Ordinary Meeting

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 9.00am

Public Access relating to items on this Agenda can be made between 9.00am and

10.30am on the day of the Meeting. Requests for public access should be

made to the General Manager or Mayor no later than 12.00 midday on the day

prior to the Meeting.

Mark

Arnold

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the Code

of Conduct for Councillors (eg. A friendship, membership of an association,

society or trade union or involvement or interest in an activity and may

include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in the Code of Conduct

for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary

interest in a matter if:

·

The

person’s spouse or de facto partner or a relative of the person has a

pecuniary interest in the matter, or

·

The

person, or a nominee, partners or employer of the person, is a member of a

company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the parent,

grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or

adopted child of the person or of the person’s spouse;

(b) the spouse

or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

·

If

the person is unaware of the relevant pecuniary interest of the spouse, de

facto partner, relative or company or other body, or

·

Just

because the person is a member of, or is employed by, the Council.

·

Just

because the person is a member of, or a delegate of the Council to, a company

or other body that has a pecuniary interest in the matter provided that the

person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

·

A

Councillor or a member of a Council Committee who has a pecuniary interest in

any matter with which the Council is concerned and who is present at a meeting

of the Council or Committee at which the matter is being considered must

disclose the nature of the interest to the meeting as soon as practicable.

·

The

Councillor or member must not be present at, or in sight of, the meeting of the

Council or Committee:

(a) at

any time during which the matter is being considered or discussed by the

Council or Committee, or

(b) at

any time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

·

It

may be appropriate that no action be taken where the potential for conflict is

minimal. However, Councillors should consider providing an explanation of

why they consider a conflict does not exist.

·

Limit

involvement if practical (eg. Participate in discussion but not in decision

making or vice-versa). Care needs to be taken when exercising this

option.

·

Remove

the source of the conflict (eg. Relinquishing or divesting the personal

interest that creates the conflict)

·

Have

no involvement by absenting yourself from and not taking part in any debate or

voting on the issue as of the provisions in the Code of Conduct (particularly

if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act

1993 – Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to

a development application, an environmental planning instrument, a development

control plan or a development contribution plan under that Act, but

(b) not including the making of an

order under that Act.

(2) The general manager is required

to keep a register containing, for each planning decision made at a meeting of

the council or a council committee, the names of the councillors who supported the

decision and the names of any councillors who opposed (or are taken to have

opposed) the decision.

(3) For the purpose of maintaining

the register, a division is required to be called whenever a motion for a

planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the

register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a meeting

that is closed to the public.

BUSINESS OF Ordinary Meeting

1. Public Access

2. Apologies

3. Requests

for Leave of Absence

4. Declarations

of Interest – Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary

Interest Returns (Cl 4.9

Code of Conduct for Councillors)

6. Adoption

of Minutes from Previous Meetings

6.1 Ordinary

Meeting held on 17 December 2020

7. Reservation

of Items for Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 Mayor's

Discretionary Allowance................................................................................ 7

10. Petitions

10.1 Tallowood

Ridge............................................................................................................ 9

10.2 Petition

against the changing of Ewingsdale rulings, R5 and R2...................... 11

10.3 Petition

with 140 signatures to reduce speed at Rifle Range Road................... 13

11. Submissions and Grants

11.1 Grants

and Submissions February 2021................................................................. 14

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Licence

to Byron Bay Community Association Incorporated for occupation of the Byron

Community Cabin........................................................................................................ 19

13.2 Financial

hardship of the Upper Main Arm Community Assocation Incorporated 24

13.3 Licence

for the operation and maintenance of Byron Bay car parks................. 28

Corporate and Community

Services

13.4 Security

Services Tender Outcome.......................................................................... 31

13.5 Conduct

a Constitutional referendum or council poll at the Local Government election in

September 2021........................................................................................................... 35

13.6 Section

355 Management Committees - resignations and appointments update 38

13.7 Council

Investments - 1 December 2020 to 31 December 2020......................... 43

13.8 Policy

Review 2020-2021 - Part 2............................................................................. 53

13.9 National

General Assembly of Local Government 2021....................................... 62

13.10 Council

Resolutions Quarterly Review - Q2 - 1 October to 31 December 2020 66

13.11 Council

Investments - 1 January 2021 to 31 January 2021................................. 69

13.12 Budget

Review - 1 October 2020 to 31 December 2020....................................... 79

13.13 Delivery

Program 6-monthly Report and 2020/21 Operational Plan Report - Q2 - December

2020............................................................................................................................... 90

Sustainable Environment and

Economy

13.14 Compliance

Priorities Program Report 2020........................................................... 94

13.15 PLANNING

- DA 10.2020.230.1 Use of existing Nursery Structure ancillary to Community

Facility (Mullumbimby Community Garden) at 156 Stuart Street Mullumbimby 109

13.16 Proposed

Activity - Byron Music Festival 2021 on Reserve 82000 Dening Park, Byron Bay...................................................................................................................................... 128

Infrastructure Services

13.17 Former

Mullumbimby Sewage Treatment Plant Land Use Options Report.... 136

13.18 Tender

2020-0063 - Railway Corridor Park........................................................... 141

13.19 Byron

Shire Rail with Trail (Update)....................................................................... 146

13.20 Design

and Construction of the Byron STP Additional Flow Path................... 153

14. Reports of Committees

Infrastructure Services

14.1 Report

of the Local Traffic Committee Meeting held on 27 January 2021...... 159

14.2 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 28

January 2021............................................................................................................................. 162

14.3 Report

of the Byron Shire Floodplain Risk Management Committee Meeting held on 28

January 2021............................................................................................................. 165

15. Questions With Notice

15.1 Agglomerated

data on dwelling supply in Byron Shire...................................... 168

Questions with Notice: A response to Questions with

Notice will be provided at the meeting if possible, that response will be

included in the meeting minutes. If a response is unable to be provided

the question will be taken on notice, with an answer to be provided to the

person/organisation prior to the next Ordinary Meeting and placed on Councils

website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

16. Confidential Reports

General Manager

16.1 Confidential - Lease to AFL Queensland

Limited........................................ 174

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director prior to the meeting. Any suggested amendments to the

recommendations should be provided to Councillor Support prior to the meeting

to allow the changes to be typed and presented on the overhead projector at the

meeting.

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 Mayor's

Discretionary Allowance

File No: I2021/164

I move:

1. That

Council confirms the following donation from the Mayor’s

Discretionary Allowance 2020/21:

$1,100 – Sustainable Schools

Program to support a Byron Shire School’s attendance

2. That

Council advertise the donations in accordance with Section 356 of the

Local Government Act 1993.

Attachments:

1 2021

Sustainability Symposium - Information Package, E2021/27341

Signed: Cr

Simon Richardson

Councillor’s supporting

information:

The Sustainable Schools Network (SSN) has approached

Council, requesting funding of $1,100 to support a Byron Shire school to

participate in the 2021 Sustainable Schools Symposium, to be held over three

days at All Saints Anglican School on the Gold Coast,

The funding would enable one Byron Shire school (chosen

through an EOI process) to participate in the ‘Kids Teaching Kids’

opportunity (see page 6 of Attachment 1). This involves students from the

chosen school actively facilitating a workshop for other students using the UN

Sustainable Development Goal themes, Good Health and Wellbeing or Life Below

Water.

The SSN has so far secured speakers such as Ash Buchanan (https://benefitmindset.com/about/

) and academics from Griffith University, Curtin University, the University of

Tasmania, and the University of Southern Queensland.

The funding would provide the following for the chosen

school:

• 2

x teachers to participate, over two days, in the Professional Development

sessions

• 14

students and 2 adults to attend the Kids Teaching Kids sessions

• 1

x School Leader (Principal or Business Service Manager) to attend the student

session

Council’s funding does not include transport to the

event or accommodation; this would need to be provided by the successful

school.

An EOI would be sent to all schools in Byron Shire to ensure

a fair and equitable application process. Mullumbimby High School and Byron

High School have already shown an interest in the event.

Staff comments

by Vanessa Adams, Director

Corporate and Community Services:

(Management Comments must not

include formatted recommendations – resolution 11-979)

There is sufficient funding available and if the NoM is

adopted staff will process accordingly.

Financial/Resource/Legal Implications:

The 2020/21 Budget adopted by Council included an allocation

of $2,000.00 for budget item Mayor – Discretionary Allowance. Sufficient

funds are available for making the nominated donation of $1,100.

In relating to the making of Section 356 Donations from

Mayor – Discretionary Allowance, Council at its Ordinary meeting held on

14 May 2009 resolved as follows: -

“09-349 Resolved that Council confirm that all s356

donations, to be made from the budget allocation “Mayor –

Discretionary Allowance”, must be the subject of a resolution of the

Council at Ordinary or Extraordinary meeting.”

This Notice of Motion is to confirm the making of the listed

Section 356 Donation.

The Section 356 Donation will be advertised and public

notice of financial assistance provided in accordance with Section 356 of the

Local Government Act 1993.

Is the proposal consistent with any Delivery Program tasks?

Yes

The project aligns with OP action - Provide coastal,

environmental and sustainability information and encourage and support

community activities and groups

Petitions 10.1

Petitions

Petition No. 10.1 Tallowood Ridge

Directorate: Sustainable Environment and Economy

Report Author: Shannon Burt, Director Sustainable Environment and

Economy

File No: I2021/17

Council is in receipt of a petition containing 489

signatures which seeks:

We are asking Byron Shire

Council to:

Zone the area to prevent any

further development in the forested area along the ridge and to ensure Council

takes responsibility for the long-term management and protection of the koalas,

other native animals and plants/trees that are found there. To place the ridge

line and koala reserve into public ownership to allow access and for it to

become a community asset for generations to come.

Comments from Director Sustainable Environment and Economy:

The Tallowood Ridge land was the subject of a recent Notice

of Motion at the Ordinary Meeting 17 December 2020.

Notice of Motion 9.2 Tallowood Ridge Reserve: https://byron.infocouncil.biz/Open/2020/12/OC_17122020_AGN_1178.PDF

20-720 Resolved that Council:

1. Enter negotiations

with the relevant landowners and/or developer to seek the gifting of the land

outlined in the map in the report for the management of Council in conjunction

with the community in perpetuity.

2. Ensure that these

negotiations stipulate that this is not instead of any other previous

environmental agreement.

3. Acknowledge that if

negotiations are successful, staff will take the appropriate steps to prepare a

Plan of Management (Ndiaye/Richardson)

|

RECOMMENDATION:

1. That

the petition regarding Tallowood Ridge be noted.

2. That

the petition be referred to the Director Sustainable Environment and Economy.

|

.Attachments:

1 Confidential

- Petition with 489 signatures regarding Tallowood Ridge requesting protection

of Koalas, E2020/102617

Petitions 10.2

Petition

No. 10.2 Petition against the changing of Ewingsdale rulings,

R5 and R2

Directorate: Sustainable Environment and Economy

Report Author: Shannon

Burt, Director Sustainable Environment and Economy

File No: I2021/19

Council is in receipt of a petition containing 294

signatures which seeks:

“We the people

of rural Ewingsdale village insist the R5 & R2 ruling remain in line with

what this village is all about, Country!

We suggest that

‘INGENIA’ forfeit their deposit & move onto their other

options.”

Comments from Director Sustainable Environment and Economy:

This petition is in response to a consultation undertaken by

Ingenia Lifestyle for an over 55s to retire or age in place proposal on Lot

101, Ewingsdale Road Ewingsdale.

https://ingenialifestyle.com.au/ewingsdale#contact

This consultation was proponent initiated and led and not

part of any formal Council process.

Council’s Business and Industrial Lands Strategy 2020

states:

Any development proposal in proximity to the hospital

will be assessed against its consistency with the function of the hospital, its

ability to value add to existing community and economic benefits of the

hospital and its commercial viability. Areas adjoining the hospital precinct

are to be utilised for allied hospital services, except where designated as

having high ecological values or for public access and movement.

Allied uses are described as offering:

• medical

devices;

• precision

medicine and regenerative medicine products and services

• medical

specialist consulting rooms

• health

care worker services, such as a child care facility

• health

education, training and research

• residential

facilities providing for resident needs to visit hospital for management of a

chronic or acute health condition or to receive treatment for an injury. This

may include a residential aged care facility, with either permanent or respite

basis accommodation.

Any application received for the development of this land

will be considered against the BILs criteria.

|

RECOMMENDATION:

1. That

the petition regarding the possible rezoning of Lot 101 Ewingsdale Road be

noted.

2. That

the petition be referred to the Director Sustainable Environment and Economy.

|

.Attachments:

1 Confidential

- Petition from Residents of Ewingsdale Regarding Possible Rezoning of Lot 101

Ewingsdale Road EWINGSDALE - 294 Signatures, S2020/11180

Petitions 10.3

Petition

No. 10.3 Petition with 140 signatures to reduce speed at Rifle

Range Road

Directorate: Infrastructure Services

Report Author: Joshua

Provis, Road and Bridge Engineer

File No: I2021/182

Council is in receipt of a petition containing 140

signatures to reduce the speed zone on Lismore-Bangalow Road at the Rifle Range

Road signatures which states:

“Reduce

speed limit at intersection of Rifle Range and Lismore Road”

Comments from Director Infrastructure:

Lismore-Bangalow is a state government controlled road, and

Transport for NSW is the authority required to undertake speed zone reviews,

Council cannot undertake a speed zone review.

Therefore following receipt of the petition Council staff

requested TfNSW undertake a speed zone review at the location.

The speed zone review was undertaken by TfNSW on Wednesday 3

February 2021.

Pending the TfNSW approvals process an outcome of the review

is expected in late March 2021.

RECOMMENDATION:

1. That

the petition regarding Reduce speed

limit at intersection of Rifle Range and Lismore Road be noted.

2. That

the petition be referred to the Director Infrastructure Services.

Attachments:

1 Confidential

- Petition with 140 signatures to reduce speed at Rifle Range Road, E2020/102685

Submissions and Grants 11.1

Submissions and Grants

Report No. 11.1 Grants

and Submissions February 2021

Directorate: Corporate

and Community Services

Report Author: Donna

Johnston, Grants Coordinator

File No: I2021/154

Summary:

Council has submitted applications

for a number of grant programs which, if successful, would provide funding to

enable the delivery of identified projects. This report provides an update on

these grant submissions.

RECOMMENDATION:

That Council notes the report and Attachment 1

(E2021/23600) for Byron Shire Council’s Submissions and Grants as at 31

January 2021.

Attachments:

1 Grants

Report to Council - February 2021, E2021/23600

Report

This report provides an update on

grant submissions since the last report to Council.

Successful applications

Council was not advised of any

successful applications during December 2020 and January 2021.

Unsuccessful applications

Council was advised prior to

Christmas that it was unsuccessful in the Fixing Country Roads 2019 Tranche 2

(Transport for NSW) applications for Manns Road, Booyong Road and Byron Arts

and Industry Estate arterial roads. Applications for Manns Road and Byron

Arts and Industry Estate arterial roads were resubmitted for the Fixing Country

Roads 2020 funding program in December 2020.

The

Fixing Country Roads funding program is about moving freight more efficiently

supporting jobs, and supporting the economic growth and productivity of

regional NSW by reducing the cost of getting goods to market.

Feedback

from Transport for NSW for 2019 Tranche 2 was provided at the end of January

2021 and included:

· TOTAL funding

pool $20M (limited funding release, and slow assessments, was due to COVID).

· 93

applications received.

· 4 successful

applications.

· In general,

more evidence on the benefits relating to heavy freight movement was required

versus the safety aspects of improved roads.

· More evidence

required to demonstrate ‘growing’ economies.

· Acknowledged

the good letters of support for the projects.

On a positive note, the next funding round will be released

in 2 to 3 months, with an increased funding pool of $80M. Webinars will

be run to support applications.

January also saw NSW Planning Industry & Planning advise

Council was unsuccessful in its application to the 2021-21 Crown Reserves

Improvement Fund for:

· South

Beach Reserve (Brunswick Heads) - $300,000 towards new toilet block

· Summers

Park – $20,000 weed eradication on the riparian vegetation along the

Brunswick Heads Recreation Grounds

· Byron

Bay Surf Club Hall – application submitted direct by Surf Club

Over 900 applications were received for this grant

round. Council is waiting on feedback directly relating to the grant

applications submitted.

Applications submitted

Eleven grant applications were submitted in December and

January including:

1) Bushfire

Local Economic Recovery Fund 2021

- Mullumbimby

to Brunswick Heads Cycleway

- Bangalow

Cycleway

- The

Green Line - Byron Bay to Belongil Coast Walk

- Repurposing

Byron Hospital

2) Regional

NSW - Summer Break Activities

- Slip

N Slide Fun at Mullumbimby Petria Thomas Swimming Pool

3) Transport

for NSW - Fixing Country Roads

- Byron Arts and Industry Estate arterial roads

- Manns Road

- Springvale Rd

- Midgen Flat Rd

4) Transport

for NSW - Fixing Local Roads

- Seven

Mile Beach Rd

- Various

roads Ocean Shores, South Golden Beach and New Brighton

Upcoming grant opportunities

There are a number of upcoming grant opportunities for which

Council will submit funding applications including:

Building Better

Regions Fund 2021

· Sandhills

Wetlands Project

· Bioenergy

Facility

Heritage NSW

· Local

Government Heritage Studies for Aboriginal cultural heritage mapping/management

plan

Create NSW

· Local

Government Authorities (LGA) Arts & Cultural Funding

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 5:

We have community led decision making which is open and inclusive

|

5.6

|

Manage Council’s

resources sustainably

|

5.6.12

|

Implement strategic grants

management systems to deliver priority projects for Byron’s community

(SP)

|

5.6.12.2

|

Provide governance for grants

management

|

Legal/Statutory/Policy

Considerations

Under

Section 409 3(c) of the Local Government Act 1993 Council is

required to ensure that ‘money that has been received from the Government

or from a public authority by way of a specific purpose advance or grant, may

not, except with the consent of the Government or public authority, be used otherwise

than for that specific purpose’. This legislative requirement governs

Council’s administration of grants.

Financial Considerations

If

Council is successful in obtaining the identified grants, more than $18 million

would be achieved which would provide significant funding for Council

projects. Some of the grants require a contribution from Council (either

cash or in-kind) and others do not. Council’s contribution is funded.

The potential funding and

allocation is detailed below:

Requested

funds from funding bodies $32,871,038

Council

Contribution Cash $2,823,842

Council

Contribution In-Kind $153,500

Other

contributions $288,809

Funding

applications submitted and

awaiting

notification (total project value) $36,137,189

Consultation and

Engagement

Cross-organisational consultation has occurred in relation

to the submission of relevant grants, and the communication of proposed grant

applications.

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Licence

to Byron Bay Community Association Incorporated for occupation of the Byron

Community Cabin

Directorate: General

Manager

Report Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2021/31

Summary:

The Byron Bay Community Association Incorporated requests a

five year licence over the Byron Community Cabin located in the Byron

Recreation Grounds Folio 444/28/758207 for the purpose of a community hall and

ancillary use of shower facilities by persons that are homeless.

|

RECOMMENDATION:

1. That

Council notes that no submissions were received on the proposal to

grant the Byron Bay Community Association Incorporated a five year licence

over the Byron Community Cabin located in Lot 444 Section 28 DP758207.

2. That

Council authorises the General Manager to enter into licence with the Byron

Bay Community Association Incorporated over the Byron Community Cabin located

in Lot 444 Section 28 DP758207 on the following terms:

a) term five years

to commence 1 March 2021,

b) purpose of

a community hall and ancillary use of shower facilities by persons that are

homeless on a booking system,

c) the

Licensee to pay initial rent of $490 (exclusive GST) with rent increased

thereafter annually by Consumer Price Index all Groups Sydney,

d) the

Licensee to pay outgoings for the use of all services connected to the

premises and requisite insurance covers,

e) Council to

pay outgoings to the full value of general land rates (if applicable), fixed

water and sewerage charges, building insurance, pest inspections and fire

safety compliance,

f) Council

to subsidise licence preparation costs of $536 (inclusive GST).

|

.

Report

The Byron Bay Community Association Incorporation

(‘BBCA’) holds an annual licence to operate and manage the Byron

Community Cabin (the Premises’) located in the Byron Recreation Grounds,

Lot 444 Section 28 DP 758207.

The BBCA requests a new five year licence over to ensure

eligibility for grant funding to upgrade fittings within the Premises.

The land:

Lot 444 Section 28 DP 758207 is Council owned land

classified as community land and categorised as a sportsground and general

community use. The Premises is located on land categorised for general

community use.

The Plan of Management for the Byron Recreation Grounds

expressly authorises the grant of a licence for a term up to 21 years over land

categorised for general community use for purposes in accordance with the Local

Government Act.

Background:

The BBCA has held a series of one year licences to occupy

the premises since 1 June 2016 for the purpose of a community hall and homeless

showering.

Terms of the licence requires that the BBCA offer the premises

for hire to the public or specific sections of the public for low impact

activities between 9:00am and 5:00pm all days. The BBCA may also offer

use of shower facilities in the premises to persons that are homeless under a

booking system between 10:00am and 2:00pm weekdays only. The BBCA must

consider use and occupation of surrounding recreation grounds by schools and

organised sporting groups in determining when bookings may be made.

The licence is offered to the BBCA on the condition that no

alcohol or illicit drugs are taken into the Premises or consumed within or

immediate surrounding grounds of the Premises.

Public notification of the proposed licence:

In accordance with the Local Government Act 1993

(NSW), Council sought public comment on the proposed licence between 10

December 2020 and 14 January 2021. Council received no submissions on the

proposed licence.

Proposed licence:

This report recommends that a new five year licence is

granted to the BBCA for the period 1 March 2021 to 28 February 2026 on the

following terms:

· for

use as a community hall with ancillary use of shower facilities by persons that

are homeless by bookings only,

· initial

rent to be set at the value of minimum Crown rent currently $490 (exclusive of

GST) and thereafter increased Consumer Price Index all Groups Sydney for the

licence term.

· licence

preparation costs to be subsidised by Council,

· the

Licensee to pay outgoings for usage cost of all services connected to the

premises including but not limited to electricity, phone, water and waste

management costs,

· the

Licensee to provide $20 million public liability, and contents insurance for

all owned fixture and fittings for full replacement value, and

· Council

to pay outgoings limited to the full value of general land rates (if payable),

annual fixed water and sewerage charges, building insurance, security, pest

inspections and fire safety compliance costs.

Due to ongoing vandalism incidents at the Premises, Council

is proposing the install closed circuit television (‘CCTV’) during

the licence term. Ownership and maintenance of the CCTV equipment will

remain with Council and termed in the Licence.

Direct negotiation:

Council may directly negotiate the proposed five year

licence with the BBCA being a non-profit organisation, in accordance with

section 46A(3) of the Local Government Act 1993 (NSW).

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 2: We cultivate and celebrate our

diverse cultures, lifestyle and sense of community

|

2.2

|

Support access to a wide range of services and

activities that contribute to the wellbeing of all members of the Byron

Shire community

|

2.2.1

|

Develop and maintain collaborative relationships with

government, sector and community

|

2.2.1.2

|

Participate in and inform community planning

|

Legal/Statutory/Policy Considerations

Local Government Act 1993 (NSW)

s47 Leases, licences and other estates in

respect of community land—terms greater than 5 years

(1) If a council proposes to grant

a lease, licence or other estate in respect of community land for a period

(including any period for which the lease, licence or other estate could be

renewed by the exercise of an option) exceeding 5 years, it must:

(a) give public notice of the

proposal (including on the council’s website), and

(b) exhibit notice of the proposal

on the land to which the proposal relates, and

(c) give notice of

the proposal to such persons as appear to it to own or occupy the land

adjoining the community land, and

(d) give notice of

the proposal to any other person, appearing to the council to be the owner or

occupier of land in the vicinity of the community land, if in the opinion of

the council the land the subject of the proposal is likely to form the primary

focus of the person’s enjoyment of community land.

(2) A notice of the proposal must

include:

• information sufficient to identify the

community land concerned

• the purpose for which the land will be

used under the proposed lease, licence or other estate

• the term of the proposed lease, licence

or other estate (including particulars of any options for renewal)

• the name of the person to whom it is proposed

to grant the lease, licence or other estate (if known)

• a statement that submissions in writing

may be made to the council concerning the proposal within a period, not less

than 28 days, specified in the notice.

(3) Any person may make a submission in

writing to the council during the period specified for the purpose in the

notice.

(4) Before granting the lease, licence

or other estate, the council must consider all submissions duly made to it.

s47A Leases, licences and other estates in

respect of community land—terms of 5 years or less

(1) This section applies to a lease,

licence or other estate in respect of community land granted for a period that

(including any period for which the lease, licence or other estate could be

renewed by the exercise of an option) does not exceed 5 years, other than a

lease, licence or other estate exempted by the regulations.

(2) If a council proposes to grant a

lease, licence or other estate to which this section applies:

(a) the proposal must be notified

and exhibited in the manner prescribed by section 47, and

(b) the provisions

of section 47 (3) and (4) apply to the proposal, and

(c) on

receipt by the council of a written request from the Minister, the proposal is

to be referred to the Minister, who is to determine whether or not the

provisions of section 47 (5)–(9) are to apply to the proposal.

(3) If the Minister, under subsection

(2) (c), determines that the provisions of section 47 (5)–(9) are to

apply to the proposal:

(a) the

council, the Minister and the Director of Planning are to deal with the

proposal in accordance with the provisions of section 47 (1)–(8), and

(b) section 47 (9)

has effect with respect to the Minister’s consent.

Financial Considerations

This report recommends that

initial rent is set at the value of minimum Crown rent at $490 (exclusive of

GST) and thereafter increased by Consumer Price Index all groups Sydney .

The Licensee to pay outgoings of all user charges for all

services connected to the premises and required insurances.

Council to pay

outgoings of general land rates (if payable), fixed water and sewerage charges,

building insurance, security, pest inspections and fire safety compliance

costs.

Consultation and Engagement

In accordance with s47A(2)(a) of the Local Government

Act, Council called for public comment on the proposed licence between 10

December 2020 to 14 January 2021 and individually contacted all surrounding

residences.

Staff Reports - General Manager 13.2

Report

No. 13.2 Financial hardship of

the Upper Main Arm Community Assocation Incorporated

Directorate: General

Manager

Report Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2021/41

Summary:

The Upper Main Arm Community Association Incorporated is the

Licensee of the Kohinur Hall. The Licensee is in financial hardship due

to a complete loss of hall booking caused by COVID-19 restrictions. The

Licensee seeks financial assistance from Council to keep the Hall open.

|

RECOMMENDATION:

1. That

Council waives 100% of the rent payable under a licence granted to the Upper

Main Arm Community Association Incorporated for the period 1 August 2020 to

31 July 2021 at a cost of $539 inclusive of GST.

2. That

Council gifts the Upper Main Arm Community Association Incorporated $800

inclusive of GST for the payment of Public Liability Insurance cover due 11

February 2021 upon issue of an invoice.

3. That

Council includes the Kohinur Hall in its review of Section 355 Committees of

Council to secure the future of the Hall in the Main Arm community.

|

Attachments:

1 Confidential

2018 Financial Statement Upper Main Arm Community Association Inc, E2021/3803

Report

Council resolved (20-167) to enter into a five year

licence with the Upper Main Arm Community Association Incorporated (‘the

Licensee’) to manage and operate the Kohinur Hall, Lot 1 DP771568 as a

community hall commencing 1 August 2020.

On 6 January 2021, the Licensee contacted Council requesting

financial assistance to keep the Hall open. The Licensee is in financial

hardship. See Confidential attachment 1. The Licensee has not previously

requested rent relief.

With no bookings for weddings or other events since March

2020 due to COVID-19 restrictions, the Licensee has no means to generate income

to cover rent and outgoings in the short-term. The Licensee is confident

that bookings will resume to pre-COVID-19 levels once the pandemic restrictions

are lifted with a tentative booking for a wedding in April 2021.

Financial assistance:

Terms of the Licence requires the

Licensee to pay rent and certain outgoings including electricity and insurance

costs.

The Licensee provided its 2018

financial statements that detailed the Hall, at that time, was running at a

loss but the Committee held sufficient funds to cover its outgoings.

In 2021 the viability and

sustainability of the Licensee and its ability to manage the Hall is now in

question. The Licensee has insufficient funds to cover its outgoings and

requests the following financial assistance:

i. a full waiver

of annual rent at a cost of $539 inclusive of GST; and

ii. a gift of $800 to

renew its public liability insurance cover.

Council has received similar

requests from other tenants also in financial distress due to COVID-19. In

those circumstances Council offered to waive rent rather than offer direct

financial assistance by way of a gift or a loan.

Options:

Council has the following options

regarding the financial assistance request:

1. Provide $539 rental

assistance thereby enabling the Licensee to meet its insurance costs from

available funds but leave the Licensee with little funds to pay other outgoings

as they become due and payable; or

2. Provide $539 rental

assistance and gift $800 to cover insurance costs totalling $1,339 thereby

retaining the Licensee in its current financial position; or

3. Provide no financial

assistance with the following likely consequences:

a. The Hall remains open

either by;

i. the Licensee

relaxing COVID restrictions to open up the Hall for hire to any person for any

activity; or

ii. private persons cover

rent and other outgoings either gratuitously or via a loan to the Licensee.

Placing the Licensee in a vulnerable

financial position could result in the return of the previous problematic use

of the Kohinur Hall. Use of the Hall was subject to numerous complaints

and Police interventions for illegal camping and rubbish, excessive noise,

trespass, assaults and other serious anti-social behaviour. Since

licensing the Hall, Council has not received any complaints however, the Hall

has not held an event since March 2020.

b. The Hall is closed either

by:

i. the Licensee

defaulting under the Licence for non-payment of rent, or

ii. Council resolving to

suspend the Licence and temporarily closing the Hall until bookings return.

The

Hall is highly valued by the local community. The voluntary closure of the Hall

would not be sanctioned by the community or assist the Licensee resolve its

financial hardship. Upon closure of the Hall all costs associated with

maintenance and management of a vacant building pass unbudgeted to Council.

4. Establish a section 355

committee of Council under the Local Government Act for the care, control and

management of the Hall. The Licensee’s financial hardship raises

questions about the long-term viability and suitability of management of the

Hall under a licence arrangement particularly given the every increasing cost

of insurance cover. This report recommends that Council include the Hall into

its upcoming review of Section 355 Committees to secure the future of the Hall

in the Main Arm community.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 1: We have infrastructure, transport and services which meet

our expectations

|

1.2

|

Provide

essential services and reliable infrastructure which meet an acceptable

community standard

|

1.2.8

|

Develop

capital upgrades, renewal and enhancements works program for buildings-

including community buildings, public toilets, emergency services, sports

club facilities and Council operations buildings (SP)

|

1.2.8.1

|

Consult

with user groups to establish user agreements, leases, licenses and Plans of

Management

|

Legal/Statutory/Policy Considerations

Retail and Other Commercial Leases (COVID-19) Regulation

2020

Financial Considerations

The quantum of the recommended is $1,339

inclusive of GST.

Consultation and Engagement

Nil.

Staff Reports - General Manager 13.3

Report

No. 13.3 Licence for the

operation and maintenance of Byron Bay car parks

Directorate: General

Manager

Report Author: Claire

McGarry, Place Manager - Byron Bay

Ralph

James, Legal Counsel

File No: I2021/201

Summary:

This report recommends that Council authorise the General

Manager to continue to negotiate and enter into a 10 year property licence

agreement with Transport for NSW for the operations, maintenance and

revenue-share of two car parks in Byron Bay:

· Railway Hotel car park

· Lawson St South car park

This agreement is based on a

revenue-share arrangement for revenue collected via the introduction of paid

parking on both sites.

RECOMMENDATION:

That the General Manager be authorised to enter into a

Property Licence between Transport Asset Holding Entity of New South Wales and

Byron Shire Council for part Lot 1 in DP 1001454 and part Lot 4729 DP

1228104 subject to the terms of the licence to be finalised under delegation.

Attachments:

1 Confidential

- DRAFT TAHE CRN Property Licence for Car Park, E2021/29853

2 Confidential

- Overview of Licence Conditions, E2021/30220

Background

During 2019 and 2020, the NSW

Government have been constructing a new Byron Bay bus interchange on Butler

Street, Byron Bay.

The scope of works for this

construction included significant upgrades to the Railway Hotel carpark and

Lawson Street South carpark as well as the introduction of paid parking in

these areas.

As works near completion,

Transport for NSW have proposed an agreement for the operation, maintenance and

revenue-share arrangements from these car parks – see Confidential

Attachment 1.

Essentially, the agreement

requires Council to manage and maintain the infrastructure built by NSW in

these two parking areas.

Under the arrangement, Council

pays a licence fee to Transport for NSW. This fee is calculated as such:

Revenue (paid parking) minus

expenses ($65,000 + meter operations)

The operation and maintenance expenses for the carpark are

covered by the $65,000 annual contribution.

Parking fines collected in the parking areas are not counted

as revenue with fine revenue going directly to Council.

Licence Conditions

The license is 47 pages long and contains 29 clauses with

numerous subclauses. The license contains 6 schedules. They are numbered 1

through 7- schedule 2 is not used.

The parties are Transport Asset Holding Entity of New South

Wales (TAHE) and Byron Shire Council. TAHE is the owner of the Licence Area.

Clause 27 of the licence

deals with confidentiality and requires each party to keep the contents of the

licence (and all plans, documents and information made available to that party

for the purpose of entering into the licence or in the course of the

performance of the licence) confidential, and not to disclose any information

to any other person without the written consent of the other party.

A document has been prepared providing Councillors with an

overview of the licence conditions. Confidential Attachment 2.

Strategic Considerations

Community Strategic Plan

and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 1:

We have infrastructure, transport and services which meet our expectations

|

1.3

|

Support, through partnership, a

network of integrated sustainable transport options

|

1.3.1

|

Ensure an integrated and

accessible transport network (SP)

|

1.3.1.3

|

Support the Byron Bay Bus

Interchange in partnership with Transport for NSW

|

Legal/Statutory/Policy

Considerations

Nil

Financial Considerations

The licence agreement includes a payment to Council to cover

any expenses incurred.

Staff Reports - Corporate and Community Services 13.4

Staff Reports - Corporate and Community

Services

Report No. 13.4 Security

Services Tender Outcome

Directorate: Corporate

and Community Services

Report

Author: Len

Reilly, Property Maintenance Coordinator

File No: I2020/1592

Summary:

On 21 August 2020, the General Manager, under delegated

authority, approved the use of the open tender method to call for tenders for

Contract 2020-0009 Security Services.

The Request for Tender was advertised from 15/10/2020 to

15/11/2020.

Tenders have been assessed in accordance with the provisions

of the Local Government (General) Regulations 2005. This report

summarises the background and assessment of the tenders and provides a

recommendation to award the tender for Contract 2020-0009.

|

RECOMMENDATION:

1. That

Council award Tender 2020-0009 Security Services to the

preferred tenderer as identified in the Confidential Attachment (E2021/5095).

2. That

Council’s seal is affixed to the relevant documents.

3. That Council makes public its decision, including the name and

amount of the successful tenderer, in accordance with Clause 179(b) of the

Local Government (General) Regulation 2005.

|

Attachments:

1 Confidential

- Tender 2020-0009 Evaluation Report, E2021/5095

Report

On 21 August 2020 the General Manager, under delegated

authority, approved the use of the open tendering method to call for tenders

for Contract 2020-0009 Security Services.

The previous contract for Security Services has

expired. Council requires Security Services for Community Buildings,

Council Operations Buildings, Water and Sewer Treatment Plants, Depot Stores

and yards.

The Request for Tender sought responses from proponents to

provide Security Patrols, Security Alarm Monitoring Services, Alarm System

Maintenance, Cash Collection and CCTV Systems Maintenance.

The Contract is expected to commence in March 2021 for a

period of three years, with the option of two one year extensions.

The Contract will be managed by the Property Maintenance

Coordinator.

Tenders were advertised as follows:

· Vendor

Panel: 15/10/2020

· Council’s

website: 15/10/2020

No site briefings were held due to travel restrictions in

place for COVID 19 control.

An Evaluation Panel comprising four Council staff members

was formed.

Tenders closed on 15/10/2020 and 12 tenders were received.

Tenders were evaluated by the Evaluation Panel in accordance with the following

evaluation criteria:

Mandatory criteria:

a) Tenderer

must have a valid Australian Business Number.

b) Substantial

conformance to Conditions of Contract and Statement of Requirements.

c) Workers

compensation insurance for all employees.

d) Holds,

or is willing to obtain, the insurances as specified in the Statement of

Requirements.

e) Satisfactory

Work Health and Safety practices.

f) Commitment

to ethical business practice principles.

Qualitative

criteria:

|

Criteria

|

Elements

|

|

Profile and relevant experience

|

Tenderer profile

|

|

Previous relevant experience

|

|

Environmental practices

|

|

Opportunities for disadvantaged people

|

|

Local employment opportunities

|

|

Quality and availability of resources

|

Proposed key personnel

|

|

Proposed staff

|

|

Use of subcontractors

|

|

Vehicles, plant and equipment

|

|

Delivery Plan

|

Goods/services standards and methodology

|

|

Implementation plan

|

|

Product sustainability

|

|

Supporting local business, social enterprise and Indigenous

business

|

|

Price

|

Total contract price

|

Following the evaluation, the Evaluation Panel conducted

referee checks on the preferred tenderer. The results of these checks

were deemed by the Evaluation Panel to be satisfactory as detailed in the

attached Evaluation Report.

Financial Implications

The price basis for the contract is a schedule of rates.

Council spends over $400,000.00 per year on Security

Services.

There is sufficient funding for the proposed contract in the

current budget.

Statutory and Policy Compliance Implications

The tendering process has been undertaken in accordance with

Council’s Purchasing and Procurement Policy, and the provisions of the

Local Government (General) Regulation 2005.

The Local Government (General) Regulations 2005 define the

options available to Council. An extract is provided below.

Local

Government (General) Regulation 2005 - Reg 178

Acceptance

of tenders

178 Acceptance

of tenders

(1) After

considering the tenders submitted for a proposed contract, the council must

either:

(a) accept

the tender that, having regard to all the circumstances, appears to it to be

the most advantageous, or

(b) decline

to accept any of the tenders.

(2) A

council must ensure that every contract it enters into as a result of a tender

accepted by the council is with the successful tenderer and in accordance with

the tender (modified by any variation under clause 176). However, if the

successful tender was made by the council (as provided for in section

55 (2A) of the Act),

the council is not required to enter into any contract in order to carry out

the requirements of the proposed contract.

(3) A

council that decides not to accept any of the tenders for a proposed contract

or receives no tenders for the proposed contract must, by resolution, do one of

the following:

(a) postpone

or cancel the proposal for the contract,

(b) invite,

in accordance with clause 167, 168 or 169, fresh tenders based on the same or

different details,

(c) invite,

in accordance with clause 168, fresh applications from persons interested in

tendering for the proposed contract,

(d) invite,

in accordance with clause 169, fresh applications from persons interested in

tendering for contracts of the same kind as the proposed contract,

(e)

enter into negotiations with any person (whether or not the person was a

tenderer) with a view to entering into a contract in relation to the subject

matter of the tender,

(f) carry

out the requirements of the proposed contract itself.

(4) If

a council resolves to enter into negotiations as referred to in subclause (3)

(e), the resolution must state the following:

(a) the

council’s reasons for declining to invite fresh tenders or applications

as referred to in subclause (3) (b)–(d),

(b) the

council’s reasons for determining to enter into negotiations with the

person or persons referred to in subclause (3) (e).

Council’s endorsement of the recommendation to award

the tender as recommended in the attached Evaluation Report is sought.

Staff Reports - Corporate and Community Services 13.5

Report

No. 13.5 Conduct a

Constitutional referendum or council poll at the Local Government election in

September 2021

Directorate: Corporate

and Community Services

Report Author: Lisa

Brennan, EA Corporate and Community Services

Esmeralda

Davis, A/Manager Corporate Services

File No: I2021/7

Summary:

Council may conduct a Constitutional referendum or poll in

conjunction with the Local Government Election, to be held in September

2021. If Council resolves to do so, the NSW Electoral Commissioner

(NSWEC) must be informed as soon as possible in order that it can prepare to

administer the referendum or poll.

|

RECOMMENDATION:

That Council determines if there is to be a

Constitutional referendum or council poll conducted in association with the

Local Government election on 4 September 2021.

|

Attachments:

1 Circular

20-39 NSW Office of Local Government - Constitutional referenda and council

polls, E2020/96277

Report

On 22 August 2019 Council resolved

to enter into a contract with the NSW Electoral Commissioner (NSWEC) to

administer all elections, council polls and constitutional referenda (Res

19-385).

Councils are required to inform

the NSWEC if they resolve to administer a Constitutional referendum or poll in

conjunction with the September 2021 Local Government election. The NSWEC

has requested that Council notifies it as soon as possible (prior to end June

at the latest) if it wishes to enter into an arrangement for the administration

of a referendum or poll.

Constitutional referendum

Under section 16 of the Local

Government Act 1993, a council must obtain the approval of its electors at a

constitutional referendum to do each of the following:

· divide a council area into wards or abolish wards

· change the number of councillors

· change the method of electing the mayor

· change the method of election for councillors where the

council’s area is divided into wards.

Further information in relation to

proposing a referendum can be found in the Circular at Attachment

1(E2020/96277).

Any changes approved at a

referendum will come into effect at the September 2024 Local Government

elections.

The decision made at a

Constitutional referendum binds the council until changed by a subsequent

constitutional referendum.

Council poll

Section 14 of the Local Government

Act states “A council may take a poll of electors for its information and

guidance on any matter”.

If a council resolves that a

constitutional referendum or poll is to be conducted, it must comply with the

notification requirements contained in Schedule 10 of the Local

Government (General) Regulation 2005.

Council did not propose either a

Constitutional referendum or council poll for the 2016 Local Government

election.

Options

1. Council proposes to conduct a

Constitutional referendum or council poll in conjunction with the 2021 local

government election.

2. Council does not conduct a

Constitutional referendum or council poll in conjunction with the 2021 local

government election.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 5: We have community led

decision making which is open and inclusive

|

5.2

|

Create a culture of trust with the community by being

open, genuine and transparent

|

5.2.3

|

Provide access to publicly available corporate registers

|

5.2.3.3

|

Develop and implement pre-election community information

program

|

Legal/Statutory/Policy Considerations

Sections 14 and 16 of the Local Government Act 1993 (Conduct

Referendum/Poll)

Section 296(2), (3) and 5(A) of the Local Government Act

1993 (Contract)

Schedule 10 of the Local Government (General) Regulation

2005 (Referendum/Poll)

Financial Considerations

The 2021 election costs will be incorporated in the draft

Budget for 2021/22. The cost estimate by the NSW Electoral Commission to

administer the election is currently $232,590 excluding GST, as per the current

contract.

Additional costs will apply to conduct a poll/referendum and

the NSWEC advises this would be approximately 10% or potentially an additional

$23,300 on top of the initial election cost.

Consultation and Engagement

If Council resolves to proceed with a referendum/poll,

details and explanation will be included on Council’s website well in

advance of the September election, in addition to Media Releases, social media

posts and newsletters.

Staff Reports - Corporate and Community Services 13.6

Report

No. 13.6 Section 355 Management

Committees - resignations and appointments update

Directorate: Corporate

and Community Services

Report Author: Joanne

McMurtry, Community Project Officer

File No: I2021/26

Summary:

This report updates Council on recent resignations and

proposed new appointments for Section 355 committees where nominations have

been received.

|

RECOMMENDATION:

1. That

the resignation from Jim Beatson from the Marvell Hall Management Committee

be accepted and that a letter of thanks be provided.

2. That

the resignations from Glenn Wright and Jennifer Parenteau from the

Mullumbimby Civic Hall Management Committee be accepted and that a letter of

thanks be provided.

3. That

the resignations from Zerina Millard, Jennifer Parenteau, Gabrielle

Rinaldi and Tony Horrigan from the South Golden Beach Hall Management

Committee be accepted and that letters of thanks be provided.

4. That

the nominee in Confidential Attachment 1 be appointed to the South Golden

Beach Hall Management Committee.

|

.Attachments:

1 Confidential

- Confidential attachment to Council report 25 February - Nominees for Section

355 committees, E2020/97177

Report

This report details resignations for Section 355 committees

where nominations have been received for each committee below.

Following Council resolution 20-385 to extend the

term for Advisory Committees, Panels and Section 355 Committees until September

2021, community representatives on Section 355 Management Committees and Boards

were given the option to continue until this date or give notice to resign.

Some of the resignations below were received following this communication.

Advertising for new members

for South Golden Beach Hall was conducted recently and a nomination was

received following this process.

Marvell Hall

A resignation has been received from Jim Beatson from the

Marvell Hall Management Committee.

Current members on this Management Committee are:

Councillors

· Cr

Cate Coorey

· Cr

Jan Hackett (alternate)

Community Representatives

· Margaret

Robertson (Booking)

· Caroline

Lloyd (Chair/Maintenance)

· Maureen

Lightfoot (Treasurer)

· Cate

Bailey

Management Recommendation

That the resignation from Jim Beatson from the Marvell Hall

Management Committee be accepted and that a letter of thanks be provided.

Mullumbimby Civic Hall

Resignations have been received from Glenn Wright and

Jennifer Parenteau from the Mullumbimby Civic Hall Management Committee.

Current members on this Management Committee are:

Councillors

· Cr

Jeannette Martin

· Cr

Michael Lyon (alternate)

Community Representatives

· Sam

Fell (Secretary)

· Maureen

Lightfoot (Treasurer)

· John

Dorczak

· Anthony

Reardon

Management Recommendation

That the resignations from Glenn Wright and Jennifer

Parenteau from the Mullumbimby Civic Hall Management Committee be accepted and

that a letter of thanks be provided.

South Golden Beach Hall

Resignations have been received from Zerina Millard,

Jennifer Parenteau, Gabrielle Rinaldi and Tony Horrigan from the South Golden

Beach Hall Management Committee.

Current members on this Board of Management are:

Councillors

· Cr

Basil Cameron

· Cr

Sarah Ndiaye (alternate)

Community Representatives:

· Lotte

Boer

· Maureen

Lightfoot (Treasurer)

Management Recommendation:

That the resignations from Zerina Millard, Jennifer

Parenteau, Gabrielle Rinaldi and Tony Horrigan from the South Golden Beach Hall

Management Committee be accepted and that letters of thanks be provided.

That the nominee in Confidential Attachment 1 be appointed

to the South Golden Beach Hall Management Committee.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community

Objective 1: We have infrastructure, transport and services which meet our

expectations

|

1.2

|

Provide

essential services and reliable infrastructure which meet an acceptable

community standard

|

1.2.1

|

Deliver

infrastructure maintenance services in line with Community Solutions Panel

values (SP)

|

1.2.1.1

|

Building

assets managed to support the provision of services to the community.

|

|

Community

Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and

sense of community

|

2.3

|

Provide

accessible, local community spaces and facilities

|

2.3.2

|

Support

effective management of community buildings (SP)

|

2.3.2.2

|

Review

community building management models to maximise effective operation

|

Legal/Statutory/Policy Considerations

Management Committees and

Boards of Management operate under Guidelines which state:

3.2 Committee Membership

Committee membership will

number not less than four and not more than nine and each committee will state

the actual number in their Terms of Reference unless otherwise decided by

Council. The exception will be the Bangalow Parks (Showground) committee which

numbers twelve. Council reserves the right to appoint up to two Councillors to

each Committee. The total number of members includes office bearer committee

members and Councillor members which are appointed by Council.

Whilst no particular

qualifications are necessary (not withstanding 3.1.a), a commitment to the

activities of the Committee and a willingness to be actively involved in

Committee issues is essential. Committees work best when the workload is shared

amongst committee members and there is evident goodwill and cooperation amongst

members.

Further information on the

operations and meeting minutes for these Committees and Boards can be found on

Council’s web site at https://www.byron.nsw.gov.au/Council/Committees-and-groups/Section-355-Committees-and-Boards-of-Management.

Financial Considerations

Community Members of Section 355 Management Committees are

volunteer positions unless otherwise resolved by Council.

Consultation and Engagement

Section 355 Committee members are

nominated in response to an open period of advertising calling to fill a

vacancy. To hold office and be responsible for the management of a Council

facility, all community committee members will be assessed against a set of

criteria. Nominations are formally submitted in writing to Council for

appointment.

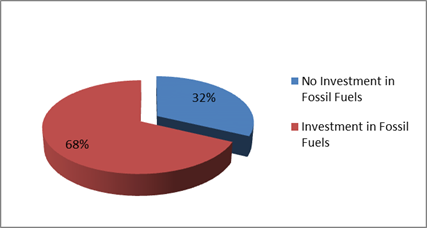

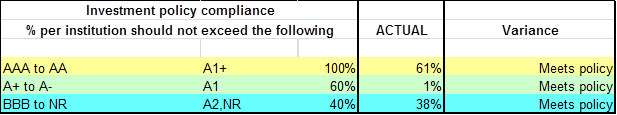

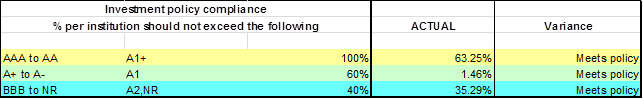

Staff Reports - Corporate and Community Services 13.7

Report

No. 13.7 Council Investments - 1

December 2020 to 31 December 2020

Directorate: Corporate

and Community Services

Report Author: James

Brickley, Manager Finance

File No: I2021/29

Summary:

This report includes a list of investments and identifies

Council’s overall cash position for the period 1 December 2020 to 31

December 2020 for information.

This report is prepared to comply with Regulation 212 of the

Local Government (General) Regulation 2005

|

RECOMMENDATION:

That Council notes the report listing

Council’s investments and overall cash position as at 31 December 2020.

|

.

Report

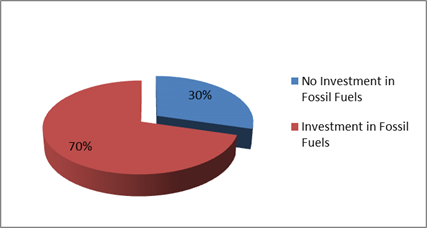

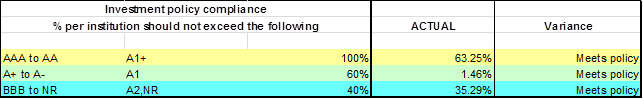

Council has continued to maintain a diversified portfolio of

investments. At 31 December 2020, the average 90 day bank bill rate (BBSW) for

the month of December 2020 was 0.016%. Council’s performance to 31

December 2020 was 0.79%. This is largely due to the active ongoing management

of the investment portfolio, maximising investment returns through secure term

deposits, bonds and purchasing floating rate notes with attractive interest

rates. It should be noted that as investments mature, Council’s

investment return may continue to decrease due to the lower rates available in

the current market.

The table below identifies the investments held by Council

as at 31 December 2020

Schedule of

Investments held as at 30 December 2020

|

Purch Date

|

Principal ($)

|

Description

|

CP*

|

Rating

|

Maturity Date

|

No Fossil Fuel

|

Type

|

Interest Rate Per

Annum

|

Current Value

|

|

24/03/17

|

1,000,000

|

NAB Social Bond (Gender Equality)

|

Y

|

AA-

|

24/03/22

|

N

|

B

|

3.25%

|

1,046,700.00

|

|

15/11/18

|

980,060

|

NSW Treasury Corp (Green Bond)

|

N

|

AAA

|

15/11/28

|

Y

|

B

|

3.00%

|

1,164,520.00

|

|

20/11/18

|

1,018,290

|

QLD Treasury Corp (Green Bond)

|

N

|

AA+

|

22/03/24

|

Y

|

B

|

3.00%

|

1,090,260.00

|

|

28/03/19

|

1,000,000

|

National Housing Finance & Investment

Corporation

|

Y

|

AAA

|

28/03/31

|

Y

|

B

|

2.38%

|

1,113,250.00

|

|

21/11/19

|

1,000,250

|

NSW Treasury Corp (Sustainability Bond)

|

N

|

AAA

|

20/03/25

|

Y

|

B

|

1.25%

|

1,038,420.00

|

|

27/11/19

|

500,000

|

National Housing Finance & Investment

Social Bond

|

Y

|

AAA

|

27/05/30

|

Y

|

B

|

1.57%

|

560,612.50

|

|

31/03/17

|

1,000,000

|

CBA Climate Bond

|

Y

|

AA-

|

31/03/22

|

N

|

FRN

|

1.02%

|

1,010,430.00

|

|

16/11/17

|

750,000

|

Bank of Queensland

|

Y

|

BBB+

|

16/11/21

|

N

|

FRN

|

1.12%

|

755,557.50

|

|

30/08/18

|

500,000

|

Bank Australia Ltd (Sustainability Bond)

|

Y

|

BBB+

|

30/08/21

|

Y

|

FRN

|

1.39%

|

502,540.00

|

|

06/01/20

|

1,000,000

|

Judo Bank

|

Y

|

NR

|

05/01/21

|

N

|

TD

|

2.10%

|

1,000,000.00

|

|

20/01/20

|

1,000,000

|

Westpac (Tailored)

|

Y

|

AA-

|

20/01/21

|

N

|

TD

|

1.41%

|

1,000,000.00

|

|

24/07/20

|

2,000,000

|

Bank of Queensland

|

N

|

BBB+

|

19/07/21

|

N

|

TD

|

0.90%

|

2,000,000.00

|

|

28/07/20

|

1,000,000

|

ME Bank

|

Y

|

BBB

|

29/01/21

|

Y

|

TD

|

0.63%

|

1,000,000.00

|

|

30/07/20

|

1,000,000

|

Judo Bank

|

N

|

NR

|

30/07/21

|

N

|

TD

|

1.25%

|

1,000,000.00

|

|

03/08/20

|

1,000,000

|

NAB

|

N

|

AA-

|

03/08/21

|

N

|

TD

|

0.85%

|

1,000,000.00

|

|

04/08/20

|

2,000,000

|

Suncorp

|

Y

|

A+

|

01/02/21

|

N

|

TD

|

0.70%

|

2,000,000.00

|

|

19/08/20

|

2,000,000

|

NAB

|

N

|

AA-

|

19/08/21

|

N

|

TD

|

0.80%

|

2,000,000.00

|

|

26/08/20

|

1,000,000

|

AMP Bank

|

Y

|

BBB

|

26/08/21

|

N

|

TD

|

0.80%

|

1,000,000.00

|

|

02/09/20

|

1,000,000

|

Bank of Queensland

|

N

|

BBB+

|

01/09/21

|

N

|

TD

|

0.78%

|

1,000,000.00

|

|

02/09/20

|

1,000,000

|

NAB

|

N

|

AA-

|

02/09/21

|

N

|

TD

|

0.75%

|

1,000,000.00

|

|

07/09/20

|

2,000,000

|

NAB

|

N

|

AA-

|

05/01/21

|

N

|

TD

|

0.70%

|

2,000,000.00

|

|

24/09/20

|

2,000,000

|

NAB

|

N

|

AA-

|

24/09/21

|

N

|

TD

|

0.65%

|

2,000,000.00

|

|

30/09/20

|

1,000,000

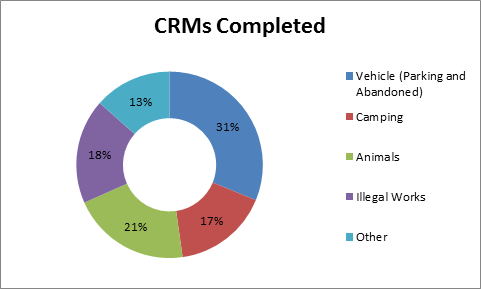

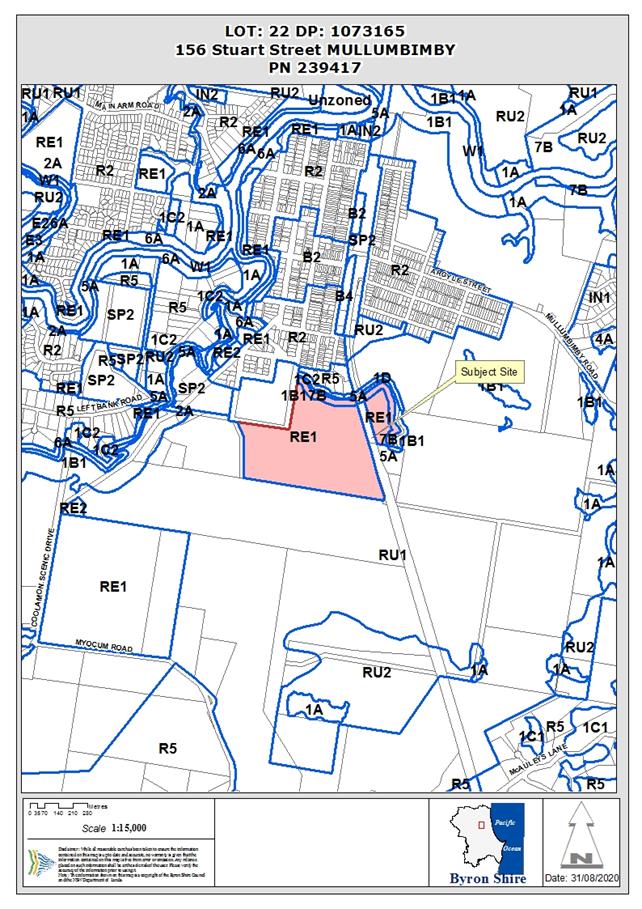

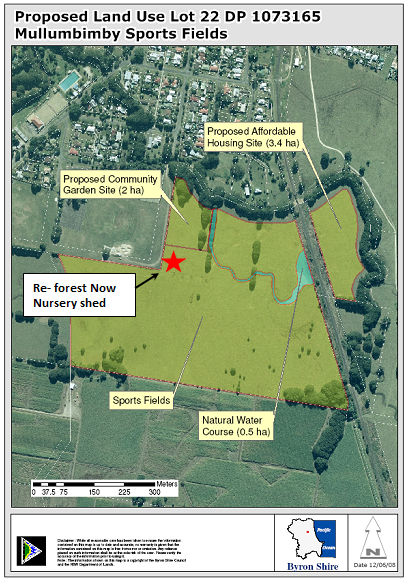

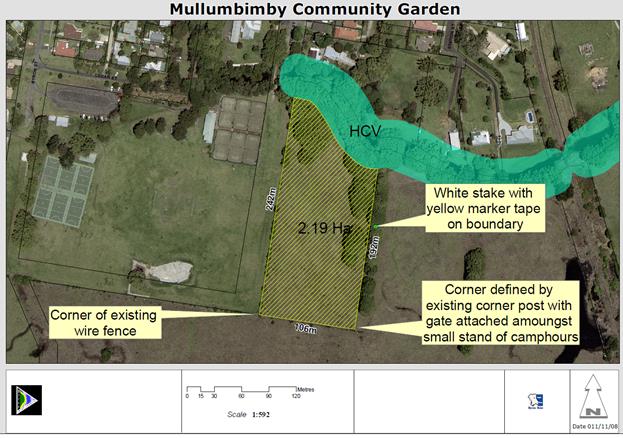

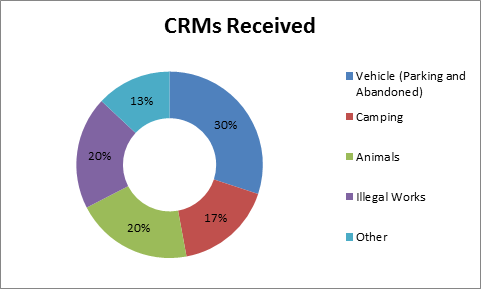

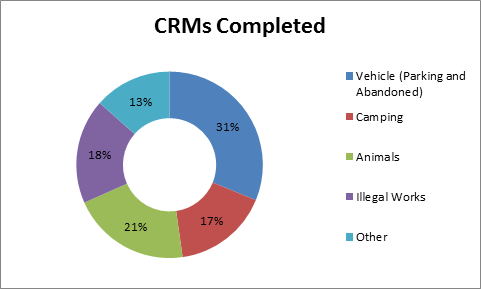

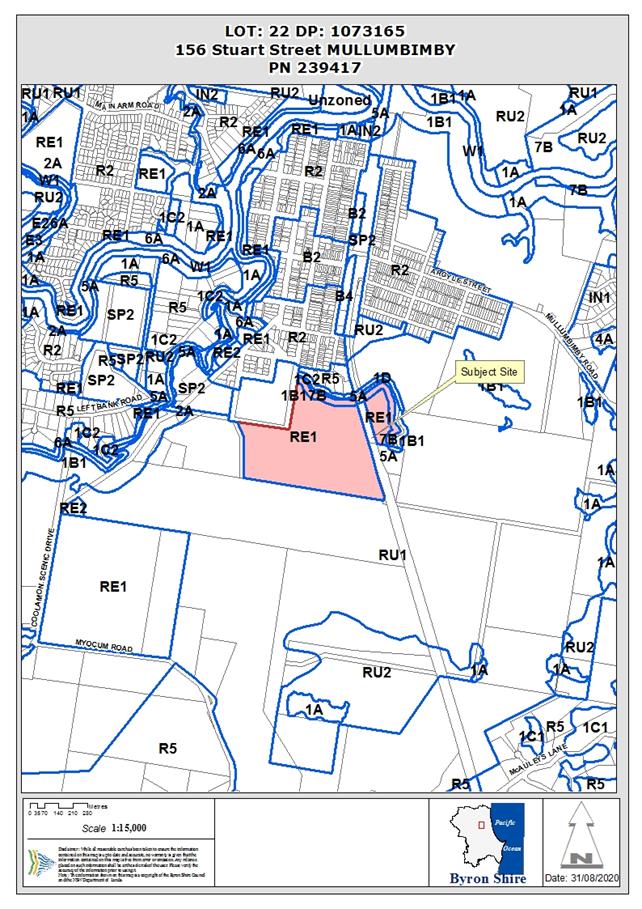

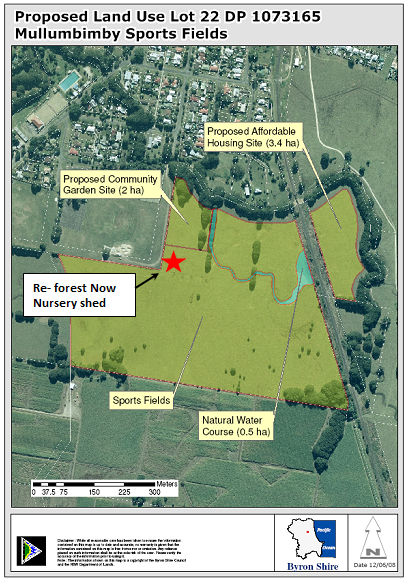

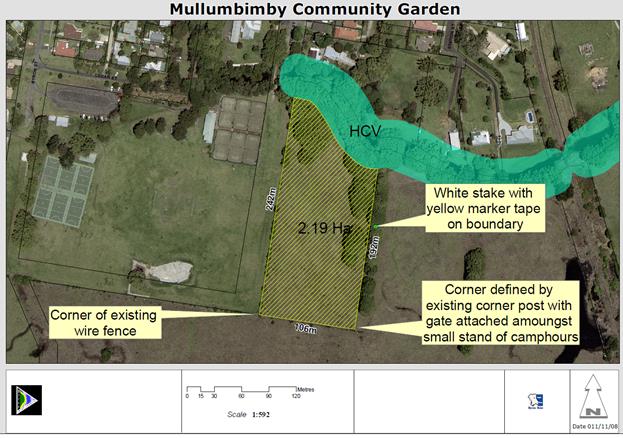

|