Agenda

Ordinary

Meeting

Thursday,

27 June 2019

held

at Council Chambers, Station Street, Mullumbimby

commencing

at 9.00am

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Public Access relating to items

on this Agenda can be made between 9.00am and 10.30am on the day of the

Meeting. Requests for public access should be made to the General Manager

or Mayor no later than 12.00 midday on the day prior to the Meeting.

Mark

Arnold

General

Manager

What is a “Conflict of Interests” - A conflict of

interests can be of two types:

Pecuniary - an interest that a person has in a matter because of a reasonable

likelihood or expectation of appreciable financial gain or loss to the person

or another person with whom the person is associated.

Non-pecuniary – a private or personal interest that a Council

official has that does not amount to a pecuniary interest as defined in the

Local Government Act (eg. A friendship, membership of an association, society

or trade union or involvement or interest in an activity and may include an

interest of a financial nature).

Remoteness – a person does not have a pecuniary interest in a matter

if the interest is so remote or insignificant that it could not reasonably be

regarded as likely to influence any decision the person might make in relation

to a matter or if the interest is of a kind specified in Section 448 of the

Local Government Act.

Who has a Pecuniary Interest? - a person has a pecuniary interest in a

matter if the pecuniary interest is the interest of the person, or another

person with whom the person is associated (see below).

Relatives, Partners - a person is taken to have a pecuniary interest in a

matter if:

§ The person’s

spouse or de facto partner or a relative of the person has a pecuniary interest

in the matter, or

§ The person, or a

nominee, partners or employer of the person, is a member of a company or other

body that has a pecuniary interest in the matter.

N.B. “Relative”, in relation to a person means any of the

following:

(a) the

parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal

descends or adopted child of the person or of the person’s spouse;

(b) the

spouse or de facto partners of the person or of a person referred to in

paragraph (a)

No Interest in the Matter - however, a person is not taken to have a

pecuniary interest in a matter:

§ If the person is

unaware of the relevant pecuniary interest of the spouse, de facto partner,

relative or company or other body, or

§ Just because the

person is a member of, or is employed by, the Council.

§ Just because the

person is a member of, or a delegate of the Council to, a company or other body

that has a pecuniary interest in the matter provided that the person has no

beneficial interest in any shares of the company or body.

Disclosure and participation in meetings

§ A Councillor or a

member of a Council Committee who has a pecuniary interest in any matter with

which the Council is concerned and who is present at a meeting of the Council

or Committee at which the matter is being considered must disclose the nature

of the interest to the meeting as soon as practicable.

§ The Councillor or

member must not be present at, or in sight of, the meeting of the Council or

Committee:

(a) at any

time during which the matter is being considered or discussed by the Council or

Committee, or

(b) at any

time during which the Council or Committee is voting on any question in

relation to the matter.

No Knowledge - a person does not breach this Clause if the person did

not know and could not reasonably be expected to have known that the matter

under consideration at the meeting was a matter in which he or she had a

pecuniary interest.

Participation in Meetings Despite Pecuniary Interest (S 452 Act)

A Councillor is not prevented from taking part in the consideration or

discussion of, or from voting on, any of the matters/questions detailed in

Section 452 of the Local Government Act.

Non-pecuniary Interests - Must be disclosed in meetings.

There are a broad range of options available for managing conflicts &

the option chosen will depend on an assessment of the circumstances of the

matter, the nature of the interest and the significance of the issue being

dealt with. Non-pecuniary conflicts of interests must be dealt with in at

least one of the following ways:

§ It may be appropriate

that no action be taken where the potential for conflict is minimal.

However, Councillors should consider providing an explanation of why they

consider a conflict does not exist.

§ Limit involvement if

practical (eg. Participate in discussion but not in decision making or

vice-versa). Care needs to be taken when exercising this option.

§ Remove the source of

the conflict (eg. Relinquishing or divesting the personal interest that creates

the conflict)

§ Have no involvement by

absenting yourself from and not taking part in any debate or voting on the

issue as if the provisions in S451 of the Local Government Act apply

(particularly if you have a significant non-pecuniary interest)

RECORDING OF VOTING ON PLANNING MATTERS

Clause 375A of the Local Government Act 1993

– Recording of voting on planning matters

(1) In this section, planning

decision means a decision made in the exercise of a function of a council

under the Environmental Planning and Assessment Act 1979:

(a) including a decision

relating to a development application, an environmental planning instrument, a

development control plan or a development contribution plan under that Act, but

(b) not including the making of

an order under Division 2A of Part 6 of that Act.

(2) The general manager is

required to keep a register containing, for each planning decision made at a

meeting of the council or a council committee, the names of the councillors who

supported the decision and the names of any councillors who opposed (or are

taken to have opposed) the decision.

(3) For the purpose of

maintaining the register, a division is required to be called whenever a motion

for a planning decision is put at a meeting of the council or a council

committee.

(4) Each decision recorded in

the register is to be described in the register or identified in a manner that

enables the description to be obtained from another publicly available

document, and is to include the information required by the regulations.

(5) This section extends to a

meeting that is closed to the public.

Ordinary Meeting

BUSINESS OF Ordinary Meeting

1. Public Access

2. Apologies

3. Requests for Leave of

Absence

4. Declarations of Interest

– Pecuniary and Non-Pecuniary

5. Tabling of Pecuniary

Interest Returns (s450A Local Government Act 1993)

6. Adoption of Minutes from

Previous Meetings

6.1 Byron

Shire Reserve Trust Committee held on 23 May 2019

6.2 Ordinary

Meeting held on 23 May 2019

7. Reservation of Items for

Debate and Order of Business

8. Mayoral Minute

9. Notices of Motion

9.1 Participation

in the Holiday Time Child Pedestrian Road Safety Signage Campaign...... 6

9.2 Arts

and Cultural Funding.................................................................................................. 8

10. Petitions

11. Submissions and Grants

12. Delegates' Reports

13. Staff Reports

General Manager

13.1 Former

Byron hospital project - governance models...................................................... 11

13.2 Licence

to Mullumbimby Sustainability Education and Enterprise Development Inc.... 27

13.3 Feedback

on Council's website....................................................................................... 35

Corporate and Community Services

13.4 Mayor

and Councillor Fees 2019/20............................................................................... 42

13.5 Section

355 Management Committees - resignations, appointments............................ 46

13.6 Investments

- 1 May 2019 to 31 May 2019.................................................................... 50

13.7 Community

Initiatives Program (Section 356) - 2019/20 funding round applications.... 58

13.8 Report

of the Public Art Panel meeting 9 May 2019...................................................... 61

13.9 Adoption

of the 2019/20 Operational Plan, including Budget, Statement of Revenue Policy,

and Fees and Charges.................................................................................................................... 63

13.10 Byron

Shire Council Submissions and Grants as at 1 June 2019.................................. 75

13.11 Policy

Review - Debt Management and Financial Hardship Assistance........................ 78

13.12 Making

of the 2019/20 Ordinary Rates and Charges..................................................... 82

Sustainable Environment and Economy

13.13 Request

for fee relief - A Day In The Bay...................................................................... 88

13.14 Byron

Shire Climate Emergency Response................................................................... 91

Infrastructure Services

13.15 Belongil

Catchment Drainage and Issues Investigation.................................................. 98

13.16 Multi

Use Byron Shire Rail Corridor.............................................................................. 104

13.17 Brunswick

Heads Parking Scheme Performance Review.......................................... 109

13.18 South

Arm Bridge - Proposed Delivery Timeline.......................................................... 132

13.19 BioEnergy

Facility Technical Operations Review......................................................... 137

14. Reports of Committees

Corporate and Community Services

14.1 Report

of the Audit, Risk and Improvement Committee Meeting held on 30 May 2019 143

Infrastructure Services

14.2 Report

of the Local Traffic Committee Meeting held on 14 May 2019........................ 148

14.3 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 14 May

2019 152

14.4 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 17 May

2019 154

14.5 Report

of the Transport and Infrastructure Advisory Committee Meeting held on 13 June

2019 156

14.6 Report

of the Byron Shire Floodplain Risk Management Committee Meeting held on 13 June

2019....................................................................................................................................... 159

14.7 Report

of the Coastal Estuary Catchment Panel Meeting held on 7 June 2019.......... 161

14.8 Report

of the Water, Waste and Sewer Advisory Committee Meeting held on 13 June 2019 164

6.1 Regulatory

Signage - Byron St, BANGALOW - extend motorcycle parking, provide loading zone 148

6.2 No

Stopping Signs on Skinners Shoot Road. 149

6.3 Signage

requests from Compliance Team - Paterson St, Byron Bay; New Brighton Rd, New

Brighton; Wilfred St, Billinudgel; Sunrise Blvd, Byron Bay. 149

6.4 Byron

Bay Bypass Linemarking and Signage. 150

15. Questions

With Notice

Questions with Notice: A response to Questions with

Notice will be provided at the meeting if possible, that response will be

included in the meeting minutes. If a response is unable to be provided

the question will be taken on notice, with an answer to be provided to the

person/organisation prior to the next Ordinary Meeting and placed on Councils

website www.byron.nsw.gov.au/Council/Council-meetings/Questions-on-Notice

16. Confidential Reports

Infrastructure Services

16.1 Confidential - Tender 2019-0009 for the

Processing of Co-mingled Recyclables to Polytrade Pty Ltd.................................................................................................................................. 168

Councillors are

encouraged to ask questions regarding any item on the business paper to the

appropriate Director prior to the meeting. Any suggested amendments to the

recommendations should be provided to Councillor Support prior to the meeting

to allow the changes to be typed and presented on the overhead projector at the

meeting.

Notices of Motion 9.1

Notices of Motion

Notice of Motion No. 9.1 Participation

in the Holiday Time Child Pedestrian Road Safety Signage Campaign

File No: I2019/896

|

I move that Council participate in the Child Pedestrian

Road Safety Signage Campaign for Dec 2019 - January 2020 and send a letter to

LBDF advising them of our thanks for and acceptance of their invitation to

participate.:

|

Attachments:

1 Invitation

to join the Little Blue Dinosaur Foundations "Holiday Time" Child

pedestrian road safety signage campaign, E2019/41684

Signed: Cr

Michael Lyon

Councillor’s supporting information:

In January 2014, while on holidays with his family at

McMasters Beach, four year old Tom McLaughlin stepped onto a road and was

killed when hit by a 4WD. Out of this tragedy the Little Blue Dinosaur

Foundation (LBDF) was created by Tom’s parents, Michelle and David

McLaughlin, in memory of their son and to prevent this happening to

others. The focus of the LBDF is to champion road safety within holiday

towns (with a combination of high vehicle and pedestrian movements) and within

holiday times through close collaboration with local governments.

Staff comments by Phil Holloway, Director Infrastructure

Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

Background

Through the creation of posters, corflute’s, banners

and other signage at key tourist hot spots, the LBDF flagship “Holiday

Time” campaign is up and running in 42 local government areas across

Australia, including: Tweed, Kiama, Midcoast, Newcastle and Port Macquarie

Councils.

Port Macquarie – Hastings Council and Midcoast Council

stated during preliminary research by Council staff that their campaigns had strong

community support for such a personal campaign. A sign the community has

embraced the campaign the Port Macquarie - Hastings community keeps suggesting

new locations which council considers and reviews each year.

The manner in which a campaign is rolled out and designed is

typically done in close collaboration with the LBDF, drawing on their

experience of what does and doesn’t work. In particular, LBDF can assist

with items, such as:

· Identifying

the best location for signage and recommended signage at each location which

Council can then confirmed or amended based on local knowledge. Within Byron

Bay Shire it is anticipate the campaign could potentially be rolled out in a

number of areas (subject to proper planning), such as: Brunswick Heads, Byron

Bay, Wategos, Suffolk Park and Broken Head. For the first year it may be

appropriate to limit it to just one township.

· Provide

signage which the LBDF developed in consultation with the RMS (note, signs can

be from small bin stickers to large 3m by 3m signs). Below is an example of the

types of signs that can be designed and potentially supplied.

Once the

campaign is designed it is Council’s responsibility to then:

· Put

up the signs in early December and then taken down late January.

· Organise

a launch event to advertise and celebrate the campaign. This event is

prepared by Council’s in consultation with LBDF who help provide mascots

and signage. Some Council’s have organised large BBQ events at

beach front parks with Police, Fire and Rescue are present with their vehicles

for show and colour. Others invite local news and media to attend for maximum

coverage.

· Depending

on the number of signs, area over which signs are installed and scale of the

launch event it is recommended to ensure specific and sufficient staff is

dedicated to the campaign and a working group establish over summer to set up

signs, run the launch event, maintain signage and bring them down at the end.

· Council

funds the time and labour to install the signs, advertise the campaign and take

down the signs. A potential source of funding is through the Road Safety

Program funding to launch the campaign and purchase more signs if required and

advertise.

Council staff are currently undertaking discussions with RMS

to confirm whether funding to support the campaign can be obtained through the

Road Safety Program.

Financial/Resource/Legal Implications:

Signage and posters provided. Some in kind support from

staff.

Potential Funding from RMS up to $10,000 applications close

30 June 2019.

Is the proposal consistent with any Delivery Program

tasks?

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

|

Community

Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and

sense of community

|

2.4

|

Enhance

community safety and amenity while respecting our shared values

|

2.4.2

|

Support

community driven safety initiatives

|

Notices of Motion 9.2

Notice of Motion No. 9.2 Arts

and Cultural Funding

File No: I2019/903

|

I move that Council:

1. Undertake

a full cultural planning exercise in order to design a new Arts and Cultural

Policy, Plan and Strategy.

2. Review

the current Public Art Strategy and revise the Commissioning Contract.

3. Allocate

up to $100,000 in the 2019-20 Operational Plan and Budget, as per staff

report estimates (August 2, 2018, for Res 18-450), for the engagement of a

specialist arts consultant or contractor to assist in house staff over a 12

month period.

|

Signed: Cr

Jan Hackett

Councillor’s supporting information:

Note resolutions 18-256 (19 April 2018) and 18-450 (2 August

2018). The promised Arts and Cultural Policy has been twice delayed from June

2019, to September 2019 and most recently February 2020.

In the meantime, spending in the Arts continues to be

budgeted in a seemingly ad hoc and reactive fashion – exhibition

coordinator salary (Lone Goat Gallery), prizes/awards (Mayor’s

discretionary allowance), Public Art, and Arts Northern Rivers annual

contribution. It would appear that Council is attempting to develop and

coordinate their engagement in the Arts using non-specialist in-house staff and

without a budget. It’s an impossible ask and yet another example of the

Arts being seen as non-core business - simply icing on the cake. Yet their

value to community wellbeing is immense.

The random reactive ad hoc approach to the arts adopted so

far, without an overarching long-term policy or strategy in place or any

community consultation with our rich arts community, has put a huge burden on

staff from the Corporate and Community Service Department.

With public failures having resulted with some large-scale

early projects (eg Bayshore Drive unfinished sculpture), continuing to delay

“putting the head on the chook” is fraught with problems. Therefore,

the engagement of specialist part-time staff or the hiring of professional

consultants is vitally needed in the next financial year if we are going to

effectively operate on a level playing field and maximise our low spend in this

socially beneficial field. How Council proceeds - as leader, enabler, provider,

funder or simply advocate – depends on consultation with key stakeholders

and the broader arts community.

The Creative Arts are a powerful social force. They are

vital to any community’s sense of identity, inclusion, liveability,

reconciliation and survival. Arts and culture play a critical role in enriching

ratepayer’s lives. They are the glue that strengthens a community and

keeps it connected. This Shire is rich with practicing and aspiring artists and

general creative endeavour. If Council is to engage in this sector it must

start with its strong art community. Together we can then determine what level

of support and engagement Council can sustain over time.

It must be noted Byron Shire Council is lagging far behind other

Shire Councils of similar size in its support for the arts. While the Shire

provides a rich tapestry of workshops, exhibitions, theatre, events, concerts

etc., these have all been made possible by private individuals, not for

profits, or commercial enterprises. Council’s role in the arts and

culture must concentrate on furthering community engagement and participation

to help bring this increasingly fragmented community together.

Byron Shire Council is one of the few remaining Councils in

NSW without a Community or Regional Gallery. Local council run galleries, with

their associated activities (workshops, lectures, art classes, studio practice,

et al) are one of the major building blocks for community wellbeing and

cohesion. They are also an alternative tourist drawcard, a meeting place or

destination, and have real and substantial economic values for communities.

Byron Shire needs to live up to its self-promotion of being

a “go to” creative hub in this region. We need to engage and plan

in one of our richest assets - our independent, wildly individual and original,

creative community.

Staff comments by Sarah Ford, Manager Social and Cultural

Planning, Corporate and Community Services:

(Management Comments must not include formatted

recommendations – resolution 11-979)

A Notice of Motion by Cr Hackett to the 19 April 2018

Ordinary Meeting Council resolved (Res 18-256):

“That

the Community Development Team prepare a report for Council outlining the human

resources and costs required to develop and oversee an Arts and Cultural policy

so that we might have an integrated approach to whole-of-Council planning for

the arts and culture in Byron Shire. This report to be delivered prior to the

end of the financial year (June 2018).”

The Social and Cultural Development team made enquiries in

relation to best practice examples of Arts and Cultural policies with other

regional local councils. The report was delivered to Council at the 2 August

2018 Ordinary Meeting.

Staff outlined the varied approaches of other local

councils, noting that a simple Policy review was within the resourcing

capabilities of the Social and Cultural Development team. However should a

Cultural Planning exercise be considered by Council, cost estimates for a

consultant/contractor were that it would be in the vicinity of $100,000.

Council resolved (Res 18-450):

“That

Council note that the Cultural Policy will be reviewed by June 2019 to develop

a new ‘Arts and Cultural Policy’ within existing Council resources

utilising best practice examples and including consultation with key arts and

cultural stakeholders as outlined in the report”

The Social and Cultural

Development team is in the early stages of the review which includes;

· Literature

review

· Existing

Policy review

· Consultation

with key stakeholders

The Arts and Cultural Policy was to be delivered by June

2019, however due to the additional requirement to review and update the Public

Art Guidelines and commissioning contract and process, plus the currently

ongoing requirements of the Lighthouse project, the Social and Cultural

Development team will have a draft Arts and Cultural Policy completed by

February 2020.

Financial/Resource/Legal Implications:

Based on recent (2017/18) research into the cost of

developing an Arts and Cultural Plan and associated strategy, it is still

considered that a budget of $100,000 would be required to engage an experienced

arts consultant to undertake the work.

This cost however does not take into consideration the staff

resources required to support the effective delivery of a large scale planning

exercise. Based on feedback from other Councils that have engaged in a Cultural

Planning process, staff would be required to:

· Assist

with engagement and stakeholder mapping

· Attend

engagement sessions

· Provide

existing documentation

· Distribute

key information to community

· Develop

and implement a media and communications plan

· Provide

a point of contact for community

· Manage

the contract

Currently this has not been factored into the Social and

Cultural Development team’s proposed projects in the 2019/2020

Operational Plan. If this support were to be delivered within existing

resources, there would be considerable negative impact on other planned

projects for 2019/20.

The 2019/20 budget is subject to a separate report to this

Council meeting and is already projecting a deficit position prior to

consideration of adding the estimated costs outlined in this Notice of Motion

to the budget.

Is the proposal consistent with any Delivery Program

tasks?

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

|

Community

Objective 2: We cultivate and celebrate our diverse cultures, lifestyle and

sense of community

|

2.1

|

Support and

encourage our vibrant culture and creativity

|

2.1.3

|

Enhance

opportunities for interaction with art in public spaces

|

Staff Reports - General Manager 13.1

Staff Reports - General Manager

Report No. 13.1 Former

Byron hospital project - governance models

Directorate: General

Manager

Report

Author: Claire

McGarry, Place Manager - Byron Bay

File No: I2019/750

Summary:

In May 2019, Council resolved to purchase the former Byron

Hospital site from the NSW Government following a proposal from a Community

Steering Committee to return the site to the local community.

While Council and community are working together to progress

plans for future use of the site, determining the best governance model for the

operation of the site is critically important to its success.

A range of governance models have been investigated based on

what will meet the project objectives as detailed in this report, including:

- Providing

the most effective operating model to maximise opportunities for the site

- Embracing

community-led governance

- Ensuring

transparency.

This report details the benefits and risks of a range of

models and seeks Council endorsement of a direct lease model.

|

RECOMMENDATION:

That Council:

1. Notes

the range of governance models investigated for the development and operation

of the former Byron Bay Hospital site

2. Notes

the intention of the Community Steering Committee to form a

not-for-profit incorporated association to manage the project

3. Nominates

the incorporated association formed by the Community Steering Committee

as a direct lessee for the site with a view to formalising the terms and

conditions of this lease at the next stage of the project

4. Be

provided with draft documentation for consideration prior to a lease being

negotiated, including but not limited to:

-

Constitution of incorporated association and processes around Board election;

-

Draft terms and conditions of head lease

-

Draft terms and conditions of sub-leases

-

Tenancy selection requirements

-

Rental subsidy methodologies

5. Request

the General Manager, or his delegate, to liaise with the Office of Local

Government on the proposed mechanism to ensure that Council meets its

statutory requirements

|

Attachments:

1 Proposal

to NSW Health - Repurposing of the former Byron Hospital site.pdf, E2018/56011

2 Draft

Governance Model Options for former Byron Bay Hospital - Version 1, E2019/10988

REPORT

Getting Here

April 2016 In

response to enquiries from members of the public about the future of the former

Byron Hospital property, Local Health District advised that it is normal

practice for Health Administration Corporation to work with Government Property

NSW in the disposal of surplus properties at the appropriate time.

2017 Community

group hold community meetings to discuss future of the site

Dec 2017 Council

resolved (Res 17-692):

That

Council write to NSW Health and Health Minister to:

1. outline

Council’s interest in working alongside the Byron Bay community to

provide a community focused use of the old Byron Bay hospital site.

2. request

NSW Health to defer any decision on any potential sale of the site for six

months, in order for Council and a partnership with the community to form and

develop a proposal to either purchase the site or pursue a long term lease

arrangement.

Jan 2018 State

Government announces a 6-month moratorium on sale of the site to enable

community group to prepare and submit their proposal to NSW Government.

June 2018 Byron

Shire Council, on behalf of the community (Res 18-427), submitted a

proposal to the Department of Premier and Cabinet to return the Byron hospital

to the local community (Attachment 1) to provide “vital and currently

lacking welfare, social, cultural and educational services”.

Feb 2019 Council

received an update on the hospital project including governance models to be

investigated (Res 19-077)

May 2019 Council

resolved to purchase the site from the NSW Health Administration Corporation

(Res 19-223) and classify it as operational land

Facility Ownership,

Management and Operation (Governance)

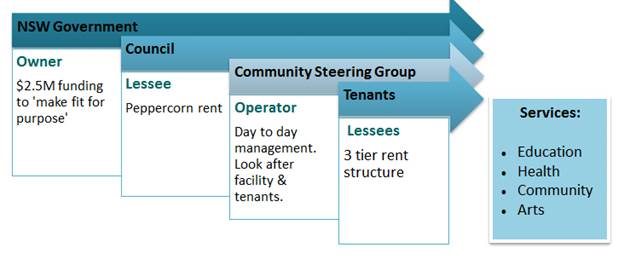

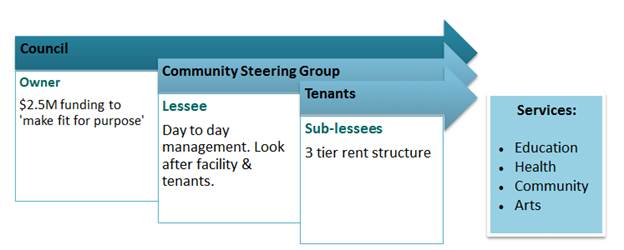

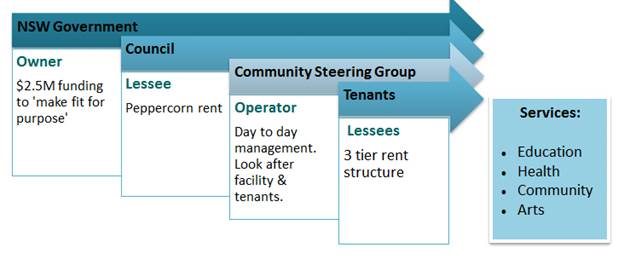

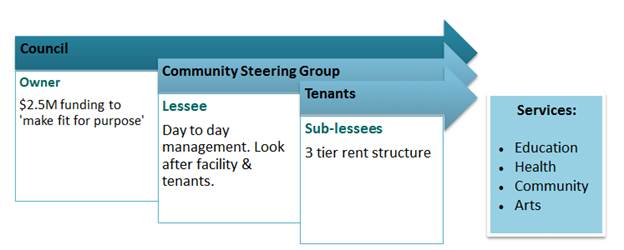

The

original proposal involved four main layers of involvement, with

Council’s role being lessee or trustee for State Government and

with State Government retaining ownership of the facility and funding the

estimated $2.5m costs to make it fit for purpose.

The terms of the contract with the

State Government were that Council owns the facility and is responsible for

most of the estimated costs to make it fit for purpose (with State Government

contributing $200,000 towards immediate ‘make safe’ costs).

The result is reduction of one main

layer of involvement but the same recommended overall structure and service

outcomes as shown below.

Original Proposal - Main Governance

Layers:

Final Proposal – Main

Governance Layers:

Staff undertook preliminary investigations

into governance model options to ascertain which model(s) the Community

Steering Committee and Council would consider workable, and the processes and

requirements to establish them.

Staff initially identified at

least 11 potential governance models that could be considered for this project

– these are outlined in the attached Research Paper (Attachment 2).

These were prepared at a time when NSW Government would remain the owner, so

with the later change in ownership to Council some of the initial models become

redundant. Each of the models had varying levels of:

· impost on Council (cost, resourcing and risk);

· degree of community involvement;

· process complexity; and

· level of autonomy and decision-making power.

In order to determine the most

appropriate governance model, a number of Governance Project Objectives were

developed and are outlined below.

Governance Project

Objectives

The Community Steering Committee

developed objectives for the governance model which are to ensure that it:

· Maximises opportunities to harness grant, public and

philanthropic funds.

· Maintains capacity to access low interest loans to

part-fund re-development.

· Enables employment of staff.

· Minimises red tape.

· Ensures a high level of transparency and a medium-high

level of autonomy.

· Enables the generation of income (profit) that can be

redistributed to community services associated with the project.

In addition, Council’s

objectives for the governance model are that it:

· Enables continuation of leadership by the community

steering group.

· Demonstrates Council’s leadership and commitment to

Community-led Governance principles including supporting co-design and

co-delivery of services and optimising use of public spaces.

· Ensures high levels of transparency, accountability,

effectiveness (including sound risk management) and efficiency (including

cost-effectiveness).

· Ensures statutory compliance.

In addition, shared objectives of

State Government, Community Steering Committee and Council are that the

governance model:

· Ensures that profits generated from operations be

reinvested back into the building and in providing community services from the

building – this is a contractual requirement.

· Is replicable on other sites, to the greatest extent

possible, as this appears to be a first in NSW.

Governance Model Options

The Initial governance models

investigated (as outlined in attachment 1) include:

1. Direct service

delivery

2. Section 355

committee

3. Lease of operational

land

4. Lease of community

land (not applicable now)

5. Service contract

6. Public Private

Partnership

7. Incorporated

Association (owned by Council)

8. Company limited by

guarantee (Ltd) (Council operated)

9. Company limited by

shares (Pty Ltd) (Council operated)

10. Land Trust/Charitable

Foundation (Privately operated company limited by guarantee)

11. Company limited by shares

(Private ownership)

Following initial consideration by

Council in February 2019, staff have been working with the Community Steering

Committee to narrow the list of potential governance models. The four models

below were nominated for further investigation and discussion:

1. Section 355

committee

2. Lease (preferred

option)

3. Service contract

4. Land

Trust/Charitable Foundation (Privately operated company limited by guarantee)

Option 1 – Section 355

committee

|

Summary

|

A s355 committee is used by

Council for the management of community halls and facilities. These

committees provide a mechanism by which interested persons can have an active

role in the management of Council facilities. This gives the committee the

protection of operating under the banner of Council, and provides Council

with assistance in carrying out its functions.

|

|

Process to establish

|

Step

|

Timeframe

|

|

Council resolution to establish

a S355 Committee, call for membership and appoint members

|

3-4 months

|

|

Committee Volunteer training and

induction

|

1 month

|

|

Benefits

|

Interested persons can have an

active role in the provision/management of Council facilities and services.

Local people are provided an

opportunity to participate in local community life.

|

|

Risks

|

Limitation of powers would

generate significant constraints.

Council is required to provide

advice and direction on matters associated with s355 Committees, however, the

scale and complexity of the site and project is beyond Council’s

expertise to manage and under a 355 committee model would present a high level

of risk to Council and prospective tenants.

|

|

Ability to generate financial

return

|

Significant constraints around

Committee activities and use of the facility could hinder income generation.

|

Option 2 – lease

|

Summary

|

Council would directly lease the

premises to the Community Steering Committee who would manage the building

and the services provided.

The Steering Committee would

register as a not-for-profit incorporated association. It would have a

constitution and be run by a Board, elected in accordance with its

constitution. The association would have the capacity to hire staff, seek

grants and philanthropic funding, enter contracts (like sub-leases) etc.

Council would retain ownership

of the property and the association would have secure tenure by way of a long

term lease. If the Association were wound up, the property would remain in

Council ownership and any money the Association had would be applied towards

debts first and any amount left over, distributed in accordance with its

constitution (which Council could make a condition of the lease).

The Council lease would include

all the terms and conditions that Council and community need to set the scope

of the building management and service delivery. The terms and conditions

would clearly set out the limits and restrictions Council imposes. For

example it would set out:

- allowed uses on the site

- what types of services

and sub-leases could occur;

- limits on types of

commercial sub-leases would be acceptable;

- limits on what percentage

of floor space could be used for commercial activities;

- rental payable to Council

and outgoings and costs payable by the tenant;

- sub-tenant rental and

rental subsidy methodologies;

- tenancy selection

requirements and limitations on sub-leases (based on the proposal accepted by

State Government);

- requirements for

investment of returns in building maintenance and upgrades;

- reinvestment of profits

into broader community services;

- building and grounds

maintenance and service level requirements e.g., maintaining public access

- accountability measures

e.g. requirements for publishing reasoning for decisions, providing

information to the public, reporting requirements, auditing

- dispute resolution and

lease termination processes, for example what would happen if the

not-for-profit association became defunct

- usual requirements of

commercial leases e.g. need to get and maintain approvals, insurance, safe

systems of work etc.

Directly entering a lease to the

registered not-for-profit association without a competitive process is

authorised by s55 of the Local Government Act.

|

|

Process to establish

|

Step

|

Timeframe

|

|

Based on the adopted governance model, staff finalise

project initiation stage including updating detailed risk assessment and

finalising statement of outcomes, project and communications plans. Staff

also to seek confirmation from Office of Local Government that the

arrangement would not meet the definition of Public Private Partnership and

is also otherwise compliant, for example with s358 of the Local Government

Act.

|

1 - 3 months

|

|

Council develops head-lease,

policy and parameter documents (e.g. sub-lease template), with expert legal

advice as required

|

3 - 6 months

|

|

Steering Committee registers an

incorporated association

|

concurrent with steps 1 & 2)

|

|

Council staff develop

transparency and accountability tools that will ensure updated information remains

available to the public, so decision information can be published from

commencement

|

concurrent with steps 1 - 3)

|

|

Steering group commences

planning building work and negotiating with prospective tenants

|

concurrent with steps 1 - 3)

|

|

Benefits

|

· Meets all of the objectives of all three groups

· Has the capacity to provide a dividend to Council via

rental returns

· Does not present a significant amount of process

complexity or cost either in establishment or operational stages

· Enables Council to build facility management and

transparency and accountability requirements into lease terms and conditions

· Enables the establishment of a skills-based association

board

· Enables the Board to make operational and tenancy

decisions

· Enables a reinvestment of rent per year back in to

community services associated with the facility

|

|

Risks

|

· Community concerns over lack of competitive process

– this can be mitigated through communication and engagement, adherence

to the proposal presented to and accepted by the State Government and

referral to Office of Local Government for advice.

· Risk of failed project – the success of the

Steering Committee to date in securing the site for community use is evidence

in favour of proceeding with this group, who have the skills and experience

to deliver a project of this type and scale. Additionally, if the project

fails, the liability lies with the incorporated association running it

– Council’s role is essentially that of a landlord.

· Competing interests in the community – the proposed

uses for the site, as detailed in the proposal to State Government, form

clear parameters for the project. Additionally, lease conditions could

include limitations on ability to amend the Association’s constitution

without prior Council approval and the publication of Association’s

documentation to ensure transparency of decision-making around all decisions.

|

|

Ability to generate financial

return

|

To Community

Under this model, the

Incorporated Association would be set up to invest in building upgrade and

maintenance and reinvest any surplus income from the facility into

community welfare programs addressing homelessness, women’s refuge

services and social projects.

To Council

The lease would contain rent

provisions that enable Council to recover over time the costs incurred during

the initial period of managing the building, to cover ongoing administrative

and lessor costs and to build a reserve to meet future structural building

costs (that would stay the responsibility of Council as the building owner,

like they do in all leases of this type).

|

This is the preferred model

recommended to Council.

It retains Council ownership of

the property and is a common model used widely across NSW local government. It

is already used by Council and is familiar to the Byron Shire community. Other

examples include commercial premises owned by Council and community-outcomes

based leases of premises such as ACE (Adult Community Education) Mullumbimby

and Katia Nursery social enterprise lease.

It is the simplest and shortest

model to set up, and it maintains high levels of transparency and

accountability, along with a capacity for the community to monitor outcomes and

become involved. Council would also be able to exercise a high degree of

control through the lease conditions it sets, while giving the community

steering group autonomy. The model also provides certainty to facilitate

attraction of grant, philanthropic and social impact investment.

If the directly negotiated lease

model is progressed, Council will be provided with draft documentation

for consideration prior to a lease being negotiated, including but not limited

to:

- Constitution

of incorporated association and processes around Board election;

- Draft

terms and conditions of head lease

- Draft

terms and conditions of sub-leases

- Tenancy

selection requirements

- Rental

subsidy methodologies

If the directly negotiated lease

model is progressed, Council will complete a detailed risk assessment and seek

independent review of it from the Office of Local Government to confirm that

does not meet the definition of a Public-Private-Partnership, or if it does,

that the proposal satisfies the requirements, and that it complies with any

other statutory requirements.

Option 3 – service

contract

|

Summary

|

Council would issue a contract

to occupy and manage the premises. The contractor could take any form, i.e. a

for-profit company or a not-for-profit company. The contractor would

perform services for Council as set out in the contract. They would be paid

by Council (usually calculated by reference to the profit generated) and

profits above that payment would be payable to Council.

Council would retain ownership

of the property but would also retain responsibility for maintenance of the

asset and administrative processes such as setting fees for use.

Like the lease option above, the

contract would include all the terms and conditions that Council and

community need, in order to set the scope of the building management and

service delivery.

There is no authority in the

Local Government Act to directly negotiate a service contract, so Council

would have to run a competitive process. Council could set criteria for

eligibility to be a contractor (e.g. not-for-profit status) and outcomes

(e.g. preferred service outcomes) but the process would still involve a risk

of losing the skills and experience base that has delivered this project to

this point.

|

|

Process to establish

|

Step

|

Timeframe

|

|

Based on the adopted governance model, staff finalise project

initiation stage including updating detailed risk assessment and finalising

statement of outcomes, project and communications plans.

|

3 – 6 months

|

|

Council develops a service

contract, policy and parameter documents (e.g. sub-lease template), with expert

legal advice as required

|

6 – 9 months concurrent

with step 1

|

|

Council calls a competitive

process

|

3 – 4 months

sequential

|

|

Contract negotiations and taking

over occupation of the premises

|

1 month

sequential

|

|

|

Contractor then commences

planning building work and negotiating

|

sequential

|

|

Benefits

|

· Has the capacity to provide a dividend to Council via

rental

· Does not involve a very complex process or high cost

either in the establishment or the operational stages

· Enables Council to build facility management and

transparency and accountability requirements into contract terms and

conditions

· Enables the appointment of an experienced facility

operator

· Retains greater decision-making with Council.

· Provides Council with potential to apply income to

Council delivered community services.

|

|

Risks

|

· Does not meet all the Governance Model Objectives, as an

example it:

- does not maximise

opportunities for philanthropic funds;

- does not demonstrate

commitment to some community-led governance principles;

- can have a profit driver,

meaning that not all income generated would necessarily be reinvested back

providing community services.

· Imposes greater responsibility for maintenance, higher

risk and higher administration on Council.

· Risk of failed project – lack of certainty that

competitive process will result in an appropriately skilled/experienced

operator that is acceptable to Council and the community.

· Council managed service delivery (via a service contract)

means this model is not eligible for Deductible Gift Registration status and

this would reduce the likelihood of being able to attract philanthropic

funding.

· Risk of losing corporate and community knowledge (i.e.

Steering Committee) that has successfully delivered this project to this

point.

· Competing interests in the community – risk of

diversion from the proposed uses for the site, as detailed in the proposal to

State Government

|

|

Ability to generate financial

return

|

To Community

Under this model the contracted

operator would receive payment for services and if that was a not-for-profit

community group they could then apply that money towards their purposes, but

they would not necessarily be linked to the community services outlined in

the original proposal.

To Council

Council would receive the

balance of profit, after paying for the contracted operator’s services,

to apply as it saw fit. It is likely that this model would be less attractive

for philanthropic or social impact investment.

|

Option 4 – Land

Trust/Charitable Foundation (Privately operated company limited by guarantee)

Company models were

originally investigated based on the original proposal where State Government

retained ownership of the property and a company would be established to manage

and run the facility.

Circumstances have since

changed and Council has become the owner of the property, so there is no need

for Council to establish a separate entity to operate a State-owned property.

As Council is now the

owner of the property, a trust (company) model would only work now either via a

lease to a company (i.e. the recommended direct lease model at Option 2 above)

or with transfer of ownership of the property to the company. Council would

need to seek State-Government advice, if it were to now considering

transferring ownership of the property to a company (as a trust or a charity)

as this is different to the Council ownership outcome that has been negotiated.

The table below provides

information on how the trust or company model could apply if Council were to

consider transferring ownership of the property, but this is not recommended.

|

Summary

|

Sometimes referred to as a

‘trust’ model, this would involve registering a company limited

by guarantee, to own the property ‘on trust’ for Council and to

manage it consistent with its purposes set out in its constitution.

Ownership of the company could

be either via private shareholders or a mix of private shareholders and

Council owning shares. It would have a constitution and be run by a Board,

elected in accordance with its constitution.

The company would be limited by

guarantee, i.e. be not-for-profit, so it would be unable to pay a dividend to

anyone, including Council, and all its profits would have to be applied to

the purposes set out in its constitution.

As owner of the property, the

company would have autonomy to manage the building in any way it saw fit. The

only limitation on the company would be that the uses of the property would

have to be consistent with its constitution (but it could change its

constitution subject to usual company laws) and consistent with the

restricted uses registered on the title to the property, and of course all

approvals any property owner requires would be necessary.

There would be statutory company

reporting requirements (e.g. annual reporting to ASIC and/or ACNC) but no

capacity for Council to compel publication of additional information to the

community. If the company were wound up, the property and any money it had at

the time would be applied to debts first, then distributed in accordance with

its constitution.

|

|

Process to establish

|

Step

|

Timeframe

|

|

Seek NSW Government concurrence on transfer of ownership

of property

|

1 - 3 months

|

|

Staff seek confirmation from Office of Local Government

that the arrangement would not meet the definition of Public Private

Partnership and is also otherwise compliant.

|

1 - 3 months

|

|

Council works with Steering

Committee to develop a constitution and register a company limited by

guarantee (i.e. a trust or a charity).

|

3 – 6 months

|

|

Council prepares trust, contract

and transfer of ownership documents, with expert legal advice

|

6 – 9 months concurrent

with step 3)

|

|

Benefits

|

· Enables the establishment of a skills-based association

board

· Enables the Board to make all decisions

· Enables a reinvestment of all profits back into community

services associated with the facility

|

|

Risks

|

· Does not meet all the objectives of community, Council or

State Government and may not be supported by State Government.

· Community concerns over lack of competitive process

– this can be mitigated through communication and engagement but

adherence to the proposal presented to and accepted by the State Government

cannot be guaranteed by Council.

· Community concerns over privatisation of public assets.

At the time when the property was on the open market, ownership ‘on

trust’ by a company limited by guarantee provided a higher level of

‘ownership’ compared to full privatisation of the property

through sale. However, Council has now secured ownership of the property, so

transfer of ownership ‘on trust’ to a company would reduce the

level of public ownership.

· Risk of failed project – the success of the

Steering Committee to date in securing the site for community use is evidence

in favour of proceeding with the steering committee which has the skills and

experience to deliver a project of this type and scale. However, with a

company limited by guarantee model, there could be a risk of a lack of return

of the property if the company or project failed with large debt levels.

· Competing interests in the community – the proposed

uses for the site, as detailed in the proposal to State Government, form

clear parameters for the project. However, other than as a shareholder (if

Council was one) there would be limited ability for Council to restrict the

company’s ability to amend its constitution without prior Council

approval or to influence the publication of company’s documentation to

ensure transparency of decision-making around all decisions.

|

|

Ability to generate financial

return

|

To Community

Under this model, the Company

would own, on trust, and be responsible for the upgrade and maintenance of

the building and providing services from it. As a company limited by

guarantee it would have to apply all its profits to the purposes set out in

its constitution.

To Council

None.

|

The company limited by guarantee

model is not recommended. It was considered at a time when State Government

would continue to own the asset but that is no longer the case, and this model

involves an unnecessary level of complexity and higher level of risk to Council

than others.

The model is not commonly used in

NSW local government and has not previously been tried in Byron Shire. There

are successful examples of the model working in a range of situations, such as

community housing trusts and cultural spaces owned by State Government vested

to charitable trusts, such as Abbotsford Convent in

Victoria. There are also some examples of company structures for community

service provision, but some have experienced difficulties with distribution of

assets on winding up, such as the legal dispute that occurred over distribution

of donations when the new Northern NSW Helicopter Rescue Service Limited

(company limited by guarantee) commenced and its predecessor company ceased.

Governance Model

Recommendation

Of the 11 models previously

investigated and discussed with Council and the Community Steering Committee,

it is recommended that a direct lease model be adopted whereby:

1. The Steering

Committee establishes a not-for-profit incorporated association, with a

constitution that requires all profits to be put back into the property and the

community services set out in the proposal.

2. Council provides the

incorporated association with a lease of the facility to manage and operate as

per the terms of the lease that Council sets (including for example a

requirement not to amend the constitution).

3. Staff commence work

on the next steps for a direct lease model set out above which include:

a. Finalising project

initiation stage including updating detailed risk assessment and finalising

statement of outcomes, project and communications plans. Staff also to seek

confirmation from Office of Local Government that the arrangement would not

meet the definition of Public Private Partnership and is also otherwise

compliant.

b. Developing

the key documents e.g. the head-lease and policy and template documents (e.g.

sub-leases), with expert legal advice as required

c. Further

workshops and reports to Council as matter progresses,

including for approval of the key documents.

Refurbishment Funding

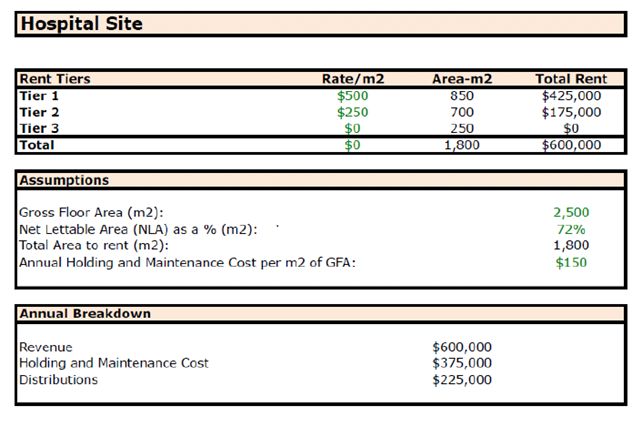

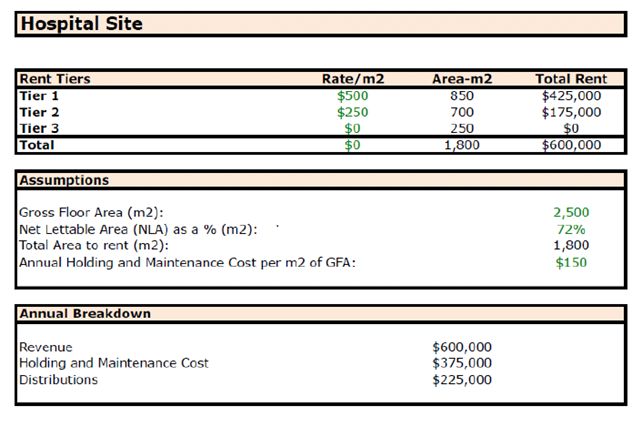

The original community proposal involved:

1. NSW

Government continuing to own the facility and, as owner, funding the estimated

$2.5 million of necessary refurbishment works, to ‘make it fit for

purpose’;

2. Rental

from key anchor tenant/s (Tier 1 tenants) occupying around half of the

available area and meeting ongoing operating costs, thereby allowing

subsidisation of rental for other tenants (Tier 2 and 3 tenants) in the

remaining half of the available area.

Instead, Council has resolved to purchase the facility

(worth well over $2.5 million in land value alone), and NSW Government is

providing $200,000 to cover the costs of some minor works to remove asbestos

and contamination (minor areas only) and carry out some minor repairs to the

roofing to fix water leaks.

This means that Council will have to find the estimated $2.5

million upfront to carry out the necessary refurbishment works to make the

building fit for purpose and there are two options currently available to do

this discussed below.

Making the building fit for purpose by funding the upfront

capital costs is key to the success of this project and options include:

1. Council

authorising the head-lessee to enter into arrangements with one or more key

anchor tenants, with a requirement for them to pay rent in advance, in sums

sufficient to meet the upfront capital costs. Choosing this option would give

certainty to everyone, with the space occupied by the key anchor tenant/s (and

therefore the remaining space that will be available for other more subsidised

community uses) and the amount of funding available both known before capital

costs are incurred.

2. Council

borrowing the funds and setting the rental in its head-lease at an appropriate

level to meet the additional loan repayment costs. Under this option,

there would be risk to Council of having taken on debt without certainty as to

funding for repayments. It would also involve uncertainty for community or

prospective tenants on how the available space may be used in future. Council

would also need to consider reducing the level of sub-leasing restrictions it

might otherwise apply, to enable the head-lessee to ensure they can raise

sufficient income to meet their rent obligations to Council as well as

operating costs.

This option will most

likely require Council to complete a capital expenditure review and submit to

the Office of Local Government for consideration/approval prior to any loan

funds being drawn. Loan funding this proposal whilst potentially self

financing, will increase Council’s overall loan borrowings and may influence

Council’s loan borrowing capacity for other projects in future.

Next Steps

If the recommendation in this report is adopted and Council

nominates a direct lease model be progressed with the Community Steering

Committee , staff will work with this group and engage specialist commercial

consultants to begin drafting key documentation for Council’s

consideration.

This documentation will define the parameters for use of the

site – operations, management, permitted uses, tenancy selection and

financial modelling.

Simultaneously, staff will liaise with the Office of Local

Government on the proposed mechanism to ensure that Council meets its statutory

requirements.

The outcomes of this work will be reported back to Council

for consideration prior to the negotiation of a head lease.

STRATEGIC CONSIDERATIONS

Community Strategic Plan and

Operational Plan

|

CSP Objective

|

L2

|

CSP Strategy

|

L3

|

DP Action

|

L4

|

OP Activity

|

|

Community Objective 1:

We have infrastructure, transport and services which meet our expectations

|

1.2

|

Provide essential services and

reliable infrastructure which meet an acceptable community standard

|

1.2.7

|

Optimise Council’s

property portfolio (SP)

|

1.2.7.3

|

Investigate Byron Bay Hospital

development options

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal/Statutory/Policy Considerations

Each governance model has particular requirements and

processes which Council will have to comply with.

The recommended direct lease model:

ü Meets the principles of

Council’s Supporting Partnerships Policy in that:

o While there has not been

a market based process, any community group was able to put forward a proposal

to State Government for management of the property.

o The partnership with the

Community Steering Group has delivered ownership of the former hospital site to

the Byron Shire community, when Council itself could never have achieved that.

o It focuses on funding

community services that Council could not otherwise deliver and delivering

quadruple bottom line outcomes for community.

o It would generate

recurrent revenue for Council as well as deliver quantifiable, demonstrable and

recurrent benefits to the community.

o It has stopped the asset

being sold and secured it in Council ownership. The proposal does involve a

medium term lease (length still to be determined by Council) but on terms and

conditions that will set out requirements for equitable and outcomes-based

access to and use of the premises.

ü s55(3)(e) of the Local

Government Act authorises direct “leasing … of land, other

than the leasing … of community land …”. This land is

classified as Operational Land, so s55(3)(e) applies.

ü Confirmation will be

sought from Office of Local Government that the arrangement is not a public

private partnership or, if it is, that the intended governance model satisfies

the requirements of the guidelines for public private partnerships.

· Confirmation will

also be sought from Office of Local Government that s358 of the Local

Government Act (imposing restrictions on the formation or participation in

formation of a corporation) does not apply to the recommended governance model.

ü Meets a number of the

circumstances supporting direct negotiations as set out in the Independent Commission Against Corruption (ICAC) Direct Negotiations Guidelines for Managing Risk . For example, this venture originally started by a proposal

from the State Government for a competitive process where the property was to

be put on the open market and everyone would have the opportunity to vie for it

and on the basis of uniqueness, in that the community Steering Group is the

only reason the Byron Shire community has obtained ownership of this asset and

without them Council would not be considering governance models.

If Council considers a different governance model, other

legal and statutory requirements could arise and this can be addressed as part

of the review of project planning that will occur after Council decides on a

governance model.

Financial Considerations

The original proposal highlighted refurbishment costs of

$2.5m to restore the building to a basic safe standard and fit for purpose. A

full breakdown of these costs is provided in the original proposal –

Attachment 1.

As noted above, NSW Health has indicated it will provide

$200,000 towards site remediation to remove some minor contamination and fix

roof leaks.

The original community proposal included basic financial

projections, as outlined below.

This modelling is indicative only, and is intended to show

the financial viability of the facility based on conservative estimates of

market rates and net lettable area.

The proposed 2019/20 budget (subject to a separate report to

this Ordinary Council Meeting) includes $400,000 for holding costs and $50,000

to engage specialist expertise in establishing key legal documentation.

Funding of this expenditure is proposed to be provided by the Holiday Park

Reserve with the view that over time these costs will be reimbursed once

redevelopment has been completed and the facility becomes operational.

Should Council proceed with the recommendation to this

report, and if a ‘Tier 1’ anchor tenant can be secured on the basis

of providing upfront rental covering a number of years in advance, this can

provide the funding required to refurbish the facility. As indicated

earlier in the report, alternatively Council could consider loan borrowings to

refurbish the facility with the view that the loan can be financed from rental

revenues post refurbishment. Depending upon outcomes associated with

leasing the facility may require a future report to Council in respect of

financing the refurbishment costs.

Consultation and Engagement

The repurposing of the former Byron hospital site into the

Byron Community Hub was discussed at length, between 2016 and proposal

submission in 2018, across a wide range of community forums including:

· An

initial ‘concept’ meeting with around 80 attendees

· 15

Steering Committee meetings

· Hundreds

of meetings with interested individuals and small groups

The original proposal was developed by the Community

Steering Committee, who used local media to gather community input and support

and made direct contact with more than 100 local citizens to gauge interest.

The proposal was well received and is strongly supported by the Byron Bay

community.

Following these discussions, the Committee researched the

proposition with a wide range of stakeholders in the Byron Shire to understand

its viability, the risks and community appetite and gauge the interest of

potential tenants. The proposal received over 75 letters of support from the

local community.

The project has attracted considerable interest from a wide

range of prominent organisations wishing to deliver services to the Byron Bay

community from a local base. This is in addition to a plethora of requests from

smaller, locally-based community organisations who are crippled by existing

market rates or are unable to deliver services from Byron Bay.

Since acceptance of the Community Proposal, information has

been available on Council’s website and in Council reports and media

updates.

The recommended governance model of direct lease to an

incorporated version of the Community Steering Committee, would not involve a

further community consultation process or a competitive market process for the

opportunity to lease the premises. The reasons for this are listed above but in

summary, the Community Steering Group is the only reason that Council is now

considering options for future management of this facility.

Other community groups, trusts or incorporated associations

could have also put forward proposals to NSW Government, and Council would have

engaged with them on the same basis. An example is the community group which

has been working on a submission to State Government for surplus rail land in

Mullumbimby. For the former Byron Bay Hospital site, the Community Steering

Group volunteered, extensively engaged with and secured support from the

community and achieved a great result for the Byron Shire community. Many

100’s of skilled volunteer hours from the Community Steering Group have

delivered this project to this point and that group has the skills and

expertise necessary to achieve the outcomes it set out to achieve back in 2016.

The Steering Committee has committed to working with Council

to continue to engage the local community as the project progresses and

openness, accountability and transparency requirements would be built into the

recommended direct lease ensuring that the community can stay informed.

Staff Reports - General Manager 13.2

Report No. 13.2 Licence

to Mullumbimby Sustainability Education and Enterprise Development Inc

Directorate: General

Manager

Report

Author: Paula

Telford, Leasing and Licensing Coordinator

File No: I2019/800

Summary:

Council resolved (19-159) at its 18 April 2019 meeting

to negotiate a temporary licence with Mullumbimby Sustainability Education and

Enterprise Development Inc for occupation of part of Lot 22 DP 1073165 for the

purpose of a community garden.

In accordance with s47(1) of the Local Government Act,

Council advertised the proposed licence for 28 days and received a number of

submissions. A summary of submissions received is detailed in this report.

Council must duly consider all submissions received prior to

determining whether or not to grant the licence in accordance with the previous

resolution (19-159).

|

RECOMMENDATION:

That Council having duly considered all

submissions received grant a temporary licence to the Mullumbimby

Sustainability Education and Enterprise Development Inc for occupation of

part of Lot 22 DP 1073165 known as the Mullumbimby Community Gardens

in accordance with Resolution (19-159) being:

a) term

one (1) month with monthly holding over;

b) for

the purpose of a community garden as defined in Policy No. 14/008 Byron Shire

Council Community Gardens;

c) rent

payable monthly at the value of one twelfth of the minimum Crown rent as

determined by clause 38 of the Crown Land Management Regulations 20017 (NSW);

d) the

Licensee to pay outgoings of water, contents and building insurances; and

e) the

Licensor to pay outgoings of the value of general land rates (if payable).

|

Attachments:

1 Submissions

to grant of licence to Mullumbimby SEED, resolution 19-159, E2019/39737

REPORT

Council resolved 19-159 at it 18 April 2019 meeting:

1. That

Council authorise the General Manager to negotiate a temporary licence

with Mullumbimby Sustainability Education and Enterprise Development Inc for

occupation of part of Lot 22 DP 1073165 known as the Mullumbimby Community Gardens

on the following terms:

a) term

one (1) month with monthly holding;

b) for

the purpose of a community garden as defined in Policy No. 14/008 Byron Shire

Community Gardens;

c) rent

payable monthly at the value of one twelfth of the minimum Crown rent as

determined by clause 38 of the Crown Land Management Regulations 2017 (NSW);

d) the

Licensee to pay outgoings of water, contents and building insurances; and

e) the

Licensor to pay outgoings of the value of general land rates (if payable).

2. That

Council authorise the publication of the proposed temporary one (1)

month licence with monthly holding over to the Mullumbimby Sustainability

Education an Enterprise Development Inc for a period of 28 days seeking public

comment.

3. That

in the event no submissions are received, that Council delegate to the General

Manager the authority to enter into the licence referred to in 1 above.

4. That

if submissions are received that a new report be reported to Council at its

June 2019 meeting.

Public consultation:

Council publically advertised the

proposed licence from 1 to 29 May 2019. Council received seven submissions and one 62 signature petition in support of the

grant of a new licence and three submissions opposing the grant of a new

licence.

A summary of submissions is tabled

below:

|

Submissions supporting the

licence

|

Council reply

|

|

(E2019/4818)

Many amazing things happen at

the community garden;

· Children pick fruit and vegetables and gather eggs being

important to their understandings;

· FFA food section feed many in need and others by

donation;

· Plant nursery supplies seedlings to the site and others

at reasonable prices;

· Applying for an ABN to permit work for the dole people to

develop the garden to be self-reliant with minimum grant funding;

· Lunch-time Tuesday is internationally known attracting

many overseas visitors;

· The garden assist people to pay off expensive fines by

allowing them to still feed themselves;

· Anyone may enter the garden and few have disrespect for

the garden;

· No where else in Australia like the community garden and

the garden needs to be preserved and supported;

· The garden is under management and Council’s

patience is sought until things settle down; and

· The community garden profits so many of the community.

|

· Council notes support given.

|

|

(E2019/4824)

· The community garden is a nourishing and refreshing place

for the community and celebrate children’s birthdays;

· A place to hold families together after separation

through gardening;

· Seen the garden grow and flourish for both persons and

plans; and

· Yes renew the licence.

|

· Council notes support given.

|

|

(E2019/4837)

· The community garden is a delightful and inspiring place

to visit;

· Community support includes:

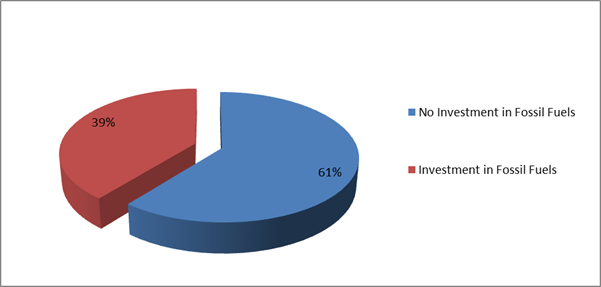

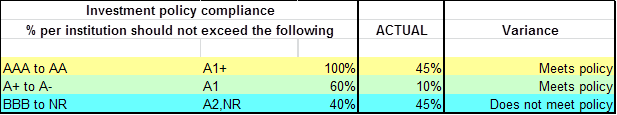

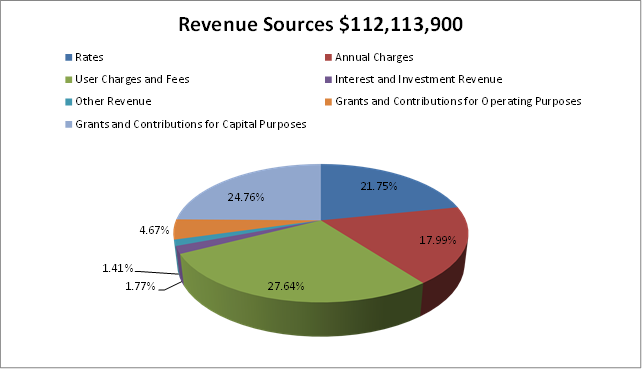

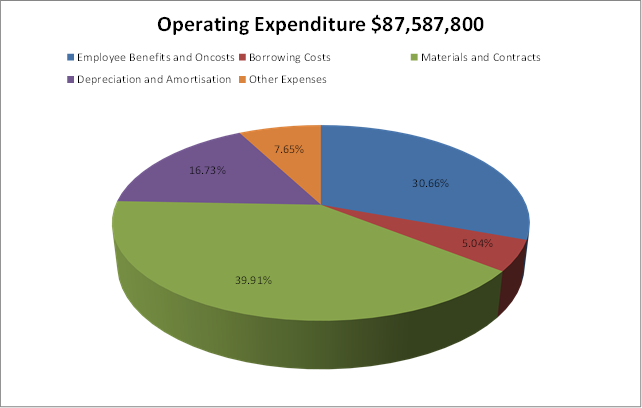

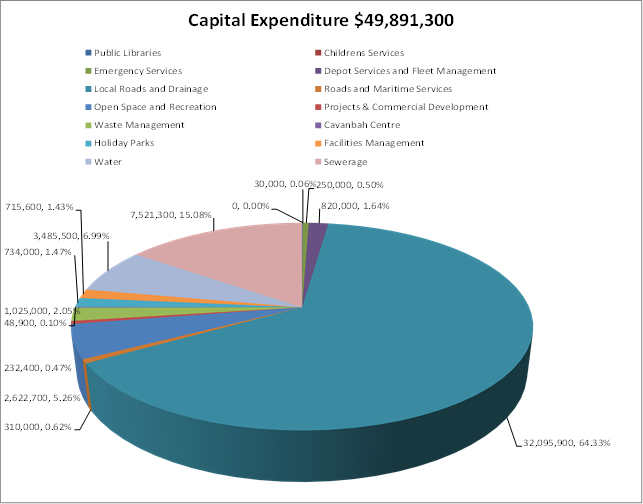

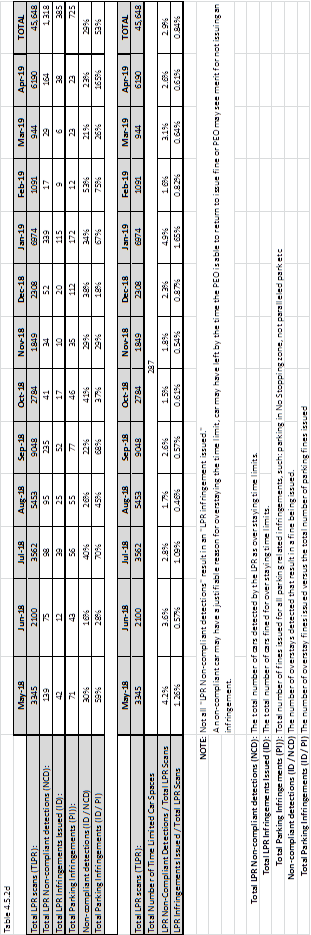

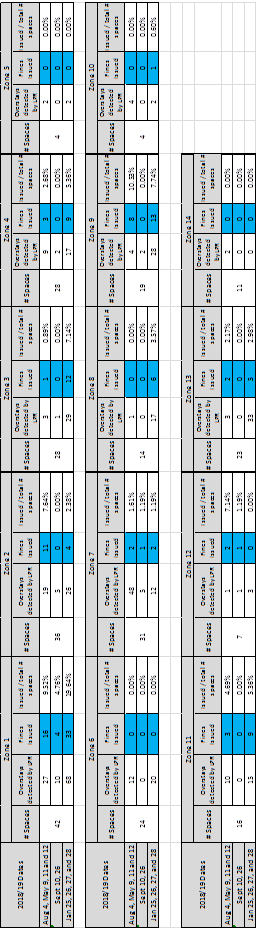

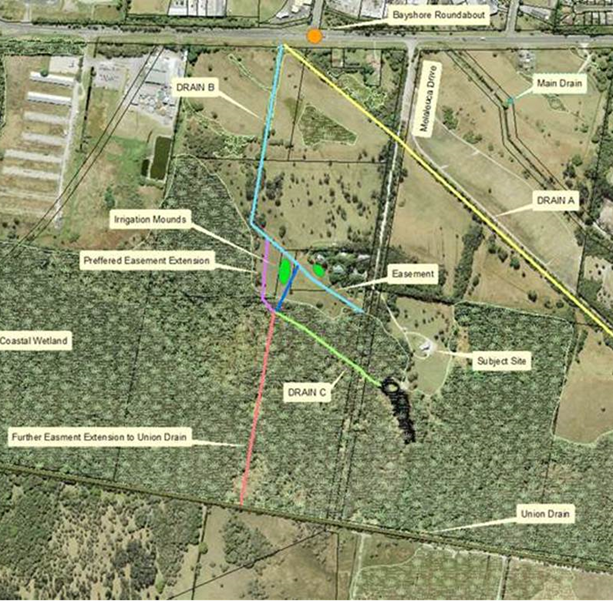

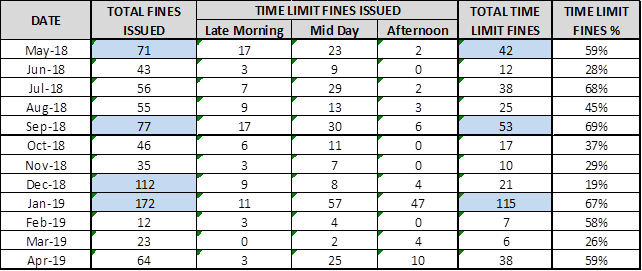

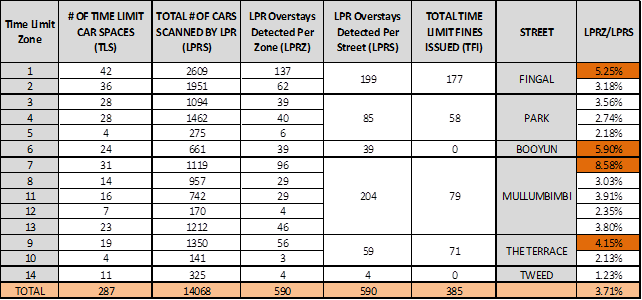

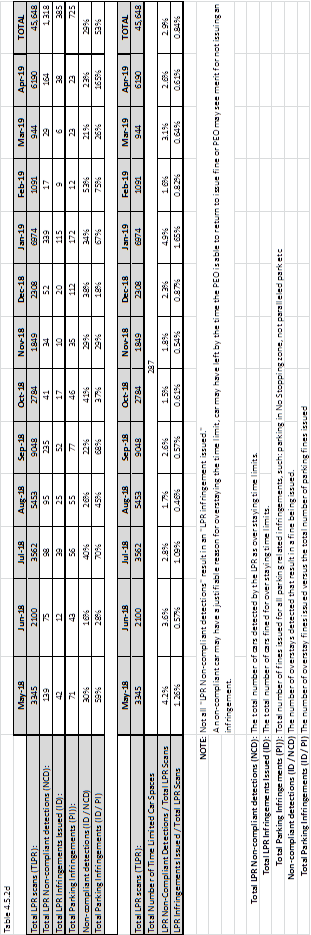

o Gardening plots,