Agenda

Agenda

Ordinary Meeting

|

Thursday, 24 February 2022

Agenda

Agenda

Ordinary Meeting

|

Agenda Ordinary Meeting

held at Council Chambers, Station Street, Mullumbimby

commencing at 9am

Public access relating to items on this agenda can be made between 9:00 and 10:30 am on the day of the meeting. Requests for public access should be made to the General Manager or Mayor no later than 12:00 midday on the day prior to the meeting.

Mark Arnold

General Manager

CONFLICT OF INTERESTS

What is a “Conflict of Interests” - A conflict of interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council official has that does not amount to a pecuniary interest as defined in the Code of Conduct for Councillors (eg. A friendship, membership of an association, society or trade union or involvement or interest in an activity and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter if the interest is so remote or insignificant that it could not reasonably be regarded as likely to influence any decision the person might make in relation to a matter or if the interest is of a kind specified in the Code of Conduct for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a matter if the pecuniary interest is the interest of the person, or another person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a matter if:

· The person’s spouse or de facto partner or a relative of the person has a pecuniary interest in the matter, or

· The person, or a nominee, partners or employer of the person, is a member of a company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the following:

(a) the parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or adopted child of the person or of the person’s spouse;

(b) the spouse or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary interest in a matter:

· If the person is unaware of the relevant pecuniary interest of the spouse, de facto partner, relative or company or other body, or

· Just because the person is a member of, or is employed by, the Council.

· Just because the person is a member of, or a delegate of the Council to, a company or other body that has a pecuniary interest in the matter provided that the person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

· A Councillor or a member of a Council Committee who has a pecuniary interest in any matter with which the Council is concerned and who is present at a meeting of the Council or Committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

· The Councillor or member must not be present at, or in sight of, the meeting of the Council or Committee:

(a) at any time during which the matter is being considered or discussed by the Council or Committee, or

(b) at any time during which the Council or Committee is voting on any question in relation to the matter.

No Knowledge - a person does not breach this Clause if the person did not know and could not reasonably be expected to have known that the matter under consideration at the meeting was a matter in which he or she had a pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts & the option chosen will depend on an assessment of the circumstances of the matter, the nature of the interest and the significance of the issue being dealt with. Non-pecuniary conflicts of interests must be dealt with in at least one of the following ways:

· It may be appropriate that no action be taken where the potential for conflict is minimal. However, Councillors should consider providing an explanation of why they consider a conflict does not exist.

· Limit involvement if practical (eg. Participate in discussion but not in decision making or vice-versa). Care needs to be taken when exercising this option.

· Remove the source of the conflict (eg. Relinquishing or divesting the personal interest that creates the conflict)

· Have no involvement by absenting yourself from and not taking part in any debate or voting on the issue as of the provisions in the Code of Conduct (particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993 – Recording of voting on planning matters

(1) In this section, planning decision means a decision made in the exercise of a function of a council under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development application, an environmental planning instrument, a development control plan or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register containing, for each planning decision made at a meeting of the council or a council committee, the names of the councillors who supported the decision and the names of any councillors who opposed (or are taken to have opposed) the decision.

(3) For the purpose of maintaining the register, a division is required to be called whenever a motion for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described in the register or identified in a manner that enables the description to be obtained from another publicly available document, and is to include the information required by the regulations.

(5) This section extends to a meeting that is closed to the public.

1. Public Access

3. Requests for Leave of Absence

4. Declarations of Interest – Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary Interest Returns (Cl 4.9 Code of Conduct for Councillors)

6. Adoption of Minutes from Previous Meetings

6.1 Extraordinary Meeting held on 3 February 2022

7. Reservation of Items for Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 Objectives for some Advisory Committees.......... 7

9.2 Development Application Processing Performance 11

10. Petitions

11. Submissions and Grants

11.1 Grants January 2022........................................ 20

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Lease to Huron Bay Pty Ltd (A.C.N )................. 25

13.2 Grant of 5-year licence over Mullumbimby Community Hall (former Mullumbimby Scout Hall) to preferred respondent.................................... 32

Corporate and Community Services

13.3 Council Investments - 1 November 2021 to 30 November 2021................................................ 39

13.4 Council Investments - 1 December 2021 to 31 December 2021................................................ 49

13.5 Council Investments - 1 January 2022 to 31 January 2022................................................... 59

13.6 Budget Review - 1 October 2021 to 31 December 2021................................................................ 69

13.7 Council Resolutions Quarterly Review - Q2 - 1 October to 31 December 2021.......................... 83

13.8 Delivery Program 6-monthly Report and 2021/22 Operational Q2 Report - to 31 December 2021. 86

13.9 Draft Community Strategic Plan - Our Byron Our Future 2032..................................................... 90

Sustainable Environment and Economy

13.10 Main Beach and Dening Park, Byron Bay - Crown Reserve R82000 - clarification of future uses pending adoption of a Plan of Management...... 96

13.11 Place Planning Collective Update and Expression of Interest for Upcoming Vacancies................. 110

13.12 Terms of Reference and Membership - Byron Shire Housing and Affordability Committee..... 116

13.13 Economic Impact Assessment of Planning Proposal for Short-Term Rental Accommodation 119

Infrastructure Services

13.14 Kolora Way - Pedestrian Bridge and Shared Path - Project Update............................................. 143

13.15 Request for exemption of developer contributions by Byron Community Centre........................... 148

14. Questions With Notice

Nil

Councillors are encouraged to ask questions regarding any item on the business paper to the appropriate Director prior to the meeting. Any suggested amendments to the recommendations should be provided to Councillor Support prior to the meeting to allow the changes to be typed and presented on the overhead projector at the meeting.

BYRON SHIRE COUNCIL

Notices of Motion 9.1

Notice of Motion No. 9.1 Objectives for some Advisory Committees

File No: I2022/101

I move:

1. That Council considers including in the draft Objectives for our Coast and ICOLLs Advisory Committee the following purposes:

a) steering & advising Council towards our Coastal Management Program;

b) creating and revising Council Strategies applying to our ICOLLs and Estuaries;

c) offering a platform for stakeholders to talk with Council on these matters.

2. That Council considers structuring the draft Objectives for our Climate Change and Resource Recovery Advisory Committee to distinguish between the following endeavours:

a) Advising Council on recovering resources from so-called waste streams, especially from our municipal collection systems;

b) Advising Council on reducing council and community carbon emissions as our contribution to a better outcome for the planet; and

c) Advising Council on how and when to adapt to the impacts of Climate Change within Byron Shire.

Signed: Cr Duncan Dey

Councillor’s supporting information:

We will likely consider draft Objectives for our Advisory Committees via a staff report to our March meeting. The Committees themselves, once populated, also get to discuss and advise Council on their Objectives. My purpose here is to table a perspective based on my years of working in these fields.

I trust staff will also advise us, including on regulatory requirements that need to be or could be included in the Committee’s Objectives. Coastal Zone Management Plans (the predecessor of Coastal Management Plans) used to require a reference group. Whether CMP’s do or not, progressing our CMP will benefit from having one.

My view is that Climate Change requires attention to two distinct objectives. The first one is to reduce council and community emissions. The second is to plan the adaptation we and our descendants will need when dealing with the impacts of Climate Change. Physical impacts include more intense storms, longer droughts, higher ocean levels, higher air temperatures, more bushfires of higher intensity. Adaptation to these could include:

(i) locating new development to minimise new exposure to hazards like coastal erosion, flood inundation, bushfire, higher temperatures, etc;

(ii) encouraging existing development to relocate away from exposure to hazards like coastal and flood inundation, bushfire, western aspects, etc;

(iii) allowing existing development that cannot relocate and thus remains exposed to hazards to serve out its useful life without redevelopment;

(iv) supporting and bolstering our depleted Emergency Services;

(v) relocating or abandoning vulnerable public assets such as roads, water & sewer infrastructure;

(vi) encouraging other authorities to relocate or abandon but certainly not to build or rebuild assets like arterial roads, rail, telecommunications in vulnerable locations.

Climate Change will also have social and health impacts. Collaboration will be an advantage.

The activities of the CC&RR Advisory Committee will overlap with those of the Coast & ICOLLs Committee and of the Floodplain Management Committee. I believe this is not a knock-out problem and can be accommodated by creating a ‘rolling’ meeting schedule such that the three Committees meet in different months. Staff, Councillors and community members who sit on multiple Committees can then carry ideas forward from one committee to the others. Draft meeting Minutes will be available in that same sequence.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy:

(Management Comments must not include formatted recommendations – resolution 11-979)

Council considered Report No. 5.7 Advisory Committee Structure and Determination of Councillor Representatives at the extra ordinary meeting 3 February 2022. By Resolution 22-026 it established committees some with revised structures and objectives and councillor representation for each. A meeting schedule was also adopted by point 10 of the Resolution.

The current adopted schedule has the meetings in the following months for:

|

Committee Name |

Months |

||

|

Climate Change and Resource Recovery Advisory Committee |

June |

September |

November |

|

Coastal and ICOLL Advisory Committee |

June |

October |

|

An expression of interest has now commenced to call for community members for each of the committees. It is anticipated that the EOI process will be reported to the March meeting of Council so that these committees can commence their meetings as per the adopted meeting schedule.

The purpose of the mentioned committees follows:

Coastal and ICOLL Advisory Committee

The purpose of the Coast and ICOLL Advisory Committee is to:

· Assist Council in the development of Coastal Management Programs for the Shire’s coast, estuary and ICOLLs.

· Provide input and feedback on existing projects, plans and strategies related to the coast and estuaries/ICOLLs.

· Offer a platform and conduit for communication between stakeholders and community members and agencies.

Climate Change and Resource Recovery Advisory Committee

· To assist Council in the development, implementation and review of relevant sustainability, resource recovery and climate change mitigation and adaptation plans, policies, and projects such as:

· Council’s Net Zero Emissions Strategy and Action Plan

· Council’s Towards Zero Integrated Waste Management and Resource Recovery Strategy

· Councils Illegal Dumping and Litter Enforcement and Education Plan

· Climate Change Adaptation Plan

· Renewable energy projects

· Local network trading and local network charges

· Carbon reporting

· Waste avoidance, resource recovery, circular economy and reuse programs

· Other sustainability and resource recovery initiatives.

· To support our community’s drive towards zero emissions and zero waste to landfill.

· To identify and report opportunities or concerns regarding resource recovery, waste management, sustainability and climate change adaptation and mitigation issues to Council including, but not limited to, funding opportunities, special events, government policy, practice, or guidelines.

The mentioned committee TORs will be provided to the committees at their first meeting for review and endorsement, which in turn would be reported to Council by way of the minutes of that committee meeting. The objectives suggested in the Notice of Motion can be considered by the mentioned committees then.

Financial/Resource/Legal Implications:

Each Advisory Committee operates under an adopted Constitution and Council’s Code of Meeting Practice.

Is the proposal consistent with any Delivery Program tasks?

|

CSP Objective |

CSP Strategy |

DP Action |

|

Community Objective 5: We have community led decision making which is open and inclusive |

5.2: Create a culture of trust with the community by being open, genuine and transparent |

5.2.4: Support Councillors to carry out their civic duties |

BYRON SHIRE COUNCIL

Notices of Motion 9.2

Notice of Motion No. 9.2 Development Application Processing Performance

File No: I2022/102

1. That Council notes:

a) as outlined in Resolution 22-032, that Council determines more Development Applications (DA’s) than average in NSW and that Council staff determine more DA’s per staff member than average Council in NSW;

b) that recruitment of appropriate skills and staff has been difficult;

c) that DA processing times and uncertainty over processing times are matters of significant public frustration;

d) incorrect or incomplete paperwork being submitted creates significant workload for assessment staff and often leads to delays and increased complexity.

2. That Council receives a report by April 2022 on measures that may improve KPI’s, reduce waiting times for DA processing, increase certainty in DA processing times and meet the requirements as set out in the letter from the Minister, including:

b) determining guidelines that would qualify DA’s to be fast tracked. These guidelines may include simplicity and levels of correct paperwork submitted;

c) allocating additional funding towards DA processing; and

d) adjusting DA assessment procedures towards refusal with an invitation to re-lodge when DA documentation is deficient, and away from coaching for larger DA’s to get inadequate documentation up to speed.

Signed: Cr Duncan Dey and Cr Asren Pugh

Councillor’s supporting information:

Council resolved on 3 February via Resolution 22-032 to receive a letter of 15 December 2021 from the NSW Government setting out Minister’s Expectations on Development Assessment, Planning Proposals, and Strategic Planning Obligations. The letter set performance benchmarks that Council should be able to achieve. It also threatened Councils with removal of their planning powers.

In the financial year 2020 Byron Shire Council determined almost 3 times as many Development Applications (DA’s) per 1000 residents as the average of NSW Councils (25.8 versus 9.4 based on LGPEP data for 2020). In that same period, 38% more applications were determined by each Full Time Equivalent staff member than the NSW average (36 versus 26).

The load on DA processing has not lifted since then. Impacts of the overload include reputational damage to Council, and increased avoidance of the application and assessment process. Some DA’s are lodged with poor documentation and inadequate consideration of matters that must be addressed in the application. All this results in poor development, environmental & social damage, and a plethora of compliance tasks.

The motion seeks ways to grow respect for the assessment process, to complete assessments quickly and to encourage developers to stay legal.

Staff comments

by Shannon Burt, Director, Sustainable Environment and Economy:

(Management Comments must not include formatted recommendations – resolution 11-979)

Report No. 5.13 Environmental Planning and Assessment (Statement of Expectations) Order 2021 Agenda of Extraordinary Meeting - Thursday, 3 February 2022 (infocouncil.biz) provided a comprehensive update to Councillors on the current performance reporting and benchmarks for development applications and planning proposals, resourcing, and continuous improvement programs for both.

It also made mention that Byron Shire is not the only council in the northern rivers region under pressure from development. Notwithstanding this, the report showed that Byron Shire is performing above its weight given size, workload and resourcing. This is acknowledged by point 1a).

Planning system

The NOM places a heavy emphasis on development application processing and what Council staff can do to simplify, fast track and triage development applications to make it easier for applicants to navigate the system, and for the system to give them a quicker determination. It asks for new KPIS in this regard.

The NOM also asks staff to look at:

2d) adjusting DA assessment procedures towards refusal with an invitation to re-lodge when DA documentation is deficient, and away from coaching for larger DA’s to get inadequate documentation up to speed.

Staff are already doing this.

What the NOM fails to recognise is that the planning system is set by the State Government via their legislation and their Planning Portal, and in its current form neither allows Council to reject applications that are poorly made, without merit and or ambit claims against planning controls.

Once a development application is uploaded to the Planning Portal, meets a simple development application document checklist, and is paid for in the planning portal, the statutory assessment time period starts; with appeal rights after 40 days irrespective of staff requests for additional information or design amendments.

The current statutory development application fees also fail to cost recover the work done by staff in assessing development applications and appeals. The fee structure impedes Council’s ability to properly resource its planning services in periods of highest demand. A review of the fees by the State Government is understood to be imminent with no details available at this time.

Volume of state government reform

In addition to the above, it is also important for Councillor’s to understand the current roll out of state government reforms which are many and complex. See table below. Each of these reforms has implications for the way Council staff manages development applications, assesses development applications, and determines development applications.

Also, the Planning Portal is about to be further updated which is also likely to impact staff responsible for its administration, and staff that use it for development application assessments.

Table - Summary January 2022 State Government reform

|

Name |

Description |

Timeframes |

|

Minister’s Planning Principles |

Nine principles that will provide direction for planning in NSW SEPPs are being consolidated into 11 ‘themes’. S9.1 Directions to be ‘grouped’ into 9 themes https://www.planning.nsw.gov.au/Policy-and-Legislation/Planning-Principles |

Updates commence 1 March 2022 |

|

EP&A Regulation 2021 |

Significant number of changes – see https://www.planningportal.nsw.gov.au/EPA-regulation-review and attached Guide. |

Updated regulation will commence 1 March 2022 |

|

New approach to rezoning |

Overhaul of the planning proposal process, including categorising rezonings, new streamlined processes and timeframes for each category.

Includes an updated Local Environmental Plan Making Guidelines https://www.planning.nsw.gov.au/-/media/Files/DPE/Guidelines/LEP-Making-Guideline.pdf |

Submissions on Discussion paper due by 28 February 2022 Webinars on discussion paper and draft guideline in early Feb |

|

Draft Design and Place SEPP |

Replaces and repeals SEPP 65 and SEPP BASIX Includes revised Apartment Design Guide, new Urban Design Guide, updates to BASIX and new Local Government Design Review Panel Manual

Also includes a draft s9.1 Ministers Direction – Design principles and Urban Design Guide objectives to be considered in some Planning Proposals |

Exhibition until 28 February 2022 |

|

Review of Infrastructure SEPP |

Various amendments |

EIE on exhibition until February 2022 |

|

Education SEPP |

Changes include: · providing changes to CIV thresholds to ensure planning assessment pathway is commensurate with scale and impacts of proposed project; · saving time and money through streamlined approval processes, making it easier for schools, TAFEs and universities to build new facilities and improve existing ones; · supporting the new student housing strategy proposed in the Housing Diversity SEPP for student housing on schools and tertiary institution campuses including TAFEs; · supporting the changing nature of tertiary institutions by making provision for innovation hub activities within existing tertiary institutions; · addressing concerns about impacts of child-care centres within Low Density Residential Zones (R2); · addressing existing policy anomalies in the Education SEPP. |

|

|

Planning amendments for agriculture |

Draft Standard Instrument (Local Environmental Plans) Amendment (Agritourism) Order 2021 released. The LEP Order will introduce new land use terms into the Standard Instrument: · ‘agritourism’, ‘farm gate premises’ and ‘farm experience premises’ and · amend the definition of ‘farm stay accommodation’. It also includes two optional clauses councils can choose to adopt in their LEPs for farm stay accommodation and farm gate premises. |

Council’s must advise whether they want to adopt the optional clauses by 25 February 2022 (using nomination form available on Portal) Final amending SEPP anticipated by 31 March 2022. |

|

Employment Zones |

Consolidation of Business and Industrial zones into 5 new “E Zones” Name changes for environmental protection zones |

Translation tables to be returned to DPIE by 31 Jan 2022 (returned 17 Jan) Draft SEPP aiming for March |

|

Statement of Expectations |

Environmental Planning and Assessment (Statement of Expectations) Order 2021 Sets out matters the Minister can consider when deciding whether to revoke a Council’s Planning Powers. |

Order is now in force. |

|

Infrastructure contributions |

Environmental Planning and Assessment Amendment (Infrastructure Contributions) Regulation 2021 |

July 2022 |

|

Clause 4.6 Review |

EIE for revised test exhibited in 2021 |

Reform package expected early 2022 |

|

Dept Primary Industries – State Significant Farmland mapping |

Update to mapping framework. |

|

|

Regional Plan review |

Review of the North Coast Regional Plan |

Comments on draft narrative & map by 24 Jan 2022 Public exhibition expected April 2022 |

|

Standard conditions of consent |

New prescribed conditions New set of standard conditions |

Legislation change Feb 2022 to introduce new prescribed conditions |

|

Planning for a more resilient NSW |

A strategic guide to planning for natural hazards Includes a ‘Resources Kit’ with links to various resources, data sources etc, and a ‘Natural resources Handbook’, with various checklists useful for strategic decision making |

|

|

Complying Development reforms |

Proposed changes to State Environmental Planning Policy (Exempt and Complying Development Codes) 2008 (Codes SEPP) to support economic recovery. These include changes to complying development for retail, commercial and industrial uses and for the delivery of data centres. |

Legislation changes to be introduced 1 Feb 2022 |

|

Regional Housing Taskforce |

Regional Housing Taskforce established by State Government in July 2021 to investigate regional housing issues, challenges and planning system barriers preventing the delivering of housing supply. The Taskforce submitted a Findings Report (Sept 2021) and a Recommendations Report (Oct 2021) to the Minister for Planning and Public Spaces. The NSW Government's response to the Taskforce is expected sometime in 2022. |

2022 |

|

NSW Heritage Act Review |

In October 2021, the Legislative Council Standing Committee on Social Issues published the report of their inquiry into the Heritage Act 1977. The inquiry looked at the effectiveness of the Heritage Act and the NSW heritage regulatory system, along with heritage aspects of the Environmental Protection and Assessment Act 1979. The Government Response to the report was released in December 2021. |

|

|

Housing SEPP |

Changes include: Introduces two new housing types to meet changing needs: · Co-living housing · Independent living units

Improves the way existing types of homes are delivered including: · Boarding houses · Build-to-rent housing · Seniors housing

Includes the planning rules for: · Caravan parks and manufactured home estates · Group homes · Retention of existing affordable rental housing · Secondary dwellings (sometimes known as granny flats) · Social housing

|

Legislation changes introduced November 2021 |

|

STRA SEPP |

The STRA provisions now apply in the Byron Shire LGA, including a maximum of 180 days per year for non-hosted STRA. |

Legislation changes introduced January 2022 |

Audit in development application process

Further to the above. Byron Shire Council is one of 3 Councils that has been selected by the Audit Office of NSW to participate in an audit in 2021-22 into the development assessment (DA) process in local councils.

The audit will assess the extent to which the assessment of DAs by selected councils aligns with relevant legislation and relevant guidance from the Department of Planning, Industry and Environment and the Independent Commission Against Corruption.

This audit will also review how we do things and where we can improve compared to others. The audit objectives and outcomes correlate with the NOM. The audit has commenced and is expected to be completed over the next 12 months.

With the above said, it would be fair to say that a report back to Council in April on points:

2a) establishing a ‘fast lane’ for qualifying DA’s, with a triage approach for determining if DA’s meet the criteria to be ‘fast tracked’;

2b) determining guidelines that would qualify DA’s to be fast tracked. These guidelines may include simplicity and levels of correct paperwork submitted;

is unrealistic given the volume and breadth of change currently being managed by planning staff that needs to be taken into consideration before any reasonable and informed response to these points can be made. To undertake this work also would mean diverting staff from planning administration and development assessment duties which would only further exacerbate the pressure on these staff with their current workloads.

It is staff preference that the report as requested be presented to Council - post reforms introduction and post the Audit review process completion (likely at the end of 2022).

In the meantime, staff from planning administration and development assessment will continue to work on continuous improvements to the systems, look at additional resourcing options where needed, and to meet existing KPIs in the Operational Plan and those in the Order for development application determinations.

Financial/Resource/Legal Implications:

Potential and significant financial and resource implications to Council which need further consideration.

Is the proposal consistent with any Delivery Program tasks?

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 4: We manage growth and change responsibly |

4.1: Support the visions and aspirations of local communities through place-based planning and management |

4.1.3: Manage development through a transparent and efficient assessment process |

4.1.3.1 |

Assess and determine development applications |

BYRON SHIRE COUNCIL

Submissions and Grants 11.1

Report No. 11.1 Grants January 2022

Directorate: Corporate and Community Services

Report Author: Donna Johnston, Grants Coordinator

File No: I2022/48

Summary:

Council has submitted applications for a number of grant programs which, if successful, would provide funding to enable the delivery of identified projects. This report provides an update on these grant submissions.

RECOMMENDATION:

That Council notes the report and Attachment 1 (#E2022/9955) for Byron Shire Council’s grant submissions as of 31 January 2022.

1 Grant

submissions as at 31 January 2022, E2022/9955

![]()

Report

This report provides an update on grant submissions since the last report to Council. Currently Council has 18 grant submissions awaiting determination and announcement.

Successful applications

Council was advised of the following successful applications:

|

Funding body |

Funding scheme |

Project name |

Total

project |

Amount requested $ |

|

NSW Department Planning, Industry & Environment |

Public Spaces Legacy Program |

Sandhills Wetlands |

*$6,300,000 |

$3,000,000 |

|

National Australia Day Council |

National Australia Day Council |

Australia Day - Citizenship and Awards Ceremony |

$34,000 |

$30,000 |

|

NSW Government - Office of Sport |

Regional Sports Facility |

Suffolk Park Football Club |

$489,483 |

$389,483 |

|

Department of Planning, Industry and Environment |

Summer Night Fund |

Mullum Pool - Slip Sliding Summer Fun |

$15,000 |

$15,000 |

|

Transport for NSW |

Fixing Local Roads |

Rifle Range Road - additional funding |

$597,015 |

$597,015 |

*Sandhills Wetland project value is an estimate and is still being finalised. Funding options for the Council contribution have been identified and when the full costs are determined, will be detailed within an upcoming separate report.

Unsuccessful applications

Council has been advised of the following unsuccessful applications.

|

Funding body |

Funding scheme |

Project name |

Total project |

Amount requested $ |

|

Australia Government |

National Landcare Program - Smart Farms Small Grants |

Soil Science and Sustainable Farms in Byron Shire |

$108,973 |

$108,973 |

|

NSW Government |

Everyone Can Play |

Byron Recreation Grounds Amenities block |

$200,006 |

$100,000 |

|

Department Regional NSW |

Stronger Country Communities Fund R4 |

Byron Street (Bangalow) Footpath |

$471,884 |

$471,884 |

|

Department Regional NSW |

Stronger Country Communities Fund R4 |

Cavanbah Centre |

$70,600 |

$70,600 |

|

Department Regional NSW |

Stronger Country Communities Fund R4 |

Bangalow Pathway |

$50,000 |

$50,000 |

|

Department Regional NSW |

Stronger Country Communities Fund R4 |

Mullumbimby Netball Club |

$118,475 |

$118,475 |

|

Department Regional NSW |

Stronger Country Communities Fund R4 |

Byron Street (Bangalow) Footpath |

$471,884 |

$471,884 |

No feedback was provided for the National Landcare Program and Everyone Can Play. Council was successful in the previous Everyone Can Play program and is currently delivering this project.

Feedback on Stronger Country Communities will be provided in February. Suffolk Park Football Club was also submitted under this program however, it has been successfully funded under the Regional Sports Facility Fund program.

Applications submitted in November 2021 to January 2022

|

Funding body |

Funding scheme |

Project name |

Total project |

Amount requested |

|

Department of Planning, Industry and Environment |

Habitat Action Grant |

Marshalls Creek |

$80,000 |

$40,000 |

|

Department of Planning, Industry and Environment |

Coastal Estuary Implementation Program 2021 - planning stream |

Scoping Study for the Southern Shire Coastline and Belongil Estuary - Stage 2 |

$111,500 |

$74,331 |

|

NSW Environment Protection Authority |

Own it and Act R 6 - Stream 1 |

Reuse in Bruns |

$75,000 |

$75,000 |

|

NSW Environment Protection Authority |

Own it and Act R 6 - Stream 2 |

Stormwater litter |

$50,000 |

$50,000 |

|

National Australia Day Council |

National Australia Day Council |

Australia Day - Citizenship and Awards Ceremony |

$34,000 |

$30,000 |

|

Department of Planning, Industry and Environment |

Summer Night Fund |

Mullum Pool - Slip Sliding Summer Fun |

$15,000 |

$15,000 |

|

Australian Government - National Recovery and Resilience Agency |

Preparing Australian Communities |

Byron Drainage Strategy |

$1,281,720 |

$1,081,720 |

Upcoming grant opportunities

Streets as Shared Spaces Program | NSW Dept of Planning, Industry and Environment – Round 2

The program supports the Premier's Priority to increase walkable access to quality open, green and public space in urban areas.

An Expression of Interest Application was submitted in November 2021 and Council has been invited to submit a full application in February 2022. The application supports the trial of Car Free Sundays in Byron Bay in conjunction with the Byron Community Markets.

The $1.38 billion Building Better Regions Fund (BBRF) supports the Australian Government's commitment to create jobs, drive economic growth and build stronger regional communities into the future.

The fund invests in projects located in or benefiting eligible areas outside the major capital cities of Sydney, Melbourne, Brisbane, Perth, Adelaide, and Canberra. A total of $250 million is available within Round 6.

Following the positive feedback from Round 5 and the project reaching the Ministerial Panel, Council will be submitting the Bioenergy Byron project.

Walking and Cycling Program | Transport for NSW

The Walking & Cycling Program’s strategic objectives are aimed at:

· improving bike riding to and within centres, neighbourhoods and to key destinations

· improving walkability in centres, neighbourhoods and at key destinations, and

· enable vibrant centres and liveable neighbourhoods through the creation of street environments that prioritise walking and cycling.

Applications for strategic planning, design and construction can be submitted. Council projects being reviewed include:

Construction

· Byron St, Bangalow – upgraded path to connect Feros, sports field through the primary school

· Orana Road, Ocean Shores – new shared path from Balemo Road to Water Lily Park

Design

· Lighthouse Road, Byron – new path (along road) to connect to the Lighthouse – to support access and safety

· Raftons Road – new share path

· Rifle Range Road, Bangalow – new share path

Projects identified are priority programs within the Byron Shire Bike Plan 2019.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 5: We have community led decision making which is open and inclusive |

5.6: Manage Council’s resources sustainably |

5.6.12: Implement strategic grants management systems to deliver priority projects for Byron’s community (SP) |

5.6.12.2 |

Provide sound governance for grants management |

Legal/Statutory/Policy Considerations

Under Section 409 3(c) of the Local Government Act 1993 Council is required to ensure that ‘money that has been received from the Government or from a public authority by way of a specific purpose advance or grant, may not, except with the consent of the Government or public authority, be used otherwise than for that specific purpose’. This legislative requirement governs Council’s administration of grants.

Financial Considerations

If Council is successful in obtaining the identified grants, this would bring funding sought to $39.5 million which would provide significant funding for Council projects. Some of the grants require a contribution from Council (either cash or in-kind) and others do not. Council’s contribution is funded.

The potential funding is detailed below:

Requested funds from funding bodies $18,267,218

Council Contribution Cash $21,183,070

Council Contribution In-Kind $36,000

Other contributions $0

Funding applications submitted and

awaiting notification (total value) $39,516,288

Consultation and Engagement

Cross-organisational consultation has occurred in relation to the submission of relevant grants, and the communication of proposed grant applications.

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Lease to Huron Bay Pty Ltd (A.C.N )

Directorate: General Manager

Report Author: Paula Telford, Leasing and Licensing Coordinator

File No: I2021/1952

Summary:

Mr William Francis Bailey requested a new 7-year lease with an option of 7-years over Lot 6 DP836887 (‘the Land’) to Parington Pty Ltd to secure hangar access to support his farming business. Council resolved (21-430) to grant a new five-year lease to Parington Pty Ltd.

Following resolution (21-430), Mr William Francis Bailey contacted Council requesting the new lease be granted to his other company Huron Bay Pty Ltd (A.C.N 654 298 405) and not Parington Pty Ltd. As a result, a new report is tabled for Council consideration.

RECOMMENDATION:

That Council authorises the General Manager, under delegation, to enter into a Head Lease with Huron Bay Pty Ltd (A.C.N. 654 298 405) on the following terms:

a) over Lot 6 DP836887 Staceys Way Tyagarah,

b) term five-years,

c) base rent to be set by an independent market valuation (yet to be received) with rent annually increased thereafter by Consumer Price Index All Groups Sydney,

d) for the purpose of storage of aircraft,

e) the Lessor to consent to the Lessee sub-leasing part of the leased land to T & L West for the same term and purpose as the Head Lease,

f) the Lessor acknowledges that the Lessee and T & L West own all improvements on the Land,

g) Lessee must, at its cost, be responsible for the following:

i) all outgoings payable in respect of the Land,

ii) all maintenance of improvements on the Land including but not limited to all buildings, road access and or carpark constructed on the Land,

iii) providing a minimum $20 million public risk insurance cover noting Byron Shire Council as an interested party, and

iv) hold all consents, approvals, and others authorisation for storage of aircraft on the Land.

h) Lessee must, at its cost, removal all improvements from the Land and return the Land as vacant possession to the Lessor on the day the Head Lease ends, unless a new lease is negotiated to commence on the day after the end of the Head Lease.

i) The Lessee to enter into an Access Licence for the Tyagarah Airfield upon acceptance of a Head Lease over the Land.

Report

Council resolved (21-430) at its 28 October 2021 meeting:

That Council authorises the General Manager, under delegation, to enter into a lease with Parington Pty Ltd (A.C.N. 002 015 581) on the following terms:

a) Lot 6 DP836887 Staceys Way Tyagarah,

b) term five-years,

c) base rent to be set by an independent market valuation (yet to be received) with rent annually increased thereafter by Consumer Price Index All Groups Sydney,

d) for the purpose of storage of aircraft,

e) the Lessor to consent to the Lessee sub-leasing part of the leased land to T & L West for the same term and purpose as the Head Lease held by the Lessee,

f) the Lessor acknowledges that the Lessee and T & L West owns all buildings and improvements on the Land,

g) Lessee must, at its cost, be responsible for the following:

i) all outgoings payable in respect of the Land,

ii) all maintenance of improvements on the Land including but not limited to all buildings, road access and or carpark constructed on the Land,

iii) minimum $20 million public risk insurance covers noting Byron Shire Council as an interested party provided by the Lessee; and

iv) all consents, approvals and others authorisation for storage of aircraft on the Land.

h) Lessee and Sub-Lessee must at their cost, removal all buildings and other improvements from the Land and return the Land to vacant possession at the end of the lease unless a new lease is negotiated to commence on the day after the end date of the lease.

Following Council resolution (21-430) Mr William Francis Bailey (‘Mr Bailey’) director of Parington Pty Ltd, contacted Council requesting that Council enter into a new lease with his other company Huron Bay Pty Ltd (A.C.N 654 298 405) and not Parington Pty Ltd.

Background

Lot 6 DP836887 (‘the Land’), as vacant land, was first leased to Ron Llewellyn in September 1988 for seven years for the purpose of an aircraft hangar, clubhouse, recreation, camping and children’s playground. This lease ended without any construction taking place on the Land.

On 12 August 1993, Council entered into a seven-year lease, with a 7-year option with Mr Bailey in accordance with Council resolution (02-1237). Terms of the lease authorised the construction of a hangar, office, amenities and carparking subject to development consent. Terms of the Lease required the Lessee, at its cost, to remove all improvements on the land within one-month from termination of the lease. A hangar was constructed on the land under development approval 94/487.

On 13 November 1997, Council, by letter signed by the then General Manager Mr Ray Kent, consented to the Lessee sub-leasing part of the leased land for the same purpose as the lease held by Mr Bailey. Mr Bailey then sub-leased part of the Land to T & L West. T & L West constructed a second hangar on the Land following a Land and Environment Court ruling in 2000.

On 1 July 2007 Council entered into a new lease with Mr Bailey for a term of 5-years commencing 1 July 2007 for hangar and associated activities. The Lessee currently holds this lease under holding over provisions. Clause 13(b) of the lease requires the Lessee to remove, at its cost, all its improvements from the Land at the end of the lease.

Mr Bailey requests a new seven-year Head Lease for hangar and associated activities over the land to Huron Bay Pty Ltd (A.C.N 654 298 405).

The Land:

The Land is Council owned and classified as operational.

Council’s Business and Industrial Lands Strategy identified the Land as a preliminary site for a potential 9-hectare industrial land area referred to Area Number 3: Gulgan East Industrial Site.

The Strategy suggests a timeframe of 3-to-5-years to undertake a planning proposal to rezone the land. The rezoning is conditional on the provision of essential infrastructure to the site for water, sewerage, and road connections to the M1 Motorway.

No action in currently reported in Councils Operational Plan to advance investigations into the Tyagarah site. Other lands identified in the Strategy are also being investigated.

The report recommends that a five-year lease is granted to the Lessee to prevent any impact on the progress of the Business and Industrial Lands Strategy by Council.

Improvements on the Land:

Two aircraft hangars are built on the Land.

· Hanger One, built to the rear of the Land and authorised by development consent 94/487.

· Hanger Two, built to the front of the Land and authorised by development consent 99/0227 after a Land and Environment Court ruling.

According to terms of the current lease, the Lessee owns Hanger One along with all its other improvements on the Land.

Hanger Two appears to be owned by T & L West and occupies the land under a private agreement with the Lessee.

Staff recommend that a new five-year Head Lease is granted to Huron Bay Pty Ltd with terms of the Head Lease permitting the Lessee to sub-lease part of the land to T & L West for the same term and purpose as the Head Lease.

That the proposed five-year lease requires the Lessee to remove, at its cost, all improvements from the land, including improvements owned by T & L West, and to return the land to the Lessor as vacant possession on the day the Head Lease ends, unless a new lease is entered into prior to the end of the Head Lease.

Use of Tyagarah Airfield:

Use of the Tyagarah Airfield is controlled by an Access Licence with user costs set out in Councils Fees and Charges. Council will require Huron Bay Pty Ltd (A.C.N 654 298 405) to enter into an Access Licence for the Tyagarah Airfield upon acceptance of a Head Lease over the Land.

Terms of proposed lease:

Council staff propose a new Head Lease to Huron Bay Pty Ltd (A.C.N 654 298 405) on the following:

a) over Lot 6 DP836887 Staceys Way Tyagarah,

b) term five-years,

c) base rent to be set by an independent market valuation (yet to be received) with rent annually increased thereafter by Consumer Price Index All Groups Sydney,

d) for the purpose of storage of aircraft,

e) the Lessor to consent to the Lessee sub-leasing part of the leased land to T & L West for the same term and purpose as the Head Lease,

f) the Lessor acknowledges that the Lessee and T & L West own all improvements on the Land,

g) Lessee must, at its cost, be responsible for the following:

i) all outgoings payable in respect of the Land,

ii) all maintenance of improvements on the Land including but not limited to all buildings, road access and or carpark constructed on the Land,

iii) providing a minimum $20 million public risk insurance cover noting Byron Shire Council as an interested party, and

iv) hold all consents, approvals, and others authorisation for storage of aircraft on the Land.

h) Lessee must, at its cost, removal all improvements from the Land and return the Land as vacant possession to the Lessor on the day the Head Lease ends, unless a new lease is negotiated to commence on the day after the end of the Head Lease.

i) The Lessee to enter into an Access Licence for the Tyagarah Airfield upon acceptance of a Head Lease over the Land.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

Community Objective 1: We have infrastructure, transport and services which meet our expectations |

1.2: Provide essential services and reliable infrastructure which meet an acceptable community standard |

1.2.6: Optimise Council’s property portfolio (SP) |

1.2.6.9 |

Manage leases and contracts at Tyagarah Airfield |

|

Community Objective 5: We have community led decision making which is open and inclusive |

5.5: Manage Council’s finances sustainably |

5.5.1: Enhance the financial capability and acumen of Council |

5.5.1.2 |

Support the organisation in identifying financial implications of projects, proposals and plans |

Recent Resolutions

· Resolution (21-430)

Legal/Statutory/Policy Considerations

As detailed in the report.

Financial Considerations

Base rent to be set by independent market rent valuation from an approved Valuer. Base rent will be increased annually by Consumer Price Index All Groups Sydney for the term.

Ancillary uses of the airfield by Huron Bay Pty Ltd (A.C.N 654 298 405) and its sub-Lessee to be charged in accordance with Councils Fees and Charges for landing, parking, and aircraft access registration fees.

Consultation and Engagement

Council staff have advised Mr Bailey that the report will recommend a five-year lease instead of his requested seven-year with seven-year option to prevent any impact on the progress of the Business and Industrial Lands Strategy by Council over the leased land.

BYRON SHIRE COUNCIL

Staff Reports - General Manager 13.2

Report No. 13.2 Grant of 5-year licence over Mullumbimby Community Hall (former Mullumbimby Scout Hall) to preferred respondent

Directorate: General Manager

Report Author: Paula Telford, Leasing and Licensing Coordinator

File No: I2021/1954

Summary:

A Request for Proposal to licence the Mullumbimby Community Hall over five-years for the purpose of a multi-use community building was advertised between 4 November and 2pm 6 December 2021.

This report recommends a new licence is granted to the successful respondent to the Request for Proposal.

RECOMMENDATION:

1. That Council note that no submissions were received from public notice of a proposed five-year licence over the Mullumbimby Community Hall advertised between 4 January and 2 February 2021.

2. That Council award a five-year licence over the Mullumbimby Community Hall to the successful Respondent listed in Confidential Attachment 1 – Final Evaluation Report with the following terms:

a) part Folio 321/755692 being the building known as the Mullumbimby Community Hall,

b) term of five-years,

c) purpose of a community building as defined by the Byron Local Environmental Plan 1998,

d) base rent to be set at $490 per annum exclusive of GST and increased thereafter annually by Consumer Price Index All Groups Sydney,

e) Council to subsidise rent to the value of $16,790 (exclusive GST),

f) Council to subsidise fixed rates and charges payable in accordance with Policy Section 256 Donations – Rates and Charges 2021,

g) Licensee to pay all other outgoings and must provide public liability insurance to the minimum value of $20 million noting Byron Shire Council as an interested party.

3. That Council makes public its decision, including the name of the successful Respondent.

4. That Council thanks the Mullumbimby Scout Group for its contribution and long-term commitment to the Mullumbimby community.

Attachments:

1 Confidential - Attachment 1: Final Evaluation Panel Report, E2021/151754

2 Confidential - Attachment 2: Probity Report, E2021/152423

Report

Background:

Lot 321 DP755692, River Terrace Mullumbimby is Council owned land classified as community land. The Mullumbimby Community Hall (previously known as the Mullumbimby Scout Hall), (‘the Hall) is built on the land.

In October 2021, Scouts NSW Mullumbimby Branch was forced to close and vacated the Hall. Scouts Mullumbimby Branch having been active in the community since before 1930’s having initially occupied the Mullumbimby Drill Hall before moving into the Hall in the 1960’s. Council thanks the Mullumbimby Scout Group for its contribution and long-term commitment to the Mullumbimby community.

To ensure hirers of the Hall were not disadvantaged by Scouts vacating the Hall, Council staff took over management of the Hall from November 2021 allowing all regular hirers continued use of the Hall free of charge until a new licensee could be found.

Request for Proposal

A Request for Proposal to licence the Hall over five years was run between 4 November and 2:00pm 6 December 2021. The Request for Proposal was open to non-profit organisations to manage and maintain the Hall as a multi-use community building in accordance with the Plan of Management for the land.

Council received three submissions:

· Creative Mullumbimby Incorporated,

· Mullum Cares Incorporated, and

· Mullumbimby & District Neighbourhood Centre Incorporated.

Evaluation of submissions received:

Submissions received were assessed against predetermined Compliance and Qualitative criteria as provided in the Request for Proposal document.

The evaluation assessment period ran from 7 to 15 December 2021 in accordance with the Evaluation Plan. The Evaluation Panel was chaired by the Acting Manager Open Space with probity advice provided by Councils Corporate Planning and Improvement Coordinator.

In accordance with the Evaluation Plan, the Evaluation Panel was required to:

· evaluate the compliance criteria and establish that a submission was compliant,

· score the qualitative criteria against pre-defined weightings,

· clarify information with respondents if required, and

· make recommendations of a preferred Respondent.

The Evaluation Panel independently evaluated each submission by scoring both the compliance and weighted qualitative criteria. The Panel meet on two occasions to resolved discrepancies before reaching a consensus as to the preferred Respondent.

Compliance Criteria:

|

Detail |

Compliance |

|

1. Conflict of Interest Declaration |

Yes/No |

|

2. Instrument of proposal: i. Organisation name and Trading name if different, ii. A.B.N and/or A.C.N, iii. Evidence of non-profit status, iv. Organisation profile, v. Referee details |

Yes/No |

|

3. Details of insurance or statement insurance will be obtained. |

Yes/No |

|

4. Commencement date of licence. |

Yes/No |

Qualitative Criteria:

|

Weighting |

|

|

1. Describe your organisation vision and demonstrated understanding Minimum information to provide: a) Describe your vision and how it aligns with Council’s vision to ‘strongly protect the shire’s lifestyle, diversity and community spirit’? b) Describe the community outcomes you are hoping to achieve and how you will know if you’re achieving them, supported by a list of Key Performance Indicators? c) Describe your organisations anticipated support for diverse community user groups with different needs and goals to fully realise the potential of the Mullumbimby Community Hall, including anticipated marketing and promotion of the Hall for community activities? d) Detail your anticipated hire fee structures? e) Describe any similar experiences in running a community hall or alike?

|

50% |

|

2. Describe the proposed management and key personnel Minimum information to provide: a) Describe how the Mullumbimby Community Hall will be managed, including governance as well as operational matters such as proposed opening hours and how after hour’s usage will be provided and managed? b) Describe any additional services to be provided and core personnel? c) Describe your bookings management system including ability to report usage back to Council? d) Describe how the organisation will enable community and stakeholder input into decision making and how will you manage compliments and complaints? |

40% |

|

3. Describe proposed improvements to the Premises. Minimum information to provide: a) Describe your anticipated maintenance schedule for Mullumbimby Community Hall over the licence term? |

10% |

Following assessment of each submission against the assessment criteria, the Evaluation Panel recommended the successful Respondent as detailed in Attachment 1: Final Evaluation Panel Report.

A Probity Report of the evaluation process is contained in Confidential Attachment 2.

Community Consultation

Public notice of a proposed five-year licence was exhibited between 4 January and 2 February 2022. Council received no submissions.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

L2 |

CSP Strategy |

L3 |

DP Action |

L4 |

OP Activity |

|

Community Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and sense of community |

2.2 |

Support access to a wide range of services and activities that contribute to the wellbeing of all members of the Byron Shire community |

2.2.1 |

Develop and maintain collaborative relationships with government, sector and community |

2.2.1.2 |

Participate in and inform community planning |

Recent Resolutions

· Nil.

Legal/Statutory/Policy Considerations

Local Government Act 1993 (NSW)

s47 Leases, licences and other estates in respect of community land—terms greater than 5 years

(1) If a council proposes to grant a lease, licence or other estate in respect of community land for a period (including any period for which the lease, licence or other estate could be renewed by the exercise of an option) exceeding 5 years, it must:

(a) give public notice of the proposal (including on the council’s website), and

(b) exhibit notice of the proposal on the land to which the proposal relates, and

(c) give notice of the proposal to such persons as appear to it to own or occupy the land adjoining the community land, and

(d) give notice of the proposal to any other person, appearing to the council to be the owner or occupier of land in the vicinity of the community land, if in the opinion of the council the land the subject of the proposal is likely to form the primary focus of the person’s enjoyment of community land.

(2) A notice of the proposal must include:

• information sufficient to identify the community land concerned

• the purpose for which the land will be used under the proposed lease, licence or other estate

• the term of the proposed lease, licence or other estate (including particulars of any options for renewal)

• the name of the person to whom it is proposed to grant the lease, licence or other estate (if known)

• a statement that submissions in writing may be made to the council concerning the proposal within a period, not less than 28 days, specified in the notice.

(3) Any person may make a submission in writing to the council during the period specified for the purpose in the notice.

(4) Before granting the lease, licence or other estate, the council must consider all submissions duly made to it.

s47A Leases, licences and other estates in respect of community land—terms of 5 years or less

(1) This section applies to a lease, licence or other estate in respect of community land granted for a period that (including any period for which the lease, licence or other estate could be renewed by the exercise of an option) does not exceed 5 years, other than a lease, licence or other estate exempted by the regulations.

(2) If a council proposes to grant a lease, licence or other estate to which this section applies:

(a) the proposal must be notified and exhibited in the manner prescribed by section 47, and

(b) the provisions of section 47 (3) and (4) apply to the proposal, and

(c) on receipt by the council of a written request from the Minister, the proposal is to be referred to the Minister, who is to determine whether or not the provisions of section 47 (5)–(9) are to apply to the proposal.

(3) If the Minister, under subsection (2) (c), determines that the provisions of section 47 (5)–(9) are to apply to the proposal:

(a) the council, the Minister and the Director of Planning are to deal with the proposal in accordance with the provisions of section 47 (1)–(8), and

(b) section 47 (9) has effect with respect to the Minister’s consent.

Financial Considerations

The Request for Proposal stipulated subsidised annual rent to the value of minimum Crown is payable by the Licensee. As a result, Council must subsidise annual rent to the value of $16,790 calculated from the following formula: 6% of the unimproved value of the land at $17,280 less minimum Crown rent at $490.

In accordance with its Policy Section 356 Donations – rates and charges, the licensee is eligible for a full subsidy of annual fixed rates and charges payable on the land.

All remaining outgoings is payable by the Licensee. Annual rent will be increased by CPI, all groups Sydney commencing year two of the lease for the term.

Consultation and Engagement

Public notice of the proposed five-year licence was advertised on Council’s website between 4 January and 2 February 2022. No submissions were received.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.3

Staff Reports - Corporate and Community Services

Report No. 13.3 Council Investments - 1 November 2021 to 30 November 2021

Directorate: Corporate and Community Services

Report Author: James Brickley, Manager Finance

File No: I2021/1922

Summary:

This report includes a list of investments and identifies Council’s overall cash position for the period 1 November 2021 to 30 November 2021 for information.

This report is prepared to comply with Section 212 of the Local Government (General) Regulation 2021.

|

That Council notes the report listing Council’s investments and overall cash position as at 30 November 2021. |

.

Report

Council has continued to maintain a diversified portfolio of investments. As of 30 November 2021, the average 90-day bank bill rate (BBSW) for the month of November 2021 was 0.02%. Council’s performance to November 2021 was 0.55%. This is largely due to the active ongoing management of the investment portfolio, maximising investment returns through secure term deposits, bonds and purchasing floating rate notes with attractive interest rates. It should be noted that as investments mature, Council’s investment return may continue to decrease due to the lower rates available in the current market.

The table below identifies the investments held by Council as at 30 November 2021

Schedule of Investments held as at 30 November 2021

|

Purch Date |

Principal ($) |

Description |

CP* |

Rating |

Maturity Date |

No Fossil Fuel |

Type |

Int. Rate |

Current Value |

|

24/03/17 |

1,000,000.00 |

NAB Social Bond (Gender Equality) |

Y |

AA- |

24/03/22 |

N |

B |

3.25% |

1,011,900.00

|

|

15/11/18 |

1,000,000.00 |

NSW Treasury Corp (Green Bond) |

N |

AAA |

15/11/28 |

Y |

B |

3.00% |

1,064,660.00

|

|

20/11/18 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

22/03/24 |

Y |

B |

3.00% |

1,057,630.00

|

|

28/03/19 |

1,000,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

28/03/31 |

Y |

B |

2.38% |

1,014,590.00

|

|

21/11/19 |

1,000,000.00 |

NSW Treasury Corp (Sustainability Bond) |

N |

AAA |

20/03/25 |

Y |

B |

1.25% |

993,570.00

|

|

27/11/19 |

500,000.00 |

National Housing Finance & Investment Social Bond |

Y |

AAA |

27/05/30 |

Y |

B |

1.52% |

469,907.00

|

|

06/09/21 |

1,000,000.00 |

Northern Territory TCorp |

Y |

Aa3 |

15/12/26 |

Y |

B |

1.40% |

1,000,000.00 |

|

16/09/21 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

02/03/32 |

Y |

B |

1.50% |

918,390.00 |

|

31/03/17 |

1,000,000.00 |

CBA Climate Bond |

Y |

AA- |

31/03/22 |

N |

FRN |

0.95% |

1,003,440.00

|

|

15/06/21 |

500,000.00 |

National Housing Finance & Investment Social Bond |

Y |

AAA |

01/07/31

|

Y |

FRN |

0.21% |

501,295.00

|

|

17/12/20 |

2,000,000.00 |

NAB |

Y |

AA- |

17/12/21 |

N |

TD |

0.50% |

2,000,000.00 |

|

05/01/21 |

2,000,000.00 |

NAB |

N |

AA- |

05/01/22 |

N |

TD |

0.45% |

2,000,000.00 |

|

20/01/21 |

1,000,000.00 |

Westpac (Tailored) |

Y |

AA- |

20/01/22 |

N |

TD |

0.38% |

1,000,000.00 |

|

27/01/21 |

1,000,000.00 |

The Mutual Bank |

Y |

NR |

27/01/22 |

Y |

TD |

0.50% |

1,000,000.00 |

|

29/01/21 |

1,000,000.00 |

ME Bank |

Y |

BBB |

31/01/22 |

Y |

TD |

0.45% |

1,000,000.00 |

|

09/06/21 |

1,000,000.00 |

Illawarra Credit Union |

Y |

NR |

09/12/21 |

Y |

TD |

0.45% |

1,000,000.00 |

|

24/06/21 |

1,000,000.00 |

ME Bank |

N |

BBB |

24/02/22 |

Y |

TD |

0.45% |

1,000,000.00 |

|

30/06/21 |

1,000,000.00 |

ME Bank |

N |

BBB |

27/01/22 |

Y |

TD |

0.45% |

1,000,000.00 |

|

06/07/21 |

1,000,000.00 |

Judo Bank |

Y |

BBB- |

04/07/22 |

Y |

TD |

0.70% |

1,000,000.00 |

|

23/07/21 |

1,000,000.00 |

AMP Bank |

Y |

BBB |

23/12/21 |

Y |

TD |

0.50% |

1,000,000.00 |

|

30/07/21 |

1,000,000.00 |

AMP Bank |

N |

BBB |

28/06/22 |

Y |

TD |

0.75% |

1,000,000.00 |

|

09/08/21 |

1,000,000.00 |

The Mutual Bank |

N |

NR |

07/02/22 |

Y |

TD |

0.45% |

1,000,000.00 |

|

26/08/21 |

1,000,000.00 |

AMP Bank |

N |

BBB |

22/02/22 |

N |

TD |

0.35% |

1,000,000.00 |

|

01/09/21 |

1,000,000.00 |

Bank of Queensland |

Y |

BBB+ |

02/03/22 |

N |

TD |

0.33% |

1,000,000.00 |

|

10/09/21 |

1,000,000.00 |

The Mutual Bank |

N |

NR |

10/03/22 |

Y |

TD |

0.45% |

1,000,000.00 |

|

03/09/21 |

2,000,000.00 |

Suncorp |

Y |

A+ |

02/03/22 |

Y |

TD |

0.30% |

2,000,000.00 |

|

03/09/21 |

2,000,000.00 |

Bank of Queensland |

N |

BBB+ |

04/01/22 |

N |

TD |

0.30% |

2,000,000.00 |

|

06/09/21 |

1,000,000.00 |

Volt Bank |

Y |

NR |

06/12/21 |

Y |

TD |

0.40% |

1,000,000.00 |

|

09/09/21 |

1,000,000.00 |

Illawarra Credit Union |

N |

NR |

09/09/22 |

Y |

TD |

0.55% |

1,000,000.00 |

|

01/10/2021 |

1,000,000.00 |

AMP Bank |

N |

BBB |

01/04/22 |

N |

TD |

0.65% |

1,000,000.00 |

|

04/11/2021 |

2,000,000.00 |

NAB |

N |

AA- |

04/11/22 |

N |

TD |

0.45% |

2,000,000.00 |

|

30/11/2021 |

2,000,000.00 |

NAB |

N |

AA- |

29/04/22 |

N |

TD |

0.38% |

2,000,000.00 |

|

N/A |

17,285,825.83 |

CBA Business Saver |

N |

AA- |

N/A |

N |

CALL |

0.20% |

17,285,825.83 |

|

N/A |

8,154,610.38 |

CBA Business Saver – Tourism Infrastructure Grant |

N |

AA- |

N/A |

N |

CALL |

0.20% |

8,154,610.38 |

|

N/A |

2,112,906.02 |

NSW Treasury Corp |

N |

AAA |

N/A |

Y |

CALL |

0.00% |

2,112,906.02 |

|

N/A |

15,019,326.79 |

Macquarie Accelerator Call |

N |

A |

N/A |

N |

CALL |

0.35% |

15,019,326.79 |

|

Total |

79,572,669.02 |

|

|

|

|

|

AVG |

0.55% |

79,608,051.02 |

|

Note 1. |

CP = Capital protection on maturity |

|||

|

|

N = No Capital Protection |

|||

|

|

Y = Fully covered by Government Guarantee |

|||

|

|

P = Partial Government Guarantee of $250,000 (Financial Claims Scheme) |

|||

|

|

|

|||

|

Note 2. |

No Fossil Fuel ADI |

|||

|

|

Y = No investment in Fossil Fuels |

|||

|

|

N = Investment in Fossil Fuels |

|||

|

|

U = Unknown Status |

|||

|

|

|

|

|

|

|

Note 3. |

Type |

Description |

|

|

|

|

B |

Bonds |

Principal can vary based on valuation, interest payable via a fixed interest, payable usually each quarter. |

|

|

|

FRN |

Floating Rate Note |

Principal can vary based on valuation, interest payable via a floating interest rate that varies each quarter. |

|

|

|

TD |

Term Deposit |

Principal does not vary during investment term. Interest payable is fixed at the rate invested for the investment term. |

|

|

|

CALL |

Call Account |

Principal varies due to cash flow demands from deposits/withdrawals. Interest is payable on the daily balance. |

|

Environmental and Socially Responsible Investing (ESRI)

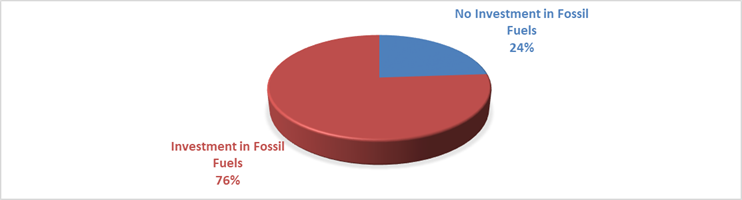

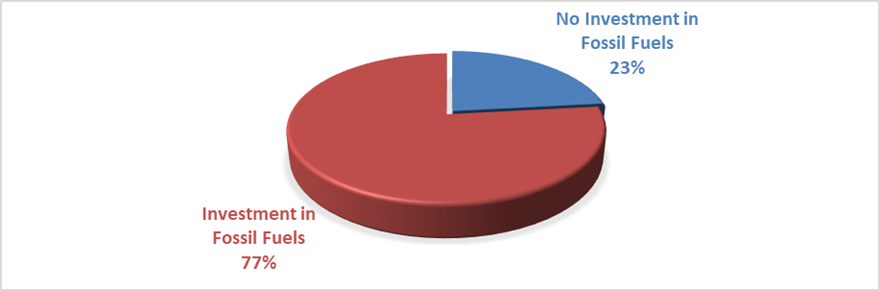

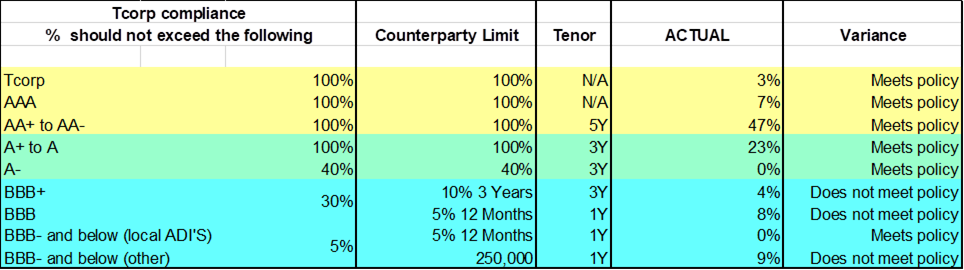

An additional column has been added to the schedule of Investments to identify if the financial institution holding the Council investment has been assessed as a ‘No Fossil Fuel’ investing institution. This information has been sourced through www.marketforces.org.au and identifies financial institutions that either invest in fossil fuel related industries or do not. The graph below highlights the percentage of each classification across Council’s total investment portfolio in respect of fossil fuels only.

The notion of Environmental and Socially Responsible Investing is much broader than whether a financial institution as rated by ‘marketforces.org.au’ invests in fossil fuels or not. Council’s current Investment Policy defines Environmental and Socially Responsible Investing at Section 4.1 of the Policy which can be found on Council’s website.

Council has two investments with financial institutions that invest in fossil fuels but are nevertheless aligned with the broader definition of Environmental and Socially Responsible investments i.e.:

1. $1,000,000 investment with the National Australia Bank maturing on 24 March 2022 known as a Social Bond that promotes Gender Equity.

2. $1,000,000 investment with Commonwealth Bank maturing on 31 March 2022 known as a Climate Bond.

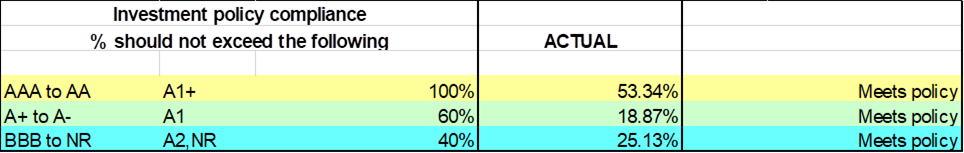

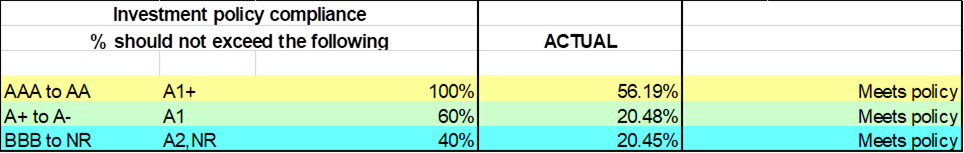

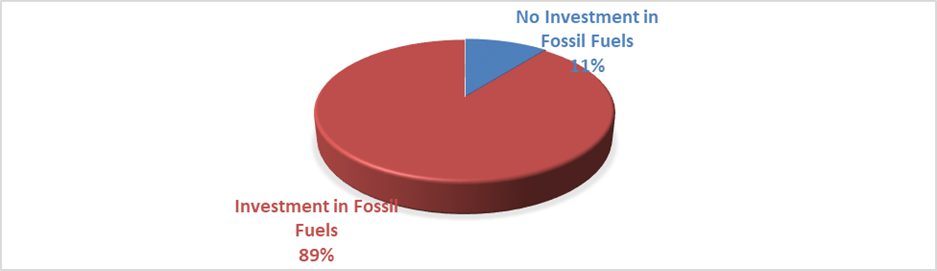

The above table identifies compliance with Council’s Investment Policy by the proportion of the investment portfolio invested with financial institutions, along with their associated credit ratings compared to parameters in the Investment Policy. The parameters are designed to support prudent short and long-term management of credit risk and ensure diversification of the investment portfolio. Note that the financial institutions currently offering investments in the ‘ethical’ area are still mainly those with lower credit ratings (being either BBB or not rated at all i.e., credit unions).

NSW Treasury Corporation Compliance – Loan Borrowing Conditions

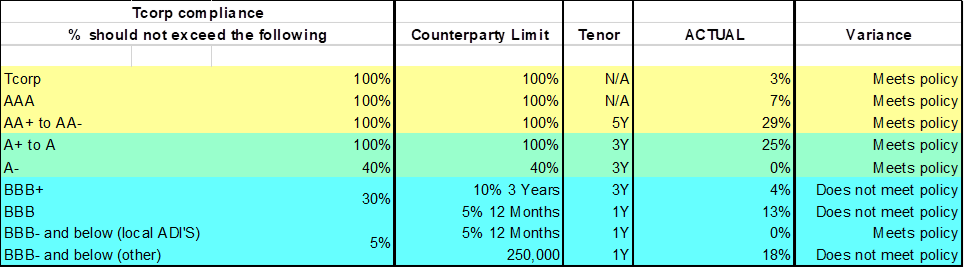

Council has borrowed loans through NSW Treasury Corporation under the Local Government Low Cost Loans Initiative. As part of these loan borrowings, NSW Treasury Corporation has placed restrictions on Council’s investments in terms of where Council can invest based on the credit rating of the financial institution, the term of the investment and counterparty limit. NSW Treasury Corporation has reviewed Council’s Investment Portfolio and has reminded Council it needs to remain within the investment parameters outlined in the accepted loan agreements. Council currently does not comply as is indicated in the table below:

Council has had discussions with NSW Treasury Corporation and indicated it would start reporting the compliance in the monthly investment report to Council. Council is able to hold existing investments not in compliance until maturity but must ensure new investments meet the compliance requirements.

Meeting the NSW Treasury Corporation compliance means Council will be limited in taking up investments that may be for purposes associated with Environmental and Socially Responsible outcomes where investments do not comply with NSW Treasury Corporation requirements, and investments with financial institutions that do not support fossil fuels will have to be decreased due to their credit rating status or lack of credit rating.

The investment portfolio is outlined in the table below by investment type for the period 1 November 2021 to 30 November 2021:

Dissection of Council Investment Portfolio as at 30 November 2021

|

Investment Linked to: |

Current Market Value ($) |

Cumulative Unrealised Gain/(Loss) ($) |

|

|

28,000,000.00 |

Term Deposits |

28,000,000.00 |

0.00 |

|

2,500,000.00 |

Floating Rate Note |

2,562,365.00 |

62,365.00 |

|

17,285,825.83 |

CBA Business Saver |

17,285,825.83 |

0.00 |

|

8,154,610.38 |

CBA Business Saver – Tourism Infrastructure Grant |

8,154,610.38 |

0.00 |

|

2,112,906.02 |

NSW Treasury Corp |

2,112,906.02 |

0.00 |

|

15,019,326.79 |

Macquarie Accelerator |

15,019,326.79 |

0.00 |

|

6,500,000.00 |

Bonds |

6,473,017.00 |

-26,983.00 |

|

79,572,669.02 |

|

79,608,051.02 |

35,382.00 |