Agenda

Agenda

Ordinary Meeting

Thursday, 24 August 2023

Agenda

Agenda

Ordinary Meeting

Thursday, 24 August 2023

Agenda Ordinary Meeting

held at Conference Room, Station Street, Mullumbimby

commencing at 9:00am

Public access relating to items on this agenda can be made between 9:00 and 10:30 am on the day of the meeting. Requests for public access should be made to the General Manager or Mayor no later than 12:00 midday on the day prior to the meeting.

Mark Arnold

General Manager

CONFLICT OF INTERESTS

What is a “Conflict of Interests” - A conflict of interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council official has that does not amount to a pecuniary interest as defined in the Code of Conduct for Councillors (eg. A friendship, membership of an association, society or trade union or involvement or interest in an activity and may include an interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter if the interest is so remote or insignificant that it could not reasonably be regarded as likely to influence any decision the person might make in relation to a matter or if the interest is of a kind specified in the Code of Conduct for Councillors.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a matter if the pecuniary interest is the interest of the person, or another person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a matter if:

· The person’s spouse or de facto partner or a relative of the person has a pecuniary interest in the matter, or

· The person, or a nominee, partners or employer of the person, is a member of a company or other body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the following:

(a) the parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descends or adopted child of the person or of the person’s spouse;

(b) the spouse or de facto partners of the person or of a person referred to in paragraph (a)

No Interest in the Matter - however, a person is not taken to have a pecuniary interest in a matter:

· If the person is unaware of the relevant pecuniary interest of the spouse, de facto partner, relative or company or other body, or

· Just because the person is a member of, or is employed by, the Council.

· Just because the person is a member of, or a delegate of the Council to, a company or other body that has a pecuniary interest in the matter provided that the person has no beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

· A Councillor or a member of a Council Committee who has a pecuniary interest in any matter with which the Council is concerned and who is present at a meeting of the Council or Committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

· The Councillor or member must not be present at, or in sight of, the meeting of the Council or Committee:

(a) at any time during which the matter is being considered or discussed by the Council or Committee, or

(b) at any time during which the Council or Committee is voting on any question in relation to the matter.

No Knowledge - a person does not breach this Clause if the person did not know and could not reasonably be expected to have known that the matter under consideration at the meeting was a matter in which he or she had a pecuniary interest.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts & the option chosen will depend on an assessment of the circumstances of the matter, the nature of the interest and the significance of the issue being dealt with. Non-pecuniary conflicts of interests must be dealt with in at least one of the following ways:

· It may be appropriate that no action be taken where the potential for conflict is minimal. However, Councillors should consider providing an explanation of why they consider a conflict does not exist.

· Limit involvement if practical (eg. Participate in discussion but not in decision making or vice-versa). Care needs to be taken when exercising this option.

· Remove the source of the conflict (eg. Relinquishing or divesting the personal interest that creates the conflict)

· Have no involvement by absenting yourself from and not taking part in any debate or voting on the issue as of the provisions in the Code of Conduct (particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993 – Recording of voting on planning matters

(1) In this section, planning decision means a decision made in the exercise of a function of a council under the Environmental Planning and Assessment Act 1979:

(a) including a decision relating to a development application, an environmental planning instrument, a development control plan or a development contribution plan under that Act, but

(b) not including the making of an order under that Act.

(2) The general manager is required to keep a register containing, for each planning decision made at a meeting of the council or a council committee, the names of the councillors who supported the decision and the names of any councillors who opposed (or are taken to have opposed) the decision.

(3) For the purpose of maintaining the register, a division is required to be called whenever a motion for a planning decision is put at a meeting of the council or a council committee.

(4) Each decision recorded in the register is to be described in the register or identified in a manner that enables the description to be obtained from another publicly available document, and is to include the information required by the regulations.

(5) This section extends to a meeting that is closed to the public.

OATH AND AFFIRMATION FOR COUNCILLORS

Councillors are reminded of the oath of office or affirmation of office made at or before their first meeting of the council in accordance with Clause 233A of the Local Government Act 1993. This includes undertaking the duties of the office of councillor in the best interests of the people of Byron Shire and the Byron Shire Council and faithfully and impartially carrying out the functions, powers, authorities and discretions vested under the Act or any other Act to the best of one’s ability and judgment.

1. Public Access

3. Attendance by Audio-Visual Link

4. Requests for Leave of Absence

5. Declarations of Interest – Pecuniary and Non-Pecuniary

6. Tabling of Pecuniary Interest Returns (Cl 4.14 Code of Conduct for Councillors)

7. Adoption of Minutes from Previous Meetings

7.1 Ordinary Meeting held on 22 June 2023

8. Reservation of Items for Debate and Order of Business

9. Notices of Motion

9.1 Murwillumbah Rd Mullumbimby................................................................................... 9

10. Mayoral Minute

10.1 Feros Aged Care Village Byron Bay......................................................................... 13

11. Petitions

12. Delegates' Reports

12.1 ALGA National General Assemly.............................................................................. 15

12.2 Northern Rivers Joint Organisation - Quarterly Meeting....................................... 17

13. Staff Reports

General Manager

13.1 Agistment licence to Leela Plantations Pty Ltd (A.C.N 064 533 777)................. 19

13.2 Policy Commercial Activities on Coastal and Riparian Crown Reserves review 24

Corporate and Community Services

13.3 Local Government NSW Annual Conference 2023................................................ 33

13.4 Community Initiatives Program 2023-2024 Recommendations for Funding...... 38

13.5 Council Investments - 1 June 2023 to 30 June 2023............................................. 41

13.6 Carryovers for Inclusion in the 2023-2024 Budget................................................. 49

13.7 Delivery Program 6-monthly Report and Operational Plan 2022/23 Quarter 4 Report - to 30 June 2023............................................................................................................ 54

13.8 Council Resolutions Quarterly Review - Q4 - 1 April to 30 June 2023............... 62

13.9 Council Investments - 1 July 2023 to 31 July 2023................................................ 65

13.10 Budget Review - 1 April to 30 June 2023................................................................. 73

13.11 Revised Delivery Program 2022-26.......................................................................... 83

13.12 Reinstate footpath usage fees for use of Council land/road reserve to enable construction work events or temporary use............................................................. 89

13.13 Grants July 2023.......................................................................................................... 93

13.14 Establishment of Alcohol Free Zones....................................................................... 99

13.15 2023/24 Loan Borrowing Program.......................................................................... 104

Sustainable Environment and Economy

13.16 Summary of Community Feedback on Byron Bay Triathlon 2023.................... 108

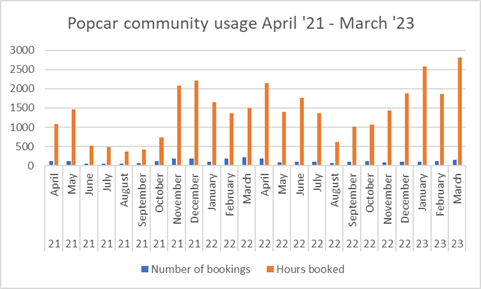

13.17 Car share: (1) Expression of Interest evaluation results, and (2) 2022/23 community usage........................................................................................................................... 113

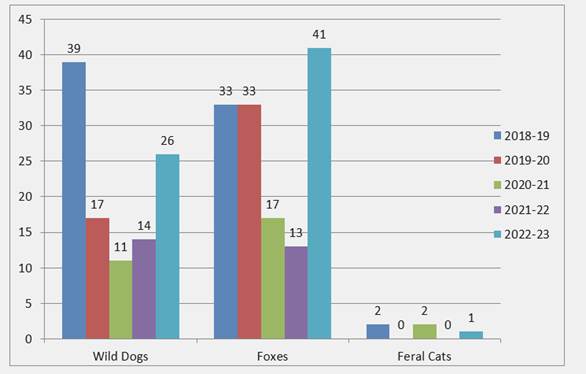

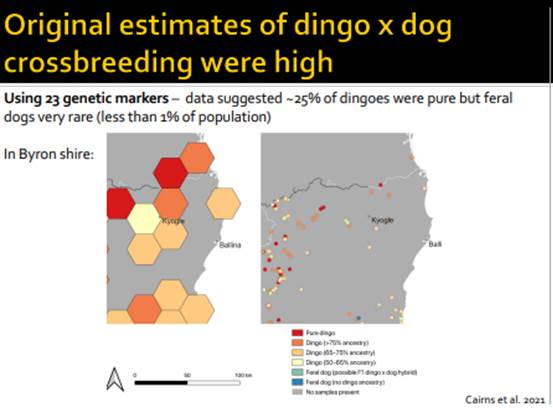

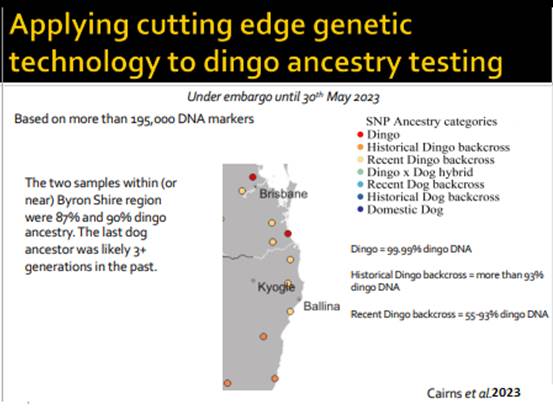

13.18 Dingo and Wild Dog Control in Byron Shire.......................................................... 120

13.19 Review of Council's Onsite Sewage Management Strategy 2001 and Onsite Sewage Management Guidelines 2004................................................................................. 132

13.20 Appointment of Replacement Community Member to the Climate Change and Resource Recovery Advisory Committee.............................................................. 137

Infrastructure Services

13.21 Adoption of the Byron Design Guide...................................................................... 140

13.22 Levels of Service to Heritage Park Arboretum...................................................... 150

13.23 Northern and Western Rail Corridor Reports........................................................ 156

13.24 Tender: 2023-1590 Provision of Mowing and Ground Maintenance Services 160

13.25 Bangalow Sports Fields Plan of Management and Landscape Masterplan.... 166

13.26 Tender: Bangalow Sportsfield Lighting.................................................................. 169

13.27 Mullumbimby Heritage Park Landscape Masterplan........................................... 176

13.28 Update on the Additional Flow Path project - Response to Council Resolutions 23-108 and 23-277.................................................................................................................. 185

14. Reports of Committees

Corporate and Community Services

14.1 Report of the Arts and Creative Industries Advisory Committee Meeting held on 29 June 2023................................................................................................................... 192

Sustainable Environment and Economy

14.2 Report of the Business and Industry Advisory Committee Meeting held on 15 June 2023............................................................................................................................. 196

14.3 Report of the Climate Change and Resource Recovery Advisory Committee Meeting held on 29 June 2023................................................................................................ 198

Infrastructure Services

14.4 Report of the Water and Sewer Advisory Committee Meeting held on 15 June 2023...................................................................................................................................... 201

14.5 Report of the Local Traffic Committee Meeting held on 21 July 2023.............. 205

14.6 Report of the Moving Byron Advisory Committee Meeting held on 15 June 2023 210

15. Questions With Notice

15.1 Urban Water and Sewer Systems Part 2............................................................... 213

16. Confidential Reports

General Manager

16.1 Confidential - Lease to Catholic Healthcare Limited over proposed Lot 50 in unregistered plan of subdivision (presently part Folio 188/728535) request for further holding over................................................................................................................ 215

Questions with Notice: A response to Questions with Notice will be provided at the meeting if possible, that response will be included in the meeting minutes. If a response is unable to be provided the question will be taken on notice, with an answer to be provided to the person/organisation prior to the next Ordinary Meeting and placed on Councils website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

Councillors are encouraged to ask questions regarding any item on the business paper to the appropriate Director prior to the meeting. Any suggested amendments to the recommendations should be provided to Councillor Support prior to the meeting to allow the changes to be typed and presented on the overhead projector at the meeting.

BYRON SHIRE COUNCIL

Notices of Motion 9.1

Notice of Motion No. 9.1 Murwillumbah Rd Mullumbimby

File No: I2023/1185

I move that Council:

1. Accepts the need to and if necessary, determine or applies to the relevant authority for the existing, above mentioned, road to become a gazetted road.

2. Accepts responsibility for any future upgrade and ongoing maintenance required to provide suitable, standard vehicular access to the adjoining properties.

Signed: Cr Alan Hunter

Councillor’s supporting information:

Council where appropriate should always aim to provide safe and open access on public roads and pathways across the shire.

In this case, the street is a 150 mt remnant from the old interstate highway on the eastern side of the Main Arm Rd - Coolamon Scenic Dr intersection in Mullumbimby, so it is difficult to see how it has never been gazetted as has been claimed by staff when asked about maintaining the road.

The road has been referred to differently by staff at various times including, an ungazetted road, a road reserve, a shared driveway and a public road, all used to avoid acknowledging any obligation to maintain the road carriageway.

Council in the past has required development applicants in the street to provide a bond to repair any damage caused by the developer.

It is clearly not a private access road, instead open to the public and providing the only access to lots 17, 19 & 21 for many years.

Despite all this Council has on a few occasions carried out some maintenance at various times over the last 40 years stressing it as a favour for the street residents and claiming it is not a council responsibility. Council has a water main also under

the road which has required repairs in past years causing further damage to the road surface.

Council has also required a bond on development applicants in the street to repair any damage to the road by the building works. A normal standard requirement for any development that abuts council managed land.

Staff comments

by James Flockton, Infrastructure Planning Coordinator, Infrastructure Services:

Council has a considerable road network to maintain, sealed and unsealed. As has been previously reported to Council in Asset Management Plan’s, existing budgets are limited to maintain Council’s existing network.

Significant improvements have been made in recent times due to grant funding, but existing recurrent funding continues to be insufficient to cover all road and drainage infrastructure needs. Therefore staff and Council need to carefully consider committing to increasing the maintenance burden.

Staff maintain mapping of the road segments we currently maintain. The driveway / access road in question that provides access to 3 properties is likely within Council Road Reserve, but is not a segment we maintain.

The image below shows the property / road reserve boundary with a red line.

Survey would be required to ensure the driveway is wholly within road reserve or not.

Council does not currently have a policy that has a methodology for deciding which segments we do or do not maintain.

Historically staff have used a rule that if an access road within road reserve provides access to five or more properties, it will be included as a road segment to be maintained.

The subject access does not meet this criteria therefore staff do not support the maintaining of this access at this time.

Resolving as recommended will set a precedent that with time will result in a reduction in Council’s overall service levels for road maintenance.

Council’s current policy on road maintenance can be found at the below link.

Register of Roads Maintained by Council Policy - Byron Shire Council (nsw.gov.au)

The Policy Statement is as below:

2.1. Council shall maintain a detailed register properly identifying all approved roads

under the care, control and management of Council.

2.2. Council funds shall not be expended on any road not included in the roads register.

2.3. Council may complete maintenance and construction on private roads or roads not

under Council's control at the applicant's expense.

2.4. Council may accept the responsibility for other roads providing the road is

constructed to the standards provided in Council's Code for Civil Works.

It is recommended that the following alternate resolution be considered prior to making a final decision on maintaining the above access road:

That Council’s Infrastructure Advisory Committee receive a report regarding Councils Register of Roads Maintained By Council Policy and that the report include an updated policy and case studies to support the direction stipulated by the policy

This will allow Council to consider the subject site as a case study while also considering the precedent that the movers resolution will set on Council’s limited resources to maintain roads across the shire.

Financial/Resource/Legal Implications:

Whilst the maintenance of the proposed section may appear to have a minor impact on Councils overall budget, it is the precedent that this decision makes that has the greater financial impact and risk on Council long term ability to maintain current service levels.

Is the proposal consistent with any Delivery Program tasks?

No. Delivery Program tasks require staff to maintain roads as per current policies and as noted above, the proposed road is not a segment Council maintains. Council would need to resolve to add this segments to its maintenance segments.

ere BYRON SHIRE COUNCIL

Mayoral Minute 10.1

Mayoral Minute No. 10.1 Feros Aged Care Village Byron Bay

File No: I2023/1174

I move that Council:

a) Responds to the letter from the Hon. Steven Kamper MP, Minister for Lands, confirming Council supports Crown Lands running an Expression of Interest process to test interest from potential aged care providers for Feros Village.

b) Authorises the General Manager to allocate resources to support Crown Lands with their EOI process as needed.

c) Notes this resolution compliments, and does not replace, Council Resolution 23-306.

Attachments:

1 Letter

from The Hon. Steve Kamper MP Minister for Lands & Property - Feros Care

facility in Byron Bay - Crown Reserve R140024, E2023/83078 ![]()

Background Notes:

As a community we owe it to our older members to ensure that they have the facilities and services they need and ensuring Feros Village continues long into the future is a key part. Feros Village exists because of George Feros and other heroes in the community that raised the funds and delivered the facility.

The community has incredibly strong ties to the facility and their expectations of being involved in decisions about its future use are reasonable and need to be respected. This can be achieved by the role of Crown Land Manager being separated from the role of a Lessee Service Provider in future and that has been progressing under Res 23-306.

On 8 August 2023, The Hon. Steve Kamper MP, Minister for Small Business, Lands and Property, Multiculturalism and Sport, wrote to Council providing:

a) an update on Crown Lands’ progress of Res 23-306

b) an offer to run an Expression of Interest process to test interest from potential aged care providers, if Council see value in an EOI process.

A copy of the letter is attached.

Crown Lands have the option to directly negotiate a lease with Feros Care or run an Expression of Interest process, which Feros Care and any other interested aged care providers could apply for.

Residents’ representatives have indicated that there are other service providers interested in operating Feros Village though no formal offers have been made as of yet. An EOI process would put beyond doubt the question of whether there are other aged care service providers interested in the site or not.

Also, it is clear from feedback to Councillors, that the community has lost confidence in Feros Care after the way they treated the residents and tried to make decisions about future redevelopment of the reserve without consulting residents, community, Council or Crown Lands. That loss of confidence should be a trigger for testing the market. Certainly any proposed demolition of the existing facility, which is owned by the community, is a trigger for an evaluation of options.

Feros Care have a proven track record of providing quality aged care services but they failed badly with their recent lack of resident and community consultation. An open EOI process would provide Feros Care the opportunity to demonstrate that they remain the best placed provider to deliver aged care services and show how they will improve their approach to resident and community consultation in future.

I believe Council should:

· welcome Crown Lands running an open Expression of Interest process

· call on Feros Care to continue to provide services to the existing residents pending the outcome of the EOI process, as per the commitment they’ve given that “no resident will be left homeless or forcibly removed from the village at any stage” (a continuing service, which they could no doubt point to in their EOI submission).

Signed: Cr Michael Lyon

BYRON SHIRE COUNCIL

Delegates' Reports 12.1

Delegate's Report No. 12.1 ALGA

National General Assemly

File No: I2023/1217

As always, it was a fantastic opportunity for networking. I was invited to dinner at the Governor-General’s residence along with other Mayors of shires that were impacted by natural disasters. We were treated to a song by Her Excellency, copy below.

I attended the Australian Council of Local Government Dinner. Each table had a representative from the Federal Government. I sat a table with Annika Wells, Minister for Aged Care and Minister for Sport. It was relayed by several attendees that it had been a rather toxic week inside Parliament House. Disappointing to hear first hand how bad the political culture is in Canberra, but I suppose it should come as no surprise.

Peter Dutton addressed the conference. I asked him a question from the floor about his opposition to Labor’s Housing Australia Future Fund, and what his plan was to address the housing crisis. They have no plan, a policy will be released in “due course”.

I attended a break-out group of Mayors from all over the country to discuss alternative responses to the Short-term Holiday Let issue, including the Mayors of Noosa, Hobart and Mornington Peninsula. Agreement to keep dialogue going and work together for reform across all jurisdictions.

One of the highlights was the presentation by Saul Griffith, an engineer specialising in clean and renewable technologies who has founded Rewiring America and Rewiring Australia. A key point made was the need to electrify and move away from gas in homes and businesses and convert to electric options for heating.

Most motions in the business papers were passed without incident. I moved one amendment on behalf of Council which was to add into a motion on housing reform a need to review capital gains tax and negative gearing arrangements.

Signed: Cr Michael Lyon

BYRON SHIRE COUNCIL

Delegates' Reports 12.2

Delegate's Report No. 12.2 Northern Rivers Joint Organisation - Quarterly Meeting

File No: I2023/1218

The meeting received a presentation from the Department of Primary Industries (DPI) Management Team on the current status of the infestation of Imported Fire Ants within Queensland and the potential impact on New South Wales to lifestyle and business. The main points being:-

- Need for increased budget and response; virgin females mate in the air and can drop up to 2kms away – often on to material being transported such as hay

- Satellite heat-spot detection and dogs also employed to detect.

The meeting agenda and minutes can be found on NRJO’s website:

Meetings - Northern Rivers Joint Organisation (nsw.gov.au)

I had the following motion before NRJO, which was passed unanimously:

“The Northern Rivers Joint Organisation Board recognises Byron Shire Council’s efforts to

address the housing crisis;

1. Notes that alleviating the housing crisis in the region will require a multi-faceted and

coordinated approach;

2. Notes that the concentration of holiday letting in the Byron Shire is at the highest level in Australia;

3. Notes support for the regulation of holiday letting where appropriate by the NSW Upper House and the Federal Minister for Housing

4. Supports Byron Shire Council in its efforts to regulate holiday letting in its shire as per

the recommendations by the Independent Planning Commission of April 2023;

5. Requests the Planning Minister, Paul Scully to meet with a delegation of Byron Shire

Council prior to handing down his decision on this issue.”

I also put forward the urgency that was passed by Council the day prior, as follows, which also passed unanimously:

“Resolved that:

1. Members provide a report to NRJO on the following:

a) their LGA’s approaches to, and levels of preparation for, the 2023-24 bushfire season

b) any implementation – by either member councils or state/federal agencies in their LGA – of the seventy-six recommendations of the Final Report of the NSW Bushfire Inquiry 2020

2. NRJO considers the implications for the region of the upcoming bushfire season and plans to collaborate on managing the 2023-24 bushfire season

3. Any collaboration includes, but is not limited to, cross-border collaboration with Queensland in fighting bushfires in cross border areas including national parks”

All other matters passed as per their recommendations in the business papers.

Signed: Cr Michael Lyon

BYRON SHIRE COUNCIL

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Agistment licence to Leela Plantations Pty Ltd (A.C.N 064 533 777)

Directorate: General Manager

Report Author: Paula Telford, Leasing and Licensing Coordinator

File No: I2023/1088

Summary:

Leela Plantations Pty (A.C.N 064 533 777) Ltd holds a current agistment licence over Folio 15/1178892,1 Dingo Lane Myocum that ends on 31 December 2023. Leela Plantations Pty Ltd has requested a new agistment licence for the continued occupation of the land.

RECOMMENDATION:

1. That Council, delegates the General Manager, to enter into an Agistment Licence with Leela Plantations Pty Ltd (A.C.N 064 533 777) on the following terms and conditions

a) over part Folio 15/1178892, 1 Dingo Lane Myocum,

b) term of twelve-months with ongoing holding over as a monthly tenant,

c) base rent to start at $6,240 (exclusive GST) per annum with base rent increased annually thereafter on each anniversary by Consumer Price Index All Groups Sydney (‘CPI’)

d) purpose for the grazing no more than 40 head of cattle and five horses, with horses to be grazed in the ‘Top Paddock’ on the land.

e) Licensee to pay:

i) all outgoings payable to occupy the land for the purpose,

ii) public liability insurance cover,

iii) carry out improvements to existing fencing, weed control and other

on the land as negotiated with the Licensor prior to commencement

of the Agistment Licence.

f) that if Council commences work on the 5MW Solar Farm Project on the Land, the licence to terminate.

Report

Leela Plantations Pty Ltd (A.C.N. 064 533 777), (‘Leela Plantations’) has requested a new agistment licence over part Lot 15 DP 1178892 (‘the Land’) for the grazing of cattle and horses on the Land.

Council resolved (21-511) at its 26 November 2021 meeting:

That Council authorises the General Manager, under delegation, to enter into an agistment licence with Leela Plantations (A.C.N. 364 533 777) on the following terms:

a) part Lot 15 DP 1178892,

b) term 12-months plus an option of 12-months,

c) base rent set at $6,240 (excluding GST) with rent increased annually thereafter

by Consumer Price Index All Groups Sydney,

d) purpose of grazing no more than 40 head of cattle and five horses, with horses

to be grazed in the ‘Top Paddock’ on the Land,

e) the Licensee to pay:

i) all outgoings payable to occupy the Land for the purpose, and

ii) required insurances, and

iii) carry out improvements to existing fencing, weed control and other on the Land as negotiated with the Licensor prior to commencement of the Licence.

f) the Licence to terminate prior to expiry of the term and option if Council

commences work on a 5MW Solar Farm Project on the Land.

The Land:

The Land being 1 Dingo Lane Myocum (‘the Land’) is Council owned land classified as operational. The Land is a proposed site for a 5MW Solar Farm Project.

Council resolved (21-169) in relation to the Dingo Lane 5MW Solar Farm Project:

1. Notes the Business Case included as Attachment 1 (E2021/44986) and endorse Option 3 as the preferred option,

2. Continues with the current Development Application to progress the project to shovel ready status, and

3. Receives a further report on the project, following the determination of current grant applications for the proposed Bioenergy Facility at the Byron STP to consider the holistic financial implications of both projects on Council’s Long Term Financial Strategy.

Leela Plantations requests the right to continue to licence the Land for agistment until such a time as Council resolves to proceed to build the 5MW Solar Farm on the Land and the agistment licence ends.

Direct negotiation

Council may directly negotiate the proposed twelve-month agistment licence with ongoing holding over as a monthly tenant in accordance with s55(3)(n)(i) of the Local Government Act 1993 because the value of the contract over the term is less than the prescribed statutory value.

As the Land is classified as operational land, mandatory community consultation provisions in the Local Government Act do not apply to the agistment licence.

Term of proposed agistment licence:

The proposed agistment licence is to be offered on following:

1. part Folio 15/1178892, 1 Dingo Lane Myocum,

2. term of twelve-months with holding over as a monthly tenant,

3. base rent set at $6,240 (exclusive GST) per annum with base rent to be increased annually thereafter on each anniversary by Consumer Price Index All Groups Sydney (‘CPI’),

4. purpose of grazing no more than 40 head of cattle and five horses, with horses to be grazed in the ‘Top Paddock’ on the Land,

5. Licensee to pay:

a. all outgoings payable to occupy the Land for the purpose, and

b. required insurances, and

c. carry out improvements to existing fencing, weed control and other the Land as negotiated with the Licensor prior to commencement of the Licence.

6. that if Council commences work on the 5MW Solar Farm Project on the Land, the licence to terminate.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

|

3: Nurtured Environment |

3.5: Minimise waste and encourage recycling and resource recovery practices |

3.5.5: Facilities and services - Provide resource recovery facilities and services that meet statutory requirements |

3.5.5.2 |

Develop and implement an Asset Management Plan and Programmed Maintenance Schedule for waste assets at the Byron Resource Recovery Centre |

|

Recent Resolutions

· 21-169, 21-511

Legal/Statutory/Policy Considerations

Local Government Act 1993 (NSW)

s55 Requirements for tendering

(3) This section does not apply to the following contracts

(n) a contract involving an estimated expenditure or receipt of an amount of—

(i) less than $250,000 or another amount as may be prescribed by the

regulations, or

(ii) less than $150,000 or another amount as may be prescribed by the regulations for a contract involving the provision of services where those services are, at the time of entering the contract, being provided by employees of the council,

ICAC Direct Negotiations Guidelines:

According to the Independent Commission Against Corruption (‘ICAC’) Direct Negotiation Guidelines, Council may directly negotiate in the following circumstances:

a) Exemption by State legislation, see s55(3)(n)(i) of the Local Government Act, or

b) where income derived from the proposed contract is relatively low to the cost of conducting a competitive process.

Council Leasing and Licensing Policy 2020:

Clause 4.3 Selection Process authorises the direct negotiation of a licence when permitted by the Independent Commission Against Corruption (‘ICAC’) Direct Negotiation Guidelines.

Financial Considerations

An independent market rent valuation for the proposed agistment licence set base rent at $6,240 (exclusive GST) per annum.

The licence preparation fee $601.00 (incl GST) as set in Council’s 2023-2024 Fees and Charges is payable by Leela Plantations Pty Ltd.

Consultation and Engagement

Council is not required to publicly advertise the propose twelve-month agistment licence to Leela Plantations Pty Ltd because the Land is classified as operational land.

Internal consultation has occurred with the Manager Resource Recovery being the asset manager for the Land.

BYRON SHIRE COUNCIL

Staff Reports - General Manager 13.2

Report No. 13.2 Policy Commercial Activities on Coastal and Riparian Crown Reserves review

Directorate: General Manager

Report Author: Paula Telford, Leasing and Licensing Coordinator

File No: I2023/1057

Summary:

A review of Council Policy Commercial Activities on Coastal and Riparian Crown Reserves is due. Consultation with key stakeholders on the Policy review has occurred and has resulted in several proposed Policy amendments. This report recommends that an amended draft Policy is placed on exhibition for 28-day and public comment invited.

RECOMMENDATION:

That Council adopts the amendments to Policy Commercial Activities on Coastal and Riparian Crown Reserves as detailed in the attached Draft Policy and places the Draft Policy on public exhibition for 28-days, and

a) should no submissions be received, that the Draft Policy is adopted, and

b) should submissions be received that all submissions are reported back to Council.

1 Attachment:

Draft Policy Commercial Activities on Coastal & Riparian Crown Reserves

2023, E2023/2345 ![]()

Report

Council Policy Commercial Activities on Coastal and Riparian Crown Reserves (‘the Policy’) guides the granting of licences for commercial and non-commercial activities on coastal reserves in the Shire.

The Policy continues to distinguish between non-commercial activities requiring a Class 1 licence and commercial activities requiring a Class 2 sub-licence. Class 2 sub-licences are to be granted following a competitive tender.

With the next competitive tender due in 2024, a review of the Policy is now due so as to ensure that guidance provided in the Policy remains relevant.

Consultation on the Policy review:

Consultation on the Policy review has already occurred with external agencies, current Class 2 sub-licence holders, Councillors, together with a general stakeholder workshop.

A summary of consultation to date follows:

a) Consultation with external agencies:

In February 2023 Council hosted a meeting to discuss the Policy review with the Department of Planning and Environment - Crown Lands, Cape Byron Marine Park, Transport for NSW, National Parks and Wildlife Services and Reflections Holiday Parks.

External agencies requested no change to the type and number of Class 2 sub-licences offered following a competitive tender for water-based activities.

National Parks and Wildlife Services required no increase in commercial activities within National Park areas at Clarkes Beach and The Pass as required by the Cape Byron State Conservation Area Plan of Management.

The Department of Planning and Environment – Crown Lands consented to Council including one new Class 2 sub-licence for access through reserves for equestrian activities in the Policy review.

b) Consultation with current commercial sub-licensee holders:

Current Class 2 sub-license holders and other interested persons were invited to make written submissions on the Policy review during May 2023. Council received 15 submissions. A summary of submissions received was presented at a Councillor workshop on 1 June 2023.

c) Workshop with Councillors:

Councillors considered outcomes from the February external agencies meeting and a summary of written submissions received from current Class 2 sub-licence holders and others at the 1 June 2023 workshop. Councillors agreed in-principle to:

· include one new Class 2 sub-licence for access through reserves for equestrian activities in the Policy review, and

· leave terms and conditions of a Class 2 sub-licence as listed in the Policy unchanged in the Policy review.

d) Stakeholder workshop 20 July 2023:

A stakeholder workshop with current Class 2 sub-licence holders, other interested persons and external agencies was held on 20 July 2023. Outcomes of that workshop include:

1. Change to terms and conditions of Class 2 sub-licence:

a) Stakeholders suggested the current limit on 2 surf schools per day is no longer suitable and requested that clause 3.6.1 in the Policy be amended to allow for a 3rd surf school per day when certain conditions are met.

This proposal has been included in the draft Policy.

b) Stakeholders further suggested that the current limit of 10 students per surf school session is outdated and a likely contributing factor to the growth of unlicensed surf schools in the Shire. The limiting of supply of student places in surf schools causes the schools to fill quickly resulting in interested persons looking to social media to meet the demand.

This proposal has not been included in the Policy review due to the Cape Byron State Conservation Area Plan of Management that prevents an increase in surf school participation numbers in the National Park at Clarkes Beach, The Pass and Tallows Beach.

c) Sea kayak stakeholders requested that clause 3.6.1 of the Policy is amended to bring the Policy in line with Paddle Australia Guidelines for the instructor to student ratio based on prevailing weather conditions.

This proposal has been included in the draft Policy.

d) Sea kayak stakeholders additionally requested that clause 3.6.1 of the Policy is further amended to establish an annual limit on sea kayak tours whereby a maximum of 3 tours per day are possible when certain conditions are met.

This proposal has been included in the draft Policy.

2. Parking and storage of equipment on a coastal reserve:

Council discussed its intention with stakeholders that no storage or parking on a coastal reserve is to be offered in the 2024 tender.

To assist Class 2 sub-licensees with a safe location to handle their equipment, Council proposes the construction of a loading zone on Lawson Street. Stakeholders were encouraged to assist Council in the design of the loading zone to achieve best outcomes.

Further, parking permits will remain available for trailers up to 6 metres in length to park in Clarkes Beach carpark, however timed parking will still apply.

As the current Policy does not authorise or permit parking or the storage of equipment on a coastal reserve, no Policy amendments are required.

3. Enforcement of unlicensed commercial surf schools operating in the Shire:

Stakeholders raised concerns about the number of unlicensed surf schools trading in the Shire and requested new financial penalty provisions in the Policy dealing with the issue. As fees for proven offences are set by the Local Government Act, no assistance can be provided by a Policy amendment.

Council did give an undertaking to investigate and follow up all complaints regarding unlicensed surf schools trading in the Shire.

Policy amendments

To ensure guidance provided by the Policy is clear and concise, the Policy content has been reformatted to comply with Councils new Policy template.

Further, to ensure that guidance provided in the Policy remains relevant, the following amendments are proposed:

1. New clause 1.1 new Policy objectives:

a. To establish a balance between passive and active recreational use of coastal reserves,

b. To protect coastal reserve environments during licensed activities,

c. To clarify the types of low impact commercial recreational activities that may occur in coastal reserves and the regulation of those activities, and

d. To provide a fair and transparent process for the grant of licences on coastal reserves.

2. New clause 3.1 requires all proposed activities on a coastal reserve to meet a general threshold criterion before either a Class 1 licence or a Class 2 sub-licence can be considered.

The proposed activity must be:

a. consistent with the coastal Reserve, reserve purpose,

b. consistent with any Plan of Management applying to the coastal Reserve, or if none, the activity must not change the nature or use of the coastal Reserve,

c. a valid Future Act under the Native Title legislation on a coastal Reserve where Native Title rights and interests do or could continue,

d. consistent with the terms of any Crown Lands licence or lease that applies to the coastal Reserves, and

e. lawful, which means additional approvals or permissions may also be required.

3. Amended clause 3.3 to include two new types of Class 1 licences being:

a. environmental protection, conservation or restoration or environmental studies, and

b. site investigation.

4. Clause 3.4 new Class 2 sub-licence is included for access through a coastal reserve for equestrian activities,

5. New clause 3.5 to deal with ad hoc requests to conduct commercial activities on a coastal reserve. The proposed activity must meet the general threshold criteria in clause 3.1 and if so, Council has the option to resolve to permit the commercial activity on the coastal reserve.

6. Clause 3.6.1 is amended as follows:

a. Frequency of surf schools and personalised surf schools is amended to:

i. 2 surf school sessions per day except:

· 3 surf school sessions per day may occur during the overlap of NSW and Queensland school holidays in April and October and for the period 26 December to 26 January inclusive, and

· a 3rd session per day must not occur within the National Park at Clarkes Beach, The Pass and Tallows Beach, and

· sub-licensees must notify Council in writing of the location and time of a 3rd session before it is held.

b. Frequency of sea kayak tours amended to:

i. a maximum annual tour limit of 730 tours, and

ii. a maximum of 3 tours per day per sub-licence, and

iii. sub-licensees must notify Council and the Cape Byron Marine Park in writing before conducting a 3rd tour per day, and

iv. sub-licensees must report in writing to Council and the Cape Byron Marine Park before the end of December, March, June, and September in each year of the sub-licence the total number of tours conducted during the quarter and total number of tours year to date.

c. The participation ratio of students to instructors for sea kayaks is amended to Paddle Australia guidelines being:

i. baseline starting ratio of 1 instructor to 6 students or 1 instructor to 8 students if using tandem kayaks,

ii. supervision should be increased towards a ratio of 1:2 considering the following conditions or variables:

· participants have special needs, including behavioural, physical, or mental disability,

· participants are primary school children,

· foreseeable conditions are poor, including swell, breaking waves, spring tides and/or wind (especially if against the tide),

· the water temperature is cold and may affect participants’ capabilities,

· a trip is being undertaken which:

o is along a committing shoreline,

o is remote from observation,

o involves unavoidable tide races or over falls.

o Access or egress will involve surf > 1 metre.

iii. Supervision may be relaxed towards a ration of 1:10 considering the following conditions or variables:

· all participants are adults,

· all participants are competent, both individually and as a group, to deal with likely problems, which may be encountered,

· all participants are reliable rollers,

· good weather forecast for a stable sea state with no spring tides or tidal stream,

· water temperatures are warm and present little risk to participants,

· the location /route is in not remote and assistance from other groups or craft is available,

· the location/route is always close to an easily accessible shoreline, and

· the leader holds a higher qualification than required for the activity.

This report recommends that Council adopt the amended and reformatted Policy and resolve to publicly exhibit the new draft Policy for twenty-eight days for additional public comment.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

5:

Connected Infrastructure |

5.4: Provide accessible community facilities and open spaces |

5.4.2: Parks and open spaces - Provide and maintain active and passive recreational community space that is accessible and inclusive for all |

5.4.2.11 |

Progress Plans of Management for Crown Reserves |

Recent Resolutions

· 21-429

Legal/Statutory/Policy Considerations

Crown Land Management Act 2016

2.20 Short-term licences over dedicated or reserved Crown land

(1) The regulations may make provision for or with respect to the following concerning short-term licences over dedicated or reserved Crown land—

(a) any purposes for which the licences may be granted (prescribed purpose),

(b) any conditions to which the licences are subject (prescribed condition),

(c) the maximum term for which licences may be granted (prescribed maximum term).

(2) The Minister may grant a short-term licence over dedicated or reserved Crown land for any prescribed purpose.

(3) A short-term licence may be granted even if the purpose for which it is granted is inconsistent with the purposes for which the Crown land is dedicated or reserved.

(4) A short-term licence may be granted subject to conditions specified by the Minister and is also subject to any prescribed conditions.

(6) A short-term licence ceases to have effect when the prescribed maximum term after it is granted expires unless it is revoked sooner by the Minister or is granted for a shorter term.

(7) Sections 2.18 and 2.19 do not limit the circumstances in which short-term licences can be granted under this section.

Crown Land Management Regulations 2018

cl31 Short-term licences over dedicated or reserved Crown land

(1) Each of the following purposes is prescribed as a purpose for which a short-term licence may be granted under section 2.20 of the Act—

(a) access through a reserve,

(e) community, training, or education,

(f) emergency occupation,

(g) entertainment,

(h) environmental protection, conservation or restoration or environmental studies,

(j) exhibitions,

(k) filming (as defined in the Local Government Act 1993),

(l) functions,

(q) meetings,

(v) site investigations,

(w) sporting and organised recreational activities,

(y) storage.

(2) In addition to any other condition to which a short-term licence granted under section 2.20 of the Act is subject, the condition that the relationship of landlord and tenant is not created between the parties is also prescribed.

(3) The period of one year is prescribed as the maximum term for which a short-term licence may be granted under section 2.20 of the Act (including any further term available under an option or holding over provision).

Financial Considerations

Nil.

Consultation and Engagement

The following consultation has occurred regarding the Policy review:

1. February 2023 meeting with Department of Planning and Environment - Crown Lands, Cape Byron Marine Park, Transport for NSW, National Parks and Wildlife Services and Reflections Holiday Parks.

2. May 2023 request for written submissions on the Policy review from Class 2 sub-licence holders and other interested persons.

3. June 2023 workshop with Councillors on the Policy review.

4. July 2023 stakeholder workshop on the Policy review.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.3

Staff Reports - Corporate and Community Services

Report No. 13.3 Local Government NSW Annual Conference 2023

Directorate: Corporate and Community Services

Report Author: Amber Evans Crane, Governance Support Officer

File No: I2023/1035

Summary:

The Local Government NSW Annual Conference 2023 will be held from Sunday, 12 November to Tuesday, 14 November 2023 at the Grand Pavilion, Rosehill Gardens Racecourse, Rosehill in the City of Paramatta.

Council is entitled to three voting delegates in the debating session. In accordance with the Councillor Expenses and Facilities Policy, “A resolution of Council is required to authorise attendance of Councillors at LGNSW Conference(s) as a voting delegate.”

RECOMMENDATION:

That Council:

1. Authorises the attendance of Crs __________, __________, and __________ as voting delegates at the Local Government NSW Annual Conference 2023, to be held from 12 to 14 November 2023.

2. Notes that LGNSW members are encouraged to submit motions by Friday 15 September 2023.

3. Submits

the motion that:

“That LGNSW advocates to the Local Government Remuneration Tribunal to

formally recognise Deputy Mayors as a distinct category within the local

government remuneration framework.”

Report

The Local Government NSW Annual Conference 2023 will be held from Sunday, 12 November to Tuesday, 14 November 2023 at the Grand Pavilion, Rosehill Gardens Racecourse, Rosehill in the City of Paramatta.

The Conference brings together delegates of member councils to submit, debate, and vote on motions relating to strategic local government issues. Resolutions form the LGNSW advocacy priorities for the year ahead.

In assessing a Councillor request to attend a conference, Clause 6.40 of the Policy asserts the following factors must be considered:

1. relevance of the topics and presenters to current Council priorities and business and the exercise of the Councillor’s civic duties

2. cost of the event in relation to the total remaining budget.

Conference voting delegates

Council is entitled to three voting delegates in the debating session. This number is determined by population, further information is available here.

As per Clause 6.37 of the Councillor Expenses and Facilities Policy 2022, “A resolution of Council is required to authorise attendance of Councillors at… LGNSW Conference(s) as a voting delegate”.

Conference motions

All LGNSW member councils are invited to submit motions in accordance with the 2023 Motions Submission Guide.

The LGNSW criteria for motion submission specifies that motions must be:

1. consistent with the objects of LGNSW (see Rule 4 of the Association’s rules),

2. relate to or concern local government as a sector in NSW and/or across Australia,

3. seek to establish or change policy positions of LGNSW and/or improve governance of the Association (noting that the LGNSW Board is responsible for decisions around resourcing any campaigns or operational activities, and any necessary resource allocations will be subject to the LGNSW budgetary process),

4. have a lawful purpose (a motion does not have a lawful purpose if its implementation would require or encourage non-compliance with prevailing laws),

5. clearly worded and unambiguous in nature, and

6. not expressing preference for one or several members over one or several other members.

As per clause 6.40 of the Councillor Expenses and Facilities Policy 2022, motions to the Local Government NSW Annual Conference must first be endorsed by Council prior to submission.

Proposed Motions

When determining the fees payable to the Mayor and Councillors for the 2023/24 financial year, Council resolved (22-229) that Council:

1. Fixes the fee payable to each Councillor under section 248 of the Local Government Act 1993 for the period 1 July 2023 to 30 June 2024 at $26,070.

2. Fixes the fee payable to the Mayor under section 249 of the Local Government Act 1993, for the period from 1 July 2023 to 30 June 2024 at $64,390.

3. Not determine a fee payable to the Deputy Mayor, in accordance with current practice, and:

a) Prepare a submission for the LGNSW Conference requesting that Deputy Mayors are recognised as a separate category in remuneration

b) Continue to make submissions to the Remuneration Tribunal for a specific allowance for Deputy Mayors

A draft motion and supporting material is provided below for Council endorsement.

That LGNSW advocates to the Local Government Remuneration Tribunal to formally recognise Deputy Mayors as a distinct category within the local government remuneration framework.

Supporting information:

Deputy Mayors undertake significant responsibilities, including representing the Mayor in their absence, chairing committees, and playing a pivotal role in decision-making and advocacy. These duties often demand extensive time, effort, and expertise beyond their role as a Councillor. The Local Government Act 1993 s249(5) provides that “A council may pay the deputy mayor (if there is one) a fee determined by the council for such time as the deputy mayor acts in the office of the mayor. The amount of the fee so paid must be deducted from the mayor’s annual fee.” This provision does not appropriately or equitably recognise the increased responsibilities of the Deputy Mayor on a day to day basis.

The current remuneration structure fails to account for the instances where the Deputy Mayor is required to step in and/or support the Mayor, not just during periods of absence, but also during times of heavy workload or emergencies. These situations often demand the Deputy Mayor's immediate attention, involvement, and leadership.

To adequately address this gap, we request that LGNSW advocates to the Local Government Remuneration Tribunal to establish a remuneration structure that recognises the distinct role and contributions of Deputy Mayors.

Key deadlines:

|

Date (2023) |

Due |

|

29 August |

Due date for notices of motion to the 14 September Council (Planning) Meeting. This is the last opportunity for motions to be considered by Council and meet the timeframes for inclusion in the LGNSW Business Paper (below). |

|

15 September |

Due date for motion submission to LGNSW to allow for preparation of the Business Paper before the Conference. |

|

5 October |

Latest date motions can be submitted to LGNSW for inclusion in the business paper. |

|

27 October (5pm) |

Due date for notification to LGNSW of council voting delegates. |

Delegate report

Following the Conference, Councillor/s are requested to submit a delegate’s report in writing to an Ordinary Meeting of Council on the aspects of the conference, seminar, workshop, or function relevant to Council business and or the local community.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.1: Enhance trust and accountability through open and transparent leadership |

1.1.2: Governance - Ensure legislative compliance and support Councillors to carry out their civic duties |

1.1.2.3 |

Provide administrative support to Councillors to carry out their civic duties |

Legal/Statutory/Policy Considerations

Councillor

Expenses and Facilities Policy 2022

Financial Considerations

The draft 2023/24 budget provides an allocation of $30,000.00 for Councillor attendance at conferences throughout the financial year.

Costs (per delegate) expected to be incurred are as follows:

Registration Fee (Early bird) $1150.00

Conference Dinner $230.00

Flights* $200.00

Accommodation (3 nights)* $800.00

Total $2,380.00

*Approximate

Consultation and Engagement

Not applicable.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.4

Report No. 13.4 Community Initiatives Program 2023-2024 Recommendations for Funding

Directorate: Corporate and Community Services

Report Author: Melitta Firth, Arts & Culture Officer

Emily Fajerman, Community & Cultural Development Coordinator

Vanessa Miller, Project Officer (Collaboration Lead)

File No: I2023/1037

Summary:

The Community Initiatives Program provides funding to not-for-profit community organisations and community groups to deliver projects that create positive social, cultural, and environmental outcomes.

Council called for applications between 16 May and 12 June 2023 and 20 eligible applications were received. This report recommends that 11 community projects are funded to the value of $52,427 for the 2023/2024 financial year.

RECOMMENDATION:

That Council approves the recommended projects for

the Community Initiatives Program as per Confidential Attachment 1

(E2023/79113), listed below and notes projects not recommended for funding.

(to be inserted following Council determination):

_______________________________

1 Confidential - Community Initiatives Program 2023-2024 - Assessment Panel ~ for Council, E2023/79113

Report

Through the provision of grants, sponsorships and funding, Council works in collaboration with community groups to further the aims identified in the four-year Delivery Program and annual Operational Plan.

Each year, incorporated not-for-profit organisations and community groups are eligible to apply for grants of up to $5,000 through Council’s Community Initiatives Program. The maximum amount available for the 2023/2024 program is $52,800 and the total amount requested in applications was $91,837.

On 16 May Council opened the Community Initiatives Program round for 2023/2024 and applications closed on 12 June 2023.

Information about the Community Initiatives Program such as application dates, guidelines, eligibility, and criteria were made available on Council’s website, Facebook page and via the Echo Newspaper. Email campaigns were also utilised to target interested stakeholders and networks.

A total of 20 eligible applications were received. Applications were assessed against defined criteria as well as the integrity of the proposed budget, project plan, partnerships, contributions, and connection to the local community.

Council’s assessment panel included:

· Resource Recovery Education and Compliance Officer

· Acting Community Development Coordinator

· Councillor Support / NYE Soul Street Coordinator

· Public Space Liaison Officer

The panel recommends that Council funds 11 of the highest ranked community projects, detailed in Attachment 1 (E2023/79113), for a total value of $52,427.

The selected community projects are geographically dispersed throughout the Shire and celebrate cultural diversity, access and inclusion, community connection and resilience. The projects prioritise the environment, mental health, youth leadership and the arts through education programs, immersive experiences, events and programs.

All funding recipients will be required to sign a contract, share project outcomes, and acquit their funding to Council by June 2024.

Next steps

Contracts will be entered into with all successful applicants, pending Council approval by resolution.

The contract management process will involve staff in the Community and Cultural Development team setting contract conditions for each approved project, establishing communications and information management, meeting with community stakeholders and reviewing project acquittals.

Strategic Considerations

Community Strategic Plan and Operational Plan

|

CSP Objective |

CSP Strategy |

DP Action |

Code |

OP Activity |

|

1:

Effective Leadership |

1.5: Empower community leadership through collaboration, capacity building, and cultivating community driven initiatives |

1.5.1: Community grant programs - Provide financial assistance and grants to empower community groups and organisations to deliver priority projects |

1.5.1.1 |

Deliver annual Community Initiatives Program and associated funding and support |

Legal/Statutory/Policy Considerations

The Community Initiatives Program (Section 356) Policy details the process and approach for delivering the funding. The Policy was reviewed in March 2022, resulting in changes to improve program delivery, and was adopted by Council on 25 March 2022 (Res 22-077).

Section 356 of the Local Government Act 1993 provides that a council may, in accordance with a resolution of the council, contribute money or otherwise grant financial assistance to persons for the purpose of exercising its functions.

The provisions of section 356 (2) have been complied with.

Financial Considerations

A total value of $52,427 is recommended in this report and is provided in the 2023/2024 Community Development budget.

BYRON SHIRE COUNCIL

Staff Reports - Corporate and Community Services 13.5

Report No. 13.5 Council Investments - 1 June 2023 to 30 June 2023

Directorate: Corporate and Community Services

Report Author: James Brickley, Manager Finance

File No: I2023/1050

Summary:

This Report includes a list of investments and identifies Council’s overall cash position for the period 1 June 2023 to 30 June 2023 for information.

This Report is prepared to comply with Section 212 of the Local Government (General) Regulation 2021.

RECOMMENDATION:

That Council notes the Report listing Council’s investments and overall cash position as of 30 June 2023.

Report

Council has continued to maintain a diversified portfolio of investments. As of 30 June 2023, the average 90-day bank bill rate (BBSW) for the month was 4.05%. Council’s performance for June 2023 was 4.16%.

The increased interest rates from new investments is recognised and as a result Council is performing above the average BBSW. The table below identifies the investments held by Council as at 30 June 2023.

Schedule of Investments held as at 30 June 2023

|

Purch Date |

Principal ($) |

Description |

CP* |

Rating |

Maturity Date |

No Fossil Fuel |

Type |

Int. Rate |

Current Value ($) |

|

15/11/18 |

1,000,000.00 |

NSW Treasury Corp (Green Bond) |

N |

AAA |

15/11/28 |

Y |

B |

3.00% |

940,790.00 |

|

20/11/18 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

22/03/24 |

Y |

B |

1.78% |

997,450.00

|

|

28/03/19 |

1,000,000.00 |

National Housing Finance & Investment Corporation |

Y |

AAA |

28/03/29 |

Y |

B |

2.38% |

912,290.00

|

|

21/11/19 |

1,000,000.00 |

NSW Treasury Corp (Sustainability Bond) |

N |

AAA |

20/03/25 |

Y |

B |

1.25% |

950,570.00

|

|

27/11/19 |

500,000.00 |

National Housing Finance & Investment Corp |

Y |

AAA |

27/05/30 |

Y |

B |

1.52% |

419,303.50

|

|

15/06/21 |

500,000.00 |

National Housing Finance & Investment Corp |

Y |

AAA |

01/07/31

|

Y |

B |

1.99% |

504,018.81

|

|

06/09/21 |

1,000,000.00 |

Northern Territory TCorp |

N |

Aa3 |

15/12/26 |

Y |

B |

1.40% |

1,000,000.00 |

|

16/09/21 |

1,000,000.00 |

QLD Treasury Corp (Green Bond) |

N |

AA+ |

02/03/32 |

Y |

B |

1.83% |

790,060.00 |

|

04/01/23 |

2,000,000.00 |

NAB |

P |

AA- |

01/09/23 |

N |

TD |

4.60% |

2,000,000.00 |

|

05/01/23 |

2,000,000.00 |

NAB |

N |

AA- |

04/09/23 |

N |

TD |

4.60% |

2,000,000.00 |

|

01/02/23 |

2,000,000.00 |

NAB |

N |

AA- |

31/07/23 |

N |

TD |

4.35% |

2,000,000.00 |

|

14/02/23 |

2,000,000.00 |

NAB |

N |

AA- |

13/09/23 |

N |

TD |

4.95% |

2,000,000.00 |

|

21/02/23 |

2,000,000.00 |

NAB |

N |

AA- |

21/09/23 |

N |

TD |

5.05% |

2,000,000.00 |

|

23/02/23 |

2,000,000.00 |

Bank of QLD |

P |

BBB+ |

25/09/23 |

N |

TD |

5.05% |

2,000,000.00 |

|

28/02/23 |

2,000,000.00 |

NAB |

N |

AA- |

26/09/23 |

N |

TD |

5.09% |

2,000,000.00 |

|

13/03/23 |

2,000,000.00 |

NAB |

N |

AA- |

11/07/23 |

N |

TD |

4.35% |

2,000,000.00 |

|

24/01/23 |

1,000,000.00 |

Macquarie Bank |

P |

A |

26/07/23 |

N |

TD |

4.42% |

1,000,000.00 |

|

28/03/23 |

1,000,000.00 |

Police Bank |

P |

BBB |

26/07/23 |

Y |

TD |

4.35% |

1,000,000.00 |

|

04/04/23 |

2,000,000.00 |

Auswide Bank Ltd |

P |

BBB |

04/07/23 |

Y |

TD |

4.55% |

2,000,000.00 |

|

05/04/23 |

1,000,000.00 |

NAB |

N |

AA- |

04/07/23 |

N |

TD |

4.35% |

1,000,000.00 |

|

19/04/23 |

1,000,000.00 |

Bank of QLD |

N |

BBB+ |

14/07/23 |

N |

TD |

4.45% |

1,000,000.00 |

|

20/04/23 |

1,000,000.00 |

AMP Bank |

P |

BBB |

20/07/23 |

N |

TD |

4.50% |

1,000,000.00 |

|

27/04/23 |

1,000,000.00 |

AMP Bank |

N |

BBB |

27/07/23 |

N |

TD |

4.45% |

1,000,000.00 |

|

05/06/23 |

1,000,000.00 |

AMP Bank |

N |

BBB |

31/08/23 |

N |

TD |

4.85% |

1,000,000.00 |

|

20/06/23 |

1,000,000.00 |

Bank of QLD |

N |

BBB |

20/09/23 |

N |

TD |

5.05% |

1,000,000.00 |

|

20/06/23 |

1,000,000.00 |

AMP Bank |

N |

BBB |

19/09/23 |

N |

TD |

5.20% |

1,000,000.00 |

|

29/06/23 |

1,000,000.00 |

Judo Bank |

P |

BBB- |

28/09/23 |

Y |

TD |

5.35% |

1,000,000.00 |

|

N/A |

24,655,650.78

|

CBA Business Saver |

P |

AA- |

N/A |

N |

CALL |

4.20% |

24,655,650.78

|

|

N/A |

117,294.15

|

CBA Business Saver – Tourism Infrastructure Grant |

N |

AA- |

N/A |

N |

CALL |

4.20% |

117,294.15

|

|

N/A |

10,361,882.42

|

Macquarie Accelerator Call |

N |

A |

N/A |

N |

CALL |

3.95% |

10,361,882.42

|

|

Total |

70,134,827.35 |

|

|

|

|

|

AVG |

4.16% |

69,649,309.66 |

|

Note 1. |

CP = Capital protection on maturity |

|||

|

|

|

|||

|

|

N = No Capital Protection |

|||

|

|

Y = Fully covered by Government Guarantee |

|||

|

|

P = Partial Government Guarantee of $250,000 (Financial Claims Scheme) |

|||

|

|

|

|||

|

Note 2. |

No Fossil Fuel ADI |

|||

|

|

Y = No investment in Fossil Fuels |

|||

|

|

N = Investment in Fossil Fuels |

|||

|

|

U = Unknown Status |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 3. |

Type |

Description |

|

|

|

|

B |

Bonds |

Principal can vary based on valuation, interest payable via a fixed interest, payable usually each quarter. |

|

|

|

FRN |

Floating Rate Note |

Principal can vary based on valuation, interest payable via a floating interest rate that varies each quarter. |

|

|

|

TD |

Term Deposit |

Principal does not vary during investment term. Interest payable is fixed at the rate invested for the investment term. |

|

|

|

CALL |

Call Account |

Principal varies due to cash flow demands from deposits/withdrawals. Interest is payable on the daily balance. |

|

Environmental and Socially Responsible Investing (ESRI)

An additional column has been added to the schedule of Investments to identify if the financial institution holding the Council investment has been assessed as a ‘No Fossil Fuel’ investing institution. This information has been sourced through www.marketforces.org.au and identifies financial institutions that either invest in fossil fuel related industries or do not. The graph below highlights the percentage of each classification across Council’s total investment portfolio in respect of fossil fuels only.

The notion of Environmental and Socially Responsible Investing is much broader than whether a financial institution as rated by ‘marketforces.org.au’ invests in fossil fuels or not. Council’s current Investment Policy defines Environmental and Socially Responsible Investing at Section 4.1 of the Policy which can be found on Council’s website.

Council may from time to time have an investment with a financial institution that invests in fossil fuels but is nevertheless aligned with the broader definition of Environmental and Socially Responsible investments.

Investment Policy Compliance

The below table identifies compliance with Council’s Investment Policy by the proportion of the investment portfolio invested with financial institutions, along with their associated credit ratings compared to parameters in the Investment Policy. The parameters are designed to support prudent short and long-term management of credit risk and ensure diversification of the investment portfolio. Note that the financial institutions currently offering investments in the ‘ethical’ area are still mainly those with lower credit ratings (being either BBB or not rated at all i.e., credit unions).

|

Investment policy compliance |

|

|

||

|

% should not exceed the following |

ACTUAL |

|

||

|

|

|

|

|

|

|

AAA to AA |

A1+ |

100% |

66% |

Meets policy |

|

A+ to A- |

A1 |

60% |

17% |

Meets policy |

|

BBB to NR |

A2,NR |

40% |

17% |

Meets policy |

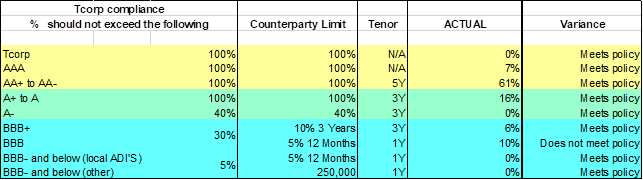

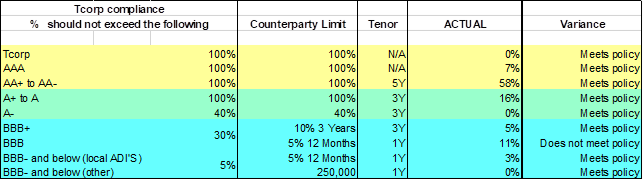

NSW Treasury Corporation Compliance – Loan Borrowing Conditions

Council has borrowed loans through NSW Treasury Corporation under the Local Government Low Cost Loans Initiative. As part of these loan borrowings, NSW Treasury Corporation has placed restrictions on where Council can invest based on the credit rating of the financial institution, the term of the investment and counterparty limit.

NSW Treasury Corporation has reviewed Council’s Investment Portfolio and reminded Council it needs to remain within the investment parameters outlined in the accepted loan agreements. Council currently complies with T Corp Borrowing conditions as indicated in the table below:

Council had discussions with NSW Treasury Corporation and indicated it would start reporting the compliance in the monthly investment report to Council. Council is able to hold existing investments not in compliance until maturity but must ensure new investments meet the compliance requirements.

Meeting the NSW Treasury Corporation compliance means Council will be limited in taking up investments that may be for purposes associated with Environmental and Socially Responsible outcomes. Investments which do not comply with NSW Treasury Corporation requirements and investments with financial institutions that do not support fossil fuels will have to be decreased due to their credit rating status or lack of credit rating.

The investment portfolio is outlined in the table below by investment type for the period 1 June 2023 to 30 June 2023:

Dissection of Council Investment Portfolio as at 30 June 2023

|

Investment Linked to: |

Current Market Value ($) |

Cumulative Unrealised Gain/(Loss) ($) |

|

|

28,000,000.00 |

Term Deposits |

28,000,000.00 |

0.00 |

|

24,655,650.78 |

CBA Business Saver |

24,655,650.78 |

0.00 |

|

117,294.15

|

CBA Business Saver – Tourism Infrastructure Grant |

117,294.15

|

0.00 |

|

10,361,882.42 |

Macquarie Accelerator |

10,361,882.42 |

0.00 |

|

7,000,000.00 |

Bonds |

6,514,482.31 |

(485,517.69) |

|

70,134,827.35 |

Total |

69,649,309.66 |

(485,517.69) |

Council’s overall ‘cash position’ is not only measured by funds invested but also by the funds retained in its consolidated fund or bank account for operational purposes. The table below identifies Council’s overall cash position for the month of June 2023 as follows:

Dissection of Council’s Cash Position as at 30 June 2023

|

Principal Value ($) |

Current Market Value ($) |

Cumulative Unrealised Gain/(Loss) ($) |

|

|

Investments Portfolio |

|||

|

Term Deposits |

28,000,000.00 |

28,000,000.00 |

0.00 |

|

CBA Business Saver |

24,655,650.78

|

24,655,650.78

|

0.00 |

|

CBA Business Saver – Tourism Infrastructure Grant |

117,294.15

|

117,294.15

|

0.00 |

|

Macquarie Accelerator |

10,361,882.42

|

10,361,882.42

|

0.00 |

|

Bonds |

7,000,000.00 |

6,514,482.31 |

(485,517.69) |

|

Total Investment Portfolio |

70,134,827.35 |

69,649,309.66 |

(485,517.69) |

|

Cash at Bank |

|||

|

Consolidated Fund |

3,623,564.03 |

3,623,564.03 |

0.00 |

|

Total Cash at Bank |

3,623,564.03 |

3,623,564.03 |

0.00 |

|

Total Cash Position |

73,758,391.38

|

73,272,873.69

|

(485,517.69) |

Strategic Considerations

Community Strategic Plan and Operational Plan