanding Ratio – This assesses the impact of

uncollected rates and annual charges on Councils liquidity and the adequacy of

recovery efforts

o Asset

Renewals Ratio – This assesses the rate at which assets are being

renewed relative to the rate at which they are depreciating.

These may be expanded in future to accommodate any

additional KPIs that Council may adopt to use in the future.

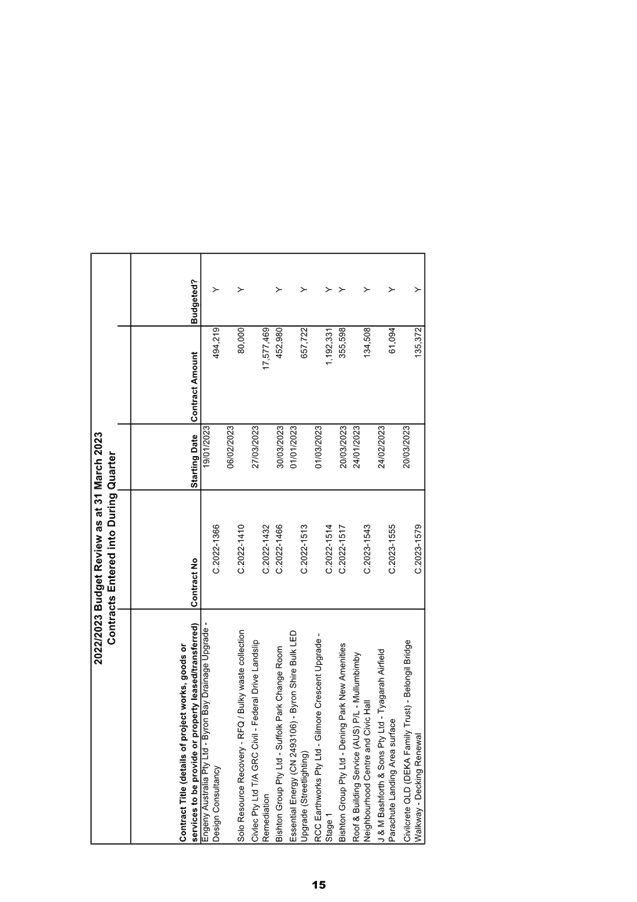

Contracts and Other Expenses - This report highlights any

contracts Council entered into during the January to March quarter that are

greater than $50,000.

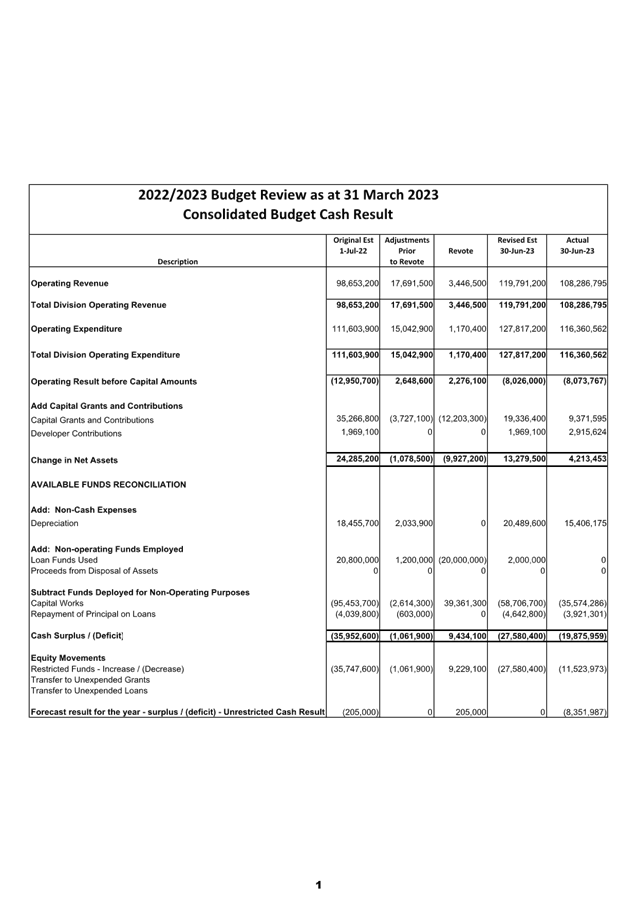

CONSOLIDATED RESULT

The following table provides

a summary of the overall Council budget on a consolidated basis inclusive of

all Funds’ budget movements for the 2022/2023 financial year projected to

30 June 2023 but revised as at 31 March 2023.

|

2022/2023 Budget Review Statement as at 31 March 2023

|

Original Estimate (Including Carryovers)

1/7/2022

|

Adjustments to 31 Mar 2023 including Resolutions*

|

Proposed 31 March 2023 Review Revotes

|

Revised Estimate 30/6/2023 at 31/03/2023

|

|

Operating

Revenue

|

98,653,200

|

17,691,500

|

3,446,500

|

119,791,200

|

|

Operating

Expenditure

|

111,603,900

|

15,042,900

|

1,170,400

|

127,817,200

|

|

Operating

Result – Surplus/Deficit

|

(12,950,700)

|

2,648,600

|

2,276,100

|

(8,026,000)

|

|

Add:

Capital Revenue

|

37,235,900

|

(3,727,100)

|

(12,203,300)

|

21,305,500

|

|

Change

in Net Assets

|

24,285,200

|

(1,078,500)

|

(9,927,200)

|

13,279,500

|

|

Add:

Non Cash Expenses

|

18,455,700

|

2,033,900

|

0

|

20,489,600

|

|

Add:

Non-Operating Funds Employed

|

20,800,000

|

1,200,000

|

(20,000,000)

|

2,000,000

|

|

Subtract:

Funds Deployed for Non-Operating Purposes

|

(99,493,500)

|

(3,217,300)

|

39,361,300

|

(63,349,500)

|

|

Cash

Surplus/(Deficit)

|

(35,952,600)

|

(1,061,900)

|

9,434,100

|

(27,580,400)

|

|

Restricted

Funds – Increase / (Decrease)

|

(35,747,600)

|

(1,061,900)

|

9,229,100

|

(27,580,400)

|

|

Forecast

Result for the Year – Surplus/(Deficit) – Unrestricted Cash

Result

|

(205,000)

|

0

|

205,000

|

0

|

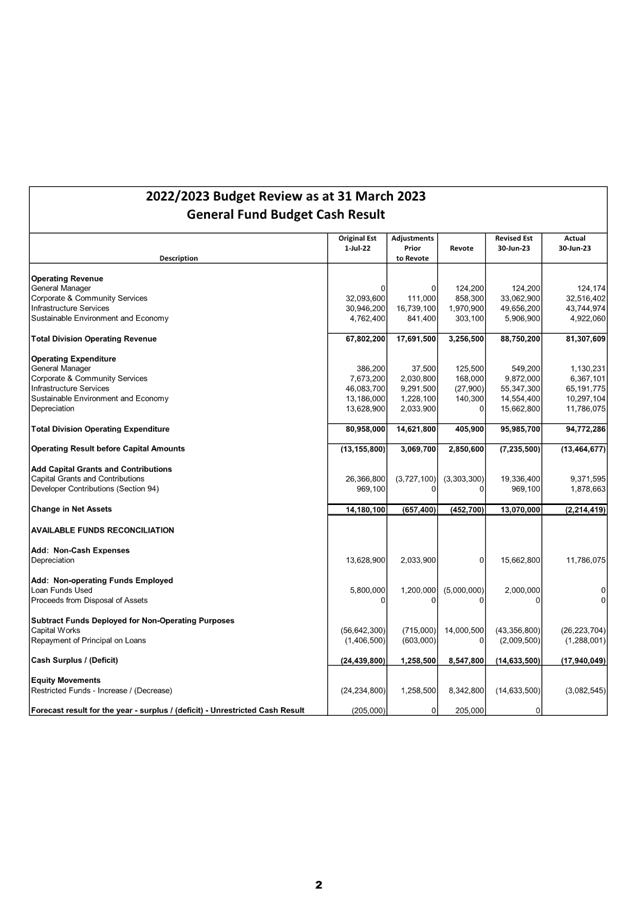

GENERAL FUND

In terms of the General Fund

projected Unrestricted Cash Result the following table provides a

reconciliation of the estimated position as at 31 March 2023:

|

Opening

Balance – 1 July 2022

|

$0

|

|

Plus

original budget movement and carryovers

|

(205,000)

|

|

Council

Resolutions July – September Quarter

|

(2,000)

|

|

September

QBR – increase/(decrease)

|

0

|

|

Council

Resolutions October – December Quarter

|

2,000

|

|

December

QBR – increase/(decrease)

|

0

|

|

Council

Resolutions January – March Quarter

|

0

|

|

Recommendations

within this Review – increase/(decrease)

|

205,000

|

|

Estimated

Unrestricted Cash Result Closing Balance – 30 June 2023

|

$0

|

The General Fund financial position overall has increased as

a result of this budget review, leaving the forecast cash result for the year

at $0. The proposed budget changes are detailed in Attachment 1 and summarised

further in this report below.

Council Resolutions

There were no council resolutions that affected the budget

result in the January to March quarter.

Budget Adjustments

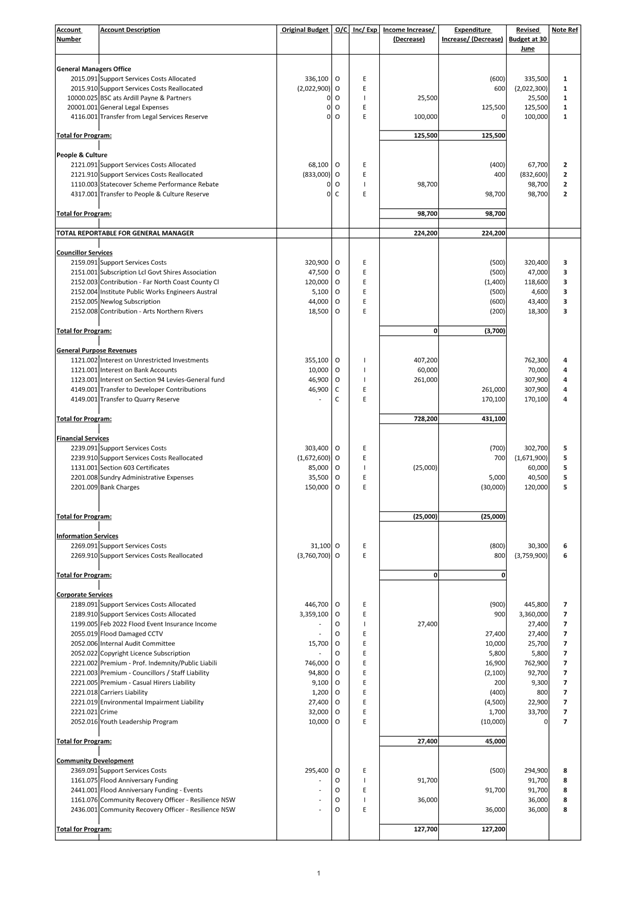

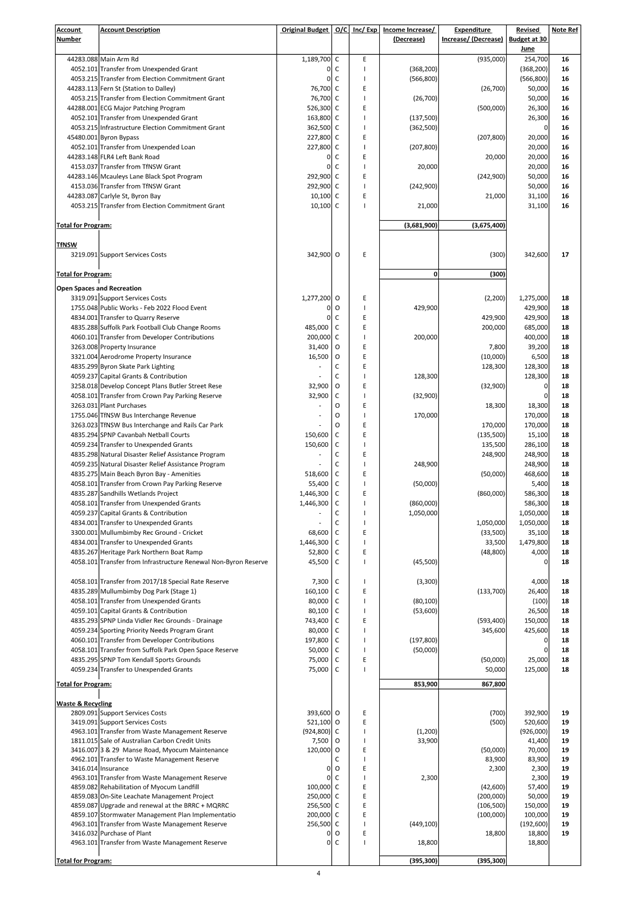

The budget adjustments

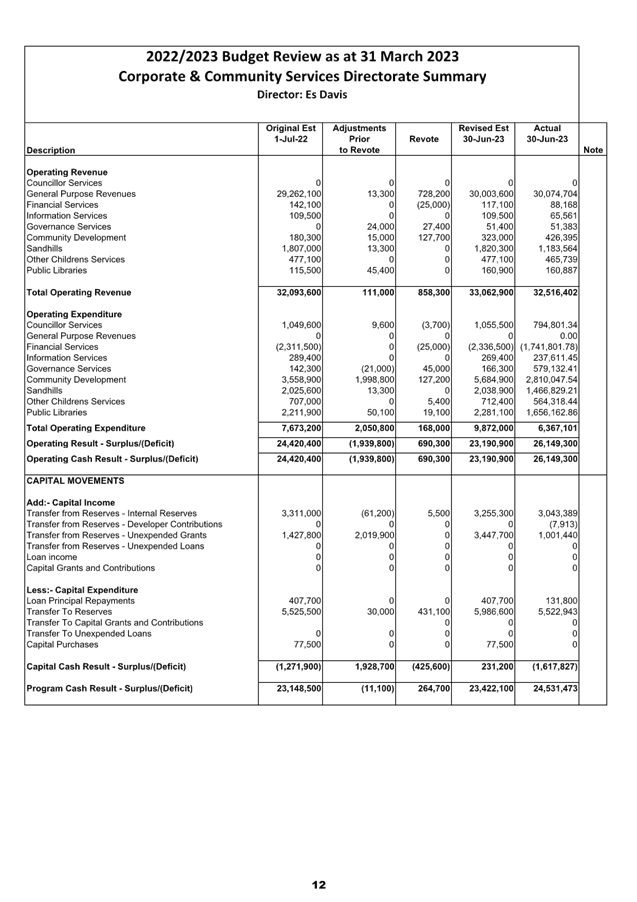

identified in Attachments 1 and 2 for the General Fund have been summarised by

Budget Directorate in the following table:

|

Budget

Directorate

|

Revenue Increase/

(Decrease) $

|

Expenditure Increase/

(Decrease) $

|

Accumulated Surplus (Working Funds) Increase/

(Decrease) $

|

|

General Manager

|

224,200

|

224,200

|

0

|

|

Corporate &

Community Services

|

858,300

|

593,600

|

264,700

|

|

Infrastructure

Services

|

(10,868,800)

|

(10,790,800)

|

(78,000)

|

|

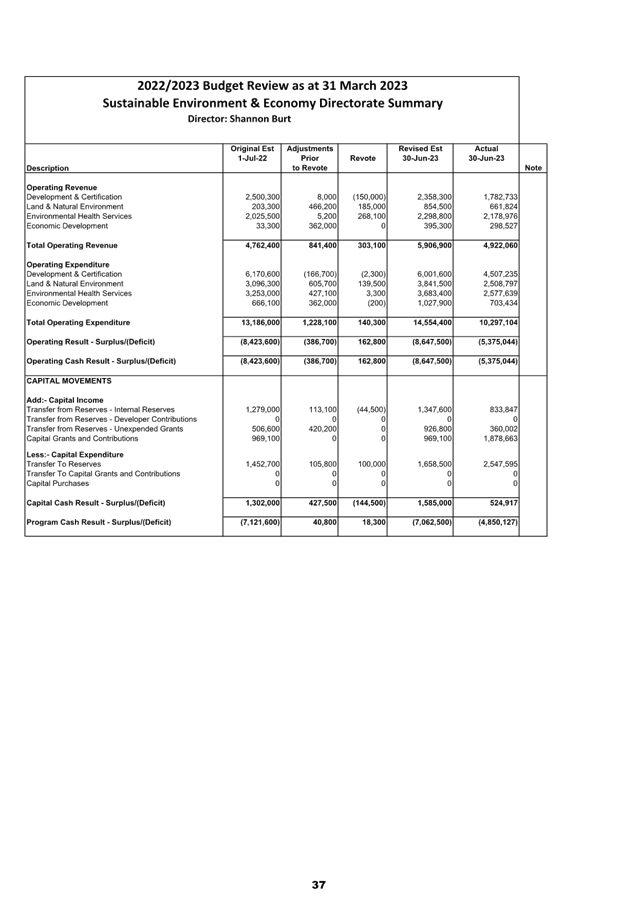

Sustainable

Environment & Economy

|

258,600

|

240,300

|

18,300

|

|

Total Budget

Movements

|

(9,527,700)

|

(9,732,700)

|

205,000

|

Budget Adjustment Comments

Within each of the Budget Directorates of the General Fund,

are a series of budget adjustments identified in detail at Attachment 1 and

2. More detailed notes on these are provided in Attachment 1 but in

summary the major additional items included are summarised below by Directorate

and are included in the overall budget adjustments table above.

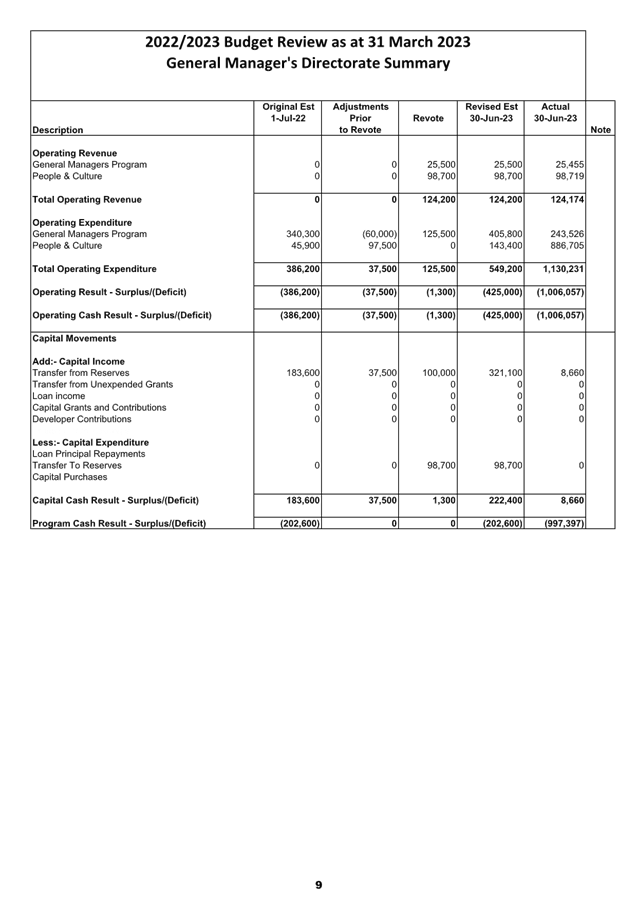

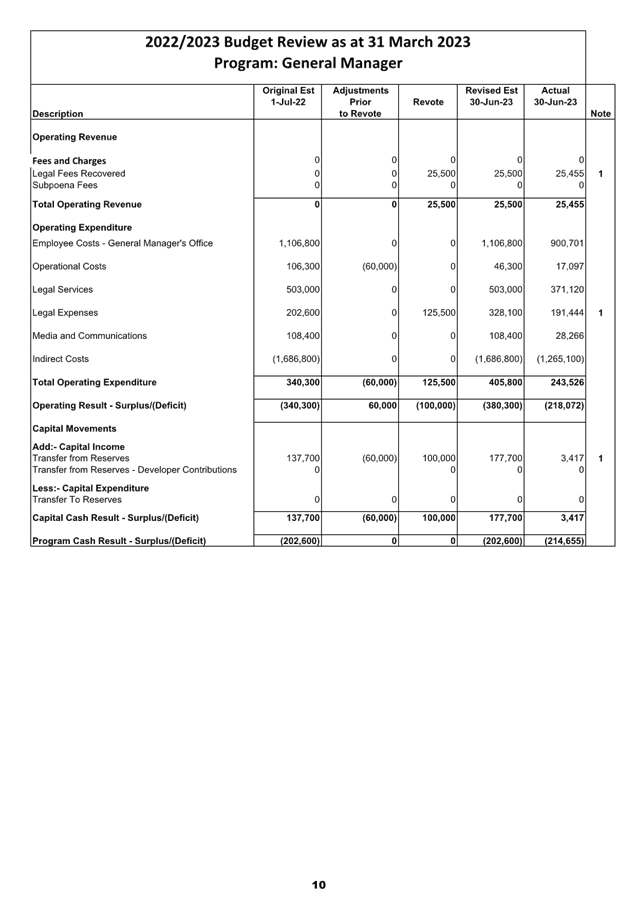

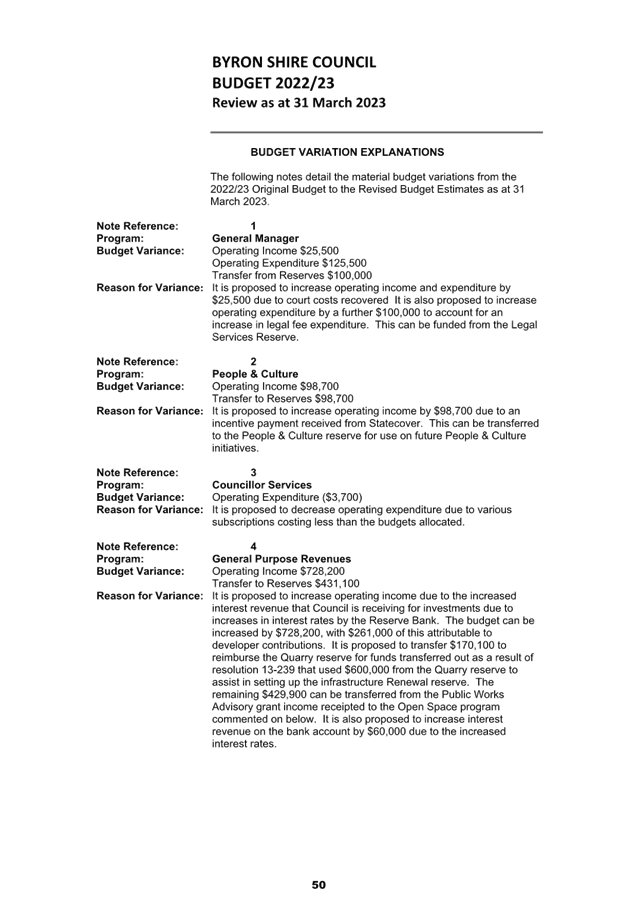

General Manager

· In

the General Managers program, it is proposed to increase operating expenditure

by $125,500 due to increased legal fee expenditure. This can be funded

from legal fees recovered ($25,500) and a transfer from the Legal Service

Reserve of $100,000.

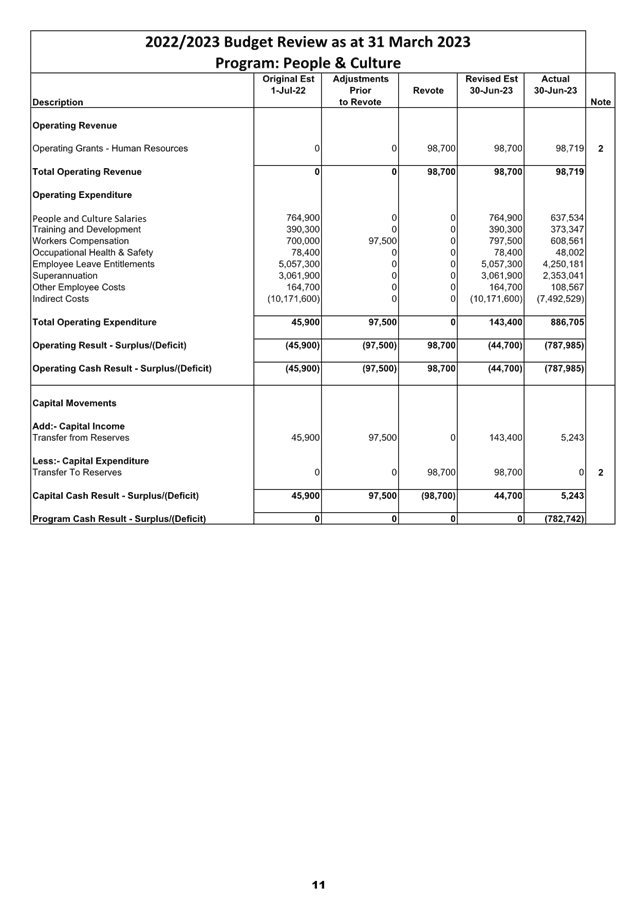

· In

the People & Culture program, it is proposed to increase operating income

by $98,700 due a rebate received from Statecover. This can be transferred

to the People & Culture Reserve for future use.

Corporate and Community Services

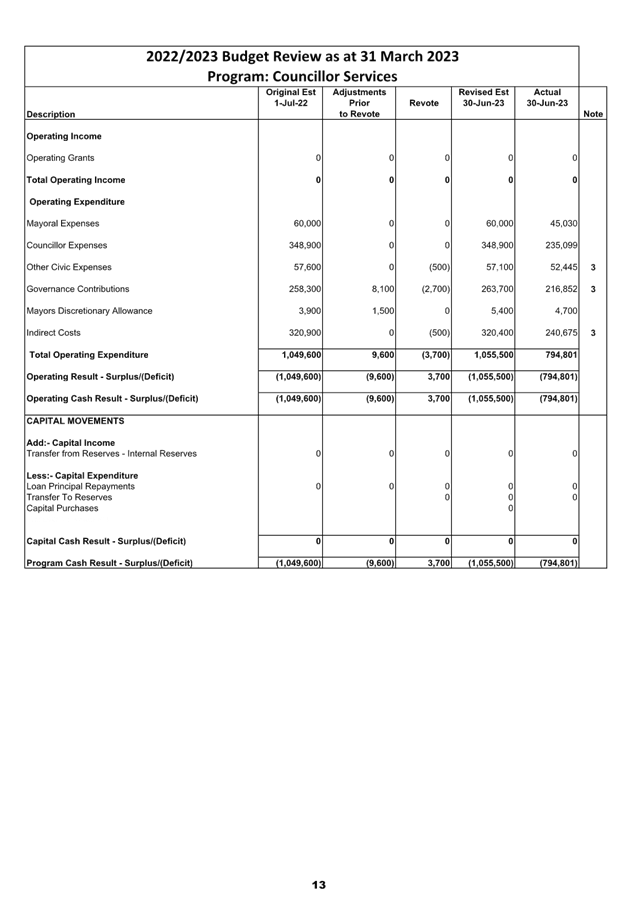

· In

the Councillor Services program, it is proposed to decrease operating

expenditure due to various subscriptions costing less than the budgets

allocated.

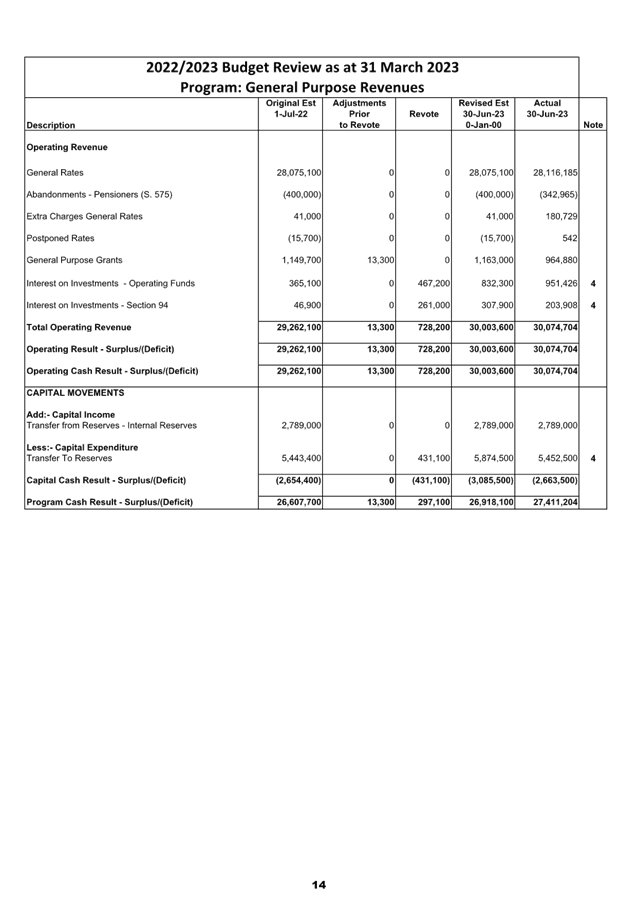

· In

the General Purpose Revenue program, it is proposed to increase operating

income due to the increased interest revenue that Council is receiving for

investments due to increases in interest rates by the Reserve Bank. The

budget can be increased by $728,200, with $261,000 of this attributable to

developer contributions. It is also proposed to increase interest on the

bank account by $60,000 due to the increased rates as well. Of note here

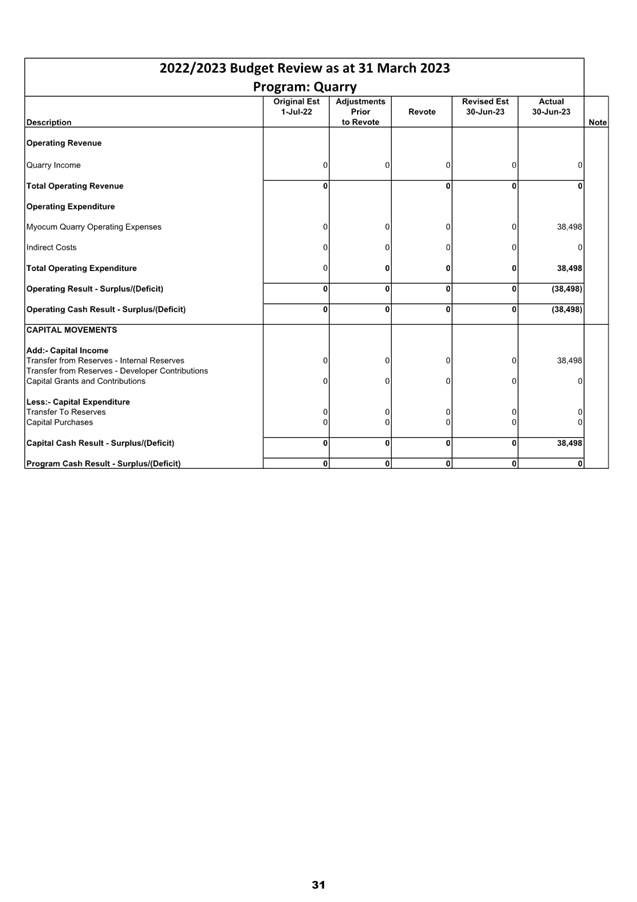

is also additional interest revenue being allocated to Reserve to repay in part

a long outstanding liability to the Quarry Reserve.

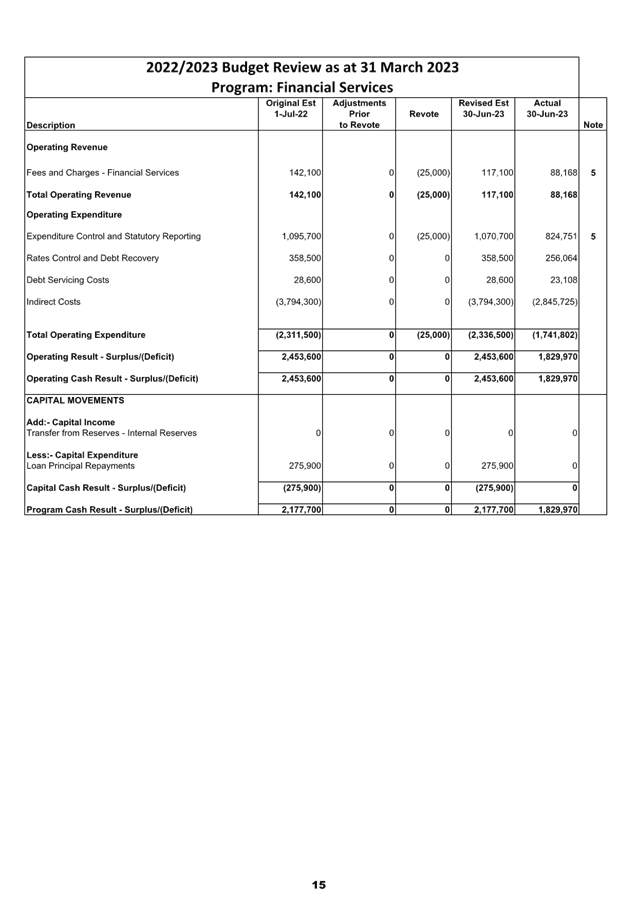

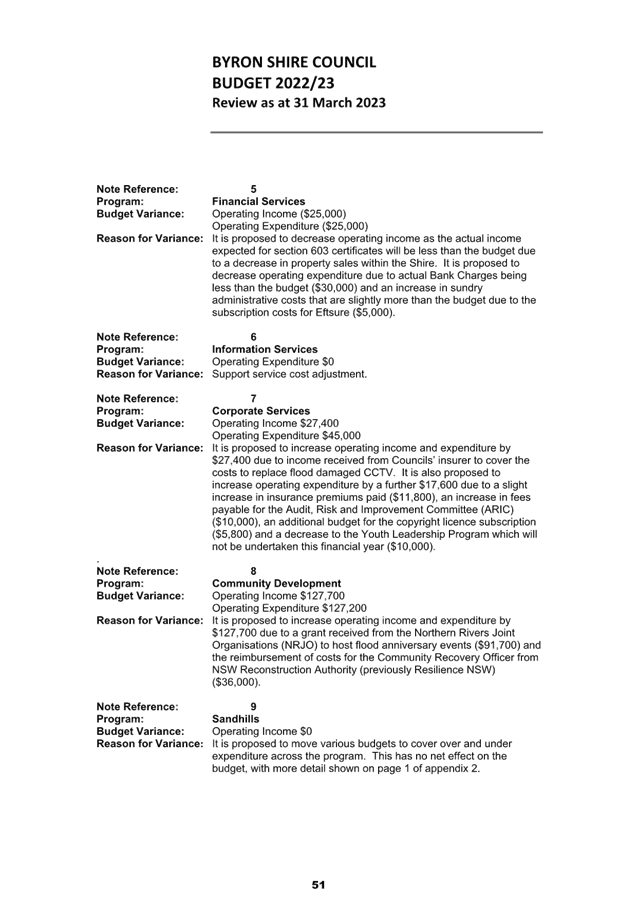

· In

the Financial Services program, it is proposed to decrease operating income as

the actual income expected for section 603 certificates will be less than the

budget due to a decrease in sales within the Shire. It is proposed to

decrease operating expenditure due to actual Bank Charges being less than the

budget ($30,000) and an increase in sundry administrative costs that are

slightly more than the budget due to the subscription costs for Eftsure

($5,000).

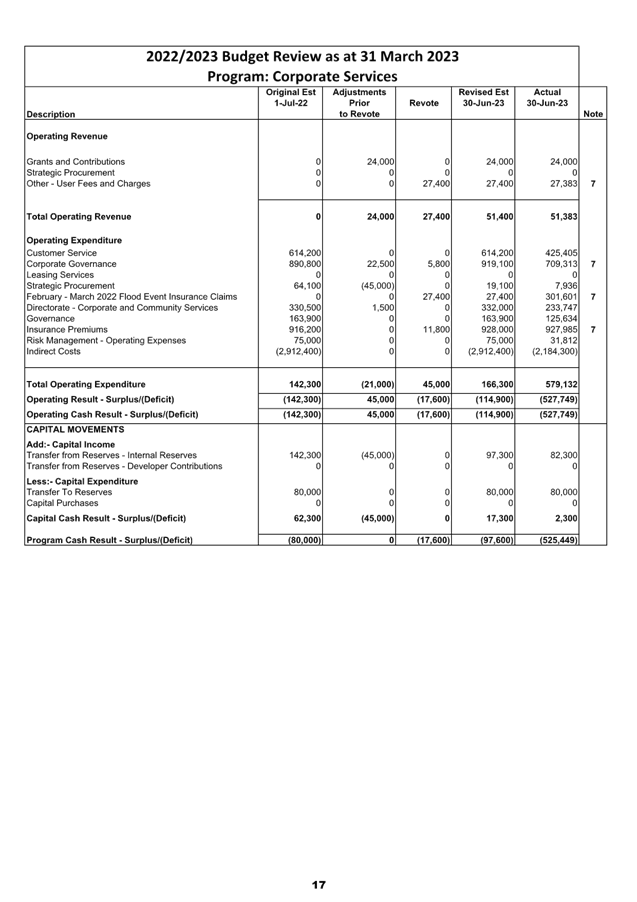

· In

the Corporate Services program, it is proposed to increase operating income and

expenditure by $27,400 due to income received from Councils’ insurer to

cover the costs to replace flood damaged CCTV. It is also proposed to

increase operating expenditure by a further $17,600 due to a slight increase in

insurance premiums paid ($11,800), an increase in fees payable for the Audit,

Risk and Improvement Committee (ARIC) ($10,000), an additional budget for the

copyright licence subscription ($5,800) and a decrease to the Youth Leadership

Program which will not be undertaken this financial year ($10,000).

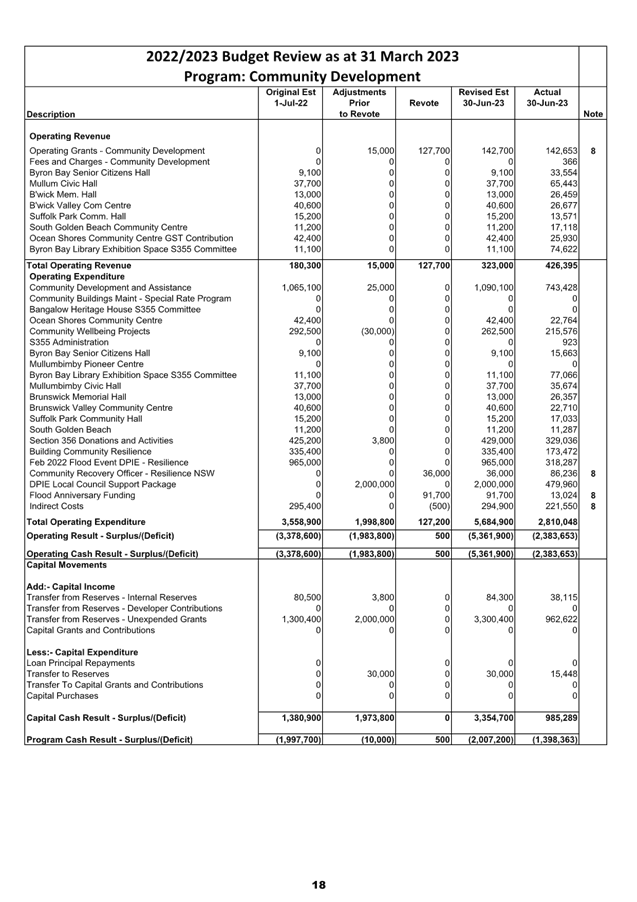

· In

the Community Development program, it is proposed to increase operating income

and expenditure by $127,700 due to a grant received from the Northern Rivers

Joint Organisations (NRJO) to host flood anniversary events ($91,700) and the

reimbursement of costs for the Community Recovery Officer from NSW

Reconstruction Authority (previously Resilience NSW) ($36,000).

· In

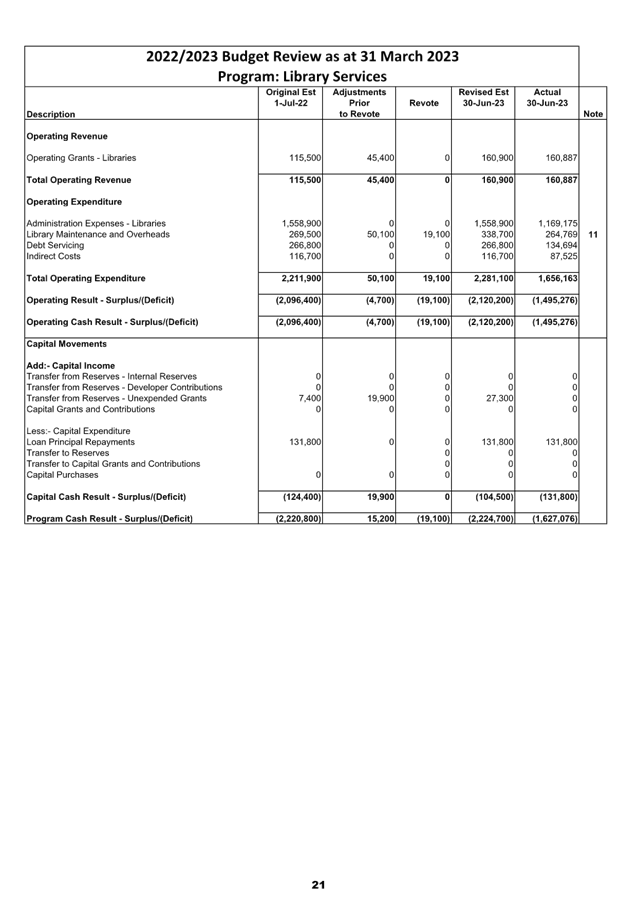

the Public Libraries program, it is proposed to increase operating expenditure

due to a separate budget being added for building insurance that was previously

charged to the Facilities Management Budget Program.

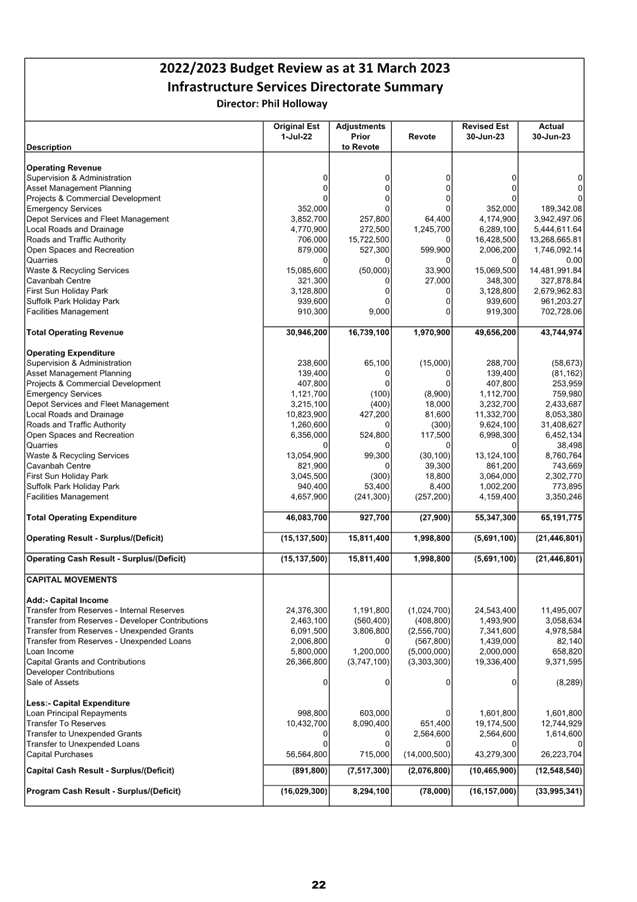

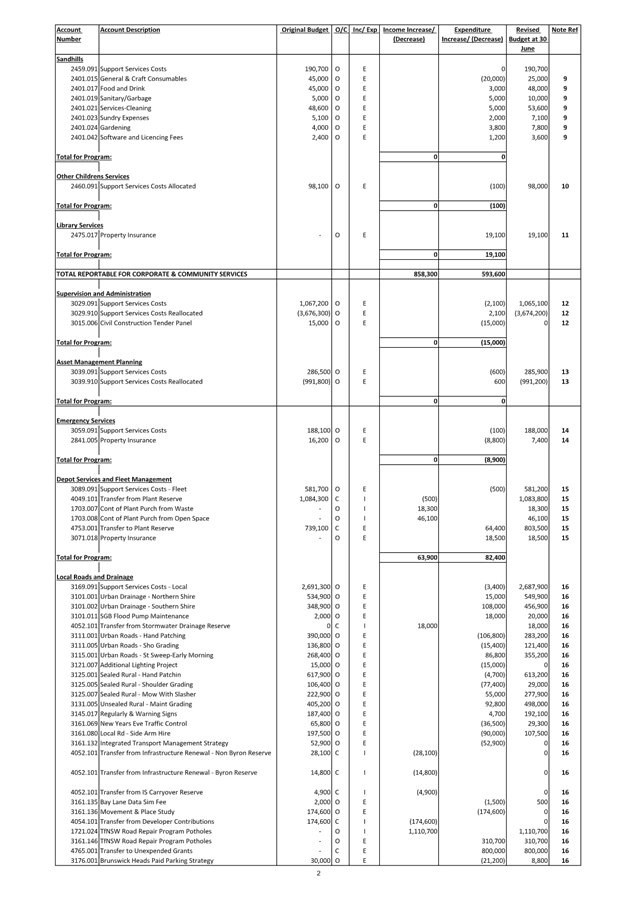

Infrastructure Services

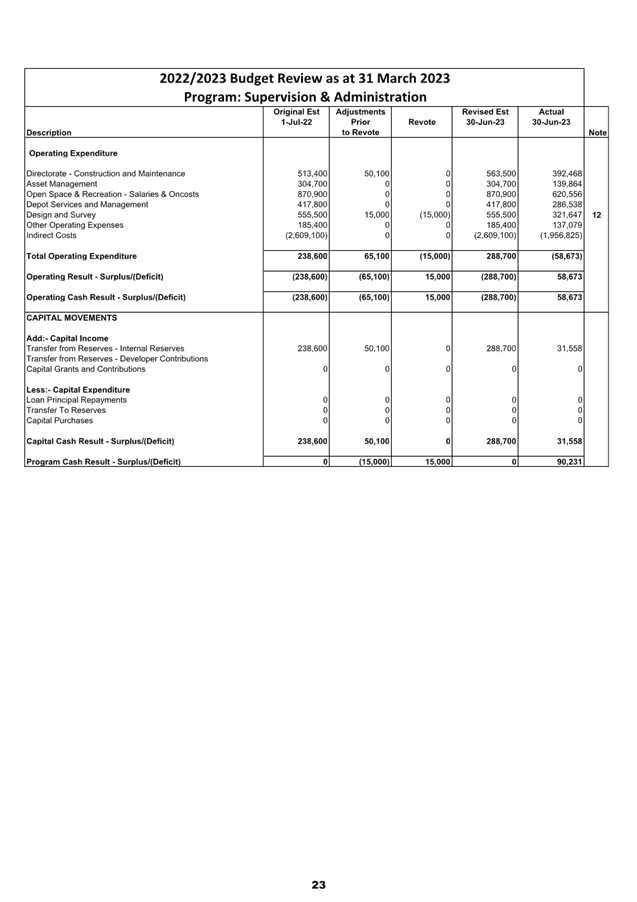

· In the Supervision

and Administration program, it is proposed to decrease operating expenditure

due to the budget allocated for the Civil Constriction Tender Panel no longer

being required.

· In the Depot Services

program, it is proposed to increase operating income as a contribution to the

Plant reserve is required from the Waste ($18,300) and Open Space ($46,100)

programs due to the Plant fund contributing to the costs for vehicles within

those programs. There are offsetting costs in the Waste and Open Space

programs. Operating expenditure increased due to a budget required for

building insurance ($18,500).

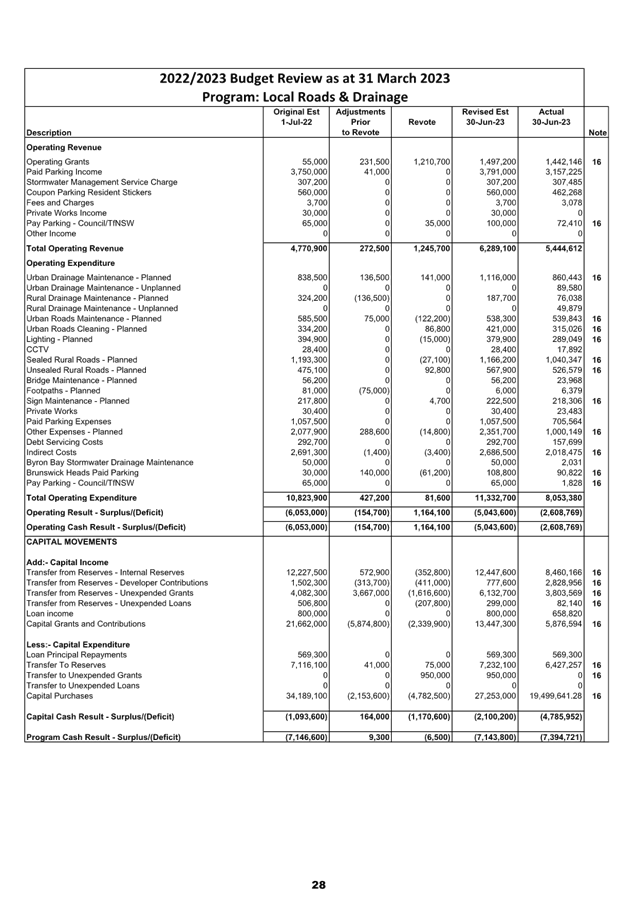

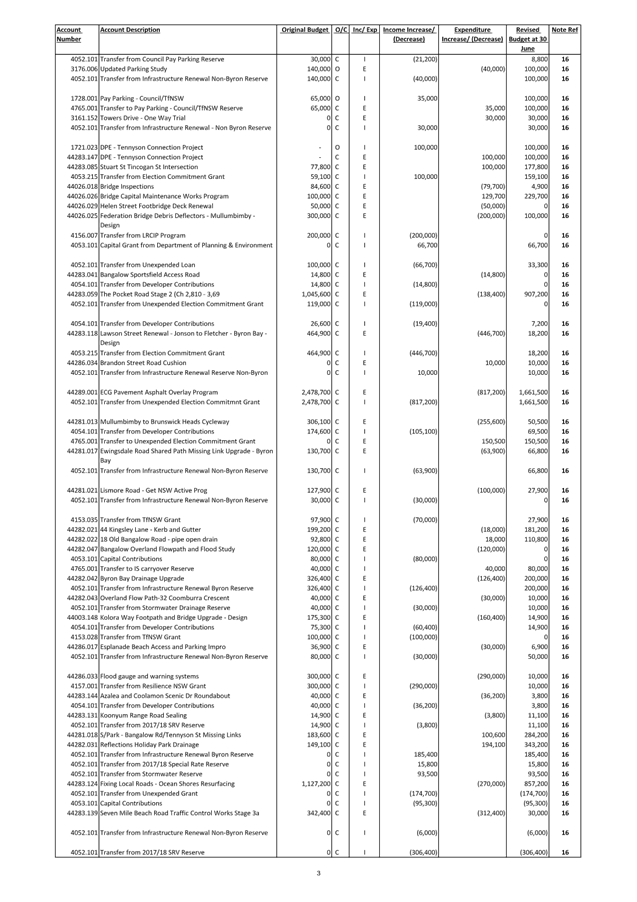

· In the Local Roads and

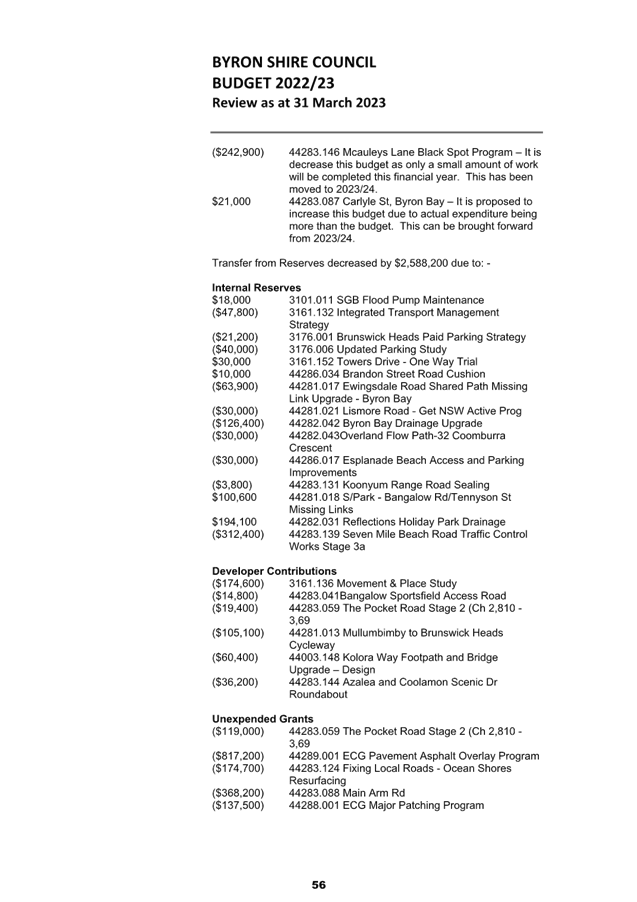

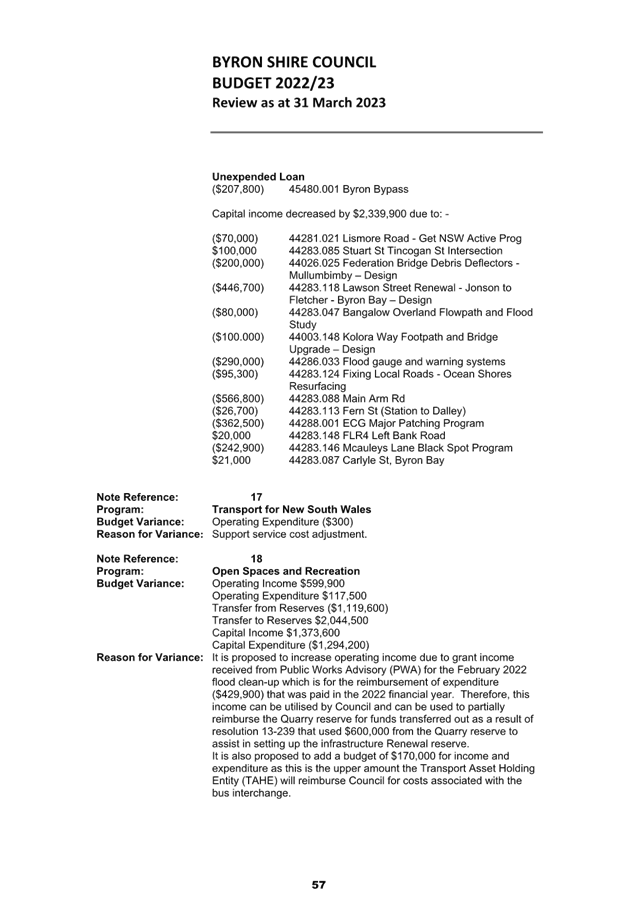

Drainage program, there are a number of adjustments outlined under Note 16 on

pages 53 to 57 in the Budget Variations explanations section of Attachment 1. Further

disclosure is included in the second, third and fourth pages of Attachment 2

under the budget program heading Local Roads and Drainage.

· In

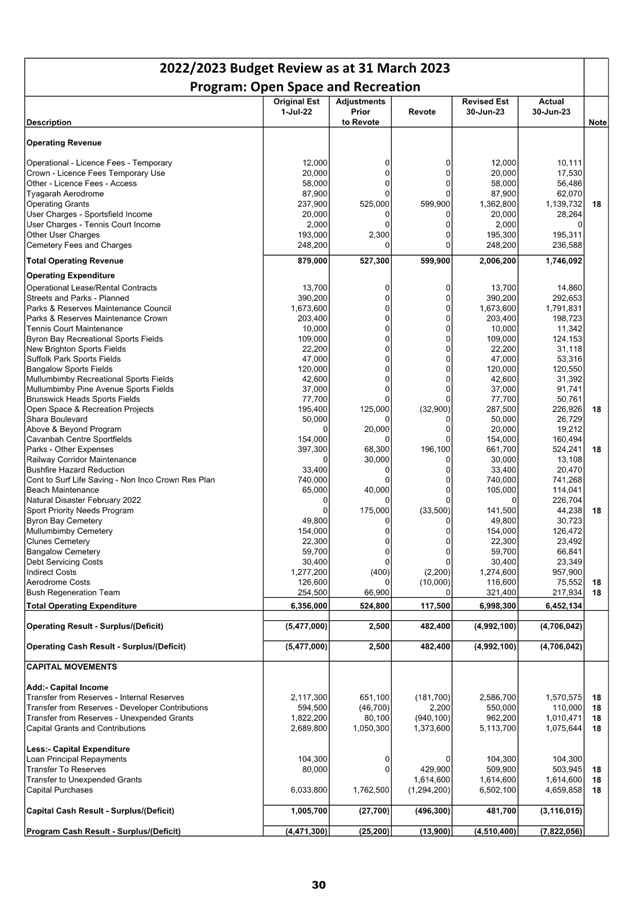

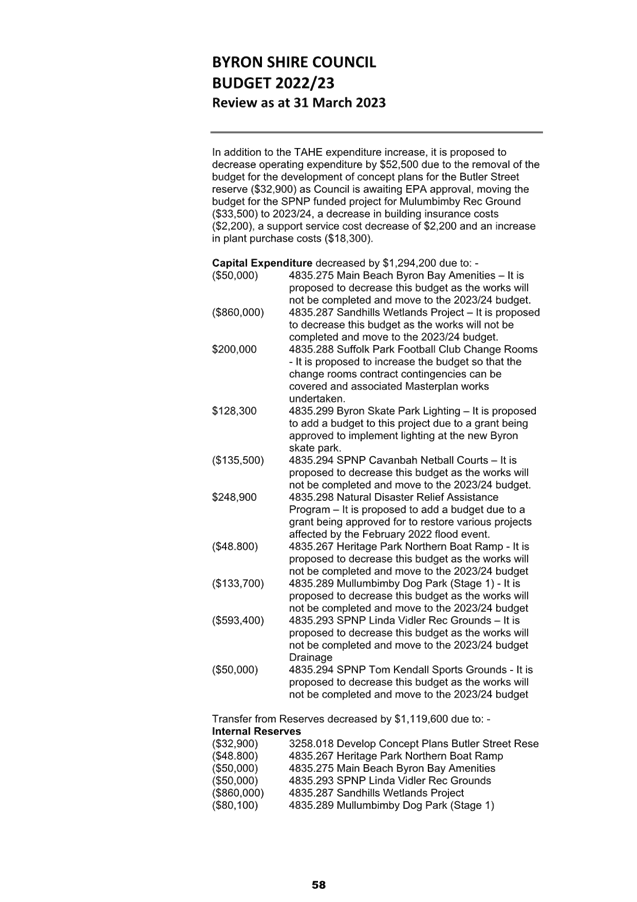

the Open Space and Recreation program, there are a number of adjustments outlined

under Note 18 on pages 57 to 59 in the Budget Variations explanations section

of Attachment 1. Further disclosure is included in the fourth page of

Attachment 2 under the budget program heading Open Space &

Recreation. Of note here also is funds received from Public Works

Advisory for flood recovery expenditure incurred last financial year and their

treatment.

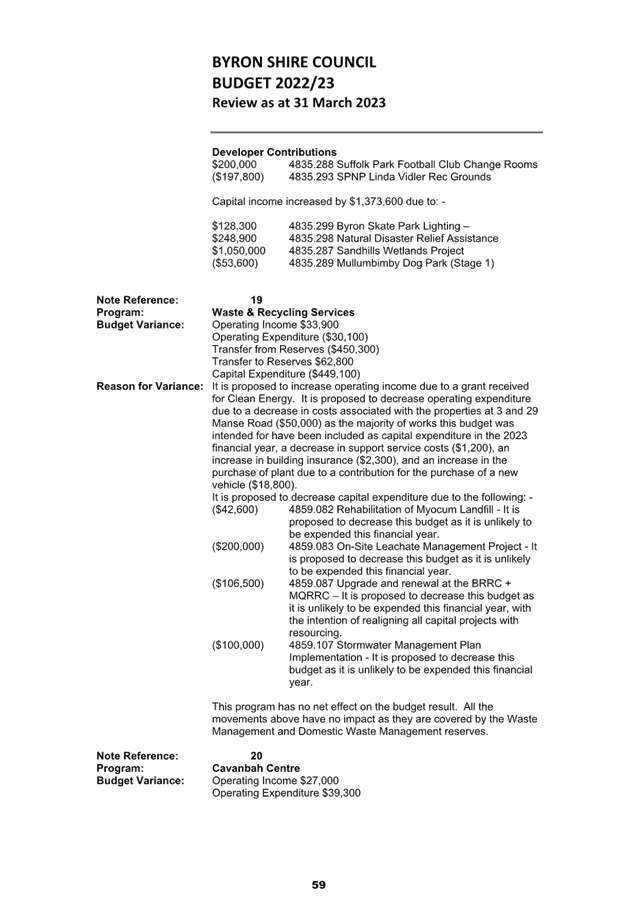

· In

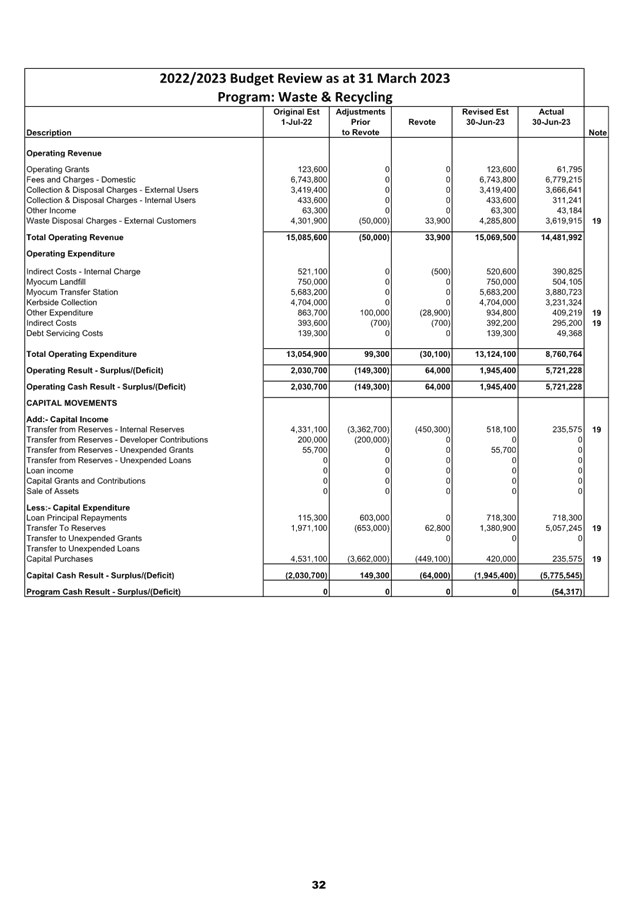

the Waste & Recycling program, it is proposed to increase operating income

due to a grant received for Clean Energy. It is proposed to decrease

operating expenditure due to a decrease in costs associated with the properties

at 3 and 29 Manse Road ($50,000) as the majority of works this budget was

intended for have been included as capital expenditure in the 2024 financial

year, a decrease in support service costs ($1,200), an increase in building

insurance ($2,300), and an increase in the purchase of plant due to a

contribution for the purchase of a new vehicle ($18,800). It is proposed

to decrease capital expenditure due to the Rehabilitation of Myocum Landfill

($42,600), the On-Site Leachate Management Project ($200,000), Upgrade and

renewal at the BRRC + MQRRC ($106,500) and the Stormwater Management Plan

($100,000) not being completed this financial year and being moved to 2023/04.

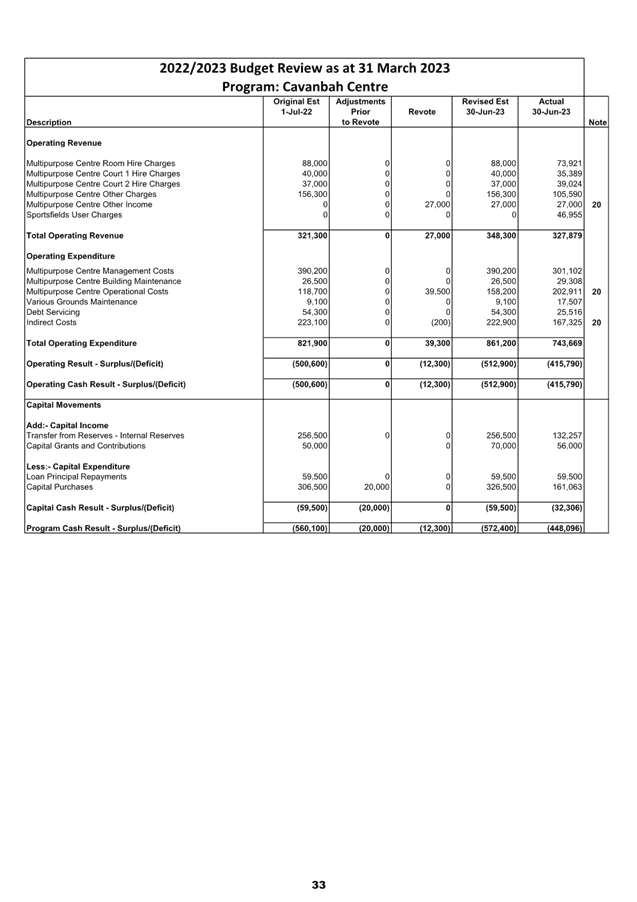

· In

the Cavanbah Centre program, it is proposed to increase operating income and

expenditure by $27,000 due to the 2023 Active Fest being held at the

centre. It is also proposed to increase operating expenditure by a

further $12,500 due to building insurance costs

· In

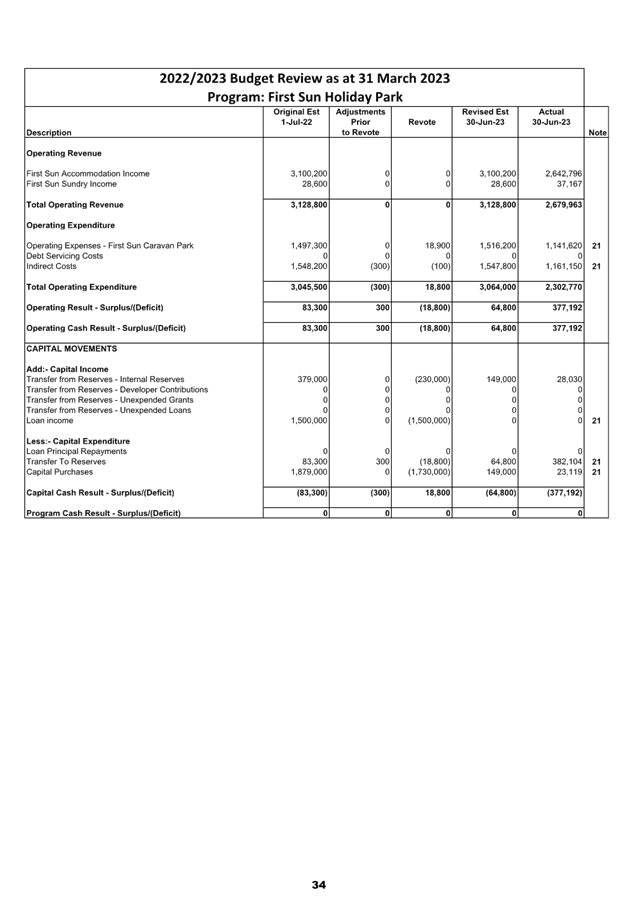

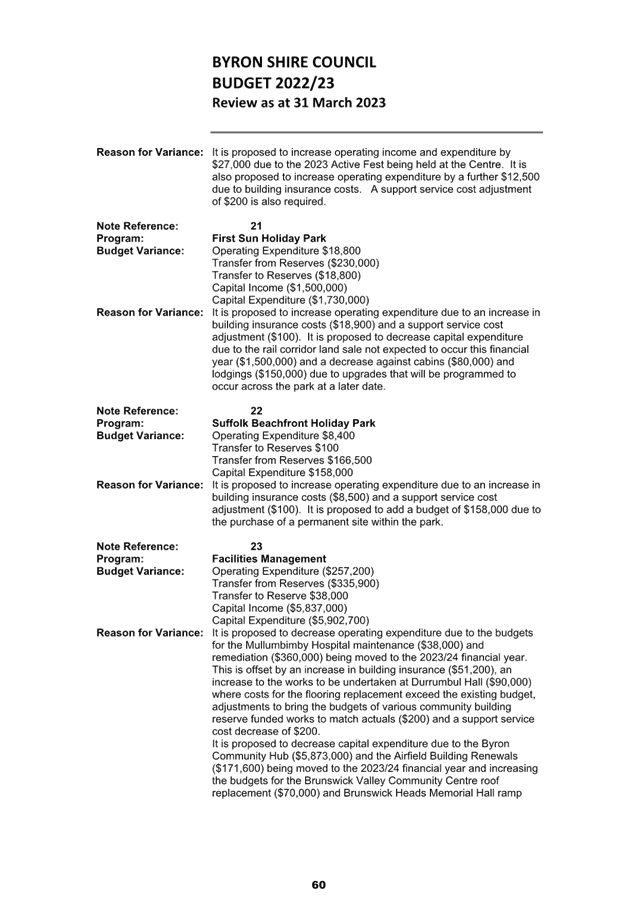

the First Sun Holiday Park program, it is proposed to increase operating

expenditure due to an increase in building insurance costs ($18,900) and a

support service cost adjustment ($100). It is proposed to decrease

capital expenditure due to the rail corridor land purchase not expected to

occur this financial year ($1,500,000) and a decrease against cabins ($80,000)

and lodgings ($150,000) due to upgrades that will be programmed to occur across

the park at a later date.

· In

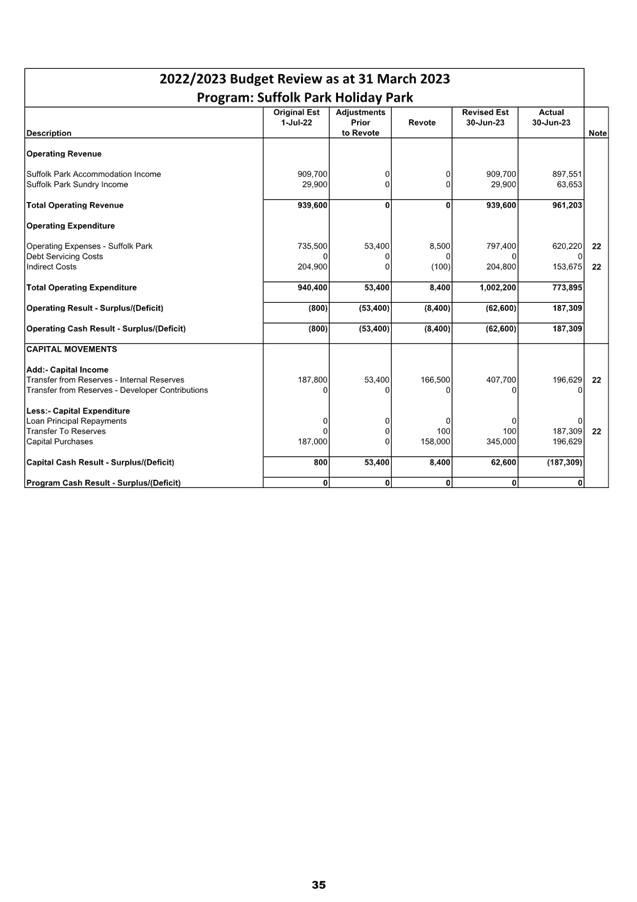

the Suffolk Park Holiday Park program, it is proposed to increase operating

expenditure due to an increase in building insurance costs ($8,500) and a

support service cost adjustment ($100). It is proposed to add a budget of

$158,000 due to the purchase of a permanent site within the park.

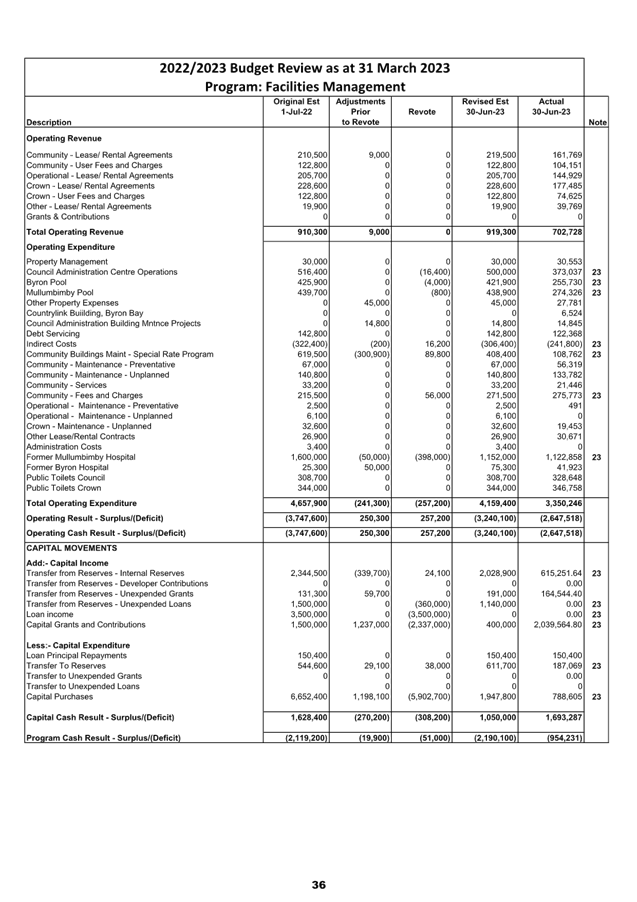

· In

the Facilities Management program, it is proposed to decrease operating

expenditure due to the budgets for the Mullumbimby Hospital maintenance

($38,000) and remediation ($360,000) being moved to the 2023/24 financial

year. This is offset by an increase in building insurance ($51,200), an

increase to the works to be undertaken at Durrumbul Hall ($90,000) where costs

for the flooring replacement exceed the existing budget, adjustments to bring

the budgets of various community building reserve funded works to match actuals

($200) and a support service cost decrease of $200.

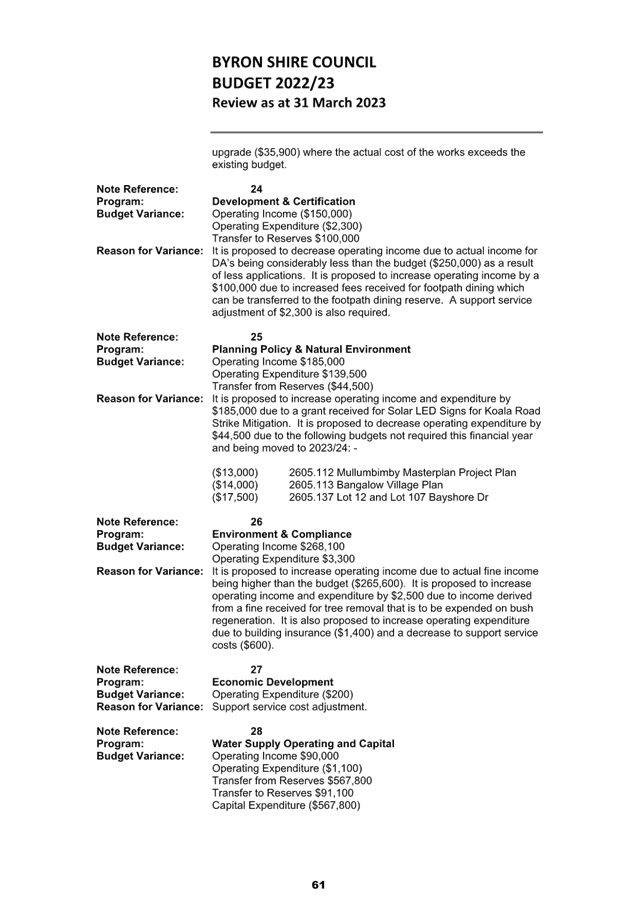

It is proposed to decrease capital expenditure due to the

Byron Community Hub ($5,873,000) and the Airfield Building Renewals ($171,600)

being moved to the 2023/24 financial year and increasing the budgets for the

Brunswick Valley Community Centre roof replacement ($70,000) and Brunswick

Heads Memorial Hall ramp upgrade ($35,900) where the actual cost of the works

exceeds the existing budget.

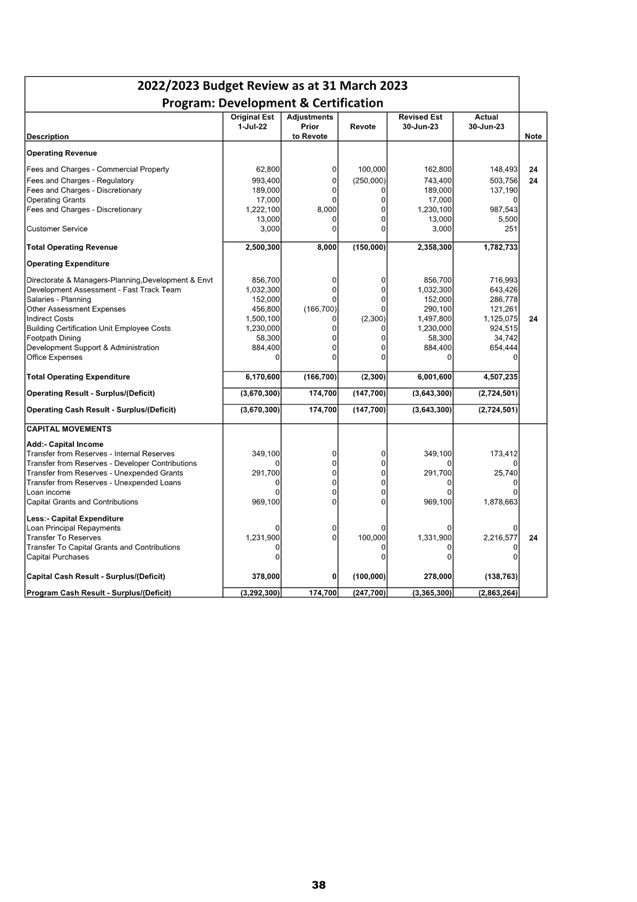

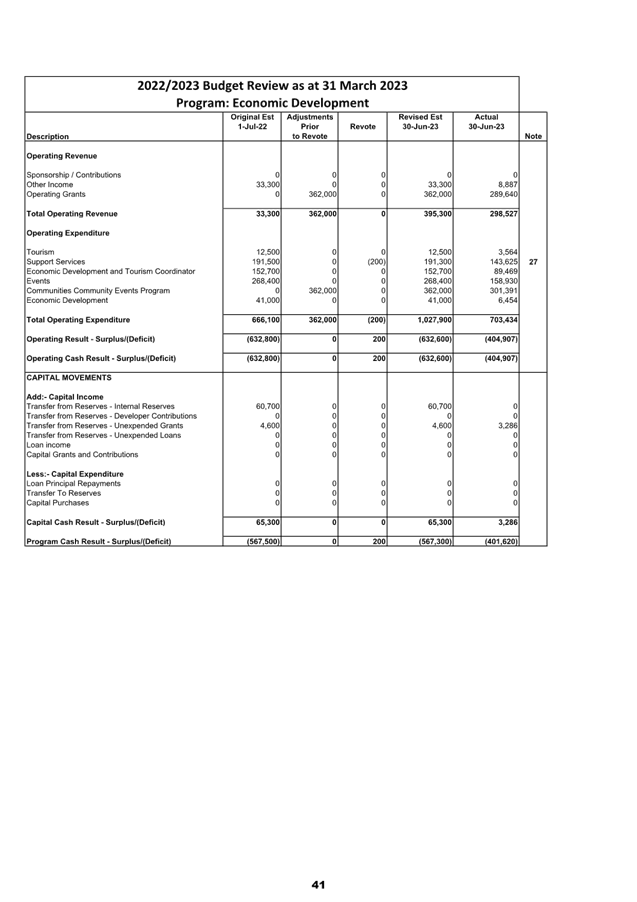

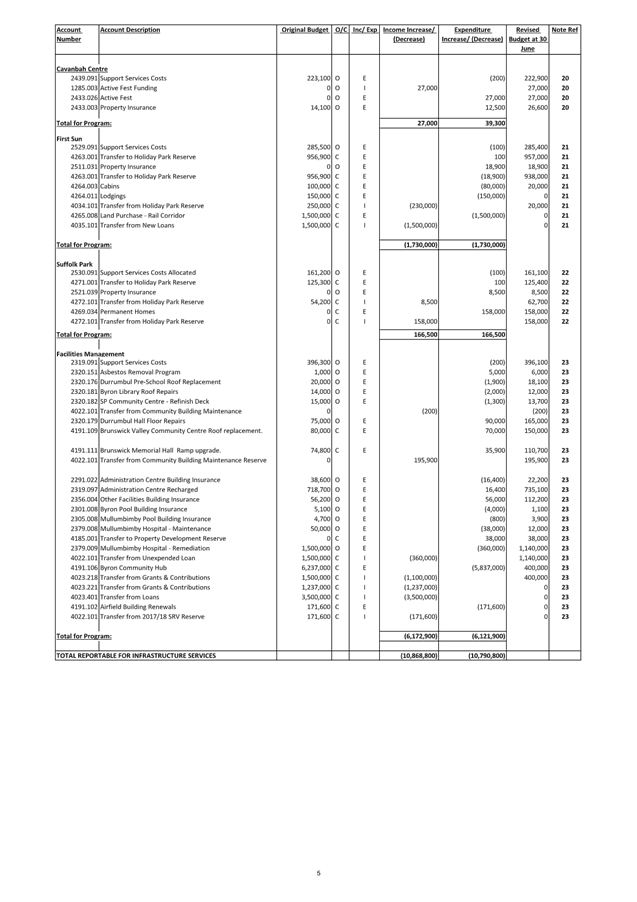

Sustainable Environment and Economy

· In

the Development & Certification program, it is proposed to decrease

operating income due to actual income for DA’s being considerably less

than the budget ($250,000) as a result of less applications. It is

proposed to increase operating income by $100,000 due to increased fees

received for footpath dining which can be transferred to the footpath dining

reserve

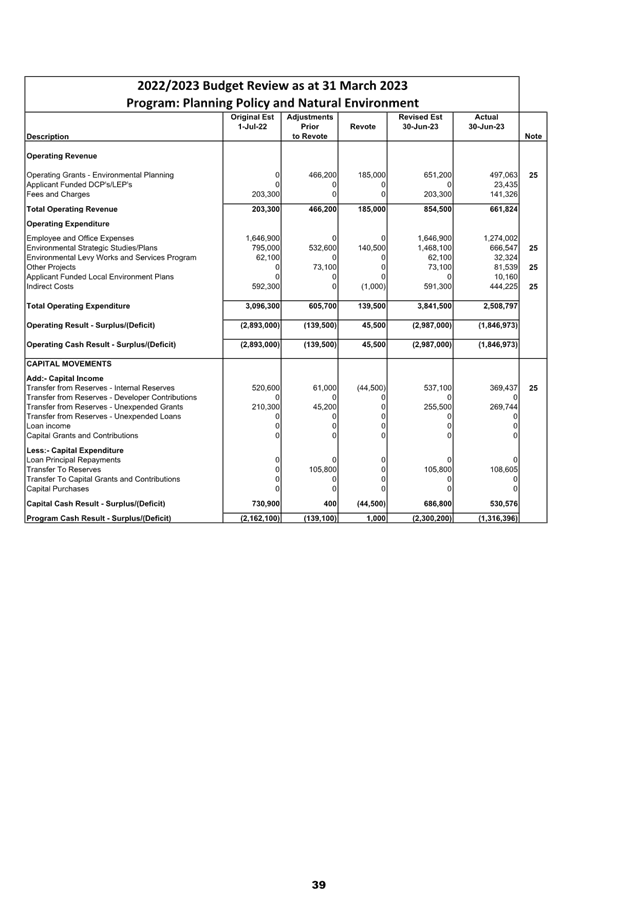

· In

the Planning Policy & Natural Environment program, it is proposed to

increase operating income and expenditure by $185,000 due to a grant received

for Solar LED Signs for Koala Road Strike Mitigation. It is proposed to

decrease operating expenditure by $44,500 due to the Mullumbimby Masterplan

Project Plan ($13,000), the Bangalow Village Plan ($14,000) and Lot 12 and Lot

107 Bayshore Dr ($17,500) budget being moved to 2023/24.

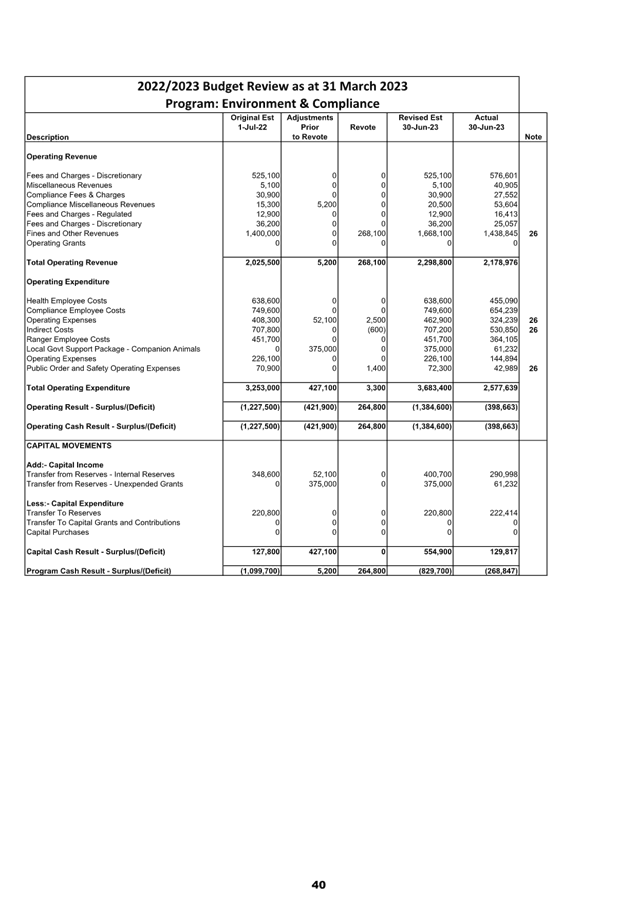

· In

the Environment & Compliance program, it is proposed to increase operating

income due to actual fine income being higher than the budget ($265,600).

It is proposed to increase operating income and expenditure by $2,500 due to

income derived from a fine received for tree removal that is to be expended on

bush regeneration. It is also proposed to increase operating expenditure

due to building insurance ($1,400).

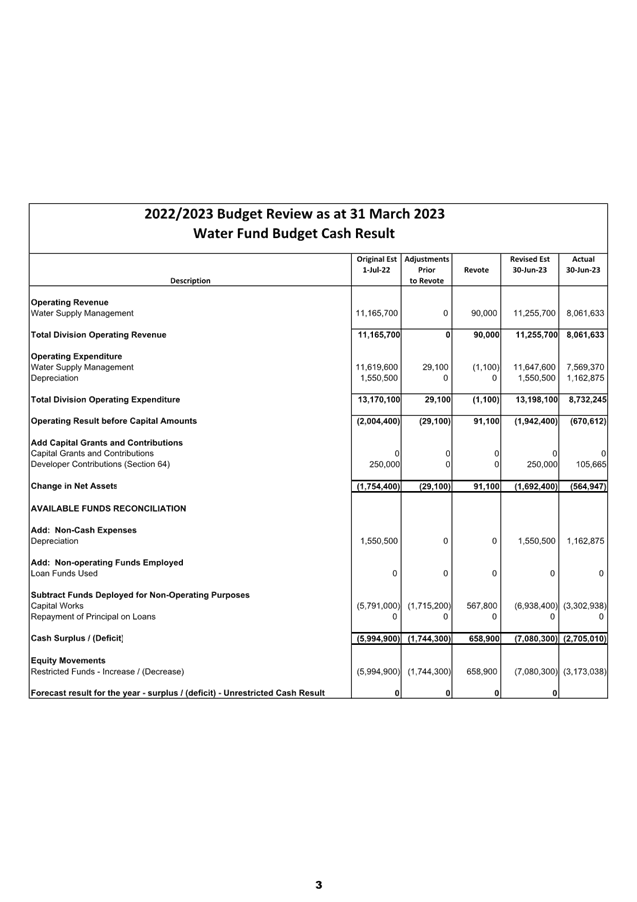

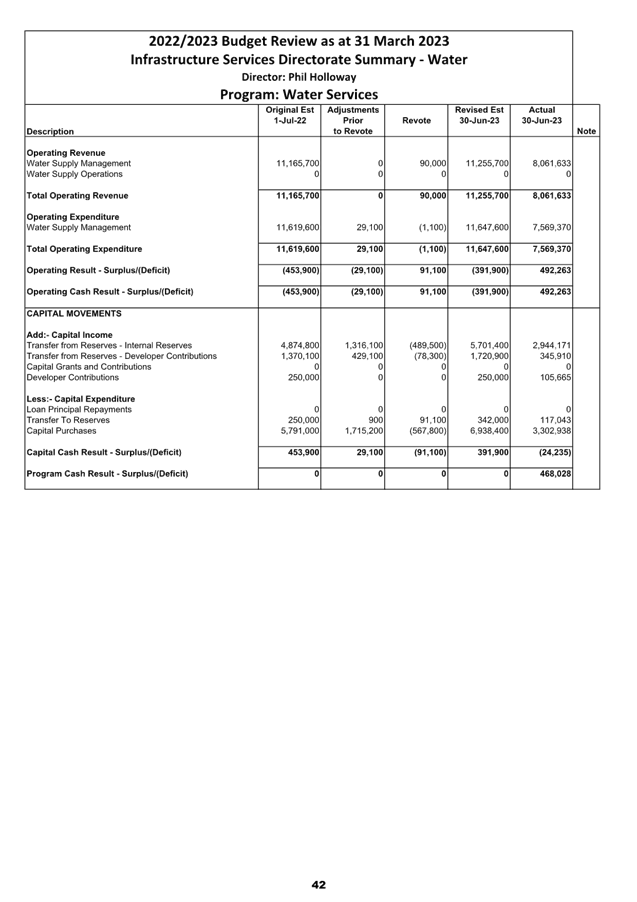

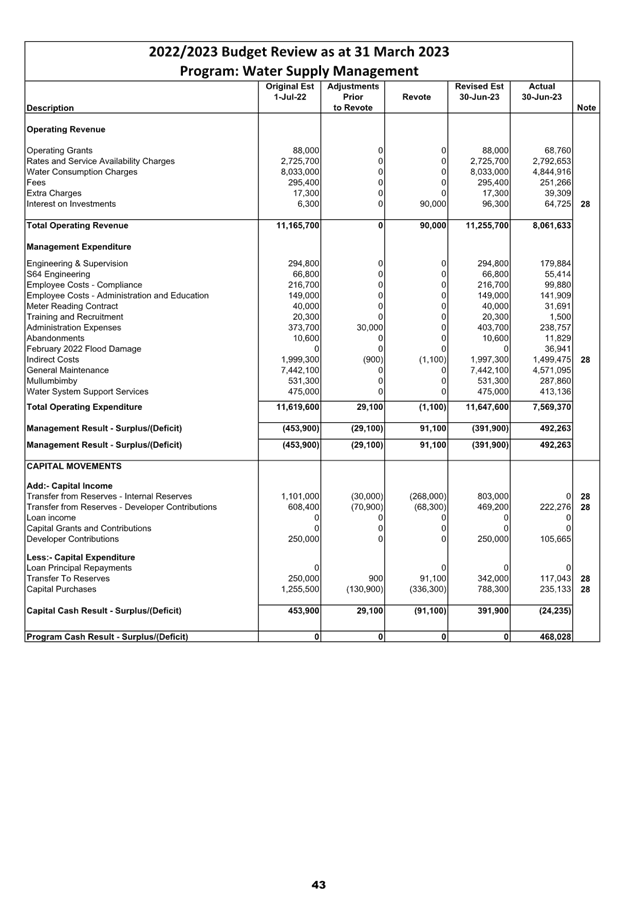

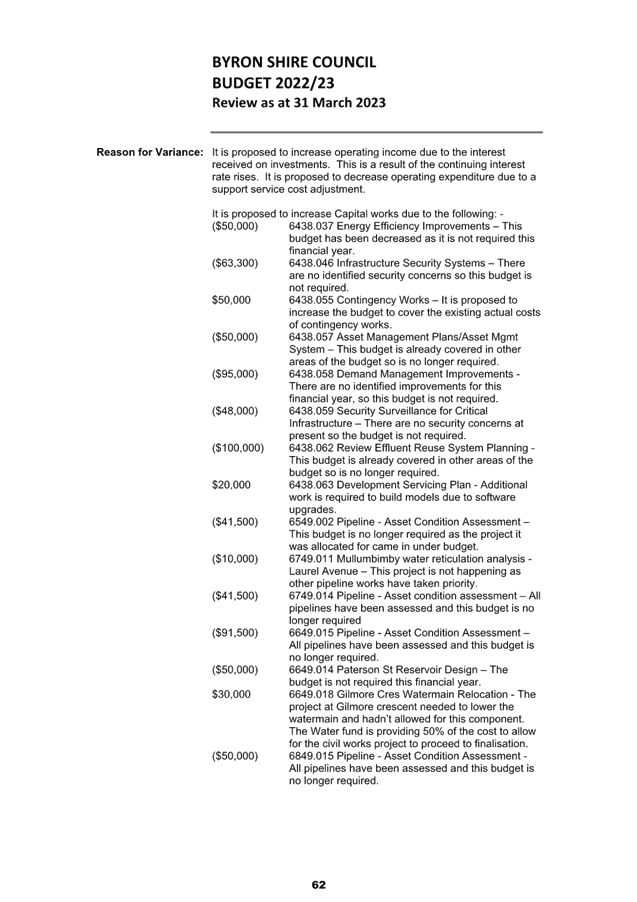

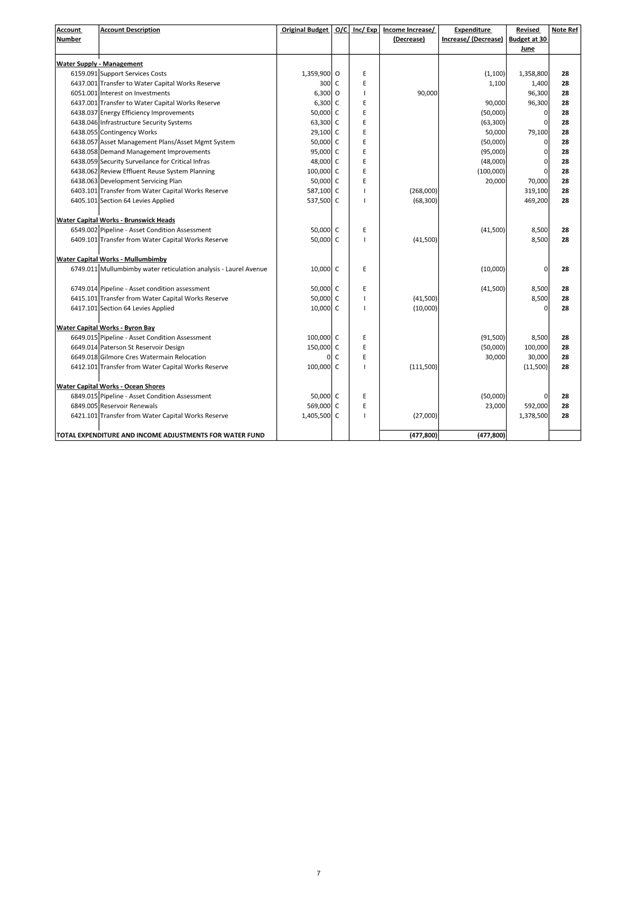

WATER FUND

After

completion of the 2021/2022 Financial Statements the Water Fund as at 30 June

2022 has a capital works reserve of $8,953,800 and held $1,844,900 in

section 64 developer contributions.

The estimated Water Fund reserve

balances as at 30 June 2023, and forecast in this Quarter Budget Review, are

derived as follows:

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2021

|

$8,953,800

|

|

Plus original budget reserve

movement

|

(4,874,800)

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(1,036,100)

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(279,100)

|

|

Resolutions January - March

Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review Adjustments

– increase / (decrease)

|

580,600

|

|

Forecast Reserve Movement for

2022/2023 – Increase / (Decrease)

|

(5,609,400)

|

|

Estimated Reserve Balance at 30

June 2023

|

$3,344,400

|

Section

64 Developer Contributions

|

Opening

Reserve Balance at 1 July 2022

|

$1,844,900

|

|

Plus

original budget reserve movement

|

(1,120,100)

|

|

Resolutions

July - September Quarter – increase / (decrease)

|

0

|

|

September

Quarterly Review Adjustments – increase / (decrease)

|

(500,000)

|

|

Resolutions

October - December Quarter – increase / (decrease)

|

0

|

|

December

Quarterly Review Adjustments – increase / (decrease)

|

70,900

|

|

Resolutions

January - March Quarter – increase / (decrease)

|

0

|

|

March

Quarterly Review Adjustments – increase / (decrease)

|

78,300

|

|

Forecast

Reserve Movement for 2022/2023 – Increase / (Decrease)

|

(1,470,900)

|

|

Estimated

Reserve Balance at 30 June 2023

|

$374,000

|

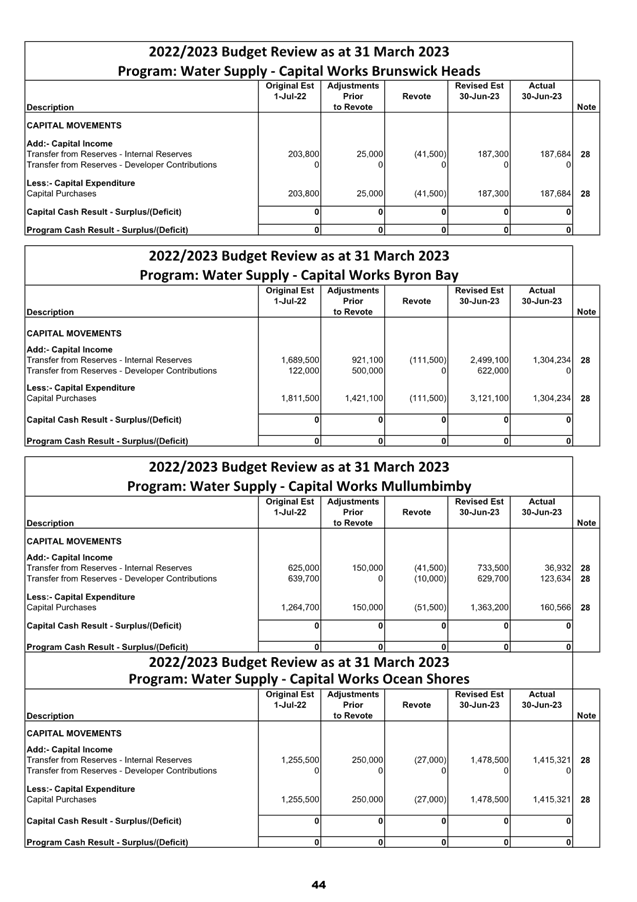

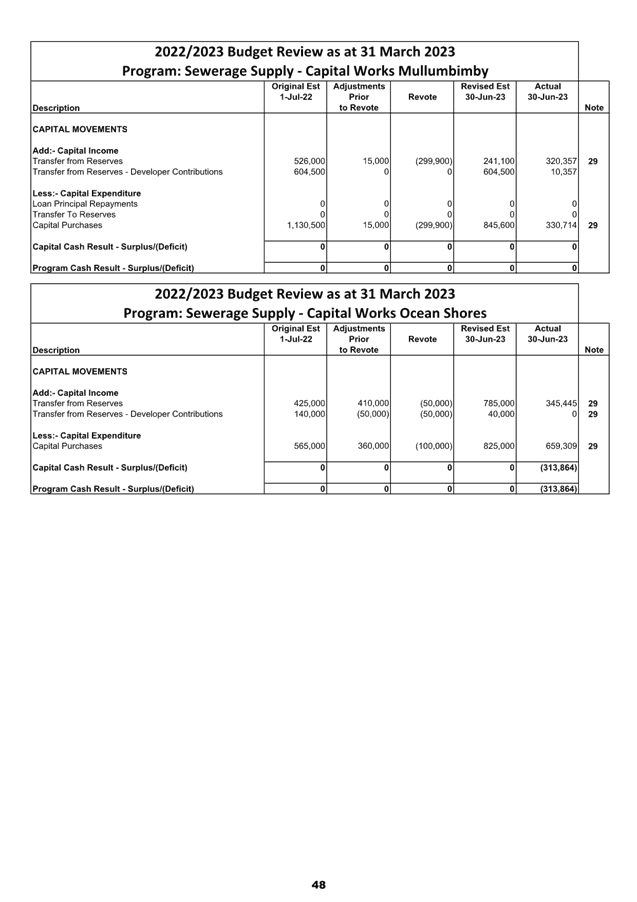

Movements for Water Fund can be seen in Attachment 1 with a

proposed estimated increase to reserves (including S64 Contributions) overall

of $658,900 from the 31 March 2023 Quarter Budget Review.

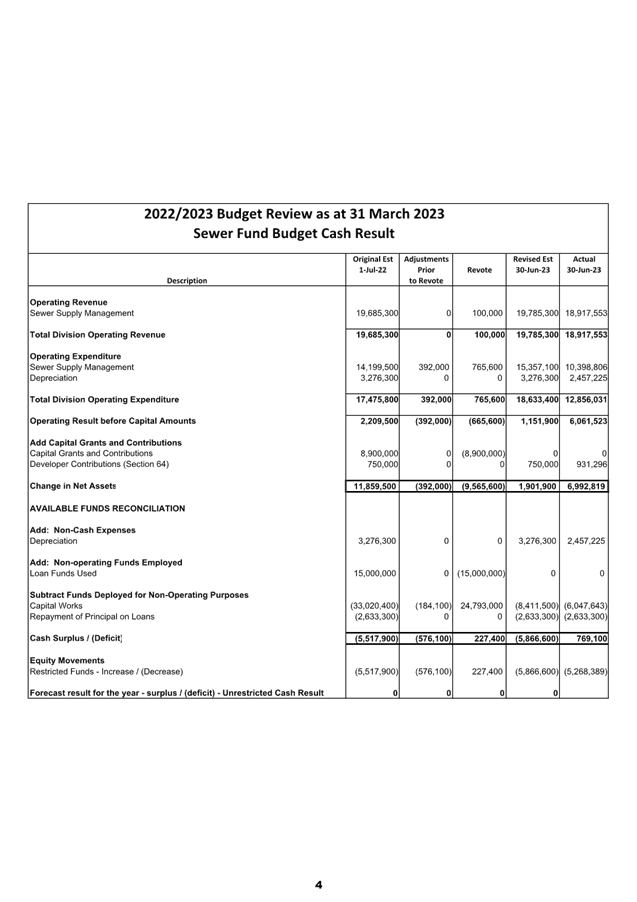

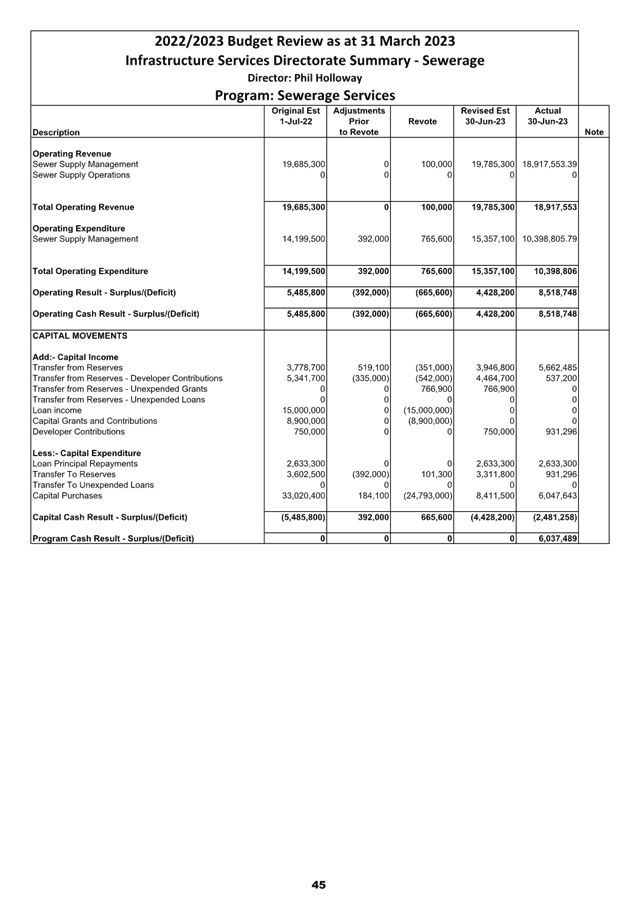

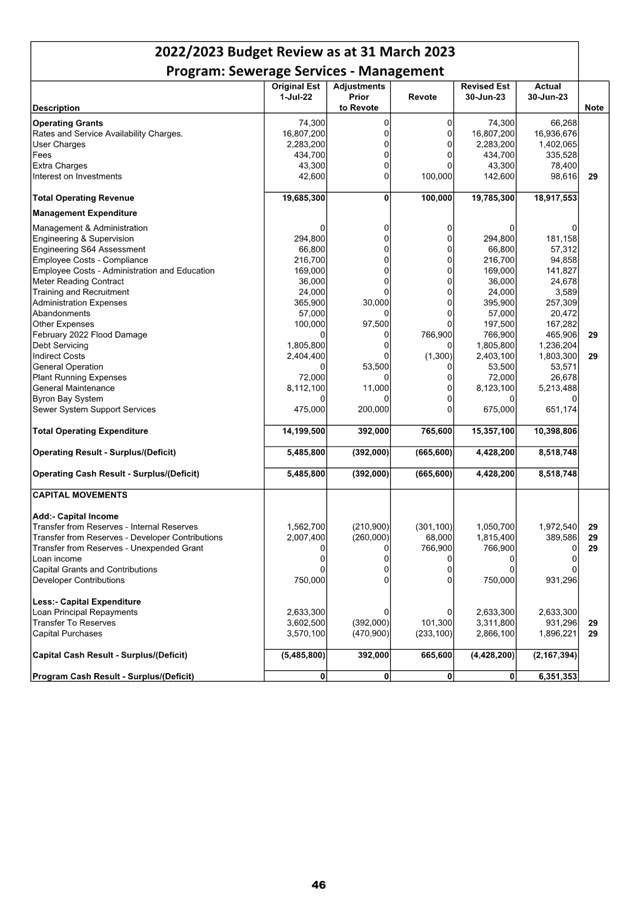

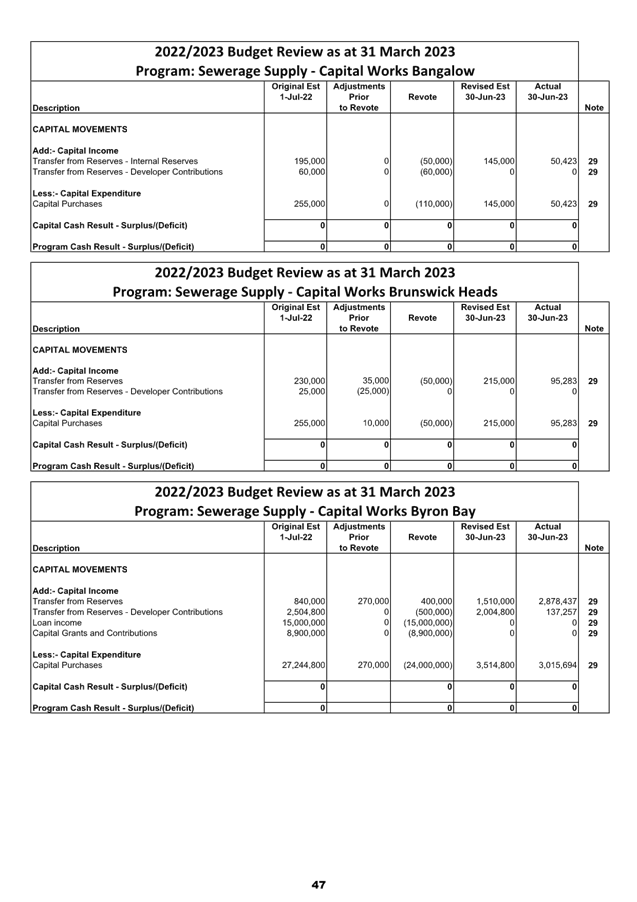

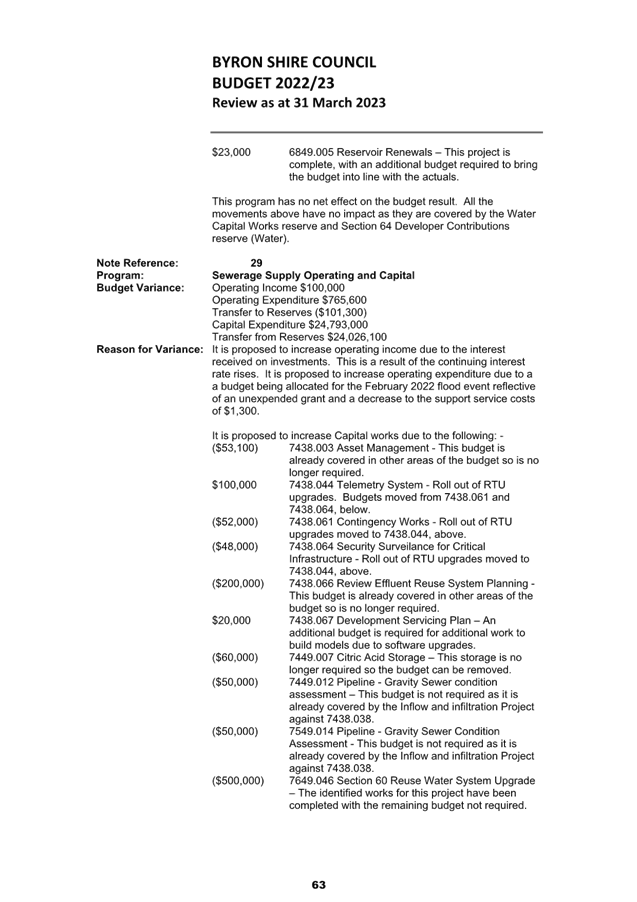

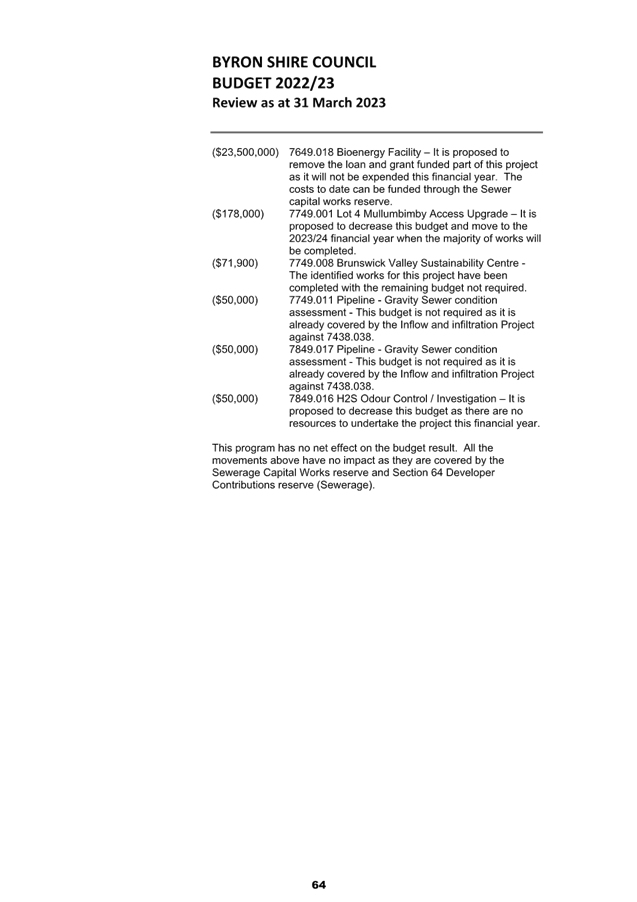

SEWERAGE FUND

After completion of the 2021/2022

Financial Statements the Sewer Fund as at 30 June 2022 has a capital works

reserve of $2,701,600 and plant reserve of $896,200. It also held

$7,180,100 in section 64 developer contributions and a $766,900 unexpended

grant.

Capital Works Reserve

|

Opening Reserve Balance at 1

July 2022

|

$2,701,600

|

|

Plus original budget reserve

movement

|

(926,200)

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

(653,600)

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(257,500)

|

|

Resolutions January - March

Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review Adjustments

– increase / (decrease)

|

452,300

|

|

Forecast Reserve Movement for

2022/2023 – Increase / (Decrease)

|

(1,385,000)

|

|

Estimated Reserve Balance at 30

June 2023

|

$1,316,600

|

Plant

Reserve

|

Opening

Reserve Balance at 1 July 2022

|

$896,200

|

|

Plus

original budget reserve movement

|

0

|

|

Resolutions

July - September Quarter – increase / (decrease)

|

0

|

|

September

Quarterly Review Adjustments – increase / (decrease)

|

0

|

|

Resolutions

October - December Quarter – increase / (decrease)

|

0

|

|

December

Quarterly Review Adjustments – increase / (decrease)

|

0

|

|

Resolutions

January - March Quarter – increase / (decrease)

|

0

|

|

March

Quarterly Review Adjustments – increase / (decrease)

|

0

|

|

Forecast

Reserve Movement for 2022/2023 – Increase / (Decrease)

|

0

|

|

Estimated

Reserve Balance at 30 June 2023

|

$896,200

|

Section 64 Developer

Contributions

|

Opening Reserve Balance at 1

July 2021

|

$7,180,100

|

|

Plus original budget reserve

movement

|

(4,591,700)

|

|

Resolutions July - September Quarter

– increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

375,000

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

(40,000)

|

|

Resolutions January - March

Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review Adjustments

– increase / (decrease)

|

542,000

|

|

Forecast Reserve Movement for

2022/2023 – Increase / (Decrease)

|

(3,714,700)

|

|

Estimated Reserve Balance at 30

June 2023

|

$3,465,400

|

Unexpended Grants

|

Opening Reserve Balance at 1

July 2021

|

$766,900

|

|

Plus original budget reserve

movement

|

0

|

|

Resolutions July - September

Quarter – increase / (decrease)

|

0

|

|

September Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions October - December

Quarter – increase / (decrease)

|

0

|

|

December Quarterly Review

Adjustments – increase / (decrease)

|

0

|

|

Resolutions January - March

Quarter – increase / (decrease)

|

0

|

|

March Quarterly Review Adjustments

– increase / (decrease)

|

(766,900)

|

|

Forecast Reserve Movement for

2022/2023 – Increase / (Decrease)

|

0

|

|

Estimated Reserve Balance at 30

June 2023

|

$0

|

Movements for the Sewerage Fund can be seen in Attachment 1

with a proposed estimated overall increase to reserves (including S64

Contributions and unexpended grants) of $227,400 from the 31 March 2023 Quarter

Budget Review.

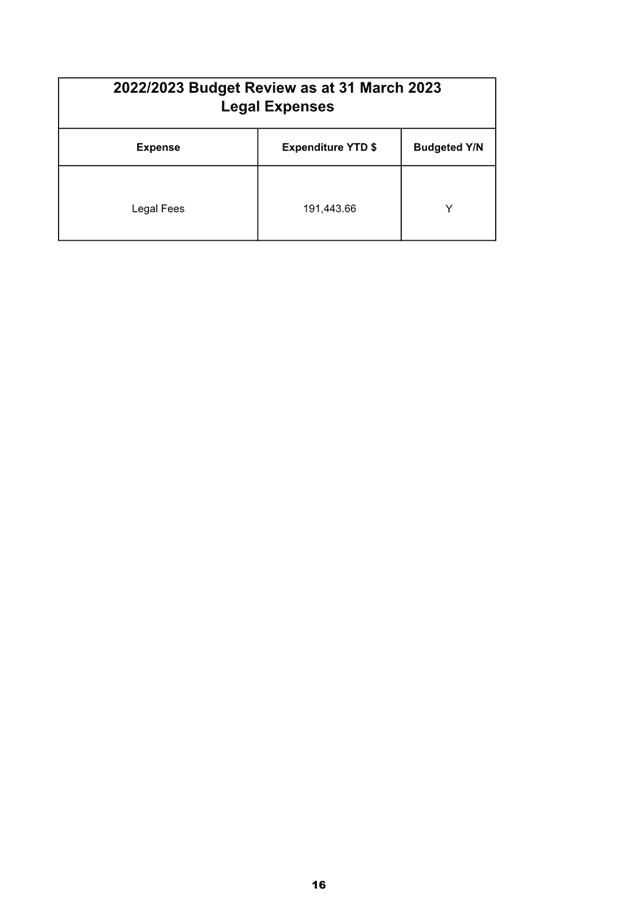

Legal Expenses

One of the major financial concerns for Council over

previous years has been legal expenses. Not only does this item represent a

large expenditure item funded by general revenue, but can also be susceptible

to large fluctuations.

The table that follows indicates the allocated budget and

actual legal expenditure within Council on a fund basis as at 31 March 2023.

Total Legal Income &

Expenditure as at 31 March 2023

|

Program

|

2022/2023

Budget

($)

|

Actual

($)

|

Percentage

To Revised Budget

|

|

Income

|

|

|

|

|

Legal Expenses Recovered

|

0

|

25,500

|

0%

|

|

Total Income

|

0

|

25,500

|

0%

|

|

|

|

|

|

|

Expenditure

|

|

|

|

|

General Legal Expenses

|

202,600

|

191,444

|

94.49%

|

|

Total Expenditure General Fund

|

202,600

|

191,444

|

94.49%

|

Note: At the time of preparing this report, Council

has expended and committed additional expenditure of $95,867 that brings the

total legal expenditure for 2022/23 to $287,311. Taking into account the

income of $25,500, the Legal Services budget is currently $59,211 over

budget. It is proposed to transfer $100,000 from the Legal Services

reserve within this review to cover the shortfall and any further expenditure

this financial year.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

CSP Strategy

|

DP Action

|

Code

|

OP Activity

|

|

1:

Effective Leadership

We have effective decision making and

community leadership that is open and informed

|

1.3:

Ethical and efficient management of resources

|

1.3.1:

Financial Management - Ensure the financial integrity and sustainability of

Council through effective financial management

|

1.3.1.2

|

Provide

Quarterly Budget Reviews to Council for adoption.

|

|

|

|

|

|

|

Legal/Statutory/Policy

Considerations

In accordance with Section 203 of

the Local Government (General) Regulation 2021 the Responsible Accounting

Officer of a Council must:

(1) Not

later than 2 months after the end of each quarter (except the June quarter),

the responsible accounting officer of a council must prepare and submit to the

council a budget review statement that shows, by reference to the estimate of

income and expenditure set out in the statement of the council’s revenue

policy included in the operational plan for the relevant year, a revised

estimate of the income and expenditure for that year.

(2) A

budget review statement must include or be accompanied by:

(a) a

report as to whether or not the responsible accounting officer believes that

the statement indicates that the financial position of the council is

satisfactory, having regard to the original estimate of income and expenditure,

and

(b) if

that position is unsatisfactory, recommendations for remedial action.

(3) A

budget review statement must also include any information required by the Code

to be included in such a statement.

Financial Considerations

The 31 March 2023 Quarter Budget Review of the 2022/2023

Budget has increased the budget position by $205,000. This leaves the movement

against the unrestricted cash balance attributable to the General Fund to an

estimated surplus of $205,000 for the year, leaving the unrestricted cash

balance attributable to the General Fund at an estimated $0 at 30 June

2023.

It is the view of the Responsible Accounting Officer that

the short term financial position of the Council is still satisfactory for the

2022/2023 financial year, having consideration of the original estimate of

income and expenditure at the 31 March 2023 Quarter Budget Review.

This opinion is based on the estimated General Fund

Unrestricted Cash Result position and that the current indicative budget

position for 2022/2023 outlined in this Budget Review is further improved through

the remaining quarterly budget review for the 2022/2023 financial year. Council

must remember it has a short term financial goal of maintaining $1,000,000 in

unrestricted cash.

Of particular concern to Council is the ongoing cash flow

issues around the flood recovery and the timing of receiving Natural Disaster

Funding from the NSW State Government. In the lead up to 30 June 2023,

Council must endeavour to recover as much outstanding payments via claims to

improve the cash position and funding of reserves given the forecast position

of no unrestricted cash balance. Currently Council is due approximately

$4.6million in outstanding flood recovery expenditure through the NSW

Reconstruction Authority, Public Works Advisory and Transport for NSW.

This Budget Review is assuming this funding will be mostly recovered before 30

June 2023.